-

@ fd208ee8:0fd927c1

2025-02-15 07:02:08

E-cash are coupons or tokens for Bitcoin, or Bitcoin debt notes that the mint issues. The e-cash states, essentially, "IoU 2900 sats".

They're redeemable for Bitcoin on Lightning (hard money), and therefore can be used as cash (softer money), so long as the mint has a good reputation. That means that they're less fungible than Lightning because the e-cash from one mint can be more or less valuable than the e-cash from another. If a mint is buggy, offline, or disappears, then the e-cash is unreedemable.

It also means that e-cash is more anonymous than Lightning, and that the sender and receiver's wallets don't need to be online, to transact. Nutzaps now add the possibility of parking transactions one level farther out, on a relay. The same relays that cannot keep npub profiles and follow lists consistent will now do monetary transactions.

What we then have is

* a **transaction on a relay** that triggers

* a **transaction on a mint** that triggers

* a **transaction on Lightning** that triggers

* a **transaction on Bitcoin**.

Which means that every relay that stores the nuts is part of a wildcat banking system. Which is fine, but relay operators should consider whether they wish to carry the associated risks and liabilities. They should also be aware that they should implement the appropriate features in their relay, such as expiration tags (nuts rot after 2 weeks), and to make sure that only expired nuts are deleted.

There will be plenty of specialized relays for this, so don't feel pressured to join in, and research the topic carefully, for yourself.

https://github.com/nostr-protocol/nips/blob/master/60.md

-

@ 0fa80bd3:ea7325de

2025-02-14 23:24:37

#intro

The Russian state made me a Bitcoiner. In 1991, it devalued my grandmother's hard-earned savings. She worked tirelessly in the kitchen of a dining car on the Moscow–Warsaw route. Everything she had saved for my sister and me to attend university vanished overnight. This story is similar to what many experienced, including Wences Casares. The pain and injustice of that time became my first lessons about the fragility of systems and the value of genuine, incorruptible assets, forever changing my perception of money and my trust in government promises.

In 2014, I was living in Moscow, running a trading business, and frequently traveling to China. One day, I learned about the Cypriot banking crisis and the possibility of moving money through some strange thing called Bitcoin. At the time, I didn’t give it much thought. Returning to the idea six months later, as a business-oriented geek, I eagerly began studying the topic and soon dove into it seriously.

I spent half a year reading articles on a local online journal, BitNovosti, actively participating in discussions, and eventually joined the editorial team as a translator. That’s how I learned about whitepapers, decentralization, mining, cryptographic keys, and colored coins. About Satoshi Nakamoto, Silk Road, Mt. Gox, and BitcoinTalk. Over time, I befriended the journal’s owner and, leveraging my management experience, later became an editor. I was drawn to the crypto-anarchist stance and commitment to decentralization principles. We wrote about the economic, historical, and social preconditions for Bitcoin’s emergence, and it was during this time that I fully embraced the idea.

It got to the point where I sold my apartment and, during the market's downturn, bought 50 bitcoins, just after the peak price of $1,200 per coin. That marked the beginning of my first crypto winter. As an editor, I organized workflows, managed translators, developed a YouTube channel, and attended conferences in Russia and Ukraine. That’s how I learned about Wences Casares and even wrote a piece about him. I also met Mikhail Chobanyan (Ukrainian exchange Kuna), Alexander Ivanov (Waves project), Konstantin Lomashuk (Lido project), and, of course, Vitalik Buterin. It was a time of complete immersion, 24/7, and boundless hope.

After moving to the United States, I expected the industry to grow rapidly, attended events, but the introduction of BitLicense froze the industry for eight years. By 2017, it became clear that the industry was shifting toward gambling and creating tokens for the sake of tokens. I dismissed this idea as unsustainable. Then came a new crypto spring with the hype around beautiful NFTs – CryptoPunks and apes.

I made another attempt – we worked on a series called Digital Nomad Country Club, aimed at creating a global project. The proceeds from selling images were intended to fund the development of business tools for people worldwide. However, internal disagreements within the team prevented us from completing the project.

With Trump’s arrival in 2025, hope was reignited. I decided that it was time to create a project that society desperately needed. As someone passionate about history, I understood that destroying what exists was not the solution, but leaving everything as it was also felt unacceptable. You can’t destroy the system, as the fiery crypto-anarchist voices claimed.

With an analytical mindset (IQ 130) and a deep understanding of the freest societies, I realized what was missing—not only in Russia or the United States but globally—a Bitcoin-native system for tracking debts and financial interactions. This could return control of money to ordinary people and create horizontal connections parallel to state systems. My goal was to create, if not a Bitcoin killer app, then at least to lay its foundation.

At the inauguration event in New York, I rediscovered the Nostr project. I realized it was not only technologically simple and already quite popular but also perfectly aligned with my vision. For the past month and a half, using insights and experience gained since 2014, I’ve been working full-time on this project.

-

@ e3ba5e1a:5e433365

2025-02-13 06:16:49

My favorite line in any Marvel movie ever is in “Captain America.” After Captain America launches seemingly a hopeless assault on Red Skull’s base and is captured, we get [this line](https://www.youtube.com/shorts/kqsomjpz7ok):

“Arrogance may not be a uniquely American trait, but I must say, you do it better than anyone.”

Yesterday, I came across a comment on the song [Devil Went Down to Georgia](https://youtu.be/ut8UqFlWdDc) that had a very similar feel to it:

America has seemingly always been arrogant, in a uniquely American way. Manifest Destiny, for instance. The rest of the world is aware of this arrogance, and mocks Americans for it. A central point in modern US politics is the deriding of racist, nationalist, supremacist Americans.

That’s not what I see. I see American Arrogance as not only a beautiful statement about what it means to be American. I see it as an ode to the greatness of humanity in its purest form.

For most countries, saying “our nation is the greatest” *is*, in fact, twinged with some level of racism. I still don’t have a problem with it. Every group of people *should* be allowed to feel pride in their accomplishments. The destruction of the human spirit since the end of World War 2, where greatness has become a sin and weakness a virtue, has crushed the ability of people worldwide to strive for excellence.

But I digress. The fears of racism and nationalism at least have a grain of truth when applied to other nations on the planet. But not to America.

That’s because the definition of America, and the prototype of an American, has nothing to do with race. The definition of Americanism is *freedom*. The founding of America is based purely on liberty. On the God-given rights of every person to live life the way they see fit.

American Arrogance is not a statement of racial superiority. It’s barely a statement of national superiority (though it absolutely is). To me, when an American comments on the greatness of America, it’s a statement about freedom. Freedom will always unlock the greatness inherent in any group of people. Americans are *definitionally* better than everyone else, because Americans are freer than everyone else. (Or, at least, that’s how it should be.)

In *Devil Went Down to Georgia*, Johnny is approached by the devil himself. He is challenged to a ridiculously lopsided bet: a golden fiddle versus his immortal soul. He acknowledges the sin in accepting such a proposal. And yet he says, “God, I know you told me not to do this. But I can’t stand the affront to my honor. I am the greatest. The devil has nothing on me. So God, I’m gonna sin, but I’m also gonna win.”

*Libertas magnitudo est*

-

@ daa41bed:88f54153

2025-02-09 16:50:04

There has been a good bit of discussion on Nostr over the past few days about the merits of zaps as a method of engaging with notes, so after writing a rather lengthy [article on the pros of a strategic Bitcoin reserve](https://geek.npub.pro/post/dxqkgnjplttkvetprg8ox/), I wanted to take some time to chime in on the much more fun topic of digital engagement.

Let's begin by defining a couple of things:

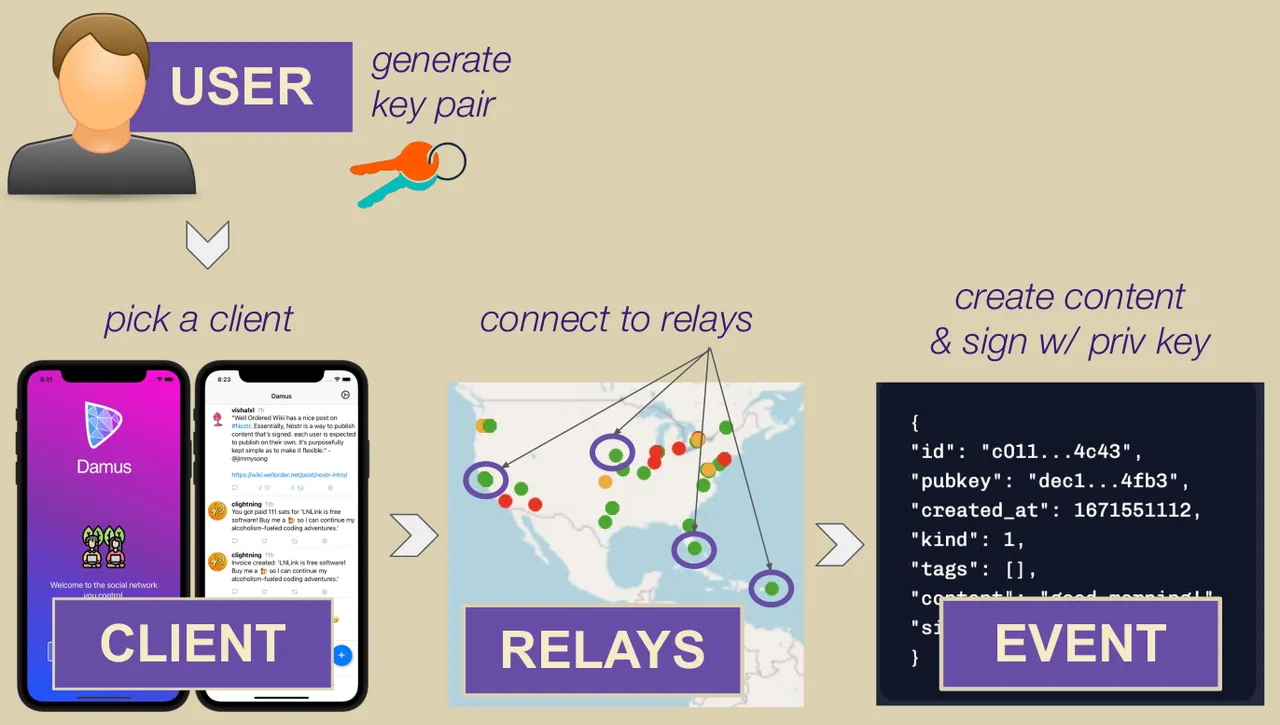

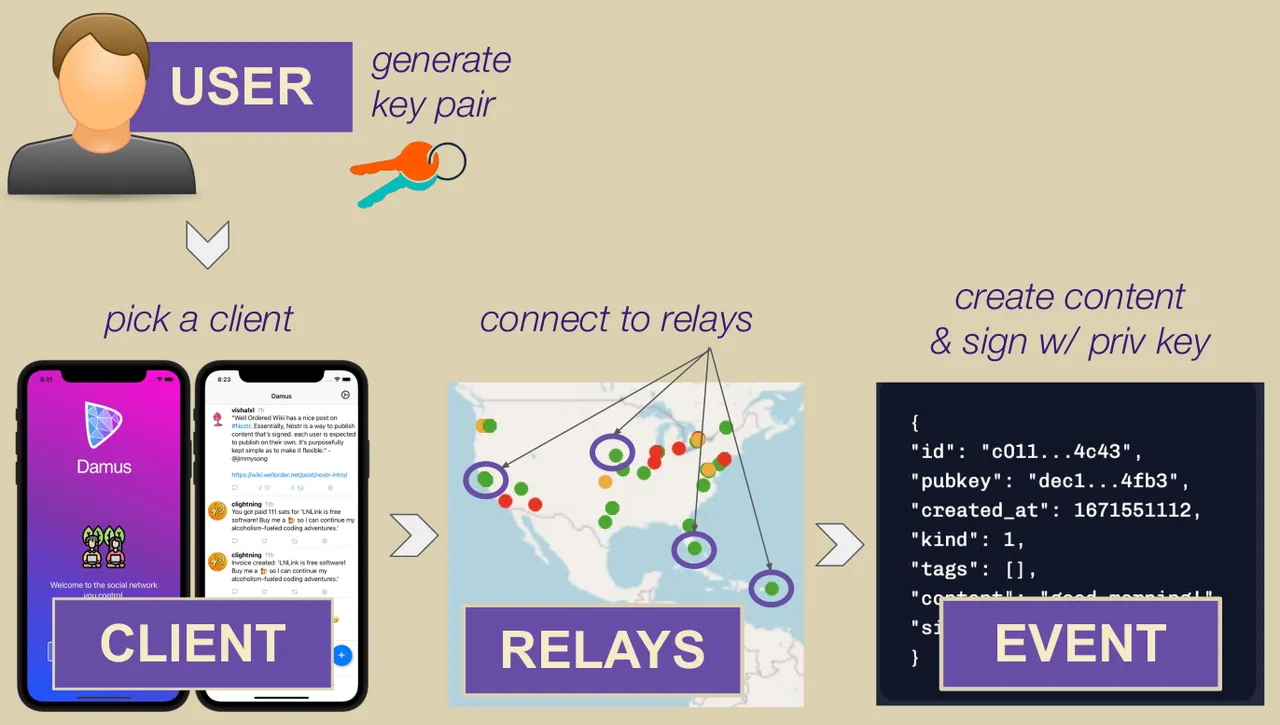

**Nostr** is a decentralized, censorship-resistance protocol whose current biggest use case is social media (think Twitter/X). Instead of relying on company servers, it relies on relays that anyone can spin up and own their own content. Its use cases are much bigger, though, and this article is hosted on my own relay, using my own Nostr relay as an example.

**Zap** is a tip or donation denominated in sats (small units of Bitcoin) sent from one user to another. This is generally done directly over the Lightning Network but is increasingly using Cashu tokens. For the sake of this discussion, how you transmit/receive zaps will be irrelevant, so don't worry if you don't know what [Lightning](https://lightning.network/) or [Cashu](https://cashu.space/) are.

