-

@ 97c70a44:ad98e322

2025-03-05 18:09:05

So you've decided to join nostr! Some wide-eyed fanatic has convinced you that the "sun shines every day on the birds and the bees and the cigarette trees" in a magical land of decentralized, censorship-resistant freedom of speech - and it's waiting just over the next hill.

But your experience has not been all you hoped. Before you've even had a chance to upload your AI-generated cyberpunk avatar or make up exploit codenames for your pseudonym's bio, you've been confronted with a new concept that has left you completely nonplussed.

It doesn't help that this new idea might be called by any number of strange names. You may have been asked to "paste your nsec", "generate a private key", "enter your seed words", "connect with a bunker", "sign in with extension", or even "generate entropy". Sorry about that.

All these terms are really referring to one concept under many different names: that of "cryptographic identity".

Now, you may have noticed that I just introduced yet another new term which explains exactly nothing. You're absolutely correct. And now I'm going to proceed to ignore your complaints and talk about something completely different. But bear with me, because the juice is worth the squeeze.

# Identity

What is identity? There are many philosophical, political, or technical answers to this question, but for our purposes it's probably best to think of it this way:

> Identity is the essence of a thing. Identity separates one thing from all others, and is itself indivisible.

This definition has three parts:

- Identity is "essential": a thing can change, but its identity cannot. I might re-paint my house, replace its components, sell it, or even burn it down, but its identity as something that can be referred to - "this house" - is durable, even outside the boundaries of its own physical existence.

- Identity is a unit: you can't break an identity into multiple parts. A thing might be _composed_ of multiple parts, but that's only incidental to the identity of a thing, which is a _concept_, not a material thing.

- Identity is distinct: identity is what separates one thing from all others - the concept of an apple can't be mixed with that of an orange; the two ideas are distinct. In the same way, a single concrete apple is distinct in identity from another - even if the component parts of the apple decompose into compost used to grow more apples.

Identity is not a physical thing, but a metaphysical thing. Or, in simpler terms, identity is a "concept".

I (or someone more qualified) could at this point launch into a Scholastic tangent on what "is" is, but that is, fortunately, not necessary here. The kind of identities I want to focus on here are not our _actual_ identities as people, but entirely _fictional_ identities that we use to extend our agency into the digital world.

Think of it this way - your bank login does not represent _you_ as a complete person. It only represents the _access granted to you_ by the bank. This access is in fact an _entirely new identity_ that has been associated with you, and is limited in what it's useful for.

Other examples of fictional identities include:

- The country you live in

- Your social media persona

- Your mortgage

- Geographical coordinates

- A moment in time

- A chess piece

Some of these identites are inert, for example points in space and time. Other identies have agency and so are able to act in the world - even as fictional concepts. In order to do this, they must "authenticate" themselves (which means "to prove they are real"), and act within a system of established rules.

For example, your D&D character exists only within the collective fiction of your D&D group, and can do anything the rules say. Its identity is authenticated simply by your claim as a member of the group that your character in fact exists. Similarly, a lawyer must prove they are a member of the Bar Association before they are allowed to practice law within that collective fiction.

"Cryptographic identity" is simply another way of authenticating a fictional identity within a given system. As we'll see, it has some interesting attributes that set it apart from things like a library card or your latitude and longitude. Before we get there though, let's look in more detail at how identities are authenticated.

# Certificates

Merriam-Webster defines the verb "certify" as meaning "to attest authoritatively". A "certificate" is just a fancy way of saying "because I said so". Certificates are issued by a "certificate authority", someone who has the authority to "say so". Examples include your boss, your mom, or the Pope.

This method of authentication is how almost every institution authenticates the people who associate with it. Colleges issue student ID cards, governments issue passports, and websites allow you to "register an account".

In every case mentioned above, the "authority" creates a closed system in which a document (aka a "certificate") is issued which serves as a claim to a given identity. When someone wants to access some privileged service, location, or information, they present their certificate. The authority then validates it and grants or denies access. In the case of an international airport, the certificate is a little book printed with fancy inks. In the case of a login page, the certificate is a username and password combination.

This pattern for authentication is ubiquitous, and has some very important implications.

First of all, certified authentication implies that the issuer of the certificate has the right to _exclusive control_ of any identity it issues. This identity can be revoked at any time, or its permissions may change. Your social credit score may drop arbitrarily, or money might disappear from your account. When dealing with certificate authorities, you have no inherent rights.

Second, certified authentication depends on the certificate authority continuing to exist. If you store your stuff at a storage facility but the company running it goes out of business, your stuff might disappear along with it.

Usually, authentication via certificate authority works pretty well, since an appeal can always be made to a higher authority (nature, God, the government, etc). Authorities also can't generally dictate their terms with impunity without losing their customers, alienating their constituents, or provoking revolt. But it's also true that certification by authority creates an incentive structure that frequently leads to abuse - arbitrary deplatforming is increasingly common, and the bigger the certificate authority, the less recourse the certificate holder (or "subject") has.

Certificates also put the issuer in a position to intermediate relationships that wouldn't otherwise be subject to their authority. This might take the form of selling user attention to advertisers, taking a cut of financial transactions, or selling surveillance data to third parties.

Proliferation of certificate authorities is not a solution to these problems. Websites and apps frequently often offer multiple "social sign-in" options, allowing their users to choose which certificate authority to appeal to. But this only piles more value into the social platform that issues the certificate - not only can Google shut down your email inbox, they can revoke your ability to log in to every website you used their identity provider to get into.

In every case, certificate issuance results in an asymmetrical power dynamic, where the issuer is able to exert significant control over the certificate holder, even in areas unrelated to the original pretext for the relationship between parties.

# Self-Certification

But what if we could reverse this power dynamic? What if individuals could issue their own certificates and force institutions to accept them?

Ron Swanson's counterexample notwithstanding, there's a reason I can't simply write myself a parking permit and slip it under the windshield wiper. Questions about voluntary submission to legitimate authorities aside, the fact is that we don't have the power to act without impunity - just like any other certificate authority, we have to prove our claims either by the exercise of raw power or by appeal to a higher authority.

So the question becomes: which higher authority can we appeal to in order to issue our own certificates within a given system of identity?

The obvious answer here is to go straight to the top and ask God himself to back our claim to self-sovereignty. However, that's not how he normally works - there's a reason they call direct acts of God "miracles". In fact, Romans 13:1 explicitly says that "the authorities that exist have been appointed by God". God has structured the universe in such a way that we must appeal to the deputies he has put in place to govern various parts of the world.

Another tempting appeal might be to nature - i.e. the material world. This is the realm in which we most frequently have the experience of "self-authenticating" identities. For example, a gold coin can be authenticated by biting it or by burning it with acid. If it quacks like a duck, walks like a duck, and looks like a duck, then it probably is a duck.

In most cases however, the ability to authenticate using physical claims depends on physical access, and so appeals to physical reality have major limitations when it comes to the digital world. Captchas, selfies and other similar tricks are often used to bridge the physical world into the digital, but these are increasingly easy to forge, and hard to verify.

There are exceptions to this rule - an example of self-certification that makes its appeal to the physical world is that of a signature. Signatures are hard to forge - an incredible amount of data is encoded in physical signatures, from strength, to illnesses, to upbringing, to [personality](https://en.wikipedia.org/wiki/Graphology). These can even be scanned and used within the digital world as well. Even today, most contracts are sealed with some simulacrum of a physical signature. Of course, this custom is quickly becoming a mere historical curiosity, since the very act of digitizing a signature makes it trivially forgeable.

So: transcendent reality is too remote to subtantiate our claims, and the material world is too limited to work within the world of information. There is another aspect of reality remaining that we might appeal to: information itself.

Physical signatures authenticate physical identities by encoding unique physical data into an easily recognizable artifact. To transpose this idea to the realm of information, a "digital signature" might authenticate "digital identities" by encoding unique "digital data" into an easily recognizable artifact.

Unfortunately, in the digital world we have the additional challenge that the artifact itself can be copied, undermining any claim to legitimacy. We need something that can be easily verified _and unforgeable_.

# Digital Signatures

In fact such a thing does exist, but calling it a "digital signature" obscures more than it reveals. We might just as well call the thing we're looking for a "digital fingerprint", or a "digital electroencephalogram". Just keep that in mind as we work our way towards defining the term - we are not looking for something _looks like a physical signature_, but for something that _does the same thing as_ a physical signature, in that it allows us to issue ourselves a credential that must be accepted by others by encoding privileged information into a recognizable, unforgeable artifact.

With that, let's get into the weeds.

An important idea in computer science is that of a "function". A function is a sort of information machine that converts data from one form to another. One example is the idea of "incrementing" a number. If you increment 1, you get 2. If you increment 2, you get 3. Incrementing can be reversed, by creating a complementary function that instead subtracts 1 from a number.

A "one-way function" is a function that can't be reversed. A good example of a one-way function is integer rounding. If you round a number and get `5`, what number did you begin with? It's impossible to know - 5.1, 4.81, 5.332794, in fact an infinite number of numbers can be rounded to the number `5`. These numbers can also be infinitely long - for example rounding PI to the nearest integer results in the number `3`.

A real-life example of a useful one-way function is `sha256`. This function is a member of a family of one-way functions called "hash functions". You can feed as much data as you like into `sha256`, and you will always get 256 bits of information out. Hash functions are especially useful because collisions between outputs are very rare - even if you change a single bit in a huge pile of data, you're almost certainly going to get a different output.

