-

@ 5bdb0e24:0ccbebd7

2025-01-15 15:44:04

I am a huge fan of Flatpak applications on Linux. I like how they work. I like how easy they are to install. I like how you can control their permissions with such granularity. Etc.

Well now, I have yet another reason to love Flatpaks: easy installation reproducibility. Let me show you what I mean.

---

Let's say you have been using Flatpaks for a while, and you have all the apps you could want installed on your system.

Then, for whatever reason, you have to set up an OS on a new machine. For example, it could be that a new version of Ubuntu is about to drop, and you want to install it from scratch on your laptop.

Well, now you can easily install all the Flatpaks that you use and love on that new OS with just a few commands.

First, on your current machine, we want to list out all the installed Flatpaks. But, we don't want to just do it with a `flatpak list`, because that gives us too much information.

All we want right now is a list of the Application IDs. We can do that with the following command:

```

flatpak list --app --columns application

```

Now, this is great, and we can just manually copy and paste this list into a text file if we want.

Instead, what we are going to do is take that output and redirect it to a file with the output redirection operator. We are going to call that output something like "flatpaks.txt" or something else unimportant, because we need to rename the file in the next step.

```

flatpak list --app --columns application > flatpaks.txt

```

Great! Now, we have a text file of every Flatpak we currently have installed on our system. Next, we need to format it, so we can easily input the contents of the text file into the command line for install at a later time.

We can easily format this file appropriately with the next command and output the contents into a new text file. In my experience, if we try to overwrite the contents of the first file, the command won't work. Here's how to do it:

```

cat flatpaks.txt | tr '\n' ' ' | sed 's/ $/\n/' > flatpakinstalls.txt

```

Now, this is technically a few commands, and when broken down they simply say "take this file's contents, replace the new lines with spaces, remove the trailing space at the end of the line, and write this new output to a new file." Regular expressions are wild.

The last thing you'll want to do is delete the original file, since now you have two:

```

rm flatpaks.txt

```

With that, you have a clean text file containing all the Flatpaks installed on your system that you can reference on any other machine. But, we can actually do this a little better.

With all of that out of the way, we can take that three or four-step process and boil it down to one simple copy pasta command thanks to the and operator, `&&`:

```

flatpak list --app --columns application > flatpaks.txt && cat flatpaks.txt | tr '\n' ' ' | sed 's/ $/\n/' > flatpakinstalls.txt && rm flatpaks.txt

```

That's it! Easy as pie.

Just keep this file backed up and safe. Then, after you are done installing your new OS, you'll need to make sure Flatpak is set up and ready by following the official Flatpak documentation.

After that, you can move this text file over to that machine, copy the contents, and paste them after the `flatpak install` command to quickly and effortlessly reproduce the Flatpak setup you had on your old installation.

Hope you find this as helpful as I do.

-

@ 5bdb0e24:0ccbebd7

2025-01-15 15:29:59

In infosec, there is a seemingly never ending list of acronyms any cyber professional must be familiar with in order to work efficiently and effectively. One of those is a common vulnerability known as IDOR.

IDOR stands for Insecure Direct Object Reference, and it's a type of vulnerability that can have serious implications for the security of web applications if not properly addressed. But what is it exactly?

## What is IDOR?

---

IDOR is a security vulnerability that occurs when an application exposes internal implementation objects to users without proper authorization checks. In simpler terms, it means that an attacker can manipulate parameters in the application's URL or form fields to access unauthorized data or functionality.

Ok, that's a mouthful, so let's break it down further.

## How Does IDOR Work?

---

To understand how IDOR works, consider a scenario where a web application reveals information about what you're accessing or viewing via the URL. For example, a user profile page may have a URL like the following: `https://example.com/profile?id=123`.

In a secure application, the server would verify that the user has the necessary permissions to access the profile with ID 123. However, in the case of an IDOR vulnerability, an attacker could change the ID parameter in the URL to something like `https://example.com/profile?id=456` to access a different user's profile, potentially exposing sensitive customer information.

The consequences of an IDOR vulnerability go beyond unauthorized access to customer information as well. Attackers could gain access to other sensitive data, such as financial records, administrative functions, or other business related data. This can lead to data breaches, privacy violations, and reputational damage to the organization.

## Preventing IDOR Attacks

---

Preventing IDOR attacks requires a proactive approach to security. Here are some basic best practices to mitigate theses attacks:

1. Implement Proper Access Controls: Ensure that all user requests are properly authenticated and authorized before granting access to resources.

2. Use Indirect Object References: Instead of exposing internal object references directly in URLs, use indirect references that are mapped to internal objects on the server side.

3. Validate User Input: Sanitize and validate all user input to prevent malicious manipulation of parameters.

4. Employ Role-Based Access Control: Implement role-based access control to restrict users' access to only the resources they are authorized to view or modify.

5. Regular Security Audits: Conduct regular security audits and penetration testing to identify and remediate potential IDOR vulnerabilities.

IDOR is a critical security issue that requires proactive measures to mitigate. By understanding how IDOR works and implementing various security controls, organizations can safeguard their web applications against potential threats and ensure the confidentiality, integrity, and availability of their data.

-

@ 5bdb0e24:0ccbebd7

2025-01-15 15:22:03

In cybersecurity, there is a buzzword I've seen some confusion about online recently. It's called zero trust, and though it sounds like vague corporate-ese at first, it actually represents a necessary approach to digital security.

Cyber threats are constantly evolving, and IT professionals need to be prepared for the worst at all times. Zero trust is a valid part of defense in depth and the principle of least privilege within a network or series of networks. But what exactly does that mean?

Well, historically, cyber professionals relied on perimeter defenses like firewalls to determine trust, assuming that everything inside the network was trustworthy. Zero trust challenges this notion by requiring strict identity verification for every user and device trying to access resources, regardless of their location.

You'll often hear the term "never trust, always verify" when talking about zero trust. Practically, this means that every user and device must authenticate their identity before accessing the resources on the network, ensuring that only authorized individuals can access sensitive data.

It also means users are granted the minimum level of access required to perform their tasks (the principle of least privilege I mentioned a second ago). This not only limits the potential damage that can be caused in case of a security breach, but it impedes insider threats from doing even more damage than would be possible otherwise.

Zero trust also makes it harder for attackers to move laterally within a network by implementing network segmentation. This divides larger networks up into smaller pieces, isolating each segment, and protecting them from threats in other segments.

Effectively implementing these steps is not a set it and forget it kind of thing either. Zero trust requires continuous monitoring of user and device behavior to detect anomalies or suspicious activities that may indicate security threats. Proper implementation takes the "never trust" part to the extreme.

In other words, zero trust means that organizations don't blindly trust their employees and internal networks. Threats can come from anywhere, including within, and implementing various controls to mitigate these risks can significantly enhance an organization's security posture and enable them to better protect all constituents involved.

-

@ 5bdb0e24:0ccbebd7

2025-01-15 15:11:28

The internet is a dangerous place, full of vulnerabilities attackers leverage to malicious ends. One of the more common vulnerabilities that websites face is cross-site scripting (XSS) attacks. XSS attacks can have serious consequences, ranging from stealing sensitive information to defacing websites. Without wasting any time, let's jump into what XSS is, how it works, and how to mitigate it on your websites.

## What is Cross-Site Scripting (XSS)?

---

XSS is a type of injection security vulnerability typically found in web applications, and it exploits the trust users have in websites. It occurs when an attacker injects malicious scripts into web pages via input fields, URLs, or even cookies.

When a user visits a compromised page, the injected script is executed in the user's browser, allowing the attacker to carry out various malicious activities. This works because the scripts are assumed to have come from a trusted source. When executed, they can steal sensitive information, hijack user sessions, or deface the website.

## Types of XSS Attacks

---

There are three types of XSS:

1. **Stored XSS**: The malicious script is stored on the server and executed whenever a user accesses the compromised page.

2. **Reflected XSS**: The malicious script is reflected off a web server and executed in the user's browser.

3. **DOM-based XSS**: The attack occurs in the Document Object Model (DOM) of the web page, allowing the attacker to manipulate the page's content.

## Preventing XSS Attacks

---

There are several ways to mitigate XSS, some examples include the following:

1. **Input Validation**: Validate and sanitize all user input to prevent the injection of malicious scripts.

2. **Output Encoding**: Encode user input before displaying it on the web page to prevent script execution.

3. **Content Security Policy (CSP)**: Implement a CSP to restrict the sources from which scripts can be loaded on your website.

4. **Use HTTPS**: Ensure that your website uses HTTPS to encrypt data transmitted between the server and the user's browser.

## Conclusion

---

Cross-site scripting attacks pose a significant threat to web security. By understanding how XSS works and implementing best practices to prevent such attacks, you can safeguard your website and protect your users' sensitive information. Stay vigilant, stay informed, and stay secure in the ever-evolving landscape of web security.

-

@ 5bdb0e24:0ccbebd7

2025-01-15 14:58:45

In the ever-evolving world of cybersecurity, understanding the various vulnerabilities that can be exploited by attackers is crucial for maintaining robust defenses. One such vulnerability that poses a significant risk is Local File Inclusion (LFI). This blog post aims to demystify LFI, explaining what it is, how it can be exploited, and what measures can be taken to prevent it.

## What is Local File Inclusion (LFI)?

---

Local File Inclusion is a type of web application vulnerability that allows an attacker to access files from the server where the application is hosted. This can be achieved by exploiting poorly written code in the web application that processes user input. Essentially, if an application allows users to specify a file to be included, and it doesn't properly sanitize the input, attackers can manipulate this input to include arbitrary files from the server.

LFI vulnerabilities often arise in applications that use scripts like PHP, where the `include`, `require`, `include_once`, and `require_once` functions are used to include files dynamically. When these functions are used improperly, they can become a gateway for attackers.

