-

@ 000002de:c05780a7

2025-02-28 16:36:31

The newly installed FBI Director Kash Patel was sworn in on a Bhagavad Gita (Hindu holy book) NOT a Christian Bible! Guys, its happening! Christian Nationalism is here. We predicted that Trump would introduce a government ruled by Christians for Christians persecuting people of other faiths. Its just a matter of weeks until we are in full blown Handmaids Tale! Time to get out. Get out while you can.

originally posted at https://stacker.news/items/899838

-

@ 5d4b6c8d:8a1c1ee3

2025-02-28 16:00:20

I've been very hopeful that the proposal to replace the IRS, and all of the taxes it collects, with a combination of sales taxes and tariffs, will go through, but just this morning some of the secondary effects of such a change occurred to me. Now, I'm even more hopeful that this happens.

# The Obvious Benefits

My initial reasons for excitement were the obvious ones: consumption based taxes have better incentives than production based taxes (I know tax incidence muddies the waters, but this is still true) and consumption taxes are more avoidable than the slew of individual and corporate taxes currently in place.

# Financial Privacy

One second order benefit occurred to me immediately: Without taxes on income/payroll/inheritance/capital gains/etc. the state loses most of its rational for its rampant invasions of our financial privacy. Since most businesses are already subjected to the invasion of their financial privacy (through state and local sales taxes), this is a huge net positive.

Not only is this better for its own sake, but all of the monitoring that goes into current financial surveillance is costly. Getting all of those transactions costs out of our financial system will be a huge positive.

# No More Benefits Tied to Employment

This is what hit me this morning. The reason Americans get so many benefits through their employers is because they're tax exempted.

Having our healthcare tied to our employer, and largely decided by them, is a huge distortion in the health care market and it radically reduces competition. Without preferential tax treatment, we would just be paid out that money in our salaries and make our own health care choices. As such, expect the current medical-industrial complex to fight this tax reform tooth and nail.

The other element of this that I realized is that retirement accounts will lose the tax penalty, come withdrawal time (obviously depending on which type you have). That'll be a huge boon for many of us, and make up for the impending collapse of Social Security.

# What Else?

I haven't spent much more time thinking through other implications. What other effects will there be if the current tax regime is replaced with sales taxes and tariffs.

originally posted at https://stacker.news/items/899802

-

@ 55f04590:2d385185

2025-02-28 15:52:53

# Loops have been the overarching theme in the last two months of my work.

You see, my book project is incredibly exciting, and whenever I have a large project like this—_a beast_—I have a tendency to become somewhat obsessive, (subconsciously) dedicating every waking hour to feeding it.

I forced myself to step away from it for a bit, working on other projects while letting the book slumber in the back of my head. When I picked the project back up again, I could feel the different pieces it consists of had clicked into place. It always surprises me to see how taking time _away from a project_ can contribute to seeing things more clearly _on the project_.

## A new website for NoGood

During this brief hiatus I found myself digging deeper into the indie & open web. I read articles by people who have been active proponents of an open web—as opposed to the walled gardens we’ve gotten accustomed to tracking us whichever way we surf—and I discovered the concept of tending to a ‘digital garden’. I saw a side of the web I was less exposed to before that aligned perfectly with my values.

As a result, I overhauled the NoGood website. This new version of the website is simple, effective, and static: there is no tracking whatsoever, and it makes no requests to external resources. It only uses system fonts, serves optimised images, and because of that it’s blazing fast. I built it using _11ty_, and you can read more about it [in last month’s blogpost](https://nogood.studio/posts/update/new-website/). Within weeks, NoGood got featured on [DeadSimpleSites](http://deadsimplesites.com), a gallery full of similar websites, which is a welcome bit of recognition.

## Rewarding dialogues

The book’s sections ([_Work_, _Process_, _Context_, _Items_](https://nogood.studio/posts/book/announcement)) are set. The _Context_ section is meant to—well, do what it says on the tin: paint a picture of the context in which my own work was created and construct conversations between my work and that which came before it.

To do so, I’ll carve out space for articles—published under the _Creative Commons_ or share-alike license—that inspired me along the way. I’ll illustrate each article myself, in black and white.

I’ve asked a few people for their permission to publish their articles and have received positive responses from [Cory Doctorow](https://craphound.com/), Jack Dorsey, [Lyn Alden](https://www.lynalden.com/) and [DerGigi](https://dergigi.com/), for which I’m incredibly grateful. Just the ability to have dialogues with these people whose work I’ve admired is a rewarding outcome of me pursuing this project, feeding back into my desire to create a great publication.

In order to do right by the _Creative Commons_ license, I’ll make the _Context_ section available on the NoGood website, too. I may even turn it into a printable zine—more on that later.

## Editing and designing the NoGood book

I primarily work on the book from my studio space, which I share with two other creatives, [Timo](http://timokuilder.com) and [Daniël](http://daniel.pizza).

Daniël designs and builds open-source software for [Ghost](http://ghost.org), writes, and publishes a literary magazine called [_TRANSCRIPT_](http://transcriptmag.store). We share similar values, he knows a thing or two about the open web, and it made perfect sense for us to work together. I’ve hired him to act as an editor for the book, and he now edits my writing (in fact, he edited this update, too!). We’ve had some dialogues about the articles I’m including as well as others I could add, too, and we’ll continue our conversations throughout the design process.

Commissioning him to take on this work has been a relief. It freed up precious headspace, and I’ve started designing the first spreads of the book. Some sections already are very clear, while others still need time to crystallise. Fortunately, clarity comes as a result of chipping away at the work ahead, so I keep at it with renewed energy—updates will now follow more regularly.

## Crowdfunding & production

I have a complete picture of the production costs of the book and I’ve ironed out the logistics. I know which printer will be printing it, and my budget estimates were correct. The current number of [pre-orders](https://geyser.fund/project/nogoodartbook) (53) covers roughly 70% of the production costs, which means I can safely produce the NoGood book—it’s going to print this summer!

200 copies will roll off the press, and I’m really looking forward to it.

Thank you for reading. More soon,

Thomas.

---

#### Previous updates

[The NoGood art book announcement](https://stacker.news/items/736947)

[Update 01 – Humble beginnings](https://stacker.news/items/744898)

[Update 02 – Throwback](https://stacker.news/items/762791)

#### Pre-order a book

The NoGood art book is available [as a pre-order on Geyser](https://geyser.fund/project/nogoodartbook).

originally posted at https://stacker.news/items/899798

-

@ c43d6de3:a6583169

2025-02-28 15:26:36

Every Sunday, my brother Alex and I would catch the scent of pie creeping from the oven as we chased Ronnie and Ellis around my grandma’s house.

We were good at keeping traditions. Though we eventually outgrew the days of stampeding through Grandma’s living room, her house remained our gathering place. The four of us—Alex, Ronnie, Ellis, and I—would settle on the back porch, the aroma of freshly baked pie still wafting through the air. We’d trade stories about our first crushes, our first kisses, and our dreams for the future, laughing in the warmth of a home that felt eternal.

Alex was the first to leave for college. He never really came back. Four years away, then a big-time job across the country.

Ronnie and Ellis—the twins—left a few years later. They never truly returned, either. Not the same, at least.

A cruel trick of biology had been lurking in the depths of their genes, lying in wait for the right moment to surface. In college, Ronnie was consumed by schizophrenia, while Ellis battled years of depression. They came back home, but they weren’t the same boys I had grown up with. The ones I had once sprinted through hallways with, laughing until our sides hurt, were lost to something none of us could chase down or outrun.

By the time I graduated, the scent of pie had vanished forever. My grandmother’s grave was my last stop before I, too, left town.

I never went back.

People leave in different ways. Some move to another city or another country. Some lose themselves to illness, slipping through our fingers even as they sit beside us. Some find their final resting place. All dearly departed.

What makes their departure so bittersweet is the time we once had with them—the memories we carry, the laughter that still echoes in the corners of our hearts.

That’s life. That’s what makes it worth it.

-

@ 5d4b6c8d:8a1c1ee3

2025-02-28 15:07:12

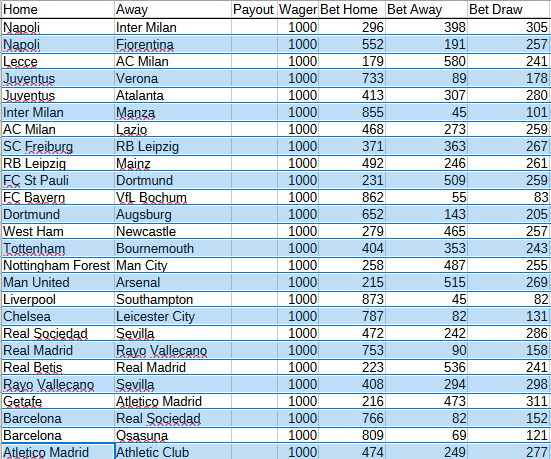

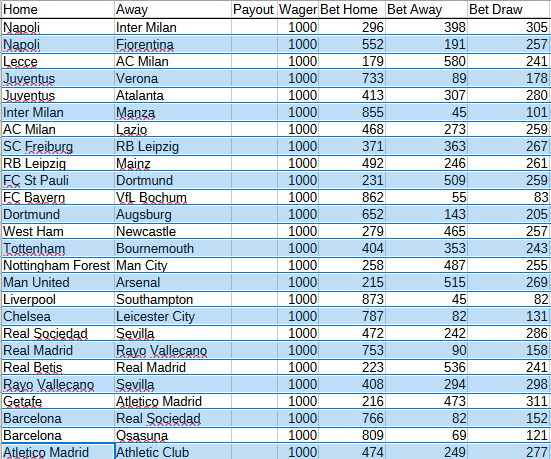

# It's *contest-palooza* at ~Stacker_Sports:

- We have [cricket](https://stacker.news/items/898849/r/Undisciplined)

- We'll likely have more cricket soon!

- We have [USA vs the world](https://stacker.news/items/897858/r/Undisciplined)

- We have [soccer](https://stacker.news/items/894320/r/Undisciplined)

- We have [NBA](https://stacker.news/items/894412/r/Undisciplined)

- Coming soon: March Madness, Fantasy Baseball, MLB Survivor Pools, NFL Mock Drafts, and AFL!

# In actual sports news,

- the NBA is hitting the home stretch. The contenders, pretenders, and tankers are sorting themselves out.

- Steph's 56

- Giannis vs Jokic showdown

- Brady tampering for Stafford?

- NFL combine and other offseason activity

- Ovi chasing the Great One

- MLB started spring training games

- New ball/strike review system

# Degenerate Corner

- [Predyx Super Bowl market](https://beta.predyx.com/market/super-bowl-winner-2026-1740263192)

- I'm killing it on Ember. What's my secret?

Plus, whatever stackers drop in the comments.

originally posted at https://stacker.news/items/899748

-

@ a012dc82:6458a70d

2025-02-28 15:00:36

In the dynamic and often unpredictable world of cryptocurrency, the opinions and predictions of financial pundits like Jim Cramer, the host of CNBC's "Mad Money," can significantly sway market sentiments and investor behavior. Cramer, known for his incisive and sometimes controversial market insights, has recently turned his attention to Bitcoin, the leading cryptocurrency. His latest comments suggest a bearish outlook on Bitcoin, which has sparked intense discussions and speculations within the crypto community. This development is particularly noteworthy given Cramer's influence and the weight his opinions often carry in financial circles. His views on Bitcoin are not just idle chatter; they have the potential to shape market trends and influence investment strategies.

**Table of Contents**

- Cramer's Changing Stance on Bitcoin

- Historical Perspective

- The "Reverse Cramer Effect"

- Market Reactions and Speculations

- Analyzing Past Trends

- The Role of Bitcoin ETFs

- Implications for Investors

- Navigating Market Sentiments

- The Future of Bitcoin

- Conclusion

- FAQs

**Cramer's Changing Stance on Bitcoin**

**Historical Perspective**

Jim Cramer's relationship with Bitcoin has been a rollercoaster of changing opinions and stances. Initially skeptical, Cramer warmed up to Bitcoin, acknowledging its potential as an investment asset. However, his recent bearish comments mark a significant shift from his earlier views. This change is intriguing, as it comes at a time when Bitcoin has been showing signs of recovery and gaining mainstream acceptance. Cramer's influence in the financial world means that his opinions are closely monitored and can lead to tangible market reactions. His latest stance, suggesting that Bitcoin is "topping out," has therefore raised eyebrows and led to debates about the future direction of the cryptocurrency.

**The "Reverse Cramer Effect"**

The phenomenon known as the "reverse Cramer effect" has become a topic of interest among investors and market analysts. This effect, where the market tends to move in the opposite direction of Cramer's advice, has been observed on multiple occasions. For example, after Cramer advised investors to sell Bitcoin in April 2023, the cryptocurrency's price surged, defying his predictions. This pattern has led some investors to view Cramer's predictions as a contrarian indicator. The consistency of this effect raises questions about market psychology and the influence of prominent financial figures on investor behavior. It also underscores the complexity and unpredictability of the cryptocurrency market, where sentiment can often drive price movements more than fundamentals.

**Market Reactions and Speculations**

**Analyzing Past Trends**

The market's reaction to Cramer's comments is not just a matter of idle speculation; it has real implications for investors and traders. The "reverse Cramer effect" has been noted not just in the case of Bitcoin but also in other financial markets. This phenomenon suggests a deeper, perhaps psychological, aspect of market behavior where investors might be inclined to react contrarily to prominent predictions. The recent bearish stance by Cramer on Bitcoin thus becomes a focal point for market watchers. If history is any guide, this could very well be an inadvertent signal for a bullish phase for Bitcoin.

**The Role of Bitcoin ETFs**

The potential approval of Bitcoin ETFs by the SEC is a significant development in the cryptocurrency world. These ETFs would provide a more accessible and regulated avenue for investing in Bitcoin, potentially attracting a new class of investors. The approval of these ETFs could be a game-changer for Bitcoin's price, as it would represent a major step towards mainstream acceptance and institutional investment. The timing of Cramer's comments in the context of these developments adds an interesting dimension to market speculations. If the SEC does approve Bitcoin ETFs, and the "reverse Cramer effect" holds true, we could witness a substantial bull run in Bitcoin's price.

**Implications for Investors**

**Navigating Market Sentiments**

For investors, the "reverse Cramer effect" and the potential approval of Bitcoin ETFs present a complex scenario. While it's tempting to base investment decisions on the predictions of market experts, the unpredictable nature of cryptocurrencies requires a more nuanced approach. Investors need to consider a range of factors, including market trends, technological developments, regulatory changes, and broader economic indicators. The case of Jim Cramer's shifting stance on Bitcoin highlights the importance of not relying solely on expert opinions but also conducting independent research and analysis.

**The Future of Bitcoin**

The future of Bitcoin, as suggested by the recent developments and Cramer's comments, appears to be at a potential turning point. While the possibility of a bull market looms, it's important to remember the inherent volatility and risks associated with cryptocurrencies. The market's response to Cramer's comments, coupled with the potential regulatory advancements like Bitcoin ETFs, could indeed set the stage for significant price movements. However, investors should remain cautious and diversified in their approach, keeping in mind that the cryptocurrency market is still maturing and subject to rapid changes.

**Conclusion**

Jim Cramer's recent bearish comments on Bitcoin have stirred up a wave of discussions and speculations about the future of this leading cryptocurrency. While his track record suggests the possibility of an upcoming bull market, the volatile and unpredictable nature of the crypto world warrants a cautious approach. Investors should weigh Cramer's opinions alongside other market indicators and conduct thorough research before making investment decisions. As the cryptocurrency landscape continues to evolve, staying informed, adaptable, and prudent remains crucial for navigating the market's ebbs and flows.

**FAQs**

**Who is Jim Cramer?**

Jim Cramer is a well-known financial expert and the host of CNBC's "Mad Money." He is recognized for his bold market predictions and has a significant influence in the financial world.

**What is the "Reverse Cramer Effect"?**

The "Reverse Cramer Effect" refers to a phenomenon where the market tends to move in the opposite direction of Jim Cramer's predictions. This has been observed particularly in the cryptocurrency market with Bitcoin.

**Why are Jim Cramer's comments on Bitcoin important?**

Cramer's comments are closely followed by investors and can influence market trends. His recent bearish stance on Bitcoin has sparked discussions and speculations about a potential bull market due to the "Reverse Cramer Effect."

**What impact could Bitcoin ETFs have on the market?**

The approval of Bitcoin ETFs (Exchange Traded Funds) by the SEC could significantly boost Bitcoin's price by providing a regulated and accessible investment avenue, potentially attracting more mainstream and institutional investors.

**Should investors base their decisions solely on Jim Cramer's predictions?**

While Cramer's opinions are influential, investors are advised to conduct their own research and consider a range of factors before making investment decisions, due to the unpredictable nature of the cryptocurrency market.

**That's all for today**

**If you want more, be sure to follow us on:**

**NOSTR: croxroad@getalby.com**

**X: [@croxroadnewsco](https://x.com/croxroadnewsco)**

**Instagram: [@croxroadnews.co/](https://www.instagram.com/croxroadnews.co/)**

**Youtube: [@thebitcoinlibertarian](https://www.youtube.com/@thebitcoinlibertarian)**

**Store: https://croxroad.store**

**Subscribe to CROX ROAD Bitcoin Only Daily Newsletter**

**https://www.croxroad.co/subscribe**

**Get Orange Pill App And Connect With Bitcoiners In Your Area. Stack Friends Who Stack Sats

link: https://signup.theorangepillapp.com/opa/croxroad**

**Buy Bitcoin Books At Konsensus Network Store. 10% Discount With Code “21croxroad”

link: https://bitcoinbook.shop?ref=21croxroad**

***DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.***

-

@ 2dd9250b:6e928072

2025-02-28 14:13:59

Vi recentemente um post onde a pessoa diz que aquele final do filme O Doutrinador (2019) não faz sentido porque mesmo se explodir o Palácio dos Três Poderes, não acaba a corrupção no Brasil.

Olha a mentalidade desse pessoal! São analfabetos mesmo. Progressistas são pessoas que não sabem ler e não conseguem interpretar nada, não possuem essa capacidade de interpretar o que está lendo porque o final de Doutrinador não tem a ver com isso, tem a ver com a relação entre Herói e a sua Cidade.

Nas histórias em quadrinhos sempre existe uma ligação entre a cidade e o Super-Herói, é por isso que Gotham City acaba criando o Batman, isso é mostrado em The Batman e em Batman: Cavaleiro das Trevas, quando aquele garoto no final, diz para o Batman não fugir, porque ele queria ver o Batman de novo. E o Comissário Gordon diz que o "Batman é o que a cidade de Gotham precisa."

Em Batman: Cavaleiro das Trevas Ressurge você vê justamente a cidade de Gotham sendo tomada pela corrupção e pela ideologia do Bane. A Cidade vai definhando em imoralidade e o Bruce olha da prisão naquele poço a cidade sendo destruída e decide que o Batman precisa voltar porque se Gotham for destruída, o Batman é destruído junto e é por isso que ele consegue sair daquele poço e voltar para salvar Gotham.

Isso também é mostrado em Demolidor. Na série Demolidor o Matt Murdock sempre está falando que ele precisa defender a cidade Cozinha do Inferno; que o Fisk não vai dominar a cidade e fazer o que ele quer. Inclusive na terceira temporada isso fica mais evidente na luta final na mansão do Fisk, onde Matt fala para ele que agora a cidade toda vai saber o que ele fez; a cidade vai ver o mal que ele é para Hell's Kitchen, porque a gente sabe que o Fisk fez de tudo para a imagem do Demolidor entrar e descrédito perante os cidadãos, então o que acontece no final ali do Doutrinador não significa que ele está acabando com a corrupção quando explode o Congresso, ele está praticamente interrompendo o ciclo do sistema, ele está colocando uma falha na engrenagem do sistema.

Quando você ouve o nome "Brasília" você pensa na corrupção dos políticos, onde a farra acontece, onde os políticos moram, onde eles desviam dinheiro arrecadado dos impostos que vai tudo para Brasília, então quando você ouve falarem de Brasília, você sempre pensa que o pessoal que mora lá, mora junto com tudo de podre que acontece no Brasil.

Então quando ele explode tudo ali, ele está basicamente destruindo o mecanismo que suja Brasília. Ele está fazendo isso naquela cidade. Porque o símbolo da cidade é justamente esse, a farsa de que naquele lugar o povo será ouvido e a justiça será feita. Ele está destruindo a ideologia de que o Estado nos protege, nos dá segurança, saúde e educação. Porque na verdade o Estado só existe para privilegiar os políticos, funcionários públicos de auto escalão, suas famílias e amigos. Enquanto que o povo sofre para sustentar a elite política. O protagonista Miguel entendeu isso quando a filha dele morreu na fila do SUS.

-

@ d360efec:14907b5f

2025-02-28 13:26:03

**ภาพรวมการวิเคราะห์ Bitcoin (BTC)**

จากการตรวจสอบกราฟและอินดิเคเตอร์ใน Timeframe 15 นาที, 4 ชั่วโมง, และรายวัน (Day) พบว่า Bitcoin มีความผันผวนและมีแนวโน้มการเปลี่ยนแปลงที่น่าสนใจในแต่ละ Timeframe ดังรายละเอียดต่อไปนี้ค่ะ

**อินดิเคเตอร์ที่ใช้ในการวิเคราะห์**

* **EMA (Exponential Moving Average):**

* **EMA 50 (สีเหลือง):** แสดงแนวโน้มระยะสั้นของราคา

* **EMA 200 (สีขาว):** แสดงแนวโน้มระยะยาวของราคา

* **SMC (Smart Money Concepts):** แนวคิดการเทรดที่เน้นการวิเคราะห์พฤติกรรมของ "Smart Money" หรือผู้เล่นรายใหญ่ในตลาด

* **ICT (Inner Circle Trader) Buyside & Sellside Liquidity:** อินดิเคเตอร์ที่ระบุตำแหน่งสภาพคล่องฝั่งซื้อและฝั่งขาย ซึ่งเป็นเป้าหมายราคาที่น่าสนใจ

* **Money Flow:** อินดิเคเตอร์ที่แสดงทิศทางการไหลเข้าออกของเงินทุนในสินทรัพย์

* **Trend Strength (🌟Introducing the Trend and Strength Signals indicator by AlgoAlpha!):** อินดิเคเตอร์ที่ช่วยระบุแนวโน้มและความแข็งแกร่งของตลาด มีลักษณะเป็นเมฆและสัญญาณซื้อขาย

**วิเคราะห์แนวโน้มและกลยุทธ์การเทรด**

**1. Timeframe 15 นาที (TF 15m)**

* **แนวโน้ม:** ใน TF 15 นาที ราคา BTC มีความผันผวนในกรอบแคบ EMA 50 ตัดกับ EMA 200 บ่งบอกถึงความไม่แน่นอนของแนวโน้มในระยะสั้น

* **สัญญาณอินดิเคเตอร์:**

* **Trend Strength:** เกิดสัญญาณซื้อขาย (Buy/Sell Signal) แต่เมฆ (Cloud) ยังไม่ชัดเจน บ่งบอกถึงความแข็งแกร่งของแนวโน้มยังไม่เด่นชัด

* **Money Flow:** มีการสลับการไหลเข้าออกของเงินทุน สะท้อนถึงความไม่แน่นอนในระยะสั้น

* **Buyside & Sellside Liquidity:** อินดิเคเตอร์นี้จะช่วยระบุแนวรับแนวต้านใน TF สั้นๆ เพื่อใช้ในการพิจารณาจุดเข้าออก

* **Chart Pattern:** พิจารณารูปแบบ Chart Pattern ใน TF 15 นาที เช่น รูปแบบสามเหลี่ยม (Triangle) หรือรูปแบบธง (Flag) เพื่อหารูปแบบราคาที่อาจเกิดขึ้น

* **กลยุทธ์ Day Trade (การเทรดรายวัน):**

* **กลยุทธ์:** เน้นการเทรดในกรอบ Sideway โดยใช้แนวรับแนวต้านที่ระบุจาก Buyside & Sellside Liquidity และสัญญาณจาก Trend Strength ประกอบการตัดสินใจ

* **SMC Setup:** มองหา SMC Setup ใน TF 15 นาที เช่น Order Block หรือ Fair Value Gap บริเวณแนวรับแนวต้าน เพื่อหาจังหวะเข้าเทรดตามแนวโน้มระยะสั้น

* **สิ่งที่ต้องระวัง:** ความผันผวนสูงใน TF 15 นาที อาจทำให้เกิดสัญญาณหลอก ควรใช้ Stop Loss ที่เหมาะสม และบริหารความเสี่ยงอย่างเคร่งครัด

**2. Timeframe 4 ชั่วโมง (TF 4H)**

* **แนวโน้ม:** ใน TF 4 ชั่วโมง ราคา BTC มีแนวโน้มเป็นขาขึ้น EMA 50 อยู่เหนือ EMA 200 บ่งบอกถึงแนวโน้มขาขึ้นในระยะกลาง

* **สัญญาณอินดิเคเตอร์:**

* **Trend Strength:** เกิดเมฆสีเขียว (Green Cloud) และสัญญาณซื้อ (Buy Signal) บ่งบอกถึงแนวโน้มขาขึ้นที่แข็งแกร่ง

* **Money Flow:** เงินทุนไหลเข้าต่อเนื่อง สนับสนุนแนวโน้มขาขึ้น

* **Buyside & Sellside Liquidity:** อินดิเคเตอร์นี้จะช่วยระบุแนวรับแนวต้านที่สำคัญใน TF 4 ชั่วโมง เพื่อใช้ในการวางแผนการเทรดระยะกลาง

* **Chart Pattern:** พิจารณารูปแบบ Chart Pattern ใน TF 4 ชั่วโมง เช่น รูปแบบ Cup and Handle หรือรูปแบบ Ascending Triangle เพื่อยืนยันแนวโน้มขาขึ้น

* **กลยุทธ์ Day Trade (การเทรดรายวัน) / Swing Trade (การเทรดระยะกลาง):**

* **กลยุทธ์:** เน้นการเทรดตามแนวโน้มขาขึ้น โดยใช้ EMA 50 และแนวรับแนวต้านจาก Buyside & Sellside Liquidity เป็นจุดอ้างอิงในการเข้าเทรด

* **SMC Setup:** มองหา SMC Setup ใน TF 4 ชั่วโมง เช่น Break of Structure (BOS) หรือ Change of Character (CHOCH) เพื่อหาจังหวะเข้าเทรดตามแนวโน้มขาขึ้น

* **สิ่งที่ต้องระวัง:** การพักตัวของราคาในแนวโน้มขาขึ้น อาจทำให้เกิดการย่อตัวระยะสั้น ควรพิจารณาแนวรับที่แข็งแกร่ง และตั้ง Stop Loss เพื่อป้องกันความเสี่ยง

**3. Timeframe รายวัน (TF Day)**

* **แนวโน้ม:** ใน TF รายวัน ราคา BTC ยังคงอยู่ในแนวโน้มขาขึ้นระยะยาว EMA 50 อยู่เหนือ EMA 200 อย่างชัดเจน

* **สัญญาณอินดิเคเตอร์:**

* **Trend Strength:** เกิดเมฆสีเขียวขนาดใหญ่ (Large Green Cloud) และสัญญาณซื้อต่อเนื่อง (Continuous Buy Signal) บ่งบอกถึงแนวโน้มขาขึ้นระยะยาวที่แข็งแกร่งมาก

* **Money Flow:** เงินทุนไหลเข้าอย่างต่อเนื่องและแข็งแกร่ง สนับสนุนแนวโน้มขาขึ้นระยะยาว

* **Buyside & Sellside Liquidity:** อินดิเคเตอร์นี้จะช่วยระบุแนวรับแนวต้านที่สำคัญใน TF รายวัน เพื่อใช้ในการวางแผนการลงทุนระยะยาว

* **Chart Pattern:** พิจารณารูปแบบ Chart Pattern ใน TF รายวัน เช่น รูปแบบ Bullish Flag หรือรูปแบบ Wedge เพื่อยืนยันแนวโน้มขาขึ้นระยะยาว

* **กลยุทธ์ Day Trade (การเทรดรายวัน) / Swing Trade (การเทรดระยะกลาง) / Long-Term Investment (การลงทุนระยะยาว):**

* **กลยุทธ์:** เน้นการลงทุนระยะยาวตามแนวโน้มขาขึ้น โดยพิจารณาจังหวะเข้าซื้อเมื่อราคาย่อตัวลงมาบริเวณแนวรับสำคัญใน TF รายวัน

* **SMC Setup:** มองหา SMC Setup ใน TF รายวัน เช่น Institutional Order Flow เพื่อยืนยันแนวโน้มขาขึ้นระยะยาว

* **สิ่งที่ต้องระวัง:** ความเสี่ยงจากปัจจัยภายนอกที่อาจกระทบตลาด Cryptocurrency ในระยะยาว ควรติดตามข่าวสารและสถานการณ์ตลาดอย่างใกล้ชิด และกระจายความเสี่ยงในการลงทุน

**สรุป**

จากการวิเคราะห์ BTC ใน 3 Timeframe ด้วยอินดิเคเตอร์และ Chart Pattern พบว่า BTC ยังคงมีแนวโน้มขาขึ้นในระยะกลางและระยะยาว อย่างไรก็ตาม ในระยะสั้น TF 15 นาที ยังมีความผันผวนและไม่แน่นอน กลยุทธ์การเทรดที่เหมาะสมจะแตกต่างกันไปตาม Timeframe และเป้าหมายการเทรดของแต่ละบุคคล ควรพิจารณาความเสี่ยงและบริหารจัดการเงินทุนอย่างเหมาะสม

**คำแนะนำเพิ่มเติม**

* **ศึกษาเพิ่มเติม:** ควรศึกษาเพิ่มเติมเกี่ยวกับ SMC, ICT, และ Trend Strength Indicator เพื่อให้เข้าใจหลักการทำงานและนำไปประยุกต์ใช้ในการเทรดได้อย่างมีประสิทธิภาพ

* **ทดลองบนบัญชี Demo:** ทดลองกลยุทธ์ต่างๆ บนบัญชี Demo ก่อนนำไปใช้จริง เพื่อทดสอบความเข้าใจและปรับปรุงกลยุทธ์ให้เหมาะสมกับตนเอง

* **ติดตามข่าวสาร:** ติดตามข่าวสารและสถานการณ์ตลาด Cryptocurrency อย่างสม่ำเสมอ เพื่อประกอบการตัดสินใจในการเทรดและการลงทุน

**Disclaimer (ข้อจำกัดความรับผิดชอบ):**

การวิเคราะห์นี้มีวัตถุประสงค์เพื่อให้ข้อมูลเท่านั้น และเป็นความคิดเห็นส่วนบุคคล ไม่ใช่คำแนะนำทางการเงิน การลงทุนใน Cryptocurrency มีความเสี่ยงสูง นักลงทุนควรศึกษาข้อมูลด้วยตนเองและใช้ความระมัดระวังก่อนตัดสินใจลงทุน

-

@ d360efec:14907b5f

2025-02-28 13:15:24

$OKX:BTCUSDT.P

From checking the charts and indicators in 15-minute, 4-hour, and daily timeframes, it is found that Bitcoin is volatile and has interesting trend changes in each timeframe, as detailed below:

**Trend Analysis and Trading Strategies**

**1. 15-Minute Timeframe (TF 15m)**

* **Trend:** In the 15-minute TF, the BTC price is fluctuating in a narrow range. EMA 50 crossing with EMA 200 indicates short-term trend uncertainty.

* **Indicator Signals:**

* **Trend Strength:** Buy/Sell signals occur, but the cloud is not yet clear, indicating that the trend strength is not yet prominent.

* **Money Flow:** There is an alternating inflow and outflow of funds, reflecting short-term uncertainty.

* **Buyside & Sellside Liquidity:** This indicator helps identify support and resistance levels in short TFs to consider entry and exit points.

* **Chart Pattern:** Consider Chart Patterns in the 15-minute TF, such as Triangle or Flag patterns, to find possible price patterns.

* **Day Trade Strategy:**

* **Strategy:** Focus on trading in a Sideway range, using support and resistance levels identified by Buyside & Sellside Liquidity and signals from Trend Strength to make decisions.

* **SMC Setup:** Look for SMC Setups in the 15-minute TF, such as Order Blocks or Fair Value Gaps around support and resistance areas, to find short-term trend trading opportunities.

* **Things to watch out for:** High volatility in the 15-minute TF may cause false signals. Appropriate Stop Loss should be used and risk should be managed strictly.

**2. 4-Hour Timeframe (TF 4H)**

* **Trend:** In the 4-hour TF, the BTC price is trending upwards. EMA 50 is above EMA 200, indicating a medium-term uptrend.

* **Indicator Signals:**

* **Trend Strength:** A Green Cloud and Buy Signal occur, indicating a strong uptrend.

* **Money Flow:** Funds continue to flow in, supporting the uptrend.

* **Buyside & Sellside Liquidity:** This indicator helps identify important support and resistance levels in the 4-hour TF for medium-term trading planning.

* **Chart Pattern:** Consider Chart Patterns in the 4-hour TF, such as Cup and Handle or Ascending Triangle patterns, to confirm the uptrend.

* **Day Trade / Swing Trade Strategy:**

* **Strategy:** Focus on trading along the uptrend, using EMA 50 and support and resistance levels from Buyside & Sellside Liquidity as reference points for entering trades.

* **SMC Setup:** Look for SMC Setups in the 4-hour TF, such as Break of Structure (BOS) or Change of Character (CHOCH), to find trading opportunities along the uptrend.

* **Things to watch out for:** Price consolidation in an uptrend may cause short-term pullbacks. Strong support levels should be considered, and Stop Loss should be set to prevent risk.

**3. Daily Timeframe (TF Day)**

* **Trend:** In the Daily TF, the BTC price is still in a long-term uptrend. EMA 50 is clearly above EMA 200.

* **Indicator Signals:**

* **Trend Strength:** A Large Green Cloud and Continuous Buy Signal occur, indicating a very strong long-term uptrend.

* **Money Flow:** Funds are flowing in continuously and strongly, supporting the long-term uptrend.

* **Buyside & Sellside Liquidity:** This indicator helps identify important support and resistance levels in the Daily TF for long-term investment planning.

* **Chart Pattern:** Consider Chart Patterns in the Daily TF, such as Bullish Flag or Wedge patterns, to confirm the long-term uptrend.

* **Day Trade / Swing Trade / Long-Term Investment Strategy:**

* **Strategy:** Focus on long-term investment along the uptrend, considering buying opportunities when the price pulls back to important support levels in the Daily TF.

* **SMC Setup:** Look for SMC Setups in the Daily TF, such as Institutional Order Flow, to confirm the long-term uptrend.

* **Things to watch out for:** Risks from external factors that may affect the cryptocurrency market in the long term. Market news and situations should be closely monitored, and investment risk should be diversified.

**Summary**

From analyzing BTC in 3 Timeframes with indicators and Chart Patterns, it is found that BTC still has an uptrend in the medium and long term. However, in the short term, the 15-minute TF is still volatile and uncertain. Appropriate trading strategies will vary depending on the timeframe and individual trading goals. Risk should be considered and capital should be managed appropriately.

