-

@ a012dc82:6458a70d

2025-02-19 16:20:32

The cryptocurrency world is on the verge of a groundbreaking transformation with the anticipated introduction of Bitcoin Exchange-Traded Funds (ETFs). This significant development is set to redefine the realm of crypto-investment, merging the innovative world of digital currencies with the established domain of traditional finance. Bitcoin ETFs represent a monumental shift, not just as a novel investment option, but as a revolutionary bridge connecting the cutting-edge technology of cryptocurrencies with the more familiar territory of stock market investments. This fusion is poised to unlock a new level of accessibility, drawing mainstream investors into the Bitcoin sphere, who were previously hesitant due to the complexities and perceived risks associated with direct cryptocurrency dealings.

**Table of Contents**

- The Emergence of Bitcoin ETFs

- Unveiling Opportunities

- Confronting the Dangers

- The Road Ahead

- Expanding the Horizon

- Enhanced Market Dynamics

- Technological Advancements

- Educational Initiatives

- Global Impact

- Conclusion

- FAQs

**The Emergence of Bitcoin ETFs**

Bitcoin ETFs are poised to revolutionize the cryptocurrency market. They offer a streamlined avenue for investment in Bitcoin, bypassing the intricacies of direct ownership such as wallet management and key security. This simplicity could democratize Bitcoin investment, potentially enhancing its liquidity and stability.

**Unveiling Opportunities**

- **Broader Investor Appeal:** Bitcoin ETFs simplify cryptocurrency investment, making it more approachable for the average investor and traditional financial players. This could lead to wider adoption and recognition of Bitcoin as a viable asset class.

- **Influx of Institutional Capital:** ETFs could catalyze a surge of institutional funds into the Bitcoin market. Institutions, previously hesitant due to regulatory and security concerns, might view ETFs as a safer investment avenue.

- **Market Evolution:** The advent of Bitcoin ETFs signals a maturation of the cryptocurrency market, transitioning towards regulated, mainstream financial products. This evolution could bolster investor confidence and market stability.

**Confronting the Dangers**

The introduction of Bitcoin ETFs is not devoid of risks and challenges.

- **Amplified Volatility:** Bitcoin's notorious volatility could be intensified by the influx of new investors via ETFs, particularly if large capital movements occur swiftly.

- **Regulatory Hurdles:** The evolving regulatory framework for cryptocurrencies could become more complex with Bitcoin ETFs, inviting stricter regulations that may impact the market dynamics.

- **Systemic Implications:** Integrating Bitcoin into the traditional financial system through ETFs could introduce new systemic risks. A significant downturn in Bitcoin's value might have broader implications for investors and funds linked to these ETFs.

**The Road Ahead**

As the Bitcoin ETF era dawns, investors should exercise caution. The potential of Bitcoin ETFs is substantial, but the accompanying risks warrant serious consideration. Investors should engage in comprehensive research and assess their risk appetite before engaging with these new investment vehicles.

**Expanding the Horizon**

**Enhanced Market Dynamics**

The introduction of Bitcoin ETFs could lead to more dynamic market behaviors. As traditional and crypto markets become more intertwined, the impact of global economic events on Bitcoin's price could become more pronounced, leading to new investment strategies and market analysis techniques.

**Technological Advancements**

The growth of Bitcoin ETFs might spur technological advancements in trading platforms and financial tools. Enhanced security measures, improved trading algorithms, and more sophisticated risk management tools could emerge, catering to the unique needs of cryptocurrency ETFs.

**Educational Initiatives**

With the growing interest in Bitcoin ETFs, there's likely to be an increase in educational resources and initiatives aimed at helping investors understand the nuances of cryptocurrency investments. This could lead to a more informed investor base, capable of making better investment decisions in the volatile world of cryptocurrencies.

**Global Impact**

The success of Bitcoin ETFs in one region, such as the United States, could encourage other countries to follow suit, leading to a more globalized cryptocurrency market. This could have significant implications for international financial regulations and cooperation.

**Conclusion**

The potential introduction of Bitcoin ETFs marks a significant milestone in the journey of cryptocurrency investment. While it heralds new opportunities and greater accessibility, it also brings forth challenges and risks that need to be navigated with care. The future of Bitcoin ETFs will hinge on the balance between these opportunities and dangers, and the market's ability to adapt to this new phase of crypto-investment. As we stand at the threshold of this exciting era, the global financial community watches with bated breath, ready to witness the unfolding story of Bitcoin ETFs.

**FAQs**

**How does a Bitcoin ETF differ from direct Bitcoin investment?**

Investing in a Bitcoin ETF means you're investing in a fund that holds Bitcoin as its primary asset, as opposed to buying Bitcoin directly and managing your own digital wallet and security. ETFs are also subject to different regulatory and tax treatments.

**What are the benefits of Bitcoin ETFs?**

Bitcoin ETFs offer easier access to Bitcoin investment, potentially lower risks compared to direct ownership, and the convenience of trading through traditional investment platforms.

**What risks are associated with Bitcoin ETFs?**

Risks include the inherent volatility of Bitcoin, potential regulatory changes, and systemic risks if the cryptocurrency market impacts the broader financial system.

**Are Bitcoin ETFs available globally?**

The availability of Bitcoin ETFs varies by country, depending on the regulatory environment. Some countries may not yet have approved Bitcoin ETFs for trading.

**Can Bitcoin ETFs impact the price of Bitcoin?**

Yes, Bitcoin ETFs can impact Bitcoin's price as they can increase market liquidity and bring in more institutional investors, potentially leading to price changes.

**That's all for today**

**If you want more, be sure to follow us on:**

**NOSTR: croxroad@getalby.com**

**X: [@croxroadnews.co](https://x.com/croxroadnewsco)**

**Instagram: [@croxroadnews.co](https://www.instagram.com/croxroadnews.co/)**

**Youtube: [@croxroadnews](https://www.youtube.com/@croxroadnews)**

**Store: https://croxroad.store**

**Subscribe to CROX ROAD Bitcoin Only Daily Newsletter**

**https://www.croxroad.co/subscribe**

***DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.***

-

@ 6ad3e2a3:c90b7740

2025-02-19 14:17:22

Like most members of the human race, I don’t enjoy filing my taxes. “Don’t enjoy” though understates my actual feeling which is “would rather do a tour in Afghanistan.” It’s not even the money I’m forced to pay that I know for sure will be misallocated, stolen or worse — put to use in ways that are anathema to everything I believe and in direct opposition to conditions in which human beings thrive. That’s only part of it.

The other and perhaps bigger part is they require me — under penalty of law — to do homework. They command me, as though they were my boss, to complete this work project, my tax return, and if I don’t I’ll have my property seized, my credit destroyed and even go to prison. This is so even though I am not a criminal, and I never agreed to work for this boss.

And it’s not just a random work project I am required to submit, so that they can misallocate, steal and attack me with my own money. It’s a project that requires me to divulge private details about myself, what transactions I’ve made, with whom I made them and for what purpose. I am a private citizen, I hold no public office or official role, and yet the public sector is not only entitled to comb through the details of my life, but I must be complicit in helping them under penalty of law, i.e., threat of violence if I don’t comply.

. . .

This was not always the case. The income tax was only introduced in 1913, and at the time was only for the richest of the rich. That is to say, it is not the default state of affairs in the United States under its original constitution, and it’s strange that it’s been normalized as such. And despite it being normalized — for the greater good, of course — our government is still somehow $36 trillion in debt.

In other words, despite the annual indignity to which we subject ourselves, the government spends far more money than it takes in. I am reminded of Dostoyevsky’s line: “Your worst sin is that you have destroyed and betrayed yourself for nothing.” The government is spending money it doesn’t have, whether you pay it or not, and the money you do pay, for things you not only do not want but are vehemently against, doesn’t come close to covering their cost.

. . .

I was having lunch with some normies last month, and the subject of taxes came up. They were talking about the ways in which they, as ex-pats, minimize their tax burden, using certain loopholes, and at one point someone questioned why government pensions were taxed, given the entity paying the pension and demanding it be taxed was one and the same. Why not just pay a smaller pension?

One of them asked me, and I said: “I don’t think anyone should be taxed.” She shook her head and muttered in amusement, “No, people need to be taxed.” This despite not two minutes earlier explaining how she was optimizing her tax status, which no doubt she would have optimized all the way to zero or if she were able!

. . .

Taxes are necessary, it’s assumed, to pay for things individuals won’t. “Who will build the roads?” they wonder. I would imagine car makers would be invested in building roads, those who ship goods via truck might have an interest and consumers, flush with their new zero percent tax rate, might pay a little more for the end products to facilitate road creation so those products get to them on time and in good condition. In fact, it might be *more* expensive to ship them via horseback or whatever alternate form of transport would take the place of motor vehicles should no one shell out for roads.

Moreover, people seem to believe taxes should always be taken not from them, but from those rich enough to afford them painlessly. Never mind anyone reading this substack is vastly wealthy compared to much of the third world (how painful can taxes be so long as you have food on the table and a roof over your head?), and never mind no one ever voluntarily pays more tax than he owes. Why not? If taxation is a good thing, why not do *more* good by overpaying?

But no, it’s always someone else who needs to be forced under penalty of law, i.e., threat of violence, to give up his property for what those in authority deem “the greater good”. Taken to its logical conclusion, if the authorities deem anyone sufficiently wealthy and the greater good sufficiently necessary, they can legally take that wealth by force. We can quibble about how much funding is necessary and what is the “greater good,” but it’s often essential things like the “safe and effective” vaccine without which millions would surely die or the necessity of invading Iraq, which cost $6 trillion to prevent Sadaam Hussein’s “weapons of mass destruction” from reaching US soil.

It’s amazing authorities so often discover urgent projects without which people will die or suffer terribly, on account of which it’s necessary to commandeer money you’ve earned or saved! And while I am taking about the indignity of filing *income* tax, I don’t mean to leave out property tax, sales tax, estate tax, individual state and city taxes and the like. At least with some of those you have a fixed amount to pay, and you don’t have to submit to an on-camera self-administered anal cavity search of your finances in those cases.

You’d also think given how many ways citizens are taxed that roads would be in tip top condition, our water and environment would be clean, our airports modern and state of the art, our health care affordable and accessible, but of course none of that is the case. Again per Dostoyevsky — we have betrayed ourselves for nothing.

. . .

The irony of this essay/diatribe is I will file my taxes like the cuck I am over the next week or so. I don’t want to do this, but it’s simply not worth the consequences for non-compliance. And I feel bad about making this compromise — bad about myself because I am doing something I feel is wrong for convenience, the same kind of calculation people made when they injected themselves with experimental mRNA chemicals they didn’t want to keep their jobs or travel. I like to think of myself as resolute and uncompromising, but in this instance I roll over every year. Perhaps that’s part of why I dread it so much.

. . .

I’ll end with a footnote of sorts. In the late spring of 2023, I discovered I was due a significant refund, and I paid my accountants who figured this out $400 to re-file for me. They told me I could expect it to take up to nine months to process, so I largely forgot about it until spring of 2024 when I called but got phone-treed to death and waited until September to brute-force my way to a human in another department to explain the situation. They didn’t tell me anything, but agreed to do a “trace” which a couple weeks later revealed someone else had intercepted and cashed my check. (It’s not direct deposit because I’m overseas.)

I immediately returned the form proving it was not my signature on the deposited check, and now, five months later, in February of 2025, they are still processing my purported payment which I have yet to receive. I did, however, receive a notice of the interest I was “paid” for 2024 on which I’m expected to be taxed. That interest went to the person who stole my original check obviously, they know this, and yet it apparently hasn’t caught up in the system. And the truth is I will probably pay the tax on it as the hassle of explaining why I’m not is simply not worth it, and I will sort it out on next year’s tax return, assuming Trump hasn’t abolished the IRS entirely, God willing, and delivered us, in small part, from this abject dystopia.

-

@ e83b66a8:b0526c2b

2025-02-19 11:00:29

In the UK, as Bitcoin on-ramps become throttled more and more by government interference, ironically more and more off-ramps are becoming available.

So here, as Bitcoin starts its bull run and many people will be spending or taking profits within the next year or so, I am going to summarise my experience with off ramps.

N.B. many of these off-ramps are also on-ramps, but I’m primarily focusing on spending Bitcoin.

Revolut:

At last in the UK, Revolut is a “probation” full bank and so now has most of the fiat guarantees that other legacy banks have.

Apart from its excellent multi-currency account services for fiat, meaning you can spend native currencies in many countries, Revolut have for some time allowed you to buy a selection of Crypto currencies including Bitcoin.

You can send those coins to self custody wallets, or keep them on Revolut and either sell or spend on specific DeFi cards which can be added to platforms like Apple Pay. Fees, as you would expect are relatively high, but it is a very good, seamless service.

Uphold:

This was an exchange I was automatically signed up to by using the “Brave Browser” and earning BAT tokens for watching adds. I have however found the built in virtual debit card, which I’ve added to Apple Pay useful for shedding my shitcoins by cashing them in and spending GBP in the real world, buying day to day stuff.

Xapo Bank:

I signed up about a year ago to the first “Bitcoin Bank” founded by Wences Casares a very early Bitcoiner.

