-

@ 7d33ba57:1b82db35

2025-03-10 11:22:03

**Roque Nublo & Pico de las Nieves Gran Canaria’s Highest Points**

🏞 **Roque Nublo (1,813m)**

One of the island’s most famous landmarks, this volcanic rock formation offers incredible views after a short (1.5 km) hike. It was once a sacred site for the indigenous Guanche people. On clear days, you can see Mount Teide in Tenerife.

⛰ **Pico de las Nieves (1,949m) – The Highest Point**

A short drive from Roque Nublo, this is Gran Canaria’s highest peak. You’ll get 360° views of the island, including Roque Nublo and the deep ravines of the Caldera de Tejeda. Unlike Roque Nublo, you can drive almost to the top.

🌤 **Best Time to Visit:**

- Sunrise or sunset for stunning views.

- Bring layers—it can be chilly at higher altitudes.

🚗 **Getting There:**

- Roque Nublo requires a short hike.

- Pico de las Nieves is accessible by car.

-

@ c11cf5f8:4928464d

2025-03-10 10:39:55

Here we are again with our monthly [Magnificent Seven](https://stacker.news/AGORA#the-magnificent-seven---of-all-times), the summary giving you a hit of what you missed in the ~AGORA territory.

- - -

### Top-Performing Ads

This month, the most engaging ones are:

* `01` [eSIM for Spain](https://stacker.news/items/908065/r/AG) by @south_korea_ln

* `02` [[OFFER] Small batch handcrafted ground meat jerky (unique flavors)](https://stacker.news/items/906891/r/AG) by @beejay

* `03` [[HIRE] Bitcoin & Nostr Development agency, IT outsoucing company](https://stacker.news/items/898547/r/AG) by @a68dd96af9

* `04` [[AUCTION] 🤘Kreator band signed poster, Start at: 21k sats (Prague/CZ) + postal](https://stacker.news/items/886008/r/AG) by @bogo

* `05` [[SELL] Your Tombstone, 1k sats](https://stacker.news/items/903776/r/AG) by @jasonb

* `06` [[SELL] First Public Printing of the 1787 United States Constitution $49.75/share](https://stacker.news/items/893666/r/AG) by @mo

* `07` [Official Patriots Coin - .9999 Fine REAL GOLD - 1 Gr. Bar 17.94K sats](https://stacker.news/items/889970/r/AG) by @watchmancbiz

- - -

### Professional Services accepting Bitcoin

- https://stacker.news/items/900208/r/AG @unschooled offering Language Tutoring

- https://stacker.news/items/813013/r/AG @gpvansat's [OFFER][Graphic Design]

From the paste editions (It's important to keep these offers available)

- https://stacker.news/items/775383/r/AG @TinstrMedia - Color Grading (Styling) Your Pictures as a Service

- https://stacker.news/items/773557/r/AG @MamaHodl, MATHS TUTOR 50K SATS/hour English global

- https://stacker.news/items/684163/r/AG @BTCLNAT's OFFER HEALTH COUNSELING [21 SAT/ consultation

- https://stacker.news/items/689268/r/AG @mathswithtess [SELL] MATHS TUTOR ONILINE, 90k sats per hour. Global but English only.

###### In case you missed

Here some interesting post, opening conversations and free speech about markets and business on the bitcoin circular economy:

- https://stacker.news/items/902115/r/AG Just curious - what are the top darknet sites accepting BTC Lightning nowadays? by @kristapsk

- https://stacker.news/items/881075/r/AG Can someone produce a cheap linux based 4g phone for me to use in New Zealand? by @Solomonsatoshi

- https://stacker.news/items/896651/r/AG 🌰Missing Nut String for todays Saloon Nut 🌰 by @BlokchainB

- https://stacker.news/items/899384/r/AG Sales Corner (Is AI the future of sales?) by @Akg10s3

###### BUYing or SELLing Cowboys Credits?

[BUY](https://stacker.news/~AGORA/post?type=discussion&title=[BUY]%20XXX%20Cowboys%20Credits%20for%20YYY%20sats) or [SELL](https://stacker.news/~AGORA/post?type=discussion&title=[SELL]%20XXX%20Cowboys%20Credits%20for%20YYY%20sats) Cowboy Credits for sats

on the SN ~AGORA marketplace

###### 🏷️ Spending Sunday

Share your most recent Bitcoin purchases of just check what other stackers are buying with their sats!

Read more https://stacker.news/items/908074/r/AG

- - -

### Create your Ads now!

Looking to start something new? Hit one of the links below to free your mind:

* [💬 TOPIC](https://stacker.news/~AGORA/post?type=discussion) for conversation,

* [\[⚖️ SELL\]](https://w3.do/b_v2wutP) anything! or,

* if you're looking for something, hit the [\[🛒 BUY\]](https://w3.do/zvixtuSh)!

* [\[🧑💻 HIRE\]](https://w3.do/_j0kpVsi) any bitcoiner skill or stuff from bitcoiners

* [\[🖇 OFFER\]](https://w3.do/EfWF8yDL) any product or service and stack more sats

* [\[🧑⚖️ AUCTION\]](https://w3.do/sbbCjZ0e) to let stackers decide a fair price for your item

* [\[🤝 SWAP\]](https://w3.do/V_iP4lY5) if you're looking to exchange anything with anything else

* [\[🆓 FREE\]](https://w3.do/DdVEE1ME) your space, make a gift!

* [\[⭐ REVIEW\]](https://w3.do/CAZ5JxCk) any bitcoin product or LN service you recently bought or subscribed to

- - -

Or contact @AGORA team on [nostr DM](https://iris.to/agora_sn), and we can help you publish a personalized post.

.

`#nostr` `#bitcoin` `#stuff4sats` `#sell` `#buy` `#plebchain` `#grownostr` `#asknostr` `#market` `#business`