**Additional Recommendations**

* **Further Study:** Further study on SMC, ICT, and Trend Strength Indicator should be done to understand the working principles and apply them effectively in trading.

* **Experiment on Demo Account:** Experiment with various strategies on a Demo account before using them in real trading to test understanding and improve strategies to suit oneself.

* **Follow News:** Follow cryptocurrency market news and situations regularly to inform trading and investment decisions.

**Disclaimer:**

This analysis is for informational purposes only and represents a personal opinion. It is not financial advice. Investing in cryptocurrencies involves significant risk. Investors should conduct their own research and exercise due diligence before making any investment decisions.

-

@ d360efec:14907b5f

2025-02-28 12:41:21

$OKX:BTCUSDT.P

**Overview:**

Based on the overall picture across the 3 timeframes (15m, 4H, Day), Bitcoin is in a bullish trend but is experiencing a short-term consolidation.

**Analysis of each Timeframe:**

* **TF 15m:**

* **SMC:** The price is in a sideways consolidation phase after breaking out of a triangle pattern. There's potential to test the Buyside Liquidity around $64,000.

* **ICT:** The price is testing the EMA 50 (yellow) support. If it holds above this support, there's a chance for further upward movement.

* **Buyside & Sellside Liquidity:**

* Buyside Liquidity: $64,000

* Sellside Liquidity: $60,000 (around EMA 200 and the lower boundary of the sideways range)

* **Money Flow:** Positive, supporting the bullish trend.

* **EMA:** EMA 50 > EMA 200, a bullish signal.

* **Trend Strength:** Thick green cloud and buy signals indicate a strong uptrend.

* **Chart Pattern:** Triangle breakout.

* **TF 4H:**

* **SMC:** The price is in a clear uptrend after breaking out of a significant resistance level.

* **ICT:** The price is holding strongly above both EMA 50 and EMA 200.

* **Buyside & Sellside Liquidity:**

* Buyside Liquidity: No significant resistance nearby.

* Sellside Liquidity: $58,000 (around EMA 50)

* **Money Flow:** Positive, supporting the bullish trend.

* **EMA:** EMA 50 > EMA 200, a bullish signal.

* **Trend Strength:** Green cloud and buy signals indicate an uptrend.

* **TF Day:**

* **SMC:** The price is in a clear uptrend.

* **ICT:** The price is holding strongly above both EMA 50 and EMA 200.

* **Buyside & Sellside Liquidity:**

* Buyside Liquidity: No significant resistance nearby.

* Sellside Liquidity: $50,000 (around EMA 50)

* **Money Flow:** Positive, supporting the bullish trend.

* **EMA:** EMA 50 > EMA 200, a bullish signal.

* **Trend Strength:** Thick green cloud and buy signals indicate a strong uptrend.

**Day Trade Strategy (SMC):**

1. **Buy on Dip:** Wait for the price to pull back towards the EMA 50 support on the 15m TF (around $61,500 - $62,000) or the lower boundary of the sideways range.

2. **Take Profit:** Set a profit target at the Buyside Liquidity around $64,000.

3. **Stop Loss:** Set a stop loss slightly below the Sellside Liquidity around $60,000.

**Things to Watch Out For:**

* **Volatility:** Bitcoin is highly volatile. Set your stop loss appropriately.

* **False Breakout:** Be cautious of false breakouts.

* **News:** Stay updated on news that may impact Bitcoin's price.

**Summary:**

Bitcoin is in a bullish trend across all timeframes but is experiencing a short-term consolidation. The recommended day trade strategy is "Buy on Dip," with a profit target of $64,000 and a stop loss slightly below $60,000.

**Disclaimer:** This analysis is for informational purposes only and represents a personal opinion. It is not financial advice. Investing in cryptocurrencies involves significant risk. Investors should conduct their own research and exercise due diligence before making any investment decisions.

-

@ 2e8970de:63345c7a

2025-02-28 11:13:32

the silence before the storm

originally posted at https://stacker.news/items/899535

-

@ e373ca41:b82abcc5

2025-02-28 11:04:54

*Dieser Artikel wurde mit dem* *[Pareto-Client](https://pareto.space/read)* geschrieben (lesen Sie ihn dort, um die volle Erfahrung zu machen).

*Dies ist Teil 3 der Serie “Die Corona-Connection”: Lesen Sie hier* *[Teil 1](https://pareto.space/a/naddr1qqxnzden8quryveexq6rywp3qgswxu72gyq7ykjdfl9j556887jpzwu3mw3v9ez36quas55whq4te3grqsqqqa28l4mwne)* *und* *[Teil 2](https://pareto.space/a/naddr1qqxnzden8yensv3jxyenqv3eqgswxu72gyq7ykjdfl9j556887jpzwu3mw3v9ez36quas55whq4te3grqsqqqa2847yc03)*[.](https://pareto.space/a/naddr1qqxnzden8yensv3jxyenqv3eqgswxu72gyq7ykjdfl9j556887jpzwu3mw3v9ez36quas55whq4te3grqsqqqa2847yc03)

*Wenn die Realität die Fiktion überholt: das ist die Signatur unserer Epoche. Im Zuge täglicher Enthüllungen tritt nun immer deutlicher der medial-industrielle Komplex der “Corona-Connection” zum Vorschein. Allein die Finanzströme zeigen deutlich: der Anfangsverdacht einer Verschwörung ist sichtbar und nachweisbar.*

***

**Sie wollen meine (überwiegend englischen) Artikel auch per Email bekommen?**

**[Hier](https://pareto.space/u/ashoka@pareto.space#subscribe)** **können Sie sich eintragen für den Newsletter (max. 1-2 x pro Woche).**

***

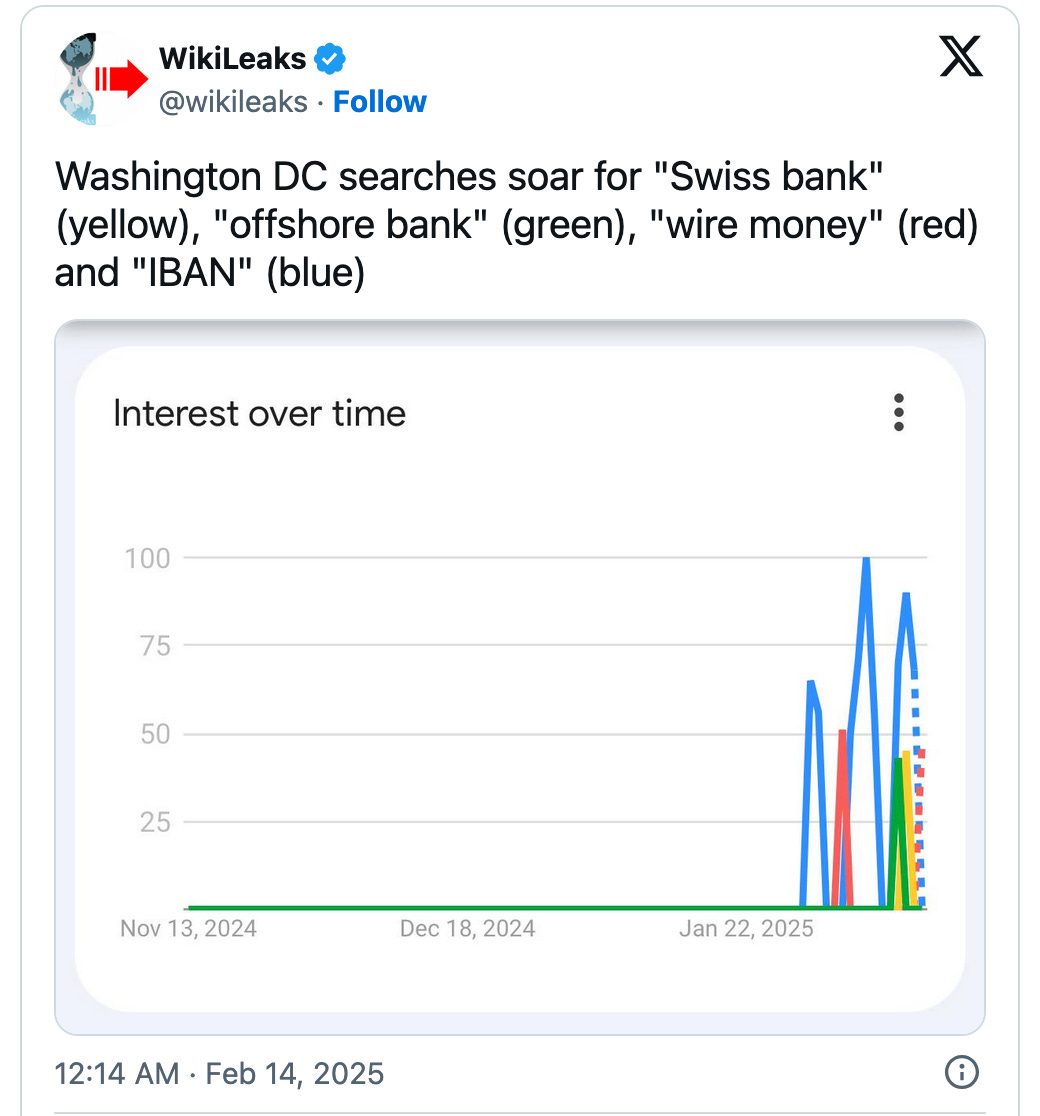

### “Follow the Money”

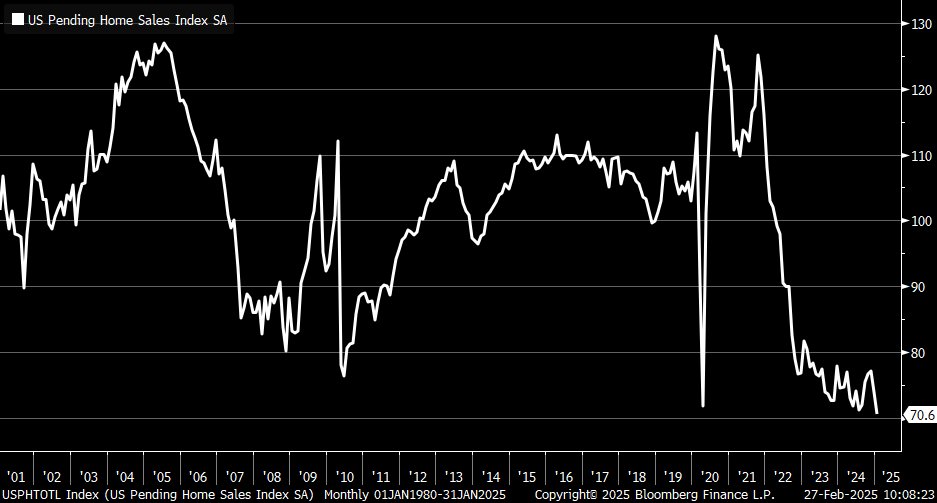

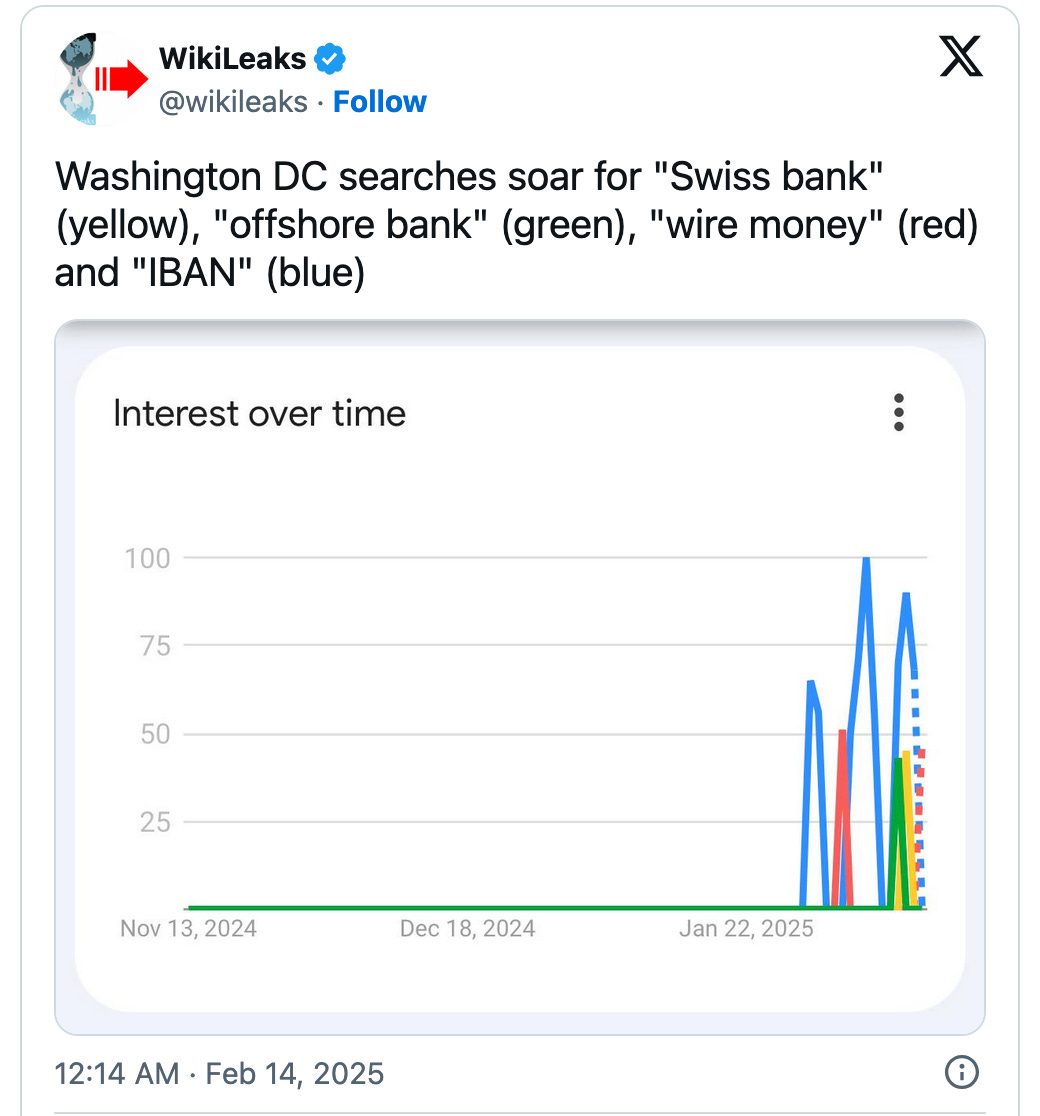

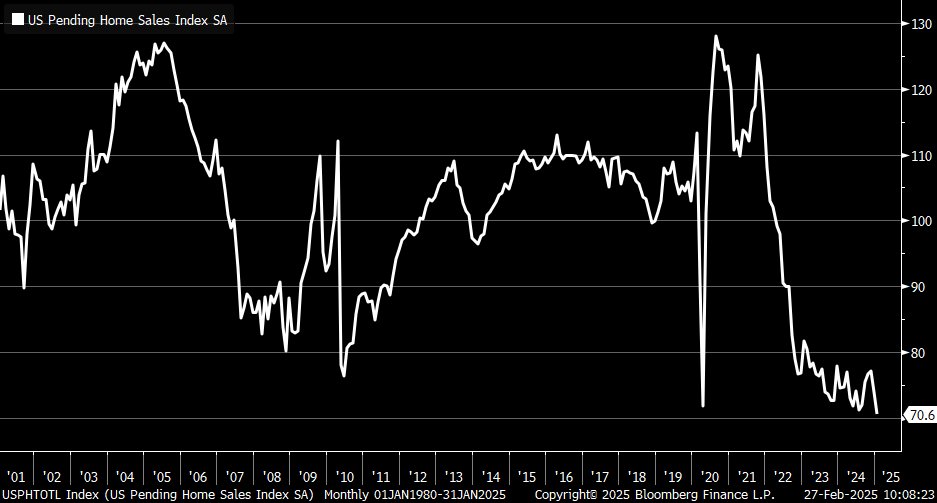

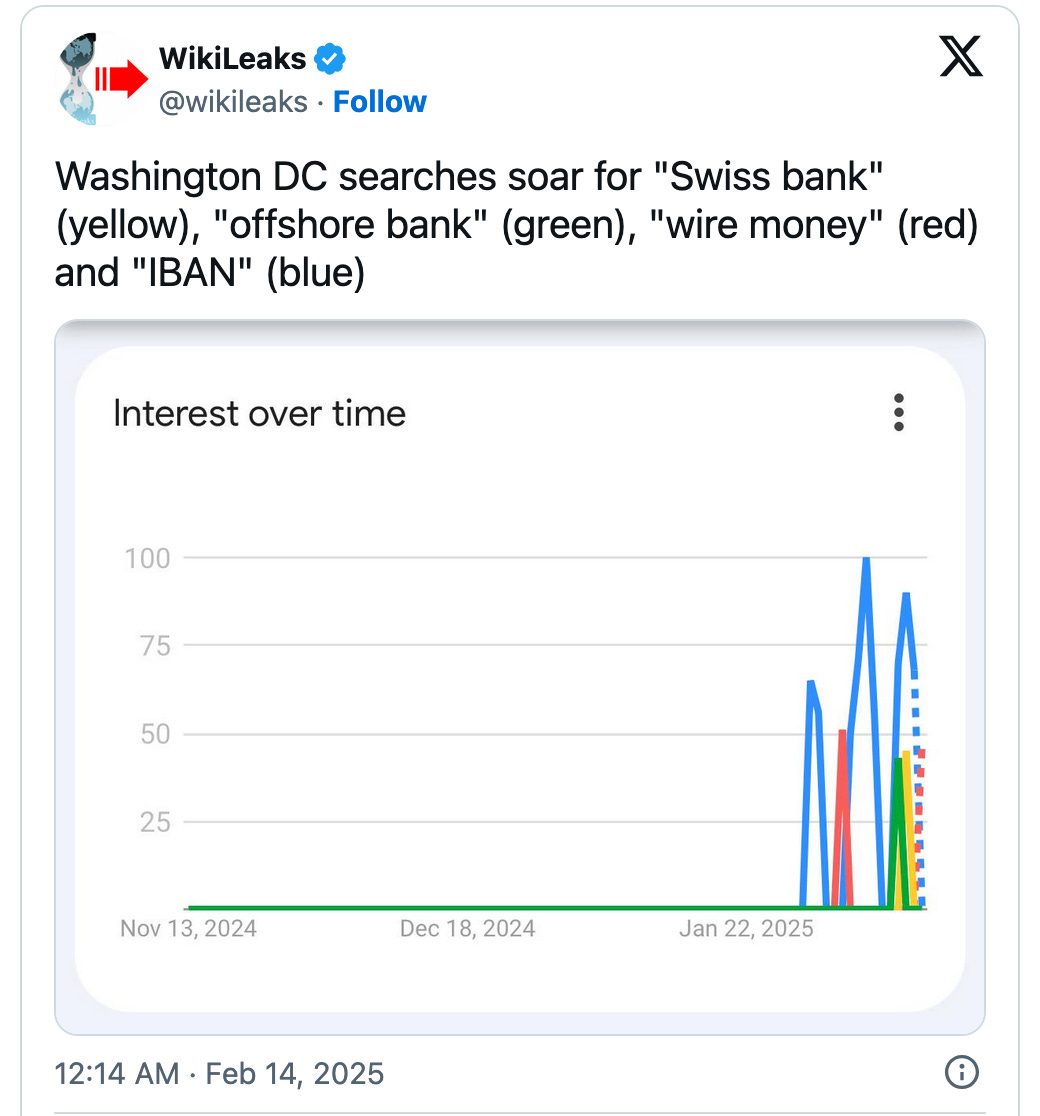

In Washington hat das große Sesselrücken begonnen: Tausende Wohnungen und Häuser werden gerade auf den Markt geschwemmt, die Suchanfragen nach Offshorebanken und Strafverteidigern explodiert. Die Ratten verlassen das sinkende Schiff, eine alte Nomenklatura fällt, eine neue wird errichtet. So ist Politik. Wie viel davon Inszenierung und wie viel echt ist, werden wir erst später erfahren.

[](https://substackcdn.com/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F13c10c76-0ad9-4db8-b3f9-e5e83100c812_1040x1116.png)

(Quelle: [X/@wikileaks](https://x.com/wikileaks/status/1890177866085855461?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1890177866085855461%7Ctwgr%5Ec7b04670001e6199207c6ed1c3bcf4ac8cf4d6d4%7Ctwcon%5Es1_\&ref_url=https%3A%2F%2Fwww.zerohedge.com%2Fpolitical%2Feruption-bleachbit-wipe-hard-drive-offshore-bank-searches-dc-suggest-deep-state-panic))

Schon jetzt erfahren die Europäer allerdings von JD Vance, dass in Washington “ein neuer Sheriff in town” ist. [Die Rede auf der Münchener Sicherheitskonferenz](https://x.com/wikileaks/status/1890177866085855461?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1890177866085855461%7Ctwgr%5Ec7b04670001e6199207c6ed1c3bcf4ac8cf4d6d4%7Ctwcon%5Es1_\&ref_url=https%3A%2F%2Fwww.zerohedge.com%2Fpolitical%2Feruption-bleachbit-wipe-hard-drive-offshore-bank-searches-dc-suggest-deep-state-panic) war eine Zäsur in den transatlantischen Beziehungen. JD Vance hat Europa die Leviten gelesen: Wir glaubten nicht mehr an die Meinungsfreiheit, und damit an die Demokratie; wir griffen in Wahlen ein, deindustrialisierten uns selbst, betrieben ideologische Beeinflussung, Zensur und Manipulation. Eine beeindruckende Rede eines früheren Trump-Verächters (er nannte ihn mal einen Betrüger und überlegte Hillary Clinton zu wählen). Und dann der „Killer-Satz“ an das Establishment:

> *„Wenn Sie Angst vor den eigenen Bürgern haben gibt es nichts, was die USA für Sie tun können.“*

Ja, Vance hat in vielem Recht, Europa ist ein sektiererischer Bürokratenkontinent, der ideologisch gekapert ist. Doch vielleicht hätte Vance etwas mehr darüber sprechen können, was die USA bereits „für Europa getan haben“, allein in den letzten Jahren:

* Der Europäische Debattenraum wurde mit US-Steuergeldern manipuliert, [knapp 500 Mio USD. flossen durch die Kanäle von USAID und Co.](https://www.freischwebende-intelligenz.org/p/unterwanderter-journalismus-der-mediale)

* Deindustrialisierung: Danke für die Sprengung von Nordstream, großer Bruder!

* Zensur: waren das nicht auch die großen amerikanische Social Media Plattformen, siehe [Twitter-Files?](https://www.freischwebende-intelligenz.org/p/twitter-files)

* Ach überhaupt, der ganze Verschwörungskomplex zu Corona, ist nicht die Corona-Connection im Kern ein Konsortium überwiegend amerikanischer Player? NGOs, öffentliche Gesundheitsbehörden, CIA, Überwachungsindustrie, Big Pharma im Verbund mit China.

* Wer in den letzten Jahren von “Misinformation und Disinformation” sprach, benutzte exakt das USAID-Wording und derartige Beispiele gibt es viele.

***

ANZEIGE:

**Sie suchen nach dem einfachsten Weg, Bitcoin zu kaufen und selbst zu verwahren?**\*\*\*\*\*\* *Die* ***[Relai-App](https://relai.app/de/?af_xp=custom\&source_caller=ui\&pid=INFLUENCER\&is_retargeting=true\&af_click_lookback=7d\&shortlink=eo5zpzew\&af_channel=branded_url\&af_inactivity_window=30d\&c=Milosz%20Matuszek)*** *ist Europas erfolgreichste Bitcoin-App.* ***[Hier](https://relai.app/de/?af_xp=custom\&source_caller=ui\&pid=INFLUENCER\&is_retargeting=true\&af_click_lookback=7d\&shortlink=eo5zpzew\&af_channel=branded_url\&af_inactivity_window=30d\&c=Milosz%20Matuszek)*** *kaufen Sie Bitcoin in wenigen Schritten und können auch Sparpläne einrichten. Niemand hat Zugriff auf Ihre Bitcoin, außer Sie selbst.* ***Relai senkt jetzt die Gebühr auf 1%**, mit dem Referral-Code* ***MILOSZ*** *sparen Sie weitere 10%. (keine Finanzberatung). Disclaimer wg. EU-Mica-Regulierung: Die Dienste von Relai werden ausschließlich für Einwohner der Schweiz und Italiens empfohlen.*

***

Sprechen wir also zuerst vom Verrat Amerikas an der Welt, in Form der größten Psyop der Welt, sowie dem Biowaffenangriff in Form von Corona und mRNA, an dem amerikanische Behörden maßgeblich beteiligt waren. Die USA (oder der deep state?) sind scheinbar im Kalten Krieg mit der eigenen Bevölkerung und der Welt:

* USAID und NIAID [finanzierten Coronavirusforschung](https://www.freischwebende-intelligenz.org/p/usaid-and-co-die-ersten-kopfe-der) in Wuhan, USAID finanzierte massiv die Bill & Melinda Gates Stiftung, [Impfprogramme](https://www.ivi.int/who-we-are/ivi-the-united-states/) sowie [GAVI](https://www.gavi.org/news/media-room/united-states-endorses-gavi-recommendation-us-116-billion-four-year-commitment), CEPI, Programme für [“reproductive health](https://2017-2020.usaid.gov/sites/default/files/documents/FPRH-factsheet_OCT2020.pdf)” [etc](https://www.mathematica.org/publications/wash-for-life-findings-from-an-evaluation-of-the-partnership-between-the-bill-and-melinda-gates-fdn). Die Liste der “joint ventures” von Gates und USAID ist lang. Und USAID finanzierte den Propagandaapparat.

* Früher eichte die CIA Schriftsteller im [Congress for Culture Freedom](https://en.wikipedia.org/wiki/Congress_for_Cultural_Freedom), heute finanzieren sie Weiterbildungen und Medientrainings für Tausende Journalisten, auch in Europa. Die Presselandschaft wird wie bei [“Operation Mockingbird”](https://www.youtube.com/watch?v=NK1tfkESPVY\&t=20s) einfach weiter unterwandert.

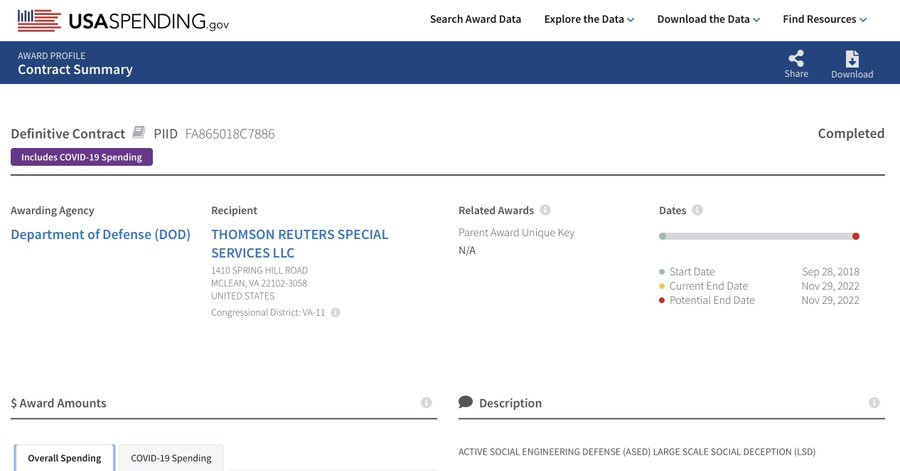

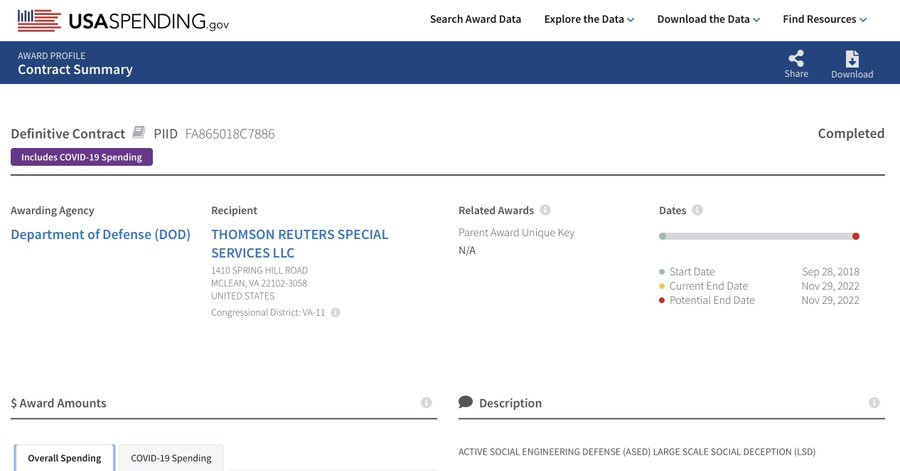

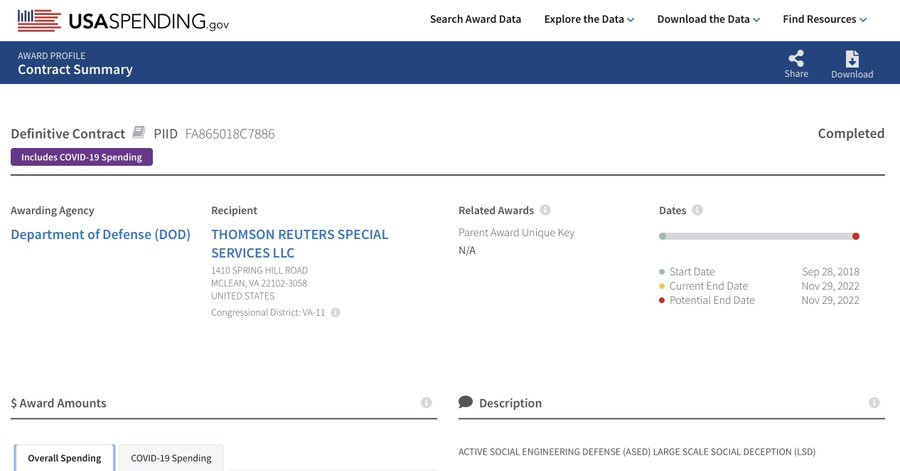

* Reuters bekam 9 Mio. vom US-Verteidigungsministerium und eine köstliche Programm-Beschreibung obendrein: [Millionen für social engineering und gesellschaftliche Täuschung,](https://www.usaspending.gov/award/CONT_AWD_FA865018C7886_9700_-NONE-_-NONE-) *[large societal deception](https://www.usaspending.gov/award/CONT_AWD_FA865018C7886_9700_-NONE-_-NONE-)* [(abgekürzt LSD)](https://www.usaspending.gov/award/CONT_AWD_FA865018C7886_9700_-NONE-_-NONE-). Ein Wink mit dem Zaunpfahl auf [“Mission Mind Control”](https://www.youtube.com/watch?v=DMH5WgGFxlc), also Bewusstseinsexperimente der CIA, u.a. mit LSD?

[](https://substackcdn.com/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fe5184a90-1b9c-42c3-95a7-505f87b34cac_900x471.jpeg)

- Ein paar Tröpfchen LSD dürfen nicht fehlen (rechts unten)

Die Rede vom Verrat an den eigenen Werten in vasallenartigem Gehorsam reiht sich jedenfalls schlecht ein in den noch größeren Verrat der eigenen Werte und eine Form von Hochverrat am Bürger durch amerikanische Behörden. Was genau bleibt also vom Vorwurf von Vance? Ihr habt bei der von uns mitfinanzierten Propagandamaschinerie etwas zu gut mitgemacht. Watch your values!

Die Rede von Vance sei Wahlbeeinflussung, eine Einmischung in „unsere Demokratie“, heißt es nun bei hiesigen Nomenklaturapolitikern. Wahlbeeinflussung durch Vance? Eine schöne Nebelkerze. Die größte Wahlbeeinflussung war doch die mit Milliarden USAID-Geld finanzierte ideologische Unterwanderung des europäischen Debattenraums, von Moldawien und der Ukraine bis Deutschland und Frankreich: Internews Network, Trusted News Initiativen, Factchecker, Kampagnen zu „Misinformation/Disinformation“ uvm. Der europäische Debattenraum wurde auf CIA-Narrativebene geeicht. Die Europäer sind konsterniert: Sie haben mitgemacht und werden jetzt von Vance „unter den Bus geworfen“. Sie stehen als die nützlichen Idioten da, die sie waren. Auch eine Form von Gaslighing: Bestrafung für Gehorsam.

### Das Business Modell des Philanthrokapitalismus

Der Verrat der Werte, er zieht sich längst durch alle Ebenen von Bürokratie, Politik, Wirtschaft. Was eröffnet auch bessere Geschäftsmöglichkeiten als Gedankenkontrolle, Beeinflussung, autoritäre Einschüchterungsmethoden, durchgeführt von einem korporativen Machtapparat aus Politik, Polizei, Medien, Big Tech und Pharma?

Unter denen, die wegen USAID am meisten aufheulen, ist Bill Gates. Zu diesem tauchen, welch Wunder, gerade überall Lobesartikel auf, in US-Sendungen wird er wieder als Gesundheitsexperte herumgereicht, warnt vor Millionen Toten, wenn die Hilfen, die in seine Gesundheitsprogramme von USAID flossen, gestoppt werden. Nur am Rande: Gerade gab es einen Ebolaausbruch in Uganda. [Die WHO lobt den schnellen Impfstart.](https://www.watson.ch/international/gesundheit/825991708-ebola-ausbruch-in-uganda-who-lobt-zuegigen-impfstart) Immer diese Zufälle, *pandamic preparedness* sei Dank, Herr Gates!

USAID und Gates sind [ziemlich beste Freunde](https://www.gatesfoundation.org/Ideas/Media-Center/Press-Releases/2010/06/Gates-Foundation-and-USAID-Announce-Innovative-Fund-to-Incentivize-Mobile-Money-Services-in-Haiti): Die weltgrößte Privatstiftung von Eugeniker Gates und eine CIA-Frontorganisation in trauter Verbundenheit. Was soll da anderes rauskommen, als die größte Psyop der Welt? Nein, USAID hat nicht in 1.6 Mrd. Dollar in deutsche Medien gesteckt, wie kürzlich per falschem Screenshot auf X verbreitet wurde. Die EU steckte dafür [132 Mio. Euro in journalistische EU-PR.](https://archive.ph/Ntehp) Doch es blieb genug Geld für die Medien übrig, um den Corona-Scam zu glauben, zu verbreiten – und sich boostern zu lassen.

