-

@ c43d6de3:a6583169

2025-02-20 23:54:51

## "So, What’s the News?"

Were it not for these very words, we might never have had a modern capitalistic society.

Between 1500 and 1800, coffeehouses were more than just places to grab a quick hit of caffeine—they were the beating heart of local communities. These spaces buzzed with debate, discussion, and the exchange of groundbreaking ideas. Strangers became intellectual sparring partners, not merely reading the news but dissecting and debating it in real-time.

One could easily imagine Adam Smith engaged in animated conversation with David Hume in a coffeehouse on Edinburgh’s Royal Mile—the former outlining the invisible hand of the market, the latter countering that human behavior is driven more by emotion than reason. Such debates weren’t confined to elite scholars. Merchants, craftsmen, and common laborers sat shoulder to shoulder, engaging in discussions that transcended social class.

But then came industrialization.

The rise of factory life replaced the organic rhythms of community engagement with rigid work schedules. As cities expanded and people became busier, the once-thriving coffeehouses—where time was slow, conversation was deep, and debate was central—began to empty. The demand for efficiency left little room for leisurely discussions, and over time, the public square of ideas withered.

-----------

nostr:npub1uzt238htjzpq39dxmltlx60vxym9fetk9czz6kddq6fhvkf4z3usy9qtrh

Mouth watering Hodl rounds- Bitcoin only

https://shopstr.store/listing/84f20c5e1ef94762b60f0d5fb4398594ace6c5589212f94269e9542fbe351732

-----------

> Photos Courtesy of nostr:npub1c8n9qhqzm2x3kzjm84kmdcvm96ezmn257r5xxphv3gsnjq4nz4lqelne96 Give him a follow and some zap love if you like his art

## Empty Street Corners and Hollow Venues

Adam Smith would lose his mind with how interconnected the world is today.

Yet, he might also notice something unsettling: while we are globally connected, our local communities feel more fragmented than ever before.

He’d have a hell of an online presence but he, just like many do today, might get the sense that something isn't quite right. The world is quieter<a href="https://yakihonne.com/naddr1qvzqqqr4gupzp3padh3au336rew4pzfx78s050p3dw7pmhurgr2ktdcwwxn9svtfqq2kjjzzfpjxvutjg33hjvpcw5cyjezyv9y5k0umm6k">than ever before</a> while online discourse teeters on the verge of violent physical manifestations.

It’s not that public discourse has disappeared. Rather, it has been exiled to the internet. Social media has become our new coffeehouse, but instead of robust face-to-face engagement, we navigate a landscape of curated algorithms, viral outrage, and fragmented conversations. The once-public square of ideas has transformed into isolated echo chambers, where avatars shape narratives that must be adhered to lest one be accused of inconsistency and lose credibility.

The result? People live layered lives with layered personas—some even attaining secret fame in online communities while remaining anonymous in their own neighborhoods. Meanwhile, the street corners remain empty, and the venues that once thrived with the fervor of intellectual thought stand hollow.

> Photos Courtesy of nostr:npub1c8n9qhqzm2x3kzjm84kmdcvm96ezmn257r5xxphv3gsnjq4nz4lqelne96 Give him a follow and some zap love if you like his art

## The Need for a Modern Coffeehouse

Historically, coffeehouses were revolutionary because they democratized knowledge. They provided an open forum for ideas, allowing philosophy, politics, and commerce to intermingle freely. Unlike monasteries or universities, coffeehouses welcomed anyone who could afford a cup of coffee.

With the rise of digital discourse, have we lost something essential? The depth, accountability, and personal engagement that once defined public debate have been replaced by reactionary commentary and fleeting viral moments. The question is no longer where we discuss ideas—it’s how we engage with them.

We need to ask ourselves: Can we reclaim a physical space for intellectual exchange? Or has the age of meaningful, face-to-face discourse faded, vanishing with the steam of yesterday’s coffee?

Can We Bring Back the Local Forum? Should We Care?

Before coffeehouses, philosophy lived in elite institutions and royal courts. With the rise of coffee culture, it became truly public, shaping modern democracy, scientific thought, and social progress. The internet, for all its wonders, lacks the tactile, immediate, and personal engagement that once made intellectual debate so powerful.

The challenge ahead is not just about nostalgia for coffeehouse debates—it’s about asking whether we can create new spaces, physical or digital, that foster real intellectual exchange. Without them, we risk losing something fundamental: the ability to challenge, refine, and reshape our ideas through genuine human connection. But most of all, we risk the possibility great ideas come but no action is ever taken to make them real in this real world.

So, what’s the news?

-----------

Thank you for reading!

If this article resonated with you, let me know with a zap and share it with friends who might find it insightful.

All zap revenue from this article is shared with nostr:npub1c8n9qhqzm2x3kzjm84kmdcvm96ezmn257r5xxphv3gsnjq4nz4lqelne96 for his photograph contributions.

Your help sends a strong signal for content creators like us to keep making cool shit like this!

Interested in fiction? Follow nostr:npub1j9cmpzhlzeex6y85c2pnt45r5zhxhtx73a2twt77fyjwequ4l4jsp5xd49 for great short stories and serialized fiction.

More photography and articles you might like from nostr:npub1cs7kmc77gcapuh2s3yn0rc868sckh0qam7p5p4t9ku88rfjcx95sq8tqw9 and nostr:npub1c8n9qhqzm2x3kzjm84kmdcvm96ezmn257r5xxphv3gsnjq4nz4lqelne96 :

nostr:naddr1qvzqqqr4gupzps0x2pwq9k5drv99k0tdkmsekt4j9hx4fu8gvvrwez3p8yptx9t7qqxnqvfjxqer2tfh0fekz7r5l270gu

https://pictureroom.substack.com/p/020825

nostr:naddr1qvzqqqr4gupzp3padh3au336rew4pzfx78s050p3dw7pmhurgr2ktdcwwxn9svtfqq24s4mrfdm55utg23z55ufs94argvn523k5yqhkrc3

nostr:naddr1qvzqqqr4gupzp3padh3au336rew4pzfx78s050p3dw7pmhurgr2ktdcwwxn9svtfqq2nvnr5d4nngw2zgd5k5c6etftrzez9fd9kkcl0pzp

-

@ a2eddb26:e2868a80

2025-02-20 20:28:46

In personal finance, the principles of financial independence and time sovereignty (FITS) empower individuals to escape the debt-based cycle that forces them into perpetual work. What if companies could apply the same principles? What if businesses, instead of succumbing to the relentless push for infinite growth, could optimize for real demand?

This case study of the GPU industry aims to show that fiat-driven incentives distort technological progress and imagines an alternative future built on sound money.

### **Fiat Business: Growth or Death**

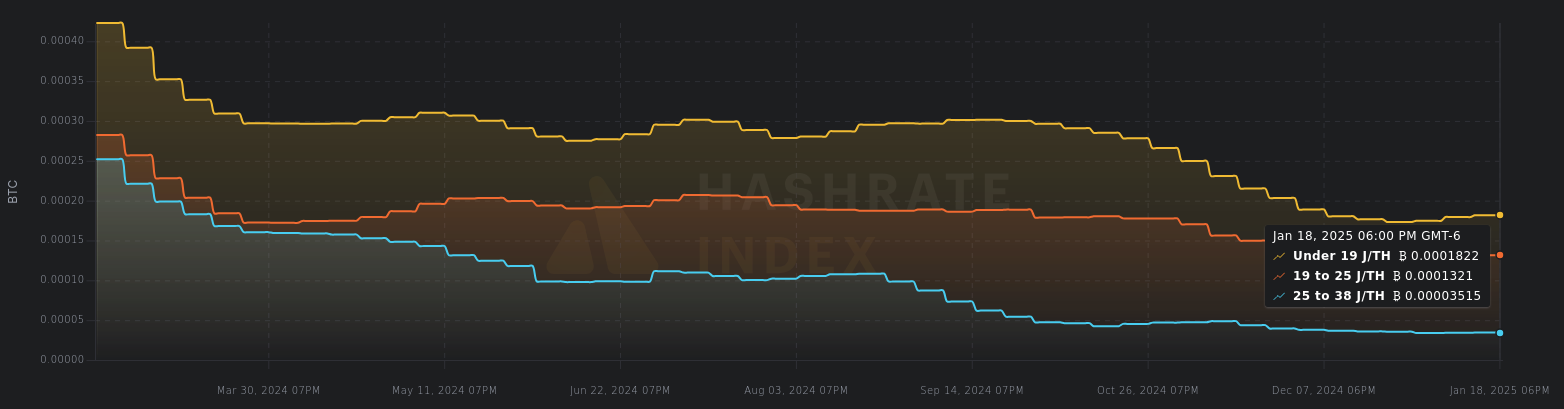

Tech companies no longer optimize for efficiency, longevity, or real user needs. Instead, under a fiat system, they are forced into a perpetual growth model. If NVIDIA, AMD, or Intel fail to show revenue expansion, their stock price tanks. Let's take NVIDIA's GPUs as an example. The result is predictable:

- GPUs that nobody actually needs but everyone is told to buy.

- A focus on artificial benchmarks instead of real-world performance stability.

