-

@ 7e6f9018:a6bbbce5

2025-05-22 18:17:57

@ 7e6f9018:a6bbbce5

2025-05-22 18:17:57Governments and the press often publish data on the population’s knowledge of Catalan. However, this data only represents one stage in the linguistic process and does not accurately reflect the state of the language, since a language only has a future if it is used. Knowledge is a necessary step toward using a language, but it is not the final stage — that stage is actual use.

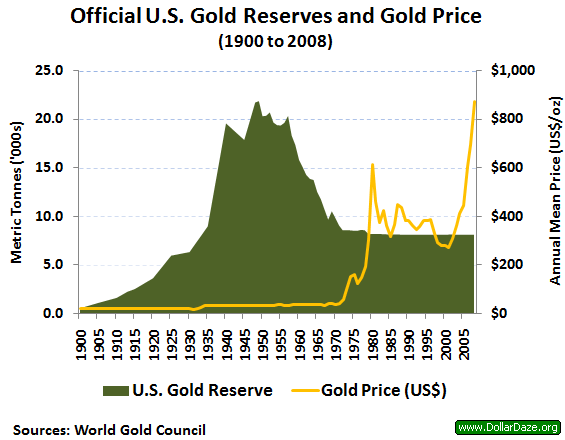

So what is the state of Catalan usage? If we look at data on regular use, we see that the Catalan language has remained stagnant over the past hundred years, with nearly the same number of regular speakers. In 1930, there were around 2.5 million speakers, and in 2018, there were 2.7 million.

Regular use of Catalan in Catalonia, in millions of speakers. The dotted segments are an estimate of the trend, based on the statements of Joan Coromines and adjusted according to Catalonia’s population growth.

Regular use of Catalan in Catalonia, in millions of speakers. The dotted segments are an estimate of the trend, based on the statements of Joan Coromines and adjusted according to Catalonia’s population growth.These figures wouldn’t necessarily be negative if the language’s integrity were strong, that is, if its existence weren’t threatened by other languages. But the population of Catalonia has grown from 2.7 million in 1930 to 7.5 million in 2018. This means that today, regular Catalan speakers make up only 36% of Catalonia’s population, whereas in 1930, they represented 90%.

Regular use of Catalan in Catalonia, as a percentage of speakers. The dotted segments are an estimate of the trend, based on the statements of Joan Coromines and adjusted according to Catalonia’s population growth.

Regular use of Catalan in Catalonia, as a percentage of speakers. The dotted segments are an estimate of the trend, based on the statements of Joan Coromines and adjusted according to Catalonia’s population growth.The language that has gained the most ground is mainly Spanish, which went from 200,000 speakers in 1930 to 3.8 million in 2018. Moreover, speakers of other foreign languages (500,000 speakers) have also grown more than Catalan speakers over the past hundred years.

Notes, Sources, and Methodology

The data from 2003 onward is taken from Idescat (source). Before 2003, there are no official statistics, but we can make interpretations based on historical evidence. The data prior to 2003 is calculated based on two key pieces of evidence:

-

1st Interpretation: In 1930, 90% of the population of Catalonia spoke Catalan regularly. Source and evidence: The Romance linguist Joan Coromines i Vigneaux, a renowned 20th-century linguist, stated in his 1950 work "El que s'ha de saber de la llengua catalana" that "In this territory [Greater Catalonia], almost the entire population speaks Catalan as their usual language" (1, 2).\ While "almost the entire population" is not a precise number, we can interpret it quantitatively as somewhere between 80% and 100%. For the sake of a moderate estimate, we assume 90% of the population were regular Catalan speakers, with the remaining 10% being immigrants and officials of the Spanish state.

-

2nd Interpretation: Regarding population growth between 1930 and 1998, on average, 60% is due to immigration (mostly adopting or already using Spanish language), while 40% is natural growth (likely to acquire Catalan language from childhood). Source and evidence: Between 1999 and 2019, when more detailed data is available, immigration accounted for 68% of population growth. From 1930 to 1998, there was a comparable wave of migration, especially between 1953 and 1973, largely of Spanish-speaking origin (3, 4, 5, 6). To maintain a moderate estimate, we assume 60% of population growth during that period was due to immigration, with the ratio varying depending on whether the period experienced more or less total growth.

