-

@ 502ab02a:a2860397

2025-05-07 01:08:58

@ 502ab02a:a2860397

2025-05-07 01:08:58สัปดาห์นี้ถือว่าเป็นเบรคคั่นพักผ่อนแก้เครียดนิดหน่อยแล้วกันครับ เรามาเล่าย้อนอดีตกันนิดหน่อย เหมือนสตาร์วอส์ที่ฉายภาค 4-5-6 แล้วย้อนไป 1-2-3 ฮาๆๆๆ

เคยได้ยินคำว่า Nuremberg Trials ไหมครับ ย้อนความนิดนึงว่า Nuremberg (Nürnberg อ่านว่า เนือร์นแบร์ก) คือชื่อเมืองในเยอรมนีที่เคยเป็นเวทีพิจารณาคดีประวัติศาสตร์หลังสงครามโลกครั้งที่ 2

“Nuremberg Trials” คือการไต่สวนผู้มีส่วนเกี่ยวข้องกับ อาชญากรรมสงครามของนาซีเยอรมัน หลังสงครามโลกครั้งที่ 2 ในปี 1945–46 พันธมิตรผู้ชนะสงครามได้จับตัวผู้นำนาซี นักการเมือง หมอ นักวิทยาศาสตร์ มาขึ้นศาล ข้อหาของพวกเขาไม่ได้แค่ฆ่าคน แต่รวมถึงการละเมิดศีลธรรมมนุษย์ขั้นพื้นฐาน อย่างการทดลองทางการแพทย์กับนักโทษ โดยไม่มีการขอความยินยอม

จากการไต่สวนนี้ จึงเกิดหลักจริยธรรมที่ชื่อว่า “Nuremberg Code” ซึ่งกลายเป็นรากฐานของการทดลองทางการแพทย์ยุคใหม่ หัวใจของโค้ดนี้คือคำว่า “Informed Consent” แปลว่า ถ้าจะทำอะไรกับร่างกายใคร ต้องได้รับความยินยอมจากเขาอย่างเต็มใจ และมีข้อมูลครบถ้วน นี่แหละ คือบทเรียนจากบาดแผลของสงครามโลก

แต่แล้ว...ในปี 2020 โลกก็เข้าสู่ยุคที่ใครบางคนบอกว่า “ต้องเชื่อผู้เชี่ยวชาญ” ใครกังวล = คนไม่รักสังคม ใครถามเยอะ = คนต่อต้านวิทยาศาสตร์ การยินยอมโดยสมัครใจ เริ่มกลายเป็นแค่คำเชิงสัญลักษณ์

ในช่วงหลังนี้เราอาจจะได้ยินข่าวหรือทฤษฎีในอินเตอร์เนทเกี่ยวกับคำว่า Nuremberg 2.0 กันนะครับ เพราะเริ่มผุดขึ้นตามกระทู้เงียบ ๆ คลิปใต้ดิน และเวทีเสวนาแปลก ๆ ที่ไม่มีใครอยากอ้างชื่อบนเวที TED Talk ซึ่ง กลุ่มที่ใช้คำนี้มักจะหมายถึงความต้องการให้มีการ “ไต่สวน” หรือ “เอาผิด” กับนักการเมือง นักวิทยาศาสตร์ แพทย์ หรือองค์กรที่เกี่ยวข้องกับ การออกคำสั่ง การบังคับ การเซ็นเซอร์ข้อมูลที่ขัดแย้งกับแนวทางรัฐ การเผยแพร่ข้อมูลโดยไม่โปร่งใส พวกเขามองว่า นโยบายเหล่านั้นละเมิดสิทธิเสรีภาพของประชาชนในระดับที่เปรียบได้กับ “อาชญากรรมต่อมนุษยชาติ” จึงเสนอแนวคิด “Nuremberg 2.0”

พวกเขาไม่ได้เรียกร้องแค่ความโปร่งใส แต่เขาอยากเห็นการทบทวน ว่าใครกันแน่ที่ละเมิดหลักจริยธรรมที่โลกเคยตกลงกันไว้เมื่อ 80 ปีก่อน

Nuremberg คือการไต่สวนคนที่ใช้อำนาจรัฐฆ่าคนอย่างจงใจ Nuremberg 2.0 คือคำเตือนว่า “การใช้ความกลัวครอบงำเสรีภาพ” อาจไม่ต่างกันนัก

ทีนี้เคยสงสัยไหม แล้วมันเกี่ยวอะไรกับอาหาร?

เพราะจากวิกฤตโรคระบาด เราเริ่มเห็น “วิทยาศาสตร์แบบผูกขาด” คุมเกมส์ บริษัทเทคโนโลยีเริ่มเข้ามาทำอาหาร ชื่อใหม่ของเนื้อสเต๊กกลายเป็น “โปรตีนทางเลือก” อาหารจากแล็บกลายเป็น “ทางรอดของโลก” สารเคมีอัดลงไปแทนเนื้อจริง ๆ แต่มีฉลากติดว่า "รักษ์โลก ปลอดภัย ยั่งยืน"

แต่ถ้ามองให้ลึกลงไปอีกนิด บางกลุ่มคนกลับเริ่มเห็นอะไรบางอย่างที่ขนลุกกว่า เพราะมันคือ “ระบบควบคุมสุขภาพ” ที่อาศัย “ความกลัว” เป็นหัวเชื้อ และ “วิทยาศาสตร์แบบผูกขาด” เป็นกลไก

จากนั้น…ทุกอย่างก็จะถูกเสิร์ฟอย่างสวยงามในรูปแบบ "นวัตกรรมเพื่ออนาคต" ไม่ว่าจะเป็นอาหารเสริมชนิดใหม่ เนื้อสัตว์ปลูกในแล็บ หรืออาหารที่ไม่ต้องเคี้ยว

ลองคิดเล่น ๆครับ ถ้าสารอาหารถูกควบคุมได้ เหมือนที่เราเคยถูกบังคับกับบางอย่างได้ล่ะ? วันหนึ่ง เราอาจถูกขอให้ "กิน" ในสิ่งที่ระบบสุขภาพอนาคตเขาบอกว่าดี แล้วถ้าเฮียบอกว่าไม่อยากกิน...เขาอาจไม่ห้าม แต่ App สุขภาพจะเตือนว่า “คุณมีพฤติกรรมเสี่ยงต่อโลกใบนี้” แต้มเครดิตจะสุขภาพจะลดลงและส่วนลดข้าวกล่องเนื้อจากจุลินทรีย์จะไม่เข้าบัญชีเฮียอีกเลย

ใช่…มันไม่เหมือนการบังคับ แต่มันคือการสร้าง “ระบบทางเดียว” ที่ทำให้คนที่อยากเดินออกนอกแถว เหมือนเดินลงเหว

Nuremberg 2.0 จึงไม่ใช่แค่เรื่องของอดีตหรือโรคระบาด แต่มันเป็นกระจกที่สะท้อนว่า “ถ้าเราไม่เรียนรู้จากประวัติศาสตร์ เราอาจกินซ้ำรอยมันเข้าไปในมื้อเย็น”

อนาคตของอาหารอาจไม่ได้อยู่ในจาน แต่อยู่ในนโยบาย อยู่ในบริษัทที่ผลิตโปรตีนจากอากาศ อยู่ในทุนที่ซื้อนักวิทยาศาสตร์ไว้ทั้งวงการ และถ้าเราหลับตาอีกครั้ง หลายคนก็กลัวว่า...บทไต่สวน Nuremberg รอบใหม่ อาจไม่สามารถเกิดขึ้นอีกต่อไป เพราะคราวนี้ คนร้ายจะไม่ได้ถือปืน แต่อาจถือใบรับรองโภชนาการระดับโลกในมือแทน

#pirateketo #กูต้องรู้มั๊ย #ม้วนหางสิลูก #siamstr

-

@ c9badfea:610f861a

2025-05-06 23:05:40

@ c9badfea:610f861a

2025-05-06 23:05:40ℹ️ To add profiles to the follow packs, please leave a comment

-

@ 57d1a264:69f1fee1

2025-05-06 06:00:25

@ 57d1a264:69f1fee1

2025-05-06 06:00:25Album art didn’t always exist. In the early 1900s, recorded music was still a novelty, overshadowed by sales of sheet music. Early vinyl records were vastly different from what we think of today: discs were sold individually and could only hold up to four minutes of music per side. Sometimes, only one side of the record was used. One of the most popular records of 1910, for example, was “Come, Josephine, in My Flying Machine”: it clocked in at two minutes and 39 seconds.

The invention of album art can get lost in the story of technological mastery. But among all the factors that contributed to the rise of recorded music, it stands as one of the few that was wholly driven by creators themselves. Album art — first as marketing material, then as pure creative expression — turned an audio-only medium into a multi-sensory experience.

This is the story of the people who made music visible.

originally posted at https://stacker.news/items/972642

-

@ 57d1a264:69f1fee1

2025-05-06 05:49:01

@ 57d1a264:69f1fee1

2025-05-06 05:49:01I don’t like garlic. It’s not a dislike for the taste in the moment, so much as an extreme dislike for the way it stays with you—sometimes for days—after a particularly garlicky meal.

Interestingly enough, both of my brothers love garlic. They roast it by itself and keep it at the ready so they can have a very strong garlic profile in their cooking. When I prepare a dish, I don’t even see garlic on the ingredient list. I’ve cut it out of my life so completely that my brain genuinely skips over it in recipes. While my brothers are looking for ways to sneak garlic into everything they make, I’m subconsciously avoiding it altogether.