They are based in Gibraltar and offer a USD, Tether and Bitcoin banking service which allows you to deposit GBP or spend GBP, but converts everything into either USD or BTC. You have a full UK bank account number and sort code, but everything received in it is converted to USD on the fly.

They also support Lightning and they have integrated LightSparks UMA Universal Money Addressing protocol explained here:

https://www.lightspark.com/uma

When I signed up the fees were $150 per annum, but they have since increased them to $1,000 per annum for new users.

I have yet to use the bank account or debit card in any earnest, but it will be my main spending facility when I take profits

Strike:

Strike it really focused on cross border payments and sending fiat money around the world for little to no cost using Bitcoin as the transmission rails. You need to KYC to sign up, but you then get, in the UK at least, a nominee bank account in your name, a Lightning and Bitcoin wallet address and the ability to send payments immediately to any other Strike user by name, or any Bitcoin or Lightning address.

In the U.S. they have also recently launched a bill pay service, using your Strike account to pay your regular household bills using either fiat or Bitcoin.

Coinbase:

Back in 2017, I signed up for a Coinbase debit card and was spending Sats in daily life with it automatically converting Sats to GBP on the fly. I let it lapse in 2021 and haven’t bothered to replace it. I believe it is still option to consider.

Crypto.com

I have a debit card which I cannot add to Apple Pay, but I have managed to add it to Curve card: https://www.curve.com/en-gb/ which is in turn added to Apple Pay. This allows me to spend any fiat which I have previously cashed from selling coins.

I currently have some former exchange coins cashed out which I am gradually spending in the real world as GBP.

SwissBorg

Has had a troubled past with the FCA, but does currently allow deposits and withdrawals from UK banks, although Barclays have blocked transactions to my own nominee account within SwissBorg on a couple of occasions. They have a debit card option for investors in their platform, which I am not and they intend to make this generally available in the future. SwissBorg are a not an exchange, but more of a comparison site, searching the market for the best prices and activating deals for you across multiple platforms, taking a commission. They have been my main source for buying BTC and when they are not being interfered with by the FCA, they are excellent. You also get a nominee bank account in their platform in your own name.

-

@ 0b118e40:4edc09cb

2025-02-19 01:21:45

Are we living in his definition of democracy?

It’s interesting how political parties can divide a country, especially in democracies where both oppression and individual choice coexist.

As I was exploring global economics and political ideologies, I picked up *The Republic* by Plato (again). The first time I read it, I only read the book on the Allegory of the Cave and it felt enlightening. This time around, I read through all the books and I thought to myself : *this is absolutely nuts!*

Over 2,000 years ago, *The Republic* imagined a world disturbingly similar to Gattaca or 1984. For a quick rundown, Plato believed in a police state, eugenics, a caste system, and brainwashing people through state-controlled media and education. Sounds wild? I thought so too.

And for some reason, Plato had a serious grudge against art. To him, art was deceptive and emotionally manipulative. Maybe because there was a skit making fun of Socrates at that time by Aristophanes (the father of comedy) or maybe because he struggled to deal with emotions, we will never know.

Plato obviously wasn’t a fan of democracy as he wanted a dystopian world. But to be fair, he genuinely thought that his ideal world (Kallipolis) was a utopia. Maybe someone who loves extreme order and control might think the same but I sure don’t.

His teacher Socrates was also not a fan of democracy because he believed the mass majority were too ignorant to govern and only those intelligent enough could. His student, Aristotle, was more moderate but still critical, seeing democracy as vulnerable to corruption and mob rule. Socrates, Plato, and Aristotle were around the Classical Greek era, 5th to 4th century BC.

The idea of democracy existed long before them. The first recorded version was in Athens during the 6th BC, developed by leaders like Solon and Pericles. It was a direct democracy where free male citizens (non-slaves) could vote on laws themselves instead of electing representatives.

These guys influenced how we think about democracy today. But looking around, I wonder, did we end up in Plato’s dystopian world?

### **Plato’s take on democracy**

Plato’s lack of trust of democracy stemmed from Socrates’ death. Socrates himself was a fierce critic of democracy, as he believed governance should be based on wisdom rather than popularity.

Other thinkers, like Pythagoras and Herodotus (father of history), also examined different political systems, but Socrates was the most influential critic. He warned that allowing the uneducated masses to choose leaders would lead to poor governance, as they could be easily swayed by persuasive speakers rather than guided by knowledge.

Athenian democracy relied on large citizen juries and was particularly vulnerable to rhetoric and public sentiment.

In the end, Socrates became a victim of the very system he criticized. His relentless questioning of widely accepted beliefs, now known as the **Socratic Method**, earned him powerful enemies. Socrates’ constant probing forced them to confront uncomfortable truths. It annoyed people so much, that it eventually led to his trial and execution. Socrates was condemned to death by popular vote.

I wonder, if we applied the Socratic Method today to challenge both the left and the right on the merits of the opposing side, would they be open to expanding their perspectives, or would they react with the same hostility?

This questioning technique is now also used in some schools and universities as a teaching method, encouraging open-ended discussion where students contribute their own thoughts rather than passively receiving information. But how open a school, system, or educator is to broad perspectives depends largely on their own biases and beliefs. Even with open-ended questions, the direction of the conversation can be shaped by those in charge, potentially limiting the range of perspectives explored.

Socrates’ brutal death deeply grounded Plato’s belief that democracy, without intellectual rigor, was nothing but a mob rule. He saw it as a system doomed to chaos, where the unqualified, driven by emotion or manipulated by rhetoric, made decisions that ultimately paved the way for tyranny.

### **The Republic**

*The Republic* was written around 375 BC, after the Peloponnesian War. One of its most famous sections is the Allegory of the Cave, where prisoners are stuck watching shadows on a wall, thinking that it’s reality until one breaks free and sees the real world. That’s when the person becomes enlightened, using knowledge and reason to escape ignorance. They return to free others, spreading the truth. I love this idea of breaking free from suppression through knowledge and awareness.

But as I went deeper into Plato’s work, I realized what the plot twist was.

Plato wrote this book for strict state control. He wanted total control over education, media, and even families like in the book 1984. He argued that people should be sorted into a caste system, typically workers, warriors, and philosopher-kings so that society runs like a well-oiled machine. The “guardians” would police the state and everyone would go through physical and military training. To top it off, kids would be taken away from their parents and raised by the state for the “greater good.” like in the movie Gattaca. If that sounds a little too Orwellian, that’s because it is.

Plato believed that only philosophers, the truly enlightened ones from that “cave”, should rule. To him, democracy was a joke, a breeding ground for corruption and tyranny.

I found it completely ironic that this book that warns about brainwashing in the Allegory of the Cave also pushes for a state-controlled society, where thinking for yourself isn’t really an option.

And yet, looking around today, I wonder, are we really any different? We live in a world where oppression and enlightenment exist side by side.

Plato was slightly progressive in that he thought men and women should have equal education, but only for the ruling Guardian class.

In *The Republic*, Plato didn’t focus much on economics or capitalism as we understand them today. His philosophies were more concerned with justice, governance, and the ideal structure of society. He did touch on wealth and property, particularly in *The Republic and Laws* but it was more on being against wealth accumulation by rulers (philosopher-kings had to live communally and without private property).

While these ideas echo elements of socialism, he never outlined a full economic system like capitalism or socialism.

### **The hatred for art**

Plato was deeply skeptical of art. He believed that it appealed to emotions over rational thought and distorted reality. In *The Republic* (Book X), he argued that art is an imitation of an imitation, pulling people further from the truth. If he had his way, much of modern entertainment, including poetry, drama, and even certain types of music, would not exist in their expressive forms.

Despite Plato’s distrust of the arts, his time was a golden age for Greek drama, sculpture, and philosophy. Ironically, the very city where he built his Academy, Athens, was flourishing with the kind of creativity he wanted to censor.

Even medicine, which thrived under Hippocrates (the father of medicine), was considered an art requiring lifelong mastery. His quote, ‘**Life is short, and art is long**,’ reflects the long span of time it takes to cultivate and appreciate knowledge and skills, which was something Plato valued. Yet, he dismissed most art as a distraction from truth.

Plato particularly criticized poets and playwrights like Homer, as he claimed they spread false ideas about gods and morality. He was also wary of Aristophanes, as he believed his work stirred emotions rather than encouraging rational thought. It probably did not help that Aristophanes mocked Socrates in his play *The Clouds*, which may have influenced Plato’s views.

What’s clear is that Plato didn’t hate art because he didn’t understand it. He deeply understood the power of storytelling and its ability to mold societal beliefs. He argued for banning poets entirely from his “ideal city” to prevent them from misleading the public.

But he did value some forms of art. After all, he was a writer himself, and writing is a form of art. He approved of artistic expressions that promoted moral and intellectual virtue, such as hymns, architecture, and patriotic poetry, as long as they served the greater purpose of instilling order and wisdom in society.

### **Plato’s five regimes**

Plato believed governments naturally decay over time, moving from order to chaos. He outlined five regimes, which he considers each to be worse than the last.

1. *Aristocracy (Philosopher-King rule)* : This is his pitch, the ideal state, ruled by wise elites who value knowledge over power. Some aspects of modern authoritarian states echo this model

2. *Timocracy (Military rule)* : A government driven by honor and discipline, like Sparta. Over time, ambition overtakes virtue, leading to oligarchy.

3. *Oligarchy (Rule by the wealthy)* : The rich seizes power and deepens inequality. Many democracies today show oligarchic tendencies, where money dominates politics.

4. *Democracy (Rule by the masses)* : The people overthrow the elites, prioritizing freedom over order. But without stability, democracy becomes fragile, and vulnerable to demagogues and external manipulation.

5. *Tyranny (Dictatorship)* : When democracy collapses, a charismatic leader rises, promising order but seizing absolute power. What begins as freedom ends in oppression.

Modern politics seems stuck in a cycle, shifting between democracy, oligarchy, and authoritarian control. If Plato was right, no system is permanent and only the illusion of stability remains.

### **Does Plato’s ideal state exist in any country today?**

Some aspects of modern *benevolent dictatorships*, like Singapore under Lee Kuan Yew, or *socialist states* like China, may resemble Plato’s vision in their emphasis on elite rule, long-term planning, and state control. But, these governments operate pragmatically, balancing governance with economic power, political strategy, and public influence rather than strictly adhering to philosophical ideals.

Could this be compared to Taliban rule, given the censorship, authoritarian control, and rigid social hierarchy? While there are superficial similarities, the key difference is that Plato valued knowledge, reason, and meritocracy, while the Taliban enforced religious fundamentalism and theocratic rule. Plato’s Kallipolis also included some level of gender equality for the ruling class, whereas the Taliban’s system is heavily restrictive, especially toward women.

While Plato’s ideas echo in certain authoritarian-leaning states, his rigid caste system, philosopher-led governance, and rejection of democracy set his vision apart from any modern political system.

### **Aristotle’s take on democracy**

Aristotle wasn’t Athenian, but he documented and analyzed 158 constitutions, including Athenian democracy. He studied at Plato’s Academy for over 20 years, growing up in a world influenced by Athens’ democratic experiment. He lived through the tail end of Athens’ golden age, witnessed its decline, and experienced how different forms of rule influenced politics and the mindset of the people under them.

For Aristotle, governments were good or corrupted. The good ones were monarchs, aristocracy (wise elites), and polity (a constitutional gov’t where the middle class keeps power balanced). The corrupted ones were tyranny (monarchy gone wrong), oligarchy, and democracy.

Aristotle saw how democracy, if unchecked, could spiral into chaos or be co-opted by populist leaders. But unlike Plato, who rejected democracy outright, Aristotle believed it could work if properly structured.

His concept of ‘**polity**’ was a constitutional government that balanced democratic participation with stability, relying on a strong middle class to prevent both mob rule and elite domination. This idea of checks and balances, a mixed government, and middle-class stability make polity the closest to modern constitutional democracies today when compared to all 3 of the Greek philosophers.

### **What happened after Athens?**

Of course, democracy didn’t end with Athens, it evolved over time. After Athens’ golden age came Alexander the Great (Aristotle’s student and the king of Macedonia). He conquered Greece, Persia, Egypt, and part of India, creating the largest empire of his time. After his death in 323 BCE, his empire split among his generals, marking the beginning of the Hellenistic period.

Rome saw a shift from the fall of the Roman Republic to the rise of the Roman Empire under Augustus moving away from democratic ideals to centralized rule. But the Western Roman Empire fell about 500 years later largely due to internal decline and invasions by the Germanic Tribes (modern-day Sweden, Switzerland, Germany). The Eastern Roman Empire (Byzantine Empire, based in Constantinople or modern-day Turkey) rose and survived for nearly 1,000 more years until it fell to the Ottoman Turks in 1453.

During the Medieval period (5th–15th century), Europe saw a rise in monarchies and feudalism. Power shifted to kings, nobles, and the church, with little direct participation from ordinary people. Some democratic elements survived in places like Venice and Florence, where wealthy merchant families controlled city-states.

By the 17th century, democracy started creeping back into political thought, though not without skepticism. Machiavelli and Hobbes weren’t exactly fans of democracy, but they had plenty to say about power and governance. Later on Machiavelli hinted on the possible idea of a republic/mixed government in the *Discourses of Livy *

Meanwhile, England was going through its own struggles with power. The English Civil War (1642–1651) was a showdown between King Charles I, who wanted absolute power, and Parliament, which wanted more influence. Charles ignored Parliament and was executed in 1649. England briefly became a republic under Oliver Cromwell, but the monarchy returned after his death.

