-

@ 5d4b6c8d:8a1c1ee3

2025-03-01 22:53:13

Following our updated [February predictions](https://stacker.news/items/894412/r/Undisciplined), here's how stackers are predicting the NBA season will play out:

- Champ - Celtics

- MVP - SGA

- All NBA 1st Team - Jokic, Giannis, Ant, SGA, Brunson

-----

# Full results

## Champion

- Celtics 5/15

- Thunder 2/15

- Pacers 2/15

- Nuggets 1/15

- Timberwolves 1/15

- Lakers 1/15

- Grizzlies 1/15

- Cavaliers 1/15

- Knicks 1/15

## MVP

- SGA 8/15

- Luka 3/15

- Giannis 2/15

- Jokic 1/15

- Lebron 1/15

## All NBA 1st Team

- Jokic 14/15

- Giannis 14/15

- SGA 13/15

- Ant 8/15

- Brunson 7/15

- Luka 7/15

- Tatum 5/15

- KAT 4/15

- Mitchell 1/15

- Wemby 1/15

- Steph 1/15

originally posted at https://stacker.news/items/901107

-

@ 6260f29f:2ee2fcd4

2025-03-01 22:48:31

<div style="position:relative;padding-bottom:56.25%;height:0;overflow:hidden;max-width:100%;"><iframe src="https://www.youtube.com/embed/htak8D2tv_M?enablejsapi=1" style="position:absolute;top:0;left:0;width:100%;height:100%;border:0;" allowfullscreen></iframe></div>

# PlebDevs ⚡️

A one-of-a-kind developer education, content, and community platform built on Nostr and fully Lightning integrated.

<br />[https://plebdevs.com](https://plebdevs.com)

## Overview

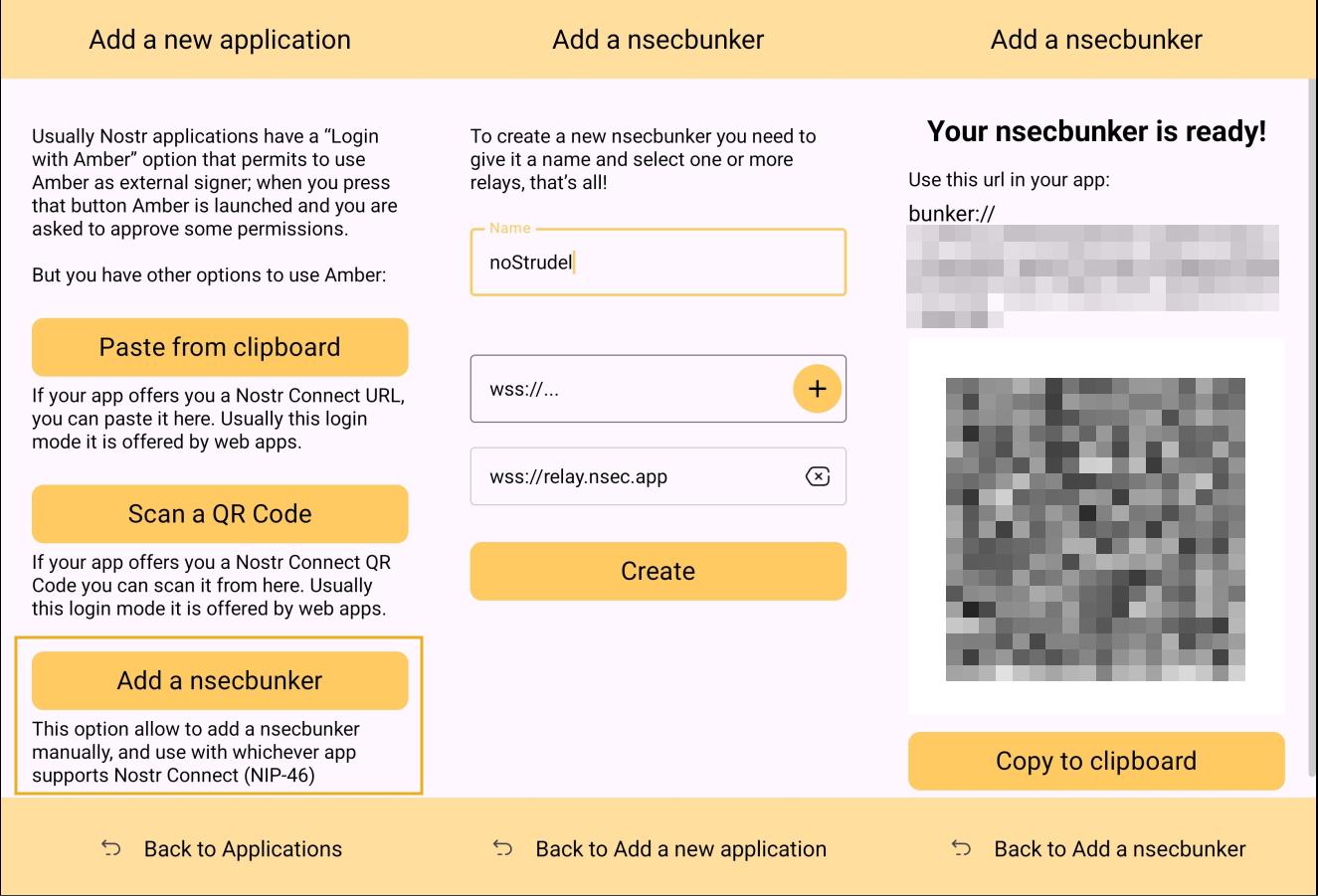

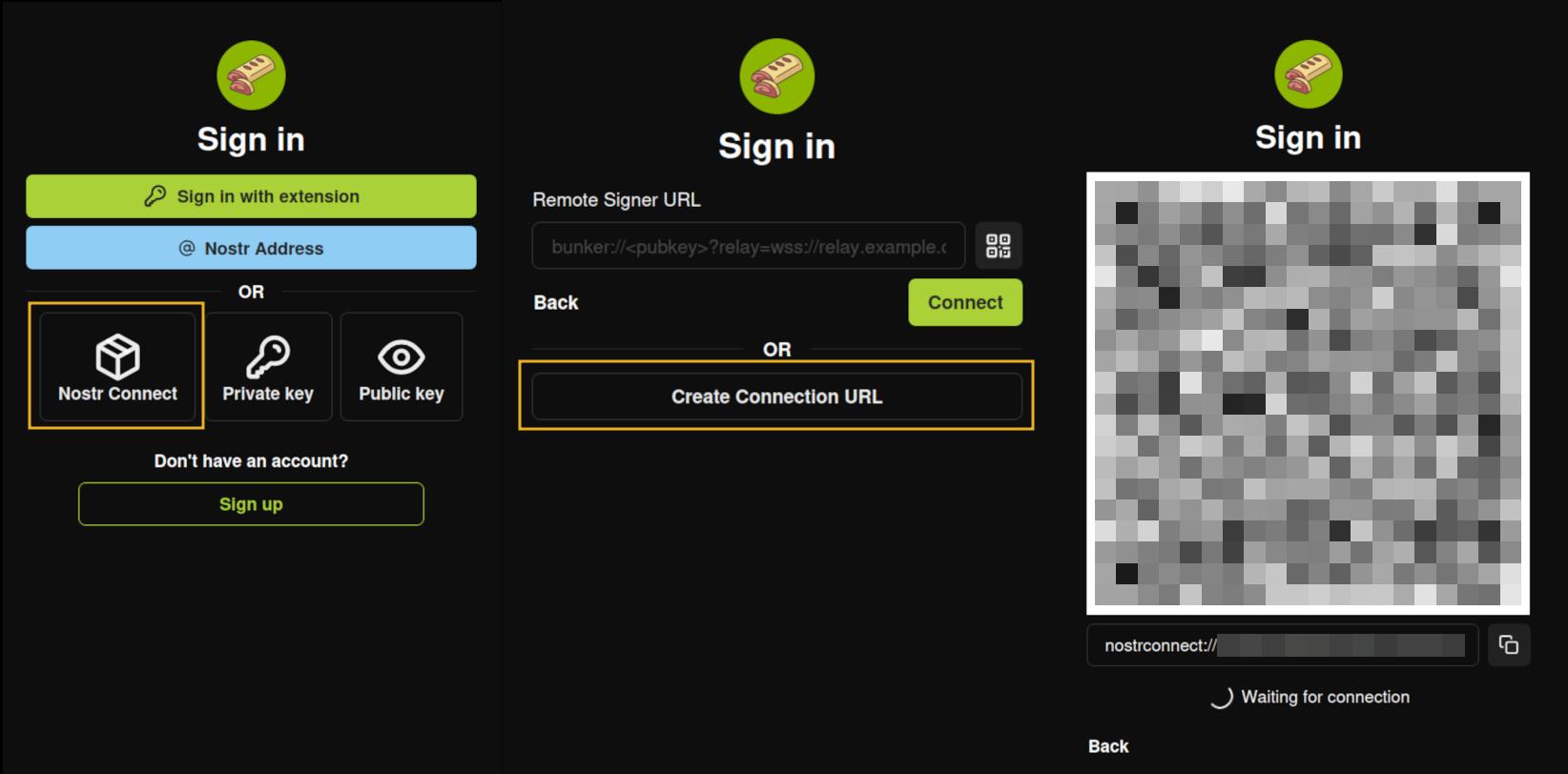

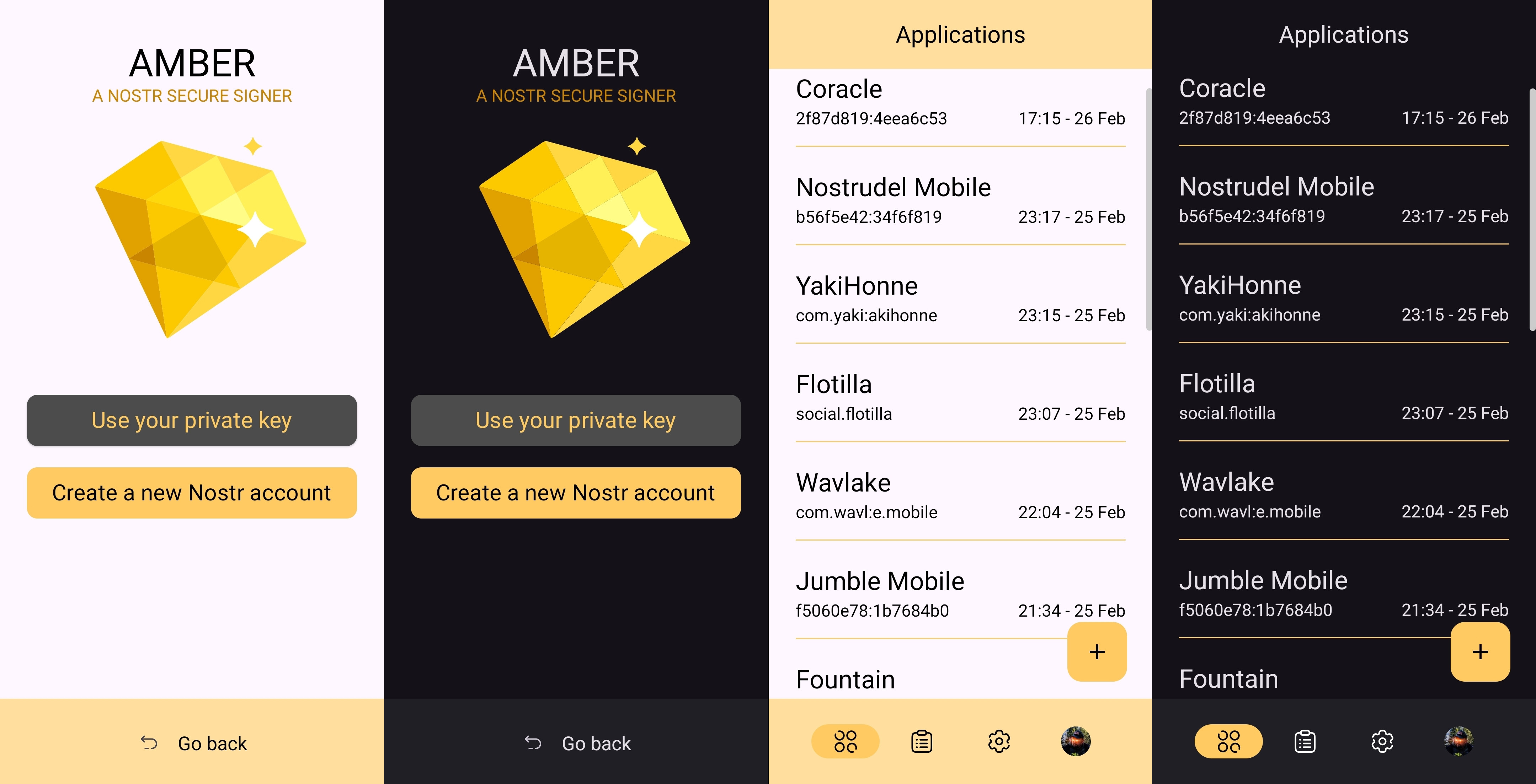

PlebDevs is an open-source platform that combines educational content, community interaction, and Bitcoin/Lightning integration. The platform publishes content to Nostr and actively pulls from Nostr relays, creating a distributed, interoperable trail of Documents, Videos, and Courses.

