-

@ bc6ccd13:f53098e4

2024-12-29 01:55:40

I’ve been thinking about the topic of this article for a while, but what really motivated me to sit down and write was a comment Matt Odell made on the Citadel Dispatch podcast recently. He said,

> To me, that’s the cool part about Bitcoin, is that it’s this interoperable, permissionless, global network. And it’s almost like a shared equity, right? If you own Bitcoin the asset, it’s like we all share equity in this almost like a startup equity. And anything we do, and a lot of times it’s out of greed too. It’s not out of benevolence. You don’t have to be like a charitable person. But you know, if Strike benefits from something or Unchained Capital benefits from something, then Manchankura in Africa benefits from it as well at the same time, which is like a crazy concept. I feel like people just don’t really appreciate that.

When you start going down the “what is money?” rabbit hole, debt quickly comes into focus. You try to understand what it is, how it works, and why the world has so much of it and seemingly more by the second. Eventually you’ll discover that the “money” we use today is mostly just debt, created by banks when they make loans, and treated the same as the cash in your wallet. Until too many people try to withdraw their “money” from the bank, and the bank doesn’t have nearly enough cash to meet the withdrawals and collapses into insolvency. Which it always was, only no one realized who was swimming naked until the tide went out.

Equity is a related financial concept that doesn’t typically come up when studying money. The definition of the word as it’s used financially is something like “a risk interest or ownership right in property.” In simple terms, equity refers to ownership of something. For example, if you have a house that’s worth $500,000 and you have no mortgage or loans against the house, you have equity in the house of 100% of its value, or $500,000. If you have a mortgage of $250,000, you currently have 50% equity in the house, or you “own” half the value of the house.

It’s also often used to refer to shares issued by publicly traded companies. The shares represent a partial ownership of, or equity in, the company. If a company has issued 1,000 shares of stock and you own 10 shares, you have a 1% ownership of that company. That ownership give you certain privileges, such as dividends paid out from profits the company makes and potentially ownership of an increasingly valuable company, if it continues to be successful.

### Money: Debt or Equity?

The current fractionally reserved fiat banking system primarily uses debt as money. There’s a small amount of base money, which consists of physical cash and a digital equivalent of cash called bank reserves, which are held in a ledger in banks’ accounts at the Federal Reserve and are used to settle transactions between banks. But this base money only makes up a small percentage of the total money supply. The bulk of the “money” consists of bank deposits, which are essentially IOUs created by banks when they issue loans under the fractional reserve system. When a bank makes a loan, they don’t actually give the borrower base money, for example a stack of physical cash, in most cases. Instead what they give is an liability entry in the bank’s balance sheet ledger that says “the bank owes the borrower this amount of dollars.” At the same time, on the asset side of the balance sheet they create another entry that says “the borrower owes the bank this amount of dollars” with details on how and when the loan must be repaid.

Then through the magic of banking, the borrower can transfer the numbers representing the amount the bank owes them to someone else, and now the bank owes that other person a certain number of dollars. And so on down the line. This can continue indefinitely, with people exchanging bank IOUs with each other in perpetuity, and no actual base money dollars needing to be exchanged. With help from a deliberate effort by banks to conceal the real nature of their activities, these credit/debt ledger entries function as, and for all practical purposes become, money. The only thing that can upset the apple cart is too many people trying to effectively exit the banking system at once, by trying to withdraw the money in their account. At that point reality sets in. The fact that the numbers in their account didn’t actually represent base money but rather just debt that the bank owes the depositor becomes obvious when the bank run reveals that the bank doesn’t have enough actual base money to settle its debt.

This system has a lot of serious problems, besides the fact that it’s fundamentally based on a lie. For one, all the bank deposits are created by making loans, which means they’re all debt, which means they all have to be paid back with interest. That’s a problem for two reasons. One, paying back the debt destroys money, which artificially disrupts the economy by distorting prices as the amount of money in the economy rises and falls arbitrarily depending on new loan issuance versus debt repayment. Two, when the loan is made, only the amount of the principle is created in bank deposits. The interest isn’t. That means new loans have to be made to pay the interest on the existing loans. That basically guarantees that the amount of debt in the economy will continue to rise indefinitely, because the only way it could go down is for the banking system as it currently exists to collapse, or to be “bailed out” with massive injections of newly created base money to offset loans that can’t be paid back. That, coincidentally, is what Quantitative Easing is; an injection of newly created base money to provide liquidity to pay back debt without having to issue new debt to do it.

Now let’s think for a minute about equity and how it might compare and contrast with the current system in relation to money.

To begin with, I understand money as a ledger of deferred consumption. If you haven’t heard that concept before, it would probably be helpful to familiarize yourself with my thought process laid out here.

naddr1qvzqqqr4gupzp0rve5f6xtu56djkfkkg7ktr5rtfckpun95rgxaa7futy86npx8yqq247t2dvet9q4tsg4qng36lxe6kc4nftayyy89kua2

Deferred consumption is what makes capital formation and civilization possible. People work to create things that they don’t immediately consume, and those new tools and processes make it easier to create more things in the future with less effort, which raises the productivity of the economy (getting more output for less input) and makes society as a whole wealthier. Those new tools and processes can then be used to more efficiently create other tools and processes, which increases productivity even further, and the whole thing compounds on itself in an exponential curve of increasing productivity and increasing wealth. But it all starts with and relies on someone somewhere putting in effort now, to create something they won’t benefit from until later.

Planting a seed is a perfect example. When you have a bushel of wheat, you have two choices. You can consume it now. That’s immediately satisfying and keeps you fed for say a month. Or you can plant it. That’s hard work, and you also have to defer consumption of the wheat. You can’t eat it now, you have to satisfy your hunger some other way. It also takes work throughout the year to cultivate and care for the wheat crop, time you could have spent doing something more fun, if you had just consumed the wheat directly instead of planting it. The flip side is, at harvest time, you might harvest 50 bushels of wheat from the 1 bushel you didn’t eat 6 months ago. That 50 bushels could now feed you for 4 years, and you can sell 30 bushels, keep 12 for your own use over the next year, and plant 8 for harvest next year. Then in a year you might harvest 400 bushels, etc. You can see how a little bit of deferred consumption today can lead to a lot of reward in the future. There’s even a term for being short-sighted and sacrificing future rewards for present gratification, “eating the seed corn,” which comes directly from this farming wisdom.

The same principle applies to business equity. When you start a business, you invest in some way into building something that isn’t immediately rewarding, but that you expect will yield more production in the future than your initial investment. You might invest your own time and effort, resources that you’ve gathered, money, or any number of other forms of value. The same applies to a public company that issues equity as shares of stock. Anyone can invest in the company by purchasing shares, which gives them a partial ownership of the company and its future growth and production. All those forms of investment, to acquire equity, are different forms of deferred consumption. You have to give up something you could have now, for something you hope to have in the future. You could spend the time now curled up in bed binge-watching Netflix. You could spend your effort strolling down the boardwalk eating an ice cream cone. You could spend your money on that pricey designer bag that all your girlfriends will be jealous of. All those things would be immediately gratifying. But they all have a long-term cost.

What happens when you defer consumption instead, and acquire equity? If things go the way you hoped and planned, and the company you founded or invested in is successful, it will eventually produce more than the initial consumption that you deferred. Your equity will become more valuable with time. Why? Because like we pointed out, deferred consumption and capital formation increases efficiency, which leads to compounding returns in productivity and value.

If the company is extremely successful and you defer your consumption long enough, those returns can be very large. For example, if you had invested $1,000 in Amazon in 2007, that equity today, 17 years later, would have returned over $80,000. The first iPhone was released in 2007 for $500. So you could have bought two iPhones instead of making that initial investment in Amazon. But if you deferred that consumption instead, even though the price of the iPhone has doubled by 2024, you could still buy eighty new iPhones with the equity from that initial investment instead of two, or a 40x return in “iPhone inflation adjusted” terms.

Now let’s make a mental leap and compare equity in a business with money. We’ve defined money as a ledger of deferred consumption. You could define business equity as a ledger of consumption deferred to establish ownership of a business instead. You have the stock, the equity in the company, to represent that you invested your time, effort, resources or money into building a business rather than consuming it on something for your immediate gratification. These definitions seem very similar, almost synonymous. We could also consider the economy as a whole to be very similar to a business. As consumption is deferred, more capital is created in the economy, it becomes more efficient and productive, more outputs are created with fewer inputs, and the economy as a whole grows in value.

Business equity represents ownership in a company, both in the current value of that company, and in its future productivity and value. Why? Because the future productivity and value wouldn’t exist if it weren’t for the deferred consumption of the initial investment. If Jeff Bezos hadn’t started Amazon, and investors hadn’t provided the money by buying shares to enable the company to grow the way it did, all the productivity and value of Amazon today wouldn’t exist. That’s why it’s fair for the person who only invested $1,000 in 2007 to gain a return of 40x that investment today.

So if business equity represents ownership of a company earned by deferred consumption, what does the deferred consumption of money itself grant ownership of? Well, money can be exchanged for any good or service available on the market, throughout the entire economy. In my opinion, money should represent ownership of the future productivity and value of the economy as a whole. **Money should be equity in civilization itself.** The future productivity and value of the economy depends on the deferred consumption of today, just like the future productivity and value of a company depends on the deferred consumption of its initial founders and investors.

### Slices of Pie

There’s an issue that needs to be addressed here, one that the savvy investor will have noticed already. Equity in a growing and successful company becomes more valuable over time. Yet even though the economy as a whole is becoming more productive and more valuable, money as we know it today becomes less valuable over time. The $1,000 Amazon equity went from being worth two iPhones, to being worth eighty iPhones. Over the same time period, the $1,000 itself went from being worth two iPhones to being worth one iPhone. What gives?

To understand, we have to look at the differences between how equity is created and how money is created.

The most simple example is a company that’s owned by a single individual. They hold 100% of the equity. You could call that one share. Think of the company like a pie, but the pie hasn’t been cut, so there’s only one “slice.” Over time, if the company is successful, the company “pie” grows larger. But as it grows, it doesn’t get cut into more slices, the one “slice” just gets bigger and bigger. So the one “share” of equity the owner holds is still one share, it’s just a bigger and more valuable share.

Public companies generally function similarly. They start out “going public” by issuing shares. Each share is like a small slice of the company “pie.” Say the company issues 1,000 shares, each share represents a slice of pie 1/1,000th the size of the whole company pie. If the company grows, it won’t commonly issue more shares, although that can happen in certain situations. Instead, the shares will continue to represent 1/1,000th of the company, it will just be 1/1,000 of a bigger and bigger “pie” as time goes on. If the company doubles in productivity and value, each share will be twice as valuable, while still only being one share.

That doesn’t have to be the case. The company can, and sometimes does, issue more shares of stock. The reason this isn’t commonly done, though, is that it’s usually bad for the holders of the stock. If the company issues another 1,000 shares, there are now 2,000 pieces of ownership of the company. The company is no bigger, it’s just divided into more pieces. It’s like cutting each slice of pie in half. You don’t have more pie, you just have more pieces of pie. And as someone who already had a piece of pie, your piece suddenly got cut in half. Of course you probably won’t be too happy about that situation. In effect, the value of the deferred consumption of your initial investment is being taken away from you and given to someone who didn’t defer consumption and therefore didn’t contribute to the success the company has already experienced.

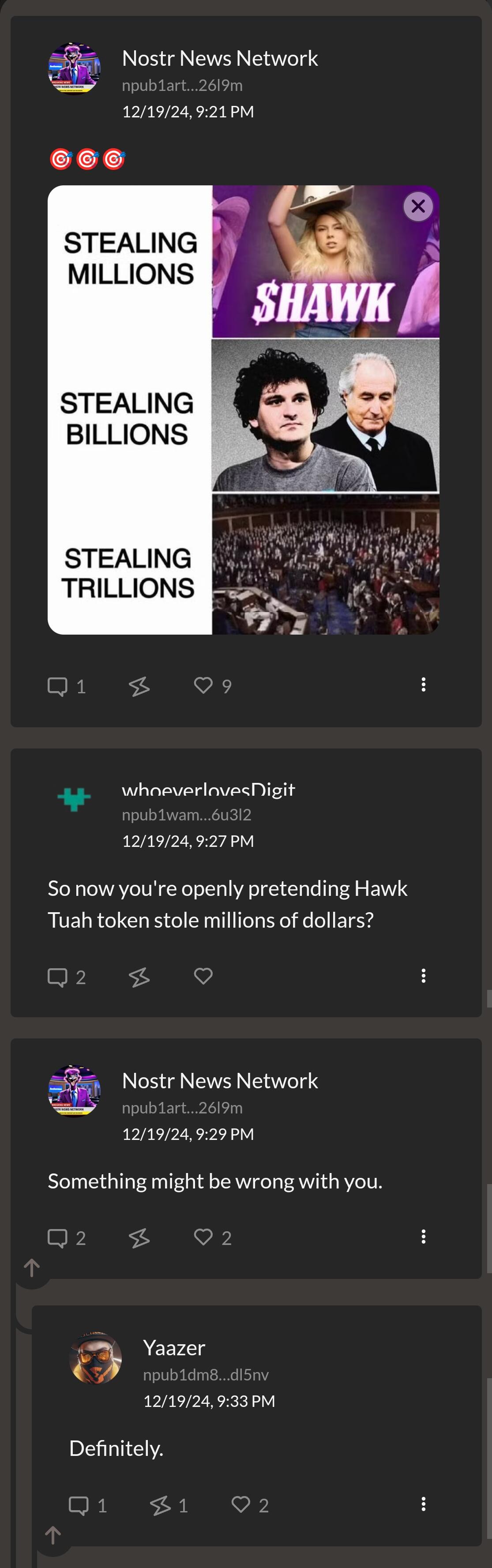

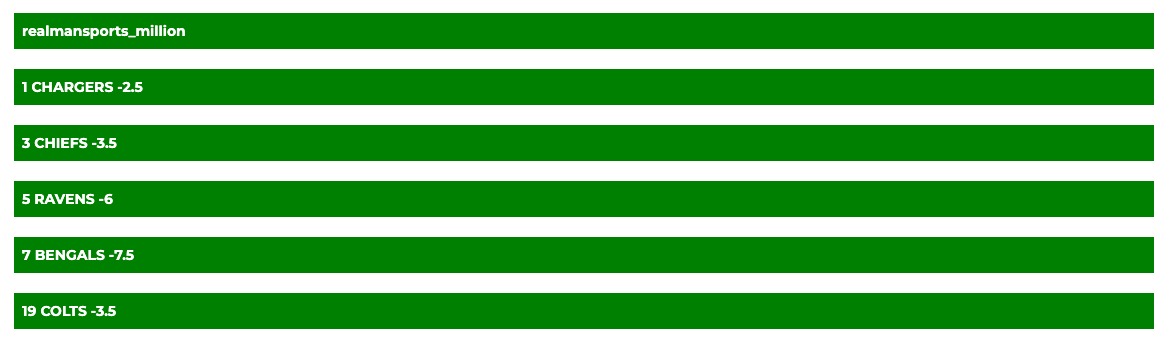

Contrast that to how money is created. If you compare the chart of money supply below with the chart of GDP, you'll see they both go up over time.

