-

@ e3ba5e1a:5e433365

2025-02-13 06:16:49

My favorite line in any Marvel movie ever is in “Captain America.” After Captain America launches seemingly a hopeless assault on Red Skull’s base and is captured, we get [this line](https://www.youtube.com/shorts/kqsomjpz7ok):

“Arrogance may not be a uniquely American trait, but I must say, you do it better than anyone.”

Yesterday, I came across a comment on the song [Devil Went Down to Georgia](https://youtu.be/ut8UqFlWdDc) that had a very similar feel to it:

America has seemingly always been arrogant, in a uniquely American way. Manifest Destiny, for instance. The rest of the world is aware of this arrogance, and mocks Americans for it. A central point in modern US politics is the deriding of racist, nationalist, supremacist Americans.

That’s not what I see. I see American Arrogance as not only a beautiful statement about what it means to be American. I see it as an ode to the greatness of humanity in its purest form.

For most countries, saying “our nation is the greatest” *is*, in fact, twinged with some level of racism. I still don’t have a problem with it. Every group of people *should* be allowed to feel pride in their accomplishments. The destruction of the human spirit since the end of World War 2, where greatness has become a sin and weakness a virtue, has crushed the ability of people worldwide to strive for excellence.

But I digress. The fears of racism and nationalism at least have a grain of truth when applied to other nations on the planet. But not to America.

That’s because the definition of America, and the prototype of an American, has nothing to do with race. The definition of Americanism is *freedom*. The founding of America is based purely on liberty. On the God-given rights of every person to live life the way they see fit.

American Arrogance is not a statement of racial superiority. It’s barely a statement of national superiority (though it absolutely is). To me, when an American comments on the greatness of America, it’s a statement about freedom. Freedom will always unlock the greatness inherent in any group of people. Americans are *definitionally* better than everyone else, because Americans are freer than everyone else. (Or, at least, that’s how it should be.)

In *Devil Went Down to Georgia*, Johnny is approached by the devil himself. He is challenged to a ridiculously lopsided bet: a golden fiddle versus his immortal soul. He acknowledges the sin in accepting such a proposal. And yet he says, “God, I know you told me not to do this. But I can’t stand the affront to my honor. I am the greatest. The devil has nothing on me. So God, I’m gonna sin, but I’m also gonna win.”

*Libertas magnitudo est*

-

@ d360efec:14907b5f

2025-02-13 05:54:17

**ภาพรวม LUNCUSDT (OKX):**

LUNCUSDT กำลังอยู่ในช่วงที่ *มีความผันผวนสูงและมีความไม่แน่นอนมาก* แม้ว่าในอดีต (TF Day) จะเคยมีสัญญาณของการพยายามกลับตัวเป็นขาขึ้น (Breakout EMA 50 และเกิด Golden Cross) แต่ปัจจุบันแรงซื้อเหล่านั้นเริ่มอ่อนแรงลง และมีแรงขายเข้ามาในตลาดมากขึ้น ทำให้เกิดความขัดแย้งระหว่าง Timeframes ต่างๆ

**สถานะปัจจุบัน:**

* **แนวโน้ม:**

* **TF Day:** เริ่มไม่แน่นอน (จากเดิมที่เป็น Early Uptrend) - แม้ว่าราคาจะยังอยู่เหนือ EMA 50/200 แต่ Money Flow เริ่มแสดงสัญญาณเตือน

* **TF4H:** เริ่มไม่แน่นอน (พักตัว, ทดสอบแนวรับ EMA 50) - Money Flow บ่งบอกถึงแรงขายที่เข้ามา

* **TF15:** ผันผวนสูง, ไม่มีทิศทางชัดเจน (Sideways) - Money Flow แสดงถึงแรงขาย แต่ก็มีแรงซื้อกลับเข้ามาบ้าง

* **Money Flow (LuxAlgo):**

* **TF Day:** แรงซื้อเริ่มอ่อนแรงลงอย่างมีนัยสำคัญ, มีแรงขายเข้ามา

* **TF4H:** แรงขายมีมากกว่าแรงซื้อ

* **TF15:** แรงขายและแรงซื้อผสมกัน, โดยรวมแรงขายยังมากกว่า

* **EMA:**

* **TF Day:** EMA 50/200 เป็นแนวรับ/แนวต้าน

* **TF4H:** EMA 50 กำลังถูกทดสอบ, EMA 200 เป็นแนวต้าน

* **TF15:** EMA 50/200 เป็นแนวต้าน

**โครงสร้างราคา (SMC):**

| Timeframe | Break of Structure (BOS) | Change of Character (CHoCH) | Higher High (HH) & Higher Low (HL) | Equal Highs (EQH) / Equal Lows (EQL) |

| :-------- | :----------------------- | :--------------------------- | :----------------------------------- | :------------------------------------- |

| Day | ด้านบนและล่าง | ด้านบน | เริ่มก่อตัว (แต่ไม่แข็งแกร่ง) | - |

| 4H | ด้านบน | ด้านบน | เริ่มก่อตัว (แต่ไม่ชัดเจน) | มี EQH หลายจุด |

| 15m | ด้านบนและล่าง | มีทั้งบนและล่าง | Lower Highs (LH) & Lower Lows (LL) | มี EQH และ EQL หลายจุด |

**แนวรับ-แนวต้านสำคัญ:**

| Timeframe | แนวรับ | แนวต้าน |

| :-------- | :----------------------------------------------------------- | :--------------------------------------------------------------------- |

| Day | EMA 50 (≈0.00010000), EMA 200 (≈0.00008000), 0.00006000-0.00007000 | 0.00017953 (High ล่าสุด), 0.00014000 (Volume Profile) |

| 4H | EMA 50 (≈0.00007000), 0.00006000-0.00007000 | EMA 200 (≈0.00008000), 0.00008132, บริเวณ 0.00010000-0.00012000 (EQH) |

| 15m | บริเวณ Low ล่าสุด | EMA 50, EMA 200, บริเวณ 0.000075-0.000076 (EQH) |

**กลยุทธ์ (LUNCUSDT):**

1. **Wait & See (ทางเลือกที่ดีที่สุด):**

* **เหตุผล:** ความขัดแย้งระหว่าง Timeframes สูงมาก, แนวโน้มไม่ชัดเจน, Money Flow ใน TF4H และ TF15 เป็นลบ

* รอให้ราคาแสดงทิศทางที่ชัดเจนกว่านี้ (ยืนเหนือ EMA 50 ใน TF4H ได้, Breakout แนวต้านใน TF15)

2. **Buy on Dip (Day, 4H) - *ความเสี่ยงสูงมาก ไม่แนะนำ*:**

* **เหตุผล:** แนวโน้มระยะยาวอาจจะยังเป็นขาขึ้นได้ (ถ้าไม่หลุดแนวรับสำคัญ)

* **เงื่อนไข:** *ต้อง* รอสัญญาณการกลับตัวใน TF15 ก่อน

* **จุดเข้า:** พิจารณาเฉพาะบริเวณแนวรับที่แข็งแกร่งมากๆ (EMA ของ Day/4H) *และต้องดู TF15 ประกอบ*

* **Stop Loss:** ต่ำกว่า Low ล่าสุดของ TF15

3. **Short (15, ความเสี่ยงสูงมาก):**

* **เหตุผล:** แนวโน้ม TF15 เป็นขาลง, Money Flow เป็นลบ

* **เงื่อนไข:** ราคาไม่สามารถ Breakout EMA หรือแนวต้านอื่นๆ ใน TF15 ได้

* **จุดเข้า:** บริเวณ EMA หรือแนวต้านของ TF15

* **Stop Loss:** เหนือ High ล่าสุดของ TF15

**คำแนะนำ (เน้นย้ำ):**

* **LUNC เป็นเหรียญที่มีความเสี่ยงสูงมาก (High Risk):** มีความผันผวนสูง และอาจมีการเปลี่ยนแปลงอย่างรวดเร็ว

* **ความขัดแย้งของ Timeframes:** สถานการณ์ของ LUNCUSDT มีความขัดแย้งสูงมาก และมีความเสี่ยงสูง

* **Money Flow:** บ่งบอกถึงแรงขายที่เริ่มเข้ามา และแนวโน้มขาขึ้น (ระยะกลาง-ยาว) ที่อ่อนแอลง

* **ถ้าไม่แน่ใจ อย่าเพิ่งเข้าเทรด:** "รอ" เป็นกลยุทธ์ที่ดีที่สุด

* **Risk Management:** สำคัญที่สุด ไม่ว่าจะเลือกกลยุทธ์ใด ต้องมีการบริหารความเสี่ยงที่ดี

**สรุป:** LUNCUSDT กำลังอยู่ในช่วงเวลาที่ยากลำบากและมีความเสี่ยงสูงมากที่สุดในบรรดา 3 เหรียญที่เราวิเคราะห์กันมา การตัดสินใจที่ผิดพลาดอาจนำไปสู่การขาดทุนได้ ควรพิจารณาอย่างรอบคอบก่อนเข้าเทรดทุกครั้ง และ "รอ" จนกว่าจะมีสัญญาณที่ชัดเจนกว่านี้ เป็นทางเลือกที่ปลอดภัยที่สุดสำหรับนักลงทุนส่วนใหญ่ค่ะ

**Disclaimer:** การวิเคราะห์นี้เป็นเพียงความคิดเห็นส่วนตัว ไม่ถือเป็นคำแนะนำในการลงทุน ผู้ลงทุนควรศึกษาข้อมูลเพิ่มเติมและตัดสินใจด้วยความรอบคอบ

