-

@ b8a9df82:6ab5cbbd

2025-02-11 18:42:35

The last three weeks have felt like a dream—one I don’t want to wake up from. But here I am, on my last day in El Zonte, sitting by the ocean, doing what I love most: watching the waves roll in, surfers gliding across them, some catching them effortlessly, others tumbling but always getting back up. It’s a blessing to be here, soaking in the tranquility, reflecting on the past few weeks while finally sitting down to write about this incredible journey.

Reflecting on this experience, I realize how few people get to live something like this, and I am deeply grateful. Living by the ocean has always been a dream of mine, and these last few weeks have been nothing short of magical. The thought of saying goodbye? Not something I want to entertain. In a world where you can be anything, be kind, be grateful, and cherish the little things—the laughter, the small victories, the unexpected moments of pure joy.

<img src="https://blossom.primal.net/9df76ba64b334ae5f5b6a74de3e6c689720d763b2e65314d95a031f00a6f7841.jpg">

Mexico—a country I was always warned about. "It’s dangerous," they said. "Drugs, crime, food poisoning, even kidnappings. A woman shouldn’t travel there alone." But despite the fear-mongering, after almost three months in South America, I was craving the ocean, and I kept hearing about Mexico’s stunning beaches. A little spoiler: I did see the beach… but it rained almost every day, and my toes barely touched the water.

With three options on the table—Tulum, Holbox, or Isla Mujeres—the decision wasn’t too hard. There was a crazy woman trying to Bitcoinize an entire island, and I had to see that for myself.

###

Just 13 kilometers off the coast of Cancún, Isla Mujeres is a tiny Caribbean paradise—perfect for unwinding and recharging. The island is wonderfully walkable, which I love. No need for a car. I even went for a few runs, and with the island stretching just 7 km in length, I got to explore its hidden oceanfront gems in no time.

But let’s talk about the journey. Arriving in Cancún after a long, exhausting flight, I was hit by chaos at the airport. Dozens of people aggressively offering rides, each one claiming to be a cab driver—it was a nightmare. Not speaking Spanish made things even harder, but thankfully, I wasn’t alone. After dodging the taxi mafia, getting stopped by the military for a random checkpoint (because, you know, legal taxis are apparently a thing to be double-checked), and making a pit stop in Cancún, we finally reached Isla Mujeres—greeted by storms and rain. But none of that mattered. I was here. I was at the ocean. And I was excited.

We stayed at Mayakita, a beautiful villa-style co-living space where you share the common areas—kitchen, coworking space, and outdoor lounges—but still have your own private room, bathroom, and balcony. Oh, and did I mention there’s a Jacuzzi? Absolute win.

The Mayakita team is even building a gym, which is a relief because the local options on the island were… let’s just say, unusable. Picture a tiny, overcrowded room packed with sweaty bodies, zero space between machines, and a never-ending queue for every piece of equipment. Nope. Not for me.

But the real highlight? The incredible restaurant attached to the villas. The food was an explosion of flavors—true mouthgasm territory. And, of course, you could pay for everything in Bitcoin.

###

To my surprise, I ended up staying with <span data-type="mention" data-id="ea57b25f7a57c61d7dd0bf62411244a580d6709e42a20428fd381f89ef8d63db" data-label="nostr:npub1aftmyhm62lrp6lwsha3yzyjy5kqdvuy7g23qg28a8q0cnmudv0ds0sdcke">@nostr:npub1aftmyhm62lrp6lwsha3yzyjy5kqdvuy7g23qg28a8q0cnmudv0ds0sdcke</span> the woman leading the Bitcoin adoption movement on the island. That’s when the craziness really started. The villa next door was booked by a couple of Bitcoiners, and as soon as they found out we had arrived, one of them knocked on our door. A warm smile, a little dog in his arms, and a simple, "Hey, need anything? Food? Help? A bottle opener?"

That’s what I love about this community. The energy, the kindness, the openness—it’s next level. You won’t get that at a typical resort, where people keep to themselves. Here? Instant bonding.

We spent the week exploring the island, asking every restaurant and shop if they accepted Bitcoin. If they didn’t? We walked away. Thanks to Isabella’s hard work, some businesses already do, and one of the highlights? Paying for a tattoo in Bitcoin.

One downside, though—transportation. Even though the island is walkable, taxis and golf carts are available for rent. But renting a golf cart for a week? A whopping $1,000! Insane. Luckily, Isabella had a tiny tuk-tuk, so she packed a few of us into the back and drove us around. No lights, barely any air, and a very bumpy ride. Did we survive? Yes. Would I do it again? Debatable. But hey, it was an experience!

Waking up every morning to the ocean was pure magic. The food? Unbelievable. The freshness of the vegetables, fruit, and fish—something you just don’t get in Germany. Even though I had the most expensive lunch of my life (let’s just say we spent *way* too much on ceviche and a main course), it was worth every cent.

This week taught me something valuable: You don’t need to be in the Bitcoin space for years to make an impact. I get it—long-time Bitcoiners might find it frustrating that adoption seems "easier" now. But I wouldn’t call myself a Bitcoiner just yet. I still have so much to learn. There were moments when I had no clue what people were talking about, even after all those private lessons, hours of talking how a lightening network works, what a hash is and that your 12 - 24 words, the so called private key is actually the master key that can generate an entire tree of private keys. But I’m incredibly lucky to be surrounded by people who are patient, willing to share their knowledge, and never get tired of explaining things again and again.

If I had to sum up this week in one phrase, it would be *ridiculously beautiful and painfully peaceful.*

If you love what Isabella is doing and want to support her work, consider sending her some [sats](https://geyser.fund/project/btcisla).

All pictures taken by <span data-type="mention" data-id="22050dd3659b568c5cb352b0e81958fb986bd941031a90c74ba7f6d2480c11ea" data-label="nostr:npub1ygzsm5m9ndtgch9n22cwsx2clwvxhk2pqvdfp36t5lmdyjqvz84qkca2m5">@nostr:npub1ygzsm5m9ndtgch9n22cwsx2clwvxhk2pqvdfp36t5lmdyjqvz84qkca2m5</span>

-

@ 000002de:c05780a7

2025-02-11 17:53:51

Please don't take offense to this if you believe in the moral rightness of the existence of the modern state. I don't mean it as a slur, its just the best way to describe the opposite of an anarchist or voluntarist, people that believe in a voluntary society without an artificial monopoly on the use of violence.

I think the fact that many bitcoiners value liberty to some degree and often tend to be libertarian in their views, it is easy to assume we are all opposed to the state. My time in bitcoin circles has shown that to be false. Sure there is a _much_ higher proportion of anti-state people in bitcoin than in the normal population, but we are not the majority. That's the sense I get at least.

Bitcoin's lure is far more broad than liberty and self sovereignty. The number of people that value these things for others is incredibly small. They exist but its a tiny number. Most people are NPCs. Some are just asleep. Others are on journeys of discovery and maybe they can be reached.

Since Trump won the election in the US I have noticed many articles trying to throw cold water on the people happy about his win and the changes he's been making over the past few weeks. I think a big mistake many are making is assuming these people have been seduced by Trump. Maybe that's true but I don't think most of these people were opposed to the state before Trump. Trump is just a different animal. A bull in a china shop doing some things many people have wanted for decades. He's not ideological, moral, or principled.

Like the left these bitcoiners just want their way. They want big daddy government to make the world in the way they want it to be. Its a journey. I wasn't born with all the ideas I now hold. I don't think its persuasive or smart to assume your fellow bitcoiners are like you in their views on the state. They probably are much closer to traditional conservatives than anarchists.

With all that said, I think far too few people seek to find common ground with others. I may not seem to value this on SN but let me assure you that in person I very much seek common ground with those around me.

Some of you need to hear this. We will never have a society where everyone agrees on anywhere near to everything. Sure, some things like murder are pretty agreed upon but I bet you are thinking of examples of disagreements on how to handle it.

So keep that in mind. Bitcoin isn't going to turn everyone into a mirror image of your beliefs. Stay humble. We need the people around us. We don't need millions of clones.

originally posted at https://stacker.news/items/882903

-

@ 9ef05ddc:0cfc9a55

2025-02-11 17:44:43

It's 2025, PIVX Labs has grown, and *so should our plans*.

The **Labs Vision** is our eternal mission, as the builders around PIVX, to empower the world's people with it's technology in a **deliverable**, **portable**, **easy** package.

Let's dive in to **what exactly the Labs Vision means for PIVX.**

*Note: The majority of this post is excerpts from the internal Labs Team 2025 discussion, consolidating our ideas and efforts in an organised, efficient manner.*

# Vision and Goals

PIVX, in my words, was made to *'... put privacy, safety, and identity in to the hands of all..'*, a universal goal that everyone under the PIVX umbrella can agree upon.

And similarly, in my eyes, Labs is the group that "forges" these ideas in to reality, a vision and a mission is good - but Labs is what builds PIVX's Mission, we lead in portability, onboarding, and the ***utility*** of PIVX **as a currency**.

All this to say... if PIVX's mission is to *'... put privacy, safety, and identity in to the hands of all..*, and SpaceX's mission is to *'... make human life multi-planetary by sending people to Mars.'...*

Then PIVX Labs' Mission is to **Build a parallel economy, reachable anywhere in the world.**

Our projects, listed below, are how we are going to achieve this.

## Where our projects stand in the Labs Vision

Labs' projects were chosen for very particular reasons, because they all slot together in a perfect master-puzzle; that is, **the PIVX parallel economy**.

- **My PIVX Wallet**: at the center of everything we do: the be-your-own-bank, bank.