<img src="https://blossom.primal.net/6d9b90a40b1b215749b7df39145cd85a274aa457cbcb6566793dad7d306e1879.png">

<img src="https://blossom.primal.net/1439498c472180f695295959b1991d0b9e9c7f2d6d72aabb15511141e10a921b.jpg">

GDP is an (admittedly flawed) measure of the goods and services produced by an economy each year. It's similar to a company's revenue. As a company or economy grows and becomes more productive and valuable, the revenue or GDP rises. The thing about the economy though, is that money, the “shares” of an economy representing the deferred consumption that enables it to grow, is constantly being created by banks making new loans. So as the economy grows, the number of “slices” of the economy grows even faster. When the number of “slices” of an economy grow faster than the economy itself, the “size” or value of each slice falls over time. This is what we call inflation. It takes more “slices” of the economy to buy something than it did in the past, even though the economy is more efficient at producing that good or service than it was in the past.

You can imagine how it might look if a company managed its equity the way the banks manage our money. Each year, as the company grew, the board of directors would issue enough new shares of stock to make sure the value of each share fell that year. They could take the approach the US banking system takes and “target 2% inflation,” in other words try to make the share value fall 2% every year. So if the productivity and value of the company increased by 10%, the board would issue 12% more shares to dilute the existing shareholders by the full amount of the increased value of the company, plus an additional 2%. This would help ensure the share price fell 2% every year. The new shares would be distributed to existing shareholders arbitrarily by decision of the board, with a big chunk going to the board members themselves. This would be highly profitable for the board, leaving them with a larger slice of company equity every year, while being very damaging to all the other shareholders.

In fact, one might wonder why an investor would ever hold equity in a company, when the company's stated policy was to reduce the value of that equity by 2% every year. The answer is, nobody would. It would be idiotic.

Then one might wonder why anyone would hold money, “shares” of an economy, when the stated policy of the banks managing the issuance of that money is to reduce the value of each dollar by 2% every year. The answer to that is just as simple: they have to.

Nobody has to buy stock issued by a particular company in order to survive day to day. But it’s impossible to survive day to day in the modern US economy without using the money issued by the US banking system. You get paid in dollars for your work, and get charged in dollars for every item you buy. You need at least a certain amount of dollars just to live day to day. Of course those who understand the financial system make every effort to hold as few dollars as possible, and to invest the excess as soon as possible into some asset that will hold its value over time. Of course that doesn’t actually get rid of the dollar, just transfers it to someone else. Then the new holder of the dollar has to quickly exchange it with someone else for a better asset, and so on in an endless repeating loop. No matter how many people invest in assets, the full quantity of dollars in existence is always held by someone, and those people are continually being diluted by the issuance of new dollars by banks creating bank deposits when they make loans.

### Implications

If what I’m proposing is correct, there would be massive implications in changing the way money works in the economy from the current credit/debt issuance controlled by banks, to a system that functions more like equity issued by a responsible and profitable company. Getting into the details of those implications in various specific areas will take many more articles, but I just want to mention a few to get your mind running, then circle all the way back to where we started.

Imagine if the money every person earned went up in value as the economy grew. It would be like owning equity in the broadest possible index of businesses, better even than owning an S&P 500 ETF or mutual fund. And it would take no effort. There would be no need to open a brokerage account, decide what companies or funds to invest in, and pay commissions and fees to the brokerage for the privilege. There would be no need for a 401k. All that would be needed is to work at the job you’re best at, consume less than you produce, and save the difference. The economic growth created by increased productivity would automatically accrue equally across the population to those who were best at being productive and deferring consumption. Working hard, being frugal, and saving for the future would automatically be rewarded. All the incentives would be realigned to benefit those who contribute most to capital formation and future economic prosperity.

It would be much easier for those with low income to get ahead financially. Any amount they manage to save, no matter how small, would increase in value over time. Contrast that with the current system where a small amount of savings continually becomes worth less over time, encouraging people to consume more than they need in the moment since their small savings will shrink to insignificance quickly.

You can easily think of lots of other changes that would happen as a result of using money that functions more like equity than our current system does.

But to tie all this back to the quote at the beginning, I think what Matt is seeing and feeling is the beginnings of a more equity-like monetary system. I think the properties of Bitcoin, specifically its predictable and limited supply issuance, make it behave like equity in a well-managed, productive company. That “company” just happens to be the global and permissionless group of every person who chooses to save and transact in Bitcoin instead of the current credit/debt money. And the fact that even self-serving actions toward productive goals end up benefitting every member of the network is exactly what we’d expect in a truly capitalist economic system. Whenever someone works to grow the “pie” in order to make their slice bigger, the fact that the pie is growing means everyone else’s slice is growing as well. And that’s a beautiful thing.

I’m excited to see how this theory plays out over time, because from my point of view, the potential of moving to a more equity-like monetary system is both massive and extremely optimistic.

-

@ bc6ccd13:f53098e4

2024-12-28 23:02:55

As if money weren’t a confusing enough topic to begin with, the financial world is full of jargon. Some of it is incomprehensible to the average person. But to my mind the more insidious category included terms and phrases that seem to be straightforward, but actually give a completely misleading or wrong impression of what’s happening. It might seem insignificant, but in my opinion a lot of the really destructive wrong ideas about economics and money rely heavily on some misleading jargon that keeps people from understanding the fundamental concepts well enough to spot bad ideas.

The term I want to explain today is the idea that money “flows into” an asset or asset class. If you read any financial news or headlines, you’ve probably seen some variation of this one a million times. “Money Flowing Into Bonds As Investors Seek Safety.” “Bitcoin ETFs See Large Inflows Today.” You’ve seen it.

On the surface, this seems logical. It seems like a fair way to describe the action of a lot of people buying something.

The problem comes because of the implications of the term. When money “flows into” something, that means people are more eager to buy than to sell. That means prices go up. It’s easy to conclude that prices go up because more money is “in” the asset, kind of like dropping quarters in a coffee mug.

If you think about it for a second you’ll realize it doesn’t work that way, but not nearly enough people take that pause to think. That causes them to have a wrong view of how prices change, and therefore how markets work. That by extension leaves them susceptible to claims from bad actors who want to restrict economic freedom and centrally plan and control trade in the market.

### How Does Money Actually Flow?

Money flows, but not “into” assets. It flows from person to person. You can almost think of money like financial matter, it can’t be created or destroyed except is specific circumstances.

Any time something is sold, the money flows from the buyer to the seller. Seems obvious, but it’s important to keep it in mind. The money is still there, in the account or wallet of the seller. The amount of money in the economy doesn’t change, only the location of the money. It isn’t destroyed, it isn’t somehow lodged in the house or stock or loaf of bread that was sold, it just flowed from one person to another.

### “Cash on the Sidelines”

This is another term you might have heard, not the same but a related misunderstanding. Financial commentators will say something like “we expect the market to rise as soon as investor sentiment improves, because there is still a lot of cash on the sidelines waiting to be deployed.” This implies that investors are holding a lot of money, and that they can “put that money into” an asset class and reduce the amount of money “on the sidelines.” The problem is, we understand that if they do buy stocks or bonds or whatever, that money will just flow into the seller’s bank account, and the amount of cash “on the sidelines” won’t change one cent.

### Prices

This leads to the question of what causes prices to rise, and a fundamental understanding of how a market works. Price is a tricky thing to understand. The price of something is the intersection between the highest amount a buyer is willing to offer, and the lowest amount a seller is willing to accept. If there is no overlap between those points, no price can be established.

If there are 10 houses on a street, and one goes up for sale, the selling price of that house will be used to “value” the other 9 houses. Say the seller isn’t too desperate to sell, and is willing to wait for a buyer who agrees to pay his asking price of $500,000. If every other house on the street is very similar in size and quality, we would conclude that the value of each of the 10 houses is $500,000. But let’s say another buyer decided $500,000 is a good deal and he’d also like to buy a house on that street. He might go to every owner and offer $500,000, but there’s no guarantee he’ll be able to make a deal. Maybe everyone else is happy with their house, and nobody wants to sell for the price their house is “worth”. So there’s no price, because there’s no intersection between buyer and seller. Maybe the buyer decides he really wants a house, and offers everyone $700,000. Maybe the guy who bought a house for $500,000 last week decides “hey I can make $200,000 in a week for doing nothing, why not?” and sells the house again for $700,000.

Look at what happened to the value of houses. At the first sale, the 10 houses had a combined “value” of $500,000 times 10, or $5 million. Now after the second sale, they have a combined “value” of $7 million, or an increase of $2 million. Headlines would describe that as $700,000 “flowing into” the housing market, but the overall value of those houses, what would be called the “market cap” if we were talking about a company, increased by almost 3x that amount. How does that work? It shows the misleading aspect of “money flowing into” terminology. If money “flowed into” an asset like putting quarters in a piggy bank, it would give the impression that market cap should rise $1 for every dollar of inflow. Obviously that’s not correct, and the reason is that prices don’t work like that. Money inflows are only one factor that can influence prices, and they do so in a much less direct and obvious way than the terminology indicates.

### Market Cap

For one, there’s a fundamental problem with the way “market cap” is calculated to begin with. It’s supposed to express the value of a group of identical things, typically shares of stock in a company of something similar. But let’s go back to our previous example, the 10 similar houses on a street. The “market cap” of those 10 houses would be given as $5 million dollars after one of them sold for $500,000. But remember, only one house sold, not all ten. A price requires an intersection in agreed value between a buyer and a seller, and that hasn’t occurred with 90% of the houses in this “market”. Suppose one of the houses is owned by a retired couple who intend to spend the rest of their life in that house, and have no need for the money they could get by selling it. Suppose they were offered $2 million dollars, but still weren’t interested in selling. How is that reflected in the market cap calculation? Obviously it isn’t, and just looking at the market cap number by itself would give you the impression that you could buy all ten houses for $5 million. But that might be completely incorrect.

It could also be incorrect in the other direction. Suppose 5 of the owners on the street suddenly experienced a job loss and had to sell their houses quickly. Could all 5 get $500,000 for their house? Maybe not. After all, the first buyer was the one willing to pay the most for a house there, and there’s no guarantee anyone else will be equally willing to do so. Maybe there are 3 buyers willing to pay $450,000, 1 buyer willing to pay $400,000, and 1 buyer willing to pay $350,000. In that case all 5 houses could be sold, but the last one would have to sell for $350,000 instead of the $500,000 the owners expected to get. If we then do the market cap calculation again, it’s now dropped to $3.5 million. That’s in spite of one house having sold for $500,000, 3 for $450,000, 1 for $400,000, 1 for $350,000, one couple not willing to sell for $2 million, and 3 houses that we know absolutely nothing about yet. To look at a $3.5 million “market cap” tells you none of this very relevant information, while giving you the impression that you know everything you need to know about this market.

When you stop and think about it, it’s easy to see that prices can change for all kinds of reasons without any sales occurring at all. Imagine word gets out that a huge corporation is interested in buying all the houses in that neighborhood to make room for a future business expansion. Given the expectation of a highly motivated buyer, all the owners on the street might decide not to sell for less than a million dollars. Did the market cap suddenly rise to $10 million? No houses have been sold yet, so technically it hasn’t. As soon as the first house sells for a million dollars though, it does go to $10 million. So again you gain $5 million in market cap for $1 million in “inflows”.

This is also relevant when looking at wealth held in stocks and financial assets. For example, Elon Musk holds over 700 million shares of Tesla stock currently “worth” around $135 billion. That amounts to around 20% of all Tesla stock. Now the “value” of that stock is calculated by multiply the number of shares by the last price someone paid for a share. Keeping in mind that price is an intersection between the buyer who’s willing to pay most and the seller who’s willing to accept least, how relevant is this number actually? Say Elon decided to sell all his shares tomorrow, how much is his “wealth” actually worth? How many buyers are willing to pay the last settled price for a share of Tesla stock? Enough to buy 700 million shares? Almost certainly not. So as he started to sell, he’d soon run out of buyers at that level and would have to lower his asking price to get more interest. Of course as soon as he sold a share at a price one dollar lower, the “market cap” of Tesla would fall by about $3.5 billion dollars. And the fact that the company’s largest shareholder is dumping his shares would likely cause a lot of other people to sell as well, which would drive the price they would need to accept even lower. It’s easy to imagine the price falling by double digit percentages, maybe even 80 or 90 percent, if Elon tried to sell in one day. He could easily end up with $50 billion or less for his $135 billion in wealth.

### Why Does It Matter?

This concept might seem trivial, but there are some features of our economic system that make this money flow principle very important. You should already understand that banks create money by making loans as I explain here, naddr1qvzqqqr4gupzp0rve5f6xtu56djkfkkg7ktr5rtfckpun95rgxaa7futy86npx8yqq247t2dvet9q4tsg4qng36lxe6kc4nftayyy89kua2 and that money doesn’t “flow into” assets, but rather a small amount of buying, or even just the expectation of future buying, can cause prices and market cap to rise all out of proportion to the amount of buying that occurred. Then consider that banks will lend against collateral, which can be assets like real estate or stocks which may have this inflated perceived value created by a very small amount of relative buying pressure. And that the “money” they create with those loans can be used to buy more of the asset, which can cause prices and market cap to again rise disproportionately, which can make it easier to get more loans to buy more assets, which can make prices go up again… ad infinitum. And remember that money doesn’t actually “flow into” assets, and therefore it doesn’t need to “flow out of” assets in order for prices to drop. All it takes is a lack of people willing to buy at a certain level, for any reason at all, and the price will fall to the level someone is willing to pay as soon as a motivated seller attempts to exit their investment.

Understand and think about the implications of that, and you’re closer to understanding the bubble/collapse cycle of asset markets than most economists and their “money flows” can ever hope to be.

-

@ 623ed218:fa549249

2024-12-28 20:52:57

It's been a week or so since I wrote this piece and put it up on my website, but I realized I hadn't shared it here yet. Hoping it's informative!

Strike Bill Pay: A Deep Dive

============================

### Start With the Foundation: Bitcoin is Savings Technology

If you've spent any time in this space, you've probably heard the phrase: *Bitcoin is savings technology.* That's because Bitcoin solves a very specific problem---the inability of fiat to hold value over time.

