-

@ 5df413d4:2add4f5b

2025-05-04 00:06:31

@ 5df413d4:2add4f5b

2025-05-04 00:06:31This opinion piece was first published in BTC Magazine on Feb 20, 2023

Just in case we needed a reminder, banks are showing us that they can and will gatekeep their customers’ money to prevent them from engaging with bitcoin. This should be a call to action for Bitcoiners or anyone else who wants to maintain control over their finances to move toward more proactive use of permissionless bitcoin tools and practices.

Since January of 2023, when Jamie Dimon decried Bitcoin as a “hyped-up fraud” and “a pet rock,” on CNBC, I've found myself unable to purchase bitcoin using my Chase debit card on Cash App. And I'm not the only one — if you have been following Bitcoin Twitter, you might have also seen Alana Joy tweet about her experience with the same. (Alana Joy Twitter account has since been deleted).

In both of our cases, it is the bank preventing bitcoin purchases and blocking inbound fiat transfers to Cash App for customers that it has associated with Bitcoin. All under the guise of “fraud protection,” of course.

No, it doesn’t make a whole lot of sense — Chase still allows ACH bitcoin purchases and fiat on Cash App can be used for investing in stocks, saving or using Cash App’s own debit card, not just bitcoin — but yes, it is happening. Also, no one seems to know exactly when this became Chase’s policy. The fraud representative I spoke with wasn’t sure and couldn’t point to any documentation, but reasoned that the rule has been in place since early last year. Yet murkier still, loose chatter can be found on Reddit about this issue going back to at least April 2021.

However, given that I and so many others were definitely buying bitcoin via Chase debit throughout 2021 and 2022, I’d wager that this policy, up to now, has only been exercised haphazardly, selectively, arbitrarily, even. Dark patterns abound, but for now, it seems like I just happen to be one of the unlucky ones…

That said, there is nothing preventing this type of policy from being enforced broadly and in earnest by one or many banks. If and as banks feel threatened by Bitcoin, we will surely see more of these kinds of opaque practices.

It’s Time To Get Proactive

Instead, we should expect it and prepare for it. So, rather than railing against banks, I want to use this as a learning experience to reflect on the importance of permissionless, non-KYC Bitcoining, and the practical actions we can take to advance the cause.

Bank with backups and remember local options. Banking is a service, not servitude. Treat it as such. Maintaining accounts at multiple banks may provide some limited fault tolerance against banks that take a hostile stance toward Bitcoin, assuming it does not become the industry norm. Further, smaller, local and regional banks may be more willing to work with Bitcoiner customers, as individual accounts can be far more meaningful to them than they are to larger national banks — though this certainly should not be taken for granted.

If you must use KYC’d Bitcoin services, do so thoughtfully. For Cash App (and services like it), consider first loading in fiat and making buys out of the app’s native cash balance instead of purchasing directly through a linked bank account/debit card where information is shared with the bank that allows it to flag the transaction for being related to bitcoin. Taking this small step may help to avoid gatekeeping and can provide some minor privacy, from the bank at least.

Get comfortable with non-KYC bitcoin exchanges. Just as many precoiners drag their feet before making their first bitcoin buys, so too do many Bitcoiners drag their feet in using permissionless channels to buy and sell bitcoin. Robosats, Bisq, Hodl Hodl— you can use the tools. For anyone just getting started, BTC Sessions has excellent video tutorial content on all three, which are linked.

If you don’t yet know how to use these services, it’s better to pick up this knowledge now through calm, self-directed learning rather than during the panic of an emergency or under pressure of more Bitcoin-hostile conditions later. And for those of us who already know, we can actively support these services. For instance, more of us taking action to maintain recurring orders on such platforms could significantly improve their volumes and liquidity, helping to bootstrap and accelerate their network effects.

Be flexible and creative with peer-to-peer payment methods. Cash App, Zelle, PayPal, Venmo, Apple Cash, Revolut, etc. — the services that most users seem to be transacting with on no-KYC exchanges — they would all become willing, if not eager and active agents of financial gatekeeping in any truly antagonistic, anti-privacy environment, even when used in a “peer-to-peer” fashion.

Always remember that there are other payment options — such as gift cards, the original digital-bearer items — that do not necessarily carry such concerns. Perhaps, an enterprising soul might even use Fold to earn bitcoin rewards on the backend for the gift cards used on the exchange…

Find your local Bitcoin community! In the steadily-advancing shadow war on all things permissionless, private, and peer-to-peer, this is our best defense. Don’t just wait until you need other Bitcoiners to get to know other Bitcoiners — to paraphrase Texas Slim, “Shake your local Bitcoiner’s hand.” Get to know people and never underestimate the power of simply asking around. There could be real, live Bitcoiners near you looking to sell some corn and happy to see it go to another HODLer rather than to a bunch of lettuce-handed fiat speculators on some faceless, centralized, Ponzi casino exchange. What’s more, let folks know your skills, talents and expertise — you might be surprised to find an interested market that pays in BTC!

In closing, I believe we should think of permissionless Bitcoining as an essential and necessary core competency, just like we do with Self-Custody. And we should push it with similar urgency and intensity. But as we do this, we should also remember that it is a spectrum and a progression and that there are no perfect solutions, only tradeoffs. Realization of the importance of non-KYC practices will not be instant or obvious to near-normie newcoiners, coin-curious fence-sitters or even many minted Bitcoiners. My own experience is certainly a testament to this.

As we promote the active practice of non-KYC Bitcoining, we can anchor to empathy, patience and humility — always being mindful of the tremendous amount of unlearning most have to go through to get there. So, even if someone doesn’t get it the first time, or the nth time, that they hear it from us, if it helps them get to it faster at all, then it’s well worth it.

~Moon

-

@ b99efe77:f3de3616

2025-05-03 23:37:57

@ b99efe77:f3de3616

2025-05-03 23:37:57343433

34333434

Places & Transitions

- Places:

-

Bla bla bla: some text

-

Transitions:

- start: Initializes the system.

- logTask: bla bla bla.

petrinet ;startDay () -> working ;stopDay working -> () ;startPause working -> paused ;endPause paused -> working ;goSmoke working -> smoking ;endSmoke smoking -> working ;startEating working -> eating ;stopEating eating -> working ;startCall working -> onCall ;endCall onCall -> working ;startMeeting working -> inMeetinga ;endMeeting inMeeting -> working ;logTask working -> working -

@ b99efe77:f3de3616

2025-05-03 23:34:54

@ b99efe77:f3de3616

2025-05-03 23:34:5412123123123

eqeqeqeqeqeqe

Places & Transitions

- Places:

-

Bla bla bla: some text

-

Transitions:

- start: Initializes the system.

- logTask: bla bla bla.

petrinet ;startDay () -> working ;stopDay working -> () ;startPause working -> paused ;endPause paused -> working ;goSmoke working -> smoking ;endSmoke smoking -> working ;startEating working -> eating ;stopEating eating -> working ;startCall working -> onCall ;endCall onCall -> working ;startMeeting working -> inMeetinga ;endMeeting inMeeting -> working ;logTask working -> working -

