-

@ daa41bed:88f54153

2025-02-09 16:50:04

There has been a good bit of discussion on Nostr over the past few days about the merits of zaps as a method of engaging with notes, so after writing a rather lengthy [article on the pros of a strategic Bitcoin reserve](https://geek.npub.pro/post/dxqkgnjplttkvetprg8ox/), I wanted to take some time to chime in on the much more fun topic of digital engagement.

Let's begin by defining a couple of things:

**Nostr** is a decentralized, censorship-resistance protocol whose current biggest use case is social media (think Twitter/X). Instead of relying on company servers, it relies on relays that anyone can spin up and own their own content. Its use cases are much bigger, though, and this article is hosted on my own relay, using my own Nostr relay as an example.

**Zap** is a tip or donation denominated in sats (small units of Bitcoin) sent from one user to another. This is generally done directly over the Lightning Network but is increasingly using Cashu tokens. For the sake of this discussion, how you transmit/receive zaps will be irrelevant, so don't worry if you don't know what [Lightning](https://lightning.network/) or [Cashu](https://cashu.space/) are.

If we look at how users engage with posts and follows/followers on platforms like Twitter, Facebook, etc., it becomes evident that traditional social media thrives on engagement farming. The more outrageous a post, the more likely it will get a reaction. We see a version of this on more visual social platforms like YouTube and TikTok that use carefully crafted thumbnail images to grab the user's attention to click the video. If you'd like to dive deep into the psychology and science behind social media engagement, let me know, and I'd be happy to follow up with another article.

In this user engagement model, a user is given the option to comment or like the original post, or share it among their followers to increase its signal. They receive no value from engaging with the content aside from the dopamine hit of the original experience or having their comment liked back by whatever influencer they provide value to. Ad revenue flows to the content creator. Clout flows to the content creator. Sales revenue from merch and content placement flows to the content creator. We call this a linear economy -- the idea that resources get created, used up, then thrown away. Users create content and farm as much engagement as possible, then the content is forgotten within a few hours as they move on to the next piece of content to be farmed.

What if there were a simple way to give value back to those who engage with your content? By implementing some value-for-value model -- a circular economy. Enter zaps.

Unlike traditional social media platforms, Nostr does not actively use algorithms to determine what content is popular, nor does it push content created for active user engagement to the top of a user's timeline. Yes, there are "trending" and "most zapped" timelines that users can choose to use as their default, but these use relatively straightforward engagement metrics to rank posts for these timelines.

That is not to say that we may not see clients actively seeking to refine timeline algorithms for specific metrics. Still, the beauty of having an open protocol with media that is controlled solely by its users is that users who begin to see their timeline gamed towards specific algorithms can choose to move to another client, and for those who are more tech-savvy, they can opt to run their own relays or create their own clients with personalized algorithms and web of trust scoring systems.

Zaps enable the means to create a new type of social media economy in which creators can earn for creating content and users can earn by actively engaging with it. Like and reposting content is relatively frictionless and costs nothing but a simple button tap. Zaps provide active engagement because they signal to your followers and those of the content creator that this post has genuine value, quite literally in the form of money—sats.

I have seen some comments on Nostr claiming that removing likes and reactions is for wealthy people who can afford to send zaps and that the majority of people in the US and around the world do not have the time or money to zap because they have better things to spend their money like feeding their families and paying their bills. While at face value, these may seem like valid arguments, they, unfortunately, represent the brainwashed, defeatist attitude that our current economic (and, by extension, social media) systems aim to instill in all of us to continue extracting value from our lives.

Imagine now, if those people dedicating their own time (time = money) to mine pity points on social media would instead spend that time with genuine value creation by posting content that is meaningful to cultural discussions. Imagine if, instead of complaining that their posts get no zaps and going on a tirade about how much of a victim they are, they would empower themselves to take control of their content and give value back to the world; where would that leave us? How much value could be created on a nascent platform such as Nostr, and how quickly could it overtake other platforms?

Other users argue about user experience and that additional friction (i.e., zaps) leads to lower engagement, as proven by decades of studies on user interaction. While the added friction may turn some users away, does that necessarily provide less value? I argue quite the opposite. You haven't made a few sats from zaps with your content? Can't afford to send some sats to a wallet for zapping? How about using the most excellent available resource and spending 10 seconds of your time to leave a comment? Likes and reactions are valueless transactions. Social media's real value derives from providing monetary compensation and actively engaging in a conversation with posts you find interesting or thought-provoking. Remember when humans thrived on conversation and discussion for entertainment instead of simply being an onlooker of someone else's life?

If you've made it this far, my only request is this: try only zapping and commenting as a method of engagement for two weeks. Sure, you may end up liking a post here and there, but be more mindful of how you interact with the world and break yourself from blind instinct. You'll thank me later.

-

@ e3ba5e1a:5e433365

2025-02-05 17:47:16

I got into a [friendly discussion](https://x.com/snoyberg/status/1887007888117252142) on X regarding health insurance. The specific question was how to deal with health insurance companies (presumably unfairly) denying claims? My answer, as usual: get government out of it!

The US healthcare system is essentially the worst of both worlds:

* Unlike full single payer, individuals incur high costs

* Unlike a true free market, regulation causes increases in costs and decreases competition among insurers

I'm firmly on the side of moving towards the free market. (And I say that as someone living under a single payer system now.) Here's what I would do:

* Get rid of tax incentives that make health insurance tied to your employer, giving individuals back proper freedom of choice.

* Reduce regulations significantly.

* In the short term, some people will still get rejected claims and other obnoxious behavior from insurance companies. We address that in two ways:

1. Due to reduced regulations, new insurance companies will be able to enter the market offering more reliable coverage and better rates, and people will flock to them because they have the freedom to make their own choices.

2. Sue the asses off of companies that reject claims unfairly. And ideally, as one of the few legitimate roles of government in all this, institute new laws that limit the ability of fine print to allow insurers to escape their responsibilities. (I'm hesitant that the latter will happen due to the incestuous relationship between Congress/regulators and insurers, but I can hope.)

Will this magically fix everything overnight like politicians normally promise? No. But it will allow the market to return to a healthy state. And I don't think it will take long (order of magnitude: 5-10 years) for it to come together, but that's just speculation.

And since there's a high correlation between those who believe government can fix problems by taking more control and demanding that only credentialed experts weigh in on a topic (both points I strongly disagree with BTW): I'm a trained actuary and worked in the insurance industry, and have directly seen how government regulation reduces competition, raises prices, and harms consumers.

And my final point: I don't think any prior art would be a good comparison for deregulation in the US, it's such a different market than any other country in the world for so many reasons that lessons wouldn't really translate. Nonetheless, I asked Grok for some empirical data on this, and at best the results of deregulation could be called "mixed," but likely more accurately "uncertain, confused, and subject to whatever interpretation anyone wants to apply."

https://x.com/i/grok/share/Zc8yOdrN8lS275hXJ92uwq98M

-

@ 91bea5cd:1df4451c

2025-02-04 17:24:50

### Definição de ULID:

Timestamp 48 bits, Aleatoriedade 80 bits

Sendo Timestamp 48 bits inteiro, tempo UNIX em milissegundos, Não ficará sem espaço até o ano 10889 d.C.

e Aleatoriedade 80 bits, Fonte criptograficamente segura de aleatoriedade, se possível.

#### Gerar ULID

```sql

CREATE EXTENSION IF NOT EXISTS pgcrypto;

CREATE FUNCTION generate_ulid()

RETURNS TEXT

AS $$

DECLARE

-- Crockford's Base32

encoding BYTEA = '0123456789ABCDEFGHJKMNPQRSTVWXYZ';

timestamp BYTEA = E'\\000\\000\\000\\000\\000\\000';

output TEXT = '';

unix_time BIGINT;

ulid BYTEA;

BEGIN

-- 6 timestamp bytes

unix_time = (EXTRACT(EPOCH FROM CLOCK_TIMESTAMP()) * 1000)::BIGINT;

timestamp = SET_BYTE(timestamp, 0, (unix_time >> 40)::BIT(8)::INTEGER);

timestamp = SET_BYTE(timestamp, 1, (unix_time >> 32)::BIT(8)::INTEGER);

timestamp = SET_BYTE(timestamp, 2, (unix_time >> 24)::BIT(8)::INTEGER);

timestamp = SET_BYTE(timestamp, 3, (unix_time >> 16)::BIT(8)::INTEGER);

timestamp = SET_BYTE(timestamp, 4, (unix_time >> 8)::BIT(8)::INTEGER);

timestamp = SET_BYTE(timestamp, 5, unix_time::BIT(8)::INTEGER);

-- 10 entropy bytes

ulid = timestamp || gen_random_bytes(10);

-- Encode the timestamp

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(ulid, 0) & 224) >> 5));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(ulid, 0) & 31)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(ulid, 1) & 248) >> 3));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(ulid, 1) & 7) << 2) | ((GET_BYTE(ulid, 2) & 192) >> 6)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(ulid, 2) & 62) >> 1));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(ulid, 2) & 1) << 4) | ((GET_BYTE(ulid, 3) & 240) >> 4)));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(ulid, 3) & 15) << 1) | ((GET_BYTE(ulid, 4) & 128) >> 7)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(ulid, 4) & 124) >> 2));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(ulid, 4) & 3) << 3) | ((GET_BYTE(ulid, 5) & 224) >> 5)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(ulid, 5) & 31)));

-- Encode the entropy

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(ulid, 6) & 248) >> 3));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(ulid, 6) & 7) << 2) | ((GET_BYTE(ulid, 7) & 192) >> 6)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(ulid, 7) & 62) >> 1));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(ulid, 7) & 1) << 4) | ((GET_BYTE(ulid, 8) & 240) >> 4)));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(ulid, 8) & 15) << 1) | ((GET_BYTE(ulid, 9) & 128) >> 7)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(ulid, 9) & 124) >> 2));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(ulid, 9) & 3) << 3) | ((GET_BYTE(ulid, 10) & 224) >> 5)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(ulid, 10) & 31)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(ulid, 11) & 248) >> 3));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(ulid, 11) & 7) << 2) | ((GET_BYTE(ulid, 12) & 192) >> 6)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(ulid, 12) & 62) >> 1));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(ulid, 12) & 1) << 4) | ((GET_BYTE(ulid, 13) & 240) >> 4)));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(ulid, 13) & 15) << 1) | ((GET_BYTE(ulid, 14) & 128) >> 7)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(ulid, 14) & 124) >> 2));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(ulid, 14) & 3) << 3) | ((GET_BYTE(ulid, 15) & 224) >> 5)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(ulid, 15) & 31)));

RETURN output;

END

$$

LANGUAGE plpgsql

VOLATILE;

```

#### ULID TO UUID

```sql

CREATE OR REPLACE FUNCTION parse_ulid(ulid text) RETURNS bytea AS $$

DECLARE

-- 16byte

bytes bytea = E'\\x00000000 00000000 00000000 00000000';

v char[];

-- Allow for O(1) lookup of index values

dec integer[] = ARRAY[

255, 255, 255, 255, 255, 255, 255, 255, 255, 255,

255, 255, 255, 255, 255, 255, 255, 255, 255, 255,

255, 255, 255, 255, 255, 255, 255, 255, 255, 255,

255, 255, 255, 255, 255, 255, 255, 255, 255, 255,

255, 255, 255, 255, 255, 255, 255, 0, 1, 2,

3, 4, 5, 6, 7, 8, 9, 255, 255, 255,

255, 255, 255, 255, 10, 11, 12, 13, 14, 15,

16, 17, 1, 18, 19, 1, 20, 21, 0, 22,

23, 24, 25, 26, 255, 27, 28, 29, 30, 31,

255, 255, 255, 255, 255, 255, 10, 11, 12, 13,

14, 15, 16, 17, 1, 18, 19, 1, 20, 21,

0, 22, 23, 24, 25, 26, 255, 27, 28, 29,

30, 31

];

BEGIN

IF NOT ulid ~* '^[0-7][0-9ABCDEFGHJKMNPQRSTVWXYZ]{25}$' THEN

RAISE EXCEPTION 'Invalid ULID: %', ulid;

END IF;

v = regexp_split_to_array(ulid, '');

-- 6 bytes timestamp (48 bits)

bytes = SET_BYTE(bytes, 0, (dec[ASCII(v[1])] << 5) | dec[ASCII(v[2])]);

bytes = SET_BYTE(bytes, 1, (dec[ASCII(v[3])] << 3) | (dec[ASCII(v[4])] >> 2));

bytes = SET_BYTE(bytes, 2, (dec[ASCII(v[4])] << 6) | (dec[ASCII(v[5])] << 1) | (dec[ASCII(v[6])] >> 4));

bytes = SET_BYTE(bytes, 3, (dec[ASCII(v[6])] << 4) | (dec[ASCII(v[7])] >> 1));

bytes = SET_BYTE(bytes, 4, (dec[ASCII(v[7])] << 7) | (dec[ASCII(v[8])] << 2) | (dec[ASCII(v[9])] >> 3));

bytes = SET_BYTE(bytes, 5, (dec[ASCII(v[9])] << 5) | dec[ASCII(v[10])]);

-- 10 bytes of entropy (80 bits);

bytes = SET_BYTE(bytes, 6, (dec[ASCII(v[11])] << 3) | (dec[ASCII(v[12])] >> 2));

bytes = SET_BYTE(bytes, 7, (dec[ASCII(v[12])] << 6) | (dec[ASCII(v[13])] << 1) | (dec[ASCII(v[14])] >> 4));

bytes = SET_BYTE(bytes, 8, (dec[ASCII(v[14])] << 4) | (dec[ASCII(v[15])] >> 1));

bytes = SET_BYTE(bytes, 9, (dec[ASCII(v[15])] << 7) | (dec[ASCII(v[16])] << 2) | (dec[ASCII(v[17])] >> 3));

bytes = SET_BYTE(bytes, 10, (dec[ASCII(v[17])] << 5) | dec[ASCII(v[18])]);

bytes = SET_BYTE(bytes, 11, (dec[ASCII(v[19])] << 3) | (dec[ASCII(v[20])] >> 2));

bytes = SET_BYTE(bytes, 12, (dec[ASCII(v[20])] << 6) | (dec[ASCII(v[21])] << 1) | (dec[ASCII(v[22])] >> 4));

bytes = SET_BYTE(bytes, 13, (dec[ASCII(v[22])] << 4) | (dec[ASCII(v[23])] >> 1));

bytes = SET_BYTE(bytes, 14, (dec[ASCII(v[23])] << 7) | (dec[ASCII(v[24])] << 2) | (dec[ASCII(v[25])] >> 3));

bytes = SET_BYTE(bytes, 15, (dec[ASCII(v[25])] << 5) | dec[ASCII(v[26])]);

RETURN bytes;

END

$$

LANGUAGE plpgsql

IMMUTABLE;

CREATE OR REPLACE FUNCTION ulid_to_uuid(ulid text) RETURNS uuid AS $$

BEGIN

RETURN encode(parse_ulid(ulid), 'hex')::uuid;

END

$$

LANGUAGE plpgsql

IMMUTABLE;

