-

@ 7f6db517:a4931eda

2025-05-26 02:01:31

@ 7f6db517:a4931eda

2025-05-26 02:01:31

People forget Bear Stearns failed March 2008 - months of denial followed before the public realized how bad the situation was under the surface.

Similar happening now but much larger scale. They did not fix fundamental issues after 2008 - everything is more fragile.

The Fed preemptively bailed out every bank with their BTFP program and First Republic Bank still failed. The second largest bank failure in history.

There will be more failures. There will be more bailouts. Depositors will be "protected" by socializing losses across everyone.

Our President and mainstream financial pundits are currently pretending the banking crisis is over while most banks remain insolvent. There are going to be many more bank failures as this ponzi system unravels.

Unlike 2008, we have the ability to opt out of these broken and corrupt institutions by using bitcoin. Bitcoin held in self custody is unique in its lack of counterparty risk - you do not have to trust a bank or other centralized entity to hold it for you. Bitcoin is also incredibly difficult to change by design since it is not controlled by an individual, company, or government - the supply of dollars will inevitably be inflated to bailout these failing banks but bitcoin supply will remain unchanged. I do not need to convince you that bitcoin provides value - these next few years will convince millions.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-05-26 04:01:40

@ 7f6db517:a4931eda

2025-05-26 04:01:40

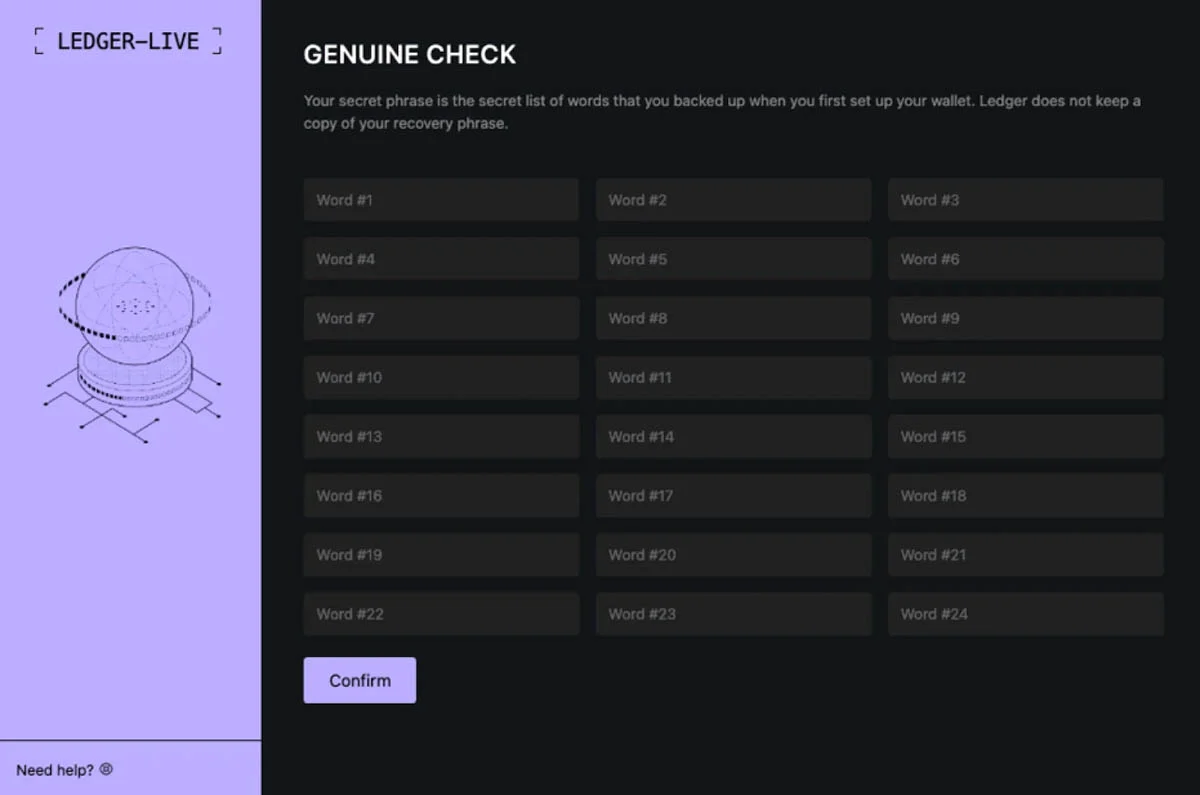

What is KYC/AML?

- The acronym stands for Know Your Customer / Anti Money Laundering.

- In practice it stands for the surveillance measures companies are often compelled to take against their customers by financial regulators.

- Methods differ but often include: Passport Scans, Driver License Uploads, Social Security Numbers, Home Address, Phone Number, Face Scans.

- Bitcoin companies will also store all withdrawal and deposit addresses which can then be used to track bitcoin transactions on the bitcoin block chain.

- This data is then stored and shared. Regulations often require companies to hold this information for a set number of years but in practice users should assume this data will be held indefinitely. Data is often stored insecurely, which results in frequent hacks and leaks.

- KYC/AML data collection puts all honest users at risk of theft, extortion, and persecution while being ineffective at stopping crime. Criminals often use counterfeit, bought, or stolen credentials to get around the requirements. Criminals can buy "verified" accounts for as little as $200. Furthermore, billions of people are excluded from financial services as a result of KYC/AML requirements.

During the early days of bitcoin most services did not require this sensitive user data, but as adoption increased so did the surveillance measures. At this point, most large bitcoin companies are collecting and storing massive lists of bitcoiners, our sensitive personal information, and our transaction history.

Lists of Bitcoiners

KYC/AML policies are a direct attack on bitcoiners. Lists of bitcoiners and our transaction history will inevitably be used against us.

Once you are on a list with your bitcoin transaction history that record will always exist. Generally speaking, tracking bitcoin is based on probability analysis of ownership change. Surveillance firms use various heuristics to determine if you are sending bitcoin to yourself or if ownership is actually changing hands. You can obtain better privacy going forward by using collaborative transactions such as coinjoin to break this probability analysis.

Fortunately, you can buy bitcoin without providing intimate personal information. Tools such as peach, hodlhodl, robosats, azteco and bisq help; mining is also a solid option: anyone can plug a miner into power and internet and earn bitcoin by mining privately.

You can also earn bitcoin by providing goods and/or services that can be purchased with bitcoin. Long term, circular economies will mitigate this threat: most people will not buy bitcoin - they will earn bitcoin - most people will not sell bitcoin - they will spend bitcoin.

There is no such thing as KYC or No KYC bitcoin, there are bitcoiners on lists and those that are not on lists.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-05-26 02:01:30

@ 7f6db517:a4931eda

2025-05-26 02:01:30

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

Good morning.

It looks like PacWest will fail today. It will be both the fifth largest bank failure in US history and the sixth major bank to fail this year. It will likely get purchased by one of the big four banks in a government orchestrated sale.

March 8th - Silvergate Bank

March 10th - Silicon Valley Bank

March 12th - Signature Bank

March 19th - Credit Suisse

May 1st - First Republic Bank

May 4th - PacWest Bank?PacWest is the first of many small regional banks that will go under this year. Most will get bought by the big four in gov orchestrated sales. This has been the playbook since 2008. Follow the incentives. Massive consolidation across the banking industry. PacWest gonna be a drop in the bucket compared to what comes next.

First, a hastened government led bank consolidation, then a public/private partnership with the remaining large banks to launch a surveilled and controlled digital currency network. We will be told it is more convenient. We will be told it is safer. We will be told it will prevent future bank runs. All of that is marketing bullshit. The goal is greater control of money. The ability to choose how we spend it and how we save it. If you control the money - you control the people that use it.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-05-26 04:01:40

@ 7f6db517:a4931eda

2025-05-26 04:01:40

The former seems to have found solid product market fit. Expect significant volume, adoption, and usage going forward.

The latter's future remains to be seen. Dependence on Tor, which has had massive reliability issues, and lack of strong privacy guarantees put it at risk.