## How Does LFI Work?

---

To understand how LFI works, let's consider a simple example. Here we see a PHP script that uses user input to include different page templates:

```php

<?php

$page = $_GET['page'];

include("pages/" . $page . ".php");

?>

```

If the application fails to properly validate the `page` parameter from user input, an attacker could manipulate it by inserting paths that lead to unintended files:

```

http://example.com/index.php?page=../../etc/passwd

```

In this scenario, if not properly secured, the attacker could potentially read sensitive system files like `/etc/passwd` on Unix-based systems.

## Impacts of LFI Vulnerabilities

---

LFI vulnerabilities can have severe consequences, including but not limited to the following:

1\. **Information Disclosure**: Attackers can gain access to sensitive files, such as configuration files, passwords, and application source code.\

2. **Remote Code Execution**: In some cases, attackers can leverage LFI to execute arbitrary code on the server, especially if they can upload malicious files to the server.\

3. **Access to Internal Systems**: Attackers may use LFI to pivot and access other systems within the network, potentially leading to broader compromises.

## Preventing LFI Vulnerabilities

---

Preventing LFI vulnerabilities requires a combination of secure coding practices and proper input validation. Here are some key measures to take:

1\. **Input Validation**: Always validate and sanitize user inputs. Ensure that the input corresponds to the expected format and type, and reject any suspicious or malformed input.\

\

2. **Whitelist Files**: Instead of allowing arbitrary file inclusion, use a whitelist of allowable files that can be included. This restricts the files that can be included to a predefined set.\

\

3. **Avoid User-Controlled File Paths**: Where possible, avoid using user input directly in file paths. If it is necessary, use predefined directories and filenames.\

\

4. **Use Built-In Functions**: Utilize built-in functions and libraries that handle file inclusions more securely. For example, PHP’s `filter_input()` can help sanitize input data.\

\

5. **Principle of Least Privilege**: Ensure that the web server and application run with the least privileges necessary, minimizing the impact of a potential compromise.\

\

6. **Security Testing**: Regularly conduct security testing, including code reviews and penetration testing, to identify and fix vulnerabilities.

## Conclusion

---

Local File Inclusion is a potent vulnerability that can lead to significant security breaches if left unchecked. By understanding how LFI works and implementing robust security measures, developers and administrators can protect their applications from being exploited.

Ensuring that user inputs are properly validated and sanitized, using whitelists, and adhering to the principle of least privilege are fundamental steps in safeguarding against LFI attacks. Regular security assessments and staying informed about the latest security practices will further bolster defenses against this and other vulnerabilities.

-

@ b8851a06:9b120ba1

2025-01-14 15:28:32

## **It Begins with a Click**

It starts with a click: *“Do you agree to our terms and conditions?”*\

You scroll, you click, you comply. A harmless act, right? But what if every click was a surrender? What if every "yes" was another link in the chain binding you to a life where freedom requires approval?

This is the age of permission. Every aspect of your life is mediated by gatekeepers. Governments demand forms, corporations demand clicks, and algorithms demand obedience. You’re free, of course, as long as you play by the rules. But who writes the rules? Who decides what’s allowed? Who owns your life?

---

## **Welcome to Digital Serfdom**

We once imagined the internet as a digital frontier—a vast, open space where ideas could flow freely and innovation would know no bounds. But instead of creating a decentralized utopia, we built a new feudal system.

- Your data? Owned by the lords of Big Tech.

- Your money? Controlled by banks and bureaucrats who can freeze it on a whim.

- Your thoughts? Filtered by algorithms that reward conformity and punish dissent.

The modern internet is a land of serfs and lords, and guess who’s doing the farming? You. Every time you agree to the terms, accept the permissions, or let an algorithm decide for you, you till the fields of a system designed to control, not liberate.

They don’t call it control, of course. They call it *“protection.”* They say, “We’re keeping you safe,” as they build a cage so big you can’t see the bars.

---

## **Freedom in Chains**

But let’s be honest: we’re not just victims of this system—we’re participants. We’ve traded freedom for convenience, sovereignty for security. It’s easier to click “I Agree” than to read the fine print. It’s easier to let someone else hold your money than to take responsibility for it yourself. It’s easier to live a life of quiet compliance than to risk the chaos of true independence.

We tell ourselves it’s no big deal. What’s one click? What’s one form? But the permissions pile up. The chains grow heavier. And one day, you wake up and realize you’re free to do exactly what the system allows—and nothing more.

---

## **The Great Unpermissioning**

It doesn’t have to be this way. You don’t need their approval. You don’t need their systems. You don’t need their permission.

The Great Unpermissioning is not a movement—it’s a mindset. It’s the refusal to accept a life mediated by gatekeepers. It’s the quiet rebellion of saying, *“No.”* It’s the realization that the freedom you seek won’t be granted—it must be reclaimed.

- **Stop asking.** Permission is their tool. Refusal is your weapon.

- **Start building.** Embrace tools that decentralize power: Bitcoin, encryption, open-source software, decentralized communication. Build systems they can’t control.

- **Stand firm.** They’ll tell you it’s dangerous. They’ll call you a radical. But remember: the most dangerous thing you can do is comply.

The path won’t be easy. Freedom never is. But it will be worth it.

---

## **The New Frontier**

The age of permission has turned us into digital serfs, but there’s a new frontier on the horizon. It’s a world where you control your money, your data, your decisions. It’s a world of encryption, anonymity, and sovereignty. It’s a world built not on permission but on principles.

This world won’t be given to you. You have to build it. You have to fight for it. And it starts with one simple act: refusing to comply.

---

## **A Final Word**

They promised us safety, but what they delivered was submission. The age of permission has enslaved us to the mundane, the monitored, and the mediocre. The Great Unpermissioning isn’t about tearing down the old world—it’s about walking away from it.

You don’t need to wait for their approval. You don’t need to ask for their permission. The freedom you’re looking for is already yours. Permission is their power—refusal is yours.

-

@ b8851a06:9b120ba1

2025-01-14 10:56:55

Starting in January 2025, the EU’s MiCA regulation enforced strict KYC requirements, especially for Bitcoin transactions over €1,000 between exchanges and self-hosted wallets. While this creates new challenges, there are still legitimate ways to protect your privacy and maintain control over your Bitcoin.

## Effective Privacy Solutions

1. Take Control with Self-Custody

• Run Your Own Node: This ensures you’re not relying on third-party servers, giving you full control of your transactions.

• Use Fresh Addresses: Always generate a new address for each transaction to keep your activity private and harder to trace.

• Choose the Right Wallets: Use wallets like #Sparrow or #Wasabi, which let you connect directly to your own node for added privacy (check if there are any legal cases against any wallet before you use one.).

2. Leverage the Lightning Network

• Keep Transactions Off-Chain: Lightning lets you make payments without broadcasting them to the blockchain.

• #Onion Routing for Privacy: This hides your payment path, protecting both you and the recipient.

• Hard-to-Trace Payments: With multiple hops between nodes, tracking transactions becomes nearly impossible.

3. Smarter Transaction Habits

• Keep Channels Open: By leaving your #Lightning payment channels open, you minimize on-chain activity.

• Use Public Channels Wisely: Multiple public channels provide plausible deniability.

• Go Private with Unannounced Channels: For maximum privacy, consider private payment channels.

## How to Implement These Tools

1. Setting Up the Lightning Network

• Privacy-First Funding: When funding your channels, use methods like #CoinJoin to enhance privacy.

• Better Receiver Privacy: Use tools like #Voltage Flow 2.0 for added anonymity when receiving payments.

• Stay on Top of Channel Management: Properly manage your payment channels to avoid privacy leaks.

2. Strengthen Your Operational Security

• Avoid Reusing Addresses: Reusing the same wallet address makes it easier to trace your transactions.

• Separate Public and Private Transactions: Keep identified funds and private wallets completely separate.

• Use Tor or VPNs: Always use privacy tools like Tor or a #VPN when accessing Bitcoin wallets or services.

## Staying Safe

1. Legal Awareness

• Mind the Limits: Be cautious with transactions over €1,000, as they’ll trigger reporting requirements.

• Peer-to-Peer Freedom: Transactions between unhosted wallets remain outside #MiCA ’s reach, so direct transfers are still an option.

• Check Local Rules: Privacy tool regulations vary between countries, so make sure you’re up to speed on what’s allowed where you live.

2. Practical Safeguards

• Double-Check Everything: Always verify wallet addresses before sending funds to avoid costly mistakes.

• Stay Updated: Keep your wallets, nodes, and security tools current with the latest updates.

• Keep Offline Backups: Store your recovery phrases and backups somewhere secure and offline.

#Bitcoin #privacy isn’t automatic—it takes effort and vigilance. But by following these steps, you can stay in control of your financial freedom even in an increasingly regulated world. Stay informed, make smart decisions, and build habits that protect your privacy.

Disclaimer:

This post is for educational purposes only and is not financial, legal, or investment advice. The tools and techniques shared here are not meant to help anyone break the law or avoid regulations. You’re responsible on complying with local laws and consult legal professionals if you’re unsure about anything.

The goal is to inform and empower you to take control of your privacy responsibly.

Stay safe and stay free.

-

@ c8adf82a:7265ee75

2025-01-14 03:04:17

Trigger warning. Please have an open mind and I will open a perspective for you

---

In this world, we are always told to follow our heart. Have you ever think deeply about this?

You had your first love, didn’t you really love them? You defend them, you put them over your family. No mom he/she is not like that, you just don’t understand. And then you distance yourself from your mom, the person who gave you life. Your mom will tell you please take it slow, but you say no I love this person. This is the love of my life!