```

#### UUID to ULID

```sql

CREATE OR REPLACE FUNCTION uuid_to_ulid(id uuid) RETURNS text AS $$

DECLARE

encoding bytea = '0123456789ABCDEFGHJKMNPQRSTVWXYZ';

output text = '';

uuid_bytes bytea = uuid_send(id);

BEGIN

-- Encode the timestamp

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(uuid_bytes, 0) & 224) >> 5));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(uuid_bytes, 0) & 31)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(uuid_bytes, 1) & 248) >> 3));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(uuid_bytes, 1) & 7) << 2) | ((GET_BYTE(uuid_bytes, 2) & 192) >> 6)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(uuid_bytes, 2) & 62) >> 1));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(uuid_bytes, 2) & 1) << 4) | ((GET_BYTE(uuid_bytes, 3) & 240) >> 4)));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(uuid_bytes, 3) & 15) << 1) | ((GET_BYTE(uuid_bytes, 4) & 128) >> 7)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(uuid_bytes, 4) & 124) >> 2));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(uuid_bytes, 4) & 3) << 3) | ((GET_BYTE(uuid_bytes, 5) & 224) >> 5)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(uuid_bytes, 5) & 31)));

-- Encode the entropy

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(uuid_bytes, 6) & 248) >> 3));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(uuid_bytes, 6) & 7) << 2) | ((GET_BYTE(uuid_bytes, 7) & 192) >> 6)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(uuid_bytes, 7) & 62) >> 1));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(uuid_bytes, 7) & 1) << 4) | ((GET_BYTE(uuid_bytes, 8) & 240) >> 4)));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(uuid_bytes, 8) & 15) << 1) | ((GET_BYTE(uuid_bytes, 9) & 128) >> 7)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(uuid_bytes, 9) & 124) >> 2));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(uuid_bytes, 9) & 3) << 3) | ((GET_BYTE(uuid_bytes, 10) & 224) >> 5)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(uuid_bytes, 10) & 31)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(uuid_bytes, 11) & 248) >> 3));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(uuid_bytes, 11) & 7) << 2) | ((GET_BYTE(uuid_bytes, 12) & 192) >> 6)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(uuid_bytes, 12) & 62) >> 1));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(uuid_bytes, 12) & 1) << 4) | ((GET_BYTE(uuid_bytes, 13) & 240) >> 4)));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(uuid_bytes, 13) & 15) << 1) | ((GET_BYTE(uuid_bytes, 14) & 128) >> 7)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(uuid_bytes, 14) & 124) >> 2));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(uuid_bytes, 14) & 3) << 3) | ((GET_BYTE(uuid_bytes, 15) & 224) >> 5)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(uuid_bytes, 15) & 31)));

RETURN output;

END

$$

LANGUAGE plpgsql

IMMUTABLE;

```

#### Gera 11 Digitos aleatórios: YBKXG0CKTH4

```sql

-- Cria a extensão pgcrypto para gerar uuid

CREATE EXTENSION IF NOT EXISTS pgcrypto;

-- Cria a função para gerar ULID

CREATE OR REPLACE FUNCTION gen_lrandom()

RETURNS TEXT AS $$

DECLARE

ts_millis BIGINT;

ts_chars TEXT;

random_bytes BYTEA;

random_chars TEXT;

base32_chars TEXT := '0123456789ABCDEFGHJKMNPQRSTVWXYZ';

i INT;

BEGIN

-- Pega o timestamp em milissegundos

ts_millis := FLOOR(EXTRACT(EPOCH FROM clock_timestamp()) * 1000)::BIGINT;

-- Converte o timestamp para base32

ts_chars := '';

FOR i IN REVERSE 0..11 LOOP

ts_chars := ts_chars || substr(base32_chars, ((ts_millis >> (5 * i)) & 31) + 1, 1);

END LOOP;

-- Gera 10 bytes aleatórios e converte para base32

random_bytes := gen_random_bytes(10);

random_chars := '';

FOR i IN 0..9 LOOP

random_chars := random_chars || substr(base32_chars, ((get_byte(random_bytes, i) >> 3) & 31) + 1, 1);

IF i < 9 THEN

random_chars := random_chars || substr(base32_chars, (((get_byte(random_bytes, i) & 7) << 2) | (get_byte(random_bytes, i + 1) >> 6)) & 31 + 1, 1);

ELSE

random_chars := random_chars || substr(base32_chars, ((get_byte(random_bytes, i) & 7) << 2) + 1, 1);

END IF;

END LOOP;

-- Concatena o timestamp e os caracteres aleatórios

RETURN ts_chars || random_chars;

END;

$$ LANGUAGE plpgsql;

```

#### Exemplo de USO

```sql

-- Criação da extensão caso não exista

CREATE EXTENSION

IF

NOT EXISTS pgcrypto;

-- Criação da tabela pessoas

CREATE TABLE pessoas ( ID UUID DEFAULT gen_random_uuid ( ) PRIMARY KEY, nome TEXT NOT NULL );

-- Busca Pessoa na tabela

SELECT

*

FROM

"pessoas"

WHERE

uuid_to_ulid ( ID ) = '252FAC9F3V8EF80SSDK8PXW02F';

```

### Fontes

- https://github.com/scoville/pgsql-ulid

- https://github.com/geckoboard/pgulid

-

@ 91bea5cd:1df4451c

2025-02-04 17:15:57

### Definição de ULID:

Timestamp 48 bits, Aleatoriedade 80 bits

Sendo Timestamp 48 bits inteiro, tempo UNIX em milissegundos, Não ficará sem espaço até o ano 10889 d.C.

e Aleatoriedade 80 bits, Fonte criptograficamente segura de aleatoriedade, se possível.

#### Gerar ULID

```sql

CREATE EXTENSION IF NOT EXISTS pgcrypto;

CREATE FUNCTION generate_ulid()

RETURNS TEXT

AS $$

DECLARE

-- Crockford's Base32

encoding BYTEA = '0123456789ABCDEFGHJKMNPQRSTVWXYZ';

timestamp BYTEA = E'\\000\\000\\000\\000\\000\\000';

output TEXT = '';

unix_time BIGINT;

ulid BYTEA;

BEGIN

-- 6 timestamp bytes

unix_time = (EXTRACT(EPOCH FROM CLOCK_TIMESTAMP()) * 1000)::BIGINT;

timestamp = SET_BYTE(timestamp, 0, (unix_time >> 40)::BIT(8)::INTEGER);

timestamp = SET_BYTE(timestamp, 1, (unix_time >> 32)::BIT(8)::INTEGER);

timestamp = SET_BYTE(timestamp, 2, (unix_time >> 24)::BIT(8)::INTEGER);

timestamp = SET_BYTE(timestamp, 3, (unix_time >> 16)::BIT(8)::INTEGER);

timestamp = SET_BYTE(timestamp, 4, (unix_time >> 8)::BIT(8)::INTEGER);

timestamp = SET_BYTE(timestamp, 5, unix_time::BIT(8)::INTEGER);

-- 10 entropy bytes

ulid = timestamp || gen_random_bytes(10);

-- Encode the timestamp

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(ulid, 0) & 224) >> 5));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(ulid, 0) & 31)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(ulid, 1) & 248) >> 3));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(ulid, 1) & 7) << 2) | ((GET_BYTE(ulid, 2) & 192) >> 6)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(ulid, 2) & 62) >> 1));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(ulid, 2) & 1) << 4) | ((GET_BYTE(ulid, 3) & 240) >> 4)));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(ulid, 3) & 15) << 1) | ((GET_BYTE(ulid, 4) & 128) >> 7)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(ulid, 4) & 124) >> 2));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(ulid, 4) & 3) << 3) | ((GET_BYTE(ulid, 5) & 224) >> 5)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(ulid, 5) & 31)));

-- Encode the entropy

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(ulid, 6) & 248) >> 3));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(ulid, 6) & 7) << 2) | ((GET_BYTE(ulid, 7) & 192) >> 6)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(ulid, 7) & 62) >> 1));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(ulid, 7) & 1) << 4) | ((GET_BYTE(ulid, 8) & 240) >> 4)));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(ulid, 8) & 15) << 1) | ((GET_BYTE(ulid, 9) & 128) >> 7)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(ulid, 9) & 124) >> 2));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(ulid, 9) & 3) << 3) | ((GET_BYTE(ulid, 10) & 224) >> 5)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(ulid, 10) & 31)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(ulid, 11) & 248) >> 3));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(ulid, 11) & 7) << 2) | ((GET_BYTE(ulid, 12) & 192) >> 6)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(ulid, 12) & 62) >> 1));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(ulid, 12) & 1) << 4) | ((GET_BYTE(ulid, 13) & 240) >> 4)));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(ulid, 13) & 15) << 1) | ((GET_BYTE(ulid, 14) & 128) >> 7)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(ulid, 14) & 124) >> 2));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(ulid, 14) & 3) << 3) | ((GET_BYTE(ulid, 15) & 224) >> 5)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(ulid, 15) & 31)));

RETURN output;

END

$$

LANGUAGE plpgsql

VOLATILE;

```

#### ULID TO UUID

```sql

CREATE OR REPLACE FUNCTION parse_ulid(ulid text) RETURNS bytea AS $$

DECLARE

-- 16byte

bytes bytea = E'\\x00000000 00000000 00000000 00000000';

v char[];

-- Allow for O(1) lookup of index values

dec integer[] = ARRAY[

255, 255, 255, 255, 255, 255, 255, 255, 255, 255,

255, 255, 255, 255, 255, 255, 255, 255, 255, 255,

255, 255, 255, 255, 255, 255, 255, 255, 255, 255,

255, 255, 255, 255, 255, 255, 255, 255, 255, 255,

255, 255, 255, 255, 255, 255, 255, 0, 1, 2,

3, 4, 5, 6, 7, 8, 9, 255, 255, 255,

255, 255, 255, 255, 10, 11, 12, 13, 14, 15,

16, 17, 1, 18, 19, 1, 20, 21, 0, 22,

23, 24, 25, 26, 255, 27, 28, 29, 30, 31,

255, 255, 255, 255, 255, 255, 10, 11, 12, 13,

14, 15, 16, 17, 1, 18, 19, 1, 20, 21,

0, 22, 23, 24, 25, 26, 255, 27, 28, 29,

30, 31

];

BEGIN

IF NOT ulid ~* '^[0-7][0-9ABCDEFGHJKMNPQRSTVWXYZ]{25}$' THEN

RAISE EXCEPTION 'Invalid ULID: %', ulid;

END IF;

v = regexp_split_to_array(ulid, '');

-- 6 bytes timestamp (48 bits)

bytes = SET_BYTE(bytes, 0, (dec[ASCII(v[1])] << 5) | dec[ASCII(v[2])]);

bytes = SET_BYTE(bytes, 1, (dec[ASCII(v[3])] << 3) | (dec[ASCII(v[4])] >> 2));

bytes = SET_BYTE(bytes, 2, (dec[ASCII(v[4])] << 6) | (dec[ASCII(v[5])] << 1) | (dec[ASCII(v[6])] >> 4));

bytes = SET_BYTE(bytes, 3, (dec[ASCII(v[6])] << 4) | (dec[ASCII(v[7])] >> 1));

bytes = SET_BYTE(bytes, 4, (dec[ASCII(v[7])] << 7) | (dec[ASCII(v[8])] << 2) | (dec[ASCII(v[9])] >> 3));

bytes = SET_BYTE(bytes, 5, (dec[ASCII(v[9])] << 5) | dec[ASCII(v[10])]);

-- 10 bytes of entropy (80 bits);

bytes = SET_BYTE(bytes, 6, (dec[ASCII(v[11])] << 3) | (dec[ASCII(v[12])] >> 2));

bytes = SET_BYTE(bytes, 7, (dec[ASCII(v[12])] << 6) | (dec[ASCII(v[13])] << 1) | (dec[ASCII(v[14])] >> 4));

bytes = SET_BYTE(bytes, 8, (dec[ASCII(v[14])] << 4) | (dec[ASCII(v[15])] >> 1));

bytes = SET_BYTE(bytes, 9, (dec[ASCII(v[15])] << 7) | (dec[ASCII(v[16])] << 2) | (dec[ASCII(v[17])] >> 3));

bytes = SET_BYTE(bytes, 10, (dec[ASCII(v[17])] << 5) | dec[ASCII(v[18])]);

bytes = SET_BYTE(bytes, 11, (dec[ASCII(v[19])] << 3) | (dec[ASCII(v[20])] >> 2));

bytes = SET_BYTE(bytes, 12, (dec[ASCII(v[20])] << 6) | (dec[ASCII(v[21])] << 1) | (dec[ASCII(v[22])] >> 4));

bytes = SET_BYTE(bytes, 13, (dec[ASCII(v[22])] << 4) | (dec[ASCII(v[23])] >> 1));

bytes = SET_BYTE(bytes, 14, (dec[ASCII(v[23])] << 7) | (dec[ASCII(v[24])] << 2) | (dec[ASCII(v[25])] >> 3));

bytes = SET_BYTE(bytes, 15, (dec[ASCII(v[25])] << 5) | dec[ASCII(v[26])]);

RETURN bytes;

END

$$

LANGUAGE plpgsql

IMMUTABLE;

CREATE OR REPLACE FUNCTION ulid_to_uuid(ulid text) RETURNS uuid AS $$

BEGIN

RETURN encode(parse_ulid(ulid), 'hex')::uuid;

END

$$

LANGUAGE plpgsql

IMMUTABLE;

```

#### UUID to ULID

```sql

CREATE OR REPLACE FUNCTION uuid_to_ulid(id uuid) RETURNS text AS $$

DECLARE

encoding bytea = '0123456789ABCDEFGHJKMNPQRSTVWXYZ';

output text = '';

uuid_bytes bytea = uuid_send(id);

BEGIN

-- Encode the timestamp

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(uuid_bytes, 0) & 224) >> 5));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(uuid_bytes, 0) & 31)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(uuid_bytes, 1) & 248) >> 3));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(uuid_bytes, 1) & 7) << 2) | ((GET_BYTE(uuid_bytes, 2) & 192) >> 6)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(uuid_bytes, 2) & 62) >> 1));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(uuid_bytes, 2) & 1) << 4) | ((GET_BYTE(uuid_bytes, 3) & 240) >> 4)));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(uuid_bytes, 3) & 15) << 1) | ((GET_BYTE(uuid_bytes, 4) & 128) >> 7)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(uuid_bytes, 4) & 124) >> 2));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(uuid_bytes, 4) & 3) << 3) | ((GET_BYTE(uuid_bytes, 5) & 224) >> 5)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(uuid_bytes, 5) & 31)));

-- Encode the entropy

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(uuid_bytes, 6) & 248) >> 3));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(uuid_bytes, 6) & 7) << 2) | ((GET_BYTE(uuid_bytes, 7) & 192) >> 6)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(uuid_bytes, 7) & 62) >> 1));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(uuid_bytes, 7) & 1) << 4) | ((GET_BYTE(uuid_bytes, 8) & 240) >> 4)));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(uuid_bytes, 8) & 15) << 1) | ((GET_BYTE(uuid_bytes, 9) & 128) >> 7)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(uuid_bytes, 9) & 124) >> 2));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(uuid_bytes, 9) & 3) << 3) | ((GET_BYTE(uuid_bytes, 10) & 224) >> 5)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(uuid_bytes, 10) & 31)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(uuid_bytes, 11) & 248) >> 3));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(uuid_bytes, 11) & 7) << 2) | ((GET_BYTE(uuid_bytes, 12) & 192) >> 6)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(uuid_bytes, 12) & 62) >> 1));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(uuid_bytes, 12) & 1) << 4) | ((GET_BYTE(uuid_bytes, 13) & 240) >> 4)));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(uuid_bytes, 13) & 15) << 1) | ((GET_BYTE(uuid_bytes, 14) & 128) >> 7)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(uuid_bytes, 14) & 124) >> 2));

output = output || CHR(GET_BYTE(encoding, ((GET_BYTE(uuid_bytes, 14) & 3) << 3) | ((GET_BYTE(uuid_bytes, 15) & 224) >> 5)));

output = output || CHR(GET_BYTE(encoding, (GET_BYTE(uuid_bytes, 15) & 31)));

RETURN output;

END

$$

LANGUAGE plpgsql

IMMUTABLE;

