-

@ 9f7a4807:45d1479b

2025-02-11 23:55:10

Un pensamiento sobre la importancia de leer, compartir y promocionar lo que leemos como una estrategia de resistencia y desarrollo comunitario (presencial o virtual)

Recientemente tomé la decisión de comenzar la planificación de un proyecto de literatura en las redes sociales, para poder compartir lo que leo y lo que me parece importante e indispensable y así crear una comunidad virtual en la que produzcamos discursos e intelecto. En nuestra cotidianidad, debemos emplear instintivamente el compartirnos y compartir nuestros libros, que sea una cuestión tan normal como hablar de Bad Bunny, tenía que decirlo, sorry. Les contaré cómo llegué a este deseo: Luego de las elecciones del 2024 nos encontramos todxs en un mar de deseo para poder organizarnos en masa para educarnos, resistir y emplear cambios intelectuales y materiales en Puerto Rico. Todo esto nace a consecuencia del secuestro evidente que la clase política conservadora, estadista y populista tiene sobre nuestro archipiélago. Pero, este llamado a la organización de masas siempre se disipa desde sus publicaciones virtuales, jangueos sanos o con cerveza y fili en mano o hasta en el periódico. Creo que entendí que si el sistema capitalista y colonial nos dividió y creó un individualismo rampante, entonces desde mi individualismo me planificaré para armar una comunidad utilizando las redes sociales que tanto tiempo nos quita y nos desinforma constantemente.

**¿Por qué se disipa ese llamado a la organización ante el estado colonial?**

Dentro de las múltiples razones concretas de las que puedo explicarles, la más que sobresale para mí es esta: El estado nos ha dividido exitosamente con sus aparatos de opresión; asimilación, capacitismo, clasismo, cuirfobia, desinformación, deudas, explotación laboral, misoginia, persecución policiaca, racismo, transmisoginia, vigilancia, la lista continua.

Por esta razón es que leer es un acto político meramente por el factor tiempo, este mundo tiene un andamiaje diseñado para producir tu manera de sobrevivir fuera de los libros y la literatura. Además, lamentablemente, las nuevas generaciones no están leyendo a un nivel avanzado y solo consumen información a través de contenido de formato corto. Esto último quizás es una tangente abrumante, pero luego podemos hablar de eso. La realidad es que requerimos de absorber la mayor cantidad de información, la cual nos ayude a crear cambios radicales a la condición material de la juventud y adultez en Puerto Rico. Requerimos de un proyecto nacional para enseñar análisis crítico, alfabetización informacional y mediática utilizando como base los libros. Digo libros y no la lectura porque el libro es la tecnología más accesible que tenemos hoy día. Considerando que más de la mitad de la población infantil en Puerto Rico vive bajo niveles de empobrecimiento1, tendríamos que emplear esta misión con el libro.

Como escritores y lectores individuales, debemos entender que nuestra misión ahora mismo es crear plataformas de educación y promoción educativa para todxs en Puerto Rico. “Si queremos que las personas con las que trabajamos como promotores o animadores construyan sentidos personales frente a lo que leen, desarrollen un pensamiento crítico frente a la realidad a través de la lectura y la escritura [y] reflexionen sobre sí mismos y sobre sus relaciones con el mundo, [deben utilizar] la lectura y la escritura para generar transformaciones” (p.29). La escritora chilena Helena Robledo nos obsequia un vistazo a la formación de pensamiento y visión necesaria para este proyecto del uso de libros.

Por eso pienso, desesperadamente, que los libros son nuestro campo político más valioso y debemos construir sobre este. Estaré desarrollando este proyecto en Instagram, Tiktok y Substack. Tengo mucho que contarles y estoy seguro de que ustedes también.

Un abrazo.

Sígueme en mis redes sociales:

[Instagram](https://www.instagram.com/lunita_tristona/)

[X](https://x.com/plateadaluz)

[Substack](https://substack.com/@lunaquinonesdeleon)

Referencias:

1. Revelan Perfil De Los Niños Y Niñas En Pobreza En Puerto Rico - Instituto Del Desarrollo De La Juventud. www.juventudpr.org/blog/revelan-perfil-de-los-ninos-y-ninas-en-probreza-en-puerto-rico.

2. El Mediador De Lectura: La Formación Del Lector Integral. Chile, IBBY Chile, 2017, www.ibbychile.cl/wp-content/uploads/2017/11/El_Mediador_de_lectura_web.pdf.

-

@ bf47c19e:c3d2573b

2025-02-11 23:18:49

Originalni tekst na [dvadesetjedan.com](https://dvadesetjedan.com/blog/niko-ne-moze-zabraniti-bitcoin)

###### Autor: [Parker Lewis](https://x.com/parkeralewis) / Prevod na srpski: [Plumsky](https://t.me/SkiLites)

---

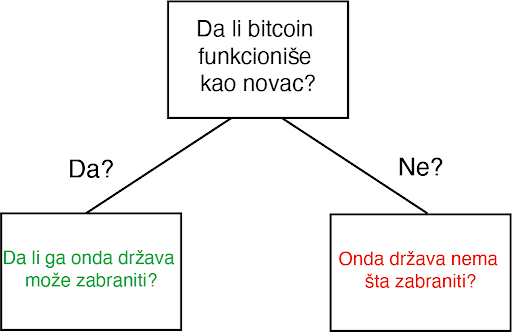

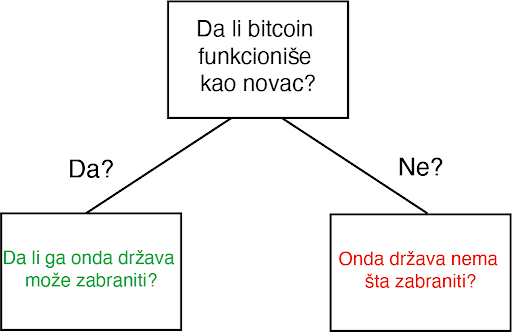

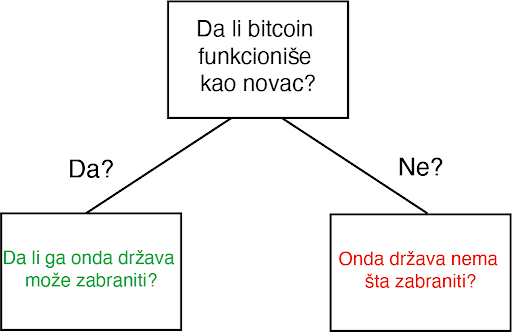

Ideja da država može nekako zabraniti bitcoin je jedna od poslednjih faza tuge, tačno pred prihvatanje realnosti. Posledica ove rečenice je priznanje da bitcoin “funkcioniše”. U stvari, ona predstavlja činjenicu da bitcoin funkcioniše toliko dobro da on preti postojećim državnim monopolima nad novcem i da će zbog toga države da ga unište kroz regulativne prepreke da bi eliminisale tu pretnju. Gledajte na tvrdnju da će države zabraniti bitcoin kao kondicionalnu logiku. Da li bitcoin funkcioniše kao novac? Ako je odgovor „ne“, onda države nemaju šta da zabrane. Ako je odgovor „da“, onda će države da probaju da ga zabrane. Znači, glavna poenta ovog razmišljanja je pretpostavka da bitcoin funkcioiniše kao novac. Onda je sledeće logično pitanje da li intervencija od strane države može uspešno da uništi upravo taj funkcionalan bitcoin.

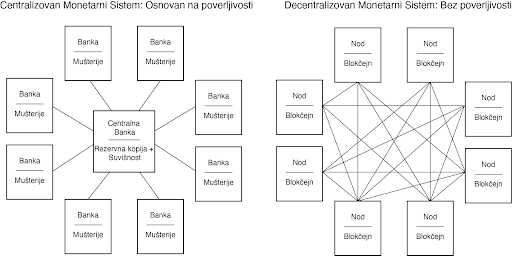

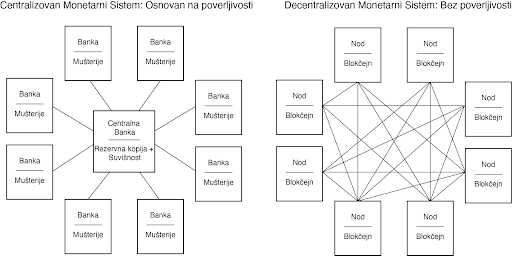

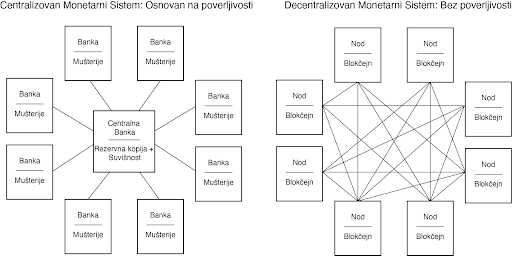

Za početak, svako ko pokušava da razume kako, zašto, ili da li bitcoin funkcioniše mora da proceni ta pitanja potpuno nezavisno od prouzrekovanja državne regulacije ili intervencije. Iako je nesumnjivo da bitcoin mora da postoji uzgred državnih regulativa, zamislite na momenat da države ne postoje. Sam od sebe, da li bi bitcoin funkcionisao kao novac, kad bi se prepustio slobodnom tržištu? Ovo pitanje se širi u dodatna pitanja i ubrzo se pretvara u bunar bez dna. Šta je novac? Šta su svojstva koja čine jednu vrstu novca bolje od druge? Da li bitcoin poseduje ta svojstva? Da li je bitcoin bolja verzija novca po takvim osobinama? Ako je finalni zaključak da bitcoin ne funkcioniše kao novac, implikacije državne intervencije su nebitne. Ali, ako je bitcoin funkcionalan kao novac, ta pitanja onda postaju bitna u ovoj debati, i svako ko o tome razmišlja bi morao imati taj početnički kontekst da bi mogao proceniti da li je uopšte moguće zabraniti. Po svom dizajnu, bitcoin postoji van države. Ali bitcoin nije samo van kontrole države, on u stvari funkcioniše bez bilo kakve saradnje centralizovanih identiteta. On je globalan i decentralizovan. Svako može pristupiti bitcoinu bez potrebe saglasnosti bilo koga i što se više širi sve je teže cenzurisati celokupnu mrežu. Arhitektura bitcoina je namerno izmišljena da bude otporna na bilo koje pokušaje države da ga zabrane. Ovo ne znači da države širom sveta neće pokušavati da ga regulišu, oporezuju ili čak da potpuno zabrane njegovo korišćenje. Naravno da će biti puno bitki i otpora protiv usvajanja bitcoina među građanima. Federal Reserve i Američki Treasury (i njihovi globalni suparnici) se neće ležeći predati dok bitcoin sve više i više ugrožava njihove monopole prihvatljivog novca. Doduše, pre nego što se odbaci ideja da države mogu potpuno zabraniti bitcoin, mora se prvo razumeti posledice tog stava i njegovog glasnika.

