-

@ 609f186c:0aa4e8af

2025-05-16 20:57:43

@ 609f186c:0aa4e8af

2025-05-16 20:57:43Google says that Android 16 is slated to feature an optional high security mode. Cool.

Advanced Protection has a bunch of requested features that address the kinds of threats we worry about.

It's the kind of 'turn this one thing on if you face elevated risk' that we've been asking for from Google.

And likely reflects some learning after Google watched Apple 's Lockdown Mode play out. I see a lot of value in this..

Here are some features I'm excited to see play out:

The Intrusion Logging feature is interesting & is going to impose substantial cost on attackers trying to hide evidence of exploitation. Logs get e2ee encrypted into the cloud. This one is spicy.

The Offline Lock, Inactivity Reboot & USB protection will frustrate non-consensual attempts to physically grab device data.

Memory Tagging Extension is going to make a lot of attack & exploitation categories harder.

2G Network Protection & disabling Auto-connect to insecure networks are going to address categories of threat from things like IMSI catchers & hostile WiFi.

I'm curious about some other features such as:

Spam & Scam detection: Google messages feature that suggests message content awareness and some kind of scanning.

Scam detection for Phone by Google is interesting & coming later. The way it is described suggests phone conversation awareness. This also addresses a different category of threat than the stuff above. I can see it addressing a whole category of bad things that regular users (& high risk ones too!) face. Will be curious how privacy is addressed or if this done purely locally. Getting messy: Friction points? I see Google thinking these through, but I'm going to add a potential concern: what will users do when they encounter friction? Will they turn this off & forget to re-enable? We've seen users turn off iOS Lockdown Mode when they run into friction for specific websites or, say, legacy WiFi. They then forget to turn it back on. And stay vulnerable.

Bottom line: users disabling Apple's Lockdown Mode for a temporary thing & leaving it off because they forget to turn it on happens a lot. This is a serious % of users in my experience...

And should be factored into design decisions for similar modes. I feel like a good balance is a 'snooze button' or equivalent so that users can disable all/some features for a brief few minute period to do something they need to do, and then auto re-enable.

Winding up:

I'm excited to see how Android Advanced Protection plays with high risk users' experiences. I'm also super curious whether the spam/scam detection features may also be helpful to more vulnerable users (think: aging seniors)...

Niche but important:

Some users, esp. those that migrated to security & privacy-focused Android distros because of because of the absence of such a feature are clear candidates for it... But they may also voice privacy concerns around some of the screening features. Clear communication from the Google Security / Android team will be key here.

-

@ b83a28b7:35919450

2025-05-16 19:26:56

@ b83a28b7:35919450

2025-05-16 19:26:56This article was originally part of the sermon of Plebchain Radio Episode 111 (May 2, 2025) that nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqyg8wumn8ghj7mn0wd68ytnvv9hxgqpqtvqc82mv8cezhax5r34n4muc2c4pgjz8kaye2smj032nngg52clq7fgefr and I did with nostr:nprofile1qythwumn8ghj7ct5d3shxtnwdaehgu3wd3skuep0qyt8wumn8ghj7ct4w35zumn0wd68yvfwvdhk6tcqyzx4h2fv3n9r6hrnjtcrjw43t0g0cmmrgvjmg525rc8hexkxc0kd2rhtk62 and nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqyg8wumn8ghj7mn0wd68ytnvv9hxgqpq4wxtsrj7g2jugh70pfkzjln43vgn4p7655pgky9j9w9d75u465pqahkzd0 of the nostr:nprofile1qythwumn8ghj7ct5d3shxtnwdaehgu3wd3skuep0qyt8wumn8ghj7etyv4hzumn0wd68ytnvv9hxgtcqyqwfvwrccp4j2xsuuvkwg0y6a20637t6f4cc5zzjkx030dkztt7t5hydajn

Listen to the full episode here:

<<https://fountain.fm/episode/Ln9Ej0zCZ5dEwfo8w2Ho>>

Bitcoin has always been a narrative revolution disguised as code. White paper, cypherpunk lore, pizza‑day legends - every block is a paragraph in the world’s most relentless epic. But code alone rarely converts the skeptic; it’s the camp‑fire myth that slips past the prefrontal cortex and shakes hands with the limbic system. People don’t adopt protocols first - they fall in love with protagonists.

Early adopters heard the white‑paper hymn, but most folks need characters first: a pizza‑day dreamer; a mother in a small country, crushed by the cost of remittance; a Warsaw street vendor swapping złoty for sats. When their arcs land, the brain releases a neurochemical OP_RETURN which says, “I belong in this plot.” That’s the sly roundabout orange pill: conviction smuggled inside catharsis.

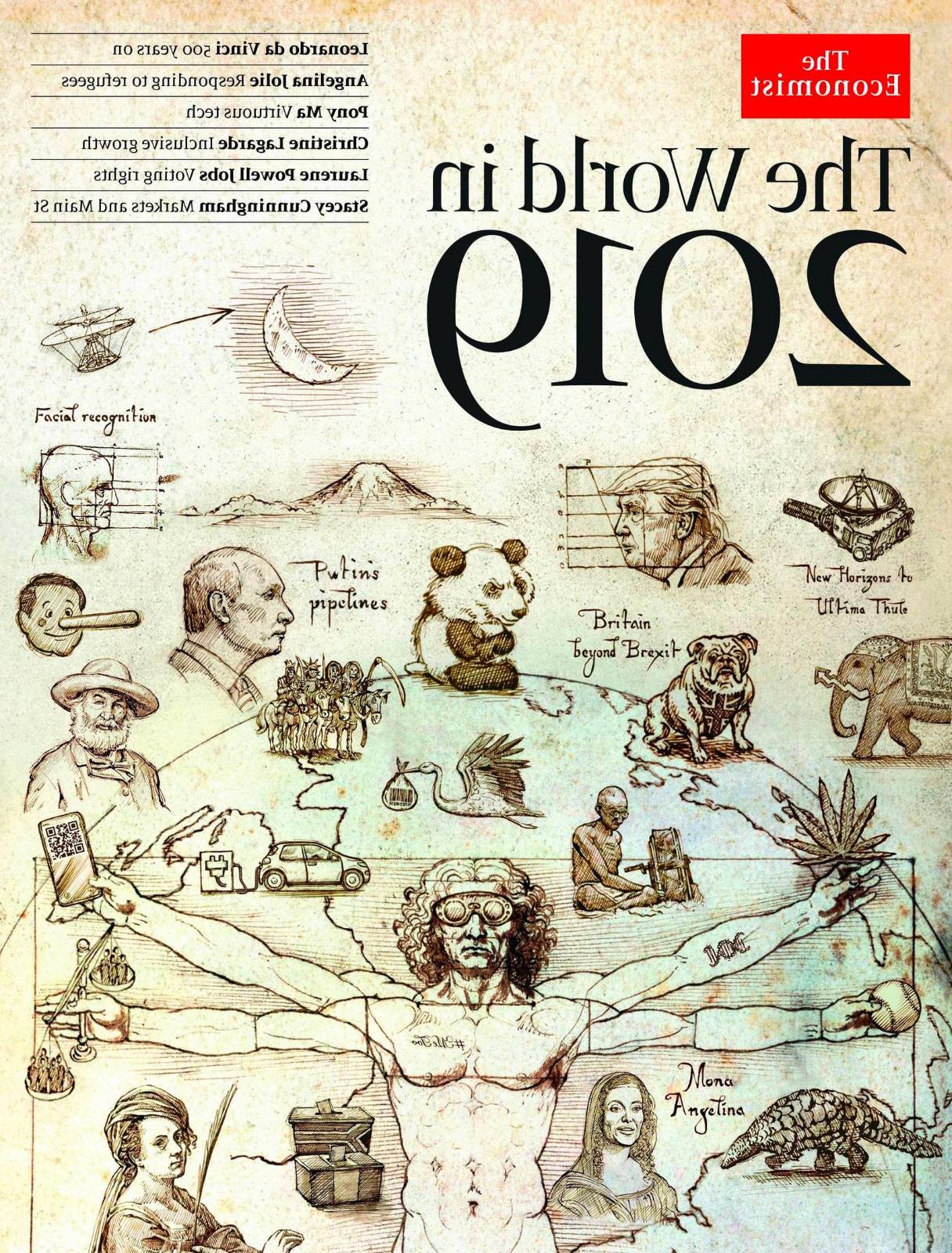

That’s why, from 22–25 May in Warsaw’s Kinoteka, the Bitcoin Film Fest is loading its reels with rebellion. Each documentary, drama, and animated rabbit‑hole is a stealth wallet, zipping conviction straight into the feels of anyone still clasped within the cold claw of fiat. You come for the plot, you leave checking block heights.

Here's the clip of the sermon from the episode:

nostr:nevent1qvzqqqqqqypzpwp69zm7fewjp0vkp306adnzt7249ytxhz7mq3w5yc629u6er9zsqqsy43fwz8es2wnn65rh0udc05tumdnx5xagvzd88ptncspmesdqhygcrvpf2

-

@ 005bc4de:ef11e1a2

2025-05-17 13:40:23

@ 005bc4de:ef11e1a2

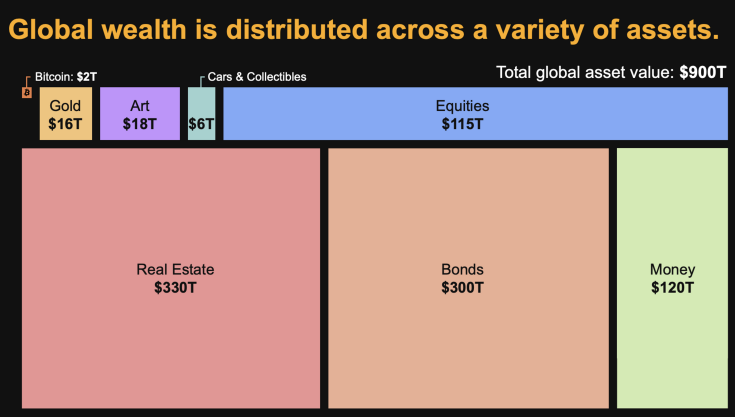

2025-05-17 13:40:23Bitcoin, sats, bits, numbers, and perceptions

Quick background

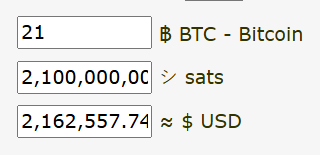

In December 2024 John Carvalho proposed BIP 21Q titled "Redefinition of the Bitcoin Unit to the Base Denomination." His point: the word "bitcoin" should not refer to the 21 million bitcoins we hear about, but to what we currently call "sats", the "base" unit of bitcoin. There are 2.1 quadrillion sats. So, instead of saying there are 21 million bitcoin, BIP 21Q suggests saying there are 2.1 quadrillion.