```

#### Gera 11 Digitos aleatórios: YBKXG0CKTH4

```sql

-- Cria a extensão pgcrypto para gerar uuid

CREATE EXTENSION IF NOT EXISTS pgcrypto;

-- Cria a função para gerar ULID

CREATE OR REPLACE FUNCTION gen_lrandom()

RETURNS TEXT AS $$

DECLARE

ts_millis BIGINT;

ts_chars TEXT;

random_bytes BYTEA;

random_chars TEXT;

base32_chars TEXT := '0123456789ABCDEFGHJKMNPQRSTVWXYZ';

i INT;

BEGIN

-- Pega o timestamp em milissegundos

ts_millis := FLOOR(EXTRACT(EPOCH FROM clock_timestamp()) * 1000)::BIGINT;

-- Converte o timestamp para base32

ts_chars := '';

FOR i IN REVERSE 0..11 LOOP

ts_chars := ts_chars || substr(base32_chars, ((ts_millis >> (5 * i)) & 31) + 1, 1);

END LOOP;

-- Gera 10 bytes aleatórios e converte para base32

random_bytes := gen_random_bytes(10);

random_chars := '';

FOR i IN 0..9 LOOP

random_chars := random_chars || substr(base32_chars, ((get_byte(random_bytes, i) >> 3) & 31) + 1, 1);

IF i < 9 THEN

random_chars := random_chars || substr(base32_chars, (((get_byte(random_bytes, i) & 7) << 2) | (get_byte(random_bytes, i + 1) >> 6)) & 31 + 1, 1);

ELSE

random_chars := random_chars || substr(base32_chars, ((get_byte(random_bytes, i) & 7) << 2) + 1, 1);

END IF;

END LOOP;

-- Concatena o timestamp e os caracteres aleatórios

RETURN ts_chars || random_chars;

END;

$$ LANGUAGE plpgsql;

```

#### Exemplo de USO

```sql

-- Criação da extensão caso não exista

CREATE EXTENSION

IF

NOT EXISTS pgcrypto;

-- Criação da tabela pessoas

CREATE TABLE pessoas ( ID UUID DEFAULT gen_random_uuid ( ) PRIMARY KEY, nome TEXT NOT NULL );

-- Busca Pessoa na tabela

SELECT

*

FROM

"pessoas"

WHERE

uuid_to_ulid ( ID ) = '252FAC9F3V8EF80SSDK8PXW02F';

```

### Fontes

- https://github.com/scoville/pgsql-ulid

- https://github.com/geckoboard/pgulid

-

@ e3ba5e1a:5e433365

2025-02-04 08:29:00

President Trump has started rolling out his tariffs, something I [blogged about in November](https://www.snoyman.com/blog/2024/11/steelmanning-tariffs/). People are talking about these tariffs a lot right now, with many people (correctly) commenting on how consumers will end up with higher prices as a result of these tariffs. While that part is true, I’ve seen a lot of people taking it to the next, incorrect step: that consumers will pay the entirety of the tax. I [put up a poll on X](https://x.com/snoyberg/status/1886035800019599808) to see what people thought, and while the right answer got a lot of votes, it wasn't the winner.

For purposes of this blog post, our ultimate question will be the following:

* Suppose apples currently sell for $1 each in the entire United States.

* There are domestic sellers and foreign sellers of apples, all receiving the same price.

* There are no taxes or tariffs on the purchase of apples.

* The question is: if the US federal government puts a $0.50 import tariff per apple, what will be the change in the following:

* Number of apples bought in the US

* Price paid by buyers for apples in the US

* Post-tax price received by domestic apple producers

* Post-tax price received by foreign apple producers

Before we can answer that question, we need to ask an easier, first question: before instituting the tariff, why do apples cost $1?

And finally, before we dive into the details, let me provide you with the answers to the ultimate question. I recommend you try to guess these answers before reading this, and if you get it wrong, try to understand why:

1. The number of apples bought will go down

2. The buyers will pay more for each apple they buy, but not the full amount of the tariff

3. Domestic apple sellers will receive a *higher* price per apple

4. Foreign apple sellers will receive a *lower* price per apple, but not lowered by the full amount of the tariff

In other words, regardless of who sends the payment to the government, both taxed parties (domestic buyers and foreign sellers) will absorb some of the costs of the tariff, while domestic sellers will benefit from the protectionism provided by tariffs and be able to sell at a higher price per unit.

## Marginal benefit

All of the numbers discussed below are part of a [helper Google Sheet](https://docs.google.com/spreadsheets/d/14ZbkWpw1B9Q1UDB9Yh47DmdKQfIafVVBKbDUsSIfGZw/edit?usp=sharing) I put together for this analysis. Also, apologies about the jagged lines in the charts below, I hadn’t realized before starting on this that there are [some difficulties with creating supply and demand charts in Google Sheets](https://superuser.com/questions/1359731/how-to-create-a-supply-demand-style-chart).

Let’s say I absolutely love apples, they’re my favorite food. How much would I be willing to pay for a single apple? You might say “$1, that’s the price in the supermarket,” and in many ways you’d be right. If I walk into supermarket A, see apples on sale for $50, and know that I can buy them at supermarket B for $1, I’ll almost certainly leave A and go buy at B.

But that’s not what I mean. What I mean is: how high would the price of apples have to go *everywhere* so that I’d no longer be willing to buy a single apple? This is a purely personal, subjective opinion. It’s impacted by how much money I have available, other expenses I need to cover, and how much I like apples. But let’s say the number is $5.

How much would I be willing to pay for another apple? Maybe another $5. But how much am I willing to pay for the 1,000th apple? 10,000th? At some point, I’ll get sick of apples, or run out of space to keep the apples, or not be able to eat, cook, and otherwise preserve all those apples before they rot.