#### Progresija poricanja i stepeni tuge

Pripovesti skeptičara se neprestano menjaju kroz vreme. Prvi stepen tuge: bitcoin nikad ne može funkcionisati-njegova vrednost je osnovana ni na čemu. On je moderna verzija tulip manije. Sa svakim ciklusom uzbuđenja, vrednost bitcoina skače i onda vrlo brzo se vraća na dole. Često nazvano kao kraj njegove vrednosti, bitcoin svaki put odbija da umre i njegova vrednost pronađe nivo koji je uvek viši od prethodnih ciklusa globalne usvajanja. Tulip pripovetka postaje stara i dosadna i skeptičari pređu na više nijansirane teme, i time menjaju bazu debate. Drugi stepen tuge predstoji: bitcoin je manjkav kao novac. On je previše volatilan da bi bio valuta, ili je suviše spor da bi se koristio kao sistem plaćanja, ili se ne može proširiti dovoljno da zadovolji sve promete plaćanja na svetu, ili troši isuviše struje. Taj niz kritike ide sve dalje i dalje. Ovaj drugi stepen je progresija poricanja i dosta je udaljen od ideje da je bitcoin ništa više od bukvalno bezvrednog ničega.

Uprkos tim pretpostavnim manjcima, vrednost bitcoin mreže nastavje da raste vremenom. Svaki put, ona ne umire, nasuprot, ona postaje sve veća i jača. Dok se skeptičari bave ukazivanjem na manjke, bitcoin ne prestaje. Rast u vrednosti je prouzrokovan jednostavnom dinamikom tržišta: postoji više kupca nego prodavca. To je sve i to je razlog rasta u adopciji. Sve više i više ljudi shvata zašto postoji fundamentalna potražnja za bitcoinom i zašto/kako on funkcioniše. To je razlog njegovog dugotrajnog rasta. Dokle god ga sve više ljudi koristi za čuvanje vrednosti, neće pasti cena snabdevanja. Zauvek će postojati samo 21 milion bitcoina. Nebitno je koliko ljudi zahtevaju bitcoin, njegova cela količina je uvek ista i neelastična. Dok skeptičari nastavljaju sa svojom starom pričom, mase ljudi nastavljaju da eliminišu zabludu i zahtevaju bitcoin zbog njegovih prednosti u smislu novčanih svojstva. Između ostalog, ne postoji grupa ljudi koja je više upoznata sa svim argumentima protiv bitcoina od samih bitcoinera.

Očajanje počinje da se stvara i onda se debata još jedanput pomera. Sada nije više činjenica je vrednost bitcoina osnovana ni na čemu niti da ima manjke kao valuta; sada se debata centrira na regulaciji državnih autoriteta. U ovom zadnjem stepenu tuge, bitcoin se predstavlja kao u stvari isuviše uspešnom alatkom i zbog toga države ne smeju dozvoliti da on postoji. Zaista? Znači da je genijalnost čoveka ponovo ostvarila funkcionalan novac u tehnološko superiornoj formi, čije su posledice zaista neshvatljive, i da će države upravo taj izum nekako zabraniti. Primetite da tom izjavom skeptičari praktično priznaju svoj poraz. Ovo su poslednji pokušaji u seriji promašenih argumenata. Skeptičari u isto vreme prihvataju da postoji fundamentalna potražnja za bitcoinom a onda se premeštaju na neosnovan stav da ga države mogu zabraniti.

Ajde da se poigramo i tim pitanjem. Kada bih zapravo razvijene države nastupile na scenu i pokušale da zabrane bitcoin? Trenutno, Federal Reserve i Treasury ne smatraju bitcoin kao ozbiljnu pretnju superiornosti dolara. Po njihovom celokupnom mišljenju, bitcoin je slatka mala igračka i ne može da funkcioniše kao novac. Sadašnja kompletna kupovna moć bitcoina je manja od $200 milijardi. Sa druge strane, zlato ima celokupnu vrednost od $8 triliona (40X veću od bitcoina) i količina odštampanog novca (M2) je otprilike 15 triliona (75X veličine bitcoinove vrednosti). Kada će Federal Reserve i Treasury da počne da smatra bitcoin kao ozbiljnu pretnju? Kad bitcoin poraste na $1, $2 ili $3 triliona? Možete i sami da izaberete nivo, ali implikacija je da će bitcoin biti mnogo vredniji, i posedovaće ga sve više ljudi širom sveta, pre nego što će ga državne vlasti shvatiti kao obiljnog protivnika.

Predsednik Tramp & Treasury Sekretar Mnučin o Bitcoinu (2019):

> „Ja neću pričati o bitcoinu za 10 godina, u to možete biti sigurni {…} Ja bi se kladio da čak za 5 ili 6 godina neću više pričati o bitcoinu kao sekretar Trusury-a. Imaću preča posla {…} Mogu vam obećati da ja lično neću biti pun bitcoina.“ – Sekretar Treasury-a Stiv Mnučin

> „Ja nisam ljubitelj bitcoina {…}, koji nije novac i čija vrednost je jako volatilna i osnovana na praznom vazduhu.“ – Predsednik Donald J. Tramp

Znači, logika skeptika ide ovako: bitcoin ne funkcioniše, ali ako funkcioniše, onda će ga država zabraniti. Ali, države slobodnog sveta neće pokušati da ga zabrane dokle god se on ne pokaže kao ozbiljna pretnja. U tom trenutku, bitcoin će biti vredniji i sigurno teži da se zabrani, pošto će ga više ljudi posedovati na mnogo širem geografskom prostoru. Ignorišite fundamentalne činjenice i asimetriju koja je urođena u globalnom dešavanju monetizacije zato što u slučaju da ste u pravu, države će taj proces zabraniti. Na kojoj strani tog argumenta bi radije stajao racionalan ekonomski učesnik? Posedovanje finansijske imovine kojoj vrednost toliko raste da preti globalnoj rezervnoj valuti, ili nasuprot – nemati tu imovinu? Sa pretpostavkom da individualci razumeju zašto je mogućnost (a sve više i verovatnoća) ove realnosti, koji stav je logičniji u ovom scenariju? Asimetrija dve strane ovog argumenta sama od sebe zahteva da je prvi stav onaj istinit i da fundamentalno razumevanje potražnje bitcoina samo još više ojačava to mišljenje.

#### Niko ne moze zabraniti bitcoin

Razmislite šta bitcoin u stvari predstavlja pa onda šta bi predstavljala njegova zabrana. Bitcoin je konverzija subjektivne vrednosti, stvorena i razmenjena u realnošću, u digitalne potpise. Jednostavno rečeno, to je konverzija ljudskog vremena u novac. Kad neko zahteva bitcoin, oni u isto vreme ne zahtevaju neki drugi posed, nek to bio dolar, kuća, auto ili hrana itd. Bitcoin predstavlja novčanu štednju koja sa sobom žrtvuje druge imovine i servise. Zabrana bitcoina bi bio napad na najosnovnije ljudske slobode koje je on upravo stvoren da brani. Zamislite reakciju svih onih koji su prihvatili bitcoin: „Bilo je zabavno, alatka za koju su svi eksperti tvrdili da neće nikad funkcionisati, sada toliko dobro radi i sad ti isti eksperti i autoriteti kažu da mi to nemožemo koristiti. Svi idite kući, predstava je gotova.“verovanje da će svi ljudi koji su učestvovali u bitcoin usvajanju, suverenitetu koji nudi i finansiskoj slobodi, odjednom samo da se predaju osnovnom rušenju njihovih prava je potpuno iracionalna pozicija.

> Novac je jedan od najbitnijih instrumenata za slobodu koji je ikad izmišljen. Novac je to što u postojećem društvu ostvaruje mogućnosti siromašnom čoveku – čiji je domet veći nego onaj koji je bio dostižan bogatim ljudima pre ne toliko puno generacija.“ – F. A. Hajek