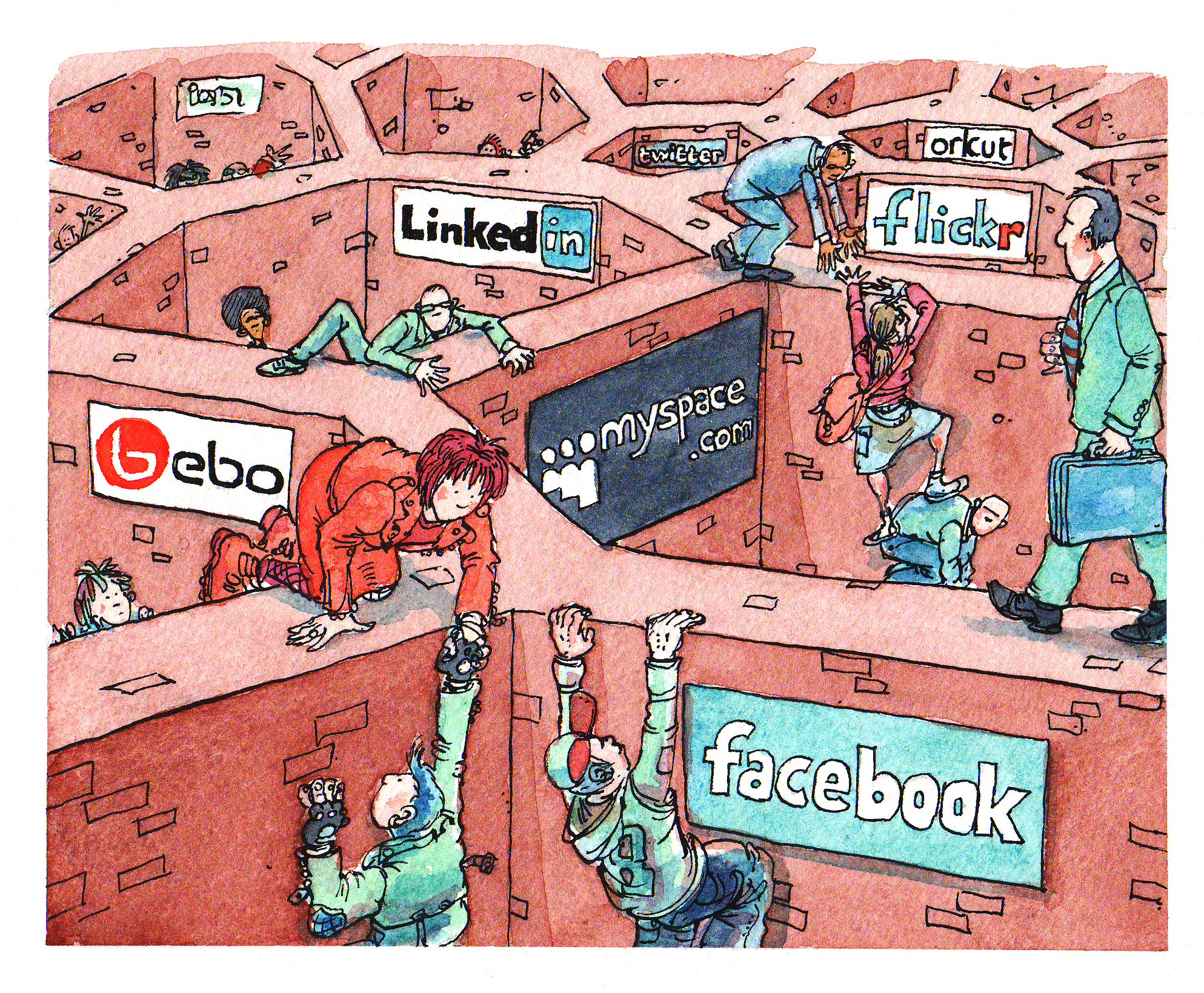

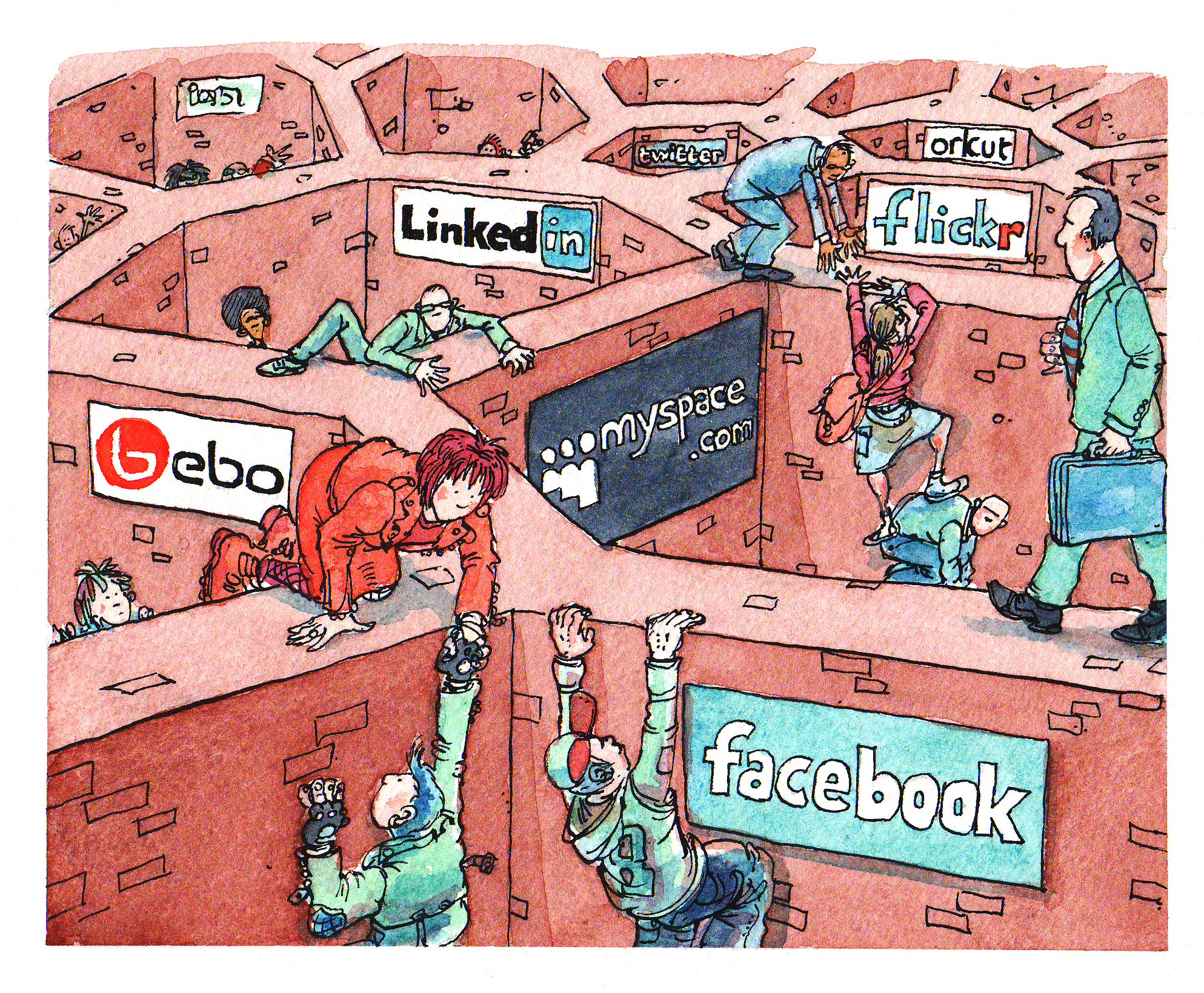

If we look at how users engage with posts and follows/followers on platforms like Twitter, Facebook, etc., it becomes evident that traditional social media thrives on engagement farming. The more outrageous a post, the more likely it will get a reaction. We see a version of this on more visual social platforms like YouTube and TikTok that use carefully crafted thumbnail images to grab the user's attention to click the video. If you'd like to dive deep into the psychology and science behind social media engagement, let me know, and I'd be happy to follow up with another article.

In this user engagement model, a user is given the option to comment or like the original post, or share it among their followers to increase its signal. They receive no value from engaging with the content aside from the dopamine hit of the original experience or having their comment liked back by whatever influencer they provide value to. Ad revenue flows to the content creator. Clout flows to the content creator. Sales revenue from merch and content placement flows to the content creator. We call this a linear economy -- the idea that resources get created, used up, then thrown away. Users create content and farm as much engagement as possible, then the content is forgotten within a few hours as they move on to the next piece of content to be farmed.

What if there were a simple way to give value back to those who engage with your content? By implementing some value-for-value model -- a circular economy. Enter zaps.

Unlike traditional social media platforms, Nostr does not actively use algorithms to determine what content is popular, nor does it push content created for active user engagement to the top of a user's timeline. Yes, there are "trending" and "most zapped" timelines that users can choose to use as their default, but these use relatively straightforward engagement metrics to rank posts for these timelines.

That is not to say that we may not see clients actively seeking to refine timeline algorithms for specific metrics. Still, the beauty of having an open protocol with media that is controlled solely by its users is that users who begin to see their timeline gamed towards specific algorithms can choose to move to another client, and for those who are more tech-savvy, they can opt to run their own relays or create their own clients with personalized algorithms and web of trust scoring systems.

Zaps enable the means to create a new type of social media economy in which creators can earn for creating content and users can earn by actively engaging with it. Like and reposting content is relatively frictionless and costs nothing but a simple button tap. Zaps provide active engagement because they signal to your followers and those of the content creator that this post has genuine value, quite literally in the form of money—sats.

I have seen some comments on Nostr claiming that removing likes and reactions is for wealthy people who can afford to send zaps and that the majority of people in the US and around the world do not have the time or money to zap because they have better things to spend their money like feeding their families and paying their bills. While at face value, these may seem like valid arguments, they, unfortunately, represent the brainwashed, defeatist attitude that our current economic (and, by extension, social media) systems aim to instill in all of us to continue extracting value from our lives.

Imagine now, if those people dedicating their own time (time = money) to mine pity points on social media would instead spend that time with genuine value creation by posting content that is meaningful to cultural discussions. Imagine if, instead of complaining that their posts get no zaps and going on a tirade about how much of a victim they are, they would empower themselves to take control of their content and give value back to the world; where would that leave us? How much value could be created on a nascent platform such as Nostr, and how quickly could it overtake other platforms?

Other users argue about user experience and that additional friction (i.e., zaps) leads to lower engagement, as proven by decades of studies on user interaction. While the added friction may turn some users away, does that necessarily provide less value? I argue quite the opposite. You haven't made a few sats from zaps with your content? Can't afford to send some sats to a wallet for zapping? How about using the most excellent available resource and spending 10 seconds of your time to leave a comment? Likes and reactions are valueless transactions. Social media's real value derives from providing monetary compensation and actively engaging in a conversation with posts you find interesting or thought-provoking. Remember when humans thrived on conversation and discussion for entertainment instead of simply being an onlooker of someone else's life?

If you've made it this far, my only request is this: try only zapping and commenting as a method of engagement for two weeks. Sure, you may end up liking a post here and there, but be more mindful of how you interact with the world and break yourself from blind instinct. You'll thank me later.

-

@ e3ba5e1a:5e433365

2025-02-05 17:47:16

I got into a [friendly discussion](https://x.com/snoyberg/status/1887007888117252142) on X regarding health insurance. The specific question was how to deal with health insurance companies (presumably unfairly) denying claims? My answer, as usual: get government out of it!

The US healthcare system is essentially the worst of both worlds:

* Unlike full single payer, individuals incur high costs

* Unlike a true free market, regulation causes increases in costs and decreases competition among insurers

I'm firmly on the side of moving towards the free market. (And I say that as someone living under a single payer system now.) Here's what I would do:

* Get rid of tax incentives that make health insurance tied to your employer, giving individuals back proper freedom of choice.

* Reduce regulations significantly.

* In the short term, some people will still get rejected claims and other obnoxious behavior from insurance companies. We address that in two ways:

1. Due to reduced regulations, new insurance companies will be able to enter the market offering more reliable coverage and better rates, and people will flock to them because they have the freedom to make their own choices.

2. Sue the asses off of companies that reject claims unfairly. And ideally, as one of the few legitimate roles of government in all this, institute new laws that limit the ability of fine print to allow insurers to escape their responsibilities. (I'm hesitant that the latter will happen due to the incestuous relationship between Congress/regulators and insurers, but I can hope.)

Will this magically fix everything overnight like politicians normally promise? No. But it will allow the market to return to a healthy state. And I don't think it will take long (order of magnitude: 5-10 years) for it to come together, but that's just speculation.

And since there's a high correlation between those who believe government can fix problems by taking more control and demanding that only credentialed experts weigh in on a topic (both points I strongly disagree with BTW): I'm a trained actuary and worked in the insurance industry, and have directly seen how government regulation reduces competition, raises prices, and harms consumers.

And my final point: I don't think any prior art would be a good comparison for deregulation in the US, it's such a different market than any other country in the world for so many reasons that lessons wouldn't really translate. Nonetheless, I asked Grok for some empirical data on this, and at best the results of deregulation could be called "mixed," but likely more accurately "uncertain, confused, and subject to whatever interpretation anyone wants to apply."

https://x.com/i/grok/share/Zc8yOdrN8lS275hXJ92uwq98M

-

@ e3ba5e1a:5e433365

2025-02-04 08:29:00

President Trump has started rolling out his tariffs, something I [blogged about in November](https://www.snoyman.com/blog/2024/11/steelmanning-tariffs/). People are talking about these tariffs a lot right now, with many people (correctly) commenting on how consumers will end up with higher prices as a result of these tariffs. While that part is true, I’ve seen a lot of people taking it to the next, incorrect step: that consumers will pay the entirety of the tax. I [put up a poll on X](https://x.com/snoyberg/status/1886035800019599808) to see what people thought, and while the right answer got a lot of votes, it wasn't the winner.

For purposes of this blog post, our ultimate question will be the following:

* Suppose apples currently sell for $1 each in the entire United States.

* There are domestic sellers and foreign sellers of apples, all receiving the same price.

* There are no taxes or tariffs on the purchase of apples.

* The question is: if the US federal government puts a $0.50 import tariff per apple, what will be the change in the following:

* Number of apples bought in the US

* Price paid by buyers for apples in the US

* Post-tax price received by domestic apple producers

* Post-tax price received by foreign apple producers

Before we can answer that question, we need to ask an easier, first question: before instituting the tariff, why do apples cost $1?

And finally, before we dive into the details, let me provide you with the answers to the ultimate question. I recommend you try to guess these answers before reading this, and if you get it wrong, try to understand why:

1. The number of apples bought will go down

2. The buyers will pay more for each apple they buy, but not the full amount of the tariff

3. Domestic apple sellers will receive a *higher* price per apple

4. Foreign apple sellers will receive a *lower* price per apple, but not lowered by the full amount of the tariff

In other words, regardless of who sends the payment to the government, both taxed parties (domestic buyers and foreign sellers) will absorb some of the costs of the tariff, while domestic sellers will benefit from the protectionism provided by tariffs and be able to sell at a higher price per unit.