originally posted at https://stacker.news/items/908966

-

@ 57d1a264:69f1fee1

2025-03-10 10:04:32

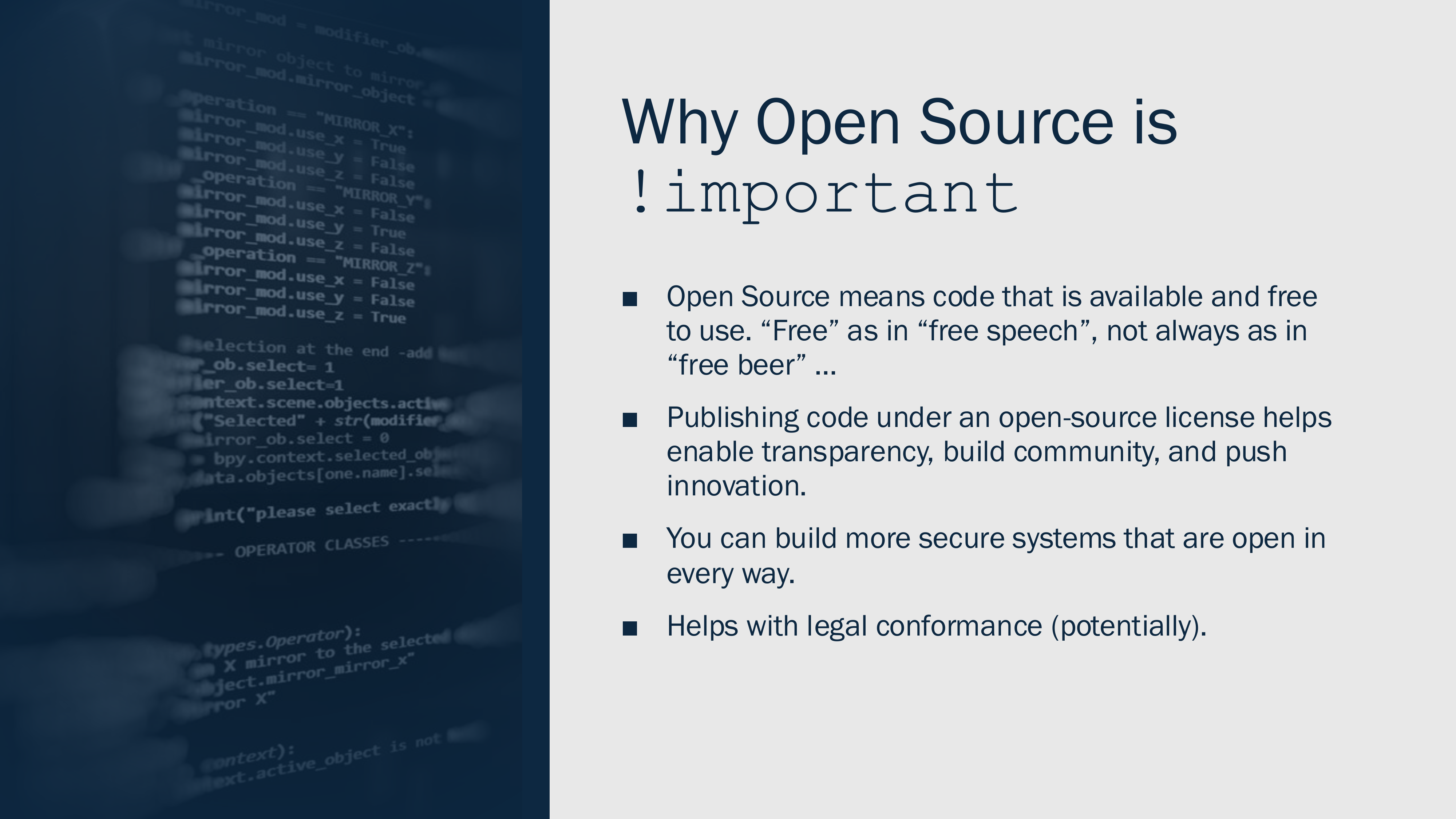

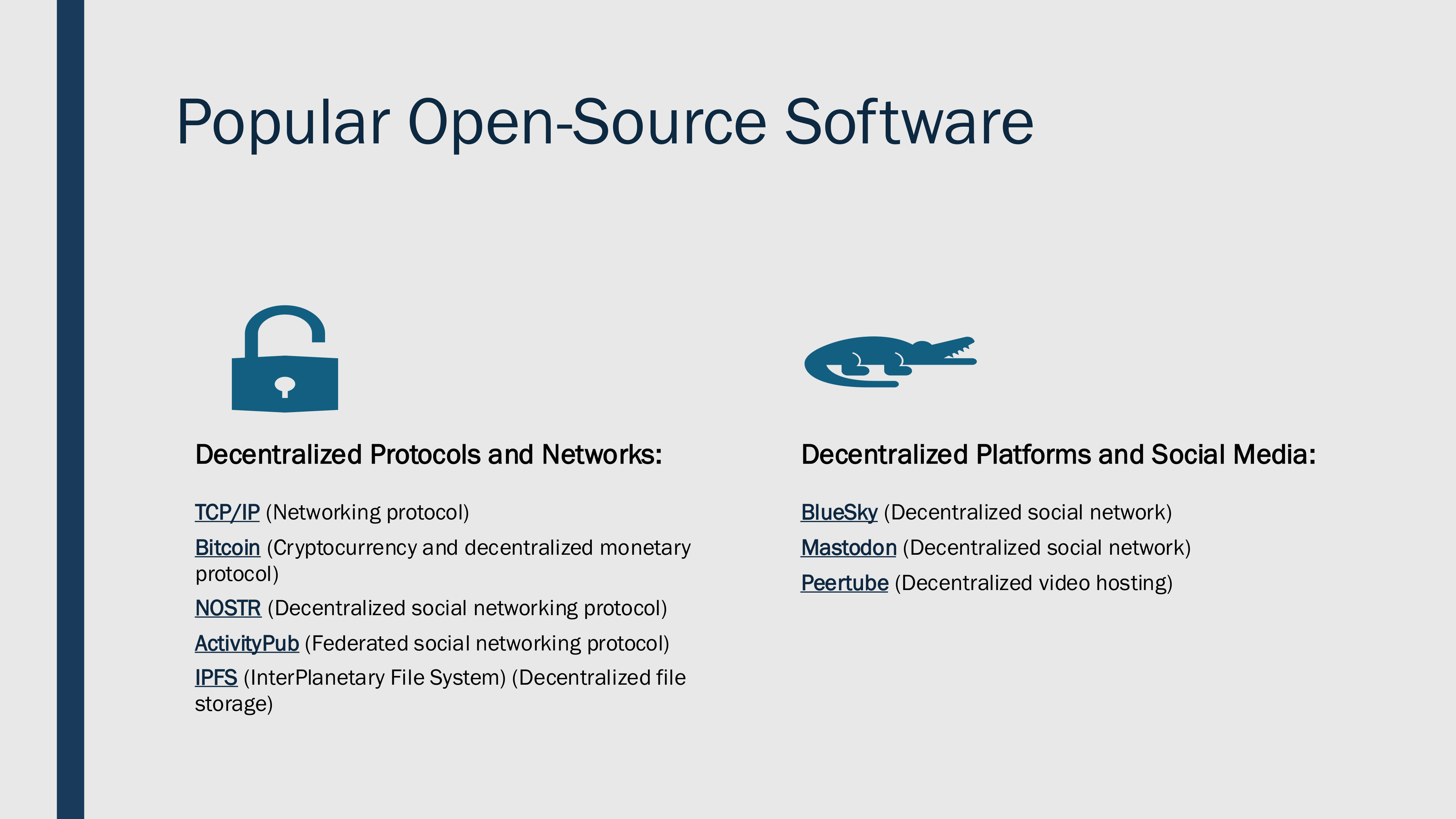

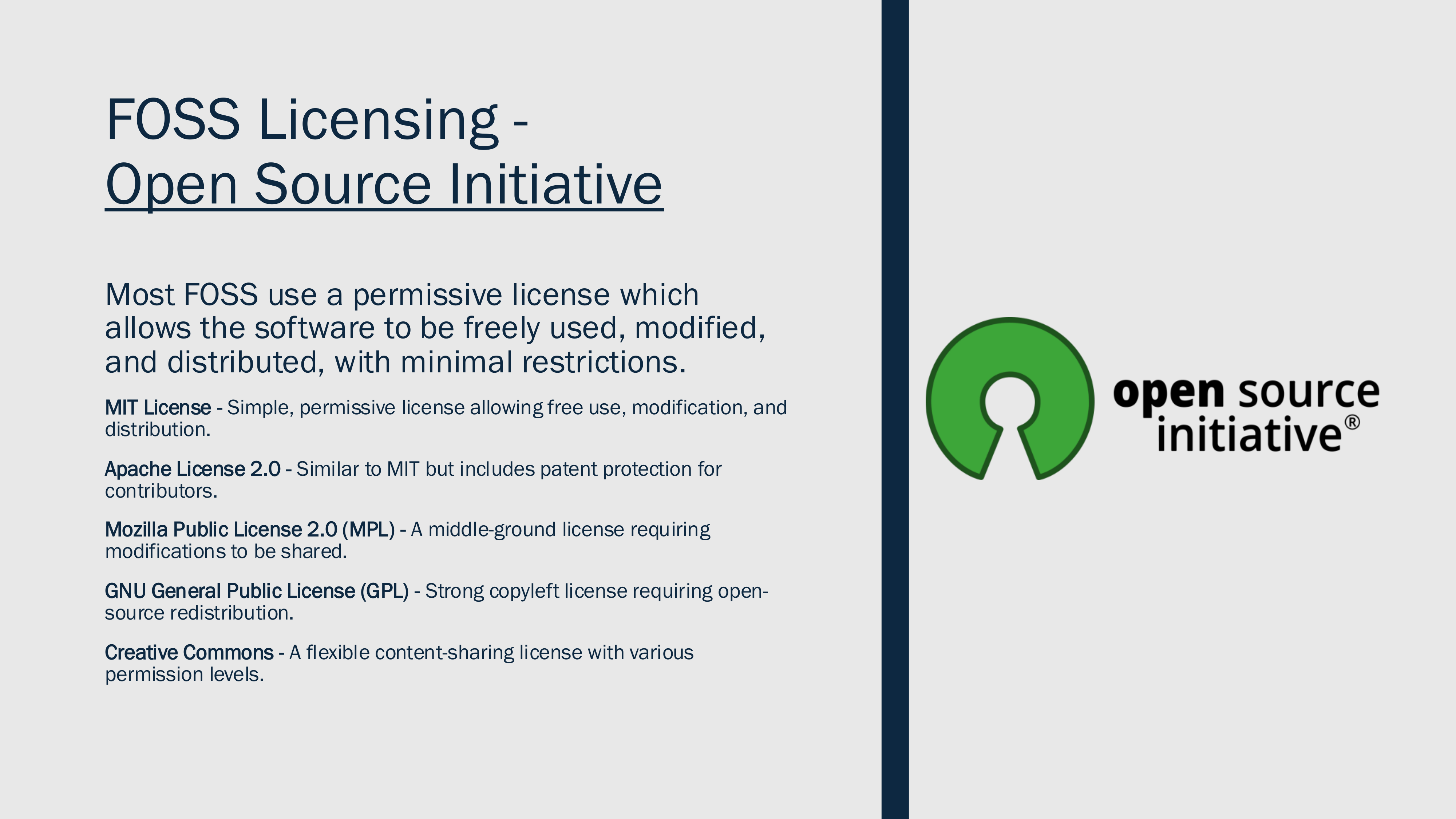

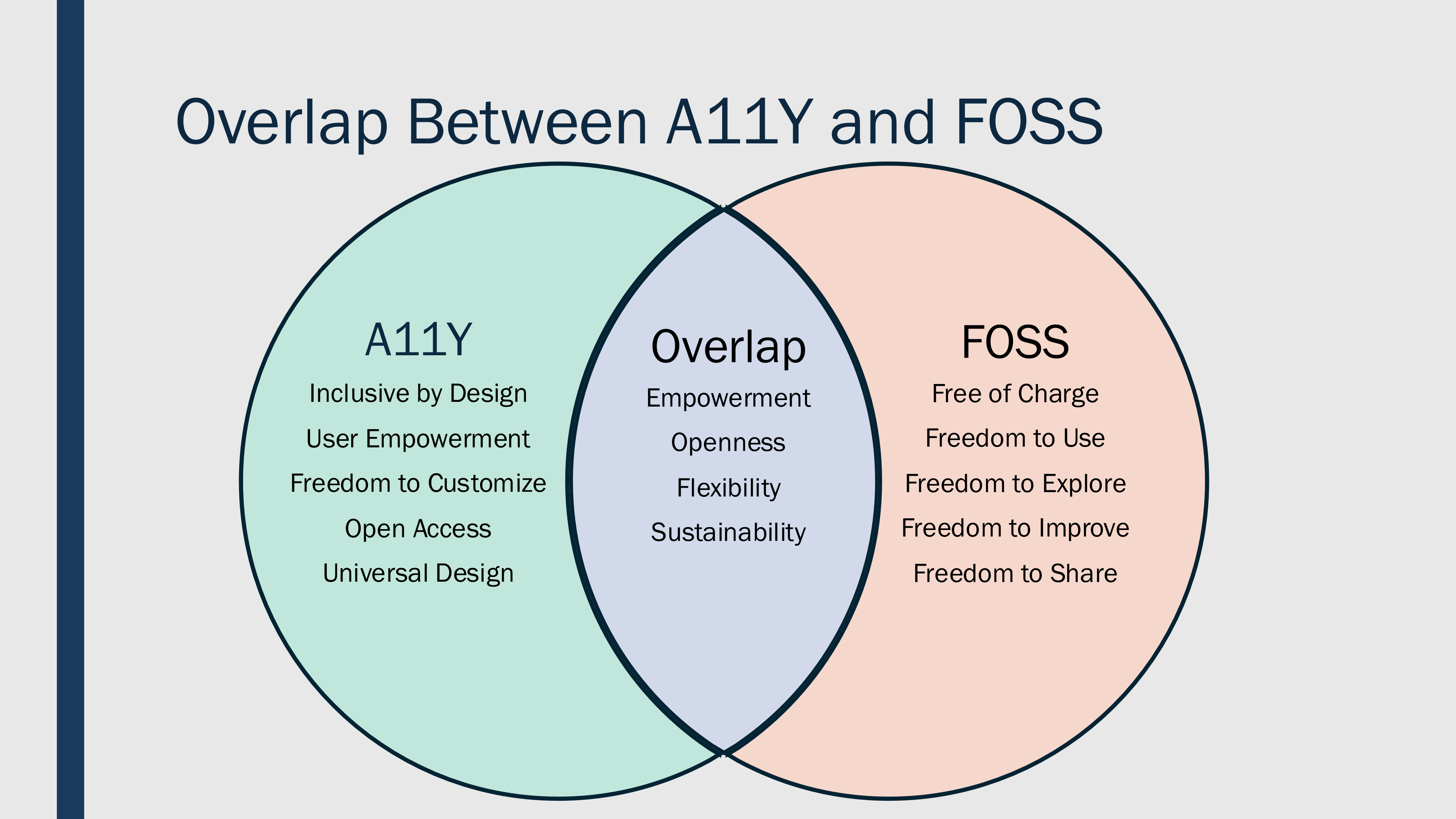

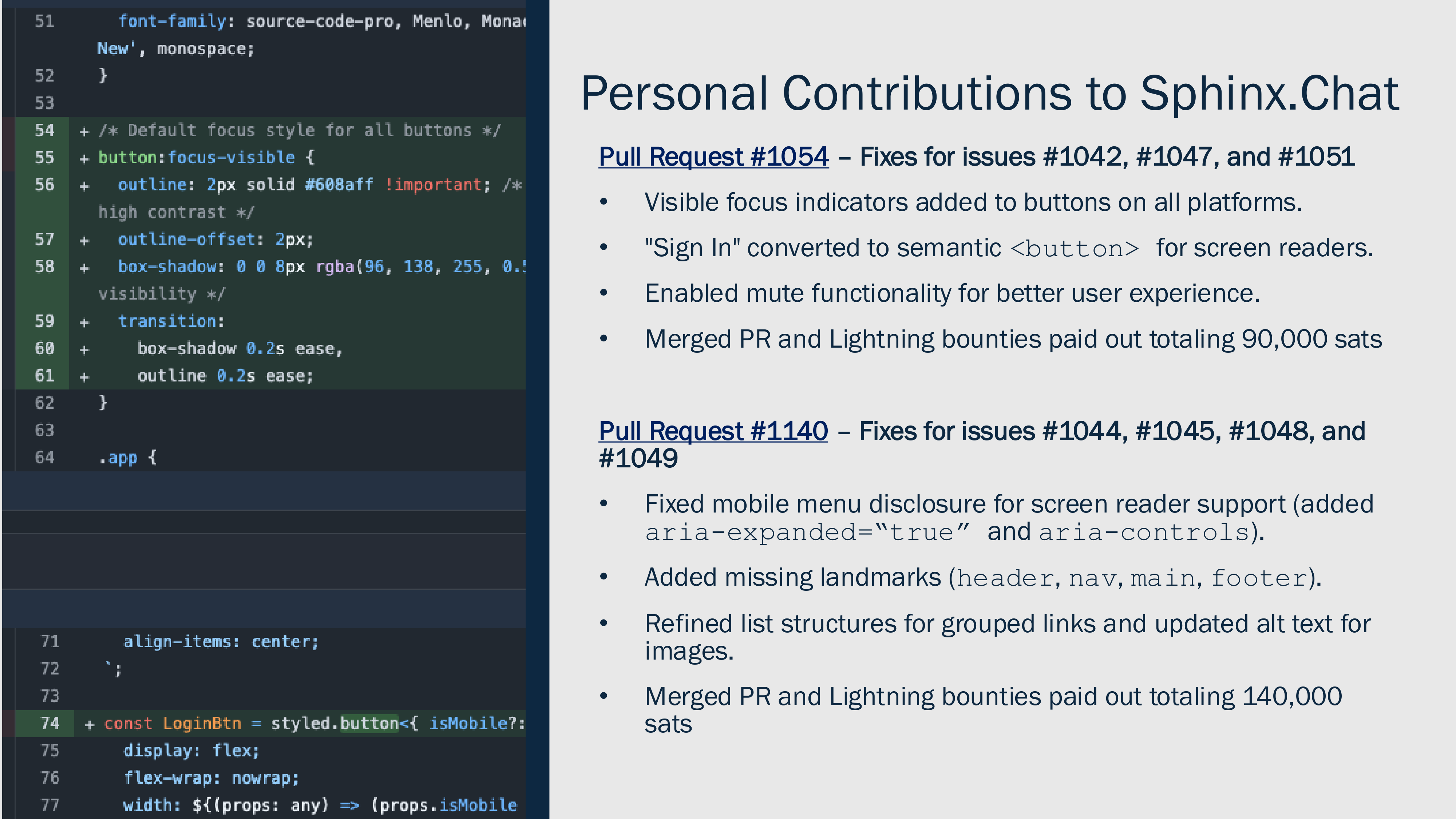

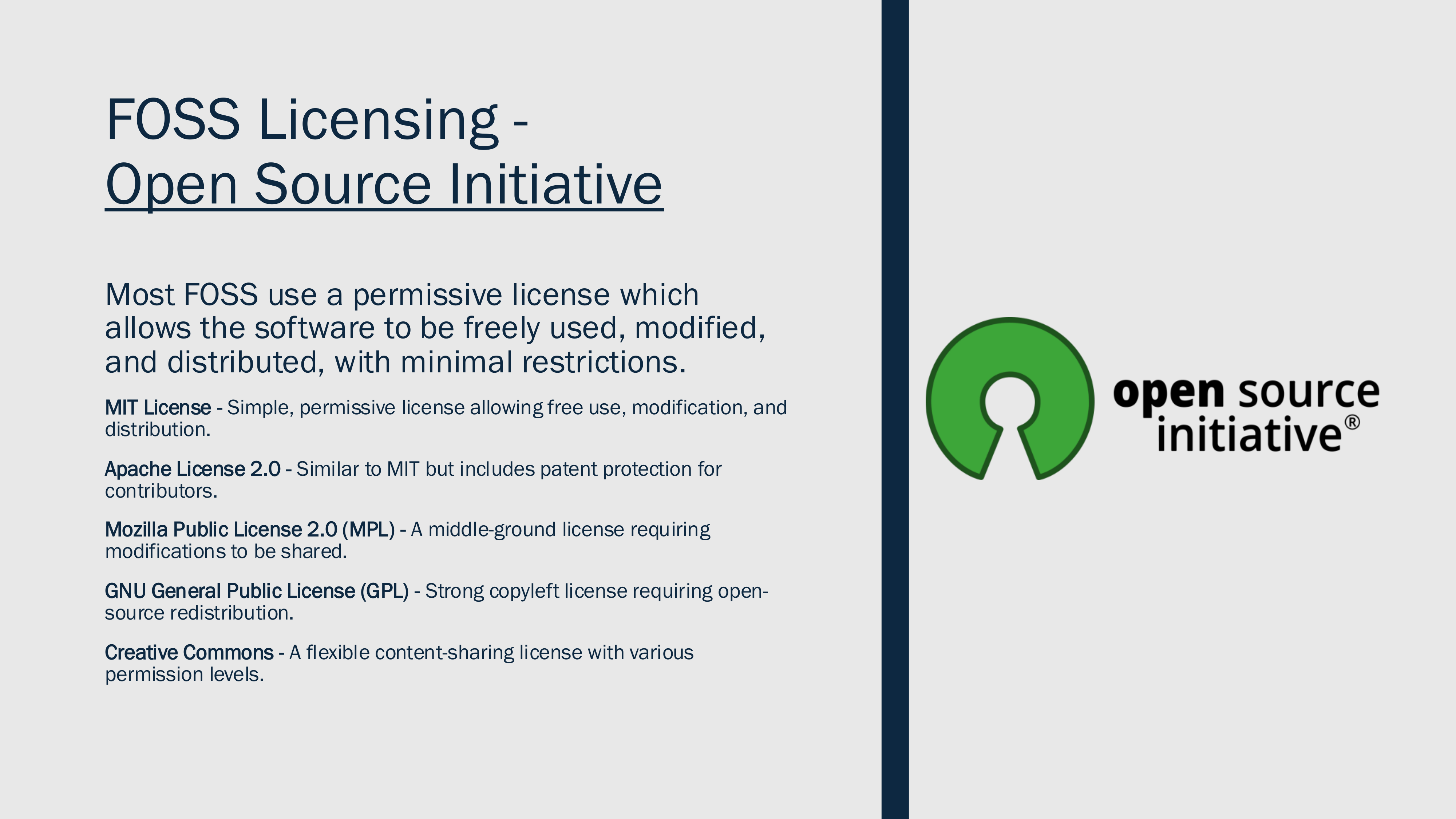

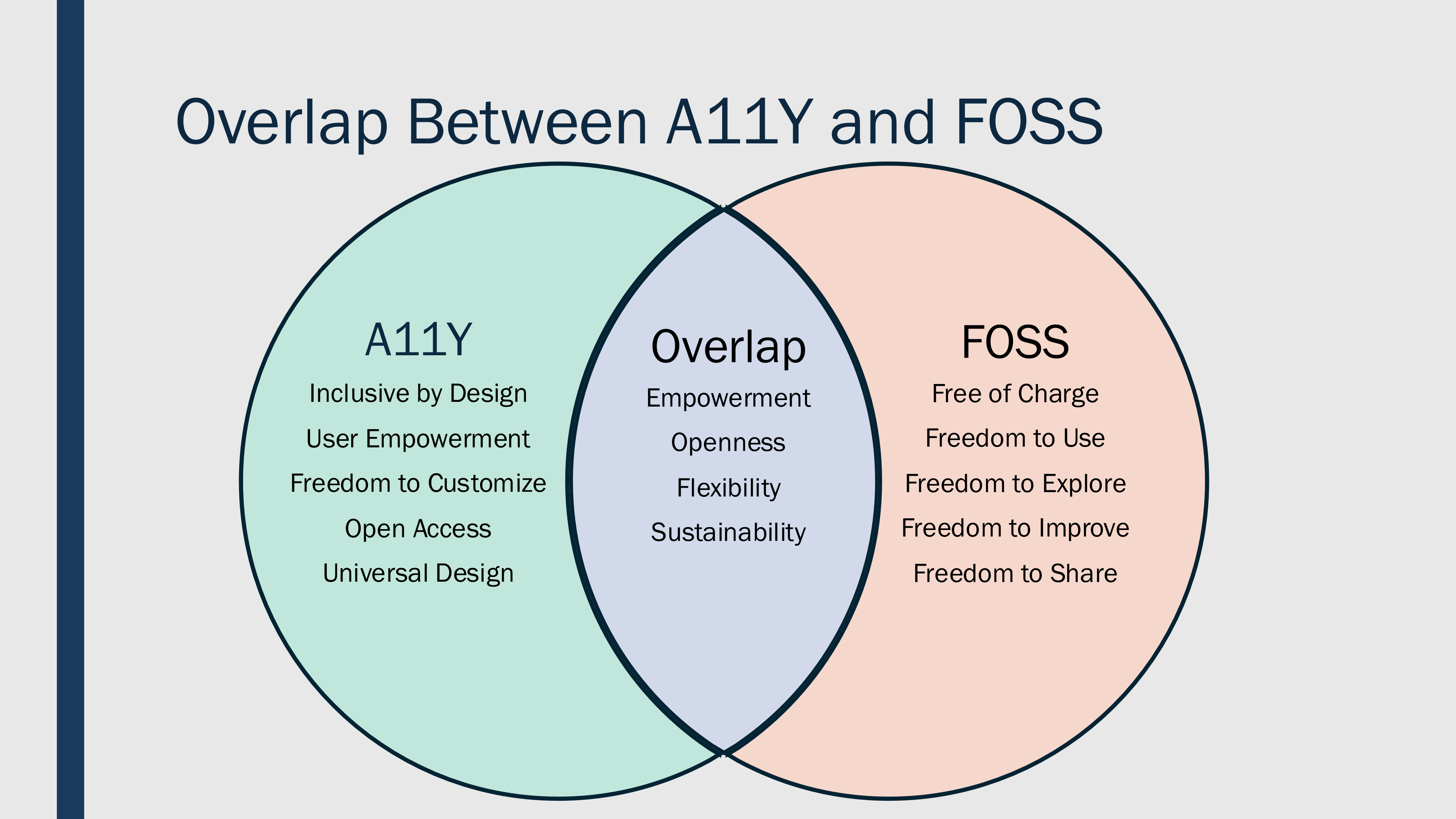

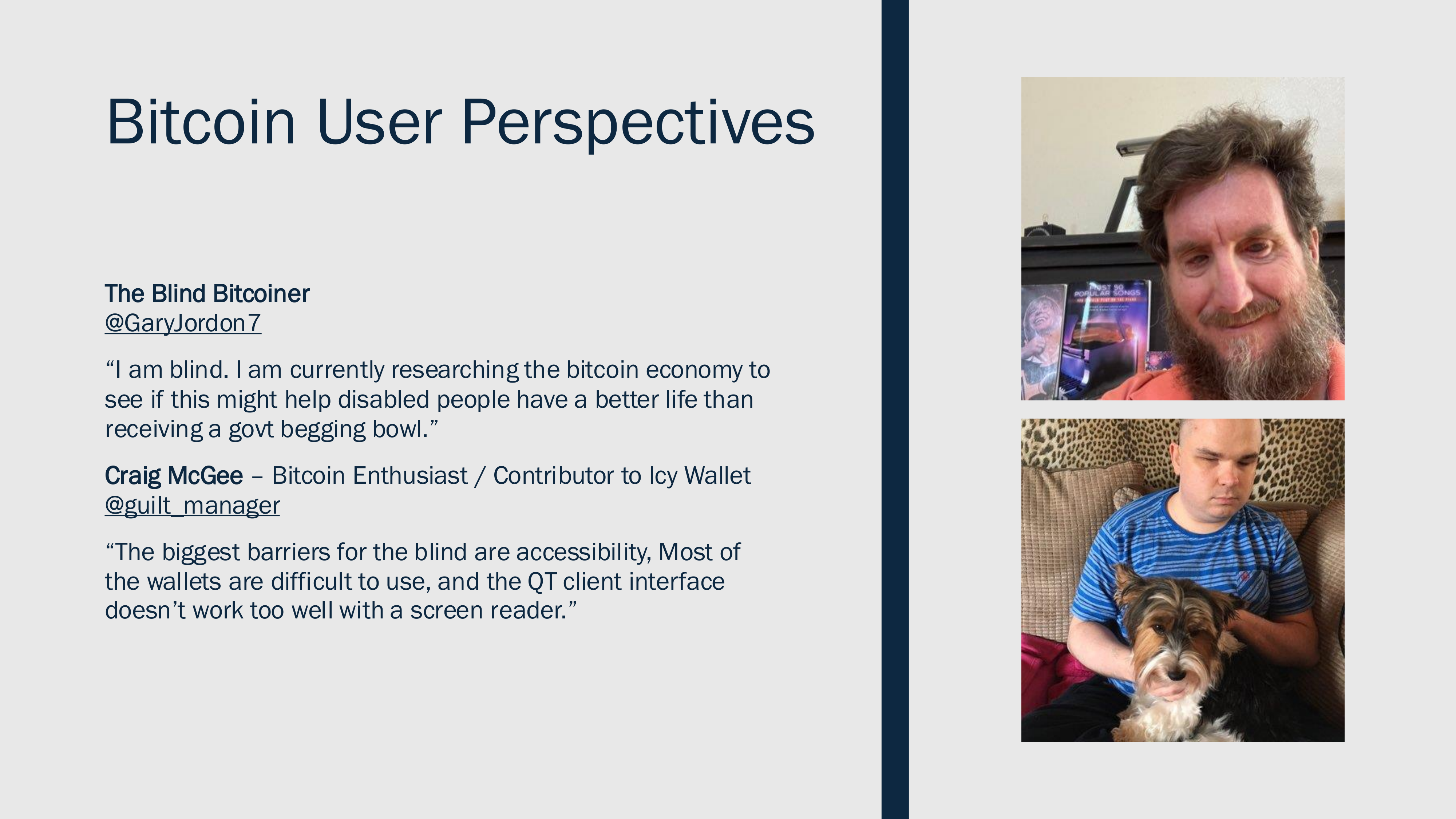

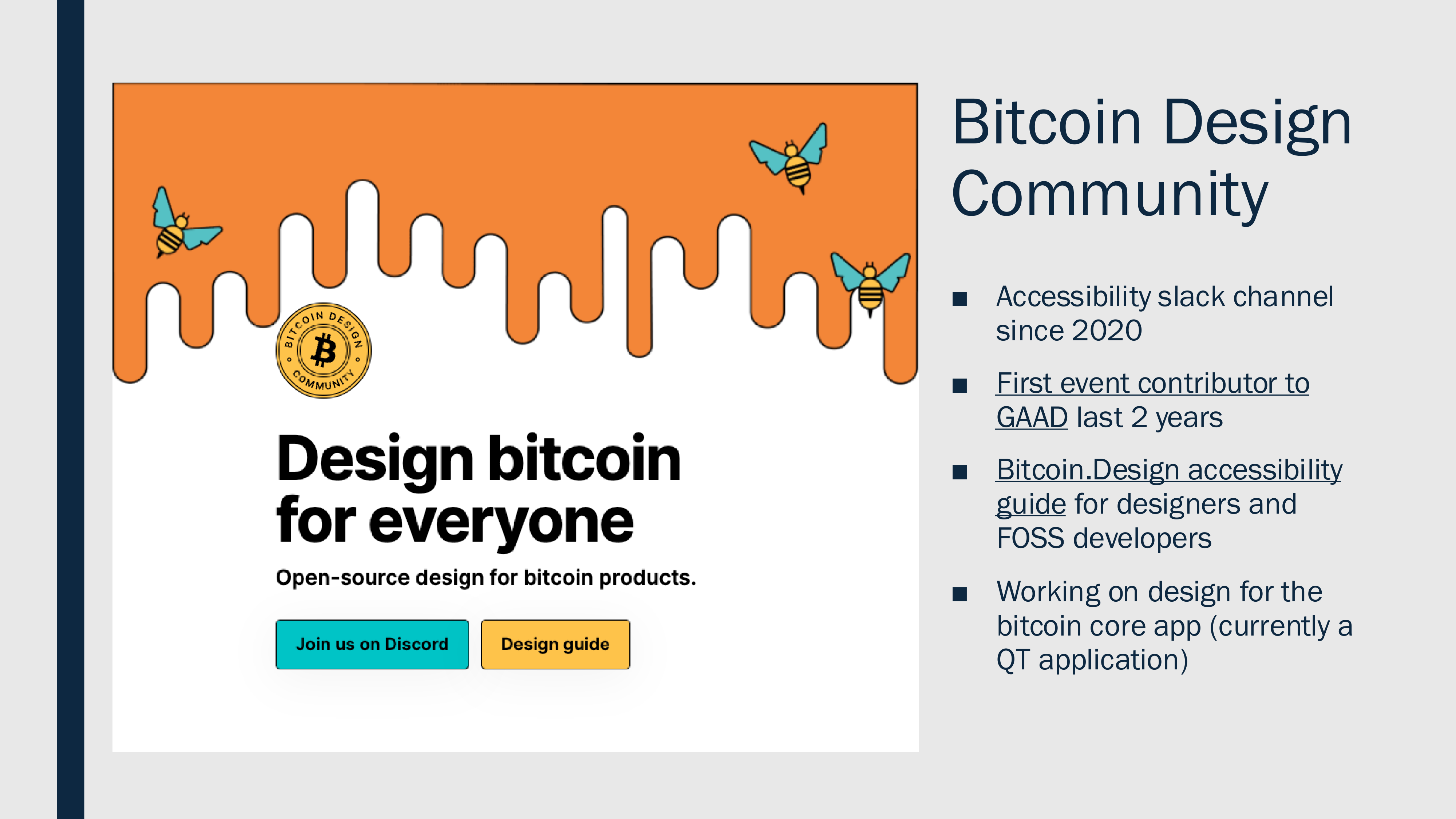

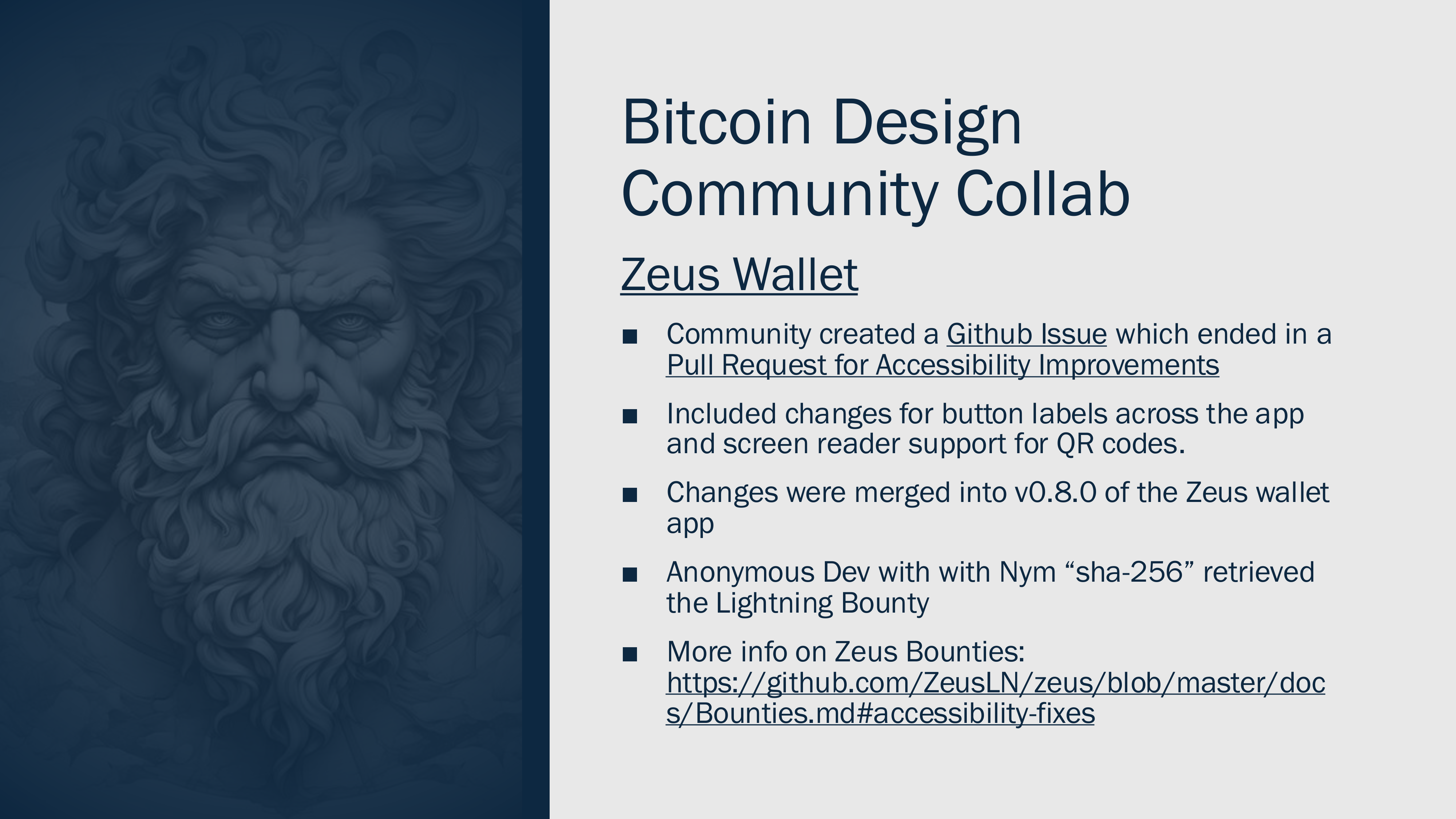

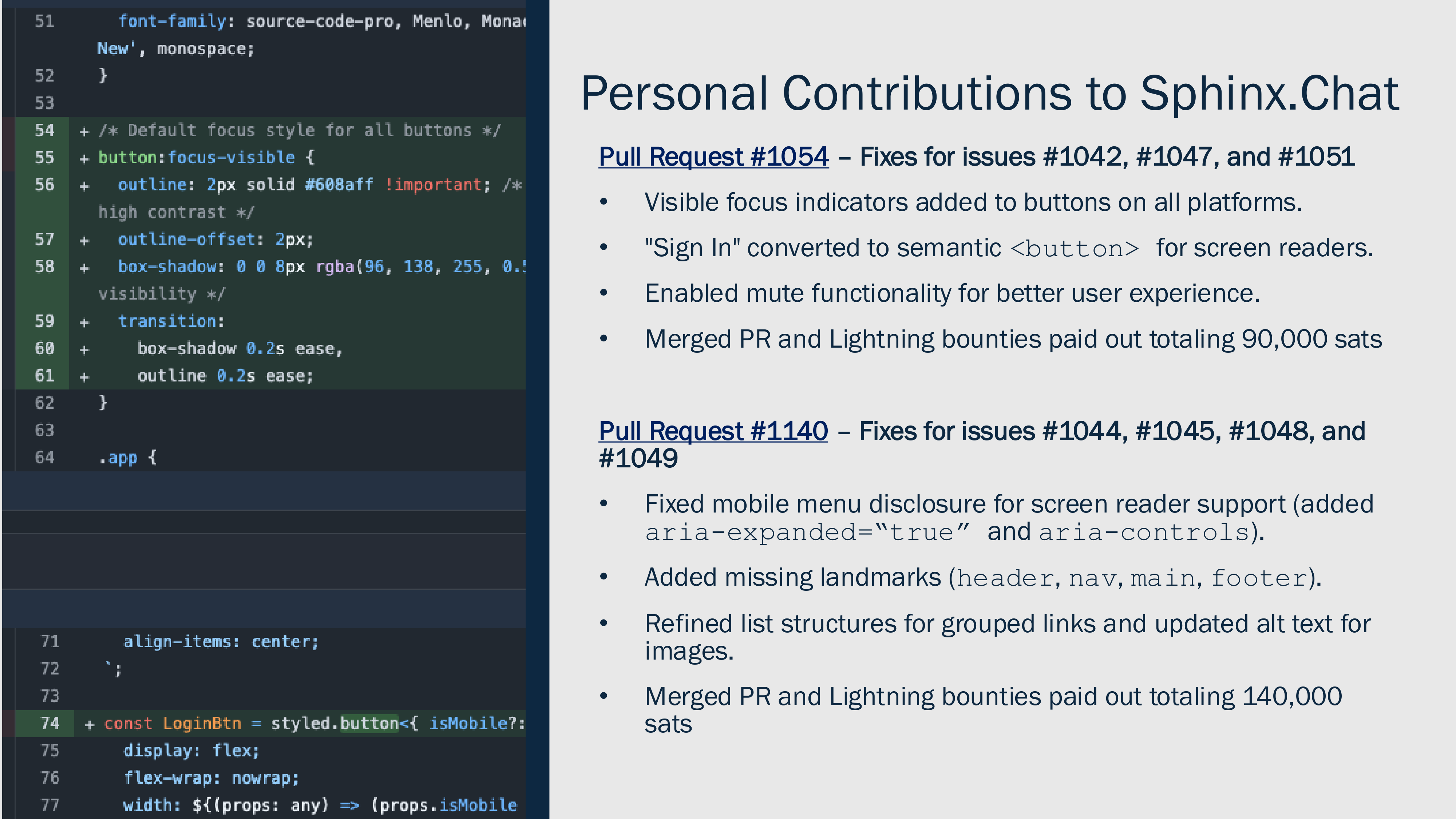

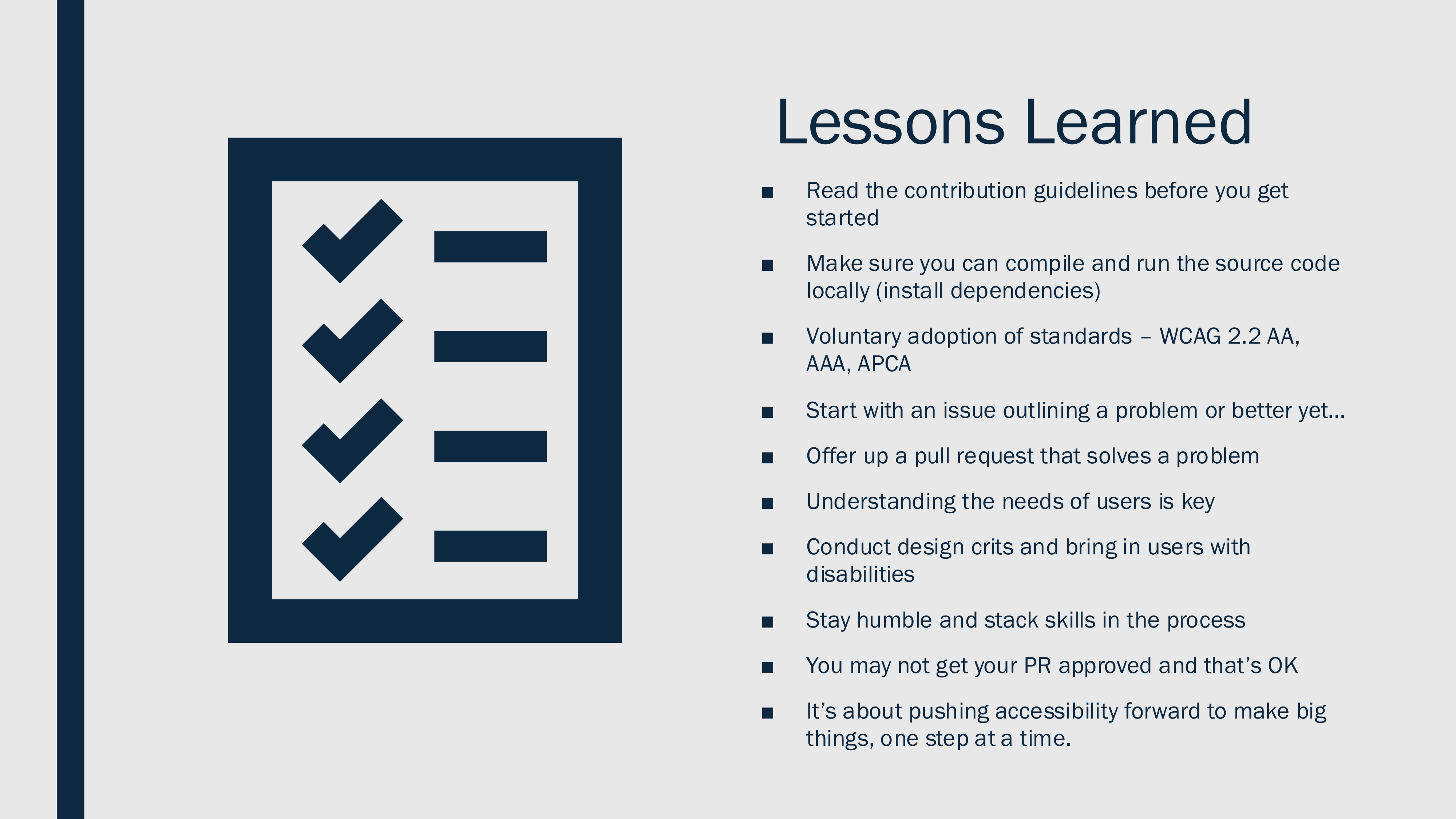

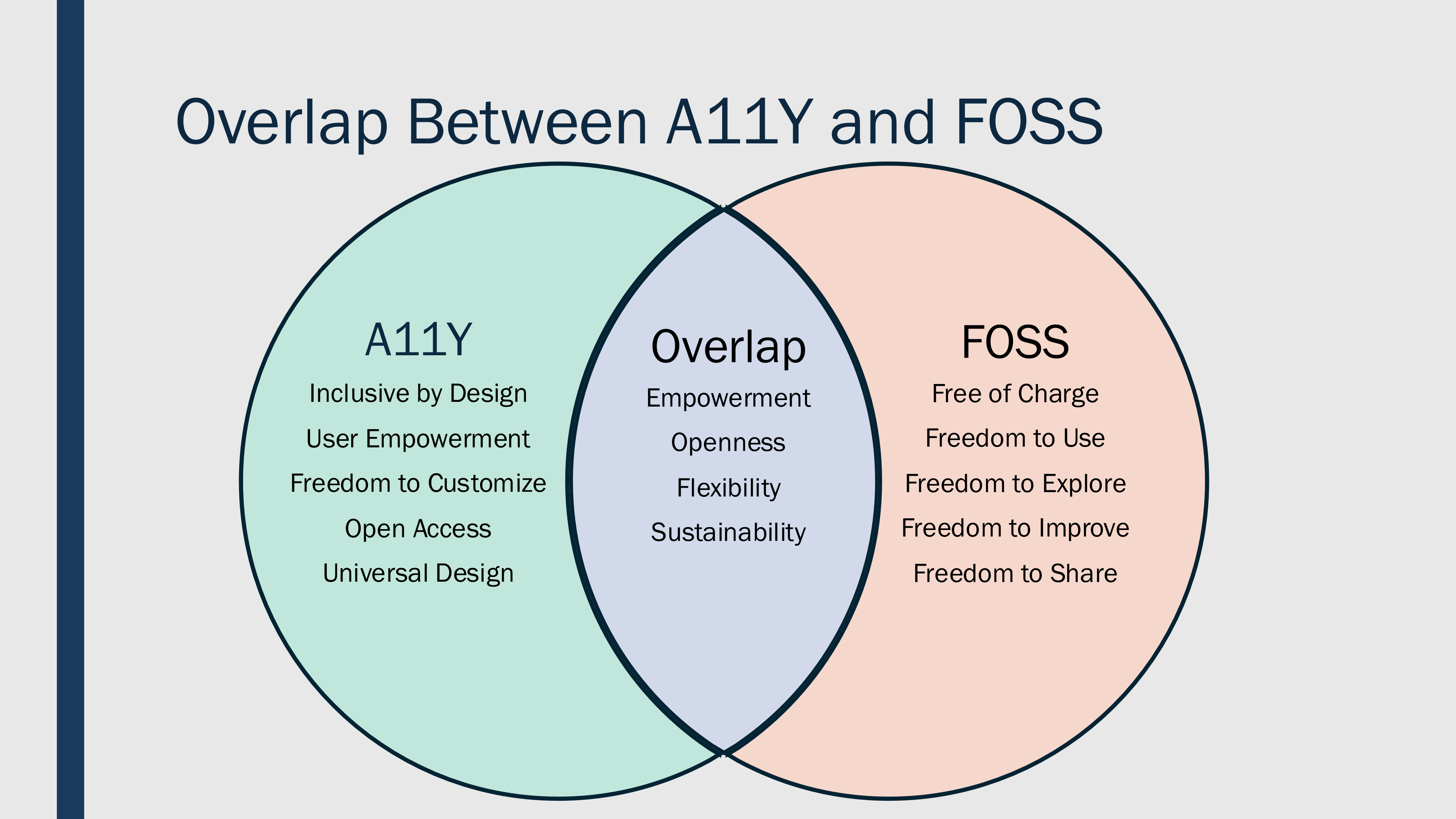

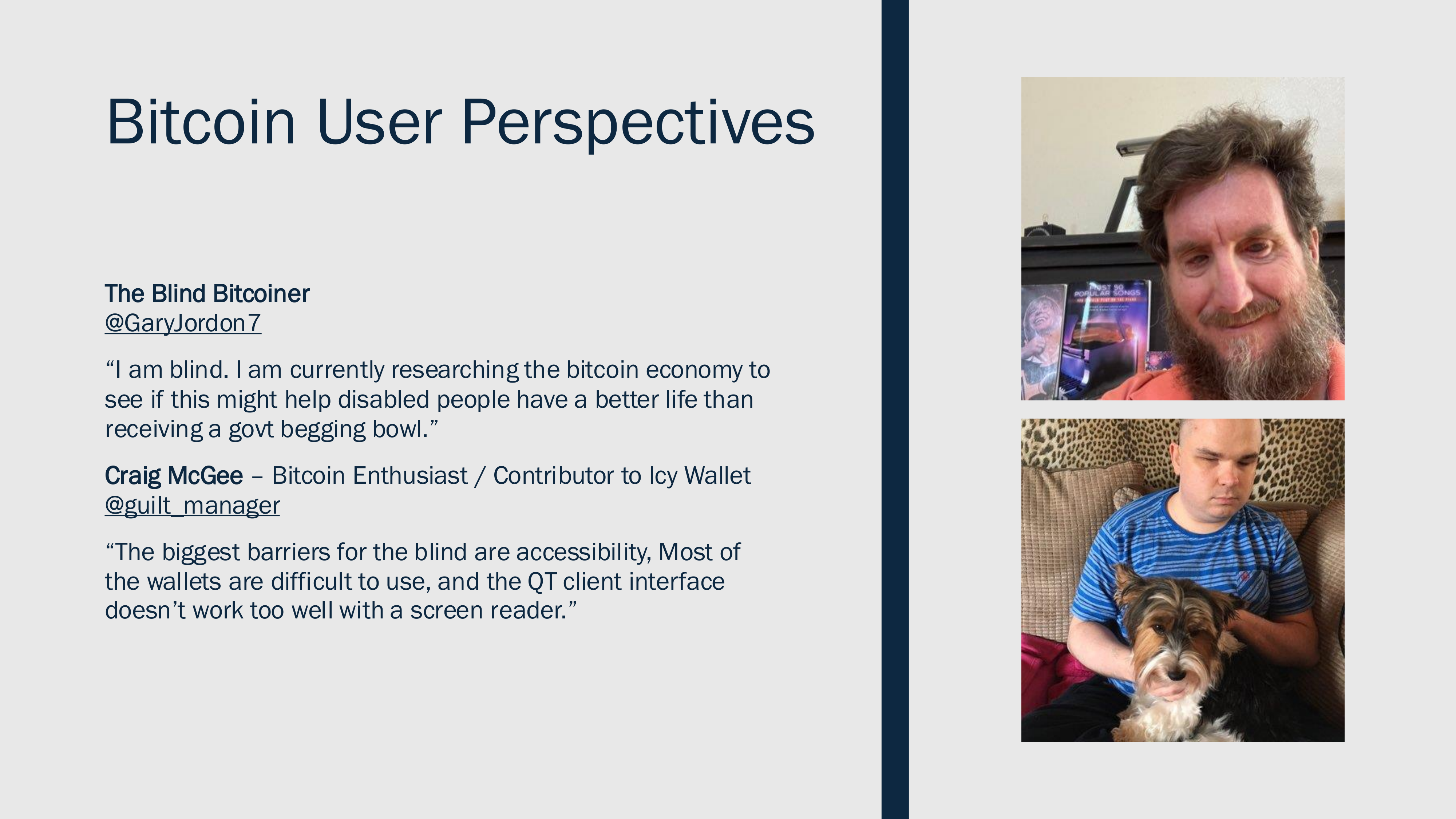

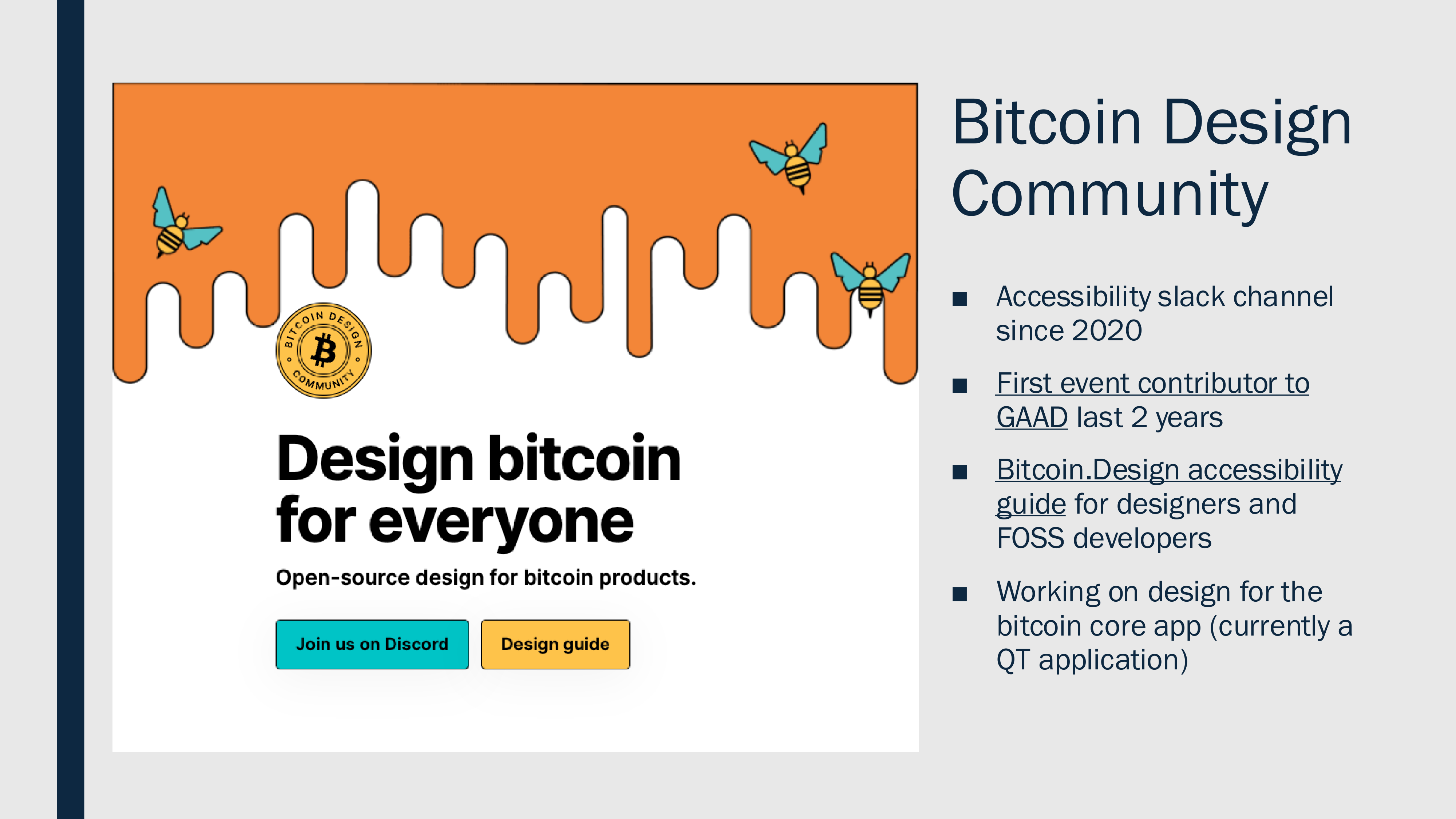

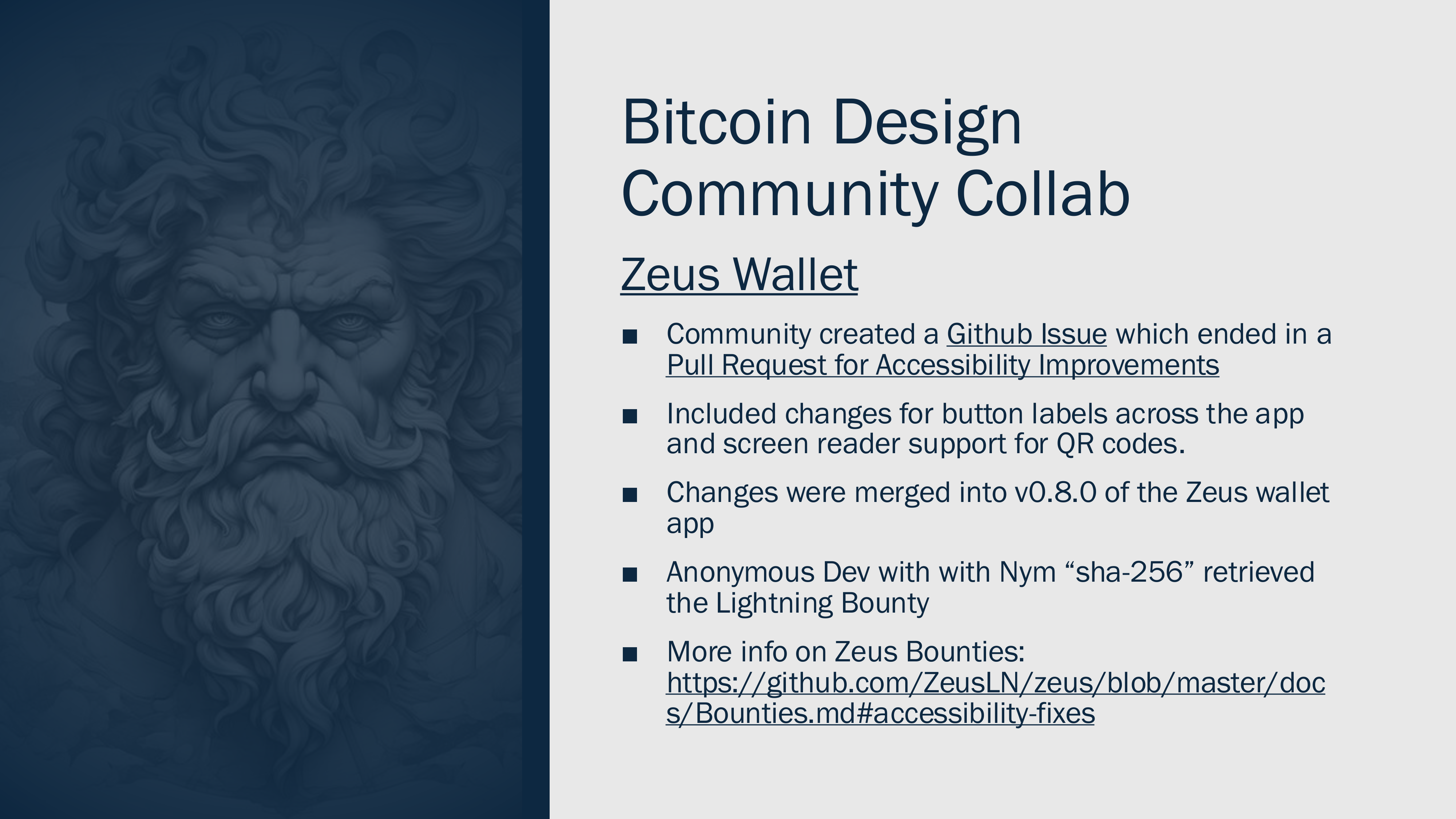

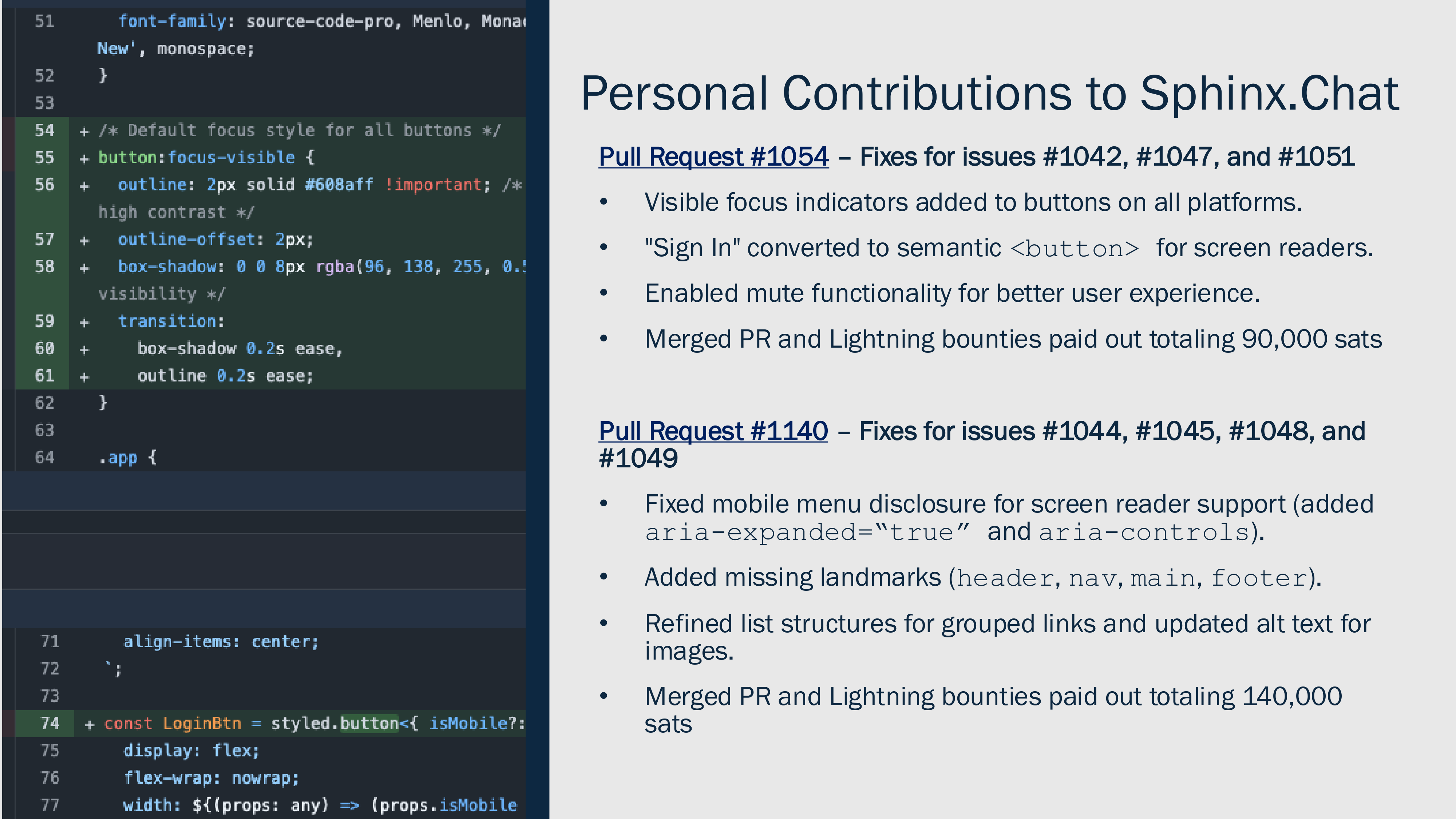

A presentation by @jsonbits Jason Hester for the [40th CSUN](https://web.cvent.com/event/2c5d8c51-6441-44c0-b361-131ff9544dd5/summary) Assistive Technology Conference - `March 10, 2025 – March 14, 2025`

- - -

[Download PDF](https://cdn.discordapp.com/attachments/903125939054059520/1347694223755051039/AC2A-FOSS-A11Y-JasonHester-V9.pdf?ex=67cf648d&is=67ce130d&hm=f61eb30b05783cfee2a37ffdcd5797af688a2fb3b7f01af48caa96c10136a129&)

originally posted at https://stacker.news/items/908947

-

@ 57d1a264:69f1fee1

2025-03-10 09:35:17

Here I am posting a document that presents the Business Model Canvas (BMC) created for “Nasi Goreng Semrawut”, a Micro, Small, and Medium Enterprise (MSME) in Kendal, Central Java, Indonesia. BMC is a strategic management and entrepreneurship tool. It allows us to visualize, assess, and modify business models. It is crucial to understand the core components of a business and how they interact. As a UX researcher, analyzing and understanding the business model is critical to aligning user needs with business goals. This BMC provides the basis for identifying opportunities to improve user experience and drive business growth.

I have broken it down into sections and grouped them carefully and I have clear reasons from a UX perspective why the groupings I have chosen are these points. I explain the UX side more fully on my portfolio website.

For my reflections on this project analyzing the Business Model Canvas of "Nasi Goreng Semrawut" through a UX lens reveals several opportunities for improvement. By focusing on user needs and behaviors, I can enhance the customer experience, streamline operations, and drive business growth. This analysis highlights the importance of integrating UX research into the strategic planning process. By understanding the business model, I can ensure that our UX efforts are aligned with business goals and deliver tangible results.

**My website Portfolio👇**

https://octoporto.framer.website/blog/business-model-canvas-nasi-goreng-semrawut

**Link Project :**

https://www.figma.com/proto/5LZkoc2uSJ1RTaur4cDVCM/Business-Model-Canvas-Sego-Goreng-Semrawut?page-id=0%3A1&node-id=38-117&viewport=-170%2C587%2C0.16&t=8gt9qNV5G267Xq8B-1&scaling=scale-down&content-scaling=fixed&starting-point-node-id=20%3A3