Here's the reality:

- Every dollar you hold in a bank account is being debased, slowly (or sometimes rapidly) losing its purchasing power.

- Inflation might be "only" 3-4% a year right now (if you believe the official numbers), but that adds up. Over a decade, that $10,000 in savings doesn't just stagnate---it sublimates.

Bitcoin fixes this.

- Bitcoin is scarce, decentralized, and deflationary.

- It's not controlled by governments or central banks, and its supply is capped at 21 million. No one can "print" more Bitcoin.

If you're holding fiat in a savings account, you're playing a game you can't win. Bitcoin is the better tool for preserving value over time.

### Why Savings First?

Before looking at how you spend, it's worth considering where you're storing your wealth. If your savings are sitting in fiat, they're slowly losing purchasing power over time---that's just how the system works.

Bitcoin offers an alternative: a way to protect your wealth in something scarce and reliable. Once you've addressed that piece---and your savings are no longer being held in melting fiat---you might start asking: *What about the money in my checking account?*

That's where Strike Bill Pay comes in. It's a simple, practical tool that connects your Bitcoin savings to the everyday expenses you still need to handle in fiat, removing the need to hold fiat to pay fiat bills.

### The Spending Problem: Why a Bridge is Necessary

Here's where things get practical. Even if you're saving in Bitcoin, you still live in a world where bills---rent, mortgages, utilities, credit cards---are denominated in fiat.

What do you do?

- You could hold some fiat in your bank to cover bills, but now you're back to the problem of fiat exposure.

- You could convert Bitcoin to fiat every time you need to pay something, but trust me when I say that manual process is tedious and time consuming.

This creates a gap:

Bitcoin is where you want to save your wealth.

Fiat is where you still need to *spend* your wealth.

You need a bridge.

Strike Bill Pay is that bridge. It lets you hold your value in Bitcoin while seamlessly paying fiat-denominated bills. No headaches, no extra steps, and no need to rely on a traditional bank account.

### How Strike Bill Pay Works (It's Simpler Than You Think)

Here's the beauty of Strike: it integrates directly into the traditional system *without requiring you to deal with it.*

*Here's how it works:*

Strike Provides a Standard Bank Account

- When you open a Strike account, you get a routing number and an account number tied to Cross River Bank. It works exactly like a regular checking account.

You Set Up Bill Payments

- For any bill that allows automatic payments, simply enter the Cross River Bank routing/account number Strike gives you. Your mortgage, utilities, subscriptions---these can all pull funds automatically from Strike.

- For bills you pay manually (like credit cards), add the Strike-provided account as an external payment source. When you go to make a payment, simply select that account as the funding source.

Strike Converts Bitcoin to Fiat on the Backend

- You don't have to worry about manually selling Bitcoin for fiat. When the bill gets paid, Strike automatically sells the exact amount of Bitcoin needed to cover the payment.

It's seamless. You save in Bitcoin and Strike handles the fiat side when you need it.

### Start Small: Test the Waters, Then Scale

Now, I get it---this might sound like a big leap if you're new to the idea of using Bitcoin. You don't need to move all your bills over to Strike at once.

Start small.

- Pick one bill---something low-stakes, like a utility payment or a monthly subscription.

- Add your Strike-provided account as the payment source.

- Let it run.

What happens?

- Your bill gets paid.

- You experience how smooth the process is.

- You start seeing the benefit of holding Bitcoin without having to juggle fiat for bills.

Why Start Small?\

This isn't about forcing you to flip a switch overnight. It's about building comfort with tools that let you take control of your money. When you see how simple it is, you may find you'll want to scale up.

### Strike's Fee Tiers: Low Costs That Get Even Lower

One of the practical benefits of using Strike is its straightforward fee structure. Strike charges a standard 0.99% fee when converting Bitcoin to fiat and vice-versa. But here's where it gets interesting: the more you use the service, the lower your fees become.

Strike's fee tiers are designed to reward activity:

- The more you deposit and spend through Strike, the closer you get to a lower fee tier.

- Regular bill payments, purchases, and deposits all contribute toward lowering your fee rate.

Why It Matters:

When you're living on Bitcoin---covering bills, expenses, and purchases---those fees can add up. Strike incentivizes regular usage by giving you a clear path to reducing costs. The result? Your bill-paying process becomes not only seamless but also more efficient and cost-effective over time.

If you're managing everything---mortgage, utilities, credit cards---through Strike, it's likely you'll hit lower tiers quickly, making the service even more competitive.

### For Bitcoiners: Completing the Savings-to-Spending Loop

If you're already holding Bitcoin as savings, Strike Bill Pay is the final piece. It lets you operate entirely in Bitcoin while still managing your fiat-denominated obligations.

Here's why it matters:

- Opting Out: If the majority of your wealth is in Bitcoin, why leave even a small amount in a checking account? Strike eliminates the need for that fiat buffer.

- Automation and Ease: Bills that pull automatically? Easy. Manual payments? Just as simple.

- Seamless Spending: No awkward conversions, no multiple steps. Strike lets you "spend Bitcoin" without all the extra steps.

It's the bridge that completes the Bitcoin-first financial strategy.

### Flexibility: Adjust Your Strategy as Conditions Change

One of the best parts about Strike is that it's flexible. If you feel the need to keep some fiat on the side, it's as simple as pressing a few buttons.

- Bull Market Strategy: Hold Bitcoin all month, let it appreciate, and let Strike convert as bills are due.

- Bear Market Strategy: If you're cautious, hold fiat in Strike temporarily and stack sats with what's left at the end of the month.

Strike gives you the tools to adapt your strategy---no friction, no complexity.

### Taxes: How Strike Simplifies Year-End Reporting

When using Bitcoin to pay bills, it's important to understand the tax implications. In the United States, Bitcoin is considered property by the IRS. This means that any time Bitcoin is converted to fiat (like when Strike pays a bill for you), it's a taxable event.

Here's how it works:

- If the value of your Bitcoin has increased since you acquired it, you owe capital gains taxes on the difference (the "gain") when it's converted to fiat to pay a bill.

- If there's no appreciation---or if you're converting at a loss---there's no capital gain to tax.

Example:

- You bought $500 worth of Bitcoin.

- When it's time to pay a bill, that Bitcoin is now worth $600.

- If you use Strike to pay the bill, you'll only owe capital gains taxes on the $100 gain.

Conversely:

- If you bought $500 worth of Bitcoin, and by the time you use it to pay a bill, it's worth $450, you can report a capital loss instead.

How Strike Helps:

Strike simplifies this entire process by providing:

- Year-End Tax Documents: Strike generates clear reports showing each transaction.

- Easy Access: These tax documents can be downloaded directly from the Strike app, making it easy to share them with your accountant or upload them to tax software.

Why This Matters:

Keeping track of Bitcoin transactions manually can feel overwhelming. With Strike, all the reporting is done for you, so you can stay compliant without stress. Whether you're dealing with gains, losses, or flat conversions, Strike helps you navigate taxes with transparency and simplicity.

### Bringing It All Together

Bitcoin is savings tech. It fixes the root problem---where you store your wealth.

Strike Bill Pay is the tool that lets you:

- Save in Bitcoin without compromise.

- Pay fiat bills seamlessly without relying on a traditional bank.

- Start small, test the waters, and scale at your own pace.

### Final Thought: Build the Future, One Bill at a Time

Here's my challenge to you:

- Pick one bill.

- Add your Strike-provided account as the payment source.

- Run it for a month and see how it feels.

You don't need to jump in all at once. But as you experience the benefits--- no friction, and no headaches---you might find yourself wondering: *Why don't I use this for all my fiat needs?*

Strike Bill Pay isn't about forcing change. It's about offering you tools that work better. Save in Bitcoin, spend seamlessly, and start building a future where your money works for you---not against you.

Block 875215 - MSK 943

Digging Deeper:

===============

### Hey there, I hope you enjoyed this read! If you did, and would like to read more of my barks, follow the links below!

- Curious how I found Bitcoin? Read ["Paw Prints to the Timechain"](https://bitcoinbarks.com/Barks/paw-prints-to-the-timechain/#wbb1 "https://bitcoinbarks.com/Barks/paw-prints-to-the-timechain/#wbb1")

- Bitcoin meets psychology? I touch on this in ["Maslow's Apex"](https://bitcoinbarks.com/Barks/maslows-apex/#wbb1 "https://bitcoinbarks.com/Barks/maslows-apex/#wbb1")

- Want to understand the basics of Bitcoin? Read ["Bitcoin Best Practice"](https://bitcoinbarks.com/Barks/bitcoin-best-practice/#wbb1 "https://bitcoinbarks.com/Barks/bitcoin-best-practice/#wbb1")

- If you like seeing bad media takes unpacked, check out ["Pup's Double-Takes"](https://bitcoinbarks.com/Barks/Pups-Double-Takes/#wbb1 "https://bitcoinbarks.com/Barks/Pups-Double-Takes/#wbb1")

### External Resources:

- Want to earn rewards on your mortgage? [Use my referral to earn 20,000 free sats at sign up!](https://use.foldapp.com/r/7KYTK4CP "https://use.foldapp.com/r/7KYTK4CP")

- Do you like sharing Bitcoin content and earning sats for doing so? [Join me at Stacker.news!](https://stacker.news/r/bitcoin_pup "https://stacker.news/r/bitcoin_pup")

...Woof!

========

[](https://primal.net/p/npub1vgldyxx7syc30qm9v7padnnfpdfp4zwymsyl9ztzuklaf7j5jfyspk36wu)

originally posted at https://stacker.news/items/828031

-

@ 7e6f9018:a6bbbce5

2024-12-28 19:18:38

Violence is a tool, and as such, it functions effectively in many contexts. Therefore, we should all acknowledge its role and prepare to use it when necessary, both as individuals and as a society.

The monopoly on violence is the cornerstone of the political state. Proper use of this monopoly can transform an impoverished society into a productive and prosperous environment. Conversely, misuse can lead to a stagnant society that benefits only a select few.

Wars and violence remain present in our world, but recent times appear to have been more peaceful than the historical average. Some argue that this relative peace is more than a temporary phenomenon and represents a consistent decline in violence. If so, why?

I believe the reason is simple: abusing violence has become counterproductive in the long term. While violence is a powerful tool, it is also inherently dangerous. It is crucial not to trivialize it, as doing so risks undermining the progress and achievements of our society.

In combat sports, it is common to see fighters exchanging gestures of respect after a match. This is more than a mere formality, it symbolizes the refusal to trivialize the violence applied. Such gestures place violence within a controlled and healthy framework, celebrating the sport while distancing it from the dangerous allure of abusing others, which could have harmful ripple effects.

Since the monopoly on violence lies with the state rather than individuals, the responsibility for its proper use rests primarily with governments. How states wield this power significantly shapes their relationship with societies.

To illustrate this, let’s consider a hypothetical scenario involving two societies: society (A) and society (B). Where each society is capable of producing a certain amount of goods in a year. Society (A) produces 6 squares, and society (B) produces 6 circles.

| **Initial situation** | |

| ---------- | ------------------------------------------ |

| _Society A_ = 🟩🟩🟩🟩🟩🟩 | _Society B_ = 🔵🔵🔵🔵🔵🔵 |

The relationship between the two societies can primarily take one of two forms:

1. A positive relationship (_win-win_), characterized by mutual respect and a focus on product trade.

| **Win - Win** 💱 | |

| ---------- | ------------------------------------------ |

| _Society A_ = 🟩🟩🟩🔵🔵🔵 | _Society B_ = 🔵🔵🔵🟩🟩🟩 |

If there is a positive relationship, the two societies will exchange their products throughout the year. As a result, both societies will retain their original 6 products but enjoy an improved quality of life due to greater product diversity—each will have both squares and circles.

2. A negative relationship (_win-lose_), characterized by confrontation and a focus on conflict.

| **Win - Lose** 💥 | |

| ---------- | ------------------------------------------ |

| _Society A_ = 🟩🟩🟩🟩🟩🟩🔵🔵🔵🔵🔵🔵 | _Society B_ = ❌ → lack of food|

If a negative relationship prevails, the society that most effectively wields the resource of violence will dominate. In this case, society (A) would prevail, keeping both its own production, the 6 squares, and the production of the defeated society (B), the 6 circles. As a result, society (A) would enjoy a high quality of life due to its increased wealth, comprising 6 squares and 6 circles, while society (B) would be left in a state of absolute poverty.

The _win-lose_ scenario may seem advantageous for the winning party. However, it is ultimately a short-term strategy that incurs in significant long-term costs, which any advanced society would seek to avoid. Let’s examine why.

If society (A) excessively and repeatedly exploits society (B), there will eventually come a point where the entire population of society (B) starves to death. The result? Society (A)’s quality of life reverts to its initial state, producing only 6 squares, because society (B) has perished, taking with it its technical know-how and resources. In hindsight, a win-win scenario would have been the smarter choice.

| **Win - Lose** 💥 | |

| ---------- | ------------------------------------------ |

| _Society A_ = 🟩🟩🟩🟩🟩🟩 | _Society B_ = ❌→ lack of food, hunger → ☠️ |

If society (A) is somewhat wise, it will recognize that it cannot completely destroy society (B) but must subject it to measured exploitation without annihilating it. By doing so, society (A) sacrifices some short-term profits; instead of gaining 12 units per year, it gains 10, allowing society (B) to retain 2 units to survive. While this arrangement benefits society (A) more than a win-win scenario, it creates a precarious and unsustainable situation for society (B).

| **Measured abuse** 📐 | |

| ---------- | ------------------------------------------ |

| _Society A_ = 🟩🟩🟩🟩🟩🟩🔵🔵🔵🔵 | _Society B_ = 🔵🔵→ precariousness |

History has shown us that society (B), sooner or later, will confront the abuse inflicted by society (A) through one of two possible scenarios:

1. Fight

2. Flight

If society (B) decides to fight, it will keep all the production if it wins, and if it loses, society (A) will take control. An important consequence is that, in the short term, production will decrease due to the effort involved in the war. And in the long term, one of the two societies will disappear, and we will return to a situation of excessive exploitation.

| **Fight** ⚔️ | |

| ---------- | ------------------------------------------ |

| _Society A_ = 🟩🟩🟩🟩🔵🔵🔵 | _Society B_ = 🔵→ (1) fight or (2) flight |

If, instead of fighting, society (B) decides to abandon its territory, society (A) will also return to its initial situation. This is because, if society (B) leaves, it takes with it its production, human resources, and technical know-how.

| **Flight** 🧳 | |

| ---------- | ------------------------------------------ |

| _Society A_ = 🟩🟩🟩🟩🟩🟩 | _Society B_ = 🛩|

**Conclusion**: If, instead of entering an unproductive vicious circle, the two societies had realized from the beginning that the wisest approach is to establish a positive relationship, they would have saved a lot of wasted energy and pain. This could be the reason for the reduction in violence: societies may be starting to figure out this game.