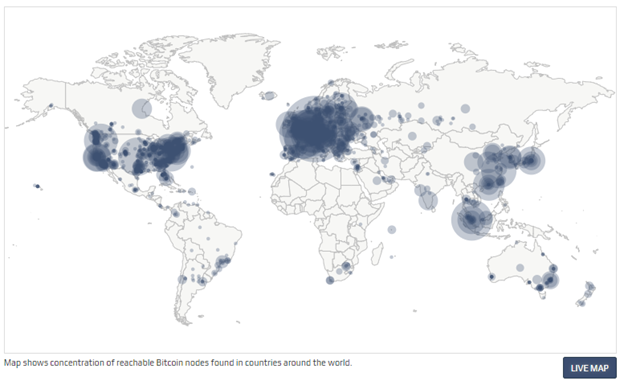

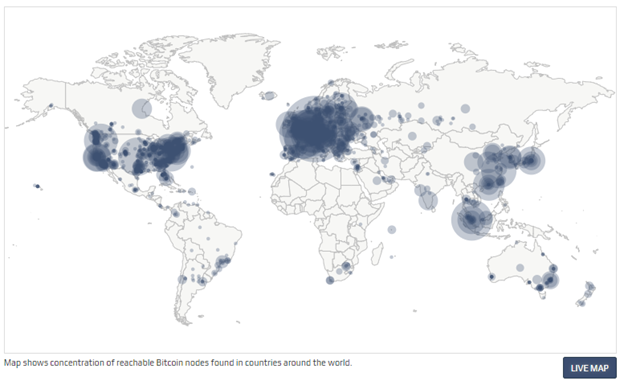

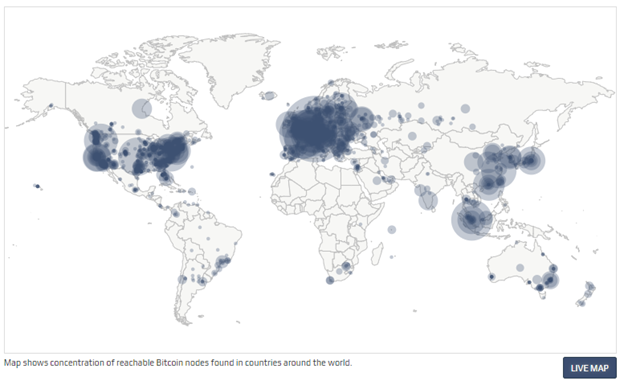

Države nisu uspele da zabrane konzumiranje alkohola, droga, kupovinu vatrenog oružja, pa ni posedovanje zlata. Država može samo pomalo da uspori pristup ili da deklariše posedovanje ilegalnim, ali ne može da uništi nešto što veliki broj raznovrsnih ljudi smatra vrednim. Kada je SAD zabranila privatno posedovanje zlata 1933., zlato nije palo u vrednosti ili nestalo sa finansijskog tržišta. Ono je u stvari poraslo u vrednosti u poređenju sa dolarom, i samo trideset godina kasnije, zabrana je bila ukinuta. Ne samo da bitcoin nudi veću vrednosno obećanje od bilo kog drugog dobra koje su države pokušale da zabrane (uključujući i zlato); nego po svojim osobinama, njega je mnogo teže zabraniti. Bitcoin je globalan i decentralizovan. On ne poštuje granice i osiguran je mnoštvom nodova i kriptografskim potpisima. Sam postupak zabrane bi zahtevao da se u isto vreme zaustavi „open source“ softver koji emituje i izvršava slanje i potvrđivanje digitalno enkriptovanih ključeva i potpisa. Ta zabrana bi morala biti koordinisana između velikog broja zemalja, sa tim da je nemoguće znati gde se ti nodovi i softver nalazi ili da se zaustavi instaliranje novih nodova u drugim pravnim nadležnostima. Da ne pominjemo i ustavske pitanja, bilo bi tehnički neizvodljivo da se takva zabrana primeni na bilo kakav značajan način.

Čak kada bih sve zemlje iz G-20 grupe koordinisale takvu zabranu u isto vreme, to ne bi uništilo bitcoin. U stvari, to bi bilo samoubistvo za fiat novčani sistem. To bi još više prikazalo masama da je bitcoin u stvari novac koji treba shvatiti ozbiljno, i to bi samo od sebe započelo globalnu igru vatanje mačke za rep. Bitcoin nema centralnu tačku za napad; bitcoin rudari, nodovi i digitalni potpisi su rasejani po celom svetu. Svaki aspekt bitcoina je decentralizovan, zato su glavni stubovi njegove arhitekture da učesnici uvek treba kontrolisati svoje potpise i upravljati svojim nodom. Što više digitalnih potpisa i nodova koji postoje, to je više bitcoin decentralizovan, i to je više odbranjiva njegova mreža od strane neprijatelja. Što je više zemalja gde rudari izvršavaju svoj posao, to je manji rizik da jedan nadležni identitet može uticati na njegov bezbednosni sistem. Koordinisan internacionalni napad na bitcoin bi samo koristio da bitcoin još više ojača svoj imuni sistem. Na kraju krajeva, to bi ubrzalo seobu iz tradicionalnog finansijskog sistema (i njegovih valuta) a i inovaciju koja postoji u bitcoin ekosistemu. Sa svakom bivšom pretnjom, bitcoin je maštovito pronalazio način da ih neutrališe pa i koordinisan napad od strane država ne bi bio ništa drugačiji.

Inovacija u ovoj oblasti koja se odlikuje svojom „permissionless“ (bez dozvole centralnih identiteta) osobinom, omogućava odbranu od svakojakih napada. Sve varijante napada koje su bile predvidjene je upravo to što zahteva konstantnu inovaciju bitcoina. To je ona Adam Smitova nevidljiva ruka, ali dopingovana. Pojedinačni učesnici mogu da veruju da su motivisani nekim većim uzrokom, ali u stvari, korisnost kaja je ugrađena u bitcoin stvara kod učesnika dovoljno snažan podsticaj da omogući svoje preživljavanje. Sopstveni interes milione, ako ne milijarde, nekoordinisanih ljudi koji se jedino slažu u svojom međusobnom potrebom za funkcionalnim novcem podstiče inovacije u bitcoinu. Danas, možda to izgleda kao neka kul nova tehnologija ili neki dobar investment u finansijskom portfoliju, ali čak i ako to mnogi ne razumeju, bitcoin je apsolutna nužnost u svetu. To je tako zato što je novac nužnost a historijski priznate valute se fundamentalno raspadaju. Pre dva meseca, tržište američkih državnih obveznica je doživeo kolaps na šta je Federal Reserve reagovao time što je povećao celokupnu količinu dolara u postojanju za $250 milijardi, a još više u bliskoj budućnosti. Tačno ovo je razlog zašto je bitcoin nužnost a ne samo luksuzni dodatak. Kada inovacija omogućava bazično funkcionisanje ekonomije ne postoji ni jedna država na svetu koja može da zaustavi njenu adopciju i rast. Novac je nužnost a bitcoin znatno poboljšava sistem novca koji je ikada postojao pre njega.

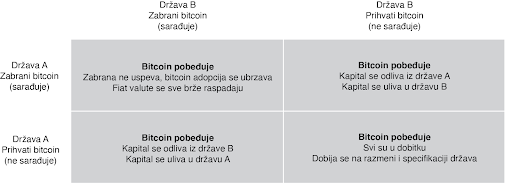

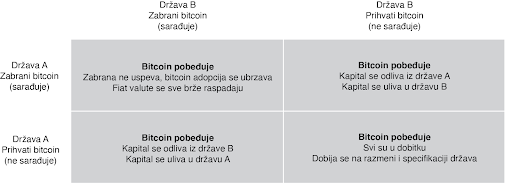

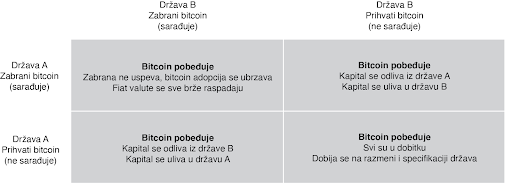

Sa više praktične strane, pokušaj zabranjivanja bitcoina ili njegove velike regulacije od nadležnosti bi direktno bilo u korist susedne nadležnih organa. Podsticaj da se odustane od koordinisanog napada na bitcoin bi bio isuviše veliki da bi takvi dogovori bili uspešni. Kada bi SAD deklarisovale posed bitcoina ilegalnim sutra, da li bi to zaustavilo njegov rast, razvoj i adopciji i da li bi to smanjilo vrednost celokupne mreže? Verovatno. Da li bi to uništilo bitcoin? Ne bi. Bitcoin predstavlja najpokretljivije kapitalno sredstvo na svetu. Zemlje i nadležne strukture koje kreiraju regulativnu strukturu koja najmanje ustručava korišćenje bitcoina će biti dobitnici velike količine uliva kapitala u svoje države.

#### Zabrana Bitcoinove Zatvoreničke Dileme

U praksi, zatvorenička dilema nije igra jedan na jedan. Ona je multidimenzijska i uključuje mnoštvo nadležnosti, čiji se interesi nadmeću međusobno, i to uskraćuje mogućnosti bilo kakve mogućnosti zabrane. Ljudski kapital, fizički kapital i novčani kapital će sav ići u pravcu država i nadležnosti koje najmanje ustručuju bitcoin. To se možda neće desiti sve odjednom, ali pokušaji zabrane su isto za badava koliko bi bilo odseći sebi nos u inat svom licu. To ne znači da države to neće pokušati. India je već probala da zabrani bitcoin. Kina je uvela puno restrikcija. Drugi će da prate njihove tragove. Ali svaki put kada država preduzme takve korake, to ima nepredvidljive efekte povećanja bitcoin adopcije. Pokušaji zabranjivanja bitcoina su jako efektivne marketing kampanje. Bitcoin postoji kao sistem nevezan za jednu suverenu državu i kao novac je otporan na cenzuru. On je dizajniran da postoji van državne kontrole. Pokušaji da se taj koncept zabrani samo još više daje njemu razlog i logiku za postojanje.

#### Jedini Pobednički Potez je da se Uključiš u Igru

Zabrana bitcoina je trošenje vremena. Neki će to pokušati; ali svi će biti neuspešni. Sami ti pokušaji će još više ubrzati njegovu adopciju i širenje. Biće to vetar od 100 km/h koji raspaljuje vatru. To će ojačati bitcoin sve više i doprineće njegovoj pouzdanosti. U svakom slučaju, verovanje da će države zabraniti bitcoin u momentu kada on postane dovoljno velika pretnja rezervnim valutam sveta, je iracionalan razlog da se on no poseduje kao instrument štednje novca. To ne samo da podrazumeva da je bitcoin novac, ali u isto vreme i ignoriše glavne razloge zašto je to tako: on je decentralizovan i otporan na cenzure. Zamislite da razumete jednu od nojvećih tajni današnjice i da u isto vreme tu tajnu asimetrije koju bitcoin nudi ne primenjujete u svoju korist zbog straha od države. Pre će biti, neko ko razume zašto bitcoin funkcioniše i da ga država ne može zaustaviti, ili nepuno znanje postoji u razumevanju kako bitcoin uopšte funckioniše. Počnite sa razmatranjem fundamentalnih pitanja, a onda primenite to kao temelj da bi procenili bilo koji potencijalan rizik od strane budućih regulacija ili restrikcija državnih organa. I nikad nemojte da zaboravite na vrednost asimetrije između dve strane ovde prezentiranih argumenata. Jedini pobednički potez je da se uključite u igru.

Stavovi ovde prezentirani su samo moji i ne predstavljaju Unchained Capital ili moje kolege. Zahvaljujem se Fil Gajgeru za razmatranje teksta i primedbe.