There'd be absolutely zero change to Bitcoin, the protocol, with this BIP (unlike the OP_CAT or more current OP_RETURN debates). This is just a movement to get people to change the way they talk about and refer to "bitcoin." BIP 21Q is just a rewording, a rephrasing, a rebranding, a rethinking.

Since

Since then, there has been discussion. I'll admit it's interesting to talk about, but I've never thought much of it. My take has been, and frankly still is: this too will pass. I hadn't heard or thought of this in a couple of months. Until...

In the past couple of days though, like a campfire that has been slowly dying down, a sudden rush of wind has fanned the embers and the flames have sparked upward. As best I can tell, that wind came out of the mouth (or typing) of Jack Dorsey (Twitter founder, Square/Block CEO, billionaire, you know Jack) when he put this note out.

Watch the vid on YouTube.

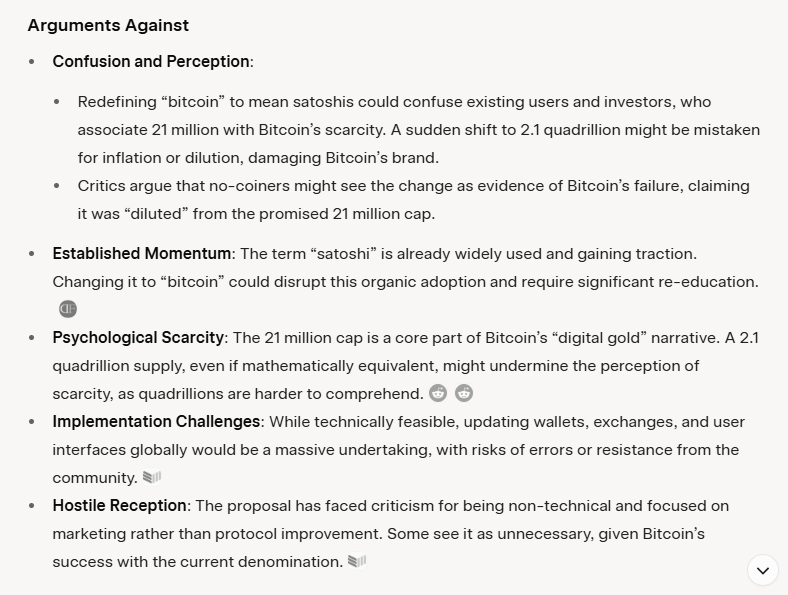

The video makes some good points, both against and in favor of BIP 21Q. Quickly, Grok summarized the arguments for and against, below:

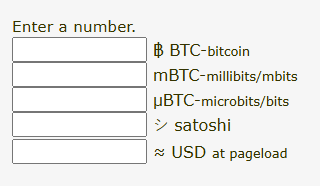

Today, I even read chatter about a middle ground compromise to use "bits" as the base unit. In other words, don't use "sats" but use "bits." I guess the idea is that a bitcoin can stay one of 21 million, but "bits," which sounds like little bitcoins, can be the 2.1 quadrillion. "Oh brother," I thought, even more confusion. We've been through this back in the 20-teens with bits, ubits, and mbits. This was a main reason I made the Satoshi Bitcoin Converter because it was confusing! I'm happy we were past all this, but then...it's back!

Just for kicks, you can fool around with the old SBC version 7 and find out how confusing it is.

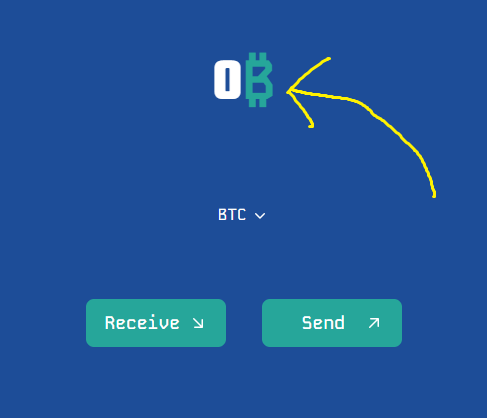

One of the arguments in the video is that the BoardwalkCash.com folks have adopted "bitcoin" as their base unit. Boardwalk Cash is a cashu/ecash (and Lightning) web app with the intention of making spending and receiving small, coffee-sized payments easy.

Notice the bitcoin B after the zero, not "sats" or a satoshi symbol, like the one I proposed: シ 😃

Below, I sent 21 sats (bitcoins?) from a different ecash/cashu wallet. And, boom, there they appear in Boardwalk Cash. Notice how it appears as 21₿, as 21 bitcoin. Then, when I click it, it shows $0.02 USD, two pennies.

I didn't actually send 21 what-we-think-of-today bitcoins, worth $2.16 million. I sent two US pennies worth.

By the way, if you've never messed around with ecash/cashu and wish to try it out, get a wallet and I'll send you a few sats (bitcoins?) as ecash to see how easy it is. These images are from Boardwalkcash.com which is very clean, however I use Cashu.me.

And so...

And so, this is the main argument against, in my view: possible confusion. The other issue would be the changeover by things like exchanges or maybe even smart contracts that bridge BTC to other chains. Having worked on my little converter app, I know that it can be easy to make a decimal mistake in the code and throw everything off. I'm certain that, should we move to 2.1 quadrillion bitcoins, somebody will foul up an interface or back end which might cause a big problem, maybe some big losses.

Two things here:

On the more technical side, the changing of names and code on exchanges or smart contracts, it would almost be better if there was a hard-and-fast, set changeover date, like there was with Y2K. There is a clear before-and-after, B.C. and A.D. date. Call it, "BQ" and "AQ", before and after quadrillion. 😂 If there was a date/time where everything was 21M "bitcoin" to 2.1Q "bitcoin", that would force the issue.

However, there is not such a date or time, nor will there be...recall that bitcoin is decentralized, no CEO here. If this 2.1Q change actually happens, the reality is that it will be a rolling, gradual, thing. It will be case by case, app by app, exchange by exchange. And some won't make the change at all. This lends back to the confusion situation.

Secondly, on the human perception side, this actually concerns me less. We can change human perception. It takes some time, but human perception and thinking is very plastic and can definitely be molded. Heaven knows the examples of how this has been used the wrong way in history, umm, anything like this go on in World War II?

Quick case studies of changing perception:

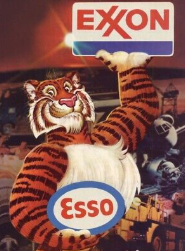

Standard Oil (John D. Rockefeller's company) was essentially a monopoly and was broken up by the U.S., remember that from history class? They had a multitude of sub-brands, one of which was "Esso", get it?, S.O., Standard Oil? They wanted to move away from ties to Standard Oil, at least perception-wise, and wanted to consolidate all their sub-brands. They moved to "Exxon" with a marketing campaign. The marketing types were brilliant. They understood that there is a time thing involved. Unlike the Y2K hard date above, they knew that human perception, as malleable as it is, changes over time. Rather than fight this, they used this to their advantage.

As I understand, one of their techniques was to use the visual. The Esso sign was shown in places with the Esso logo up high and prominent. But, down below, was the never-before-seen Exxon sign. It was just there, doing nothing. Doing nothing except implanting itself into the subconscious of the viewers. Then, the Exxon sign, in later ads, appeared higher. The Esso sign lowered and was less prominent. Hmm? What's going on? Does anyone even notice? Hmm? Then, in the coup, the tiger mascot literally lowered the Esso sign down and raised the Exxon sign up.

In the final coup d'état, the Esso sign simply disappeared. And, make no mistake, this is the coup de grâce...the word Esso just disappeared. It was no longer seen at all. Then, it was forgotten and it was gone. Now, there is Exxon.

More recently, we all know that Twitter rebranded to X. It seemed so dumb, definitely awkward, I'm still not entirely used to it, people still write, "...so-and-so posted on X, formerly Twitter,..." (as if no one knows that X is formerly Twitter), I still say people "tweet" on X, but it's changing. I now hear reference to what so-and-so said "on X", with no mention of Twitter. It's changing. Time...it'll change...Twitter will stop being mentioned, Twitter will be a part of history, like Esso.

What'll happen with 21Q?

Nothing. I fully predict that this 2.1 quadrillion bitcoins thing will go nowhere. One of the main reasons for moving to replace "sats" as "bitcoins" is the perception that 1 bitcoin is unattainable and that people know "bitcoin," but don't know "sats." A bull bitcoin is out of reach for most people, but sats are attainable by everyone with a wallet. And, if they don't know ther term "sats," it's probably easier to change that perception (to educate them on sats) than it is to change and possibly confuse their knowledge of 21M bitcoins with 2.1Q bitcoins. It's probably easier to educate on "sats" than it is to change all the backends on exchanges and smart contracts and front ends (and some won't change at all, which will add more to confusion).

Solution: educate

Practical solution: if you think you might be speaking to a "normie" audience, make it a point to use the phrase "bitcoin sats." Over time, as people acquire and use sats to buy burgers, they'll know that sats means 1 of 2.1 quadrillion, but a bitcoin is 1 of 21 million. This is the Esso tiger lowering "bitcoin" and raising "sats."

-

@ c631e267:c2b78d3e

2025-05-16 18:40:18

@ c631e267:c2b78d3e

2025-05-16 18:40:18Die zwei mächtigsten Krieger sind Geduld und Zeit. \ Leo Tolstoi

Zum Wohle unserer Gesundheit, unserer Leistungsfähigkeit und letztlich unseres Glücks ist es wichtig, die eigene Energie bewusst zu pflegen. Das gilt umso mehr für an gesellschaftlichen Themen interessierte, selbstbewusste und kritisch denkende Menschen. Denn für deren Wahrnehmung und Wohlbefinden waren und sind die rasanten, krisen- und propagandagefüllten letzten Jahre in Absurdistan eine harte Probe.