In 1688, the Glorious Revolution forced King James II (Charles I’s son) to flee to France. Parliament then invited William of Orange (a Dutch Protestant) and his wife Mary to take the throne. In 1689, they signed the English Bill of Rights, which limited the monarchy’s power, strengthened Parliament, and guaranteed certain rights to citizens.

This was a significant moment in history as it effectively ended the absolute monarchy and established a constitutional monarchy in England.

The American Revolution in 1776 and the French Revolution in 1789 pushed democratic ideals forward but still excluded women, slaves, and the poor. Historian Luciano Canfora, in his book* Democracy in Europe*, argues that early liberal democracy was full of contradictions as it preached equality, yet economic and social exclusion remained.

(Note: If you want to understand the history of *anarchism*, the French Revolution is a key starting point. It influenced early anti-authoritarian thought, which later evolved into socialist and anti-capitalist movements. Over time, libertarians adopted anarchist principles, leading to the development of anarcho-capitalism. The concept of anarchism in politics has taken nearly two centuries to emerge in its modern form).

The 19th and 20th centuries saw the expansion of democracy. But as Canfora explains it, it also saw its exploitation and manipulation. Although industrialization and social movements pushed for broader suffrage, democracy remained controlled by elites who feared true mass participation. Democracy became a tool for maintaining power rather than a true expression of the people’s will.

According to Canfora, the Cold War turned democracy into a geopolitical tool, with Western powers supporting or opposing democratic movements based on strategic interests rather than principles.

Today, there are many versions of democracy from direct democracy to representative democracy, presidential democracy, social democracy, religious democracy, constitutional democracy, communist democracy, and more. And is often viewed as a brand name for “good governance”. But are they?

### **In the end, was Plato right?**

At a meta level, Plato’s argument was about control, be it controlling what people read, hear, and even think. The debate often centers on curated knowledge vs rhetoric. Plato believed that absolute obedience would bring harmony, even at the cost of individuality. Today, we call that totalitarian or dictatorship

But when we take a second look at things, are we already living in Plato’s world?

Governments across the globe control education, influence media narratives, and regulate speech. Many so-called democracies aren’t as free as they claim to be. So maybe Plato’s influence on modern democracies runs deeper than we realize.

Another key debate today is that, unlike Plato’s time, most people *are* educated. However, much of this education is still designed by state systems, which can influence how people think and vote. How do we balance empowering people through education while ensuring true independence in a system built on critical thinking rather than one that merely feeds information?

Truth is, democracy has never been a pure, people-driven system. It has always been influenced by power struggles, wealth, and manipulation. Often it has been an instrument of control rather than liberation.

Yet, the people have always resisted. In the past, they gathered in the streets, risking tear gas, rubber bullets or being dragged into Black Marias. Today, digital activism has allowed for mass mobilization with fewer risks. In many countries especially in third-world countries, online movements on platforms like Twitter during Jack’s time, forced governments to overturn policies. This may be the closest we've come to real democracy which is direct action without the usual state violence.

But with this rise in digital activism comes the counterforce through government and corporate requirements for censorship, algorithmic manipulation, and the quiet steering of public discourse. Platforms once seen as tools of liberation can become tools of control. *Facebook mood experiment* in 2012 tested positive and negative content on 700,000 people and proved emotions can be manipulated at scale. *Cambridge Analytica* was exposed in its attempt to manipulate votes.

This is where decentralized networks like Nostr matter as a fundamental resistance to centralized control over speech. If democracy is to return to the people, it must also break free from algorithmic gatekeepers and censorship.

Because the so-called ‘ignorant masses’, the very people Plato dismissed, are the ones who fight for freedom.

Because real democracy isn’t about control.

It’s about freedom.

It’s about choice.

It’s about the people, always.

-

@ 6ad3e2a3:c90b7740

2025-02-18 17:08:23

I’m not doing any writing today. Taking the day, maybe the week, off. Just not in the mood.

This whole idea you’re supposed to write, get the thoughts out, the ideas moving is stupid. To what end? I’m done with evaluating myself for productivity, justifying myself to myself — or anyone else.

What I really need is to find some pleasant distractions. Something to fill my time, or as Elon Musk says of Twitter “to avoid regretted user seconds.” I’ve tried Twitter itself, of course, but Musk’s algorithm falls woefully short. After an hour of doom and dopamine scrolling, punctuated with the occasional shitpost, many seconds are regretted — roughly 3500 of them.

I could turn to alcohol or drugs, but too many side effects. Yes, you’re distracted, but what about after that? You’re always left worse off than where you started. Even alcoholics and drug addicts — the pros! — know it’s a dead end.

I don’t know, maybe spend more time with loved ones? You hear that a lot. “If I didn’t have to work so much, I’d spend more time with loved ones.” LOL. Like what, you’re going to hang around while your “loved ones” are doing things with their actual lives. Maybe I’ll take the bus to school with Sasha, hang out with her and her friends, see how that goes. Quality time!

Exercise. It’s the perfect solution, good for your health, you feel better, your mind is calm. Only problem is it’s fucking miserable. If your aim is to avoid sitting at a desk to write, forcing your carcass around a track is hardly an upgrade. It’s like quitting your middle management job to break rocks in a prison chain gang.

There must be something I can do. Eating sugary processed food is out of the question for the same reason alcohol and drugs are. Becoming obese and diabetic is no solution, as many of the pros (obese diabetics) would no doubt attest.

Meditation. That’s it! You sit on a cushion, count your breaths. Pretty soon you are calm. You can meditate for as long as you want! It’s perfect, and it’s easy. Well, it’s not that easy. You get distracted by your thoughts and you’re just sitting there thinking about the things for which you hope and dread in your life.

Of course, you notice that distraction and come back to the breath, but pretty soon you’re wandering again. And you come back again. But really you’re wondering how long you’ve been sitting, your feet are falling asleep, your back is tight and you don’t feel much different. You weren’t even properly distracted because instead of being distracted *from* your mind, you are being distracted *by* it. It’s a worst-case scenario of sorts — you neither get anything done, nor escape the endless self-evaluation and justification.

That just means you’re doing it wrong, though. You’re failing at it. If you did it right, it would be the perfect escape from yourself. But it’s not working, so you’re failing. Or maybe you succeeded a little bit. You’re not sure. You are still evaluating whether that was a good use of your time. The same evaluation process you use to decide whether you’ve done enough writing, the same tired bullshit from which you were trying to escape in the first place!

Let’s face it, you’re not just going to meditate your way out of the problem. If you could, you would have already, and so would everyone else. We would all be enlightened. Maybe you need to go to an ashram or something, find a guru on top of a mountain in the Himalayas. LOL, you’re not gonna do that! You are way too attached to your comforts and daily routines, no matter how dull and unsatisfying they ultimately are.

There’s nowhere to run, nowhere to hide, no one to see, nothing to do. You are out of options. There is only one thing in your absolute control, and it’s where you direct your attention. And you have decided that no matter how bleak and pointless the alternatives the one thing about which you are resolute is you are taking the day off from writing.

-

@ 6bae33c8:607272e8

2025-02-17 18:31:27

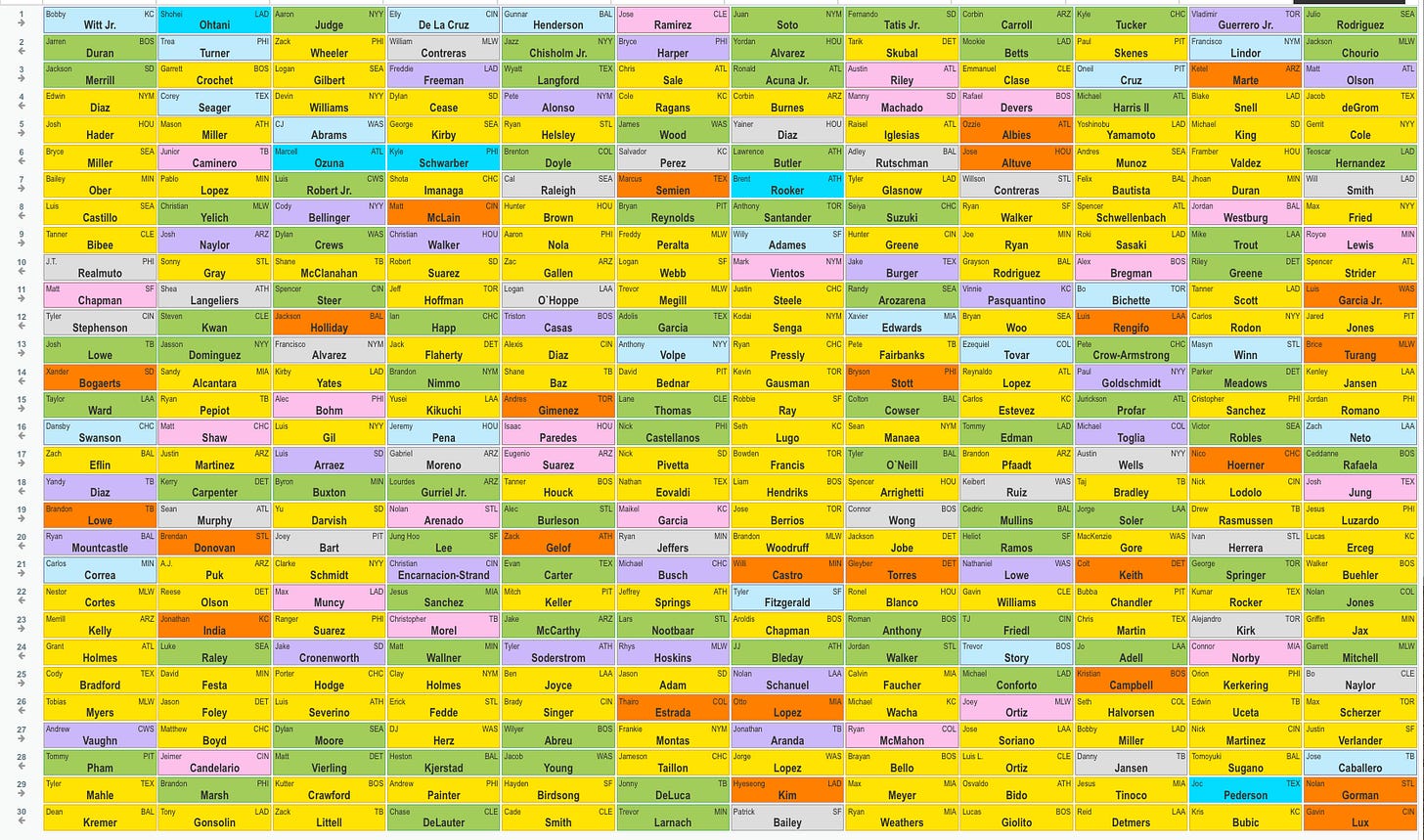

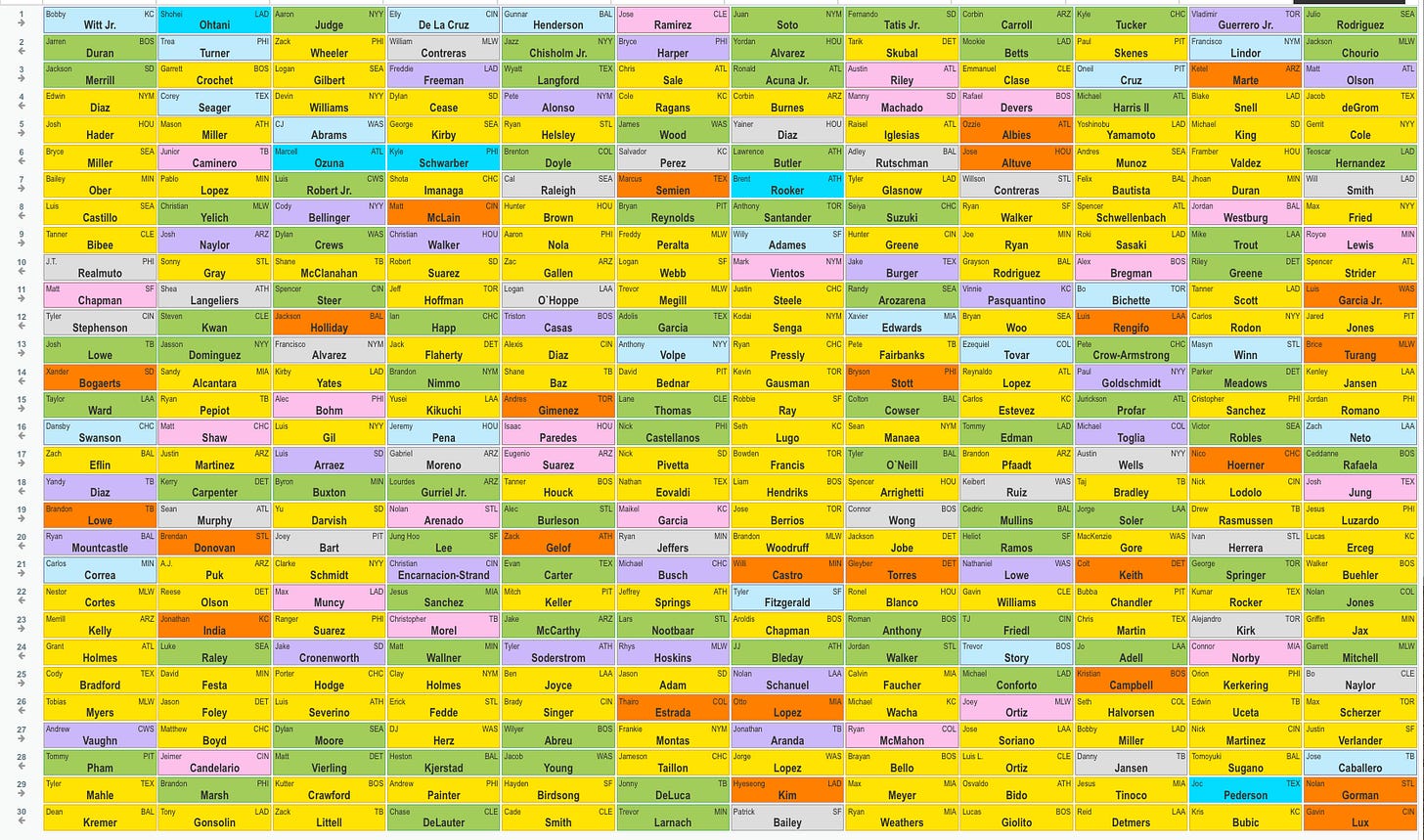

I did my first NFBC draft Sunday night — I drew the 12th pick. Here’s the [link to the live-stream](https://x.com/Chris_Liss/status/1891230585043226641).

