-

@ ef1744f8:96fbc3fe

2025-02-24 14:15:14

U0Cp38MGIOL5TzaGvfIycZJgQ11ij6LtT5IVmNP8oZS04RKSHhvLTkaHRmnZHZ2kdZbWBVr5fsqc7sR6Gysv/9t+eX+F15l8sd8PokSCMU6l3EYZdP+draq30zuUH7fHHmrH6sKAKBXB8wzhG+da7km97dUO1KHELhR+vGFWtYIyuT1gbM2AvywldcugDWRpEE/a8UsLyROYNB/DhUrD62GN4qP6GCLYNgp7FuUvgD1QYL2kb/ctcwI+OAT1CSk70XwpQjWmKH+eo2Uhlp8bFg1Nm+AI9FTqgsnj2WFhjmfzbVPF4TtBGo1Kp+Guc+1M7jVro1Wy5bYVhZghJ7B4OdkePHcMWaQqXv+V1mgqUG/guOUqvtypP4ATNSj/tsw1?iv=fgZcFd3B4QHwr05LjzYfDQ==

-

@ ef1744f8:96fbc3fe

2025-02-24 13:57:07

bIzjKZ+i0/ZpWslLWXk1tkVypOiX0ErueLoBWso7NSKAdjOdPLPFcrJnePQIJrTHmFxb9hgNnThqbl8iD4/cFvCZb9fzeJpdVuiJ3S457HH1Rd+e/lp/eYxwLl/ZsjxV6jCBfhRH6UTAdwJlIubLf0lRgt3gghV1kQhC6Lhb8CFXe87Lt/0eMFR9xg6x9n96Rx14xqTq1pHnBl0zc6wPdwTebK7wVy6k6qoqP9TpAfbJP2Bcy3g0+p+Cz1j7Sv6hkqyY1w12Fsb+I/8TxI6rVEJdsCViZgjNvRZVBPjlsYrmrM6Kv2Sl/ZcmhCDyuDNzeA1/XtXNwzVX0l7SG5DduLvDt7qqRhPbZc9wZOwa1zg=?iv=6BgowrrUlWNFO8u9jGBCNw==

-

@ 4d41a7cb:7d3633cc

2025-02-24 13:57:04

Money is more abstract than most people think, as I will show in this article. Debt slavery stems from financial illiteracy, which occurs intentionally. The biggest secret is how bankers actually create **currency claims out of thin air and transfer the wealth of their clients (including nation states) to themselves for free without risking a cent, real money, or currency.**

## **MONEY**

Money, one of the most important things in our lives, is so important that we exchange wealth to obtain it. Not because we want it but because we need it in order to buy food, shelter, clothes, etc.

Money is not inherently bad, although some may argue that the love for money is the root of all evil, and I'll agree. If you are willing to sacrifice your soul, honor, reputation, family, or friends for money, it indicates a lack of morality and a willingness to engage in harmful actions to satisfy your greed and materialistic desires.

**Money is a technology, a tool, and like any tool or technology, it is impartial**; it cannot be inherently good or bad. It can be used to help others or to destroy them. At the end of the day, it’s all about the intention behind human behavior.

Money is not just a useful tool; it’s **the most important tool** to have for global commerce, division of labor, specialists, and the level of sophistication and comfort we achieve as humanity. All of this will not be possible without this tool working as a common medium of exchange and standard of value, a common language for all humanity: the language of monetary value.

**Money is the cornerstone of civilization.** Money is the bloodstream of commerce, and commerce is the spine of civilization; it’s what made our civilization so prosperous, letting any one of us decide how we want to provide value to society.

Money is half of every transaction, and since we will always need to intermediate between every exchange, money is the perfect intermediary to help achieve millions of different combinations of exchanges. It will be practically impossible to barter on a global scale; even in a small community with a few different products, it will be a mess.

For example, if there were 10 products, there would be 45 combinations; if there were 100, there would be 4950 combinations. Imagine a scenario on a large scale, requiring the exchange of hundreds of thousands of products every second..

This issue **necessitated the development of a new technology: money, which in turn led to the emergence of moneychangers (v4v). Money is a tool to exchange, measure, and store wealth.** Wealth is anything we can sell: our labor (time and energy), our house, a car, a product, a service, etc.

**Gold and silver were money for thousands of years** because of their unique characteristics of scarcity, durability, divisibility, and transportability. The most important characteristic of these metals is that they are scarce, and they can’t be created out of thin air or reproduced with no effort.

**Only God can control the supply of gold and silver found in nature.** Men can only extract it, and it requires investment, work, time, and effort to find and mine it. So the common knowledge and the common sense of the people over thousands of years consensually chose gold and silver as money. And **this money is the only lawful money under common law.**

> “Gold is money, everything else is credit”

>

> J.P. Morgan 1912

As an interesting fact, the word "money" is used 140 times in the King James Bible, the word "gold" is mentioned 417 times, and the word "silver" over 320 times. But the word “currency” is not mentioned a single time.

The most important function of money is to **exchange and store your time and energy**. You work to acquire money and then use that money to acquire other goods and services.

**Our time and energy is our real wealth** because it’s limited. We all have a limited time on earth, and we can do certain things in the 24 hours we have every day, so we have to be conscious about how we administrate and store the fruits of our labor.

Money is a means to an end; we don't want money; we want what money can buy, and guess what, money cannot buy more time.

