-

@ f6488c62:c929299d

2025-05-24 05:10:20

@ f6488c62:c929299d

2025-05-24 05:10:20คุณเคยจินตนาการถึงอนาคตที่ AI มีความฉลาดเทียบเท่ามนุษย์หรือไม่? นี่คือสิ่งที่ Sam Altman ซีอีโอของ OpenAI และทีมพันธมิตรอย่าง SoftBank, Oracle และ MGX กำลังผลักดันผ่าน โครงการ Stargate! โครงการนี้ไม่ใช่แค่เรื่องเทคโนโลยี แต่เป็นก้าวกระโดดครั้งใหญ่ของมนุษยชาติ! Stargate คืออะไร? Stargate เป็นโปรเจกต์สร้าง ศูนย์ข้อมูล AI ขนาดยักษ์ที่ใหญ่ที่สุดในประวัติศาสตร์ ด้วยเงินลงทุนเริ่มต้น 100,000 ล้านดอลลาร์ และอาจสูงถึง 500,000 ล้านดอลลาร์ ภายในปี 2029! เป้าหมายคือการพัฒนา Artificial General Intelligence (AGI) หรือ AI ที่ฉลาดเทียบเท่ามนุษย์ เพื่อให้สหรัฐฯ ครองความเป็นผู้นำด้าน AI และแข่งขันกับคู่แข่งอย่างจีน โครงการนี้เริ่มต้นที่เมือง Abilene รัฐเท็กซัส โดยจะสร้างศูนย์ข้อมูล 10 แห่ง และขยายไปยังญี่ปุ่น สหราชอาณาจักร และสหรัฐอาหรับเอมิเรตส์ ทำไม Stargate ถึงสำคัญ?

นวัตกรรมเปลี่ยนโลก: AI จาก Stargate จะช่วยพัฒนาวัคซีน mRNA รักษามะเร็งได้ใน 48 ชั่วโมง และยกระดับอุตสาหกรรมต่าง ๆ เช่น การแพทย์และความมั่นคงแห่งชาติสร้างงาน: คาดว่าจะสร้างงานกว่า 100,000 ตำแหน่ง ในสหรัฐฯ

พลังงานมหาศาล: ศูนย์ข้อมูลอาจใช้พลังงานถึง 1.2 กิกะวัตต์ เทียบเท่ากับเมืองขนาดใหญ่!

ใครอยู่เบื้องหลัง? Sam Altman ร่วมมือกับ Masayoshi Son จาก SoftBank และได้รับการสนับสนุนจาก Donald Trump ซึ่งผลักดันนโยบายให้ Stargate เป็นจริง การก่อสร้างดำเนินการโดย Oracle และพันธมิตรด้านพลังงานอย่าง Crusoe Energy Systems ความท้าทาย? ถึงจะยิ่งใหญ่ แต่ Stargate ก็เจออุปสรรค ทั้งปัญหาการระดมทุน ความกังวลเรื่องภาษีนำเข้าชิป และการแข่งขันจากคู่แข่งอย่าง DeepSeek ที่ใช้โครงสร้างพื้นฐานน้อยกว่า แถม Elon Musk ยังออกมาวิจารณ์ว่าโครงการนี้อาจ “ไม่สมจริง” แต่ Altman มั่นใจและเชิญ Musk ไปดูไซต์งานที่เท็กซัสเลยทีเดียว! อนาคตของ Stargate ศูนย์ข้อมูลแห่งแรกจะเริ่มใช้งานในปี 2026 และอาจเปลี่ยนโฉมวงการ AI ไปตลอดกาล นี่คือก้าวสำคัญสู่ยุคใหม่ของเทคโนโลยีที่อาจเปลี่ยนวิถีชีวิตของเรา! และไม่ใช่ประตูดวงดาวแบบในหนังนะ! ถึงชื่อ Stargate จะได้แรงบันดาลใจจากภาพยนตร์ sci-fi อันโด่งดัง แต่โครงการนี้ไม่ได้พาเราไปยังดวงดาวอื่น มันคือการเปิดประตูสู่โลกแห่ง AI ที่ทรงพลัง และอาจเปลี่ยนอนาคตของมนุษยชาติไปเลย! และไม่เหมือน universechain ของ star ของผมนะครับ

Stargate #AI #SamAltman #OpenAI #อนาคตของเทคโนโลยี

-

@ c1d77557:bf04ec8b

2025-05-24 05:02:26

@ c1d77557:bf04ec8b

2025-05-24 05:02:26O 567br é uma plataforma de entretenimento online que tem se destacado pela sua inovação, variedade de jogos e foco na experiência do jogador. Com uma interface amigável e recursos de alta qualidade, a plataforma oferece uma jornada divertida e segura para os seus usuários. Neste artigo, vamos explorar os principais aspectos do 567br, incluindo a introdução da plataforma, os jogos que ela oferece e como a experiência do jogador é aprimorada em cada detalhe.

O 567br foi desenvolvido com o objetivo de proporcionar aos jogadores uma experiência imersiva e prazerosa. Sua interface é simples, intuitiva e de fácil navegação, permitindo que os usuários encontrem rapidamente seus jogos favoritos. A plataforma também é otimizada para dispositivos móveis, o que significa que os jogadores podem acessar seus jogos em qualquer lugar e a qualquer momento, seja no computador ou no smartphone.

Além disso, o 567brse preocupa com a segurança de seus usuários, implementando tecnologias de criptografia de ponta para garantir que todos os dados pessoais e financeiros estejam protegidos. A plataforma também oferece suporte ao cliente de alta qualidade, disponível 24/7, para resolver quaisquer dúvidas ou problemas que possam surgir durante a experiência de jogo.

Jogos Empolgantes e Variedade para Todos os Gostos No 567br, a diversidade de jogos é um dos pontos fortes da plataforma. Desde jogos de mesa e cartas até opções de entretenimento mais dinâmicas e inovadoras, há algo para todos os gostos e preferências. Os jogos disponíveis são desenvolvidos por alguns dos melhores fornecedores de conteúdo da indústria, garantindo gráficos de alta qualidade, jogabilidade fluida e mecânicas envolventes.

Os jogadores podem escolher entre diferentes categorias, como:

Jogos de Mesa: Para quem gosta de uma experiência mais estratégica e de tomada de decisões, os jogos de mesa são uma excelente opção. São oferecidas diversas variantes de jogos populares, como pôquer, blackjack, roleta, entre outros.

Jogos de Ação e Aventura: Para os que buscam adrenalina e emoção, a plataforma oferece uma seleção de jogos de ação e aventura com temas envolventes e gráficos impressionantes. Esses jogos garantem uma experiência de jogo emocionante e desafiadora.

Jogos de Arcade: Se você está em busca de algo mais descontraído e divertido, os jogos de arcade são uma excelente escolha. Eles são rápidos, fáceis de entender e proporcionam diversão instantânea.

A plataforma está sempre atualizando seu portfólio de jogos para garantir que os jogadores tenham acesso às últimas novidades e inovações do mundo do entretenimento online.

A Experiência do Jogador: Personalização e Interatividade O 567br não se limita a oferecer apenas uma plataforma de jogos, mas também busca criar uma experiência personalizada e interativa para cada jogador. A plataforma possui funcionalidades que permitem que os usuários ajustem sua experiência de jogo de acordo com suas preferências individuais.

A personalização da interface é um exemplo claro disso. O jogador pode escolher o tema e a disposição dos elementos na tela, criando um ambiente que seja confortável e agradável de usar. Além disso, o 567br oferece recursos interativos, como chats ao vivo, onde os jogadores podem interagir com outros usuários e até mesmo com os dealers, proporcionando uma sensação de comunidade.

Outro aspecto importante é a possibilidade de acompanhar o desempenho e os resultados de jogo. A plataforma oferece relatórios detalhados, permitindo que os jogadores monitorem seu progresso, analisem suas vitórias e perdas, e façam ajustes em sua estratégia de jogo.

Promoções e Benefícios para os Jogadores O 567br também oferece uma série de promoções e benefícios que tornam a experiência de jogo ainda mais atrativa. Novos jogadores podem aproveitar bônus de boas-vindas e outras ofertas especiais, enquanto jogadores regulares podem se beneficiar de programas de fidelidade e promoções exclusivas.

Essas ofertas ajudam a aumentar a diversão e proporcionam mais oportunidades para que os jogadores explorem novos jogos e tenham uma experiência ainda mais rica. Além disso, o sistema de recompensas é transparente e justo, garantindo que todos os jogadores tenham as mesmas oportunidades de aproveitar os benefícios.

Conclusão: Uma Plataforma Completa para Todos os Gostos Com sua interface intuitiva, variedade de jogos e foco na experiência do jogador, o 567br se consolida como uma plataforma de entretenimento online de alta qualidade. Seja para quem busca jogos estratégicos, ação intensa ou diversão casual, o 567br tem algo para todos.

A segurança, o suporte ao cliente e a personalização da experiência de jogo tornam o 567br uma opção atraente para jogadores que buscam mais do que apenas uma plataforma de jogos – buscam uma jornada de entretenimento envolvente e segura. Se você está procurando por uma experiência completa e agradável, o 567br é, sem dúvida, uma excelente escolha.

-

@ c1d77557:bf04ec8b

2025-05-24 05:01:44

@ c1d77557:bf04ec8b

2025-05-24 05:01:44O P11Bet é uma plataforma inovadora que chega para oferecer uma experiência de jogo única, reunindo uma variedade de opções para os entusiastas de diferentes tipos de entretenimento online. Com uma interface moderna e fácil de usar, ela se destaca por proporcionar uma jornada divertida e segura para os jogadores, com um foco especial na qualidade da experiência e no atendimento às necessidades do público.

Uma Plataforma Completa e Acessível Ao acessar o P11Bet, os usuários encontram uma plataforma intuitiva, que facilita a navegação e oferece uma variedade de recursos para tornar o jogo mais agradável. A estrutura do site é otimizada para fornecer uma experiência fluida, seja no desktop ou em dispositivos móveis. Além disso, a plataforma se preocupa em manter um ambiente seguro, garantindo a proteção dos dados dos jogadores e permitindo que se concentrem na diversão.

A plataforma é projetada para todos os tipos de jogadores, desde os iniciantes até os mais experientes. A simplicidade de uso é uma das grandes vantagens, permitindo que qualquer pessoa possa se registrar e começar a jogar sem dificuldades. Além disso, a p11betoferece suporte ao cliente em português, o que facilita a comunicação e garante um atendimento de alta qualidade para os usuários brasileiros.

Diversidade de Jogos para Todos os Gostos O P11Bet se destaca pela vasta gama de opções de jogos que oferece aos seus usuários. A plataforma abriga uma seleção diversificada que vai desde jogos clássicos até as opções mais modernas, atendendo a todos os estilos e preferências. Entre as opções mais procuradas estão jogos de mesa, apostas esportivas, slots, e outras modalidades que garantem horas de entretenimento.

Um dos principais atrativos do P11Bet são os jogos de habilidade e de sorte, que exigem tanto estratégia quanto um pouco de sorte. As opções variam desde os mais simples aos mais complexos, oferecendo algo para todos os gostos. Os jogadores podem se aventurar em diversas modalidades, testando suas habilidades em jogos que vão de roletas e blackjack a versões mais inovadoras e dinâmicas.

Para aqueles que preferem algo mais emocionante e competitivo, as apostas esportivas são uma das maiores atrações. O P11Bet oferece uma ampla variedade de eventos esportivos ao vivo para apostar, com odds atrativas e uma plataforma que permite realizar apostas de forma rápida e eficiente. Seja em esportes populares como futebol, basquete ou até mesmo esportes menos tradicionais, há sempre algo para os apostadores mais exigentes.