- Endless FPS increases that mean nothing for 99% of users.

The RTX 5090 is not for gamers. It is for NVIDIA’s quarterly earnings. This is not a surprise on a fiat standard.

### **Fiat Marketing: The Illusion of Need and the Refresh Rate Trap**

Benchmarks confirm that once a GPU maintains 120+ FPS in worst-case scenarios, additional performance gains become irrelevant for most players. This level of capability was reached years ago. The problem is that efficiency does not sell as easily as bigger numbers.

This extends beyond raw GPU power and into the display market, where increasing refresh rates and resolutions are marketed as critical upgrades, despite diminishing real-world benefits for most users. While refresh rates above 120Hz may offer marginal improvements for competitive esports players, the average user sees little benefit beyond a certain threshold. Similarly, 8K resolutions are pushed as the next frontier, even though 4K remains underutilized due to game optimization and hardware constraints. This is why GPUs keep getting bigger, hotter, and more expensive, even when most gamers would be fine with a card from five years ago. It is why every generation brings another “must-have” feature, regardless of whether it impacts real-world performance.

Marketing under fiat operates on the principle of making people think they need something they do not. The fiat standard does not just distort capital allocation. It manufactures demand by exaggerating the importance of specifications that most users do not truly need.

The goal is not technological progress but sales volume. True innovation would focus on meaningful performance gains that align with actual gaming demands, such as improving latency, frame-time consistency, and efficient power consumption. Instead, marketing convinces consumers they need unnecessary upgrades, driving them into endless hardware cycles that favor stock prices over user experience.

They need the next-gen cycle to maintain high margins. The hardware is no longer designed for users. It is designed for shareholders. A company operating on sound money would not rely on deceptive marketing cycles. It would align product development with real user needs instead of forcing artificial demand.

### **The Shift to AI**

For years, GPUs were optimized for gaming. Then AI changed everything. OpenAI, Google, and Stability AI now outbid consumers for GPUs. The 4090 became impossible to find, not because of gamers, but because AI labs were hoarding them.

The same companies that depended on the consumer upgrade cycle now see their real profits coming from data centers. Yet, they still push gaming hardware aggressively. However, legitimate areas for improvement do exist. While marketing exaggerates the need for higher FPS at extreme resolutions, real gaming performance should focus on frame stability, low latency, and efficient rendering techniques. These are the areas where actual innovation should be happening. Instead, the industry prioritizes artificial performance milestones to create the illusion of progress, rather than refining and optimizing for the gaming experience itself. Why?

### **Gamers Fund the R&D for AI and Bear the Cost of Scalping**

NVIDIA still needs gamers, but not in the way most think. The gaming market provides steady revenue, but it is no longer the priority. With production capacity shifting toward AI and industrial clients, fewer GPUs are available for gamers. This reduced supply has led to rampant scalping, where resellers exploit scarcity to drive up prices beyond reasonable levels. Instead of addressing the issue, NVIDIA benefits from the inflated demand and price perception, creating an even stronger case for prioritizing enterprise sales. Gaming revenue subsidizes AI research. The more RTX cards they sell, the more they justify pouring resources into data-center GPUs like the H100, which generate significantly higher margins than gaming hardware.

AI dictates the future of GPUs. If NVIDIA and AMD produced dedicated gamer-specific GPUs in higher volumes, they could serve that market at lower prices. But in the fiat-driven world of stockholder demands, maintaining artificially constrained supply ensures maximum profitability. Gamers are left paying inflated prices for hardware that is no longer built with them as the primary customer. That is why GPU prices keep climbing. Gamers are no longer the main customer. They are a liquidity pool.

### **The Financial Reality**

The financial reports confirm this shift: **NVIDIA’s 2024 fiscal year** saw a 126% revenue increase, reaching \$60.9 billion. The data center segment alone grew 217%, generating \$47.5 billion. ([Source](https://investor.nvidia.com/news/press-release-details/2024/NVIDIA-Announces-Financial-Results-for-Fourth-Quarter-and-Fiscal-2024/))

The numbers make it clear. The real money is in AI and data centers, not gaming. NVIDIA has not only shifted its focus away from gamers but has also engaged in financial engineering to maintain its dominance. The company has consistently engaged in substantial stock buybacks, a hallmark of fiat-driven financial practices. In August 2023, NVIDIA announced a \$25 billion share repurchase program, surprising some investors given the stock's significant rise that year. ([Source](https://www.reuters.com/technology/nvidias-25-billion-buyback-a-head-scratcher-some-shareholders-2023-08-25/)) This was followed by an additional \$50 billion buyback authorization in 2024, bringing the total to \$75 billion over two years. ([Source](https://www.marketwatch.com/story/nvidias-stock-buyback-plan-is-one-of-the-biggest-of-2024-is-that-a-good-thing-9beba5c5))

These buybacks are designed to return capital to shareholders and can enhance earnings per share by reducing the number of outstanding shares. However, they also reflect a focus on short-term stock price appreciation rather than long-term value creation. Instead of using capital for product innovation, NVIDIA directs it toward inflating stock value, ultimately reducing its long-term resilience and innovation potential. In addition to shifting production away from consumer GPUs, NVIDIA has also enabled AI firms to use its chips as collateral to secure massive loans. Lambda, an AI cloud provider, secured a \$500 million loan backed by NVIDIA's H200 and Blackwell AI chips, with financing provided by Macquarie Group and Industrial Development Funding. ([Source](https://www.reuters.com/technology/lambda-secures-500-mln-loan-with-nvidia-chips-collateral-2024-04-04/))

This practice mirrors the way Bitcoin miners have used mining hardware as collateral, expecting continuous high returns to justify the debt. GPUs are fast-depreciating assets that lose value rapidly as new generations replace them. Collateralizing loans with such hardware is a high-risk strategy that depends on continued AI demand to justify the debt. AI firms borrowing against them are placing a leveraged bet on demand staying high. If AI market conditions shift or next-generation chips render current hardware obsolete, the collateral value could collapse, leading to cascading loan defaults and liquidations.

This is not a sound-money approach to business. It is fiat-style quicksand financialization, where loans are built on assets with a limited shelf life. Instead of focusing on sustainable capital allocation, firms are leveraging their future on rapid turnover cycles. This further shifts resources away from gamers, reinforcing the trend where NVIDIA prioritizes high-margin AI sales over its original gaming audience.

At the same time, NVIDIA has been accused of leveraging anti-competitive tactics to maintain its market dominance. The GeForce Partner Program (GPP) launched in 2018 sought to lock hardware partners into exclusive deals with NVIDIA, restricting consumer choice and marginalizing AMD. Following industry backlash, the program was canceled. ([Source](https://en.wikipedia.org/wiki/GeForce_Partner_Program))

NVIDIA is not merely responding to market demand but shaping it through artificial constraints, financialization, and monopolistic control. The result is an industry where consumers face higher prices, limited options, and fewer true innovations as companies prioritize financial games over engineering excellence.

On this basis, short-term downturns fueled by stock buybacks and leveraged bets create instability, leading to key staff layoffs. This forces employees into survival mode rather than fostering long-term innovation and career growth. Instead of building resilient, forward-looking teams, companies trapped in fiat incentives prioritize temporary financial engineering over actual product and market development.

### **A Sound Money Alternative: Aligning Incentives**

Under a sound money system, consumers would become more mindful of purchases as prices naturally decline over time. This would force businesses to prioritize real value creation instead of relying on artificial scarcity and marketing hype. Companies would need to align their strategies with long-term customer satisfaction and sustainable engineering instead of driving demand through planned obsolescence.

Imagine an orange-pilled CEO at NVIDIA. Instead of chasing infinite growth, they persuade the board to pivot toward sustainability and long-term value creation. The company abandons artificial product cycles, prioritizing efficiency, durability, and cost-effectiveness. Gaming GPUs are designed to last a decade, not three years. The model shifts to modular upgrades instead of full replacements. Pricing aligns with real user needs, not speculative stock market gains.

Investors initially panic. The stock takes a temporary hit, but as consumers realize they no longer need to upgrade constantly, brand loyalty strengthens. Demand stabilizes, reducing volatility in production and supply chains. Gamers benefit from high-quality products that do not degrade artificially. AI buyers still access high-performance chips but at fair market prices, no longer subsidized by forced consumer churn.

This is not an abstract vision. Businesses could collateralize loans with Bitcoin. Companies could also leverage highly sought-after end products that maintain long-term value. Instead of stock buybacks or anti-competitive practices, companies would focus on building genuine, long-term value. A future where Bitcoin-backed reserves replace fiat-driven financial engineering would stabilize capital allocation, preventing endless boom-bust cycles. This shift would eliminate the speculative nature of AI-backed loans, fostering financial stability for both borrowers and lenders.

Sound money leads to sound business. When capital allocation is driven by real value rather than debt-fueled expansion, industries focus on sustainable innovation rather than wasteful iteration.

### **Reclaiming Time Sovereignty for Companies**

The fiat system forces corporations into unsustainable growth cycles. Companies that embrace financial independence and time sovereignty can escape this trap and focus on long-term value.