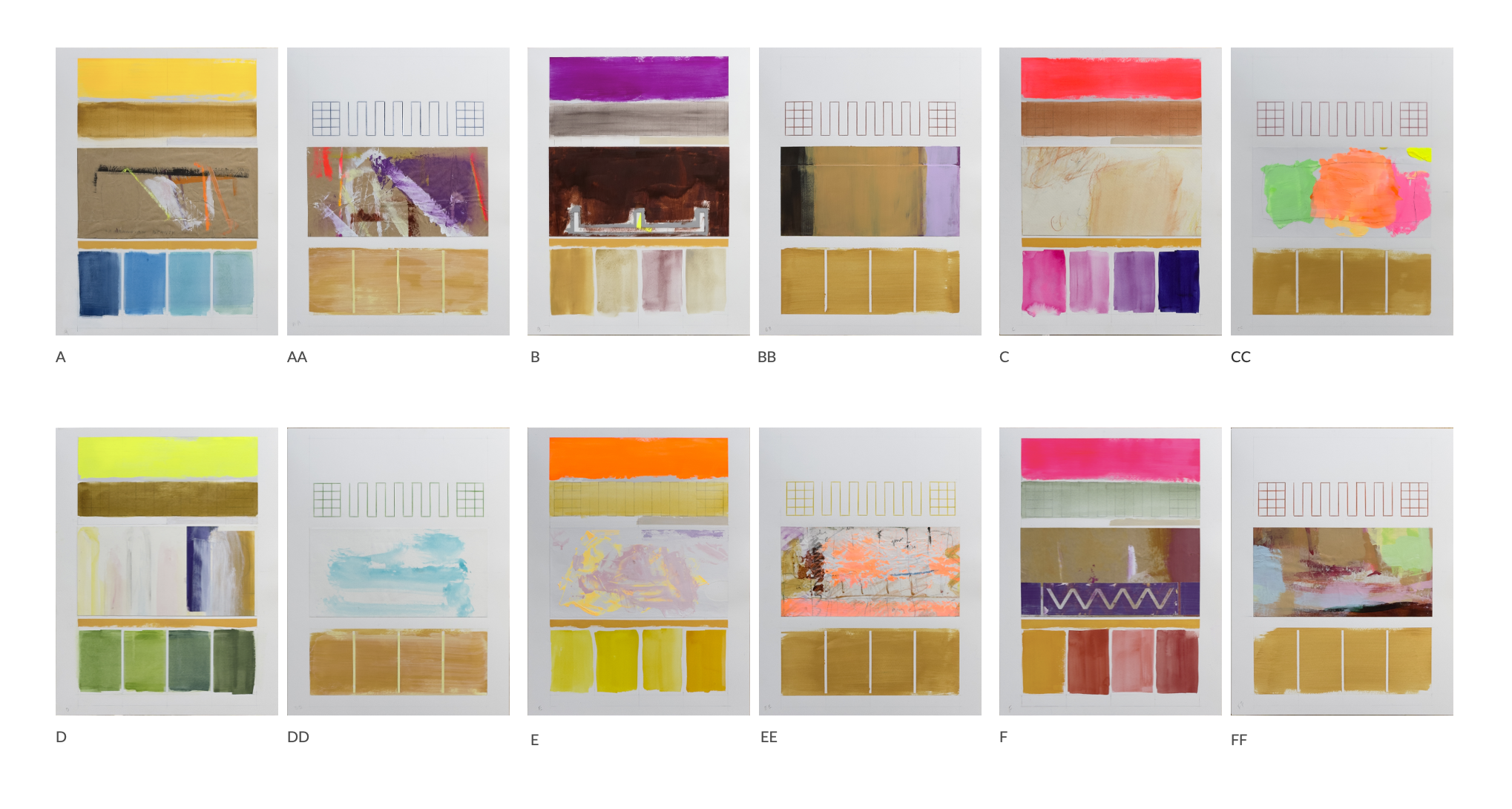

A few years back, when I was digging intensely into how design systems mature, I stumbled on the concept of a design system origin story. There are two extreme origin stories and an infinite number of possibilities between. On one hand you have the grassroots system, where individuals working on digital products are simply trying to solve their own daily problems. They’re frustrated with having to go cut and paste elements from past designs or with recreating the same layouts over and over, so they start to work more systematically. On the other hand, you have the top down system, where leadership is directing teams to take a more systematic approach, often forming a small partially dedicated core team to tackle some centralized assets and guidelines for all to follow. The influences in those early days bias a design system in interesting and impactful ways.

We’ve established that there are a few types of bias that are either intentionally or unintentionally embedded into our design systems. Acknowledging this is a great first step. But, what’s the impact of this? Does it matter?

I believe there are a few impacts design system biases, but there’s one that stands out. The bias in your design system makes some individuals feel the system is meant for them and others feel it’s not. This is a problem because, a design system cannot live up to it’s expected value until it is broadly in use. If individuals feel your design system is not for them, the won’t use it. And, as you know, it doesn’t matter how good your design system is if nobody is using it.

originally posted at https://stacker.news/items/972641

-

@ 000002de:c05780a7

2025-05-06 20:24:08

@ 000002de:c05780a7

2025-05-06 20:24:08https://www.youtube.com/watch?v=CIMZH7DEPPQ

I really enjoy listening to non-technical people talk about technology when they get the bigger picture impacts and how it relates to our humanity.

I was reminded of this video by @k00b's post about an AI generated video of a victim forgiving his killer.

Piper says, "Computers are better at words than you. Than I". But they are machines. They cannot feel. They cannot have emotion.

This people honors me with their lips, but their heart is far from me

~ Matthew 15:8

Most of us hate it when people are fake with us. When they say things they don't mean. When they say things just to get something they want from us. Yet, we are quickly falling into this same trap with technology. Accepting it as real and human. I'm not suggesting we can't use technology but we have to be careful that we do not fall into this mechanical trap and forget what makes humans special.

We are emotional and spiritual beings. Though AI didn't exist during the times Jesus walked the earth read the verse above in a broader context.

Then Pharisees and scribes came to Jesus from Jerusalem and said, “Why do your disciples break the tradition of the elders? For they do not wash their hands when they eat.” He answered them, “And why do you break the commandment of God for the sake of your tradition? For God commanded, ‘Honor your father and your mother,’ and, ‘Whoever reviles father or mother must surely die.’ But you say, ‘If anyone tells his father or his mother, “What you would have gained from me is given to God,” he need not honor his father.’ So for the sake of your tradition you have made void the word of God. You hypocrites! Well did Isaiah prophesy of you, when he said:

“‘This people honors me with their lips,

but their heart is far from me;

in vain do they worship me,

teaching as doctrines the commandments of men.’”

Empty words. Words without meaning because they are not from a pure desire and love. You may not be a Christian but don't miss the significance of this. There is a value in being real. Sharing true emotion and heart. Don't fall into the trap of the culture of lies that surrounds us. I would rather hear true words with mistakes and less eloquence any day over something fake. I would rather share a real moment with the ones I love than a million fake moments. Embrace the messy imperfect but real world.

originally posted at https://stacker.news/items/973324

-

@ 5d4b6c8d:8a1c1ee3

2025-05-06 19:49:39

@ 5d4b6c8d:8a1c1ee3

2025-05-06 19:49:39One of the best first rounds in recent memory just concluded. Let's recap our playoff contests.

Bracket Challenge

In our joint contest with Global Sports Central, @WeAreAllSatoshi is leading the way with 85 points, while me and some nostr jabroni are tied for second with 80 points.

The bad news is that they are slightly ahead of us, with an average score of 62 to our 60.8. We need to go back in time and make less stupid picks.

Points Challenge

With the Warriors victory, I jumped into a commanding lead over @grayruby. LA sure let most of you down. I say you hold @realBitcoinDog responsible for his beloved hometown's failures.

I still need @Car and @Coinsreporter to make their picks for this round. The only matchup they can choose from is Warriors (7) @ Timberwolves (6). Lucky for them, that's probably the best one to choose from.

| Stacker | Points | |---------|--------| | @Undisciplined | 25| | @grayruby | 24| | @Coinsreporter | 19 | | @BlokchainB | 19| | @Carresan | 18 | | @gnilma | 18 | | @WeAreAllSatoshi | 12 | | @fishious | 11 | | @Car | 1 |

originally posted at https://stacker.news/items/973284

-

@ 8671a6e5:f88194d1

2025-05-06 16:23:25

@ 8671a6e5:f88194d1

2025-05-06 16:23:25"I tried pasting my login key into the text field, but no luck—it just wouldn't work. Turns out, the login field becomes completely unusable whenever the on-screen keyboard shows up on my phone. So either no one ever bothered to test this on a phone, or they did and thought, ‘Eh, who needs to actually log in anyway?’."

### \ \ Develop and evolve

Any technology or industry at the forefront of innovation faces the same struggle. Idealists, inventors, and early adopters jump in first, working to make things usable for the technical crowd. Only later do the products begin to take shape for the average user.

Bitcoin’s dropping the Ball on usability (and user-experience)

First, we have to acknowledge the progress we've made. Bitcoin has come a long way in terms of usability—no doubt about it. Even if I still think it’s bad, it’s nowhere near as terrible as it was ten or more years ago. The days of printing a paper wallet from some shady website and hoping it would still work months or years later are behind us. The days of buggy software never getting fixed are mostly over.

The Bitcoin technology itself made progress through many BIPs (Bitcoin Improvement Proposals) and combined with an increasing number of apps, devs, websites and related networks (Liquid, Lightning, Nostr, ....) we can say that we're seeing a strong ecosystem going its way. The ecosystem is alive and expanding, and technically, things are clearly working. The problem is that we’re still building with a mindset where developers and project managers consider usability—but don’t truly care about it in practice. They don’t lead with it. (Yes, there are always exceptions.)

All that progress looks cool, when you see the latest releases of hardware wallets, software wallets, exchanges, nostr clients and services built purely for bitcoin, you're usually thinking that we've progressed nicely. But I want to focus on the downside of all these shiny tools. Because if Bitcoin has made it this far, it’s mostly thanks to people who deeply understand its value and are stubborn enough to push through the friction. They don’t give up when the user experience sucks.

