-

@ e31e84c4:77bbabc0

2025-02-25 15:03:34

*The Fine Line: Bitcoin Companies Navigating Regulation and Freedom was [written by Bri](https://x.com/cyberBri). If you enjoyed this article then support her writing, by donating to her lightning wallet: bri_1@walletofsatoshi.com*

We all know the value proposition of Bitcoin: Bitcoin cannot be controlled by the state. Bitcoin is permissionless, it doesn't need a KYC and we can send money to anyone in the world, without middlemen, without censorship, without limits.

However, when companies use Bitcoin, and more so when they offer Bitcoin services, their activities are indeed controlled by the state. In order to fulfil the regulatory requirements, companies usually have to employ entire compliance teams.

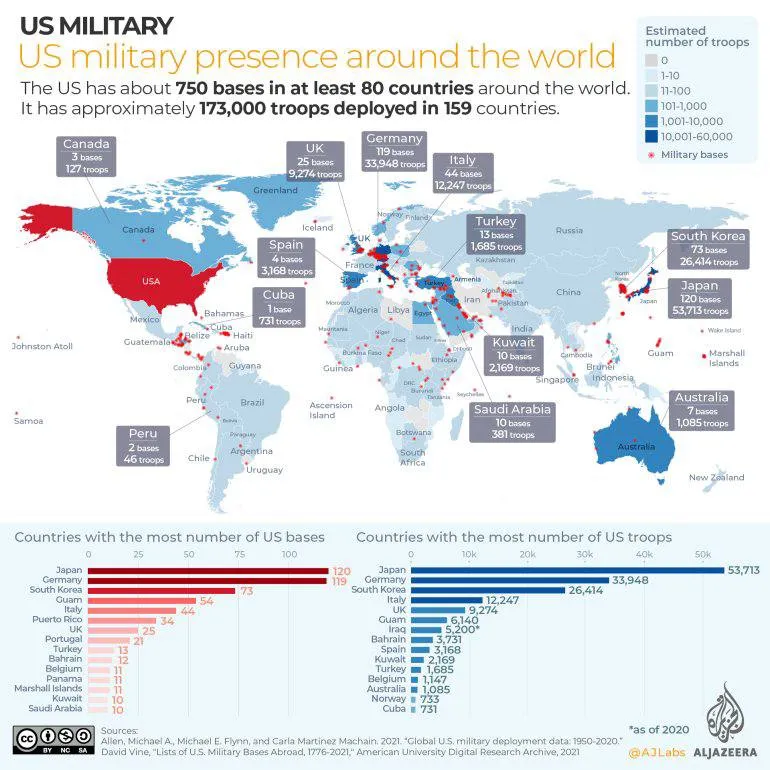

Bitcoin-only exchanges are probably not better off than crypto service providers, even if one can sometimes hopefully recognise an increasing pro-Bitcoin attitude in the world. The Bitcoin scene recently looked expectantly to Nashville when Trump appeared at the Bitcoin 2024 conference as part of his election campaign. He doesn't really seem to be able to distinguish between Bitcoin and crypto though – in his keynote speech he promised to make the U.S. the ‘crypto capital of the planet’.

Nevertheless, the news that the United States plans to accumulate Bitcoin as a strategic reserve currency made headlines around the world and many Bitcoin supporters are delighted. Bitcoin's negative image could be somewhat corrected and it would certainly also be beneficial for Bitcoin adoption, so the hope goes. And indeed, the price of Bitcoin climbed to new record highs during the US election campaign, reaching its ATH of USD 109,000 when Trump took office on 20 January 2025.

The US announcement of a bitcoin strategic reserve can certainly be described as a historic moment. At the moment, it doesn't seem to be entirely clear whether Bitcoin or crypto, but a number of US states are working on advancing Bitcoin reserves. Whether it is a good thing when nation states start hoarding Bitcoin is another question. After all, from the very beginning and to this day, Bitcoin has been about taking power over money away from the state and giving it to the people.

Back to the Bitcoin companies. Let's assume that someone understands Bitcoin and has even discovered that there are Bitcoin-only exchanges. These companies recognise Bitcoin as sound money, support the Bitcoin community and want to integrate the Bitcoin ethos into their business model in the best possible way. Ouch – that already sounds like a compromise.

**The Dilemma – Bitcoin at Heart, Regulation at the Back of the Neck**

Bitcoin companies are caught between maximum independence and regulatory requirements. Companies such as Strike, Relai and River aim to make it as easy as possible for their customers to access Bitcoin while at the same time enabling them to maximise their independence from third parties. An important aspect of this is self-custody. Customers have full control over their Bitcoin and can avoid counterparty risks such as exchange failures or government seizures.

In contrast, most providers on the market, such as the major players Coinbase or Binance, rely on classic, centralised structures with full custody - and a large range of digital assets. They are basically fiat companies that offer crypto products.

And then, at the other end of the spectrum, there are projects such as Samourai, Wasabi Wallet or Tornado Cash, which are radically opposed to any form of control. They are developing powerful tools for more financial privacy – in line with Bitcoin's original idea as a decentralised cash system. But this commitment comes at a price: the founders of Samourai Wallet were arrested and the developers of Tornado Cash were prosecuted.

These Bitcoin rebels are putting the limits of state regulation to the test. And they raise the fundamental question: Is privacy an inalienable right or should it be subordinated to the public security interest?

**The Middle Ground Builders**

Bitcoin-only companies that choose the middle ground play an important role in the bitcoin ecosystem. This is because they appeal to the masses by keeping onboarding simple and often offering a range of interesting services. At the same time, they want to give their customers the greatest possible independence.

But are their business models sustainable? Or do these companies run the risk of being worn down by the balancing act between Bitcoin ethos and state control? How can these pioneers survive in a constantly changing regulatory environment?

It's a balancing act between regulation and Bitcoin values, and it's often a fight for the fundamental rights of not just Bitcoiners but people in general. For example, these companies need to have KYC processes in place to be compliant with the law and allow customers the greatest possible flexibility in their Bitcoin activities.

*Some popular Bitcoin-companies and their strategies:*

- [Strike](https://strike.me/): Custodial, fast lightning transactions, DCA, bill payments

- [Relai](https://relai.app/de/): Simple onramp, self-custody, private and business services

- [River](https://river.com/): Multisig and cold storage, proof of reserves, inheritance

- [Unchained](https://unchained.com/): Multisig vaults, DCA, inheritance, loans, retirement, advisory

- [Bull Bitcoin](https://www.bullbitcoin.com/): Non-custodial exchange, DCA, bill payments, OTC desk

Typical features of these accounts usually include a KYC check, which allows users to be granted higher buy and sell limits. Many Bitcoin companies offer self-custody wallets and often some also multi-sig solutions that increase security for users. Partnerships with banks or payment service providers facilitate buying and selling and enable services such as the creation of savings plans.

Bitcoin companies face several challenges. Regulatory pressure remains a key concern, as authorities may tighten KYC obligations or introduce new restrictions. Trust is another issue since die-hard Bitcoiners often see these companies as not being consistent enough with Bitcoin's core principles.

**Regulatory Framework and Political Influences**

***USA: Trump's Bitcoin course and the ‘Crypto Czar’***

There are currently contradictory signals in the USA: on the one hand, Donald Trump has hinted at using Bitcoin as a strategic reserve (Strategic Bitcoin Reserve, SBR), while on the other hand, regulation is being tightened further. The newly created position of ‘White House AI and Crypto Czar’, presumably conceived in collaboration with Elon Musk, is intended to implement clear rules for blockchain, AI and the crypto market. This is also likely to affect companies that are committed to the Bitcoin ethos.

- Positive signals: Bitcoin is increasingly recognised as a legitimate asset class.

- Regulatory pressure: Stricter regulations could threaten the existence of smaller companies.

- Possible future: If the US promotes Bitcoin as a strategic asset, this could fundamentally change the regulatory landscape.

***Europe and Global Developments***

- MiCA (Markets in Crypto-Assets Regulation): New EU regulation for crypto companies, requiring strict KYC and AML rules, among other things.

- Restrictive countries: China and India continue to rely on tough regulation or bans.

- Friendly jurisdictions: Countries such as El Salvador or Switzerland offer attractive conditions for Bitcoin companies.

**Self-custody of Bitcoin**

The so-called ‘Travel Rule’ (Transfer of Funds Regulation, TFR) requires detailed information about the sender and recipient. This makes it more difficult for Europeans to interact with self-custody Bitcoin wallets. For transactions over 1,000 euros, users must prove that they are the owners of these wallets (proof of ownership).

Yet self-custody is a very important aspect of Bitcoin. It is the only way to avoid the risks associated with relying on centralised custodians. Self-custody ensures that you alone have control over your money. The new regulations represent a gradual financial disenfranchisement, which is not only criticised by Bitcoiners. And that is only part of the problem.

The disadvantages of centralised storage of customer assets are well known. Just think of the scandalous examples from the recent past: The fall of the FTX cryptocurrency exchange and the knock-on effects on the cryptocurrency industry or the fraudulent business practices of Celsius, which lost billions of customers' money.

> *“Not your keys, not your coins.”– Andreas Antonopoulos*

However, it is often the users themselves who, consciously or unconsciously, jeopardise their funds. The obstacles to self-custody lie in both technical and practical aspects. Not everyone is willing or able to navigate hardware wallets and multisig solutions. Furthermore, without an adequate backup, there is a risk of losing coins irretrievably.

By keeping their coins in self-custody, Bitcoiners eliminate third-party risk. However, self-custody can be a challenge, especially for beginners. ‘Study Bitcoin’ is more than just a phrase here. Only those who know their way around can protect themselves against errors, misuse and loss.

**CONCLUSION**

The uncertainties caused by ever-changing regulation in different jurisdictions is a constant challenge for businesses. However, as Bitcoin is increasingly being categorised as harmless by the authorities, pure Bitcoin platforms might face fewer regulatory risks compared to crypto exchanges.

The growing acceptance of Bitcoin and the plans of the United States and other countries to create a strategic Bitcoin reserve may have a positive impact on how Bitcoin companies continue to be treated by regulators. I would, though, like to quote Maya Parbhoe, the Surinamese presidential candidate for 2025, at this point, even if it seems a little off-topic:

> *“A Bitcoin Strategic Reserve is not the answer.*

*> *The moment a government holds Bitcoin as a reserve, it centralizes control over an asset designed to be decentralized. It strengthens the very system Bitcoin was created to replace.*

*> *Governments holding Bitcoin do not give power to the people, they give themselves a hedge while continuing to debase their fiat currency. They still print, they still tax, they still control. The people remain trapped in the same system, only now with a government-backed Bitcoin price floor that serves the state, not the individual.*

*> *Bitcoin was not made to be stockpiled by central banks. It was made to be used. As currency, as a tool of self-sovereignty, as a weapon against state overreach.”*

So let's summarise what we have covered in this article in the spirit of these liberal ideas. The following rules, which have just been created, should be mandatory reading for Bitcoin aficionados until further notice:

<img src="https://blossom.primal.net/914ac66c228ea1a398ec1f008234e4cd213da85f268de73fb36dc9e344dcfb45.jpg">

*The Fine Line: Bitcoin Companies Navigating Regulation and Freedom was [written by Bri](https://x.com/cyberBri). If you enjoyed this article then support her writing, by donating to her lightning wallet: bri_1@walletofsatoshi.com*

-

@ 71df2119:9542d9d7

2025-02-25 14:57:23

Das Pareto-Team [(](https://njump.me/nprofile1qyvhwumn8ghj7un9d3shjtnndehhyapwwdhkx6tpdshsz9mhwden5te0wfjkccte9ec8y6tdv9kzumn9wshsqg9grf5ej25t0llsj2annf4rx5vpc9htx72g74depu796z0nc5pvssldhkxp)<https://tinylink.net/mIyvf>[)](https://njump.me/nprofile1qyvhwumn8ghj7un9d3shjtnndehhyapwwdhkx6tpdshsz9mhwden5te0wfjkccte9ec8y6tdv9kzumn9wshsqg9grf5ej25t0llsj2annf4rx5vpc9htx72g74depu796z0nc5pvssldhkxp) hat in den letzten Tagen die Unterstützung für *Zaps* veröffentlicht. *Zaps* sind *Lightning-Transfers* über *Nostr*, die im Pareto an Artikel oder Autoren gesendet werden können. Die aktuelle Umsetzung in der Pareto-App ist als erster Schritt zu verstehen, und es werden weitere Ausbau-Stufen folgen. In diesem Artikel wird die Nutzung des neuen Pareto-Features erklärt.

##### Artikel Zappen

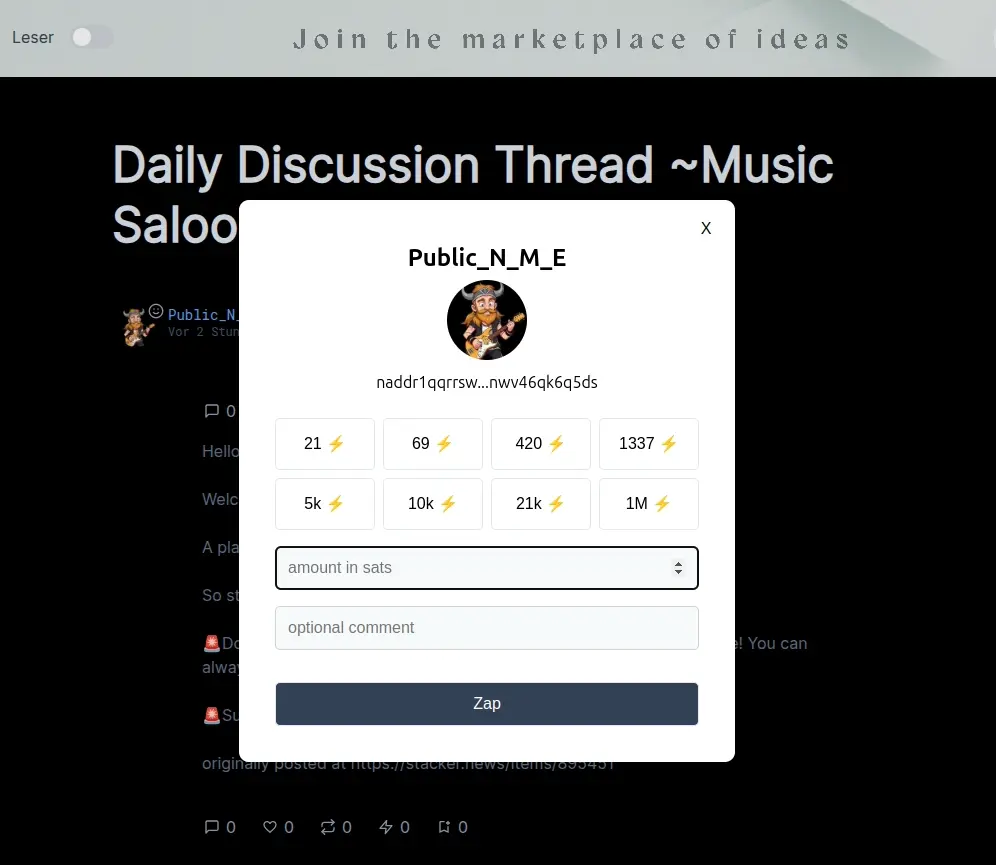

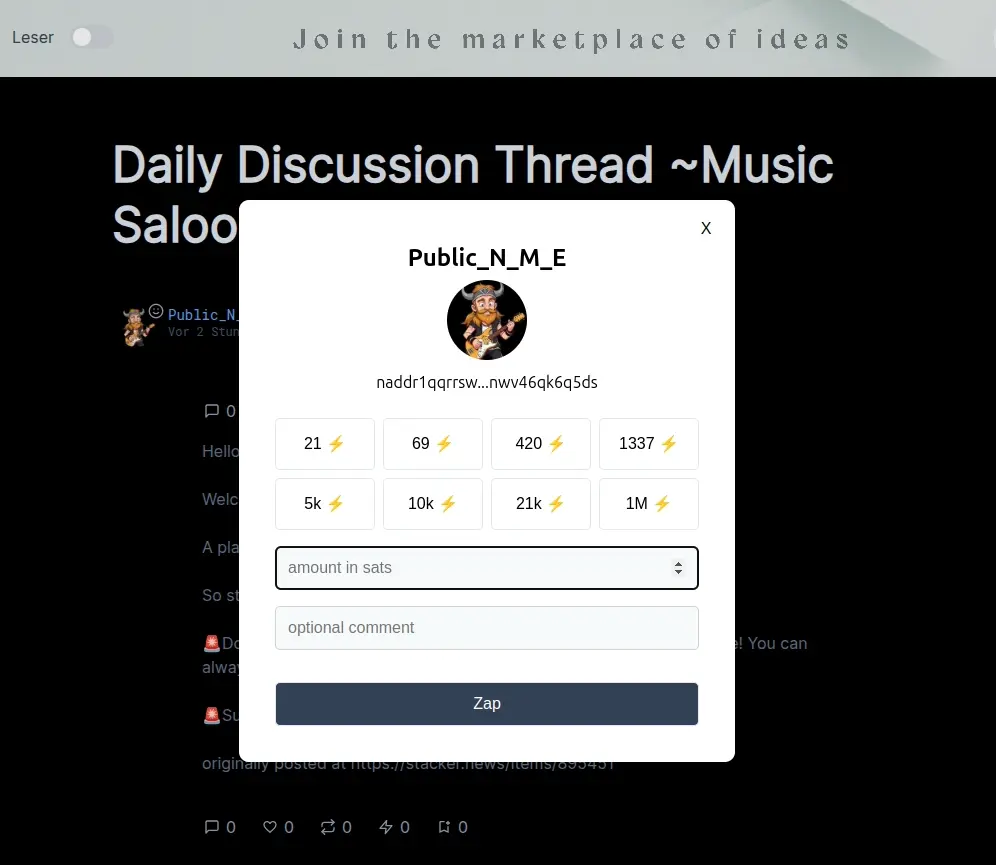

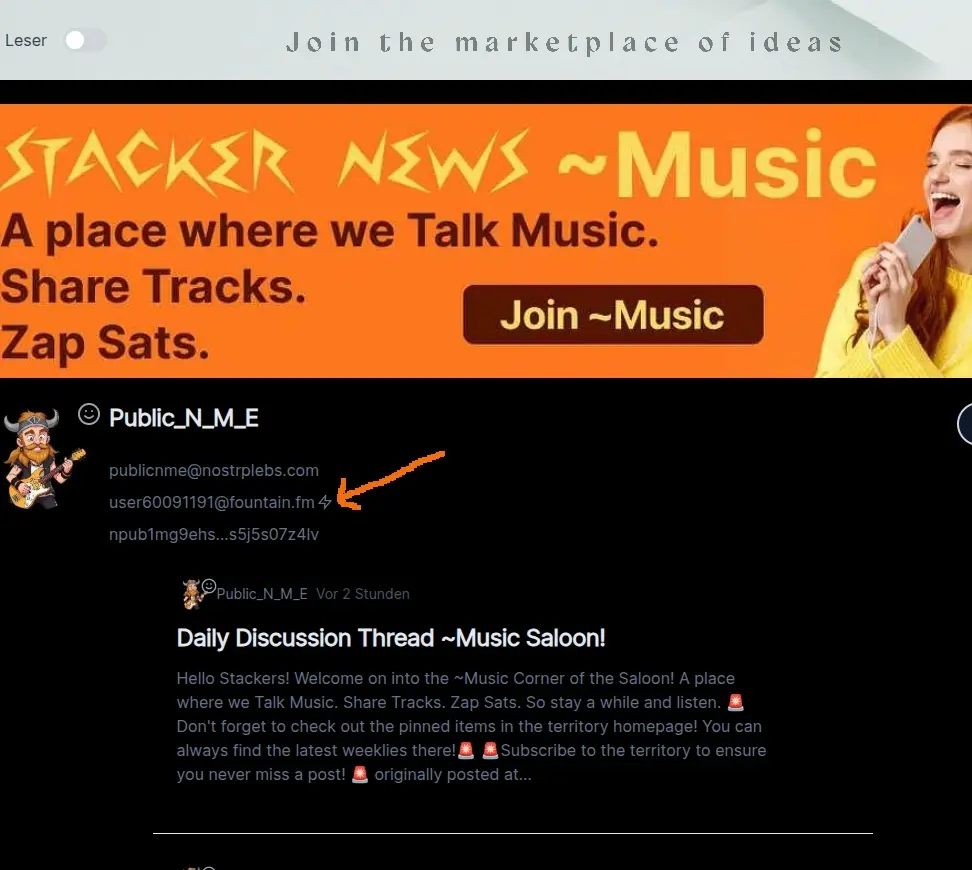

Auf der Artikel-Seite des Pareto-Readers ist jetzt das Blitz-Symbol unter dem Artikelbild aktiviert. Durch einen Klick erscheint ein Dialog wie dieser:

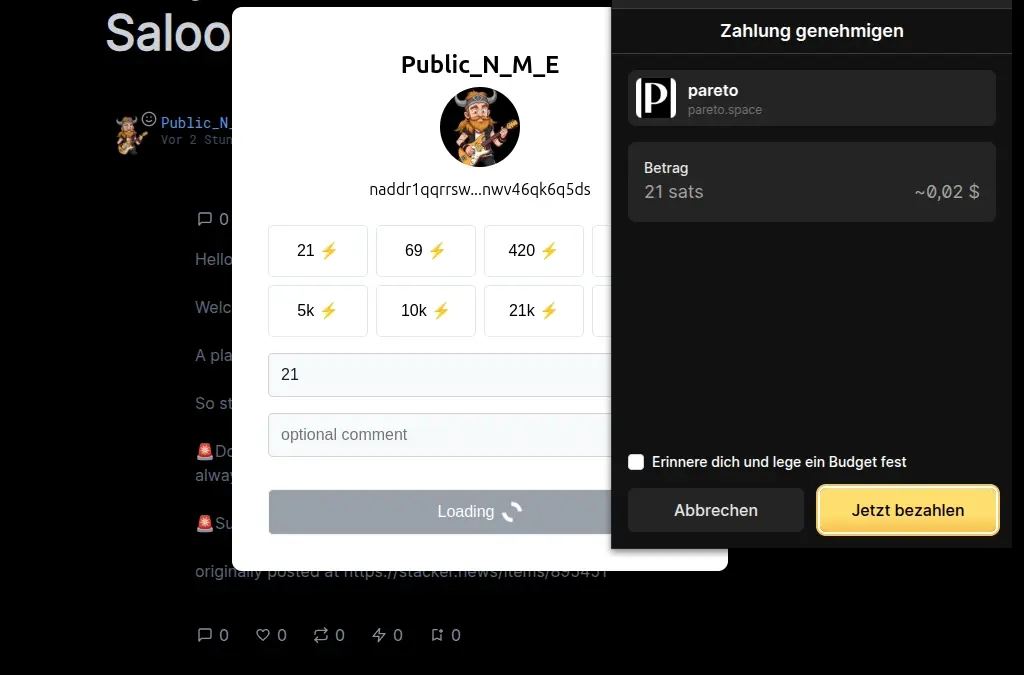

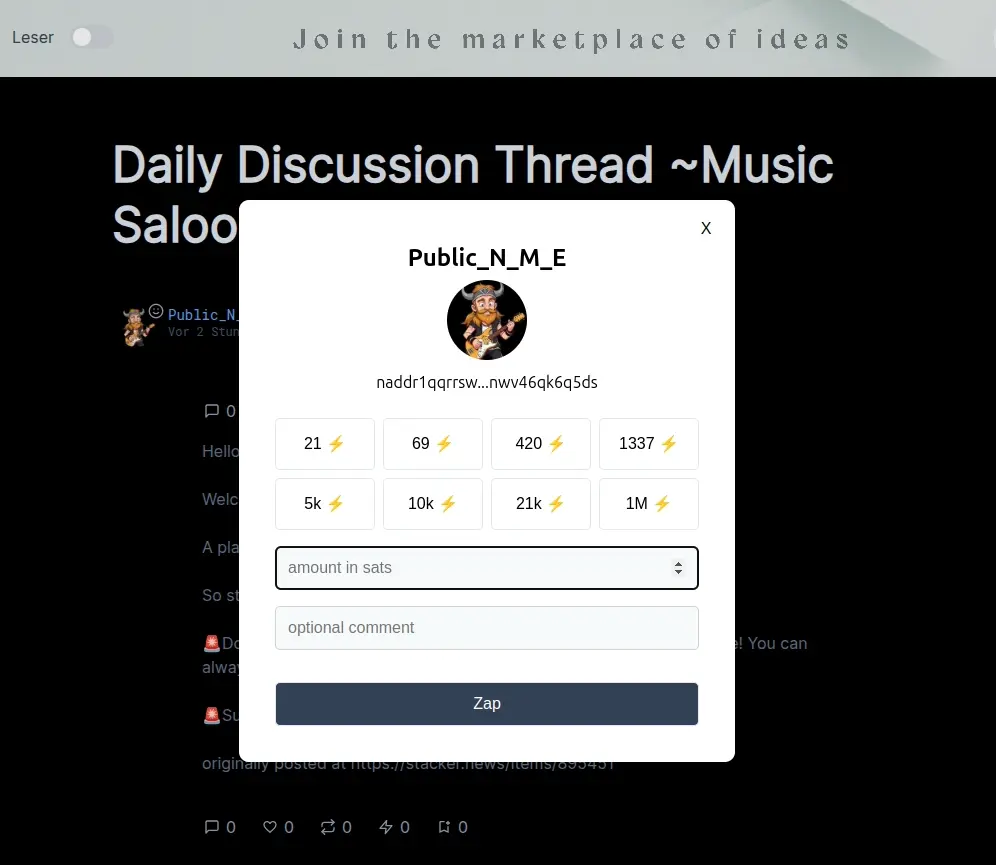

Im Dialog können verschiedene vorgegebene Beträge ausgewählt oder ein eigener Betrag manuell eingegeben werden. Ein optionales Kommentarfeld steht, wie üblich, ebenfalls zur Verfügung. Nach dem Betätigen der *Zap-Schaltfläche* verhält sich die App unterschiedlich, abhängig davon, ob der Nutzer eine *Wallet-Erweiterung* im Browser installiert hat oder nicht. Falls ja, folgt die Interaktion mit der *Wallet-Erweiterung*, in diesem Beispiel Alby:

Hier kann die Zahlung freigegeben werden, und der Vorgang wird dann von der Software abgeschlossen.

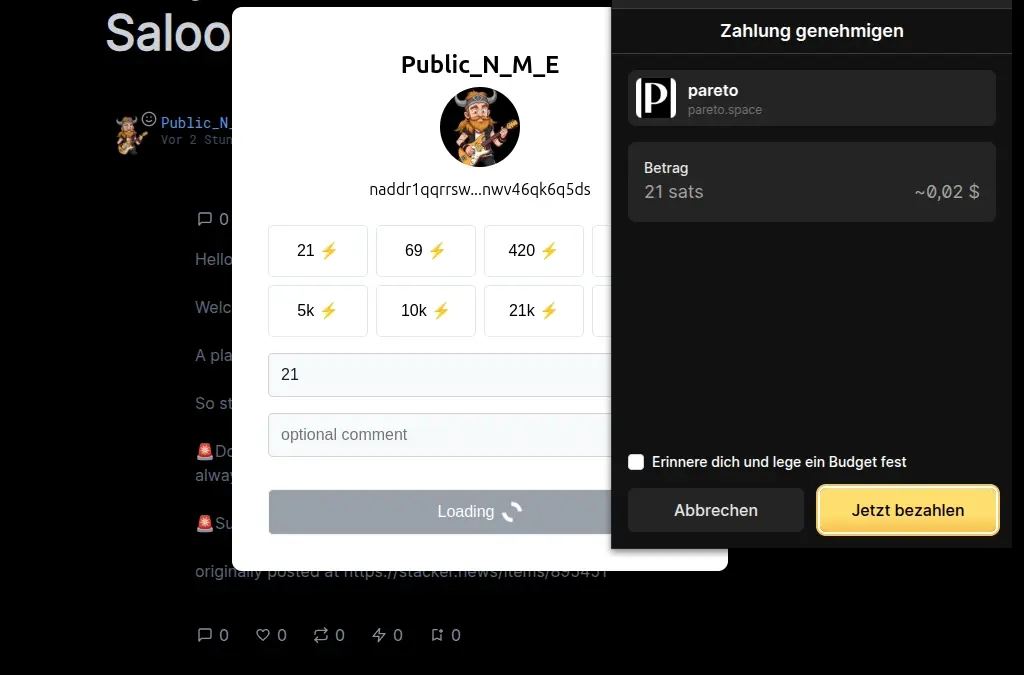

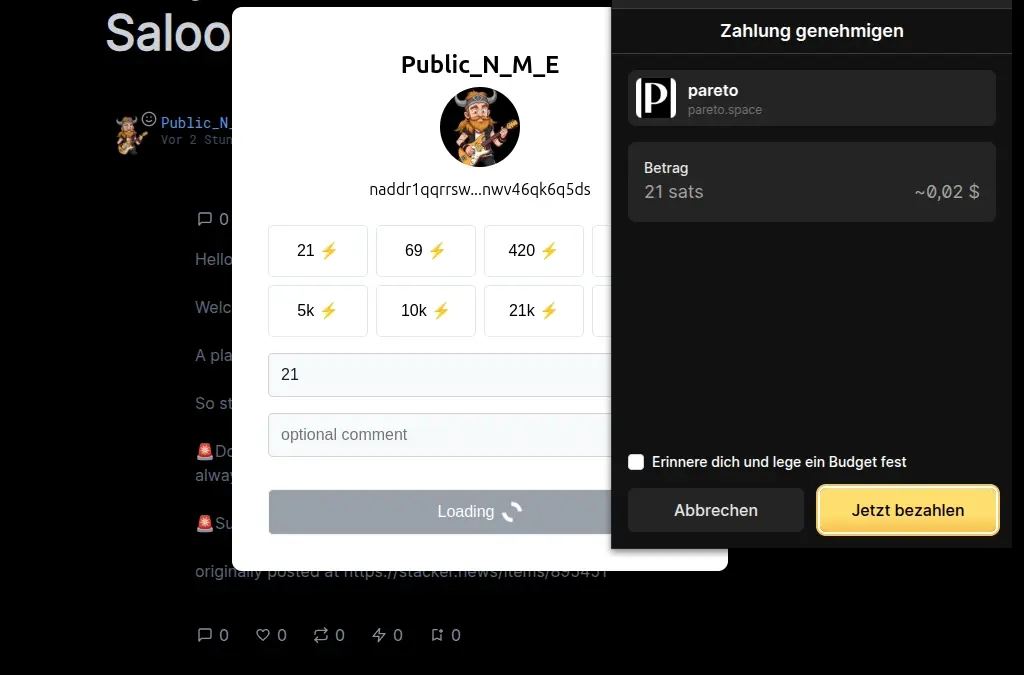

Wenn der Nutzer keine *Wallet-Erweiterung* verwendet, erfordert der Vorgang weitere Schritte. Statt dem oben gezeigten Dialog erscheint eine *Lighting-Rechnung*:

An dieser Stelle gibt es mehrere Möglichkeiten: Man kann mit einer *Lightning-Wallet* den *QR-Code* einscannen oder die Rechnung in Textform kopieren. Alternativ kann man auch eine *Wallet* auf demselben Gerät öffnen und die Zahlung dort bestätigen.

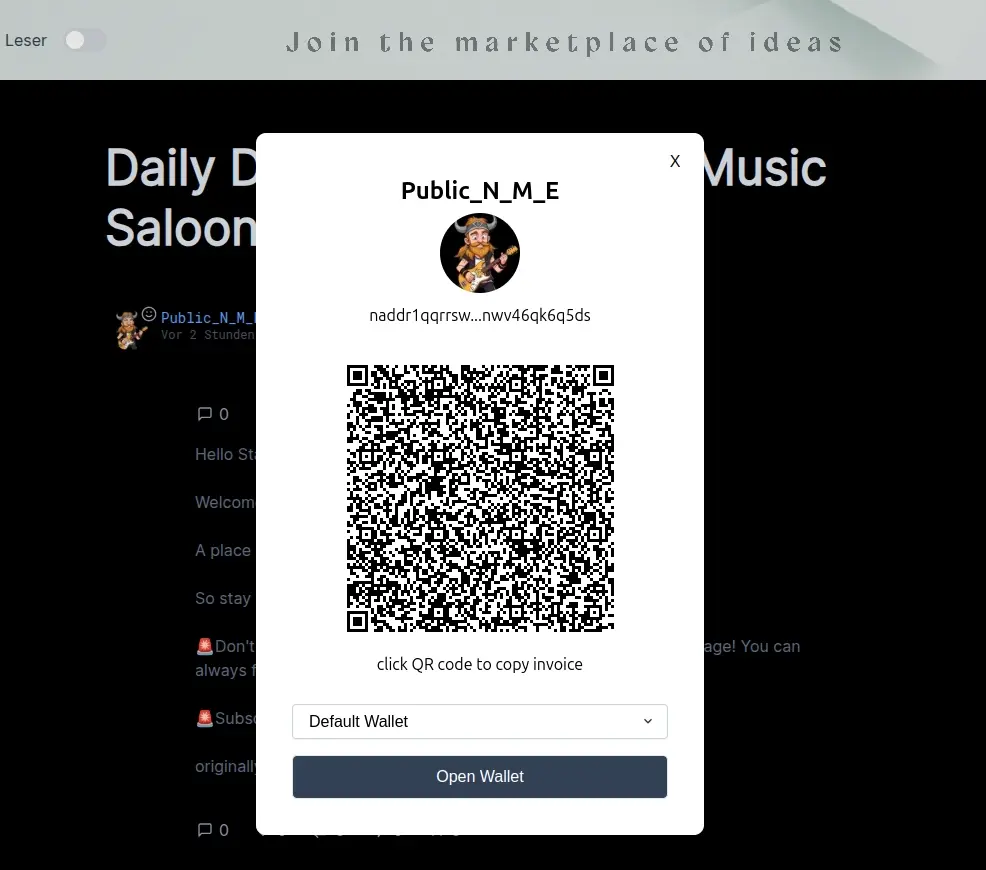

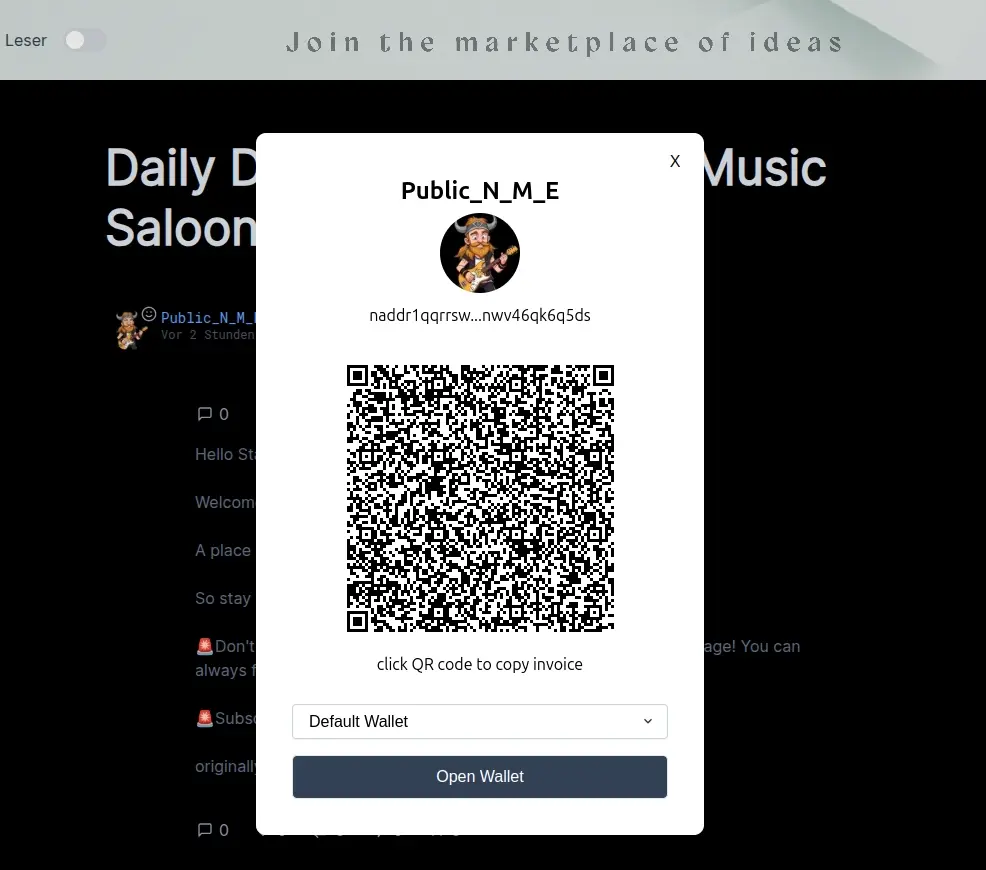

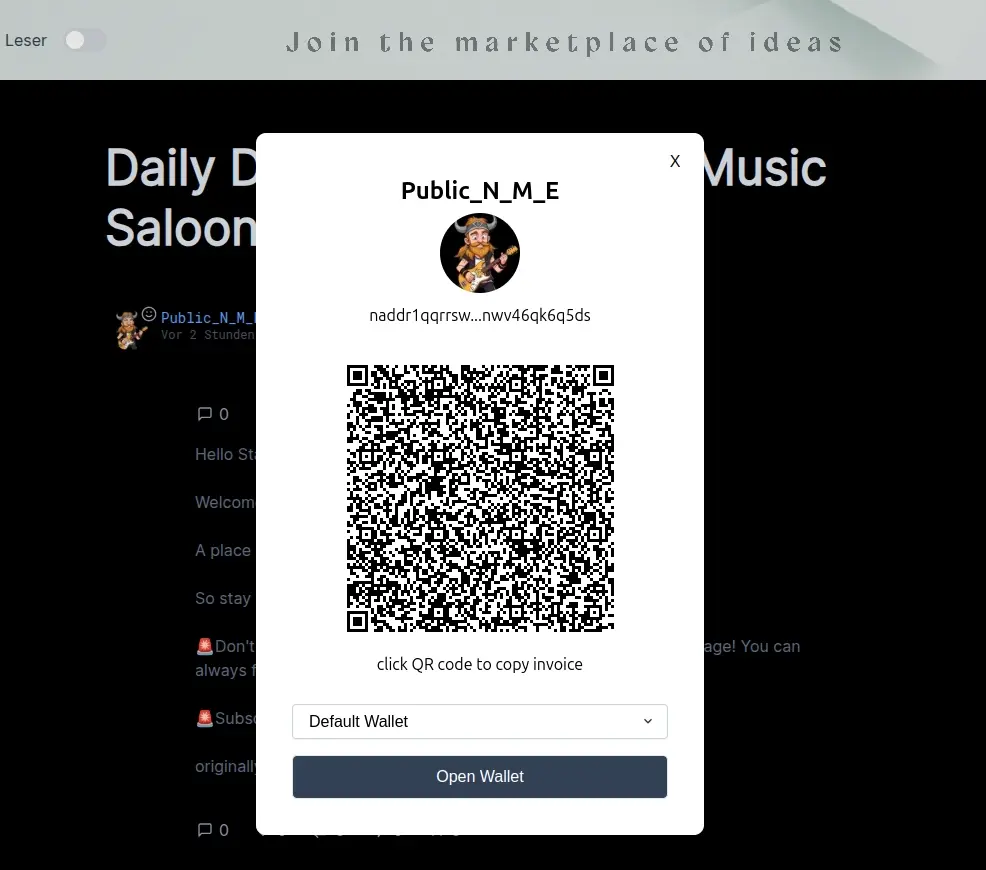

##### Zaps an Autoren

Wie am Anfang erwähnt, können auch Autoren direkt, ohne Artikelbezug, *Zaps* erhalten. Auf der Profilseite des Autors gibt es neben der neu hinzugekommenen *Lightning-Adresse* einen *Blitz-Button,* ähnlich wie auf der Artikelseite:

Durch einen Klick können, ähnlich wie beim Artikel, *Zaps* an den Autor gesendet werden.

***

*Das Zap-Feature in der Pareto-App basiert auf der Community-Bibliothek nostr-zap (*<https://github.com/SamSamskies/nostr-zap>*). Wir bedanken uns für den Code und haben mit einer Erweiterung der Funktionalität beigetragen - ganz im Sinne von Open-Source!*

***

##### Ausblick

Wie eingangs erwähnt, sind weitere Ausbaustufen des *Zap-Features* geplant, darunter:

* Unterstützung für *Nostr Wallet Connect* für eine nahtlosere Integration und ein besseres Nutzungserlebnis.

* Unterstützung für *eCash*, *Cashu-Nutzaps*.

Bleib auf dem Laufenden und folge uns auf unseren verschiedenen Kanälen:

* *Nostr*: <https://tinylink.net/mIyvf>,

* *Web*: [https://pareto.space,](https://tinylink.net/mIyvf)

* *Geyser*: [https://geyser.fund/project/pareto.](https://geyser.fund/project/pareto)

**Wir bei Pareto stehen erst am Anfang - nicht ausschließlich bezüglich Zaps!**

-

@ 9171b08a:8395fd65

2025-02-25 14:53:19

Rein sat with her back against the cold steel of the jail cell, wrists and ankles bound.

She hadn’t seen light or another human face in almost two weeks. The grinding and whirling of the Guardian’s mechanical gears was the only thing to break the silence, its daily arrival at noon serving as her only reminder of time. It brought her food, but nothing else; not a word, not a gesture of humanity.

In her waking moments, she sat and replayed the events that landed her in jail, and in her slumber, those thoughts morphed into haunting nightmares with specters stalking her in hell. Hell was no longer a distant fear; it had found her. Her fate now rested in the hands of the man she once considered her best friend. Whatever evidence he was putting together would serve to either absolve her or condemn her.

A sharp beam of light pierced the darkness of the jail cell from the cell block entrance. The overhead lights came on, and she stood as David, Rein’s partner and closest friend, appeared before the cell bars.

He stared at his feet and said, “Today's your trial.”

Rein struggled to keep her eyes open from the intense brightness over the overhead lights and said, “That wasn’t nearly enough time to gather evidence.”

David pressed his lips together, eyes fixed on the floor. “I had your back on this, Rein.” Then he shook his head, and as Rein finally overcame the harsh brightness, she noticed he was staring into her eyes. “The evidence is damning. And, well, something pretty terrible has happened that has the government cracking down harder than ever.”