Forty days later you cry because you got cheated on, and the only person that consoles you is your mom. What happened? I thought you loved that person? You gave everything, you love, and boom, you hate. Do you know why? Because you don’t know this verse:

> *“The heart is deceitful above all things, and desperately wicked: who can know it?”*

*> *Jeremiah 17:9 KJV*

We are groomed by the prince of this world, satan, to follow our heart. This is why we are always volatile. Happy sad happy sad. This is why God records this verse in the Bible. He’s just like: “Hey guys, just so you know, this is your heart. You will never know it, so I record it here because I love you”. Sadly, we never read our Bible, so we don’t know the heart of God. And when we don’t know the heart of God, we can only trust our heart and we become easily deceived

Let’s go deeper, what is the antithesis of God? Satan. What is satan’s objective? Deceive. How is he like? Cunning and deceitful. Does satan want you to kill? No. To hate? No. Satan just wants a lot of people to stay with him in hell when the world ends

Aren’t you just walking around existing? You’re not striving, you’re not thriving, you’re just existing. Why? Because you trust your thoughts and feelings. Those that deceive you. Your problem isn’t empty or depression. Empty or depression doesn’t come from God. This is the characteristics of satan

God compared our heart to the characteristics of satan. Satan is cunning and deceitful, we should never trust our heart because trusting your heart directly correlates with trusting and worshiping satan

Satan never say worship me, satan says believe in yourself. Satan says worship yourself. Individualism, greed, pride, sloth, all deadly sins. Worship that!

And when you follow that, you die

-

@ b8851a06:9b120ba1

2025-01-13 23:12:14

In a world where sovereignty is supposedly sacred, a startling truth emerges: The United States' attempt to purchase Greenland has exposed how territories and their populations can still be viewed as tradeable assets in the 21st century. This investigation reveals the true scope of what could be the most audacious territorial acquisition since the Alaska Purchase of 1867.

## THE SOVEREIGNTY PARADOX

When Danish Prime Minister Frederiksen declared "Greenland is not for sale," she inadvertently highlighted a crucial irony: Denmark's authority to reject the sale implies ownership of a territory seeking self-determination. Prime Minister Egede's recent accusation of Danish genocide over the 1960s forced contraceptive program adds a chilling historical context to this modern power play.

## THE REAL PRICE OF A NATION

The initial estimates of $12.5-77 billion, calculated by former New York Fed economist David Barker, barely scratch the surface. The true cost approaches $2 trillion when factoring in:

- Infrastructure development: $1.5 trillion

- Annual subsidies: $775 million

- Resident compensation: $5.7-57 billion

- Environmental protection costs: Billions annually

## THE COLONIAL ECHO CHAMBER

**HISTORICAL WOUNDS AND MODERN AMBITIONS**

Trump's refusal to rule out military force against a NATO ally marks an unprecedented threat in post-WW2 diplomacy. Meanwhile, Donald #Trump Jr.'s "private visits" to Greenland, coupled with Denmark's pointed refusal to meet him, reveals the intersection of personal business interests and national security policy.

## THE RESOURCE SOVEREIGNTY EQUATION

Beneath Greenland's ice lies an estimated $1.1 trillion in mineral wealth, presenting an alluring economic incentive. However, this potential wealth raises fundamental questions about resource sovereignty:

**DEVELOPMENT COSTS**

- 24 major development projects needed

- $5 billion per project

- 25-year implementation timeline

- Current GDP: $3.236 billion

**STRATEGIC RESOURCES**

- Rare earth elements crucial for technology

- 31.9 billion barrels of oil equivalent

- Vast hydroelectric potential

- Green hydrogen production possibilities

## THE ENVIRONMENTAL STAKES

Greenland's ice sheet contains enough water to raise global sea levels by 23 feet. Climate change is rapidly transforming resource accessibility, while environmental protection costs would run into billions annually. This environmental transformation creates both opportunities and responsibilities:

- Tourism sector potential: $450 million annually

- Climate change monitoring costs

- Environmental protection infrastructure

- Indigenous land management rights

## THE GEOPOLITICAL CHESSBOARD

**POWER DYNAMICS**

The acquisition would fundamentally alter Arctic power structures:

- #NATO alliance relationships

- Chinese economic interests

- Arctic Council voting power

- Maritime shipping routes

**THE CHINESE SHADOW**

Denmark's 2017 intervention blocking Chinese acquisition of a former military base reveals Greenland's role in a larger geopolitical game. China's growing Arctic ambitions add urgency to American interests.

## THE MONARCHICAL DIMENSION

King Frederik X's strategic modification of #Denmark 's royal coat of arms to emphasize Greenland ownership serves as a direct challenge to American ambitions, adding traditional power structures to modern sovereignty disputes.

## PROBABILITY AND RESISTANCE

Current analysis suggests:

- 60% chance of failure due to international opposition

- 30% chance of diplomatic compromise

- 10% chance of successful acquisition

## THE INFLATION FACTOR

The purchase would trigger significant inflationary pressures through:

- Massive fiscal expenditure in an already heated economy

- Supply chain disruptions

- Construction and development costs

- Core PCE inflation impact

- Federal Reserve policy complications

## LEGAL AND FINANCIAL HURDLES

The acquisition faces numerous obstacles:

- International maritime law complications

- Indigenous rights considerations

- Existing mining licenses

- Danish sovereign debt obligations

- NATO alliance implications

## THE SOVEREIGNTY SOLUTION

The path forward likely lies not in purchase but in supporting Greenlandic self-determination. With only 56,000 residents, the per capita acquisition cost would be astronomical, but the human cost of ignoring sovereignty rights would be immeasurable.

## CONCLUSION: THE PRICE OF FREEDOM

The true cost of purchasing Greenland extends beyond economics into the realm of human rights and dignity. As climate change transforms the Arctic landscape, the question isn't whether Greenland can be bought—it's whether territorial transactions should have any place in a world that claims to value self-determination.

The convergence of colonial history, indigenous rights, and geopolitical ambitions in Greenland serves as a mirror to our times. While major powers still think in terms of territorial acquisition, the people of Greenland remind us that sovereignty isn't for sale. Their struggle for self-determination, caught between American ambitions, Chinese influence, Danish sovereignty, and their own independence aspirations, may well define the future of Arctic politics and indigenous rights in the 21st century.

The most viable path appears to be enhanced economic partnership without formal territorial acquisition, possibly through a free association agreement following #Greenland 's potential independence. As the Arctic's strategic importance grows, this #nostr analysis becomes increasingly relevant for future policy considerations and global power dynamics.

-

@ c68e2176:4439e6cf

2025-01-13 22:28:38

I am not a big fan of open letters, it’s really difficult to write on a topic that applies so broadly without exception. Yet, here I am with a topic that I believe meets this criteria.

In this post, I will not attempt to sell you on the merits of Bitcoin or the evils of fiat currency. There is enough content out there that can explain those topics better than I ever could. Instead, I want to convince church leaders around the world that you should seriously consider equipping your church to be able to accept Bitcoin as a medium of tithes and offerings from your congregants.

Here is a list of reasons I came up with for church leaders to consider:

1. **Bitcoin Wallet is very simple to set up**

1. It’s quite simple to set up a bitcoin wallet. Do not let the technology make you think it is too complicated. If you have someone in your congregation familiar with BTC, they can help. Or, if you go to a company like Unchained Capital, their staff will walk you thru it step by step. There may be a small fee, but should be seriously considered.

2. **We should try to accommodate our congregation**

1. Especially if it’s easy to set up, we should try to accommodate accepting our tithes and offerings in how our congregation is led to give. If there are members in the congregation who are inclined to tithe in BTC, the church should be set up to accept it.

2. Anecdote: In college I knew a pastor who tithed in 1oz silver coins. He subscribed to Austrian economics, and said “why should I give to my Lord money that devalues”. The church bought a safe and stored it. All congregations should have the same mentality

3. **Sending money to foreign missionaries:**

1. No transaction or exchange fees

2. Sending a wire to a foreign missionary with accountability is painful. We used to do this and needed two signatures and the sending financial institution required us to fax approval.

3. Many times, individuals who serve on Church Finances have full time day jobs and the coordination and administration becomes logistically very difficult. Church finances should have accountability but our existing financial institutions make this difficult or they do not consistently enforce it.

4. Bitcoin Multi-Sig makes this extremely simple and easy. You skip Transaction and Exchange fees and accountability is built in with Multi-Sig. For those of you unfamiliar with multi-sig, just imagine the following scenario: You have 3 authorized signers at your Church. In order to send money, you need 2 out of those 3 signers to authorize sending funds.

4. **Financial Sovereignty**

1. Any student of church history knows that governments have been the greatest persecutors of the church. The separation of Church and state is dwindling as government power continues to grow. With BTC, the government cannot seize or freeze your assets.

2. All you have to think about is Covid. Imagine if you did not want to shut down your Church during Covid (I.e. The state of New Jersey froze and seized assets of Atilis Gym) This does not apply to just governments, but also financial institutions.