-

@ d360efec:14907b5f

2025-02-13 05:27:39

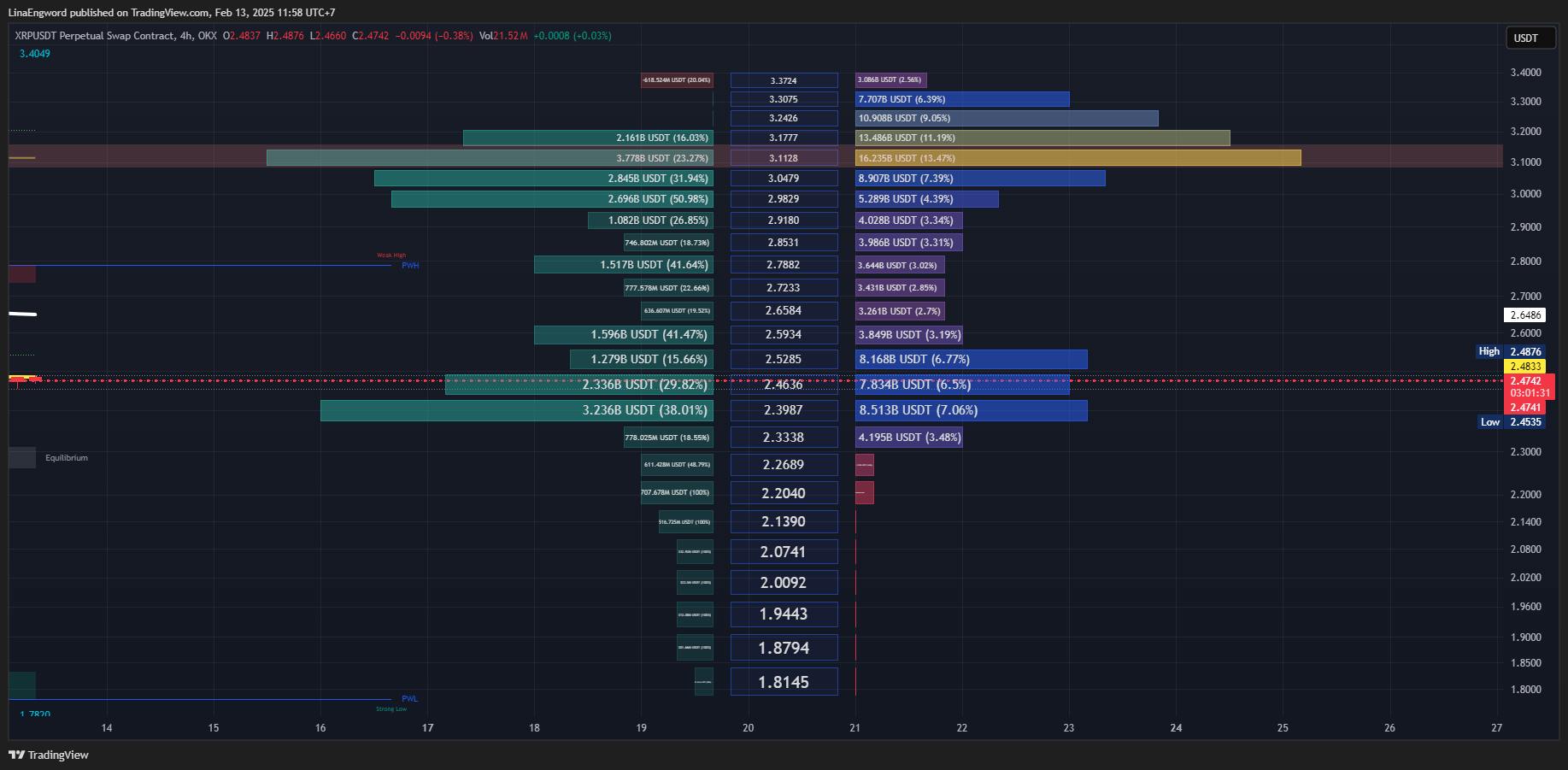

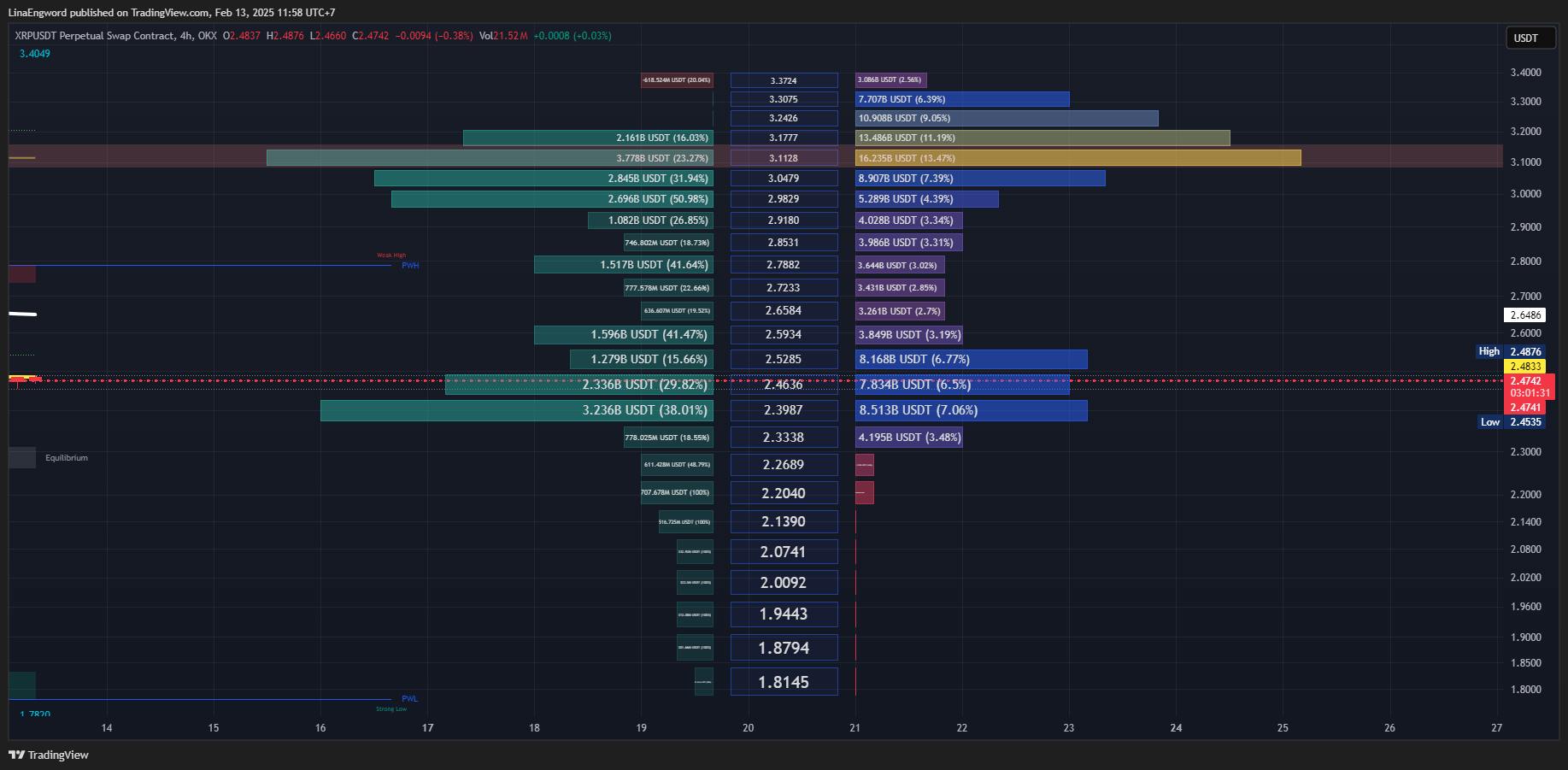

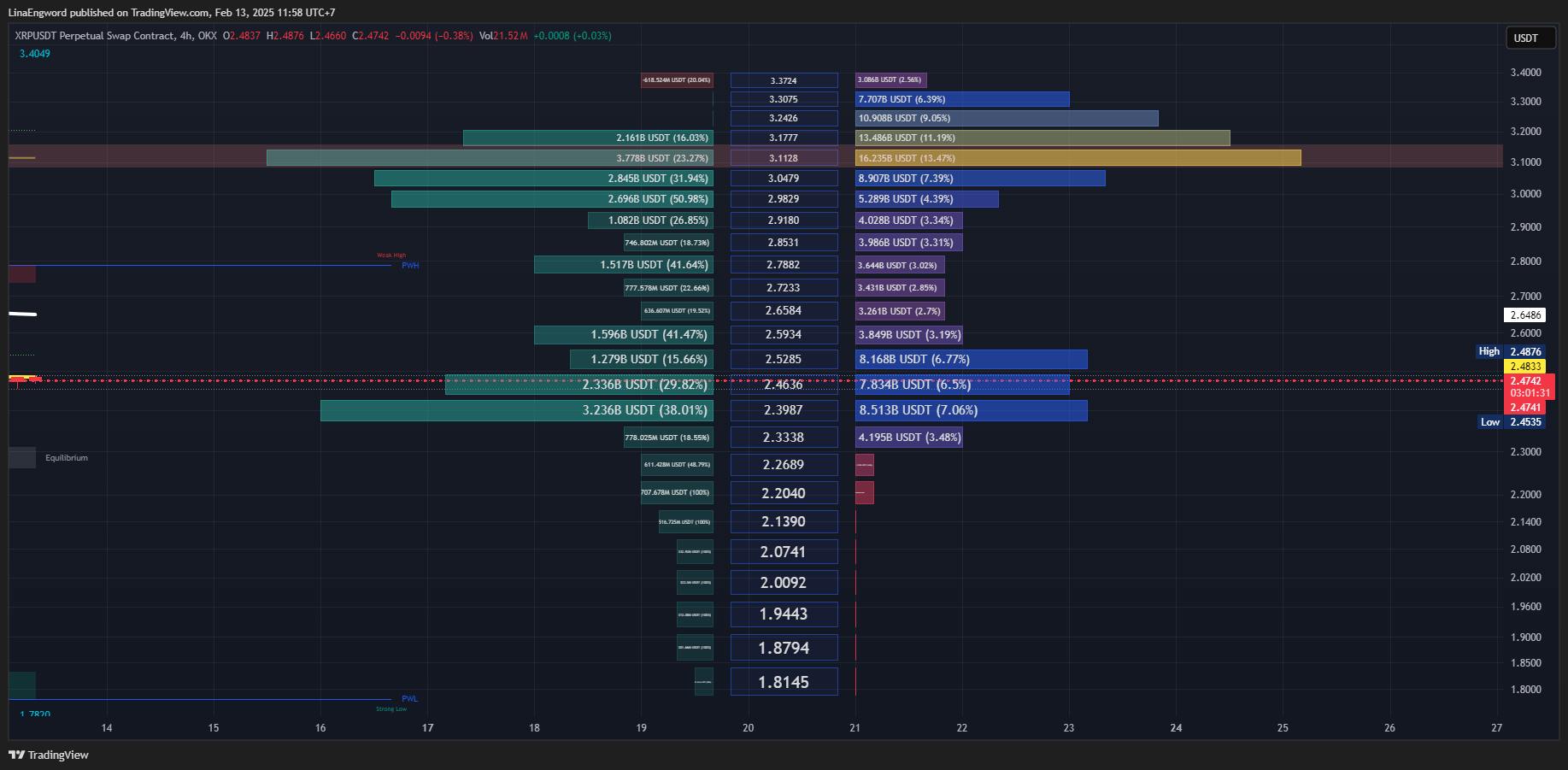

**ภาพรวม XRPUSDT (OKX):**

XRPUSDT กำลังอยู่ในช่วงสำคัญ แนวโน้มระยะยาว (TF Day) เริ่มมีสัญญาณบวกของการเป็นขาขึ้น (Early Uptrend) หลังราคา Breakout EMA 50 และ Money Flow สนับสนุน อย่างไรก็ตาม แนวโน้มระยะกลาง (TF4H) เริ่มแสดงความอ่อนแอลง โดยราคาพักตัวลงมาทดสอบแนวรับสำคัญ และ Money Flow บ่งชี้ถึงแรงซื้อที่ลดลงและแรงขายที่เพิ่มขึ้น ส่วนแนวโน้มระยะสั้นมาก (TF15) เป็นขาลงชัดเจน

**แนวโน้ม:**

* **TF Day:** เริ่มเป็นขาขึ้น (Early Uptrend) - Breakout EMA 50, Money Flow เป็นบวก

* **TF4H:** เริ่มไม่แน่นอน (พักตัว, ทดสอบแนวรับ EMA 50 และ EQL) - Money Flow เริ่มเป็นลบ

* **TF15:** ขาลง (Downtrend) ระยะสั้นมาก - ราคาหลุด EMA, โครงสร้างราคาเป็น Lower Highs/Lows, Money Flow เป็นลบ

**โครงสร้างราคา (SMC):**

| Timeframe | Break of Structure (BOS) | Change of Character (CHoCH) | Higher High (HH) & Higher Low (HL) | Equal Highs (EQH) / Equal Lows (EQL) |

| :-------- | :----------------------- | :--------------------------- | :----------------------------------- | :------------------------------------- |

| Day | ด้านบน (Breakout EMA 50) | ไม่ชัดเจน | เริ่มก่อตัว (แต่ยังไม่ชัดเจน) | - |

| 4H | ด้านบน | ไม่ชัดเจน | เริ่มก่อตัว (แต่ไม่ชัดเจน) | EQH: 3.00-3.20, EQL: 2.2667 |

| 15m | ด้านล่าง | มีทั้งบนและล่าง | Lower Highs (LH) & Lower Lows (LL) | EQH: 2.48-2.50, EQL: 2.38 |

**Money Flow (LuxAlgo):**

* **TF Day:** แรงซื้อแข็งแกร่ง

* **TF4H:** แรงซื้อเริ่มอ่อนแรงลง, แรงขายเริ่มเข้ามา

* **TF15:** แรงขายมีอิทธิพลเหนือกว่า

**EMA (Exponential Moving Average):**

* **TF Day:** EMA 50 & 200 เป็นแนวรับ

* **TF4H:** EMA 50 กำลังถูกทดสอบ, EMA 200 เป็นแนวรับถัดไป

* **TF15:** EMA 50 & 200 เป็นแนวต้าน

**แนวรับ-แนวต้านสำคัญ:**

| Timeframe | แนวรับ | แนวต้าน |

| :-------- | :----------------------------------------------------- | :----------------------------------------------------------------------- |

| Day | EMA 50 (≈1.56), EMA 200 (≈1.08) | 3.4049 (High), 3.00-3.20 (EQH) |

| 4H | EMA 50 (≈2.20), *2.2667 (EQL)*, EMA 200, 1.7820 | 3.4049, 2.3987 (Volume Profile), 3.00-3.20 (EQH) |

| 15m | 2.38 (EQL, Volume Profile), 2.3274 | EMA 50, EMA 200, 2.4196, Equilibrium (≈2.44), 2.48-2.50 (EQH) |

**กลยุทธ์ (XRPUSDT):**

1. **Wait & See (ทางเลือกที่ดีที่สุด):**

* **เหตุผล:** ความขัดแย้งระหว่าง Timeframes สูง, TF4H กำลังทดสอบแนวรับสำคัญ, Money Flow ใน TF4H และ TF15 เป็นลบ

* รอให้ราคาแสดงทิศทางที่ชัดเจน (ยืนเหนือ EMA 50 ใน TF4H ได้ หรือ Breakout แนวต้านใน TF15)

2. **Buy on Dip (Day, 4H) - *ความเสี่ยงสูงมาก*:**

* **เหตุผล:** แนวโน้มระยะยาวยังมีโอกาสเป็นขาขึ้น, Money Flow ใน TF Day เป็นบวก

* **เงื่อนไข (สำคัญมาก):** *ต้อง* รอสัญญาณการกลับตัวใน TF15 ก่อน เช่น:

* Breakout แนวต้านย่อยๆ พร้อม Volume

* Money Flow (TF15) เปลี่ยนเป็นสีเขียว

* Bullish Candlestick Patterns

* **จุดเข้า (Day):** EMA 50, EMA 200 (*ดู TF15 ประกอบ*)

* **จุดเข้า (4H):** EMA 50, *2.2667 (EQL)* (*ดู TF15 ประกอบ*)