mirorred from [dribbble](https://dribbble.com/shots/25718733-Business-Model-Canvas-Nasi-Goreng-Semrawut)

originally posted at https://stacker.news/items/908920

-

@ 95cb4330:96db706c

2025-03-10 08:42:59

## **Introduction: Why Small Actions Lead to Huge Success**

Most people **underestimate** the power of **small, consistent improvements** over time. They chase **quick wins** and expect success overnight. But the truth is, **the most successful people and businesses in the world rely on the power of compounding effort**—making **small, incremental improvements daily** that scale into **massive long-term results**.

This principle, known as **The Law of Compounding Effort**, is embraced by **Jeff Bezos, Sam Altman, and Peter Thiel**. Instead of looking for instant success, they focus on **building systems, habits, and investments that grow exponentially over time**.

In this article, we’ll break down:

✔ **What the Law of Compounding Effort is and why it works**

✔ **Examples from top entrepreneurs who applied it to build billion-dollar empires**

✔ **How you can use it to improve your own work, habits, and investments**

---

## **What Is the Law of Compounding Effort?**

The **Law of Compounding Effort** is based on a simple but powerful idea:

> **Small, consistent improvements in thinking, decision-making, and execution create exponential results over time.**

Instead of trying to make **huge leaps** all at once, **improving just 1% per day leads to massive growth over months and years**.

Mathematically, it looks like this:

- If you improve **1% every day** for a year → **You’ll be 37x better** than where you started.

- If you get **1% worse every day** → **You’ll lose almost all your progress.**

This is **why daily habits and small decisions matter more than big, one-time actions**.

---

## **Examples of the Law of Compounding Effort in Action**

### **1. Jeff Bezos and Amazon: Reinvesting for Long-Term Growth**

Jeff Bezos didn’t build Amazon into a **trillion-dollar empire** overnight. He **compounded small improvements for decades** by:

- **Reinvesting Amazon’s profits** into better **infrastructure, logistics, and technology**.

- **Focusing on customer obsession**, constantly improving Amazon’s efficiency and convenience.

- **Scaling AWS (Amazon Web Services)** from a side project into the **backbone of the internet**, generating billions in profit.

Bezos was **never focused on short-term profits**—he **compounded effort and reinvested resources into long-term scalability**.

📌 **Lesson:** Instead of chasing **quick money**, **build systems that get better and stronger over time**.

---

### **2. Sam Altman and AI: Betting on the Future**

Sam Altman, CEO of OpenAI, has built his career by **compounding small breakthroughs in artificial intelligence**:

- He **funded AI research when others ignored it**, knowing that **small improvements would snowball**.

