-

@ e5de992e:4a95ef85

2025-02-25 12:46:53

The future of decentralized identity promises a digital landscape where users have full control over their personal data, privacy, and interactions. When users own their digital presence, several transformative changes could reshape the internet:

---

## Empowerment and Control

### Self-Sovereignty

Users will manage their identities through cryptographic keys rather than relying on third-party platforms. This means you decide what data to share, how to share it, and with whom, eliminating reliance on centralized authorities.

### Data Portability

Decentralized identity frameworks enable seamless movement of personal data across various services. Without vendor lock-in, you can maintain a consistent digital persona, regardless of the platform or application you choose to use.

---

## Privacy and Security

### Enhanced Privacy

With decentralized identity, you control the amount and type of information you reveal. This minimizes exposure to data breaches, unauthorized surveillance, and privacy violations that are common in centralized systems.

### Stronger Security

Cryptography plays a central role in decentralized identity, reducing the risk of identity theft and fraud. Since your identity is not stored in a single, vulnerable location, it's much harder for attackers to compromise your personal information.

---

## Interoperability and Innovation

### Interoperable Ecosystems

Decentralized identity standards can pave the way for interoperable systems where different services and platforms recognize and trust your digital credentials. This can lead to smoother user experiences and increased innovation in digital services.

### New Economic Models

Ownership of your digital identity might also enable new ways to monetize personal data. Instead of platforms harvesting data for profit, users could potentially control and even earn from the use of their own information.

---

## Social and Cultural Impact

### Democratizing the Digital Space

A user-owned digital identity reduces the power imbalance between large tech corporations and individuals. It fosters a more democratic online environment where freedom of expression and personal autonomy are respected.

### Resilience Against Censorship

Decentralized systems distribute data across multiple nodes, making it far more resistant to censorship. This ensures that your voice can be heard even in environments where centralized platforms might suppress it.

---

## Challenges Ahead

### Usability and Adoption

While the potential benefits are significant, mainstream adoption will require overcoming technical and usability challenges. Managing cryptographic keys, for instance, may be daunting for non-technical users unless user-friendly solutions are developed.

### Regulatory and Standardization Issues

As decentralized identity becomes more prevalent, there will be a need for clear standards and regulations to ensure interoperability, security, and consumer protection without stifling innovation.

---

## In Summary

When users own their digital presence, the future of decentralized identity is marked by increased privacy, enhanced control, and a more open, interoperable digital ecosystem. This shift not only empowers individuals but also encourages the development of innovative technologies and business models that prioritize user rights and freedoms in the online world.

-

@ 57d1a264:69f1fee1

2025-02-25 12:38:46

I've been pondering how LSPs (lightning service providers) might pan out over time and how that might affect fees, and I am wondering what everyone else is thinking. Some people will always prefer to manage their own channels, and for some specific use cases, that might be preferable. But I am thinking about the broad userbase that does not want to do that. We will need a massive LSP infrastructure to onboard people and to enable insane amounts of payments.

LSPs will need to efficiently open and adjust channels for users, using their own liquidity or sourcing liquidity from other providers, using just-in-time channels, batching and/or splicing to reduce costs and wait times. Across all this, along with facilitating payments, they need to make their business model work and offer different options for users to pay for their services.

Users might be able to:

1. Pay-as-you-go (pay X for Y more liquidity for Z amount of time)

2. Pay X per month for Y inbound liquidity

3. Pay X per month for unlimited liquidity

4. Nothing for liquidity, but higher transaction fees

A wallet might also automatically choose an appropriate LSP based on what is the best and most appropriate deal at the time.

Let's look at user scenarios:

- If someone sends and receives the same amount every month, they will never need more liquidity. They just draw down the same channel and fill it up again. So they would only pay the LSP for them assigning that fixed amount of liquidity to them. Maybe options 1 and 2 are good for them.

- If someone receives more than they send (they save a certain amount every month), they will need more and more inbound liquidity over time. They might choose option 2.

- An online store that receives a ton and can't really estimate how much, might go for option 3.

- For option 4, it depends if the higher transaction fees are fixed or percentage-based.

It's a bit like choosing a data plan for your phone (or for internet at home). You can get a prepaid card, a regular plan with certain limits, or go unlimited. And there are separate plans for small and large businesses, etc. And there are massive amounts of complex infrastructure behind these service providers to make it all work.

So when someone starts using a lightning wallet, maybe they have to first pick an LSP and a plan before being able to receive. Or maybe they get a first channel for free and pay higher fees, and are then prompted to choose a plan. Maybe they need to wait an hour until the LSP has enough channel opens for a batch/splice, to reduce costs. A complex market at work.

Is that how things might pan out? Am I completely off? Is it worth mocking up different scenarios?

```

#bitcoin #LN #BTC #Lightning #LSP #service #zaps #sats #wallet

```

originally posted at https://stacker.news/items/896520

-

@ f4c59e4c:82f66850

2025-02-25 12:14:45

## Introduction

Dora Factory actively participated in governance across multiple blockchain ecosystems, including Cosmos Hub, dYdX, Injective, and Osmosis, by casting votes on key proposals. These decisions reflect Dora Factory’s commitment to supporting network upgrades, optimizing infrastructure, and ensuring responsible treasury and market management. Below is a summary of recent governance actions.

---

## Proposals

### Cosmos Hub

[2025-02-14 Cosmos Proposal 988 Yes](https://www.mintscan.io/cosmos/proposals/988)

Dora Factory voted YES on Cosmos Proposal 987 to approve the Gaia v22 software upgrade. The upgrade includes updates to the Cosmos Hub binary and has been tested by Informal Systems and Hypha Co-op.

### dYdX

[2025-02-04 dYdX Proposal 208 Yes](https://www.mintscan.io/dydx/proposals/208)

Dora Factory voted YES on dYdX Proposal 208 to add the dYdX Operations subDAO (DOS) signer as a market authority in the market map module and remove the 10% revenue share. This change allows DOS to update the market map while ensuring no fees accrue to Market Mappers, aligning with the community’s interests.

[2025-02-08 dYdX Proposal 210 No](https://www.mintscan.io/dydx/proposals/210)

Dora Factory voted NO on dYdX Proposal 210, which aimed to revive the dYdX client to Sifchain. The proposal was flagged as suspicious due to false claims of support from Informal Systems, lack of prior discussion, and potential security implications for dYdX Chain.

[2025-02-10 dYdX Proposal 211 Yes](https://www.mintscan.io/dydx/proposals/211)

Dora Factory voted YES on dYdX Proposal 211, which recalls the Stride Liquid Staking Program. The proposal transfers control of stDYDX from the dYdX Community Treasury to the dYdX Treasury SubDAO, allowing it to redeem and manage the assets directly.

### Injective

[2025-01-29 Injective Proposal 490 Yes](https://www.mintscan.io/injective/proposals/490)

Dora Factory voted YES on Injective Proposal 490, which aimed to recover the IBC client for Kopi chain.

[2025-02-03 Injective Proposal 491 Yes](https://www.mintscan.io/injective/proposals/491)

Dora Factory voted YES on Injective Proposal 491, which aimed to increase the maximum gas amount per block to 150,000,000 to optimize on-chain transaction handling

[2025-02-06 Injective Proposal 493 Abstain](https://www.mintscan.io/injective/proposals/493)

Dora Factory ABSTAINED on Injective Proposal 493, which aimed to launch an on-chain S&P 500 Index market by introducing the SPY/USDT perpetual market across Injective Exchange dApps.

[2025-02-12 Injective Proposal 494 Yes](https://www.mintscan.io/injective/proposals/494)

Dora Factory voted YES on Injective Proposal 494, which proposed the Nivara mainnet upgrade. The upgrade includes enhancements to the RWA oracle and module architecture, improved delegation controls, and security updates for the exchange module and Injective Bridge.

[2025-02-12 Injective Proposal 495 Yes](https://www.mintscan.io/injective/proposals/495)

Dora Factory voted YES on Injective Proposal 495, which aimed to recover the IBC client used by the Kopi chain. The proposal passed with significant support.

[2025-02-12 Injective Proposal 496 Yes](https://www.mintscan.io/injective/proposals/496)

Dora Factory voted YES on Injective Proposal 496, which aimed to modify the ticker for the TRADFI/USDT PERP market to reflect the appropriate ticker.

[2025-02-20 Injective Proposal 498 Yes](https://www.mintscan.io/injective/proposals/498)

Dora Factory VOTED YES on Injective Proposal 498, which aims to launch the JNI/HDRO Spot Market for trading the JNI token in HDRO-denominated quote.

### Osmosis

[2025-01-29 Osmosis Proposal 897 Yes](https://www.mintscan.io/osmosis/proposals/897)

Dora Factory voted YES on Osmosis Proposal 897, which aimed to recover the IBC client used by the Kopi chain.

[2025-02-04 Osmosis Proposal 898 Yes](https://www.mintscan.io/osmosis/proposals/898)

Dora Factory voted YES on Osmosis Proposal 898, which aimed to reduce gas consumption for Mars contracts by pinning binary contracts and reducing resource usage.

[2025-02-04 Osmosis Proposal 899 Yes](https://www.mintscan.io/osmosis/proposals/899)

Dora Factory voted YES on Osmosis Proposal 899, which aimed to increase the static limits for Alloyed BTC during its rapid growth phase.

[2025-02-04 Osmosis Proposal 900 Yes](https://www.mintscan.io/osmosis/proposals/900)

Dora Factory voted YES on Osmosis Proposal 900, which requested $150,000 USDC from the Osmosis community pool to bootstrap DOGE liquidity by purchasing DOGE and adding it to a DOGE/USDC liquidity pool on Osmosis.

[2025-02-07 Osmosis Proposal 901 Yes](https://www.mintscan.io/osmosis/proposals/901)

Dora Factory voted YES on Osmosis Proposal 901, which authorized the purchase of BTC using 25% of Osmosis' non-OSMO taker fees. The January 2025 purchase was expected to be around 1.4 BTC.

---

## Conclusion

Dora Factory’s recent votes demonstrate a strong focus on enhancing blockchain infrastructure, optimizing network efficiency, and ensuring responsible asset management. By supporting essential upgrades, market optimizations, and community-driven initiatives, Dora Factory continues to contribute to the long-term sustainability and innovation of these ecosystems.

-

@ bc575705:dba3ed39

2025-02-25 11:07:17

Perfection is often held as the ultimate goal in many creative pursuits. But in music—particularly in the world of lo-fi and experimental genres—imperfections can be a source of magic. As a producer and artist, I’ve come to embrace the raw, unpolished elements in my compositions, finding that they add depth, character, and emotional resonance. In this post, I want to reflect on why imperfections are not just acceptable but essential to my music.

## **The Beauty of Imperfections**

Imperfections in music—whether it’s a slightly out-of-tune note, the hiss of tape, or the ambient noise of a recording space—have a way of grounding the sound in reality. They remind us that music is a human endeavor, full of quirks and unpredictability. These imperfections don’t detract from the music; they enhance it by creating a sense of authenticity and intimacy.

In my productions, I often incorporate elements like vinyl crackle, tape distortion, and ambient noise to evoke a feeling of nostalgia. These textures bring a warmth and organic quality to the music that can be hard to achieve with overly polished production.

## **Emotional Resonance Through Rawness**

There’s something deeply emotional about hearing a piece of music that isn’t perfect. A wavering vocal, an unsteady rhythm, or a faint background hum can make a song feel more alive and relatable. Perfection can sometimes feel distant and unattainable, but imperfections invite listeners in, creating a connection that feels personal and genuine.

For example, in one of my tracks, I left in the faint sound of my fingers brushing against piano keys as I played. It wasn’t intentional at first, but when I listened back, I realized it added a layer of intimacy—as if the listener was right there in the room with me.

## **Lo-Fi: A Celebration of Imperfection**

Lo-fi music, by its very definition, is an embrace of imperfection. It revels in the hiss of cassette tapes, the crackle of vinyl, and the subtle flaws that traditional production methods might seek to eliminate. This aesthetic aligns perfectly with my philosophy as an artist: that music doesn’t need to be flawless to be impactful.

Lo-fi’s imperfections are not limitations; they’re features that shape its character. By allowing these raw elements to shine, lo-fi creates an atmosphere of nostalgia and comfort—a reminder that beauty often lies in the imperfect and the incomplete.

## **Finding Freedom in the Flaws**

When I stopped striving for perfection, I found freedom. Embracing imperfections allowed me to focus on the emotional core of my work rather than obsessing over technical precision. It’s in the rawness of a recording, the spontaneity of an improvised melody, or the unpredictable texture of a field recording that I find the most inspiration.

This approach also opens the door to experimentation. When perfection is not the goal, creativity can flow freely. I’ve discovered new sounds and techniques simply by letting go of the need for everything to be “just right.”

## **A Reflection of Life Itself**

Life is imperfect, and music that reflects this reality often feels the most honest. Just as our lives are filled with unexpected turns, small mistakes, and moments of vulnerability, so too can our music. By embracing these elements, we create art that resonates on a deeper level: music that feels human!

## **Final Thoughts**

Imperfections are not flaws to be hidden; they are the soul of the music. They add character, depth, and emotion that can’t be replicated by pristine production alone. As a producer, I’ve found that some of my most meaningful work comes from leaning into the raw, unpolished moments and letting them shape the sound.

To anyone creating music, my advice is this: don’t be afraid of imperfections. Embrace them, celebrate them, and let them tell their own story. You might just find that they hold the key to something truly beautiful.

-

@ 2063cd79:57bd1320

2025-02-25 10:44:02

Ich stimme mit Anonymous überein, dass es Probleme mit der tatsächlichen Verwendung von digitalem Bargeld auf kurze Sicht gibt. Aber es hängt in gewissem Maße davon ab, welches Problem man zu lösen versucht.

Eine Sorge, die ich habe, ist, dass der Übergang zum elektronischen Zahlungsverkehr die Privatsphäre einschränken wird, da es einfacher wird, Transaktionen zu protokollieren und aufzuzeichnen. Es könnten Profile angelegt werden, in denen das Ausgabeverhalten eines jeden von uns verfolgt wird.

Schon jetzt wird, wenn ich etwas telefonisch oder elektronisch mit meiner Visa-Karte bestelle, genau aufgezeichnet, wie viel ich ausgegeben habe und wo ich es ausgegeben habe. Im Laufe der Zeit könnten immer mehr Transaktionen auf diese Weise abgewickelt werden, und das Ergebnis könnte einen großen Verlust an Privatsphäre bedeuten.