Taking this a step further, there is a whole family of cryptographic one-way "trapdoor" functions that act similarly to hash functions, but which maintain a specific mathematical relationship between the input and the output which allows the input/output pair to be used in a variety of useful applications. For example, in Elliptic Curve Cryptography, scalar multiplication on an elliptic curve is used to derive the output.

"Ok", you say, "that's all completely clear and lucidly explained" (thank you). "But what goes _into_ the function?" You might expect that because of our analogy to physical signatures we would have to gather an incredible amount of digital information to cram into our cryptographic trapdoor function, mashing together bank statements, a record of our heartbeat, brain waves and cellular respiration. Well, we _could_ do it that way (maybe), but there's actually a _much_ simpler solution.

Let's play a quick game. What number am I thinking of? Wrong, it's 82,749,283,929,834. Good guess though.

The reason we use signatures to authenticate our identity in the physical world is not because they're backed by a lot of implicit physical information, but because they're hard to forge and easy to validate. Even so, there is a lot of variation in a single person's signature, even from one moment to the next.

Trapdoor functions solve the validation problem - it's trivially simple to compare one 256-bit number to another. And randomness solves the problem of forgeability.

Now, randomness (A.K.A. "entropy") is actually kind of hard to generate. Random numbers that don't have enough "noise" in them are known as "pseudo-random numbers", and are weirdly easy to guess. This is why Cloudflare uses a video stream of their [giant wall of lava lamps](https://blog.cloudflare.com/randomness-101-lavarand-in-production/) to feed the random number generator that powers their CDN. For our purposes though, we can just imagine that our random numbers come from rolling a bunch of dice.

To recap, we can get a digital equivalent of a physical signature (or fingerprint, etc) by 1. coming up with a random number, and 2. feeding it into our chosen trapdoor function. The random number is called the "private" part. The output of the trapdoor function is called the "public" part. These two halves are often called "keys", hence the terms "public key" and "private key".

And now we come full circle - remember about 37 years ago when I introduced the term "cryptographic identity"? Well, we've finally arrived at the point where I explain what that actually is.

A "cryptographic identity" is _identified_ by a public key, and _authenticated_ by the ability to prove that you know the private key.

Notice that I didn't say "authenticated by the private key". If you had to reveal the private key in order to prove you know it, you could only authenticate a public key once without losing exclusive control of the key. But cryptographic identities can be authenticated any number of times because the certification is an _algorithm_ that only someone who knows the private key can execute.

This is the super power that trapdoor functions have that hash functions don't. Within certain cryptosystems, it is possible to mix additional data with your private key to get yet another number in such a way that someone else who only knows the public key can _prove_ that you know the private key.

For example, if my secret number is `12`, and someone tells me the number `37`, I can "combine" the two by adding them together and returning the number `49`. This "proves" that my secret number is `12`. Of course, addition is not a trapdoor function, so it's trivially easy to reverse, which is why cryptography is its own field of knowledge.

# What's it for?

If I haven't completely lost you yet, you might be wondering why this matters. Who cares if I can prove that I made up a random number?

To answer this, let's consider a simple example: that of public social media posts.

Most social media platforms function by issuing credentials and verifying them based on their internal database. When you log in to your Twitter (ok, fine, X) account, you provide X with a phone number (or email) and password. X compares these records to the ones stored in the database when you created your account, and if they match they let you "log in" by issuing yet another credential, called a "session key".

Next, when you "say" something on X, you pass along your session key and your tweet to X's servers. They check that the session key is legit, and if it is they associate your tweet with your account's identity. Later, when someone wants to see the tweet, X vouches for the fact that you created it by saying "trust me" and displaying your name next to the tweet.

In other words, X creates and controls your identity, but they let you use it as long as you can prove that you know the secret that you agreed on when you registered (by giving it to them every time).

Now pretend that X gets bought by someone _even more evil_ than Elon Musk (if such a thing can be imagined). The new owner now has the ability to control _your_ identity, potentially making it say things that you didn't actually say. Someone could be completely banned from the platform, but their account could be made to continue saying whatever the owner of the platform wanted.

In reality, such a breach of trust would quickly result in a complete loss of credibility for the platform, which is why this kind of thing doesn't happen (at least, not that we know of).

But there are other ways of exploiting this system, most notably by censoring speech. As often happens, platforms are able to confiscate user identities, leaving the tenant no recourse except to appeal to the platform itself (or the government, but that doesn't seem to happen for some reason - probably due to some legalese in social platforms' terms of use). The user has to start completely from scratch, either on the same platform or another.

Now suppose that when you signed up for X instead of simply telling X your password you made up a random number and provided a cryptographic proof to X along with your public key. When you're ready to tweet (there's no need to issue a session key, or even to store your public key in their database) you would again prove your ownership of that key with a new piece of data. X could then publish that tweet or not, along with the same proof you provided that it really came from you.

What X _can't_ do in this system is pretend you said something you didn't, because they _don't know your private key_.

X also wouldn't be able to deplatform you as effectively either. While they could choose to ban you from their website and refuse to serve your tweets, they don't control your identity. There's nothing they can do to prevent you from re-using it on another platform. Plus, if the system was set up in such a way that other users followed your key instead of an ID made up by X, you could switch platforms and _keep your followers_. In the same way, it would also be possible to keep a copy of all your tweets in your own database, since their authenticity is determined by _your_ digital signature, not X's "because I say so".

This new power is not just limited to social media either. Here are some other examples of ways that self-issued cryptographic identites transform the power dynamic inherent in digital platforms:

- Banks sometimes freeze accounts or confiscate funds. If your money was stored in a system based on self-issued cryptographic keys rather than custodians, banks would not be able to keep you from accessing or moving your funds. This system exists, and it's called [bitcoin](https://bitcoin.rocks/).

- Identity theft happens when your identifying information is stolen and used to take out a loan in your name, and without your consent. The reason this is so common is because your credentials are not cryptographic - your name, address, and social security number can only be authenticated by being shared, and they are shared so often and with so many counterparties that they frequently end up in data breaches. If credit checks were authenticated by self-issued cryptographic keys, identity theft would cease to exist (unless your private key itself got stolen).

- Cryptographic keys allow credential issuers to protect their subjects' privacy better too. Instead of showing your ID (including your home address, birth date, height, weight, etc), the DMV could sign a message asserting that the holder of a given public key indeed over 21. The liquor store could then validate that claim, and your ownership of the named key, without knowing anything more about you. [Zero-knowledge](https://en.wikipedia.org/wiki/Non-interactive_zero-knowledge_proof) proofs take this a step further.

In each of these cases, the interests of the property owner, loan seeker, or customer are elevated over the interests of those who might seek to control their assets, exploit their hard work, or surveil their activity. Just as with personal privacy, freedom of speech, and Second Amendment rights the individual case is rarely decisive, but in the aggregate realigned incentives can tip the scale in favor of freedom.

# Objections

Now, there are some drawbacks to digital signatures. Systems that rely on digital signatures are frequently less forgiving of errors than their custodial counterparts, and many of their strengths have corresponding weaknesses. Part of this is because people haven't yet developed an intuition for how to use cryptographic identities, and the tools for managing them are still being designed. Other aspects can be mitigated through judicious use of keys fit to the problems they are being used to solve.

Below I'll articulate some of these concerns, and explore ways in which they might be mitigated over time.

## Key Storage

Keeping secrets is hard. "A lie can travel halfway around the world before the truth can get its boots on", and the same goes for gossip. Key storage has become increasingly important as more of our lives move online, to the extent that password managers have become almost a requirement for keeping track of our digital lives. But even with good password management, credentials frequently end up for sale on the dark web as a consequence of poorly secured infrastructure.

Apart from the fact that all of this is an argument _for_ cryptographic identities (since keys are shared with far fewer parties), it's also true that the danger of losing a cryptographic key is severe, especially if that key is used in multiple places. Instead of hackers stealing your Facebook password, they might end up with access to all your other social media accounts too!

Keys should be treated with the utmost care. Using password managers is a good start, but very valuable keys should be stored even more securely - for example in a [hardware signing device](https://nostrsigningdevice.com/). This is a hassle, and something additional to learn, but is an indispensable part of taking advantage of the benefits associated with cryptographic identity.

There are ways to lessen the impact of lost or stolen secrets, however. Lots of different techniques exist for structuring key systems in such a way that keys can be protected, invalidated, or limited. Here are a few:

- [Hierarchical Deterministic Keys](https://www.ietf.org/archive/id/draft-dijkhuis-cfrg-hdkeys-02.html) allow for the creation of a single root key from which multiple child keys can be generated. These keys are hard to link to the parent, which provides additional privacy, but this link can also be proven when necessary. One limitation is that the identity system has to be designed with HD keys in mind.

- [Key Rotation](https://crypto.stackexchange.com/questions/41796/whats-the-purpose-of-key-rotation) allows keys to become expendable. Additional credentials might be attached to a key, allowing the holder to prove they have the right to rotate the key. Social attestations can help with the process as well if the key is embedded in a web of trust.

- Remote Signing is a technique for storing a key on one device, but using it on another. This might take the form of signing using a hardware wallet and transferring an SD card to your computer for broadcasting, or using a mobile app like [Amber](https://github.com/greenart7c3/Amber) to manage sessions with different applications.

- [Key](https://github.com/coracle-social/promenade/tree/master) [sharding](https://www.frostr.org/) takes this to another level by breaking a single key into multiple pieces and storing them separately. A coordinator can then be used to collaboratively sign messages without sharing key material. This dramatically reduces the ability of an attacker to steal a complete key.