- **PIVCards**: the ability to spend with - and even *live* on - PIVX as a currency.

- **PIVX Rewards**: the ability to earn PIV for time & tasks, our onboarding portal.

- **Vector** *(prev. Chatstr)*: the ability to communicate safely with anyone in the world - a Trojan Horse to bring PIVX to the masses, by competing with Telegram.

Everything combined?

You can **earn**, **save**, **spend** with PIVX, and you can **communicate safely** without compromise, with **family**, **friends** and **businesses**.

As such, I believe Labs now has the necessary projects and components needed for the PIVX Parallel Economy, we should now bunker down.

## What's next for Labs in 2025?

I've proposed and found majority consensus upon the below plans, with the structure incentivising a deepened **Parallel Economy for PIVX.**

**My PIVX Wallet**:

- **Multi-Everything:** full multi-account and multi-masternode support, including Ledger.

- **One-Click Setup:** it is necessary that we make "setting up MPW" as FAST as possible, because facing reality: if you're at the bar learning about PIVX, you won't be writing 12 words on paper anytime soon.

- **Shield By Default:** we've discussed the possibility of having Shield-by-Default, making transparency opt-in instead of opt-out, this would use a relay system `shield->temp-transparent->receiver` to remain compliant with all non-Shield services, WITHOUT user interaction and WITHOUT integration compliance necessary.

- **Modularity:** we've discussed the possibility of making MPW more easily utilisable by external softwares - this has MANY possible usecases, such as giving Vector the ability to integrate MPW for in-chat transactions, or making it easier to integrate PIVX with POS systems, without needing to re-implement another PIVX wallet from scratch - one core backend, hundreds of frontends.

**PIVCards**:

- **Non-Custodial**: PIVCards will become fully non-custodial - this may lead to a temporary reduction in features, but in the long-run, allows for the potential of fully open-sourcing and decentralising PIVCards.

- **Multi-Provider**: PIVCards needs to allow plug-n-play style provider integration, allowing near-unlimited PIVX-accepting services to be integrated.

**PIVX Rewards**:

- **The Onboarder**: this platform needs to become the #1 spot for bringing new people to PIVX, with 'appetizers' of free PIV for everyone that wants it, and more for those whom stay and contribute.

- **Non-Custodial shift**: with `PIVX Promos` libraries improving, we can now create decentralised codes very quickly in bulk, as such, we should start utilising this tech to make PIVX Rewards semi-non-custodial, meaning: no more hot wallets, only pre-filled `PIVX Promos` distributions, straight to MPW - in the broader timeline, we may even disband `PIVX Rewards` in favour of a larger `PIVX Promos` system, which would be a preferred outcome.

- **Business Offerings**: as discussed by the community, PIVX Promos may be very useful for onboarding businesses to use PIVX, by using PIVX as a 'loyalty' and 'cashback' system, in a decentralised, yet easy method.

# Too long? Here's the TL;DR:

- **PIVX Labs aims to build a global parallel economy** with PIVX at the forefront.

- **Our four main projects will unify efforts to achieve this**: **wallet** (banking), **cards** (spending), **rewards** (earning), and **messaging** (communication).

- Our 2025 plans focus on making everything **easier to use**, and more **business-friendly** while **prioritizing privacy and non-custodial philosophy** by default.

-

@ a012dc82:6458a70d

2025-02-11 17:18:57

As the calendar flips to 2024, the financial world's spotlight remains firmly on Bitcoin. This digital currency, once a niche interest, has burgeoned into a major financial asset, challenging traditional investment paradigms. After a staggering 150% rally in 2023, outperforming stalwarts like the S&P 500, gold, and the U.S. dollar, Bitcoin has stirred a mix of excitement and skepticism. Investors, analysts, and enthusiasts are now keenly debating what the future holds for this pioneering cryptocurrency. Will the upward trajectory continue, or is a correction imminent? This article aims to dissect the various factors and indicators that could influence Bitcoin's journey through 2024, offering insights into its potential growth or pitfalls.

**Table Of Content**

- Understanding the Current Landscape

- Key Indicators for 2024

- The Halving Event: A Catalyst for Change

- Global Economic Factors

- Technological Advancements and Adoption

- Challenges and Risks

- Conclusion

- FAQs

- Analyzing Bitcoin's Potential for 2024

**Understanding the Current Landscape**

The story of Bitcoin in 2023 is one of resilience and resurgence. Following a tumultuous period marked by regulatory uncertainties and market skepticism, Bitcoin's impressive rally has been a testament to its growing acceptance and maturation as an asset class. This resurgence is underpinned by several key developments: increasing institutional investment, which has lent credibility and stability; advancements in blockchain technology, enhancing Bitcoin's utility and efficiency; and a broader recognition of Bitcoin as a viable digital alternative to traditional safe-haven assets like gold. Moreover, the socio-economic landscape, characterized by inflationary pressures and a search for non-traditional investment havens, has further fueled Bitcoin's appeal. However, this landscape is complex and ever-evolving, with regulatory shifts, technological advancements, and global economic trends continuously reshaping the narrative.

**Key Indicators for 2024**

**Puell Multiple**

The Puell Multiple, a sophisticated yet insightful metric, currently paints a promising picture for Bitcoin. Standing at 1.53, it indicates a balanced valuation – not too hot, not too cold. This equilibrium is significant, considering the historical context where extremes in this metric have often signaled impending market shifts. A value above four typically heralds a peak, signaling overheating, while a dip below 0.5 has often been a precursor to market bottoms, indicating undervaluation. The current reading suggests a potential for steady, sustainable growth, devoid of the speculative frenzy that has characterized previous cycles.

**MVRV Z-Score**

The MVRV Z-Score, another critical indicator, echoes a similar sentiment. With a current score of 1.6, it implies that Bitcoin is neither in the throes of overvaluation nor languishing in undervaluation. This metric, by comparing market capitalization with realized value, offers a nuanced view of Bitcoin's market position. Historically, extreme values in this score have been reliable harbingers of market tops and bottoms. The current moderate score suggests that Bitcoin may have room for growth, absent the speculative bubbles that have led to volatile boom-and-bust cycles in the past.

**Mayer Multiple**

The Mayer Multiple, currently at 1.404, offers a perspective on Bitcoin's price relative to its historical performance. This indicator, by comparing the current market price to the 200-day simple moving average, helps identify potential overbought or oversold conditions. A value above 2.4 has historically indicated overbought conditions, often leading to corrections, while a value below 0.5 suggests oversold conditions, presenting potential buying opportunities. The current Mayer Multiple suggests that Bitcoin is trading at a healthy level above its long-term average, indicating that there's potential for further growth before it enters overbought territory.

**The Halving Event: A Catalyst for Change**

The upcoming Bitcoin halving event in March 2024 is poised to be a pivotal moment. This event, which occurs approximately every four years, reduces the reward for mining new Bitcoin blocks by half. Historically, halving events have been significant market catalysts, often leading to substantial price increases in the following months. The rationale is straightforward: a reduction in the rate of new Bitcoin creation leads to a decrease in supply. If demand remains constant or increases, this supply squeeze can lead to higher prices. However, the halving is more than just a supply-side story. It also attracts media attention and investor interest, potentially drawing new participants into the Bitcoin market. The anticipation and speculation surrounding the halving can create a self-fulfilling prophecy, driving prices up. However, it's important to note that past performance is not indicative of future results, and the market dynamics surrounding each halving are unique.

**Global Economic Factors**

The trajectory of Bitcoin in 2024 will also be heavily influenced by the broader global economic environment. Factors such as inflation rates, monetary policies of major central banks, and geopolitical tensions play a significant role in shaping investor sentiment towards risk assets, including cryptocurrencies. In an environment where traditional currencies are devalued due to inflation or economic instability, Bitcoin could gain further traction as a digital store of value. Conversely, a tightening of monetary policy, leading to higher interest rates, could dampen investor appetite for riskier assets like Bitcoin. Additionally, geopolitical events that create uncertainty in traditional markets could either drive investors towards safe-haven assets like gold and potentially Bitcoin or lead to a broader risk-off sentiment, adversely affecting all risk assets, including cryptocurrencies.

**Technological Advancements and Adoption**

The ongoing development and adoption of Bitcoin and blockchain technology will be crucial determinants of Bitcoin's value in 2024. The evolution of the Lightning Network, which promises faster and cheaper transactions, could significantly enhance Bitcoin's utility as a medium of exchange. This, in turn, could broaden its appeal beyond just a store of value, potentially attracting a new wave of users and investors. Furthermore, the integration of Bitcoin into more mainstream financial services and the continued growth of the decentralized finance (DeFi) sector could provide additional use cases and increase its value proposition. However, technological advancements are not without risks. Issues such as network scalability, security vulnerabilities, and the environmental impact of Bitcoin mining continue to be areas of concern that could influence public perception and regulatory scrutiny.

**Challenges and Risks**

Despite the optimistic outlook based on current indicators, the path ahead for Bitcoin is fraught with uncertainties and risks. Regulatory developments remain a wildcard. Governments and financial regulators around the world are still grappling with how to best regulate cryptocurrencies. Stricter regulations, or even outright bans in certain jurisdictions, could impact Bitcoin's accessibility and attractiveness. Additionally, the inherent volatility of Bitcoin remains a significant concern. While this volatility can present opportunities for high returns, it also poses substantial risks for investors, particularly those who are not well-versed in the cryptocurrency market. Moreover, the technological landscape of cryptocurrencies is rapidly evolving, and Bitcoin faces competition from newer, potentially more technologically advanced cryptocurrencies. This competition could impact Bitcoin's market dominance and investor sentiment.