A Experiência do Jogador: Diversão e Segurança O P11Bet não apenas se preocupa com a diversidade de jogos, mas também com a experiência do jogador. A plataforma foi desenvolvida para garantir que os jogadores possam desfrutar de seus jogos favoritos com a maior segurança e conforto possível. Além de um design intuitivo, a plataforma oferece diversas opções de pagamento, incluindo métodos populares no Brasil, para facilitar depósitos e retiradas. Isso garante que o processo de transações seja simples, rápido e seguro.

Outro ponto positivo do P11Bet é a experiência imersiva que ele oferece aos jogadores. A plataforma está sempre atualizada com novas funcionalidades, com promoções atraentes e bônus especiais que aumentam ainda mais a diversão. A interação com outros jogadores também é um diferencial, com espaços que permitem competir, conversar e trocar experiências com pessoas de todo o mundo.

Além disso, o suporte ao cliente da P11Bet é um dos mais elogiados pelos usuários. A equipe está sempre disponível para resolver dúvidas e fornecer assistência de maneira eficaz e amigável. Isso garante que os jogadores tenham sempre uma experiência tranquila, sem se preocupar com questões técnicas ou problemas relacionados à plataforma.

Conclusão Em resumo, o P11Bet é uma excelente escolha para quem busca uma plataforma completa e de qualidade para se divertir e desafiar suas habilidades. Com uma grande variedade de jogos, uma interface de fácil navegação e um suporte excepcional, ele garante que cada momento na plataforma seja único e prazeroso. Para quem deseja se aventurar no mundo dos jogos online, o P11Bet é uma opção que combina segurança, inovação e diversão.

-

@ 9ca447d2:fbf5a36d

2025-05-24 05:01:35

@ 9ca447d2:fbf5a36d

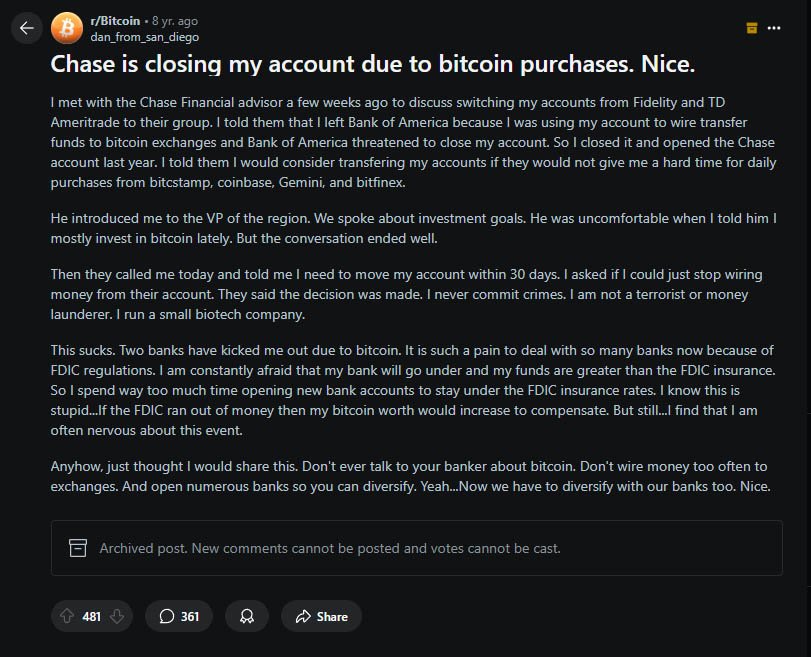

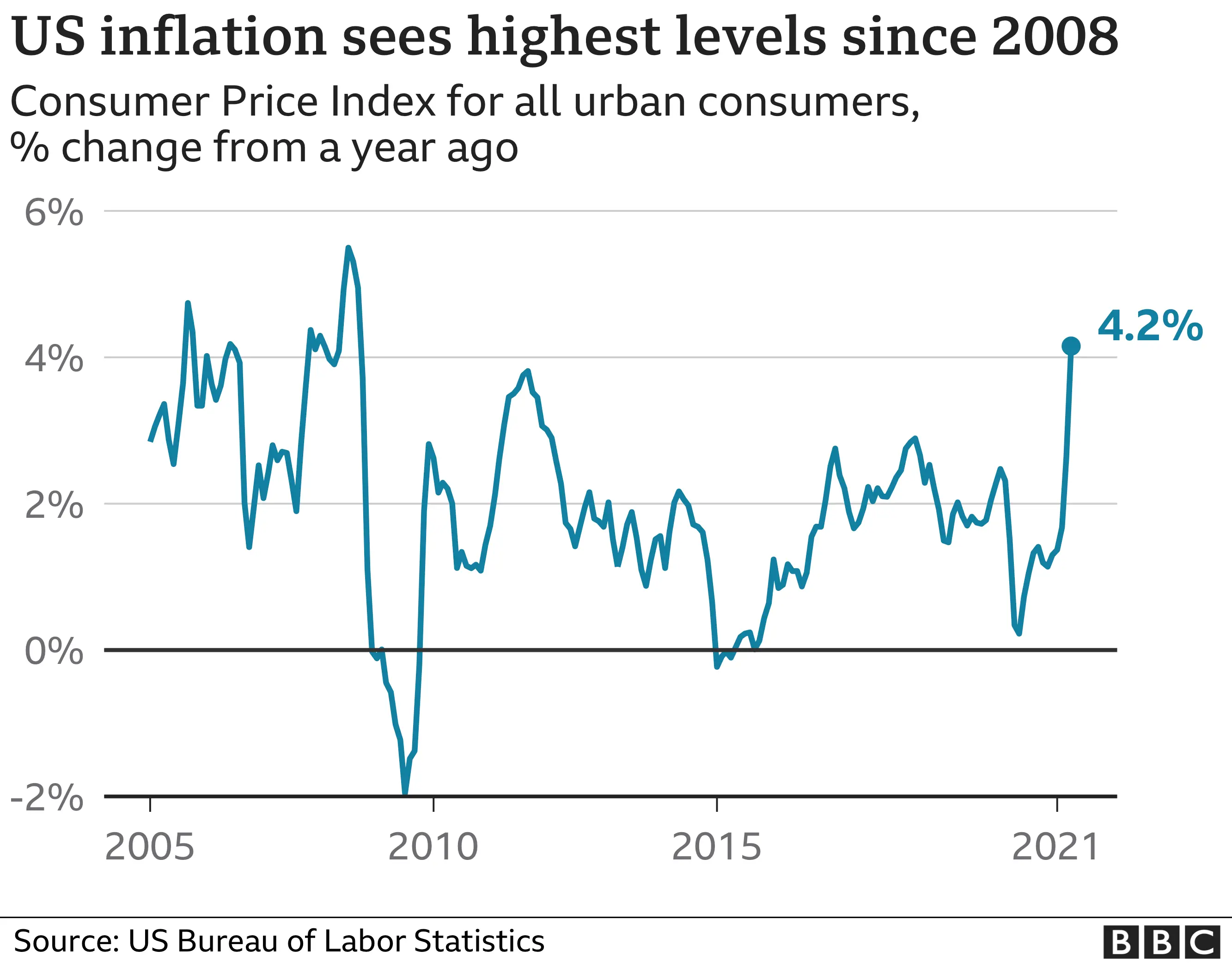

2025-05-24 05:01:35KYC database of Coinbase, the largest U.S. digital asset exchange, has been breached and up to 1% of monthly active users, or around 100,000 customers, have had their personal info stolen.

Hackers reportedly bribed overseas customer support agents and contractors to leak internal company info and user data. They then demanded $20 million and threatened to release the stolen data if Coinbase didn’t pay.

Instead of paying the ransom, Coinbase said no and is setting up a $20 million reward fund for anyone who can help catch the hackers.

“They then tried to extort Coinbase for $20 million to cover this up. We said no,” the company said in a blog post. “Instead of paying the $20 million ransom, we’re establishing a $20 million reward fund.”

So what’s been stolen? The breach, which was first disclosed in a filing with the U.S. Securities and Exchange Commission (SEC), did not involve any theft of customer funds, login credentials, private keys or wallets.

But the hackers did get:

- Full names

- Addresses

- Phone numbers

- Email addresses

- Last 4 digits of Social Security numbers

- Bank account numbers and some bank identifiers

- Government ID images (driver’s licenses, passports, etc.)

- Account balances and transaction history

- Internal corporate documents and training materials

Coinbase says Prime accounts were not affected and no passwords or 2FA codes were stolen.

According to Coinbase, the attackers targeted outsourced support agents in countries like India. They were offering cash bribes in exchange for access to the company’s internal customer support tools.

“What these attackers were doing was finding Coinbase employees and contractors based in India who were associated with our business process outsourcing or support operations, that kind of thing, and bribing them in order to obtain customer data,” said Philip Martin, Coinbase’s Chief Security Officer.

Coinbase said it first saw suspicious activity in January 2025 but didn’t get a direct email from the threat actors until May 11. The email had evidence of stolen data and the ransom demand.

Coinbase quickly launched an investigation, fired all the involved support agents and notified law enforcement. It also started notifying users via email on May 15.

The Coinbase data breach has hit it hard, financially and publicly. The company estimates it will spend $180-$400 million on security upgrades, reimbursements and other remediation.

Coinbase’s stock also took a hit, dropping 6.4% after the news broke, before rebounding.

Analysts say this couldn’t have come at a worse time, as Coinbase is about to be added to the S&P 500 index – a big deal for any publicly traded company.

It’s definitely an unfortunate timing. “This may push the industry to adopt stricter employee vetting and introduce some reputational risks,” said Bo Pei, analyst at U.S. Tiger Securities.

Coinbase will reimburse any customers who were tricked into sending their digital assets to the attackers as part of social engineering scams. They’ve also introduced new security measures:

- Extra ID verification for high-risk withdrawals

- Scam-awareness prompts

- A new U.S.-based support center

- Stronger insider threat monitoring

- Simulation testing for internal systems

Affected customers have already been notified and the exchange is working with U.S. and international law enforcement to track down the attackers.

This is part of a larger trend in the digital assets world. Earlier this year, Bybit, another exchange, was hit with a $1.5 billion theft, dubbed the biggest digital asset heist in history.

Research from Chainalysis shows over $2.2 billion was stolen from digital asset platforms in 2024 alone.

-

@ eb0157af:77ab6c55

2025-05-24 05:01:15

@ eb0157af:77ab6c55

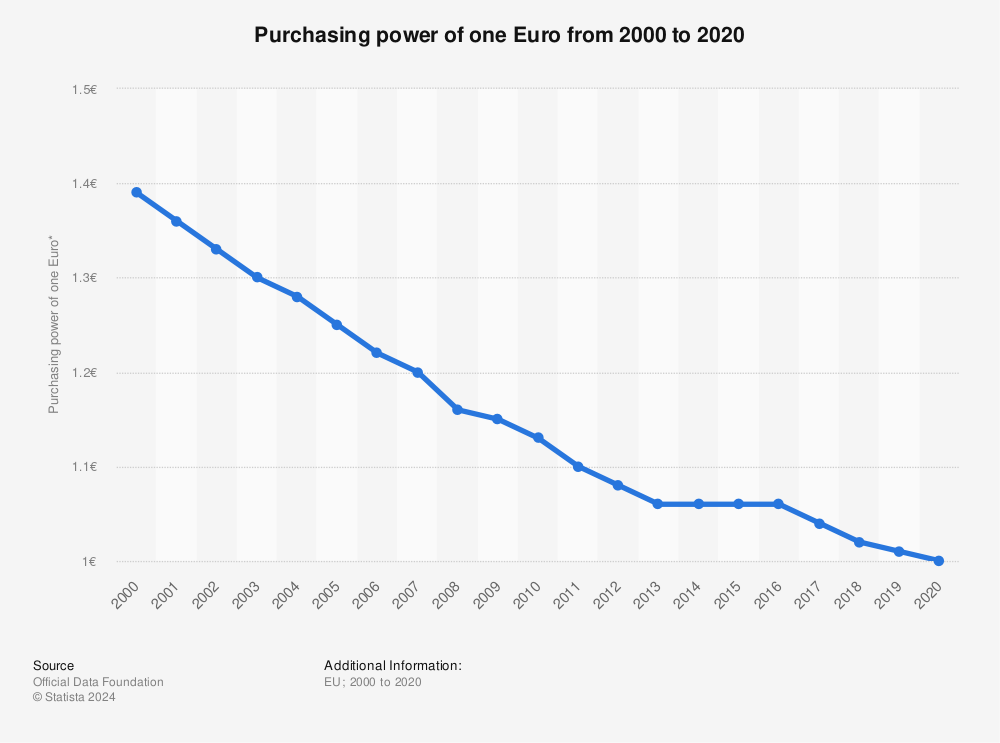

2025-05-24 05:01:15A new study reveals: 4 out of 5 Americans would like the US to convert some of its gold into Bitcoin.