-

-

@ 90152b7f:04e57401

2025-05-22 17:35:20

@ 90152b7f:04e57401

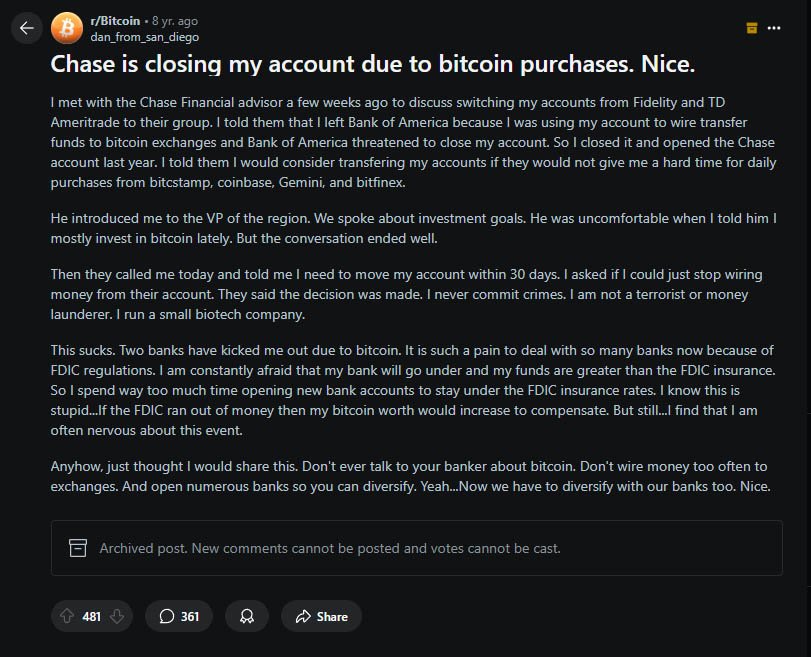

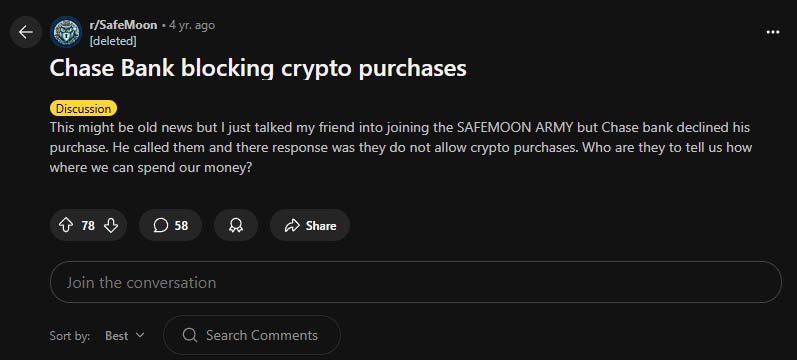

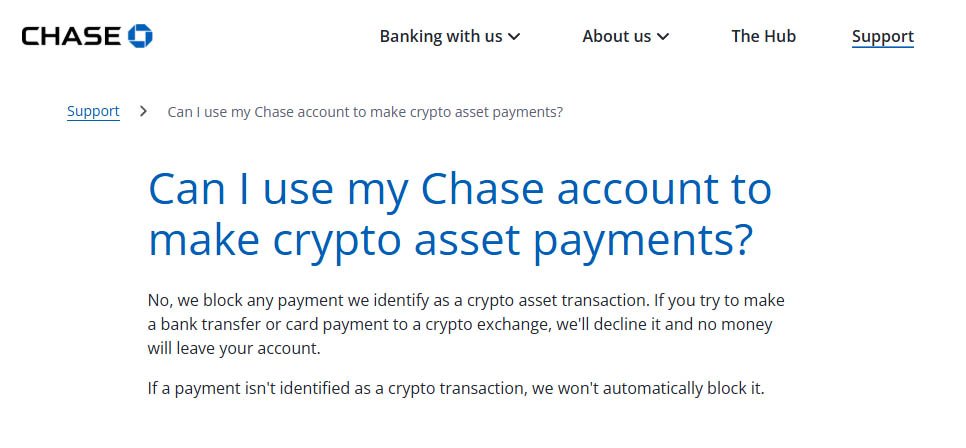

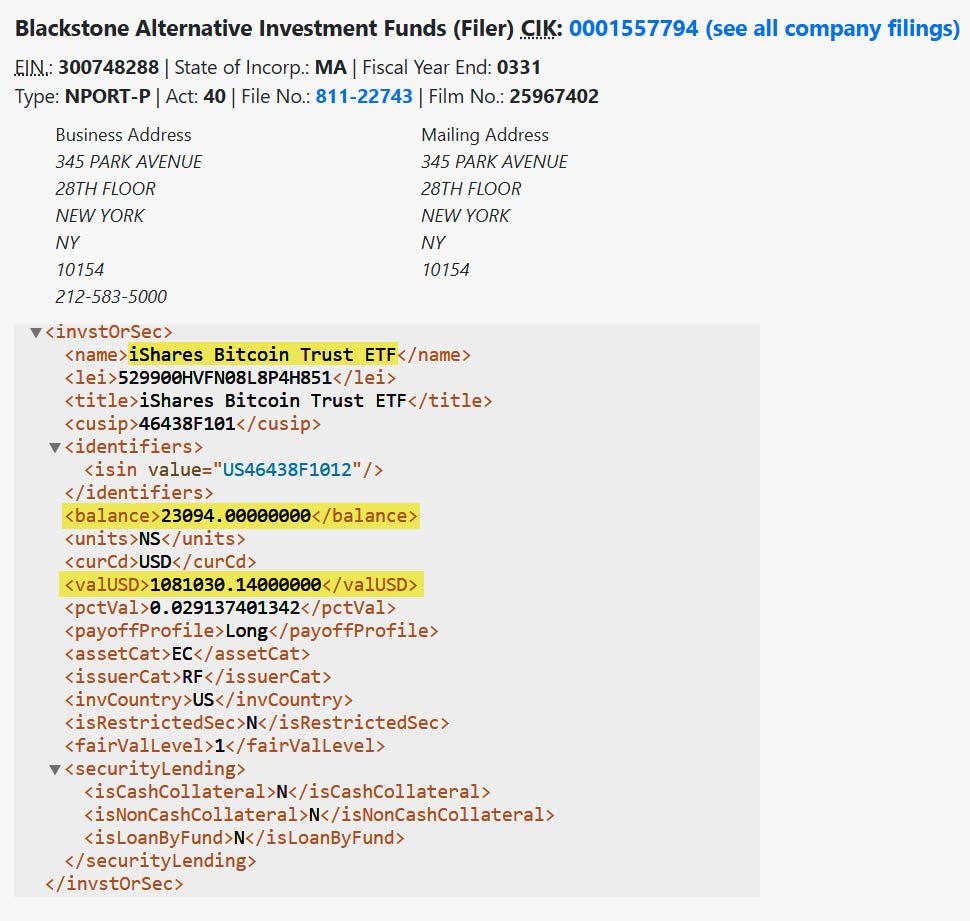

2025-05-22 17:35:20[Analytical & Intelligence Comments]\ \ “On Monday February 27th, 2012, WikiLeaks began publishing The Global Intelligence Files, over five million e-mails from the Texas headquartered "global intelligence" company Stratfor. The e-mails date between July 2004 and late December 2011. They reveal the inner workings of a company that fronts as an intelligence publisher, but provides confidential intelligence services to large corporations, such as Bhopal's Dow Chemical Co., Lockheed Martin, Northrop Grumman, Raytheon and government agencies, including the US Department of Homeland Security, the US Marines and the US Defence Intelligence Agency. The emails show Stratfor's web of informers, pay-off structure, payment laundering techniques and psychological methods.”\ \ Released on 2013-02-13 00:00 GMT Email-ID 13332210 Date 2011-05-04 16:26:59\ From jetdrive@earthlink.net To responses@stratfor.com CROYDON KEMP sent a\ message using the contact form at https://www.stratfor.com/contact\ \ Mossad ran 9/11 Arab "hijacker" terrorist operation\ \ By Wayne Madsen\ \ British intelligence reported in February 2002 that the Israeli Mossad ran the Arab hijacker cells that were later blamed by the U.S. government's 9/11 Commission for carrying out the aerial attacks on the World Trade Center and Pentagon. WMR has received details of the British intelligence report which was suppressed by the government of then-Prime Minister Tony Blair.\ \ A Mossad unit consisting of six Egyptian- and Yemeni-born Jews infiltrated "Al Qaeda" cells in Hamburg (the Atta-Mamoun Darkanzali cell), south Florida, and Sharjah in the United Arab Emirates in the months before 9/11. The Mossad not only infiltrated cells but began to run them and give them specific orders that would eventually culminate in their being on board four regularly-scheduled flights originating in Boston, Washington Dulles, and Newark, New Jersey on 9/11.\ \ The Mossad infiltration team comprised six Israelis, comprising two cells of three agents, who all received special training at a Mossad base in the Negev Desert in their future control and handling of the "Al Qaeda" cells. One Mossad cell traveled to Amsterdam where they submitted to the operational control of the Mossad's Europe Station, which operates from the El Al complex at Schiphol International Airport. The three-man Mossad unit then traveled to Hamburg where it made contact with Mohammed Atta, who believed they were sent by Osama Bin Laden. In fact, they were sent by Ephraim Halevy, the chief of Mossad.\ \ The second three-man Mossad team flew to New York and then to southern Florida where they began to direct the "Al Qaeda" cells operating from Hollywood, Miami, Vero Beach, Delray Beach, and West Palm Beach. Israeli "art students," already under investigation by the Drug Enforcement Administration for casing the offices and homes of federal law enforcement officers, had been living among and conducting surveillance of the activities, including flight school training, of the future Arab "hijacker" cells, particularly in Hollywood and Vero Beach.\ \ In August 2001, the first Mossad team flew with Atta and other Hamburg "Al Qaeda" members to Boston. Logan International Airport's security was contracted to Huntleigh USA, a firm owned by an Israeli airport security firm closely connected to Mossad — International Consultants on Targeted Security – ICTS. ICTS's owners were politically connected to the Likud Party, particularly the Netanyahu faction and then-Jerusalem mayor and future Prime Minister Ehud Olmert. It was Olmert who personally interceded with New York Mayor Rudolph Giuliani to have released from prison five Urban Moving Systems employees, identified by the CIA and FBI agents as Mossad agents. The Israelis were the only suspects arrested anywhere in the United States on 9/11 who were thought to have been involved in the 9/11 attacks.\ \ The two Mossad teams sent regular coded reports on the progress of the 9/11 operation to Tel Aviv via the Israeli embassy in Washington, DC. WMR has learned from a Pentagon source that leading Americans tied to the media effort to pin 9/11 on Arab hijackers, Osama Bin Laden, and the Taliban were present in the Israeli embassy on September 10, 2001, to coordinate their media blitz for the subsequent days and weeks following the attacks. It is more than likely that FBI counter-intelligence agents who conduct surveillance of the Israeli embassy have proof on the presence of the Americans present at the embassy on September 10. Some of the Americans are well-known to U.S. cable news television audiences.\ \ In mid-August, the Mossad team running the Hamburg cell in Boston reported to Tel Aviv that the final plans for 9/11 were set. The Florida-based Mossad cell reported that the documented "presence" of the Arab cell members at Florida flight schools had been established.\ \ The two Mossad cells studiously avoided any mention of the World Trade Center or targets in Washington, DC in their coded messages to Tel Aviv. Halevy covered his tracks by reporting to the CIA of a "general threat" by an attack by Arab terrorists on a nuclear plant somewhere on the East Coast of the United States. CIA director George Tenet dismissed the Halevy warning as "too non-specific." The FBI, under soon-to-be-departed director Louis Freeh, received the "non-specific" warning about an attack on a nuclear power plant and sent out the information in its routine bulletins to field agents but no high alert was ordered.\ \ The lack of a paper trail pointing to "Al Qaeda" as the masterminds on 9/11, which could then be linked to Al Qaeda's Mossad handlers, threw off the FBI. On April 19, 2002, FBI director Robert Mueller, in a speech to San Francisco's Commonwealth Club, stated: "In our investigation, we have not uncovered a single piece of paper — either here in the United States, or in the treasure trove of information that has turned up in Afghanistan and elsewhere — that mentioned any aspect of the September 11 plot."\ \ The two Mossad "Al Qaeda" infiltration and control teams had also helped set up safe houses for the quick exfiltration of Mossad agents from the United States. Last March, WMR reported: "WMR has learned from two El Al sources who worked for the Israeli airline at New York’s John F. Kennedy airport that on 9/11, hours after the Federal Aviation Administration (FAA) grounded all civilian domestic and international incoming and outgoing flights to and from the United States, a full El Al Boeing 747 took off from JFK bound for Tel Aviv’s Ben Gurion International Airport. The two El Al employee sources are not Israeli nationals but legal immigrants from Ecuador who were working in the United States for the airline. The flight departed JFK at 4:11 pm and its departure was, according to the El Al sources, authorized by the direct intervention of the U.S. Department of Defense. U.S. military officials were on the scene at JFK and were personally involved with the airport and air traffic control authorities to clear the flight for take-off. According to the 9/11 Commission report, Transportation Secretary Norman Mineta ordered all civilian flights to be grounded at 9:45 am on September 11." WMR has learned from British intelligence sources that the six-man Mossad team was listed on the El Al flight manifest as El Al employees.\ \ WMR previously reported that the Mossad cell operating in the Jersey City-Weehawken area of New Jersey through Urban Moving Systems was suspected by some in the FBI and CIA of being involved in moving explosives into the World Trade Center as well as staging "false flag" demonstrations at least two locations in north Jersey: Liberty State Park and an apartment complex in Jersey City as the first plane hit the World Trade Center's North Tower. One team of Urban Moving Systems Mossad agents was arrested later on September 11 and jailed for five months at the Metropolitan Detention Center in Brooklyn. Some of their names turned up in a joint CIA-FBI database as known Mossad agents, along with the owner of Urban Moving Systems, Dominik Suter, whose name also appeared on a "Law Enforcement Sensitive" FBI 9/11 suspects list, along with the names of key "hijackers," including Mohammed Atta and Hani Hanjour, as well as the so-called "20th hijacker," Zacarias Moussaoui.\ \ Suter was allowed to escape the United States after the FBI made initial contact with him at the Urban Moving Systems warehouse in Weehawken, New Jersey, following the 9/11 attacks. Suter was later permitted to return to the United States where he was involved in the aircraft parts supply business in southern Florida, according to an informe3d source who contacted WMR. Suter later filed for bankruptcy in Florida for Urban Moving Systems and other businesses he operated: Suburban Moving & Storage Inc.; Max Movers, Inc.; Invsupport; Woodflooring Warehouse Corp.; One Stop Cleaning LLC; and City Carpet Upholstery, Inc. At the time of the bankruptcy filing in Florida, Suter listed his address as 1867 Fox Court, Wellington, FL 33414, with a phone number of 561 204-2359.