-

@ b8af284d:f82c91dd

2025-02-25 08:11:32

Liebe Abonnenten,

*„The Fourth Turning“ ist ein epochemachendes wie hellseherisches Buch von William Strauss und Neil Howe. Es erschien 1997 mit der These, wonach Geschichte in Zyklen von 80 bis 100 Jahren verlaufe. Jede Gesellschaft durchlaufe vier Phasen („Turnings“): **High, Awakening, Unraveling und Crisis**. Nach der Crisis kommt es zum „Fourth Turning“ - welches die Autoren in den Jahren 2020 bis 2030 prophezeiten. Das klingt nach esoterischer Science-Fiction-Literatur, ist es aber nicht: Der mittlerweile verstorbene Strauss war Historiker, Howl ist Ökonom. In „The Fourth Turning“ argumentieren sie demnach weitgehend wissenschaftlich. Die Argumentation hier wiederzugeben, würden den Rahmen sprengen. Aber nur soviel: Wir sind mittendrin. Abseits des turbulenten Tagesgeschehens beginnt sich, eine neue Finanzordnung abzuzeichnen.*

Musk und sein “[Department of Government Efficiency](https://x.com/DOGE)” drehen gerade jeden Stein um, den sie finden können. Alle Ausgaben der Regierung kommen auf den Prüfstand.

Deswegen wurden sämtliche Zahlungen an die vermeintliche Entwicklungshilfe-Organisation USAID gestrichen. In die meisten Leitmedien schafften es nur Meldungen, wonach nun [Projekte zur Förderung von Beschneidungen in Mozambique und Biodiversität in Nepal ](https://x.com/DOGE/status/1890849405932077378)kein Geld mehr erhalten. Weniger war davon zu lesen, dass USAID als Deckorganisation für die CIA funktionierte und zum Beispiel[ die Forschung an pathogenen Corona-Viren in China](https://www.washingtonexaminer.com/news/486983/usaid-wont-give-details-on-4-67-million-grant-to-wuhan-lab-collaborator-ecohealth-alliance/) mit 4,6 Millionen finanzierte. Auch mit dabei: [2,6 Millionen Dollar an ein Zensur-Programm namens “Center for Countering Digital Hate (CCDH](https://x.com/AllumBokhari/status/1892027594666541412))” und vieles mehr: eine gute Übersicht findet man hier auf der [Website des Weißen Haus](https://www.whitehouse.gov/fact-sheets/2025/02/at-usaid-waste-and-abuse-runs-deep/)’. Die Einsparungen sind so hoch aktuell rund neun Milliarden US-Dollar, das darüber nachgedacht wird, einen Teil der Steuergelder wieder an die Bürger zurückzuzahlen: [Die “DogeDividend” könnte bei 5000$ pro Kopf liegen](https://x.com/DeItaone/status/1892182305487097877). (Wer sich noch an den Covid-Stimulus in Höhe von 1200$ erinnert, weiß, welche Rally die Zahlungen 2020 auslösten).

Der Kassensturz umfasst aber längst nicht nur USAID, sondern betrifft sämtliche Staatsausgaben. Sämtliche Ausgaben und Vermögenswerte der USA werden erfasst und hinsichtlich ihrer Nützlichkeit überprüft.

Im Rahmen von DOGE ließ Elon Musk kürzlich fragen, ob es nicht mal Zeit für eine Zählung der Gold-Reserven wäre. In Fort Knox, das die meisten wahrscheinlich aus James-Bond-Filmen oder Donald-Duck-Comics kennen, lagern mindestens 4800 Tonnen Gold - über die Hälfte der amerikanischen Reserven. Das heißt: Niemand weiß genau, wie viel es eigentlich sind. Die letzte Inventur fand 1953 statt.

Dasselbe gilt für die Zahlungen in die Ukraine. Mindestens 270 Milliarden US-Dollar haben die USA an Kiew gezahlt. Das Resultat: vermutlich über eine halbe Million Tote, ein völlig zerstörtes Land und ein korruptes System.

Nach der Rede von JD Vance bei der Münchener Sicherheitskonferenz ist Europa erst einmal in Schnappatmung gefallen. Am Dienstag darauf folgten zum ersten Mal seit Jahren direkte Gespräche zwischen Moskau und Washington in Saudi-Arabien. Europäer waren nicht eingeladen, die hielten stattdessen ein Krisentreffen in Paris ab.

Innerhalb der EU wird jetzt von einem neuen Militärfonds gefaselt, um die größte Aufrüstung des Kontinents seit 1933 zu finanzieren. [700 Milliarden Euro soll der umfassen, finanziert durch Steuererhöhungen](https://www.berliner-zeitung.de/wirtschaft-verantwortung/baerbock-verplappert-sich-nach-der-wahl-milliarden-fuer-ukraine-li.2295623), da ja der Schutz der USA jetzt wegfalle. Man kann nur hoffen, dass die EU-Bürokratie zusammen mit Selenski nicht auf die Idee kommt, den Krieg allein weiterzuführen oder den Friedensprozess zu sabotieren.

Vielen dürfte allerdings klar sein, dass sich demnächst etwas grundsätzlich ändern wird. Die Trump-Administration ordnet die Welt neu, und damit auch die globale Finanzarchitektur. Was hat es damit auf sich? Und worum geht es eigentlich?

