-

@ 8f291fe3:1cbc5ad2

2024-02-20 07:43:19

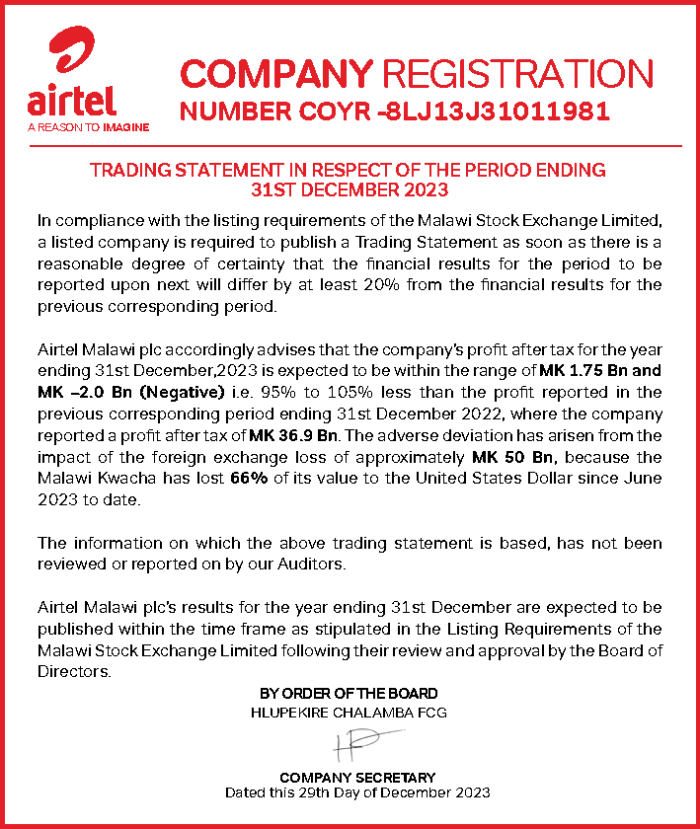

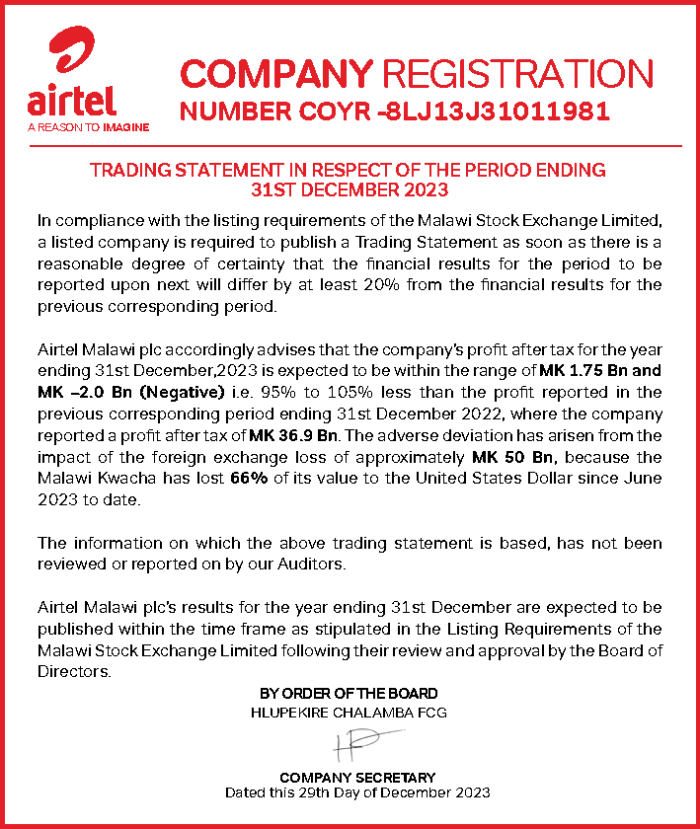

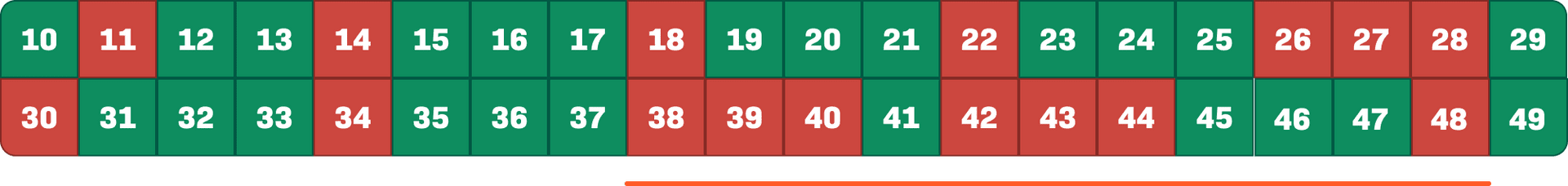

比特幣現貨 ETF 買氣持續升溫,數位資產管理公司 CoinShares 周一指出,加密貨幣投資產品上周流入資金達到創紀錄的 24.5 億美元,其中光是比特幣基金就吸引了高達 99% 、 24.2 億美元的資金流入,成為吸金主力。

[CoinShares 研究主管 James Butterfill 表示](https://blog.coinshares.com/volume-170-digital-asset-fund-flows-weekly-report-1ec8ffde2dda),今年迄今為止,加密貨幣投資基金的資金流入總額已達到驚人的 52 億美元,相較之下,去年全年的吸金規模為 [22.25 億美元](https://blockcast.it/2024/01/04/bitcoin-dominates-crypto-investment-inflows-surpassing-1-9-billion/)。

受惠於錢潮洶湧、幣價行情高漲,加密貨幣基金公司目前的資產管理規模(AUM)合計達 670 億美元,為 2021 年 12 月上一輪牛市高峰以來首見。

至於比特幣現貨 ETF 上周的表現,根據 CoinShares 數據,貝萊德(BlackRock)的 IBIT 和富達(Fidelity)的 FBTC 分別吸金 16 億美元和 6.48 億美元,足以抵銷掉灰度(Grayscale)GBTC 多達 6.23 億美元的資金外流。此外。

James Butterfill 說:「這意味著資金流入的速度明顯提升,廣泛分散在各個發行商之間,表明人們對現貨 ETF 的興趣日益濃厚。」

雖然比特幣基金獲得了大部分的資金流入,但其他加密貨幣基金也頗受關注,例如以太幣(ETH)基金就吸引了 2,110 萬美元的資金流入;Avalanche(AVAX)基金流入 100 萬美元;Chainlink(LINK)和 Polygon(MATIC)產品則各別流入 90 萬美元;而 Solana(SOL)則因網路當機打擊了市場情緒,導致投資產品資金外流 160 萬美元。

James Butterfill 補充道,區塊鏈股票 ETF 上周也見到投資人獲利了結,資金流出總額達 1.67 億美元。

-

@ 10f074e8:46423506

2024-02-19 21:57:51

test

-

@ 83defd06:45cb69da

2024-02-19 19:47:02

testing testing. again. again.

-

@ 83defd06:45cb69da

2024-02-19 19:33:32

testing sorry. Will update this after the fact. Updated.

-

@ f3df9bc0:a95119eb

2024-02-19 13:08:37

hello

-

@ 03742c20:2df9aa5d

2024-02-19 05:54:15

ปกติแล้ว Nostr extension ส่วนใหญ่จะมีอยู่ในเบราว์เซอร์บน PC ถ้าเป็นในมือถือเบราว์เซอร์ต่างๆจะไม่มีฟังก์ชั่นนี้มาให้ นอกจาก Kiwi browser และ Firefox for Android

ถ้าเป็น ios ส่วนใหญ่จะใช้ Nostore

แต่สำหรับ Android แล้วมีวิธีที่ง่ายกว่าดาวน์โหลด kiwi browser แล้วผติดตั้ง Extension มันหลายขั้นตอนเกินไปอาจจะยากสำหรับใครที่พึ่งเริ่มใช้งาน ในปัจจุบันมีแอปพลิเคชันที่ชื่อว่า Spring ที่ช่วยให้ง่ายขึ้น

https://spring.site/

# Spring

ดาวน์โหลด [Spring](https://spring.site/) มาติดตั้งบนเครื่องของเรา

1 เปิด spring ขึ้นมาแล้วกดที่มุมขวาบนที่เป็นรูปคนเพื่อ Login

2 Login ในการเข้าใช้งานทาง Spring มีให้เราเลือกหลายแบบแต่ถ้าง่ายสุดแนะนำให้เราเลือก Import private key จากนั้นให้วาง private key ของเราแล้วกด save

แค่นี้เราก็ใช้งานได้แล้วแล้ว

> จะสังเกตได้ว่าภายใน spring จะรวม Clients ต่างๆที่มีอยู่บน Nostr ไว้เกือบหมดเลย

## งั้นเรามาลองใช้งานกันดีกว่า

เลือก Clients ที่เราอยากใช้งานแล้วกดเปิดขึ้นมาแล้วกด Login จากนั้นให้เลือก Login with extension ทาง Spring จะขึ้นถาม Permission ให้เรากด Allow แค่นี้เราก็ Login ได้แล้ว

> ไปลองใช้งานกันได้ครับภายในโปรโตคอล Nostr มีอะไรให้เราลองอีกเยอะเลยครับ

ใครติดขัดขัดตรงไหนแวะมาพูดคุยกันได้ครับ

แล้วเจอกันใหม่ครั้งหน้า บ๊ะบาย

#Siamstr #Nostr

-

@ 1cb14ab3:95d52462

2024-02-17 23:48:01

---

## No. 1 - The Less Touristy "Bund"

https://image.nostr.build/ec45a7a71faf6504321f984665123ecda239c16fcb267286316536802e000ddc.jpg

The Bund is certainly a must-see if you are traveling to Shanghai for the first time - and it will be at the top of every travel guide out there, for good reason - there are equally as stunning alternatives away from the crowds. If you want to enjoy the skyline from a more relaxed perspective, consider the Pudong side of the river. There are parks, basketball courts, and green spaces along the riverbank for you to chill at and take in the sights. You can also hop on a ferry or a sightseeing boat to cross the river and admire the views from the renowned Bund.

---

## No. 2 - Walks Along Golden Street

https://image.nostr.build/9e396a1ba9d2b6ea3077d6f1d99d9a069f5df1f455f774cd2d693d857f5e01e2.jpg

This one is out in Gubei, a suburban area in the west of Shanghai. It may be a bit of a trek, but it is worth it if you are looking for a more relaxing and peaceful pedestrian street in the city. Golden Street, or Jinxiu Road, is a great place to walk a dog, grab an afternoon drink, or enjoy a romantic dinner with your loved one. While it may be a bit far from downtown, it makes for a great joyride on your scooter or bicycle.

---

## No. 3 - Moganshan Road Graffiti Wall

https://image.nostr.build/92b22c11564e3732f14a10c1701f20d64e1baf444d4a8e851e3e4543f8aa5284.jpg

Moganshan Road is a gem for all things art. It is home to M50, the best art district in the city, where you will find dozens of galleries, studios, and workshops showcasing a wide range of art. There are also plenty of cool spots scattered around the area, particularly the graffiti wall. The wall is a welcome contrast to some of the drab and monotonous architecture found around the city; with colorful display of street art featuring various styles and themes. Stop by and admire the works of local and international artists, and even jump in to join them in adding your own mark. The wall is constantly evolving, so you can always find something new.

---

## No. 4 - Jiaotong University in the Fall

https://image.nostr.build/9e0873ed9b9c40254f6d5f5522ded5a62d0dd88b073fb18c346598c3a9dd9269.jpg

Easily one of the best spots in town for catching rows of bright yellow and red leaves. Jiaotong University is one of the oldest and most prestigious universities in China. The campus is located in Xuhui District and has a mix of Chinese and Western architectural styles to admire as well. Try to visit in late October or early November for the best leaf-peeping. You can walk along the tree-lined paths, set up a blanket in the field for a picnic, or simply take photos and enjoy the scenery.

---

## No. 5 - Day Drinking at Highline

https://image.nostr.build/9a722c7646e3a232c71f083bfe42120954f7ce47b790e1140f6f91747fb08302.jpg

Hands down one of the top five rooftop bars in the city, along with Bar Rouge, Kartel, and others; Highline is a go-to-spot that offers great views of the city and excellent food. Find it on the sixth floor of the Ascott Hotel in Huaihai Road in Xintiandi. Nothing beats a laid back Saturday afternoon at Highline. I prefer the views during the day, though it is equally as nice a night. Sip cocktails, wine, or beer, and enjoy the music and vibe. Highline is a perfect place to spend an afternoon.

---

### Additional Photos

https://image.nostr.build/24d01f75be1999cb0e6524536fc86bf6ea55453b7599e8d2aa38697cae8b1e5e.jpg

https://image.nostr.build/5974f8953906a039bbbf42b5a5e2a543f32893ea2de87937343cf223f6c599df.jpg

https://image.nostr.build/c6d475edf3db206490cdf7b7c783923ff2a7d24dc5303b3f1e9d87b43cb23edf.jpg

https://image.nostr.build/1a762728d90a3224819d448ac60e20910216300845d3c1b99b631b1134430a66.jpg

https://image.nostr.build/906d3367c0529df385653d3eef2e4049c25dd5c97de150d9dda88d2f79141fa8.jpg

---

Originally published as an Instagram Guide on Feb. 02, 2021.

Reworked and published at [habla.news/u/hes@nostrplebs.com/1708203955986]() on Feb. 17, 2024.

Find more of my writing here: [https://habla.news/u/hes@nostrplebs.com]()

View my website here: [www.connorhesen.net]()

-

@ 10f074e8:46423506

2024-02-17 20:20:14

test

-

@ 10f074e8:46423506

2024-02-17 20:13:26

asdf test test

-

@ d91191e3:7efd4075

2024-02-17 13:54:35

Before I tell you how to design perfect software, let's look at the two most common design processes in use today.

These don't work, yet are firmly applied by a majority of engineers and designers, especially in software where it's possible to construct byzantine complexity.

They are slow-motion tragedies but can be fun to watch, from a safe distance.

## Shit Driven Development (SDD)

The most popular design process in large businesses is *Shit Driven Development*.

SDD feeds off the belief that ideas are scarce and we just need a good idea to make money.

The main output of SDD is expensive "ideations", concepts, design documents, and finally products that go straight into the garbage.

1. The *Creative People* come up with long lists of "we could do X and Y". Once the creative work of ideation has been done it's just a matter of implementation.

2. Managers and consultants pass these brilliant ideas to UX designers.

3. The designs get passed to engineers, who scratch their heads and wonder who came up with such stupid nonsense.

The designs do not factor in the practical costs of implementation. Minor whims create weeks of work. The project gets delayed and the managers bully the engineers into working harder.

Something resembling a working product makes it out the door, but no-one wants to use it.

After twelve months of intense marketing, the company shelves it and buys a competing product from a small start-up.

#### The main lessons of SDD

Ideas are cheap. No exceptions. There are no brilliant ideas.

The starting point for a good design process is to collect problems that confront people, and filter out anything that isn't valuable enough to solve.

Success depends on how good and cheap the solution is, how important the problem is, and how simple the solution is to actually use.

## Complexity Driven Development (CDD)

Really good engineering teams can usually build good products. But the vast majority of products still end up being too complex and less successful than they might be. This is because specialist teams, even the best, usually follow Complexity Driven Development (CDD).

Management correctly identifies some interesting and difficult problem with economic value. In doing so they leapfrog any Shit Driven Developemt team.

The team loves building things and they get straigh to it, starting with prototypes and core layers. These work as designed and the team is encouraged and enthusiastic. They go off into intense design and architecture discussions, coming up with elegant schemas that look beautiful and solid.

Management comes back and challenges team with yet more difficult problems. We tend to equate value with cost, so the harder the problem, and more expensive to solve, the more the solution should be worth, in their minds.

The team, being engineers and thus loving to build stuff, build stuff. They build and build and build and end up with massive, perfectly designed complexity.

The products go to market, and the market scratches its head and asks, "seriously, is this the best you can do?" People do use the products, especially if they aren't spending their own money in climbing the learning curve.

Management gets positive feedback from its larger customers, who share the same idea that high cost (in training and use) means high value.

Meanwhile somewhere across the world, a small team is solving the same problem using Simplicity Driven Development, and a year later smashes the market to little pieces.

CDD is characterized by a team obsessively solving the wrong problems to the point of ridiculousness. CDD products tend to be large, ambitious, complex, and unpopular. A lot of open source software is the output of CDD processes. It is insanely hard for engineers to stop extending a design to cover more potential problems. They argue, "what if someone wants to do X?" but never ask themselves, "what is the real value of solving X?"

A good example of CDD in practice is Bluetooth, a complex, over-designed set of protocols that users hate. It continues to exist only because there are no alternatives. Bluetooth is perfectly secure, which is close to useless for a proximity protocol. At the same time it lacks a standard API for developers, meaning it's really costly to use Bluetooth in applications.

CDD is a form of large-scale "rabbit holing", in which designers and engineers cannot distance themselves from the technical details of their work. They add more and more features, utterly misreading the economics of their work.

#### The main lessons of CDD

- Making stuff that you don't immediately have a need for is pointless. Doesn't matter how talented or brilliant you are, if you just sit down and make stuff, you are most likely wasting your time.

- Not all problems are not equal. Some are simple, and some are complex. Ironically, solving the simpler problems often has more value to more people than solving the really hard ones.

- It is crucial to have a "stop mechanism", a way to set short, hard deadlines that force people to make smaller, simpler answers to just the most crucial problems.

## Reality Driven Development (RDD)

Reality Driven Development starts with a realization: we do not know what we have to make until after we start making it.

Coming up with ideas, or large-scale designs isn't just wasteful, it's directly toxic to creating truly accurate solutions. The really juicy problems are hidden away in crevices across the landscape. Any activity except active scouting creates a fog that hides those crevices. You need to keep mobile, pack light, and move fast.

RDD works as follows:

We collect a set of interesting problems (by looking at how people use technology or other products) and we line these up from simple to complex, looking for and identifying patterns of use.

We take the simplest, most dramatic problem and we solve this with a minimal plausible solution, or "patch". Each patch solves exactly a genuine and agreed problem in a brutally minimal fashion.

We apply one measure of quality to patches, namely "can this be done any simpler while still solving the stated problem?" We can measure complexity in terms of concepts and models that the user has to learn or guess in order to use the patch. The fewer, the better. A perfect patch solves a problem with zero learning required by the user.

Our product development consists of a patch that solves the problem "we need a proof of concept" and then evolves in an unbroken line to a mature series of products, through hundreds or thousands of patches piled on top of each other.

We do not do anything that is not a patch. We enforce this rule with formal processes that demands that every activity or task is tied to a genuine and agreed problem, explicitly enunciated and documented.

We build our projects into a supply chain where each project can provide problems to its "suppliers" and receive patches in return. This arrangement creates a "stop mechanism" - when people are impatiently waiting for a patch, we necessarily cut our work short.

Individuals are free to work on any projects, and provide patches at any place they feel it's worthwhile. No individuals "own" any project, except to enforce the formal processes. A single project can have many variations, each a collection of different, competing patches.

Projects export formal and documented interfaces so that upstream (client) projects are unaware of change happening in supplier projects. Thus multiple supplier projects can compete for client projects, in effect creating a free and competitive market.

We tie our supply chain to real users and we iterate the whole process in rapid cycles so that a problem received from a user can be analyzed, evaluated, and solved with a patch in a few hours.

At every moment from the very first patch, our product is shippable. This is essential, because a large proportion of patches will be wrong (10-30%) and only by giving the product to users can we know which patches have become problems and themselves need solving.

RDD is a form of "hill climbing algorithm" or a drunken stumble to greatness. It's a reliable way of finding optimal solutions to the most significant problems in an unknown landscape.

This was created as a collaboration between G and Pieter H.