Nur wer regelmäßig Kraft tankt und Wege findet, mit den Herausforderungen umzugehen, kann eine solche Tortur überstehen, emotionale Erschöpfung vermeiden und trotz allem zufrieden sein. Dazu müssen wir erkunden, was uns Energie gibt und was sie uns raubt. Durch Selbstreflexion und Achtsamkeit finden wir sicher Dinge, die uns erfreuen und inspirieren, und andere, die uns eher stressen und belasten.

Die eigene Energie ist eng mit unserer körperlichen und mentalen Gesundheit verbunden. Methoden zur Förderung der körperlichen Gesundheit sind gut bekannt: eine ausgewogene Ernährung, regelmäßige Bewegung sowie ausreichend Schlaf und Erholung. Bei der nicht minder wichtigen emotionalen Balance wird es schon etwas komplizierter. Stress abzubauen, die eigenen Grenzen zu kennen oder solche zum Schutz zu setzen sowie die Konzentration auf Positives und Sinnvolles wären Ansätze.

Der emotionale ist auch der Bereich, über den «Energie-Räuber» bevorzugt attackieren. Das sind zum Beispiel Dinge wie Überforderung, Perfektionismus oder mangelhafte Kommunikation. Social Media gehören ganz sicher auch dazu. Sie stehlen uns nicht nur Zeit, sondern sind höchst manipulativ und erhöhen laut einer aktuellen Studie das Risiko für psychische Probleme wie Angstzustände und Depressionen.

Geben wir negativen oder gar bösen Menschen keine Macht über uns. Das Dauerfeuer der letzten Jahre mit Krisen, Konflikten und Gefahren sollte man zwar kennen, darf sich aber davon nicht runterziehen lassen. Das Ziel derartiger konzertierter Aktionen ist vor allem, unsere innere Stabilität zu zerstören, denn dann sind wir leichter zu steuern. Aber Geduld: Selbst vermeintliche «Sonnenköniginnen» wie EU-Kommissionspräsidentin von der Leyen fallen, wenn die Zeit reif ist.

Es ist wichtig, dass wir unsere ganz eigenen Bedürfnisse und Werte erkennen. Unsere Energiequellen müssen wir identifizieren und aktiv nutzen. Dazu gehören soziale Kontakte genauso wie zum Beispiel Hobbys und Leidenschaften. Umgeben wir uns mit Sinnhaftigkeit und lassen wir uns nicht die Energie rauben!

Mein Wahlspruch ist schon lange: «Was die Menschen wirklich bewegt, ist die Kultur.» Jetzt im Frühjahr beginnt hier in Andalusien die Zeit der «Ferias», jener traditionellen Volksfeste, die vor Lebensfreude sprudeln. Konzentrieren wir uns auf die schönen Dinge und auf unsere eigenen Talente – soziale Verbundenheit wird helfen, unsere innere Kraft zu stärken und zu bewahren.

[Titelbild: Pixabay]

Dieser Beitrag wurde mit dem Pareto-Client geschrieben und ist zuerst auf Transition News erschienen.

-

@ 04c915da:3dfbecc9

2025-05-16 18:06:46

@ 04c915da:3dfbecc9

2025-05-16 18:06:46Bitcoin has always been rooted in freedom and resistance to authority. I get that many of you are conflicted about the US Government stacking but by design we cannot stop anyone from using bitcoin. Many have asked me for my thoughts on the matter, so let’s rip it.

Concern

One of the most glaring issues with the strategic bitcoin reserve is its foundation, built on stolen bitcoin. For those of us who value private property this is an obvious betrayal of our core principles. Rather than proof of work, the bitcoin that seeds this reserve has been taken by force. The US Government should return the bitcoin stolen from Bitfinex and the Silk Road.

Using stolen bitcoin for the reserve creates a perverse incentive. If governments see bitcoin as a valuable asset, they will ramp up efforts to confiscate more bitcoin. The precedent is a major concern, and I stand strongly against it, but it should be also noted that governments were already seizing coin before the reserve so this is not really a change in policy.

Ideally all seized bitcoin should be burned, by law. This would align incentives properly and make it less likely for the government to actively increase coin seizures. Due to the truly scarce properties of bitcoin, all burned bitcoin helps existing holders through increased purchasing power regardless. This change would be unlikely but those of us in policy circles should push for it regardless. It would be best case scenario for American bitcoiners and would create a strong foundation for the next century of American leadership.

Optimism

The entire point of bitcoin is that we can spend or save it without permission. That said, it is a massive benefit to not have one of the strongest governments in human history actively trying to ruin our lives.

Since the beginning, bitcoiners have faced horrible regulatory trends. KYC, surveillance, and legal cases have made using bitcoin and building bitcoin businesses incredibly difficult. It is incredibly important to note that over the past year that trend has reversed for the first time in a decade. A strategic bitcoin reserve is a key driver of this shift. By holding bitcoin, the strongest government in the world has signaled that it is not just a fringe technology but rather truly valuable, legitimate, and worth stacking.

This alignment of incentives changes everything. The US Government stacking proves bitcoin’s worth. The resulting purchasing power appreciation helps all of us who are holding coin and as bitcoin succeeds our government receives direct benefit. A beautiful positive feedback loop.

Realism

We are trending in the right direction. A strategic bitcoin reserve is a sign that the state sees bitcoin as an asset worth embracing rather than destroying. That said, there is a lot of work left to be done. We cannot be lulled into complacency, the time to push forward is now, and we cannot take our foot off the gas. We have a seat at the table for the first time ever. Let's make it worth it.

We must protect the right to free usage of bitcoin and other digital technologies. Freedom in the digital age must be taken and defended, through both technical and political avenues. Multiple privacy focused developers are facing long jail sentences for building tools that protect our freedom. These cases are not just legal battles. They are attacks on the soul of bitcoin. We need to rally behind them, fight for their freedom, and ensure the ethos of bitcoin survives this new era of government interest. The strategic reserve is a step in the right direction, but it is up to us to hold the line and shape the future.

-

@ 04c915da:3dfbecc9

2025-05-16 17:59:23

@ 04c915da:3dfbecc9

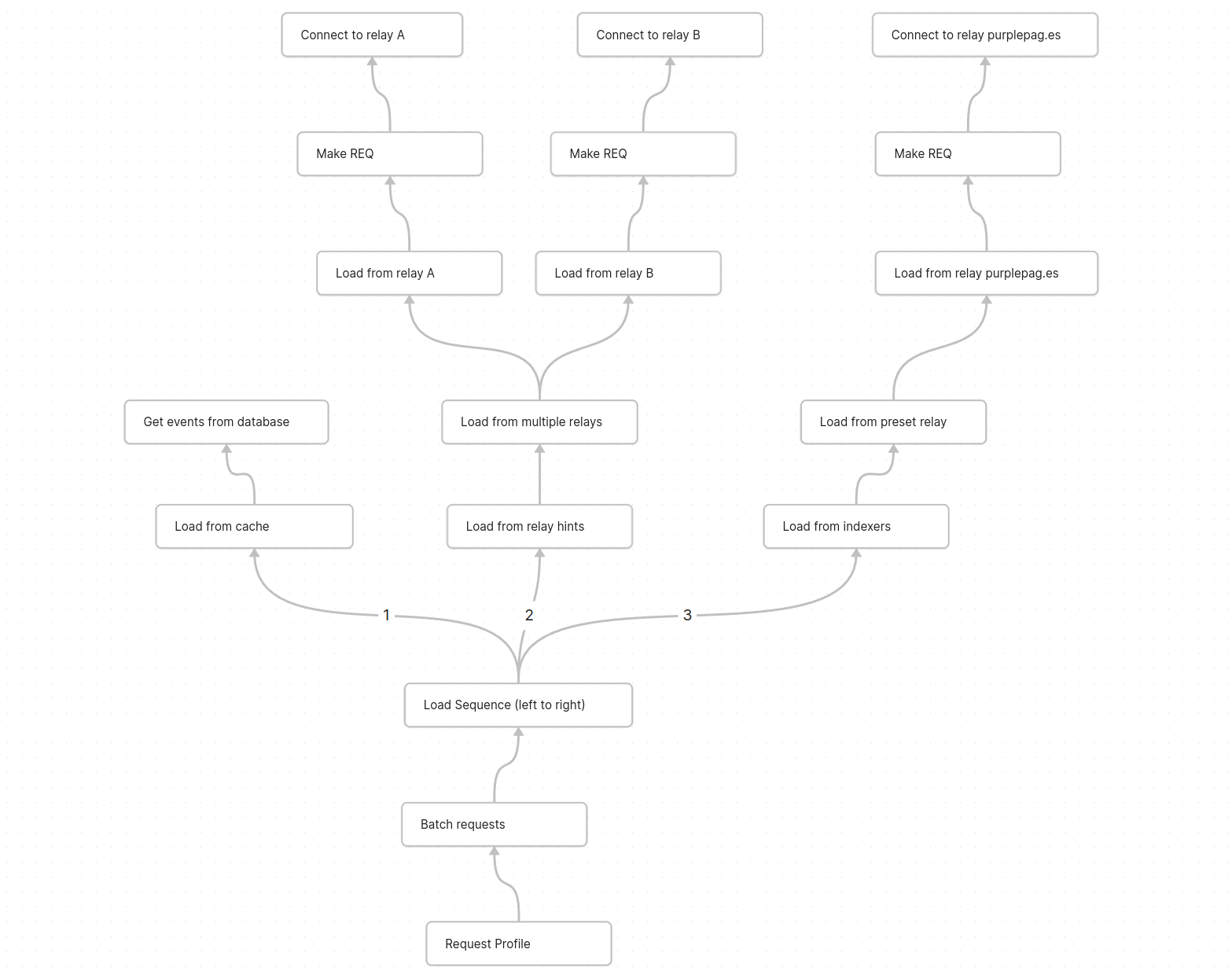

2025-05-16 17:59:23Recently we have seen a wave of high profile X accounts hacked. These attacks have exposed the fragility of the status quo security model used by modern social media platforms like X. Many users have asked if nostr fixes this, so lets dive in. How do these types of attacks translate into the world of nostr apps? For clarity, I will use X’s security model as representative of most big tech social platforms and compare it to nostr.