## **CURRENCY = FAKE MONEY**

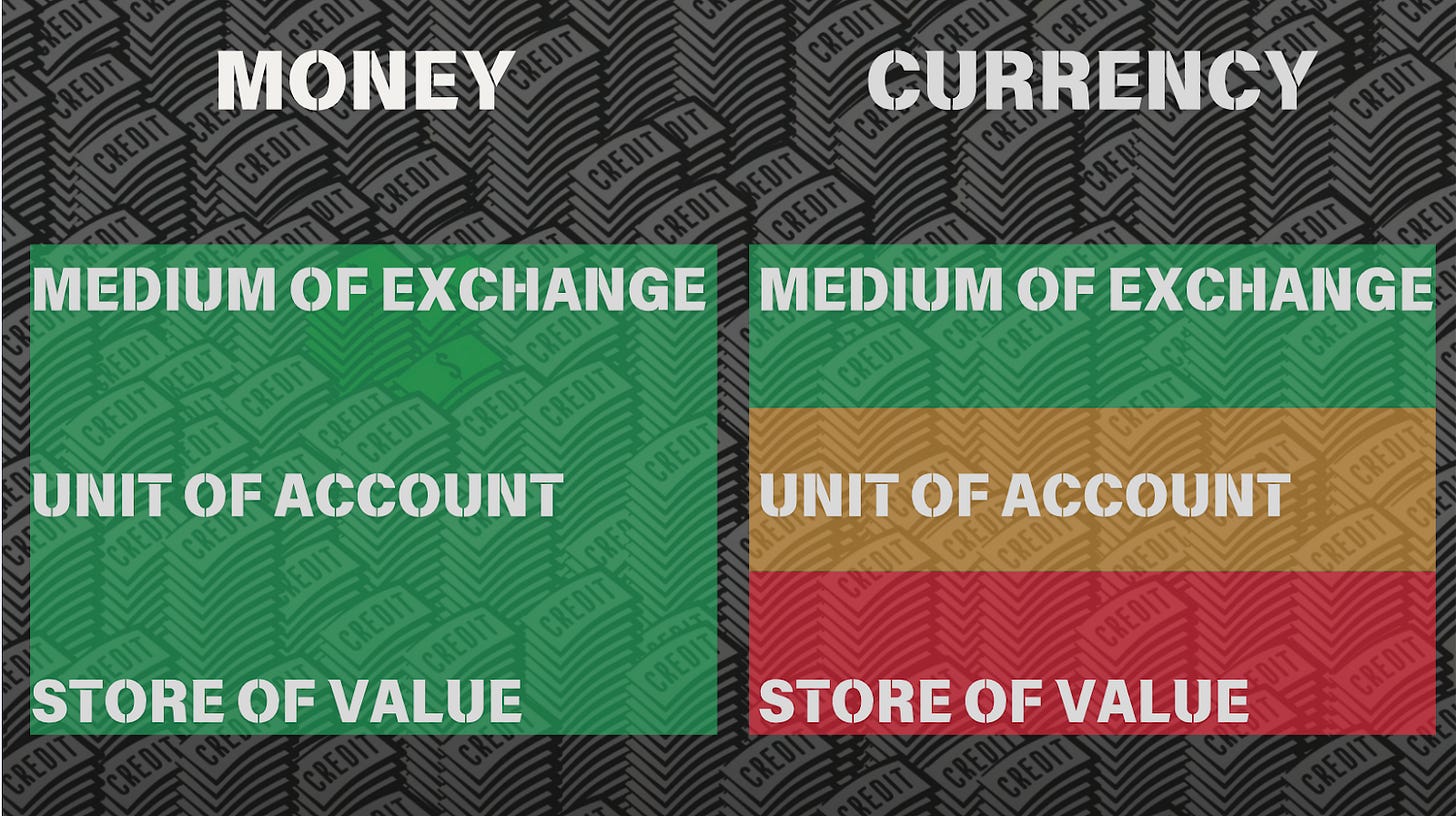

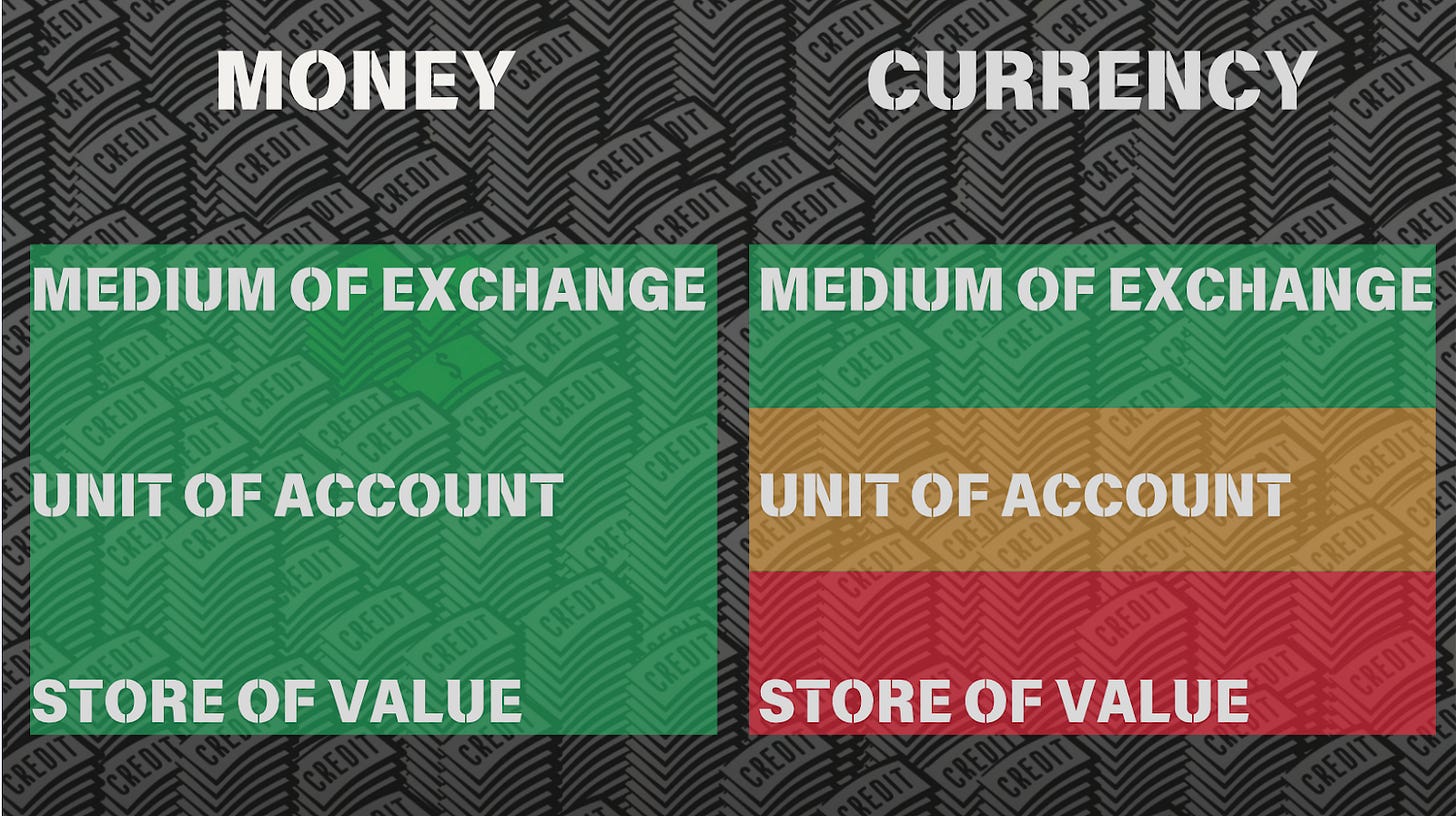

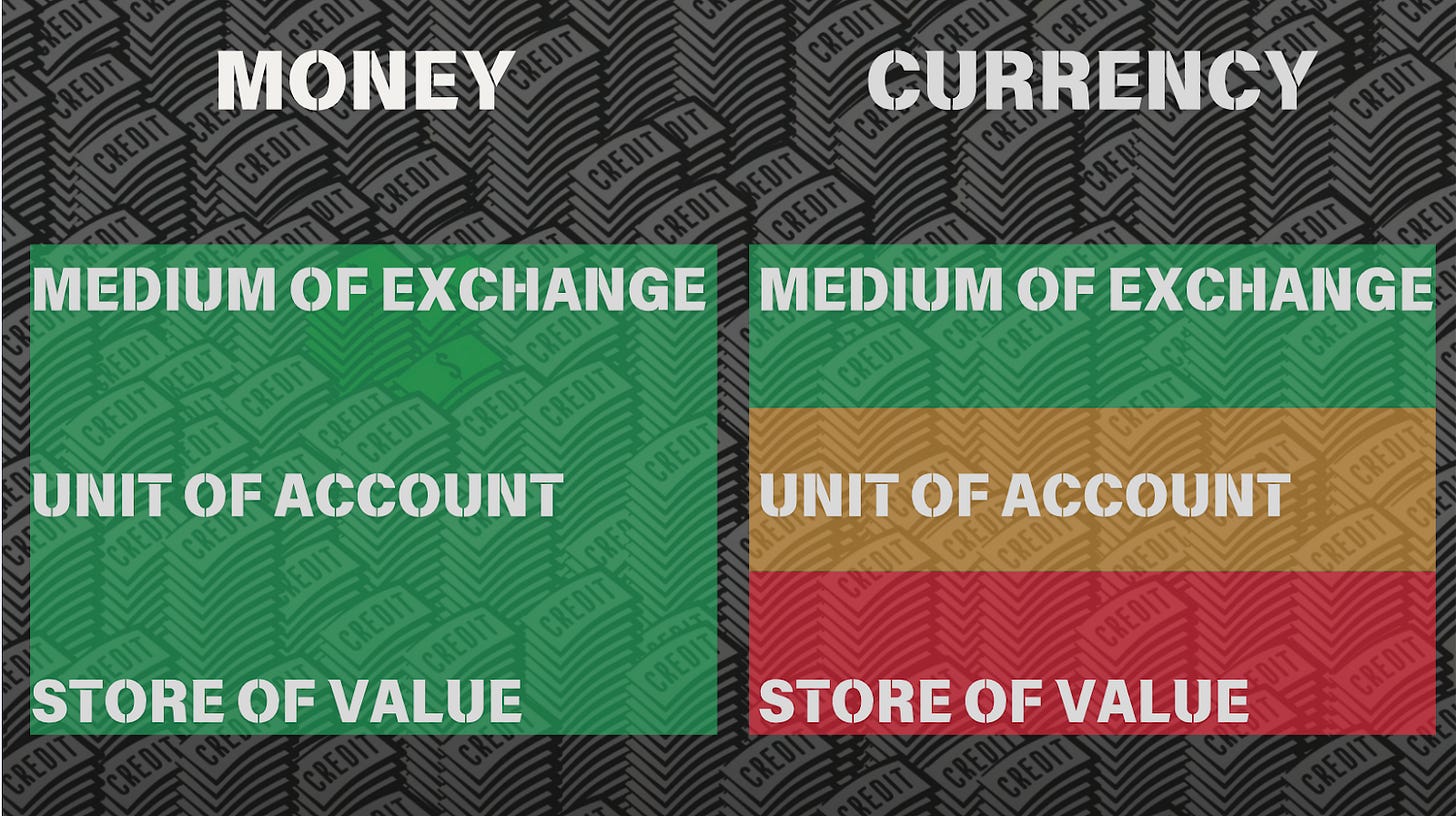

**Currency exists as a money substitute.** Currencies began as the opposite of money, the **promise to deliver money in the future: debt**. Currencies can be used to exchange wealth, but they are not a fair unit of account and are never a good way to store it because men are tempted to create more and dilute its value (a process known as inflation)

Currencies have almost all the same characteristics of money, but there’s a big difference: **currency is not scarce and durable**. Missing the store of value characteristic of money, since **its supply can be manipulated by men.**

For wealth preservation and measuring, modern currencies make no sense. Men control the supply of currency; **banks and governments can inflate or deflate it in any amount they please, giving them supreme power and control over wealth distribution.** This creates two classes of citizens: those who work to acquire currency and those who create it instantly and for free.

International banks have stolen money (gold and silver) over the past century, replacing its supply with currency or fake money (paper receipts). \[1913, 1933, 1944, 1971\]

Under this monetary game, those with "fixed income," savers, and creditors are the biggest losers, while debtors and asset owners are the winners..

The **most important distinction to keep in mind is that nature controls the money supply, making artificial inflation impossible.** On the other hand, men can inflate currency in unlimited amounts. It is **a manifestation of God's power on earth, as the mediums of exchange serve as the lifeblood of commerce, the backbone of our economic system, and facilitate the division of labor.**

If someone can **inflate the currency supply, this has the same economic effect as counterfeiting,** and he’s effectively stealing from everyone contracting, trading, and saving in that currency. Manipulating the mediums of exchange in an economy enables manipulation of every security, industry, and business.

This is the reason the founding fathers of the United States made gold and silver only lawful money for the payment of debts. To give everyone equal protection under the law and to get rid of the nobility and two types of citizens: bankers and workers or nobles and plebeians.

> Bank-notes are not money. It 's currency. It’s unfair to take banks' currency as a standard for comparison.

>

> Bank-note currency is not “lawful money”. It never could be counted as part of banks cash reserves. ***It would be too much like a man writing and signing his own promissory note for a million and then claiming that this made him a millionaire.***

>

> The very grave evils any currency depreciation always impose upon businesses and the people.

>

> Alfred Owen Crozier, US Money vs Corporate currency, 1912

So money has three very important functions that work as the pillars on which the wellness of our economic system and civilizations relies. Currency is not a store of value because its supply can be easily manipulated, men in power can create more of it, and so using this always-changing currency as a standard of value or a unit of account is like using an always-changing ruler to measure distance. A dollar today does not buy the same as a dollar one year ago. So yesterday prices are not equal to today's prices; this is an unfair business calculation.

So money has three very important functions that work as the pillars on which the wellness of our economic system and civilizations rel**ies. Currency is not a store of value because its supply can be easily manipulated**, men in power can create more of it, and so using this always-changing currency as a standard of value or a unit of account is like using an always-changing ruler to measure distance. **A dollar today does not buy the same as a dollar one year ago**. So yesterday prices are not equal to today's prices; this is an unfair business calculation.

There are several Bible verses that discuss the manipulation of weights and measures, emphasizing the importance of honesty and fairness in commercial dealings.

1. Leviticus 19:35-36 New International Version (NIV): "**Do not use dishonest standards when measuring length, weight, or quantity.** Use honest scales and honest weights, an honest ephah, and an honest hin.

2. Deuteronomy 25:13-15: Do not have two differing weights in your bag—one heavy, one light. Do not have two differing measures in your house—one large, one small. **You must have accurate and honest weights and measures**.

3. Proverbs 11:1—"A "**dishonest scale is an abomination to the Lord**, but a just weight is his delight."

**Fake money (currency) is always and everywhere a dishonest scale.** So if you want a real measure of value or wealth use something with real value instead, like gold, commodities, products, times, etc.