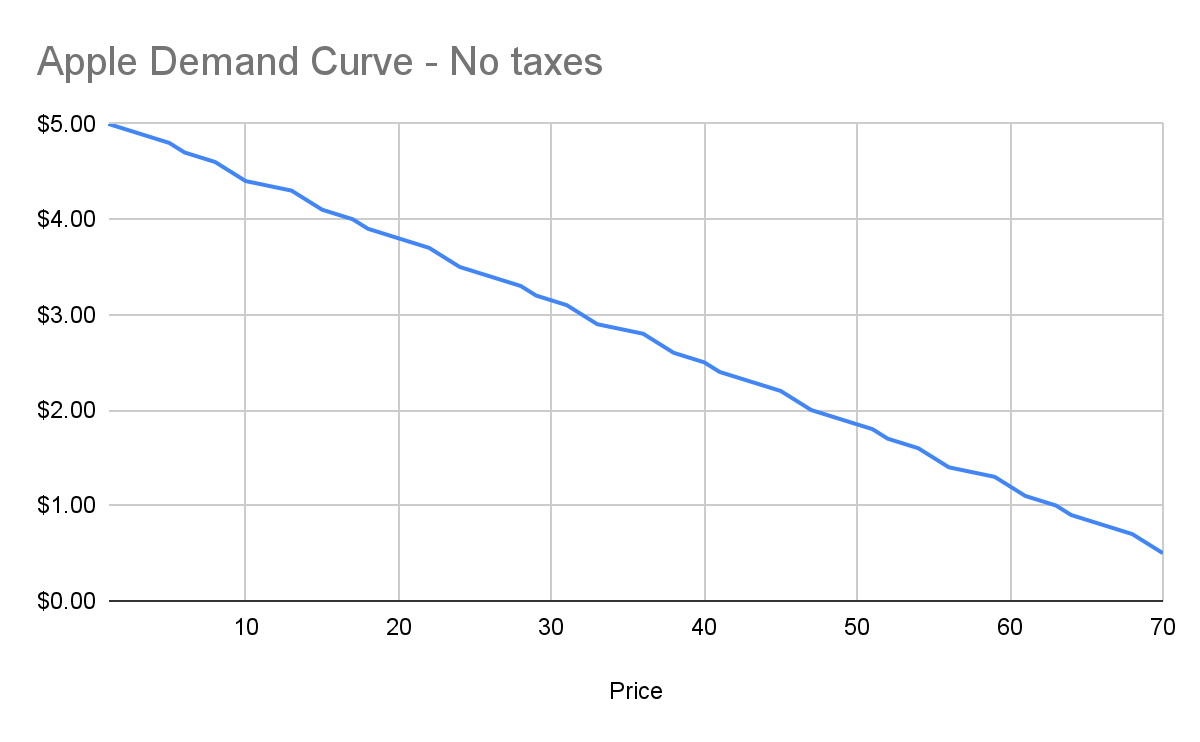

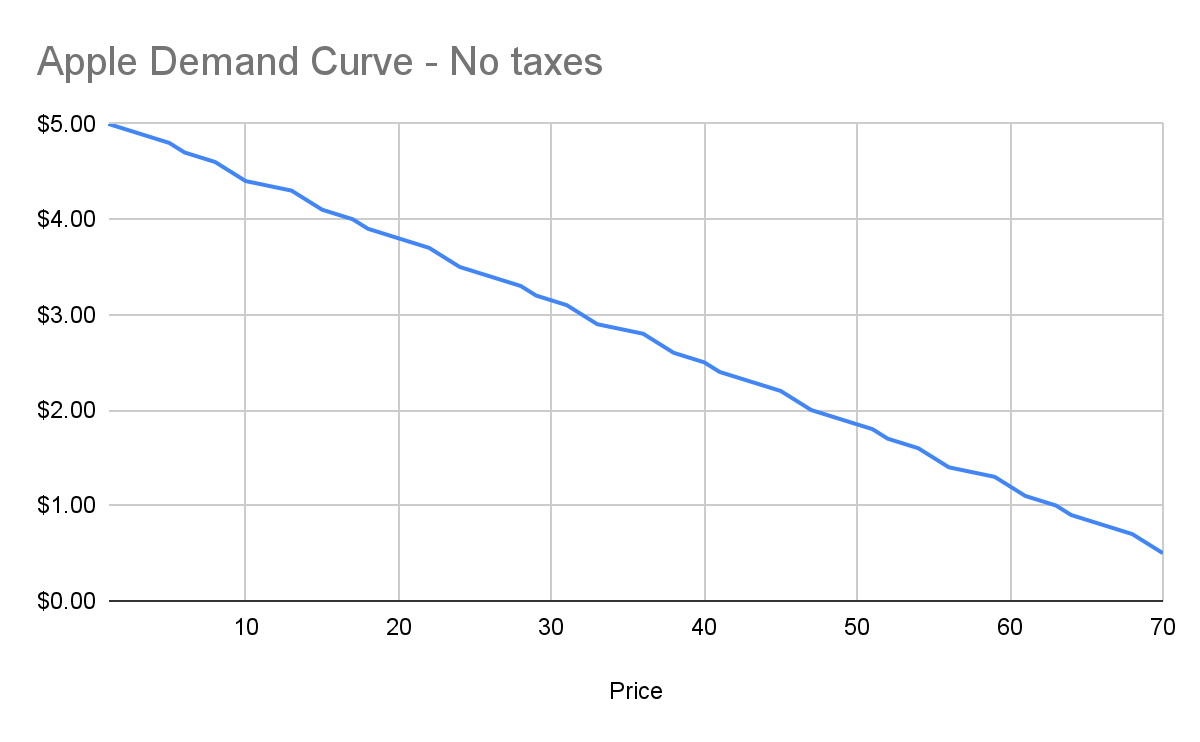

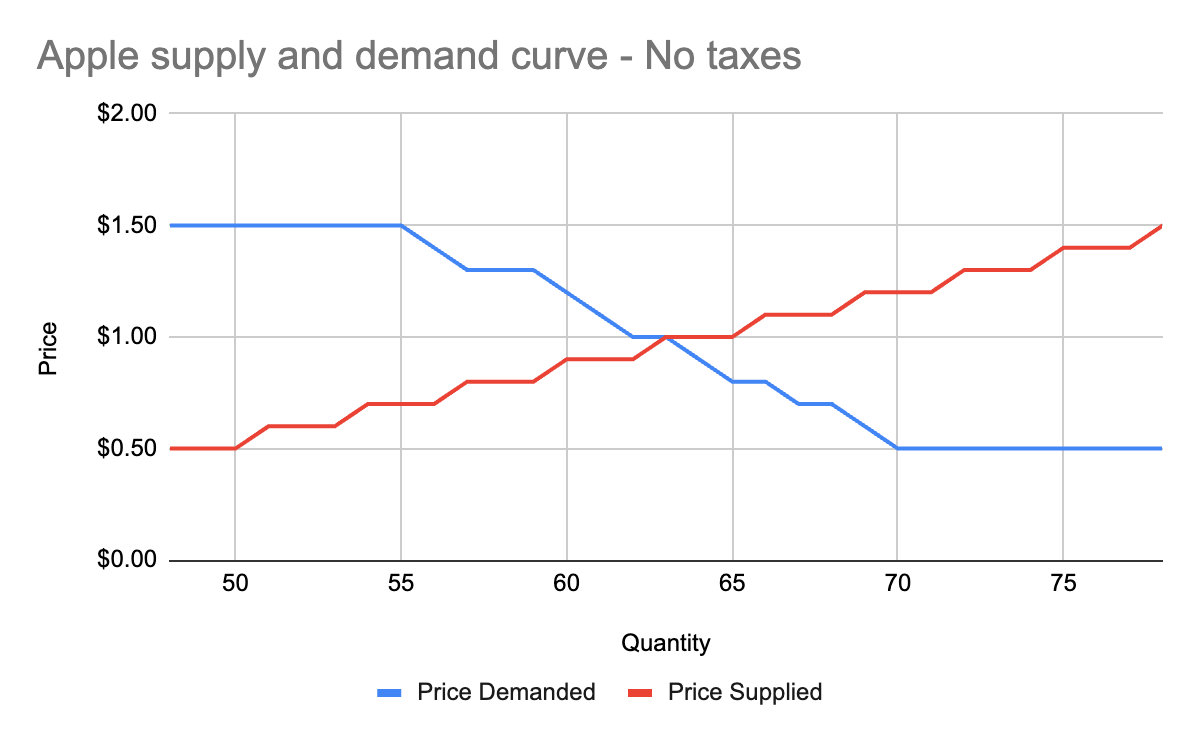

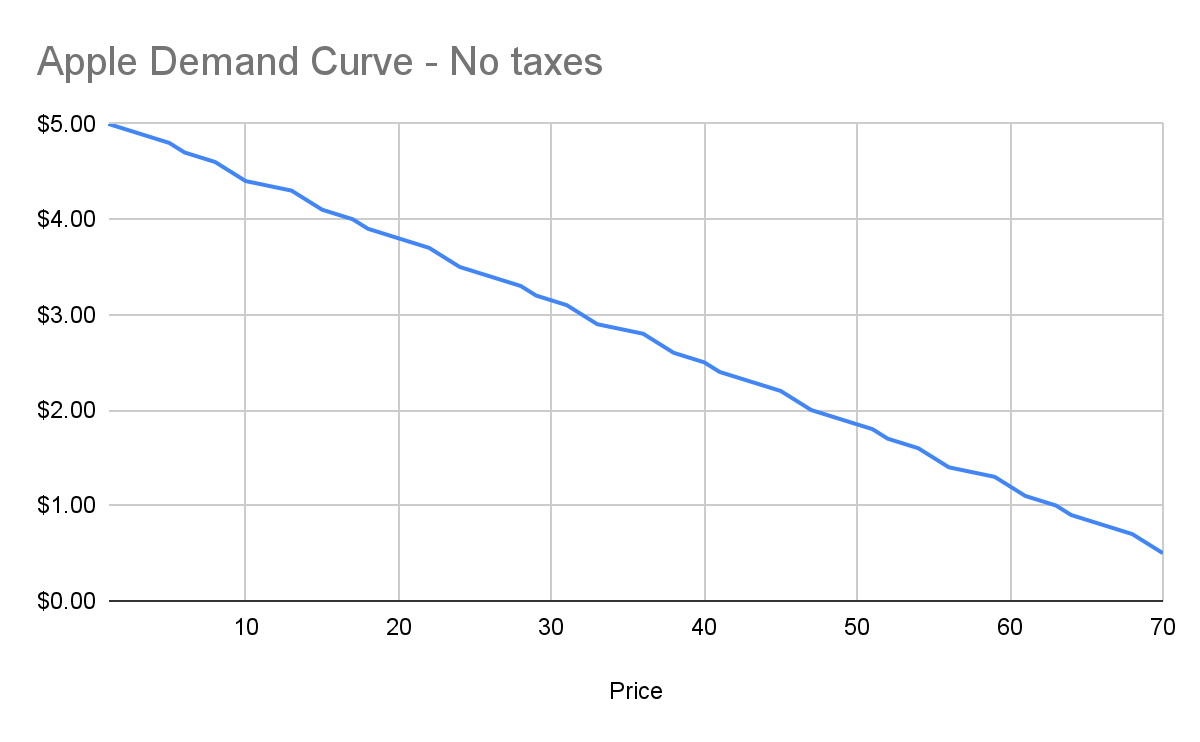

The point being: I’ll be progressively willing to spend less and less money for each apple. This form of analysis is called *marginal benefit*: how much benefit (expressed as dollars I’m willing to spend) will I receive from each apple? This is a downward sloping function: for each additional apple I buy (quantity demanded), the price I’m willing to pay goes down. This is what gives my personal *demand curve*. And if we aggregate demand curves across all market participants (meaning: everyone interested in buying apples), we end up with something like this:

Assuming no changes in people’s behavior and other conditions in the market, this chart tells us how many apples will be purchased by our buyers at each price point between $0.50 and $5. And ceteris paribus (all else being equal), this will continue to be the demand curve for apples.

## Marginal cost

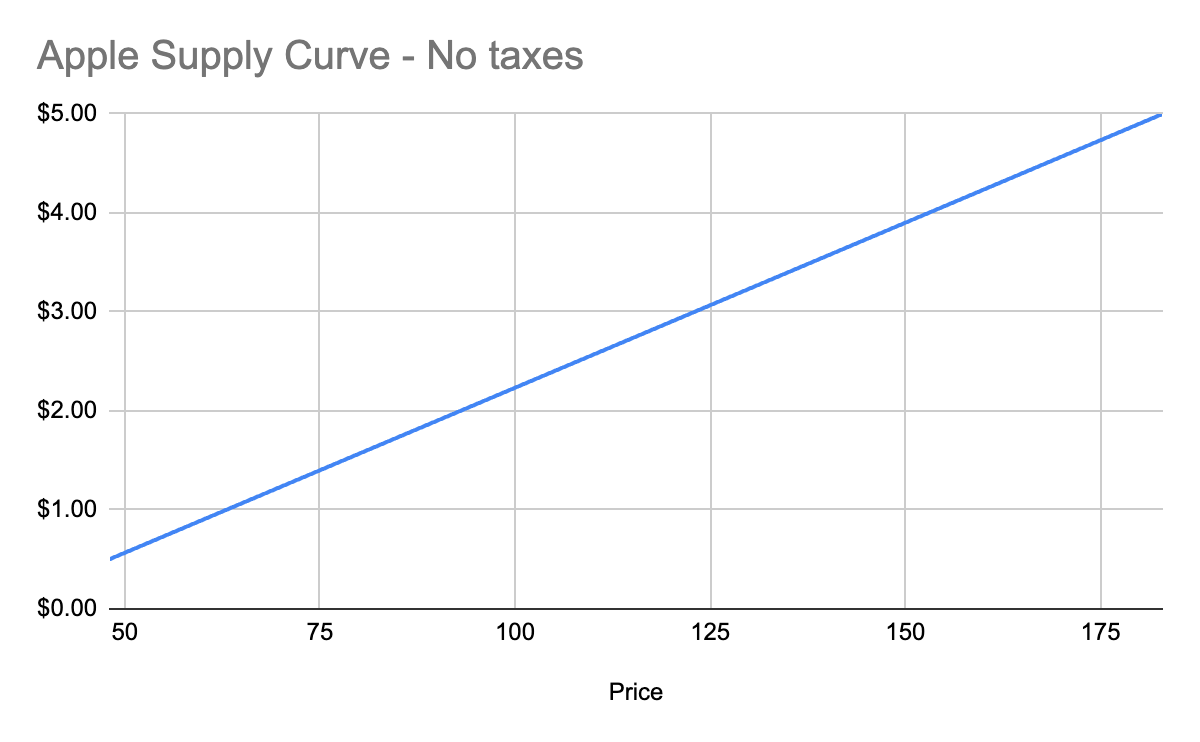

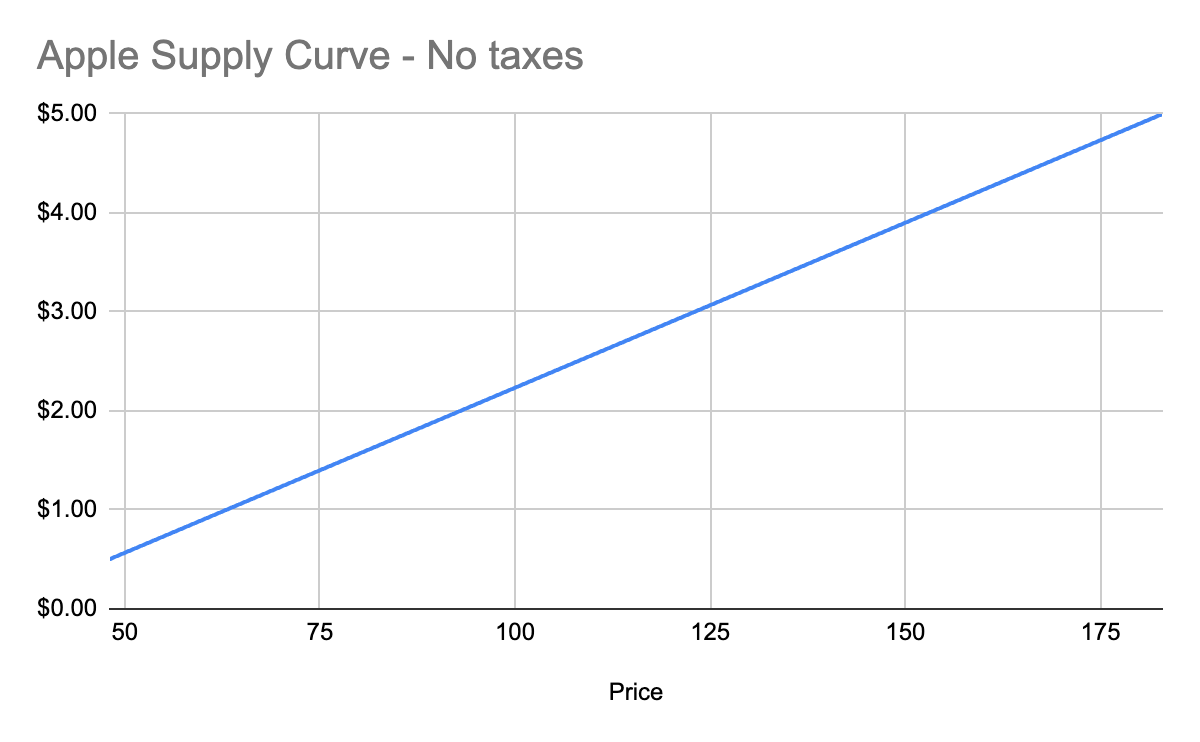

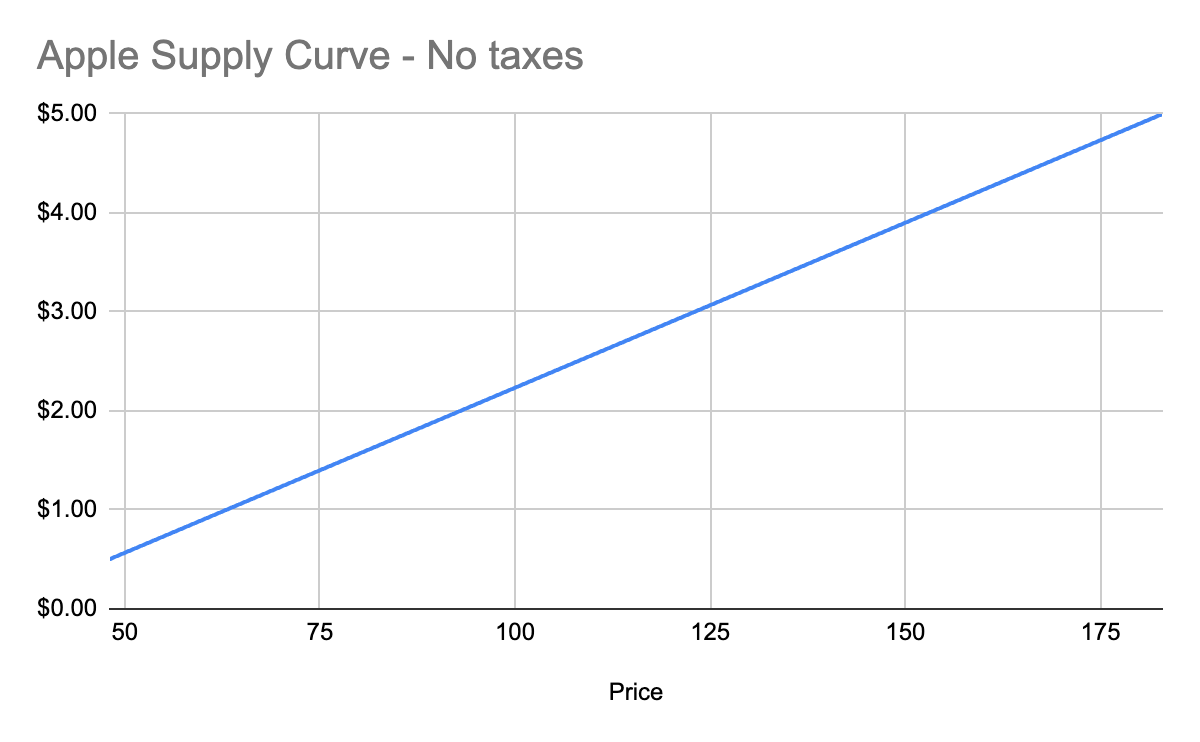

Demand is half the story of economics. The other half is supply, or: how many apples will I sell at each price point? Supply curves are upward sloping: the higher the price, the more a person or company is willing and able to sell a product.

Let’s understand why. Suppose I have an apple orchard. It’s a large property right next to my house. With about 2 minutes of effort, I can walk out of my house, find the nearest tree, pick 5 apples off the tree, and call it a day. 5 apples for 2 minutes of effort is pretty good, right?

Yes, there was all the effort necessary to buy the land, and plant the trees, and water them… and a bunch more than I likely can’t even guess at. We’re going to ignore all of that for our analysis, because for short-term supply-and-demand movement, we can ignore these kinds of *sunk costs*. One other simplification: in reality, supply curves often start descending before ascending. This accounts for achieving efficiencies of scale after the first number of units purchased. But since both these topics are unneeded for understanding taxes, I won’t go any further.

Anyway, back to my apple orchard. If someone offers me $0.50 per apple, I can do 2 minutes of effort and get $2.50 in revenue, which equates to a $75/hour wage for me. I’m more than happy to pick apples at that price\!

However, let’s say someone comes to buy 10,000 apples from me instead. I no longer just walk out to my nearest tree. I’m going to need to get in my truck, drive around, spend the day in the sun, pay for gas, take a day off of my day job (let’s say it pays me $70/hour). The costs go up significantly. Let’s say it takes 5 days to harvest all those apples myself, it costs me $100 in fuel and other expenses, and I lose out on my $70/hour job for 5 days. We end up with:

* Total expenditure: $100 \+ $70 \* 8 hours a day \* 5 days \== $2900

* Total revenue: $5000 (10,000 apples at $0.50 each)

* Total profit: $2100

So I’m still willing to sell the apples at this price, but it’s not as attractive as before. And as the number of apples purchased goes up, my costs keep increasing. I’ll need to spend more money on fuel to travel more of my property. At some point I won’t be able to do the work myself anymore, so I’ll need to pay others to work on the farm, and they’ll be slower at picking apples than me (less familiar with the property, less direct motivation, etc.). The point being: at some point, the number of apples can go high enough that the $0.50 price point no longer makes me any money.