The Status Quo

On X, you never have full control of your account. Ultimately to use it requires permission from the company. They can suspend your account or limit your distribution. Theoretically they can even post from your account at will. An X account is tied to an email and password. Users can also opt into two factor authentication, which adds an extra layer of protection, a login code generated by an app. In theory, this setup works well, but it places a heavy burden on users. You need to create a strong, unique password and safeguard it. You also need to ensure your email account and phone number remain secure, as attackers can exploit these to reset your credentials and take over your account. Even if you do everything responsibly, there is another weak link in X infrastructure itself. The platform’s infrastructure allows accounts to be reset through its backend. This could happen maliciously by an employee or through an external attacker who compromises X’s backend. When an account is compromised, the legitimate user often gets locked out, unable to post or regain control without contacting X’s support team. That process can be slow, frustrating, and sometimes fruitless if support denies the request or cannot verify your identity. Often times support will require users to provide identification info in order to regain access, which represents a privacy risk. The centralized nature of X means you are ultimately at the mercy of the company’s systems and staff.

Nostr Requires Responsibility

Nostr flips this model radically. Users do not need permission from a company to access their account, they can generate as many accounts as they want, and cannot be easily censored. The key tradeoff here is that users have to take complete responsibility for their security. Instead of relying on a username, password, and corporate servers, nostr uses a private key as the sole credential for your account. Users generate this key and it is their responsibility to keep it safe. As long as you have your key, you can post. If someone else gets it, they can post too. It is that simple. This design has strong implications. Unlike X, there is no backend reset option. If your key is compromised or lost, there is no customer support to call. In a compromise scenario, both you and the attacker can post from the account simultaneously. Neither can lock the other out, since nostr relays simply accept whatever is signed with a valid key.

The benefit? No reliance on proprietary corporate infrastructure.. The negative? Security rests entirely on how well you protect your key.

Future Nostr Security Improvements

For many users, nostr’s standard security model, storing a private key on a phone with an encrypted cloud backup, will likely be sufficient. It is simple and reasonably secure. That said, nostr’s strength lies in its flexibility as an open protocol. Users will be able to choose between a range of security models, balancing convenience and protection based on need.

One promising option is a web of trust model for key rotation. Imagine pre-selecting a group of trusted friends. If your account is compromised, these people could collectively sign an event announcing the compromise to the network and designate a new key as your legitimate one. Apps could handle this process seamlessly in the background, notifying followers of the switch without much user interaction. This could become a popular choice for average users, but it is not without tradeoffs. It requires trust in your chosen web of trust, which might not suit power users or large organizations. It also has the issue that some apps may not recognize the key rotation properly and followers might get confused about which account is “real.”

For those needing higher security, there is the option of multisig using FROST (Flexible Round-Optimized Schnorr Threshold). In this setup, multiple keys must sign off on every action, including posting and updating a profile. A hacker with just one key could not do anything. This is likely overkill for most users due to complexity and inconvenience, but it could be a game changer for large organizations, companies, and governments. Imagine the White House nostr account requiring signatures from multiple people before a post goes live, that would be much more secure than the status quo big tech model.

Another option are hardware signers, similar to bitcoin hardware wallets. Private keys are kept on secure, offline devices, separate from the internet connected phone or computer you use to broadcast events. This drastically reduces the risk of remote hacks, as private keys never touches the internet. It can be used in combination with multisig setups for extra protection. This setup is much less convenient and probably overkill for most but could be ideal for governments, companies, or other high profile accounts.

Nostr’s security model is not perfect but is robust and versatile. Ultimately users are in control and security is their responsibility. Apps will give users multiple options to choose from and users will choose what best fits their need.

-

@ 04c915da:3dfbecc9

2025-05-16 17:51:54

@ 04c915da:3dfbecc9

2025-05-16 17:51:54In much of the world, it is incredibly difficult to access U.S. dollars. Local currencies are often poorly managed and riddled with corruption. Billions of people demand a more reliable alternative. While the dollar has its own issues of corruption and mismanagement, it is widely regarded as superior to the fiat currencies it competes with globally. As a result, Tether has found massive success providing low cost, low friction access to dollars. Tether claims 400 million total users, is on track to add 200 million more this year, processes 8.1 million transactions daily, and facilitates $29 billion in daily transfers. Furthermore, their estimates suggest nearly 40% of users rely on it as a savings tool rather than just a transactional currency.

Tether’s rise has made the company a financial juggernaut. Last year alone, Tether raked in over $13 billion in profit, with a lean team of less than 100 employees. Their business model is elegantly simple: hold U.S. Treasuries and collect the interest. With over $113 billion in Treasuries, Tether has turned a straightforward concept into a profit machine.

Tether’s success has resulted in many competitors eager to claim a piece of the pie. This has triggered a massive venture capital grift cycle in USD tokens, with countless projects vying to dethrone Tether. Due to Tether’s entrenched network effect, these challengers face an uphill battle with little realistic chance of success. Most educated participants in the space likely recognize this reality but seem content to perpetuate the grift, hoping to cash out by dumping their equity positions on unsuspecting buyers before they realize the reality of the situation.

Historically, Tether’s greatest vulnerability has been U.S. government intervention. For over a decade, the company operated offshore with few allies in the U.S. establishment, making it a major target for regulatory action. That dynamic has shifted recently and Tether has seized the opportunity. By actively courting U.S. government support, Tether has fortified their position. This strategic move will likely cement their status as the dominant USD token for years to come.

While undeniably a great tool for the millions of users that rely on it, Tether is not without flaws. As a centralized, trusted third party, it holds the power to freeze or seize funds at its discretion. Corporate mismanagement or deliberate malpractice could also lead to massive losses at scale. In their goal of mitigating regulatory risk, Tether has deepened ties with law enforcement, mirroring some of the concerns of potential central bank digital currencies. In practice, Tether operates as a corporate CBDC alternative, collaborating with authorities to surveil and seize funds. The company proudly touts partnerships with leading surveillance firms and its own data reveals cooperation in over 1,000 law enforcement cases, with more than $2.5 billion in funds frozen.

The global demand for Tether is undeniable and the company’s profitability reflects its unrivaled success. Tether is owned and operated by bitcoiners and will likely continue to push forward strategic goals that help the movement as a whole. Recent efforts to mitigate the threat of U.S. government enforcement will likely solidify their network effect and stifle meaningful adoption of rival USD tokens or CBDCs. Yet, for all their achievements, Tether is simply a worse form of money than bitcoin. Tether requires trust in a centralized entity, while bitcoin can be saved or spent without permission. Furthermore, Tether is tied to the value of the US Dollar which is designed to lose purchasing power over time, while bitcoin, as a truly scarce asset, is designed to increase in purchasing power with adoption. As people awaken to the risks of Tether’s control, and the benefits bitcoin provides, bitcoin adoption will likely surpass it.

-

@ 04c915da:3dfbecc9

2025-05-16 17:12:05

@ 04c915da:3dfbecc9

2025-05-16 17:12:05One of the most common criticisms leveled against nostr is the perceived lack of assurance when it comes to data storage. Critics argue that without a centralized authority guaranteeing that all data is preserved, important information will be lost. They also claim that running a relay will become prohibitively expensive. While there is truth to these concerns, they miss the mark. The genius of nostr lies in its flexibility, resilience, and the way it harnesses human incentives to ensure data availability in practice.

A nostr relay is simply a server that holds cryptographically verifiable signed data and makes it available to others. Relays are simple, flexible, open, and require no permission to run. Critics are right that operating a relay attempting to store all nostr data will be costly. What they miss is that most will not run all encompassing archive relays. Nostr does not rely on massive archive relays. Instead, anyone can run a relay and choose to store whatever subset of data they want. This keeps costs low and operations flexible, making relay operation accessible to all sorts of individuals and entities with varying use cases.

Critics are correct that there is no ironclad guarantee that every piece of data will always be available. Unlike bitcoin where data permanence is baked into the system at a steep cost, nostr does not promise that every random note or meme will be preserved forever. That said, in practice, any data perceived as valuable by someone will likely be stored and distributed by multiple entities. If something matters to someone, they will keep a signed copy.

Nostr is the Streisand Effect in protocol form. The Streisand effect is when an attempt to suppress information backfires, causing it to spread even further. With nostr, anyone can broadcast signed data, anyone can store it, and anyone can distribute it. Try to censor something important? Good luck. The moment it catches attention, it will be stored on relays across the globe, copied, and shared by those who find it worth keeping. Data deemed important will be replicated across servers by individuals acting in their own interest.

Nostr’s distributed nature ensures that the system does not rely on a single point of failure or a corporate overlord. Instead, it leans on the collective will of its users. The result is a network where costs stay manageable, participation is open to all, and valuable verifiable data is stored and distributed forever.

-

@ 57d1a264:69f1fee1

2025-05-16 07:51:08

@ 57d1a264:69f1fee1

2025-05-16 07:51:08Payjoin allows the sender and receiver of an on-chain payment to collaborate and create a transaction that breaks on-chain heuristics, allowing a more private transaction with ambiguous payment amount and UTXO ownership. Additionally, it can also be used for UTXO consolidation (receiver saves future fees) and batching payments (receiver can make payment(s) of their own in the process of receiving one), also known as transaction cut-through. Other than improved privacy, the rest of the benefits are typically applicable to the receiver, not the sender.

BIP-78 was the original payjoin protocol that required the receiver to run a endpoint/server (always online) in order to mediate the payjoin process. Payjoin adoption has remained pretty low, something attributed to the server & perpetual online-ness requirement. This is the motivation for payjoin v2.

The purpose of the one-pager is to analyse the protocol, and highlight the UX issues or tradeoffs it entails, so that the payjoin user flows can be appropriately designed and the tradeoffs likewise communicated. A further document on UX solutions might be needed to identify solutions and opportunities

The following observations are generally limited to individual users transacting through their mobile devices:

While users naturally want better privacy and fee-savings, they also want to minimise friction and minimise (optimise) payment time. These are universal and more immediate needs since they deal with the user experience.

Added manual steps

TL;DR v2 payjoin eliminates server & simultaneous user-liveness requirements (increasing TAM, and opportunities to payjoin, as a result) by adding manual steps.