\ \ From the list of creditors it can be determined that Suter had been operating in the United States since 1993, the year of the first attack on the World Trade Center. In 1993, Suter began racking up American Express credit card charges totaling $21,913.97. Suter also maintained credit card accounts with HSBC Bank and Orchard Bank c/o HSBC Card Services of Salinas, California, among other banks. Suter also did business with the Jewish Community Center of Greater Palm Beach in Florida and Ryder Trucks in Miami. Miami and southern Florida were major operating areas for cells of Israeli Mossad agents masquerading as "art students," who were living and working near some of the identified future Arab "hijackers" in the months preceding 9/11.\ \ ABC's 20/20 correspondent John Miller ensured that the Israeli connection to "Al Qaeda's" Arab hijackers was buried in an "investigation" of the movers' activities on 9/11. Anchor Barbara Walters helped Miller in putting a lid on the story about the movers and Suter aired on June 21, 2002. Miller then went on to become the FBI public affairs spokesman to ensure that Mueller and other FBI officials kept to the "Al Qaeda" script as determined by the Bush administration and the future 9/11 Commission. But former CIA chief of counter-terrorism Vince Cannistraro let slip to ABC an important clue to the operations of the Mossad movers in New Jersey when he stated that the Mossad agents "set up or exploited for the purpose of launching an intelligence operation against radical Islamists in the area, particularly in the New Jersey-New York area." The "intelligence operation" turned out to have been the actual 9/11 attacks. And it was no coincidence that it was ABC's John Miller who conducted a May 1998 rare interview of Osama Bin Laden at his camp in Afghanistan. Bin Laden played his part well for future scenes in the fictional "made-for-TV" drama known as 9/11.\ \ WMR has also learned from Italian intelligence sources that Mossad's running of "Al Qaeda" operatives did not end with running the "hijacking" teams in the United States and Hamburg. Other Arab "Al Qaeda" operatives, run by Mossad, were infiltrated into Syria but arrested by Syrian intelligence. Syria was unsuccessful in turning them to participate in intelligence operations in Lebanon. Detailed information on Bin Laden's support team was offered to the Bush administration, up to days prior to 9/11, by Gutbi al-Mahdi, the head of the Sudanese Mukhabarat intelligence service. The intelligence was rejected by the Biush White House. It was later reported that Sudanese members of "Al Qaeda's" support network were double agents for Mossad who had also established close contacts with Yemeni President Ali Abdullah Saleh and operated in Egypt, Saudi Arabia, and Eritrea, as well as Sudan. The Mossad connection to Al Qaeda in Sudan was likely known by the Sudanese Mukhabarat, a reason for the rejection of its intelligence on "Al Qaeda" by the thoroughly-Mossad penetrated Bush White House. Yemen had also identified "Al Qaeda" members who were also Mossad agents. A former chief of Mossad revealed to this editor in 2002 that Yemeni-born Mossad "deep insertion" commandos spotted Bin Laden in the Hadhramaut region of eastern Yemen after his escape from Tora Bora in Afghanistan, following the U.S. invasion.\ \ French intelligence determined that other Egyptian- and Yemeni-born Jewish Mossad agents were infiltrated into Sharjah in the United Arab Emirates as radical members of the Muslim Brotherhood. However, the "Muslim Brotherhood" agents actually were involved in providing covert Israeli funding for "Al Qaeda" activities. On February 21, 2006, WMR reported on the U.S. Treasury Secretary's firing by President Bush over information discovered on the shady "Al Qaeda" accounts in the United Arab Emirates: "Banking insiders in Dubai report that in March 2002, U.S. Secretary of Treasury Paul O’Neill visited Dubai and asked for documents on a $109,500 money transfer from Dubai to a joint account held by hijackers Mohammed Atta and Marwan al Shehhi at Sun Trust Bank in Florida. O'Neill also asked UAE authorities to close down accounts used by Al Qaeda . . . . The UAE complained about O’Neill’s demands to the Bush administration. O’Neill’s pressure on the UAE and Saudis contributed to Bush firing him as Treasury Secretary in December 2002 " O'Neill may have also stumbled on the "Muslim Brotherhood" Mossad operatives operating in the emirates who were directing funds to "Al Qaeda."\ \ After the collapse of the Soviet Union and the rise to power of the Taliban in Afghanistan, Sharjah's ruler, Sultan bin Mohammed al-Qasimi, who survived a palace coup attempt in 1987, opened his potentate to Russian businessmen like Viktor Bout, as well as to financiers of radical Muslim groups, including the Taliban and "Al Qaeda."\ \ Moreover, this Israeli support for "Al Qaeda" was fully known to Saudi intelligence, which approved of it in order to avoid compromising Riyadh. The joint Israeli-Saudi support for "Al Qaeda" was well-known to the Sharjah and Ras al Khaimah-based aviation network of the now-imprisoned Russian, Viktor Bout, jailed in New York on terrorism charges. The presence of Bout in New York, a hotbed of Israeli intelligence control of U.S. federal prosecutors, judges, as well as the news media, is no accident: Bout knows enough about the Mossad activities in Sharjah in support of the Taliban and Al Qaeda in Afghanistan, where Bout also had aviation and logistics contracts, to expose Mossad as the actual mastermind behind 9/11. Bout's aviation empire also extended to Miami and Dallas, two areas that were nexuses for the Mossad control operations for the "Al Qaeda" flight training operations of the Arab cell members in the months prior to 9/11.\ \ Bout's path also crossed with "Al Qaeda's" support network at the same bank in Sharjah, HSBC. Mossad's phony Muslim Brotherhood members from Egypt and Yemen controlled financing for "Al Qaeda" through the HSBC accounts in Sharjah. Mossad's Dominik Suter also dealt with HSBC in the United States. The FBI's chief counter-terrorism agent investigating Al Qaeda, John O'Neill, became aware of the "unique" funding mechanisms for Al Qaeda. It was no mistake that O'Neill was given the job as director of security for the World Trade Center on the eve of the attack. O'Neill perished in the collapse of the complex.Mossad uses a number of Jews born in Arab countries to masquerade as Arabs. They often carry forged or stolen passports from Arab countries or nations in Europe that have large Arab immigrant populations, particularly Germany, France, Britain, Denmark, Sweden, and the Netherlands.\ \ For Mossad, the successful 9/11 terrorist "false flag" operation was a success beyond expectations. The Bush administration, backed by the Blair government, attacked and occupied Iraq, deposing Saddam Hussein, and turned up pressure on Israel's other adversaries, including Iran, Syria, Pakistan, Hamas, and Lebanese Hezbollah. The Israelis also saw the U.S., Britain, and the UN begin to crack down on the Lebanese Shi'a diamond business in Democratic Republic of Congo and West Africa, and with it, the logistics support provided by Bout's aviation companies, which resulted in a free hand for Tel Aviv to move in on Lebanese diamond deals in central and west Africa.\ \ Then-Israeli Finance Minister Binyamin Netanyahu commented on the 9/11 attacks on U.S. television shortly after they occurred. Netanyahu said: "It is very good!" It now appears that Netanyahu, in his zeal, blew Mossad's cover as the masterminds of 9/11.\ \ Wayne Madsen is a Washington, DC-based investigative journalist, author and syndicated columnist. He has written for several renowned papers and blogs.\ \ Madsen is a regular contributor on Russia Today. He has been a frequent political and national security commentator on Fox News and has also appeared on ABC, NBC, CBS, PBS, CNN, BBC, Al Jazeera, and MS-NBC. Madsen has taken on Bill O’Reilly and Sean Hannity on their television shows. He has been invited to testifty as a witness before the US House of Representatives, the UN Criminal Tribunal for Rwanda, and an terrorism investigation panel of the French government.\ \ As a U.S. Naval Officer, he managed one of the first computer security programs for the U.S. Navy. He subsequently worked for the National Security Agency, the Naval Data Automation Command, Department of State, RCA Corporation, and Computer Sciences Corporation.\ \ Madsen is a member of the Society of Professional Journalists (SPJ), Association for Intelligence Officers (AFIO), and the National Press Club. He is a regular contributor to Opinion Maker

-

@ 9ca447d2:fbf5a36d

2025-05-22 14:01:52

@ 9ca447d2:fbf5a36d

2025-05-22 14:01:52Gen Z (those born between 1997 and 2012) are not rushing to stack sats, and Oliver Porter, Founder & CEO of Jippi, understands the challenge better than most. His strategy revolves around adapting Bitcoin education to fit seamlessly into the digital lives of young adults.

“We need to meet them where they are,” Oliver explains. “90% of Gen Z plays games. 70% expect to earn rewards.”

So, what will effectively introduce them to Bitcoin? In Oliver’s mind, the answer is simple: games that don’t feel preachy but still plant the orange pill.

Learn more at Jippi.app

That’s exactly what Jippi is. Based in Austin, Texas, the team has created a mobile augmented reality (AR) game that rewards players in bitcoin and sneakily teaches them why sound money matters.

“It’s Pokémon GO… but for sats,” Oliver puts it succinctly.