3. Churches should learn to self custody assets. Underground churches will attest to this.

-

@ c8adf82a:7265ee75

2025-01-13 13:54:55

Imagine playing a MMO gen 1 Pokémon game, the goal of the game is still personal, to be the Pokémon league champion. To get to the Pokémon league, you need to defeat gym leaders and get their badges (if you never played, please play so you can relate and teach this lesson too)

Some players just go through the storyline right away, some have fear and grind levels hard, some just wanted to chill and catch ‘em all

Some got stuck at the mew rumour at S.S.Anne\* and got disappointed, some grind too hard that they forgot the main quest, some try to teach other people how to be a champion before being a champion themselves

If you are not interested in being the champion, that is totally fine, it is your game after all. Some enjoy the up and down of the journey and they just don’t want to finish the game yet. I respect these people because they know what they want and they’re doing what they can to get what they want

But there’s this special group of players that wants to be the champion, but are misled to believe they can be a ‘better’ champion if they do these special tasks before fighting the Elite Four. Can be from a game guide magazine, a friend that you think is smart, whatever. The sad truth is, you cannot be a ‘better’ champion in this game — and these guys just got misled their whole life

Now, these guys do meet other players that told them “hey, just go fight the Elite Four, that’s the only way for you to be champion”, and they kept replying “please respect me, I know I have to beat the Elite Four, I just want to be a ‘better’ champion, you just don’t understand”. These players get stuck in some sort of internal pride war sunk cost fallacy because they have spent their whole life trying to be a ‘better’ champion that actually doesn’t exist

Now why this story? This is life. No matter how hard you try, you still need to follow the main storyline. You can change your path, but everyone’s end goal eventually converge — eternal peace. When you become the league champion, you attain the ability to serve and radiate love. Evil spirits will forever try to hold you back from being a champion, some religion even tells you that you can be a ‘better’ champion. But really all you need to do is stay humble and stack sats, I mean, start the main quest

One day when you actually become a champion, you will realize that the only way to live is to serve other people so we all become champions. Because life is best enjoyed with the people we love

---

\*https://gaming-urban-legends.fandom.com/wiki/Mew_Under_the_Truck

-

@ bf47c19e:c3d2573b

2025-01-13 13:40:13

###### Originalni tekst na [thebitcoinmanual.com](https://thebitcoinmanual.com/blockchain/lightning-chain/)

---

*Lightning Network* (eng. *lightning* - munja, *network* - mreža) je jedno od primarnih rešenja za skaliranje Bitkoin mreže sa ciljem da je više ljudi može koristiti na različite načine čime bi se zaobišla ograničenja glavnog blokčejna. *Lightning* mreža deluje kao "drugi sloj" koji je dodat Bitkoin (BTC) blokčejnu koji omogućava transakcije van glavnog lanca (blokčejna) pošto se transakcije između korisnika ne registruju na samoj blokčejn mreži.

*Lightning* kao "sloj-2 (*layer-2*)" pojačava skalabilnost blokčejn aplikacija tako što upravlja transakcijama van glavnog blokčejna ("sloj-1" / *layer-1*), dok istovremeno uživa benefite moćne decentralizovane sigurnosti glavnog blokčejna, tako da korisnici mogu ulaziti i izlaziti iz *Lightning* mreže koristeći *custodial* ili *non-custodial* servise u zavisnosti od sopstvene sposobnosti i znanja da koriste glavni blokčejn.

Kao što i samo ime govori *Lightning Network* je dizajnirana za brza, instant i jeftina plaćanja u svrhu sredstva razmene i druga programabilna plaćanja kojima nije potrebna instant konačnost (*finality*) ali ni sigurnost glavnog lanca. *Lightning* je najbolje uporediti sa vašom omiljenom aplikacijom za plaćanja ili debitnom karticom.

#### Šta je *Lightning* mreža?

*Lightning* mreža vuče svoje poreklo još od tvorca Bitkoina, Satošija Nakamota, ali je formalizovana od strane istraživača *Joseph Poon*-a i *Thaddeus Dryja*-a koji su 14. januara 2016. godine objavili [beli papir](https://lightning.network/lightning-network-paper.pdf) o *Lightning Network*-u.

Radilo se o predlogu alternativnog rešenja za skaliranje Bitkoina da bi se izbeglo proširenje kapaciteta bloka Bitkoin mreže i smanjio rizik od centralizacije blokčejna. Dalje, skaliranje van glavnog lanca znači zadržavanje integriteta samog blokčejna što omogućuje više eksperimentalnog rada na Bitkoinu bez ograničenja koja su postavljena na glavnom blokčejnu.

*Lightning Labs*, kompanija za blokčejn inženjering, pomogla je pokretanje beta verzije *Lightning* mreže u martu 2018. - pored dve druge popularne implementacije od strane kompanija kao što su *ACINQ* i *Blockstream*.

* *Lightning Labs – LND*

* *Blockstream – Core Lightning* (implementacija nekada poznata kao *c-lightning*)

* *ACINQ – Eclair*

Svaka verzija protokola ima svoje poglede i načine kako rešava određene probleme ali ostaje interoperabilna sa ostalim implementacijama u smislu korišćenja novčanika, tako da za krajnjeg korisnika nije bitno kojom verzijom se služi kada upravlja svojim čvororom (*node*-om).

*Lightning Network* je protokol koji svako može koristiti i razvijati ga, proširivati i unapređivati i koji kreira posebno i odvojeno okruženje za korišćenje Bitkoina kroz seriju pametnih ugovora (*smart contracts*) koji zaključavaju BTC na *Lightning*-u radi izbegavanja dvostruke potrošnje (*double-spending*). *Lightning Network* nije blokčejn ali živi i funkcioniše na samom Bitkoinu i koristi glavni lanac kao sloj za konačno, finalno poravnanje.

*Lightning* mreža ima sopstvene čvorove koji pokreću ovaj dodatni protokol i zaključavaju likvidnost Bitkoina u njemu sa ciljem olakšavanja plaćanja.

*Lightning* omogućava svakom korisniku da kreira *p2p* (*peer-to-peer*) platni kanal (*payment channel*) između dve strane, kao npr. između mušterije i trgovca. Kada je uspostavljen, ovaj kanal im omogućava da međusobno šalju neograničen broj transakcija koje su istovremeno gotovo instant i veoma jeftine. Ponaša se kao svojevrsna mala "knjiga" (*ledger*) koja omogućava korisnicima da plaćaju još manje proizvode i usluge poput kafe i to bez uticaja na glavnu Bitkoin mrežu.

#### Kako radi *Lightning Network*?

*Lightning Network* se zasniva na pametnim ugovorima koji su poznati kao *hashed time lock contracts* koji između dve strane kreiraju platne kanale van glavnog blokčejna (*off-chain payment channels*). Kada zaključate BTC na glavnom lancu u ovim posebnim pametnim ugovorima, ova sredstva se otključavaju na *Lightning* mreži.

Ova sredstva zatim možete koristiti da biste napravili platne kanale sa ostalim korisnicima *Lightning* mreže, aplikacijama i menjačnicama.

Ovo su direktne platne linije koje se dešavaju na vrhu, odnosno izvan glavnog blokčejna. Kada je platni kanal otvoren, možete izvršiti neograničen broj plaćanja sve dok ne potrošite sva sredstva.

Korišćenje *Lightning* sredstava nije ograničeno pravilima glavnog Bitkoin lanca i ova plaćanja se vrše gotovo trenutno i za samo delić onoga što bi koštalo na glavnom blokčejnu.

Vaš platni kanal ima svoj sopstveni zapisnik (*ledger*) u koji se beleže transakcije izvan glavnog BTC blokčejna. Svaka strana ima mogućnost da ga zatvori ili obnovi po svom nahođenju i vrati sredstva nazad na glavni Bitkoin lanac objavljivanjem transakcije kojom se zatvara kanal.

Kada dve strane odluče da zatvore platni kanal, sve transakcije koje su se desile unutar njega se objedinjuju i zatim objavljuju na glavni blokčejn "registar".

#### Zašto biste želeli da koristite *Lightning* mrežu?

---

**Trenutno slanje satošija**

*Lightning Network* je "sloj-2" izgrađen na vrhu glavnog Bitkoin lanca koji omogućava instant i veoma jeftine transakcije između *lightning* novčanika. Ova mreža se nalazi u interakciji sa glavnim blokčejnom ali se plaćanja pre svega sprovode *off-chain*, van glavnog lanca, pošto koristi sopstvenu evidenciju plaćanja na *lightning* mreži.

Razvijene su različite aplikacije koje su kompatibilne sa *Lightning* mrežom, koje su veoma lake za korišćenje i ne zahtevaju više od QR koda za primanje i slanje prekograničnih transakcija.

Možete deponovati BTC na vaše *lightning* novčanike tako što ćete slati satošije sa menjačnica ili ih kupovati direktno unutar ovih aplikacija. Većina ovih novčanika ima ograničenje od nekoliko miliona satošija (iako će se ovaj limit povećavati kako više biznisa i država bude prihvatalo Bitkoin) koje možete poslati po transakciji što ima smisla budući da je za slanje većih iznosa bolje korišćenje glavnog blokčejna.

**Pokretanje sopstvenog čvora**

Kako se više ljudi bude povezivalo sa *lightning* mrežom i koristilo njene mogućnosti, sve više ljudi pokreće svoje čvorove radi verifikacije transakcija putem svojih *lightning* platnih kanala. Kroz ove kanale je moguće bezbedno poslati različite iznose satošija, a takođe je moguće zarađivati i male naknade za svaku transakciju koja prolazi kroz vaš kanal.

**Transakcione naknade**

Uprkos trenutnim transakcijama, još uvek postoje transakcione naknade povezane sa otvaranjem i zatvaranjem platnih kanala koje se moraju platiti rudarima na glavnom blokčejnu prilikom finalizacije *lightning* platnih kanala. Takođe postoje i naknade za rutiranje (*routing fees*) koje idu *lightning* čvorovima (i njihovim platnim kanalima) koji su uspostavljeni da bi se omogućila plaćanja.

Sa daljim napredovanjem razvoja Bitkoina i novim nadogradnjama, imaćemo sve veći rast i razvoj *layer-2* aplikacija kao što je *lightning*.

#### Više izvora o Lightning mreži

Ukoliko želite da naučite više o *Lightning* mreži, najbolje je da pročitate dodatne tekstove na sajtu [thebitcoinmanual.com](https://thebitcoinmanual.com/?s=lightning).