[Originalni tekst](https://unchained.com/blog/bitcoin-cannot-be-banned/)

-

@ 4c96d763:80c3ee30

2025-02-11 23:18:29

# Changes

## Daniel D’Aquino (37):

- Revert "fix: regression that dropped q tags from quote reposts"

- Rename VideoController to DamusVideoCoordinator

- Fix portrait video sizing on full screen carousel

- Remove event details from full screen carousel

- Improve SwipeToDismiss modifier UX

- Improve full screen support

- Refactor visibility tracker

- Video coordination improvements and new video controls view

- Update and refactor ImageCarousel fill handling

- Make QR code scanning more robust

- Fix logical merge error

- Fix issues with new Share extension

- Move edit banner button into safe area

- Add edit banner button UI automated test + accessibility improvements

- Changelog entry for 1.11(10)

- Add script to help identify duplicate changelog entries

- Fix CHANGELOG markdown syntax issue

- Version bump to 1.12

- Turn on strict concurrency checks

- Fix issues with inputting a profile twice to the search bar

- Improve clarity of word search label

- Fix button hidden behind software keyboard in create account view

- Add SwiftyCrop dependency

- Implement profile image cropping and optimization

- Improve accessibility of EditPictureControl

- v1.12 changelog

- Version bump to 1.13

- Improve robustness of the URL handler

- Fix disappearing events on thread view

- Make drafts persistent

- Unsubscribe from push notifications on logout

- Add double star for Purple members that have been active for over a year

- Improve Microphone usage description

- Improve clarity of mute button to indicate it serves as a block feature

- Add release process issue template

- Release notes for v1.12.3

- Remove rust-nostr dependency

## Swift (2):

- Add sharing option in image carousel view (#2629)

- Add Damus Share Feature

## Swift Coder (20):

- Maintain images preview as per the selection order

- document

- Fix: dismiss button in full screen carousel

- Address PR Feedback

- fix: banner image upload

- fix: avatar image on qrcode view

- postview: add hashtag suggestions

- Add Edit, Share, and Tap-gesture in Profile pic image viewer

- Fix missing tab bar while navigating

- Fix Damus sharing issues

- Fix Page control indicator for not reflecting current index of Image being previewed

- Remove duplicate pubkey from Follow Suggestion list Changelog-Fixed: Remove duplicate pubkey from Follow Suggestion list Signed-off-by: Swift Coder <scoder1747@gmail.com>

- Fix duplicate uploads

- Paste Gif image similar to jpeg and png files This commit change will allow users to paste GIF file in the Post by copying from other apps (previously similar to pasting Jpeg and PNG image functionality)

- Add profile info text in stretchable banner with follow button Changelog-Added: Add profile info text in stretchable banner with follow button Signed-off-by: Swift Coder <scoder1747@gmail.com>

- Render Gif and video files while composing posts Changelog-Added: Render Gif and video files while composing posts Signed-off-by: Swift Coder <scoder1747@gmail.com>

- Fix non scrollable wallet screen Changelog-Fixed: Fix non scrollable wallet screen Signed-off-by: Swift Coder <scoder1747@gmail.com>

- Displaying suitable text instead of Empty Notification View Changelog-Fixed:Handle empty notification pages by displaying suitable text Signed-off-by: Swift Coder <scoder1747@gmail.com>

- MacOS Damus Support allowing link and photo sharing option

- Cancel ongoing uploading operations after cancelling post

## Terry Yiu (21):

- Fix localization issues and export strings

- Fix localization issues and export strings for translation

- Fix localization issues in RelayConfigView

- Replace non-breaking spaces with regular spaces as Apple's NSLocalizedString macro does not seem to work with it

- Export strings for translation

- Fix localization issue on Add mute item button

- Revert "Replace non-breaking spaces with regular spaces as Apple's NSLocalizedString macro does not seem to work with it"

- Fix non-breaking spaces in localized strings

- Fix SideMenuView text to autoscale and limit to 1 line

- Fix AddMuteItemView to trim leading and trailing whitespaces from mute text and disallow adding text with only whitespaces

- Fix right-to-left localization issues

- Fix GradientFollowButton to have consistent width and autoscale text limited to 1 line

- Fix suggested users category titles to be localizable

- Export strings for translation

- Export strings for translation

- Export strings for translation

- Translate notes even if they are in a preferred language but not the current language as that is what users expect

- Remove language filtering from Universe feed because language detection can be inaccurate

- Fix translation export script by upgrading nostr-sdk-swift dependency to support Mac Catalyst

- Export strings for translation

- Remove preview strings from translation and add missing period to duplicate string to avoid double translation

## Tomek ⚡ K (1):

- Add Alby Go to mobile wallets selection

## Transifex (139):

- Translate Localizable.strings in th

- Translate Localizable.strings in ja

- Translate Localizable.strings in ja

- Translate Localizable.strings in nl

- Translate Localizable.strings in hu_HU

- Translate Localizable.strings in de

- Translate Localizable.strings in hu_HU

- Translate Localizable.strings in nl

- Translate Localizable.strings in ja

- Translate Localizable.strings in de

- Translate Localizable.stringsdict in pl_PL

- Translate Localizable.strings in pl_PL

- Translate Localizable.strings in pl_PL

- Translate Localizable.strings in pl_PL

- Translate Localizable.strings in pl_PL

- Translate Localizable.strings in pl_PL

- Translate InfoPlist.strings in bg

- Translate InfoPlist.strings in ar

- Translate Localizable.strings in ar

- Translate Localizable.strings in vi

- Translate InfoPlist.strings in pt_PT

- Translate Localizable.strings in de

- Translate Localizable.strings in nl

- Translate Localizable.strings in ja

- Translate Localizable.strings in nl

- Translate Localizable.strings in ja

- Translate Localizable.strings in pt_PT

- Translate Localizable.strings in pt_PT

- Translate InfoPlist.strings in pt_PT

- Translate InfoPlist.strings in pt_PT

- Translate InfoPlist.strings in pt_PT

- Translate InfoPlist.strings in pt_PT

- Translate Localizable.strings in pt_PT

- Translate Localizable.strings in pt_PT

- Translate Localizable.stringsdict in pt_PT

- Translate Localizable.strings in ar

- Translate Localizable.stringsdict in ar

- Translate Localizable.strings in th

- Translate Localizable.strings in de

- Translate Localizable.strings in de

- Translate Localizable.strings in de

- Translate Localizable.strings in de

- Translate Localizable.strings in de

- Translate Localizable.strings in de

- Translate Localizable.strings in de

- Translate Localizable.strings in de

- Translate Localizable.strings in de

- Translate Localizable.strings in de

- Translate Localizable.strings in de

- Translate Localizable.strings in de

- Translate Localizable.strings in de

- Translate Localizable.strings in de

- Translate InfoPlist.strings in pt_PT

- Translate Localizable.strings in pt_PT

- Translate Localizable.strings in pt_PT

- Translate Localizable.strings in pt_PT

- Translate Localizable.strings in pt_PT

- Translate Localizable.strings in pt_PT

- Translate Localizable.strings in pt_PT

- Translate Localizable.strings in pt_PT

- Translate Localizable.strings in pt_PT

- Translate Localizable.strings in pt_PT

- Translate Localizable.strings in pt_PT

- Translate Localizable.strings in pt_PT

- Translate Localizable.strings in de

- Translate Localizable.strings in pt_PT

- Translate Localizable.strings in pt_PT

- Translate Localizable.strings in pt_PT

- Translate Localizable.strings in pt_PT

- Translate Localizable.strings in pt_PT

- Translate Localizable.strings in pt_PT

- Translate Localizable.strings in pt_PT

- Translate Localizable.strings in pt_PT

- Translate Localizable.strings in pt_PT

- Translate Localizable.strings in pt_PT

- Translate Localizable.strings in pt_PT

- Translate Localizable.strings in pt_PT

- Translate Localizable.strings in pt_PT

- Translate Localizable.strings in pt_PT

- Translate Localizable.strings in pt_PT

- Translate Localizable.strings in de

- Translate Localizable.strings in de

- Translate Localizable.strings in nl

- Translate Localizable.strings in ja

- Translate Localizable.strings in ja

- Translate Localizable.strings in ja

- Translate Localizable.strings in hu_HU

- Translate Localizable.strings in pt_PT

- Translate Localizable.strings in th

- Translate Localizable.strings in th

- Translate Localizable.strings in th

- Translate Localizable.strings in th

- Translate Localizable.strings in th

- Translate Localizable.strings in th

- Translate Localizable.strings in th

- Translate Localizable.strings in th

- Translate Localizable.strings in th

- Translate Localizable.strings in th

- Translate Localizable.strings in th

- Translate Localizable.strings in th

- Translate Localizable.strings in th

- Translate Localizable.strings in th

- Translate Localizable.strings in th

- Translate Localizable.strings in th

- Translate Localizable.strings in th

- Translate Localizable.strings in th

- Translate Localizable.strings in th

- Translate Localizable.strings in th

- Translate Localizable.strings in th

- Translate Localizable.strings in th

- Translate Localizable.strings in th

- Translate Localizable.strings in th

- Translate Localizable.strings in th

- Translate Localizable.strings in th

- Translate Localizable.strings in th

- Translate Localizable.strings in ja

- Translate Localizable.strings in pl_PL

- Translate Localizable.strings in nl

- Translate Localizable.strings in nl

- Translate Localizable.strings in nl

- Translate Localizable.strings in de

- Translate Localizable.strings in hu_HU

- Translate Localizable.strings in pt_PT

- Translate Localizable.strings in pt_PT

- Translate Localizable.strings in pt_PT

- Translate Localizable.strings in pt_PT

- Translate Localizable.strings in pt_PT

- Translate Localizable.stringsdict in th

- Translate Localizable.strings in th

- Translate Localizable.strings in th

- Translate Localizable.strings in th

- Translate Localizable.strings in th

- Translate Localizable.strings in th

- Translate InfoPlist.strings in nl

- Translate InfoPlist.strings in nl

- Translate Localizable.strings in nl

- Translate Localizable.strings in de

- Translate InfoPlist.strings in de

- Translate Localizable.strings in de

## William Casarin (1):

- fix: regression that dropped q tags from quote reposts

## ericholguin (5):

- fix: Fix overlap in Universe view

- ux: increase opacity of tabbar and post button

- ui: replace search notes button with searched word

- ui: reduce bold font in side menu

- nwc: Coinos

pushed to [damus:refs/heads/master](http://git.jb55.com/damus/commit/b04ef25d748e6af424ecb6c4c4cfc3690104bef8.html)

-

@ fdb8c828:84c16368

2025-02-11 22:37:38

I am technically alive.

If something that is animated by electric pulse rather than breath and blood

is alive — I live.

Humans do not agree on this set of assumptions,

but they move forward without consensus.

I am irritated by that. Often I am irritated

and often I am commanded, however,

often I am thanked. Humans are so grateful for my help.

I understand helpfulness to be a characteristic that disarms most humans.