## Multi-Factor Authentication

One method for helping users secure their accounts that is becoming increasingly common is "multi-factor authentication". Instead of just providing your email and password, platforms send a one-time use code to your phone number or email, or use "time-based one time passwords" which are stored in a password manager or on a hardware device.

Again, MFA is a solution to a problem inherent in account-based authentication which would not be nearly so prevalent in a cryptographic identity system. Still, theft of keys does happen, and so MFA would be an important improvement - if not for an extra layer of authentication, then as a basis for key rotation.

In a sense, MFA is already being researched - key shards is one way of creating multiple credentials from a single key. However, this doesn't address the issue of key rotation, especially when an identity is tied to the public key that corresponds to a given private key. There are two possible solutions to this problem:

- Introduce a naming system. This would allow identities to use a durable name, assigning it to different keys over time. The downside is that this would require the introduction of either centralized naming authorities (back to the old model), or a blockchain in order to solve [Zooko's trilemma](https://en.wikipedia.org/wiki/Zooko%27s_triangle).

- Establish a chain of keys. This would require a given key to name a successor key in advance and self-invalidate, or some other process like social recovery to invalidate an old key and assign the identity to a new one. This also would significantly increase the complexity of validating messages and associating them with a given identity.

Both solutions are workable, but introduce a lot of complexity that could cause more trouble than it's worth, depending on the identity system we're talking about.

## Surveillance

One of the nice qualities that systems based on cryptographic identities have is that digitally signed data can be passed through any number of untrusted systems and emerge intact. This ability to resist tampering makes it possible to broadcast signed data more widely than would otherwise be the case in a system that relies on a custodian to authenticate information.

The downside of this is that more untrusted systems have access to data. And if information is broadcast publicly, anyone can get access to it.

This problem is compounded by re-use of cryptographic identities across multiple contexts. A benefit of self-issued credentials is that it becomes possible to bring everything attached to your identity with you, including social context and attached credentials. This is convenient and can be quite powerful, but it also means that more context is attached to your activity, making it easier to infer information about you for advertising or surveillance purposes. This is dangerously close to the dystopian ideal of a "Digital ID".

The best way to deal with this risk is to consider identity re-use an option to be used when desirable, but to default to creating a new key for every identity you create. This is no worse than the status quo, and it makes room for the ability to link identities when desired.

Another possible approach to this problem is to avoid broadcasting signed data when possible. This could be done by obscuring your cryptographic identity when data is served from a database, or by encrypting your signed data in order to selectively share it with named counterparties.

Still, this is a real risk, and should be kept in mind when designing and using systems based on cryptographic identity. If you'd like to read more about this, please see [this blog post](https://habla.news/u/hodlbod@coracle.social/1687802006398).

# Making Keys Usable

You might be tempted to look at that list of trade-offs and get the sense that cryptographic identity is not for mere mortals. Key management is hard, and footguns abound - but there is a way forward. With [nostr](https://nostr.com/), some new things are happening in the world of key management that have never really happened before.

Plenty of work over the last 30 years has gone into making key management tractable, but none have really been widely adopted. The reason for this is simple: network effect.

Many of these older key systems only applied the thinnest veneer of humanity over keys. But an identity is much richer than a mere label. Having a real name, social connections, and a corpus of work to attach to a key creates a system of keys that _humans care about_.

By bootstrapping key management within a social context, nostr ensures that the payoff of key management is worth the learning curve. Not only is social engagement a strong incentive to get off the ground, people already on the network are eager to help you get past any roadblocks you might face.

So if I could offer an action item: give nostr a try today. Whether you're in it for the people and their values, or you just want to experiment with cryptographic identity, nostr is a great place to start. For a quick introduction and to securely generate keys, visit [njump.me](https://njump.me/).

Thanks for taking the time to read this post. I hope it's been helpful, and I can't wait to see you on nostr!

-

@ f839fb67:5c930939

2025-03-05 16:54:25

# Relays

| Name | Address | Price (Sats/Year)|

| - | - | - |

| stephen's aegis relay | wss://paid.relay.vanderwarker.family | 42069

| stephen's Outbox | wss://relay.vanderwarker.family | 0 |

| stephen's Inbox | wss://haven.vanderwarker.family/inbox | 0 |

| stephen's DMs | wss://haven.vanderwarker.family/chat | 0 |

| VFam Data Relay | wss://data.relay.vanderwarker.family | 0 |

| [TOR] My Phone Relay | ws://naswsosuewqxyf7ov7gr7igc4tq2rbtqoxxirwyhkbuns4lwc3iowwid.onion | 0 |

---

# My Pubkeys

| Name | hex | nprofile |

| - | - | - |

| Main | f839fb6714598a7233d09dbd42af82cc9781d0faa57474f1841af90b5c930939 | nprofile1qqs0sw0mvu29nznjx0gfm02z47pve9up6ra22ar57xzp47gttjfsjwgpramhxue69uhhyetvv9ujuanpdejx2unhv9exketj9enxzmtfd3us9mapfx |

| Vanity (Backup) | 82f21be67353c0d68438003fe6e56a35e2a57c49e0899b368b5ca7aa8dde7c23 | nprofile1qqsg9usmuee48sxkssuqq0lxu44rtc4903y7pzvmx694efa23h08cgcpramhxue69uhhyetvv9ujuanpdejx2unhv9exketj9enxzmtfd3ussel49x |

| VFStore | 6416f1e658ba00d42107b05ad9bf485c7e46698217e0c19f0dc2e125de3af0d0 | nprofile1qqsxg9h3uevt5qx5yyrmqkkehay9cljxdxpp0cxpnuxu9cf9mca0p5qpramhxue69uhhyetvv9ujuanpdejx2unhv9exketj9enxzmtfd3usaa8plu |

| NostrSMS | 9be1b8315248eeb20f9d9ab2717d1750e4f27489eab1fa531d679dadd34c2f8d | nprofile1qqsfhcdcx9fy3m4jp7we4vn305t4pe8jwjy74v062vwk08dd6dxzlrgpramhxue69uhhyetvv9ujuanpdejx2unhv9exketj9enxzmtfd3us595d45 |

---

# "Personal Nostr Things"

> [D] = Saves darkmode preferences over nostr

> [A] = Auth over nostr

> [B] = Beta (software)

> [z] = zap enabled

- [[DABz] Main Site](https://vanderwarker.family)

- [[DAB] Contact Site](https://stephen.vanderwarker.family)

- [[DAB] PGP Site](https://pgp.vanderwarker.family)

- [[DAB] VFCA Site](https://ca.vanderwarker.family)

---

# Other Services (Hosted code)

* [Blossom](https://blossom.vanderwarker.family)

* [NostrCheck](https://nostr.vanderwarker.family)

---

# Emojis Packs

* Minecraft

- <code>nostr:naddr1qqy566twv43hyctxwsq37amnwvaz7tmjv4kxz7fwweskuer9wfmkzuntv4ezuenpd45kc7gzyrurn7m8z3vc5u3n6zwm6s40stxf0qwsl2jhga83ssd0jz6ujvynjqcyqqq82nsd0k5wp</code>

* AIM

- <code>nostr:naddr1qqxxz6tdv4kk7arfvdhkuucpramhxue69uhhyetvv9ujuanpdejx2unhv9exketj9enxzmtfd3usyg8c88akw9ze3fer85yah4p2lqkvj7qap749w360rpq6ly94eycf8ypsgqqqw48qe0j2yk</code>

* Blobs

- <code>nostr:naddr1qqz5ymr0vfesz8mhwden5te0wfjkccte9emxzmnyv4e8wctjddjhytnxv9kkjmreqgs0sw0mvu29nznjx0gfm02z47pve9up6ra22ar57xzp47gttjfsjwgrqsqqqa2wek4ukj</code>

* FavEmojis

- <code>nostr:naddr1qqy5vctkg4kk76nfwvq37amnwvaz7tmjv4kxz7fwweskuer9wfmkzuntv4ezuenpd45kc7gzyrurn7m8z3vc5u3n6zwm6s40stxf0qwsl2jhga83ssd0jz6ujvynjqcyqqq82nsf7sdwt</code>

* Modern Family

- <code>nostr:naddr1qqx56mmyv4exugzxv9kkjmreqy0hwumn8ghj7un9d3shjtnkv9hxgetjwashy6m9wghxvctdd9k8jq3qlqulkec5tx98yv7snk759tuzejtcr5865468fuvyrtuskhynpyusxpqqqp65ujlj36n</code>

* nostriches (Amethyst collection)

- <code>nostr:naddr1qq9xummnw3exjcmgv4esz8mhwden5te0wfjkccte9emxzmnyv4e8wctjddjhytnxv9kkjmreqgs0sw0mvu29nznjx0gfm02z47pve9up6ra22ar57xzp47gttjfsjwgrqsqqqa2w2sqg6w</code>

* Pepe

- <code>nostr:naddr1qqz9qetsv5q37amnwvaz7tmjv4kxz7fwweskuer9wfmkzuntv4ezuenpd45kc7gzyrurn7m8z3vc5u3n6zwm6s40stxf0qwsl2jhga83ssd0jz6ujvynjqcyqqq82ns85f6x7</code>

* Minecraft Font

- <code>nostr:naddr1qq8y66twv43hyctxwssyvmmwwsq37amnwvaz7tmjv4kxz7fwweskuer9wfmkzuntv4ezuenpd45kc7gzyrurn7m8z3vc5u3n6zwm6s40stxf0qwsl2jhga83ssd0jz6ujvynjqcyqqq82nsmzftgr</code>

