-

@ ef1744f8:96fbc3fe

2025-03-10 15:36:36

SM5t1lcoE7YMLxevcZD8Y1h6hOVUW2m+VBEgnobNaxqFnMiAxLnx5Mv1yJXBWbJUHJUVjVqTSnMMh+kmOFAm45sJ91t1ZbJexRwjCt/bcUupUg9muo9yhWNLF90hRhGOukV5dvtDEm0wSi55BKco+cKN6Bv+/YgoOzVslHyhdc7uwMOi4dYvf1QzKwbgdnbeaxJ/rmC5+a1u936gtak0Q3W8RU+r9ori727kCYAkHa75rpZq7EoP7hX4/Fhi1UFHFnSRlVReZ2i4BJSVsuMHMQ5HesLCdvYQsje/AGaHcQAOGsqCcrZKyXpiGpHoFQ76JfH2qb9MgsLhy9/uWtSkFGfVhTXLJ7xBrn4nvXB4NeZCm6lH0RxqMEpAs9pJFQ13WB0B+PnhaKzt+/gd4BTyxvt1kS9UI1Tx38C64fUc4H8=?iv=Ad5BmIVyn2mtZrVQpujcvQ==

-

@ 0463223a:3b14d673

2025-03-10 13:08:11

Whilst starting out documenting coming off prescription drugs and an attempt at self improvement. I now understand that I want to write a weekly blog to clarify my thoughts and provide a means for self introspection and self improvement. It’s pretty narcissistic to be honest but I’m fine with that. I’m trying to be honest in my approach and it is what it is.

Some folks will write about economics, others culture war hot topics or how they stick raw egg up their arse for profit type diet advice. It’s unlikely I’ll approach any of those topics, there’s a lot of noise already and I don’t want to add to the pile.

Each week I will write a page of A4 and hope over time the writing style will improve. It’s coming from an extremely low base so I’m most optimistic about the upside potential!

I’ve been pretty hard on myself in the last week, folks who interact with me here may have noticed, my wife certainly has and it’s true. I’ve been an emotional wreck. For over a decade my brain chemistry was altered by drugs and my brain is not a comfortable place. Staying on the drugs was easy but it’s not the answer.

I notice it’s quite common for folks to say you should never speak ill of yourself here, words have power. On one level I agree, no one should beat themselves unnecessarily but I think it’s just as important to be self aware, understand where you have biases, where you have strengths and weaknesses. If you’re never hard on yourself, how do you improve? Only by facing problems face on is what I’m thinking.

I broke down in tears on a live stream last week, pretty embarrassing. The day before I’d seen footage of a gig I’d done in 2013 (I think), a gig that helped pave the way for some of the cool projects I’ve been involved with over the last decade. It was nothing fancy, just a night in a local pub. What truly broke my heart was seeing my late friend on drums. He committed suicide not long after that gig.

I was on such a high at that time. We had begun working with world class musicians, acts people had actually heard of, not Pop but credible artists. Our own band had just got its first national radio play and we’d been offered a deal to make an album with a reasonable advance. We were doing tonnes of gigs, studio sessions and having fun (at least I thought). Nothing glamorous, long sessions in low budget studios, gigs getting paid fuck all but we were DOING THINGS. We were doing what we’d always wanted to do. Make music.

So with that fresh in my memory I thought I’d try playing a record we’d made together on the stream, absolute car crash. I could barely speak. Music completely kicked my arse that day. After all this time, I’m still not over it.

Him dying like that kicked the shit out of me in ways I can’t begin to describe. I fell into a very deep depression myself after that and I was so fucking angry. I’d say more but I don’t feel comfortable talking about it, knowing whatever pain I feel, it’s nothing compared to the pain his family feel. They are very private people. I respect that.

It was around that time I started being medicated. I came very close to committing suicide myself and was talked out of driving my car off a cliff by the samaritans. Fun right!?

Aside from the music stuff, we were both working for a charity helping kids from tough backgrounds develop life skills through music. The week before his death we’d both lost a lot of hours work due to government cut backs. Cut backs that were put in place as our country was compelled to bail out a bunch of bankers. I’m STILL angry about that, but less so now.

I want to keep anything I earn as far away from the banks as is possible. Seriously, fuck them. Fuck them. Fuck them. Fortunately there is an opt out.

It’s unlikely I’ll say much more on the subject. Sure I could game Nostr by endless posting pictures of Michael Sailor but frankly, no. I have nothing in common with the guy. He gave up music because there was no money in it. Fuck him, his beats would suck anyway, he has no soul haha but hey, he’s enjoying himself and that’s good for h.

I don’t have thousands upon thousands of bitcoin but I have no money in the bank and thousands of Sats. Win!

-

@ a012dc82:6458a70d

2025-03-10 12:52:39

The cryptocurrency landscape is witnessing a significant shift as institutional investors, led by giants like BlackRock, are increasingly venturing into Bitcoin, marking a new era in the digital asset's journey. This article delves into the recent acquisition spree where institutional entities have amassed a substantial 3.3% of Bitcoin's total supply, exploring the implications and potential outcomes of this trend. The movement signifies a departure from traditional investment paradigms, as these financial behemoths traditionally steered clear of highly volatile assets like Bitcoin. However, the changing economic landscape, marked by inflation fears and the search for non-correlated assets, has led these institutions to reconsider their stance. The involvement of firms like BlackRock not only brings substantial capital to the Bitcoin market but also signals to other institutional and retail investors that Bitcoin is a viable asset class. This shift is not merely about investment in digital assets but represents a broader acceptance of cryptocurrency as an integral part of the modern financial landscape.

**Table of Contents**

- The Rise of Institutional Investment in Bitcoin

- The 3.3% Supply Phenomenon

- Implications of Institutional Holdings

- Challenges and Controversies

- The Road Ahead

- Conclusion

- FAQs

**The Rise of Institutional Investment in Bitcoin**

In recent years, Bitcoin has transitioned from a speculative investment for individual traders to a legitimate asset class attracting institutional investors. The introduction of Bitcoin exchange-traded funds (ETFs) has been a pivotal moment, providing a regulated and accessible avenue for institutional players to enter the cryptocurrency market. Companies like BlackRock, the world's largest asset manager, have led the charge, signaling a significant endorsement of Bitcoin's long-term value. This trend is reinforced by the growing dissatisfaction with traditional financial systems and the low-yield environment, driving institutions to seek alternative investments. The rise of institutional investment has been facilitated by improved regulatory clarity and the development of more sophisticated cryptocurrency services, including custody and trading solutions tailored for institutional needs. This wave of institutional interest is not just a fad but a reflection of a deeper understanding and acceptance of blockchain technology and its potential to revolutionize financial systems. As more institutions enter the market, we can expect to see a ripple effect, with increased innovation, product offerings, and perhaps even regulatory reforms tailored to accommodate the burgeoning asset class.

**The 3.3% Supply Phenomenon**

A recent report has shed light on a remarkable development: the combined applicants of 11 spot Bitcoin ETFs now hold approximately 3.3% of the total circulating Bitcoin supply. This group includes heavyweight financial institutions such as Grayscale, Fidelity, and Franklin Templeton, among others. This collective move by institutional investors to secure a sizable portion of Bitcoin's supply underscores their bullish outlook on the cryptocurrency's future. The strategic acquisition of such a significant portion of the supply is not just a vote of confidence in Bitcoin's value proposition; it also reflects a strategic positioning for future financial landscapes where digital assets play a central role. This accumulation can lead to a reduction in market liquidity, which, while potentially increasing volatility in the short term, may also lead to higher prices as demand continues to grow against a limited supply. The actions of these institutions highlight a strategic shift towards diversification and the recognition of Bitcoin as a digital gold, a hedge against inflation, and a new asset class with unique properties.

**Implications of Institutional Holdings**

The substantial acquisition of Bitcoin by institutional investors has several implications. Firstly, market stability is expected to improve as institutional investors are typically long-term holders, reducing the market's susceptibility to large, speculative price swings. Unlike retail investors, who may be prone to panic selling during market downturns, institutions are more likely to hold their positions through volatility, providing a stabilizing effect on the market. Secondly, the price impact, while not immediately evident, could manifest significantly in the long term. As institutions continue to accumulate Bitcoin, the reduced supply could lead to price increases, especially if retail and other institutional investors continue to enter the market. Thirdly, the legitimacy and adoption of Bitcoin are likely to increase as institutional involvement can be seen as an endorsement of its viability as an investment. However, this shift also brings challenges, such as potential centralization and the risk of large-scale market manipulation. The increased institutional presence in the Bitcoin market is a double-edged sword; while it brings legitimacy and stability, it also introduces new risks and challenges that the cryptocurrency community must navigate.

**Challenges and Controversies**

Despite the optimistic outlook, the move has not been without its challenges and controversies. The approval of Bitcoin ETFs by regulatory bodies like the SEC has been met with mixed reactions. SEC Chair Gary Gensler's comments highlighted the irony in approving spot Bitcoin ETFs, pointing out the potential for increased centralization and speculation in a market that values decentralization. This decision has sparked a debate within the cryptocurrency community about the future of Bitcoin and whether institutional involvement will dilute its foundational principles. Furthermore, the large-scale acquisition of Bitcoin by institutions could lead to a concentration of wealth and power within the ecosystem, which contradicts the decentralized ethos that Bitcoin was built upon. Additionally, there are concerns about the environmental impact of Bitcoin mining and whether institutional investors will push for more sustainable practices or exacerbate the issue. The entry of institutional investors into the Bitcoin space is a complex development that brings both opportunities and challenges, and its long-term impact remains to be seen.

**The Road Ahead**

As the market adjusts to the new reality of institutional involvement in Bitcoin, all eyes will be on the impact of these developments on the cryptocurrency's price, supply dynamics, and overall market structure. Additionally, the upcoming Bitcoin halving event in April is set to further influence the market, reducing the rate at which new Bitcoins are created and possibly leading to tighter supply conditions. This event could exacerbate the effects of institutional accumulation, potentially leading to significant price movements. The road ahead for Bitcoin is fraught with uncertainties and possibilities. The increasing institutional interest in Bitcoin is likely to continue shaping the cryptocurrency landscape, influencing everything from regulatory approaches to technological innovations within the space. As we move forward, the key will be balancing the benefits of institutional involvement with the need to preserve the decentralized, open nature of cryptocurrencies.

**Conclusion**

The acquisition of 3.3% of Bitcoin's supply by institutional investors marks a significant milestone in the cryptocurrency's evolution. As institutions like BlackRock and others bet big on Bitcoin, the landscape of digital assets is set to change dramatically. While challenges remain, the long-term outlook for Bitcoin appears more promising than ever, with institutional investment paving the way for broader acceptance and stability in the cryptocurrency market. However, as the market evolves, it will be crucial to monitor the impacts of this shift, ensuring that Bitcoin remains a tool for financial empowerment and innovation, rather than becoming an instrument of traditional financial systems. The journey of Bitcoin continues to unfold, and the involvement of institutional investors is just the latest chapter in its ongoing story.

**FAQs**

**Why are institutional investors like BlackRock interested in Bitcoin?**

Institutional investors are turning to Bitcoin as a new asset class to diversify their portfolios, hedge against inflation, and capitalize on the potential for high returns. The growing acceptance of Bitcoin as a legitimate investment, improved regulatory clarity, and the development of institutional-grade trading and custody services have also contributed to this interest.

**What does the 3.3% Bitcoin supply acquisition mean?**

The 3.3% supply acquisition refers to the combined total of Bitcoin currently held by the applicants of 11 spot Bitcoin ETFs. This significant holding indicates a strong belief in the future value of Bitcoin and represents a substantial portion of the total circulating supply, highlighting the growing influence of institutional investors in the cryptocurrency market.

**How does institutional investment affect the Bitcoin market?**

Institutional investment is expected to bring more stability, reduce volatility, and increase market maturity. However, it could also lead to potential centralization and influence market dynamics, such as supply scarcity, which may drive up prices.

**What are the challenges and controversies surrounding institutional investment in Bitcoin?**

Challenges include potential market manipulation, centralization of Bitcoin holdings, and deviation from Bitcoin's original ethos of decentralization. Controversies also arise from environmental concerns related to Bitcoin mining and the potential for increased speculation and volatility.

**That's all for today**

**If you want more, be sure to follow us on:**

**NOSTR: croxroad@getalby.com**

**X: [@croxroadnewsco](https://x.com/croxroadnewsco)**

**Instagram: [@croxroadnews.co/](https://www.instagram.com/croxroadnews.co/)**

**Youtube: [@thebitcoinlibertarian](https://www.youtube.com/@thebitcoinlibertarian)**

**Store: https://croxroad.store**

**Subscribe to CROX ROAD Bitcoin Only Daily Newsletter**

**https://www.croxroad.co/subscribe**

**Get Orange Pill App And Connect With Bitcoiners In Your Area. Stack Friends Who Stack Sats

link: https://signup.theorangepillapp.com/opa/croxroad**

**Buy Bitcoin Books At Konsensus Network Store. 10% Discount With Code “21croxroad”

link: https://bitcoinbook.shop?ref=21croxroad**

*DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.*

-

@ d360efec:14907b5f

2025-03-10 12:34:35

**ภาพรวมสถานการณ์ :**

https://www.tradingview.com/chart/F8mO3cIx/

Bitcoin (BTC) ประสบกับการร่วงลงอย่างรุนแรง (sharp sell-off) ในวันที่ 10 มีนาคม 2568. การเคลื่อนไหวนี้, โดยเฉพาะอย่างยิ่งที่เห็นได้ชัดใน Timeframe 15 นาที, ได้ทำลายแนวรับสำคัญหลายระดับ และยืนยันถึงแนวโน้มขาลงในระยะสั้นอย่างชัดเจน. แม้ว่า Timeframe Day จะยังไม่ *เสีย* โครงสร้างขาขึ้นในระยะยาวไปทั้งหมด, แต่ก็แสดงสัญญาณเตือนที่สำคัญหลายประการ, รวมถึงแท่งเทียน Bearish Engulfing, Money Flow ที่เปลี่ยนเป็นลบ, และ Trend Strength ที่อ่อนแอลง. การวิเคราะห์นี้จะพิจารณาทุก Timeframe อย่างละเอียดเพื่อหากลยุทธ์ที่เหมาะสมกับความเสี่ยงที่สูงมากในปัจจุบัน.

**การวิเคราะห์ทางเทคนิค (Technical Analysis):**

* **Timeframe 15 นาที (15m) - *เน้น***:

* **SMC (Smart Money Concepts):** ราคา Breakout แนวรับสำคัญทั้งหมดลงมาอย่างรุนแรง. มีการสร้าง Lower Lows (LL) อย่างต่อเนื่อง. นี่แสดงถึงการควบคุมตลาดของแรงขายอย่างเบ็ดเสร็จ (complete dominance of selling pressure).

* **ICT Buyside & Sellside Liquidity:**

* *Buyside Liquidity (แนวต้าน):* $68,000 (แนวรับเดิมที่ตอนนี้กลายเป็นแนวต้านสำคัญ), $69,000, $70,000.

* *Sellside Liquidity (แนวรับ):* ไม่มีแนวรับที่แข็งแกร่งในระยะใกล้. อาจมีแนวรับทางจิตวิทยา (psychological support) ที่ $60,000, และต่ำกว่านั้นที่ $58,000, $56,000. การระบุแนวรับที่ชัดเจนในสภาวะนี้เป็นเรื่องยาก.

* **Money Flow:** เป็นลบอย่างรุนแรง (Strong Outflow). นี่คือการยืนยันที่สำคัญที่สุดอย่างหนึ่งของแรงขาย.

* **EMA (Exponential Moving Average):** EMA 50 (สีเหลือง) อยู่ต่ำกว่า EMA 200 (สีขาว) อย่างชัดเจน, และระยะห่างระหว่างเส้นทั้งสองกำลังขยายออก. นี่คือสัญญาณ Bearish ที่แข็งแกร่ง.

* **Trend Strength:** เมฆสีแดงหนาแน่น, และมีสัญญาณ Sell อย่างชัดเจน.

* **Chart Pattern:** ไม่มีรูปแบบ Chart Pattern ใดๆ ที่บ่งบอกถึงการกลับตัวเป็นขาขึ้น (Bullish).

* **สรุป 15m:** *แนวโน้มขาลงชัดเจนและแข็งแกร่งมาก.*

* **Timeframe 4 ชั่วโมง (4H):**

* **SMC:** ราคาอยู่ในช่วงการปรับฐาน (correction). ได้หลุดลงมาต่ำกว่า EMA 50 และกำลังทดสอบ EMA 200.

* **ICT Buyside & Sellside Liquidity:**

* *Buyside Liquidity (แนวต้าน):* $68,000 - $69,000.

* *Sellside Liquidity (แนวรับ):* EMA 200 (ประมาณ $60,000), $58,000 (บริเวณ Demand Zone ก่อนหน้า).

* **Money Flow:** เป็นลบ (Outflow).

* **EMA:** EMA 50 (สีเหลือง) ตัด EMA 200 (สีขาว) ลงมาแล้ว (Death Cross). นี่คือสัญญาณ Bearish ในระยะกลาง.

* **Trend Strength:** เมฆสีแดงบ่งบอกถึงแนวโน้มขาลงระยะกลาง.

* **Chart Pattern:** ไม่มีรูปแบบการกลับตัวที่เป็น Bullish ที่ชัดเจน.

* **สรุป 4H:** *ยืนยันการปรับฐานในระยะกลาง. แนวโน้มเป็นขาลง.*

* **Timeframe Day (Day):**

* **SMC:** *ยังไม่* เสียโครงสร้างขาขึ้นหลักในระยะยาว (คือ ยังไม่ได้ทำ Lower Low ที่ต่ำกว่า $59,000 - $60,000). *อย่างไรก็ตาม*, แท่งเทียนล่าสุดคือ Bearish Engulfing ซึ่งเป็นสัญญาณกลับตัวที่สำคัญ, และความรุนแรงของการร่วงลงบ่งบอกถึงความอ่อนแอที่เพิ่มขึ้น.

* **ICT Buyside & Sellside Liquidity:**

* *Buyside Liquidity (แนวต้าน):* $72,000, $75,000 (All-Time High).

* *Sellside Liquidity (แนวรับ):* $60,000 (แนวรับสำคัญทางจิตวิทยา, Low ก่อนหน้า), $58,000, และ $50,000 - $52,000 (EMA 200 และ Demand Zone).

* **Money Flow:** *เริ่มเปลี่ยนเป็นลบ (Outflow)*. นี่เป็นการเปลี่ยนแปลงที่สำคัญและเป็นสัญญาณเตือนที่ร้ายแรง.

* **EMA:** EMA 50 (สีเหลือง) ยังคงอยู่เหนือ EMA 200 (สีขาว), แต่ระยะห่างระหว่างเส้นทั้งสองแคบลง.

* **Trend Strength:** เมฆสีเขียวเริ่มบางลง, และมีสัญญาณ Neutral (ก่อนหน้านี้), *และตอนนี้มีสัญญาณ Sell*.

* **Chart Pattern:** *Bearish Engulfing* - สัญญาณกลับตัวเป็นขาลงที่แข็งแกร่ง.

* **สรุป Day:** *แนวโน้มระยะยาวยังคงเป็นขาขึ้นทางเทคนิค, แต่มีสัญญาณเตือนที่สำคัญหลายประการ, และมีความเสี่ยงสูงที่จะเปลี่ยนเป็นขาลง.*

**กลยุทธ์การเทรด (Trading Strategies):**

1. **Day Trade (15m):**

* **กลยุทธ์หลัก:** *Short Selling เท่านั้น*. ความเสี่ยงสูงมาก.

* **เงื่อนไข:** รอการ Rebound (การดีดตัวขึ้นชั่วคราว) ไปยังแนวต้าน (เช่น EMA ใน TF 15m, หรือบริเวณ $68,000). จากนั้น, *รอสัญญาณ Bearish* ที่ชัดเจน (เช่น Bearish Engulfing, Evening Star, หรือการ Breakout ของ Rebound นั้นลงมา).