- He **scaled OpenAI’s models like GPT-4**, refining them step by step to become **industry-changing technologies**.

- He **invests in AI infrastructure**, believing that today’s progress will lead to **exponential advancements in the future**.

Altman’s entire strategy is **about playing the long game**—knowing that **AI’s compounding improvements will change everything**.

📌 **Lesson:** **The biggest future opportunities come from compounding small improvements today.**

---

### **3. Peter Thiel and Facebook: The Power of Network Effects**

Peter Thiel was **one of the first investors in Facebook**, putting in **$500,000 when few people saw its potential**.

Why? He understood **the compounding nature of network effects**:

- As more users joined Facebook, **its value increased exponentially**.

- More advertisers came, bringing **more revenue and funding more innovation**.

- Facebook **scaled from a small project to a multi-billion-dollar company**.

Thiel’s investment in Facebook was a classic **compounding success**—he **saw the long-term potential, not just the short-term returns**.

📌 **Lesson:** The best investments **grow stronger over time**—look for compounding effects in business, investing, and technology.

---

## **How to Apply the Law of Compounding Effort in Your Own Life**

You don’t need to be a billionaire to apply this principle—**compounding effort works in every area of life**.

### **1. Improve 1% Every Day**

If you **get slightly better every day**, the results **compound into massive progress**.

Ask yourself:

- **What’s one skill I can improve today?**

- **How can I refine my decision-making?**

- **What process can I optimize for long-term growth?**

📌 **Example:** **Investing** → Instead of trying to "get rich quick," **invest consistently, reinvest profits, and let your portfolio compound over years.**

---

### **2. Focus on Scalable Actions**

Not all work compounds. Focus on efforts that **scale and grow over time**, like:

✅ **Building a brand** → Content, reputation, and trust compound.

✅ **Investing in automation** → Systems that work for you 24/7.

✅ **Compounding relationships** → The right connections open exponential opportunities.

📌 **Example:** **Business Growth** → Instead of doing **one-time sales**, build a **repeatable system** that grows without constant effort.

---

### **3. Avoid Negative Compounding**

Just as small positive actions **build up over time**, **bad habits and decisions compound negatively**.

Ask yourself:

- **Am I wasting time on low-value tasks?**

- **Am I making impulsive decisions instead of strategic ones?**

- **Am I neglecting habits that will improve my long-term growth?**

📌 **Example:** **Health & Productivity** → Small unhealthy choices **compound into major problems later**. But **small positive habits compound into a strong body and sharp mind**.

---

## **Final Thoughts: Small Wins, Big Results**

The **Law of Compounding Effort** proves that **success isn’t about big, flashy moves—it’s about consistent, focused progress over time**.