-

@ 378562cd:a6fc6773

2025-01-11 19:37:30

**Money**. It’s one of the most powerful forces in our world, and for many, it evokes mixed emotions. On the one hand, money provides security, opportunities, and the freedom to pursue dreams. On the other, it’s often tied to stress, inequality, and a sense of unending competition. This love-hate relationship with money is universal, and it stems from a system that often feels rigged against the average person.

Enter Nostr—a decentralized protocol designed to address some of the deepest flaws in how we interact with value and communication online. While Nostr isn’t just about money, its principles are profoundly reshaping how we think about value exchange, financial sovereignty, and freedom.

### The Root of the Problem

At the core of our collective frustration with money is control. Traditional financial systems are centralized, opaque, and prone to manipulation. Whether it’s through inflation eating away at savings, unfair access to banking, or censorship of financial transactions, the system leaves many feeling powerless. Add to this the societal obsession with consumerism and wealth accumulation, and it’s no wonder money can feel more like a burden than a tool.

Even digital spaces, which promised democratization, often mirror these problems. Social media platforms monetize user data while censoring or shadow-banning content. Payment platforms can freeze accounts or deny access, reinforcing the imbalance of power.

### Nostr: A Fresh Perspective on Value and Freedom

Nostr (short for "*Notes and Other Stuff Transmitted by Relays*") isn’t just a technical innovation—it’s a philosophy. Built on a simple yet powerful decentralized protocol, Nostr allows users to share information, communicate, and exchange value directly, without reliance on centralized entities. It’s an open, censorship-resistant network that puts control back into the hands of individuals.

So, how is Nostr addressing the money dilemma?

1. **Decentralized Value Exchange**\

Nostr integrates seamlessly with tools like Bitcoin’s Lightning Network, enabling instant, low-cost payments without intermediaries. This means individuals can send and receive money directly, whether it’s a micro-tip to support a content creator or a peer-to-peer transaction across borders. No banks. No middlemen. Just value exchanged freely.

2. **Censorship Resistance**\

One of the most frustrating aspects of modern finance is the potential for censorship. Banks and platforms can freeze accounts or block payments based on arbitrary criteria. Nostr flips this script by creating a network where transactions and communication are uncensorable. Value flows freely, aligned with the principles of individual sovereignty.

3. **Empowering Creators**\

In traditional models, creators often rely on centralized platforms to earn revenue, losing a significant portion to fees or being at the mercy of algorithms. On Nostr, creators can directly monetize their work through Bitcoin tips or other decentralized payment methods, creating a more equitable system where value flows directly between creator and consumer.

4. **Transparency and Trust**\

Unlike traditional systems shrouded in secrecy, Nostr operates on an open protocol. This transparency builds trust and removes many of the frustrations people associate with hidden fees, arbitrary rules, or lack of accountability in centralized systems.

### A New Relationship with Money

By decentralizing how value is exchanged and communication occurs, Nostr helps redefine the role of money in our lives. It shifts the narrative from control and dependency to empowerment and freedom. Money becomes what it was always meant to be—a tool, not a master.

Imagine a world where tipping someone online is as easy as liking a post, where no one can block you from accessing your own funds, and where creators earn directly from their audience without gatekeepers taking a cut. That’s the world Nostr is helping to build.

### Closing Thoughts

The love-hate relationship with money isn’t going away overnight. But as protocols like Nostr grow and mature, they offer a glimpse of what’s possible when we rethink the systems that shape our lives. By putting individuals back in control of their communication and financial exchanges, Nostr is doing more than fixing the flaws of the old system—it’s creating a new one entirely.

In the end, it’s not just about money. It’s about freedom, fairness, and the ability to live a life where value flows freely, aligned with our principles and priorities. Nostr isn’t just a tool; it’s a movement. And for anyone tired of the current system, that’s something worth paying attention to.

-

@ 378562cd:a6fc6773

2025-01-10 16:37:38

For many of us, reading isn’t just a pastime—it’s a deeply personal goal tied to self-growth, relaxation, and exploration. Yet, despite knowing its importance, we often struggle to make it happen. We start and stop, let books gather dust, and feel guilty for not finishing them. The truth? It’s not a time issue; it’s a mental barrier.

This guide is designed to help you break through those barriers with a structured, rewarding framework that keeps you interested, engaged, and building momentum. Let’s turn reading into a habit you love—and can sustain.

---

### **Step 1: Understand the Real Problem**

Before diving into action, take a moment to reflect. The issue isn’t that you don’t have time—it’s that you haven’t made reading a priority. Life pulls us in countless directions, but we always find time for what matters most. Reading deserves that place in your life because it nourishes your mind, brings you joy, and inspires growth.

**Ask Yourself:**

- Why do I want to read more?

- How would my life improve if I prioritized reading?

Write down your answers and keep them visible. Let your 'why' guide you forward.

---

### **Step 2: Start Where You Are (Small and Simple Wins)**

Many people fail because they set huge, overwhelming goals like finishing a book every week. The secret to success? Start small. Commit to just **5 minutes a day** or a single page. Progress matters more than perfection.

**Mini Challenge #1:**

- Pick a book you’re genuinely excited about (not one you feel you *should* read).

- Read for 5 minutes today. Just 5 minutes.

When you complete this, check it off. That little win is the first step toward building momentum.

---

### **Step 3: Create a System That Fits Your Life**

Habits thrive when they’re tied to something you already do. Look for natural openings in your day to read.

- **Morning:** Read while sipping coffee or tea.

- **Lunch Break:** Sneak in a few pages while eating.

- **Evening:** Replace 10 minutes of scrolling with reading before bed.

Make it impossible to forget by keeping books or an e-reader where you spend the most time: next to the bed, on the couch, or in your bag.

**Mini Challenge #2:**

- Set a specific time to read tomorrow. Write it down and stick to it.

---

### **Step 4: Make It Fun and Rewarding**

Let’s face it—habits stick when they feel good. Build instant gratification into your reading routine.

- **Gamify the Process:** Create a simple list of mini challenges (like the ones here) and cross them off as you go.

- **Set Rewards:** For every milestone—like finishing a chapter or hitting a week of daily reading—treat yourself. It could be a fancy coffee, a cozy reading corner upgrade, or just the joy of marking progress.

**Mini Challenge #3:**

- Set a reward for finishing your first chapter or reading streak. Make it something exciting!

---

### **Step 5: Follow Your Interests, Not Rules**

One of the biggest mental barriers is feeling like you *have to* finish every book you start. Forget that. Reading should be enjoyable, not a chore. If a book isn’t grabbing you, it’s okay to stop and try another. The key is to stay engaged, not stuck.

**Mini Challenge #4:**

- If you’re not loving a book after 50 pages, give yourself permission to move on.

---

### **Step 6: Build Momentum with Layered Challenges**

To make reading exciting and natural, set challenges that grow progressively:

1. **Day 1–3:** Read 5 minutes daily.

2. **Day 4–7:** Extend to 10 minutes.

3. **Week 2:** Finish a chapter or two from a book you love.

4. **Week 3:** Try a new genre or author.

Each challenge builds on the last, creating a sense of accomplishment. By the time you finish the third week, you’ll likely be hooked.

---

### **Step 7: Track and Celebrate Progress**

Progress tracking is one of the simplest yet most effective ways to build a habit. Create a log to note what you’ve read, even if it’s just a chapter or a short story. Seeing your progress motivates you to keep going.

**Ideas for Tracking:**

- Use a journal or app to list books and dates you started/finished.

- Jot down favorite quotes or lessons learned.

- Share your progress with friends or join a book club for accountability.

**Mini Challenge #5:**

- Start a reading journal and write down what you love about the book you’re currently reading.

---

### **Step 8: Stay Flexible and Forgive Yourself**

Life gets busy, and you might miss a day (or week). That’s okay. Habits are built over time, not overnight. The key is to keep coming back to your reading routine without guilt. Remember, even a little reading is better than none.

---

### **Final Thoughts**

Reading is a gift you give yourself. It’s not about how fast you finish or how many books you complete—it’s about the joy, knowledge, and escape it brings. By breaking your mental barriers, starting small, and creating a system of rewards and challenges, you can make reading a natural and deeply fulfilling part of your life.

So, grab a book, set a timer, and dive in. Your reading journey starts today.

-

@ 71a4b7ff:d009692a

2025-01-10 06:56:00

FOMO is the anxiety that arises from the belief that the most interesting, important, or trending events are happening elsewhere while others gain unique experiences.

It’s widely believed that FOMO stems from unmet social connection needs and reflects our innate fear of ostracism. These fears—of being left behind or excluded—are amplified in the digital age, where our perception of reality is often skewed. This can escalate from mild unease to overwhelming fear, significantly impacting mental well-being.

FOMO consists of two key components:

1. An unsettling feeling of missing out on something exciting or valuable.

2. Obsessive behaviors aimed at resolving this anxiety, which paradoxically only intensify it.

In today’s hyper-connected world, we have unprecedented, instant access to what others are doing. Social feeds, channels, and chats bombard us with endless options on how to live, what we lack, and what to value. But the sheer volume of this information far exceeds what anyone can process, leading many to feel overwhelmed.

The curated nature of digital lives, constant upward social comparisons, unrealistic expectations, and ceaseless data streams erode self-esteem and emotional stability. Our fear of alienation and loneliness fuels this cycle, pushing us deeper into digital platforms. These platforms, designed to stimulate our brain’s reward system, trap us in a feedback loop of anxiety and fleeting gratification.

We’re drawn in by the promise of effortless connection—quick, low-risk, and convenient interactions via swipes, likes, emojis, texts, even zaps. In contrast, real-life relationships, with their inherent complexities, take time, effort, and risk. This shift is causing us to lose touch with essential social skills like commitment, empathy, and genuine communication.