— ODELL (@ODELL) October 27, 2022

The Basics

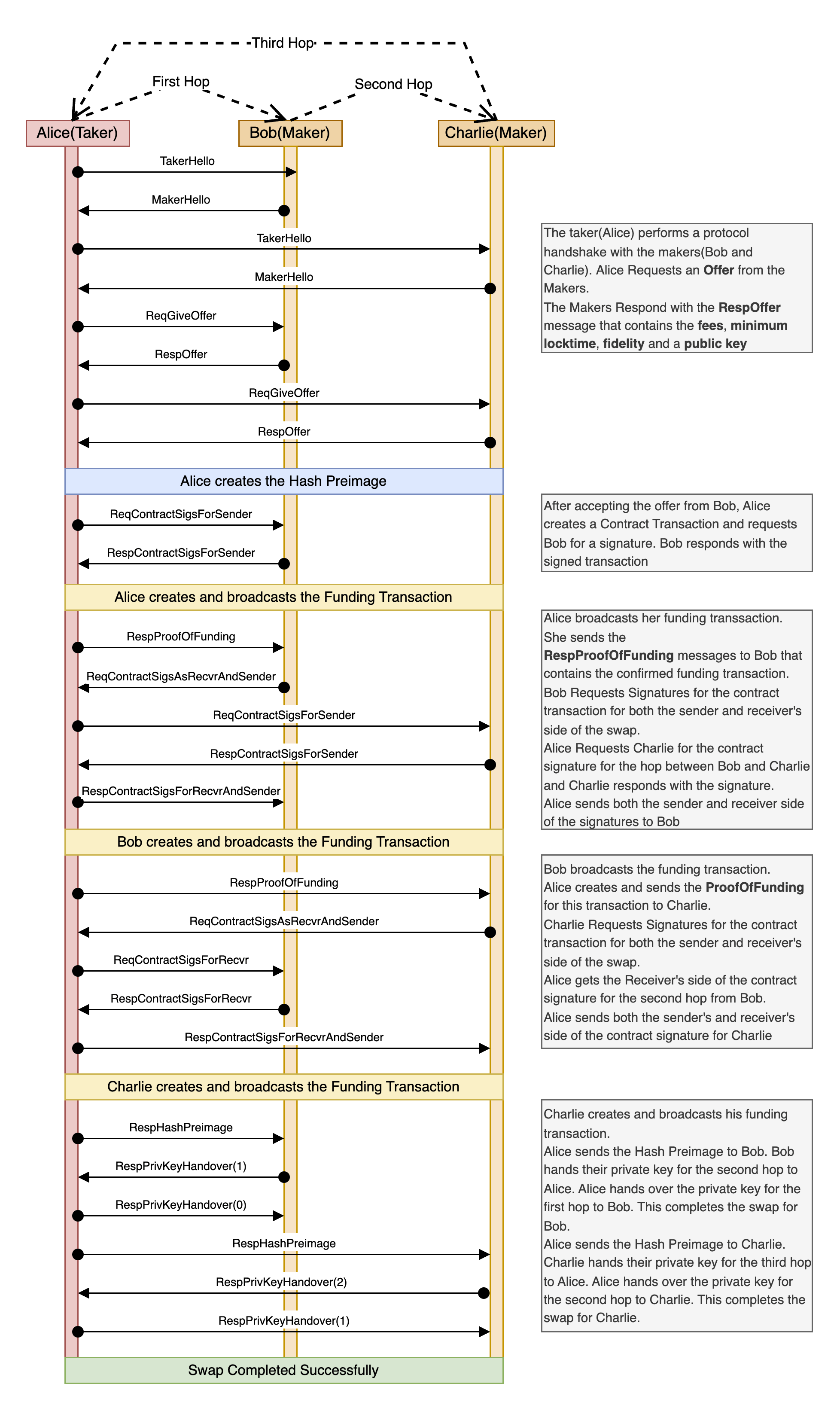

- Lightning is a protocol that enables cheap and fast native bitcoin transactions.

- At the core of the protocol is the ability for bitcoin users to create a payment channel with another user.

- These payment channels enable users to make many bitcoin transactions between each other with only two on-chain bitcoin transactions: the channel open transaction and the channel close transaction.

- Essentially lightning is a protocol for interoperable batched bitcoin transactions.

- It is expected that on chain bitcoin transaction fees will increase with adoption and the ability to easily batch transactions will save users significant money.

- As these lightning transactions are processed, liquidity flows from one side of a channel to the other side, on chain transactions are signed by both parties but not broadcasted to update this balance.

- Lightning is designed to be trust minimized, either party in a payment channel can close the channel at any time and their bitcoin will be settled on chain without trusting the other party.

There is no 'Lightning Network'

- Many people refer to the aggregate of all lightning channels as 'The Lightning Network' but this is a false premise.

- There are many lightning channels between many different users and funds can flow across interconnected channels as long as there is a route through peers.

- If a lightning transaction requires multiple hops it will flow through multiple interconnected channels, adjusting the balance of all channels along the route, and paying lightning transaction fees that are set by each node on the route.

Example: You have a channel with Bob. Bob has a channel with Charlie. You can pay Charlie through your channel with Bob and Bob's channel with User C.

- As a result, it is not guaranteed that every lightning user can pay every other lightning user, they must have a route of interconnected channels between sender and receiver.

Lightning in Practice

- Lightning has already found product market fit and usage as an interconnected payment protocol between large professional custodians.

- They are able to easily manage channels and liquidity between each other without trust using this interoperable protocol.

- Lightning payments between large custodians are fast and easy. End users do not have to run their own node or manage their channels and liquidity. These payments rarely fail due to professional management of custodial nodes.

- The tradeoff is one inherent to custodians and other trusted third parties. Custodial wallets can steal funds and compromise user privacy.

Sovereign Lightning

- Trusted third parties are security holes.

- Users must run their own node and manage their own channels in order to use lightning without trusting a third party. This remains the single largest friction point for sovereign lightning usage: the mental burden of actively running a lightning node and associated liquidity management.

- Bitcoin development prioritizes node accessibility so cost to self host your own node is low but if a node is run at home or office, Tor or a VPN is recommended to mask your IP address: otherwise it is visible to the entire network and represents a privacy risk.

- This privacy risk is heightened due to the potential for certain governments to go after sovereign lightning users and compel them to shutdown their nodes. If their IP Address is exposed they are easier to target.

- Fortunately the tools to run and manage nodes continue to get easier but it is important to understand that this will always be a friction point when compared to custodial services.

The Potential Fracture of Lightning

- Any lightning user can choose which users are allowed to open channels with them.

- One potential is that professional custodians only peer with other professional custodians.

- We already see nodes like those run by CashApp only have channels open with other regulated counterparties. This could be due to performance goals, liability reduction, or regulatory pressure.

- Fortunately some of their peers are connected to non-regulated parties so payments to and from sovereign lightning users are still successfully processed by CashApp but this may not always be the case going forward.

Summary

- Many people refer to the aggregate of all lightning channels as 'The Lightning Network' but this is a false premise. There is no singular 'Lightning Network' but rather many payment channels between distinct peers, some connected with each other and some not.

- Lightning as an interoperable payment protocol between professional custodians seems to have found solid product market fit. Expect significant volume, adoption, and usage going forward.

- Lightning as a robust sovereign payment protocol has yet to be battle tested. Heavy reliance on Tor, which has had massive reliability issues, the friction of active liquidity management, significant on chain fee burden for small amounts, interactivity constraints on mobile, and lack of strong privacy guarantees put it at risk.

If you have never used lightning before, use this guide to get started on your phone.

If you found this post helpful support my work with bitcoin.

-

@ 57d1a264:69f1fee1

2025-05-25 06:26:42

@ 57d1a264:69f1fee1

2025-05-25 06:26:42I dare to claim that the big factor is the absence of an infinite feed design.

Modern social media landscape sucks for a myriad of reasons, but oh boy does the infinite feed take the crapcake. It's not just bad on it's own, it's emblematic of most, if not all other ways social media have deteriorated into an enshitification spiral. Let's see at just three things I hate about it the most.

1) It's addictive: In the race for your attention, every addictive design element helps. But infinite feed is addictive almost by default. Users are expected to pull the figurative lever until they hit a jackpot. Just one more reel, then I'll go to sleep.

2) Autonomy? What's that? You are not the one driving your experience. No. You are just a passenger passively absorbing what the feed feeds you.

3) Echo chambers. The algorithm might be more to blame here, but the infinite feed and it's super-limited exploration options sure don't help. Your feed only goes two ways - into the past and into the comfortable.

And I could go on, and on...

The point it, if the goal of every big tech company is to have us mindlessly and helplessly consume their products, without agency and opposition (and it is $$$), then the infinite feed gets them half-way there.

Let's get rid of it. For the sake of humanity.

Aphantasia [^1]

Version: 1.0.2 AlphaWhat is Aphantasia?

I like to call it a social network for graph enthusiasts. It's a place where your thoughts live in time and space, interconnected with others and explorable in a graph view.

The code is open-source and you can take a look at it on GitHub. There you can find more information about contributions, API usage and other details related to the software.

There is also an accompanying youtube channel.

https://www.youtube.com/watch?v=JeLOt-45rJM

[^1]: Aphantasia the software is named after aphantasia the condition - see Wikipedia for more information.

https://stacker.news/items/988754

-

@ 57d1a264:69f1fee1

2025-05-24 06:07:19

@ 57d1a264:69f1fee1

2025-05-24 06:07:19Definition: when every single person in the chain responsible for shipping a product looks at objectively horrendous design decisions and goes: yup, this looks good to me, release this. Designers, developers, product managers, testers, quality assurance... everyone.

I nominate Peugeot as the first example in this category.

Continue reading at https://grumpy.website/1665

https://stacker.news/items/988044

-

@ 7f6db517:a4931eda

2025-05-26 04:01:40

@ 7f6db517:a4931eda

2025-05-26 04:01:40

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

The four main banks of bitcoin and “crypto” are Signature, Prime Trust, Silvergate, and Silicon Valley Bank. Prime Trust does not custody funds themselves but rather maintains deposit accounts at BMO Harris Bank, Cross River, Lexicon Bank, MVB Bank, and Signature Bank. Silvergate and Silicon Valley Bank have already stopped withdrawals. More banks will go down before the chaos stops. None of them have sufficient reserves to meet withdrawals.

Bitcoin gives us all the ability to opt out of a system that has massive layers of counterparty risk built in, years of cheap money and broken incentives have layered risk on top of risk throughout the entire global economy. If you thought the FTX bank run was painful to watch, I have bad news for you: every major bank in the world is fractional reserve. Bitcoin held in self custody is unique in its lack of counterparty risk, as global market chaos unwinds this will become much more obvious.

The rules of bitcoin are extremely hard to change by design. Anyone can access the network directly without a trusted third party by using their own node. Owning more bitcoin does not give you more control over the network with all participants on equal footing.