“Something terrible? What happened?” asked Rein.

“I would’ve never thought you were in so deep with this.” He seemed personally outraged when he said, “After everything we’ve been through together, after everything *you’ve* sacrificed for this city. You’ve been pretending this entire time. I’ve never known the real you.” He scoffed. “Yet there you are.”

“C’mon, David, you don’t actually think—”

David raised a hand and said, “Stop. Don’t try that shit with me. You’re lucky to even be getting a trial.”

Two Guardians entered the cell block and came to parade rest behind David. He opened the cell, and the Guardians stepped in.

“What did you find? What happened?” asked Rein.

The Guardians seized Rein’s shoulders and pushed her forward, past David.

“What did you find, David?” Urged Rein.

David remained silent. He simply watched as the Guardians took her.

A hush fell over the precinct as officers gathered around the flickering television in the corner of the reception room. Flashing across the screen were the haunting images taken from an aircraft of a city on fire, thousands of black silhouettes infiltrating the city walls. The words ***Shadow Crawlers Strike, Orion Dome In Ruins*** were emblazoned the bottom of the newscast.

Rein strained against the Guardian’s grasp to try and get a closer look at the screen and gasped, “Chronos have mercy.”

Those standing before the television turned and stared at her. Those seated at their desks stood at the sight of the Guardians ushering Rein through the offices, and within seconds, the precinct was heavy with tension. Everyone she had cared about now gaped at her with a fierce look of betrayal. Though Rein wished she could explain herself with a compelling defense, she could tell she was as good as dead to them.

---

The vehicle transporting her to the courthouse was as dark as the cell she had been locked up in. Rein ground her teeth and stared at the ray of light that shone through the slit in between the vehicle doors, contemplating what she had just seen on the precinct television.

After several minutes of toiling in the darkness with her own thoughts, the vehicle halted, and its doors opened at the hands of the two Guardians who towered over the roof of the hovercraft.

Many of the city people’s eyes, imbued in different shades of red, turned to stare as Rein stepped out. Their gazes were not so much filled with judgment as they were with fear. She stepped onto the walkway with her head sagged, ashamed to look at the very people she had sworn to protect.

> Join the furnace of the Empire! Invest in Elius today and be a part of the Industrial heart of Aurial.

Rein clenched her fist as she contemplated the words on the crumpled flyer laying on the sidewalk beside her foot. She couldn’t help but think of what her father had been up to in that city.

She had never paid much attention to the image of the man on the flyer, his arms crossed and his head held high before a massive furnace that sparked embers into the four corners of the paper. The silhouette of a building was portrayed on one corner, a soldier held a weapon on another, the image of a child holding a toy on the bottom right, and a family held up a shirt on the remaining corner.

Those flyers were hung up throughout the precinct offices, inside coffee shops, and gathering places, attempting to attract the wealth that easily found itself in the pockets of the kind of people that lived in Roxis. It seemed to have worked on her father.

***But what had he been up to?***

Rein never understood why her father had abandoned Roxis for Elius, nor had he ever offered an explanation. As a financial hub, Roxis attracted wealth and intellect, leaving cities like Elius with a rougher class of laborers— many of whom turned to crime to escape extreme poverty and hard work in the very factories exhibited on the promotional flyer.

The city of Roxis had been good to Rein. Though many a passerby would think differently seeing her now with her wrists and ankles shackled as she walked up the steps of the Judgment House. She’d grown to be a God-loving woman and spent most of her adult life protecting the city from criminals the likes of which the people walking by, now, would think she was.

One of the Guardians towering at her side nudged her shoulder, and with the artificial voice generated from within its chest said, “You must move along, Miss Lancer.”

The robot’s hand ushered her forward, and a ray of sunlight nearly blinded her as she gazed upon the Judgment House made almost entirely of glass and marble.

The crest of Aurialian Empire above the entrance of the building made her pause. Her eyes lingered on the star that lay at the center of the red and blue shield of Ariel, the archangel. A character that looked like an angular and unfinished number eight with a line drawn through the middle sat like a crown above the words "***Out of God, An Empire***", inscribed around the crest of the Aurilian Empire.

The symbol of peace felt like a cruel joke now. She had once sworn to uphold the empire’s sanctity, yet here she was, condemned by it.

***Episode 2 coming soon...***

---

Thank you for reading!

If you enjoyed this episode, let me know with a zap and share it with friends who might like it too!

Your feedback sends a strong signal to keep making content like this!

Interested in blog posts? Follow @Beneath The Ink for great short stories and serialized fiction.

More short stories you might like from Fervid Fables:

nostr:naddr1qvzqqqr4gupzpyt3kz9079njd5g0fs5rxhtg8g9wdwkdar65kuhaujfyajpetlt9qq2kx6zzdap9s3nnde5hy7f5wej57d2twp54y82h07y

nostr:naddr1qvzqqqr4gupzpyt3kz9079njd5g0fs5rxhtg8g9wdwkdar65kuhaujfyajpetlt9qq2h5etx2fghgumyg3mhjanewgeysa6wdfmrs85l27m

-

@ 85bdb587:7339d672

2025-02-25 14:14:57

## Marty's Bent

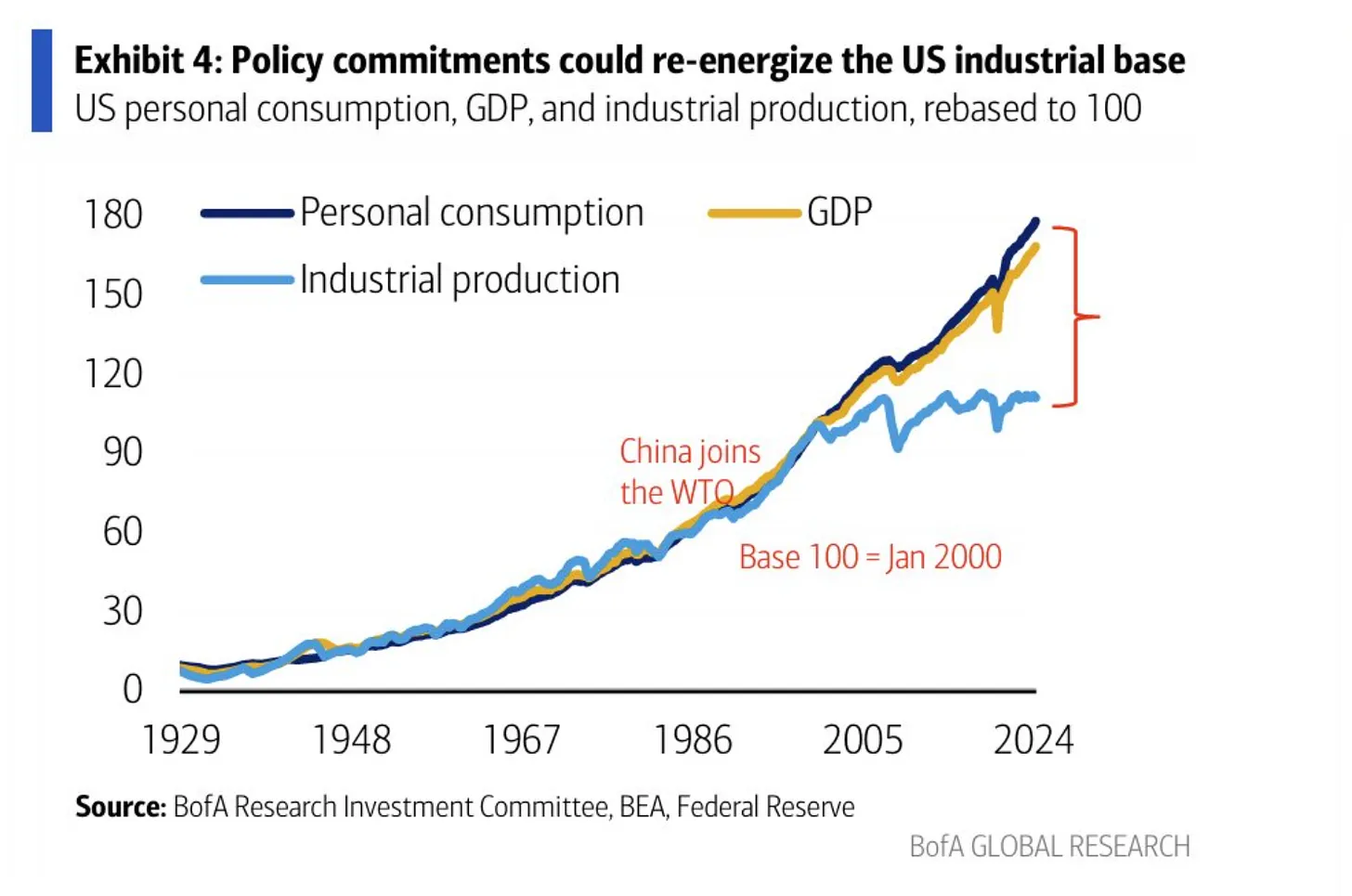

Since mid-2022 the Fed has been reigning in its balance sheet via a process called quantitative tightening (QT), in which they allow some of the debt assets they hold to come to maturity without reinvesting in them. This leads to a reduction in the Fed's balance sheet and is done to remove the excess liquidity introduced to the markets during the COVID crisis so that inflation can be reeled in. On top of this, the Fed is hoping that the extraordinary measures it took to step in during a time of crisis allowed the banking system to get their houses in order in preparation for a period of relatively tighter liquidity. Ideally, everyone took the time and effort to clean up their balance sheets, properly manage their duration risk, and get themselves on solid footing to move forward without the Fed stepping in to prop up the market.

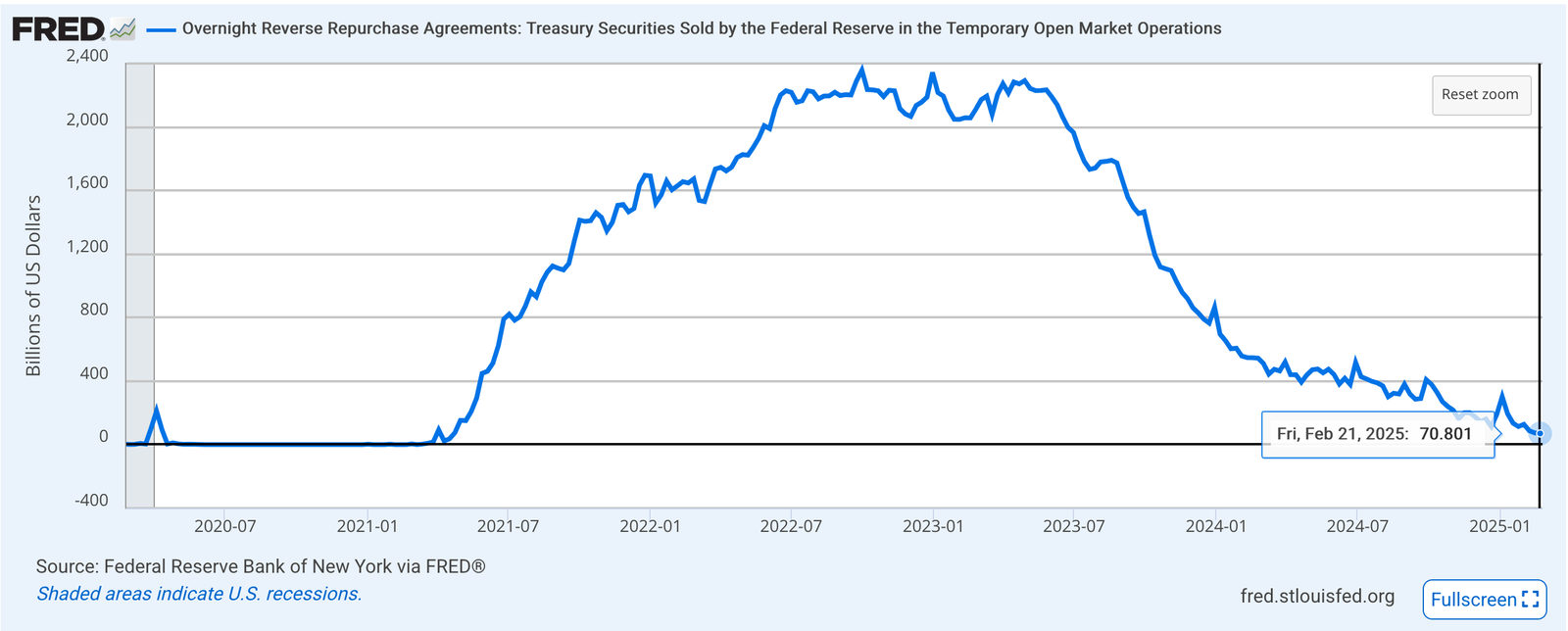

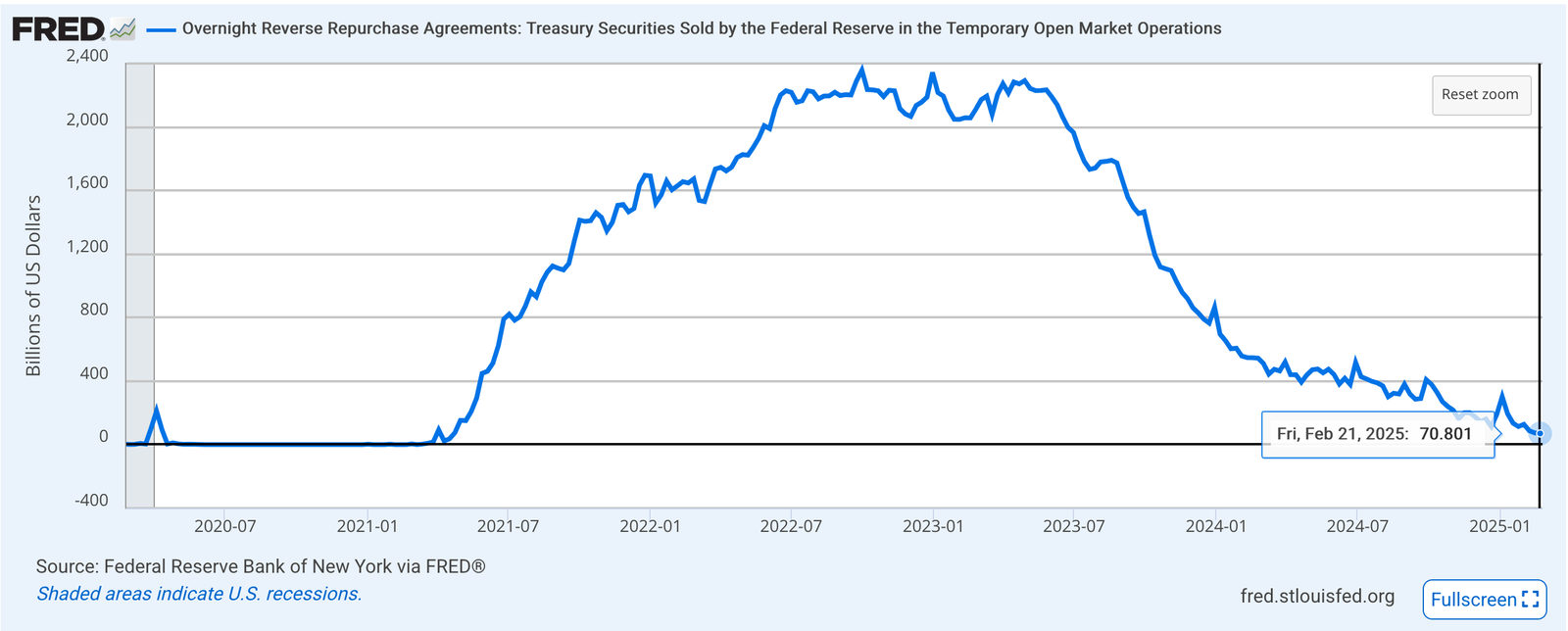

At its peak, the overnight reverse repo facility had around $2.36T of liquidity in the form of debt instruments like treasuries and mortgage backed securities available to banks, money market funds and certain government enterprises. These entities lend the Fed cash for these instruments and get interest back in return. This acts as a mechanism the Fed can leverage to keep short-term rates in line with wherever their targets are at any given point in time. Over the last ~13 quarters the Fed has been slowly but surely letting these markets drain and, as of last Friday, they currently sit at $70.8B. At its current pace the reverse repo facility should be completely drained by the end of next month or beginning of April.

The question on everybody's mind is, what happens once the reverse repo markets are empty?

The last time the Fed embarked on QT was in October 2017. It drained the reverse repo over the course of a little less than two years before the market was drained and the overnight rates in the market spiked into the low teens in September of 2019. Many don't remember this, but it was a "holy shit" moment that forced the Fed to create new facilities overnight to band aid over the hemorrhaging. Coincidentally, a few months later COVID would overtake the world and the Fed had a convenient excuse to double the monetary base well above $6T.

If September 2019 is an example of exactly what happens when the reverse repo market drains, we may be in for a liquidity crunch. However, the Fed is posturing that it has learned its lessons from the 2019 rate spasm and has adjusted some things accordingly to ensure a smoother transition from a state of excess liquidity to a state of significantly less liquidity. Particularly, more control over SOFR and how it interacts with this market. If we reach the point where the reverse repo markets have been successfully drained without a 2019-like spasm, the Fed will then move on to the excess liquidity sitting on the balance sheets of commercial banks and continue their journey to try to reel in inflation.

President Trump certainly isn't making the Fed's job easier with promises of lower domestic taxes and the levying of aggressive tariffs, which could both be inflationary. I'm sure Jerome Powell is praying that DOGE continues their swift work and gets the signal out to markets that the US government is committed to getting its fiscal house in order to make treasuries more appealing to the market so that rates can float down.

I have no idea exactly what is going to happen, but I have a feeling that a liquidity crunch is on the horizon. It may not be once the reverse repo market is drained. I would not be the least bit surprised if the work the Fed has done behind the scenes to ensure a spasm like we experienced in 2019 doesn't happen is successful. Though, it likely only buys some time and delays the inevitable. As my good friend Parker Lewis likes to say, "There's too much debt and not enough dollars." At some point, QT will hit a point where it cannot be sustained because too many dollars have been pulled out of a system with ever increasing amounts of debt that need to be serviced with dollars. Whether it happens when the reverse repo market is drained or at some point after the Fed starts unwinding the excess liquidity on bank balance sheets isn't really that important.

We're getting early warning signs that a liquidity crunch may be near with the mad dash for bringing physical gold into the US, the VIX spiking above 20 earlier today and bitcoin "crashing" toward $90,000. Volatility is increasing at a time when the reverse repo market is almost tapped and the world is a bit uncertain as it tries to figure out the ramifications of Trump's blitzkreig his first month in office.

For those scratching their heads about the price of bitcoin falling during a time like this, it is pretty typical. Bitcoin is traded 24/7/365, has a ton of liquidity, and is easy to buy and sell. When markets sense volatility, bitcoin is usually one of the first assets to be sold off as investors try to sure up their cash balances and pay off debts. It is usually the first and quickest to move lower, but also the first and quickest to move higher when the dust has settled. I find it hard to believe that the price of bitcoin will stay down long if it falls considerably.

The fundamentals have never been stronger and too many people have been waiting for an opportune buying opportunity to pass it up. The question is how many of those looking for a buying opportunity will have dry powder and be liquid if and when it happens.

## Bitcoin's Institutional Moment: Big Players Are Entering the Game

Bitcoin's journey into mainstream financial markets is accelerating. During our conversation last week, Peruvian Bull highlighted several key milestones, including Abu Dhabi's $430 million position in Bitcoin ETFs and regulatory progress with the SEC's SAB 122, which now allows banks to custody Bitcoin. This fundamental shift isn't just about price – it represents a structural change in how traditional financial institutions view Bitcoin as a legitimate asset class.

"*This is a massive opportunity for bitcoin companies - go start a custody service and get a bunch of bitcoiners together and teach institutions how to safely custody their bitcoin.*" - [Peruvian Bull](https://x.com/peruvian_bull)

As I've observed through our work at Ten31, there's a growing recognition that a Bitcoin treasury strategy makes sense for both public and private companies. We're seeing this with MicroStrategy, Tesla, Bitcoin miners, and potentially GameStop. More importantly, the infrastructure is being built by major institutions like State Street and Citibank to support this adoption. While gold has the established financial plumbing, Bitcoin's institutional rails are being constructed rapidly, setting the stage for the next wave of adoption.

TLDR: Major institutions building Bitcoin infrastructure signals mainstream adoption

Check out the [full podcast here](https://youtu.be/aHzPTDDPXfU) for more on gold market disruptions, GameStop's potential Bitcoin strategy, and the looming debt crisis that's creating perfect conditions for Bitcoin adoption.

## Headlines of the Day

El Salvador Boosts Bitcoin Reserve - via [X](https://x.com/i/trending/1894181975528763539)

Jamie Dimon Sold $233.7M in JPM Stock - via [X](https://x.com/MartyBent/status/1894175451209220205)

Montana, North Dakota, and Wyoming Rejected Bills for SBR - via [X](https://x.com/SimplyBitcoinTV/status/1894071294653604257)

## Bitcoin Lesson of the Day

Bitcoin uses cryptographic **keys** to secure **transactions**. A private key, a secret random number, allows you to spend bitcoin, while a public key, derived from the private key, is used to receive bitcoin.