Die Bezahlung mit Bargeld ist zwar immer noch per Post möglich, aber dies ist unsicher und umständlich. Ich denke, dass die Bequemlichkeit von Kredit- und Debitkarten die Bedenken der meisten Menschen in Bezug auf Privatsphäre ausräumen wird und dass wir uns in einer Situation befinden werden, in der große Mengen an Informationen über das Privatleben aller Leute existieren.

Hier könnte ich mir vorstellen, dass digitales Bargeld eine Rolle spielen könnte. Stellt euch ein Visa-ähnliches System vor, bei dem ich für die Bank nicht anonym bin. Stellt euch in diesem Modell vor, dass mir die Bank einen Kredit gewährt, ganz so wie bei einer Kreditkarte. Allerdings, anstatt mir nur eine Kontonummer zu geben, die ich am Telefon ablese oder in einer E-Mail verschicke, gibt sie mir das Recht, bei Bedarf digitales Bargeld zu verlangen.

Ich habe immer etwas digitales Bargeld beiseite, dass ich für Transaktionen ausgeben kann, wie bereits in früheren Beiträgen beschrieben. Wenn das Geld knapp wird, schicke ich eine E-Mail an die Bank und erhalte mehr digitales Bargeld (dcash). Jeden Monat sende ich einen Check an die Bank, um mein Konto auszugleichen, genauso wie ich es mit meinen Kreditkarten mache. Meine Beziehung zur Bank sind meinen derzeitigen Beziehungen zu den Kreditkartenunternehmen sehr ähnlich: häufige Überweisungen und eine einmalige Rückzahlung jeden Monat per Check.

Das hat mehrere Vorteile gegenüber dem System, auf das wir zusteuern. Es werden keine Aufzeichnungen darüber geführt, wofür ich mein Geld ausgebe. Die Bank weiß nur, wie viel ich jeden Monat abgehoben habe; es könnte sein, dass ich es zu diesem Zeitpunkt ausgegeben habe oder auch nicht. Bei einigen Transaktionen (z.B. Software) könnte ich für den Verkäufer anonym sein; bei anderen könnte der Verkäufer meine wirkliche Adresse kennen, aber dennoch ist keine zentrale Stelle in der Lage, alles zu verfolgen, was ich kaufe.

(Es gibt auch einen Sicherheitsvorteil gegenüber dem lächerlichen aktuellen System, bei dem die Kenntnis über eine 16-stellige Nummer und eines Ablaufdatums es jedem ermöglicht, etwas auf meinen Namen zu bestellen!)

Außerdem sehe ich nicht ein, warum dieses System nicht genauso legal sein sollte wie die derzeitigen Kreditkarten. Der einzige wirkliche Unterschied besteht darin, dass nicht nachverfolgt werden kann, wo die Nutzer ihr Geld ausgeben, und soweit ich weiß, war diese Möglichkeit nie ein wichtiger rechtlicher Aspekt von Kreditkarten. Sicherlich wird heute niemand zugeben, dass die Regierung ein Interesse daran hat, ein Umfeld zu schaffen, in dem jede finanzielle Transaktion nachverfolgt werden kann.

Zugegeben, dies bietet keine vollständige Anonymität. Es ist immer noch möglich, ungefähr zu sehen, wie viel jede Person ausgibt (obwohl nichts eine Person daran hindert, viel mehr Bargeld abzuheben, als sie in einem bestimmten Monat ausgibt, außer vielleicht für Zinsausgaben; aber vielleicht kann sie das zusätzliche digitale Bargel (digicash) selbst verleihen und dafür Zinsen erhalten, um das auszugleichen). Und es orientiert sich an demselben Kunden/ Verkäufer-Modell, das Anonymous kritisierte. Ich behaupte aber, dass dieses Modell heute und in naher Zukunft die Mehrheit der elektronischen Transaktionen ausmachen wird.

Es ist erwähnenswert, dass es nicht trivial ist, ein Anbieter zu werden, der Kreditkarten akzeptiert. Ich habe das mit einem Unternehmen, das ich vor ein paar Jahren betrieben habe, durchgemacht. Wir verkauften Software über den Versandhandel, was die Kreditkartenunternehmen sehr nervös machte. Es gibt zahlreiche Telefonbetrügereien, bei denen Kreditkartennummern über einige Monate hinweg gesammelt werden und dann große Beträge von diesen Karten abgebucht werden. Bis der Kunde seine monatliche Abrechnung erhält und sich beschwert, ist der Verkäufer bereits verschwunden. Um unser Kreditkartenterminal zu bekommen, wandten wir uns an ein Unternehmen, das Start-ups dabei „hilft“. Sie schienen selbst ein ziemlich zwielichtiges Unternehmen zu sein. Wir mussten unseren Antrag dahingehend fälschen, dass wir etwa 50% der Geräte auf Messen verkaufen würden, was offenbar als Verkauf über den Ladentisch zählte. Und wir mussten etwa 3.000 Dollar im Voraus zahlen, als Bestechung, wie es schien. Selbst dann hätten wir es wahrscheinlich nicht geschafft, wenn wir nicht ein Büro im Geschäftsviertel gehabt hätten.

Im Rahmen des digitalen Bargeldsystems könnte dies ein geringeres Problem darstellen. Das Hauptproblem bei digitalem Bargeld sind doppelte Ausgaben, und wenn man bereit ist, eine Online-Überprüfung vorzunehmen (sinnvoll für jedes Unternehmen, das mehr als ein paar Stunden für die Lieferung der Ware benötigt), kann dies vollständig verhindert werden. Es gibt also keine Möglichkeit mehr, dass Händler Kreditkartennummern für spätere Betrügereien sammeln. (Allerdings gibt es immer noch Probleme mit der Nichtlieferung von Waren, so dass nicht alle Risiken beseitigt sind). Dadurch könnte das System schließlich eine größere Verbreitung finden als die derzeitigen Kreditkarten.

Ich weiß nicht, ob dieses System zur Unterstützung von illegalen Aktivitäten, Steuerhinterziehung, Glücksspiel oder Ähnlichem verwendet werden könnte. Das ist nicht der Zweck dieses Vorschlags. Er bietet die Aussicht auf eine Verbesserung der Privatsphäre und der Sicherheit in einem Rahmen, der sogar rechtmäßig sein könnte, und das ist nicht verkehrt.

-----

Englischer Artikel erschienen im Nakamoto Institute: [Digital Cash & Privacy](https://nakamotoinstitute.org/library/digital-cash-and-privacy/here)

-

@ 2181959b:80f0d27d

2025-02-25 10:38:33

أطلقت مايكروسوفت بهدوء إصدارًا مجانيًا من تطبيقات Office لأجهزة ويندوز، يتيح للمستخدمين تحرير المستندات دون الحاجة إلى اشتراك في Microsoft 365 أو ترخيص مدفوع.

ومع ذلك، يأتي هذا الإصدار مع إعلانات دائمة وقيود على بعض الميزات الأساسية.

**ما هي قيود الإصدار المجاني من تطبيقات Office؟**

وفقًا لموقع Beebom، يعتمد الإصدار المجاني على التطبيقات المكتبية الكاملة لكنه يُقيد معظم الميزات خلف اشتراك Microsoft 365.

وهذه القيود تتمثل في الآتي:

1: يتم عرض الإعلانات بشكل دائم داخل تطبيقات Word وPowerPoint وExcel أثناء العمل على المستندات.

2: يمكن حفظ الملفات فقط على OneDrive، دون دعم لتحرير الملفات المحلية.

3: لا يتوفر الإملاء الصوتي، والإضافات، والتنسيقات المتقدمة، وSmartArt، مما يجعله مناسبًا للمهام الأساسية فقط.

https://image.nostr.build/bbfd97a76b189c9b826d98208537600ee607169f9ee98c0b3f3a99bb04f3b1f4.jpg

**كيفية الوصول إلى الإصدار المجاني من تطبيقات Office؟**

يمكن للمستخدمين تخطي طلب تسجيل الدخول عند تشغيل أحد تطبيقات Office لأول مرة، وبعد ذلك سيحصلون على خيار استخدامه مجانًا مقابل الإعلانات والميزات المحدودة.

في هذا الوضع، يمكن فتح المستندات وعرضها وتحريرها، تمامًا كما هو الحال في إصدار Office على الويب.

**هل هو متاح للجميع؟**

حاليًا، يبدو أن هذا الإصدار لا يزال في مرحلة الاختبار المحدود، حيث لم يتمكن بعض المستخدمين من تجاوز شاشة تسجيل الدخول عند تشغيل Office. ومن المحتمل أن مايكروسوفت تختبر هذه النسخة في مناطق محددة أو مع مجموعة صغيرة من المستخدمين قبل إطلاقها رسميًا.

حتى الآن، لم تُعلن الشركة رسميًا عن هذا الإصدار، ولم تذكره في مستندات الدعم الخاصة بها، لكن قد تكشف مايكروسوفت عن تفاصيل إضافية خلال الأيام أو الأسابيع المقبلة.

[المصدر]( https://www.windowscentral.com/software-apps/office-365/microsoft-quietly-launches-free-ad-supported-version-of-office-apps-for-windows-with-limited-functionality)

-

@ d360efec:14907b5f

2025-02-25 10:16:18

**ภาพรวม BTCUSDT (OKX):**

Bitcoin (BTCUSDT) แนวโน้มระยะยาว TF Day ยังคงเป็นขาลง แนวโน้มระยะกลาง TF 4H Sideway down และแนวโน้มระยะสั้น TF 15M Sideways Down

**วิเคราะห์ทีละ Timeframe:**

**(1) TF Day (รายวัน):**

* **แนวโน้ม:** ขาลง (Downtrend)

* **SMC:**

* Lower Highs (LH) และ Lower Lows (LL)

* Break of Structure (BOS) ด้านล่าง

* **Liquidity:**

* มี Sellside Liquidity (SSL) อยู่ใต้ Lows ก่อนหน้า

* มี Buyside Liquidity (BSL) อยู่เหนือ Highs ก่อนหน้า

* **ICT:**

* **Order Block** ราคาไม่สามารถผ่าน Order Block ได้

* **EMA:**

* ราคาอยู่ใต้ EMA 50 และ EMA 200

* **Money Flow (LuxAlgo):**

* สีแดง

* **Trend Strength (AlgoAlpha):**

* สีแดง แสดงถึงแนวโน้มขาลง

* **Chart Patterns:** *ไม่มีรูปแบบที่ชัดเจน*

* **Volume Profile:**

* Volume ค่อนข้างนิ่ง

* **แท่งเทียน:** แท่งเทียนล่าสุดเป็นสีแดง

* **แนวรับ:** บริเวณ Low ล่าสุด

* **แนวต้าน:** EMA 50, EMA 200 , Order Block

* **สรุป:** แนวโน้มขาลง

**(2) TF4H (4 ชั่วโมง):**

* **แนวโน้ม:** ขาลง (Downtrend)

* **SMC:**

* Lower Highs (LH) และ Lower Lows (LL)

* Break of Structure (BOS) ด้านล่าง

* **Liquidity:**

* มี SSL อยู่ใต้ Lows ก่อนหน้า

* มี BSL อยู่เหนือ Highs ก่อนหน้า

* **ICT:**

* **Order Block** ราคาไม่สามารถผ่าน Order Block ได้

* **EMA:**

* ราคาอยู่ใต้ EMA 50 และ EMA 200

* **Money Flow (LuxAlgo):**

* สีแดง แสดงถึงแรงขาย

* **Trend Strength (AlgoAlpha):**

* สีแดง แสดงถึงแนวโน้มขาลง

* **Chart Patterns:** *ไม่มีรูปแบบที่ชัดเจน*

* **Volume Profile:**

* Volume ค่อนข้างนิ่ง

* **แนวรับ:** บริเวณ Low ล่าสุด

* **แนวต้าน:** EMA 50, EMA 200, Order Block

* **สรุป:** แนวโน้มขาลง,

**(3) TF15 (15 นาที):**

* **แนวโน้ม:** Sideway Down

* **SMC:**

* Lower High (LH) และ Lower Lows (LL)

* Break of Structure (BOS) ด้านล่าง

* **ICT:**

* **Order Block:** ราคา Sideways ใกล้ Order Block

* **EMA:**

* EMA 50 และ EMA 200 เป็นแนวต้าน

* **Money Flow (LuxAlgo):**

* แดง

* **Trend Strength (AlgoAlpha):**

* แดง/ ไม่มีสัญญาณ

* **Chart Patterns:** *ไม่มีรูปแบบที่ชัดเจน*

* **Volume Profile:** Volume ค่อนข้างสูง

* **แนวรับ:** บริเวณ Low ล่าสุด

* **แนวต้าน:** EMA 50, EMA 200, Order Block

* **สรุป:** แนวโน้ม Sideways Down,

**สรุปภาพรวมและกลยุทธ์ (BTCUSDT):**

* **แนวโน้มหลัก (Day):** ขาลง

* **แนวโน้มรอง (4H):** ขาลง

* **แนวโน้มระยะสั้น (15m):** Sideways Down

* **Liquidity:** มี SSL ทั้งใน Day, 4H, และ 15m

* **Money Flow:** เป็นลบในทุก Timeframes

* **Trend Strength:** Day/4H/15m เป็นขาลง

* **Chart Patterns:** ไม่พบรูปแบบที่ชัดเจน

* **กลยุทธ์:**

1. **Wait & See (ดีที่สุด):** รอความชัดเจน

2. **Short (เสี่ยง):** ถ้าไม่สามารถ Breakout EMA/แนวต้านใน TF ใดๆ ได้ หรือเมื่อเกิดสัญญาณ Bearish Continuation

3. **ไม่แนะนำให้ Buy:** จนกว่าจะมีสัญญาณกลับตัวที่ชัดเจนมากๆ

**Day Trade & การเทรดรายวัน:**

* **Day Trade (TF15):**

* **Short Bias:** หาจังหวะ Short เมื่อราคาเด้งขึ้นไปทดสอบแนวต้าน (EMA, Order Block)

* **Stop Loss:** เหนือแนวต้านที่เข้า Short

* **Take Profit:** แนวรับถัดไป (Low ล่าสุด)

* **ไม่แนะนำให้ Long**

* **Swing Trade (TF4H):**

* **Short Bias:** รอจังหวะ Short เมื่อราคาไม่สามารถผ่านแนวต้าน EMA หรือ Order Block ได้