Many bitcoiners completely lost their perspective on the software front in my opinion. Because we could have been so much further ahead, and we didn't because some of the most important components on the user-facing side of Bitcoin (arguably the most important part) hasn’t kept pace with the popularity and possible growth. And that should be a great concern, because Bitcoin is meant to be open and accessible. The blockchain is public. This is supposed to be for everyone. This is an open ledger technology so in theory everything is user-facing to one extent or another. Yet we fail on that front to make the glue stick. Somewhere, we’re easily amused by the tools we create, and often contains hurdles we can’t see or feel. While users reject it after 5 seconds tops.

We didn’t came a lot further yet, because we’ve ignored usability at its core (pun intended).

I’m not talking about usability in the “it works on my machine” sense. I’m talking about usability that meets the standard of modern apps. Think Spotify, Instagram, Uber, Gmail. Products that ordinary people use without reading a manual or digging through forums.

That’s the bar. We’re still far from it.

Bad UX scares your grandma away

… and that’s how many bitcoiners apparently like it.

Subsequently, when I say usability, I’m using it as an umbrella term. For me, it covers user experience, user interface, and real-life, full-cycle testing—from onboarding a brand new user to rolling out a new version of the app. And oh boy, our onboarding is so horrible. (“Hey wanna try bitcoin? Here’s an app that takes up to 4 minutes or more to get though, but wait, you’ll have to install a plugin, or wait I’ll send you an on-chain transaction…)

Take a look at the listings on Bitvocation, an excellent job board for Bitcoiners and related projects. You’ll quickly notice a pattern: almost no companies are hiring software testers. It’s marketing, more marketing, some sales, and of course, full-stack developers. But … No testers.

Because testing has become something that’s often skipped or automated in a hurry. Maybe the devs run a test locally to confirm that the feature they just built doesn’t crash outright. That’s it. And if testing does happen at a company, it’s usually shallow—focused only on the top five percent of critical bugs. The finer points that shape real user experience, like button placement, navigation flow, and responsiveness, are dumped on “the community.”

Which leads to some software being rushed out to production, and only then do teams discover how many problems exist in the real world. If there’s anyone left to care that is, since most teams are scattered all over the world and get paid by the hour by some VC firm on a small runway to a launch date.

This has real life consequences I’ve seen for myself with new users. Like a lightning wallet having a +5 minute onboarding time, and a fat on-screen error for the new users, or a hardware wallet stuck in an endless upgrade loop, just because nobody tested it on a device that was “old” (as in, one year old).

The result is clear: usability and experience testing are so low on the priority list, they may as well not exist. And that’s tragic, because the enthusiasm of new users gets crushed the moment they run into what I call Linux’plaining.

That’s when something obvious fails — like a lookup command that’s copied straight from their own help documentation but doesn’t work — and the answer you get as a user is something like: “Yeah, but first you have to…” followed by an explanation that isn’t mentioned anywhere in the interface or documentation. You were just supposed to know. No one updates the documentation, and no one cares. As most of the projects are very temporary or don’t really care if it succeeds or not, because they’re bitcoiners and bitcoin always wins. Just like PGP always was super cool and good, and users should just be smarter.

Lessons from the past usability disasters

We can always learn from the past especially when its precedents are still echoing through the systems we use today

So here goes, some examples from the legacy / fiat industry:

Lotus Notes, for example. Once a titan in enterprise communication software, which managed to capture about 145 million mailboxes. But its downfall is an example of what happens when you ignore and keep ignoring real-life user needs and fail to evolve with the market. Software like that doesn’t just fade, it collapses under the weight of its own inertia and bloat. If you think bitcoin can’t have that, yes… we’re of course not having a competitor in the market (hard money is hard money, not a mailbox or office software provider of course). But we can erode trust to the extent that it becomes LotusNotes’d.

Its archaic 1990s interface came with clunky navigation and a chaotic document management system. Users got frustrated fast—basic tasks took too long. Picture this: you're stuck in a cubicle, trying to find the calendar function in Lotus Notes while a giant office printer hisses and spits out stacks of paper behind you. The platform never made the leap to modern expectations. It failed to deliver proper mobile clients and clung to outdated tech like LotusScript and the Domino architecture, which made it vulnerable to security issues and incompatible with the web standards of the time. By 2012, IBM pulled the plug on the Lotus brand, as businesses moved en masse to cloud-based alternatives.

Another kind of usability failure has plagued PGP1 (and still does so after 34 years). PGP (Pretty Good Privacy) is a time-tested and rock-solid method for encryption and key exchange, but it’s riddled with usability problems, especially for anyone who isn’t technically inclined.

Its very nature and complexity are already steep hurdles (and yes, you can’t make it fully easy without compromising how it’s supposed to work—granted). But the real problem? Almost zero effort has gone into giving even the most eager new users a manageable learning curve. That neglect slowly killed off any real user base—except for the hardcore encryption folks who already know what they’re doing.

Ask anyone in a shopping street or the historic center of your city if they’ve heard of PGP. And on the off chance someone knows it’s not a trendy new fast-food joint called “Perfectly Grilled Poultry,” the odds of them having actually used it in the past six months are basically zero, unless you happen to bump into that one neckbeard guy in his 60s wearing a stained Star Wars T-shirt named Leonard.

The builders of PGP made one major mistake: they never treated usability as a serious design goal (that’s normal for people knee deep in encryption, I get that, it’s the way it is). PGP is fantastic on itself. Other companies and projects tried to build around it, but while they stumbled, tools like Signal and ProtonMail stepped in; offering the same core features of encryption and secure messaging, minus the headache. They delivered what PGP never could: powerful functionality wrapped in something regular people can actually use. Now, we’ve got encrypted communication flowing through apps like Signal, where all the complex tech is buried so deep in the background, the average user doesn’t even realize it’s there. ProtonMail went one step further even, integrating PGP so cleanly that users never need to exchange keys or understand the cryptography behind it all, yet still benefit from bulletproof encryption.

There’s no debate—this shift is a good thing. History shows that unusable software fades into irrelevance. Whether due to lack of interest, failure to reach critical mass, or a competitor swooping in to eat market share, clunky tools don’t survive. Now, to be clear, Bitcoin doesn’t have to worry about that kind of threat. There’s no real competition when it comes to hard money. Unless, of course, you genuinely believe that flashy shitcoins are a viable alternative—in which case, you might as well stop reading here and go get yourself scammed on the latest Solana airdrop or whatever hype train’s leaving the station today for the degens.

The main takeaway here is that Bitcoin must avoid becoming the next Lotus Notes, bloated with features but neglected by users—or the next PGP, sidelined by its own lack of usability. That kind of trajectory would erode trust, especially if usability and onboarding keep falling behind. And honestly, we’re already seeing signs of this in bitcoin. User adoption in Europe, especially in countries like Germany is noticeably lagging. The introduction of the EU’s MiCA regulations isn’t helping either. Most of the companies that were actually pushing adoption are now either shutting down, leaving the EU, or jumping through creative loopholes just to stay alive. And the last thing on anyone’s mind is improving UX. It takes time, effort, and specialized people to seriously think through how to build this properly, from the beginning, with this ease of use and onboarding in mind. That’s a luxury most teams can’t or won’t prioritize right now. Understandably when the lack of funds is still a major issue within the bitcoin space. (for people sitting on hard money, there’s surprisingly little money flowing into useful projects that aren’t hyped up empty boxes)

The number of nodes being set up by end users worldwide isn’t exactly skyrocketing either. Sure, there’s some growth but let’s not overstate it. Based on Bitnodes’ snapshots taken in March of each year, we’re looking at: 2022 : around 10500 2023 : around 17000 2024 : around 18500 2025 : around 21000 (I know there are different methods of measuring these, like read-only nodes, the % change is roughly the same nonetheless)

In my opinion, if we had non-clunky software that was actually released with proper testing and usability in mind, we could’ve easily doubled those node numbers. A bad user experience with a wallet spreads fast—and brings in exactly zero new users. The same goes for people trying to set up a miner or spin up a node, only to give up after a few frustrating steps. Sure, there are good people out there making guides and videos2 to help mitigate those hurdles, and that helps. But let’s be honest: there’s still very little “wow” factor when average users interact with most Bitcoin software. Almost every time they walk away, it’s because of one of two things—usability issues or bugs.

For the record: if a user can’t set up a wallet because the interface is so rotten or poorly tested, so they don’t know where to click or how to even select a seed word from a list, then that’s a problem — that’s a bug. Argue all you want: sure, it’s not a code-level bug and no, it’s not a system crash. But it is a usability failure. Call it onboarding friction, UX flaw, whatever fits your spreadsheet or circus Maximus of failures in your ticketing system. Bottom line: if your software doesn’t help users accomplish its core purpose, it’s broken. It’s a bug. Pretending it’s something a copywriter or marketing team can fix is pure deflection. The solution isn’t to relabel the problem, 1990’s telecom-style, just to avoid dealing with it. It’s to actually sit down, think, collaborate, and go through the issue, and getting real solutions out. ”No it’s not an issue, that’s how it works” like someone from a failing (and by now defunct) wallet told me once, is not a solution.

You got 21 seconds

The user can’t be onboarded because your software has an “issue”? In my book, that’s a bug. The usual response when you report it? “Yeah, that’s not a priority.” Well, guess what? It actually is a priority. All these small annoyances, hurdles, and bits of BS still plague this industry, and they make the whole experience miserable for regular people trying it out for the first time. The first 21 seconds (yeah, you see what I did there) are the most important when someone opens new software. If it doesn’t click right away—if they’re fiddling with sats or dollar signs, or hunting for some hidden setting buried behind a tiny arrow—it’s game over. They’re annoyed. They’re gone.

And this is exactly why we’re seeing a flood of shitcoin apps sweeping new users off their feet with "faster apps" or "nicer designs" apps that somehow can afford the UI specialists and slick, centralized setups to spread their lies and scams.

I hate to say it, but the Phantom wallet for example, for the Solana network, loaded with fake airdrop schemes and the most blatant scams — has a far better UX than most Bitcoin wallets and Lightning Wallets. Learn from it. Download that **** and get to know what we do wrong and how we can learn from the enemy.