## Technical Implementation

### Nostr Integration

- **Content Distribution**: Implements NIP-23 for rich multimedia content embedding

- **Content Encryption**: Paid content bodies are encrypted while maintaining metadata visibility

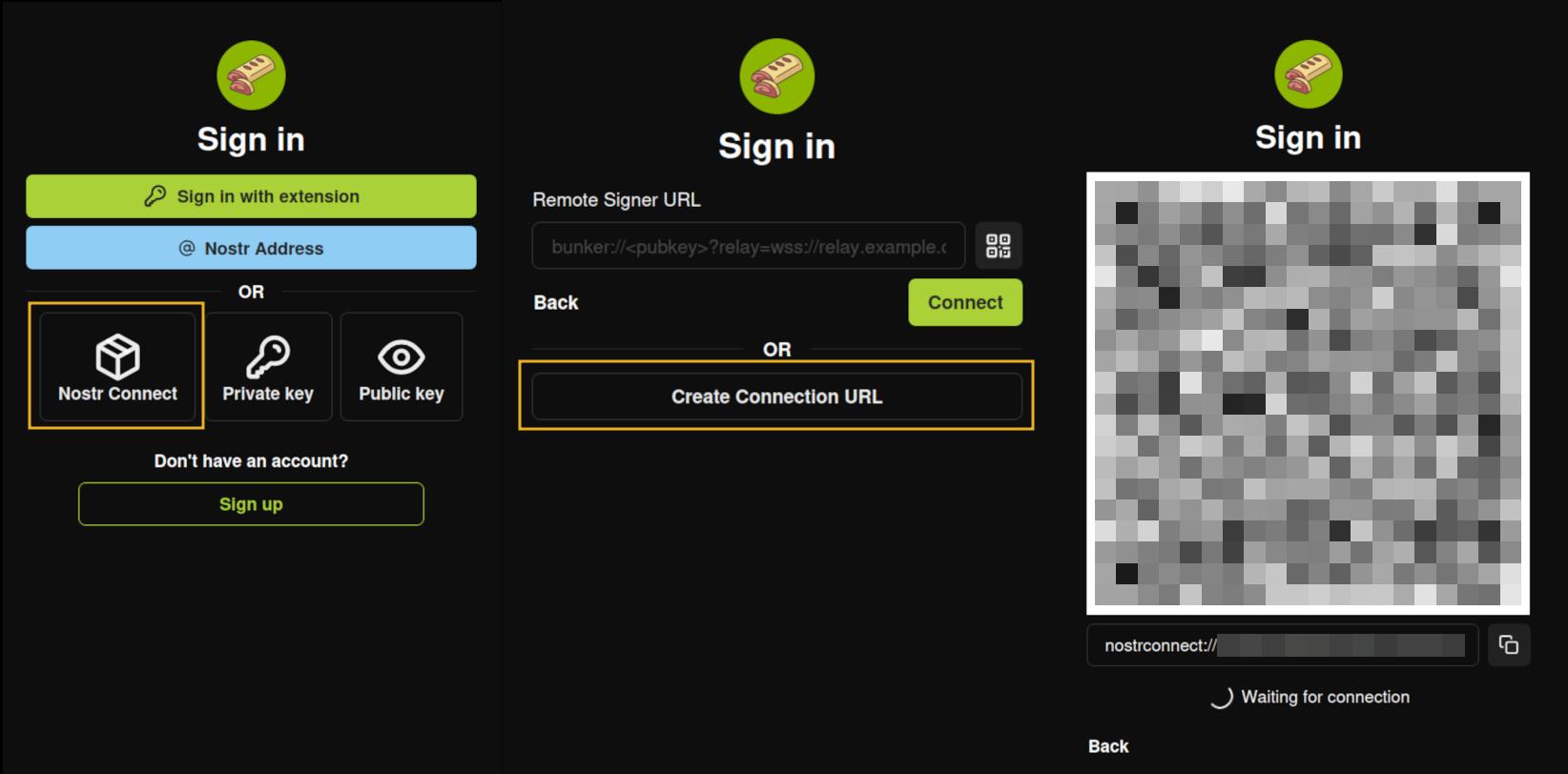

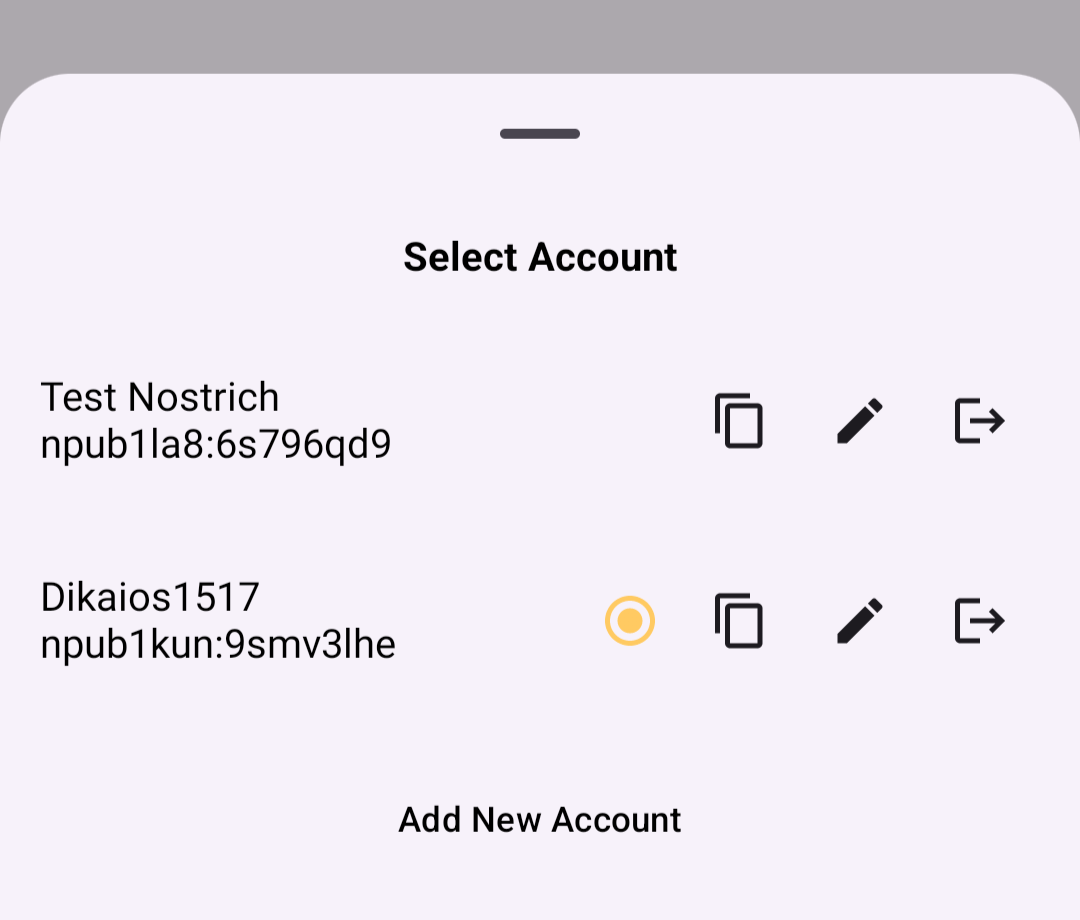

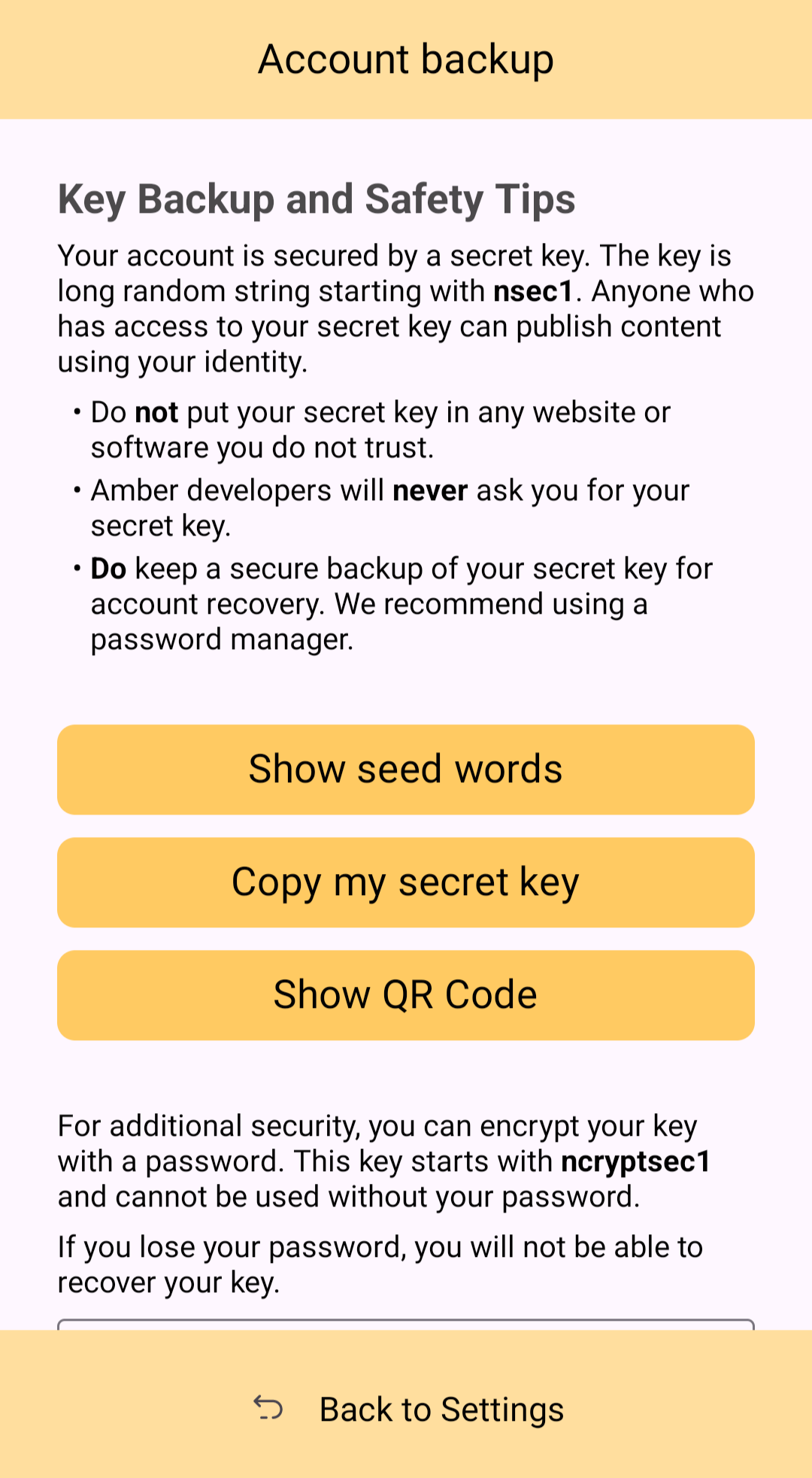

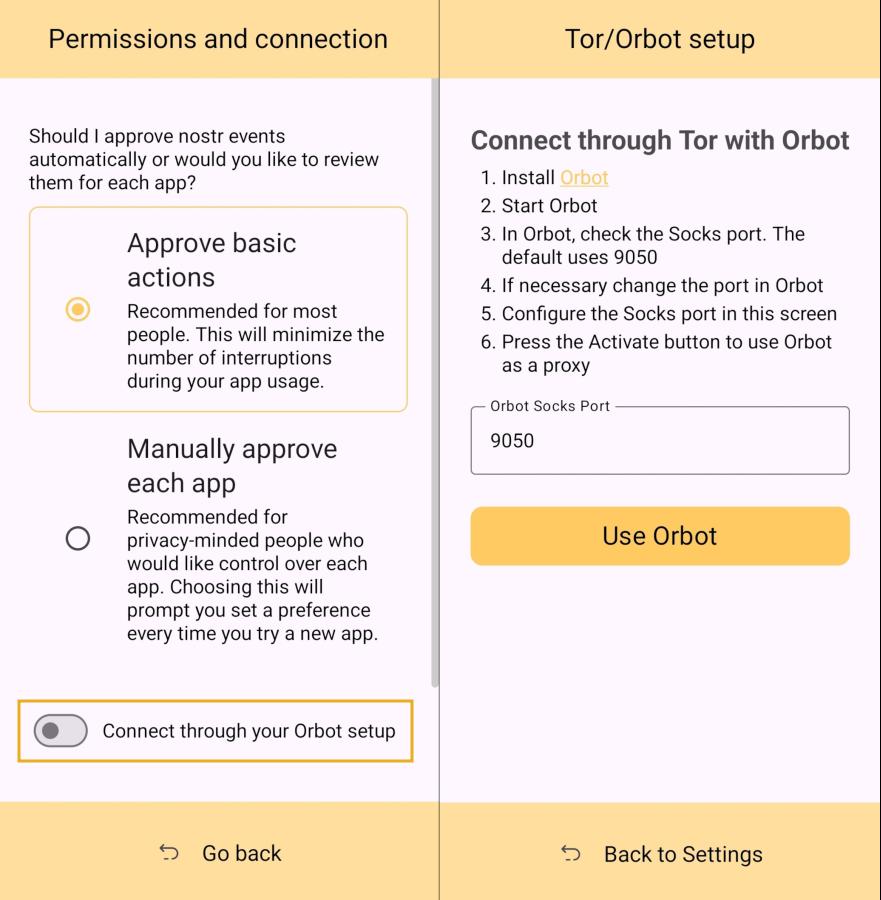

- **Authentication**:

- Multi-method signup (NIP-07, Email, GitHub, Anonymous)

- Ephemeral keypair generation for non-Nostr users

- Account linking and recovery system

- **Lists & Courses**: NIP-51 implementation for structured content organization

- **Monetization**: NIP-99 for digital content sales

- **Automated Subscriptions**: NIP-47 (Nostr Wallet Connect) for recurring payments

- **Badge System**: NIP-58 for automated achievement rewards

- **Identity**: NIP-05 for custom platform identities

- **Additional NIPs**: Implements NIP-01, NIP-19, NIP-39, NIP-57

### Platform Architecture

- **Content Management**:

- Draft system with preview capabilities

- Parameterized replaceable events

- Multi-format support (Markdown, Video, Mixed Media)

- Course builder with drag-and-drop ordering

- **User Management**:

- Profile synchronization with Nostr

- Activity tracking and progress monitoring

- Custom relay configuration

- Wallet connection management

- **Admin Features**:

- Protected admin routes based on pubkey configuration

- Content creation and management interface

- Draft/publish workflow

- Course assembly tools

-

@ 4f1c14e5:b8546d05

2025-03-01 22:33:36

Training ideologies often lead to tribalism when they shouldn’t. As with all things, there are no solutions - only tradeoffs.