* **Stop Loss:** เหนือแนวต้านที่เข้า Short

* **Take Profit:** แนวรับถัดไป

* **ไม่แนะนำให้ Long**

**สิ่งที่ต้องระวัง:**

* **Sellside Liquidity (SSL):** มีโอกาสสูงที่ราคาจะถูกลากลงไปแตะ SSL

* **False Breakouts:** ระวัง

* **Volatility:** สูง

**Setup Day Trade แบบ SMC (ตัวอย่าง):**

1. **ระบุ Order Block:** หา Order Block ขาลง (Bearish Order Block) ใน TF15

2. **รอ Pullback:** รอให้ราคา Pullback ขึ้นไปทดสอบ Order Block นั้น

3. **หา Bearish Entry:**

* **Rejection:** รอ Price Action ปฏิเสธ Order Block

* **Break of Structure:** รอให้ราคา Break โครงสร้างย่อยๆ

* **Money Flow:** ดู Money Flow ให้เป็นสีแดง

4. **ตั้ง Stop Loss:** เหนือ Order Block

5. **ตั้ง Take Profit:** แนวรับถัดไป

**คำแนะนำ:**

* **ความขัดแย้งของ Timeframes:** ไม่มีแล้ว ทุก Timeframes สอดคล้องกัน

* **Money Flow:** เป็นลบในทุก Timeframes

* **Trend Strength:** เป็นลบ

* **Order Block TF Day:** หลุด Order Block ขาขึ้นแล้ว

* **ถ้าไม่แน่ใจ อย่าเพิ่งเข้าเทรด**

**Disclaimer:** การวิเคราะห์นี้เป็นเพียงความคิดเห็นส่วนตัว ไม่ถือเป็นคำแนะนำในการลงทุน ผู้ลงทุนควรศึกษาข้อมูลเพิ่มเติมและตัดสินใจด้วยความรอบคอบ

-

@ d360efec:14907b5f

2025-02-25 09:12:44

$OKX:BTCUSDT.P

**Overall Assessment:**

Bitcoin (BTCUSDT) on OKX is currently showing a bearish trend across all analyzed timeframes (Daily, 4-Hour, and 15-Minute). While the long-term trend (Daily) was technically an uptrend, it has *significantly weakened* and broken key support levels, including a major bullish Order Block and the 50-period EMA. The 4-hour and 15-minute charts confirm the downtrend. This analysis focuses on identifying potential areas of Smart Money activity (liquidity pools and order blocks), assessing trend strength, and looking for any emerging chart patterns.

**Detailed Analysis by Timeframe:**

**(1) TF Day (Daily):**

* **Trend:** Downtrend

* **SMC (Smart Money Concepts):**

* The Higher Highs (HH) and Higher Lows (HL) structure is *broken*.

* Prior Breaks of Structure (BOS) to the upside, but now a significant and deep pullback/reversal is underway.

* **Liquidity:**

* **Sellside Liquidity (SSL):** Significant SSL rests below previous lows in the 85,000 - 90,000 range.

* **Buyside Liquidity (BSL):** BSL is present above the all-time high.

* **ICT (Inner Circle Trader Concepts):**

* **Order Block:** The price has *broken below* the prior bullish Order Block. This is a *major bearish signal*.

* **FVG:** No significant Fair Value Gap is apparent at the current price level.

* **EMA (Exponential Moving Average):**

* Price is *below* the 50-period EMA (yellow).

* The 200-period EMA (white) is the next major support level.

* **Money Flow (LuxAlgo):**

* A *long red bar* indicates strong and sustained selling pressure.

* **Trend Strength (AlgoAlpha):**

* Red cloud, indicating a downtrend. No buy/sell signals are present.

* **Chart Patterns:** No readily identifiable chart patterns are dominant.

* **Volume Profile:** Relatively low volume.

* **Candlesticks:** Recent candlesticks are red, confirming selling pressure.

* **Support:** EMA 200, 85,000-90,000 (SSL area).

* **Resistance:** EMA 50, Previous All-Time High.

* **Summary:** The Daily chart has shifted to a downtrend. The break below the Order Block and 50 EMA, combined with negative Money Flow and Trend Strength, are all strong bearish signals.

**(2) TF4H (4-Hour):**

* **Trend:** Downtrend.

* **SMC:**

* Lower Highs (LH) and Lower Lows (LL).

* BOS to the downside.

* **Liquidity:**

* **SSL:** Below previous lows.

* **BSL:** Above previous highs.

* **ICT:**

* **Order Block:** The price was rejected by a bearish Order Block.

* **EMA:**

* Price is below both the 50-period and 200-period EMAs (bearish).

* **Money Flow (LuxAlgo):**

* Predominantly red, confirming selling pressure.

* **Trend Strength (AlgoAlpha):**

* Red cloud, confirming downtrend.

* **Chart Patterns:** No readily identifiable chart patterns.

* **Volume Profile:** Relatively steady volume.

* **Support:** Recent lows.

* **Resistance:** EMA 50, EMA 200, Order Block.

* **Summary:** The 4-hour chart is in a confirmed downtrend. Money Flow and Trend Strength are bearish.

**(3) TF15 (15-Minute):**

* **Trend:** Downtrend / Sideways Down

* **SMC:**

* Lower Highs (LH) and Lower Lows (LL).

* BOS to the downside.

* **ICT:**

* **Order Block** price is near to a bearish Order Block.

* **EMA:**

* The 50-period and 200-period EMAs are acting as resistance.

* **Money Flow (LuxAlgo):**

* Red

* **Trend Strength (AlgoAlpha):**

* Red/No signals

* **Chart Patterns:** None

* **Volume Profile:**

* Relatively High Volume

* **Support:** Recent lows.

* **Resistance:** EMA 50, EMA 200, Order Block.

* **Summary:** The 15-minute chart is clearly bearish, with price action, EMAs, and Money Flow all confirming the downtrend.

**Overall Strategy and Recommendations (BTCUSDT):**

* **Primary Trend (Day):** Downtrend

* **Secondary Trend (4H):** Downtrend.

* **Short-Term Trend (15m):** Downtrend/ Sideways Down.

* **Liquidity:** Significant SSL zones exist below the current price on all timeframes.

* **Money Flow:** Negative on all timeframes.

* **Trend Strength:** Bearish on Day,4H and 15m.

* **Chart Patterns:** None identified.

* **Strategies:**

1. **Wait & See (Best Option):** The strong bearish momentum on all shorter timeframes.

2. **Short (High Risk):** This aligns with the 4H and 15m downtrends.

* **Entry:** On rallies towards resistance levels (EMAs on 15m/4H, previous support levels that have turned into resistance, Order Blocks).

* **Stop Loss:** Above recent highs on the chosen timeframe, or above a key resistance level.

* **Target:** The next support levels (recent lows on 15m, then potentially the SSL zones on the 4H and Daily charts).

3. **Buy (Extremely High Risk - NOT Recommended):** Do *not* attempt to buy until there are *very strong and consistent* bullish reversal signals across *all* timeframes.

**Key Recommendations:**

* **Conflicting Timeframes:** The conflict is resolved toward the downside. The Daily is weakening significantly.

* **Money Flow:** Consistently negative across all timeframes, a major bearish factor.

* **Trend Strength:** Bearish on Day,4h and 15m.

* **Daily Order Block:** The *break* of the bullish Order Block on the Daily chart is a significant bearish development.

* **Sellside Liquidity (SSL):** Be aware that Smart Money may target the SSL zones below. This increases the risk of stop-loss hunting.

* **Risk Management:** Due to the high uncertainty and volatility, *strict risk management is absolutely critical.* Use tight stop-losses, do not overtrade, and be prepared for rapid price swings.

* **Volume:** Confirm any breakout or breakdown with volume.

**Day Trading and Intraday Trading Strategies:**

* **Day Trade (TF15 focus):**

* **Short Bias:** Given the current 15m downtrend and negative Money Flow, the higher probability is to look for shorting opportunities.

* **Entry:** Look for price to rally to resistance levels (EMAs, Order Blocks, previous support levels that have become resistance) and then show signs of rejection (bearish candlestick patterns, increasing volume on the downside).

* **Stop Loss:** Place a stop-loss order above the resistance level where you enter the short position.

* **Take Profit:** Target the next support level (recent lows).

* **Avoid Long positions** until there's a *clear* and *confirmed* bullish reversal on the 15m chart (break above EMAs, positive Money Flow, bullish market structure).

* **Swing Trade (TF4H focus):**

* **Short Bias:** The 4H chart is in a downtrend.

* **Entry:** Wait for price to rally to resistance levels (EMAs, Order Blocks) and show signs of rejection.

* **Stop Loss:** Above the resistance level where you enter the short position.

* **Take Profit:** Target the next support levels (e.g., the 200 EMA on the Daily chart, SSL zones).

* **Avoid Long positions** until there's a *clear* and *confirmed* bullish reversal on the 4H chart.

**SMC Day Trade Setup Example (TF15 - Bearish):**

1. **Identify Bearish Order Block:** Locate a bearish Order Block on the TF15 chart (a bullish candle before a strong downward move).

2. **Wait for Pullback:** Wait for the price to pull back up to test the Order Block (this may or may not happen).

3. **Bearish Entry:**

* **Rejection:** Look for price action to reject the Order Block (e.g., a pin bar, engulfing pattern, or other bearish candlestick pattern).

* **Break of Structure:** Look for a break of a minor support level on a *lower* timeframe (e.g., 1-minute or 5-minute) after the price tests the Order Block. This confirms weakening bullish momentum.

* **Money Flow:** Confirm that Money Flow remains negative (red).

4. **Stop Loss:** Place a stop-loss order *above* the Order Block.

5. **Take Profit:** Target the next support level (e.g., recent lows) or a bullish Order Block on a higher timeframe.

**In conclusion, BTCUSDT is currently in a high-risk, bearish environment. The "Wait & See" approach is strongly recommended for most traders. Shorting is the higher-probability trade *at this moment*, but only for experienced traders who can manage risk extremely effectively. Buying is not recommended at this time.**

**Disclaimer:** This analysis is for informational purposes only and represents a personal opinion. It is not financial advice. Investing in cryptocurrencies involves significant risk. Investors should conduct their own research and exercise due diligence before making any investment decisions.

-

@ b8af284d:f82c91dd

2025-02-25 08:11:32

Liebe Abonnenten,

*„The Fourth Turning“ ist ein epochemachendes wie hellseherisches Buch von William Strauss und Neil Howe. Es erschien 1997 mit der These, wonach Geschichte in Zyklen von 80 bis 100 Jahren verlaufe. Jede Gesellschaft durchlaufe vier Phasen („Turnings“): **High, Awakening, Unraveling und Crisis**. Nach der Crisis kommt es zum „Fourth Turning“ - welches die Autoren in den Jahren 2020 bis 2030 prophezeiten. Das klingt nach esoterischer Science-Fiction-Literatur, ist es aber nicht: Der mittlerweile verstorbene Strauss war Historiker, Howl ist Ökonom. In „The Fourth Turning“ argumentieren sie demnach weitgehend wissenschaftlich. Die Argumentation hier wiederzugeben, würden den Rahmen sprengen. Aber nur soviel: Wir sind mittendrin. Abseits des turbulenten Tagesgeschehens beginnt sich, eine neue Finanzordnung abzuzeichnen.*

Musk und sein “[Department of Government Efficiency](https://x.com/DOGE)” drehen gerade jeden Stein um, den sie finden können. Alle Ausgaben der Regierung kommen auf den Prüfstand.

Deswegen wurden sämtliche Zahlungen an die vermeintliche Entwicklungshilfe-Organisation USAID gestrichen. In die meisten Leitmedien schafften es nur Meldungen, wonach nun [Projekte zur Förderung von Beschneidungen in Mozambique und Biodiversität in Nepal ](https://x.com/DOGE/status/1890849405932077378)kein Geld mehr erhalten. Weniger war davon zu lesen, dass USAID als Deckorganisation für die CIA funktionierte und zum Beispiel[ die Forschung an pathogenen Corona-Viren in China](https://www.washingtonexaminer.com/news/486983/usaid-wont-give-details-on-4-67-million-grant-to-wuhan-lab-collaborator-ecohealth-alliance/) mit 4,6 Millionen finanzierte. Auch mit dabei: [2,6 Millionen Dollar an ein Zensur-Programm namens “Center for Countering Digital Hate (CCDH](https://x.com/AllumBokhari/status/1892027594666541412))” und vieles mehr: eine gute Übersicht findet man hier auf der [Website des Weißen Haus](https://www.whitehouse.gov/fact-sheets/2025/02/at-usaid-waste-and-abuse-runs-deep/)’. Die Einsparungen sind so hoch aktuell rund neun Milliarden US-Dollar, das darüber nachgedacht wird, einen Teil der Steuergelder wieder an die Bürger zurückzuzahlen: [Die “DogeDividend” könnte bei 5000$ pro Kopf liegen](https://x.com/DeItaone/status/1892182305487097877). (Wer sich noch an den Covid-Stimulus in Höhe von 1200$ erinnert, weiß, welche Rally die Zahlungen 2020 auslösten).

Der Kassensturz umfasst aber längst nicht nur USAID, sondern betrifft sämtliche Staatsausgaben. Sämtliche Ausgaben und Vermögenswerte der USA werden erfasst und hinsichtlich ihrer Nützlichkeit überprüft.

Im Rahmen von DOGE ließ Elon Musk kürzlich fragen, ob es nicht mal Zeit für eine Zählung der Gold-Reserven wäre. In Fort Knox, das die meisten wahrscheinlich aus James-Bond-Filmen oder Donald-Duck-Comics kennen, lagern mindestens 4800 Tonnen Gold - über die Hälfte der amerikanischen Reserven. Das heißt: Niemand weiß genau, wie viel es eigentlich sind. Die letzte Inventur fand 1953 statt.

Dasselbe gilt für die Zahlungen in die Ukraine. Mindestens 270 Milliarden US-Dollar haben die USA an Kiew gezahlt. Das Resultat: vermutlich über eine halbe Million Tote, ein völlig zerstörtes Land und ein korruptes System.

Nach der Rede von JD Vance bei der Münchener Sicherheitskonferenz ist Europa erst einmal in Schnappatmung gefallen. Am Dienstag darauf folgten zum ersten Mal seit Jahren direkte Gespräche zwischen Moskau und Washington in Saudi-Arabien. Europäer waren nicht eingeladen, die hielten stattdessen ein Krisentreffen in Paris ab.

