-

@ daa41bed:88f54153

2025-02-09 16:50:04

There has been a good bit of discussion on Nostr over the past few days about the merits of zaps as a method of engaging with notes, so after writing a rather lengthy [article on the pros of a strategic Bitcoin reserve](https://geek.npub.pro/post/dxqkgnjplttkvetprg8ox/), I wanted to take some time to chime in on the much more fun topic of digital engagement.

Let's begin by defining a couple of things:

**Nostr** is a decentralized, censorship-resistance protocol whose current biggest use case is social media (think Twitter/X). Instead of relying on company servers, it relies on relays that anyone can spin up and own their own content. Its use cases are much bigger, though, and this article is hosted on my own relay, using my own Nostr relay as an example.

**Zap** is a tip or donation denominated in sats (small units of Bitcoin) sent from one user to another. This is generally done directly over the Lightning Network but is increasingly using Cashu tokens. For the sake of this discussion, how you transmit/receive zaps will be irrelevant, so don't worry if you don't know what [Lightning](https://lightning.network/) or [Cashu](https://cashu.space/) are.

If we look at how users engage with posts and follows/followers on platforms like Twitter, Facebook, etc., it becomes evident that traditional social media thrives on engagement farming. The more outrageous a post, the more likely it will get a reaction. We see a version of this on more visual social platforms like YouTube and TikTok that use carefully crafted thumbnail images to grab the user's attention to click the video. If you'd like to dive deep into the psychology and science behind social media engagement, let me know, and I'd be happy to follow up with another article.

In this user engagement model, a user is given the option to comment or like the original post, or share it among their followers to increase its signal. They receive no value from engaging with the content aside from the dopamine hit of the original experience or having their comment liked back by whatever influencer they provide value to. Ad revenue flows to the content creator. Clout flows to the content creator. Sales revenue from merch and content placement flows to the content creator. We call this a linear economy -- the idea that resources get created, used up, then thrown away. Users create content and farm as much engagement as possible, then the content is forgotten within a few hours as they move on to the next piece of content to be farmed.

What if there were a simple way to give value back to those who engage with your content? By implementing some value-for-value model -- a circular economy. Enter zaps.

Unlike traditional social media platforms, Nostr does not actively use algorithms to determine what content is popular, nor does it push content created for active user engagement to the top of a user's timeline. Yes, there are "trending" and "most zapped" timelines that users can choose to use as their default, but these use relatively straightforward engagement metrics to rank posts for these timelines.

That is not to say that we may not see clients actively seeking to refine timeline algorithms for specific metrics. Still, the beauty of having an open protocol with media that is controlled solely by its users is that users who begin to see their timeline gamed towards specific algorithms can choose to move to another client, and for those who are more tech-savvy, they can opt to run their own relays or create their own clients with personalized algorithms and web of trust scoring systems.

Zaps enable the means to create a new type of social media economy in which creators can earn for creating content and users can earn by actively engaging with it. Like and reposting content is relatively frictionless and costs nothing but a simple button tap. Zaps provide active engagement because they signal to your followers and those of the content creator that this post has genuine value, quite literally in the form of money—sats.

I have seen some comments on Nostr claiming that removing likes and reactions is for wealthy people who can afford to send zaps and that the majority of people in the US and around the world do not have the time or money to zap because they have better things to spend their money like feeding their families and paying their bills. While at face value, these may seem like valid arguments, they, unfortunately, represent the brainwashed, defeatist attitude that our current economic (and, by extension, social media) systems aim to instill in all of us to continue extracting value from our lives.

Imagine now, if those people dedicating their own time (time = money) to mine pity points on social media would instead spend that time with genuine value creation by posting content that is meaningful to cultural discussions. Imagine if, instead of complaining that their posts get no zaps and going on a tirade about how much of a victim they are, they would empower themselves to take control of their content and give value back to the world; where would that leave us? How much value could be created on a nascent platform such as Nostr, and how quickly could it overtake other platforms?

Other users argue about user experience and that additional friction (i.e., zaps) leads to lower engagement, as proven by decades of studies on user interaction. While the added friction may turn some users away, does that necessarily provide less value? I argue quite the opposite. You haven't made a few sats from zaps with your content? Can't afford to send some sats to a wallet for zapping? How about using the most excellent available resource and spending 10 seconds of your time to leave a comment? Likes and reactions are valueless transactions. Social media's real value derives from providing monetary compensation and actively engaging in a conversation with posts you find interesting or thought-provoking. Remember when humans thrived on conversation and discussion for entertainment instead of simply being an onlooker of someone else's life?

If you've made it this far, my only request is this: try only zapping and commenting as a method of engagement for two weeks. Sure, you may end up liking a post here and there, but be more mindful of how you interact with the world and break yourself from blind instinct. You'll thank me later.

-

@ 16d11430:61640947

2025-02-09 00:12:22

Introduction: The Power of Focused Attention

In an age of distraction, power is not merely held through material wealth, authority, or control over others—it is built through focused attention. The human brain, a complex quantum-biological processor, constructs reality through perception. When harnessed correctly, focused attention allows individuals to transcend limitations, reshape their reality, and live free.

Power, then, is not external—it is a construct supported by the mind and created within the brain. Understanding how this works offers a path to transcendence, autonomy, and liberation from imposed limitations.

The Neuroscience of Focused Attention: Constructing Reality

The brain is a prediction engine, constantly processing information and filtering out irrelevant stimuli. Focused attention directs this process, acting as a spotlight that selects what becomes part of one's conscious experience. This is the fundamental mechanism behind cognitive power.

1. Neuroplasticity: Building Power Through Repetition

The brain adapts to repeated stimuli through neuroplasticity. What one focuses on consistently rewires neural pathways, strengthening certain thoughts, beliefs, and abilities. Over time, this focus builds an internal structure of power—a network of ideas and perceptions that define one’s reality.

If one focuses on problems, they grow.

If one focuses on solutions, they appear.

If one focuses on fear, it shapes perception.

If one focuses on mastery, skills develop.

2. The Quantum Mind: Attention as a Creative Force

Quantum physics suggests that observation influences reality. Just as subatomic particles behave differently when measured, focused attention may act as a force that shapes possibilities into tangible outcomes.

This aligns with the ancient concept that "energy flows where attention goes." What one attends to with intention can manifest as action, opportunity, and ultimately, freedom.

3. The Reticular Activating System (RAS): Filtering Reality

The Reticular Activating System (RAS) in the brainstem acts as a gatekeeper for focus. It determines what information enters conscious awareness. When trained, it can filter out distractions and amplify pathways toward a desired goal.

Want to see opportunities? Program the RAS by setting clear intentions.

Want to break free from limiting beliefs? Train focus away from conditioned fears.

The Mind’s Role: Transcending Limitations

The mind is the interpreter of the brain’s electrical and biochemical activity. While the brain processes raw data, the mind provides meaning. This distinction is crucial because meaning determines how one experiences reality.

1. Breaking Mental Chains: Rewriting Narratives

Most limitations are narratives—stories imposed by culture, society, or personal history. True power lies in rewriting these stories.

Instead of “I am trapped by my circumstances,” shift to “I create my own reality.”

Instead of “I need permission,” shift to “I give myself permission.”

By restructuring meaning, the mind can redefine the limits of what is possible.

2. The Silence Paradox: Accessing Higher States

Silence, both literal and mental, creates space for higher-order thinking. Just as quantum tunneling allows subatomic particles to pass through barriers without energy loss, silence allows the mind to bypass noise and access deeper intelligence.

Meditation, stillness, and solitude amplify internal power.

The ability to not react is a form of control over external influence.

True mastery comes from detachment—engaging the world without being controlled by it.

Transcendence: Living Free Through Mental Autonomy

To transcend means to rise above imposed structures—whether societal, psychological, or energetic. The construct of power built through focused attention allows one to escape control mechanisms and live autonomously.

1. Sovereignty of Mind: Owning One’s Thoughts

A free mind is one that chooses its inputs rather than being programmed by external forces. This requires:

Awareness of mental conditioning (social narratives, propaganda, biases)

Intentional thought selection (curating what enters the mental space)

Guarding attention fiercely (not allowing distraction to hijack focus)

2. Detachment From Control Structures

Society operates on the principle of attention capture—through media, politics, and algorithms that direct thought patterns. Escaping these requires detachment.

Do not react emotionally to fear-based programming.

Cultivate independent thought by questioning imposed narratives.

Reduce external noise to amplify internal wisdom.

3. The Flow State: Moving Beyond Constraints

When focus is refined to its highest degree, one enters flow state—a condition where action and awareness merge, and limitations dissolve.

In flow, work becomes effortless.

Creativity becomes boundless.

Freedom becomes not just a philosophy, but a lived experience.

Conclusion: The Mind as the Ultimate Key to Freedom

Power is not an external possession—it is the ability to direct one’s own focus. Through the interplay of brain function, cognitive attention, and mental discipline, one constructs personal sovereignty. The individual who masters focus, controls reality.

Freedom is not given. It is built—through attention, intention, and an unwavering commitment to mental autonomy.

-

@ e3ba5e1a:5e433365

2025-02-04 08:29:00

President Trump has started rolling out his tariffs, something I [blogged about in November](https://www.snoyman.com/blog/2024/11/steelmanning-tariffs/). People are talking about these tariffs a lot right now, with many people (correctly) commenting on how consumers will end up with higher prices as a result of these tariffs. While that part is true, I’ve seen a lot of people taking it to the next, incorrect step: that consumers will pay the entirety of the tax. I [put up a poll on X](https://x.com/snoyberg/status/1886035800019599808) to see what people thought, and while the right answer got a lot of votes, it wasn't the winner.

For purposes of this blog post, our ultimate question will be the following:

* Suppose apples currently sell for $1 each in the entire United States.

* There are domestic sellers and foreign sellers of apples, all receiving the same price.

* There are no taxes or tariffs on the purchase of apples.

* The question is: if the US federal government puts a $0.50 import tariff per apple, what will be the change in the following:

* Number of apples bought in the US

* Price paid by buyers for apples in the US

* Post-tax price received by domestic apple producers

* Post-tax price received by foreign apple producers

Before we can answer that question, we need to ask an easier, first question: before instituting the tariff, why do apples cost $1?

And finally, before we dive into the details, let me provide you with the answers to the ultimate question. I recommend you try to guess these answers before reading this, and if you get it wrong, try to understand why:

1. The number of apples bought will go down

2. The buyers will pay more for each apple they buy, but not the full amount of the tariff

3. Domestic apple sellers will receive a *higher* price per apple

4. Foreign apple sellers will receive a *lower* price per apple, but not lowered by the full amount of the tariff

In other words, regardless of who sends the payment to the government, both taxed parties (domestic buyers and foreign sellers) will absorb some of the costs of the tariff, while domestic sellers will benefit from the protectionism provided by tariffs and be able to sell at a higher price per unit.

## Marginal benefit

All of the numbers discussed below are part of a [helper Google Sheet](https://docs.google.com/spreadsheets/d/14ZbkWpw1B9Q1UDB9Yh47DmdKQfIafVVBKbDUsSIfGZw/edit?usp=sharing) I put together for this analysis. Also, apologies about the jagged lines in the charts below, I hadn’t realized before starting on this that there are [some difficulties with creating supply and demand charts in Google Sheets](https://superuser.com/questions/1359731/how-to-create-a-supply-demand-style-chart).

Let’s say I absolutely love apples, they’re my favorite food. How much would I be willing to pay for a single apple? You might say “$1, that’s the price in the supermarket,” and in many ways you’d be right. If I walk into supermarket A, see apples on sale for $50, and know that I can buy them at supermarket B for $1, I’ll almost certainly leave A and go buy at B.