The public key is hashed and encoded into a Bitcoin address (e.g., 1A1zP1eP5QGefi2DMPTfTL5SLmv7DivfNa), a shorter, user-friendly string shared to receive funds. Private keys must be kept secure—losing them means losing access to your bitcoin, and anyone with your private key can spend it.

Addresses are generated from public keys via hashing (SHA-256 and RIPEMD-160) and include a checksum for error detection. Bitcoin wallets manage these keys, often using seed phrases to recover them. Understanding keys and addresses is fundamental to securely using Bitcoin.

[Full Learnmeabitcoin.com post here](https://learnmeabitcoin.com/beginners/guide/keys-addresses/)

ICYMI [Fold](https://foldapp.com/credit-card?r=BgwRS) opened the waiting list for the new Bitcoin Rewards Credit Card. Fold cardholders will get unlimited 2% cash back in sats.

**[Get on the waiting list](https://foldapp.com/credit-card?r=BgwRS) now before it fills up!**

$200k worth of prizes are up for grabs.

Ten31, the largest bitcoin-focused investor, has deployed $150M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at [ten31.vc/funds](https://ten31.vc/funds).

-

@ 6a6be47b:3e74e3e1

2025-02-25 14:14:41

Hi frens,

While drawing this fly 🪰 👇🏻

nostr:nevent1qgsx56ly0wcj7gwasrc7707l9px39g5nzn82p35akhkdqj448e6w8cgqyrrnhgtqqfvcvf007gtxmffrhd8zw5j0t93cuxc3yrykl2dzyp3tvj4hcjx

I started thinking about how to make my art stand out. Maybe I should focus on making it more appealing—or at least improving its presentation. Don’t get me wrong, I’m not against making my work more consumable, but the marketing side of things takes so much time away from actually creating art. It’s sad that sometimes it feels less about delivering high-quality work and more about turning it into “content.”

Honestly, that can be exhausting. Like Fall Out Boy said, “all this effort to make it look effortless.”It’s not really my style to turn my art—or the process of creating it—into content. That’s why I sometimes struggle with crafting or presenting it in a way that fits today’s trends.

Sometimes, the pressure to make my art presentable is so overwhelming that it makes me feel like not creating at all. And when it doesn’t yield the kind of recognition or financial support I hope for after all that effort, it can be really disappointing. It’s like watching all that hard work slowly erode my soul. It’s tough to keep going when it feels like my art isn’t being valued in the way I wish it could be.

I want to be clear: this isn’t me dissing anyone. You do you, and I’ll do me. As Crowley would say, “Do what thou wilt.” What I’m really trying to figure out is how to find that sweet spot—where I can keep up with the times and make my art more appealing without losing my soul in the process.

I’m trying my best, and I know I’ll make mistakes along the way, but I’ll keep going. I just wanted to share these thoughts with you because I’m usually pretty upbeat here—maybe even a little superficial at times—but this is me being _more_ real with you.

Art is such a huge part of my life, and through my work, I’m already sharing something raw and personal with you. But now you also know why my presentation might sometimes feel simple or plain. I’m working on finding that balance, and I’ll get there eventually.

Godspeed, my frens

-

@ eaef5965:511d6b79

2025-02-25 14:14:11

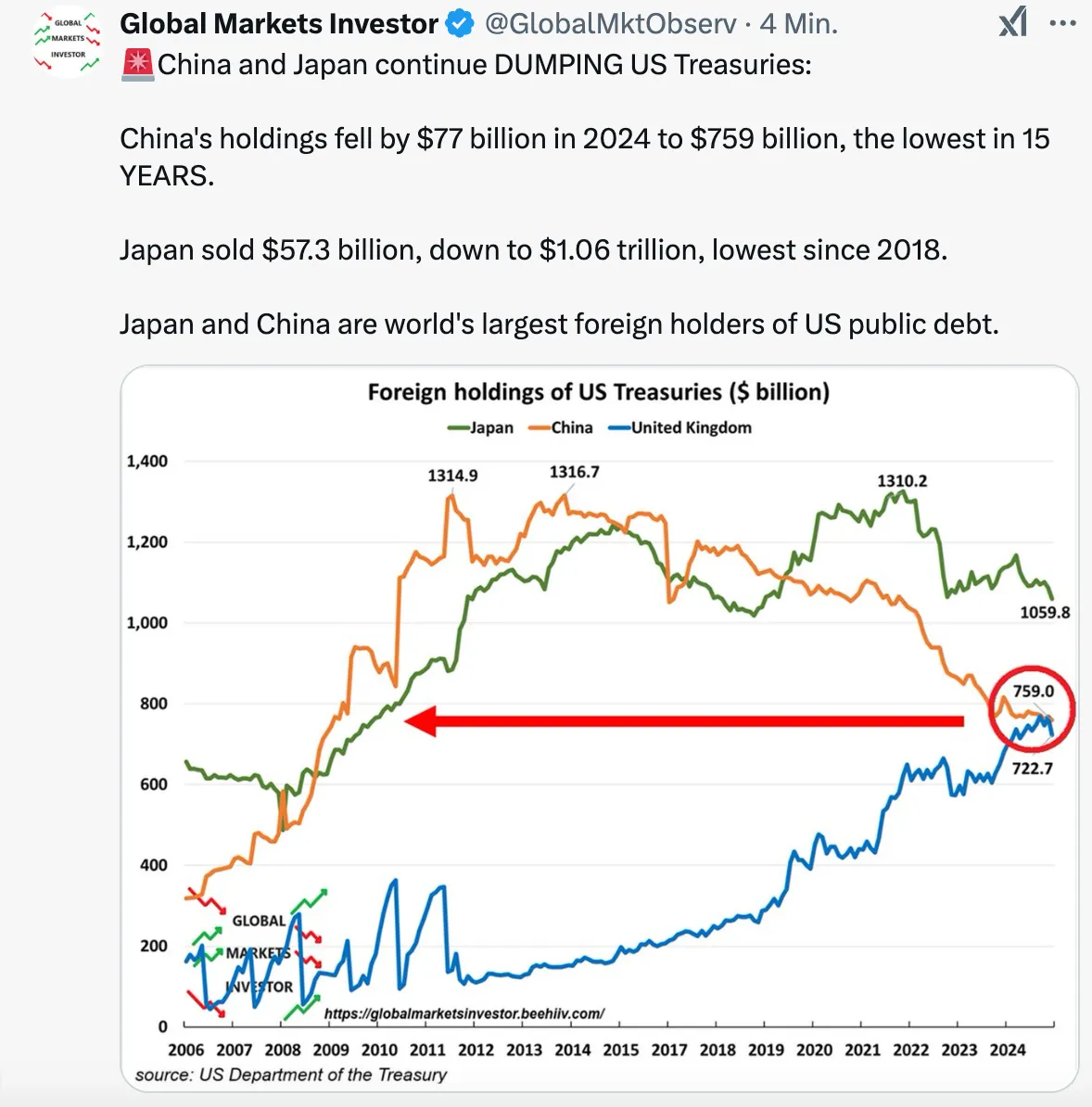

Another quarter, another update on the global money supply.

I remember three years ago yesterday, texting my Ukrainian friends for updates as they fled with their families for safety from Putin's full-scale, unprovoked attack on their country. Three years on, they continue to fight incredibly bravely, for if they do not, there will be no Ukraine. Europe has drip-fed them enough support to not lose, but not enough to win. America now demands repayment for its aid to the victim in the form of mineral rights, and will not recognize the aggressor as the aggressor. The era of Reagan-style, speak softly while carrying a big stick approach to dictators seems no more, for now, from the new US admin. The world order is changing rapidly, and Europe is quickly finding out what the Baltics and Poland have known for 200 years: the threat from the East does not share its values; it is simply uncompromising.

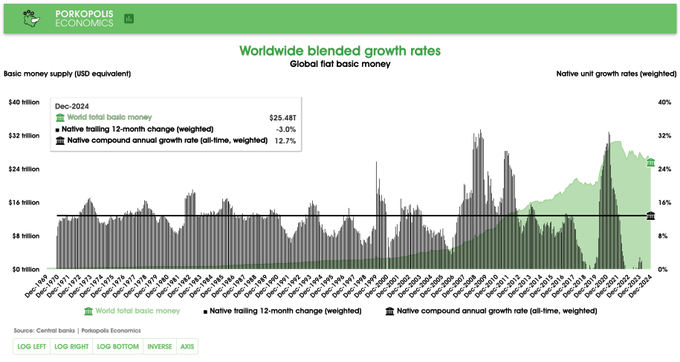

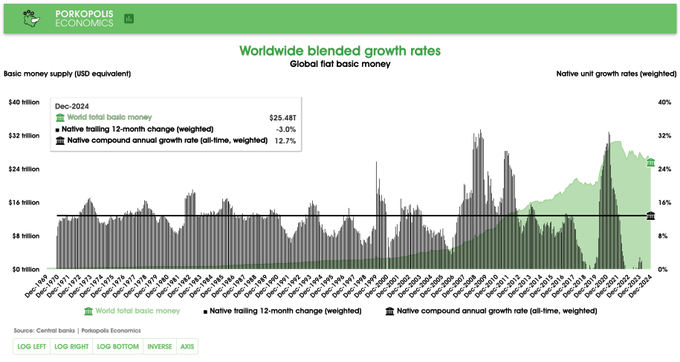

As this next round of political theater plays out, and one can only hope for just, lasting peace and security with clear eyes from all democratic allies, the printing presses will do as instructed. But as we look through this update, you will see that we are actually at very low, relative-levels of money printing historically, even slight negative money growth.