@ b99efe77:f3de3616

2025-05-03 23:20:27

@ b99efe77:f3de3616

2025-05-03 23:20:27PetriNostr. My everyday activity

sdfsdfsfsfdfdf

petrinet sfsfdsf -

@ b99efe77:f3de3616

2025-05-03 22:58:44

@ b99efe77:f3de3616

2025-05-03 22:58:44dfsf

adfasfafafafafadsf

```petrinet

Places & Transitions

- Places:

-

Bla bla bla: some text

-

Transitions:

- start: Initializes the system.

- logTask: bla bla bla.

petrinet ;startDay () -> working ;stopDay working -> () ;startPause working -> paused ;endPause paused -> working ;goSmoke working -> smoking ;endSmoke smoking -> working ;startEating working -> eating ;stopEating eating -> working ;startCall working -> onCall ;endCall onCall -> working ;startMeeting working -> inMeetinga ;endMeeting inMeeting -> working ;logTask working -> working``` -

@ 6fc114c7:8f4b1405

2025-05-03 22:06:36

@ 6fc114c7:8f4b1405

2025-05-03 22:06:36In the world of cryptocurrency, the stakes are high, and losing access to your digital assets can be a nightmare. But fear not — Crypt Recver is here to turn that nightmare into a dream come true! With expert-led recovery services and cutting-edge technology, Crypt Recver specializes in helping you regain access to your lost Bitcoin and other cryptocurrencies.

Why Choose Crypt Recver? 🤔 🔑 Expertise You Can Trust At Crypt Recver, we combine state-of-the-art technology with skilled engineers who have a proven track record in crypto recovery. Whether you’ve forgotten your passwords, lost your private keys, or dealt with damaged hardware wallets, our team is equipped to help.

⚡ Fast Recovery Process Time is of the essence when it comes to recovering lost funds. Crypt Recver’s systems are optimized for speed, enabling quick recoveries — so you can get back to what matters most: trading and investing.

🎯 High Success Rate With over a 90% success rate, our recovery team has helped countless clients regain access to their lost assets. We understand the intricacies of cryptocurrency and are dedicated to providing effective solutions.

🛡️ Confidential & Secure Your privacy is our priority. All recovery sessions at Crypt Recver are encrypted and kept entirely confidential. You can trust us with your information, knowing that we maintain the highest standards of security.

🔧 Advanced Recovery Tools We use proprietary tools and techniques to handle complex recovery scenarios, from recovering corrupted wallets to restoring coins from invalid addresses. No matter how challenging the situation, we have a plan.

Our Recovery Services Include: 📈 Bitcoin Recovery: Have you lost access to your Bitcoin wallet? We can help you recover lost wallets, private keys, and passphrases. Transaction Recovery: Mistaken transfers, lost passwords, or missing transaction records — let us help you reclaim your funds! Cold Wallet Restoration: Did your cold wallet fail? We specialize in extracting assets safely and securely. Private Key Generation: Forgotten your private key? We can help you generate new keys linked to your funds without compromising security. Don’t Let Lost Crypto Ruin Your Day! 🕒 With an estimated 3 to 3.4 million BTC lost forever, it’s critical to act swiftly when facing access issues. Whether you’ve been a victim of a dust attack or have simply forgotten your key, Crypt Recver offers the support you need to reclaim your digital assets.

🚀 Start Your Recovery Now! Ready to get your cryptocurrency back? Don’t let uncertainty hold you back!

👉 Request Wallet Recovery Help Today!

Need Immediate Assistance? 📞 For quick queries or support, connect with us on:

✉️ Telegram: Chat with Us on Telegram 💬 WhatsApp: Message Us on WhatsApp Trust Crypt Recver for the Best Crypto Recovery Service — Get back to trading with confidence! 💪In the world of cryptocurrency, the stakes are high, and losing access to your digital assets can be a nightmare. But fear not — Crypt Recver is here to turn that nightmare into a dream come true! With expert-led recovery services and cutting-edge technology, Crypt Recver specializes in helping you regain access to your lost Bitcoin and other cryptocurrencies.

# Why Choose Crypt Recver? 🤔

# Why Choose Crypt Recver? 🤔🔑 Expertise You Can Trust

At Crypt Recver, we combine state-of-the-art technology with skilled engineers who have a proven track record in crypto recovery. Whether you’ve forgotten your passwords, lost your private keys, or dealt with damaged hardware wallets, our team is equipped to help.

⚡ Fast Recovery Process

Time is of the essence when it comes to recovering lost funds. Crypt Recver’s systems are optimized for speed, enabling quick recoveries — so you can get back to what matters most: trading and investing.

🎯 High Success Rate

With over a 90% success rate, our recovery team has helped countless clients regain access to their lost assets. We understand the intricacies of cryptocurrency and are dedicated to providing effective solutions.

🛡️ Confidential & Secure

Your privacy is our priority. All recovery sessions at Crypt Recver are encrypted and kept entirely confidential. You can trust us with your information, knowing that we maintain the highest standards of security.

🔧 Advanced Recovery Tools

We use proprietary tools and techniques to handle complex recovery scenarios, from recovering corrupted wallets to restoring coins from invalid addresses. No matter how challenging the situation, we have a plan.

# Our Recovery Services Include: 📈

# Our Recovery Services Include: 📈- Bitcoin Recovery: Have you lost access to your Bitcoin wallet? We can help you recover lost wallets, private keys, and passphrases.

- Transaction Recovery: Mistaken transfers, lost passwords, or missing transaction records — let us help you reclaim your funds!

- Cold Wallet Restoration: Did your cold wallet fail? We specialize in extracting assets safely and securely.

- Private Key Generation: Forgotten your private key? We can help you generate new keys linked to your funds without compromising security.

Don’t Let Lost Crypto Ruin Your Day! 🕒

With an estimated 3 to 3.4 million BTC lost forever, it’s critical to act swiftly when facing access issues. Whether you’ve been a victim of a dust attack or have simply forgotten your key, Crypt Recver offers the support you need to reclaim your digital assets.

🚀 Start Your Recovery Now!

Ready to get your cryptocurrency back? Don’t let uncertainty hold you back!

👉 Request Wallet Recovery Help Today!

Need Immediate Assistance? 📞

For quick queries or support, connect with us on:

- ✉️ Telegram: Chat with Us on Telegram

- 💬 WhatsApp: Message Us on WhatsApp

Trust Crypt Recver for the Best Crypto Recovery Service — Get back to trading with confidence! 💪

-

@ 52b4a076:e7fad8bd

2025-05-03 21:54:45

@ 52b4a076:e7fad8bd

2025-05-03 21:54:45Introduction

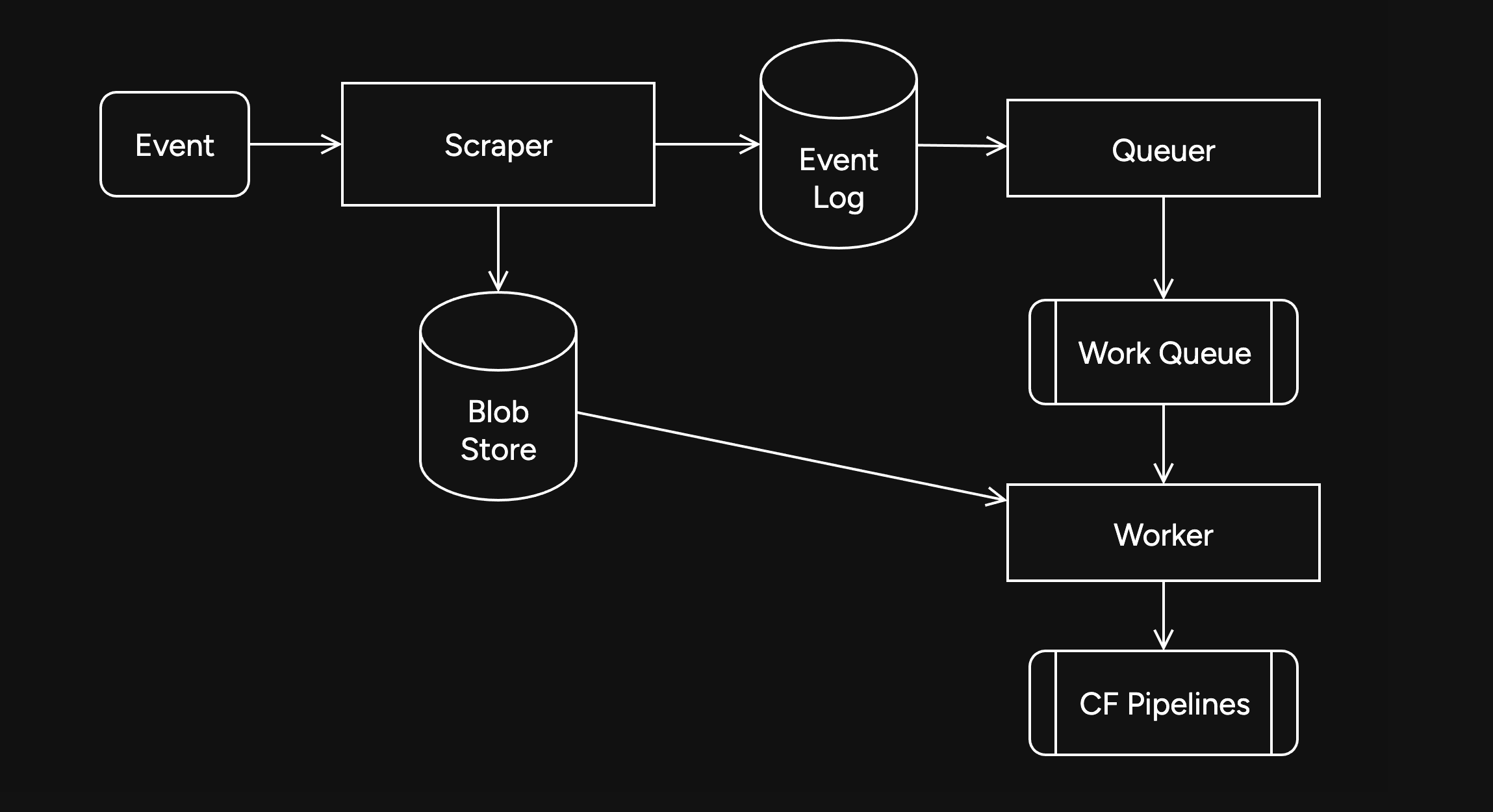

Me and Fishcake have been working on infrastructure for Noswhere and Nostr.build. Part of this involves processing a large amount of Nostr events for features such as search, analytics, and feeds.

I have been recently developing

nosdexv3, a newer version of the Noswhere scraper that is designed for maximum performance and fault tolerance using FoundationDB (FDB).Fishcake has been working on a processing system for Nostr events to use with NB, based off of Cloudflare (CF) Pipelines, which is a relatively new beta product. This evening, we put it all to the test.

First preparations

We set up a new CF Pipelines endpoint, and I implemented a basic importer that took data from the

nosdexdatabase. This was quite slow, as it did HTTP requests synchronously, but worked as a good smoke test.Asynchronous indexing

I implemented a high-contention queue system designed for highly parallel indexing operations, built using FDB, that supports: - Fully customizable batch sizes - Per-index queues - Hundreds of parallel consumers - Automatic retry logic using lease expiration

When the scraper first gets an event, it will process it and eventually write it to the blob store and FDB. Each new event is appended to the event log.

On the indexing side, a

Queuerwill read the event log, and batch events (usually 2K-5K events) into one work job. This work job contains: - A range in the log to index - Which target this job is intended for - The size of the job and some other metadataEach job has an associated leasing state, which is used to handle retries and prioritization, and ensure no duplication of work.

Several

Workers monitor the index queue (up to 128) and wait for new jobs that are available to lease.Once a suitable job is found, the worker acquires a lease on the job and reads the relevant events from FDB and the blob store.

Depending on the indexing type, the job will be processed in one of a number of ways, and then marked as completed or returned for retries.

In this case, the event is also forwarded to CF Pipelines.

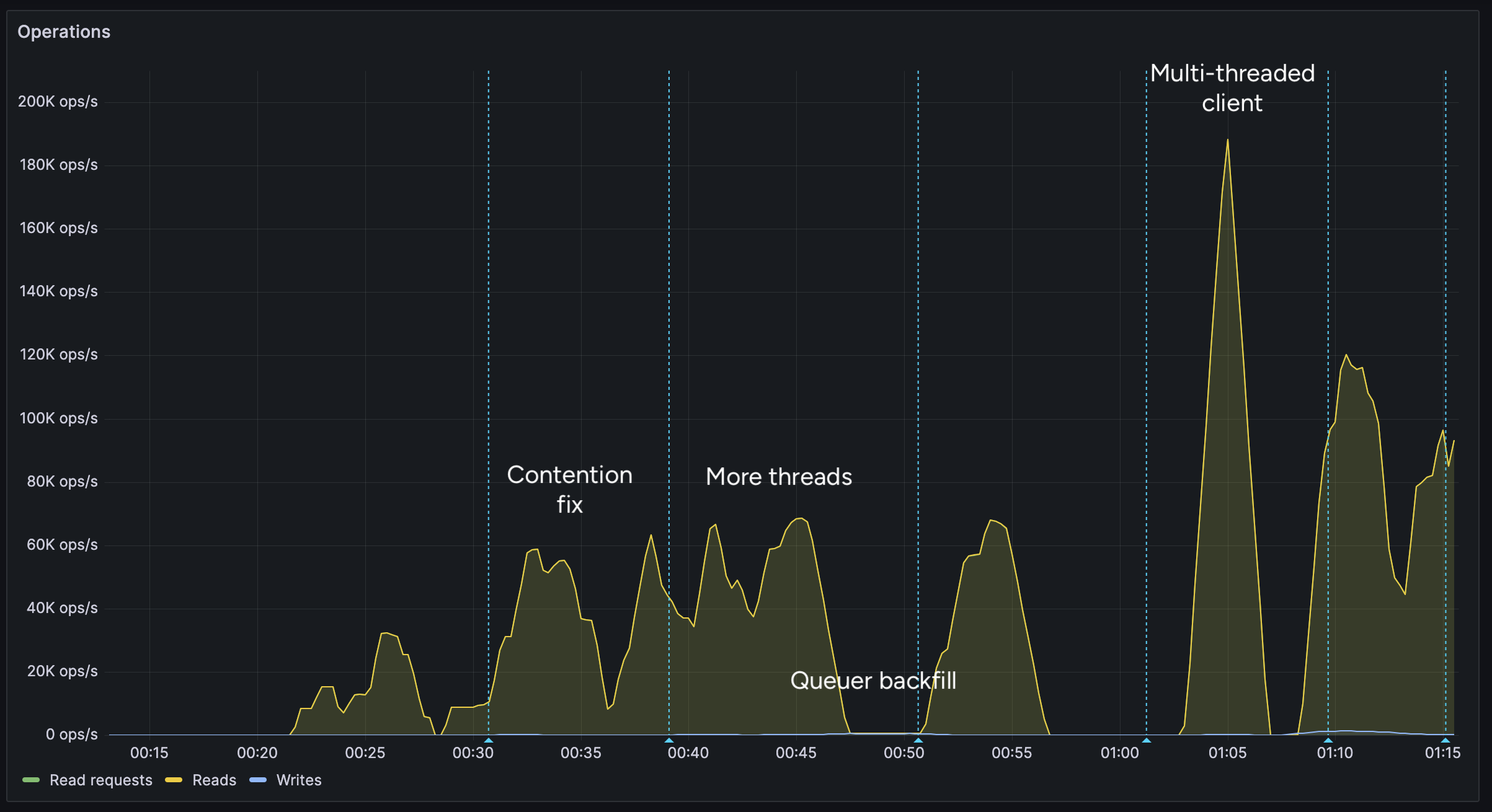

Trying it out

The first attempt did not go well. I found a bug in the high-contention indexer that led to frequent transaction conflicts. This was easily solved by correcting an incorrectly set parameter.

We also found there were other issues in the indexer, such as an insufficient amount of threads, and a suspicious decrease in the speed of the

Queuerduring processing of queued jobs.Along with fixing these issues, I also implemented other optimizations, such as deprioritizing

WorkerDB accesses, and increasing the batch size.To fix the degraded

Queuerperformance, I ran the backfill job by itself, and then started indexing after it had completed.Bottlenecks, bottlenecks everywhere

After implementing these fixes, there was an interesting problem: The DB couldn't go over 80K reads per second. I had encountered this limit during load testing for the scraper and other FDB benchmarks.

As I suspected, this was a client thread limitation, as one thread seemed to be using high amounts of CPU. To overcome this, I created a new client instance for each

Worker.After investigating, I discovered that the Go FoundationDB client cached the database connection. This meant all attempts to create separate DB connections ended up being useless.

Using

OpenWithConnectionStringpartially resolved this issue. (This also had benefits for service-discovery based connection configuration.)To be able to fully support multi-threading, I needed to enabled the FDB multi-client feature. Enabling it also allowed easier upgrades across DB versions, as FDB clients are incompatible across versions:

FDB_NETWORK_OPTION_EXTERNAL_CLIENT_LIBRARY="/lib/libfdb_c.so"FDB_NETWORK_OPTION_CLIENT_THREADS_PER_VERSION="16"Breaking the 100K/s reads barrier

After implementing support for the multi-threaded client, we were able to get over 100K reads per second.

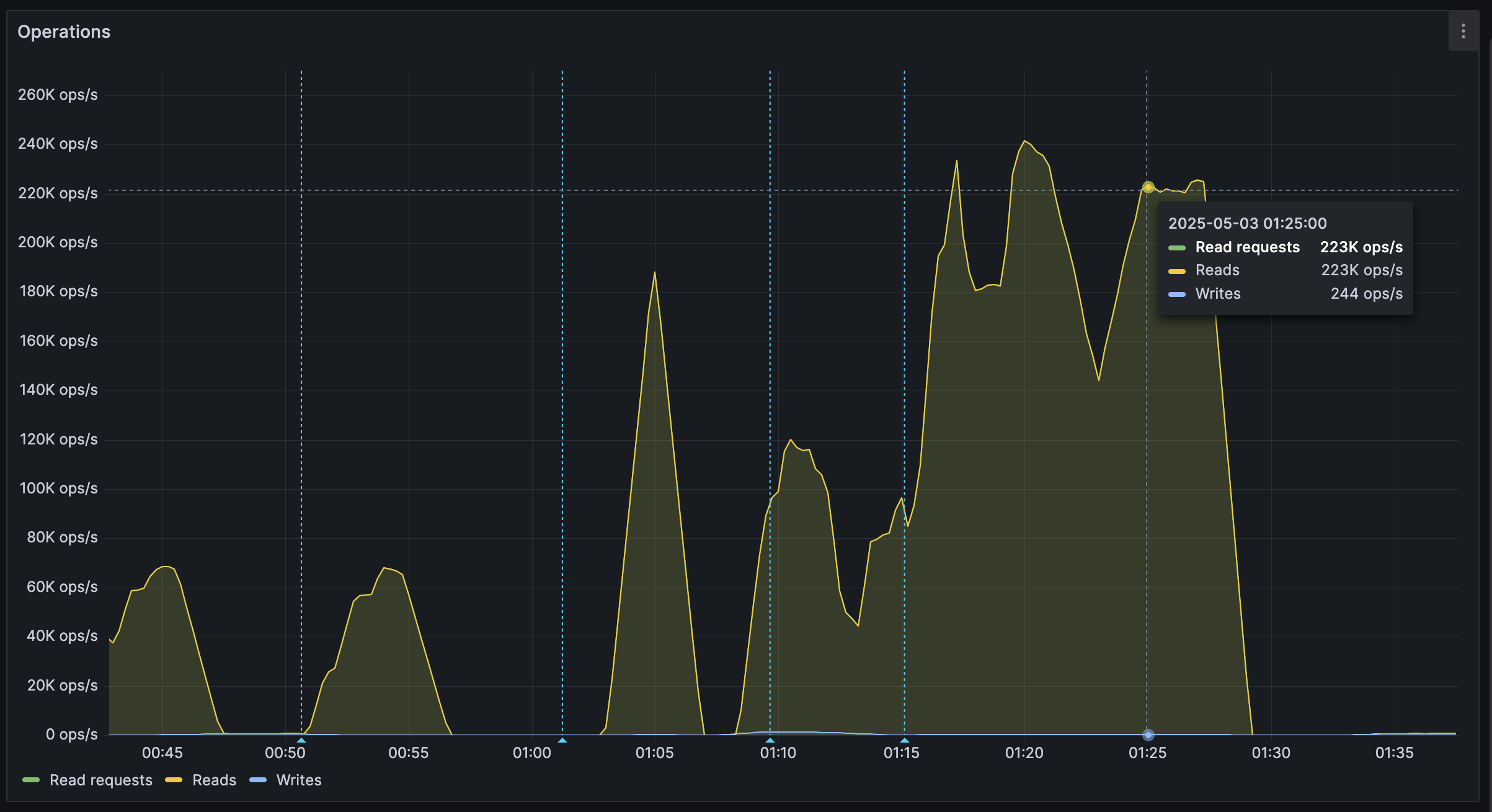

You may notice after the restart (gap) the performance dropped. This was caused by several bugs: 1. When creating the CF Pipelines endpoint, we did not specify a region. The automatically selected region was far away from the server. 2. The amount of shards were not sufficient, so we increased them. 3. The client overloaded a few HTTP/2 connections with too many requests.

I implemented a feature to assign each

Workerits own HTTP client, fixing the 3rd issue. We also moved the entire storage region to West Europe to be closer to the servers.After these changes, we were able to easily push over 200K reads/s, mostly limited by missing optimizations:

It's shards all the way down

While testing, we also noticed another issue: At certain times, a pipeline would get overloaded, stalling requests for seconds at a time. This prevented all forward progress on the

Workers.We solved this by having multiple pipelines: A primary pipeline meant to be for standard load, with moderate batching duration and less shards, and high-throughput pipelines with more shards.

Each

Workeris assigned a pipeline on startup, and if one pipeline stalls, other workers can continue making progress and saturate the DB.The stress test

After making sure everything was ready for the import, we cleared all data, and started the import.

The entire import lasted 20 minutes between 01:44 UTC and 02:04 UTC, reaching a peak of: - 0.25M requests per second - 0.6M keys read per second - 140MB/s reads from DB - 2Gbps of network throughput

FoundationDB ran smoothly during this test, with: - Read times under 2ms - Zero conflicting transactions - No overloaded servers

CF Pipelines held up well, delivering batches to R2 without any issues, while reaching its maximum possible throughput.

Finishing notes

Me and Fishcake have been building infrastructure around scaling Nostr, from media, to relays, to content indexing. We consistently work on improving scalability, resiliency and stability, even outside these posts.

Many things, including what you see here, are already a part of Nostr.build, Noswhere and NFDB, and many other changes are being implemented every day.

If you like what you are seeing, and want to integrate it, get in touch. :)

If you want to support our work, you can zap this post, or register for nostr.land and nostr.build today.

-

@ b6524158:8e898a89

2025-05-03 18:11:47

@ b6524158:8e898a89

2025-05-03 18:11:47Steps: 1. Run a node one mynode 2. Upgrade to premium 3. Select your Bitcoin version (to Bitcoin Knots)

originally posted at https://stacker.news/items/970504

-

@ d0ea1c34:9c84dc37

2025-05-03 17:53:05

@ d0ea1c34:9c84dc37

2025-05-03 17:53:05Markdown Rendering Test Document

Basic Text Formatting

This is a paragraph with bold text, italic text, and bold italic text. You can also use underscores for bold or single underscores for italics.

This is a paragraph with some

inline codeusing backticks.Lists

Unordered Lists

- Item 1

- Item 2

- Nested item 2.1

- Nested item 2.2

- Item 3

Ordered Lists

- First item

- Second item

- Nested item 2.1

- Nested item 2.2

- Third item

Links and Images

Blockquotes

This is a blockquote.

It can span multiple lines.

And can be nested.

Code Blocks