Jippi is like Pokemon Go, but for sats

Oliver’s Bitcoin journey, like many in the space, began long before he was ready. A former colleague had tried planting the seed years earlier, handing him a copy of The Bitcoin Standard. But the moment passed.

It wasn’t until the chaos of 2020 when lockdowns hit, printing presses roared, and civil liberties shrank that the message finally landed for him.

“The government got so good at doing reverse Robin Hood,” Oliver explains. “They steal from the working population and reward the rich.”

By 2020, though, the absurdity of the covid hysteria had caused his eyes to be opened and the orange light seemed the best path back to freedom.

He left the UK for Austin “one of the best places for Bitcoiners,” he says, and dove headfirst into the industry, working at Swan for a year before founding Jippi on PlebLab’s accelerator program.

Jippi’s flagship game lets players roam their cities hunting digital creatures, Bitcoin Beasts, tied to real-world locations. Catching them requires answering Bitcoin trivia, and the reward is sats.

No jargon. No hour-long lectures. Just gameplay with sound money principles woven right in.

The model is working. At a recent hackathon in Austin, Jippi beat out 14 other teams to win first place and $15,000 in prize money.

Oliver of Jippi won Top Builder Season 2 — PlebLab on X

“We’re backdooring Bitcoin education,” Oliver admits. “And while we’re at it, encouraging people to get outside and touch grass.”

Not everyone’s been thrilled. When Jippi team members visited one of the more liberal-leaning places in Texas, UT Austin, to test interest in Bitcoin, they found some seriously committed no-coiners on the campus.

“One young woman told me, ‘I would rather die than talk about Bitcoin,'” Oliver recalls, highlighting the cultural resistance that’s built up among younger demographics.

This resistance is backed by hard data. According to Oliver, some of the Bitcoin podcasters they met with in the space to do market research reported that less than 1% of their listeners are from Gen Z and that number is dropping.

“Unless we find a way to capture their interest in a meaningful way, there’s going to be a big problem around trying to sway Gen Z away from the siren call of s***coins and crypto casinos and towards Bitcoin,” Oliver warns.

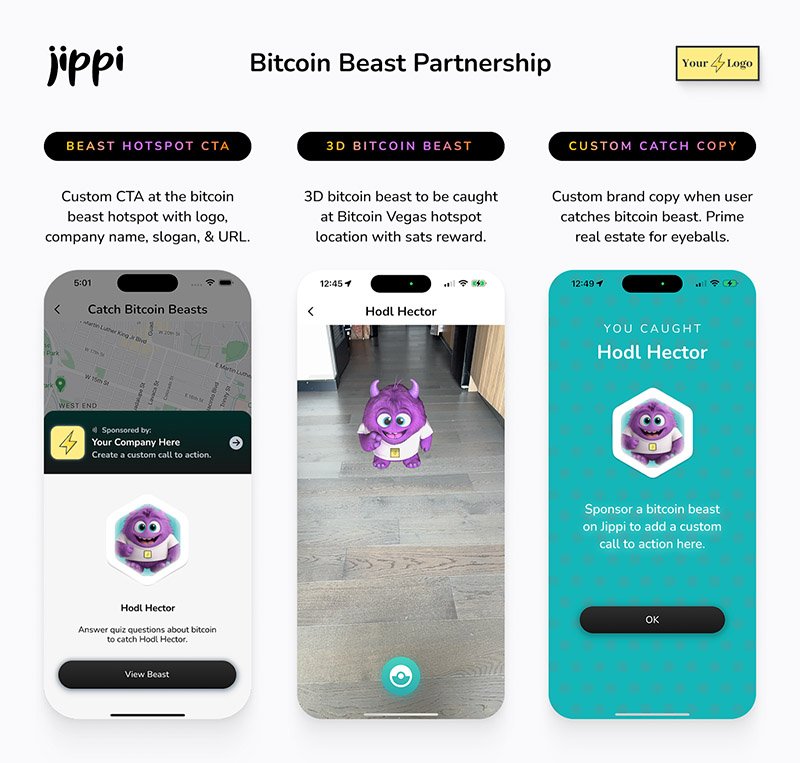

Jippi’s next big move is Las Vegas, where they’ll launch the Beast Catch experience at the Venetian during a major Bitcoin event. To mark the occasion, they’re opening up six limited sponsorship spots for Bitcoin companies, each one tied to a custom in-game beast.

Jippi looks to launch a special event at Bitcoin 2025

“It’s real estate inside the game,” Oliver explains. “Brands become allies, not intrusions. You get a logo, company name, and call to action, so we can push people to your site or app.”

Bitcoin Well—an automatic self-custody Bitcoin platform—has claimed Beast #1. Only five exclusive spots remain for Bitcoin companies to “beastify their brand” through Jippi’s immersive AR game.

“I love the Jippi mission. I think gamified learning is how we will onboard the next generation and it’s exciting to see what the Jippi team is doing! I love working with bitcoiners towards our common mission – bullish!” said Adam O’Brien, Bitcoin Well CEO.

Jippi’s sponsorship model is simple: align incentives, respect users, and support builders. Instead of throwing ad money at tech giants, Bitcoin companies can connect with new users naturally while they’re having fun and earning sats in the process.

For Bitcoin companies looking to reach a younger demographic, this represents a unique opportunity to showcase their brand to up to 30,000 potential customers at the Vegas event.

Jippi Bitcoin Beast partnership

While Jippi’s current focus is simple, get the game into more cities, Oliver sees a future where AR glasses and AI help personalize Bitcoin education even further.

“The magic is going to really happen when Apple releases the glasses form factor,” he says, describing how augmented reality could enhance real-world connections rather than isolate users.

In the longer term, Jippi aims to evolve from a free-to-play model toward a pay-to-play version with higher stakes. Users would form “tribes” with friends to compete for substantial bitcoin prizes, creating social connections along with financial education.

Unlike VC-backed startups, Jippi is raising funds pleb style via Timestamp, an open investment platform for Bitcoin companies.

“You don’t have to be an accredited investor,” Oliver explains. “You’re directly supporting the parallel Bitcoin economy by investing in Bitcoin companies for equity.”

Anyone can invest as little as $100. Perks include early access, exclusive game content, and even creating your own beast design with your name/pseudonym and unique game lore. Each investment comes with direct ownership of an early-stage Bitcoin company like Jippi.

For Oliver, this is more than just a business. It’s about future-proofing Bitcoin adoption and ensuring Satoshi’s vision lives on, especially as many people are lured by altcoins, NFTs, and social media dopamine.

“We’re on the right side of history,” he says firmly. “I want my grandkids to know that early on in the Bitcoin revolution, games like Jippi helped make it stick.”

In a world increasingly absorbed by screens and short attention spans, Jippi’s combination of outdoor play, sats rewards, and Bitcoin education might be exactly the bridge Gen Z needs.

Interested in sponsoring a Beast or investing in Jippi? Reach out to Jippi directly by heading to their partnerships page on their website or visit their Timestamp page to invest in Jippi today.

-

@ f1989a96:bcaaf2c1

2025-05-22 17:09:23

@ f1989a96:bcaaf2c1

2025-05-22 17:09:23Good morning, readers!

Today, we begin in China, where the central bank injected $138 billion into the economy and expanded the money supply by 12.5% year-over-year. As the regime eases monetary conditions to prop up a decelerating economy, Chinese citizens are rushing to preserve their savings, evidenced by Bitcoin/CNY trading activity jumping over 20% on the news. But while some escape to harder money, others remain trapped. In Hunan, an elderly Chinese woman died outside a bank after being forced to appear in person in order to withdraw her own money for medical care.\ \ In Central America, Salvadoran President Bukele revived a “foreign agents” bill that would impose a 30% tax on foreign-funded NGOs, threatening to financially crush organizations that hold those in power accountable and protect journalists and civil society. The proposal mirrors laws used in Russia, China, Belarus, and beyond to suppress dissent. And it arrives amid Bukele’s authoritarian drift and increasing threats to independent journalists.\ \ In open-source news, we highlight a new tool called ChapSmart, a Bitcoin-powered remittance service that allows users to send Bitcoin to citizens and families in Tanzania and have it disbursed in Tanzanian shillings (TZS) via M-PESA. This tool is increasingly helpful as the Tanzanian regime tightens control over foreign currency, mandating that all transactions be conducted in TZS. ChapSmart provides an accessible way for nonprofits and dissidents to access value from abroad using Bitcoin.\ \ We end with an Ask Me Anything (AMA) with Bitcoin educator Anita Posch on Stacker News, who shares her thoughts, experiences, and views from her time conducting Bitcoin education in authoritarian regimes in Africa. We also feature an article from Togolese human rights advocate Farida Nabourema, who critiques Nigeria’s new investment act for classifying Bitcoin as a security and for the regulatory hurdles this will impose on the grassroots adoption of freedom tech in the country.

Be sure to tune in next week at 2 p.m. Oslo time on Wednesday, May 28, as the Oslo Freedom Forum’s Freedom Tech track airs on Bitcoin Magazine’s livestream channels, headlined by speakers Ziya Sadr, Abubakr Nur Khalil, Amiti Uttarwar, Calle, Sarah Kreps, Ben Perrin, and many more.

Now, let’s read on!