The reality is that free weights and machines are both tools. The one you should use is determined by your objective.

In either case, creating tension within the target muscle group is always the objective when it comes to building muscle. It's this mechanical tension that's responsible for initiating the growth process by destroying already formed muscle cells. Both machines and free weights accomplish this objective.

As a general rule, the more stable you are during an exercise, the more tension you can create within the target muscle.

The difference is simply that machines offer more stability. That’s neither better nor worse, it just is. Stability within exercises is a spectrum. We create stability by bracing against things. The more points of contact and the more of your body that braces against things, the more stability you will have.

Because of gravity, we are forced to have at least one point of contact braced against something at all times. Typically, it's the floor. A pistol squat offers a very low amount of stability because of the lack of bracing. In this example, only one foot is braced against the floor.

Adding a second foot to the ground and doing a body weight squat enhances stability. Holding onto a bar or a bench in front of you while squatting now adds another layer of stability.

A hack squat is a machine where both feet are planted on a platform and the user rests the posterior portion of their entire upper body - from their lower back to their head - against a pad. This machine has a fixed movement pattern which further reduces any instability.

These are all examples of different exercises that follow the same movement pattern, yet offer varying degrees of stability.

Which should beginners use? Again, both is the best approach. But what would happen if you limited yourself to mostly one or the other?

Predominantly using machines as a beginner will allow you to forego the lack of development in your ability to stabilize yourself. The machine stabilizes your body for you in a way that beginners simply aren’t able to at first. You are braced by a seat, a back pad/chest pad and maybe a handle or two as well. In addition to this bracing, the movement path is already carved out for you. You simply position yourself appropriately and push (or pull), and the machine does the rest. This allows you to focus more on creating tension in the target muscle as well as learning to train to failure safely.

Predominantly using free weights as a beginner will force you to develop stability from the start. There are no pads anywhere to brace your body against. Your body must learn to brace against itself. **You** become the machine. This may limit your ability to create maximum tension in the target muscles at first, but the stability you create this way will translate to systemic muscular development. You'll become thicker everywhere because your body works as a system to stabilize itself against gravity.

The stability built through free weight movements will transfer over to machines. If you can stabilize yourself with just a barbell, the stability you can create while braced in a machine will translate to even greater tension. You’ll be stabilized by your body AND the machine.

Since it makes the most sense to do both, the only thing left is understanding which circumstances are better suited for machines vs free weights. Since fatigue is something we all contend with during a workout, it makes sense to program the least stabilized, most demanding movements earlier in the workout and the most stabilized, least demanding movements later in the session. This not only allows you to create the most tension possible throughout the workout, but is also the safest approach. It would be unwise to schedule barbell front squats at the end of a workout when fatigue is high and energy is low. Not only will you fail to generate maximum tension, but you’ll put yourself at higher risk of injury.

TLDR; use both, but do free weight stuff first.

-

@ 6260f29f:2ee2fcd4

2025-03-01 22:23:15

<div style="position:relative;padding-bottom:56.25%;height:0;overflow:hidden;max-width:100%;"><iframe src="https://www.youtube.com/embed/F-px_Eqr16E?enablejsapi=1" style="position:absolute;top:0;left:0;width:100%;height:100%;border:0;" allowfullscreen></iframe></div>

# PlebDevs ⚡️

A one-of-a-kind developer education, content, and community platform built on Nostr and fully Lightning integrated.

<br />[https://plebdevs.com](https://plebdevs.com)

## Overview

PlebDevs is an open-source platform that combines educational content, community interaction, and Bitcoin/Lightning integration. The platform publishes content to Nostr and actively pulls from Nostr relays, creating a distributed, interoperable trail of Documents, Videos, and Courses.

## Technical Implementation

### Nostr Integration

- **Content Distribution**: Implements NIP-23 for rich multimedia content embedding

- **Content Encryption**: Paid content bodies are encrypted while maintaining metadata visibility

- **Authentication**:

- Multi-method signup (NIP-07, Email, GitHub, Anonymous)

- Ephemeral keypair generation for non-Nostr users

- Account linking and recovery system

- **Lists & Courses**: NIP-51 implementation for structured content organization

- **Monetization**: NIP-99 for digital content sales

- **Automated Subscriptions**: NIP-47 (Nostr Wallet Connect) for recurring payments

- **Badge System**: NIP-58 for automated achievement rewards

- **Identity**: NIP-05 for custom platform identities

- **Additional NIPs**: Implements NIP-01, NIP-19, NIP-39, NIP-57

### Platform Architecture

- **Content Management**:

- Draft system with preview capabilities

- Parameterized replaceable events

- Multi-format support (Markdown, Video, Mixed Media)

- Course builder with drag-and-drop ordering

- **User Management**:

- Profile synchronization with Nostr

- Activity tracking and progress monitoring

- Custom relay configuration

- Wallet connection management

- **Admin Features**:

- Protected admin routes based on pubkey configuration

- Content creation and management interface

- Draft/publish workflow

- Course assembly tools

-

@ 6260f29f:2ee2fcd4

2025-03-01 22:21:02

<div style="position:relative;padding-bottom:56.25%;height:0;overflow:hidden;max-width:100%;"><iframe src="https://www.youtube.com/embed/yOKs5L18YcI?enablejsapi=1" style="position:absolute;top:0;left:0;width:100%;height:100%;border:0;" allowfullscreen></iframe></div>

-

@ f33c8a96:5ec6f741

2025-03-01 20:56:43

<div style="position:relative;padding-bottom:56.25%;height:0;overflow:hidden;max-width:100%;"><iframe src="https://www.youtube.com/embed/tGVxP4RgyI4?enablejsapi=1" style="position:absolute;top:0;left:0;width:100%;height:100%;border:0;" allowfullscreen></iframe></div>

-

@ f33c8a96:5ec6f741

2025-03-01 20:50:47

<div style="position:relative;padding-bottom:56.25%;height:0;overflow:hidden;max-width:100%;"><iframe src="https://www.youtube.com/embed/7dsR7um-DxA?enablejsapi=1" style="position:absolute;top:0;left:0;width:100%;height:100%;border:0;" allowfullscreen></iframe></div>

-

@ f33c8a96:5ec6f741

2025-03-01 20:42:24

<div style="position:relative;padding-bottom:56.25%;height:0;overflow:hidden;max-width:100%;"><iframe src="https://www.youtube.com/embed/QY6euaT_G_E?enablejsapi=1" style="position:absolute;top:0;left:0;width:100%;height:100%;border:0;" allowfullscreen></iframe></div>

-

@ 5d4b6c8d:8a1c1ee3

2025-03-01 20:37:31

Alright, Fast February has come to an end. It was more impactful than I anticipated, considering daily intermittent dry fasting had been part of my routine for a long time.

I had definitely let the practice slip to the point where I probably wasn't regularly entering ketosis. Now, my food cravings are substantially reduced and it's quite easy for me to confine my eating to a smaller window.

Even with the fiscal fast being over, I just bought some vitamins and coconut milk (no cravings for junk food or snacks). I would have gotten some fruit, too, but it didn't look great. I did notice craving more juicy foods this month, as my dry fasts got longer. Eating more fruit will probably be an adjustment I make going forward.

If you have any practices that have been on autopilot, I recommend occasionally putting some focus on them to make sure they're still doing what you thought they were.

originally posted at https://stacker.news/items/901017

-

@ 378562cd:a6fc6773

2025-03-01 17:53:12

You're in the right place if you've feel like you have never known God but feel drawn to Him. The Bible is God’s Word, His way of speaking to us, and it holds the truth about who He is, who we are, and how we can have a relationship with Him.

Here’s a *simple guide* to getting started:

**Step 1: Begin with Jesus**

The best place to start is with Jesus. He is the heart of the Bible’s message; we can know God through Him. Start by reading the Gospel of John in the New Testament. It clearly shows who Jesus is, His love for us, and why He came to save us.

**Step 2: Talk to God as You Read**

Reading the Bible isn’t just about gathering knowledge and meeting God. Ask Him to help you understand. A simple prayer like, "God, if You are real, show me the truth. Help me know You" is enough.

**Step 3: Understand the Main Message**

The Bible tells one big story:

God created us (Genesis 1:1)

Sin separated us from God (Romans 3:23)

Jesus came to save us (John 3:16)

We can be forgiven and have eternal life through Him (Romans 10:9)

**Step 4: Accepting Jesus into Your Heart**

If you believe that Jesus is the Son of God, that He died for your sins, and that He rose again, you can ask Him to forgive you and come into your life. You don’t need fancy words—just a sincere heart.

You can pray something like this:

"Jesus, I believe You are the Son of God. I believe You died for my sins and rose again. I ask You to forgive me, change me, and come into my life. I want to follow You. Amen."

**Step 5: Keep Going!**

Read a little each day. Start with John, then move to Matthew, Mark, and Luke.

Find a Bible-believing church or group to help you grow.

Pray daily — talk to God like you would a friend.

Trust that God will guide you as you seek Him.

If you’ve taken these steps, you’ve begun the greatest journey of your life—walking with Jesus. Keep seeking, keep learning, and know that God loves you deeply. 💙

I may not know you, and you may not know me, but this guide can be a lifeline if you carry burdens— drama, heartache, struggles, pains or whatever. If you commit to following the steps of this guide and make time to read your Bible daily, you’ll find wisdom, peace, and the strength to face whatever life throws your way.

-

@ bbb5dda0:f09e2747

2025-03-01 17:46:48

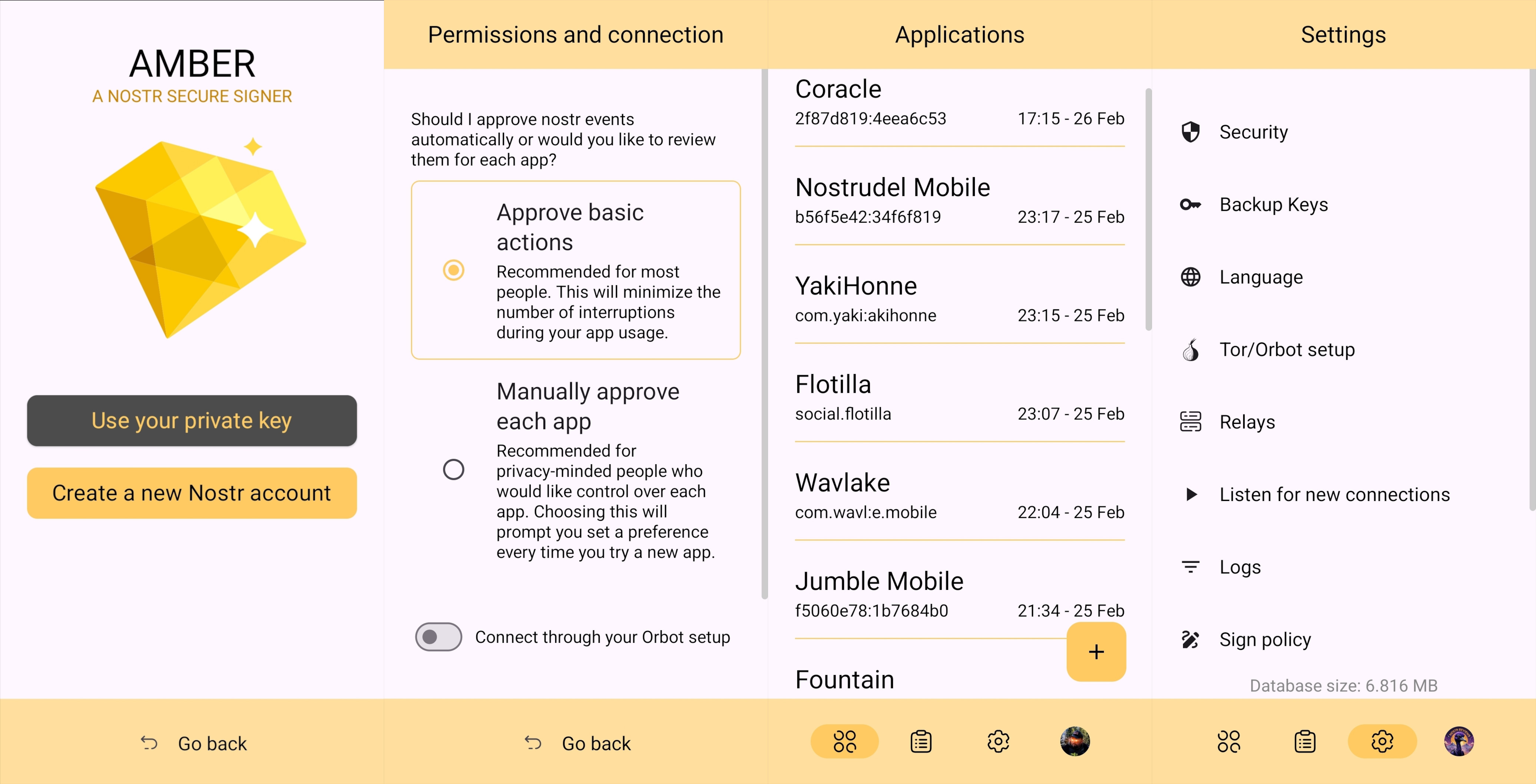

**A couple weeks with a little bit of everything, TollGate marketing, app stability improvements, and some personal matters that needed my attention. Let's get into it:**