Instead, we seek solace in a digital environment that offers the illusion of safety, excitement, and eternal connectivity. But this comes at a cost. By overloading our internal reward systems, we drain the joy and meaning from authentic experiences, replacing them with an endless stream of curated content—images and videos we compulsively scroll through.

We’re lured by promises of knowledge, vivid experiences, and truth, yet what we often get is an avalanche of life hacks, misinformation, and conspiracy theories. Gigabit technologies, addictive interfaces, and external agendas fan the flames of loneliness, anxiety, and stress in our ancient, slow-evolving brains. This relentless burn depletes our reserves, leaving behind doubt: Are we doing enough? Are we in the right place? Will we be accepted?

Our already complex lives risk being consumed by a bleak cycle of doomscrolling.

But there is hope.

Fighting FOMO is possible. The more time we spend in knowledge-consuming environments, the more susceptible we become to its effects. The key is self-awareness and limiting screen time. Ironically, the very devices and services that fuel FOMO can also help us combat it. With thoughtful use of technology and intentional boundaries, we can regain control.

This is where NOSTR steps into the spotlight. Our favorite protocol has the potential to not only draw lessons from the legacy web but also to evolve beyond mere mimicry. It can introduce innovative ways for people to connect and collaborate—across services, networks, and each other. I believe it’s one of the most promising spaces on the Internet today, and its future depends entirely on what we make of it.

Thanks for You Time. Geo

-

@ df478568:2a951e67

2025-01-10 01:04:32

*Note. I plan on publishing this on SubStack, but I will publish to nostr first.*

Hello SubStack!

My government name is Marc. I write a blog about freedom tech on [nostr](https://start.njump.me/). You can find this blog at npub.npub.pro. but I decided to cross post this blog on Substack because more people use Substack then [habla.news](https://habla.news/). Here's a little more about the blog.

## A Free And Open Source Blog

This blog is written using the [Creative Commons 0 license](https://gitea.marc26z.com/marc/BlogImprovementProposals/src/branch/main/LICENSE). Since I write about free and open source software I call freedom tech. I thought it would be silly to keep my writing behind a paywall. I would rather my prose be available for free for all. This means all of my work is available for free, but to be honest, I like the subscription model. If SubStack gave me an option to charge sats, I would use their subscription service. Since they don't, I set up an account with [Flash](https://paywithflash.com) using [Alby Hub](https://albyhub.com).

### Ads Suck, But Product Reviews Can Help Bootstrap The Circular Economy

**Ads** suck as much as paywalls, but I also wish to monetize this. Therefore, I have decided to try Jack Spirko's Membership Brigade model I learned about on [The Side Hustle Show](https://fountain.fm/episode/YjUia39xEzXvFGNoBNUO). I already was a member when I listened to this episode, bur the basic idea is ro charge $5.00 a month. For this price, Jack saves his listeners money by procuring discounts for products and services he uses and work great for him. He basically gives product reviews for his advertisers and his membership brigade receives discounts for those products and services. Since I'm just starting out, I don't have any discounts to offer yet, but I have some ideas. I also recommend free and open-source software that can save you money because it's free.

These are not ads. They are more like consumer reviews. There is a bitcoin circular economy developing on nostr. I want to recomend great products from this circular economy like LeatherMint's belts. They're not cheap, but very high quality. He hand crafts these belts to a size customized to yoir wasteline. He's from Canada and he sells these high quality belts for sats.

That was not an ad. It's my honest opinion. LeatherMint did not pay me to say this, but I wouldn't mind if he did. I give my recommendations to the Marc's Mention Members. The goal is to provide value by saving you sats. It's still a work in progress.

### Shop Marc's Merch

I also created a merch shop on shopstr.store. This is nostr-powered shopping, an online mall that uses the native currency of the Internet. This is a quintessential example of freedom tech. I don't have too many products, but my goal is to add more. I'm working on personalized coffee mugs, but I don't yet have a minimally viable product. Until then, I'll sell other stuff. I also must test it some more before I start taking real money. :)

Thanks for reading.

[Marc](nostr:npub1marc26z8nh3xkj5rcx7ufkatvx6ueqhp5vfw9v5teq26z254renshtf3g0)

[878,550](https://mempool.marc26z.com/block/00000000000000000000b8d817132eb988ed6adb55e9b578dbb0c03ee7856542)

[Become Marc's Mention Member](https://marc26z.com/become-a-marcs-mention-member/)

[Marc's Merch](nostr:npub1marc26z8nh3xkj5rcx7ufkatvx6ueqhp5vfw9v5teq26z254renshtf3g0)

-

@ df173277:4ec96708

2025-01-09 17:02:52

> OpenSecret is a backend for app developers that turns private encryption on by default. When sensitive data is readable only by the user, it protects both the user and the developer, creating a more free and open internet. We'll be launching in 2025. [Join our waitlist to get early access.](https://opensecret.cloud)

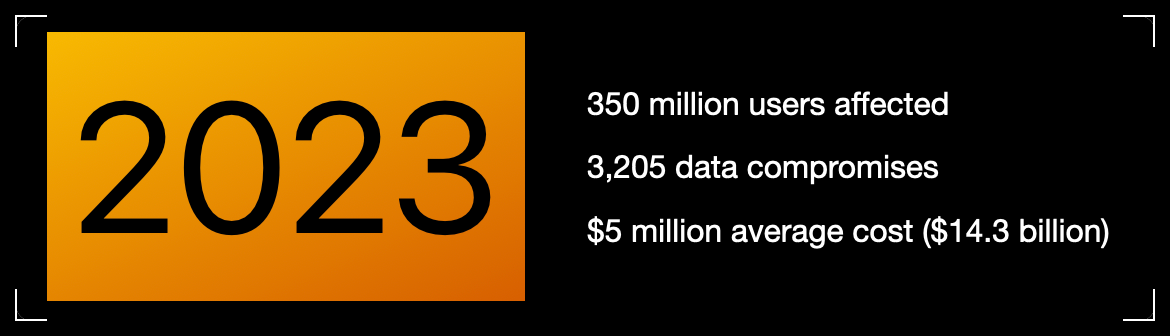

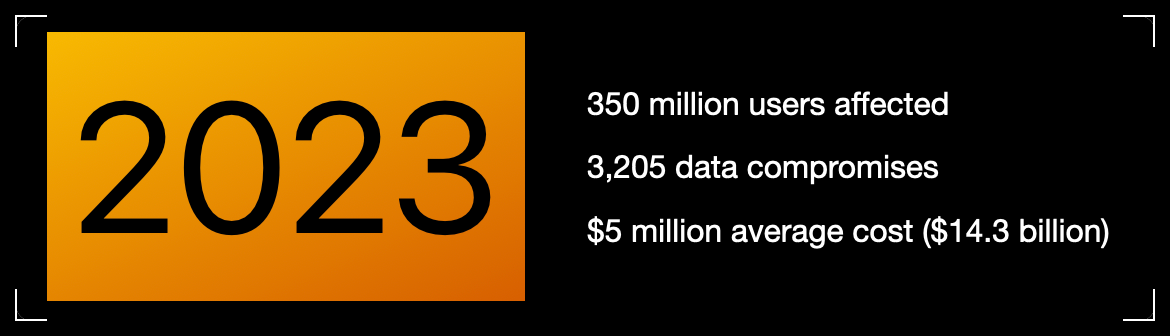

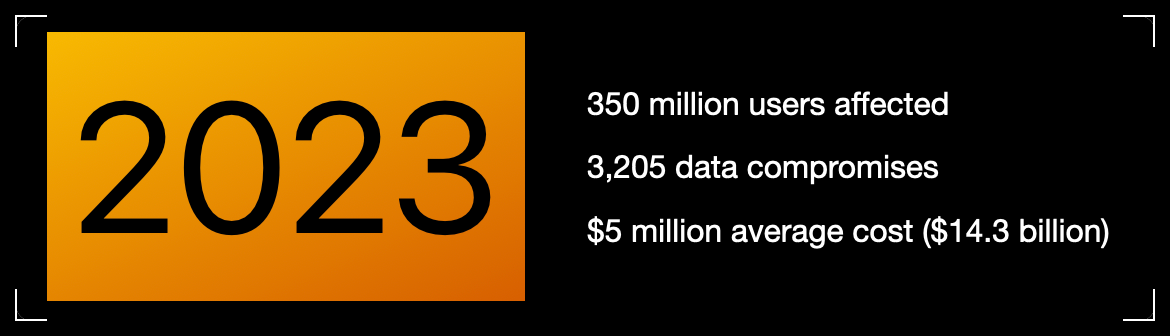

In today's digital age, personal data is both an asset and a liability. With the rise of data breaches and cyber attacks, individuals and companies struggle to protect sensitive information. The consequences of a data breach can be devastating, resulting in financial losses, reputational damage, and compromised user trust. In 2023, the average data breach cost was $5 million, with some resulting in losses of over $1 billion.

Meanwhile, individuals face problems related to identity theft, personal safety, and public embarrassment. Think about the apps on your phone, even the one you're using to read this. How much data have you trusted to other people, and how would it feel if that data were leaked online?

Thankfully, some incredibly talented cypherpunks years ago gave the world cryptography. We can encrypt data, rendering it a secret between two people. So why then do we have data breaches?

> Cryptography at scale is hard.

#### The Cloud

The cloud has revolutionized how we store and process data, but it has limitations. While cloud providers offer encryption, it mainly protects data in transit. Once data is stored in the cloud, it's often encrypted with a shared key, which can be accessed by employees, third-party vendors, or compromised by hackers.

The solution is to generate a personal encryption password for each user, make sure they write it down, and, most importantly, hope they don't lose it. If the password is lost, the data is forever unreadable. That can be overwhelming, leading to low app usage.

> Private key encryption needs a UX upgrade.