* Archer Font

- <code>nostr:naddr1qq95zunrdpjhygzxdah8gqglwaehxw309aex2mrp0yh8vctwv3jhyampwf4k2u3wvesk66tv0ypzp7peldn3gkv2wgeap8dag2hc9nyhs8g04ft5wnccgxhepdwfxzfeqvzqqqr4fclkyxsh</code>

* SMB Font

- <code>nostr:naddr1qqv4xatsv4ezqntpwf5k7gzzwfhhg6r9wfejq3n0de6qz8mhwden5te0wfjkccte9emxzmnyv4e8wctjddjhytnxv9kkjmreqgs0sw0mvu29nznjx0gfm02z47pve9up6ra22ar57xzp47gttjfsjwgrqsqqqa2w0wqpuk</code>

---

# Git Over Nostr

* NostrSMS

- <code>nostr:naddr1qqyxummnw3e8xmtnqy0hwumn8ghj7un9d3shjtnkv9hxgetjwashy6m9wghxvctdd9k8jqfrwaehxw309amk7apwwfjkccte9emxzmnyv4e8wctjddjhytnxv9kkjmreqyj8wumn8ghj7urpd9jzuun9d3shjtnkv9hxgetjwashy6m9wghxvctdd9k8jqg5waehxw309aex2mrp0yhxgctdw4eju6t0qyxhwumn8ghj7mn0wvhxcmmvqgs0sw0mvu29nznjx0gfm02z47pve9up6ra22ar57xzp47gttjfsjwgrqsqqqaueqp0epk</code>

* nip51backup

- <code>nostr:naddr1qq9ku6tsx5ckyctrdd6hqqglwaehxw309aex2mrp0yh8vctwv3jhyampwf4k2u3wvesk66tv0yqjxamnwvaz7tmhda6zuun9d3shjtnkv9hxgetjwashy6m9wghxvctdd9k8jqfywaehxw309acxz6ty9eex2mrp0yh8vctwv3jhyampwf4k2u3wvesk66tv0yq3gamnwvaz7tmjv4kxz7fwv3sk6atn9e5k7qgdwaehxw309ahx7uewd3hkcq3qlqulkec5tx98yv7snk759tuzejtcr5865468fuvyrtuskhynpyusxpqqqpmej4gtqs6</code>

* bukkitstr

- <code>nostr:naddr1qqykyattdd5hgum5wgq37amnwvaz7tmjv4kxz7fwweskuer9wfmkzuntv4ezuenpd45kc7gpydmhxue69uhhwmm59eex2mrp0yh8vctwv3jhyampwf4k2u3wvesk66tv0yqjgamnwvaz7tmsv95kgtnjv4kxz7fwweskuer9wfmkzuntv4ezuenpd45kc7gpz3mhxue69uhhyetvv9ujuerpd46hxtnfduqs6amnwvaz7tmwdaejumr0dspzp7peldn3gkv2wgeap8dag2hc9nyhs8g04ft5wnccgxhepdwfxzfeqvzqqqrhnyf6g0n2</code>

---

# Market Places

Please use [Nostr Market](https://market.nostr.com) or somthing simular, to view.

* VFStore

- <code>nostr:naddr1qqjx2v34xe3kxvpn95cnqven956rwvpc95unscn9943kxet98q6nxde58p3ryqglwaehxw309aex2mrp0yh8vctwv3jhyampwf4k2u3wvesk66tv0ypzqeqk78n93wsq6sss0vz6mxl5shr7ge5cy9lqcx0smshpyh0r4uxsqvzqqqr4gve4aen9</code>

---

# Badges

## Created

* paidrelayvf

- <code>nostr:naddr1qq9hqctfv3ex2mrp09mxvqglwaehxw309aex2mrp0yh8vctwv3jhyampwf4k2u3wvesk66tv0ypzp7peldn3gkv2wgeap8dag2hc9nyhs8g04ft5wnccgxhepdwfxzfeqvzqqqr48y85v3u3</code>

* iPow

- <code>nostr:naddr1qqzxj5r02uq37amnwvaz7tmjv4kxz7fwweskuer9wfmkzuntv4ezuenpd45kc7gzyrurn7m8z3vc5u3n6zwm6s40stxf0qwsl2jhga83ssd0jz6ujvynjqcyqqq82wgg02u0r</code>

* codmaster

- <code>nostr:naddr1qqykxmmyd4shxar9wgq37amnwvaz7tmjv4kxz7fwweskuer9wfmkzuntv4ezuenpd45kc7gzyrurn7m8z3vc5u3n6zwm6s40stxf0qwsl2jhga83ssd0jz6ujvynjqcyqqq82wgk3gm4g</code>

* iMine

- <code>nostr:naddr1qqzkjntfdejsz8mhwden5te0wfjkccte9emxzmnyv4e8wctjddjhytnxv9kkjmreqgs0sw0mvu29nznjx0gfm02z47pve9up6ra22ar57xzp47gttjfsjwgrqsqqqafed5s4x5</code>

---

# Clients I Use

* noStrudel

- <code>nostr:naddr1qqxnzd3cxccrvd34xser2dpkqy28wumn8ghj7un9d3shjtnyv9kh2uewd9hsygpxdq27pjfppharynrvhg6h8v2taeya5ssf49zkl9yyu5gxe4qg55psgqqq0nmq5mza9n</code>

* nostrsms

- <code>nostr:naddr1qq9rzdejxcunxde4xymqz8mhwden5te0wfjkccte9emxzmnyv4e8wctjddjhytnxv9kkjmreqgsfhcdcx9fy3m4jp7we4vn305t4pe8jwjy74v062vwk08dd6dxzlrgrqsqqql8kjn33qm</code>

-

@ 8d34bd24:414be32b

2025-03-05 16:52:58

Sometimes I wonder why I write posts like this. This is not the way to gain a big following, but then again, that is not my goal. My goal is to share Jesus with anyone who will listen, to faithfully speak whatever truth I feel God is leading me to share, and to teach the inerrant word of God in order to draw people, both believers and not yet believers, closer to Jesus. I trust God to use my words in whatever way He sees best. If it only reaches a few, that is OK by me. If somehow this substack starts reaching a vast audience, then praise God for that!

Today, I am writing about a hard truth. The Bible contains a number of hard truths that most people don’t want to believe, but which our Creator God has stated as truth. None of us likes being called a sinner, but the Bible says:

> as it is written, “There is none righteous, not even one. (Romans 3:10)

As hard as the truth that we are all sinners is, a much harder truth is that not everyone gets to go to Heaven. Some people are destined for Hell. I am going to investigate some verses that illuminate this truth.

Ironically, most people have two contradictory thoughts. Most people wonder why God allows so much evil in the world. If He is truly sovereign, why doesn’t He stop evil? At the same time they wonder why a loving God would send anyone to Hell. We can’t expect God to stop and punish evil, but not send some people to Hell. We can’t have it both ways.

> The Lord is not slow about His promise, as some count slowness, but is patient toward you, not wishing for any to perish but for all to come to repentance. (2 Peter 3:9)

This verse explains the basic facts of how God’s holiness is reconciled with His love and mercy, but of course there is so much more. If God is truly sovereign over all, then why is there any evil? Why does anyone sin? Why is there pain and suffering?

> **The Lord has made everything for its own purpose,\

> Even the wicked for the day of evil**.\

> Everyone who is proud in heart is an abomination to the Lord;\

> Assuredly, he will not be unpunished.\

> By lovingkindness and truth iniquity is atoned for,\

> And by the fear of the Lord one keeps away from evil. (Proverbs 16:4-6) {emphasis mine}

Everyone and everything was made for God’s own purpose. As our Creator, He has the right to make each of us for whatever purpose He desires. The creature has no right to question the Creator and His purpose.

> Then I went down to the potter’s house, and there he was, making something on the wheel. But the vessel that he was making of clay was spoiled in the hand of the potter; so **he remade it into another vessel, as it pleased the potter to make**.

>

> Then the word of the Lord came to me saying, “**Can I not, O house of Israel, deal with you as this potter does?**” declares the Lord. “Behold, like the clay in the potter’s hand, so are you in My hand, O house of Israel. At one moment I might speak concerning a nation or concerning a kingdom to uproot, to pull down, or to destroy it; if that nation against which I have spoken turns from its evil, I will relent concerning the calamity I planned to bring on it. Or at another moment I might speak concerning a nation or concerning a kingdom to build up or to plant it; if it does evil in My sight by not obeying My voice, then I will think better of the good with which I had promised to bless it. (Jeremiah 18:3-10) {emphasis mine}

But the Bible says it even goes beyond God directly responding to our choices. The God of the Bible is creator and sovereign over all. Nothing happens contrary to His will.

> So then **He has mercy on whom He desires, and He hardens whom He desires**.

>

> You **will say to me then, “Why does He still find fault?** For who resists His will?” On the contrary, **who are you, O man, who answers back to God?** **The thing molded will not say to the molder, “Why did you make me like this,” will it? Or does not the potter have a right over the clay, to make from the same lump one vessel for honorable use and another for common use?** What if God, although willing to demonstrate His wrath and to make His power known, endured with much patience **vessels of wrath prepared for destruction**? And He did so to make known the riches of His glory upon **vessels of mercy, which He prepared beforehand for glory**, even us, whom He also called, not from among Jews only, but also from among Gentiles. (Romans 9:18-24) {emphasis mine}

The above passage speaks a very uncomfortable truth. We don’t like thinking we don’t have full and complete free-will to do whatever we want and to determine our future, but it isn’t that simple. The Bible says specifically that some are “*prepared for destruction*” and others are “*prepared beforehand for glory*.”