**Conclusion**

As we look towards 2024, the journey of Bitcoin continues to be an intriguing blend of potential and unpredictability. The indicators and factors discussed in this article suggest a cautiously optimistic outlook for Bitcoin. However, it is crucial for investors and enthusiasts to remain vigilant and informed, considering both the opportunities and the risks involved. The evolution of Bitcoin is not just a financial story; it's a technological and socio-economic narrative that continues to unfold in fascinating and often unexpected ways. The coming year promises to be another chapter in this ongoing saga, as Bitcoin navigates the complex interplay of market dynamics, technological advancements, and global economic trends.

**FAQs**

**What is the significance of the Bitcoin halving event in 2024?**

The Bitcoin halving, expected in March 2024, is a pivotal event where the reward for mining new Bitcoin blocks is halved. Historically, this has led to a reduction in supply and often a subsequent increase in price, attracting significant investor attention.

**How do economic factors influence Bitcoin's value?**

Global economic factors such as inflation rates, monetary policies, and geopolitical tensions can significantly impact Bitcoin's value. Inflation or economic instability can enhance Bitcoin's appeal as a digital store of value, while tighter monetary policies might reduce the appetite for riskier assets like Bitcoin.

**What are the key indicators to watch for Bitcoin in 2024?**

Key indicators include the Puell Multiple, MVRV Z-Score, and Mayer Multiple. These metrics provide insights into Bitcoin's valuation, market capitalization, and comparison to historical performance, helping gauge its potential growth or correction.

**How does technological advancement affect Bitcoin?**

Technological advancements, like improvements in the Lightning Network, enhance Bitcoin's utility and efficiency. This can broaden its use cases, potentially increasing its value. However, technological risks and competition from other cryptocurrencies also play a role.

**That's all for today**

**If you want more, be sure to follow us on:**

**NOSTR: croxroad@getalby.com**

**X: [@croxroadnews.co](https://x.com/croxroadnewsco)**

**Instagram: [@croxroadnews.co](https://www.instagram.com/croxroadnews.co/)**

**Youtube: [@croxroadnews](https://www.youtube.com/@croxroadnews)**

**Store: https://croxroad.store**

**Subscribe to CROX ROAD Bitcoin Only Daily Newsletter**

**https://www.croxroad.co/subscribe**

***DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.***

-

@ 000002de:c05780a7

2025-02-11 17:09:02

Have you ever tried to explain the political factions in the US to a curious young person? If you haven't you might not realize how little sense they make. This is only becoming more evident with the radical changes the current admin are making.

I have to say I'm enjoy being a spectator of it all. When I was a kid the dems were called liberals and they called themselves liberals. The republicans didn't always call themselves conservatives but over the years that has become more of the case.

These days with a new admin that is hardly conservative, the left is losing their mind because of the new admin's strategy for reforming the executive branch. When I listen to them they sound a lot like conservatives. Talking about how long this thing or that thing has been in place. How these kids are being given power. Its all rather funny and hypocritical to me.

Conservatives typically don't like change but they seem to like the new approach in Washington. I would argue what is going on is NOT conservative. Its actually pretty radical. I have long thought that the conservative movement was a joke. What are they conserving? They seem to never get the core problems and how deep the rot goes. They seem to be stuck in some nostalgic dream of a time that never existed. A perpetual 20 years ago time that never existed. When education was great and morals were more to their liking.

Michael Malice said it best I think, "Conservatives are progressives going the speed limit".

The dems typically call themselves progressive now which is also a bad descriptor. They seem to be bigger moralists than their opponents. Rather than progressing towards a bright future, blazing a new trail they seem to want to try to old meritless ideas of old men like Marx. Their answers to every problem are centralizing power and giving more of your freedoms away. This is hardly a progressive or new idea. Its an old idea. One of a strong state that controls more of your life. Its hardly liberal either.

I don't have new terms that work and even if I did good luck changing them :)

Just one man's observation.

originally posted at https://stacker.news/items/882858

-

@ 7f2d6fd6:64710921

2025-02-11 16:54:13

Deep within the primordial forest of Novuschroma, where the pines clawed at a bruise-purple sky and the earth exhaled whispers of forgotten aeons, there dwelled a gnome artificer named Thaddeus Glimmervein.

His cave, a jagged maw in the flank of a cyclopean hill, hummed with the clatter of clockwork drills and the eerie glow of arcane lanterns. Thaddeus, a diminutive figure with a beard like frayed copper wire and goggles smeared with eldritch ichor, had spent decades tunneling into the black heart of the earth, seeking diamonds—*perfect* diamonds, he insisted, to power his magnum opus: a machine that would "harvest starlight itself."

The villagers (those who dared speak of him) claimed Thaddeus had gone mad. They spoke of how his cave shuddered at night, how his drills bit into strata best left undisturbed, and how shadows pooled thicker there, as if the dark resented being carved. But Thaddeus scoffed. He had uncovered veins of crystalline wonder, each gem throbbing with an inner fire he swore was *alive*. "Cosmic seeds," he called them, "fragments of the old gods’ dreams!" His journals (later found waterlogged and reeking of brine) detailed visions of diamond lattices humming in harmonic resonance with the Hyades star cluster—a music only he could hear.

One night, his drills broke into a cavern no mortal map had ever charted. The walls gleamed with diamonds, yes, but they were *wrong*. Their facets curved in non-Euclidean geometries, their light a sickly greenish-white that cast no shadows but instead *absorbed* them. At the chamber’s heart lay a titanic, obsidian obelisk, its surface etched with spiraling glyphs that squirmed when observed. Thaddeus, trembling with triumph, pried loose a central gem the size of his fist. It pulsed like a heart.

The machine, of course, was his undoing. When he slotted the diamond into his starlight harvester, the device awoke with a shriek of grinding gears and a stench of burning ozone. The cavern trembled. The diamonds sang. Thaddeus watched in rapture as beams of corrosive light lanced upward, tearing a rift in the sky—a gateway to a swirling abyss where colossal *things* with too many eyes and too few limbs writhed in anticipation. His starlight harvester, it seemed, was not a bridge to the heavens… but a dinner bell.

As the first tendril, slick and iridescent, slithered through the rift, Thaddeus laughed—a high, broken sound. His life’s work had succeeded beyond his wildest dreams! The stars *were* right! The Great Old Ones *had* noticed! But as the tendril coiled around his ankles, he realized, too late, the irony: the diamonds were not seeds. They were *eggs*.

The villagers found the cave silent days later. Thaddeus’s machine lay dormant, the central diamond replaced by a hollow, obsidian shell. Of the gnome, there was no trace—save his goggles, crushed beneath a single, perfect footprint: a cloven hoof, steaming faintly, pressed into the stone as if the rock were clay.

And in the night sky, now, a new star glimmers hungrily. It winks.

It waits.

-

@ 527b02f7:b0ed5fd2

2025-02-11 16:17:50

Después de un tiempo sin escribir, he decidido retomar el blog con un enfoque más amplio. Seguiré compartiendo contenidos sobre póker, _mental game_ y pot-limit omaha, pero también quiero adentrarme en otros temas que me despiertan curiosidad y que he explorado a fondo últimamente: Bitcoin, inteligencia artificial, finanzas, productividad…

Espero que las nuevas entradas que tengo previstas publicar te resulten interesantes y que puedan inspirarte, ayudarte a reflexionar o simplemente ofrecerte una lectura amena. Hoy quiero comenzar con un tema que me apasiona particularmente: **Bitcoin**.

Cuando alguien afirma que "Bitcoin no sirve para nada" o que no tiene valor intrínseco, está sugiriendo que todos los casos de uso documentados de Bitcoin carecen de valor. Pero ¿es realmente así? Este artículo se inspira en una brillante contestación de X (Twitter) de _[Daniel Batten](https://x.com/DSBatten)_, donde refuta esta afirmación enumerando **19 casos concretos** donde Bitcoin ya está marcando una diferencia tangible. Desde proyectos de sostenibilidad energética en África hasta la inclusión financiera para millones de personas, los ejemplos abundan.

[](https://x.com/DSBatten/status/1857845062991769918)

Antes de abordar estos casos, es importante explorar una pregunta clave: ¿Qué entendemos por "valor"?

## El valor: una perspectiva subjetiva

El concepto de valor, lejos de ser una cualidad objetiva e intrínseca de los objetos, es una construcción subjetiva que depende del contexto, la percepción individual y las circunstancias específicas de cada persona. Esta afirmación, que puede parecer intuitiva en lo cotidiano, tiene profundas implicaciones filosóficas y prácticas que han sido objeto de debate desde la antigüedad hasta nuestros días.

**En términos filosóficos**, podemos remontarnos a la escuela estoica, que sostenía que no son los eventos ni los objetos los que tienen valor en sí mismos, sino las opiniones que formamos sobre ellos. _Epicteto_, por ejemplo, afirmaba:

> “No son las cosas las que nos perturban, sino las opiniones que tenemos sobre ellas.”

Este principio encapsula la idea de que el valor no reside en los objetos, sino en la forma en que interactuamos emocional y racionalmente con ellos.

Desde una **perspectiva económica,** esta noción de subjetividad se formaliza en la teoría del valor subjetivo, desarrollada por economistas como _Carl Menger_ durante la revolución marginalista. Según esta teoría, el valor de un bien no depende de sus características intrínsecas, sino de la utilidad percibida que ofrece al individuo en un momento dado.