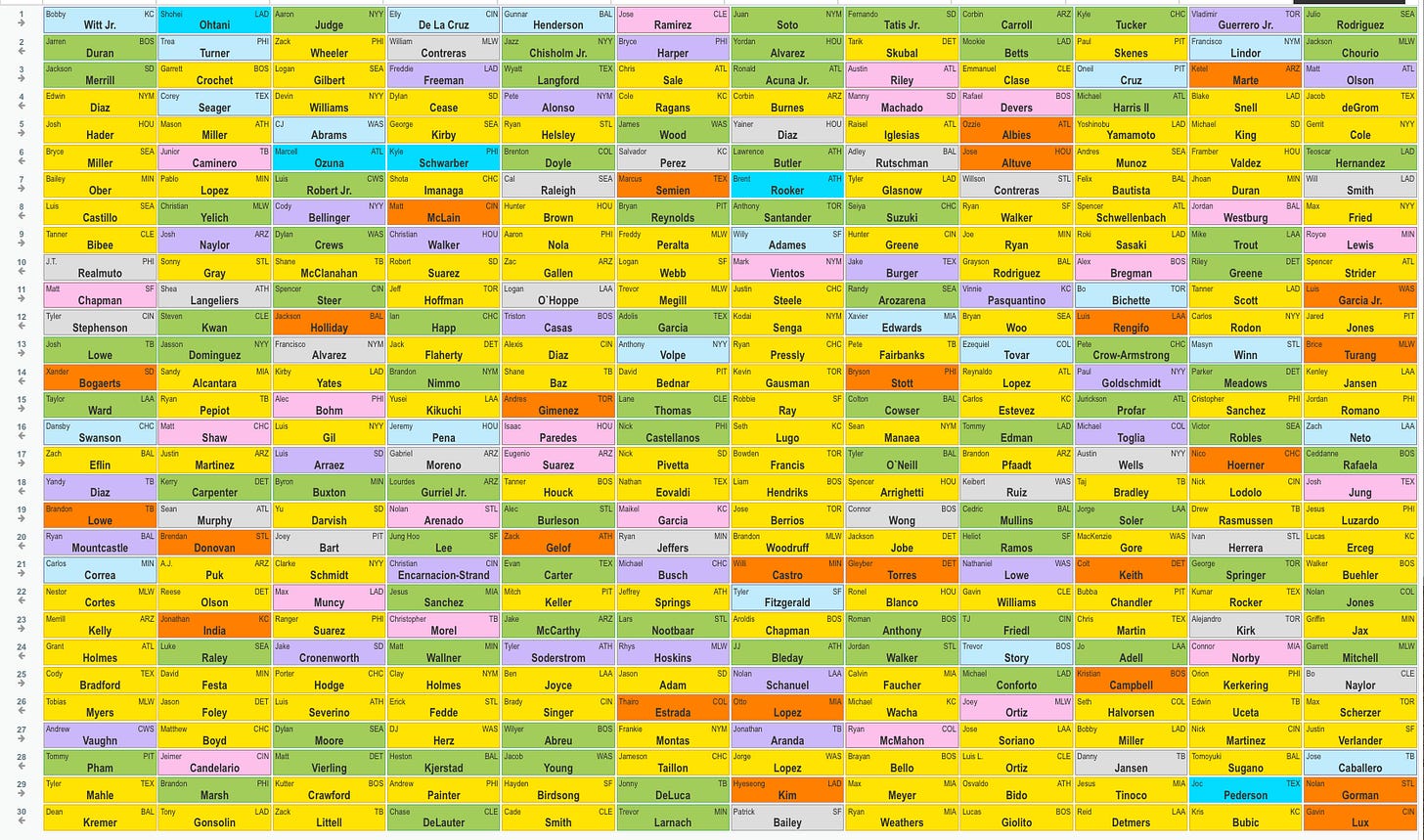

The full results are below:

This draft went about as well as I could have hoped, especially given [how little I had prepared](https://www.realmansports.com/p/beat-chris-liss-1-8c2). That doesn’t mean the team is \*good\*, only that I didn’t have any major regrets or gaffes, something that’s rare over 30 rounds.

I also never once got swiped on a pick. I got priced out of the top closers early, but rolled with it in the way one should when that happens, getting players I wanted and doubling back to closers when I needed to.

This team is built to win the overall — high-risk, high reward, an exercise in imagining not what could go wrong, not what’s the base case, but what could go right.

**The Draft**

**1.12 Julio Rodriguez** — I had mapped out the first 10 rounds, decided on Rodriguez and Jackson Chourio ahead of time. I knew Chourio would be there, per ADP, but if Rodriguez were gone, I’d have gone with Mookie Betts. I wanted two OF with power and speed to start my draft. Rodriguez had 32 homers and 37 steals as a 22-year old in 2023, was going in the 2-4 overall range last year and nothing that happened since should move the needle much heading into his age 24 season.

**2.1 Jackson Chourio —** Chourio had 21 homers and 22 steals as a 20-year-old rookie, and those numbers were weighed down by a slow start where the Brewers were constantly pulling him from the lineup for no reason. From June until the end of the year, he hit .303 and should only get better in Year 2. His healthy floor is 25-25, and there’s stolen base and batting average upside.

**3.12 Matt Olson** — While Rodriguez and Chourio offer solid pop, I wanted a 40-HR type to compensate for the lack of top-end power with my first two picks, while filling the scarce-in-recent-years 1B slot. Olson had an off year in 2024, but chalk that up to variance. I still like him in that park and lineup.

**4.1 Jacob deGrom** — I’m not here to win the $1500 league prize but the $150K overall. deGrom isn’t just the best pitcher in baseball when he’s healthy, he’s one of the best in baseball history. If I get 100 IP of vintage deGrom, that’s worth a fourth-round pick. At 130-150, it’s a first-rounder. I also like that he’s nearly two years out from Tommy John surgery, pitched at the end of last season and is healthy now. While there’s no chance of 200 IP, he’s also not a rookie they need to ramp up slowly, but a veteran with a massive contract, i.e., the Rangers will want to get their money’s worth if he’s dealing.

**5.12 Gerrit Cole** — When Raisel Iglesias went four picks ahead of me, I was pretty sure I was going Cole who typically goes in the first or second round. Cole had an off year, but the sample was small as he missed time due to a nerve issue in the spring, and there wasn’t much of a drop-off from 2023, even with the irregular start to the year. Pitchers ebb and flow with health, and the light workload might redound to his benefit.

**6.1 Teoscar Hernandez** — This was just a value-take in the sixth round. Hernandez gives you pop, runs a little and hits in the best lineup in baseball.

**7.12 Will Smith** — I didn’t love the options in these rounds, so I punted and nabbed a solid catcher with 20-HR pop. I don’t really see the difference between Smith and Adley Rutschman who goes two rounds earlier either.

**8.1 Max Fried** — With deGrom shaky on innings, and five hitters in my first seven picks, I wanted another horse to anchor the rotation. I like lefties in Yankee Stadium too.

**9.12 Royce Lewis** — I needed a third baseman, and Lewis, who was going in the fifth round last year, was the one with the most upside. The key is that he’s healthy now, as he finished the season in the lineup and hasn’t had a setback this offseason. Lewis is a potential 30-HR/.290 bat if he can hold up for 140-odd games.

**10.1 Spencer Strider** — As I said, I’m trying to win the overall. Strider will start the year on the DL, but the timetable for the type of surgery he had is roughly one year, and Strider’s was in mid-April, i.e., there’s no reason he shouldn’t be back in May and might even see some action in spring training. If I get 220 combined IP from deGrom and Strider at their former levels, that’s worth the 1.1. (The “former levels” part is the rub, but as I said I’m focused on what could go right.) I also thought about Shane McClanahan instead, but narrowly opted for Strider.

**11.12 Luis Garcia** — I was set to take Brice Turang here to lock down speed and finally get a middle infielder, but I pivoted at the last second to Garcia who is a better-rounded hitter and more likely to have a prominent spot in his lineup.

**12.1 Jared Jones** — He was on my list because I remembered the hype after his strong start, and the cost seemed cheap relative to his skills. I almost took Carlos Rodon, as I prefer veterans. Maybe that will turn out to have been a mistake.

**13.12 Brice Turang** — What do you know, Turang made it all the way back. I guess people didn’t like his second-half collapse at the plate. But Turang is a gold glove defender, and he stole 50 bags last year. That glove keeps him in the lineup and should set a nice 30-steal floor.

**14.1 Kenley Jansen** — I could play closer chicken no more. Jansen is my favorite type of old warhorse closer, a guy so used to the job, he’s not going to lose it unless his stuff is truly gone.

**15.12 Jordan Romano** — Romano got $8.5 million from the Phillies, so I’m assuming he’s (a) healthy and (b) set to close. His ERA while pitching hurt for 14 innings last year is irrelevant.

**16.1 Zach Neto** — I needed a shortstop, and while Neto’s hurt right now, he went 23-30 as a 23-year old last year, and I couldn’t pass him up. I almost took Ceddanne Rafaela, but Neto’s upside higher.

**17.12 Ceddanne Rafaela** — Turns out Rafaela fell to me anyway, and I snapped him up, as I’ll need a SS early in the year with Neto presumably out. Rafaela went 15-19 as a 23-YO in his own right, also qualifies in the OF and his gold-glove-level defense should keep him in the lineup.

**18.1 Josh Jung** — I needed a CI, and also a backup 3B for the injury-prone Royce Lewis, so I took the injury-prone Jung. The key facts about Jung and Lewis are both can hit, and both are healthy as of right now. My team seems like it has a lot of injuries, but only Strider and Neto are hurt now. There is a difference between injury risk (deGrom, Lewis, Jung, Romano) and already injured. You can often find value by exploiting people’s conflation of those two related, but distinct categories.

**19.12 Jesus Luzardo** — Another skilled, but injury-prone player coming at a steep discount who is healthy now.

**20.1 Lucas Erceg** — A speculative closer play. Right now Carlos Estevez, who went in Round 15, is probably the favorite, but who knows?

**21.12 Walker Buehler** — More of the same theme. A player (especially a pitcher) who has shown elite skills, was derailed by injuries, but who is healthy now.

**22.1 Nolan Jones** — I had almost forgotten he existed, but there he was in Round 22, just one year removed from being a fifth-round pick after a 20-20-.297 season. Jones is only 26 and healthy as of now.

**23.12 Griffin Jax** — A setup guy with elite stuff, behind a closer that had nine losses and a 1.16 WHIP last year.

**24.1 Garrett Mitchell** — I took him narrowly over Jordan Walker. Mitchell went 8-11 in 224 at-bats, plays in a good park and has the physical tools to be good.

**25.12 Bo Naylor** — I needed a second catcher, and he is one. Naylor has a little pop, even runs a bit and should improve in his age 25 season.

**26.1 Max Scherzer** — Are we sure he’s done? He had a 1.15 WHIP last year and 40K in 43 IP despite returning from back surgery. He’s healthy now and signed a $15.5M deal this offseason presumably to pitch more than 100 innings.

**27.12 Justin Verlander** — Wait, they let me have deGrom, Cole, Strider, Buehler, Scherzer and Verlander? Those were like the top-six pitchers on the board a few years ago! Seriously though, Verlander is in a good park, and last year’s poor numbers were put up over a 90-inning sample while battling various ailments. He’s more likely to be done than Scherzer, but he knows how to pitch, and it’s just a matter of the stuff returning to above the minimum threshold. I wouldn’t be shocked to see one more strong year out of the 41-YO future Hall of Famer.

**28.1 Jose Caballero** — I drafted this gentleman in the 28th round because he qualifies everywhere and steals a lot of bases.