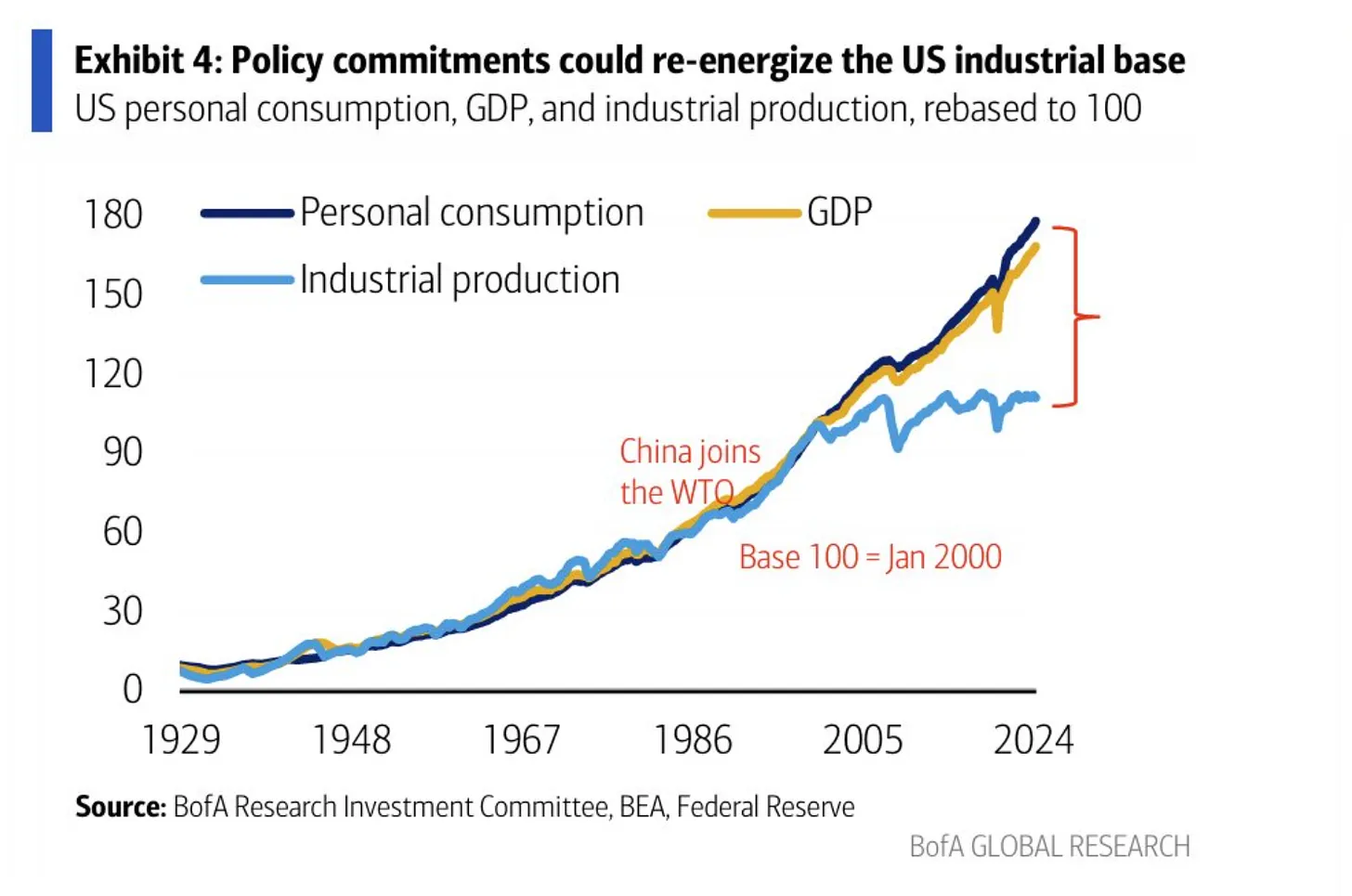

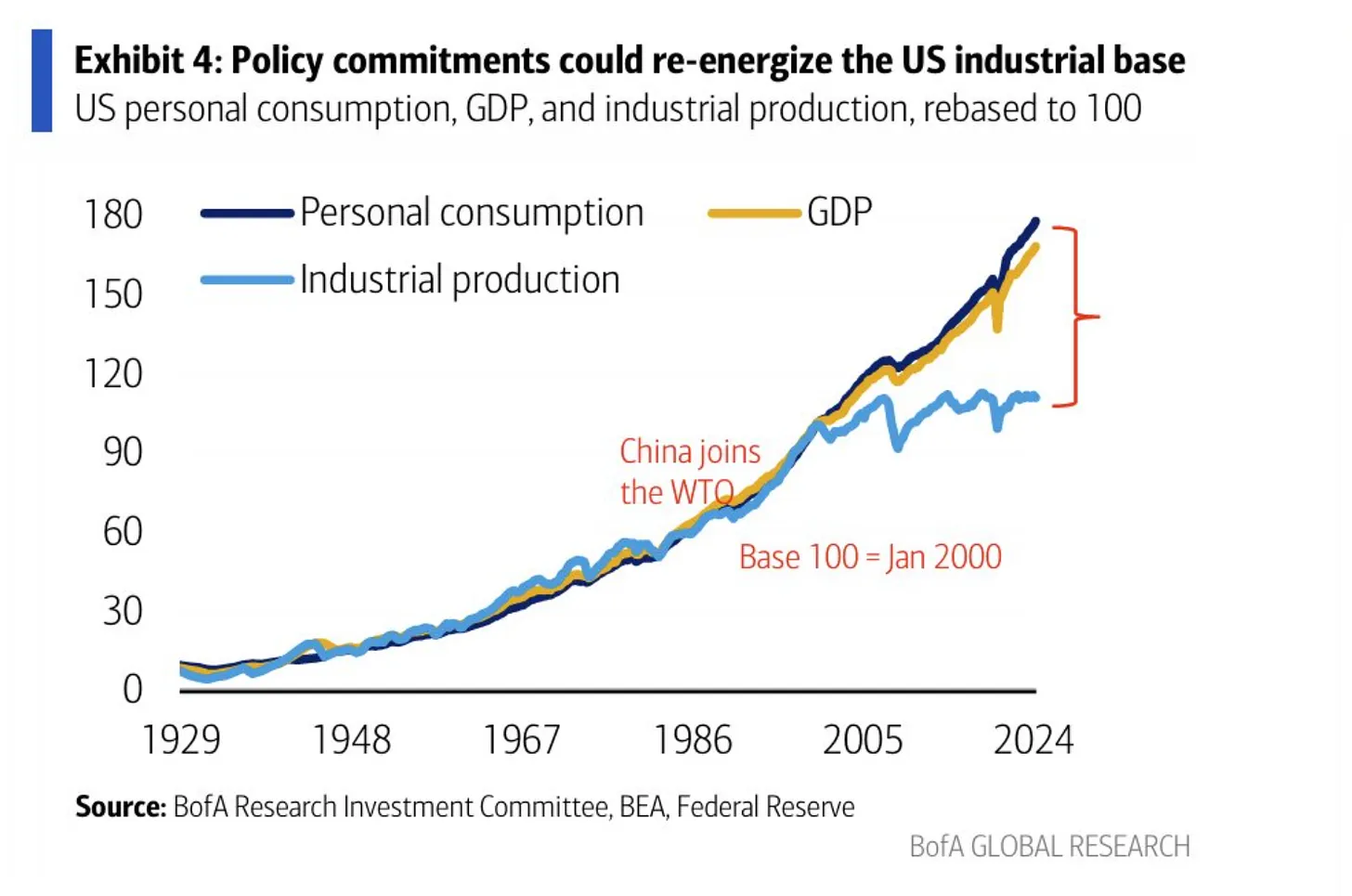

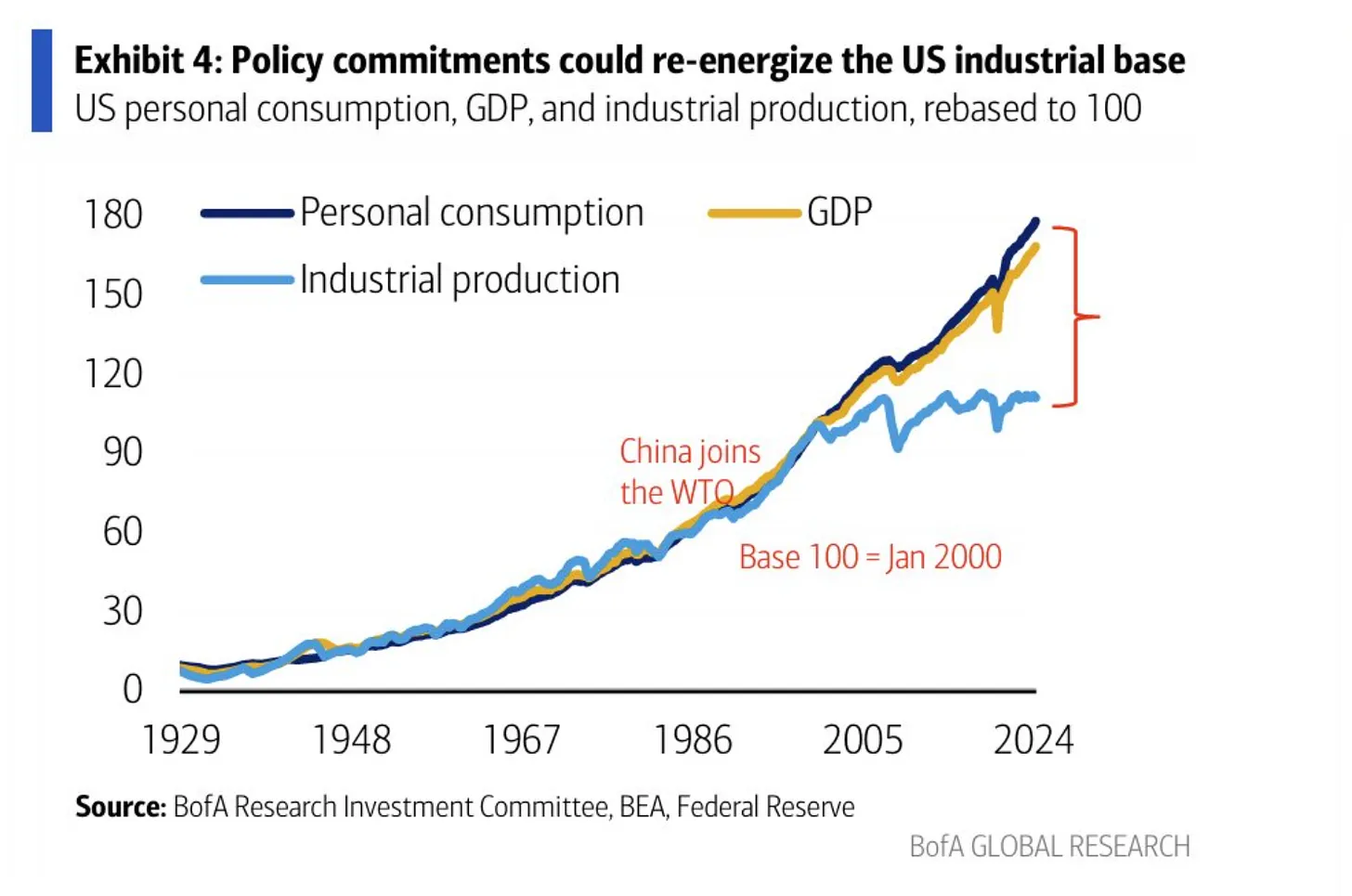

Zur Erinnerung: Mit dem Beitritt Chinas zur Welthandelsorganisation 2001 wurde die industrielle Basis der USA nach und nach ausgehöhlt. Chinesische Waren waren billiger - und so verlagerten sich immer mehr Industrien nach China. Deutschland profitierte relativ länger von dieser Entwicklung, da die Automobilindustrie wettbewerbsfähiger war und deutsche Maschinenbauer chinesische Fabriken ausstatteten.

\

Trump 1 versuchte diese Entwicklung mit Zöllen zu unterbinden. Bei Trump 2 geht es um mehr. Zölle sind nur noch die vorübergehende Waffe, die Ziele durchzusetzen. Ziel ist ein schwächerer Dollar.

Eine starke Währung klingt nett, bedeutet aber nichts anderes, als dass Importe aus anderen Ländern günstiger sind und Exporte in andere Länder vergleichsweise teurer sind. Eine schwächere Währung heißt dagegen, dass Exporte günstiger und damit wettbewerbsfähiger sind. Ein starker Dollar behindert deswegen den (Rück-)Aufbau der amerikanischen Industrie. Allerdings ist das eben auch genau der Preis, den ein Land für eine Leit- oder Reserve-Währung zahlen muss. Weil die Welt mit US-Dollar bezahlt - auch ein mexikanisches Unternehmen, das mit einem chinesischen handelt, wickelt das mit Dollar ab - ist die Nachfrage nach US-Dollar hoch, und die Währung damit stark:

> *From a trade perspective, the dollar is persistently overvalued, in large part because dollar assets function as the world’s reserve currency. This overvaluation has weighed heavily on the American manufacturing sector while benefiting financialized sectors of the economy in manners that benefit wealthy Americans.*

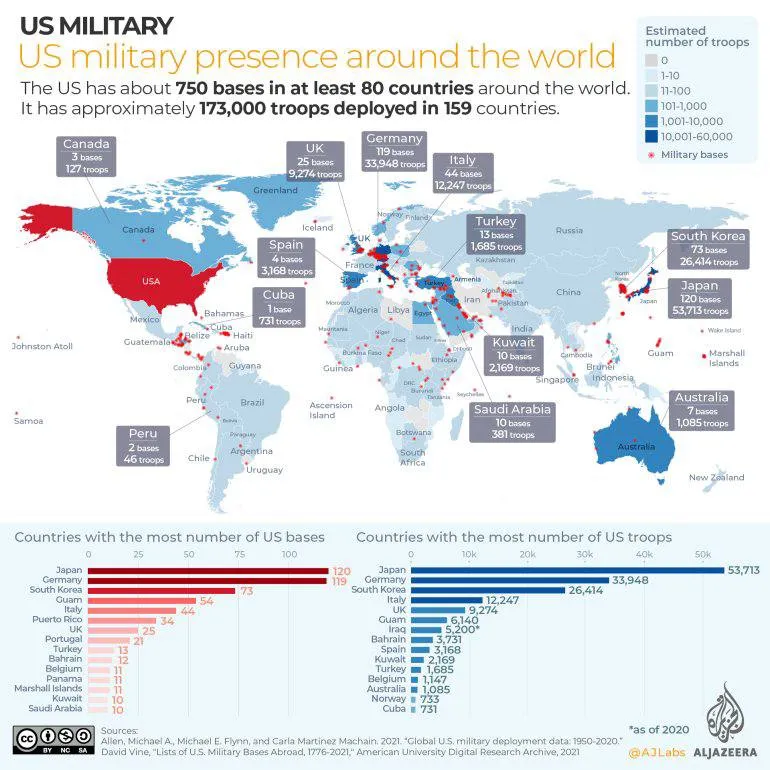

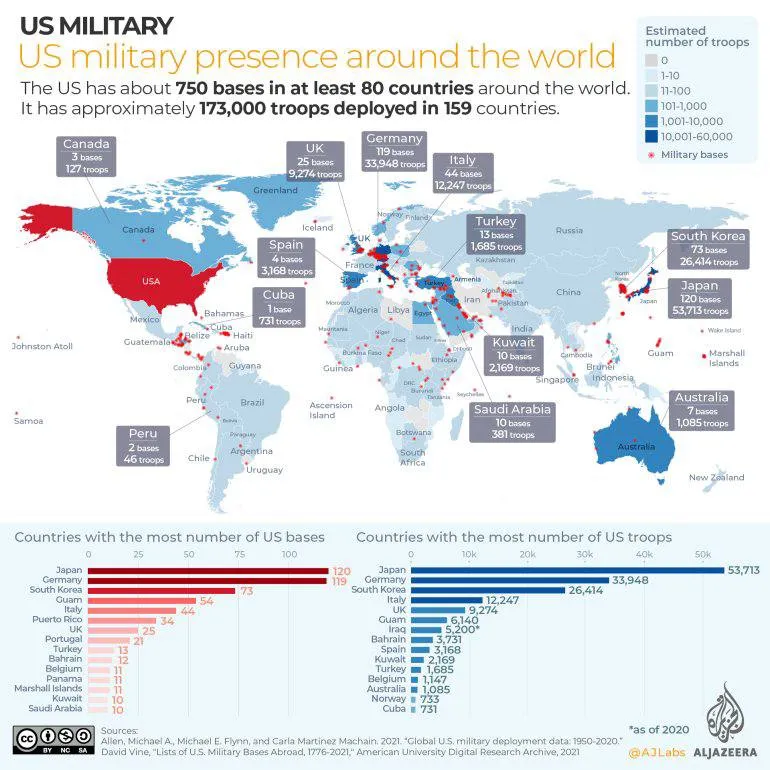

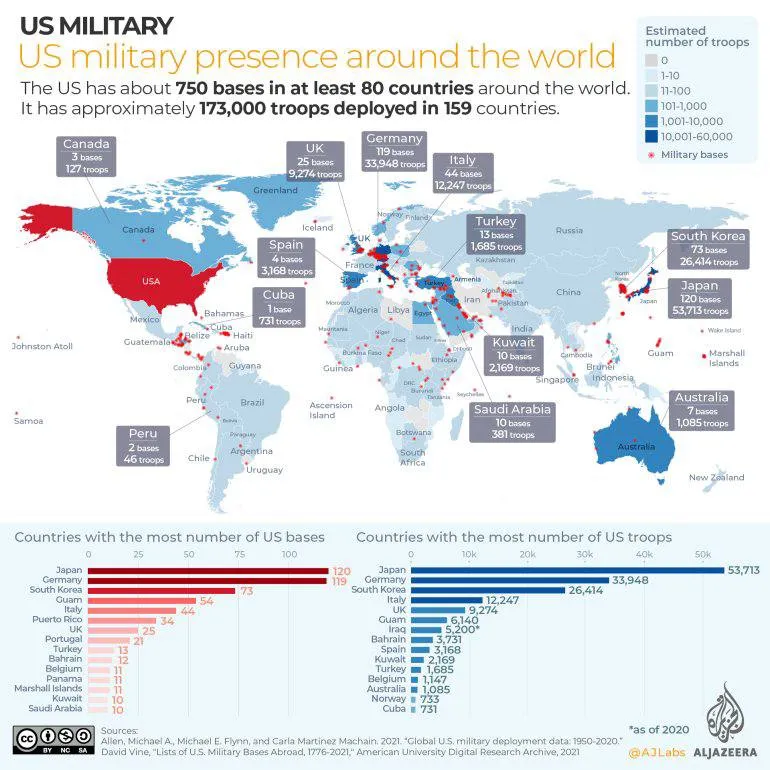

Die USA zahlten indirekt für dieses Privileg, indem sie es sich zur Aufgabe machten, internationale Handelswege zu schützen. Die US-Marine übernahm nach 1945 und besonders nach 1989 den Job der British Royal Navy, und bewacht seitdem alle wichtigen Schifffahrtswege weltweit, um freien Handel zu ermöglichen.

\

*The U.S. dollar is the reserve asset in large part because America provides stability, liquidity, market depth and the rule of law. Those are related to the characteristics that make America powerful enough to project physical force worldwide and allow it to shape and defend the global international order. The history of intertwinement between reserve currency status and national security is long.*