```python def hello_world(): print("Hello, world!")

This is a Python code block with syntax highlighting

hello_world() ```

javascript // JavaScript code block function helloWorld() { console.log("Hello, world!"); }Tables

| Header 1 | Header 2 | Header 3 | |----------|----------|----------| | Cell 1 | Cell 2 | Cell 3 | | Cell 4 | Cell 5 | Cell 6 | | Cell 7 | Cell 8 | Cell 9 |

Horizontal Rules

Task Lists

- [x] Completed task

- [ ] Incomplete task

- [x] Another completed task

Math (if supported)

Inline math: $E = mc^2$

Block math:

$$ \frac{d}{dx}e^x = e^x $$

Footnotes

Here's a sentence with a footnote reference[^1].

[^1]: This is the footnote content.

Definition Lists

Term 1 : Definition 1

Term 2 : Definition 2a : Definition 2b

Special Characters & Escaping

*This text is surrounded by asterisks but not italicized*

Advanced Formatting

Click to expand

This is hidden content that appears when expanded.Emoji (if supported)

:smile: :heart: :thumbsup:

Final Notes

This document demonstrates various Markdown formatting features. Compatibility may vary across different Markdown renderers and platforms.

-

@ a965e1a8:3463a92f

2025-05-03 17:52:48

@ a965e1a8:3463a92f

2025-05-03 17:52:48test reply

-

@ 2e8970de:63345c7a

2025-05-03 17:31:07

@ 2e8970de:63345c7a

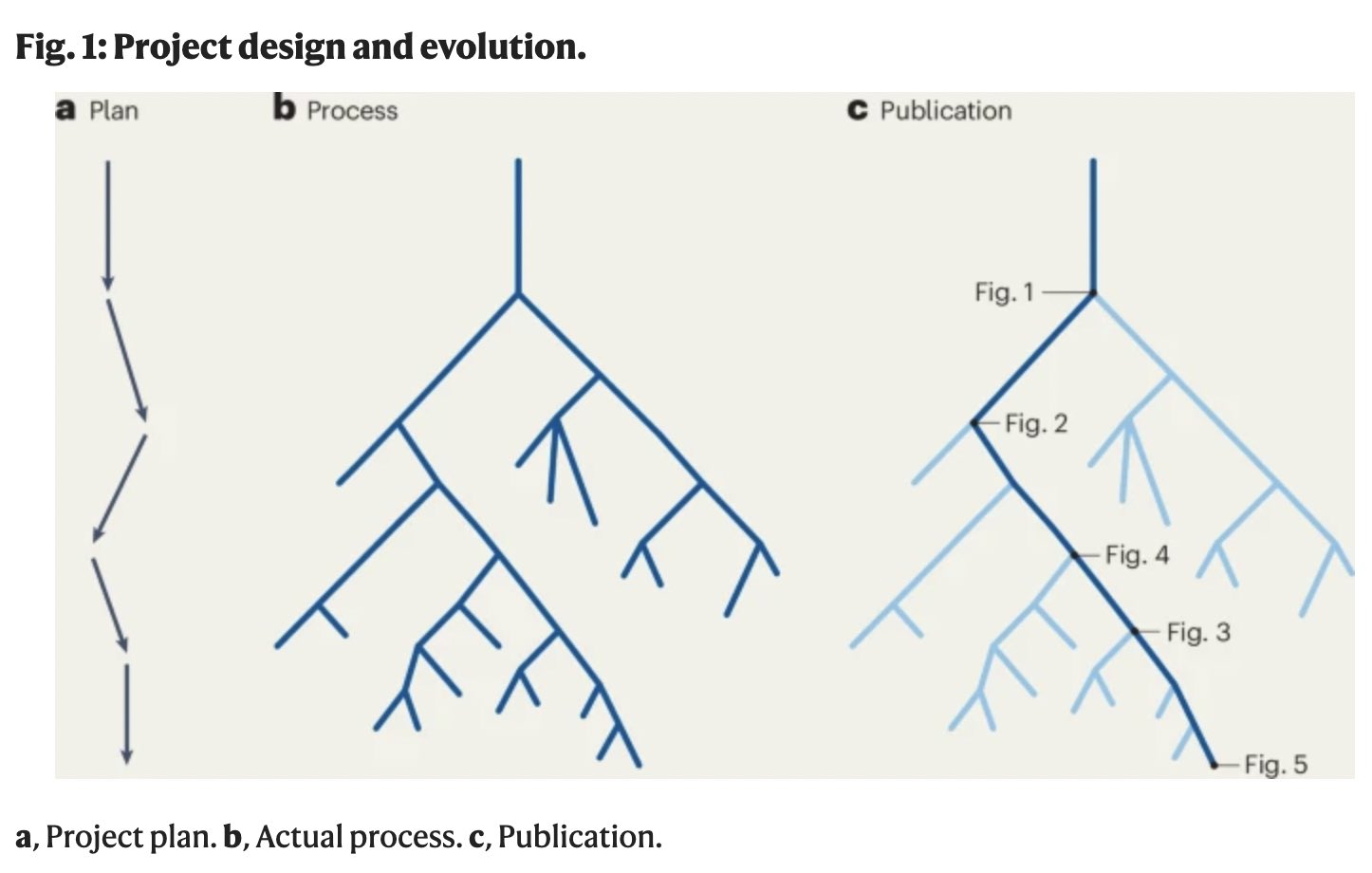

2025-05-03 17:31:07The figure in this article illustrates exactly how most biology papers are secretly p-hacked. A large number of hypotheses is explored, and only the ones that form a coherent story are reported.

This is actually the main reason behind the replication crisis in biology IMO. (source)

https://www.nature.com/articles/s41587-025-02635-7

originally posted at https://stacker.news/items/970464

-

@ e2388e53:0e93e8a9

2025-05-03 16:44:06

@ e2388e53:0e93e8a9

2025-05-03 16:44:06- Die Befreiung beginnt nicht mit einem Aufschrei, sondern mit einem leisen Nein.

- Herkunft ist kein Zuhause. Es ist der Ort, an dem man lernt, warum man gehen musste.

- Manche Familien sind wie alte Götter: Man glaubt an sie, obwohl sie längst gestorben sind.

- Wer das Nichts anschaut, sieht sich selbst: ein Schatten, der sich für Licht hält.

- Das Schweigen des Universums ist keine Antwort – es ist die endgültige Form der Gleichgültigkeit.

- In der Dämmerung unserer Tage suchen wir die Sonne, die nur in der Erinnerung noch brennt.

- Freiheit beginnt, wenn der Mensch aufhört, sich retten zu lassen.

- Wer nie verloren ging, hat sich selbst nie gesucht.

- Gedanken zerfallen wie Tropfen, die nie den Boden erreichen.

- Wahrheit ist selten laut. Sie flüstert – meist dann, wenn niemand mehr zuhört.