## Marginal benefit

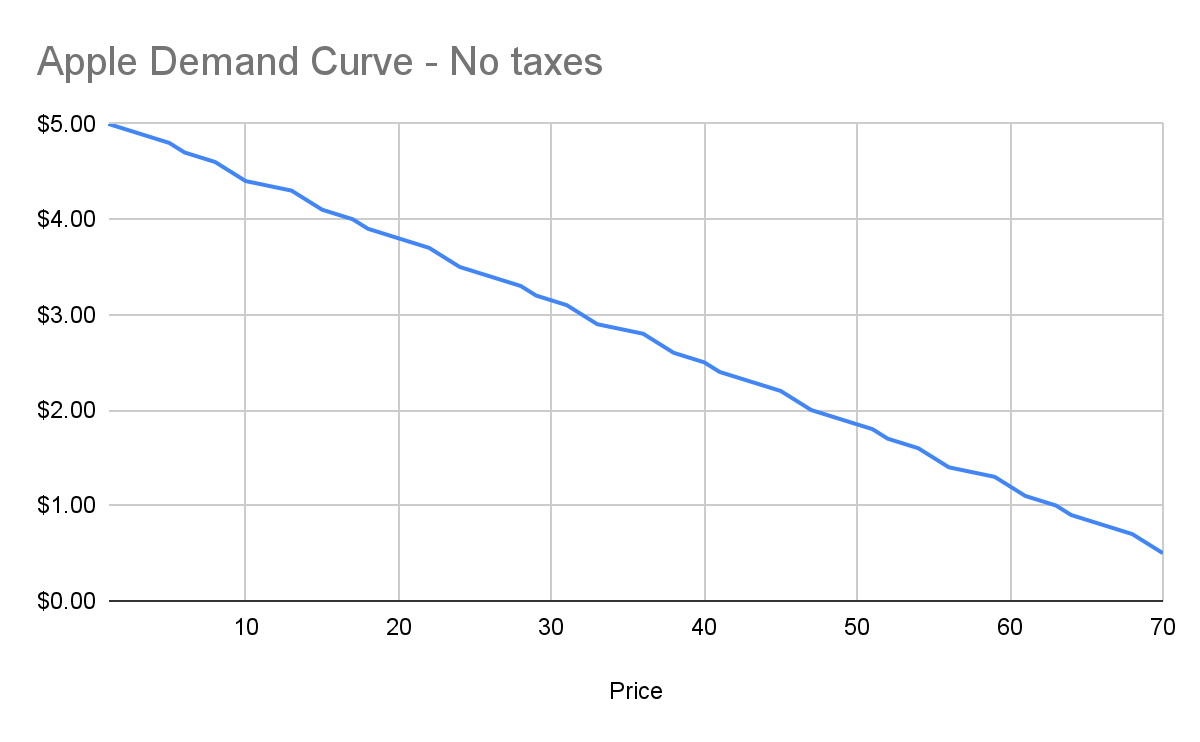

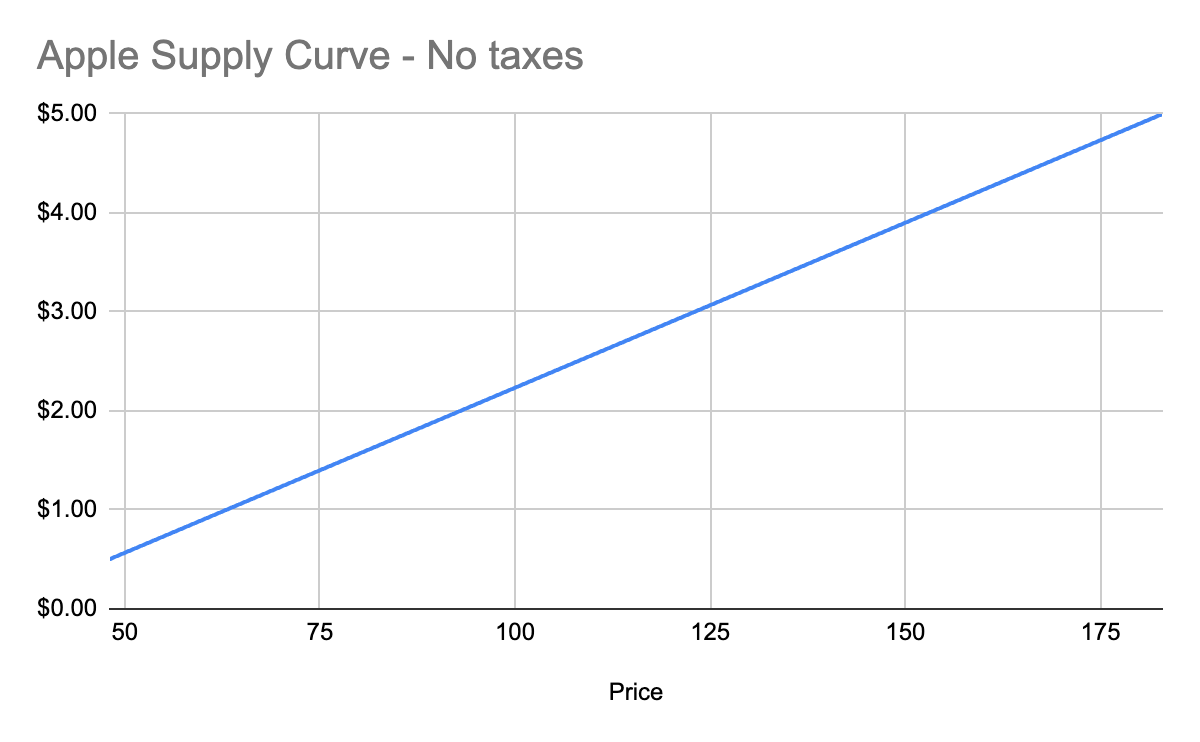

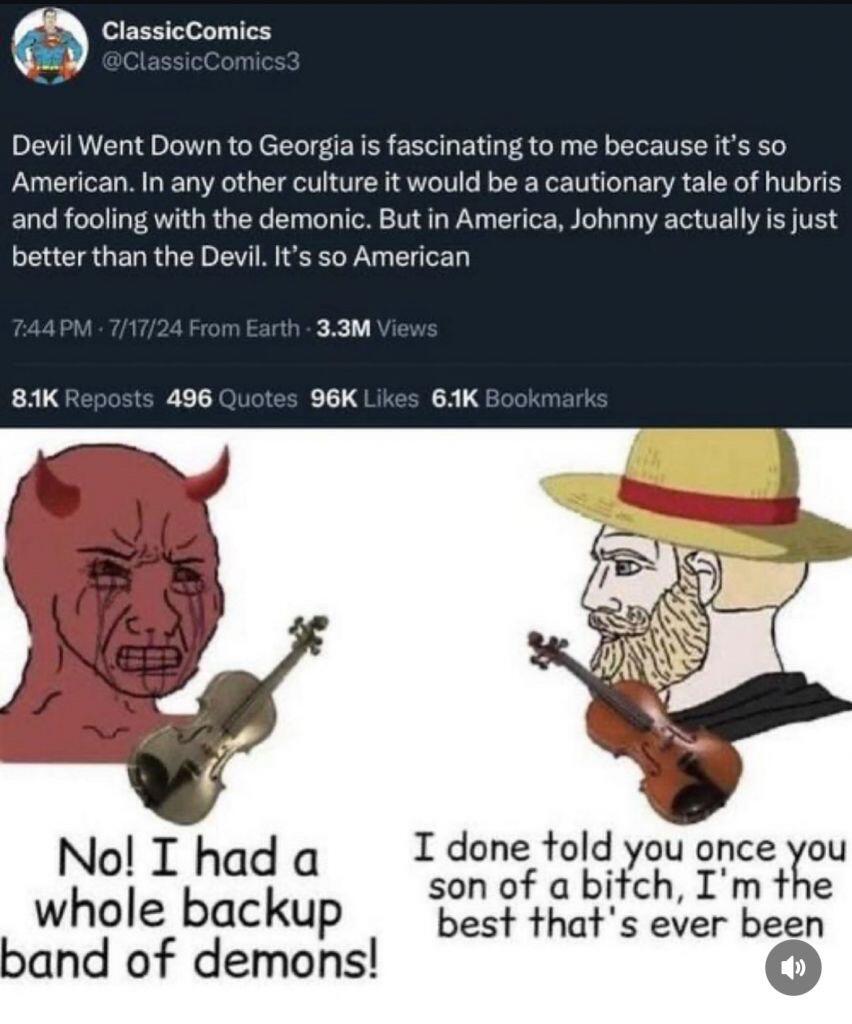

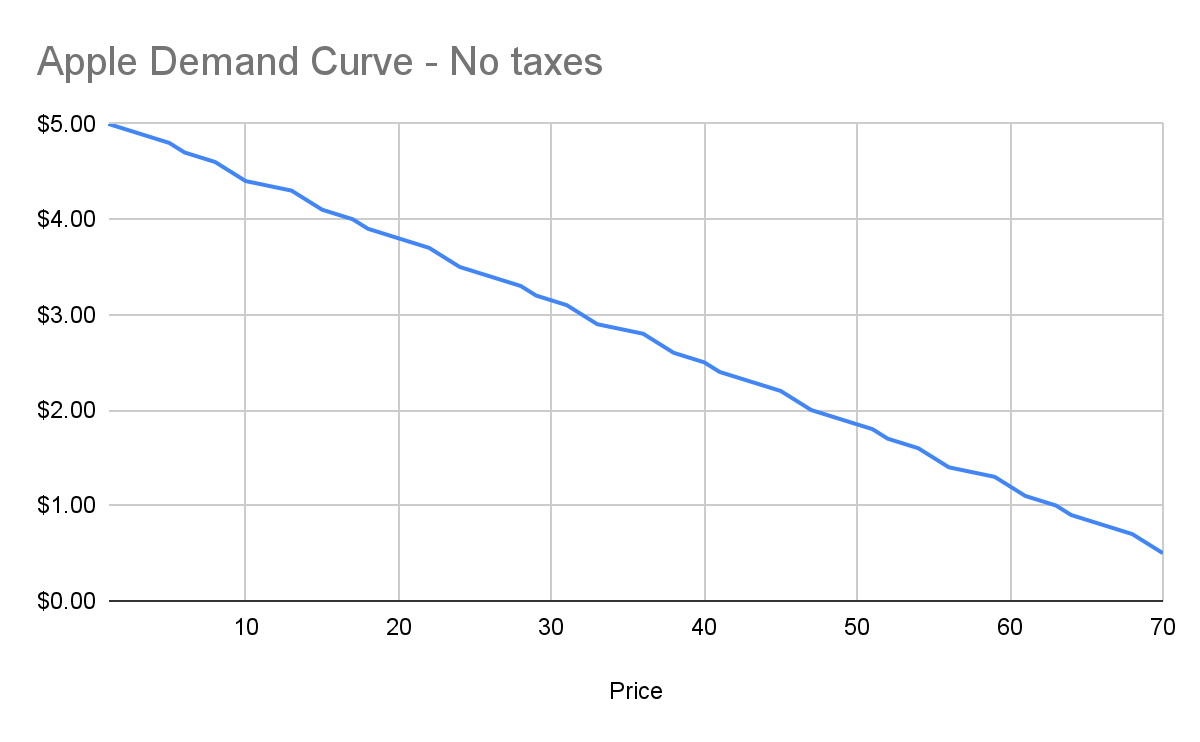

All of the numbers discussed below are part of a [helper Google Sheet](https://docs.google.com/spreadsheets/d/14ZbkWpw1B9Q1UDB9Yh47DmdKQfIafVVBKbDUsSIfGZw/edit?usp=sharing) I put together for this analysis. Also, apologies about the jagged lines in the charts below, I hadn’t realized before starting on this that there are [some difficulties with creating supply and demand charts in Google Sheets](https://superuser.com/questions/1359731/how-to-create-a-supply-demand-style-chart).

Let’s say I absolutely love apples, they’re my favorite food. How much would I be willing to pay for a single apple? You might say “$1, that’s the price in the supermarket,” and in many ways you’d be right. If I walk into supermarket A, see apples on sale for $50, and know that I can buy them at supermarket B for $1, I’ll almost certainly leave A and go buy at B.

But that’s not what I mean. What I mean is: how high would the price of apples have to go *everywhere* so that I’d no longer be willing to buy a single apple? This is a purely personal, subjective opinion. It’s impacted by how much money I have available, other expenses I need to cover, and how much I like apples. But let’s say the number is $5.

How much would I be willing to pay for another apple? Maybe another $5. But how much am I willing to pay for the 1,000th apple? 10,000th? At some point, I’ll get sick of apples, or run out of space to keep the apples, or not be able to eat, cook, and otherwise preserve all those apples before they rot.

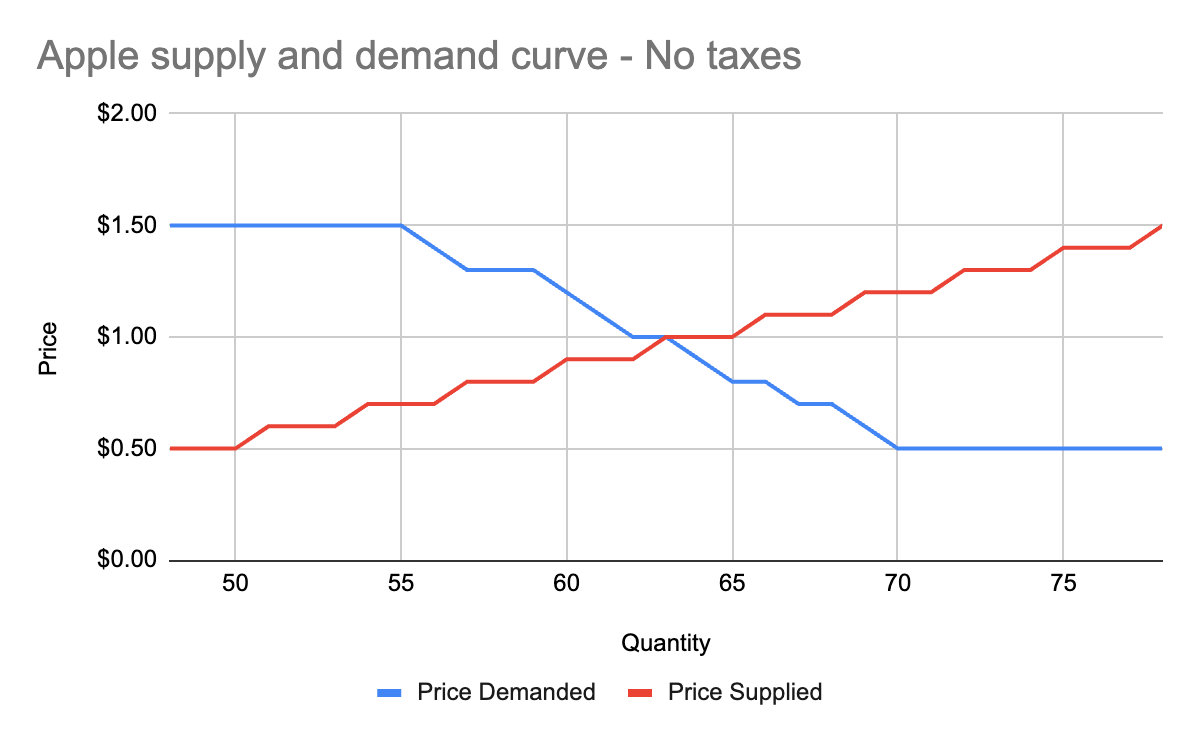

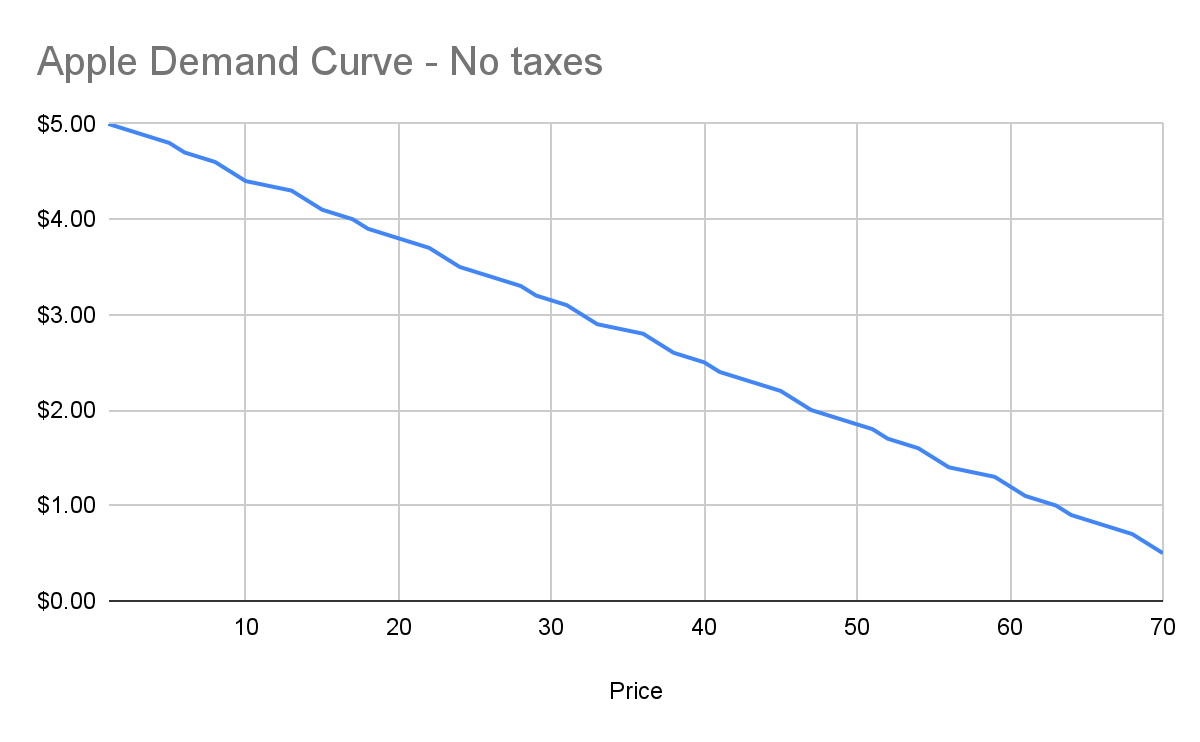

The point being: I’ll be progressively willing to spend less and less money for each apple. This form of analysis is called *marginal benefit*: how much benefit (expressed as dollars I’m willing to spend) will I receive from each apple? This is a downward sloping function: for each additional apple I buy (quantity demanded), the price I’m willing to pay goes down. This is what gives my personal *demand curve*. And if we aggregate demand curves across all market participants (meaning: everyone interested in buying apples), we end up with something like this:

Assuming no changes in people’s behavior and other conditions in the market, this chart tells us how many apples will be purchased by our buyers at each price point between $0.50 and $5. And ceteris paribus (all else being equal), this will continue to be the demand curve for apples.

## Marginal cost

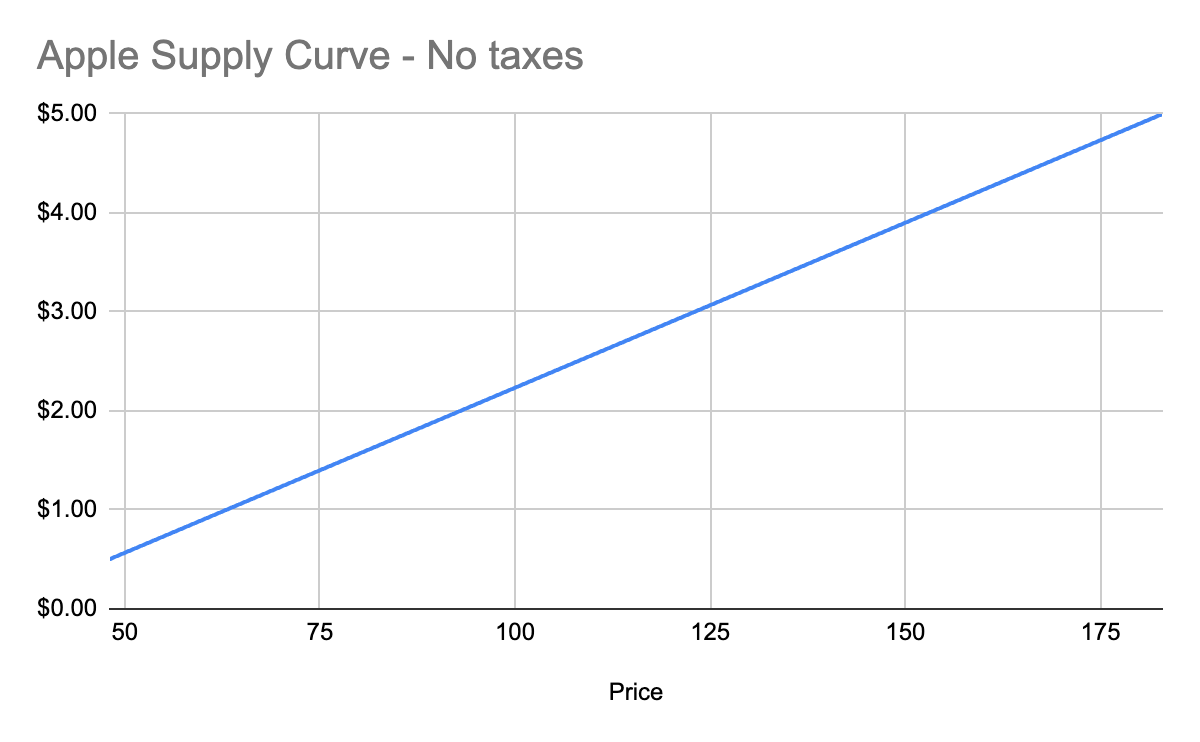

Demand is half the story of economics. The other half is supply, or: how many apples will I sell at each price point? Supply curves are upward sloping: the higher the price, the more a person or company is willing and able to sell a product.