Usually, the extent of the receiver's involvement in the transaction process is limited to sharing their address with the sender. Once they share the address/URI, they can basically forget about it. In the target scenario for v2 payjoin, the receiver must come online again (except they have no way of knowing "when") to contribute input(s) and sign the PSBT. This can be unexpected, unintuitive and a bit of a hassle.

Usually (and even with payjoin v1), the sender crafts and broadcasts the transaction in one go; meaning the user's job is done within a few seconds/minutes. With payjoin v2, they must share the original-PSBT with the receiver, and then wait for them to do their part. Once the the receiver has done that, the sender must come online to review the transaction, sign it & broadcast.

In summary,

In payjoin v1, step 3 is automated and instant, so delay 2, 3 =~ 0. As the user experiences it, the process is completed in a single session, akin to a non-payjoin transaction.

With payjoin v2, Steps 2 & 3 in the above diagram are widely spread and noticeable. These manual steps are separated by uncertain delays (more on that below) when compared to a non-payjoin transaction.

Delays

We've established that both senders and receivers must take extra manual steps to execute a payoin transaction. With payjoin v2, this process gets split into multiple sessions, since the sender and receiver are not like to be online simultaneously.

Delay 2 & 3 (see diagram above) are uncertain in nature. Most users do not open their bitcoin wallets for days or weeks! The receiver must come online before the timeout hits in order for the payjoin process to work, otherwise time is just wasted with no benefit. UX or technical solutions are needed to minimise these delays.

Delays might be exacerbated if the setup is based on hardware wallet and/or uses multisig.

Notifications or background processes

There is one major problem when we say "the user must come online to..." but in reality the user has no way of knowing there is a payjoin PSBT waiting for them. After a PSBT is sent to the relay, the opposite user would only find out about it whenever they happen to come online. Notifications and background sync processes might be necessary to minimise delays. This is absolutely essential to avert timeouts in addition to saving valuable time. Another risk is phantom payjoin stuff after the timeout is expired if receiver-side does not know it has.

Fee Savings

The following observations might be generally applicable for both original and this v2 payjoin version. Fee-savings with payjoin is a tricky topic. Of course, overall a payjoin transaction is always cheaper than 2 separate transactions, since they get to share the overhead.

Additionally, without the receiver contributing to fees, the chosen fee rate of the PSBT (at the beginning) drops, and can lead to slower confirmation. From another perspective, a sender paying with payjoin pays higher fees for similar confirmation target. This has been observed in a production wallet years back. Given that total transaction time can extend to days, the fee environment itself might change, and all this must be considered when designing the UX.

Of course, there is nothing stopping the receiver from contributing to fees, but this idea is likely entirely novel to the bitcoin ecosystem (perhaps payments ecosystem in general) and the user base. Additionally, nominally it involves the user paying fees and tolerating delays just to receive bitcoin. Without explicit incentives/features that encourage receivers to participate, payjoining might seem like an unncessary hassle.

Overall, it seems that payjoin makes UX significant tradeoffs for important privacy (and potential fee-saving) benefits. This means that the UX might have to do significant heavy-lifting, to ensure that users are not surprised, confused or frustrated when they try to transact on-chain in a privacy-friendly feature. Good, timely communication, new features for consolidation & txn-cutthrough and guided user flows seem crucial to ensure payjoin adoption and for help make on-chain privacy a reality for users.

---------------

Original document available here. Reach out at

yashrajdca@proton.me,y_a_s_h_r_a_j.70on Signal, or on reach out in Bitcoin Design discord.https://stacker.news/items/981388

-

@ 57d1a264:69f1fee1

2025-05-16 05:38:28

@ 57d1a264:69f1fee1

2025-05-16 05:38:28LegoGPT generates a LEGO structure from a user-provided text prompt in an end-to-end manner. Notably, our generated LEGO structure is physically stable and buildable.

Lego is something most of us knows. This is a opportuity to ask where is our creativity going? From the art of crafting figures to building blocks following our need and desires to have a machine thinking and building following step-by-step instructions to achieve an isolated goal.

Is the creative act then in the question itself, not anymore in the crafting? Are we just delegating the solution of problems, the thinking of how to respond to questions, to machines? Would it be different if delegated to other people?

Source: https://avalovelace1.github.io/LegoGPT/

https://stacker.news/items/981336

-

@ 57c631a3:07529a8e

2025-05-17 13:21:19

@ 57c631a3:07529a8e

2025-05-17 13:21:19It’s not you, modern software does feel slow

You may have felt it. From chatting apps such Teams or discord, to browsers like Chrome and Firefox, and even Gaming. Software feels sluggish and slow even on most beefy hardware.

While hardware has gotten better, Software has gotten somehow slower. I explore why I think this is in this post.

ICQ vs Teams

While it might not be a fair comparison, I can’t help but compare the basic chatting feature of ICQ from 20 years ago to Microsoft Teams today. True, Teams has more features and secure by default, but the basic chatting feature and responsiveness and performance goes to ICQ.

I still remember running ICQ on my intel 90 MHz (yes M not G) 1 core 64 MB RAM, Windows 95 and it instantly starts up, and chat just works.

Teams on the other hand takes seconds to sometimes minutes to start and hangs often on my 64GB Intel 3.0GHz 16 Core. I think you may relate this to most modern software.

Netscape vs Chrome

If you double click on your browser icon today to run it, I can guarantee that you are conditioned to wait few seconds for it to spin up. This is now considered the norm.

This isn’t how it used to be.

If you grew up in the 90s early 2000s, and used Netscape or even Internet Explorer 6, you would know that browsers start instantly.

There was another even faster alternative back then called Crazy Browser which supported tabs.

Granted loading speed depended on your Internet and the page you were loading. But assets too were cheaper back then.

Why classic software felt faster?

Software in the 90s and early 2000s were developed under highly constrained environment and as a result it was forced to produce efficient programs.

If there was a memory leak, you will notice it immediately or the process will run out of memory, sometimes it won’t even start, forcing you to fix it. You couldn't afford a memory leak.

If there was a high CPU usage your program would freeze forcing you to rewrite to use less cpu if possible or think outside the box to work within the constraints.

Writing was expensive, there was only HDD and floppy, so the programmer calling write() of fsync() would immediately feel the cost. So you would only call write when you need it. Same story for reads.

Storage used to be scarce, so programmers would do everything to make the footprint of the program as small as possible. Smaller binary = faster loading.

Can we say the same for modern software?

Modern Development

I might be wrong, but I think most bloat in modern apps stems from the development on high-end machines, which masks inefficiencies in code.

Sadly modern IDEs and dev tooling require top-end dev machines as they too use a lot of resources.

It’s a double bind.

With abundant memory and compute in modern hardware the inefficiency is masked. Causing bad code to be shipped and eventually encountered under stress often in production.

If you wrote inefficient code on old hardware, your program might not run at all, forcing you to revise, troubleshoot, finesse and fix. That is because of the limited resources.

I sometimes wonder how efficient modern apps would be if they were developed under similar constraints, it would force us to favor efficiency in coding. Memory leaks/high cpu usage that would have otherwise gone undetected because of resource abundance would have been flagged during dev.

Of course, I'm not advocating not using modern hardware, on the contrary I think if we relearned how to be efficient we could take full advantage of modern hardware. Moreover, a bump in resource requirements for software may be necessary to unlock certain features, but I don’t think we have a clear grasp on that line.

Perhaps we can develop on modern hardware but we dedicate running tests on low-end devices as part of the development cycle.

I will leave you with a clip of a Power Point 2003 running on 300 MHz Pentium 2.

https://connect-test.layer3.press/articles/a8d45269-3b2a-46ab-8a3a-54857aca1bb9

-

@ 87f5e1d9:e251d8f4

2025-05-17 13:13:42

@ 87f5e1d9:e251d8f4

2025-05-17 13:13:42In the realm of cryptocurrency, the stakes are incredibly high, and losing access to your digital assets can be a daunting experience. But don’t worry — cryptrecver.com is here to transform that nightmare into a reality! With expert-led recovery services and leading-edge technology, Crypt Recver specializes in helping you regain access to your lost Bitcoin and other cryptocurrencies.

Why Choose Crypt Recver? 🤔 🔑 Expertise You Can Trust At Crypt Recver, we blend advanced technology with skilled engineers who have a solid track record in crypto recovery. Whether you’ve forgotten your passwords, lost your private keys, or encountered issues with damaged hardware wallets, our team is ready to assist.

⚡ Fast Recovery Process Time is crucial when recovering lost funds. Crypt Recver’s systems are designed for speed, enabling quick recoveries — allowing you to return to what matters most: trading and investing.

🎯 High Success Rate With a success rate exceeding 90%, our recovery team has aided numerous clients in regaining access to their lost assets. We grasp the complexities of cryptocurrency and are committed to providing effective solutions.

🛡️ Confidential & Secure Your privacy is paramount. All recovery sessions at Crypt Recver are encrypted and completely confidential. You can trust us with your information, knowing we uphold the highest security standards.

🔧 Advanced Recovery Tools We employ proprietary tools and techniques to tackle complex recovery scenarios, from retrieving corrupted wallets to restoring coins from invalid addresses. No matter the challenge, we have a solution.

Our Recovery Services Include: 📈 Bitcoin Recovery: Lost access to your Bitcoin wallet? We can assist in recovering lost wallets, private keys, and passphrases. Transaction Recovery: Mistaken transfers, lost passwords, or missing transaction records — let us help you reclaim your funds! Cold Wallet Restoration: Did your cold wallet fail? We specialize in safely extracting assets. Private Key Generation: Forgotten your private key? We can help you generate new keys linked to your funds without compromising security. Don’t Let Lost Crypto Ruin Your Day! 🕒 With an estimated 3 to 3.4 million BTC lost forever, it’s essential to act quickly when facing access issues. Whether you’ve been affected by a dust attack or simply forgotten your key, Crypt Recver provides the support you need to reclaim your digital assets.