Bankers have redefined the word money to mean fake money, currency, or debt. And this is not the worst part. Let’s introduce another concept: credit.

## **CREDIT = FAKE CURRENCY**

**Real credit is the promise to pay money in the future.** It involves delaying the payment of money. **Currency was born as credit**, as a money certificate or receipt. During the last century, banks gradually replaced 100% of the money with currency and bank credit to further boost their profits and control. \[1913, 1933, 1944, 1971\]

But in order to achieve this goal, **bankers redefined the word money to mean the opposite of money: credit/debt. This is like calling a night a day or evil a good.**

When you take out a loan from a friend, you receive credit from him, but you also incur a debt with him. You promise your friends that you will pay them (asset/right), and you owe them (liability/obligation). The asset and the liability are one and part of the same deal; they cannot exist without the other. There’s no credit with no debt, no debt with no credit, and no liability with no asset.

Federal Reserve notes, commonly known as **“dollars,”** are a private corporate currency; they are **not money** because they are not gold or silver, nor receipts for these metals as many people still believe. They were not redeemable in money from the start, despite being created under the assumption.

The “peso” (Spanish word for weight) used to be a standardized amount of gold or silver, but it’s not any more; it's just a debt denomination. And what's owing? Currency. **How can someone lend the opposite of money and charge interest? O**nly deceiving you into believing that he is lending you money. So they redefined the word money to mean the opposite of it.

But redefining words does not change the economic effect of the transaction.

When currencies first appeared, I can imagine people asking themselves, "How can people trust these paper certificates in exchange for their money?" Who will be that stupid?” And **nowadays, people don’t understand the difference between money and currency, to the point that bankers redefined the word "money" to mean the opposite of "money."**

Lesson: Money is not just a medium of exchange; it is also a store of value and a unit of account. Currency, the opposite of money, is debt. Since it can be created in unlimited amounts, it can't work as a store of value because its value depreciates as more units are created; for this same reason, it is not fair to denominate values in currency units since one currency unit today does not buy the same as a year ago because of inflation, the loss of purchasing power.

Summarize: While money, currency, and credit all serve as effective mediums of exchange, only money serves as a reliable store of value for saving. Currency and credit are not stores of value (not good to save), and there are not fair units of account (not good for price).

In simple terms, money is not currency, because currency is just credit and debt. We can conceptualize it as a ledger, a record of who owes what to whom. Currency is fake money since it’s the opposite of a store of value; it's always depreciating in value while its supply is inflated. This is the definition of inflation.

**Modern credit is not currency; it’s the opposite. It’s the promise to deliver currency in the future, the promise of a promise of money (in theory). But there’s no money behind. It’s an air loan.**

But how did we get here? Is everyone stupid? No, we have been tricked, manipulated, and dictated to use these currencies, and this banking system was forced on us. They stole our money and replaced it with fake substitutes to boost their profits.

## **MODERN MEDIUMS OF EXCHANGE = MONOPOLY MONEY**

**So nowadays we have fake money acting as cash/currency and fake currency acting as bank deposits or credit.** One is worse than the other, but both of them serve only as mediums of exchange. Those who store wealth with them will be robbed, and those who calculate business will be lied to.

Today we use currencies (government notes), coins, bank deposits (currency claims), checks (bank deposit claims), credit cards, and debit cards. All of them are ‘monopoly money’ fake claims based on a big and global fraud.

- *Government notes (government debt)*

Since governments are under the control of central banks, they can only create currency by borrowing. Governments must issue bonds, or debt, and the central bank can generate credit, or currency, to purchase these bonds.

The bond (government liability) is the counterpart of the ‘asset’ (the currency, a central bank asset). Bonds are debt, and currencies are credit.

When the central bank creates currency to lend it to the government at interest, it has literally the economic effect of **transferring the wealth of the nation to the banks for free**. The banks are not lending anything that they had to labor to produce; instead, they are creating it by printing paper notes or digital currency.

On the other side, governments have to collect money from citizens (producers, merchants, and workers) to pay the interest on the debt.

Despite their best efforts, governments are unable to repay the debt due to interest, which makes it bigger than the amount of currency. Let’s say the debt is 100 at 1% interest. So there’s only 100 in currency. But at the end of the year, there’s going to be a debt of 101. In order for the system to keep working, someone else has to go into debt to create more currency units, and governments have to keep borrowing and at least only paying the interest and rolling the debt.

The important thing is that if you have government currency debt free, you own it. This is the new ‘money.’. **Government currency is the ‘real’ cash, liquidity, or water.**

- *Bank deposits (bank debt)*

When you deposit your government currency in the bank, you are legally lending your currency to the bank, and the bank owes you the amount you deposit. This currency is not stored by banks until you request it. Banks use this currency as if it were theirs, and they do business with it. That’s why I said, **‘Your money in the bank’ is not yours; it’s not money; it’s not in the bank.** Its currency, its owe to you, is only registered on the bank ledger as a debt, not in a safe box.

The numbers you get in the bank account, or your balance, are government currency substitutes; they are bank deposits. Your currency deposit is the asset, and the number on your bank account balance is the liability.

But this is not the worst part. Banks lend around 10 times more currency than they have in deposits. So banks have more liabilities than assets (they are literally broke).

People often treat bank deposits, also known as government currency substitutes or bank tokens, as legal tender, allowing banks to create them arbitrarily and 'lend' them to unsuspecting clients who mistakenly believe they are receiving currency.

This is possible only because the bank's deposit has equal cash value.

***Government bonds, government currency, and bank deposits have equal value. But they are not the same.***

All of them have counterparty risk, but **cash, or government currency, is better** or safer than bonds or bank deposits. If interest rates rise, the value of bonds can decrease, and default on bank deposits can result in total loss, a scenario that has frequently occurred.

Keep in mind that bank deposits represent the bank's debts, also known as liabilities. Business activities and risk-taking make your currency unsecured, and they don't compensate you enough for the loan and risk.

- *Debit cards (bank deposit transfer)*

Your bank deposit is your right to get your currency back. When you use a credit card to buy something, you are transferring that right to the seller so he can redeem that bank token for currency if he wishes.

But you have to have had a deposit before you can spend it or transfer it.

- *Checks (bank deposit transfer)*

The same applies to checks. Your bank deposit is your right to get your currency back. When you use a check to buy something, you are transferring that right to the seller so he can redeem that bank token for currency if he wishes.

- *Credit card (bank deposit creator)*

Credit cards are different. When you use a credit card, you are creating a bank deposit backed by your promise of paying it back. By allowing the bank to create a currency substitute out of nothing and charge you high interest, you are essentially working for them for free.

Not only this, but you are also letting them collect fees from the payments processing that cost them nothing and support their fake money as a medium of exchange.

**Using credit cards is literally voting for financial slavery.** This is why companies make credit cards so convenient and offer benefits, with the intention of incentivizing and pushing people into the debt slavery system.

## **BANKS = MONEYCHANGERS**

‘Loans’ = exchanges

Not only do they create bank deposits when you deposit currency, but they also create them when you "take a loan." Banks do not lend money, and they do not lend currency; they lend bank deposits (bank tokens/IOUs/currency substitutes).

Banks had to redefine the word money to mean the opposite of money (debt) to trick the people. How can you lend the oposite of money and expect to be paid back plus interest?

**The fact is that this is not a loan but an exchange.** When you take a loan, you sign a contract that creates a promissory note, which is your promise to pay. The bank then takes this promissory note, without your permission (steals), and sells it for cash (if you requiere it) or government bonds (to earn interest).

Your promissory note has equal value to cash and government bonds. And banks always need an asset to create a bank deposit (liability). So the banks literally steal your asset (promissory note) and sell them to create IOUs that they will ‘lend’ to you.

They ‘lend’ the oposite of money and call it a loan. The truth is that they are acting as moneychangers, and they are exchanging your IOU (promissory note) for a bank IOU (bank deposit) without your permission and pretending that you pay it back, but they never pay back theirs…

How is this possible? This is only possible because most people treat bank deposits (bank tokens, IOUs, and debts) as a medium of exchange because they trust the banks.

This is the root of inequality under the law. While one group can create IOUs from nothing and steal others, the other must work for them or exchange wealth.

If this bank defaults, its IOUs quickly vanish. This is a mathematical certainty; that’s why banks that are 'too big to fail' demand bailouts. **Every bank is bankrupt** since they have 7–10 times more liabilities than assets, and the assets they have are not theirs but their clients' assets. The only thing that keeps them alive is the trust of the public and the bailouts of the government.

**This is legalized slavery and theft.** There’s no other name. Banks own every industry, government, public figure, actor, etc. They have the power of God on earth, and it's time to stop them.

If we let the bank take our wealth for free, we will end up bankrupt, and they will end up owning everything. Every medium of exchange nowadays is an IOU or an IOU of an IOU. Ultimately, it is mathematically impossible to repay all of those IOUs, and banks pretend to keep all the assets.

*Check: IOU = deposit; IOU = cash; IOU = bond; IOU + interest*

The only way this system can continue is to keep creating new IOUs to pay the old ones, but even then (as it has been for over a century), the value of those IOUs keeps falling, causing hyperinflation.

If banks and governments want to ‘avoid’ (imposible) or relent to hyperinflation, they need to incur a great confiscation. So heads you lose, tails they lose; playing this game doesn't make any fucking sense.

Buy Bitcoin, self custody, and fuck the government and the banking system.

Live free or die trying.