**29.12 Nolan Gorman** — The Cardinals want to get him regular at-bats, and there’s a 35-HR, .240 season somewhere in this skill set.

**30.1 Gavin Lux** — A big-time prospect that’s only shown flashes, should get regular playing time and a big upgrade in park. He might eventually qualify at some other positions too.

**Roster By Position**

**C** Will Smith/Bo Naylor

**1B** Matt Olson

**2B** Luis Garcia

**3B** Royce Lewis

**SS** Zach Neto

**CI** Josh Jung

**MI** Brice Turang

**OF** Julio Rodriguez/Jackson Chourio/Teoscar Hernandez/Ceddanne Rafaela/Nolan Jones

**UT** Garrett Mitchell

**SP** Jacob deGrom/Gerrit Cole/Max Fried/Spencer Strider/Jared Jones/Jesus Luzardo/Walker Buehler

**RP** Kenley Jansen/Jordan Romano

**B** Lucas Erceg/Griffin Jax/Max Scherzer/Justin Verlander/Jose Caballero/Nolan Gorman/Gavin Lux

-

@ fe32298e:20516265

2025-02-17 17:39:31

I keep a large collection of music on a local file server and use [DeaDBeeF](https://deadbeef.sourceforge.io/) for listening. I've never been able to pin DeadBeeF to the dock in Ubuntu, and it's always had the ugly default icon.

I asked DeepSeek for help, and it turned out to be easier than I thought.

1. Create `~/.local/share/applications/deadbeef.desktop`:

```bash

[Desktop Entry]

Name=DeadBeeF Music Player

Comment=Music Player

Exec=/home/user/Apps/deadbeef-1.9.6/deadbeef

Icon=/home/user/Apps/deadbeef-1.9.6/deadbeef.png

Terminal=false

Type=Application

Categories=AudioVideo;Player;

```

1. Make `deadbeef.desktop` executable:

```bash

chmod +x ~/.local/share/applications/deadbeef.desktop

```

And just like that, DeadBeeF has an icon and I can pin it to the dock.

`.desktop` files are part of the [Freedesktop.org standards](https://specifications.freedesktop.org/desktop-entry-spec/latest/). They're used in most popular desktop environments like GNOME, KDE and XFCE.

Tor Browser has the same issue, but it comes with a `.desktop` file already, so it only needs to by symlinked to the applications folder:

```

ln -s ~/Apps/tor-browser/start-tor-browser.desktop ~/.local/share/applications/

```

-

@ dbe0605a:f8fd5b2c

2025-02-17 06:42:38

Originally posted on Nostr: https://highlighter.com/a/naddr1qvzqqqr4gupzpklqvpdfcuch9wkh2gary7erd4275jmrf6qw0z5sz0dhj8u06kevqyvhwumn8ghj7urjv4kkjatd9ec8y6tdv9kzumn9wshszxrhwden5te0ve5kcar9wghxummnw3ezuamfdejj7qgwwaehxw309ahx7uewd3hkctcpz4mhxue69uhhyetvv9ujuerpd46hxtnfduhszythwden5te0dehhxarj9emkjmn99uqzqjn0d9hz6argv5k57ur9dck5y6t5vdhkjm3df4shqtt5xduxz6tsrdmw7l

I care deeply about bitcoin adoption and ability to use bitcoin with all features of money — saving, spending, earning. We're entering an age where more and more people realise "hodl never spend" meme is hindering bitcoin adoption. More and more of use want to use bitcoin in everyday life, because we're living on it and because it's superior in every aspect. It's also incredibly fun to use it for payments.

For money to thrive, it needs to circulate. Spending bitcoin orangepills merchants, their families and people around them — with each bitcoiner coming to a shop and paying with bitcoin, it's a point of contact that can trigger a train of though that later may fruit into action — "_Why are they so interested in bitcoin, what's actually so special about it?_" "_Hmm, maybe this time I will not exchange it for fiat immediately?_"

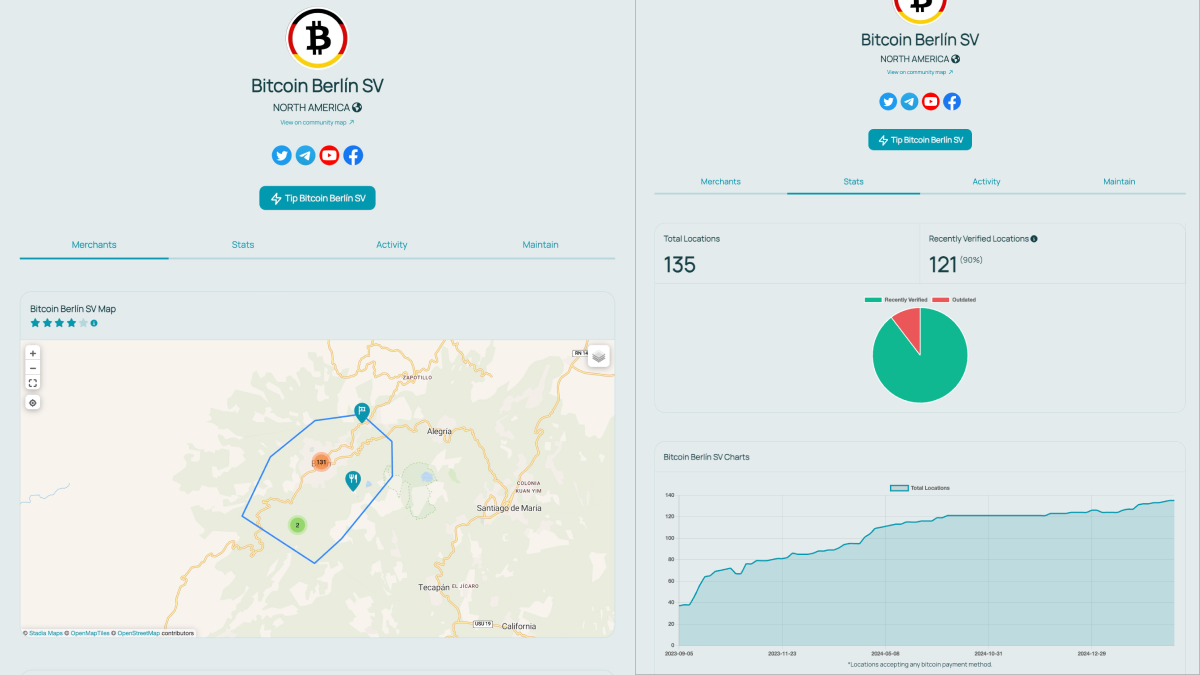

Global merchant adoption grows, every day new business around the world decide to start accepting bitcoin payments. Circular economies are blooming on all continents, where people live in a new, experimental, orange coin paradigm. Companies and projects like Blink, Bitcoin Jungle, Plan B, Orange Pill App do an amazing job in facilitating this — providing great wallets, tools & services for merchants, and finally onboarding merchants themself. They also often support circular economies financially or in other ways. This is very valuable and makes the road to hyperbitcoinization a tad shorter.

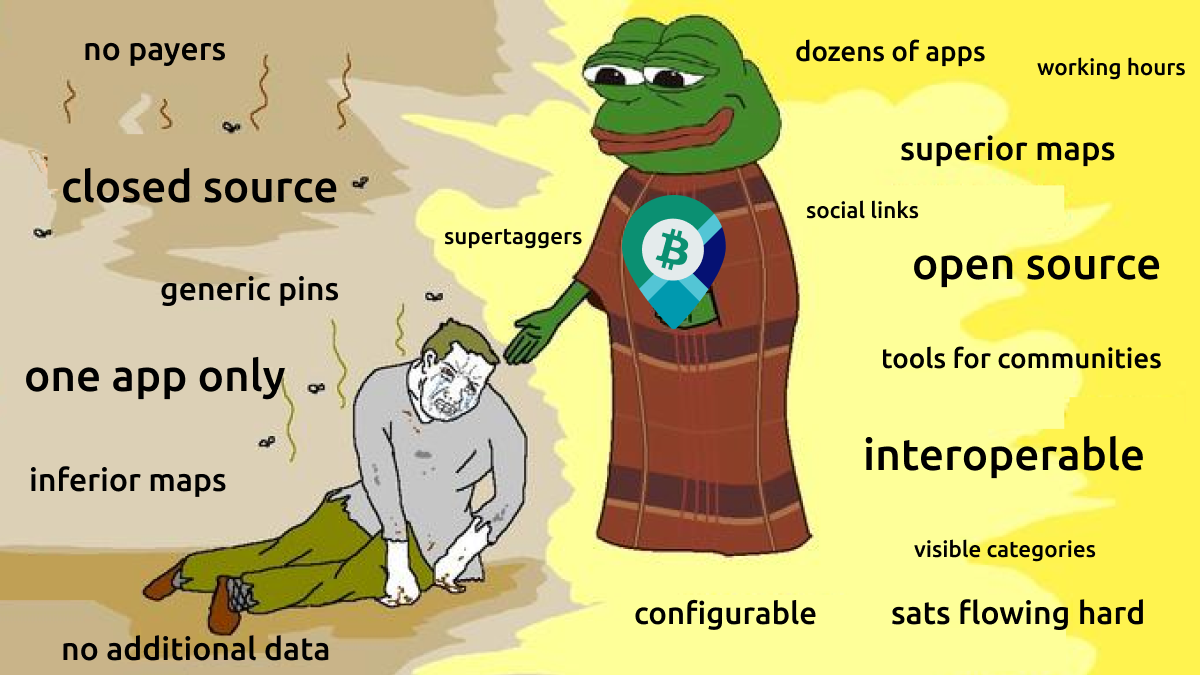

But there is one thing those companies are doing wrong — they're using their own, proprietary maps that display only merchants using their own wallets or POS software. I'd like to now list a few reasons why those great projects should migrate their maps into an open source, bitcoin map that is BTC Map.

## Open source, stupid

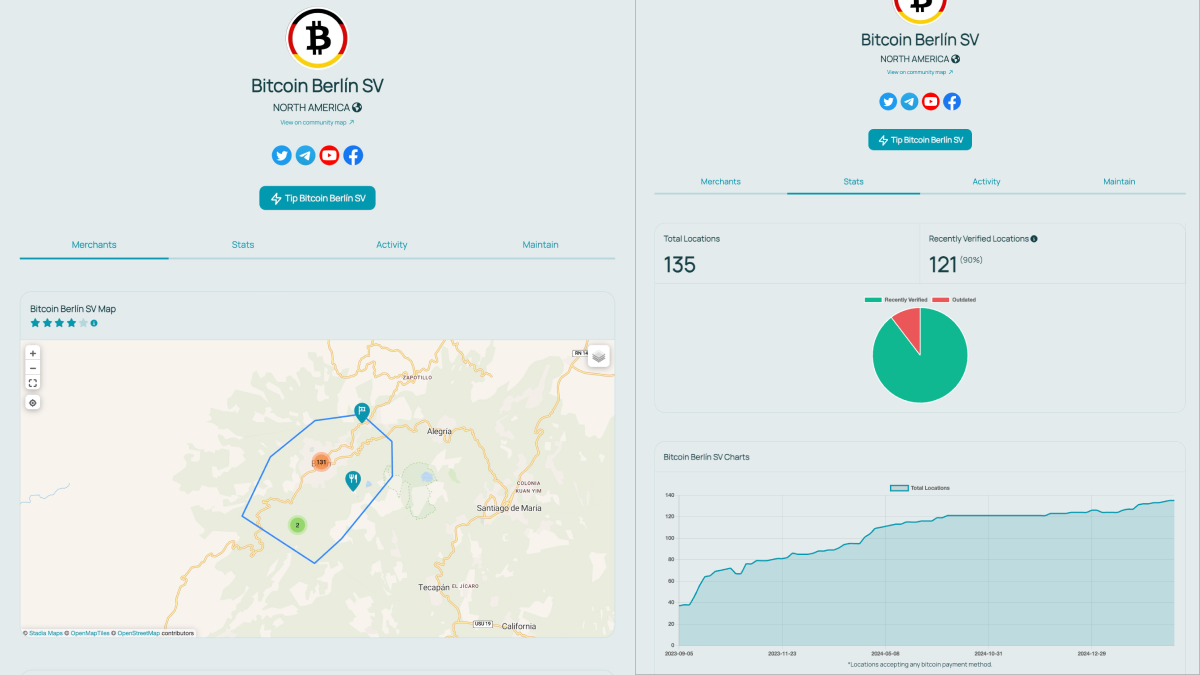

[BTCmap](https://btcmap.org/) is open source, built on OpenStreetMaps, open to both developers contributions but also for map taggers (called [shadowy supertaggers](https://www.openstreetmap.org/)). Anyone can contribute, even If you don't code. Anyone can verify merchants or add new merchants to the map. BTC Map team developed [a neat system of verifications](https://btcmap.org/verify-location) that just works better than anything before or any alternative maps today.