A recent survey conducted by the Nakamoto Project revealed that a majority of Americans support converting a portion of the United States’ gold reserves into Bitcoin. The survey, carried out online by Qualtrics between February and March 2025, involved 3,345 participants with demographic characteristics representative of US census standards. Most respondents expressed a desire to convert between 1% and 30% of the gold reserves into BTC.

Troy Cross, co-founder of the Nakamoto Project, stated:

“When given a slider and asked to advise the US government on the right proportion of Bitcoin and gold, subjects were very reluctant to put that slider on 0% Bitcoin and 100% gold. Instead, they settled around 10% Bitcoin.”

One significant finding from the research is the correlation between age and openness to Bitcoin: younger respondents showed a greater inclination toward the cryptocurrency compared to older generations.

A potential US strategy

Bo Hines, a White House advisor, is promoting an initiative for the Treasury Department to acquire Bitcoin by selling off a portion of its gold. Under the proposed plan, the government could acquire up to 1 million BTC over the next five years.

To finance these purchases, the government plans to sell Federal Reserve gold certificates. The proposal aligns with Senator Cynthia Lummis’ 2025 Bitcoin Act, which aims to declare Bitcoin a critical national strategic asset.

Currently, the United States holds 8,133 metric tons of gold, valued at over $830 billion, and about 200,000 BTC, valued at $21 billion.

The post The majority in the US wants to convert part of the gold reserves into Bitcoin appeared first on Atlas21.

-

@ 06830f6c:34da40c5

2025-05-24 04:21:03

@ 06830f6c:34da40c5

2025-05-24 04:21:03The evolution of development environments is incredibly rich and complex and reflects a continuous drive towards greater efficiency, consistency, isolation, and collaboration. It's a story of abstracting away complexity and standardizing workflows.

Phase 1: The Bare Metal & Manual Era (Early 1970s - Late 1990s)

-

Direct OS Interaction / Bare Metal Development:

- Description: Developers worked directly on the operating system's command line or a basic text editor. Installation of compilers, interpreters, and libraries was a manual, often arcane process involving downloading archives, compiling from source, and setting environment variables. "Configuration drift" (differences between developer machines) was the norm.

- Tools: Text editors (Vi, Emacs), command-line compilers (GCC), Makefiles.

- Challenges: Extremely high setup time, dependency hell, "works on my machine" syndrome, difficult onboarding for new developers, lack of reproducibility. Version control was primitive (e.g., RCS, SCCS).

-

Integrated Development Environments (IDEs) - Initial Emergence:

- Description: Early IDEs (like Turbo Pascal, Microsoft Visual Basic) began to integrate editors, compilers, debuggers, and sometimes GUI builders into a single application. This was a massive leap in developer convenience.

- Tools: Turbo Pascal, Visual Basic, early Visual Studio versions.

- Advancement: Improved developer productivity, streamlined common tasks. Still relied on local system dependencies.

Phase 2: Towards Dependency Management & Local Reproducibility (Late 1990s - Mid-2000s)

-

Basic Build Tools & Dependency Resolvers (Pre-Package Managers):

- Description: As projects grew, manual dependency tracking became impossible. Tools like Ant (Java) and early versions of

autoconf/makefor C/C++ helped automate the compilation and linking process, managing some dependencies. - Tools: Apache Ant, GNU Autotools.

- Advancement: Automated build processes, rudimentary dependency linking. Still not comprehensive environment management.

- Description: As projects grew, manual dependency tracking became impossible. Tools like Ant (Java) and early versions of

-

Language-Specific Package Managers:

- Description: A significant leap was the emergence of language-specific package managers that could fetch, install, and manage libraries and frameworks declared in a project's manifest file. Examples include Maven (Java), npm (Node.js), pip (Python), RubyGems (Ruby), Composer (PHP).

- Tools: Maven, npm, pip, RubyGems, Composer.

- Advancement: Dramatically simplified dependency resolution, improved intra-project reproducibility.

- Limitation: Managed language-level dependencies, but not system-level dependencies or the underlying OS environment. Conflicts between projects on the same machine (e.g., Project A needs Python 2.7, Project B needs Python 3.9) were common.

Phase 3: Environment Isolation & Portability (Mid-2000s - Early 2010s)

-

Virtual Machines (VMs) for Development:

- Description: To address the "it works on my machine" problem stemming from OS-level and system-level differences, developers started using VMs. Tools like VMware Workstation, VirtualBox, and later Vagrant (which automated VM provisioning) allowed developers to encapsulate an entire OS and its dependencies for a project.

- Tools: VMware, VirtualBox, Vagrant.

- Advancement: Achieved strong isolation and environment reproducibility (a true "single environment" for a project).

- Limitations: Resource-heavy (each VM consumed significant CPU, RAM, disk space), slow to provision and boot, difficult to share large VM images.

-

Early Automation & Provisioning Tools:

- Description: Alongside VMs, configuration management tools started being used to automate environment setup within VMs or on servers. This helped define environments as code, making them more consistent.

- Tools: Chef, Puppet, Ansible.

- Advancement: Automated provisioning, leading to more consistent environments, often used in conjunction with VMs.

Phase 4: The Container Revolution & Orchestration (Early 2010s - Present)

-

Containerization (Docker):

- Description: Docker popularized Linux Containers (LXC), offering a lightweight, portable, and efficient alternative to VMs. Containers package an application and all its dependencies into a self-contained unit that shares the host OS kernel. This drastically reduced resource overhead and startup times compared to VMs.

- Tools: Docker.

- Advancement: Unprecedented consistency from development to production (Dev/Prod Parity), rapid provisioning, highly efficient resource use. Became the de-facto standard for packaging applications.

-

Container Orchestration:

- Description: As microservices and container adoption grew, managing hundreds or thousands of containers became a new challenge. Orchestration platforms automated the deployment, scaling, healing, and networking of containers across clusters of machines.

- Tools: Kubernetes, Docker Swarm, Apache Mesos.

- Advancement: Enabled scalable, resilient, and complex distributed systems development and deployment. The "environment" started encompassing the entire cluster.

Phase 5: Cloud-Native, Serverless & Intelligent Environments (Present - Future)

-

Cloud-Native Development:

- Description: Leveraging cloud services (managed databases, message queues, serverless functions) directly within the development workflow. Developers focus on application logic, offloading infrastructure management to cloud providers. Containers become a key deployment unit in this paradigm.

- Tools: AWS Lambda, Azure Functions, Google Cloud Run, cloud-managed databases.

- Advancement: Reduced operational overhead, increased focus on business logic, highly scalable deployments.

-

Remote Development & Cloud-Based IDEs:

- Description: The full development environment (editor, terminal, debugger, code) can now reside in the cloud, accessed via a thin client or web browser. This means developers can work from any device, anywhere, with powerful cloud resources backing their environment.

- Tools: GitHub Codespaces, Gitpod, AWS Cloud9, VS Code Remote Development.

- Advancement: Instant onboarding, consistent remote environments, access to high-spec machines regardless of local hardware, enhanced security.

-

Declarative & AI-Assisted Environments (The Near Future):

- Description: Development environments will become even more declarative, where developers specify what they need, and AI/automation tools provision and maintain it. AI will proactively identify dependency issues, optimize resource usage, suggest code snippets, and perform automated testing within the environment.

- Tools: Next-gen dev container specifications, AI agents integrated into IDEs and CI/CD pipelines.

- Prediction: Near-zero environment setup time, self-healing environments, proactive problem identification, truly seamless collaboration.

web3 #computing #cloud #devstr

-

-

@ c1d77557:bf04ec8b

2025-05-24 05:01:11

@ c1d77557:bf04ec8b

2025-05-24 05:01:11Se você está em busca de uma experiência de jogo dinâmica e diversificada, o 59h é a plataforma que você precisa conhecer. Com um foco claro na satisfação dos jogadores, ela oferece uma ampla variedade de opções de entretenimento, além de uma interface amigável e segura. Neste artigo, vamos explorar a plataforma 59h, destacando suas principais funcionalidades, jogos emocionantes e a experiência do usuário.

O Que é a Plataforma 59h? O 59h é uma plataforma inovadora que oferece uma vasta gama de jogos e experiências digitais para os entusiastas do entretenimento online. A plataforma se destaca pela sua interface intuitiva, que permite aos jogadores navegar com facilidade entre as diferentes categorias de jogos. Ela é ideal para quem busca uma experiência divertida e acessível, sem complicações.

Desde o momento em que você acessa o 59h, fica evidente o compromisso com a qualidade. A plataforma é projetada para ser acessível em diversos dispositivos, seja no seu computador, tablet ou smartphone. Isso garante que os jogadores possam aproveitar seus jogos favoritos a qualquer momento e em qualquer lugar, com a mesma qualidade e desempenho.

Uma Grande Variedade de Jogos para Todos os Gostos O 59h se destaca por sua impressionante variedade de jogos. Independentemente do tipo de jogo que você prefere, certamente encontrará algo que se adapte ao seu estilo. A plataforma oferece desde jogos de habilidade, até opções mais relaxantes e divertidas para aqueles que buscam algo mais descontraído.

Entre as opções mais populares, destacam-se os jogos de mesa, onde os jogadores podem testar suas habilidades em jogos como pôquer, blackjack e outros. Para quem prefere algo mais voltado para a sorte, o 59h também oferece jogos com elementos de sorte que podem garantir grandes recompensas.

Além disso, a plataforma está sempre atualizando seu portfólio de jogos, trazendo novidades para os jogadores. Isso significa que você nunca ficará entediado, já que sempre haverá algo novo e emocionante para experimentar.

A Experiência do Jogador no 59h Uma das maiores qualidades da plataforma 59h é sua atenção à experiência do usuário. Desde o processo de registro até a escolha de um jogo, tudo foi pensado para garantir uma navegação tranquila e sem estresse.

A plataforma é completamente segura, oferecendo métodos de pagamento rápidos e confiáveis. Isso significa que os jogadores podem depositar e retirar seus fundos com confiança, sem se preocupar com a segurança de suas informações pessoais. Além disso, o suporte ao cliente está sempre disponível para ajudar em caso de dúvidas ou problemas, garantindo que sua experiência seja o mais fluida possível.

Outro ponto que merece destaque é a comunidade de jogadores. A interação com outros jogadores é uma parte importante da plataforma, permitindo que você compartilhe dicas, participe de torneios e crie amizades. A plataforma 59h se esforça para criar um ambiente amigável e inclusivo, onde todos podem se divertir e aprender uns com os outros.