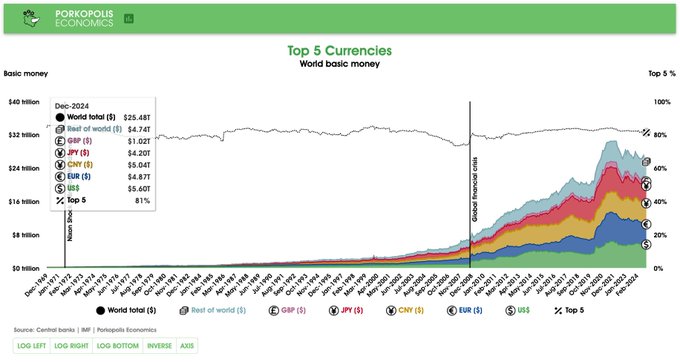

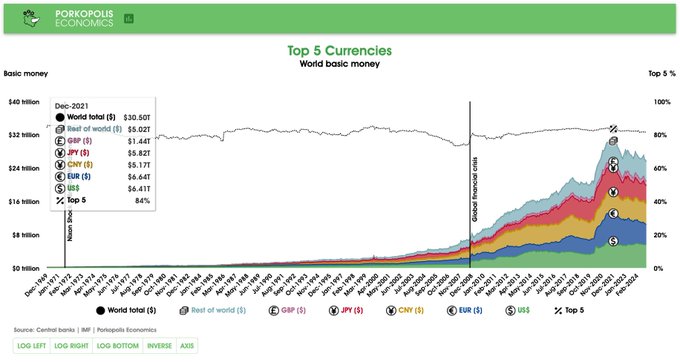

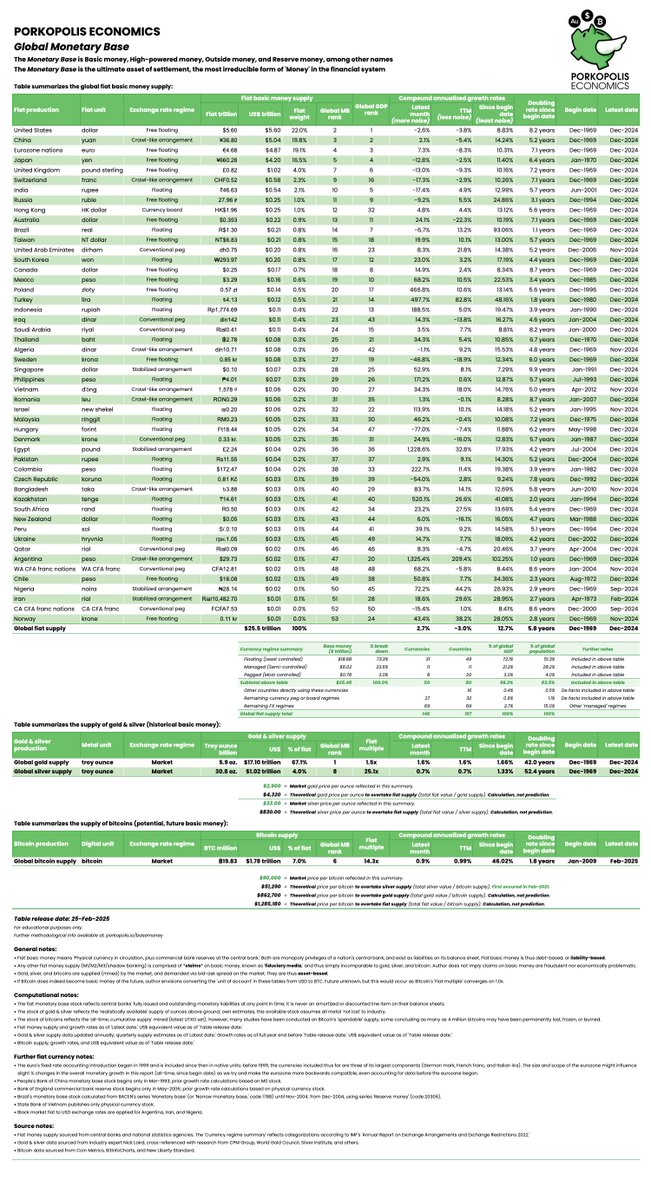

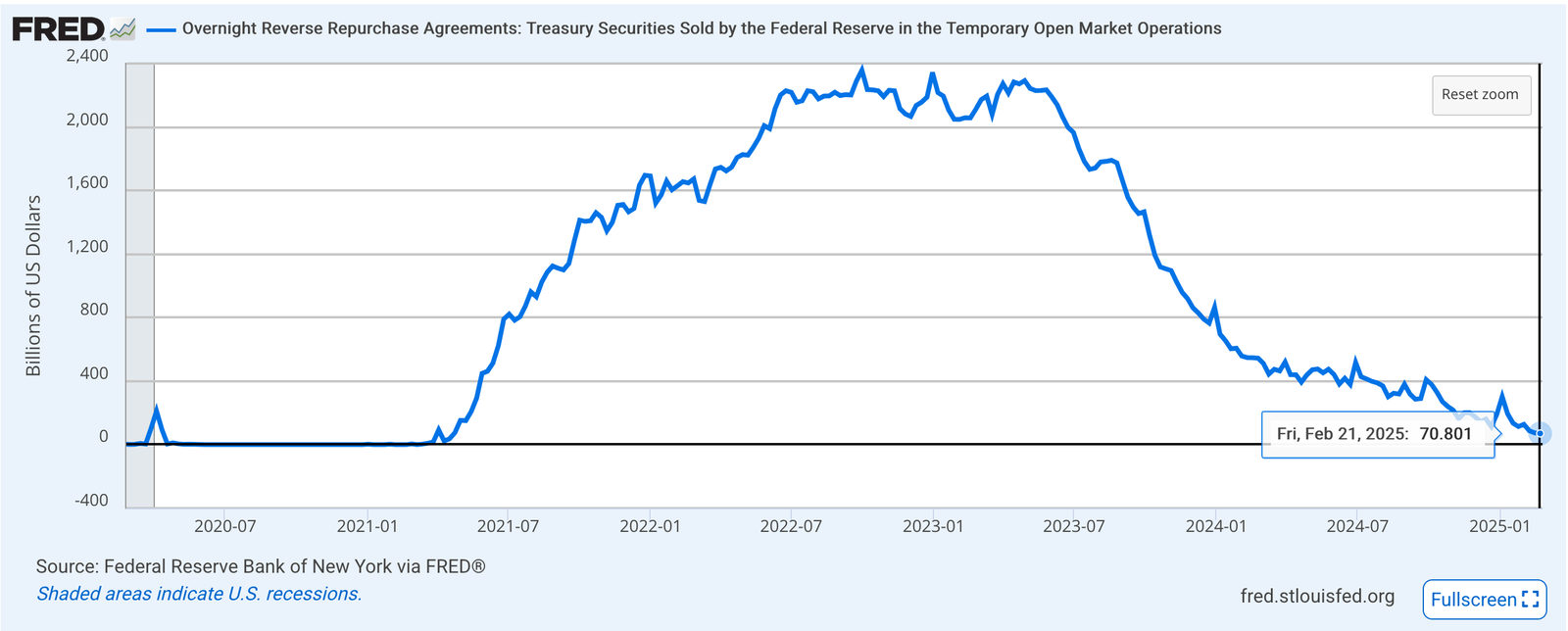

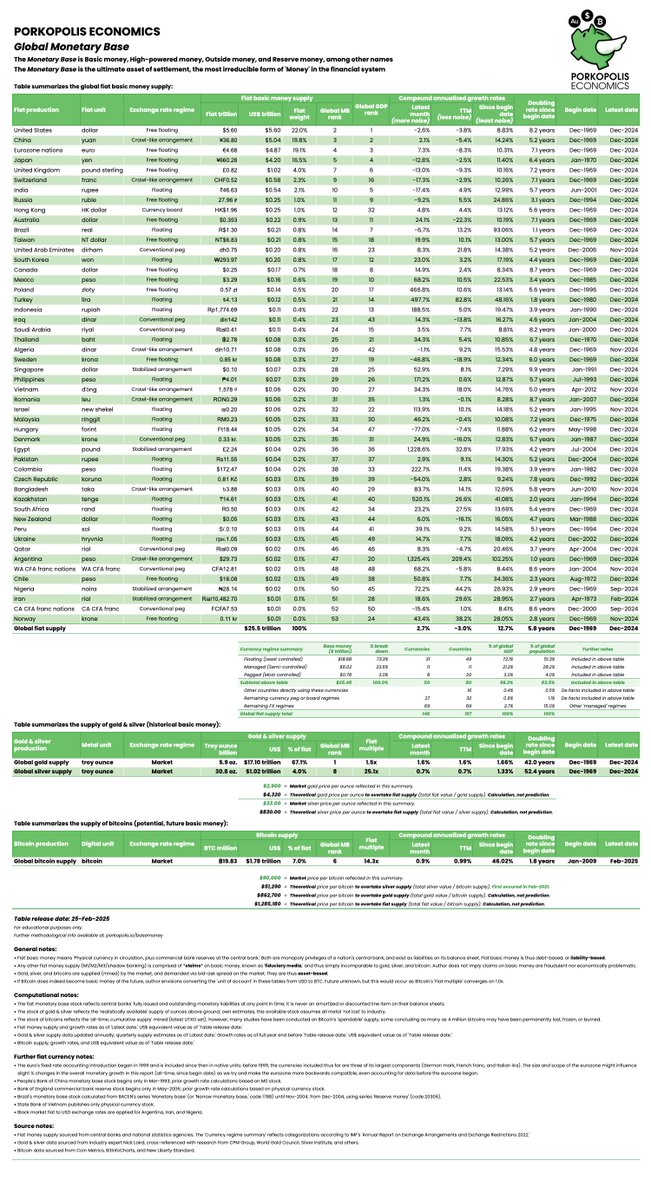

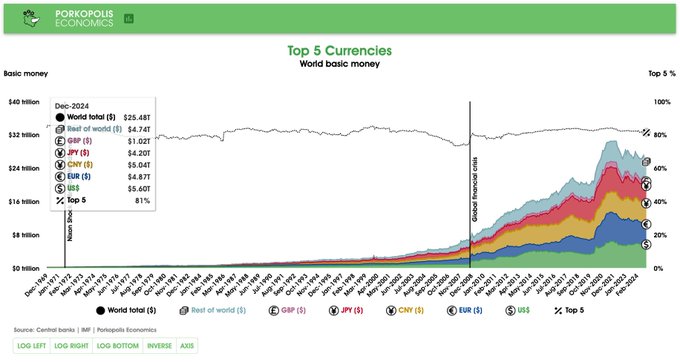

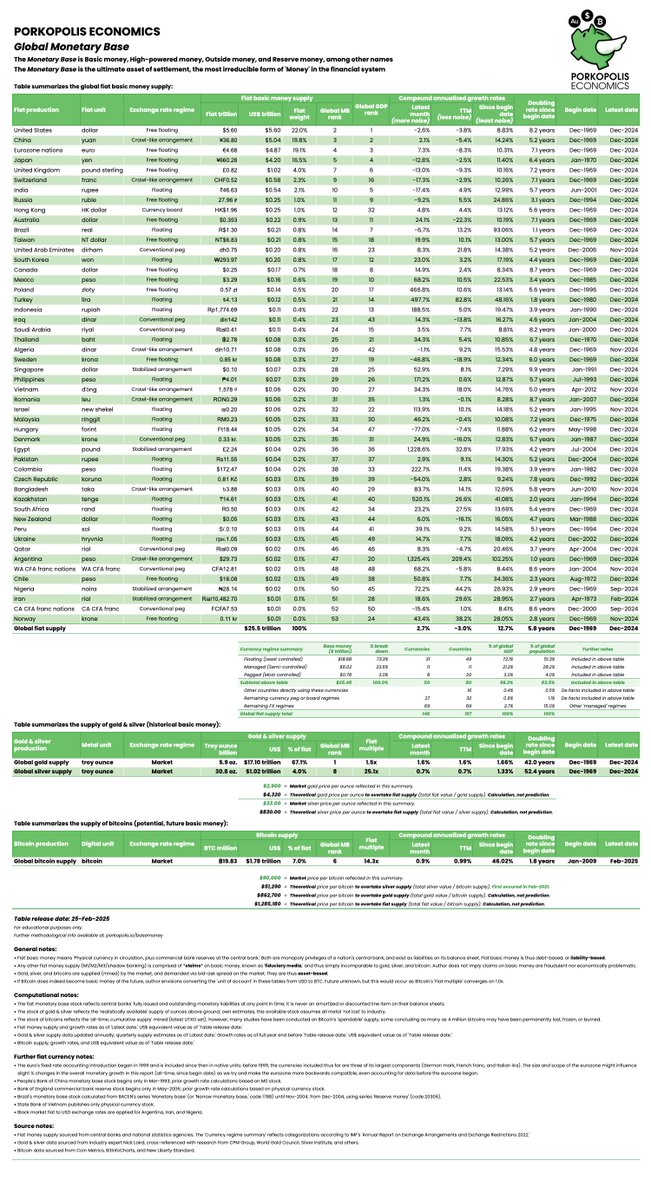

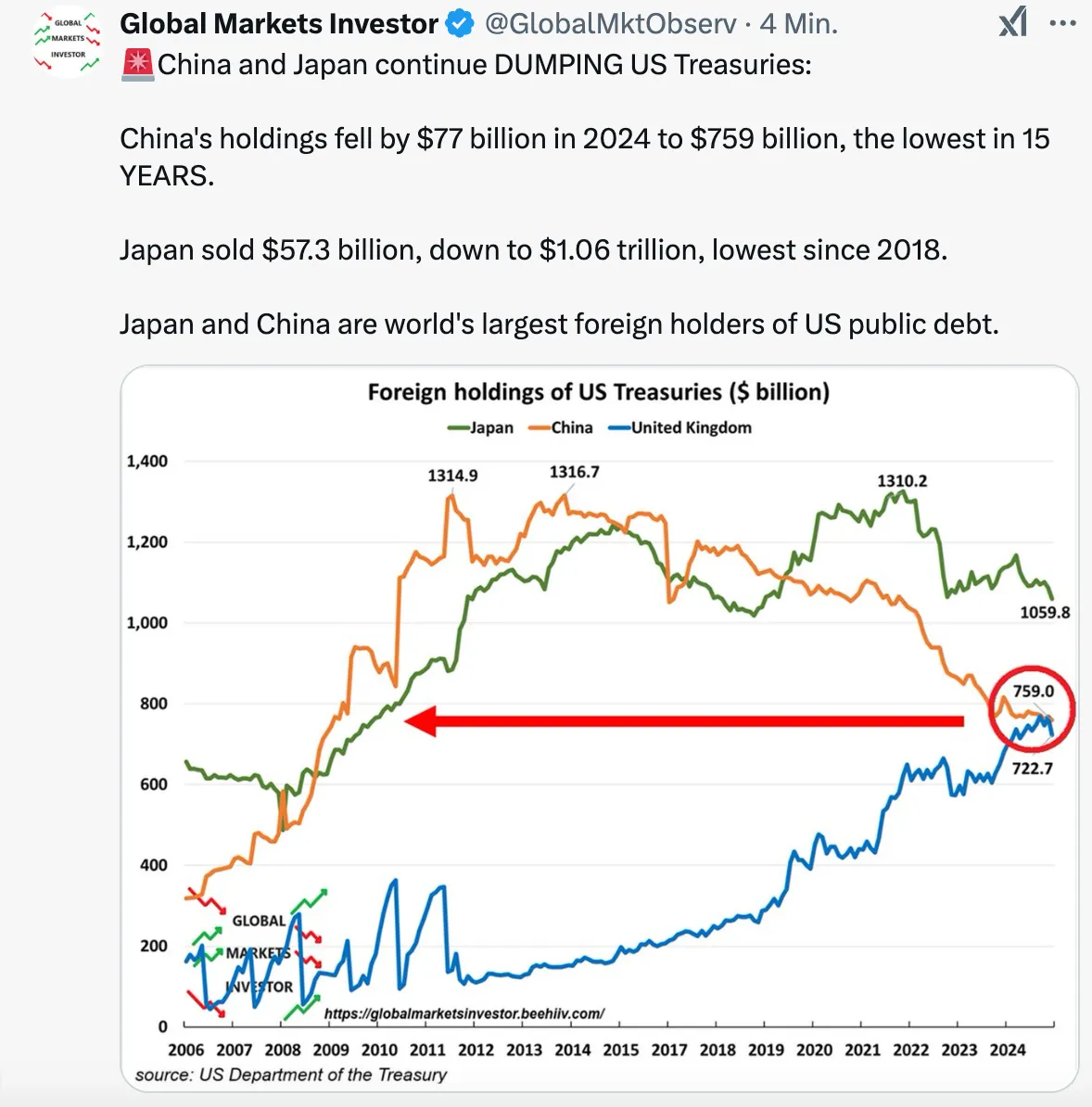

Bitcoin continues on, and as of 31 December 2024, its **$1.8 trillion market cap was 7.2% of the global monetary base**. That means that the global monetary base, for this update, is $25.5 trillion.

## **Why the global monetary base?**

It is the only money supply that is economically analogous to bitcoins, digital store of value today, and to gold and silver ounces, store of values from the past.

The monetary base is **central bank money**, comprised of two supplies:

1. **Physical currency**: Notes and coins, or “cash;”

2. **Bank reserves**: The “Master account” that each commercial bank holds with its central bank.

Now, why do I refer to this as *Central bank money*?

This is because, unlike all other money supplies in the fiduciary banking world (like M1/M2/M3), the Monetary base is the sole and ultimate money supply controlled by the central bank. It is, literally, the printing press. What follows won't be a lesson in reserve ratios or monetary economics. The point is that you simply understand that there is a money supply that central banks solely control, and of course (of course!) this is what Bitcoin's 21 million are up against.

The monetary base is to the core of the entire fiat financial system, as 21 million bitcoins are to the core of the Bitcoin protocol. One is open and permissionless, and one is not. By the way, the monetary base is essentially (though not entirely) analogous to the total liabilities of a central bank, so we can (basically) say that the monetary base is the "balance sheet" of each central bank.

**On cash**. Quick notes on the above. Certainly you understand what "cash" is, and it is indeed an instrument that has been fully monopolized by each central bank in each nation around the world--only they can print it. Even though it is true that banks in more free banking societies in the past could freely print and strike notes and coins, the central bank (or state) monopoly has been around for a long time. Kublai Khan was the first to do it 750 years ago.

**On bank reserves**. Don't stress your brain on this too much, but this is the main "settlement money" that banks use between each other, when they want to settle their debts. It is digital now (Fedwire in US, CHAPS in UK), but it doesn't technically have to be, and of course before modern technology took over even a few decades ago, it was not. These two stacks of retail and wholesale cash, stacks of central bank money, are what make up the **Monetary base**. *This is the printing press*. Only this compares to 21 million bitcoins. And gold, and silver by the way.

Final note, central bank digital currencies, or CBDCs, which are simply LARPing on Bitcoin's success, are indeed created by central banks, and they are indeed classified as Base money. They are going to be a "third rail." They are thankfully incredibly small, pilot projects today. We will see how far democracies will be tested, as autocracies no doubt will mainstream them; but for now, consider them, at least economically, to be inconsequential to the update below. It appears that central banks are actually cooling to them, as of this writing.

With that review out of the way, onward to Q4 update for 2024.

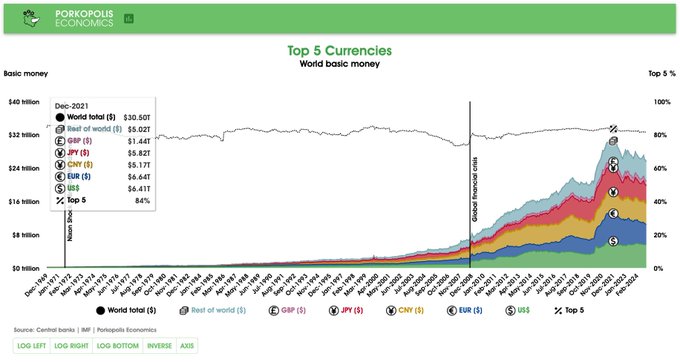

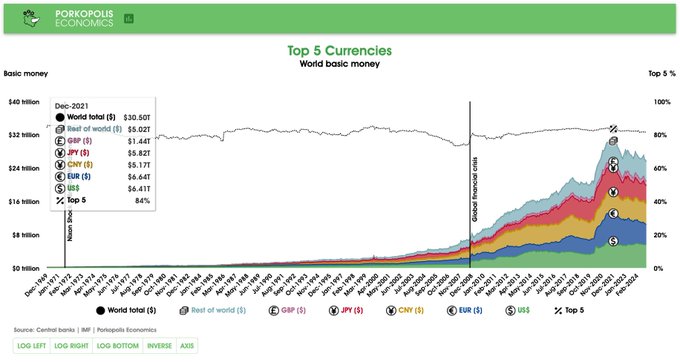

## **Bitcoin is the 6th largest money in the world**

This is unchanged from last quarter.

In February 2024, it surpassed the monetary base of the United Kingdom; that is, its value was larger than the Bank of England's balance sheet, and it remains so to this day.

As of 31 December 2024, it is only the balance sheets of the big four central banks that are larger than Bitcoin. These currencies are:

1. **Federal Reserve (dollar)**: $5.60 trillion

2. **People's Bank of China (yuan)**: $5.04 trillion equivalent

3. **European Central Bank (euro)**: $4.87 trillion equivalent

4. **Bank of Japan (yen)**: $4.20 trillion equivalent

If we remove gold from the equation (and we shouldn't), then Bitcoin could be considered the fifth largest money in the world. Including gold, Bitcoin is the sixth.

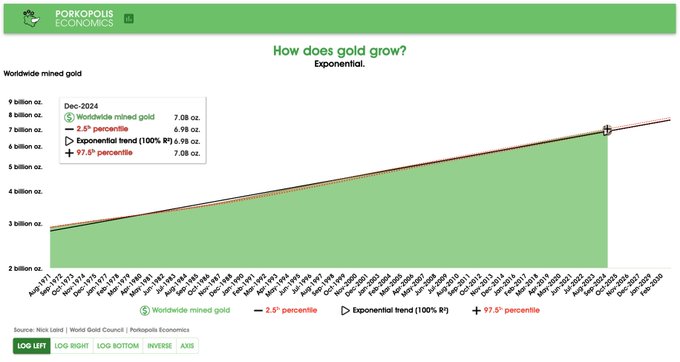

However, the all-important monetary metal throughout history that even a child knows about--gold--is still king at around **$17 trillion in value**, or 6 billion ounces worldwide. Note, this does not include gold lost/recycled through industry; in that case, it is estimated that about 7 billion ounces of gold have been mined throughout humanity.

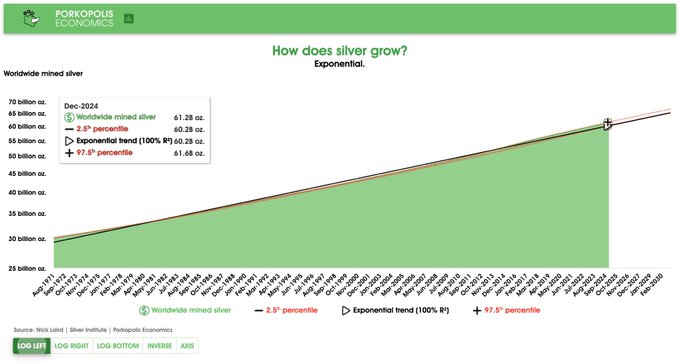

Silver, for what it's worth, is still a big "monetary" metal; though it is true, much more silver is gobbled up in industry compared to gold. There are about 31 billion ounces of non-industrial silver floating around the world (most of it in jewelry and silverware form) that is valued in today's prices at nearly $1 trillion. Bitcoin bigger.

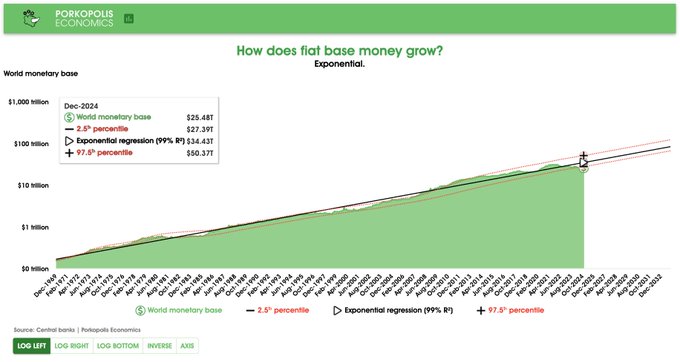

## **State of the print: $25.5 trillion**

This is down $1.5 trillion from last quarter!

However, we must also remember that as currencies lose value against the best-looking horse in the glue factory; that is, the dollar, then this dollar value actually "dampens" the effect of the print. More on this below.

If we consider **$25.5 trillion as the Big Boss** of central bank money, then Bitcoin at $1.8 trillion network value (December, quarter-end figure) indeed has some way to go. But as anyone who follows Bitcoin for a sustained about of time knows, this can change rapidly. We can also imagine how the Pareto distribution occurs even in money, if Bitcoin after only 15 years is already larger than every central bank money in the world except for four of them. Wild to ponder.

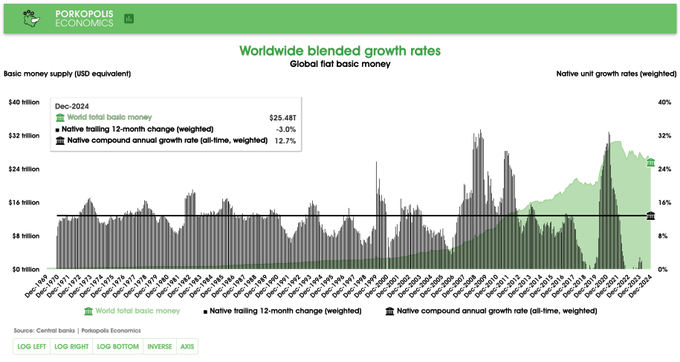

## **All-time supply (monetary) inflation: 12.7% per year compounded**

This is a long-term, "smoothed" monetary inflation, or money growth figure. It is looking across all the 50 currencies in my sample, going back to 31 December 1969 for almost 40% of them, and for those that don't, simply adding them into the weighted basket as data becomes available.

Roughly stated, it means that central banks on balance double their money supply every 5.8 years. This is a fact.

However, this overall rate of increase is indeed declining, and has been since 2022. For example, if we looked at this headline figure from last year ending 2023, it blended to **12.9% all-time, or 0.2% higher than now**. Still, even though central banks have been trying to tighten from their overheated 2020-22 money print, the overall, net effects of money growth **in native fiat units** have not changed significantly.

For more detail, we can look at the latest year.

## **Trailing 12-month money growth: -3.0%**

What is very interesting, however, and alluded to above, is how all global currencies continue to decline in *relative value against the dollar*. According to the simple, USD-based trendline analysis for all global currencies in the dataset (see below), we should have a $34 trillion monetary base right now, based on past performance. We have a $25.5 trillion monetary base right now. We are actually *lower than the 2.5th percentile* on this trendline.

But take note: What you are really seeing is actually *not that much less of money printing* (they have been letting up the gas, to be sure), but rather, a tremendous loss in purchasing power of all currencies versus the dollar!

In other words, from 2023 to 2024:

1. The weighted average, native change in money base growth of all currencies was **-3.0% over the prior 12 months**;

2. The overall dollar value change was **-8.5% over the prior 12 months ($25.5 trillion vs. $27.8 trillion)**.

This means that, in the last year, government money lost an **additional 5.5% per year in dollar purchasing power**, beyond its reduction of 3.0% in money print. Wild.

## **Since 2021 peak**

I don't publicize this information as much, and I probably should. In dollar terms, in December 2021, global central bank money printing **peaked at $30.5 trillion**. Big number. Now, it is $25.5 trillion. So one would assume that the printing presses have cooled by 16.4% in the last three years.

But again, as I have just described above, we are trying to see beyond Wittgenstein's Ruler here. This can be difficult, because we have 50 different currencies to contend with.

It is true, in the last three years, the **dollar value** of the top 50 currencies in the world has fallen by 16.4%.

*But does that mean that central banks are printing 16.4% less than before 2021?*

No.

In fact, when you look at the weighted average of each central bank's performance over the last three years, in their *native currency units*, you will find **that the weighted average decline in printing is only 2.4%**.

Notice anything? This decrease over three years is actually *less* than the decline over the last 12 months, which was 3.0% (section above).

And most obviously, **it is far less than 16.4%**.

There are dollar values. These grow differently from all the **native currency units**, because of foreign exchange rates.

**There are native currency units**. These grow differently from all the dollar values of these currencies, because of foreign exchange rates.

Central banks are printing less over the last three years: **2.4% less overall**. But this is much less than the decline in the dollar value of 50 currency stocks over the last three years: **16.4% decline**.

One must tear through the numbers to understand both ideas. I have provided you with both.

## **New data: China**

Firstly, what I am about to say has nothing to do with what I've described above, except for a very small impact on the overall, headline figure of 12.7% money growth. This is a historical addition.

I have added some important new monetary data this quarter, and that is from the quasi-transparent yet enormous economy of China. On the PBoC website, they publish balance sheet data back to only 31 December 1999. I have used this timespan for seven years now in my quarterly updates. However, I have now gone through some new figures from the book *China Financial Statistics (1949-2005)* and added additional data points all the way back to 1969 for China. It is published from PBoC sources. I am using M0 figures from 1969 until 1993 (only available, very compatible, as a subset of base money), and from 1993, they begin publishing full monetary base data. The break in growth metrics when switching from M0 to MB in 1993 is ignored.

The changes from this new data--from a huge, growing economy such as China will, as expected, boost the overall inflation numbers in my dataset. These are the net effects of the new data, as of 31 December 2024:

**China Monetary base average monthly growth for entire series:**

1. Old data from 1999: 0.85%

2. New data from 1969: 1.04%

**China Monetary base compound annual growth for entire series:**

1. Old data from 1999: 10.73%

2. New data from 1969: 14.24%

**Overall Monetary base compound annual growth for entire series:**

1. Before this additional China data: 12.56%

2. After this additional China data: 12.73%

So the net effect on "global monetary inflation" with this additional data is 17 basis points, or 0.17%. I thought the overall effect could be higher, but one must remember these growth rates are weighted by the *relative USD value of each respective base money*, on a continuous basis, updating each month. In the 1960s, 1970s, and 1980s, China was a much smaller proportion of the global economic pie than it is today.

One final point with this new data, and with my monetary inflation data overall. I am fairly confident my headline number of **12.6-12.7% per year compounded** for global money growth is *conservative*. These are the top 50 currencies in the world. We just saw what new data did to the entire dataset, and from a huge country no less. If I were to add more currencies, such as those from Kenya or Morocco (and I will), these currencies will only marginally affect this headline money growth figure. What's more, this new data will by definition come from ***smaller, more volatile, higher inflation-producing*** currencies, so I would only expect my headline figure to creep higher, the further it is refined.

***Huge thanks to Eryn @reltbracco (npub1e2rd2k45ym2jmctnysfadxumrvrr57vqj69ck6trt2y62c40r0kqs9lx8t) for sifting through tons of Chinese historical content here, and for eventually finding a great book with Chinese historical monetary data that was in English!***

## **The trends**

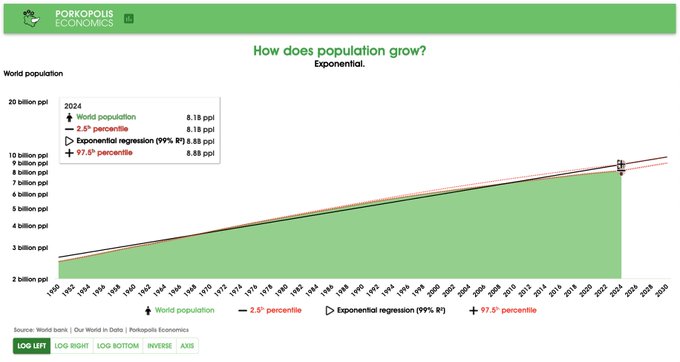

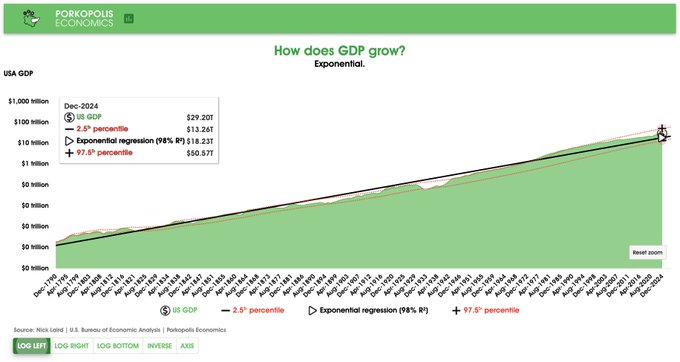

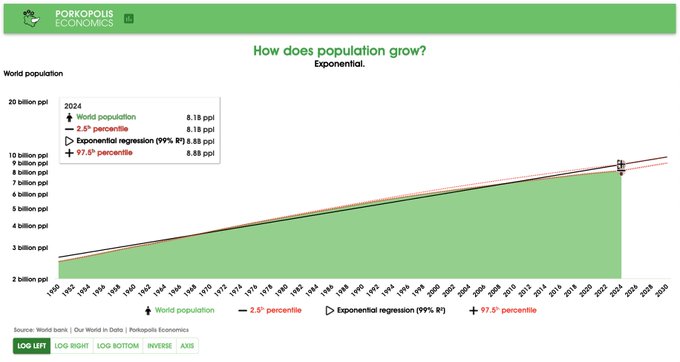

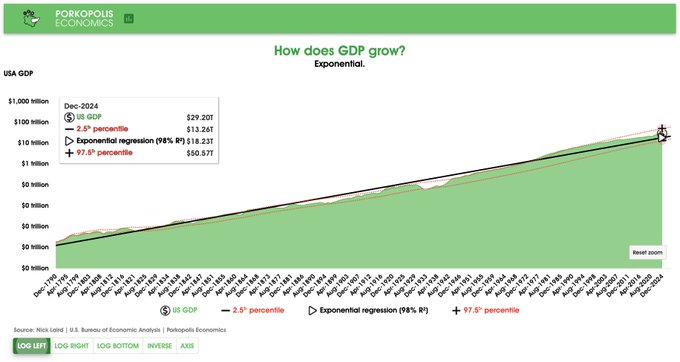

The remainder of the report is an update on global trends in demographics, money, and economics. All of these trends are **exponential curves**. The sole exception, is Bitcoin. It's price and market cap action, across time, are **power curves**.