SUBSCRIBE HERE

GLOBAL NEWS

El Salvador | Bukele Reintroduces Foreign Agents Bill

In El Salvador, President Nayib Bukele revived a controversial “foreign agents” bill that threatens to severely restrict the finances and operations of NGOs. While the bill is not finalized, Bukele shared on X that the proposal would impose a 30% tax on donations to NGOs receiving foreign funding. This punitive financial measure alone would severely restrict Salvadoran organizations that protect independent journalism, advocate for human rights, and hold the government accountable. In neighboring Nicaragua, a similar foreign agents law has enabled the closure of more than 3,500 NGOs. El Salvador’s foreign agents bill arrives alongside other alarming moves, including arrest warrants against El Faro journalists, the arrest of human rights lawyer Ruth López, and the detention of more than 200 Venezuelan migrants under dubious claims of gang affiliation.

China | Injects Billions to Stabilize Economy

The Chinese Communist Party (CCP) has injected $138 billion in liquidity through interest rate cuts and a 0.5% reduction in banks’ reserve requirements, in effect expanding the money supply by 12.5% year-over-year. While the state eases monetary conditions to prop up a fragile system, ordinary citizens are left scrambling to preserve the value of their savings. Bitcoin/CNY trading volumes jumped over 20% in response, as people sought refuge from a weakening yuan. But while some can quietly escape to harder money, others are trapped in a system that treats access to money as a privilege. In Hunan, an elderly woman in a wheelchair died outside a bank after being forced to appear in person to withdraw her own money for medical care. Too weak to pass mandatory facial recognition scans, she collapsed after repeated failed attempts.

World | Authoritarian Regimes Lead CBDC Push, Study Finds

A new international study from the Nottingham Business School, part of Nottingham Trent University in England, set out to understand what is driving countries to pursue central bank digital currencies (CBDCs). Researchers found the answer lies mostly in political motives. Analyzing 68 countries, the report revealed that authoritarian governments are pushing CBDCs most aggressively, using their centralized power to hastily roll out CBDCs that can monitor transactions, restrict the movement of money, and suppress dissent. On the other hand, the report found democracies are moving more cautiously, weighing concerns over privacy, transparency, and public trust. The study also noted a correlation: countries with high levels of perceived corruption are more likely to explore CBDCs, often framing them as tools to fight illicit finance. These findings are consistent with HRF’s research, revealing nearly half the global population lives under an authoritarian regime experimenting with a CBDC.

Thailand | Plans to Issue New “Investment Token”

Thailand’s Ministry of Finance plans to issue 5 billion baht ($151 million) worth of “G-Tokens,” a new digital investment scheme that allows Thais to buy government bonds for as little as 100 baht ($3). Officials claim the project will democratize access to state-backed investments and offer higher returns than traditional bank deposits. But in a country rapidly advancing central bank digital currency (CBDC) infrastructure, this initiative raises apparent concerns. The move closely follows Thailand’s repeated digital cash handouts via a state-run wallet app, which restricts spending, tracks user behavior, and enforces expiration dates on money, all clear hallmarks of a CBDC. Luckily, the Thai government postponed the latest handout, but the infrastructure remains. Framing this project as inclusionary masks the reality: Thailand is building state-run digital systems that give the regime more power over citizens’ savings and spending.

Russia | Outlaws Amnesty International

Russia officially banned Amnesty International, designating it as an “undesirable organization” and criminalizing cooperation with the global human rights group. Russian officials claim Amnesty promotes “Russophobic projects” and undermines national security. This adds to the Kremlin’s assault on dissent, targeting human rights advocates, independent journalists, and civil society in the years since the 2022 full-scale invasion of Ukraine. The designation exposes anyone financially, publicly, or privately supporting Amnesty’s work to prosecution and imprisonment up to five years. With more than 220 organizations now blacklisted, Russia is systematically cutting off avenues for international accountability and isolating Russians from external support.

BITCOIN AND FREEDOM TECH NEWS

ChapSmart | Permissionless Remittances in Tanzania

ChapSmart is a Bitcoin-powered remittance service that allows users to send money to individuals and families in Tanzania while having it disbursed in Tanzanian shillings (TZS) via M-PESA. With ChapSmart, no account is needed: just enter your name, email, and the recipient’s M-Pesa details. Choose how much USD to send, pay in bitcoin via the Lightning Network, and ChapSmart delivers Tanzanian shillings instantly to the recipient's M-Pesa account with zero fees. This tool is especially useful as Tanzania’s regime enacts restrictions on foreign currencies, banning most citizens from quoting prices or accepting payment in anything other than TZS. ChapSmart offers a practical and accessible way for families, nonprofits, and individuals to access value from abroad using Bitcoin, even as the state tries to shut out financial alternatives.

Bitkey | Multisignature for Families Protecting Wealth from State Seizure

Decades ago, Ivy Galindo’s family lost their savings overnight when the Brazilian government froze citizens’ bank accounts to “fight inflation.” That moment shaped her understanding of financial repression and why permissionless tools like Bitcoin are essential. When her parents later chose to start saving in Bitcoin, Ivy knew a wallet with a single private key wasn’t enough, as it can be lost, stolen, or handed over under pressure or coercion from corrupt law enforcement or state officials. Multisignature (multisig) wallets, which require approval from multiple private keys to move funds, offer stronger protection against this loss and coercion and eliminate any single points of failure in a Bitcoin self-custody setup. But multisig setups are often too technical for everyday families. Enter Bitkey. This multisig device offered Ivy’s family a simple, secure way to share custody of their Bitcoin in the face of financial repression. In places where wealth confiscation and frozen bank accounts are a lived reality, multisignature wallets can help families stay in full control of their savings.

Parasite Pool | New Zero-Fee, Lightning Native Bitcoin Mining Pool

Parasite Pool is a new open-source Bitcoin mining pool built for home miners who want to contribute to Bitcoin’s decentralization without relying on the large and centralized mining pools. It charges zero fees and offers Lightning-native payouts with a low 10-satoshi threshold, allowing individuals to earn directly and instantly. Notably, it has a “pleb eat first” reward structure, which allocates 1 BTC to the block finder and splits the remaining 2.125 BTC plus fees among all non-winning participants via Lightning. This favors small-scale miners, who can earn outsized rewards relative to their hashpower, inverting the corporate bias of legacy mining pools. This makes Parasite Pool especially attractive for small scale miners, such as those operating in authoritarian contexts who need to mine discreetly and independently. In turn, these very same miners contribute to the Bitcoin network’s resistance to censorship, regulatory capture, and corporate control, ensuring it remains a tool for freedom and peaceful resistance for those who need it most. Learn more about the mining pool here.

Cake Wallet | Implements Payjoin V2

Cake Wallet, a non-custodial, privacy-focused, and open-source mobile Bitcoin wallet, released version 4.28, bringing Payjoin V2 to its user base. Payjoin is a privacy technique that allows two users to contribute an input to a Bitcoin transaction, breaking the common chain analysis heuristic that assumes a sender owns all inputs. This makes it harder for dictators to trace payments or link the identities of activists or nonprofits. Unlike the original Payjoin, which required both the sender and recipient to be online and operate a Payjoin server, Payjoin v2 removes both barriers and introduces asynchronous transactions and serverless communication. This means users can now conduct private transactions without coordination or technical setup, making private Bitcoin transactions much more accessible and expanding the tools dissidents have to transact in the face of censorship, extortion, and surveillance. HRF is pleased to have sponsored the Payjoin V2 specification with a bounty and is happy to see this functionality now in the wild.

Mi Primer Bitcoin | Receives Grant from startsmall

Mi Primer Bitcoin, a nonprofit organization supporting independent Bitcoin education in Central America, announced that it received a $1 million grant from Jack Dorsey’s startsmall public fund. This support will accelerate Mi Primer Bitcoin’s impartial, community-led, Bitcoin-only education. The initiative has trained tens of thousands of students while supporting over 65 grassroots projects across 35+ countries through its Independent Bitcoin Educators Node Network, pushing financial freedom forward where needed most. The Mi Primer Bitcoin (MPB) team stresses the importance of remaining free from government or corporate influence to preserve the integrity of their mission. As founder John Dennehy puts it, “Education will be captured by whoever funds it… We need to create alternative models for the revolution of Bitcoin education to realize its full potential.” MPB has been adopted by many education initiatives working under authoritarian regimes.

Phoenix Wallet | Introduces Unlimited BOLT 12 Offers and Manual Backup Options

Phoenix Wallet, a mobile Bitcoin Lightning wallet, introduced support for unlimited BOLT 12 offers in its v2.6.0 update, allowing users to generate as many reusable Lightning invoices as they like. These offers, which function like static Bitcoin addresses, remain permanently valid and can now include a custom description and amount — ideal for nonprofits or dissidents who need to receive regular donations discreetly. The update also introduces manual export and import of the payments database on Android, enabling users to securely transfer their payment history to new devices. These updates strengthen Phoenix’s position as one of the most user-friendly and feature-complete non-custodial Lightning wallets. BOLT 12 — once a pipe dream — is now a usable activist tool on popularly accessible mobile wallets.

RECOMMENDED CONTENT

Bitcoin Is Not a Security: Why Nigeria’s New Investment and Security Act Misses the Mark by Farida Nabourema

In this article, Togolese human rights advocate Farida Nabourema critiques Nigeria’s 2025 Investment and Securities Act for classifying Bitcoin as a security. Nabourema argues this approach is flawed, economically damaging, disconnected from the realities of Bitcoin usage and innovation across Africa, and an attempt to constrict a human rights tool. She warns that this regulatory framework risks stifling builders and harming the very communities that Bitcoin is helping in a context of widespread currency devaluations, inflation, and exclusion. Read it here.