GPU development illustrates this distortion. The RTX 3080 met nearly all gaming needs, yet manufacturers push unnecessary performance gains to fuel stock prices rather than improve usability. GPUs are no longer designed for gamers but for AI and enterprise clients, shifting NVIDIA’s priorities toward financial engineering over real innovation.

This cycle of GPU inflation stems from fiat-driven incentives—growth for the sake of stock performance rather than actual demand. Under a sound money standard, companies would build durable products, prioritizing efficiency over forced obsolescence.

Just as individuals can reclaim financial sovereignty, businesses can do the same. Embracing sound money fosters sustainable business strategies, where technology serves real needs instead of short-term speculation.

#Bitcoin

#FITS

#Marketing

#TimeSovereignty

#BitcoinFixesThis

#OptOut

#EngineeringNotFinance

#SoundBusiness

-

@ 000002de:c05780a7

2025-02-20 20:06:20

> The argument for liberty is not an argument against organization, which is one of the most powerful tools human reason can employ, but an argument against all exclusive, privileged, monopolistic organization, against the use of coercion to prevent others from doing better.

~ Friedrich August von Hayek, The Constitution of Liberty

originally posted at https://stacker.news/items/892255

-

@ 000002de:c05780a7

2025-02-20 19:45:50

Are you seeing it? Been oddly quiet for me but I have friends that are seeing people come unglued. Think its hard to sustain that level if outrage. It's not healthy for sure. I was so angry during Covid and realized it wasn't worth it.

What's your experience. Not online but IRL.

originally posted at https://stacker.news/items/892219

-

@ 378562cd:a6fc6773

2025-02-20 16:35:11

In the ever-evolving landscape of social media, platforms like Twitter and Facebook have dominated the space for years. They’ve shaped the way we interact, share, and consume information. But as censorship concerns, algorithmic manipulation, and corporate control over data become more apparent, a new contender has emerged—NOSTR (Notes and Other Stuff Transmitted by Relays). The differences are striking for those who have stepped into the NOSTR ecosystem. Let’s dive into what sets it apart and why it’s more than just another social media platform—**it’s a movement**.

### **Decentralization vs. Corporate Control**

The fundamental structure is one of the most noticeable differences between NOSTR and traditional platforms like Twitter or Facebook. Both are owned by massive corporations that dictate what can and cannot be said. They collect data, sell advertisements, and use algorithms to curate what users see.

NOSTR, on the other hand, is fully decentralized. No single entity controls the platform, no shadowy moderation teams tweak visibility based on corporate interests, and no risk of being permanently banned by a faceless algorithm. Instead, NOSTR operates on an open protocol, allowing anyone to participate without gatekeepers. Your content is truly yours, and no one can take that away from you.

### **A Different Class of People**

Scrolling through Twitter or Facebook often feels like wading through a digital battlefield. Political flame wars, mind-numbing clickbait, and attention-seeking outrage dominate the feeds. While both platforms do have intelligent and well-meaning users, they are drowned out by noise, bots, and engagement-hacking algorithms designed to fuel division.

NOSTR, by contrast, attracts a different breed of users—people who value free speech, independent thought, and meaningful conversation. Many of them are builders, thinkers, and pioneers eager to create a better way of interacting online. There’s a noticeable shift in tone; rather than content driven by controversy and outrage, you’ll find people discussing innovation, philosophy, and real-world solutions. Conversations feel more organic, unfiltered, and free from the artificial constraints imposed by big tech algorithms.

### **Similarities Exist But With a Better Foundation**

At a glance, using a NOSTR client may seem similar to traditional social media platforms. Users post messages (called ‘notes’), interact with others, and build followings. You can reply, share, and engage much like you would on Twitter. But under the hood, everything operates on a more open, transparent system.

Instead of relying on centralized servers controlled by corporations, NOSTR functions through relays—public or private servers that transmit messages. Since there’s no corporate overlord dictating what gets priority in your feed, you see content chronologically and unfiltered. Additionally, identity and reputation are built through cryptographic keys rather than being at the mercy of a username that a platform can seize or shadowban at will.

### **No Ads, No Tracking, No Manipulation**

Let’s be honest—traditional social media has become a giant advertisement machine. Everything is optimized to keep you engaged just long enough to serve more ads and collect more data. Your feed isn’t showing you what’s most relevant; it’s showing you what makes the company the most money.

NOSTR eliminates this problem entirely. There are no forced ads, no trackers collecting your data, and no algorithm deciding what you should see. Instead, users fund relays or tip content creators directly, creating an ecosystem that values people over profit.

### **For New Users: A Starting Point**

If you’re new to NOSTR, welcome! I’m still a beginner myself, but I’ve already seen the potential this platform has to change how we connect online. Getting started can seem overwhelming at first, but there are a few key tools and resources that can help smooth the transition.

For a great user-friendly NOSTR client, **Damus** (for iOS) and **Amethyst** (for Android) are excellent places to start. If you prefer a web-based option, **Primal.net** offers a simple and intuitive experience. These platforms make it easy to dive in, start posting, and get a feel for how NOSTR operates.

But NOSTR isn’t just about social media—it’s a foundation for something bigger. Developers and innovators are expanding their reach beyond simple note-sharing. Specialized communities and applications are already emerging, including platforms for **photography, recipe sharing, and even swap sites**, all built using the NOSTR framework. The possibilities are growing, and the future looks bright.

### **Final Thoughts**

The shift from Twitter or Facebook to NOSTR isn’t just about switching platforms; it’s about embracing a fundamentally better way to communicate online. With decentralization, real freedom of expression, and a community of forward-thinking individuals, NOSTR offers an experience that traditional social media simply cannot match.

For those seeking a place where ideas flow freely, where profit-driven algorithms don’t dictate engagement, and where you control your own digital presence, NOSTR is not just an alternative. It’s an upgrade.

Let's connect and learn together!

npub1x7zk9nfqsjwuuwm5mpdu8eevsnu2kk0ff23fv58p45d50fhuvaeszg44p2

primal.net/Goody

-

@ 5d4b6c8d:8a1c1ee3

2025-02-20 16:20:02

We made a minor adjustment to the reply fee, raising it to 2 sats.

Lest you think @grayruby is just a greedy SOB (not that he isn't), we are trying to think through how to use some of the territory profits to help support the contests being run by stackers and those extra sats can help with that effort.

# How is ~Stacker_Sports doing?

The past month has been awesome for us. Of course, that may be related to the NFL playoffs.

- Posts: 271, 4th ranked territory

- Comments: ***2992, 2nd ranked territory!***

- Stacking: ***193.9k, 2nd ranked territory!***

- Spending: ***300.9k, 2nd ranked territory!***

Top Post: [Super Bowl Discussion Thread](https://stacker.news/items/880943/r/Undisciplined) by @grayruby - 1088 sats/ 109 comments

I'm looking forward to another awesome month!

originally posted at https://stacker.news/items/891926

-

@ 8f69ac99:4f92f5fd

2025-02-20 16:14:03

Imagine-se numa fila de uma feira de emprego com dois amigos igualmente qualificados, mas provenientes de contextos socioeconómicos diferentes. Um dos amigos, devido às suas circunstâncias económicas, recebe um tratamento preferencial—como um aumento de 10% na pontuação da sua candidatura, como parte de uma política destinada a corrigir desvantagens sistémicas. O outro amigo, apesar de igualmente qualificado, não recebe qualquer vantagem. Quem conseguirá o emprego para o qual ambos estão capacitados? Este cenário destaca o paradoxo no cerne de muitas políticas de justiça social: tratar as pessoas de forma diferente para atingir a igualdade muitas vezes resulta em resultados desiguais, desafiando o princípio de equidade e minando a confiança.

Esta tensão entre os objetivos da justiça social e a necessidade de equidade tem moldado debates sobre ações afirmativas, tributação progressiva, programas de bem-estar social e outras políticas destinadas a promover a equidade entre grupos. Embora bem-intencionadas, estas iniciativas podem marginalizar o mérito individual e gerar ressentimento entre aqueles que se sentem injustamente tratados.

A tese central deste artigo é que, embora a justiça social tenha como objetivo promover a igualdade, as suas políticas requerem inerentemente um tratamento desigual, o que paradoxalmente arrisca criar novas formas de desigualdade. Este paradoxo destaca os desafios de buscar a equidade através da intervenção estatal.

### O Princípio da Justiça Social

As políticas de justiça social frequentemente focam-se em atingir a igualdade de resultados através da intervenção estatal. Por exemplo, a ação afirmativa na educação promove a representação de grupos sub-representados através de medidas como cotas raciais ou tratamento preferencial em processos de admissão universitária. De forma semelhante, a tributação progressiva procura redistribuir riqueza ao impor maiores encargos fiscais a determinados grupos de rendimento.

Embora estas políticas visem corrigir desigualdades sistémicas, elas inerentemente requerem tratar as pessoas de forma diferente com base em fatores como raça, rendimento ou condição socioeconómica. Esta discrepância pode criar uma perceção de favoritismo, erodindo a confiança nas instituições e gerando ressentimento entre aqueles que se sentem injustamente prejudicados. Ao dar prioridade à identidade de grupo em detrimento das circunstâncias individuais, estas políticas podem comprometer a equidade e minar a confiança nas instituições, criando percepções de injustiça e ineficiência económica.