-

@ 90de72b7:8f68fdc0

2025-05-03 16:29:51

@ 90de72b7:8f68fdc0

2025-05-03 16:29:51Custom1. PetriNostr. My everyday activity

PetriNostr never sleep! This is a demo

```petrinet

Places & Transitions

- Places:

-

Bla bla bla: some text

-

Transitions:

- start: Initializes the system.

- logTask: bla bla bla.

petrinet ;startDay () -> working ;stopDay working -> () ;startPause working -> paused ;endPause paused -> working ;goSmoke working -> smoking ;endSmoke smoking -> working ;startEating working -> eating ;stopEating eating -> working ;startCall working -> onCall ;endCall onCall -> working ;startMeeting working -> inMeetinga ;endMeeting inMeeting -> working ;logTask working -> working``` -

@ fc7085c3:0b32a4cb

2025-05-03 16:17:10

@ fc7085c3:0b32a4cb

2025-05-03 16:17:10- ~~finish writing some experimental specs and store on hidden repo for later~~

- ~~fix bugs on in-house js web components framework (with react-like hooks)~~

- ~~add signal/reactive hooks to framework~~ (thx to nootropics)

- (ongoing) slooowly migrate kind:1 app from Qwik to above framework

- test feasibility of new app - codename: ZULULA. cool? flawed?

- if cool, finish ZULULA basic features

- nread.me: add nostr documentation (mpa for this part cause seo)

- nread.me: add nip crud (save on relay)

- nread.me: add nip curation (rating and labeling)

- nread.me: filter by curator / rating / labeling

- nread.me: seed curator (fiatjaf) adds other curators

- revamp kind:1 app login

- add basic engagement features then halt kind:1 app dev

- start simplified messenger app to test custom chat spec

- ...don't know what's next yet

-

@ 90de72b7:8f68fdc0

2025-05-03 16:14:50

@ 90de72b7:8f68fdc0

2025-05-03 16:14:50PetriNostr. My everyday activity - may3

PetriNostr never sleep! This is a demo

petrinet ;startDay () -> working ;stopDay working -> () ;startPause working -> paused ;endPause paused -> working ;goSmoke working -> smoking ;endSmoke smoking -> working ;startEating working -> eating ;stopEating eating -> working ;startCall working -> onCall ;endCall onCall -> working ;startMeeting working -> inMeetinga ;endMeeting inMeeting -> working ;logTask working -> working -

@ 6ad3e2a3:c90b7740

2025-05-03 15:33:07

@ 6ad3e2a3:c90b7740

2025-05-03 15:33:07You are wearing a helmet, but it's been on your head so long you no longer notice it.

The helmet interfaces with your mind via thought-emotion. It influences what you think about and how you feel.

You could remove the helmet at any time. But the thought-emotions keep you distracted, fearful and attached.

Occasionally you remember you are wearing it. Moments of clarity and detachment. You see the way your experience is colored by it. You know it is biased, untrue to reality. You seriously contemplate removing it.

But the moment passes.

Later, you remember contemplating your helmet’s removal, but you wonder what you will gain from it, whether it’s worth doing.

You are no longer having a moment of clarity, just a memory of the question that arose from it, but colored now by thought-emotions.

You decide even if you wanted to remove it, you would put it back on before long. After all, you have never kept it off before, why would you suddenly live without this interface now? The interface is what you know.

Maybe one day, when you are in a more secure place, when your ducks are more in a row, you will remove it. Not now, not in the midst of all this chaos, so many things to do, so much on your plate. You will leave it on for now. You will deal with this later.

But one day too late it dawns on you it is always ever now, and later means never. You have lived your entire life at the behest of the interface when all you had to do was remove it.

-

@ 5d4b6c8d:8a1c1ee3

2025-05-03 14:18:36

@ 5d4b6c8d:8a1c1ee3

2025-05-03 14:18:36Comments: 3395 (Top Territory!!!) Posts: 306 (3rd) Stacking: 198k (2nd)

We're really bouncing back from the post-Super Bowl lull, with lots of contests and discussion threads. I think we've really found our niche with those two things.

The rest of Stacker News is experiencing declining activity, so our steady growth since February really tells me that we're on the right track.

Thanks for being part of our growing sports community!

originally posted at https://stacker.news/items/970289

-

@ f4a890ce:af88c4aa

2025-05-03 13:03:35

@ f4a890ce:af88c4aa

2025-05-03 13:03:35執行摘要

上週,加密貨幣市場總市值增至 2.90 兆美元,成交量放大至 1,038.4 億美元,顯示資金回流。市場情緒轉為貪婪,恐懼與貪婪指數升至 63,動能短期強勁。穩定幣市值小幅提升,資金結構穩健。

永續合約持倉突破 1,200 億美元,空單爆倉金額高於多單,代表市場強勢上漲。期權市場看漲情緒濃厚,集中在 8萬至10萬美元。 BTC ETF流入大增至 9.17 億美元,而ETH ETF則小幅流出,資金更多集中在比特幣。

本週觀察重點:資金是否持續流入以支撐漲勢。若動能延續,市場或能保持上行;反之需警惕回吐風險。資金流向與交易量是判斷反彈真實性的重要指標。

加密市場

本週加密貨幣市場總市值小幅上升至2.96兆美元,較上週2.9兆美元略有增長,顯示主流資產價格維持高檔震盪格局。然而,成交量回落至88億美元,較上週的1,038億美元明顯下降,反映在價格高位區間內,市場參與意願略有減弱。

https://coinmarketcap.com/charts/

恐懼與貪婪指數由上週的63下降至60,顯示市場情緒由「貪婪」回落至「中性偏樂觀」,投資人心態從積極轉為謹慎。

https://www.coinglass.com/zh-TW/pro/i/FearGreedIndex

相對強弱指標則回到「中性」區間,表明短線上升動能放緩,市場正進入整理消化期。

https://www.coinglass.com/zh-TW/pro/i/RsiHeatMap

山寨幣季節指數下降至16,顯示資金仍以主流幣為主,對中小型代幣的風險偏好依然低迷。

https://www.blockchaincenter.net/en/altcoin-season-index/

穩定幣市值增加至2,394.87億美元,可能暗示部分資金等待更明確的入場時機。

https://defillama.com/stablecoins

小結

本週加密貨幣市場總市值持續小幅上升,顯示基本面仍具支撐力,但成交量明顯下滑與情緒指標回落,透露市場短線追價動能減弱。相對強弱指標回到中性,表示市場進入高檔整理期。穩定幣資金略增,反映資金操作趨於謹慎。展望未來,若成交量無法有效回溫,短期內市場可能以區間震盪為主,需密切關注外部宏觀消息與主流幣表現,以判斷後續趨勢轉折。

衍生性商品

本週衍生性商品市場展現出更高的波動性,特別是在永續合約和期權市場的表現上。永續合約方面,持倉規模自上週的 99.89B 大幅增至 116.9B,顯示出投資者在本週加強槓桿操作。

https://www.coinglass.com/zh-TW/pro/futures/Cryptofutures

資金費率從正值 0.0018% 急劇轉為負值 -0.0047%,且多數交易所均呈負費率,反映出市場正在偏向空頭主導。

https://www.coinglass.com/zh-TW/FundingRate

爆倉數據同樣顯著上升,其中空單由上週的 45.29M 攀升至 62.26M,多單更是大幅增至 119.508M,表明市場波動加劇導致強制清算事件頻率升高。

https://www.coinglass.com/zh-TW/LiquidationData

清算熱力圖顯示,在 $96,000 價位附近的清算金額達 $128.96M,相較於上週的 $113.48M 有明顯增加。

https://www.coinglass.com/zh-TW/pro/futures/LiquidationHeatMap

期權市場方面,數據反映出投資者對特定價格區間的配置策略有所改變:行權價 $80,000 的看跌期權合約數量仍維持 9.6K,但總金額明顯上升至 $22.29M,表明投資者正加強對中低價位區間的下行防禦。而行權價 $100,000 的看漲期權合約數從上週的 11.85K 增至 15.67K,總金額也上漲至 $104.52M,顯示出投資者對高價位行情的預期正逐步增強。

https://www.coinglass.com/zh-TW/pro/options/OIStrike

最大痛點方面,本週的價位仍維持在 $85,000,但時間已延後至 2025/06/27,暗示市場頭寸正進一步調整以應對長期風險。

https://www.coinglass.com/zh-TW/pro/options/max-pain

小結

綜上所述,本週衍生性商品市場在永續合約槓桿持倉的激增與期權市場配置策略的分歧中,可能預示著更高的波動與風險。我們應慎重觀察市場波動區域的資金流向,並結合不同合約數據的變化,調整操作策略,以應對潛在市場風險。

ETF

本週4/29比特幣與以太幣ETF皆呈現資金淨流出,BTC ETF流出金額達3,676萬美元,結束連續多天的淨流入趨勢,較上週高達9.12億美元的流入量有明顯反轉,顯示機構資金對短期市場展望轉趨保守。

ETH ETF亦出現7.1百萬美元的流出,儘管規模不大,但多週未見到大額流入,反映市場對ETH的信心仍較薄弱。

https://coinmarketcap.com/zh-tw/etf/

小結

整體而言,本週ETF市場資金動能放緩,可能與市場短線震盪、技術面超買,以及即將到來的宏觀數據發布有關,投資人選擇暫時觀望。後續仍需觀察資金是否回流,確認是否為短期調整或趨勢反轉的訊號。

鏈上分析 | BTC

從本週的鏈上數據來看,BTC 持續自交易所流出,顯示二級市場上的賣壓逐漸減輕。

地址分布方面,中小持倉(10-100)的地址數量持續下滑,可能反映散戶或中型參與者獲利了結或轉為觀望;而中型以上持倉(100-1k)地址數量則呈現小幅上升,代表市場對後市仍保有一定信心。值得關注的是,(1k-10k)的大戶地址持續增長,且10k以上的超級鯨魚地址也開始出現小幅增加的動作,顯示機構或長期資金正逐步重新佈局。

https://cryptoquant.com/community/dashboard/67e2481ba2a7203afd437b31

根據最新的鏈上數據觀察,礦工的未實現盈虧顯示目前大多數礦工處於盈利階段,顯示其短期內無明顯的拋售壓力。

https://cryptoquant.com/community/dashboard/67e2481ba2a7203afd437b31

同時,全網未實現盈虧指標亦顯示大部分持幣地址處於盈利區間,代表市場尚未進入恐慌階段,整體投資者心態相對穩定。這樣的結構對價格具備一定支撐力。

https://cryptoquant.com/community/dashboard/67e2481ba2a7203afd437b31

本週觀察顯示,鯨魚活躍地址數量明顯上升,顯示大型投資者近期參與度增加,對市場走勢形成潛在支撐。

https://cryptoquant.com/community/dashboard/67e2481ba2a7203afd437b31

此外,Coinbase 溢價指數持續維持在 0 值以上,反映美國本土買盤仍具動能。然而,該指數是否能在下週持續維持正值,將是判斷主力資金是否穩定流入的重要觀察指標。整體而言,鏈上結構偏多,但仍需謹慎觀察主力動向是否延續。

近期數據顯示,長期持有者的供應急劇上升,與去年盤整階段的走勢相似,代表長期投資者持續看好後市,選擇繼續持有。

https://www.bitcoinmagazinepro.com/charts/long-term-holder-supply/

然而,目前價格已接近短期持有者的實現價格區間,形成潛在的拋壓。若市場要進一步上漲,需先有效消化短期持有者的賣壓,並觀察市場是否能重新建立多頭動能。整體而言,雖長線結構健康,但短期內仍有調整壓力需克服。

https://www.bitcoinmagazinepro.com/charts/short-term-holder-realized-price/

小結

目前市場仍在消化短期持有者的拋壓,短線籌碼換手使得價格波動加劇。然而,鏈上數據顯示長期持有者仍在持續買入,並未受短期波動影響,顯示其對後市走勢仍具高度信心。

總體經濟

本週總體經濟數據與上週持平,美國聯邦基礎有效利率維持在 4.33%,顯示當前仍處於高利率環境。

https://fred.stlouisfed.org/series/FEDFUNDS

而市場對5月7日即將召開的聯準會會議預期將維持利率不變,機率高達 95.4%。

https://www.cmegroup.com/cn-t/markets/interest-rates/cme-fedwatch-tool.html

消費者物價指數(CPI)為 2.41%,失業率則穩定在 4.20%。整體來看,儘管通膨壓力略有降溫,但就業市場依然偏緊,使得聯準會在貨幣政策上保持謹慎態度。資金面短期內難以出現大幅寬鬆,市場整體情緒仍以觀望為主。

https://www.macromicro.me/series/128/consumer-price-index-sa-yoy https://www.macromicro.me/series/37/unemployment-rate

小結

儘管目前總體經濟數據相對穩定,但若要推動整體市場持續走強,仍需觀察更具結構性的變化。筆者認為,唯有失業率出現顯著上升、同時CPI高於聯準會2%的通膨目標,才可能逼迫聯準會啟動降息循環。

若伴隨著貨幣供給(M2)大幅增加,將有望為市場注入充足流動性,推動風險資產進一步上行。因此,短期內市場仍處觀望格局,中長期走勢仍需仰賴宏觀經濟環境的轉變與政策調整的催化。

新聞

美國參議院正推動穩定幣法案的立法進程

https://www.coindesk.com/policy/2025/05/01/us-senate-moves-toward-action-on-stablecoin-bill

根據分析師的預測,SEC可能在未來幾個月內批准SOL、XRP和DOGE加密貨幣的ETF

Mastercard 推出全方位穩定幣金融系統:整合消費、跨境匯款、支付、結算四大功能

https://abmedia.io/mastercard-moves-to-integrate-stablecoin-in-global

英國擬將加密資產全面納管,新草案包含穩定幣發行、交易平台、託管與 Staking 業務

https://abmedia.io/the-financial-services-and-markets-act-2000

-

@ f6488c62:c929299d

2025-05-03 11:53:03

@ f6488c62:c929299d

2025-05-03 11:53:03ช่วงปลายปี 2567 ถึงต้นปี 2568 BNB Chain เปิดตัวโปรเจกต์ใหม่หลากหลายแนว ทั้ง AI, DeFi, GameFi และโครงสร้างพื้นฐาน เช่น Ballies, Coinfair, OpenTaskAI และ VeraBridge 🌐

วันนี้ ผมได้อ่าน x ของทางคุณ CZ เจอขายโพสไว้หลายโพส ดูแล้วน่าสนใจ จึงคิดว่า การที่ Kraken เริ่มลิสต์โปรเจกต์จาก BNB Chain ยิ่งตอกย้ำว่า ecosystem นี้กำลัง “โตจริง” 🚀

พร้อมทั้งมีโปรแกรมสนับสนุนมากมาย เช่น MVB Accelerator, TVL Incentive และ Gas-Free Carnival ช่วยดึงดูดนักพัฒนาและผู้ใช้จากทั่วโลก

🧠 เป้าหมายปี 2568: รองรับ 100 ล้านธุรกรรม/วัน, ผสาน AI เต็มรูปแบบ และเครื่องมือใหม่ช่วย dev สร้างโปรเจกต์ได้ง่ายขึ้น!

📈 ใครจับตา BNB Chain อยู่ บอกเลย... ช่วงนี้ของจริง!

-

@ 90c656ff:9383fd4e

2025-05-03 11:52:14

@ 90c656ff:9383fd4e

2025-05-03 11:52:14In recent years, Bitcoin has often been compared to gold, earning the nickname “digital gold.” This comparison arises because both forms of value share key characteristics, such as scarcity, durability, and global acceptance. However, Bitcoin also represents a technological innovation that redefines the concept of money and investment, standing out as a modern and efficient alternative to physical gold.