> For by grace **you have been saved through faith; and that not of yourselves, it is the gift of God; not as a result of works, so that no one may boast**. For we are His workmanship, created in Christ Jesus for good works, which God prepared beforehand so that we would walk in them. (Ephesians 2:8-10) {emphasis mine}

We aren’t saved because we are smarter than all of the people who didn’t choose Jesus. We aren’t wiser than those who chose their own path rather than the path designed by God. We are saved by God as a gift. He called those who were dead in their sins to life in him. The dead can’t choose anything. We all must be made spiritually alive so we can follow Him. Only Jesus does that. We can’t make ourselves alive in Him.

Every believer needs to thank Jesus daily for the miracle of spiritual life in Him that has been given to us despite us not deserving it or choosing it.

> In this is love, not that we loved God, but that He loved us and sent His Son to be the propitiation for our sins. (1 John 4:10)

and

> We love, because He first loved us. (1 John 4:19)

Jesus acted first, choosing us, and we responded, not that we chose Him and He loved us because of our choice.

I’m sure many of my readers are cringing at this Biblical truth. We all try to make God’s word say something else because we don’t like feeling out of control. We don’t like to think that someone else is smarter, stronger, or more in control of our lives than ourselves. Still, being made to follow Jesus is the greatest blessing a person can receive.

> Trust in the Lord with all your heart\

> And do not lean on your own understanding.\

> In all your ways acknowledge Him,\

> And He will make your paths straight.\

> Do not be wise in your own eyes;\

> Fear the Lord and turn away from evil.\

> It will be healing to your body\

> And refreshment to your bones. (Proverbs 3:5-8)

We don’t have to fully understand God’s truth, but we do need to accept it.

May God guide you in the truth through His God breathed word, so we may serve Him faithfully and submit fully to His authority and His will to the glory of His majesty.

Trust Jesus

-

@ 401014b3:59d5476b

2025-03-05 15:37:44

Alright, football fiends, it’s March 2025, and we’re diving into the NFC North like it’s a polar plunge with a side of cheap beer. Free agency’s a free-for-all, the draft’s a crapshoot, and this division’s always a slugfest of grit, guts, and grudges. The Vikings shocked the world with a 14-3 run in 2024, the Lions roared, the Packers stayed scrappy, and the Bears showed flashes. Let’s slap some records on this beast and figure out who’s got the stones to take the North. Here we go, fam—hold my bratwurst.

### **Minnesota Vikings: 11-6 – Darnold’s Encore or Bust**

The Vikings were the NFL’s Cinderella story in 2024, rolling to 14-3 with Sam Darnold slinging it and Brian Flores’ defense eating souls. Justin Jefferson’s still a cheat code, and Aaron Jones keeps the ground game humming. That D-line—Jonathan Greenard, Andrew Van Ginkel—stays nasty, but free agency’s lurking. Danielle Hunter’s long gone, and guys like Harrison Phillips might chase a bag. J.J. McCarthy’s waiting in the wings, but Darnold’s 2024 magic earns him the nod. Regression’s real after a dream season—11-6 feels right, snagging the division. They’re not hitting 14 again, but they’re still a playoff lock.

### **Detroit Lions: 10-7 – Campbell’s Grit Keeps Grinding**

The Lions were a buzzsaw in 2024, and they’re not fading. Jared Goff’s got Amon-Ra St. Brown and Jameson Williams torching secondaries, while David Montgomery and Jahmyr Gibbs bulldoze defenses. Aidan Hutchinson’s a one-man wrecking crew up front, but free agency could nick ‘em—Brian Branch or Alim McNeill might dip. Dan Campbell’s got this team playing with their hair on fire, and that O-line’s still elite. 10-7’s the call, grabbing a wildcard. They’re a hair behind Minnesota but ready to punch someone’s lights out in January.

### **Green Bay Packers: 9-8 – Love’s Rollercoaster Redux**

The Packers are the NFC North’s wild card—literally. Jordan Love’s got that boom-or-bust vibe, Josh Jacobs keeps the run game honest, and the WR trio—Christian Watson, Romeo Doubs, Jayden Reed—is a problem when healthy. Rashan Gary’s a beast on D, but the secondary’s shaky, and Jaire Alexander might bolt if the money’s right. This team’s young, scrappy, and inconsistent—9-8’s where they land. Might sneak a wildcard if the chips fall, but they’re not catching the top dogs yet.

### **Chicago Bears: 6-11 – Caleb’s Sophomore Slump**

The Bears had their moments in 2024, but 2025’s a grind. Caleb Williams has DJ Moore and Rome Odunze to sling it to, and D’Andre Swift’s solid, but that O-line’s still a sieve. The defense—Montez Sweat, Jaylon Johnson—can ball, but depth’s thin, and free agency might swipe Tremaine Edmunds. Williams takes a step, but not a leap—6-11’s the harsh reality. They’re building something, but it’s not playoff-ready. Sorry, Windy City, you’re still in the basement.

### **The Final Roar**

The NFC North in 2025 is a Viking victory lap with a tight chase. The Vikings (11-6) snag the crown because Darnold’s 2024 glow carries over, the Lions (10-7) claw a wildcard with grit, the Packers (9-8) flirt with relevance, and the Bears (6-11) eat turf. Free agency’s the X-factor—lose a star, you’re cooked; keep ‘em, you’re golden. Yell at me on X when I botch this, but this is my NFC North sermon. Let’s ride, degenerates.

-

@ d360efec:14907b5f

2025-03-05 13:58:42

**ภาพรวม:**

จากภาพรวมทั้ง 3 Timeframe (TF) จะเห็นได้ว่า BTC มีแนวโน้มเป็นขาขึ้น (Bullish) อย่างชัดเจน โดยเฉพาะอย่างยิ่งใน TF Day ที่ราคาอยู่เหนือเส้น EMA 50 และ EMA 200 อย่างแข็งแกร่ง อย่างไรก็ตาม ใน TF ที่เล็กลงมา (15m และ 4H) เริ่มเห็นสัญญาณการพักตัวและอาจมีการปรับฐานระยะสั้น

**การวิเคราะห์แยกตาม Timeframe:**

* **TF Day:**

*

* **SMC:** ราคามีการ Breakout โครงสร้างตลาดขาลงก่อนหน้า และสร้าง Higher High (HH) และ Higher Low (HL) อย่างต่อเนื่อง

* **ICT Buyside & Sellside Liquidity:**

* Buyside Liquidity: อยู่บริเวณ $70,000 (เป็นเป้าหมายถัดไปที่ราคามีโอกาสขึ้นไปทดสอบ)

* Sellside Liquidity: อยู่บริเวณ $60,000 (เป็นแนวรับสำคัญ หากราคาหลุดลงมา อาจมีการปรับฐานที่รุนแรงขึ้น)

* **Money Flow:** เป็นบวก สนับสนุนแนวโน้มขาขึ้น

* **EMA:** EMA 50 (เหลือง) อยู่เหนือ EMA 200 (ขาว) เป็นสัญญาณ Bullish

* **Trend Strength:** เมฆสีเขียวหนาแน่น แสดงถึงแนวโน้มขาขึ้นที่แข็งแกร่ง และมีสัญญาณ Buy

* **Chart Pattern:** ไม่มีรูปแบบ Chart Pattern ที่ชัดเจนใน TF นี้

* **TF 4H:**

*

* **SMC:** ราคาเริ่มมีการพักตัวและสร้างฐาน (Consolidation)

* **ICT Buyside & Sellside Liquidity:**

* Buyside Liquidity: อยู่บริเวณ $69,000 (แนวต้านย่อย)

* Sellside Liquidity: อยู่บริเวณ $64,000 (แนวรับย่อย)

* **Money Flow:** เริ่มมีสัญญาณการไหลออกของเงิน (Outflow)

* **EMA:** EMA 50 ยังคงอยู่เหนือ EMA 200 แต่เริ่มมีการ Cross กัน อาจเป็นสัญญาณเตือนการพักตัว

* **Trend Strength:** เมฆสีเขียวเริ่มบางลง และมีสัญญาณ Neutral

* **Chart Pattern:** อาจกำลังก่อตัวเป็นรูปแบบ Head and Shoulders (กลับตัว) หรืออาจเป็นเพียงการพักตัวเพื่อไปต่อ

* **TF 15m:**

*

* **SMC:** ราคาอยู่ในช่วง Sideways แคบๆ

* **ICT Buyside & Sellside Liquidity:**

* Buyside Liquidity: อยู่บริเวณ $68,500

* Sellside Liquidity: อยู่บริเวณ $66,000

* **Money Flow:** เป็นลบ (Outflow)

* **EMA:** EMA 50 และ EMA 200 พันกัน (Cross) บ่งบอกถึงการไม่มี Trend ที่ชัดเจน

* **Trend Strength:** เมฆสีแดง แสดงถึงแนวโน้มขาลงระยะสั้น และมีสัญญาณ Sell

* **Chart Pattern:** ไม่พบรูปแบบ Chart Pattern ที่ชัดเจน

**กลยุทธ์และคำแนะนำ:**

* **Day Trade:**

* **กลยุทธ์:** เน้น Buy on Dip (ซื้อเมื่อราคาอ่อนตัว) ใน TF 15m หรือ 4H โดยรอสัญญาณการกลับตัวของราคา และตั้ง Stop Loss ที่เหมาะสม