Ask Me Anything with Anita Posch on Stacker News

After spending five months traveling through countries like Kenya and Zimbabwe, Bitcoin for Fairness Founder Anita Posch joined Stacker News for an Ask Me Anything (AMA) to discuss her view on Bitcoin adoption across the continent. She highlighted major progress since 2020, noting that several grassroots initiatives she supported have become self-sufficient and are now running their own education programs. Despite persistent challenges, like wallet usability, high on-chain fees, and Bitcoin’s misunderstood reputation, she shared stories of real-life impact, including cross-border remittances using mobile airtime and widespread Lightning use via apps like Tando in Kenya. Read the full conversation here.

If this article was forwarded to you and you enjoyed reading it, please consider subscribing to the Financial Freedom Report here.

Support the newsletter by donating bitcoin to HRF’s Financial Freedom program via BTCPay.\ Want to contribute to the newsletter? Submit tips, stories, news, and ideas by emailing us at ffreport @ hrf.org

The Bitcoin Development Fund (BDF) is accepting grant proposals on an ongoing basis. The Bitcoin Development Fund is looking to support Bitcoin developers, community builders, and educators. Submit proposals here.

-

@ 57d1a264:69f1fee1

2025-05-22 13:13:36

@ 57d1a264:69f1fee1

2025-05-22 13:13:36Graphics materials for Bitcoin Knots https://github.com/bitcoinknots branding. See below guide image for reference, a bit cleaner and scalable:

Font family "Aileron" is provided free for personal and commercial use, and can be found here: https://www.1001fonts.com/aileron-font.html

Source: https://github.com/Blissmode/bitcoinknots-gfx/tree/main

https://stacker.news/items/986624

-

@ 21335073:a244b1ad

2025-05-21 16:58:36

@ 21335073:a244b1ad

2025-05-21 16:58:36The other day, I had the privilege of sitting down with one of my favorite living artists. Our conversation was so captivating that I felt compelled to share it. I’m leaving his name out for privacy.

Since our last meeting, I’d watched a documentary about his life, one he’d helped create. I told him how much I admired his openness in it. There’s something strange about knowing intimate details of someone’s life when they know so little about yours—it’s almost like I knew him too well for the kind of relationship we have.

He paused, then said quietly, with a shy grin, that watching the documentary made him realize how “odd and eccentric” he is. I laughed and told him he’s probably the sanest person I know. Because he’s lived fully, chasing love, passion, and purpose with hardly any regrets. He’s truly lived.

Today, I turn 44, and I’ll admit I’m a bit eccentric myself. I think I came into the world this way. I’ve made mistakes along the way, but I carry few regrets. Every misstep taught me something. And as I age, I’m not interested in blending in with the world—I’ll probably just lean further into my own brand of “weird.” I want to live life to the brim. The older I get, the more I see that the “normal” folks often seem less grounded than the eccentric artists who dare to live boldly. Life’s too short to just exist, actually live.

I’m not saying to be strange just for the sake of it. But I’ve seen what the crowd celebrates, and I’m not impressed. Forge your own path, even if it feels lonely or unpopular at times.

It’s easy to scroll through the news and feel discouraged. But actually, this is one of the most incredible times to be alive! I wake up every day grateful to be here, now. The future is bursting with possibility—I can feel it.

So, to my fellow weirdos on nostr: stay bold. Keep dreaming, keep pushing, no matter what’s trending. Stay wild enough to believe in a free internet for all. Freedom is radical—hold it tight. Live with the soul of an artist and the grit of a fighter. Thanks for inspiring me and so many others to keep hoping. Thank you all for making the last year of my life so special.

-

@ 7e6f9018:a6bbbce5

2025-05-22 16:33:07

@ 7e6f9018:a6bbbce5

2025-05-22 16:33:07Per les xarxes socials es parla amb efusivitat de que Bitcoin arribarà a valer milions de dòlars. El mateix Hal Finney allà pel 2009, va estimar el potencial, en un cas extrem, de 10 milions $:

\> As an amusing thought experiment, imagine that Bitcoin is successful and becomes the dominant payment system in use throughout the world. Then the total value of the currency should be equal to the total value of all the wealth in the world. Current estimates of total worldwide household wealth that I have found range from $100 trillion to $300 trillion. Withn 20 million coins, that gives each coin a value of about $10 million. <https://satoshi.nakamotoinstitute.org/emails/bitcoin-list/threads/4/>

No estic d'acord amb els càlculs del bo d'en Hal, ja que no consider que la valoració d'una moneda funcioni així. En qualsevol cas, el 2009 la capitalització de la riquesa mundial era de 300 bilions $, avui és de 660 bilions $, és a dir ha anat pujant un 5,3% de manera anual,

$$(660/300)^{1/15} = 1.053$$La primera apreciació amb aquest augment anual del 5% és que si algú llegeix aquest article i té diners que no necessita aturats al banc (estalvis), ara és bon moment per començar a moure'ls, encara sigui amb moviments defensius (títols de deute governamental o la propietat del primer habitatge). La desagregació per actius dels 660 bilions és:

-

Immobiliari residencial = 260 bilions $

-

Títols de deute = 125 bilions $

-

Accions = 110 bilions

-

Diners fiat = 78 bilions $

-

Terres agrícoles = 35 bilions $

-

Immobiliari comercial = 32 bilions $

-

Or = 18 bilions $

-

Bitcoin = 2 bilions $

La riquesa mundial és major que 660 bilions, però aquests 8 actius crec que són els principals, ja que s'aprecien a dia d'avui. El PIB global anual és de 84 bilions $, que no són bromes, però aquest actius creats (cotxes, ordinadors, roba, aliments...), perden valor una vegada produïts, aproximant-se a 0 passades unes dècades.

Partint d'aquest nombres com a vàlids, la meva posició base respecte de Bitcoin, ja des de fa un parell d'anys, és que te capacitat per posar-se al nivell de capitalització de l'or, perquè conceptualment s'emulen bé, i perquè tot i que Bitcoin no té un valor tangible industrial com pot tenir l'or, sí que te un valor intangible tecnològic, que és pales en tot l'ecosistema que s'ha creat al seu voltant:

-

Creació de tecnologies de pagament instantani: la Lightning Network, Cashu i la Liquid Network.

-

Producció d'aplicacions amb l'íntegrament de pagaments instantanis. Especialment destacar el protocol de Nostr (Primal, Amethyst, Damus, Yakihonne, 0xChat...)

-

Industria energètica: permet estabilitzar xarxes elèctriques i emprar energia malbaratada (flaring gas), amb la generació de demanda de hardware i software dedicat.

-

Educació financera i defensa de drets humans. És una eina de defensa contra governs i estats repressius. La Human Rights Foundation fa una feina bastant destacada d'educació.

Ara posem el potencial en nombres:

-

Si iguala l'empresa amb major capitalització, que és Apple, arribaria a uns 160 mil dòlars per bitcoin.

-

Si iguala el nivell de l'or, arribaria a uns 800 mil dòlars per bitcoin.

-

Si iguala el nivell del diner fiat líquid, arribaria a un 3.7 milions de dòlars per bitcoin.

Crec que igualar la capitalització d'Apple és probable en els pròxims 5 - 10 anys. També igualar el nivell de l'or en els pròxims 20 anys em sembla una fita possible. Ara bé, qualsevol fita per sota d'aquesta capitalització ha d'implicar tota una serie de successos al món que no sóc capaç d'imaginar. Que no vol dir que no pugui passar.

-

-

@ 57d1a264:69f1fee1

2025-05-22 12:36:20

@ 57d1a264:69f1fee1

2025-05-22 12:36:20Graphics materials for Bitcoin Knots https://github.com/bitcoinknots branding. See below guide image for reference, a bit cleaner and scalable:

Font family "Aileron" is provided free for personal and commercial use, and can be found here: https://www.1001fonts.com/aileron-font.html

Source: https://github.com/Blissmode/bitcoinknots-gfx/tree/main

https://stacker.news/items/986587

-

@ 9b308fda:b6c7310d

2025-05-22 18:30:19

@ 9b308fda:b6c7310d

2025-05-22 18:30:19@15/05/2025 ✨ Week 0 – Getting Started with My Internship at Formstr (Onboarding)

I’m excited to share that I’ve been selected as a Summer of Bitcoin intern at Formstr!

After the final exams wrapped up on May 4th, I took a short, well-deserved break while traveling back home from college for the summer. Once settled in, I quickly transitioned into internship mode and began diving into the project assigned to me at Formstr.

It’s been a great start so far, and I’m looking forward to learning, building, and sharing more along the way.

@22/05/2025 — Week 01 – Building Features and Brainstorming at Formstr

This week at Formstr was packed with development and discussions.

The major highlight was completing the row popup view for form responses — now, clicking on any response row shows a clean and complete view of that user's submission. I'm happy to share that the pull request has been merged! It feels great to contribute something that improves the user experience so visibly.

Alongside that, I started brainstorming the LLM-Analysis feature. We had a productive discussion during the weekly developer meeting on Signal, where I shared my initial thoughts and got valuable input from the team. There's a lot of potential in this, and it’s exciting to shape it from the ground up.

I also worked on improving relay management in the form settings to reduce redundancy. The changes are in progress, and it’s almost done — just final touches left before merging.

Another topic we tackled was the “Form Filler with AI” feature. There are still some open questions around implementation and user flow, so we’ve decided to continue discussions with more team members before finalizing the plan.