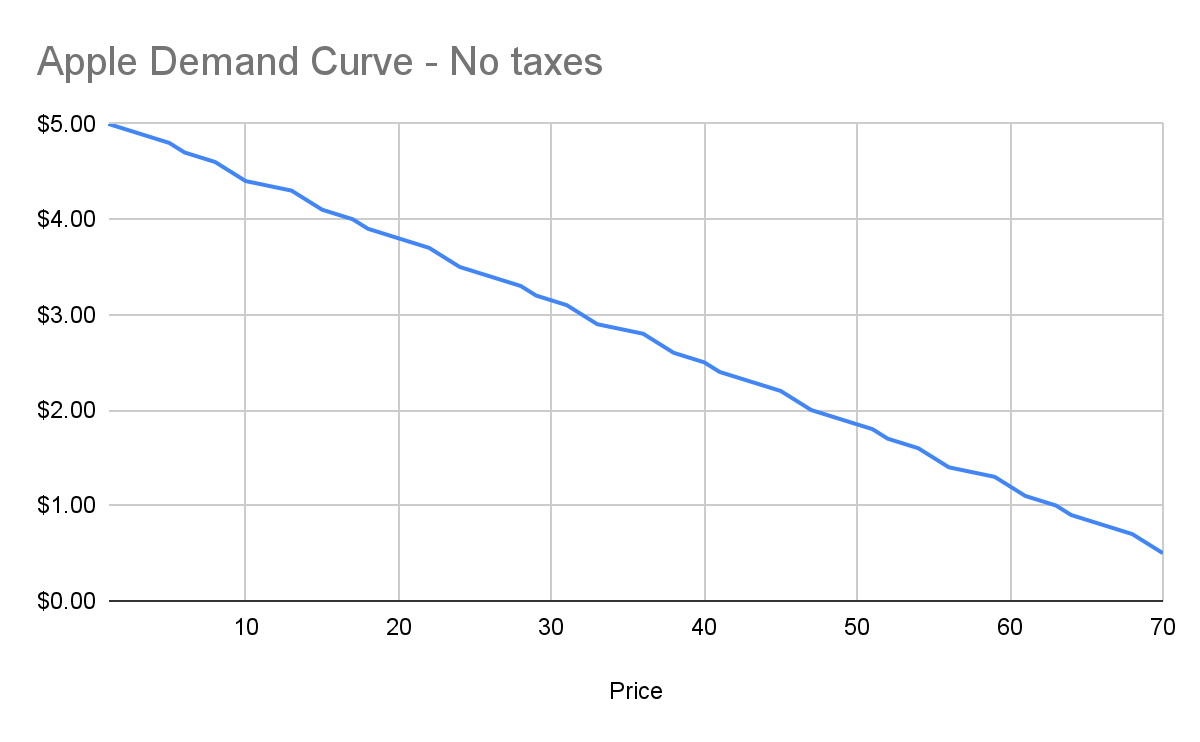

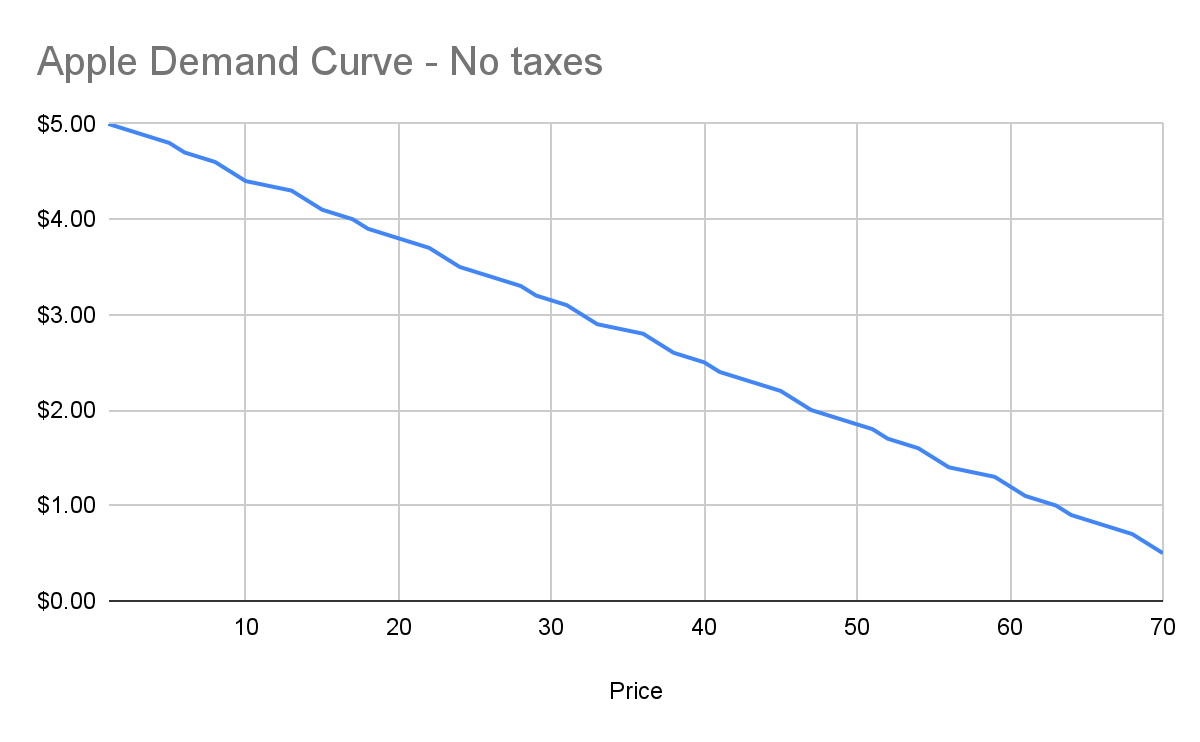

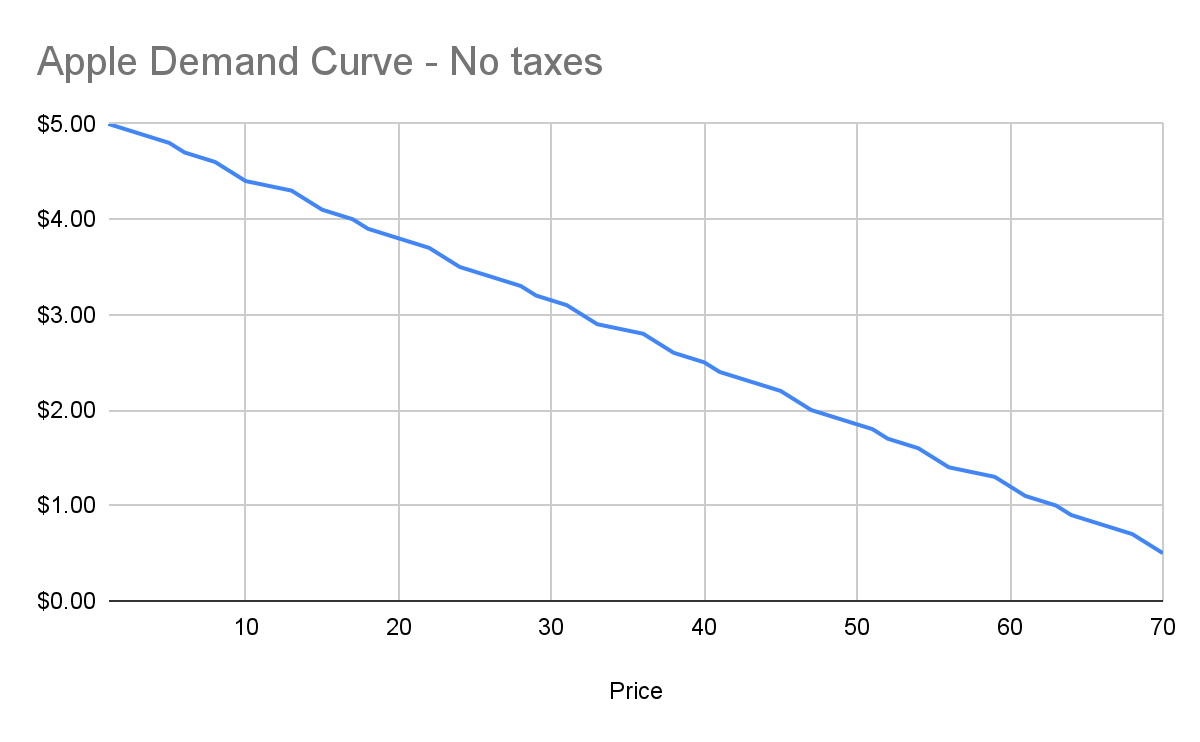

But that’s not what I mean. What I mean is: how high would the price of apples have to go *everywhere* so that I’d no longer be willing to buy a single apple? This is a purely personal, subjective opinion. It’s impacted by how much money I have available, other expenses I need to cover, and how much I like apples. But let’s say the number is $5.

How much would I be willing to pay for another apple? Maybe another $5. But how much am I willing to pay for the 1,000th apple? 10,000th? At some point, I’ll get sick of apples, or run out of space to keep the apples, or not be able to eat, cook, and otherwise preserve all those apples before they rot.

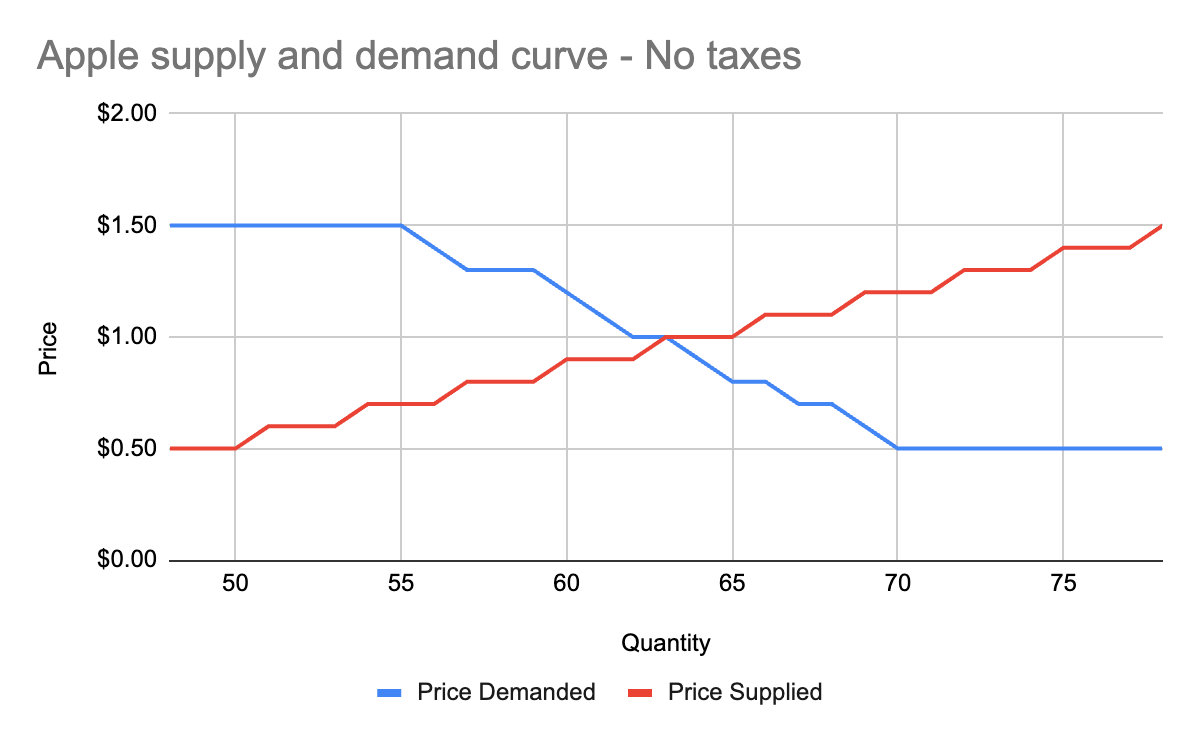

The point being: I’ll be progressively willing to spend less and less money for each apple. This form of analysis is called *marginal benefit*: how much benefit (expressed as dollars I’m willing to spend) will I receive from each apple? This is a downward sloping function: for each additional apple I buy (quantity demanded), the price I’m willing to pay goes down. This is what gives my personal *demand curve*. And if we aggregate demand curves across all market participants (meaning: everyone interested in buying apples), we end up with something like this:

Assuming no changes in people’s behavior and other conditions in the market, this chart tells us how many apples will be purchased by our buyers at each price point between $0.50 and $5. And ceteris paribus (all else being equal), this will continue to be the demand curve for apples.