-

@ 642ef7b5:40542543

2024-02-17 08:33:42

最近很多人說:「果殼,你真的很幸運!比特幣5萬了,你買這麼低點,現在漲成這樣,讓你過好年。」

「果殼,你新書一上市,就碰到牛市,也太爽了吧!」

我當然很幸運,有我喜歡的工作,讓我有固定的勞動收入,但同時,我認同矽谷創業家納瓦爾(Naval Ravikant )強調的:如何不靠運氣致富。

過年很多人想拼手氣、靠運氣抽刮刮樂、抽尾牙大獎,但我的手氣通常都很差。

我所有比特幣,都不是靠運氣買的。都是貨真價實,一點一滴買回來的,我把定期購買比特幣當成是最好的儲蓄,靠的是認知,與時間差。

認知:比特幣是數位黃金

創業家納瓦爾說:「不要浪費時間學習商業技能或讀商業故事,裡面有太多倖存者偏差,應該多學習基礎原理。」

比特幣價值儲存的特性比肩黃金,但稀缺性更好,尤其在減半週期前夕,是好的累積時間點。

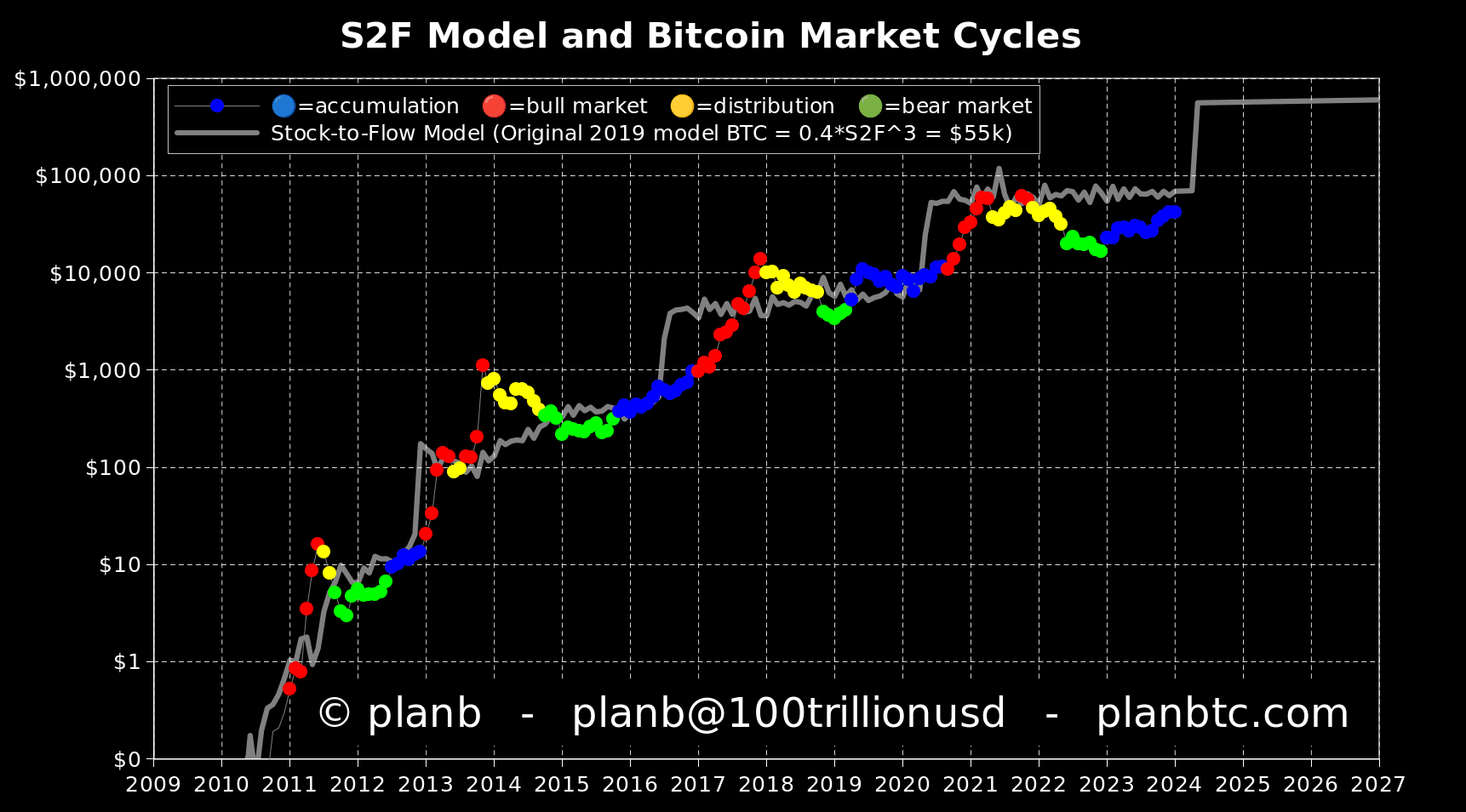

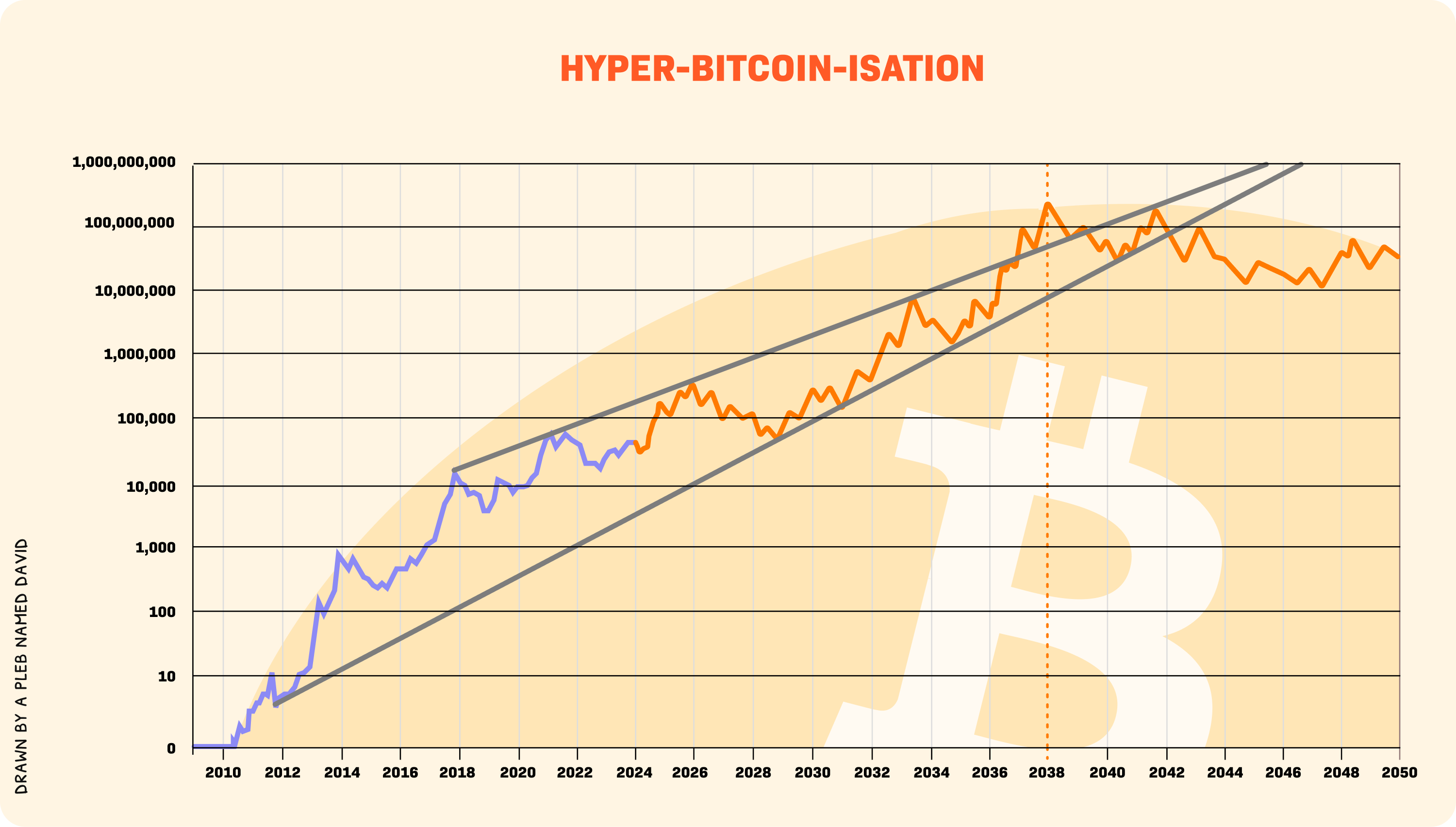

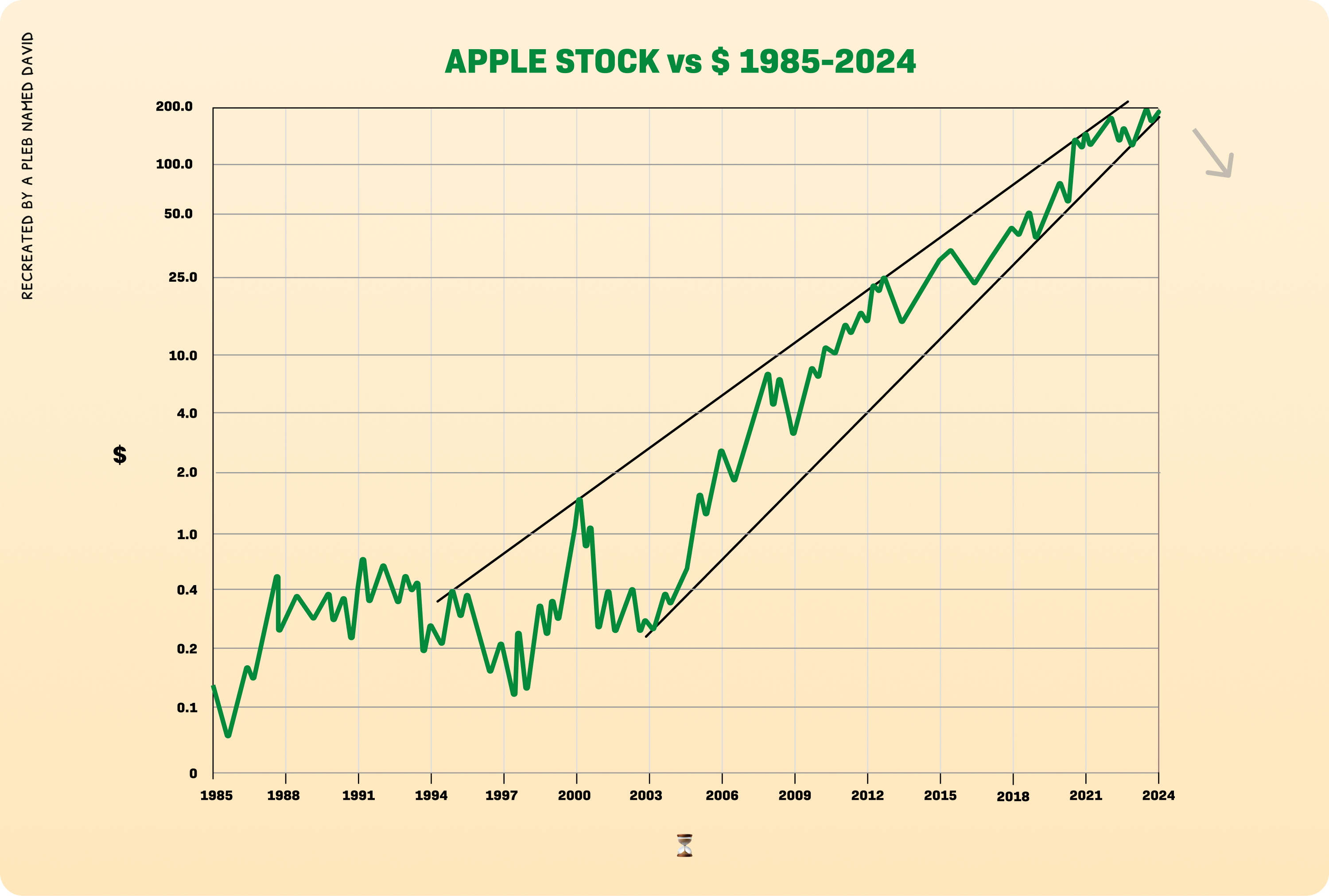

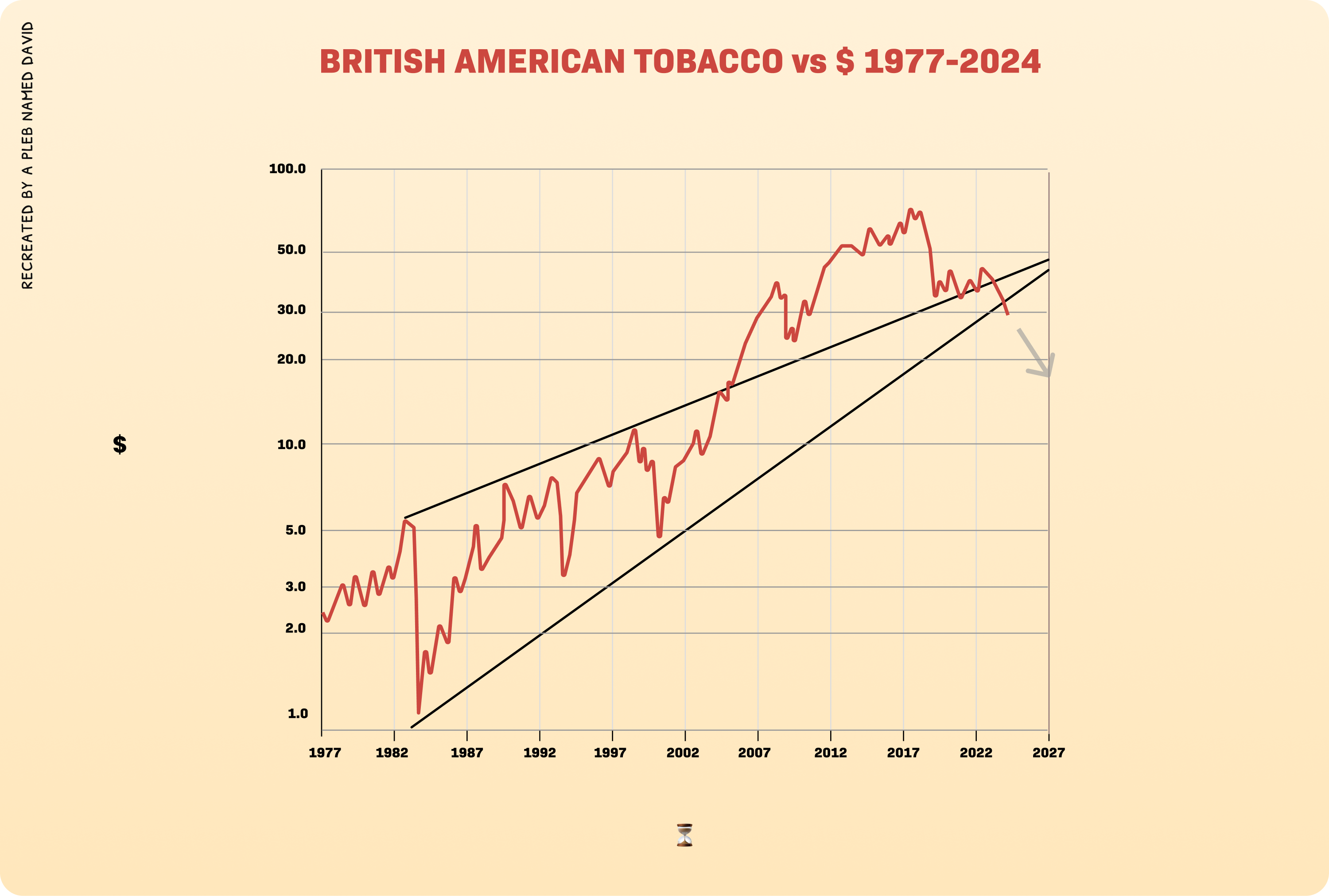

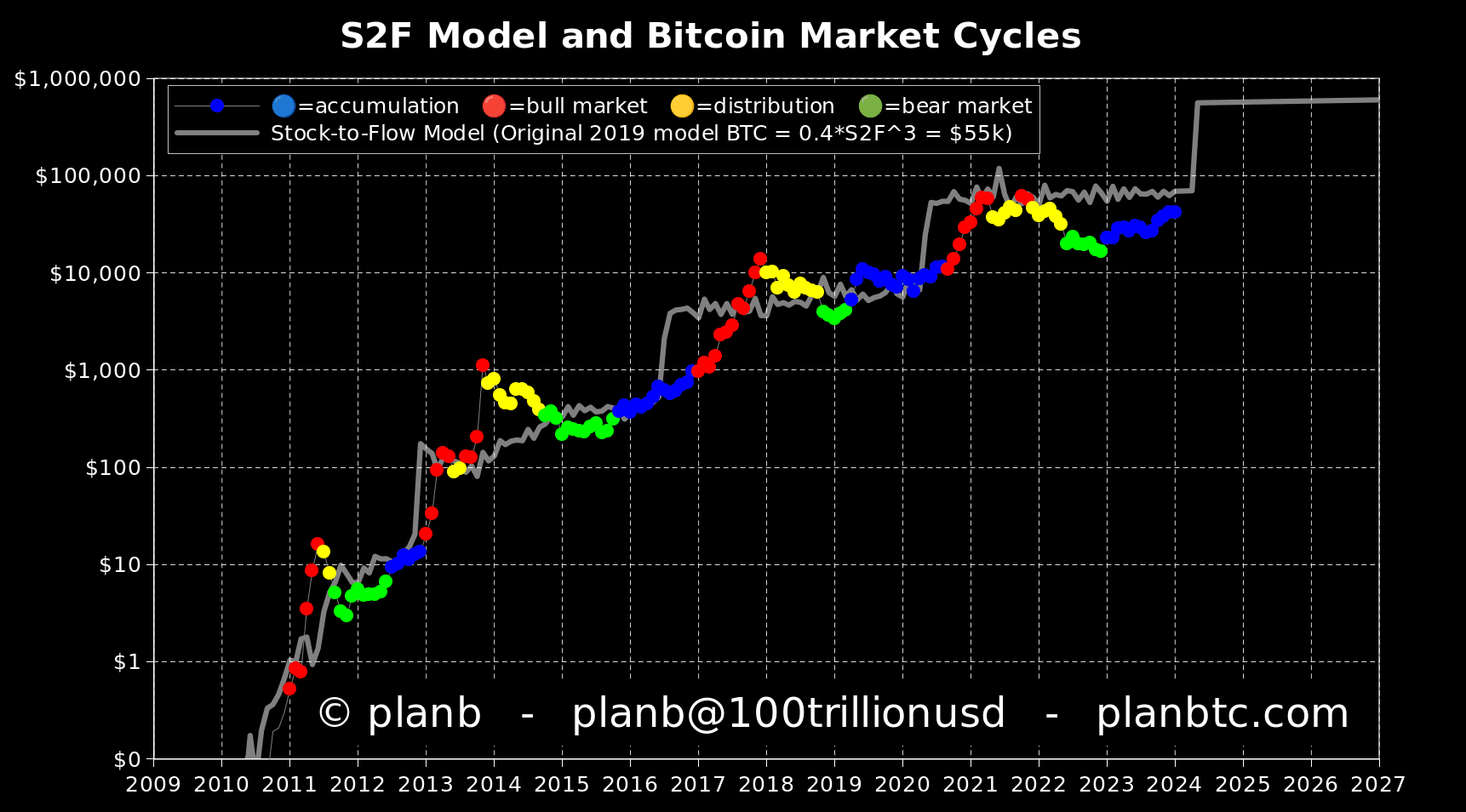

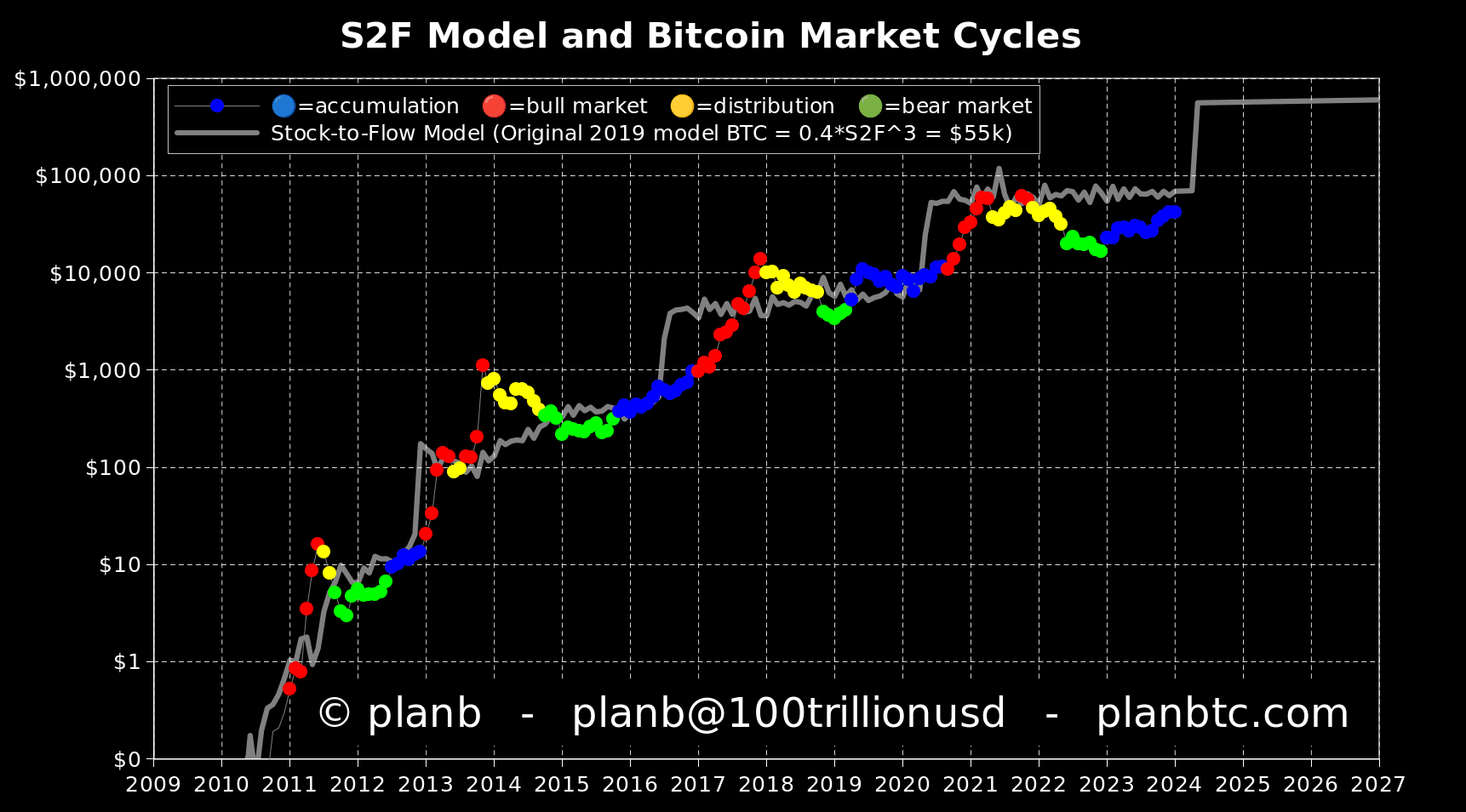

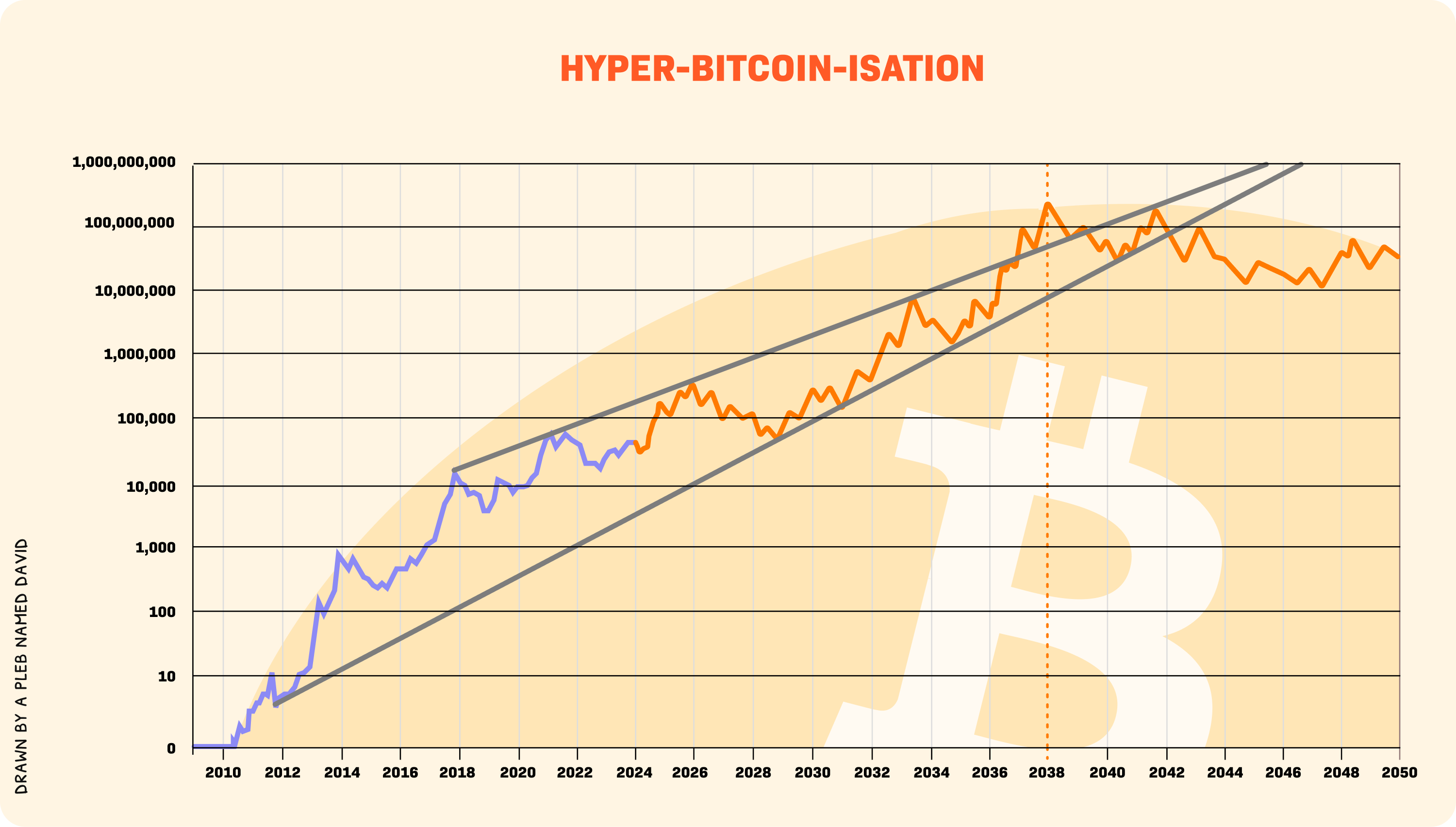

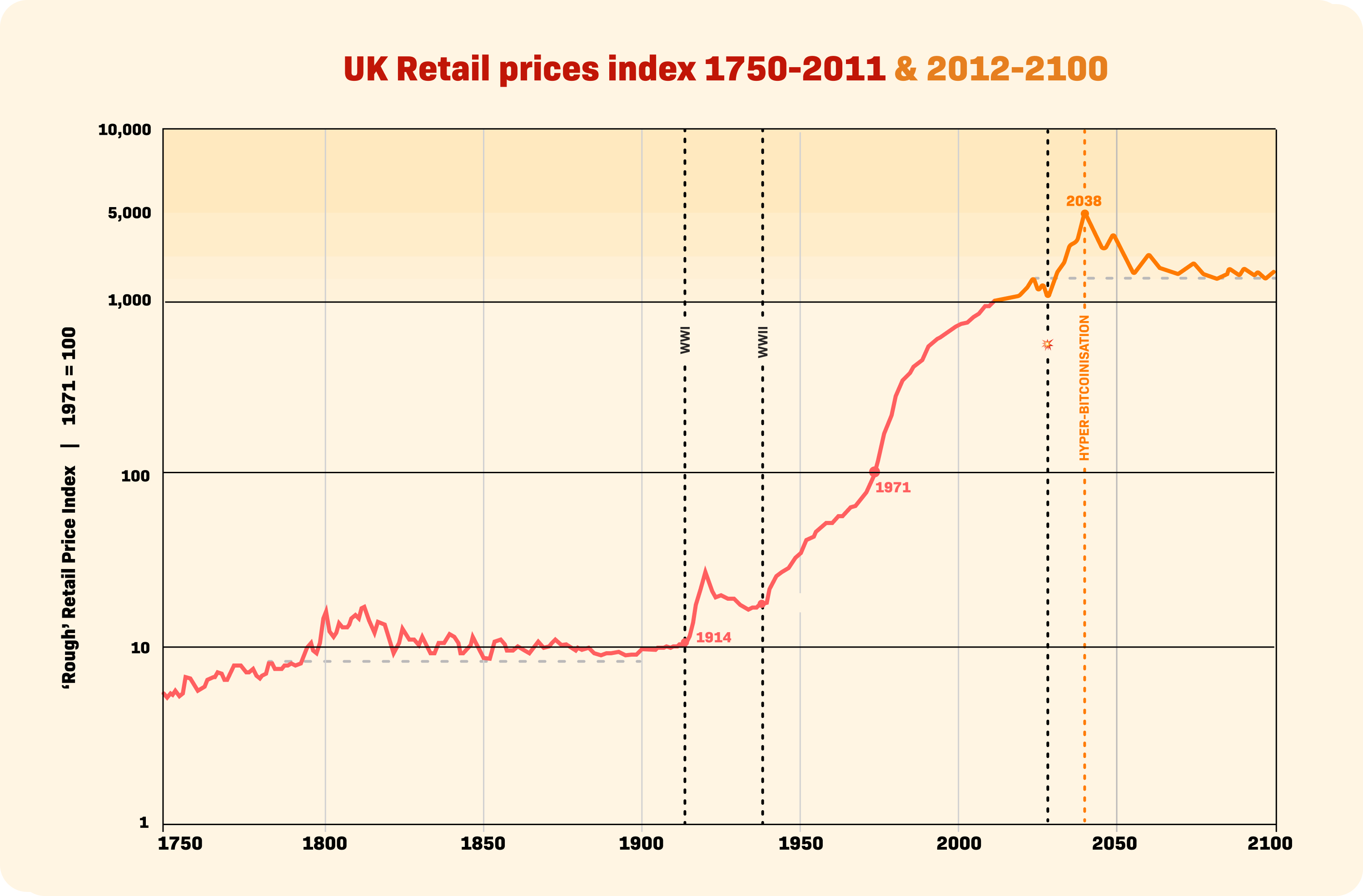

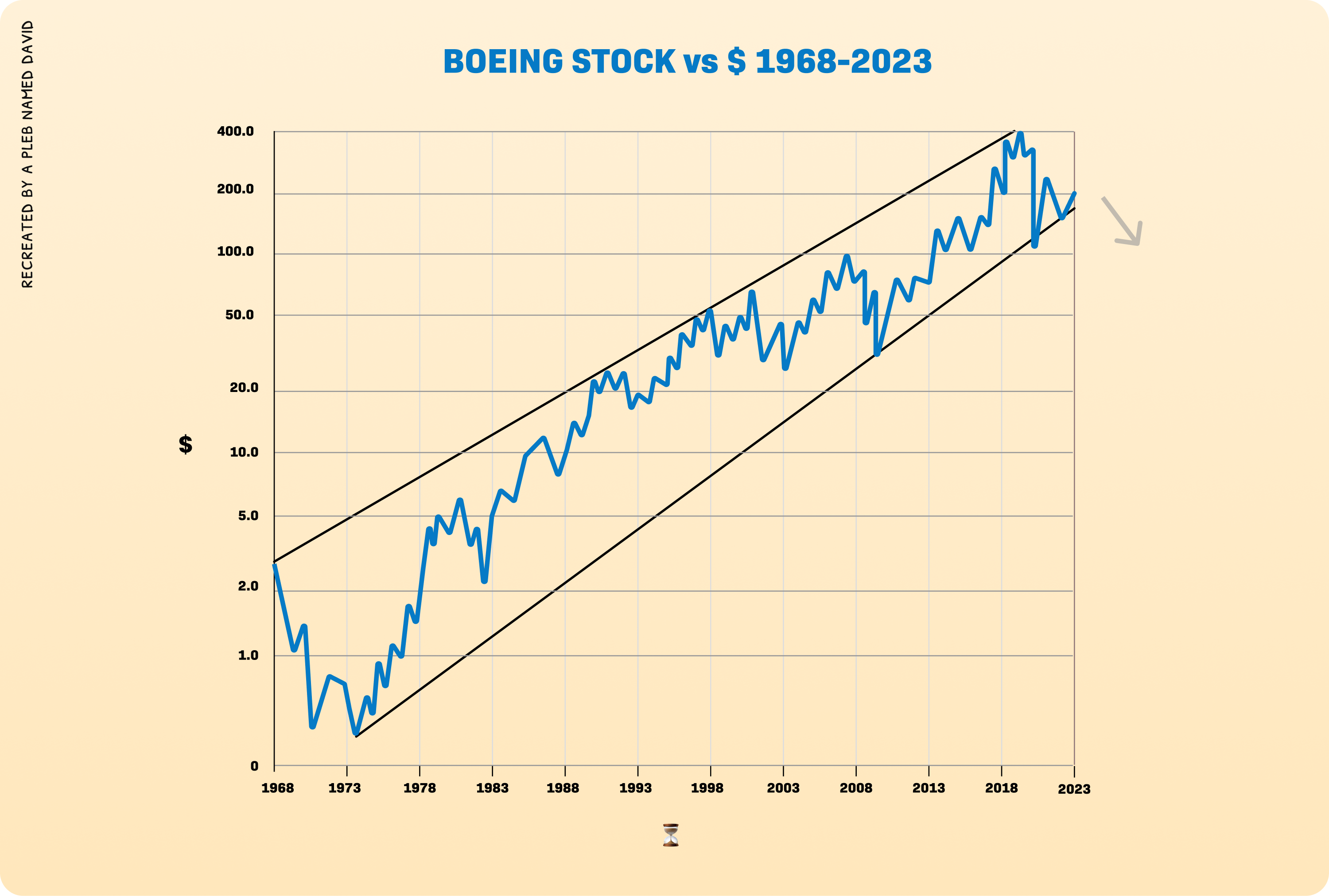

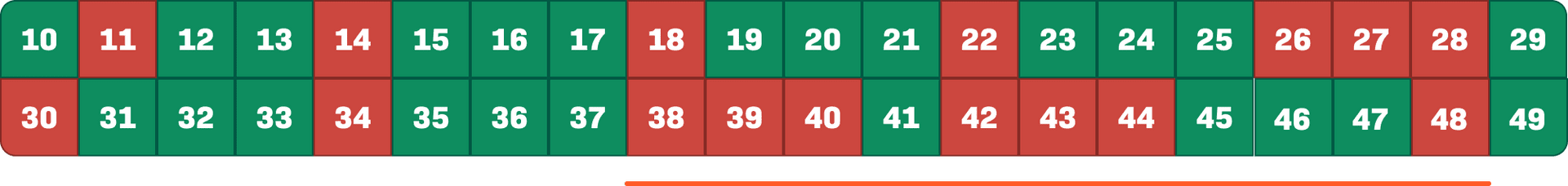

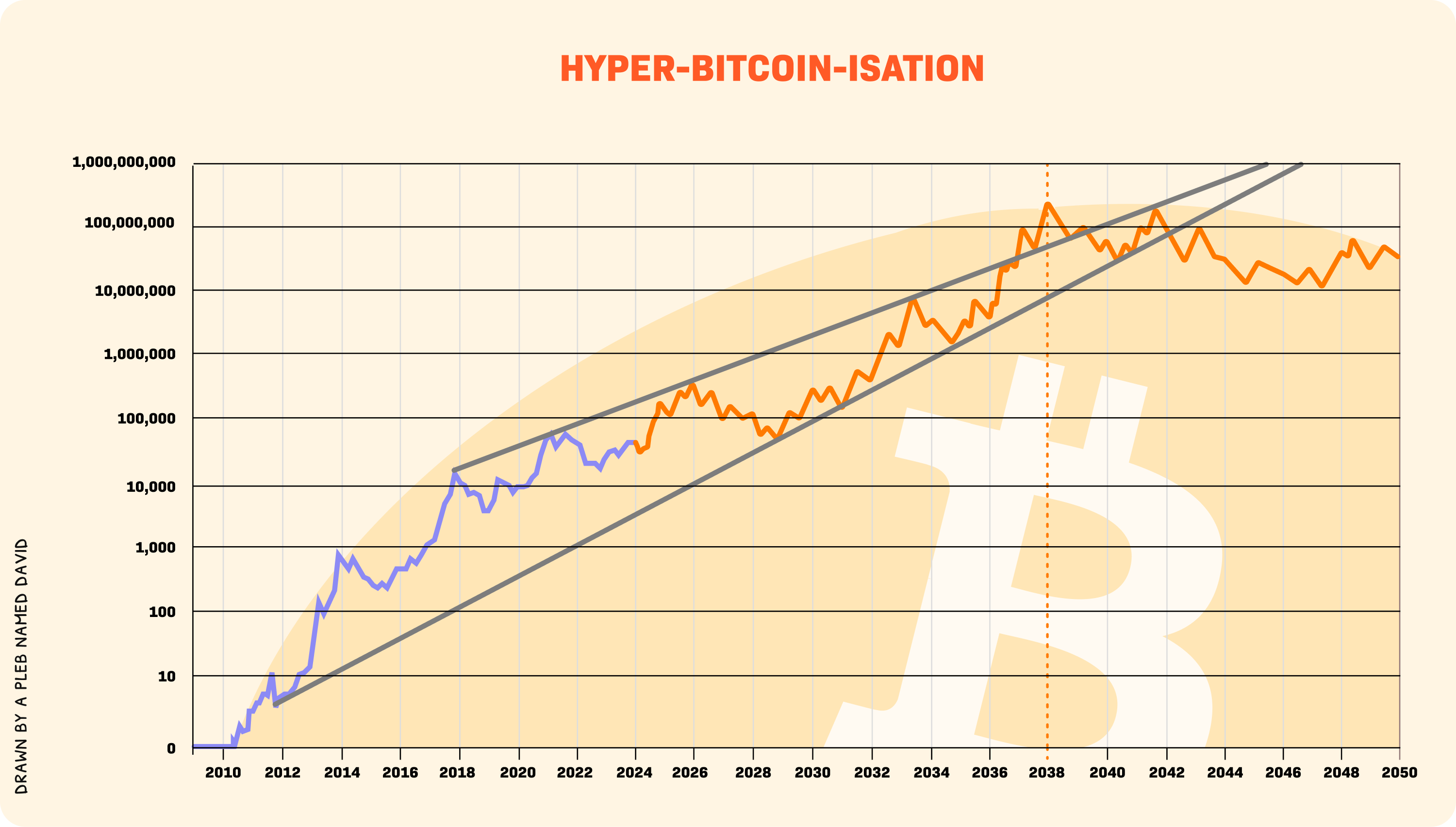

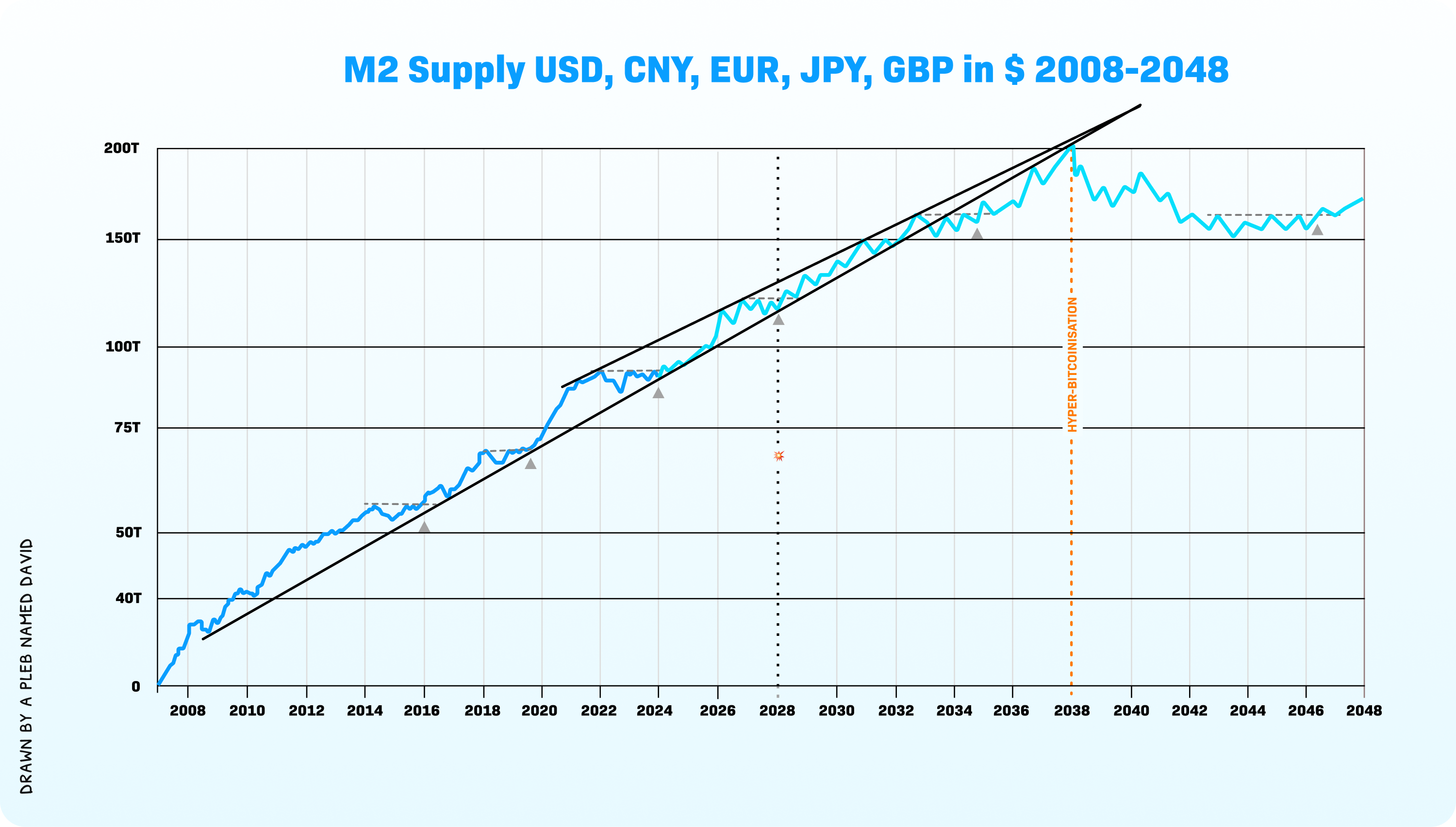

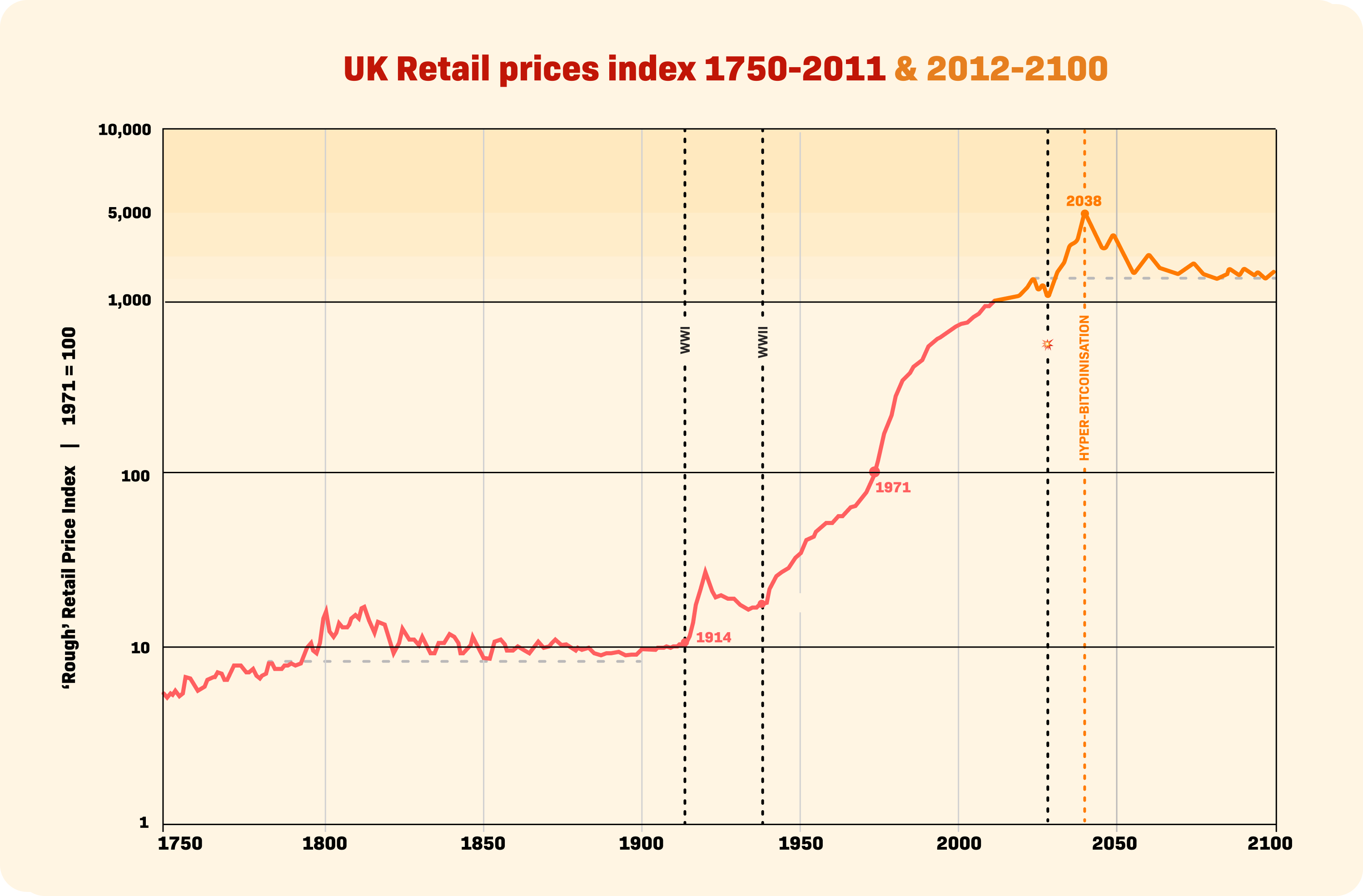

我相信分析師Plan B的The Stock-to-Flow (S2F) 模型: 主要考慮兩個變數,現存供應量 (Stock) 及資產的年產量 (Flow)。這樣的計算方式是為了量化稀缺性(Scarcity),而比特幣的每四年減半是最重要的稀缺事件。

在 2100 萬枚比特幣的最大供應上限中,約 1800 萬個比特幣已經被開採出來,其餘的預計將在 西元2140 年開採完畢。

庫存與流量的比值越高,資產估值就越高,也就是以「稀少性」衡量資產價值。比特幣2022年的庫存流量比(SF),約為 57(年),在預計 2024 年減半之後,比特幣的 SF 比率可能會飆升至接近 120。作為對比,黃金的庫存流量比在2022年是62(205,235頓存量/3,300頓流量),意思是開採出目前黃金存量,需要62年。

隨著區塊獎勵減半,每四年流入市場的新比特幣 (Flow) 產量減半,這會提高 S2F 比率,如同上圖的粗白色線,其預測的比特幣價格每四年呈現階梯式上升(圖片來源)。

但有模型是一件事,如何做是另一件事。

我的新書-加密法律第五章提到:

「買比特幣人人都會講,但一般人很難累積比特幣⋯會有很多事情讓你想賣掉。

我目前在進行一個小實驗,設定的目標是:平均每日定期定額投資一百美元,持續累積比特幣。」

(比特幣其他特性,我的新書裡有詳細解釋)

時間差:早於華爾街

第二個是時間差,因為有人還不相信,甚至傻傻的認為比特幣是騙局(這不只是時間差,還有智商稅)

很多人也還在觀望,因此早期投入的,會有更大的優勢。我在新書加密法律第一章提到:「美國的加密戰略⋯目前加密貨幣的監管世界形成兩大陣營⋯另一大陣營即是美國,美國支持以『美元法幣』作為錨定的穩定幣,並將支付及商用領域開放,對於特定加密貨幣業務,則加以監管。」

但需要等待,等待時差被拉平,這需要極大的耐心,因為你不知道要到等多久,而且需要反覆的「認知確認」。

我比特幣從兩年前的5萬美元,一路買下來,最低到1萬6千,整整有一年半的嚴重下跌、底盤盤整。

現在時間差逐漸在弭平中,過去十年,美國證管會一直都拒絕核可現貨比特幣ETF。美國證管會(SEC)於2024年1月10日核准了首批直接投資比特幣的ETF,比特幣現貨ETF架構裡,機構會真正持有比特幣,這與投資於比特幣期貨的商品不同。投資比特幣期貨,是以特定價格,在之後的日期買入或賣出比特幣合約。

因此我認為,絕對不是運氣好,我們必須找到時間差,至少要比華爾街早一步。我知道今天的情況會發生,我只是不知道確切何時,只能先準備好,慢慢等。

想當初在籌備這本 #加密法律,簽約後,我跟出版社沒有訂實際出版日期,出版社的夥伴常常很急,覺得要趕著出版,我卻一點都不急,一次又一次反覆修改。

因為我每天都在等,等待的時間,無所事事,就一直寫,我相信這一天會到來,所以我只是把書先寫好,等著這一天發生。

做事不靠運氣,靠運氣,反而常常倒霉。

這本書,加密法律:幣圈律師的真摯告白,是我不靠運氣做事的最好紀錄。

#加密法律 #幣圈律師的真摯告白 #果殼

-

@ 642ef7b5:40542543

2024-02-17 08:25:46

(示意圖/圖片取自unsplash)

歐洲中央銀行(European Central Bank,ECB)執行董事會成員 Piero Cipollone 本週在歐洲議會經濟和貨幣事務委員會上,談到了發行數位歐元相關準備工作的目前進度,並詳細闡述了歐洲央行在數位歐元籌備階段正面臨的四個關鍵問題。

包括尋找合適供應商來開發數位歐元平台和基礎建設、編寫數位歐元相關規則手冊、確保金融穩定,以及在涉及數位支付時,要能高度確保用戶隱私。

事實上早在去年 6 月,歐盟執委會(European Commission)就公佈了支持數位歐元的立法計劃,稱這將確保歐洲民眾能夠在整個歐元區免費、離線且安全地使用數位歐元進行數位支付。

而據 Coindesk 去年10月報導,法國央行總裁戴加洛(Francois Villeroy de Galhau)表示,歐洲央行將在幾周內,制定關於批發型 CBDC 的計劃,以使金融機構結算證券和外匯交易方式更創新。

de Galhau 表示,相較於零售型 CBDC 可能引發公民對隱私的疑慮和對商業銀行的影響,批發型 CBDC 的進展更快速,預計包括真實交易的實驗將在隔年推出。

去年11月 Bitcoin.com 報導稱,作為實施數位歐元計畫的一環,歐盟已在試行數位身份錢包協議,旨在利用簡單的文件應用程式,使錢包具有「最高級別的安全性和隱私性」,讓歐洲人控制哪些應用程式可以查看他們的數據。

同月月底,根據 CoinDesk 報導,歐洲議會成員也召開了與數位歐元相關的聽證會,該聽證會旨在幫助立法者在考慮立法提案時,更好地理解在支付效率相當高的司法管轄區創建CBDC的必要性、公民隱私是否會得到保護,以及數位歐元是否有可能被歐盟國家用來擴大控制範圍等更具爭議性的問題。然而受邀專家在幾乎所有問題上都存在分歧,比如數位歐元是否會取代現金、個人持有數位歐元是否有限額等。

不過歐洲央行顯然已對 CBDC 產生興趣,今年 1 月,為完善離線支付,歐洲央行公告將向可提供風險管理、資訊安全和用戶應用等一系列功能的供應商,提供一大筆現金,至多 12 億歐元(約 13 億美元),其中一半以上被指定用於線下支付服務。

而在本週官方消息指出,Layer1 隱私增強區塊鏈 Aleph Zero 宣佈加入總部位於德國法蘭克福的數位歐元協會,以協助塑造歐洲及其他地區數位貨幣的未來。

【本文作者張詠晴/幣特財經】

-

@ 0d6c8388:46488a33

2024-02-16 17:12:25

One of my favorite essays of all time is [WrathOfGnon's "How to Build a Small Town in Texas."](https://wrathofgnon.substack.com/p/how-to-build-a-small-town-in-texas)

He takes something that sounds so foreign, complicated, and unbounded, and breaks it down into a process that sounds so straightforward and obvious that it's almost astonishing that it doesn't happen all the time!

I want there to exist a new operating system for mobile devices. I have very many "wishes" for this theoretical OS, and very few powers to grant those wishes. After hearing my thoughts on this subject you will in no way believe this is straightforward, obvious, or be surprised there is no such OS being built.