Let’s understand why. Suppose I have an apple orchard. It’s a large property right next to my house. With about 2 minutes of effort, I can walk out of my house, find the nearest tree, pick 5 apples off the tree, and call it a day. 5 apples for 2 minutes of effort is pretty good, right?

Yes, there was all the effort necessary to buy the land, and plant the trees, and water them… and a bunch more than I likely can’t even guess at. We’re going to ignore all of that for our analysis, because for short-term supply-and-demand movement, we can ignore these kinds of *sunk costs*. One other simplification: in reality, supply curves often start descending before ascending. This accounts for achieving efficiencies of scale after the first number of units purchased. But since both these topics are unneeded for understanding taxes, I won’t go any further.

Anyway, back to my apple orchard. If someone offers me $0.50 per apple, I can do 2 minutes of effort and get $2.50 in revenue, which equates to a $75/hour wage for me. I’m more than happy to pick apples at that price\!

However, let’s say someone comes to buy 10,000 apples from me instead. I no longer just walk out to my nearest tree. I’m going to need to get in my truck, drive around, spend the day in the sun, pay for gas, take a day off of my day job (let’s say it pays me $70/hour). The costs go up significantly. Let’s say it takes 5 days to harvest all those apples myself, it costs me $100 in fuel and other expenses, and I lose out on my $70/hour job for 5 days. We end up with:

* Total expenditure: $100 \+ $70 \* 8 hours a day \* 5 days \== $2900

* Total revenue: $5000 (10,000 apples at $0.50 each)

* Total profit: $2100

So I’m still willing to sell the apples at this price, but it’s not as attractive as before. And as the number of apples purchased goes up, my costs keep increasing. I’ll need to spend more money on fuel to travel more of my property. At some point I won’t be able to do the work myself anymore, so I’ll need to pay others to work on the farm, and they’ll be slower at picking apples than me (less familiar with the property, less direct motivation, etc.). The point being: at some point, the number of apples can go high enough that the $0.50 price point no longer makes me any money.

This kind of analysis is called *marginal cost*. It refers to the additional amount of expenditure a seller has to spend in order to produce each additional unit of the good. Marginal costs go up as quantity sold goes up. And like demand curves, if you aggregate this data across all sellers, you get a supply curve like this:

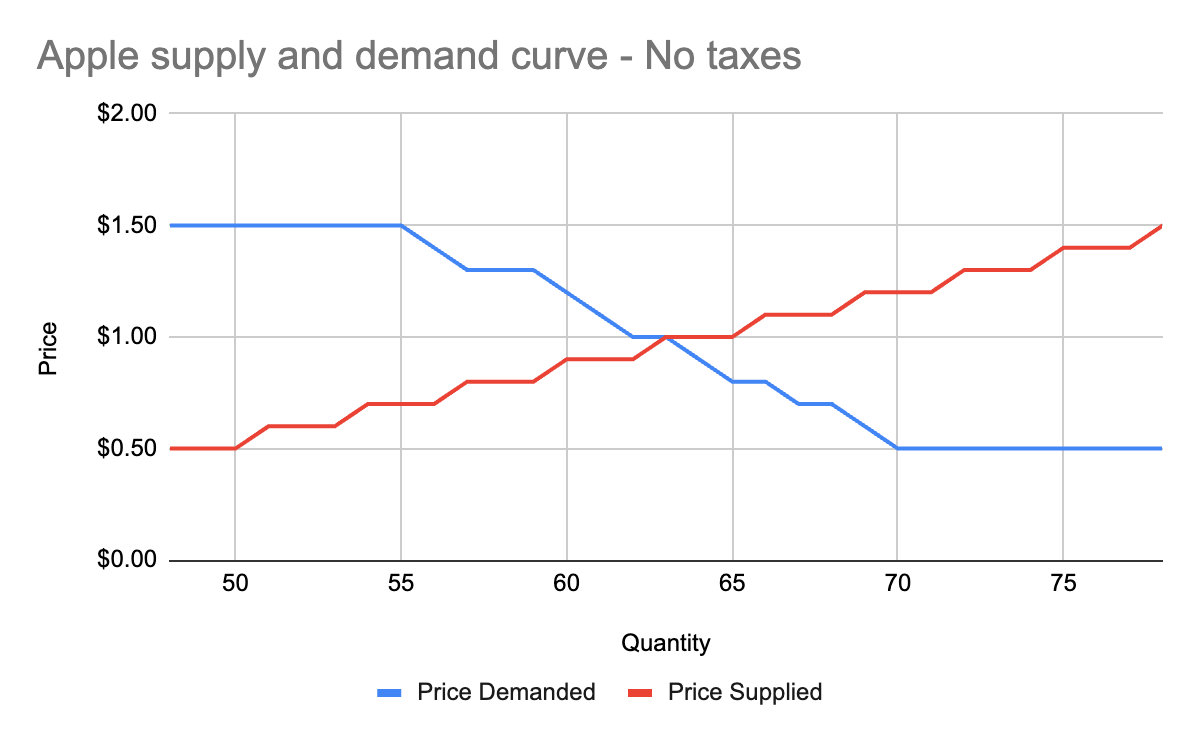

## Equilibrium price

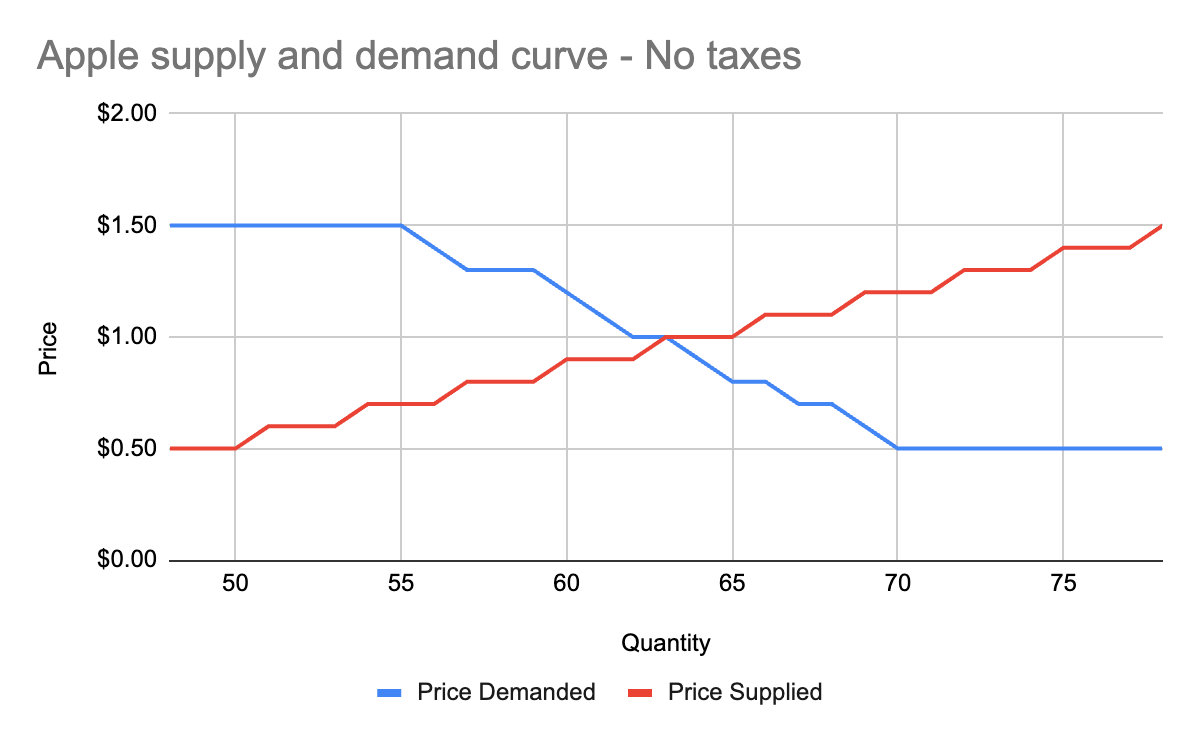

We now know, for every price point, how many apples buyers will purchase, and how many apples sellers will sell. Now we find the equilibrium: where the supply and demand curves meet. This point represents where the marginal benefit a buyer would receive from the next buyer would be less than the cost it would take the next seller to make it. Let’s see it in a chart:

You’ll notice that these two graphs cross at the $1 price point, where 63 apples are both demanded (bought by consumers) and supplied (sold by producers). This is our equilibrium price. We also have a visualization of the *surplus* created by these trades. Everything to the left of the equilibrium point and between the supply and demand curves represents surplus: an area where someone is receiving something of more value than they give. For example:

* When I bought my first apple for $1, but I was willing to spend $5, I made $4 of consumer surplus. The consumer portion of the surplus is everything to the left of the equilibrium point, between the supply and demand curves, and above the equilibrium price point.

* When a seller sells his first apple for $1, but it only cost $0.50 to produce it, the seller made $0.50 of producer surplus. The producer portion of the surplus is everything to the left of the equilibrium point, between the supply and demand curves, and below the equilibrium price point.

Another way of thinking of surplus is “every time someone got a better price than they would have been willing to take.”

OK, with this in place, we now have enough information to figure out how to price in the tariff, which we’ll treat as a negative externality.

## Modeling taxes

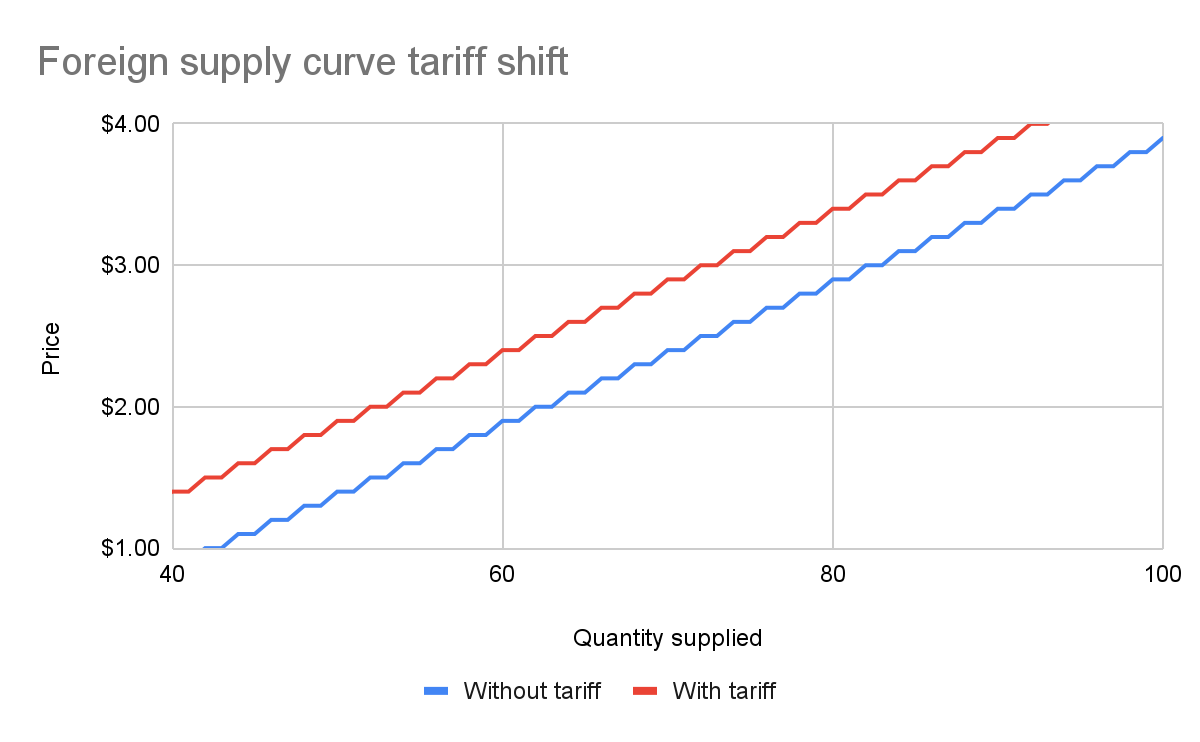

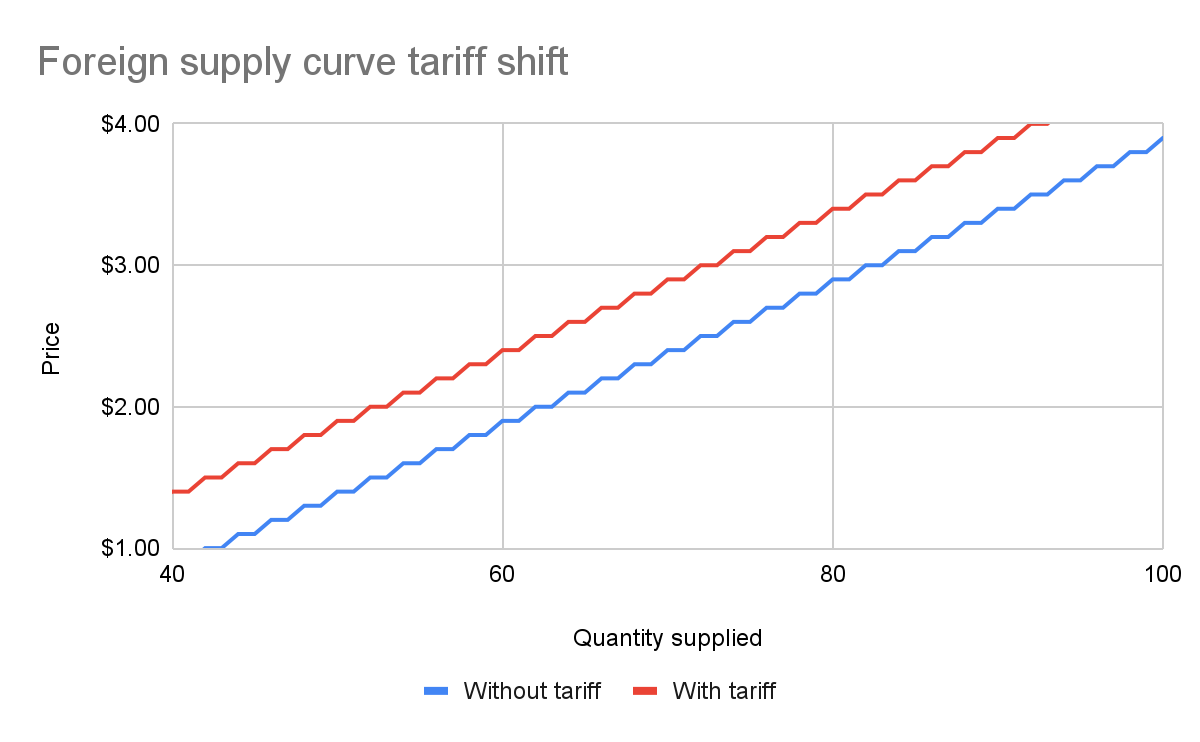

Alright, the government has now instituted a $0.50 tariff on every apple sold within the US by a foreign producer. We can generally model taxes by either increasing the marginal cost of each unit sold (shifting the supply curve up), or by decreasing the marginal benefit of each unit bought (shifting the demand curve down). In this case, since only some of the producers will pay the tax, it makes more sense to modify the supply curve.