## Marginal cost

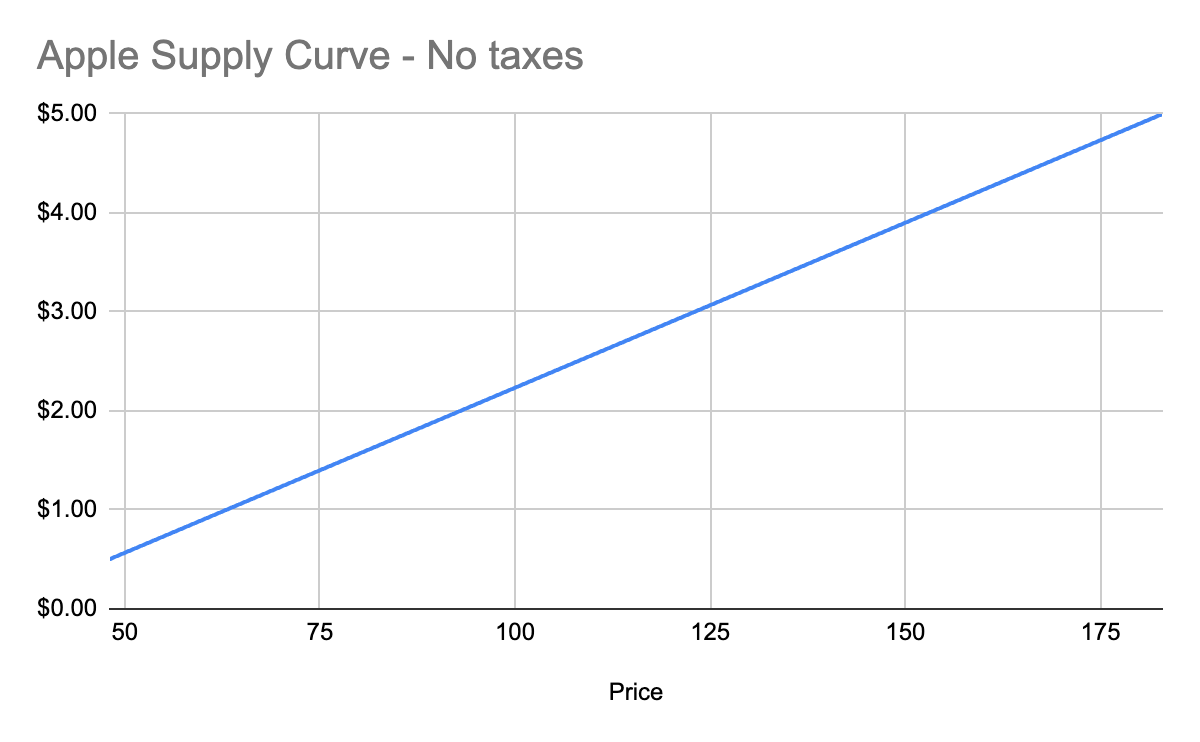

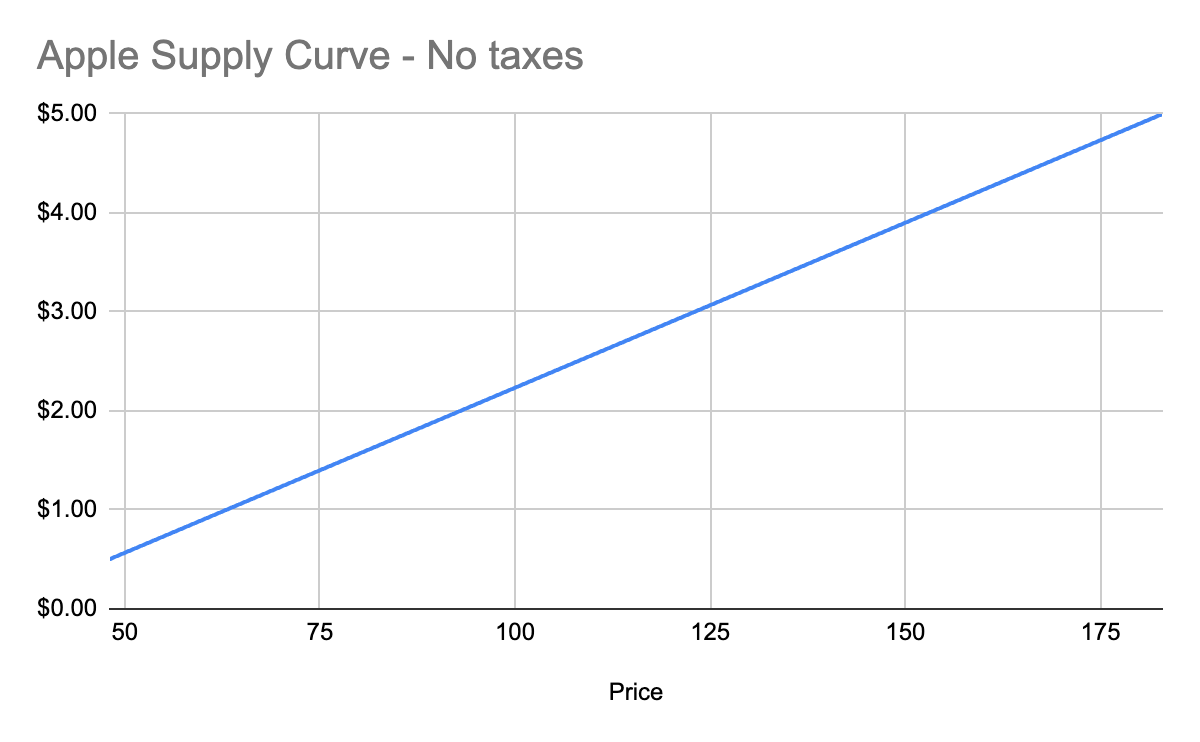

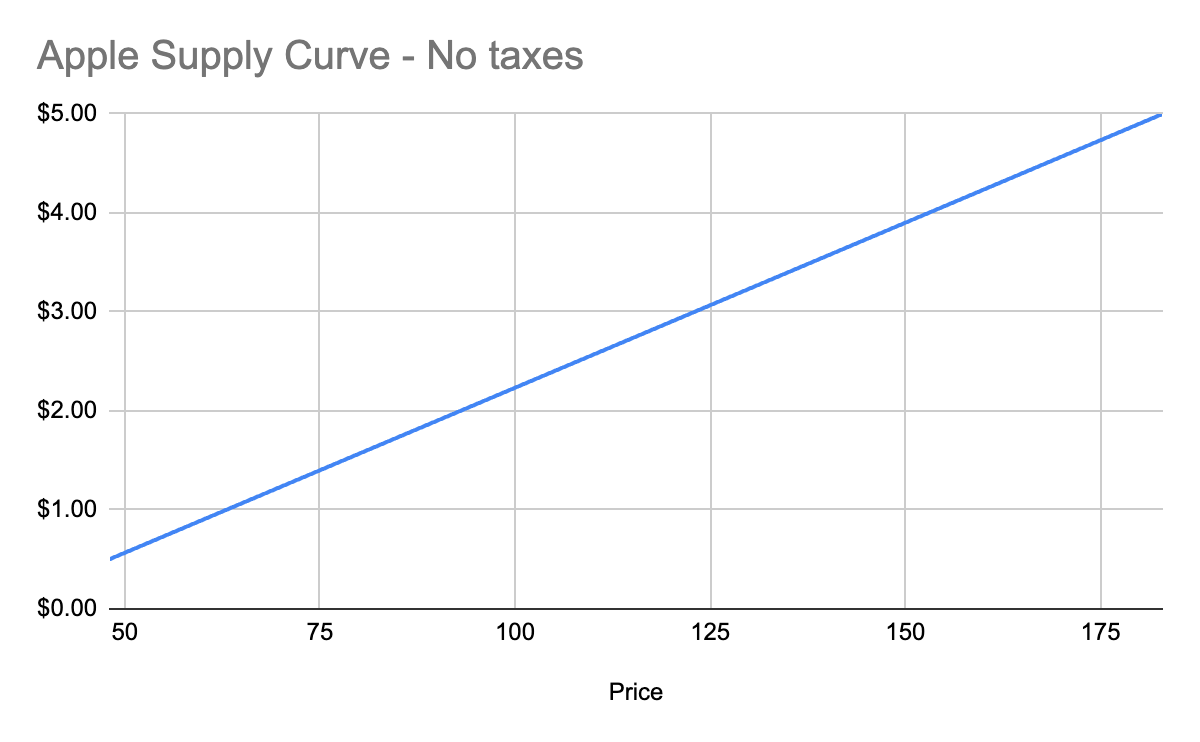

Demand is half the story of economics. The other half is supply, or: how many apples will I sell at each price point? Supply curves are upward sloping: the higher the price, the more a person or company is willing and able to sell a product.

Let’s understand why. Suppose I have an apple orchard. It’s a large property right next to my house. With about 2 minutes of effort, I can walk out of my house, find the nearest tree, pick 5 apples off the tree, and call it a day. 5 apples for 2 minutes of effort is pretty good, right?

Yes, there was all the effort necessary to buy the land, and plant the trees, and water them… and a bunch more than I likely can’t even guess at. We’re going to ignore all of that for our analysis, because for short-term supply-and-demand movement, we can ignore these kinds of *sunk costs*. One other simplification: in reality, supply curves often start descending before ascending. This accounts for achieving efficiencies of scale after the first number of units purchased. But since both these topics are unneeded for understanding taxes, I won’t go any further.

Anyway, back to my apple orchard. If someone offers me $0.50 per apple, I can do 2 minutes of effort and get $2.50 in revenue, which equates to a $75/hour wage for me. I’m more than happy to pick apples at that price\!

However, let’s say someone comes to buy 10,000 apples from me instead. I no longer just walk out to my nearest tree. I’m going to need to get in my truck, drive around, spend the day in the sun, pay for gas, take a day off of my day job (let’s say it pays me $70/hour). The costs go up significantly. Let’s say it takes 5 days to harvest all those apples myself, it costs me $100 in fuel and other expenses, and I lose out on my $70/hour job for 5 days. We end up with:

* Total expenditure: $100 \+ $70 \* 8 hours a day \* 5 days \== $2900

* Total revenue: $5000 (10,000 apples at $0.50 each)

* Total profit: $2100

So I’m still willing to sell the apples at this price, but it’s not as attractive as before. And as the number of apples purchased goes up, my costs keep increasing. I’ll need to spend more money on fuel to travel more of my property. At some point I won’t be able to do the work myself anymore, so I’ll need to pay others to work on the farm, and they’ll be slower at picking apples than me (less familiar with the property, less direct motivation, etc.). The point being: at some point, the number of apples can go high enough that the $0.50 price point no longer makes me any money.

This kind of analysis is called *marginal cost*. It refers to the additional amount of expenditure a seller has to spend in order to produce each additional unit of the good. Marginal costs go up as quantity sold goes up. And like demand curves, if you aggregate this data across all sellers, you get a supply curve like this:

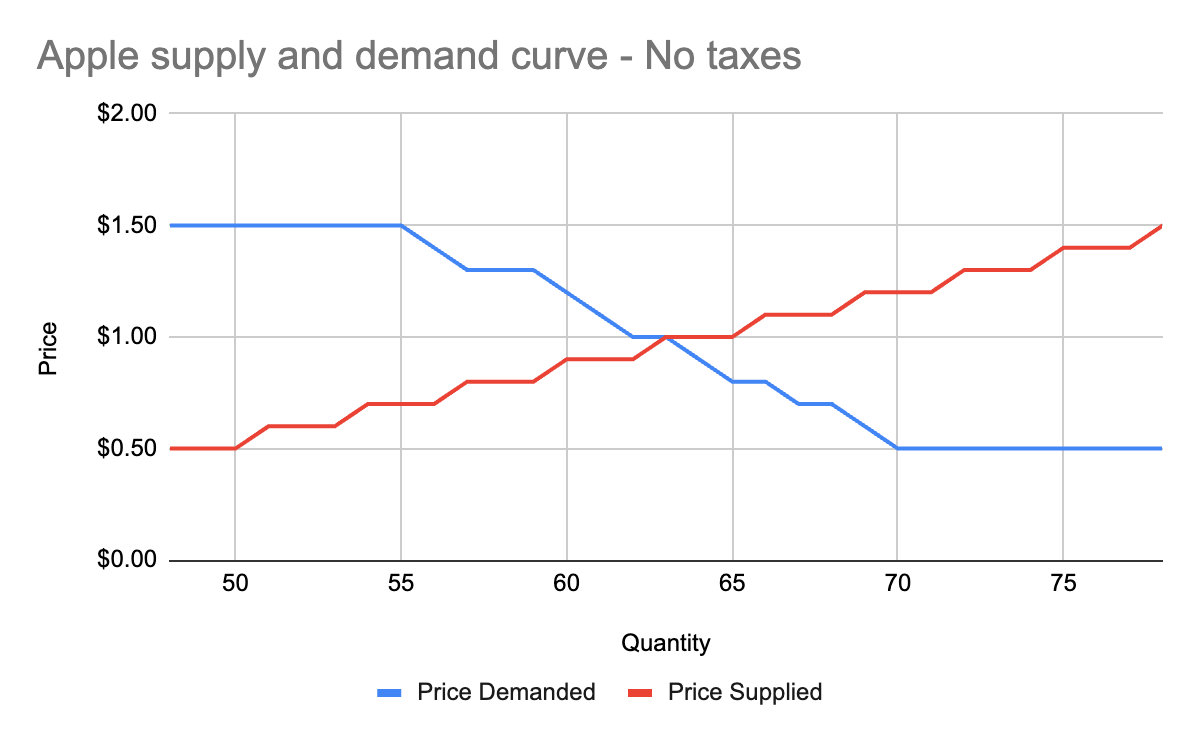

## Equilibrium price

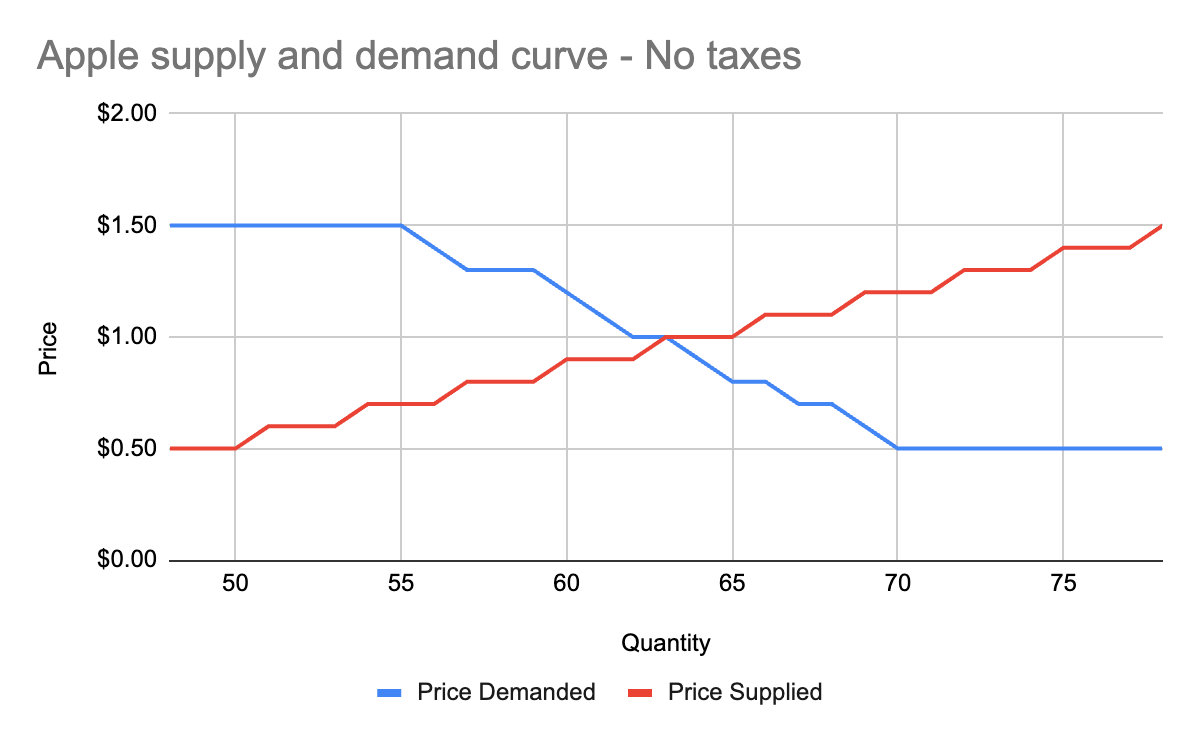

We now know, for every price point, how many apples buyers will purchase, and how many apples sellers will sell. Now we find the equilibrium: where the supply and demand curves meet. This point represents where the marginal benefit a buyer would receive from the next buyer would be less than the cost it would take the next seller to make it. Let’s see it in a chart:

You’ll notice that these two graphs cross at the $1 price point, where 63 apples are both demanded (bought by consumers) and supplied (sold by producers). This is our equilibrium price. We also have a visualization of the *surplus* created by these trades. Everything to the left of the equilibrium point and between the supply and demand curves represents surplus: an area where someone is receiving something of more value than they give. For example:

* When I bought my first apple for $1, but I was willing to spend $5, I made $4 of consumer surplus. The consumer portion of the surplus is everything to the left of the equilibrium point, between the supply and demand curves, and above the equilibrium price point.