One further change. I have allowed the 2.5 and 97.5 red percentile bands to evolve over time. I think this presentation allows the reader to see that trends indeed can change, across time. However, **the all-time trendline**, as of today, is the solid, black trendline.

We are where we are. Plan accordingly, never financial advice.

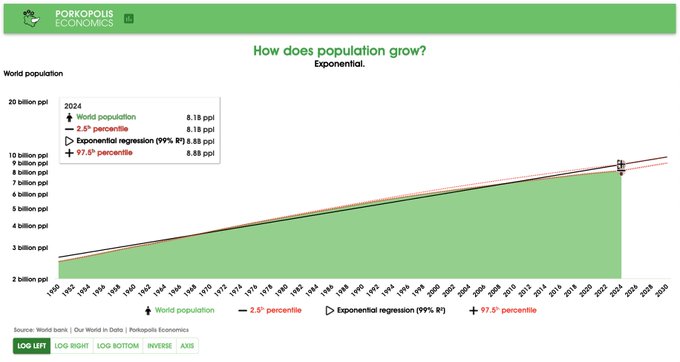

## **Population**

The world has grown exponentially at **1.7% per year** over the last 75 years. However, despite all the overpopulation myths you've probably heard, this rate of growth is actually falling, well below trend, and we only grow at **0.9% per year** at the moment, pulling the overall trend down every year.

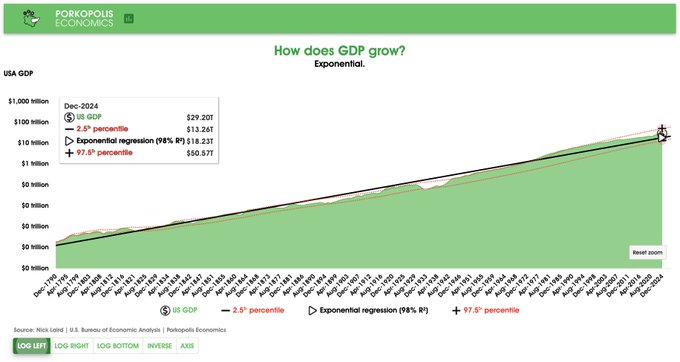

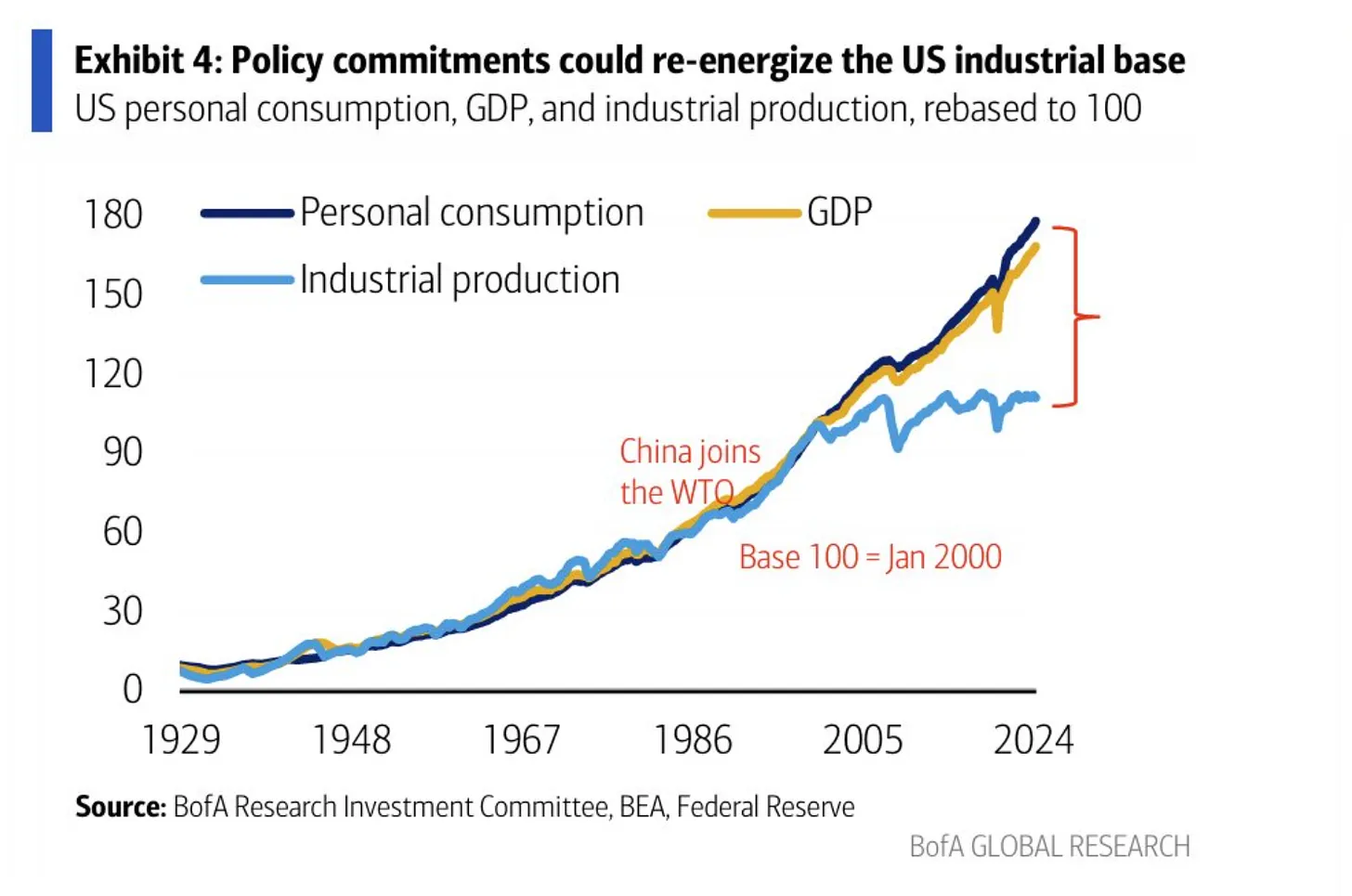

## **US GDP**

The United States has grown its economy at 5.2% compounded per year since the founding of the republic. We are at the higher end of this trend right now, $29 trillion output per year, growing at **5.3% per year**. As this is exponential growth, if I put it on log scale, it will become a straight line.

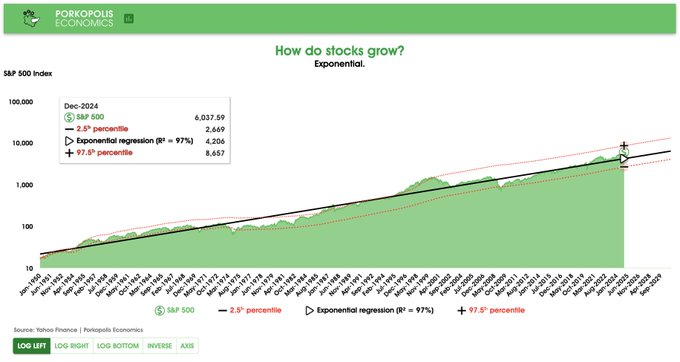

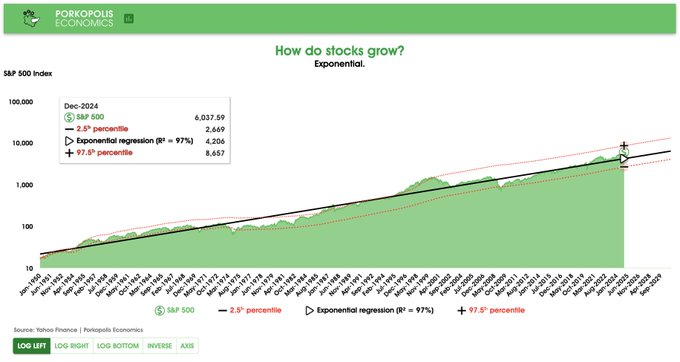

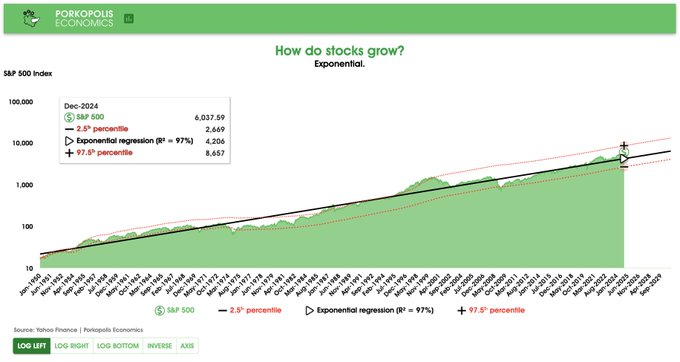

## **Stock market**

Stocks grow exponentially as well, don't let anyone tell you otherwise. The growth rate is **7.3% per year** for the S&P 500, the main US index that tracks more than 80% of total market caps. Currently, the market is well above trend.

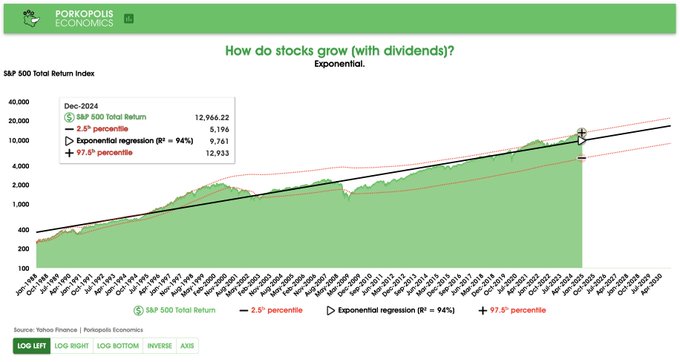

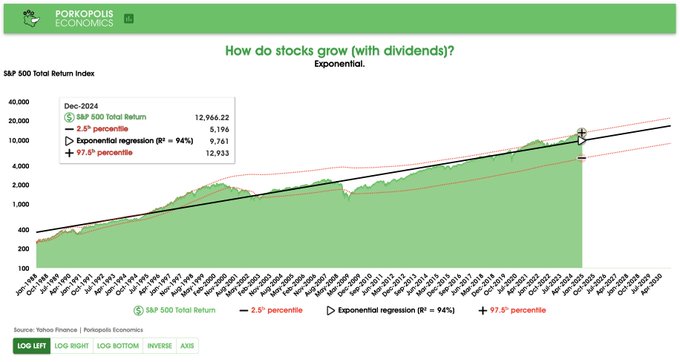

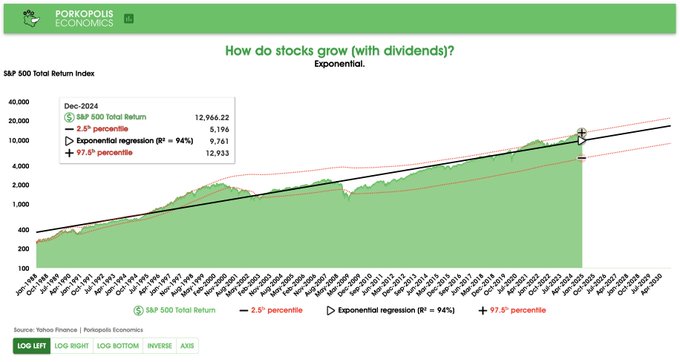

## **Stock market: Dividends reinvested**

*If you reinvest those dividends* into the same stock market, you'll earn more. The all-time compound annual growth increases by 2% to **9.3% per year** for the S&P.

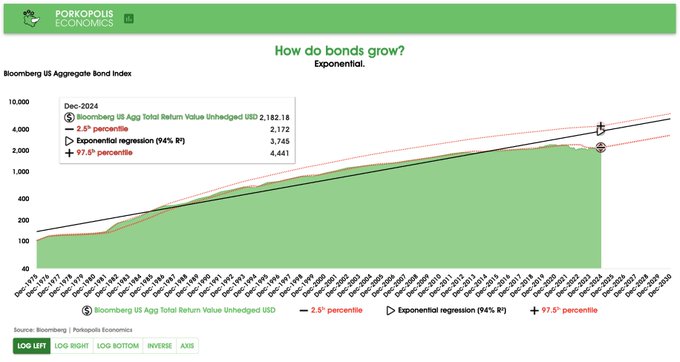

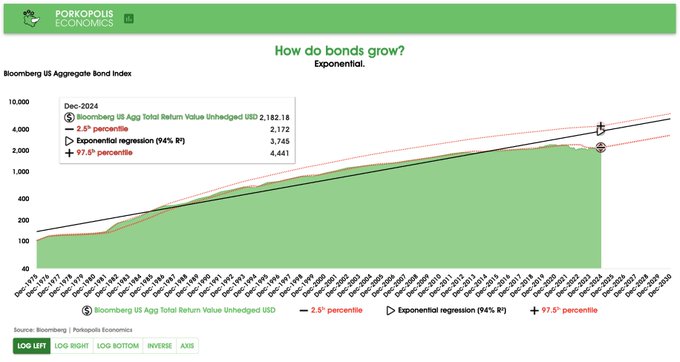

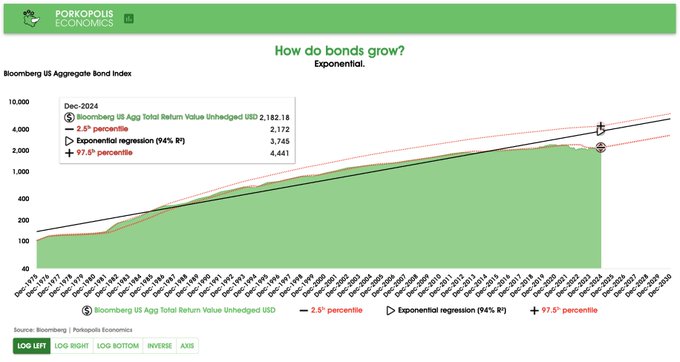

## **Bonds**

Bonds are supposedly safer than stocks (bondholders get paid back first), and more regular cash flowing. If you look at the longest running bond index in the US, it grows at **7.0% per year**, compounded. Notice how, in a rising interest rate environment (which we are in at the moment), bond prices will suffer. In this case, it's the Bloomberg Aggregate Bond Index. This has kept the bond market returns at the lower end of the range, since the global financial crisis in 2008. Not even 1% TTM return.

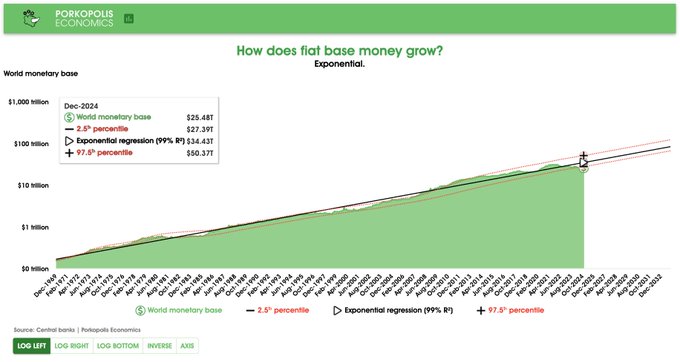

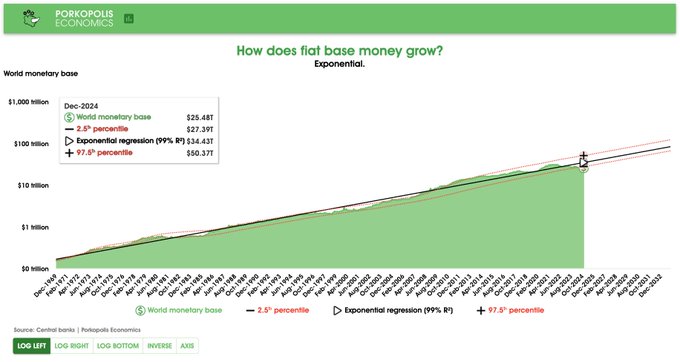

## **Base Money**

As we've discussed, base money grows across the world at a weighted average of **12.7% compounded per year**. However, this trendline analysis looks at it differently than my headline figure. It simply looks at the USD value of the global monetary base (again, currently **$25.5 trillion**), and draws an exponential trendline on that USD equivalent growth for 50+ years. In other words, this is going to be *after all currency fluctuations* have played themselves out.

**Slope of the trend is 10.2% compounded for this one.**

This is further confirmation that, even though central banks around the world like to print at 12.7% compounded all-time in native unit terms, they will always lose value against the world's reserve currency, as that shakes out to around 10.2% compounded in USD-terms.

And we really are scraping the bottom of this range. 0.7x the trendline, which

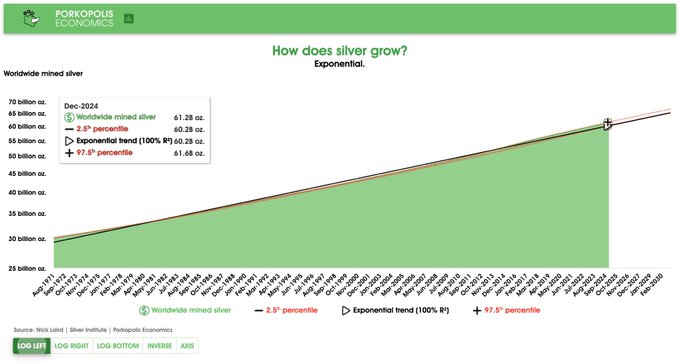

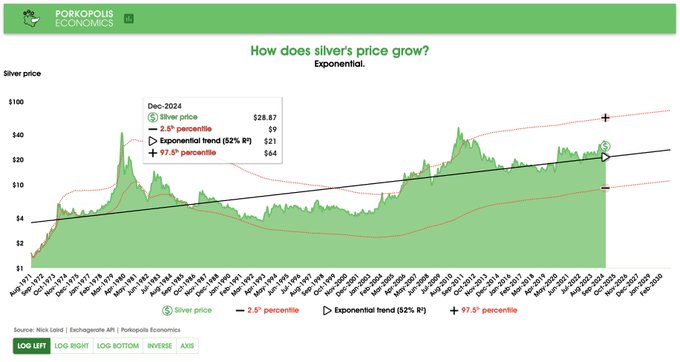

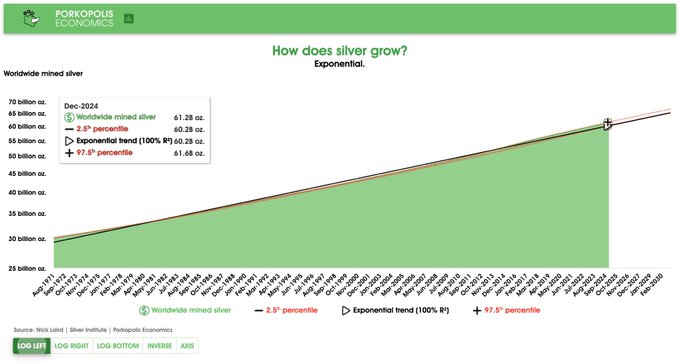

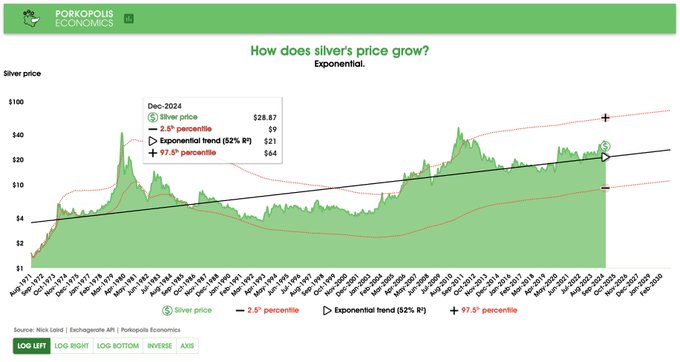

## **Silver supply**

This is total ounces ever mined. They trend upward at **1.4% per year**.