* **Stop Loss:** ต่ำกว่า Low ล่าสุดของ TF15 หรือต่ำกว่าแนวรับที่เข้าซื้อ

3. **Short (15, ความเสี่ยงสูงมาก):**

* **เหตุผล:** แนวโน้ม TF15 เป็นขาลง, Money Flow เป็นลบ

* **เงื่อนไข:** ราคาไม่สามารถกลับขึ้นไปยืนเหนือ EMA ของ TF15 ได้

* **จุดเข้า:** บริเวณ EMA ของ TF15 หรือแนวต้านอื่นๆ

* **Stop Loss:** เหนือ High ล่าสุดของ TF15

**คำแนะนำ:**

* **ความขัดแย้งของ Timeframes:** XRPUSDT มีความขัดแย้งสูงมาก และมีความเสี่ยงสูง

* **Money Flow:** Day เป็นบวก, 4H เริ่มเป็นลบ, 15m เป็นลบ

* **EMA 50 (TF4H) & EQL 2.2667:** จุดชี้ชะตา

* **ถ้าไม่แน่ใจ อย่าเพิ่งเข้าเทรด:** "รอ" ดีที่สุด

* **Risk Management:** สำคัญที่สุด

**สรุป:** สถานการณ์ของ XRPUSDT ตอนนี้มีความเสี่ยงสูงมาก และไม่เหมาะกับนักลงทุนที่รับความเสี่ยงได้ต่ำ การ "รอ" จนกว่าจะมีสัญญาณที่ชัดเจนกว่านี้ เป็นทางเลือกที่ปลอดภัยที่สุดค่ะ

Disclaimer: การวิเคราะห์นี้เป็นเพียงความคิดเห็นส่วนตัว ไม่ถือเป็นคำแนะนำในการลงทุน ผู้ลงทุนควรศึกษาข้อมูลเพิ่มเติมและตัดสินใจด้วยความรอบคอบ

-

@ d360efec:14907b5f

2025-02-13 04:47:20

**ภาพรวม BTCUSDT :**

Bitcoin (BTCUSDT) กำลังอยู่ในช่วงสำคัญ แม้ว่าแนวโน้มหลักในระยะกลางถึงยาว (TF Day & 4H) จะยังคงเป็นขาขึ้นที่แข็งแกร่ง แต่ในระยะสั้นมาก (TF15) กลับแสดงสัญญาณของความอ่อนแอและการปรับฐานลงมา ทำให้เกิดความไม่แน่นอนในทิศทางของราคา อย่างไรก็ตาม *Money Flow ใน TF Day บ่งชี้ว่าแรงซื้อโดยรวมยังคงแข็งแกร่ง*

**แนวโน้ม:**

* **TF Day:** ขาขึ้น (Uptrend) แข็งแกร่ง – ราคาอยู่เหนือ EMA 50 และ EMA 200, โครงสร้างราคาเป็น Higher Highs (HH) และ Higher Lows (HL), *Money Flow เป็นบวก (แรงซื้อ)*

* **TF4H:** ขาขึ้น (Uptrend) – ราคาอยู่เหนือ EMA, มีการพักตัวลงมา (Pullback) แต่ยังไม่เสียโครงสร้างขาขึ้น, *Money Flow เริ่มอ่อนแรง (แรงซื้อลดลง, แรงขายเพิ่มขึ้น)*

* **TF15:** ขาลง (Downtrend) ระยะสั้นมาก – ราคาหลุด EMA และแนวรับย่อย, โครงสร้างราคาเป็น Lower Highs (LH) และ Lower Lows (LL), *Money Flow เป็นลบ (แรงขาย)*

**โครงสร้างราคา (SMC):**

* **TF Day:** ยืนยันแนวโน้มขาขึ้น (HH, HL, BOS)

* **TF4H:** ยืนยันแนวโน้มขาขึ้น (HH, HL, BOS), มี Equal Highs (EQH) ที่เป็นแนวต้าน

* **TF15:** บ่งบอกถึงแนวโน้มขาลงระยะสั้น (BOS ด้านล่าง, LH, LL), มี EQH เป็นแนวต้าน

**Money Flow (LuxAlgo) - สรุป:**

* **TF Day:** แรงซื้อยังคงแข็งแกร่งอย่างชัดเจน

* **TF4H:** แรงซื้อเริ่มอ่อนแรงลง, มีแรงขายเข้ามา

* **TF15:** แรงขายมีอิทธิพลเหนือกว่า

**EMA (Exponential Moving Average):**

* **TF Day & 4H:** EMA 50 & 200 เป็นแนวรับสำคัญ

* **TF15:** EMA 50 & 200 กลายเป็นแนวต้าน

**แนวรับ-แนวต้านสำคัญ:**

| Timeframe | แนวรับ | แนวต้าน |

| :-------- | :------------------------------------------------------------------------- | :-------------------------------------------------------------- |

| Day | EMA 50, EMA 200, 96,000-98,000, 85,724.7 | 109,998.9 (High เดิม) |

| 4H | EMA 50, EMA 200, 96,000-98,000, 89,037.0 | 109,998.9 (EQH, High เดิม) |

| 15m | 95,200 (Low ล่าสุด), 94,707.4 (Low ก่อนหน้า) | EMA 50, EMA 200, บริเวณ 96,000, 96,807.8, 97,000-97,200 |

**กลยุทธ์ (BTCUSDT):**

1. **Buy on Dip (Day, 4H) - *มีความน่าเชื่อถือมากขึ้น แต่ยังคงต้องระมัดระวัง*:**

* **เหตุผล:** แนวโน้มหลักยังเป็นขาขึ้น, Money Flow ใน TF Day แข็งแกร่ง

* **เงื่อนไข:** *ยังคงต้องรอสัญญาณการกลับตัวของราคาใน TF15 ก่อน* (Breakout แนวต้านย่อย, Money Flow TF15 เป็นบวก, Bullish Candlestick Patterns)

* **จุดเข้า (Day):** EMA 50, EMA 200, บริเวณ 96,000-98,000

* **จุดเข้า (4H):** EMA 50

* **Stop Loss:** ต่ำกว่า Low ล่าสุดของ TF15 หรือต่ำกว่าแนวรับที่เข้าซื้อ

2. **Short (15, ความเสี่ยงสูงมาก):**

* **เหตุผล:** แนวโน้ม TF15 เป็นขาลง, Money Flow TF15 เป็นลบ

* **เงื่อนไข:** ราคาไม่สามารถกลับขึ้นไปยืนเหนือ EMA ของ TF15 ได้

* **จุดเข้า:** บริเวณ EMA ของ TF15 หรือแนวต้านอื่นๆ

* **Stop Loss:** เหนือ High ล่าสุดของ TF15

3. **Wait & See (ทางเลือกที่ปลอดภัย):**

* **เหตุผล:** ความขัดแย้งระหว่าง Timeframes ยังคงมีอยู่

* รอให้ตลาดเฉลยทิศทางที่ชัดเจนกว่านี้

**คำแนะนำ (เน้นย้ำ):**

* **Money Flow ใน TF Day:** เป็นปัจจัยบวกที่สำคัญ ทำให้กลยุทธ์ Buy on Dip มีน้ำหนักมากขึ้น

* **ความขัดแย้งของ Timeframes:** ยังคงต้องระวัง TF15 ที่เป็นขาลง

* **Volume:** การ Breakout/Breakdown ใดๆ ควรมี Volume สนับสนุน

* **Risk Management:** สำคัญที่สุด

**สรุป:**

สถานการณ์ของ BTCUSDT โดยรวมยังคงเป็นบวก (ขาขึ้น) แต่มีความเสี่ยงในระยะสั้นจาก TF15 การตัดสินใจลงทุนควรพิจารณาจาก Timeframe ที่เหมาะสมกับสไตล์การเทรดของคุณ และอย่าลืมบริหารความเสี่ยงเสมอค่ะ

**Disclaimer:** การวิเคราะห์นี้เป็นเพียงความคิดเห็นส่วนตัว ไม่ถือเป็นคำแนะนำในการลงทุน ผู้ลงทุนควรศึกษาข้อมูลเพิ่มเติมและตัดสินใจด้วยความรอบคอบ

-

@ 2183e947:f497b975

2025-02-13 04:44:45

# How Coinpools Improve Bitcoin

# Problems with bitcoin

UX problems with base layer payments include:

- Mining fees are sometimes high

- Confirmations usually take several minutes

- Using it privately requires running a coinjoin server

UX problems with lightning payments include:

- Setup fees are sometimes high

- Payments frequently fail

- Payments aren't asynchronous (the recipient has to stand there with their device open waiting to do a revoke_and_ack on their old state -- unless they use a custodian)

- Payments that *do* succeed occasionally take more than 30 seconds (due to stuck payments, automatic retries, and no ability to say "stop retrying" in any existing wallets that I'm aware of)

- Using it privately requires manual channel management

# Solutions

A lot of my recent work focuses on non-interactive coinpools. I figured out a way to do them on bitcoin if we had CTV + CSFS, and then, with a bit more thought, I figured out that my model didn't actually require those things, so I am now working on an implementation. But my model does benefit a lot from CTV (less sure about CSFS at this point) so let me outline how non-interactive coinpools fix the above problems and along the way I will share how CTV specifically improves coinpools.

## "Mining fees are sometimes high"

Coinpools improve the problem of "mining fees are sometimes high" by letting you bypass them in more cases. If you're in a coinpool and pay someone else in the same coinpool, your payment does not show up on the base layer, it just involves modifying some unilateral withdrawal transactions such that the sender can withdraw less and the recipient can withdraw more. The transactions are off-chain, like LN transactions, so you can do that without paying a base layer fee.

## "Confirmations usually take several minutes"

Coinpools improve the problem of "confirmations usually take several minutes" in a similar manner. Payments *inside* a coinpool (i.e. to another pool user) merely involve modifying off-chain data (and revoking an old state), so they can be as fast as lightning. In most cases I expect them to be a bit faster because there's less need for pathfinding or negotiating with a variety of routing nodes. If the sender and the recipient are in the same pool, they only need to talk to each other and, in my model, a coordinator.

## "Using the base layer privately requires running a coinjoin server"

Coinpools improve the problem of "using the base layer privately requires running a coinjoin server" in two ways: first, if you're in a coinpool and you send money to a bitcoin address, the blockchain doesn't know which coinpool user sent that payment. Analysts might be able to trace the payment to the coinpool, but from the blockchain's perspective, that's just a multisig; the actual person *inside* the multisig who sent the money is not revealed. However, my model uses a coordinator, and the coordinator probably knows which user sent the payment. Still, only 1 person knowing is better than having everyone on the blockchain know.

Second, if you send money to someone *inside* the coinpool, in my model, the only people who know about your payment are the sender, the recipient, and the coordinator, and the recipient does not know who the sender is. Moreover, my model allows users to act as bridges from LN to other pool users, so even the coordinator doesn't know if the person who *looks* like the sender was the *real* sender or just a bridge node, with the *real* sender being someone on lightning.

## "Setup fees on lightning are sometimes high"

Coinpools improve the problem of "setup fees are sometimes high" by having multiple users share the setup cost. My model allows a single bitcoin transaction to fund a coinpool with a number of members between 1 and probably about 100. (The max I've actually successfully tested is 11.) If the users share the cost of that transaction, then even in a high fee scenario, where bitcoin transactions cost $50, each user only has to pay a fraction of that, where the fraction is determined by how many users are joining the pool. If 10 people are joining, each user would pay $5 instead of $50. If 50 people are joining, each user would pay $1. If 100 people are joining, each user would pay 50¢.

## Sidebar: how CTV improves my coinpool model

The setup is also where CTV greatly improves my model. For my model to work, the users have to coordinate to create the pool in something I call a "signing ceremony," which is very similar to a coinjoin. The signing ceremony has to be scheduled and each user has to show up for it or they won't get into the pool. With CTV, you could fix this: instead of a signing ceremony, an exchange could autosend your money into a coinpool on e.g. a monthly basis and email you the data you need to perform your unilateral exit. All they need from you is a pubkey, and they can do everything else.

## "Lightning payments frequently fail"

Coinpools improve the problem of "payments frequently fail" by reducing the need for pathfinding, which is a typical cause of failure on lightning. If you are paying someone in the same pool as you, you always know an exact path: it will be you -> coordinator -> recipient. These short paths also reduce the likelihood of routing nodes having insufficient capacity to forward the payment. You've only got one "routing node" to worry about -- the coordinator.

## "Lightning payments aren't asynchronous"

Coinpools *in general* don't improve the problem of "payments aren't asynchronous" but my model in particular *does* improve that problem because I am combining it with my hedgehog protocol from last year, which *does* allow for asynchronous lightning-like payments. Relatedly, my coinpool model technically has a network model, it's just a hub-and-spoke network: the coordinator is connected to every user of the pool and can forward asynchronous hedgehog payments to them. This means you can send money to someone when they are offline; they'll get it whenever they *do* get online, even if *you* went offline in the meantime.

## "Lightning payments sometimes take too long"

Coinpools improve the problem of "stuck" lightning payments by reducing the number of hops along the route. As above, a payment inside the pool (per my model) is always just sender -> coordinator -> recipient. Due to only having 1 hop, there are fewer opportunities for a node to have a network issue and cause a delay.

## "Channel management is a pain"

Coinpools have multiple ways of improving the problem of manual channel management. In particular, not all coinpool models *have* channels, so channel management is not always needed in a coinpool. My model, however, does have channels, so channel management is still a thing.

Nonetheless, my model improves channel management in two ways: first, the setup costs are lower for the reasons given above. Second, payment asynchronicity helps for the following reason:

The worst pain point in channel management *today* occurs when someone sends you a payment but it fails because you didn't have enough inbound capacity. That doesn't happen in my coinpool model because payments are asynchronous. If you don't have enough inbound capacity, the payment doesn't fail, it just remains pending. So all you have to do is open a new channel (i.e. enter a new pool) and *then* finalize the payment.