* When a seller sells his first apple for $1, but it only cost $0.50 to produce it, the seller made $0.50 of producer surplus. The producer portion of the surplus is everything to the left of the equilibrium point, between the supply and demand curves, and below the equilibrium price point.

Another way of thinking of surplus is “every time someone got a better price than they would have been willing to take.”

OK, with this in place, we now have enough information to figure out how to price in the tariff, which we’ll treat as a negative externality.

## Modeling taxes

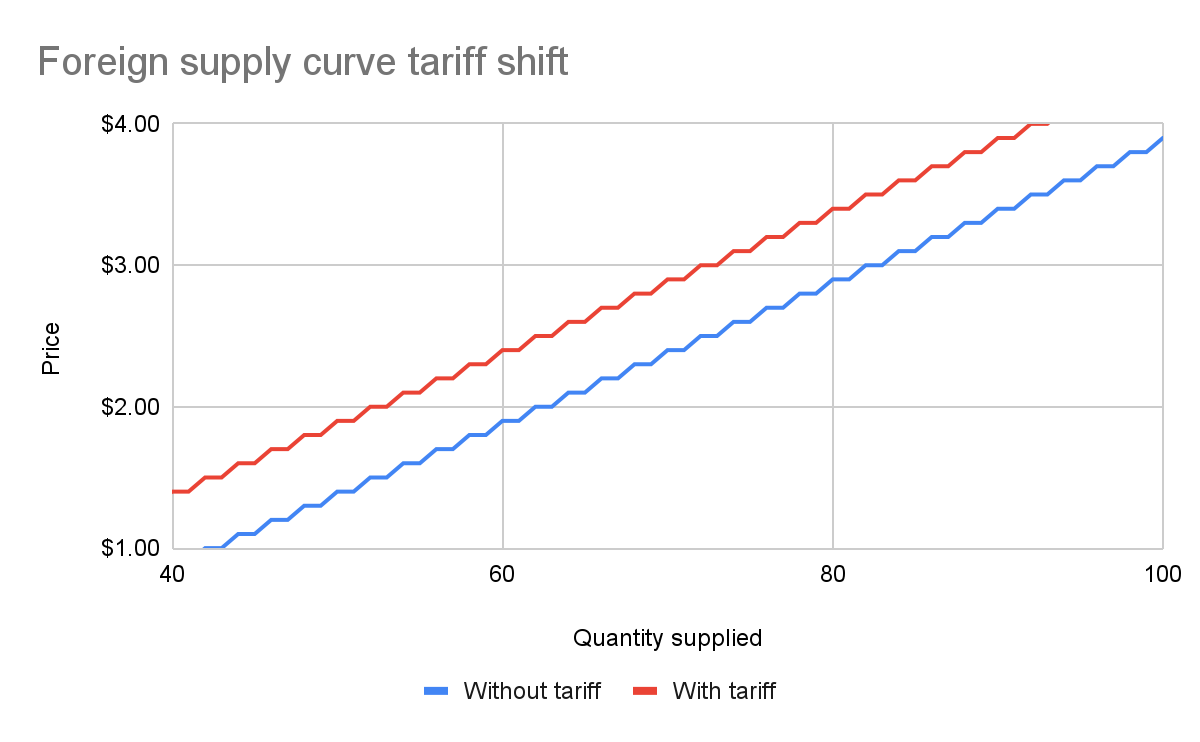

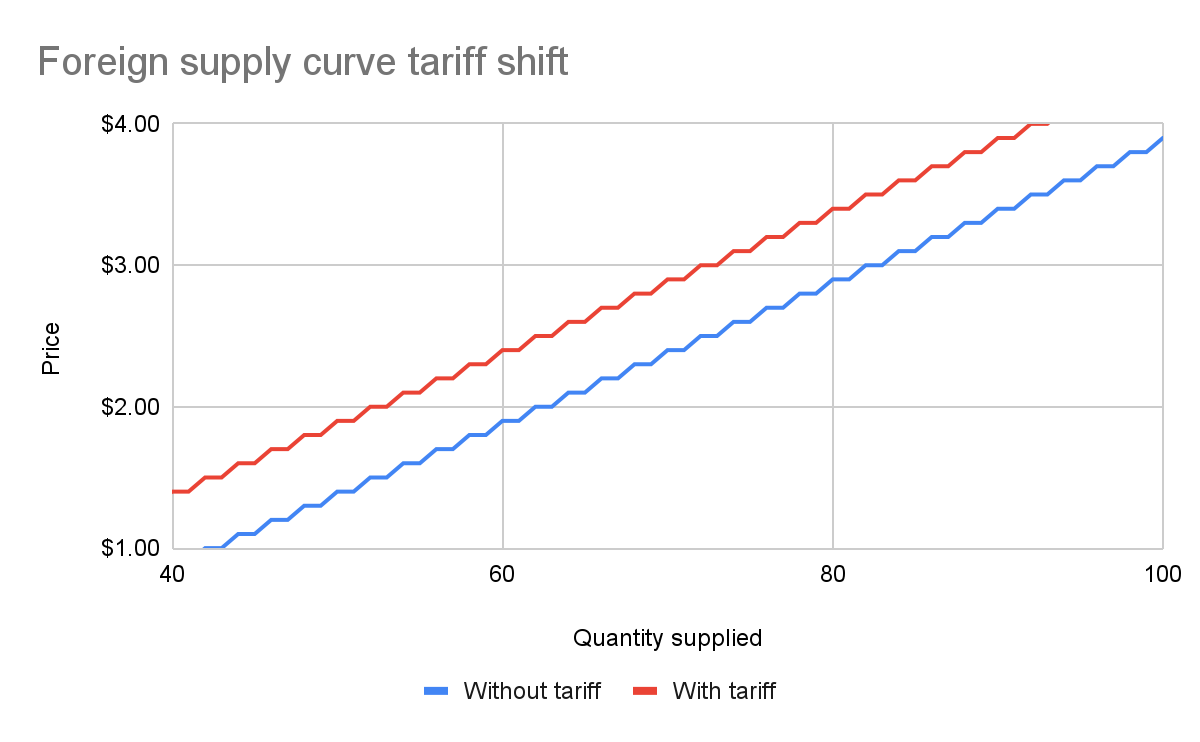

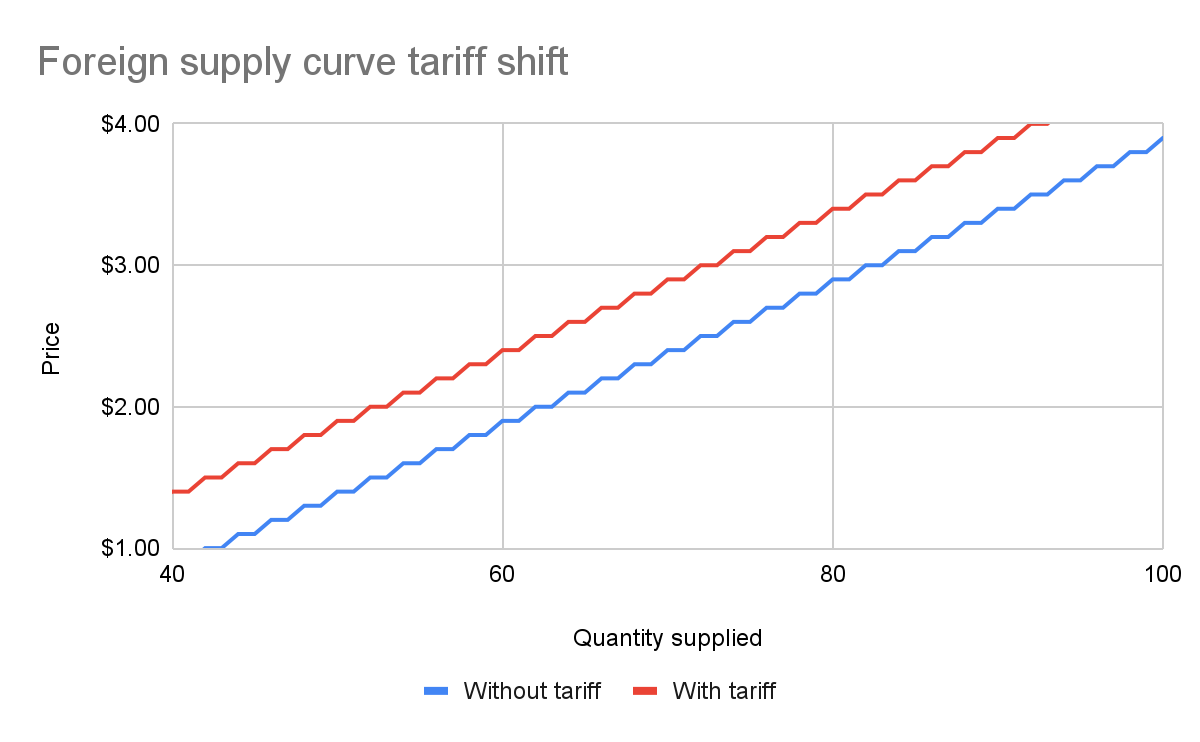

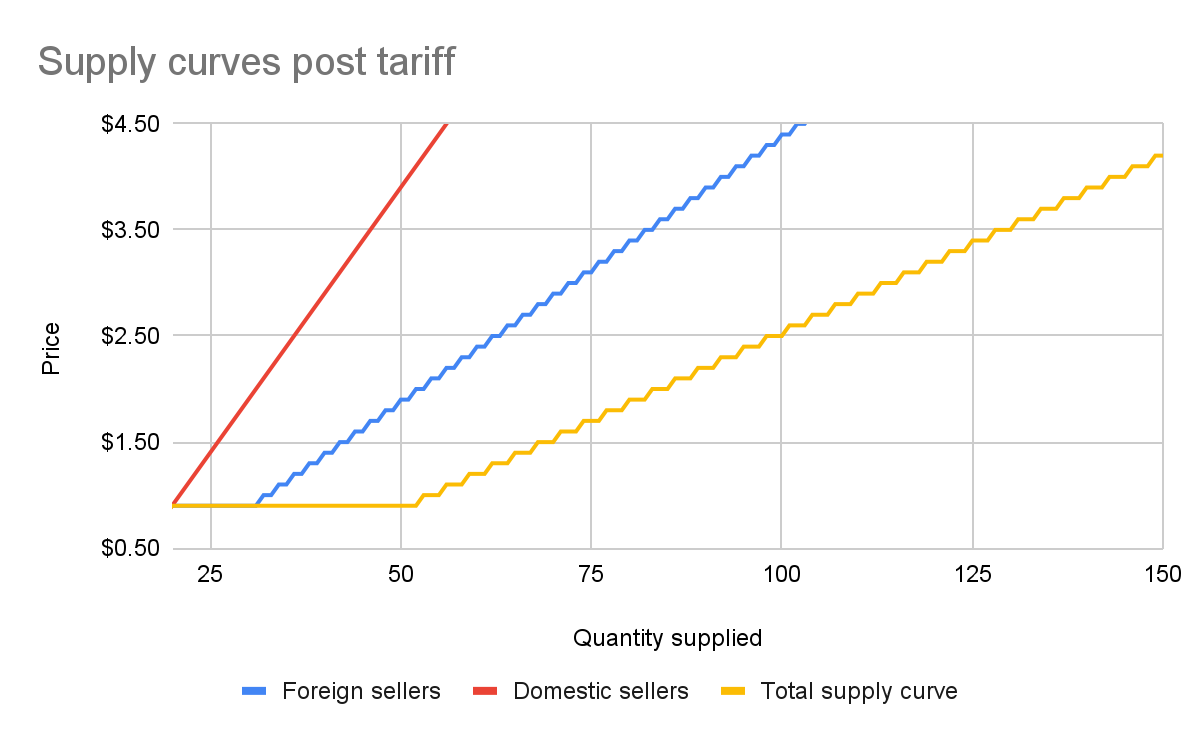

Alright, the government has now instituted a $0.50 tariff on every apple sold within the US by a foreign producer. We can generally model taxes by either increasing the marginal cost of each unit sold (shifting the supply curve up), or by decreasing the marginal benefit of each unit bought (shifting the demand curve down). In this case, since only some of the producers will pay the tax, it makes more sense to modify the supply curve.