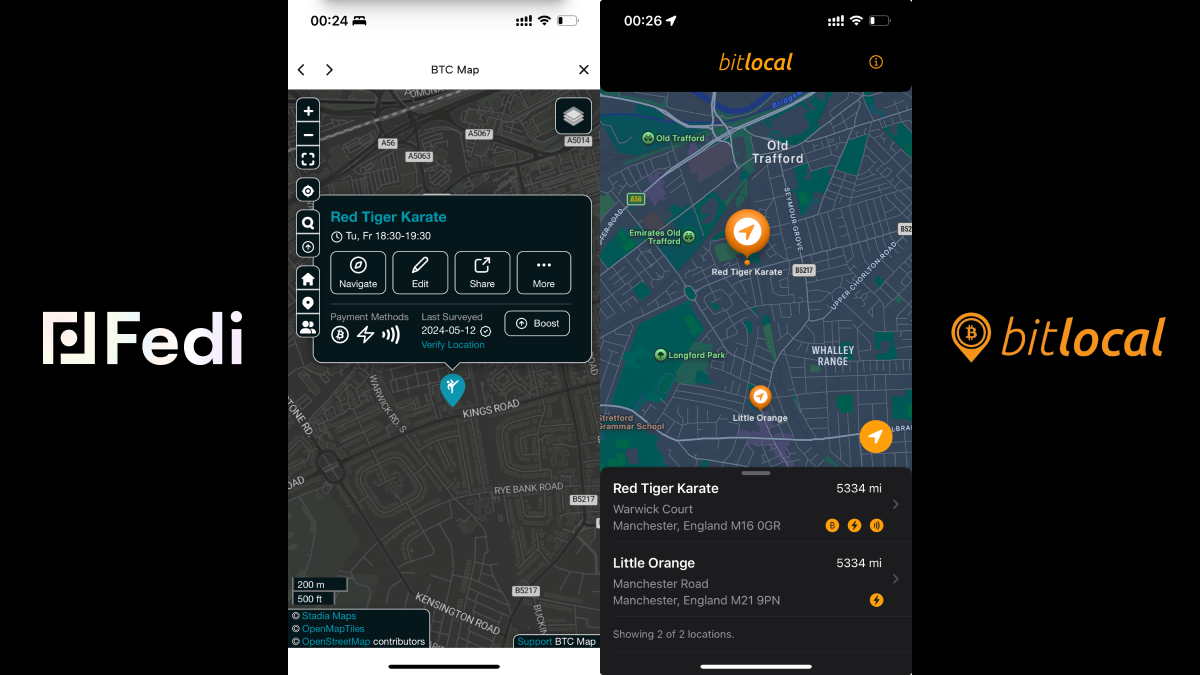

## Many apps, one map

BTC Map is integrated inside a dozen of wallets and apps, to name a few: Wallet of Satoshi, Coinos, Bitlocal, Fedi or Aqua. It's a public good that any bitcoin product can use and grow it's network effect.

## Uniting mappers' work

BTC Map does not discriminate bitcoin merchants, that means all the merchants from proprietary maps are being mapped by taggers to BTC Map. By mapping on a closed source, proprietary map, the same merchant is mapped two times, usually by two different people — it's duplicating the same work without any bringing any benefit to both projects. Using BTC Map also brings you way more people verifying If those merchants actually still accept bitcoin, making it easier to have an up-to-date database of actual adoption.

## More bitcoin spent at your merchants

When you have a business focused on spending bitcoin and onboarding merchants, you want as much bitcoin spent there as possible. If a bitcoiner coming to the area does not use your own map but some other map, they can be completely unaware that they can let their sats flow to your merchants. If we all use one merchants database, this problem disappears and more sats will flow. Why wouldn't you want your merchants displayed in dozens of other apps, completely for free?

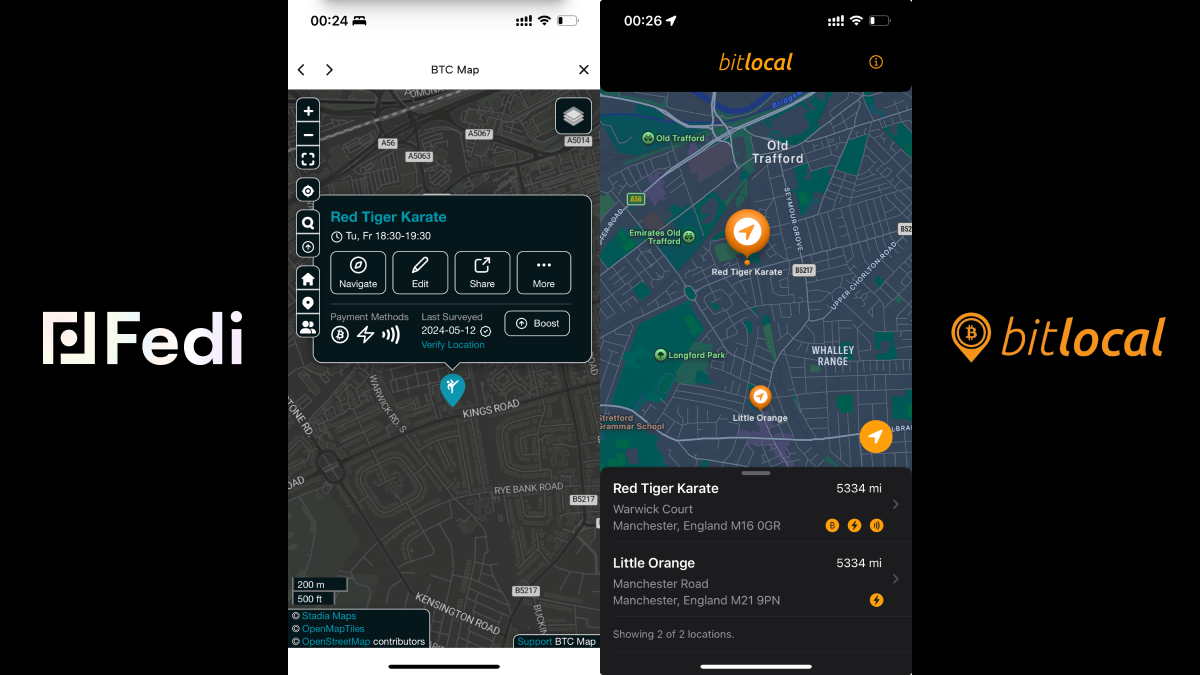

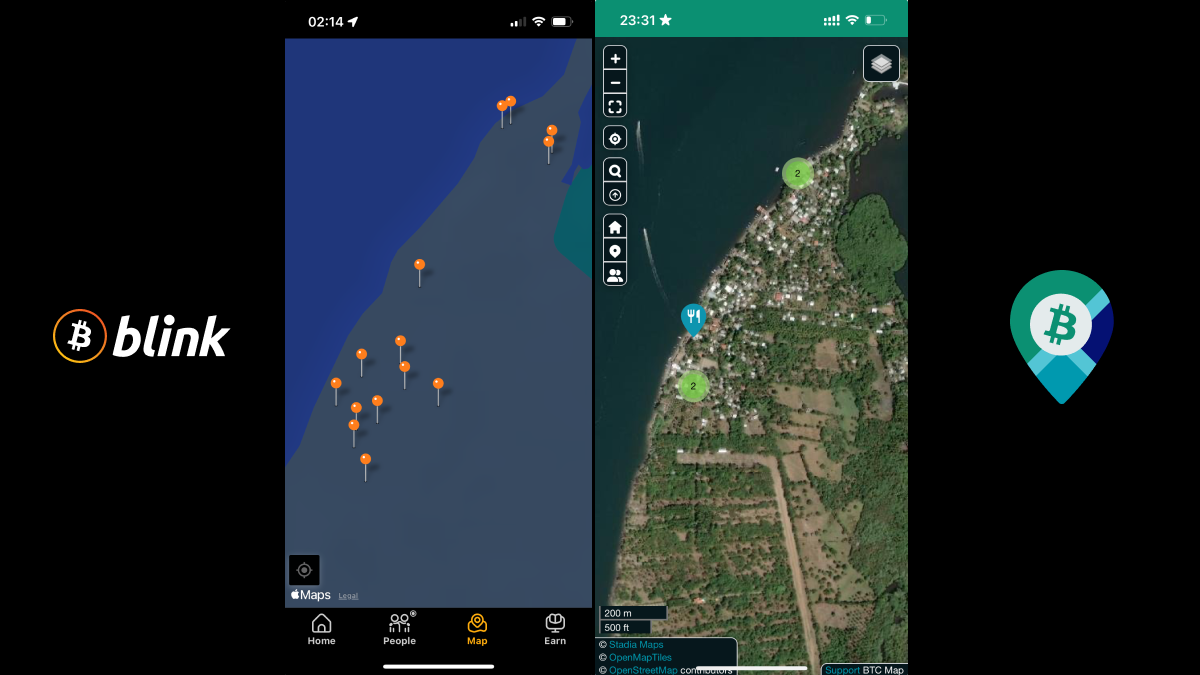

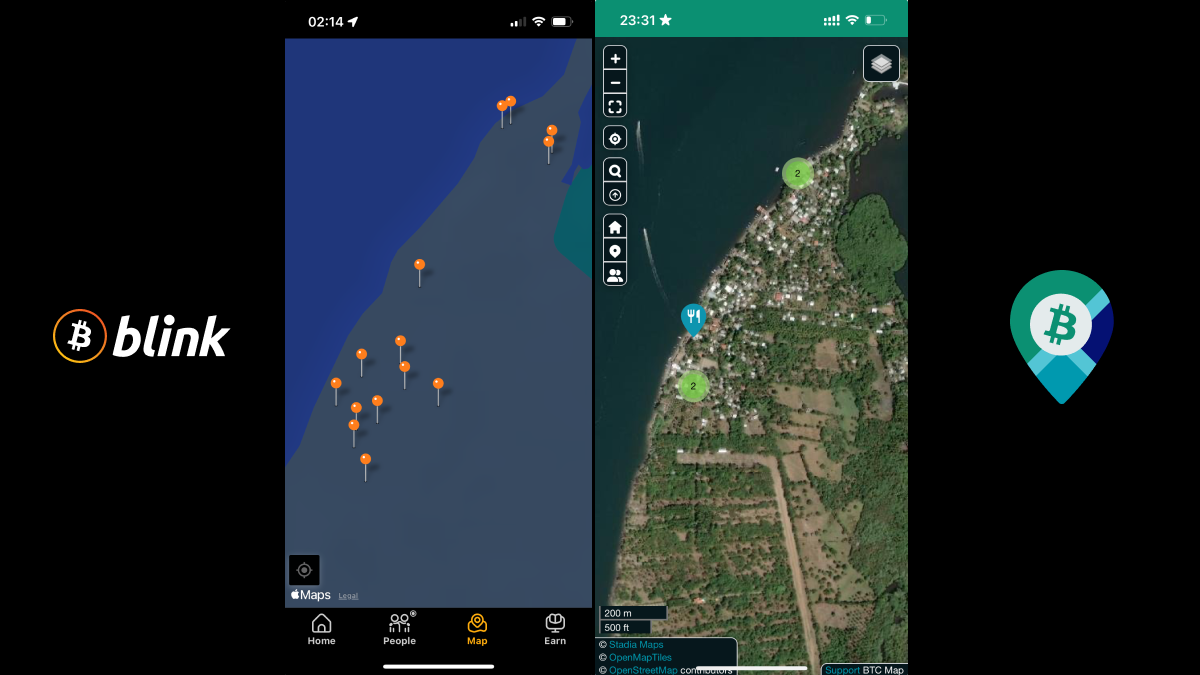

## OpenStreetMap map is just better

Take a look at the image above: It's [La Pirraya](https://btcmap.org/community/bitcoin-la-pirraya), a small sleepy island town in El Salvador with a circular economy being facilitated by Bitcoin Beach. Even though Blink has many more merchants compared to BTC Map, when I visited it a few months ago I could find them. Not because they do not exist, but because the map does not show any roads and it was very hard to locate them in a dense network of narrow streets of La Pirraya. BTC Map allows you to turn multiple versions of satellite maps views, making it way easier to find your point of interest. Pins also indicate what kind of business it is, where in Blink all the pins are the same and you need to click each to find out what it is. Even then not always it's clear, since Blink only displays names, while BTC Map tells you type of the merchant, and very often shows you working hours, phone numbers, website, social links, etc.