### O Problema do Tratamento Desigual

Uma das preocupações centrais com as políticas de justiça social é a sua dependência no tratamento desigual para atingir a igualdade de resultados. Embora concebidas para promover a equidade, estas políticas frequentemente conduzem a consequências indesejadas que desafiam a equidade e a coesão social.

Por exemplo, as políticas de acção afirmativa têm sido criticadas por enfatizarem a identidade de grupo em detrimento do mérito individual. Isto pode resultar na seleção de candidatos com base em cotas em vez de qualificações, gerando frustração entre aqueles que se sentem preteridos, apesar dos seus esforços ou competências. De forma semelhante, os sistemas de tributação progressiva sobrecarregam desproporcionalmente certos grupos, criando a perceção de penalização injusta.

As cotas na educação ou no emprego são particularmente controversas. Ao impor limites ou metas com base na identidade de grupo, estas políticas podem inadvertidamente excluir indivíduos que não se enquadram nos critérios definidos. Esta exclusão muitas vezes gera ressentimento, pois os afetados percebem o sistema como priorizando a equidade para uns em detrimento de outros.

Além disso, ao enfatizar a identidade de grupo sobre o mérito individual, as políticas de justiça social podem inadvertidamente enfraquecer incentivos à excelência e à responsabilidade pessoal, gerando impactos negativos na produtividade e na confiança nas instituições. Esta dinâmica pode corroer a responsabilidade e a confiança nas instituições, criando divisões dentro da sociedade. Ao enfatizar a igualdade de resultados sobre a igualdade de oportunidades, tais políticas arriscam consolidar novas formas de desigualdade.

### Estudos de Caso e Exemplos do Mundo Real

**Acção Afirmativa na Educação**

A política de acção afirmativa da Universidade do Texas em Austin, que considera a raça como um dos factores nas admissões, gerou desafios legais. Críticos argumentaram que a política prejudicava injustamente candidatos igualmente ou mais qualificados que não atendiam aos critérios da política. Embora os tribunais tenham apoiado a política, a controvérsia destaca a tensão entre promover diversidade e preservar o mérito individual.

**Programas de Bem-Estar Redistributivo**

Nos Estados Unidos, o Crédito Tributário por Rendimento do Trabalho (EITC) visa aliviar a pobreza entre indivíduos de baixos rendimentos. Contudo, disparidades na sua implementação causaram fricções. Por exemplo, estudos mostram variações nos benefícios entre grupos demográficos, deixando alguns com a sensação de tratamento injusto, apesar de circunstâncias financeiras semelhantes. Estes resultados ilustram como políticas redistributivas podem inadvertidamente gerar ressentimento.

**Cotas de Diversidade na Contratação**

Muitas empresas implementaram cotas de diversidade para aumentar a representação. Contudo, estas medidas frequentemente levantam preocupações sobre equidade. Empregados contratados sob cotas por vezes relatam sentir-se estigmatizados, e outros percebem o sistema como desvalorizando o mérito. Isto mina a moral e a confiança no local de trabalho, como demonstrado em inquéritos que revelam insatisfação com práticas de contratação baseadas em cotas.

Os exemplos acima ilustram como políticas desenhadas para promover equidade podem, na prática, comprometer os princípios de justiça e meritocracia, resultando em consequências imprevistas que minam a confiança nas instituições. A dependência generalizada na identidade de grupo, em vez do desempenho individual, arrisca criar divisões e reduzir a confiança nas instituições.

### Crítica Filosófica e Ética

A busca pela justiça social levanta dilemas filosóficos e éticos, particularmente no equilíbrio entre igualdade e equidade. Por um lado, a igualdade sugere tratar os indivíduos de forma imparcial, independentemente da identidade. Por outro, atingir a igualdade de resultados frequentemente requer tratamento desigual.

Sob uma perspetiva rawlsiana, as políticas redistributivas são justificadas para corrigir desigualdades sistémicas e promover a equidade. Contudo, pensadores libertários como Robert Nozick argumentam que tais intervenções violam os direitos e as liberdades individuais. Para Nozick, a justiça reside na proteção da autonomia e da propriedade pessoal, não na redistribuição de recursos para atingir objetivos coletivos.

Ademais, uma énfase excessiva na identidade de grupo pode fomentar uma cultura de vitimização, onde os indivíduos priorizam queixas em detrimento da responsabilidade pessoal. Esta dinâmica pode consolidar divisões, incentivar direitos adquiridos e minar a coesão social. As políticas que promovem a igualdade de resultados podem inadvertidamente criar privilégios para alguns enquanto desfavorecem outros, perpetuando novas formas de desigualdade.

Uma abordagem equilibrada deve considerar as implicações éticas das medidas redistributivas, preservando as liberdades individuais e a meritocracia. Ao focar na oportunidade em vez do resultado, as sociedades podem buscar a equidade sem comprometer a autonomia.

### Soluções Alternativas

**Investir na Educação**

Proporcionar acesso à educação de alta qualidade é uma forma poderosa de nivelar o campo de jogo. Programas que ampliem as oportunidades educacionais para comunidades desfavorecidas podem promover mobilidade social sem depender de tratamentos preferenciais.

**Garantir Liberdade Económica**

Reduzir barreiras regulatórias e promover mercados livres pode estimular a inovação, o empreendedorismo e a criação de emprego. Ao incentivar a competição, os indivíduos podem prosperar com base nas suas capacidades em vez de depender de intervenções externas.

**Aproveitar Sistemas Descentralizados**

Tecnologias descentralizadas como o Bitcoin podem empoderar indivíduos ao oferecer inclusão financeira e reduzir a dependência de sistemas estatais. Estas ferramentas proporcionam transparência e autonomia, minimizando oportunidades de favoritismo ou corrupção.

**Medidas Práticas**

- Bolsas de estudo e subsídios baseados no mérito.

- Programas de formação profissional para desenvolver competências de mercado.

- Apoio ao empreendedorismo através de financiamento e mentoria.

- Reformas para simplificar os sistemas fiscais e regulatórios.

Estas soluções priorizam a equidade, o empoderamento individual e a oportunidade, promovendo uma sociedade onde as pessoas prosperem com base no mérito e no esforço.

### Conclusão

As políticas de justiça social frequentemente procuram atingir a igualdade através do tratamento desigual, mas esta abordagem pode criar novas formas de desigualdade e divisão. A énfase na identidade de grupo em detrimento do mérito individual arrisca corroer a equidade e a confiança, minando os objetivos que estas políticas procuram atingir.

Para alcançar uma sociedade mais justa e sustentável, é essencial focar na igualdade de oportunidades, garantindo que todos tenham acesso aos mesmos recursos e condições para prosperar, sem comprometer a autonomia individual ou distorcer os princípios da meritocracia. Investimentos na educação, liberdade económica e tecnologias descentralizadas oferecem caminhos práticos para empoderar indivíduos e fomentar a meritocracia. Um compromisso com estes princípios pode criar um futuro mais inclusivo e equitativo, onde todos tenham a chance de prosperar com base nos seus próprios esforços e capacidades.

_Photo by [Cody Pulliam](https://unsplash.com/@codyaustinpulliam?utm_content=creditCopyText&utm_medium=referral&utm_source=unsplash) on

[Unsplash](https://unsplash.com/photos/person-holding-brown-cardboard-box-GGKVGSkKIzM?utm_content=creditCopyText&utm_medium=referral&utm_source=unsplash)_

-

@ 8f69ac99:4f92f5fd

2025-02-20 15:24:24

Anarquia: uma palavra que frequentemente evoca imagens de caos e desordem, associada ao velho oeste sem lei ou a futuros distópicos onde impera a força bruta. No entanto, para aqueles que investigam mais a fundo, a anarquia revela-se como algo muito mais sofisticado—um sistema não definido pela ausência de regras, mas sim pela ausência de governantes (*rules without rulers*). Essa distinção fundamental é essencial para compreender um dos conceitos mais fascinantes e, ao mesmo tempo, mais difamados da sociedade.

A ideia de que anarquia significa desordem ou uma sociedade sem estrutura é um equívoco baseado no medo do desconhecido e na falta de compreensão dos seus princípios básicos. Na realidade, a anarquia assenta sobre um princípio fundamental: o **Princípio da Não-Agressão (PNA)**. Este princípio estabelece que nenhum indivíduo tem o direito de iniciar o uso da força, coerção ou fraude contra os outros, sem o seu consentimento, sendo este um dos pilares fundamentais para a preservação da propriedade privada e das liberdades individuais.

Não se trata, portanto, de uma sociedade sem regras, mas sim de uma organização baseada em **estruturas legais descentralizadas e orgânicas**, como a **lei natural e o direito consuetudinário**, que emergem naturalmente através das interacções voluntárias entre indivíduos. A história demonstra que, mesmo na ausência de uma autoridade central, os seres humanos são perfeitamente capazes de criar ordens sociais complexas, baseadas na cooperação, na ajuda mútua e no progresso.