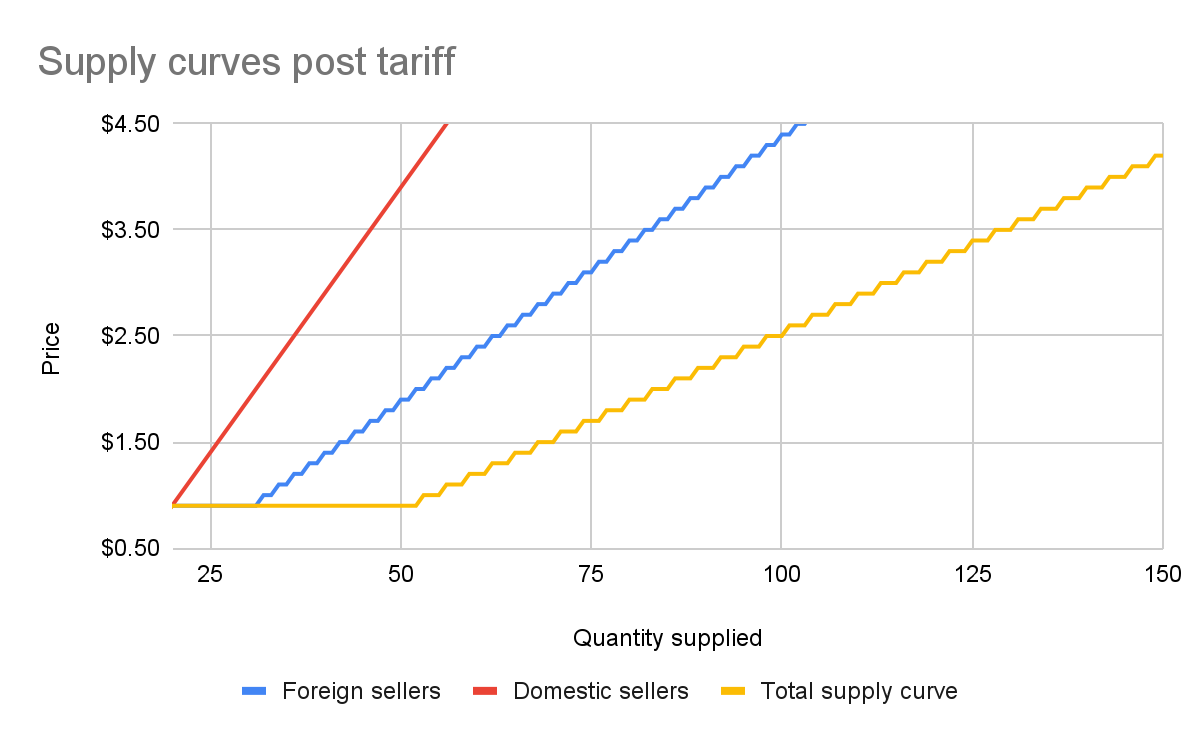

First, let’s see what happens to the foreign seller-only supply curve when you add in the tariff:

With the tariff in place, for each quantity level, the price at which the seller will sell is $0.50 higher than before the tariff. That makes sense: if I was previously willing to sell my 82nd apple for $3, I would now need to charge $3.50 for that apple to cover the cost of the tariff. We see this as the tariff “pushing up” or “pushing left” the original supply curve.

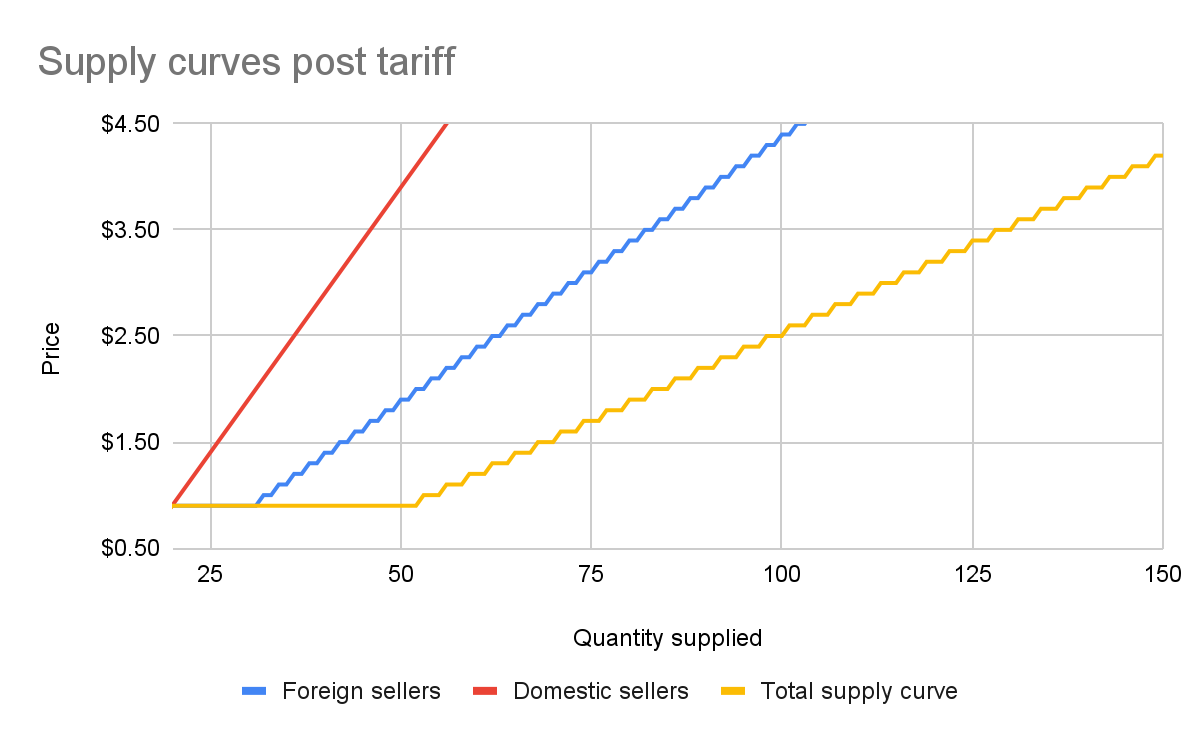

We can add this new supply curve to our existing (unchanged) supply curve for domestic-only sellers, and we end up with a result like this:

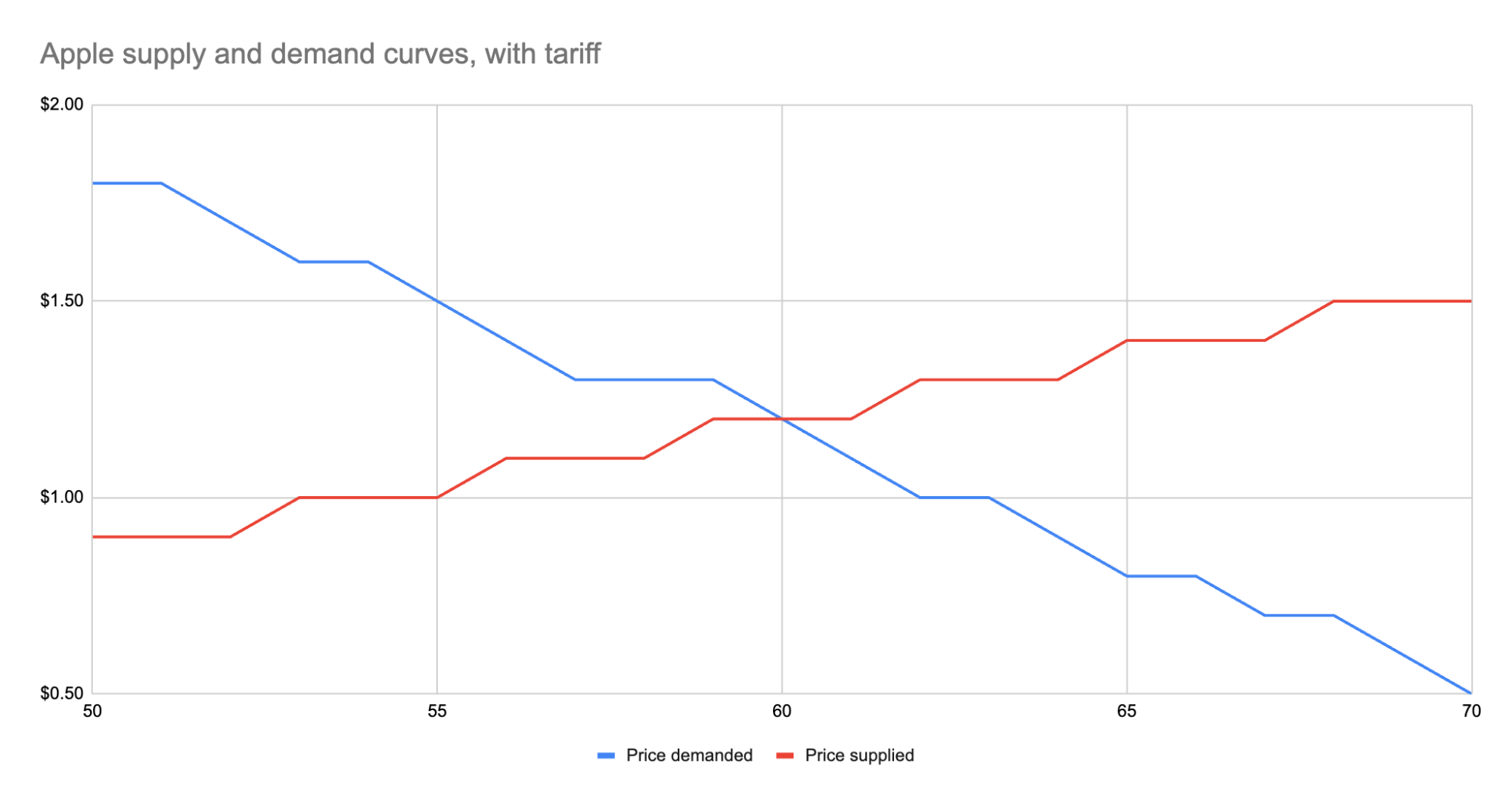

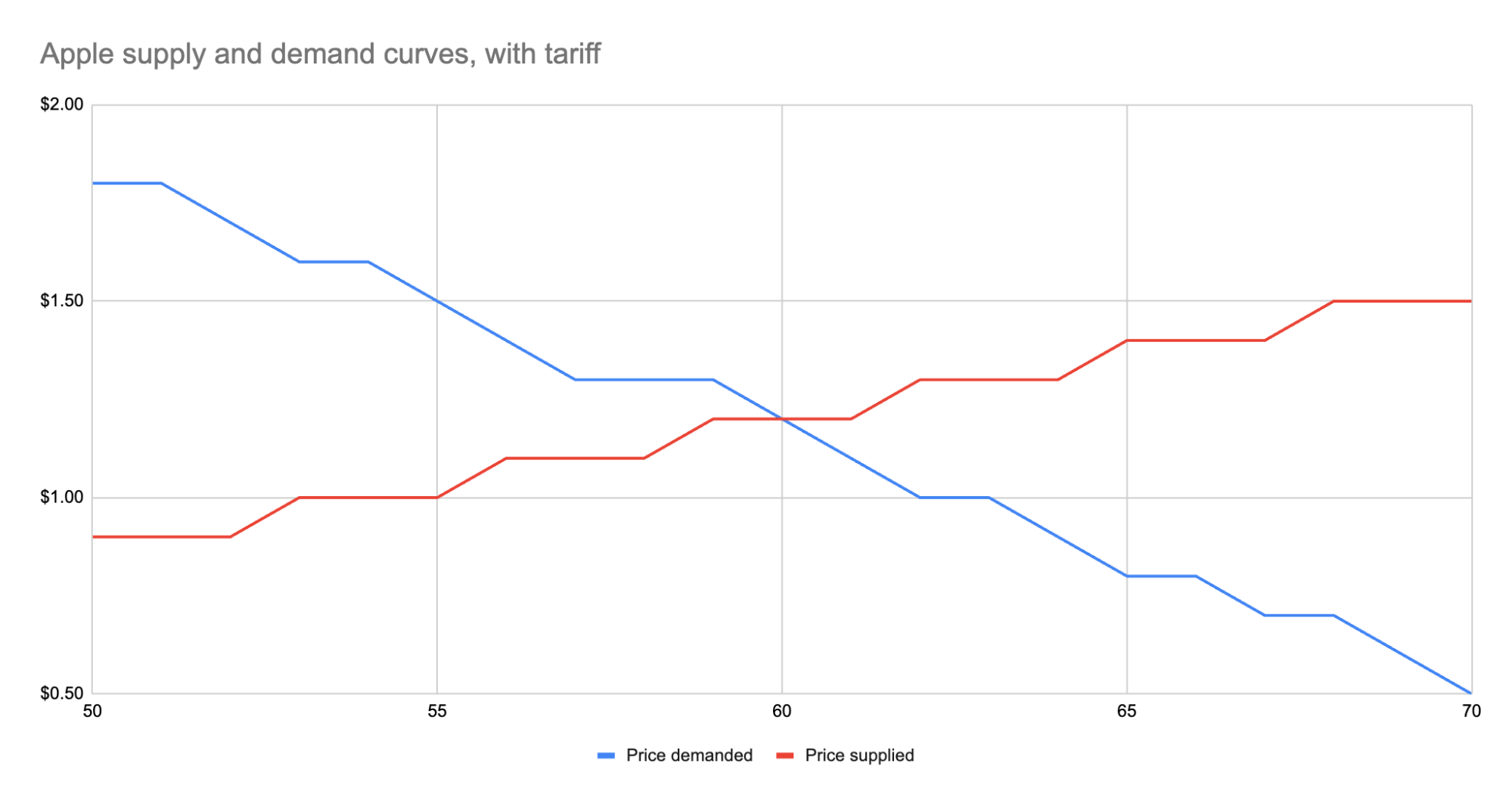

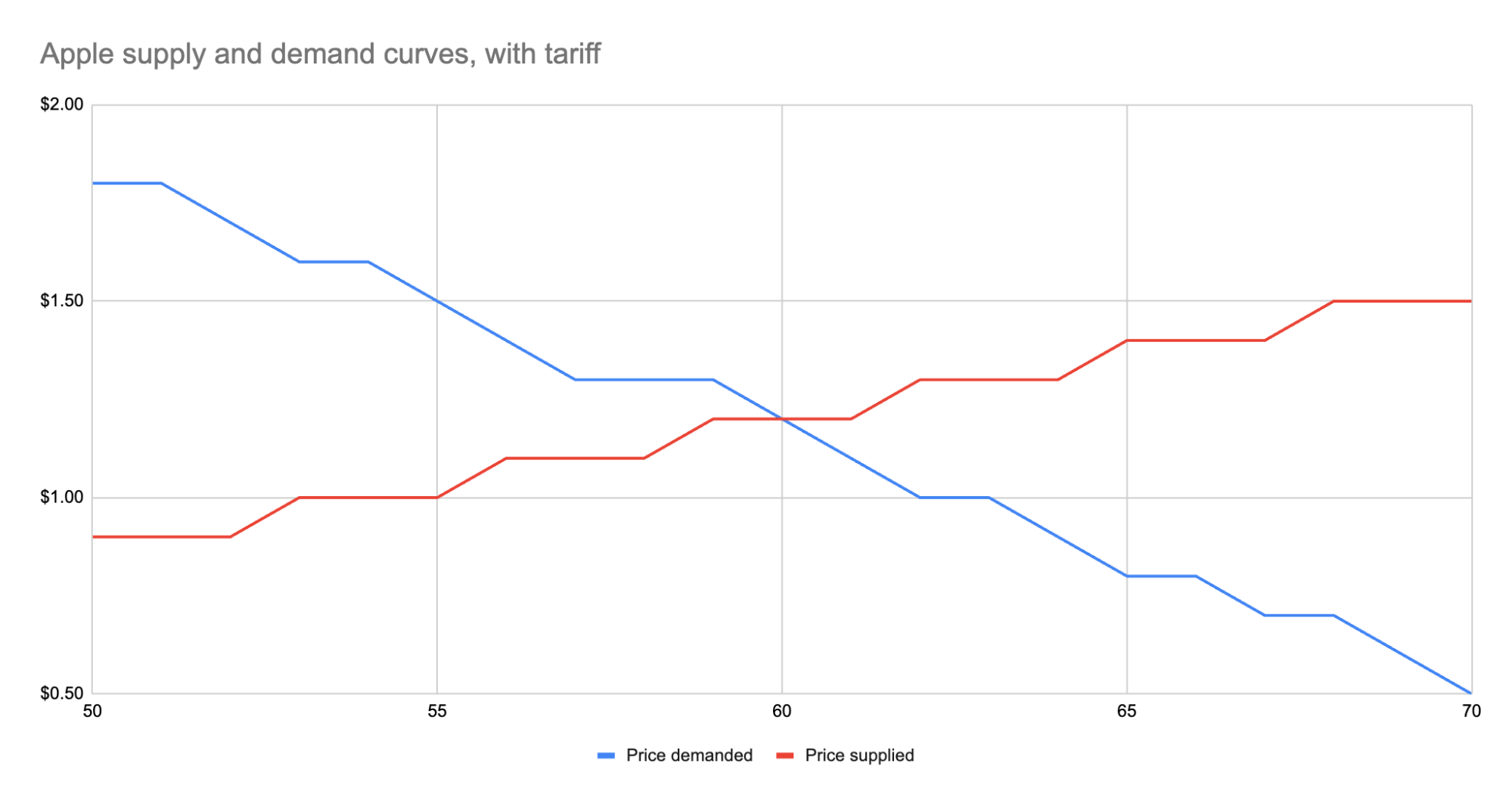

The total supply curve adds up the individual foreign and domestic supply curves. At each price point, we add up the total quantity each group would be willing to sell to determine the total quantity supplied for each price point. Once we have that cumulative supply curve defined, we can produce an updated supply-and-demand chart including the tariff:

As we can see, the equilibrium has shifted:

* The equilibrium price paid by consumers has risen from $1 to $1.20.

* The total number of apples purchased has dropped from 63 apples to 60 apples.

* Consumers therefore received 3 less apples. They spent $72 for these 60 apples, whereas previously they spent $63 for 3 more apples, a definite decrease in consumer surplus.

* Foreign producers sold 36 of those apples (see the raw data in the linked Google Sheet), for a gross revenue of $43.20. However, they also need to pay the tariff to the US government, which accounts for $18, meaning they only receive $25.20 post-tariff. Previously, they sold 42 apples at $1 each with no tariff to be paid, meaning they took home $42.

* Domestic producers sold the remaining 24 apples at $1.20, giving them a revenue of $28.80. Since they don’t pay the tariff, they take home all of that money. By contrast, previously, they sold 21 apples at $1, for a take-home of $21.

* The government receives $0.50 for each of the 60 apples sold, or in other words receives $30 in revenue it wouldn’t have received otherwise.

We could be more specific about the surpluses, and calculate the actual areas for consumer surplus, producer surplus, inefficiency from the tariff, and government revenue from the tariff. But I won’t bother, as those calculations get slightly more involved. Instead, let’s just look at the aggregate outcomes:

* Consumers were unquestionably hurt. Their price paid went up by $0.20 per apple, and received less apples.

* Foreign producers were also hurt. Their price received went down from the original $1 to the new post-tariff price of $1.20, minus the $0.50 tariff. In other words: foreign producers only receive $0.70 per apple now. This hurt can be mitigated by shifting sales to other countries without a tariff, but the pain will exist regardless.

* Domestic producers scored. They can sell less apples and make more revenue doing it.

* And the government walked away with an extra $30.

Hopefully you now see the answer to the original questions. Importantly, while the government imposed a $0.50 tariff, neither side fully absorbed that cost. Consumers paid a bit more, foreign producers received a bit less. The exact details of how that tariff was split across the groups is mediated by the relevant supply and demand curves of each group. If you want to learn more about this, the relevant search term is “price elasticity,” or how much a group’s quantity supplied or demanded will change based on changes in the price.

## Other taxes

Most taxes are some kind of a tax on trade. Tariffs on apples is an obvious one. But the same applies to income tax (taxing the worker for the trade of labor for money) or payroll tax (same thing, just taxing the employer instead). Interestingly, you can use the same model for analyzing things like tax incentives. For example, if the government decided to subsidize domestic apple production by giving the domestic producers a $0.50 bonus for each apple they sell, we would end up with a similar kind of analysis, except instead of the foreign supply curve shifting up, we’d see the domestic supply curve shifting down.

And generally speaking, this is what you’ll *always* see with government involvement in the economy. It will result in disrupting an existing equilibrium, letting the market readjust to a new equilibrium, and incentivization of some behavior, causing some people to benefit and others to lose out. We saw with the apple tariff, domestic producers and the government benefited while others lost.

You can see the reverse though with tax incentives. If I give a tax incentive of providing a deduction (not paying income tax) for preschool, we would end up with:

* Government needs to make up the difference in tax revenue, either by raising taxes on others or printing more money (leading to inflation). Either way, those paying the tax or those holding government debased currency will pay a price.

* Those people who don’t use the preschool deduction will receive no benefit, so they simply pay a cost.

* Those who do use the preschool deduction will end up paying less on tax+preschool than they would have otherwise.

This analysis is fully amoral. It’s not saying whether providing subsidized preschool is a good thing or not, it simply tells you where the costs will be felt, and points out that such government interference in free economic choice does result in inefficiencies in the system. Once you have that knowledge, you’re more well educated on making a decision about whether the costs of government intervention are worth the benefits.

-

@ 4fe4a528:3ff6bf06

2025-02-01 13:41:28

<img src="https://blossom.primal.net/58a3e225ae607d5f110cff5f44a68268d27d3d239ba6d58279c2dd872259fbbb.jpg">

In my last article I wrote about NOSTR. I found another local bitcoiner via NOSTR last week so here is why it is important to join / use NOSTR — start telling people “Look me up on NOSTR”

Self-sovereign identity (SSI) is a revolutionary approach to digital identity that puts individuals in control of their own identity and personal data. Unlike traditional digital identity models, which rely on third-party organizations to manage and authenticate identities, SSI empowers individuals to own and manage their digital identity.

This approach is made possible by emerging technologies such as secure public / private key pairs. Decentralized identifiers, conceived and developed by nostr:npub180cvv07tjdrrgpa0j7j7tmnyl2yr6yr7l8j4s3evf6u64th6gkwsyjh6w6 is an attempt to create a global technical standard around cryptographically secured identifiers - a secure, universal, and sovereign form of digital ID. This technology uses peer-to-peer technology to remove the need for intermediaries to own and authenticate ID information.

Notably, NOSTR, a decentralized protocol, has already begun to utilize decentralized IDs, demonstrating the potential of this technology in real-world applications. Via NOSTR, users can be sure that the person or computer publishing to a particular npub knows their nsec (password for your npub), highlighting the secure and decentralized nature of this approach.

With SSI, individuals can decide how their personal data is used, shared, and protected, giving them greater control and agency over their digital lives.

The **benefits** of SSI are numerous, including:

Enhanced security and protection of personal data. Reduced risk of identity theft and fraud Increased autonomy and agency over one's digital identity. Improved scalability and flexibility in digital identity management

**challenges**:

Ensuring the security and integrity of decentralized identity systems. Developing standards and protocols for interoperability and compatibility. Addressing concerns around ownership and control of personal data. Balancing individual autonomy with the need for verification and authentication in various contexts.

Overall, self-sovereign identity has the potential to transform the way we think about digital identity and provide individuals with greater control and agency over their personal data. Without people in control of their bitcoin seed words no freedom loving people would be able to exchange their money with others. Yes, keep enjoying using the only free market on the planet BITCOIN. Long live FREEDOM!

-

@ 9e69e420:d12360c2

2025-01-30 12:23:04

Tech stocks have taken a hit globally after China's DeepSeek launched a competitive AI chatbot at a much lower cost than US counterparts. This has stirred market fears of a $1.2 trillion loss across tech companies when trading opens in New York.

DeepSeek’s chatbot quickly topped download charts and surprised experts with its capabilities, developed for only $5.6 million.

The Nasdaq dropped over 3% in premarket trading, with major firms like Nvidia falling more than 10%. SoftBank also saw losses shortly after investing in a significant US AI venture.

Venture capitalist Marc Andreessen called it “AI’s Sputnik moment,” highlighting its potential impact on the industry.

![] (https://www.telegraph.co.uk/content/dam/business/2025/01/27/TELEMMGLPICT000409807198_17379939060750_trans_NvBQzQNjv4BqgsaO8O78rhmZrDxTlQBjdGLvJF5WfpqnBZShRL_tOZw.jpeg)

@ daa41bed:88f54153

2025-02-09 16:50:04There has been a good bit of discussion on Nostr over the past few days about the merits of zaps as a method of engaging with notes, so after writing a rather lengthy [article on the pros of a strategic Bitcoin reserve](https://geek.npub.pro/post/dxqkgnjplttkvetprg8ox/), I wanted to take some time to chime in on the much more fun topic of digital engagement. Let's begin by defining a couple of things: **Nostr** is a decentralized, censorship-resistance protocol whose current biggest use case is social media (think Twitter/X). Instead of relying on company servers, it relies on relays that anyone can spin up and own their own content. Its use cases are much bigger, though, and this article is hosted on my own relay, using my own Nostr relay as an example. **Zap** is a tip or donation denominated in sats (small units of Bitcoin) sent from one user to another. This is generally done directly over the Lightning Network but is increasingly using Cashu tokens. For the sake of this discussion, how you transmit/receive zaps will be irrelevant, so don't worry if you don't know what [Lightning](https://lightning.network/) or [Cashu](https://cashu.space/) are. If we look at how users engage with posts and follows/followers on platforms like Twitter, Facebook, etc., it becomes evident that traditional social media thrives on engagement farming. The more outrageous a post, the more likely it will get a reaction. We see a version of this on more visual social platforms like YouTube and TikTok that use carefully crafted thumbnail images to grab the user's attention to click the video. If you'd like to dive deep into the psychology and science behind social media engagement, let me know, and I'd be happy to follow up with another article. In this user engagement model, a user is given the option to comment or like the original post, or share it among their followers to increase its signal. They receive no value from engaging with the content aside from the dopamine hit of the original experience or having their comment liked back by whatever influencer they provide value to. Ad revenue flows to the content creator. Clout flows to the content creator. Sales revenue from merch and content placement flows to the content creator. We call this a linear economy -- the idea that resources get created, used up, then thrown away. Users create content and farm as much engagement as possible, then the content is forgotten within a few hours as they move on to the next piece of content to be farmed. What if there were a simple way to give value back to those who engage with your content? By implementing some value-for-value model -- a circular economy. Enter zaps.  Unlike traditional social media platforms, Nostr does not actively use algorithms to determine what content is popular, nor does it push content created for active user engagement to the top of a user's timeline. Yes, there are "trending" and "most zapped" timelines that users can choose to use as their default, but these use relatively straightforward engagement metrics to rank posts for these timelines. That is not to say that we may not see clients actively seeking to refine timeline algorithms for specific metrics. Still, the beauty of having an open protocol with media that is controlled solely by its users is that users who begin to see their timeline gamed towards specific algorithms can choose to move to another client, and for those who are more tech-savvy, they can opt to run their own relays or create their own clients with personalized algorithms and web of trust scoring systems. Zaps enable the means to create a new type of social media economy in which creators can earn for creating content and users can earn by actively engaging with it. Like and reposting content is relatively frictionless and costs nothing but a simple button tap. Zaps provide active engagement because they signal to your followers and those of the content creator that this post has genuine value, quite literally in the form of money—sats.  I have seen some comments on Nostr claiming that removing likes and reactions is for wealthy people who can afford to send zaps and that the majority of people in the US and around the world do not have the time or money to zap because they have better things to spend their money like feeding their families and paying their bills. While at face value, these may seem like valid arguments, they, unfortunately, represent the brainwashed, defeatist attitude that our current economic (and, by extension, social media) systems aim to instill in all of us to continue extracting value from our lives. Imagine now, if those people dedicating their own time (time = money) to mine pity points on social media would instead spend that time with genuine value creation by posting content that is meaningful to cultural discussions. Imagine if, instead of complaining that their posts get no zaps and going on a tirade about how much of a victim they are, they would empower themselves to take control of their content and give value back to the world; where would that leave us? How much value could be created on a nascent platform such as Nostr, and how quickly could it overtake other platforms? Other users argue about user experience and that additional friction (i.e., zaps) leads to lower engagement, as proven by decades of studies on user interaction. While the added friction may turn some users away, does that necessarily provide less value? I argue quite the opposite. You haven't made a few sats from zaps with your content? Can't afford to send some sats to a wallet for zapping? How about using the most excellent available resource and spending 10 seconds of your time to leave a comment? Likes and reactions are valueless transactions. Social media's real value derives from providing monetary compensation and actively engaging in a conversation with posts you find interesting or thought-provoking. Remember when humans thrived on conversation and discussion for entertainment instead of simply being an onlooker of someone else's life? If you've made it this far, my only request is this: try only zapping and commenting as a method of engagement for two weeks. Sure, you may end up liking a post here and there, but be more mindful of how you interact with the world and break yourself from blind instinct. You'll thank me later.