-

@ ef1744f8:96fbc3fe

2025-02-24 13:45:13

pNUdPvyEHgjojXtxjD1BOACaI89rMEdno/4NTVplJyoIXZz39sNoWhVbkd9p6I9J0kBWYuwmmiyJBTeJl/HZrx8nSXTa6IHJ83JeD9kZRb/hQghKXM4+ivG/MzH01EVlhlbb3mqNQmE0P3wVGJR4VYJv4LB70Mco6VSNJKEwPIp5qYhF+QsT1/Hd9zBsqREE2K8eOKy/4TGEQTd7PVBUoX61hpQCX4gr7Q8VL9AVZIwEnXjpWkKhuyMZ61SYjIJ6W/Ilsx+/bwTMasMfJxDC3ILXTU6VGm+zVm0IkRcgd2Es2Ukj5oKOVDD5403IcOY9Q+et7XFT7BQV5UvnEpZ4BSrLiLxHc7DgNPVXkKUgxvA=?iv=9erGHlZFRRgCb9x6SMl01g==

-

@ a012dc82:6458a70d

2025-02-24 13:16:04

The financial landscape has been dramatically reshaped with the U.S. Securities and Exchange Commission's (SEC) landmark approval of the first-ever batch of spot bitcoin exchange-traded funds (ETFs). This pivotal moment not only signifies a major leap forward for the cryptocurrency realm but also marks a significant evolution in traditional investment methodologies. The integration of Bitcoin into the ETF framework heralds a new era of digital asset investment, blending the innovative world of cryptocurrencies with the stability and familiarity of traditional financial markets. This article aims to provide a comprehensive understanding of Bitcoin ETFs, their profound implications for the investment community, and the transformative potential they hold for the future of financial diversification and strategy.

**Table of Contents**

- What is a Bitcoin ETF?

- The Significance of SEC’s Approval

- Impact on the Cryptocurrency Market

- Benefits for Investors

- Enhanced Accessibility

- Portfolio Diversification

- Regulatory Safety Net

- Challenges and Considerations

- Conclusion

- FAQs

**What is a Bitcoin ETF?**

A Bitcoin ETF represents a seismic shift in investment opportunities, offering a bridge between the cutting-edge realm of cryptocurrencies and the established world of stock market investing. It functions as an investment fund that closely tracks the value of Bitcoin, allowing investors to buy shares that mirror the performance of the digital currency. These shares are traded on conventional stock exchanges, akin to stocks, thereby democratizing access to Bitcoin investment. This innovative approach eliminates the technical barriers and security concerns associated with direct cryptocurrency investments, such as understanding blockchain technology, managing digital wallets, and safeguarding private keys. By simplifying the investment process, Bitcoin ETFs are poised to attract a diverse range of investors, from seasoned stock market enthusiasts to newcomers intrigued by the potential of digital currencies.

**The Significance of SEC’s Approval**

The SEC's approval of Bitcoin ETFs is a watershed moment, signaling a paradigm shift in the financial sector's approach to digital assets. It's a recognition of Bitcoin's growing relevance and maturity as an investment asset, and a nod to its potential to integrate seamlessly into the broader financial system. This move is not just about regulatory compliance; it's a strong endorsement of the legitimacy and viability of cryptocurrencies. The involvement of heavyweight financial institutions in sponsoring these ETFs is a testament to the growing confidence in Bitcoin's future. This development is expected to catalyze further innovations in the cryptocurrency space, encouraging more rigorous standards, enhanced security protocols, and greater transparency, all of which are essential for mainstream acceptance and long-term growth.

**Impact on the Cryptocurrency Market**

The launch of Bitcoin ETFs is set to revolutionize the cryptocurrency market. By offering a regulated, familiar, and accessible investment vehicle, these ETFs are likely to attract a new demographic of investors, including those who have been on the sidelines due to the perceived complexities and risks of cryptocurrencies. This broader investor base could lead to increased market capitalization and liquidity for Bitcoin, potentially reducing volatility and fostering a more stable pricing environment. Moreover, the introduction of Bitcoin ETFs could serve as a catalyst for the development of similar products for other cryptocurrencies, paving the way for a more diverse and robust digital asset market. This could also spur innovation in blockchain technology and crypto-related services, further integrating these into the mainstream financial ecosystem.

**Benefits for Investors**

**Enhanced Accessibility**

Bitcoin ETFs represent a democratization of cryptocurrency investment, making it accessible to a wider audience. This inclusivity extends beyond individual investors to institutional ones, who may have been hesitant to invest in cryptocurrencies due to regulatory concerns or logistical complexities. By trading on major stock exchanges, Bitcoin ETFs offer a familiar and regulated environment, lowering the entry barrier for those new to digital currencies.

**Portfolio Diversification**

The introduction of Bitcoin ETFs offers a novel avenue for portfolio diversification. Historically, investors seeking diversification would turn to a mix of stocks, bonds, and commodities. Bitcoin ETFs add a new dimension to this mix, providing exposure to an asset class that has shown a low correlation with traditional markets. This diversification can be particularly appealing in times of economic uncertainty or inflationary pressures, where Bitcoin has often been touted as a 'digital gold'.

**Regulatory Safety Net**

Trading within the regulated framework of stock exchanges, Bitcoin ETFs offer a level of oversight and consumer protection not typically available in direct cryptocurrency investments. This regulatory safety net can be particularly reassuring for risk-averse investors and those concerned about the legal implications of cryptocurrency investments.

Simplified Investment and Taxation Process: Investing in Bitcoin directly involves a complex maze of tax implications and ownership challenges. Bitcoin ETFs streamline this process, offering a straightforward investment vehicle that fits neatly into existing tax and investment frameworks. This simplification is a boon for both individual investors managing their portfolios and financial advisors seeking to incorporate digital assets into their clients' strategies.

**Challenges and Considerations**

While Bitcoin ETFs offer numerous advantages, they are not without their challenges and risks. The cryptocurrency market, known for its volatility, presents a unique risk profile that may not be suitable for all investors. The price of Bitcoin can be influenced by a range of factors, from regulatory news to technological developments, and investor sentiment. Therefore, while ETFs provide a more accessible route to Bitcoin investment, they do not shield investors from the inherent price volatility of the underlying asset. Additionally, as with any emerging investment vehicle, there is a learning curve associated with understanding how Bitcoin ETFs fit into a broader investment strategy. Investors should conduct thorough research, consider their long-term investment goals, and possibly consult with financial advisors to understand how Bitcoin ETFs align with their risk tolerance and investment objectives.

**Conclusion**

The introduction of Bitcoin ETFs is a landmark development in the financial world, bridging the gap between traditional investment mechanisms and the burgeoning world of digital currencies. This innovation not only expands the accessibility of Bitcoin to a broader range of investors but also enhances the overall credibility and stability of the cryptocurrency market. As the financial landscape continues to evolve, Bitcoin ETFs stand as a beacon of the growing synergy between conventional finance and digital asset innovation, offering a glimpse into a future where such collaborations are not just possible but are a cornerstone of investment strategy. As we move forward, Bitcoin ETFs will likely play a pivotal role in shaping the dynamics of investment portfolios, offering a unique combination of innovation, accessibility, and diversification.

**FAQs**

**What is a Bitcoin ETF?**

A Bitcoin ETF is an exchange-traded fund that tracks the price of Bitcoin, allowing investors to buy shares in the ETF on traditional stock exchanges, without directly purchasing and managing Bitcoin.

**How does a Bitcoin ETF differ from buying Bitcoin directly?**

Unlike direct Bitcoin purchases, which require a cryptocurrency exchange account and a digital wallet, a Bitcoin ETF allows investors to trade shares representing Bitcoin on conventional stock exchanges, simplifying the investment process.

**Are Bitcoin ETFs safe investments?**

While Bitcoin ETFs offer the safety of regulated stock exchanges and eliminate the need for digital wallet management, they still carry the inherent volatility and risks associated with Bitcoin prices.

**Can Bitcoin ETFs be included in retirement portfolios?**

Yes, Bitcoin ETFs can be included in various investment portfolios, including retirement plans, offering a way to diversify with a new asset class.

**What are the tax implications of investing in a Bitcoin ETF?**

Bitcoin ETFs simplify tax reporting compared to direct cryptocurrency investments. However, investors should consult with a tax professional to understand specific implications.

**That's all for today**

**If you want more, be sure to follow us on:**

**NOSTR: croxroad@getalby.com**

**X: @croxroadnews.co**

**Instagram: @croxroadnews.co**

**Youtube: @croxroadnews**

**Store: https://croxroad.store**

**Subscribe to CROX ROAD Bitcoin Only Daily Newsletter**

**https://www.croxroad.co/subscribe**

***DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.***

-

@ 0463223a:3b14d673

2025-02-24 12:34:15

I’m in a weird space of nostalgia. 24 hours without any pharmaceutical help for mood and anxiety problems. As mentioned previously, I’ve been boshing RRSIs and the like for 10 plus years. They’re very addictive to be honest. For context I’ve given up nicotine, amphetamines, crack cocaine and heroin in the past so I think I’m a decent benchmark for a drug’s addictive qualities...

Top, without question was nicotine. Not for the side effects but the fact it took many years to kick and a lot of on/off usage. I can’t remember the last time I smoked a cigarette so it’s been quite a few years now. Heroin was fun…. Well if you call fun having a horrible case of flu where you also hallucinate, that sort of fun.

But RRSIs have been very tough and it’s only been 24 hours (after slowly reducing the dose over 6 months). I feel pretty shit to be honest but I’ll get through today. I’ve also quit Pregabalin today which, as I understand, is an anti-psychotic so I can’t rule out the possibility of psychopathy today… I tried once before and it came close to ending my relationship with my wife (not for psychopathy I hasten to add, just an absolutely foul, unstable mood). This time I’ve taken the process a lot slower.

I’ve been trapped in a weird feeling of nostalgia these last 24 hours, it’s odd as it is being trapped inside the perception of a piece of music. I don’t think I can describe the feeling well but the track is from a cassette I had as a kid. The true origins of the tape I don’t know. I taped it from a friend who told me it was from the club we frequented in 1991, a place called Slammers. Still without doubt the best club I ever went to. It was tiny, like not much bigger than an average house in the UK, in fact probably smaller, depends on your perception of house sizes. I’m going by turn of the century terraced houses common in the UK. The club coincided with a particularly good run of ecstasy tablets in the UK. The downstairs of the club was truly mental. There were no lights at all. Pitch black, the only lighting being from the turntables and mixer. It was nuts. It was a life changing experience. Being broke I only ever went a handful of times but the idea the tape originated from there was good enough for me. The in house DJ crew were the Get Down Crew from Bethnal Green (at least I think this is what I remember). Namely two guys by the names of Wigs and Easy T. The music played was a lot of what paved the way for Jungle in 1993 and the term Jungle Techno was being used by us around this time. Now the tape may not have been Wigs and Easy T, part of me wonders if it was DJ Rap (Or Fabio???). Whist the tunes were great, the mixing wasn’t amazing and reminiscent of Rap’s style (sorry DJ Rap!) but it exists in my memory, a very real artefact.