Acessibilidade e Facilidade de Uso O 59h não é apenas sobre a diversidade de jogos; também se trata de tornar o acesso o mais simples possível. A plataforma oferece um design responsivo, que se adapta perfeitamente a qualquer tipo de dispositivo. Isso significa que você pode jogar no computador, smartphone ou tablet com a mesma facilidade.

O processo de cadastro é simples e rápido, permitindo que você comece a jogar em questão de minutos. Além disso, a plataforma oferece uma série de recursos adicionais, como promoções e bônus exclusivos, que tornam a experiência ainda mais empolgante.

Conclusão O 59h se posiciona como uma plataforma de entretenimento online completa, oferecendo uma vasta gama de jogos, uma experiência de usuário de alta qualidade e um ambiente seguro e amigável para jogadores de todos os níveis. Se você procura uma plataforma confiável, diversificada e divertida, o 59h é a escolha ideal. Não importa se você é um iniciante ou um jogador experiente, há sempre algo novo para descobrir e aproveitar no 59h.

-

@ 58537364:705b4b85

2025-05-24 03:25:05

@ 58537364:705b4b85

2025-05-24 03:25:05Ep 228 "วิชาชีวิต"

คนเราเมื่อเกิดมาแล้ว ไม่ได้หวังแค่มีชีวิตรอดเท่านั้น แต่ยังปรารถนา "ความเจริญก้าวหน้า" และ "ความสุขในชีวิต"

จึงพากันศึกษาเล่าเรียนเพื่อให้มี "วิชาความรู้" สำหรับการประกอบอาชีพ โดยเชื่อว่า การงานที่มั่นคงย่อมนำ "ความสำเร็จ" และ "ความเจริญก้าวหน้า" มาให้

อย่างไรก็ตาม...ความสำเร็จในวิชาชีพหรือความเจริญก้าวหน้าในชีวิต ไม่ได้เป็นหลักประกันความสุขอย่างแท้จริง

แม้เงินทองและทรัพย์สมบัติจะช่วยให้ชีวิตมีความสุข สะดวก สบาย แต่ไม่ได้ช่วยให้สุขใจในสิ่งที่ตนมี หากยังรู้สึกว่า "ตนยังมีไม่พอ"

ขณะเดียวกันชื่อเสียงเกียรติยศที่ได้มาก็ไม่ช่วยให้คลายความทุกข์ใจ เมื่อต้องเผชิญปัญหาต่างๆ นาๆ

ทั้งการพลัดพราก การสูญเสียบุคคลผู้เป็นที่รัก ความเจ็บป่วย และความตายที่ต้องเกิดขึ้นกับทุกคน

ยิ่งกว่านั้น...ความสำเร็จในอาชีพและความเจริญก้าวหน้าในชีวิต ล้วนเป็น "สิ่งไม่เที่ยง" แปรผันตกต่ำ ไม่สามารถควบคุมได้

วิชาชีพทั้งหลายช่วยให้เราหาเงินได้มากขึ้น แต่ไม่ได้ช่วยให้เราเข้าถึง "ความสุขที่แท้จริง"

คนที่ประสบความสำเร็จในวิชาชีพไม่น้อย ที่มีชีวิตอมทุกข์ ความเครียดรุมเร้า สุขภาพเสื่อมโทรม

หากเราไม่อยากเผชิญกับสิ่งเหล่านี้ ควรเรียน "วิชาชีวิต" เพื่อเข้าใจโลก เข้าใจชีวิต รู้เท่าทันความผันแปรไปของสรรพสิ่ง

วิชาชีวิต...เรียนจากประสบการณ์ชีวิต เมื่อมีปัญหาต่างๆ ขอให้คิดว่า คือ "บททดสอบ"

จงหมั่นศึกษาหาบทเรียนจากวิชานี้อยู่เสมอ สร้าง "ความตระหนักรู้" ถึงความสำคัญในการมีชีวิต

ช่วงที่ผ่านมา เมื่อมีปัญหาฉันไม่สามารถหาทางออกจากทุกข์ได้เศร้า เสียใจ ทุรน ทุราย สอบตก "วิชาชีวิต"

โชคดีครูบาอาจารย์ให้ข้อคิด กล่าวว่า เป็นเรื่องธรรมดาหากเรายังไม่เข้าใจชีวิต ทุกสิ่งล้วนผันแปร เกิด-ดับ เป็นธรรมดา ท่านเมตตาส่งหนังสือเล่มนี้มาให้

เมื่อค่อยๆ ศึกษา ทำความเข้าใจ นำความทุกข์ที่เกิดขึ้นมาพิจารณา เห็นว่าเมื่อ "สอบตก" ก็ "สอบใหม่" จนกว่าจะผ่านไปได้

วิชาทางโลกเมื่อสอบตกยังเปิดโอกาสให้เรา "สอบซ่อม" วิชาทางธรรมก็เช่นเดียวกัน หากเจอปัญหา อุปสรรค หรือ ความทุกข์ถาโถมเข้ามา ขอให้เราตั้งสติ ว่า จะตั้งใจทำข้อสอบนี้ให้ผ่านไปให้จงได้

หากเราสามารถดำเนินชีวิตด้วยความเข้าใจ เราจะค้นพบ "วิชาชีวิต" ที่สามารถทำให้หลุดพ้นจากความทุกข์ได้แน่นอน

ด้วยรักและปรารถนาดี ปาริชาติ รักตะบุตร 21 เมษายน 2566

น้อมกราบขอบพระคุณพระ อ.ไพศาล วิสาโล เป็นอย่างสูง ที่ท่านเมตตา ให้ข้อธรรมะยามทุกข์ใจและส่งหนังสือมาให้ จึงตั้งใจอยากแบ่งปันเป็นธรรมทาน

-

@ dfa02707:41ca50e3

2025-05-24 05:00:55

@ dfa02707:41ca50e3

2025-05-24 05:00:55Contribute to keep No Bullshit Bitcoin news going.

- "Today we're launching the beta version of our multiplatform Nostr browser! Think Google Chrome but for Nostr apps. The beta is our big first step toward this vision," announced Damus.

- This version comes with the Dave Nostr AI assistant, support for zaps and the Nostr Wallet Connect (NWC) wallet interface, full-text note search, GIFs and fullscreen images, multiple media uploads, user tagging, relay list and mute list support, along with a number of other improvements."

"Included in the beta is the Dave, the Nostr AI assistant (its Grok for Nostr). Dave is a new Notedeck browser app that can search and summarize notes from the network. For a full breakdown of everything new, check out our beta launch video."

What's new

- Dave Nostr AI assistant app.

- GIFs.

- Fulltext note search.

- Add full screen images, add zoom, and pan.

- Zaps! NWC/ Wallet UI.

- Introduce last note per pubkey feed (experimental).

- Allow multiple media uploads per selection.

- Major Android improvements (still WIP).

- Added notedeck app sidebar.

- User Tagging.

- Note truncation.

- Local network note broadcast, broadcast notes to other notedeck notes while you're offline.

- Mute list support (reading).

- Relay list support.

- Ctrl-enter to send notes.

- Added relay indexing (relay columns soon).

- Click hashtags to open hashtag timeline.

- Fixed timelines sometimes not updating (stale feeds).

- Fixed UI bounciness when loading profile pictures

- Fixed unselectable post replies.

-

@ 502ab02a:a2860397

2025-05-24 01:14:43

@ 502ab02a:a2860397

2025-05-24 01:14:43ในสายตาคนรักสุขภาพทั่วโลก “อโวคาโด” คือผลไม้ในฝัน มันมีไขมันดี มีไฟเบอร์สูง ช่วยลดคอเลสเตอรอลได้ มีวิตามินอี มีโพแทสเซียม และที่สำคัญคือ "ดูดี" ทุกครั้งที่ถูกปาดวางบนขนมปังโฮลวีตในชามสลัด หรือบนโฆษณาอาหารคลีนสุดหรู

แต่ในสายตาชาวไร่บางคนในเม็กซิโกหรือชุมชนพื้นเมืองในโดมินิกัน อโวคาโดไม่ใช่ผลไม้แห่งสุขภาพ แต่มันคือสัญลักษณ์ของความรุนแรง การกดขี่ และการสูญเสียเสรีภาพในผืนดินของตัวเอง

เมื่ออาหารกลายเป็นทองคำ กลุ่มอิทธิพลก็ไม่เคยพลาดจะเข้าครอบครอง

เรามักได้ยินคำว่า "ทองคำเขียว" หรือ Green Gold ใช้เรียกอโวคาโด เพราะในรอบ 20 ปีที่ผ่านมา ความต้องการบริโภคของมันพุ่งสูงขึ้นเป็นเท่าตัว โดยเฉพาะในสหรัฐฯ และยุโรป จากผลการวิจัยของมหาวิทยาลัยฮาร์วาร์ดและข้อมูลการส่งออกของ USDA พบว่า 90% ของอโวคาโดที่บริโภคในอเมริกา มาจากรัฐมิโชอากังของเม็กซิโก พื้นที่ซึ่งควบคุมโดยกลุ่มค้ายาเสพติดไม่ต่างจากเจ้าของสวนตัวจริง

พวกเขาเรียกเก็บ “ค่าคุ้มครอง” จากเกษตรกร โดยใช้วิธีเดียวกับมาเฟีย คือ ถ้าไม่จ่าย ก็เจ็บตัวหรือหายตัว ไม่ว่าจะเป็นกลุ่ม CJNG (Jalisco New Generation Cartel), Familia Michoacana หรือ Caballeros Templarios พวกเขาไม่ได้สนใจว่าใครปลูกหรือใครรดน้ำ ตราบใดที่ผลผลิตสามารถเปลี่ยนเป็นเงินได้

องค์กรอาชญากรรมเหล่านี้ไม่ได้แค่ “แฝงตัว” ในอุตสาหกรรม แต่ ยึดครอง ห่วงโซ่การผลิตทั้งหมด ตั้งแต่แปลงปลูกไปจนถึงโรงบรรจุและเส้นทางขนส่ง คนที่ไม่ยอมเข้าระบบมืดอาจต้องพบจุดจบในป่า หรือไม่มีชื่ออยู่ในทะเบียนบ้านอีกต่อไป

จากรายงานของเว็บไซต์ Food is Power องค์กรไม่แสวงกำไรด้านความยุติธรรมด้านอาหารในสหรัฐฯ เผยว่า ในปี 2020 มีเกษตรกรในเม็กซิโกจำนวนมากที่ถูกข่มขู่ บางรายถึงขั้นถูกฆาตกรรม เพราะปฏิเสธจ่ายค่าคุ้มครองจากกลุ่มค้ายา

การปลูกอโวคาโดไม่ใช่เรื่องเบาๆ กับธรรมชาติ เพราะมันต้องการ “น้ำ” มากถึง 272 ลิตรต่อผลเดียว! เรามาดูว่า “272 ลิตร” นี้ เท่ากับอะไรบ้างในชีวิตจริง อาบน้ำฝักบัวนาน 10–12 นาที (โดยเฉลี่ยใช้น้ำ 20–25 ลิตรต่อนาที) ใช้น้ำซักเสื้อผ้าเครื่องหนึ่ง (เครื่องซักผ้า 1 ครั้งกินประมาณ 60–100 ลิตร) น้ำดื่มของคนหนึ่งคนได้นานเกือบ เดือน (คนเราต้องการน้ำดื่มประมาณ 1.5–2 ลิตรต่อวัน)