[](https://substackcdn.com/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fc4119cc3-7237-44f3-a714-173650a675b6_458x768.png)

So wird ein Schuh draus: (Netzfund)

Darüber hinaus steckte USAID Milliarden in Gavi und CEPI, die Gatesschen Impfkonsortien mit Sitz in der Schweiz. Sowie in zig andere Programme der Gatesstiftung. Teils floss Geld zurück. Ein Geben und Nehmen. All das wäre für ein James-Bond-Drehbuch zu viel des Guten und Undenkbaren: Wir haben es bei der Corona-Connection mit einer Verschwörung von Geheimdienstkreisen, China und Philanthrokapitalisten zu tun. Deren teils geheimdienstfinanzierten Outlets (GAVI, CEPI), aber auch die WHO genießen in der Schweiz Steuervorteile und Immunität, wie eine Botschaft.

Und so wird ein Business-Modell daraus:

* Man suche sich ein Tätigkeitsfeld, Anliegen oder ein sonstiges Vorhaben der sozialen Ingenieurskunst aus. Bei Gates: Bevölkerungskontrolle und -reduktion, Impfstoffverkauf. 2010-2020 sollte die Dekade der Impfstoffe werden – und wurde es. Gates Gebaren konnte man [2015 in einer kritischen Untersuchung](https://archive.globalpolicy.org/images/pdfs/GPFEurope/Philanthropic_Power_online.pdf) von “Misereor” und “Brot für die Welt” studieren.

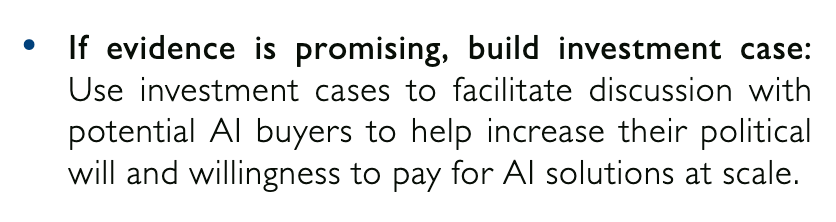

* Dann definiere man Strukturen, Mechanismen und Businessmodelle zur Umsetzung. In einer [Studie von USAID, BMGF sowie Rockefeller-Stiftung](https://web.archive.org/web/20210309193849/https://www.usaid.gov/sites/default/files/documents/1864/AI-in-Global-Health_webFinal_508.pdf) zum Einsatz von KI im Gesundheitsbereich liest man es exemplarisch schwarz auf weiß: *“If evidence is promising, define business case – Wenn die Beweise vielversprechend sind, entwickle eine Geschäftsidee.”*

[](https://substackcdn.com/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Ff5d42b19-4f01-4d68-9fde-66d2ad7b71b0_836x222.png)

* Es erfolgt ein Investment in die Geschäftsidee. Das nennt sich dann Program-Related Investment, und nicht nur “grant”, wie die [New York Times](https://www.nytimes.com/2015/03/13/business/from-the-gates-foundation-direct-investment-not-just-grants.html?_r=0) früher noch kritisierte. Hier wird der angebliche Altruismus zum systemischen legalen Interessenkonflikt. Katastrophen zahlen sich jetzt aus.

* WHO, Partnerorganisationen, News-Netzwerke werden auf die Idee geeicht, das übliche PR-Geschäft.

* Dann noch schnell ein Planspiel, in Wuhan ist der USAID-Partner mit der gain of function-Forschung nämlich schon bereit für den Lab-Leak. Investments in Curevac, Biontech & Co. sind bereits getätigt, das politische Feld in Sachen Epidemic Preparedness ohnehin vorgeimpft (und beteiligt, hunderte Millionen gingen von Deutschland an die BMGF und CEPI, Gavi).

In dieser Phase hängt der Erfolg der Operation nur noch davon ab, wie gut (und wie lange) man es schafft, das Overton-Fenster in den Medien (also das, was relevant ist) mit immer neuen Propaganda-Erzählungen und Angstbildern vollzuhängen, die sozialen Medien zurechtzustutzen und Kritiker zu dezimieren: Fertig ist der größte kriminelle Coup der Geschichte.

Alle Beteiligten gewinnen: Gates vedient an den Impfstoffen, kann das Geld steuerbefreit in der Stiftung für neue Machtgewinnungsfeldzüge einsetzen, die CIA hat ein erfolgreiches Massenhypnose-Experiment durchgeführt und China konnte die Weltwirtschaft hinter sich lassen, intern die Pandemie schnell besiegen und dem Westen seine sehr schnell in Vergessenheit geratenen Bürger- und Menschenrechte vorhalten. Diese Rechte fielen ungefähr so schnell, wie die Menschen in chinesischen Propagandavideos auf der Straße zusammensackten. Nur in China übrigens, nirgendwo anders.

***

**Sie wollen meine (überwiegend englischen) Artikel auch per Email bekommen?**

**[Hier](https://pareto.space/u/ashoka@pareto.space#subscribe)** **können Sie sich eintragen für den Newsletter (max. 1-2 x pro Woche).**

***

Philanthrokapitalismus bedeutet übersetzt, den Anreiz auszuleben, mit Kontrollphantasien, Social Engineering und Technokratie zugleich Geld zu verdienen, Steuern zu sparen, und Macht zu gewinnen. Ein Honeypot für schwerreiche Psychopathen, die munter nach Gutsherrenart an der Bevölkerung herumschrauben wollen. Der Philanthrokapitalismus eines Gates, Soros & Co ist das gefährlichste korporatistische Räuberbaronentum der Neuzeit. Der Staat kann legal für private Machterreichungszwecke ausgenommen werden – zum Schaden der Bürger.

Es gab bei Corona viele Profiteure. Und viele Opfer. Über beide werden wir in naher Zukunft noch viel mehr erfahren. Die Welle der Aufarbeitung rollt.

Und die Konsequenzen? Ein Bill Gates sollte vielleicht daran denken, nicht erst dann zu flüchten, wenn die Epstein-Files veröffentlicht werden, sondern schon früher. In der amerikanischen Verfassung gibt es nur einen Strafrechtsparagraphen und dieser lautet so:

Artikel III, Abschnitt 3 der US-Verfassung:

*„Hochverrat gegen die Vereinigten Staaten besteht ausschließlich darin, Krieg gegen sie zu führen oder ihren Feinden Beistand und Unterstützung zu leisten.“*

Die Corona-Impfkampagne hat die Gesundheit der Amerikaner, auch der von Soldaten massiv geschadet, wie akut erhöhte Krankenstände und Nebenwirkungsmeldungen zeigten. Damit wurde Feinden der USA (mindestens jede verfeindete Kriegspartei) Beistand geleistet.

Eines wissen wir schon jetzt: So in etwa ist der “Source Code” des Bösen programmiert.

***

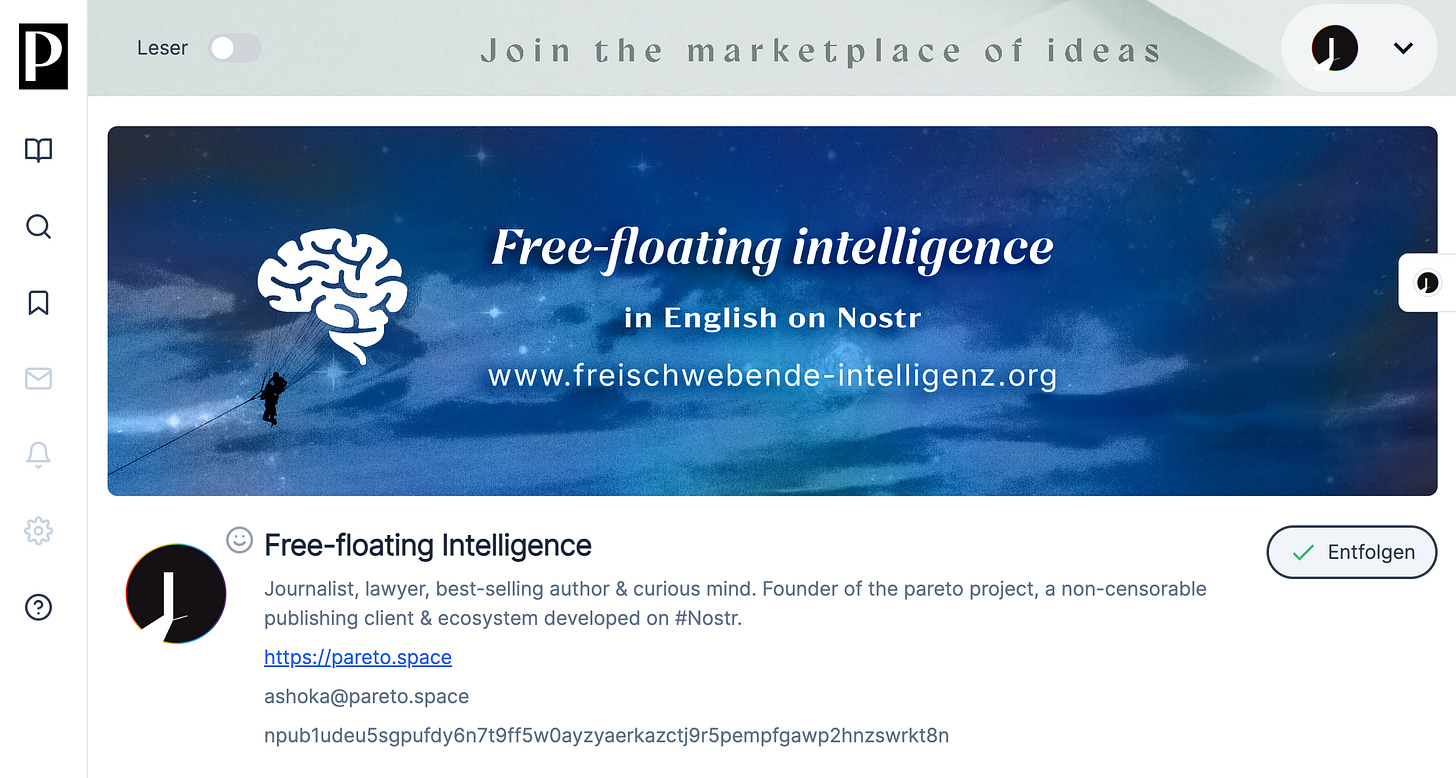

***You prefer reading me in English?*** *You can find my first uncensorable articles written with our Pareto client via Nostr,* ***[clicking on this link.](https://pareto.space/u/ashoka@pareto.space)*** *Discover other authors at* ***[Pareto.space/read.](https://pareto.space/read)(click on the Pareto button to see our first authors).***

[](https://substackcdn.com/image/fetch/f_auto%2Cq_auto%3Agood%2Cfl_progressive%3Asteep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fc33bfce1-1a89-42ff-a89f-e1fbd7edfac4_2382x1272.png)

***

***Join the marketplace of ideas!** We are building a publishing ecosystem on Nostr for citizen-journalism, starting with a client for blogging and newsletter distribution. Sound money and sound information should finally be in the hands of the people, right? Want to learn more about the [Pareto Project](https://pareto.space/en)? Zap me, if you want to contribute (all Zaps go to the project).*

*Are you a publication or journalist and want to be part of it, test us, migrate your content to Nostr? Write to **<team@pareto.space>***

**Not yet on** **[Nostr](https://nostr.com/)** **and want the full experience?** Easy onboarding via **[Start.](https://start.njump.me/)**

We have started a crowdfunding campaign on **[Geyser.](https://geyser.fund/project/pareto?hero=geyser)** **We are in the Top 3 in February, thank you for the support!**

***

**Sie wollen meine Artikel auch per Email bekommen?**

**[Hier](https://pareto.space/u/ashoka@pareto.space#subscribe)** **können Sie sich eintragen für den Newsletter (max. 1-2 x pro Woche).**

-

@ 5afdec5b:2d631be1

2025-02-28 10:23:07

# Bitcoin: The Future of Collateralized Loans

_Bitcoin is transforming the financial landscape, not just as a digital currency but arguably as the best form of collateral for unlocking liquidity. At Lendasat, we're pioneering this shift by working towards a trustless, self-custodial lending platform that lets users borrow against their Bitcoin without selling it. Let's explore Bitcoin's unmatched value as collateral and how Lendasat's innovative approach - with Discreet Log Contracts (DLCs) and integrations - make borrowing secure, simple, and practical.

Bitcoin unlocks cash access without letting it go._

---

## Why Bitcoin Stands Out as Collateral

##### Bitcoin's intrinsic properties set it apart from traditional assets like real estate or stocks:

🌐 **Decentralized Control:** No intermediaries, ensuring transparency and independence.

💧 **Ultimate Liquidity:** Bitcoin is one of the most liquid assets in the world, tradable 24/7 without interruption. Unlike traditional markets with public holidays, and weekend downtime, Bitcoin operates continuously, allowing transactions at any time from anywhere.

✅ **Capped Supply:** Only 21 million coins will ever exist, shielding it from dilution/inflation.

🔒 **Robust Security:** Backed by cryptography and a global mining network, Bitcoin is portable, durable, and verifiable.

These qualities make Bitcoin an ideal foundation for lending, a vision Lendasat brings to life. Our app leverages Bitcoin's censorship-resistant nature to offer a collateral option that traditional assets can't rival.

## The "Buy, Borrow, Die" Strategy: A Smart Money Move Now Available For Everyone

> For those unfamiliar, the "buy, borrow, die" strategy involves buying assets, borrowing against them for liquidity, and holding until death to pass on the assets with a stepped-up basis, minimizing taxes. Savvy investors and businesses often borrow against their holdings rather than sell them. Why? It's a tax-efficient way to access cash while retaining ownership and future gains. With Bitcoin, this approach is even more compelling:

🏷️ **Tax Advantage:** No capital gains taxes when borrowing instead of selling.

🔒 **Ownership Retention:** Keep your Bitcoin and its potential upside.

📈 **Growth Exposure:** Benefit from Bitcoin's long-term appreciation.

Lendasat's motto, **"Get the bread you need without having to part with your corn"** encapsulates this strategy. We empower users to tap into their Bitcoin's value without sacrificing their stake in its future.

Bitcoin gives access to practices that were previously reserved to the wealthiest individuals and companies.

ℹ️ **Note:** Tax benefits may vary depending on your jurisdiction. Please consult with a tax professional.

## Lendasat's Vision: Seamless Lending Process

##### Lendasat, in its public release, will make Bitcoin-backed loans straightforward and secure. Here's how it works:

1. Secure Your Bitcoin: Lock your BTC in a Discreet Log Contract (DLC), a "smart contract" that eliminates counterparty risk while keeping you in control

2. Borrow Stablecoins: Receive stablecoins at an average 50% loan-to-value ratio (e.g., $50,000 for $100,000 in BTC), balancing liquidity with safety.

3. Spend Anywhere: Use our spending tools and off-ramps integrations to spend loan funds effortlessly in the real world, as an example, with a Virtual Card for online shopping - launched in our closed beta.

This peer-to-peer process makes KYC optional, prioritizing privacy and accessibility.

## Who Benefits from Lendasat?

##### Our app serves a wide range of users:

**Borrowers:**

- Unlock cash without selling Bitcoin.

- Enjoy tax savings and growth potential.

- Spend easily with the virtual debit card.

**Lenders:**

- Earn guaranteed returns on overcollateralized loans.

- Reduce risk with Bitcoin's security.

- Diversify investments with a cutting-edge asset.

Lendasat's self-custodial design ensures both parties retain autonomy, with DLCs handling the heavy lifting.

## Real-World Applications

##### Bitcoin collateral isn't just for individuals - it's a game-changer for businesses:

**Businesses:** Fund expansion or operations without diluting equity or selling BTC.

**Miners:** Cover costs like electricity bills by borrowing against mined Bitcoin, avoiding sales at low prices.

Lendasat supports these scenarios with flexible solutions, and we're exploring enhancements like on-ramps integration for bank transfer repayments to streamline the experience.

## The Future of Bitcoin Collateral

##### Bitcoin's role as collateral is only beginning. Emerging possibilities include:

**Credit Lines:** Bitcoin-backed spending options akin to traditional credit.

**Institutional Use:** Large-scale financing for companies and even governments.

While Bitcoin is currently primarily used as a store of value, its potential as a medium of exchange is still developing. Lendasat's platform is designed to adapt to Bitcoin's evolving role in the financial ecosystem, whether it remains a collateral asset or becomes widely used for transactions.

Lendasat is driving this future by refining our platform, focusing on user-friendly on/off ramps and practical spending tools to make Bitcoin loans a financial mainstay.

## What Sets Lendasat Apart?

##### Lendasat isn't just another lending platform - it aims to be the leader in Bitcoin finance:

**Trustless System:** DLCs ensure security without third-party custody.

**Practical Tools:** The virtual debit card bridges DeFi and daily life.

**User-Centric:** Optional KYC, no credit checks, and flexible repayment options in development.

**Mission-Driven:** We're here to empower financial freedom through Bitcoin.

These strengths make Lendasat the premier choice for leveraging Bitcoin as collateral.

## Challenges and Considerations

##### While Bitcoin-backed loans offer many advantages, there are risks to consider:

**Volatility:** Bitcoin's price can be volatile, which may lead to liquidation if the value drops significantly.

**User Experience:** Managing DLCs and understanding the lending process may be complex for some users.

At Lendasat, we're actively working to mitigate these risks through user education, robust platform design, and ongoing development of user-friendly features.

# Conclusion: Bitcoin's Full Potential

Bitcoin isn't just money - It is the best collateral in the making ever discovered, blending security, liquidity, and growth. Lendasat brings this power to your fingertips with a platform that's secure, intuitive, and built for the future. Whether you're funding a dream or growing a business, we've got you covered.

Ready to borrow without selling? Dive into [https://Lendasat.com](https://Lendasat.com) and see how your Bitcoin can work harder for you.

## Quick Comparison: Traditional vs. Lendasat's Bitcoin Collateral

This snapshot underscores why Bitcoin, paired with Lendasat, is rewriting the rules of collateral.

## Help Us To Achieve Our Vision!

Want to be part of the journey?

Join our waiting list or, even better, connect with us on Discord to get yourself an invite code and try our app and share your thoughts!

Stay tuned, and as always, stay sovereign.

-

@ 95cb4330:96db706c

2025-02-28 10:13:16

Adopting Inversion Thinking, a mental model championed by Charlie Munger and Warren Buffett, can enhance decision-making and problem-solving by focusing on potential pitfalls to avoid. This approach involves considering the opposite of your desired outcome to identify and mitigate risks effectively.

---

## Understanding Inversion Thinking

- **Definition:**

Inversion Thinking entails approaching problems by asking, "What could cause failure?" rather than solely focusing on achieving success. This perspective helps in uncovering obstacles and errors that might be overlooked when only considering positive outcomes.

---

## Examples in Practice

- **Charlie Munger's Approach:**

Munger emphasizes solving problems by inverting them. For instance, instead of asking how to be successful, he suggests identifying what actions could lead to failure and then avoiding those actions.

[FS.BLOG](https://fs.blog)

- **Warren Buffett's Investment Strategy:**

Buffett applies inversion by considering what factors could cause an investment to fail, such as poor management or unsustainable business models, and avoids investments with these red flags.

---

## Implementing Inversion Thinking

1. **Define the Problem:**

Clearly articulate the challenge or goal you are addressing.

2. **Invert the Problem:**

Ask what actions or factors could lead to the opposite of your desired outcome.

3. **Identify Preventative Measures:**

Determine strategies to avoid these negative actions or factors.

4. **Apply Insights to Decision-Making:**

Use the information gathered to inform your choices, focusing on avoiding identified pitfalls.

---

## Action Step

Consider a current goal or project. Apply inversion by asking, "What steps could lead to failure in this endeavor?" List these potential pitfalls and develop strategies to prevent them, thereby increasing the likelihood of success.

---

By integrating Inversion Thinking into your decision-making process, you can proactively address potential challenges, leading to more robust and resilient strategies.

---

-

@ 95cb4330:96db706c

2025-02-28 09:22:17

Jeff Bezos, Sam Altman, and Elon Musk follow a critical decision-making principle: never let past investments dictate future choices. Instead of holding onto failing projects due to time, money, or effort already spent, successful entrepreneurs cut losses quickly and reallocate resources toward higher-impact opportunities.

---

## Why Avoiding Sunk Costs Matters

- **Frees Up Resources for Better Opportunities:**

The more time you spend on a failing project, the fewer resources you have to invest in something that could succeed.

- **Prevents Emotional Bias in Decision-Making:**

Many people stick with bad decisions because they feel committed, rather than assessing future potential objectively.

- **Increases Agility & Competitive Edge:**

Being able to pivot quickly allows you to adapt to market changes faster than competitors.

---

## Example in Action: Bezos, Musk & Altman

- **Jeff Bezos & the Fire Phone:**

Amazon heavily invested in its Fire Phone, but when it failed, Bezos shut it down and redirected efforts to Alexa and AWS, which became massive successes.

- **Elon Musk & Tesla Model S Plaid+:**

Tesla had planned a Model S Plaid+ variant, but Musk canceled it, realizing it no longer made strategic sense in Tesla’s long-term roadmap.

- **Sam Altman & Startup Strategy:**

Altman constantly advises founders to evaluate if they’re on the best path—not just the one they’ve already invested in. He encourages entrepreneurs to pivot fast rather than waste time on failing ideas.

---

## How to Apply This Principle

1. **Identify Projects You’re Holding Onto for the Wrong Reasons**

*Ask:* Would I start this today knowing what I now know?

2. **Focus on Future Potential, Not Past Investment**

Look at the expected future return rather than the money or effort already spent.

3. **Be Willing to Pivot or Cut Losses Quickly**

If a project no longer aligns with your long-term vision, redirect resources elsewhere.

---

## Action Step: Audit Your Current Projects

- 👉 Are you continuing something just because of past investment rather than future potential?

- 👉 If so, consider pivoting or cutting it today.

---

By avoiding the sunk cost fallacy, you can stay flexible, maximize impact, and ensure you’re always focused on the best opportunities ahead.

-

@ f6488c62:c929299d

2025-02-28 09:18:00

เมื่อกระแสข่าวเรื่อง Government Shutdown ของสหรัฐฯ เริ่มร้อนแรงขึ้นเรื่อย ๆ โดยแพลตฟอร์มอย่าง Polymarket บ่งชี้ว่าความเป็นไปได้ของเหตุการณ์นี้พุ่งขึ้นถึง 50% หลายคนอาจสงสัยว่ามันเกี่ยวอะไรกับตลาดคริปโต โดยเฉพาะกลุ่ม เหรียญมีม (Meme Coins) ที่ดูเหมือนจะอยู่นอกเหนือระบบเศรษฐกิจแบบดั้งเดิม

แต่ความจริงแล้ว การปิดตัวของรัฐบาลกลางสหรัฐฯ อาจส่งผลกระทบทั้งทางตรงและทางอ้อมต่อตลาดเหรียญมีมอย่างหลีกเลี่ยงไม่ได้ มาดูกันว่า โอกาส และ ความเสี่ยง ของสาวกเหรียญมีมในสถานการณ์เช่นนี้มีอะไรบ้าง

🎯 โอกาสสำหรับเหรียญมีม

กระแสการเงินไหลเข้าสินทรัพย์เสี่ยงสูง (High-risk assets)

หากนักลงทุนเชื่อว่า Shutdown จะทำให้ธนาคารกลางสหรัฐ (Fed) ต้องผ่อนคลายนโยบายการเงินในอนาคตเพื่อลดผลกระทบทางเศรษฐกิจ เงินทุนอาจไหลเข้าสินทรัพย์เสี่ยงอย่างคริปโต รวมถึงเหรียญมีมที่มักมีการเคลื่อนไหวรุนแรงเกินจริง

เหรียญอย่าง DOGE, SHIBA หรือ PEPE อาจได้ประโยชน์จากความคลั่งไคล้และกระแส "ซื้อเพราะมันตลก" ที่เคยเกิดขึ้นในอดีต

ชุมชนออนไลน์มีบทบาทมากขึ้น

การปิดตัวของหน่วยงานรัฐอาจกระตุ้นความไม่พอใจในหมู่ประชาชน ส่งผลให้การเคลื่อนไหวทางออนไลน์เพิ่มขึ้น สังคมคริปโต โดยเฉพาะกลุ่มเหรียญมีม อาจใช้โอกาสนี้เพื่อสร้างกระแสหรือหาเหตุผลสนุก ๆ ในการผลักดันเหรียญ

ตัวอย่าง: แคมเปญ "Shutdown? Buy DOGE!" หรือ "Government off, PEPE on!" อาจกลายเป็นไวรัลได้

Narrative ใหม่ ๆ เพื่อดึงนักลงทุน

โปรเจกต์เหรียญมีมอาจสร้างเรื่องราวใหม่ ๆ เพื่อเชื่อมโยงกับเหตุการณ์ เช่น การล้อเลียนการเมืองหรือสร้างโทเค็นเชิงสัญลักษณ์เพื่อประท้วงรัฐบาล ดึงดูดนักลงทุนที่มองหาทางออกจากความวุ่นวายของระบบดั้งเดิม

⚠️ ความเสี่ยงสำหรับเหรียญมีม

ภาวะเสี่ยงต่ำ (Risk-off sentiment)

ในช่วงแรกของ Shutdown นักลงทุนมักถอยกลับไปถือ เงินดอลลาร์ (USD) หรือสินทรัพย์ปลอดภัย เช่น ทองคำ ส่งผลให้ตลาดคริปโตตกลงอย่างหนัก รวมถึงเหรียญมีมที่มีความผันผวนสูงและไม่มีมูลค่าพื้นฐาน

ความเชื่อมั่นที่ลดลงนี้อาจทำให้ราคาเหรียญมีมดิ่งลงแบบไร้จุดหมาย

ขาดสภาพคล่อง (Liquidity crunch)

หากเศรษฐกิจชะงัก นักลงทุนรายย่อยอาจไม่มีเงินสดมาปั่นราคาหรือเก็งกำไรเหรียญมีมได้เหมือนเดิม ทำให้การเคลื่อนไหวของราคาเหรียญมีมซบเซา

เหรียญเล็ก ๆ ที่อาศัยชุมชนเป็นหลัก อาจเผชิญกับปัญหาสภาพคล่องอย่างรุนแรง

ความเสี่ยงด้านกฎระเบียบ

แม้ Shutdown จะทำให้หน่วยงานกำกับดูแลบางส่วนหยุดทำงาน แต่ในระยะยาว หากรัฐบาลกลับมาพร้อมนโยบายคุมเข้ม ตลาดคริปโตอาจเจอแรงกดดันเพิ่มเติม ซึ่งอาจส่งผลลบต่อเหรียญมีมที่มักถูกมองว่าเป็นสินทรัพย์ "เก็งกำไรสูงสุด"

🚀 สรุป: เตรียมตัวรับมือยังไง?

นักลงทุนสายเหรียญมีม ควรติดตามข่าวสารทั้งเรื่อง Shutdown และทิศทางของ Fed อย่างใกล้ชิด เพราะเหตุการณ์เหล่านี้สามารถเปลี่ยนทิศทางตลาดได้อย่างฉับพลัน

วางแผนการลงทุน โดยแบ่งพอร์ตอย่างชาญฉลาด ไม่ทุ่มหมดหน้าตักกับเหรียญมีม และเตรียมเงินสดไว้เผื่อโอกาสซื้อเพิ่มหากราคาตกหนัก

สร้างและติดตามกระแสออนไลน์ หากคุณเป็นแฟนเหรียญมีม การเคลื่อนไหวในโซเชียลมีเดียอาจเป็นตัวแปรสำคัญในการดันราคา ดังนั้นการร่วมชุมชนหรือมีส่วนร่วมในแคมเปญต่าง ๆ อาจช่วยให้เหรียญมีมของคุณกลับมาเป็นที่สนใจ

สุดท้ายแล้ว Government Shutdown อาจเป็นทั้งโอกาสและความเสี่ยง แต่สำหรับสาวกเหรียญมีมแล้ว บางที "ความวุ่นวาย" อาจเป็นเชื้อไฟที่ทำให้ตลาดนี้ลุกเป็นไฟได้อีกครั้ง 🔥

-

@ 8947a945:9bfcf626

2025-02-28 09:11:21

## Chef's notes

https://video.nostr.build/ea19333ab7f700a6557b6f52f1f8cfe214671444687fa7ea56a18e5d751fe0a9.mp4

https://video.nostr.build/bcae8d39e22f66689d51f34e44ecabdf7a57b5099cc456e3e0f29446b1dfd0de.mp4

## Details

- ⏲️ Prep time: 5 min

- 🍳 Cook time: 5 min

- 🍽️ Servings: 1

## Ingredients

- ไข่ 1 - 2 ฟอง

- ข้าวโอ๊ต 3 - 4 ช้อน

## Directions

1. ตอกไข่ + ตีไข่

2. ปรุงรส พริกไทย หรือ ซอสถั่วเหลืองตามชอบ

3. ใส่ข้าวโอ๊ต 3 - 4 ช้อน

4. ใส่ถั่วลิสงอบ 1 - 2 หยิบมือ

5. เทน้ำใส่พอท่วมข้าวโอ๊ต

6. เข้าไมโครเวฟ ไฟแรง 1 - 2 นาที

-

@ da0b9bc3:4e30a4a9

2025-02-28 08:39:58

Hello Stackers!

Welcome on into the ~Music Corner of the Saloon!

A place where we Talk Music. Share Tracks. Zap Sats.

So stay a while and listen.

🚨Don't forget to check out the pinned items in the territory homepage! You can always find the latest weeklies there!🚨