El valor que asociamos de un activo viene determinado por varias características. La utilidad es una de ellas, pero no es la única, ya que si esa fuera la única, el aire que respiramos sería el activo más valioso. El problema es que, al no ser escaso, su valor percibido no es alto. Por ejemplo, un vaso de agua puede ser trivial en una ciudad con acceso a agua potable, pero se convierte en un objeto de valor incalculable para alguien que atraviesa un desierto. Por tanto, **un bien debe ser no solo útil, sino también escaso para tener un alto valor.**

> Esto subraya que el valor es dinámico y depende tanto del contexto como de las necesidades y deseos del individuo.

En el caso de tecnologías como Bitcoin, este principio es aún más evidente. Para un habitante de una economía estable, con acceso a servicios financieros modernos, Bitcoin puede parecer un experimento especulativo o una moda pasajera. Sin embargo, para alguien en una región afectada por la hiperinflación o excluida del sistema bancario, puede representar una herramienta crucial para preservar sus ahorros y participar en la economía global.

Esto nos lleva a la conclusión de que **el valor no puede ser medido universalmente ni reducido a una fórmula fija**. Depende de quién lo perciba, bajo qué circunstancias y con qué expectativas.

> Así, el valor es un reflejo de nuestra humanidad: una mezcla de subjetividad, contexto y significado que le conferimos a las cosas. Entender esto no solo nos ayuda a apreciar la diversidad de perspectivas, sino también a cuestionar nuestras propias suposiciones sobre lo que consideramos valioso.

**El oro**, por ejemplo, es el activo con mayor valor en términos de capitalización de mercado, estimado en aproximadamente **16.3 trillones de dólares**. Aunque su utilidad práctica es limitada —principalmente en adornos ornamentales, como la joyería, y en algunas aplicaciones tecnológicas por su alta conductividad y resistencia a la corrosión—, no alimenta a nadie, ni genera energía. Sin embargo, sus **propiedades y aceptación universal** a lo largo de los siglos, le han otorgado un estatus especial. El oro es fácilmente reconocible, divisible y difícil de producir, lo que lo convierte en un bien apreciado y valioso. No obstante, presenta ciertos inconvenientes, como la dificultad para transportarlo, verificar su autenticidad y su vulnerabilidad a la confiscación. Además, aunque su tasa de inflación es baja, cada año se extrae nuevo oro y su producción puede aumentar si la demanda así lo requiere.

De manera similar, **el arte** puede ser invaluable para algunos y un objeto sin sentido para otros. ¿Cómo explicamos que una pintura contemporánea o una escultura de un artista moderno pueda valer millones para algunos y carecer de valor para otros? **Es la percepción subjetiva de las personas, y su escasez, lo que determina el valor, no una cualidad objetiva inherente a la obra.**

El valor de **los bienes inmuebles** no está determinado únicamente por sus propiedades (metros, calidades) si no que está profundamente ligado a la escasez. Un apartamento en primera línea de playa tiene un valor elevado porque existe una cantidad limitada de espacio en estas zonas, lo que lo convierte en un bien escaso y no replicable. De manera similar, los inmuebles más preciados en las ciudades suelen encontrarse donde hay mayor infraestructura, oportunidades de negocio y servicios. En cambio, un inmueble en mitad de la nada, aunque tenga las mismas dimensiones, calidades y número de habitaciones que otro inmueble en una ubicación privilegiada, no es escaso ni está rodeado de servicios o infraestructura, lo que reduce significativamente su valor percibido. A mayor demanda del inmueble y menor oferta del mismo, mayor será su valor en el mercado.

Por otro lado, el valor de **las acciones de una empresa** está relacionado con su capacidad de aportar soluciones a problemas reales y generar beneficios. Una empresa crea valor porque satisface una demanda en el mercado, mejora la vida de las personas y, en consecuencia, genera ingresos y flujos de caja positivos. Este valor intrínseco se refleja en el precio de las acciones, que no solo capturan el rendimiento financiero actual de la empresa, sino también las expectativas de su crecimiento futuro y su capacidad de seguir generando beneficios.

**Las monedas fiduciarias**, como el dólar o el euro, son efectivas para realizar transacciones gracias a su red de aceptación global y su estabilidad de precio en el corto plazo. Sin embargo, estas monedas **pierden valor de forma predecible y gradual**, (debido a la continua creación de nuevas unidades por parte de los bancos centrales), lo cual las hace adecuadas como medio de intercambio, pero no como reserva de riqueza a largo plazo. **Una inflación anual del 2% implica que en 50 años habrás perdido el 100% del poder adquisitivo de tu capital.** Y esto aplica a las monedas más estables del mundo; si hablamos de monedas con tasas de inflación más altas, la pérdida es aún mayor. Además, la inflación real, en términos de la pérdida de capacidad de compra, suele ser significativamente superior al 2% anual, ya que el incremento de la masa monetaria es mayor al 2%.

**Esto hace que el capital fluya hacia otros tipos de activos**, mencionados anteriormente, con el objetivo de preservar su valor a lo largo del tiempo. Acciones, bonos del tesoro, bienes inmuebles, arte y oro son algunos de los activos que absorben gran parte del capital global, actualmente estimado en unos **450 trillones de dólares** (trillones con T).

Bitcoin no puede encuadrarse en el marco de los activos tradicionales, ya que **se trata de un tipo de activo nuevo, el primer activo real digital.** Esta nueva clase de activo permite transferir y almacenar valor en el tiempo, sin necesidad de confianza en terceros ni de intermediarios, de manera segura.

> A diferencia de los activos tradicionales, Bitcoin no está sujeto a la inflación monetaria, la intervención de gobiernos o el riesgo de contraparte que afectan a divisas y otros activos. Su **naturaleza descentralizada** y **deflacionaria** lo convierte en una forma de preservación de valor que supera los desafíos de los activos convencionales, ofreciendo seguridad y autonomía sin precedentes.

El verdadero cambio de paradigma que plantea Bitcoin es que, como tecnología, **permite preservar el capital a lo largo del tiempo** de una manera sin precedentes. Con **mínimos costes de mantenimiento y absoluta seguridad**, Bitcoin ofrece una alternativa que supera las limitaciones históricas de preservar riqueza. Hasta ahora, preservar el capital o la riqueza a lo largo del tiempo no era posible debido a la naturaleza inflacionaria de los métodos de preservación de capital utilizados hasta el siglo XX. Los métodos tradicionales del mundo analógico, como los activos financieros, el arte, los bienes inmuebles, las acciones, los bonos del tesoro o los metales preciosos, padecen de distintos defectos que los hacen susceptibles a la inflación y presentan riesgos significativos, como el riesgo de contraparte.

Como activo de reserva de valor, Bitcoin proporciona una serie de beneficios y ofrece una serie de características novedosas y muy interesantes, si lo comparamos con otros activos que se han usado históricamente para tal uso:

**Beneficios**

- Sin impuestos

- Sin tráfico

- Sin inquilinos

- Sin disputas legales

- Sin problemas

- Sin alcalde o gobierno local

- Sin dependencia del clima

- Sin corrosión

- Sin regulador

**Características**

- Invisible

- Indestructible

- Inmortal

- Teletransportable

- Programable

- Divisible

- Fungible

- Configurable

Bitcoin representa una nueva forma de preservar valor que no depende de la confianza en intermediarios, ya que está protegida de la devaluación por su naturaleza deflacionaria (nadie puede crear más unidades arbitrariamente) y está respaldada por la energía utilizada en su proceso de minería.

Esta energía asegura la red y garantiza la seguridad de las transacciones, haciendo que el valor de Bitcoin esté protegido por un recurso tangible y difícil de replicar. **Se trata de una solución específicamente diseñada para resolver el problema de la pérdida de capital a lo largo del tiempo.** Estas características hacen que Bitcoin sea una opción única y potente en el ámbito de la preservación de riqueza, una solución que no ha existido hasta ahora.

> Al ser un **avance tecnológico** y un **activo intangible**, muchas personas no logran entender la trascendencia del significado de Bitcoin. No se debe a una falta de capacidad intelectual, sino a que lo están analizando desde una perspectiva equivocada o con un enfoque anticuado. **Intentar agruparlo con otros activos tradicionales impide apreciar su verdadero significado** y las implicaciones de primer, segundo y tercer orden que conlleva este descubrimiento.

## Bitcoin como revolución tecnológica

Bitcoin no es una moneda digital; es una tecnología disruptiva. Para comprender su impacto, podríamos usar la analogía de la pólvora, popularizada por _Álvaro D. María_:

> "Bitcoin viene a redefinir el derecho de propiedad, es a las finanzas lo que la pólvora fue a las batallas."

En sus inicios, la pólvora fue vista como un experimento curioso, sin aplicaciones reales para quienes no comprendían su potencial. Pero una vez que su poder transformador se hizo evidente, cambió las reglas del juego para siempre. Lo mismo está sucediendo con Bitcoin.

_Álvaro D. María_ utiliza la analogía de la pólvora para ilustrar cómo Bitcoin está revolucionando el sistema financiero. Al igual que la pólvora transformó la guerra, alterando para siempre el equilibrio de poder y permitiendo nuevas tácticas y estrategias, Bitcoin está haciendo lo mismo con el dinero. **La pólvora eliminó las barreras tradicionales de poder basadas en la fuerza física,** mientras que Bitcoin está eliminando la necesidad de depender de intermediarios y de las estructuras centralizadas que han dominado el sistema financiero durante siglos.