ถ้าเราใช้ข้อมูลจาก FAO และ Water Footprint Network การผลิตเนื้อวัว 1 กิโลกรัม ต้องใช้น้ำ 15,000 ลิตร (รวมทั้งการปลูกหญ้า อาหารสัตว์ การดื่มน้ำของวัว ฯลฯ) ได้โปรตีนราว 250 กรัม อโวคาโด 1 กิโลกรัม (ราว 5 ผล) ใช้น้ำประมาณ 1,360 ลิตร ได้โปรตีนเพียง 6–8 กรัมเท่านั้น พูดง่ายๆคือ เมื่อเทียบอัตราส่วนเป็นลิตรต่อกรัมโปรตีนแล้วนั้น วัวใช้น้ำ 60 ลิตรต่อกรัมโปรตีน / อโวคาโด ใช้น้ำ 194 ลิตรต่อกรัมโปรตีน แถมการเลี้ยงวัวในระบบธรรมชาติ (เช่น pasture-raised หรือ regenerative farming) ยังสามารถเป็นส่วนหนึ่งของระบบหมุนเวียนน้ำและคาร์บอนได้ พอเห็นภาพแล้วใช่ไหมครับ ดังนั้นเราควรระมัดระวังการเสพสื่อเอาไว้ด้วยว่า คำว่า "ดีต่อโลก" ไม่ได้หมายถึงพืชอย่างเดียว ทุกธุรกิจถ้าทำแบบที่ควรทำ มันยังสามารถผลักดันโลกไม่ให้ตกอยู่ในมือองค์กร future food ได้ เพราะมูลค่ามันสูงมาก

และเมื่อราคาสูง พื้นที่เพาะปลูกก็ขยายอย่างไร้การควบคุม ป่าธรรมชาติในรัฐมิโชอากังถูกแอบโค่นแบบผิดกฎหมายเพื่อแปลงสภาพเป็นไร่ “ทองเขียว” ข้อมูลจาก Reuters พบว่าผลไม้ที่ถูกส่งออกไปยังสหรัฐฯ บางส่วนมาจากแปลงปลูกที่บุกรุกป่าคุ้มครอง และรัฐบาลเองก็ไม่สามารถควบคุมได้เพราะอิทธิพลของกลุ่มทุนและมาเฟีย

ในโดมินิกันก็เช่นกัน มีรายงานจากสำนักข่าว Gestalten ว่าพื้นที่ป่าสงวนหลายพันไร่ถูกเปลี่ยนเป็นไร่อโวคาโด เพื่อป้อนตลาดผู้บริโภคในอเมริกาและยุโรปโดยตรง โดยไม่มีการชดเชยใดๆ แก่ชุมชนท้องถิ่น

สุขภาพที่ดีไม่ควรได้มาจากการทำลายสุขภาพของคนอื่น ไม่ควรมีผลไม้ใดที่ดูดีในจานของเรา แล้วเบื้องหลังเต็มไปด้วยคราบเลือดและน้ำตาของคนปลูก

เฮียไม่ได้จะบอกให้เลิกกินอโวคาโดเลย แต่เฮียอยากให้เรารู้ทัน ว่าความนิยมของอาหารสุขภาพวันนี้ กำลังเป็นสนามใหม่ของกลุ่มทุนโลก ที่พร้อมจะครอบครองด้วย “อำนาจอ่อน” ผ่านแบรนด์อาหารธรรมชาติ ผ่านกฎหมายสิ่งแวดล้อม หรือแม้แต่การครอบงำตลาดเสรีด้วยกำลังอาวุธ

นี่ไม่ใช่เรื่องไกลตัว เพราะเมื่อกลุ่มทุนเริ่มฮุบเมล็ดพันธุ์ คุมเส้นทางขนส่ง คุมฉลาก Certified Organic ทั้งหลาย พวกเขาก็ “ควบคุมสุขภาพ” ของผู้บริโภคเมืองอย่างเราไปด้วยโดยอ้อม

คำถามสำคัญที่มาทุกครั้งเวลามีเนื้อหาอะไรมาฝากคือ แล้วเราจะทำอะไรได้? 555555 - เลือกบริโภคผลไม้จากแหล่งที่โปร่งใสหรือปลูกเองได้ - สนับสนุนเกษตรกรรายย่อยที่ไม่อยู่ภายใต้กลุ่มทุน - ใช้เสียงของผู้บริโภคกดดันให้มีระบบตรวจสอบต้นทางจริง ไม่ใช่แค่ฉลากเขียวสวยๆ - และที่สำคัญ อย่าเชื่อว่า “ทุกสิ่งที่เขาวางให้ดูสุขภาพดี” จะดีจริง (ข้อนี่ละตัวดีเลยครับ)

สุขภาพไม่ใช่สินค้า และอาหารไม่ควรเป็นอาวุธของกลุ่มทุน หากเราเริ่มตระหนักว่าอาหารคือการเมือง น้ำคืออำนาจ และแปลงเกษตรคือสนามรบ เฮียเชื่อว่าผู้บริโภคอย่างเราจะไม่ยอมเป็นหมากอีกต่อไป #pirateketo #กูต้องรู้มั๊ย #ม้วนหางสิลูก #siamstr

-

@ b1ddb4d7:471244e7

2025-05-24 05:00:42

@ b1ddb4d7:471244e7

2025-05-24 05:00:42Asia has emerged as a powerhouse for bitcoin adoption, with diverse countries across the region embracing the world’s leading digital currency in unique ways.

From institutional investors in Singapore to grassroots movements in Indonesia, the Asian bitcoin ecosystem presents a fascinating tapestry of innovation, regulation, and community-driven initiatives.

We dive deep into the current state of bitcoin adoption across key Asian markets, providing investors with actionable insights into this dynamic region.

The Numbers: Asia’s Bitcoin Dominance

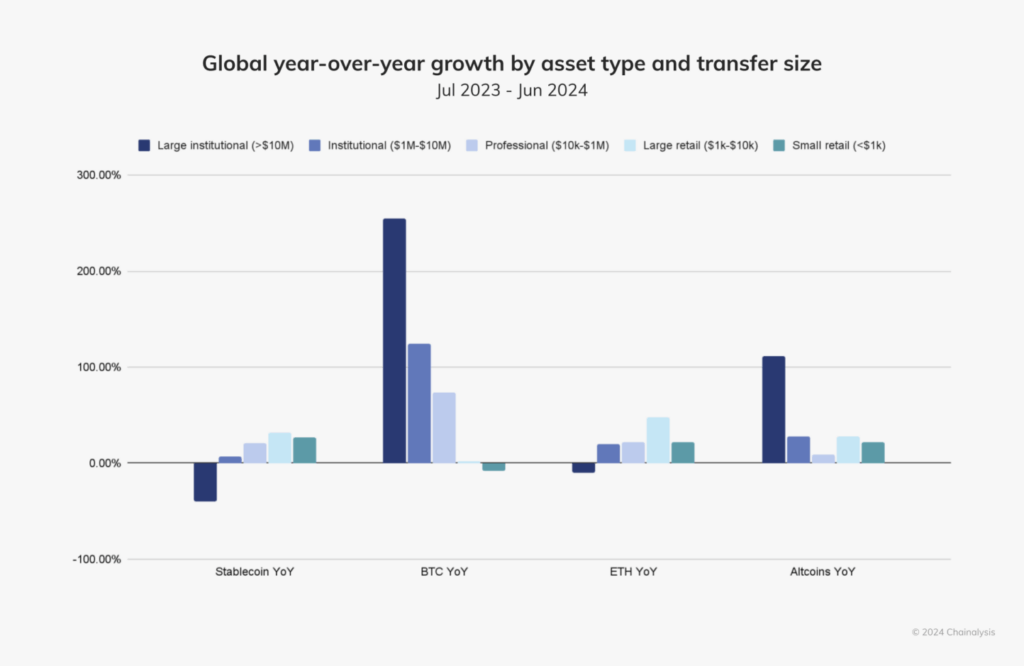

As of early 2025, over 500 million people worldwide hold some form of digital currency, with bitcoin remaining the most widely adopted digital asset. Asia stands at the forefront of this adoption wave, with the Central & Southern Asia and Oceania (CSAO) region leading the world in digital currency adoption according to Chainalysis’s 2024 Global Crypto Adoption Index.

The statistics paint a compelling picture:

- Seven of the top 20 countries in global crypto adoption are located in the CSAO region.

- India and China together comprise almost half of the world’s digital currency user base.

- Japan’s digital currency market is expected to reach 19.43 million users by the end of 2025, with a penetration rate of 15.93%.

Behind these impressive numbers lies a complex ecosystem shaped by diverse factors including regulatory environments, technological infrastructure, economic necessities, and vibrant community initiatives.

Photo Source: Chainalysis

Country-by-Country Analysis

India: The Grassroots Powerhouse

India ranks first in Chainalysis’s Global Crypto Adoption Index, with bitcoin adoption thriving particularly in tier-2 and tier-3 cities. This grassroots movement is driven primarily by:

- Financial inclusion: Bitcoin offers banking-like services to India’s large unbanked population.

- Remittance solutions: Lower fees for the significant Indian diaspora sending money home.

- Mobile wallet proliferation: India’s high smartphone penetration enables easy access to bitcoin services.

Japan: The Regulatory Pioneer

Japan has long played a significant role in bitcoin’s evolution, from hosting some of the earliest exchanges to pioneering regulatory clarity. In 2025, Japan finds itself at a fascinating crossroads:

- The Japan Financial Services Agency is considering reclassifying digital currency assets as financial products akin to stocks, potentially enhancing user protection.

- Major corporations like Metaplanet Inc. are expanding their bitcoin holdings, with plans to increase holdings by 470% to reach 10,000 BTC in 2025.

- The country boasts a thriving grassroots bitcoin community and a strong developer ecosystem.

Bitcoin adoption in Japan is uniquely balanced between institutional involvement and community enthusiasm, with initiatives like Blockstream’s Tokyo office working to promote layer-2 solutions, self-custody, and developer education.

Vietnam: The P2P Leader

Vietnam consistently ranks among the top countries for bitcoin adoption per capita. The country’s relationship with bitcoin is characterized by:

- Strong peer-to-peer (P2P) platform usage for daily transactions and remittances.

- High mobile wallet adoption driving grassroots usage.

- Bitcoin serving as a hedge against local currency fluctuations.

- Relatively favorable regulatory attitude compared to some neighboring countries.

Singapore: The Institutional Hub

Singapore has established itself as Asia’s premier institutional bitcoin destination through:

- Clear and forward-thinking regulatory frameworks, particularly the Payment Services Act.

- Growing presence of global digital currency firms including Gemini, OKX, and HashKey, which have received regulatory approvals.

- A robust financial infrastructure catering to high-net-worth individuals and institutional investors.

While Singapore’s consumer protection-focused framework restricts promotional activities and public advertising by digital currency service providers, the city-state remains a beacon for institutional bitcoin adoption in Asia.

South Korea: Retail Dominance Transitioning to Institutional

South Korea presents a fascinating case study of a market in transition:

- Retail investors currently dominate digital currency trading volume, while institutional participation significantly lags behind.

- Experts expect institutional involvement to increase, though a significant shift may not occur until around 2027.

- The local finance watchdog recently launched a crypto committee to assess permissions for corporate digital currency investors and ETFs.

- Users must access fiat-to-digital currency services through local exchanges with official banking partnerships, linking digital currency activities to legal identities.

Bitcoin Communities: The Grassroots Movements

What truly sets Asia apart in the global bitcoin landscape is the vibrant tapestry of community-driven initiatives across the region. These grassroots movements are instrumental in driving adoption from the ground up.

Bitcoin House Bali: A Community Hub

In Indonesia, the Bitcoin House Bali project exemplifies grassroots innovation. This initiative has transformed an old mining container into a vibrant hub for bitcoin education and community engagement.