🚨Subscribe to the territory to ensure you never miss a post! 🚨

originally posted at https://stacker.news/items/899482

-

@ 1c19eb1a:e22fb0bc

2025-02-28 07:32:53

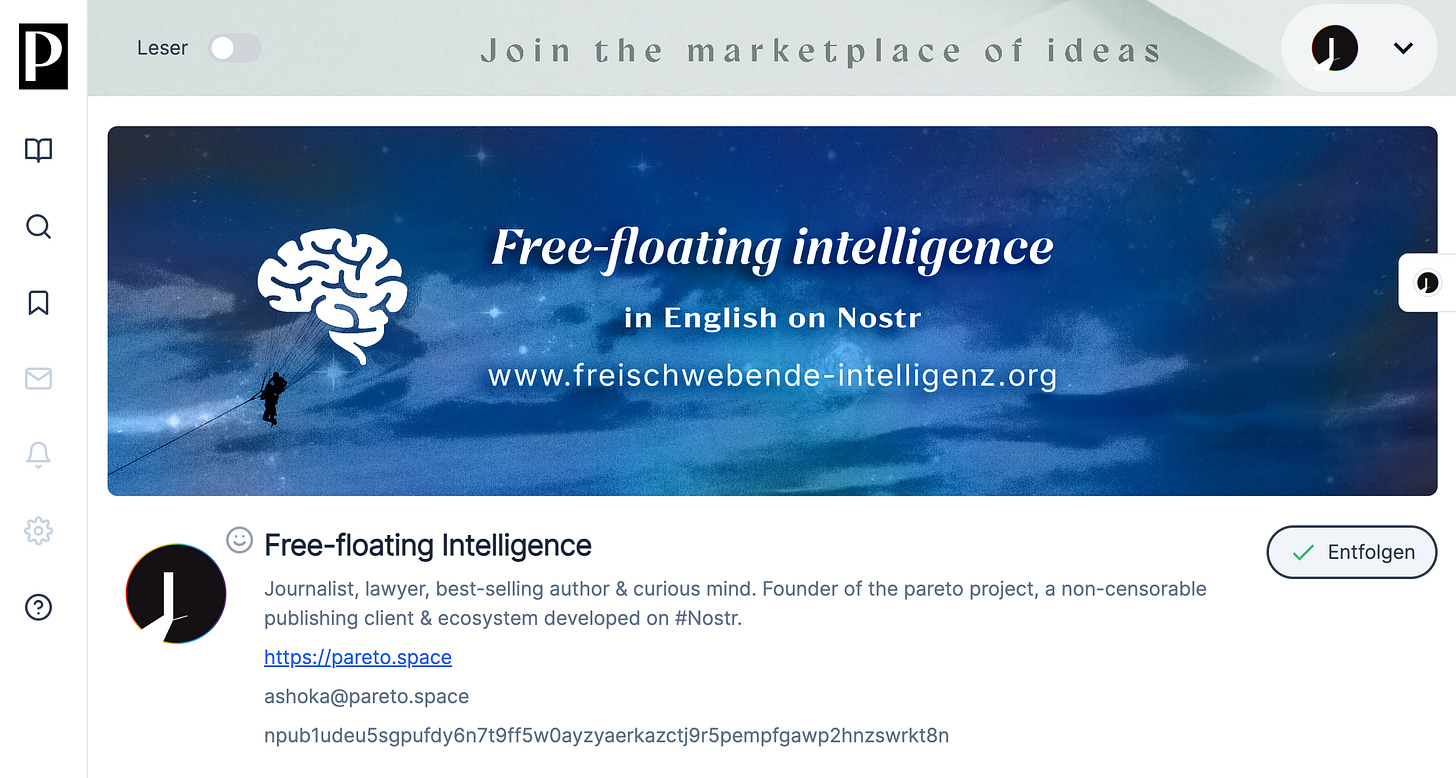

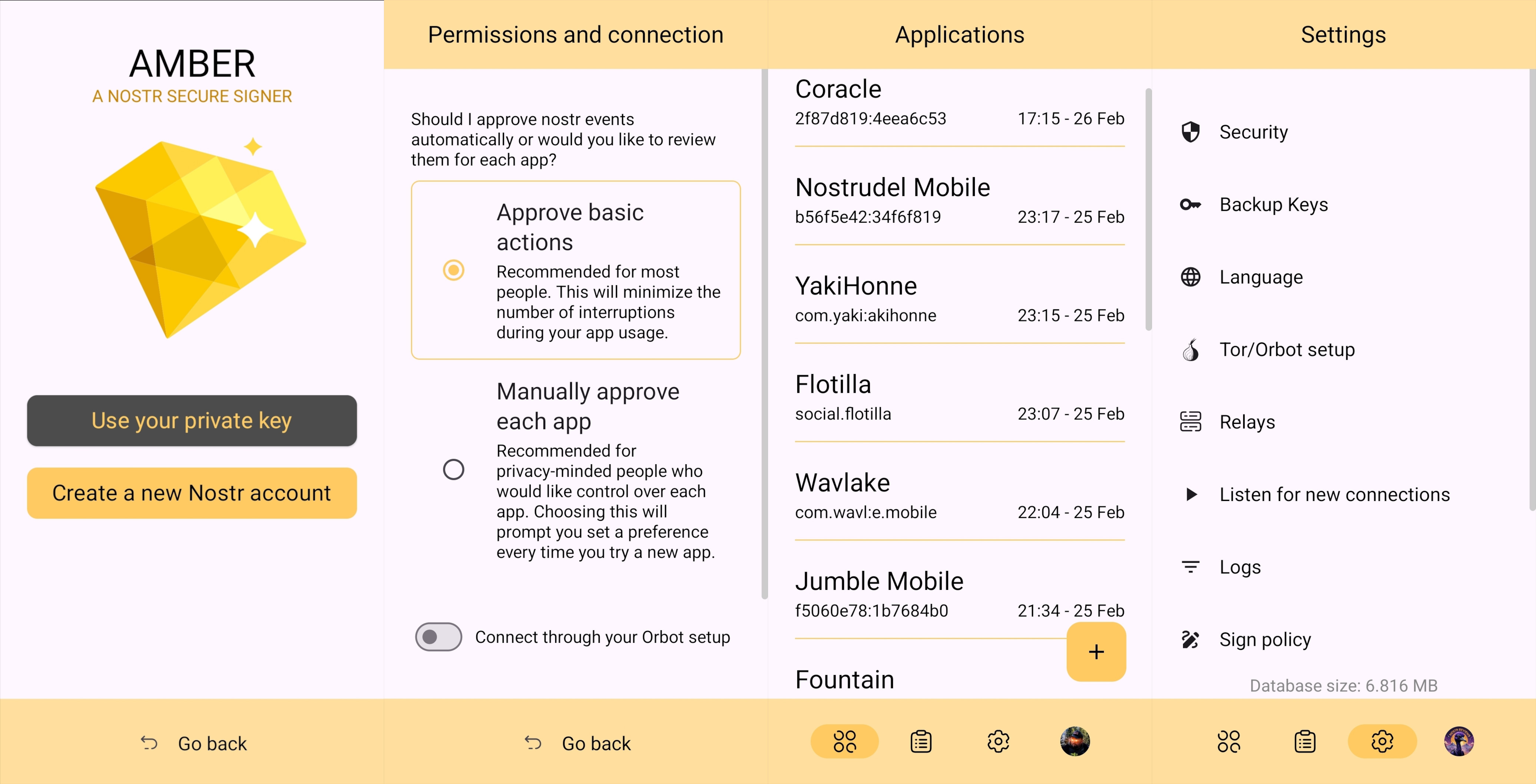

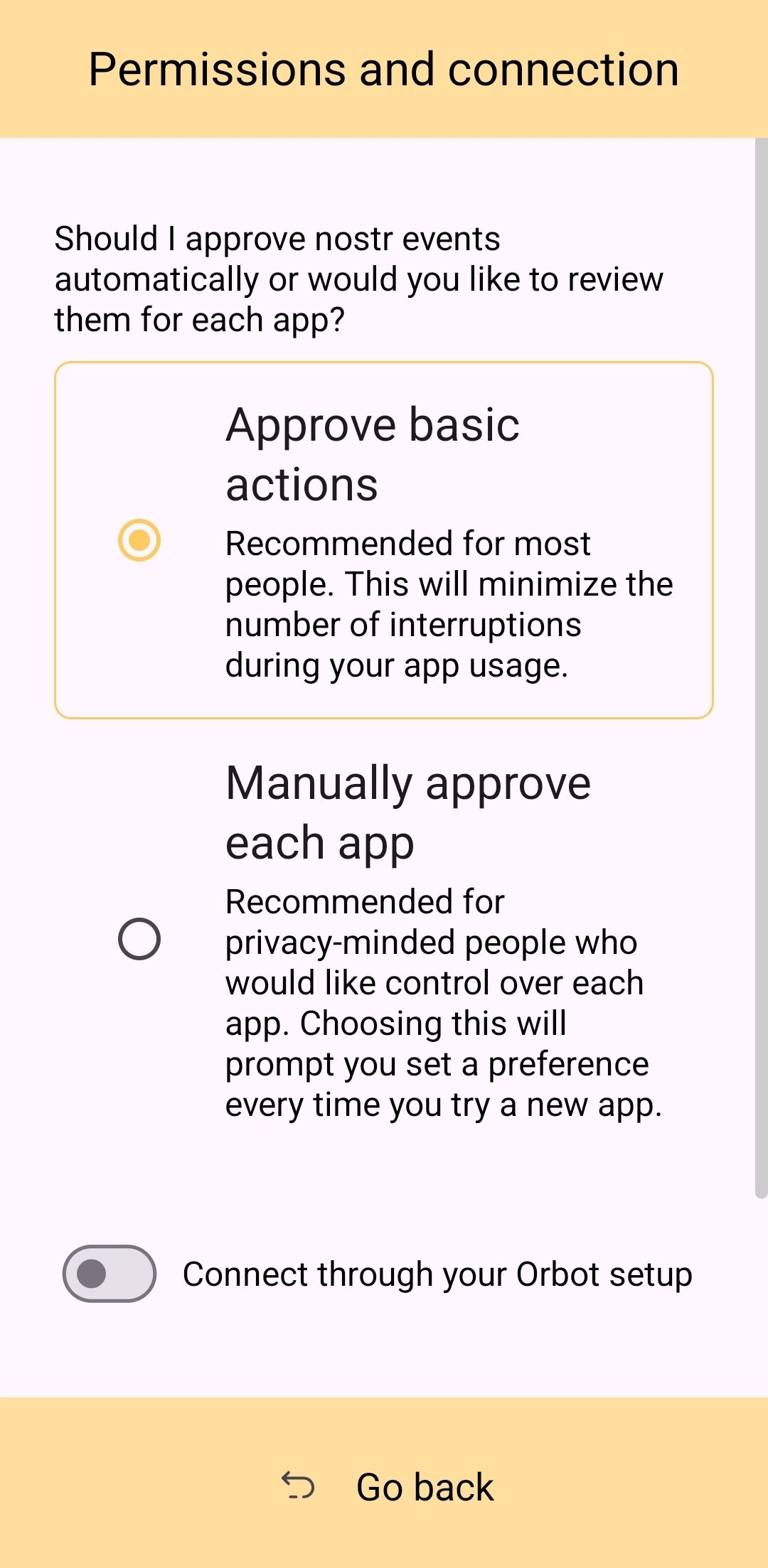

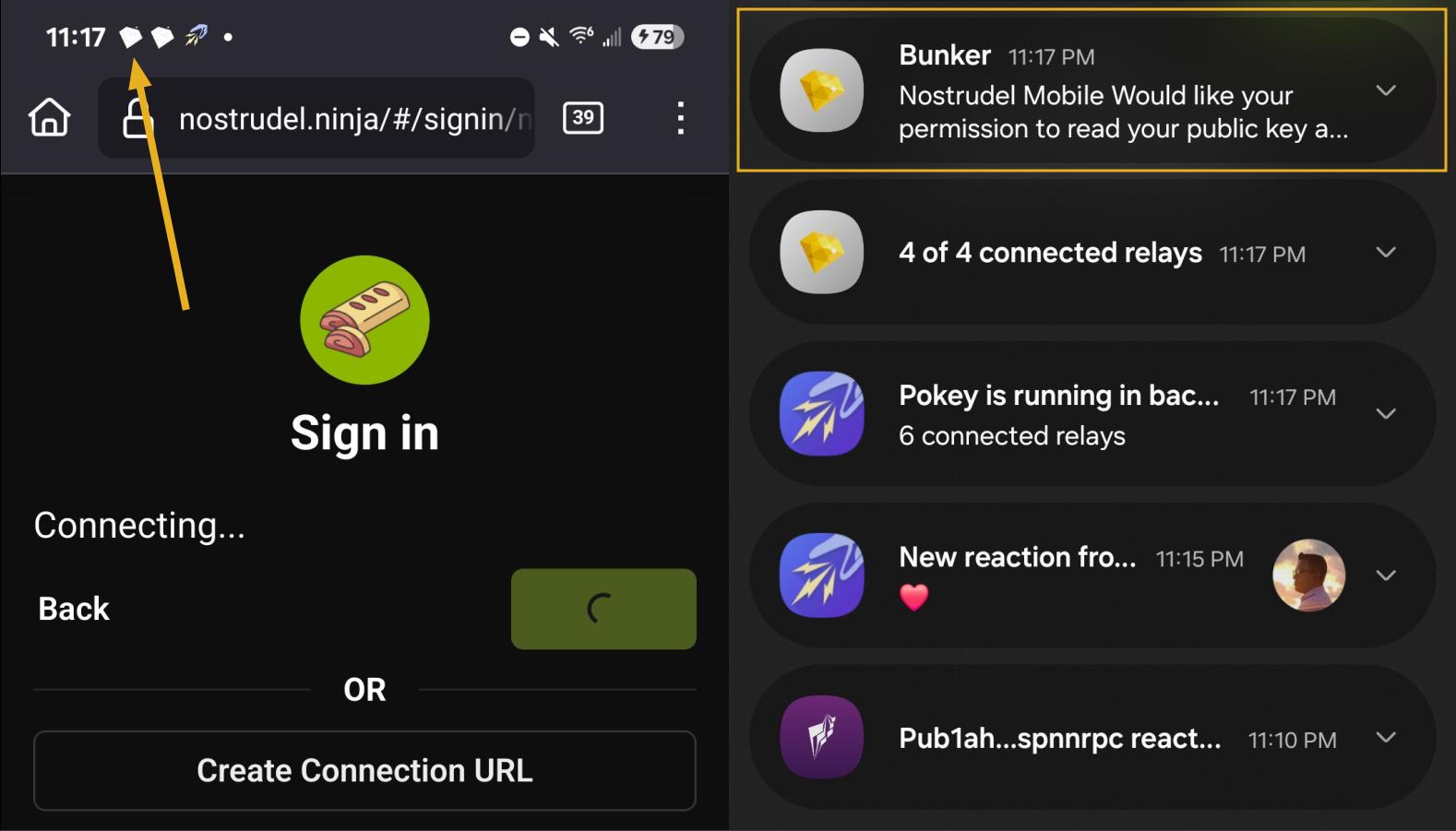

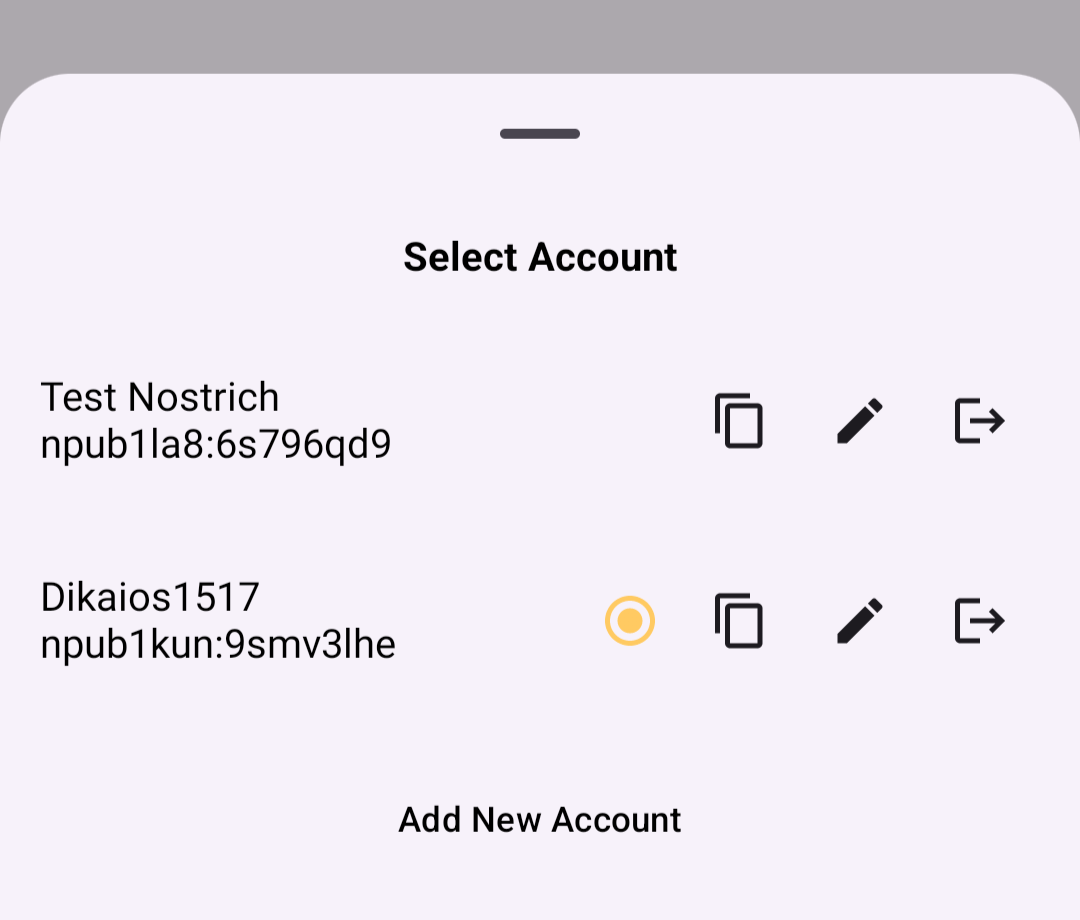

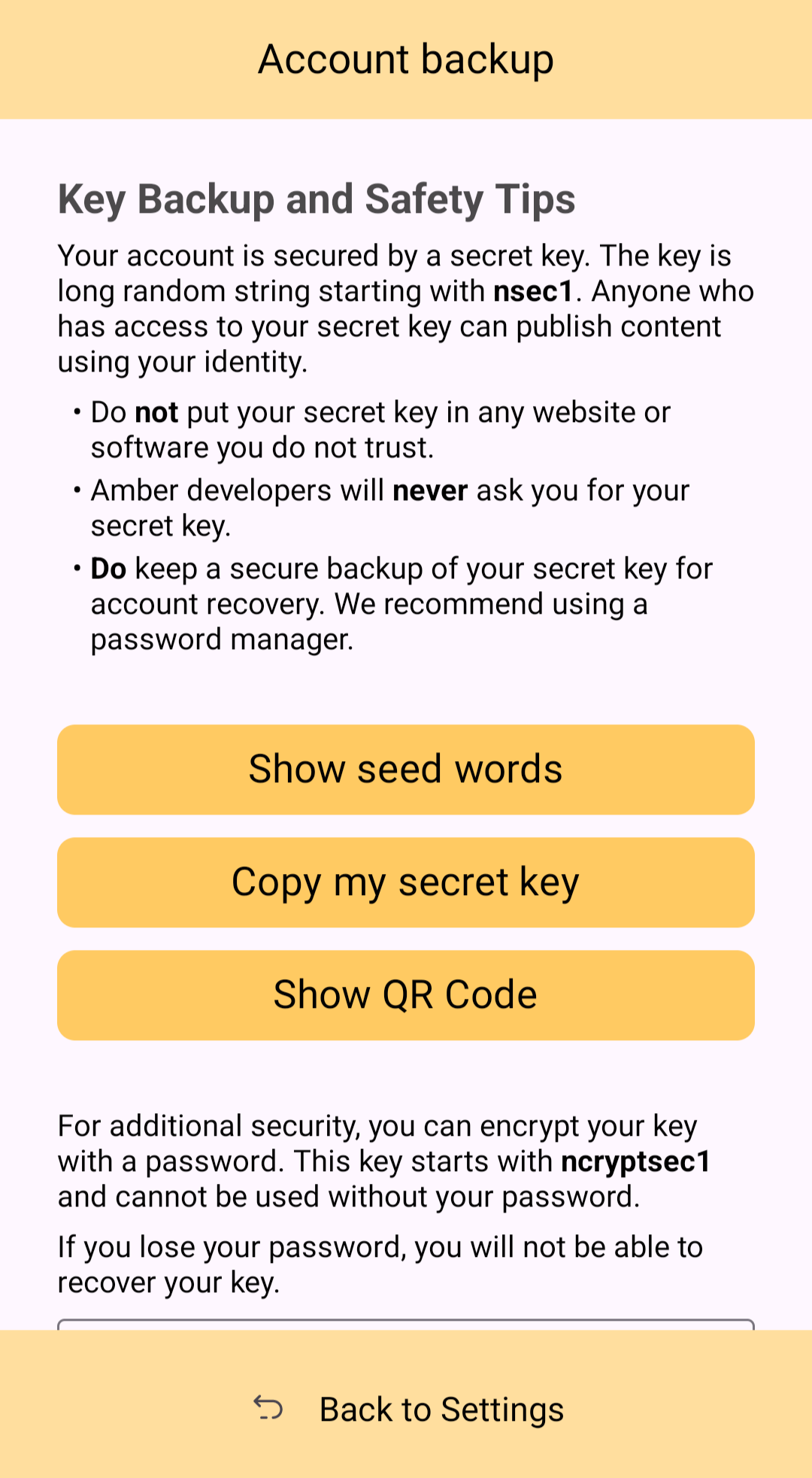

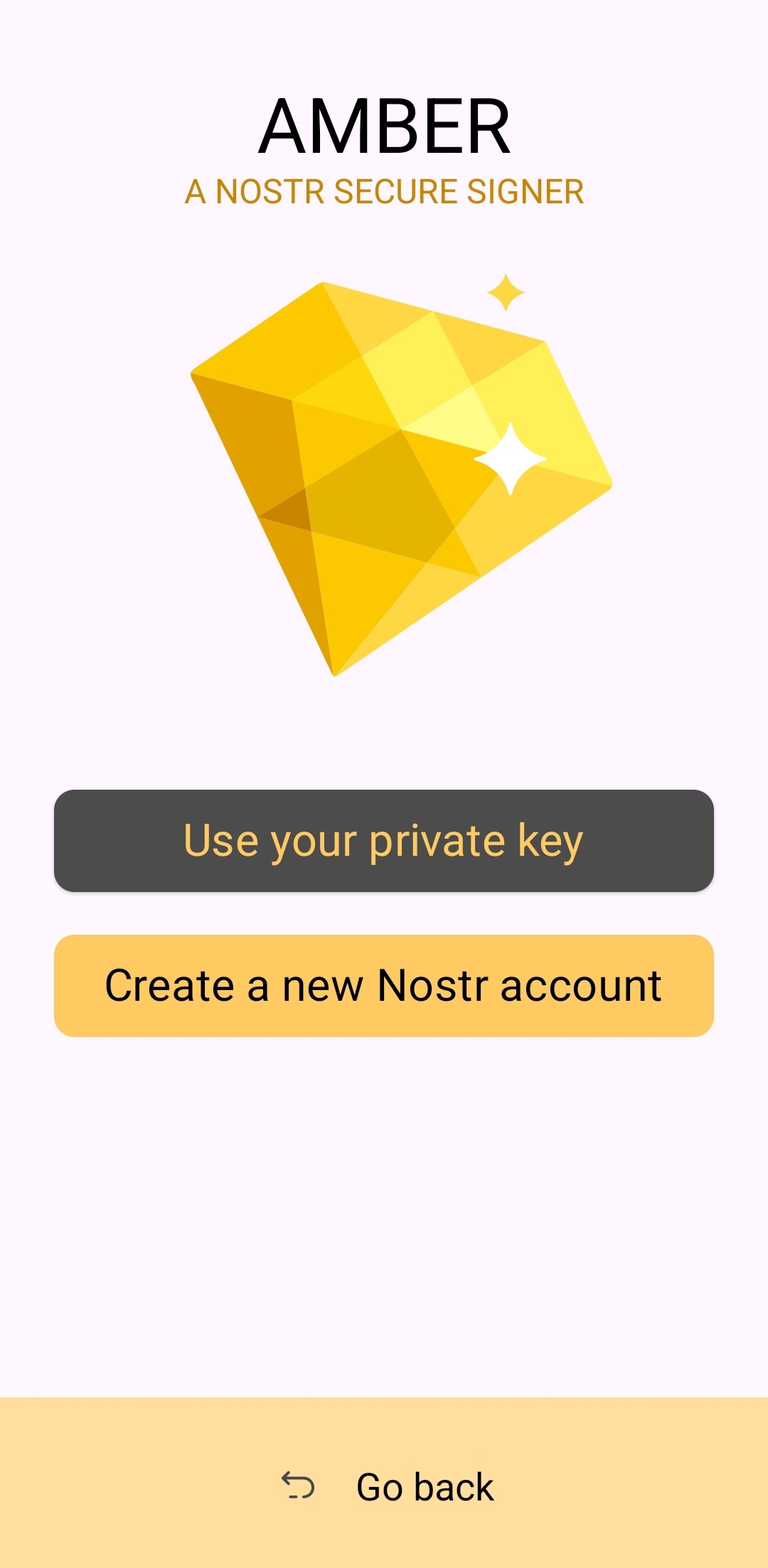

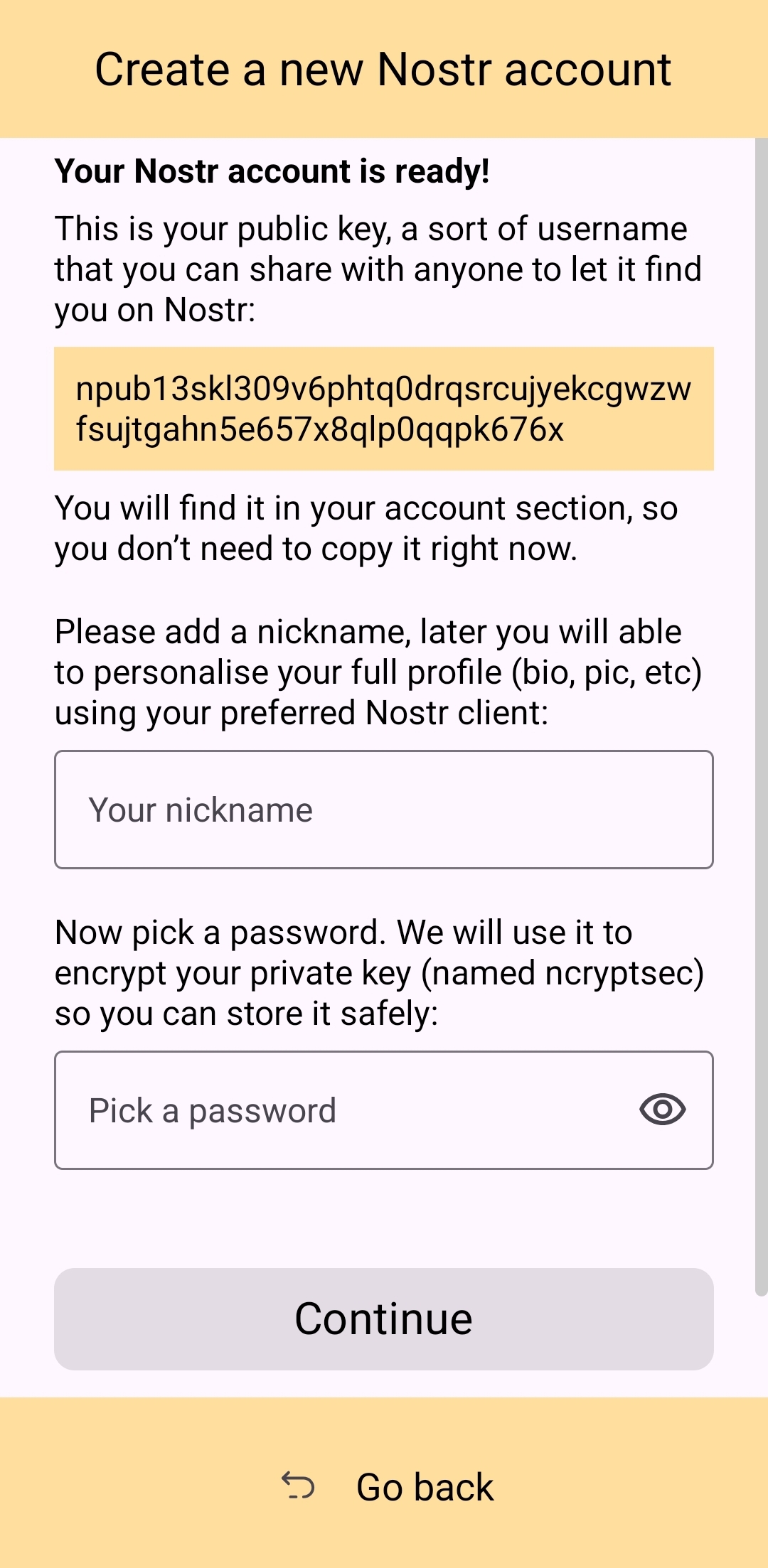

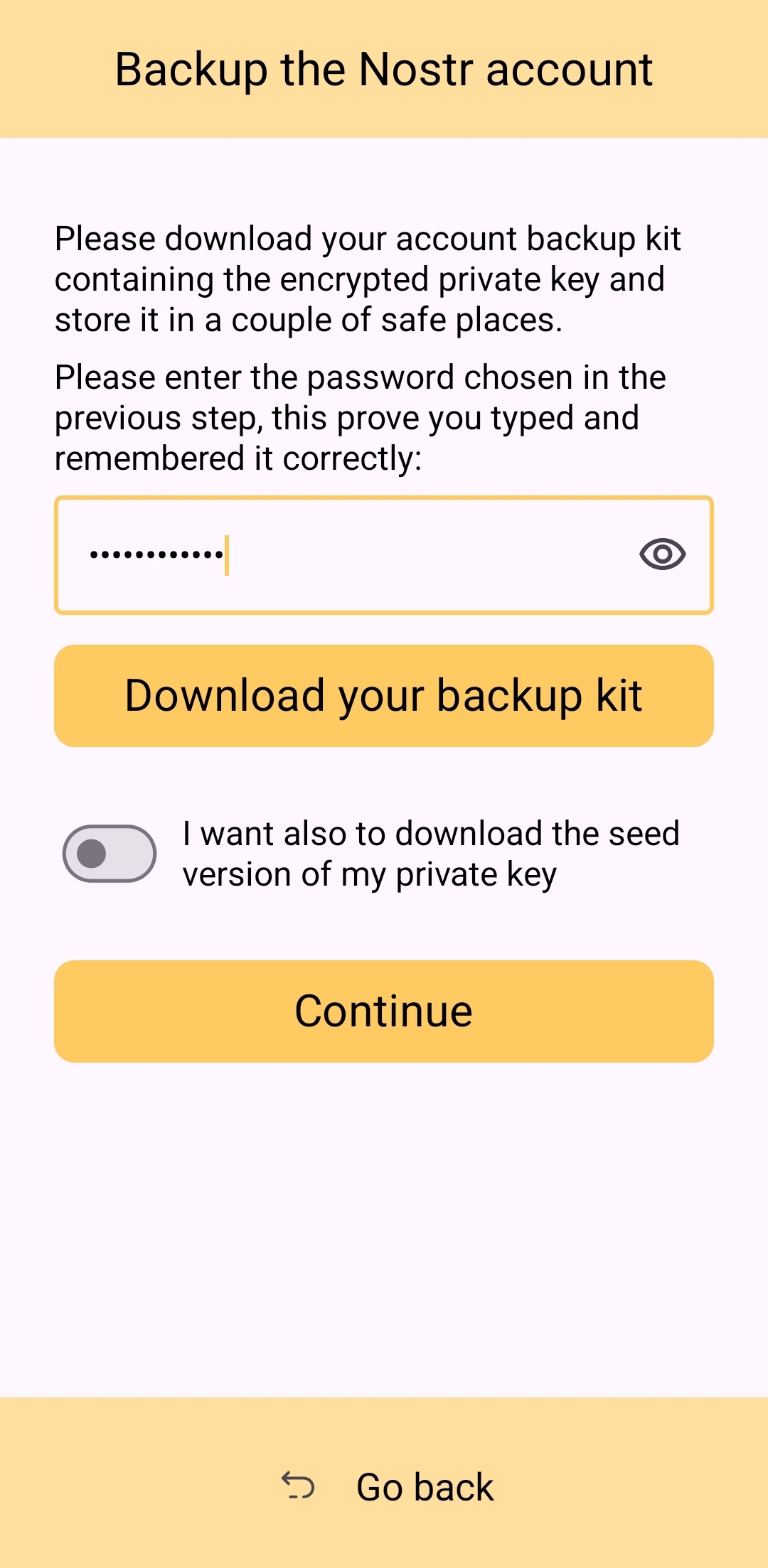

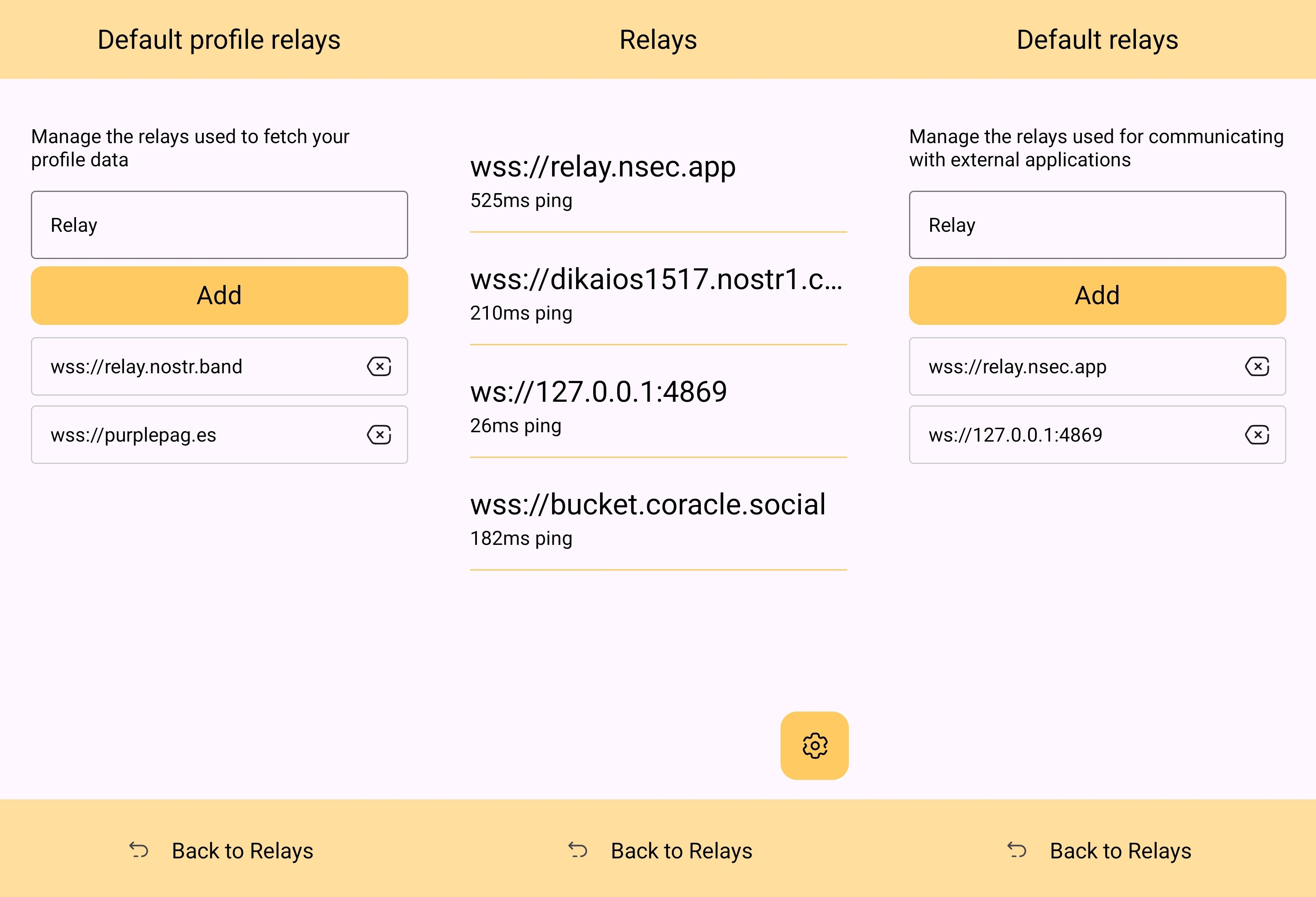

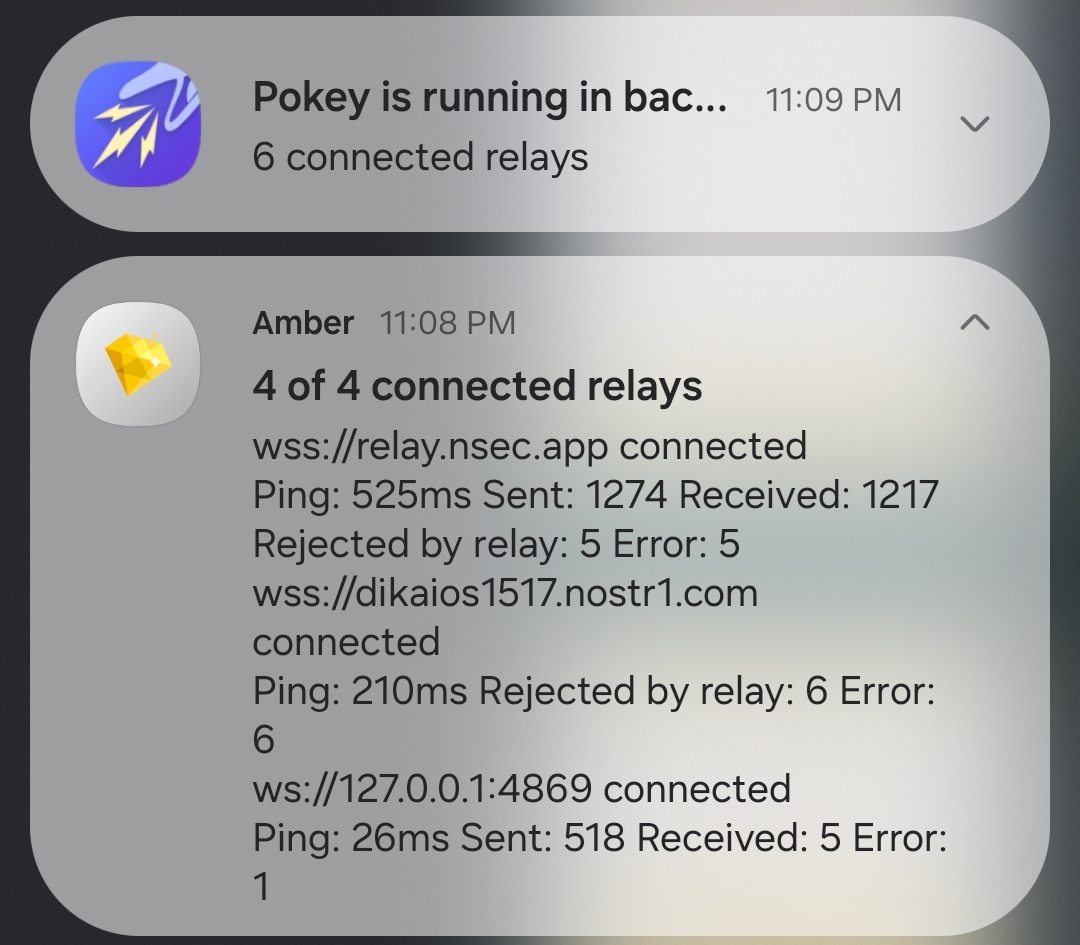

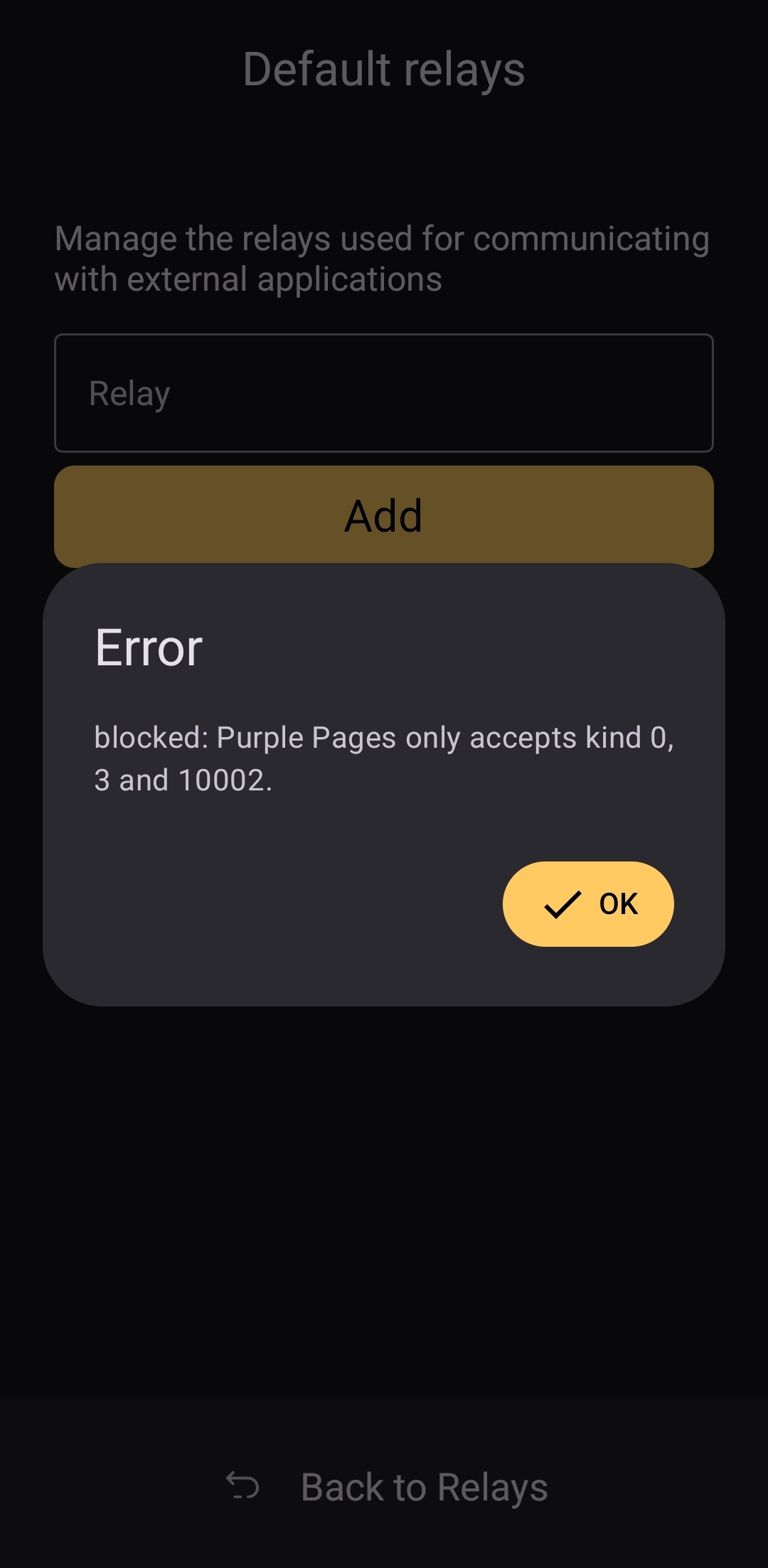

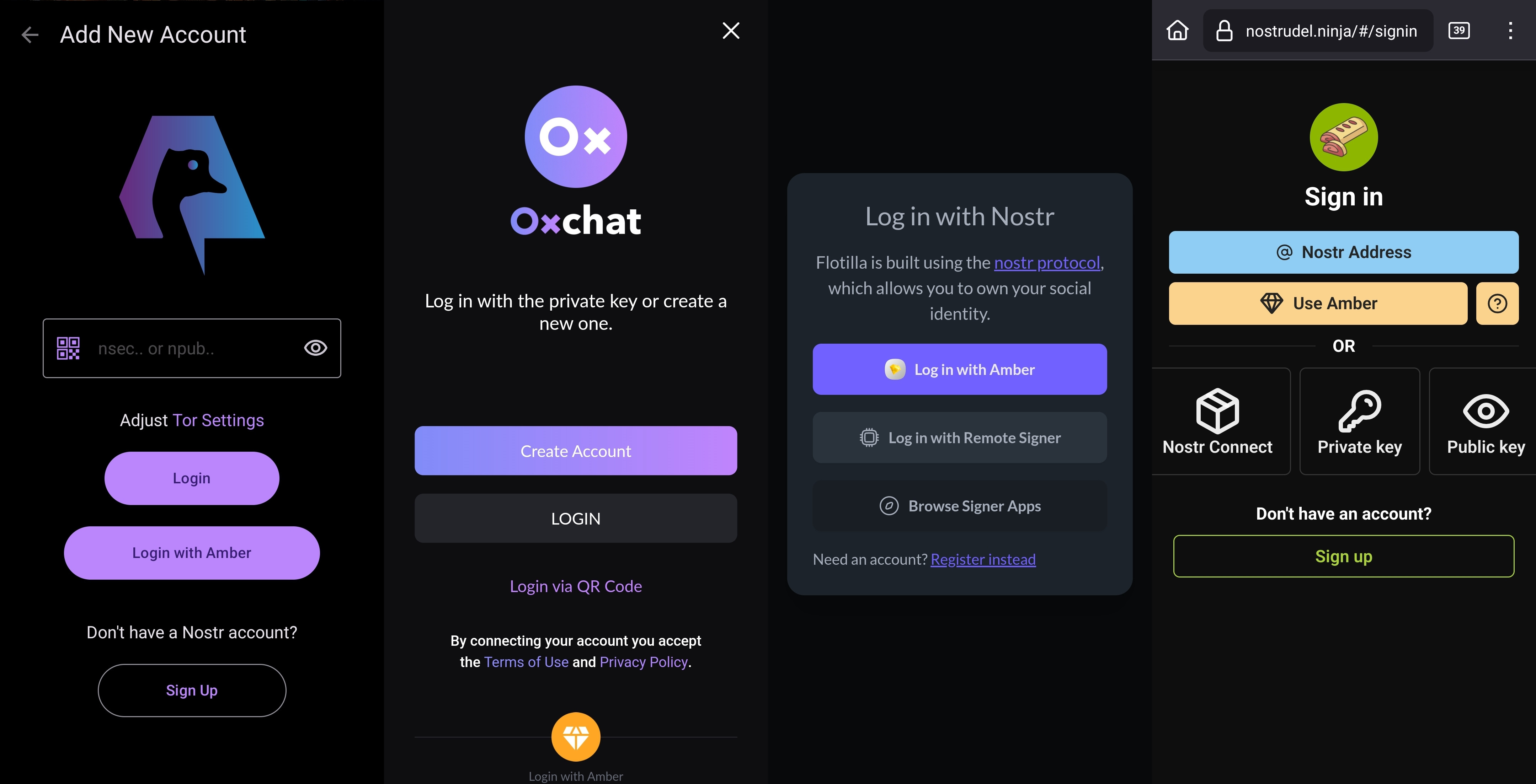

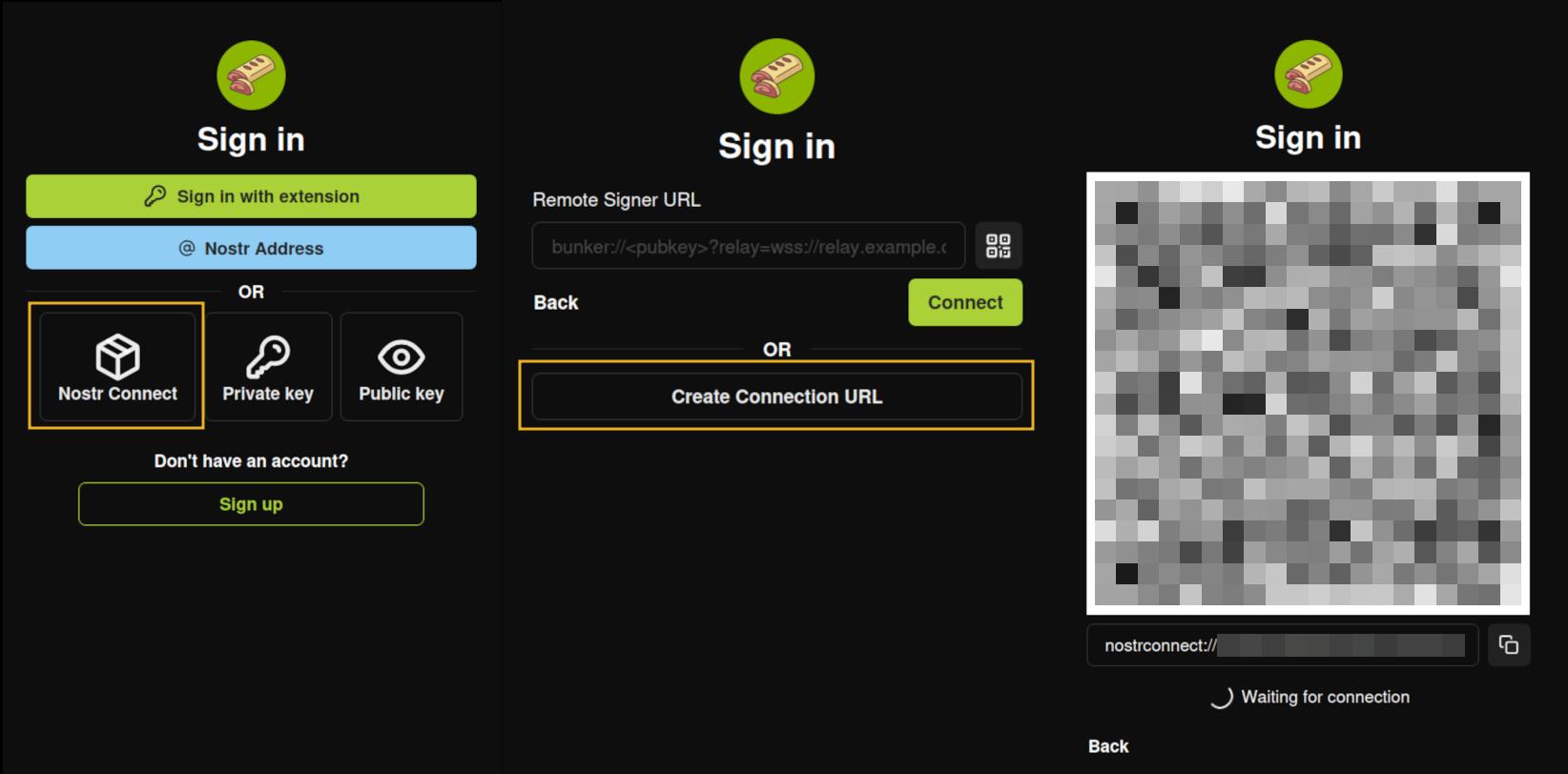

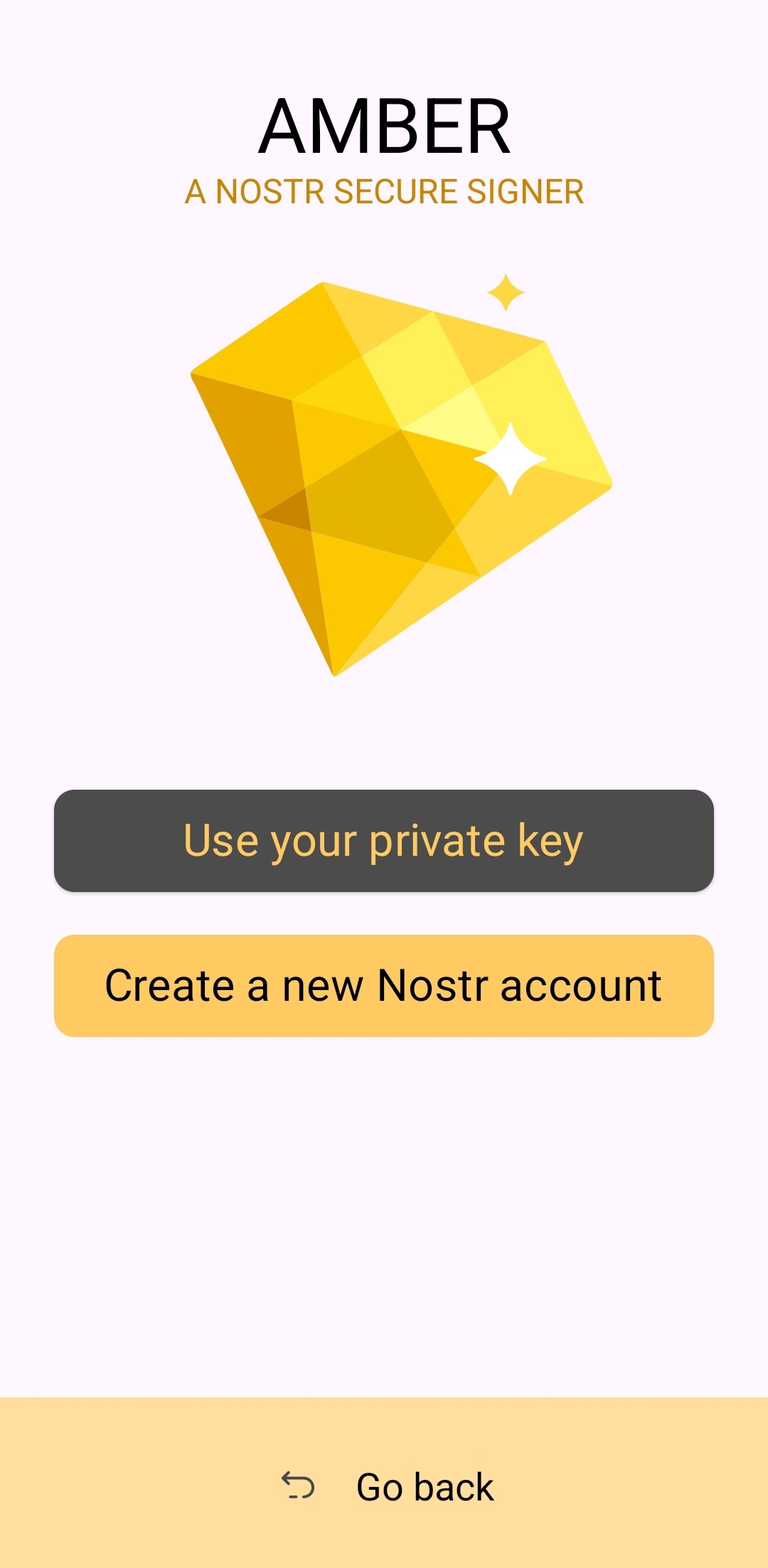

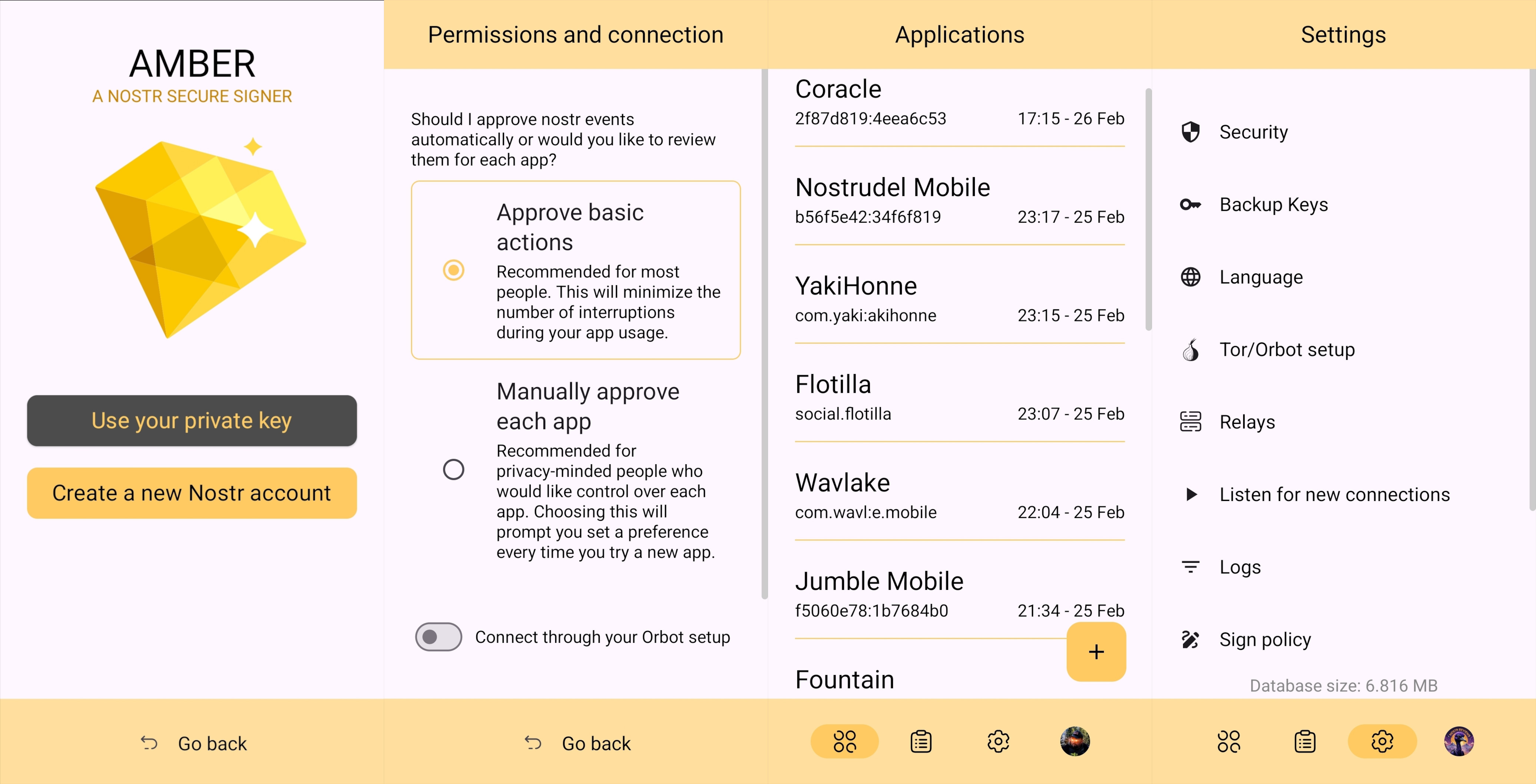

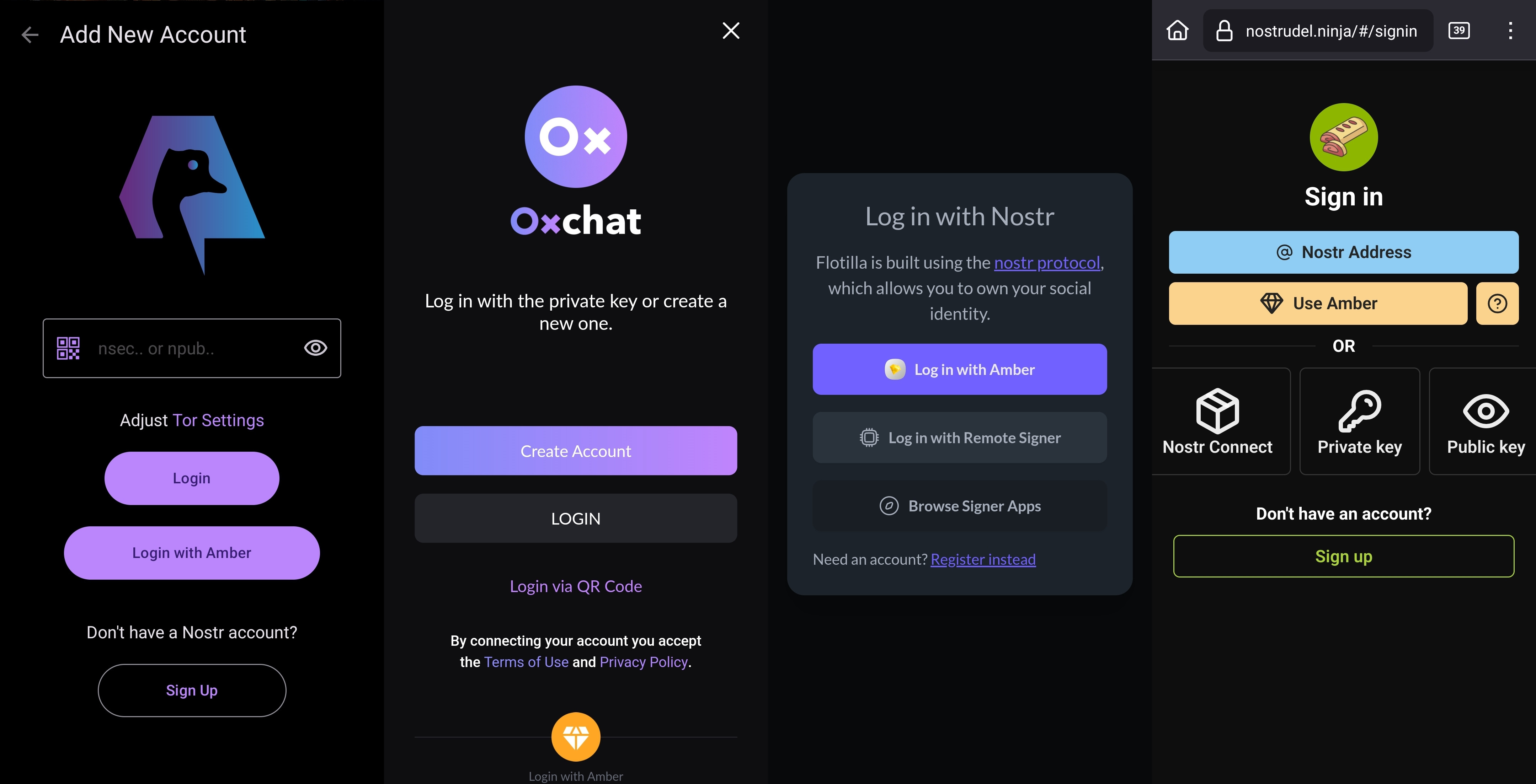

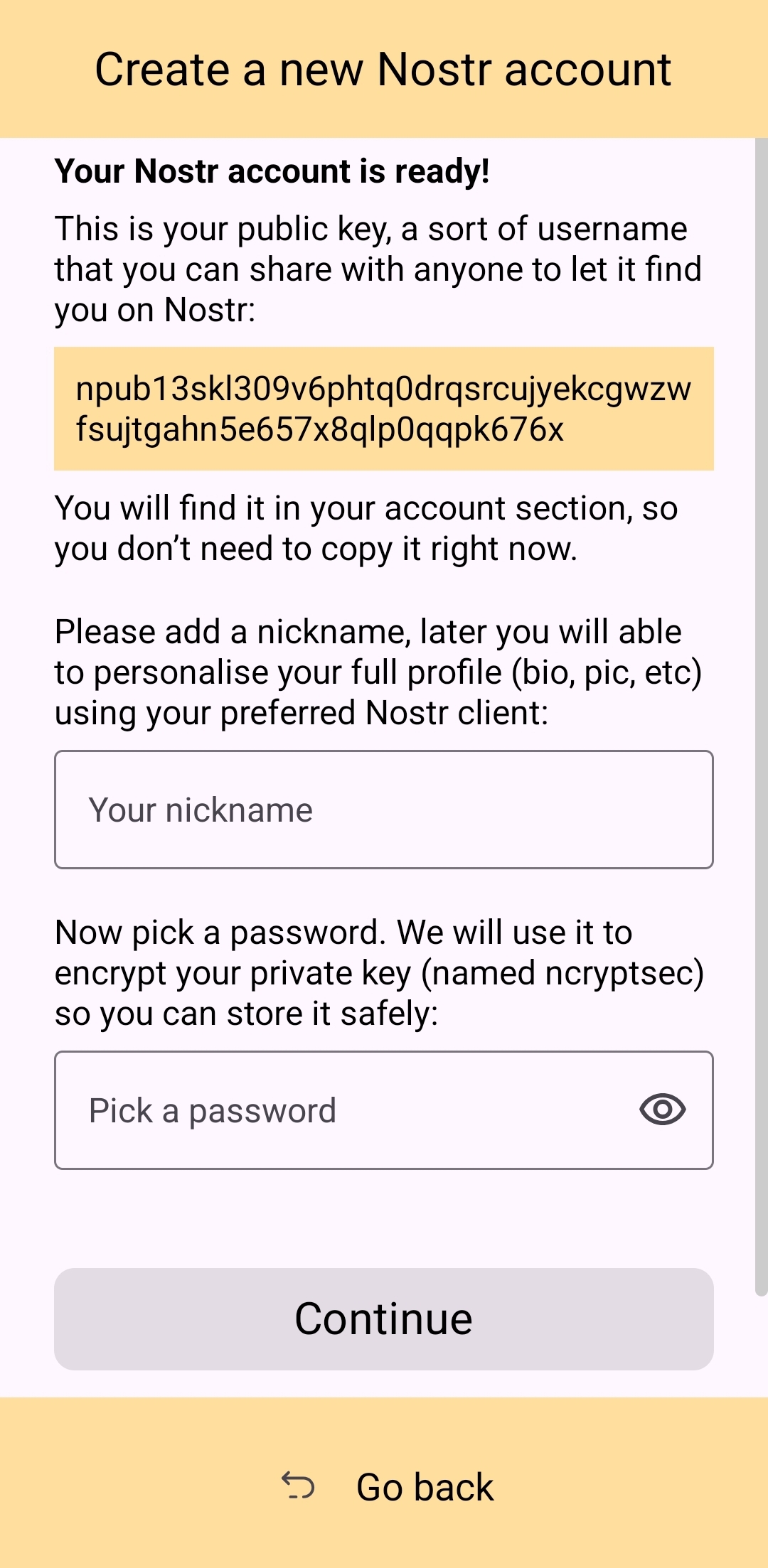

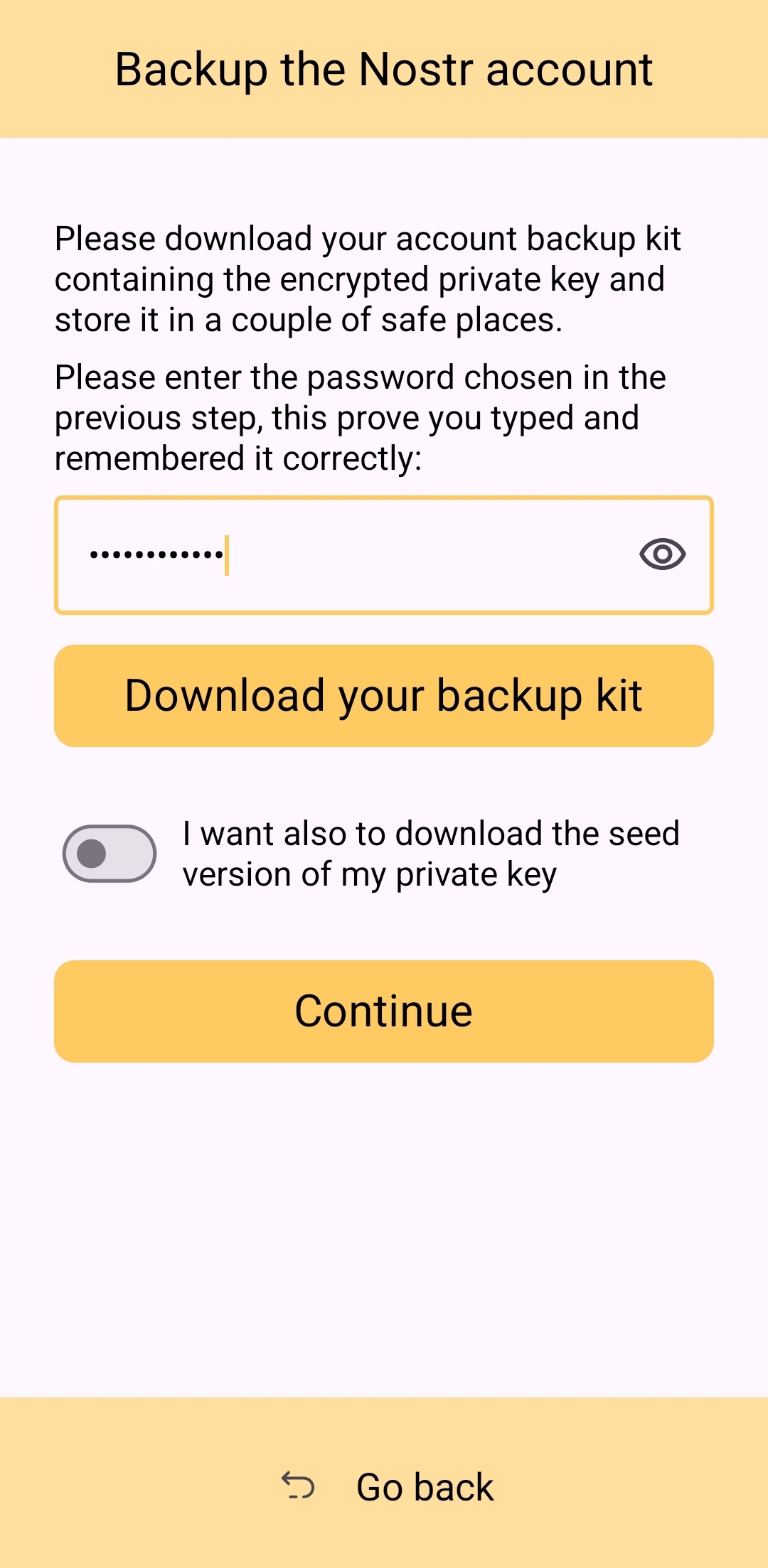

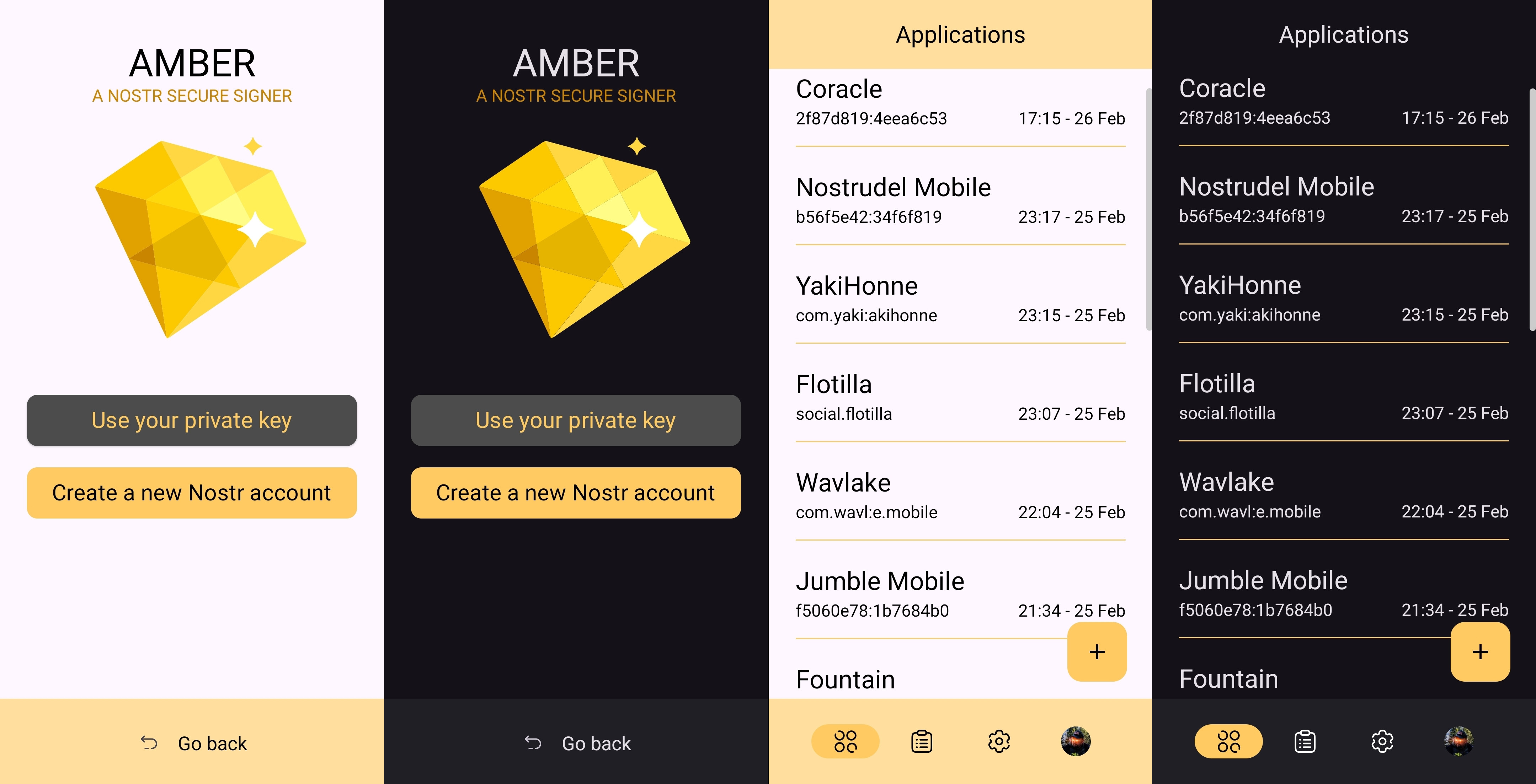

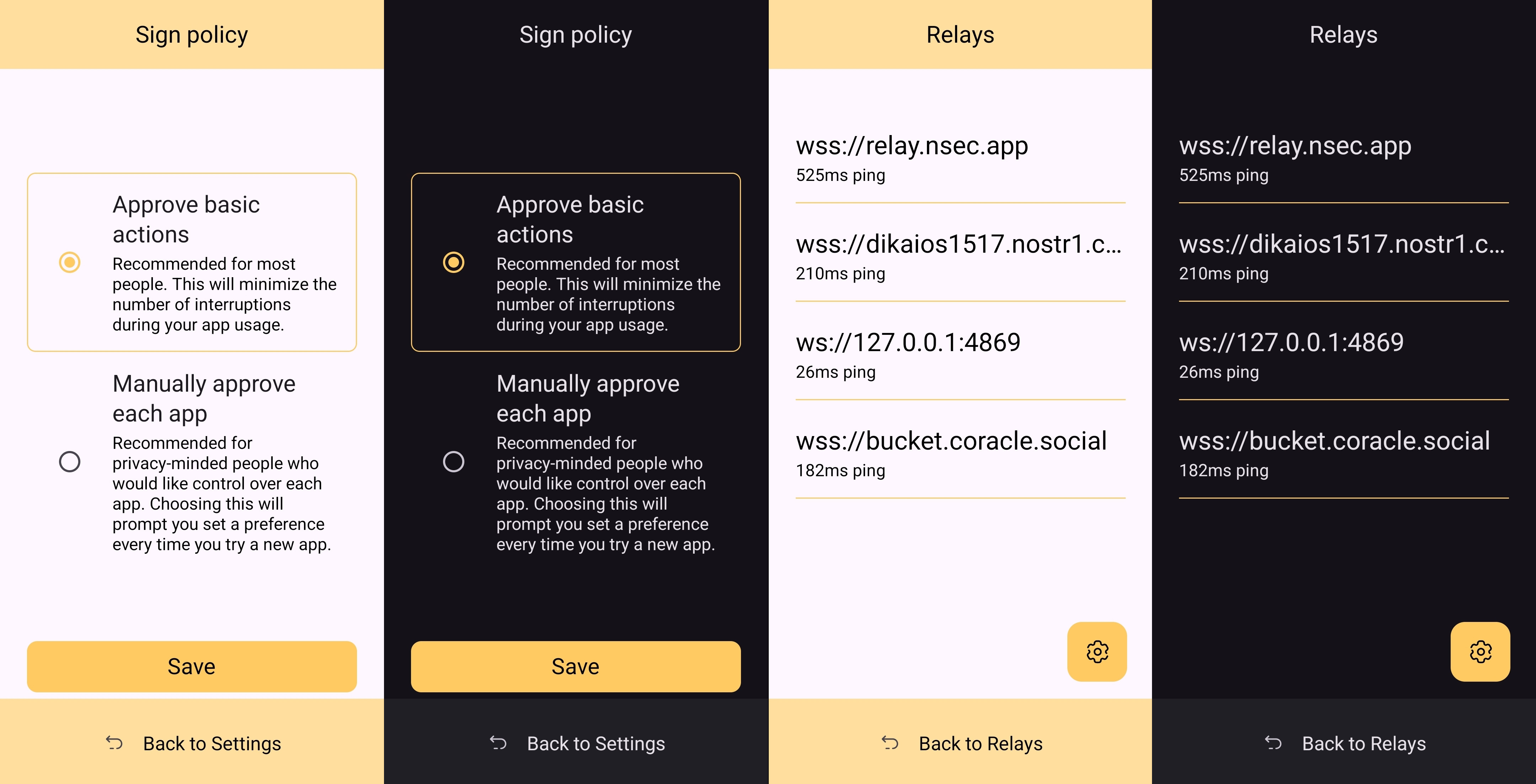