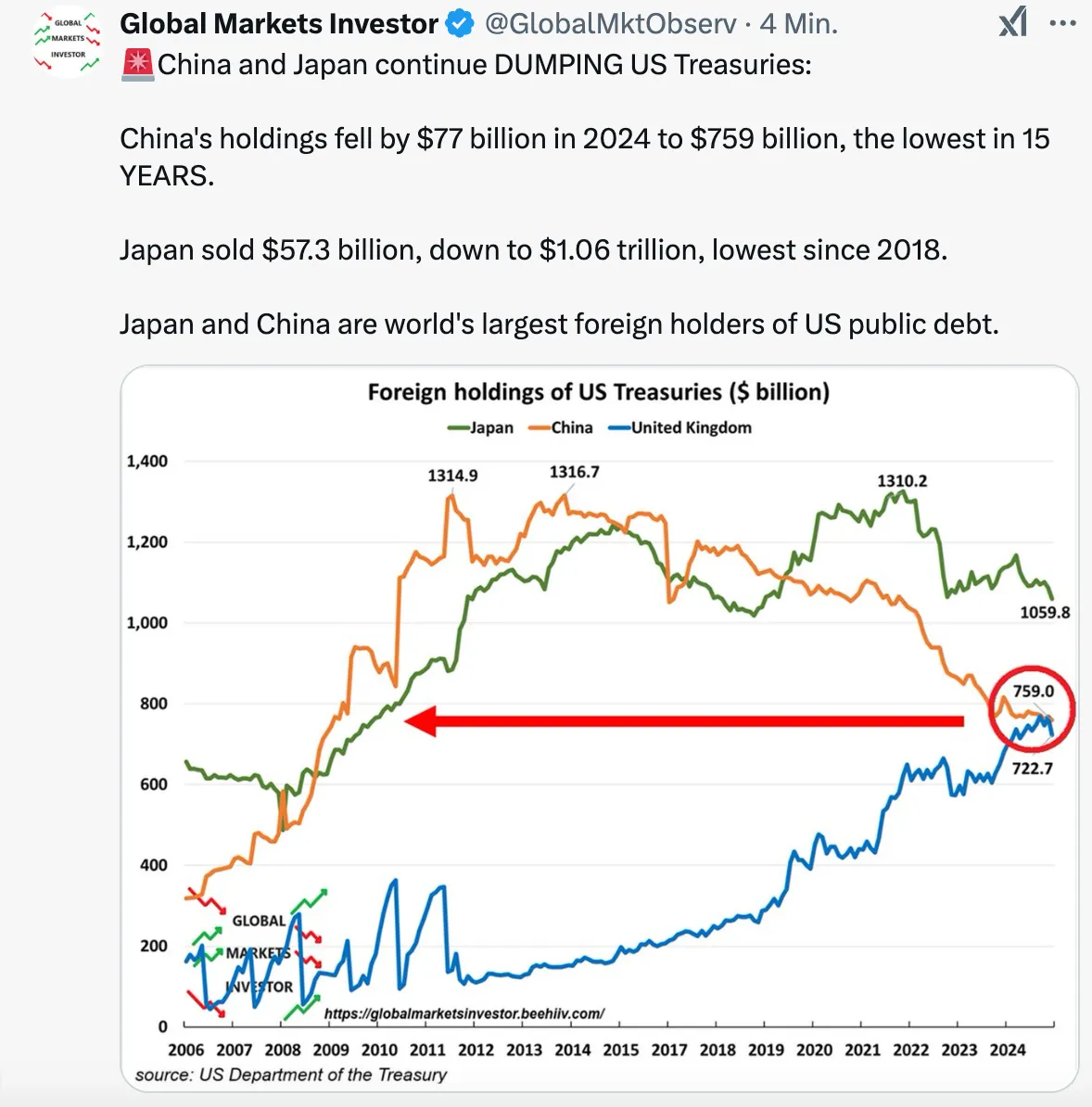

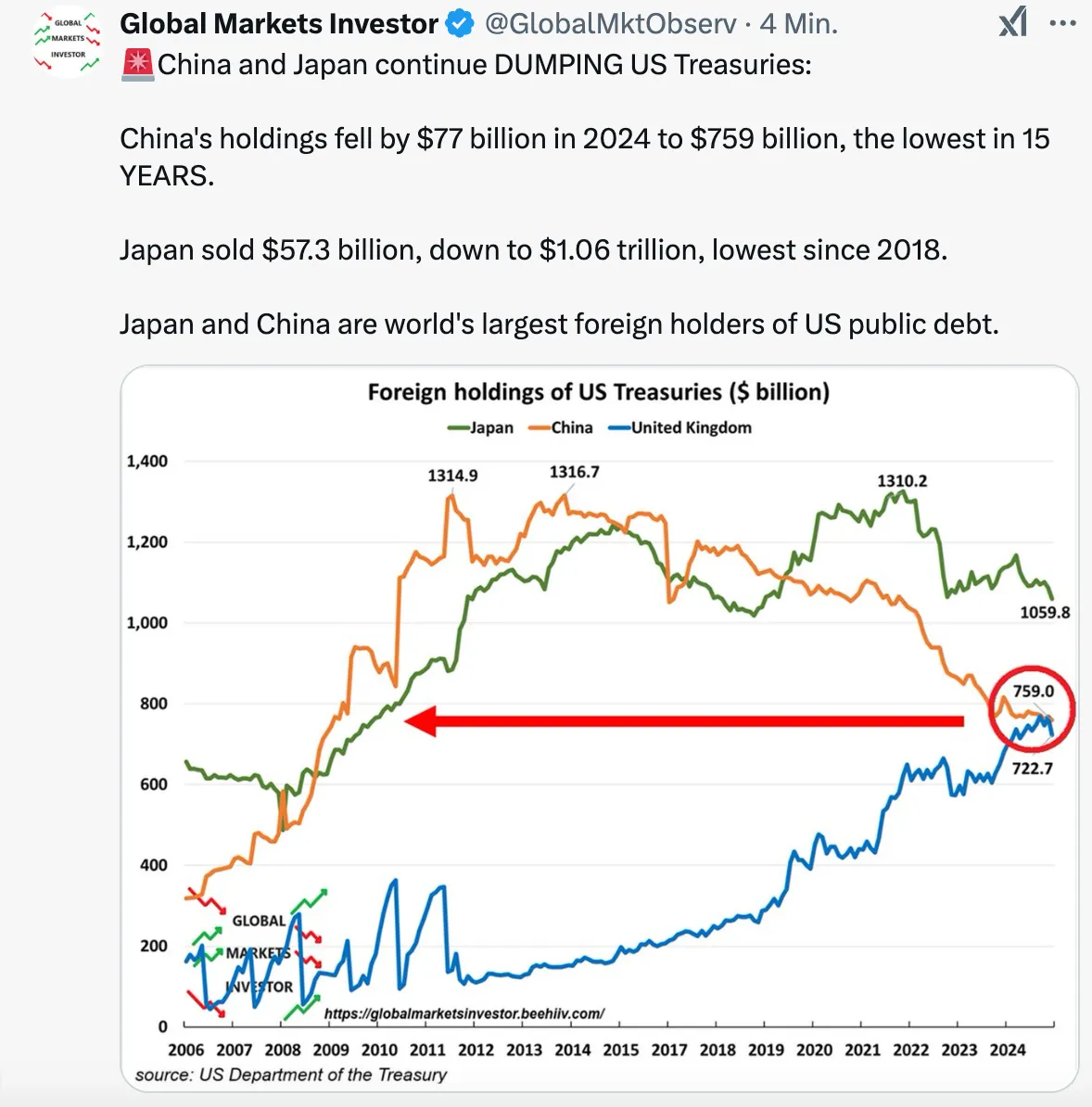

Das System funktionierte auch deswegen, weil die allermeisten, befreundeten Staaten, ihr Überschüsse wieder in US-Dollar-Anleihen anlegten (US-Treasuries). Dieses Recycling aus “Amerikaner konsumieren und zahlen mit US-Dollar, die China, Japan und die EU wiederum in US-Anleihen anlegen” funktionierte lange gut.

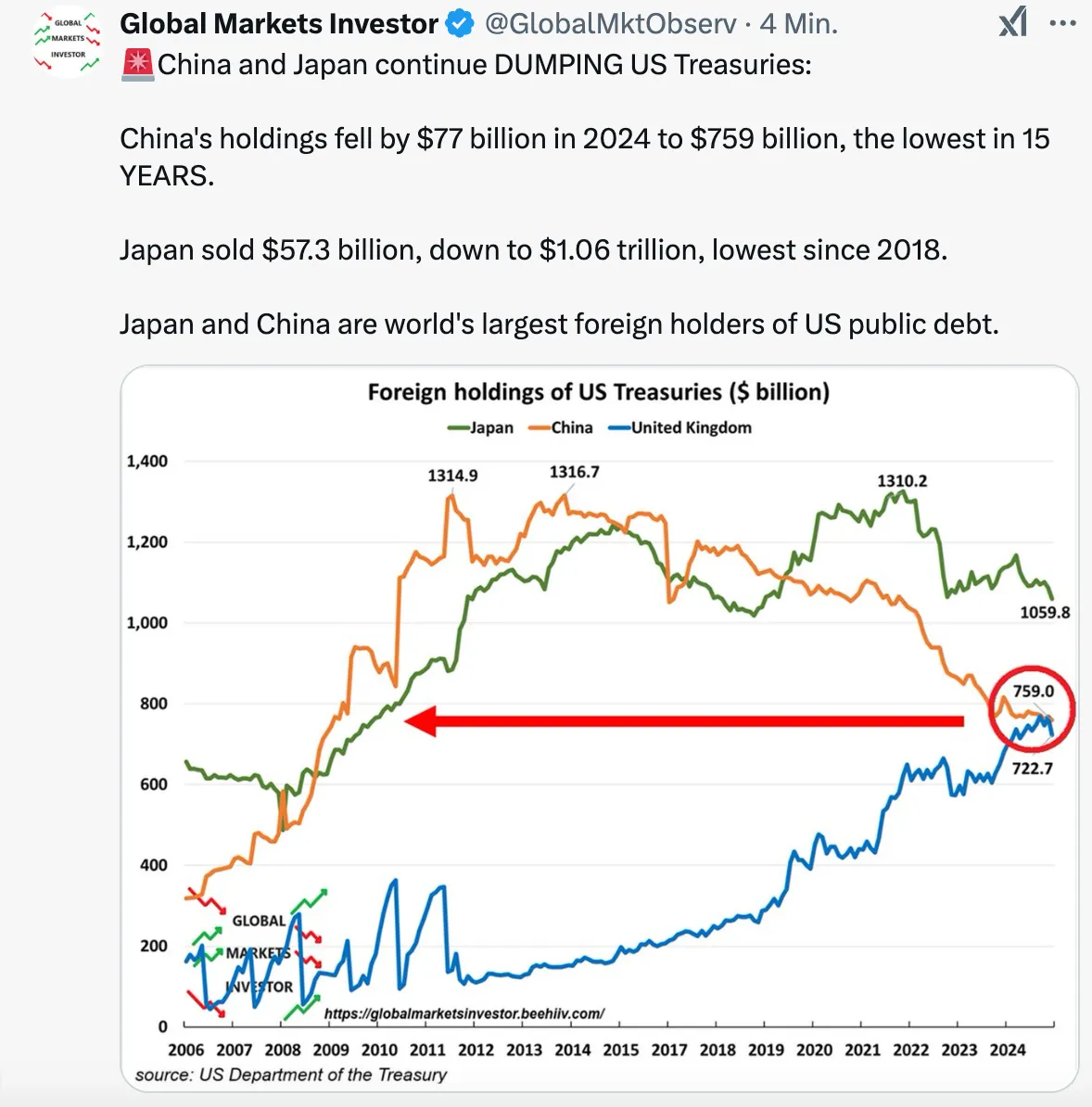

Das Problem ist seit einigen Jahren: Die Situation hat sich zuungunsten der USA verschoben. Man zahlt viel für das Militär, aber die Gewinne, die sich aus einer Leitwährung ergeben, sind gefallen. Kurz gesagt: Das Verteidigungsbudget wächst, während Arbeitsplätze verloren gegangen sind. Zwar konnten sich die USA in den vergangenen Jahren günstiger als andere verschulden. Trotzdem erdrückt die Schuldenlast mittlerweile den Etat, und immer weniger Staaten haben Lust, ihre Reserven in US-Treasuries anzulegen. Sie kaufen lieber Gold (und vielleicht auch bald Bitcoin).

Eine Neugewichtung des Deals ist notwendig. Daher der Kassensturz. Daher die ständigen Aufforderungen Trumps an Verbündete, künftig mehr zu zahlen.

Die Lösung könnte ein „Mar-a-Lago“-Accord sein. Die USA befanden sich in den 1980er Jahren schon einmal in einer ähnlichen Situation: Japanische und deutsche Waren überschwemmten die amerikanischen Märkte. Nach einem verlorenen Krieg in Vietnam und hoher Inflation hatten sich innerhalb Gesellschaft große Spannungen aufgebaut. Ronald Reagan, übrigens ein Präsident, der ähnlich polarisierte wie Trump heute, sprach 1985 Klartext: Japan und in geringerem Maße die BRD, Frankreich und Großbritannien hatten ihre Währungen aufzuwerten. Damit wurde die Flut der Exporte in die USA gestemmt und die Finanzflüsse stabilisiert.

Seit einigen Wochen gibt es relativ klare Pläne, wie diese neue Ordnung aussehen soll. Sie gehen zurück auf den Ökonomen Steve Miran, der bereits unter der ersten Trump-Administration eine Berater-Rolle hatte. Seit Dezember 2024 ist der Vorsitzender des Council of Economic Advisers. Miran wiederum steht [Zoltan Pozsar nahe, der 2022/23 zum Shooting Star der Macro-Economy-Nerds wurde](https://www.finews.ch/themen/guruwatch/58206-zoltan-pozsar-ex-uno-plures-resarch-dollar-zinsen-bretton-woods-ungarn). Worum geht es?

Weiter geht es auf <https://blingbling.substack.com/p/der-mar-a-lago-accord>

-

@ 57d1a264:69f1fee1

2025-02-25 07:28:18

@Voltage team will be building a simple implementation of a Lightning gated API service using a Voltage LND Node and the L402 protocol.

📅 Thursday, February 27th 4:00 PM CDT

📷 Live on Voltage Discord, on X, or on YouTube.

- discord.gg/EN93fDfQ

- https://x.com/voltage_cloud/status/1892938201980919985

- https://www.youtube.com/@voltage_cloud

originally posted at https://stacker.news/items/896373

-

@ 6389be64:ef439d32

2025-02-25 05:53:41

Biochar in the soil attracts microbes who take up permanent residence in the "coral reef" the biochar provides. Those microbes then attract mycorrhizal fungi to the reef. The mycorrhizal fungi are also attached to plant roots connecting diverse populations to each other, allowing transportation of molecular resources (water, cations, anions etc).

The char surface area attracts positively charged ions like

K+

Ca2+

Mg2+

NH4+

Na+

H+

Al3+

Fe2+

Fe3+

Mn2+

Cu2+

Zn2+

Many of these are transferred to plant roots by mycorrhizal fungi in exchange for photosynthetic products (sugars). Mycorrhizal fungi are connected to both plant roots and biochar. Char adsorbs these cations so, it stands to reason that under periods of minimal need by plants for these cations (stress, low or no sunlight etc.), mycorrhizal fungi could deposit the cations to the char surfaces. The char would be acting as a "bank" for the cations and the deposition would be of low energy cost.

Once the plant starts exuding photosynthetic products again, signaling a need for these cations, the fungi can start "stripping" the cations off of the char surface for immediate exchange of the cations for the sugars. This would be a high energy transaction because the fungi would have to expend energy to strip the cations off of the char surface, in effect, an "interest rate".

The char might act as a reservoir of cations that were mined by the fungi while the sugar flow from the roots was active. It's a bank.

originally posted at https://stacker.news/items/896340

-

@ ef1744f8:96fbc3fe

2025-02-25 05:51:23

kZPO/Pgqm/nOfGtpHNVK3gcDhzs5sSvyVqUZlAJrs95os0xUFhO4VlBC5GuEYF0uYTTGVGe60TjK8sm+ixOIPxpd3eYGGtZs9CjkRzis8vU=?iv=KyDTZEV4fCT/lKJWR4heeQ==

-

@ ef1744f8:96fbc3fe

2025-02-25 05:45:21

B3rafJgfWeHKOv/c2y8pk7thAOvmYYooCN1BMJh+gtmngdanQ7Mnimz048gzTWlV8Ap6wHRtu2rD6W6KDt6r82HlaftHm8jRBH1BGJ8Aw+GYy/PRGuQnUZP3DcjZusRchZSIhWuFBnhonWUHrxwnzrmcolx6yPekWKzxn9DR8Kt2qWIxbg2791EnuQn6orrAdw8MJJQg/hZhEdqib8KuweUrn6YDPi8ICV099rHUAlWBR6NSn/kwyomarCmV6U0bucUiv5y6QrBUSIQGfMTKYGBgmdXdeWTQ4YSYTaF0cZNDCJorksVIxx32dpc8RhYsvooZwk0OAAGg5LO5dekA1rn5jZk6rbmAnRcvnQFcue0=?iv=gZIUGRNTRQULCjSeRae+YQ==

-

@ ef1744f8:96fbc3fe

2025-02-25 04:39:34

z9Lx1dooDqHDDhWqropQYC1DWuFDIPxnfgiKc2T0ZFYdD45DOQNWX/kVslqJzGIe3s7KB8QBIhaxcYte84h631adZwVR/15tZOC8FeeLeIt8fM8QCromJVIoPJU29yY4kLepPMDWw7WoWfDysolhLDv1dtPrOkIWZ+188YOjAc8byhgWsvWgfwxlfS+26BpZadFIBolA4kDqN1dO+SQnyM9mUD1jc3aLe4utOlij/+gU0XkN93W7637MBN41AXGBLAv4E4AG+ywAQrx8f2R8JUY+Vg+DLmq1/vuUH+S1qTC/Lz6HEy5H2HiGeSyK43UB7QV7HLGn0e5KUtn6dxjl/irrJQL6dDdilCpdCBgCBBk=?iv=xctArPoh36458mWve+tqEw==

-

@ ef1744f8:96fbc3fe

2025-02-25 04:33:53

qT0bRNd6LiQzh1Y34rZv39xcgw5TCv9xZ5xAxbHoBDrhfaYGyll5g4XvgHY0LgfxcxSt8XcMI50yjY19WYfwvxl0gASsXBljn8SzhlO4RiF0NorJCklhOjDo93kQON/pVOYNmIi9oGTpqMWWxE5Qh53tvA2zaPG67B6CBCjh7wbVnFrLqCdq1KV9iBSRZmFXaBYWcn3pFcGKlqTV/NGrHnVFwqjS1uFAZZrScwxWRmbM1TVplp6f5dHNxTfe8pXajSsvO3kXV5jRCLr6C2jJMWepUFWw33tjBCwGOyo9kbkf0C++OTHrlPMECi5vXq18C1L+bA0ouVlVlfYu5j/ywg==?iv=BgxOFzpGx/RiIRYKZZz/8g==

-

@ ef1744f8:96fbc3fe

2025-02-25 04:19:37

gGRBBQfw8RRgMK4XZ9kE3MpdCdFgngP/0/QQUfUdEbX6ZjUr2cZ6B6yID05lexoOosOSlzmPbTbx5y8Imur0ls8EHBik31l/IZdYdln8vPGnQ341Ul4Kp88VCjJ9UWNY6l+Sel9XbwwGGqzBvIIRsg+OWCAput62iAErCDmsVkMYMfnmhH8cSVYFOwEWqk4H1iKFSsWnRbRZ8w5scRXgjHIaQNQ6QSsSWAgC8jeZi7mFmTJN+JrBPBQEzM30AUWFpMjUy8NVKflfe9dRJ9j1OfDFCwZxAmohvBpWx3TgFDvcpAOnIH3J/d4XO7XJpZ4pJPSo5Sej73lDwYKQSEpGng==?iv=XKhoZRopkCInuqqAzP1haQ==

-

@ 04c915da:3dfbecc9

2025-02-25 03:55:08

Here’s a revised timeline of macro-level events from *The Mandibles: A Family, 2029–2047* by Lionel Shriver, reimagined in a world where Bitcoin is adopted as a widely accepted form of money, altering the original narrative’s assumptions about currency collapse and economic control. In Shriver’s original story, the failure of Bitcoin is assumed amid the dominance of the bancor and the dollar’s collapse. Here, Bitcoin’s success reshapes the economic and societal trajectory, decentralizing power and challenging state-driven outcomes.