Innerhalb der EU wird jetzt von einem neuen Militärfonds gefaselt, um die größte Aufrüstung des Kontinents seit 1933 zu finanzieren. [700 Milliarden Euro soll der umfassen, finanziert durch Steuererhöhungen](https://www.berliner-zeitung.de/wirtschaft-verantwortung/baerbock-verplappert-sich-nach-der-wahl-milliarden-fuer-ukraine-li.2295623), da ja der Schutz der USA jetzt wegfalle. Man kann nur hoffen, dass die EU-Bürokratie zusammen mit Selenski nicht auf die Idee kommt, den Krieg allein weiterzuführen oder den Friedensprozess zu sabotieren.

Vielen dürfte allerdings klar sein, dass sich demnächst etwas grundsätzlich ändern wird. Die Trump-Administration ordnet die Welt neu, und damit auch die globale Finanzarchitektur. Was hat es damit auf sich? Und worum geht es eigentlich?

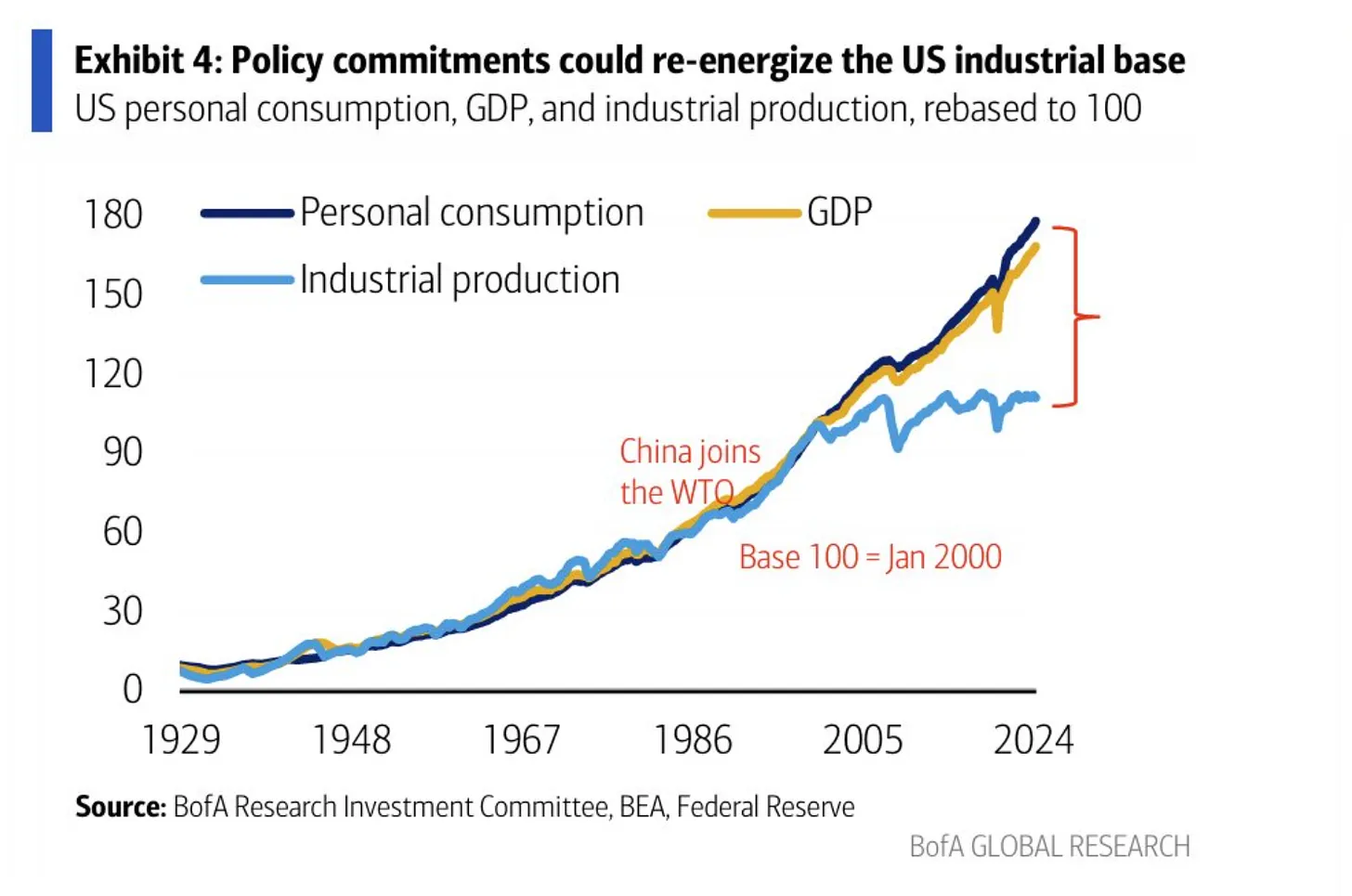

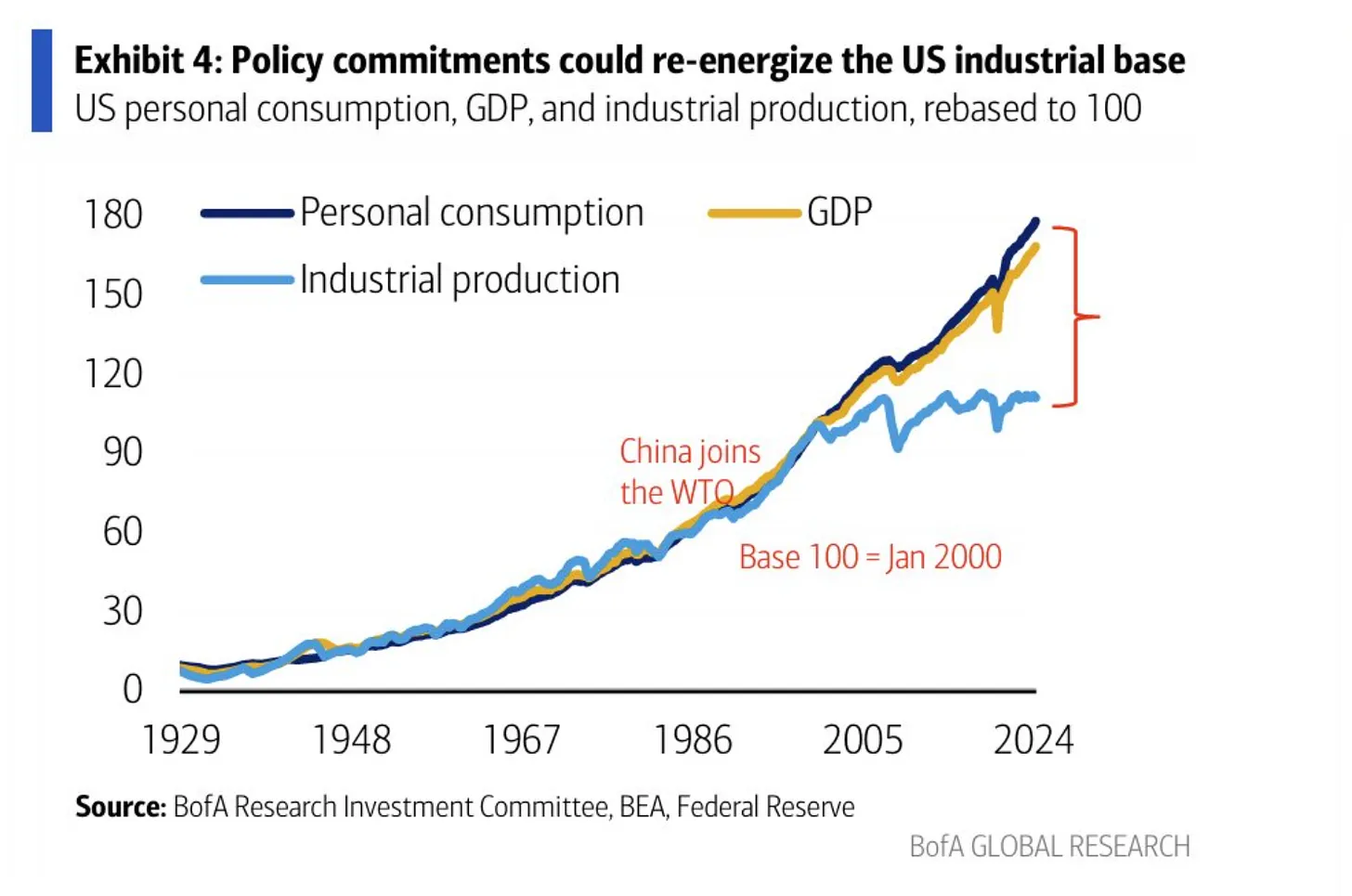

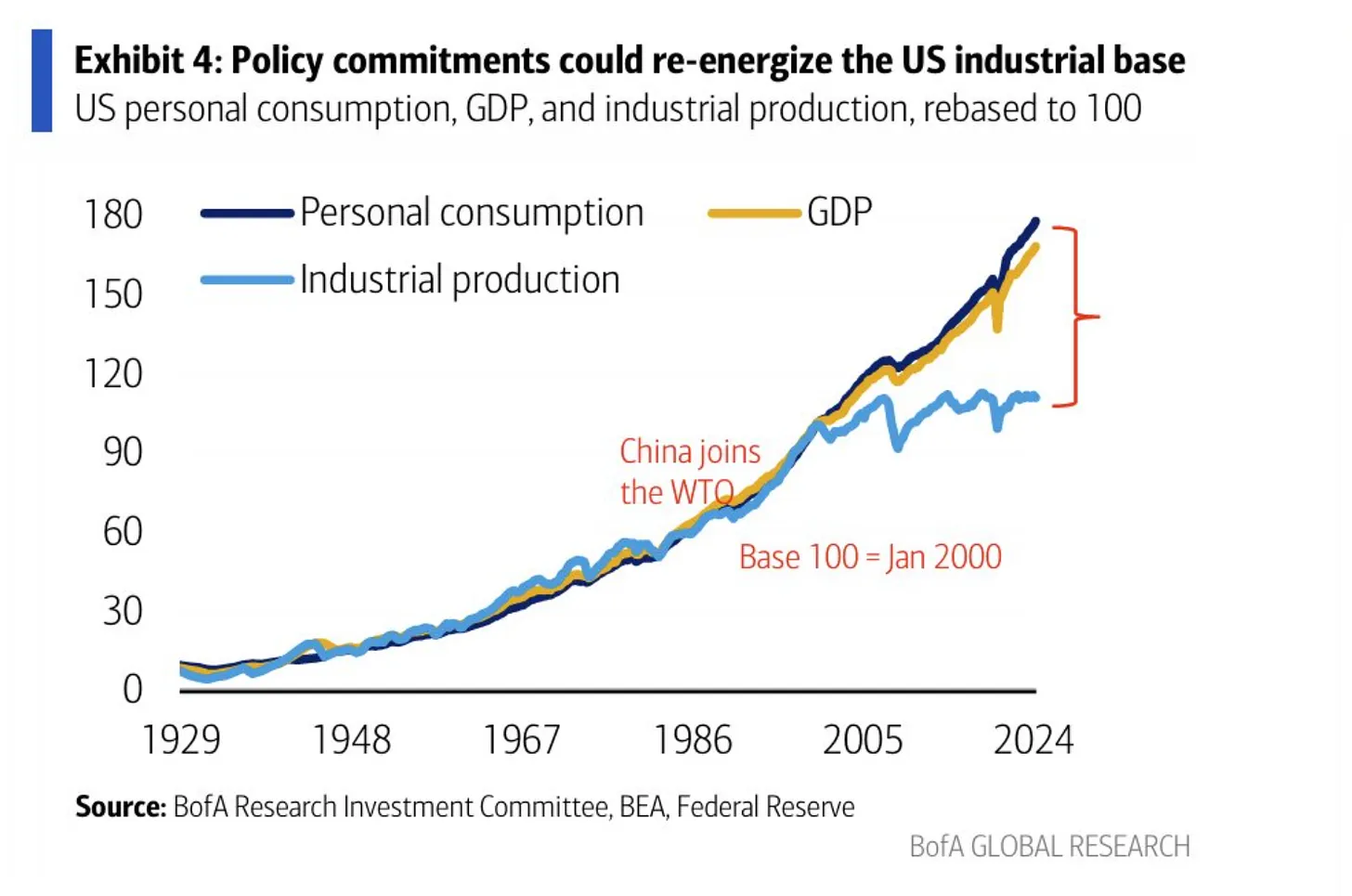

Zur Erinnerung: Mit dem Beitritt Chinas zur Welthandelsorganisation 2001 wurde die industrielle Basis der USA nach und nach ausgehöhlt. Chinesische Waren waren billiger - und so verlagerten sich immer mehr Industrien nach China. Deutschland profitierte relativ länger von dieser Entwicklung, da die Automobilindustrie wettbewerbsfähiger war und deutsche Maschinenbauer chinesische Fabriken ausstatteten.

\

Trump 1 versuchte diese Entwicklung mit Zöllen zu unterbinden. Bei Trump 2 geht es um mehr. Zölle sind nur noch die vorübergehende Waffe, die Ziele durchzusetzen. Ziel ist ein schwächerer Dollar.