Bitcoin democratiza el acceso a una reserva de valor, permite transferencias de capital sin restricciones y redefine el concepto de confianza en las transacciones financieras. Por ejemplo, al eliminar la necesidad de intermediarios como los bancos, **Bitcoin permite que personas de cualquier parte del mundo transfieran valor directamente entre sí, sin depender de una institución centralizada que garantice la transacción.** De la misma forma que la pólvora permitió a pequeños ejércitos vencer a grandes potencias, Bitcoin permite a individuos tomar el control de su propia riqueza, sin necesidad de confiar en bancos o gobiernos.

Esta revolución tecnológica está apenas comenzando, y su potencial para reconfigurar el panorama económico mundial es tan profundo como lo fue la pólvora para la historia de la humanidad.

Si quieres escuchar la opinión de _Álvaro D. María_ directamente de sus propias palabras, te recomiendo que veas esta entrevista que puedes ver en YouTube:

https://www.youtube.com/watch?v=6Yefg_g-iXg&t=945s

## Desmontando el argumento de la inutilidad

A continuación, repasamos algunos ejemplos concretos que muestran por qué decir que Bitcoin "no sirve para nada" es ignorar su impacto en el mundo real.

*_Al final del artículo tienes enlaces a las noticias reales de todos y cada uno de los casos que expongo a continuación_

### **1. Energía y sostenibilidad**

Bitcoin está ayudando a aprovechar recursos energéticos que, de otro modo, se desperdiciarían. Por ejemplo, en Bután, la minería de Bitcoin utiliza energía hidroeléctrica sobrante, acelerando la independencia energética de la región.

En África, proyectos de minería impulsan la construcción de infraestructuras energéticas en aldeas aisladas, proporcionando electricidad a comunidades que antes no tenían acceso.

### **2. Inclusión financiera**

Más de 2 mil millones de personas en el mundo no tienen acceso a servicios bancarios. Bitcoin está cambiando eso al ofrecer una alternativa que no requiere permisos ni documentación.

En Afganistán, miles de mujeres utilizan Bitcoin para esquivar la discriminación financiera y acceder a sus propios ahorros. En países como Venezuela o Argentina, donde la hiperinflación erosiona los ahorros, Bitcoin actúa como una salvaguarda.

### **3. Soberanía económica y justicia global**

Catorce países africanos aún sufren los efectos de una colonización financiera ejercida a través del franco CFA. Bitcoin ofrece una vía para lograr la independencia económica, permitiendo a estas naciones gestionar su riqueza sin interferencias externas.

Además, los refugiados de guerra encuentran en Bitcoin un medio seguro para recibir ayuda económica directamente, sin depender de sistemas que podrían bloquear los fondos.

### **4. Innovación ambiental**

Bitcoin no solo reduce la dependencia de energías fósiles, sino que también mitiga las emisiones de metano al reutilizar gas quemado o ventilado para generar energía. Esto ha llevado a proyectos que, en conjunto, reducen más emisiones que el mayor proyecto de captura de carbono del mundo.

### **5. Bitcoin como Capital Digital**

> Bitcoin es más que una moneda digital; **es una revolución en cómo entendemos y preservamos el valor.**

_Satoshi Nakamoto_ descubrió un método para transferir y almacenar valor sin la necesidad de un intermediario de confianza, lo cual es un logro monumental en la historia del dinero. Bitcoin representa la transformación de nuestro capital, pasando de activos financieros y físicos a activos digitales.

Este nuevo tipo de activo digital no está sujeto a los riesgos financieros de las divisas, acciones o bonos, ni a los riesgos físicos que afectan a los bienes inmuebles o propiedades. Bitcoin es, esencialmente, **capital digital**: un activo seguro y descentralizado que proporciona una alternativa sin precedentes para almacenar valor de manera efectiva, sin la intervención de terceros y sin las restricciones propias de los sistemas financieros tradicionales.

Esto es algo que el mercado está descubriendo y que ha estado mostrando al mundo durante sus primeros años de vida.

## Bitcoin no es un test de inteligencia, es un test de ego

Negar la utilidad de Bitcoin a pesar de la evidencia puede reflejar una falta de comprensión o una resistencia natural al cambio más que una evaluación crítica. A menudo, la adopción de nuevas tecnologías no depende de su perfección, sino de nuestra disposición a comprender y aceptar su impacto.

A Bitcoin le es indiferente que creas o no en él; no tiene en cuenta si lo valoras o no. La red seguirá creciendo y generando bloques a un ritmo constante de aproximadamente 10 minutos por bloque, independientemente de su valor en términos de moneda fiduciaria. Mientras tanto, el mundo y el mercado irán descubriendo, poco a poco, su propuesta de valor.

La verdadera cuestión no es si Bitcoin tiene valor hoy, sino si estamos preparados para adaptarnos al cambio monumental que representa. Aquellos que comprendan esta transformación a tiempo podrán beneficiarse de la misma, mientras que los que la ignoren se enfrentarán a una realidad en la que Bitcoin ya es parte fundamental del sistema económico global.

A continuación tienes todos los casos de uso citados en el tweet y los enlaces a los artículos correspondientes:

> 1. Ayudar a traer abundancia energética a 1800 aldeanos africanos no tiene valor.

> [https://t.co/bgOaasQeUG](https://t.co/bgOaasQeUG)

> 2. Enviar ayuda a miles de refugiados de guerra es inútil.

> [https://t.co/WKD4FNPGlq](https://t.co/WKD4FNPGlq)

> 3. Desarrollar independencia energética en Bután es inútil.

> [https://t.co/fKBkfEKDea](https://t.co/fKBkfEKDea)

> 4. Proteger Parques Nacionales en África es inútil.

> [https://t.co/455ChX6f9P](https://t.co/455ChX6f9P)

> 5. Ayudar a 19,4 millones de mujeres afganas a evitar la discriminación financiera estatal es inútil.

> [https://t.co/GsClHWJn7H](https://t.co/GsClHWJn7H)

> 6. Establecer la soberanía económica de 14 naciones africanas que aún sufren colonización financiera francesa es inútil.

> [https://t.co/s18NsVHKKT](https://t.co/s18NsVHKKT)

> 7. Crear una alternativa a un sistema monetario que prolonga guerras, aumenta brechas de riqueza, rescata banqueros pero no protege a empleados ni pequeñas empresas es inútil.

> [https://t.co/T6D7yoGZdz](https://t.co/T6D7yoGZdz)

> 8. Ofrecer servicios bancarios a 2 mil millones de personas no bancarizadas es inútil. [https://t.co/T4mjBZ8oRo](https://t.co/T4mjBZ8oRo)

> 9. Proveer un sistema financiero más difícil de usar para el lavado de dinero que las monedas fiat es inútil.

> [https://t.co/CLghbaZfU5](https://t.co/CLghbaZfU5)

> 10. Evitar represalias financieras por liderar campañas humanitarias en naciones autocráticas donde viven 5,7 mil millones de personas es inútil.

> [https://t.co/2KM9kuAUQp](https://t.co/2KM9kuAUQp)

> 11. Ofrecer a 250 millones de personas en países con hiperinflación una forma de evitar la erosión del 50% o más de sus ahorros anuales es inútil.

> [https://t.co/7Yu7IpSSpd](https://t.co/7Yu7IpSSpd)

> 12. Permitir a las personas en naciones en desarrollo recibir remesas sin retrasos ni altas comisiones es inútil.

> [https://t.co/NWTeMOLUny](https://t.co/NWTeMOLUny)

> 13. Tener un depósito de valor seguro, sin permisos, descentralizado, disponible 24/7 y con suministro monetario fijo es inútil.

> [https://t.co/J75wOAXWzS](https://t.co/J75wOAXWzS)

> 14. Lograr ser la industria más sustentablemente alimentada del mundo es inútil.

> [https://twitter.com/DSBatten/status/1670320573480833025](https://twitter.com/DSBatten/status/1670320573480833025)

> 15. Acelerar la transición a energías renovables haciéndolas más rentables es inútil.

> [https://t.co/4SCHxTMRBu](https://t.co/4SCHxTMRBu)

> 16. Reducir más emisiones de vertederos que el mayor proyecto de captura de carbono del mundo es inútil.

> [https://t.co/5IysyKbWrg](https://t.co/5IysyKbWrg)

> 17. Desarrollar un sistema financiero con significativamente menos emisiones que el sistema bancario es inútil.

> [https://t.co/RIiW2jx63R](https://t.co/RIiW2jx63R)

> [https://twitter.com/DSBatten/status/1671336675497349121](https://twitter.com/DSBatten/status/1671336675497349121)

> 18. Conservar gas natural perdido, ventilado o quemado a través de la minería de Bitcoin, evitando contaminación por metano.

> [https://t.co/EZ1kjBz4Pt](https://t.co/EZ1kjBz4Pt)

> 19. Mejorar la estabilidad de la red eléctrica.

> [https://t.co/c5rny2m66V](https://t.co/c5rny2m66V)

-

@ e83b66a8:b0526c2b

2025-02-11 15:59:51

I am seeing a groundswell of interest in adopting Bitcoin in small businesses replacing or augmenting existing merchant services.

This has many advantages for these businesses including:

Attracting Bitcoiners as customers over your competitors.

Allowing a self custody payment system which does not require purchasing equipment, monthly service fees and high transaction fees.

Self custody your money, removing banks and merchant service companies from taking a cut or interfering in the transaction process. i.e. Bitcoin behaves much more like cash in face to face transactions.

Building a Bitcoin Strategic Reserve allowing your profits to accumulate in value over time, just as Bitcoin increases in value due to scarceness and increased adoption.

If any or all of these are interesting to you, then here are a scale of merchant options available to you depending on your needs and interests.