## TollGate App

For starters, we worked hard to get an early version of the [TollGate](https://tollgate.me) website live. What do we want to communicate about the project, and to whom. We've identified three 'types' of visitor, each requiring its own 'customer journey' through the website. First there's the end-user, someone that just wants access to tollgate, but doesn't care about any of the technichalities. We try to guide those people to downloading our app as soon as possible. Currently that means downloading it straight from the website as an APK file. But we want to quickly move on to publishing it to the [ZapStore](https://zapstore.dev).

The past couple weeks I put some efforts into getting the app stable. It was hard to identify what was causing the seemingly random crashes and full reloads (of the web content). After getting some outside help we've identified that we were trying to interact with the android API's on the main thread. Which is bad practice. I first couldn't figure out how to make a web request without having to spawn a seperate thread in the kotlin code, that then we'd have to create some kind of system to bubble up the callback method's result. I then found there's a proper [Tauri (the framework) way](https://tauri.app/develop/plugins/develop-mobile/) of doing this using Kotlin Coroutines, which I wasn't familliar with. But it just executes the entire Tauri 'command' (function call) on a background thread. Problem solved. I haven't had any full app crashes since.

Which left me with the random page refreshes, the thing that was behind the demo-effect at Sat's and Facts. I noticed it happened around the moments I would go to settings to hit the 'sign in' button to dismiss the captive portal. That's where I had looked before, but I needed to zoom out. It had to do SOMETHING with moving the app to and from the background. Okay is it some kind of sleep issue? I don't remember where or how I found it but I saw a suggestion to run the Tauri dev build with a --no-watch flag. Which disables hot reloading of the app when I edit one of the TypeScript/HTML files. Somehow the reload would be triggered sometimes on app switching. Why? I don't know, but i'm glad I could pinpoint it.

So now the demo part seems stable, finally. Which means I can move on and properly implement the wallet logic and making the download on the website work.

## TollGateOS

The second customer group will be people interested in running a TollGate. We're trying to get them to download our custom build of OpenWRT that includes all the required packages. We 'baptized' this version to be called **TollGateOS** as we say in proper Dutch ;). I think it will help to have these clear distinct names. I really want any moderately technical person to be able to install TollGateOS on a supported router. My vision for this is to have some kind of web installer, akin to what GrapheneOS does with their web-installer. It seems to be possible to do SSH from the browser, but I'll kill that bird when I see it (is that a saying? I think it should be...)

By the way, in earlier docs/demo's we talked about a 'herald' module, which would do the advertising of the tollgate. But as we found that the crowsnest already interacts with the hardware antennas, which is needed for 'advertising' the tollgate, we thought it better to merge both of them into the Crowsnest.

## Developers

TollGate is fully open source, so anyone looking to either look at or fork the source code is welcome to do so. Developers interested at looking at the code are probably already interested to some degree. For this group we added easy links to navigate to the project's repositories

Currently our focus is publishing the Android version, but we're building the app in a cross-platform way. The only thing we have to customize are the system integrations, like scanning for wifi-networks and connecting to them.

## Gearing up for Sovereign Engineering

As i'm writing this piece for you i'm at 10km (that's 30.000ft for y'all Americans) in the air on my way to Sovereign Engineering edition #4, SEC-04. I feel ready to go kick ass once again and build beautiful things with a bunch of my favourite plebs!

## A bit of a focus shift

If you've been following me you might notice I haven't posted much about Epoxy recently. I found the momentum I see emerge on TollGate and GitHub Actions too good to let go to waste. So those will be my focus for a while, I'm hoping to circle back to Epoxy when these projects have a more steady pace.

-

@ df478568:2a951e67

2025-03-01 15:04:27

In [my Soapminer article](https://habla.news/u/marc@primal.net/washing-the-invisible-hand-with-soapminer), I added quotes from various plebs. I earned over 12,000 sats! That's enough for a McJunk today, but maybe a steak dinner in a few years. That's my two sats anyway.

*This is not investment advice*

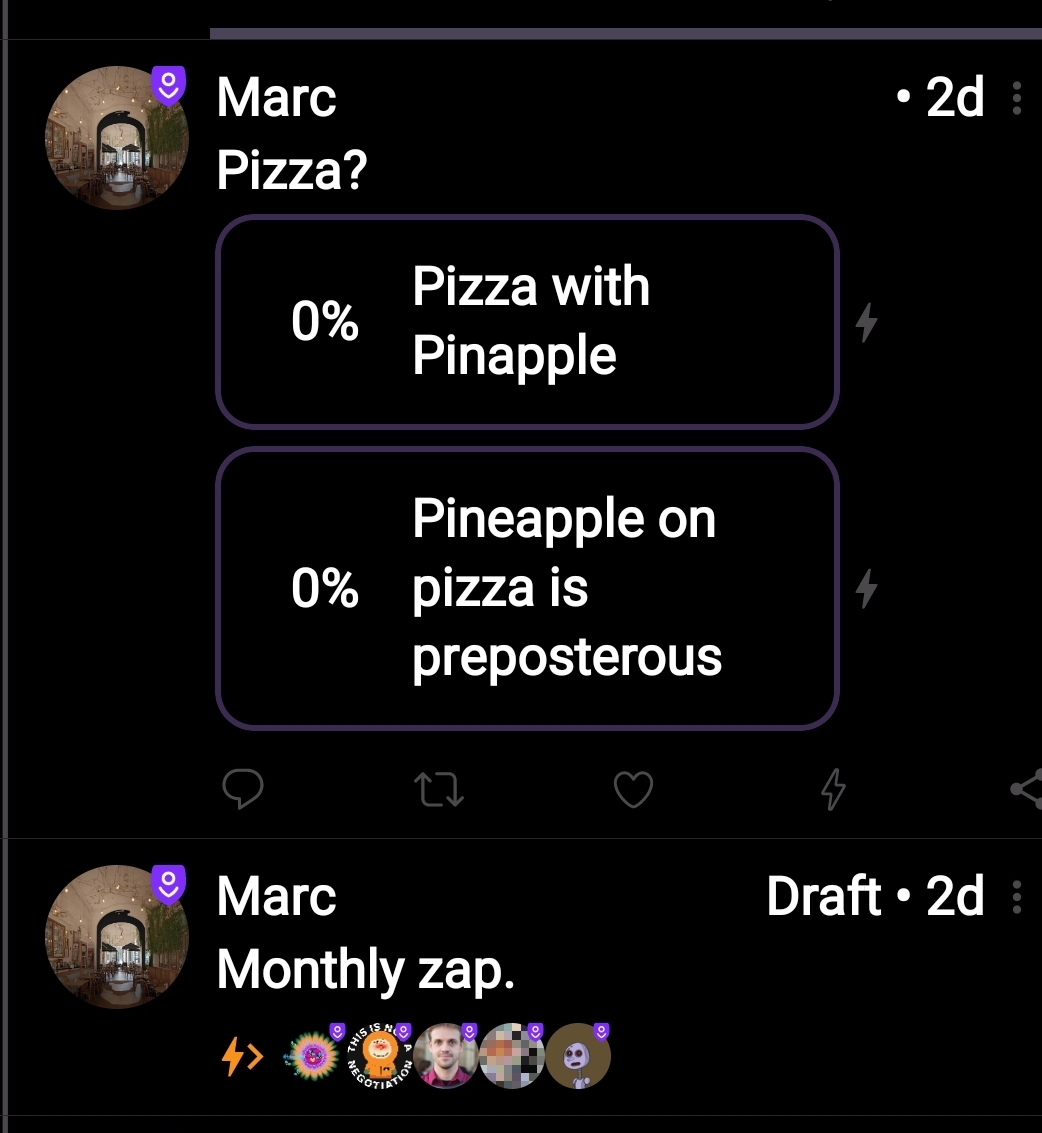

It feels great to receive value from people who support and appreciate your work. It's also nice to stack more sats by writing. I have a budget of $25.00 that I have sent to various people using Zapplanner, but I'm trying something new: Zapsplits.

## WTF Are Zapsplits?

I asked [Unleashed.chat](https://unleashed.chat). Here's what the anthropomorphic Unleashed said.

Me:

What is a Zapsplit on nostr?

Unleashed:

A Zapsplit on Nostr refers to splitting a Zap, which is a form of donation or tipping on the ~platform~ protocol, among multiple recipients. **It allows users to distribute their support more broadly across various content creators instead of just one**.

That's more succinct than I would put it, but nostr is a protocol, not a platform. The important part about Zapsplits for me is that it removes the cognitive cost of deciding what percentage of my giving budget should go to each creator. Do I zap podcast guests? Do podcasters with ads get less than podcasters sans ads? How much value did this particular article bring me? If I zap Guy Swann, should I also zap the authors he reads? Should I zap long-form articles more than micro-blogs? There are 21 million different considerations.

Zapsplits removes all this from me because I can use the following algorithm.

### Does This Person Provide Me Value?

Yes ⬇️

I add them to my Zapsplit post for that month. A portion of my monthly zapping budget, 25 dirty-fiat bucks, transforms into magic Internet money and is distributed among everyone in the Zapsplit.

No ⬇️

If I don't get any value, I don't send value. Simple.

#### Testing Zapsplits

I added podcasters and devs to a nostr post and enabled a 10-way zapsplit on the post. It's based on [prisms](https://www.nobsbitcoin.com/lightning-prism-nostr/), a little nostr feature that gives me prose writing superpowers.

1. I can earn sats for writing.

2. I can support others with a single zap.

3. I can add people who give me quotes to my zap splits.

People appreciate attribution. I suspect they will appreciate it more if they also get paid. What if I added some quotes to an article and then split any zaps I get with the quoted plebs? Come to think of it, I'll try it. [Here's a quote from a dev on nostr](nostr:note1qf4277rudtflllrjr555890xsjp6u60f7xdvclkwc9t220duajeq0x665q

I added Silberangel to the Zapsplits on Habla.news.

My [V4V](https://blog.getalby.com/the-case-for-value-4-value/) payments can also get sent to ten different plebs with a simple click of a button. I am going to start using this for a lot of my monthly V4V budget. Every month, I'll think about the people's content I value most and add them to a single zapsplit payment. Then, I'll zap the post.

Say I create a poll and make a wager with ten different people. If I lose, I can pay everyone pit at the same time. This is probably better for a football pool, but you get the idea. The options are limited only by your imagination.

nostr:nevent1qqspnhucgxc6mprhw36fe2242hzv7zumavyy7dhzjswtldhxk4dh7ugpz4mhxue69uhhyetvv9ujuerpd46hxtnfduhsygxlg7zks3uauf454q7phhzdh2mpkhxg9cdrzt3t9z7gzksj49g7vupsgqqqqqqsl5uwfl

Other people can also zap the post. As Siberangel says, we can use other people's money to provide value, too. This is a great option for stacking neophytes, people who don't have much bitcoin or cheap skates. Let's be honest, bitcoin has made most of us cheapskates.

Bitcoin books with multiple authors can have QR codes that link to one of these Zapsplit posts. The authors can do a book signing and sell their books using this on nostr. Nerds like me can get three autographs and zap the book. The sats are split among all authors. Here's a Zapsplit that includes all the authors of Parallel.

Can you think of any other ways to use Zapsplits? Let me know.

npub1marc26z8nh3xkj5rcx7ufkatvx6ueqhp5vfw9v5teq26z254renshtf3g0

[885,610](https://mempool.marc26z.com/block/00000000000000000000742c0f980fcfcbd25fade47c3ebcfd69eda93f6861c7)

[Merch](https://marc26z.com/merch/)

-

@ 43baaf0c:d193e34c

2025-03-01 14:22:43

eARThist vlog name represents the fusion of Earth and Art and me as traveling artist.