Eine starke Währung klingt nett, bedeutet aber nichts anderes, als dass Importe aus anderen Ländern günstiger sind und Exporte in andere Länder vergleichsweise teurer sind. Eine schwächere Währung heißt dagegen, dass Exporte günstiger und damit wettbewerbsfähiger sind. Ein starker Dollar behindert deswegen den (Rück-)Aufbau der amerikanischen Industrie. Allerdings ist das eben auch genau der Preis, den ein Land für eine Leit- oder Reserve-Währung zahlen muss. Weil die Welt mit US-Dollar bezahlt - auch ein mexikanisches Unternehmen, das mit einem chinesischen handelt, wickelt das mit Dollar ab - ist die Nachfrage nach US-Dollar hoch, und die Währung damit stark:

> *From a trade perspective, the dollar is persistently overvalued, in large part because dollar assets function as the world’s reserve currency. This overvaluation has weighed heavily on the American manufacturing sector while benefiting financialized sectors of the economy in manners that benefit wealthy Americans.*

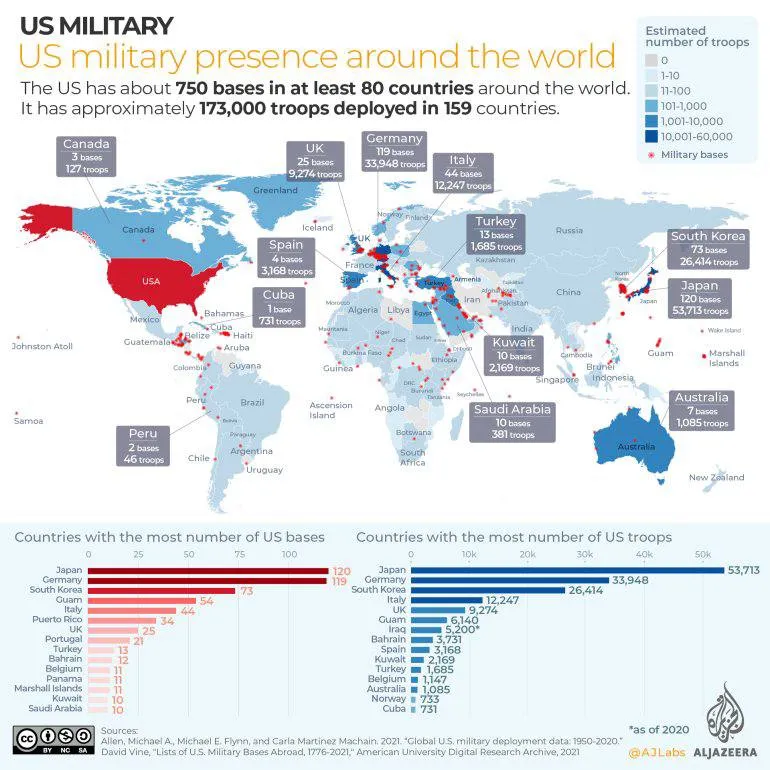

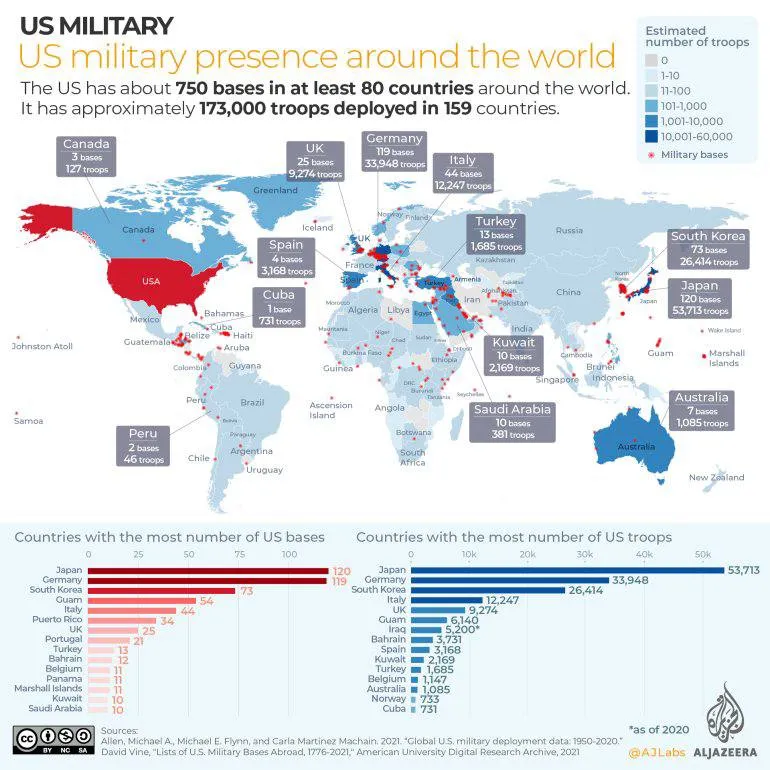

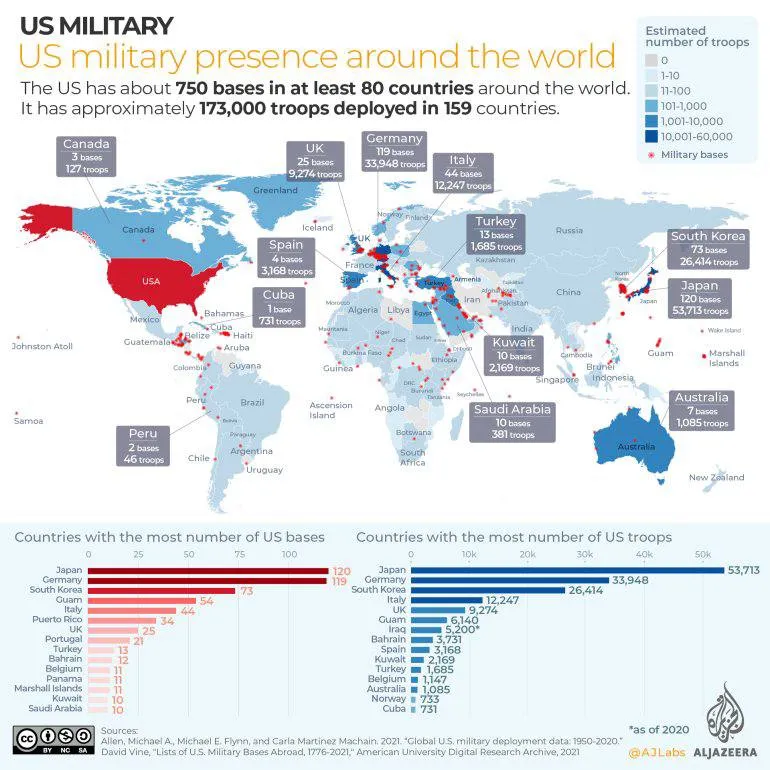

Die USA zahlten indirekt für dieses Privileg, indem sie es sich zur Aufgabe machten, internationale Handelswege zu schützen. Die US-Marine übernahm nach 1945 und besonders nach 1989 den Job der British Royal Navy, und bewacht seitdem alle wichtigen Schifffahrtswege weltweit, um freien Handel zu ermöglichen.

\

*The U.S. dollar is the reserve asset in large part because America provides stability, liquidity, market depth and the rule of law. Those are related to the characteristics that make America powerful enough to project physical force worldwide and allow it to shape and defend the global international order. The history of intertwinement between reserve currency status and national security is long.*

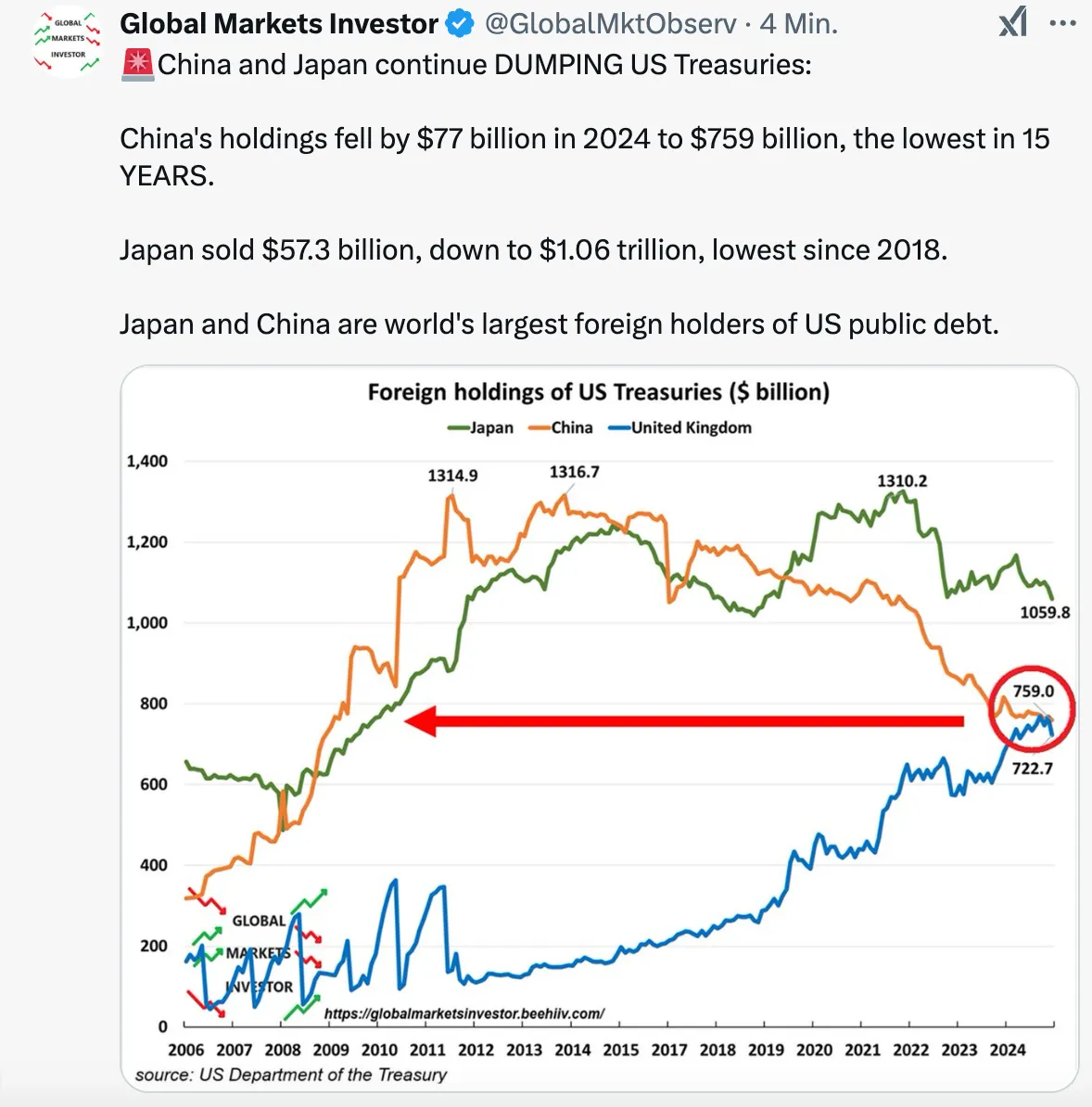

Das System funktionierte auch deswegen, weil die allermeisten, befreundeten Staaten, ihr Überschüsse wieder in US-Dollar-Anleihen anlegten (US-Treasuries). Dieses Recycling aus “Amerikaner konsumieren und zahlen mit US-Dollar, die China, Japan und die EU wiederum in US-Anleihen anlegen” funktionierte lange gut.