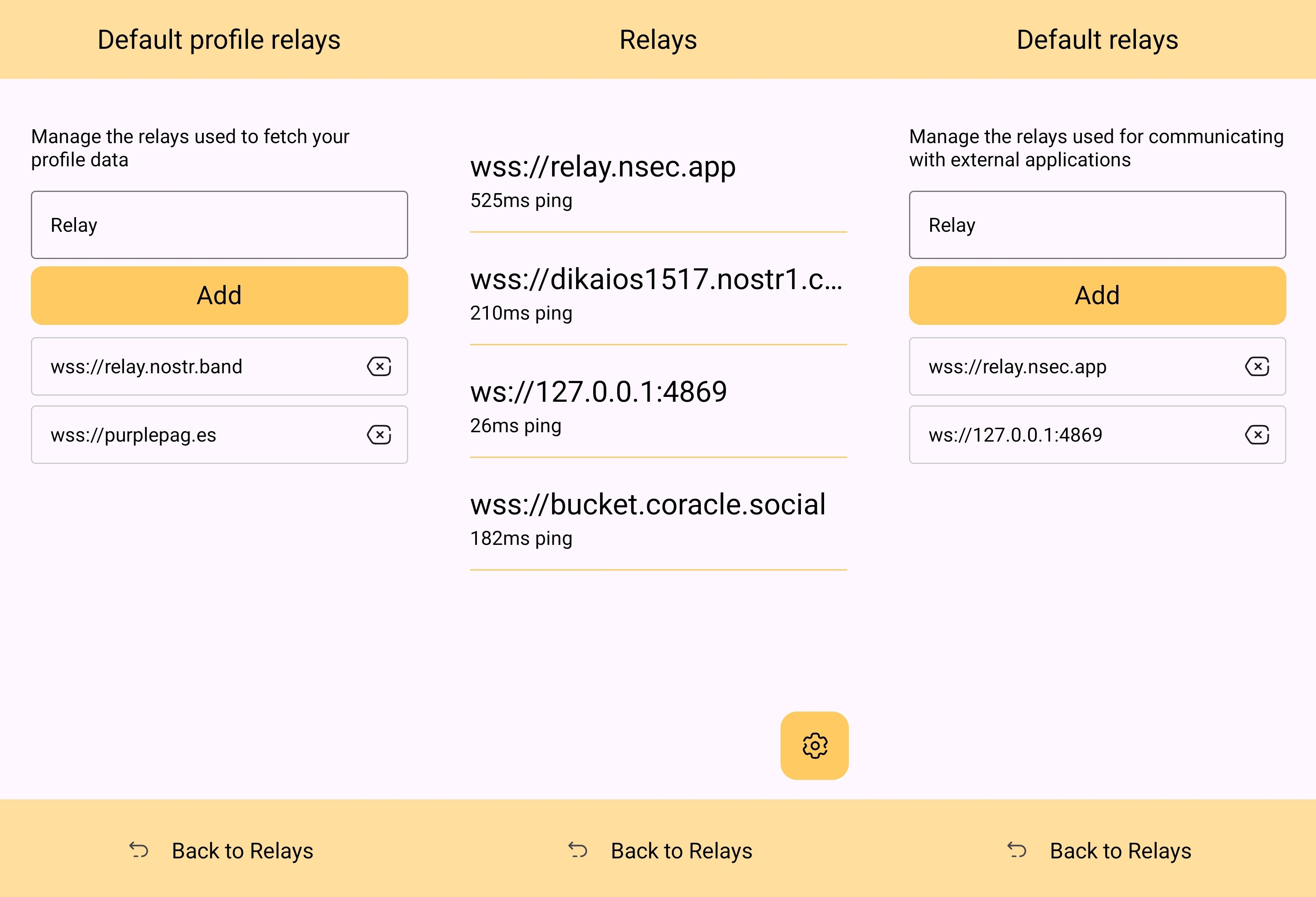

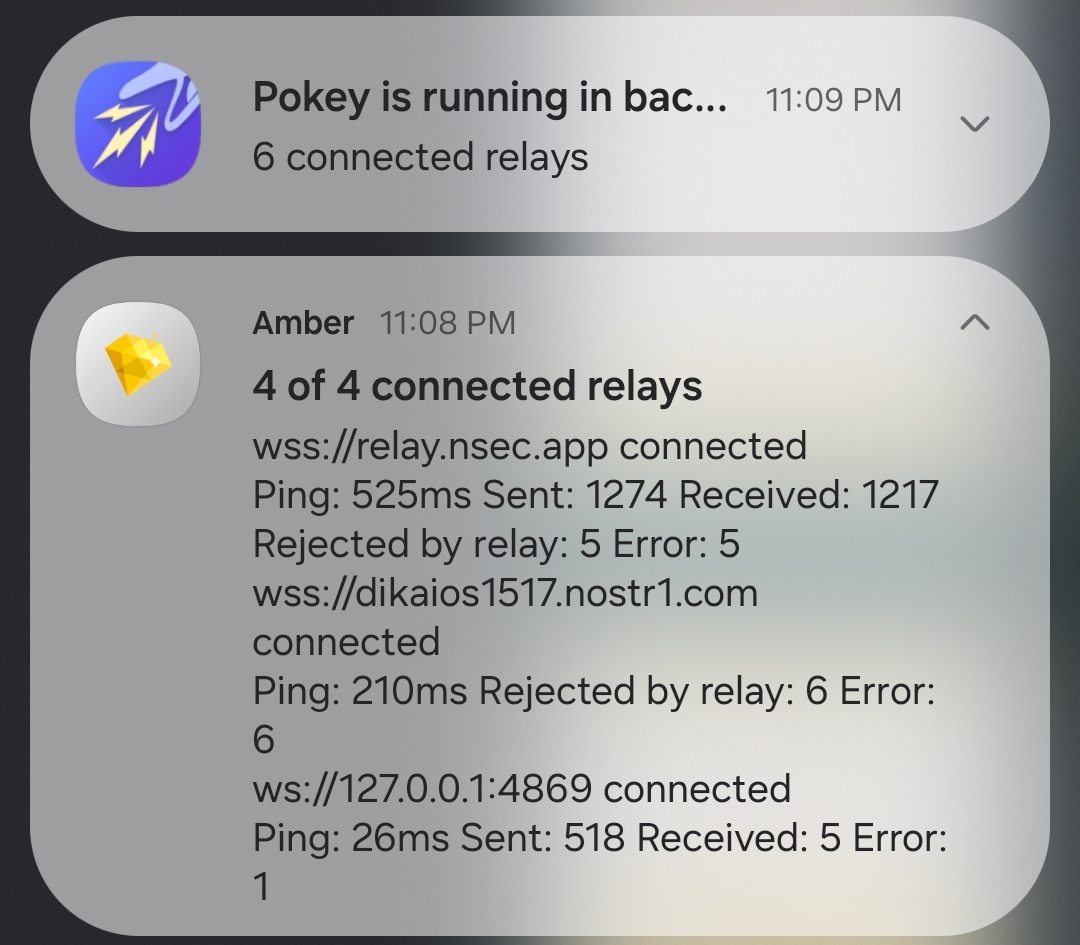

After my first major review of [Primal on Android](https://www.nostr-reviews.com/post/1733635103705/), we're going to go a very different direction for this next review. Primal is your standard "Twitter clone" type of kind 1 note client, now branching into long-form. They also have a team of developers working on making it one of the best clients to fill that use-case. By contrast, this review will not be focusing on any client at all. Not even an "other stuff" client.

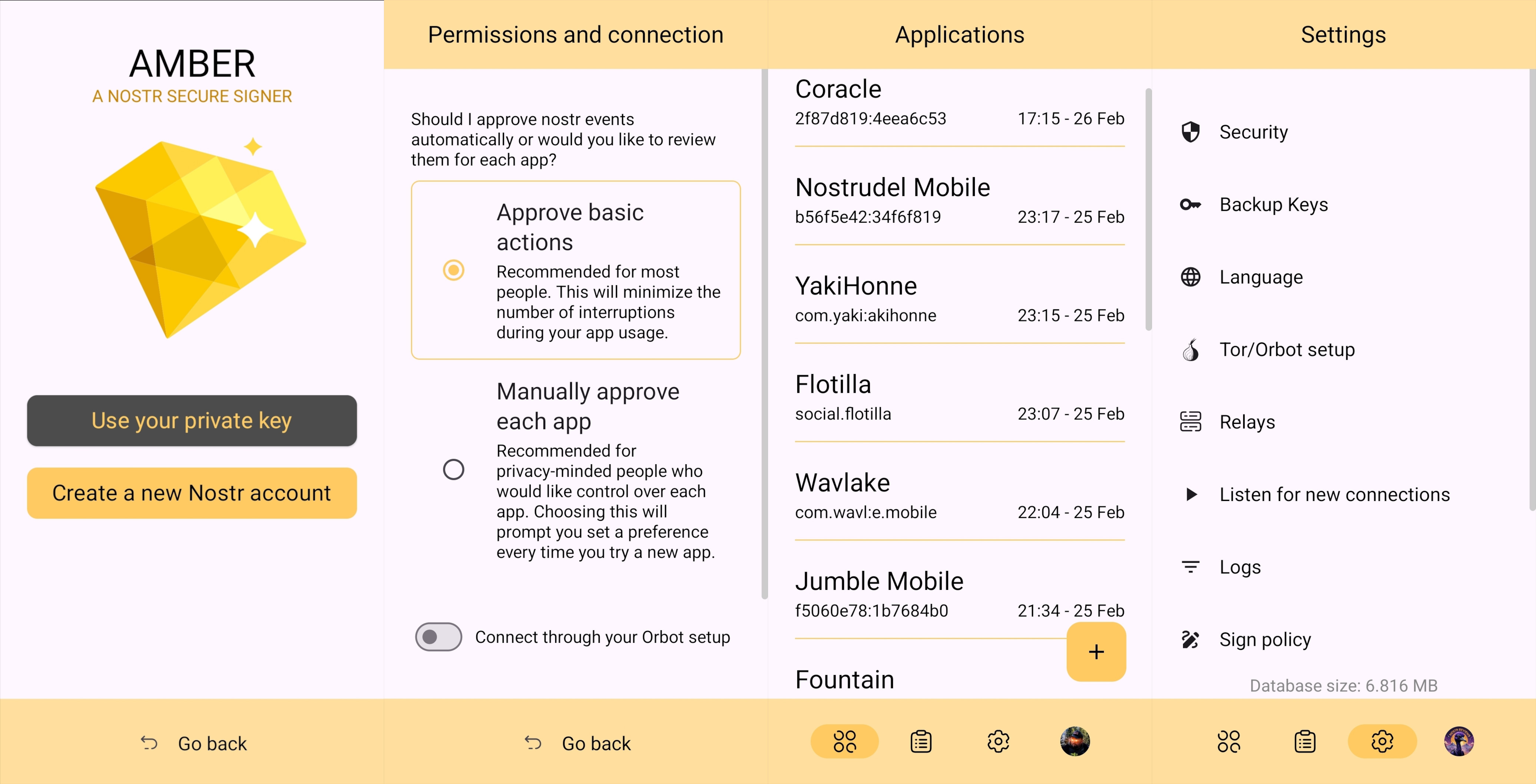

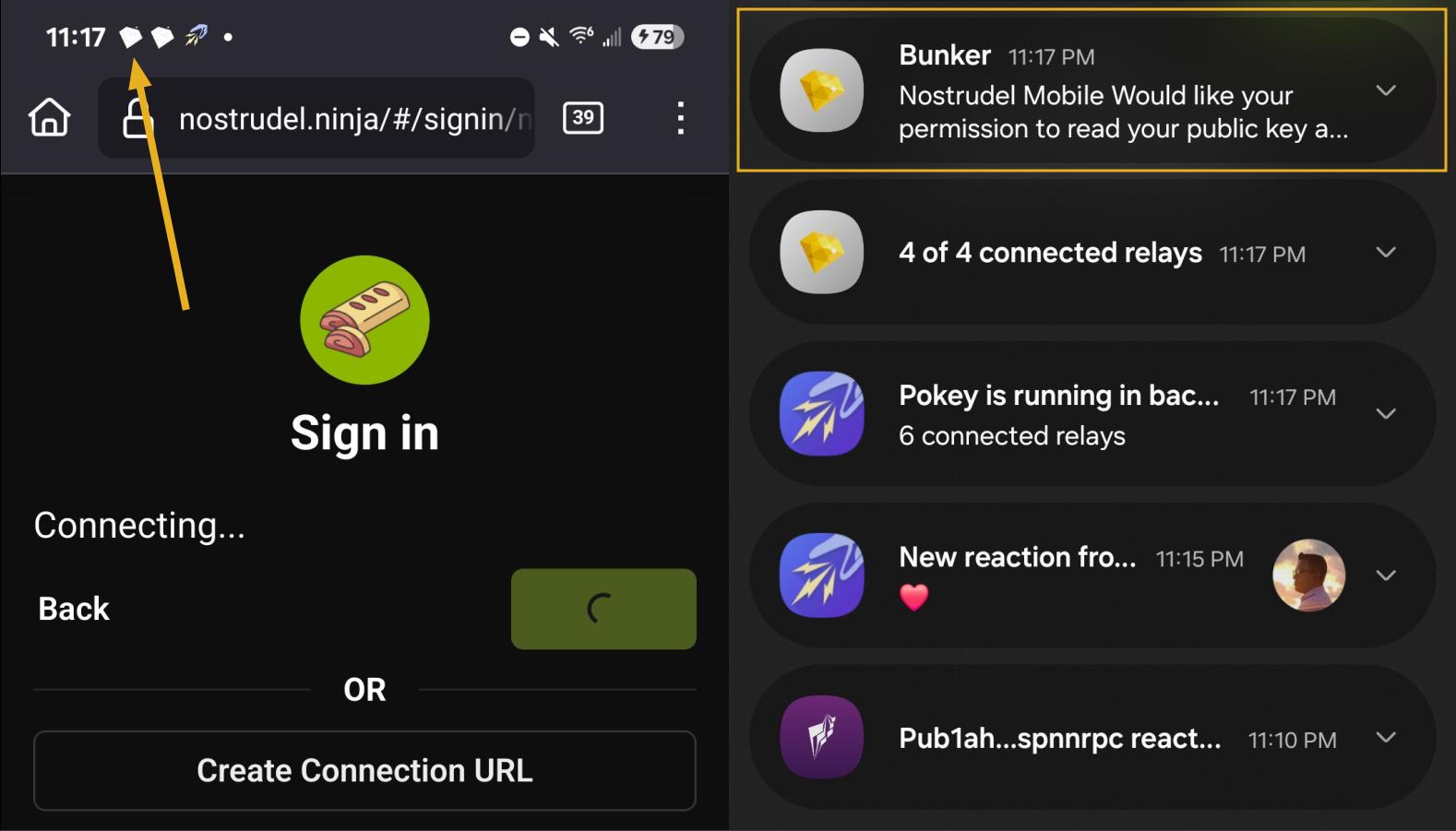

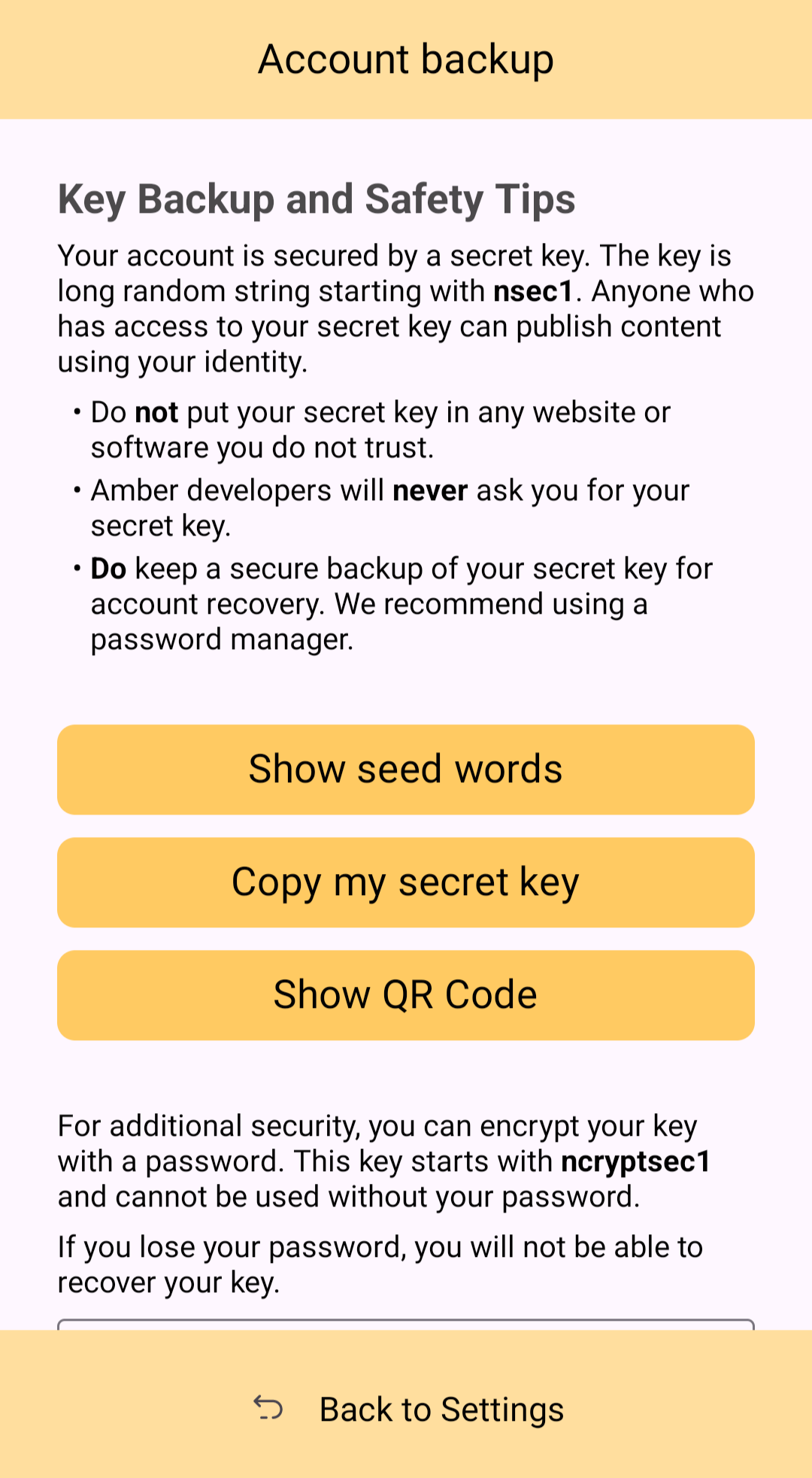

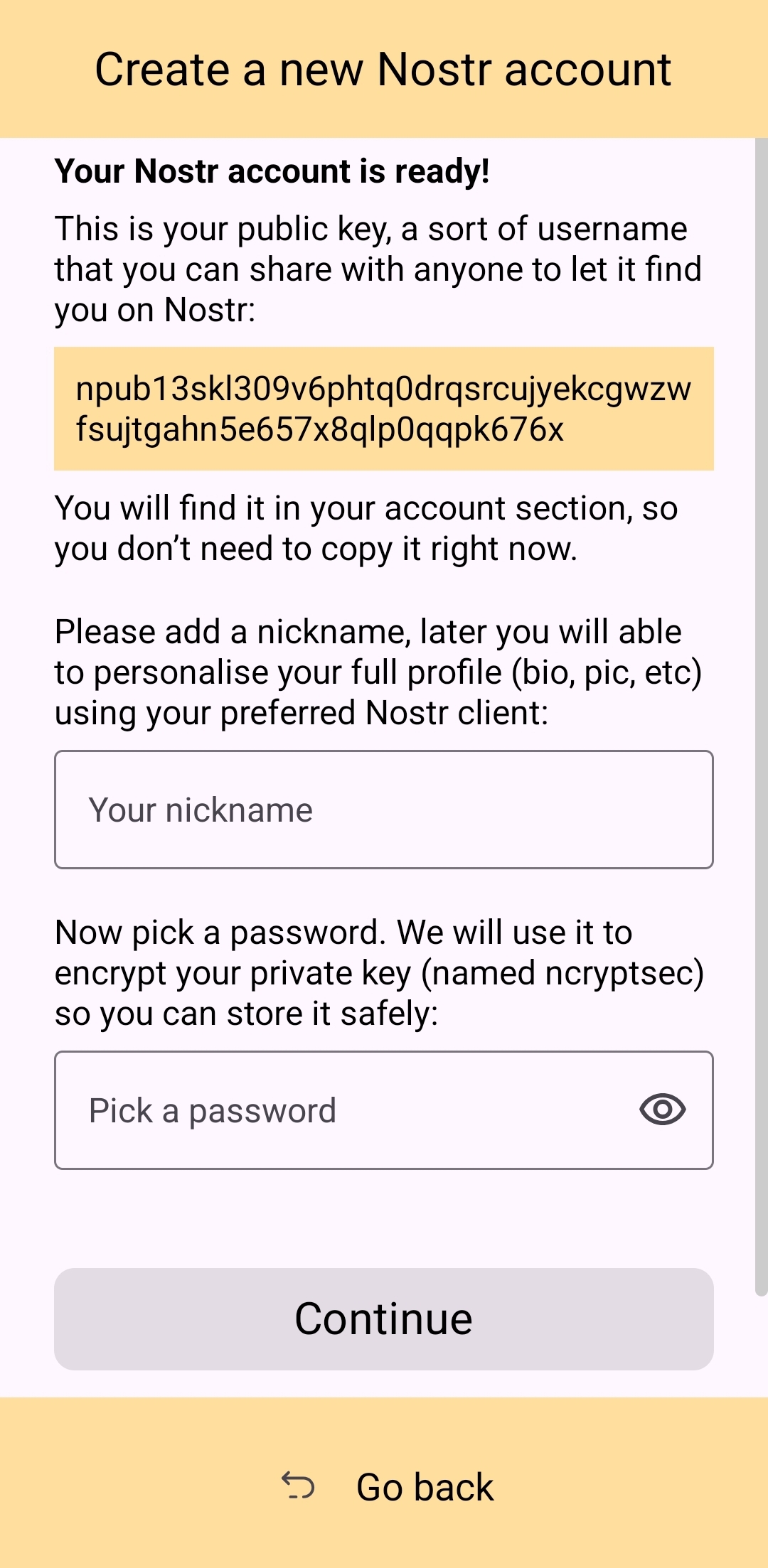

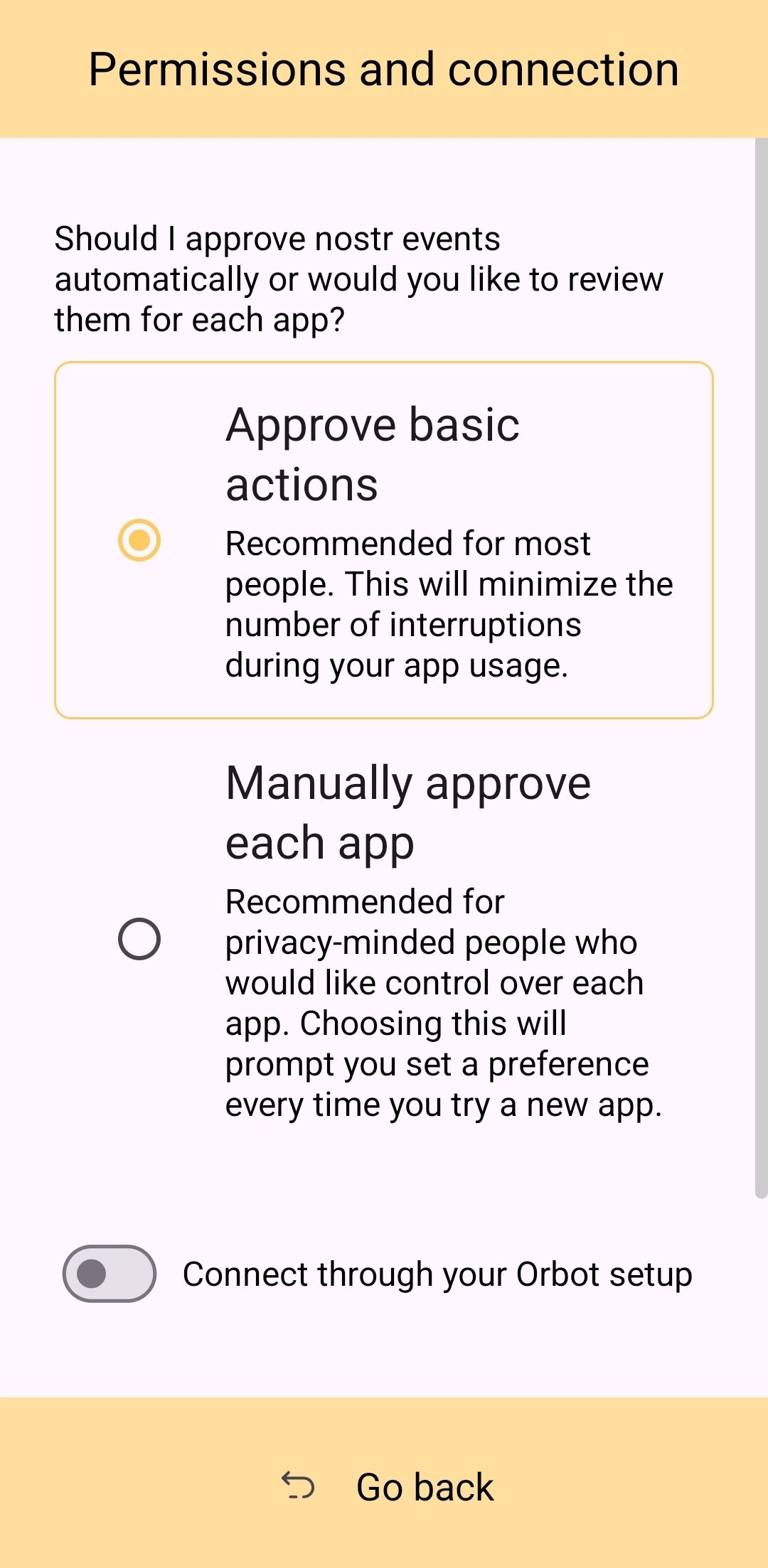

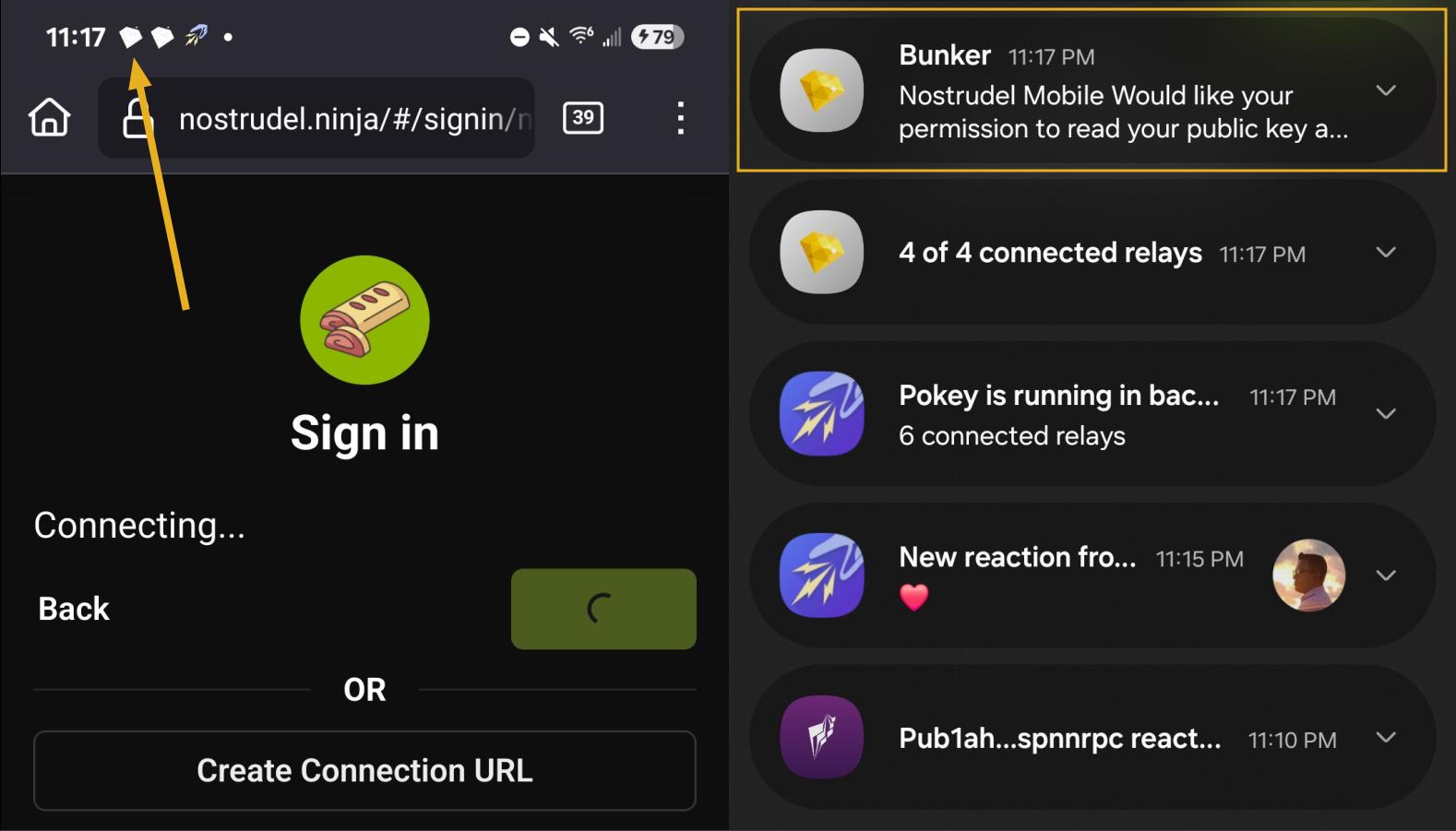

Instead, we will be reviewing a very useful tool created and maintained by nostr:npub1w4uswmv6lu9yel005l3qgheysmr7tk9uvwluddznju3nuxalevvs2d0jr5 called #Amber. For those unfamiliar with Amber, it is an #Android application dedicated to managing your signing keys, and allowing you to log into various #Nostr applications without having to paste in your private key, better known as your #nsec. It is not recommended to paste your nsec into various applications because they each represent another means by which it could be compromised, and anyone who has your nsec can post as you. On Nostr, your #npub is your identity, and your signature using your private key is considered absolute proof that any given note, reaction, follow update, or profile change was authorized by the rightful owner of that identity.

It happens less often these days, but early on, when the only way to try out a new client was by inputting your nsec, users had their nsec compromised from time to time, or they would suspect that their key may have been compromised. When this occurs, there is no way to recover your account, or set a new private key, deprecating the previous one. The only thing you can do is start over from scratch, letting everyone know that your key has been compromised and to follow you on your new npub.