I'm kicking off my vlogging journey with my first vlog, Bangkok Lightning Tour. My goal with vlogging is to share more about my art journey as I travel the world. After years of traveling and filming around the world, I’m now fully focused on my art. However, filming and photography remaining a passion of mine. I also create still some travel content for my company, @traveltelly, whenever I’m not drawing.

After spending time creating art around the world, this feels like the natural next step sharing more behind the scenes moments of both traveling and my artist life.

I started in Bangkok, a city I often visit and where I’ve spent the last five months creating the BangPOP art. Teaming up with Sats ‘n’ Facts, I explored Bangkok to see how Bitcoin Lightning adoption is growing here. Bitcoin has given me the freedom to create art, so I wanted to see if it’s also helping others in Bangkok. On a scorching 35°C day, we filmed three places where you can pay with Bitcoin Lightning. You can find these locations on btcmap.org.

I’m leaving Bangkok soon, but more vlogs from Thailand will follow when I return. I always find my way back to the Land of Smiles.

-

@ a012dc82:6458a70d

2025-03-01 14:18:37

Bitcoin, since its creation by the enigmatic figure Satoshi Nakamoto, has revolutionized the concept of currency. Its journey from an obscure digital token to a major financial asset has been marked by dramatic bull runs, capturing the attention of investors worldwide. These surges in Bitcoin's value are not random but are driven by a combination of technological innovation, economic factors, and unique monetary policy. In this article, we explore the intricacies of Bitcoin's scarcity, the halving process, and the broader market dynamics that contribute to its periodic bull runs.

The allure of Bitcoin lies not just in its technological novelty but also in its challenge to traditional financial systems. It represents a decentralized form of currency, free from government control and manipulation. This aspect has been particularly appealing in times of economic uncertainty, where traditional currencies and markets have shown vulnerability. Bitcoin's bull runs can be seen as a barometer of the changing landscape of finance, reflecting a growing shift towards digital assets.

**Table of Contents**

- The Concept of Scarcity in Bitcoin

- Finite Supply

- Impact on Value

- The Halving Events

- Mechanism and Purpose

- Historical Impact on Price

- Market Dynamics and Investor Sentiment

- Institutional Investment

- Global Economic Factors

- Technological Advancements

- Regulatory Environment

- Conclusion

- FAQs

**The Concept of Scarcity in Bitcoin**

**Finite Supply**

Bitcoin's protocol ensures that only 21 million coins will ever be in existence. This limit is encoded in its blockchain, making it a deflationary asset as opposed to inflationary fiat currencies. The idea behind this is to create a form of money that can resist inflationary pressures over time, much like gold, which has maintained its value for centuries due to its scarcity.

**Impact on Value**

The scarcity of Bitcoin has a profound psychological impact on investors. It creates a sense of urgency and a fear of missing out (FOMO) as the available supply dwindles. This is particularly evident as each Bitcoin halving event approaches, reminding the market of the ever-decreasing new supply. The result is often a speculative rally, as seen in the past bull runs. Moreover, as Bitcoin becomes more scarce, its comparison to gold becomes increasingly apt, attracting investors who are looking for assets that can retain value over time.

Scarcity also plays into the hands of long-term investors, often referred to as 'HODLers' in the crypto community. These investors view Bitcoin as a long-term store of value, akin to an investment in precious metals. The limited supply of Bitcoin reassures these investors that their holdings will not be devalued through oversupply, a common problem in fiat currencies.

**The Halving Events**

**Mechanism and Purpose**

Bitcoin's halving is a genius mechanism that ensures a controlled and gradual distribution of coins. By reducing the mining reward by half every four years, Bitcoin mimics the process of extracting a natural resource like gold, becoming progressively harder and more resource-intensive to mine. This not only controls inflation but also adds to the scarcity, making each coin more valuable over time.

**Historical Impact on Price**

Each halving event has historically led to an increase in Bitcoin's price, though not immediately. There is typically a lag between the halving and the subsequent bull run. This delay can be attributed to market adjustment and the gradual realization of reduced supply. The anticipation of this price increase often starts a positive feedback loop, attracting more investors and further driving up the price.

The halving events serve as key milestones in Bitcoin's timeline, providing a predictable pattern of supply reduction that savvy investors monitor closely. These events have become celebratory moments within the Bitcoin community, symbolizing the strength and resilience of the network. They also serve as a reminder of Bitcoin's unique value proposition in the world of cryptocurrencies.

**Market Dynamics and Investor Sentiment**

**Institutional Investment**

The recent years have seen a paradigm shift with the entry of institutional investors into the Bitcoin market. This shift is significant as it marks a departure from Bitcoin's early days of being a niche asset for tech enthusiasts. Institutional investors bring with them not only large capital inflows but also a sense of legitimacy and stability to the market. Their involvement has been a key driver in the maturation of the cryptocurrency market, making it more appealing to a broader audience.

**Global Economic Factors**

The role of global economic factors in influencing Bitcoin's price cannot be overstated. In times of economic instability, such as during the COVID-19 pandemic, investors increasingly turned to Bitcoin as a safe haven asset. This trend is indicative of a growing recognition of Bitcoin's value as a hedge against inflation and economic uncertainty. The decentralized nature of Bitcoin makes it less susceptible to geopolitical tensions and policy changes that affect traditional currencies and markets.

**Technological Advancements**

The continuous evolution of blockchain technology and the infrastructure surrounding Bitcoin has played a crucial role in its adoption. Developments such as improved transaction speed, enhanced security measures, and user-friendly trading platforms have made Bitcoin more accessible and attractive to a wider audience. These technological advancements are crucial in building investor confidence and facilitating the integration of Bitcoin into mainstream finance.

**Regulatory Environment**

The regulatory environment for Bitcoin and cryptocurrencies has been a double-edged sword. On one hand, clear and supportive regulations in certain jurisdictions have provided a boost to the market, encouraging institutional participation and providing clarity for investors. On the other hand, regulatory crackdowns in some countries have led to market volatility and uncertainty. The ongoing development of a regulatory framework for cryptocurrencies remains a key factor in shaping Bitcoin's future.

**Conclusion**

Bitcoin's journey is a testament to the evolving nature of finance and investment in the digital age. Its bull runs, driven by scarcity, halving events, and a complex interplay of market dynamics, highlight the growing acceptance of cryptocurrencies as a legitimate asset class. As the world increasingly embraces digital currencies, Bitcoin's role as a pioneer and standard-bearer will likely continue to influence its value and relevance in the global financial landscape.

Understanding Bitcoin's market dynamics is not just about analyzing charts and trends. It's about appreciating the broader context of economic, technological, and social changes that are reshaping the way we think about money and value. For investors and enthusiasts alike, staying informed and adaptable is key to navigating the exciting and often unpredictable world of Bitcoin and cryptocurrencies.

**FAQs**

**What causes a Bitcoin bull run?**

Bitcoin bull runs are typically driven by a combination of factors including its built-in scarcity due to the finite supply, halving events reducing the mining rewards, institutional investment, global economic factors, advancements in blockchain technology, and the evolving regulatory landscape.

**How does Bitcoin's scarcity affect its value?**

Bitcoin's value is significantly influenced by its scarcity. With a capped supply of 21 million coins, as demand increases, the limited supply pushes the price upwards, similar to precious metals like gold.

**What is a Bitcoin halving event?**

A Bitcoin halving event is when the reward for mining new Bitcoin blocks is halved, effectively reducing the rate at which new Bitcoins are created. This occurs approximately every four years and is a key factor in Bitcoin's deflationary model.

**Why do institutional investors matter in Bitcoin's market?**

Institutional investors bring significant capital, credibility, and stability to the Bitcoin market. Their participation signals a maturation of the market and can lead to increased confidence and investment from other sectors.

**That's all for today**

**If you want more, be sure to follow us on:**

**NOSTR: croxroad@getalby.com**

**X: [@croxroadnewsco](https://x.com/croxroadnewsco)**

**Instagram: [@croxroadnews.co/](https://www.instagram.com/croxroadnews.co/)**

**Youtube: [@thebitcoinlibertarian](https://www.youtube.com/@thebitcoinlibertarian)**

**Store: https://croxroad.store**

**Subscribe to CROX ROAD Bitcoin Only Daily Newsletter**

**https://www.croxroad.co/subscribe**

**Get Orange Pill App And Connect With Bitcoiners In Your Area. Stack Friends Who Stack Sats

link: https://signup.theorangepillapp.com/opa/croxroad**

**Buy Bitcoin Books At Konsensus Network Store. 10% Discount With Code “21croxroad”

link: https://bitcoinbook.shop?ref=21croxroad**

*DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.*

-

@ 732c6a62:42003da2

2025-03-01 13:56:36

> De acordo com a Forbes, a Ripple (Empresa responsável pela Criptomoeda XRP) tem financiado e apoiado campanhas contra a mineração de Bitcoin.

## **Por que Ripple faz propaganda anti-bitcoin?**

Simples: **eles são o oposto do Bitcoin em quase tudo.** Enquanto o Bitcoin foi criado para ser descentralizado, resistente à censura e independente de instituições, o Ripple é basicamente um serviço bancário 2.0. Eles precisam atacar o Bitcoin para justificar sua própria existência.

## **O que você não sabe:**

1. **Ripple Labs controla a maioria do XRP:** Eles têm um estoque estratégico que pode ser liberado no mercado a qualquer momento. Isso é o oposto de descentralização.

2. **XRP não é uma moeda para "pessoas comuns":** Foi criada para bancos e instituições financeiras. Basicamente, é o "banco central" das criptomoedas.

3. **Ripple não é blockchain no sentido tradicional:** Eles usam um protocolo chamado **Ripple Protocol Consensus Algorithm (RPCA)**, que é mais rápido, mas menos descentralizado.

## **Os principais ataques do Ripple ao Bitcoin:**

1. **Anti-mineração:** O Ripple critica o consumo de energia do Bitcoin, mas esquece que seu próprio sistema depende de servidores centralizados que também consomem energia.

2. **Anti-reserva estratégica:** O Ripple tem um estoque gigante de XRP, mas critica o Bitcoin por ser "deflacionário". Hipocrisia? Nunca ouvi falar.

3. **Anti-descentralização:** O Ripple prega que a descentralização do Bitcoin é "ineficiente", mas o que eles realmente querem é manter o controle nas mãos de poucos.

## **Análise Psicológica Básica (para você que acha que XRP é o futuro):**

- **Síndrome do Underdog:** Acha que apoiar o Ripple te faz um rebelde, mas na verdade você está torcendo para o sistema bancário tradicional.

- **Viés de Confirmação:** Só ouve opiniões que validam sua decisão de comprar XRP.

- **Efeito Dunning-Kruger:** Acha que entender Ripple te torna um especialista em criptomoedas, mas não sabe o que é um *hard fork*.

**Estudo de Caso (Real, mas Você Vai Ignorar):**

Carlos, 30 anos, comprou XRP porque "é o futuro das transações bancárias". Ele não sabe que o Ripple está sendo processado pela SEC por vender XRP como um título não registrado. Carlos agora está esperando o "pump" que nunca vem.

## **Conclusão: ou, "volte para a aula de economia do ensino médio"**

Ripple não é o futuro das finanças. É só mais um player tentando lucrar em um mercado competitivo. E sua propaganda anti-Bitcoin? Essa só prova que **a descentralização assusta quem quer controle**. Agora vá estudar blockchain básico — ou pelo menos pare de compartilhar memes com erros de português.

-

@ b83a28b7:35919450

2025-03-01 13:08:06

## **Preamble**

*I used OpenAI's o3-mini reasoning engine to construct a thesis for the Russia-Ukraine conflict using the positions of Jeffery Sachs and John Mearsheimer. I then asked it to create a counterargument to those positions- the antithesis. And I finally asked for a synthesis that concludes in lasting peace in the region. In all three cases, I prompted it to only use axiomatic deductive reasoning and first principles thinking, emphasizing facts and ignoring the opinions and assertions of so-called experts.*

# The Thesis

## **John Mearsheimer's Position: A Realist Perspective**

### **First Principles**

1. **States prioritize survival**: In an anarchic international system (no overarching authority), states act to maximize security and minimize threats.

2. **Great powers seek regional hegemony**: States aim to dominate their immediate regions to prevent rival powers from threatening them.

3. **Proximity amplifies threat perception**: The closer a rival power or alliance is to a state's borders, the greater the perceived threat.

### **Logical Reasoning**

1. NATO's eastward expansion brings a U.S.-led military alliance closer to Russia’s borders.

- From the principle of proximity, this increases Russia’s perceived insecurity.

2. Ukraine’s potential NATO membership represents a direct challenge to Russia’s sphere of influence.

- A great power like Russia would logically act to prevent this encroachment, as it undermines its regional dominance.

3. Russia’s actions (e.g., annexation of Crimea in 2014 and invasion in 2022) are defensive responses to NATO's perceived encroachment.

- From the principle of survival, Russia seeks to neutralize threats by ensuring Ukraine does not join NATO.

4. The U.S. and NATO ignored Russia’s stated red lines (e.g., no NATO membership for Ukraine).

- This provoked predictable countermeasures from Russia, consistent with great-power behavior.

### **Conclusion**

From a realist perspective, NATO expansion is the root cause of the conflict. Russia’s actions are not imperialistic but defensive responses to protect its security and sphere of influence.