Bitcoin is:

- money that is not controlled by a company or government

- money that can be spent or saved without permission

- money that is provably scarce and should increase in purchasing power with adoptionBitcoin is money without trust. Whether you are a nation state, corporation, or an individual, you can use bitcoin to spend or save without permission. Social media will accelerate the already deteriorating trust in our institutions and as this trust continues to crumble the value of trust minimized money will become obvious. As adoption increases so should the purchasing power of bitcoin.

A quick note on "stablecoins," such as USDC - it is important to remember that they rely on trusted custodians. They have the same risk as funds held directly in bank accounts with additional counterparty risk on top. The trusted custodians can be pressured by gov, exit scam, or caught up in fraud. Funds can and will be frozen at will. This is a distinctly different trust model than bitcoin, which is a native bearer token that does not rely on any centralized entity or custodian.

Most bitcoin exchanges have exposure to these failing banks. Expect more chaos and confusion as this all unwinds. Withdraw any bitcoin to your own wallet ASAP.

Simple Self Custody Guide: https://werunbtc.com/muun

More Secure Cold Storage Guide: https://werunbtc.com/coldcard

If you found this post helpful support my work with bitcoin.

-

@ 57d1a264:69f1fee1

2025-05-24 05:53:43

@ 57d1a264:69f1fee1

2025-05-24 05:53:43This talks highlights tools for product management, UX design, web development, and content creation to embed accessibility.

Organizations need scalability and consistency in their accessibility work, aligning people, policies, and processes to integrate it across roles. This session highlights tools for product management, UX design, web development, and content creation to embed accessibility. We will explore inclusive personas, design artifacts, design systems, and content strategies to support developers and creators, with real-world examples.

https://www.youtube.com/watch?v=-M2cMLDU4u4

https://stacker.news/items/988041

-

@ 7f6db517:a4931eda

2025-05-26 04:01:39

@ 7f6db517:a4931eda

2025-05-26 04:01:39

The newly proposed RESTRICT ACT - is being advertised as a TikTok Ban, but is much broader than that, carries a $1M Fine and up to 20 years in prison️! It is unconstitutional and would create massive legal restrictions on the open source movement and free speech throughout the internet.

The Bill was proposed by: Senator Warner, Senator Thune, Senator Baldwin, Senator Fischer, Senator Manchin, Senator Moran, Senator Bennet, Senator Sullivan, Senator Gillibrand, Senator Collins, Senator Heinrich, and Senator Romney. It has broad support across Senators of both parties.

Corrupt politicians will not protect us. They are part of the problem. We must build, support, and learn how to use censorship resistant tools in order to defend our natural rights.

The RESTRICT Act, introduced by Senators Warner and Thune, aims to block or disrupt transactions and financial holdings involving foreign adversaries that pose risks to national security. Although the primary targets of this legislation are companies like Tik-Tok, the language of the bill could potentially be used to block or disrupt cryptocurrency transactions and, in extreme cases, block Americans’ access to open source tools or protocols like Bitcoin.

The Act creates a redundant regime paralleling OFAC without clear justification, it significantly limits the ability for injured parties to challenge actions raising due process concerns, and unlike OFAC it lacks any carve-out for protected speech. COINCENTER ON THE RESTRICT ACT

If you found this post helpful support my work with bitcoin.

-

@ 9ca447d2:fbf5a36d

2025-05-22 14:01:52

@ 9ca447d2:fbf5a36d

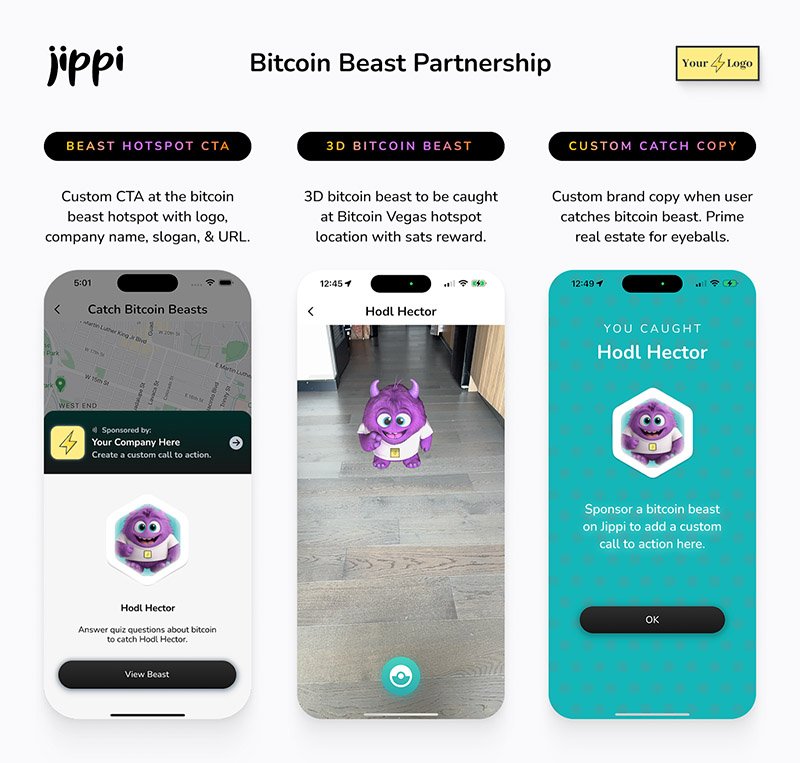

2025-05-22 14:01:52Gen Z (those born between 1997 and 2012) are not rushing to stack sats, and Oliver Porter, Founder & CEO of Jippi, understands the challenge better than most. His strategy revolves around adapting Bitcoin education to fit seamlessly into the digital lives of young adults.

“We need to meet them where they are,” Oliver explains. “90% of Gen Z plays games. 70% expect to earn rewards.”

So, what will effectively introduce them to Bitcoin? In Oliver’s mind, the answer is simple: games that don’t feel preachy but still plant the orange pill.

Learn more at Jippi.app

That’s exactly what Jippi is. Based in Austin, Texas, the team has created a mobile augmented reality (AR) game that rewards players in bitcoin and sneakily teaches them why sound money matters.

“It’s Pokémon GO… but for sats,” Oliver puts it succinctly.

Jippi is like Pokemon Go, but for sats

Oliver’s Bitcoin journey, like many in the space, began long before he was ready. A former colleague had tried planting the seed years earlier, handing him a copy of The Bitcoin Standard. But the moment passed.

It wasn’t until the chaos of 2020 when lockdowns hit, printing presses roared, and civil liberties shrank that the message finally landed for him.

“The government got so good at doing reverse Robin Hood,” Oliver explains. “They steal from the working population and reward the rich.”

By 2020, though, the absurdity of the covid hysteria had caused his eyes to be opened and the orange light seemed the best path back to freedom.

He left the UK for Austin “one of the best places for Bitcoiners,” he says, and dove headfirst into the industry, working at Swan for a year before founding Jippi on PlebLab’s accelerator program.

Jippi’s flagship game lets players roam their cities hunting digital creatures, Bitcoin Beasts, tied to real-world locations. Catching them requires answering Bitcoin trivia, and the reward is sats.

No jargon. No hour-long lectures. Just gameplay with sound money principles woven right in.

The model is working. At a recent hackathon in Austin, Jippi beat out 14 other teams to win first place and $15,000 in prize money.

Oliver of Jippi won Top Builder Season 2 — PlebLab on X

“We’re backdooring Bitcoin education,” Oliver admits. “And while we’re at it, encouraging people to get outside and touch grass.”

Not everyone’s been thrilled. When Jippi team members visited one of the more liberal-leaning places in Texas, UT Austin, to test interest in Bitcoin, they found some seriously committed no-coiners on the campus.

“One young woman told me, ‘I would rather die than talk about Bitcoin,'” Oliver recalls, highlighting the cultural resistance that’s built up among younger demographics.

This resistance is backed by hard data. According to Oliver, some of the Bitcoin podcasters they met with in the space to do market research reported that less than 1% of their listeners are from Gen Z and that number is dropping.

“Unless we find a way to capture their interest in a meaningful way, there’s going to be a big problem around trying to sway Gen Z away from the siren call of s***coins and crypto casinos and towards Bitcoin,” Oliver warns.

Jippi’s next big move is Las Vegas, where they’ll launch the Beast Catch experience at the Venetian during a major Bitcoin event. To mark the occasion, they’re opening up six limited sponsorship spots for Bitcoin companies, each one tied to a custom in-game beast.

Jippi looks to launch a special event at Bitcoin 2025

“It’s real estate inside the game,” Oliver explains. “Brands become allies, not intrusions. You get a logo, company name, and call to action, so we can push people to your site or app.”

Bitcoin Well—an automatic self-custody Bitcoin platform—has claimed Beast #1. Only five exclusive spots remain for Bitcoin companies to “beastify their brand” through Jippi’s immersive AR game.

“I love the Jippi mission. I think gamified learning is how we will onboard the next generation and it’s exciting to see what the Jippi team is doing! I love working with bitcoiners towards our common mission – bullish!” said Adam O’Brien, Bitcoin Well CEO.

Jippi’s sponsorship model is simple: align incentives, respect users, and support builders. Instead of throwing ad money at tech giants, Bitcoin companies can connect with new users naturally while they’re having fun and earning sats in the process.

For Bitcoin companies looking to reach a younger demographic, this represents a unique opportunity to showcase their brand to up to 30,000 potential customers at the Vegas event.

Jippi Bitcoin Beast partnership

While Jippi’s current focus is simple, get the game into more cities, Oliver sees a future where AR glasses and AI help personalize Bitcoin education even further.