And yet, I _wish such an essay would exist_, so this is my weak first attempt at such a thing.

The tl;dr: we should build a "human scale" operating system. Less code, fewer bugs, more human agency, more human sympathy. That's how we win.

### 1. **Size and borders: “You can’t have a garden without fences.”**

This ideal OS needs sufficient hardware support, sufficient application support, done with minimal code.

What's the least amount of code required to run applications on a "modern" phone (5G, high-res touch display, GPU)? That's the operating system.

As a point of motivation, [QNX fit a whole OS including a web browser on a floppy disk](https://winworldpc.com/product/qnx/144mb-demo) (1.44MB).

[MenuetOS / KolibriOS](https://en.wikipedia.org/wiki/MenuetOS) is another more modern example of an OS that fits on a floppy.

### 2. **Water, energy, food and connections: the needs hierarchy of towns.**

An operating system needs to provide reliable, safe, and permissioned access to underlying hardware capabilities such as storage, memory, CPU, GPU, graphics, sound, and touch input.

Simultaneously, it needs to expose this access in a way that simplifies the work of the application developer, or at the very least does not complicate it.

Casey Muratori in his ["The Thirty Million Line Problem" video essay](https://www.youtube.com/watch?v=kZRE7HIO3vk) blames most of the complexity explosion of modern operating systems on the lack of standardization and over-reliance on software drivers in aspects of the system outside the well-defined CPU ISA (Instruction Set Architecture). He argues a well-defined ISA for using network and graphics hardware could simplify the OS back down to Linux's original 20k lines.

In the 80s and early 90s many "apps" shipped with their own operating systems because it provided the best performance and because the underlying system was simple enough to make this possible.

The great irony is that modern OS abstractions actually are often a source of additional complexity for the application dev, rather than simplification. The exact same GPU, when passed through an OS, can be exposed to the developer as DirectX 12, Vulkan, or Metal.

This unnecessary complexity and layering cries out for a protocol.

Casey points out that [experiments in removing layers](https://arrakis.cs.washington.edu/) has shown dramatic performance improvements.

I believe these performance improvements could perhaps make up for the lack of expensive, megacorp-driven optimizations, and bleeding-edge TSMC chips, that the complex operating systems currently enjoy.

### 3. **Materials and harmony.**

One of the greatest failings of "Linux on the desktop" is that there are so many flavors of everything, there's no cohesive, single vision that can give users a common UX across apps or distros. Freedom to choose results in many choices.

That said, the modern web seems to have _some_ trend toward a sort of cohesion and shared UI language. And many native apps are built with web views or non-"native" toolkits anyways. So it's not worth stressing too much about this.

I do believe, like React for the web, highly popular UI frameworks and toolkits will emerge (and have emerged) for popular efficient languages like Rust, Zig, C, and C++ that will allow developers to make apps out of common components so the wheel is not constantly reinvented.

### 4. **The problem of undeveloped and vacant lots.**

No matter how good a new operating system is, it's nothing without apps. This was the death of Windows Phone, which in my opinion limited the expressivity of app developers to its detriment. This was also the death of Palm's WebOS, which likely bet on web technologies too early.