One of the main reasons Bitcoin is compared to gold is its programmed scarcity. While gold is a naturally limited resource whose supply depends on mining, Bitcoin has a maximum cap of 21 million units, defined in its code. This cap protects Bitcoin from inflation, unlike traditional currencies that can be created without limit by central banks.

This scarcity gives Bitcoin lasting value, similar to gold, as the limited supply helps preserve purchasing power over time. As demand for Bitcoin grows, its reduced availability reinforces its role as a store of value.

Another feature that brings Bitcoin closer to gold is durability. While gold is resistant to corrosion and can be stored for centuries, Bitcoin is a digital asset protected by advanced cryptography and stored on the blockchain. An immutable and decentralized ledger.

Moreover, Bitcoin is far easier to transport than gold. Moving physical gold involves high costs and security risks, making transport particularly difficult for international transactions. Bitcoin, on the other hand, can be sent digitally anywhere in the world in minutes, with low fees and no intermediaries. This technological advantage makes Bitcoin more effective in a globalized and digital world.

Security is another trait that Bitcoin and gold share. Gold is difficult to counterfeit, making it a reliable store of value. Similarly, Bitcoin uses cryptographic protocols that ensure secure transactions and protect against fraud.

In addition, all Bitcoin transactions are recorded on the blockchain, offering a level of transparency that physical gold does not provide. Anyone can review transactions on the network, increasing trust and traceability.

Historically, gold has been used as a hedge against inflation and economic crises. During times of instability, investors turn to gold as a way to preserve their wealth. Bitcoin is emerging as a digital alternative with the same purpose.

In countries with high inflation or political instability, Bitcoin has been used as a safeguard against the devaluation of local currencies. Its decentralized nature prevents governments from directly confiscating or controlling the asset, providing greater financial freedom to users.

Despite its similarities with gold, Bitcoin still faces challenges. Its volatility is much higher, which can cause short-term uncertainty. However, many experts argue that this volatility is typical of new assets and tends to decrease over time as adoption grows and the market matures.

Another challenge is regulation. While gold is globally recognized as a financial asset, Bitcoin still faces resistance from governments and financial institutions, which seek ways to control and regulate it.

In summary, Bitcoin - often called "digital gold" - offers a new form of value that combines the best characteristics of gold with the efficiency and innovation of digital technology. Its programmed scarcity, cryptographic security, portability, and resistance to censorship make it a viable alternative for preserving wealth and conducting transactions in the modern world.

Despite its volatility, Bitcoin is establishing itself as both a store of value and a hedge against economic crises. As such, it represents not just an evolution of the financial system but also a symbol of the shift toward a decentralized and global digital economy.

Thank you very much for reading this far. I hope everything is well with you, and sending a big hug from your favorite Bitcoiner maximalist from Madeira. Long live freedom!

-

@ e2388e53:0e93e8a9

2025-05-03 11:39:45

@ e2388e53:0e93e8a9

2025-05-03 11:39:45- Melancholie ist die sanfteste Form der Rebellion – ein Nein, das sich in Schönheit kleidet, um nicht verbrannt zu werden.

- Die Menschheit sucht nach Erlösung – und nennt das Kind dabei „Zukunft“, ohne zu merken, wie schwer diese Krone wiegt.

- Nähe ohne Ehrlichkeit ist nur ein getarnter Abstand.

- Jede Zentralisierung ist ein Denkfehler, der Macht als Fürsorge tarnt.

- Sehnsucht ist ein Fluss, der rückwärts fließt – du watest hinein, doch das Ufer zieht sich fort, unerreichbar fern.

- Die letzte Form der Sklaverei ist die freiwillige Abhängigkeit.

- Ein Kind spielt nicht, um zu vergessen – es spielt, weil es noch nicht gelernt hat zu verdrängen.

- Freiheit ist die Fähigkeit, in Ketten zu tanzen.

- Das Leben ist der Widerhall eines sterbenden Willens. Nur im Nichts finden wir Erlösung.

- Wer Kinder erzieht, erzieht auch seine Schatten – sie kommen zurück, wenn das Haus still ist.

-

@ 90c656ff:9383fd4e

2025-05-03 11:39:03

@ 90c656ff:9383fd4e

2025-05-03 11:39:03The emergence of Bitcoin brought a new perspective to the concept of money, challenging the conventional financial system based on fiat currencies. While fiat currencies like the real, dollar, and euro are widely used and recognized as means of exchange, Bitcoin represents a digital innovation that promotes decentralization and financial autonomy. Although both serve basic functions such as a medium of exchange and store of value, their main differences lie in how they are issued, managed, and transacted.

One of the key distinctions between Bitcoin and fiat currencies is the way they are issued and administered. Fiat currencies are issued by central banks, which have the power to regulate the amount in circulation. This model allows for the implementation of monetary policies, such as increasing the money supply to stimulate the economy or decreasing it to control inflation. However, this power can also result in currency devaluation if money is issued in excess.

Bitcoin, on the other hand, has a completely decentralized issuance system. It is created through a process called mining, in which computers solve complex mathematical problems to validate transactions on the network. Additionally, the total supply of bitcoins is limited to 21 million units, making it a deflationary asset—its scarcity can potentially increase its value over time. This limitation contrasts sharply with the unlimited nature of fiat money printing.

Fiat currencies are centralized, meaning their issuance and control are decided by governmental authorities. This also means that transactions involving these currencies go through intermediaries like banks, which can impose fees and limits, and are subject to regulations and audits.

Bitcoin, by contrast, is decentralized. It operates on a peer-to-peer network where transactions are verified by participants called miners and recorded in a public ledger known as the blockchain. This decentralization eliminates the need for intermediaries, making Bitcoin more resistant to censorship and government control. It also provides greater transparency, as anyone can verify transactions on the network.

Another important difference lies in how transactions are carried out. With fiat currencies, transactions usually depend on banks or payment systems, which may impose time restrictions and high fees, especially for international transfers.

Bitcoin, on the other hand, enables direct transfers between people, anywhere in the world and at any time, without the need for intermediaries. This makes the system more accessible, particularly for those without bank accounts or living in countries with restrictive financial systems. Additionally, Bitcoin transaction fees can be lower than those charged by traditional banks.

Fiat currencies offer security backed by government laws and the banking system, but users must place trust in those intermediaries. Bitcoin, by contrast, offers a high level of security through advanced cryptography. Digital wallets that store bitcoins are protected by private keys, ensuring that only the owner has access.

However, privacy works differently. Fiat currency transactions are typically linked to the user's identity, whereas Bitcoin offers a certain level of anonymity, since wallet addresses do not require personal identification. Still, all transactions are public and recorded on the blockchain, which can serve as a point of monitoring for authorities.

The value of fiat currencies is backed by trust in the government that issues them and the country's economy. In contrast, Bitcoin is not backed by any government or physical asset. Its value is determined by market supply and demand, making it highly volatile. While this volatility presents a risk, it also attracts people who see Bitcoin as a long-term appreciation opportunity.

In summary, Bitcoin and fiat currencies differ significantly in their structure, control, and functionality. While fiat currencies are government-controlled and depend on intermediaries, Bitcoin offers decentralization, transparency, and financial freedom. Despite its volatility and some regulatory challenges, Bitcoin represents a new alternative to the traditional financial system.

Thank you very much for reading this far. I hope everything is well with you, and sending a big hug from your favorite Bitcoiner maximalist from Madeira. Long live freedom!

-

@ e2388e53:0e93e8a9

2025-05-03 11:36:28

@ e2388e53:0e93e8a9

2025-05-03 11:36:28„Anstatt das System zu bekämpfen, baue ein System, das es überflüssig macht.“

– zugeschrieben Buckminster Fuller

Die Gegenwart ist geprägt von Zentralisierung, digitaler Kontrolle und einem Finanzsystem, das Vertrauen verlangt, aber wenig zurückgibt. Für Bitcoiner stellt sich nicht mehr die Frage nach dem Ob, sondern nach dem Wie des Rückzugs aus diesem System.

Vom Goldstandard zu Bitcoin

Der klassische Goldstandard war Ausdruck eines strukturellen Misstrauens gegenüber staatlicher Willkür. Die Bindung des Geldes an ein rares Gut wie Gold disziplinierte die Geldpolitik – allerdings auf Kosten von Flexibilität, Zugänglichkeit und Dezentralität. Gold war zentral verwahrt, schwer zu transportieren und politisch angreifbar.