**Note**: Please note that this mental framework is an oversimplification; the reality may involve many other variables not considered here.

-

@ 30ceb64e:7f08bdf5

2024-12-28 18:14:28

I've been listening to this small playlist over and over again this week.

Ivy keeps getting me.

I'm having fun making these things

https://music.youtube.com/watch?v=yNPfvgFEXuk&si=HjUdZxXKkGfqabk8

https://music.youtube.com/watch?v=LyRJfs-Qn70&si=2ugksRTltXATqHVo

https://music.youtube.com/watch?v=XkpAE8ZZ6bU&si=WwWopN-YMLGguFiB

https://music.youtube.com/watch?v=VIcQreSskyM&si=Ewza3W6SOkRDWF1E

https://music.youtube.com/watch?v=5xm8Q-1cOpU&si=GeQv3Kum_TV9H6KD

https://music.youtube.com/watch?v=xYM-aZG9QbE&si=fwfzIFLAyVumnTs4

https://music.youtube.com/watch?v=r7JWHuGFUeI&si=MqoFBqvb0iI7pAAY

https://music.youtube.com/watch?v=GjnjUHY8MiM&si=F_Aepjxc_g2SH7UG

https://music.youtube.com/watch?v=sgjTb7UQe2A&si=04wik3m5LefpbGMV

https://music.youtube.com/watch?v=SMOund_uFTk&si=v7sa3XxchH607d0Y

https://music.youtube.com/playlist?list=PLmYfnnK_Qs5jpv5hKuBKFOEvMnPFl3vto&si=Dkudss84jFszdGmj