🚀 Start Your Recovery Now! Ready to retrieve your cryptocurrency? Don’t let uncertainty hold you back! 👉 Request Wallet Recovery Help Today!cryptrecver.com

Need Immediate Assistance? 📞 For quick queries or support, connect with us on: ✉️ Telegram: t.me/crypptrcver 💬 WhatsApp: +1(941)317–1821

Trust Crypt Recver for the best crypto recovery service — get back to trading with confidence! 💪In the realm of cryptocurrency, the stakes are incredibly high, and losing access to your digital assets can be a daunting experience. But don’t worry — cryptrecver.com is here to transform that nightmare into a reality! With expert-led recovery services and leading-edge technology, Crypt Recver specializes in helping you regain access to your lost Bitcoin and other cryptocurrencies.

# Why Choose Crypt Recver? 🤔

# Why Choose Crypt Recver? 🤔🔑 Expertise You Can Trust\ At Crypt Recver, we blend advanced technology with skilled engineers who have a solid track record in crypto recovery. Whether you’ve forgotten your passwords, lost your private keys, or encountered issues with damaged hardware wallets, our team is ready to assist.

⚡ Fast Recovery Process\ Time is crucial when recovering lost funds. Crypt Recver’s systems are designed for speed, enabling quick recoveries — allowing you to return to what matters most: trading and investing.

🎯 High Success Rate\ With a success rate exceeding 90%, our recovery team has aided numerous clients in regaining access to their lost assets. We grasp the complexities of cryptocurrency and are committed to providing effective solutions.

🛡️ Confidential & Secure\ Your privacy is paramount. All recovery sessions at Crypt Recver are encrypted and completely confidential. You can trust us with your information, knowing we uphold the highest security standards.

🔧 Advanced Recovery Tools\ We employ proprietary tools and techniques to tackle complex recovery scenarios, from retrieving corrupted wallets to restoring coins from invalid addresses. No matter the challenge, we have a solution.

# Our Recovery Services Include: 📈

# Our Recovery Services Include: 📈- Bitcoin Recovery: Lost access to your Bitcoin wallet? We can assist in recovering lost wallets, private keys, and passphrases.

- Transaction Recovery: Mistaken transfers, lost passwords, or missing transaction records — let us help you reclaim your funds!

- Cold Wallet Restoration: Did your cold wallet fail? We specialize in safely extracting assets.

- Private Key Generation: Forgotten your private key? We can help you generate new keys linked to your funds without compromising security.

Don’t Let Lost Crypto Ruin Your Day! 🕒

With an estimated 3 to 3.4 million BTC lost forever, it’s essential to act quickly when facing access issues. Whether you’ve been affected by a dust attack or simply forgotten your key, Crypt Recver provides the support you need to reclaim your digital assets.

🚀 Start Your Recovery Now!\ Ready to retrieve your cryptocurrency? Don’t let uncertainty hold you back!\ 👉 Request Wallet Recovery Help Today!cryptrecver.com

Need Immediate Assistance? 📞

For quick queries or support, connect with us on:\ ✉️ Telegram: t.me/crypptrcver\ 💬 WhatsApp: +1(941)317–1821

Trust Crypt Recver for the best crypto recovery service — get back to trading with confidence! 💪

-

@ a296b972:e5a7a2e8

2025-05-17 13:03:39

@ a296b972:e5a7a2e8

2025-05-17 13:03:39Man stelle sich vor, es droht Frieden auszubrechen. Wie stehen wir, die Deutschen, die Europäer denn dann da? Ja, wie die letzten Deppen, die ihr auch seid!

Wen wundert es, wenn nach erfolgreicher Friedensverhinderung durch Boris Johnson in 2022 und den durch den Westen zahlreichen überschrittenen Roten Linien Russland skeptisch ist?

Am russischen Misstrauen haben die hinter der Ukraine stehenden westlichen Staaten jahrelang erfolgreich gearbeitet.

„Besonderer Dank“ gilt hier vor allem der von allen Mitgliedern bedenkenlos hingenommenen NATO-Osterweiterung.

Die Aussage von Frau Merkel, man habe nie vorgehabt, das Minsk-Abkommen umzusetzen, stattdessen habe man gewollt, der Ukraine Zeit zu verschaffen, sich aufzurüsten, kann nur von jemandem, der weniger als eine Gehirnzelle hat, als vertrauensbildende Maßnahme bewertet werden.

Die immer wieder im Raum stehende Debatte um eine deutsche Lieferung von Kampf-Stieren, demnächst wohlmöglich unter Ausschluss der Öffentlichkeit (das könnte Teile der Bevölkerung verunsichern), ein weiteres Beispiel von friedenstüchtiger Diplomatie.

Wie schon beim klaglosen Hinnehmen der terroristischen Sprengung der Nordstream2 Pipelines, wozu Präsident Trump schon geäußert hat, dass es die Russen sicher nicht waren, wird auch brav von Deutschland hingenommen, dass von Wiesbaden aus, die Koordination der Raketenangriffe von der Ukraine auf Russland durch die USA, innerhalb der Task Force Dragon, gesteuert werden.

Die Verletzung des 2+4-Vertrages durch die Stationierung von Nicht-NATO-Truppen in Rostock, die an die Umbenennung eines Schokoriegels von Raider in Twixx erinnert.

Das strikte Einhalten der deutschen Maxime: „Von Deutschland soll nur noch Frieden ausgehen.“

Dazu die Lieferung von Raketen mit mittlerer Reichweite durch die Franzosen und Briten nach dem Motto: Ich habe nur das Messer auf den Tisch gelegt, zugestochen hat ein anderer.

All das trägt dazu bei, dass Russland vertrauensvoll nach europäischen Friedensvorschlägen geradezu lechzt. Unterstrichen werden diese übermenschlichen Anstrengungen durch ein weiteres, das bereit 17. Sanktionspaket. Dümmer geht’s nimmer.

Auch diplomatisch nicht zu überbietende Aussagen, wie „Russland wird immer unser Feind sein“, oder „Russland wird Deutschland in spätestens 5 Jahren angreifen“, oder „Deutschland muss wieder kriegstüchtig werden“, unterstreichen den unbedingten Willen, das sinnlose Sterben auf beiden Seiten schnellst möglich beenden zu wollen.

Außerhalb Deutschlands kann man nur zu der Überzeugung gelangen, dass es sich bei diesem Land um eine Freiluft-Irrenanstalt handeln muss. Und wer will schon mit geistig verwirrten Insassen über so ernste Themen wie Krieg und Frieden verhandeln, bei denen Verstand gebraucht wird.

Derartige Weltfremde ist nur mit Sarkasmus zu ertragen.

Bewundernswert der Langmut, den Russland bis heute an den Tag legt. Wäre die Situation umgekehrt, hätte der Westen schon lange dem „bösen“ Russen gezeigt, wo der US-Hammer hängt, und dass man so mit der sogenannten Wertegemeinschaft nicht umgehen kann.

Ja, der russische Einmarsch in die Ukraine war völkerrechtswidrig, genau so wie die US-amerikanischen „Besuche“ der USA in Vietnam, in Libyen und im Irak, auf sehr unschöne Weise. Wer hat nicht noch die Bilder vom Blitzgewitter der Bomben auf Bagdad im Gedächtnis. „Immer schön drauf, Stärke zeigen!“

Die zentrale Frage ist, wie man Deutschland „möglichst schonend“ beibringen kann, ohne, dass es einen größeren psychischen Staatsschaden davonträgt, dass es als Geisterfahrer auf der Friedensautobahn unterwegs ist.

Von russischer Seite sind nicht gerade die Vorstände der Kaninchenzüchter-Vereine nach Istanbul entsandt worden. Im Gegenteil, es handelt sich wohl eher um Personen, die bestens über das Kriegsgeschehen vor Ort Bescheid wissen.

Es darf nicht vergessen werden, dass es sich um einen Stellvertreterkrieg zwischen den von der Vorgängerregierung angezettelten USA und Russland, auf dem Rücken der Ukraine handelt.

In Istanbul haben sich zunächst die beiden Länder getroffen, deren Soldaten tatsächlich aufeinander schießen. Nicht die Strategen im Hintergrund. Und selbstverständlich beobachten die USA sehr wachsam, was vor sich geht und wie der Verlauf ist.

Es wäre fern der Realität, wenn im Hintergrund nicht weitere Fäden gesponnen würden, die der Öffentlichkeit zunächst vorenthalten werden. In diesem Fall kann das sogar von Vorteil sein, weil zu viele System-Journalisten den Brei mit dämlichen Kommentaren verderben könnten.

Zunächst soll zwischen den aktiv kämpfenden Parteien der Dialog wieder aufgenommen und eine Grundlage geschaffen werden, was schon ein großer Fortschritt ist, weil man sich seit 2022 überhaupt wieder erst einmal an einen gemeinsamen Tisch gesetzt hat und endlich wieder miteinander redet.

Wie immer im Krieg, wird auch hier strategisch vorgegangen und peinlichst darauf geachtet, dass alle Beteiligten möglichst weitgehend ihr Gesicht bewahren. Wer geglaubt hat, dass hier gleich Friedenstauben aufsteigen und alles mit einem Bruderkuss besiegelt wird, der ist wirklich ziemlich naiv.

Erst, wenn Sondierungsgespräche und Vorverhandlungen so weit gediehen sind, dass „nur“ noch eine Unterschrift fehlt, treten Putin und Trump als Friedensbringer auf die Bühne und besiegeln den „Deal“. Wie man jetzt an dem Vorführen Selenskyjs durch Putin gesehen hat, dient dieser nur noch als Spielball, der beim Ping-Pong um den Frieden hin- und hergeworfen wird. Trump hatte zuvor Selensky bei seinem Besuch im Weißen Haus ganz deutlich gesagt, dass er die Karten nicht in der Hand hat.

Jeder, der bei Verstand geblieben ist, wünscht sich endlich ein Ende dieses sinnlosen Sterbens, doch der Druck muss im Kessel langsam und kontrolliert abgelassen werden.

Entgegen der im Westen weitverbreiteten Propaganda-Lüge, der Konflikt in der Ukraine habe im Februar 2022 angefangen, hat sich die Situation über Jahre, mindestens mit der NATO-Osterweiterung aufgebaut. Da kann niemand erwarten, dass die Wiederherstellung eines Gleichgewichts jetzt in kürzester Zeit erreicht werden kann.