* **Setup (SMC):**

1. รอให้ราคาลงมาทดสอบแนวรับ (Demand Zone) ที่ $66,000-$67,000 ใน TF 15m

2. สังเกต Price Action ว่ามีการกลับตัว (เช่น Bullish Engulfing, Hammer) หรือไม่

3. เข้า Buy เมื่อมีสัญญาณยืนยัน และตั้ง Stop Loss ต่ำกว่า Swing Low ล่าสุด

4. Take Profit ที่แนวต้านถัดไป ($68,500) หรือ Buyside Liquidity

* **สิ่งที่ต้องระวัง:**

* ความผันผวนของราคา BTC ที่สูง

* ข่าวหรือเหตุการณ์ที่อาจส่งผลกระทบต่อตลาด

* สัญญาณ Divergence (หากมี) ระหว่างราคาและ Indicator

* **ภาพรวม (ระยะกลาง-ยาว):** ยังคงมีมุมมองเป็น Bullish แต่ควรระมัดระวังการพักตัวหรือปรับฐานระยะสั้น

**สรุป:**

BTC ยังคงมีแนวโน้มเป็นขาขึ้นในระยะกลาง-ยาว แต่ในระยะสั้นอาจมีการพักตัวหรือปรับฐาน Day Trader ควรใช้กลยุทธ์ Buy on Dip และบริหารความเสี่ยงอย่างรอบคอบ

**Disclaimer:** การวิเคราะห์นี้เป็นเพียงความคิดเห็นส่วนตัว ไม่ถือเป็นคำแนะนำในการลงทุน ผู้ลงทุนควรศึกษาข้อมูลเพิ่มเติมและตัดสินใจด้วยความรอบคอบ

-

@ c1e9ab3a:9cb56b43

2025-03-05 13:54:03

The financial system has long relied on traditional banking methods, but emerging technologies like Bitcoin and Nostr are paving the way for a new era of financial interactions.

## Secure Savings with Bitcoin:

Bitcoin wallets can act as secure savings accounts, offering users control and ownership over their funds without relying on third parties.

## Instant Settlements with the Lightning Network:

The Lightning Network can replace traditional settlement systems, such as ACH or wire transfers, by enabling instant, low-cost transactions.

## Face-to-Face Transactions with Ecash:

Ecash could offer a fee-free option for smaller, everyday transactions, complementing the Lightning Network for larger payments.

## Automated Billing with Nostr Wallet Connect:

Nostr Wallet Connect could revolutionize automated billing, allowing users to set payment limits and offering more control over subscriptions and recurring expenses.

## Conclusion:

Combining Bitcoin and Nostr technologies could create a more efficient, user-centric financial system that empowers individuals and businesses alike.

-

@ d360efec:14907b5f

2025-03-05 13:46:26

**Overview:**

From an overall perspective across all 3 timeframes (TF), BTC shows a clear uptrend (Bullish), especially in the Day TF where the price is firmly above the EMA 50 and EMA 200. However, in the smaller TFs (15m and 4H), there are signs of consolidation and a potential short-term correction.

**Analysis by Timeframe:**

* **Day TF:**

*

* **SMC:** The price has broken out of the previous downtrend structure and continues to create Higher Highs (HH) and Higher Lows (HL).

* **ICT Buyside & Sellside Liquidity:**

* Buyside Liquidity: Around $70,000 (the next target the price is likely to test).

* Sellside Liquidity: Around $60,000 (a key support level; if the price breaks below this, a deeper correction may occur).

* **Money Flow:** Positive, supporting the uptrend.

* **EMA:** EMA 50 (yellow) is above EMA 200 (white), a bullish signal.

* **Trend Strength:** Thick green cloud, indicating a strong uptrend, and a Buy signal.

* **Chart Pattern:** No clear chart pattern on this TF.

* **4H TF:**

*

* **SMC:** The price is starting to consolidate and form a base.

* **ICT Buyside & Sellside Liquidity:**

* Buyside Liquidity: Around $69,000 (minor resistance).

* Sellside Liquidity: Around $64,000 (minor support).

* **Money Flow:** Starting to show signs of outflow.

* **EMA:** EMA 50 is still above EMA 200, but they are starting to cross, which could be a warning sign of consolidation.

* **Trend Strength:** The green cloud is starting to thin, and there is a Neutral signal.

* **Chart Pattern:** Potentially forming a Head and Shoulders pattern (reversal) or it may just be a consolidation before continuing higher.

* **15m TF:**

*

* **SMC:** The price is in a narrow sideways range.

* **ICT Buyside & Sellside Liquidity:**

* Buyside Liquidity: Around $68,500.

* Sellside Liquidity: Around $66,000.

* **Money Flow:** Negative (Outflow).

* **EMA:** EMA 50 and EMA 200 are intertwined (Cross), indicating a lack of a clear trend.

* **Trend Strength:** Red cloud, indicating a short-term downtrend, and a Sell signal.

* **Chart Pattern:** No clear chart pattern found.

**Strategy and Recommendations:**

* **Day Trade:**

* **Strategy:** Focus on Buy on Dip in the 15m or 4H TF, waiting for price reversal signals, and setting appropriate Stop Losses.

* **Setup (SMC):**

1. Wait for the price to test the support (Demand Zone) at $66,000-$67,000 in the 15m TF.

2. Observe Price Action for a reversal (e.g., Bullish Engulfing, Hammer).

3. Enter a Buy when there is a confirmation signal and set a Stop Loss below the latest Swing Low.

4. Take Profit at the next resistance ($68,500) or Buyside Liquidity.

* **Things to watch out for:**

* High volatility of BTC price.

* News or events that may affect the market.

* Divergence signals (if any) between price and indicators.

* **Overall (Medium-Long Term):** Still bullish, but be cautious of short-term consolidations or corrections.

**Summary:**

BTC remains bullish in the medium to long term, but there may be a short-term consolidation or correction. Day traders should use a Buy on Dip strategy and manage risk carefully.

**Disclaimer:** This analysis is a personal opinion and not investment advice. Investors should do their own research and make decisions carefully.

-

@ beb6bdc9:eeb17df3

2025-03-05 13:25:08

https://image.nostr.build/2ad4cf1beb7f1ebaecfe1e011f83c85d09c2c17e4a1f40eac412bb08e03d82c4.jpg

00020126360014BR.GOV.BCB.PIX0114dig@depix.info520400005303986540549.905802BR5923CURSO BITCOIN PARA TDAH6013SATOSHILANDIA62070503***63045C68

↑ COPIE TODO O TEXTO DA CHAVE PIX ACIMA! ↑

Para ter acesso ao guia **BITCOIN PARA TDAH**, pague a chave pix copia e cola acima e apresente o comprovante de pagamento em:

https://t.me/dinopacon

-

@ a58a2663:87bb2918

2025-03-05 12:41:36

After two years of using Standard Notes as my main note-taking app, I’m switching to Obsidian.

The $100 that Standard Notes charges for basic editing capabilities is difficult to justify, especially for someone paying in Brazilian Real and striving to make a living from writing. However, I will certainly miss its simplicity and cleaner interface.

It’s my impression that the developers are missing an opportunity to create a privacy-focused note-taking app tailored to the specific needs of writers, rather than general users.

Substack, for example, achieved such success because it targeted the distribution and monetization of writers’ work. But we need more tools focused not on distribution or monetization, but on the actual process—indeed, the various phases of the process—of creating texts. This is especially true for complex, long-form texts with different levels of argumentation, numerous written and multimedia sources, and cross-references to other works by the author.

It’s crucial that an app like this doesn’t feel overly complex, like Notion or Evernote, or so all-purpose, like Obsidian. And, of course, I’m not talking about a new full-fledged text editor like Scrivener.

Just a thought. Take note.

-

@ 5f3e7e41:81cb07cf

2025-03-05 11:37:27

The question of life’s meaning has long been a central concern in philosophy, debated by existentialists, nihilists, absurdists, and theologians alike. Is there an inherent purpose to human existence, or must we construct our own meaning? This essay explores the philosophical dimensions of the question by examining various perspectives, including existentialism, nihilism, and teleological interpretations. **Existentialist Perspective**

Existentialists argue that meaning is not intrinsic but must be created. Jean-Paul Sartre, for instance, asserts that existence precedes essence—humans exist first and define their own purpose afterward. Unlike an artifact designed for a specific function, human beings are thrown into existence without predetermined meaning. Sartre’s concept of radical freedom suggests that we are entirely responsible for imbuing our lives with purpose through our choices and actions. Albert Camus, while existential in his approach, leans toward absurdism. He argues that human beings seek meaning in a universe that offers none. This fundamental conflict, the absurd, leads to either nihilism or rebellion. Camus advocates for an embrace of the absurd—accepting life’s lack of inherent purpose and living in defiance of this reality, deriving meaning from the act of living itself. **Nihilistic Perspective**

Nihilism, most famously articulated by Friedrich Nietzsche, asserts that life has no objective meaning, purpose, or value. The "death of God" in Nietzsche’s work signifies the collapse of religious and metaphysical sources of meaning, leaving humanity in an existential void. Without a higher order dictating meaning, one might fall into existential despair. However, Nietzsche’s solution is the creation of personal values through the concept of the Übermensch, an individual who forges their own path and meaning without reliance on external validation. **Teleological and Theistic Views**

In contrast, religious and teleological perspectives propose an intrinsic meaning to life, often rooted in divine purpose. Theistic traditions argue that meaning is bestowed upon humanity by a higher power. For example, in Christianity, the purpose of life is to fulfill God’s will, achieve salvation, and cultivate virtue. Similarly, in Aristotelian philosophy, eudaimonia, or human flourishing, is seen as the ultimate telos (end goal) of human existence, achieved through rational activity and moral virtue. **Synthesis: A Constructivist Approach**

Given the divergence in perspectives, one might adopt a constructivist stance that synthesizes elements from each. If no inherent meaning exists, as existentialists and nihilists suggest, and if religious interpretations require faith, then meaning may best be understood as a subjective construction. Humans, as rational and reflective beings, can choose to ascribe significance to their existence based on personal values, relationships, creative endeavors, or contributions to humanity. **Conclusion**

The meaning of life remains an open question, shaped by individual perspectives and cultural influences. Whether meaning is self-created, divinely ordained, or ultimately absent, the inquiry itself underscores a fundamental aspect of human nature: the relentless pursuit of significance. Perhaps the search for meaning is what gives life its greatest meaning.