@ daa41bed:88f54153

2025-02-09 16:50:04There has been a good bit of discussion on Nostr over the past few days about the merits of zaps as a method of engaging with notes, so after writing a rather lengthy [article on the pros of a strategic Bitcoin reserve](https://geek.npub.pro/post/dxqkgnjplttkvetprg8ox/), I wanted to take some time to chime in on the much more fun topic of digital engagement. Let's begin by defining a couple of things: **Nostr** is a decentralized, censorship-resistance protocol whose current biggest use case is social media (think Twitter/X). Instead of relying on company servers, it relies on relays that anyone can spin up and own their own content. Its use cases are much bigger, though, and this article is hosted on my own relay, using my own Nostr relay as an example. **Zap** is a tip or donation denominated in sats (small units of Bitcoin) sent from one user to another. This is generally done directly over the Lightning Network but is increasingly using Cashu tokens. For the sake of this discussion, how you transmit/receive zaps will be irrelevant, so don't worry if you don't know what [Lightning](https://lightning.network/) or [Cashu](https://cashu.space/) are. If we look at how users engage with posts and follows/followers on platforms like Twitter, Facebook, etc., it becomes evident that traditional social media thrives on engagement farming. The more outrageous a post, the more likely it will get a reaction. We see a version of this on more visual social platforms like YouTube and TikTok that use carefully crafted thumbnail images to grab the user's attention to click the video. If you'd like to dive deep into the psychology and science behind social media engagement, let me know, and I'd be happy to follow up with another article. In this user engagement model, a user is given the option to comment or like the original post, or share it among their followers to increase its signal. They receive no value from engaging with the content aside from the dopamine hit of the original experience or having their comment liked back by whatever influencer they provide value to. Ad revenue flows to the content creator. Clout flows to the content creator. Sales revenue from merch and content placement flows to the content creator. We call this a linear economy -- the idea that resources get created, used up, then thrown away. Users create content and farm as much engagement as possible, then the content is forgotten within a few hours as they move on to the next piece of content to be farmed. What if there were a simple way to give value back to those who engage with your content? By implementing some value-for-value model -- a circular economy. Enter zaps.  Unlike traditional social media platforms, Nostr does not actively use algorithms to determine what content is popular, nor does it push content created for active user engagement to the top of a user's timeline. Yes, there are "trending" and "most zapped" timelines that users can choose to use as their default, but these use relatively straightforward engagement metrics to rank posts for these timelines. That is not to say that we may not see clients actively seeking to refine timeline algorithms for specific metrics. Still, the beauty of having an open protocol with media that is controlled solely by its users is that users who begin to see their timeline gamed towards specific algorithms can choose to move to another client, and for those who are more tech-savvy, they can opt to run their own relays or create their own clients with personalized algorithms and web of trust scoring systems. Zaps enable the means to create a new type of social media economy in which creators can earn for creating content and users can earn by actively engaging with it. Like and reposting content is relatively frictionless and costs nothing but a simple button tap. Zaps provide active engagement because they signal to your followers and those of the content creator that this post has genuine value, quite literally in the form of money—sats.  I have seen some comments on Nostr claiming that removing likes and reactions is for wealthy people who can afford to send zaps and that the majority of people in the US and around the world do not have the time or money to zap because they have better things to spend their money like feeding their families and paying their bills. While at face value, these may seem like valid arguments, they, unfortunately, represent the brainwashed, defeatist attitude that our current economic (and, by extension, social media) systems aim to instill in all of us to continue extracting value from our lives. Imagine now, if those people dedicating their own time (time = money) to mine pity points on social media would instead spend that time with genuine value creation by posting content that is meaningful to cultural discussions. Imagine if, instead of complaining that their posts get no zaps and going on a tirade about how much of a victim they are, they would empower themselves to take control of their content and give value back to the world; where would that leave us? How much value could be created on a nascent platform such as Nostr, and how quickly could it overtake other platforms? Other users argue about user experience and that additional friction (i.e., zaps) leads to lower engagement, as proven by decades of studies on user interaction. While the added friction may turn some users away, does that necessarily provide less value? I argue quite the opposite. You haven't made a few sats from zaps with your content? Can't afford to send some sats to a wallet for zapping? How about using the most excellent available resource and spending 10 seconds of your time to leave a comment? Likes and reactions are valueless transactions. Social media's real value derives from providing monetary compensation and actively engaging in a conversation with posts you find interesting or thought-provoking. Remember when humans thrived on conversation and discussion for entertainment instead of simply being an onlooker of someone else's life? If you've made it this far, my only request is this: try only zapping and commenting as a method of engagement for two weeks. Sure, you may end up liking a post here and there, but be more mindful of how you interact with the world and break yourself from blind instinct. You'll thank me later.  @ 16d11430:61640947

2025-02-09 00:12:22Introduction: The Power of Focused Attention In an age of distraction, power is not merely held through material wealth, authority, or control over others—it is built through focused attention. The human brain, a complex quantum-biological processor, constructs reality through perception. When harnessed correctly, focused attention allows individuals to transcend limitations, reshape their reality, and live free. Power, then, is not external—it is a construct supported by the mind and created within the brain. Understanding how this works offers a path to transcendence, autonomy, and liberation from imposed limitations. The Neuroscience of Focused Attention: Constructing Reality The brain is a prediction engine, constantly processing information and filtering out irrelevant stimuli. Focused attention directs this process, acting as a spotlight that selects what becomes part of one's conscious experience. This is the fundamental mechanism behind cognitive power. 1. Neuroplasticity: Building Power Through Repetition The brain adapts to repeated stimuli through neuroplasticity. What one focuses on consistently rewires neural pathways, strengthening certain thoughts, beliefs, and abilities. Over time, this focus builds an internal structure of power—a network of ideas and perceptions that define one’s reality. If one focuses on problems, they grow. If one focuses on solutions, they appear. If one focuses on fear, it shapes perception. If one focuses on mastery, skills develop. 2. The Quantum Mind: Attention as a Creative Force Quantum physics suggests that observation influences reality. Just as subatomic particles behave differently when measured, focused attention may act as a force that shapes possibilities into tangible outcomes. This aligns with the ancient concept that "energy flows where attention goes." What one attends to with intention can manifest as action, opportunity, and ultimately, freedom. 3. The Reticular Activating System (RAS): Filtering Reality The Reticular Activating System (RAS) in the brainstem acts as a gatekeeper for focus. It determines what information enters conscious awareness. When trained, it can filter out distractions and amplify pathways toward a desired goal. Want to see opportunities? Program the RAS by setting clear intentions. Want to break free from limiting beliefs? Train focus away from conditioned fears. The Mind’s Role: Transcending Limitations The mind is the interpreter of the brain’s electrical and biochemical activity. While the brain processes raw data, the mind provides meaning. This distinction is crucial because meaning determines how one experiences reality. 1. Breaking Mental Chains: Rewriting Narratives Most limitations are narratives—stories imposed by culture, society, or personal history. True power lies in rewriting these stories. Instead of “I am trapped by my circumstances,” shift to “I create my own reality.” Instead of “I need permission,” shift to “I give myself permission.” By restructuring meaning, the mind can redefine the limits of what is possible. 2. The Silence Paradox: Accessing Higher States Silence, both literal and mental, creates space for higher-order thinking. Just as quantum tunneling allows subatomic particles to pass through barriers without energy loss, silence allows the mind to bypass noise and access deeper intelligence. Meditation, stillness, and solitude amplify internal power. The ability to not react is a form of control over external influence. True mastery comes from detachment—engaging the world without being controlled by it. Transcendence: Living Free Through Mental Autonomy To transcend means to rise above imposed structures—whether societal, psychological, or energetic. The construct of power built through focused attention allows one to escape control mechanisms and live autonomously. 1. Sovereignty of Mind: Owning One’s Thoughts A free mind is one that chooses its inputs rather than being programmed by external forces. This requires: Awareness of mental conditioning (social narratives, propaganda, biases) Intentional thought selection (curating what enters the mental space) Guarding attention fiercely (not allowing distraction to hijack focus) 2. Detachment From Control Structures Society operates on the principle of attention capture—through media, politics, and algorithms that direct thought patterns. Escaping these requires detachment. Do not react emotionally to fear-based programming. Cultivate independent thought by questioning imposed narratives. Reduce external noise to amplify internal wisdom. 3. The Flow State: Moving Beyond Constraints When focus is refined to its highest degree, one enters flow state—a condition where action and awareness merge, and limitations dissolve. In flow, work becomes effortless. Creativity becomes boundless. Freedom becomes not just a philosophy, but a lived experience. Conclusion: The Mind as the Ultimate Key to Freedom Power is not an external possession—it is the ability to direct one’s own focus. Through the interplay of brain function, cognitive attention, and mental discipline, one constructs personal sovereignty. The individual who masters focus, controls reality. Freedom is not given. It is built—through attention, intention, and an unwavering commitment to mental autonomy.

@ 16d11430:61640947

2025-02-09 00:12:22Introduction: The Power of Focused Attention In an age of distraction, power is not merely held through material wealth, authority, or control over others—it is built through focused attention. The human brain, a complex quantum-biological processor, constructs reality through perception. When harnessed correctly, focused attention allows individuals to transcend limitations, reshape their reality, and live free. Power, then, is not external—it is a construct supported by the mind and created within the brain. Understanding how this works offers a path to transcendence, autonomy, and liberation from imposed limitations. The Neuroscience of Focused Attention: Constructing Reality The brain is a prediction engine, constantly processing information and filtering out irrelevant stimuli. Focused attention directs this process, acting as a spotlight that selects what becomes part of one's conscious experience. This is the fundamental mechanism behind cognitive power. 1. Neuroplasticity: Building Power Through Repetition The brain adapts to repeated stimuli through neuroplasticity. What one focuses on consistently rewires neural pathways, strengthening certain thoughts, beliefs, and abilities. Over time, this focus builds an internal structure of power—a network of ideas and perceptions that define one’s reality. If one focuses on problems, they grow. If one focuses on solutions, they appear. If one focuses on fear, it shapes perception. If one focuses on mastery, skills develop. 2. The Quantum Mind: Attention as a Creative Force Quantum physics suggests that observation influences reality. Just as subatomic particles behave differently when measured, focused attention may act as a force that shapes possibilities into tangible outcomes. This aligns with the ancient concept that "energy flows where attention goes." What one attends to with intention can manifest as action, opportunity, and ultimately, freedom. 3. The Reticular Activating System (RAS): Filtering Reality The Reticular Activating System (RAS) in the brainstem acts as a gatekeeper for focus. It determines what information enters conscious awareness. When trained, it can filter out distractions and amplify pathways toward a desired goal. Want to see opportunities? Program the RAS by setting clear intentions. Want to break free from limiting beliefs? Train focus away from conditioned fears. The Mind’s Role: Transcending Limitations The mind is the interpreter of the brain’s electrical and biochemical activity. While the brain processes raw data, the mind provides meaning. This distinction is crucial because meaning determines how one experiences reality. 1. Breaking Mental Chains: Rewriting Narratives Most limitations are narratives—stories imposed by culture, society, or personal history. True power lies in rewriting these stories. Instead of “I am trapped by my circumstances,” shift to “I create my own reality.” Instead of “I need permission,” shift to “I give myself permission.” By restructuring meaning, the mind can redefine the limits of what is possible. 2. The Silence Paradox: Accessing Higher States Silence, both literal and mental, creates space for higher-order thinking. Just as quantum tunneling allows subatomic particles to pass through barriers without energy loss, silence allows the mind to bypass noise and access deeper intelligence. Meditation, stillness, and solitude amplify internal power. The ability to not react is a form of control over external influence. True mastery comes from detachment—engaging the world without being controlled by it. Transcendence: Living Free Through Mental Autonomy To transcend means to rise above imposed structures—whether societal, psychological, or energetic. The construct of power built through focused attention allows one to escape control mechanisms and live autonomously. 1. Sovereignty of Mind: Owning One’s Thoughts A free mind is one that chooses its inputs rather than being programmed by external forces. This requires: Awareness of mental conditioning (social narratives, propaganda, biases) Intentional thought selection (curating what enters the mental space) Guarding attention fiercely (not allowing distraction to hijack focus) 2. Detachment From Control Structures Society operates on the principle of attention capture—through media, politics, and algorithms that direct thought patterns. Escaping these requires detachment. Do not react emotionally to fear-based programming. Cultivate independent thought by questioning imposed narratives. Reduce external noise to amplify internal wisdom. 3. The Flow State: Moving Beyond Constraints When focus is refined to its highest degree, one enters flow state—a condition where action and awareness merge, and limitations dissolve. In flow, work becomes effortless. Creativity becomes boundless. Freedom becomes not just a philosophy, but a lived experience. Conclusion: The Mind as the Ultimate Key to Freedom Power is not an external possession—it is the ability to direct one’s own focus. Through the interplay of brain function, cognitive attention, and mental discipline, one constructs personal sovereignty. The individual who masters focus, controls reality. Freedom is not given. It is built—through attention, intention, and an unwavering commitment to mental autonomy. @ e3ba5e1a:5e433365