### Part One: 2029–2032

- **2029 (Early Year)**\

The United States faces economic strain as the dollar weakens against global shifts. However, Bitcoin, having gained traction emerges as a viable alternative. Unlike the original timeline, the bancor—a supranational currency backed by a coalition of nations—struggles to gain footing as Bitcoin’s decentralized adoption grows among individuals and businesses worldwide, undermining both the dollar and the bancor.

- **2029 (Mid-Year: The Great Renunciation)**\

Treasury bonds lose value, and the government bans Bitcoin, labeling it a threat to sovereignty (mirroring the original bancor ban). However, a Bitcoin ban proves unenforceable—its decentralized nature thwarts confiscation efforts, unlike gold in the original story. Hyperinflation hits the dollar as the U.S. prints money, but Bitcoin’s fixed supply shields adopters from currency devaluation, creating a dual-economy split: dollar users suffer, while Bitcoin users thrive.

- **2029 (Late Year)**\

Dollar-based inflation soars, emptying stores of goods priced in fiat currency. Meanwhile, Bitcoin transactions flourish in underground and online markets, stabilizing trade for those plugged into the bitcoin ecosystem. Traditional supply chains falter, but peer-to-peer Bitcoin networks enable local and international exchange, reducing scarcity for early adopters. The government’s gold confiscation fails to bolster the dollar, as Bitcoin’s rise renders gold less relevant.

- **2030–2031**\

Crime spikes in dollar-dependent urban areas, but Bitcoin-friendly regions see less chaos, as digital wallets and smart contracts facilitate secure trade. The U.S. government doubles down on surveillance to crack down on bitcoin use. A cultural divide deepens: centralized authority weakens in Bitcoin-adopting communities, while dollar zones descend into lawlessness.

- **2032**\

By this point, Bitcoin is de facto legal tender in parts of the U.S. and globally, especially in tech-savvy or libertarian-leaning regions. The federal government’s grip slips as tax collection in dollars plummets—Bitcoin’s traceability is low, and citizens evade fiat-based levies. Rural and urban Bitcoin hubs emerge, while the dollar economy remains fractured.

### Time Jump: 2032–2047

- Over 15 years, Bitcoin solidifies as a global reserve currency, eroding centralized control. The U.S. government adapts, grudgingly integrating bitcoin into policy, though regional autonomy grows as Bitcoin empowers local economies.

### Part Two: 2047

- **2047 (Early Year)**\

The U.S. is a hybrid state: Bitcoin is legal tender alongside a diminished dollar. Taxes are lower, collected in BTC, reducing federal overreach. Bitcoin’s adoption has decentralized power nationwide. The bancor has faded, unable to compete with Bitcoin’s grassroots momentum.

- **2047 (Mid-Year)**\

Travel and trade flow freely in Bitcoin zones, with no restrictive checkpoints. The dollar economy lingers in poorer areas, marked by decay, but Bitcoin’s dominance lifts overall prosperity, as its deflationary nature incentivizes saving and investment over consumption. Global supply chains rebound, powered by bitcoin enabled efficiency.

- **2047 (Late Year)**\

The U.S. is a patchwork of semi-autonomous zones, united by Bitcoin’s universal acceptance rather than federal control. Resource scarcity persists due to past disruptions, but economic stability is higher than in Shriver’s original dystopia—Bitcoin’s success prevents the authoritarian slide, fostering a freer, if imperfect, society.

### Key Differences

- **Currency Dynamics**: Bitcoin’s triumph prevents the bancor’s dominance and mitigates hyperinflation’s worst effects, offering a lifeline outside state control.

- **Government Power**: Centralized authority weakens as Bitcoin evades bans and taxation, shifting power to individuals and communities.

- **Societal Outcome**: Instead of a surveillance state, 2047 sees a decentralized, bitcoin driven world—less oppressive, though still stratified between Bitcoin haves and have-nots.

This reimagining assumes Bitcoin overcomes Shriver’s implied skepticism to become a robust, adopted currency by 2029, fundamentally altering the novel’s bleak trajectory.

-

@ f6488c62:c929299d

2025-02-25 03:22:49

การที่สหรัฐอเมริกาปรับมูลค่าทองคำในคลัง (re-peg) จะมีผลกระทบที่สำคัญต่อทั้งระบบการเงินโลกและบิทคอยน์ ด้วยเหตุผลต่างๆ ที่อาจเกิดขึ้นดังนี้:

ทองคำในฐานะสินทรัพย์เก็บมูลค่า: หากสหรัฐอเมริกาปรับราคาทองคำจาก 42 ดอลลาร์ต่อออนซ์เป็นราคาปัจจุบันที่สูงถึง 2,953.5 ดอลลาร์ต่อออนซ์ การปรับนี้จะทำให้ทองคำได้รับความนิยมและมีมูลค่าเพิ่มขึ้นอย่างมากในมุมมองของนักลงทุนทั่วโลก ส่งผลให้ทองคำมีบทบาทสำคัญขึ้นในระบบการเงิน อีกทั้งยังเป็นทางเลือกการลงทุนที่น่าสนใจมากขึ้นในฐานะ "safe haven" หรือสินทรัพย์ที่ปลอดภัย.

ผลกระทบต่อตลาดดอลลาร์สหรัฐ: การประเมินมูลค่าทองคำใหม่จะทำให้ค่าเงินดอลลาร์อ่อนค่าลง เนื่องจากทองคำถูกมองว่าเป็นตัวบ่งชี้ความมั่งคั่งและเสถียรภาพทางการเงิน การอ่อนค่าของดอลลาร์อาจส่งผลให้บิทคอยน์เป็นที่น่าสนใจมากขึ้นในฐานะสินทรัพย์ที่ไม่ขึ้นกับเงินดอลลาร์และธนาคารกลางใด ๆ.

การเติบโตของบิทคอยน์: เมื่อระบบการเงินดั้งเดิม (เช่น ดอลลาร์สหรัฐ) เริ่มสั่นคลอนหรือลดความน่าเชื่อถือ บิทคอยน์ซึ่งเป็นสินทรัพย์ดิจิทัลที่ไม่ขึ้นกับรัฐบาลหรือธนาคารกลางก็จะได้รับความสนใจมากขึ้นจากนักลงทุนที่ต้องการหลีกเลี่ยงความเสี่ยงในระบบการเงินแบบดั้งเดิม นอกจากนี้บิทคอยน์ยังถือเป็นสินทรัพย์ที่มีการจำกัดจำนวน (21 ล้าน BTC) ซึ่งถือว่าเป็นการป้องกันภาวะเงินเฟ้อที่มักจะเกิดขึ้นจากการพิมพ์เงินจำนวนมากโดยธนาคารกลาง.

การปรับตัวของประเทศอื่นๆ: หากสหรัฐฯ ปรับมูลค่าทองคำใหม่ ประเทศอื่นๆ อาจจำเป็นต้องปรับเปลี่ยนมูลค่าทองคำของตนเองเพื่อตอบสนองต่อการเปลี่ยนแปลงนี้ และอาจเห็นการเคลื่อนไหวในการสนับสนุนสินทรัพย์ดิจิทัลอย่างบิทคอยน์มากขึ้นเพื่อกระจายความเสี่ยงจากการพึ่งพาระบบการเงินดอลลาร์สหรัฐ.

สรุปได้ว่า หากการปรับมูลค่าทองคำของสหรัฐเป็นจริง การเคลื่อนไหวนี้อาจเป็นตัวกระตุ้นให้บิทคอยน์เติบโตขึ้น เนื่องจากนักลงทุนมองหาทางเลือกที่ปลอดภัยจากความไม่แน่นอนในระบบการเงินดั้งเดิม และเพิ่มการยอมรับในสินทรัพย์ดิจิทัลมากขึ้น.

-

@ 8da249fe:ecc00e09

2025-02-25 01:08:49

Existem diversas corretoras onde você pode comprar e vender bitcoins e outras moedas. O ideal é sempre escolher empresas idoneas e com boa fama, para isso, antes de ir comprando bitcoin conheça pessoas que usam estas corretoras, veja os depoimentos destas pessoas sobre esta plataforma, isso é bem básico e serve para qualquer coisa.

Geralmente estas exchanges (corretoras) exigem alguns dados pessoais, ou seja, são fontes de bitcoin por KYC. Para pessoas que querem ter bitcoin sem seus dados registrados é necessário a compra peer-to-peer, que é a compra direta por pessoas sem a uma "instituição financeira" mediando a transação.

Dica número 1 : Nunca deixe seus bitcoins armazenados em corretoras.

Apesar do bitcoin ainda não ter nenhum tipo de regulamentação, as corretoras por serem consideradas "instituições financeiras" são reguladas pelo Sistema Financeiro Nacional, sendo vulneráveis as decisões governamentais.

Além disso, as corretoras por movimentarem grandes quantidades de dinheiro, estão vulneráveis ataques hackears que são frequentementes.

Dica número 2: Sempre deposite seus bitcoins em carteiras

As carteiras são locais de armazenamento seguros e alguns tipos com as cold Wallet não há gestão dos seus fundos por intermediários, logo a responsabilidade pelo seu dinheiro é totalmente sua.

Sempre importante guardar e ter uma boa organização quanto as senhas de acesso, pois uma vez que perde não há nenhuma forma de recuperá-la.

Algo que o economista Fernando Roxo fala no YT que concordo plenamente ,é , que não se deve deixar todos os ovos numa cesta só. O que aplico no universo bitcoin que não se deve colocar todos os seus bitcoin em apenas uma carteira. É muito importante dificultar o máximo para os criminosos roubarem, por isso devem ter várias carteiras.

Dica número 3: Entenda que Bitcoin não é investimento, e sim uma solução econômica.

Não desista do bitcoin , só porque ele ocila de valor. O bitcoin não é um investimento a onde se aplica e você tem um lucro. O bitcoin é uma solução em decorrência da desonestidade dos governos que imprimem moedas sem valor agregado.

Este conhecimento é extremamente importante para que não se iluda com promessa de ficar milionário ou algo do tipo. O bitcoin é uma moeda segura que tem o intuito de proteger o mercado financeiro em decorrência da má fé de estados, e também uma arma contra governos.

Dica número 4 : Ajude a comunidade, comercialize em bitcoin.

Quer você seja consumidor ou produtor, faça com que seus fundos estejam em bitcoin. Apesar de estamos engatinhando no mercado há muitas iniciativas como o Bitrefill, maquininhas e software para movimentações em bitcoin que tem facilitado as transações.

Dica número 5: Conheça os termos técnico sobre este universo.

Fique sempre atualizados com os termos da comunidade com KYC, cold wallet, hot wallet, fiat ...

Assim você poderá seu um "agente" pró bitcoin e ajudar pessoas simples a entrarem neste universo e ter sua auto custódia e estarem imunes aos desgovernos.

-

@ d57360cb:4fe7d935

2025-02-24 23:30:38

The moments and events that leave you lost. Shook. In Disbelief.

Those are the moments you need most. They unlock something dormant in you. Feelings you didn't think imaginable. Journeys you thought unlikely to happen.

Paths and roads filled with ups and downs. Uncertainties, roadblocks, long distances of absolutely nothing in sight. Periods of turmoil and absolute stillness.

Don't mistake where you are for the finale.

Embrace life, it gives you character.

-

@ 378562cd:a6fc6773

2025-02-24 22:13:45

As someone deeply interested in decentralized technology, I’ve been closely following the rapid rise of the Nostr (Notes and Other Stuff Transmitted by Relays) protocol. Although I've only just begun investigating it, I have already almost all but canceled my X, Facebook, and Truth Social accounts!

Nostr is an exciting alternative to traditional social media and communication platforms. It is built on censorship resistance, user control, and interoperability principles. Given the growing concerns over centralized control, privacy breaches, and biased content moderation, I believe Nostr presents a compelling solution. In this ~~article~~ long note, I want to share my thoughts on how Nostr has evolved, its recent advancements, and its potential impact on the digital landscape.

**Understanding Nostr**

Nostr is a lightweight, open-source protocol that allows users like me and you to share notes, messages, and other digital interactions via relays rather than centralized servers. It’s designed to be simple, robust, and censorship-resistant. Instead of relying on a single platform or authority, Nostr operates on a peer-to-peer model. Users interact through cryptographic key pairs and publish content to relays that distribute the data across the network.

Unlike traditional social networks like Twitter or Facebook, where all data is stored on centralized servers controlled by corporations, Nostr empowers me to truly own and control my digital identity. My data isn’t locked away by a single company or subject to the whims of ever-changing policies, government overreach, or arbitrary bans. Instead, I can run my own relay or connect to multiple independent relays, ensuring that my presence online remains resilient and censorship-resistant. Even if one or more relays shut down, my data is not lost—it remains accessible through the broader network. This decentralized structure not only protects free expression but also guarantees that no single entity has the power to dictate who stays online and who gets silenced. With Nostr, I am in control, and my data belongs to me—just as it should.

Since its inception, Nostr has seen impressive development, both technically and in terms of adoption. Some of the advancements that excite me the most include:

**Growing Ecosystem of Clients and Relays**

Developers have built a diverse ecosystem of client applications, ranging from sleek web-based interfaces to powerful mobile apps, making accessing and interacting with the Nostr network easier than ever. Whether on a desktop, smartphone or even experimental hardware, users have a growing array of options to stay connected seamlessly.