The modern web is easily powerful enough to serve as a stop-gap for many apps. But for the next operating system to be _better_ than its overly complex predecessors it will require amazing native apps that aren't available on existing systems.

These better apps can potentially arise out of the operating system's simpler, more minimal abstractions. App developers will (hopefully) be attracted to a system where they can express their intent more directly, rather than fighting against the grain of highly opinionated frameworks like SwiftUI, JetPack Compose, and GTK.

### 5. **Who will live there?**

A new operating system needs users. Early on, this new operating system will be lacking in many features and many killer apps. Who would choose such suffering?

I can think of three primary candidates:

1. **Cypherpunks.** If you run GrapheneOS you experience a small subset of this suffering. If a new operating system offers one or two novel applications, you might be willing to adopt additional suffering to further live out your cypherpunk vision.

2. **Developers.** An operating system simple enough to "hack" on would be very exciting to a certain kind of developer. Think of the guy with a great Vim config or Emacs environment that he lovingly curates and codes for.

3. **People who hate change.** Ironically, modern devices, by economic necessity, continue to underserve a huge portion of the population that views a mobile device as a pragmatic tool and loathes the annual (often forced) churn to their user experience. A minimal OS can fight the sort of bitrot that makes unchange so hard for modern software. If it works, it can keep on working.

### 6. **Build to the edge of the lot**

With a much smaller set of built-in OS SDKs, app developers will need to discover new protocols and methods for inter-app communication and harmony. This will be challenging and is not guaranteed to succeed. But the dream is for non-dev users to finally have access to abstractions as powerful as Unix pipes for their normie workflows.

### 7. Alright, I'm done copying headers from the town-in-Texas piece

If you're curious and want some imagination fuel, the remaining headers are:

7. **Personality, neighborhoods, and character.**

8. **The Story, the founding Myth.**

9. **Build the least valuable lots first.**

10. **Public space.**

11. **A grand entrance.**

12. **How to live without cars.**

13. **To grid or not to grid.**

### 8. **The goals**

Okay, so in summary here are some of the goals I believe a "next OS" should try to achieve, with some hints at methodology:

* Freedom to use, freedom to change (through minimalism)

* Performance (through minimalism, layer collapse)

* Fight bitrot / change (through minimalism)

* Good UX (hard. unlikely to emerge without good monetization)

* All the apps (probably web tech / PWA / "enhanced" PWAs at the outset)

### 9. The hard parts

Naturally, this is a very challenging project. Possibly the hardest part will be Casey's proposal for a broader SoC ISA, which might turn out to be a required foundation for the whole system.

The other hard part is a browser, which would be necessary to get all these "free" web apps.

It's likely that WebKit can be ported to a sufficiently advanced system, but I don't know how much underlying complexity that "bakes in" to the OS at the outset. Serenity OS, a "hobby" OS for the desktop that's gotten to a truly impressive state, has its own browser Ladybird that covers a surprising amount of web technologies, but is still far from rivaling Chrome, Firefox, or WebKit.

### 10. The good news

On a positive note, there are a ton of really cool projects that provide reasons to hope that a new mobile operating system is possible in our lifetime. Some of them might even be the building blocks that get us there. Others might serve as testing ground for these ideas before we can get the OS to bring them all together.