That’s a hard truth. So, instead of just screaming “Uh, shitcooooin!” (yes, we know it is), maybe we should start learning from it. Their apps are better than ours in terms of UI and UX. They attract more people 5x faster (we know that’s also because of the fast gains and retardation playing with the marketing) but we can’t keep ignoring that. Somehow these apps attract more than our trustworthiness, our steady, secure, decentralized hard money truth.

It’s like stepping into one of the best Italian restaurants in town—supposedly. But then the menu’s a mess, the staff is scrolling on their phones, and something smells burnt coming from the kitchen. So, what do you do? You walk out. You cross the street to the fast food joint and order a burger and fries. And as you’re walking out with your food, someone from the Italian place yells at you: “Fast food is bad!” ”Yeah man I know, I wanted a nice Spaghetti aglio e olio, but here I am, digesting a cheeseburger that felt rather spongy.” (the problem is so gone so deep now, that users just walk past that Italian restaurant, don’t even recognize it as a restaurant because it doesn’t have cheeseburgers).

Fear of the dark

Technical people, not marketeers built bitcoin, it’s build on hundreds of small building blocks that interacted over time to have the bitcoin network and it’s immer evolving value. At one point David Chaum cooked up eCash, using blind signatures to let people send digital money anonymously — except it was still stuck on clunky centralized servers. Go back even further, to the 1970s, when Diffie, Hellman, and Rivest introduced public-key cryptography—the magic sauce that gave us secure digital signatures and authentication, making sure your messages stayed private and tamper-proof.

Fast forward to the 1990s, where peer-to-peer started to take off, decentralized networks getting started. Adam Back’s Hashcash in ‘97 used proof-of-work to fight email spam, and the cypherpunks were all about sticking it to the man with privacy-first, the invention 199 Human-Readable 128-bit keys3, decentralized systems. We started to swap files over p2p networks and later, torrents.

All these parts—anonymous cash, encryption, and leaderless networks finally clicked into place when Satoshi Nakamoto poured them into a chain of blocks, built on an ingenious “time-stamping” system: the timechain, or blockchain if you prefer. And just like that, Bitcoin was born—a peer-to-peer money system that didn’t need middlemen and actually worked without any central servers.

So yes, it’s only natural that Bitcoin and the many tools, born from math, obscurity, and cryptography, isn’t exactly always a user-interface darling. That’s also it’s charm for me in any case, as the core is robust and valuable beyond belief. That’s why we love to so see more use, more adoption.

But that doesn’t mean we can’t squash critical “show-stopper” bugs before releasing bitcoin-related software. And it sure as hell doesn’t mean we should act like jerks when a user points out something’s broken, confusing, or just doesn’t meet expectations. We can’t be complacent either about our role as builders of the next generations, as the core is hard money, and it would be a fatal mistake for the world to see it being used only for some rockstars from Wall Street and their counterparts to store their debt laden fiat. We can free people, make them better, make them elevate themselves. And yet, the people we try to elevate, we often alienate. All because we don’t test our stuff well enough. We should be so good, we blow the banking apps away. (they’re blowing themselves out of the market luckily with fiat “features” and overly over the top use of “analytics” to measure your carbon footprint for example).

We should be so damn professional that someone using Bitcoin apps for a full year wouldn’t even notice any bugs, because there wouldn’t be much to get annoyed by.

So… we have to do better. I’ve seen it time and time again — on Lightning tipping apps, Nostr plugins, wallets, hardware wallets, even metal plates we can screw up somehow … you name it. “It works on my machine”, isn’t enough anymore! Those days are over.

Even apps built with solid funding and strong dev and test teams like fedi.xyz4 can miss the mark. While the idea was good and the app itself ran fine without too much hurdles and usual bugs. But usability failed on a different front: there was just nothing meaningful to do in the app beyond poking around, chatting a bit, and sending a few sats back and forth. The communities it’s supposed to connect, just aren’t there, or weren’t there “yet”.

It’s a beautifully designed application and a strong proof-of-concept for federated community funds. But then… nothing. No one I know uses it. Their last blogpost was from beginning of October 2024, which doesn’t bode well, writing this than 6 months after. That said, they got some great onboarding going, usually under 20 seconds, which proves it can be done right (even if it was all a front-end for a more complex backend).

As you can see “usability” is a broad terminology, covering technical aspects, user-interface, but also use-cases. Even if you have a cool app that works really well and is well thought-out users won’t use it if there’s no real substance. You can’t get that critical mass by waiting for customers to come in or communities to embrace it. They won’t, because most of the individuals already had past experiences with bitcoin apps or services, and there’s a reason for them not being on-board already.

A lot of bitcoin companies build tools for new people. Never for the lapsed people, the persons that came in, thought of it as an investment or “a coin”… then left because of a bad experience or the price going down in fiat. All the while we have some software that usually isn’t so kind to new people, or causes loss of funds and time. Even if they make one little “mistake” of not knowing the system beforehand.

Bitcoin’s Moby Dick

\ Bitcoin itself has a big issue here. The user base could grow faster, and more robust, if there wasn’t software that worked as a sort of repellent against users.

I especially see a younger and less tech-savvy audience absolutely disliking the software we have now. No matter if it’s Electrum’s desktop wallet (hardly the sexiest tool out there, although I like it myself, but it lacks some features), Sparrow, or any lightning wallet out there (safe for WoS). I even saw people disliking Proton wallet, which I personally thought of as something really slick, well-made and polished. But even that doesn’t cut it for many people, as the “account” and “wallet” system wasn’t clear enough for them. (You see, we all have the same bias, because we know bitcoin, we look at it from a perspective of “facepalm, of course it’s a wallet named “account”, but when you sit next to a new user, it becomes clear that this is a hurdle. (please proton wallet: name a wallet a wallet, not “account”. But most users already in bitcoin, love what you’re doing)

Naturally disliking usability

The same technically brilliant people who maintain Bitcoin and build its apps haven’t quite tapped into their inner Steve Jobs—if that person even exists in the Bitcoin space. Let’s be honest: the next iOS-style wow moment, or the kind of frictionless usability seen in Spotify or Instagram, probably won’t come from hardcore Bitcoin devs alone. In fact, some builders in the space seem to actively disregard—or even look down on—discussions about usability. Just mention names like Wallet of Satoshi (yes, we all know it’s a custodial frontend) or the need for smoother interactions with Bitcoin, and you’ll get eye-rolls or defensive rants instead of curiosity or openness.

Moving more towards a better user interface for things like Sparrow or Bitcoin Core for example, would bring all kinds of “bad things” according to some, and on top of that, bring in new users (noobs) that ask questions like: “Do you burn all these sats when I make a transaction?” (Yes, that’s a real one.)

I get the “usability sucks” gripe — fear of losing key features, dumbing things down, or opening the door to unwanted changes (like BIP proposals real bitcoiners hate) that tweak bitcoin to suit any user’s whim. Close to no one in bitcoin (really in bitcoin!) wants that, including me.

That fear is however largely unfounded; because Bitcoin doesn’t change without consensus. Any change that would undermine its core use or value proposition simply won’t make it through. And let’s be honest: most of the users who crave these “faster,” centralized alternatives—those drawn to slick apps, one-click solutions, and dopamine-driven UI—will either stick with fiat, ape into the shitcoin-of-the-month, or praise the shiny new CBDC once it drops (“much fast, much cool”). These degen types, chasing fiat gains and jackpot dreams, aren’t relevant to this story, No matter what we build for bitcoin, they’ll always love the fiat-story and will always dislike bitcoin because it’s not a jackpot for them. (Honestly, why don’t they just gamble at a casino?)

People who fear that improving usability will somehow bring down the Bitcoin network are being a bit too paranoid—and honestly, they often don’t understand what usability or proper testing actually means.

They treat it like fluff, when in reality it's fundamental. Usability doesn't mean dumbing things down or compromising Bitcoin's core values; it means understanding why your fancy new app isn’t being used by anyone outside of your bubble. Testing is the beating heart of getting things out with confidence. Nothing more satisfying in software building than to proudly show even your beta versions to users, knowing it’s well tested. It’s much more than clicking a few buttons and tossing your code on GitHub. It's about asking real questions: can someone outside your Telegram group actually use this and will it they be using the software at all?

If you create a Nostr app that opens an in-app browser window and then tries to log you in with your NIPS05 or NIPS07 or whatever number it is that authenticates you, then you need to think about how it’s going to work in real life. Have people already visited this underlying website? Is that website using the exact same mechanism? Is it really working like we think it is in the real world? (Some notable good things are happening with the development of Keychat for example, I have the feeling they get it, it’s not all bad). And yes, there are still bugs and things to improve there, they’re just starting. (The browser section and nostr login need some work imho).

Guess what? You can test your stuff. But it takes time and effort. The kind of effort that, if skipped, gets multiplied across thousands of people. Thousands of people wasting their time trying to use your app, hitting errors, assuming they did something wrong, retrying, googling workarounds—only to eventually realize: it’s not them. It’s a bug. A bug you didn’t catch. Because you didn’t test. And now everyone loses. And guess what? Those users? They’re not coming back.

A good example (to stay positive here) is Fountain App, where the first versions were , eh… let’s say not so good, and then quickly evolved into a company and product that works really well, and also listens to their users and fixes their bugs. The interface can still be better in my opinion, but it’s getting there. And it’s super good now.

A bad example? Alby. (Sorry to say.) It still suffers from a bloated, clunky interface and an onboarding flow that utterly confuses new or returning users. It just doesn’t get the job done. Opinions may vary, sure, but hand this app to any non-technical user and ask them to get online and do a Nostr zap. Watch what happens. If they even manage to get through the initial setup, that is.

Another example? Bitkit. When I tried transferring funds from the "savings" to the "spending" account, the wallet silently opened a Lightning channel—no warning, no explanation—and suddenly my coins were locked up. To make things worse, the wallet still showed the full balance as spendable, even though part of it was now stuck in that channel. That was in November 2024, the last time I touched Bitkit. I wasted too much time trying to figure it out, I haven’t looked back (assuming the project is even still alive, I didn’t see them pop up anywhere).