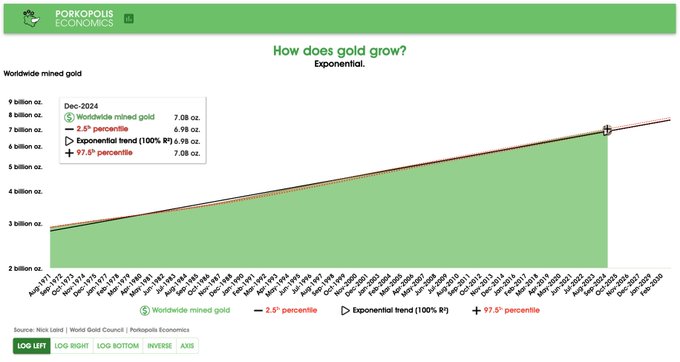

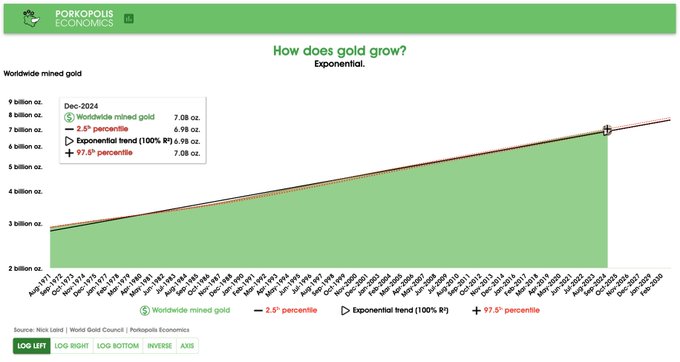

## **Gold supply**

This is total ounces ever mined. Gold trends upward at **1.7% per year**. Faster than silver. Surprised? Notice the R-squared (goodness of fit) for both silver and gold production increase.

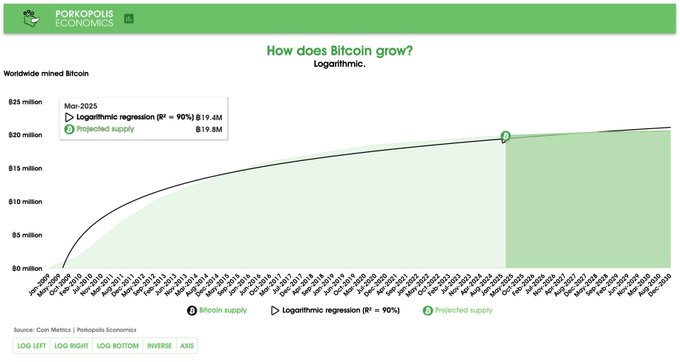

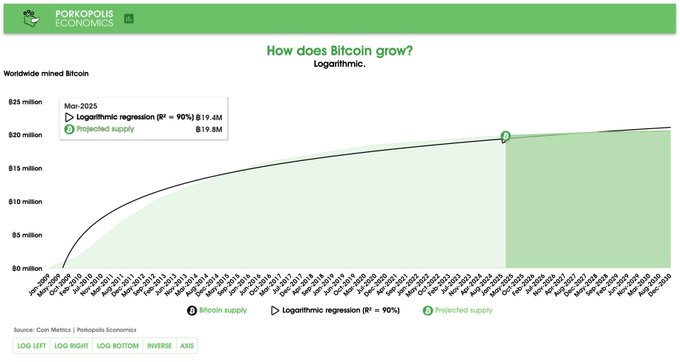

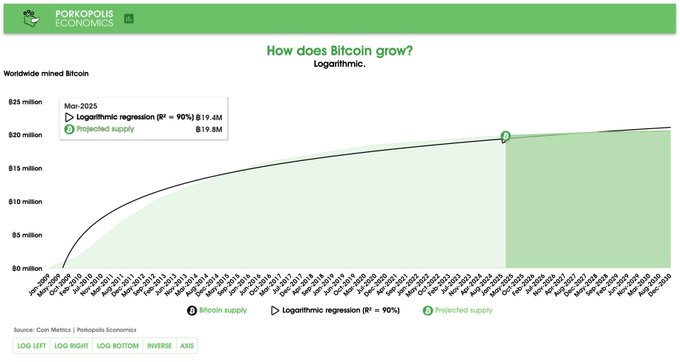

## **Bitcoin supply**

Bitcoins grow according to a basic logarithmic curve. Trying to draw percentiles is pointless here, and even measuring a trendline is relatively pointless, as everyone knows the bitcoins prescribed into the future, per the protocol. Better to just quote the trailing 12-month growth figure, and it is **1.2% per year** and falling, as of quarter end Dec-2024. Less than gold or silver.

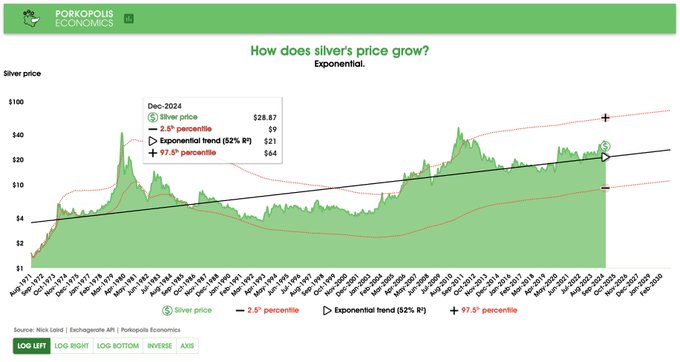

## **Silver price**

Since 1971 it's trended at 3.5% per year. Silver bug?

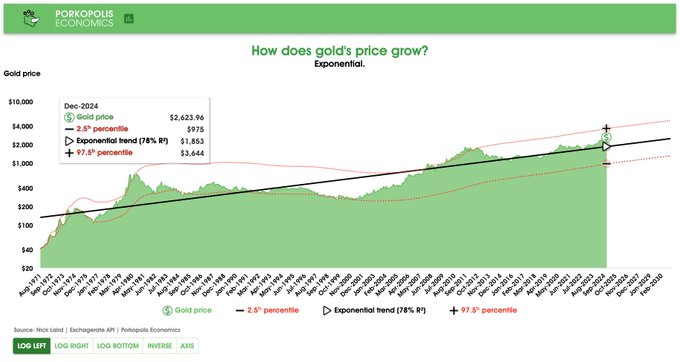

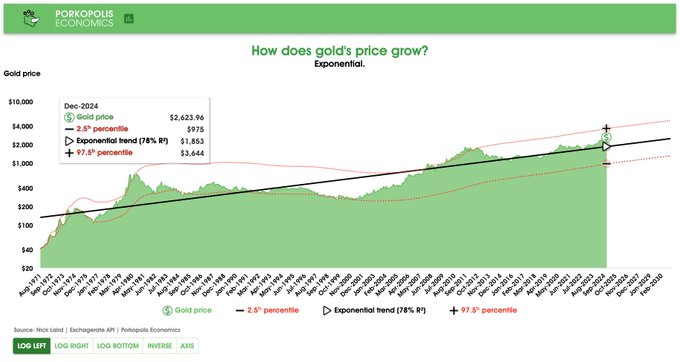

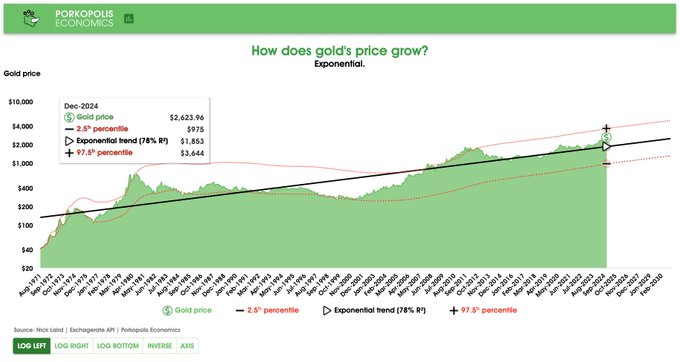

## **Gold price**

Since 1971 it's trended at 5.1% per year. Gold bug?

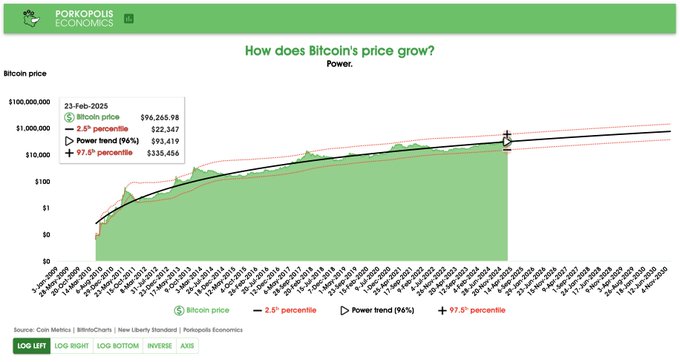

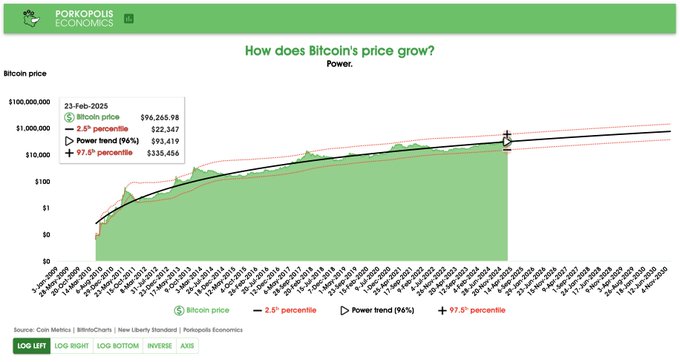

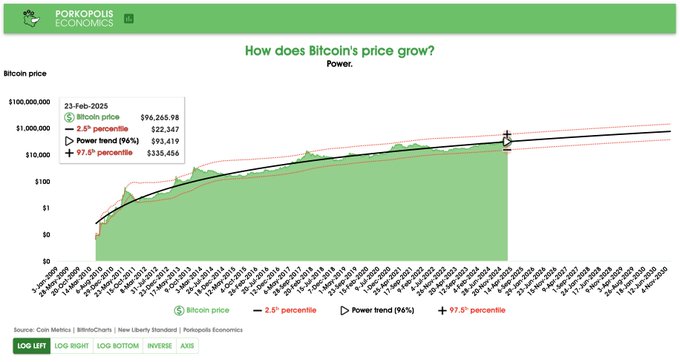

## **Bitcoin price**

Bitcoin's price (and market cap) grows according to a power trend. Did you notice that the prior exponential trends displayed themselves as straight lines on log scale? Well, with Bitcoin, the power trendline gradually falls across time, but the growth is still well larger than anything we've covered thus far. Now, we have finally arrived at something that grows differently than exponential.

[As I've observed since 2018](https://x.com/1basemoney/status/1079740420438011905)

.

Why? Because you are viewing an *adoption curve*. This is how networks scale.

Bitcoin's power trendline has grown **164% per year** since Bitcoin Pizza Day in 2010. Note that this is something akin to a "Lifetime Achievement" figure, and it will continue to fall every day. Over the prior 12 months ending 31-Dec-2024, Bitcoin grew **121.1%.** The compound growth of the power trend today is just under **44% per year**. By 2030 it will fall to "only" **31% per year**. You can find more dissection of the

[power curve on my website here](https://www.porkopolis.io/thechart/)

.

Oh yes, and it is free (as in speech), open, and permissionless money.

## **To summarize**

That was a lot of data across a lot of charts. I've compiled all these trendlines and data in a helpful table here for you to review at any time. These are the growth trends of the monetary and major asset world, as of year-end 2024:

Again, a quick breakdown on why Bitcoin is so interesting, and confounding. Where most things in the financial and economic world grow *exponentially*, Bitcoin is actually a compilation of *three* different trend patterns:

## **Conclusion**

Below is a detailed summary of all the input assets:

1. 50 fiat currencies: $25.5 trillion

2. Gold: $17.1 trillion

3. Silver: $1 trillion

4. Bitcoin: $1.8 trillion

Print it out if you like!

Thank you for reading. This takes a lot of time to put together each quarter. If you enjoyed, please consider zapping, and you can also donate to my [BTCPay](https://donations.cryptovoices.com/) on [my website](https://www.porkopolis.io/) if you'd like to help keep this research going.

Take care.

-

@ 4d41a7cb:7d3633cc

2025-02-25 13:53:41

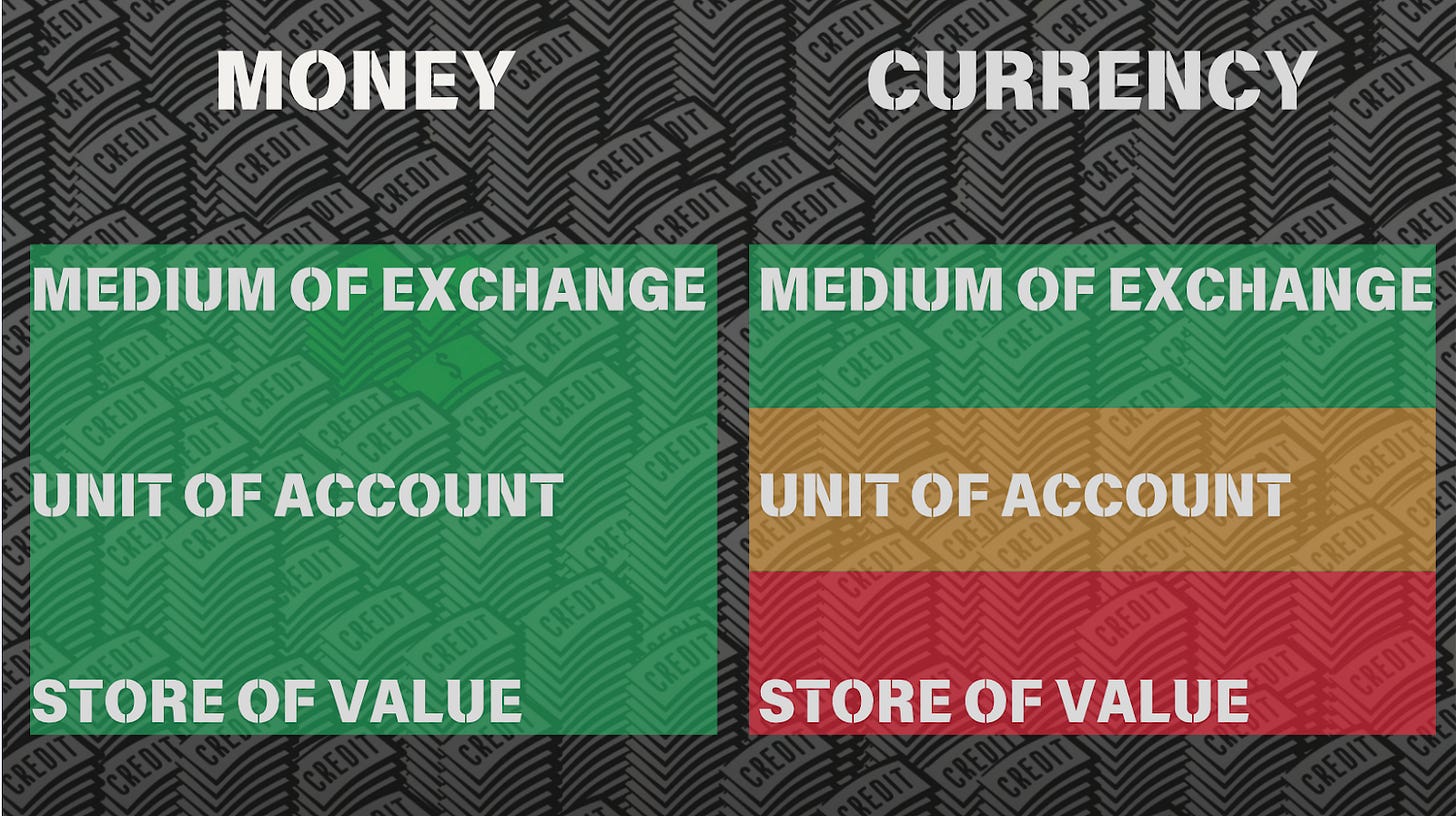

Money is more abstract than most people think, as I will show in this article. Debt slavery stems from financial illiteracy, which occurs intentionally. The biggest secret is how bankers actually create **currency claims out of thin air and transfer the wealth of their clients (including nation states) to themselves for free without risking a cent, real money, or currency.**

## **MONEY**

Money, one of the most important things in our lives, is so important that we exchange wealth to obtain it. Not because we want it but because we need it in order to buy food, shelter, clothes, etc.

Money is not inherently bad, although some may argue that the love for money is the root of all evil, and I'll agree. If you are willing to sacrifice your soul, honor, reputation, family, or friends for money, it indicates a lack of morality and a willingness to engage in harmful actions to satisfy your greed and materialistic desires.

**Money is a technology, a tool, and like any tool or technology, it is impartial**; it cannot be inherently good or bad. It can be used to help others or to destroy them. At the end of the day, it’s all about the intention behind human behavior.

Money is not just a useful tool; it’s **the most important tool** to have for global commerce, division of labor, specialists, and the level of sophistication and comfort we achieve as humanity. All of this will not be possible without this tool working as a common medium of exchange and standard of value, a common language for all humanity: the language of monetary value.

**Money is the cornerstone of civilization.** Money is the bloodstream of commerce, and commerce is the spine of civilization; it’s what made our civilization so prosperous, letting any one of us decide how we want to provide value to society.

Money is half of every transaction, and since we will always need to intermediate between every exchange, money is the perfect intermediary to help achieve millions of different combinations of exchanges. It will be practically impossible to barter on a global scale; even in a small community with a few different products, it will be a mess.

For example, if there were 10 products, there would be 45 combinations; if there were 100, there would be 4950 combinations. Imagine a scenario on a large scale, requiring the exchange of hundreds of thousands of products every second..

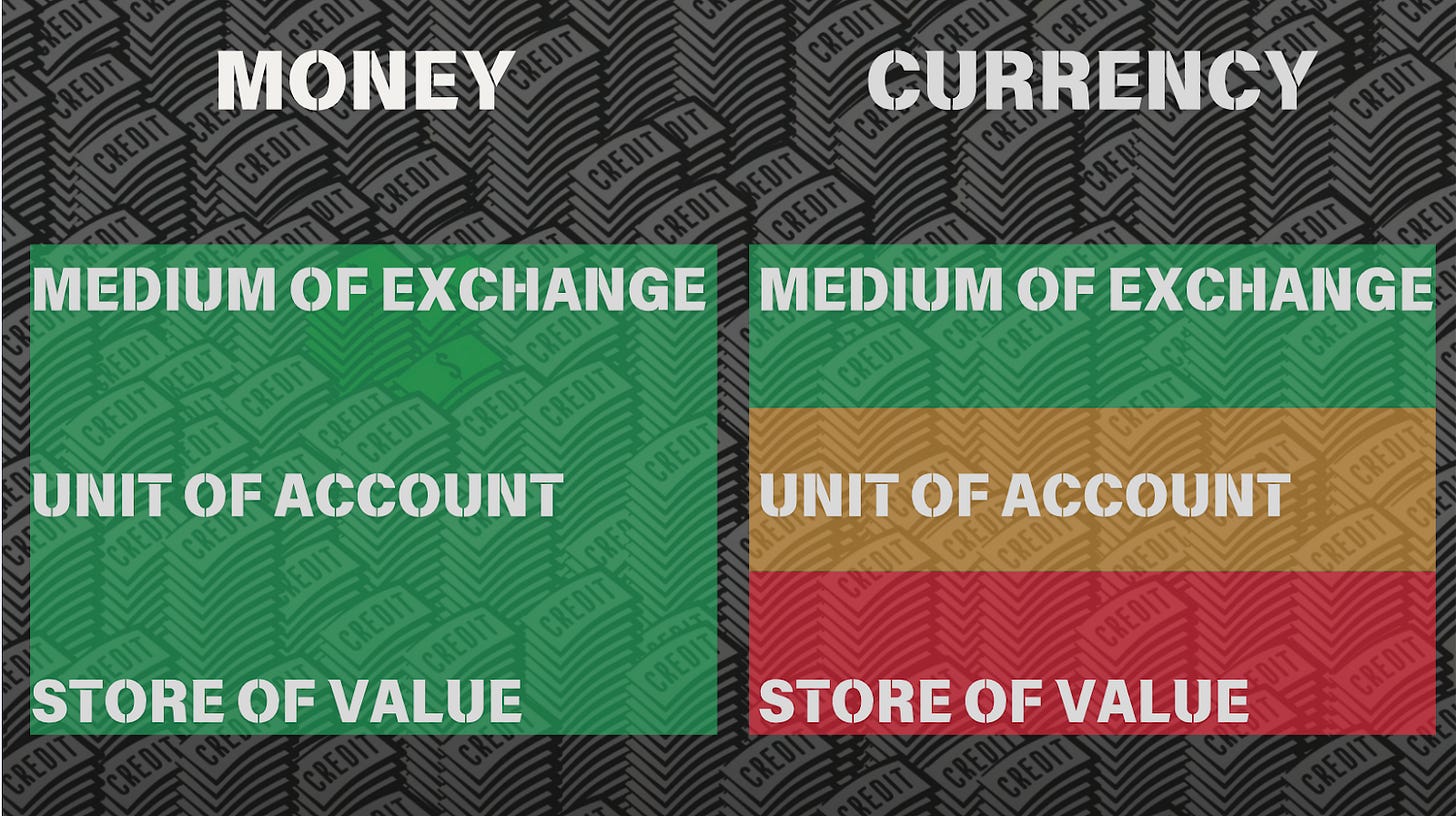

This issue **necessitated the development of a new technology: money, which in turn led to the emergence of moneychangers (v4v). Money is a tool to exchange, measure, and store wealth.** Wealth is anything we can sell: our labor (time and energy), our house, a car, a product, a service, etc.