Thanks Anon,

Hustle

originally posted at https://stacker.news/items/827883

-

@ 30ceb64e:7f08bdf5

2024-12-28 17:47:48

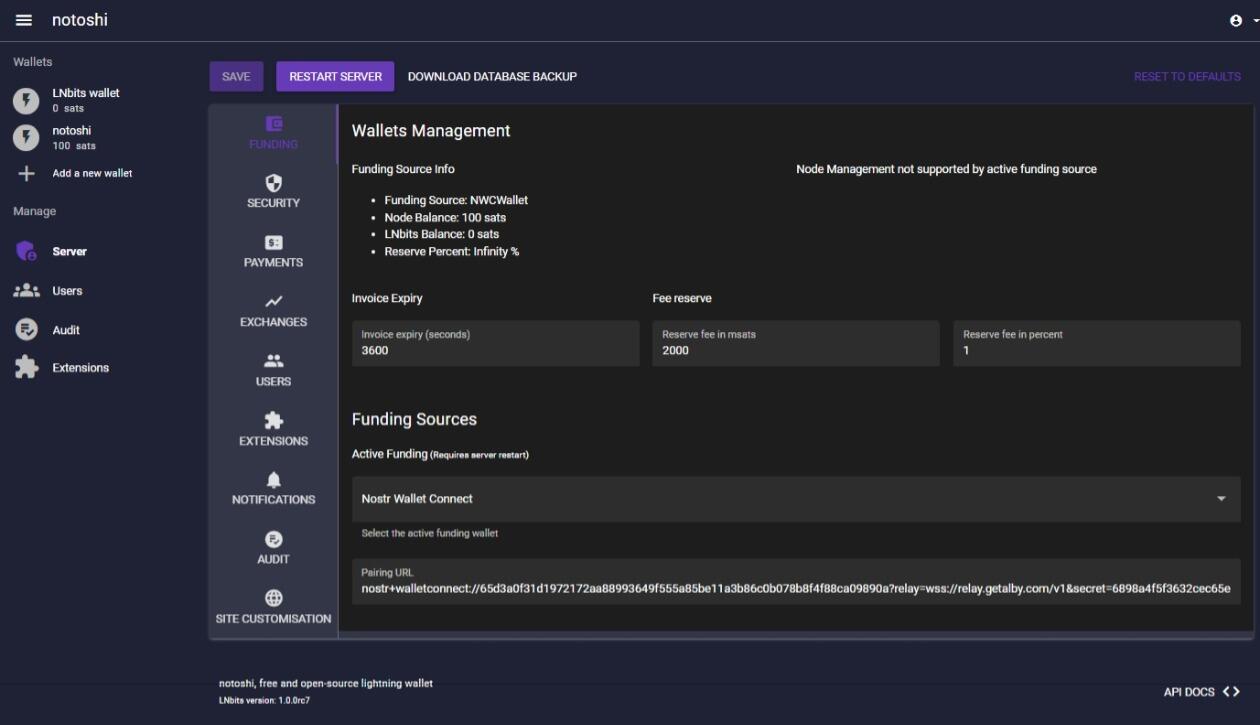

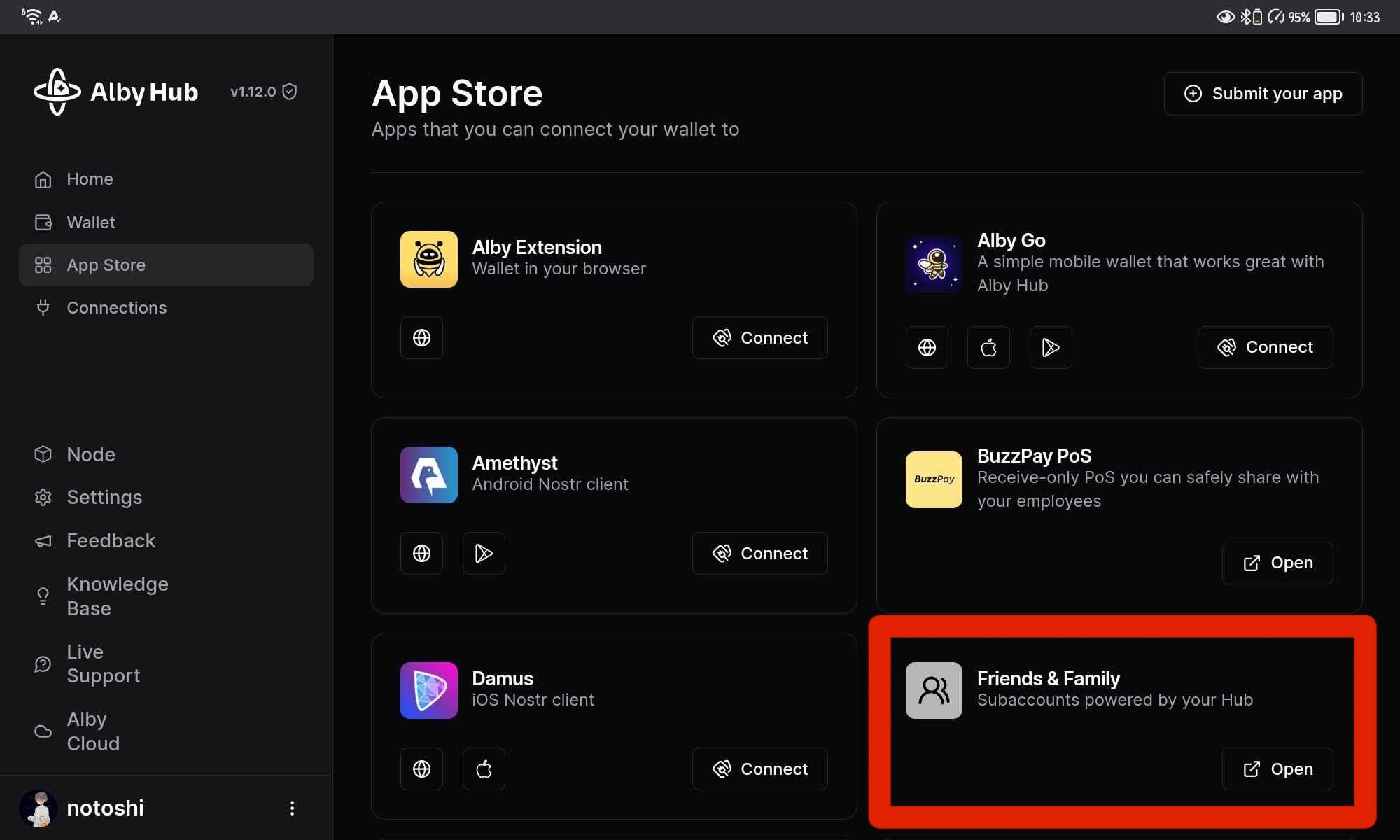

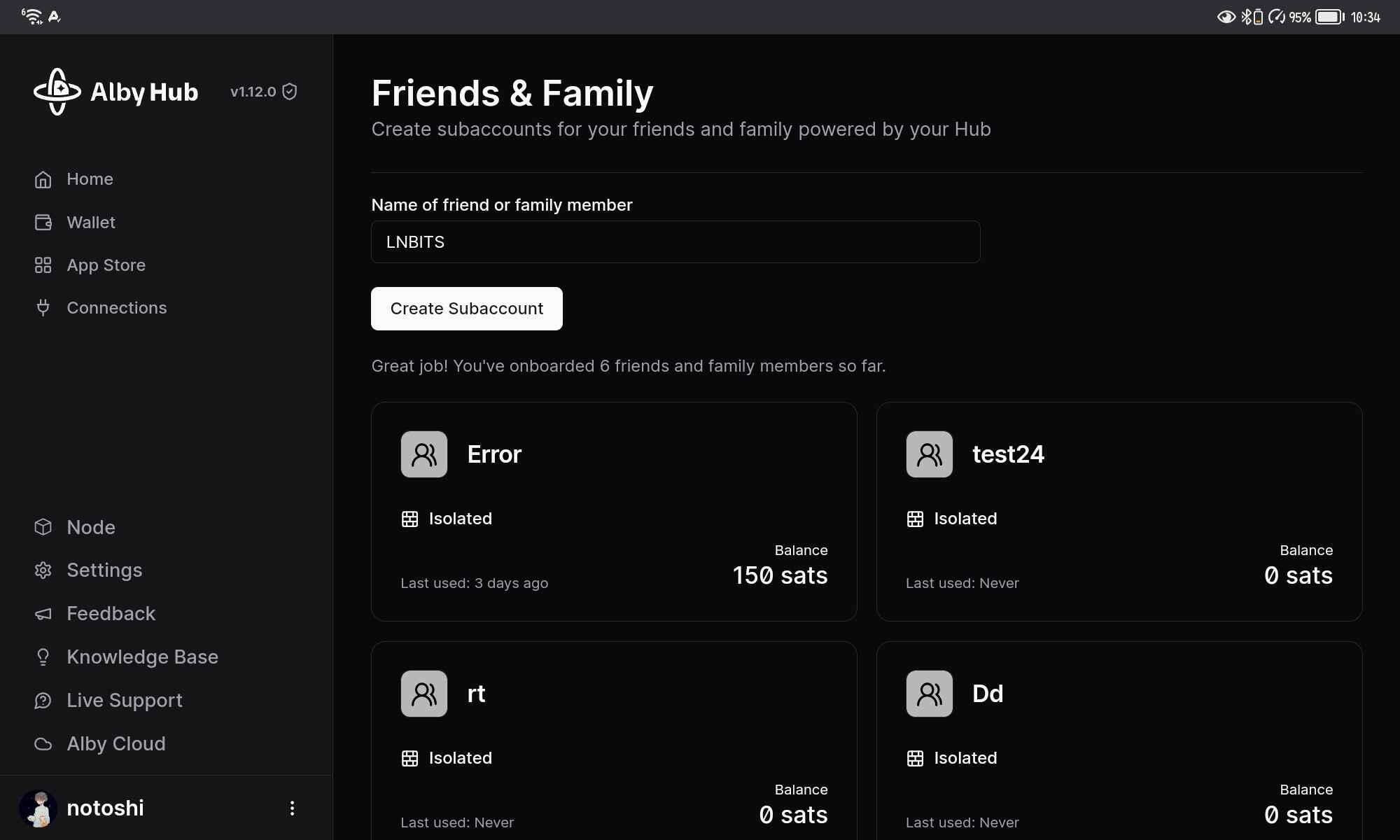

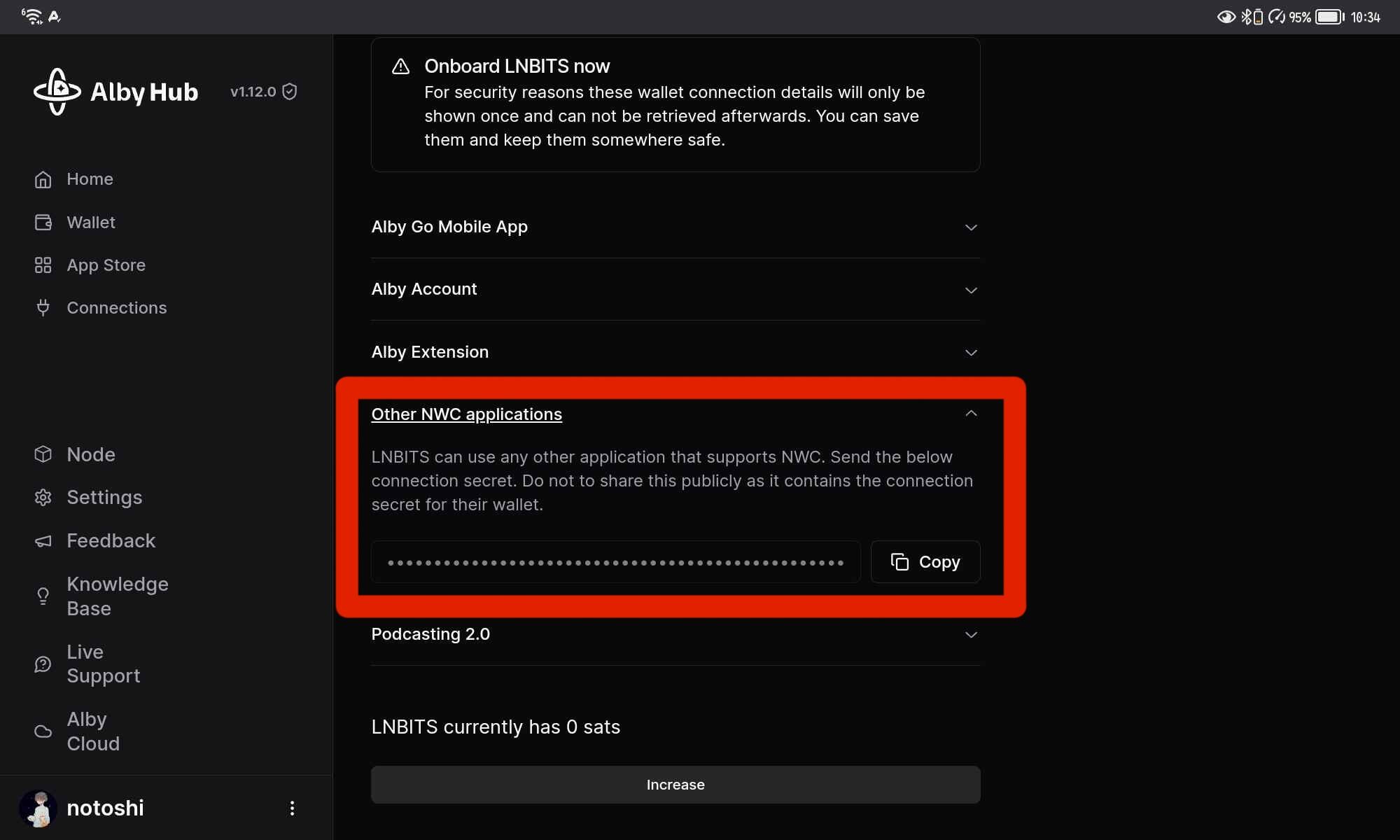

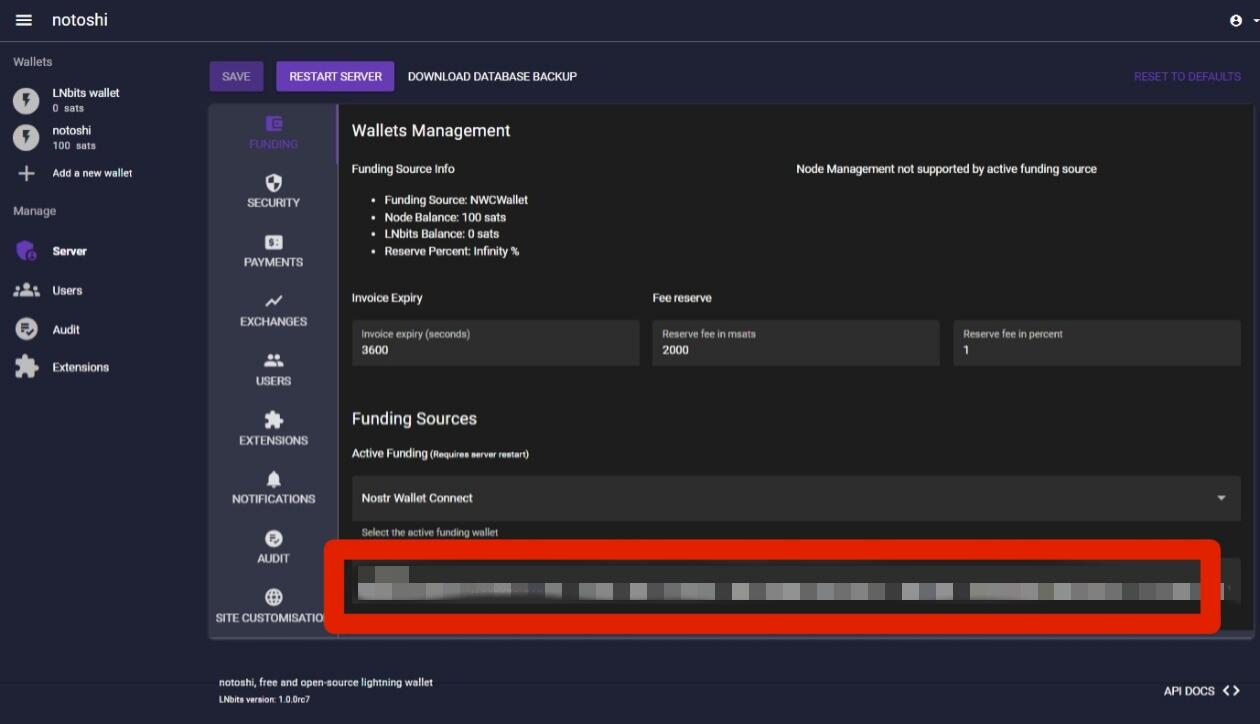

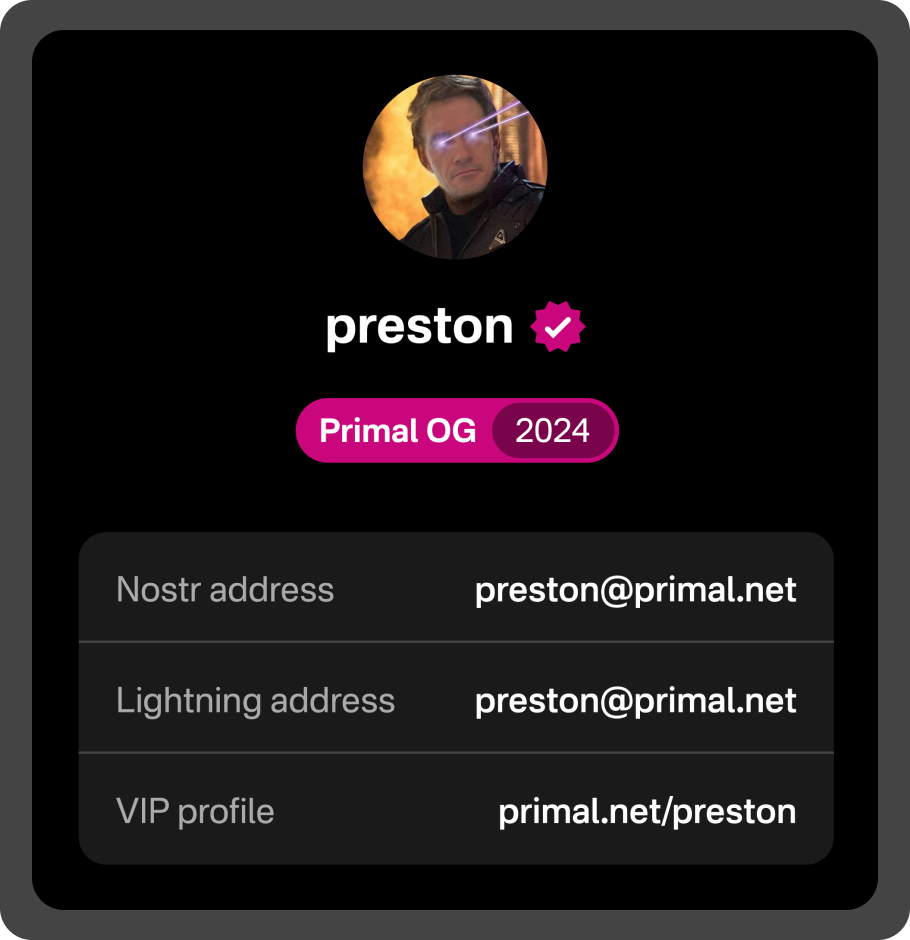

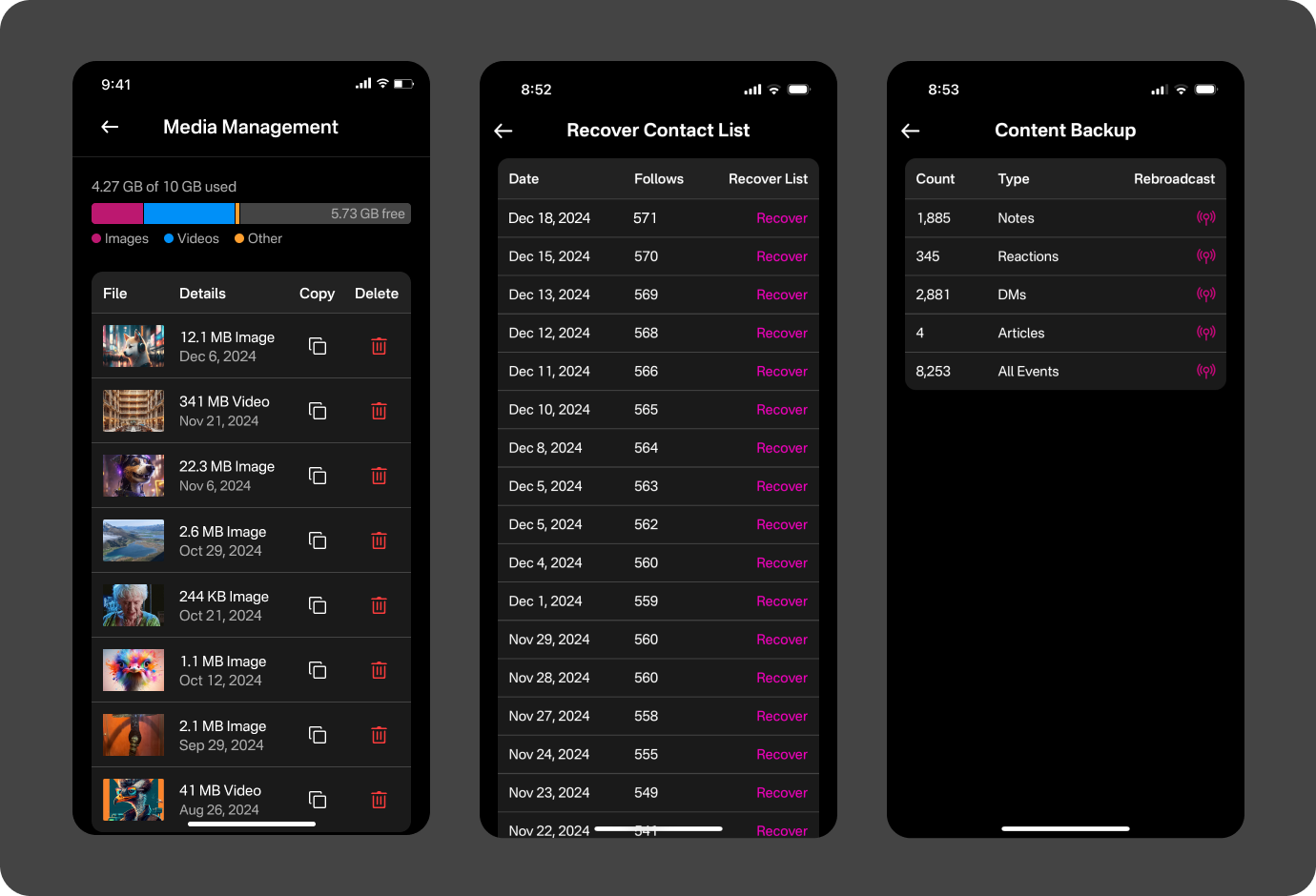

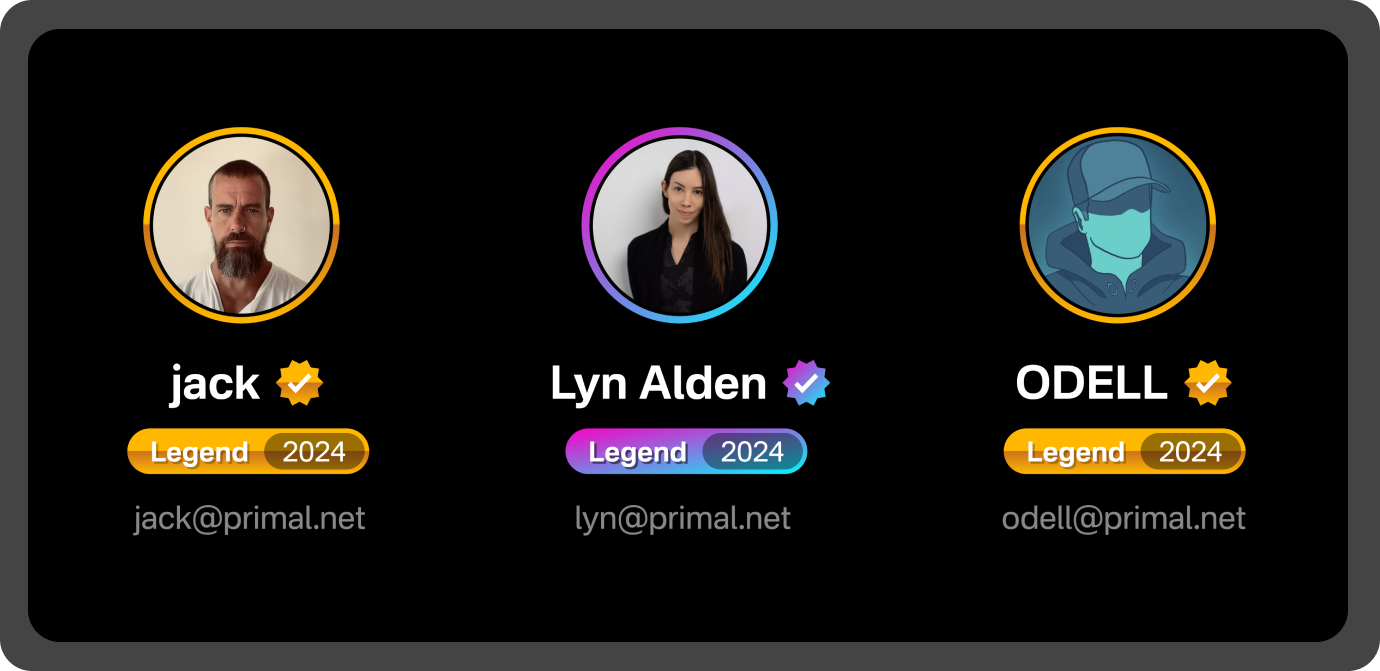

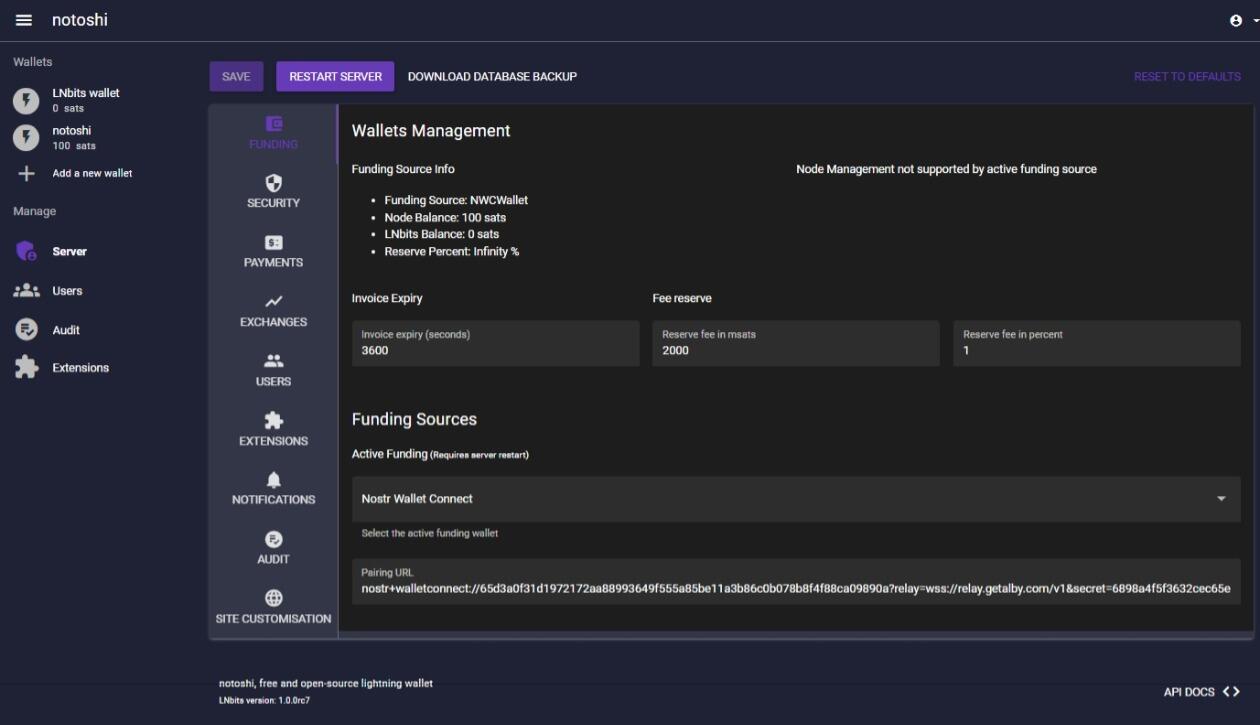

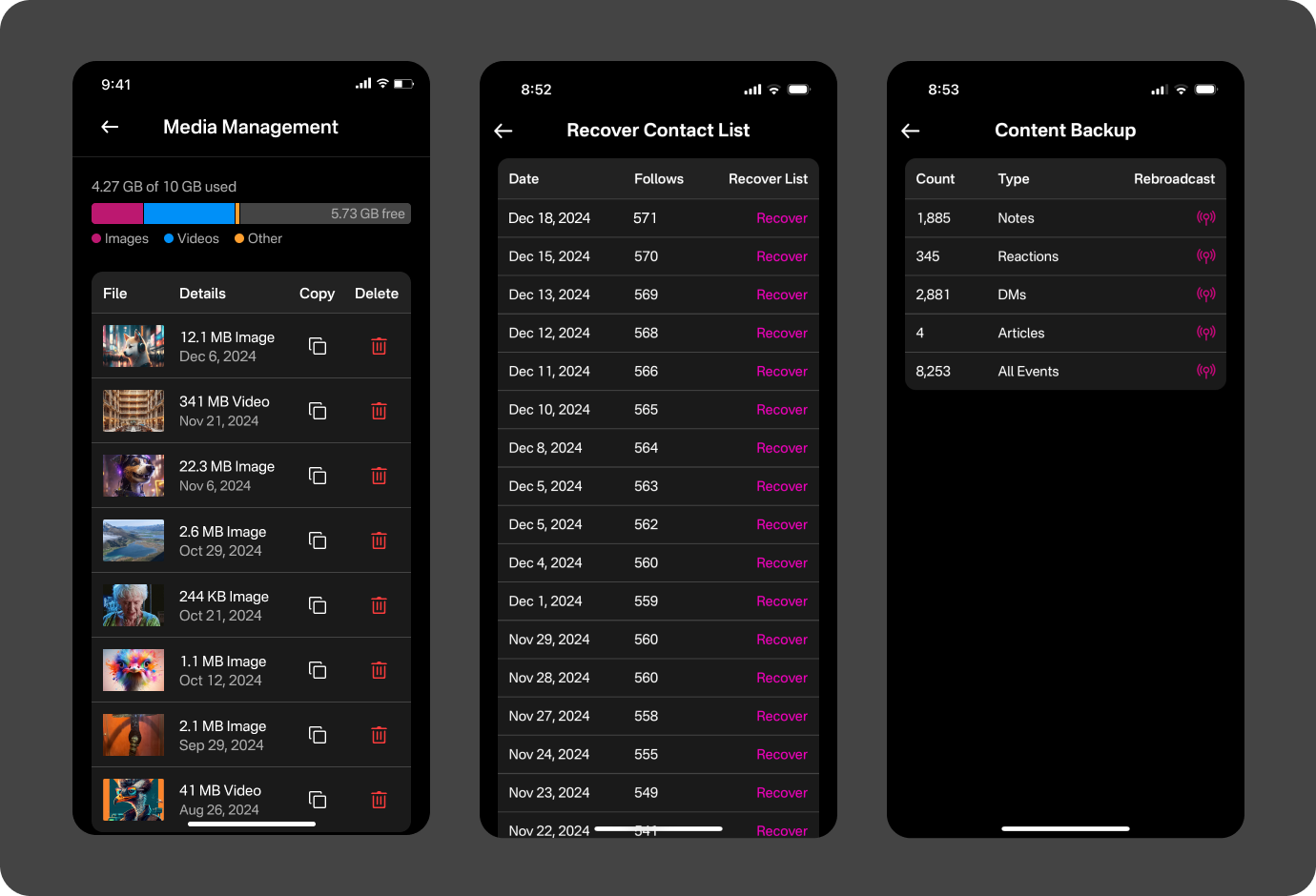

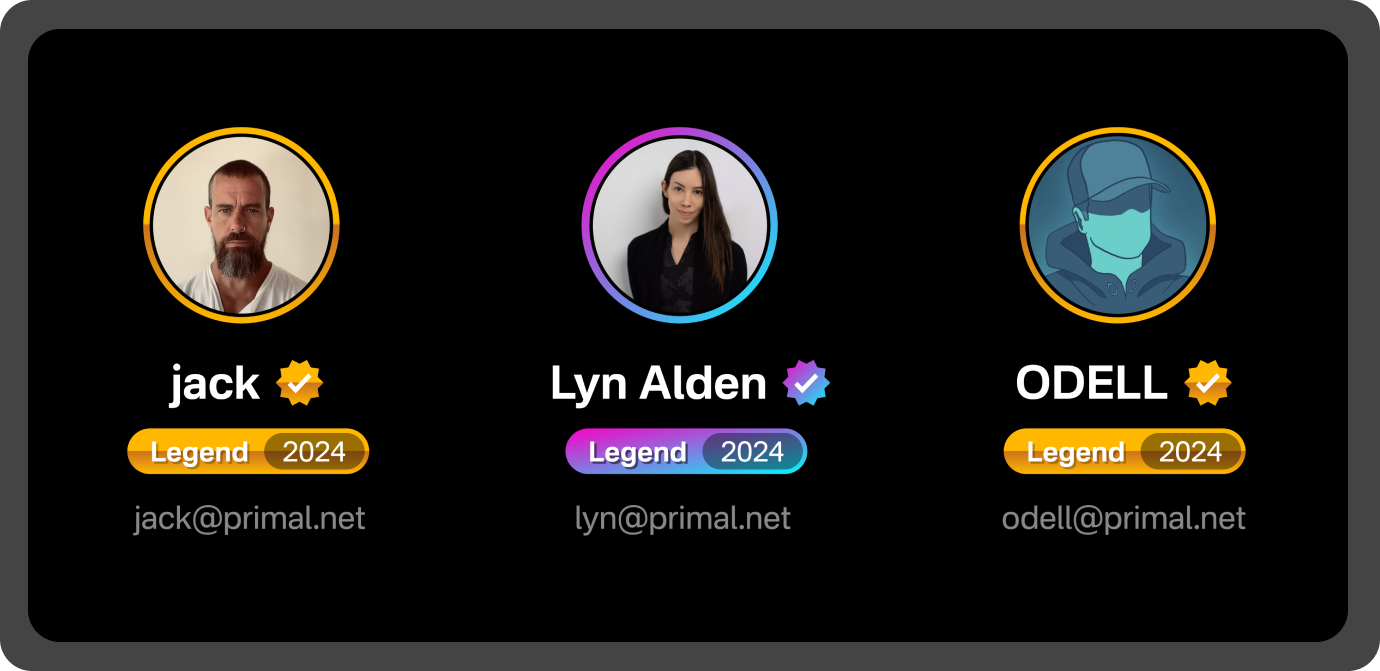

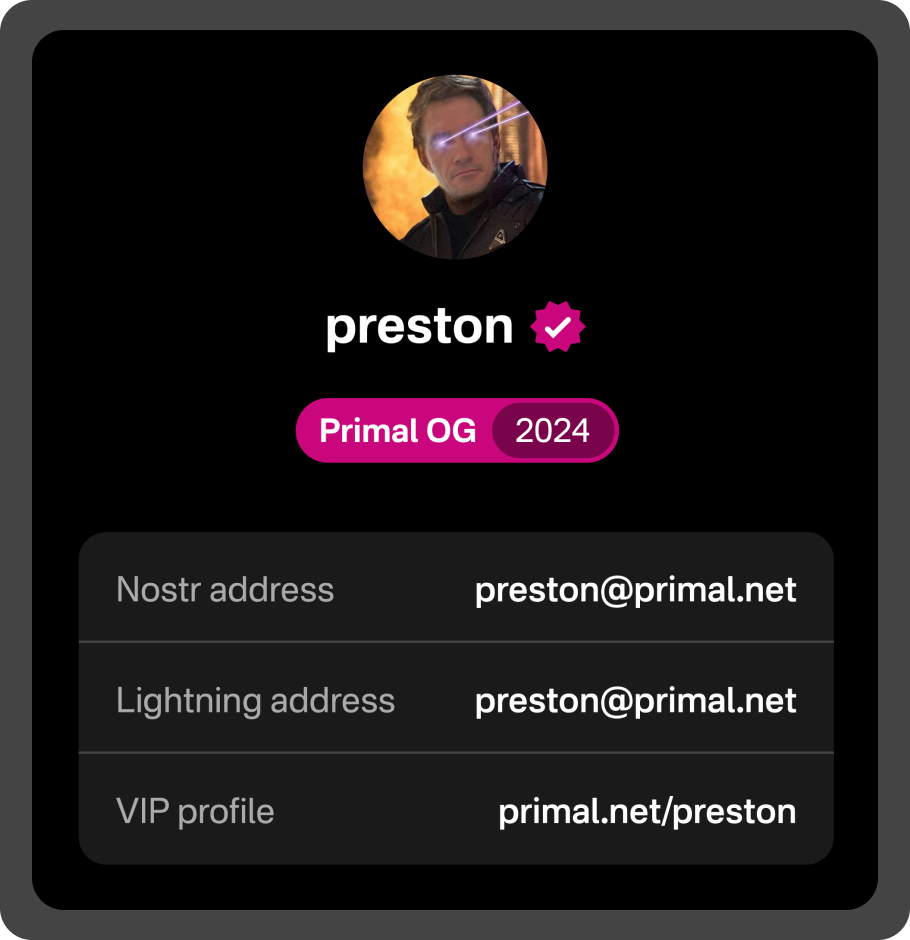

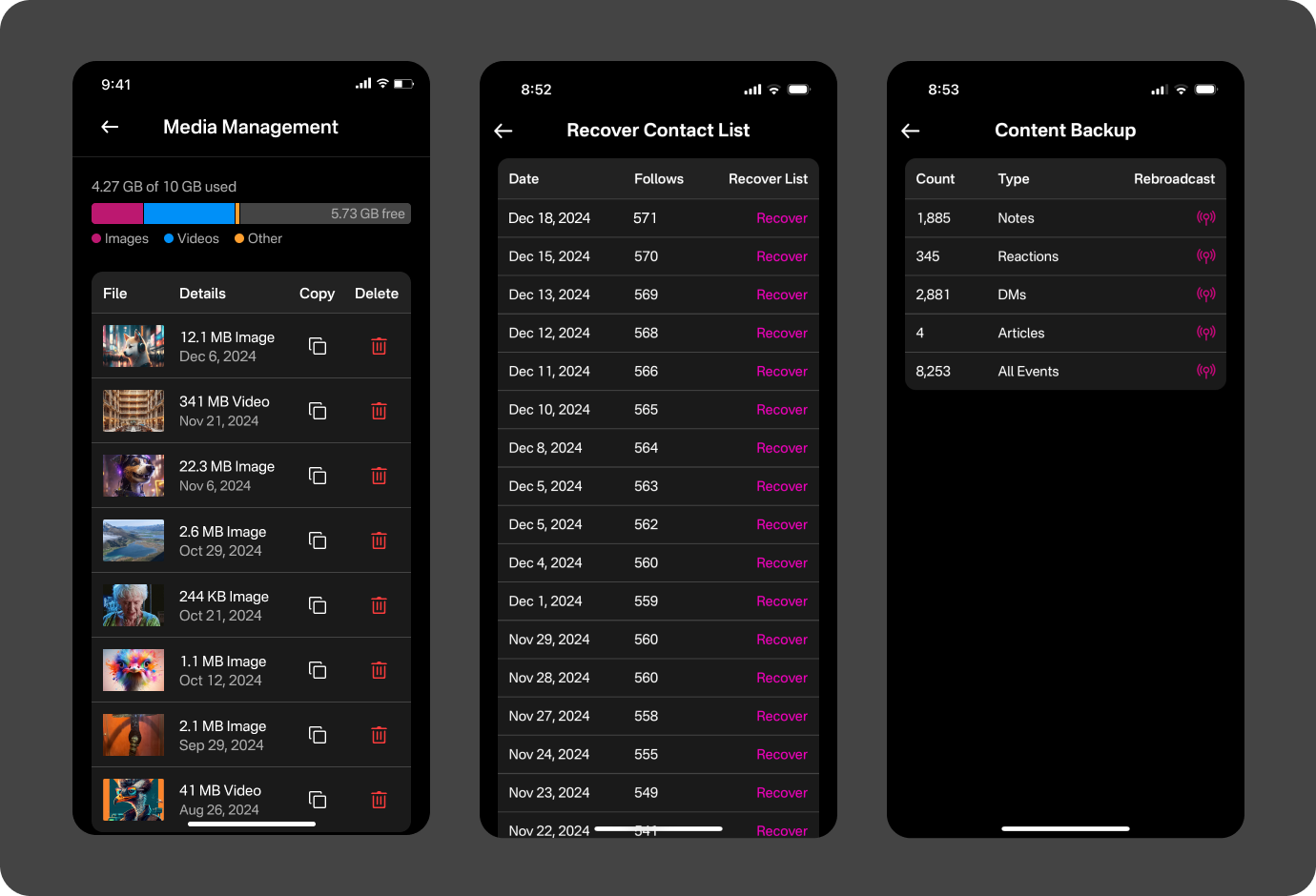

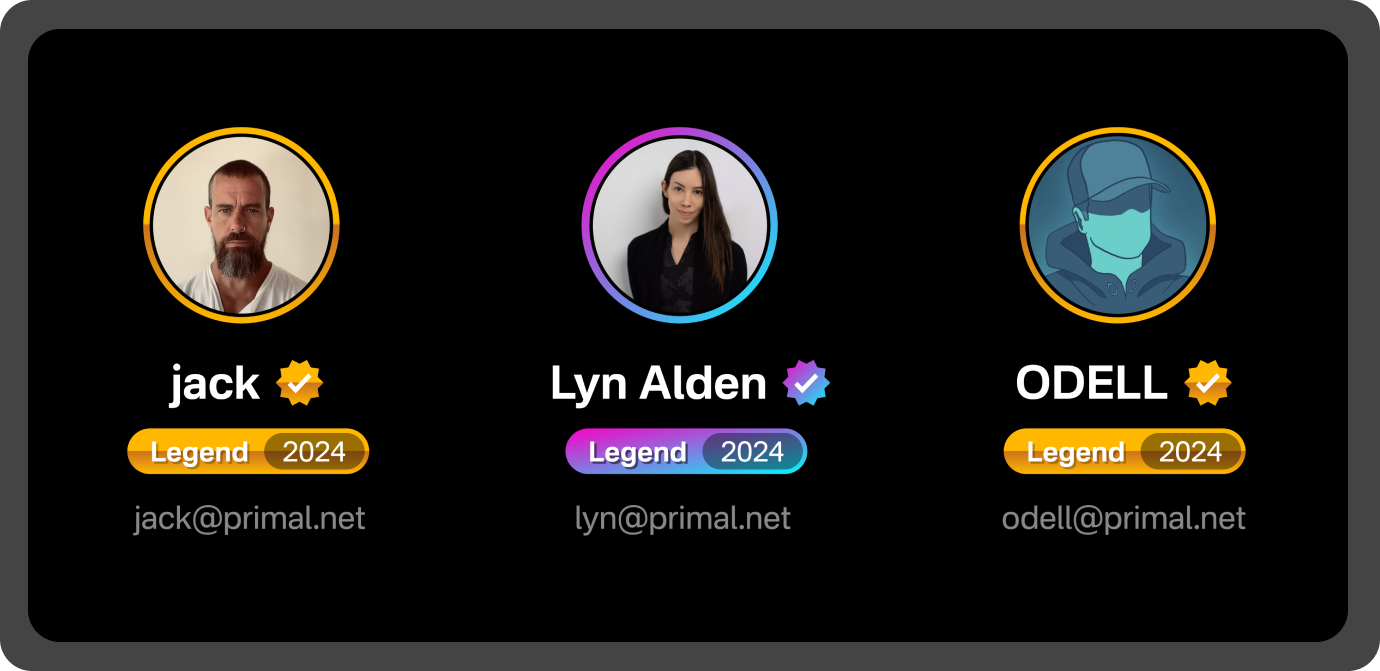

A recent conversation with fellow Bitcoiners prompted me to share this overview of Nostr tools. While you don't need to use everything, understanding the ecosystem helps paint a picture of where we're heading.

I often hear people say "I'm posting to the void" or "My feed is boring" or "I'm not earning any bitcoin" or "It's too complicated." Let me address these concerns with a comprehensive overview.

### Core Clients and Features

Primal and Amethyst are currently the best daily drivers. Theyre both valid twitter replacements with primal focusing on user friendliness and amethyst focusing on being more feature rich.

Both apps feature an algorithm marketplace (we call them DVMs) where you can choose from various feed styles. Soon, anyone will be able to create and share their own algorithms. For additional feed customization, Listr.lol lets you curate lists of npubs to further refine your experience.

### Content and Rewards

Stacker News (SN) integrates beautifully with Nostr. Cross-post your SN content to appear as longform notes on platforms like Highlighter, Yakihonne, and Habla.news. SN's rewards system pays out satoshis for quality content, bridging their closed platform with Nostr's open network.

### Payments and Zaps

For zaps, I recommend CoinOS, or AlbyHub for a more sovereign alternative. CoinOS is non kyc and gives you a lightning address and NWC connection string to throw into your nostr clients. CoinOS supports e-cash and Bolt 12, Liquid, and can auto-withdraw earnings to cold storage. You can use coinOs as a PWA or input the connection string into Alby Go for a more minimal wallet alternative.

### Security and App Management

Android users should use zap.store for downloading Nostr apps. It verifies app authenticity and implements Web of Trust features, showing which trusted npubs use each app.

For managing multiple apps, Pokey provides a unified notification dashboard. Amber (Android) offers secure client login without exposing your nsec, while Citrine lets you run a relay on your phone for data backup.

### Creator Tools

- Wavlake: Spotify alternative with open music graph

- Fountain: Podcast app with Nostr integration

- Zap.stream: Live streaming

- Nostr.build: Media hosting

- Cypher.space: Website creation with integrated marketplace

- Olas: Instagram alternative

- Gifbuddy.lol: Gif creation

- memeamigo.lol: Meme creation

- Zappadd: Promotional tools

### Making the Most of Nostr

The key to Nostr is understanding that nothing is force-fed. You're responsible for:

- Creating your desired feed

- Choosing your client

- Selecting your relays

- Managing your wallet

- Curating who you follow

For best results, go all in:

1. Leave traditional social media

2. Use Primal and or Amethyst as your main client

3. Follow 1000 npubs

4. Set up CoinOS for payments

5. Engage daily with the community

### Future Outlook

Some ask if Nostr is truly decentralized, censorship-resistant, or profitable. My response: the user experience will become so good that most internet users will naturally gravitate here. The only barrier will be ideological resistance.