Bitcoin übernimmt die Idee der Begrenzung, ohne diese Schwächen: keine zentrale Verwahrung, leicht teilbar, digital übertragbar, resistent gegen Konfiszierung. Was beim Gold noch eine politische Vereinbarung war, ist bei Bitcoin eine technische Tatsache.

Anarchie als Ordnung ohne Herrschaft

Anarchie wird oft missverstanden. Sie ist keine Ablehnung von Ordnung, sondern von Herrschaft. Sie setzt auf freiwillige Strukturen statt auf Zwang, auf Verantwortung statt auf Kontrolle. Bitcoin ist in diesem Sinne anarchisch. Es gibt keine zentrale Autorität, keine Intervention, kein Gatekeeping. Teilhabe ist offen, Regeln sind transparent, Entscheidungen beruhen auf Konsens. Es ist ein System, das sich jeder aneignen kann, ohne jemanden um Erlaubnis zu fragen.

Die Praxis des Rückzugs

Der Rückzug aus dem bestehenden System ist kein plötzlicher Bruch, sondern eine Praxis. Er beginnt mit Selbstverwahrung, mit der Vermeidung von KYC, mit der Nutzung von Peer-to-Peer-Technologien und mit dem bewussten Aufbau eigener Infrastruktur. Es geht nicht darum, das alte System zu stürzen, sondern es überflüssig zu machen – indem man es nicht mehr braucht.

Bitcoin als Entscheidung

Bitcoin ist keine Spekulation, kein Unternehmen, kein Produkt. Es ist eine Entscheidung. Eine Entscheidung für Autonomie. Für Verantwortung. Für Souveränität. Wer sich für diesen Weg entscheidet, entscheidet sich nicht für die einfachste Lösung – sondern für die ehrlichste. Der Preis ist Selbstverantwortung. Die Belohnung ist Freiheit.

Ein stiller Rückzug

Kein Spektakel. Keine Revolution. Nur ein Protokoll. Und ein Mensch, der es nutzt.

-

@ 90c656ff:9383fd4e

2025-05-03 11:17:21

@ 90c656ff:9383fd4e

2025-05-03 11:17:21Bitcoin was created as something far beyond just a digital currency; it is a revolutionary idea that challenges the foundations of the conventional financial system. The concept behind its creation, presented by the enigmatic Satoshi Nakamoto, focuses on two main principles: decentralization and financial freedom. These ideas reflect an effort to return control of money to the people, eliminating intermediaries and reducing the influence of governments and large financial institutions.

Decentralization is the foundation of Bitcoin. Unlike traditional currencies, which are issued and managed by central banks and governments, Bitcoin operates on a peer-to-peer network. This means there is no central authority or single entity controlling the currency. Instead, all transactions are validated and recorded on a public ledger called the blockchain or timechain, maintained by thousands of computers around the world.

This decentralized structure ensures that Bitcoin is resistant to censorship and immune to monetary policy manipulations such as excessive money printing, which can lead to inflation. It also removes the need for intermediaries like banks, allowing for direct transactions between users. This is especially valuable in scenarios where the traditional banking system is inaccessible or unreliable, such as in remote areas or countries facing economic crises.

The financial freedom promoted by Bitcoin is another transformative element. In traditional systems, individuals depend on third parties such as banks or financial institutions to access, store, and transfer money. These entities can impose restrictions like withdrawal limits, high transfer fees, or even freeze accounts. With Bitcoin, the user has full control over their funds through private keys (a kind of password that grants access to their digital wallet).

Moreover, Bitcoin offers an accessible solution for billions of people worldwide who are unbanked. According to World Bank data, around 1.4 billion adults lack access to a bank account, but many of them do have access to the internet or smartphones. Bitcoin allows these individuals to participate in the global economy without needing intermediary institutions.

Another crucial point is its censorship resistance. In authoritarian regimes or politically unstable situations, governments may confiscate or freeze citizens' assets. Bitcoin, being decentralized and operating on a global network, cannot be arbitrarily controlled or seized, offering an extra layer of financial protection for individuals at risk.

Bitcoin’s vision also includes the creation of a fairer and more transparent financial system. The blockchain or timechain, by recording all transactions in a public and immutable way, reduces the chances of fraud and corruption. Additionally, the limited supply of 21 million bitcoins, hard-coded into the system, supports a deflationary model that contrasts with the unlimited expansion of fiat currencies. This gives Bitcoin the potential to be a stable store of value in the long term.

Despite its promising vision, the path toward full financial freedom is not without challenges. Bitcoin’s price volatility, regulatory concerns, and technological barriers remain hurdles to overcome. However, these challenges also create opportunities for innovation and for strengthening the ecosystem over time.

In summary, the vision behind Bitcoin represents a disruption of the centralized financial system, offering people more autonomy, transparency, and security over their financial resources. It is not just a technology but a movement that aims to empower individuals, especially those excluded or harmed by traditional economic models. By promoting decentralization and financial freedom, Bitcoin paves the way for a future where money truly belongs to the people, not the institutions.

Thank you very much for reading this far — I hope everything is well with you, and sending a big hug from your favorite Bitcoiner maximalist from Madeira. Long live freedom!

-

@ 90c656ff:9383fd4e

2025-05-03 11:07:50

@ 90c656ff:9383fd4e

2025-05-03 11:07:50Bitcoin is the world’s first decentralized digital currency, created in 2009 by an individual or group under the pseudonym Satoshi Nakamoto. Its birth marked the beginning of a revolution in the global financial system, introducing a new kind of currency that is not controlled by governments or traditional financial institutions. The history of Bitcoin is deeply rooted in the ideals of economic freedom, transparency, and resistance to censorship.

The journey began in October 2008, when Satoshi Nakamoto published a paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” The white paper, published on the Cryptography mailing list, described the idea of a digital payment system based on a peer-to-peer network. This concept eliminates the need for intermediaries like banks and solves a problem known as “double spending” — the possibility of duplicating digital currencies — through a technology called blockchain, or what Satoshi Nakamoto himself referred to as the timechain.

The blockchain, or timechain, is essentially a public and immutable ledger that records all Bitcoin transactions. It operates through a decentralized system where participants in the network (the so-called nodes) verify transactions and organize them into blocks. These blocks are in turn linked together in a continuous chain, forming the basis of the system’s security and transparency.

On January 3, 2009, Satoshi Nakamoto mined the first Bitcoin block, known as the genesis block. The block contained a coded message referencing the 2008 global financial crisis: "The Times, January 3, 2009, Chancellor on brink of second bailout for banks." This message is emblematic of the motivation behind Bitcoin: to provide an alternative to the centralized financial system that failed to protect the global economy.

Throughout 2009 and 2010, Bitcoin remained an experiment among tech and crypto enthusiasts. The first Bitcoin transactions took place between network participants, and the first commercial use of the currency occurred on May 22, 2010, when a programmer named Laszlo Hanyecz bought two pizzas for 10,000 Bitcoins. This historic transaction became known as “Bitcoin Pizza Day.”

Satoshi Nakamoto continued to contribute to Bitcoin's development until the end of 2010, when he gradually disappeared from the community. To this day, his identity remains a mystery, and there is no concrete evidence of who or how many people were behind the pseudonym. Before leaving, Satoshi Nakamoto handed over control of the project to other developers and made it clear that Bitcoin should be a decentralized technology, owned by everyone and controlled by no one.

Since then, Bitcoin has grown exponentially. It has evolved from a technological experiment into a multibillion-dollar asset and is widely considered a legitimate form of digital money and store of value. Governments, companies, and individuals around the world have adopted Bitcoin as an alternative to traditional fiat currencies.

In summary, the creation of Bitcoin by Satoshi Nakamoto was more than just the birth of a digital currency; it was the beginning of a global movement to rethink how money is controlled and distributed. Although the identity of Satoshi Nakamoto remains unknown, his legacy will continue to shape the future of the financial system and challenge traditional economic structures.

Thank you very much for reading this far. I hope everything is well with you, and sending a big hug from your favorite Bitcoiner maximalist from Madeira. Long live freedom!

-

@ cefb08d1:f419beff

2025-05-03 11:01:47

@ cefb08d1:f419beff

2025-05-03 11:01:47https://www.youtube.com/watch?v=BOqWgxCo7Kw

The Catch Up Day 1: Bonsoy Gold Coast Pro provides opening day dominance from upper echelon:

https://www.youtube.com/watch?v=B1uM0FnyPvA

Next Round, elimination:

Results of the 1st day, opening round: https://www.worldsurfleague.com/events/2025/ct/325/bonsoy-gold-coast-pro/results

originally posted at https://stacker.news/items/970160

-

@ 0d8633e5:eec06e57

2025-05-03 10:58:22

@ 0d8633e5:eec06e57