Este artigo explora como a anarquia funciona enquanto sistema de cooperação voluntária e direito natural, desafiando as concepções erradas que persistem sobre o tema e revelando o seu potencial para fortalecer a liberdade individual e a coesão social. Ao analisar as suas raízes filosóficas, o papel do Estado dentro de um enquadramento anarquista e os exemplos históricos que demonstram a capacidade da humanidade para se auto-organizar, procuramos iluminar um futuro onde a liberdade não seja apenas um sonho utópico, mas uma possibilidade concreta.

## Principio da Não Agressão (PNA)

A **base da anarquia** assenta sobre um princípio inegociável: o Princípio da Não-Agressão. Este postulado não é apenas uma directriz moral, mas sim uma regra essencial de conduta, destinada a fomentar uma sociedade cooperativa e pacífica, onde os indivíduos vivem sem medo da coerção ou da violência.

A partir deste princípio, deriva-se naturalmente a **propriedade privada**, pois cada indivíduo tem o direito de usufruir e gerir os recursos que adquire sem recorrer à força contra terceiros. Da mesma forma, a violação deste princípio—seja através do roubo, homicídio ou qualquer tipo de agressão física ou psicológica, não consentida—é condenada de forma universal, pois representa um atentado contra a liberdade de cada um.

Num enquadramento anarquista, a ausência de uma estrutura coerciva não significa a ausência de ordem. Métodos como **pressão social, ostracismo de infractores e mecanismos privados de justiça** ajudam a manter a harmonia social. Por exemplo, em situações de litígio entre vizinhos sobre a posse de um terreno, em vez de recorrer ao Estado, poderiam simplesmente resolver a disputa através de um mediador comunitário ou de um serviço de arbitragem voluntário.

## Ordem Sem Autoridade Central

A crença de que a lei e a ordem dependem de um poder centralizado ignora uma vasta tradição histórica de **sistemas legais descentralizados** que surgiram espontaneamente, sem intervenção estatal. A anarquia não significa ausência de normas, mas sim uma **ordem espontânea baseada em leis naturais e consuetudinárias**.

A lei natural consiste em princípios universais, reconhecidos pela razão, que não dependem da autoridade estatal. Já o direito consuetudinário assenta na tradição e nos precedentes, evoluindo conforme as necessidades das comunidades. Um excelente exemplo histórico é o código jurídico medieval islandês "Grágás", que regulava litígios e contratos através de mediação voluntária.

Sistemas baseados na reputação também são eficazes. No passado, comerciantes que desrespeitassem contratos viam-se rapidamente excluídos do mercado. Hoje, soluções descentralizadas como a arbitragem privada demonstram que contratos podem ser cumpridos sem necessidade de coerção estatal.

## Anarquia como Estado Natural da Cooperação Humana

A cooperação voluntária está no cerne da natureza humana. A ideia de que é necessária uma autoridade central para garantir harmonia social desconsidera as inúmeras instâncias de colaboração espontânea ao longo da história.

O funcionamento dos mercados ilustra perfeitamente a anarquia em acção. Sem um governo a ditar regras, indivíduos interagem livremente, criando riqueza e inovação. A busca pelo progresso científico também reflecte este princípio: Albert Einstein, Nikola Tesla, Henry Ford ou Thomas Edison não foram forçados pelo Estado a desenvolver as suas invenções—fizeram-no por interesse próprio, beneficiando toda a humanidade.

Da mesma forma, a revolução industrial não foi um plano centralizado, mas sim o resultado de inúmeras inovações individuais que impulsionaram a prosperidade global. A tecnologia moderna, com exemplos como Bitcoin e Nostr, redes descentralizadas, prova que sociedades podem operar sem intermediários estatais, ou autoridades centrais.

## Estado: Pode Existir Num Enquadramento Anarquista?

O Estado, mesmo na sua versão mais reduzida, pode representar um risco para a liberdade individual. Alguns, eu incluído, argumentam que um "Estado mínimo" (minarquia) poderia existir para garantir segurança e mediar disputas, mas essa estrutura pode rapidamente expandir-se e transformar-se num mecanismo de coerção.

### A necessidade de mecanismos de controlo e equilíbrio

Mesmo um Estado reduzido exigiria salvaguardas para evitar abusos de poder. Para isso, seriam necessários mecanismos que garantam que nenhuma autoridade se torne dominante e que a sociedade mantenha a sua autonomia.

Algumas soluções incluem:

- **Representação directa**: Em vez de delegar decisões a políticos, a população poderia ter mais influência directa nas questões que afectam a sua vida (como na Suiça por exemplo).

- **Arbitragem independente**: Conflitos poderiam ser resolvidos sem recorrer a tribunais estatais, através de mediação voluntária e sistemas de justiça comunitária.

- **Redes de apoio social**: Fortalecer redes de ajuda mútua reduziria a necessidade de um governo central para fornecer serviços essenciais.

### Exemplos práticos

Algumas iniciativas mostram que a sociedade pode funcionar com estruturas descentralizadas:

- **Cidades com participação cívica activa**: Experiências como o orçamento participativo em algumas cidades demonstram como a sociedade pode gerir recursos colectivos sem excessiva intervenção estatal.

- **Redes de ajuda mútua**: Grupos como a *Mutual Aid Disaster Response Network* nos EUA provam que comunidades podem organizar-se para responder a crises sem depender do Estado.

O desafio não é apenas imaginar um mundo sem Estado, mas conceber modelos descentralizados que garantam a liberdade individual e impeçam a concentração de poder. A verdadeira questão é: conseguiremos criar sistemas mais justos e funcionais sem recorrer à coerção estatal?

## Raízes Filosóficas da Anarquia

A anarquia tem uma longa tradição filosófica que remonta a pensadores como **William Godwin**, **Pierre-Joseph Proudhon** e **Max Stirner**, cada um contribuindo com diferentes perspectivas sobre a organização social sem governantes. No século XX, pensadores como **Murray Rothbard** e **Hans-Hermann Hoppe** aprofundaram a ideia do anarco-capitalismo, propondo que todos os serviços actualmente providenciados pelo Estado poderiam ser oferecidos por meio de mercados livres.

A raiz histórica da anarquia está firmemente ancorada no pensamento de esquerda (a tradicional... ), na medida em que a sua proposta fundamental é a **eliminação do poder central**. O anarquismo clássico emergiu como uma resposta ao absolutismo e ao capitalismo industrial, defendendo que a autoridade imposta pelo Estado e pelas elites económicas deveria ser desmantelada para dar lugar a um sistema de cooperação voluntária e descentralizada. Proudhon, ao afirmar "a propriedade é roubo", reflectia esta preocupação com a concentração de poder e riqueza nas mãos de poucos.

Com o tempo, no entanto, diferentes correntes começaram a emergir dentro da tradição anarquista. A tradição anarquista de **esquerda** enfatiza a justiça social e a solidariedade comunitária, rejeitando tanto o Estado como o capitalismo. Nomes como **Bakunin** e **Kropotkin** defenderam a abolição da propriedade privada em favor de sistemas cooperativos, argumentando que apenas a auto gestão e o apoio mútuo poderiam garantir a verdadeira liberdade.

Por outro lado, no século XX, surgiu uma vertente anarquista mais **associada à direita**, especialmente com Rothbard e Hoppe, que viam o mercado como a melhor alternativa ao Estado. Para os anarco-capitalistas, a liberdade individual é prioritária, e a descentralização deve ocorrer não apenas ao nível político, mas também económico, permitindo que todas as transacções sejam voluntárias e baseadas na propriedade privada.

Apesar dessas divergências, há um ponto comum entre todas as vertentes anarquistas: a rejeição do **monopólio da violência estatal**. Tanto anarquistas de esquerda quanto de direita reconhecem que o poder centralizado inevitavelmente conduz à opressão e à limitação da liberdade individual. O debate interno dentro do anarquismo não é sobre a necessidade de abolir o Estado, mas sim sobre o que deve substituí-lo: auto gestão comunitária e colectivismo ou mercados livres e concorrência voluntária?

A preservação da propriedade privada e a liberdade de associação são, para mim, princípios fundamentais dentro do pensamento anarquista. Nada impede que, numa sociedade anarquista, grupos de indivíduos escolham unir-se voluntariamente para formar projectos cooperativos baseados em valores partilhados. O que distingue essa abordagem da imposição estatal é o carácter voluntário e descentralizado dessas associações, garantindo que cada pessoa possa viver conforme os seus próprios princípios sem coerção externa.

Esta dicotomia entre esquerda e direita dentro do anarquismo reflecte diferentes interpretações sobre a melhor forma de organizar a sociedade sem coerção. O que permanece inegável é que a anarquia, independentemente da vertente, continua a ser uma proposta de resistência contra qualquer forma de domínio centralizado, colocando a liberdade e a autonomia no centro da organização social.

## Conclusão

A anarquia não é um sonho utópico, mas sim uma alternativa viável à organização centralizada da sociedade. Através do respeito pelo Princípio da Não-Agressão, da descentralização das normas jurídicas e da cooperação voluntária, podemos construir um mundo mais livre, onde as pessoas têm o poder de se governar a si mesmas.