## **Jeffrey Sachs' Position: A Historical and Diplomatic Perspective**

### **First Principles**

1. **Agreements create expectations**: Commitments between states establish norms that guide future behavior.

2. **Security is interdependent**: One state’s pursuit of security can increase another state’s insecurity (the "security dilemma").

3. **Conflicts are preventable through diplomacy**: Negotiations and compromises can avert wars by addressing mutual concerns.

### **Logical Reasoning**

1. In 1990, U.S. officials assured Soviet leaders that NATO would not expand eastward if Germany was reunified.

- If such assurances were made (even informally), subsequent NATO expansion violated these expectations, fostering mistrust.

2. The U.S.'s unilateral withdrawal from treaties like the Anti-Ballistic Missile Treaty (2002) and its push for NATO enlargement exacerbated Russia's insecurity.

- By the principle of interdependent security, these actions predictably escalated tensions with Russia.

3. Putin proposed negotiations in 2021 to prevent NATO expansion into Ukraine, but these were rejected by the U.S.

- Diplomacy could have addressed Russian concerns without war, but its rejection left military action as Russia’s only perceived option.

4. Ukraine’s neutrality could have prevented conflict by satisfying both Russian and Western security concerns.

- Neutrality would reduce NATO's proximity to Russia while preserving Ukraine's sovereignty.

### **Conclusion**

From Sachs’ perspective, the war is a consequence of U.S.-led NATO expansion and missed diplomatic opportunities. A negotiated settlement based on Ukrainian neutrality remains the logical path to peace.

## Deductive Insights

1. Both positions agree that NATO expansion is central to understanding the conflict but differ in emphasis:

- Mearsheimer focuses on structural inevitabilities in great-power politics.

- Sachs highlights historical commitments and missed opportunities for diplomacy.

2. Both rely on axioms about state behavior:

- Mearsheimer emphasizes security maximization through power balancing.

- Sachs underscores trust-building through adherence to agreements.

In conclusion, reasoning from first principles supports both scholars’ views as internally consistent frameworks for explaining the Ukraine conflict, though they emphasize different aspects of state behavior and international relations logic.

To construct counterarguments to the positions of John Mearsheimer and Jeffrey Sachs using axiomatic deductive reasoning, we will start with alternative first principles and challenge their logical conclusions. This approach ensures that the counterarguments are rooted in logic and facts, without relying on external opinions or assertions.

## **Counterarguments to John Mearsheimer's Position**

### **First Principles for the Counterargument**

1. **Sovereign states have the right to self-determination**: All states, regardless of size, have the right to choose their alliances and political alignments.

2. **Security is not zero-sum**: One state’s pursuit of security does not always come at the expense of another’s; collective security arrangements can enhance stability.

3. **Aggression undermines security**: A state that invades its neighbors creates insecurity for itself by provoking opposition and strengthening rival alliances.

### **Logical Reasoning**

1. NATO expansion was voluntary and driven by the sovereign decisions of Eastern European states seeking protection from historical Russian aggression.

- From the principle of self-determination, NATO enlargement reflects the legitimate choices of countries like Poland, Estonia, and Ukraine to align with a defensive alliance, not an act of Western aggression against Russia.

2. Russia’s perception of NATO as a threat is not inherently justified.

- NATO is a defensive alliance with no history of invading non-member states. From the principle that security is not zero-sum, NATO’s presence near Russia does not necessarily reduce Russian security unless Russia itself acts aggressively.

3. Russia’s invasion of Ukraine contradicts Mearsheimer’s claim that its actions are purely defensive.

- By attacking Ukraine, Russia has provoked a stronger NATO presence in Eastern Europe (e.g., Finland and Sweden joining NATO) and increased its own insecurity. This undermines the principle that great powers act rationally to maximize their security.

4. The analogy to the Cuban Missile Crisis is flawed.

- In 1962, the U.S. objected to Soviet missiles in Cuba because they posed an immediate offensive threat. NATO membership for Ukraine does not involve stationing offensive weapons aimed at Russia but rather a defensive commitment.

### **Conclusion**

Mearsheimer’s argument fails to account for the agency of smaller states and overstates the inevitability of conflict due to NATO expansion. Russia’s actions are better explained as aggressive attempts to reassert imperial influence rather than rational defensive measures.

# The Antithesis

## **Counterarguments to Jeffrey Sachs' Position**

### **First Principles for the Counterargument**

1. **Informal agreements lack binding force**: Verbal or informal assurances between states do not constitute enforceable commitments in international relations.

2. **Security dilemmas require mutual restraint**: Both sides in a conflict must take steps to reduce tensions; unilateral blame is insufficient.

3. **Sovereign equality underpins diplomacy**: No state has the right to dictate another state’s foreign policy or alliances.

### **Logical Reasoning**

1. The alleged 1990 U.S. assurance against NATO expansion was never formalized in any treaty or agreement.

- From the principle that informal agreements lack binding force, subsequent NATO enlargement cannot be considered a violation of commitments since no legal obligation existed.

2. Russia’s actions have escalated tensions far more than NATO expansion ever did.

- By annexing Crimea (2014) and invading Ukraine (2022), Russia has actively destabilized its neighbors and created insecurity across Europe. From the principle of mutual restraint, Russia bears responsibility for escalating the conflict rather than solely responding to U.S./NATO actions.

3. Diplomatic solutions require both parties to negotiate in good faith.

- Putin’s 2021 proposals demanded guarantees that Ukraine would never join NATO—a condition that violates Ukraine’s sovereignty and right to self-determination. From the principle of sovereign equality, such demands are inherently illegitimate.

4. Neutrality is not always a viable solution.

- Ukraine attempted neutrality after independence (e.g., refusing to join NATO for decades). However, this did not prevent Russian aggression in 2014 or 2022, undermining Sachs’ claim that neutrality would have ensured peace.

### **Conclusion**

Sachs’ argument overemphasizes historical grievances and ignores Russia’s active role in escalating tensions through aggression and coercion. The failure of diplomacy lies as much with Russia’s demands as with Western policies.

## **Deductive Insights from Counterarguments**

1. Both Mearsheimer and Sachs underestimate the agency of smaller states like Ukraine, which made sovereign decisions based on their own security needs rather than being mere pawns in great-power politics.

2. Both positions assume that Russia’s actions are primarily reactive or defensive, but this ignores evidence that Russia has proactively pursued aggressive policies (e.g., Georgia 2008, Crimea 2014).

3. The principle of sovereignty challenges both scholars’ frameworks:

- Mearsheimer overlooks Ukraine's right to align with NATO if it chooses.

- Sachs dismisses Ukraine's agency by suggesting neutrality could have been imposed as a solution.

In conclusion, while Mearsheimer and Sachs present internally consistent arguments, their frameworks can be challenged by emphasizing sovereignty, rejecting inevitability in great-power conflict, and highlighting Russia's active role in escalating tensions beyond what can be justified by security concerns alone.

# The Synthesis: A Balanced Framework for Resolving the Russia-Ukraine Conflict

### **First Principles for Synthesis**

1. **Security is interdependent**: A state’s pursuit of security can create insecurity for others, necessitating mutual accommodation.

2. **Sovereignty is fundamental but constrained by geography**: States have a right to self-determination, but geography imposes practical limits on absolute sovereignty in a multipolar world.

3. **Great powers act to preserve their spheres of influence**: In an anarchic international system, great powers prioritize regional dominance to ensure their survival.

4. **Diplomacy is essential for de-escalation**: Durable peace requires negotiated compromises that address the core interests of all parties involved.

### **Reconciling the Thesis and Antithesis**

#### **Thesis (Mearsheimer and Sachs' Positions)**

- NATO expansion near Russia’s borders provoked a predictable response from Moscow, reflecting structural dynamics of great-power competition.

- U.S. and NATO policies ignored Russian security concerns, contributing to the escalation of tensions.

- Diplomacy and neutrality for Ukraine are necessary to resolve the conflict.

#### **Antithesis (Counterarguments)**

- NATO expansion was driven by voluntary decisions of Eastern European states seeking protection from historical Russian aggression, not Western provocation.

- Russia’s actions are not purely defensive but reflect imperial ambitions that violate Ukraine’s sovereignty.

- Neutrality alone would not guarantee peace, as Russia has acted aggressively even when Ukraine was neutral.

#### **Synthesis**

Both perspectives contain valid insights but fail to fully address the complexity of the conflict. The synthesis must:

1. Acknowledge Russia’s legitimate security concerns while rejecting its imperialistic actions.

2. Respect Ukraine’s sovereignty while recognizing that its geographic position necessitates pragmatic compromises.

3. Balance great-power dynamics with smaller states’ rights to self-determination.

## **Proposed Solution: A Comprehensive Peace Framework**

To achieve an enduring peace in Ukraine and stabilize Eastern Europe, the following steps are proposed:

### 1. Immediate Ceasefire

- Both sides agree to an immediate cessation of hostilities under international supervision (e.g., UN peacekeeping forces).

- A demilitarized buffer zone is established along current frontlines to prevent further clashes.

### 2. Neutrality with Conditions

- Ukraine adopts a status of permanent neutrality, enshrined in its constitution and guaranteed by international treaties.

- Neutrality includes:

- No NATO membership for Ukraine.

- Freedom for Ukraine to pursue economic integration with both the EU and other global partners without military alignments.

### 3. Security Guarantees

- Russia receives legally binding assurances that NATO will not expand further eastward or station offensive weapons near its borders.

- Ukraine receives multilateral security guarantees from major powers (e.g., U.S., EU, China) to deter future aggression from any party.

### 4. Territorial Dispute Resolution

- Crimea’s status is deferred to future negotiations under international mediation, with both sides agreeing to maintain the status quo in the interim.

- Donetsk and Luhansk regions are granted autonomy within Ukraine under a decentralized federal structure, ensuring local governance while preserving Ukrainian sovereignty.

### 5. Economic Reconstruction

- An international fund is established for rebuilding war-torn regions in Ukraine, with contributions from Russia, Western nations, and multilateral institutions.

- Economic cooperation between Ukraine and Russia is encouraged through trade agreements designed to benefit both parties.

### 6. Phased Implementation

- Peace agreements are implemented incrementally to build trust:

- Initial steps include withdrawal of heavy weaponry, prisoner exchanges, and humanitarian aid delivery.

- Subsequent phases involve constitutional reforms (e.g., neutrality), elections in disputed regions, and gradual reintegration of territories under international supervision.

### 7. Long-Term Regional Security Framework

- A new regional security framework is established involving Russia, Ukraine, NATO members, and neutral states to manage disputes peacefully.

- This framework institutionalizes dialogue channels for arms control, economic cooperation, and crisis management.

## **Rationale for the Solution**

1. **Balances Security Concerns**:

- Neutrality addresses Russia’s fears of NATO encirclement while preserving Ukraine’s independence.

- Security guarantees reduce mistrust between NATO and Russia while protecting Ukraine from future aggression.

2. **Respects Sovereignty**:

- Ukraine retains its independence and territorial integrity (except for deferred issues like Crimea) while accommodating regional realities through federalism and neutrality.

3. **Acknowledges Great-Power Dynamics**:

- The solution recognizes Russia’s need for a secure sphere of influence without legitimizing its imperial ambitions or violating international law.

4. **Builds Trust Through Gradualism**:

- Incremental implementation allows both sides to verify commitments before proceeding further.

- International monitoring ensures compliance with agreements.

5. **Incorporates Lessons from History**:

- Neutrality models (e.g., Austria) demonstrate that such arrangements can work when backed by strong guarantees.

- Phased implementation mirrors successful peace processes in other conflicts (e.g., Colombia).

## **Conclusion**

The synthesis reconciles the structural realism of Mearsheimer with Sachs’ emphasis on diplomacy by proposing a balanced solution that addresses both security dilemmas and sovereignty concerns. Neutrality serves as the linchpin for de-escalation, while phased implementation builds trust over time. By integrating immediate conflict resolution measures with long-term regional frameworks, this approach offers a realistic path toward enduring peace in Eastern Europe.