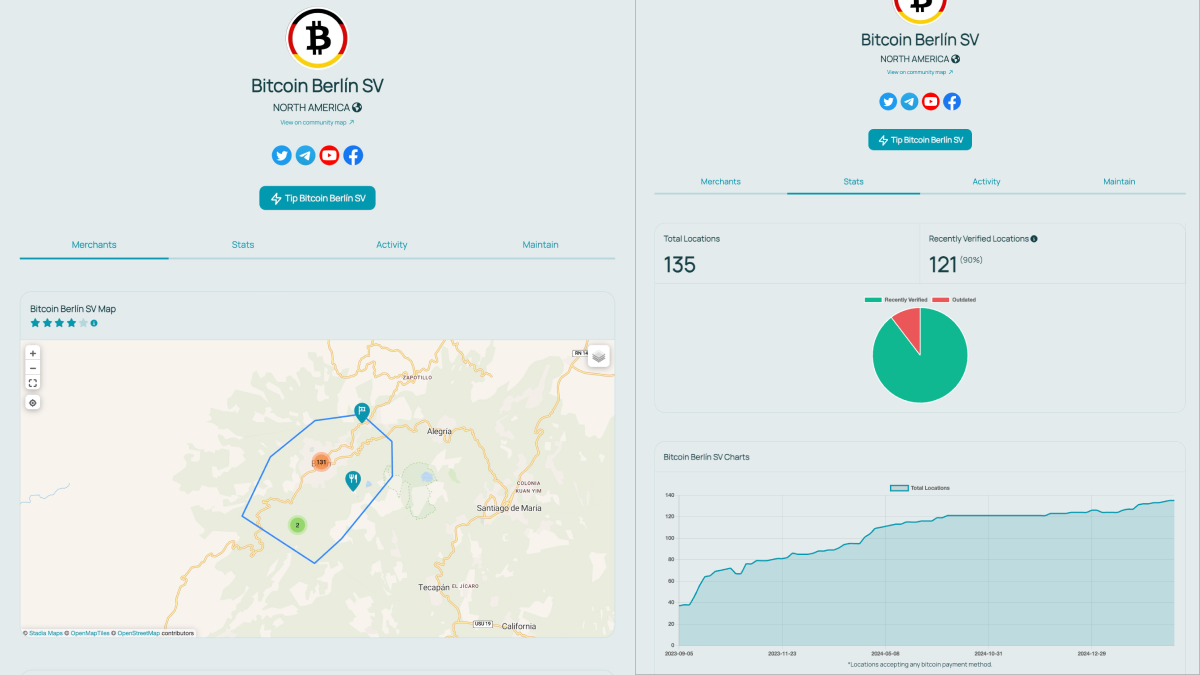

## Excellent community tools

BTC Map is focusing providing tools for communities to maintain their merchants map. [Each community has it's own page](https://btcmap.org/communities) with own links to community website or socials, displays a list of all the merchants, shows community stats, displays merchants that were not verified for a long time, and more. It even allows to "boost" merchants to make them more visible on the map and on the list. It's perfect tooling both for communities and businesses onboarding merchants to their software.

## Easy integration & configuration

Integrating BTC Map on your website or app is easy. It's just [a few lines of code of iframe](https://arc.net/l/quote/vrdudfnn) to embed the map, but you can also use [BTC Map API](https://arc.net/l/quote/sybkpvcu) for more custom integration. Do you to display, eg. you can display only merchants from your community? No problem, you can do that. Since it's all open source, you can configure it in many ways that will suit your needs.

## Kudos

I'd like to thank projects that understood all above and integrated BTC Map already. Those are Coinos, Wallet of Satoshi, Pouch, Bolt Card, BitLocal, Fedi, Decouvre Bitcoin, Osmo, Bitcoin Rocks!, Lipa, Spirit of Satoshi, Blockstream, Satlantis, Aqua Wallet and Adopting Bitcoin

## Encouragement & an offer

I'll end that with encouragement to projects that use their own maps, but haven't embraced BTC Map yet. Those are Blink, Bitcoin Jungle, Plan B, Osmo, Athena, Orange Pill App, Inbitcoin (I probably missed some, tag them!). You are doing great work, but let's join forces and paint the world orange together!

From here I would like to offer help in tagging your merchants on BTC Map. Just reach me out, and me and other supertaggers will do the work.

Let the sats flow!

originally posted at https://stacker.news/items/888088

-

@ dbe0605a:f8fd5b2c

2025-02-17 06:33:48

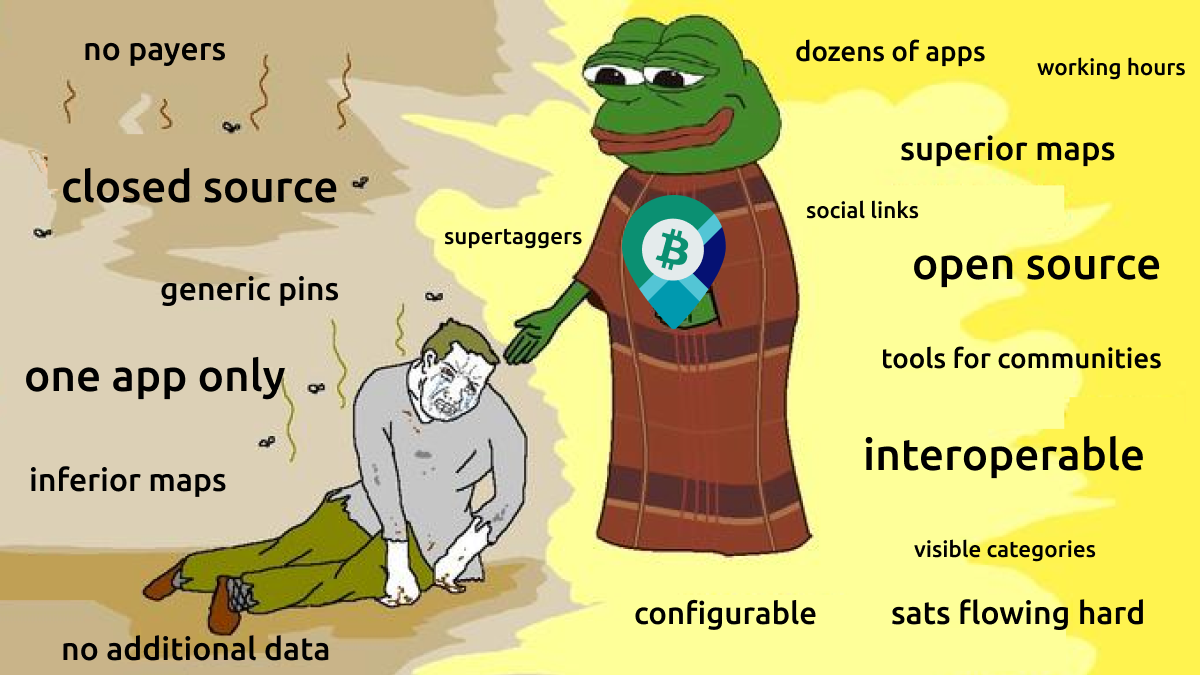

<img src="https://blossom.primal.net/8c7ed1e00dc0b41fda7894c7c91f1f8de6d89abc8a988fd989ced9470c0f056d.png">

\

I care deeply about bitcoin adoption and ability to use bitcoin with all features of money — saving, spending, earning. We're entering an age where more and more people realise "hodl never spend" meme is hindering bitcoin adoption. More and more of use want to use bitcoin in everyday life, because we're living on it and because it's superior in every aspect. It's also incredibly fun to use it for payments.

For money to thrive, it needs to circulate. Spending bitcoin orangepills merchants, their families and people around them — with each bitcoiner coming to a shop and paying with bitcoin, it's a point of contact that can trigger a train of though that later may fruit into action — "*Why are they so interested in bitcoin, what's actually so special about it?*" "*Hmm, maybe this time I will not exchange it for fiat immediately?*"

Global merchant adoption grows, every day new business around the world decide to start accepting bitcoin payments. Circular economies are blooming on all continents, where people live in a new, experimental, orange coin paradigm. Companies and projects like Blink, Bitcoin Jungle, Plan B, Orange Pill App do an amazing job in facilitating this — providing great wallets, tools & services for merchants, and finally onboarding merchants themself. They also often support circular economies financially or in other ways. This is very valuable and makes the road to hyperbitcoinization a tad shorter.

But there is one thing those companies are doing wrong — they're using their own, proprietary maps that display only merchants using their own wallets or POS software. I'd like to now list a few reasons why those great projects should migrate their maps into an open source, bitcoin map that is BTC Map.

## Open source, stupid

[BTCmap](https://btcmap.org/) is open source, built on OpenStreetMaps, open to both developers contributions but also for map taggers (called [shadowy supertaggers](https://www.openstreetmap.org/)). Anyone can contribute, even If you don't code. Anyone can verify merchants or add new merchants to the map. BTC Map team developed[ a neat system of verifications](https://btcmap.org/verify-location) that just works better than anything before or any alternative maps today.

<img src="https://blossom.primal.net/2cb0fda0b5b07f4f2ea79589060ada3bc0cec4db4db8634f52843083d8cdfd36.png">

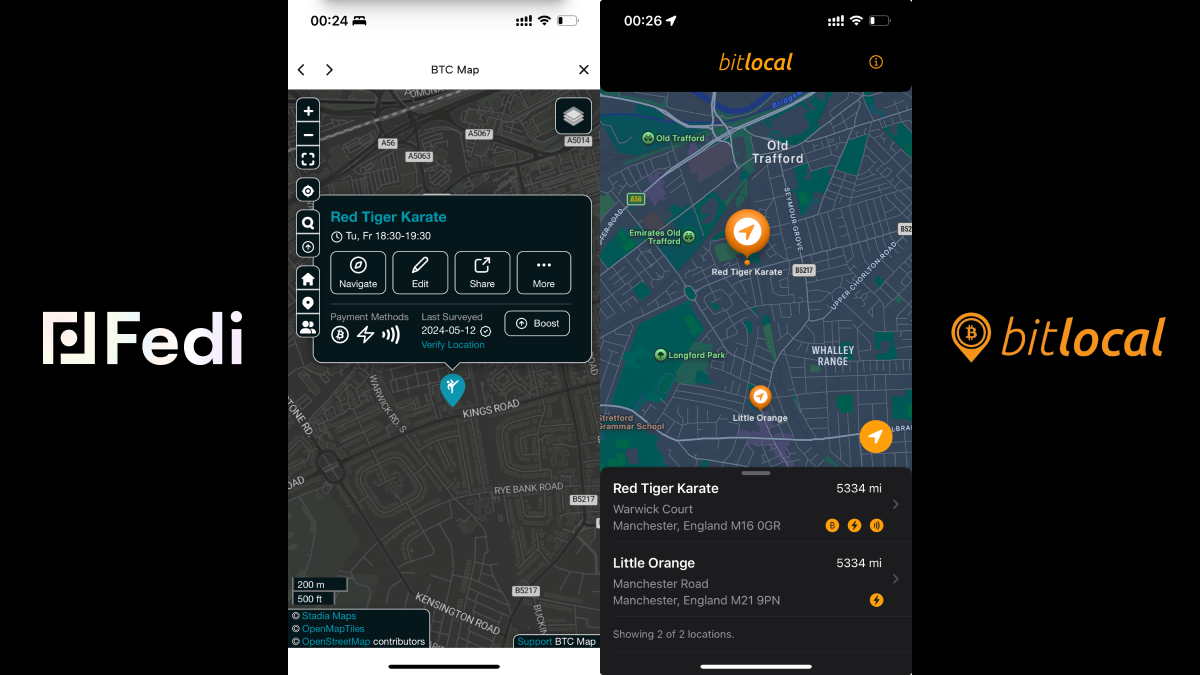

## Many apps, one map

BTC Map is integrated inside a dozen of wallets and apps, to name a few: Wallet of Satoshi, Coinos, Bitlocal, Fedi or Aqua. It's a public good that any bitcoin product can use and grow it's network effect.

<img src="https://blossom.primal.net/47359543b383d8add9ac641daac03e7d55ab1606255d7f7f6a8acc98b7972b1c.png">

## Uniting mappers' work

BTC Map does not discriminate bitcoin merchants, that means all the merchants from proprietary maps are being mapped by taggers to BTC Map. By mapping on a closed source, proprietary map, the same merchant is mapped two times, usually by two different people — it's duplicating the same work without any bringing any benefit to both projects. Using BTC Map also brings you way more people verifying If those merchants actually still accept bitcoin, making it easier to have an up-to-date database of actual adoption.

## More bitcoin spent at your merchants

When you have a business focused on spending bitcoin and onboarding merchants, you want as much bitcoin spent there as possible. If a bitcoiner coming to the area does not use your own map but some other map, they can be completely unaware that they can let their sats flow to your merchants. If we all use one merchants database, this problem disappears and more sats will flow. Why wouldn't you want your merchants displayed in dozens of other apps, completely for free?