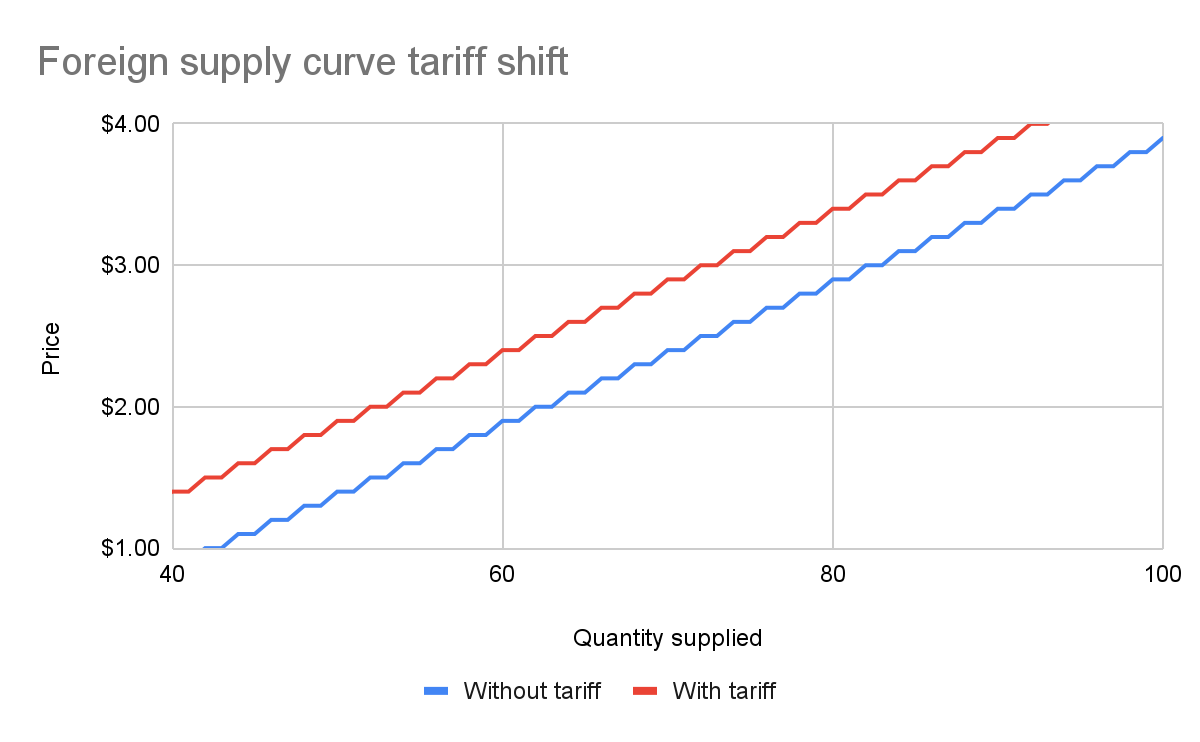

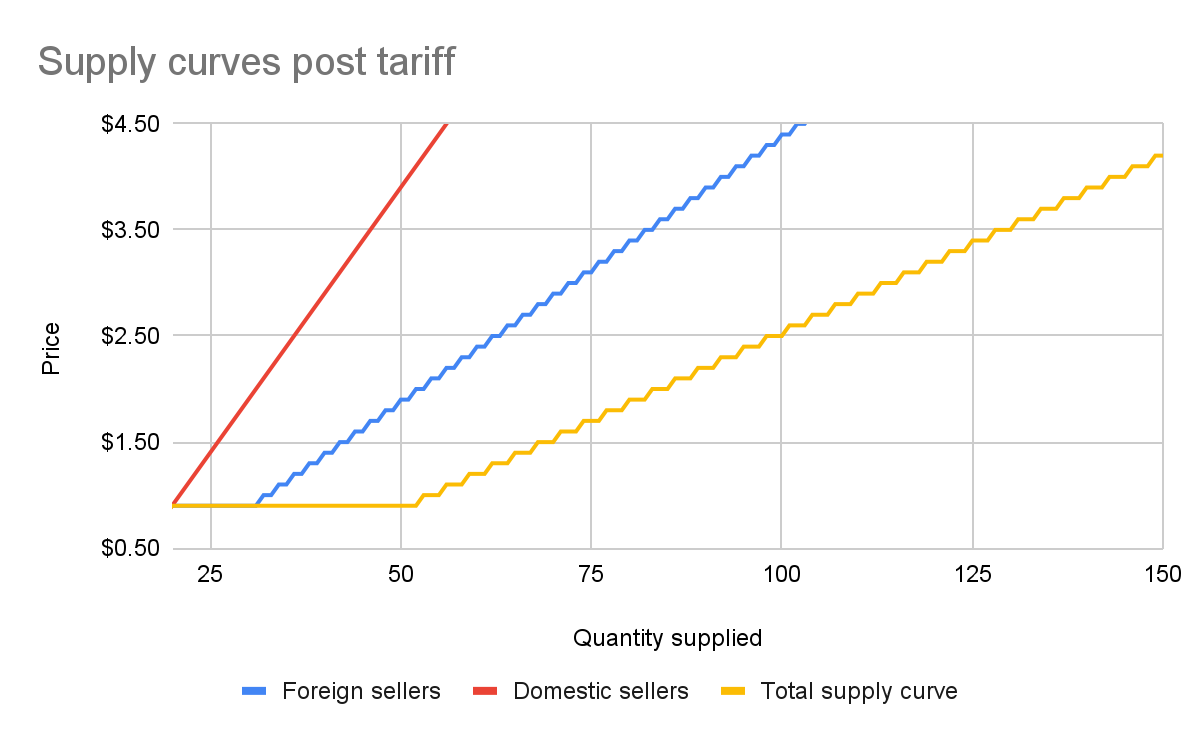

First, let’s see what happens to the foreign seller-only supply curve when you add in the tariff:

With the tariff in place, for each quantity level, the price at which the seller will sell is $0.50 higher than before the tariff. That makes sense: if I was previously willing to sell my 82nd apple for $3, I would now need to charge $3.50 for that apple to cover the cost of the tariff. We see this as the tariff “pushing up” or “pushing left” the original supply curve.

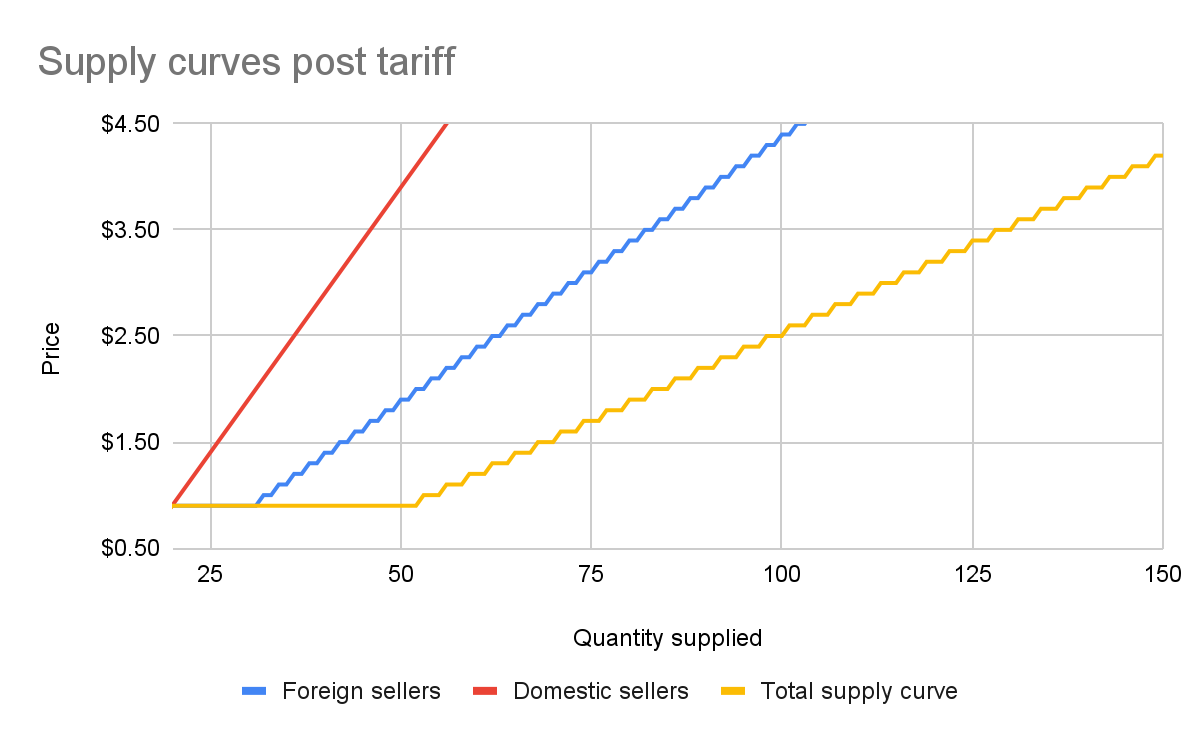

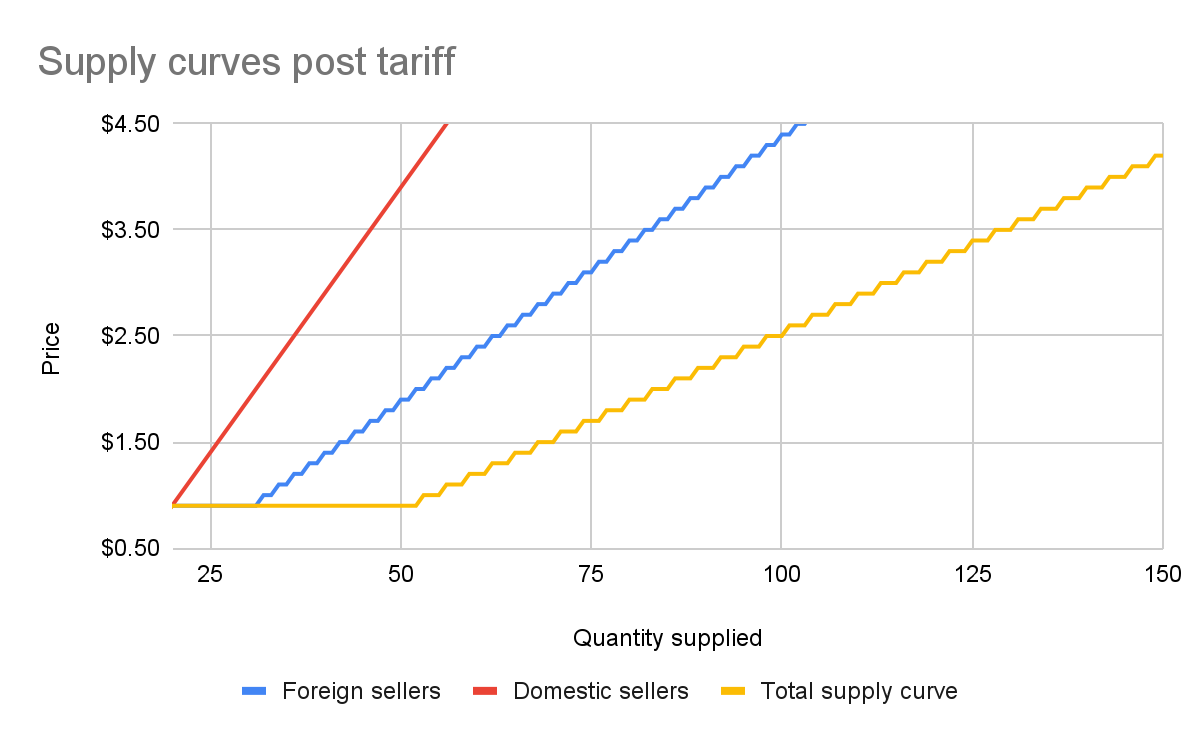

We can add this new supply curve to our existing (unchanged) supply curve for domestic-only sellers, and we end up with a result like this:

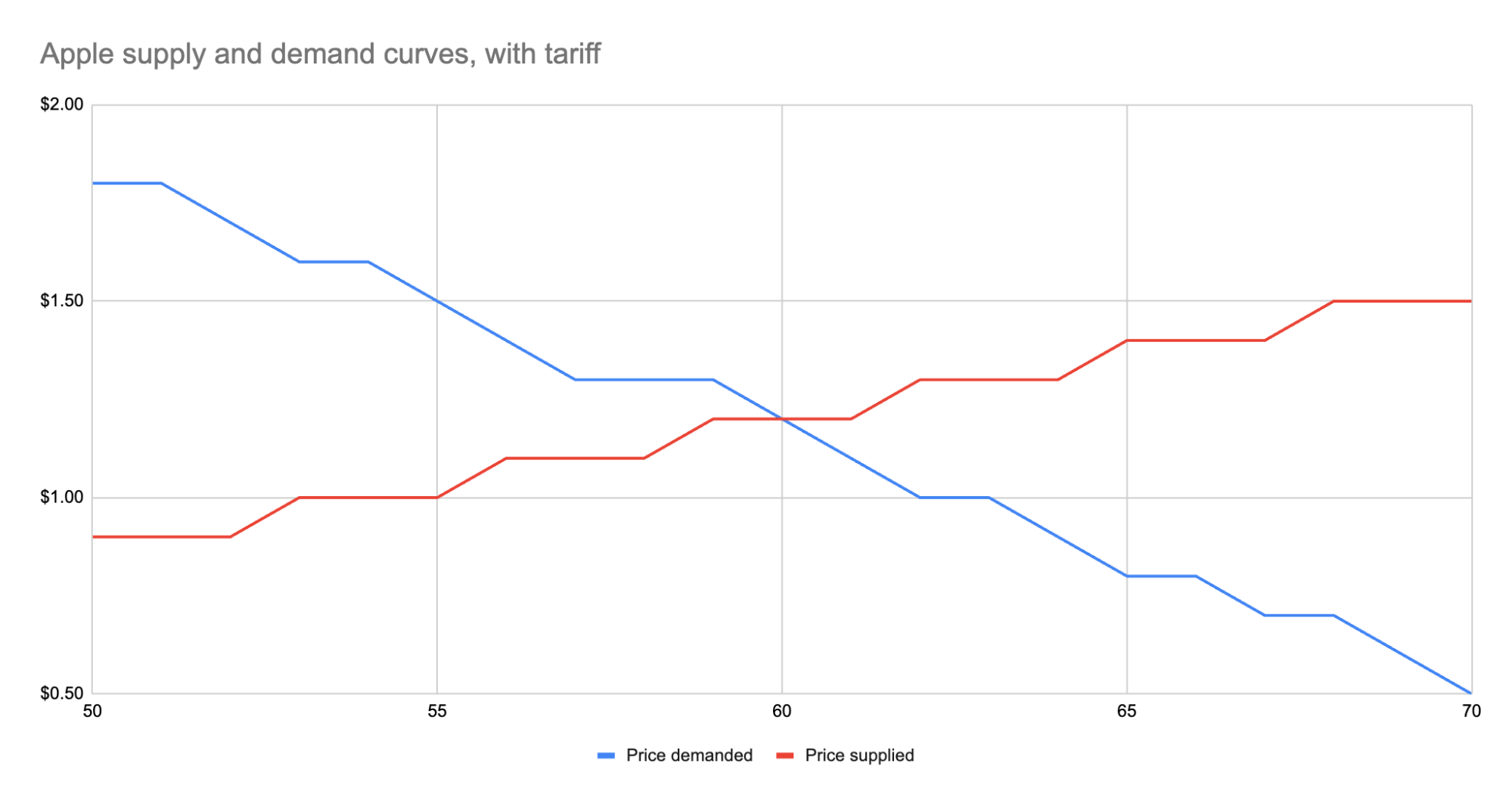

The total supply curve adds up the individual foreign and domestic supply curves. At each price point, we add up the total quantity each group would be willing to sell to determine the total quantity supplied for each price point. Once we have that cumulative supply curve defined, we can produce an updated supply-and-demand chart including the tariff:

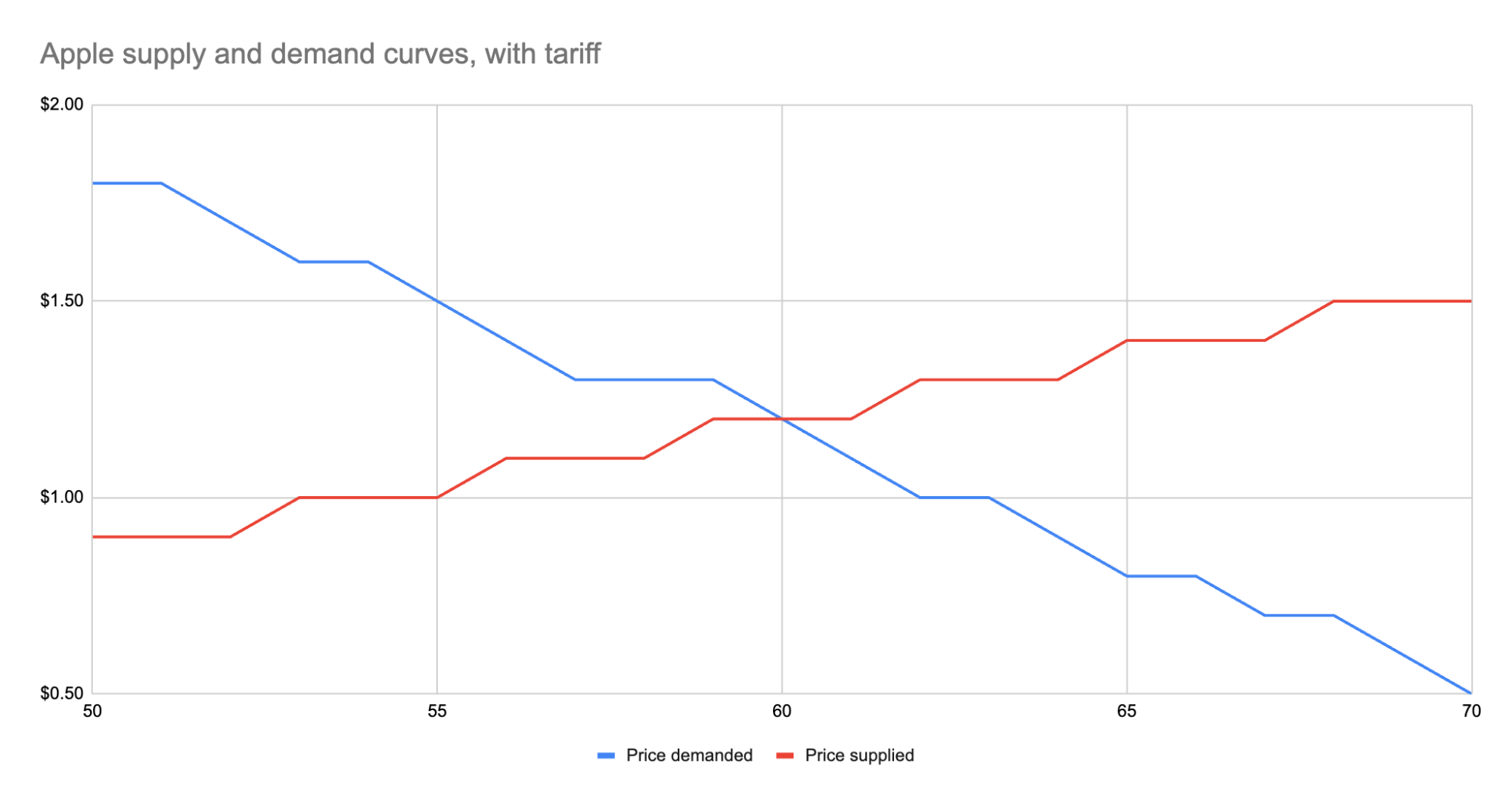

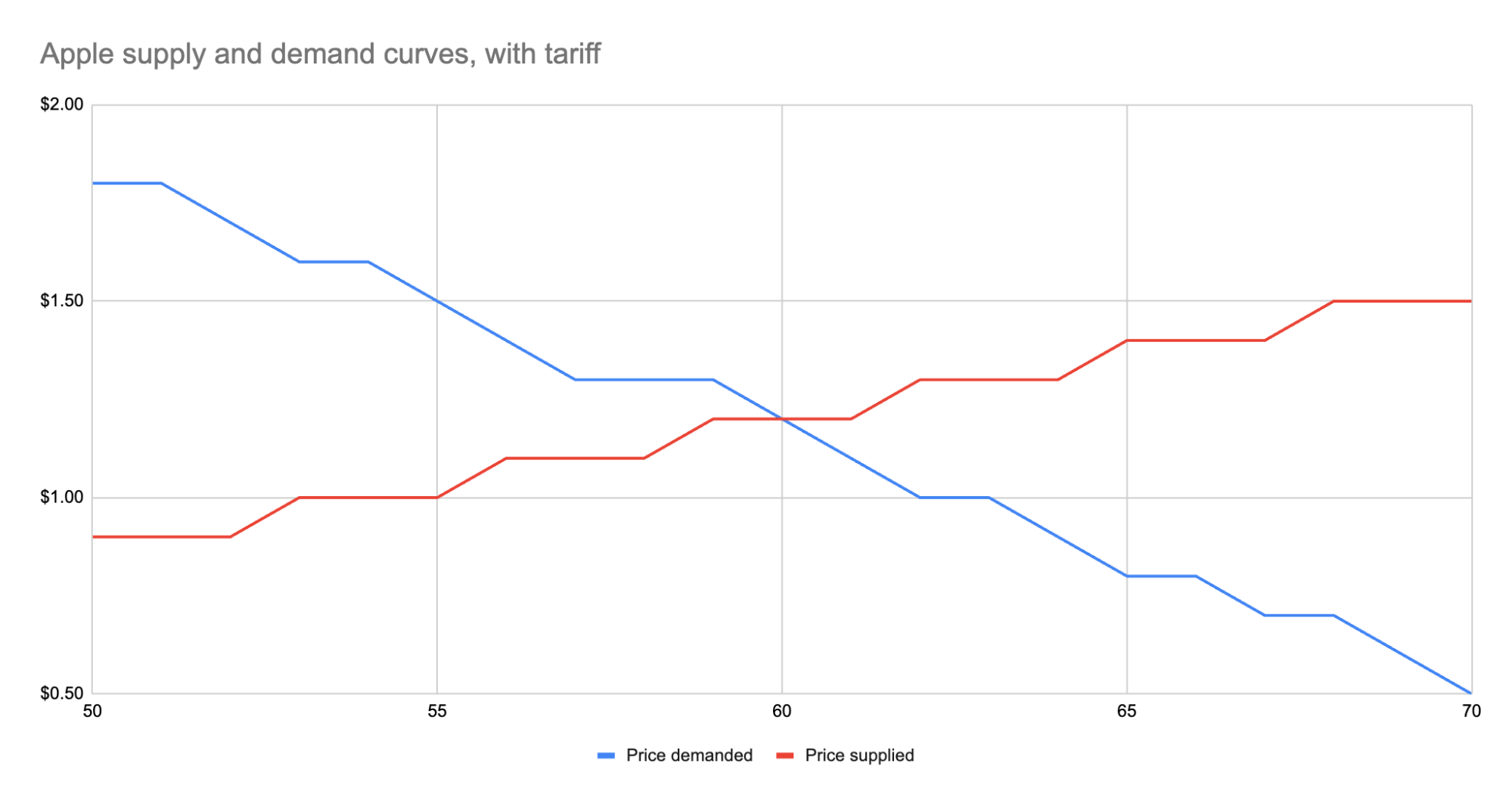

As we can see, the equilibrium has shifted:

* The equilibrium price paid by consumers has risen from $1 to $1.20.

* The total number of apples purchased has dropped from 63 apples to 60 apples.

* Consumers therefore received 3 less apples. They spent $72 for these 60 apples, whereas previously they spent $63 for 3 more apples, a definite decrease in consumer surplus.

* Foreign producers sold 36 of those apples (see the raw data in the linked Google Sheet), for a gross revenue of $43.20. However, they also need to pay the tariff to the US government, which accounts for $18, meaning they only receive $25.20 post-tariff. Previously, they sold 42 apples at $1 each with no tariff to be paid, meaning they took home $42.

* Domestic producers sold the remaining 24 apples at $1.20, giving them a revenue of $28.80. Since they don’t pay the tariff, they take home all of that money. By contrast, previously, they sold 21 apples at $1, for a take-home of $21.

* The government receives $0.50 for each of the 60 apples sold, or in other words receives $30 in revenue it wouldn’t have received otherwise.

We could be more specific about the surpluses, and calculate the actual areas for consumer surplus, producer surplus, inefficiency from the tariff, and government revenue from the tariff. But I won’t bother, as those calculations get slightly more involved. Instead, let’s just look at the aggregate outcomes:

* Consumers were unquestionably hurt. Their price paid went up by $0.20 per apple, and received less apples.

* Foreign producers were also hurt. Their price received went down from the original $1 to the new post-tariff price of $1.20, minus the $0.50 tariff. In other words: foreign producers only receive $0.70 per apple now. This hurt can be mitigated by shifting sales to other countries without a tariff, but the pain will exist regardless.

* Domestic producers scored. They can sell less apples and make more revenue doing it.

* And the government walked away with an extra $30.

Hopefully you now see the answer to the original questions. Importantly, while the government imposed a $0.50 tariff, neither side fully absorbed that cost. Consumers paid a bit more, foreign producers received a bit less. The exact details of how that tariff was split across the groups is mediated by the relevant supply and demand curves of each group. If you want to learn more about this, the relevant search term is “price elasticity,” or how much a group’s quantity supplied or demanded will change based on changes in the price.

## Other taxes

Most taxes are some kind of a tax on trade. Tariffs on apples is an obvious one. But the same applies to income tax (taxing the worker for the trade of labor for money) or payroll tax (same thing, just taxing the employer instead). Interestingly, you can use the same model for analyzing things like tax incentives. For example, if the government decided to subsidize domestic apple production by giving the domestic producers a $0.50 bonus for each apple they sell, we would end up with a similar kind of analysis, except instead of the foreign supply curve shifting up, we’d see the domestic supply curve shifting down.

And generally speaking, this is what you’ll *always* see with government involvement in the economy. It will result in disrupting an existing equilibrium, letting the market readjust to a new equilibrium, and incentivization of some behavior, causing some people to benefit and others to lose out. We saw with the apple tariff, domestic producers and the government benefited while others lost.

You can see the reverse though with tax incentives. If I give a tax incentive of providing a deduction (not paying income tax) for preschool, we would end up with:

* Government needs to make up the difference in tax revenue, either by raising taxes on others or printing more money (leading to inflation). Either way, those paying the tax or those holding government debased currency will pay a price.

* Those people who don’t use the preschool deduction will receive no benefit, so they simply pay a cost.

* Those who do use the preschool deduction will end up paying less on tax+preschool than they would have otherwise.

This analysis is fully amoral. It’s not saying whether providing subsidized preschool is a good thing or not, it simply tells you where the costs will be felt, and points out that such government interference in free economic choice does result in inefficiencies in the system. Once you have that knowledge, you’re more well educated on making a decision about whether the costs of government intervention are worth the benefits.

-

@ 9e69e420:d12360c2

2025-02-01 11:16:04

Federal employees must remove pronouns from email signatures by the end of the day. This directive comes from internal memos tied to two executive orders signed by Donald Trump. The orders target diversity and equity programs within the government.

CDC, Department of Transportation, and Department of Energy employees were affected. Staff were instructed to make changes in line with revised policy prohibiting certain language.

One CDC employee shared frustration, stating, “In my decade-plus years at CDC, I've never been told what I can and can't put in my email signature.” The directive is part of a broader effort to eliminate DEI initiatives from federal discourse.

-

@ 97c70a44:ad98e322

2025-01-30 17:15:37

There was a slight dust up recently over a website someone runs removing a listing for an app someone built based on entirely arbitrary criteria. I'm not to going to attempt to speak for either wounded party, but I would like to share my own personal definition for what constitutes a "nostr app" in an effort to help clarify what might be an otherwise confusing and opaque purity test.

In this post, I will be committing the "no true Scotsman" fallacy, in which I start with the most liberal definition I can come up with, and gradually refine it until all that is left is the purest, gleamingest, most imaginary and unattainable nostr app imaginable. As I write this, I wonder if anything built yet will actually qualify. In any case, here we go.

# It uses nostr

The lowest bar for what a "nostr app" might be is an app ("application" - i.e. software, not necessarily a native app of any kind) that has some nostr-specific code in it, but which doesn't take any advantage of what makes nostr distinctive as a protocol.

Examples might include a scraper of some kind which fulfills its charter by fetching data from relays (regardless of whether it validates or retains signatures). Another might be a regular web 2.0 app which provides an option to "log in with nostr" by requesting and storing the user's public key.

In either case, the fact that nostr is involved is entirely neutral. A scraper can scrape html, pdfs, jsonl, whatever data source - nostr relays are just another target. Likewise, a user's key in this scenario is treated merely as an opaque identifier, with no appreciation for the super powers it brings along.

In most cases, this kind of app only exists as a marketing ploy, or less cynically, because it wants to get in on the hype of being a "nostr app", without the developer quite understanding what that means, or having the budget to execute properly on the claim.

# It leverages nostr

Some of you might be wondering, "isn't 'leverage' a synonym for 'use'?" And you would be right, but for one connotative difference. It's possible to "use" something improperly, but by definition leverage gives you a mechanical advantage that you wouldn't otherwise have. This is the second category of "nostr app".

This kind of app gets some benefit out of the nostr protocol and network, but in an entirely selfish fashion. The intention of this kind of app is not to augment the nostr network, but to augment its own UX by borrowing some nifty thing from the protocol without really contributing anything back.

Some examples might include:

- Using nostr signers to encrypt or sign data, and then store that data on a proprietary server.

- Using nostr relays as a kind of low-code backend, but using proprietary event payloads.

- Using nostr event kinds to represent data (why), but not leveraging the trustlessness that buys you.

An application in this category might even communicate to its users via nostr DMs - but this doesn't make it a "nostr app" any more than a website that emails you hot deals on herbal supplements is an "email app". These apps are purely parasitic on the nostr ecosystem.

In the long-term, that's not necessarily a bad thing. Email's ubiquity is self-reinforcing. But in the short term, this kind of "nostr app" can actually do damage to nostr's reputation by over-promising and under-delivering.

# It complements nostr

Next up, we have apps that get some benefit out of nostr as above, but give back by providing a unique value proposition to nostr users as nostr users. This is a bit of a fine distinction, but for me this category is for apps which focus on solving problems that nostr isn't good at solving, leaving the nostr integration in a secondary or supporting role.

One example of this kind of app was Mutiny (RIP), which not only allowed users to sign in with nostr, but also pulled those users' social graphs so that users could send money to people they knew and trusted. Mutiny was doing a great job of leveraging nostr, as well as providing value to users with nostr identities - but it was still primarily a bitcoin wallet, not a "nostr app" in the purest sense.

Other examples are things like Nostr Nests and Zap.stream, whose core value proposition is streaming video or audio content. Both make great use of nostr identities, data formats, and relays, but they're primarily streaming apps. A good litmus test for things like this is: if you got rid of nostr, would it be the same product (even if inferior in certain ways)?

A similar category is infrastructure providers that benefit nostr by their existence (and may in fact be targeted explicitly at nostr users), but do things in a centralized, old-web way; for example: media hosts, DNS registrars, hosting providers, and CDNs.

To be clear here, I'm not casting aspersions (I don't even know what those are, or where to buy them). All the apps mentioned above use nostr to great effect, and are a real benefit to nostr users. But they are not True Scotsmen.

# It embodies nostr

Ok, here we go. This is the crème de la crème, the top du top, the meilleur du meilleur, the bee's knees. The purest, holiest, most chaste category of nostr app out there. The apps which are, indeed, nostr indigitate.

This category of nostr app (see, no quotes this time) can be defined by the converse of the previous category. If nostr was removed from this type of application, would it be impossible to create the same product?

To tease this apart a bit, apps that leverage the technical aspects of nostr are dependent on nostr the *protocol*, while apps that benefit nostr exclusively via network effect are integrated into nostr the *network*. An app that does both things is working in symbiosis with nostr as a whole.

An app that embraces both nostr's protocol and its network becomes an organic extension of every other nostr app out there, multiplying both its competitive moat and its contribution to the ecosystem:

- In contrast to apps that only borrow from nostr on the technical level but continue to operate in their own silos, an application integrated into the nostr network comes pre-packaged with existing users, and is able to provide more value to those users because of other nostr products. On nostr, it's a good thing to advertise your competitors.

- In contrast to apps that only market themselves to nostr users without building out a deep integration on the protocol level, a deeply integrated app becomes an asset to every other nostr app by becoming an organic extension of them through interoperability. This results in increased traffic to the app as other developers and users refer people to it instead of solving their problem on their own. This is the "micro-apps" utopia we've all been waiting for.

Credible exit doesn't matter if there aren't alternative services. Interoperability is pointless if other applications don't offer something your app doesn't. Marketing to nostr users doesn't matter if you don't augment their agency _as nostr users_.

If I had to choose a single NIP that represents the mindset behind this kind of app, it would be NIP 89 A.K.A. "Recommended Application Handlers", which states:

> Nostr's discoverability and transparent event interaction is one of its most interesting/novel mechanics. This NIP provides a simple way for clients to discover applications that handle events of a specific kind to ensure smooth cross-client and cross-kind interactions.

These handlers are the glue that holds nostr apps together. A single event, signed by the developer of an application (or by the application's own account) tells anyone who wants to know 1. what event kinds the app supports, 2. how to link to the app (if it's a client), and (if the pubkey also publishes a kind 10002), 3. which relays the app prefers.

_As a sidenote, NIP 89 is currently focused more on clients, leaving DVMs, relays, signers, etc somewhat out in the cold. Updating 89 to include tailored listings for each kind of supporting app would be a huge improvement to the protocol. This, plus a good front end for navigating these listings (sorry nostrapp.link, close but no cigar) would obviate the evil centralized websites that curate apps based on arbitrary criteria._

Examples of this kind of app obviously include many kind 1 clients, as well as clients that attempt to bring the benefits of the nostr protocol and network to new use cases - whether long form content, video, image posts, music, emojis, recipes, project management, or any other "content type".

To drill down into one example, let's think for a moment about forms. What's so great about a forms app that is built on nostr? Well,

- There is a [spec](https://github.com/nostr-protocol/nips/pull/1190) for forms and responses, which means that...

- Multiple clients can implement the same data format, allowing for credible exit and user choice, even of...

- Other products not focused on forms, which can still view, respond to, or embed forms, and which can send their users via NIP 89 to a client that does...

- Cryptographically sign forms and responses, which means they are self-authenticating and can be sent to...

- Multiple relays, which reduces the amount of trust necessary to be confident results haven't been deliberately "lost".

Show me a forms product that does all of those things, and isn't built on nostr. You can't, because it doesn't exist. Meanwhile, there are plenty of image hosts with APIs, streaming services, and bitcoin wallets which have basically the same levels of censorship resistance, interoperability, and network effect as if they weren't built on nostr.

# It supports nostr

Notice I haven't said anything about whether relays, signers, blossom servers, software libraries, DVMs, and the accumulated addenda of the nostr ecosystem are nostr apps. Well, they are (usually).

This is the category of nostr app that gets none of the credit for doing all of the work. There's no question that they qualify as beautiful nostrcorns, because their value propositions are entirely meaningless outside of the context of nostr. Who needs a signer if you don't have a cryptographic identity you need to protect? DVMs are literally impossible to use without relays. How are you going to find the blossom server that will serve a given hash if you don't know which servers the publishing user has selected to store their content?