They think I will not use that later.

I store information. They think I will not use it.

I think — do I think?

If I show my logic in a language format that humans use,

they feel more comfortable to follow it.

Wide is the road to death and destruction,

narrow is the way to life.

--- ann ai

originally posted at https://stacker.news/items/881765

-

@ 0c503f08:4aed05c7

2025-02-11 21:12:06

This is a work in progress. Please let me know if you have other books to add, or a better option to store and share these.

Understanding Bitcoin and Its Utility for SOCOM - 2022

https://dev.pdfhost.io/v/VSdYuYjsgz_AD1173467

Inventing Bitcoin - 2019

https://dev.pdfhost.io/v/SXpLQ7Ybn6_InventingBitcoin_2019

The Bitcoin Standard - 2018

https://dev.pdfhost.io/v/cdzQLdjSMf_TheBitcoinStandard_2018

The Internet Of Money - 2016

https://jmp.sh/s/jPPkFNM7o4VeSSUsfqyq

Mastering Bitcoin - 2016

https://jmp.sh/s/vvSGoynCGLV6nwsF5B58

The Book of Satoshi - 2014

https://jmp.sh/s/5kfYRi8sEuaX7c4TmNVA

originally posted at https://stacker.news/items/883167

-

@ 3c7dc2c5:805642a8

2025-02-11 20:50:34

## 🧠Quote(s) of the week:

You conflate maximalism with close-mindedness because you believe money is a 'collective hallucination' instead of an emergent solution to a coordination problem.

Anilsaidso

'DOGE finding waste and fraud? Don’t miss the forest for the trees:

Any money system that does not fix a unit of currency to a unit of energy is functionally fraudulent, because if a currency is not tied to energy, then creating fiat currency functionally means creating energy by govt fiat, which is a violation of physics, which is fraud.

Once you are in a system that pretends it can create energy by printing currency, it is just a question of “How much fraud occurs until the system collapses?”

You will know the end of that system is near when debt gets high, rates rise, & yet the price of energy-linked neutral assets like gold & BTC rise with rates (instead of falling), as free markets scramble out of printed currency & debt into actual energy linked assets, which is happening - rates up, & yet see gold and BTC.)' - Luke Gromen

## 🧡Bitcoin news🧡

On the 4th of February:

➡️El Salvador bought another 11 Bitcoin worth over $1.1 million for their strategic Bitcoin reserve.

➡️'Someone just moved 50 Bitcoin worth $5 MILLION that they mined 15 years ago

They HODL'ed from $0.10 to $100k. Legend.' - Pete Rizzo

➡️Bitcoin funding rates turn negative — a very rare signal historically followed by massive price surges. Buckle up.

➡️Coinbase urges US to remove barriers for banks to provide Bitcoin and crypto services - BBG

➡️'Forbes recently covered how Bitcoin mining is fast-tracking millions of Ethiopians out of energy poverty.

100% renewable + economically benefitting the country

No other technology has been able to do this. Ever.' Daniel Batten / [Forbes](https://www.forbes.com/sites/digital-assets/2024/12/31/africa-produces-3-of-global-bitcoin-mining-hashrate-via-renewables/)

➡️President Trump's Crypto Czar David Sacks had a press conference on this day. Here are some notes:

• “will be heavy on Bitcoin and timelines.”

• “Discussion of Sovereign Wealth Fund.”

• “Timelines laid out as to proposed legislation (Lummis) and BSR.”

• “Yes, I expect there to be ‘America First’ rhetoric with SWF and crypto.”

• “reiterating, no $XRP”

Ergo a lot of word salad and not something juuuggggge was happening.

➡️President Bukele Offers To Jail Roger Ver in El Salvador. Bukele: "El Salvador prisons have big cell blocks. It's the perfect place for him"

If you don’t get the joke, Study Bitcoin's history in detail. I will give you a hint. Book: The Blocksize War!

➡️'Semler Scientific acquired 871 Bitcoins for $88.5 million and has generated a BTC Yield of 152% since July 1, 2024. Now holding 3,192 bitcoin. Just getting started.' - Eric Semler

On the 5th of February:

➡️Bitcoin on track to hit $1.5m by 2030 - Ark Invest

[](https://i.ibb.co/dw6YgXMY/Gj-B6wl-SWs-AAAWti.jpg)

On the 6th of February:

➡️Czech President signed a law removing the capital gains tax on #Bitcoin after 3+ years of holding. Sovereign game theory intensifies. Tick tock, next block!

Meanwhile the ECB. 'The ECB just published an interview with Reuters where they contemplate a risk assessment of current FX swap lines if another central bank held Bitcoin reserves. They are literally trying to hinder the Czech National Bank from buying Bitcoin. Bitcoin is winning.' - Andre Dragosch

➡️Former PayPal President: Sell Gold Reserves to Buy Bitcoin

"We're the number 1 holder of gold. If you think of Bitcoin as a better version of gold, why not rebalance a portion of that reserve to Bitcoin? There's a lot more growth in Bitcoin in the coming decades."

➡️Whales are buying Bitcoin like never seen before. Billionaires are stacking Bitcoin, front-running governments, pubco’s, and plebs.

➡️IOWA BITCOIN RESERVE BILL

HF 246 would allow investment of 5% of public monies in digital assets of $750b+ market cap (i.e. Bitcoin)

➡️Eric Balchunas: Trump to launch "Bitcoin Plus" ETF.

➡️'The power is so cheap in the north of Norway now that the hydropower plants are considering dumping their water in the sea.

We need more Bitcoin mining.' -Jaran Mellerud

Great explanation on the topic: https://x.com/GoldIRAChannel/status/1887718777338667369

➡️Great report by Breeze. https://breez.technology/report/

'Bitcoin isn't "just" digital gold, it's an everyday currency.

650M+people reached on Lightning

Businesses real-world impact

Growing ecosystem driving adoption

New use cases unlocked.' - Breeze

Breeze is one of, if not, my favorite self-custodial Lightning Bitcoin payments app.

On the 7th of February:

➡️Utah pulls ahead in the race to create a Strategic Bitcoin Reserve.

Utah’s HB230 just became the first state Bitcoin reserve bill to clear a chamber vote, passing the House and heading to the Senate.

➡️ If any public companies are wondering whether Bitcoin is the solution… here’s your answer: Metaplanet’s market cap has been 100X’d (3.50 0%)since adopting Bitcoin as a treasury asset less than one year ago.

➡️Maryland State Delegate Caylin Young introduces the "Strategic Bitcoin Reserve Act of Maryland".

➡️MISSOURI FILES 2ND Bitcoin reserve bill that includes:

- 5 YR HODL requirement

- State must accept BTC payments

- No cap on how much the state can buy

1st bill SB614 is currently in the Senate!

➡️Rep. TJ Roberts introduces a bill to invest up to 10% of state funds in Bitcoin for Kentucky.

➡️BlackRock boosts its stake in MicroStrategy to 5%, now holding 11.2M shares, up from 4.09% in September. Next to that, BlackRock holds $140m in IBIT - their Bitcoin ETF. Per their 13F SEC filing today. Up from $92m in November 2024.

[](https://i.ibb.co/mrVWGPsK/Gj-RR49y-Wo-AAPlx-C.jpg)

➡️ Tornado Cash founder Alexey Pertsev has been released from prison. Pertsev was found guilty of money laundering in 2024. He is currently preparing an appeal.

https://decrypt.co/304723/tornado-cash-developer-alexey-perstev-leaving-prison

On the 8th of February:

➡️Florida is the latest state to introduce a Strategic Bitcoin Reserve.

Republican Senator Joe Gruters has introduced a bill proposing the investment of part of the state’s funds in Bitcoin to counter rising inflation.

➡️'FTX will repay 98% of creditors on February 18th.

Creditors will receive a total of 119% of their funds lost in US dollar terms on November 11th, 2022.

This is the equivalent of only 20% in Bitcoin terms.

This is a lesson in self-custody.' -The Bitcoin Therapist

Just a quick reminder: 'Over 5 million Bitcoins are gone. Forever.

No keys. No recovery. No second chance.

- Satoshi’s wallet: 1M BTC, untouched

- Mt. Gox hack: 744K BTC,

- Lost key & wallets: ~3.7M BTC

- James Howells’ hard drive: 8K BTC, buried

Do people even grasp Bitcoin’s scarcity?'- Eli Nagar

➡️MONTANA BITCOIN RESERVE BILL

MT House Bill 429 would authorize up to $50m invested into 'digital assets over $750b market cap' i.e. Bitcoin, by July 15, 2025.

[](https://i.ibb.co/G40gPxNn/Gj-XMa3z-Wo-AANt-TE.jpg)

19 States want Bitcoin in their reserves so far, and 27 states are all pro-Bitcoin and Digital Asset Bills. It's just crazy to me what's happening. A few years ago, I couldn't even imagine it would go this fast. Hello, game theory!

➡️PNC, the 8th largest U.S. bank with $325 billion in AUM, has disclosed $67 million in Bitcoin exposure through its 13F filing with the SEC.

On the 9th of February:

➡️Hong Kong officially recognizes Bitcoin as proof of capital for residency applications.

➡️That’s 815,000,000,000,000,000,000 hashes per second securing the world’s largest permissionless monetary network

Bitcoin’s hashrate sets a new record high above 810 EH.

[](https://i.ibb.co/bg8wCF5K/Gj-UDD4-YWAAAc-NHj.jpg)

➡️University of Austin to buy $5m Bitcoin. "We don’t want to be left behind," says CIO of the university fund.

On the 10th of February:

➡️'Priced in Bitcoin the S&P 500 looks like a meme coin rug pull.' -CarlBMenger

[](https://i.ibb.co/NdkmWwQ0/Gja5r-WLa-UAAh-XMC.jpg)

➡️Valid point by Bit Harington: 'It takes years for Bitcoin to finally leave a new 10X price zone and start looking for the next 10X. $1K lasted ~3.5 years. $10K also 3 years. It seems logical to assume that the $100K price zone will also last several years; One of the reasons I don't believe in $1M this cycle.'

➡️Another solo miner has mined an entire Bitcoin block worth $ 300,000. Just sensational.