SOLE TRADER

The easiest way for a sole trader to accept Bitcoin is to download the app “Wallet of Satoshi”

https://www.walletofsatoshi.com/

or for regions this is not available, use a web equivalent called COINOS

https://coinos.io/

This gives everything you’ll need, Bitcoin and Lightning receiving addresses, publishable as text or scannable as a QR code. The ability to generate a specific value invoice using Lightning which can be paid face to face or remotely over the Internet and a wallet to hold your Bitcoin balance.

This is a perfect start point, but moving forward it has some drawbacks. It is custodial, meaning that a company actually holds your Bitcoin. Unlike a bank, if that company fails, you loose your Bitcoin.

There is also no direct ability to move that Bitcoin to fiat currencies like USD or GBP, so if you need some of those earnings to pay suppliers in fiat currencies, you will struggle to convert.

If you are an online only retailer, then the industry standard is BTCPay

https://btcpayserver.org/

which can be integrated into most e-commerce systems

TRADITIONAL MERCHANT SERVICES

So the next option is to use a Bitcoin merchant service company. They look very similar to traditional fiat merchant service companies, they can supply infrastructure like PoS terminals and also handle the payments for you, optionally settling balances to your bank in USD or GBP etc…

They charge for the physical devices and their services and they charge a fee on each transaction in the same way traditional merchant service companies do, but usually these fees are significantly smaller.

Companies like MUSQET can help setup your business in this way if you wish.

https://musqet.tech/

CONSULTANCY

The third option is to use a consultancy service like Bridge2Bitcoin

https://bridge2bitcoin.com/

this is a company that will come in, explain the concepts and options and build a service around your needs. The company will build the solution you are looking for and make their money by providing the equipment and optionally running the payment solution for you.

SELF BUILD

If you have experience with Bitcoin and have optionally run your own Lightning node for a while, the tools exist to be able to develop your own solution in-house. And just as Bitcoin allows you to be your own bank, so Lightning allows you to be your own merchant services company.

Solutions like Umbrel

https://umbrel.com/

running Albyhub

https://albyhub.com/

with their POS solution

https://pos.albylabs.com/

are a low cost option you can build yourself. If you require devices like PoS terminals, these can be purchased from companies like

Swiss Bitcoin Pay:

https://swiss-bitcoin-pay.ch/store#!/Bitcoin-Merchant-Kit/p/709060174

as a package or Bitcoinize directly or in volume:

https://bitcoinize.com/

There is also the lower cost option of use software loaded onto your staffs iPhone or Android phone to use as a PoS terminal for your business:

https://swiss-bitcoin-pay.ch/

Swiss Bitcoin Pay can also take the Bitcoin payment and settle a final amount daily or even convert to fiat and deposit in your bank the next day.

HYBRID

MUSQET also offer a PoS system for both Bitcoin and Fiat. They onboard merchants with traditional card services for Visa, Mastercard and Amex with Apple Pay and Google Pay all within the same device where they deploy Bitcoin Lightning as standard:

https://musqet.tech/

-

@ c43d6de3:a6583169

2025-02-11 14:37:44

## A Brief History of Ownership

### The Forgotten Struggle for Ownership

History reveals that our ancestors labored—both intellectually and physically—to secure the freedoms we are subconsciously giving away.

We stand at the threshold of a new era.

Across the globe, long-established institutions are showing signs of strain. Trust in governments, banks, and major corporations is eroding, leaving many individuals feeling as though their rights are being infringed upon—even if they struggle to articulate exactly how. Social media and traditional news outlets amplify this sense of unease, painting a picture of impending upheaval, as if we are on the brink of a revolution whose name will only become clear in hindsight, once the first sparks ignite into a full-blown blaze.

Yet, when we examine the state of the global economy, this narrative begins to unravel. Economic inequality has reached levels unseen in nearly a century, and while many point fingers at politicians, policies, or the so-called greed of the 1% hoarding all the wealth, the true culprit may be much closer than most realize. At a time when legal structures worldwide strongly protect ownership and economic mobility, it is individuals themselves who are willingly surrendering their financial power to the very elites they criticize.

I know—“willingly” might seem like a stretch. After all, no one consciously chooses to give up their economic freedom. But take a closer look at the way people spend, borrow, and consume, and it becomes painfully clear: most are actively forfeiting their ability to build and own wealth.

How did we get here?

Much of this self-inflicted harm comes from a fundamental ignorance of the history of ownership and the struggles fought to secure it.

This article serves as a short exploration of the past.

I'll examine what might be considered the natural state of humanity, how the majority has historically struggled to achieve ownership rights, and the deadly conflicts that had to occur for the modern individual to enjoy the very rights they are now squandering.

### I. The Era of Communal Ownership

No one is born into this world alone.

We do not simply materialize into existence; we arrive as part of the first unit of human society—the family.

Before the rise of civilization, the primary focus of the family was survival. Ownership was a foreign concept, as early human tribes lived in a state of communal resource-sharing. Material possessions were fleeting, and with that, so was the notion of personal property.

In the state of nature, no individual had an exclusive claim to anything. Instead, ownership existed in a tribal sense: “This land belongs to us.” The idea of “mine” extended only by association—what belonged to the tribe also, by extension, belonged to each of its members.

This was a fragile system. Resources required constant upkeep, and as populations grew, leadership emerged to manage the complexity of distribution. This shift laid the foundation for the rise of kings and centralized authority. The concept of ownership, once a communal right, gradually became something dictated by those in power. The people no longer owned anything outright; they merely had the privilege of stewarding what belonged to their ruler.

### II. The Rise of Peasants and Kings

The first codified legal system, the Code of Hammurabi, laid out extensive laws on ownership. Interestingly, this ancient civilization granted more property rights to commoners than many societies did even a few centuries ago.

A few millennia later, Greece laid the philosophical foundations for ownership, but true legal protections for private property did not emerge until much later. In medieval Europe, ownership rights almost disintegrated—not even nobles truly owned land. Everything belonged to the king, and monarchs waged war over control of vast territories, including the people within them.

Meanwhile, in the Islamic Golden Age, the Middle East saw an unprecedented period of economic freedom. Under Sharia law, property rights were protected for the average citizen, something unheard of in much of medieval Europe. The extent of these rights depended largely on religious affiliation, but compared to their European counterparts, many commoners in the Islamic Empire enjoyed greater economic autonomy.

### III. The Birth of Property Rights: The Rights of Man

As the Islamic Golden Age waned and the Mongol Horde thundered toward Baghdad, another seismic shift was occurring in England. In 1215, rebellious nobles captured London and forced King John to sign the Magna Carta, the first written document to impose limits on absolute monarchical power and introduce property protections—though these rights were initially reserved for the nobility.

This moment planted the seeds of change. Over the next several centuries, the fight for ownership rights expanded beyond the aristocracy. The Black Death (1347–1351) wiped out over 30% of England’s population, increasing labor shortages and bargaining power for peasants. By the 1381 Peasants’ Revolt, the common man demanded a greater share of land and wealth.

Yet, it wasn’t until the 1700s with the Enclosure Acts that private property became legally protected for the broader population. What began as a noble rebellion in 1215 ultimately transformed ownership from royal privilege to individual liberty.

### IV. The Age of Renting: The Illusion of Ownership Today

Despite centuries of struggle, we now find ourselves at a paradoxical moment in history: ownership is more legally protected than ever, yet fewer people actually own anything of value.

**Homeownership in Decline:** The U.S. homeownership rate peaked in 2005, only to decline for a decade, hitting a low of 63% in 2015. Despite slight rebounds, high housing costs have pushed many into perpetual rentership.

**Vehicles as Subscriptions:** In 2024, one-fifth of new vehicles were leased, and long-term auto loans have become the norm. A financed car is not truly owned—it’s rented from a bank until the debt is cleared.

**The Subscription Economy:** Ownership of media, software, and even personal data has been replaced with monthly fees. Cloud storage, SaaS, and streaming services have ensured that we no longer possess even our own information.

### V. The Consequences of Financial Illiteracy

We now live in a society built on renting, where economic stability depends on a continuous stream of payments. The more we lease, subscribe, and finance, the more control shifts from individuals to corporations and financial institutions.

**This shift has profound implications:**

- A person who owns little has little power.

- A society that rents everything can be controlled by those who own everything.

- Wealth is no longer built through accumulation, but through debt and dependency.

For millennia, people fought for the right to own. Today, through financial illiteracy and consumer habits, we are giving it away.

How much do we truly own, and how much have we already forfeited?

-----------

Thank you for reading! If this article resonated with you, let me know with a zap and share it with friends who might find it insightful. Your help sends a strong signal to keep making content like this!

More articles you might like from Beneath The Ink:

nostr:naddr1qvzqqqr4gupzp3padh3au336rew4pzfx78s050p3dw7pmhurgr2ktdcwwxn9svtfqq2kjjzzfpjxvutjg33hjvpcw5cyjezyv9y5k0umm6k

nostr:naddr1qvzqqqr4gupzp3padh3au336rew4pzfx78s050p3dw7pmhurgr2ktdcwwxn9svtfqqa9wefdwfjj6stvdsk57cnnv4ehxety94mkjarg94g8ymm8wfjhxuedg9hxgt2fw3ej6sm0wd6xjmn8946hxtfjvsuhsdnju045ml

nostr:naddr1qvzqqqr4gupzp3padh3au336rew4pzfx78s050p3dw7pmhurgr2ktdcwwxn9svtfqq2ns3jnfa985c29xp2rs3pexpykz6mjxetxu2g25x6

-

@ d57360cb:4fe7d935

2025-02-11 14:09:51

# **Disbelief in oneself**

Theres a scene near the opening of the movie where Terence Fletcher (JK Simmons) is yelling at one of his trombone players about being out of tune. He’s asks him ‘Do you think you’re out of tune?’ The player nervous and shook by Fletcher puts his head down and says yes. Fletcher proceeds to yelling in his face and kicking him out.