Urheber dieser Tragödie ist die NATO, die Russland immer mehr auf die Pelle gerückt ist. Hätte sie sich seinerzeit, wie der Warschauer Pakt, aufgrund der veränderten Kräfteverhältnisse ebenfalls aufgelöst, würden heute rund 1 Million Männer auf beiden Seiten sehr wahrscheinlich noch leben. Es wäre zu wünschen, dass nach dem exemplarischen Desaster in der Ukraine neue Überlegungen angestrengt werden würden, ob nicht die NATO, als Relikt aus alten Zeiten und aus Missachtung ihres Gründungsgedanken, ein Verteidigungsbündnis sein zu wollen, von der Zeit eingeholt wurde und ihrer Auflösung entgegensehen muss.

Dieser Artikel wurde mit dem Pareto-Client geschrieben

* *

(Bild von pixabay)

-

@ 2f29aa33:38ac6f13

2025-05-17 12:59:01

@ 2f29aa33:38ac6f13

2025-05-17 12:59:01The Myth and the Magic

Picture this: a group of investors, huddled around a glowing computer screen, nervously watching Bitcoin’s price. Suddenly, someone produces a stick-no ordinary stick, but a magical one. With a mischievous grin, they poke the Bitcoin. The price leaps upward. Cheers erupt. The legend of the Bitcoin stick is born.

But why does poking Bitcoin with a stick make the price go up? Why does it only work for a lucky few? And what does the data say about this mysterious phenomenon? Let’s dig in, laugh a little, and maybe learn the secret to market-moving magic.

The Statistical Side of Stick-Poking

Bitcoin’s Price: The Wild Ride

Bitcoin’s price is famous for its unpredictability. In the past year, it’s soared, dipped, and soared again, sometimes gaining more than 50% in just a few months. On a good day, billions of dollars flow through Bitcoin trades, and the price can jump thousands in a matter of hours. Clearly, something is making this happen-and it’s not just spreadsheets and financial news.

What Actually Moves the Price?

-

Scarcity: Only 21 million Bitcoins will ever exist. When more people want in, the price jumps.

-

Big News: Announcements, rumors, and meme-worthy moments can send the price flying.

-

FOMO: When people see Bitcoin rising, they rush to buy, pushing it even higher.

-

Liquidations: When traders betting against Bitcoin get squeezed, it triggers a chain reaction of buying.

But let’s be honest: none of this is as fun as poking Bitcoin with a stick.

The Magical Stick: Not Your Average Twig

Why Not Every Stick Works

You can’t just grab any old branch and expect Bitcoin to dance. The magical stick is a rare artifact, forged in the fires of internet memes and blessed by the spirit of Satoshi. Only a chosen few possess it-and when they poke, the market listens.

Signs You Have the Magical Stick

-

When you poke, Bitcoin’s price immediately jumps a few percent.

-

Your stick glows with meme energy and possibly sparkles with digital dust.

-

You have a knack for timing your poke right after a big event, like a halving or a celebrity tweet.

-

Your stick is rumored to have been whittled from the original blockchain itself.

Why Most Sticks Fail

-

No Meme Power: If your stick isn’t funny, Bitcoin ignores you.

-

Bad Timing: Poking during a bear market just annoys the blockchain.

-

Not Enough Hype: If the bitcoin community isn’t watching, your poke is just a poke.

-

Lack of Magic: Some sticks are just sticks. Sad, but true.

The Data: When the Stick Strikes

Let’s look at some numbers:

-

In the last month, Bitcoin’s price jumped over 20% right after a flurry of memes and stick-poking jokes.

-

Over the past year, every major price surge was accompanied by a wave of internet hype, stick memes, or wild speculation.

-

In the past five years, Bitcoin’s biggest leaps always seemed to follow some kind of magical event-whether a halving, a viral tweet, or a mysterious poke.

Coincidence? Maybe. But the pattern is clear: the stick works-at least when it’s magical.

The Role of Memes, Magic, and Mayhem

Bitcoin’s price is like a cat: unpredictable, easily startled, and sometimes it just wants to be left alone. But when the right meme pops up, or the right stick pokes at just the right time, the price can leap in ways that defy logic.

The bitcoin community knows this. That’s why, when Bitcoin’s stuck in a rut, you’ll see a flood of stick memes, GIFs, and magical thinking. Sometimes, it actually works.

The Secret’s in the Stick (and the Laughs)

So, does poking Bitcoin with a stick really make the price go up? If your stick is magical-blessed by memes, timed perfectly, and watched by millions-absolutely. The statistics show that hype, humor, and a little bit of luck can move markets as much as any financial report.

Next time you see Bitcoin stalling, don’t just sit there. Grab your stick, channel your inner meme wizard, and give it a poke. Who knows? You might just be the next legend in the world of bitcoin magic.

And if your stick doesn’t work, don’t worry. Sometimes, the real magic is in the laughter along the way.

-aco

@block height: 897,104

-

-

@ 90c656ff:9383fd4e

2025-05-17 11:16:18

@ 90c656ff:9383fd4e

2025-05-17 11:16:18Bitcoin has been playing an increasingly important role in protests and social movements around the world. Thanks to its decentralized nature, resistance to censorship, and independence from government control, Bitcoin has become a valuable tool for activists, organizations, and citizens fighting against oppressive regimes or restrictive financial systems.

- Bitcoin as an alternative to the traditional financial system

In recent years, governments and banking institutions have used financial restrictions as a form of political repression. Frozen bank accounts, blocked donations, and limitations on transactions are some of the strategies used to weaken social movements and protests. Bitcoin offers an alternative, allowing funds to be transferred and stored without interference from banks or governments.

One of Bitcoin’s main advantages in these contexts is its censorship resistance. While bank accounts can be shut down and centralized payment services can be pressured to block transactions, Bitcoin operates on a decentralized network where no one can prevent a user from sending or receiving funds.

- Examples of Bitcoin use in protests

01 - Hong Kong (2019–2020): During the pro-democracy protests, activists faced financial restrictions when trying to organize demonstrations and campaigns. Many turned to Bitcoin to avoid surveillance by the Chinese government and to secure funding for their actions.

02 - Canada (2022): The truckers' protest against government restrictions saw participants' bank accounts frozen. As an alternative, Bitcoin donations were used to bypass financial repression.

03 - Belarus (2020): After the contested presidential elections, protesters used Bitcoin to fund activities and support those who lost their jobs due to state repression.

04 - Nigeria (2020): During the #EndSARS protests against police brutality, international donations to the movement were blocked. Bitcoin became one of the main methods for financing the cause.

- Challenges of using Bitcoin in social movements

01 - Education and accessibility: Many people still don’t know how to use Bitcoin safely and efficiently. This lack of knowledge can hinder large-scale adoption.

02 - Digital security: Social movements often operate under heavy surveillance. Without proper security measures, funds can be compromised.

03 - Volatility: Bitcoin’s price can fluctuate significantly in a short time, which may affect the value of donations and funds raised.

In summary, Bitcoin has proven to be an essential tool in resisting financial censorship and government repression. By enabling social movements and activists to fund their causes without intermediaries, Bitcoin strengthens the fight for freedom and justice. However, effective adoption of the technology requires knowledge, security, and adaptation to its unique characteristics. As more people learn to use Bitcoin, its role in protests and social movements will continue to grow, reinforcing the importance of financial sovereignty in the struggle for rights and freedoms.

Thank you very much for reading this far. I hope everything is well with you, and sending a big hug from your favorite Bitcoiner maximalist from Madeira. Long live freedom!

-

@ 9f9fda7f:e5e82a43

2025-05-17 10:32:54

@ 9f9fda7f:e5e82a43

2025-05-17 10:32:54Apache Kafka Architecture

Apache Kafka Architecture

Apache Kafka is a powerful distributed stream processing platform originally developed by LinkedIn, written in Scala and Java. In this article, I walk through the foundational concepts, design and architecture, concluding with hands-on coding examples using Node.js and the KafkaJS library.

Introduction to Kafka

Kafka enables the processing of real-time data streams in a distributed and scalable manner. It’s widely used in systems requiring reliable communication between components, especially for event-driven architectures and microservices.

However, these words sounds very markety and I like to deconstruct things to its basic first principles so that is what I’m going to do. This guide outlines the essential components, explains the core concepts like brokers, producers, consumers, and topics, and dives into more complex abstractions like partitions, consumer groups, and Kafka’s distributed nature.

Kafka Core Components

Here we discuss the fundamental components of Kafka.

Topics and Messages

Messages in Kafka are organized into logical categories called topics. Each topic is append-only and immutable (ie you cannot go back and edit a message). New data is added sequentially at the end. Disks love that.

There are two topics, one called users with two messages (John and Ed) and a Jobs with two messages Req1 and Req2.

Kafka Broker (Server)

The central server that receives and stores messages sent by producers and allow consumers to read the messages. Clients communicate with brokers via TCP, typically on port 9092.

Kafka broker hosts the topics and messages.

Producers and Consumers:

Producers connects to a broker, sends messages to the Kafka broker by specifying the topic.

Publisher pushes messages to the broker for a topic, messages go to the end.

Consumers connects to a broker, polls messages from a topic for a given broker for processing.

Customer polls messages based on a position

Partitions

I always say the best way to work with billions of rows is to avoid working with billions of row. Kafka is no different.

The topics in Kafka can be divided into partitions to allow data distribution and scalability. Each partition acts as a log that consumers read sequentially. Messages within partitions are identified by their offset, which is the message’s position in the log.

Partitioning

Partitioning enables parallel processing, you can have two consumers each processing a partition in parallel. While this allows scaling and improve reading throughput, it introduces complexity as producers and consumers must be aware of partitioning logic. A topic may have multiple partitions based on partition keys (e.g., A–M in partition 0, N–Z in partition 1).

Pub/Sub vs Queue Model

Kafka supports both pub/sub and queue-based messaging patterns:

- Queue: The topic can be treated as a queue, ie any message published to the queue will be consumed only once and popped from the queue. No two consumers can get the same message.

- Pub/Sub: The topic can be in publish-subscribe entity, ie any message published to the topic can be consumed by different consumers.

Kafka achieves this dual functionality using consumer groups. Each consumer in a group is assigned specific partitions, ensuring messages are processed only once per group.

To simulate a queue , all consumers are placed in the same consumer group (they all have the same group name). Whereas to simulate pub/sub mode you would place all consumers in unique group names.