**Gold and silver were money for thousands of years** because of their unique characteristics of scarcity, durability, divisibility, and transportability. The most important characteristic of these metals is that they are scarce, and they can’t be created out of thin air or reproduced with no effort.

**Only God can control the supply of gold and silver found in nature.** Men can only extract it, and it requires investment, work, time, and effort to find and mine it. So the common knowledge and the common sense of the people over thousands of years consensually chose gold and silver as money. And **this money is the only lawful money under common law.**

> “Gold is money, everything else is credit”

>

> J.P. Morgan 1912

As an interesting fact, the word "money" is used 140 times in the King James Bible, the word "gold" is mentioned 417 times, and the word "silver" over 320 times. But the word “currency” is not mentioned a single time.

The most important function of money is to **exchange and store your time and energy**. You work to acquire money and then use that money to acquire other goods and services.

**Our time and energy is our real wealth** because it’s limited. We all have a limited time on earth, and we can do certain things in the 24 hours we have every day, so we have to be conscious about how we administrate and store the fruits of our labor.

Money is a means to an end; we don't want money; we want what money can buy, and guess what, money cannot buy more time.

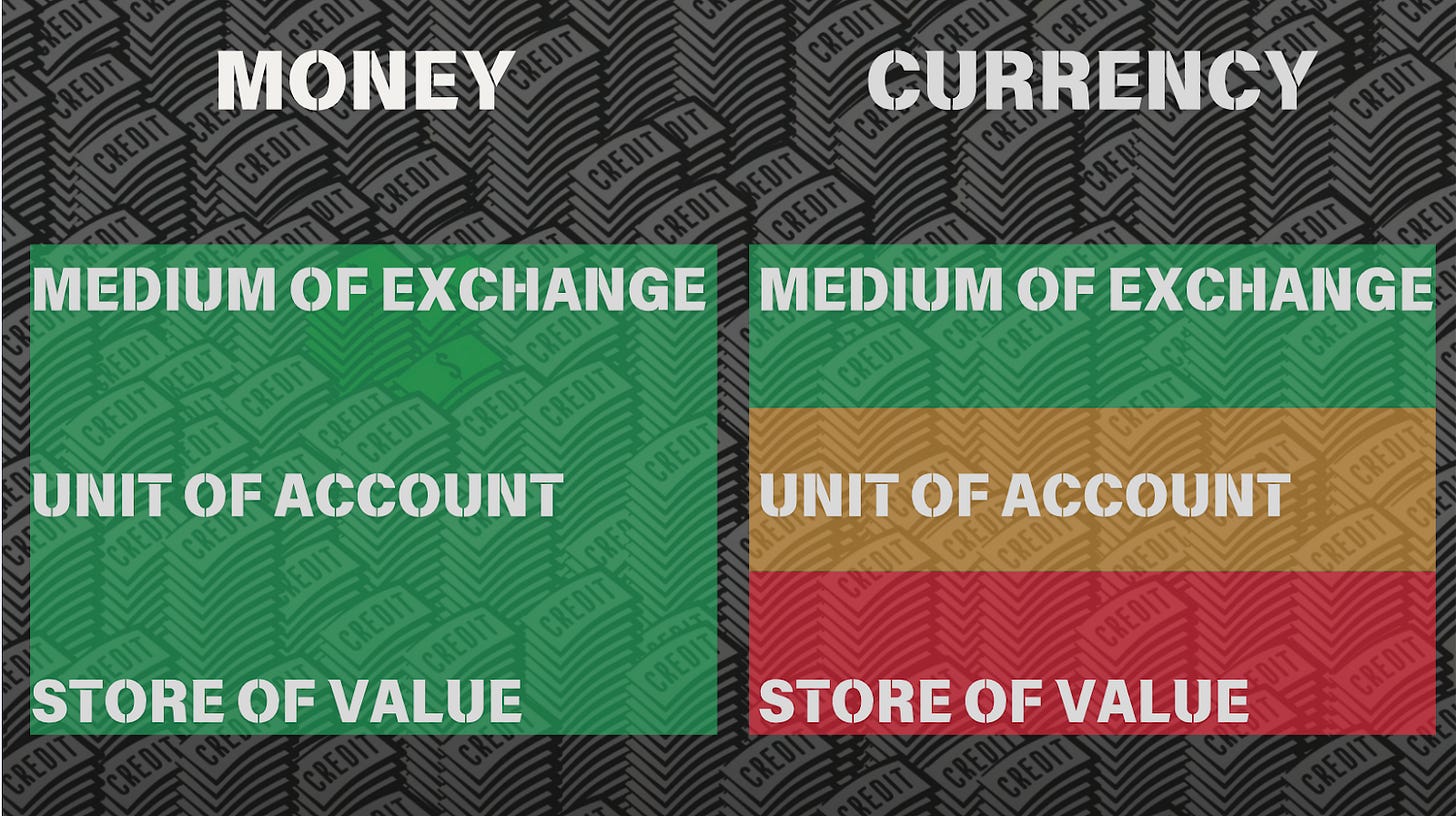

## **CURRENCY = FAKE MONEY**

**Currency exists as a money substitute.** Currencies began as the opposite of money, the **promise to deliver money in the future: debt**. Currencies can be used to exchange wealth, but they are not a fair unit of account and are never a good way to store it because men are tempted to create more and dilute its value (a process known as inflation)

Currencies have almost all the same characteristics of money, but there’s a big difference: **currency is not scarce and durable**. Missing the store of value characteristic of money, since **its supply can be manipulated by men.**

For wealth preservation and measuring, modern currencies make no sense. Men control the supply of currency; **banks and governments can inflate or deflate it in any amount they please, giving them supreme power and control over wealth distribution.** This creates two classes of citizens: those who work to acquire currency and those who create it instantly and for free.

International banks have stolen money (gold and silver) over the past century, replacing its supply with currency or fake money (paper receipts). \[1913, 1933, 1944, 1971\]

Under this monetary game, those with "fixed income," savers, and creditors are the biggest losers, while debtors and asset owners are the winners..

The **most important distinction to keep in mind is that nature controls the money supply, making artificial inflation impossible.** On the other hand, men can inflate currency in unlimited amounts. It is **a manifestation of God's power on earth, as the mediums of exchange serve as the lifeblood of commerce, the backbone of our economic system, and facilitate the division of labor.**

If someone can **inflate the currency supply, this has the same economic effect as counterfeiting,** and he’s effectively stealing from everyone contracting, trading, and saving in that currency. Manipulating the mediums of exchange in an economy enables manipulation of every security, industry, and business.

This is the reason the founding fathers of the United States made gold and silver only lawful money for the payment of debts. To give everyone equal protection under the law and to get rid of the nobility and two types of citizens: bankers and workers or nobles and plebeians.

> Bank-notes are not money. It 's currency. It’s unfair to take banks' currency as a standard for comparison.

>

> Bank-note currency is not “lawful money”. It never could be counted as part of banks cash reserves. ***It would be too much like a man writing and signing his own promissory note for a million and then claiming that this made him a millionaire.***

>

> The very grave evils any currency depreciation always impose upon businesses and the people.

>

> Alfred Owen Crozier, US Money vs Corporate currency, 1912

So money has three very important functions that work as the pillars on which the wellness of our economic system and civilizations relies. Currency is not a store of value because its supply can be easily manipulated, men in power can create more of it, and so using this always-changing currency as a standard of value or a unit of account is like using an always-changing ruler to measure distance. A dollar today does not buy the same as a dollar one year ago. So yesterday prices are not equal to today's prices; this is an unfair business calculation.

So money has three very important functions that work as the pillars on which the wellness of our economic system and civilizations rel**ies. Currency is not a store of value because its supply can be easily manipulated**, men in power can create more of it, and so using this always-changing currency as a standard of value or a unit of account is like using an always-changing ruler to measure distance. **A dollar today does not buy the same as a dollar one year ago**. So yesterday prices are not equal to today's prices; this is an unfair business calculation.

There are several Bible verses that discuss the manipulation of weights and measures, emphasizing the importance of honesty and fairness in commercial dealings.

1. Leviticus 19:35-36 New International Version (NIV): "**Do not use dishonest standards when measuring length, weight, or quantity.** Use honest scales and honest weights, an honest ephah, and an honest hin.

2. Deuteronomy 25:13-15: Do not have two differing weights in your bag—one heavy, one light. Do not have two differing measures in your house—one large, one small. **You must have accurate and honest weights and measures**.

3. Proverbs 11:1—"A "**dishonest scale is an abomination to the Lord**, but a just weight is his delight."

**Fake money (currency) is always and everywhere a dishonest scale.** So if you want a real measure of value or wealth use something with real value instead, like gold, commodities, products, times, etc.

Bankers have redefined the word money to mean fake money, currency, or debt. And this is not the worst part. Let’s introduce another concept: credit.

## **CREDIT = FAKE CURRENCY**

**Real credit is the promise to pay money in the future.** It involves delaying the payment of money. **Currency was born as credit**, as a money certificate or receipt. During the last century, banks gradually replaced 100% of the money with currency and bank credit to further boost their profits and control. \[1913, 1933, 1944, 1971\]

But in order to achieve this goal, **bankers redefined the word money to mean the opposite of money: credit/debt. This is like calling a night a day or evil a good.**

When you take out a loan from a friend, you receive credit from him, but you also incur a debt with him. You promise your friends that you will pay them (asset/right), and you owe them (liability/obligation). The asset and the liability are one and part of the same deal; they cannot exist without the other. There’s no credit with no debt, no debt with no credit, and no liability with no asset.

Federal Reserve notes, commonly known as **“dollars,”** are a private corporate currency; they are **not money** because they are not gold or silver, nor receipts for these metals as many people still believe. They were not redeemable in money from the start, despite being created under the assumption.

The “peso” (Spanish word for weight) used to be a standardized amount of gold or silver, but it’s not any more; it's just a debt denomination. And what's owing? Currency. **How can someone lend the opposite of money and charge interest? O**nly deceiving you into believing that he is lending you money. So they redefined the word money to mean the opposite of it.

But redefining words does not change the economic effect of the transaction.

When currencies first appeared, I can imagine people asking themselves, "How can people trust these paper certificates in exchange for their money?" Who will be that stupid?” And **nowadays, people don’t understand the difference between money and currency, to the point that bankers redefined the word "money" to mean the opposite of "money."**

Lesson: Money is not just a medium of exchange; it is also a store of value and a unit of account. Currency, the opposite of money, is debt. Since it can be created in unlimited amounts, it can't work as a store of value because its value depreciates as more units are created; for this same reason, it is not fair to denominate values in currency units since one currency unit today does not buy the same as a year ago because of inflation, the loss of purchasing power.

Summarize: While money, currency, and credit all serve as effective mediums of exchange, only money serves as a reliable store of value for saving. Currency and credit are not stores of value (not good to save), and there are not fair units of account (not good for price).

In simple terms, money is not currency, because currency is just credit and debt. We can conceptualize it as a ledger, a record of who owes what to whom. Currency is fake money since it’s the opposite of a store of value; it's always depreciating in value while its supply is inflated. This is the definition of inflation.

**Modern credit is not currency; it’s the opposite. It’s the promise to deliver currency in the future, the promise of a promise of money (in theory). But there’s no money behind. It’s an air loan.**

But how did we get here? Is everyone stupid? No, we have been tricked, manipulated, and dictated to use these currencies, and this banking system was forced on us. They stole our money and replaced it with fake substitutes to boost their profits.

## **MODERN MEDIUMS OF EXCHANGE = MONOPOLY MONEY**

**So nowadays we have fake money acting as cash/currency and fake currency acting as bank deposits or credit.** One is worse than the other, but both of them serve only as mediums of exchange. Those who store wealth with them will be robbed, and those who calculate business will be lied to.

Today we use currencies (government notes), coins, bank deposits (currency claims), checks (bank deposit claims), credit cards, and debit cards. All of them are ‘monopoly money’ fake claims based on a big and global fraud.

- *Government notes (government debt)*

Since governments are under the control of central banks, they can only create currency by borrowing. Governments must issue bonds, or debt, and the central bank can generate credit, or currency, to purchase these bonds.

The bond (government liability) is the counterpart of the ‘asset’ (the currency, a central bank asset). Bonds are debt, and currencies are credit.

When the central bank creates currency to lend it to the government at interest, it has literally the economic effect of **transferring the wealth of the nation to the banks for free**. The banks are not lending anything that they had to labor to produce; instead, they are creating it by printing paper notes or digital currency.

On the other side, governments have to collect money from citizens (producers, merchants, and workers) to pay the interest on the debt.

Despite their best efforts, governments are unable to repay the debt due to interest, which makes it bigger than the amount of currency. Let’s say the debt is 100 at 1% interest. So there’s only 100 in currency. But at the end of the year, there’s going to be a debt of 101. In order for the system to keep working, someone else has to go into debt to create more currency units, and governments have to keep borrowing and at least only paying the interest and rolling the debt.

The important thing is that if you have government currency debt free, you own it. This is the new ‘money.’. **Government currency is the ‘real’ cash, liquidity, or water.**

- *Bank deposits (bank debt)*

When you deposit your government currency in the bank, you are legally lending your currency to the bank, and the bank owes you the amount you deposit. This currency is not stored by banks until you request it. Banks use this currency as if it were theirs, and they do business with it. That’s why I said, **‘Your money in the bank’ is not yours; it’s not money; it’s not in the bank.** Its currency, its owe to you, is only registered on the bank ledger as a debt, not in a safe box.

The numbers you get in the bank account, or your balance, are government currency substitutes; they are bank deposits. Your currency deposit is the asset, and the number on your bank account balance is the liability.

But this is not the worst part. Banks lend around 10 times more currency than they have in deposits. So banks have more liabilities than assets (they are literally broke).

People often treat bank deposits, also known as government currency substitutes or bank tokens, as legal tender, allowing banks to create them arbitrarily and 'lend' them to unsuspecting clients who mistakenly believe they are receiving currency.

This is possible only because the bank's deposit has equal cash value.

***Government bonds, government currency, and bank deposits have equal value. But they are not the same.***

All of them have counterparty risk, but **cash, or government currency, is better** or safer than bonds or bank deposits. If interest rates rise, the value of bonds can decrease, and default on bank deposits can result in total loss, a scenario that has frequently occurred.

Keep in mind that bank deposits represent the bank's debts, also known as liabilities. Business activities and risk-taking make your currency unsecured, and they don't compensate you enough for the loan and risk.

- *Debit cards (bank deposit transfer)*

Your bank deposit is your right to get your currency back. When you use a credit card to buy something, you are transferring that right to the seller so he can redeem that bank token for currency if he wishes.

But you have to have had a deposit before you can spend it or transfer it.

- *Checks (bank deposit transfer)*

The same applies to checks. Your bank deposit is your right to get your currency back. When you use a check to buy something, you are transferring that right to the seller so he can redeem that bank token for currency if he wishes.

- *Credit card (bank deposit creator)*

Credit cards are different. When you use a credit card, you are creating a bank deposit backed by your promise of paying it back. By allowing the bank to create a currency substitute out of nothing and charge you high interest, you are essentially working for them for free.

Not only this, but you are also letting them collect fees from the payments processing that cost them nothing and support their fake money as a medium of exchange.

**Using credit cards is literally voting for financial slavery.** This is why companies make credit cards so convenient and offer benefits, with the intention of incentivizing and pushing people into the debt slavery system.

## **BANKS = MONEYCHANGERS**

‘Loans’ = exchanges

**The history of money is the history of moneychangers**, money dealers, or bankers. Money is an inanimate object. Bankers are alive; they are the ones in charge of making the money, currency, and credit flow or stop.

**They have been in existence for thousands of years**, from Egypt to Rome, where Jesus Christ himself threw them out of the temple and called them thieves, and he was not wrong.

Moneychangers played a crucial role in facilitating trade by exchanging different forms of currency and commodities. The profession of moneychangers evolved over time, particularly during the Roman Empire and the Middle Ages when various currencies were in circulation. In these times, moneychangers would set up shop at markets or public spaces to provide their services and **help merchants convert their money into a form that could be used for transactions with other traders.** As banking systems developed over time, the role of moneychangers expanded to include more complex financial services.

Today, moneychangers are still an essential part of the global economy, helping people exchange currencies and facilitating international trade.

**The Knights Templars** were a Christian military order established in 1119 who played a crucial role in the establishment of the financial system in medieval Europe. They established **a gold-backed credit system** that laid the foundation for the modern banking system. Their financial services included deposit accounts, loans, and even a form of early traveler's checks.

**The history of the goldsmiths** starts around 700 years ago in the year 1327. The company became responsible for hallmarking precious metals and played a significant role in regulating the quality and authenticity of gold and silver items. **In exchange for written acknowledgments or "receipts,"** they also provided gold deposit services.

Both groups played significant roles in the development of these early financial instruments, with goldsmiths issuing written acknowledgments for deposited gold and the Knights Templar establishing banking institutions that facilitated the use of such receipts as a form of payment.

This is a brief summary of the beginning of the moneychangers and how they discovered how to multiply money with paper receipts, better understood as counterfeiting. We now refer to it as fractional reserve banking, and let me tell you something: it's based on fraud.

Not only do they create bank deposits when you deposit currency, but they also create them when you "take a loan." Banks do not lend money, and they do not lend currency; they lend bank deposits (bank tokens/IOUs/currency substitutes/ paper receipts).

Banks had to redefine the word money to mean the opposite of money (debt) to trick the people. How can you lend the oposite of money and expect to be paid back plus interest? This took them thousands of years to achieve.

**The fact is that this is not a loan but an exchange.** When you take a loan, you sign a contract that creates a promissory note, which is your promise to pay. The bank then takes this promissory note, without your permission (steals), and sells it for cash (if you requiere it) or government bonds (to earn interest).

Your promissory note has equal value to cash and government bonds. And banks always need an asset to create a bank deposit (liability). So the banks literally steal your asset (promissory note) and sell them to create IOUs that they will ‘lend’ to you.

They ‘lend’ the oposite of money and call it a loan. The truth is that they are acting as moneychangers, and they are exchanging your IOU (promissory note) for a bank IOU (bank deposit) without your permission and pretending that you pay it back, but they never pay back theirs…

How is this possible? This is only possible because most people treat bank deposits (bank tokens, IOUs, and debts) as a medium of exchange because they trust the banks.

This is the root of inequality under the law. While one group can create IOUs from nothing and steal others, the other must work for them or exchange wealth.

If this bank defaults, its IOUs quickly vanish. This is a mathematical certainty; that’s why banks that are 'too big to fail' demand bailouts. **Every bank is bankrupt** since they have 7–10 times more liabilities than assets, and the assets they have are not theirs but their clients' assets. The only thing that keeps them alive is the trust of the public and the bailouts of the government.

**This is legalized slavery and theft.** There’s no other name. Banks own every industry, government, public figure, actor, etc. They have the power of God on earth, and it's time to stop them.

If we let the bank take our wealth for free, we will end up bankrupt, and they will end up owning everything. Every medium of exchange nowadays is an IOU or an IOU of an IOU. Ultimately, it is mathematically impossible to repay all of those IOUs, and banks pretend to keep all the assets.

*Check: IOU = deposit; IOU = cash; IOU = bond; IOU + interest*

The only way this system can continue is to keep creating new IOUs to pay the old ones, but even then (as it has been for over a century), the value of those IOUs keeps falling, causing hyperinflation.

If banks and governments want to ‘avoid’ (imposible) or relent to hyperinflation, they need to incur a great confiscation. So heads you lose, tails they win, playing this game doesn't make any fucking sense.

Buy Bitcoin, self custody, and fuck the government and the banking system.

Live free or die trying.

-

@ f3873798:24b3f2f3

2025-02-25 13:51:32

Estamos próximos a uma das principais premiações da indústria. Vemos não só a perversão de pautas woke e destruição de valores ocidentes, mas também um grande confronto entre o que mais forte o ativismo Lgbt ou o ativismo político entre as atrizes Fernanda Torres e Karla Gascon.

Só evidência o caos que é os conflitos de interesse de diversas vertentes que a esquerda abraça e diz que é sua.

Mas, o que mais impressiona é o fato do Oscar ter um filme no indicado que até o momento não ganhou nada, porém é notório a superioridade aos outros, este filme é Sing Sing.

Porque o filme Sing sing foi ignorado pelos avaliadores?

O filme tem uma narrativa de superação e como a arte pode mudar as pessoas e as realidades mais pertubadoras. Ele retrata o Sistema carcerário americano, onde realidade de vários presos é mudada atraves de um projeto de um teatro na prisão.

Observando friamente a sintese do filme é uma história que se encaixa perfeitamente aos vies de bandidolatria, se não tivesse um questão, a ação transformadora da arte e deixando de serem vítimas e serem artistas.

Porém apesar de ser uma obra de arte que estimula as pessoas pensarem sobre a vida e ter uma pegada inovadora e completamente diferente dos demais filmes que retratam o sistema carcerário, ele é totalmente ignorado por não ser suficientemente lacrativo.

-

@ 9171b08a:8395fd65

2025-02-25 13:27:26