* **Stop Loss:** เหนือ Swing High ล่าสุดของการ Rebound *อย่างเคร่งครัด*.

* **Take Profit:** แนวรับทางจิตวิทยา ($60,000), หรือต่ำกว่านั้น ($58,000, $56,000). *ไม่ควรถือยาว*.

* **คำเตือน:** ห้ามสวนเทรนด์ (ห้าม Buy) โดยเด็ดขาด. ตลาดมีความผันผวนสูงมาก.

2. **Swing Trade (4H):**

* **กลยุทธ์หลัก:** *Wait and See (รอดู)*. ยังไม่มีสัญญาณให้ Buy.

* **เงื่อนไข:** รอให้ราคาลงไปทดสอบแนวรับสำคัญ (EMA 200 ที่ประมาณ $60,000, หรือ $58,000). จากนั้น, *ต้องเห็นสัญญาณการกลับตัวที่เป็น Bullish ที่ชัดเจนและแข็งแกร่ง* (เช่น Bullish Engulfing, Hammer, Morning Star, พร้อม Volume สูง) จึงจะพิจารณาเข้า Buy.

* **Stop Loss:** ต่ำกว่าแนวรับที่เข้าซื้อ.

* **Take Profit:** แนวต้าน ($68,000 - $69,000), หรือสูงกว่านั้นหากแนวโน้มเปลี่ยน.

* **คำเตือน:** การเข้าซื้อที่แนวรับโดยไม่มีสัญญาณกลับตัวมีความเสี่ยงสูง.

3. **Position Trade (Day):**

* **กลยุทธ์หลัก:** *Wait and See (รอดู)*. ยังเร็วเกินไปที่จะ Buy.

* **เงื่อนไข:** รอให้ราคาลงไปทดสอบแนวรับที่แข็งแกร่งมาก ($50,000 - $52,000, ซึ่งเป็น EMA 200 และ Demand Zone). *จากนั้น, ต้องเห็นสัญญาณการกลับตัวที่เป็น Bullish ที่ชัดเจนมาก* จึงจะพิจารณาเข้าซื้อ. หรือ, รอให้โครงสร้างตลาดเปลี่ยนเป็นขาขึ้นอีกครั้ง (สร้าง Higher High).

* **Stop Loss:** ต่ำกว่าแนวรับที่เข้าซื้อ.

* **Take Profit:** ขึ้นอยู่กับสัญญาณการกลับตัวและเป้าหมายระยะยาว.

* **คำเตือน:** การเข้าซื้อตอนนี้มีความเสี่ยงสูงมากที่ราคาจะลงต่อ.

**สิ่งที่ต้องระวัง (Important Considerations):**

* **ความผันผวน (Volatility):** ความผันผวนของ BTC สูงมากในช่วงนี้. การเคลื่อนไหวของราคาอาจรุนแรงและรวดเร็ว.

* **ข่าว (News):** ติดตามข่าวสารและเหตุการณ์ที่อาจส่งผลกระทบต่อตลาดคริปโตเคอร์เรนซี.

* **False Breakouts/Dead Cat Bounces:** ระวังการดีดตัวขึ้นชั่วคราว (Dead Cat Bounce) ก่อนที่จะร่วงลงต่อ.

* **Risk Management:** การบริหารความเสี่ยงเป็นสิ่งสำคัญที่สุด. ใช้ Stop Loss เสมอ. อย่า Overtrade (เทรดเกินตัว).

**สรุป (Conclusion):**

Bitcoin กำลังอยู่ในช่วงการปรับฐานที่รุนแรง. แนวโน้มระยะสั้น (15m) เป็นขาลงอย่างชัดเจน. แนวโน้มระยะกลาง (4H) ยืนยันการปรับฐาน. แนวโน้มระยะยาว (Day) เริ่มอ่อนแอลงและมีสัญญาณเตือนที่สำคัญ. *กลยุทธ์ที่ดีที่สุดในตอนนี้คือการ Wait and See สำหรับนักลงทุนระยะกลางและยาว, ส่วน Day Trader ที่รับความเสี่ยงได้สูงมาก อาจพิจารณา Short Sell ตามเงื่อนไขที่เข้มงวด.* การ Buy ในตอนนี้มีความเสี่ยงสูงมาก.

**Disclaimer:** การวิเคราะห์นี้เป็นเพียงความคิดเห็นส่วนตัว, ไม่ถือเป็นคำแนะนำในการลงทุน. ผู้ลงทุนควรศึกษาข้อมูลเพิ่มเติมและตัดสินใจด้วยความรอบคอบ.

-

@ ddf03aca:5cb3bbbe

2025-03-10 12:33:46

# Testing comet.md

This is a test post published using comet.md

```

This is a code block

```

-

@ d360efec:14907b5f

2025-03-10 12:26:42

$OKX: $BTC $USDT.P

https://www.tradingview.com/chart/F8mO3cIx/

**Situation Overview:**

Bitcoin (BTC) experienced a sharp sell-off on March 10, 2025. This movement, especially evident in the 15-minute timeframe, broke several key support levels and confirms a clear short-term downtrend. While the Daily timeframe has not *completely* broken its long-term uptrend structure, it shows significant warning signs, including a Bearish Engulfing candlestick, negative Money Flow, and weakened Trend Strength. This analysis will consider all timeframes in detail to find strategies appropriate for the current very high risk.

**Technical Analysis:**

* **15-Minute Timeframe (15m) - *Focus***:

* **SMC (Smart Money Concepts):** Price broke down through all key support levels with strong momentum. Continuous Lower Lows (LL) are being formed. This indicates complete dominance of selling pressure.

* **ICT Buyside & Sellside Liquidity:**

* *Buyside Liquidity (Resistance):* $68,000 (former support, now key resistance), $69,000, $70,000.

* *Sellside Liquidity (Support):* No strong support in the near term. Possible psychological support at $60,000, and below that at $58,000, $56,000. Identifying clear support in this condition is difficult.

* **Money Flow:** Strongly negative (Strong Outflow). This is one of the most important confirmations of selling pressure.

* **EMA (Exponential Moving Average):** EMA 50 (yellow) is clearly below EMA 200 (white), and the distance between the two lines is widening. This is a strong Bearish signal.

* **Trend Strength:** Thick red cloud, and a clear Sell signal.

* **Chart Pattern:** No chart patterns indicating a Bullish reversal.

* **15m Summary:** *The downtrend is clear and very strong.*

* **4-Hour Timeframe (4H):**

* **SMC:** Price is in a correction phase. It has broken below the EMA 50 and is testing the EMA 200.

* **ICT Buyside & Sellside Liquidity:**

* *Buyside Liquidity (Resistance):* $68,000 - $69,000.

* *Sellside Liquidity (Support):* EMA 200 (approximately $60,000), $58,000 (previous Demand Zone).

* **Money Flow:** Negative (Outflow).

* **EMA:** EMA 50 (yellow) crossed below EMA 200 (white) (Death Cross). This is a Bearish signal in the medium term.

* **Trend Strength:** Red cloud indicating a medium-term downtrend.

* **Chart Pattern:** No clear Bullish reversal pattern.

* **4H Summary:** *Confirms the medium-term correction. The trend is down.*

* **Daily Timeframe (Day):**

* **SMC:** The long-term uptrend structure is *not yet* broken (it has not made a Lower Low below $59,000 - $60,000). *However*, the latest candlestick is a Bearish Engulfing, which is a significant reversal signal, and the speed and strength of the drop indicate increasing weakness.

* **ICT Buyside & Sellside Liquidity:**

* *Buyside Liquidity (Resistance):* $72,000, $75,000 (All-Time High).

* *Sellside Liquidity (Support):* $60,000 (key psychological support, previous Low), $58,000, and $50,000 - $52,000 (EMA 200 and Demand Zone).

* **Money Flow:** *Starting to turn negative (Outflow)*. This is a significant change and a serious warning sign.

* **EMA:** EMA 50 (yellow) is still above EMA 200 (white), but the distance between the lines is narrowing.

* **Trend Strength:** The green cloud is starting to thin, and there was a Neutral signal (previously), *and now there is a Sell signal*.

* **Chart Pattern:** *Bearish Engulfing* - a strong bearish reversal signal.

* **Day Summary:** *The long-term trend is technically still up, but there are several significant warning signs, and there is a high risk of a trend change.*

**Trading Strategies:**

1. **Day Trade (15m):**

* **Main Strategy:** *Short Selling only*. Very high risk.

* **Conditions:** Wait for a Rebound (temporary upward bounce) to resistance levels (such as the EMA on the 15m TF, or around $68,000). Then, *wait for a clear Bearish signal* (e.g., Bearish Engulfing, Evening Star, or a breakout of that Rebound to the downside).

* **Stop Loss:** Strictly above the most recent Swing High of the Rebound.

* **Take Profit:** Psychological support ($60,000), or lower ($58,000, $56,000). *Do not hold for long*.

* **Warning:** Do not counter-trend (do not Buy). The market is extremely volatile.

2. **Swing Trade (4H):**

* **Main Strategy:** *Wait and See*. There are no Buy signals.

* **Conditions:** Wait for the price to test key support levels (EMA 200 at around $60,000, or $58,000). Then, *a clear and strong Bullish reversal signal must be seen* (e.g., Bullish Engulfing, Hammer, Morning Star, with high volume) before considering a Buy.

* **Stop Loss:** Below the support level where you entered.

* **Take Profit:** Resistance levels ($68,000 - $69,000), or higher if the trend changes.

* **Warning:** Buying at support without a reversal signal is high risk.

3. **Position Trade (Day):**

* **Main Strategy:** *Wait and See*. It's too early to Buy.

* **Conditions:** Wait for the price to test very strong support levels ($50,000 - $52,000, which is the EMA 200 and a Demand Zone). *Then, a very clear Bullish reversal signal must be seen* before considering a Buy. Alternatively, wait for the market structure to turn bullish again (create a Higher High).

* **Stop Loss:** Below the support level where you entered.

* **Take Profit:** Depends on the reversal signal and long-term targets.

* **Warning:** Buying now has a very high risk of further downside.

**Important Considerations:**

* **Volatility:** BTC's volatility is extremely high during this period. Price movements can be severe and rapid.

* **News:** Monitor news and events that could affect the cryptocurrency market.

* **False Breakouts/Dead Cat Bounces:** Beware of temporary upward bounces (Dead Cat Bounces) before further declines.

* **Risk Management:** Risk management is paramount. Always use Stop Losses. Do not Overtrade (trade beyond your risk tolerance).

**In summary**, the Daily chart confirms that the recent sharp drop in BTC is not just a minor blip. It's a significant event that has weakened the uptrend and increased the likelihood of a deeper correction. Caution is paramount.

-

@ 4857600b:30b502f4

2025-03-10 12:09:35

At this point, we should be arresting, not firing, any FBI employee who delays, destroys, or withholds information on the Epstein case. There is ZERO explanation I will accept for redacting anything for “national security” reasons. A lot of Trump supporters are losing patience with Pam Bondi. I will give her the benefit of the doubt for now since the corruption within the whole security/intelligence apparatus of our country runs deep. However, let’s not forget that probably Trump’s biggest mistakes in his first term involved picking weak and easily corruptible (or blackmailable) officials. It seemed every month a formerly-loyal person did a complete 180 degree turn and did everything they could to screw him over, regardless of the betrayal’s effect on the country or whatever principles that person claimed to have. I think he’s fixed his screening process, but since we’re talking about the FBI, we know they have the power to dig up any dirt or blackmail material available, or just make it up. In the Epstein case, it’s probably better to go after Bondi than give up a treasure trove of blackmail material against the long list of members on his client list.

-

@ 7d33ba57:1b82db35

2025-03-10 11:22:03

**Roque Nublo & Pico de las Nieves Gran Canaria’s Highest Points**

🏞 **Roque Nublo (1,813m)**

One of the island’s most famous landmarks, this volcanic rock formation offers incredible views after a short (1.5 km) hike. It was once a sacred site for the indigenous Guanche people. On clear days, you can see Mount Teide in Tenerife.

⛰ **Pico de las Nieves (1,949m) – The Highest Point**

A short drive from Roque Nublo, this is Gran Canaria’s highest peak. You’ll get 360° views of the island, including Roque Nublo and the deep ravines of the Caldera de Tejeda. Unlike Roque Nublo, you can drive almost to the top.

🌤 **Best Time to Visit:**

- Sunrise or sunset for stunning views.

- Bring layers—it can be chilly at higher altitudes.

🚗 **Getting There:**

- Roque Nublo requires a short hike.

- Pico de las Nieves is accessible by car.

-

@ c11cf5f8:4928464d

2025-03-10 10:39:55

Here we are again with our monthly [Magnificent Seven](https://stacker.news/AGORA#the-magnificent-seven---of-all-times), the summary giving you a hit of what you missed in the ~AGORA territory.

- - -

### Top-Performing Ads

This month, the most engaging ones are:

* `01` [eSIM for Spain](https://stacker.news/items/908065/r/AG) by @south_korea_ln

* `02` [[OFFER] Small batch handcrafted ground meat jerky (unique flavors)](https://stacker.news/items/906891/r/AG) by @beejay

* `03` [[HIRE] Bitcoin & Nostr Development agency, IT outsoucing company](https://stacker.news/items/898547/r/AG) by @a68dd96af9

* `04` [[AUCTION] 🤘Kreator band signed poster, Start at: 21k sats (Prague/CZ) + postal](https://stacker.news/items/886008/r/AG) by @bogo

* `05` [[SELL] Your Tombstone, 1k sats](https://stacker.news/items/903776/r/AG) by @jasonb

* `06` [[SELL] First Public Printing of the 1787 United States Constitution $49.75/share](https://stacker.news/items/893666/r/AG) by @mo

* `07` [Official Patriots Coin - .9999 Fine REAL GOLD - 1 Gr. Bar 17.94K sats](https://stacker.news/items/889970/r/AG) by @watchmancbiz

- - -

### Professional Services accepting Bitcoin

- https://stacker.news/items/900208/r/AG @unschooled offering Language Tutoring

- https://stacker.news/items/813013/r/AG @gpvansat's [OFFER][Graphic Design]

From the paste editions (It's important to keep these offers available)

- https://stacker.news/items/775383/r/AG @TinstrMedia - Color Grading (Styling) Your Pictures as a Service

- https://stacker.news/items/773557/r/AG @MamaHodl, MATHS TUTOR 50K SATS/hour English global

- https://stacker.news/items/684163/r/AG @BTCLNAT's OFFER HEALTH COUNSELING [21 SAT/ consultation

- https://stacker.news/items/689268/r/AG @mathswithtess [SELL] MATHS TUTOR ONILINE, 90k sats per hour. Global but English only.

###### In case you missed

Here some interesting post, opening conversations and free speech about markets and business on the bitcoin circular economy:

- https://stacker.news/items/902115/r/AG Just curious - what are the top darknet sites accepting BTC Lightning nowadays? by @kristapsk

- https://stacker.news/items/881075/r/AG Can someone produce a cheap linux based 4g phone for me to use in New Zealand? by @Solomonsatoshi

- https://stacker.news/items/896651/r/AG 🌰Missing Nut String for todays Saloon Nut 🌰 by @BlokchainB

- https://stacker.news/items/899384/r/AG Sales Corner (Is AI the future of sales?) by @Akg10s3

###### BUYing or SELLing Cowboys Credits?

[BUY](https://stacker.news/~AGORA/post?type=discussion&title=[BUY]%20XXX%20Cowboys%20Credits%20for%20YYY%20sats) or [SELL](https://stacker.news/~AGORA/post?type=discussion&title=[SELL]%20XXX%20Cowboys%20Credits%20for%20YYY%20sats) Cowboy Credits for sats

on the SN ~AGORA marketplace

###### 🏷️ Spending Sunday

Share your most recent Bitcoin purchases of just check what other stackers are buying with their sats!

Read more https://stacker.news/items/908074/r/AG

- - -

### Create your Ads now!

Looking to start something new? Hit one of the links below to free your mind:

* [💬 TOPIC](https://stacker.news/~AGORA/post?type=discussion) for conversation,

* [\[⚖️ SELL\]](https://w3.do/b_v2wutP) anything! or,

* if you're looking for something, hit the [\[🛒 BUY\]](https://w3.do/zvixtuSh)!

* [\[🧑💻 HIRE\]](https://w3.do/_j0kpVsi) any bitcoiner skill or stuff from bitcoiners

* [\[🖇 OFFER\]](https://w3.do/EfWF8yDL) any product or service and stack more sats

* [\[🧑⚖️ AUCTION\]](https://w3.do/sbbCjZ0e) to let stackers decide a fair price for your item

* [\[🤝 SWAP\]](https://w3.do/V_iP4lY5) if you're looking to exchange anything with anything else

* [\[🆓 FREE\]](https://w3.do/DdVEE1ME) your space, make a gift!

* [\[⭐ REVIEW\]](https://w3.do/CAZ5JxCk) any bitcoin product or LN service you recently bought or subscribed to

- - -

Or contact @AGORA team on [nostr DM](https://iris.to/agora_sn), and we can help you publish a personalized post.

.