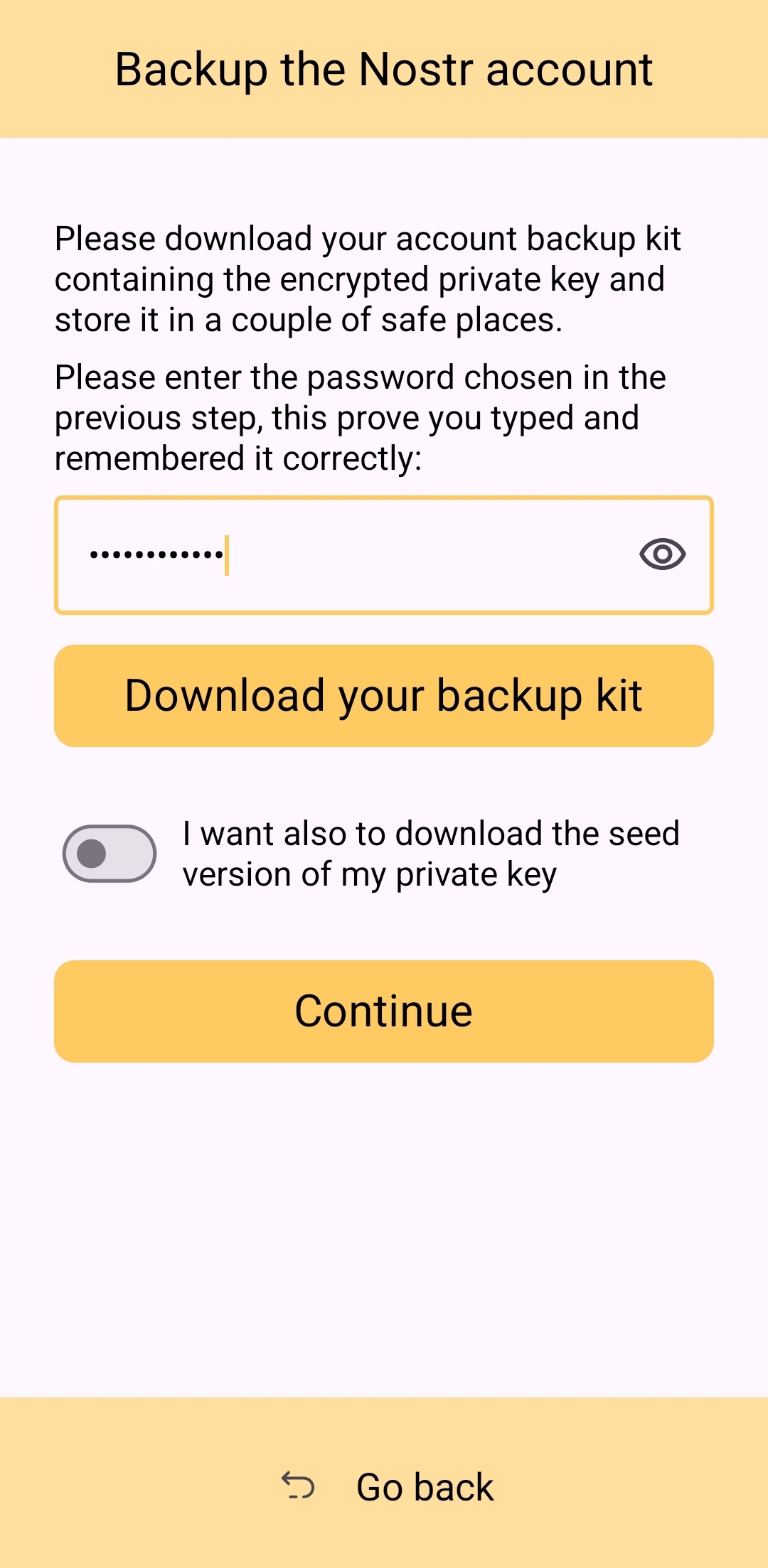

If you use Amber to log into other Nostr apps, you significantly reduce the likelihood that your private key will be compromised, because only one application has access to it, and all other applications reach out to Amber to sign any events. This isn't quite as secure as storing your private key on a separate device that isn't connected to the internet whatsoever, like many of us have grown accustomed to with securing our #Bitcoin, but then again, an online persona isn't nearly as important to secure for most of us as our entire life savings.

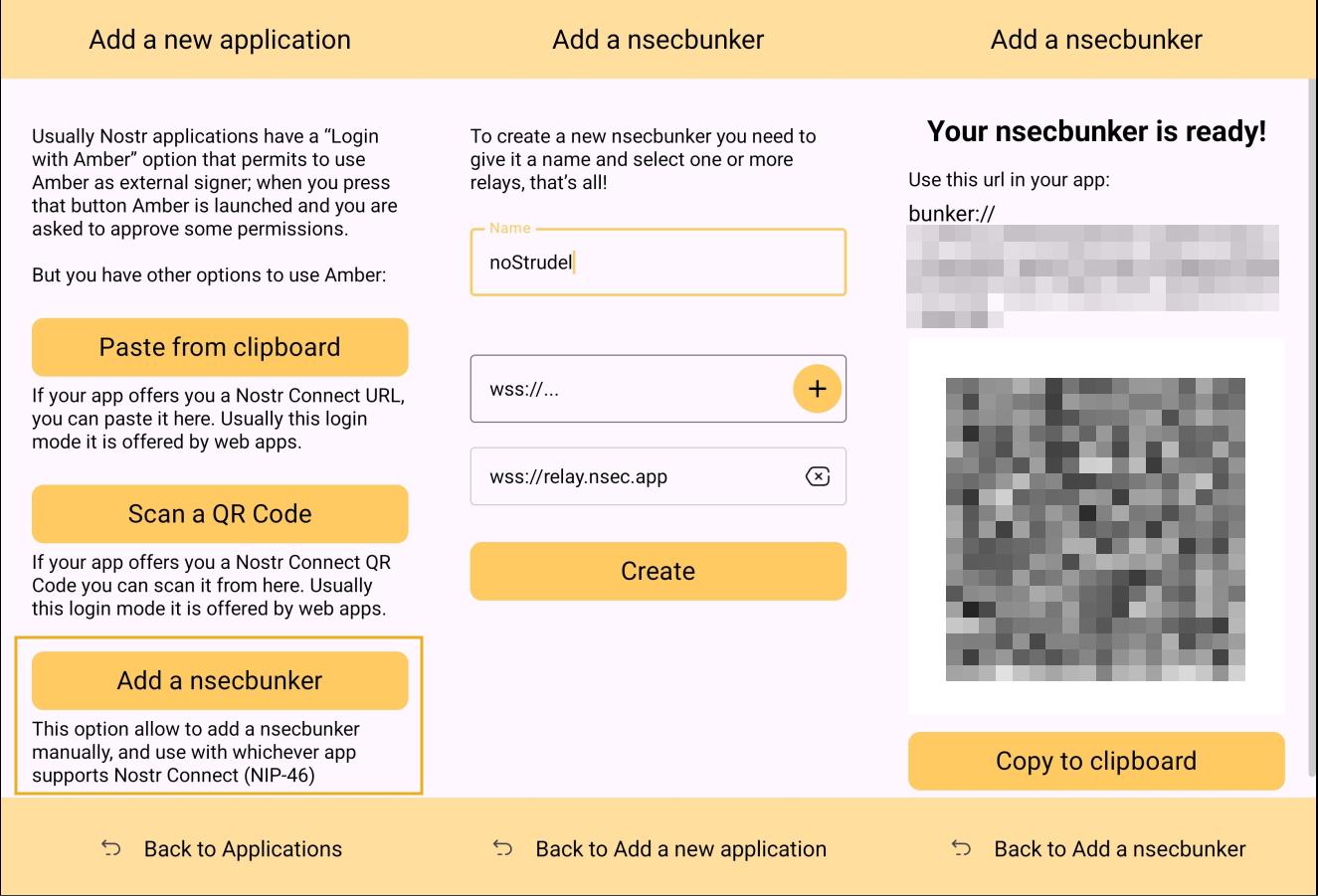

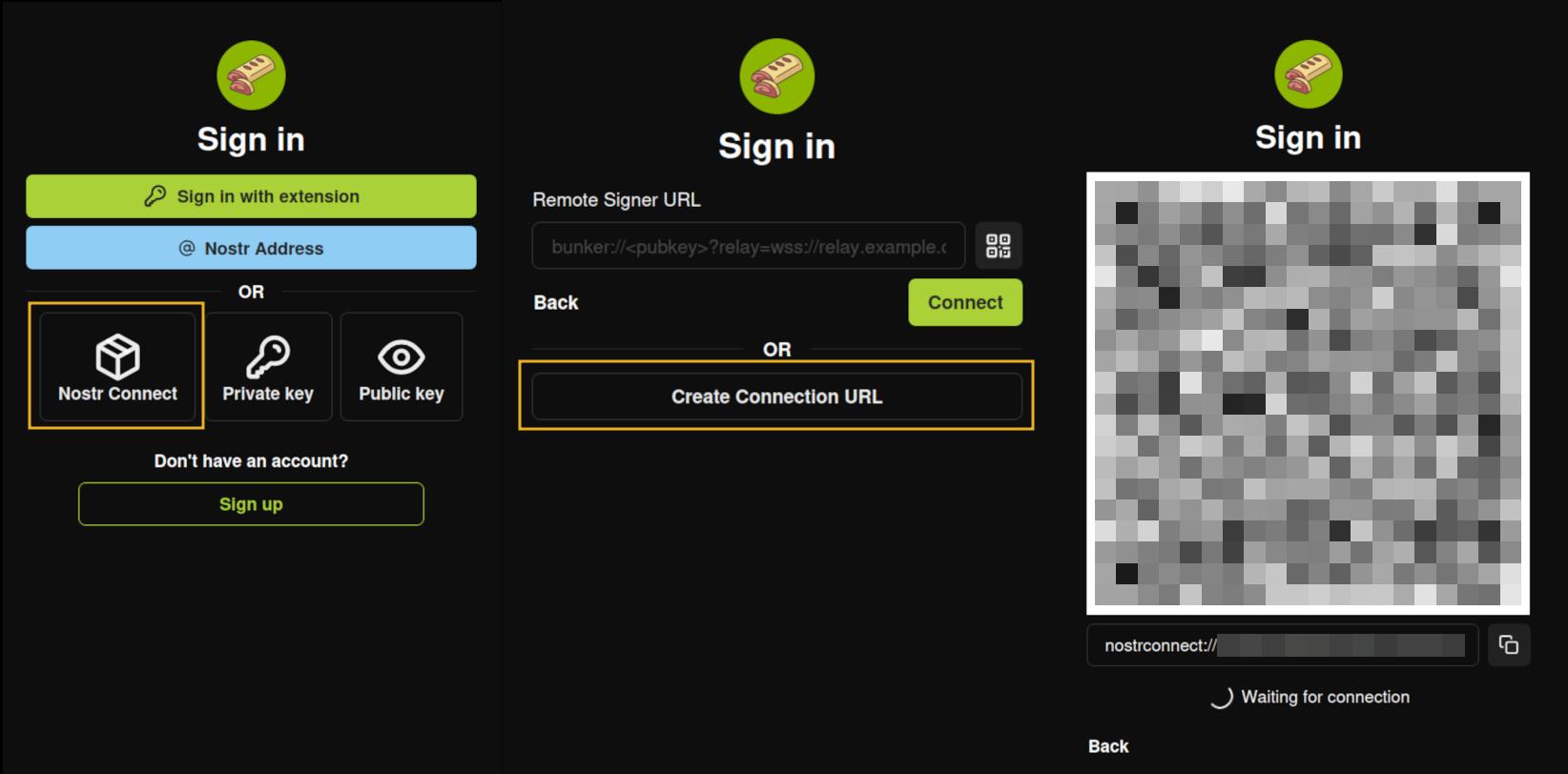

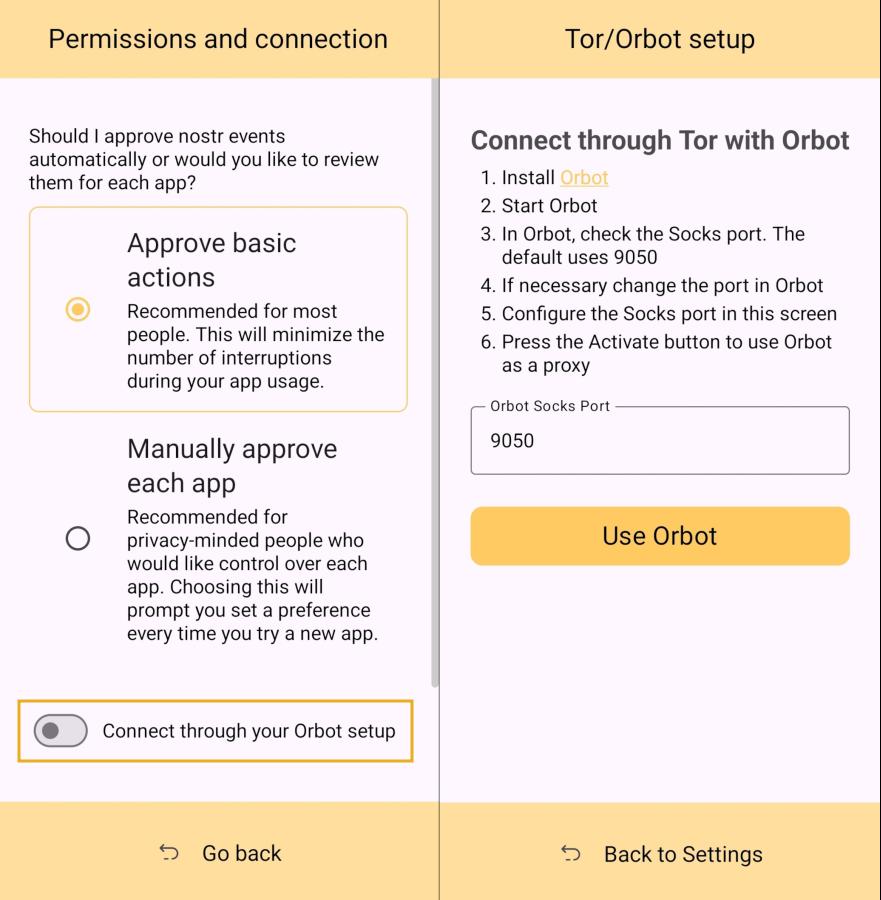

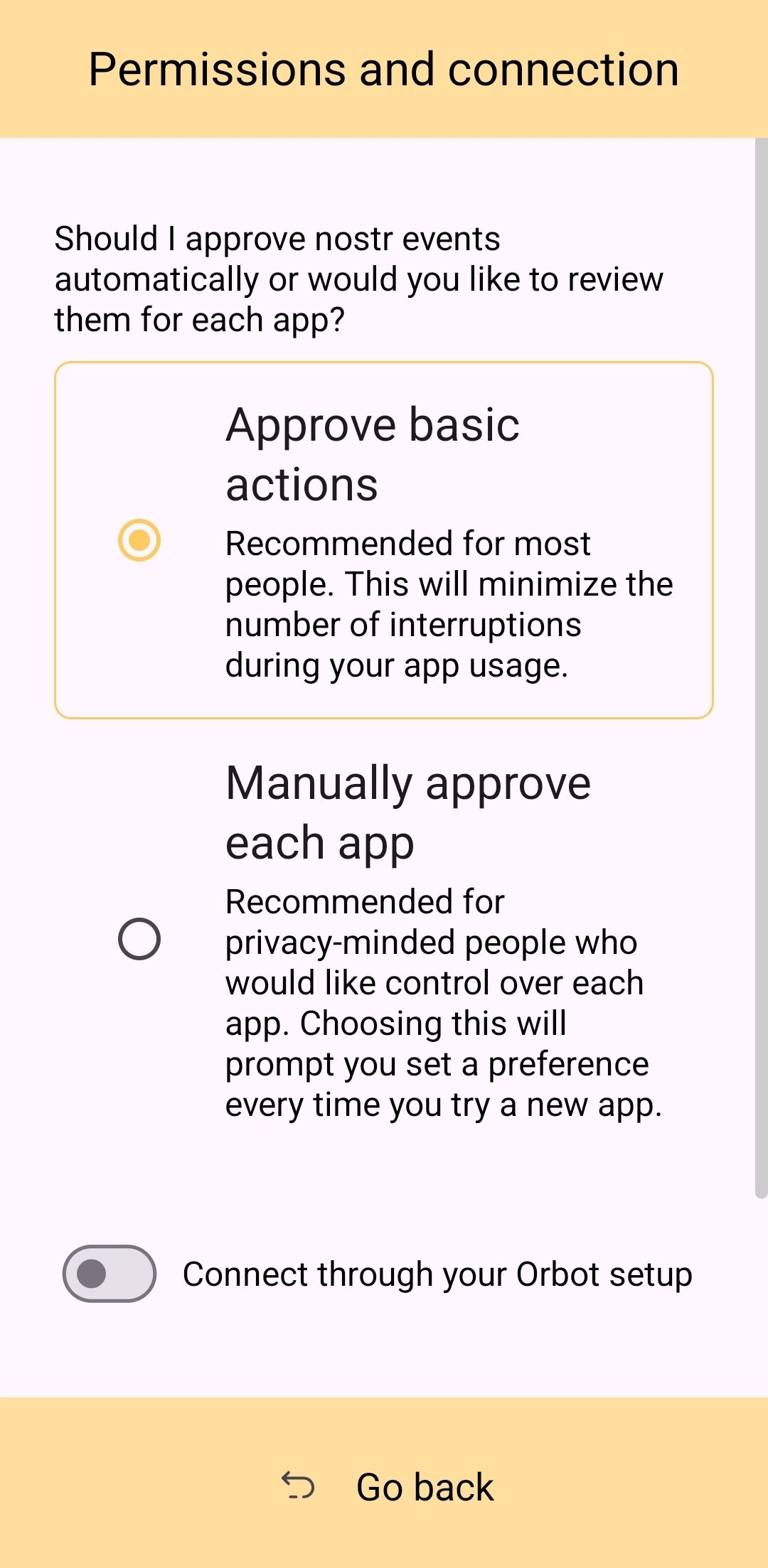

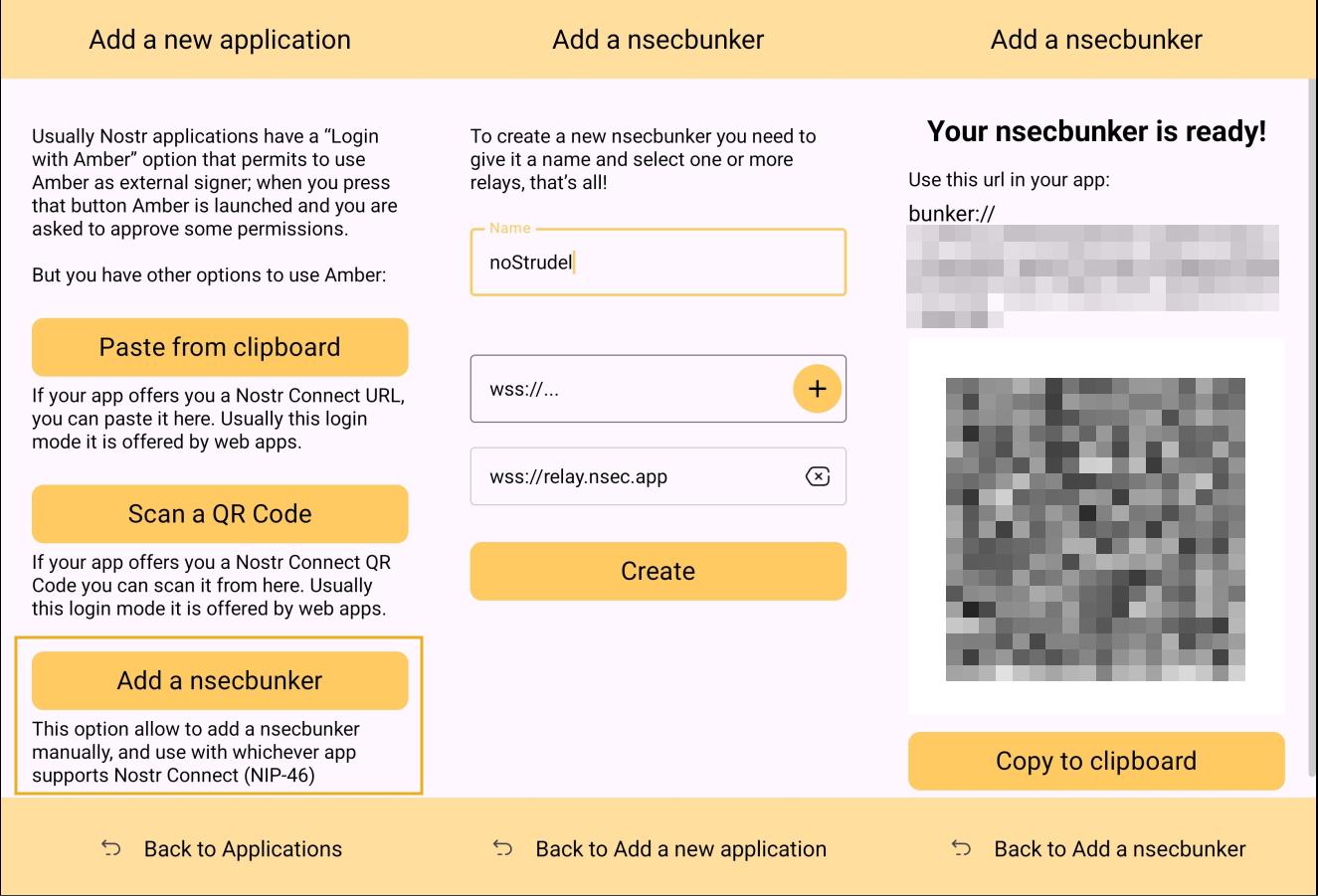

Amber is the first application of its kind for managing your Nostr keys on a mobile device. nostr:npub1w4uswmv6lu9yel005l3qgheysmr7tk9uvwluddznju3nuxalevvs2d0jr5 didn't merely develop the application, but literally created the specification for accomplishing external signing on Android which can be found in [NIP-55](https://github.com/nostr-protocol/nips/blob/master/55.md). Unfortunately, Amber is only available for Android. A signer application for iOS is in the works from nostr:npub1yaul8k059377u9lsu67de7y637w4jtgeuwcmh5n7788l6xnlnrgs3tvjmf, but is not ready for use at this time. There is also a new mobile signer app for Android and iOS called Nowser, but I have not yet had a chance to try this app out. From a cursory look at the Android version, it is indeed in the very early stages of development and cannot be compared with Amber.

This review of Amber is current as of version 3.2.5.

## Overall Impression

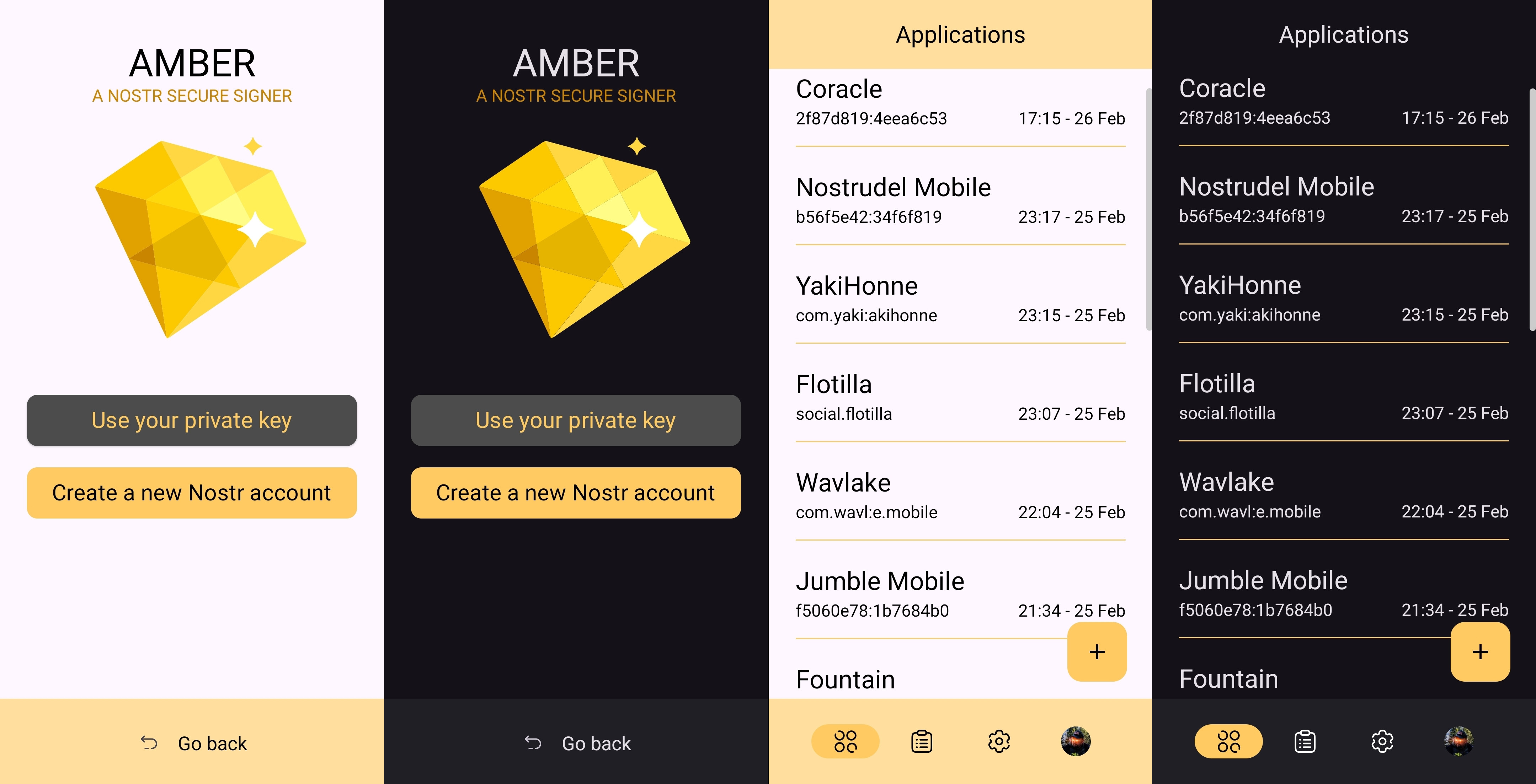

Score: **4.5** / 5

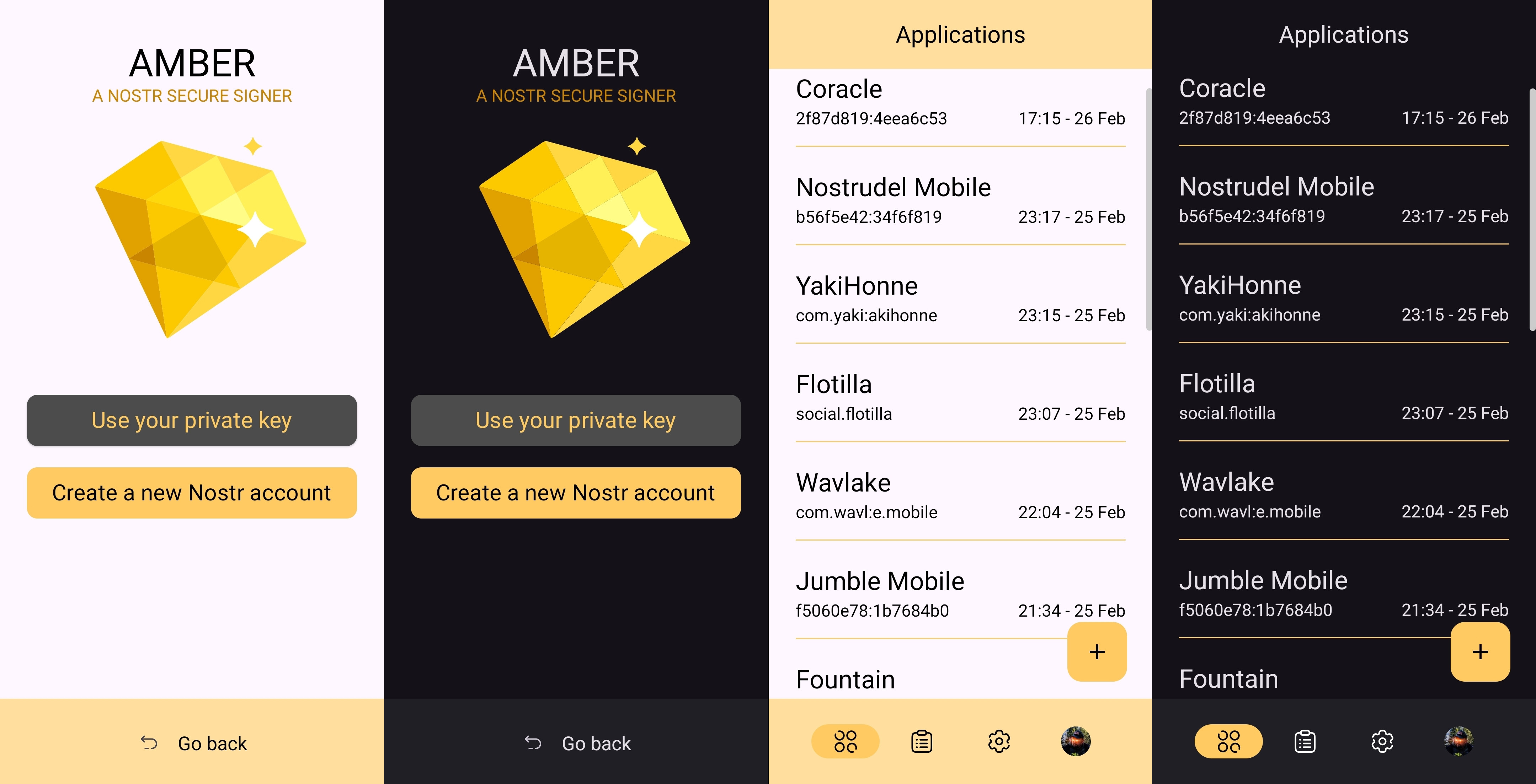

I cannot speak highly enough about Amber as a tool that every Nostr user on Android should start using if they are not already. When the day comes that we have more options for well-developed signer apps on mobile, my opinion may very well change, but until then Amber is what we have available to us. Even so, it is an incredibly well thought-out and reliable tool for securing your nsec.

Despite being the only well-established Android signer available for Android, Amber ***can*** be compared with other external signing methods available on other platforms. Even with more competition in this arena, though, Amber still holds up incredibly well. If you are signing into web applications on a desktop, I still would recommend using a browser extension like #Alby or #Nos2x, as the experience is usually faster, more seamless, and far more web apps support this signing method ([NIP-07](https://github.com/nostr-protocol/nips/blob/master/07.md)) than currently support the two methods employed by Amber. Nevertheless that gap is definitely narrowing.

A running list I created of applications that support login and signing with Amber can be found here: [Nostr Clients with External Signer Support](nostr:naddr1qvzqqqrcvgpzpde8f55w86vrhaeqmd955y4rraw8aunzxgxstsj7eyzgntyev2xtqydhwumn8ghj7un9d3shjtnzwf5kw6r5vfhkcapwdejhgtcpr4mhxue69uhkg6ttv95k7ue3x5cnwtnwdaehgu339e3k7mf0qq4xummnw3ez6cmvd9jkuarn94mkjarg94jhsar9wfhxzmpdwd5kwmn9wgkhxatswphhyaqrcy76t)

I have run into relatively few bugs in my extensive use of Amber for all of my mobile signing needs. Occasionally the application crashes when trying to send it a signing request from a couple of applications, but I would not be surprised if this is no fault of Amber at all, and rather the fault of those specific apps, since it works flawlessly with the vast majority of apps that support either [NIP-55](https://github.com/nostr-protocol/nips/blob/master/55.md) or [NIP-46](https://github.com/nostr-protocol/nips/blob/master/46.md) login.

I also believe that mobile is the ideal platform to use for this type of application. First, because most people use Nostr clients on their phone more than on a desktop. There are, of course, exceptions to that, but in general we spend more time on our phones when interacting online. New users are also more likely to be introduced to Nostr by a friend having them download a Nostr client on their phone than on a PC, and that can be a prime opportunity to introduce the new user to protecting their private key. Finally, I agree with the following assessment from nostr:npub1jlrs53pkdfjnts29kveljul2sm0actt6n8dxrrzqcersttvcuv3qdjynqn.

nostr:nevent1qqsw0r6gzn05xg67h5q2xkplwsuzedjxw9lf7ntrxjl8ajm350fcyugpz4mhxue69uhhyetvv9ujuerpd46hxtnfduhsyg9hyaxj3clfswlhyrd5kjsj5v04clhjvgeq6pwztmysfzdvn93gevpsgqqqye9qd30q62

The one downside to Amber is that it will be quite foreign for new users. That is partially unavoidable with Nostr, since folks are not accustomed to public/private key cryptography in general, let alone using a private key to log into websites or social media apps. However, the initial signup process is a bit cumbersome if Amber is being used as the means of initially generating a key pair. I think some of this could be foregone at start-up in favor of streamlining onboarding, and then encourage the user to back-up their private key at a later time.