🔹 **Jeff Bezos built Amazon by reinvesting and compounding small efficiencies.**

🔹 **Sam Altman bet on AI, knowing that small breakthroughs would add up.**

🔹 **Peter Thiel invested in Facebook, recognizing its compounding network effects.**

And **you can do the same**.

💡 **Action Step:** **Find one habit, process, or investment you can improve by 1% today. Stick with it, and let it compound over time.**

---

## **Resources to Learn More**

- 📖 [**The Power of Compounding** – Farnam Street](https://fs.blog/compounding/)

- 🎥 [**Jeff Bezos on Long-Term Thinking** – Harvard Business Review](https://hbr.org/)

- 📰 [**Sam Altman on Compounding Success** – Blog](https://blog.samaltman.com/)

🚀 **The best results don’t come from one big move. They come from small, consistent improvements over time.** Start compounding today!

-

@ 95cb4330:96db706c

2025-03-10 08:34:05

## **Introduction: The Power of the Few**

Most people assume that effort and results follow a **linear** relationship—that every action contributes equally to success. However, reality follows a very different pattern: **Power Laws**.

The **Power Law Principle**, championed by thinkers like **Peter Thiel** and **Jeff Bezos**, states that a **small number of key efforts drive the majority of outcomes**. Instead of distributing energy evenly across tasks, investments, or decisions, the **smartest individuals and companies focus on the few areas that truly matter**—the ones that yield **outsized** returns.

In this article, we’ll explore:

✔ **What the Power Law is and why it matters**

✔ **Examples of Power Laws in business and investing**

✔ **How to apply the Power Law Principle in your own work and life**

---

## **What Is the Power Law?**

The **Power Law** is a mathematical relationship where **a small input leads to a disproportionately large output**. It is the foundation of **Pareto’s Principle (the 80/20 rule)**, which states that:

- **80% of results come from 20% of efforts**

- **80% of revenue comes from 20% of customers**

- **80% of profits come from 20% of investments**

But **Power Laws go even further**. In reality, it’s not just 80/20—it’s often **90/10 or even 99/1**.

In **venture capital**, for example, a handful of companies (like Facebook, Google, and Tesla) account for nearly **all** of the industry’s profits. If you had invested in 100 startups, it wouldn’t be the case that 20 of them returned good money—it would be that just **one or two** produced nearly **all the profits**, while the rest failed or broke even.

Power Laws appear **everywhere** in business, investing, technology, and even personal development.

---

## **Examples of the Power Law in Action**

### **1. Venture Capital: Peter Thiel and Facebook**

Peter Thiel, co-founder of PayPal and early investor in Facebook, built his fortune using Power Law thinking.

- In 2004, he invested **$500,000 in Facebook**—a small startup most people ignored.

- That one investment turned into **billions of dollars**, while dozens of other startups he backed failed.

- **One bet made up for every loss**—and much more.

Thiel himself says:

> "We don’t live in a normal world. We live under a **Power Law**."

Venture capitalists **don’t succeed by investing in 100 decent companies**—they succeed by **finding the 1 company that dominates an industry**.

---

### **2. Jeff Bezos and AWS: One Decision That Built a Trillion-Dollar Empire**

Amazon started as an online bookstore, but **one decision made Amazon a tech giant**: **Amazon Web Services (AWS)**.

- In the early 2000s, Jeff Bezos realized that **cloud computing** could be the foundation of the internet.

- He shifted **massive resources** into AWS, even though it had **nothing to do with selling books**.

- AWS **became the backbone of the internet**, powering companies like Netflix, Airbnb, and even government agencies.

- Today, AWS generates **over 60% of Amazon’s total profits**, **funding Amazon’s entire e-commerce business**.

Without **one key decision**, Amazon might still just be an online retailer. But by following the **Power Law**, Bezos **doubled down on what truly mattered**—and that made all the difference.

---

### **3. Sam Altman and AI: Betting on the Future**

Sam Altman, CEO of OpenAI, has **focused his entire career** on **one high-upside opportunity**: **Artificial Intelligence (AI)**.

- Instead of investing in **many different technologies**, he **put all his energy into AI**.

- He **believes AI will reshape every industry**, making it **one of the highest-upside bets in history**.

- OpenAI’s **ChatGPT** is now one of the fastest-growing software products ever, with **100 million+ users** in a matter of months.

Altman’s approach? **Find the area with the biggest possible impact—and go all in.**

---

## **How to Apply the Power Law Principle in Your Life**

Most people **waste time** by treating all tasks equally. But if you want **real success**, you need to **identify and focus on the few things that actually matter**.

### **1. Identify the 20% That Drives 80% of Results**

Ask yourself:

- **What 20% of my efforts produce 80% of my success?**

- **Which investments or decisions have the biggest impact?**

- **What skills, relationships, or habits generate the highest returns?**

---

### **2. Cut the Noise—Eliminate Low-Impact Tasks**

Once you identify the **high-impact areas**, **cut distractions mercilessly**.

- **In investing:** Stop spreading your money across **20 mediocre bets**. Instead, find the **1-2 asymmetric opportunities** that could **change everything**.

- **In business:** Instead of launching **10 different products**, focus on the **one product that dominates your industry**.

- **In personal development:** Instead of learning **random skills**, master **one rare, valuable skill** that **sets you apart**.

---

### **3. Double Down on What Works**

Once you find what works, **go all in**.

- If a stock, business, or skill is **compounding massively**, **allocate more resources** to it.

- If an investment is performing **exponentially better than others**, **increase your stake**.

- If one product or strategy is **dominating the market**, **scale it up aggressively**.

Most people **diversify too much** because they’re afraid of **missing out**. But **true success comes from concentrating on what actually works**.

---

## **Final Thoughts: The Few That Matter**

The **Power Law** is one of the **most important concepts in business, investing, and life**. The majority of success **comes from a small number of actions**—so the key is to:

✅ **Find the few things that truly drive results**

✅ **Eliminate distractions and low-impact efforts**

✅ **Double down on what works and scale it massively**

The difference between **mediocrity and massive success** is simple:

**Most people work hard on everything. The smartest people work hard on the right things.**

Start **thinking in Power Laws**—and you’ll see exponential results. 🚀

---

## **Resources to Learn More**

- 📖 [**Understanding Power Laws** – Farnam Street](https://fs.blog/power-laws/)

- 🎥 [**Peter Thiel on Power Laws in Investing** – NFX](https://www.youtube.com/watch?v=1dWxSZIrKZ0)

- 📰 [**How to Apply Power Laws in Business** – Medium](https://medium.com/@gregoryivers/how-to-use-power-laws-to-your-advantage-3149bd979ef5)

**Action Step:** 🔥 **Look at your current projects, tasks, or investments. What is the 20% that drives 80% of your success? Cut the rest, and focus more on what truly matters.**

Let me know what you think—drop a comment below! 🚀

-

@ b8af284d:f82c91dd

2025-03-10 08:28:07

Liebe Abonnenten,

[800 Milliarden Euro will die EU ausgeben](https://ec.europa.eu/commission/presscorner/detail/sv/statement_25_673), um die Ukraine und den Kontinent in ein “stählernes Stachelschwein” zu verwandeln. Deutschland selbst will künftig Verteidigungsausgaben aus der Schuldenbremse ausnehmen, was nichts anderes als eine unbegrenzte Kreditlinie für das Militär bedeutet. [Hinzu kommt ein “Sondervermögen” in Höhe von 500 Milliarden Euro für Infrastruktur](https://www.tagesschau.de/inland/innenpolitik/sondierungen-finanzen-faq-100.html). Das klingt nach einem Spartopf, den man für schwere Zeiten angelegt hat. Es soll die Tatsache verschleiern, dass es sich dabei um Schulden handelt. Der vermutlich baldige Kanzler Friedrich Merz bricht damit sein Wahlversprechen, die Schuldenbremse einzuhalten. Beschließen soll das Paket noch ein abgewählter Bundestag, da im neuen wohl die Mehrheit fehlt.

Womit also ist zu rechnen, wenn demnächst fast eine Billion frisch gedruckte Euro in Drohnen, Panzer und Raketen investiert werden?

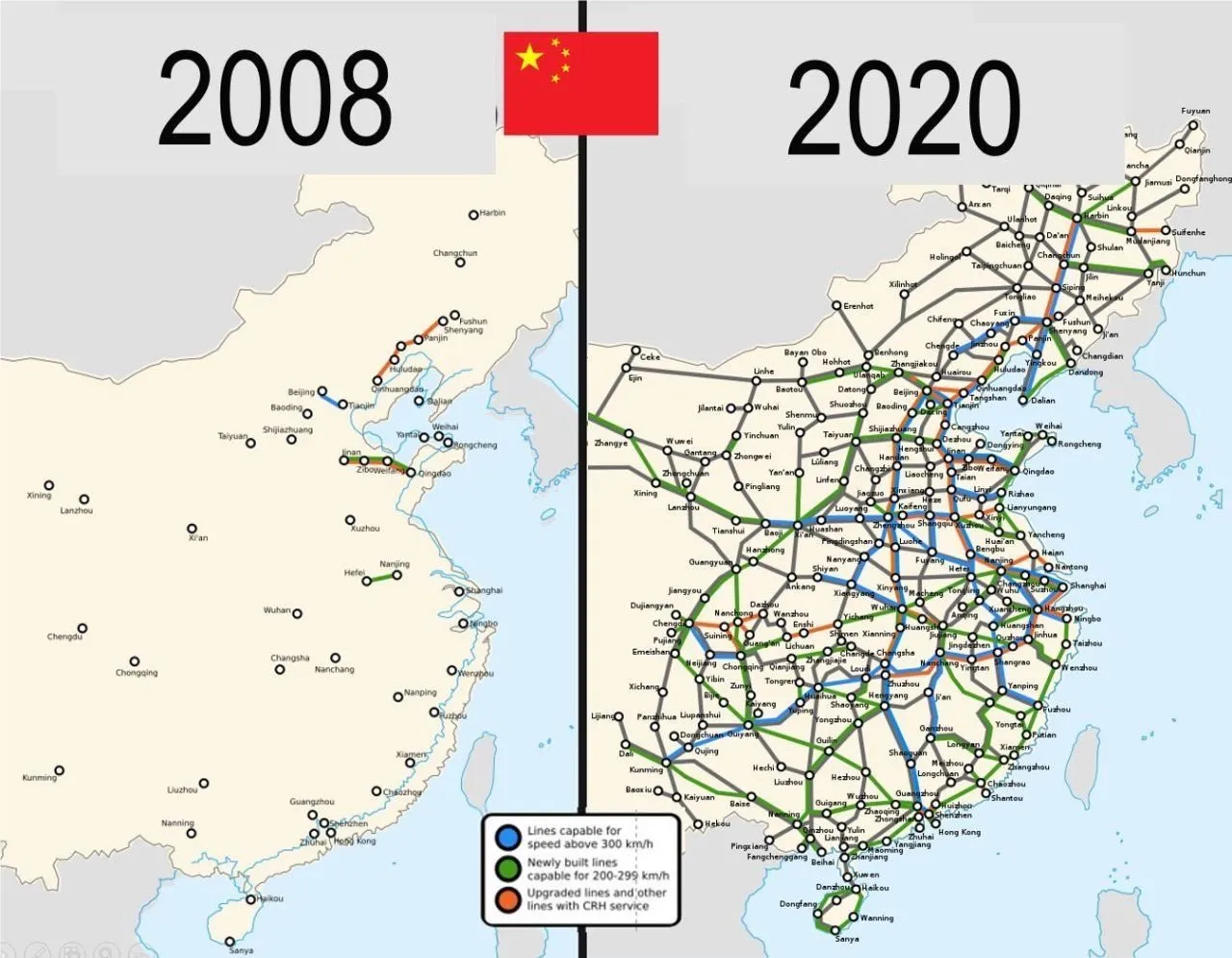

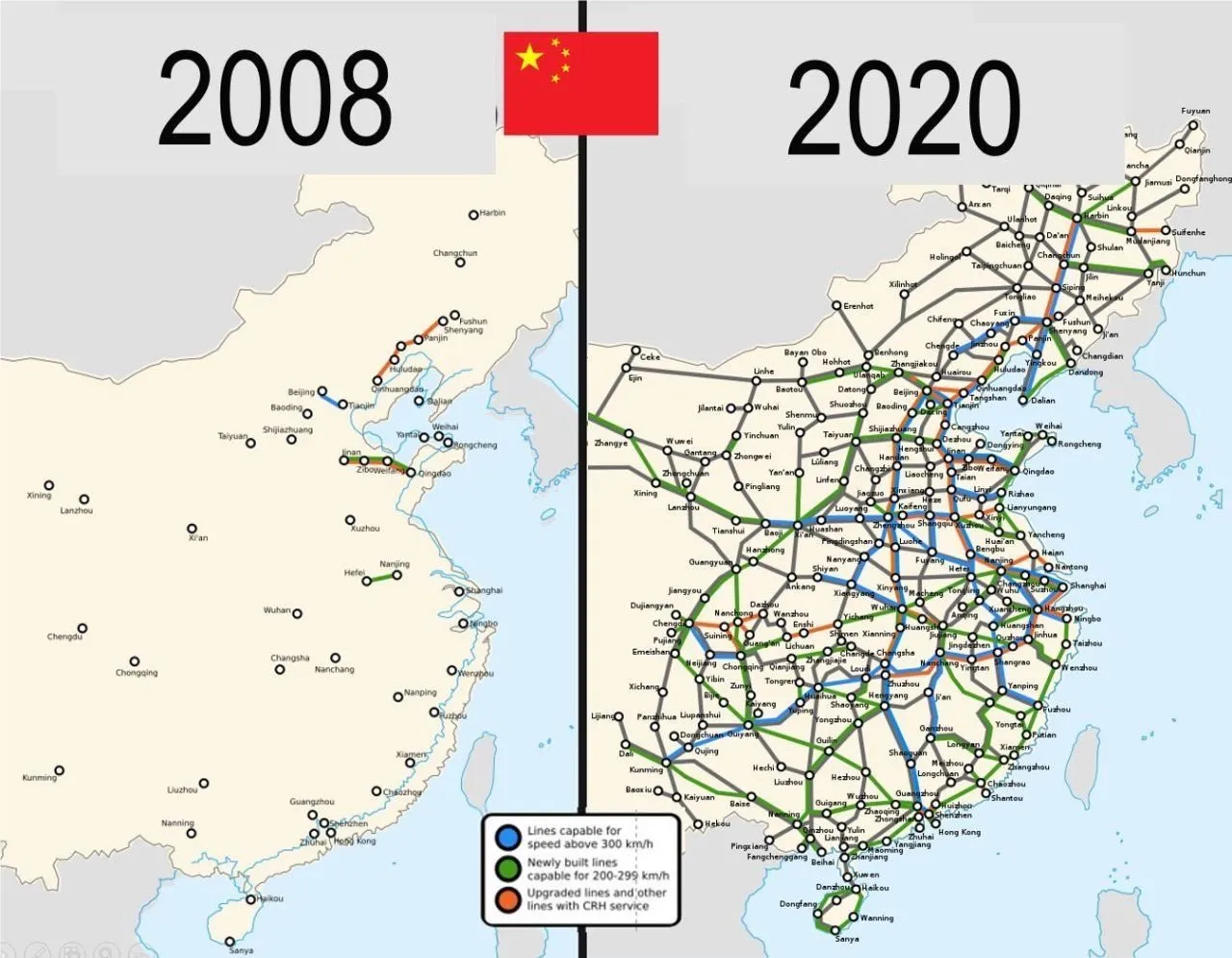

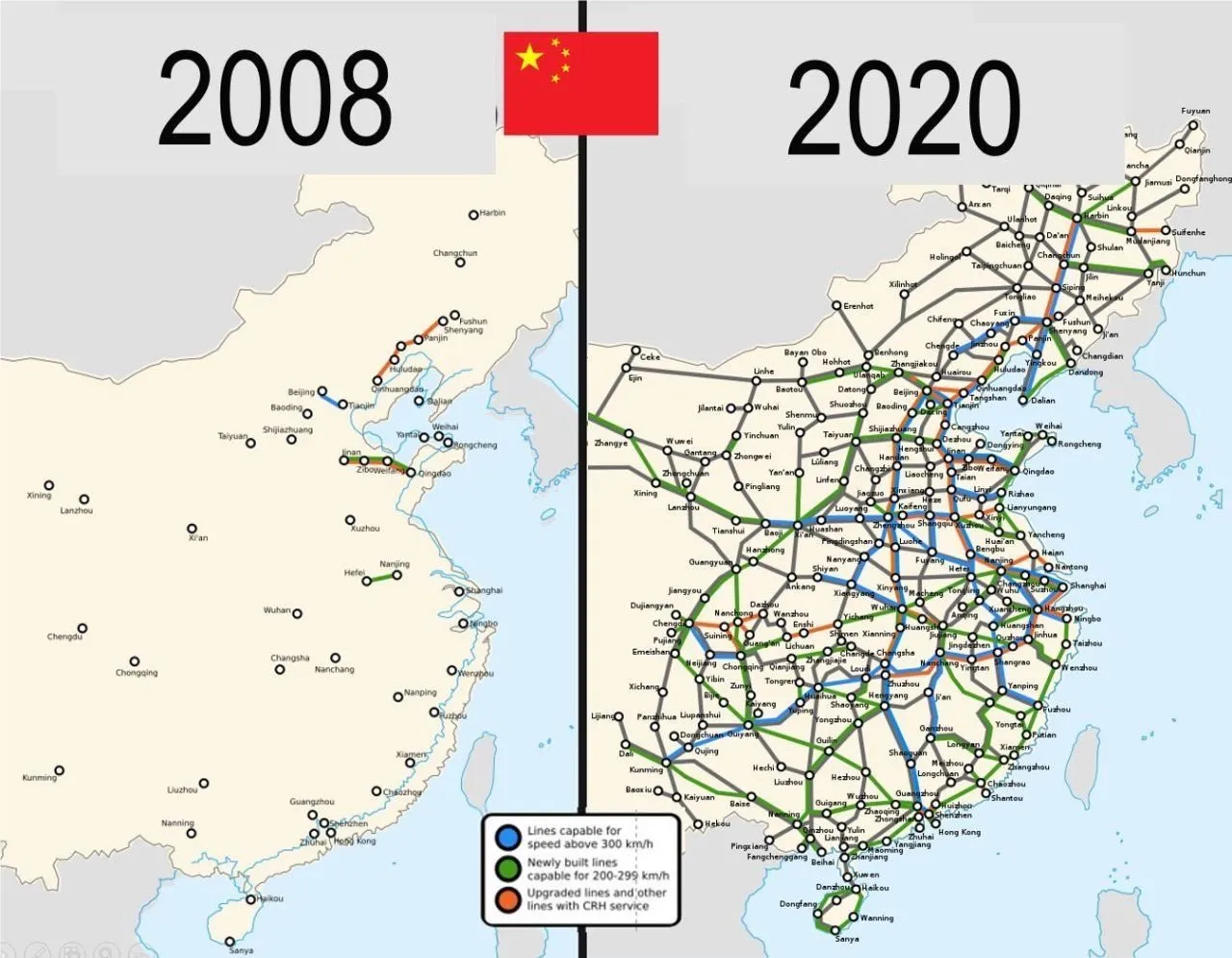

Das beste Beispiel der jüngeren Geschichte ist China: 2009 legte die chinesische Regierung das bisher größte Infrastrukturprojekt der Welt in Höhe von 440 Milliarden Euro auf. Finanziert wurde es durch günstige Kredite, die vor allem an Staatsunternehmen vergeben wurden. Nachdem die Welt nach der in den USA ausgelösten Immobilienkrise 2008 in die Rezession gerutscht war, „rettete“ dieses Paket die globale Konjunktur. China hatte zu diesem Zeitpunkt großen Bedarf an Flughäfen, Straßen und vor allem Zügen. Das Paket war riskant: Schier unbegrenztes Geld, das begrenzten Waren hinterherjagt, führt zu Inflation. Billige Kredite führen meist dazu, dass Unternehmen nicht mehr effizient wirtschaften, und Schuldenberge vor sich her wälzen.