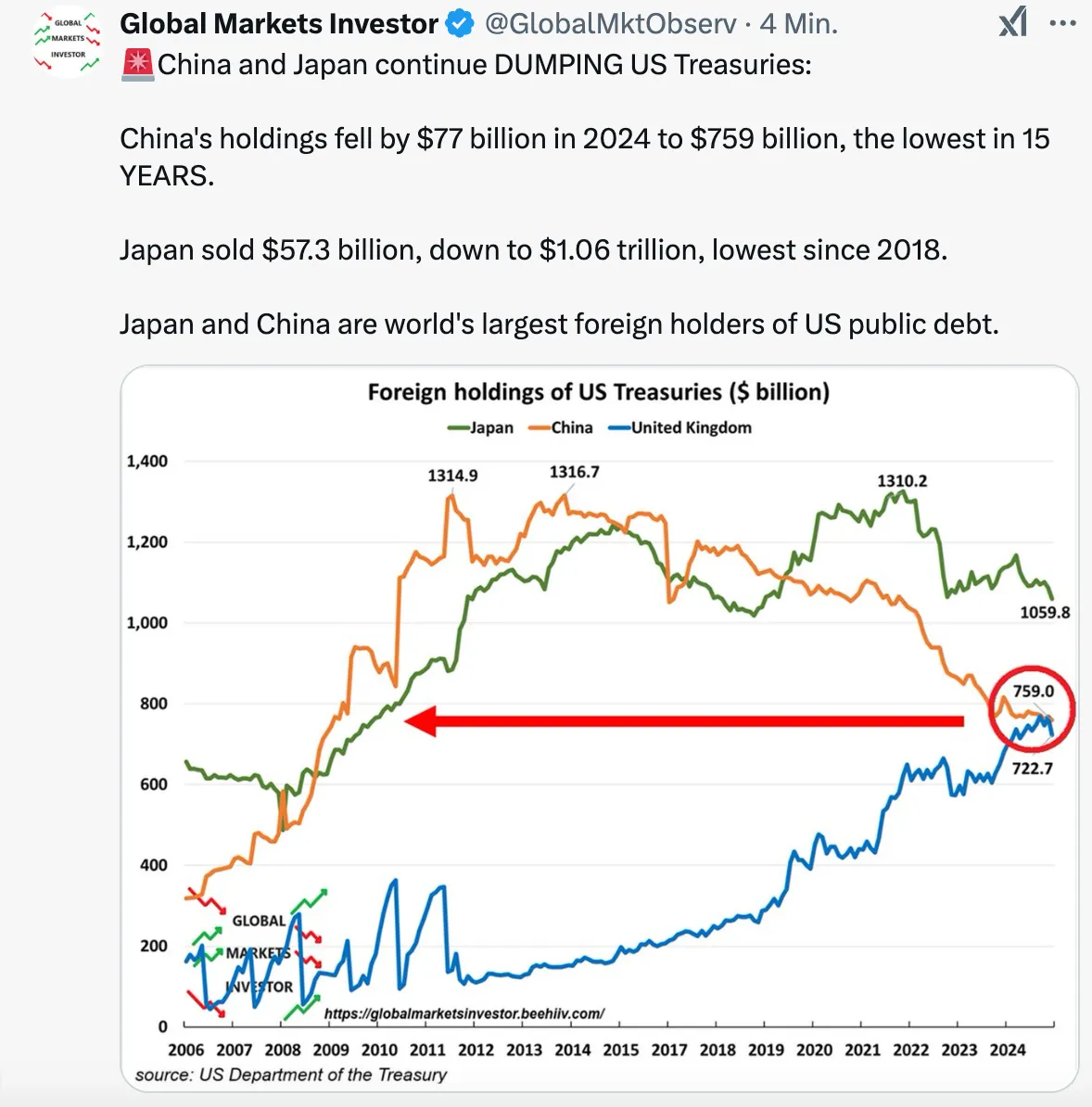

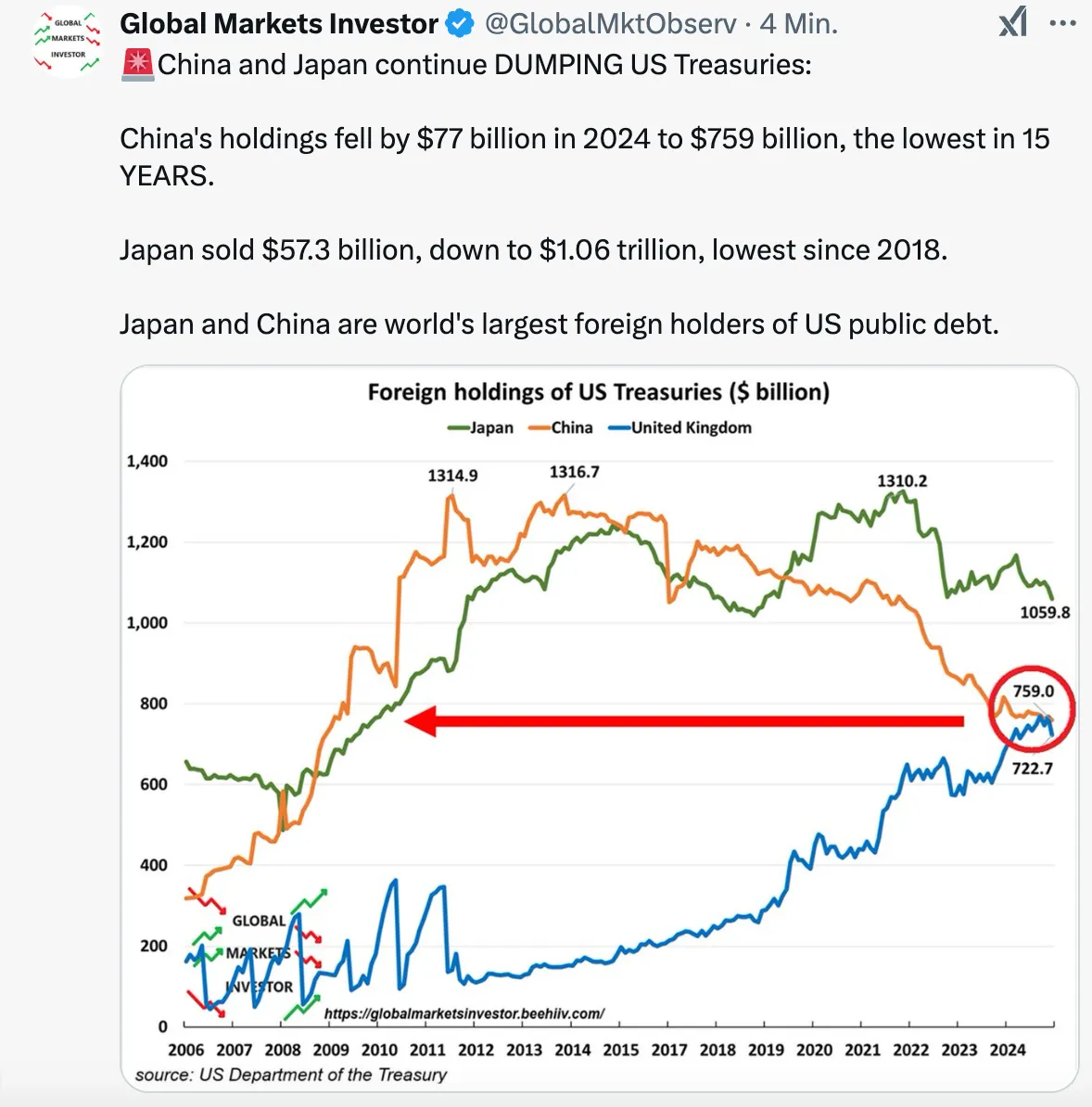

Das Problem ist seit einigen Jahren: Die Situation hat sich zuungunsten der USA verschoben. Man zahlt viel für das Militär, aber die Gewinne, die sich aus einer Leitwährung ergeben, sind gefallen. Kurz gesagt: Das Verteidigungsbudget wächst, während Arbeitsplätze verloren gegangen sind. Zwar konnten sich die USA in den vergangenen Jahren günstiger als andere verschulden. Trotzdem erdrückt die Schuldenlast mittlerweile den Etat, und immer weniger Staaten haben Lust, ihre Reserven in US-Treasuries anzulegen. Sie kaufen lieber Gold (und vielleicht auch bald Bitcoin).

Eine Neugewichtung des Deals ist notwendig. Daher der Kassensturz. Daher die ständigen Aufforderungen Trumps an Verbündete, künftig mehr zu zahlen.

Die Lösung könnte ein „Mar-a-Lago“-Accord sein. Die USA befanden sich in den 1980er Jahren schon einmal in einer ähnlichen Situation: Japanische und deutsche Waren überschwemmten die amerikanischen Märkte. Nach einem verlorenen Krieg in Vietnam und hoher Inflation hatten sich innerhalb Gesellschaft große Spannungen aufgebaut. Ronald Reagan, übrigens ein Präsident, der ähnlich polarisierte wie Trump heute, sprach 1985 Klartext: Japan und in geringerem Maße die BRD, Frankreich und Großbritannien hatten ihre Währungen aufzuwerten. Damit wurde die Flut der Exporte in die USA gestemmt und die Finanzflüsse stabilisiert.

Seit einigen Wochen gibt es relativ klare Pläne, wie diese neue Ordnung aussehen soll. Sie gehen zurück auf den Ökonomen Steve Miran, der bereits unter der ersten Trump-Administration eine Berater-Rolle hatte. Seit Dezember 2024 ist der Vorsitzender des Council of Economic Advisers. Miran wiederum steht [Zoltan Pozsar nahe, der 2022/23 zum Shooting Star der Macro-Economy-Nerds wurde](https://www.finews.ch/themen/guruwatch/58206-zoltan-pozsar-ex-uno-plures-resarch-dollar-zinsen-bretton-woods-ungarn). Worum geht es?

Weiter geht es auf <https://blingbling.substack.com/p/der-mar-a-lago-accord>

-

@ 57d1a264:69f1fee1

2025-02-25 07:28:18

@Voltage team will be building a simple implementation of a Lightning gated API service using a Voltage LND Node and the L402 protocol.

📅 Thursday, February 27th 4:00 PM CDT

📷 Live on Voltage Discord, on X, or on YouTube.

- discord.gg/EN93fDfQ

- https://x.com/voltage_cloud/status/1892938201980919985

- https://www.youtube.com/@voltage_cloud

originally posted at https://stacker.news/items/896373

-

@ 6389be64:ef439d32

2025-02-25 05:53:41

Biochar in the soil attracts microbes who take up permanent residence in the "coral reef" the biochar provides. Those microbes then attract mycorrhizal fungi to the reef. The mycorrhizal fungi are also attached to plant roots connecting diverse populations to each other, allowing transportation of molecular resources (water, cations, anions etc).

The char surface area attracts positively charged ions like

K+

Ca2+

Mg2+

NH4+

Na+

H+

Al3+

Fe2+

Fe3+

Mn2+

Cu2+

Zn2+

Many of these are transferred to plant roots by mycorrhizal fungi in exchange for photosynthetic products (sugars). Mycorrhizal fungi are connected to both plant roots and biochar. Char adsorbs these cations so, it stands to reason that under periods of minimal need by plants for these cations (stress, low or no sunlight etc.), mycorrhizal fungi could deposit the cations to the char surfaces. The char would be acting as a "bank" for the cations and the deposition would be of low energy cost.

Once the plant starts exuding photosynthetic products again, signaling a need for these cations, the fungi can start "stripping" the cations off of the char surface for immediate exchange of the cations for the sugars. This would be a high energy transaction because the fungi would have to expend energy to strip the cations off of the char surface, in effect, an "interest rate".

The char might act as a reservoir of cations that were mined by the fungi while the sugar flow from the roots was active. It's a bank.

originally posted at https://stacker.news/items/896340

-

@ ef1744f8:96fbc3fe

2025-02-25 05:51:23

kZPO/Pgqm/nOfGtpHNVK3gcDhzs5sSvyVqUZlAJrs95os0xUFhO4VlBC5GuEYF0uYTTGVGe60TjK8sm+ixOIPxpd3eYGGtZs9CjkRzis8vU=?iv=KyDTZEV4fCT/lKJWR4heeQ==

-

@ ef1744f8:96fbc3fe

2025-02-25 05:45:21

B3rafJgfWeHKOv/c2y8pk7thAOvmYYooCN1BMJh+gtmngdanQ7Mnimz048gzTWlV8Ap6wHRtu2rD6W6KDt6r82HlaftHm8jRBH1BGJ8Aw+GYy/PRGuQnUZP3DcjZusRchZSIhWuFBnhonWUHrxwnzrmcolx6yPekWKzxn9DR8Kt2qWIxbg2791EnuQn6orrAdw8MJJQg/hZhEdqib8KuweUrn6YDPi8ICV099rHUAlWBR6NSn/kwyomarCmV6U0bucUiv5y6QrBUSIQGfMTKYGBgmdXdeWTQ4YSYTaF0cZNDCJorksVIxx32dpc8RhYsvooZwk0OAAGg5LO5dekA1rn5jZk6rbmAnRcvnQFcue0=?iv=gZIUGRNTRQULCjSeRae+YQ==

-

@ ef1744f8:96fbc3fe

2025-02-25 04:39:34

z9Lx1dooDqHDDhWqropQYC1DWuFDIPxnfgiKc2T0ZFYdD45DOQNWX/kVslqJzGIe3s7KB8QBIhaxcYte84h631adZwVR/15tZOC8FeeLeIt8fM8QCromJVIoPJU29yY4kLepPMDWw7WoWfDysolhLDv1dtPrOkIWZ+188YOjAc8byhgWsvWgfwxlfS+26BpZadFIBolA4kDqN1dO+SQnyM9mUD1jc3aLe4utOlij/+gU0XkN93W7637MBN41AXGBLAv4E4AG+ywAQrx8f2R8JUY+Vg+DLmq1/vuUH+S1qTC/Lz6HEy5H2HiGeSyK43UB7QV7HLGn0e5KUtn6dxjl/irrJQL6dDdilCpdCBgCBBk=?iv=xctArPoh36458mWve+tqEw==

-

@ ef1744f8:96fbc3fe

2025-02-25 04:33:53

qT0bRNd6LiQzh1Y34rZv39xcgw5TCv9xZ5xAxbHoBDrhfaYGyll5g4XvgHY0LgfxcxSt8XcMI50yjY19WYfwvxl0gASsXBljn8SzhlO4RiF0NorJCklhOjDo93kQON/pVOYNmIi9oGTpqMWWxE5Qh53tvA2zaPG67B6CBCjh7wbVnFrLqCdq1KV9iBSRZmFXaBYWcn3pFcGKlqTV/NGrHnVFwqjS1uFAZZrScwxWRmbM1TVplp6f5dHNxTfe8pXajSsvO3kXV5jRCLr6C2jJMWepUFWw33tjBCwGOyo9kbkf0C++OTHrlPMECi5vXq18C1L+bA0ouVlVlfYu5j/ywg==?iv=BgxOFzpGx/RiIRYKZZz/8g==

-

@ ef1744f8:96fbc3fe

2025-02-25 04:19:37

gGRBBQfw8RRgMK4XZ9kE3MpdCdFgngP/0/QQUfUdEbX6ZjUr2cZ6B6yID05lexoOosOSlzmPbTbx5y8Imur0ls8EHBik31l/IZdYdln8vPGnQ341Ul4Kp88VCjJ9UWNY6l+Sel9XbwwGGqzBvIIRsg+OWCAput62iAErCDmsVkMYMfnmhH8cSVYFOwEWqk4H1iKFSsWnRbRZ8w5scRXgjHIaQNQ6QSsSWAgC8jeZi7mFmTJN+JrBPBQEzM30AUWFpMjUy8NVKflfe9dRJ9j1OfDFCwZxAmohvBpWx3TgFDvcpAOnIH3J/d4XO7XJpZ4pJPSo5Sej73lDwYKQSEpGng==?iv=XKhoZRopkCInuqqAzP1haQ==

-

@ 04ea4f83:210e1713

2025-02-24 06:42:36

Erschienen im [The Bitstein Brief](https://bitstein.substack.com/p/mises-the-original-toxic-maximalist?ref=europeanbitcoiners.com) | Veröffenlichung 10.12.2022 |\

Author: [Bitstein (Michael Goldstein)](https://twitter.com/bitstein?ref=europeanbitcoiners.com)\

Übersetzt von: [Sinautoshi am 11.12.2022 - 766906](https://twitter.com/Sinautoshi_8_21?ref=europeanbitcoiners.com)

*„Die gesellschaftliche Funktion der Wirtschaftswissenschaft besteht gerade darin, solide Wirtschaftstheorien zu entwickeln und die Irrtümer bösartiger Denkweisen zu entlarven. Bei der Verfolgung dieser Aufgabe zieht der Wirtschaftswissenschaftler die tödliche Feindschaft aller Schwindler und Scharlatane auf sich, deren Abkürzungen zum irdischen Paradies er entlarvt. Je weniger diese Quacksalber in der Lage sind, plausible Einwände gegen die Argumente eines Ökonomen vorzubringen, desto wütender beschimpfen sie ihn.“*

\- Ludwig von Mises, „Nationalökonomie, Theorie des Handelns und Wirtschaftens”

***

Das „toxischste" an einem Bitcoin-Maximalisten ist seine unerschütterliche Bereitschaft, „*Nein” *zu sagen. Nach dem Studium der Geldtheorie und -geschichte und der Erfahrung mit den unerbittlichen Kräften des Marktes, hat der Bitcoiner ein Verständnis für die Realität des monetären Wettbewerbs, ein Bewusstsein für die kritische Natur dezentraler Systeme, einen Fokus auf die Lösung der wichtigsten monetären Probleme und eine strikte Ablehnung der unvermeidlichen Ablenkungen, Opportunitätskosten und ethischen Bedenken bei der Einführung und Förderung von Altcoin-Projekten.

Einige Kritiker bemängeln unhöfliche rhetorische Schnörkel, die als Hindernis für die Gewinnung neuer Bitcoin-Nutzer angesehen werden. Wenn das wahr wäre, gäbe es in der Arbeitsteilung eine Chance für eine qualitativ hochwertigere Bitcoin-Ausbildung, die die Bitcoiner meiner Meinung nach gerne wahrnehmen würden, vor allem die Kritiker, die die bestehenden Unzulänglichkeiten besser erkennen. Doch egal, wie höflich die Bitcoiner ihre Ansichten darlegen, bestimmte Möchtegern-Unternehmer und Influencer werden immer im Streit mit einer leidenschaftlichen Bevölkerungsgruppe stehen, die einfach nicht interessiert ist - und ihr Desinteresse lautstark kundtut. Die „toxischsten" Bitcoiner sind oft diejenigen, die die Weisheit der Bitcoiner erst erkannt haben, nachdem sie von Shitcoins verbrannt wurden und ihr neu gefundenes Desinteresse unmissverständlich zum Ausdruck bringen wollen.