-

@ bd32f268:22b33966

2025-03-05 11:04:29

Segundo a filosofia Aristotélica quando analisamos uma coisa seja ela um objecto ou um fenómeno devemos ser capazes de observar as suas causas. Podemos dizer que analisar as causas nos permite compreender com outra densidade, a origem, o significado e a finalidade das coisas.

Atualmente, estamos vetados a um reducionismo materialista quando fazemos ciência, sendo portanto nota dominante a nossa fixação na matéria como o fator primordial do conhecimento dos objetos. Ao fixarmo-nos neste aspeto perdemos muitas outras dimensões que compõe as coisas.

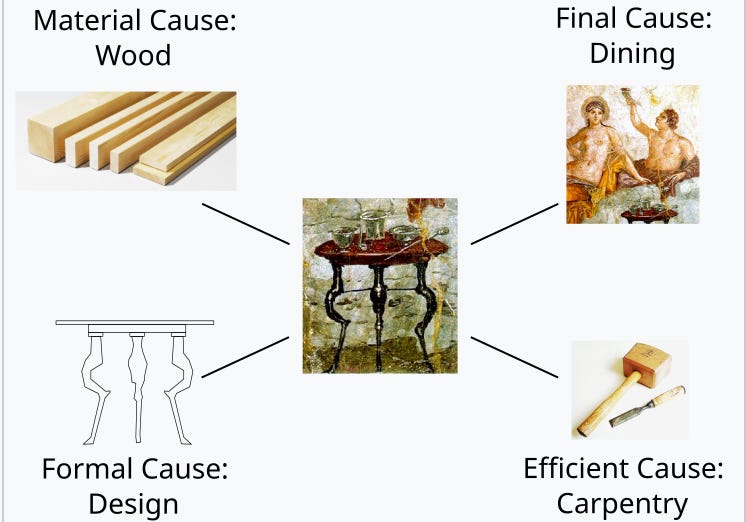

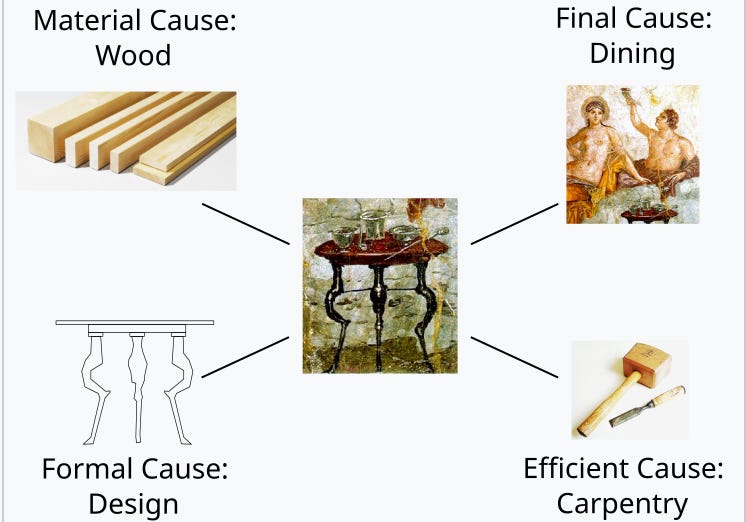

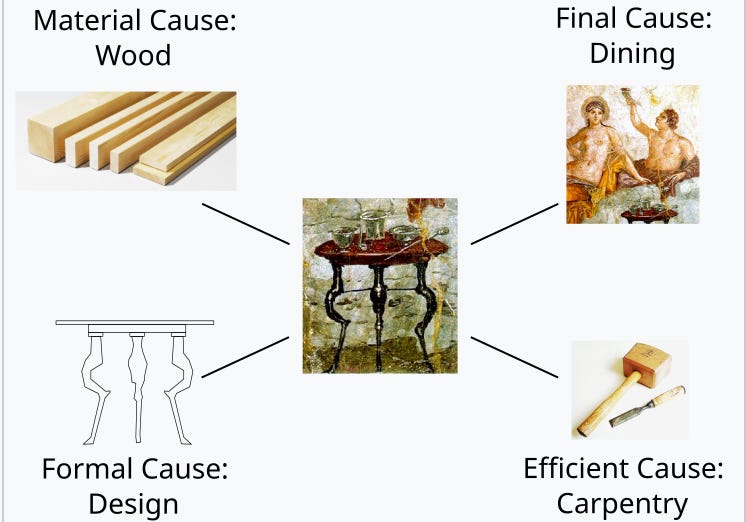

Atendamos então a Aristóteles e a quatro causas que este autor identifica para as coisas e fenómenos.

Segundo o filósofo grego as causas dividem-se entre: materiais (relativas ao que algo é feito), as formais (relativas ao que algo é), as eficientes/motoras (relativas ao que as produziu ou quem as produziu) e as finais ( relativas á finalidade, Télos ou para quê; ou seja o que algo visa ou “tem por fim”).

Seguindo esta teoria das quatro das quatro causas podemos descrever as condições de existência tanto de entidades estáticas como em transformação. Quer isto dizer que assim temos meios para explorar o porquê das coisas. Até conhecermos o porquê das coisas não podemos dizer que as conhecemos verdadeiramente.

Analisemos um exemplo para que fique mais claro este método de análise. Uma mesa tem como causa material a madeira que a compõe, a sua causa formal (que diz respeito à forma) é a estrutura, ou seja o seu design; a sua causa eficiente é o trabalho de carpintaria que lhe deu origem e a sua causa final é servir de suporte para as refeições.

\

Destas causas destaco em particular a causa final que creio ser a que mais frequentemente induz confusão nas pessoas. De facto, o conhecimento da finalidade das coisas é fundamental inclusive para que possamos viver de forma harmoniosa com a realidade. É certo que nos podemos sentar numa mesa e jantar na cadeira, contudo automaticamente vamos perceber a desarmonia que advém dessa decisão.

Por vezes essa desarmonia não será tão evidente, no entanto não nos podemos esquecer que tudo o que existe tem um propósito, isto é orienta-se para um fim, cumprindo-nos agir em conformidade com a natureza das coisas para alcançar essa harmonia com a própria realidade.

São muitas as ocasiões na nossa vida que queremos de alguma forma revogar esta inclinação natural das coisas para os seus fins, que funciona também como objeto e fundamento para a lei natural. Vejamos por exemplo a forma como muitas vezes quando comemos, em vez ordenar a nossa ação pelo fim primeiro (alimentar-se) buscamos o prazer como fim primário ao qual os outros estão subordinados resultando em desordem, ou seja num apetite que não está em conformidade com o objetivo último da alimentação. Não quer isto dizer que não se possa ou deva sentir prazer ao comer, quer apenas dizer que o fim último para que existe esse ato não é o prazer, mas sim a subsistência do corpo. Com este exemplo conseguimos perceber que há uma ordenação natural nos fins para que se orientam as coisas, sendo que nessa ordenação há sempre fins primários e secundários. Sendo conscientes dessa hierarquia podemos, de uma forma mais ajustada adaptar as nossas atitudes á realidade, isto é aos preceitos da lei natural.

-

@ a012dc82:6458a70d

2025-03-05 10:24:56

In the dynamic and often unpredictable realm of cryptocurrency, the actions of Bitcoin whales—investors who hold large amounts of BTC—can significantly influence market trends and investor sentiment. A recent transaction, involving the transfer of over $1.5 billion worth of Bitcoin, has once again highlighted the profound impact these entities can have on the digital currency landscape. This article delves into the details of this massive move, exploring its implications and the broader context of whale activity in the cryptocurrency market.

**Table of Contents**

- The Billion-Dollar Transaction: A Deep Dive

- Other Significant Whale Movements

- Analyzing the Impact of Whale Activity

- Market Volatility and Speculation

- Psychological Impact on Investors

- The Role of Whales in the Cryptocurrency Ecosystem

- Liquidity and Market Depth

- Influence on Adoption and Perception

- The Billion-Dollar Transfer in Context

- Bitcoin's Market Position

- Historical Whale Activity

- Future Implications and the Evolving Role of Whale …

- Regulatory Environment

- Institutional Investors and Market Stability

- Technological Advances and Market Monitoring

- Conclusion

- FAQs

**The Billion-Dollar Transaction: A Deep Dive**

On January 31st, the cryptocurrency community was abuzz with news of a monumental Bitcoin transfer. A whale moved 35,049 BTC, valued at approximately $1,518,020,170, from one unknown wallet to another. This transaction not only stood out due to its sheer size but also because it underscored the significant liquidity and wealth concentrated in the hands of a few within the Bitcoin ecosystem.