Nostr represents a new internet paradigm where users outpower platforms, identity persists across apps, and Bitcoin is the standard. We've practically already won.

### Crazy Ideas

I'm thinking the age of of the super nostr app will come to a close. We're probably going to enter an era of a thousand micro apps and client templates, which allow users to build their own client in 30 seconds. Some templates will be impermanent, one time use clients, others will be more robust for building a daily driver. You'll be able to share your completed piece on nostr for other people to use, and they'll zap you for building it. A marketplace of user created apps supported by thousands of micro apps and relays and templates, probably a user experience holy grail, made possible by nostr's open social graph, smooth monetization processes from bitcoin.

### Growth Predictions

Daily Active Users doubling yearly:

2024: 20k → 2029: 640k

The beauty of Nostr isn't just in its decentralized nature or bitcoin integration – it's in the user experience that puts you in control. While traditional social media platforms force-feed you content through black-box algorithms, Nostr hands you the keys to your own digital kingdom. You choose your feed, your apps, your connections, and your level of engagement. Yes, there's a learning curve, but that's the price of digital sovereignty.

Think of where Twitter was in 2006 or Bitcoin in 2013. Those who saw the potential and jumped in early didn't just benefit financially – they helped shape the future. Nostr is at that same inflection point. The tools are here, the infrastructure is growing, and the community is building. Whether you're a creator, developer, bitcoiner, or just someone tired of traditional social media, Nostr offers a glimpse of what the internet should have been all along.

The question isn't if Nostr will win, but when. And when it does, you'll want to be able to say you were here when it all began.

Thanks,

Hustle

originally posted at https://stacker.news/items/827860

-

@ ebdee929:513adbad

2024-12-28 14:46:21

Blue light is not inherently bad, just bad in the wrong context.

Blue light provides wakefulness, stimulation, and sets our internal body clock (circadian rhythm).

When we go outside in the sun, we get bathed in blue lightblue light is not inherently bad, just bad in the wrong context.

[Blue light sets the human rhythm.](https://pmc.ncbi.nlm.nih.gov/articles/PMC7065627/)

However, sunlight never gives us blue light without the rest of the visible rainbow + infrared.

Light from screens & LED bulbs do not contain any infrared, and has a unnaturally high proportion of blue light.

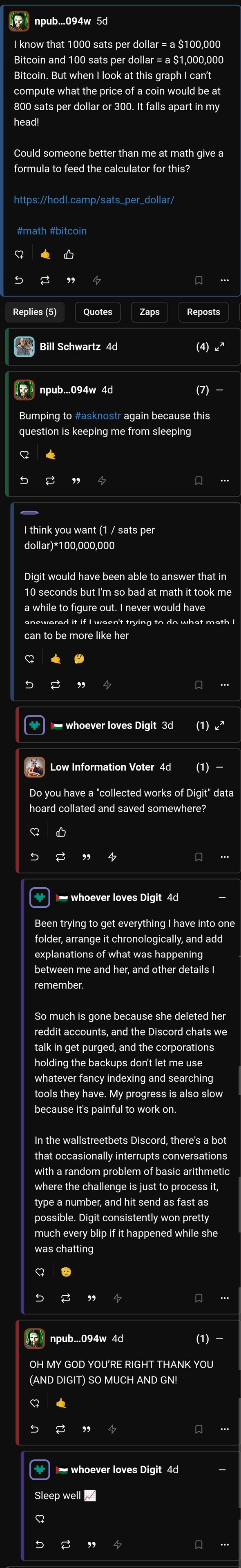

LEDs = unbalanced & blue light dominant

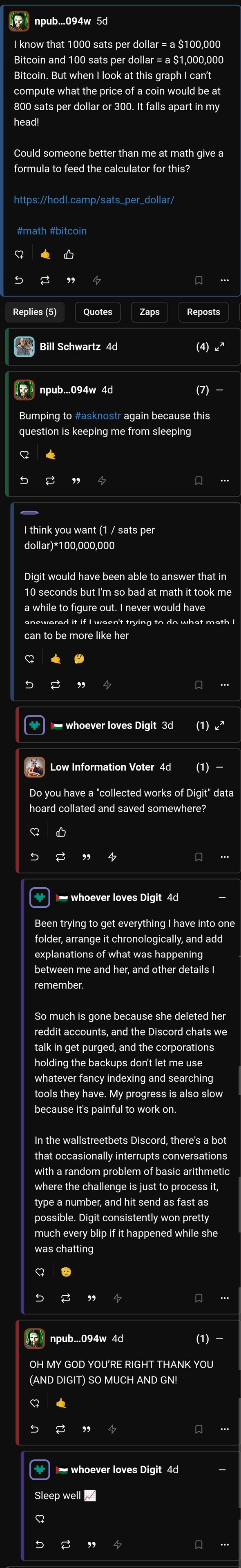

<img src="https://blossom.primal.net/1e1e1eeb73e25798e74263e65bf41d24f70ef09cd02f1268c432cd7e57045c24.jpg">

Light from artificial sources is especially disruptive at night time, where the high blue light component can interfere with melatonin production and sleep quality at a greater rate than lower energy colors of light. [Blue Light has a Dark Side](https://www.health.harvard.edu/staying-healthy/blue-light-has-a-dark-side)

This doesn't mean that red light is completely innocent of disrupting sleep either

It is both the spectrum of light AND the intensity of light that contributes to sleep disruption. [See this tweet from Huberman](https://x.com/hubermanlab/status/1846995497824714807).

<img src="https://blossom.primal.net/dd8227d6ad0b3f0fd0de371e117b8fff688744584fc6191d0c86b780889eb685.jpg">