Sistemas como Bitcoin já demonstram que a descentralização funciona e que a ausência de intermediários coercivos é não só possível, mas desejável. O desafio não é saber se a anarquia pode funcionar, mas sim **quanto tempo levará para as pessoas perceberem que um mundo sem Estado é mais próspero e justo**.

#anarquia #anarco #bitcoin

---

_Photo by [Orit Matee](https://unsplash.com/@splashcom?utm_content=creditCopyText&utm_medium=referral&utm_source=unsplash) on [Unsplash](https://unsplash.com/photos/black-and-silver-heart-shaped-wall-decor-qqiAxa9hpaA?utm_content=creditCopyText&utm_medium=referral&utm_source=unsplash)_

-

@ a012dc82:6458a70d

2025-02-20 15:02:29

The Financial Accounting Standards Board (FASB) has recently introduced a groundbreaking ruling that significantly alters the way Bitcoin and other cryptocurrencies are accounted for in financial statements. This new development is poised to transform the landscape of crypto accounting, bringing in more transparency and alignment with traditional financial practices. Let's delve into the details of this pivotal change.

**Table of Contents**

- Introduction to the New FASB Ruling

- The Shift to Fair Value Accounting

- Understanding Fair Value Accounting

- Impact on Financial Reporting

- Advantages of the New Approach

- Enhanced Transparency and Accuracy

- Positive Implications for Companies

- Challenges and Considerations

- Dealing with Volatility

- Auditor Expertise

- Industry Response and Future Outlook

- Embracing the Change

- Long-Term Implications

- Conclusion

- FAQs

**Introduction to the New FASB Ruling**

The FASB, the principal body responsible for establishing accounting standards in the United States, announced a new set of rules concerning the accounting of cryptocurrencies like Bitcoin. This announcement marks a significant shift from the previous accounting practices for digital assets. Previously, the lack of clear guidelines led to inconsistencies and uncertainties in how companies reported their crypto holdings. The new ruling aims to standardize these practices and reflects the growing importance of cryptocurrencies in the financial world.

**The Shift to Fair Value Accounting**

**Understanding Fair Value Accounting**

Under the new FASB rules, companies are now required to account for cryptocurrencies at their fair value. Fair value accounting involves assessing assets and liabilities based on their current market value, rather than their historical cost. This approach is expected to provide a more accurate and real-time reflection of a company's financial status. It marks a significant departure from the traditional cost-based accounting methods, which often do not reflect the current market realities, especially in the case of highly volatile assets like cryptocurrencies.

**Impact on Financial Reporting**

This shift to fair value accounting means that companies holding cryptocurrencies will report the value of these assets based on their market prices at the end of each reporting period. This move is a departure from the previous method where Bitcoin was treated as an intangible asset, leading to certain limitations in financial reporting. For instance, under the old rules, if the value of Bitcoin fell below its purchase price, companies had to report a loss, but they couldn't report an increase in value unless the asset was sold. The new approach allows for a more dynamic and responsive reporting system that better reflects the economic realities of holding cryptocurrencies.

**Advantages of the New Approach**

**Enhanced Transparency and Accuracy**

One of the primary benefits of this new ruling is the increased transparency and accuracy it brings to financial reporting. Companies can now reflect the actual market value of their crypto holdings, providing a clearer picture of their financial health. This change is particularly significant given the volatile nature of cryptocurrencies. By reporting the fair market value, companies can provide stakeholders with a more accurate depiction of their financial standing, which is crucial for informed decision-making by investors, regulators, and other stakeholders.

**Positive Implications for Companies**

Companies are likely to welcome this change as it allows them to report unrealized gains and losses on cryptocurrencies. This could encourage more businesses to add cryptocurrencies like Bitcoin to their balance sheets, as they can now recognize the appreciation in value without needing to sell the assets. This change could also lead to a broader acceptance of cryptocurrencies as a legitimate and valuable asset class, potentially spurring further investment and innovation in the crypto space.

**Challenges and Considerations**

**Dealing with Volatility**

The inherent volatility of cryptocurrencies like Bitcoin poses a significant challenge in fair value accounting. Companies will need to develop robust methods to accurately assess the market value of these assets, which can fluctuate widely. This volatility requires continuous monitoring and frequent valuation adjustments, which can be resource-intensive and complex. Companies will need to invest in sophisticated valuation models and possibly seek external expertise to ensure accuracy and compliance.

**Auditor Expertise**

Another challenge lies in the need for auditors to acquire expertise in valuing cryptocurrencies. Assessing the fair market value of digital assets is a complex task that requires specific knowledge and skills. Auditors will need to stay abreast of the rapidly evolving crypto market and develop new methodologies for valuation. This requirement not only adds a layer of complexity to the audit process but also underscores the need for ongoing education and training in this emerging field.

**Industry Response and Future Outlook**

**Embracing the Change**

The industry's response to the FASB's ruling has been largely positive. Industry leaders view this as a step towards mainstream acceptance of cryptocurrencies and a move that aligns digital assets with traditional financial reporting standards. This ruling is seen as a validation of the growing role of cryptocurrencies in the financial sector and a sign that regulatory bodies are beginning to recognize and adapt to the unique characteristics of these digital assets.

**Long-Term Implications**

In the long run, this ruling could lead to greater institutional adoption of cryptocurrencies. As financial reporting becomes more standardized and transparent, it may foster greater trust and confidence among investors and regulators. This could pave the way for more widespread use of cryptocurrencies in various financial transactions and potentially influence the development of new financial products and services centered around digital assets.

**Conclusion**

The FASB's latest ruling on cryptocurrency accounting is a landmark decision that aligns the treatment of digital assets with traditional financial practices. While it presents certain challenges, particularly in terms of volatility and the need for specialized auditor expertise, the overall impact is expected to be profoundly positive. This change not only enhances transparency and accuracy in financial reporting but also paves the way for broader acceptance and integration of cryptocurrencies in the mainstream financial world. As the industry adapts to these new rules, we can expect to see a more mature and robust crypto market, potentially leading to innovative financial solutions and greater economic opportunities.

**FAQs**

**When will the new FASB rules take effect?**

The new rules are set to take effect from December 15, 2024, but companies have the option to apply them earlier.

**How does fair value accounting affect financial reporting?**

Fair value accounting allows companies to report the value of cryptocurrencies based on current market prices, providing a more accurate and real-time reflection of a company's financial status.

**What are the benefits of the new FASB ruling?**

The new ruling enhances transparency and accuracy in financial reporting and encourages more businesses to add cryptocurrencies to their balance sheets by allowing them to report unrealized gains and losses.

**What challenges does the new ruling present?**

The main challenges include dealing with the volatility of cryptocurrencies in fair value accounting and the need for auditors to develop expertise in valuing these digital assets.

**What is the industry's response to the new ruling?**

The industry has largely responded positively, viewing it as a step towards mainstream acceptance of cryptocurrencies and alignment with traditional financial reporting standards.

**That's all for today**

**If you want more, be sure to follow us on:**

**NOSTR: croxroad@getalby.com**

**X: [@croxroadnews.co](https://x.com/croxroadnewsco)**

**Instagram: [@croxroadnews.co](https://www.instagram.com/croxroadnews.co/)**

**Youtube: [@croxroadnews](https://www.youtube.com/@croxroadnews)**

**Store: https://croxroad.store**

**Subscribe to CROX ROAD Bitcoin Only Daily Newsletter**

**https://www.croxroad.co/subscribe**

***DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.***

-

@ f1989a96:bcaaf2c1

2025-02-20 14:21:39

Good morning, readers!

This week, we honor the loss of the late Alexei Navalny, whose bravery inspired millions of Russians to stand up against Vladimir Putin’s financial, political, and social repression. Since his murder, the Kremlin has only tightened its grip — imprisoning citizens for political donations, blocking NGOs from funding, advancing its central bank digital currency, and limiting access to open alternatives like Bitcoin.

In global news, a new [survey](https://www.omfif.org/2025/02/why-central-banks-should-take-the-next-step-on-cbdcs/) of 34 central banks by the Official Monetary and Financial Institutions Forum (OMFIF) revealed that 31% have [delayed](https://cointelegraph.com/news/central-banks-pushing-back-cbdc-plans-survey) plans to issue a retail central bank digital currency (CBDC). While this is a welcome shift, given that CBDCs threaten to give authoritarian regimes unprecedented tools to micro-control society, efforts to oppose and expose CBDCs must continue. The Human Rights Foundation (HRF) is proud that its CBDC Tracker (you can explore it [here](https://cbdctracker.hrf.org/home)) continues to reveal these threats.

In privacy news, Bitcoin Core developer Carl Dong unveiled a new VPN called Obscura, the first open-source VPN that can’t log your network activity by design and outsmarts network filters for enhanced censorship resistance. Tools like this make the work of activists harder to surveil and censor under authoritarian regimes. Additionally, Zeus Wallet and Primal introduced support for Nostr Wallet Connect (NWC), further expanding interoperability between Nostr clients and Lightning wallets and giving more power back to the people.