- [x] A good money (Bitcoin)

- [x] Decentralized protocols protocol (Nostr)

- [x] Modern low-level languages (Rust, Zig)

- [x] Binary portability / sandboxing (WASM)

- [x] Portable modern graphics standard (WebGPU)

- [x] Far-along complex desktop OS projects (Redox OS, Serenity OS)

- [x] Cross-platform "native" GUI libraries (Iced, Egui, Dear Imgui)

- [x] Cross-platform "web + native" frameworks (Tauri, Electron, Capacitor)

- [x] Cross-platform windowing (Winit, SDL)

- [x] Linux-based phones (Pinephone, Purism)

- [x] Open source ISA (RISC-V)

- [x] "Reinvent everything" communication device (Precursor / Betrusted / Xous OS)

### 11. One final optimism

Here's an FPGA running Quake 1. What's bonkers is that this guy define his own ISA ([MRISC32](https://mrisc32.bitsnbites.eu/)), designed a soft CPU to run that ISA on an FPGA, modified a C compiler to target his ISA, [and compiled Quake 1 with that compiler](https://vimeo.com/901506667) (running at 30fps).

This is an obvious case of genius, but it's also inspirational to me that we have this many high-leverage tools at our disposal that a work of lone genius like this is even possible.

We shouldn't limit our dreams to match only the methods that have been employed in the past. The methods of the past got us iPhones and Linux on the desktop. Billions of man hours got us our current tech stack. We, by definition, have no way of knowing how much work is necessary to build our next tech stack. That will be a process of discovery.

-

@ 2d5b6404:d4b500b0

2024-02-16 15:57:05

1. アンフィールドでリバプールの試合を観戦する

2. イタリアでピザ食べたりエスプレッソ飲む

3. じゅりよんやラルフ、ewelina、マルティン、jefgとかに会いにヨーロッパ旅行行く

4. 長崎ぺんぎん水族館に行く

5. 九十九里で貝を食べる

6. 奄美大島でクジラの鳴き声を聞く

7. 蒸気機関車に乗る

8. 台湾旅行に行く

9. 韓国旅行に行く

10. 船で東京か大阪、四国に行く

11. Punkt. MP02を買い替える

12. ベトナムに住んでる友達に会いに行く

13. ホームベースとなる共同体を見つける。もしくは作る

14. 収入の10分の1を寄付する

15. ~~デスストランディングをクリアする~~

16. ブレワイ、ティアキンをクリアする

17. べランピングする

18. こたつで友達とゲームしたりする

-

@ 06639a38:655f8f71

2024-02-16 10:12:42

**Apple is going all-in with a fight against the EU by disabling all WebApp and PWA (progressive web app) features only in EU countries.**

I also posted this on my blog: https://sebastix.nl/blog/apple-is-killing-webapps-pwas-power-play-against-the-eu/

Apple made a decision:

> iOS, Safari, and the App Store are part of an integrated, end-to-end system that Apple has designed to help protect the safety, security, and privacy of our users, and provide a simple and intuitive user experience. We strive to earn users’ trust by promptly resolving issues with apps, purchases, or web browsing through App Review, AppleCare customer support, and more.

>

> **The DMA requires changes to this system that bring greater risks to users and developers. This includes new avenues for malware, fraud and scams, illicit and harmful content, and other privacy and security threats. These changes also compromise Apple’s ability to detect, prevent, and take action against malicious apps on iOS and to support users impacted by issues with apps downloaded outside of the App Store.**

*Source: [https://developer.apple.com/support/dma-and-apps-in-the-eu#dev-qaa](https://developer.apple.com/support/dma-and-apps-in-the-eu#dev-qaa)*

💩 To me this is just a piece of bullshit 💩

Apple is not an open web advocate. They always opposed implementing open standards around [WebApps](https://www.w3.org/TR/appmanifest/) and PWA’s in their Webkit browser engine. They never made it easy to use a PWA on iOS devices. For example, they ignored the integration of push notifications for a long time, which was implemented very late in iOS 16.4 ([March 2023](https://webkit.org/blog/13878/web-push-for-web-apps-on-ios-and-ipados/)).

Now within one year all this will be disabled in their next iOS update - version 17.4 - in EU countries!

### What is at stake is Apple’s revenue stream - their 15-30% (!) cut from any app purchase - from app developers in their walled garden called the App Store.

From a business perspective it’s pretty obvious it’s worth a fight for them. As in most cases, just follow the money to get a better view on the incentives.

WebApps and PWAs are providing a fantastic way to build beautiful apps in the open without the need of any permission. This toolset is getting more traction and adoption among developers and Apple know this is a threat for their business model.

## **Who’s the real victim?**

I am one with many others. Others who love to build with open web technology in open systems. We are so-called open web advocates. Many of them are app developers who love to build sites and apps with the modern technology what is at hand. Developers who are preserving digital autonomy by choosing for open, independent and permissionless technologies.

With BigTech out there, the fight for an open web is a never ending fight. I think you should always fight back, otherwise the web will be less open in the future.

## Let’s unite to fight back

**Fill in this form if you’re affected in any means by this decision from Apple:**

[https://docs.google.com/forms/d/e/1FAIpQLSfNgzepH4lwmWf2kaKC4EpKPdfi69jUHFM8kf4-TBsAyWU1BA/viewform](https://docs.google.com/forms/d/e/1FAIpQLSfNgzepH4lwmWf2kaKC4EpKPdfi69jUHFM8kf4-TBsAyWU1BA/viewform)

Initiated by the Open Web Advocacy group.

> The [Open Web Advocacy](https://open-web-advocacy.org/) (OWA) is a group of software engineers from all over that world who provide regulators, legislators and policy makers the technical details to understand anti-competitive issues like Apple not allowing real third-party browsers on iOS so web apps cannot compete with native apps.

*Source: https://modern-web-weekly.ghost.io/your-single-page-app-may-soon-be-a-polyfill*

I’m sure there is more that can be done, so please let me know your suggestions!

-

@ 7b351277:001ba418

2024-02-15 13:08:13

Opinion about the city of Seattle

<!--HEADER END-->

test

<!--FOOTER START-->

#myCloneOfTripadvisor #askNostr #nostrOpinion

[Join the conversation!](https://www.myCloneOfTripadvisor.com/Search?q=seattle)\n\nJust Testing ...

-

@ ff3d87cc:7738cb1a

2024-02-15 06:11:30

我第一本個人專書來了,加密法律這本書,是我在比特幣、加密貨幣領域鑽研、生存的唯一註解。

為什麼叫加密法律?

我發現加密貨幣跟法律根本分不開,我是其中的見證、實踐者。本書第一章,你將看到比特幣的貨幣規則、加密貨幣的應用與新型資產的出現,以及對法律、制度的影響。

這本書,將帶著大家一起探索:

✅全球國監管全貌

收錄高達11個司法管轄區的加密貨幣法律,讓您在這本書可以全面理解加密貨幣在全球的監管現況。

✅幣圈真相

比特幣到底是什麼,為什麼有人把他當成一生信仰?世界需要數位法幣嗎?台灣法制到底如何評價?

✅同時也是真情告白,把幣圈黑暗面揭露,不藏私,公開我在這圈子的所見所聞。

比特幣及區塊鏈席捲全世界之際,我認為我有一個重大責任,必須寫下這本書— 我稱之為「加密法律」(Crypto Law)

這本書正式開始預購(👉 https://reurl.cc/OGR3ng )過年完即發貨。

讓我們進入到加密世界。

#記得手刀購起來 👉

博客來:https://reurl.cc/97W1Wn

——

同時,我也要感謝本書的重要推薦人:

沒有你們的支持,不可能會有這本書誕生:

★Jimmy/ #酷可實驗室 創辦人

★腦哥 Raizel/腦哥 Brain Bro創辦人

★鄭光泰/幣託集團 BitoEX創辦人暨執行長

★劉世偉/MaiCoin創辦人暨執行長

★高培勛/奧果區塊顧問 Argoblocks創辦人、#尋找黑天鵝 共同作者

★林繼恆/#恆業法律事務所 主持律師

★王琍瑩/Next & Nexus 明日科技法律事務所主持律師

★吳德威/矽谷Acorn Pacific Ventures 創投基金合夥人

★范紀鍠 Paul/#Circle集團 工程副總裁暨台灣總經歷

- --推薦序---

★徐珮菱 / 中信金融管理學院科技金融研究所所長

★葛如鈞(寶博士)/中華民國(台灣)不分區立法委員

-

@ 18e3af1e:1d42e5df

2024-02-14 21:31:21

Even though the cultural paradigm change of Value 4 Value is relatively new, ( we can't expect everyone in the world to jump in) the core idea of giving value in real time for content, can be pretty difficult to grasp for this generation; specially the less tech savvy individuals and older people.

There is also the challenge for people that generate content of getting a consistent incentives that keep them creating; a constant stream of funds rather than tips if I may say.

[Nostr Wallet Connect](https://nwc.dev/) and [Autozaps](https://www.zapplepay.com/autozap/npub1rr3678k7ajms2sht0cqqeawy86sdd5ahn6akfj8zex9ng82zuh0sz8nywd) by Zapple pay could play a HUGE role in fixing the inconsistency of V4V model in its pure form, by allowing the supporters to donate a fix amount set by them either daily, weekly or monthly. Look it as a mix between the V4V Model and the Legacy Subscription Model with Better and Faster Money.

Do we need something like Autozaps now, while educate newer generations?

Let me know your thoughts.

-

@ fa984bd7:58018f52

2024-02-14 13:00:14

This is a new document I'm writing using https://collab-lemon.vercel.app/ which allows for collaborative editing of documents on nostr.

The cool part is that this very simple tool, that I basically wrote in one hour last night, has some interesting primitives that can allow for a decentrailized wiki.

In this flow I can invite editors to collaborate with me; they can suggest changes and I can see them typing in "real-time". When they suggest a change they essentially create a fork of my document, which I can then resign as my own, essentially accepting their changes.

But the cool thing is that suggesting edits is not restricted to the people I authorize, anyone can do it. In my Whynotstr client these "unauthorized" edits are displayed separately and only if you choose to see them.

But anyone can see them. Which means that anyone can fork my document and create their own competing document.

## Decentralized wiki

From a "Wiki" perspective, this could mean that I write an entry for "Second World War"; the entry might be fully biased and I might leave out a bunch of nuance you, coming at it from a different perspective

-

@ bc4cdf40:640b4c19

2024-02-14 12:01:12

Russian forces dealt a devastating blow to the Ukrainian military. On the morning of February 13, Russian strikes destroyed reserves of the Armed Forces of Ukraine (AFU), which came for the joint combat training to the village of Selidovo in the Donetsk People’s Republic.

Several waves of Russian strikes hit the training ground, where about 1,500 Ukrainian servicemen could be deployed. There are still no official statements from any of the warring parties. The Ukrainian media remain silent, while Russian sources that are close to the military provide details of the attack.

There were reportedly at least two waves of strikes. The Russian military learned the tactics which Ukrainian Nazis are using against civilians in the Donbass and other regions that Kiev lost. After the first attack hit the ranks of Ukrainian servicemen, leaving dozens killed and wounded, the second wave of strikes targeted military and security forces that came to the spot to evacuate the killed and wounded.

The Russian military reportedly used several Iskander missiles with a cluster munition. Additionally Smerch MLRS, also with a cluster part, were used.

The real number of casualties is unlikely to be officially revealed by the Kiev regime. According to some preliminary reports from the spot, the attack resulted in about 500 Ukrainian servicemen killed and about 700 others wounded. According, to other reports, there are dozens killed. It is clear that the number of casualties is likely to rise, as many soldiers have been seriously injured and their lives are at risk.

Selidovo is a strategically important logistics hub of the Ukrainian military. Ukrainian units come there from Pavlograd and Pokrovsk before being sent to the frontlines. The military facilities in the village were used for accumulation of Ukrainian military reserves before they were sent to plug the holes in defense in the Donetsk direction. According to preliminary reports, a large part of the victims of today’s attack were servicemen of the notorious 3rd Assault Brigade “Azov”. The Ukrainian military command had previously declared that this unit would be send to reinforce Ukrainian garrison in Avdiivka.

Deputy of the Verkhovna Rada of Ukraine Mariana Bezuglaya reportedly confirmed the attack and claimed that after the incident in Selidovo, mass inspections began in the Armed Forces of Ukraine, from the General Staff to those responsible “on the ground.”

Reports from Selidovo also confirm heavy losses to the Ukrainian Army. All the roads in the area were blockaded by security forces. There are many ambulances and trucks to take the corpses. The Security Service of Ukraine is reportedly raiding the village looking for spotters on the ground, those who leaked information about the accumulation of large Ukrainian forces on the training ground.

This is far from the first Russian precision strikes on the accumulation of Ukrainian forces near the front. In November, 2023, the 128th Brigade of the AFU lost dozens killed and wounded after Iskander thwarted the awarding ceremony in the village of Dimitrovo in the Zaporozhie region.[LINK](https://southfront.press/kiev-counts-losses-after-russian-strike-on-failed-awarding-ceremony-videos-18/)

However, this is the first such bloody attack on Ukrainian units in the rear after the new Ukrainian commander-in-chief Syrsky took office. Such an incident will definitely worsen his already weak reputation among the Ukrainian population, especially among the military.

In an attempt to distract the population from another defeat, Kiev is expected to launch another bloody attack in the Russian rear, including on civilian targets.

-

@ bc4cdf40:640b4c19

2024-02-14 11:19:53

Amid the ongoing offensive on the Donbass frontlines, the Russian military continues precision strikes, destroying Ukrainian military and infrastructure facilities in the eastern and southern Ukrainian regions.

The last night was not an exception. On February 13, Kiev proudly declared that the almighty Ukrainian air defense forces intercepted 16 out of 23 Russian kamikaze UAVs. The effective operation of Ukrainian air defense systems and mobile fire groups allegedly prevented any damage from the Russian strikes.

However, Kiev’s claims were immediately refuted by reports from the city of Dnipro. Immediately after the Russian strikes, water and power supplies were cut off in the city. The local residents confirmed a series of loud explosions at the local TPP. The station provided electricity to numerous local industrial facilities used by the Ukrainian military.

More Russian strikes were reported in the Ukrainian border town of Volchansk in the Kharkiv region, which is targeted by Russian drones and missiles on a regular basis. The Ukrainian military accumulated some reserves there in order to secure the border and launch sabotage attacks on Russian territory.

On the morning of February 13, there was a massive Russian attack on the Ukrainian military training ground in Selidovo in the Donetsk People’s Republic. The strike reportedly hit the ranks of Ukrainian infantry, which came there for training and combat coordination before being sent to Avdiivka. According to preliminary reports, about 1,500 servicemen and various military warehouses came under attack. Heavy losses were inevitable, but the Ukrainian side is yet to officially declare the number of victims.

The ongoing Russian strikes on Ukrainian strategic reserves allow the Russian troops to maintain the military initiative along the Donbass frontlines.

While the assault groups are surrounding the Ukrainian grouping in Avdiivka, Russian forces are also improving their positions on the outskirts of the city and in the settlements nearby. As a result of several successful assaults, Russian forces are coming closer to surrounding the Ukrainian Zenith stronghold on the southern outskirts of Avdiivka. Russian forces advanced from both the west and north of the area but the Ukrainian command does not withdraw forces from the cauldron.

In the Bakhmut region, Russian forces continue assaults towards Chasov Yar. They recently took control of the forest area north-west of Ivanovskoe. As a result of Russian successes, the village was encircled from the north.

The Russian military also gained new victories in the south Donetsk direction. As a result of the recent attacks, Russian troops broke through Ukrainian defenses north and east of the village of Pobeda and gained a foothold on the outskirts. At the same time, Ukrainian forces lost control of a large part of Novomikhailovka.

Despite the changes in the country’s military leadership, Ukrainian forces cannot stop the Russian offensive on all frontlines.

-

@ 83defd06:45cb69da

2024-02-13 17:05:15

testing

-

@ 83defd06:45cb69da

2024-02-13 17:03:57

testing sorry

-

@ 83defd06:45cb69da

2024-02-13 16:06:27

lorem ipsum lorem ipsum

-

@ 46fcbe30:6bd8ce4d

2024-02-13 02:38:57

Opinion about the city of Seattle

<!--HEADER END-->

asdf asdf

<!--FOOTER START-->

#myCloneOfTripadvisor #askNostr #nostrOpinion

[Join the conversation!](https://www.myCloneOfTripadvisor.com/Search?q=seattle)\n\nJust Testing ...

-

@ 0f2955a6:2ad7991a

2024-02-12 23:23:59

test test

-

@ d19fec54:1e6c5495

2024-02-12 23:15:54

test test

-

@ d19fec54:1e6c5495

2024-02-12 22:43:48

test

-

@ 46fcbe30:6bd8ce4d

2024-02-12 20:06:27

Opinion about Nostr Implementation Possibility 'Git With Nostr' by nostr:npub...

<!--HEADER END-->

**test**

<!--FOOTER START-->

#NostrOpinion

-

@ 18e3af1e:1d42e5df

2024-02-12 17:44:04

Why does your job SUCKS and what would you do with your time instead?

Comment if you hate your current job, and why would you work on, if you didn't have to work to keep the bills at bay.

As a plus, you can tell me about your dream job in Bitcoin.

DON'T HOLD ANYTHING BACK

-

@ b2caa9b3:9eab0fb5

2024-02-12 12:29:04

**In a time long ago, humanity led a humble existence, devoid of the luxuries we often take for granted today. It was an era characterized by simplicity, where true value was placed on genuine connections and respect for one another. I speak of a time when my grandparents were just children, residing in an old, quaint house in Ukraine.**

This house, a relic from the past, evokes memories of a bygone era. A time when life was modest, constructed with clay, wood, and adorned with a coat of whitewash. It's hard to fathom this way of life in today's fast-paced world, where we wake up to the comforts of central heating. Back then, the chill of the morning greeted the household, urging them to kindle warmth within the walls. Mornings meant venturing out to feed the geese and chickens, followed by a shared family breakfast at a humble table. Those times have slipped away into history, but the vivid recollections of my grandmother keep the memories alive.

Upon seeing the house in Ukraine, I found myself transported back to my own childhood. A time when I sat with my grandmother, absorbing tales of her youth spent in Ukraine. She recounted stories of a time when her home was made of clay and wood, a dwelling of humble simplicity. Her anecdotes painted a picture of her father, bravely setting off to fight in the First World War, only to never return.

Standing before this house, I was compelled to capture the moment through a photograph. It allowed me to momentarily travel back in time, immersing myself in the wonder of that era. The echoes of the past whispered tales of struggle, love, and resilience, reminding us of the beauty in life's simplicity. The house, a symbol of a simpler time, serves as a bridge between generations, allowing us to reflect on the strength and endurance of those who came before us.

In cherishing our heritage and embracing the stories of our ancestors, we find a deeper connection to our roots and a profound appreciation for the comforts we enjoy today. It's a reminder that amidst our fast-paced modern lives, there's great wisdom in revisiting the past and understanding the simple, beautiful truths that once guided our existence.

## Photo information

- Author: Ruben Storm

- Created on: 16. September 2018

- Camera: Motorola Moto G5 Plus

- Original: [[Photo on Flickr]](https://flic.kr/p/2hoS46t) | [Flickr profile](http://bit.ly/rst-flickr)

-

@ 765da722:17c600e6

2024-02-11 21:19:33

In her book, *A Daily Dose of God's Word,* Ruby Ramsey wrote for Feb. 11 about how to improve one's spiritual health by walking. The New Testament uses the figure of walking for progress in spiritual matters. She gave seven ideas about walking with accompanying texts.

1. Walk in Christ, Colossians 2.6-7.

2. Walk in truth, 3 John 3-4.

3. Walk in good works, Ephesians 2.10.

4. Walk as Christ walked, 1 John 2.5-6.

5. Walk in love, Ephesians 5.1-2.

6. Walk in light, Ephesians 5.8.

7. Walk in wisdom, Ephesians 5.15-16.

Then she ended with an eighth idea: Walk to please God, 1 Thessalonians 4.1-2.

She ended by saying, “Walking like this is important for your spiritual health ─ and your very soul!”