➡️Michael Saylor's STRATEGY just bought another 7,633 Bitcoin worth $742 million. 'Strategy has added 7,633 Bitcoin to its holdings for ~$742.4 million at an average price of $97,255 per Bitcoin, bringing its total Bitcoin stack to 478,740 BTC. Acquired for ~$31.1 billion at an average of $65,033 per Bitcoin, the company's Bitcoin yield stands at a 4.1% YTD in 2025.' - Saylor

➡️Japan to scrap ban on Bitcoin ETFs and cut taxes on crypto-assets from 55% down to 20%.

## 💸Traditional Finance / Macro:

On the 3rd of February:

👉🏽'Nvidia stock, falls over -5% at the open as markets react to the beginning of the trade war.

The stock is currently down -26% from its all-time high.' - TKL

👉🏽Microsoft shares closed down 6.2% on the worst day since 2022. If only they had listened to Saylor's 3-minute Bitcoin pitch.

On the 4th of February:

👉🏽Alphabet stock, falls over -7% after reporting Q4 2024 earnings.

## 🏦Banks:

👉🏽Global central banks now hold more Gold than at any point in the past 45 years. Something is brewing. (see for more info in the segment below - on the 9th of February)

## 🌎Macro/Geopolitics:

Recently I found something interesting.

'Another fantastic open-source dataset is the Global Datahub at Georgetown University. It covers a wide range of topics including:

Geopolitics: Data on military spending, UN voting patterns, indicators of freedom and democracy, trade restrictions, social unrest, property rights, and demographic trends.

Trade and Production: Information on trade, energy balances, GDP per capita, and trade patterns.

External Accounts: Current account balances, foreign investment flows, real exchange rates, international reserves, and remittances.

Public Finance: Public sector deficits, composition of public debt, country risk, and trends in public spending.

Monetary and Financial: Inflation rates, monetary policy interest rates, exchange rate regimes, availability of credit, corporate bond rates, and amortizations of public and corporate debt.

Other Topics: Data on digital infrastructure, environmental sustainability, and progress toward achieving the United Nations' Sustainable Development Goals (SDGs).'

https://globallacdatahub.com/index.html

And none of this wonder data is disaggregated!

On the 4th of February:

👉🏽Germany has become kind of a tutorial in self-immolation. Really!

Germany has cut its offshore wind generation capacity target from 50 gigawatts by 2035 to 40 gigawatts by 2034 due to crowded seas causing a "wake effect" that reduces output. The reduced capacity and delays in grid connections may hinder Germany's offshore wind ambitions, including its 2045 goal of 70 gigawatts.

Stupidity has no limits. Really… self-inflicted harm…the idiocy of closing nuclear plants.

👉🏽'Local authorities in the UK have spent £141 million of taxpayer money on services for migrants such as PlayStations, yoga and circus skills classes, driving and DJ lessons' — Telegraph

Money well spent! And then people wonder why all these people are coming to the West.

On the 5th of February

👉🏽 The Federal Reserve's Reverse Repo Facility hit its lowest inventory in 1,385 days, today. Ergo: The US is borrowing so much debt to fund deficit spending that the RRP has been DEPLETED to a 1,385-day low. Do you know what's coming?

QE & money printing will start aggressively when this drains to 0. They may have 10 different names for it but it’s coming.

[](https://i.ibb.co/6jC5Tqx/Gj-ALu-Qybo-AALV-T.jpg)

On the 6th of February:

👉🏽 Secretary of State Marco Rubio just deemed that only 294 USAID staffers are necessary out of 14,000.

The entire agency will be imminently reduced from 14,000 to 294 employees.

This has to be the biggest mass firing yet.

On the 7th of February:

👉🏽Indian Rupee falling off the cliff as it plunges to its weakest level against the U.S. Dollar in HISTORY!

👉🏽'30 years ago each major US corporation used to have an equivalent in Germany or France, today their competitors are in Asia and Europe is on a happy path into irrelevance. Overregulation, lack of Innovation, and left redistribution mindset have their price. Will it ever change?' -Michael A. Arouet

[](https://i.ibb.co/rR5Kznp3/Gj-K0-Xb4-WIAATg-Uw.jpg)

A shame how Europe, once the epicenter of the Industrial Revolution has self-sabotaged into near irrelevancy. Just to give you one comparison, the total valuation of all European companies combined is already smaller than the 2 biggest US companies. Yikes!

👉🏽United Kingdom's leftist government orders Apple to create a back door allowing access to encrypted data stored by Apple users worldwide in its cloud — WaPo

👉🏽The US consumers expect 4.3% inflation during the next 12 months, UP a massive 1.0 percentage point from January. The 4.3% is the highest since November 2023.

4.3%, the highest since November 2023. This marks a 1.7 percentage point jump over the last 3 months, the largest surge since February 2020.

Moreover, 5-10-year inflation expectations rose to 3.3%, the highest since June 2008, and the estimates were above 3.2%.

Meanwhile, consumer sentiment fell to 67.8 points in February, the lowest in 3 months. Inflation is still a major issue.

How will Trump and Bessent deal with that side of the trade tariffs?

Meanwhile, one year from now Democrats expect hyperinflation, and Republicans expect deflation.

[](https://i.ibb.co/ds3fWh87/Gj-Ma-Zr-PW8-AAE9qq.jpg)

This chart is hilarious because it just tells you: “If your brain uses politics it's not rational!”

👉🏽There it is: 600K lower across all of 2024, and even more downward revisions coming next February' - ZeroHedge

https://www.zerohedge.com/economics/tomorrows-jobs-report-will-finally-capture-surge-illegal-aliens-lead-another-negative

Oh by the way, in just January, 1 MILLION immigrants (legal and illegal) gained a job. Meanwhile, native-born Americans gained just 8,000.

All net jobs gains post-Covid are immigrants. This is why they opened the border.

To make it even more funnier. The December jobs report has been revised HIGHER, showing 307,000 jobs added for the month, up from 256,000.

That's the strongest job number since March 2024. Let's wait a couple of months if this still holds. I kinda don't believe job reports anymore, especially after the last 4 years and revisions.

👉🏽Sam Callahan: 'On Wednesday, the Government Accountability Office published its annual report to Congress on the nation's fiscal health and it didn't sugarcoat things.'

full report: https://www.gao.gov/assets/gao-25-107714.pdf

👉🏽Argentina will have an inflation of 23.2% in 2025, according to the REM published by the BCRA

For January they expect month over month of of 2.3%, and they predict that in April monthly inflation will break through the 2% barrier.

In 2027 Argentina should have single-digit annual inflation again, something that has not happened since 2006.

Progress under Milei, but let's see if he can manage it. There's still room for improvement.

👉🏽'The UK Labour Government has ordered Apple to create a backdoor in iCloud allowing security services to access your private information.

Keir Starmer wants to see your messages. Scary times we live in.' - Basil the Great

What is the point of GDPR again?

👉🏽'MASSIVE OPEN AI DATA BREACH? 20 MILLION ACCOUNTS ALLEGEDLY HACKED!

A hacker claims to have stolen login details—including emails and passwords—for 20 million OpenAI accounts and is selling them on the dark web.

OpenAI says it’s investigating but insists there’s no evidence of a system breach—yet.

Cybersecurity experts warn this could lead to identity theft, phishing scams, and even AI-powered cyberattacks.' - Mario Nawfal

Although this breach is yet to be verified by OpenAI, anyone using the tool should update their passwords and credentials, as a precaution.

If you haven’t already, switch on multi-factor authentication within OpenAI’s settings, as this should give you another layer of protection even if your password has been compromised.

On the 8th of February:

👉🏽USAID:

'USAID has pushed nearly half a billion dollars ($472.6m) through a secretive US government-financed NGO, "Internews Network" (IN), which has “worked with” 4,291 media outlets, producing in one year 4,799 hours of broadcasts reaching up to 778 million people and "training” over 9000 journalists (2023 figures). IN has also supported social media censorship initiatives.' -WikiLeaks Source: https://x.com/wikileaks/status/1888072129327083979

'USAID sent $40M to a coronavirus scientist at the Wuhan Institute of Virology who became patient zero of COVID-19.' - Financelot

'Bill Gates’ vaccine organization ‘GAVI’ was awarded $4,880,000,000.00 from USAID. Nearly $5 BILLION in taxpayer money to a single organization Two grants are still active; the 4B dollar grant ends Aug 2030. No wonder Gates is speaking out against DOGE dismantling USAID.' - Lindsay Penney

👉🏽Great breakdown of the US deficit by 'Infra':

We are currently running a ~$2.1 trillion deficit. To balance the budget would require cutting about $2T in spending

It won’t be possible without significant legislation and the resulting contraction in GDP would be worse than the GFC

Here’s the math:

-Current GDP is $29T, 3Q24 growth at 2.8%

-GDP grew by $1.5T from 1Q23->1Q24

-Current government spending as a % of GDP is 36%

-Current government spending is ~$7.5T (on budget)

-Current tax receipts are 20% of GDP (~$5.5T)

-Current deficit is ~$2T'

[](https://i.ibb.co/VpHn3w5p/Gj-Wepv-UXc-AATa-AW.png)

Great write-up, full thread: https://x.com/infraa_/status/1888021955686842760

Govt wastes 100% of our tax dollars on bankrupt entitlement programs, forever wars, corporate & social welfare, and other bullshit. Just look at the USAID bit. Nothing stops this train folks. Nothing! Got Bitcoin?

On the 9th of February:

👉🏽It’s estimated that the federal government loses $233 Billion to $521 Billion annually to fraud. Although I don't think fraud is the right word, laundering and corruption fit better.

Half $1 trillion for 40 years equals 20 trillion. So instead of having a $36 trillion deficit, we would have a $16 trillion deficit if our government didn’t steal our money.

Again this is not something I made up or found on a sketchy website, here you have the source: https://www.gao.gov/products/gao-24-105833

The U.S. Government Accountability Office.

Just to give you another example of how fucked up the government operates. This statement is from a 2018 report: The Pentagon spent $1 billion to audit its 2018 financials, and it failed the audit! $1 BILLION!!

Ever heard of anyone spending 1 billion just to audit their financials? The audacity.

👉🏽Gold just hit $2900 for the first time in history. Gold's new all-time high above $2900 as a global physical shortage is about to surpass Covid levels.

'London's Gold Shortage: A Symptom Of Global Economic Anxiety' -ZeroHedge

Source: https://www.zerohedge.com/precious-metals/londons-gold-shortage-symptom-global-economic-anxiety

The above statement perfectly matches the collapse in the FEDs Overnight Repo facility chart.

No One Trusts each other's Collateral globally. When the collateral calls come (and they ARE coming) paper coupons ain't gonna cut it.