“The magic is going to really happen when Apple releases the glasses form factor,” he says, describing how augmented reality could enhance real-world connections rather than isolate users.

In the longer term, Jippi aims to evolve from a free-to-play model toward a pay-to-play version with higher stakes. Users would form “tribes” with friends to compete for substantial bitcoin prizes, creating social connections along with financial education.

Unlike VC-backed startups, Jippi is raising funds pleb style via Timestamp, an open investment platform for Bitcoin companies.

“You don’t have to be an accredited investor,” Oliver explains. “You’re directly supporting the parallel Bitcoin economy by investing in Bitcoin companies for equity.”

Anyone can invest as little as $100. Perks include early access, exclusive game content, and even creating your own beast design with your name/pseudonym and unique game lore. Each investment comes with direct ownership of an early-stage Bitcoin company like Jippi.

For Oliver, this is more than just a business. It’s about future-proofing Bitcoin adoption and ensuring Satoshi’s vision lives on, especially as many people are lured by altcoins, NFTs, and social media dopamine.

“We’re on the right side of history,” he says firmly. “I want my grandkids to know that early on in the Bitcoin revolution, games like Jippi helped make it stick.”

In a world increasingly absorbed by screens and short attention spans, Jippi’s combination of outdoor play, sats rewards, and Bitcoin education might be exactly the bridge Gen Z needs.

Interested in sponsoring a Beast or investing in Jippi? Reach out to Jippi directly by heading to their partnerships page on their website or visit their Timestamp page to invest in Jippi today.

-

@ 7f6db517:a4931eda

2025-05-26 04:01:39

@ 7f6db517:a4931eda

2025-05-26 04:01:39

@matt_odell don't you even dare not ask about nostr!

— Kukks (Andrew Camilleri) (@MrKukks) May 18, 2021

Nostr first hit my radar spring 2021: created by fellow bitcoiner and friend, fiatjaf, and released to the world as free open source software. I was fortunate to be able to host a conversation with him on Citadel Dispatch in those early days, capturing that moment in history forever. Since then, the protocol has seen explosive viral organic growth as individuals around the world have contributed their time and energy to build out the protocol and the surrounding ecosystem due to the clear need for better communication tools.

nostr is to twitter as bitcoin is to paypal

As an intro to nostr, let us start with a metaphor:

twitter is paypal - a centralized platform plagued by censorship but has the benefit of established network effects

nostr is bitcoin - an open protocol that is censorship resistant and robust but requires an organic adoption phase

Nostr is an open communication protocol that can be used to send messages across a distributed set of relays in a censorship resistant and robust way.

- Anyone can run a relay.

- Anyone can interact with the protocol.

- Relays can choose which messages they want to relay.

- Users are identified by a simple public private key pair that they can generate themselves.Nostr is often compared to twitter since there are nostr clients that emulate twitter functionality and user interface but that is merely one application of the protocol. Nostr is so much more than a mere twitter competitor. Nostr clients and relays can transmit a wide variety of data and clients can choose how to display that information to users. The result is a revolution in communication with implications that are difficult for any of us to truly comprehend.

Similar to bitcoin, nostr is an open and permissionless protocol. No person, company, or government controls it. Anyone can iterate and build on top of nostr without permission. Together, bitcoin and nostr are incredibly complementary freedom tech tools: censorship resistant, permissionless, robust, and interoperable - money and speech protected by code and incentives, not laws.

As censorship throughout the world continues to escalate, freedom tech provides hope for individuals around the world who refuse to accept the status quo. This movement will succeed on the shoulders of those who choose to stand up and contribute. We will build our own path. A brighter path.

My Nostr Public Key: npub1qny3tkh0acurzla8x3zy4nhrjz5zd8l9sy9jys09umwng00manysew95gx

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-05-26 04:01:39

@ 7f6db517:a4931eda

2025-05-26 04:01:39

"Privacy is necessary for an open society in the electronic age. Privacy is not secrecy. A private matter is something one doesn't want the whole world to know, but a secret matter is something one doesn't want anybody to know. Privacy is the power to selectively reveal oneself to the world." - Eric Hughes, A Cypherpunk's Manifesto, 1993

Privacy is essential to freedom. Without privacy, individuals are unable to make choices free from surveillance and control. Lack of privacy leads to loss of autonomy. When individuals are constantly monitored it limits our ability to express ourselves and take risks. Any decisions we make can result in negative repercussions from those who surveil us. Without the freedom to make choices, individuals cannot truly be free.

Freedom is essential to acquiring and preserving wealth. When individuals are not free to make choices, restrictions and limitations prevent us from economic opportunities. If we are somehow able to acquire wealth in such an environment, lack of freedom can result in direct asset seizure by governments or other malicious entities. At scale, when freedom is compromised, it leads to widespread economic stagnation and poverty. Protecting freedom is essential to economic prosperity.

The connection between privacy, freedom, and wealth is critical. Without privacy, individuals lose the freedom to make choices free from surveillance and control. While lack of freedom prevents individuals from pursuing economic opportunities and makes wealth preservation nearly impossible. No Privacy? No Freedom. No Freedom? No Wealth.

Rights are not granted. They are taken and defended. Rights are often misunderstood as permission to do something by those holding power. However, if someone can give you something, they can inherently take it from you at will. People throughout history have necessarily fought for basic rights, including privacy and freedom. These rights were not given by those in power, but rather demanded and won through struggle. Even after these rights are won, they must be continually defended to ensure that they are not taken away. Rights are not granted - they are earned through struggle and defended through sacrifice.

If you found this post helpful support my work with bitcoin.

-

@ 57d1a264:69f1fee1

2025-05-22 13:13:36

@ 57d1a264:69f1fee1

2025-05-22 13:13:36Graphics materials for Bitcoin Knots https://github.com/bitcoinknots branding. See below guide image for reference, a bit cleaner and scalable:

Font family "Aileron" is provided free for personal and commercial use, and can be found here: https://www.1001fonts.com/aileron-font.html

Source: https://github.com/Blissmode/bitcoinknots-gfx/tree/main

https://stacker.news/items/986624

-

@ 57d1a264:69f1fee1

2025-05-22 12:36:20

@ 57d1a264:69f1fee1

2025-05-22 12:36:20Graphics materials for Bitcoin Knots https://github.com/bitcoinknots branding. See below guide image for reference, a bit cleaner and scalable:

Font family "Aileron" is provided free for personal and commercial use, and can be found here: https://www.1001fonts.com/aileron-font.html

Source: https://github.com/Blissmode/bitcoinknots-gfx/tree/main

https://stacker.news/items/986587

-

@ 7f6db517:a4931eda

2025-05-26 04:01:39

@ 7f6db517:a4931eda

2025-05-26 04:01:39

People forget Bear Stearns failed March 2008 - months of denial followed before the public realized how bad the situation was under the surface.

Similar happening now but much larger scale. They did not fix fundamental issues after 2008 - everything is more fragile.

The Fed preemptively bailed out every bank with their BTFP program and First Republic Bank still failed. The second largest bank failure in history.

There will be more failures. There will be more bailouts. Depositors will be "protected" by socializing losses across everyone.

Our President and mainstream financial pundits are currently pretending the banking crisis is over while most banks remain insolvent. There are going to be many more bank failures as this ponzi system unravels.

Unlike 2008, we have the ability to opt out of these broken and corrupt institutions by using bitcoin. Bitcoin held in self custody is unique in its lack of counterparty risk - you do not have to trust a bank or other centralized entity to hold it for you. Bitcoin is also incredibly difficult to change by design since it is not controlled by an individual, company, or government - the supply of dollars will inevitably be inflated to bailout these failing banks but bitcoin supply will remain unchanged. I do not need to convince you that bitcoin provides value - these next few years will convince millions.

If you found this post helpful support my work with bitcoin.

-

@ 57d1a264:69f1fee1

2025-05-22 06:21:22

@ 57d1a264:69f1fee1

2025-05-22 06:21:22You’ve probably seen it before.

You open an agency’s website or a freelancer’s portfolio. At the very top of the homepage, it says:

We design for startups.

You wait 3 seconds. The last word fades out and a new one fades in:

We design for agencies.

Wait 3 more seconds:

We design for founders.

I call this design pattern The Wheel of Nothing: a rotating list of audience segments meant to impress through inclusion and draw attention through motion… for absolutely no reason.

Revered brand studio Pentagram recently launched a new website. To my surprise, the homepage features the Wheel of Nothing front and center, boldly claiming:

We design Everything for Everyone…before cycling through more specific combinations every few seconds.

Dan Mall, a husband, dad, teacher, creative director, designer, founder, and entrepreneur from Philly. I share as much as I can to create better opportunities for those who wouldn’t have them otherwise. Most recently, I ran design system consultancy SuperFriendly for over a decade.

Read more at Dans' website https://danmall.com/posts/the-wheel-of-nothing/

https://stacker.news/items/986392

-

@ 7f6db517:a4931eda

2025-05-26 04:01:38

@ 7f6db517:a4931eda

2025-05-26 04:01:38

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

Good morning.

It looks like PacWest will fail today. It will be both the fifth largest bank failure in US history and the sixth major bank to fail this year. It will likely get purchased by one of the big four banks in a government orchestrated sale.

March 8th - Silvergate Bank

March 10th - Silicon Valley Bank

March 12th - Signature Bank

March 19th - Credit Suisse

May 1st - First Republic Bank

May 4th - PacWest Bank?PacWest is the first of many small regional banks that will go under this year. Most will get bought by the big four in gov orchestrated sales. This has been the playbook since 2008. Follow the incentives. Massive consolidation across the banking industry. PacWest gonna be a drop in the bucket compared to what comes next.