At the same time, the relay infrastructure has evolved rapidly, with new nodes optimized for speed, security, and regional accessibility. These relays ensure that messages are delivered efficiently while maintaining the network's decentralized and censorship-resistant nature. With relays distributed worldwide, Nostr continues to grow stronger, providing a resilient and open platform where users are free to communicate without relying on any single point of failure.

**Enhanced User Experience**

Early implementations of Nostr were simple and barebones, catering mostly to tech-savvy early adopters. However, the user experience has since evolved dramatically. Modern Nostr clients now feature sleek, intuitive UI designs, making navigation smooth and enjoyable. Enhanced media support allows for seamless sharing of images, videos, and other content, while improved interaction mechanisms—such as threaded conversations, reactions, and richer notifications—make engagement more dynamic and user-friendly.

To further streamline the experience, user-friendly wallets and browser extensions have been introduced, simplifying secure key management and making onboarding far more accessible. Newcomers no longer need to wrestle with complex cryptographic keys; instead, they can leverage intuitive tools that ensure both security and ease of use. As Nostr continues to grow, the focus on refining UX is making it an increasingly viable and compelling alternative to traditional social networks.

**Integration with Lightning Network**

Integrating Bitcoin’s Lightning Network into Nostr is a game-changer, revolutionizing how value is exchanged within the network. With seamless microtransactions and tipping systems, I can directly support content creators, developers, and other users without relying on traditional ad-driven revenue models or third-party payment processors. This fosters a more organic, community-driven economy where creators are rewarded instantly and fairly for their contributions.

By using Bitcoin for payments and interactions, Nostr enhances financial sovereignty, allowing users like me to transact in a truly decentralized manner—free from corporate gatekeepers, banking restrictions, or censorship. However, it’s important to remember that Nostr is still in its early days. While the potential is enormous, adoption and refinement take time. Content creators and users alike may need to be patient as the ecosystem matures, but those who embrace it early are helping to shape the future of open, censorship-resistant communication and finance.

**Privacy and Security Enhancements**

One of the most significant advancements in Nostr has been the introduction of end-to-end encrypted messaging, ensuring truly private and secure communication. Unlike traditional platforms that may scan, store, or even monetize user conversations, Nostr guarantees that only the intended recipient can decrypt and read messages. This level of privacy is a game-changer for those who value secure, censorship-resistant interactions.

Beyond private messaging, new identity verification methods leveraging cryptographic signatures have also emerged, allowing users to confirm authenticity without sacrificing pseudonymity. This means that while I can prove I am who I say I am, I don’t have to tie my identity to a real-world name, giving me the best of both security and privacy in an increasingly surveilled digital landscape.

Mainstream Adoption and High-Profile Endorsements

As Nostr continues to gain traction, high-profile figures like Jack Dorsey have publicly supported and contributed to its development, lending credibility and visibility to the project. His endorsement, along with growing enthusiasm from privacy advocates, developers, and free speech supporters, has accelerated Nostr’s momentum.

More developers and tech enthusiasts are now embracing Nostr as a viable alternative to corporate-controlled social networks, building innovative applications and expanding its ecosystem. While still in its early days, the rapid pace of development suggests that Nostr is on a trajectory toward becoming a mainstream, decentralized communication platform that challenges the dominance of traditional social media.

**Challenges and the Road Ahead**

Despite its rapid progress, Nostr still faces some hurdles that need to be overcome for it to achieve mainstream adoption:

Scalability Issues: Maintaining a reliable and efficient relay system remains challenging as the number of users grows, which is understandable.

User Adoption and Education: While I find the protocol exciting, helping non-technical users (like me in a lot of ways) understand its benefits and navigate its interface is an ongoing challenge.

Without centralized control, Nostr relies on decentralized, user-driven solutions for spam and moderation. Relays set their own rules, allowing users to choose environments that match their preferences—some with strict moderation, others more open.

Client-side filtering also plays a key role, with modern Nostr clients enabling users to block, mute, or filter unwanted content. Reputation-based systems and algorithmic filtering are emerging to help surface valuable discussions while minimizing spam. As Nostr evolves, these community-driven approaches will continue to refine the balance between free expression and a quality user experience.

**Conclusion**

The advancement of the Nostr protocol marks a major shift toward decentralized, censorship-resistant communication networks. By giving users like US full control over their data and interactions, Nostr presents a strong alternative to traditional social media platforms. As the protocol continues to evolve, its integration with other decentralized technologies, such as Bitcoin and cryptographic identity solutions, will further solidify its role in shaping the future of the Internet.

While challenges remain, I firmly believe Nostr is redefining how we interact online by prioritizing freedom, privacy, and resilience in the digital age. I may be old, but I love Nostr and am glad I can participate at such an early stage. Let's learn together!

-

@ d34e832d:383f78d0

2025-02-24 21:09:52

https://blossom.primal.net/af0bc86b52c7f91c26633ed0cba4f151bb74e5a5702b892f7f1efaa9e4640018.mp4

[npub16d8gxt2z4k9e8sdpc0yyqzf5gp0np09ls4lnn630qzxzvwpl0rgq5h4rzv]

### **What is Reticulum?**

Reticulum is a cryptographic networking stack designed for resilient, decentralized, and censorship-resistant communication. Unlike the traditional internet, Reticulum enables fully independent digital communications over various physical mediums, such as radio, LoRa, serial links, and even TCP/IP.

The key advantages of Reticulum include:

- **Decentralization** – No reliance on centralized infrastructure.

- **Encryption & Privacy** – End-to-end encryption built-in.

- **Resilience** – Operates over unreliable and low-bandwidth links.

- **Interoperability** – Works over WiFi, LoRa, Bluetooth, and more.

- **Ease of Use** – Can run on minimal hardware, including Raspberry Pi and embedded devices.

Reticulum is ideal for off-grid, censorship-resistant communications, emergency preparedness, and secure messaging.

---

## **1. Getting Started with Reticulum**

To quickly get started with Reticulum, follow the official guide:

[Reticulum: Getting Started Fast](https://markqvist.github.io/Reticulum/manual/gettingstartedfast.html)

### **Step 1: Install Reticulum**

#### **On Linux (Debian/Ubuntu-based systems)**

```sh

sudo apt update && sudo apt upgrade -y

sudo apt install -y python3-pip

pip3 install rns

```

#### **On Raspberry Pi or ARM-based Systems**

```sh

pip3 install rns

```

#### **On Windows**

Using Windows Subsystem for Linux (WSL) or Python:

```sh

pip install rns

```

#### **On macOS**

```sh

pip3 install rns

```

---

## **2. Configuring Reticulum**

Once installed, Reticulum needs a configuration file. The default location is:

```sh

~/.config/reticulum/config.toml

```

To generate the default configuration:

```sh

rnsd

```

This creates a configuration file with default settings.

---

## **3. Using Reticulum**

### **Starting the Reticulum Daemon**

To run the Reticulum daemon (`rnsd`), use:

```sh

rnsd

```

This starts the network stack, allowing applications to communicate over Reticulum.

### **Testing Your Reticulum Node**

Run the diagnostic tool to ensure your node is functioning:

```sh

rnstatus

```

This shows the status of all connected interfaces and peers.

---

## **4. Adding Interfaces**

### **LoRa Interface (for Off-Grid Communications)**

Reticulum supports long-range LoRa radios like the **RAK Wireless** and **Meshtastic devices**. To add a LoRa interface, edit `config.toml` and add:

```toml

[[interfaces]]

type = "LoRa"

name = "My_LoRa_Interface"

frequency = 868.0

bandwidth = 125

spreading_factor = 9

```

Restart Reticulum to apply the changes.

### **Serial (For Direct Device-to-Device Links)**

For communication over serial links (e.g., between two Raspberry Pis):

```toml

[[interfaces]]

type = "Serial"

port = "/dev/ttyUSB0"

baudrate = 115200

```

### **TCP/IP (For Internet-Based Nodes)**

If you want to bridge your Reticulum node over an existing IP network:

```toml

[[interfaces]]

type = "TCP"

listen = true

bind = "0.0.0.0"

port = 4242

```

---

## **5. Applications Using Reticulum**

### **LXMF (LoRa Mesh Messaging Framework)**

LXMF is a delay-tolerant, fully decentralized messaging system that operates over Reticulum. It allows encrypted, store-and-forward messaging without requiring an always-online server.

To install:

```sh

pip3 install lxmf

```

To start the LXMF node:

```sh

lxmfd

```

### **Nomad Network (Decentralized Chat & File Sharing)**

Nomad is a Reticulum-based chat and file-sharing platform, ideal for **off-grid** communication.

To install:

```sh

pip3 install nomad-network

```

To run:

```sh

nomad

```

### **Mesh Networking with Meshtastic & Reticulum**

Reticulum can work alongside **Meshtastic** for true decentralized long-range communication.

To set up a Meshtastic bridge:

```toml

[[interfaces]]

type = "LoRa"

port = "/dev/ttyUSB0"

baudrate = 115200

```

---

## **6. Security & Privacy Features**

- **Automatic End-to-End Encryption** – Every message is encrypted by default.

- **No Centralized Logging** – Communication leaves no metadata traces.

- **Self-Healing Routing** – Designed to work in unstable or hostile environments.

---

## **7. Practical Use Cases**

- **Off-Grid Communication** – Works in remote areas without cellular service.

- **Censorship Resistance** – Cannot be blocked by ISPs or governments.

- **Emergency Networks** – Enables resilient communication during disasters.

- **Private P2P Networks** – Create a secure, encrypted communication layer.

---

## **8. Further Exploration & Documentation**

- **Reticulum Official Manual**: [https://markqvist.github.io/Reticulum/manual/](https://markqvist.github.io/Reticulum/manual/)

- **Reticulum GitHub Repository**: [https://github.com/markqvist/Reticulum](https://github.com/markqvist/Reticulum)

- **Nomad Network**: [https://github.com/markqvist/NomadNet](https://github.com/markqvist/NomadNet)

- **Meshtastic + Reticulum**: [https://meshtastic.org](https://meshtastic.org)