-

@ d1d17471:5b15ed44

2024-02-11 15:18:32

Nostrプロトコルを利用したアプリケーションの開発に役立つ資料をまとめていく場です。

## プロトコル仕様書

### nostr-protocol/nips

https://github.com/nostr-protocol/nips

Nostrプロトコルの仕様を定めるNIPs(Nostr Implementation Possibilities)を取りまとめるリポジトリ。

また、issue・PRは新規NIPの提案や既存NIPの改善などに関する議論を交わす場となっている。

必須仕様はすべて **NIP-01** にまとまっているので、まずはNIP-01を読みましょう

### nips-ja

https://github.com/nostr-jp/nips-ja

NIPsの日本語訳プロジェクト。

## プロトコルの解説

### Web記事

- [Nostrプロトコル(damus)を触ってみた](https://qiita.com/gpsnmeajp/items/77eee9535fb1a092e286)

- [Nostr の面白さをエンジニア目線で解説してみる](https://zenn.dev/mattn/articles/cf43423178d65c)

- [Nostr Scrapbox](https://scrapbox.io/nostr/)

### 書籍

- [Hello, Nostr! 先住民が教えるNostrの歩き方](https://nip-book.nostr-jp.org/book/1/)

- [learn-nostr-by-crafting](https://github.com/nostr-jp/learn-nostr-by-crafting): 本書内記事「手を動かして学ぶNostrプロトコル」の演習用リポジトリ

- [Hello, Nostr! Yo Bluesky! 分散SNSの最前線](https://nip-book.nostr-jp.org/book/2/)

- [learn-nostr-by-crafting-2](https://github.com/nostr-jp/learn-nostr-by-crafting-2): 本書内記事「演習!作ってみよう「日本語 TL のぞき窓」の演習用リポジトリ

- [Software Design誌 連載「新時代の分散SNS Nostr」(2023年7月号~12月号)](https://gihyo.jp/magazine/SD/backnumber)

- 第1回(7月号)〜第3回(9月号): Nostrプロトコルやアプリケーションの紹介

- 第4回(10月号): Nostrプロトコルの解説

- 第5回(11月号), 第6回(12月号): Nostrアプリケーションの実装解説

### 動画

- [分散型SNSプロトコル nostrの解説](https://www.youtube.com/watch?v=vB905DhX9nQ)

## ライブラリ

### nostr-tools

https://github.com/nbd-wtf/nostr-tools

Nostrアプリケーションの開発で頻出する処理を提供するJS/TSライブラリ。

- 秘密鍵の生成・秘密鍵から公開鍵への変換

- イベントの署名・検証

- リレーとの通信(イベント購読・発行)

- bech32形式識別子(`npub`, `nsec`, `nevent`などから始まる識別子、NIP-19)のencode/decode

- ドメイン認証(NIP-05)の検証

- etc...

### NDK

https://github.com/nostr-dev-kit/ndk

Nostrプロトコルに対する、nostr-toolsよりも高いレイヤの抽象を提供するJS/TSライブラリ

[ドキュメント](https://ndk.fyi/docs/)

### rx-nostr

https://github.com/penpenpng/rx-nostr

イベント購読をはじめとするNostrリレーとのやり取りを、RxのSubscriptionとして扱えるようにするJS/TSライブラリ。

[ドキュメント](https://penpenpng.github.io/rx-nostr/)

### nostr-fetch

https://github.com/jiftechnify/nostr-fetch

Nostrリレーから過去のイベントを取得する機能を提供するJS/TSライブラリ。最新のReplaceable Eventの取得にも便利。

(リレーから過去のイベントを正確に取得しようと思うと、落とし穴が多くて意外と大変。詳細は[こちら](https://speakerdeck.com/jiftechnify/nostrnorirekaralou-renakusubetenoibentowoqu-tutekuruji-shu))

### rust-nostr

https://github.com/rust-nostr/nostr

Rust向けにNostrプロトコル全般の抽象を提供するライブラリ。機能ごとにクレートが分割されている。

- nostr: Nostrプロトコルの低レイヤの実装

- nostr-sdk: nostrクレートをベースとする、より高レイヤの抽象。クライアントの実装向け

- nostr-database: Nostrイベントの永続化処理に関する抽象。

- etc

また、さまざまなプログラミング言語向けのbindingが提供されている

### go-nostr

https://github.com/nbd-wtf/go-nostr

Nostrプロトコル全般の抽象を提供するGoライブラリ。

### eventstore

https://github.com/fiatjaf/eventstore

Nostrイベントの永続化処理に関する抽象を提供するGoライブラリ。

### khatru

https://github.com/fiatjaf/khatru

Go向けのNostrリレー実装用のフレームワーク。

-

@ babaf02c:049eee5d

2024-02-08 06:19:29

Introducing Amazon Cleaning, the trusted name in ***[Smyrna cleaning service.](https://amazoncleaning.net/service-area/smyrna/)*** We are committed to making your space shine, so you can sit back and relax. With our team of expert cleaners, you can trust that every nook and cranny will be thoroughly cleaned and sanitized to perfection. From residential homes to commercial spaces, we offer a wide range of cleaning services tailored to your specific needs. Whether it's a weekly, bi-weekly, or one-time cleaning, we've got you covered. Our attention to detail, professionalism, and use of eco-friendly products sets us apart from the rest. Experience the convenience and happiness of a spotless space with Amazon Cleaning today!

-

@ 0f22c06e:6194f8b6

2024-02-08 01:26:43

On social media and in the Nostr space in particular, there’s been a lot of debate about the idea of supporting deletion and editing of notes.

Some people think they’re vital features to have, others believe that more honest and healthy social media will come from getting rid of these features. The discussion about these features quickly turns to the feasibility of completely deleting something on a decentralized protocol. We quickly get to the “We can’t really delete anything from the internet, or a decentralized network.” argument. This crowds out how Delete and Edit can mimic elements of offline interactions, how they can be used as social signals.

When it comes to issues of deletion and editing content, what matters more is if the creator can communicate their intentions around their content. Sure, on the internet, with decentralized protocols, there’s no way to be sure something’s deleted. It’s not like taking a piece of paper and burning it. Computers make copies of things all the time, computers don’t like deleting things. In particular, distributed systems tend to use a Kafka architecture with immutable logs, it’s just easier to keep everything around, as deleting and reindexing is hard. Even if the software could be made to delete something, there’s always screenshots, or even pictures of screens. We can’t provably make something disappear.

What we need to do in our software is clearly express intention. A delete is actually a kind of retraction. “I no longer want to associate myself with this content, please stop showing it to people as part of what I’ve published, stop highlighting it, stop sharing it.” Even if a relay or other server keeps a copy, and keeps sharing it, being able to clearly state “hello world, this thing I said, was a mistake, please get rid of it.” Just giving users the chance to say “I deleted this” is a way of showing intention. It’s also a way of signaling that feedback has been heard. Perhaps the post was factually incorrect or perhaps it was mean and the person wants to remove what they said. In an IRL conversation, for either of these scenarios there is some dialogue where the creator of the content is learning something and taking action based on what they’ve learned.

Without delete or edit, there is no option to signal to the rest of the community that you have learned something because of how the content is structured today. On most platforms a reply or response stating one’s learning will be lost often in a deluge of replies on the original post and subsequent posts are often not seen especially when the original goes viral. By providing tools like delete and edit we give people a chance to signal that they have heard the feedback and taken action.

The Nostr Protocol supports delete and expiring notes. It was one of the reasons we switched from secure scuttlebutt to build on Nostr. Our nos.social app offers delete and while we know that not all relays will honor this, we believe it’s important to provide social signaling tools as a means of making the internet more humane.

We believe that the power to learn from each other is more important than the need to police through moral outrage which is how the current platforms and even some Nostr clients work today.

It’s important that we don’t say Nostr doesn’t support delete. Not all apps need to support requesting a delete, some might want to call it a retraction. It is important that users know there is no way to enforce a delete and not all relays may honor their request.

Edit is similar, although not as widely supported as delete. It’s a creator making a clear statement that they’ve created a new version of their content. Maybe it’s a spelling error, or a new version of the content, or maybe they’re changing it altogether. Freedom online means freedom to retract a statement, freedom to update a statement, freedom to edit your own content. By building on these freedoms, we’ll make Nostr a space where people feel empowered and in control of their own media.

-

@ b2caa9b3:9eab0fb5

2024-02-06 17:59:45

Remember my post from a couple of days ago? I believe it was two days ago when I shared my adventure titled “Unplugged in Paradise: A Day at the Beach Hotel Office”. In that post, I found myself in a stunning location, attempting to work, but alas, I couldn't connect to the Wi-Fi. I had to rely on my phone data to stay connected. Well, guess where I am today? Yes, I'm back at the same place because I couldn't resist the breathtaking view and the refreshing ocean breeze. Especially compared to the scorching heat at my rented home lately. So, I decided to return today and soak up this fantastic view while writing a series of blog posts - call it a blogging marathon if you will.

Getting here was a breeze; I hopped on a TukTuk and only paid 150 Kes this time, a significant improvement from the 300 Kes I shelled out previously. It's safe to say that today's price felt more reasonable. I'm hoping for a productive day in this exquisite location.

Lately, I've been eagerly awaiting a package I ordered from Germany: a brand-new razor. My old one was made of plastic, and this year, I made a personal commitment to reduce my carbon footprint and eliminate plastic from my life in favor of more sustainable choices. Conveniently, my old razor fell apart, though not in an ideal location. Dealing with customs has been a bit of a hassle, even though Amazon covered all the import fees and charged my card. I'm keeping my fingers crossed that it will arrive this weekend or early next week. Now, you might be wondering, why did I order a razor from Europe? Well, the issue is that you can find expensive blades and the old-style cheap ones here, but you can't find a quality razor. Every time you try to buy one, they have to order it from Europe, and you have to pay upfront. You never really know what you'll get, except that it will be pricey and likely low quality. So, I decided to take matters into my own hands and ordered it from Amazon, which offers worldwide express shipping for a reasonable 23 euros.

For now, I'll wrap up this post and get back to writing and taking photos of this beautiful place.

Fast forward to late evening, and I'm back at my accommodation. This afternoon was fairly low-key; I tied up some loose ends, packed my laptop into my bag, and headed to the pool area. I lounged around for a bit, snapped some photos, and took a leisurely stroll. Then, I decided it was time for a refreshing dip in the pool. I'd called ahead earlier to check if it was okay for me to spend the day working here, and they assured me that their Wi-Fi was top-notch and that I could use the pool as well. Excited, I waded into the pool and explored the area. There was even a bar by the poolside, allowing guests to enjoy a drink while cooling off. However, to reach the bar, you had to be a swimmer, as the water was about 2 meters deep on the way there. At the bar, it was just deep enough to stand comfortably.

But my plans took an unexpected turn when a man approached me before I could reach the bar. He informed me that there was a fee for using the pool, though he didn't specify the amount. After a few minutes, he returned with a bill, demanding 1000 Kes, roughly 7 euros. I was taken aback and insisted on a comprehensive bill for everything I'd consumed. He took my money, left for a while, and when he finally returned, he presented a bill, but it didn't include the pool charge. He had essentially rewrote and split the bill into two, separating the drinks from the pool fee. I was upset by this and sought someone to resolve the issue. I asked for a separate receipt for the pool fee, and after some apologies, he finally handed it over.

Feeling frustrated, I decided to take a stroll along the pristine white beach back to my place. It was a beautiful walk, even though I had to navigate some sharp rocks due to the rising tide. I couldn't help but wonder why these rocks were always so sharp; it's a mystery I can't explain. Despite the business mishap at the pool, the walk was absolutely enchanting. However, if you were to ask me whether I'd turn this place into my office again, the answer is no. It's a stunning spot, no doubt, but the way they conduct business isn't to my liking. Sadly, it's a common practice in Kenya. Nevertheless, let's keep moving and explore more beautiful places. There are plenty out there waiting to be discovered.

-

@ b2caa9b3:9eab0fb5

2024-02-06 17:53:14

In today's adventure, I decided to switch up my work setting and take you along for the ride as I settled into a beach hotel, a truly delightful one at that, promising excellent wifi for a productive workday. I'm a proud minimalist, equipped with nothing more than my trusty Osprey Nebula 32L backpack, housing all my essentials, weighing in at less than 10 kg - clothes, shoes, electronics, toothbrush, toothpaste, and soap neatly stowed away.

As I prepared for my excursion, I emptied my backpack, leaving only the electronics inside. The first leg of my journey involved catching a tuktuk to the beach hotel, where I was greeted by a friendly security guard who welcomed me with a warm "caribou" - a precursor to the enchanted world that awaited beyond the imposing iron gate.

Following the security guard's directions, I wandered along a path lined with quaint cottages available for rent until I reached a breathtaking scene: a pool, a bar, and a restaurant all nestled within a lush, jungle-like resort. I chose the pavilion as my workspace for the day, offering a panoramic view of the resort on one side and a stunning vista of the beach with its powdery white sands on the other.

However, my plans hit a snag when I discovered that the promised wifi wasn't functional in the pavilion. Attempts to relocate to the restaurant and poolside in search of a stable connection proved futile, eventually forcing me to rely on my mobile data to salvage a couple of hours of work amidst picturesque surroundings.

In true African fashion, the assurance of good wifi often falls short of reality, leading to a day filled with beautiful scenery but a less-than-productive workday. Nonetheless, I made the most of it, even indulging in a delectable pizza during my quest for a functioning wifi connection.

As the day wound down, I packed up my laptop and headed back to my temporary abode. In hindsight, it wasn't the most productive workday, but it was undeniably a picturesque and enchanting mobile home-office experience. Take a peek at the photos to capture a glimpse of this unique workspace.

*Follow me on Nostr*

-

@ 11be7dbc:82a5f8e9

2024-02-06 16:01:37

In 2022, Cyberyen emerged seemingly out of thin air, presenting a potent response to the entrenched corruption within the cryptocurrency landscape. Its ideology has offered a simple yet powerful antidote, founded on the core principles of cypherpunk ideology—privacy, decentralization, and liberation from institutional control. Cyberyen rose as a rallying call against prevailing financial dominion.

This nascent ideology encapsulates a spirit of rebellion, aspiring to democratize finance and cultivate a community-centric digital economy. Today, in its embryonic stage, Cyberyen epitomizes a digital social contract, offering a liberated space where collaboration, innovation, and communal interaction flourished, unshackled from the constraints imposed by traditional financial frameworks.

Due to the fact that the original purity of cypherpunk's intentions—to stand as a symbolic rebellion against a corrupt system—gradually succumbed to the speculative frenzy dominating the financial world. Rather than upholding the foundational principles of a liberated digital society, cryptocurrency became synonymous with speculative bubbles, market frenzy, and the whims of investor sentiment.

Yet, amidst this moral decay, the idea of Cyberyen metamorphoses into a transformative force. Within the shadows of speculation lies the potential for the resurgence of community, innovation, and decentralization, aspiring to reclaim its intrinsic position in the realm of digital currencies. It evolves beyond a mere facilitator of transactions to shape a unique environment transcending conventional boundaries of geography, socio-economics, and governance.

Acknowledging Cyberyen's early stage invites envisioning it not merely as a digital coin but as a sovereign state—an intangible expanse where individual interactions shape its foundation. Much akin to our integration into society at birth, Cyberyen welcomes participants into a shared realm where interactions, engagements, and collaborations weave the fabric of a burgeoning digital society. Within this ethereal space, physical geography dissolves, allowing individuals globally to converge and coexist within the Cyberyen ecosystem.

At its core, Cyberyen functions as a decentralized, borderless platform, accessible to anyone with an internet connection. Serving as an overlay to societal and economic structures, it seamlessly integrates into participants' lives, transcending geographical limitations. This integration fosters an environment conducive to self-discovery, expression, and connectivity, reminiscent of familial, communal, and national landscapes shaping our physical realm identities.

Privacy and anonymity stand as pillars within this digital enclave, empowering users to engage without the necessity of divulging personal information. Such anonymity liberates individuals from societal judgments prevalent in the physical world, fostering authentic expression and interaction devoid of prejudice or discrimination.

Moreover, Cyberyen champions universal interaction, eradicating the barriers posed by country-specific regulations, currencies, or social delineations. This democratization creates a level playing field for all participants, irrespective of background or location. Its inherent inclusivity ensures that opportunities and resources are not bound by conventional societal frameworks but are accessible to individuals irrespective of their socio-economic status or geographic coordinates.

Cyberyen's integration extends beyond financial transactions, envisioning usability in decentralized marketplaces, social platforms, cultural spheres, and multifaceted activities, fundamentally reshaping societal structures.

Distinct from activist networks advocating complete anonymity and a dark market, Cyberyen does not aim to dismantle government institutions. Instead, it aspires to weave an independent, invisible environment—a transparent digital matrix offering an alternative mode of interaction and settlement between individuals.

The blockchain underlying Cyberyen serves as the scaffolding for an independent people’s economy, embodying a promise beyond financial transactions—a platform for creating opportunities parallel to one's real-life endeavors. Through Cyberyen integration, individuals forge a secondary environment for business activity, fostering a new cultural layer detached from geographical confines.

At the heart of Cyberyen's evolution lies the fortification of its foundation—the strength of its network. The amalgamation of mining power and nodes forms the bedrock upon which the ecosystem thrives. Beyond technical robustness, the cultivation of a distinctive culture becomes imperative—an underground, creative ethos fostering innovation, inclusivity, and cultural diversity within the Cyberyen community.

Looking deeper, Cyberyen holds the promise of catalyzing social interaction, fostering economic growth, and nurturing a globally connected, culturally diverse society. It surpasses the role of a mere financial tool; rather, it stands as an incubator nurturing cultural expression and societal amalgamation. Cyberyen's narrative is a borderless router processing connections of collaboration, innovation, and inclusive progress—a profound testament to technology's capacity in crafting an autonomous social fabric. Within this realm, individuals are empowered to discover their voice, collaborate uninhibitedly, and collectively forge a novel cultural paradigm.

In conclusion, Cyberyen's essence transcends conventional currency, aspiring to create an enclave fostering an ecosystem where individuals interact, create, and thrive. Its potential lies in a united community constructing a vibrant, inclusive, and innovative digital society—a space of connectivity, creativity, and collective evolution in the digital age.