So this tape was another source for me to find records, most that I really liked I identified over the years but some eluded me. One was Virtual by The Black Dog (ironic), that I found on night online, probably a few glasses of wine in… And I now know that there were only 500 copies of that record made, copies go for around £100 these days. Worst is I actually nearly bought it at the time but the dude in the record shop said it probably wasn't my thing!?!?!?!? Even back in 1991 the song sounded like some ancient artefact. Such a warm noise. “World World World, I sit in my room imagine the future”. Damn.

The other track I only recently found out, and it was on the B Side from a group I already loved and had some of their records. However, unlike The Black Dog, it’s not rare, just overlooked as the group were more known for their Hip Hop output. It was The Cash Crew all along?! Fuck!!!! Now since finding I play on my streaming show a lot and given I’d listened so much on cassette too, I know that record inside out!

Well no I don’t!??! After editing for a mixtape, I noticed layers of vocals I never knew existed and I’m also now trapped in this nostalgic frame and it feels immeasurably sad. The fact is I never actually heard that record in a club, despite it being on a tape that I help as an ultimate reference point for a moment in time that I never actually experienced. That sums up the feeling of coming off RRSIs. Maybe this all sounds frivolous but music has always make up a core of my identity, more so than being a fucking spastic ever did.

Now I own the record, I am old as fuck and millions of miles away from a moment that never existed. I can’t explain.

Cash Crew – HUMP

https://video.mxtthxw.art/w/dQHPt96bXwMP8Ggyjrcq8x

-

@ e7bc35f8:3ed2a7cf

2025-02-24 12:15:30

Contrary to what its multi-million dollar [international PR campaign]( https://youtu.be/D_MZKRG3frQ) would have you believe, the "White Helmets" are not a group of volunteer search-and-rescue workers that sprang spontaneously out of the Syrian soil.

In November 2017, journalist Vanessa Beeley gave a [groundbreaking presentation]( https://www.youtube.com/live/lC7ZxdFzdzQ) to the Swiss Press Club in Geneva on the so-called "Syria Civil Defence" (better known as the "White Helmets"), which presents itself as an impartial group of volunteer search and rescue workers working "_to save lives and strengthen communities in Syria._"

In her presentation, Beeley demonstrated the connections between this supposedly "neutral" organization, recognized terrorist groups operating in Syria, and the UK government.

VANESSA BEELEY

> During my time working in East Aleppo, it was clear that the councils were working hand in hand with [Al] Nusra Front. Their centers in each district were always next door to Nusra Front headquarters and White Helmet centres, i.e., they always formed an integrated complex.

Less than three weeks later, [The Guardian]( https://www.theguardian.com/world/2017/dec/18/syria-white-helmets-conspiracy-theories) released a report painting all skeptics of the White Helmets, including Beeley and other "anti-imperialist activists", as proponents of a Russian propaganda campaign directed by the Kremlin.

This is no coincidence.

The White Helmets are in fact part of a coordinated propaganda campaign. But that campaign is not being directed by the Kremlin, but the western governments which have been responsible for the founding and funding of the White Helmets.

And the ones promoting that propaganda are not independent journalists like Beeley, but establishment mouthpieces like The Guardian.

The White Helmets won an Oscar at the 2017 Academy Awards. This is, after all, an organization that thrives on the magic of movie-making to make themselves into heroes. Surely any movie that could turn a group funded by the US and UK governments, associated with western intelligence operatives, and embedded with Al Qaeda terrorists, into a group of crusading heroes is as worthy of an Academy Award as any similarly fictitious movie about superheroes saving the world.

It was also fitting that the leader of the group, Raed Saleh, [was not at the ceremony]( https://youtu.be/EJ5uFsEMLGw) to help accept the prize as originally planned.

🔸NPR REPORTER:

> Hi, I 'm wondering…um, I thought the White Helmets we’re gonna be here, or the leader and the cinematographer who shot a lot of this film. What happened?

🔸ORLANDO VON EINSIEDEL:

> Well, Raed Saleh, who’s the leader of the White Helmets, he couldn’t come in the end because the last couple of days in Syria the violence has really escalated and he does life-saving work[…]. Our cinematographer, I mean, you know we’re confused about this, too. The last two weeks have been very difficult. He had a US visa, he tried to board a plane, and he wasn’t able to come, so we - you know, we’re very sad about that.

What Orlando von Einsiedel, the director of the film, neglected to mention is that this was not the first time that Raed Saleh, the leader of the White Helmets, failed to appear in the US.

In April of 2016, InterAction, an alliance of NGOs, held a gala dinner in Washington, where it planned to honour Saleh and the work of the White Helmets in Syria.

However, Saleh [was refused entry]( https://www.nytimes.com/2016/04/21/world/middleeast/leader-of-syria-rescue-group-arriving-in-us-for-award-is-refused-entry.html?_r=0) into the country when he arrived at Washington’s Dulles Airport.

Declining to talk about the details of the case, a [State Department spokesman]( https://youtu.be/ehdAVgmPODY) merely said, "_The U.S. government’s system of continual vetting means that traveler records are screened against available information in real time_".

🔸MATT LEE:

> You commend this group, you’re going to continue to support them, and yet you revoked the visa of their leader? I don’t…that makes zero sense to me. […]

🔸MARK TONER:

> ...unfortunately, we can’t speak to individual visa cases. I think broadly speaking, though on any visa case we are constantly looking at new information, so-called 'continually vetting' travel or records and if we do have new information that we believe an individual would pose a security risk we’ll certainly act on that.

🔸LEE:

> I’m saying that it just strikes me as a bit odd that you’re saying that this group is wonderful and does such a great job and you’re commending them for their heroism, and yet you’re doing this just 10 days after the leader of this group, who was supposed to be, you know…got his visa revoked or wasn’t allowed to travel here. […]

🔸TONER:

> Well, he’s one individual in the group, and any individual—again, I’m broadening my language here for specific reasons—but any individual in any group suspected of ties or relations with extremist groups, or that we have believed to be a security threat to the United States, we would act accordingly. But that does not by extension mean we condemn or would cut off ties to the group for which that individual works for.

So how is this possible?

How could the leader of such a valiant team of crusading do-gooders himself be denied a visa to enter the United States as a potential security threat with ties to terrorists?

The multi-million dollar PR campaign that surrounds the White Helmets, after all, portrayed the group as being pure as the driven snow.

A perfect example for this is [the story]( https://youtu.be/L5ULObu2ByM) about the boy named Omran Daqneesh.

A story that eventually turned to be totally [fake news]( https://www.mintpressnews.com/mintpress-meets-father-iconic-aleppo-boy-says-media-lied-son/228722/).

But what is always left out of these glowing mainstream media puff pieces is any actual information about the organization.

Where did it come from?

Who founded it?

Where does it get its funding?

And why did it operate exclusively in terrorist-held areas of Syria?

The first clues about the real nature of the group come from their name itself. Calling themselves the "Syria Civil Defence" is misleading in multiple ways.

First, it implies that the group was founded in Syria by Syrians.

It was not.

The group was in fact founded in March 2013 in Turkey, by James Le Mesurier, a former British military intelligence officer then doing contract work for the US and UK governments.

None of this information is even controversial. This is the story as told by [Le Mesurier]( https://youtu.be/sw3NMEyMSTw) himself.

The name "Syria Civil Defence" was also a lie because there was a [real Syria Civil Defence]( https://21stcenturywire.com/2016/09/23/exclusive-the-real-syria-civil-defence-expose-natos-white-helmets-as-terrorist-linked-imposters/) that has been operating in the country for 65 years.

The actual Syria Civil Defence, a volunteer search and rescue organization, was established in Syria in 1953.

Unlike the White Helmets, the [real Syria Civil Defence]( https://icdo.org/) was a member of the International Civil Defence Organisation and (again, in contrast to the White Helmets) had an emergency number (113) that can be called in Syria by those needing assistance.

But thar Syria Civil Defence does not enjoy the glitz and glamour of Oscar-winning documentaries, the constant attention of the international press, or the [more than $60 million]( https://web.archive.org/web/20170103120950/https://www.youtube.com/watch?v=J2mWdvgCOqs) in [funding]( https://21stcenturywire.com/2017/12/02/white-helmets-local-councils-uk-fco-financing-terrorism-syria-taxpayer-funds/) by [foreign governments]( https://web.archive.org/web/20170730064327/http://www.adamsmithinternational.com/explore-our-work/middle-east-north-africa/syria/building-the-capacity-for-governance-in-communities-across-opposition-contr/) that have been bestowed on the [White Helmets]( https://www.theguardian.com/global-development/2016/may/08/gazientep-turkey-tamkeen-quest-to-rebuild-syria).

But even more disturbing than the unusual founding of the group is the evidence demonstrating that the White Helmets, far from their official claim to political neutrality, are in fact intimately embedded with known and listed terrorist organizations in Syria.

Again, the most damning evidence in this regard is not controversial in the slightest. It comes directly from the White Helmets themselves.

Numerous videos and photos have surfaced showing the White Helmets parading on the dead bodies of Syrian government forces and flying the flags of known terrorist organizations.

An in-depth report on "The Syrian War Blog" in 2017, examined the social media profiles of 65 different White Helmets-connected figures and found numerous posts in support of ISIS, Jabhat al-Nusra, Ahrar al-Sham and other listed terrorist organizations.

Some even [posted pictures]( https://syrianwar1.blogspot.com/2017/11/white-helmets-exposed-as-extremists-65.html?m=1) of themselves with known terrorist leaders or waving the flag of terrorist groups like ISIS, and many proudly displayed images of dead Syrian soldiers.

Most of this evidence is explained away as "bad apples" in the organization acting on their own.

Some of these "bad apples" are then castigated in public displays, like when one White Helmet was fired when footage surfaced showing him [disposing the mutilated corpses]( https://www.newsweek.com/oscar-win-white-helmets-syria-volunteer-dump-bodies-rebels-628407) of Syrian government fighters.