We’ve also agreed to hold weekly team meetings going forward to keep everyone aligned on ideas, progress, and blockers. I’m glad to be part of such a collaborative and thoughtful team!

-

@ 51bbb15e:b77a2290

2025-05-21 00:24:36

@ 51bbb15e:b77a2290

2025-05-21 00:24:36Yeah, I’m sure everything in the file is legit. 👍 Let’s review the guard witness testimony…Oh wait, they weren’t at their posts despite 24/7 survellience instructions after another Epstein “suicide” attempt two weeks earlier. Well, at least the video of the suicide is in the file? Oh wait, a techical glitch. Damn those coincidences!

At this point, the Trump administration has zero credibility with me on anything related to the Epstein case and his clients. I still suspect the administration is using the Epstein files as leverage to keep a lot of RINOs in line, whereas they’d be sabotaging his agenda at every turn otherwise. However, I just don’t believe in ends-justify-the-means thinking. It’s led almost all of DC to toss out every bit of the values they might once have had.

-

@ 9ca447d2:fbf5a36d

2025-05-22 18:03:14

@ 9ca447d2:fbf5a36d

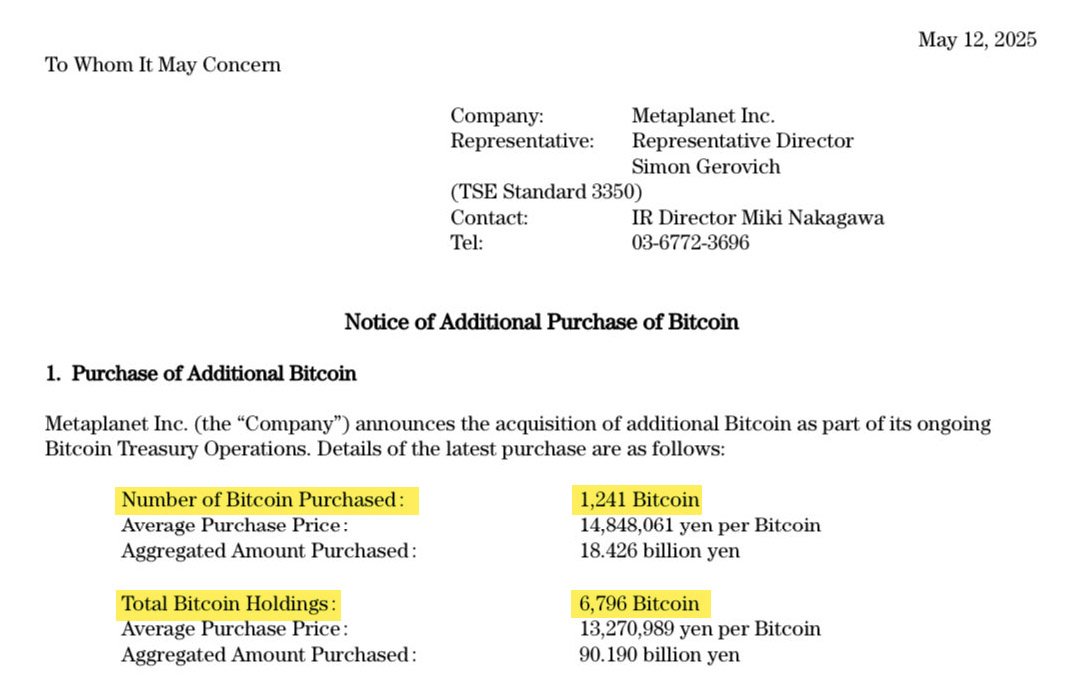

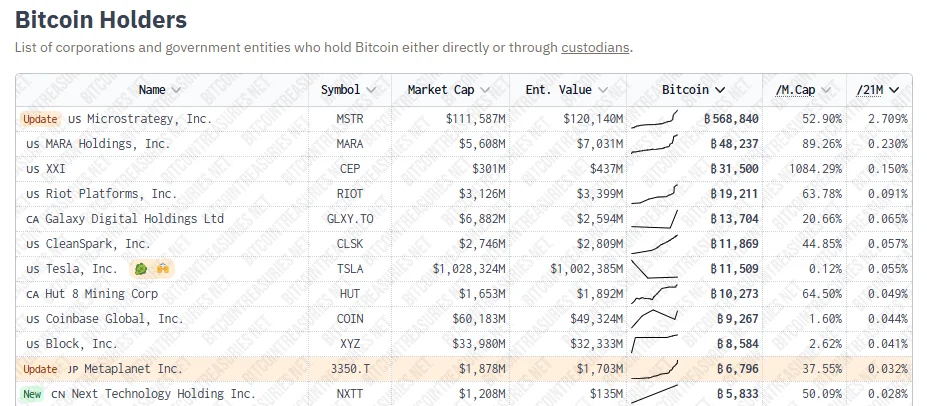

2025-05-22 18:03:14Tokyo-listed investment firm Metaplanet has officially surpassed El Salvador in bitcoin holdings after its biggest-ever single purchase of the scarce digital asset.

On May 12, 2025, the company announced it had bought 1,241 Bitcoin (BTC) for approximately $123.8 million, or ¥18.4 billion. The average price per coin was about $102,111, marking the firm’s largest purchase to date.

This latest buy brings Metaplanet’s total bitcoin reserves to 6,796 BTC, worth over $700 million.

Metaplanet on X

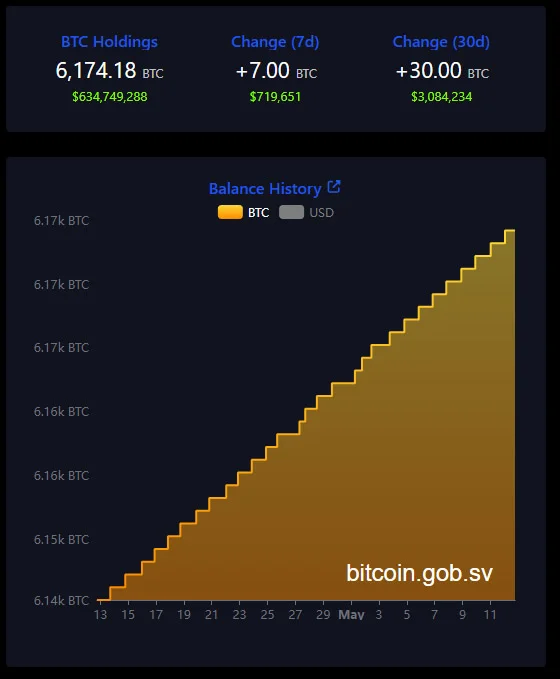

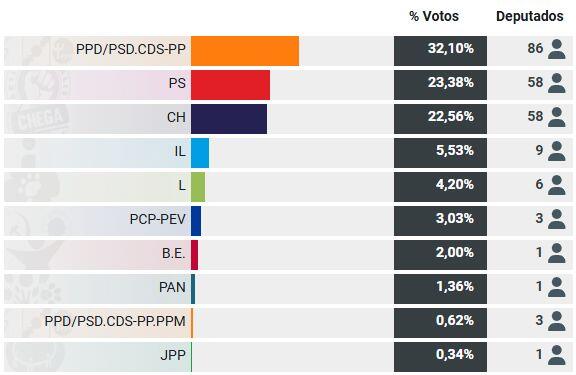

That puts Metaplanet ahead of El Salvador, the Central American nation that made headlines in 2021 for adopting bitcoin as legal tender. According to its National Bitcoin Office, El Salvador currently holds 6,174 BTC, worth roughly $642 million.

El Salvador bitcoin holdings — bitcoin.gob.sv

“Metaplanet now holds more bitcoin than El Salvador. From humble beginnings to rivaling nation-states, we’re just getting started,” said CEO Simon Gerovich on X after the company’s announcement.

The Japanese investment company started its bitcoin treasury strategy in April 2024 and has become the largest corporate holder of bitcoin in Asia and 11th globally. It aims to hold 10,000 BTC by the end of 2025.

Metaplanet is now the 11th largest corporate holder of bitcoin — BitcoinTreasuries

To fund these purchases, the firm has turned to bond issuances, including zero-percent bonds. In early May, Metaplanet issued $25 million worth of 0% bonds under its EVO FUND program to finance bitcoin buys without diluting shares or taking on traditional debt.

And Metaplanet’s strategy seems to be working. Its BTC Yield — a proprietary metric that measures bitcoin accumulation per share — is 38% for Q2 2025 so far. In previous quarters, the firm reported 95.6% in Q1 and a whopping 309.8% in Q4 2024.

The stock price has also gone up 1,800% since May 2024 and 51% in 2025 alone, currently trading above 550 JPY.

Metaplanet is often called “Japan’s MicroStrategy”, a reference to the U.S.-based company Strategy (formerly MicroStrategy) led by Bitcoin advocate Michael Saylor. Strategy is the world’s largest corporate bitcoin holder with over 568,840 BTC in its coffers, worth more than $58 billion.

Like Strategy, Metaplanet is using creative financing tools such as convertible bonds and non-dilutive bond issuance to build a big bitcoin treasury. These financial instruments give the company the ability to fund further bitcoin purchases without diluting shareholders’ value.

Metaplanet is buying bitcoin very rapidly. This has become a trend in the corporate world, where private companies are challenging nation-states in the digital asset space.

Unlike governments which face regulatory and political hurdles, corporations like Metaplanet can move quickly and decisively. Since 2020 over 80 publicly traded companies have collectively bought more than 632,000 BTC worth over $65 billion.