## Zap me

I hope this essay clarifies why coinpools improve the problems I outlined and why CTV improves coinpools. I also hope this gets you a bit excited for my latest coinpool invention, which I hope to release soon :D (It really is very close to demo-ready.) If you liked this essay, consider zapping me: supertestnet@coinos.io

-

@ a012dc82:6458a70d

2025-02-13 04:00:01

In the dynamic world of global finance, the interplay between traditional monetary policy and the burgeoning digital asset market is becoming increasingly prominent. The U.S. Federal Reserve's recent pivot towards a more accommodative monetary policy has sparked intense discussion among investors, economists, and cryptocurrency enthusiasts. This shift, characterized by an expected reduction in interest rates, is not just a routine adjustment but a significant move that could have far-reaching implications for various asset classes, including cryptocurrencies like Bitcoin. As we delve into this topic, we aim to unravel the complexities of the Fed's policy change and its potential ripple effects on Bitcoin, a digital asset that has been a subject of much intrigue and speculation.

**Table Of Content**

- Understanding the Fed's Policy Shift

- Impact on Traditional Financial Markets

- Bitcoin's Response to Monetary Easing

- Analyzing the Economic Backdrop

- Bitcoin: A Safe Haven or Risk Asset?

- Risks and Opportunities

- Conclusion

- FAQs

**Understanding the Fed's Policy Shift**

The Federal Reserve, the guardian of the U.S. monetary system, wields immense influence over global financial markets. Its recent signaling of a dovish turn – an expectation of 75 basis points in rate cuts by 2024 – marks a significant departure from its previous stance. This change is reflective of the Fed's response to a confluence of macroeconomic factors, such as fluctuating inflation rates, global economic uncertainties, and domestic financial stability concerns. The Fed's decisions are closely monitored as they set the tone for economic growth, inflation control, and financial market stability. In this context, the anticipated rate cuts suggest a strategic move to stimulate economic activity by making borrowing cheaper, thereby potentially boosting investment and consumption. However, this policy shift is not without its complexities and nuances, as it must balance the fine line between stimulating growth and controlling inflation.

**Impact on Traditional Financial Markets**

The ripple effects of the Fed's policy announcement were immediately felt across traditional financial markets. Stock markets, often seen as a barometer of economic sentiment, reacted positively, with indices like the Dow Jones Industrial Average reaching new heights. This surge reflects investors' optimism about the potential for increased corporate profits and economic growth in a lower interest rate environment. Similarly, the bond market experienced a significant rally, with yields on government securities falling as bond prices rose. This movement in the bond market is indicative of investors' expectations of a more accommodative monetary policy, which typically leads to lower yields on fixed-income securities. These market reactions underscore the pivotal role of central bank policies in shaping investor sentiment and the direction of financial markets. They also highlight the interconnectedness of various asset classes, as changes in monetary policy can have cascading effects across different sectors of the economy.

**Bitcoin's Response to Monetary Easing**

Bitcoin's reaction to the Fed's dovish turn has been a subject of keen interest. The cryptocurrency, which had been experiencing volatility, showed signs of recovery following the Fed's announcement. This response is indicative of Bitcoin's increasing correlation with broader financial market trends, a significant development given its history as an uncorrelated asset. Bitcoin's sensitivity to macroeconomic factors like central bank policies points to its growing integration into the mainstream financial ecosystem. However, this integration also means that Bitcoin is increasingly exposed to the same macroeconomic risks and uncertainties that affect traditional assets. The Fed's policy shift could potentially make Bitcoin more attractive to investors seeking non-traditional assets in a low-interest-rate environment. However, Bitcoin's complex dynamics, including its decentralized nature, limited supply, and regulatory landscape, add layers of complexity to its response to monetary policy changes.

**Analyzing the Economic Backdrop**

The economic backdrop against which the Fed's policy shift occurs is multifaceted and dynamic. On one hand, the U.S. economy has demonstrated resilience, with robust GDP growth and positive retail sales figures suggesting underlying strength. On the other hand, inflation, though moderated from its peak, remains a concern, hovering above the Fed's target. This economic duality presents a challenging scenario for policymakers, who must navigate the delicate balance between stimulating growth and containing inflation. For investors and market participants, this creates an environment of uncertainty, as they must decipher mixed signals from economic data and policy announcements. In this context, Bitcoin's role and response become even more intriguing, as it operates at the intersection of technology, finance, and macroeconomics.

**Bitcoin: A Safe Haven or Risk Asset?**

The debate over Bitcoin's classification as a safe haven or a risk asset is intensified by the Fed's easing stance. Traditionally, in a low-interest-rate environment, investors seek assets that can serve as hedges against inflation and currency devaluation. Gold has historically played this role, and Bitcoin, with its fixed supply and digital scarcity, has drawn comparisons to gold. However, Bitcoin's relatively short history and high volatility make it a more complex and potentially riskier asset. The Fed's dovish policy could enhance Bitcoin's appeal as an alternative investment, especially if traditional assets like bonds offer lower returns. However, Bitcoin's classification as a safe haven is still a matter of debate, with opinions divided on its long-term stability and value retention capabilities.

**Risks and Opportunities**

Investors considering Bitcoin in light of the Fed's policy change face a landscape filled with both risks and opportunities. The potential for a Bitcoin rally in a low-interest-rate environment is counterbalanced by the cryptocurrency's inherent volatility and regulatory uncertainties. Bitcoin's price movements can be dramatic and unpredictable, influenced by a range of factors from technological developments to geopolitical events. Additionally, the regulatory environment for cryptocurrencies is still evolving, with potential changes posing risks to Bitcoin's accessibility and value. Investors must also consider the broader global economic context, including actions by other central banks and international trade dynamics, which can impact Bitcoin's market movement.

**Conclusion**

The Federal Reserve's shift towards a more accommodative monetary policy in 2024 presents a fascinating scenario for Bitcoin and the broader cryptocurrency market. This development underscores the increasing relevance of digital assets in the global financial landscape and highlights the complex interplay between traditional monetary policies and emerging financial technologies. As Bitcoin continues to evolve and gain acceptance, its response to macroeconomic factors like central bank policies will be a critical area of focus for investors. In navigating this dynamic and uncertain environment, a cautious and well-informed approach is essential for those looking to explore the opportunities and navigate the challenges of cryptocurrency investments. The coming years promise to be a pivotal period in the maturation of Bitcoin as it responds to the shifting tides of global finance.

**FAQs**

**How does the Federal Reserve's easing stance impact Bitcoin?**

The Fed's shift towards lower interest rates can make riskier assets like Bitcoin more attractive to investors. This is because lower rates often lead to reduced yields on traditional investments, prompting investors to seek higher returns elsewhere.

**What is the significance of the Fed's 'dot plot' for Bitcoin investors?**

The 'dot plot' is a projection of interest rate movements by Federal Reserve members. A shift towards lower rates, as indicated in the recent dot plot, can signal a more accommodative monetary policy, potentially impacting Bitcoin's market as investors adjust their portfolios.

**Can Bitcoin be considered a safe haven asset in light of the Fed's policy?**

Bitcoin's role as a safe haven asset is debated. While its fixed supply and digital nature offer some safe haven characteristics, its volatility and regulatory uncertainties make it a complex choice compared to traditional safe havens like gold.

**What risks should Bitcoin investors consider in the context of the Fed's easing policy?**

Investors should be aware of Bitcoin's volatility, regulatory changes, and its sensitivity to macroeconomic factors. Additionally, global economic conditions and actions by other central banks can also influence Bitcoin's market.

**How does the economic backdrop influence Bitcoin's response to the Fed's policy?**

Economic factors like GDP growth, inflation rates, and retail sales impact investor sentiment and risk appetite, which in turn can affect Bitcoin's market. A strong economy might reduce the appeal of risk assets like Bitcoin, while economic uncertainties can increase their attractiveness.

**That's all for today**

**If you want more, be sure to follow us on:**

**NOSTR: croxroad@getalby.com**

**X: @croxroadnews.co**

**Instagram: @croxroadnews.co**

**Youtube: @croxroadnews**

**Store: https://croxroad.store**

**Subscribe to CROX ROAD Bitcoin Only Daily Newsletter**

**https://www.croxroad.co/subscribe**

***DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.***

-

@ 57d1a264:69f1fee1

2025-02-13 03:45:23

**What You Will Learn:**

- Understanding the concept of cybersecurity

- Networking Basics

- Operating Systems Overview

- Introduction to Kali Linux

- Threat Actors and Cyber Threats

- Ethical Hacking Techniques and Tools.

**How to Register:**

Use this link to Register.

https://forms.gle/L8AGLCWU4djwUXxz9

originally posted at https://stacker.news/items/884407

-

@ f6488c62:c929299d

2025-02-13 02:39:41

Lowering interest rates is one of the tools that central banks use to manage the economy, especially during periods of inflation, which causes the prices of goods and services to rise. Lowering interest rates not only helps stimulate spending but can also foster sustainable growth in businesses and labor markets.

Access to Capital and Economic Stimulation

When interest rates are lowered, the public can access capital more easily. With lower interest rates, borrowing becomes less burdensome, giving individuals and businesses the opportunity to start new ventures or expand existing businesses. This leads to increased investment and spending, which in turn keeps the economy circulating and growing.

For instance, when people can easily borrow money to start a new business—such as an online store or a product manufacturing business—the increase in entrepreneurs and the availability of goods in the market will ensure that the supply is sufficient to meet consumer demand. This, in turn, prevents prices from rising too much due to a lack of supply.

Reducing Inflation by Increasing Supply

Increasing the supply of goods and services in the market can significantly help in controlling inflation. When there are more goods or services available to meet market demand, competition among producers will naturally drive prices down. This is the basic principle of market dynamics: when there’s enough supply, prices are less likely to increase, even in times of high demand.

In addition, increasing supply helps address shortages, which are one of the key drivers of rising prices. When there is enough product available to satisfy demand, inflationary pressures can be relieved, and prices can stabilize.

Redistributing Income and Reducing Inequality

Lower interest rates also play a crucial role in redistributing income within society. By making access to capital easier, especially for those with lower or middle incomes, the public’s purchasing power increases, which can stimulate spending on essential goods and services.

When people have more money in hand, they are better able to access necessary products. This boosts demand in the market. However, alongside this increased demand, sufficient supply is needed to prevent prices from rising uncontrollably, which can lead to inflation.

Moreover, supporting the population through welfare programs or initiatives that allow everyone to access education and investment opportunities helps individuals create products and value in the market. A diverse market with a variety of products increases production efficiency and helps mitigate economic inequality, ensuring a more balanced and inclusive economy.

Conclusion

Lowering interest rates and redistributing income effectively can stimulate economic growth and reduce inflation. This works by ensuring there is sufficient supply to meet market demand, while also providing capital that allows the public to start new businesses and generate new products in the market.

For sustainable long-term economic growth, managing inflation should go hand in hand with investing in infrastructure and ensuring wealth distribution. This ensures that everyone has equal access to opportunities, leading to steady economic growth without negatively impacting the majority of society.

In summary, lowering interest rates is a key tool in stimulating the economy and reducing inflation, especially when the economy faces imbalances. It not only increases supply, but also promotes income redistribution and the creation of an economy that is more equitable in the long run.

-

@ 3b7fc823:e194354f

2025-02-13 02:25:42

site:example.com

intitle:"index of"

inurl:admin

intext:"password"

site:example.com

site:.gov

site:.edu

site:*.mil

inurl:login

inurl:admin

inurl:dashboard

inurl:portal

intitle:"admin login"

intitle:"index of /"

intitle:"index of" "parent directory"

intitle:"index of" "backup"

filetype:pdf "confidential"

filetype:xls "username | password"

filetype:doc "top secret"

filetype:sql "database"

intext:"username" intext:"password"

intext:"login" intext:"password"

filetype:txt "passwords"

inurl:"viewerframe?mode="

inurl:"/view.shtml"

inurl:"/view/index.shtml"

intitle:"index of" "wp-config.php"

inurl:".git"

filetype:xls intext:"email"

filetype:csv intext:"email"

inurl:"/setup.cgi?next_file=netgear.cfg"

inurl:"/wificonf.html"

-

@ fd78c37f:a0ec0833

2025-02-13 02:24:48

In this edition, we invited Rafael from Bitcoin É Aqui to share the development of his community and its efforts in promoting Bitcoin adoption. From establishing a Bitcoin-friendly environment in Rolante to organizing and supporting events like the Bitcoin Spring Festival and KuchenFest, Rafael highlighted Bitcoin's impact on the local economy and tourism industry.

**YakiHonne**: Today, we are honored to invite Rafael from Bitcoin é Aqui to join us. Before we dive in, I'd like to take a moment to introduce YakiHonne and share a bit about what we do. YakiHonne is a decentralized media client built on the Nostr protocol that enables freedom of speech through technology. It empowers creators to create their own voice, assets, and features. It also allows features like smart widgets, verified notes, and focuses on long-form articles. Now today we'll be exploring more about the Bitcoin community. Rafael, could you please briefly introduce what sparked your interest in Bitcoin, and what motivated you to create this community?

**Rafael**:Like many, Stim's and his wife Camila's initial interest was in technology— a completely new way to transfer money with full self-custody. From the beginning, the project focused on the payment network, and at the time, they didn’t realize it would evolve into “A Project.”

**YakiHonne**: Could you share how your community got started, the strategies you used to attract members, and the early challenges you encountered?