Key features include:

- Free workshops (including “Bitcoin for Beginners” and “Bitcoin for Kids”).

- Developer programs including online classes, BitDevs Workshops, and Hackathons.

- A closed-loop economic system that turns bitcoin into community points.

- Merchant onboarding—from restaurants and drivers to scooter rentals and street vendors.

Bitcoin Seoul 2025: Bringing the Community Together

The upcoming Bitcoin Seoul 2025 conference (June 4-6, 2025) represents Asia’s largest bitcoin-focused gathering, bringing together global leaders, executives, and community members.

The event will feature:

- The Bitcoin Policy Summit: Seoul Edition, providing insights into regulatory trends.

- The Bitcoin Finance Forum, addressing institutional investment and treasury management.

- A Global Bitcoin Community Assembly for bitcoin grassroots and community leaders.

- Live Lightning Network payments demonstrations at the on-site Lightning Market.

This event underscores South Korea’s emerging role in the global Bitcoin ecosystem and highlights the growing institutional interest in the region.

Regulatory Landscapes: A Mixed Picture

The regulatory environment for bitcoin across Asia presents a complex and evolving picture that significantly impacts adoption patterns.

Japan’s Regulatory Evolution

Japan is considering tightening regulations on digital asset transactions by reclassifying them as financial products similar to stocks. If implemented, these changes would:

- Require issuers to disclose more detailed information on their corporate status.

- Potentially enhance user protection.

- Come into effect after June 2025, following policy direction outlines by the administration.

Current regulations in Japan are relatively digital currency-friendly, with bitcoin recognized as a legal form of payment under the Payment Services Act since 2016.

Singapore’s Balanced Approach

Singapore maintains a regulatory framework that emphasizes market stability and consumer protection, including:

- Restrictions on promoting digital services in public areas.

- The Payment Services Act that regulates digital currency exchanges.

- A general approach that supports institutional adoption while carefully managing retail exposure.

This balanced approach has helped establish Singapore as a trusted hub for bitcoin businesses and institutional investors.

South Korea’s Transitional Framework

South Korea’s regulatory landscape is in flux, with several developments impacting the bitcoin ecosystem:

- Corporate access to digital currenc

-

@ 9ca447d2:fbf5a36d

2025-05-22 14:01:52

@ 9ca447d2:fbf5a36d

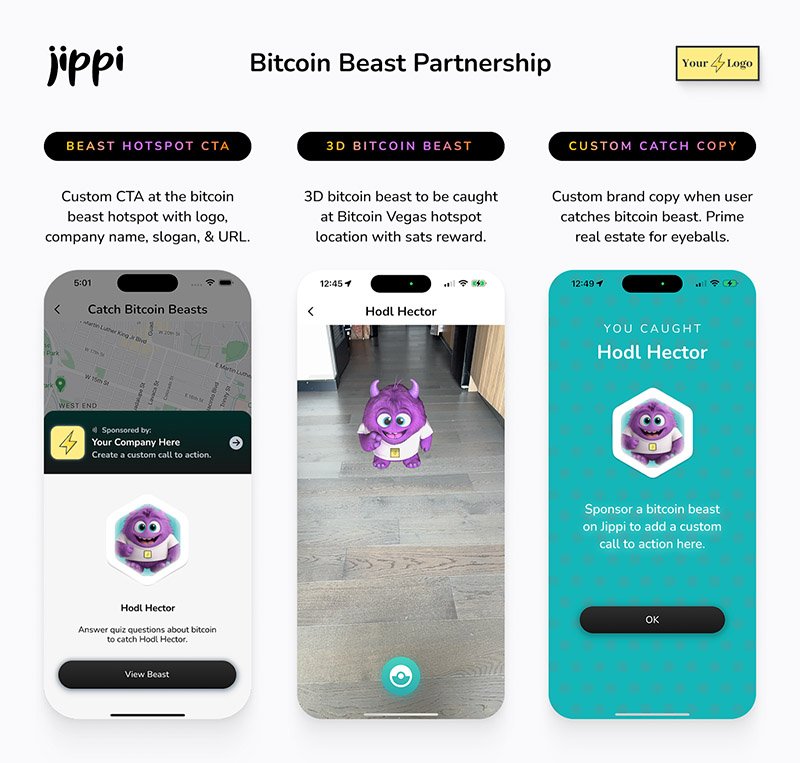

2025-05-22 14:01:52Gen Z (those born between 1997 and 2012) are not rushing to stack sats, and Oliver Porter, Founder & CEO of Jippi, understands the challenge better than most. His strategy revolves around adapting Bitcoin education to fit seamlessly into the digital lives of young adults.

“We need to meet them where they are,” Oliver explains. “90% of Gen Z plays games. 70% expect to earn rewards.”

So, what will effectively introduce them to Bitcoin? In Oliver’s mind, the answer is simple: games that don’t feel preachy but still plant the orange pill.

Learn more at Jippi.app

That’s exactly what Jippi is. Based in Austin, Texas, the team has created a mobile augmented reality (AR) game that rewards players in bitcoin and sneakily teaches them why sound money matters.

“It’s Pokémon GO… but for sats,” Oliver puts it succinctly.

Jippi is like Pokemon Go, but for sats

Oliver’s Bitcoin journey, like many in the space, began long before he was ready. A former colleague had tried planting the seed years earlier, handing him a copy of The Bitcoin Standard. But the moment passed.

It wasn’t until the chaos of 2020 when lockdowns hit, printing presses roared, and civil liberties shrank that the message finally landed for him.

“The government got so good at doing reverse Robin Hood,” Oliver explains. “They steal from the working population and reward the rich.”

By 2020, though, the absurdity of the covid hysteria had caused his eyes to be opened and the orange light seemed the best path back to freedom.

He left the UK for Austin “one of the best places for Bitcoiners,” he says, and dove headfirst into the industry, working at Swan for a year before founding Jippi on PlebLab’s accelerator program.

Jippi’s flagship game lets players roam their cities hunting digital creatures, Bitcoin Beasts, tied to real-world locations. Catching them requires answering Bitcoin trivia, and the reward is sats.

No jargon. No hour-long lectures. Just gameplay with sound money principles woven right in.

The model is working. At a recent hackathon in Austin, Jippi beat out 14 other teams to win first place and $15,000 in prize money.

Oliver of Jippi won Top Builder Season 2 — PlebLab on X

“We’re backdooring Bitcoin education,” Oliver admits. “And while we’re at it, encouraging people to get outside and touch grass.”

Not everyone’s been thrilled. When Jippi team members visited one of the more liberal-leaning places in Texas, UT Austin, to test interest in Bitcoin, they found some seriously committed no-coiners on the campus.

“One young woman told me, ‘I would rather die than talk about Bitcoin,'” Oliver recalls, highlighting the cultural resistance that’s built up among younger demographics.

This resistance is backed by hard data. According to Oliver, some of the Bitcoin podcasters they met with in the space to do market research reported that less than 1% of their listeners are from Gen Z and that number is dropping.

“Unless we find a way to capture their interest in a meaningful way, there’s going to be a big problem around trying to sway Gen Z away from the siren call of s***coins and crypto casinos and towards Bitcoin,” Oliver warns.

Jippi’s next big move is Las Vegas, where they’ll launch the Beast Catch experience at the Venetian during a major Bitcoin event. To mark the occasion, they’re opening up six limited sponsorship spots for Bitcoin companies, each one tied to a custom in-game beast.

Jippi looks to launch a special event at Bitcoin 2025

“It’s real estate inside the game,” Oliver explains. “Brands become allies, not intrusions. You get a logo, company name, and call to action, so we can push people to your site or app.”

Bitcoin Well—an automatic self-custody Bitcoin platform—has claimed Beast #1. Only five exclusive spots remain for Bitcoin companies to “beastify their brand” through Jippi’s immersive AR game.

“I love the Jippi mission. I think gamified learning is how we will onboard the next generation and it’s exciting to see what the Jippi team is doing! I love working with bitcoiners towards our common mission – bullish!” said Adam O’Brien, Bitcoin Well CEO.

Jippi’s sponsorship model is simple: align incentives, respect users, and support builders. Instead of throwing ad money at tech giants, Bitcoin companies can connect with new users naturally while they’re having fun and earning sats in the process.

For Bitcoin companies looking to reach a younger demographic, this represents a unique opportunity to showcase their brand to up to 30,000 potential customers at the Vegas event.

Jippi Bitcoin Beast partnership

While Jippi’s current focus is simple, get the game into more cities, Oliver sees a future where AR glasses and AI help personalize Bitcoin education even further.

“The magic is going to really happen when Apple releases the glasses form factor,” he says, describing how augmented reality could enhance real-world connections rather than isolate users.

In the longer term, Jippi aims to evolve from a free-to-play model toward a pay-to-play version with higher stakes. Users would form “tribes” with friends to compete for substantial bitcoin prizes, creating social connections along with financial education.

Unlike VC-backed startups, Jippi is raising funds pleb style via Timestamp, an open investment platform for Bitcoin companies.

“You don’t have to be an accredited investor,” Oliver explains. “You’re directly supporting the parallel Bitcoin economy by investing in Bitcoin companies for equity.”

Anyone can invest as little as $100. Perks include early access, exclusive game content, and even creating your own beast design with your name/pseudonym and unique game lore. Each investment comes with direct ownership of an early-stage Bitcoin company like Jippi.

For Oliver, this is more than just a business. It’s about future-proofing Bitcoin adoption and ensuring Satoshi’s vision lives on, especially as many people are lured by altcoins, NFTs, and social media dopamine.

“We’re on the right side of history,” he says firmly. “I want my grandkids to know that early on in the Bitcoin revolution, games like Jippi helped make it stick.”

In a world increasingly absorbed by screens and short attention spans, Jippi’s combination of outdoor play, sats rewards, and Bitcoin education might be exactly the bridge Gen Z needs.

Interested in sponsoring a Beast or investing in Jippi? Reach out to Jippi directly by heading to their partnerships page on their website or visit their Timestamp page to invest in Jippi today.

-

@ c1e9ab3a:9cb56b43

2025-05-18 04:14:48

@ c1e9ab3a:9cb56b43

2025-05-18 04:14:48Abstract

This document proposes a novel architecture that decouples the peer-to-peer (P2P) communication layer from the Bitcoin protocol and replaces or augments it with the Nostr protocol. The goal is to improve censorship resistance, performance, modularity, and maintainability by migrating transaction propagation and block distribution to the Nostr relay network.

Introduction

Bitcoin’s current architecture relies heavily on its P2P network to propagate transactions and blocks. While robust, it has limitations in terms of flexibility, scalability, and censorship resistance in certain environments. Nostr, a decentralized event-publishing protocol, offers a multi-star topology and a censorship-resistant infrastructure for message relay.

This proposal outlines how Bitcoin communication could be ported to Nostr while maintaining consensus and verification through standard Bitcoin clients.

Motivation

- Enhanced Censorship Resistance: Nostr’s architecture enables better relay redundancy and obfuscation of transaction origin.

- Simplified Lightweight Nodes: Removing the full P2P stack allows for lightweight nodes that only verify blockchain data and communicate over Nostr.

- Architectural Modularity: Clean separation between validation and communication enables easier auditing, upgrades, and parallel innovation.

- Faster Propagation: Nostr’s multi-star network may provide faster propagation of transactions and blocks compared to the mesh-like Bitcoin P2P network.

Architecture Overview

Components

-

Bitcoin Minimal Node (BMN):

- Verifies blockchain and block validity.

- Maintains UTXO set and handles mempool logic.

- Connects to Nostr relays instead of P2P Bitcoin peers.