---

## **Connections (Links to Other Notes)**

- **Mesh Networking for Decentralized Communication**

- **LoRa and Off-Grid Bitcoin Transactions**

- **Censorship-Resistant Communication Using Nostr & Reticulum**

## **Tags**

#Reticulum #DecentralizedComms #MeshNetworking #CensorshipResistance #LoRa

## **Donations via**

- **Bitcoin Lightning**: lightninglayerhash@getalby.com

@ b8af284d:f82c91dd

2025-02-25 08:11:32Liebe Abonnenten, *„The Fourth Turning“ ist ein epochemachendes wie hellseherisches Buch von William Strauss und Neil Howe. Es erschien 1997 mit der These, wonach Geschichte in Zyklen von 80 bis 100 Jahren verlaufe. Jede Gesellschaft durchlaufe vier Phasen („Turnings“): **High, Awakening, Unraveling und Crisis**. Nach der Crisis kommt es zum „Fourth Turning“ - welches die Autoren in den Jahren 2020 bis 2030 prophezeiten. Das klingt nach esoterischer Science-Fiction-Literatur, ist es aber nicht: Der mittlerweile verstorbene Strauss war Historiker, Howl ist Ökonom. In „The Fourth Turning“ argumentieren sie demnach weitgehend wissenschaftlich. Die Argumentation hier wiederzugeben, würden den Rahmen sprengen. Aber nur soviel: Wir sind mittendrin. Abseits des turbulenten Tagesgeschehens beginnt sich, eine neue Finanzordnung abzuzeichnen.*  Musk und sein “[Department of Government Efficiency](https://x.com/DOGE)” drehen gerade jeden Stein um, den sie finden können. Alle Ausgaben der Regierung kommen auf den Prüfstand. Deswegen wurden sämtliche Zahlungen an die vermeintliche Entwicklungshilfe-Organisation USAID gestrichen. In die meisten Leitmedien schafften es nur Meldungen, wonach nun [Projekte zur Förderung von Beschneidungen in Mozambique und Biodiversität in Nepal ](https://x.com/DOGE/status/1890849405932077378)kein Geld mehr erhalten. Weniger war davon zu lesen, dass USAID als Deckorganisation für die CIA funktionierte und zum Beispiel[ die Forschung an pathogenen Corona-Viren in China](https://www.washingtonexaminer.com/news/486983/usaid-wont-give-details-on-4-67-million-grant-to-wuhan-lab-collaborator-ecohealth-alliance/) mit 4,6 Millionen finanzierte. Auch mit dabei: [2,6 Millionen Dollar an ein Zensur-Programm namens “Center for Countering Digital Hate (CCDH](https://x.com/AllumBokhari/status/1892027594666541412))” und vieles mehr: eine gute Übersicht findet man hier auf der [Website des Weißen Haus](https://www.whitehouse.gov/fact-sheets/2025/02/at-usaid-waste-and-abuse-runs-deep/)’. Die Einsparungen sind so hoch aktuell rund neun Milliarden US-Dollar, das darüber nachgedacht wird, einen Teil der Steuergelder wieder an die Bürger zurückzuzahlen: [Die “DogeDividend” könnte bei 5000$ pro Kopf liegen](https://x.com/DeItaone/status/1892182305487097877). (Wer sich noch an den Covid-Stimulus in Höhe von 1200$ erinnert, weiß, welche Rally die Zahlungen 2020 auslösten). Der Kassensturz umfasst aber längst nicht nur USAID, sondern betrifft sämtliche Staatsausgaben. Sämtliche Ausgaben und Vermögenswerte der USA werden erfasst und hinsichtlich ihrer Nützlichkeit überprüft. Im Rahmen von DOGE ließ Elon Musk kürzlich fragen, ob es nicht mal Zeit für eine Zählung der Gold-Reserven wäre. In Fort Knox, das die meisten wahrscheinlich aus James-Bond-Filmen oder Donald-Duck-Comics kennen, lagern mindestens 4800 Tonnen Gold - über die Hälfte der amerikanischen Reserven. Das heißt: Niemand weiß genau, wie viel es eigentlich sind. Die letzte Inventur fand 1953 statt. Dasselbe gilt für die Zahlungen in die Ukraine. Mindestens 270 Milliarden US-Dollar haben die USA an Kiew gezahlt. Das Resultat: vermutlich über eine halbe Million Tote, ein völlig zerstörtes Land und ein korruptes System. Nach der Rede von JD Vance bei der Münchener Sicherheitskonferenz ist Europa erst einmal in Schnappatmung gefallen. Am Dienstag darauf folgten zum ersten Mal seit Jahren direkte Gespräche zwischen Moskau und Washington in Saudi-Arabien. Europäer waren nicht eingeladen, die hielten stattdessen ein Krisentreffen in Paris ab.  Innerhalb der EU wird jetzt von einem neuen Militärfonds gefaselt, um die größte Aufrüstung des Kontinents seit 1933 zu finanzieren. [700 Milliarden Euro soll der umfassen, finanziert durch Steuererhöhungen](https://www.berliner-zeitung.de/wirtschaft-verantwortung/baerbock-verplappert-sich-nach-der-wahl-milliarden-fuer-ukraine-li.2295623), da ja der Schutz der USA jetzt wegfalle. Man kann nur hoffen, dass die EU-Bürokratie zusammen mit Selenski nicht auf die Idee kommt, den Krieg allein weiterzuführen oder den Friedensprozess zu sabotieren. Vielen dürfte allerdings klar sein, dass sich demnächst etwas grundsätzlich ändern wird. Die Trump-Administration ordnet die Welt neu, und damit auch die globale Finanzarchitektur. Was hat es damit auf sich? Und worum geht es eigentlich? Zur Erinnerung: Mit dem Beitritt Chinas zur Welthandelsorganisation 2001 wurde die industrielle Basis der USA nach und nach ausgehöhlt. Chinesische Waren waren billiger - und so verlagerten sich immer mehr Industrien nach China. Deutschland profitierte relativ länger von dieser Entwicklung, da die Automobilindustrie wettbewerbsfähiger war und deutsche Maschinenbauer chinesische Fabriken ausstatteten. \ Trump 1 versuchte diese Entwicklung mit Zöllen zu unterbinden. Bei Trump 2 geht es um mehr. Zölle sind nur noch die vorübergehende Waffe, die Ziele durchzusetzen. Ziel ist ein schwächerer Dollar.  Eine starke Währung klingt nett, bedeutet aber nichts anderes, als dass Importe aus anderen Ländern günstiger sind und Exporte in andere Länder vergleichsweise teurer sind. Eine schwächere Währung heißt dagegen, dass Exporte günstiger und damit wettbewerbsfähiger sind. Ein starker Dollar behindert deswegen den (Rück-)Aufbau der amerikanischen Industrie. Allerdings ist das eben auch genau der Preis, den ein Land für eine Leit- oder Reserve-Währung zahlen muss. Weil die Welt mit US-Dollar bezahlt - auch ein mexikanisches Unternehmen, das mit einem chinesischen handelt, wickelt das mit Dollar ab - ist die Nachfrage nach US-Dollar hoch, und die Währung damit stark: > *From a trade perspective, the dollar is persistently overvalued, in large part because dollar assets function as the world’s reserve currency. This overvaluation has weighed heavily on the American manufacturing sector while benefiting financialized sectors of the economy in manners that benefit wealthy Americans.* Die USA zahlten indirekt für dieses Privileg, indem sie es sich zur Aufgabe machten, internationale Handelswege zu schützen. Die US-Marine übernahm nach 1945 und besonders nach 1989 den Job der British Royal Navy, und bewacht seitdem alle wichtigen Schifffahrtswege weltweit, um freien Handel zu ermöglichen. \ *The U.S. dollar is the reserve asset in large part because America provides stability, liquidity, market depth and the rule of law. Those are related to the characteristics that make America powerful enough to project physical force worldwide and allow it to shape and defend the global international order. The history of intertwinement between reserve currency status and national security is long.*  Das System funktionierte auch deswegen, weil die allermeisten, befreundeten Staaten, ihr Überschüsse wieder in US-Dollar-Anleihen anlegten (US-Treasuries). Dieses Recycling aus “Amerikaner konsumieren und zahlen mit US-Dollar, die China, Japan und die EU wiederum in US-Anleihen anlegen” funktionierte lange gut. Das Problem ist seit einigen Jahren: Die Situation hat sich zuungunsten der USA verschoben. Man zahlt viel für das Militär, aber die Gewinne, die sich aus einer Leitwährung ergeben, sind gefallen. Kurz gesagt: Das Verteidigungsbudget wächst, während Arbeitsplätze verloren gegangen sind. Zwar konnten sich die USA in den vergangenen Jahren günstiger als andere verschulden. Trotzdem erdrückt die Schuldenlast mittlerweile den Etat, und immer weniger Staaten haben Lust, ihre Reserven in US-Treasuries anzulegen. Sie kaufen lieber Gold (und vielleicht auch bald Bitcoin).  Eine Neugewichtung des Deals ist notwendig. Daher der Kassensturz. Daher die ständigen Aufforderungen Trumps an Verbündete, künftig mehr zu zahlen. Die Lösung könnte ein „Mar-a-Lago“-Accord sein. Die USA befanden sich in den 1980er Jahren schon einmal in einer ähnlichen Situation: Japanische und deutsche Waren überschwemmten die amerikanischen Märkte. Nach einem verlorenen Krieg in Vietnam und hoher Inflation hatten sich innerhalb Gesellschaft große Spannungen aufgebaut. Ronald Reagan, übrigens ein Präsident, der ähnlich polarisierte wie Trump heute, sprach 1985 Klartext: Japan und in geringerem Maße die BRD, Frankreich und Großbritannien hatten ihre Währungen aufzuwerten. Damit wurde die Flut der Exporte in die USA gestemmt und die Finanzflüsse stabilisiert. Seit einigen Wochen gibt es relativ klare Pläne, wie diese neue Ordnung aussehen soll. Sie gehen zurück auf den Ökonomen Steve Miran, der bereits unter der ersten Trump-Administration eine Berater-Rolle hatte. Seit Dezember 2024 ist der Vorsitzender des Council of Economic Advisers. Miran wiederum steht [Zoltan Pozsar nahe, der 2022/23 zum Shooting Star der Macro-Economy-Nerds wurde](https://www.finews.ch/themen/guruwatch/58206-zoltan-pozsar-ex-uno-plures-resarch-dollar-zinsen-bretton-woods-ungarn). Worum geht es? Weiter geht es auf <https://blingbling.substack.com/p/der-mar-a-lago-accord>

@ b8af284d:f82c91dd

2025-02-25 08:11:32Liebe Abonnenten, *„The Fourth Turning“ ist ein epochemachendes wie hellseherisches Buch von William Strauss und Neil Howe. Es erschien 1997 mit der These, wonach Geschichte in Zyklen von 80 bis 100 Jahren verlaufe. Jede Gesellschaft durchlaufe vier Phasen („Turnings“): **High, Awakening, Unraveling und Crisis**. Nach der Crisis kommt es zum „Fourth Turning“ - welches die Autoren in den Jahren 2020 bis 2030 prophezeiten. Das klingt nach esoterischer Science-Fiction-Literatur, ist es aber nicht: Der mittlerweile verstorbene Strauss war Historiker, Howl ist Ökonom. In „The Fourth Turning“ argumentieren sie demnach weitgehend wissenschaftlich. Die Argumentation hier wiederzugeben, würden den Rahmen sprengen. Aber nur soviel: Wir sind mittendrin. Abseits des turbulenten Tagesgeschehens beginnt sich, eine neue Finanzordnung abzuzeichnen.*  Musk und sein “[Department of Government Efficiency](https://x.com/DOGE)” drehen gerade jeden Stein um, den sie finden können. Alle Ausgaben der Regierung kommen auf den Prüfstand. Deswegen wurden sämtliche Zahlungen an die vermeintliche Entwicklungshilfe-Organisation USAID gestrichen. In die meisten Leitmedien schafften es nur Meldungen, wonach nun [Projekte zur Förderung von Beschneidungen in Mozambique und Biodiversität in Nepal ](https://x.com/DOGE/status/1890849405932077378)kein Geld mehr erhalten. Weniger war davon zu lesen, dass USAID als Deckorganisation für die CIA funktionierte und zum Beispiel[ die Forschung an pathogenen Corona-Viren in China](https://www.washingtonexaminer.com/news/486983/usaid-wont-give-details-on-4-67-million-grant-to-wuhan-lab-collaborator-ecohealth-alliance/) mit 4,6 Millionen finanzierte. Auch mit dabei: [2,6 Millionen Dollar an ein Zensur-Programm namens “Center for Countering Digital Hate (CCDH](https://x.com/AllumBokhari/status/1892027594666541412))” und vieles mehr: eine gute Übersicht findet man hier auf der [Website des Weißen Haus](https://www.whitehouse.gov/fact-sheets/2025/02/at-usaid-waste-and-abuse-runs-deep/)’. Die Einsparungen sind so hoch aktuell rund neun Milliarden US-Dollar, das darüber nachgedacht wird, einen Teil der Steuergelder wieder an die Bürger zurückzuzahlen: [Die “DogeDividend” könnte bei 5000$ pro Kopf liegen](https://x.com/DeItaone/status/1892182305487097877). (Wer sich noch an den Covid-Stimulus in Höhe von 1200$ erinnert, weiß, welche Rally die Zahlungen 2020 auslösten). Der Kassensturz umfasst aber längst nicht nur USAID, sondern betrifft sämtliche Staatsausgaben. Sämtliche Ausgaben und Vermögenswerte der USA werden erfasst und hinsichtlich ihrer Nützlichkeit überprüft. Im Rahmen von DOGE ließ Elon Musk kürzlich fragen, ob es nicht mal Zeit für eine Zählung der Gold-Reserven wäre. In Fort Knox, das die meisten wahrscheinlich aus James-Bond-Filmen oder Donald-Duck-Comics kennen, lagern mindestens 4800 Tonnen Gold - über die Hälfte der amerikanischen Reserven. Das heißt: Niemand weiß genau, wie viel es eigentlich sind. Die letzte Inventur fand 1953 statt. Dasselbe gilt für die Zahlungen in die Ukraine. Mindestens 270 Milliarden US-Dollar haben die USA an Kiew gezahlt. Das Resultat: vermutlich über eine halbe Million Tote, ein völlig zerstörtes Land und ein korruptes System. Nach der Rede von JD Vance bei der Münchener Sicherheitskonferenz ist Europa erst einmal in Schnappatmung gefallen. Am Dienstag darauf folgten zum ersten Mal seit Jahren direkte Gespräche zwischen Moskau und Washington in Saudi-Arabien. Europäer waren nicht eingeladen, die hielten stattdessen ein Krisentreffen in Paris ab.  Innerhalb der EU wird jetzt von einem neuen Militärfonds gefaselt, um die größte Aufrüstung des Kontinents seit 1933 zu finanzieren. [700 Milliarden Euro soll der umfassen, finanziert durch Steuererhöhungen](https://www.berliner-zeitung.de/wirtschaft-verantwortung/baerbock-verplappert-sich-nach-der-wahl-milliarden-fuer-ukraine-li.2295623), da ja der Schutz der USA jetzt wegfalle. Man kann nur hoffen, dass die EU-Bürokratie zusammen mit Selenski nicht auf die Idee kommt, den Krieg allein weiterzuführen oder den Friedensprozess zu sabotieren. Vielen dürfte allerdings klar sein, dass sich demnächst etwas grundsätzlich ändern wird. Die Trump-Administration ordnet die Welt neu, und damit auch die globale Finanzarchitektur. Was hat es damit auf sich? Und worum geht es eigentlich? Zur Erinnerung: Mit dem Beitritt Chinas zur Welthandelsorganisation 2001 wurde die industrielle Basis der USA nach und nach ausgehöhlt. Chinesische Waren waren billiger - und so verlagerten sich immer mehr Industrien nach China. Deutschland profitierte relativ länger von dieser Entwicklung, da die Automobilindustrie wettbewerbsfähiger war und deutsche Maschinenbauer chinesische Fabriken ausstatteten. \ Trump 1 versuchte diese Entwicklung mit Zöllen zu unterbinden. Bei Trump 2 geht es um mehr. Zölle sind nur noch die vorübergehende Waffe, die Ziele durchzusetzen. Ziel ist ein schwächerer Dollar.  Eine starke Währung klingt nett, bedeutet aber nichts anderes, als dass Importe aus anderen Ländern günstiger sind und Exporte in andere Länder vergleichsweise teurer sind. Eine schwächere Währung heißt dagegen, dass Exporte günstiger und damit wettbewerbsfähiger sind. Ein starker Dollar behindert deswegen den (Rück-)Aufbau der amerikanischen Industrie. Allerdings ist das eben auch genau der Preis, den ein Land für eine Leit- oder Reserve-Währung zahlen muss. Weil die Welt mit US-Dollar bezahlt - auch ein mexikanisches Unternehmen, das mit einem chinesischen handelt, wickelt das mit Dollar ab - ist die Nachfrage nach US-Dollar hoch, und die Währung damit stark: > *From a trade perspective, the dollar is persistently overvalued, in large part because dollar assets function as the world’s reserve currency. This overvaluation has weighed heavily on the American manufacturing sector while benefiting financialized sectors of the economy in manners that benefit wealthy Americans.* Die USA zahlten indirekt für dieses Privileg, indem sie es sich zur Aufgabe machten, internationale Handelswege zu schützen. Die US-Marine übernahm nach 1945 und besonders nach 1989 den Job der British Royal Navy, und bewacht seitdem alle wichtigen Schifffahrtswege weltweit, um freien Handel zu ermöglichen. \ *The U.S. dollar is the reserve asset in large part because America provides stability, liquidity, market depth and the rule of law. Those are related to the characteristics that make America powerful enough to project physical force worldwide and allow it to shape and defend the global international order. The history of intertwinement between reserve currency status and national security is long.*  Das System funktionierte auch deswegen, weil die allermeisten, befreundeten Staaten, ihr Überschüsse wieder in US-Dollar-Anleihen anlegten (US-Treasuries). Dieses Recycling aus “Amerikaner konsumieren und zahlen mit US-Dollar, die China, Japan und die EU wiederum in US-Anleihen anlegen” funktionierte lange gut. Das Problem ist seit einigen Jahren: Die Situation hat sich zuungunsten der USA verschoben. Man zahlt viel für das Militär, aber die Gewinne, die sich aus einer Leitwährung ergeben, sind gefallen. Kurz gesagt: Das Verteidigungsbudget wächst, während Arbeitsplätze verloren gegangen sind. Zwar konnten sich die USA in den vergangenen Jahren günstiger als andere verschulden. Trotzdem erdrückt die Schuldenlast mittlerweile den Etat, und immer weniger Staaten haben Lust, ihre Reserven in US-Treasuries anzulegen. Sie kaufen lieber Gold (und vielleicht auch bald Bitcoin).  Eine Neugewichtung des Deals ist notwendig. Daher der Kassensturz. Daher die ständigen Aufforderungen Trumps an Verbündete, künftig mehr zu zahlen. Die Lösung könnte ein „Mar-a-Lago“-Accord sein. Die USA befanden sich in den 1980er Jahren schon einmal in einer ähnlichen Situation: Japanische und deutsche Waren überschwemmten die amerikanischen Märkte. Nach einem verlorenen Krieg in Vietnam und hoher Inflation hatten sich innerhalb Gesellschaft große Spannungen aufgebaut. Ronald Reagan, übrigens ein Präsident, der ähnlich polarisierte wie Trump heute, sprach 1985 Klartext: Japan und in geringerem Maße die BRD, Frankreich und Großbritannien hatten ihre Währungen aufzuwerten. Damit wurde die Flut der Exporte in die USA gestemmt und die Finanzflüsse stabilisiert. Seit einigen Wochen gibt es relativ klare Pläne, wie diese neue Ordnung aussehen soll. Sie gehen zurück auf den Ökonomen Steve Miran, der bereits unter der ersten Trump-Administration eine Berater-Rolle hatte. Seit Dezember 2024 ist der Vorsitzender des Council of Economic Advisers. Miran wiederum steht [Zoltan Pozsar nahe, der 2022/23 zum Shooting Star der Macro-Economy-Nerds wurde](https://www.finews.ch/themen/guruwatch/58206-zoltan-pozsar-ex-uno-plures-resarch-dollar-zinsen-bretton-woods-ungarn). Worum geht es? Weiter geht es auf <https://blingbling.substack.com/p/der-mar-a-lago-accord> @ 57d1a264:69f1fee1