The funny thing about this scene is that the trombone player wasn’t actually out of tune, it was someone else. What Fletcher is looking for in his world class band are individuals who believe in themselves. The scene had nothing to do with being out of tune with the instrument but more so being out of tune with yourself. The trombone players every action is motivated by the energy of fear.

I believe Fletcher’s character represents the world and critics they are harsh, they don’t care about your feelings, they will attack you and if you lack belief you’ll give up and stop short or worse won’t even begin the journey at all.

The harshest critic can sometimes be oneself as displayed by the trombone player. His belief is so low Fletchers words act as reinforcement to his already low view of himself. In this way Fletcher acts a mirror to his students.

# **Belief in oneself**

Another scene i’d like to highlight is the exact opposite of the trombone scene. Near the end of the film Andrew Nieman (Miles Teller) is late for the bands show and he barges into the room a few minutes before the start. Irate, Fletcher attacks him for being late and tells him he’s losing his spot to another drummer. This is a test on Andrew to see how he reacts, will he crumble and fall like the trombone player?

Andrews response displays an individual with unwavering belief in his abilities he tells fletcher in essence ‘fuck off its my part’. No matter how much Fletcher attacks his skill and character, Andrew doesn’t care he’s willing to stand on his ability and not let the noise bother him.

This scene to me symbolizes the epitome of confidence. Throughout the movie Fletcher is downplaying Andrew and his skill. He tells him he’s not good enough, his skills aren’t sharp. What he was doing wasn’t pushing Andrew to practice more and get better, he was pushing him to believe in his own power and greatness.

“Our deepest fear is not that we are inadequate. Our deepest fear is that we are powerful beyond measure”.

# **Links to the clips**

Trombone clip: <https://www.youtube.com/watch?v=e0yL-avlEsg>

Andrew loses spot clip: <https://www.youtube.com/watch?v=5OxTIpMSkpw>

-

@ c69b71dc:426ba763

2025-02-11 14:07:34

# The Power of Words...

## ...Shaping a Compassionate Future

This morning I woke up with this thought:

**> If we were more mindful of our choice of words, we would immediately need to change the following: Schools would no longer have classes and classifications, but only Communities!**

This would make a huge difference in terms of togetherness, well-being, and caring for one another. 🙌🏼

### Language shapes reality

Words influence how we see the world and ourselves. When we replace terms like "classes" or "grades" with "community" and "development," it changes our entire way of thinking about education and coexistence.

For example, in companies, we often talk about "teams" instead of "departments." This unconsciously fosters unity, cooperation, and a sense of belonging on equal terms.

### Community instead of competition

In school, work, and everyday life, we often evaluate, compare, and classify. But what if we focused on cooperation and synergies instead of competition?

In some schools, there are no grades anymore, just individual feedback – this takes away the performance pressure and strengthens intrinsic motivation.

### Appreciation instead of categorization

Putting people in "boxes" – whether through grading systems, social classes, or job titles – often creates separation rather than connection.

Instead of labeling people as "successful" or "failed," we could ask: "What are their strengths? How can we support each other?"

Mindful language in everyday life

We could also reflect on our word choices in daily life:

Instead of "problem" → "challenge"

Instead of "failure" → "learning opportunity"

Instead of "mistake" → "experience"

### School as a mirror of society

How we learn to interact with each other in school shapes our behavior in society. When children grow up in communities instead of class systems, they learn that cooperation and empathy are more important than competition.

There are so-called democratic schools where there are no grade levels – children learn from each other across ages. Students support each other by sharing knowledge and helping each other. Teachers are seen as coaches, not as "all-knowing" authority figures.

They too are human and can learn from the children.

Many teachers want to give children something that will help them in life.

However, the rigid old school system dictates what must be taught and when, often disregarding the individual interests of the children. This stifles passions – in both the children and the teachers. Instead, teachers could act as inspiring sparks, igniting curiosity and enthusiasm for learning.

-----------

> **A history teacher once said to me on the phone, when discussing my son who didn’t want to read printed Wikipedia sheets: "If there is no spark in the child, the teacher can’t ignite anything."

**

This sentence frustrated me, because it shows that this teacher had long since lost his own spark!

**Children always have a spark. Always!**

-----------

### A day without evaluations

What if we consciously refrained from evaluating others for one day – whether through grades, criticism, or labels?

Instead of saying to a friend, "You made a mistake," we could say, "That was an interesting experience – what did you learn from it?"

Instead of saying, "That wasn’t good," we could ask, "How could it be done differently or better?"

Instead of grading children in school, we could tell them what they did well and where they can still grow.

Instead of getting upset about a difficult customer, we could feel empathy for their situation.

### Mindful language as the key to change

**If we are more mindful with our language – also with how we speak to ourselves – we can shape a society where people meet each other with compassion. **

`Words are vibrations that shape reality. Chosen consciously, they can create a world based on connection, growth, and love.

It is up to us to start this change within ourselves – and carry it into the world.`