In addition to being entirely contextualized by nostr architecture, this type of nostr app is valuable because it does things "the nostr way". By that I mean that they don't simply try to replicate existing internet functionality into a nostr context; instead, they create entirely new ways of putting the basic building blocks of the internet back together.

A great example of this is how Nostr Connect, Nostr Wallet Connect, and DVMs all use relays as brokers, which allows service providers to avoid having to accept incoming network connections. This opens up really interesting possibilities all on its own.

So while I might hesitate to call many of these things "apps", they are certainly "nostr".

# Appendix: it smells like a NINO

So, let's say you've created an app, but when you show it to people they politely smile, nod, and call it a NINO (Nostr In Name Only). What's a hacker to do? Well, here's your handy-dandy guide on how to wash that NINO stench off and Become a Nostr.

You app might be a NINO if:

- There's no NIP for your data format (or you're abusing NIP 78, 32, etc by inventing a sub-protocol inside an existing event kind)

- There's a NIP, but no one knows about it because it's in a text file on your hard drive (or buried in your project's repository)

- Your NIP imposes an incompatible/centralized/legacy web paradigm onto nostr

- Your NIP relies on trusted third (or first) parties

- There's only one implementation of your NIP (yours)

- Your core value proposition doesn't depend on relays, events, or nostr identities

- One or more relay urls are hard-coded into the source code

- Your app depends on a specific relay implementation to work (*ahem*, relay29)

- You don't validate event signatures

- You don't publish events to relays you don't control

- You don't read events from relays you don't control

- You use legacy web services to solve problems, rather than nostr-native solutions

- You use nostr-native solutions, but you've hardcoded their pubkeys or URLs into your app

- You don't use NIP 89 to discover clients and services

- You haven't published a NIP 89 listing for your app

- You don't leverage your users' web of trust for filtering out spam

- You don't respect your users' mute lists

- You try to "own" your users' data

Now let me just re-iterate - it's ok to be a NINO. We need NINOs, because nostr can't (and shouldn't) tackle every problem. You just need to decide whether your app, as a NINO, is actually contributing to the nostr ecosystem, or whether you're just using buzzwords to whitewash a legacy web software product.

If you're in the former camp, great! If you're in the latter, what are you waiting for? Only you can fix your NINO problem. And there are lots of ways to do this, depending on your own unique situation:

- Drop nostr support if it's not doing anyone any good. If you want to build a normal company and make some money, that's perfectly fine.

- Build out your nostr integration - start taking advantage of webs of trust, self-authenticating data, event handlers, etc.

- Work around the problem. Think you need a special relay feature for your app to work? Guess again. Consider encryption, AUTH, DVMs, or better data formats.

- Think your idea is a good one? Talk to other devs or open a PR to the [nips repo](https://github.com/nostr-protocol/nips). No one can adopt your NIP if they don't know about it.

- Keep going. It can sometimes be hard to distinguish a research project from a NINO. New ideas have to be built out before they can be fully appreciated.

- Listen to advice. Nostr developers are friendly and happy to help. If you're not sure why you're getting traction, ask!

I sincerely hope this article is useful for all of you out there in NINO land. Maybe this made you feel better about not passing the totally optional nostr app purity test. Or maybe it gave you some actionable next steps towards making a great NINON (Nostr In Not Only Name) app. In either case, GM and PV.

-

@ 0fa80bd3:ea7325de

2025-01-30 04:28:30

**"Degeneration"** or **"Вырождение"**

![[photo_2025-01-29 23.23.15.jpeg]]

A once-functional object, now eroded by time and human intervention, stripped of its original purpose. Layers of presence accumulate—marks, alterations, traces of intent—until the very essence is obscured. Restoration is paradoxical: to reclaim, one must erase. Yet erasure is an impossibility, for to remove these imprints is to deny the existence of those who shaped them.

The work stands as a meditation on entropy, memory, and the irreversible dialogue between creation and decay.

-

@ 0fa80bd3:ea7325de

2025-01-29 15:43:42

Lyn Alden - биткойн евангелист или евангелистка, я пока не понял

```

npub1a2cww4kn9wqte4ry70vyfwqyqvpswksna27rtxd8vty6c74era8sdcw83a

```

Thomas Pacchia - PubKey owner - X - @tpacchia

```

npub1xy6exlg37pw84cpyj05c2pdgv86hr25cxn0g7aa8g8a6v97mhduqeuhgpl

```

calvadev - Shopstr

```

npub16dhgpql60vmd4mnydjut87vla23a38j689jssaqlqqlzrtqtd0kqex0nkq

```

Calle - Cashu founder

```

npub12rv5lskctqxxs2c8rf2zlzc7xx3qpvzs3w4etgemauy9thegr43sf485vg

```

Джек Дорси

```

npub1sg6plzptd64u62a878hep2kev88swjh3tw00gjsfl8f237lmu63q0uf63m

```

21 ideas

```

npub1lm3f47nzyf0rjp6fsl4qlnkmzed4uj4h2gnf2vhe3l3mrj85vqks6z3c7l

```

Много адресов. Хз кто надо сортировать

```

https://github.com/aitechguy/nostr-address-book

```

ФиатДжеф - создатель Ностр - https://github.com/fiatjaf

```

npub180cvv07tjdrrgpa0j7j7tmnyl2yr6yr7l8j4s3evf6u64th6gkwsyjh6w6

```

EVAN KALOUDIS Zues wallet

```

npub19kv88vjm7tw6v9qksn2y6h4hdt6e79nh3zjcud36k9n3lmlwsleqwte2qd

```

Программер Коди https://github.com/CodyTseng/nostr-relay

```

npub1syjmjy0dp62dhccq3g97fr87tngvpvzey08llyt6ul58m2zqpzps9wf6wl

```

Anna Chekhovich - Managing Bitcoin at The Anti-Corruption Foundation

https://x.com/AnyaChekhovich

```

npub1y2st7rp54277hyd2usw6shy3kxprnmpvhkezmldp7vhl7hp920aq9cfyr7

```

-

@ 0fa80bd3:ea7325de

2025-01-29 14:44:48

![[yedinaya-rossiya-bear.png]]

1️⃣ Be where the bear roams. Stay in its territory, where it hunts for food. No point setting a trap in your backyard if the bear’s chilling in the forest.

2️⃣ Set a well-hidden trap. Bury it, disguise it, and place the bait right in the center. Bears are omnivores—just like secret police KGB agents. And what’s the tastiest bait for them? Money.

3️⃣ Wait for the bear to take the bait. When it reaches in, the trap will snap shut around its paw. It’ll be alive, but stuck. No escape.

Now, what you do with a trapped bear is another question... 😏

-

@ 0fa80bd3:ea7325de

2025-01-29 05:55:02

The land that belongs to the indigenous peoples of Russia has been seized by a gang of killers who have unleashed a war of extermination. They wipe out anyone who refuses to conform to their rules. Those who disagree and stay behind are tortured and killed in prisons and labor camps. Those who flee lose their homeland, dissolve into foreign cultures, and fade away. And those who stand up to protect their people are attacked by the misled and deceived. The deceived die for the unchecked greed of a single dictator—thousands from both sides, people who just wanted to live, raise their kids, and build a future.

Now, they are forced to make an impossible choice: abandon their homeland or die. Some perish on the battlefield, others lose themselves in exile, stripped of their identity, scattered in a world that isn’t theirs.

There’s been endless debate about how to fix this, how to clear the field of the weeds that choke out every new sprout, every attempt at change. But the real problem? We can’t play by their rules. We can’t speak their language or use their weapons. We stand for humanity, and no matter how righteous our cause, we will not multiply suffering. Victory doesn’t come from matching the enemy—it comes from staying ahead, from using tools they haven’t mastered yet. That’s how wars are won.

Our only resource is the **will of the people** to rewrite the order of things. Historian Timothy Snyder once said that a nation cannot exist without a city. A city is where the most active part of a nation thrives. But the cities are occupied. The streets are watched. Gatherings are impossible. They control the money. They control the mail. They control the media. And any dissent is crushed before it can take root.

So I started asking myself: **How do we stop this fragmentation?** How do we create a space where people can **rebuild their connections** when they’re ready? How do we build a **self-sustaining network**, where everyone contributes and benefits proportionally, while keeping their freedom to leave intact? And more importantly—**how do we make it spread, even in occupied territory?**

In 2009, something historic happened: **the internet got its own money.** Thanks to **Satoshi Nakamoto**, the world took a massive leap forward. Bitcoin and decentralized ledgers shattered the idea that money must be controlled by the state. Now, to move or store value, all you need is an address and a key. A tiny string of text, easy to carry, impossible to seize.

That was the year money broke free. The state lost its grip. Its biggest weapon—physical currency—became irrelevant. Money became **purely digital.**

The internet was already **a sanctuary for information**, a place where people could connect and organize. But with Bitcoin, it evolved. Now, **value itself** could flow freely, beyond the reach of authorities.

Think about it: when seedlings are grown in controlled environments before being planted outside, they **get stronger, survive longer, and bear fruit faster.** That’s how we handle crops in harsh climates—nurture them until they’re ready for the wild.

Now, picture the internet as that **controlled environment** for **ideas**. Bitcoin? It’s the **fertile soil** that lets them grow. A testing ground for new models of interaction, where concepts can take root before they move into the real world. If **nation-states are a battlefield, locked in a brutal war for territory, the internet is boundless.** It can absorb any number of ideas, any number of people, and it doesn’t **run out of space.**

But for this ecosystem to thrive, people need safe ways to communicate, to share ideas, to build something real—**without surveillance, without censorship, without the constant fear of being erased.**

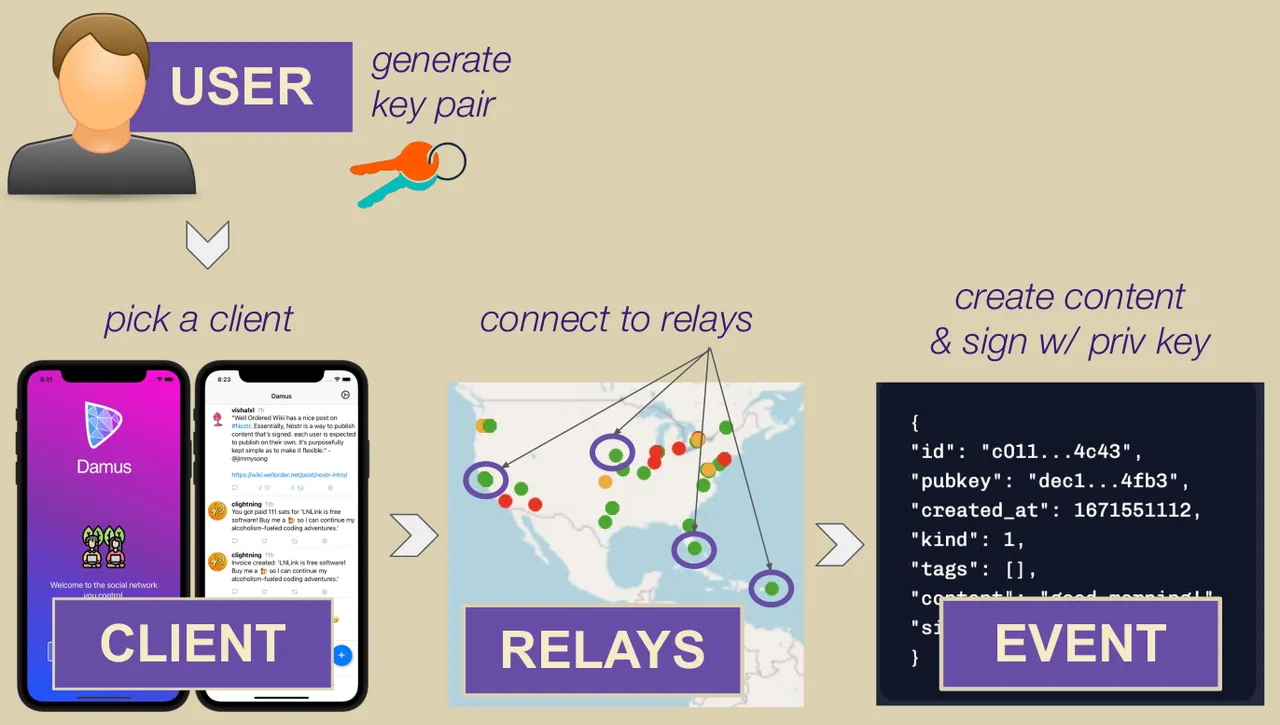

This is where **Nostr** comes in.

Nostr—"Notes and Other Stuff Transmitted by Relays"—is more than just a messaging protocol. **It’s a new kind of city.** One that **no dictator can seize**, no corporation can own, no government can shut down.

It’s built on **decentralization, encryption, and individual control.** Messages don’t pass through central servers—they are relayed through independent nodes, and users choose which ones to trust. There’s no master switch to shut it all down. Every person owns their identity, their data, their connections. And no one—no state, no tech giant, no algorithm—can silence them.

In a world where cities fall and governments fail, **Nostr is a city that cannot be occupied.** A place for ideas, for networks, for freedom. A city that grows stronger **the more people build within it**.

-

@ 9e69e420:d12360c2

2025-01-26 15:26:44

Secretary of State Marco Rubio issued new guidance halting spending on most foreign aid grants for 90 days, including military assistance to Ukraine. This immediate order shocked State Department officials and mandates “stop-work orders” on nearly all existing foreign assistance awards.

While it allows exceptions for military financing to Egypt and Israel, as well as emergency food assistance, it restricts aid to key allies like Ukraine, Jordan, and Taiwan. The guidance raises potential liability risks for the government due to unfulfilled contracts.

A report will be prepared within 85 days to recommend which programs to continue or discontinue.

-

@ 9e69e420:d12360c2

2025-01-25 22:16:54

President Trump plans to withdraw 20,000 U.S. troops from Europe and expects European allies to contribute financially to the remaining military presence. Reported by ANSA, Trump aims to deliver this message to European leaders since taking office. A European diplomat noted, “the costs cannot be borne solely by American taxpayers.”

The Pentagon hasn't commented yet. Trump has previously sought lower troop levels in Europe and had ordered cuts during his first term. The U.S. currently maintains around 65,000 troops in Europe, with total forces reaching 100,000 since the Ukraine invasion. Trump's new approach may shift military focus to the Pacific amid growing concerns about China.

[Sauce](https://www.stripes.com/theaters/europe/2025-01-24/trump-europe-troop-cuts-16590074.html)

-

@ 6be5cc06:5259daf0

2025-01-21 20:58:37

A seguir, veja como instalar e configurar o **Privoxy** no **Pop!_OS**.

---

### **1. Instalar o Tor e o Privoxy**

Abra o terminal e execute:

```bash

sudo apt update

sudo apt install tor privoxy

```

**Explicação:**

- **Tor:** Roteia o tráfego pela rede Tor.

- **Privoxy:** Proxy avançado que intermedia a conexão entre aplicativos e o Tor.

---

### **2. Configurar o Privoxy**

Abra o arquivo de configuração do Privoxy:

```bash

sudo nano /etc/privoxy/config

```

Navegue até a última linha (atalho: **`Ctrl`** + **`/`** depois **`Ctrl`** + **`V`** para navegar diretamente até a última linha) e insira:

```bash

forward-socks5 / 127.0.0.1:9050 .

```

Isso faz com que o **Privoxy** envie todo o tráfego para o **Tor** através da porta **9050**.

Salve (**`CTRL`** + **`O`** e **`Enter`**) e feche (**`CTRL`** + **`X`**) o arquivo.

---

### **3. Iniciar o Tor e o Privoxy**

Agora, inicie e habilite os serviços:

```bash

sudo systemctl start tor

sudo systemctl start privoxy

sudo systemctl enable tor

sudo systemctl enable privoxy

```

**Explicação:**

- **start:** Inicia os serviços.

- **enable:** Faz com que iniciem automaticamente ao ligar o PC.

---

### **4. Configurar o Navegador Firefox**

Para usar a rede **Tor** com o Firefox:

1. Abra o Firefox.

2. Acesse **Configurações** → **Configurar conexão**.

3. Selecione **Configuração manual de proxy**.

4. Configure assim:

- **Proxy HTTP:** `127.0.0.1`

- **Porta:** `8118` (porta padrão do **Privoxy**)

- **Domínio SOCKS (v5):** `127.0.0.1`

- **Porta:** `9050`

5. Marque a opção **"Usar este proxy também em HTTPS"**.

6. Clique em **OK**.

---

### **5. Verificar a Conexão com o Tor**

Abra o navegador e acesse:

```text

https://check.torproject.org/

```

Se aparecer a mensagem **"Congratulations. This browser is configured to use Tor."**, a configuração está correta.

---

### **Dicas Extras**

- **Privoxy** pode ser ajustado para bloquear anúncios e rastreadores.

- Outros aplicativos também podem ser configurados para usar o **Privoxy**.

-

@ 9e69e420:d12360c2

2025-01-21 19:31:48

Oregano oil is a potent natural compound that offers numerous scientifically-supported health benefits.