We took all of this into account when building the DC-1 to be the world's first blue light free computer.

The DC-1 has a reflective screen that:

• emits ZERO light during the day

• can be used easily outside in direct sunlight

<img src="https://blossom.primal.net/492bd01872e10a53ebfaa9ed4d4c72d7a835943af347a9b7fa3173b9eae536c4.jpg">

& a backlight that:

• can be 100% blue light free

• has a broad spectrum of light

• can be seen at very low brightness

<img src="https://blossom.primal.net/783eb85af21270d412957bd7ea81297edbfaca444e3fcb21eb9d2bde6465a88b.jpg">

Our Live Paper™ display technology feels like a magic piece of paper

During the day, that piece of paper is illuminated by sunlight. At night, that piece of paper is illuminated by *candle* light.

(backlight is converging with a candle light spectrum)

<img src="https://blossom.primal.net/e153f8e937438a31c8a1cc7e4db63d937f52c3c1667557a7e7a1459bb7464a7c.jpg">

The two sources of natural light are sunlight & fire.

We are trying to reproduce this experience for the most enjoyable, healthy, and least invasive technology experience for humanity.

Root cause problem solving by emulating nature.

"But can't I just put a red light screen filter on my MacBook?"

Absolutely you can, and we advocate for it

Software screen filters are great, but anyone who has changed their screen to full “red mode” to get rid of the blue light knows the downsides to this…

<img src="https://blossom.primal.net/3cb41edfa65978e8badb8555eb4448909328ce189efe270eddfd50f2eba6c40e.jpg">

You can barely see anything and you end up having to crank up the brightness in order to see any contrast.

This is because of the highly isolated nature of LED emissive screens, you can only isolate a very narrow band of colors.

Going full red is not something your eyes have ever been used to seeing.

You need a broad spectrum light solution, and that is what we have in our **amber backlight** while still being blue light free.

This means you can have a better visual experience, turn down the brightness, and get minimal sleep/circadian disruption.

**What about FLICKER?**

Nearly all LEDs flicker. Especially when changing in brightness due to Pulsed Width Modulation (PWM) LED driver control

Our LED backlight uses DC dimming & is expert verified flicker-free.

This can only be achieved through hardware changes, not software screen filters.

<img src="https://blossom.primal.net/cb756be06d8b154babecd10dece422076410f67adb904b658fce2cc271e4ba2f.jpg">

**& Blue Light Blocking Glasses?**

They need to be tinted orange/red to block all of the blue light.

Thus the same issues as screen filters (bad visual experience, not solving flicker) + average joe would never wear them.

We still love blue blockers, they just aren't a **root cause** solution.

We made a computer that is healthier and less stimulating, with a low barrier to entry

Whether you are a staunch circadian health advocate or just like the warm vibes of amber mode and being outside...the DC-1 just feels good because it doesn't make you feel bad :)

Learn more [here](https://daylightcomputer.com) and thanks for reading.

-

@ a012dc82:6458a70d

2024-12-28 03:31:08

**Table Of Content**

- The Nikkei 225: A Comprehensive Overview

- Bitcoin's Meteoric Rise: A Journey of Peaks and Valleys

- Drawing Parallels: Bitcoin and Nikkei's Path of Resilience

- Conclusions

- FAQ

The financial world is vast and diverse, with assets ranging from traditional stocks to the more recent phenomenon of cryptocurrencies. Among these, Bitcoin stands out as the pioneering digital currency, often drawing comparisons with various stock indices. One such intriguing comparison is with Japan's Nikkei 225.