## Enter OpenSecret

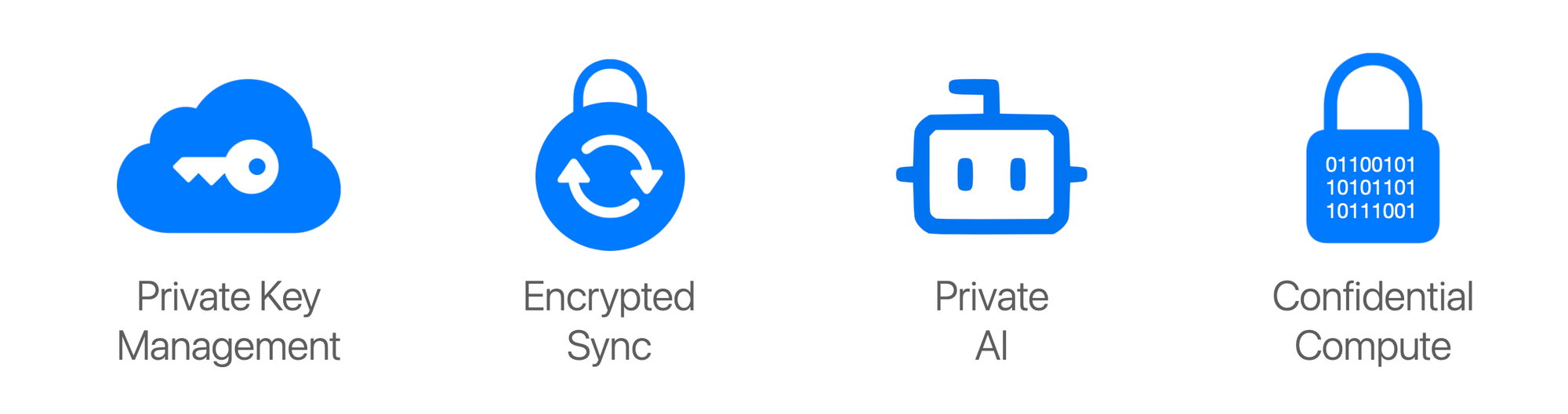

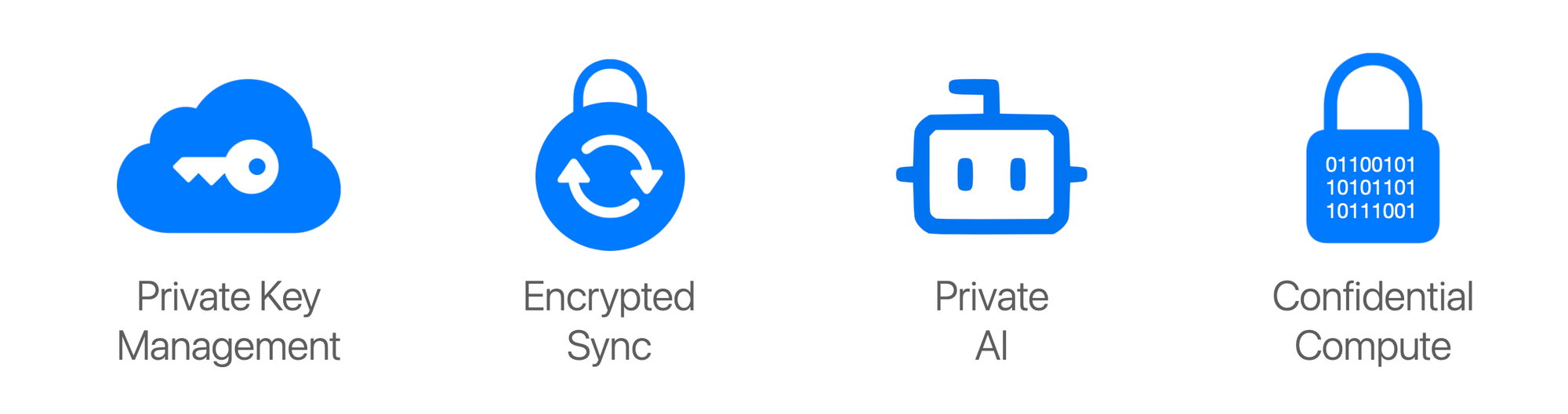

OpenSecret is a developer platform that enables encryption by default. Our platform provides a suite of security tools for app developers, including private key management, encrypted sync, private AI, and confidential compute.

Every user has a private vault for their data, which means only they can read it. Developers are free to store less sensitive data in a shared manner because there is still a need to aggregate data across the system.

### Private Key Management

Private key management is the superpower that enables personal encryption per user. When each user has a unique private key, their data can be truly private. Typically, using a private key is a challenging experience for the user because they must write down a long autogenerated number or phrase of 12-24 words. If they lose it, their data is gone.

OpenSecret uses secure enclaves to make private keys as easy as an everyday login experience that users are familiar with. Instead of managing a complicated key, the user logs in with an email address or a social media account.

The developer doesn't have to manage private keys and can focus on the app's user experience. The user doesn't have to worry about losing a private key and can jump into using your app.

### Encrypted Sync

With user keys safely managed, we can synchronize user data to every device while maintaining privacy. The user does not need to do complicated things like scanning QR codes from one device to the next. Just log in and go.

The user wins because the data is available on all their devices. The developer wins because only the user can read the data, so it isn't a liability to them.

### Private AI

Artificial intelligence is here and making its way into everything. The true power of AI is unleashed when it can act on personal and company data. The current options are to run your own AI locally on an underpowered machine or to trust a third party with your data, hoping they don't read it or use it for anything.

OpenSecret combines the power of cloud computing with the privacy and security of a machine running on your desk.

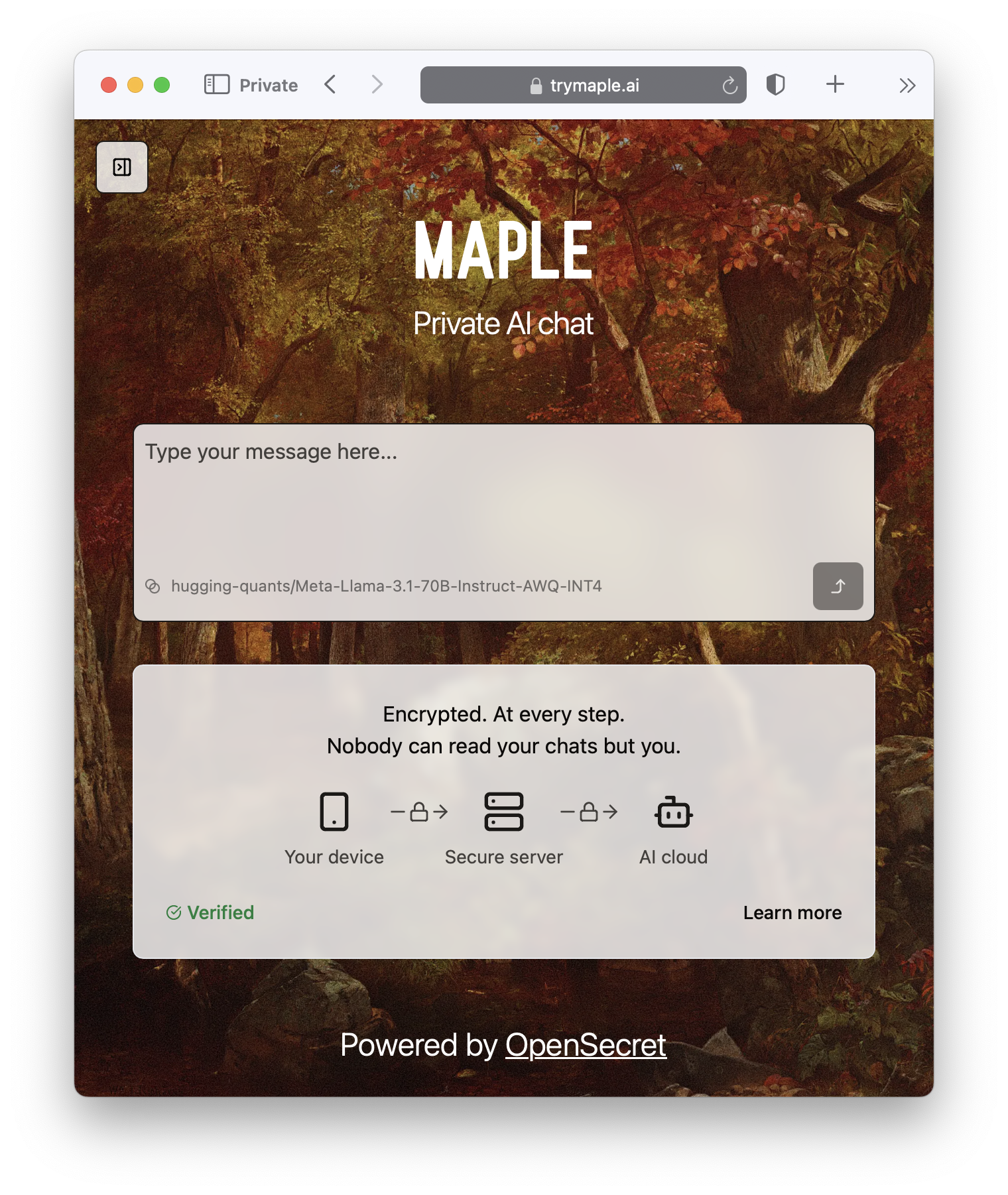

**Check out Maple AI**\

Try private AI for yourself! We built an app built with this service called [Maple AI](https://trymaple.ai). It is an AI chat that is 100% private in a verifiable manner. Give it your innermost thoughts or embarrassing ideas; we can't judge you. We built Maple using OpenSecret, which means you have a private key that is automatically managed for you, and your chat history is synchronized to all your devices. [Learn more about Maple AI - Private chat in the announcement post.](https://blog.opensecret.cloud/maple-ai-private-encrypted-chat/)

### Confidential Compute

Confidential computing is a game-changer for data security. It's like the secure hardware that powers Apple Pay and Google Pay on your phone but in the cloud. Users can verify through a process called attestation that their data is handled appropriately. OpenSecret can help you run your own custom app backend code that would benefit from the security of an enclave.