Some metal BIP39 backup tools are great in theory but poorly executed. I bought one that didn’t even include a simple instruction on how to open it. The person I gave it to spent two hours trying to open it with a screwdriver and even attempted drilling. Turns out, it just slides open with some pressure. A simple instruction would’ve saved all that frustration.

Builders often assume users “just get it,” but a small guide could’ve prevented all the hassle. It’s a small step, but it’s crucial for better user experience. So why not avoid such situations and put a friggin cheap piece of paper in the box so people know how to open it? (The creators would probably facepalm if they read this, “how can users nòt see this?”). Yeah,… put a paper in there with instructions.

That’s natural, because as a creator you’re “in” it, you know. You don’t see how others would overlook something so obvious.

Bitcoiners are extremely bad on that front.

I’ll dive deeper into some examples in part 2 of this post.

By AVB

end of part 1

If you like to support independent thought and writings on bitcoin, follow this substack please https://coinos.io/allesvoorbitcoin/receive\ \ footnotes:

1 https://philzimmermann.com/EN/findpgp/

2 BTC sessions: set up a bitcoin node

-

@ bbef5093:71228592

2025-05-06 16:11:35

@ bbef5093:71228592

2025-05-06 16:11:35India csökkentené az atomerőművek építési idejét ambiciózus nukleáris céljai eléréséhez

India célja, hogy a jelenlegi 10 évről a „világszínvonalú” 6 évre csökkentse atomerőművi projektjeinek kivitelezési idejét, hogy elérje a 2047-re kitűzött, 100 GW beépített nukleáris kapacitást.

Az SBI Capital Markets (az Indiai Állami Bank befektetési banki leányvállalata) jelentése szerint ez segítene mérsékelni a korábbi költségtúllépéseket, és vonzóbbá tenné az országot a globális befektetők számára.

A jelentés szerint a jelenlegi, mintegy 8 GW kapacitás és a csak 7 GW-nyi építés alatt álló kapacitás mellett „jelentős gyorsítás” szükséges a célok eléréséhez.

A kormány elindította a „nukleáris energia missziót”, amelyhez körülbelül 2,3 milliárd dollárt (2 milliárd eurót) különített el K+F-re és legalább öt Bharat kis moduláris reaktor (BSMR) telepítésére, de további kihívásokat kell megoldania a célok eléréséhez.

Az építési idők csökkentése kulcsfontosságú, de a jelentés átfogó rendszerszintű reformokat is javasol, beleértve a gyorsabb engedélyezést, a földszerzési szabályok egyszerűsítését, az erőművek körüli védőtávolság csökkentését, és a szabályozó hatóság (Atomic Energy Regulatory Board) nagyobb önállóságát.

A jelentés szerint a nemzet korlátozott uránkészletei miatt elengedhetetlen az üzemanyagforrások diverzifikálása nemzetközi megállapodások révén, valamint az indiai nukleáris program 2. és 3. szakaszának felgyorsítása.

India háromlépcsős nukleáris programja célja egy zárt üzemanyagciklus kialakítása, amely a természetes uránra, a plutóniumra és végül a tóriumra épül. A 2. szakaszban gyorsneutronos reaktorokat használnak, amelyek több energiát nyernek ki az uránból, kevesebb bányászott uránt igényelnek, és a fel nem használt uránt új üzemanyaggá alakítják. A 3. szakaszban fejlett reaktorok működnek majd India hatalmas tóriumkészleteire alapozva.

2025 januárjában az indiai Nuclear Power Corporation (NPCIL) pályázatot írt ki Bharat SMR-ek telepítésére, először nyitva meg a nukleáris szektort indiai magáncégek előtt.

Eddig csak az állami tulajdonú NPCIL építhetett és üzemeltethetett kereskedelmi atomerőműveket Indiában.

A Bharat SMR-ek (a „Bharat” hindiül Indiát jelent) telepítése a „Viksit Bharat” („Fejlődő India”) program része.

Engedélyezési folyamat: „elhúzódó és egymásra épülő”

A Bharat atomerőmű fejlesztésének részletei továbbra sem világosak, de Nirmala Sitharaman pénzügyminiszter júliusban elmondta, hogy az állami National Thermal Power Corporation és a Bharat Heavy Electricals Limited közös vállalkozásában valósulna meg a fejlesztés.

Sitharaman hozzátette, hogy a kormány a magánszektorral közösen létrehozna egy Bharat Small Reactors nevű céget, amely SMR-ek és új nukleáris technológiák kutatás-fejlesztésével foglalkozna.

Az SBI jelentése szerint javítani kell az SMR programot, mert az engedélyezési folyamat jelenleg „elhúzódó és egymásra épülő”, és aránytalan kockázatot jelent a magánszereplők számára a reaktorfejlesztés során.

A program „stratégiailag jó helyzetben van a sikerhez”, mert szigorú belépési feltételeket támaszt, így csak komoly és alkalmas szereplők vehetnek részt benne.

A kormánynak azonban be kellene vezetnie egy kártérítési záradékot, amely védi a magáncégeket az üzemanyag- és nehézvíz-ellátás hiányától, amely az Atomenergia Minisztérium (DAE) hatáskörébe tartozik.

A jelentés szerint mind az üzemanyag, mind a nehézvíz ellátása a DAE-től függ, és „a hozzáférés hiánya” problémát jelenthet. India legtöbb kereskedelmi atomerőműve hazai fejlesztésű, nyomottvizes nehézvizes reaktor.

A jelentés szerint: „A meglévő szabályozási hiányosságok kezelése kulcsfontosságú, hogy a magánszektor vezethesse a kitűzött 100 GW nukleáris kapacitás 50%-ának fejlesztését 2047-ig.”

Az NPCIL nemrégiben közölte, hogy India 2031–32-ig további 18 reaktort kíván hozzáadni az energiamixhez, ezzel az ország nukleáris kapacitása 22,4 GW-ra nő.

A Nemzetközi Atomenergia-ügynökség adatai szerint Indiában 21 reaktor üzemel kereskedelmi forgalomban, amelyek 2023-ban az ország áramtermelésének körülbelül 3%-át adták. Hat egység van építés alatt.

Roszatom pert indított a leállított Hanhikivi-1 projekt miatt Finnországban

Az orosz állami Roszatom atomenergetikai vállalat pert indított Moszkvában a finn Fortum és Outokumpu cégek ellen, és 227,8 milliárd rubel (2,8 milliárd dollár, 2,4 milliárd euró) kártérítést követel a finnországi Hanhikivi-1 atomerőmű szerződésének felmondása miatt – derül ki bírósági dokumentumokból és a Roszatom közleményéből.

A Roszatom a „mérnöki, beszerzési és kivitelezési (EPC) szerződés jogellenes felmondása”, a részvényesi megállapodás, az üzemanyag-ellátási szerződés megsértése, valamint a kölcsön visszafizetésének megtagadása miatt követel kártérítést.

A Fortum a NucNetnek e-mailben azt írta, hogy „nem kapott hivatalos értesítést orosz perről”.

A Fortum 2025. április 29-i negyedéves jelentésében közölte, hogy a Roszatom finn leányvállalata, a Raos Project, valamint a Roszatom nemzetközi divíziója, a JSC Rusatom Energy International, illetve a Fennovoima (a Hanhikivi projektért felelős finn konzorcium) között a Hanhikivi EPC szerződésével kapcsolatban nemzetközi választottbírósági eljárás zajlik.

2025 februárjában a választottbíróság úgy döntött, hogy nincs joghatósága a Fortummal szembeni követelések ügyében. „Ez a döntés végleges volt, így a Fortum nem része a választottbírósági eljárásnak” – közölte a cég.

A Fortum 2015-ben kisebbségi tulajdonos lett a Fennovoima projektben, de a teljes tulajdonrészt 2020-ban leírta.

A Fennovoima konzorcium, amelyben a Roszatom a Raos-on keresztül 34%-os kisebbségi részesedéssel rendelkezett, 2022 májusában felmondta a Hanhikivi-1 létesítésére vonatkozó szerződést az ukrajnai háború miatti késedelmek és megnövekedett kockázatok miatt.

A projekt technológiája az orosz AES-2006 típusú nyomottvizes reaktor lett volna.

2021 áprilisában a Fennovoima közölte, hogy a projekt teljes beruházási költsége 6,5–7 milliárd euróról 7–7,5 milliárd euróra nőtt.

2022 augusztusában a Roszatom és a Fennovoima kölcsönösen milliárdos kártérítési igényt nyújtott be egymás ellen a projekt leállítása miatt.

A Fennovoima nemzetközi választottbírósági eljárást indított 1,7 milliárd euró előleg visszafizetéséért. A Roszatom 3 milliárd eurós ellenkeresetet nyújtott be. Ezek az ügyek jelenleg is nemzetközi bíróságok előtt vannak.

Dél-koreai delegáció Csehországba utazik nukleáris szerződés aláírására

Egy dél-koreai delegáció 2025. május 6-án Csehországba utazik, hogy részt vegyen egy több milliárd dolláros szerződés aláírásán, amely két új atomerőmű építéséről szól a Dukovany telephelyen – közölte a dél-koreai kereskedelmi, ipari és energetikai minisztérium.

A delegáció, amelyben kormányzati és parlamenti tisztviselők is vannak, kétnapos prágai látogatásra indul, hogy részt vegyen a szerdára tervezett aláírási ceremónián.

A küldöttség találkozik Petr Fiala cseh miniszterelnökkel és Milos Vystrcil szenátusi elnökkel is, hogy megvitassák a Dukovany projektet.

Fiala múlt héten bejelentette, hogy Prága május 7-én írja alá a Dukovany szerződést a Korea Hydro & Nuclear Power (KHNP) céggel.

A cseh versenyhivatal nemrég engedélyezte a szerződés aláírását a KHNP-vel, miután elutasította a francia EDF fellebbezését.