This kind of analysis is called *marginal cost*. It refers to the additional amount of expenditure a seller has to spend in order to produce each additional unit of the good. Marginal costs go up as quantity sold goes up. And like demand curves, if you aggregate this data across all sellers, you get a supply curve like this:

## Equilibrium price

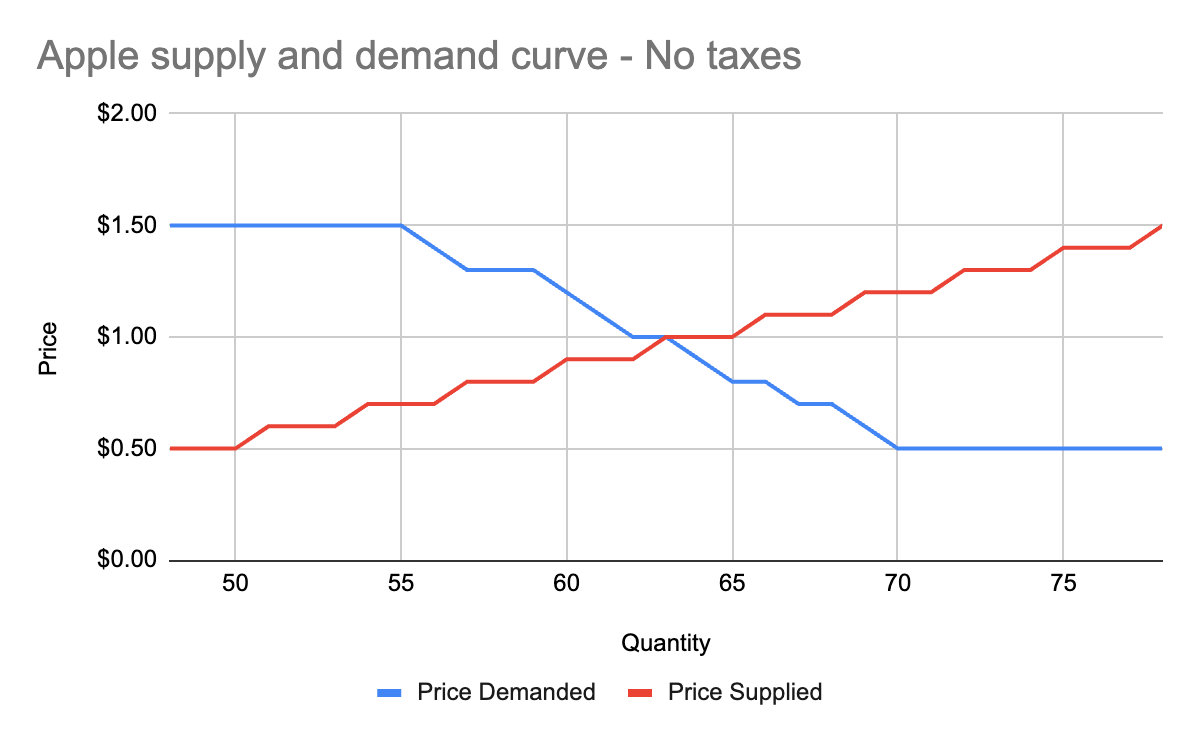

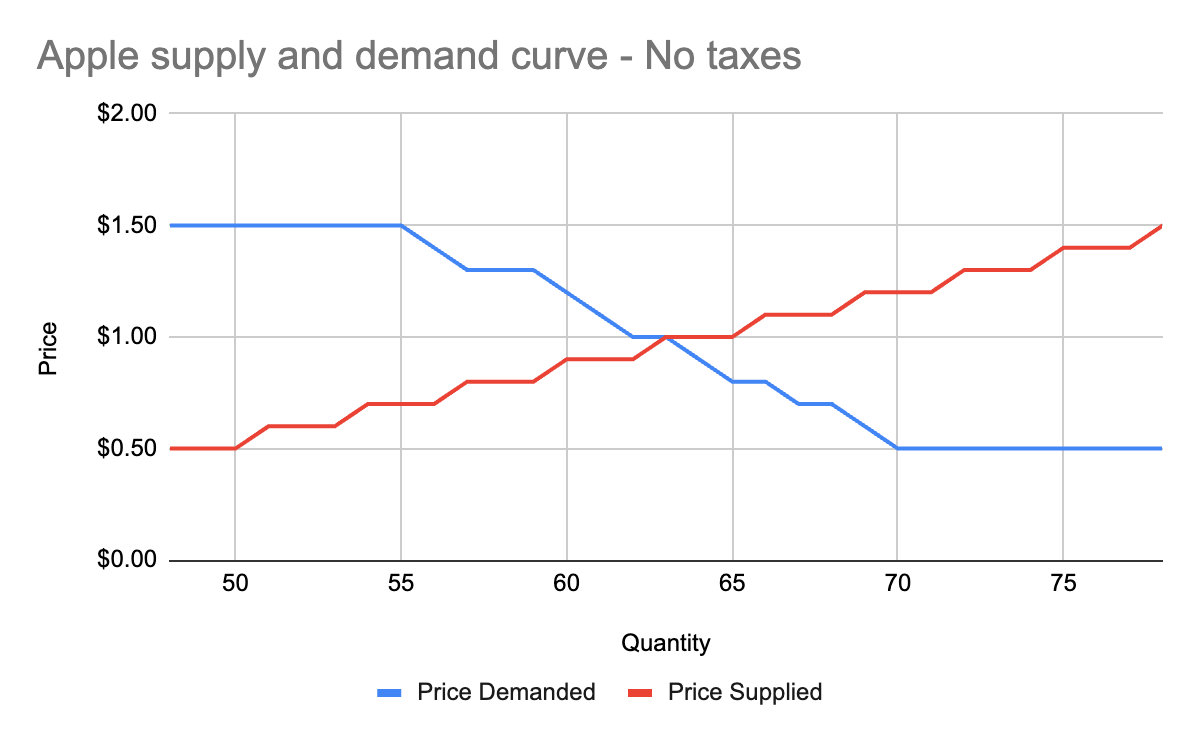

We now know, for every price point, how many apples buyers will purchase, and how many apples sellers will sell. Now we find the equilibrium: where the supply and demand curves meet. This point represents where the marginal benefit a buyer would receive from the next buyer would be less than the cost it would take the next seller to make it. Let’s see it in a chart:

You’ll notice that these two graphs cross at the $1 price point, where 63 apples are both demanded (bought by consumers) and supplied (sold by producers). This is our equilibrium price. We also have a visualization of the *surplus* created by these trades. Everything to the left of the equilibrium point and between the supply and demand curves represents surplus: an area where someone is receiving something of more value than they give. For example:

* When I bought my first apple for $1, but I was willing to spend $5, I made $4 of consumer surplus. The consumer portion of the surplus is everything to the left of the equilibrium point, between the supply and demand curves, and above the equilibrium price point.

* When a seller sells his first apple for $1, but it only cost $0.50 to produce it, the seller made $0.50 of producer surplus. The producer portion of the surplus is everything to the left of the equilibrium point, between the supply and demand curves, and below the equilibrium price point.

Another way of thinking of surplus is “every time someone got a better price than they would have been willing to take.”

OK, with this in place, we now have enough information to figure out how to price in the tariff, which we’ll treat as a negative externality.

## Modeling taxes

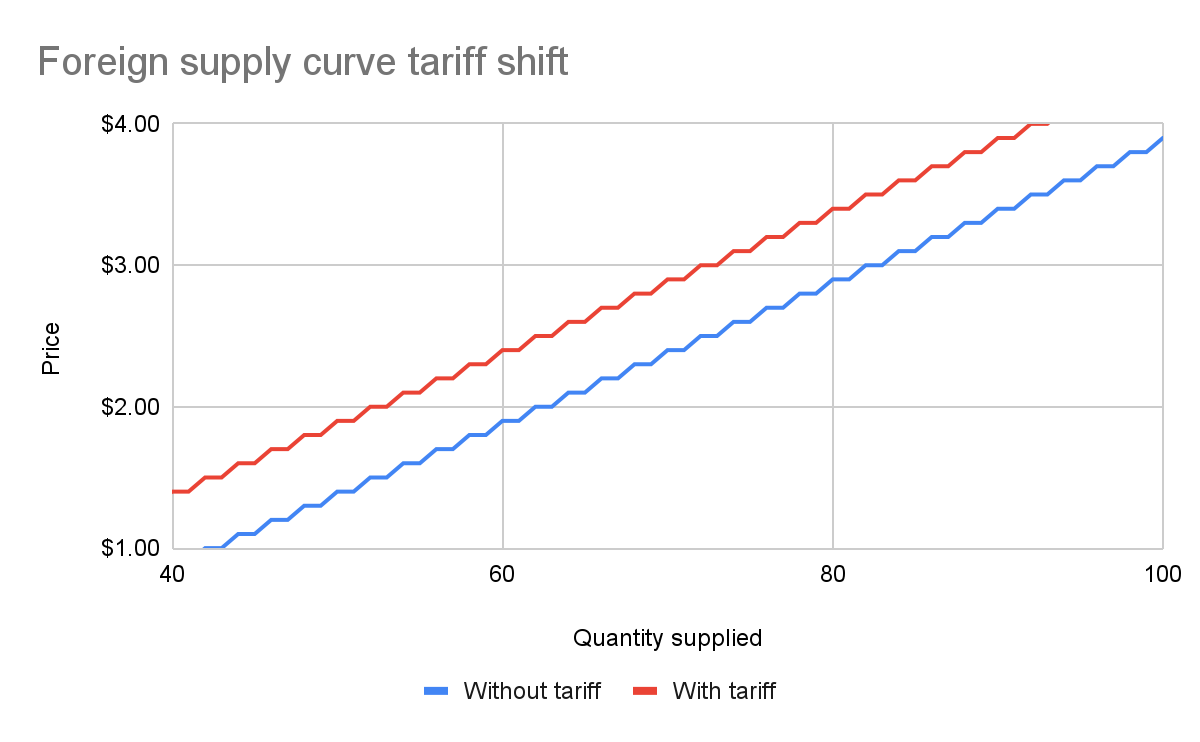

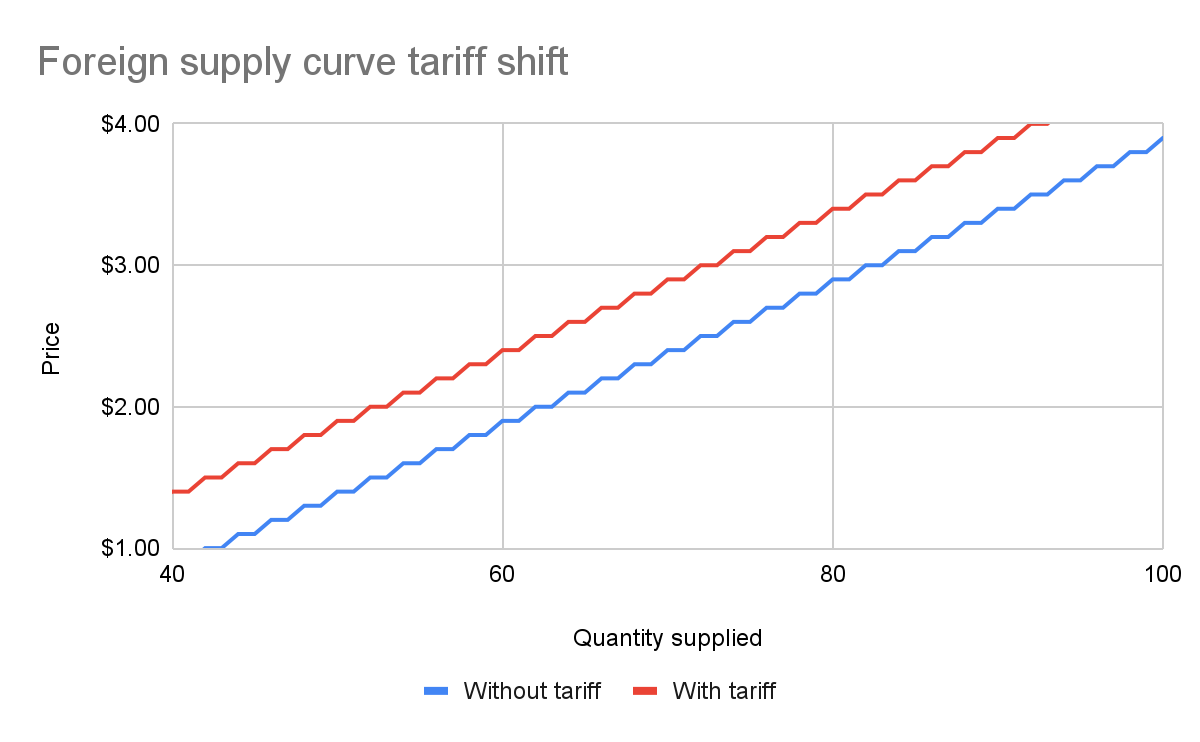

Alright, the government has now instituted a $0.50 tariff on every apple sold within the US by a foreign producer. We can generally model taxes by either increasing the marginal cost of each unit sold (shifting the supply curve up), or by decreasing the marginal benefit of each unit bought (shifting the demand curve down). In this case, since only some of the producers will pay the tax, it makes more sense to modify the supply curve.