`#nostr` `#bitcoin` `#stuff4sats` `#sell` `#buy` `#plebchain` `#grownostr` `#asknostr` `#market` `#business`

originally posted at https://stacker.news/items/908966

-

@ 57d1a264:69f1fee1

2025-03-10 10:04:32

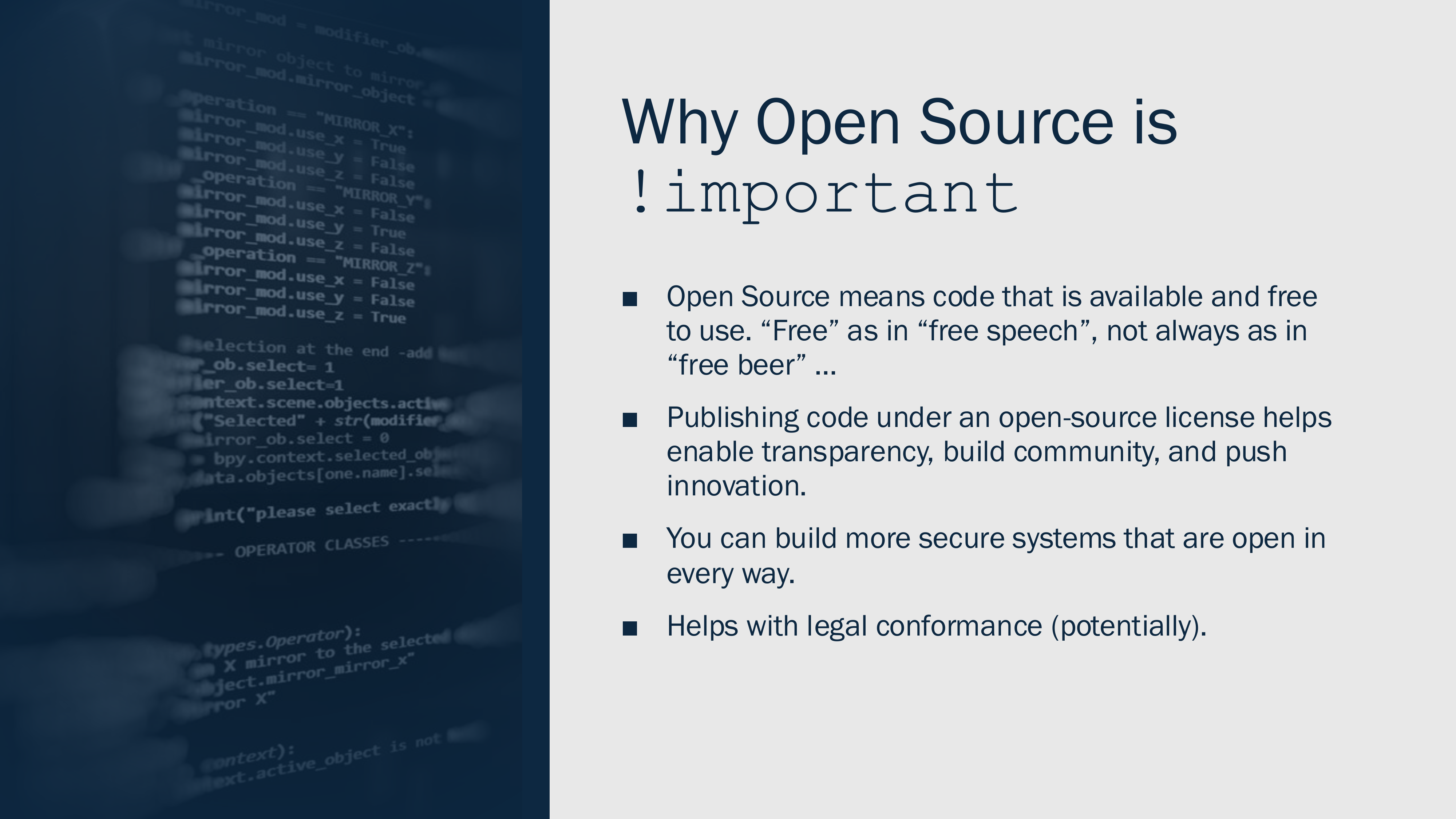

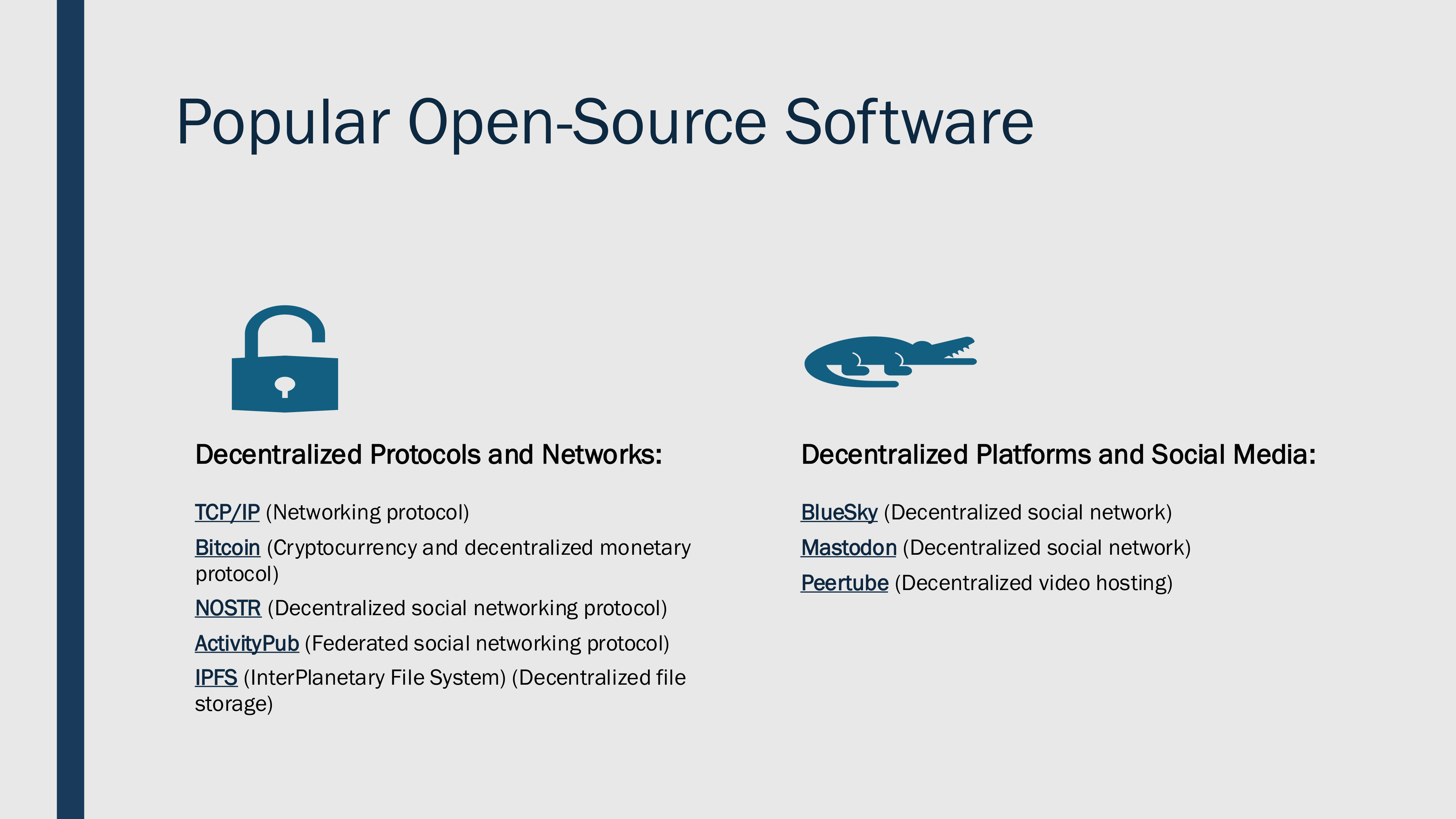

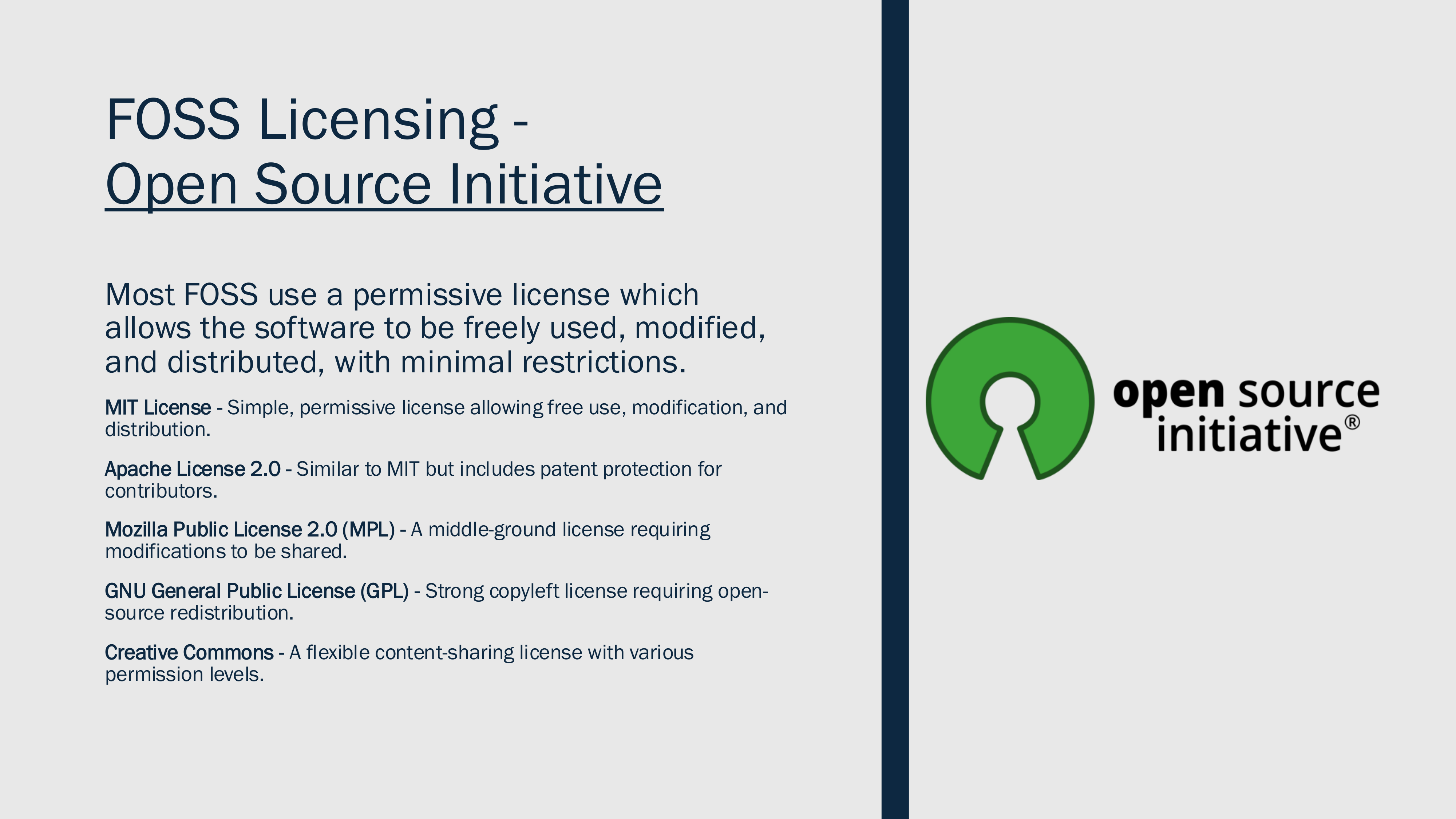

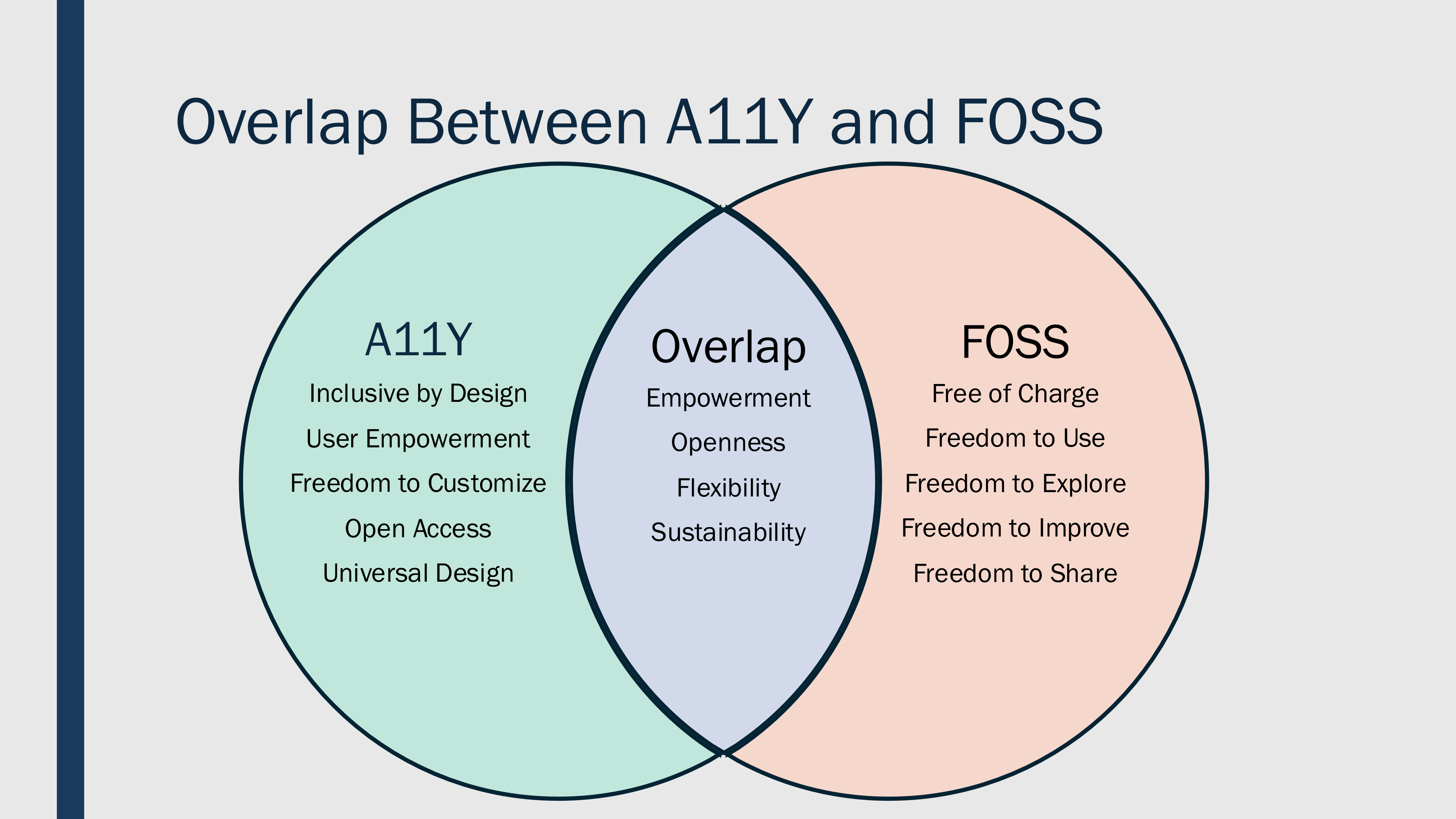

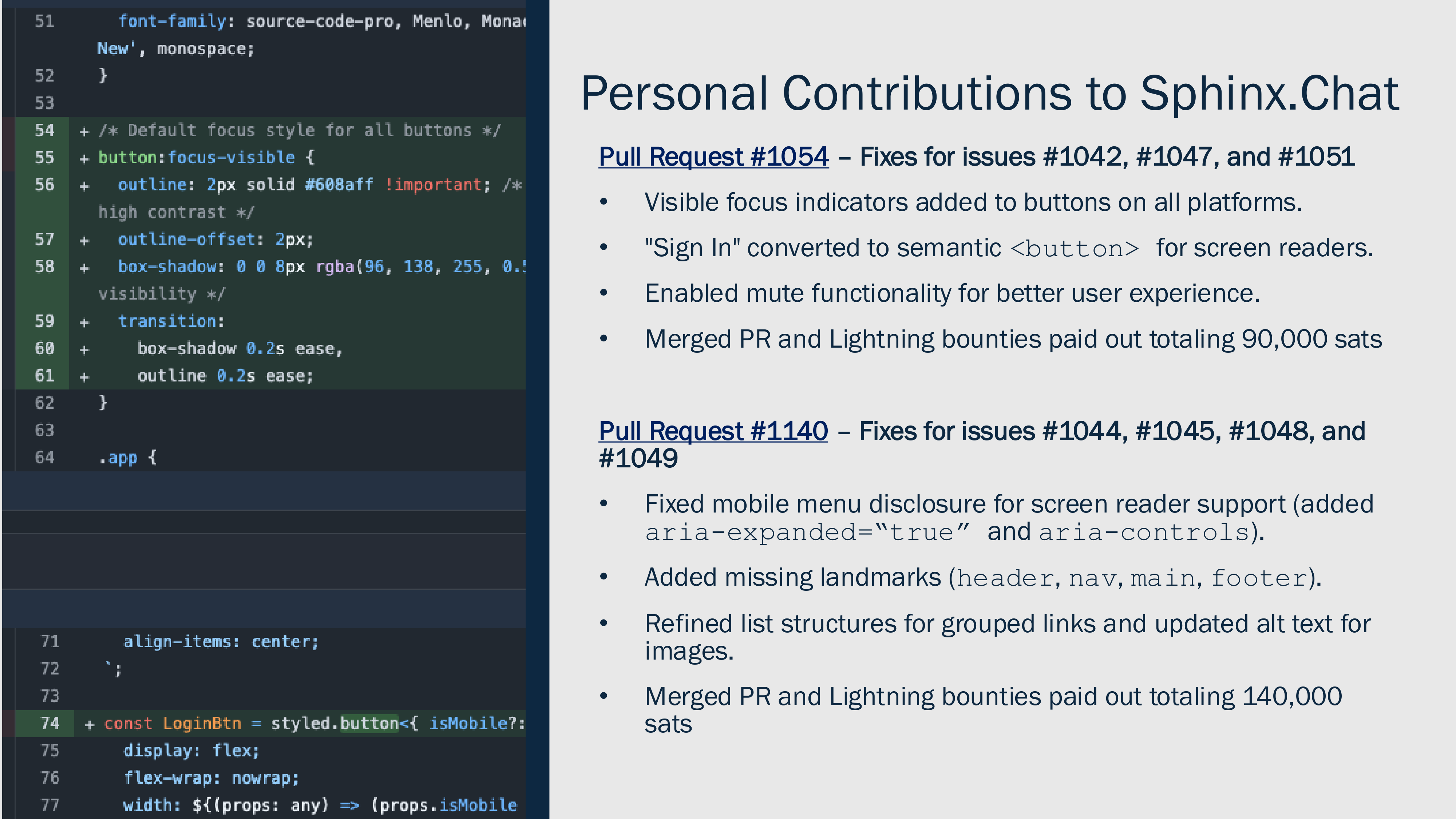

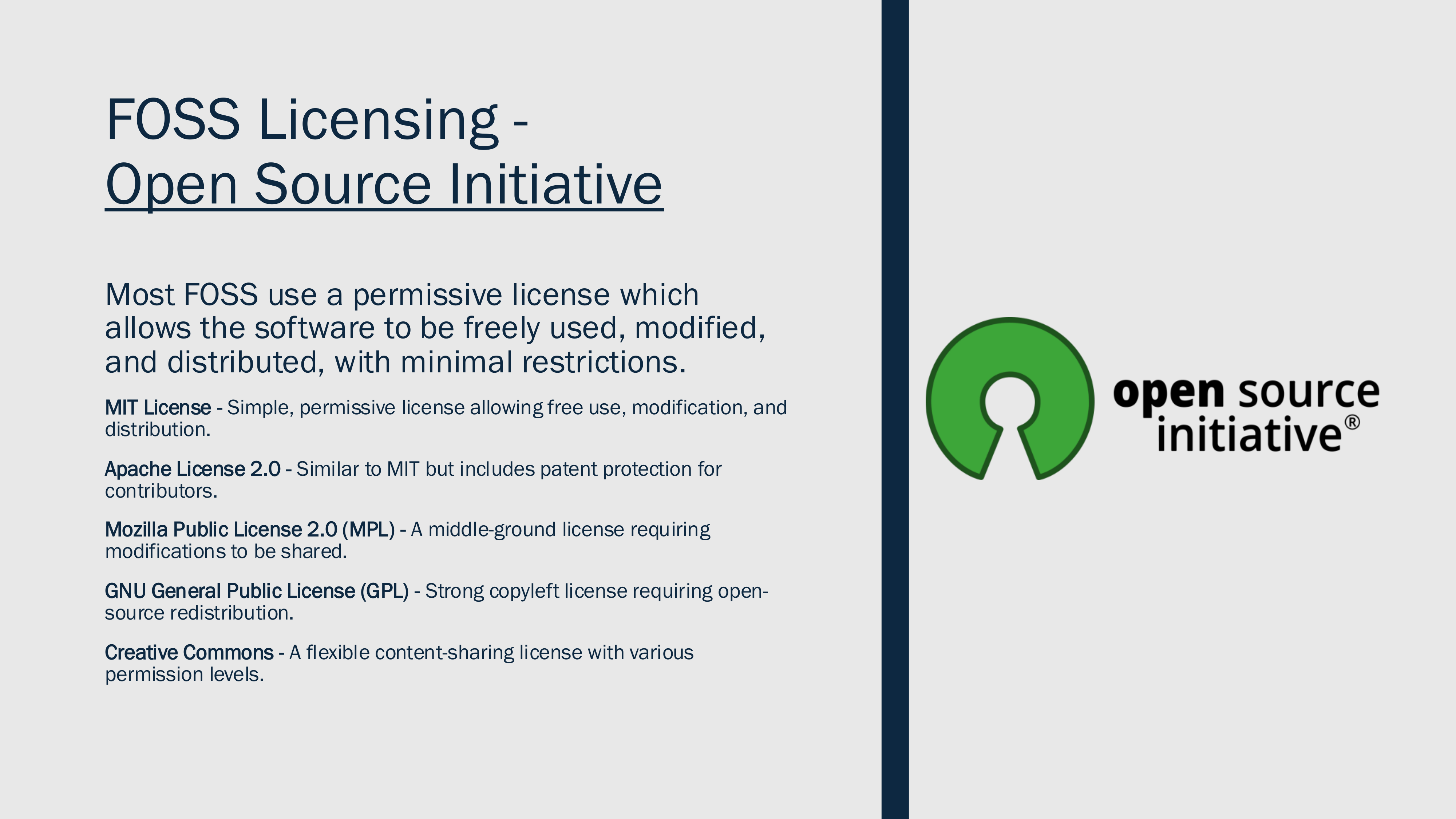

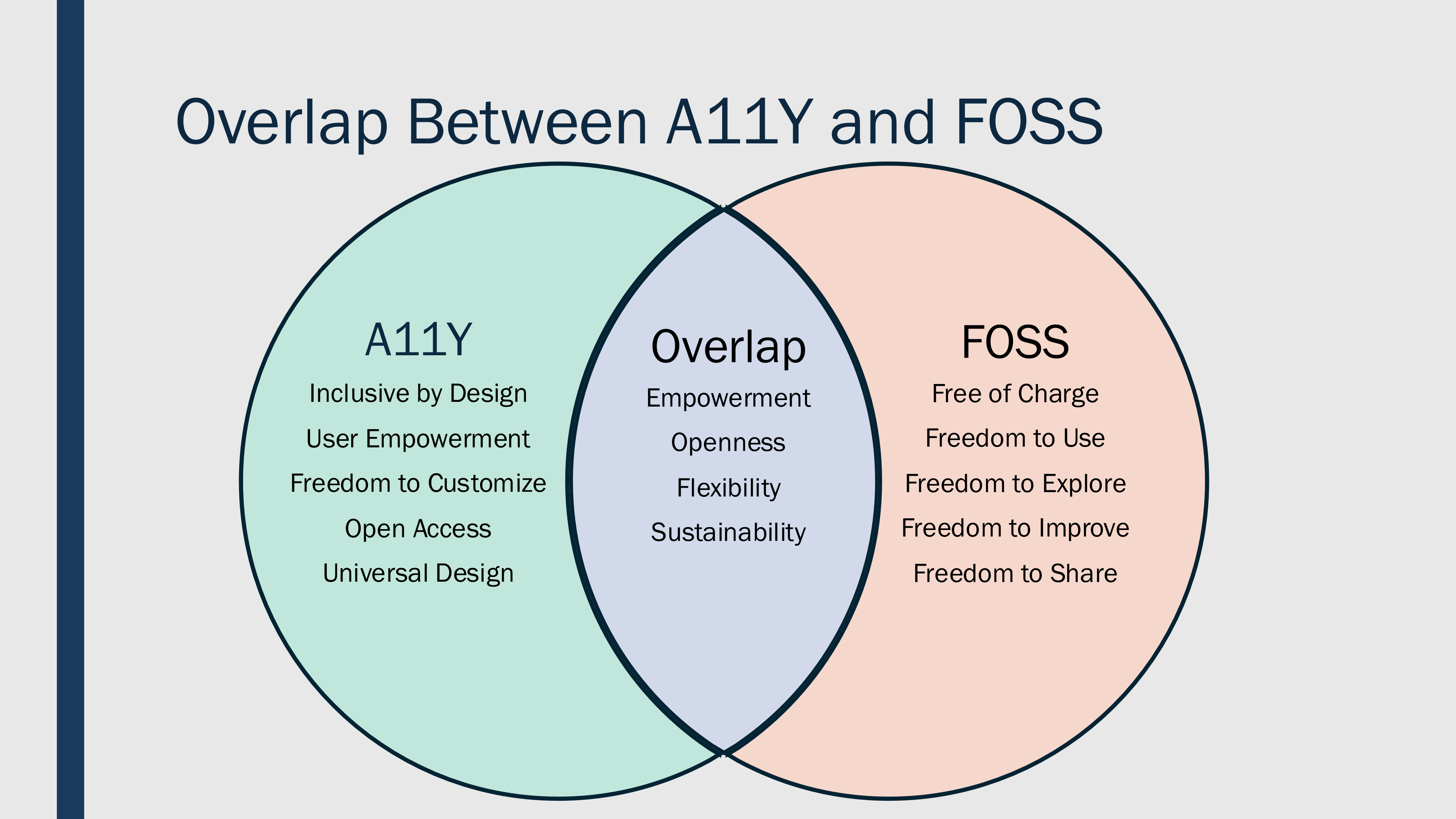

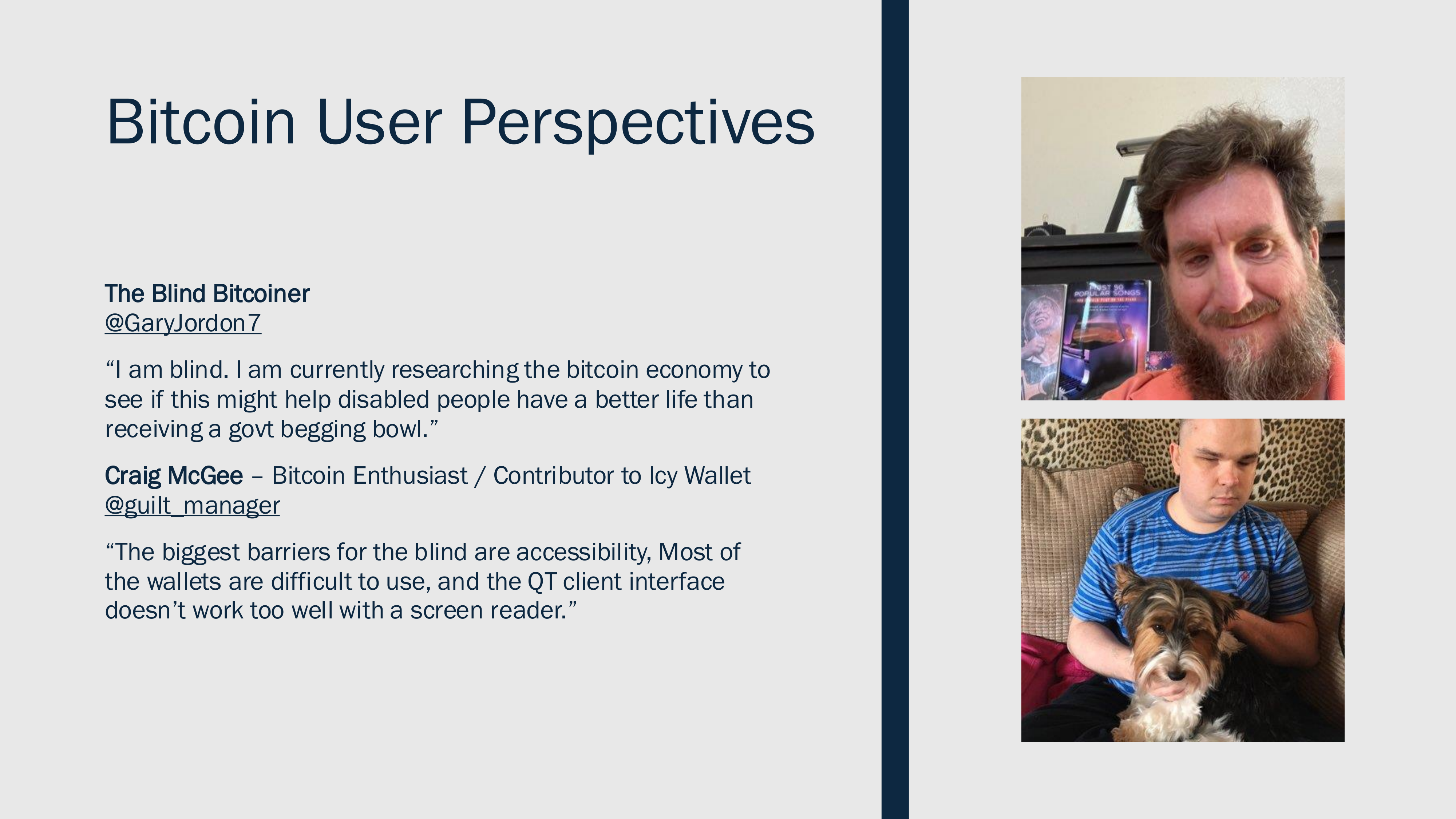

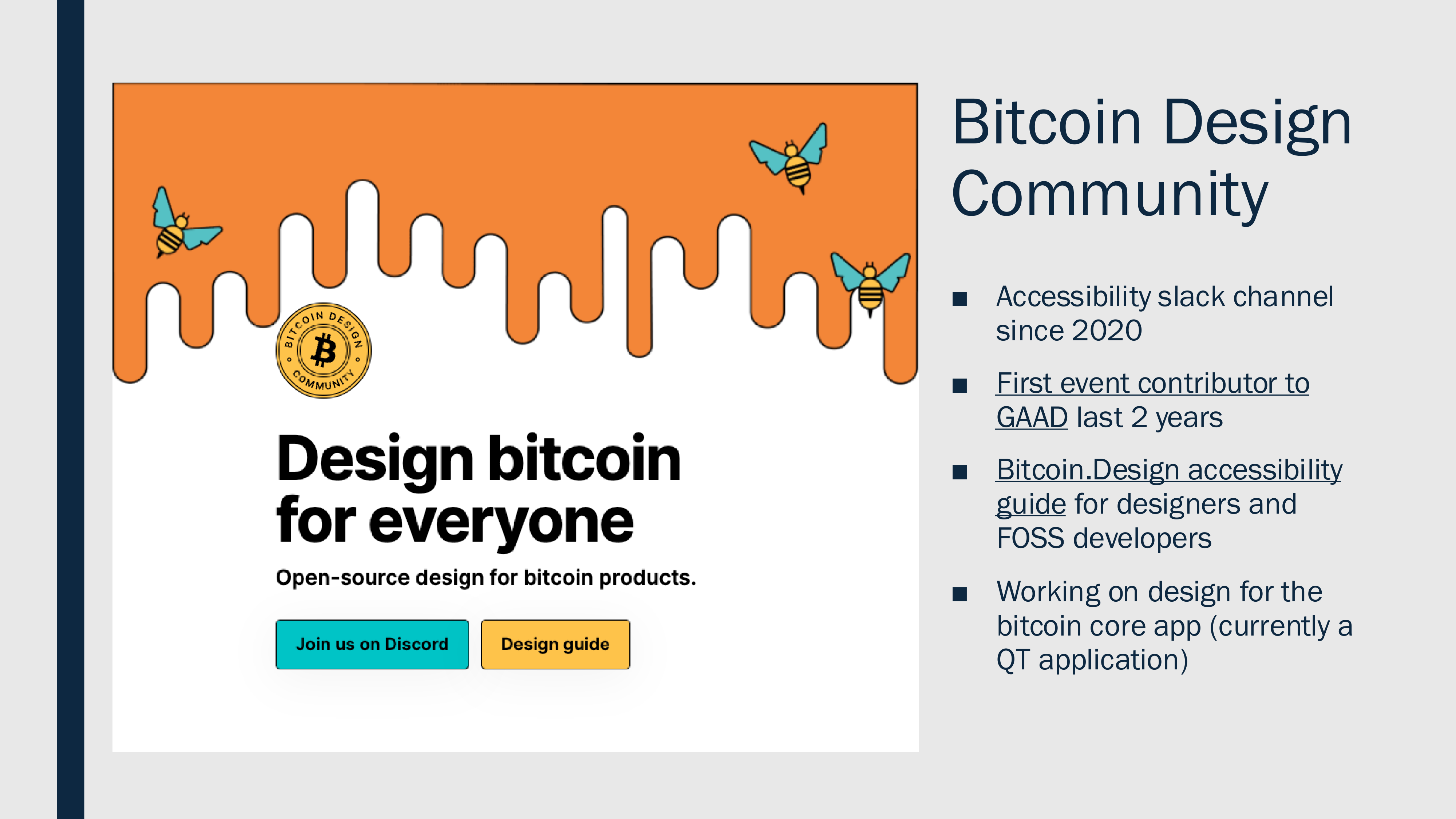

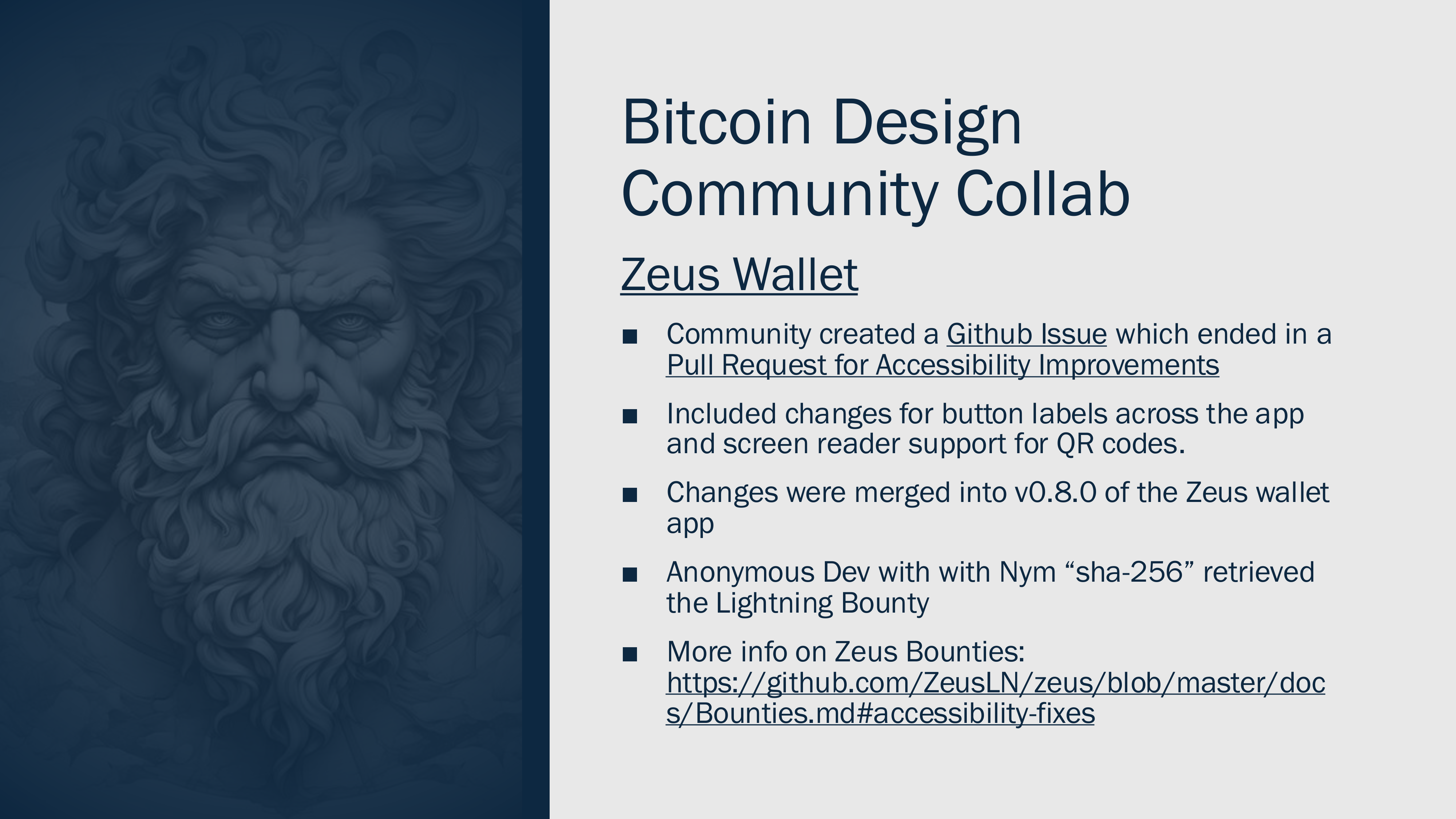

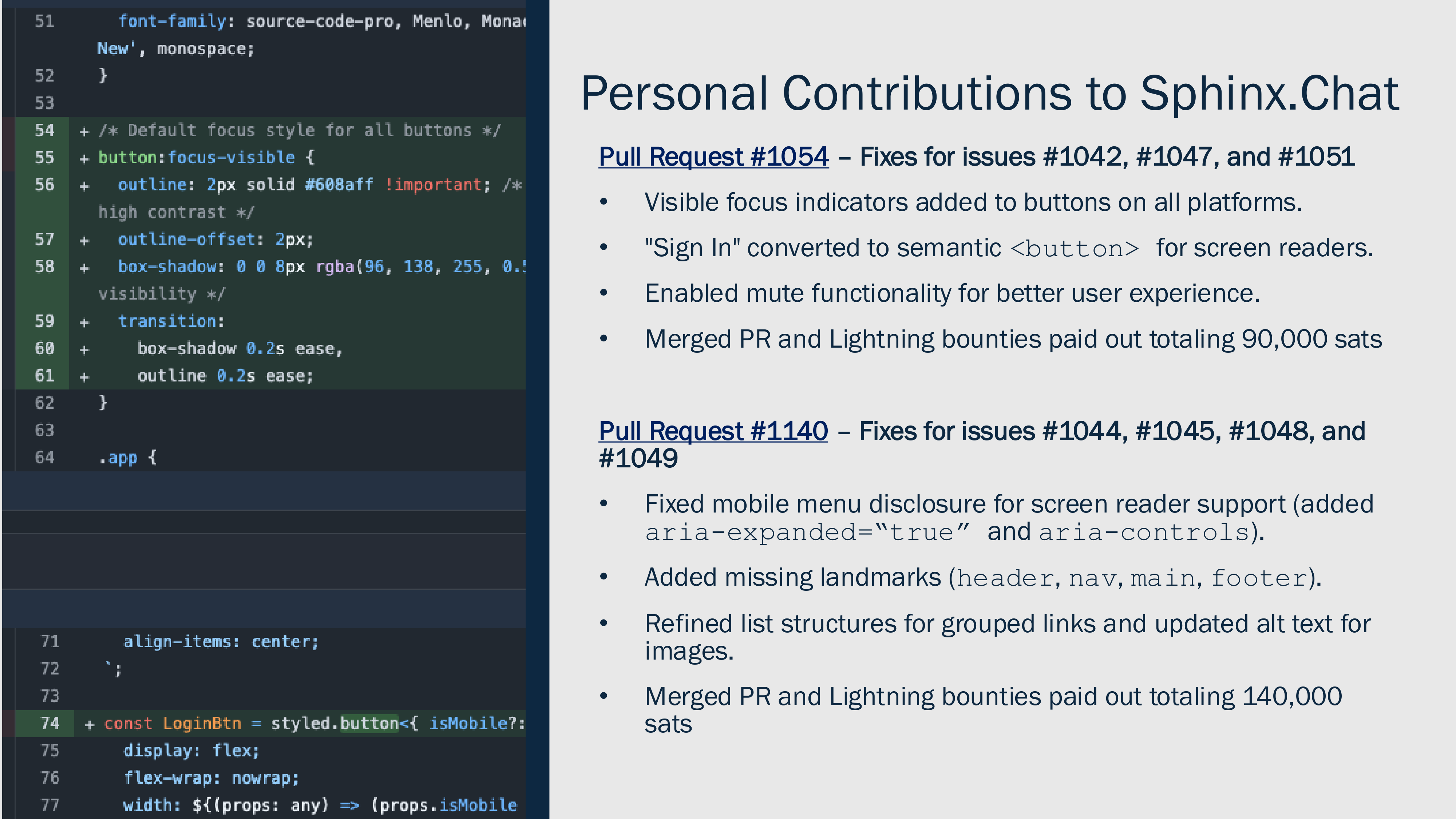