First, a hastened government led bank consolidation, then a public/private partnership with the remaining large banks to launch a surveilled and controlled digital currency network. We will be told it is more convenient. We will be told it is safer. We will be told it will prevent future bank runs. All of that is marketing bullshit. The goal is greater control of money. The ability to choose how we spend it and how we save it. If you control the money - you control the people that use it.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-05-26 04:01:38

@ 7f6db517:a4931eda

2025-05-26 04:01:38

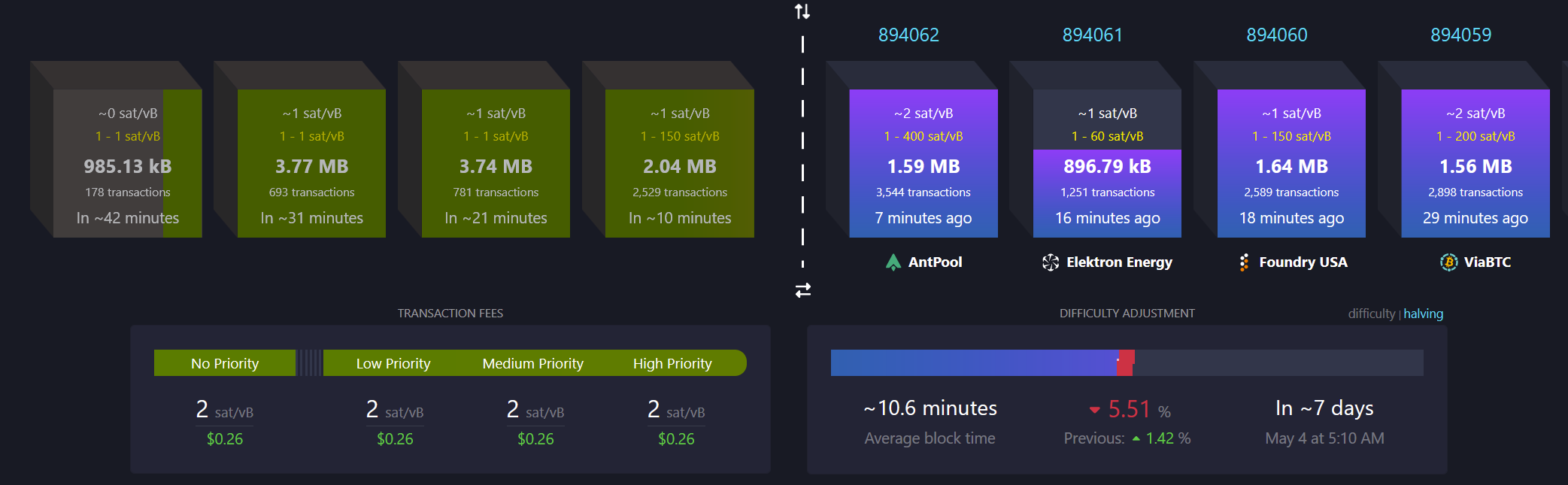

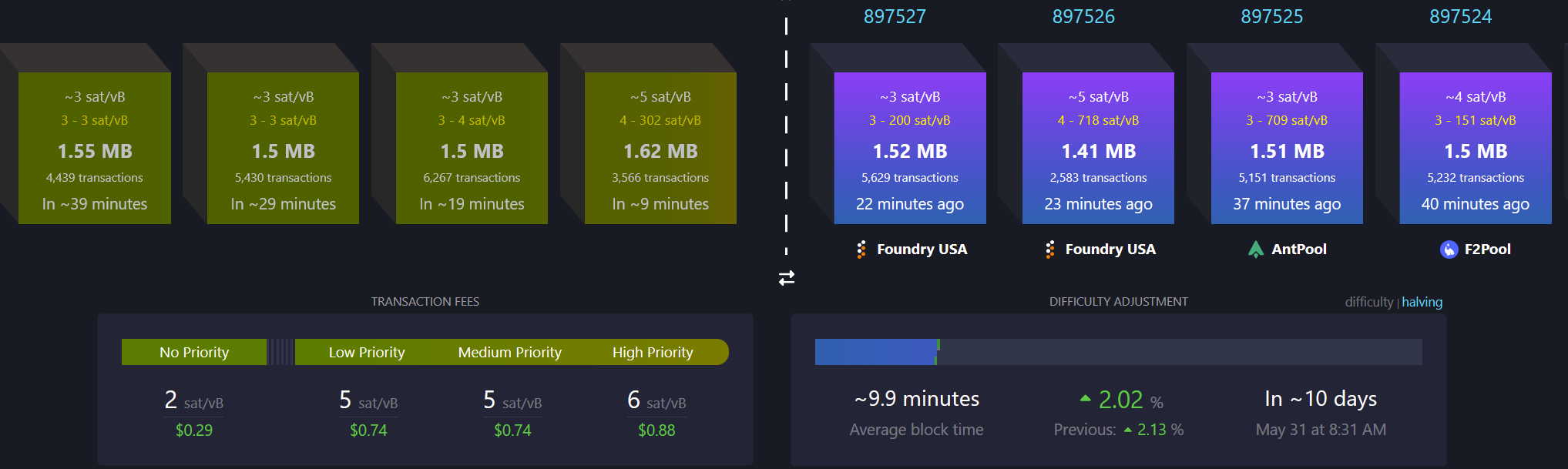

There must be a limit to how much data is transferred across the bitcoin network in order to keep the ability to run and use your own node accessible. A node is required to interact with the global bitcoin network - if you do not use your own node then you must trust someone else's node. If nodes become inaccessible to run then the network will centralize around the remaining entities that operate them - threatening the censorship resistance at the core of bitcoin's value prop. The bitcoin protocol uses three main mechanisms to keep node operation costs low - a fixed limit on the amount of data in each block, an automatic difficulty adjustment that regulates how many blocks are produced based on current mining hash rate, and a robust dynamic transaction fee market.

Bitcoin transaction fees limit network abuse by making usage expensive. There is a cost to every transaction, set by a dynamic free market based on demand for scarce block space. It is an incredibly robust way to prevent spam without relying on centralized entities that can be corrupted or pressured.

After the 2017 bitcoin fee spike we had six years of relative quiet to build tools that would be robust in a sustained high fee market. Fortunately our tools are significantly better now but many still need improvement. Most of the pain points we see today will be mitigated.

The reality is we were never going to be fully prepared - pressure is needed to show the pain points and provide strong incentives to mitigate them.

It will be incredibly interesting to watch how projects adapt under pressure. Optimistic we see great innovation here.

_If you are willing to wait for your transaction to confirm you can pay significantly lower fees. Learn best practices for reducing your fee burden here.

My guide for running and using your own bitcoin node can be found here._

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-05-26 04:01:38

@ 7f6db517:a4931eda

2025-05-26 04:01:38

I often hear "bitcoin doesn't interest me, I'm not a finance person."

Ironically, the beauty of sound money is you don't have to be. In the current system you're expected to manage a diversified investment portfolio or pay someone to do it. Bitcoin will make that optional.

— ODELL (@ODELL) September 16, 2018

At first glance bitcoin often appears overwhelming to newcomers. It is incredibly easy to get bogged down in the details of how it works or different ways to use it. Enthusiasts, such as myself, often enjoy going down the deep rabbit hole of the potential of bitcoin, possible pitfalls and theoretical scenarios, power user techniques, and the developer ecosystem. If your first touch point with bitcoin is that type of content then it is only natural to be overwhelmed. While it is important that we have a thriving community of bitcoiners dedicated to these complicated tasks - the true beauty of bitcoin lies in its simplicity. Bitcoin is simply better money. It is the best money we have ever had.

Life is complicated. Life is hard. Life is full of responsibility and surprises. Bitcoin allows us to focus on our lives while relying on a money that is simple. A money that is not controlled by any individual, company, or government. A money that cannot be easily seized or blocked. A money that cannot be devalued at will by a handful of corrupt bureaucrat who live hundreds of miles from us. A money that can be easily saved and should increase in purchasing power over time without having to learn how to "build a diversified stock portfolio" or hire someone to do it for us.

Bitcoin enables all of us to focus on our lives - our friends and family - doing what we love with the short time we have on this earth. Time is scarce. Life is complicated. Bitcoin is the most simple aspect of our complicated lives. If we spend our scarce time working then we should be able to easily save that accrued value for future generations without watching the news or understanding complicated financial markets. Bitcoin makes this possible for anyone.

Yesterday was Mother's Day. Raising a human is complicated. It is hard, it requires immense personal responsibility, it requires critical thinking, but mothers figure it out, because it is worth it. Using and saving bitcoin is simple - simply install an app on your phone. Every mother can do it. Every person can do it.

Life is complicated. Life is beautiful. Bitcoin is simple.

If you found this post helpful support my work with bitcoin.

-

@ 21335073:a244b1ad

2025-05-21 16:58:36

@ 21335073:a244b1ad

2025-05-21 16:58:36The other day, I had the privilege of sitting down with one of my favorite living artists. Our conversation was so captivating that I felt compelled to share it. I’m leaving his name out for privacy.

Since our last meeting, I’d watched a documentary about his life, one he’d helped create. I told him how much I admired his openness in it. There’s something strange about knowing intimate details of someone’s life when they know so little about yours—it’s almost like I knew him too well for the kind of relationship we have.