**Rafael**:From the start, we were all about building a payment network. We began by paying our barber, gardener, and other service providers with Bitcoin. After a few close friends joined, word started to spread—even though some were worried about scams and Bitcoin's legality. To address these concerns, we held a talk at the City's Trade Association on how merchants could legally accept Bitcoin. We expected 5 to 10 friends, but over 60 merchants attended! Today, we’re proud to say that our city is the most Bitcoin-friendly in the world, with more than 40% of stores accepting it. From plumbers to supermarkets, it’s amazing to see our community featured on the BitcoinMap website.

**YakiHonne**: What principles guide the community, and how do you maintain trust and reliability in discussions?

**Rafael**:Like Bitcoin itself, decentralization is our core principle. The project "Bitcoin É Aqui" (loosely translated as "Bitcoin is Here") assists merchants in setting up Lightning wallets and offers best practices. However, every merchant is free to operate as they see fit—choosing whether to follow our advice or to use any wallet they prefer. Moreover, many experienced merchants help onboard newcomers, building trust through established networks and reinforcing our decentralized approach.

**YakiHonne**: How do you educate members and keep them updated on Bitcoin developments?

**Rafael**:We have a group chat where we post some news, but in Brazil, almost everyone already uses WhatsApp for communication, and news usually spreads through these groups, again highlighting the decentralized nature of the Project.

**YakiHonne**: What initiatives has the community undertaken to promote Bitcoin adoption, and what results have you seen?

**Rafael**:Of course, the rising coin value draws attention, but the main attraction is tourists coming to Rolante to learn about the project. Rolante was already famed for its natural wonders—majestic mountains and breathtaking waterfalls. Combined with Bitcoin’s innovative acceptance as a payment method, it has become an even stronger magnet for visitors.

**Rafael**:In Rolante, living completely on Bitcoin is a reality. Here, you'll find travel agencies, professional tour guides, and a variety of services—from department stores and opticians to real estate agents, construction companies, architects, furniture stores, building materials suppliers, and solar energy providers. In the healthcare sector, you can rely on pharmacies, massage therapists, physiotherapists, and advanced dental services; even the city hospital accepts Bitcoin as payment.

**YakiHonne**: What are the community’s goals for the next 6-12 months, and how do you see it evolving with Bitcoin’s growth?

**Rafael**:As a project, Bitcoin É Aqui doesn’t dictate what the community should do, but we support many events like Pizza Day, Bitcoin Spring Festival, Bier Rock, KuchenFest. One major event is the biennial Bitcoin Spring Festival (BSF). The Bitcoin Spring Festival (BSF) is a key event in the Rolante Bitcoin community, aimed at promoting Bitcoin adoption and circular economy development. This year, the festival focuses on "Bitcoinization," bringing together notable figures in the Bitcoin space to showcase a real Bitcoin economic ecosystem. During the event, all transactions will be conducted via the Lightning Network, with Coinos.io and Wallet Of Satoshi recommended. BSF is not just a celebration but a movement toward financial freedom.

**Rafael**:This March, Rolante will host its most traditional event, KuchenFest, celebrating the local traditional bread delicacy. The event centers around the sweet bread Cuca, bringing together candy makers and Cuca enthusiasts to share recipes, techniques, and stories. Additionally, the festival features live music, folk dances, and family activities, showcasing rich cultural traditions. We will help the event accept and promote the use of Bitcoin.

-

@ ac6f9572:8a6853dd

2025-02-13 02:05:22

I attended Sats ‘n’ Facts to share my art, joining other Nostr artists in exhibiting our work at the event’s very first venue. It was a great opportunity to connect with fellow creatives, including Siritravelsketch, whose work I’ve admired on Nostr for some time. Meeting other artists in real life is always inspiring—there’s an undeniable creative bond that comes from sharing our passion in person.

Sats ‘n’ Facts is an Unconference, meaning there’s no strict schedule—everything is open for participants. It’s all about the connections made, the synergy shared, and, for the developers attending, the excitement of a hackathon. (A hackathon is an event where people collaborate intensively on engineering projects, often within 24 to 48 hours.)

My goal as an artist is to become a bridge between the Bitcoin tech world and the Bitcoin art and design space. Bitcoin empowers us by providing greater (financial) freedom, and with that freedom comes more time to pursue what we truly love—so in a way, you never have to “work” again. 😊

Nostr is a great example of how bubbles 🫧 POP, leading to new collaborations. Without tech, artists wouldn’t have a way to share their work, and without artists, creatives, and plebs, developers would have no one to build for. Both sides are essential for organic growth. This kind of synergy can only thrive in a decentralized system—otherwise, it risks being captured by big corporations. And that single point of failure is one of the biggest challenges we face in the world today.

Decentralization is freedom. Events like Sats ‘n’ Facts give us the opportunity to collaborate, create, and contribute to a more decentralized world—one where more people can truly become free.

Can’t wait to join the next Sats’n’facts. Maybe Barcelona!?

* * *

Originally article published by @BitPopArt on @YakiHonne: https://yakihonne.com/article/naddr1qvzqqqr4gupzqsa64uxz3ek0kx2mzlhqs0seavay4l06c4xek6a0zup8pmge8c6vqq242en0tukk7u2fwe8kkjrpv3ykgjtzwfsk5hmmfyp

#art #nostr #ThaiNostrich #artonnostr #artstr

originally posted at https://stacker.news/items/884327

-

@ df478568:2a951e67

2025-02-13 02:04:30

In the very early days, Nostr was pretty much troll-free. It was one of my favorite things about it, but I suspected this was only the case because only hardcore bitcoiners were on there. Now that the network is growing, there is more diversity of ideas. Ideology tends to make people mean. Mean people suck, so I try to remain respectful even when I disagree with others. I am not a fan of communism, but enjoy reading other perspectives. I do not wish to censor any speech at all, especially speech I do not agree with.

The freedom of speech is not about the First Amendment to me. It's about creating a space that is safe for free speech. Platforms are not a safe space for free speech. The safety of free speech is in peril on platforms. Nostr is a space where people can speak freely in an open Internet-connected society. There is some speech I would rather not see. I wish some people did not say certain things, but I do not want to stop them.

If we censor the worst speech, the speech does not go away. It merely goes underground and creates bad speech silos where people hide their true selves and go only speak to people just like them. Censorship is like prison for ideas. Prisoners improve their robbery skills because they exchange ideas with other criminals. It's like a conference for criminals. Fascists get more fascist when they only have permission to talk to fellow fascists. Communists get more communist when they can only talk to other communists. Ideas are a marketplace. May the best ideas win.

Nostr allows me to speak with people about topics I might not otherwise get a chance to speak about. I never see any pro-communist posts on Twitter. That's a problem because communists also don't see me. I also never saw sex workers talk about anything other than kinky-boinky talk on Twitter. Nostr brings the humanity back to sex workers. Sex workers are people too. They have interesting ideas and take [interesting photos]([take interesting pictures](nostr:note1svl3ne6l7dkxx4gckqsttx24nva7m37ynam7rvgq4zu83u9wl2ks86ahwx). )

On the [What is Money Show](https://fountain.fm/episode/DYPKRSkN11EmYDhrhH0H), Rabble says he wants to have Christians have a Christian-only Nostr network and sex workers to have a sex worker-only network. It's a fun idea, but I'm not convinced this would be a good thing. What if Jesus was on the Christian Nostr, but Mary Magdalen was on sex worker Nostr? I suspect Christians talking to sex workers is not such a bad thing. **What would Jesus do?**

Here is a conversation I had with a stripper on nostr. You can read the original [here](nostr:note1wxalrm6tpftrrs9rmzvv4e5gpnamkmfuu6fpwu9gs3wtudeegd7qpd5l0r) but I have reprinted it on the Habla and Substack.

I don't believe it's possible for a community or state to abolish private property when the private property can be distilled into 12 secret random words. Ironically, bitcoin does give the means of monetary production to the people, but this is a moot point given that individual people do not have equal ability. Very few people had sufficient knowledge to mine bitcoin when the block reward was 50 bitcoin every 10 minutes. Therefore, even though anybody could technically produce bitcoin blocks, very few people can.

The same is true for saving. Even if we could defy human nature with schemes such as this, it would not solve wealth inequality. Most people spend money like drunken sailors. If everyone had the same income that could not be debased or stolen, broke people would still exist because people do not have equal money management skills.

That is why I prefer capitalism with a non-socialist monetary system. The United States, contrary to popular belief, is not a capitalist economic system. It's a mixed economy where some people (banks and government) get money without doing any work aside from fudging numbers.

A bank does not save capital to buy a house. Banks print money to buy homes and collect rent from homeowners. It's an accounting trick, not capitalism.

Here's how capitalism works according to economist, Russ Roberts.

https://youtu.be/ljULutAUL7o?si=bLPY5IvwwMQvfXJK

npub1marc26z8nh3xkj5rcx7ufkatvx6ueqhp5vfw9v5teq26z254renshtf3g0

https://mempool.marc26z.com/block/00000000000000000001fa33d3d7750ed315d94e3c1def6512281b33bece333b

@ e3ba5e1a:5e433365

2025-02-13 06:16:49My favorite line in any Marvel movie ever is in “Captain America.” After Captain America launches seemingly a hopeless assault on Red Skull’s base and is captured, we get [this line](https://www.youtube.com/shorts/kqsomjpz7ok): “Arrogance may not be a uniquely American trait, but I must say, you do it better than anyone.” Yesterday, I came across a comment on the song [Devil Went Down to Georgia](https://youtu.be/ut8UqFlWdDc) that had a very similar feel to it:  America has seemingly always been arrogant, in a uniquely American way. Manifest Destiny, for instance. The rest of the world is aware of this arrogance, and mocks Americans for it. A central point in modern US politics is the deriding of racist, nationalist, supremacist Americans. That’s not what I see. I see American Arrogance as not only a beautiful statement about what it means to be American. I see it as an ode to the greatness of humanity in its purest form. For most countries, saying “our nation is the greatest” *is*, in fact, twinged with some level of racism. I still don’t have a problem with it. Every group of people *should* be allowed to feel pride in their accomplishments. The destruction of the human spirit since the end of World War 2, where greatness has become a sin and weakness a virtue, has crushed the ability of people worldwide to strive for excellence. But I digress. The fears of racism and nationalism at least have a grain of truth when applied to other nations on the planet. But not to America. That’s because the definition of America, and the prototype of an American, has nothing to do with race. The definition of Americanism is *freedom*. The founding of America is based purely on liberty. On the God-given rights of every person to live life the way they see fit. American Arrogance is not a statement of racial superiority. It’s barely a statement of national superiority (though it absolutely is). To me, when an American comments on the greatness of America, it’s a statement about freedom. Freedom will always unlock the greatness inherent in any group of people. Americans are *definitionally* better than everyone else, because Americans are freer than everyone else. (Or, at least, that’s how it should be.) In *Devil Went Down to Georgia*, Johnny is approached by the devil himself. He is challenged to a ridiculously lopsided bet: a golden fiddle versus his immortal soul. He acknowledges the sin in accepting such a proposal. And yet he says, “God, I know you told me not to do this. But I can’t stand the affront to my honor. I am the greatest. The devil has nothing on me. So God, I’m gonna sin, but I’m also gonna win.” *Libertas magnitudo est*

@ e3ba5e1a:5e433365

2025-02-13 06:16:49My favorite line in any Marvel movie ever is in “Captain America.” After Captain America launches seemingly a hopeless assault on Red Skull’s base and is captured, we get [this line](https://www.youtube.com/shorts/kqsomjpz7ok): “Arrogance may not be a uniquely American trait, but I must say, you do it better than anyone.” Yesterday, I came across a comment on the song [Devil Went Down to Georgia](https://youtu.be/ut8UqFlWdDc) that had a very similar feel to it:  America has seemingly always been arrogant, in a uniquely American way. Manifest Destiny, for instance. The rest of the world is aware of this arrogance, and mocks Americans for it. A central point in modern US politics is the deriding of racist, nationalist, supremacist Americans. That’s not what I see. I see American Arrogance as not only a beautiful statement about what it means to be American. I see it as an ode to the greatness of humanity in its purest form. For most countries, saying “our nation is the greatest” *is*, in fact, twinged with some level of racism. I still don’t have a problem with it. Every group of people *should* be allowed to feel pride in their accomplishments. The destruction of the human spirit since the end of World War 2, where greatness has become a sin and weakness a virtue, has crushed the ability of people worldwide to strive for excellence. But I digress. The fears of racism and nationalism at least have a grain of truth when applied to other nations on the planet. But not to America. That’s because the definition of America, and the prototype of an American, has nothing to do with race. The definition of Americanism is *freedom*. The founding of America is based purely on liberty. On the God-given rights of every person to live life the way they see fit. American Arrogance is not a statement of racial superiority. It’s barely a statement of national superiority (though it absolutely is). To me, when an American comments on the greatness of America, it’s a statement about freedom. Freedom will always unlock the greatness inherent in any group of people. Americans are *definitionally* better than everyone else, because Americans are freer than everyone else. (Or, at least, that’s how it should be.) In *Devil Went Down to Georgia*, Johnny is approached by the devil himself. He is challenged to a ridiculously lopsided bet: a golden fiddle versus his immortal soul. He acknowledges the sin in accepting such a proposal. And yet he says, “God, I know you told me not to do this. But I can’t stand the affront to my honor. I am the greatest. The devil has nothing on me. So God, I’m gonna sin, but I’m also gonna win.” *Libertas magnitudo est* @ d360efec:14907b5f