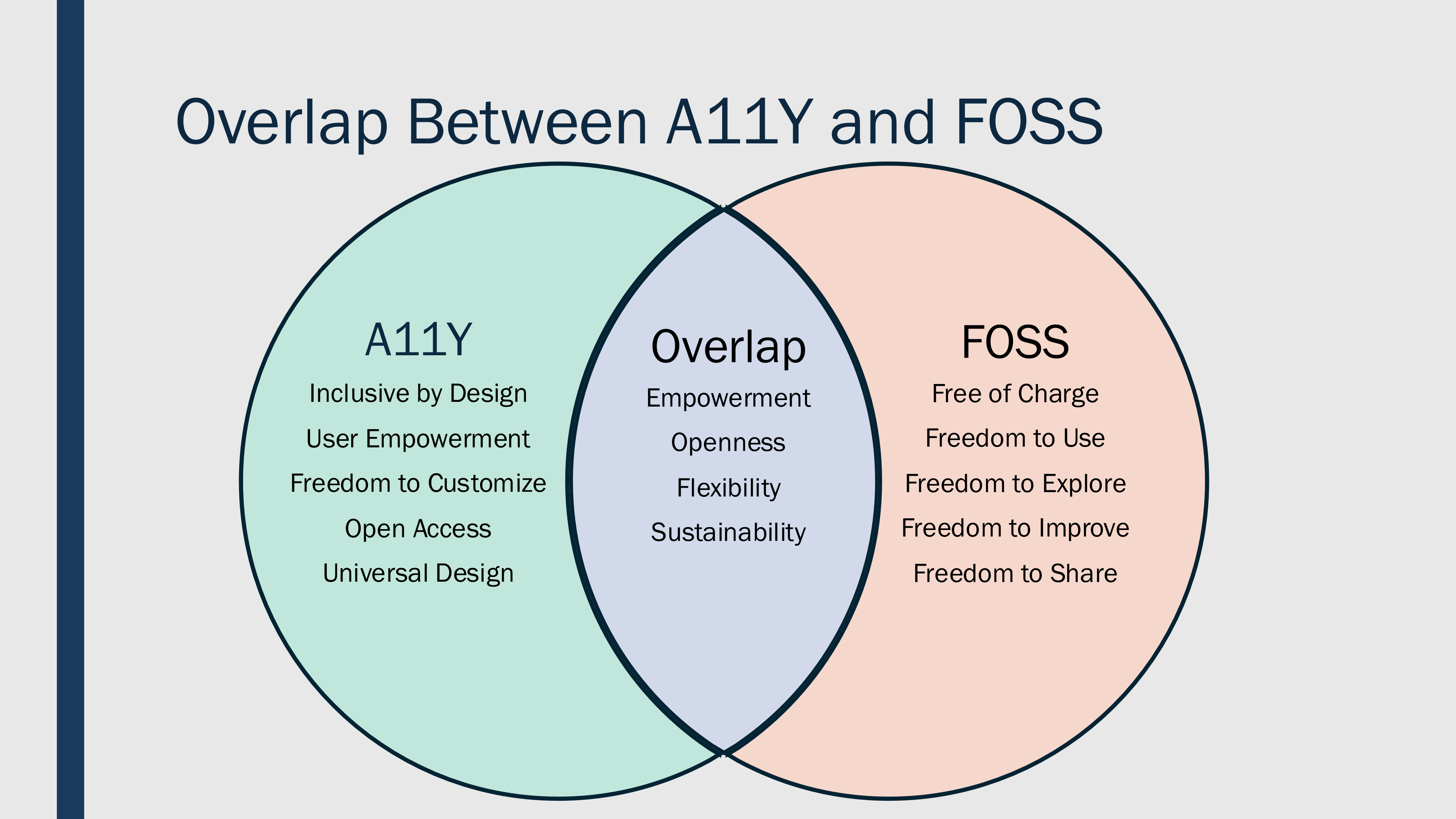

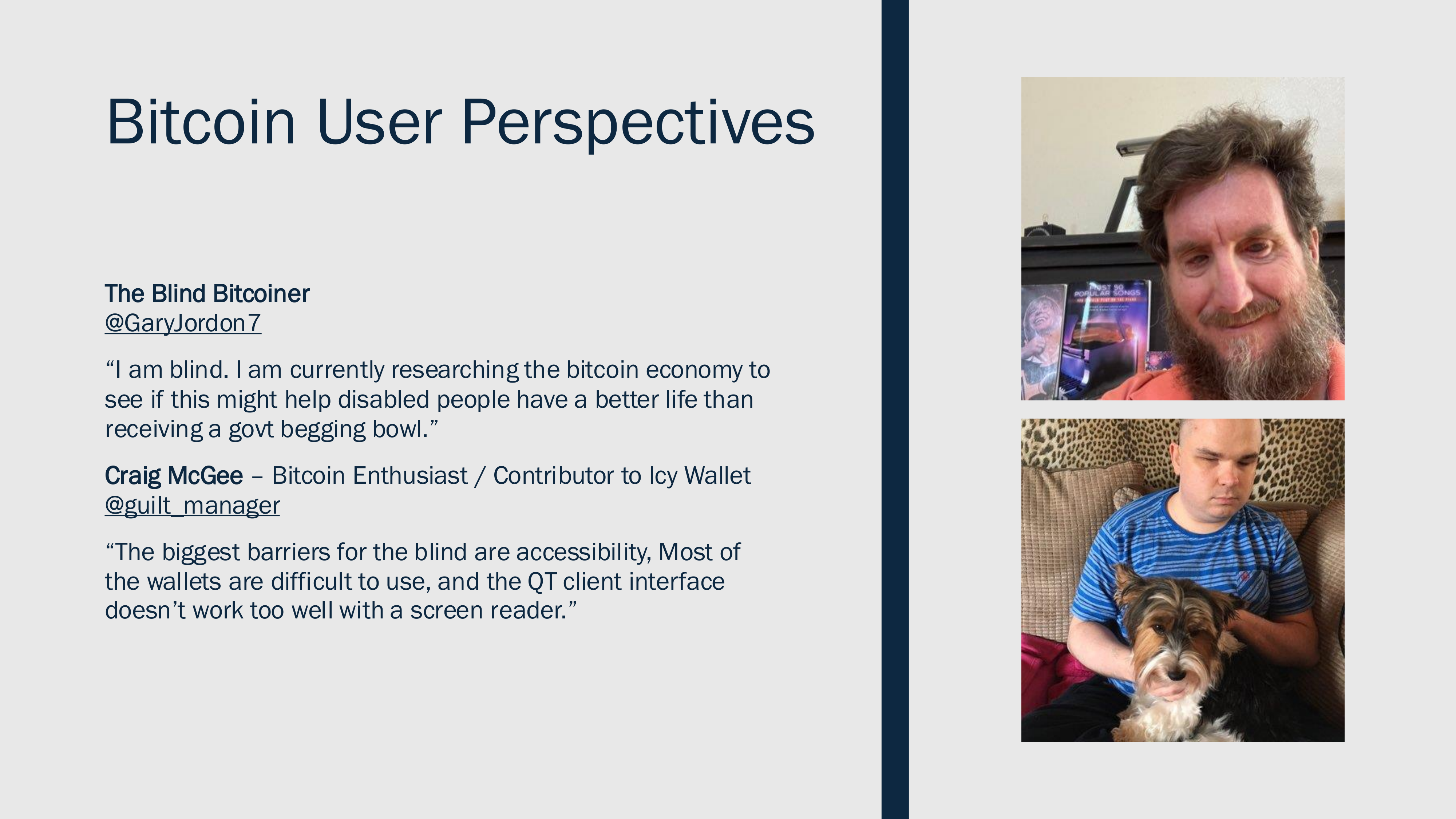

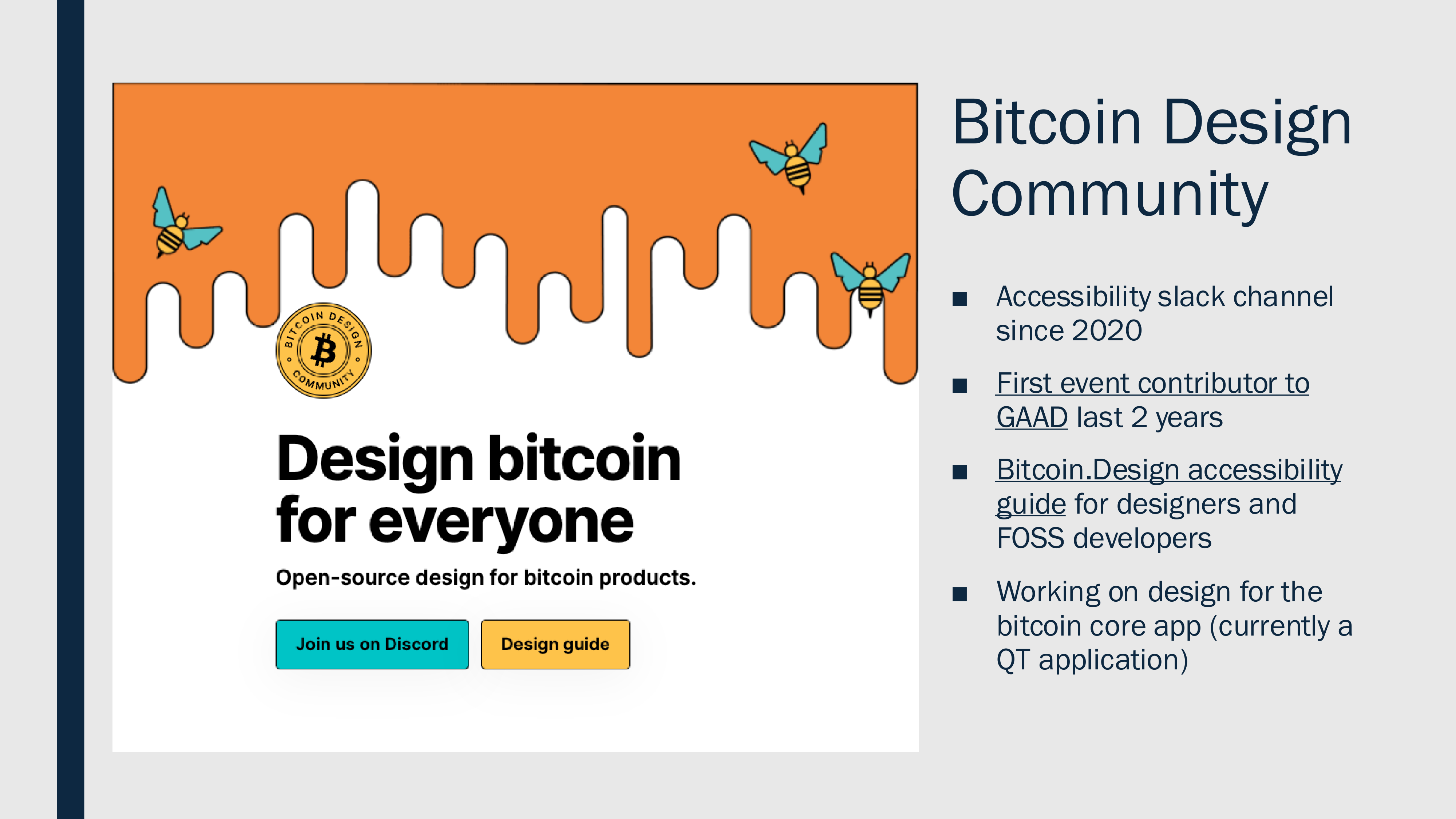

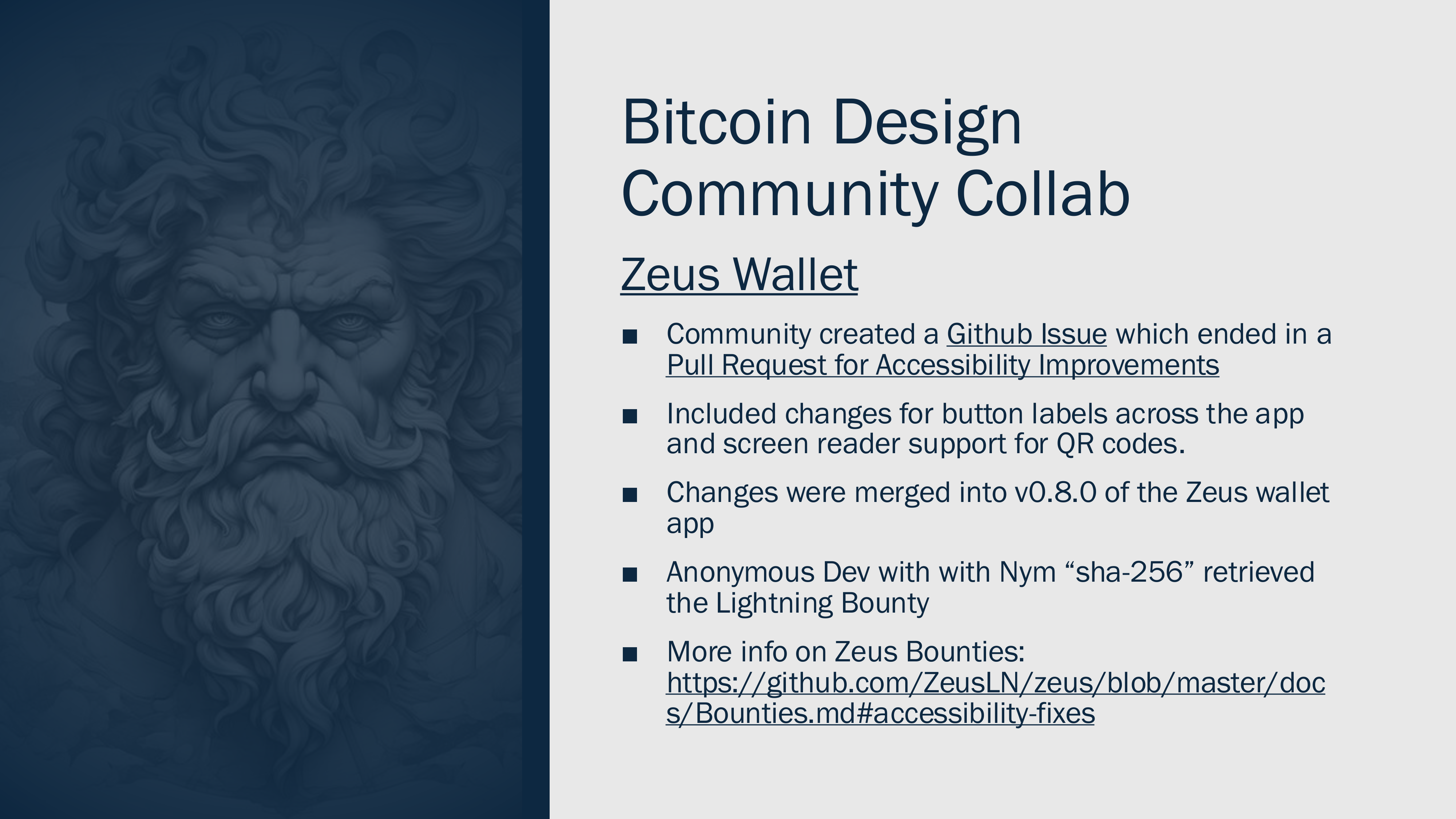

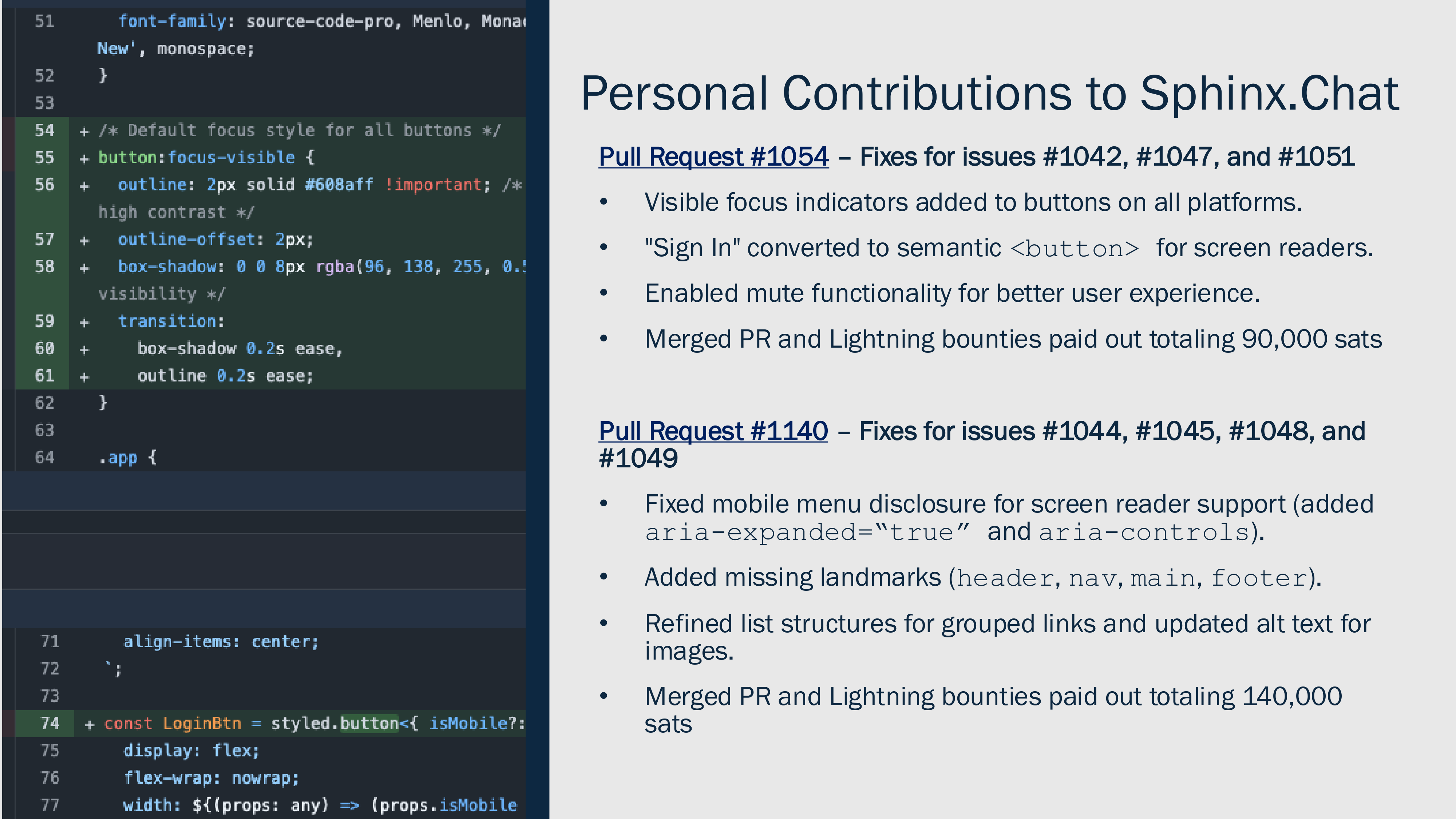

A presentation by @jsonbits Jason Hester for the [40th CSUN](https://web.cvent.com/event/2c5d8c51-6441-44c0-b361-131ff9544dd5/summary) Assistive Technology Conference - `March 10, 2025 – March 14, 2025`

- - -

[Download PDF](https://cdn.discordapp.com/attachments/903125939054059520/1347694223755051039/AC2A-FOSS-A11Y-JasonHester-V9.pdf?ex=67cf648d&is=67ce130d&hm=f61eb30b05783cfee2a37ffdcd5797af688a2fb3b7f01af48caa96c10136a129&)

originally posted at https://stacker.news/items/908947

-

@ 57d1a264:69f1fee1

2025-03-10 09:35:17

Here I am posting a document that presents the Business Model Canvas (BMC) created for “Nasi Goreng Semrawut”, a Micro, Small, and Medium Enterprise (MSME) in Kendal, Central Java, Indonesia. BMC is a strategic management and entrepreneurship tool. It allows us to visualize, assess, and modify business models. It is crucial to understand the core components of a business and how they interact. As a UX researcher, analyzing and understanding the business model is critical to aligning user needs with business goals. This BMC provides the basis for identifying opportunities to improve user experience and drive business growth.