Stay with us... C¥kuza

-

@ d34e832d:383f78d0

2024-02-06 10:17:06

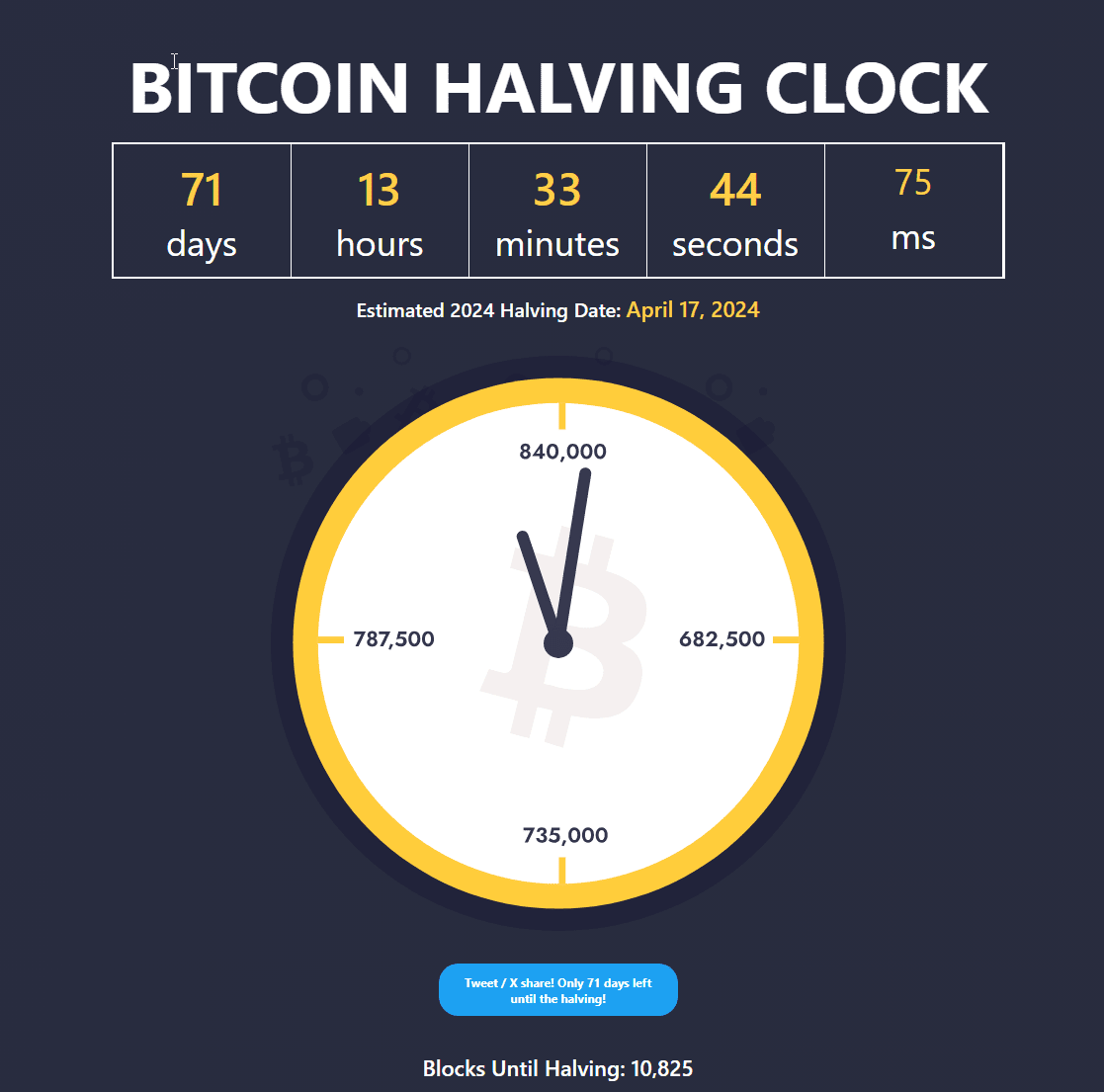

# Bitcoin Halving: Gaining an Understanding of its Significance

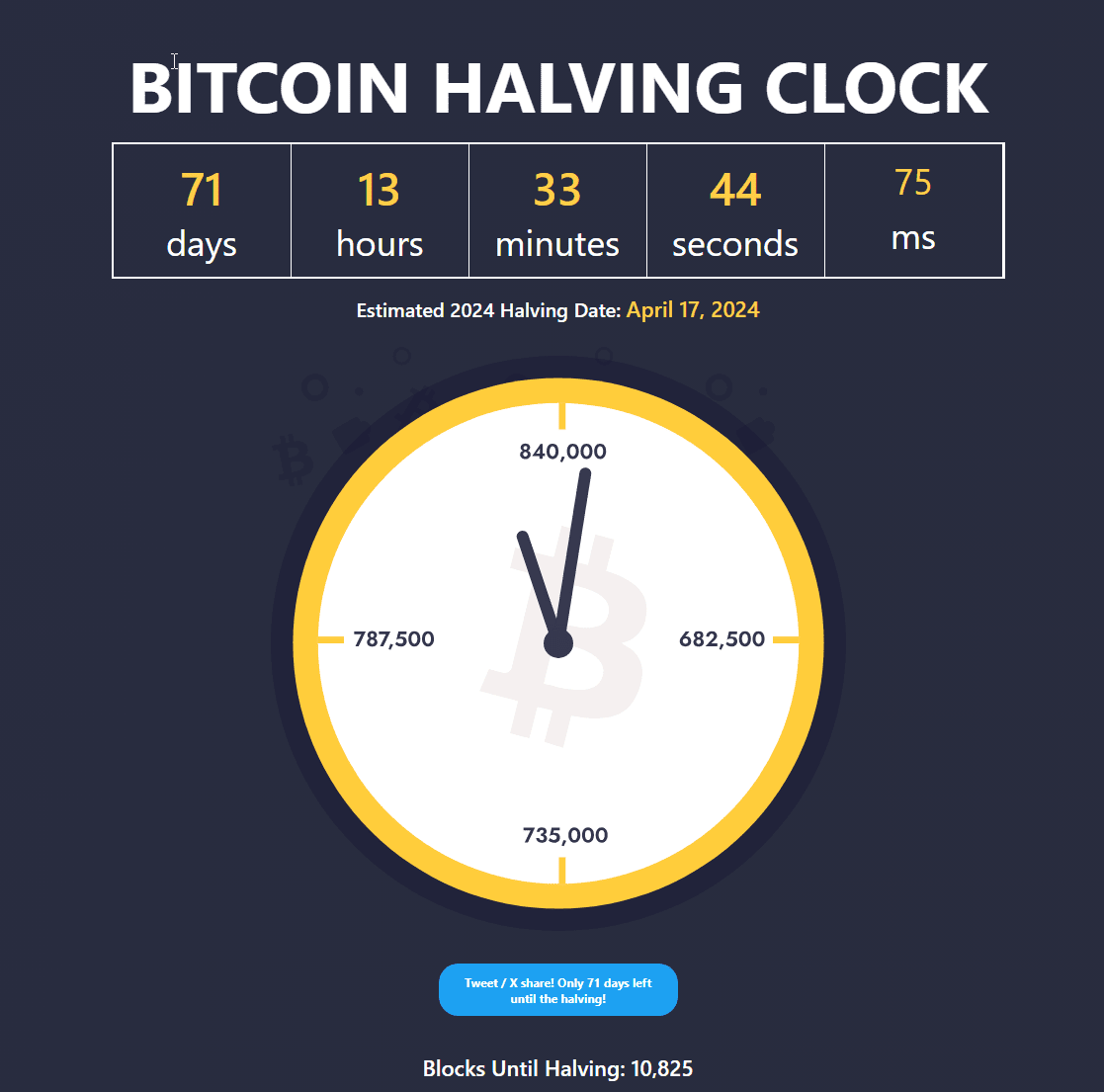

For a long time, I've operated using the opportunity of bitcoin, but applied little time to understand its halving. This periodic event, occurring approximately every four years, is more than just a routine adjustment in the Bitcoin ecosystem; it represents a fundamental aspect of Bitcoin's economic model and its impact on the supply side and demand dynamics. This is just a private note, I am making to review m understanding of this concept to my small audience and myself.

## The Halving Event

At the heart of the Bitcoin halving lies a simple yet profound mechanism. As stated by Satoshi Nakamoto in the original Bitcoin whitepaper, the total supply of Bitcoin is capped at 21 million coins. To ensure scarcity and prevent inflation, the rate at which new bitcoins are created must decrease over time. This is where the halving comes into play.

> "The halving is a pre-programmed event that occurs approximately every four years, where the block subsidy, which is the amount of new bitcoin awarded to miners for validating transactions, is cut in half."

This reduction in the block subsidy serves as a built-in mechanism to control the issuance of new bitcoins, thereby ensuring a gradual and predictable approach to reaching the maximum supply limit of 21 million coins.

## Implications for the Market

The impact of the Bitcoin halving extends far beyond its immediate effects on miners' rewards. It has profound implications for the broader cryptocurrency market and its participants.

> "This reduction in the block subsidy has implications for the supply of new bitcoin entering the market, which can impact its price and overall market dynamics."

With each halving, the rate at which new bitcoins are introduced into circulation decreases, leading to a decrease in the rate of inflation. This deflationary aspect of Bitcoin is often cited as one of its key distinguishing features compared to traditional fiat currencies.

## Market Sentiment and Price Volatility

One of the most intriguing aspects of the Bitcoin halving is its impact on market sentiment and price volatility. Historically, Bitcoin halving events have been associated with periods of heightened speculation and price volatility.

> "Investors closely monitor the halving events, anticipating their potential impact on Bitcoin's price trajectory."

While some view the halving as a bullish catalyst, others are of the consideration that no real event would occur during the next halving.

## This Halving Is A Pivotal Moment Of Where All Bitcoiners Stand

The Bitcoin halving is a pivotal event that underscores the underlying principles of scarcity and decentralization within the Bitcoin ecosystem. By reducing the rate of new bitcoin issuance, the halving plays a crucial role in shaping Bitcoin's monetary policy and economic trajectory. As investors and enthusiasts alike await the next halving event, the significance of this recurring phenomenon cannot be overstated.

# Impact of Bitcoin Halving: Potential Scenarios

While some anticipate significant bullish movements following the halving, others argue that it may not necessarily lead to major price shifts. Lets try to reconcile these contrasting scenarios and explore potential outcomes.

## Scenario 1: No Major Price Movements

In this scenario, the Bitcoin halving occurs without triggering significant price movements. Proponents of this view argue that the halving event is already priced into the market well in advance, as investors and traders anticipate the reduction in the block reward.

> "The efficient market hypothesis suggests that all available information, including future events like the halving, is already reflected in the current price of Bitcoin."

According to this perspective, any potential bullish sentiment leading up to the halving may already be factored into the market price, resulting in limited price volatility during and after the event.

## Scenario 2: Big Bullish Catalysts

Contrary to the first scenario, proponents of this view anticipate major bullish movements driven by the Bitcoin halving. They argue that historical data and market trends suggest a pattern of significant price appreciation following previous halving events.

> "Historically, Bitcoin halving events have been associated with periods of heightened speculation, increased demand, and subsequent price surges."

According to this perspective, the inherent scarcity of Bitcoin, coupled with a reduction in the rate of new coin issuance, creates a supply-demand imbalance that favors price appreciation. As investors perceive Bitcoin as a hedge against inflation and a store of value, the halving serves as a reaffirmation of its scarcity and long-term value proposition.

## Potential Positive Outcomes

Regardless of whether the Bitcoin halving leads to major price movements or not, there are potential positive outcomes for Bitcoin and the broader cryptocurrency ecosystem.

1. **Increased Awareness and Adoption**: The spotlight on Bitcoin during halving events often leads to increased media coverage and public awareness, attracting new investors and users to the ecosystem.

2. **Technological Innovations**: The anticipation of the halving encourages developers and entrepreneurs to explore innovative solutions and applications built on top of the Bitcoin protocol, driving technological advancements in the space.

3. **Long-Term Value Proposition**: Regardless of short-term price fluctuations, the fundamental value proposition of Bitcoin as a decentralized, censorship-resistant, and deflationary digital asset remains intact, attracting long-term investors seeking to preserve wealth and hedge against economic uncertainty.

## The Future Cannot Be Truly Predicted

In conclusion, the potential outcomes of the Bitcoin halving are subject to debate and speculation within the Bitcoin community. While some anticipate major price movements, others remain skeptical of its immediate impact on the market. However, beyond short-term price fluctuations, the halving event serves as a reminder of Bitcoin's scarcity and value proposition, reinforcing its position as a revolutionary financial asset with the potential to reshape the global economy.

For further exploration of Bitcoin halving and its implications, consider diving into resources such as:

- [Bitcoin Halving Explained](https://www.lopp.net/bitcoin-information.html)

- [The Economics of Bitcoin Mining, or Bitcoin in the Presence of Adversaries](https://nakamotoinstitute.org/bitcoin/)

- [Understanding Bitcoin's Halving and Its Impact](https://www.investopedia.com/terms/b/bitcoin-halving.asp)

-

@ dec2e28f:01746c77

2024-02-06 09:16:16

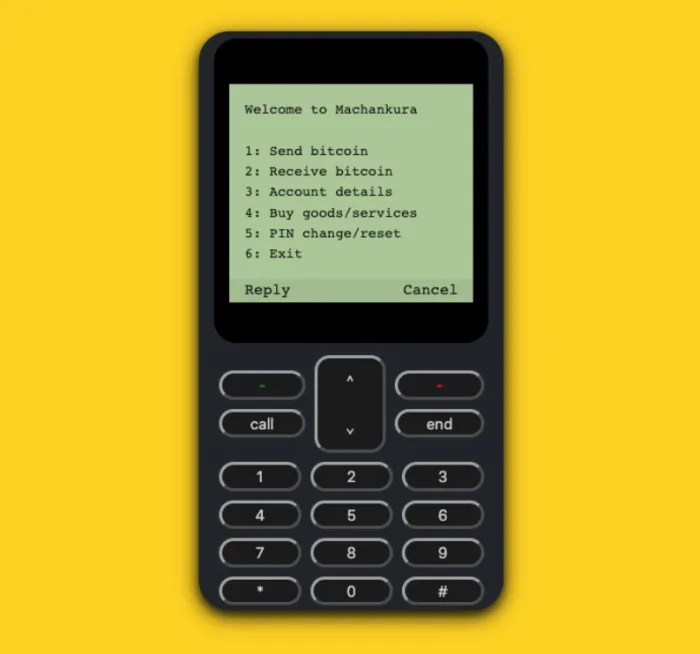

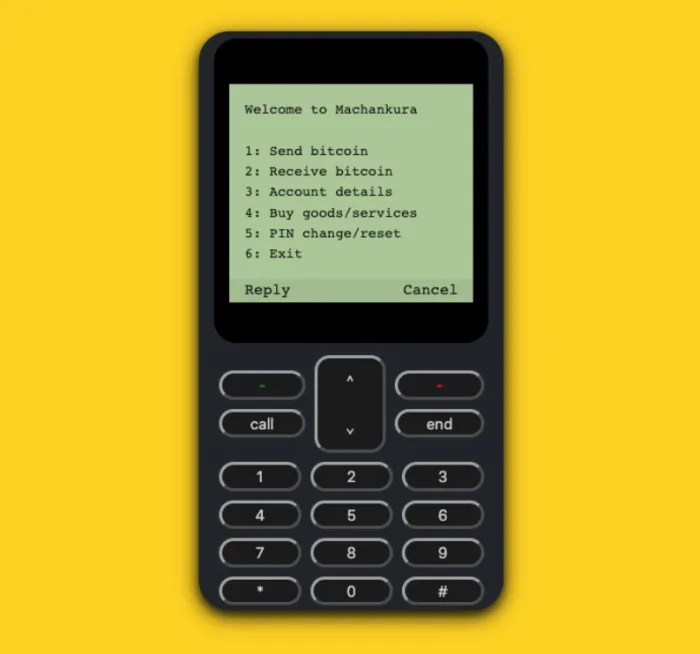

* 數以百萬計的非洲人面臨兩個阻礙他們進步的問題:6億人缺乏電力,而幾乎所有非洲大陸的14億人缺乏高品質的貨幣。與美國、北歐或日本相比,那裡幾乎所有人都能獲得穩定、負擔得起的電力,以及像美元、歐元或日元這樣廣泛接受的儲備貨幣。

* 非洲人遭受著停電和通貨膨脹的折磨時間越長,他們就越難脫身,儘管他們盡了最大努力。更糟糕的是,傳統的能源和金融提供商沒有動機解決這個問題,這意味著通貨貶值、債務陷阱和電網關閉仍然存在。

* 大多數人可能會看到這種情況,並得出結論,下一個非洲世紀將非常困難。儘管非洲擁有強大的河流、烈日、強風和地熱等豐富的能源資源,但非洲大陸仍然無法充分利用這些自然資源來推動其經濟增長。一條大河可能流經其中,但該地區的人類發展卻仍然痛苦地依賴於慈善或昂貴的外國借貸。直到現在。

* 在一些非洲企業家、教育工作者和活動家看來,有一個東西出現了,它有可能徹底改變非洲迅速增長人口的可靠電力和高品質貨幣——這是進步的基石。信不信由你,那個東西就是比特幣。

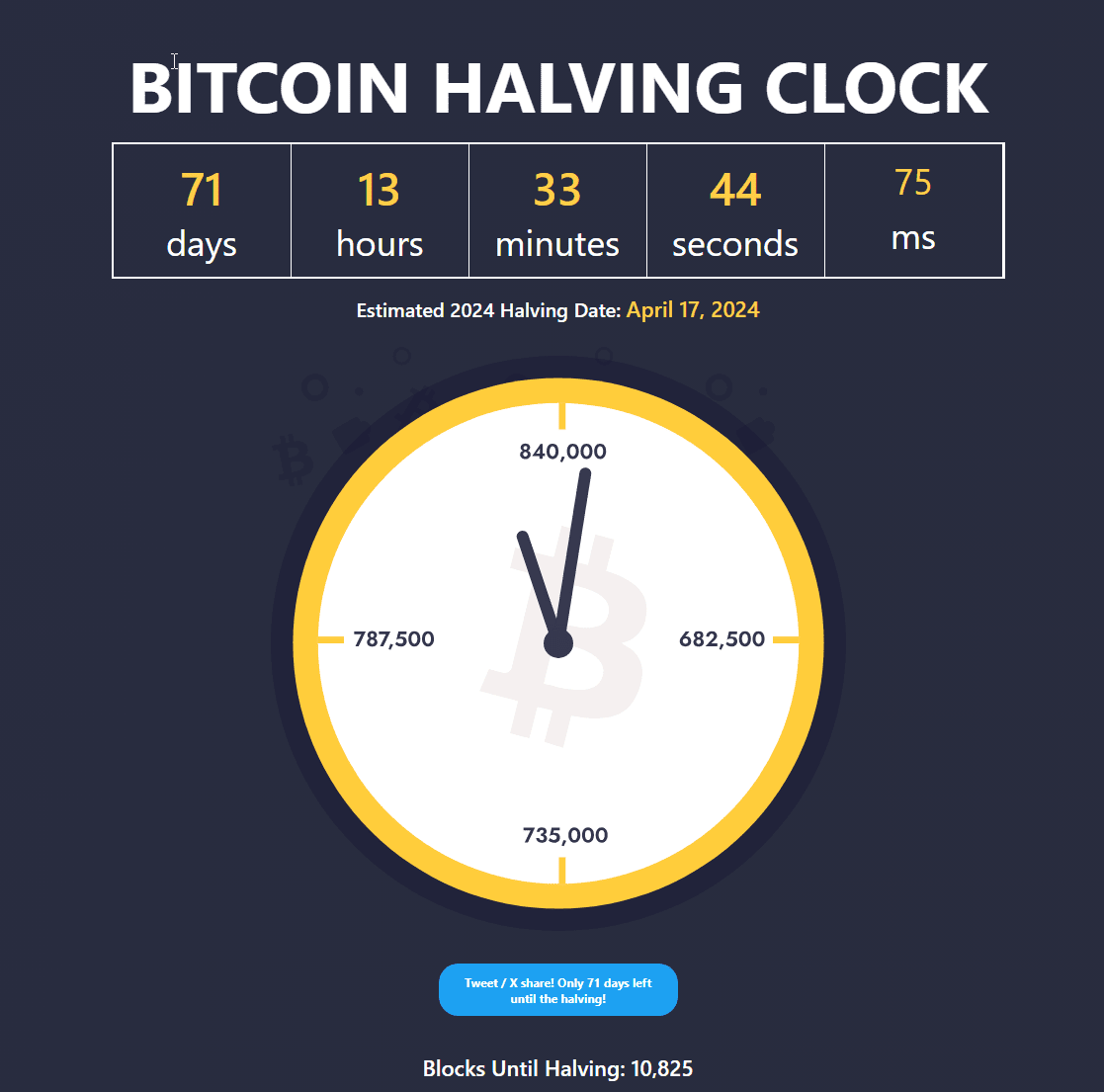

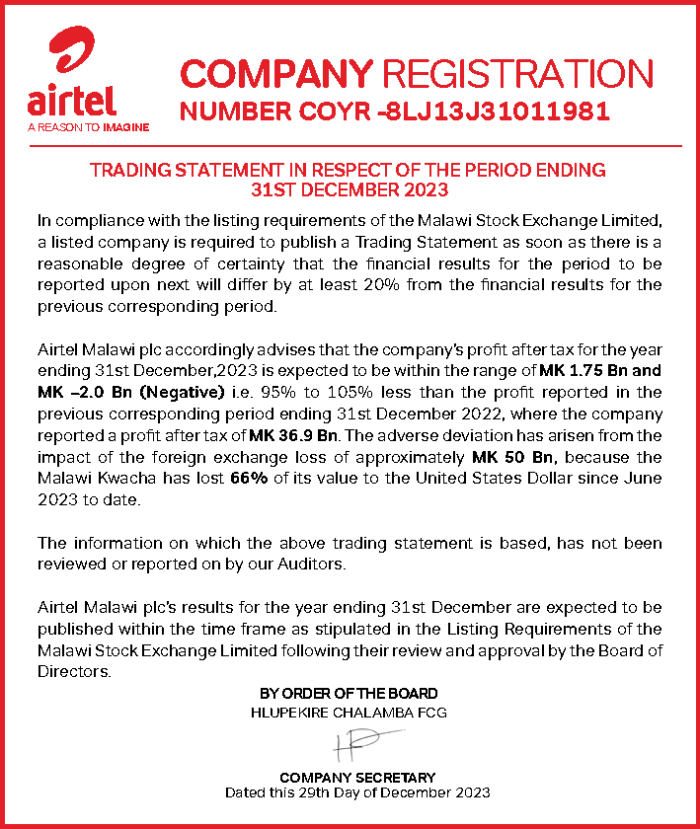

### 挖礦在木蘭傑山(Mt. Mulanje)陰影下

* 在馬拉維南部,距離布蘭太爾市(Blantyre)東南方僅一小時多的車程,沿著風景優美的土路,耸立著木蘭傑山(Mt. Mulanje)。這座壯麗的3000米高山是南非其中一座最高峰,其懸崖峭壁和峽谷群橫跨著與莫桑比克的邊界。令人驚嘆的景色媲美優勝美地,但由於其偏遠的位置,當地嚮導表示一年中有許多天幾乎沒有遊客。