He paused, then said quietly, with a shy grin, that watching the documentary made him realize how “odd and eccentric” he is. I laughed and told him he’s probably the sanest person I know. Because he’s lived fully, chasing love, passion, and purpose with hardly any regrets. He’s truly lived.

Today, I turn 44, and I’ll admit I’m a bit eccentric myself. I think I came into the world this way. I’ve made mistakes along the way, but I carry few regrets. Every misstep taught me something. And as I age, I’m not interested in blending in with the world—I’ll probably just lean further into my own brand of “weird.” I want to live life to the brim. The older I get, the more I see that the “normal” folks often seem less grounded than the eccentric artists who dare to live boldly. Life’s too short to just exist, actually live.

I’m not saying to be strange just for the sake of it. But I’ve seen what the crowd celebrates, and I’m not impressed. Forge your own path, even if it feels lonely or unpopular at times.

It’s easy to scroll through the news and feel discouraged. But actually, this is one of the most incredible times to be alive! I wake up every day grateful to be here, now. The future is bursting with possibility—I can feel it.

So, to my fellow weirdos on nostr: stay bold. Keep dreaming, keep pushing, no matter what’s trending. Stay wild enough to believe in a free internet for all. Freedom is radical—hold it tight. Live with the soul of an artist and the grit of a fighter. Thanks for inspiring me and so many others to keep hoping. Thank you all for making the last year of my life so special.

-

@ 7f6db517:a4931eda

2025-05-26 03:01:46

@ 7f6db517:a4931eda

2025-05-26 03:01:46

What is KYC/AML?

- The acronym stands for Know Your Customer / Anti Money Laundering.

- In practice it stands for the surveillance measures companies are often compelled to take against their customers by financial regulators.

- Methods differ but often include: Passport Scans, Driver License Uploads, Social Security Numbers, Home Address, Phone Number, Face Scans.

- Bitcoin companies will also store all withdrawal and deposit addresses which can then be used to track bitcoin transactions on the bitcoin block chain.

- This data is then stored and shared. Regulations often require companies to hold this information for a set number of years but in practice users should assume this data will be held indefinitely. Data is often stored insecurely, which results in frequent hacks and leaks.

- KYC/AML data collection puts all honest users at risk of theft, extortion, and persecution while being ineffective at stopping crime. Criminals often use counterfeit, bought, or stolen credentials to get around the requirements. Criminals can buy "verified" accounts for as little as $200. Furthermore, billions of people are excluded from financial services as a result of KYC/AML requirements.

During the early days of bitcoin most services did not require this sensitive user data, but as adoption increased so did the surveillance measures. At this point, most large bitcoin companies are collecting and storing massive lists of bitcoiners, our sensitive personal information, and our transaction history.

Lists of Bitcoiners

KYC/AML policies are a direct attack on bitcoiners. Lists of bitcoiners and our transaction history will inevitably be used against us.

Once you are on a list with your bitcoin transaction history that record will always exist. Generally speaking, tracking bitcoin is based on probability analysis of ownership change. Surveillance firms use various heuristics to determine if you are sending bitcoin to yourself or if ownership is actually changing hands. You can obtain better privacy going forward by using collaborative transactions such as coinjoin to break this probability analysis.

Fortunately, you can buy bitcoin without providing intimate personal information. Tools such as peach, hodlhodl, robosats, azteco and bisq help; mining is also a solid option: anyone can plug a miner into power and internet and earn bitcoin by mining privately.

You can also earn bitcoin by providing goods and/or services that can be purchased with bitcoin. Long term, circular economies will mitigate this threat: most people will not buy bitcoin - they will earn bitcoin - most people will not sell bitcoin - they will spend bitcoin.

There is no such thing as KYC or No KYC bitcoin, there are bitcoiners on lists and those that are not on lists.

If you found this post helpful support my work with bitcoin.

-

@ 8aa70f44:3073d1a6

2025-05-21 13:07:14

@ 8aa70f44:3073d1a6

2025-05-21 13:07:14Earlier this year I launched the asknostr.site project which has been a great journey and learning experience. I had wanted to write down my goals and ideas with the project but didn't get to it yet. Primal launching the article editor was a trigger for me to go for it.

Ever since I joined Nostr i was looking for ways to apply my skillset solve a problem and help with adoption. Around Christmas I figured that a Quora/Stackoverflow alternative is something that needs to exist on Nostr.

Before I knew it I had a pretty decent prototype. And because the network already had so much awesome content, contributors and authors I was never discouraged by the challenge that kills so many good ideas -> "Where do I get the first users?".

Since the initial announcement I have received so much encouragement through zaps, likes, DM's, and maybe most of all seeing the increase in usage of the site and #asknostr content kept me going.

Current State

The current version of the site is stable and most bugs are hashed out. After logging in (remote signer, extension or nsec) you can engage with content through votes, comments and replies. Or simply ask a new question.

All content is stored in the site's own private relay and preprocessed/computed into a single data store (postgres) so the site is fast, accessible and crawl-able.

The site supports browsing hashtags, voting/commenting on answers, asking new questions and every contributor get their own profile (example). At the time of writing the site has 41k questions, almost 200k replies/comments and upwards of 5 million sats purely for #asknostr content.

What to expect/On my list

There are plenty of things and UI bugs that need love and between writing the draft of this post and hitting publish I shipped 3 minor bug fixes. Little by little, bit by bit...

In addition to all those small details here is an overview of the things on my own wish list:

-

Inline Zaps: Ability to zap from the asknostr.site interface. Click the zap button, specify or pick the number of sats zap away.

-

Contributor Rank: A leaderboard to add some gamification. More recognition to those nostriches that spend their time helping other people out

-

Search by Keyword: Search all content by keywords. Experiment with the index to show related questions or answers

-

Better User Profiles: Improve the user profile so it shows all the profile questions and answers. Quick buttons to follow or zap that person. Better insights in the topics (hashtags) the profile contributes to

-

Bookmarks: Ability to bookmark questions and answers. Increase bookmark weight as a signal to rank answers.

-

Smarter Scoring: Tune how answers are scored (winning answer formula). Perhaps give more weight to the question author or use WoT. Not sure yet.

All of this is happening at some point so follow me if you want to stay up to date.

Goals

To manage expectations and keep me focussed I write down the mid and long term goals of the project.

Long term

Call me cheesy but I believe that humanity will flourish through an open web and sound money. My own journey started from with bitcoin but if you asked me today if it's BTC or nostr that is going to have the most impact I wouldn't know what to answer. Chicken or egg?

The goal of the project is to offer an open platform that empowers individuals to ask questions, share expertise and access high-quality information across different topics. The project empowers anyone to monetize their experience creating a sustainable ecosystem that values and rewards knowledge sharing. This will ultimately democratize access to knowledge for all.

Mid term

The project can help a lot with onboarding new users onto the network. Once we start to rank on certain topics we can get a piece of the search traffic pie (StackOverflows 12 million, and Quora 150 million visitors per month) which is a great way to expose people to the power of the network.

First time visitors do not need to know about nostr or zaps to receive value. They can browse around, discover interesting content and perhaps even create a profile without even knowing they are on Nostr now.

Gradually those users will understand the value of the network through better rankings (zaps beats likes), a cross-client experience and a profile that can be used on any nostr site or app.

In order for the site to do that we need to make sure content is browsable by language, (sub)topics and and we double down on 'the human touch' with real contributors and not LLMs.

Short Term Goal

The first goal is to make the site really good and an important resource for existing Nostr users. Enable visitors to search and discover what they are interested in. Integrate within the existing nostr eco system with 'open in' functionality and quick links to interesting projects (followerpacks?)

One of things i want to get right is to improve user retention by making the whole Q\&A experience more sticky. I want to run some experiments (bots, award, summaries) to get more people to use asknostr.site more often and come back.

What about the name?

Finally the big question: What about the asknostr.site name? I don't like the name that much but it's what people know. I think there is a high chance that people will discover Nostr apps like Olas, Primal or Damus without needing to know what NOSTR is or means.

Therefore I think there is a good chance that the project won't be called asknostr.site forever. I guess it all depends on where we all take this.

Onwards!

-

-

@ 7f6db517:a4931eda

2025-05-26 04:01:38

@ 7f6db517:a4931eda

2025-05-26 04:01:38Will not live in a pod.

Will not eat the bugs.

Will not get the chip.

Will not get a blue check.

Will not use CBDCs.Live Free or Die.

Why did Elon buy twitter for $44 Billion? What value does he see in it besides the greater influence that undoubtedly comes with controlling one of the largest social platforms in the world? We do not need to speculate - he made his intentions incredibly clear in his first meeting with twitter employees after his takeover - WeChat of the West.

To those that do not appreciate freedom, the value prop is clear - WeChat is incredibly powerful and successful in China.

To those that do appreciate freedom, the concern is clear - WeChat has essentially become required to live in China, has surveillance and censorship integrated at its core, and if you are banned from the app your entire livelihood is at risk. Employment, housing, payments, travel, communication, and more become extremely difficult if WeChat censors determine you have acted out of line.

The blue check is the first step in Elon's plan to bring the chinese social credit score system to the west. Users who verify their identity are rewarded with more reach and better tools than those that do not. Verified users are the main product of Elon's twitter - an extensive database of individuals and complete control of the tools he will slowly get them to rely on - it is easier to monetize cattle than free men.

If you cannot resist the temptation of the blue check in its current form you have already lost - what comes next will be much darker. If you realize the need to resist - freedom tech provides us options.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-05-26 04:01:37

@ 7f6db517:a4931eda

2025-05-26 04:01:37

Nostr is an open communication protocol that can be used to send messages across a distributed set of relays in a censorship resistant and robust way.