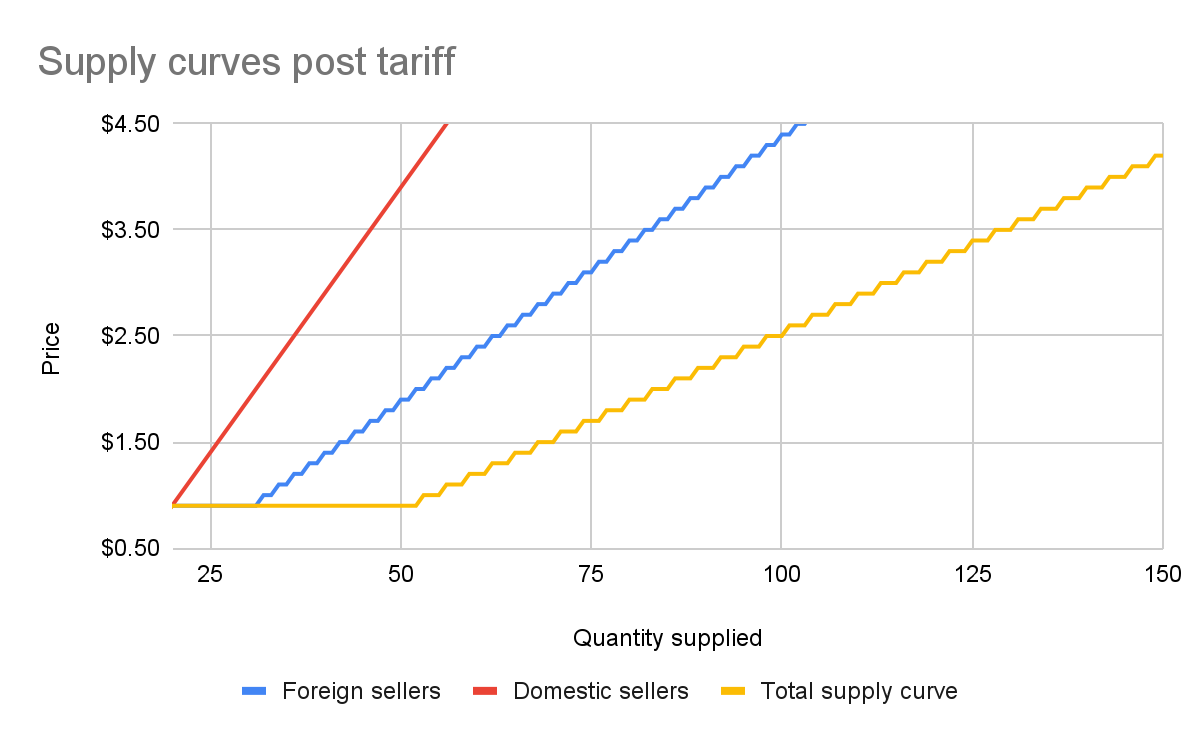

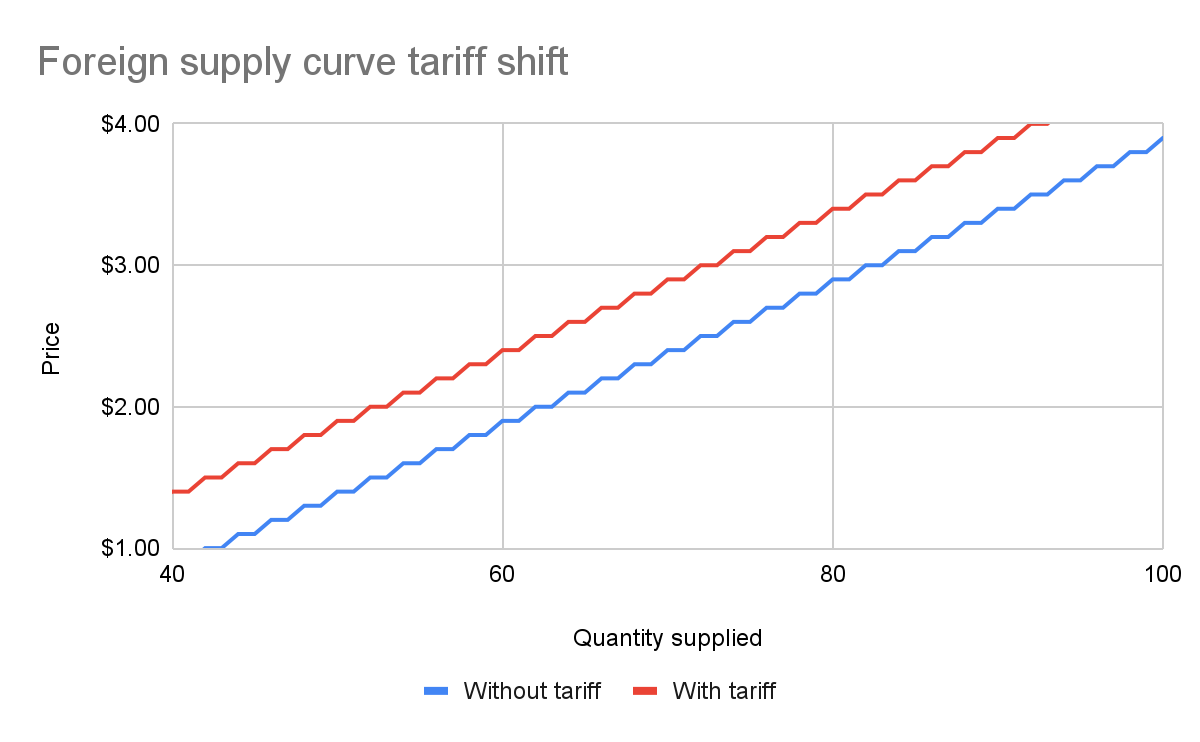

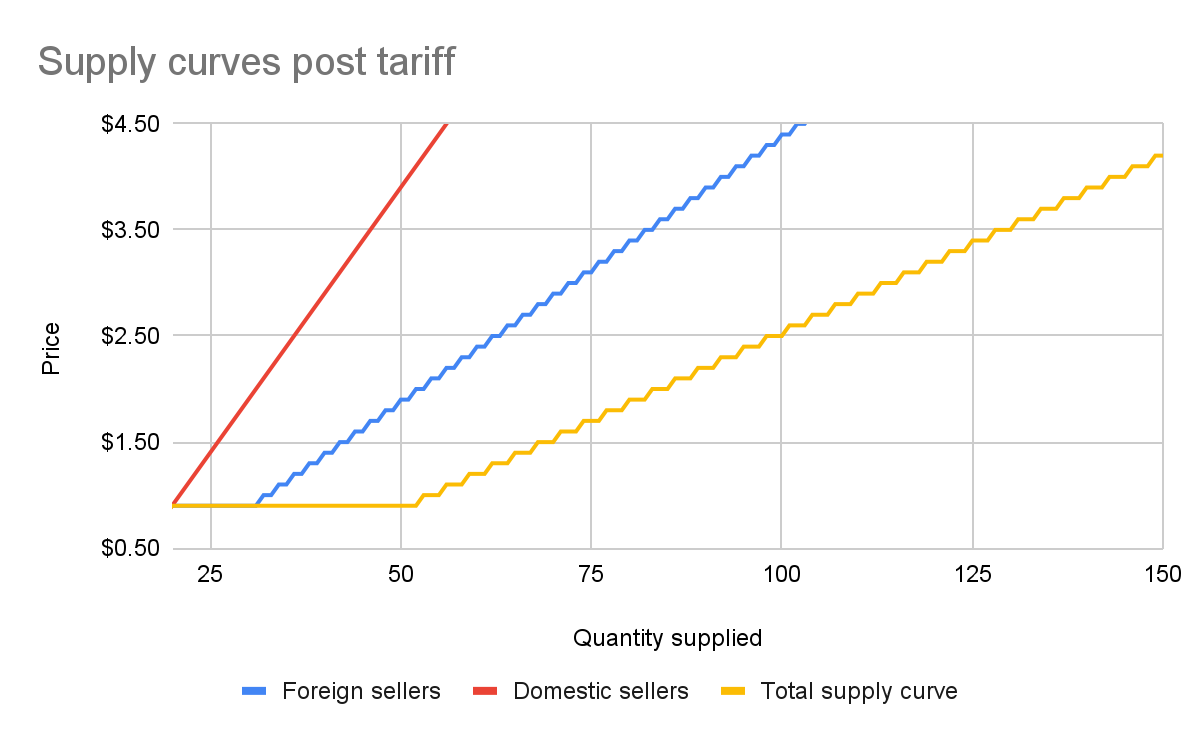

First, let’s see what happens to the foreign seller-only supply curve when you add in the tariff:

With the tariff in place, for each quantity level, the price at which the seller will sell is $0.50 higher than before the tariff. That makes sense: if I was previously willing to sell my 82nd apple for $3, I would now need to charge $3.50 for that apple to cover the cost of the tariff. We see this as the tariff “pushing up” or “pushing left” the original supply curve.

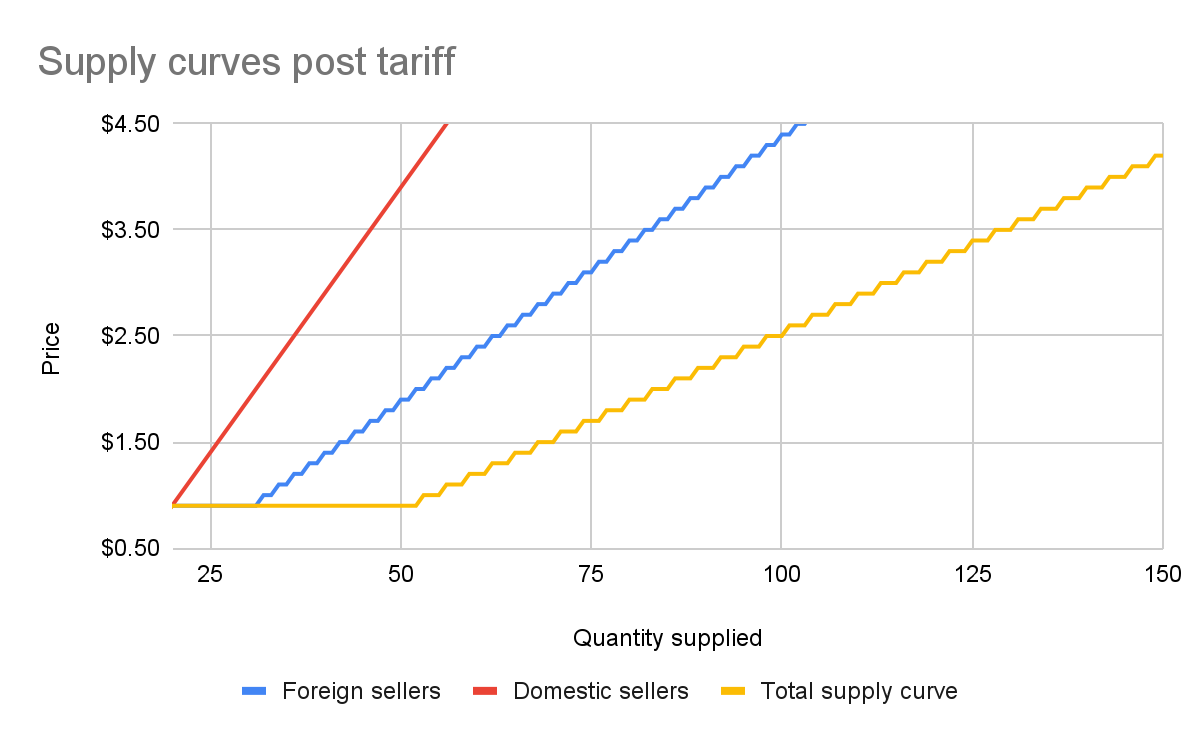

We can add this new supply curve to our existing (unchanged) supply curve for domestic-only sellers, and we end up with a result like this:

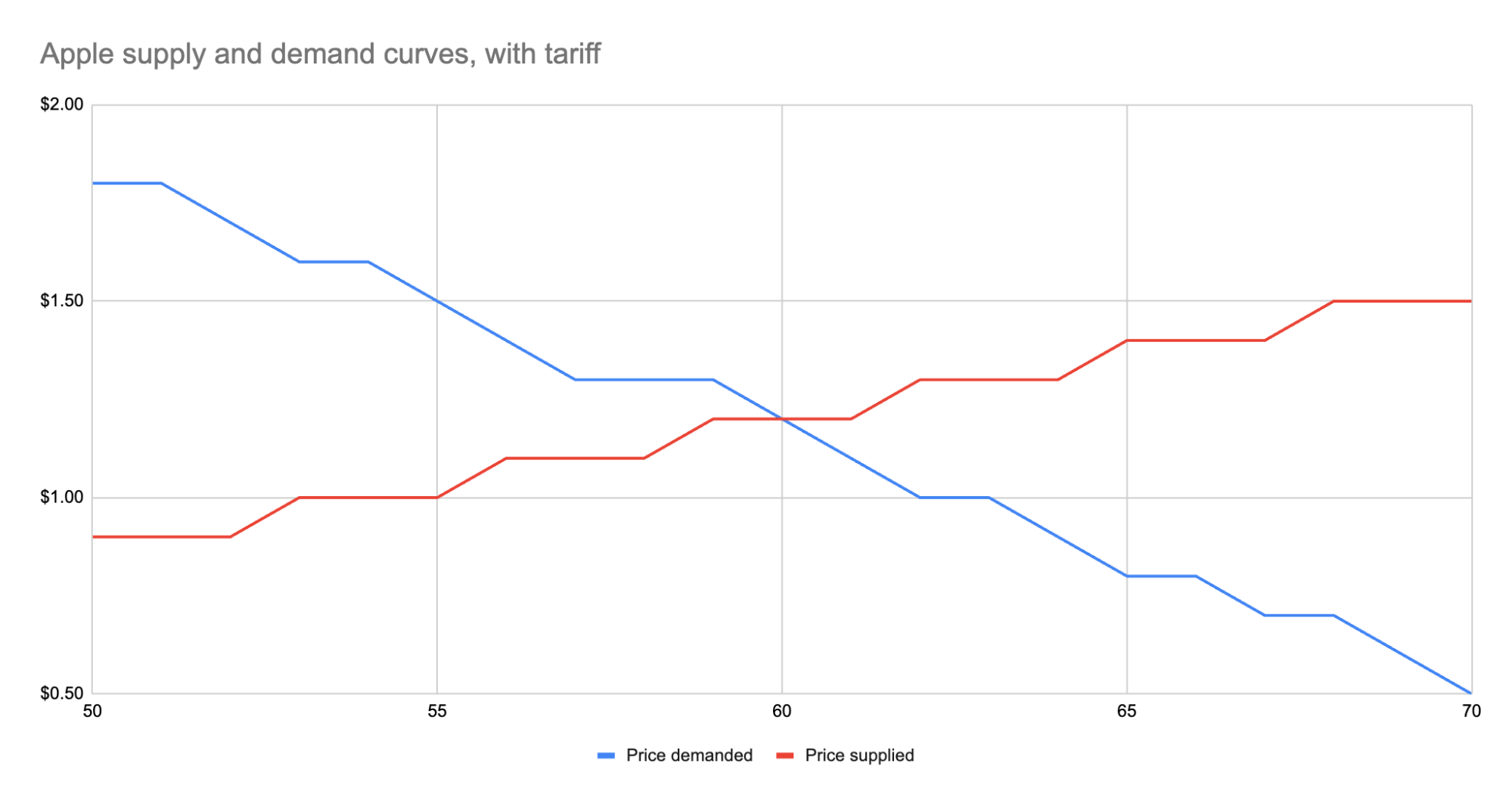

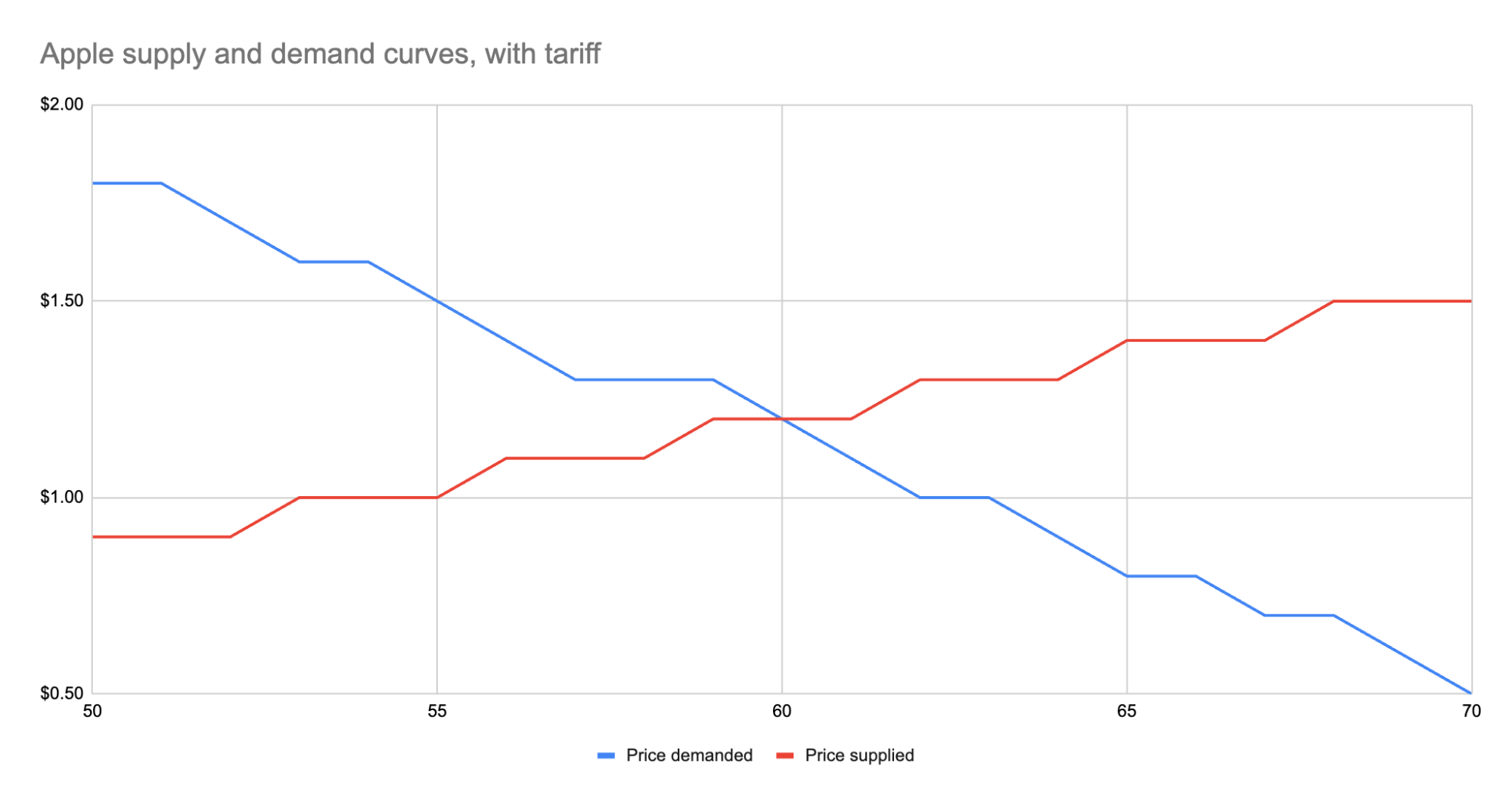

The total supply curve adds up the individual foreign and domestic supply curves. At each price point, we add up the total quantity each group would be willing to sell to determine the total quantity supplied for each price point. Once we have that cumulative supply curve defined, we can produce an updated supply-and-demand chart including the tariff:

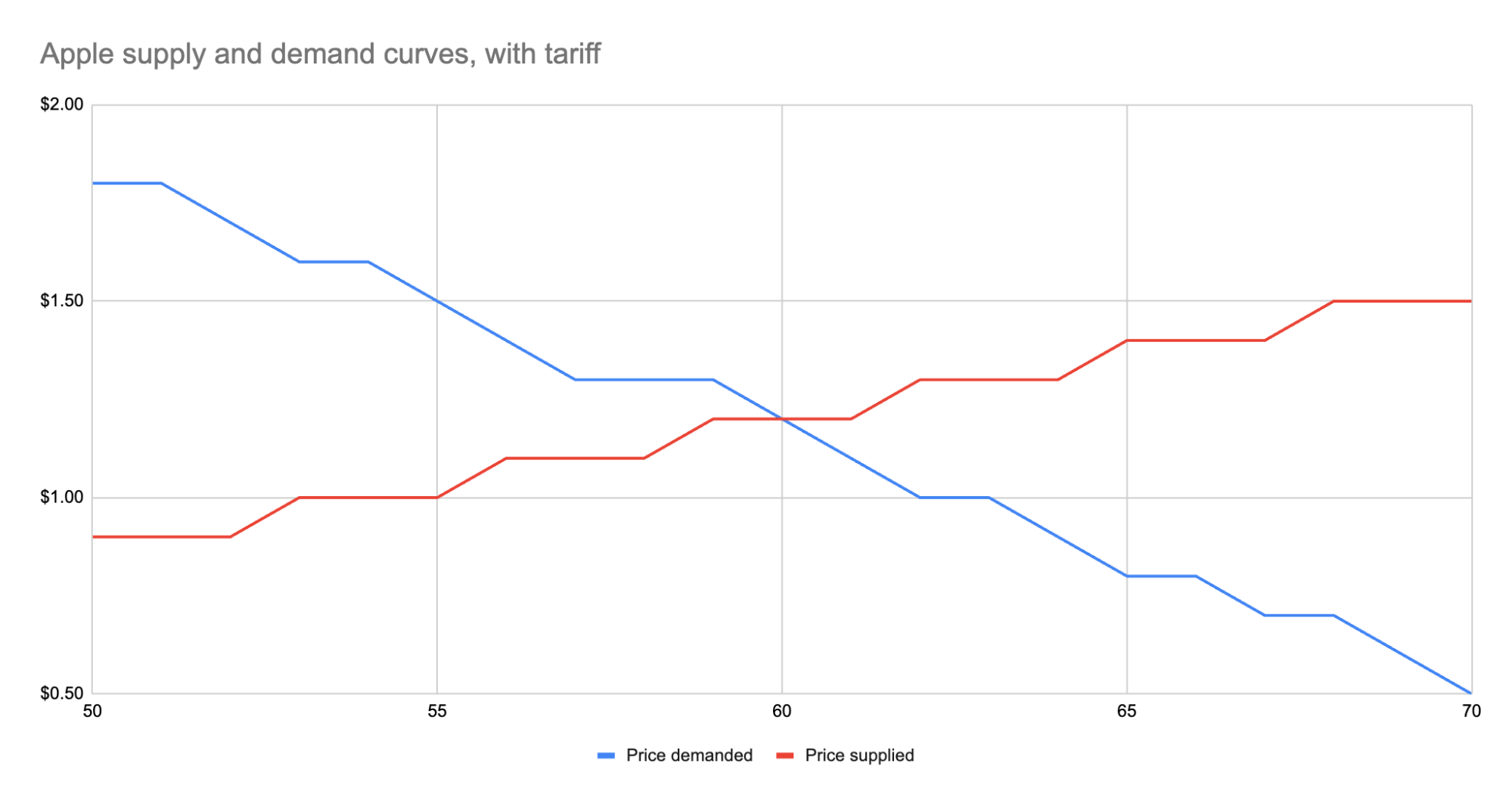

As we can see, the equilibrium has shifted:

* The equilibrium price paid by consumers has risen from $1 to $1.20.

* The total number of apples purchased has dropped from 63 apples to 60 apples.

* Consumers therefore received 3 less apples. They spent $72 for these 60 apples, whereas previously they spent $63 for 3 more apples, a definite decrease in consumer surplus.

* Foreign producers sold 36 of those apples (see the raw data in the linked Google Sheet), for a gross revenue of $43.20. However, they also need to pay the tariff to the US government, which accounts for $18, meaning they only receive $25.20 post-tariff. Previously, they sold 42 apples at $1 each with no tariff to be paid, meaning they took home $42.

* Domestic producers sold the remaining 24 apples at $1.20, giving them a revenue of $28.80. Since they don’t pay the tariff, they take home all of that money. By contrast, previously, they sold 21 apples at $1, for a take-home of $21.

* The government receives $0.50 for each of the 60 apples sold, or in other words receives $30 in revenue it wouldn’t have received otherwise.

We could be more specific about the surpluses, and calculate the actual areas for consumer surplus, producer surplus, inefficiency from the tariff, and government revenue from the tariff. But I won’t bother, as those calculations get slightly more involved. Instead, let’s just look at the aggregate outcomes:

* Consumers were unquestionably hurt. Their price paid went up by $0.20 per apple, and received less apples.

* Foreign producers were also hurt. Their price received went down from the original $1 to the new post-tariff price of $1.20, minus the $0.50 tariff. In other words: foreign producers only receive $0.70 per apple now. This hurt can be mitigated by shifting sales to other countries without a tariff, but the pain will exist regardless.

* Domestic producers scored. They can sell less apples and make more revenue doing it.

* And the government walked away with an extra $30.

Hopefully you now see the answer to the original questions. Importantly, while the government imposed a $0.50 tariff, neither side fully absorbed that cost. Consumers paid a bit more, foreign producers received a bit less. The exact details of how that tariff was split across the groups is mediated by the relevant supply and demand curves of each group. If you want to learn more about this, the relevant search term is “price elasticity,” or how much a group’s quantity supplied or demanded will change based on changes in the price.

## Other taxes

Most taxes are some kind of a tax on trade. Tariffs on apples is an obvious one. But the same applies to income tax (taxing the worker for the trade of labor for money) or payroll tax (same thing, just taxing the employer instead). Interestingly, you can use the same model for analyzing things like tax incentives. For example, if the government decided to subsidize domestic apple production by giving the domestic producers a $0.50 bonus for each apple they sell, we would end up with a similar kind of analysis, except instead of the foreign supply curve shifting up, we’d see the domestic supply curve shifting down.

And generally speaking, this is what you’ll *always* see with government involvement in the economy. It will result in disrupting an existing equilibrium, letting the market readjust to a new equilibrium, and incentivization of some behavior, causing some people to benefit and others to lose out. We saw with the apple tariff, domestic producers and the government benefited while others lost.

You can see the reverse though with tax incentives. If I give a tax incentive of providing a deduction (not paying income tax) for preschool, we would end up with:

* Government needs to make up the difference in tax revenue, either by raising taxes on others or printing more money (leading to inflation). Either way, those paying the tax or those holding government debased currency will pay a price.

* Those people who don’t use the preschool deduction will receive no benefit, so they simply pay a cost.

* Those who do use the preschool deduction will end up paying less on tax+preschool than they would have otherwise.

This analysis is fully amoral. It’s not saying whether providing subsidized preschool is a good thing or not, it simply tells you where the costs will be felt, and points out that such government interference in free economic choice does result in inefficiencies in the system. Once you have that knowledge, you’re more well educated on making a decision about whether the costs of government intervention are worth the benefits.

-

@ 9e69e420:d12360c2

2025-02-01 11:16:04

Federal employees must remove pronouns from email signatures by the end of the day. This directive comes from internal memos tied to two executive orders signed by Donald Trump. The orders target diversity and equity programs within the government.

CDC, Department of Transportation, and Department of Energy employees were affected. Staff were instructed to make changes in line with revised policy prohibiting certain language.

One CDC employee shared frustration, stating, “In my decade-plus years at CDC, I've never been told what I can and can't put in my email signature.” The directive is part of a broader effort to eliminate DEI initiatives from federal discourse.

-

@ 0fa80bd3:ea7325de

2025-01-30 04:28:30

**"Degeneration"** or **"Вырождение"**

![[photo_2025-01-29 23.23.15.jpeg]]

A once-functional object, now eroded by time and human intervention, stripped of its original purpose. Layers of presence accumulate—marks, alterations, traces of intent—until the very essence is obscured. Restoration is paradoxical: to reclaim, one must erase. Yet erasure is an impossibility, for to remove these imprints is to deny the existence of those who shaped them.

The work stands as a meditation on entropy, memory, and the irreversible dialogue between creation and decay.

-

@ 0fa80bd3:ea7325de

2025-01-29 15:43:42

Lyn Alden - биткойн евангелист или евангелистка, я пока не понял

```

npub1a2cww4kn9wqte4ry70vyfwqyqvpswksna27rtxd8vty6c74era8sdcw83a

```

Thomas Pacchia - PubKey owner - X - @tpacchia

```

npub1xy6exlg37pw84cpyj05c2pdgv86hr25cxn0g7aa8g8a6v97mhduqeuhgpl

```

calvadev - Shopstr

```

npub16dhgpql60vmd4mnydjut87vla23a38j689jssaqlqqlzrtqtd0kqex0nkq

```

Calle - Cashu founder

```

npub12rv5lskctqxxs2c8rf2zlzc7xx3qpvzs3w4etgemauy9thegr43sf485vg

```

Джек Дорси

```

npub1sg6plzptd64u62a878hep2kev88swjh3tw00gjsfl8f237lmu63q0uf63m

```

21 ideas

```

npub1lm3f47nzyf0rjp6fsl4qlnkmzed4uj4h2gnf2vhe3l3mrj85vqks6z3c7l

```

Много адресов. Хз кто надо сортировать

```

https://github.com/aitechguy/nostr-address-book

```

ФиатДжеф - создатель Ностр - https://github.com/fiatjaf

```

npub180cvv07tjdrrgpa0j7j7tmnyl2yr6yr7l8j4s3evf6u64th6gkwsyjh6w6

```

EVAN KALOUDIS Zues wallet

```

npub19kv88vjm7tw6v9qksn2y6h4hdt6e79nh3zjcud36k9n3lmlwsleqwte2qd

```

Программер Коди https://github.com/CodyTseng/nostr-relay

```

npub1syjmjy0dp62dhccq3g97fr87tngvpvzey08llyt6ul58m2zqpzps9wf6wl

```

Anna Chekhovich - Managing Bitcoin at The Anti-Corruption Foundation

https://x.com/AnyaChekhovich

```

npub1y2st7rp54277hyd2usw6shy3kxprnmpvhkezmldp7vhl7hp920aq9cfyr7

```

-

@ 0fa80bd3:ea7325de

2025-01-29 14:44:48

![[yedinaya-rossiya-bear.png]]

1️⃣ Be where the bear roams. Stay in its territory, where it hunts for food. No point setting a trap in your backyard if the bear’s chilling in the forest.

2️⃣ Set a well-hidden trap. Bury it, disguise it, and place the bait right in the center. Bears are omnivores—just like secret police KGB agents. And what’s the tastiest bait for them? Money.

3️⃣ Wait for the bear to take the bait. When it reaches in, the trap will snap shut around its paw. It’ll be alive, but stuck. No escape.

Now, what you do with a trapped bear is another question... 😏

-

@ 04c195f1:3329a1da

2025-01-29 08:16:38

Over the past week, Sweden has been rocked by an unprecedented wave of domestic terrorism. Bombings, shootings, and gang-related violence have escalated to a level that even the most hardened observers find shocking. The Swedish people are waking up—sometimes quite literally—to explosions outside their homes, their neighborhoods resembling conflict zones rather than the peaceful Scandinavian society they once knew.

### A Month of Terror

Since the beginning of the year, Sweden has witnessed at least **32 bombings**, averaging more than **one explosion per day**. In a sign of how routine this has become, state media outlet [SVT now maintains a "live ticker" tracking the growing number of explosions](https://www.svt.se/datajournalistik/sprangningar-i-sverige-ar-for-ar/)—reminiscent of the death and infection tickers used during the COVID-19 pandemic. The attacks have struck cities large and small—Stockholm, Uppsala, Helsingborg, and Örebro among them. Some explosions have targeted residential buildings, even bedrooms where children sleep. Others have been part of gang warfare, retaliation for unpaid debts, or attempts to intimidate rivals.

Just in the past **24 hours**, five separate explosions have rocked Stockholm. A grenade attack forced a school into lockdown, while an explosion in Årstaberg destroyed the entrance of an apartment building. This is not the first time—and it certainly will not be the last.

### Sweden’s Political Paralysis

Despite this unprecedented security crisis, the Swedish government refuses to take meaningful action. Prime Minister Ulf Kristersson recently acknowledged the situation, stating:

> “The criminal gangs show total disregard for the public. This is domestic terrorism that we must fight with the full force of society. The police are working intensively to prevent and stop acts of violence. The police can now conduct preventive wiretapping, and security zones are in place. These are important tools. But more is needed.”

However, this is yet another attempt to address symptoms rather than causes—and it will fail to even achieve that. Last night, I participated in a livestream where former MP Jeff Ahl likened the government's approach to **trying to stop arterial bleeding with a band-aid**. A fitting description indeed.

Meanwhile, rather than declaring a national emergency, Sweden’s political elite have prioritized ideological pet projects. Minister Paulina Brandberg was busy **opening a new DEI (Diversity, Equity, Inclusion) office at Chalmers University** while bombs tore through Stockholm’s suburbs. Justice Minister Gunnar Strömmer held a crisis meeting with the police last week, only to suggest that the government might be able to stop the gangs **in eight years**—an admission of failure if ever there was one.

### The Root of the Crisis

The media and political establishment refuse to address the root cause of this descent into chaos: mass immigration and the importation of criminal clan networks. The reality is undeniable:

- Areas like **Rinkeby and Botkyrka**—once Swedish working-class neighborhoods—now have overwhelming non-Swedish majorities, with Rinkeby exceeding **95%** and Botkyrka over **60%**. These are just two examples of the **hundreds of neighborhoods** across Sweden where Swedes are now a minority, where criminal clans thrive, and where gangs have effectively taken control—not just of the streets but also of local commerce and entire business districts.

- **Organized crime syndicates**, many with roots in the Middle East and North Africa, exert dominance over these areas, operating parallel societies with little to no interference from Swedish authorities.

- Police estimate that **30,000 individuals** are active in criminal gangs—when factoring in extended networks, the number may be in the **hundreds of thousands**.

- **Most of these people should never have been allowed into Sweden in the first place.**

### “We’re Used to It”

Perhaps the most chilling aspect of this crisis is the growing resignation among Swedes. After a bombing in Upplands-Bro last night, one resident summed it up:

> “No, I’m not worried. I’m used to it.”

This normalization of terrorism is a direct consequence of decades of political negligence, ideological blindness, and a refusal to admit policy failure. Sweden’s leaders have deliberately ignored the warnings. They have allowed the chaos to fester. And now, they pretend to be shocked as the country spirals deeper into lawlessness.

### What Comes Next?

Let’s be clear: these bombings will not stop. If history is any guide, Sweden’s authorities will issue statements, hold meetings, and maybe even arrest a few foot soldiers. But the broader networks, the root causes, and the state’s unwillingness to reclaim control over the country remain unchanged.

The question is not whether Sweden can recover. The question is whether Swedes are willing to demand real change. And if they do not, how much further can this country fall before it collapses altogether?