Allerdings wurde das Geld in Produktivität investiert. Denn wenn Menschen und Waren einfacher reisen können, nimmt die Geschäftstätigkeit zu: Arbeitnehmer werden mobiler, Unternehmen konkurrenzfähiger, die Preise sinken. Die Investitionen lohnen sich also, weil sie zu mehr Wirtschaftswachstum führen. Vereinfacht gesagt: Die Schulden können zurückgezahlt werden, und am Ende bleibt noch mehr übrig. In diesem Fall führen Schulden nicht zu Inflation: Durch die gesteigerte Produktivität stehen jetzt sogar mehr Waren der Geldmenge gegenüber.

15 Jahre später kämpft die zweitgrößte Volkswirtschaft zwar noch immer mit den Problemen, die aus diesem Paket resultieren - die Immobilienkrise ist eine indirekte Folge davon. Trotzdem war das Programm ein Erfolg: die Städte, Flughäfen und vor allem Zugstrecken führten zu einer höheren wirtschaftlichen Aktivität oder Produktivität. China ist heute ein wesentlich moderneres Land als vor dem Paket, und verfügt über modernste und größte Netz aus Hochgeschwindigkeitszügen der Welt. Neue Schulden können positiv sein - wenn das Geld produktiv investiert wird.

Auch in Europa lassen sich mit dem Geld-Paket zunächst mehrere Probleme auf einmal lösen: Deutschland ist noch immer ein Industriestandort mit hohen Produktionskapazitäten. Werke der Auto- und Zulieferindustrie können theoretisch zur Waffenproduktion umfunktioniert werden. Immer noch besser als sie stillzulegen oder an die Chinesen zu verkaufen, werden viele Kommentatoren schreiben.

Allein in der deutschen Automobil-Zulieferindustrie sind im vergangenen Jahr über 19000 Arbeitsplätze verloren gegangen. Viele von den Entlassenen können nun Arbeit in der Rüstungsindustrie finden. Oder wie Hans Christoph Atzpodien, [Hauptgeschäftsführer des Bundesverbandes der Deutschen Sicherheits- und Verteidigungsindustrie in der WirtschaftsWoche sagt](https://www.wiwo.de/politik/deutschland/schuldenplaene-ruestungsfirmen-scharf-auf-beschaeftigte-der-autoindustrie/30240510.html):

> *„Das Motto muss lauten: Autos zu Rüstung! Anstatt einen volkswirtschaftlichen Schaden durch den Niedergang der Auto-Konjunktur zu beklagen, sollten wir versuchen, Produktionseinrichtungen und vor allem Fachkräfte aus dem Automobilsektor möglichst verträglich in den Defence-Bereich zu überführen“*

Immerhin: ein großer Teil des Geldes soll auch in Infrastrukturprojekte fließen: Brücken, Bahn, Internetausbau. Deutschland, und damit Europa, wird in den kommenden Monaten also eine große Party feiern, die über die Tatsache hinwegtäuschen wird, dass man einen dummen Krieg verloren hat. In den kommenden Monaten werden sich Verbände und Organisationen um das Geld reißen. Das Geld wird ein auch kollektiv-psychologisches Ventil sein, um das eigene Versagen bei Corona, Klima und Ukraine vergessen zu machen.

Es gibt allerdings einen wesentlichen Unterschied zum chinesischen Stimulus-Paket 2009: Rüstungsgüter sind im Gegensatz zu Zugstrecken totes Kapital. Eine neue Drohne oder Panzer führt nicht zu mehr Produktivität, im Gegenteil: Kommen sie zum Einsatz, zerstören sie Brücken, Häuser, Straßen und töten Menschen. Die Produktivität sinkt also. Im besten Fall kann Militärgerät herumstehen und vor sich hin rosten. Auch dann aber ist es „totes Kapital“, das nichts zur Produktivität beiträgt. Kommt es zum Einsatz, stehen der nun verringerten Warenmenge eine noch größere Geldmenge gegenüber. Die Inflation steigt.

**Schleichende Militarisierung**

Auch gesellschaftlich wird das Paket mit seinem Blanko-Scheck für die Verteidigungsindustrie viel verändern: Es kommt zu einer „Eichung“ der Gesellschaft, eine kollektive Abscheu des gemeinsamen Feindes. Scharfmacher, eigentlich mittelmäßiger Akademiker und Bürokraten, wie Carlo Masala und Claudia Major werden eine noch größere Rolle im öffentlichen Diskurs spielen und die Talkshows dominieren, die von einer immer älter werdenden deutschen Bevölkerung geglotzt werden. Abweichende Meinungen auf Online-Plattformen zensiert, unter dem Vorwand, die Demokratie sei in Gefahr:

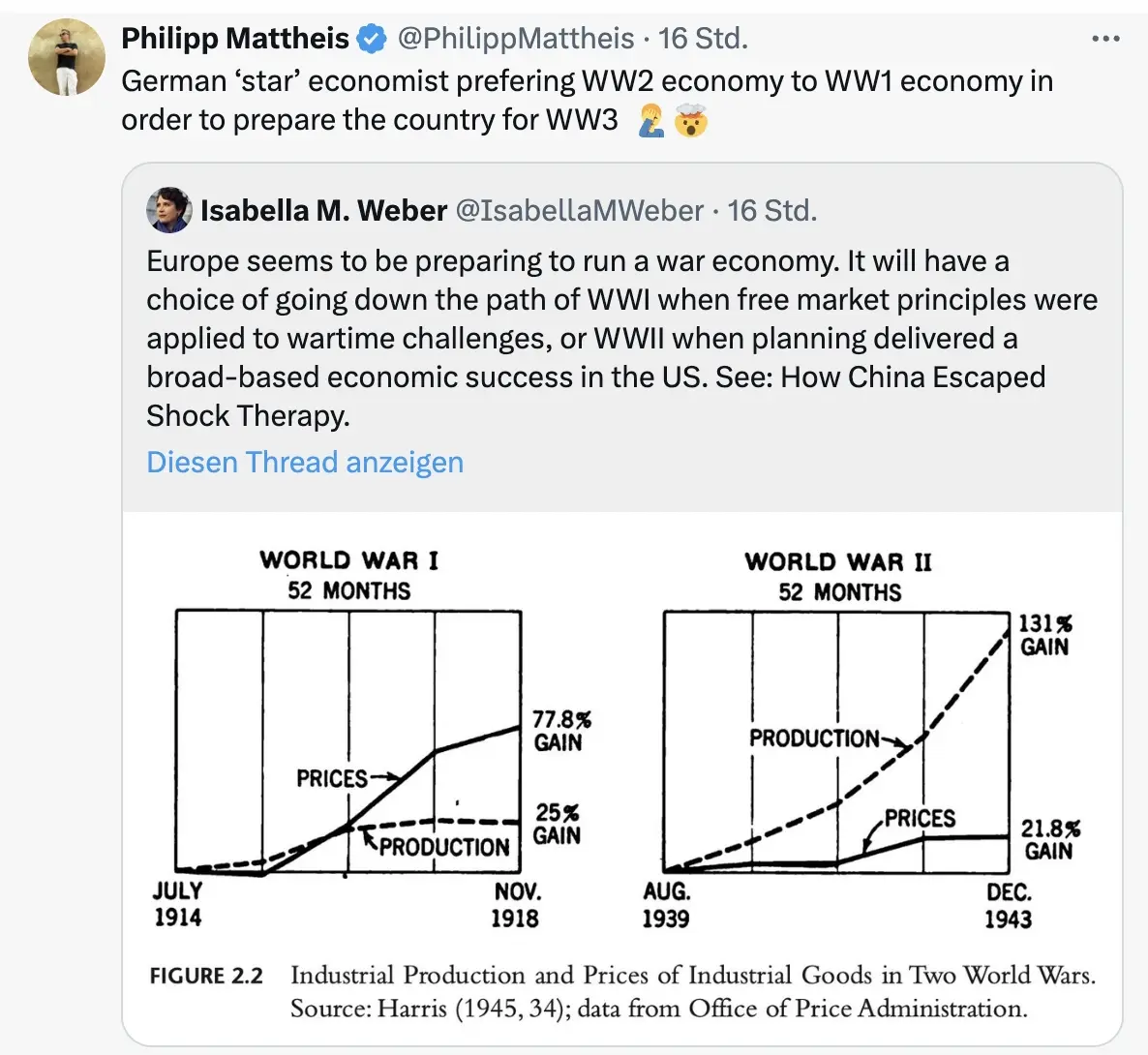

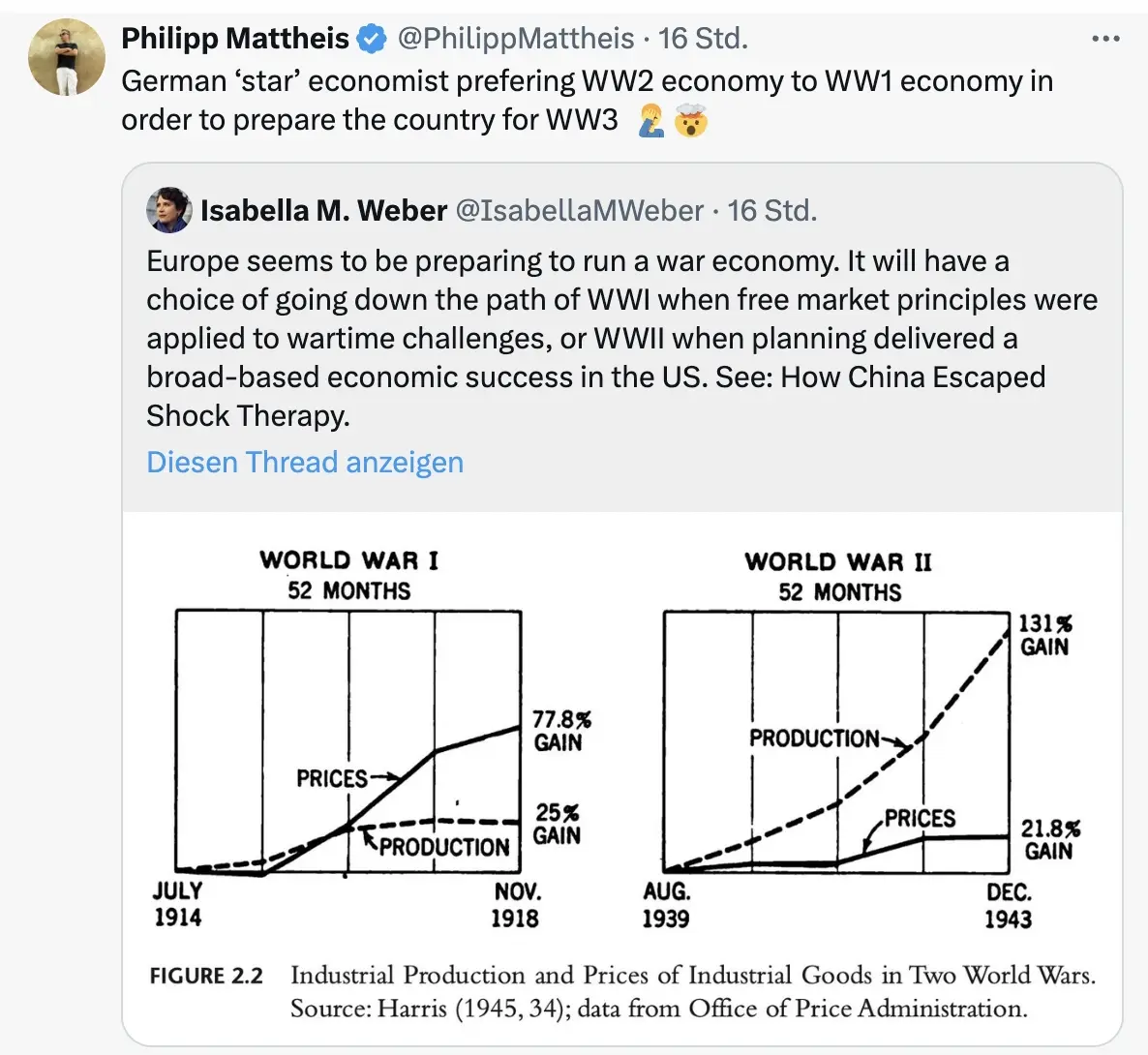

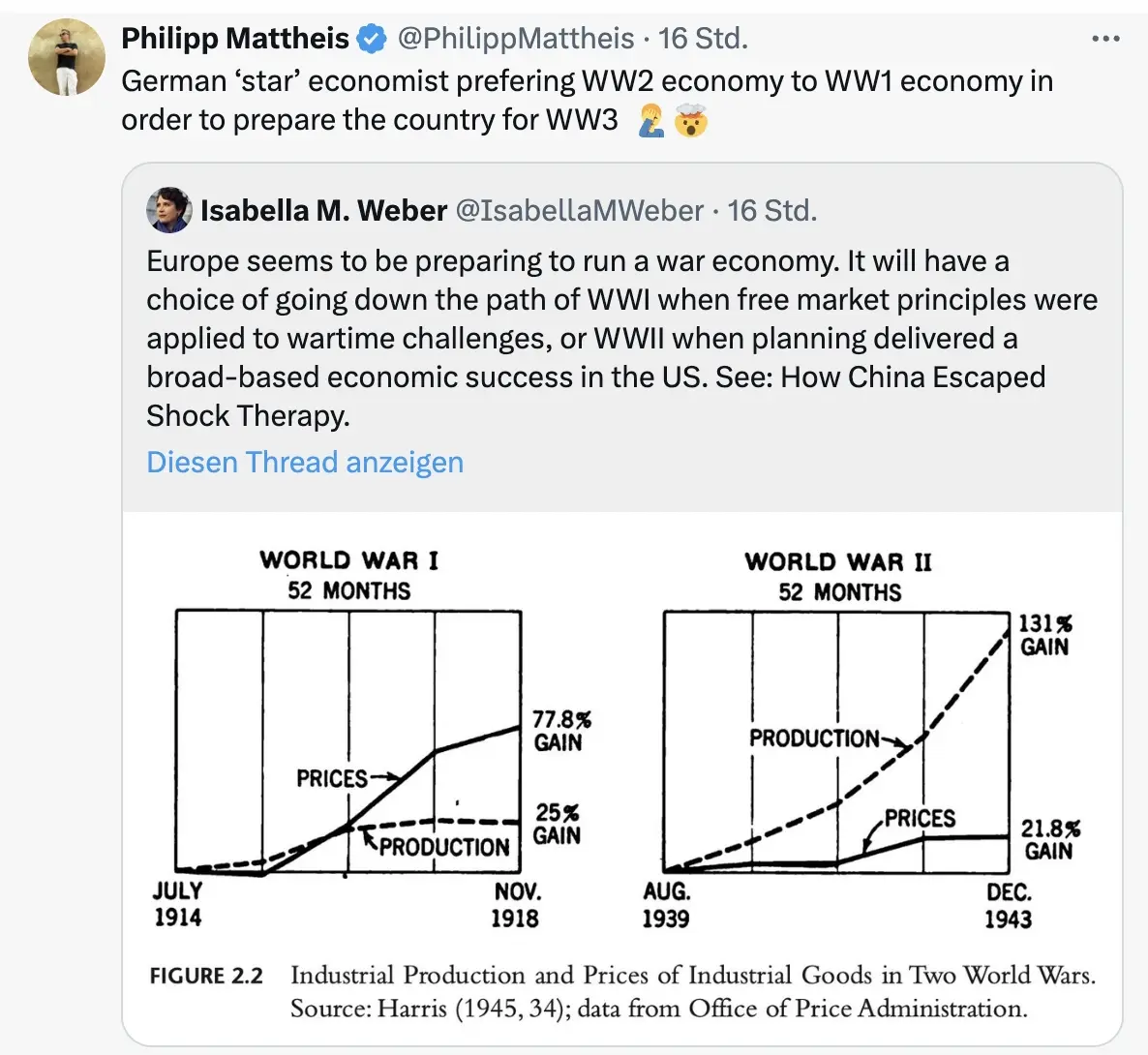

Da die Rüstungsindustrie dann eine wichtigere Rolle für die Gesamtwirtschaft spielt, wird ihr Einfluss auf die Politik in Form von Lobbyisten und Verbänden zunehmen. [Politiker merken schnell, dass sie von der medialen Aufmerksamkeitsökonomie ](https://x.com/RKiesewetter/status/1897588039418851682)nach oben gespült werden, wenn sie immer radikalere Forderungen stellen. So empfahl der ehemalige [Außenminister Joschka Fischer die Woche die Wiedereinführung der Wehrpflicht für Männer und Frauen](https://x.com/PhilippMattheis/status/1896862517688979535). “Star-Ökonomin” Isabella Weber will die Kriegswirtschaft mitplanen:

\

Der Kontinent wird sich langsam wandeln von einem „Friedensprojekt“ zu einem „metallenen Stachelschwein“, ergo Kriegsprojekt, denn ohne dämonisierten Feind funktioniert das Programm nicht. Der Ton wird rauer, autoritärer, und die Meinungsfreiheit weiter eingeschränkt werden. Die seit 2020 eingeführten Werkzeuge zur soften Propaganda („[kognitive Kriegsführung](https://www.youtube.com/watch?v=FCIsI9auGoQ)”) werden verfeinert und ausgebaut werden, sodass weiterhin 80 Prozent der Bevölkerung alle noch so antihumanen Maßnahmen gutheißen werden.

Und dann?

Wie Julian Assange einmal sagte: “[Das Ziel ist kein erfolgreicher Krieg. Das Ziel ist ein endloser Krieg.](https://x.com/wikileaks/status/1551583003490623488)” Der Konflikt muss weitergehen, ewig schwelen oder ein neuer gefunden werden, da sonst ein Teil der Wirtschaftsleistung kollabiert.

Nach ein, zwei oder auch erst drei Jahren, werden erste Probleme sichtbar. Die Party endet, der Kater setzt langsam ein. Die Finanzierung an den Kapitalmärkten wird für Deutschland immer kostspieliger. Der Schuldendienst wird einen größeren Teil des Haushalts einnehmen. Die Bürger müssen dies mitfinanzieren. Der voraussichtlich neue Bundeskanzler Friedrich Merz sprach bereits von der „[Mobilisierung der deutschen Sparguthaben](https://www.mdr.de/nachrichten/deutschland/wirtschaft/merz-enteignung-private-konten-infrastruktur-fakecheck-100.html)“.

\

Was im Ersten Weltkrieg „Kriegsanleihen“ hieß, wird einen schickeren Namen bekommen wie „olivgrüne Bonds“. You name it. Alternativ lässt sich ein Verteidigungs-Soli einführen, oder das [Kindergeld streichen, wie kürzlich Ifo-Chef Clemens Fuest forderte](https://www.wiwo.de/politik/konjunktur/nice-to-have-ifo-chef-fuest-fordert-abschaffung-des-elterngelds/30236948.html).