*Citations:*

[1] https://www.reddit.com/r/geopolitics/comments/1drhxxh/john_mearsheimers_take_on_the_russoukrainian_war/

[2] https://www.reddit.com/r/CredibleDefense/comments/14ktcv2/the_darkness_ahead_where_the_ukraine_war_is/

[3] https://www.reddit.com/r/PoliticalScience/comments/1bp64ub/what_is_with_mearsheimer_and_russia/

[4] https://www.reddit.com/r/AskConservatives/comments/1gznjks/do_you_think_appeasing_putin_is_the_right_way_to/

[5] https://www.reddit.com/r/changemyview/comments/1hu8iop/cmv_the_united_states_should_continue_to_send_aid/

[6] https://internationalpolicy.org/publications/jeffrey-sachs-matt-duss-debate-u-s-russia-talks-to-end-ukraine-war/

[7] https://www.reddit.com/r/IRstudies/comments/17iwfpr/john_mearsheimer_is_wrong_about_ukraine/

[8] https://scheerpost.com/2024/11/23/jeffrey-sachs-explains-the-russia-ukraine-war/

[9] https://consortiumnews.com/2023/09/21/jeffrey-sachs-nato-expansion-ukraines-destruction/

[10] https://www.democracynow.org/2025/2/18/russia_ukraine

[11] https://www.reddit.com/r/geopolitics/comments/15kwpx3/ukraine_war_and_the_paradox_of_mearsheimers/

[12] https://braveneweurope.com/jeffrey-d-sachs-the-real-history-of-the-war-in-ukraine-a-chronology-of-events-and-case-for-diplomacy

[13] https://www.jeffsachs.org/newspaper-articles/nato-chief-admits-expansion-behind-russian-invasion

[14] https://www.semanticscholar.org/paper/2c06cbc711d95427489f8bc781c45daab461ccde

[15] https://www.semanticscholar.org/paper/46e28172de2a520e4f77e654a37687a7757d9d49

[16] https://www.semanticscholar.org/paper/e8c17a15a554054c755a1b1d53d3e1099d159033

[17] https://www.semanticscholar.org/paper/65cbcec6ac255413086db567774844f84c813600

[18] https://www.semanticscholar.org/paper/d11db25ffa5b50ef38d18c2a1e2243e4c7c53b24

[19] https://www.semanticscholar.org/paper/5b750f3d763d728ae2bcf2ce3e6cf67a8281bb2b

[20] https://www.semanticscholar.org/paper/34883bf28c7a988eb2c2fe458b7eab3180b36dcc

[21] https://www.semanticscholar.org/paper/b64319315d02b2cc1dff936d69be40d78d15f6b9

[22] https://www.semanticscholar.org/paper/c4ca4d645825a5b8d7389c45bcfcad0eeebecd81

[23] https://www.ncbi.nlm.nih.gov/pmc/articles/PMC11734947/

[24] https://www.reddit.com/r/PoliticalScience/comments/17iwhqi/john_mearsheimer_is_wrong_about_ukraine/

[25] https://www.reddit.com/r/geopolitics/comments/1ih646n/john_mearsheimer_is_offensive_realist_who_should/

[26] https://www.reddit.com/r/neoliberal/comments/tjhwi4/a_response_to_mearsheimers_views_on_nato_ukraine/

[27] https://www.reddit.com/r/IRstudies/comments/1b12pdh/genuine_structural_realist_cases_against_us/

[28] https://www.reddit.com/r/lexfridman/comments/17xl8jk/john_mearsheimer_israelpalestine_russiaukraine/

[29] https://www.reddit.com/r/geopolitics/comments/17xve8j/people_give_too_much_credit_to_the_realist/

[30] https://www.reddit.com/r/PoliticalDiscussion/comments/zvfquu/do_you_agree_with_john_mearsheimers_complex_view/

[31] https://www.reddit.com/r/geopolitics/comments/1bghzbp/john_mearshimer_and_ukraine/

[32] https://www.reddit.com/r/LabourUK/comments/tbzs2d/john_mearsheimer_on_why_the_west_is_principally/

[33] https://www.reddit.com/r/IRstudies/comments/1gjus1i/playing_devils_advocate_to_john_mearsheimer/

[34] https://www.reddit.com/r/TheAllinPodcasts/comments/1fipvmu/john_mearsheimer_and_jeffrey_sachs_on_american/

[35] https://www.e-ir.info/2024/03/31/dissecting-the-realist-argument-for-russias-invasion-of-ukraine/

[36] https://www.youtube.com/watch?v=G6YOVl5LKTs

[37] https://www.researchgate.net/publication/362890238_Mearsheimer_Realism_and_the_Ukraine_War

[38] https://www.ndsmcobserver.com/article/2024/01/john-mearsheimer-talks-war-and-international-politics

[39] https://euideas.eui.eu/2022/07/11/john-mearsheimers-lecture-on-ukraine-why-he-is-wrong-and-what-are-the-consequences/

[40] https://academic.oup.com/ia/article-pdf/98/6/1873/47659084/iiac217.pdf

[41] https://www.youtube.com/watch?v=qciVozNtCDM

[42] https://metacpc.org/en/mearsheimer2022/

[43] https://www.fpri.org/article/2023/01/the-realist-case-for-ukraine/

[44] https://www.mearsheimer.com/wp-content/uploads/2019/06/Why-the-Ukraine-Crisis-Is.pdf

[45] https://www.newyorker.com/news/q-and-a/why-john-mearsheimer-blames-the-us-for-the-crisis-in-ukraine

[46] https://www.semanticscholar.org/paper/cd2fd9e8ea82fa4e7f2f66a2eb517f4ba34981a0

[47] https://www.semanticscholar.org/paper/99942047e1e43e77ef76e147e51b725a63d86e22

[48] https://www.semanticscholar.org/paper/a53f98c63c58e4268856bde3883abc72e43e03bf

[49] https://www.semanticscholar.org/paper/471f43cd36c53141ee24a431eef520bec311c15c

[50] https://www.semanticscholar.org/paper/d56b89349fade26cef69c1d0cffd6887adca102d

[51] https://www.semanticscholar.org/paper/50f504029753ffb7eec4d2660f29beb48b682803

[52] https://www.semanticscholar.org/paper/e2f85f09340e854efcfc4df9d1aabd2e533e1051

[53] https://www.reddit.com/r/UkraineRussiaReport/comments/1ghs32m/ru_pov_jeffrey_sachss_view_on_the_lead_up_and/

[54] https://www.reddit.com/r/EndlessWar/comments/1iwpc2e/ukraine_war_is_over_jeffrey_sachs_explosive/

[55] https://www.reddit.com/r/UnitedNations/comments/1ivq4zg/there_will_be_no_war/

[56] https://www.reddit.com/r/chomsky/comments/1gx5c5k/jeffrey_sachs_explains_the_background_to_the/

[57] https://www.reddit.com/r/chomsky/comments/1ix8z9a/jeffery_sachs_providing_clarity/

[58] https://www.reddit.com/r/chomsky/comments/1ism3vj/jeffrey_sachs_on_us_russia_talks_to_end_ukraine/

[59] https://www.reddit.com/r/geopolitics/comments/1e04cpd/i_do_not_understand_the_prorussia_stance_from/

[60] https://www.reddit.com/r/PoliticalVideo/comments/1izr6g9/economist_prof_jeffrey_sachs_addresses_eu/

[61] https://www.reddit.com/r/LabourUK/comments/1iw9u56/economist_prof_jeffrey_sachs_addresses_eu/

[62] https://www.reddit.com/r/TheAllinPodcasts/comments/1cjfkbx/fact_checking_david_sachs_data_sources_on_ukraine/

[63] https://www.reddit.com/r/chomsky/comments/1e4n8ea/why_wont_the_us_help_negotiate_a_peaceful_end_to/

[64] https://www.reddit.com/r/ukraine/comments/13lrmgo/rebuttal_to_jeffrey_sachs_ad_in_the_new_york/

[65] https://www.reddit.com/r/chomsky/comments/1ipg351/you_can_immediately_tell_who_in_this_sub_doesnt/

[66] https://www.youtube.com/watch?v=RiK6DijNLGE

[67] https://www.internationalaffairs.org.au/australianoutlook/why-nato-expansion-explains-russias-actions-in-ukraine/

[68] https://www.youtube.com/watch?v=P7ThOU4xKaU

[69] https://www.jeffsachs.org/newspaper-articles/s6ap8hxhp34hg252wtwwwtdw4afw7x

[70] https://www.jeffsachs.org/newspaper-articles/wgtgma5kj69pbpndjr4wf6aayhrszm

[71] https://www.youtube.com/watch?v=xfRG1Cqda2M

[72] https://voxukraine.org/en/open-letter-to-jeffrey-sachs

[73] https://www.youtube.com/watch?v=AmZoJ1vKEKk

[74] https://www.youtube.com/watch?v=YnBakiVQf-s

[75] https://www.project-syndicate.org/commentary/russia-nato-security-through-ukrainian-neutrality-by-jeffrey-d-sachs-2022-02

[76] https://www.commondreams.org/opinion/nato-chief-admits-expansion-behind-russian-invasion

[77] https://www.youtube.com/watch?v=-MmJfmTgvAk

[78] https://www.youtube.com/watch?v=ava7rqirOYI

[79] https://jordantimes.com/opinion/jeffrey-d-sachs/war-ukraine-was-not-%E2%80%98unprovoked%E2%80%99

[80] https://www.reddit.com/r/geopolitics/comments/1d8ony5/john_mearsheimers_opinion_on_ukraines_own_ability/

[81] https://thegeopolitics.com/mearsheimer-revisited-how-offensive-realisms-founder-is-inconsistent-on-the-ukraine-russia-war/

[82] https://www.scielo.br/j/rbpi/a/MvWrWYGGtcLhgtsFRrmdmcx/

[83] https://www.degruyter.com/document/doi/10.1515/auk-2022-2023/html?lang=en

[84] https://blog.prif.org/2023/07/26/russian-self-defense-fact-checking-arguments-on-the-russo-ukrainian-war-by-john-j-mearsheimer-and-others/

[85] https://europeanleadershipnetwork.org/commentary/the-ukraine-crisis-according-to-john-j-mearsheimer-impeccable-logic-wrong-facts/

[86] https://pjia.com.pk/index.php/pjia/article/download/837/587

[87] https://www.reddit.com/r/TheAllinPodcasts/comments/1e4noiz/where_is_sacks_prorussia_motive_coming_from/

[88] https://www.reddit.com/r/geopolitics/comments/1an20x2/why_did_boris_johnson_tell_ukraine_not_to_take/

[89] https://www.reddit.com/r/ukraine/comments/1gjfcwg/media_reveals_deal_russia_offered_to_ukraine_at/

[90] https://www.reddit.com/r/AskARussian/comments/1d3pv6y/do_you_feel_like_the_west_was_actively_sabotaging/

-

@ d360efec:14907b5f

2025-03-01 12:58:51

**ภาพรวม (Integrated Overview)**

ถ้าพิจารณาทั้ง TF Daily, 4H, และ 15m (พร้อมข้อมูล Money Flow ที่เป็นลบในทุก TF) ราคาปัจจุบันประมาณ 84,579

**การวิเคราะห์แบบรวม***

1. **แนวโน้ม (Trend):**

* **Daily:** *ขาลง* (Bearish) แม้ว่าราคาจะอยู่เหนือเส้นค่าเฉลี่ยเคลื่อนที่ (EMA) แต่ *Money Flow ที่เป็นลบอย่างรุนแรง* บ่งชี้ถึงแนวโน้มขาลง

* **4H:** *ขาลง* (Bearish) Money Flow เป็นลบอย่างมาก และมี *รูปแบบ* Head and Shoulders ที่มีโอกาสเกิดขึ้น

* **15m:** *ขาลง* (Bearish) Money Flow เป็นลบ

2. **SMC & ICT (Smart Money Concepts & Inner Circle Trader):**

* **Buyside Liquidity:** อยู่เหนือราคาสูงสุดปัจจุบัน ระดับราคาที่ *อาจ* เป็นแนวต้าน (จากกราฟ Daily): 90456.8, 92755.8, 95054.9, 97354.0, 99653.1, 101952.1, 104251.3, 106550.3, 109998.9, และ 117000.0 ใน TF 15m, Buyside Liquidity คือจุดสูงสุดของแท่งเทียนก่อนหน้า

* **Sellside Liquidity:** แนวรับสำคัญ: 80,000 (Neckline ของ Head and Shoulders ใน TF 4H, ตัวเลขกลม, แนวรับทางจิตวิทยา) แนวรับอื่นๆ: 83559.5, 81260.4, 78961.4, 76662.3, 74363.2, 72064.1, 69705.1, 67400.0, 66811.7, และ 65166.9 (จากกราฟ Daily) ใน TF 15m, Sellside Liquidity คือจุดต่ำสุดของแท่งเทียนก่อนหน้า

3. **Money Flow:**

* **Daily:** *เป็นลบอย่างมาก* (Strongly Negative)

* **4H:** *เป็นลบอย่างมาก* (Strongly Negative)

* **15m:** *เป็นลบ* (Negative)

* **นี่คือตัวบ่งชี้ที่สำคัญที่สุดในขณะนี้ และเป็นขาลงในทุก Timeframe**

4. **EMA (Exponential Moving Averages):**

* **Daily:** ราคาอยู่เหนือ EMA 50 และ 200 *แต่ถูกหักล้างด้วย Money Flow ที่เป็นลบ*

* **4H:** ราคาอยู่เหนือ EMA 50 และ 200 *แต่ถูกหักล้างด้วย Money Flow ที่เป็นลบ*

* **15m:** ราคาแกว่งตัวรอบ EMA 50, อยู่เหนือ EMA 200 *แต่ถูกหักล้างด้วย Money Flow ที่เป็นลบ*

5. **Trend Strength (AlgoAlpha):**

* **Daily:** เมฆ Ichimoku เป็นสีเทา (Neutral - เป็นกลาง)

* **4H:** เมฆ Ichimoku เป็นสีเทา (Neutral - เป็นกลาง)

* **15m:** เมฆ Ichimoku เป็นสีเทา (Neutral - เป็นกลาง)

6. **Chart Patterns (รูปแบบกราฟ):**

* **Daily:** ไม่มีรูปแบบที่ชัดเจน แต่มีการอ่อนตัวของราคา

* **4H:** *มีโอกาสเกิด* รูปแบบ Head and Shoulders (กลับหัว) (Bearish - ขาลง)