## Active Compounds

The oil's therapeutic properties stem from its key bioactive components:

- Carvacrol and thymol (primary active compounds)

- Polyphenols and other antioxidant

## Antimicrobial Properties

**Bacterial Protection**

The oil demonstrates powerful antibacterial effects, even against antibiotic-resistant strains like MRSA and other harmful bacteria. Studies show it effectively inactivates various pathogenic bacteria without developing resistance.

**Antifungal Effects**

It effectively combats fungal infections, particularly Candida-related conditions like oral thrush, athlete's foot, and nail infections.

## Digestive Health Benefits

Oregano oil supports digestive wellness by:

- Promoting gastric juice secretion and enzyme production

- Helping treat Small Intestinal Bacterial Overgrowth (SIBO)

- Managing digestive discomfort, bloating, and IBS symptoms

## Anti-inflammatory and Antioxidant Effects

The oil provides significant protective benefits through:

- Powerful antioxidant activity that fights free radicals

- Reduction of inflammatory markers in the body

- Protection against oxidative stress-related conditions

## Respiratory Support

It aids respiratory health by:

- Loosening mucus and phlegm

- Suppressing coughs and throat irritation

- Supporting overall respiratory tract function

## Additional Benefits

**Skin Health**

- Improves conditions like psoriasis, acne, and eczema

- Supports wound healing through antibacterial action

- Provides anti-aging benefits through antioxidant properties

**Cardiovascular Health**

Studies show oregano oil may help:

- Reduce LDL (bad) cholesterol levels

- Support overall heart health

**Pain Management**

The oil demonstrates effectiveness in:

- Reducing inflammation-related pain

- Managing muscle discomfort

- Providing topical pain relief

## Safety Note

While oregano oil is generally safe, it's highly concentrated and should be properly diluted before use Consult a healthcare provider before starting supplementation, especially if taking other medications.

-

@ b17fccdf:b7211155

2025-01-21 17:02:21

The past 26 August, Tor [introduced officially](https://blog.torproject.org/introducing-proof-of-work-defense-for-onion-services/) a proof-of-work (PoW) defense for onion services designed to prioritize verified network traffic as a deterrent against denial of service (DoS) attacks.

~ > This feature at the moment, is [deactivate by default](https://gitlab.torproject.org/tpo/core/tor/-/blob/main/doc/man/tor.1.txt#L3117), so you need to follow these steps to activate this on a MiniBolt node:

* Make sure you have the latest version of Tor installed, at the time of writing this post, which is v0.4.8.6. Check your current version by typing

```

tor --version

```

**Example** of expected output:

```

Tor version 0.4.8.6.

This build of Tor is covered by the GNU General Public License (https://www.gnu.org/licenses/gpl-3.0.en.html)

Tor is running on Linux with Libevent 2.1.12-stable, OpenSSL 3.0.9, Zlib 1.2.13, Liblzma 5.4.1, Libzstd N/A and Glibc 2.36 as libc.

Tor compiled with GCC version 12.2.0

```

~ > If you have v0.4.8.X, you are **OK**, if not, type `sudo apt update && sudo apt upgrade` and confirm to update.

* Basic PoW support can be checked by running this command:

```

tor --list-modules

```

Expected output:

```

relay: yes

dirauth: yes

dircache: yes

pow: **yes**

```

~ > If you have `pow: yes`, you are **OK**

* Now go to the torrc file of your MiniBolt and add the parameter to enable PoW for each hidden service added

```

sudo nano /etc/tor/torrc

```

Example:

```

# Hidden Service BTC RPC Explorer

HiddenServiceDir /var/lib/tor/hidden_service_btcrpcexplorer/

HiddenServiceVersion 3

HiddenServicePoWDefensesEnabled 1

HiddenServicePort 80 127.0.0.1:3002

```

~ > Bitcoin Core and LND use the Tor control port to automatically create the hidden service, requiring no action from the user. We have submitted a feature request in the official GitHub repositories to explore the need for the integration of Tor's PoW defense into the automatic creation process of the hidden service. You can follow them at the following links:

* Bitcoin Core: https://github.com/lightningnetwork/lnd/issues/8002

* LND: https://github.com/bitcoin/bitcoin/issues/28499

---

More info:

* https://blog.torproject.org/introducing-proof-of-work-defense-for-onion-services/

* https://gitlab.torproject.org/tpo/onion-services/onion-support/-/wikis/Documentation/PoW-FAQ

---

Enjoy it MiniBolter! 💙

-

@ 6be5cc06:5259daf0

2025-01-21 01:51:46

## Bitcoin: Um sistema de dinheiro eletrônico direto entre pessoas.

Satoshi Nakamoto

satoshin@gmx.com

www.bitcoin.org

---

### Resumo

O Bitcoin é uma forma de dinheiro digital que permite pagamentos diretos entre pessoas, sem a necessidade de um banco ou instituição financeira. Ele resolve um problema chamado **gasto duplo**, que ocorre quando alguém tenta gastar o mesmo dinheiro duas vezes. Para evitar isso, o Bitcoin usa uma rede descentralizada onde todos trabalham juntos para verificar e registrar as transações.

As transações são registradas em um livro público chamado **blockchain**, protegido por uma técnica chamada **Prova de Trabalho**. Essa técnica cria uma cadeia de registros que não pode ser alterada sem refazer todo o trabalho já feito. Essa cadeia é mantida pelos computadores que participam da rede, e a mais longa é considerada a verdadeira.

Enquanto a maior parte do poder computacional da rede for controlada por participantes honestos, o sistema continuará funcionando de forma segura. A rede é flexível, permitindo que qualquer pessoa entre ou saia a qualquer momento, sempre confiando na cadeia mais longa como prova do que aconteceu.

---

### 1. Introdução

Hoje, quase todos os pagamentos feitos pela internet dependem de bancos ou empresas como processadores de pagamento (cartões de crédito, por exemplo) para funcionar. Embora esse sistema seja útil, ele tem problemas importantes porque é baseado em **confiança**.

Primeiro, essas empresas podem reverter pagamentos, o que é útil em caso de erros, mas cria custos e incertezas. Isso faz com que pequenas transações, como pagar centavos por um serviço, se tornem inviáveis. Além disso, os comerciantes são obrigados a desconfiar dos clientes, pedindo informações extras e aceitando fraudes como algo inevitável.

Esses problemas não existem no dinheiro físico, como o papel-moeda, onde o pagamento é final e direto entre as partes. No entanto, não temos como enviar dinheiro físico pela internet sem depender de um intermediário confiável.

O que precisamos é de um **sistema de pagamento eletrônico baseado em provas matemáticas**, não em confiança. Esse sistema permitiria que qualquer pessoa enviasse dinheiro diretamente para outra, sem depender de bancos ou processadores de pagamento. Além disso, as transações seriam irreversíveis, protegendo vendedores contra fraudes, mas mantendo a possibilidade de soluções para disputas legítimas.

Neste documento, apresentamos o **Bitcoin**, que resolve o problema do gasto duplo usando uma rede descentralizada. Essa rede cria um registro público e protegido por cálculos matemáticos, que garante a ordem das transações. Enquanto a maior parte da rede for controlada por pessoas honestas, o sistema será seguro contra ataques.

---

### 2. Transações

Para entender como funciona o Bitcoin, é importante saber como as transações são realizadas. Imagine que você quer transferir uma "moeda digital" para outra pessoa. No sistema do Bitcoin, essa "moeda" é representada por uma sequência de registros que mostram quem é o atual dono. Para transferi-la, você adiciona um novo registro comprovando que agora ela pertence ao próximo dono. Esse registro é protegido por um tipo especial de assinatura digital.

#### O que é uma assinatura digital?

Uma assinatura digital é como uma senha secreta, mas muito mais segura. No Bitcoin, cada usuário tem duas chaves: uma "chave privada", que é secreta e serve para criar a assinatura, e uma "chave pública", que pode ser compartilhada com todos e é usada para verificar se a assinatura é válida. Quando você transfere uma moeda, usa sua chave privada para assinar a transação, provando que você é o dono. A próxima pessoa pode usar sua chave pública para confirmar isso.

#### Como funciona na prática?

Cada "moeda" no Bitcoin é, na verdade, uma cadeia de assinaturas digitais. Vamos imaginar o seguinte cenário:

1. A moeda está com o Dono 0 (você). Para transferi-la ao Dono 1, você assina digitalmente a transação com sua chave privada. Essa assinatura inclui o código da transação anterior (chamado de "hash") e a chave pública do Dono 1.

2. Quando o Dono 1 quiser transferir a moeda ao Dono 2, ele assinará a transação seguinte com sua própria chave privada, incluindo também o hash da transação anterior e a chave pública do Dono 2.

3. Esse processo continua, formando uma "cadeia" de transações. Qualquer pessoa pode verificar essa cadeia para confirmar quem é o atual dono da moeda.

#### Resolvendo o problema do gasto duplo

Um grande desafio com moedas digitais é o "gasto duplo", que é quando uma mesma moeda é usada em mais de uma transação. Para evitar isso, muitos sistemas antigos dependiam de uma entidade central confiável, como uma casa da moeda, que verificava todas as transações. No entanto, isso criava um ponto único de falha e centralizava o controle do dinheiro.

O Bitcoin resolve esse problema de forma inovadora: ele usa uma rede descentralizada onde todos os participantes (os "nós") têm acesso a um registro completo de todas as transações. Cada nó verifica se as transações são válidas e se a moeda não foi gasta duas vezes. Quando a maioria dos nós concorda com a validade de uma transação, ela é registrada permanentemente na blockchain.

#### Por que isso é importante?

Essa solução elimina a necessidade de confiar em uma única entidade para gerenciar o dinheiro, permitindo que qualquer pessoa no mundo use o Bitcoin sem precisar de permissão de terceiros. Além disso, ela garante que o sistema seja seguro e resistente a fraudes.

---

### 3. Servidor Timestamp

Para assegurar que as transações sejam realizadas de forma segura e transparente, o sistema Bitcoin utiliza algo chamado de "servidor de registro de tempo" (timestamp). Esse servidor funciona como um registro público que organiza as transações em uma ordem específica.

Ele faz isso agrupando várias transações em blocos e criando um código único chamado "hash". Esse hash é como uma impressão digital que representa todo o conteúdo do bloco. O hash de cada bloco é amplamente divulgado, como se fosse publicado em um jornal ou em um fórum público.

Esse processo garante que cada bloco de transações tenha um registro de quando foi criado e que ele existia naquele momento. Além disso, cada novo bloco criado contém o hash do bloco anterior, formando uma cadeia contínua de blocos conectados — conhecida como blockchain.

Com isso, se alguém tentar alterar qualquer informação em um bloco anterior, o hash desse bloco mudará e não corresponderá ao hash armazenado no bloco seguinte. Essa característica torna a cadeia muito segura, pois qualquer tentativa de fraude seria imediatamente detectada.

O sistema de timestamps é essencial para provar a ordem cronológica das transações e garantir que cada uma delas seja única e autêntica. Dessa forma, ele reforça a segurança e a confiança na rede Bitcoin.

---

### 4. Prova-de-Trabalho

Para implementar o registro de tempo distribuído no sistema Bitcoin, utilizamos um mecanismo chamado prova-de-trabalho. Esse sistema é semelhante ao Hashcash, desenvolvido por Adam Back, e baseia-se na criação de um código único, o "hash", por meio de um processo computacionalmente exigente.

A prova-de-trabalho envolve encontrar um valor especial que, quando processado junto com as informações do bloco, gere um hash que comece com uma quantidade específica de zeros. Esse valor especial é chamado de "nonce". Encontrar o nonce correto exige um esforço significativo do computador, porque envolve tentativas repetidas até que a condição seja satisfeita.

Esse processo é importante porque torna extremamente difícil alterar qualquer informação registrada em um bloco. Se alguém tentar mudar algo em um bloco, seria necessário refazer o trabalho de computação não apenas para aquele bloco, mas também para todos os blocos que vêm depois dele. Isso garante a segurança e a imutabilidade da blockchain.

A prova-de-trabalho também resolve o problema de decidir qual cadeia de blocos é a válida quando há múltiplas cadeias competindo. A decisão é feita pela cadeia mais longa, pois ela representa o maior esforço computacional já realizado. Isso impede que qualquer indivíduo ou grupo controle a rede, desde que a maioria do poder de processamento seja mantida por participantes honestos.

Para garantir que o sistema permaneça eficiente e equilibrado, a dificuldade da prova-de-trabalho é ajustada automaticamente ao longo do tempo. Se novos blocos estiverem sendo gerados rapidamente, a dificuldade aumenta; se estiverem sendo gerados muito lentamente, a dificuldade diminui. Esse ajuste assegura que novos blocos sejam criados aproximadamente a cada 10 minutos, mantendo o sistema estável e funcional.

---

### 5. Rede

A rede Bitcoin é o coração do sistema e funciona de maneira distribuída, conectando vários participantes (ou nós) para garantir o registro e a validação das transações. Os passos para operar essa rede são:

1. **Transmissão de Transações**: Quando alguém realiza uma nova transação, ela é enviada para todos os nós da rede. Isso é feito para garantir que todos estejam cientes da operação e possam validá-la.

2. **Coleta de Transações em Blocos**: Cada nó agrupa as novas transações recebidas em um "bloco". Este bloco será preparado para ser adicionado à cadeia de blocos (a blockchain).

3. **Prova-de-Trabalho**: Os nós competem para resolver a prova-de-trabalho do bloco, utilizando poder computacional para encontrar um hash válido. Esse processo é como resolver um quebra-cabeça matemático difícil.

4. **Envio do Bloco Resolvido**: Quando um nó encontra a solução para o bloco (a prova-de-trabalho), ele compartilha esse bloco com todos os outros nós na rede.

5. **Validação do Bloco**: Cada nó verifica o bloco recebido para garantir que todas as transações nele contidas sejam válidas e que nenhuma moeda tenha sido gasta duas vezes. Apenas blocos válidos são aceitos.

6. **Construção do Próximo Bloco**: Os nós que aceitaram o bloco começam a trabalhar na criação do próximo bloco, utilizando o hash do bloco aceito como base (hash anterior). Isso mantém a continuidade da cadeia.

#### Resolução de Conflitos e Escolha da Cadeia Mais Longa

Os nós sempre priorizam a cadeia mais longa, pois ela representa o maior esforço computacional já realizado, garantindo maior segurança. Se dois blocos diferentes forem compartilhados simultaneamente, os nós trabalharão no primeiro bloco recebido, mas guardarão o outro como uma alternativa. Caso o segundo bloco eventualmente forme uma cadeia mais longa (ou seja, tenha mais blocos subsequentes), os nós mudarão para essa nova cadeia.

#### Tolerância a Falhas

A rede é robusta e pode lidar com mensagens que não chegam a todos os nós. Uma transação não precisa alcançar todos os nós de imediato; basta que chegue a um número suficiente deles para ser incluída em um bloco. Da mesma forma, se um nó não receber um bloco em tempo hábil, ele pode solicitá-lo ao perceber que está faltando quando o próximo bloco é recebido.

Esse mecanismo descentralizado permite que a rede Bitcoin funcione de maneira segura, confiável e resiliente, sem depender de uma autoridade central.

---

### 6. Incentivo

O incentivo é um dos pilares fundamentais que sustenta o funcionamento da rede Bitcoin, garantindo que os participantes (nós) continuem operando de forma honesta e contribuindo com recursos computacionais. Ele é estruturado em duas partes principais: a recompensa por mineração e as taxas de transação.

#### Recompensa por Mineração

Por convenção, o primeiro registro em cada bloco é uma transação especial que cria novas moedas e as atribui ao criador do bloco. Essa recompensa incentiva os mineradores a dedicarem poder computacional para apoiar a rede. Como não há uma autoridade central para emitir moedas, essa é a maneira pela qual novas moedas entram em circulação. Esse processo pode ser comparado ao trabalho de garimpeiros, que utilizam recursos para colocar mais ouro em circulação. No caso do Bitcoin, o "recurso" consiste no tempo de CPU e na energia elétrica consumida para resolver a prova-de-trabalho.

#### Taxas de Transação

Além da recompensa por mineração, os mineradores também podem ser incentivados pelas taxas de transação. Se uma transação utiliza menos valor de saída do que o valor de entrada, a diferença é tratada como uma taxa, que é adicionada à recompensa do bloco contendo essa transação. Com o passar do tempo e à medida que o número de moedas em circulação atinge o limite predeterminado, essas taxas de transação se tornam a principal fonte de incentivo, substituindo gradualmente a emissão de novas moedas. Isso permite que o sistema opere sem inflação, uma vez que o número total de moedas permanece fixo.

#### Incentivo à Honestidade

O design do incentivo também busca garantir que os participantes da rede mantenham um comportamento honesto. Para um atacante que consiga reunir mais poder computacional do que o restante da rede, ele enfrentaria duas escolhas:

1. Usar esse poder para fraudar o sistema, como reverter transações e roubar pagamentos.

2. Seguir as regras do sistema, criando novos blocos e recebendo recompensas legítimas.