*Was kann man tun?* *[Auf BlingBling geht es um konkrete Tipps](https://blingbling.substack.com/p/panzer-statt-autos), welche Anlagen von dieser Entwicklung profitieren werden. Außerdem geht es um die “Strategische Bitcoin Reserve”, die am Donnerstag beschlossen wurde.*

@ 7d33ba57:1b82db35

2025-03-10 11:22:03**Roque Nublo & Pico de las Nieves Gran Canaria’s Highest Points**  🏞 **Roque Nublo (1,813m)** One of the island’s most famous landmarks, this volcanic rock formation offers incredible views after a short (1.5 km) hike. It was once a sacred site for the indigenous Guanche people. On clear days, you can see Mount Teide in Tenerife.  ⛰ **Pico de las Nieves (1,949m) – The Highest Point** A short drive from Roque Nublo, this is Gran Canaria’s highest peak. You’ll get 360° views of the island, including Roque Nublo and the deep ravines of the Caldera de Tejeda. Unlike Roque Nublo, you can drive almost to the top.  🌤 **Best Time to Visit:** - Sunrise or sunset for stunning views. - Bring layers—it can be chilly at higher altitudes. 🚗 **Getting There:** - Roque Nublo requires a short hike. - Pico de las Nieves is accessible by car.

@ 7d33ba57:1b82db35

2025-03-10 11:22:03**Roque Nublo & Pico de las Nieves Gran Canaria’s Highest Points**  🏞 **Roque Nublo (1,813m)** One of the island’s most famous landmarks, this volcanic rock formation offers incredible views after a short (1.5 km) hike. It was once a sacred site for the indigenous Guanche people. On clear days, you can see Mount Teide in Tenerife.  ⛰ **Pico de las Nieves (1,949m) – The Highest Point** A short drive from Roque Nublo, this is Gran Canaria’s highest peak. You’ll get 360° views of the island, including Roque Nublo and the deep ravines of the Caldera de Tejeda. Unlike Roque Nublo, you can drive almost to the top.  🌤 **Best Time to Visit:** - Sunrise or sunset for stunning views. - Bring layers—it can be chilly at higher altitudes. 🚗 **Getting There:** - Roque Nublo requires a short hike. - Pico de las Nieves is accessible by car. @ c11cf5f8:4928464d

2025-03-10 10:39:55 Here we are again with our monthly [Magnificent Seven](https://stacker.news/AGORA#the-magnificent-seven---of-all-times), the summary giving you a hit of what you missed in the ~AGORA territory. - - - ### Top-Performing Ads This month, the most engaging ones are: * `01` [eSIM for Spain](https://stacker.news/items/908065/r/AG) by @south_korea_ln * `02` [[OFFER] Small batch handcrafted ground meat jerky (unique flavors)](https://stacker.news/items/906891/r/AG) by @beejay * `03` [[HIRE] Bitcoin & Nostr Development agency, IT outsoucing company](https://stacker.news/items/898547/r/AG) by @a68dd96af9 * `04` [[AUCTION] 🤘Kreator band signed poster, Start at: 21k sats (Prague/CZ) + postal](https://stacker.news/items/886008/r/AG) by @bogo * `05` [[SELL] Your Tombstone, 1k sats](https://stacker.news/items/903776/r/AG) by @jasonb * `06` [[SELL] First Public Printing of the 1787 United States Constitution $49.75/share](https://stacker.news/items/893666/r/AG) by @mo * `07` [Official Patriots Coin - .9999 Fine REAL GOLD - 1 Gr. Bar 17.94K sats](https://stacker.news/items/889970/r/AG) by @watchmancbiz - - - ### Professional Services accepting Bitcoin - https://stacker.news/items/900208/r/AG @unschooled offering Language Tutoring - https://stacker.news/items/813013/r/AG @gpvansat's [OFFER][Graphic Design] From the paste editions (It's important to keep these offers available) - https://stacker.news/items/775383/r/AG @TinstrMedia - Color Grading (Styling) Your Pictures as a Service - https://stacker.news/items/773557/r/AG @MamaHodl, MATHS TUTOR 50K SATS/hour English global - https://stacker.news/items/684163/r/AG @BTCLNAT's OFFER HEALTH COUNSELING [21 SAT/ consultation - https://stacker.news/items/689268/r/AG @mathswithtess [SELL] MATHS TUTOR ONILINE, 90k sats per hour. Global but English only. ###### In case you missed Here some interesting post, opening conversations and free speech about markets and business on the bitcoin circular economy: - https://stacker.news/items/902115/r/AG Just curious - what are the top darknet sites accepting BTC Lightning nowadays? by @kristapsk - https://stacker.news/items/881075/r/AG Can someone produce a cheap linux based 4g phone for me to use in New Zealand? by @Solomonsatoshi - https://stacker.news/items/896651/r/AG 🌰Missing Nut String for todays Saloon Nut 🌰 by @BlokchainB - https://stacker.news/items/899384/r/AG Sales Corner (Is AI the future of sales?) by @Akg10s3 ###### BUYing or SELLing Cowboys Credits? [BUY](https://stacker.news/~AGORA/post?type=discussion&title=[BUY]%20XXX%20Cowboys%20Credits%20for%20YYY%20sats) or [SELL](https://stacker.news/~AGORA/post?type=discussion&title=[SELL]%20XXX%20Cowboys%20Credits%20for%20YYY%20sats) Cowboy Credits for sats on the SN ~AGORA marketplace ###### 🏷️ Spending Sunday Share your most recent Bitcoin purchases of just check what other stackers are buying with their sats! Read more https://stacker.news/items/908074/r/AG - - - ### Create your Ads now!  Looking to start something new? Hit one of the links below to free your mind: * [💬 TOPIC](https://stacker.news/~AGORA/post?type=discussion) for conversation, * [\[⚖️ SELL\]](https://w3.do/b_v2wutP) anything! or, * if you're looking for something, hit the [\[🛒 BUY\]](https://w3.do/zvixtuSh)! * [\[🧑💻 HIRE\]](https://w3.do/_j0kpVsi) any bitcoiner skill or stuff from bitcoiners * [\[🖇 OFFER\]](https://w3.do/EfWF8yDL) any product or service and stack more sats * [\[🧑⚖️ AUCTION\]](https://w3.do/sbbCjZ0e) to let stackers decide a fair price for your item * [\[🤝 SWAP\]](https://w3.do/V_iP4lY5) if you're looking to exchange anything with anything else * [\[🆓 FREE\]](https://w3.do/DdVEE1ME) your space, make a gift! * [\[⭐ REVIEW\]](https://w3.do/CAZ5JxCk) any bitcoin product or LN service you recently bought or subscribed to - - - Or contact @AGORA team on [nostr DM](https://iris.to/agora_sn), and we can help you publish a personalized post. . `#nostr` `#bitcoin` `#stuff4sats` `#sell` `#buy` `#plebchain` `#grownostr` `#asknostr` `#market` `#business` originally posted at https://stacker.news/items/908966

@ c11cf5f8:4928464d

2025-03-10 10:39:55 Here we are again with our monthly [Magnificent Seven](https://stacker.news/AGORA#the-magnificent-seven---of-all-times), the summary giving you a hit of what you missed in the ~AGORA territory. - - - ### Top-Performing Ads This month, the most engaging ones are: * `01` [eSIM for Spain](https://stacker.news/items/908065/r/AG) by @south_korea_ln * `02` [[OFFER] Small batch handcrafted ground meat jerky (unique flavors)](https://stacker.news/items/906891/r/AG) by @beejay * `03` [[HIRE] Bitcoin & Nostr Development agency, IT outsoucing company](https://stacker.news/items/898547/r/AG) by @a68dd96af9 * `04` [[AUCTION] 🤘Kreator band signed poster, Start at: 21k sats (Prague/CZ) + postal](https://stacker.news/items/886008/r/AG) by @bogo * `05` [[SELL] Your Tombstone, 1k sats](https://stacker.news/items/903776/r/AG) by @jasonb * `06` [[SELL] First Public Printing of the 1787 United States Constitution $49.75/share](https://stacker.news/items/893666/r/AG) by @mo * `07` [Official Patriots Coin - .9999 Fine REAL GOLD - 1 Gr. Bar 17.94K sats](https://stacker.news/items/889970/r/AG) by @watchmancbiz - - - ### Professional Services accepting Bitcoin - https://stacker.news/items/900208/r/AG @unschooled offering Language Tutoring - https://stacker.news/items/813013/r/AG @gpvansat's [OFFER][Graphic Design] From the paste editions (It's important to keep these offers available) - https://stacker.news/items/775383/r/AG @TinstrMedia - Color Grading (Styling) Your Pictures as a Service - https://stacker.news/items/773557/r/AG @MamaHodl, MATHS TUTOR 50K SATS/hour English global - https://stacker.news/items/684163/r/AG @BTCLNAT's OFFER HEALTH COUNSELING [21 SAT/ consultation - https://stacker.news/items/689268/r/AG @mathswithtess [SELL] MATHS TUTOR ONILINE, 90k sats per hour. Global but English only. ###### In case you missed Here some interesting post, opening conversations and free speech about markets and business on the bitcoin circular economy: - https://stacker.news/items/902115/r/AG Just curious - what are the top darknet sites accepting BTC Lightning nowadays? by @kristapsk - https://stacker.news/items/881075/r/AG Can someone produce a cheap linux based 4g phone for me to use in New Zealand? by @Solomonsatoshi - https://stacker.news/items/896651/r/AG 🌰Missing Nut String for todays Saloon Nut 🌰 by @BlokchainB - https://stacker.news/items/899384/r/AG Sales Corner (Is AI the future of sales?) by @Akg10s3 ###### BUYing or SELLing Cowboys Credits? [BUY](https://stacker.news/~AGORA/post?type=discussion&title=[BUY]%20XXX%20Cowboys%20Credits%20for%20YYY%20sats) or [SELL](https://stacker.news/~AGORA/post?type=discussion&title=[SELL]%20XXX%20Cowboys%20Credits%20for%20YYY%20sats) Cowboy Credits for sats on the SN ~AGORA marketplace ###### 🏷️ Spending Sunday Share your most recent Bitcoin purchases of just check what other stackers are buying with their sats! Read more https://stacker.news/items/908074/r/AG - - - ### Create your Ads now!  Looking to start something new? Hit one of the links below to free your mind: * [💬 TOPIC](https://stacker.news/~AGORA/post?type=discussion) for conversation, * [\[⚖️ SELL\]](https://w3.do/b_v2wutP) anything! or, * if you're looking for something, hit the [\[🛒 BUY\]](https://w3.do/zvixtuSh)! * [\[🧑💻 HIRE\]](https://w3.do/_j0kpVsi) any bitcoiner skill or stuff from bitcoiners * [\[🖇 OFFER\]](https://w3.do/EfWF8yDL) any product or service and stack more sats * [\[🧑⚖️ AUCTION\]](https://w3.do/sbbCjZ0e) to let stackers decide a fair price for your item * [\[🤝 SWAP\]](https://w3.do/V_iP4lY5) if you're looking to exchange anything with anything else * [\[🆓 FREE\]](https://w3.do/DdVEE1ME) your space, make a gift! * [\[⭐ REVIEW\]](https://w3.do/CAZ5JxCk) any bitcoin product or LN service you recently bought or subscribed to - - - Or contact @AGORA team on [nostr DM](https://iris.to/agora_sn), and we can help you publish a personalized post. . `#nostr` `#bitcoin` `#stuff4sats` `#sell` `#buy` `#plebchain` `#grownostr` `#asknostr` `#market` `#business` originally posted at https://stacker.news/items/908966 @ 57d1a264:69f1fee1

2025-03-10 10:04:32A presentation by @jsonbits Jason Hester for the [40th CSUN](https://web.cvent.com/event/2c5d8c51-6441-44c0-b361-131ff9544dd5/summary) Assistive Technology Conference - `March 10, 2025 – March 14, 2025`                                                            - - - [Download PDF](https://cdn.discordapp.com/attachments/903125939054059520/1347694223755051039/AC2A-FOSS-A11Y-JasonHester-V9.pdf?ex=67cf648d&is=67ce130d&hm=f61eb30b05783cfee2a37ffdcd5797af688a2fb3b7f01af48caa96c10136a129&) originally posted at https://stacker.news/items/908947

@ 57d1a264:69f1fee1

2025-03-10 10:04:32A presentation by @jsonbits Jason Hester for the [40th CSUN](https://web.cvent.com/event/2c5d8c51-6441-44c0-b361-131ff9544dd5/summary) Assistive Technology Conference - `March 10, 2025 – March 14, 2025`                                                            - - - [Download PDF](https://cdn.discordapp.com/attachments/903125939054059520/1347694223755051039/AC2A-FOSS-A11Y-JasonHester-V9.pdf?ex=67cf648d&is=67ce130d&hm=f61eb30b05783cfee2a37ffdcd5797af688a2fb3b7f01af48caa96c10136a129&) originally posted at https://stacker.news/items/908947 @ 57d1a264:69f1fee1

2025-03-10 09:35:17 Here I am posting a document that presents the Business Model Canvas (BMC) created for “Nasi Goreng Semrawut”, a Micro, Small, and Medium Enterprise (MSME) in Kendal, Central Java, Indonesia. BMC is a strategic management and entrepreneurship tool. It allows us to visualize, assess, and modify business models. It is crucial to understand the core components of a business and how they interact. As a UX researcher, analyzing and understanding the business model is critical to aligning user needs with business goals. This BMC provides the basis for identifying opportunities to improve user experience and drive business growth. I have broken it down into sections and grouped them carefully and I have clear reasons from a UX perspective why the groupings I have chosen are these points. I explain the UX side more fully on my portfolio website. For my reflections on this project analyzing the Business Model Canvas of "Nasi Goreng Semrawut" through a UX lens reveals several opportunities for improvement. By focusing on user needs and behaviors, I can enhance the customer experience, streamline operations, and drive business growth. This analysis highlights the importance of integrating UX research into the strategic planning process. By understanding the business model, I can ensure that our UX efforts are aligned with business goals and deliver tangible results. **My website Portfolio👇** https://octoporto.framer.website/blog/business-model-canvas-nasi-goreng-semrawut **Link Project :** https://www.figma.com/proto/5LZkoc2uSJ1RTaur4cDVCM/Business-Model-Canvas-Sego-Goreng-Semrawut?page-id=0%3A1&node-id=38-117&viewport=-170%2C587%2C0.16&t=8gt9qNV5G267Xq8B-1&scaling=scale-down&content-scaling=fixed&starting-point-node-id=20%3A3 mirorred from [dribbble](https://dribbble.com/shots/25718733-Business-Model-Canvas-Nasi-Goreng-Semrawut) originally posted at https://stacker.news/items/908920

@ 57d1a264:69f1fee1

2025-03-10 09:35:17 Here I am posting a document that presents the Business Model Canvas (BMC) created for “Nasi Goreng Semrawut”, a Micro, Small, and Medium Enterprise (MSME) in Kendal, Central Java, Indonesia. BMC is a strategic management and entrepreneurship tool. It allows us to visualize, assess, and modify business models. It is crucial to understand the core components of a business and how they interact. As a UX researcher, analyzing and understanding the business model is critical to aligning user needs with business goals. This BMC provides the basis for identifying opportunities to improve user experience and drive business growth. I have broken it down into sections and grouped them carefully and I have clear reasons from a UX perspective why the groupings I have chosen are these points. I explain the UX side more fully on my portfolio website. For my reflections on this project analyzing the Business Model Canvas of "Nasi Goreng Semrawut" through a UX lens reveals several opportunities for improvement. By focusing on user needs and behaviors, I can enhance the customer experience, streamline operations, and drive business growth. This analysis highlights the importance of integrating UX research into the strategic planning process. By understanding the business model, I can ensure that our UX efforts are aligned with business goals and deliver tangible results. **My website Portfolio👇** https://octoporto.framer.website/blog/business-model-canvas-nasi-goreng-semrawut **Link Project :** https://www.figma.com/proto/5LZkoc2uSJ1RTaur4cDVCM/Business-Model-Canvas-Sego-Goreng-Semrawut?page-id=0%3A1&node-id=38-117&viewport=-170%2C587%2C0.16&t=8gt9qNV5G267Xq8B-1&scaling=scale-down&content-scaling=fixed&starting-point-node-id=20%3A3 mirorred from [dribbble](https://dribbble.com/shots/25718733-Business-Model-Canvas-Nasi-Goreng-Semrawut) originally posted at https://stacker.news/items/908920 @ 95cb4330:96db706c

2025-03-10 08:42:59## **Introduction: Why Small Actions Lead to Huge Success** Most people **underestimate** the power of **small, consistent improvements** over time. They chase **quick wins** and expect success overnight. But the truth is, **the most successful people and businesses in the world rely on the power of compounding effort**—making **small, incremental improvements daily** that scale into **massive long-term results**. This principle, known as **The Law of Compounding Effort**, is embraced by **Jeff Bezos, Sam Altman, and Peter Thiel**. Instead of looking for instant success, they focus on **building systems, habits, and investments that grow exponentially over time**. In this article, we’ll break down: ✔ **What the Law of Compounding Effort is and why it works** ✔ **Examples from top entrepreneurs who applied it to build billion-dollar empires** ✔ **How you can use it to improve your own work, habits, and investments** --- ## **What Is the Law of Compounding Effort?** The **Law of Compounding Effort** is based on a simple but powerful idea: > **Small, consistent improvements in thinking, decision-making, and execution create exponential results over time.** Instead of trying to make **huge leaps** all at once, **improving just 1% per day leads to massive growth over months and years**. Mathematically, it looks like this: - If you improve **1% every day** for a year → **You’ll be 37x better** than where you started. - If you get **1% worse every day** → **You’ll lose almost all your progress.** This is **why daily habits and small decisions matter more than big, one-time actions**. --- ## **Examples of the Law of Compounding Effort in Action** ### **1. Jeff Bezos and Amazon: Reinvesting for Long-Term Growth** Jeff Bezos didn’t build Amazon into a **trillion-dollar empire** overnight. He **compounded small improvements for decades** by: - **Reinvesting Amazon’s profits** into better **infrastructure, logistics, and technology**. - **Focusing on customer obsession**, constantly improving Amazon’s efficiency and convenience. - **Scaling AWS (Amazon Web Services)** from a side project into the **backbone of the internet**, generating billions in profit. Bezos was **never focused on short-term profits**—he **compounded effort and reinvested resources into long-term scalability**. 📌 **Lesson:** Instead of chasing **quick money**, **build systems that get better and stronger over time**. --- ### **2. Sam Altman and AI: Betting on the Future** Sam Altman, CEO of OpenAI, has built his career by **compounding small breakthroughs in artificial intelligence**: - He **funded AI research when others ignored it**, knowing that **small improvements would snowball**. - He **scaled OpenAI’s models like GPT-4**, refining them step by step to become **industry-changing technologies**. - He **invests in AI infrastructure**, believing that today’s progress will lead to **exponential advancements in the future**. Altman’s entire strategy is **about playing the long game**—knowing that **AI’s compounding improvements will change everything**. 📌 **Lesson:** **The biggest future opportunities come from compounding small improvements today.** --- ### **3. Peter Thiel and Facebook: The Power of Network Effects** Peter Thiel was **one of the first investors in Facebook**, putting in **$500,000 when few people saw its potential**. Why? He understood **the compounding nature of network effects**: - As more users joined Facebook, **its value increased exponentially**. - More advertisers came, bringing **more revenue and funding more innovation**. - Facebook **scaled from a small project to a multi-billion-dollar company**. Thiel’s investment in Facebook was a classic **compounding success**—he **saw the long-term potential, not just the short-term returns**. 📌 **Lesson:** The best investments **grow stronger over time**—look for compounding effects in business, investing, and technology. --- ## **How to Apply the Law of Compounding Effort in Your Own Life** You don’t need to be a billionaire to apply this principle—**compounding effort works in every area of life**. ### **1. Improve 1% Every Day** If you **get slightly better every day**, the results **compound into massive progress**. Ask yourself: - **What’s one skill I can improve today?** - **How can I refine my decision-making?** - **What process can I optimize for long-term growth?** 📌 **Example:** **Investing** → Instead of trying to "get rich quick," **invest consistently, reinvest profits, and let your portfolio compound over years.** --- ### **2. Focus on Scalable Actions** Not all work compounds. Focus on efforts that **scale and grow over time**, like: ✅ **Building a brand** → Content, reputation, and trust compound. ✅ **Investing in automation** → Systems that work for you 24/7. ✅ **Compounding relationships** → The right connections open exponential opportunities. 📌 **Example:** **Business Growth** → Instead of doing **one-time sales**, build a **repeatable system** that grows without constant effort. --- ### **3. Avoid Negative Compounding** Just as small positive actions **build up over time**, **bad habits and decisions compound negatively**. Ask yourself: - **Am I wasting time on low-value tasks?** - **Am I making impulsive decisions instead of strategic ones?** - **Am I neglecting habits that will improve my long-term growth?** 📌 **Example:** **Health & Productivity** → Small unhealthy choices **compound into major problems later**. But **small positive habits compound into a strong body and sharp mind**. --- ## **Final Thoughts: Small Wins, Big Results** The **Law of Compounding Effort** proves that **success isn’t about big, flashy moves—it’s about consistent, focused progress over time**. 🔹 **Jeff Bezos built Amazon by reinvesting and compounding small efficiencies.** 🔹 **Sam Altman bet on AI, knowing that small breakthroughs would add up.** 🔹 **Peter Thiel invested in Facebook, recognizing its compounding network effects.** And **you can do the same**. 💡 **Action Step:** **Find one habit, process, or investment you can improve by 1% today. Stick with it, and let it compound over time.** --- ## **Resources to Learn More** - 📖 [**The Power of Compounding** – Farnam Street](https://fs.blog/compounding/) - 🎥 [**Jeff Bezos on Long-Term Thinking** – Harvard Business Review](https://hbr.org/) - 📰 [**Sam Altman on Compounding Success** – Blog](https://blog.samaltman.com/) 🚀 **The best results don’t come from one big move. They come from small, consistent improvements over time.** Start compounding today!