Was soll man also als Bitcoiner tun? Ich empfehle, sich der Wahrheit und der Förderung der Wahrheit zu verschreiben und die Wirksamkeit von Rhetorik an ihrem langfristigen Einfluss und nicht an ihrer kurzfristigen Popularität zu messen.

In dieser Hinsicht sollten sich die Bitcoiner von dem ursprünglichen toxischen Maximalisten inspirieren lassen: Ludwig von Mises. Der bedeutende Wirtschaftswissenschaftler setzte sich unbeirrt für die Wahrheit, freie Märkte und gesundes Geld ein und scheute sich nicht, das zu sagen, was gesagt werden musste, auch wenn er sich damit keine Freunde machte. Langfristig wurde er zu einem der einflussreichsten Ökonomen und Denker des 20. Jahrhunderts, und seine Arbeit hat den Weg für den Bitcoin geebnet.

### Mises, der Geldmaximalist

Einer der Hauptkritikpunkte an den Bitcoin-Maximalisten ist die Behauptung, dass die Welt auf Bitcoin (als Geld) konvergieren wird und es generell keine Verwendung für andere Währungen gibt. Dies wird als normative Aussage betrachtet. In Wirklichkeit machen die Bitcoiner eine positive, beschreibende Aussage darüber, wie der monetäre Wettbewerb funktioniert.

In der 1912 veröffentlichten *[Theorie des Geldes und der Umlaufmittel](https://mises.org/library/theory-money-and-credit?ref=europeanbitcoiners.com)*[ ](https://mises.org/library/theory-money-and-credit?ref=europeanbitcoiners.com)schrieb Mises:

***

*„So haben die Erfordernisse des Marktes allmählich dazu geführt, dass bestimmte Waren als gemeinsame Tauschmittel ausgewählt wurden. Die Gruppe der Waren, aus der diese ausgewählt wurden, war ursprünglich sehr groß und unterschied sich von Land zu Land; sie wurde aber immer mehr eingeschränkt. Wann immer ein direkter Tausch nicht in Frage kam, war jede der an einem Geschäft beteiligten Parteien bestrebt, ihre überflüssigen Waren nicht nur gegen marktgängigere Waren im Allgemeinen, sondern gegen die marktgängigsten Waren einzutauschen, und von diesen wiederum bevorzugte sie natürlich die marktgängigste Ware. Je größer die Marktfähigkeit der zuerst im indirekten Tausch erworbenen Waren ist, desto größer ist die Aussicht, das endgültige Ziel ohne weitere Manöver erreichen zu können. So gäbe es die unvermeidliche Tendenz, dass die weniger marktfähigen Güter aus der Reihe der als Tauschmittel verwendeten Waren nach und nach verworfen würden, bis schließlich nur noch ein einziges Gut übrig bliebe, das allgemein als Tauschmittel verwendet würde: das Geld.“*

***

Mises zufolge wählen die Akteure zunehmend das marktgängigste Gut als Tauschmittel aus und der natürliche Verlauf des Marktes geht in Richtung Vereinheitlichung zu einem einzigen Geldgut. Das ist schlicht und einfach monetärer Maximalismus.

Mises unterscheidet sich von den Bitcoinern lediglich durch die Stärke der Behauptungen, die er über die tatsächlichen empirischen Entscheidungen der Wirtschaftsakteure zu treffen bereit ist. Mises weist darauf hin, dass sowohl Gold als auch Silber an vielen Orten zu Geld gemacht wurden, wahrscheinlich wegen ihrer ähnlichen Eigenschaften, und dass es den Rahmen der Geldtheorie sprengt, zu sagen, ob Gold oder Silber letztlich besser verkäuflich ist. Trotzdem sagt er:

***

*„Denn es ist ziemlich sicher, dass die Vereinheitlichung auch dann ein wünschenswertes geldpolitisches Ziel gewesen wäre, wenn die ungleiche Marktfähigkeit der als Tauschmittel verwendeten Güter kein Motiv geboten hätte. Die gleichzeitige Verwendung mehrerer Geldarten bringt so viele Nachteile mit sich und verkompliziert die Technik des Tauschens so sehr, dass das Bestreben, das Geldsystem zu vereinheitlichen, in jedem Fall unternommen worden wäre.“*

***

Die natürliche Tendenz zu einem einzigen Geldgut ist so stark, dass seiner Meinung nach die Vereinheitlichung der Geldsysteme auch dann angestrebt würde, wenn zwei Güter genau gleich marktfähig wären. Zuvor stellt er außerdem fest:

***

*„Das endgültige Urteil könnte erst gefällt werden, wenn alle Hauptteile der bewohnten Erde ein einziges Handelsgebiet bilden, denn erst dann wäre es unmöglich, dass andere Nationen mit unterschiedlichen Geldsystemen sich anschließen und die internationale Organisation verändern.“*

***

Jede neue Handelsbeziehung eröffnet die Möglichkeit, ein brandneues Geldgut einzuführen, das bisher nicht verwendet wurde. Wenn seine Qualitäten ein höheres Maß an Marktfähigkeit aufrechterhalten könnten, ist es möglich, dass sich die gesamte internationale Währungsordnung aufgrund seiner natürlichen Überlegenheit bei der Bewältigung der Funktionen des Geldes um ihn herum neu organisieren könnte.

Im [Bitcoin Standard ](https://aprycot.media/shop/der-bitcoin-standard/?ref=europeanbitcoiners.com)liefert Saifedean Ammous zahlreiche Argumente dafür, warum Gold dem Silber als Geldwert überlegen war, obwohl Mises nicht bereit oder nicht daran interessiert war, diesen Punkt zu diskutieren, und warum Bitcoin ein noch besserer Geldwert ist. Mises hat die Einführung von Bitcoin in die Weltwirtschaft zwar nicht mehr erlebt, aber seine Wirtschaftstheorie erklärt genau, warum Bitcoin an Wert gewinnen würde und warum es plausibel ist, dass die gesamte internationale Währungsordnung auf einen Bitcoin-Standard umgestellt wird. Er gibt auch den theoretischen Rahmen, um zu verstehen, warum Altcoins Bitcoin nicht allein durch ihre Eigenschaften ausstechen können. Sie müssen eine bessere Marktfähigkeit in Bezug auf Raum, Zeit und Größe bieten, um einen ausreichenden Vorteil gegenüber Bitcoin zu haben. Wie bereits an anderer Stelle beschrieben, ist dies einfach nicht gelungen, und nur Bitcoin bietet ein stark dezentralisiertes, überprüfbares und glaubwürdig knappes digitales Geldgut.

### Mises, der Marktmaximalist

Die Geldtheorie ist nicht der einzige Ort, an dem der Leser eine Art „Maximalismus" in Mises' Denken spüren kann. Sein gesamtes Werk läuft auf einen unverhohlenen Marktmaximalismus hinaus, der sich weigert, durch rigorose ökonomische Theorie und Analyse sozialistischen oder interventionistischen Argumenten nachzugeben.

Ein großartiges Beispiel für seine Verteidigung des freien Marktes findet sich in einem Vortrag aus dem Jahr 1950 mit dem Titel „[Die Mitte des Weges führt zum Sozialismus](https://mises.org/library/middle-road-leads-socialism?ref=europeanbitcoiners.com)". In dieser Vorlesung greift Mises Interventionisten an, die behaupten, eine Politik der „Mitte" zwischen den beiden Extremen Kapitalismus und Sozialismus zu favorisieren. Durch strategische Interventionen kann der Staat die Auswüchse beider Systeme verhindern.

Mises betrachtet Kapitalismus und Sozialismus jedoch als diametral entgegengesetzte und unvereinbare Organisationssysteme und nicht als ein Spektrum der Wohlstandsverteilung:

***

*„Der Konflikt der beiden Prinzipien ist unüberbrückbar und lässt keinen Kompromiss zu. Kontrolle ist unteilbar. Entweder entscheidet die Nachfrage der Verbraucher, die sich auf dem Markt manifestiert, für welche Zwecke und wie die Produktionsfaktoren eingesetzt werden sollen, oder der Staat kümmert sich um diese Angelegenheiten. Es gibt nichts, was den Gegensatz zwischen diesen beiden widersprüchlichen Prinzipien abmildern könnte. Sie schließen sich gegenseitig aus. Der Interventionismus ist kein goldener Mittelweg zwischen Kapitalismus und Sozialismus. Er ist der Entwurf für ein drittes System der wirtschaftlichen Organisation der Gesellschaft und muss als solches gewürdigt werden.“*

***

Dieses dritte System ist jedoch im Grunde nur ein längerer Marsch zum Sozialismus, indem es ein falsches Lippenbekenntnis zu Privateigentum und freier Marktwirtschaft ablegt. Auf jeden Eingriff, der stattfindet, müssen weitere folgen. Die Festsetzung eines Preises hier erfordert die Festsetzung eines anderen Preises dort, und so geht es die ganze Lieferkette entlang. Am Ende hat der Interventionismus die gesamte „Marktwirtschaft" im Würgegriff.

***

*Der Interventionismus kann nicht als ein Wirtschaftssystem betrachtet werden, das dazu bestimmt ist, zu bleiben. Er ist eine Methode zur Umwandlung des Kapitalismus in den Sozialismus in mehreren aufeinanderfolgenden Schritten. Damit unterscheidet er sich von den Bemühungen der Kommunisten, den Sozialismus auf einen Schlag zu verwirklichen. Der Unterschied bezieht sich nicht auf das letztendliche Ziel der politischen Bewegung, sondern vor allem auf die Taktik, die zur Erreichung des von beiden Gruppen angestrebten Ziels angewandt wird.*

***

Trotzdem sind selbst die meisten vermeintlichen Befürworter einer freien Marktwirtschaft in Wirklichkeit von interventionistischen Ideologien und Denkweisen durchdrungen, und ihre Strategien sind immer zum Scheitern und zu Kompromissen verurteilt.

***

*„Dies hat zur Folge, dass praktisch kaum etwas getan wird, um das System der Privatwirtschaft zu erhalten. Es gibt nur Mittelsmänner, die glauben, erfolgreich gewesen zu sein, wenn sie eine besonders ruinöse Maßnahme eine Zeit lang hinausgezögert haben. Sie sind immer auf dem Rückzug. Sie nehmen heute Maßnahmen in Kauf, die sie noch vor zehn oder zwanzig Jahren für undiskutabel gehalten hätten. In ein paar Jahren werden sie sich mit anderen Maßnahmen abfinden, die sie heute noch für undiskutabel halten. Was den totalitären Sozialismus verhindern kann, ist nur ein grundlegender Wandel der Ideologien.*\

\

*Was wir brauchen, ist weder Antisozialismus noch Antikommunismus, sondern eine offene Befürwortung des Systems, dem wir all den Wohlstand verdanken, der unser Zeitalter von den vergleichsweise beengten Verhältnissen vergangener Zeiten unterscheidet.“*

***

Mises nimmt kein Blatt vor den Mund, wenn er eine interventionistische Politik fordert, und es gibt viele Lehren, die Bitcoiner daraus ziehen können.

Erstens ist das Bitcoin-Netzwerk nicht einfach nur eine andere Art des Werttransfers als eine bestehende zentralisierte Lösung, eine Art PayPal 2.0. Es ist ein strukturell anderer Ansatz für das gesamte Problem der doppelten Ausgaben. „Blockchain, nicht Bitcoin" ist eine Mogelpackung, weil sie den Kern dessen, was Bitcoin einzigartig macht (Dezentralisierung, unabhängige Überprüfbarkeit usw.), wegnimmt, während sie behauptet, „die zugrundeliegende Technologie" zu nutzen, ähnlich wie ein nationalsozialistisches oder faschistisches Regime die staatliche Kontrolle über die Produktion übernehmen könnte, während es behauptet, für Privateigentum zu sein. Wenn du die Vorteile des Marktes nutzen willst, musst du tatsächlich einen Markt haben, und wenn du die Vorteile von Bitcoin nutzen willst, musst du Bitcoin tatsächlich nutzen.

Außerdem sollte die Dezentralisierung als binäres System betrachtet werden. Entweder ist ein System dezentralisiert, oder es ist dazu verdammt, zentralisiert zu werden, manchmal mit einem Hard Fork nach dem anderen (*vgl. Ethereum*). Bitcoin-Maximalisten werden regelmäßig als toxisch bezeichnet, weil sie entschlossen an bestimmten Netzwerkparametern festhalten, selbst wenn diese willkürlich oder trivial erscheinen. Ein ganzer[ Krieg über die Blockgröße](https://amzn.to/3OZX84g?ref=europeanbitcoiners.com) wurde um eine Begrenzung von 1 MB geführt. Die Zahl schien willkürlich und die Lösung trivial zu sein, aber die Bitcoiner weigerten sich, davon abzuweichen. Und warum? Eine höhere Blockgröße würde die Kosten für den Betrieb eines vollständigen Knotens (Full Node) erhöhen, der für eine unabhängige Validierung und Dezentralisierung notwendig ist. Ein Hard Fork würde einen vernichtenden Präzedenzfall schaffen und alle zukünftigen Ansprüche auf Abwärtskompatibilität gefährden, die für die Glaubwürdigkeit der Geldpolitik und die Fähigkeit der Nodes, sich vertrauensvoll mit dem Netzwerk zu synchronisieren, erforderlich sind. Die Blockkapazität stieg zwar an, aber nur, weil SegWit, dessen Vorteile weit über die bloße Verbesserung der Skalierung hinausgingen, über einen Soft Fork aktiviert werden konnte, sodass denjenigen, die dies nicht wollten, keine neuen Kosten auferlegt wurden.