When a graphic video of the White Helmets [overseeing]( https://x.com/BenjaminNorton/status/865033499950145538?t=Ru67QyFS7hgqWRJWLuEb0g&s=19) [the execution]( https://web.archive.org/web/20170627003514/https://twitter.com/Ali_Kourani/status/877287658472472579) of a man in terrorist-occupied Daraa surfaced, the group actually [defended the workers]( https://web.archive.org/web/20170613015828/http://syriacivildefense.org/sites/syriacivildefense.org/files/18%20May%202017%20-%20.pdf) while acknowledging that they "did not fully uphold the strict principle of neutrality and impartiality".

But incredibly, Le Mesurier, the former British intel officer who founded the White Helmets in 2013, defended the workers [caught in one bloody video]( https://web.archive.org/web/20190502060841/https://www.liveleak.com/view?i=fd8_1430900709&comments=1) from May 2015.

The Middle Ground, a Singaporean website, ran a story [featuring Le Mesurier’s take ]( https://web.archive.org/web/20180212075744/http://203.211.130.27/2017/04/18/white-helmets-terrorists-fake-news-syria-assad-nobel-oscars/)on the incident.

In opposition to the deafening mainstream media silence over this incredible mountain of evidence against the White Helmets standed only a handful of independent researchers, universally ignored or marginalized from the mainstream discussion on the issue.

These independent researchers include [Vanessa Beeley]( https://youtu.be/NQL3rX6xWRg), a British researcher who has been one of the few journalists to report extensively on the ground in areas like East Aleppo over the last two years, and Eva Bartlett, a Canadian freelancer who has gained notoriety for using her own on-the-ground reporting from Syria to speak out against the mainstream narrative about the White Helmets.

Given that there were so few voices speaking up against the White Helmets, it should come as no surprise that when "The Guardian" finally deigned to address what they termed the "conspiracy theories" about the organization, they turned their attention on these very researchers.

In "How Syria’s White Helmets became victims of an online propaganda machine", The Guardian turned to Olivia Solon to dismiss all opposition to the White Helmets as the work of "anti-imperialist activists", "conspiracy theorists" and "trolls with the support of the Russian government".

The choice of Solon to report on this story is especially odd; a "technology reporter" in San Francisco, Solon has no background of any sort in geopolitics or combat zone reporting and, as far as can be determined, has never set foot in Syria.

Instead, she relied exclusively on sources such as the [murky PR lobbying firm]( https://web.archive.org/web/20170110212932/https://www.alternet.org/world/inside-shadowy-pr-firm-thats-driving-western-opinion-towards-regime-change-syria), The Syria Campaign, to praise the White Helmets and [castigate their detractors]( https://www.theguardian.com/world/2017/dec/18/syria-white-helmets-conspiracy-theories).

Bizarrely, the report devotes a great deal of attention to the White Helmets’ [Mannequin Challenge video]( https://youtu.be/Zgl271A6LgQ), footage of an admittedly fake and staged "rescue" operation released by the group in an attempt to cash in on a viral internet video trend taking place at the time.

The inference of the video is obvious: that the group is perfectly capable of staging incredibly realistic and completely fake "rescue" operations at any time.

These fake videos, stripped of their context, would be uncritically promoted as authentic by mainstream outlets like The Guardian in the exact same way that the completely fictitious video of a "Syrian" boy rescuing his sister under sniper fire was uncritically accepted by the mainstream media…until it was admitted to be a [fake video produced in Malta]( https://www.bbc.com/news/blogs-trending-30057401) by a Norwegian film crew "_to see how the media would respond to such a video_".

The Guardian’s headline when the fake Norwegian film production was released? "[Syrian boy 'saves girl from army sniper]( https://www.theguardian.com/world/video/2014/nov/12/syrian-boy-saves-girl-from-army-sniper-video)' – video."

Strangely, Solon’s report does not mention that incident.

The majority of The Guardian's report focuses on why the innocent and virtuous White Helmets would be so viciously attacked by independent journalists and how all opposition to the group is connected to the Kremlin.

This is supposedly demonstrated in an utterly meaningless "infographic" of colored dots showing precisely nothing of substance.

Unsurprisingly, Solon's contact with the reporters whose work she was set to impugn displayed her biases from the very start.

[Bartlett exposed the conversation]( https://www.globalresearch.ca/how-the-mainstream-media-whitewashed-al-qaeda-and-the-white-helmets-in-syria/5624930) she had with Olivia Solon and the emails received from her, where you can see her real [dishonest intentions]( https://ingaza.wordpress.com/2017/01/28/those-who-transmit-syrian-voices-are-russian-propagandists-monitors-of-fake-news-negate-syrian-suffering/).

Olivia Solon contacted Beeley as well.

Her attempt to put them in a position of having to defend themselves [becomes obvious]( https://youtu.be/NQL3rX6xWRg).

Of course what would you have expected from The Guardian?

[In 2016 it lobbied]( https://www.theguardian.com/commentisfree/2016/oct/05/the-guardian-view-on-the-nobel-peace-prize-give-it-to-syrias-white-helmets), effectively, for the White Helmets to win the Nobel Peace Prize, and when it was inundated with negative comments it simply closed comments.

Researchers like Beeley, Bartlett and Professor Tim Anderson, also mentioned in Solon’s report, are easy enough targets for The Guardian.

Independent journalists taking it upon themselves to counter the Syria narrative, they would never be taken seriously by establishment media circles in the first place.

Curiously omitted from The Guardian article, however, are the award-winning, internationally respected journalists who have similarly expressed skepticism about the White Helmets, their backers, and the PR campaign that surrounds them.

There is [Gareth Porter]( https://web.archive.org/web/20170104164043/https://www.alternet.org/grayzone-project/how-syrian-white-helmets-played-western-media), the award-winning journalist who has contributed to Foreign Policy, Foreign Affairs, The Nation, Al Jazeera, Salon, The Huffington Post, Alternet and countless other outlets, who wrote "How a Syrian White Helmets Leader Played Western Media" in November 2016.

There is [Philip Giraldi]( https://www.unz.com/pgiraldi/the-fraud-of-the-white-helmets/), a former CIA counter-terrorism specialist and military intelligence officer who wrote "The Fraud of the White Helmets" in July of 2017.

There is [Stephen Kinzer]( https://www.theguardian.com/profile/stephenkinzer), former New York Times correspondent who tweeted his [congratulations to "al-Qaeda and Syrian jihadists"]( https://x.com/stephenkinzer/status/836216952913809409?t=1hqvhtGMQn1FYbz7OL7y6Q&s=19) when the film about "their PR outfit, the White Helmets", won the Oscar.

So the issue here is not merely one of PR and propaganda, as appalling as the uncritical reporting about the White Helmets has been.

What is worrying is that the so-called Syrian Civil Defence is, as we have seen, not Syrian at all.

Founded, funded and promoted by foreign governments, foreign contractors and foreign lobbyists and PR agencies, the White Helmets are not a spontaneous Syrian search-and-rescue operation, but a template.

A template that, if successful, can and will be employed anywhere and everywhere that those same foreign powers want to destabilize targeted governments in the future.

-

@ d360efec:14907b5f

2025-02-24 11:33:16

**ภาพรวม BTCUSDT (OKX):**

Bitcoin (BTCUSDT) ยังคงแสดงความผันผวนและแนวโน้มที่ไม่ชัดเจน แม้ว่าแนวโน้มระยะยาว (TF Day) จะยังคงมีลักษณะเป็นขาขึ้น (แต่*อ่อนแรงลงอย่างมาก*) แนวโน้มระยะกลาง (TF4H) และระยะสั้น (TF15) เป็นขาลง/Sideways Down การวิเคราะห์ครั้งนี้จะเน้นไปที่ SMC, ICT, และรูปแบบ Chart Patterns เพื่อเพิ่มความแม่นยำในการระบุแนวโน้มและจุดเข้า/ออก

**วิเคราะห์ทีละ Timeframe:**

**(1) TF Day (รายวัน):**

* **แนวโน้ม:** ขาขึ้น (Uptrend) *อ่อนแรงลงอย่างมาก, มีความเสี่ยงที่จะเปลี่ยนแนวโน้ม*

* **SMC:**

* Higher Highs (HH) และ Higher Lows (HL) *เริ่มไม่ชัดเจน, ราคาหลุด Low ก่อนหน้า*

* Break of Structure (BOS) ด้านบน *แต่มีการปรับฐานที่รุนแรง*

* **Liquidity:**

* มี Sellside Liquidity (SSL) อยู่ใต้ Lows ก่อนหน้า (บริเวณ 85,000 - 90,000)

* มี Buyside Liquidity (BSL) อยู่เหนือ High เดิม

* **ICT:**

* **Order Block:** ราคาหลุด Order Block ขาขึ้น

* **FVG:** ไม่มี FVG ชัดเจน

* **EMA:**

* ราคา *หลุด* EMA 50 (สีเหลือง) ลงมาแล้ว

* EMA 200 (สีขาว) เป็นแนวรับถัดไป

* **Money Flow (LuxAlgo):**

* *สีแดงยาว* แสดงถึงแรงขายที่แข็งแกร่ง

* **Trend Strength (AlgoAlpha):**

* สีแดง (เมฆแดง) แสดงถึงแนวโน้มขาลง *และไม่มีสัญญาณซื้อ/ขายปรากฏ*

* **Chart Patterns:** *ไม่มีรูปแบบที่ชัดเจน*

* **Volume Profile:** Volume ค่อนข้างเบาบาง

* **แท่งเทียน:** แท่งเทียนล่าสุดเป็นสีแดง แสดงถึงแรงขาย

* **แนวรับ:** EMA 200, บริเวณ 85,000 - 90,000 (SSL)

* **แนวต้าน:** EMA 50, High เดิม

* **สรุป:** แนวโน้มขาขึ้นอ่อนแรงลงอย่างมาก, *สัญญาณอันตรายหลายอย่าง*, Money Flow และ Trend Strength เป็นลบ, *หลุด Order Block และ EMA 50*

**(2) TF4H (4 ชั่วโมง):**

* **แนวโน้ม:** ขาลง (Downtrend)

* **SMC:**

* Lower Highs (LH) และ Lower Lows (LL)