@ 95cb4330:96db706c

2025-03-10 08:42:59## **Introduction: Why Small Actions Lead to Huge Success** Most people **underestimate** the power of **small, consistent improvements** over time. They chase **quick wins** and expect success overnight. But the truth is, **the most successful people and businesses in the world rely on the power of compounding effort**—making **small, incremental improvements daily** that scale into **massive long-term results**. This principle, known as **The Law of Compounding Effort**, is embraced by **Jeff Bezos, Sam Altman, and Peter Thiel**. Instead of looking for instant success, they focus on **building systems, habits, and investments that grow exponentially over time**. In this article, we’ll break down: ✔ **What the Law of Compounding Effort is and why it works** ✔ **Examples from top entrepreneurs who applied it to build billion-dollar empires** ✔ **How you can use it to improve your own work, habits, and investments** --- ## **What Is the Law of Compounding Effort?** The **Law of Compounding Effort** is based on a simple but powerful idea: > **Small, consistent improvements in thinking, decision-making, and execution create exponential results over time.** Instead of trying to make **huge leaps** all at once, **improving just 1% per day leads to massive growth over months and years**. Mathematically, it looks like this: - If you improve **1% every day** for a year → **You’ll be 37x better** than where you started. - If you get **1% worse every day** → **You’ll lose almost all your progress.** This is **why daily habits and small decisions matter more than big, one-time actions**. --- ## **Examples of the Law of Compounding Effort in Action** ### **1. Jeff Bezos and Amazon: Reinvesting for Long-Term Growth** Jeff Bezos didn’t build Amazon into a **trillion-dollar empire** overnight. He **compounded small improvements for decades** by: - **Reinvesting Amazon’s profits** into better **infrastructure, logistics, and technology**. - **Focusing on customer obsession**, constantly improving Amazon’s efficiency and convenience. - **Scaling AWS (Amazon Web Services)** from a side project into the **backbone of the internet**, generating billions in profit. Bezos was **never focused on short-term profits**—he **compounded effort and reinvested resources into long-term scalability**. 📌 **Lesson:** Instead of chasing **quick money**, **build systems that get better and stronger over time**. --- ### **2. Sam Altman and AI: Betting on the Future** Sam Altman, CEO of OpenAI, has built his career by **compounding small breakthroughs in artificial intelligence**: - He **funded AI research when others ignored it**, knowing that **small improvements would snowball**. - He **scaled OpenAI’s models like GPT-4**, refining them step by step to become **industry-changing technologies**. - He **invests in AI infrastructure**, believing that today’s progress will lead to **exponential advancements in the future**. Altman’s entire strategy is **about playing the long game**—knowing that **AI’s compounding improvements will change everything**. 📌 **Lesson:** **The biggest future opportunities come from compounding small improvements today.** --- ### **3. Peter Thiel and Facebook: The Power of Network Effects** Peter Thiel was **one of the first investors in Facebook**, putting in **$500,000 when few people saw its potential**. Why? He understood **the compounding nature of network effects**: - As more users joined Facebook, **its value increased exponentially**. - More advertisers came, bringing **more revenue and funding more innovation**. - Facebook **scaled from a small project to a multi-billion-dollar company**. Thiel’s investment in Facebook was a classic **compounding success**—he **saw the long-term potential, not just the short-term returns**. 📌 **Lesson:** The best investments **grow stronger over time**—look for compounding effects in business, investing, and technology. --- ## **How to Apply the Law of Compounding Effort in Your Own Life** You don’t need to be a billionaire to apply this principle—**compounding effort works in every area of life**. ### **1. Improve 1% Every Day** If you **get slightly better every day**, the results **compound into massive progress**. Ask yourself: - **What’s one skill I can improve today?** - **How can I refine my decision-making?** - **What process can I optimize for long-term growth?** 📌 **Example:** **Investing** → Instead of trying to "get rich quick," **invest consistently, reinvest profits, and let your portfolio compound over years.** --- ### **2. Focus on Scalable Actions** Not all work compounds. Focus on efforts that **scale and grow over time**, like: ✅ **Building a brand** → Content, reputation, and trust compound. ✅ **Investing in automation** → Systems that work for you 24/7. ✅ **Compounding relationships** → The right connections open exponential opportunities. 📌 **Example:** **Business Growth** → Instead of doing **one-time sales**, build a **repeatable system** that grows without constant effort. --- ### **3. Avoid Negative Compounding** Just as small positive actions **build up over time**, **bad habits and decisions compound negatively**. Ask yourself: - **Am I wasting time on low-value tasks?** - **Am I making impulsive decisions instead of strategic ones?** - **Am I neglecting habits that will improve my long-term growth?** 📌 **Example:** **Health & Productivity** → Small unhealthy choices **compound into major problems later**. But **small positive habits compound into a strong body and sharp mind**. --- ## **Final Thoughts: Small Wins, Big Results** The **Law of Compounding Effort** proves that **success isn’t about big, flashy moves—it’s about consistent, focused progress over time**. 🔹 **Jeff Bezos built Amazon by reinvesting and compounding small efficiencies.** 🔹 **Sam Altman bet on AI, knowing that small breakthroughs would add up.** 🔹 **Peter Thiel invested in Facebook, recognizing its compounding network effects.** And **you can do the same**. 💡 **Action Step:** **Find one habit, process, or investment you can improve by 1% today. Stick with it, and let it compound over time.** --- ## **Resources to Learn More** - 📖 [**The Power of Compounding** – Farnam Street](https://fs.blog/compounding/) - 🎥 [**Jeff Bezos on Long-Term Thinking** – Harvard Business Review](https://hbr.org/) - 📰 [**Sam Altman on Compounding Success** – Blog](https://blog.samaltman.com/) 🚀 **The best results don’t come from one big move. They come from small, consistent improvements over time.** Start compounding today! @ 95cb4330:96db706c

2025-03-10 08:34:05## **Introduction: The Power of the Few** Most people assume that effort and results follow a **linear** relationship—that every action contributes equally to success. However, reality follows a very different pattern: **Power Laws**. The **Power Law Principle**, championed by thinkers like **Peter Thiel** and **Jeff Bezos**, states that a **small number of key efforts drive the majority of outcomes**. Instead of distributing energy evenly across tasks, investments, or decisions, the **smartest individuals and companies focus on the few areas that truly matter**—the ones that yield **outsized** returns. In this article, we’ll explore: ✔ **What the Power Law is and why it matters** ✔ **Examples of Power Laws in business and investing** ✔ **How to apply the Power Law Principle in your own work and life** --- ## **What Is the Power Law?** The **Power Law** is a mathematical relationship where **a small input leads to a disproportionately large output**. It is the foundation of **Pareto’s Principle (the 80/20 rule)**, which states that: - **80% of results come from 20% of efforts** - **80% of revenue comes from 20% of customers** - **80% of profits come from 20% of investments** But **Power Laws go even further**. In reality, it’s not just 80/20—it’s often **90/10 or even 99/1**. In **venture capital**, for example, a handful of companies (like Facebook, Google, and Tesla) account for nearly **all** of the industry’s profits. If you had invested in 100 startups, it wouldn’t be the case that 20 of them returned good money—it would be that just **one or two** produced nearly **all the profits**, while the rest failed or broke even. Power Laws appear **everywhere** in business, investing, technology, and even personal development. --- ## **Examples of the Power Law in Action** ### **1. Venture Capital: Peter Thiel and Facebook** Peter Thiel, co-founder of PayPal and early investor in Facebook, built his fortune using Power Law thinking. - In 2004, he invested **$500,000 in Facebook**—a small startup most people ignored. - That one investment turned into **billions of dollars**, while dozens of other startups he backed failed. - **One bet made up for every loss**—and much more. Thiel himself says: > "We don’t live in a normal world. We live under a **Power Law**." Venture capitalists **don’t succeed by investing in 100 decent companies**—they succeed by **finding the 1 company that dominates an industry**. --- ### **2. Jeff Bezos and AWS: One Decision That Built a Trillion-Dollar Empire** Amazon started as an online bookstore, but **one decision made Amazon a tech giant**: **Amazon Web Services (AWS)**. - In the early 2000s, Jeff Bezos realized that **cloud computing** could be the foundation of the internet. - He shifted **massive resources** into AWS, even though it had **nothing to do with selling books**. - AWS **became the backbone of the internet**, powering companies like Netflix, Airbnb, and even government agencies. - Today, AWS generates **over 60% of Amazon’s total profits**, **funding Amazon’s entire e-commerce business**. Without **one key decision**, Amazon might still just be an online retailer. But by following the **Power Law**, Bezos **doubled down on what truly mattered**—and that made all the difference. --- ### **3. Sam Altman and AI: Betting on the Future** Sam Altman, CEO of OpenAI, has **focused his entire career** on **one high-upside opportunity**: **Artificial Intelligence (AI)**. - Instead of investing in **many different technologies**, he **put all his energy into AI**. - He **believes AI will reshape every industry**, making it **one of the highest-upside bets in history**. - OpenAI’s **ChatGPT** is now one of the fastest-growing software products ever, with **100 million+ users** in a matter of months. Altman’s approach? **Find the area with the biggest possible impact—and go all in.** --- ## **How to Apply the Power Law Principle in Your Life** Most people **waste time** by treating all tasks equally. But if you want **real success**, you need to **identify and focus on the few things that actually matter**. ### **1. Identify the 20% That Drives 80% of Results** Ask yourself: - **What 20% of my efforts produce 80% of my success?** - **Which investments or decisions have the biggest impact?** - **What skills, relationships, or habits generate the highest returns?** --- ### **2. Cut the Noise—Eliminate Low-Impact Tasks** Once you identify the **high-impact areas**, **cut distractions mercilessly**. - **In investing:** Stop spreading your money across **20 mediocre bets**. Instead, find the **1-2 asymmetric opportunities** that could **change everything**. - **In business:** Instead of launching **10 different products**, focus on the **one product that dominates your industry**. - **In personal development:** Instead of learning **random skills**, master **one rare, valuable skill** that **sets you apart**. --- ### **3. Double Down on What Works** Once you find what works, **go all in**. - If a stock, business, or skill is **compounding massively**, **allocate more resources** to it. - If an investment is performing **exponentially better than others**, **increase your stake**. - If one product or strategy is **dominating the market**, **scale it up aggressively**. Most people **diversify too much** because they’re afraid of **missing out**. But **true success comes from concentrating on what actually works**. --- ## **Final Thoughts: The Few That Matter** The **Power Law** is one of the **most important concepts in business, investing, and life**. The majority of success **comes from a small number of actions**—so the key is to: ✅ **Find the few things that truly drive results** ✅ **Eliminate distractions and low-impact efforts** ✅ **Double down on what works and scale it massively** The difference between **mediocrity and massive success** is simple: **Most people work hard on everything. The smartest people work hard on the right things.** Start **thinking in Power Laws**—and you’ll see exponential results. 🚀 --- ## **Resources to Learn More** - 📖 [**Understanding Power Laws** – Farnam Street](https://fs.blog/power-laws/) - 🎥 [**Peter Thiel on Power Laws in Investing** – NFX](https://www.youtube.com/watch?v=1dWxSZIrKZ0) - 📰 [**How to Apply Power Laws in Business** – Medium](https://medium.com/@gregoryivers/how-to-use-power-laws-to-your-advantage-3149bd979ef5) **Action Step:** 🔥 **Look at your current projects, tasks, or investments. What is the 20% that drives 80% of your success? Cut the rest, and focus more on what truly matters.** Let me know what you think—drop a comment below! 🚀

@ 95cb4330:96db706c

2025-03-10 08:34:05## **Introduction: The Power of the Few** Most people assume that effort and results follow a **linear** relationship—that every action contributes equally to success. However, reality follows a very different pattern: **Power Laws**. The **Power Law Principle**, championed by thinkers like **Peter Thiel** and **Jeff Bezos**, states that a **small number of key efforts drive the majority of outcomes**. Instead of distributing energy evenly across tasks, investments, or decisions, the **smartest individuals and companies focus on the few areas that truly matter**—the ones that yield **outsized** returns. In this article, we’ll explore: ✔ **What the Power Law is and why it matters** ✔ **Examples of Power Laws in business and investing** ✔ **How to apply the Power Law Principle in your own work and life** --- ## **What Is the Power Law?** The **Power Law** is a mathematical relationship where **a small input leads to a disproportionately large output**. It is the foundation of **Pareto’s Principle (the 80/20 rule)**, which states that: - **80% of results come from 20% of efforts** - **80% of revenue comes from 20% of customers** - **80% of profits come from 20% of investments** But **Power Laws go even further**. In reality, it’s not just 80/20—it’s often **90/10 or even 99/1**. In **venture capital**, for example, a handful of companies (like Facebook, Google, and Tesla) account for nearly **all** of the industry’s profits. If you had invested in 100 startups, it wouldn’t be the case that 20 of them returned good money—it would be that just **one or two** produced nearly **all the profits**, while the rest failed or broke even. Power Laws appear **everywhere** in business, investing, technology, and even personal development. --- ## **Examples of the Power Law in Action** ### **1. Venture Capital: Peter Thiel and Facebook** Peter Thiel, co-founder of PayPal and early investor in Facebook, built his fortune using Power Law thinking. - In 2004, he invested **$500,000 in Facebook**—a small startup most people ignored. - That one investment turned into **billions of dollars**, while dozens of other startups he backed failed. - **One bet made up for every loss**—and much more. Thiel himself says: > "We don’t live in a normal world. We live under a **Power Law**." Venture capitalists **don’t succeed by investing in 100 decent companies**—they succeed by **finding the 1 company that dominates an industry**. --- ### **2. Jeff Bezos and AWS: One Decision That Built a Trillion-Dollar Empire** Amazon started as an online bookstore, but **one decision made Amazon a tech giant**: **Amazon Web Services (AWS)**. - In the early 2000s, Jeff Bezos realized that **cloud computing** could be the foundation of the internet. - He shifted **massive resources** into AWS, even though it had **nothing to do with selling books**. - AWS **became the backbone of the internet**, powering companies like Netflix, Airbnb, and even government agencies. - Today, AWS generates **over 60% of Amazon’s total profits**, **funding Amazon’s entire e-commerce business**. Without **one key decision**, Amazon might still just be an online retailer. But by following the **Power Law**, Bezos **doubled down on what truly mattered**—and that made all the difference. --- ### **3. Sam Altman and AI: Betting on the Future** Sam Altman, CEO of OpenAI, has **focused his entire career** on **one high-upside opportunity**: **Artificial Intelligence (AI)**. - Instead of investing in **many different technologies**, he **put all his energy into AI**. - He **believes AI will reshape every industry**, making it **one of the highest-upside bets in history**. - OpenAI’s **ChatGPT** is now one of the fastest-growing software products ever, with **100 million+ users** in a matter of months. Altman’s approach? **Find the area with the biggest possible impact—and go all in.** --- ## **How to Apply the Power Law Principle in Your Life** Most people **waste time** by treating all tasks equally. But if you want **real success**, you need to **identify and focus on the few things that actually matter**. ### **1. Identify the 20% That Drives 80% of Results** Ask yourself: - **What 20% of my efforts produce 80% of my success?** - **Which investments or decisions have the biggest impact?** - **What skills, relationships, or habits generate the highest returns?** --- ### **2. Cut the Noise—Eliminate Low-Impact Tasks** Once you identify the **high-impact areas**, **cut distractions mercilessly**. - **In investing:** Stop spreading your money across **20 mediocre bets**. Instead, find the **1-2 asymmetric opportunities** that could **change everything**. - **In business:** Instead of launching **10 different products**, focus on the **one product that dominates your industry**. - **In personal development:** Instead of learning **random skills**, master **one rare, valuable skill** that **sets you apart**. --- ### **3. Double Down on What Works** Once you find what works, **go all in**. - If a stock, business, or skill is **compounding massively**, **allocate more resources** to it. - If an investment is performing **exponentially better than others**, **increase your stake**. - If one product or strategy is **dominating the market**, **scale it up aggressively**. Most people **diversify too much** because they’re afraid of **missing out**. But **true success comes from concentrating on what actually works**. --- ## **Final Thoughts: The Few That Matter** The **Power Law** is one of the **most important concepts in business, investing, and life**. The majority of success **comes from a small number of actions**—so the key is to: ✅ **Find the few things that truly drive results** ✅ **Eliminate distractions and low-impact efforts** ✅ **Double down on what works and scale it massively** The difference between **mediocrity and massive success** is simple: **Most people work hard on everything. The smartest people work hard on the right things.** Start **thinking in Power Laws**—and you’ll see exponential results. 🚀 --- ## **Resources to Learn More** - 📖 [**Understanding Power Laws** – Farnam Street](https://fs.blog/power-laws/) - 🎥 [**Peter Thiel on Power Laws in Investing** – NFX](https://www.youtube.com/watch?v=1dWxSZIrKZ0) - 📰 [**How to Apply Power Laws in Business** – Medium](https://medium.com/@gregoryivers/how-to-use-power-laws-to-your-advantage-3149bd979ef5) **Action Step:** 🔥 **Look at your current projects, tasks, or investments. What is the 20% that drives 80% of your success? Cut the rest, and focus more on what truly matters.** Let me know what you think—drop a comment below! 🚀 @ b8af284d:f82c91dd