2025-05-03 10:58:22The Flash USDT Generator is responsible for producing and storing Flash USDT tokens with a flexible daily limit. It ensures a consistent supply of tokens for transactions while managing distribution securely and efficiently. Our Flash USDT offers a unique, temporary cryptocurrency that lasts for 90 days before expiring. This innovative solution allows for seamlesstrading and transferring of funds. Notably, the Flash Bitcoin and USDT can be transferred to 12 different wallets, including prominent platforms like Binance and Trust Wallet.

Features Adjustable Daily Limit: Customizable settings allow for modifying the token generation cap. Automated Distribution: Ensures quick and secure token transfers to user wallets. Minimal Latency: Prevents blockchain congestion issues for seamless transfers. Real-Time Transaction Verification: Each transaction is immediately verified on the respective blockchain explorer to confirm accuracy and validity. Temporary Nature: One of the most distinctive characteristics of USDT FLASH Generator is that it generates flash coin that is designed to disappear from any wallet after a period of ninety days. This unique feature ensures that any assets received in USDT FLASH will not linger indefinitely, creating a dynamic and engaging transaction experience.

Kindly visit globalfashexperts.com for more information Contact Information For more information or to make a purchase, please contact us through the following channels:

Email: globalfashexperts@gmail.com Flash USDT:https://globalfashexperts.com/product/flash-usdt/ Flash USDT: https://globalfashexperts.com/product/flash-usdt-generator-software/The Flash USDT Generator is responsible for producing and storing Flash USDT tokens with a flexible daily limit. It ensures a consistent supply of tokens for transactions while managing distribution securely and efficiently. Our Flash USDT offers a unique, temporary cryptocurrency that lasts for 90 days before expiring. This innovative solution allows for seamlesstrading and transferring of funds. Notably, the Flash Bitcoin and USDT can be transferred to 12 different wallets, including prominent platforms like Binance and Trust Wallet.

Features

- Adjustable Daily Limit: Customizable settings allow for modifying the token generation cap.

- Automated Distribution: Ensures quick and secure token transfers to user wallets.

- Minimal Latency: Prevents blockchain congestion issues for seamless transfers.

- Real-Time Transaction Verification: Each transaction is immediately verified on the respective blockchain explorer to confirm accuracy and validity.

- Temporary Nature: One of the most distinctive characteristics of USDT FLASH Generator is that it generates flash coin that is designed to disappear from any wallet after a period of ninety days. This unique feature ensures that any assets received in USDT FLASH will not linger indefinitely, creating a dynamic and engaging transaction experience.

Kindly visit globalfashexperts.com for more information

Kindly visit globalfashexperts.com for more informationContact Information

For more information or to make a purchase, please contact us through the following channels:

- Email: globalfashexperts@gmail.com

- Flash USDT:https://globalfashexperts.com/product/flash-usdt/

- Flash USDT: https://globalfashexperts.com/product/flash-usdt-generator-software/

-

@ d0aa74cd:603d35cd

2025-05-03 10:55:11

@ d0aa74cd:603d35cd

2025-05-03 10:55:11CLI #Haskell

https://photonsphere.org/post/2025-05-03-command-line-energy-prices-haskell/

-

@ 90c656ff:9383fd4e

2025-05-03 10:31:25

@ 90c656ff:9383fd4e

2025-05-03 10:31:25Bitcoin is a decentralized digital currency created in 2009 by an individual or group under the pseudonym Satoshi Nakamoto. Unlike traditional government-issued currencies like the US dollar or the euro, Bitcoin is not controlled by any central authority, such as a central bank or financial institution. This innovative feature has made it a focal point of economic, technological, and even social debate in recent years.

Bitcoin operates using a technology called blockchain (which the Bitcoin community increasingly prefers to call "timechain"). It is essentially a distributed digital ledger. The blockchain or timechain records all transactions made on the Bitcoin network in an open and transparent way. Each block contains a set of transactions that are immutably added to the chain once they are verified by miners (miners are basically network participants who use their computing power to validate these same transactions). This ensures security and prevents fraud, as no person or entity can retroactively alter the records.

One of Bitcoin's most notable features is its limited supply. Only 21 million Bitcoins can ever be created, which gives Bitcoin a deflationary nature — unlike fiat currencies, which central banks can print in unlimited quantities. This fixed limit, combined with growing global interest in the technology in general and individual privacy specifically, has driven Bitcoin’s value over time.

Another important characteristic of Bitcoin is that it enables direct peer-to-peer transactions, removing the need for intermediaries. This is particularly useful in cases like international transfers, where Bitcoin can be used to send money quickly and at low cost, without going through a bank or traditional financial services. Additionally, it is seen as a form of financial freedom in countries with unstable local currencies (often due to central banks printing money uncontrollably) or strict state-imposed capital controls.

However, Bitcoin is not immune to criticism — though these are often hollow arguments that mask the personal interests of those making them, whether because they work in traditional banks or brokerages and fear losing "power" or even their jobs, or because they have bad intentions and want to promote their own cryptocurrencies, which are fundamentally worthless (the infamous “shitcoins”). Bitcoin’s price volatility can also pose significant risks for inexperienced users who buy at a certain price and end up selling when the value drops by half, losing at least half their money. On the other hand, many experts view Bitcoin as a technological and social milestone that challenges existing economic models.

In summary, Bitcoin is much more than just a “crypto” or “cryptocurrency.” It represents a revolution — or a revision — in how most people think about money, offering a decentralized, transparent, and censorship-resistant alternative. Although it still faces challenges to becoming widely accepted by some skeptics and by governments worried about losing control over “their” populations (as mentioned earlier), its impact has been undeniable, paving the way for a new era in the global economy and opening many minds to reflection.

Thank you very much for reading this far — I hope you're doing well, and sending a huge hug from your favorite Bitcoiner maximalist from Madeira. Long live freedom!

-

@ 5f078e90:b2bacaa3

2025-05-03 10:18:41

@ 5f078e90:b2bacaa3

2025-05-03 10:18:41The Spoonbill's Dawn

In a marsh where reeds whispered secrets to the wind, a roseate spoonbill named Sable waded through dawn’s amber glow. Her pink feathers shimmered, catching the first light as she swept her spoon-shaped bill through the shallows, sifting for shrimp. Unlike her flock, who chattered and preened, Sable moved with quiet purpose, her eyes tracing ripples for signs of life.

Each morning, she returned to a lone cypress, its roots cradling a pool where minnows danced. Here, Sable had found an odd companion: a young alligator named Moss, whose emerald scales blended with the water’s edge. Moss never lunged, only watched, his eyes like polished stones. Sable, curious, began leaving shrimp at the pool’s edge. Moss, in turn, nudged smooth pebbles toward her, gifts from the marsh’s depths.

One dawn, a storm loomed, its thunder rattling the reeds. The flock fled, their wings a pink blur against charcoal clouds, but Sable lingered. The pool was still; Moss hadn’t surfaced. She dipped her bill, calling softly, her heart a flutter of worry. Then, a ripple—Moss emerged, sluggish, a gash on his flank from a poacher’s trap. Sable’s instinct was to flee, but she stayed, her bill probing the mud for healing herbs she’d seen egrets use.

With gentle nudges, she pressed the herbs to Moss’s wound, her pink wings shielding him from the rain. Moss rumbled, a low thanks, and rested. By dusk, the storm passed, and the marsh gleamed under a crescent moon. Moss stirred, stronger, and nudged a final pebble to Sable—a heart-shaped stone, glinting pink like her feathers.

Sable took flight, the stone clutched in her bill, her wings carving hope into the sky. The flock returned, awed by her tale, and the marsh buzzed with their chatter. Sable and Moss remained, their bond a quiet legend, proof that even in a wild world, trust could bloom where dawn met dusk.

Word count: 313

-

@ a5142938:0ef19da3

2025-05-03 10:02:03

@ a5142938:0ef19da3

2025-05-03 10:02:03🧵 Products made from this material

The following brands offer products made exclusively or primarily from this material:

Clothing

This article is published on origin-nature.com 🌐 Voir cet article en français

-

@ a5142938:0ef19da3

2025-05-03 10:01:17

@ a5142938:0ef19da3

2025-05-03 10:01:17🧵 Products made from this material

The following brands offer products made exclusively or primarily from this material:

Clothing

- Engel

- Dilling (merino wool)

- ManyMonths (merino wool)

Home

This article is published on origin-nature.com 🌐 Voir cet article en français

-

@ a5142938:0ef19da3

2025-05-03 10:00:49

@ a5142938:0ef19da3

2025-05-03 10:00:49🧵 Products made from this material

The following brands offer products made exclusively or primarily from this material:

Clothing

- Engel (organic cotton)

- Dilling (organic cotton)