Finally, we feature a Bitcoin node tutorial from Bitcoin educator Ben Perrin, “BTC Sessions,” walking viewers through setting up a node on a computer and connecting it to Sparrow Wallet. This tutorial is especially suited for dissidents and can empower curious individuals with the ability to verify the Bitcoin network independently, enhance privacy, and eliminate reliance on third parties. There is no need to be technically inclined to follow along with this tutorial.

**Now, let’s dive right in!**

## [Subscribe Here](https://mailchi.mp/hrf.org/financial-freedom-newsletter?mc_cid=bf652c0a5a)

## GLOBAL NEWS

#### **Russia | One Year Since Navalny Murdered by Regime**

One year ago, Alexei Navalny was [murdered](https://x.com/HRF/status/1891081393951613050) in a remote Arctic prison, where he was sent to die for daring to stand against dictator Vladimir Putin. Navalny was Russia’s leading opposition figure, a relentless leader who exposed regime corruption at the highest level and inspired millions to believe in a brighter future. His murder confirmed a grim reality: the Kremlin will stop at nothing to silence those who oppose it. Since Navalny’s passing, Putin has only tightened his grip — [charging](https://www.theguardian.com/world/article/2024/jun/20/russian-american-ballerina-trial-ksenia-karelina) innocent citizens for financially supporting dissent, [blocking](https://x.com/meduza_en/status/1857004048081186993?s=46&t=n7crMAWVvpABU4HOlO19Lg) NGOs from funding (and access to their own money), [accelerating](https://www.ledgerinsights.com/russia-updates-digital-ruble-rollout-including-obligation-to-accept-cbdc/) the roll-out of a CBDC to tighten financial control, and [restricting](https://www.coindesk.com/ru/policy/2024/07/30/russia-legalizes-crypto-mining-and-brings-an-experimental-regime/) access to open alternatives like Bitcoin.

#### **Argentina | Milei Facing Fraud Charges and Impeachment for Promoting Memecoin**

Argentinian President Javier Milei is [facing](https://www.reuters.com/world/americas/argentinas-opposition-threatens-impeachment-trial-after-milei-touts-crypto-coin-2025-02-16/) impeachment calls and fraud charges after promoting a cryptocurrency called $LIBRA, which has since [crashed](https://www.nobsbitcoin.com/argentinas-milei-faces-fraud-charges-impeachment-calls-after-failed-memecoin-launch/) in value. He initially [claimed](https://apnews.com/article/argentina-milei-cryptocurrency-fraud-charges-c0321f320a00cdb58edfb365ba8ce0f8) $LIBRA would “encourage economic growth by funding small businesses and startups.” Instead, the token briefly soared above $5 before plummeting. Critics [argue](https://www.bbc.co.uk/news/articles/c1w07nq8qqqo) the $LIBRA launch resembles a “rug pull,” where paid promoters inflate a token’s value, then cash out, leaving investors with worthless holdings. As the backlash grew, Milei deleted his posts promoting $LIBRA and defended himself, [insisting](https://x.com/tier10k/status/1891630044448977082) he didn't “promote it” — he simply “shared it.” Regardless, the damage is done. $LIBRA is now trading below $1, [losing](https://www.bbc.com/news/articles/c1w07nq8qqqo) tens of thousands of global citizens most of their money. Behind $LIBRA is Kelsier Ventures, a group [allegedly](https://x.com/tier10k/status/1891551659676844118?s=19) courting Nigeria and other governments with similar schemes. The saga continues to unfold, but the lessons are clear: political memecoins present major risks, and governments are not above rugging their own citizens.

#### **Zimbabwe | Ordinary Citizens Pay Price of Deeply Indebted Regime**

Zimbabwe’s [debt crisis](https://archive.ph/uMDsk) has pushed [7.6 million](https://archive.ph/uMDsk) people into food insecurity as an El niño-driven drought worsens an economy already horribly mismanaged and exploited by a military dictatorship. The roots of this crisis run deep. Former tyrant Robert Mugabe’s land seizures in the early 2000s shattered agricultural output, wiped out foreign investment, and unleashed [hyperinflation](https://apnews.com/general-news-international-international-1ce81eed4b064a529163513931b30178) that erased Zimbabweans’ savings and wages. Decades of economic mismanagement drained the national resources and exacerbated food insecurity. Now, ordinary citizens shoulder the cost of regime failures. Families who once farmed their own land depend on expensive [food imports](https://archive.ph/uMDsk) they can’t afford, while the bankrupt regime [pleads](https://archive.ph/uMDsk) for more dollar-based loans — only to weaken the local currency and sink the country further into debt.

#### **Singapore | Rising Costs Contradict Government’s Inflation Claims**

Singaporean citizens are refuting government claims that inflation is easing, pointing to the [rising](https://www.theonlinecitizen.com/2025/02/12/netizens-question-claims-of-easing-inflation-amid-continued-cost-of-living-burden-on-the-ground/) costs of essential goods and services. While official data reports a [2.4%](https://www.theonlinecitizen.com/2025/02/12/netizens-question-claims-of-easing-inflation-amid-continued-cost-of-living-burden-on-the-ground/) annual inflation rate, everyday expenses tell a different story. The government highlights falling car prices — a benefit for the wealthy — while downplaying state-imposed fare [hikes](https://www.straitstimes.com/singapore/st-explains-why-are-public-transport-fares-going-up-again) that disproportionately impact those who rely on public transport (lower-income individuals). With elections looming, many accuse the government of [manipulating](https://www.theonlinecitizen.com/2025/02/12/netizens-question-claims-of-easing-inflation-amid-continued-cost-of-living-burden-on-the-ground/) narratives to downplay these economic struggles. The persistent rise in everyday costs reveals a common disconnect between opaque government statistics issued by autocrats and the financial realities lived by ordinary citizens.

#### **World | Central Banks Delaying CBDC Plans**

A new [survey](https://www.omfif.org/2025/02/why-central-banks-should-take-the-next-step-on-cbdcs/) of 34 central banks by the Official Monetary and Financial Institutions Forum (OMFIF) revealed that 31% have [delayed](https://cointelegraph.com/news/central-banks-pushing-back-cbdc-plans-survey) plans to issue a retail central bank digital currency (CBDC). It also found that the share of central banks inclined to issue a CBDC fell from 38% in 2022 to just 18% today. While this slowdown is a welcomed shift, the survey [concludes](https://cointelegraph.com/news/central-banks-pushing-back-cbdc-plans-survey) that most central banks still expect to issue a CBDC in the future. In any jurisdiction, CBDCs mean more financial control in the hands of the government, which opens the door to surveillance, censorship, and control over financial activity. This concentrated power undermines civil liberties, especially in authoritarian regimes, putting dissidents and individuals at greater risk. Learn more about the dangers CBDCs pose to human rights and financial freedom [here](https://cbdctracker.hrf.org/home).

\______________________________________________________\_

#### **Webinar Series for Nonprofits: Become Unstoppable**

HRF will host a [free, three-day webinar](https://docs.google.com/forms/d/e/1FAIpQLSf0sjqwSFQo8HGMsWIIDRyhx34TsoonOSTfYoWSy-aaBbLeSw/viewform) from March 17-19, teaching human rights defenders and nonprofits how to use Bitcoin to counter state censorship and confiscation. Sessions run daily from 10:30 a.m. to 12:00 p.m. EDT and are beginner-friendly. The webinar will be led by Anna Chekhovich, HRF’s Bitcoin nonprofit adoption lead and financial manager at Alexei Navalny’s Anti-Corruption Foundation, and will be co-hosted by Ben Perrin “BTC Sessions,” one of the world’s top technical Bitcoin educators.

[Register for webinar](https://docs.google.com/forms/d/e/1FAIpQLSf0sjqwSFQo8HGMsWIIDRyhx34TsoonOSTfYoWSy-aaBbLeSw/viewform)

#### **SXSW | The Human Rights Risks of Central Bank Digital Currencies (CBDCs)**

Join HRF at [SXSW 2025](https://www.sxsw.com/) in Austin from March 7-13 to explore how CBDCs threaten financial freedom. Experts [Roger Huang](https://x.com/Rogerh1991), [Charlene Fadirepo](https://x.com/CharFadirepo), and [Nick Anthony](https://x.com/EconWithNick) will discuss how authoritarian regimes use CBDCs for surveillance and control. Attendees can also visit HRF’s [CBDC Tracker](https://cbdctracker.hrf.org/) booth to explore an interactive map of CBDC developments worldwide.

[Get your tickets](https://www.sxsw.com/conference/)

\______________________________________________________\_

## BITCOIN AND FREEDOM TECH NEWS

#### **Obscura | New Virtual Private Network**

Bitcoin Core developer [Carl Dong](https://x.com/carl_dong?ref_src=twsrc%5Egoogle%7Ctwcamp%5Eserp%7Ctwgr%5Eauthor) [launched](https://x.com/carl_dong/status/1889381916081791265) [Obscura VPN](https://obscura.net/), the first private and [open-source](https://github.com/Sovereign-Engineering/obscuravpn-client) VPN designed for maximum censorship resistance. Unlike traditional VPNs, it cannot log your network activity by design. Obscura achieves this by never seeing users’ encrypted Internet traffic. Because of this, it is impossible to log activity — even if compelled or compromised. Additionally, Obscura uses a custom stealth protocol that blends in with regular Internet traffic, making the VPN harder to detect or block. Tools like this make the work of activists under authoritarian regimes harder to surveil and censor.