* 在18世紀和19世紀,該地區受到歐洲和阿拉伯奴隸貿易的重創。葡萄牙、阿曼、英國和其他帝國從莫桑比克、馬拉維和周邊地區擄走了成[千上萬的奴隸](https://www.mozambique.co.za/About_Mozambique-travel/mozambique-info.html),通過象津巴布魯等地區港口運送到美洲和中東強迫勞動。生還率最好的也只有五分之一。奴隸航路直接穿越了木蘭傑山,這是一個明顯的標誌。如今,山麓地區佈滿了茂密的森林,茶園不斷擴展,農民種植著鳳梨、香蕉和玉米。這個生態系統是世界寶藏,擁有特有的植物和動物,包括史前銀杏、馬拉維濒危的國樹木蘭傑雪松,以及一些地球上最稀有的昆蟲和爬行動物。

* 不幸的是,長久以來的剝削以不同形式繼續存在。伐木和礦業威脅著當地環境,沒有工業基礎設施,居民被孤立起來,不得不自求生存。

* 這裡的人口可能擁有許多自然資源,但現代進步之母卻與他們無緣。僅有大約15%的馬拉維人——以及僅有大約5%的居住在該國鄉村地區的人——可以使用電力。在木蘭傑山麓的一個小村莊邦多(Bondo),一些居民於2016年夜晚首次獲得照明。根據該鎮的長老酋長的說法,“在那之前”,這裡只有黑暗。

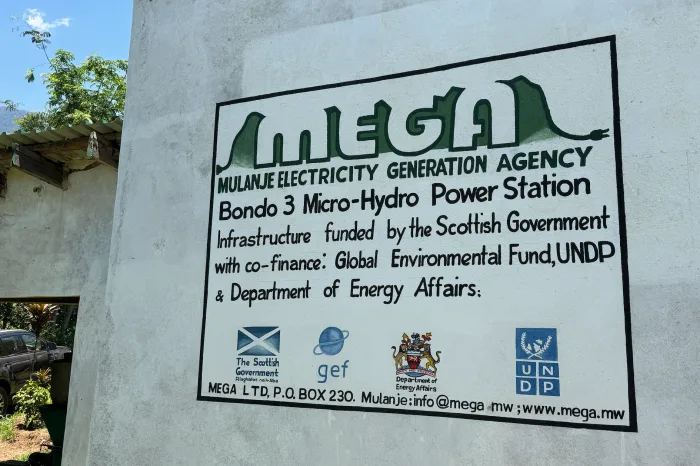

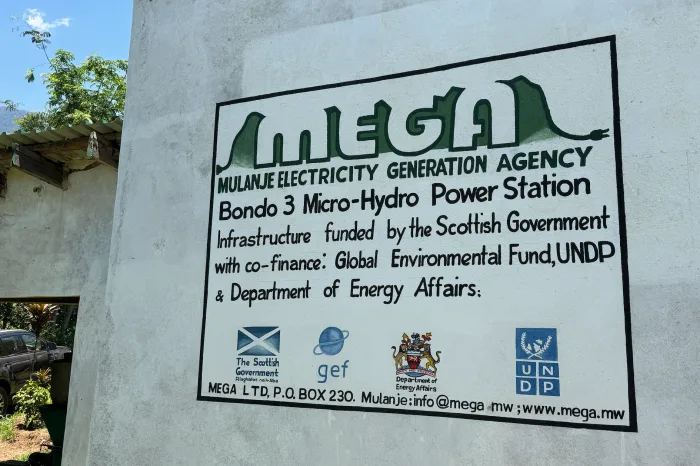

* 電力不足給不斷增長的人口帶來了幾個問題。居民無法使用爐灶,只能砍伐山區的樹木和灌木來生火或製作木炭燒煮食物。夜間,孩子們在危險的煤油燈光下學習,或根本不學習。砍伐樹木[破壞了森林](https://www.oneearth.org/ecoregions/mulanje-montane-forest-grassland/),火災和燈光造成有害的室內空氣污染。外國捐助者——包括蘇格蘭政府——於2008年為邦多建造了一座小型水力發電廠,在長達八年的施工後,該發電廠開始為部分當地居民提供電力。

* 在此期間,卡爾·布魯索(Carl Bruessow)——一位熱衷於徒步旅行並擔任木蘭傑山保護信託基金會主席——幫助成立了木蘭傑電力發電機構(Mega),這是馬拉維第一家私營微型水力發電供應商。 Mega也是一家社會企業,其使命是為邦多的市民提供電力。像蘇格蘭人在木蘭傑山河岸上資助的小型水力方案一樣,從該方案獲得的電力成本非常高,接近每千瓦時90美分。作為對比,美國或歐洲的住宅電力每千瓦時價格為10美分至20美分。非洲的電力供應通常在20美分至40美分之間。例如,在肯尼亞,電力售價為27美分。為了回饋當地社區,卡爾大幅補貼了邦多居民支付給Mega的每千瓦時不到20美分的電費。

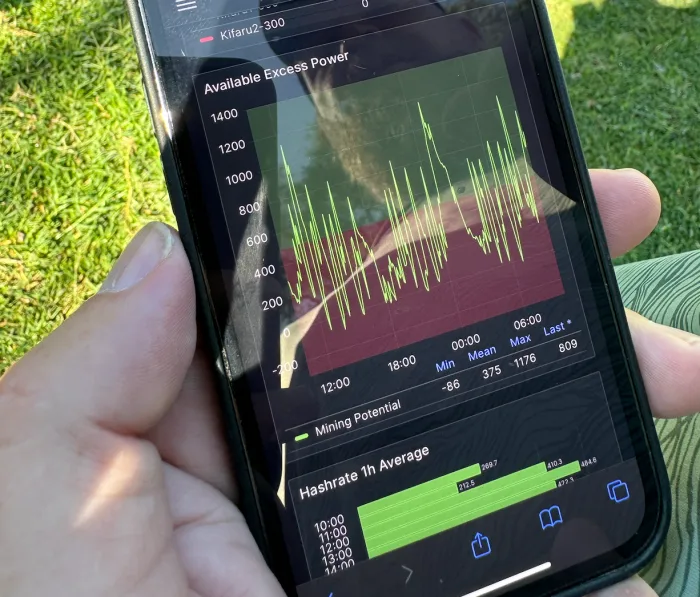

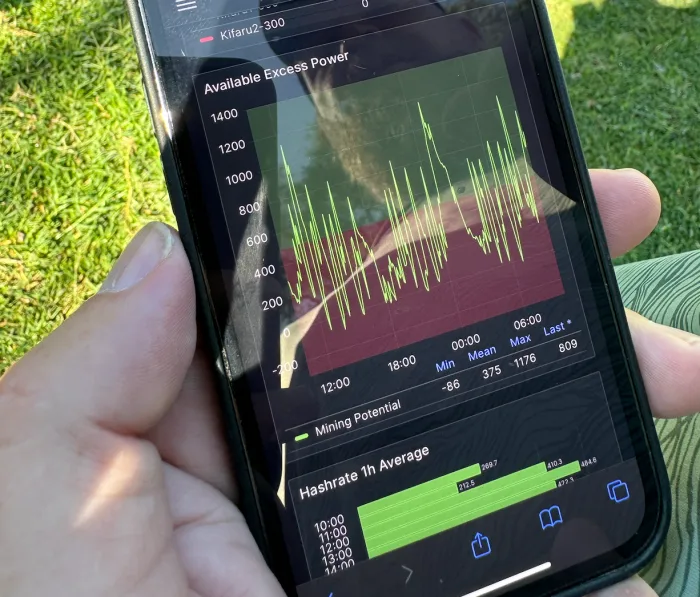

* 卡爾支付了差額,但這樣的操作是不可持續的。到目前為止,已有超過2000個家庭接入了Mega電網,但另外3000個家庭仍在等待連接。電力站生產的電力已經超過了5000個家庭的需求,但大部分電力無法銷售,因為Mega沒有資金購買設備將新家庭接入電網。而且,也沒有資本考慮擴展,以免在夏季乾旱期間水力發電減少。

* 在一些地方,工業作業可能會購買農村的多餘電力。但在邦多這樣的地方,幾乎沒有許多耗電量大的企業。多餘的電力無法銷售,因此電力站建造了機器,專門用來吸收未使用的電力。這在下雨時尤其可悲,或在夜間低需求時,電站不得不消散絕大多數珍貴的電力,完全浪費。

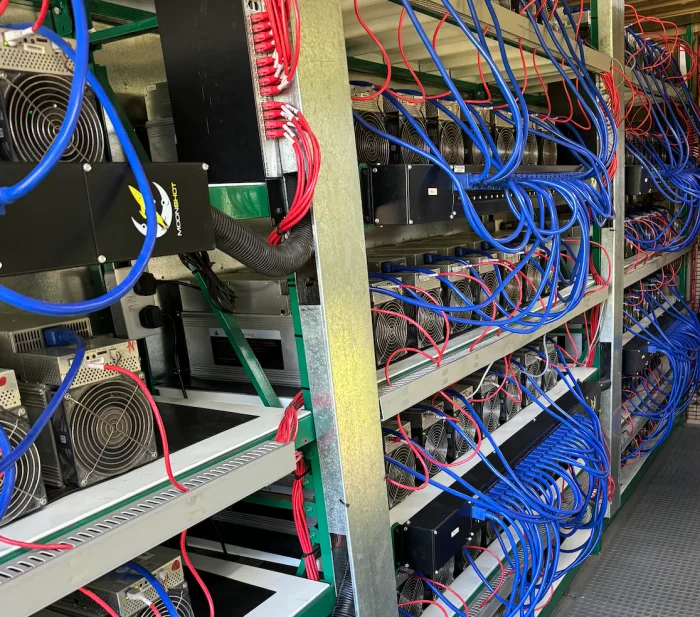

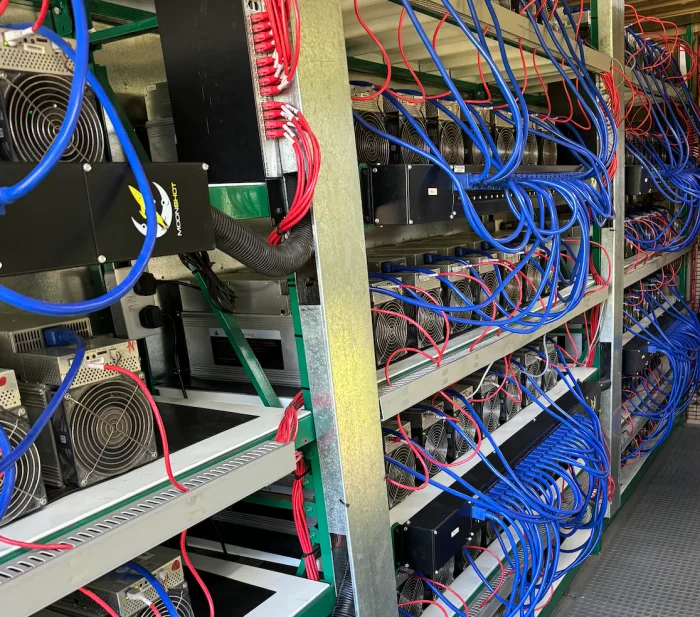

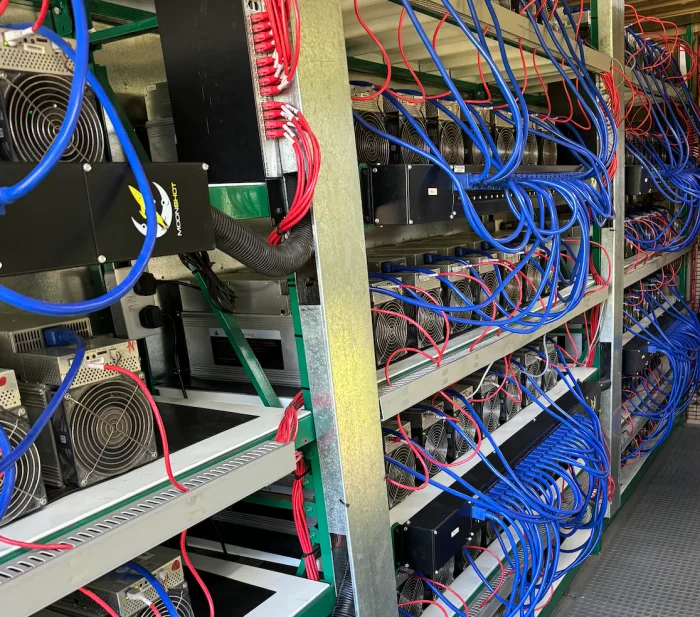

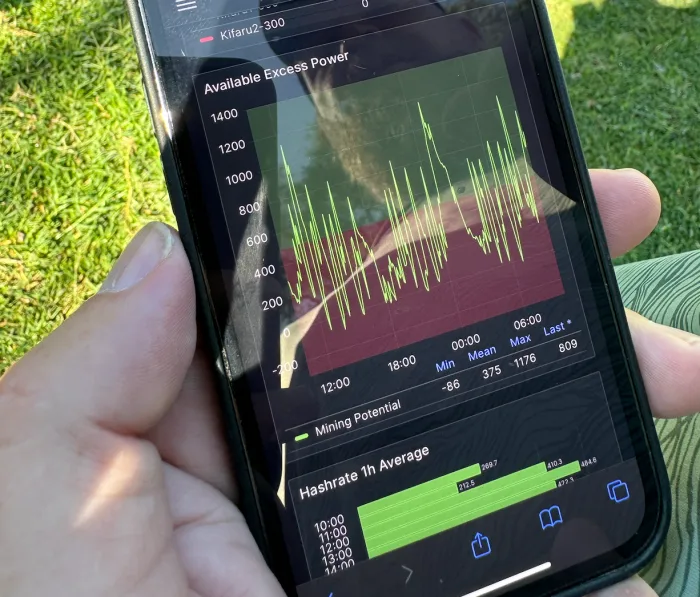

* 兩年前,企業家埃里克·赫斯曼(Erik Hersman)、珍妮特·邁吉(Janet Maingi)和菲利普·沃爾頓(Philip Walton)創立了[Gridless](https://gridlesscompute.com/),這是一家專注於非洲離網比特幣挖掘的新公司。這三人曾在Ushahidi、BRCK和iHub等公司工作,擅長建造硬件、編寫軟件,以及擴展通信和互聯網基礎設施,使他們成為該任務的合適人選。他們最初的一次現場訪問就是在邦多,他們與卡爾會面,並檢查了邦多的發電站。在2023年初,一個Gridless比特幣數據中心被安裝並啟動,現在,卡爾和Mega有了新的資金來源。去年十二月,我有機會前往邦多,以弄清楚一切是如何運作的。

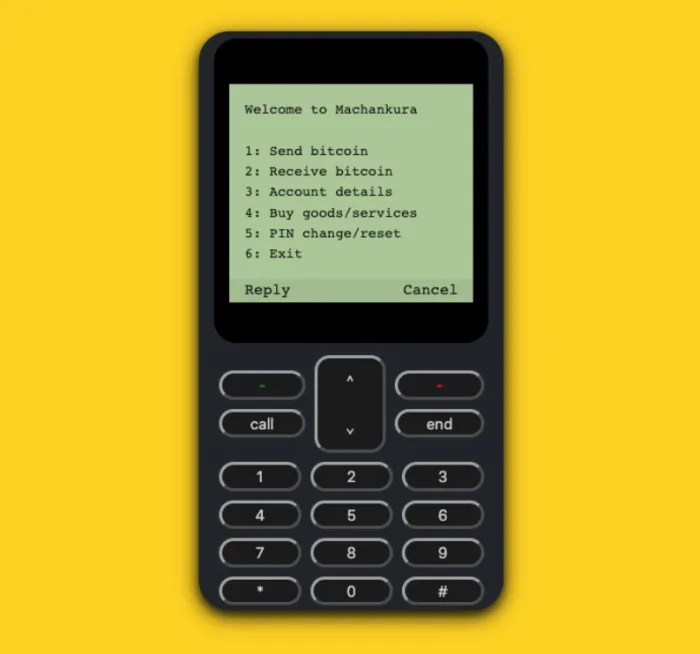

* 如今,邦多發電站產生的所有多餘電力都由Gridless的礦工即時售給比特幣網絡,卡爾可以從中獲得30%的收入。這筆收入直接轉到Mega的錢包,以比特幣形式存入。新資本使Mega能夠將更多客戶連接到電力,降低成本,擴大業務,最終將邦多地區的所有人都接入電力。Mega、社區和Gridless都受益。最深刻的部分是?不需要任何援助或政府補貼。

* 比特幣常常被批評為能源浪費。但在邦多,就像世界上許多其他地方一樣,情況變得非常明顯,如果你不挖掘比特幣,你就在浪費能源。曾經是陷阱的地方現在是一個機遇。比特幣礦工可以被看作是蜣螂,它們將沒有人想要的廢能源收集起來,轉化為有價值的東西。

* 隨著Mega越來越多地接入客戶,Gridless可能會關閉一些挖掘機器,並遷移到其他地方,或者將挖掘機搬到同一地區的新發電站,這些發電站正在等待連接客戶。如果比特幣網絡支付X,客戶就需要支付X+1,因此礦工最終會開始價格上漲。但即使在當地需求在下午5點接近可用容量的情況下,挖掘仍然可以賺錢,因為夜間需求很少,河流永不停歇。

* 在馬拉維的其他地方,國家電網故障。截至2023年12月,接入國家電網的人每天遭受6至8小時的[“負載分配”](https://loadshedding.eskom.co.za/LoadShedding/Description),電力公司會切斷大片人口的電力供應。但在邦多,沒有負載分配。比特幣礦工平衡了小型電網。如果水力不足,Gridless的自動軟件會關閉ASIC。如果有太多水力來自例如定期襲擊該地區的熱帶氣旋之一,Gridless的ASIC運作會吸收它。令人驚訝的是,在小小的邦多,電力運行更穩定,比大城市更一致。

* 在我訪問邦多的某個晚上,當夕陽逐漸消失時,卡爾要求我停下來看看我們周圍的山丘:山腳下的燈光都開始亮起。這是一幅強大的景象,令人震驚的是,比特幣正在幫助實現這一切,將浪費的能源轉化為人類進步。

* 這種模式擴展的潛力令人震驚。考慮到:非洲的電力發電通常是按照未來的規劃,例如,以30年的時間窗口進行。因此,建造的場地是為未來的容量而設計的,而不是為了今天的容量。因此,當像邦多這樣的場地啟動時,需要一段時間才能從0%提高到20%的容量。在這一點上,在比特幣之前,電力公司可能不得不對出售的電力收取5倍的價格,才能使自己達到平衡。