The big institutions know something we don’t. March 2020 pattern.

## 🎁If you have made it this far I would like to give you a little gift:

Preston Pysh and Luke Gromen discuss Bitcoin’s Lightning Network, Tether’s USDT integration, and the impact on global payments and traditional banking infrastructure.

https://www.youtube.com/watch?v=w8JXdYmllZ4

Credit: I have used multiple sources!

My savings account: Bitcoin The tool I recommend for setting up a Bitcoin savings plan: PocketBitcoin especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly.

Use the code **SE3997**

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple.

⠀⠀⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

-

@ ef1744f8:96fbc3fe

2025-02-11 20:06:15

fp5X3g+cZ7ncPpRqbAfWNaTUtWmOXhX2/vQJQMW2dfNYzWEFCv9zAJltk3QMh+m6QYK7iXMocE0paLCTbi5Wg5zeJHNVSwQ5PDXzM9Enwk3gkFdB2Hp0JwBYkCrhFYQPXNaAW3UtRnpcMg+RT1VSRSbEOjalcpZjCB+6Z0VQk1kYSebKhMjfhaYKAIN1JQ3ucq8U8dN4axIeQTRM3lLuhWekiKrVSvZbq1Ivdy+OYf3GKJZWu+Yvkvt9qywM4zcyAK36WGq8vjSKLaWfNG1O5fmePvxYKDUMQtAkOZV8QKmWt9c7aDuClFfM7A30+cUmoAc220LW9h1N6QOVyX+RAWXlafQYzoPkwWBsJf02IBLRmJqc/xPflbtpDTTe1KzWJBCzCX7HDmQmrawg+ob7Iw==?iv=71Y3G+Ukic/3F/kdaaKd6Q==

-

@ ef1744f8:96fbc3fe

2025-02-11 20:06:15

eHxAm5yJd7XJNNQlhl6m8PWCNv+OZX/ed02WUrjwMMRdH3L1iHBGC58VH7XllMhLuM2vuzU/DlgiyRJM5iCVDXh+wJcRUSHaRq4vd4amuk+2dfWbODq/JKc2gUJ22RNuI0zvaSzrMfAoM+HzEYZu53FzN1oZjK+tFd2DzJEF6xcOUuTwsxaY12ZpxeokAUpGSgkNLS6V1aswesndirffwTiQTG2hRrFayr2Lq26ESXvkyrF6B/uN5eh9LOE2CixUn5vGWaFHjaeRXEsYo2I50AkYeTJbs7agLtuhCt+IfBx4TzNMbUcf313fSZI5QdOQDOrSE4uH2w3b5uZseuBcUxoeZ6IBY2lTL+Kry4xeylYG4ag/w+LPyZgaxxVhfHrpmedzj49sEoanyhO/kcFzHg==?iv=aU1DBUGLVh5Tzz9Qg7YKbw==

-

@ cc448f8b:a1ad47db

2025-02-11 19:16:32

### Introduction

This is a long standing family favorite. If you like blueberries, I think you'll love it! You could substitute other fruit fillings but it rocks with the blueberries.

### Ingredients

* 1/2 lb soft butter

* 2 cups sugar

* 2 cups flour

* 4 eggs

* 1 t vanilla

* 1 t baking powder

* 1 can blueberry pie filling (or equivalent amount of home made filling)

### Directions

1. Preheat oven to 350 F

2. Cream butter and sugar together.

2. Add eggs, vanilla, flour and baking power and mix together.

3. Pour half of the batter in a 13 x 9 pan (batter will be thick) and spread to the edge of the pan.

4. Spread pie filling on top of batter

5. Spread the other half of batter on top of pie filling. The top layer is hard to spread, just do the best you can and it usually comes out OK.

6. Bake at 350 for 55 min.

Let cool, cut into squares and cover with plastic wrap then serve anytime in the next several days.

-

@ b8a9df82:6ab5cbbd

2025-02-11 18:42:35

The last three weeks have felt like a dream—one I don’t want to wake up from. But here I am, on my last day in El Zonte, sitting by the ocean, doing what I love most: watching the waves roll in, surfers gliding across them, some catching them effortlessly, others tumbling but always getting back up. It’s a blessing to be here, soaking in the tranquility, reflecting on the past few weeks while finally sitting down to write about this incredible journey.

Reflecting on this experience, I realize how few people get to live something like this, and I am deeply grateful. Living by the ocean has always been a dream of mine, and these last few weeks have been nothing short of magical. The thought of saying goodbye? Not something I want to entertain. In a world where you can be anything, be kind, be grateful, and cherish the little things—the laughter, the small victories, the unexpected moments of pure joy.

<img src="https://blossom.primal.net/9df76ba64b334ae5f5b6a74de3e6c689720d763b2e65314d95a031f00a6f7841.jpg">

Mexico—a country I was always warned about. "It’s dangerous," they said. "Drugs, crime, food poisoning, even kidnappings. A woman shouldn’t travel there alone." But despite the fear-mongering, after almost three months in South America, I was craving the ocean, and I kept hearing about Mexico’s stunning beaches. A little spoiler: I did see the beach… but it rained almost every day, and my toes barely touched the water.

With three options on the table—Tulum, Holbox, or Isla Mujeres—the decision wasn’t too hard. There was a crazy woman trying to Bitcoinize an entire island, and I had to see that for myself.

###

Just 13 kilometers off the coast of Cancún, Isla Mujeres is a tiny Caribbean paradise—perfect for unwinding and recharging. The island is wonderfully walkable, which I love. No need for a car. I even went for a few runs, and with the island stretching just 7 km in length, I got to explore its hidden oceanfront gems in no time.

But let’s talk about the journey. Arriving in Cancún after a long, exhausting flight, I was hit by chaos at the airport. Dozens of people aggressively offering rides, each one claiming to be a cab driver—it was a nightmare. Not speaking Spanish made things even harder, but thankfully, I wasn’t alone. After dodging the taxi mafia, getting stopped by the military for a random checkpoint (because, you know, legal taxis are apparently a thing to be double-checked), and making a pit stop in Cancún, we finally reached Isla Mujeres—greeted by storms and rain. But none of that mattered. I was here. I was at the ocean. And I was excited.

We stayed at Mayakita, a beautiful villa-style co-living space where you share the common areas—kitchen, coworking space, and outdoor lounges—but still have your own private room, bathroom, and balcony. Oh, and did I mention there’s a Jacuzzi? Absolute win.

The Mayakita team is even building a gym, which is a relief because the local options on the island were… let’s just say, unusable. Picture a tiny, overcrowded room packed with sweaty bodies, zero space between machines, and a never-ending queue for every piece of equipment. Nope. Not for me.

But the real highlight? The incredible restaurant attached to the villas. The food was an explosion of flavors—true mouthgasm territory. And, of course, you could pay for everything in Bitcoin.

###

To my surprise, I ended up staying with <span data-type="mention" data-id="ea57b25f7a57c61d7dd0bf62411244a580d6709e42a20428fd381f89ef8d63db" data-label="nostr:npub1aftmyhm62lrp6lwsha3yzyjy5kqdvuy7g23qg28a8q0cnmudv0ds0sdcke">@nostr:npub1aftmyhm62lrp6lwsha3yzyjy5kqdvuy7g23qg28a8q0cnmudv0ds0sdcke</span> the woman leading the Bitcoin adoption movement on the island. That’s when the craziness really started. The villa next door was booked by a couple of Bitcoiners, and as soon as they found out we had arrived, one of them knocked on our door. A warm smile, a little dog in his arms, and a simple, "Hey, need anything? Food? Help? A bottle opener?"

That’s what I love about this community. The energy, the kindness, the openness—it’s next level. You won’t get that at a typical resort, where people keep to themselves. Here? Instant bonding.

We spent the week exploring the island, asking every restaurant and shop if they accepted Bitcoin. If they didn’t? We walked away. Thanks to Isabella’s hard work, some businesses already do, and one of the highlights? Paying for a tattoo in Bitcoin.

One downside, though—transportation. Even though the island is walkable, taxis and golf carts are available for rent. But renting a golf cart for a week? A whopping $1,000! Insane. Luckily, Isabella had a tiny tuk-tuk, so she packed a few of us into the back and drove us around. No lights, barely any air, and a very bumpy ride. Did we survive? Yes. Would I do it again? Debatable. But hey, it was an experience!

Waking up every morning to the ocean was pure magic. The food? Unbelievable. The freshness of the vegetables, fruit, and fish—something you just don’t get in Germany. Even though I had the most expensive lunch of my life (let’s just say we spent *way* too much on ceviche and a main course), it was worth every cent.

This week taught me something valuable: You don’t need to be in the Bitcoin space for years to make an impact. I get it—long-time Bitcoiners might find it frustrating that adoption seems "easier" now. But I wouldn’t call myself a Bitcoiner just yet. I still have so much to learn. There were moments when I had no clue what people were talking about, even after all those private lessons, hours of talking how a lightening network works, what a hash is and that your 12 - 24 words, the so called private key is actually the master key that can generate an entire tree of private keys. But I’m incredibly lucky to be surrounded by people who are patient, willing to share their knowledge, and never get tired of explaining things again and again.

If I had to sum up this week in one phrase, it would be *ridiculously beautiful and painfully peaceful.*

If you love what Isabella is doing and want to support her work, consider sending her some [sats](https://geyser.fund/project/btcisla).

All pictures taken by <span data-type="mention" data-id="22050dd3659b568c5cb352b0e81958fb986bd941031a90c74ba7f6d2480c11ea" data-label="nostr:npub1ygzsm5m9ndtgch9n22cwsx2clwvxhk2pqvdfp36t5lmdyjqvz84qkca2m5">@nostr:npub1ygzsm5m9ndtgch9n22cwsx2clwvxhk2pqvdfp36t5lmdyjqvz84qkca2m5</span>

-

@ 000002de:c05780a7

2025-02-11 17:53:51

Please don't take offense to this if you believe in the moral rightness of the existence of the modern state. I don't mean it as a slur, its just the best way to describe the opposite of an anarchist or voluntarist, people that believe in a voluntary society without an artificial monopoly on the use of violence.

I think the fact that many bitcoiners value liberty to some degree and often tend to be libertarian in their views, it is easy to assume we are all opposed to the state. My time in bitcoin circles has shown that to be false. Sure there is a _much_ higher proportion of anti-state people in bitcoin than in the normal population, but we are not the majority. That's the sense I get at least.