* Break of Structure (BOS) ด้านล่าง

* **Liquidity:**

* มี SSL อยู่ใต้ Lows ก่อนหน้า

* มี BSL อยู่เหนือ Highs ก่อนหน้า

* **ICT:**

* **Order Block:** ราคาไม่สามารถผ่าน Order Block ขาลงได้

* **EMA:**

* ราคาอยู่ใต้ EMA 50 และ EMA 200

* **Money Flow (LuxAlgo):**

* สีแดง แสดงถึงแรงขาย

* **Trend Strength (AlgoAlpha):**

* แดง/ไม่มีสัญญาณ

* **Chart Patterns:** *ไม่มีรูปแบบที่ชัดเจน*

* **Volume Profile:**

* Volume ค่อนข้างนิ่ง

* **แนวรับ:** บริเวณ Low ล่าสุด

* **แนวต้าน:** EMA 50, EMA 200, บริเวณ Order Block

* **สรุป:** แนวโน้มขาลงชัดเจน, แรงขายมีอิทธิพล

**(3) TF15 (15 นาที):**

* **แนวโน้ม:** Sideways Down (แกว่งตัวลง)

* **SMC:**

* Lower Highs (LH) และ Lower Lows (LL)

* Break of Structure (BOS) ด้านล่าง

* **ICT:**

* ราคา Sideway

* **EMA:**

* EMA 50 และ EMA 200 เป็นแนวต้าน

* **Money Flow (LuxAlgo):**

* แดง/เขียว สลับกัน

* **Trend Strength (AlgoAlpha):**

* สีแดง แสดงถึงแนวโน้มขาลง

* **Chart Patterns:** *ไม่มีรูปแบบที่ชัดเจน*

* **Volume Profile:**

* Volume ค่อนข้างนิ่ง

* **แนวรับ:** บริเวณ Low ล่าสุด

* **แนวต้าน:** EMA 50, EMA 200

* **สรุป:** แนวโน้ม Sideways Down,

**สรุปภาพรวมและกลยุทธ์ (BTCUSDT):**

* **แนวโน้มหลัก (Day):** ขาขึ้น (*อ่อนแรงลงอย่างมาก, เสี่ยงที่จะเปลี่ยนแนวโน้ม*)

* **แนวโน้มรอง (4H):** ขาลง

* **แนวโน้มระยะสั้น (15m):** ขาลง/Sideways Down

* **Liquidity:** มี SSL ทั้งใน Day, 4H, และ 15m

* **Money Flow:** เป็นลบในทุก Timeframes

* **Trend Strength:** Day/15m เป็นขาลง, 4H Sideways

* **Chart Patterns:** ไม่พบรูปแบบที่ชัดเจน

* **กลยุทธ์:**

1. **Wait & See (ดีที่สุด):** รอความชัดเจน

2. **Short (เสี่ยง):** ถ้าไม่สามารถ Breakout EMA/แนวต้านใน TF ใดๆ ได้ หรือเมื่อเกิดสัญญาณ Bearish Continuation

3. **ไม่แนะนำให้ Buy:** จนกว่าจะมีสัญญาณกลับตัวที่ชัดเจนมากๆ

**Day Trade & การเทรดรายวัน:**

* **Day Trade (TF15):**

* **Short Bias:** หาจังหวะ Short เมื่อราคาเด้งขึ้นไปทดสอบแนวต้าน (EMA, Order Block)

* **Stop Loss:** เหนือแนวต้านที่เข้า Short

* **Take Profit:** แนวรับถัดไป (Low ล่าสุด)

* **ไม่แนะนำให้ Long**

* **Swing Trade (TF4H):**

* **Short Bias:** รอจังหวะ Short เมื่อราคาไม่สามารถผ่านแนวต้าน EMA หรือ Order Block ได้

* **Stop Loss:** เหนือแนวต้านที่เข้า Short

* **Take Profit:** แนวรับถัดไป

* **ไม่แนะนำให้ Long**

**สิ่งที่ต้องระวัง:**

* **Sellside Liquidity (SSL):** มีโอกาสสูงที่ราคาจะถูกลากลงไปแตะ SSL

* **False Breakouts:** ระวัง

* **Volatility:** สูง

**Setup Day Trade แบบ SMC (ตัวอย่าง):**

1. **ระบุ Order Block:** หา Order Block ขาลง (Bearish Order Block) ใน TF15

2. **รอ Pullback:** รอให้ราคา Pullback ขึ้นไปทดสอบ Order Block นั้น

3. **หา Bearish Entry:**

* **Rejection:** รอ Price Action ปฏิเสธ Order Block

* **Break of Structure:** รอให้ราคา Break โครงสร้างย่อยๆ

* **Money Flow:** ดู Money Flow ให้เป็นสีแดง

4. **ตั้ง Stop Loss:** เหนือ Order Block

5. **ตั้ง Take Profit:** แนวรับถัดไป

**คำแนะนำ:**

* **ความขัดแย้งของ Timeframes:** มีอยู่ แต่แนวโน้มระยะกลาง-สั้น เป็นลบ

* **Money Flow:** เป็นลบในทุก Timeframes

* **Trend Strength:** เป็นลบ

* **Order Block TF Day:** หลุด Order Block ขาขึ้นแล้ว

* **ถ้าไม่แน่ใจ อย่าเพิ่งเข้าเทรด**

**Disclaimer:** การวิเคราะห์นี้เป็นเพียงความคิดเห็นส่วนตัว ไม่ถือเป็นคำแนะนำในการลงทุน ผู้ลงทุนควรศึกษาข้อมูลเพิ่มเติมและตัดสินใจด้วยความรอบคอบ

-

@ 86a82cab:b5ef38a0

2025-02-24 10:58:53

Not everyone wants a super app though, and that’s okay. As with most things in the Nostr ecosystem, flexibility is key. Notedeck gives users the freedom to choose how they engage with it—whether it’s simply following hashtags or managing straightforward feeds. You'll be able to tailor Notedeck to fit your needs, using it as extensively or minimally as you prefer.

\

\

Not everyone wants a super app though, and that’s okay. As with most things in the Nostr ecosystem, flexibility is key. Notedeck gives users the freedom to choose how they engage with it—whether it’s simply following hashtags or managing straightforward feeds. You'll be able to tailor Notedeck to fit your needs, using it as extensively or minimally as you prefer.</span>

[IMage](https://nostrtips.com/wp-content/uploads/2023/03/nostr-structure-1-1024x576.jpg)

-

@ d360efec:14907b5f

2025-02-24 10:49:26

$OKX:BTCUSDT.P

**Overall Assessment:**

Bitcoin (BTCUSDT) on OKX continues to exhibit high volatility and an uncertain trend. While the long-term trend (Daily chart) is technically still an uptrend, it has *weakened considerably*. The 4-hour and 15-minute charts are in downtrends, creating conflicting signals. This analysis focuses on identifying potential areas of Smart Money activity (liquidity pools and order blocks), assessing trend strength, and identifying any relevant chart patterns.

**Detailed Analysis by Timeframe:**

**(1) TF Day (Daily):**

* **Trend:** Uptrend (*Significantly Weakening, High Risk of Reversal*).

* **SMC (Smart Money Concepts):**

* The Higher Highs (HH) and Higher Lows (HL) structure is *becoming less defined*. The recent price action has broken a previous low.

* Prior Breaks of Structure (BOS) to the upside, but the current pullback is very deep.

* **Liquidity:**

* **Sellside Liquidity (SSL):** Significant SSL rests below previous lows in the 85,000 - 90,000 range. This is a likely target for Smart Money.

* **Buyside Liquidity (BSL):** BSL is present above the all-time high.

* **ICT (Inner Circle Trader Concepts):**

* **Order Block:** The price has *broken below* the prior bullish Order Block (the large green candle before a significant up-move). This is a *major bearish signal*.

* **FVG:** No clear, significant Fair Value Gap is apparent at the current price level on the Daily chart.

* **EMA (Exponential Moving Average):**

* Price has *broken below* the 50-period EMA (yellow), a bearish signal.

* The 200-period EMA (white) is the next major support level.

* **Money Flow (LuxAlgo):**

* A *long red bar* indicates strong and sustained selling pressure.

* **Trend Strength (AlgoAlpha):**

* Red cloud indicates a downtrend. No buy/sell signals are present.

* **Chart Patterns:** No readily identifiable, classic chart patterns are apparent on the Daily chart.

* **Volume Profile:** Relatively low volume on the decline.

* **Candlesticks:** The most recent candlestick is red, confirming selling pressure.

* **Support:** EMA 200, 85,000-90,000 (SSL area).

* **Resistance:** EMA 50, Previous All-Time High.

* **Summary:** The Daily chart's uptrend is significantly weakening. The break below the 50 EMA *and* the bullish Order Block, combined with the negative Money Flow and bearish Trend Strength, are all major red flags. The SSL below is a key area to watch.

**(2) TF4H (4-Hour):**

* **Trend:** Downtrend.

* **SMC:**

* Lower Highs (LH) and Lower Lows (LL).

* BOS to the downside.

* **Liquidity:**

* **SSL:** Below previous lows.

* **BSL:** Above previous highs.

* **ICT:**

* **Order Block:** The price failed to break above a bearish Order Block.

* **EMA:**

* Price is below both the 50-period and 200-period EMAs (bearish).

* **Money Flow (LuxAlgo):**

* Predominantly red, confirming selling pressure.

* **Trend Strength (AlgoAlpha):**

* Red, indicating no particular trend or a sideways movement. No buy/sell signals.

* **Chart Patterns:** No readily identifiable, classic chart patterns are apparent.

* **Volume Profile:** Relatively consistent volume.

* **Support:** Recent lows.

* **Resistance:** EMA 50, EMA 200, Order Block.

* **Summary:** The 4-hour chart is in a confirmed downtrend. The Money Flow is bearish, price below both EMAs.

**(3) TF15 (15-Minute):**

* **Trend:** Downtrend / Sideways Down

* **SMC:**

* Lower Highs (LH) and Lower Lows (LL).

* BOS to the downside.

* **ICT:**

* **Order Block** Price could not break up the bearish Order Block.

* **EMA:**

* The 50-period and 200-period EMAs are acting as resistance.

* **Money Flow (LuxAlgo):**

* Red and Green

* **Trend Strength (AlgoAlpha):**

* Red cloud (Bearish)

* **Chart Patterns:** No readily identifiable, classic chart patterns are apparent.

* **Volume Profile**

* Relatively high volume.

* **Support:** Recent lows.