**I will continue to report on this crisis—because while mainstream media acknowledges the violence, they refuse to confront its root cause. If we do not acknowledge the failure of multiculturalism and dismantle this ideological experiment, we will never resolve this crisis.**

For near-daily updates, follow me on [**X**](https://www.x.com/erikssondan)**, [Telegram](https://t.me/danerikssonSE), and [Nostr](https://primal.net/daneriksson)**, where I report on these events as they unfold. Stay informed, stay vigilant, and if you value my work, consider subscribing and sharing this newsletter.

■

-

@ 0fa80bd3:ea7325de

2025-01-29 05:55:02

The land that belongs to the indigenous peoples of Russia has been seized by a gang of killers who have unleashed a war of extermination. They wipe out anyone who refuses to conform to their rules. Those who disagree and stay behind are tortured and killed in prisons and labor camps. Those who flee lose their homeland, dissolve into foreign cultures, and fade away. And those who stand up to protect their people are attacked by the misled and deceived. The deceived die for the unchecked greed of a single dictator—thousands from both sides, people who just wanted to live, raise their kids, and build a future.

Now, they are forced to make an impossible choice: abandon their homeland or die. Some perish on the battlefield, others lose themselves in exile, stripped of their identity, scattered in a world that isn’t theirs.

There’s been endless debate about how to fix this, how to clear the field of the weeds that choke out every new sprout, every attempt at change. But the real problem? We can’t play by their rules. We can’t speak their language or use their weapons. We stand for humanity, and no matter how righteous our cause, we will not multiply suffering. Victory doesn’t come from matching the enemy—it comes from staying ahead, from using tools they haven’t mastered yet. That’s how wars are won.

Our only resource is the **will of the people** to rewrite the order of things. Historian Timothy Snyder once said that a nation cannot exist without a city. A city is where the most active part of a nation thrives. But the cities are occupied. The streets are watched. Gatherings are impossible. They control the money. They control the mail. They control the media. And any dissent is crushed before it can take root.

So I started asking myself: **How do we stop this fragmentation?** How do we create a space where people can **rebuild their connections** when they’re ready? How do we build a **self-sustaining network**, where everyone contributes and benefits proportionally, while keeping their freedom to leave intact? And more importantly—**how do we make it spread, even in occupied territory?**

In 2009, something historic happened: **the internet got its own money.** Thanks to **Satoshi Nakamoto**, the world took a massive leap forward. Bitcoin and decentralized ledgers shattered the idea that money must be controlled by the state. Now, to move or store value, all you need is an address and a key. A tiny string of text, easy to carry, impossible to seize.

That was the year money broke free. The state lost its grip. Its biggest weapon—physical currency—became irrelevant. Money became **purely digital.**

The internet was already **a sanctuary for information**, a place where people could connect and organize. But with Bitcoin, it evolved. Now, **value itself** could flow freely, beyond the reach of authorities.

Think about it: when seedlings are grown in controlled environments before being planted outside, they **get stronger, survive longer, and bear fruit faster.** That’s how we handle crops in harsh climates—nurture them until they’re ready for the wild.

Now, picture the internet as that **controlled environment** for **ideas**. Bitcoin? It’s the **fertile soil** that lets them grow. A testing ground for new models of interaction, where concepts can take root before they move into the real world. If **nation-states are a battlefield, locked in a brutal war for territory, the internet is boundless.** It can absorb any number of ideas, any number of people, and it doesn’t **run out of space.**

But for this ecosystem to thrive, people need safe ways to communicate, to share ideas, to build something real—**without surveillance, without censorship, without the constant fear of being erased.**

This is where **Nostr** comes in.

Nostr—"Notes and Other Stuff Transmitted by Relays"—is more than just a messaging protocol. **It’s a new kind of city.** One that **no dictator can seize**, no corporation can own, no government can shut down.

It’s built on **decentralization, encryption, and individual control.** Messages don’t pass through central servers—they are relayed through independent nodes, and users choose which ones to trust. There’s no master switch to shut it all down. Every person owns their identity, their data, their connections. And no one—no state, no tech giant, no algorithm—can silence them.

In a world where cities fall and governments fail, **Nostr is a city that cannot be occupied.** A place for ideas, for networks, for freedom. A city that grows stronger **the more people build within it**.

@ daa41bed:88f54153

2025-02-09 16:50:04There has been a good bit of discussion on Nostr over the past few days about the merits of zaps as a method of engaging with notes, so after writing a rather lengthy [article on the pros of a strategic Bitcoin reserve](https://geek.npub.pro/post/dxqkgnjplttkvetprg8ox/), I wanted to take some time to chime in on the much more fun topic of digital engagement. Let's begin by defining a couple of things: **Nostr** is a decentralized, censorship-resistance protocol whose current biggest use case is social media (think Twitter/X). Instead of relying on company servers, it relies on relays that anyone can spin up and own their own content. Its use cases are much bigger, though, and this article is hosted on my own relay, using my own Nostr relay as an example. **Zap** is a tip or donation denominated in sats (small units of Bitcoin) sent from one user to another. This is generally done directly over the Lightning Network but is increasingly using Cashu tokens. For the sake of this discussion, how you transmit/receive zaps will be irrelevant, so don't worry if you don't know what [Lightning](https://lightning.network/) or [Cashu](https://cashu.space/) are. If we look at how users engage with posts and follows/followers on platforms like Twitter, Facebook, etc., it becomes evident that traditional social media thrives on engagement farming. The more outrageous a post, the more likely it will get a reaction. We see a version of this on more visual social platforms like YouTube and TikTok that use carefully crafted thumbnail images to grab the user's attention to click the video. If you'd like to dive deep into the psychology and science behind social media engagement, let me know, and I'd be happy to follow up with another article. In this user engagement model, a user is given the option to comment or like the original post, or share it among their followers to increase its signal. They receive no value from engaging with the content aside from the dopamine hit of the original experience or having their comment liked back by whatever influencer they provide value to. Ad revenue flows to the content creator. Clout flows to the content creator. Sales revenue from merch and content placement flows to the content creator. We call this a linear economy -- the idea that resources get created, used up, then thrown away. Users create content and farm as much engagement as possible, then the content is forgotten within a few hours as they move on to the next piece of content to be farmed. What if there were a simple way to give value back to those who engage with your content? By implementing some value-for-value model -- a circular economy. Enter zaps.  Unlike traditional social media platforms, Nostr does not actively use algorithms to determine what content is popular, nor does it push content created for active user engagement to the top of a user's timeline. Yes, there are "trending" and "most zapped" timelines that users can choose to use as their default, but these use relatively straightforward engagement metrics to rank posts for these timelines. That is not to say that we may not see clients actively seeking to refine timeline algorithms for specific metrics. Still, the beauty of having an open protocol with media that is controlled solely by its users is that users who begin to see their timeline gamed towards specific algorithms can choose to move to another client, and for those who are more tech-savvy, they can opt to run their own relays or create their own clients with personalized algorithms and web of trust scoring systems. Zaps enable the means to create a new type of social media economy in which creators can earn for creating content and users can earn by actively engaging with it. Like and reposting content is relatively frictionless and costs nothing but a simple button tap. Zaps provide active engagement because they signal to your followers and those of the content creator that this post has genuine value, quite literally in the form of money—sats.  I have seen some comments on Nostr claiming that removing likes and reactions is for wealthy people who can afford to send zaps and that the majority of people in the US and around the world do not have the time or money to zap because they have better things to spend their money like feeding their families and paying their bills. While at face value, these may seem like valid arguments, they, unfortunately, represent the brainwashed, defeatist attitude that our current economic (and, by extension, social media) systems aim to instill in all of us to continue extracting value from our lives. Imagine now, if those people dedicating their own time (time = money) to mine pity points on social media would instead spend that time with genuine value creation by posting content that is meaningful to cultural discussions. Imagine if, instead of complaining that their posts get no zaps and going on a tirade about how much of a victim they are, they would empower themselves to take control of their content and give value back to the world; where would that leave us? How much value could be created on a nascent platform such as Nostr, and how quickly could it overtake other platforms? Other users argue about user experience and that additional friction (i.e., zaps) leads to lower engagement, as proven by decades of studies on user interaction. While the added friction may turn some users away, does that necessarily provide less value? I argue quite the opposite. You haven't made a few sats from zaps with your content? Can't afford to send some sats to a wallet for zapping? How about using the most excellent available resource and spending 10 seconds of your time to leave a comment? Likes and reactions are valueless transactions. Social media's real value derives from providing monetary compensation and actively engaging in a conversation with posts you find interesting or thought-provoking. Remember when humans thrived on conversation and discussion for entertainment instead of simply being an onlooker of someone else's life? If you've made it this far, my only request is this: try only zapping and commenting as a method of engagement for two weeks. Sure, you may end up liking a post here and there, but be more mindful of how you interact with the world and break yourself from blind instinct. You'll thank me later.

@ daa41bed:88f54153

2025-02-09 16:50:04There has been a good bit of discussion on Nostr over the past few days about the merits of zaps as a method of engaging with notes, so after writing a rather lengthy [article on the pros of a strategic Bitcoin reserve](https://geek.npub.pro/post/dxqkgnjplttkvetprg8ox/), I wanted to take some time to chime in on the much more fun topic of digital engagement. Let's begin by defining a couple of things: **Nostr** is a decentralized, censorship-resistance protocol whose current biggest use case is social media (think Twitter/X). Instead of relying on company servers, it relies on relays that anyone can spin up and own their own content. Its use cases are much bigger, though, and this article is hosted on my own relay, using my own Nostr relay as an example. **Zap** is a tip or donation denominated in sats (small units of Bitcoin) sent from one user to another. This is generally done directly over the Lightning Network but is increasingly using Cashu tokens. For the sake of this discussion, how you transmit/receive zaps will be irrelevant, so don't worry if you don't know what [Lightning](https://lightning.network/) or [Cashu](https://cashu.space/) are. If we look at how users engage with posts and follows/followers on platforms like Twitter, Facebook, etc., it becomes evident that traditional social media thrives on engagement farming. The more outrageous a post, the more likely it will get a reaction. We see a version of this on more visual social platforms like YouTube and TikTok that use carefully crafted thumbnail images to grab the user's attention to click the video. If you'd like to dive deep into the psychology and science behind social media engagement, let me know, and I'd be happy to follow up with another article. In this user engagement model, a user is given the option to comment or like the original post, or share it among their followers to increase its signal. They receive no value from engaging with the content aside from the dopamine hit of the original experience or having their comment liked back by whatever influencer they provide value to. Ad revenue flows to the content creator. Clout flows to the content creator. Sales revenue from merch and content placement flows to the content creator. We call this a linear economy -- the idea that resources get created, used up, then thrown away. Users create content and farm as much engagement as possible, then the content is forgotten within a few hours as they move on to the next piece of content to be farmed. What if there were a simple way to give value back to those who engage with your content? By implementing some value-for-value model -- a circular economy. Enter zaps.  Unlike traditional social media platforms, Nostr does not actively use algorithms to determine what content is popular, nor does it push content created for active user engagement to the top of a user's timeline. Yes, there are "trending" and "most zapped" timelines that users can choose to use as their default, but these use relatively straightforward engagement metrics to rank posts for these timelines. That is not to say that we may not see clients actively seeking to refine timeline algorithms for specific metrics. Still, the beauty of having an open protocol with media that is controlled solely by its users is that users who begin to see their timeline gamed towards specific algorithms can choose to move to another client, and for those who are more tech-savvy, they can opt to run their own relays or create their own clients with personalized algorithms and web of trust scoring systems. Zaps enable the means to create a new type of social media economy in which creators can earn for creating content and users can earn by actively engaging with it. Like and reposting content is relatively frictionless and costs nothing but a simple button tap. Zaps provide active engagement because they signal to your followers and those of the content creator that this post has genuine value, quite literally in the form of money—sats.  I have seen some comments on Nostr claiming that removing likes and reactions is for wealthy people who can afford to send zaps and that the majority of people in the US and around the world do not have the time or money to zap because they have better things to spend their money like feeding their families and paying their bills. While at face value, these may seem like valid arguments, they, unfortunately, represent the brainwashed, defeatist attitude that our current economic (and, by extension, social media) systems aim to instill in all of us to continue extracting value from our lives. Imagine now, if those people dedicating their own time (time = money) to mine pity points on social media would instead spend that time with genuine value creation by posting content that is meaningful to cultural discussions. Imagine if, instead of complaining that their posts get no zaps and going on a tirade about how much of a victim they are, they would empower themselves to take control of their content and give value back to the world; where would that leave us? How much value could be created on a nascent platform such as Nostr, and how quickly could it overtake other platforms? Other users argue about user experience and that additional friction (i.e., zaps) leads to lower engagement, as proven by decades of studies on user interaction. While the added friction may turn some users away, does that necessarily provide less value? I argue quite the opposite. You haven't made a few sats from zaps with your content? Can't afford to send some sats to a wallet for zapping? How about using the most excellent available resource and spending 10 seconds of your time to leave a comment? Likes and reactions are valueless transactions. Social media's real value derives from providing monetary compensation and actively engaging in a conversation with posts you find interesting or thought-provoking. Remember when humans thrived on conversation and discussion for entertainment instead of simply being an onlooker of someone else's life? If you've made it this far, my only request is this: try only zapping and commenting as a method of engagement for two weeks. Sure, you may end up liking a post here and there, but be more mindful of how you interact with the world and break yourself from blind instinct. You'll thank me later.  @ e3ba5e1a:5e433365

2025-02-05 17:47:16I got into a [friendly discussion](https://x.com/snoyberg/status/1887007888117252142) on X regarding health insurance. The specific question was how to deal with health insurance companies (presumably unfairly) denying claims? My answer, as usual: get government out of it! The US healthcare system is essentially the worst of both worlds: * Unlike full single payer, individuals incur high costs * Unlike a true free market, regulation causes increases in costs and decreases competition among insurers I'm firmly on the side of moving towards the free market. (And I say that as someone living under a single payer system now.) Here's what I would do: * Get rid of tax incentives that make health insurance tied to your employer, giving individuals back proper freedom of choice. * Reduce regulations significantly. * In the short term, some people will still get rejected claims and other obnoxious behavior from insurance companies. We address that in two ways: 1. Due to reduced regulations, new insurance companies will be able to enter the market offering more reliable coverage and better rates, and people will flock to them because they have the freedom to make their own choices. 2. Sue the asses off of companies that reject claims unfairly. And ideally, as one of the few legitimate roles of government in all this, institute new laws that limit the ability of fine print to allow insurers to escape their responsibilities. (I'm hesitant that the latter will happen due to the incestuous relationship between Congress/regulators and insurers, but I can hope.) Will this magically fix everything overnight like politicians normally promise? No. But it will allow the market to return to a healthy state. And I don't think it will take long (order of magnitude: 5-10 years) for it to come together, but that's just speculation. And since there's a high correlation between those who believe government can fix problems by taking more control and demanding that only credentialed experts weigh in on a topic (both points I strongly disagree with BTW): I'm a trained actuary and worked in the insurance industry, and have directly seen how government regulation reduces competition, raises prices, and harms consumers. And my final point: I don't think any prior art would be a good comparison for deregulation in the US, it's such a different market than any other country in the world for so many reasons that lessons wouldn't really translate. Nonetheless, I asked Grok for some empirical data on this, and at best the results of deregulation could be called "mixed," but likely more accurately "uncertain, confused, and subject to whatever interpretation anyone wants to apply." https://x.com/i/grok/share/Zc8yOdrN8lS275hXJ92uwq98M

@ e3ba5e1a:5e433365