2025-02-25 07:28:18  @Voltage team will be building a simple implementation of a Lightning gated API service using a Voltage LND Node and the L402 protocol. 📅 Thursday, February 27th 4:00 PM CDT 📷 Live on Voltage Discord, on X, or on YouTube. - discord.gg/EN93fDfQ - https://x.com/voltage_cloud/status/1892938201980919985 - https://www.youtube.com/@voltage_cloud originally posted at https://stacker.news/items/896373

@ 57d1a264:69f1fee1

2025-02-25 07:28:18  @Voltage team will be building a simple implementation of a Lightning gated API service using a Voltage LND Node and the L402 protocol. 📅 Thursday, February 27th 4:00 PM CDT 📷 Live on Voltage Discord, on X, or on YouTube. - discord.gg/EN93fDfQ - https://x.com/voltage_cloud/status/1892938201980919985 - https://www.youtube.com/@voltage_cloud originally posted at https://stacker.news/items/896373 @ 6389be64:ef439d32

2025-02-25 05:53:41Biochar in the soil attracts microbes who take up permanent residence in the "coral reef" the biochar provides. Those microbes then attract mycorrhizal fungi to the reef. The mycorrhizal fungi are also attached to plant roots connecting diverse populations to each other, allowing transportation of molecular resources (water, cations, anions etc). The char surface area attracts positively charged ions like K+ Ca2+ Mg2+ NH4+ Na+ H+ Al3+ Fe2+ Fe3+ Mn2+ Cu2+ Zn2+ Many of these are transferred to plant roots by mycorrhizal fungi in exchange for photosynthetic products (sugars). Mycorrhizal fungi are connected to both plant roots and biochar. Char adsorbs these cations so, it stands to reason that under periods of minimal need by plants for these cations (stress, low or no sunlight etc.), mycorrhizal fungi could deposit the cations to the char surfaces. The char would be acting as a "bank" for the cations and the deposition would be of low energy cost. Once the plant starts exuding photosynthetic products again, signaling a need for these cations, the fungi can start "stripping" the cations off of the char surface for immediate exchange of the cations for the sugars. This would be a high energy transaction because the fungi would have to expend energy to strip the cations off of the char surface, in effect, an "interest rate". The char might act as a reservoir of cations that were mined by the fungi while the sugar flow from the roots was active. It's a bank. originally posted at https://stacker.news/items/896340

@ 6389be64:ef439d32

2025-02-25 05:53:41Biochar in the soil attracts microbes who take up permanent residence in the "coral reef" the biochar provides. Those microbes then attract mycorrhizal fungi to the reef. The mycorrhizal fungi are also attached to plant roots connecting diverse populations to each other, allowing transportation of molecular resources (water, cations, anions etc). The char surface area attracts positively charged ions like K+ Ca2+ Mg2+ NH4+ Na+ H+ Al3+ Fe2+ Fe3+ Mn2+ Cu2+ Zn2+ Many of these are transferred to plant roots by mycorrhizal fungi in exchange for photosynthetic products (sugars). Mycorrhizal fungi are connected to both plant roots and biochar. Char adsorbs these cations so, it stands to reason that under periods of minimal need by plants for these cations (stress, low or no sunlight etc.), mycorrhizal fungi could deposit the cations to the char surfaces. The char would be acting as a "bank" for the cations and the deposition would be of low energy cost. Once the plant starts exuding photosynthetic products again, signaling a need for these cations, the fungi can start "stripping" the cations off of the char surface for immediate exchange of the cations for the sugars. This would be a high energy transaction because the fungi would have to expend energy to strip the cations off of the char surface, in effect, an "interest rate". The char might act as a reservoir of cations that were mined by the fungi while the sugar flow from the roots was active. It's a bank. originally posted at https://stacker.news/items/896340 @ ef1744f8:96fbc3fe

2025-02-25 05:51:23kZPO/Pgqm/nOfGtpHNVK3gcDhzs5sSvyVqUZlAJrs95os0xUFhO4VlBC5GuEYF0uYTTGVGe60TjK8sm+ixOIPxpd3eYGGtZs9CjkRzis8vU=?iv=KyDTZEV4fCT/lKJWR4heeQ==

@ ef1744f8:96fbc3fe

2025-02-25 05:51:23kZPO/Pgqm/nOfGtpHNVK3gcDhzs5sSvyVqUZlAJrs95os0xUFhO4VlBC5GuEYF0uYTTGVGe60TjK8sm+ixOIPxpd3eYGGtZs9CjkRzis8vU=?iv=KyDTZEV4fCT/lKJWR4heeQ== @ ef1744f8:96fbc3fe

2025-02-25 05:45:21B3rafJgfWeHKOv/c2y8pk7thAOvmYYooCN1BMJh+gtmngdanQ7Mnimz048gzTWlV8Ap6wHRtu2rD6W6KDt6r82HlaftHm8jRBH1BGJ8Aw+GYy/PRGuQnUZP3DcjZusRchZSIhWuFBnhonWUHrxwnzrmcolx6yPekWKzxn9DR8Kt2qWIxbg2791EnuQn6orrAdw8MJJQg/hZhEdqib8KuweUrn6YDPi8ICV099rHUAlWBR6NSn/kwyomarCmV6U0bucUiv5y6QrBUSIQGfMTKYGBgmdXdeWTQ4YSYTaF0cZNDCJorksVIxx32dpc8RhYsvooZwk0OAAGg5LO5dekA1rn5jZk6rbmAnRcvnQFcue0=?iv=gZIUGRNTRQULCjSeRae+YQ==

@ ef1744f8:96fbc3fe

2025-02-25 05:45:21B3rafJgfWeHKOv/c2y8pk7thAOvmYYooCN1BMJh+gtmngdanQ7Mnimz048gzTWlV8Ap6wHRtu2rD6W6KDt6r82HlaftHm8jRBH1BGJ8Aw+GYy/PRGuQnUZP3DcjZusRchZSIhWuFBnhonWUHrxwnzrmcolx6yPekWKzxn9DR8Kt2qWIxbg2791EnuQn6orrAdw8MJJQg/hZhEdqib8KuweUrn6YDPi8ICV099rHUAlWBR6NSn/kwyomarCmV6U0bucUiv5y6QrBUSIQGfMTKYGBgmdXdeWTQ4YSYTaF0cZNDCJorksVIxx32dpc8RhYsvooZwk0OAAGg5LO5dekA1rn5jZk6rbmAnRcvnQFcue0=?iv=gZIUGRNTRQULCjSeRae+YQ== @ ef1744f8:96fbc3fe

2025-02-25 04:39:34z9Lx1dooDqHDDhWqropQYC1DWuFDIPxnfgiKc2T0ZFYdD45DOQNWX/kVslqJzGIe3s7KB8QBIhaxcYte84h631adZwVR/15tZOC8FeeLeIt8fM8QCromJVIoPJU29yY4kLepPMDWw7WoWfDysolhLDv1dtPrOkIWZ+188YOjAc8byhgWsvWgfwxlfS+26BpZadFIBolA4kDqN1dO+SQnyM9mUD1jc3aLe4utOlij/+gU0XkN93W7637MBN41AXGBLAv4E4AG+ywAQrx8f2R8JUY+Vg+DLmq1/vuUH+S1qTC/Lz6HEy5H2HiGeSyK43UB7QV7HLGn0e5KUtn6dxjl/irrJQL6dDdilCpdCBgCBBk=?iv=xctArPoh36458mWve+tqEw==

@ ef1744f8:96fbc3fe

2025-02-25 04:39:34z9Lx1dooDqHDDhWqropQYC1DWuFDIPxnfgiKc2T0ZFYdD45DOQNWX/kVslqJzGIe3s7KB8QBIhaxcYte84h631adZwVR/15tZOC8FeeLeIt8fM8QCromJVIoPJU29yY4kLepPMDWw7WoWfDysolhLDv1dtPrOkIWZ+188YOjAc8byhgWsvWgfwxlfS+26BpZadFIBolA4kDqN1dO+SQnyM9mUD1jc3aLe4utOlij/+gU0XkN93W7637MBN41AXGBLAv4E4AG+ywAQrx8f2R8JUY+Vg+DLmq1/vuUH+S1qTC/Lz6HEy5H2HiGeSyK43UB7QV7HLGn0e5KUtn6dxjl/irrJQL6dDdilCpdCBgCBBk=?iv=xctArPoh36458mWve+tqEw== @ ef1744f8:96fbc3fe

2025-02-25 04:33:53qT0bRNd6LiQzh1Y34rZv39xcgw5TCv9xZ5xAxbHoBDrhfaYGyll5g4XvgHY0LgfxcxSt8XcMI50yjY19WYfwvxl0gASsXBljn8SzhlO4RiF0NorJCklhOjDo93kQON/pVOYNmIi9oGTpqMWWxE5Qh53tvA2zaPG67B6CBCjh7wbVnFrLqCdq1KV9iBSRZmFXaBYWcn3pFcGKlqTV/NGrHnVFwqjS1uFAZZrScwxWRmbM1TVplp6f5dHNxTfe8pXajSsvO3kXV5jRCLr6C2jJMWepUFWw33tjBCwGOyo9kbkf0C++OTHrlPMECi5vXq18C1L+bA0ouVlVlfYu5j/ywg==?iv=BgxOFzpGx/RiIRYKZZz/8g==

@ ef1744f8:96fbc3fe

2025-02-25 04:33:53qT0bRNd6LiQzh1Y34rZv39xcgw5TCv9xZ5xAxbHoBDrhfaYGyll5g4XvgHY0LgfxcxSt8XcMI50yjY19WYfwvxl0gASsXBljn8SzhlO4RiF0NorJCklhOjDo93kQON/pVOYNmIi9oGTpqMWWxE5Qh53tvA2zaPG67B6CBCjh7wbVnFrLqCdq1KV9iBSRZmFXaBYWcn3pFcGKlqTV/NGrHnVFwqjS1uFAZZrScwxWRmbM1TVplp6f5dHNxTfe8pXajSsvO3kXV5jRCLr6C2jJMWepUFWw33tjBCwGOyo9kbkf0C++OTHrlPMECi5vXq18C1L+bA0ouVlVlfYu5j/ywg==?iv=BgxOFzpGx/RiIRYKZZz/8g== @ ef1744f8:96fbc3fe

2025-02-25 04:19:37gGRBBQfw8RRgMK4XZ9kE3MpdCdFgngP/0/QQUfUdEbX6ZjUr2cZ6B6yID05lexoOosOSlzmPbTbx5y8Imur0ls8EHBik31l/IZdYdln8vPGnQ341Ul4Kp88VCjJ9UWNY6l+Sel9XbwwGGqzBvIIRsg+OWCAput62iAErCDmsVkMYMfnmhH8cSVYFOwEWqk4H1iKFSsWnRbRZ8w5scRXgjHIaQNQ6QSsSWAgC8jeZi7mFmTJN+JrBPBQEzM30AUWFpMjUy8NVKflfe9dRJ9j1OfDFCwZxAmohvBpWx3TgFDvcpAOnIH3J/d4XO7XJpZ4pJPSo5Sej73lDwYKQSEpGng==?iv=XKhoZRopkCInuqqAzP1haQ==

@ ef1744f8:96fbc3fe

2025-02-25 04:19:37gGRBBQfw8RRgMK4XZ9kE3MpdCdFgngP/0/QQUfUdEbX6ZjUr2cZ6B6yID05lexoOosOSlzmPbTbx5y8Imur0ls8EHBik31l/IZdYdln8vPGnQ341Ul4Kp88VCjJ9UWNY6l+Sel9XbwwGGqzBvIIRsg+OWCAput62iAErCDmsVkMYMfnmhH8cSVYFOwEWqk4H1iKFSsWnRbRZ8w5scRXgjHIaQNQ6QSsSWAgC8jeZi7mFmTJN+JrBPBQEzM30AUWFpMjUy8NVKflfe9dRJ9j1OfDFCwZxAmohvBpWx3TgFDvcpAOnIH3J/d4XO7XJpZ4pJPSo5Sej73lDwYKQSEpGng==?iv=XKhoZRopkCInuqqAzP1haQ== @ 04c915da:3dfbecc9