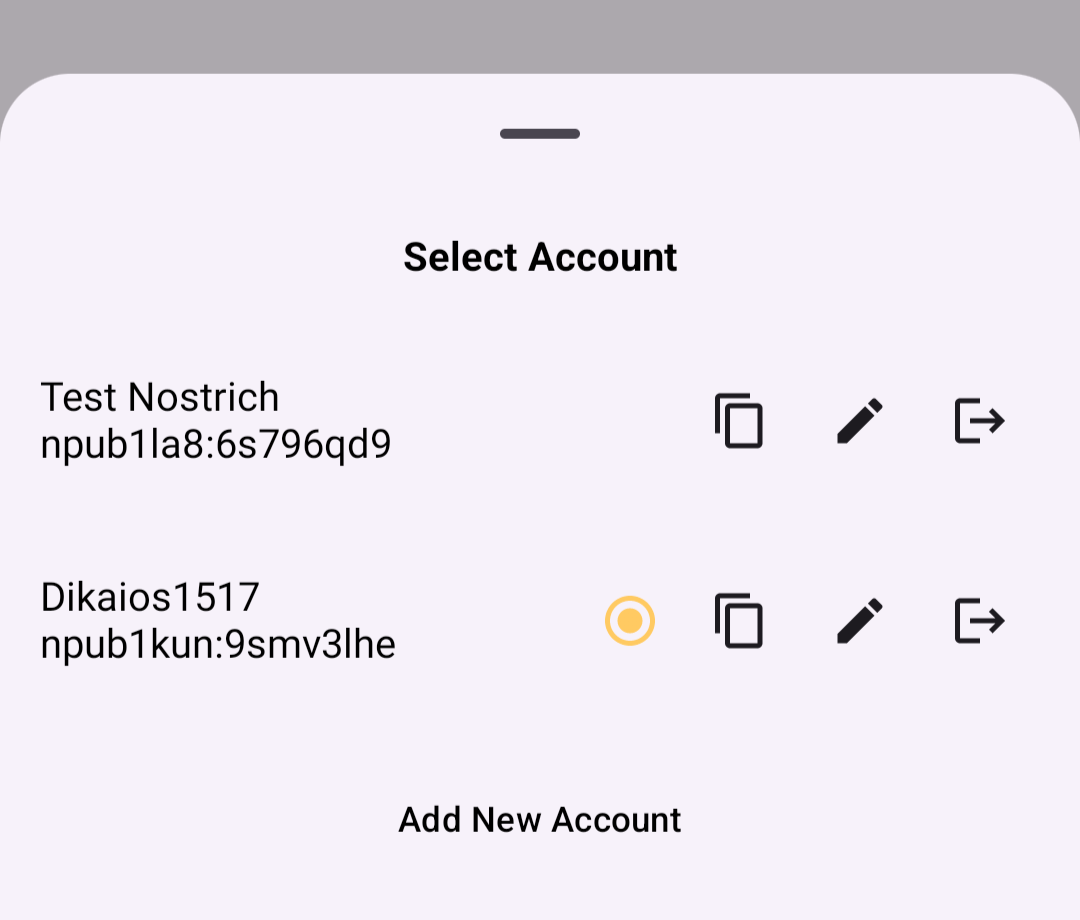

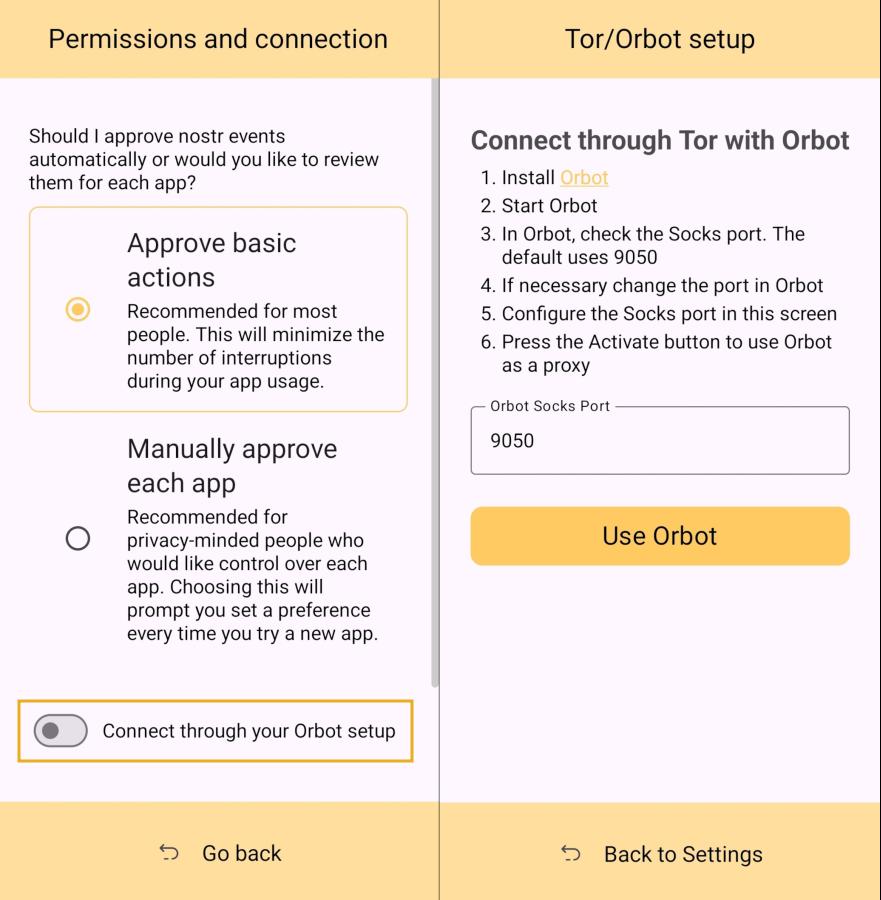

## Features

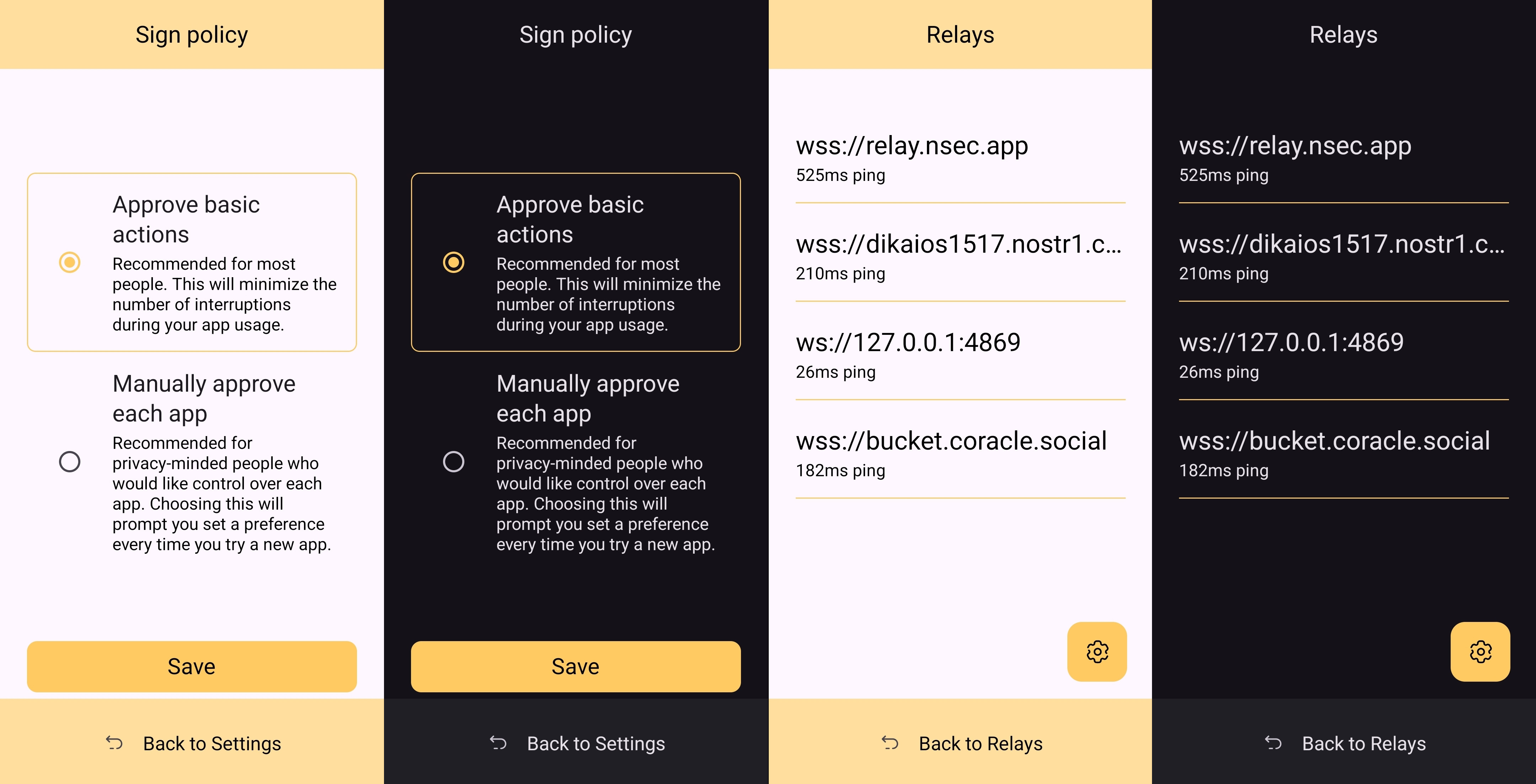

Amber has some features that may surprise you, outside of just storing your private key and signing requests from your favorite Nostr clients. It is a full key management application, supporting multiple accounts, various backup methods, and even the ability to authorize other users to access a Nostr profile you control.

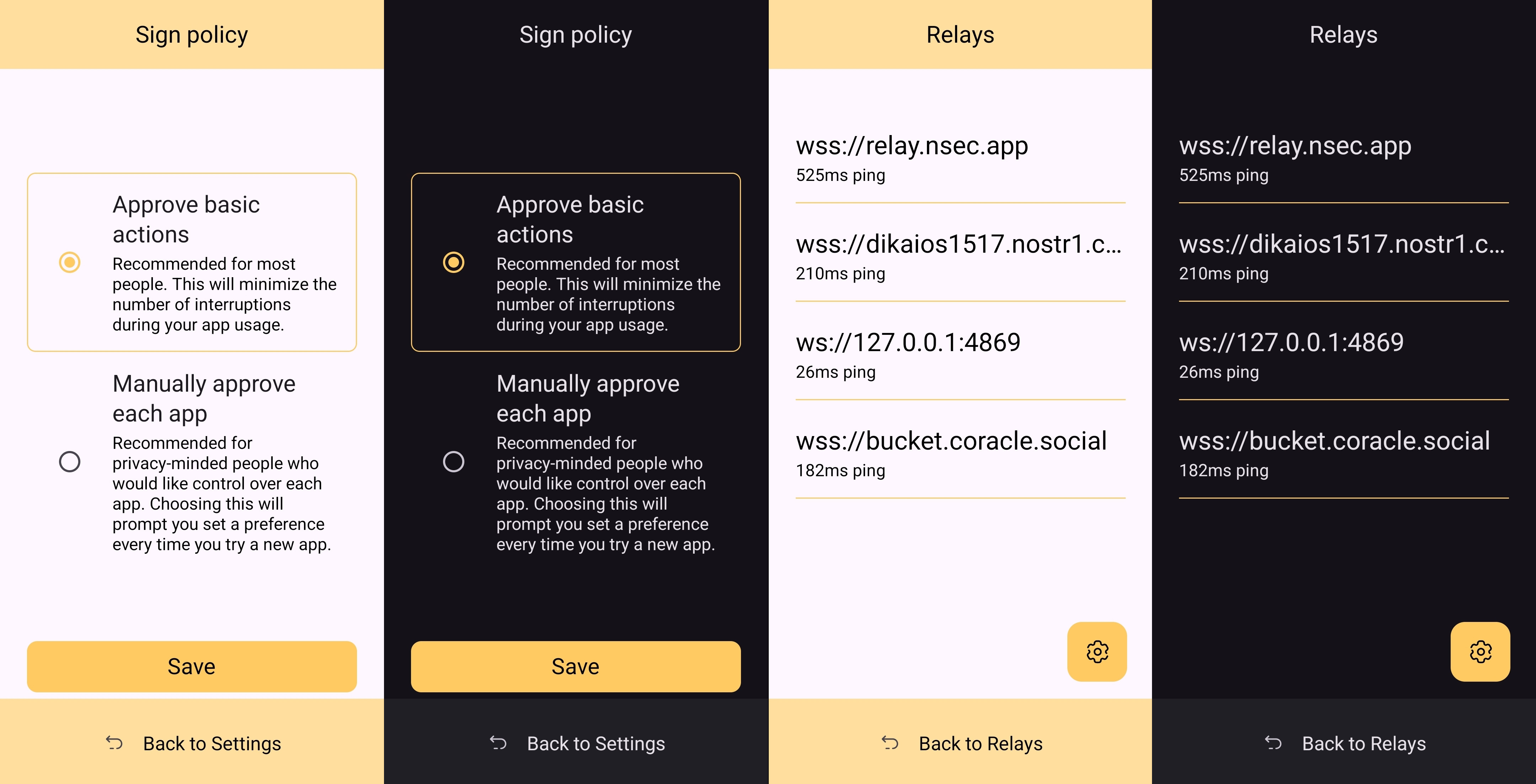

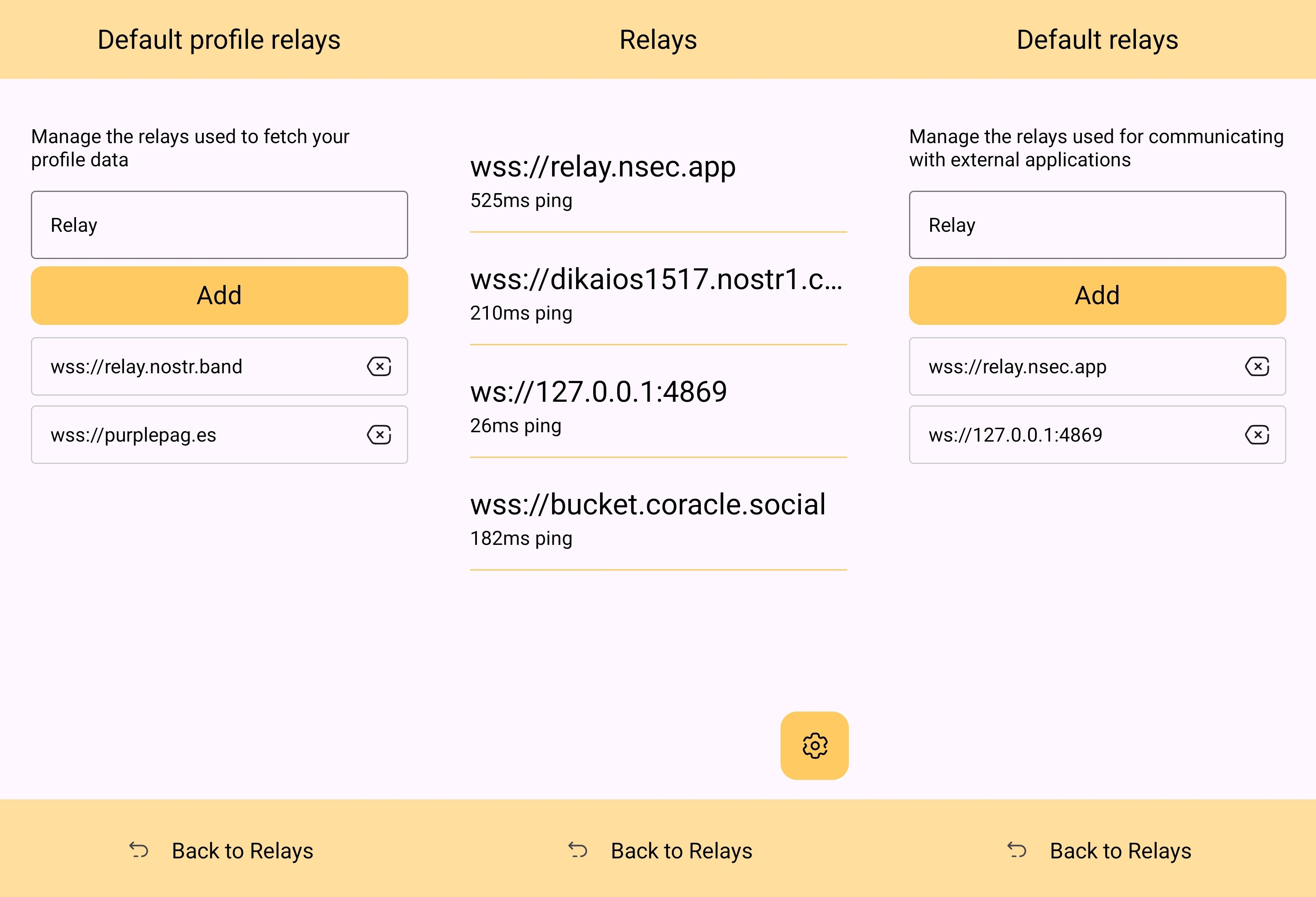

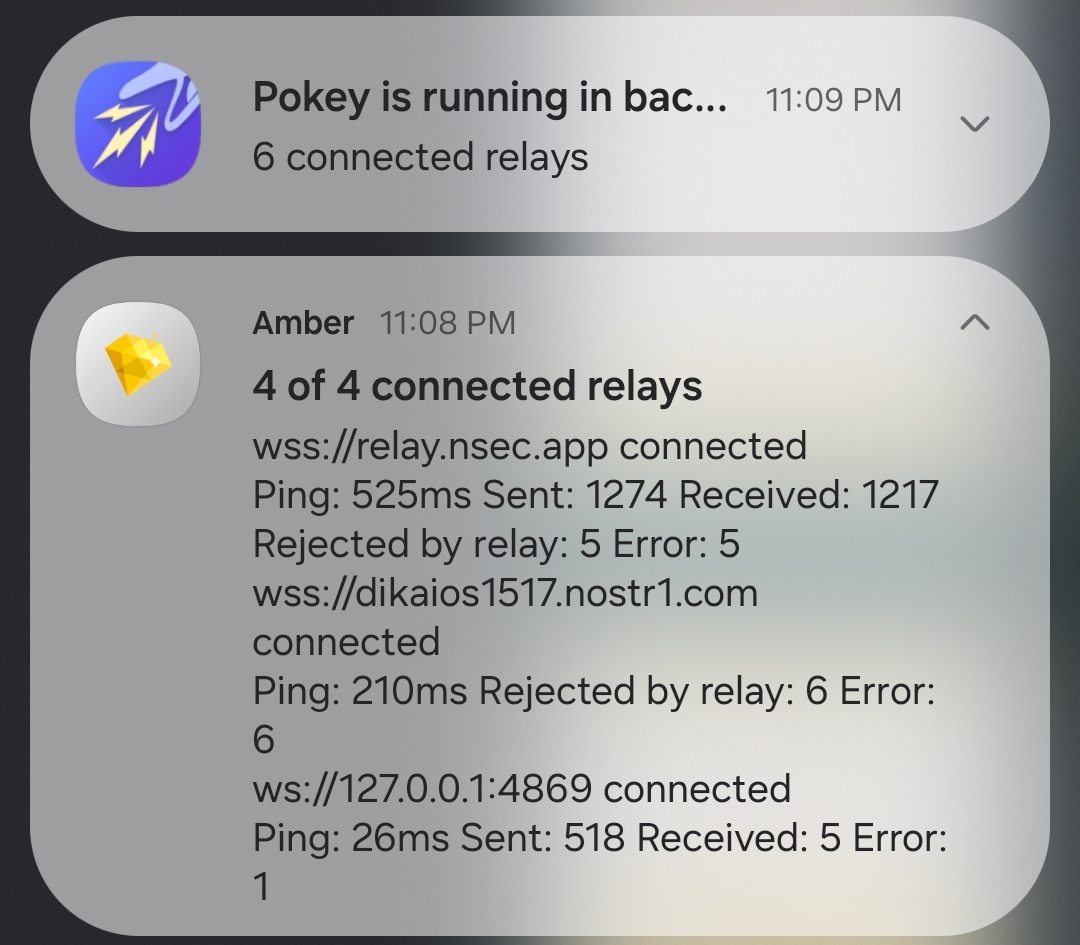

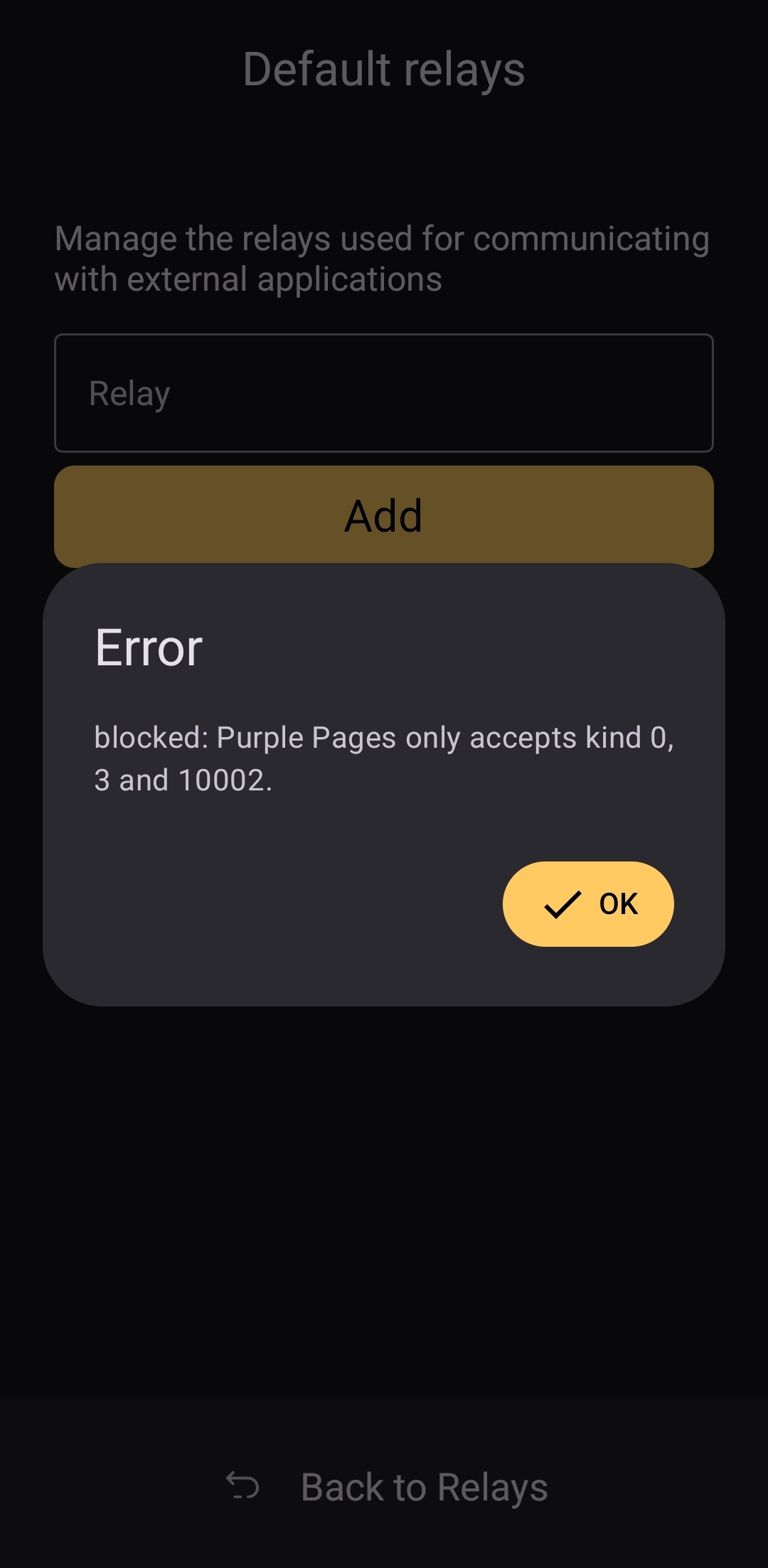

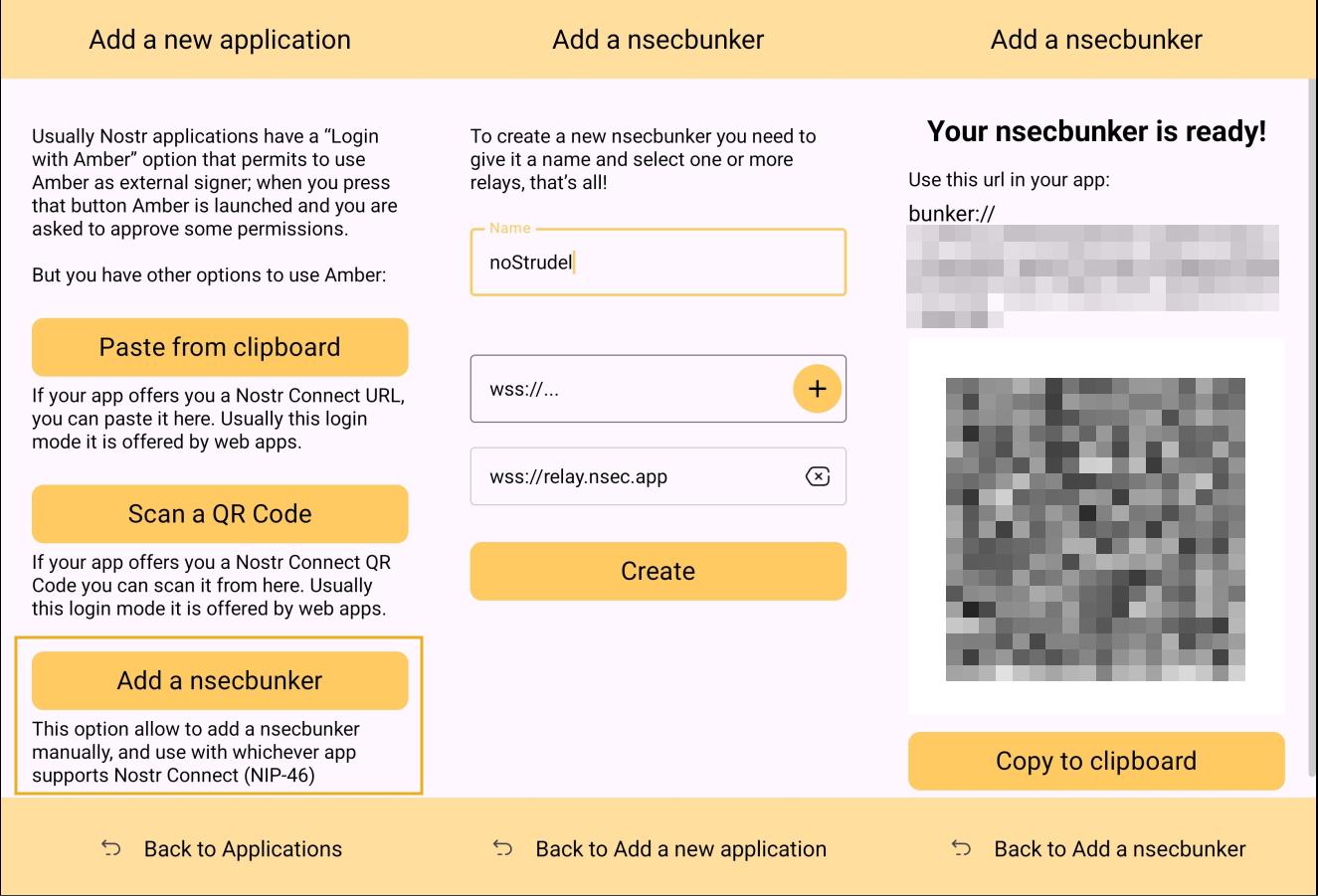

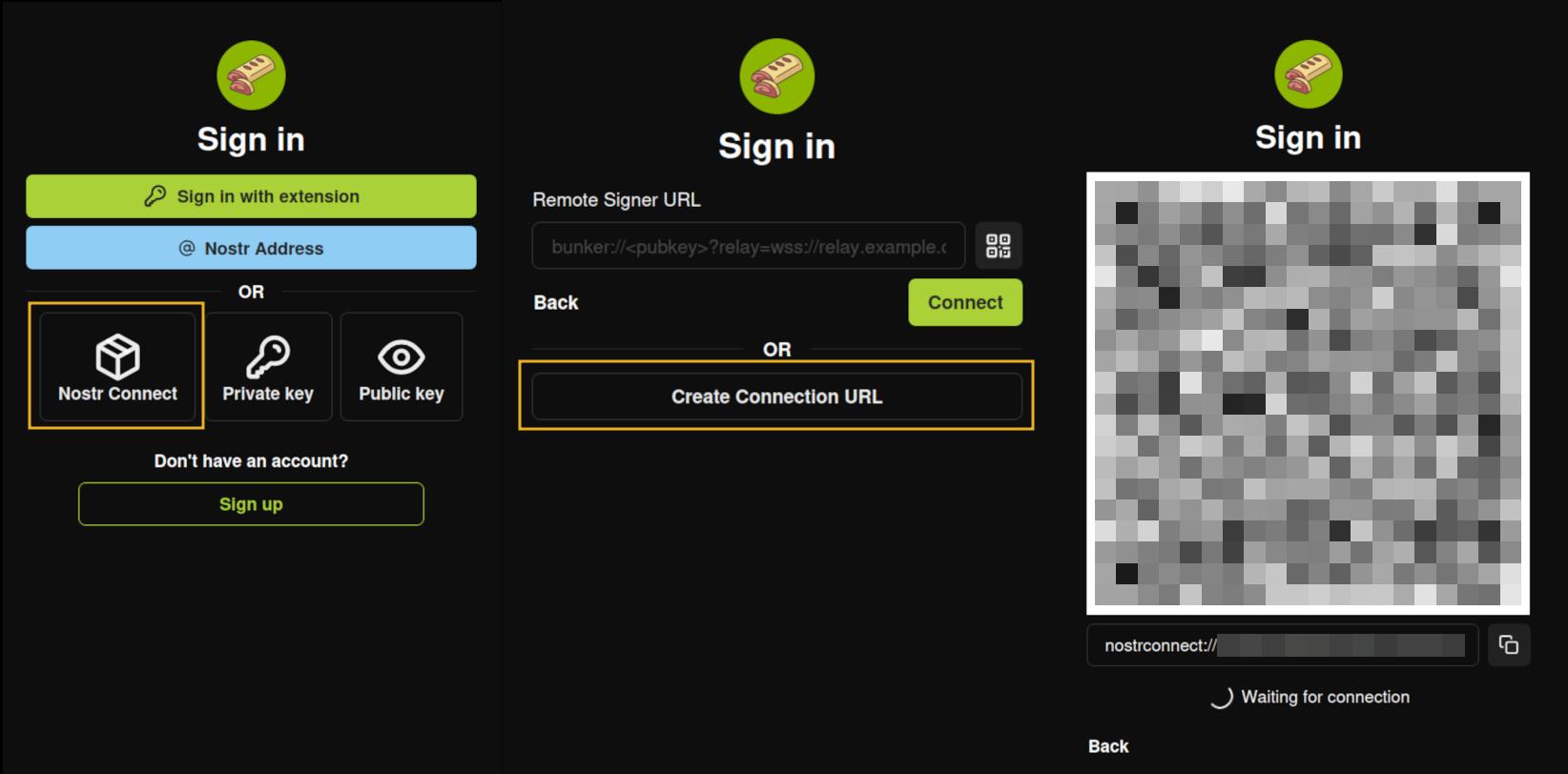

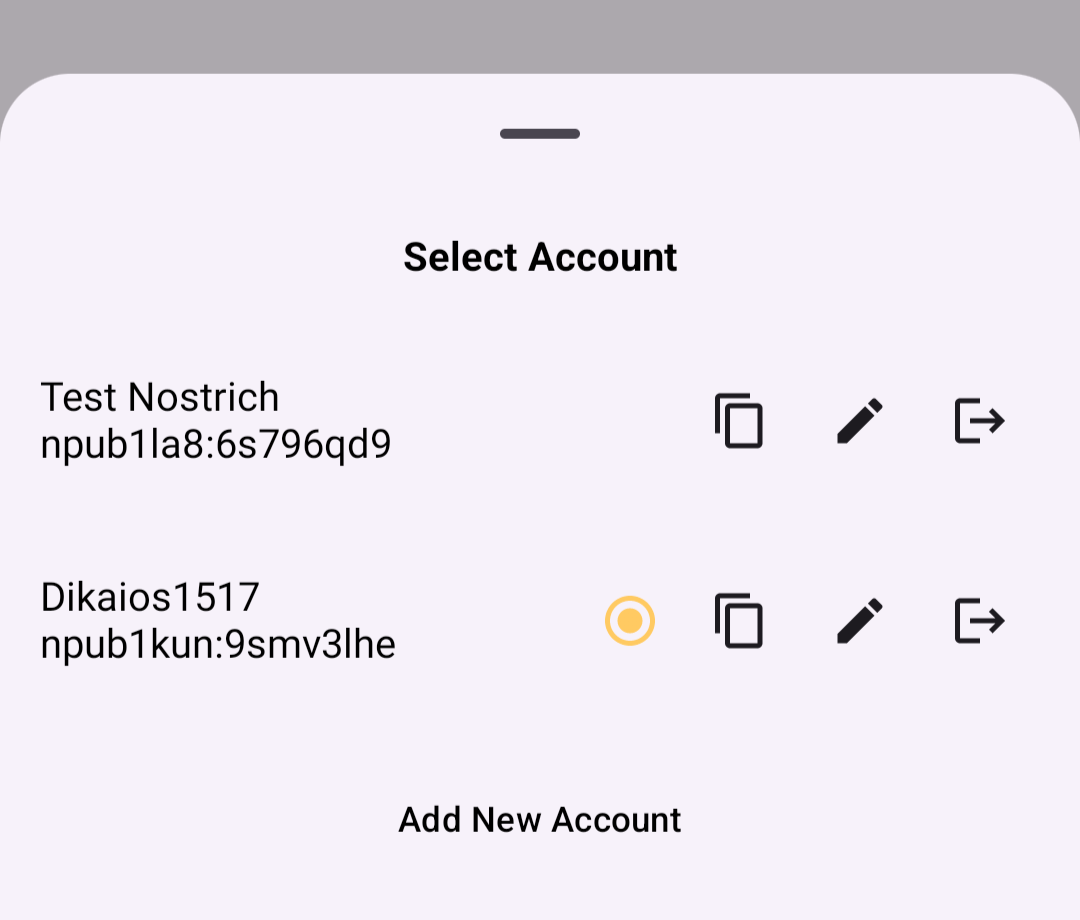

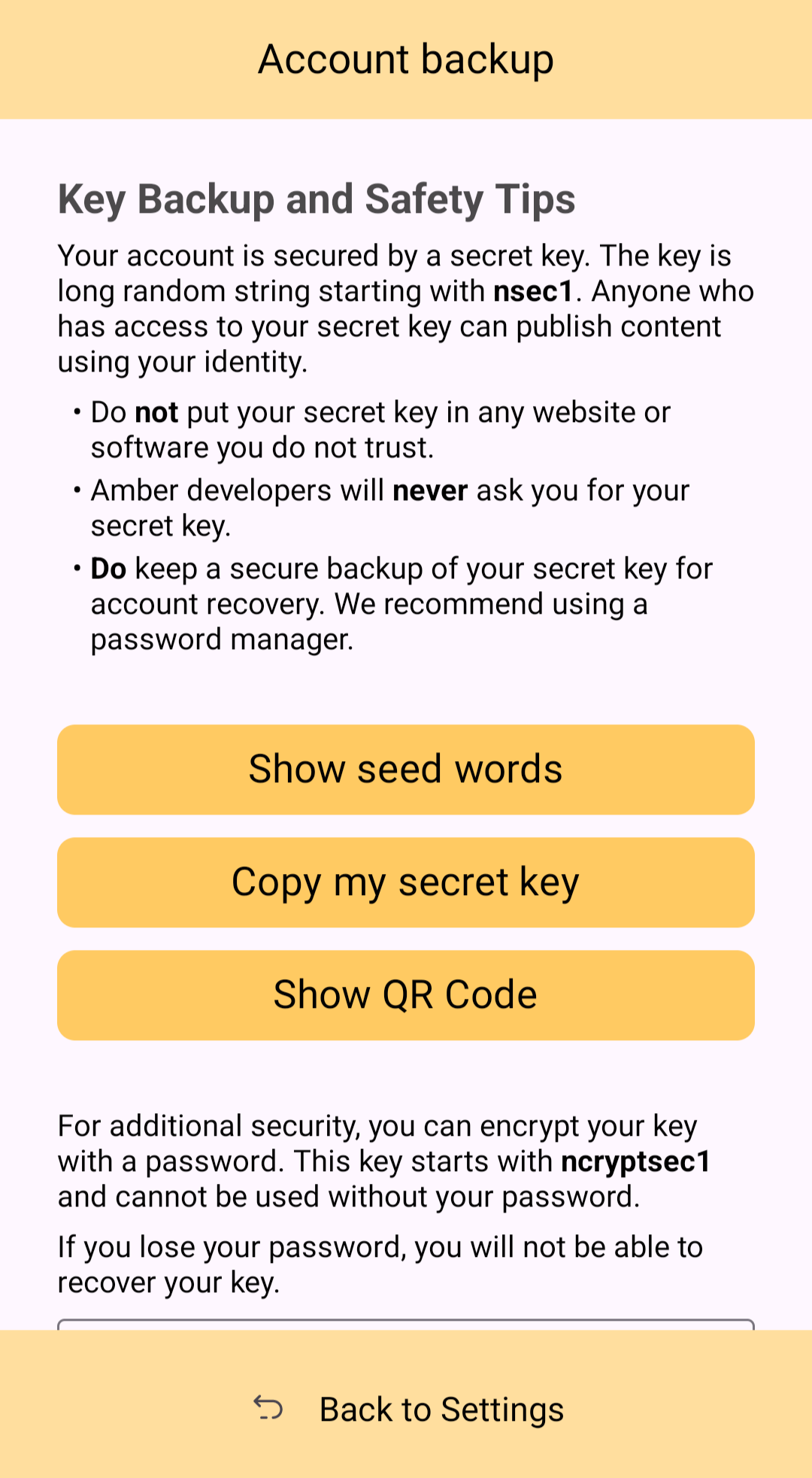

### Android Signing