I have broken it down into sections and grouped them carefully and I have clear reasons from a UX perspective why the groupings I have chosen are these points. I explain the UX side more fully on my portfolio website.

For my reflections on this project analyzing the Business Model Canvas of "Nasi Goreng Semrawut" through a UX lens reveals several opportunities for improvement. By focusing on user needs and behaviors, I can enhance the customer experience, streamline operations, and drive business growth. This analysis highlights the importance of integrating UX research into the strategic planning process. By understanding the business model, I can ensure that our UX efforts are aligned with business goals and deliver tangible results.

**My website Portfolio👇**

https://octoporto.framer.website/blog/business-model-canvas-nasi-goreng-semrawut

**Link Project :**

https://www.figma.com/proto/5LZkoc2uSJ1RTaur4cDVCM/Business-Model-Canvas-Sego-Goreng-Semrawut?page-id=0%3A1&node-id=38-117&viewport=-170%2C587%2C0.16&t=8gt9qNV5G267Xq8B-1&scaling=scale-down&content-scaling=fixed&starting-point-node-id=20%3A3

mirorred from [dribbble](https://dribbble.com/shots/25718733-Business-Model-Canvas-Nasi-Goreng-Semrawut)

originally posted at https://stacker.news/items/908920

-

@ 95cb4330:96db706c

2025-03-10 08:42:59

## **Introduction: Why Small Actions Lead to Huge Success**

Most people **underestimate** the power of **small, consistent improvements** over time. They chase **quick wins** and expect success overnight. But the truth is, **the most successful people and businesses in the world rely on the power of compounding effort**—making **small, incremental improvements daily** that scale into **massive long-term results**.

This principle, known as **The Law of Compounding Effort**, is embraced by **Jeff Bezos, Sam Altman, and Peter Thiel**. Instead of looking for instant success, they focus on **building systems, habits, and investments that grow exponentially over time**.

In this article, we’ll break down:

✔ **What the Law of Compounding Effort is and why it works**

✔ **Examples from top entrepreneurs who applied it to build billion-dollar empires**

✔ **How you can use it to improve your own work, habits, and investments**

---

## **What Is the Law of Compounding Effort?**

The **Law of Compounding Effort** is based on a simple but powerful idea:

> **Small, consistent improvements in thinking, decision-making, and execution create exponential results over time.**

Instead of trying to make **huge leaps** all at once, **improving just 1% per day leads to massive growth over months and years**.

Mathematically, it looks like this:

- If you improve **1% every day** for a year → **You’ll be 37x better** than where you started.

- If you get **1% worse every day** → **You’ll lose almost all your progress.**

This is **why daily habits and small decisions matter more than big, one-time actions**.

---

## **Examples of the Law of Compounding Effort in Action**

### **1. Jeff Bezos and Amazon: Reinvesting for Long-Term Growth**

Jeff Bezos didn’t build Amazon into a **trillion-dollar empire** overnight. He **compounded small improvements for decades** by:

- **Reinvesting Amazon’s profits** into better **infrastructure, logistics, and technology**.

- **Focusing on customer obsession**, constantly improving Amazon’s efficiency and convenience.

- **Scaling AWS (Amazon Web Services)** from a side project into the **backbone of the internet**, generating billions in profit.

Bezos was **never focused on short-term profits**—he **compounded effort and reinvested resources into long-term scalability**.

📌 **Lesson:** Instead of chasing **quick money**, **build systems that get better and stronger over time**.

---

### **2. Sam Altman and AI: Betting on the Future**

Sam Altman, CEO of OpenAI, has built his career by **compounding small breakthroughs in artificial intelligence**:

- He **funded AI research when others ignored it**, knowing that **small improvements would snowball**.

- He **scaled OpenAI’s models like GPT-4**, refining them step by step to become **industry-changing technologies**.

- He **invests in AI infrastructure**, believing that today’s progress will lead to **exponential advancements in the future**.

Altman’s entire strategy is **about playing the long game**—knowing that **AI’s compounding improvements will change everything**.

📌 **Lesson:** **The biggest future opportunities come from compounding small improvements today.**

---

### **3. Peter Thiel and Facebook: The Power of Network Effects**

Peter Thiel was **one of the first investors in Facebook**, putting in **$500,000 when few people saw its potential**.

Why? He understood **the compounding nature of network effects**:

- As more users joined Facebook, **its value increased exponentially**.

- More advertisers came, bringing **more revenue and funding more innovation**.

- Facebook **scaled from a small project to a multi-billion-dollar company**.

Thiel’s investment in Facebook was a classic **compounding success**—he **saw the long-term potential, not just the short-term returns**.

📌 **Lesson:** The best investments **grow stronger over time**—look for compounding effects in business, investing, and technology.

---

## **How to Apply the Law of Compounding Effort in Your Own Life**

You don’t need to be a billionaire to apply this principle—**compounding effort works in every area of life**.

### **1. Improve 1% Every Day**

If you **get slightly better every day**, the results **compound into massive progress**.

Ask yourself:

- **What’s one skill I can improve today?**

- **How can I refine my decision-making?**

- **What process can I optimize for long-term growth?**

📌 **Example:** **Investing** → Instead of trying to "get rich quick," **invest consistently, reinvest profits, and let your portfolio compound over years.**

---

### **2. Focus on Scalable Actions**

Not all work compounds. Focus on efforts that **scale and grow over time**, like:

✅ **Building a brand** → Content, reputation, and trust compound.

✅ **Investing in automation** → Systems that work for you 24/7.

✅ **Compounding relationships** → The right connections open exponential opportunities.

📌 **Example:** **Business Growth** → Instead of doing **one-time sales**, build a **repeatable system** that grows without constant effort.

---

### **3. Avoid Negative Compounding**

Just as small positive actions **build up over time**, **bad habits and decisions compound negatively**.

Ask yourself:

- **Am I wasting time on low-value tasks?**

- **Am I making impulsive decisions instead of strategic ones?**

- **Am I neglecting habits that will improve my long-term growth?**

📌 **Example:** **Health & Productivity** → Small unhealthy choices **compound into major problems later**. But **small positive habits compound into a strong body and sharp mind**.

---

## **Final Thoughts: Small Wins, Big Results**

The **Law of Compounding Effort** proves that **success isn’t about big, flashy moves—it’s about consistent, focused progress over time**.

🔹 **Jeff Bezos built Amazon by reinvesting and compounding small efficiencies.**

🔹 **Sam Altman bet on AI, knowing that small breakthroughs would add up.**

🔹 **Peter Thiel invested in Facebook, recognizing its compounding network effects.**

And **you can do the same**.

💡 **Action Step:** **Find one habit, process, or investment you can improve by 1% today. Stick with it, and let it compound over time.**

---

## **Resources to Learn More**

- 📖 [**The Power of Compounding** – Farnam Street](https://fs.blog/compounding/)

- 🎥 [**Jeff Bezos on Long-Term Thinking** – Harvard Business Review](https://hbr.org/)

- 📰 [**Sam Altman on Compounding Success** – Blog](https://blog.samaltman.com/)

🚀 **The best results don’t come from one big move. They come from small, consistent improvements over time.** Start compounding today!

-

@ 95cb4330:96db706c

2025-03-10 08:34:05

## **Introduction: The Power of the Few**

Most people assume that effort and results follow a **linear** relationship—that every action contributes equally to success. However, reality follows a very different pattern: **Power Laws**.

The **Power Law Principle**, championed by thinkers like **Peter Thiel** and **Jeff Bezos**, states that a **small number of key efforts drive the majority of outcomes**. Instead of distributing energy evenly across tasks, investments, or decisions, the **smartest individuals and companies focus on the few areas that truly matter**—the ones that yield **outsized** returns.

In this article, we’ll explore:

✔ **What the Power Law is and why it matters**

✔ **Examples of Power Laws in business and investing**

✔ **How to apply the Power Law Principle in your own work and life**

---

## **What Is the Power Law?**

The **Power Law** is a mathematical relationship where **a small input leads to a disproportionately large output**. It is the foundation of **Pareto’s Principle (the 80/20 rule)**, which states that:

- **80% of results come from 20% of efforts**

- **80% of revenue comes from 20% of customers**

- **80% of profits come from 20% of investments**

But **Power Laws go even further**. In reality, it’s not just 80/20—it’s often **90/10 or even 99/1**.

In **venture capital**, for example, a handful of companies (like Facebook, Google, and Tesla) account for nearly **all** of the industry’s profits. If you had invested in 100 startups, it wouldn’t be the case that 20 of them returned good money—it would be that just **one or two** produced nearly **all the profits**, while the rest failed or broke even.

Power Laws appear **everywhere** in business, investing, technology, and even personal development.

---

## **Examples of the Power Law in Action**

### **1. Venture Capital: Peter Thiel and Facebook**

Peter Thiel, co-founder of PayPal and early investor in Facebook, built his fortune using Power Law thinking.

- In 2004, he invested **$500,000 in Facebook**—a small startup most people ignored.

- That one investment turned into **billions of dollars**, while dozens of other startups he backed failed.

- **One bet made up for every loss**—and much more.

Thiel himself says:

> "We don’t live in a normal world. We live under a **Power Law**."

Venture capitalists **don’t succeed by investing in 100 decent companies**—they succeed by **finding the 1 company that dominates an industry**.

---

### **2. Jeff Bezos and AWS: One Decision That Built a Trillion-Dollar Empire**

Amazon started as an online bookstore, but **one decision made Amazon a tech giant**: **Amazon Web Services (AWS)**.

- In the early 2000s, Jeff Bezos realized that **cloud computing** could be the foundation of the internet.

- He shifted **massive resources** into AWS, even though it had **nothing to do with selling books**.

- AWS **became the backbone of the internet**, powering companies like Netflix, Airbnb, and even government agencies.

- Today, AWS generates **over 60% of Amazon’s total profits**, **funding Amazon’s entire e-commerce business**.

Without **one key decision**, Amazon might still just be an online retailer. But by following the **Power Law**, Bezos **doubled down on what truly mattered**—and that made all the difference.

---

### **3. Sam Altman and AI: Betting on the Future**

Sam Altman, CEO of OpenAI, has **focused his entire career** on **one high-upside opportunity**: **Artificial Intelligence (AI)**.

- Instead of investing in **many different technologies**, he **put all his energy into AI**.

- He **believes AI will reshape every industry**, making it **one of the highest-upside bets in history**.

- OpenAI’s **ChatGPT** is now one of the fastest-growing software products ever, with **100 million+ users** in a matter of months.

Altman’s approach? **Find the area with the biggest possible impact—and go all in.**

---

## **How to Apply the Power Law Principle in Your Life**

Most people **waste time** by treating all tasks equally. But if you want **real success**, you need to **identify and focus on the few things that actually matter**.

### **1. Identify the 20% That Drives 80% of Results**

Ask yourself:

- **What 20% of my efforts produce 80% of my success?**

- **Which investments or decisions have the biggest impact?**

- **What skills, relationships, or habits generate the highest returns?**

---

### **2. Cut the Noise—Eliminate Low-Impact Tasks**

Once you identify the **high-impact areas**, **cut distractions mercilessly**.

- **In investing:** Stop spreading your money across **20 mediocre bets**. Instead, find the **1-2 asymmetric opportunities** that could **change everything**.

- **In business:** Instead of launching **10 different products**, focus on the **one product that dominates your industry**.

- **In personal development:** Instead of learning **random skills**, master **one rare, valuable skill** that **sets you apart**.

---

### **3. Double Down on What Works**

Once you find what works, **go all in**.

- If a stock, business, or skill is **compounding massively**, **allocate more resources** to it.

- If an investment is performing **exponentially better than others**, **increase your stake**.

- If one product or strategy is **dominating the market**, **scale it up aggressively**.

Most people **diversify too much** because they’re afraid of **missing out**. But **true success comes from concentrating on what actually works**.

---

## **Final Thoughts: The Few That Matter**

The **Power Law** is one of the **most important concepts in business, investing, and life**. The majority of success **comes from a small number of actions**—so the key is to:

✅ **Find the few things that truly drive results**

✅ **Eliminate distractions and low-impact efforts**

✅ **Double down on what works and scale it massively**

The difference between **mediocrity and massive success** is simple:

**Most people work hard on everything. The smartest people work hard on the right things.**

Start **thinking in Power Laws**—and you’ll see exponential results. 🚀

---

## **Resources to Learn More**

- 📖 [**Understanding Power Laws** – Farnam Street](https://fs.blog/power-laws/)

- 🎥 [**Peter Thiel on Power Laws in Investing** – NFX](https://www.youtube.com/watch?v=1dWxSZIrKZ0)

- 📰 [**How to Apply Power Laws in Business** – Medium](https://medium.com/@gregoryivers/how-to-use-power-laws-to-your-advantage-3149bd979ef5)

**Action Step:** 🔥 **Look at your current projects, tasks, or investments. What is the 20% that drives 80% of your success? Cut the rest, and focus more on what truly matters.**

Let me know what you think—drop a comment below! 🚀

-

@ b8af284d:f82c91dd

2025-03-10 08:28:07

Liebe Abonnenten,

[800 Milliarden Euro will die EU ausgeben](https://ec.europa.eu/commission/presscorner/detail/sv/statement_25_673), um die Ukraine und den Kontinent in ein “stählernes Stachelschwein” zu verwandeln. Deutschland selbst will künftig Verteidigungsausgaben aus der Schuldenbremse ausnehmen, was nichts anderes als eine unbegrenzte Kreditlinie für das Militär bedeutet. [Hinzu kommt ein “Sondervermögen” in Höhe von 500 Milliarden Euro für Infrastruktur](https://www.tagesschau.de/inland/innenpolitik/sondierungen-finanzen-faq-100.html). Das klingt nach einem Spartopf, den man für schwere Zeiten angelegt hat. Es soll die Tatsache verschleiern, dass es sich dabei um Schulden handelt. Der vermutlich baldige Kanzler Friedrich Merz bricht damit sein Wahlversprechen, die Schuldenbremse einzuhalten. Beschließen soll das Paket noch ein abgewählter Bundestag, da im neuen wohl die Mehrheit fehlt.

Womit also ist zu rechnen, wenn demnächst fast eine Billion frisch gedruckte Euro in Drohnen, Panzer und Raketen investiert werden?