-

Bridge Node:

- Bridges Bitcoin P2P traffic to and from Nostr relays.

- Posts new transactions and blocks to Nostr.

- Downloads mempool content and block headers from Nostr.

-

Nostr Relays:

- Accept Bitcoin-specific event kinds (transactions and blocks).

- Store mempool entries and block messages.

- Optionally broadcast fee estimation summaries and tipsets.

Event Format

Proposed reserved Nostr

kindnumbers for Bitcoin content (NIP/BIP TBD):| Nostr Kind | Purpose | |------------|------------------------| | 210000 | Bitcoin Transaction | | 210001 | Bitcoin Block Header | | 210002 | Bitcoin Block | | 210003 | Mempool Fee Estimates | | 210004 | Filter/UTXO summary |

Transaction Lifecycle

- Wallet creates a Bitcoin transaction.

- Wallet sends it to a set of configured Nostr relays.

- Relays accept and cache the transaction (based on fee policies).

- Mining nodes or bridge nodes fetch mempool contents from Nostr.

- Once mined, a block is submitted over Nostr.

- Nodes confirm inclusion and update their UTXO set.

Security Considerations

- Sybil Resistance: Consensus remains based on proof-of-work. The communication path (Nostr) is not involved in consensus.

- Relay Discoverability: Optionally bootstrap via DNS, Bitcoin P2P, or signed relay lists.

- Spam Protection: Relay-side policy, rate limiting, proof-of-work challenges, or Lightning payments.

- Block Authenticity: Nodes must verify all received blocks and reject invalid chains.

Compatibility and Migration

- Fully compatible with current Bitcoin consensus rules.

- Bridge nodes preserve interoperability with legacy full nodes.

- Nodes can run in hybrid mode, fetching from both P2P and Nostr.

Future Work

- Integration with watch-only wallets and SPV clients using verified headers via Nostr.

- Use of Nostr’s social graph for partial trust assumptions and relay reputation.

- Dynamic relay discovery using Nostr itself (relay list events).

Conclusion

This proposal lays out a new architecture for Bitcoin communication using Nostr to replace or augment the P2P network. This improves decentralization, censorship resistance, modularity, and speed, while preserving consensus integrity. It encourages innovation by enabling smaller, purpose-built Bitcoin nodes and offloading networking complexity.

This document may become both a Bitcoin Improvement Proposal (BIP-XXX) and a Nostr Improvement Proposal (NIP-XXX). Event kind range reserved: 210000–219999.

-

@ b1ddb4d7:471244e7

2025-05-24 05:00:40

@ b1ddb4d7:471244e7

2025-05-24 05:00:40Global fintech leader Revolut has announced a landmark partnership with Lightspark, a pioneer in blockchain infrastructure solutions, to integrate bitcoin’s Lightning Network into its platform.

This collaboration, now live for Revolut users in the UK and select European Economic Area (EEA) countries, marks a transformative leap toward frictionless, real-time transactions—eliminating delays and exorbitant fees traditionally associated with digital asset transfers.

Major update: @RevolutApp is now partnering with @lightspark pic.twitter.com/OUblgrj6Xr

Major update: @RevolutApp is now partnering with @lightspark pic.twitter.com/OUblgrj6Xr— Lightspark (@lightspark) May 7, 2025

Breaking Barriers in Digital Currency Usability

By adopting Lightspark’s cutting-edge technology, Revolut empowers its 40+ million customers to execute bitcoin transactions instantly at a fraction of current costs.

This integration addresses longstanding pain points in digital currency adoption, positioning bitcoin as a practical tool for everyday payments. Users can now seamlessly send, receive, and store bitcoin with the same ease as traditional fiat currencies, backed by Revolut’s secure platform.

The partnership also advances Revolut’s integration into the open Money Grid, a decentralized network enabling universal interoperability between financial platforms.

This move aligns Revolut with forward-thinking fintechs adopting next-gen solutions like Lightning transactions and Universal Money Addresses (UMA), which simplify cross-border payments by replacing complex wallet codes with human-readable addresses (e.g., $john.smith).

Why This Matters

The collaboration challenges conventional payment rails, which often incur delays of days and high fees for cross-border transfers. By contrast, Lightning Network transactions settle in seconds for minimal cost, revolutionizing peer-to-peer payments, remittances, and merchant settlements. For Revolut users, this means:

- Instant transactions: Send bitcoin globally in under three seconds.

- Near-zero fees: Dramatically reduce costs compared to traditional crypto transfers.

- Enhanced utility: Use bitcoin for daily spending, not just as a speculative asset.

The Road Ahead

Revolut plans to expand Lightning Network access to additional markets in 2025, with ambitions to integrate UMA support for seamless fiat and digital currency interactions. Lightspark will continue optimizing its infrastructure to support Revolut’s scaling efforts, further bridging the gap between blockchain innovation and mainstream finance.

About Revolut

Revolut is a global financial app serving over 40 million customers worldwide. Offering services ranging from currency exchange and stock trading to digital assets and insurance, Revolut is committed to building a borderless financial ecosystem.

About Lightspark

Founded by former PayPal and Meta executives, Lightspark develops enterprise-grade solutions for the Lightning Network. Its technology stack empowers institutions to harness bitcoin’s speed and efficiency while maintaining regulatory compliance.

-

@ 57d1a264:69f1fee1

2025-05-22 13:13:36

@ 57d1a264:69f1fee1

2025-05-22 13:13:36Graphics materials for Bitcoin Knots https://github.com/bitcoinknots branding. See below guide image for reference, a bit cleaner and scalable:

Font family "Aileron" is provided free for personal and commercial use, and can be found here: https://www.1001fonts.com/aileron-font.html

Source: https://github.com/Blissmode/bitcoinknots-gfx/tree/main

https://stacker.news/items/986624

-

@ b1ddb4d7:471244e7

2025-05-24 05:00:39

@ b1ddb4d7:471244e7

2025-05-24 05:00:39In the heart of East Africa, where M-Pesa reigns supreme and innovation pulses through bustling markets, a quiet revolution is brewing—one that could redefine how millions interact with money.

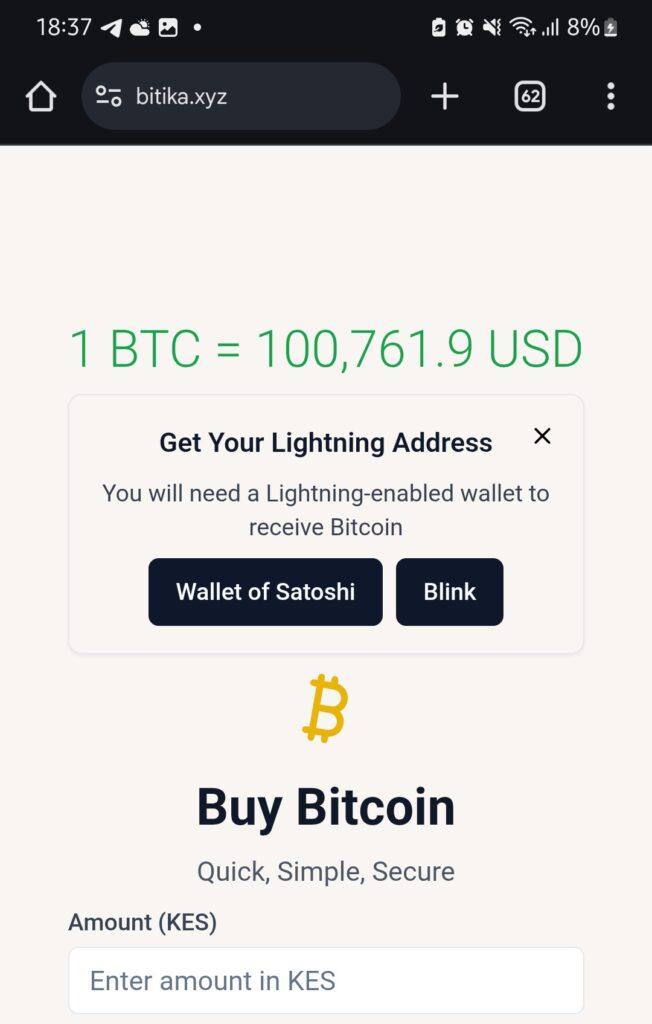

Enter Bitika, the Kenyan startup turning bitcoin’s complexity into a three-step dance, merging the lightning speed of sats with the trusted rhythm of mobile money.

At the helm is a founder whose “aha” moment came not in a boardroom, but at his kitchen table, watching his father grapple with the gap between understanding bitcoin and actually using it.

Bitika was born from that friction—a bridge between M-Pesa’s ubiquity and bitcoin’s borderless promise, wrapped in a name as playful as the Swahili slang that inspired it.

But this isn’t just a story about simplifying transactions. It’s about liquidity battles, regulatory tightropes, and a vision to turn Bitika into the invisible rails powering Africa’s Bitcoin future.

Building on Bitcoin

- Tell us a bit about yourself and how you got into bitcoin/fintech, and what keeps you passionate about this space?

I first came across bitcoin in 2020, but like many at that time, I didn’t fully grasp what it really was. It sounded too complicated, probably with the heavy terminologies. Over time, I kept digging deeper and became more curious.

I started digging into finance and how money works and realised this was what I needed to understand bitcoin’s objectives. I realized that bitcoin wasn’t just a new type of money—it was a breakthrough in how we think about freedom, ownership, and global finance.

What keeps me passionate is how bitcoin can empower people—especially in Africa—to take control of their wealth, without relying on unstable systems or middlemen.

- What pivotal moment or experience inspired you to create Bitika? Was there a specific gap in Kenya’s financial ecosystem that sparked the idea?

Yes, this idea was actually born right in my own home. I’ve always been an advocate for bitcoin, sharing it with friends, family, and even strangers. My dad and I had countless conversations about it. Eventually, he understood the concept. But when he asked, “How do I even buy bitcoin?” or “Can you just buy it for me?” and after taking him through binance—that hit me.

If someone I’d educated still found the buying process difficult, how many others were feeling the same way? That was the lightbulb moment. I saw a clear gap: the process of buying bitcoin was too technical for the average Kenyan. That’s the problem Bitika set out to solve.

- How did you identify the synergy between bitcoin and M-Pesa as a solution for accessibility?

M-Pesa is at the center of daily life in Kenya. Everyone uses it—from buying groceries to paying rent. Instead of forcing people to learn new tools, I decided to meet them where they already are. That synergy between M-Pesa and bitcoin felt natural. It’s about bridging what people already trust with something powerful and new.

- Share the story behind the name “Bitika” – does it hold a cultural or symbolic meaning?

Funny enough, Bitika isn’t a deeply planned name. It came while I was thinking about bitcoin and the type of transformation it brings to individuals. In Swahili, we often add “-ka” to words for flair—like “bambika” from “bamba.”

So, I just coined Bitika as a playful and catchy way to reflect something bitcoin-related, but also uniquely local. I stuck with it because thinking of an ideal brand name is the toughest challenge for me.

- Walk us through the user journey – how does buying bitcoin via M-Pesa in “3 simple steps” work under the hood?

It’s beautifully simple.

1. The user enters the amount they want to spend in KES—starting from as little as 50 KES (about $0.30).

2. They input their Lightning wallet address.

3. They enter their M-Pesa number, which triggers an STK push (payment prompt) on their phone. Once confirmed—pap!—they receive bitcoin almost instantly.

Under the hood, we fetch the live BTC price, validate wallet addresses, check available liquidity, process the mobile payment, and send sats via the Lightning Network—all streamlined into a smooth experience for the user.

- Who’s Bitika’s primary audience? Are you focusing on unbanked populations, tech enthusiasts, or both?