2025-02-13 05:54:17 **ภาพรวม LUNCUSDT (OKX):** LUNCUSDT กำลังอยู่ในช่วงที่ *มีความผันผวนสูงและมีความไม่แน่นอนมาก* แม้ว่าในอดีต (TF Day) จะเคยมีสัญญาณของการพยายามกลับตัวเป็นขาขึ้น (Breakout EMA 50 และเกิด Golden Cross) แต่ปัจจุบันแรงซื้อเหล่านั้นเริ่มอ่อนแรงลง และมีแรงขายเข้ามาในตลาดมากขึ้น ทำให้เกิดความขัดแย้งระหว่าง Timeframes ต่างๆ  **สถานะปัจจุบัน:** * **แนวโน้ม:** * **TF Day:** เริ่มไม่แน่นอน (จากเดิมที่เป็น Early Uptrend) - แม้ว่าราคาจะยังอยู่เหนือ EMA 50/200 แต่ Money Flow เริ่มแสดงสัญญาณเตือน * **TF4H:** เริ่มไม่แน่นอน (พักตัว, ทดสอบแนวรับ EMA 50) - Money Flow บ่งบอกถึงแรงขายที่เข้ามา * **TF15:** ผันผวนสูง, ไม่มีทิศทางชัดเจน (Sideways) - Money Flow แสดงถึงแรงขาย แต่ก็มีแรงซื้อกลับเข้ามาบ้าง * **Money Flow (LuxAlgo):** * **TF Day:** แรงซื้อเริ่มอ่อนแรงลงอย่างมีนัยสำคัญ, มีแรงขายเข้ามา * **TF4H:** แรงขายมีมากกว่าแรงซื้อ * **TF15:** แรงขายและแรงซื้อผสมกัน, โดยรวมแรงขายยังมากกว่า * **EMA:** * **TF Day:** EMA 50/200 เป็นแนวรับ/แนวต้าน * **TF4H:** EMA 50 กำลังถูกทดสอบ, EMA 200 เป็นแนวต้าน * **TF15:** EMA 50/200 เป็นแนวต้าน **โครงสร้างราคา (SMC):** | Timeframe | Break of Structure (BOS) | Change of Character (CHoCH) | Higher High (HH) & Higher Low (HL) | Equal Highs (EQH) / Equal Lows (EQL) | | :-------- | :----------------------- | :--------------------------- | :----------------------------------- | :------------------------------------- | | Day | ด้านบนและล่าง | ด้านบน | เริ่มก่อตัว (แต่ไม่แข็งแกร่ง) | - | | 4H | ด้านบน | ด้านบน | เริ่มก่อตัว (แต่ไม่ชัดเจน) | มี EQH หลายจุด | | 15m | ด้านบนและล่าง | มีทั้งบนและล่าง | Lower Highs (LH) & Lower Lows (LL) | มี EQH และ EQL หลายจุด | **แนวรับ-แนวต้านสำคัญ:** | Timeframe | แนวรับ | แนวต้าน | | :-------- | :----------------------------------------------------------- | :--------------------------------------------------------------------- | | Day | EMA 50 (≈0.00010000), EMA 200 (≈0.00008000), 0.00006000-0.00007000 | 0.00017953 (High ล่าสุด), 0.00014000 (Volume Profile) | | 4H | EMA 50 (≈0.00007000), 0.00006000-0.00007000 | EMA 200 (≈0.00008000), 0.00008132, บริเวณ 0.00010000-0.00012000 (EQH) | | 15m | บริเวณ Low ล่าสุด | EMA 50, EMA 200, บริเวณ 0.000075-0.000076 (EQH) | **กลยุทธ์ (LUNCUSDT):** 1. **Wait & See (ทางเลือกที่ดีที่สุด):** * **เหตุผล:** ความขัดแย้งระหว่าง Timeframes สูงมาก, แนวโน้มไม่ชัดเจน, Money Flow ใน TF4H และ TF15 เป็นลบ * รอให้ราคาแสดงทิศทางที่ชัดเจนกว่านี้ (ยืนเหนือ EMA 50 ใน TF4H ได้, Breakout แนวต้านใน TF15) 2. **Buy on Dip (Day, 4H) - *ความเสี่ยงสูงมาก ไม่แนะนำ*:** * **เหตุผล:** แนวโน้มระยะยาวอาจจะยังเป็นขาขึ้นได้ (ถ้าไม่หลุดแนวรับสำคัญ) * **เงื่อนไข:** *ต้อง* รอสัญญาณการกลับตัวใน TF15 ก่อน * **จุดเข้า:** พิจารณาเฉพาะบริเวณแนวรับที่แข็งแกร่งมากๆ (EMA ของ Day/4H) *และต้องดู TF15 ประกอบ* * **Stop Loss:** ต่ำกว่า Low ล่าสุดของ TF15 3. **Short (15, ความเสี่ยงสูงมาก):** * **เหตุผล:** แนวโน้ม TF15 เป็นขาลง, Money Flow เป็นลบ * **เงื่อนไข:** ราคาไม่สามารถ Breakout EMA หรือแนวต้านอื่นๆ ใน TF15 ได้ * **จุดเข้า:** บริเวณ EMA หรือแนวต้านของ TF15 * **Stop Loss:** เหนือ High ล่าสุดของ TF15 **คำแนะนำ (เน้นย้ำ):** * **LUNC เป็นเหรียญที่มีความเสี่ยงสูงมาก (High Risk):** มีความผันผวนสูง และอาจมีการเปลี่ยนแปลงอย่างรวดเร็ว * **ความขัดแย้งของ Timeframes:** สถานการณ์ของ LUNCUSDT มีความขัดแย้งสูงมาก และมีความเสี่ยงสูง * **Money Flow:** บ่งบอกถึงแรงขายที่เริ่มเข้ามา และแนวโน้มขาขึ้น (ระยะกลาง-ยาว) ที่อ่อนแอลง * **ถ้าไม่แน่ใจ อย่าเพิ่งเข้าเทรด:** "รอ" เป็นกลยุทธ์ที่ดีที่สุด * **Risk Management:** สำคัญที่สุด ไม่ว่าจะเลือกกลยุทธ์ใด ต้องมีการบริหารความเสี่ยงที่ดี **สรุป:** LUNCUSDT กำลังอยู่ในช่วงเวลาที่ยากลำบากและมีความเสี่ยงสูงมากที่สุดในบรรดา 3 เหรียญที่เราวิเคราะห์กันมา การตัดสินใจที่ผิดพลาดอาจนำไปสู่การขาดทุนได้ ควรพิจารณาอย่างรอบคอบก่อนเข้าเทรดทุกครั้ง และ "รอ" จนกว่าจะมีสัญญาณที่ชัดเจนกว่านี้ เป็นทางเลือกที่ปลอดภัยที่สุดสำหรับนักลงทุนส่วนใหญ่ค่ะ **Disclaimer:** การวิเคราะห์นี้เป็นเพียงความคิดเห็นส่วนตัว ไม่ถือเป็นคำแนะนำในการลงทุน ผู้ลงทุนควรศึกษาข้อมูลเพิ่มเติมและตัดสินใจด้วยความรอบคอบ

@ d360efec:14907b5f

2025-02-13 05:54:17 **ภาพรวม LUNCUSDT (OKX):** LUNCUSDT กำลังอยู่ในช่วงที่ *มีความผันผวนสูงและมีความไม่แน่นอนมาก* แม้ว่าในอดีต (TF Day) จะเคยมีสัญญาณของการพยายามกลับตัวเป็นขาขึ้น (Breakout EMA 50 และเกิด Golden Cross) แต่ปัจจุบันแรงซื้อเหล่านั้นเริ่มอ่อนแรงลง และมีแรงขายเข้ามาในตลาดมากขึ้น ทำให้เกิดความขัดแย้งระหว่าง Timeframes ต่างๆ  **สถานะปัจจุบัน:** * **แนวโน้ม:** * **TF Day:** เริ่มไม่แน่นอน (จากเดิมที่เป็น Early Uptrend) - แม้ว่าราคาจะยังอยู่เหนือ EMA 50/200 แต่ Money Flow เริ่มแสดงสัญญาณเตือน * **TF4H:** เริ่มไม่แน่นอน (พักตัว, ทดสอบแนวรับ EMA 50) - Money Flow บ่งบอกถึงแรงขายที่เข้ามา * **TF15:** ผันผวนสูง, ไม่มีทิศทางชัดเจน (Sideways) - Money Flow แสดงถึงแรงขาย แต่ก็มีแรงซื้อกลับเข้ามาบ้าง * **Money Flow (LuxAlgo):** * **TF Day:** แรงซื้อเริ่มอ่อนแรงลงอย่างมีนัยสำคัญ, มีแรงขายเข้ามา * **TF4H:** แรงขายมีมากกว่าแรงซื้อ * **TF15:** แรงขายและแรงซื้อผสมกัน, โดยรวมแรงขายยังมากกว่า * **EMA:** * **TF Day:** EMA 50/200 เป็นแนวรับ/แนวต้าน * **TF4H:** EMA 50 กำลังถูกทดสอบ, EMA 200 เป็นแนวต้าน * **TF15:** EMA 50/200 เป็นแนวต้าน **โครงสร้างราคา (SMC):** | Timeframe | Break of Structure (BOS) | Change of Character (CHoCH) | Higher High (HH) & Higher Low (HL) | Equal Highs (EQH) / Equal Lows (EQL) | | :-------- | :----------------------- | :--------------------------- | :----------------------------------- | :------------------------------------- | | Day | ด้านบนและล่าง | ด้านบน | เริ่มก่อตัว (แต่ไม่แข็งแกร่ง) | - | | 4H | ด้านบน | ด้านบน | เริ่มก่อตัว (แต่ไม่ชัดเจน) | มี EQH หลายจุด | | 15m | ด้านบนและล่าง | มีทั้งบนและล่าง | Lower Highs (LH) & Lower Lows (LL) | มี EQH และ EQL หลายจุด | **แนวรับ-แนวต้านสำคัญ:** | Timeframe | แนวรับ | แนวต้าน | | :-------- | :----------------------------------------------------------- | :--------------------------------------------------------------------- | | Day | EMA 50 (≈0.00010000), EMA 200 (≈0.00008000), 0.00006000-0.00007000 | 0.00017953 (High ล่าสุด), 0.00014000 (Volume Profile) | | 4H | EMA 50 (≈0.00007000), 0.00006000-0.00007000 | EMA 200 (≈0.00008000), 0.00008132, บริเวณ 0.00010000-0.00012000 (EQH) | | 15m | บริเวณ Low ล่าสุด | EMA 50, EMA 200, บริเวณ 0.000075-0.000076 (EQH) | **กลยุทธ์ (LUNCUSDT):** 1. **Wait & See (ทางเลือกที่ดีที่สุด):** * **เหตุผล:** ความขัดแย้งระหว่าง Timeframes สูงมาก, แนวโน้มไม่ชัดเจน, Money Flow ใน TF4H และ TF15 เป็นลบ * รอให้ราคาแสดงทิศทางที่ชัดเจนกว่านี้ (ยืนเหนือ EMA 50 ใน TF4H ได้, Breakout แนวต้านใน TF15) 2. **Buy on Dip (Day, 4H) - *ความเสี่ยงสูงมาก ไม่แนะนำ*:** * **เหตุผล:** แนวโน้มระยะยาวอาจจะยังเป็นขาขึ้นได้ (ถ้าไม่หลุดแนวรับสำคัญ) * **เงื่อนไข:** *ต้อง* รอสัญญาณการกลับตัวใน TF15 ก่อน * **จุดเข้า:** พิจารณาเฉพาะบริเวณแนวรับที่แข็งแกร่งมากๆ (EMA ของ Day/4H) *และต้องดู TF15 ประกอบ* * **Stop Loss:** ต่ำกว่า Low ล่าสุดของ TF15 3. **Short (15, ความเสี่ยงสูงมาก):** * **เหตุผล:** แนวโน้ม TF15 เป็นขาลง, Money Flow เป็นลบ * **เงื่อนไข:** ราคาไม่สามารถ Breakout EMA หรือแนวต้านอื่นๆ ใน TF15 ได้ * **จุดเข้า:** บริเวณ EMA หรือแนวต้านของ TF15 * **Stop Loss:** เหนือ High ล่าสุดของ TF15 **คำแนะนำ (เน้นย้ำ):** * **LUNC เป็นเหรียญที่มีความเสี่ยงสูงมาก (High Risk):** มีความผันผวนสูง และอาจมีการเปลี่ยนแปลงอย่างรวดเร็ว * **ความขัดแย้งของ Timeframes:** สถานการณ์ของ LUNCUSDT มีความขัดแย้งสูงมาก และมีความเสี่ยงสูง * **Money Flow:** บ่งบอกถึงแรงขายที่เริ่มเข้ามา และแนวโน้มขาขึ้น (ระยะกลาง-ยาว) ที่อ่อนแอลง * **ถ้าไม่แน่ใจ อย่าเพิ่งเข้าเทรด:** "รอ" เป็นกลยุทธ์ที่ดีที่สุด * **Risk Management:** สำคัญที่สุด ไม่ว่าจะเลือกกลยุทธ์ใด ต้องมีการบริหารความเสี่ยงที่ดี **สรุป:** LUNCUSDT กำลังอยู่ในช่วงเวลาที่ยากลำบากและมีความเสี่ยงสูงมากที่สุดในบรรดา 3 เหรียญที่เราวิเคราะห์กันมา การตัดสินใจที่ผิดพลาดอาจนำไปสู่การขาดทุนได้ ควรพิจารณาอย่างรอบคอบก่อนเข้าเทรดทุกครั้ง และ "รอ" จนกว่าจะมีสัญญาณที่ชัดเจนกว่านี้ เป็นทางเลือกที่ปลอดภัยที่สุดสำหรับนักลงทุนส่วนใหญ่ค่ะ **Disclaimer:** การวิเคราะห์นี้เป็นเพียงความคิดเห็นส่วนตัว ไม่ถือเป็นคำแนะนำในการลงทุน ผู้ลงทุนควรศึกษาข้อมูลเพิ่มเติมและตัดสินใจด้วยความรอบคอบ @ d360efec:14907b5f