A versenyhivatal április 24-i döntése megerősítette a korábbi ítéletet, amelyet az EDF megtámadott, miután 2024 júliusában elvesztette a tenderpályázatot a KHNP-vel szemben.

Ez lehetővé teszi, hogy a két dél-koreai APR1400 reaktor egység szerződését aláírják Dukovanyban, Dél-Csehországban. A szerződés az ország történetének legnagyobb energetikai beruházása, értéke legalább 400 milliárd korona (16 milliárd euró, 18 milliárd dollár).

A szerződést eredetileg márciusban írták volna alá, de a vesztes pályázók (EDF, Westinghouse) fellebbezései, dél-koreai politikai bizonytalanságok és a cseh cégek lokalizációs igényei miatt csúszott.

A KHNP januárban rendezte a szellemi tulajdonjogi vitát a Westinghouse-zal, amely korábban azt állította, hogy a KHNP az ő technológiáját használja az APR1400 reaktorokban.

A szerződés aláírása Dél-Korea első külföldi atomerőmű-építési projektje lesz 2009 óta, amikor a KHNP négy APR1400 reaktort épített az Egyesült Arab Emírségekben, Barakahban.

Csehországban hat kereskedelmi reaktor működik: négy orosz VVER-440-es Dukovanyban, két nagyobb VVER-1000-es Temelínben. Az IAEA szerint ezek az egységek a cseh áramtermelés mintegy 36,7%-át adják.

Az USA-nak „minél előbb” új reaktort kell építenie – mondta a DOE jelöltje a szenátusi bizottság előtt

Az USA-nak minél előbb új atomerőművet kell építenie, és elő kell mozdítania a fejlett reaktorok fejlesztését, engedélyezését és telepítését – hangzott el a szenátusi energiaügyi bizottság előtt.

Ted Garrish, aki a DOE nukleáris energiaügyi helyettes államtitkári posztjára jelöltként jelent meg, elmondta: az országnak új reaktort kell telepítenie, legyen az nagy, kis moduláris vagy mikroreaktor.

Az USA-ban jelenleg nincs épülő kereskedelmi atomerőmű, az utolsó kettő, a Vogtle-3 és Vogtle-4 2023-ban, illetve 2024-ben indult el Georgiában.

„A nukleáris energia kivételes lehetőség a növekvő villamosenergia-igény megbízható, megfizethető és biztonságos kielégítésére” – mondta Garrish, aki tapasztalt atomenergetikai vezető. Szerinte az USA-nak nemzetbiztonsági okokból is fejlesztenie kell a hazai urándúsító ipart.

Vizsgálni kell a nemzetközi piacot és a kormányközi megállapodások lehetőségét az amerikai nukleáris fejlesztők és ellátási láncok számára, valamint meg kell oldani a kiégett fűtőelemek elhelyezésének problémáját.

1987-ben a Kongresszus a nevadai Yucca Mountain-t jelölte ki a kiégett fűtőelemek végleges tárolóhelyének, de 2009-ben az Obama-adminisztráció leállította a projektet.

Az USA-ban az 1950-es évek óta mintegy 83 000 tonna radioaktív hulladék, köztük kiégett fűtőelem halmozódott fel, amelyet jelenleg acél- és betonkonténerekben tárolnak az erőművek telephelyein.

Garrish korábban a DOE nemzetközi ügyekért felelős helyettes államtitkára volt (2018–2021), jelenleg az Egyesült Haladó Atomenergia Szövetség igazgatótanácsának elnöke.

Egyéb hírek

Szlovénia közös munkát sürget az USA-val a nukleáris energiában:

Az USA és Horvátország tisztviselői együttműködésről tárgyaltak Közép- és Délkelet-Európa energiaellátásának diverzifikálása érdekében, különös tekintettel a kis moduláris reaktorokra (SMR). Horvátország és Szlovénia közösen tulajdonolja a szlovéniai Krško atomerőművet, amely egyetlen 696 MW-os nyomottvizes reaktorával Horvátország áramfogyasztásának 16%-át, Szlovéniáénak 20%-át adja. Szlovénia fontolgatja egy második blokk építését, de tavaly elhalasztotta az erről szóló népszavazást.Malawi engedélyezi a Kayelekera uránbánya újraindítását:

A Malawi Atomenergia Hatóság kiadta a sugárbiztonsági engedélyt a Lotus (Africa) Limited számára, így újraindulhat a Kayelekera uránbánya, amely több mint egy évtizede, 2014 óta állt a zuhanó uránárak és biztonsági problémák miatt. A bánya 85%-át az ausztrál Lotus Resources helyi leányvállalata birtokolja. A Lotus szerint a bánya újraindítása teljesen finanszírozott, kb. 43 millió dollár (37 millió euró) tőkével.Venezuela és Irán nukleáris együttműködést tervez:

Venezuela és Irán a nukleáris tudomány és technológia terén való együttműködésről tárgyalt. Az iráni állami média szerint Mohammad Eslami, az Iráni Atomenergia Szervezet vezetője és Alberto Quintero, Venezuela tudományos miniszterhelyettese egyetemi és kutatási programok elindításáról egyeztetett. Venezuelában nincs kereskedelmi atomerőmű, de 2010-ben Oroszországgal írt alá megállapodást új atomerőművek lehetőségéről. Iránnak egy működő atomerőműve van Bushehr-1-nél, egy másik ugyanott épül, mindkettőt Oroszország szállította. -

@ b6dcdddf:dfee5ee7

2025-05-06 15:58:23

@ b6dcdddf:dfee5ee7

2025-05-06 15:58:23You can now fund projects on Geyser using Credit Cards, Apple Pay, Bank Transfers, and more.

The best part: 🧾 You pay in fiat and ⚡️ the creator receives Bitcoin.

You heard it right! Let's dive in 👇

First, how does it work? For contributors, it's easy! Once the project creator has verified their identity, anyone can contribute with fiat methods. Simply go through the usual contribution flow and select 'Pay with Fiat'. The first contribution is KYC-free.

Why does this matter? 1. Many Bitcoiners don't want to spend their Bitcoin: 👉 Number go up (NgU) 👉 Capital gains taxes With fiat contributions, there's no more excuse to contribute towards Bitcoin builders and creators! 2. Non-bitcoin holders want to support projects too. If someone loves your mission but only has a debit card, they used to be stuck. Now? They can back your Bitcoin project with familiar fiat tools. Now, they can do it all through Geyser!

So, why swap fiat into Bitcoin? Because Bitcoin is borderless. Fiat payouts are limited to certain countries, banks, and red tape. By auto-swapping fiat to Bitcoin, we ensure: 🌍 Instant payouts to creators all around the world ⚡️ No delays or restrictions 💥 Every contribution is also a silent Bitcoin buy

How to enable Fiat contributions If you’re a creator, it’s easy: - Go to your Dashboard → Wallet - Click “Enable Fiat Contributions” - Complete a quick ID verification (required by our payment provider) ✅ That’s it — your project is now open to global fiat supporters.

Supporting Bitcoin adoption At Geyser, our mission is to empower Bitcoin creators and builders. Adding fiat options amplifies our mission. It brings more people into the ecosystem while staying true to what we believe: ⚒️ Build on Bitcoin 🌱 Fund impactful initiatives 🌎 Enable global participation

**Support projects with fiat now! ** We've compiled a list of projects that currently have fiat contributions enabled. If you've been on the fence to support them because you didn't want to spend your Bitcoin, now's the time to do your first contribution!

Education - Citadel Dispatch: https://geyser.fund/project/citadel - @FREEMadeiraOrg: https://geyser.fund/project/freemadeira - @MyfirstBitcoin_: https://geyser.fund/project/miprimerbitcoin

Circular Economies - @BitcoinEkasi: https://geyser.fund/project/bitcoinekasi - Madagascar Bitcoin: https://geyser.fund/project/madagasbit - @BitcoinChatt : https://geyser.fund/project/bitcoinchatt - Uganda Gayaza BTC Market: https://geyser.fund/project/gayazabtcmarket

Activism - Education Bitcoin Channel: https://geyser.fund/project/streamingsats

Sports - The Sats Fighter Journey: https://geyser.fund/project/thesatsfighterjourney

Culture - Bitcoin Tarot Cards: https://geyser.fund/project/bitcointarotcard

originally posted at https://stacker.news/items/973003

-

@ 40bdcc08:ad00fd2c

2025-05-06 14:24:22

@ 40bdcc08:ad00fd2c

2025-05-06 14:24:22Introduction

Bitcoin’s

OP_RETURNopcode, a mechanism for embedding small data in transactions, has ignited a significant debate within the Bitcoin community. Originally designed to support limited metadata while preserving Bitcoin’s role as a peer-to-peer electronic cash system,OP_RETURNis now at the center of proposals that could redefine Bitcoin’s identity. The immutable nature of Bitcoin’s timechain makes it an attractive platform for data storage, creating tension with those who prioritize its monetary function. This discussion, particularly around Bitcoin Core pull request #32406 (GitHub PR #32406), highlights a critical juncture for Bitcoin’s future.What is

OP_RETURN?Introduced in 2014,

OP_RETURNallows users to attach up to 80 bytes of data to a Bitcoin transaction. Unlike other transaction outputs,OP_RETURNoutputs are provably unspendable, meaning they don’t burden the Unspent Transaction Output (UTXO) set—a critical database for Bitcoin nodes. This feature was a compromise to provide a standardized, less harmful way to include metadata, addressing earlier practices that embedded data in ways that bloated the UTXO set. The 80-byte limit and restriction to oneOP_RETURNoutput per transaction are part of Bitcoin Core’s standardness rules, which guide transaction relay and mining but are not enforced by the network’s consensus rules (Bitcoin Stack Exchange).Standardness vs. Consensus Rules

Standardness rules are Bitcoin Core’s default policies for relaying and mining transactions. They differ from consensus rules, which define what transactions are valid across the entire network. For

OP_RETURN: - Consensus Rules: AllowOP_RETURNoutputs with data up to the maximum script size (approximately 10,000 bytes) and multiple outputs per transaction (Bitcoin Stack Exchange). - Standardness Rules: LimitOP_RETURNdata to 80 bytes and one output per transaction to discourage excessive data storage and maintain network efficiency.Node operators can adjust these policies using settings like