It's the new version of that lock on your web browser. When you see it, you know you're secure.

#### **But do we want our secrets to be open?**

OpenSecret renders a data breach practically useless. If hackers get into the backend, they enter a virtual hallway of locked private vaults. The leaked data would be gibberish, a secret in the open that is unreadable.

On the topic of openness, OpenSecret uses the power of open source to enable trust in the service. We publish our code in the open, and, using attestation, anyone can verify that private data is being handled as expected. This openness also provides developers with a backup option to safely and securely export their data.

> Don't trust, verify.

### **Join the Movement**

We're currently building out OpenSecret, and we invite you to join us on the journey. Our platform can work with your existing stack, and you can pick and choose the features you need. If you want to build apps with encryption enabled, [send us a message to get early access.](https://opensecret.cloud)

Users and companies deserve better encryption and privacy.\

Together, let's make that a reality.

[](https://opensecret.cloud)

-

@ 30ceb64e:7f08bdf5

2025-01-08 20:14:45

In a world dominated by surveillance banking and inflationary currencies, a new paradigm is emerging—one where individuals can operate sovereign, theft-resistant checking accounts using the world's hardest money. This isn't your grandfather's checking account; it's an entirely new financial operating system built on Bitcoin and Lightning technology.

---

## The Bitcoin Checking Account Revolution

Traditional checking accounts are permission-based systems where banks maintain ultimate control over your money. In contrast, a sovereign Bitcoin checking account operates on a fundamentally different principle: you hold your own keys, control your own node, and maintain custody of your funds at all times. This architecture is built on several key components:

- Self-hosted nodes providing direct network access

- Lightning channels for instant settlement

- Hardware wallets for secure key storage

- Non-custodial software interfaces

- Automated accounting and payment systems

The concept of a Bitcoin checking account represents a paradigm shift in daily financial operations. Imagine getting a direct deposit sent to your lightning node and using NWC and a variety of plug and play solutions to handle things regarding accounting, bill pay, and daily POS transactions. We're starting to see these options emerge through services like Bitcoin Well, Albyhub, Strike, Clams and Cash App.

## Breaking Free from Financial Surveillance

The current banking system tracks every transaction, creating a detailed financial surveillance network. Sovereign Bitcoin checking accounts offer a powerful alternative:

- Private lightning channels for daily transactions

- E-cash protocols for enhanced privacy

- Peer-to-peer transactions without intermediaries

- No account freezes or arbitrary limits

- Freedom from traditional banking hours and restrictions

Lightning and Cashu offer additional privacy and settlement speeds while enabling low cost transactions, and I believe these protocols will grow and exceed our expectations. The products and services for managing your bitcoin checking account will get more private and efficient as time moves forward.

## The Daily Operations Revolution

Operating a sovereign checking account transforms everyday financial activities:

1. Income Reception

- Direct deposit straight to Lightning

- Instant availability of funds

- No hold periods or bank delays

- Multiple invoice routes for different income streams

2. Payment Management

- Automated bill payments via Lightning

- Instant merchant settlements

- Cross-border transactions without fees

- Dynamic fee management for optimal efficiency

3. Liquidity Control

- Self-managed channel balances

- Cold storage integration for savings

- Automated rebalancing protocols

- Real-time capital efficiency

## The Deflationary Advantage

Perhaps the most revolutionary aspect is operating a checking account in deflationary money. This fundamentally changes spending psychology and financial planning:

- Each sat potentially appreciates over time

- Natural incentive for thoughtful spending

- Built-in savings mechanism

- Protection from currency debasement

## Global Market Integration

This new financial infrastructure enables seamless participation in the global economy:

- Borderless transactions

- 24/7 market access

- Direct international trade

- No forex fees or exchange rate manipulation

- Instant settlement across time zones

## Security and Resilience

The system's security model represents a significant advancement:

- Multi-signature protocols

- Timelocked recovery options

- Distributed backup systems

- Attack-resistant architecture

- No single points of failure

## The Future of Personal Banking

As this technology matures, we're likely to see:

- Simplified user interfaces

- Enhanced privacy tools

- Better integration with existing systems

- More automated financial management

- Increased merchant adoption

In conclusion, sovereign Bitcoin checking accounts represent more than just a new way to bank—they're a fundamental reset of the relationship between individuals and their money. This system combines the security of cold storage with the utility of traditional checking accounts, all while leveraging the strength of deflationary sound money. As adoption grows, these accounts will likely become the standard for those seeking financial sovereignty in an increasingly digital world.

---

The revolution isn't just about holding bitcoin—it's about using it in a way that maintains sovereignty while enabling practical daily finance. This is the future of money, and it's already here for those ready to embrace it.

-

@ bcea2b98:7ccef3c9

2025-01-08 18:22:00

originally posted at https://stacker.news/items/842405

-

@ 662f9bff:8960f6b2

2025-01-07 01:43:12

Folks - it really is time to wake up. How many more wars do we need? War on the Virus, War on Terror, War in Afghanistan, War in the Middle East, War in Vietnam - now War in Ukraine and who knows where else?

I grew up in Belfast in the 1970s and lived through the proxy war fought in my hometown. More recently I lived through a remarkably similar situation here in HK during 2019 and observed it happening too in Bangkok with some of the same participants spotted in media clips who had travelled from HK, presumably to orchestrate it there too. For years the motto of Belfast was "Belfast Says No" and it was prominent in a huge banner on the City Hall. Bitterness and resentment reigned for years until "Peace Broke Out", led by **the women of Belfast** insisting that people "**Stop Fighting**". Remember the Peace People?

Bottom line - war is never good. Benefits to society only ever emerge at times when people are working together, trading and collaborating for the better good.

In such situations you have "[Voice or Exit](https://www.youtube.com/watch?v=CLTGAJM8p6c)" - you can speak up (if you are allowed) or exit (if you are allowed). That is why I left Northern Ireland (exit); the mess continued for 25 more years after that.

Concerning "Exit" - did you ever wonder why governments are now restricting the rights to travel? Or if/how you can preserve wealth if/when war develops?

The perpetual war footing that we find ourselves in was clearly warned about in [George Orwell's 1984](https://youtu.be/37N0aFmO19o) - drumbeat of hostile distant foreign empires and their aggressions and victories. Sound familiar to anyone? Strangely, this was the conclusion of the "**Report from Iron Mountain"** from a 1967 US government panel which **concluded that war, or a credible substitute for war, is necessary if governments are to maintain power**. Search and ye shall find (still). [Link here](https://archive.org/details/pdfy-A5uQx1ByqfwWuHma) in case you cannot find it or are lazy!

Will you or your family benefit from what they say they are doing in your name?

By the way - the American People knew all this when they rebelled against the British and wrote their Constitution,

For those who prefer a more structured reading list, take your pick below:

- [The Creature from Jekyll Island](https://www.audible.com/pd/The-Creature-from-Jekyll-Island-Audiobook/B00DZUGWX6?qid=1640521765&sr=1-1&ref=a_search_c3_lProduct_1_1&pf_rd_p=83218cca-c308-412f-bfcf-90198b687a2f&pf_rd_r=WTJRBE1ZFGKEAT0WF8JV) - The untold history of the FED...

- [Sovereign Individual](https://www.audible.com/pd/The-Sovereign-Individual-Audiobook/1797103385?qid=1640521784&sr=1-1&ref=a_search_c3_lProduct_1_1&pf_rd_p=83218cca-c308-412f-bfcf-90198b687a2f&pf_rd_r=X77NN3AEHSJV1HC6ZBCD) - written in 1997 they did predict personal computers, mobile phones, cryptocurrencies and even the current pandemic situation..

- [The Fourth Turning](https://www.audible.com/pd/The-Fourth-Turning-Audiobook/B002UZN3YI?qid=1640521802&sr=1-1&ref=a_search_c3_lProduct_1_1&pf_rd_p=83218cca-c308-412f-bfcf-90198b687a2f&pf_rd_r=22DGVW1QAFPEVQP7FASD) - we have been here before

- [The Fiat Standard](https://saifedean.com/the-fiat-standard/) - How it works - what you were never taught at school

- [When Money Dies ](https://www.audible.com/pd/When-Money-Dies-Audiobook/B004DEYAS2?ref=a_library_t_c5_libItem_&pf_rd_p=80765e81-b10a-4f33-b1d3-ffb87793d047&pf_rd_r=PERH4EHHY721YTVT40J1)- The Nightmare of Deficit Spending, Devaluation, and Hyperinflation in Weimar, Germany

- [The Price of Tomorrow](https://www.amazon.com/Price-Tomorrow-Deflation-Abundant-Future/dp/1999257405/ref=sr_1_2?keywords=the+price+of+tomorrow&qid=1574403883&sr=8-2) - The key to an abundant future is not what you have been told

- One of the best interviews of the year: Peter and Lyn [discuss Currency wars](https://www.youtube.com/watch?v=TWSIkBNegjA)

- [Report from Iron Mountain - On the Possibility and Desirability of Peace](https://archive.org/details/pdfy-A5uQx1ByqfwWuHma/page/n5/mode/2up)

## **That's it!**

> ***No one can be told what The Matrix is.*** \

> ***You have to see it for yourself.***

Do share this newsletter with any of your friends and family who might be interested.

You can also email me at: [LetterFrom@rogerprice.me](undefined)