2025-02-13 05:27:39 **ภาพรวม XRPUSDT (OKX):** XRPUSDT กำลังอยู่ในช่วงสำคัญ แนวโน้มระยะยาว (TF Day) เริ่มมีสัญญาณบวกของการเป็นขาขึ้น (Early Uptrend) หลังราคา Breakout EMA 50 และ Money Flow สนับสนุน อย่างไรก็ตาม แนวโน้มระยะกลาง (TF4H) เริ่มแสดงความอ่อนแอลง โดยราคาพักตัวลงมาทดสอบแนวรับสำคัญ และ Money Flow บ่งชี้ถึงแรงซื้อที่ลดลงและแรงขายที่เพิ่มขึ้น ส่วนแนวโน้มระยะสั้นมาก (TF15) เป็นขาลงชัดเจน  **แนวโน้ม:** * **TF Day:** เริ่มเป็นขาขึ้น (Early Uptrend) - Breakout EMA 50, Money Flow เป็นบวก * **TF4H:** เริ่มไม่แน่นอน (พักตัว, ทดสอบแนวรับ EMA 50 และ EQL) - Money Flow เริ่มเป็นลบ * **TF15:** ขาลง (Downtrend) ระยะสั้นมาก - ราคาหลุด EMA, โครงสร้างราคาเป็น Lower Highs/Lows, Money Flow เป็นลบ **โครงสร้างราคา (SMC):** | Timeframe | Break of Structure (BOS) | Change of Character (CHoCH) | Higher High (HH) & Higher Low (HL) | Equal Highs (EQH) / Equal Lows (EQL) | | :-------- | :----------------------- | :--------------------------- | :----------------------------------- | :------------------------------------- | | Day | ด้านบน (Breakout EMA 50) | ไม่ชัดเจน | เริ่มก่อตัว (แต่ยังไม่ชัดเจน) | - | | 4H | ด้านบน | ไม่ชัดเจน | เริ่มก่อตัว (แต่ไม่ชัดเจน) | EQH: 3.00-3.20, EQL: 2.2667 | | 15m | ด้านล่าง | มีทั้งบนและล่าง | Lower Highs (LH) & Lower Lows (LL) | EQH: 2.48-2.50, EQL: 2.38 |   **Money Flow (LuxAlgo):** * **TF Day:** แรงซื้อแข็งแกร่ง * **TF4H:** แรงซื้อเริ่มอ่อนแรงลง, แรงขายเริ่มเข้ามา * **TF15:** แรงขายมีอิทธิพลเหนือกว่า **EMA (Exponential Moving Average):** * **TF Day:** EMA 50 & 200 เป็นแนวรับ * **TF4H:** EMA 50 กำลังถูกทดสอบ, EMA 200 เป็นแนวรับถัดไป * **TF15:** EMA 50 & 200 เป็นแนวต้าน **แนวรับ-แนวต้านสำคัญ:** | Timeframe | แนวรับ | แนวต้าน | | :-------- | :----------------------------------------------------- | :----------------------------------------------------------------------- | | Day | EMA 50 (≈1.56), EMA 200 (≈1.08) | 3.4049 (High), 3.00-3.20 (EQH) | | 4H | EMA 50 (≈2.20), *2.2667 (EQL)*, EMA 200, 1.7820 | 3.4049, 2.3987 (Volume Profile), 3.00-3.20 (EQH) | | 15m | 2.38 (EQL, Volume Profile), 2.3274 | EMA 50, EMA 200, 2.4196, Equilibrium (≈2.44), 2.48-2.50 (EQH) | **กลยุทธ์ (XRPUSDT):** 1. **Wait & See (ทางเลือกที่ดีที่สุด):** * **เหตุผล:** ความขัดแย้งระหว่าง Timeframes สูง, TF4H กำลังทดสอบแนวรับสำคัญ, Money Flow ใน TF4H และ TF15 เป็นลบ * รอให้ราคาแสดงทิศทางที่ชัดเจน (ยืนเหนือ EMA 50 ใน TF4H ได้ หรือ Breakout แนวต้านใน TF15) 2. **Buy on Dip (Day, 4H) - *ความเสี่ยงสูงมาก*:** * **เหตุผล:** แนวโน้มระยะยาวยังมีโอกาสเป็นขาขึ้น, Money Flow ใน TF Day เป็นบวก * **เงื่อนไข (สำคัญมาก):** *ต้อง* รอสัญญาณการกลับตัวใน TF15 ก่อน เช่น: * Breakout แนวต้านย่อยๆ พร้อม Volume * Money Flow (TF15) เปลี่ยนเป็นสีเขียว * Bullish Candlestick Patterns * **จุดเข้า (Day):** EMA 50, EMA 200 (*ดู TF15 ประกอบ*) * **จุดเข้า (4H):** EMA 50, *2.2667 (EQL)* (*ดู TF15 ประกอบ*) * **Stop Loss:** ต่ำกว่า Low ล่าสุดของ TF15 หรือต่ำกว่าแนวรับที่เข้าซื้อ 3. **Short (15, ความเสี่ยงสูงมาก):** * **เหตุผล:** แนวโน้ม TF15 เป็นขาลง, Money Flow เป็นลบ * **เงื่อนไข:** ราคาไม่สามารถกลับขึ้นไปยืนเหนือ EMA ของ TF15 ได้ * **จุดเข้า:** บริเวณ EMA ของ TF15 หรือแนวต้านอื่นๆ * **Stop Loss:** เหนือ High ล่าสุดของ TF15 **คำแนะนำ:** * **ความขัดแย้งของ Timeframes:** XRPUSDT มีความขัดแย้งสูงมาก และมีความเสี่ยงสูง * **Money Flow:** Day เป็นบวก, 4H เริ่มเป็นลบ, 15m เป็นลบ * **EMA 50 (TF4H) & EQL 2.2667:** จุดชี้ชะตา * **ถ้าไม่แน่ใจ อย่าเพิ่งเข้าเทรด:** "รอ" ดีที่สุด * **Risk Management:** สำคัญที่สุด **สรุป:** สถานการณ์ของ XRPUSDT ตอนนี้มีความเสี่ยงสูงมาก และไม่เหมาะกับนักลงทุนที่รับความเสี่ยงได้ต่ำ การ "รอ" จนกว่าจะมีสัญญาณที่ชัดเจนกว่านี้ เป็นทางเลือกที่ปลอดภัยที่สุดค่ะ Disclaimer: การวิเคราะห์นี้เป็นเพียงความคิดเห็นส่วนตัว ไม่ถือเป็นคำแนะนำในการลงทุน ผู้ลงทุนควรศึกษาข้อมูลเพิ่มเติมและตัดสินใจด้วยความรอบคอบ

@ d360efec:14907b5f

2025-02-13 05:27:39 **ภาพรวม XRPUSDT (OKX):** XRPUSDT กำลังอยู่ในช่วงสำคัญ แนวโน้มระยะยาว (TF Day) เริ่มมีสัญญาณบวกของการเป็นขาขึ้น (Early Uptrend) หลังราคา Breakout EMA 50 และ Money Flow สนับสนุน อย่างไรก็ตาม แนวโน้มระยะกลาง (TF4H) เริ่มแสดงความอ่อนแอลง โดยราคาพักตัวลงมาทดสอบแนวรับสำคัญ และ Money Flow บ่งชี้ถึงแรงซื้อที่ลดลงและแรงขายที่เพิ่มขึ้น ส่วนแนวโน้มระยะสั้นมาก (TF15) เป็นขาลงชัดเจน  **แนวโน้ม:** * **TF Day:** เริ่มเป็นขาขึ้น (Early Uptrend) - Breakout EMA 50, Money Flow เป็นบวก * **TF4H:** เริ่มไม่แน่นอน (พักตัว, ทดสอบแนวรับ EMA 50 และ EQL) - Money Flow เริ่มเป็นลบ * **TF15:** ขาลง (Downtrend) ระยะสั้นมาก - ราคาหลุด EMA, โครงสร้างราคาเป็น Lower Highs/Lows, Money Flow เป็นลบ **โครงสร้างราคา (SMC):** | Timeframe | Break of Structure (BOS) | Change of Character (CHoCH) | Higher High (HH) & Higher Low (HL) | Equal Highs (EQH) / Equal Lows (EQL) | | :-------- | :----------------------- | :--------------------------- | :----------------------------------- | :------------------------------------- | | Day | ด้านบน (Breakout EMA 50) | ไม่ชัดเจน | เริ่มก่อตัว (แต่ยังไม่ชัดเจน) | - | | 4H | ด้านบน | ไม่ชัดเจน | เริ่มก่อตัว (แต่ไม่ชัดเจน) | EQH: 3.00-3.20, EQL: 2.2667 | | 15m | ด้านล่าง | มีทั้งบนและล่าง | Lower Highs (LH) & Lower Lows (LL) | EQH: 2.48-2.50, EQL: 2.38 |   **Money Flow (LuxAlgo):** * **TF Day:** แรงซื้อแข็งแกร่ง * **TF4H:** แรงซื้อเริ่มอ่อนแรงลง, แรงขายเริ่มเข้ามา * **TF15:** แรงขายมีอิทธิพลเหนือกว่า **EMA (Exponential Moving Average):** * **TF Day:** EMA 50 & 200 เป็นแนวรับ * **TF4H:** EMA 50 กำลังถูกทดสอบ, EMA 200 เป็นแนวรับถัดไป * **TF15:** EMA 50 & 200 เป็นแนวต้าน **แนวรับ-แนวต้านสำคัญ:** | Timeframe | แนวรับ | แนวต้าน | | :-------- | :----------------------------------------------------- | :----------------------------------------------------------------------- | | Day | EMA 50 (≈1.56), EMA 200 (≈1.08) | 3.4049 (High), 3.00-3.20 (EQH) | | 4H | EMA 50 (≈2.20), *2.2667 (EQL)*, EMA 200, 1.7820 | 3.4049, 2.3987 (Volume Profile), 3.00-3.20 (EQH) | | 15m | 2.38 (EQL, Volume Profile), 2.3274 | EMA 50, EMA 200, 2.4196, Equilibrium (≈2.44), 2.48-2.50 (EQH) | **กลยุทธ์ (XRPUSDT):** 1. **Wait & See (ทางเลือกที่ดีที่สุด):** * **เหตุผล:** ความขัดแย้งระหว่าง Timeframes สูง, TF4H กำลังทดสอบแนวรับสำคัญ, Money Flow ใน TF4H และ TF15 เป็นลบ * รอให้ราคาแสดงทิศทางที่ชัดเจน (ยืนเหนือ EMA 50 ใน TF4H ได้ หรือ Breakout แนวต้านใน TF15) 2. **Buy on Dip (Day, 4H) - *ความเสี่ยงสูงมาก*:** * **เหตุผล:** แนวโน้มระยะยาวยังมีโอกาสเป็นขาขึ้น, Money Flow ใน TF Day เป็นบวก * **เงื่อนไข (สำคัญมาก):** *ต้อง* รอสัญญาณการกลับตัวใน TF15 ก่อน เช่น: * Breakout แนวต้านย่อยๆ พร้อม Volume * Money Flow (TF15) เปลี่ยนเป็นสีเขียว * Bullish Candlestick Patterns * **จุดเข้า (Day):** EMA 50, EMA 200 (*ดู TF15 ประกอบ*) * **จุดเข้า (4H):** EMA 50, *2.2667 (EQL)* (*ดู TF15 ประกอบ*) * **Stop Loss:** ต่ำกว่า Low ล่าสุดของ TF15 หรือต่ำกว่าแนวรับที่เข้าซื้อ 3. **Short (15, ความเสี่ยงสูงมาก):** * **เหตุผล:** แนวโน้ม TF15 เป็นขาลง, Money Flow เป็นลบ * **เงื่อนไข:** ราคาไม่สามารถกลับขึ้นไปยืนเหนือ EMA ของ TF15 ได้ * **จุดเข้า:** บริเวณ EMA ของ TF15 หรือแนวต้านอื่นๆ * **Stop Loss:** เหนือ High ล่าสุดของ TF15 **คำแนะนำ:** * **ความขัดแย้งของ Timeframes:** XRPUSDT มีความขัดแย้งสูงมาก และมีความเสี่ยงสูง * **Money Flow:** Day เป็นบวก, 4H เริ่มเป็นลบ, 15m เป็นลบ * **EMA 50 (TF4H) & EQL 2.2667:** จุดชี้ชะตา * **ถ้าไม่แน่ใจ อย่าเพิ่งเข้าเทรด:** "รอ" ดีที่สุด * **Risk Management:** สำคัญที่สุด **สรุป:** สถานการณ์ของ XRPUSDT ตอนนี้มีความเสี่ยงสูงมาก และไม่เหมาะกับนักลงทุนที่รับความเสี่ยงได้ต่ำ การ "รอ" จนกว่าจะมีสัญญาณที่ชัดเจนกว่านี้ เป็นทางเลือกที่ปลอดภัยที่สุดค่ะ Disclaimer: การวิเคราะห์นี้เป็นเพียงความคิดเห็นส่วนตัว ไม่ถือเป็นคำแนะนำในการลงทุน ผู้ลงทุนควรศึกษาข้อมูลเพิ่มเติมและตัดสินใจด้วยความรอบคอบ @ d360efec:14907b5f