-datacarrier(enables/disablesOP_RETURNrelay) and-datacarriersize(sets the maximum data size, defaulting to 83 bytes to account for theOP_RETURNopcode and pushdata byte). These settings allow flexibility but reflect Bitcoin Core’s default stance on limiting data usage.The Proposal: Pull Request #32406

Bitcoin Core pull request #32406, proposed by developer instagibbs, seeks to relax these standardness restrictions (GitHub PR #32406). Key changes include: - Removing Default Size Limits: The default

-datacarriersizewould be uncapped, allowing largerOP_RETURNdata without a predefined limit. - Allowing Multiple Outputs: The restriction to oneOP_RETURNoutput per transaction would be lifted, with the total data size across all outputs subject to a configurable limit. - Deprecating Configuration Options: The-datacarrierand-datacarriersizesettings are marked as deprecated, signaling potential removal in future releases, which could limit node operators’ ability to enforce custom restrictions.This proposal does not alter consensus rules, meaning miners and nodes can already accept transactions with larger or multiple

OP_RETURNoutputs. Instead, it changes Bitcoin Core’s default relay policy to align with existing practices, such as miners accepting non-standard transactions via services like Marathon Digital’s Slipstream (CoinDesk).Node Operator Flexibility

Currently, node operators can customize

OP_RETURNhandling: - Default Settings: Relay transactions with oneOP_RETURNoutput up to 80 bytes. - Custom Settings: Operators can disableOP_RETURNrelay (-datacarrier=0) or adjust the size limit (e.g.,-datacarriersize=100). These options remain in #32406 but are deprecated, suggesting that future Bitcoin Core versions might not support such customization, potentially standardizing the uncapped policy.Arguments in Favor of Relaxing Limits

Supporters of pull request #32406 and similar proposals argue that the current restrictions are outdated and ineffective. Their key points include: - Ineffective Limits: Developers bypass the 80-byte limit using methods like Inscriptions, which store data in other transaction parts, often at higher cost and inefficiency (BitcoinDev Mailing List). Relaxing

OP_RETURNcould channel data into a more efficient format. - Preventing UTXO Bloat: By encouragingOP_RETURNuse, which doesn’t affect the UTXO set, the proposal could reduce reliance on harmful alternatives like unspendable Taproot outputs used by projects like Citrea’s Clementine bridge. - Supporting Innovation: Projects like Citrea require more data (e.g., 144 bytes) for security proofs, and relaxed limits could enable new Layer 2 solutions (CryptoSlate). - Code Simplification: Developers like Peter Todd argue that these limits complicate Bitcoin Core’s codebase unnecessarily (CoinGeek). - Aligning with Practice: Miners already process non-standard transactions, and uncapping defaults could improve fee estimation and reduce reliance on out-of-band services, as noted by ismaelsadeeq in the pull request discussion.In the GitHub discussion, developers like Sjors and TheCharlatan expressed support (Concept ACK), citing these efficiency and innovation benefits.

Arguments Against Relaxing Limits

Opponents, including prominent developers and community members, raise significant concerns about the implications of these changes: - Deviation from Bitcoin’s Purpose: Critics like Luke Dashjr, who called the proposal “utter insanity,” argue that Bitcoin’s base layer should prioritize peer-to-peer cash, not data storage (CoinDesk). Jason Hughes warned it could turn Bitcoin into a “worthless altcoin” (BeInCrypto). - Blockchain Bloat: Additional data increases the storage and processing burden on full nodes, potentially making node operation cost-prohibitive and threatening decentralization (CryptoSlate). - Network Congestion: Unrestricted data could lead to “spam” transactions, raising fees and hindering Bitcoin’s use for financial transactions. - Risk of Illicit Content: The timechain’s immutability means data, including potentially illegal or objectionable content, is permanently stored on every node. The 80-byte limit acts as a practical barrier, and relaxing it could exacerbate this issue. - Preserving Consensus: Developers like John Carvalho view the limits as a hard-won community agreement, not to be changed lightly.

In the pull request discussion, nsvrn and moth-oss expressed concerns about spam and centralization, advocating for gradual changes. Concept NACKs from developers like wizkid057 and Luke Dashjr reflect strong opposition.

Community Feedback

The GitHub discussion for pull request #32406 shows a divided community: - Support (Concept ACK): Sjors, polespinasa, ismaelsadeeq, miketwenty1, TheCharlatan, Psifour. - Opposition (Concept NACK): wizkid057, BitcoinMechanic, Retropex, nsvrn, moth-oss, Luke Dashjr. - Other: Peter Todd provided a stale ACK, indicating partial or outdated support.

Additional discussions on the BitcoinDev mailing list and related pull requests (e.g., #32359 by Peter Todd) highlight similar arguments, with #32359 proposing a more aggressive removal of all

OP_RETURNlimits and configuration options (GitHub PR #32359).| Feedback Type | Developers | Key Points | |---------------|------------|------------| | Concept ACK | Sjors, ismaelsadeeq, others | Improves efficiency, supports innovation, aligns with mining practices. | | Concept NACK | Luke Dashjr, wizkid057, others | Risks bloat, spam, centralization, and deviation from Bitcoin’s purpose. | | Stale ACK | Peter Todd | Acknowledges proposal but with reservations or outdated support. |

Workarounds and Their Implications

The existence of workarounds, such as Inscriptions, which exploit SegWit discounts to embed data, is a key argument for relaxing

OP_RETURNlimits. These methods are costlier and less efficient, often costing more thanOP_RETURNfor data under 143 bytes (BitcoinDev Mailing List). Supporters argue that formalizing largerOP_RETURNdata could streamline these use cases. Critics, however, see workarounds as a reason to strengthen, not weaken, restrictions, emphasizing the need to address underlying incentives rather than accommodating bypasses.Ecosystem Pressures

External factors influence the debate: - Miners: Services like Marathon Digital’s Slipstream process non-standard transactions for a fee, showing that market incentives already bypass standardness rules. - Layer 2 Projects: Citrea’s Clementine bridge, requiring more data for security proofs, exemplifies the demand for relaxed limits to support innovative applications. - Community Dynamics: The debate echoes past controversies, like the Ordinals debate, where data storage via inscriptions raised similar concerns about Bitcoin’s purpose (CoinDesk).

Bitcoin’s Identity at Stake

The

OP_RETURNdebate is not merely technical but philosophical, questioning whether Bitcoin should remain a focused monetary system or evolve into a broader data platform. Supporters see relaxed limits as a pragmatic step toward efficiency and innovation, while opponents view them as a risk to Bitcoin’s decentralization, accessibility, and core mission. The community’s decision will have lasting implications, affecting node operators, miners, developers, and users.Conclusion

As Bitcoin navigates this crossroads, the community must balance the potential benefits of relaxed

OP_RETURNlimits—such as improved efficiency and support for new applications—against the risks of blockchain bloat, network congestion, and deviation from its monetary roots. The ongoing discussion, accessible via pull request #32406 on GitHub (GitHub PR #32406). Readers are encouraged to explore the debate and contribute to ensuring that any changes align with Bitcoin’s long-term goals as a decentralized, secure, and reliable system. -

@ 8f69ac99:4f92f5fd

2025-05-06 14:21:13

@ 8f69ac99:4f92f5fd

2025-05-06 14:21:13A concepção popular de "anarquia" evoca frequentemente caos, colapso e violência. Mas e se anarquia significasse outra coisa? E se representasse um mundo onde as pessoas cooperam e se coordenam sem autoridades impostas? E se implicasse liberdade, ordem voluntária e resiliência—sem coerção?

Bitcoin é um dos raros exemplos funcionais de princípios anarquistas em acção. Não tem CEO, nem Estado, nem planeador central—e, no entanto, o sistema funciona. Faz cumprir regras. Propõe um novo modelo de governação e oferece uma exploração concreta do anarcocapitalismo.

Para o compreendermos, temos de mudar de perspectiva. Bitcoin não é apenas software ou um instrumento de investimento—é um sistema vivo: uma ordem espontânea.

Ordem Espontânea, Teoria dos Jogos e o Papel dos Incentivos Económicos

Na política e economia contemporâneas, presume-se geralmente que a ordem tem de vir de cima. Governos, corporações e burocracias são vistos como essenciais para organizar a sociedade em grande escala.

Mas esta crença nem sempre se verifica.

Os mercados surgem espontaneamente da troca. A linguagem evolui sem supervisão central. Projectos de código aberto prosperam graças a contribuições voluntárias. Nenhum destes sistemas precisa de um rei—e, no entanto, têm estrutura e funcionam.

Bitcoin insere-se nesta tradição de ordens emergentes. Não é ditado por uma entidade única, mas é governado através de código, consenso dos utilizadores e incentivos económicos que recompensam a cooperação e penalizam a desonestidade.

Código Como Constituição

Bitcoin funciona com base num conjunto de regras de software transparentes e verificáveis. Estas regras determinam quem pode adicionar blocos, com que frequência, o que constitui uma transacção válida e como são criadas novas moedas.

Estas regras não são impostas por exércitos nem pela polícia. São mantidas por uma rede descentralizada de milhares de nós, cada um a correr voluntariamente software que valida o cumprimento das regras. Se alguém tentar quebrá-las, o resto da rede simplesmente rejeita a sua versão.

Isto não é governo por maioria—é aceitação baseada em regras.

Cada operador de nó escolhe qual versão do software quer executar. Se uma alteração proposta não tiver consenso suficiente, não se propaga. Foi assim que as "guerras do tamanho do bloco" foram resolvidas—não por votação, mas através de sinalização do que os utilizadores estavam dispostos a aceitar.

Este modelo de governação ascendente é voluntário, sem permissões, e extraordinariamente resiliente. Representa um novo paradigma de sistemas autorregulados.