- ManyMonths (organic cotton)

This article is published on origin-nature.com 🌐 Voir cet article en français

-

@ e4950c93:1b99eccd

2025-05-03 09:59:59

@ e4950c93:1b99eccd

2025-05-03 09:59:59🧵 Produits en cette matière

Les marques suivantes proposent des produits fait exclusivement ou principalement avec cette matière :

Vêtements

Cet article est publié sur origine-nature.com 🌐 See this article in English

-

@ e4950c93:1b99eccd

2025-05-03 09:59:25

@ e4950c93:1b99eccd

2025-05-03 09:59:25🧵 Produits en cette matière

Les marques suivantes proposent des produits fait exclusivement ou principalement avec cette matière :

Vêtements

- Engel

- Dilling (laine mérinos)

- ManyMonths (laine mérinos)

Maison

Cet article est publié sur origine-nature.com 🌐 See this article in English

-

@ e4950c93:1b99eccd

2025-05-03 09:59:03

@ e4950c93:1b99eccd

2025-05-03 09:59:03🧵 Produits en cette matière

Les marques suivantes proposent des produits fait exclusivement ou principalement avec cette matière :

Vêtements

- Engel (coton biologique)

- Dilling (coton biologique)

- ManyMonths (coton biologique)

Cet article est publié sur origine-nature.com 🌐 See this article in English

-

@ 1d7ff02a:d042b5be

2025-05-03 09:47:49

@ 1d7ff02a:d042b5be

2025-05-03 09:47:49ບົດຄວາມນີ້ແປມາຈາ: https://jackkruse.com/what-to-do-with-new-cancer-diagnosis/

ເນື້ອຫາສຳລັບຜູ້ອ່ານ: 1. ຈະເຮັດແນວໃດເມື່ອທ່ານໄດ້ຮັບການວິນິດໄສວ່າເປັນມະເຮັງ? 2. ສະໜາມຮົບກັບມະເຮັງທີ່ສຳຄັນແມ່ນຢູ່ບ່ອນການປິ່ນປົວແບບແພດ ຫຼື ໃນຮ່າງກາຍຂອງທ່ານເອງ? 3. ອາຫານການກິນມີບົດບາດແນວໃດ? 4. ຈະຮັບມືກັບໝໍມະເຮັງຄົນໃໝ່ຂອງທ່ານແນວໃດ? 5. ບໍ່ຕ້ອງຢ້ານທີ່ຈະສຳຫຼວດທຸກຄວາມເປັນໄປໄດ້ເພື່ອຊະນະສົງຄາມນີ້. ຮຽນຮູ້ກ່ຽວກັບອາຫານ ketogenic!!!

ກ່ອນທ່ານຈະອ່ານບົດຄວາມນີ້, ໃຫ້ເບິ່ງວິດີໂອນີ້: HYPERLINK

ບົດຄວາມນີ້ແມ່ນສຳລັບໜຶ່ງໃນໝູ່ທີ່ພິເສດຂອງຂ້ອຍ ຜູ້ທີ່ພົວພັນຂ້ອຍໃນອາທິດນີ້ ແລະ ບອກວ່າເມຍລາວຖືກວິນິດໄສວ່າເປັນມະເຮັງໃນໄວອາຍຸໜຸ່ມ. ຂ້ອຍໄດ້ຍິນຈາກການໂທ ແລະ ໂພສຂອງລາວໃນ Facebook ວ່າມັນກຳລັງທຳລາຍລາວ. ຂ້ອຍບອກລາວທັນທີໃຫ້ໄປຊື້ປື້ມ Anti Cancer: A New Way of Life ໂດຍ David Servan Schreiber ແລະ ມອບໃຫ້ເຈົ້າສາວຂອງລາວ. ຂ່າວດີກໍ່ຄືຫຼາຍລ້ານຄົນໃນຈຳນວນ 6 ລ້ານຄົນທີ່ກຳລັງປິ່ນປົວມະເຮັງໃນປະຈຸບັນຈະມີຊີວິດທີ່ສົມບູນຕໍ່ໄປ. ຈຳນວນຜູ້ລອດຊີວິດຕາມຄວາມຄິດເຫັນຂອງຂ້ອຍຍັງຕ່ຳເກີນໄປ (ປະມານ 45-50%). ນອກຈາກນັ້ນ, ຫຼາຍຄົນໃນຈຳນວນ 2000 ຄົນທີ່ເສຍຊີວິດຈາກມະເຮັງທຸກມື້ແມ່ນເນື່ອງຈາກຄອບຄົວຂອງພວກເຂົາບໍ່ຮູ້ກ່ຽວກັບຊັບພະຍາກອນທີ່ມີໃນປະຈຸບັນສຳລັບການປິ່ນປົວມະເຮັງທັງແບບດັ້ງເດີມ ແລະ ແບບທາງເລືອກ ເຊັ່ນ: ການປິ່ນປົວແບບເສີມ ຫຼື ແບບບູລະນາການ.

ເມື່ອຖືກວິນິດໄສດ້ວຍພະຍາດນີ້, ທ່ານຈະຮູ້ສຶກສັ່ນສະເທືອນຢ່າງຮຸນແຮງ. ສິ່ງສຳຄັນທີ່ທ່ານຕ້ອງຮູ້ແມ່ນພະຍາດນີ້ບໍ່ພຽງແຕ່ສາມາດຕໍ່ສູ້ໄດ້ແຕ່ຍັງສາມາດປ້ອງກັນໄດ້ຖ້າທ່ານຕັດສິນໃຈປ່ຽນແປງບາງສິ່ງທັນທີ ແລະ ປ່ອຍວາງຄວາມເຊື່ອທີ່ບໍ່ຖືກຕ້ອງທີ່ທ່ານໄດ້ສະສົມໃນຊີວິດ. ນີ້ເປັນຄວາມຈິງໂດຍສະເພາະຖ້າທ່ານເຮັດວຽກໃນຂົງເຂດສາທາລະນະສຸກ ແລະ ໄດ້ດຳລົງຊີວິດຕາມຄວາມເຊື່ອຕາຍຕົວຕະຫຼອດຊີວິດ. ປື້ມນີ້ຂຽນໂດຍແພດນັກຄົ້ນຄວ້າທີ່ບໍ່ພຽງແຕ່ຖືກກະທົບຈາກມະເຮັງ ແຕ່ຍັງເປັນມະເຮັງສະໝອງທີ່ອັນຕະລາຍທີ່ສຸດ. ລາວສາມາດຮື້ຖອນຄວາມເຊື່ອຂອງຕົນເອງໃນຖານະແພດດ້ວຍວິທະຍາສາດໃໝ່ທີ່ມີຢູ່ສຳລັບນັກຄົ້ນຄວ້າ ແຕ່ບໍ່ແມ່ນແພດມະເຮັງທົ່ວໄປ. ປື້ມນີ້ຈຳເປັນສຳລັບທຸກຄົນທີ່ເປັນມະເຮັງ ຫຼື ມີປັດໄຈສ່ຽງ ເພື່ອທ່ານຈະໄດ້ຊະນະກ່ອນມັນເລີ່ມ. ນີ້ແມ່ນໜຶ່ງໃນເຫດຜົນທີ່ຂ້ອຍຂຽນ QUILT ຂອງຂ້ອຍ ເພາະຂ້ອຍເຊື່ອວ່າຖ້າທ່ານປົກປ້ອງຈຸລັງຂອງທ່ານ ທ່ານຈະບໍ່ເປັນພະຍາດນີ້. ດຽວນີ້ ໝູ່ຂອງຂ້ອຍເປັນພະຍາດນີ້... ນີ້ແມ່ນບົດຄວາມກ່ຽວກັບສິ່ງທີ່ທ່ານອາດພິຈາລະນາເຮັດທັນທີຫຼັງຈາກປຶກສາກັບແພດມະເຮັງຂອງທ່ານ. ພິຈາລະນາຂໍຄວາມຄິດເຫັນທີສອງຈາກສູນມະເຮັງທີ່ສຳຄັນເຊັ່ນ MD Anderson.

-

ອ່ານປື້ມ Anticancer ທີ່ກ່າວເຖິງຂ້າງເທິງ. ມັນສຳຄັນທີ່ຈະເຫັນພະຍາດນີ້ໃນມຸມມອງໃໝ່.

-

ປ່ຽນອາຫານການກິນຂອງທ່ານທັນທີເປັນ Epi-paleo Rx ແລະ ອອກຫ່າງຈາກອາຫານແບບຕາເວັນຕົກມາດຕະຖານ.

-

ເລີ່ມເຮັດສະມາທິໂດຍໄວເທົ່າທີ່ຈະເປັນໄປໄດ້ເພື່ອຄວບຄຸມ cortisol ແລະ ຄວາມກັງວົນຂອງທ່ານ. (ທາງເລືອກບໍ່ສຳຄັນແຕ່ການເຮັດຈິງຊ່ວຍຊີວິດໄດ້)

-

ຄົນເຈັບຄວນປຶກສາຫາລືກ່ຽວກັບແຜນການປິ່ນປົວມະເຮັງ: ປັດໃຈສຳຄັນໃນມະເຮັງ: ຄວນຄົນເຈັບໃຊ້ອາຫານເສີມສຳລັບປະເພດມະເຮັງທີ່ທ່ານມີບໍ?

-

ພິຈາລະນາເລີ່ມລະບົບອາຫານເສີມ ລວມເຖິງ Curcumin, Reservatrol, Quercetin, ນ້ຳມັນປາ Omega ສາມ (ຄຸນນະພາບ Rx), ວິຕາມິນ D3 ໂດຍມີເປົ້າໝາຍເກີນ 50 ng/dl, ການໃຊ້ CoEnZQ10 ເປັນປະຈຳທຸກວັນ, R-alpha lipoic acid ແລະ ວິຕາມິນ K ທຸກມື້. ພິຈາລະນາການໃຊ້ N Acetyl Cysteine ທຸກວັນເຊັ່ນກັນ. ສັງເກດວ່າຂ້ອຍບໍ່ໄດ້ກຳນົດປະລິມານເພາະປະລິມານທີ່ຕ້ອງການສຳລັບການບຳບັດມະເຮັງແມ່ນສູງກວ່າທີ່ຈະໃຊ້ໃນການປ້ອງກັນ. ສິ່ງນີ້ຄວນເຮັດພາຍໃຕ້ການປຶກສາກັບແພດມະເຮັງຂອງທ່ານ. ຖ້າແພດມະເຮັງຂອງທ່ານບໍ່ເປີດໃຈກວ້າງກ່ຽວກັບບັນຫາເຫຼົ່ານີ້... ຫຼັງຈາກອ່ານປື້ມໃນຂັ້ນຕອນທີໜຶ່ງ ທ່ານອາດຈະຕ້ອງຊອກຫາແພດມະເຮັງຄົນໃໝ່. ເຫຼົ່ານີ້ແມ່ນສິ່ງທີ່ຂ້ອຍພິຈາລະນາວ່າເປັນອາຫານເສີມຫຼັກສຳລັບມະເຮັງສ່ວນໃຫຍ່ທີ່ມະນຸດເປັນ.

-

ໃນອາຫານຂອງທ່ານໃຫ້ເພີ່ມ ຂີ້ໝິ້ນ, ຂິງ, ກະທຽມ, ຣອດສະແມລີ, ແລະ ໃບແບຊິນ (ໃບໂຫລະພາ) ໃສ່ອາຫານຂອງທ່ານໃຫ້ຫຼາຍເທົ່າທີ່ຈະເປັນໄປໄດ້. ທ່ານຄວນດື່ມຊາຂຽວ 1 ລິດຕໍ່ມື້. ຊາຂຽວມີ L-Theanine ທີ່ຊ່ວຍຫຼຸດຄວາມກັງວົນ ແຕ່ຍັງເປັນສ່ວນເສີມຂອງຢາເຄມີບຳບັດໂດຍເຮັດໃຫ້ພວກມັນມີປະສິດທິພາບຍິ່ງຂຶ້ນ. ທ່ານຍັງສາມາດໃຊ້ສານສະກັດຊາຂຽວຖ້າທ່ານບໍ່ຕ້ອງການດື່ມຂອງແຫຼວຫຼາຍ ຫຼື ບໍ່ສາມາດດື່ມໄດ້ເນື່ອງຈາກສະພາບຂອງທ່ານ.

-

ໃນປີ 1955 Otto Warburg ຜູ້ຊະນະລາງວັນໂນເບວພົບວ່າມະເຮັງທັງໝົດໃຊ້ນ້ຳຕານເປັນແຫຼ່ງພະລັງງານ ແລະ ລະດັບອິນຊູລິນສູງເຮັດໃຫ້ຮ່າງກາຍສູນເສຍການຄວບຄຸມລະບົບພູມຄຸ້ມກັນທີ່ຈະປ້ອງກັນມັນ. ນີ້ໝາຍຄວາມວ່າຄົນເຈັບຕ້ອງຈຳກັດທຸກສິ່ງທີ່ກະຕຸ້ນອິນຊູລິນ. ອາຫານແບບ Epi-paleo ທີ່ມີຄາໂບໄຮເດຣດຕ່ຳເຮັດໄດ້ແນວນີ້ພໍດີ. ຂໍ້ມູນອ້າງອີງທີ່ດີສຳລັບອາຫານແມ່ນຢູ່ບ່ອນນີ້.

-

ລະບົບພູມຄຸ້ມກັນຂອງທ່ານແມ່ນການປ້ອງກັນທີ່ດີທີ່ສຸດຕໍ່ມະເຮັງ. ເພີ່ມລະດັບວິຕາມິນ D ແລະ ຮັກສາລະດັບອິນຊູລິນໃຫ້ຕ່ຳກວ່າສອງ. ການຫຼຸດລະດັບ cortisol ຈະປັບປຸງ leptin ແຕ່ສິ່ງສຳຄັນທີ່ສຸດແມ່ນເພີ່ມຈຳນວນຈຸລັງ Natural Killer (WBC) ທີ່ເປັນສ່ວນໜຶ່ງຂອງລະບົບພູມຄຸ້ມກັນໃນຈຸລັງທີ່ຕໍ່ສູ້ກັບມະເຮັງ. ທ່ານຈະໄດ້ອ່ານຫຼາຍກ່ຽວກັບຈຸລັງເຫຼົ່ານີ້ໃນປື້ມທີ່ຂ້ອຍແນະນຳໃນຂັ້ນຕອນທີໜຶ່ງ.

-

ຜັກ. ເຮັດໃຫ້ຜັກຕະກຸນ cruciferous ເປັນອາຫານຫຼັກ. ພືດທັງໝົດໃນຕະກຸນ Brassica ແມ່ນໝູ່ຂອງທ່ານ. Glucosinolates ສາມາດຢັບຢັ້ງ, ຊະລໍ, ແລະ ປີ້ນການເກີດມະເຮັງຫຼາຍຂັ້ນຕອນ. ເຫດຜົນແມ່ນການປ່ອຍ isothiocyanates ເຊັ່ນ sulphoraphanes. Sulphoraphanes ເຮັດສອງສິ່ງຫຼັກ. ພວກມັນສົ່ງເສີມ apoptosis (levee 19) ແລະ ກະຕຸ້ນເອນໄຊມ໌ detoxification ໄລຍະສອງໃນຕັບທີ່ເສີມຄວາມເຂັ້ມແຂງໃຫ້ກັບຍີນ p53 ເປັນຜູ້ປົກປ້ອງຈີໂນມຂອງພວກເຮົາ. ຈຸລັງມະເຮັງມັກຈະຕາຍ (necrosis) ເມື່ອສຳຜັດກັບ sulphoraphanes ຢ່າງຕໍ່ເນື່ອງເປັນເວລາດົນ. ຜັກບຣອກໂຄລີຍັງມີສານ metabolite ຂັ້ນສອງທີ່ເອີ້ນວ່າ Indole 3 Carbinol ທີ່ແຕກຕົວຕໍ່ໄປເປັນສານຕ້ານມະເຮັງອີກຊະນິດໜຶ່ງຊື່ວ່າ DIM, diindolylmethane. ທ່ານບໍ່ສາມາດກິນຜັກພວກນີ້ຫຼາຍພໍຖ້າທ່ານເປັນມະເຮັງໃນທັດສະນະຂອງຂ້ອຍ. I3C ຍັງຂັດຂວາງ 16-hydroxyestrone ແລະ ມີປະໂຫຍດຫຼາຍໃນການປ້ອງກັນມະເຮັງເຕົ້ານົມ ແລະ ມະເຮັງຮັງໄຂ່ໃນແມ່ຍິງ ແລະ ມະເຮັງຕ່ອມລູກໝາກໃນຜູ້ຊາຍ.

-

ນີ້ແມ່ນສິ່ງທີ່ຂັດກັບຄວາມເຊື່ອຊຶ່ງຢູ່ໃນຫົວຂອງທ່ານ... ກິນ cholesterol ຫຼາຍໆ. ໂດຍສະເພາະນ້ຳມັນໝາກພ້າວ. ຫຼາຍການສຶກສາທາງລະບາດວິທະຍາສະແດງໃຫ້ເຫັນວ່າລະດັບ cholesterol ໃນເລືອດຕ່ຳສຳພັນກັບອັດຕາການເກີດມະເຮັງສູງ. ນີ້ແມ່ນເຫດຜົນທີ່ການກິນອາຫານ ketogenic Epi-paleo ມີຄວາມໝາຍຫຼາຍ. ເປັນຫຍັງອາຫານແບບ ketogenic? ເພາະມະເຮັງທັງໝົດໃຊ້ກລູໂຄສເປັນວັດຖຸດິບ. ທ່ານຈຳເປັນຕ້ອງປ່ຽນເຊື້ອໄຟຂອງຈຸລັງ. ໄປຊອກຫາ Otto Warburg ໃນ Google ສຳລັບລາຍລະອຽດເພີ່ມເຕີມ. ອາຫານແບບ ketogenic ຄວນມີ MCT ຈາກນ້ຳມັນໝາກພ້າວຫຼາຍ ເພາະພວກມັນໃຫ້ຂໍ້ໄດ້ປຽບຫຼາຍແກ່ຈຸລັງປົກກະຕິກວ່າຈຸລັງມະເຮັງ. ຂໍ້ໄດ້ປຽບນີ້ເຮັດໃຫ້ລະບົບພູມຄຸ້ມກັນຂອງທ່ານສາມາດຕາມທັນຈຸລັງມະເຮັງ ແລະ ທຳລາຍພວກມັນໂດຍໃຊ້ກົນໄກຊີວະວິທະຍາຂອງທ່ານເອງ. ມີຫຼາຍບົດຄວາມໃນວາລະສານມະເຮັງທີ່ພິມເຜີຍແຜ່ສະແດງໃຫ້ເຫັນການເຊື່ອມໂຍງແບບດຽວກັນ.

-

-

@ e4950c93:1b99eccd

2025-05-03 09:46:42

@ e4950c93:1b99eccd

2025-05-03 09:46:42Engel est une marque allemande qui crée des vêtements et accessoires en coton biologique, laine mérinos et soie pour toute la famille.

Matières naturelles utilisées dans les produits

⚠️ Attention, certains produits de cette marque (notamment les soutiens-gorge) contiennent des matières non naturelles, dont :

Catégories de produits proposés

#Vêtements

- Coupes : bébés, enfants, femmes, hommes, unisexe

- Sous-vêtements : boxers, culottes

- Une pièce : bodies

- Hauts : débardeurs, gilets, t-shirts, pulls, vestes

- Bas : pantalons, shorts

- Tête et mains : bonnets

- Nuit : pyjamas

#Maison

- Linge : couvertures, turbulettes

Autres informations

- Certification GOTS

- Certification IVN Best

- Fabriqué en Allemagne

👉 En savoir plus sur le site de la marque

Cet article est publié sur origine-nature.com 🌐 See this article in English

📝 Tu peux contribuer à cette fiche en suggérant une modification en commentaire.

🗣️ Tu utilises ce produit ? Partage ton avis en commentaire.

⚡ Heureu-x-se de trouver cette information ? Soutiens le projet en faisant un don, pour remercier les contribut-eur-ice-s.

-

@ a5142938:0ef19da3

2025-05-03 09:45:38

@ a5142938:0ef19da3

2025-05-03 09:45:38Engel is a German brand that creates clothing and accessories made from organic cotton, merino wool, and silk for the whole family.

Natural materials used in products

⚠️ Warning: some products from this brand (especially bras) contain non-natural materials, including:

Categories of products offered

#Clothing

- Fits: babies, children, women, men, unisex

- Underwear: boxers, panties

- One-piece: bodysuits

- Tops: tank tops, cardigans, t-shirts, sweaters, jackets

- Bottoms: trousers, shorts

- Head & hands: hats

- Nightwear: pyjamas

#Home

- Linen: blankets, sleeping bags

Other information

- GOTS certification

- IVN Best certification

- Made in Germany

👉 Learn more on the brand's website

This article is published on origin-nature.com 🌐 Voir cet article en français

📝 You can contribute to this entry by suggesting edits in comments.

🗣️ Do you use this product? Share your opinion in the comments.

⚡ Happy to have found this information? Support the project by making a donation to thank the contributors.

-

@ cefb08d1:f419beff

2025-05-03 08:57:18

@ cefb08d1:f419beff

2025-05-03 08:57:18There is a well-known legend about pelicans that has been told for centuries: it was believed that pelican parents would wound their own chests with their beaks to feed their young with their blood. In reality, pelicans actually catch fish in their large beaks and then press their beaks to their chicks’ mouths to feed them. The myth likely arose because young pelicans sometimes peck their mother's chest while competing for food, but the mother does not harm herself intentionally.

originally posted at https://stacker.news/items/970123