2025-02-13 04:47:20 **ภาพรวม BTCUSDT :** Bitcoin (BTCUSDT) กำลังอยู่ในช่วงสำคัญ แม้ว่าแนวโน้มหลักในระยะกลางถึงยาว (TF Day & 4H) จะยังคงเป็นขาขึ้นที่แข็งแกร่ง แต่ในระยะสั้นมาก (TF15) กลับแสดงสัญญาณของความอ่อนแอและการปรับฐานลงมา ทำให้เกิดความไม่แน่นอนในทิศทางของราคา อย่างไรก็ตาม *Money Flow ใน TF Day บ่งชี้ว่าแรงซื้อโดยรวมยังคงแข็งแกร่ง*  **แนวโน้ม:** * **TF Day:** ขาขึ้น (Uptrend) แข็งแกร่ง – ราคาอยู่เหนือ EMA 50 และ EMA 200, โครงสร้างราคาเป็น Higher Highs (HH) และ Higher Lows (HL), *Money Flow เป็นบวก (แรงซื้อ)* * **TF4H:** ขาขึ้น (Uptrend) – ราคาอยู่เหนือ EMA, มีการพักตัวลงมา (Pullback) แต่ยังไม่เสียโครงสร้างขาขึ้น, *Money Flow เริ่มอ่อนแรง (แรงซื้อลดลง, แรงขายเพิ่มขึ้น)* * **TF15:** ขาลง (Downtrend) ระยะสั้นมาก – ราคาหลุด EMA และแนวรับย่อย, โครงสร้างราคาเป็น Lower Highs (LH) และ Lower Lows (LL), *Money Flow เป็นลบ (แรงขาย)* **โครงสร้างราคา (SMC):** * **TF Day:** ยืนยันแนวโน้มขาขึ้น (HH, HL, BOS) * **TF4H:** ยืนยันแนวโน้มขาขึ้น (HH, HL, BOS), มี Equal Highs (EQH) ที่เป็นแนวต้าน * **TF15:** บ่งบอกถึงแนวโน้มขาลงระยะสั้น (BOS ด้านล่าง, LH, LL), มี EQH เป็นแนวต้าน **Money Flow (LuxAlgo) - สรุป:** * **TF Day:** แรงซื้อยังคงแข็งแกร่งอย่างชัดเจน * **TF4H:** แรงซื้อเริ่มอ่อนแรงลง, มีแรงขายเข้ามา * **TF15:** แรงขายมีอิทธิพลเหนือกว่า  **EMA (Exponential Moving Average):** * **TF Day & 4H:** EMA 50 & 200 เป็นแนวรับสำคัญ * **TF15:** EMA 50 & 200 กลายเป็นแนวต้าน **แนวรับ-แนวต้านสำคัญ:** | Timeframe | แนวรับ | แนวต้าน | | :-------- | :------------------------------------------------------------------------- | :-------------------------------------------------------------- | | Day | EMA 50, EMA 200, 96,000-98,000, 85,724.7 | 109,998.9 (High เดิม) | | 4H | EMA 50, EMA 200, 96,000-98,000, 89,037.0 | 109,998.9 (EQH, High เดิม) | | 15m | 95,200 (Low ล่าสุด), 94,707.4 (Low ก่อนหน้า) | EMA 50, EMA 200, บริเวณ 96,000, 96,807.8, 97,000-97,200 | **กลยุทธ์ (BTCUSDT):** 1. **Buy on Dip (Day, 4H) - *มีความน่าเชื่อถือมากขึ้น แต่ยังคงต้องระมัดระวัง*:** * **เหตุผล:** แนวโน้มหลักยังเป็นขาขึ้น, Money Flow ใน TF Day แข็งแกร่ง * **เงื่อนไข:** *ยังคงต้องรอสัญญาณการกลับตัวของราคาใน TF15 ก่อน* (Breakout แนวต้านย่อย, Money Flow TF15 เป็นบวก, Bullish Candlestick Patterns) * **จุดเข้า (Day):** EMA 50, EMA 200, บริเวณ 96,000-98,000 * **จุดเข้า (4H):** EMA 50 * **Stop Loss:** ต่ำกว่า Low ล่าสุดของ TF15 หรือต่ำกว่าแนวรับที่เข้าซื้อ 2. **Short (15, ความเสี่ยงสูงมาก):** * **เหตุผล:** แนวโน้ม TF15 เป็นขาลง, Money Flow TF15 เป็นลบ * **เงื่อนไข:** ราคาไม่สามารถกลับขึ้นไปยืนเหนือ EMA ของ TF15 ได้ * **จุดเข้า:** บริเวณ EMA ของ TF15 หรือแนวต้านอื่นๆ * **Stop Loss:** เหนือ High ล่าสุดของ TF15 3. **Wait & See (ทางเลือกที่ปลอดภัย):** * **เหตุผล:** ความขัดแย้งระหว่าง Timeframes ยังคงมีอยู่ * รอให้ตลาดเฉลยทิศทางที่ชัดเจนกว่านี้ **คำแนะนำ (เน้นย้ำ):** * **Money Flow ใน TF Day:** เป็นปัจจัยบวกที่สำคัญ ทำให้กลยุทธ์ Buy on Dip มีน้ำหนักมากขึ้น * **ความขัดแย้งของ Timeframes:** ยังคงต้องระวัง TF15 ที่เป็นขาลง * **Volume:** การ Breakout/Breakdown ใดๆ ควรมี Volume สนับสนุน * **Risk Management:** สำคัญที่สุด **สรุป:** สถานการณ์ของ BTCUSDT โดยรวมยังคงเป็นบวก (ขาขึ้น) แต่มีความเสี่ยงในระยะสั้นจาก TF15 การตัดสินใจลงทุนควรพิจารณาจาก Timeframe ที่เหมาะสมกับสไตล์การเทรดของคุณ และอย่าลืมบริหารความเสี่ยงเสมอค่ะ **Disclaimer:** การวิเคราะห์นี้เป็นเพียงความคิดเห็นส่วนตัว ไม่ถือเป็นคำแนะนำในการลงทุน ผู้ลงทุนควรศึกษาข้อมูลเพิ่มเติมและตัดสินใจด้วยความรอบคอบ

@ d360efec:14907b5f

2025-02-13 04:47:20 **ภาพรวม BTCUSDT :** Bitcoin (BTCUSDT) กำลังอยู่ในช่วงสำคัญ แม้ว่าแนวโน้มหลักในระยะกลางถึงยาว (TF Day & 4H) จะยังคงเป็นขาขึ้นที่แข็งแกร่ง แต่ในระยะสั้นมาก (TF15) กลับแสดงสัญญาณของความอ่อนแอและการปรับฐานลงมา ทำให้เกิดความไม่แน่นอนในทิศทางของราคา อย่างไรก็ตาม *Money Flow ใน TF Day บ่งชี้ว่าแรงซื้อโดยรวมยังคงแข็งแกร่ง*  **แนวโน้ม:** * **TF Day:** ขาขึ้น (Uptrend) แข็งแกร่ง – ราคาอยู่เหนือ EMA 50 และ EMA 200, โครงสร้างราคาเป็น Higher Highs (HH) และ Higher Lows (HL), *Money Flow เป็นบวก (แรงซื้อ)* * **TF4H:** ขาขึ้น (Uptrend) – ราคาอยู่เหนือ EMA, มีการพักตัวลงมา (Pullback) แต่ยังไม่เสียโครงสร้างขาขึ้น, *Money Flow เริ่มอ่อนแรง (แรงซื้อลดลง, แรงขายเพิ่มขึ้น)* * **TF15:** ขาลง (Downtrend) ระยะสั้นมาก – ราคาหลุด EMA และแนวรับย่อย, โครงสร้างราคาเป็น Lower Highs (LH) และ Lower Lows (LL), *Money Flow เป็นลบ (แรงขาย)* **โครงสร้างราคา (SMC):** * **TF Day:** ยืนยันแนวโน้มขาขึ้น (HH, HL, BOS) * **TF4H:** ยืนยันแนวโน้มขาขึ้น (HH, HL, BOS), มี Equal Highs (EQH) ที่เป็นแนวต้าน * **TF15:** บ่งบอกถึงแนวโน้มขาลงระยะสั้น (BOS ด้านล่าง, LH, LL), มี EQH เป็นแนวต้าน **Money Flow (LuxAlgo) - สรุป:** * **TF Day:** แรงซื้อยังคงแข็งแกร่งอย่างชัดเจน * **TF4H:** แรงซื้อเริ่มอ่อนแรงลง, มีแรงขายเข้ามา * **TF15:** แรงขายมีอิทธิพลเหนือกว่า  **EMA (Exponential Moving Average):** * **TF Day & 4H:** EMA 50 & 200 เป็นแนวรับสำคัญ * **TF15:** EMA 50 & 200 กลายเป็นแนวต้าน **แนวรับ-แนวต้านสำคัญ:** | Timeframe | แนวรับ | แนวต้าน | | :-------- | :------------------------------------------------------------------------- | :-------------------------------------------------------------- | | Day | EMA 50, EMA 200, 96,000-98,000, 85,724.7 | 109,998.9 (High เดิม) | | 4H | EMA 50, EMA 200, 96,000-98,000, 89,037.0 | 109,998.9 (EQH, High เดิม) | | 15m | 95,200 (Low ล่าสุด), 94,707.4 (Low ก่อนหน้า) | EMA 50, EMA 200, บริเวณ 96,000, 96,807.8, 97,000-97,200 | **กลยุทธ์ (BTCUSDT):** 1. **Buy on Dip (Day, 4H) - *มีความน่าเชื่อถือมากขึ้น แต่ยังคงต้องระมัดระวัง*:** * **เหตุผล:** แนวโน้มหลักยังเป็นขาขึ้น, Money Flow ใน TF Day แข็งแกร่ง * **เงื่อนไข:** *ยังคงต้องรอสัญญาณการกลับตัวของราคาใน TF15 ก่อน* (Breakout แนวต้านย่อย, Money Flow TF15 เป็นบวก, Bullish Candlestick Patterns) * **จุดเข้า (Day):** EMA 50, EMA 200, บริเวณ 96,000-98,000 * **จุดเข้า (4H):** EMA 50 * **Stop Loss:** ต่ำกว่า Low ล่าสุดของ TF15 หรือต่ำกว่าแนวรับที่เข้าซื้อ 2. **Short (15, ความเสี่ยงสูงมาก):** * **เหตุผล:** แนวโน้ม TF15 เป็นขาลง, Money Flow TF15 เป็นลบ * **เงื่อนไข:** ราคาไม่สามารถกลับขึ้นไปยืนเหนือ EMA ของ TF15 ได้ * **จุดเข้า:** บริเวณ EMA ของ TF15 หรือแนวต้านอื่นๆ * **Stop Loss:** เหนือ High ล่าสุดของ TF15 3. **Wait & See (ทางเลือกที่ปลอดภัย):** * **เหตุผล:** ความขัดแย้งระหว่าง Timeframes ยังคงมีอยู่ * รอให้ตลาดเฉลยทิศทางที่ชัดเจนกว่านี้ **คำแนะนำ (เน้นย้ำ):** * **Money Flow ใน TF Day:** เป็นปัจจัยบวกที่สำคัญ ทำให้กลยุทธ์ Buy on Dip มีน้ำหนักมากขึ้น * **ความขัดแย้งของ Timeframes:** ยังคงต้องระวัง TF15 ที่เป็นขาลง * **Volume:** การ Breakout/Breakdown ใดๆ ควรมี Volume สนับสนุน * **Risk Management:** สำคัญที่สุด **สรุป:** สถานการณ์ของ BTCUSDT โดยรวมยังคงเป็นบวก (ขาขึ้น) แต่มีความเสี่ยงในระยะสั้นจาก TF15 การตัดสินใจลงทุนควรพิจารณาจาก Timeframe ที่เหมาะสมกับสไตล์การเทรดของคุณ และอย่าลืมบริหารความเสี่ยงเสมอค่ะ **Disclaimer:** การวิเคราะห์นี้เป็นเพียงความคิดเห็นส่วนตัว ไม่ถือเป็นคำแนะนำในการลงทุน ผู้ลงทุนควรศึกษาข้อมูลเพิ่มเติมและตัดสินใจด้วยความรอบคอบ @ 2183e947:f497b975