Mineiros, Incentivos e a Segurança Baseada na Teoria dos Jogos

Bitcoin assegura a sua rede utilizando a Teoria de Jogos. Os mineiros que seguem o protocolo são recompensados financeiramente. Quem tenta enganar—como reescrever blocos ou gastar duas vezes—sofre perdas financeiras e desperdiça recursos.

Agir honestamente é mais lucrativo.

A genialidade de Bitcoin está em alinhar incentivos egoístas com o bem comum. Elimina a necessidade de confiar em administradores ou esperar benevolência. Em vez disso, torna a fraude economicamente irracional.

Isto substitui o modelo tradicional de "confiar nos líderes" por um mais robusto: construir sistemas onde o mau comportamento é desencorajado por design.

Isto é segurança anarquista—não a ausência de regras, mas a ausência de governantes.

Associação Voluntária e Confiança Construída em Consenso

Qualquer pessoa pode usar Bitcoin. Não há controlo de identidade, nem licenças, nem processo de aprovação. Basta descarregar o software e começar a transaccionar.

Ainda assim, Bitcoin não é um caos desorganizado. Os utilizadores seguem regras rigorosas do protocolo. Porquê? Porque é o consenso que dá valor às "moedas". Sem ele, a rede fragmenta-se e falha.

É aqui que Bitcoin desafia as ideias convencionais sobre anarquia. Mostra que sistemas voluntários podem gerar estabilidade—não porque as pessoas são altruístas, mas porque os incentivos bem desenhados tornam a cooperação a escolha racional.

Bitcoin é sem confiança (trustless), mas promove confiança.

Uma Prova de Conceito Viva

Muitos acreditam que, sem controlo central, a sociedade entraria em colapso. Bitcoin prova que isso não é necessariamente verdade.

É uma rede monetária global, sem permissões, capaz de fazer cumprir direitos de propriedade, coordenar recursos e resistir à censura—sem uma autoridade central. Baseia-se apenas em regras, incentivos e participação voluntária.

Bitcoin não é um sistema perfeito. É um projecto dinâmico, em constante evolução. Mas isso faz parte do que o torna tão relevante: é real, está a funcionar e continua a melhorar.

Conclusão

A anarquia não tem de significar caos. Pode significar cooperação sem coerção. Bitcoin prova isso.

Procuramos, desesperados, por alternativas às instituições falhadas, inchadas e corruptas. Bitcoin oferece mais do que dinheiro digital. É uma prova viva de que podemos construir sociedades descentralizadas, eficientes e justas.

E isso, por si só, já é revolucionário.

Photo by Floris Van Cauwelaert on Unsplash

-

@ 90c656ff:9383fd4e

2025-05-06 14:10:48

@ 90c656ff:9383fd4e

2025-05-06 14:10:48Bitcoin has been gaining increasing acceptance as a means of payment, evolving from being just a digital investment asset to becoming a viable alternative to traditional currencies. Today, many companies around the world already accept Bitcoin, providing consumers with greater financial freedom and reducing reliance on traditional banking intermediaries.

- Global companies that accept Bitcoin

Over the years, several well-known companies have begun accepting Bitcoin, recognizing its benefits such as security, transparency, and low transaction fees. Among the most prominent are:

01 - Microsoft: The tech giant allows users to add funds to their Microsoft accounts using Bitcoin. This enables the purchase of digital content such as games, apps, and software available in the Microsoft Store. 02 - Overstock: One of the largest online retailers that accepts Bitcoin for the purchase of furniture, electronics, and home goods. Overstock was an early adopter, signaling a strong commitment to financial innovation. 03 - AT&T: The U.S. telecommunications company was the first in its industry to accept Bitcoin payments, giving customers the option to pay their bills with cryptocurrency through BitPay. 04 - Twitch: While Twitch does not natively support Bitcoin donations or payments, many streamers use third-party services like NOWPayments, Streamlabs (with Coinbase integration), or Plisio to accept crypto tips and donations. This opens a path for Bitcoin support through external platforms, especially within the content creator community. 05 - Namecheap: A leading domain registrar and web hosting provider that accepts Bitcoin for domain registration and hosting services, showcasing Bitcoin’s usefulness in the digital economy.

- Small businesses and local commerce

Beyond large corporations, a growing number of small businesses and local merchants are embracing Bitcoin, particularly in cities that are becoming hubs for digital innovation.

01 - Restaurants and cafés: In cities like Lisbon, London, and New York, several cafés and eateries accept Bitcoin as payment, attracting tech-savvy customers. 02 - Hotels and tourism: Certain hotel chains and travel platforms now accept Bitcoin, simplifying bookings and removing the need for currency exchange for international travelers. 03 - Online stores: Many small e-commerce businesses offer Bitcoin as a payment option or even operate exclusively using cryptocurrency, benefiting from borderless, fast transactions.

- Advantages for businesses and consumers

The growing acceptance of Bitcoin is largely driven by its advantages:

01 - Lower transaction fees: Businesses can reduce costs associated with credit card fees and payment processors. 02 - No intermediaries: Direct peer-to-peer payments cut down on bureaucracy and reduce fraud risks. 03 - Global access: Bitcoin allows for cross-border payments without the need for currency exchange, ideal for international transactions.

In summary, the adoption of Bitcoin as a means of payment continues to expand, with companies of all sizes recognizing its strategic value. From large enterprises to independent creators and local shops, Bitcoin is gradually becoming a more practical and accepted financial tool. While challenges such as volatility and regulatory uncertainty remain, the broader trend points toward a future where paying with Bitcoin could be a common part of everyday life.

Thank you very much for reading this far. I hope everything is well with you, and sending a big hug from your favorite Bitcoiner maximalist from Madeira. Long live freedom!

-

@ c1e9ab3a:9cb56b43

2025-05-06 14:05:40

@ c1e9ab3a:9cb56b43

2025-05-06 14:05:40If you're an engineer stepping into the Bitcoin space from the broader crypto ecosystem, you're probably carrying a mental model shaped by speed, flexibility, and rapid innovation. That makes sense—most blockchain platforms pride themselves on throughput, programmability, and dev agility.

But Bitcoin operates from a different set of first principles. It’s not competing to be the fastest network or the most expressive smart contract platform. It’s aiming to be the most credible, neutral, and globally accessible value layer in human history.

Here’s why that matters—and why Bitcoin is not just an alternative crypto asset, but a structural necessity in the global financial system.

1. Bitcoin Fixes the Triffin Dilemma—Not With Policy, But Protocol

The Triffin Dilemma shows us that any country issuing the global reserve currency must run persistent deficits to supply that currency to the world. That’s not a flaw of bad leadership—it’s an inherent contradiction. The U.S. must debase its own monetary integrity to meet global dollar demand. That’s a self-terminating system.

Bitcoin sidesteps this entirely by being:

- Non-sovereign – no single nation owns it

- Hard-capped – no central authority can inflate it

- Verifiable and neutral – anyone with a full node can enforce the rules

In other words, Bitcoin turns global liquidity into an engineering problem, not a political one. No other system, fiat or crypto, has achieved that.

2. Bitcoin’s “Ossification” Is Intentional—and It's a Feature

From the outside, Bitcoin development may look sluggish. Features are slow to roll out. Code changes are conservative. Consensus rules are treated as sacred.

That’s the point.

When you’re building the global monetary base layer, stability is not a weakness. It’s a prerequisite. Every other financial instrument, app, or protocol that builds on Bitcoin depends on one thing: assurance that the base layer won’t change underneath them without extreme scrutiny.

So-called “ossification” is just another term for predictability and integrity. And when the market does demand change (SegWit, Taproot), Bitcoin’s soft-fork governance process has proven capable of deploying it safely—without coercive central control.

3. Layered Architecture: Throughput Is Not a Base Layer Concern

You don’t scale settlement at the base layer. You build layered systems. Just as TCP/IP doesn't need to carry YouTube traffic directly, Bitcoin doesn’t need to process every microtransaction.

Instead, it anchors:

- Lightning (fast payments)

- Fedimint (community custody)

- Ark (privacy + UTXO compression)

- Statechains, sidechains, and covenants (coming evolution)

All of these inherit Bitcoin’s security and scarcity, while handling volume off-chain, in ways that maintain auditability and self-custody.

4. Universal Assayability Requires Minimalism at the Base Layer

A core design constraint of Bitcoin is that any participant, anywhere in the world, must be able to independently verify the validity of every transaction and block—past and present—without needing permission or relying on third parties.

This property is called assayability—the ability to “test” or verify the authenticity and integrity of received bitcoin, much like verifying the weight and purity of a gold coin.

To preserve this:

- The base layer must remain resource-light, so running a full node stays accessible on commodity hardware.

- Block sizes must remain small enough to prevent centralization of verification.

- Historical data must remain consistent and tamper-evident, enabling proof chains across time and jurisdiction.

Any base layer that scales by increasing throughput or complexity undermines this fundamental guarantee, making the network more dependent on trust and surveillance infrastructure.

Bitcoin prioritizes global verifiability over throughput—because trustless money requires that every user can check the money they receive.

5. Governance: Not Captured, Just Resistant to Coercion

The current controversy around

OP_RETURNand proposals to limit inscriptions is instructive. Some prominent devs have advocated for changes to block content filtering. Others see it as overreach.Here's what matters:

- No single dev, or team, can force changes into the network. Period.

- Bitcoin Core is not “the source of truth.” It’s one implementation. If it deviates from market consensus, it gets forked, sidelined, or replaced.

- The economic majority—miners, users, businesses—enforce Bitcoin’s rules, not GitHub maintainers.

In fact, recent community resistance to perceived Core overreach only reinforces Bitcoin’s resilience. Engineers who posture with narcissistic certainty, dismiss dissent, or attempt to capture influence are routinely neutralized by the market’s refusal to upgrade or adopt forks that undermine neutrality or openness.

This is governance via credible neutrality and negative feedback loops. Power doesn’t accumulate in one place. It’s constantly checked by the network’s distributed incentives.

6. Bitcoin Is Still in Its Infancy—And That’s a Good Thing