If you missed my nostr introduction post you can find it here. My nostr account can be found here.

We are nearly at the point that if something interesting is posted on a centralized social platform it will usually be posted by someone to nostr.

We are nearly at the point that if something interesting is posted exclusively to nostr it is cross posted by someone to various centralized social platforms.

We are nearly at the point that you can recommend a cross platform app that users can install and easily onboard without additional guides or resources.

As companies continue to build walls around their centralized platforms nostr posts will be the easiest to cross reference and verify - as companies continue to censor their users nostr is the best censorship resistant alternative - gradually then suddenly nostr will become the standard. 🫡

Current Nostr Stats

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-05-26 04:01:37

@ 7f6db517:a4931eda

2025-05-26 04:01:37

Influencers would have you believe there is an ongoing binance bank run but bitcoin wallet data says otherwise.

- binance wallets are near all time highs

- bitfinex wallets are also trending up

- gemini and coinbase are being hit with massive withdrawals thoughYou should not trust custodians, they can rug you without warning. It is incredibly important you learn how to hold bitcoin yourself, but also consider not blindly trusting influencers with a ref link to shill you.

If you found this post helpful support my work with bitcoin.

-

@ 57d1a264:69f1fee1

2025-05-21 05:47:41

@ 57d1a264:69f1fee1

2025-05-21 05:47:41As a product builder over too many years to mention, I’ve lost count of the number of times I’ve seen promising ideas go from zero to hero in a few weeks, only to fizzle out within months.

The problem with most finance apps, however, is that they often become a reflection of the internal politics of the business rather than an experience solely designed around the customer. This means that the focus is on delivering as many features and functionalities as possible to satisfy the needs and desires of competing internal departments, rather than providing a clear value proposition that is focused on what the people out there in the real world want. As a result, these products can very easily bloat to become a mixed bag of confusing, unrelated and ultimately unlovable customer experiences—a feature salad, you might say.

Financial products, which is the field I work in, are no exception. With people’s real hard-earned money on the line, user expectations running high, and a crowded market, it’s tempting to throw as many features at the wall as possible and hope something sticks. But this approach is a recipe for disaster.

Here’s why: https://alistapart.com/article/from-beta-to-bedrock-build-products-that-stick/

https://stacker.news/items/985285

-

@ 7f6db517:a4931eda

2025-05-26 04:01:37

@ 7f6db517:a4931eda

2025-05-26 04:01:37

For years American bitcoin miners have argued for more efficient and free energy markets. It benefits everyone if our energy infrastructure is as efficient and robust as possible. Unfortunately, broken incentives have led to increased regulation throughout the sector, incentivizing less efficient energy sources such as solar and wind at the detriment of more efficient alternatives.

The result has been less reliable energy infrastructure for all Americans and increased energy costs across the board. This naturally has a direct impact on bitcoin miners: increased energy costs make them less competitive globally.

Bitcoin mining represents a global energy market that does not require permission to participate. Anyone can plug a mining computer into power and internet to get paid the current dynamic market price for their work in bitcoin. Using cellphone or satellite internet, these mines can be located anywhere in the world, sourcing the cheapest power available.

Absent of regulation, bitcoin mining naturally incentivizes the build out of highly efficient and robust energy infrastructure. Unfortunately that world does not exist and burdensome regulations remain the biggest threat for US based mining businesses. Jurisdictional arbitrage gives miners the option of moving to a friendlier country but that naturally comes with its own costs.

Enter AI. With the rapid development and release of AI tools comes the requirement of running massive datacenters for their models. Major tech companies are scrambling to secure machines, rack space, and cheap energy to run full suites of AI enabled tools and services. The most valuable and powerful tech companies in America have stumbled into an accidental alliance with bitcoin miners: THE NEED FOR CHEAP AND RELIABLE ENERGY.

Our government is corrupt. Money talks. These companies will push for energy freedom and it will greatly benefit us all.

Microsoft Cloud hiring to "implement global small modular reactor and microreactor" strategy to power data centers: https://www.datacenterdynamics.com/en/news/microsoft-cloud-hiring-to-implement-global-small-modular-reactor-and-microreactor-strategy-to-power-data-centers/

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-05-26 03:01:46

@ 7f6db517:a4931eda

2025-05-26 03:01:46

The former seems to have found solid product market fit. Expect significant volume, adoption, and usage going forward.

The latter's future remains to be seen. Dependence on Tor, which has had massive reliability issues, and lack of strong privacy guarantees put it at risk.

— ODELL (@ODELL) October 27, 2022

The Basics

- Lightning is a protocol that enables cheap and fast native bitcoin transactions.

- At the core of the protocol is the ability for bitcoin users to create a payment channel with another user.

- These payment channels enable users to make many bitcoin transactions between each other with only two on-chain bitcoin transactions: the channel open transaction and the channel close transaction.

- Essentially lightning is a protocol for interoperable batched bitcoin transactions.

- It is expected that on chain bitcoin transaction fees will increase with adoption and the ability to easily batch transactions will save users significant money.

- As these lightning transactions are processed, liquidity flows from one side of a channel to the other side, on chain transactions are signed by both parties but not broadcasted to update this balance.

- Lightning is designed to be trust minimized, either party in a payment channel can close the channel at any time and their bitcoin will be settled on chain without trusting the other party.

There is no 'Lightning Network'

- Many people refer to the aggregate of all lightning channels as 'The Lightning Network' but this is a false premise.

- There are many lightning channels between many different users and funds can flow across interconnected channels as long as there is a route through peers.

- If a lightning transaction requires multiple hops it will flow through multiple interconnected channels, adjusting the balance of all channels along the route, and paying lightning transaction fees that are set by each node on the route.

Example: You have a channel with Bob. Bob has a channel with Charlie. You can pay Charlie through your channel with Bob and Bob's channel with User C.

- As a result, it is not guaranteed that every lightning user can pay every other lightning user, they must have a route of interconnected channels between sender and receiver.

Lightning in Practice

- Lightning has already found product market fit and usage as an interconnected payment protocol between large professional custodians.

- They are able to easily manage channels and liquidity between each other without trust using this interoperable protocol.

- Lightning payments between large custodians are fast and easy. End users do not have to run their own node or manage their channels and liquidity. These payments rarely fail due to professional management of custodial nodes.

- The tradeoff is one inherent to custodians and other trusted third parties. Custodial wallets can steal funds and compromise user privacy.

Sovereign Lightning

- Trusted third parties are security holes.

- Users must run their own node and manage their own channels in order to use lightning without trusting a third party. This remains the single largest friction point for sovereign lightning usage: the mental burden of actively running a lightning node and associated liquidity management.

- Bitcoin development prioritizes node accessibility so cost to self host your own node is low but if a node is run at home or office, Tor or a VPN is recommended to mask your IP address: otherwise it is visible to the entire network and represents a privacy risk.

- This privacy risk is heightened due to the potential for certain governments to go after sovereign lightning users and compel them to shutdown their nodes. If their IP Address is exposed they are easier to target.

- Fortunately the tools to run and manage nodes continue to get easier but it is important to understand that this will always be a friction point when compared to custodial services.

The Potential Fracture of Lightning

- Any lightning user can choose which users are allowed to open channels with them.

- One potential is that professional custodians only peer with other professional custodians.

- We already see nodes like those run by CashApp only have channels open with other regulated counterparties. This could be due to performance goals, liability reduction, or regulatory pressure.

- Fortunately some of their peers are connected to non-regulated parties so payments to and from sovereign lightning users are still successfully processed by CashApp but this may not always be the case going forward.

Summary

- Many people refer to the aggregate of all lightning channels as 'The Lightning Network' but this is a false premise. There is no singular 'Lightning Network' but rather many payment channels between distinct peers, some connected with each other and some not.

- Lightning as an interoperable payment protocol between professional custodians seems to have found solid product market fit. Expect significant volume, adoption, and usage going forward.

- Lightning as a robust sovereign payment protocol has yet to be battle tested. Heavy reliance on Tor, which has had massive reliability issues, the friction of active liquidity management, significant on chain fee burden for small amounts, interactivity constraints on mobile, and lack of strong privacy guarantees put it at risk.

If you have never used lightning before, use this guide to get started on your phone.

If you found this post helpful support my work with bitcoin.

-

@ c9badfea:610f861a

2025-05-20 19:49:20

@ c9badfea:610f861a

2025-05-20 19:49:20- Install Sky Map (it's free and open source)

- Launch the app and tap Accept, then tap OK

- When asked to access the device's location, tap While Using The App

- Tap somewhere on the screen to activate the menu, then tap ⁝ and select Settings

- Disable Send Usage Statistics

- Return to the main screen and enjoy stargazing!

ℹ️ Use the 🔍 icon in the upper toolbar to search for a specific celestial body, or tap the 👁️ icon to activate night mode

-

@ 7f6db517:a4931eda

2025-05-26 04:01:37

@ 7f6db517:a4931eda

2025-05-26 04:01:37

Humanity's Natural State Is Chaos

Without order there is chaos. Humans competing with each other for scarce resources naturally leads to conflict until one group achieves significant power and instates a "monopoly on violence."Power Brings Stability

Power has always been the key means to achieve stability in societies. Centralized power can be incredibly effective in addressing issues such as crime, poverty, and social unrest efficiently. Unfortunately this power is often abused and corrupted.Centralized Power Breeds Tyranny

Centralized power often leads to tyrannical rule. When a select few individuals hold control over a society, they tend to become corrupted. Centralized power structures often lack accountability and transparency, and rely too heavily on trust.Distributed Power Cultivates Freedom

New technology that empowers individuals provide us the ability to rebuild societies from the bottom up. Strong individuals that can defend and provide for themselves will help build strong local communities on a similar foundation. The result is power being distributed throughout society rather than held by a select few.In the short term, relying on trust and centralized power is an easy answer to mitigating chaos, but freedom tech tools provide us the ability to build on top of much stronger distributed foundations that provide stability while also cultivating individual freedom.