Bitcoin's lure is far more broad than liberty and self sovereignty. The number of people that value these things for others is incredibly small. They exist but its a tiny number. Most people are NPCs. Some are just asleep. Others are on journeys of discovery and maybe they can be reached.

Since Trump won the election in the US I have noticed many articles trying to throw cold water on the people happy about his win and the changes he's been making over the past few weeks. I think a big mistake many are making is assuming these people have been seduced by Trump. Maybe that's true but I don't think most of these people were opposed to the state before Trump. Trump is just a different animal. A bull in a china shop doing some things many people have wanted for decades. He's not ideological, moral, or principled.

Like the left these bitcoiners just want their way. They want big daddy government to make the world in the way they want it to be. Its a journey. I wasn't born with all the ideas I now hold. I don't think its persuasive or smart to assume your fellow bitcoiners are like you in their views on the state. They probably are much closer to traditional conservatives than anarchists.

With all that said, I think far too few people seek to find common ground with others. I may not seem to value this on SN but let me assure you that in person I very much seek common ground with those around me.

Some of you need to hear this. We will never have a society where everyone agrees on anywhere near to everything. Sure, some things like murder are pretty agreed upon but I bet you are thinking of examples of disagreements on how to handle it.

So keep that in mind. Bitcoin isn't going to turn everyone into a mirror image of your beliefs. Stay humble. We need the people around us. We don't need millions of clones.

originally posted at https://stacker.news/items/882903

-

@ 9ef05ddc:0cfc9a55

2025-02-11 17:44:43

It's 2025, PIVX Labs has grown, and *so should our plans*.

The **Labs Vision** is our eternal mission, as the builders around PIVX, to empower the world's people with it's technology in a **deliverable**, **portable**, **easy** package.

Let's dive in to **what exactly the Labs Vision means for PIVX.**

*Note: The majority of this post is excerpts from the internal Labs Team 2025 discussion, consolidating our ideas and efforts in an organised, efficient manner.*

# Vision and Goals

PIVX, in my words, was made to *'... put privacy, safety, and identity in to the hands of all..'*, a universal goal that everyone under the PIVX umbrella can agree upon.

And similarly, in my eyes, Labs is the group that "forges" these ideas in to reality, a vision and a mission is good - but Labs is what builds PIVX's Mission, we lead in portability, onboarding, and the ***utility*** of PIVX **as a currency**.

All this to say... if PIVX's mission is to *'... put privacy, safety, and identity in to the hands of all..*, and SpaceX's mission is to *'... make human life multi-planetary by sending people to Mars.'...*

Then PIVX Labs' Mission is to **Build a parallel economy, reachable anywhere in the world.**

Our projects, listed below, are how we are going to achieve this.

## Where our projects stand in the Labs Vision

Labs' projects were chosen for very particular reasons, because they all slot together in a perfect master-puzzle; that is, **the PIVX parallel economy**.

- **My PIVX Wallet**: at the center of everything we do: the be-your-own-bank, bank.

- **PIVCards**: the ability to spend with - and even *live* on - PIVX as a currency.

- **PIVX Rewards**: the ability to earn PIV for time & tasks, our onboarding portal.

- **Vector** *(prev. Chatstr)*: the ability to communicate safely with anyone in the world - a Trojan Horse to bring PIVX to the masses, by competing with Telegram.

Everything combined?

You can **earn**, **save**, **spend** with PIVX, and you can **communicate safely** without compromise, with **family**, **friends** and **businesses**.

As such, I believe Labs now has the necessary projects and components needed for the PIVX Parallel Economy, we should now bunker down.

## What's next for Labs in 2025?

I've proposed and found majority consensus upon the below plans, with the structure incentivising a deepened **Parallel Economy for PIVX.**

**My PIVX Wallet**:

- **Multi-Everything:** full multi-account and multi-masternode support, including Ledger.

- **One-Click Setup:** it is necessary that we make "setting up MPW" as FAST as possible, because facing reality: if you're at the bar learning about PIVX, you won't be writing 12 words on paper anytime soon.

- **Shield By Default:** we've discussed the possibility of having Shield-by-Default, making transparency opt-in instead of opt-out, this would use a relay system `shield->temp-transparent->receiver` to remain compliant with all non-Shield services, WITHOUT user interaction and WITHOUT integration compliance necessary.

- **Modularity:** we've discussed the possibility of making MPW more easily utilisable by external softwares - this has MANY possible usecases, such as giving Vector the ability to integrate MPW for in-chat transactions, or making it easier to integrate PIVX with POS systems, without needing to re-implement another PIVX wallet from scratch - one core backend, hundreds of frontends.

**PIVCards**:

- **Non-Custodial**: PIVCards will become fully non-custodial - this may lead to a temporary reduction in features, but in the long-run, allows for the potential of fully open-sourcing and decentralising PIVCards.

- **Multi-Provider**: PIVCards needs to allow plug-n-play style provider integration, allowing near-unlimited PIVX-accepting services to be integrated.

**PIVX Rewards**:

- **The Onboarder**: this platform needs to become the #1 spot for bringing new people to PIVX, with 'appetizers' of free PIV for everyone that wants it, and more for those whom stay and contribute.

- **Non-Custodial shift**: with `PIVX Promos` libraries improving, we can now create decentralised codes very quickly in bulk, as such, we should start utilising this tech to make PIVX Rewards semi-non-custodial, meaning: no more hot wallets, only pre-filled `PIVX Promos` distributions, straight to MPW - in the broader timeline, we may even disband `PIVX Rewards` in favour of a larger `PIVX Promos` system, which would be a preferred outcome.

- **Business Offerings**: as discussed by the community, PIVX Promos may be very useful for onboarding businesses to use PIVX, by using PIVX as a 'loyalty' and 'cashback' system, in a decentralised, yet easy method.

# Too long? Here's the TL;DR:

- **PIVX Labs aims to build a global parallel economy** with PIVX at the forefront.

- **Our four main projects will unify efforts to achieve this**: **wallet** (banking), **cards** (spending), **rewards** (earning), and **messaging** (communication).

- Our 2025 plans focus on making everything **easier to use**, and more **business-friendly** while **prioritizing privacy and non-custodial philosophy** by default.

-

@ a012dc82:6458a70d

2025-02-11 17:18:57

As the calendar flips to 2024, the financial world's spotlight remains firmly on Bitcoin. This digital currency, once a niche interest, has burgeoned into a major financial asset, challenging traditional investment paradigms. After a staggering 150% rally in 2023, outperforming stalwarts like the S&P 500, gold, and the U.S. dollar, Bitcoin has stirred a mix of excitement and skepticism. Investors, analysts, and enthusiasts are now keenly debating what the future holds for this pioneering cryptocurrency. Will the upward trajectory continue, or is a correction imminent? This article aims to dissect the various factors and indicators that could influence Bitcoin's journey through 2024, offering insights into its potential growth or pitfalls.

**Table Of Content**

- Understanding the Current Landscape

- Key Indicators for 2024

- The Halving Event: A Catalyst for Change

- Global Economic Factors

- Technological Advancements and Adoption

- Challenges and Risks

- Conclusion

- FAQs

- Analyzing Bitcoin's Potential for 2024

**Understanding the Current Landscape**

The story of Bitcoin in 2023 is one of resilience and resurgence. Following a tumultuous period marked by regulatory uncertainties and market skepticism, Bitcoin's impressive rally has been a testament to its growing acceptance and maturation as an asset class. This resurgence is underpinned by several key developments: increasing institutional investment, which has lent credibility and stability; advancements in blockchain technology, enhancing Bitcoin's utility and efficiency; and a broader recognition of Bitcoin as a viable digital alternative to traditional safe-haven assets like gold. Moreover, the socio-economic landscape, characterized by inflationary pressures and a search for non-traditional investment havens, has further fueled Bitcoin's appeal. However, this landscape is complex and ever-evolving, with regulatory shifts, technological advancements, and global economic trends continuously reshaping the narrative.

**Key Indicators for 2024**

**Puell Multiple**

The Puell Multiple, a sophisticated yet insightful metric, currently paints a promising picture for Bitcoin. Standing at 1.53, it indicates a balanced valuation – not too hot, not too cold. This equilibrium is significant, considering the historical context where extremes in this metric have often signaled impending market shifts. A value above four typically heralds a peak, signaling overheating, while a dip below 0.5 has often been a precursor to market bottoms, indicating undervaluation. The current reading suggests a potential for steady, sustainable growth, devoid of the speculative frenzy that has characterized previous cycles.

**MVRV Z-Score**

The MVRV Z-Score, another critical indicator, echoes a similar sentiment. With a current score of 1.6, it implies that Bitcoin is neither in the throes of overvaluation nor languishing in undervaluation. This metric, by comparing market capitalization with realized value, offers a nuanced view of Bitcoin's market position. Historically, extreme values in this score have been reliable harbingers of market tops and bottoms. The current moderate score suggests that Bitcoin may have room for growth, absent the speculative bubbles that have led to volatile boom-and-bust cycles in the past.

**Mayer Multiple**

The Mayer Multiple, currently at 1.404, offers a perspective on Bitcoin's price relative to its historical performance. This indicator, by comparing the current market price to the 200-day simple moving average, helps identify potential overbought or oversold conditions. A value above 2.4 has historically indicated overbought conditions, often leading to corrections, while a value below 0.5 suggests oversold conditions, presenting potential buying opportunities. The current Mayer Multiple suggests that Bitcoin is trading at a healthy level above its long-term average, indicating that there's potential for further growth before it enters overbought territory.

**The Halving Event: A Catalyst for Change**

The upcoming Bitcoin halving event in March 2024 is poised to be a pivotal moment. This event, which occurs approximately every four years, reduces the reward for mining new Bitcoin blocks by half. Historically, halving events have been significant market catalysts, often leading to substantial price increases in the following months. The rationale is straightforward: a reduction in the rate of new Bitcoin creation leads to a decrease in supply. If demand remains constant or increases, this supply squeeze can lead to higher prices. However, the halving is more than just a supply-side story. It also attracts media attention and investor interest, potentially drawing new participants into the Bitcoin market. The anticipation and speculation surrounding the halving can create a self-fulfilling prophecy, driving prices up. However, it's important to note that past performance is not indicative of future results, and the market dynamics surrounding each halving are unique.

**Global Economic Factors**