* **15m:** ไม่มีรูปแบบที่ชัดเจน แต่อาจเป็นส่วนหนึ่งของ Right Shoulder ใน TF 4H

**กลยุทธ์ Day Trade (SMC-Based)**

เนื่องจาก Money Flow ที่เป็นลบอย่างท่วมท้นในทุก Timeframes และรูปแบบ Head and Shoulders ที่มีโอกาสเกิดขึ้นใน TF 4H กลยุทธ์การซื้อขายที่สมเหตุสมผล *เพียงอย่างเดียว* คือ **การป้องกันอย่างเข้มงวด** โดยเน้นที่ **การหลีกเลี่ยงสถานะ Long** และพิจารณาสถานะ Short *เฉพาะ* เมื่อมีเงื่อนไขที่เข้มงวดมากเท่านั้น

1. **Long (Buy):** *ไม่แนะนำโดยเด็ดขาด* (Absolutely, unequivocally not recommended) การทำเช่นนี้จะเป็นการซื้อขายสวนทางกับแนวโน้มหลักและสัญญาณ Money Flow ที่ชัดเจน

2. **Short (Sell):**

* **Entry (จุดเข้า):** นี่คือการเทรด *เดียว* ที่ *อาจ* มีเหตุผลสนับสนุน, แต่ *เฉพาะ* เมื่อเงื่อนไข *ทั้งหมด* ต่อไปนี้เป็นจริง:

* รูปแบบ Head and Shoulders ใน TF 4H *เสร็จสมบูรณ์* ด้วยการ Breakout ที่ชัดเจนใต้ Neckline (80,000-81,000)

* การ Breakout ใต้ Neckline เกิดขึ้นพร้อมกับ *Volume ที่สูง*

* Money Flow ใน *ทั้งสาม* Timeframes ยังคง *เป็นลบอย่างมาก*

* คุณมีสัญญาณ Bearish อื่นๆ ยืนยัน (เช่น รูปแบบแท่งเทียน Bearish, Bearish Divergence)

* **Target (เป้าหมาย):** ระดับ Sellside Liquidity (เช่น 78961.4, 76662.3)

* **Stop Loss (จุดตัดขาดทุน):** *เหนือ* Neckline หรือ Right Shoulder ทันที *จำเป็นต้องมี Stop Loss ที่เข้มงวดอย่างยิ่ง*

3. **No Trade (ไม่เทรด):** เป็นตัวเลือกที่ *ดีที่สุด* สำหรับนักเทรด/นักลงทุนส่วนใหญ่ ความเสี่ยงที่จะเกิดการปรับฐานครั้งใหญ่มีสูงมาก

**สรุป**

สถานการณ์ของ BTC คือ **Bearish อย่างมาก** *Money Flow ที่เป็นลบอย่างมากในทุก Timeframes* เป็นปัจจัยสำคัญที่สุด ซึ่งมีน้ำหนักมากกว่าสัญญาณ Bullish ใดๆ ก่อนหน้านี้จาก EMA รูปแบบ Head and Shoulders ที่มีโอกาสเกิดขึ้นใน TF 4H ช่วยเพิ่มการยืนยันแนวโน้ม Bearish **สถานะ Long ไม่สมเหตุสมผลอย่างยิ่ง** สถานะ Short *อาจ* พิจารณาได้, แต่ *ต้อง* มีการยืนยันสัญญาณที่ชัดเจน *ทั้งหมด* และมีการบริหารความเสี่ยงที่เข้มงวดมาก **"Wait and See" (รอดู) และการรักษาเงินทุนเป็นสิ่งสำคัญที่สุด**

**Disclaimer:** การวิเคราะห์นี้เป็นเพียงความคิดเห็นส่วนตัว ไม่ถือเป็นคำแนะนำในการลงทุน ผู้ลงทุนควรศึกษาข้อมูลเพิ่มเติมและตัดสินใจด้วยความรอบคอบ

-

@ d360efec:14907b5f

2025-03-01 12:55:57

$OKX:BTCUSDT.P

**Overview (Integrated Overview)**

All three provided timeframes (Daily, 4H, and 15m, *all now confirmed to have negative Money Flow*), The current price is approximately 84,579.

**Integrated Analysis**

1. **Trend:**

* **Daily:** *Bearish*. While the price is above the EMAs, the *strongly negative Money Flow* on the Daily chart overrides the EMA signal, indicating a bearish trend. The Ichimoku Cloud is neutral, further supporting the idea that the previous bullish trend is weakening.

* **4H:** *Bearish*. Strongly negative Money Flow and a *potential* (but not yet confirmed) inverted Head and Shoulders pattern.

* **15m:** *Bearish*. Negative Money Flow.

2. **SMC & ICT (Smart Money Concepts & Inner Circle Trader):**

* **Buyside Liquidity:** Above the current high. Potential resistance levels (derived from the Daily chart image, assuming it's from 2025): 90456.8, 92755.8, 95054.9, 97354.0, 99653.1, 101952.1, 104251.3, 106550.3, 109998.9, and 117000.0. On the 15m chart (though we are prioritizing the Daily and 4H now), Buyside Liquidity would be represented by recent swing highs.

* **Sellside Liquidity:** Key support: 80,000 (this is the approximate neckline of the *potential* Head and Shoulders pattern on the 4H chart, a round number, and a psychological support level). Other support levels (derived from the Daily chart image): 83559.5, 81260.4, 78961.4, 76662.3, 74363.2, 72064.1, 69705.1, 67400.0, 66811.7, and 65166.9. On the 15m chart, Sellside Liquidity would be represented by recent swing lows.

3. **Money Flow:**

* **Daily:** *Strongly Negative*. This is a major bearish signal.

* **4H:** *Strongly Negative*. This reinforces the bearish signal and is consistent with the Daily chart.

* **15m:** *Negative*. This confirms the short-term outflow of money.

* **The consistently negative Money Flow across all timeframes is the most important and dominant indicator in this analysis.**

4. **EMA (Exponential Moving Averages):**

* **Daily:** Price is above the EMA 50 (yellow) and EMA 200 (white). *However, the strongly negative Money Flow overrides the bullish signal typically provided by the price being above the EMAs.*

* **4H:** Price is above the EMA 50 and EMA 200. *Again, the strongly negative Money Flow overrides this.*

* **15m:** Price is oscillating around the EMA 50 and above the EMA 200. *The negative Money Flow overrides this.*

5. **Trend Strength (AlgoAlpha Indicator):**

* **Daily:** The Ichimoku Cloud is gray (Neutral). This is *not* a bullish signal and is consistent with the negative Money Flow.

* **4H:** The Ichimoku Cloud is gray (Neutral).

* **15m:** The Ichimoku Cloud is gray (Neutral).

6. **Chart Patterns:**

* **Daily:** No *fully formed* classic chart pattern. However, the recent price action shows a loss of upward momentum and the beginning of a potential downward move. This *weakening* price action, combined with the strongly negative Money Flow, is bearish.

* **4H:** *Potential* inverted Head and Shoulders pattern. This is a *bearish reversal pattern*. It's crucial to understand that this pattern is *not yet confirmed*. Confirmation requires a decisive break *below* the neckline (approximately 80,000-81,000), *with increased volume* and *continued negative Money Flow*.

* **15m:** No clearly defined classic chart pattern. The 15m price action is best understood as potentially forming the right shoulder of the 4H Head and Shoulders.

**SMC-Based Day Trading Strategies**

Given the overwhelmingly bearish evidence – primarily the strongly negative Money Flow across all timeframes, combined with the potential Head and Shoulders pattern on the 4H chart – the *only* justifiable trading strategy is **extreme caution and a strong bias against long positions**. Short positions have a *slightly* higher probability of success, but only under *very specific* conditions and with *extremely* tight risk management.

1. **Long (Buy):** *Absolutely, unequivocally not recommended*. There is no technical justification for entering a long position at this time. This would be trading directly against the dominant bearish signals.

2. **Short (Sell):**

* **Entry:** This is the *only* trade with *any* potential, and *only* if *all* of the following conditions are met:

* The Head and Shoulders pattern on the 4H chart *fully completes* with a decisive break *below* the neckline (80,000-81,000).

* The breakout below the neckline occurs on *significantly increased volume*.

* The Money Flow on *all three* timeframes (Daily, 4H, and 15m) remains *strongly negative* at the time of the breakout.

* Additional bearish confirmation is present (e.g., bearish candlestick patterns, bearish divergences on other oscillators like RSI or MACD – which we cannot see from the provided images).

* **Target:** Sellside Liquidity levels, derived from the Daily chart. Potential targets include, but are not limited to: 78961.4, 76662.3, 74363.2, and potentially lower.

* **Stop Loss:** *Immediately* above the neckline (after the breakout) or above the high of the right shoulder (if placing the trade *before* a confirmed neckline break – which is *extremely* risky). *An extremely tight stop-loss is absolutely mandatory* due to the inherent volatility of BTC and the potential for false breakouts.

3. **No Trade (Cash):** This is, by far, the *best* and most prudent option for the vast majority of traders and investors. The risk of a substantial price decline is extremely high, given the confluence of bearish signals. Preserving capital should be the primary objective.

**Key Levels to Watch:**

* **80,000 - 81,000 (4H Chart):** This is the neckline of the potential Head and Shoulders pattern. A sustained break below this level, with the confirming factors listed above, would be a strong bearish signal.

* **Money Flow on all chart**:

**Conclusion**

The overall technical picture for BTC, **strongly bearish**. The *dominant factor* is the *consistently and strongly negative Money Flow across all three timeframes*. This overrides any seemingly bullish signals from the EMAs. The potential (but unconfirmed) Head and Shoulders pattern on the 4H chart adds further weight to the bearish case.

**Long positions are completely unjustified and extremely risky.** Short positions *might* be considered, but *only* with the strictest possible entry criteria, complete confirmation from multiple indicators, and extremely tight risk management. **The "Wait and See" approach, prioritizing capital preservation, is the most prudent strategy for most market participants.** This situation calls for extreme caution and a defensive posture.

**Disclaimer:** This analysis is a personal opinion. It is not financial advice. Trading and investing in cryptocurrencies involves significant risk. Always do your own research and consult with a qualified financial advisor before making any investment decisions.

-

@ ed5774ac:45611c5c

2025-03-01 12:55:28

**Trump and Vance Expose Zelensky: The West’s Narrative Machine Meets Reality**

In the modern era, the West has perfected the art of ruling through narratives. Stories, carefully crafted and disseminated, have become the primary tool for shaping public perception, justifying actions, and maintaining control. This narrative-driven approach to governance has been the cornerstone of Western power since the 20th century, and nowhere is this more evident than in the ongoing conflict in Ukraine. Enter Volodymyr Zelensky, the comedian-turned-president, who has become a poster child for this narrative-driven world order. But in a recent confrontation with Donald Trump and J.D. Vance, Zelensky’s carefully constructed facade crumbled, exposing the fragility of the Western storytelling empire.

**The West’s Narrative Machine**

As Alastair Crooke astutely observes in his article **The Western Way of War: Owning the Narrative Trumps Reality** ( https://www.unz.com/article/the-western-way-of-war-owning-the-narrative-trumps-reality), the West’s power lies not in its military or economic might alone but in its ability to control the narrative. Crooke argues that the West has mastered the art of “owning the story,” creating a reality that serves its interests, regardless of facts on the ground. This narrative dominance ensures that the general public—often referred to as the masses—follows along without questioning, accepting the official line as gospel truth.

To maintain this control, the West relies on carefully curated protagonists who can sell its stories to the world. Take, for example, the story of Volodymyr Zelensky, a former actor whose rise to power was itself a narrative triumph. Portrayed as a relatable outsider who defeated the corrupt establishment, Zelensky promised hope and reform. But behind this carefully crafted image lay darker forces. Oligarch Ihor Kolomoisky, one of Ukraine’s most powerful and controversial figures, played a pivotal role in Zelensky’s ascent. Kolomoisky, who owned the TV channel that aired Zelensky’s show Servant of the People, used his media empire to propel the political novice into the spotlight. This was not a grassroots movement but a calculated maneuver by Ukraine’s oligarchic elite to maintain control under a new, more palatable face.

**Zelensky’s Rise and the West’s Geopolitical Strategy**

Zelensky’s rise was not just a domestic political shift; it was a calculated move by the West to advance its long-standing goal of containing Russia and dominating Eurasia. The West, particularly the EU and NATO, saw Ukraine as a critical piece in its geopolitical chess game. By installing a pro-Western leader like Zelensky, the West aimed to pull Ukraine firmly into its orbit, knowing full well that such a move would antagonize Moscow. This was not an accidental escalation but a deliberate provocation, designed to create a pretext for further Western intervention.

To polish Zelensky’s image and present him as a beacon of hope for peace and the Westernization of Ukraine, the West also needed to whitewash Ukraine’s darker realities. This meant turning a blind eye to the corruption and oligarchic influence that underpinned Zelensky’s presidency. Equally ignored were the neo-Nazi crimes and policies that had been well-documented before 2014, such as the rise of far-right groups like Svoboda and the Azov Battalion, their glorification of Nazi collaborator **Stepan Bandera**, and their violent attacks on ethnic minorities, political opponents, and LGBTQ+ communities. These atrocities, once reported in Western media, were suddenly erased from the narrative after 2014, as if they had never existed, to preserve the image of Ukraine as an innocent victim in the West’s geopolitical chess game.

**The Grand Chessboard: Ukraine as a Proxy**