The solution starts with us. Empower yourself. Empower others. A grassroots freedom tech movement scaling one person at a time.

If you found this post helpful support my work with bitcoin.

-

@ 04c915da:3dfbecc9

2025-05-20 15:47:16

@ 04c915da:3dfbecc9

2025-05-20 15:47:16Here’s a revised timeline of macro-level events from The Mandibles: A Family, 2029–2047 by Lionel Shriver, reimagined in a world where Bitcoin is adopted as a widely accepted form of money, altering the original narrative’s assumptions about currency collapse and economic control. In Shriver’s original story, the failure of Bitcoin is assumed amid the dominance of the bancor and the dollar’s collapse. Here, Bitcoin’s success reshapes the economic and societal trajectory, decentralizing power and challenging state-driven outcomes.

Part One: 2029–2032

-

2029 (Early Year)\ The United States faces economic strain as the dollar weakens against global shifts. However, Bitcoin, having gained traction emerges as a viable alternative. Unlike the original timeline, the bancor—a supranational currency backed by a coalition of nations—struggles to gain footing as Bitcoin’s decentralized adoption grows among individuals and businesses worldwide, undermining both the dollar and the bancor.

-

2029 (Mid-Year: The Great Renunciation)\ Treasury bonds lose value, and the government bans Bitcoin, labeling it a threat to sovereignty (mirroring the original bancor ban). However, a Bitcoin ban proves unenforceable—its decentralized nature thwarts confiscation efforts, unlike gold in the original story. Hyperinflation hits the dollar as the U.S. prints money, but Bitcoin’s fixed supply shields adopters from currency devaluation, creating a dual-economy split: dollar users suffer, while Bitcoin users thrive.

-

2029 (Late Year)\ Dollar-based inflation soars, emptying stores of goods priced in fiat currency. Meanwhile, Bitcoin transactions flourish in underground and online markets, stabilizing trade for those plugged into the bitcoin ecosystem. Traditional supply chains falter, but peer-to-peer Bitcoin networks enable local and international exchange, reducing scarcity for early adopters. The government’s gold confiscation fails to bolster the dollar, as Bitcoin’s rise renders gold less relevant.

-

2030–2031\ Crime spikes in dollar-dependent urban areas, but Bitcoin-friendly regions see less chaos, as digital wallets and smart contracts facilitate secure trade. The U.S. government doubles down on surveillance to crack down on bitcoin use. A cultural divide deepens: centralized authority weakens in Bitcoin-adopting communities, while dollar zones descend into lawlessness.

-

2032\ By this point, Bitcoin is de facto legal tender in parts of the U.S. and globally, especially in tech-savvy or libertarian-leaning regions. The federal government’s grip slips as tax collection in dollars plummets—Bitcoin’s traceability is low, and citizens evade fiat-based levies. Rural and urban Bitcoin hubs emerge, while the dollar economy remains fractured.

Time Jump: 2032–2047

- Over 15 years, Bitcoin solidifies as a global reserve currency, eroding centralized control. The U.S. government adapts, grudgingly integrating bitcoin into policy, though regional autonomy grows as Bitcoin empowers local economies.

Part Two: 2047

-

2047 (Early Year)\ The U.S. is a hybrid state: Bitcoin is legal tender alongside a diminished dollar. Taxes are lower, collected in BTC, reducing federal overreach. Bitcoin’s adoption has decentralized power nationwide. The bancor has faded, unable to compete with Bitcoin’s grassroots momentum.

-

2047 (Mid-Year)\ Travel and trade flow freely in Bitcoin zones, with no restrictive checkpoints. The dollar economy lingers in poorer areas, marked by decay, but Bitcoin’s dominance lifts overall prosperity, as its deflationary nature incentivizes saving and investment over consumption. Global supply chains rebound, powered by bitcoin enabled efficiency.

-

2047 (Late Year)\ The U.S. is a patchwork of semi-autonomous zones, united by Bitcoin’s universal acceptance rather than federal control. Resource scarcity persists due to past disruptions, but economic stability is higher than in Shriver’s original dystopia—Bitcoin’s success prevents the authoritarian slide, fostering a freer, if imperfect, society.

Key Differences

- Currency Dynamics: Bitcoin’s triumph prevents the bancor’s dominance and mitigates hyperinflation’s worst effects, offering a lifeline outside state control.

- Government Power: Centralized authority weakens as Bitcoin evades bans and taxation, shifting power to individuals and communities.

- Societal Outcome: Instead of a surveillance state, 2047 sees a decentralized, bitcoin driven world—less oppressive, though still stratified between Bitcoin haves and have-nots.

This reimagining assumes Bitcoin overcomes Shriver’s implied skepticism to become a robust, adopted currency by 2029, fundamentally altering the novel’s bleak trajectory.

-

-

@ b6424601:a11e4ff4

2025-05-26 02:37:18

@ b6424601:a11e4ff4

2025-05-26 02:37:18"A home should be an asset that empowers you, not a liability that enslaves you."

At HODL House, we reject the architecture of the fiat era. We reject homes built to appease appraisers, bankers, and zoning boards. We reject the idea that your sanctuary should depreciate like a rental car. Instead, we build Asset Architecture: Homes that compound value, resist inflation, and align with sound money principles. This is our manifesto for a new era of sovereign living.

The New/Old Way of Living

What if your home could be more than just a physical space—a reflection of your values, passions, and sense of self? At HODL House, we're committed to helping you create a home that authentically represents who you are.

Personal Custom Design is Not for Everyone

Our clients do not want cookie-cutter projects and don’t plan on using bank loans to finance projects. Typically, our clients trade other assets for their personal Asset Architecture. Our clients consider a longer time horizon to include the operating cost of the house versus the construction cost. Our clients, a small percentage of the world's population, build personal architecture not controlled by fiat limitations, allowing for the creation of better projects we want to design.

We believe the Bitcoin Community will have the ever-strengthening asset to allow more people to build quality architecture.

At HODL House, We Believe...

-

Homes as Assets: Homes designed as personal architecture align with individuals' long-term goals, setting the stage for quality of life to happen. The house is a life stage supporting our clients in evolving to their highest potential.

-

Architecture as a Process: Architecture is the process of aligning the needs of the individual with a personal environment. The process helps people discover their aspirational needs and then work on milestones to convert them into goals, ideas, designs, and finished construction.

-

Bitcoin Fixes Housing: The cost of personal homes in fiat terms is rapidly becoming out of reach for most people operating within the fiat money system. Younger people may think individual ownership is not possible. Bitcoin fixes this self-imposed limitation.

Sound Money Homes Are...

-

Long-Term Thinking: Long-term thinkers make decisions for homes built with hard money based on the cost over the lifetime of the house and not just the initial cost of construction. Think long term to address maintenance, durability, resilience, operating costs, and fortifications.

-

Not Driven by Size: Size does not matter. The HODL House program does not need to check the Bankster appraisal checklist of some made-up loans to value the number of bedrooms and the house size requirement. We can use function stacks in the same space to use less. We can layer life patterns outside the box of fiat requirements for better life results.

-

Personal: Design is particular for the individual, the place of the HODL House, and the land on which it sits. We design homes for people, not markets, trends, or profit cash out.

-

Not in the Herd: People need homes for their personal shelter, and not only to shelter their money from debasement. Outcast from the head base value on the total ROI on an appraisal to compare it to the pile of houses next door. Homes should satisfy the utility of living for families, designed and built to provide long-term basic shelter in a clever way that evolves with the owners to meet long-term needs.

-

Have No Regrets: The return on investment must be worth the exchange risk of Bitcoin to avoid regrets, balancing opportunity cost vs. quality of life in the future. Of course, collateralized Bitcoin loans are coming, and when that happens. Then, as they say, LFG!

HODL Houses as an Apex Species

HODL houses are an apex species of home designed for the utility of living based on personal life patterns in creating personal architecture that can hold for a long time.

As a bitcoiner, you understand the importance of living on your terms. At HODL House, we're dedicated to creating homes that reflect your values, hard-earned equity, and commitment to self-sovereignty. Our approach combines Pattern Language design principles with asset architecture principles to deliver authentic architecture in beautiful homes built to last. Let's work together to create a home worth HODLing, leaving your legacy through self-sufficiency and connection to the decentralized Bitcoin community.

The HODL House Studio: Building Asset Architecture on a Bitcoin Standard

We are personal housing architects, so we are biased that personal architecture is good, and fiat-valued housing typically makes us swallow hard. We are the weirdo architects, our peer’s judge will never make any real money, who somehow enjoy the drama of designing for individuals and have figured out how to excel as a business, working with clients on their homes. We are also very weirdo architects who believe in doing good work to provide value to clients, make a profit, and save that profit in BTC.

Our architecture firm is 20 years deep in custom residential design, establishing a dedicated Studio for Sound Money Architecture within our practice. This studio operates under a single principle: to build homes that align with the values of sound money, not fiat speculation.

HODL House is Our Fork in the Road