Thank you for reading 🕊️

-

@ 2e8970de:63345c7a

2025-02-11 11:57:11

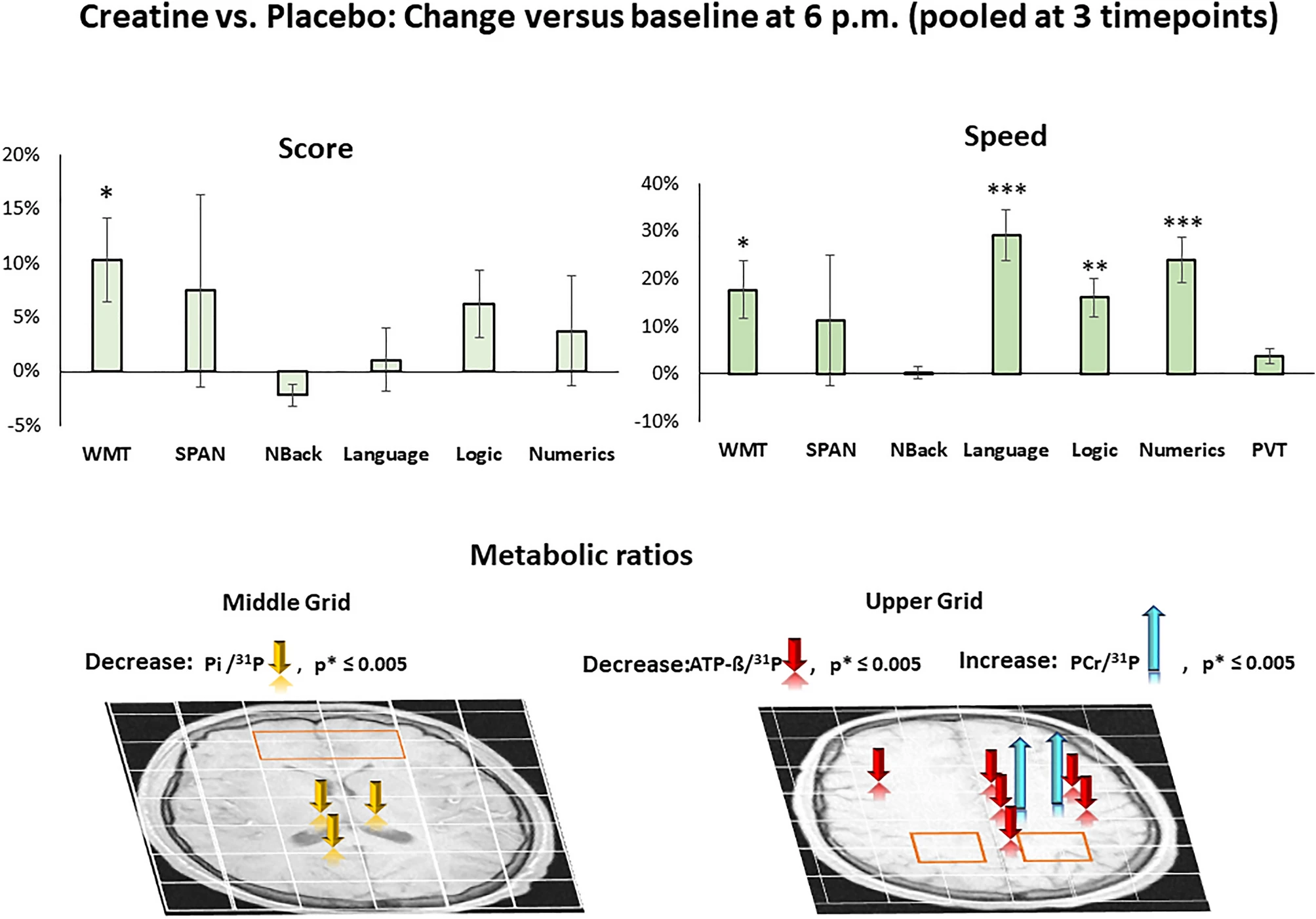

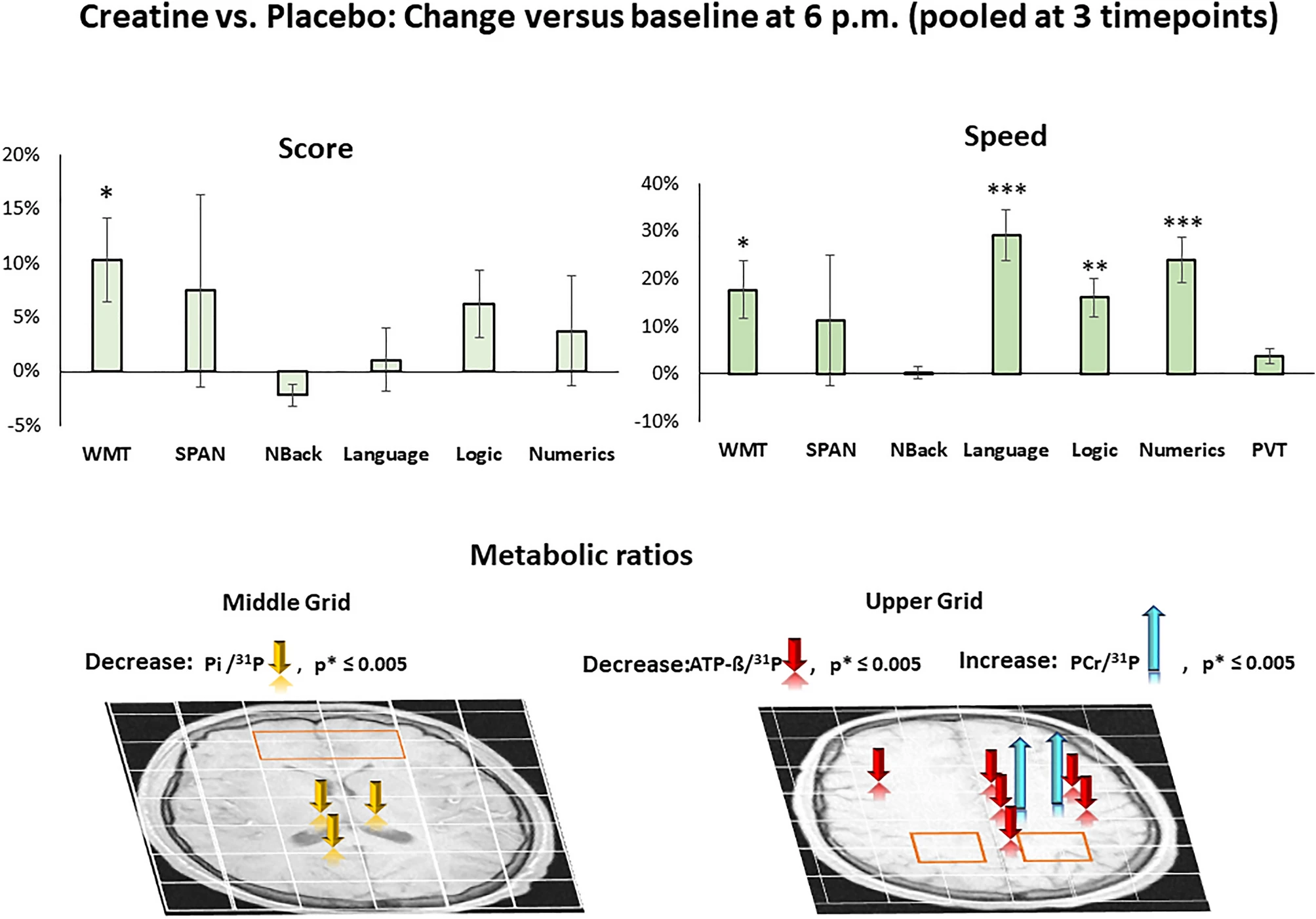

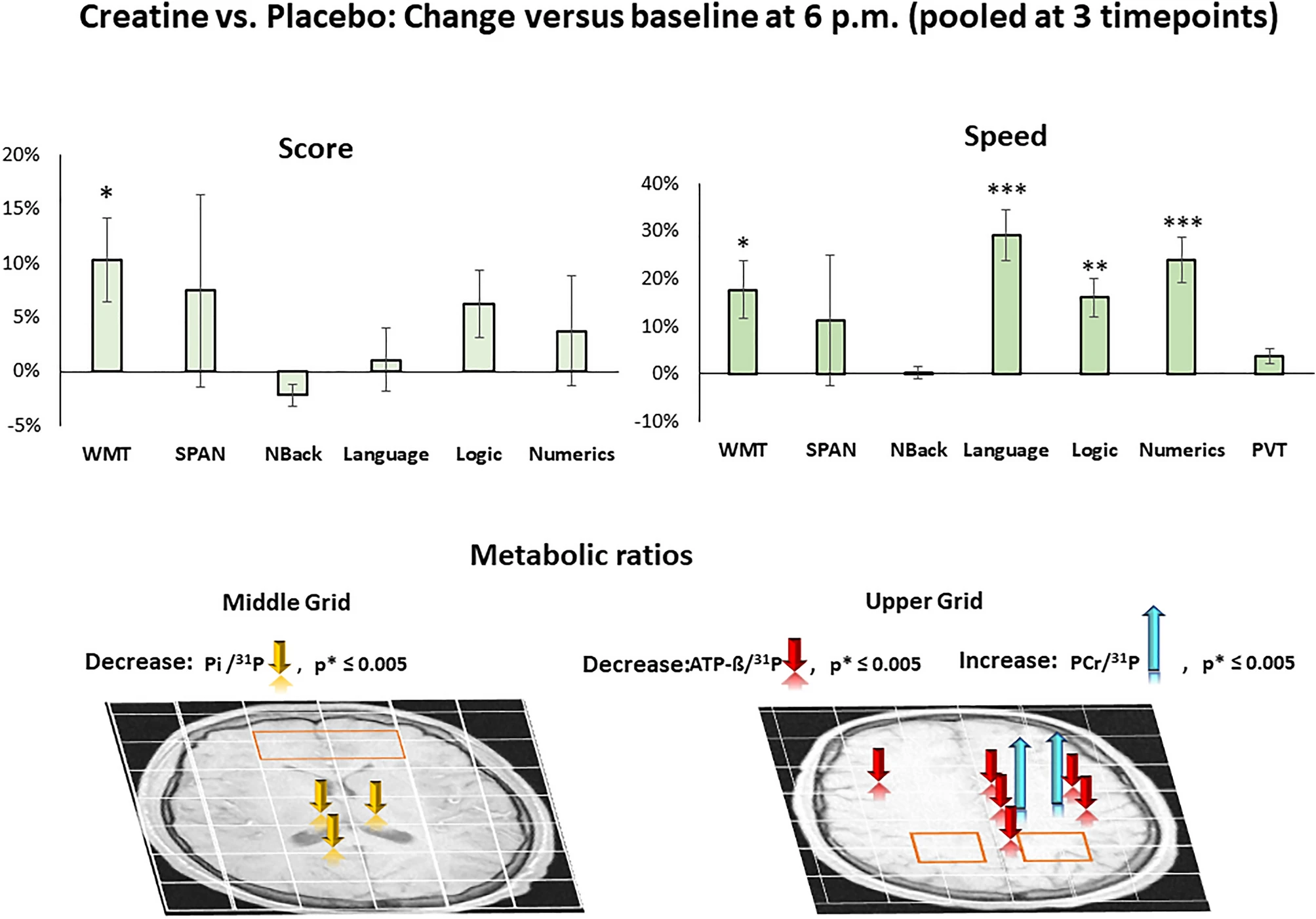

> Single dose creatine improves cognitive performance and induces changes in cerebral high energy phosphates during sleep deprivation

https://www.nature.com/articles/s41598-024-54249-9

originally posted at https://stacker.news/items/882540

-

@ 54286b98:3debc100

2025-02-11 11:33:38

We correct because we care.\

And when others correct us, it’s a reminder: We’re cared for.

“No calm ocean makes a skilled sailor,” they say. Yet we often prize safety more than the process that actually makes us skillful—able to navigate life’s oceans securely. We want the result: expertise, confidence, calm at the helm. But we’re often reluctant to embrace the very process that shapes us.

Trials and life’s tests aren’t pleasant, but maybe we should see them through our Father’s eyes. How else can we possibly grow? If not by trials, then how? Any parent knows we don’t just learn by hearing; we are stubborn beings who truly learn after experiencing.

It’s in those small, fear-fueled moments—realizing you could have fallen off a cliff, been hit by a car, or lost your career over a careless comment—that your senses awaken to very real consequences. Hopefully, that flash of adrenaline is enough to teach a lesson. But often, more often than we’d like to admit, it isn’t.

God’s parenting style is fascinating; He’s patient beyond measure. He can handle our insecurities and weaknesses for a very long time. Even when our earthly parents may have given up on us, He won't. Either we walk away from His lessons, or we keep facing the same challenges meant to shape us—making us whole, maturing us in our faith—until we finally learn and pass the test.

Paraphrasing the message of James chapter 1: “Count it all joy, pure joy, when you face trials. If you don’t understand why you’re going through what you’re going through, ask God for wisdom—He will give it to you.”

During your high, victorious moments, remember: you’ll be tested again. Take heart—because the end goal is a more resilient and confident version of you, anchored in God rather than in yourself.

During your low moments—when everything feels painfully hard—remember that you have a Father’s hand guiding you, never leaving you alone.

You’ve got this…in God.\

Until the next one,\

**J**

Legacy website article and email subscription [here](https://www.javierfeliu.com/blog/no-calm-ocean-why-safe-waters-never-grow-us/).\

Photo by [Torsten Dederichs](https://unsplash.com/@tdederichs?ref=javierfeliu.com) / [Unsplash](https://unsplash.com/?utm_source=ghost&utm_medium=referral&utm_campaign=api-credit)

@ b8a9df82:6ab5cbbd