2025-02-04 08:29:00President Trump has started rolling out his tariffs, something I [blogged about in November](https://www.snoyman.com/blog/2024/11/steelmanning-tariffs/). People are talking about these tariffs a lot right now, with many people (correctly) commenting on how consumers will end up with higher prices as a result of these tariffs. While that part is true, I’ve seen a lot of people taking it to the next, incorrect step: that consumers will pay the entirety of the tax. I [put up a poll on X](https://x.com/snoyberg/status/1886035800019599808) to see what people thought, and while the right answer got a lot of votes, it wasn't the winner.  For purposes of this blog post, our ultimate question will be the following: * Suppose apples currently sell for $1 each in the entire United States. * There are domestic sellers and foreign sellers of apples, all receiving the same price. * There are no taxes or tariffs on the purchase of apples. * The question is: if the US federal government puts a $0.50 import tariff per apple, what will be the change in the following: * Number of apples bought in the US * Price paid by buyers for apples in the US * Post-tax price received by domestic apple producers * Post-tax price received by foreign apple producers Before we can answer that question, we need to ask an easier, first question: before instituting the tariff, why do apples cost $1? And finally, before we dive into the details, let me provide you with the answers to the ultimate question. I recommend you try to guess these answers before reading this, and if you get it wrong, try to understand why: 1. The number of apples bought will go down 2. The buyers will pay more for each apple they buy, but not the full amount of the tariff 3. Domestic apple sellers will receive a *higher* price per apple 4. Foreign apple sellers will receive a *lower* price per apple, but not lowered by the full amount of the tariff In other words, regardless of who sends the payment to the government, both taxed parties (domestic buyers and foreign sellers) will absorb some of the costs of the tariff, while domestic sellers will benefit from the protectionism provided by tariffs and be able to sell at a higher price per unit. ## Marginal benefit All of the numbers discussed below are part of a [helper Google Sheet](https://docs.google.com/spreadsheets/d/14ZbkWpw1B9Q1UDB9Yh47DmdKQfIafVVBKbDUsSIfGZw/edit?usp=sharing) I put together for this analysis. Also, apologies about the jagged lines in the charts below, I hadn’t realized before starting on this that there are [some difficulties with creating supply and demand charts in Google Sheets](https://superuser.com/questions/1359731/how-to-create-a-supply-demand-style-chart). Let’s say I absolutely love apples, they’re my favorite food. How much would I be willing to pay for a single apple? You might say “$1, that’s the price in the supermarket,” and in many ways you’d be right. If I walk into supermarket A, see apples on sale for $50, and know that I can buy them at supermarket B for $1, I’ll almost certainly leave A and go buy at B. But that’s not what I mean. What I mean is: how high would the price of apples have to go *everywhere* so that I’d no longer be willing to buy a single apple? This is a purely personal, subjective opinion. It’s impacted by how much money I have available, other expenses I need to cover, and how much I like apples. But let’s say the number is $5. How much would I be willing to pay for another apple? Maybe another $5. But how much am I willing to pay for the 1,000th apple? 10,000th? At some point, I’ll get sick of apples, or run out of space to keep the apples, or not be able to eat, cook, and otherwise preserve all those apples before they rot. The point being: I’ll be progressively willing to spend less and less money for each apple. This form of analysis is called *marginal benefit*: how much benefit (expressed as dollars I’m willing to spend) will I receive from each apple? This is a downward sloping function: for each additional apple I buy (quantity demanded), the price I’m willing to pay goes down. This is what gives my personal *demand curve*. And if we aggregate demand curves across all market participants (meaning: everyone interested in buying apples), we end up with something like this:  Assuming no changes in people’s behavior and other conditions in the market, this chart tells us how many apples will be purchased by our buyers at each price point between $0.50 and $5. And ceteris paribus (all else being equal), this will continue to be the demand curve for apples. ## Marginal cost Demand is half the story of economics. The other half is supply, or: how many apples will I sell at each price point? Supply curves are upward sloping: the higher the price, the more a person or company is willing and able to sell a product. Let’s understand why. Suppose I have an apple orchard. It’s a large property right next to my house. With about 2 minutes of effort, I can walk out of my house, find the nearest tree, pick 5 apples off the tree, and call it a day. 5 apples for 2 minutes of effort is pretty good, right? Yes, there was all the effort necessary to buy the land, and plant the trees, and water them… and a bunch more than I likely can’t even guess at. We’re going to ignore all of that for our analysis, because for short-term supply-and-demand movement, we can ignore these kinds of *sunk costs*. One other simplification: in reality, supply curves often start descending before ascending. This accounts for achieving efficiencies of scale after the first number of units purchased. But since both these topics are unneeded for understanding taxes, I won’t go any further. Anyway, back to my apple orchard. If someone offers me $0.50 per apple, I can do 2 minutes of effort and get $2.50 in revenue, which equates to a $75/hour wage for me. I’m more than happy to pick apples at that price\! However, let’s say someone comes to buy 10,000 apples from me instead. I no longer just walk out to my nearest tree. I’m going to need to get in my truck, drive around, spend the day in the sun, pay for gas, take a day off of my day job (let’s say it pays me $70/hour). The costs go up significantly. Let’s say it takes 5 days to harvest all those apples myself, it costs me $100 in fuel and other expenses, and I lose out on my $70/hour job for 5 days. We end up with: * Total expenditure: $100 \+ $70 \* 8 hours a day \* 5 days \== $2900 * Total revenue: $5000 (10,000 apples at $0.50 each) * Total profit: $2100 So I’m still willing to sell the apples at this price, but it’s not as attractive as before. And as the number of apples purchased goes up, my costs keep increasing. I’ll need to spend more money on fuel to travel more of my property. At some point I won’t be able to do the work myself anymore, so I’ll need to pay others to work on the farm, and they’ll be slower at picking apples than me (less familiar with the property, less direct motivation, etc.). The point being: at some point, the number of apples can go high enough that the $0.50 price point no longer makes me any money. This kind of analysis is called *marginal cost*. It refers to the additional amount of expenditure a seller has to spend in order to produce each additional unit of the good. Marginal costs go up as quantity sold goes up. And like demand curves, if you aggregate this data across all sellers, you get a supply curve like this:  ## Equilibrium price We now know, for every price point, how many apples buyers will purchase, and how many apples sellers will sell. Now we find the equilibrium: where the supply and demand curves meet. This point represents where the marginal benefit a buyer would receive from the next buyer would be less than the cost it would take the next seller to make it. Let’s see it in a chart:  You’ll notice that these two graphs cross at the $1 price point, where 63 apples are both demanded (bought by consumers) and supplied (sold by producers). This is our equilibrium price. We also have a visualization of the *surplus* created by these trades. Everything to the left of the equilibrium point and between the supply and demand curves represents surplus: an area where someone is receiving something of more value than they give. For example: * When I bought my first apple for $1, but I was willing to spend $5, I made $4 of consumer surplus. The consumer portion of the surplus is everything to the left of the equilibrium point, between the supply and demand curves, and above the equilibrium price point. * When a seller sells his first apple for $1, but it only cost $0.50 to produce it, the seller made $0.50 of producer surplus. The producer portion of the surplus is everything to the left of the equilibrium point, between the supply and demand curves, and below the equilibrium price point. Another way of thinking of surplus is “every time someone got a better price than they would have been willing to take.” OK, with this in place, we now have enough information to figure out how to price in the tariff, which we’ll treat as a negative externality. ## Modeling taxes Alright, the government has now instituted a $0.50 tariff on every apple sold within the US by a foreign producer. We can generally model taxes by either increasing the marginal cost of each unit sold (shifting the supply curve up), or by decreasing the marginal benefit of each unit bought (shifting the demand curve down). In this case, since only some of the producers will pay the tax, it makes more sense to modify the supply curve. First, let’s see what happens to the foreign seller-only supply curve when you add in the tariff:  With the tariff in place, for each quantity level, the price at which the seller will sell is $0.50 higher than before the tariff. That makes sense: if I was previously willing to sell my 82nd apple for $3, I would now need to charge $3.50 for that apple to cover the cost of the tariff. We see this as the tariff “pushing up” or “pushing left” the original supply curve. We can add this new supply curve to our existing (unchanged) supply curve for domestic-only sellers, and we end up with a result like this:  The total supply curve adds up the individual foreign and domestic supply curves. At each price point, we add up the total quantity each group would be willing to sell to determine the total quantity supplied for each price point. Once we have that cumulative supply curve defined, we can produce an updated supply-and-demand chart including the tariff:  As we can see, the equilibrium has shifted: * The equilibrium price paid by consumers has risen from $1 to $1.20. * The total number of apples purchased has dropped from 63 apples to 60 apples. * Consumers therefore received 3 less apples. They spent $72 for these 60 apples, whereas previously they spent $63 for 3 more apples, a definite decrease in consumer surplus. * Foreign producers sold 36 of those apples (see the raw data in the linked Google Sheet), for a gross revenue of $43.20. However, they also need to pay the tariff to the US government, which accounts for $18, meaning they only receive $25.20 post-tariff. Previously, they sold 42 apples at $1 each with no tariff to be paid, meaning they took home $42. * Domestic producers sold the remaining 24 apples at $1.20, giving them a revenue of $28.80. Since they don’t pay the tariff, they take home all of that money. By contrast, previously, they sold 21 apples at $1, for a take-home of $21. * The government receives $0.50 for each of the 60 apples sold, or in other words receives $30 in revenue it wouldn’t have received otherwise. We could be more specific about the surpluses, and calculate the actual areas for consumer surplus, producer surplus, inefficiency from the tariff, and government revenue from the tariff. But I won’t bother, as those calculations get slightly more involved. Instead, let’s just look at the aggregate outcomes: * Consumers were unquestionably hurt. Their price paid went up by $0.20 per apple, and received less apples. * Foreign producers were also hurt. Their price received went down from the original $1 to the new post-tariff price of $1.20, minus the $0.50 tariff. In other words: foreign producers only receive $0.70 per apple now. This hurt can be mitigated by shifting sales to other countries without a tariff, but the pain will exist regardless. * Domestic producers scored. They can sell less apples and make more revenue doing it. * And the government walked away with an extra $30. Hopefully you now see the answer to the original questions. Importantly, while the government imposed a $0.50 tariff, neither side fully absorbed that cost. Consumers paid a bit more, foreign producers received a bit less. The exact details of how that tariff was split across the groups is mediated by the relevant supply and demand curves of each group. If you want to learn more about this, the relevant search term is “price elasticity,” or how much a group’s quantity supplied or demanded will change based on changes in the price. ## Other taxes Most taxes are some kind of a tax on trade. Tariffs on apples is an obvious one. But the same applies to income tax (taxing the worker for the trade of labor for money) or payroll tax (same thing, just taxing the employer instead). Interestingly, you can use the same model for analyzing things like tax incentives. For example, if the government decided to subsidize domestic apple production by giving the domestic producers a $0.50 bonus for each apple they sell, we would end up with a similar kind of analysis, except instead of the foreign supply curve shifting up, we’d see the domestic supply curve shifting down. And generally speaking, this is what you’ll *always* see with government involvement in the economy. It will result in disrupting an existing equilibrium, letting the market readjust to a new equilibrium, and incentivization of some behavior, causing some people to benefit and others to lose out. We saw with the apple tariff, domestic producers and the government benefited while others lost. You can see the reverse though with tax incentives. If I give a tax incentive of providing a deduction (not paying income tax) for preschool, we would end up with: * Government needs to make up the difference in tax revenue, either by raising taxes on others or printing more money (leading to inflation). Either way, those paying the tax or those holding government debased currency will pay a price. * Those people who don’t use the preschool deduction will receive no benefit, so they simply pay a cost. * Those who do use the preschool deduction will end up paying less on tax+preschool than they would have otherwise. This analysis is fully amoral. It’s not saying whether providing subsidized preschool is a good thing or not, it simply tells you where the costs will be felt, and points out that such government interference in free economic choice does result in inefficiencies in the system. Once you have that knowledge, you’re more well educated on making a decision about whether the costs of government intervention are worth the benefits.

@ e3ba5e1a:5e433365