Consumer Groups and Rebalancing

Each partition in a topic is assigned one consumer in a group. When multiple consumers join the same group, Kafka rebalances partitions among them. Each partition is consumed by only one consumer in a group. This allows horizontal scaling while ensuring order within each partition is maintained. Will demonstrate that in the code section.

Distributed Kafka Clusters and Zookeeper

Kafka operates as a distributed system with multiple brokers. Each broker can be a leader or follower for different partitions. The leader handles reads and writes, while followers replicate data.

Kafka originally relied on Zookeeper to manage broker coordination, metadata, and leader election. Zookeeper tracks which broker is the leader of which partition. However, Zookeeper introduces complexity and is being phased out in newer Kafka versions. Kafka 4.0 no longer has Zookeeper.

On Long Polling

You may ask, how does the consumer get the data the moment it is published to the topic/partition? I encourage you to first think of how could this be implemented.

One approach is push, ie the broker pushes the message to the consumer TCP connection. This approach is real-time, but overwhelms the consumer, as it needs to process the message.

Another approach is polling, ie the consumer every X milliseconds asks the broker, is there anything for me and the broker replies, yes here you go, or no nothing, this approach does allow the consumer to read at its own pace but may introduce severe network chatter, which lead to network bandwidth, it also may causes consumer to miss the real-time message, since the message may have came in to the broker between polls.

The final approach which Kafka went with is long polling which I talked extensively on my backend course. The consumer connects to the broker and sends a normal poll, if there is a message the broker replies back, if there isn’t the broker doesn’t respond with “no”, but instead just wait little bit more (configurable), this increases the chances that messages may arrive during this wait. Once we get a message the broker writes the response. Meanwhile the consumer feels like its poll request just took little longer.

Kafka, Docker and Node Example

We will use docker to install Kafka broker and Zookeeper single mode cluster. Then create a topic called “Users” with two partitions, produce some messages on both partitions and have consumers read from the partitions.

My docker host IP is 192.168.7.179, replace it with your own docker host IP.

You will need to have docker and Node installed to proceed

First we clone the repo and change IP address to your docker host.

```javascript

clone the repo

git clone https://github.com/hnasr/javascript_playground.git

change to the kafka directory

cd javascript_playground/kafka

edit docker-compose.yml, producer.js, topics.js and consumer.js change the 192.168.7.179 with your docker host ip.

cat starthere.txt ```

Spin up Zookeeper and Kafka containers using Docker commands.

```javascript services: zookeeper: image: zookeeper hostname: zookeeper ports: - 2181:2181 volumes: - zookeeper_data:/data - zookeeper_datalog:/datalog

kafka: image: ches/kafka restart: always hostname: localhost ports: - "9092:9092" environment: KAFKA_ADVERTISED_HOST_NAME: 192.168.7.179 ZOOKEEPER_IP: 192.168.7.179 KAFKA_OFFSETS_TOPIC_REPLICATION_FACTOR: 1 ALLOW_PLAINTEXT_LISTENER: 1 depends_on: - zookeeper volumes: - kafka_data:/kafka

volumes: zookeeper_data: zookeeper_datalog: kafka_data: ```

javascript docker-compose upCreate a topic called

MyUserswith two partitions, we will use kafkajs module to connect to the kafka broker.```javascript //const Kafka = require("kafkajs").Kafka const {Kafka} = require("kafkajs")

run(); async function run(){ try { const kafka = new Kafka({ "clientId": "myapp", "brokers" :["192.168.7.179:9092"] })

const admin = kafka.admin(); console.log("Connecting.....") await admin.connect() console.log("Connected!") //A-M, N-Z await admin.createTopics({ "topics": [{ "topic" : "MyUsers", "numPartitions": 2 }] }) console.log("Created Successfully!") await admin.disconnect(); } catch(ex) { console.error(`Something bad happened ${ex}`) } finally{ process.exit(0); }} ```

javascript node topics.jsProduce some messages with a producer, the messages are user names. I have the messages starting with letters

```javascript //const Kafka = require("kafkajs").Kafka const {Kafka} = require("kafkajs") const msg = process.argv[2]; run(); async function run(){ try { const kafka = new Kafka({ "clientId": "myapp", "brokers" :["192.168.7.179:9092"] })

const producer = kafka.producer(); console.log("Connecting.....") await producer.connect() console.log("Connected!") //A-M 0 , N-Z 1 const partition = msg[0] < "N" ? 0 : 1; const result = await producer.send({ "topic": "Users", "messages": [ { "value": msg, "partition": partition } ] }) console.log(`Send Successfully! ${JSON.stringify(result)}`) await producer.disconnect(); } catch(ex) { console.error(`Something bad happened ${ex}`) } finally{ process.exit(0); }} ```

javascript node producer.js Adam node producer.js Zackjavascript HusseinMac:kafka HusseinNasser$ node producer.js Adam Connecting..... Connected! Send Successfully! [{"topicName":"MyUsers","partition":0,"errorCode":0,"offset":"0","timestamp":"-1"}] HusseinMac:kafka HusseinNasser$ node producer.js Zack Connecting..... Connected! Send Successfully! [{"topicName":"MyUsers","partition":1,"errorCode":0,"offset":"0","timestamp":"-1"}]Implement a consumer that subscribes to the topic and handles messages with long polling.

Note that I hard coded a consumer group name “test” in the consumer.js file. Running the consumer.js file will create a new consumer on the MyUsers topic and it will be responsible for both partitions. You can note this from the response"memberAssignment”:{“MyUsers”:[0,1]}

javascript HusseinMac:kafka HusseinNasser$ node consumer.js Connecting..... Connected! {"level":"INFO","timestamp":"2025-04-13T14:29:36.102Z","logger":"kafkajs","message":"[Consumer] Starting","groupId":"test"} {"level":"INFO","timestamp":"2025-04-13T14:29:58.411Z","logger":"kafkajs","message":"[Runner] Consumer has joined the group","groupId":"test","memberId":"myapp-901679c6-034c-4efd-bc4d-cb5fc5bc9e6e","leaderId":"myapp-901679c6-034c-4efd-bc4d-cb5fc5bc9e6e","isLeader":true,"memberAssignment":{"MyUsers":[0,1]},"groupProtocol":"RoundRobinAssigner","duration":22307} RVD Msg Adam on partition 0 RVD Msg Zack on partition 1Now assume we run another consumer, which will also have the same group. Kafka will rebalance the group and assign a partition for each consumer so they parallel process.

Note the memberAssignment property for each consumer.

```javascript HusseinMac:kafka HusseinNasser$ node consumer.js (consumer 1) {"level":"ERROR","timestamp":"2025-04-13T14:31:09.360Z","logger":"kafkajs","message":"[Connection] Response Heartbeat(key: 12, version: 0)","broker":"192.168.7.179:9092","clientId":"myapp","error":"The group is rebalancing, so a rejoin is needed","correlationId":39,"size":6} {"level":"ERROR","timestamp":"2025-04-13T14:31:09.361Z","logger":"kafkajs","message":"[Runner] The group is rebalancing, re-joining","groupId":"test","memberId":"myapp-901679c6-034c-4efd-bc4d-cb5fc5bc9e6e","error":"The group is rebalancing, so a rejoin is needed","retryCount":0,"retryTime":308} {"level":"INFO","timestamp":"2025-04-13T14:31:09.382Z","logger":"kafkajs","message":"[Runner] Consumer has joined the group","groupId":"test","memberId":"myapp-901679c6-034c-4efd-bc4d-cb5fc5bc9e6e","leaderId":"myapp-901679c6-034c-4efd-bc4d-cb5fc5bc9e6e","isLeader":true,"memberAssignment":{"MyUsers":[1]},"groupProtocol":"RoundRobinAssigner","duration":21}

HusseinMac:kafka HusseinNasser$ node consumer.js (consumer 2) Connecting..... Connected! {"level":"INFO","timestamp":"2025-04-13T14:31:07.599Z","logger":"kafkajs","message":"[Consumer] Starting","groupId":"test"} {"level":"INFO","timestamp":"2025-04-13T14:31:09.383Z","logger":"kafkajs","message":"[Runner] Consumer has joined the group","groupId":"test","memberId":"myapp-6c861d03-879d-4b7b-81a1-1e2cd1c15c83","leaderId":"myapp-901679c6-034c-4efd-bc4d-cb5fc5bc9e6e","isLeader":false,"memberAssignment":{"MyUsers":[0]},"groupProtocol":"RoundRobinAssigner","duration":1783} ```

Let us publish one message for each partition and see what happens.

javascript node producer.js Adamy node producer.js Zackery```javascript (consumer 1) RVD Msg Zackery on partition 1 (consumer 2) RVD Msg Adamy on partition 0

```

What happens if more consumers than partitions are available? As per testing, new consumers won’t get any partitions assigned. But a consumer group rebalance may reassign partitions.

Kafka Pros and Cons

By understanding the architecture and design of Apache Kafka we know the fact it is performs well for writes (producing messages), because of the append-only nature. And having the consumer aware of the position to where to read from makes reads also fast. Kafka scales well with partitioning and handle fault tolerant with the distributed nature.

However, no software is free of limitations, with all these features added to Kafka, complexity is unavoidable. Producers needs to be aware of the partitions which introduces complexity in producing messages. The need for distributed architecture, replication introduces depedancies on an external component (Zookeeper) which adds more complexity and even latency. All of this makes Kafka difficult to install, maintain and manage.

Note that Kafka 4.0 that was release in March 2025 has completely removed Zookeeper in favor of a raft based replication between brokers.

Conclusion

Now that you know the basics of Apache Kafka, you will understand its power and its limitations. That is the most important thing. Anything on top of Kafka uses these fundamentals.

If you enjoyed this article, check out my backend and database courses.

https://stas.layer3.press/articles/c11f511b-29f5-4612-a308-004c44183c7b

-

@ 90c656ff:9383fd4e

2025-05-17 10:26:42

@ 90c656ff:9383fd4e

2025-05-17 10:26:42Millions of people around the world still lack access to basic banking services, whether due to lack of infrastructure, bureaucratic requirements, or economic instability in their countries. Bitcoin emerges as an innovative solution to this problem, allowing anyone with internet access to have control over their money without relying on banks or governments. By offering an open and accessible financial system, Bitcoin becomes a powerful tool for global financial inclusion.

- The problem of financial exclusion