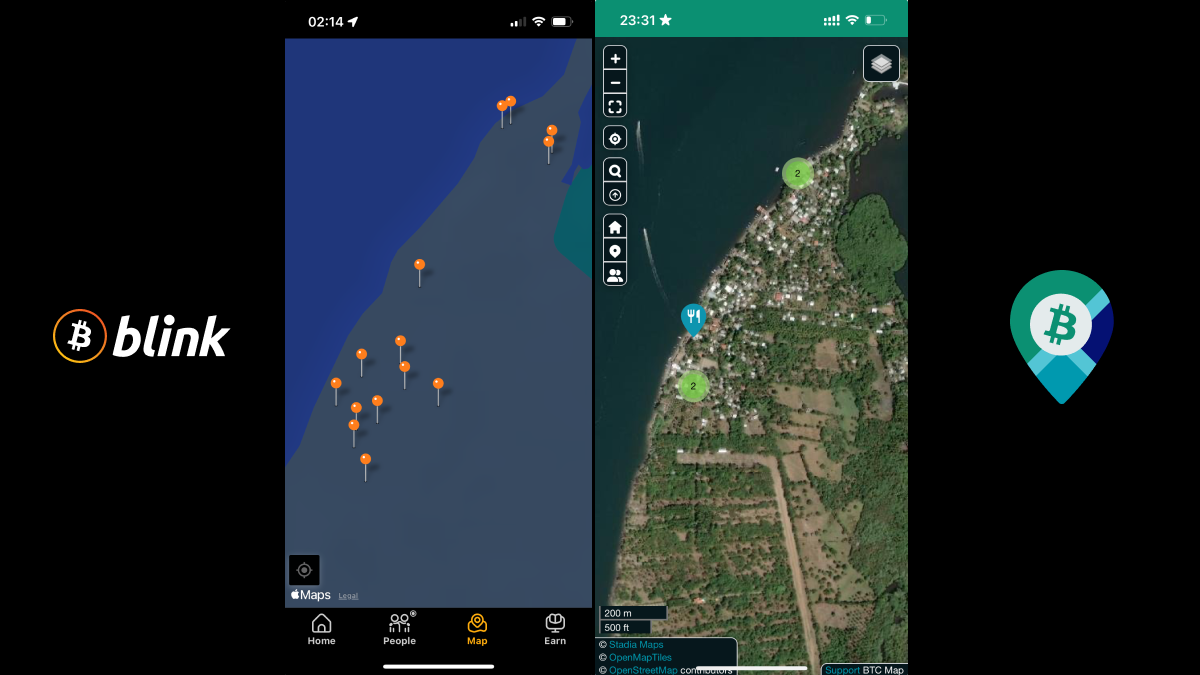

## OpenStreetMap map is just better

<img src="https://blossom.primal.net/01f40413cbde2b9355105467a91294d6d2a9489f4803a423de07a2c9366ed72d.png">

\

Take a look at the image above: It's [La Pirraya](https://btcmap.org/community/bitcoin-la-pirraya), a small sleepy island town in El Salvador with a circular economy being facilitated by Bitcoin Beach. Even though Blink has many more merchants compared to BTC Map, when I visited it a few months ago I could find them. Not because they do not exist, but because the map does not show any roads and it was very hard to locate them in a dense network of narrow streets of La Pirraya. BTC Map allows you to turn multiple versions of satellite maps views, making it way easier to find your point of interest. Pins also indicate what kind of business it is, where in Blink all the pins are the same and you need to click each to find out what it is. Even then not always it's clear, since Blink only displays names, while BTC Map tells you type of the merchant, and very often shows you working hours, phone numbers, website, social links, etc.

## Excellent community tools

BTC Map is focusing providing tools for communities to maintain their merchants map. [Each community has it's own page](https://btcmap.org/communities) with own links to community website or socials, displays a list of all the merchants, shows community stats, displays merchants that were not verified for a long time, and more. It even allows to "boost" merchants to make them more visible on the map and on the list. It's perfect tooling both for communities and businesses onboarding merchants to their software.

<img src="https://blossom.primal.net/530ee89593784c7b7ce51afc72b1ae0e2e1e07515ce35f5834b2fd7bab129f5b.png">

## Easy integration & configuration

Integrating BTC Map on your website or app is easy. It's [just a few lines of code of iframe to embed the map](https://wiki.btcmap.org/general/embedding), but you can also use [BTC Map API](https://wiki.btcmap.org/api/introduction) for more custom integration. Do you to display, eg. you can display only merchants from your community? No problem, you can do that. Since it's all open source, you can configure it in many ways that will suit your needs.

## Kudos

I'd like to thank projects that understood all above and integrated BTC Map already. Those are Coinos, Wallet of Satoshi, Pouch, Bolt Card, BitLocal, Fedi, Decouvre Bitcoin, Osmo, Bitcoin Rocks!, Lipa, Spirit of Satoshi, Blockstream, Satlantis, Aqua Wallet and Adopting Bitcoin.

## Encouragement & an offer

I'll end that with encouragement to projects that use their own maps, but haven't embraced BTC Map yet. Those are Blink, Bitcoin Jungle, Plan B, Osmo, Athena, Orange Pill App, Inbitcoin (I probably missed some, tag them!). You are doing great work, but let's join forces and paint the world orange together!

From here I would like to offer help in tagging your merchants on BTC Map. Just reach me out, and me and other supertaggers will do the work.

Let the sats flow!

-

@ c4b5369a:b812dbd6

2025-02-17 06:06:48

As promised in my last article:

nostr:naddr1qvzqqqr4gupzp394x6dfmvn69cduj7e9l2jgvtvle7n5w5rtrunjlr6tx6up9k7kqq2k6ernff9hw3tyd3y453rdtph5uvm6942kzuw08y0

In this one we will dive into how exactly an unidirectional payments channel powered ecash mint system would be implemented, using the tech available today! So if you haven't read that article yet, give it a read!

I first intended to write a longwinded article, explaining each part of the system. But then I realized that I would need some visualization to get the message across in a more digestable way. This lead me to create a slide deck, and as I started to design the slides it became more and more clear that the information is easier shown with visualizations, than written down. I will try to give a summary as best as I can in this article, but I urge you, to please go visit the slide deck too, for the best experience:

-----------

### [TAKE ME TO THE SLIDE DECK!](https://uni-chan.gandlaf.com/)

-----------

### Intro

In this article we will go over how we can build unidirectional payment channels on Bitcoin. Then we will take a look into how Cashu ecash mints work, and how we can use unidirectional payment channels to change the dynamics between ecash users and the mint.

Before we start, let me also give credits to nostr:npub1htnhsay5dmq3r72tukdw72pduzfdcja0yylcajuvnc2uklkhxp8qnz3qac for comming up with the idea, to nostr:npub148jz5r9xujcjpqygk69yl4jqwjqmzgrqly26plktfjy8g4t7xaysj9xhgp for providing an idea for non-expiring unidirectional channels, and nostr:npub1yrnuj56rnen08zp2h9h7p74ghgjx6ma39spmpj6w9hzxywutevsst7k5cx unconference for hosting an event where these ideas could be discussed and flourish.

### Building unidirectional payment channels

If you've read the previous article, you already know what unidirectional payment channels are. There are actually a coupple different ways to implement them, but they all do have a few things in common:

1. The `sender` can only send

2. The `Receiver` can only receive

3. They are VERY simple

Way simpler than the duplex channels like we are using in the lightning network today, at least. Of course, duplex channels are being deployed on LN for a reason. They are very versatile and don't have these annoying limitations that the unidirectional payment channels have. They do however have a few drawbacks:

1. Peers have liveness requirements (or they might forfeit their funds)

2. Peers must backup their state after each transaction (if they don't they might forfeit their funds)

3. It is a pretty complex system

This article is not meant to discredit duplex channels. I think they are great. I just also think that in some use-cases, their requirements are too high and the system too complex.

But anyway, let's see what kind of channels we can build!

#### Spillman/CLTV-Channel

The Spillman channel idea has been around for a long time. It's even explained in Tadge Dryjas [Presentation](https://www.youtube.com/watch?v=Hzv9WuqIzA0&t=1969s) on Payment channels and the lightning network from back in the day. I compiled a list of some of the most important propperties of them in the slide below:

Great!

Now that we know their properties, let's take a look at how we can create such a channel ([Slides](https://uni-chan.gandlaf.com/#/11)):

We start out by the `sender` creating a `funding TX`. The `sender` doesn't broadcast the transaction though. If he does, he might get locked into a multisig with the `receiver` without an unilateral exit path.

Instead the `sender` also creates a `refund TX` spending the outputs of the yet unsigned `funding TX`. The `refund TX` is timelocked, and can only be broadcast after 1 month. Both `sender` and `receiver` can sign this `refund TX` without any risks. Once `sender` receives the signed `refund TX`, he can broadcast the `funding TX` and open the channel. The `sender` can now update the channel state, by pre-signing update transactions and sending them over to the `receiver`. Being a one-way channel, this can be done in a single message. It is very simple. There is no need for invalidating old states, since the `sender` does not hold any signed `update TXs` it is impossible for the `sender` to broadcast an old state. The `receiver` only cares about the latest state anyways, since that is the state where he gets the most money. He can basically delete any old states. The only thing the `receiver` needs to make sure of, is broadcasting the latest `update TX` before the `refund TX's` timelock expires. Otherwise, the `sender` might take the whole channel balance back to himself.

This seems to be already a pretty useful construct, due to its simplicity. But we can make it even more simple!

This setup works basically the same way as the previous one, but instead of having a refund transaction, we build the `timelock` spend path directly into the `funding TX` This allows the `sender` to have an unilateral exit right from the start, and he can broadcast the `funding TX` without communicating with the `receiver`. In the worst case, the receiver rejects the channel, and the sender can get his money back after the timelock on the output has expired. Everything else basically works in the same way as in the example above.

The beauty about this channel construct is in its simplicity. The drawbacks are obvious, but they do offer some nice properties that might be useful in certain cases.

One of the major drawbacks of the `Spillman-style channels` (apart from being unidirectional) is that they expire. This expiry comes with the neat property that neither of the party has to watch the chain for channel closures, and the `sender` can operate the channel with zero additional state, apart from his private keys. But they do expire. And this can make them quite inflexible. It might work in some contexts, but not so much in others, where time needs to be more flexible.

This is where `Roose-Childs triggered channels` come into play.

#### Roose-Childs triggered channel

(I gave it that name, named after nostr:npub148jz5r9xujcjpqygk69yl4jqwjqmzgrqly26plktfjy8g4t7xaysj9xhgp and nostr:npub1htnhsay5dmq3r72tukdw72pduzfdcja0yylcajuvnc2uklkhxp8qnz3qac . If someone knows if this idea has been around before under a different name, please let us know!)

`Roose-Childs triggered channels` were an idea developed by Steven and Luke at the nostr:npub1yrnuj56rnen08zp2h9h7p74ghgjx6ma39spmpj6w9hzxywutevsst7k5cx unconference. They essentially remove the channel expiry limitation in return for introducing the need for the `sender` to create a channel backup at the time of channel creation, and for the `receiver` the need to watch the chain for trigger transactions closing the channel.

They also allow for splicing funds, which can be important for a channel without expiry, allowing the `sender` to top-up liquidity once it runs out, or for the `receiver` taking out liquidity from the channel to deploy the funds elsewhere.

Now, let's see how we can build them!

The `funding TX` actually looks the same as in the first example, and similarly it gets created, but not signed by the `sender`. Then, sender and receiver both sign the `trigger TX`. The `trigger TX` is at the heart of this scheme. It allows both `sender` and `receiver` to unilaterally exit the channel by broadcasting it (more on that in a bit).

Once the `trigger TX` is signed and returned to the `sender`, the sender can confidently sign and boradcast the `funding TX` and open the channel. The `trigger TX` remains off-chain though. Now, to update the channel, the `sender` can pre-sign transactions in similar fashion to the examples above, but this time, spending the outputs of the unbroadcasted `trigger TX`. This way, both parties can exit the channel at any time. If the `receiver` wants to exit, he simply boradcasts the `trigger TX` and immediately spends its outputs using the latest `update TX`. If the `sender` wants to exit he will broadcast the `trigger TX` and basically force the `receivers` hand. Either, the `receiver` will broadcast the latest `update TX`, or the `sender` will be able to claim the entire channel balance after the timelock expired.

We can also simplify the `receiver's` exit path, by the `sender` pre-signing an additional transaction `R exit TX` for each update. this way, the `receiver` only needs to broadcast one transaction instead of two.

As we've mentioned before, there are some different trade-offs for `Roose-Childs triggered channels`. We introduce some minimal state and liveness requirements, but gain more flexibility.

#### Ecash to fill in the gaps

(I will assume that the reader knows how ecash mints work. If not, please go check the [slides](https://uni-chan.gandlaf.com/#/43) where I go through an explanation)

Essentially, we are trying to get a lightning like experience, without all the lightning complexities and requirements. One big issue with ecash, is that it is fully custodial. If we can offset that risk by holding most of the funds in a self custodial channel, we can have a reasonable trade-off between usability and self custody.

In a system like that, we would essentially turn the banking model onto its head. Where in a traditional bank, the majority of the funds are held in the banks custody, and the user only withdraws into his custody what he needs to transact, in our model the user would hold most funds in his own custody.

If you ask me, this approach makes way more sense. Instead of a custodian, we have turned the "bank" into a service provider.

Let's take a look at how it would work in a more practical sense:

The `ecash user` would open an unidirectional payment channel to the `mint`, using one of his on-chain UTXOs. This allows him then to commit incrementally funds into the mints custody, only the amounts for his transactional needs. The mint offers connectivity to the lightning network an handles state and liveness as a service provider.

The `ecash user`, can remain offline at all times, and his channel funds will always be safe. The mint can only ever claim the balance in the channel via the `update TXs`. The `mint` can of course still decide to no longer redeem any ecash, at which point they would have basically stolen the `ecash user's` transactional balance. At that point, it would probably be best for the `ecash user` to close his channel, and no longer interact or trust this `mint`.

Here are some of the most important points of this system summarized:

And that is basically it! I hope you enjoyed this breakdown of Unidirectional payment channel enabled Ecash mints!

If you did, consider leaving me a zap. Also do let me know if this type of breakdown helps you understand a new topic well. I am considering doing similar breakdowns on other systems, such as ARK, Lightning or Statechains, if there is a lot of interest, and it helps people, I'll do it!

Pleas also let me know what you think about the `unidirectional channel - ecash mint` idea in the comments. It's kind of a new idea, an it probably has flaws, or things that we haven't thought about yet. I'd love to discuss it with you!

I'll leave you with this final slide:

Cheers,

Gandlaf

-

@ 9a4acdeb:1489913b

2025-02-16 18:26:58

## Chef's notes