* **Resistance:** EMA 50, EMA 200, Order Block.

* **Summary:** The 15-minute chart is in a downtrend, with price action, EMAs, and Money Flow all confirming.

**Overall Strategy and Recommendations (BTCUSDT):**

* **Primary Trend (Day):** Uptrend (Significantly Weakening).

* **Secondary Trend (4H):** Downtrend.

* **Short-Term Trend (15m):** Downtrend/ Sideways Down.

* **Liquidity:** Significant SSL zones exist below the current price on all timeframes.

* **Money Flow:** Negative on all timeframes.

* **Trend Strength:** Bearish on 15m and Day, Sideway on 4H.

* **Chart Patterns:** None identified.

* **Strategies:**

1. **Wait & See (Best Option):** The conflicting signals and the strong bearish momentum on the shorter timeframes, combined with the weakening Daily chart, make waiting the most prudent approach. Look for:

* **Bearish Confirmation:** A decisive break below the recent lows on the 15m and 4H charts, with increasing volume and continued negative Money Flow. This would confirm the continuation of the downtrend.

* **Bullish Confirmation:** A strong, sustained break above the 15/4H EMAs and Order Block, a shift in the 15m/4H Money Flow to green.

2. **Short (High Risk):** This aligns with the 4H and 15m downtrends.

* **Entry:** On rallies towards resistance levels (EMAs on 15m/4H, previous support levels that have turned into resistance, Order Blocks).

* **Stop Loss:** Above recent highs on the chosen timeframe, or above a key resistance level.

* **Target:** The next support levels (recent lows on 15m, then potentially the SSL zones on the 4H and Daily charts).

3. **Buy (Extremely High Risk - Not Recommended):** Do *not* attempt to buy until there are *very strong and consistent* bullish reversal signals across *all* timeframes, including a definitive shift in market structure on the 4H and 15m charts, positive Money Flow, and a clear break above resistance levels.

**Key Recommendations:**

* **Conflicting Timeframes:** The primary conflict is now resolved toward the downside. The Daily is weakening significantly.

* **Money Flow:** Consistently negative across all timeframes, a major bearish factor.

* **Trend Strength:** Bearish on 15m and Day, Sideways on 4h.

* **Daily Order Block:** The *break* of the bullish Order Block on the Daily chart is a significant bearish development.

* **Sellside Liquidity (SSL):** Be aware that Smart Money may target the SSL zones below. This increases the risk of stop-loss hunting.

* **Risk Management:** Due to the high uncertainty and volatility, *strict risk management is absolutely critical.* Use tight stop-losses, do not overtrade, and be prepared for rapid price swings.

* **Volume:** Confirm any breakout or breakdown with volume.

**Day Trading and Intraday Trading Strategies:**

* **Day Trade (TF15 focus):**

* **Short Bias:** Given the current 15m downtrend and negative Money Flow, the higher probability is to look for shorting opportunities.

* **Entry:** Look for price to rally to resistance levels (EMAs, Order Blocks, previous support levels that have become resistance) and then show signs of rejection (bearish candlestick patterns, increasing volume on the downside).

* **Stop Loss:** Place a stop-loss order above the resistance level where you enter the short position.

* **Take Profit:** Target the next support level (recent lows).

* **Avoid Long positions** until there's a *clear* and *confirmed* bullish reversal on the 15m chart (break above EMAs, positive Money Flow, bullish market structure).

* **Swing Trade (TF4H focus):**

* **Short Bias:** The 4H chart is in a downtrend.

* **Entry:** Wait for price to rally to resistance levels (EMAs, Order Blocks) and show signs of rejection.

* **Stop Loss:** Above the resistance level where you enter the short position.

* **Take Profit:** Target the next support levels (e.g., the 200 EMA on the Daily chart, SSL zones).

* **Avoid Long positions** until there's a *clear* and *confirmed* bullish reversal on the 4H chart.

**SMC Day Trade Setup Example (TF15 - Bearish):**

1. **Identify Bearish Order Block:** Locate a bearish Order Block on the TF15 chart (a bullish candle before a strong downward move).

2. **Wait for Pullback:** Wait for the price to pull back up to test the Order Block (this may or may not happen).

3. **Bearish Entry:**

* **Rejection:** Look for price action to reject the Order Block (e.g., a pin bar, engulfing pattern, or other bearish candlestick pattern).

* **Break of Structure:** Look for a break of a minor support level on a *lower* timeframe (e.g., 1-minute or 5-minute) after the price tests the Order Block. This confirms weakening bullish momentum.

* **Money Flow:** Confirm that Money Flow remains negative (red).

4. **Stop Loss:** Place a stop-loss order *above* the Order Block.

5. **Take Profit:** Target the next support level (e.g., recent lows) or a bullish Order Block on a higher timeframe.

**In conclusion, BTCUSDT is currently in a high-risk, bearish environment in the short-to-medium term. The "Wait & See" approach is strongly recommended for most traders. Shorting is the higher-probability trade *at this moment*, but only for experienced traders who can manage risk extremely effectively. Buying is not recommended at this time.**

Disclaimer: This analysis is for informational purposes only and represents a personal opinion. It is not financial advice. Investing in cryptocurrencies involves significant risk. Investors should conduct their own research and exercise due diligence before making any investment decisions.

-

@ a876a108:419b647e

2025-02-24 09:40:44

Getting verified on Kraken requires completing the KYC process, which involves submitting personal information, including a government-issued ID, proof of residence, and in some cases, financial details. The verification process has different levels, including Starter, Express, Intermediate, and Pro, each offering varying limits and access to features. Many users wonder, can I use Kraken without KYC? The answer is that while basic accounts may allow limited access to the platform, KYC is required for fiat deposits, withdrawals, and full trading capabilities. Some users also ask, why is it so hard to withdraw from Kraken? The platform enforces strict compliance measures, and withdrawals may be delayed due to verification, security checks, or bank processing times. Ensuring that your account is fully verified and your banking details are correct can help avoid issues. Despite these security measures, a Kraken account is free to create, though trading fees apply depending on the transaction type and volume. Understanding these requirements can help ensure a smooth experience while using the exchange.

@ ef1744f8:96fbc3fe

2025-02-24 14:15:14U0Cp38MGIOL5TzaGvfIycZJgQ11ij6LtT5IVmNP8oZS04RKSHhvLTkaHRmnZHZ2kdZbWBVr5fsqc7sR6Gysv/9t+eX+F15l8sd8PokSCMU6l3EYZdP+draq30zuUH7fHHmrH6sKAKBXB8wzhG+da7km97dUO1KHELhR+vGFWtYIyuT1gbM2AvywldcugDWRpEE/a8UsLyROYNB/DhUrD62GN4qP6GCLYNgp7FuUvgD1QYL2kb/ctcwI+OAT1CSk70XwpQjWmKH+eo2Uhlp8bFg1Nm+AI9FTqgsnj2WFhjmfzbVPF4TtBGo1Kp+Guc+1M7jVro1Wy5bYVhZghJ7B4OdkePHcMWaQqXv+V1mgqUG/guOUqvtypP4ATNSj/tsw1?iv=fgZcFd3B4QHwr05LjzYfDQ==

@ ef1744f8:96fbc3fe

2025-02-24 14:15:14U0Cp38MGIOL5TzaGvfIycZJgQ11ij6LtT5IVmNP8oZS04RKSHhvLTkaHRmnZHZ2kdZbWBVr5fsqc7sR6Gysv/9t+eX+F15l8sd8PokSCMU6l3EYZdP+draq30zuUH7fHHmrH6sKAKBXB8wzhG+da7km97dUO1KHELhR+vGFWtYIyuT1gbM2AvywldcugDWRpEE/a8UsLyROYNB/DhUrD62GN4qP6GCLYNgp7FuUvgD1QYL2kb/ctcwI+OAT1CSk70XwpQjWmKH+eo2Uhlp8bFg1Nm+AI9FTqgsnj2WFhjmfzbVPF4TtBGo1Kp+Guc+1M7jVro1Wy5bYVhZghJ7B4OdkePHcMWaQqXv+V1mgqUG/guOUqvtypP4ATNSj/tsw1?iv=fgZcFd3B4QHwr05LjzYfDQ== @ ef1744f8:96fbc3fe

2025-02-24 13:57:07bIzjKZ+i0/ZpWslLWXk1tkVypOiX0ErueLoBWso7NSKAdjOdPLPFcrJnePQIJrTHmFxb9hgNnThqbl8iD4/cFvCZb9fzeJpdVuiJ3S457HH1Rd+e/lp/eYxwLl/ZsjxV6jCBfhRH6UTAdwJlIubLf0lRgt3gghV1kQhC6Lhb8CFXe87Lt/0eMFR9xg6x9n96Rx14xqTq1pHnBl0zc6wPdwTebK7wVy6k6qoqP9TpAfbJP2Bcy3g0+p+Cz1j7Sv6hkqyY1w12Fsb+I/8TxI6rVEJdsCViZgjNvRZVBPjlsYrmrM6Kv2Sl/ZcmhCDyuDNzeA1/XtXNwzVX0l7SG5DduLvDt7qqRhPbZc9wZOwa1zg=?iv=6BgowrrUlWNFO8u9jGBCNw==

@ ef1744f8:96fbc3fe

2025-02-24 13:57:07bIzjKZ+i0/ZpWslLWXk1tkVypOiX0ErueLoBWso7NSKAdjOdPLPFcrJnePQIJrTHmFxb9hgNnThqbl8iD4/cFvCZb9fzeJpdVuiJ3S457HH1Rd+e/lp/eYxwLl/ZsjxV6jCBfhRH6UTAdwJlIubLf0lRgt3gghV1kQhC6Lhb8CFXe87Lt/0eMFR9xg6x9n96Rx14xqTq1pHnBl0zc6wPdwTebK7wVy6k6qoqP9TpAfbJP2Bcy3g0+p+Cz1j7Sv6hkqyY1w12Fsb+I/8TxI6rVEJdsCViZgjNvRZVBPjlsYrmrM6Kv2Sl/ZcmhCDyuDNzeA1/XtXNwzVX0l7SG5DduLvDt7qqRhPbZc9wZOwa1zg=?iv=6BgowrrUlWNFO8u9jGBCNw== @ 4d41a7cb:7d3633cc