2025-02-25 03:55:08Here’s a revised timeline of macro-level events from *The Mandibles: A Family, 2029–2047* by Lionel Shriver, reimagined in a world where Bitcoin is adopted as a widely accepted form of money, altering the original narrative’s assumptions about currency collapse and economic control. In Shriver’s original story, the failure of Bitcoin is assumed amid the dominance of the bancor and the dollar’s collapse. Here, Bitcoin’s success reshapes the economic and societal trajectory, decentralizing power and challenging state-driven outcomes. ### Part One: 2029–2032 - **2029 (Early Year)**\ The United States faces economic strain as the dollar weakens against global shifts. However, Bitcoin, having gained traction emerges as a viable alternative. Unlike the original timeline, the bancor—a supranational currency backed by a coalition of nations—struggles to gain footing as Bitcoin’s decentralized adoption grows among individuals and businesses worldwide, undermining both the dollar and the bancor. - **2029 (Mid-Year: The Great Renunciation)**\ Treasury bonds lose value, and the government bans Bitcoin, labeling it a threat to sovereignty (mirroring the original bancor ban). However, a Bitcoin ban proves unenforceable—its decentralized nature thwarts confiscation efforts, unlike gold in the original story. Hyperinflation hits the dollar as the U.S. prints money, but Bitcoin’s fixed supply shields adopters from currency devaluation, creating a dual-economy split: dollar users suffer, while Bitcoin users thrive. - **2029 (Late Year)**\ Dollar-based inflation soars, emptying stores of goods priced in fiat currency. Meanwhile, Bitcoin transactions flourish in underground and online markets, stabilizing trade for those plugged into the bitcoin ecosystem. Traditional supply chains falter, but peer-to-peer Bitcoin networks enable local and international exchange, reducing scarcity for early adopters. The government’s gold confiscation fails to bolster the dollar, as Bitcoin’s rise renders gold less relevant. - **2030–2031**\ Crime spikes in dollar-dependent urban areas, but Bitcoin-friendly regions see less chaos, as digital wallets and smart contracts facilitate secure trade. The U.S. government doubles down on surveillance to crack down on bitcoin use. A cultural divide deepens: centralized authority weakens in Bitcoin-adopting communities, while dollar zones descend into lawlessness. - **2032**\ By this point, Bitcoin is de facto legal tender in parts of the U.S. and globally, especially in tech-savvy or libertarian-leaning regions. The federal government’s grip slips as tax collection in dollars plummets—Bitcoin’s traceability is low, and citizens evade fiat-based levies. Rural and urban Bitcoin hubs emerge, while the dollar economy remains fractured. ### Time Jump: 2032–2047 - Over 15 years, Bitcoin solidifies as a global reserve currency, eroding centralized control. The U.S. government adapts, grudgingly integrating bitcoin into policy, though regional autonomy grows as Bitcoin empowers local economies. ### Part Two: 2047 - **2047 (Early Year)**\ The U.S. is a hybrid state: Bitcoin is legal tender alongside a diminished dollar. Taxes are lower, collected in BTC, reducing federal overreach. Bitcoin’s adoption has decentralized power nationwide. The bancor has faded, unable to compete with Bitcoin’s grassroots momentum. - **2047 (Mid-Year)**\ Travel and trade flow freely in Bitcoin zones, with no restrictive checkpoints. The dollar economy lingers in poorer areas, marked by decay, but Bitcoin’s dominance lifts overall prosperity, as its deflationary nature incentivizes saving and investment over consumption. Global supply chains rebound, powered by bitcoin enabled efficiency. - **2047 (Late Year)**\ The U.S. is a patchwork of semi-autonomous zones, united by Bitcoin’s universal acceptance rather than federal control. Resource scarcity persists due to past disruptions, but economic stability is higher than in Shriver’s original dystopia—Bitcoin’s success prevents the authoritarian slide, fostering a freer, if imperfect, society. ### Key Differences - **Currency Dynamics**: Bitcoin’s triumph prevents the bancor’s dominance and mitigates hyperinflation’s worst effects, offering a lifeline outside state control. - **Government Power**: Centralized authority weakens as Bitcoin evades bans and taxation, shifting power to individuals and communities. - **Societal Outcome**: Instead of a surveillance state, 2047 sees a decentralized, bitcoin driven world—less oppressive, though still stratified between Bitcoin haves and have-nots. This reimagining assumes Bitcoin overcomes Shriver’s implied skepticism to become a robust, adopted currency by 2029, fundamentally altering the novel’s bleak trajectory.

@ 04c915da:3dfbecc9

2025-02-25 03:55:08Here’s a revised timeline of macro-level events from *The Mandibles: A Family, 2029–2047* by Lionel Shriver, reimagined in a world where Bitcoin is adopted as a widely accepted form of money, altering the original narrative’s assumptions about currency collapse and economic control. In Shriver’s original story, the failure of Bitcoin is assumed amid the dominance of the bancor and the dollar’s collapse. Here, Bitcoin’s success reshapes the economic and societal trajectory, decentralizing power and challenging state-driven outcomes. ### Part One: 2029–2032 - **2029 (Early Year)**\ The United States faces economic strain as the dollar weakens against global shifts. However, Bitcoin, having gained traction emerges as a viable alternative. Unlike the original timeline, the bancor—a supranational currency backed by a coalition of nations—struggles to gain footing as Bitcoin’s decentralized adoption grows among individuals and businesses worldwide, undermining both the dollar and the bancor. - **2029 (Mid-Year: The Great Renunciation)**\ Treasury bonds lose value, and the government bans Bitcoin, labeling it a threat to sovereignty (mirroring the original bancor ban). However, a Bitcoin ban proves unenforceable—its decentralized nature thwarts confiscation efforts, unlike gold in the original story. Hyperinflation hits the dollar as the U.S. prints money, but Bitcoin’s fixed supply shields adopters from currency devaluation, creating a dual-economy split: dollar users suffer, while Bitcoin users thrive. - **2029 (Late Year)**\ Dollar-based inflation soars, emptying stores of goods priced in fiat currency. Meanwhile, Bitcoin transactions flourish in underground and online markets, stabilizing trade for those plugged into the bitcoin ecosystem. Traditional supply chains falter, but peer-to-peer Bitcoin networks enable local and international exchange, reducing scarcity for early adopters. The government’s gold confiscation fails to bolster the dollar, as Bitcoin’s rise renders gold less relevant. - **2030–2031**\ Crime spikes in dollar-dependent urban areas, but Bitcoin-friendly regions see less chaos, as digital wallets and smart contracts facilitate secure trade. The U.S. government doubles down on surveillance to crack down on bitcoin use. A cultural divide deepens: centralized authority weakens in Bitcoin-adopting communities, while dollar zones descend into lawlessness. - **2032**\ By this point, Bitcoin is de facto legal tender in parts of the U.S. and globally, especially in tech-savvy or libertarian-leaning regions. The federal government’s grip slips as tax collection in dollars plummets—Bitcoin’s traceability is low, and citizens evade fiat-based levies. Rural and urban Bitcoin hubs emerge, while the dollar economy remains fractured. ### Time Jump: 2032–2047 - Over 15 years, Bitcoin solidifies as a global reserve currency, eroding centralized control. The U.S. government adapts, grudgingly integrating bitcoin into policy, though regional autonomy grows as Bitcoin empowers local economies. ### Part Two: 2047 - **2047 (Early Year)**\ The U.S. is a hybrid state: Bitcoin is legal tender alongside a diminished dollar. Taxes are lower, collected in BTC, reducing federal overreach. Bitcoin’s adoption has decentralized power nationwide. The bancor has faded, unable to compete with Bitcoin’s grassroots momentum. - **2047 (Mid-Year)**\ Travel and trade flow freely in Bitcoin zones, with no restrictive checkpoints. The dollar economy lingers in poorer areas, marked by decay, but Bitcoin’s dominance lifts overall prosperity, as its deflationary nature incentivizes saving and investment over consumption. Global supply chains rebound, powered by bitcoin enabled efficiency. - **2047 (Late Year)**\ The U.S. is a patchwork of semi-autonomous zones, united by Bitcoin’s universal acceptance rather than federal control. Resource scarcity persists due to past disruptions, but economic stability is higher than in Shriver’s original dystopia—Bitcoin’s success prevents the authoritarian slide, fostering a freer, if imperfect, society. ### Key Differences - **Currency Dynamics**: Bitcoin’s triumph prevents the bancor’s dominance and mitigates hyperinflation’s worst effects, offering a lifeline outside state control. - **Government Power**: Centralized authority weakens as Bitcoin evades bans and taxation, shifting power to individuals and communities. - **Societal Outcome**: Instead of a surveillance state, 2047 sees a decentralized, bitcoin driven world—less oppressive, though still stratified between Bitcoin haves and have-nots. This reimagining assumes Bitcoin overcomes Shriver’s implied skepticism to become a robust, adopted currency by 2029, fundamentally altering the novel’s bleak trajectory. @ f6488c62:c929299d

2025-02-25 03:22:49การที่สหรัฐอเมริกาปรับมูลค่าทองคำในคลัง (re-peg) จะมีผลกระทบที่สำคัญต่อทั้งระบบการเงินโลกและบิทคอยน์ ด้วยเหตุผลต่างๆ ที่อาจเกิดขึ้นดังนี้: ทองคำในฐานะสินทรัพย์เก็บมูลค่า: หากสหรัฐอเมริกาปรับราคาทองคำจาก 42 ดอลลาร์ต่อออนซ์เป็นราคาปัจจุบันที่สูงถึง 2,953.5 ดอลลาร์ต่อออนซ์ การปรับนี้จะทำให้ทองคำได้รับความนิยมและมีมูลค่าเพิ่มขึ้นอย่างมากในมุมมองของนักลงทุนทั่วโลก ส่งผลให้ทองคำมีบทบาทสำคัญขึ้นในระบบการเงิน อีกทั้งยังเป็นทางเลือกการลงทุนที่น่าสนใจมากขึ้นในฐานะ "safe haven" หรือสินทรัพย์ที่ปลอดภัย. ผลกระทบต่อตลาดดอลลาร์สหรัฐ: การประเมินมูลค่าทองคำใหม่จะทำให้ค่าเงินดอลลาร์อ่อนค่าลง เนื่องจากทองคำถูกมองว่าเป็นตัวบ่งชี้ความมั่งคั่งและเสถียรภาพทางการเงิน การอ่อนค่าของดอลลาร์อาจส่งผลให้บิทคอยน์เป็นที่น่าสนใจมากขึ้นในฐานะสินทรัพย์ที่ไม่ขึ้นกับเงินดอลลาร์และธนาคารกลางใด ๆ. การเติบโตของบิทคอยน์: เมื่อระบบการเงินดั้งเดิม (เช่น ดอลลาร์สหรัฐ) เริ่มสั่นคลอนหรือลดความน่าเชื่อถือ บิทคอยน์ซึ่งเป็นสินทรัพย์ดิจิทัลที่ไม่ขึ้นกับรัฐบาลหรือธนาคารกลางก็จะได้รับความสนใจมากขึ้นจากนักลงทุนที่ต้องการหลีกเลี่ยงความเสี่ยงในระบบการเงินแบบดั้งเดิม นอกจากนี้บิทคอยน์ยังถือเป็นสินทรัพย์ที่มีการจำกัดจำนวน (21 ล้าน BTC) ซึ่งถือว่าเป็นการป้องกันภาวะเงินเฟ้อที่มักจะเกิดขึ้นจากการพิมพ์เงินจำนวนมากโดยธนาคารกลาง. การปรับตัวของประเทศอื่นๆ: หากสหรัฐฯ ปรับมูลค่าทองคำใหม่ ประเทศอื่นๆ อาจจำเป็นต้องปรับเปลี่ยนมูลค่าทองคำของตนเองเพื่อตอบสนองต่อการเปลี่ยนแปลงนี้ และอาจเห็นการเคลื่อนไหวในการสนับสนุนสินทรัพย์ดิจิทัลอย่างบิทคอยน์มากขึ้นเพื่อกระจายความเสี่ยงจากการพึ่งพาระบบการเงินดอลลาร์สหรัฐ. สรุปได้ว่า หากการปรับมูลค่าทองคำของสหรัฐเป็นจริง การเคลื่อนไหวนี้อาจเป็นตัวกระตุ้นให้บิทคอยน์เติบโตขึ้น เนื่องจากนักลงทุนมองหาทางเลือกที่ปลอดภัยจากความไม่แน่นอนในระบบการเงินดั้งเดิม และเพิ่มการยอมรับในสินทรัพย์ดิจิทัลมากขึ้น.

@ f6488c62:c929299d

2025-02-25 03:22:49การที่สหรัฐอเมริกาปรับมูลค่าทองคำในคลัง (re-peg) จะมีผลกระทบที่สำคัญต่อทั้งระบบการเงินโลกและบิทคอยน์ ด้วยเหตุผลต่างๆ ที่อาจเกิดขึ้นดังนี้: ทองคำในฐานะสินทรัพย์เก็บมูลค่า: หากสหรัฐอเมริกาปรับราคาทองคำจาก 42 ดอลลาร์ต่อออนซ์เป็นราคาปัจจุบันที่สูงถึง 2,953.5 ดอลลาร์ต่อออนซ์ การปรับนี้จะทำให้ทองคำได้รับความนิยมและมีมูลค่าเพิ่มขึ้นอย่างมากในมุมมองของนักลงทุนทั่วโลก ส่งผลให้ทองคำมีบทบาทสำคัญขึ้นในระบบการเงิน อีกทั้งยังเป็นทางเลือกการลงทุนที่น่าสนใจมากขึ้นในฐานะ "safe haven" หรือสินทรัพย์ที่ปลอดภัย. ผลกระทบต่อตลาดดอลลาร์สหรัฐ: การประเมินมูลค่าทองคำใหม่จะทำให้ค่าเงินดอลลาร์อ่อนค่าลง เนื่องจากทองคำถูกมองว่าเป็นตัวบ่งชี้ความมั่งคั่งและเสถียรภาพทางการเงิน การอ่อนค่าของดอลลาร์อาจส่งผลให้บิทคอยน์เป็นที่น่าสนใจมากขึ้นในฐานะสินทรัพย์ที่ไม่ขึ้นกับเงินดอลลาร์และธนาคารกลางใด ๆ. การเติบโตของบิทคอยน์: เมื่อระบบการเงินดั้งเดิม (เช่น ดอลลาร์สหรัฐ) เริ่มสั่นคลอนหรือลดความน่าเชื่อถือ บิทคอยน์ซึ่งเป็นสินทรัพย์ดิจิทัลที่ไม่ขึ้นกับรัฐบาลหรือธนาคารกลางก็จะได้รับความสนใจมากขึ้นจากนักลงทุนที่ต้องการหลีกเลี่ยงความเสี่ยงในระบบการเงินแบบดั้งเดิม นอกจากนี้บิทคอยน์ยังถือเป็นสินทรัพย์ที่มีการจำกัดจำนวน (21 ล้าน BTC) ซึ่งถือว่าเป็นการป้องกันภาวะเงินเฟ้อที่มักจะเกิดขึ้นจากการพิมพ์เงินจำนวนมากโดยธนาคารกลาง. การปรับตัวของประเทศอื่นๆ: หากสหรัฐฯ ปรับมูลค่าทองคำใหม่ ประเทศอื่นๆ อาจจำเป็นต้องปรับเปลี่ยนมูลค่าทองคำของตนเองเพื่อตอบสนองต่อการเปลี่ยนแปลงนี้ และอาจเห็นการเคลื่อนไหวในการสนับสนุนสินทรัพย์ดิจิทัลอย่างบิทคอยน์มากขึ้นเพื่อกระจายความเสี่ยงจากการพึ่งพาระบบการเงินดอลลาร์สหรัฐ. สรุปได้ว่า หากการปรับมูลค่าทองคำของสหรัฐเป็นจริง การเคลื่อนไหวนี้อาจเป็นตัวกระตุ้นให้บิทคอยน์เติบโตขึ้น เนื่องจากนักลงทุนมองหาทางเลือกที่ปลอดภัยจากความไม่แน่นอนในระบบการเงินดั้งเดิม และเพิ่มการยอมรับในสินทรัพย์ดิจิทัลมากขึ้น. @ 8da249fe:ecc00e09