Andere Projekte hingegen akzeptieren nicht, dass [die Kompromisse bei Bitcoin nicht wirklich willkürlich sind](https://medium.com/@nic__carter/bitcoin-bites-the-bullet-8005a2a62d29?ref=europeanbitcoiners.com). Sie bieten Turing-complete Smart Contracts, schnellere Blockzeiten, größere Blöcke oder alle möglichen anderen „Features" an. Die Features werden nicht mit demselben extrem konservativen Engagement für Sicherheit produziert wie Bitcoin und bedrohen oft die Fähigkeit, überhaupt einen vollständigen Knoten (*Full-Node*) zu betreiben. Nur bei Bitcoin kümmern sich die Leute darum, dass die Geldmenge tatsächlich überprüft werden kann. Mit der Zeit verlieren die Projekte, wenn sie überhaupt aufrechterhalten werden, jeden Anschein einer glaubwürdigen Dezentralisierung. Ethereum, das einst mit unaufhaltsamen Anwendungen und der Aussage „Code ist Gesetz" warb, erlebte den DAO-Hack und ist nach der Einführung von Proof-of-Stake (das von Natur aus zentralisierend ist) der OFAC-Zensur in unterschiedlichem Maße unterworfen.

Bitcoin akzeptiert nichts von alledem. Er beugt seine Regeln für niemanden. Bitcoiner wissen auch, dass das System gar kein Bitcoin mehr wäre, wenn die Regeln gebogen *würden*. Mises hilft uns zu verstehen, dass eine Politik des Mittelweges zu Shitcoinerei führt. Eine Währung ist entweder Bitcoin oder dazu verdammt, ein Shitcoin zu sein.

### Mises, der toxische Maximalist

Im Jahr 1947 fand in der Schweiz das erste Treffen der Mont Pèlerin Society statt. Bei diesem Treffen trafen sich viele der einflussreichsten Verfechter der freien Märkte und des klassischen Liberalismus, von Ludwig von Mises über F. A. Hayek bis hin zu Milton Friedman und vielen anderen, um darüber zu diskutieren, wie man die steigende Flut des Totalitarismus und seiner Wirtschaftsideologien durch die Förderung freier Märkte und des Privateigentums bekämpfen kann. Man könnte meinen, dass Mises genau in diese Diskussionen passt. Doch wie [Milton Friedman berichtete](https://reason.com/1995/06/01/best-of-both-worlds/?ref=europeanbitcoiners.com), kam es anders:

***

*„Die Geschichte, an die ich mich am besten erinnere, ereignete sich auf dem ersten Treffen in Mont Pèlerin, als \[Mises] aufstand und sagte: „Ihr seid alle ein Haufen Sozialisten." Wir diskutierten über die Einkommensverteilung und darüber, ob man progressive Einkommenssteuern haben sollte. Einige der Anwesenden vertraten die Ansicht, dass es eine Rechtfertigung dafür geben könnte.*\

\

*Eine andere Gelegenheit, die ebenso aufschlussreich ist: Fritz Machlup war ein Schüler von Mises, einer seiner treuesten Jünger. Bei einem der Treffen in Mont Pèlerin hielt Machlup einen Vortrag, in dem er, glaube ich, die Idee eines Goldstandards in Frage stellte; er sprach sich für freie Wechselkurse aus. Mises war so wütend, dass er drei Jahre lang nicht mit Machlup sprechen wollte. Einige Leute mussten die beiden wieder zusammenbringen. Es ist schwer zu verstehen; man kann es einigermaßen nachvollziehen, wenn man sich vor Augen führt, wie Menschen wie Mises in seinem Leben verfolgt wurden.“*

***

Wie bereits erwähnt, hielt Mises drei Jahre später einen Vortrag, in dem er eindrucksvoll erklärte, warum sie tatsächlich alle ein Haufen Sozialisten waren. Wer staatliche Eingriffe in die Einkommensverteilung akzeptiert, ist dem Sozialismus bereits verfallen, sobald genug Zeit vergangen ist. Mises war einfach nicht bereit, den sozialistischen Irrtümern, die er im Laufe seiner intellektuellen Karriere so akribisch aufgespießt hatte, Glauben zu schenken. Jörg Guido Hülsmann stellt in [Mises: *The Last Knight of Liberalism*](https://mises.org/library/mises-last-knight-liberalism-0?ref=europeanbitcoiners.com) fest, dass „Mises zwar in der Lage war, Sozialisten hoch zu schätzen, aber der Vorfall zeigte, dass er wenig Geduld mit Sozialisten hatte, die sich als Liberale ausgaben."

Doch Mises' giftiges Verhalten blieb nicht ohne Folgen. Laut Hülsmann:

***

*„Der Schlagabtausch zwischen Mises und seinen neoliberalen Gegnern prägte den Ton in der Mont Pèlerin Society für die kommenden Jahre.... Obwohl die Libertären um Mises eine kleine Minderheit waren, hatten sie die finanzielle Unterstützung der amerikanischen Hauptsponsoren wie dem Volker Fund, ohne die die Gesellschaft in jenen frühen Jahren schnell ausgestorben wäre. Solange Mises aktiv an den Treffen teilnahm, war es daher unmöglich, die technischen Details eines genehmigten staatlichen Interventionismus zu diskutieren. Das** **Laissez-faire hatte ein Comeback gefeiert. Es war zwar nicht die Mehrheitsmeinung, aber es war eine diskutierbare und diskutierte politische Option - zu viel für einige anfängliche Mitglieder wie Maurice Allais, der die Gesellschaft genau aus diesem Grund bald wieder verließ.“*

***

Indem er toxisch war, konnte Mises dazu beitragen, den Ton für eine wirklich *laissez-faire* Mont Pèlerin Society zu setzen, die ihrem erklärten Ziel gerecht werden konnte, und sie wählten F. A. Hayek zu ihrem Präsidenten. Er hatte keine Angst, Klartext zu reden, aber lautstark, sogar gegenüber Leuten, die vermutlich zu seinem „eigenen Team" gehörten. Ludwig von Mises war ein Mann, der seine Ideen ernst nahm und die Wahrheit noch viel ernster.

In seinen [Memoiren ](https://mises.org/library/memoirs?ref=europeanbitcoiners.com)schreibt Mises über seine Zeit in der österreichischen Handelskammer in den 1910er und 1920er Jahren:

***

*„Ich wurde manchmal beschuldigt, meinen Standpunkt zu schroff und unnachgiebig zu vertreten. Es wurde auch behauptet, dass ich mehr hätte erreichen können, wenn ich eine größere Kompromissbereitschaft gezeigt hätte.... Die Kritik war ungerechtfertigt; ich konnte nur dann effektiv sein, wenn ich die Dinge so darstellen konnte, wie sie mir erschienen. Wenn ich heute auf meine Arbeit bei der Handelskammer zurückblicke, bedauere ich nur meine Kompromissbereitschaft und nicht meine Unnachgiebigkeit.“*

***

In dieser Zeit trug sein Rat dazu bei, die Hyperinflation in Österreich aufzuhalten und ihre Auswirkungen im Vergleich zur Weimarer Republik abzuschwächen.

Bitcoiner werden von endlosen „Krypto-" und „Shitcoin"-Betrügern geplagt, die auf dem Rücken der innovativen Technologie und des wirtschaftlichen Erfolgs von Bitcoin reiten wollen. Den Bitcoinern wird gesagt, dass sie alle im selben Team sind. In den Augen der Öffentlichkeit sind sie das auch. Das Ergebnis ist eine getäuschte Öffentlichkeit, der zentralisierte Pump-and-Dump-Systeme und Rugpulls, Affen-Jpegs und Rube-Goldberg-Maschinen verkauft werden, die auf Schlagwörtern basieren und die Vorstellung vermitteln, dass sie in der gleichen Liga spielen wie die großartigste Geldtechnologie, die je geschaffen wurde. „Krypto" profitiert vom Erfolg von Bitcoin, und die Bekanntheit von Bitcoin sinkt mit den Misserfolgen von „Krypto". Doch wenn Bitcoiner die Unterschiede ansprechen und diese Projekte ablehnen, die sie uninteressant oder sogar verabscheuungswürdig finden, wird das als schädlich angesehen. Den Bitcoinern schadet das nicht, denn sie können weiter (Satoshis) stapeln und bauen, aber die Menschen, die unter Fiat-Regimen leben müssen, leiden darunter, dass ihnen kein Weg zu Freiheit und Wohlstand gezeigt wird.

Abgesehen davon, dass das Geld des Einzelnen in Gefahr ist, kann die Offenheit für Shitcoins auch Veränderungen im Netzwerk fördern, die die Dezentralisierung beeinträchtigen. Wenn es Unterstützung für einen Shitcoin gibt, der auf einem bestimmten Merkmal basiert, warum sollte das Merkmal dann nicht in Bitcoin existieren? Wenn es tatsächlich eine Tendenz zu einer einzigen Währung gibt, ist die Förderung einer alternativen Kryptowährung selbst ein Angriff auf das Potenzial von Bitcoin. Wirtschaft und Technik sind mit gnadenlosen Konsequenzen konfrontiert. Eine falsche Abfolge von Schritten kann zu absoluter Verwüstung führen. Bitcoiner nehmen das sehr ernst und machen keinen Hehl daraus, dass sie diese Konsequenzen fürchten. Wenn sie das tun, lehnen sie ganze unternehmerische Vorhaben ab und stellen ihre gesamte Einnahmequelle in Frage. Das ist toxisch.

Bitcoiners sollten immer den Mut haben, Mises zu zitieren und jedem zu sagen: „Ihr seid alle ein Haufen Shitcoiner."

### Der aufgehende Stern von Mises

Obwohl er aus einer adligen Familie stammte und in Österreich hohe Positionen innehatte, hatte Mises, als er auf der Flucht vor den Nazis in die Vereinigten Staaten emigrierte, nur wenige Möglichkeiten. Bis zu seiner Pensionierung war er „Gastprofessor" an der New York University. Er arbeitete im Grunde genommen im stillen Kämmerlein und unterrichtete hauptsächlich in seinen inzwischen berühmten informellen Seminaren, an denen auch Murray Rothbard und andere teilnahmen. Er benötigte die Unterstützung verschiedener philanthropischer Fonds. Hinzu kam, dass die Wirtschaftswissenschaften, wie alle Sozialwissenschaften, dem Szientismus und der Technokratie erlegen waren, so dass Mises' strenge logisch-deduktive Methoden im Vergleich zu mathematischen Formeln und statistischen Modellen als altmodisch galten. Der Goldstandard wurde zugunsten eines Fiat-Systems abgeschafft, und als Mises starb, hatte der US-Dollar keinerlei Verbindung mehr zu Edelmetallen oder realen Ersparnissen, so dass die Geldpolitik allein den Launen der Politik überlassen blieb.

Es gab allen Grund, Ludwig von Mises völlig in Vergessenheit geraten zu lassen. Doch seine Schüler, wie Murray Rothbard, hielten die österreichische Schule am Leben. Im Jahr 1982 wurde das Ludwig von Mises Institute von Rothbard und Lew Rockwell gegründet und von Dr. Ron Paul finanziert (beide wurden von ihren Kritikern als „toxisch" bezeichnet). Dr. Paul selbst wurde zu einem legendären Verfechter der Ideen von Mises und anderen, sowohl im Kongress als auch im Präsidentschaftswahlkampf. In letzterem machte Dr. Paul die von der Federal Reserve verursachte wirtschaftliche Zerstörung zu einem zentralen Bestandteil seines Programms und zum ersten Mal seit Jahrzehnten zu einem wichtigen Thema in der politischen Debatte, was den Diskurs danach für immer veränderte.

Es ist also kein Wunder, dass viele Menschen, die sich als erste für Bitcoin begeisterten, treue Schüler von Mises waren und dass seine Ideen mit dem Wachstum von Bitcoin noch mehr an Bedeutung gewonnen haben. Seine rigorose Erläuterung der Wahrheiten des Wirtschaftsrechts, die auf Subjektivismus, Marginalismus und methodologischem Individualismus beruht, gab den Menschen den Rahmen, um zu verstehen, wie Bitcoin die Geldpolitik veranschaulicht, die zu Frieden, Wohlstand und Freiheit führt. Anstatt irrelevant zu werden, ist Mises heute wichtiger denn je. Wie Ron Paul bemerkte: „[Wir sind jetzt alle Österreicher](https://www.youtube.com/watch?v=467hCNuGvNw\&ref=europeanbitcoiners.com)."

### Fazit

Das Toxische liegt im Auge des Betrachters oder des Bagholders. Die Wirtschaftswissenschaft ist, wie jedes Streben nach Wahrheit, kein Beliebtheitswettbewerb, und die Wahrheit wird immer von denen bekämpft werden, deren Geschäft und Status von der Verbreitung von Irrtümern und Unwahrheiten abhängt.\

\

Ludwig von Mises stand fest zu seinen gründlichen Analysen der Wirtschaftswissenschaften und des klassischen Liberalismus und scheute sich nicht, das zu verteidigen, was er für wahr hielt, selbst auf Kosten von Prestige und Popularität. Heute steht er weit über fast jedem anderen Sozialwissenschaftler des 20. Jahrhunderts.

Ich habe an anderer Stelle über [Memes und Rhetorik ](https://www.youtube.com/watch?v=PBAuHv5cPl8\&ref=europeanbitcoiners.com)gesprochen, und es gibt viel zu diskutieren über bestimmte Strategien und ihre Wirksamkeit. Aber vor allem muss jede Strategie die Wahrheit in den Mittelpunkt stellen. Die Wahrheit ist zeitlos, so dass ihre Relevanz nicht auf kurzfristige Popularität beschränkt ist. Wenn dies der Fall ist, ist der Vorwurf der „Toxizität" entweder eine Aufforderung zur Verbesserung oder ein Ehrenzeichen dafür, dass man trotz aller Widrigkeiten für die Wahrheit einsteht. Wie das Motto von Ludwig von Mises schon sagte: *tu ne cede malis, sed contra audentior ito.* Weiche dem Bösen nicht, trete ihm umso mutiger entgegen.

-

@ da0b9bc3:4e30a4a9

2025-02-24 06:35:50

Hello Stackers!

Welcome on into the ~Music Corner of the Saloon!

A place where we Talk Music. Share Tracks. Zap Sats.

So stay a while and listen.

🚨Don't forget to check out the pinned items in the territory homepage! You can always find the latest weeklies there!🚨

🚨Subscribe to the territory to ensure you never miss a post! 🚨

originally posted at https://stacker.news/items/895451

-

@ 583e5ea1:b44effdd

2025-02-24 06:05:24

Today, we remember and pay tribute to Parag Kumar Das, a fearless journalist and human rights activist from Assam, on what would have been his 64th birthday. Though he's no longer with us, his legacy lives on, inspiring generations to continue fighting for justice and human rights.

Das's journey as a journalist began in the 1990s, writing for local newspapers in Assam. However, he soon realized that true power lies not in reporting events, but in giving voice to the voiceless and holding those in power accountable. This marked the beginning of his journey as a human rights activist.