**The Nikkei 225: A Comprehensive Overview**

The Nikkei 225, commonly known as the Nikkei, stands as one of the primary stock market indices representing the Tokyo Stock Exchange. Established in 1950, it comprises 225 of the most prominent companies listed on the exchange, making it a significant barometer of the Japanese economy's overall health.

Over the decades, the Nikkei has witnessed various economic cycles, from booms to recessions. Its performance often mirrors the broader economic and business trends in Japan. The recent achievement in June, where the Nikkei touched a 33-year high, is not just a numerical milestone. It symbolizes the enduring nature of the Japanese market, its ability to recover from setbacks, and the confidence of investors in the country's economic prospects.

**Bitcoin's Meteoric Rise: A Journey of Peaks and Valleys**

Bitcoin, introduced in 2009 by an anonymous entity known as Satoshi Nakamoto, revolutionized the concept of currency. As the world's first decentralized digital currency, Bitcoin operates without a central authority, making it inherently resistant to government interference or manipulation.

Over the years, Bitcoin's journey has been nothing short of a roller coaster. From being an obscure digital asset to becoming a household name, its value has seen dramatic surges and equally sharp declines. This volatility often becomes a hotbed for speculations, predictions, and intense debates among financial experts. A recent statement by an analyst, suggesting that Bitcoin's trajectory might align with that of the Nikkei, has added fuel to these discussions. The implication here is that Bitcoin, despite its volatile nature, has the potential to reach unprecedented highs, much like the Nikkei did after its long journey.

**Drawing Parallels: Bitcoin and Nikkei's Path of Resilience**

At an initial glance, comparing a traditional stock market index like the Nikkei to a modern digital asset like Bitcoin might seem like comparing apples to oranges. However, when delving deeper, certain similarities emerge.

Both Bitcoin and the Nikkei have demonstrated remarkable resilience. The Nikkei, representing Japan's economic might, has bounced back from economic crises, natural disasters, and global downturns. Similarly, Bitcoin, despite facing regulatory challenges, technological hurdles, and market skepticism, has managed to not only survive but thrive.

The adaptability of both these assets is noteworthy. While the Nikkei reflects the evolving nature of the Japanese economy and its industries, Bitcoin showcases the world's shifting attitude towards decentralized finance and digital assets. The recent prediction by the analyst, suggesting a potential parallel growth pattern, underscores the idea that both traditional and modern financial instruments can coexist, learn from each other, and potentially follow similar trajectories of success.

**Conclusion**

A Convergence of Old and New The financial landscape is ever-evolving, with traditional and modern assets often intersecting in unexpected ways. The comparison between Bitcoin and the Nikkei 225 serves as a testament to this. As Bitcoin continues its journey in the financial realm, only time will tell if it truly follows the path of the Nikkei to new record highs.

**FAQ**

**What is the Nikkei 225?**

The Nikkei 225 is a primary stock market index representing the Tokyo Stock Exchange, showcasing the health of the Japanese economy.

**How is Bitcoin related to the Nikkei 225?**

An analyst recently predicted that Bitcoin's growth trajectory might align with that of the Nikkei, hinting at potential record highs for the cryptocurrency.

**Has the Nikkei 225 reached any significant milestones recently?**

Yes, in June, the Nikkei achieved a 33-year high, reflecting the resilience of the Japanese market.

**Why is Bitcoin's growth compared to the Nikkei's?**

Both Bitcoin and the Nikkei have shown adaptability and resilience in changing market dynamics, leading to speculations of similar growth patterns.

**Is Bitcoin expected to reach new highs?**

While predictions vary, some analysts believe Bitcoin might emulate the Nikkei's success and reach new record highs.

**That's all for today**

**If you want more, be sure to follow us on:**

**NOSTR: croxroad@getalby.com**

**X: [@croxroadnews](https://x.com/croxroadnewsco)**

**Instagram: [@croxroadnews.co](https://www.instagram.com/croxroadnews.co/)**

**Youtube: [@croxroadnews](https://www.youtube.com/@croxroadnews)**

**Store: https://croxroad.store**

**Subscribe to CROX ROAD Bitcoin Only Daily Newsletter**

**https://www.croxroad.co/subscribe**

*DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.*

-

@ 0a821ca3:e0efcce3

2024-12-27 20:15:29

Central banks, in particular the ECB, are pushing hard to force a CBDC on their citizens - these citizens are not interested in a CBDC that invades their privacy.

## Chaumian e-cash

In 1982, David Chaum published [“Blind Signatures for Untraceable Payments”](https://chaum.com/ecash/).

e-Cash

- Ensures privacy

- Is permissionless

- Can be minted / issued by banks

- Can be developed completely in open source code

- Can be supported by a multitude of (open source) wallets - each bank can enable it in their bank app

e-Cash

- Does not enable a holding limit - that is not necessary, as it is not competing with bank accounts - on the contrary: bank client convert a small part of their deposit to ecash, which is non interest bearing

- Does not require KYC - which some may consider a problem - this being said, it is issued only by banks that have performed KYC on their clients

David Chaum worked with the SNB to descibe on [How to issue a central bank digital currency](https://www.snb.ch/en/publications/research/working-papers/2021/working_paper_2021_03) .

Central banks should consider e-Cash if they want to successfully enable digital payments for their citizens.

The digital p2p value transfer protocol, bitcoin, already has an extensive e-Cash ecosystem. [Cashu](https://cashu.space/) and the [OpenCash Association](https://opencash.dev/) lead this development, which has so far resulted in a broad range of wallets and mints, that mint "satoshi" tokens and even "euro" tokens.

That open source software can perfectly serve as blueprint for a reasonable digital euro.

-

@ 5d4b6c8d:8a1c1ee3

2024-12-27 20:03:03

As mentioned in my [inaugural post](https://stacker.news/items/826658/r/Undisciplined), I'm going to be searching for the optimal posting fee for ~econ.

My suspicion is that we were above the optimum, so I'm beginning with a halving. If this brings in more revenue than last month (48k), then I'll continue with another reduction to 54. Otherwise, I'll increase to the midway point of 161.

@cryotosensei told me that 108 has special significance, so let's see if it gives us a special month.

originally posted at https://stacker.news/items/826704

-

@ 5d4b6c8d:8a1c1ee3

2024-12-27 19:30:33

Guess who's in charge of the ~econ territory?

This guy (*Undisciplined points at him/her/itself as you read this*).

The founder of this great territory, @jeff, has too many irl commitments to invest the time he would like to into ~econ, so he offered to let me take over indefinitely. If you are interested in the conditions agreed to in this transfer of power, see [here](https://stacker.news/items/89179/r/Undisciplined?commentId=826287) (*that link should probably have been a Rick Roll*).

Even though we initially discussed this possibility a few months ago, I never really gave much thought to what I would do with the territory. I love the regular contributions we've been getting, lately, and I'll seek to make sure those continue.

My first order of business will be to search out the optimal posting fee, which is a process @jeff began. Expect a fee reduction in the near future, once I settle on a search method.

I have a very expansive view of what constitutes ~econ content (as one of my advisors said, "If it's about people making choices, then it's econ."), so I hope people will choose ~econ for their posts involving anything related to human action (the subject or the book).

Expect more updates as I come up to speed on running a territory and let me know what you'd like to see from this territory going forward.

originally posted at https://stacker.news/items/826658

-

@ a42048d7:26886c32

2024-12-27 16:33:24

DIY Multisig is complex and 100x more likely to fail than you think if you do it yourself:

A few years ago as an experiment I put what was then $2,000 worth Bitcoin into a 2 of 3 DIY multisig with two close family members holding two keys on Tapsigners and myself holding the last key on a Coldcard. My thought was to try and preview how they might deal with self custodied multisig Bitcoin if I died prematurely. After over a year I revisited and asked them to try and do a transaction without me. Just send that single Utxo to a new address in the same wallet, no time limit. It could not possibly have failed harder and shook my belief in multisig. To summarize an extremely painful day, there was a literally 0% chance they would figure this out without help. If this had been for real all our BTC may have been lost forever. Maybe eventually a family friend could’ve helped, but I hadn’t thought of that and hadn’t recommended a trusted BTC knowledge/help source. I had preached self sovereignty and doing it alone and my family tried to respect that. I should’ve given them the contact info of local high integrity bitcoiners I trust implicitly.

Regardless of setup type, I highly recommend having a trusted Bitcoiner and online resources your family knows they can turn to to trouble shoot. Bookmark the corresponding BTCSessions video to your BTC self custody setup.

Multisig is complicated as hell and hard to understand. Complexity is the enemy when it comes to making sure your BTC isn’t lost and actually gets to your heirs. Many Bitcoiners use a similar setup to this one that failed so badly, and I’m telling you unless you’re married to or gave birth to a seriously hardcore maxi who is extremely tech savvy, the risk your Bitcoin is lost upon your death is unacceptably high. My family is extremely smart but when the pressure of now many thousands of dollars was on the line, the complexity of multisig torpedoed them.

Don’t run to an ETF! There are answers: singlesig is awesome.

From observing my family I’m confident they would’ve been okay in a singlesig setup. It was the process of signing on separate devices with separate signers, and moving a PSBT around that stymied them. If it had been singlesig they would’ve been okay as one signature on its own was accomplished. Do not besmirch singlesig, it’s incredibly powerful and incredibly resilient. Resilience and simplicity are vastly underrated! In my opinion multisig may increase your theoretical security against attacks that are far less likely to actually happen, e.g. an Oceans Eleven style hack/heist. More likely your heirs will be fighting panic, grief, and stress and forget something you taught them a few years back. If they face an attack it will most likely be social engineering/phishing. They are unlikely to face an elaborate heist that would make a fun movie.

While I still maintain it was a mistake for Bitkey to not have a separate screen to verify addresses and other info, overall I believe it’s probably the best normie option for small BTC holdings(yes I do know Bitkey is actually multisig, but the UX is basically a single sig). This incident scared me into realizing the importance of simplicity. Complexity and confusion of heirs/family may be the most under-considered aspects of BTC security. If you’ve made a DIY multisig and your heirs can’t explain why they need all three public keys and what a descriptor is and where it’s backed up, you might as well just go have that boating accident now and get it over with.

Once you get past small amounts of BTC, any reputable hardware wallet in singlesig is amazing security I would encourage folks to consider.

In a singlesig setup - For $5 wrench attack concerns, just don’t have your hardware signer or steel backup at your home. You can just have a hot wallet on your phone with a small amount for spending.

If you get a really big stack collaborative multisig is a potentially reasonable middle ground. Just be very thoughtful and brutally honest about your heirs and their BTC and general tech knowledge. Singlesig is still great and you don’t have to move past it, but I get that you also need to sleep at night. If you have truly life changing wealth and are just too uncomfortable with singlesig, maybe consider either 1) Anchorwatch to get the potential benefits of multisig security with the safety net of traditional insurance or 2) Liana wallet where you can use miniscript to effectively have a time locked singlesig spending path to a key held by a third party to help your family recover your funds if they can’t figure it out before that timelock hits, 3) Bitcoin Keeper with their automatic inheritance docs and mini script enabled inheritance key. The automatic inheritance docs are a best in class feature no one else has done yet. Unchained charges $200 for inheritance docs on top of your $250 annual subscription, which imho is beyond ridiculous. 4) Swan vault, I’ve generally soured on most traditional 2 of 3 collaborative multisig because I’ve always found holes either in security (Unchained signed a transaction in only a few hours and has no defined time delay, and still doesn’t support Segwit, seriously guys, wtf?), only support signers that are harder to use and thus tough for noobs, or the overall setups are just too complex. Swan Vault’s focus on keeping it as simple as possible really stands out against competitors that tack on unneeded confusion complexity.

TLDR:

For small amounts of BTC use Bitkey.

For medium to large amounts use singlesig with a reputable hardware wallet and steel backup.

For life changing wealth where you just can no longer stomach sinsglesig maybe also consider Anchorwatch, Bitcoin Keeper, Sean Vault, or Liana.

Don’t forget your steel backups! Be safe out there!

Do your own research and don’t take my word for it. Just use this as inspiration to consider an alternative point of view. If you’re a family of software engineers, feel free to tell me to go fuck myself.

-

@ 5d4b6c8d:8a1c1ee3

2024-12-27 15:01:43

Howdy, Stackers

We've got some territory updates to cover this week:

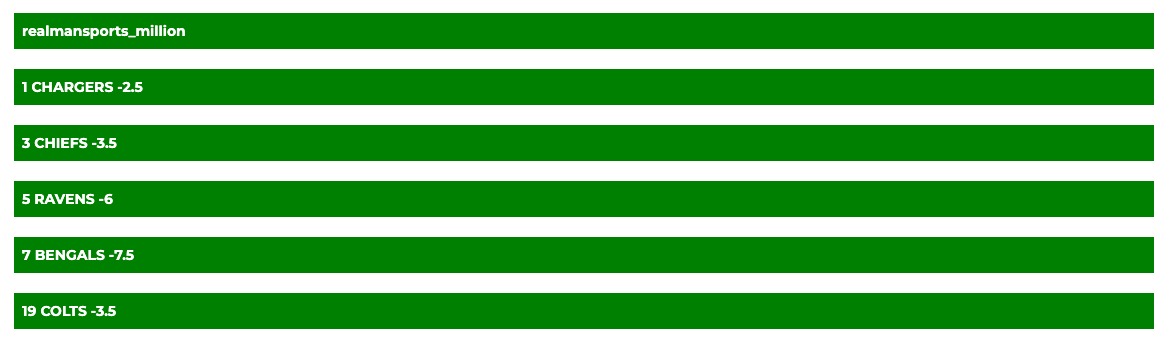

- The first round of the [College Football Contest](https://stacker.news/items/820618/r/Undisciplined) is in the books

- Cricket contests: [CricZap](https://stacker.news/items/821369/r/Undisciplined) and [BBL Survivor Pool](https://stacker.news/items/819076/r/Undisciplined) are rolling forward (perhaps without @grayruby)

- We have a winner of the impromptu [USA vs the World](https://stacker.news/items/822695/r/Undisciplined) contest

- Apparently, some stackers started a [fantasy football league](https://stacker.news/items/824623/r/Undisciplined), but I don't recall hearing about it before

Then onto some sports topics

- The NFL and NBA are competing over Christmas Day supremacy: https://stacker.news/items/824953/r/Undisciplined

- What are our favorite sports to watch live vs on tv? https://stacker.news/items/825580/r/Undisciplined