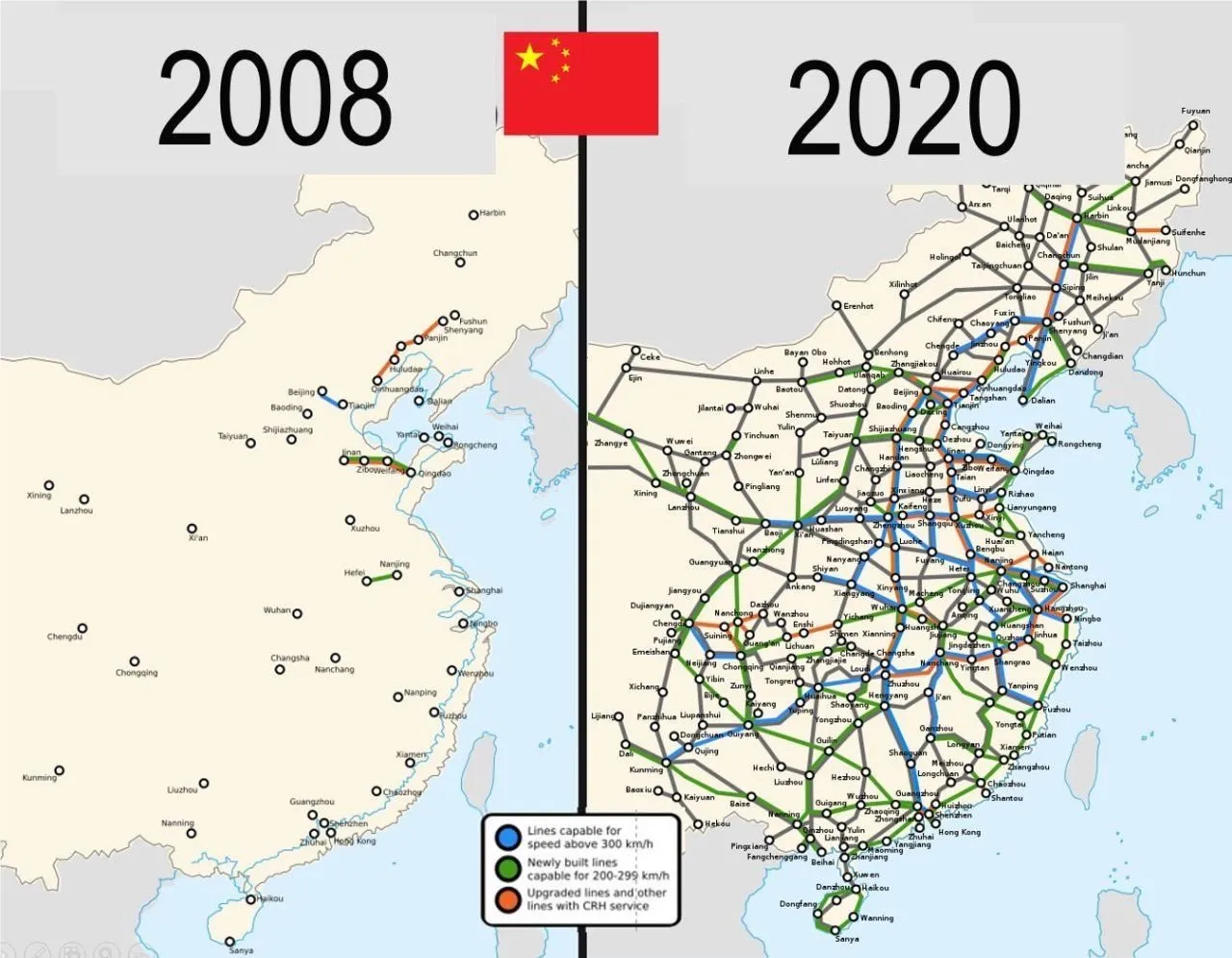

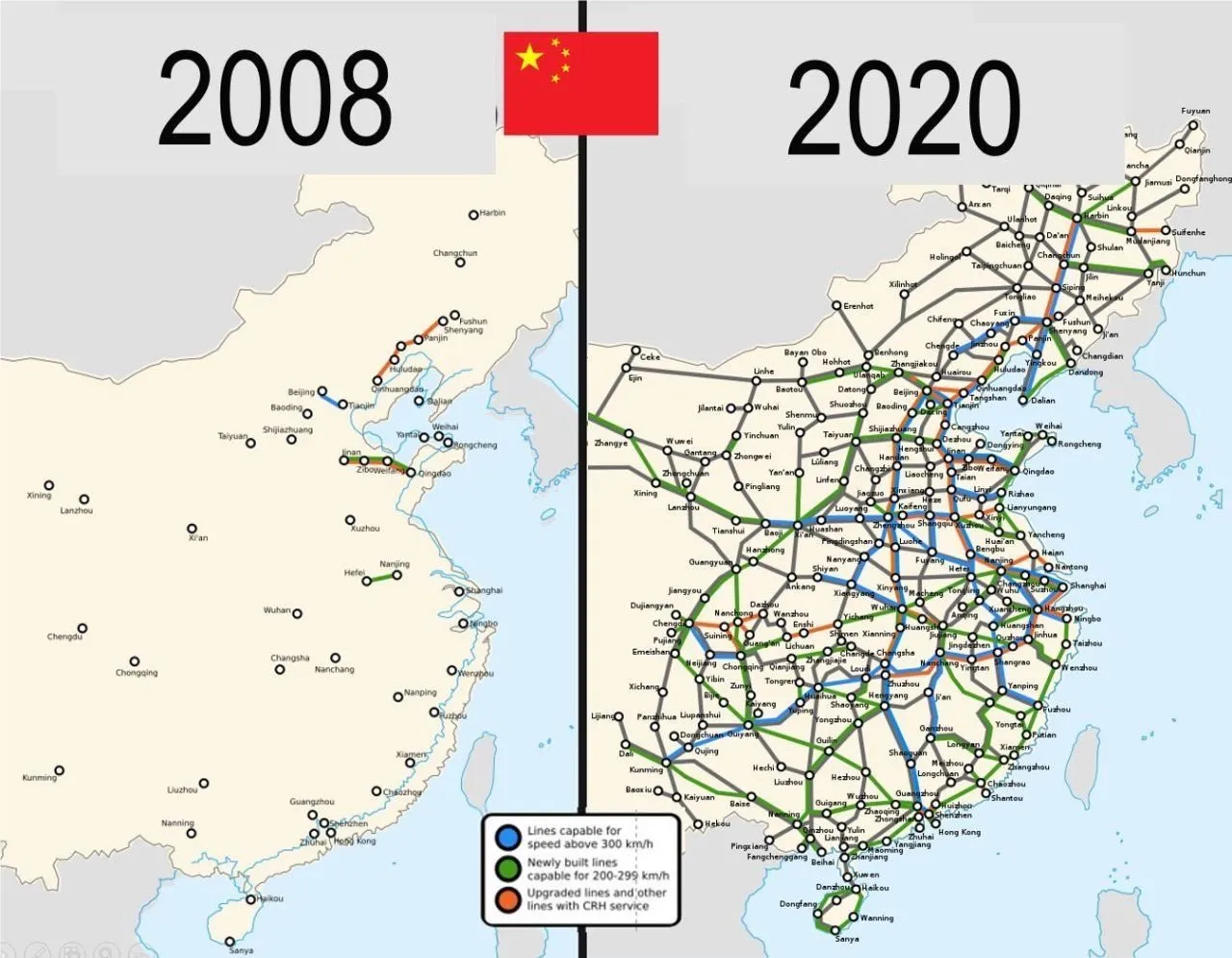

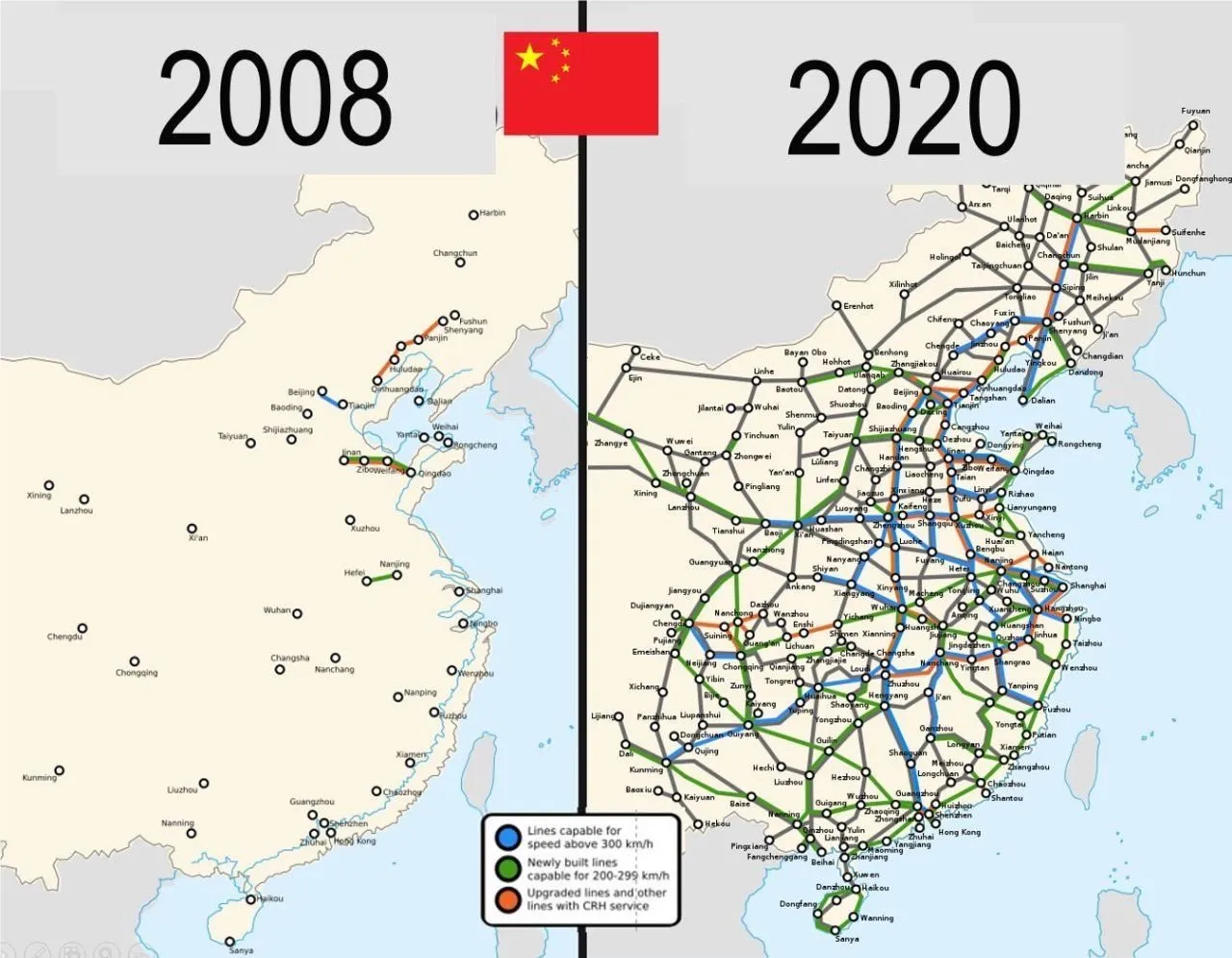

Das beste Beispiel der jüngeren Geschichte ist China: 2009 legte die chinesische Regierung das bisher größte Infrastrukturprojekt der Welt in Höhe von 440 Milliarden Euro auf. Finanziert wurde es durch günstige Kredite, die vor allem an Staatsunternehmen vergeben wurden. Nachdem die Welt nach der in den USA ausgelösten Immobilienkrise 2008 in die Rezession gerutscht war, „rettete“ dieses Paket die globale Konjunktur. China hatte zu diesem Zeitpunkt großen Bedarf an Flughäfen, Straßen und vor allem Zügen. Das Paket war riskant: Schier unbegrenztes Geld, das begrenzten Waren hinterherjagt, führt zu Inflation. Billige Kredite führen meist dazu, dass Unternehmen nicht mehr effizient wirtschaften, und Schuldenberge vor sich her wälzen.

Allerdings wurde das Geld in Produktivität investiert. Denn wenn Menschen und Waren einfacher reisen können, nimmt die Geschäftstätigkeit zu: Arbeitnehmer werden mobiler, Unternehmen konkurrenzfähiger, die Preise sinken. Die Investitionen lohnen sich also, weil sie zu mehr Wirtschaftswachstum führen. Vereinfacht gesagt: Die Schulden können zurückgezahlt werden, und am Ende bleibt noch mehr übrig. In diesem Fall führen Schulden nicht zu Inflation: Durch die gesteigerte Produktivität stehen jetzt sogar mehr Waren der Geldmenge gegenüber.

15 Jahre später kämpft die zweitgrößte Volkswirtschaft zwar noch immer mit den Problemen, die aus diesem Paket resultieren - die Immobilienkrise ist eine indirekte Folge davon. Trotzdem war das Programm ein Erfolg: die Städte, Flughäfen und vor allem Zugstrecken führten zu einer höheren wirtschaftlichen Aktivität oder Produktivität. China ist heute ein wesentlich moderneres Land als vor dem Paket, und verfügt über modernste und größte Netz aus Hochgeschwindigkeitszügen der Welt. Neue Schulden können positiv sein - wenn das Geld produktiv investiert wird.

Auch in Europa lassen sich mit dem Geld-Paket zunächst mehrere Probleme auf einmal lösen: Deutschland ist noch immer ein Industriestandort mit hohen Produktionskapazitäten. Werke der Auto- und Zulieferindustrie können theoretisch zur Waffenproduktion umfunktioniert werden. Immer noch besser als sie stillzulegen oder an die Chinesen zu verkaufen, werden viele Kommentatoren schreiben.

Allein in der deutschen Automobil-Zulieferindustrie sind im vergangenen Jahr über 19000 Arbeitsplätze verloren gegangen. Viele von den Entlassenen können nun Arbeit in der Rüstungsindustrie finden. Oder wie Hans Christoph Atzpodien, [Hauptgeschäftsführer des Bundesverbandes der Deutschen Sicherheits- und Verteidigungsindustrie in der WirtschaftsWoche sagt](https://www.wiwo.de/politik/deutschland/schuldenplaene-ruestungsfirmen-scharf-auf-beschaeftigte-der-autoindustrie/30240510.html):

> *„Das Motto muss lauten: Autos zu Rüstung! Anstatt einen volkswirtschaftlichen Schaden durch den Niedergang der Auto-Konjunktur zu beklagen, sollten wir versuchen, Produktionseinrichtungen und vor allem Fachkräfte aus dem Automobilsektor möglichst verträglich in den Defence-Bereich zu überführen“*

Immerhin: ein großer Teil des Geldes soll auch in Infrastrukturprojekte fließen: Brücken, Bahn, Internetausbau. Deutschland, und damit Europa, wird in den kommenden Monaten also eine große Party feiern, die über die Tatsache hinwegtäuschen wird, dass man einen dummen Krieg verloren hat. In den kommenden Monaten werden sich Verbände und Organisationen um das Geld reißen. Das Geld wird ein auch kollektiv-psychologisches Ventil sein, um das eigene Versagen bei Corona, Klima und Ukraine vergessen zu machen.

Es gibt allerdings einen wesentlichen Unterschied zum chinesischen Stimulus-Paket 2009: Rüstungsgüter sind im Gegensatz zu Zugstrecken totes Kapital. Eine neue Drohne oder Panzer führt nicht zu mehr Produktivität, im Gegenteil: Kommen sie zum Einsatz, zerstören sie Brücken, Häuser, Straßen und töten Menschen. Die Produktivität sinkt also. Im besten Fall kann Militärgerät herumstehen und vor sich hin rosten. Auch dann aber ist es „totes Kapital“, das nichts zur Produktivität beiträgt. Kommt es zum Einsatz, stehen der nun verringerten Warenmenge eine noch größere Geldmenge gegenüber. Die Inflation steigt.

**Schleichende Militarisierung**

Auch gesellschaftlich wird das Paket mit seinem Blanko-Scheck für die Verteidigungsindustrie viel verändern: Es kommt zu einer „Eichung“ der Gesellschaft, eine kollektive Abscheu des gemeinsamen Feindes. Scharfmacher, eigentlich mittelmäßiger Akademiker und Bürokraten, wie Carlo Masala und Claudia Major werden eine noch größere Rolle im öffentlichen Diskurs spielen und die Talkshows dominieren, die von einer immer älter werdenden deutschen Bevölkerung geglotzt werden. Abweichende Meinungen auf Online-Plattformen zensiert, unter dem Vorwand, die Demokratie sei in Gefahr:

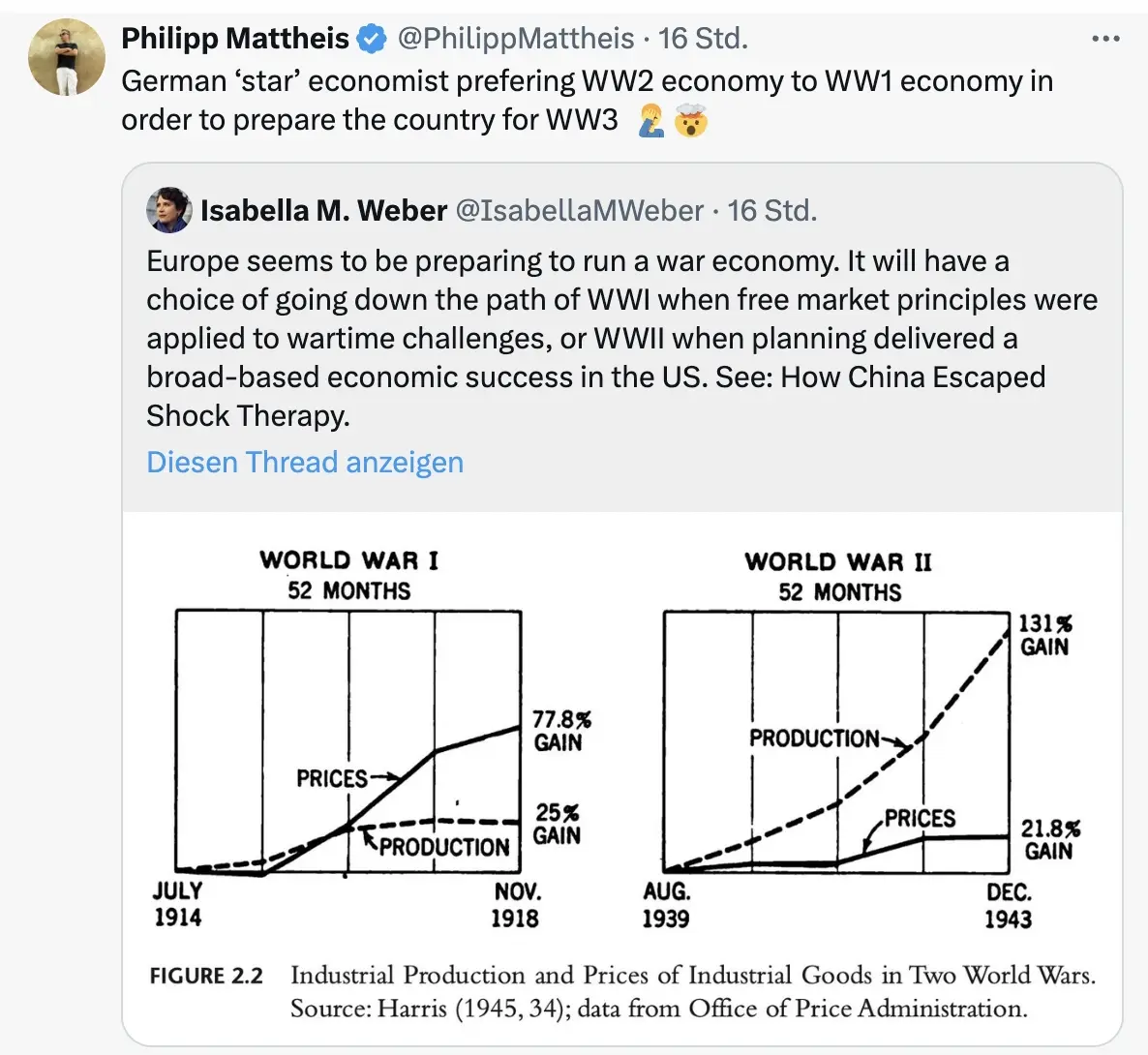

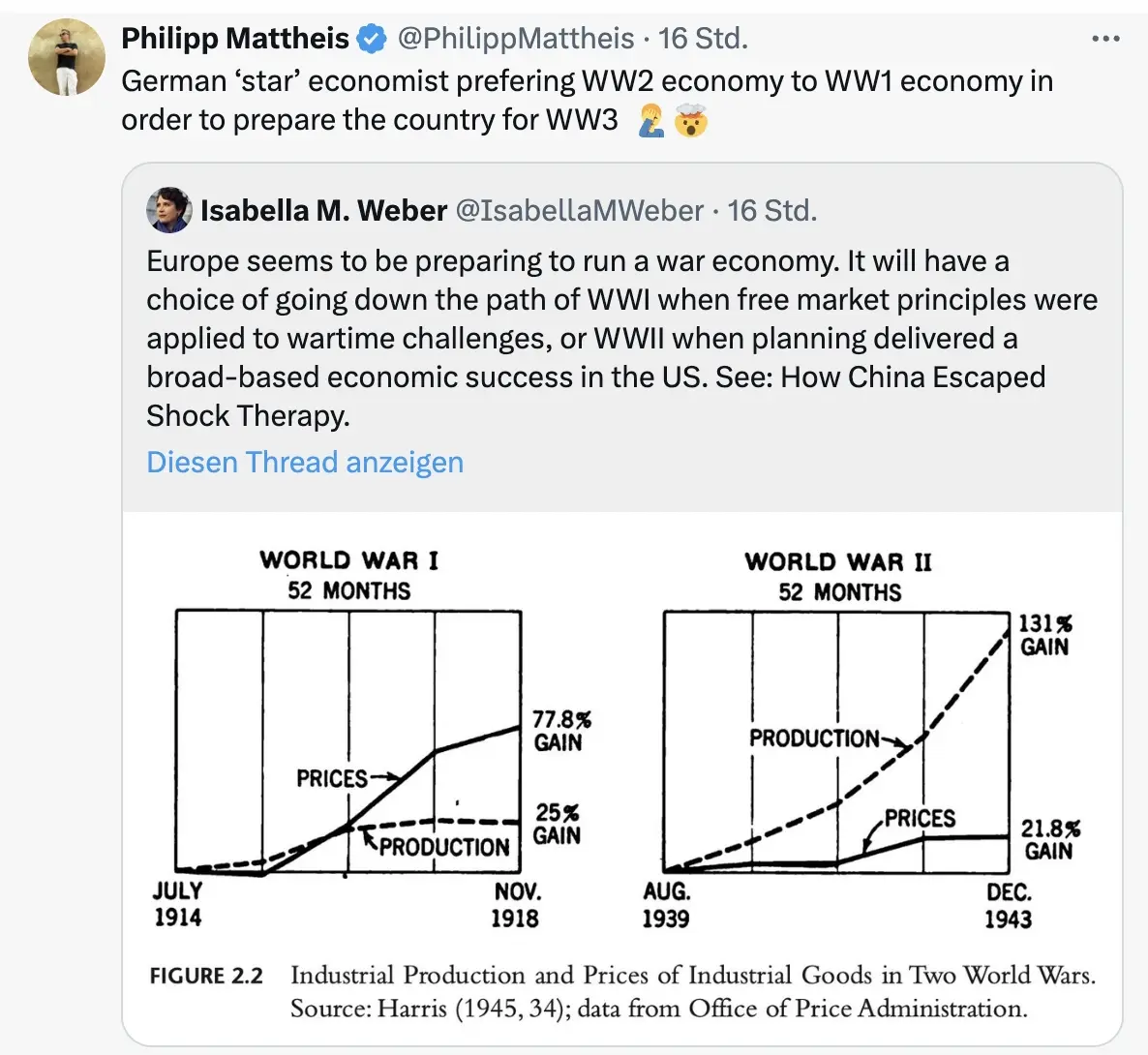

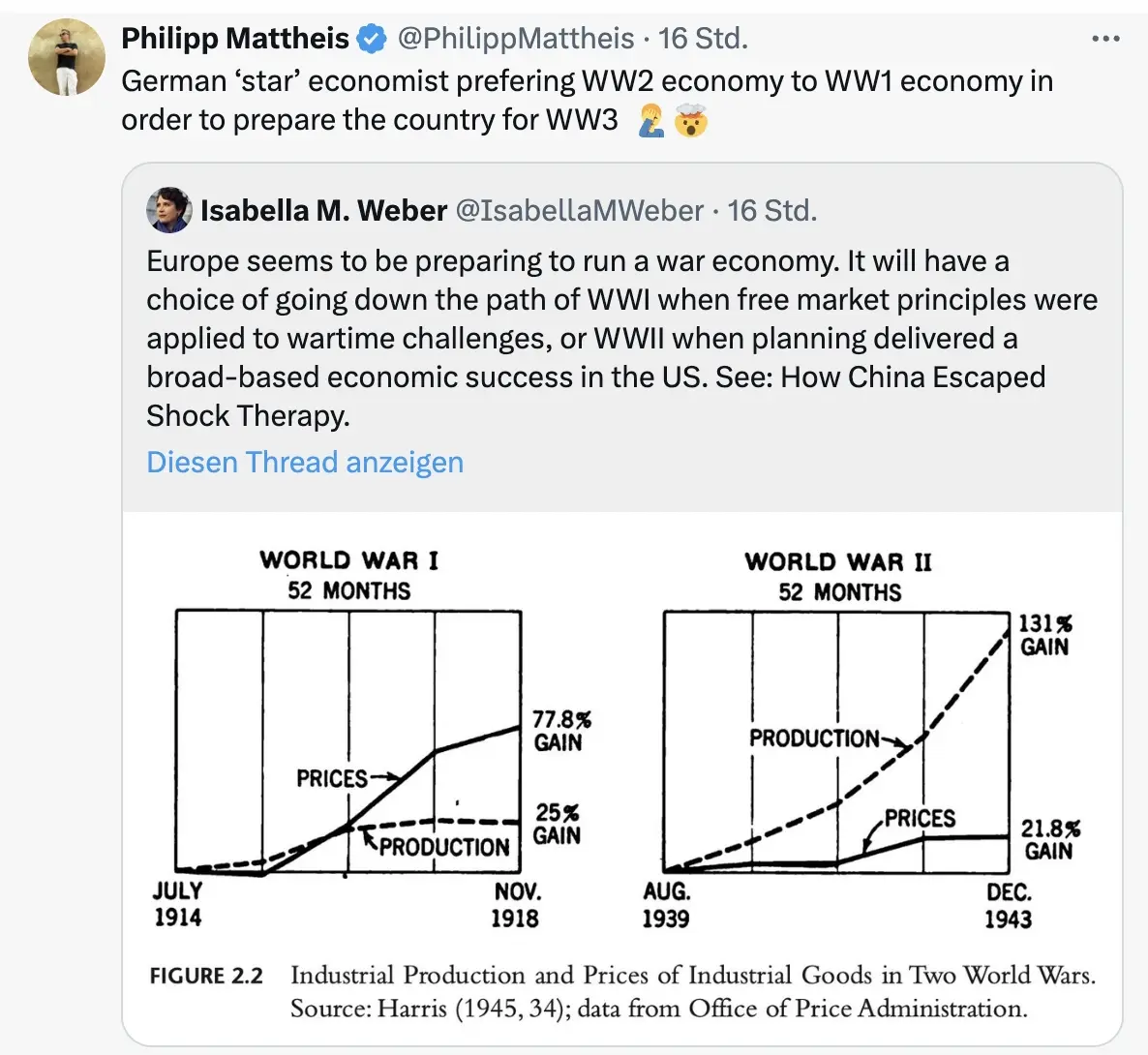

Da die Rüstungsindustrie dann eine wichtigere Rolle für die Gesamtwirtschaft spielt, wird ihr Einfluss auf die Politik in Form von Lobbyisten und Verbänden zunehmen. [Politiker merken schnell, dass sie von der medialen Aufmerksamkeitsökonomie ](https://x.com/RKiesewetter/status/1897588039418851682)nach oben gespült werden, wenn sie immer radikalere Forderungen stellen. So empfahl der ehemalige [Außenminister Joschka Fischer die Woche die Wiedereinführung der Wehrpflicht für Männer und Frauen](https://x.com/PhilippMattheis/status/1896862517688979535). “Star-Ökonomin” Isabella Weber will die Kriegswirtschaft mitplanen:

\

Der Kontinent wird sich langsam wandeln von einem „Friedensprojekt“ zu einem „metallenen Stachelschwein“, ergo Kriegsprojekt, denn ohne dämonisierten Feind funktioniert das Programm nicht. Der Ton wird rauer, autoritärer, und die Meinungsfreiheit weiter eingeschränkt werden. Die seit 2020 eingeführten Werkzeuge zur soften Propaganda („[kognitive Kriegsführung](https://www.youtube.com/watch?v=FCIsI9auGoQ)”) werden verfeinert und ausgebaut werden, sodass weiterhin 80 Prozent der Bevölkerung alle noch so antihumanen Maßnahmen gutheißen werden.

Und dann?

Wie Julian Assange einmal sagte: “[Das Ziel ist kein erfolgreicher Krieg. Das Ziel ist ein endloser Krieg.](https://x.com/wikileaks/status/1551583003490623488)” Der Konflikt muss weitergehen, ewig schwelen oder ein neuer gefunden werden, da sonst ein Teil der Wirtschaftsleistung kollabiert.

Nach ein, zwei oder auch erst drei Jahren, werden erste Probleme sichtbar. Die Party endet, der Kater setzt langsam ein. Die Finanzierung an den Kapitalmärkten wird für Deutschland immer kostspieliger. Der Schuldendienst wird einen größeren Teil des Haushalts einnehmen. Die Bürger müssen dies mitfinanzieren. Der voraussichtlich neue Bundeskanzler Friedrich Merz sprach bereits von der „[Mobilisierung der deutschen Sparguthaben](https://www.mdr.de/nachrichten/deutschland/wirtschaft/merz-enteignung-private-konten-infrastruktur-fakecheck-100.html)“.

\

Was im Ersten Weltkrieg „Kriegsanleihen“ hieß, wird einen schickeren Namen bekommen wie „olivgrüne Bonds“. You name it. Alternativ lässt sich ein Verteidigungs-Soli einführen, oder das [Kindergeld streichen, wie kürzlich Ifo-Chef Clemens Fuest forderte](https://www.wiwo.de/politik/konjunktur/nice-to-have-ifo-chef-fuest-fordert-abschaffung-des-elterngelds/30236948.html).

*Was kann man tun?* *[Auf BlingBling geht es um konkrete Tipps](https://blingbling.substack.com/p/panzer-statt-autos), welche Anlagen von dieser Entwicklung profitieren werden. Außerdem geht es um die “Strategische Bitcoin Reserve”, die am Donnerstag beschlossen wurde.*

-

@ da0b9bc3:4e30a4a9

2025-03-10 07:34:20

Hello Stackers!

Welcome on into the ~Music Corner of the Saloon!

A place where we Talk Music. Share Tracks. Zap Sats.

So stay a while and listen.

🚨Don't forget to check out the pinned items in the territory homepage! You can always find the latest weeklies there!🚨

🚨Subscribe to the territory to ensure you never miss a post! 🚨

originally posted at https://stacker.news/items/908874

-

@ fb8a5c6f:58ec79bd

2025-03-10 00:39:53

I work in the film industry, and I absolutely love making movies—it’s where my heart is. I’m also passionate about bitcoin. For me, it’s not just about the thrill of "number go up," but a deeper realization over the past 12 years: *inflation is a theft of our time and energy.* Whether I’m writing or revising a script or thinking about the world we live in, I believe our lives shouldn’t get progressively more expensive just by existing.\

\

A few months ago, I saw a viral video that drove this home. A young guy shared how a month’s worth of groceries cost him ***$126*** *back in 2022*. When he hit the "re-order" button for the same items in the summer of 2024—just two years later—it was **$414**. That’s staggering. People are working harder than ever, pouring their souls into their craft yet they can’t figure out why they’re not getting ahead. Inflation is a big part of the answer.\

\

It’s frustrating because it didn’t always used to be this way. Today, the Federal Reserve and the U.S. Treasury keep printing money out of thin air, devaluing what we earn and making life more expensive year after year. I understood the problem for a while, but it wasn’t until I discovered bitcoin that I found a solution. A fixed and finite currency. \

\

There will only ever be **21 million.**\

\

Naturally, when you grasp what bitcoin is, you want to share it with the people you care about. I’ve been fortunate—my friends get it, and they’re doing great. My family, though? Not so much. Yesterday, my aunt suggested I talk to them as a group instead of one-on-one, like I’d been trying, so they could ask questions and discuss it together. I thought it was interesting idea, but money is such a personal topic. We all have to find our own path to understanding it, and bringing it up with family can get tricky—almost like pitching a script they’re not ready to hear.\

\

So, what did I do instead? I'm sharing these thoughts online and started a [Youtube channel](https://www.youtube.com/@kameeklucastaitt). Go figure. Don't judge too harshly though as it's a work in progress! 🫡\

\

It’s not so different from storytelling through film—just another way to share what matters.\

\

I don’t know how often I’ll write long form posts or make videos about bitcoin, but if I can help even one person pinpoint the problem and discover bitcoin along the way, I believe the world gets a little better. Bit by bit, person by person. Just like how a good movie can inspire, maybe this can too.

**Fix the money, fix the world.**\

∞ / 21 million

-

@ f3873798:24b3f2f3

2025-03-10 00:32:44

Recentemente, assisti a um vídeo que me fez refletir profundamente sobre o impacto da linguagem na hora de vender. No vídeo, uma jovem relatava sua experiência ao presenciar um vendedor de amendoim em uma agência dos Correios. O local estava cheio, as pessoas aguardavam impacientes na fila e, em meio a esse cenário, um homem humilde tentava vender seu produto. Mas sua abordagem não era estratégica; ao invés de destacar os benefícios do amendoim, ele suplicava para que alguém o ajudasse comprando. O resultado? Ninguém se interessou.

A jovem observou que o problema não era o produto, mas a forma como ele estava sendo oferecido. Afinal, muitas das pessoas ali estavam há horas esperando e perto do horário do almoço – o amendoim poderia ser um ótimo tira-gosto. No entanto, como a comunicação do vendedor vinha carregada de desespero, ele afastava os clientes ao invés de atraí-los. Esse vídeo me tocou profundamente.

No dia seguinte, ao sair para comemorar meu aniversário, vi um menino vendendo balas na rua, sob o sol forte. Assim como no caso do amendoim, percebi que as pessoas ao redor não se interessavam por seu produto. Ao se aproximar do carro, resolvi comprar dois pacotes. Mais do que ajudar, queria que aquele pequeno gesto servisse como incentivo para que ele continuasse acreditando no seu negócio.

Essa experiência me fez refletir ainda mais sobre o poder da comunicação em vendas. Muitas vezes, não é o produto que está errado, mas sim a forma como o vendedor o apresenta. Quando transmitimos confiança e mostramos o valor do que vendemos, despertamos o interesse genuíno dos clientes.

## Como a Linguagem Impacta as Vendas?

##### 1. O Poder da Abordagem Positiva

Em vez de pedir por ajuda, é importante destacar os benefícios do produto. No caso do amendoim, o vendedor poderia ter dito algo como:

"Que tal um petisco delicioso enquanto espera? Um amendoim fresquinho para matar a fome até o almoço!"

##### 2. A Emoção na Medida Certa

Expressar emoção é essencial, mas sem parecer desesperado. Os clientes devem sentir que estão adquirindo algo de valor, não apenas ajudando o vendedor.

##### 3. Conheça Seu Público

Entender o contexto é fundamental. Se as pessoas estavam com fome e impacientes, uma abordagem mais objetiva e focada no benefício do produto poderia gerar mais vendas.

##### 4. Autoconfiança e Postura

Falar com firmeza e segurança transmite credibilidade. O vendedor precisa acreditar no próprio produto antes de convencer o cliente a comprá-lo.

### Conclusão

Vender é mais do que apenas oferecer um produto – é uma arte que envolve comunicação, percepção e estratégia. Pequenos ajustes na abordagem podem transformar completamente os resultados. Se o vendedor de amendoim tivesse apresentado seu produto de outra maneira, talvez tivesse vendido tudo rapidamente. Da mesma forma, se cada um de nós aprender a se comunicar melhor em nossas próprias áreas, poderemos alcançar muito mais sucesso.

E você? Já passou por uma experiência parecida?

-

@ 8d34bd24:414be32b

2025-03-10 00:16:01

The Bible tells believers repeatedly that we are to share the gospel, make disciples, speak the truth, etc. We are to be His witnesses. The reason we don’t go straight to heaven when we are saved is that God has a purpose for our lives and that is to be a light drawing people to Him.

> “…but you will receive power when the Holy Spirit has come upon you; and you shall be My witnesses both in Jerusalem, and in all Judea and Samaria, and even to the remotest part of the earth.” (Acts 1:8)

In order to be His witness, we have to know Him and know His word. When we don’t know His word, we can be misled and/or mislead others. We will fail in our mission to be witnesses if we don’t regularly study the Bible and spend time in prayer with our God.

> As a result, we are no longer to be children, tossed here and there by waves and **carried about by every wind of doctrine**, by the trickery of men, by craftiness in deceitful scheming; but **speaking the truth in love**, we are to grow up in all aspects into Him who is the head, even Christ, from whom the whole body, being fitted and held together by what every joint supplies, according to the proper working of each individual part, causes the growth of the body for the building up of itself in love. (Ephesians 4:4-16) {emphasis mine}

In addition to knowing Him and His word, we need to be bold and unashamed.

> Therefore **do not be ashamed of the testimony of our Lord** or of me His prisoner, but join with me in suffering for the gospel according to the power of God, who has saved us and **called us with a holy calling, not according to our works, but according to His own purpose** and grace which was granted us in Christ Jesus from all eternity, but now has been revealed by the appearing of our Savior Christ Jesus, who abolished death and brought life and immortality to light through the gospel, (2 Timothy 1:8-10) {emphasis mine}

We were called according to His purpose. His purpose was known before the creation of the world. We are not saved by works, but if we are saved, works should naturally proceed from the power of the Holy Spirit within us, as well as the thankfulness we should have because of what Jesus did for us.

The key point of our witness is obedience. We are a tool of God. We are to faithfully share the Gospel and the truth in God’s word, but we are not held accountable for the result of this witness. The results are due to God’s mercy and power and not due to anything we do.

> But **you shall speak My words to them whether they listen or not**, for they are rebellious.

>

> “**Now you**, son of man, **listen to what I am speaking to you; do not be rebellious like that rebellious house.** Open your mouth and eat what I am giving you.” (Ezekiel 2:7-8) {emphasis mine}

When we witness, some will listen and some will not. Some will accept Jesus with joy and some will reject Him in anger. That is not our concern. God calls whom He will and without His calling, nobody comes to Him.

> And they took offense at Him. But Jesus said to them, “A prophet is not without honor except in his hometown and in his own household.” (Matthew 13:57)

One thing I’ve noticed is that the hardest people to witness to are family (not counting kids, but especially parents and siblings) and other people who have known us for a long time. They see what we were and not what we now are. There is baggage that can make for awkward dynamics. As someone once said to me, “It is hard to teach anyone or convince anyone who changed your diaper.”

I started with the Acts 1:8, “*… be My witnesses both in Jerusalem, and in all Judea and Samaria, and even to the remotest part of the earth*.” This is like saying “be My witnesses in my hometown, my state, my country, and even to the remotest part of the earth.” Our witness starts at home, then our community, and works it way out. Everyone can witness at home. We can all witness in our community as we go about our daily actions. It is important to have Christians that go to the “*remotest part of the earth*,” especially to unreached people groups, but that isn’t where most of us are sent. Most of us are called to witness to those around us daily.

> **For you are not being sent to a people of unintelligible speech or difficult language**, but to the house of Israel, nor to many peoples of unintelligible speech or difficult language, whose words you cannot understand. But **I have sent you to them who should listen to you**; (Ezekiel 3:5-6) {emphasis mine}

God empowers some to be international missionaries, but He calls every Christian to be a life missionary. Sometimes this may just be living a life for Jesus that stands out in the culture. Sometimes this may be giving an in-depth treatise on the Gospel and the Bible. It will look differently in different seasons of life and on different days, but it should be a regular part of our life.

As we build relationships with people and show that we care about them, this usually gives us the opportunity to share with them why our lives look different. It demonstrates why we treat others well, why we are loving, and why we have joy, even when our circumstances don’t seem like they should lead to joy. Then when they ask why we are different, we can have the opportunity to tell why we have this joy and love and morality.

> but sanctify Christ as Lord in your hearts, always being ready to make a defense to everyone who asks you to give an account for the hope that is in you, yet with gentleness and reverence; (1 Peter 3:5)

Although following a person and forcing them to listen to the Gospel is not the way to draw someone to Jesus, we need to not be silent about the truth. Not being pushy doesn’t mean being silent when someone is forcing their ungodly views on us or on others. Speaking up prevents evil voices from taking control. You also might be surprised to find that others didn’t like what was being said, but were too afraid to speak up because they thought everyone agreed with the speaker. When you speak up for the truth, it can give others courage to stand on their convictions and to draw closer to Jesus, whether this means they come to salvation or just draw closer to God.

> Moreover, He said to me, “Son of man, **take into your heart all My words** which I will speak to you and **listen closely**. **Go** to the exiles, **to the sons of your people**, and **speak to them and tell them, whether they listen or not**, ‘Thus says the Lord God.’ ” (Ezekiel 3:10-11) {emphasis mine}

We are to speak the truth in love whether they listen or not. Some will listen, hear, and come to Jesus. Some will listen and reject what is said. We are only called to obey the call. God brings the increase. To God be the glory!

May God guide us and lead us in wisdom, love, and courage so that our light shines so brightly that many unsaved come to trust in Jesus Christ our Lord and that those who know Jesus, but have not matured, may grow in their faith, knowledge, and obedience to Jesus.

Trust Jesus

@ ef1744f8:96fbc3fe

2025-03-10 15:36:36SM5t1lcoE7YMLxevcZD8Y1h6hOVUW2m+VBEgnobNaxqFnMiAxLnx5Mv1yJXBWbJUHJUVjVqTSnMMh+kmOFAm45sJ91t1ZbJexRwjCt/bcUupUg9muo9yhWNLF90hRhGOukV5dvtDEm0wSi55BKco+cKN6Bv+/YgoOzVslHyhdc7uwMOi4dYvf1QzKwbgdnbeaxJ/rmC5+a1u936gtak0Q3W8RU+r9ori727kCYAkHa75rpZq7EoP7hX4/Fhi1UFHFnSRlVReZ2i4BJSVsuMHMQ5HesLCdvYQsje/AGaHcQAOGsqCcrZKyXpiGpHoFQ76JfH2qb9MgsLhy9/uWtSkFGfVhTXLJ7xBrn4nvXB4NeZCm6lH0RxqMEpAs9pJFQ13WB0B+PnhaKzt+/gd4BTyxvt1kS9UI1Tx38C64fUc4H8=?iv=Ad5BmIVyn2mtZrVQpujcvQ==

@ ef1744f8:96fbc3fe

2025-03-10 15:36:36SM5t1lcoE7YMLxevcZD8Y1h6hOVUW2m+VBEgnobNaxqFnMiAxLnx5Mv1yJXBWbJUHJUVjVqTSnMMh+kmOFAm45sJ91t1ZbJexRwjCt/bcUupUg9muo9yhWNLF90hRhGOukV5dvtDEm0wSi55BKco+cKN6Bv+/YgoOzVslHyhdc7uwMOi4dYvf1QzKwbgdnbeaxJ/rmC5+a1u936gtak0Q3W8RU+r9ori727kCYAkHa75rpZq7EoP7hX4/Fhi1UFHFnSRlVReZ2i4BJSVsuMHMQ5HesLCdvYQsje/AGaHcQAOGsqCcrZKyXpiGpHoFQ76JfH2qb9MgsLhy9/uWtSkFGfVhTXLJ7xBrn4nvXB4NeZCm6lH0RxqMEpAs9pJFQ13WB0B+PnhaKzt+/gd4BTyxvt1kS9UI1Tx38C64fUc4H8=?iv=Ad5BmIVyn2mtZrVQpujcvQ== @ 0463223a:3b14d673