Both. Bitika is designed for everyday people—especially the unbanked and underbanked who are excluded from traditional finance. But we also attract bitcoiners who just want a faster, easier way to buy sats. What unites them is the desire for a seamless and low-barrier bitcoin experience.

Community and Overcoming Challenges

- What challenges has Bitika faced navigating Kenya’s bitcoin regulations, and how do you build trust with regulators?

Regulation is still evolving here. Parliament has drafted bills, but none have been passed into law yet. We’re currently in a revision phase where policymakers are trying to strike a balance between encouraging innovation and protecting the public.

We focus on transparency and open dialogue—we believe that building trust with regulators starts with showing how bitcoin can serve the public good.

- What was the toughest obstacle in building Bitika, and how did you overcome it?

Liquidity. Since we don’t have deep capital reserves, we often run into situations where we have to pause operations often to manually restock our bitcoin supply. It’s frustrating—for us and for users. We’re working on automating this process and securing funding to maintain consistent liquidity so users can access bitcoin at any time, without disruption.

This remains our most critical issue—and the primary reason we’re seeking support.

- Are you eyeing new African markets? What’s next for Bitika’s product?

Absolutely. The long-term vision is to expand Bitika into other African countries facing similar financial challenges. But first, we want to turn Bitika into a developer-first tool—infrastructure that others can build on. Imagine local apps, savings products, or financial tools built using Bitika’s simple bitcoin rails. That’s where we’re heading.

- What would you tell other African entrepreneurs aiming to disrupt traditional finance?

Disrupting finance sounds exciting—but the reality is messy. People fear what they don’t understand. That’s why simplicity is everything. Build tools that hide the complexity, and focus on making the user’s life easier. Most importantly, stay rooted in local context—solve problems people actually face.

What’s Next?

- What’s your message to Kenyans hesitant to try bitcoin, and to enthusiasts watching Bitika?

To my fellow Kenyans: bitcoin isn’t just an investment—it’s a sovereign tool. It’s money you truly own. Start small, learn, and ask questions.

To the bitcoin community: Bitika is proof that bitcoin is working in Africa. Let’s keep pushing. Let’s build tools that matter.

- How can the bitcoin community, both locally and globally, support Bitika’s mission?

We’re currently fundraising on Geyser. Support—whether it’s financial, technical, or simply sharing our story—goes a long way. Every sat you contribute helps us stay live, grow our liquidity, and continue building a tool that brings bitcoin closer to the everyday person in Africa.

Support here: https://geyser.fund/project/bitika

-

@ eb0157af:77ab6c55

2025-05-24 05:01:14

@ eb0157af:77ab6c55

2025-05-24 05:01:14The exchange reveals the extent of the breach that occurred last December as federal authorities investigate the recent data leak.

Coinbase has disclosed that the personal data of 69,461 users was compromised during the breach in December 2024, according to documentation filed with the Maine Attorney General’s Office.

The disclosure comes after Coinbase announced last week that a group of hackers had demanded a $20 million ransom, threatening to publish the stolen data on the dark web. The attackers allegedly bribed overseas customer service agents to extract information from the company’s systems.

Coinbase had previously stated that the breach affected less than 1% of its user base, compromising KYC (Know Your Customer) data such as names, addresses, and email addresses. In a filing with the U.S. Securities and Exchange Commission (SEC), the company clarified that passwords, private keys, and user funds were not affected.

Following the reports, the SEC has reportedly opened an official investigation to verify whether Coinbase may have inflated user metrics ahead of its 2021 IPO. Separately, the Department of Justice is investigating the breach at Coinbase’s request, according to CEO Brian Armstrong.

Meanwhile, Coinbase has faced criticism for its delayed response to the data breach. Michael Arrington, founder of TechCrunch, stated that the stolen data could cause irreparable harm. In a post on X, Arrington wrote:

“The human cost, denominated in misery, is much larger than the $400m or so they think it will actually cost the company to reimburse people. The consequences to companies who do not adequately protect their customer information should include, without limitation, prison time for executives.”

Coinbase estimates the incident could cost between $180 million and $400 million in remediation expenses and customer reimbursements.

Arrington also condemned KYC laws as ineffective and dangerous, calling on both regulators and companies to better protect user data:

“Combining these KYC laws with corporate profit maximization and lax laws on penalties for hacks like these means these issues will continue to happen. Both governments and corporations need to step up to stop this. As I said, the cost can only be measured in human suffering.”

The post Coinbase: 69,461 users affected by December 2024 data breach appeared first on Atlas21.

-

@ 57d1a264:69f1fee1

2025-05-22 12:36:20

@ 57d1a264:69f1fee1

2025-05-22 12:36:20Graphics materials for Bitcoin Knots https://github.com/bitcoinknots branding. See below guide image for reference, a bit cleaner and scalable:

Font family "Aileron" is provided free for personal and commercial use, and can be found here: https://www.1001fonts.com/aileron-font.html

Source: https://github.com/Blissmode/bitcoinknots-gfx/tree/main

https://stacker.news/items/986587

-

@ b7274d28:c99628cb

2025-05-24 01:02:32

@ b7274d28:c99628cb

2025-05-24 01:02:32A few months ago, a nostrich was switching from iOS to Android and asked for suggestions for #Nostr apps to try out. nostr:npub18ams6ewn5aj2n3wt2qawzglx9mr4nzksxhvrdc4gzrecw7n5tvjqctp424 offered the following as his response:

nostr:nevent1qvzqqqqqqypzq0mhp4ja8fmy48zuk5p6uy37vtk8tx9dqdwcxm32sy8nsaa8gkeyqydhwumn8ghj7un9d3shjtnwdaehgunsd3jkyuewvdhk6tcpz4mhxue69uhhyetvv9ujuerpd46hxtnfduhszythwden5te0dehhxarj9emkjmn99uqzpwwts6n28eyvjpcwvu5akkwu85eg92dpvgw7cgmpe4czdadqvnv984rl0z

Yes. #Android users are fortunate to have some powerful Nostr apps and tools at our disposal that simply have no comparison over on the iOS side. However, a tool is only as good as the knowledge of the user, who must have an understanding of how best to wield it for maximum effect. This fact was immediately evidenced by replies to Derek asking, "What is the use case for Citrine?" and "This is the first time I'm hearing about Citrine and Pokey. Can you give me links for those?"

Well, consider this tutorial your Nostr starter-kit for Android. We'll go over installing and setting up Amber, Amethyst, Citrine, and Pokey, and as a bonus we'll be throwing in the Zapstore and Coinos to boot. We will assume no previous experience with any of the above, so if you already know all about one or more of these apps, you can feel free to skip that tutorial.

So many apps...

You may be wondering, "Why do I need so many apps to use Nostr?" That's perfectly valid, and the honest answer is, you don't. You can absolutely just install a Nostr client from the Play Store, have it generate your Nostr identity for you, and stick with the default relays already set up in that app. You don't even need to connect a wallet, if you don't want to. However, you won't experience all that Nostr has to offer if that is as far as you go, any more than you would experience all that Italian cuisine has to offer if you only ever try spaghetti.

Nostr is not just one app that does one thing, like Facebook, Twitter, or TikTok. It is an entire ecosystem of applications that are all built on top of a protocol that allows them to be interoperable. This set of tools will help you make the most out of that interoperability, which you will never get from any of the big-tech social platforms. It will provide a solid foundation for you to build upon as you explore more and more of what Nostr has to offer.

So what do these apps do?

Fundamental to everything you do on Nostr is the need to cryptographically sign with your private key. If you aren't sure what that means, just imagine that you had to enter your password every time you hit the "like" button on Facebook, or every time you commented on the latest dank meme. That would get old really fast, right? That's effectively what Nostr requires, but on steroids.

To keep this from being something you manually have to do every 5 seconds when you post a note, react to someone else's note, or add a comment, Nostr apps can store your private key and use it to sign behind the scenes for you. This is very convenient, but it means you are trusting that app to not do anything with your private key that you don't want it to. You are also trusting it to not leak your private key, because anyone who gets their hands on it will be able to post as you, see your private messages, and effectively be you on Nostr. The more apps you give your private key to, the greater your risk that it will eventually be compromised.

Enter #Amber, an application that will store your private key in only one app, and all other compatible Nostr apps can communicate with it to request a signature, without giving any of those other apps access to your private key.

Most Nostr apps for Android now support logging in and signing with Amber, and you can even use it to log into apps on other devices, such as some of the web apps you use on your PC. It's an incredible tool given to us by nostr:npub1w4uswmv6lu9yel005l3qgheysmr7tk9uvwluddznju3nuxalevvs2d0jr5, and only available for Android users. Those on iPhone are incredibly jealous that they don't have anything comparable, yet.

Speaking of nostr:npub1w4uswmv6lu9yel005l3qgheysmr7tk9uvwluddznju3nuxalevvs2d0jr5, the next app is also one of his making.

All Nostr data is stored on relays, which are very simple servers that Nostr apps read notes from and write notes to. In most forms of social media, it can be a pain to get your own data out to keep a backup. That's not the case on Nostr. Anyone can run their own relay, either for the sake of backing up their personal notes, or for others to post their notes to, as well.

Since Nostr notes take up very little space, you can actually run a relay on your phone. I have been on Nostr for almost 2 and a half years, and I have 25,000+ notes of various kinds on my relay, and a backup of that full database is just 24MB on my phone's storage.

Having that backup can save your bacon if you try out a new Nostr client and it doesn't find your existing follow list for some reason, so it writes a new one and you suddenly lose all of the people you were following. Just pop into your #Citrine relay, confirm it still has your correct follow list or import it from a recent backup, then have Citrine restore it. Done.

Additionally, there are things you may want to only save to a relay you control, such as draft messages that you aren't ready to post publicly, or eCash tokens, which can actually be saved to Nostr relays now. Citrine can also be used with Amber for signing into certain Nostr applications that use a relay to communicate with Amber.

If you are really adventurous, you can also expose Citrine over Tor to be used as an outbox relay, or used for peer-to-peer private messaging, but that is far more involved than the scope of this tutorial series.

You can't get far in Nostr without a solid and reliable client to interact with. #Amethyst is the client we will be using for this tutorial because there simply isn't another Android client that comes close, so far. Moreover, it can be a great client for new users to get started on, and yet it has a ton of features for power-users to take advantage of as well.

There are plenty of other good clients to check out over time, such as Coracle, YakiHonne, Voyage, Olas, Flotilla and others, but I keep coming back to Amethyst, and by the time you finish this tutorial, I think you'll see why. nostr:npub1gcxzte5zlkncx26j68ez60fzkvtkm9e0vrwdcvsjakxf9mu9qewqlfnj5z and others who have contributed to Amethyst have really built something special in this client, and it just keeps improving with every update that's shipped.

Most social media apps have some form of push notifications, and some Nostr apps do, too. Where the issue comes in is that Nostr apps are all interoperable. If you have more than one application, you're going to have both of them notifying you. Nostr users are known for having five or more Nostr apps that they use regularly. If all of them had notifications turned on, it would be a nightmare. So maybe you limit it to only one of your Nostr apps having notifications turned on, but then you are pretty well locked-in to opening that particular app when you tap on the notification.

Pokey, by nostr:npub1v3tgrwwsv7c6xckyhm5dmluc05jxd4yeqhpxew87chn0kua0tjzqc6yvjh, solves this issue, allowing you to turn notifications off for all of your Nostr apps, and have Pokey handle them all for you. Then, when you tap on a Pokey notification, you can choose which Nostr app to open it in.

Pokey also gives you control over the types of things you want to be notified about. Maybe you don't care about reactions, and you just want to know about zaps, comments, and direct messages. Pokey has you covered. It even supports multiple accounts, so you can get notifications for all the npubs you control.