#### **Zeus Wallet and Primal | Integrate Nostr Wallet Connect**

[Zeus](https://zeusln.com/), a Bitcoin Lightning wallet, and [Primal](http://primal.net), a Nostr client, have integrated the [Nostr Wallet Connect](https://nwc.dev/) (NWC) protocol. This protocol allows apps to interact with Bitcoin Lightning wallets, boosting interoperability between Bitcoin (decentralized money) and Nostr (decentralized communications). Zeus’s NWC [integration](https://blog.zeusln.com/zeus-v0-10-0-open-alpha/) expands wallet connectivity by allowing users to link external wallets like [Alby Hub](https://albyhub.com/) or [Cashu.me](http://cashu.me), improving transaction flexibility. Primal’s NWC integration brings even more functionality. Users can connect Primal wallet to any Nostr app, send zaps (bitcoin micropayments) from the web app, and link any self-custodial wallet that supports NWC. These updates strengthen Bitcoin and Nostr interoperability, allowing instant, censorship-resistant payments and communications without relying on traditional banking infrastructure.

#### **Proton | Officially Launches Proton Wallet**

[Proton Wallet](https://proton.me/wallet?mc_cid=e8f8ebab29&mc_eid=UNIQID), an open-source Bitcoin wallet from privacy services company [Proton](https://proton.me/?mc_cid=e8f8ebab29&mc_eid=UNIQID) (creators of [ProtonMail](https://proton.me/mail)), is [now available](https://proton.me/blog/wallet-launch) on Android, iOS, and the web. It features end-to-end encryption, address rotation for greater privacy (the same Bitcoin address is never used twice), and Replace-by-Fee (RBF) to speed up stuck transactions. It is also fully self-custodial, meaning users retain complete control over their funds. With Proton now offering both secure email and Bitcoin transactions, users have a stronger, more resilient digital toolkit to protect their communications and money. This is of particular interest to human rights activists operating in difficult environments.

#### **Bitcoin Keeper | Releases Support for Miniscript and More Signing Devices**

[Bitcoin Keeper](https://bitcoinkeeper.app/), an open-source mobile multisignature (multisig) wallet and [winner](https://hrfbounties.org/) of HRF’s “Easy Mobile Multisig” bounty, [released](https://medium.com/@ben_kaufman/welcome-to-keeper-2-0-8782593892f8) v2.0 with new security features. The update brings [Miniscript](https://bitcoinops.org/en/topics/miniscript/), a structured way to write Bitcoin scripts that enable users to create customized multisig vaults. This unlocks advanced setups for inheritance planning, time-locked savings, and more flexible security models. Support for Miniscript also expanded to more signing devices, including BitBox02, COLDCARD, Tapsigner, Blockstream Jade, and Ledger. Keeper is created and run by Indian developers, reminding us that some of the world’s best freedom tools are made by people living in difficult political environments.

#### **Coracle | Implements Nstart for Easy Onboarding**

[Coracle](https://coracle.social/), a Nostr client and HRF grantee, implemented [Nstart](https://github.com/dtonon/nstart), a tool that streamlines onboarding to the Nostr protocol. This makes it easier for first-time users to set up an account, securely back up their private keys, and get started. By lowering entry barriers, Coracle’s Nstart improves access to Nostr’s decentralized, censorship-resistant network. For activists curious about Nostr but unsure of how to start, this may be a tool worth exploring. For a quick-start Nostr guide, click [here](https://www.youtube.com/watch?v=qn-Zp491t4Y).

#### **Bitwise | Donates $150,000 to Bitcoin Open Source Development**

[Bitwise](https://bitwiseinvestments.com/), a Bitcoin ETF provider, [donated](https://x.com/BitwiseInvest/status/1891865302729883754) $150,000 to support open-source Bitcoin developers, fulfilling its pledge to allocate 10% of its Bitcoin ETF ($BITB) gross profits annually. [Brink](https://brink.dev/), [OpenSats](http://opensats.org), and [HRF](http://hrf.org) will be responsible for allocating the funds to developers working to secure and improve the network and advancing it as a tool for financial freedom and human rights. Bitwise also promised increased contributions in the future as $BITB grows. By reinvesting in Bitcoin’s open-source ecosystem, Bitwise sets a strong example of industry stewardship.

## RECOMMENDED CONTENT

#### **Bitcoin Node Tutorial by BTC Sessions**

In this [tutorial](https://www.youtube.com/watch?v=vEWl6sXLpAU), renowned Bitcoin educator Ben Perrin “[BTC Sessions](https://www.youtube.com/@BTCSessions)” guides viewers through setting up their own Bitcoin node, a device that runs the Bitcoin software. This enables them to audit Bitcoin’s supply independently and achieve greater financial sovereignty. By running a personal node, users also eliminate the need to trust third parties, enhance their privacy, and strengthen Bitcoin’s decentralization. The tutorial covers installing a free node on a computer and connecting it to [Sparrow Wallet](https://sparrowwallet.com/). If you are not technically inclined, not to worry. Perrin explains everything in a clear, beginner-friendly way, making it easy to follow along. You can watch the full walkthrough [here](https://www.youtube.com/watch?v=vEWl6sXLpAU).

#### **Bitcoin Payments: From Digital Gold to Everyday Currency by Breez and 1A1z**

In this new [report](https://breez.technology/report/) from Bitcoin Lightning company [Breez](https://breez.technology/) and freedom tech researcher [1A1z](http://1a1z.com/), the authors explore how Bitcoin is evolving beyond a store of value into a functional everyday currency. It highlights the rapid adoption of the Lightning network, the global rise of internet-native payments, and real-world use cases from businesses like Pick n Pay, Namecheap, and Mercari as examples of this. Bitcoin payments are proving their capabilities on a global scale, and this report does a commendable job of proving it.

*If this article was forwarded to you and you enjoyed reading it, please consider subscribing to the Financial Freedom Report [here](https://mailchi.mp/hrf.org/financial-freedom-newsletter?mc_cid=bf652c0a5a).*

*Support the newsletter by donating bitcoin to HRF’s Financial Freedom program [via BTCPay](https://hrf.org/btc).*\

*Want to contribute to the newsletter? Submit tips, stories, news, and ideas by emailing us at ffreport @ [hrf.org](http://hrf.org/)*

*The Bitcoin Development Fund (BDF) is accepting grant proposals on an ongoing basis. The Bitcoin Development Fund is looking to support Bitcoin developers, community builders, and educators. Submit proposals [here](https://forms.monday.com/forms/57019f8829449d9e729d9e3545a237ea?r=use1)*.

[**Subscribe to newsletter**](http://financialfreedomreport.org/)

[**Apply for a grant**](https://forms.monday.com/forms/57019f8829449d9e729d9e3545a237ea?r=use1&mc_cid=39c1c9b7e8&mc_eid=778e9876e3)

[**Support our work**](https://hrf.org/btc?mc_cid=39c1c9b7e8&mc_eid=778e9876e3)

[**Visit our website**](https://hrf.org/programs/financial-freedom/)

-

@ c43d6de3:a6583169

2025-02-20 13:14:38

## How Are We Defining Happiness?

In 1776, Thomas Jefferson penned the words that would echo through history:

> ***“…that they are endowed by their Creator with certain unalienable Rights, that among these are Life, Liberty and the pursuit of Happiness.”***

These words were not simply a poetic flourish—they reflected a deep understanding of philosophy, one that Jefferson, an avid reader of Aristotle, likely connected with the Greek concept of***eudaimonia***.

Aristotle described eudaimonia as the highest form of human flourishing, achieved through virtuous living, strong character, and meaningful social bonds.

But what does happiness mean today?

According to<a href="https://worldhappiness.report/" target="_blank">the World Happiness Report</a>, six factors determine a nation's happiness:

1. Income

2. Health

3. Social support

4. Freedom to make life decisions

5. Generosity

6. The absence of corruption

These components closely mirror Jefferson’s vision of life, liberty, and the pursuit of happiness. Yet despite living in an era of unprecedented convenience and opportunity, many in our generation struggle with unhappiness, anxiety, and a pervasive sense of dissatisfaction.

## So, what went wrong?

I believe its largely because of the absence of mentorship in modern society.

Aristotle emphasized that a person’s character—shaped by habits and guided by mentorship—was central to a flourishing life. He saw mentorship not as a luxury but as a necessity for cultivating wisdom, resilience, and social responsibility. Yet, in today’s world, strong mentor-mentee relationships have become increasingly rare.

When we invert Aristotle’s formula for happiness, we find the root causes of our collective unhappiness:

- A lack of mentorship and guidance

- Poor habits formed in the absence of discipline

- Excess and indulgence replacing moderation

- Rampant hypersensitivity rather than resilience

- A loss of moral grounding and sense of justice

- Struggles with forming and maintaining friendships

- Apathy toward civic engagement and community

Of all these, the absence of mentorship stands out as the foundational issue. Without guidance, young people are left to navigate life’s complexities alone, often falling into destructive habits.