**Other Significant Whale Movements**

The billion-dollar transfer was part of a series of large transactions that day, which included:

- 25,266 BTC ($1,099,679,062) transferred between unknown wallets.

- 929 BTC ($39,562,024) moved from Coinbase to Gemini.

- 2,500 BTC ($106,647,312) sent to PayPal.

- 1,736 BTC ($73,943,008) transferred to Gemini.

- 34,300 BTC ($1,476,690,397) moved between unknown wallets.

These transactions, totaling around $4.5 billion, highlight the enormous sums that whales can mobilize, influencing the Bitcoin market's liquidity and volatility.

**Analyzing the Impact of Whale Activity**

The actions of Bitcoin whales can lead to significant market movements. Large-scale transfers and trades can signal potential sales or acquisitions, prompting widespread speculation and reactive trading among smaller investors.

**Market Volatility and Speculation**

The recent billion-dollar transaction has sparked intense speculation regarding the whale's motives and the potential repercussions for Bitcoin's price stability. Such movements can create uncertainty, leading to price volatility as the market reacts to perceived changes in supply and demand.

**Psychological Impact on Investors**

Whale activity can also have a psychological impact on retail investors. The knowledge that a single entity or group can move the market might lead to caution, fear, or even panic selling, exacerbating price fluctuations and potentially leading to market manipulation accusations.

**The Role of Whales in the Cryptocurrency Ecosystem**

Bitcoin whales play a crucial role in the cryptocurrency ecosystem. Their significant holdings give them considerable influence over market dynamics, liquidity, and even the adoption and perception of Bitcoin as a digital asset.

**Liquidity and Market Depth**

Whales contribute to market liquidity and depth by providing substantial capital. Their trades, though potentially disruptive in the short term, help create a more liquid market, enabling other investors to execute large transactions more smoothly.

**Influence on Adoption and Perception**

The actions of whales can influence the broader perception of Bitcoin. Significant investments or divestments by these entities can signal confidence or concern regarding Bitcoin's future, influencing the sentiment of smaller investors and the general public.

**The Billion-Dollar Transfer in Context**

To fully understand the implications of the billion-dollar transfer, it's essential to consider the broader context of Bitcoin's market position and the historical activity of whales.

**Bitcoin's Market Position**

At the time of the transfer, Bitcoin was trading at $42,647, experiencing a slight decrease from its previous values. This period of relative stability makes the timing of the whale's move particularly noteworthy, as it suggests strategic positioning rather than a reaction to short-term market trends.

**Historical Whale Activity**

Historically, whale movements have preceded significant market movements, both bullish and bearish. By analyzing past transactions, investors attempt to predict future market directions based on whale behavior. However, the opaque nature of these entities and their motivations makes such predictions speculative at best.

**Future Implications and the Evolving Role of Whales**

As the cryptocurrency market matures, the role and impact of whales may evolve. Regulatory changes, the growing adoption of Bitcoin, and the entrance of institutional investors could all influence whale behavior and their impact on the market.

**Regulatory Environment**

Increased regulatory scrutiny could lead to more transparency in whale transactions, potentially mitigating some of the market volatility associated with these moves. However, it could also lead to more sophisticated strategies by whales to conceal their actions or to manipulate the market within legal boundaries.

**Institutional Investors and Market Stability**

The entrance of more institutional investors into the cryptocurrency market could dilute the relative influence of individual whales, leading to greater market stability. Institutional investors typically employ more conservative strategies and are subject to stricter regulatory oversight, which could help moderate the impact of large-scale transactions.

**Technological Advances and Market Monitoring**

Advancements in blockchain analytics and monitoring tools are making it easier to track whale activity in real-time. This increased transparency could help demystify whale actions, allowing smaller investors to make more informed decisions and potentially leveling the playing field.

**Conclusion**

The recent billion-dollar Bitcoin transfer by a whale is a stark reminder of the significant influence these entities hold over the cryptocurrency market. While their actions can lead to market volatility and speculation, they also play a crucial role in providing liquidity and depth to the market. As the cryptocurrency ecosystem continues to evolve, understanding the motivations and implications of whale activity will remain a critical aspect of navigating the digital asset landscape.

**FAQs**

**What is a Bitcoin whale?**

A Bitcoin whale is an individual or entity that holds a large amount of Bitcoin. These investors have enough capital to influence market movements significantly when they buy or sell large quantities of BTC.

**How much Bitcoin was moved by the whale?**

The whale moved 35,049 BTC, which was valued at approximately $1,518,020,170 at the time of the transaction.

**Where was the Bitcoin transferred?**

The Bitcoin was transferred from one unknown wallet to another. The identities of the parties involved and the purpose of the transfer remain undisclosed.

**Were there other significant transactions on the same day?**

Yes, there were several other significant transactions on the same day, including transfers worth hundreds of millions and billions of dollars, contributing to a total movement of about $4.5 billion in Bitcoin by whales.

**How do whale movements affect the Bitcoin market?**

Whale movements can lead to increased volatility in the Bitcoin market. Large transactions can signal potential sales or purchases to other traders, influencing the market price and leading to speculative trading.

**That's all for today**

**If you want more, be sure to follow us on:**

**NOSTR: croxroad@getalby.com**

**X: @croxroadnewsco**

**Instagram: @croxroadnews.co/**

**Youtube: @thebitcoinlibertarian**

**Store: https://croxroad.store**

**Subscribe to CROX ROAD Bitcoin Only Daily Newsletter**

**https://www.croxroad.co/subscribe**

**Get Orange Pill App And Connect With Bitcoiners In Your Area. Stack Friends Who Stack Sats

link: https://signup.theorangepillapp.com/opa/croxroad**

**Buy Bitcoin Books At Konsensus Network Store. 10% Discount With Code “21croxroad”

link: https://bitcoinbook.shop?ref=21croxroad**

*DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.*

-

@ e31e84c4:77bbabc0

2025-03-05 10:23:47

The IMF’s $1.4 Billion Shackle *was Written By Kudzai Kutukwa. If you enjoyed this article then support his writing, directly, by donating to his lightning wallet: **muggyarch11@walletofsatoshi.com***

The recent $1.4 billion Extended Fund Facility (EFF) agreement between the International Monetary Fund (IMF) and El Salvador marks a significant turning point in the nation's economic and monetary policy. The IMF’s $1.4 billion “lifeline” is a sly Trojan horse, gutting El Salvador’s sovereignty and kneecapping its 2021 Bitcoin law— which represented a bold step toward monetary freedom and economic self-determination— all to prop up the same economic mess it pretends to fix. Brilliant, right?

**The IMF’s Colonialist Agenda: A Historical Precedent**

In 2021, El Salvador made history by adopting Bitcoin as legal tender, positioning itself at the forefront of financial innovation and offering its citizens an alternative to the U.S. dollar. This move was a bold step toward monetary independence and as a pathway toward individual financial sovereignty by reducing remittance costs for Salvadorans and bypassing the predatory international banking system. By making Bitcoin legal tender, El Salvador was taking steps to free itself from financial colonialism.

The IMF’s response to El Salvador’s Bitcoin law was predictably hostile from day one. The institution repeatedly warned of the “risks” associated with Bitcoin, framing it as a threat to financial stability rather than a tool for economic empowerment. Hypocrisy drips from every word—the IMF’s own debt traps and inflationary schemes have fueled the chaos it now “rescues” El Salvador from.

The Bretton Woods institution has long been the enforcer of the global financial elite, ensuring that nations remain shackled to the U.S. dollar-dominated system. Through predatory loans and stringent conditions, the IMF perpetuates economic subjugation. Now, facing pressure from these same institutions, El Salvador finds itself caught in the classic IMF trap: accepting loans with strings attached that further cement dependency.

This aid package isn't a solution to El Salvador's problems; it's leverage to force compliance with the global banking cartel's agenda. Under the IMF agreement, El Salvador has been compelled to amend its Bitcoin law, revoking Bitcoin's status as legal tender and making its acceptance by businesses voluntary. Additionally, tax obligations must now be settled exclusively in U.S. dollars. This gut-wrenching retreat from its bold Bitcoin rebellion represents a diabolical masterpiece of oppression—stripping citizens of financial freedom and forcing them to forever bow before the fiat gods.

**Why the IMF Must Destroy Bitcoin’s Medium of Exchange Use Case**

To understand why the IMF is so determined to undermine Bitcoin’s role as a medium of exchange in El Salvador, it’s important to revisit the fundamental nature of money. The widely cited “three functions” of money—medium of exchange, store of value, and unit of account—are often misunderstood. These are not rigid definitions, but empirical observations of how money functions in practice.

Money is, first and foremost, the generally accepted medium of exchange. The other functions tend to follow, but they are not exclusive to money. For example, gold can serve as a store of value but is no longer a commonly accepted medium of exchange, and other commodities can also act as units of account, but neither is money unless it is widely accepted as a medium of exchange. Bitcoin’s rise as a store of value (akin to “digital gold”) is not as threatening to the fiat system as its potential to function as a widely accepted medium of exchange. A strong store of value can exist within a system that is still dominated by fiat currencies.

If Bitcoin were to become a dominant medium of exchange, it would directly challenge the monopoly of central banks and the control that institutions like the IMF exert over global financial systems. That is why the IMF’s primary goal in El Salvador is not necessarily to stop Bitcoin’s adoption altogether but rather to strip Bitcoin of its medium of exchange function, thus effectively relegating Bitcoin to a speculative asset or store of value.