This is a fundamental shift in how companies manage their treasuries — moving away from cash or bonds and towards the digital scarcity that bitcoin presents.

This creates a new form of financial power where corporations can hold a significant portion of a finite asset, unlike fiat currencies which governments can print to infinity.

-

@ 57d1a264:69f1fee1

2025-05-22 06:21:22

@ 57d1a264:69f1fee1

2025-05-22 06:21:22You’ve probably seen it before.

You open an agency’s website or a freelancer’s portfolio. At the very top of the homepage, it says:

We design for startups.

You wait 3 seconds. The last word fades out and a new one fades in:

We design for agencies.

Wait 3 more seconds:

We design for founders.

I call this design pattern The Wheel of Nothing: a rotating list of audience segments meant to impress through inclusion and draw attention through motion… for absolutely no reason.

Revered brand studio Pentagram recently launched a new website. To my surprise, the homepage features the Wheel of Nothing front and center, boldly claiming:

We design Everything for Everyone…before cycling through more specific combinations every few seconds.

Dan Mall, a husband, dad, teacher, creative director, designer, founder, and entrepreneur from Philly. I share as much as I can to create better opportunities for those who wouldn’t have them otherwise. Most recently, I ran design system consultancy SuperFriendly for over a decade.

Read more at Dans' website https://danmall.com/posts/the-wheel-of-nothing/

https://stacker.news/items/986392

-

@ 7e6f9018:a6bbbce5

2025-05-22 15:44:12

@ 7e6f9018:a6bbbce5

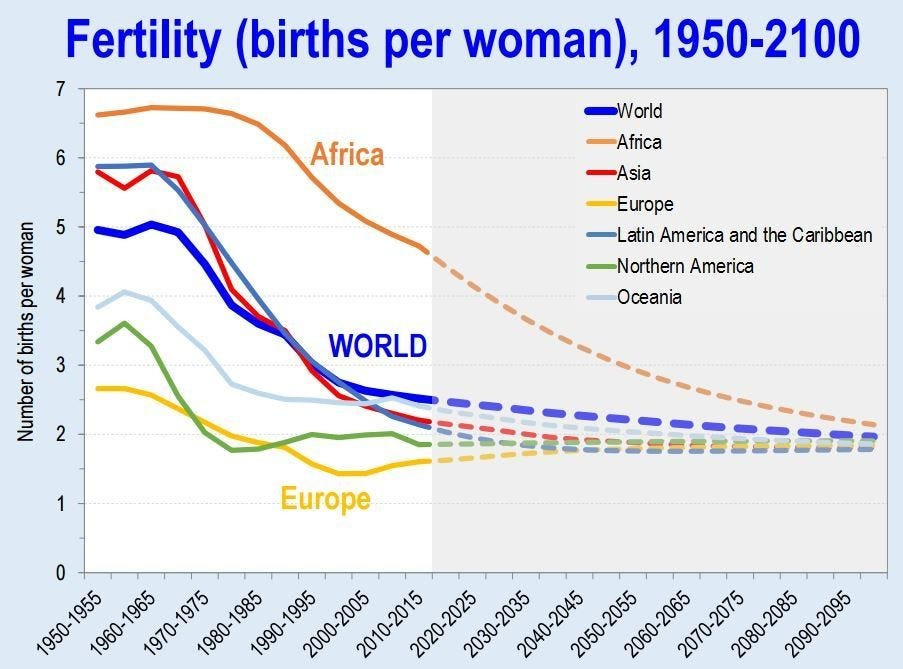

2025-05-22 15:44:12Over the last decade, birth rates in Spain have dropped by 30%, from 486,000 births in 2010 to 339,000 in 2020, a decline only comparable to that seen in Japan and the Four Asian Tigers.

The main cause seems to stem from two major factors: (1) the widespread use of contraceptive methods, which allow for pregnancy control without reducing sexual activity, and (2) women's entry into the labor market, leading to a significant shift away from traditional maternal roles.

In this regard, there is a phenomenon of demographic inertia that I believe could become significant. When a society ages and the population pyramid inverts, the burden this places on the non-dependent population could further contribute to a deeper decline in birth rates.

The more resources (time and money) non-dependent individuals have to dedicate to the elderly (dependents), the less they can allocate to producing new births (also dependents):

- An only child who has to care for both parents will bear a burden of 2 (2 ÷ 1).

- Three siblings who share the responsibility of caring for their parents will bear a burden of 0.6 (2 ÷ 3).

This burden on only children could, in many cases, be significant enough to prevent them from having children of their own.

In Spain, the generation of only children reached reproductive age in 2019(*), this means that right now the majority of people in reproductive age in Spain are only child (or getting very close to it).

If this assumption is correct, and aging feeds on itself, then, given that Spain has one of the worst demographic imbalances in the world, this phenomenon is likely to manifest through worsening birth rates. Spain’s current birth rate of 1.1 may not yet have reached its lowest point.

(*)Birth rate table and the year in which each generation reaches 32 years of age, Spain.

| Year of birth | Birth rate | Year in which the generation turns 32 | | ------------------ | -------------- | ----------------------------------------- | | 1971 | 2.88 | 2003 | | 1972 | 2.85 | 2004 | | 1973 | 2.82 | 2005 | | 1974 | 2.81 | 2006 | | 1975 | 2.77 | 2007 | | 1976 | 2.77 | 2008 | | 1977 | 2.65 | 2009 | | 1978 | 2.54 | 2010 | | 1979 | 2.37 | 2011 | | 1980 | 2.21 | 2012 | | 1981 | 2.04 | 2013 | | 1982 | 1.94 | 2014 | | 1983 | 1.80 | 2015 | | 1984 | 1.72 | 2016 | | 1985 | 1.64 | 2017 | | 1986 | 1.55 | 2018 | | 1987 | 1.49 | 2019 | | 1988 | 1.45 | 2020 | | 1989 | 1.40 | 2021 | | 1990 | 1.36 | 2022 | | 1991 | 1.33 | 2023 | | 1992 | 1.31 | 2024 | | 1993 | 1.26 | 2025 | | 1994 | 1.19 | 2026 | | 1995 | 1.16 | 2027 | | 1996 | 1.14 | 2028 | | 1997 | 1.15 | 2029 | | 1998 | 1.13 | 2030 | | 1999 | 1.16 | 2031 | | 2000 | 1.21 | 2032 | | 2001 | 1.24 | 2033 | | 2002 | 1.25 | 2034 | | 2003 | 1.30 | 2035 | | 2004 | 1.32 | 2036 | | 2005 | 1.33 | 2037 | | 2006 | 1.36 | 2038 | | 2007 | 1.38 | 2039 | | 2008 | 1.44 | 2040 | | 2009 | 1.38 | 2041 | | 2010 | 1.37 | 2042 | | 2011 | 1.34 | 2043 | | 2012 | 1.32 | 2044 | | 2013 | 1.27 | 2045 | | 2014 | 1.32 | 2046 | | 2015 | 1.33 | 2047 | | 2016 | 1.34 | 2048 | | 2017 | 1.31 | 2049 | | 2018 | 1.26 | 2050 | | 2019 | 1.24 | 2051 | | 2020 | 1.19 | 2052 |

-

@ 4fa5d1c4:fd6c6e41

2025-05-22 15:30:43

@ 4fa5d1c4:fd6c6e41

2025-05-22 15:30:43🧠 Entwickelt von OECD & EU-Kommission – jetzt zur Rückmeldung freigegeben:\ 👉 https://ailiteracyframework.org/

Das Framework beschreibt vier zentrale Domänen der KI-Kompetenz – jede mit einem klaren Profil aus Wissen, Fertigkeiten und Haltungen. Diese lassen sich hervorragend mit den vier Kompetenzbereichen verbinden:

🔹 Engaging with AI ↔ 🟢 Verstehen

Lernende erkennen KI in ihrem Alltag, verstehen ihre technischen Grundlagen (📘 Knowledge) und entwickeln die Fähigkeit, Ausgaben kritisch zu analysieren (🛠️ Skills), begleitet von einer neugierigen und verantwortungsbewussten Einstellung (🧭 Attitudes).

🔹 Creating with AI ↔ 🔵 Anwenden

Durch den kreativen Einsatz generativer KI entstehen neue Lernprodukte. Benötigt werden technisches Verständnis (📘 z. B. zu Trainingsdaten), Anwendungskompetenz (🛠️ z. B. Promptgestaltung), sowie eine innovationsorientierte Haltung (🧭 Ownership, Urheberrecht, Attribution).

🔹 Managing AI ↔ 🟠 Reflektieren

Hier geht es um bewusste Entscheidungen: Wann ist KI sinnvoll? Wie wirken sich ihre Vorschläge auf mein Denken aus? Das verlangt (📘) Orientierungswissen, (🛠️) strategisches Problemlösen und (🧭) eine ethisch begründbare Reflexion.

🔹 Designing AI ↔ 🟣 Gestalten

Lernende analysieren und entwerfen KI-Systeme: Welche Daten nutze ich? Wer profitiert? Mit welchen Folgen? Die Verbindung aus (📘) systemischem Wissen, (🛠️) Gestaltungskompetenz und (🧭) ethischer Haltung eröffnet Bildungsräume im digitalen Wandel.

📬 Rückmeldungen zum Entwurf sind willkommen – eure Expertise aus der Praxis zählt!

👉 [https://teachai.org/ailiteracy/review](https://teachai.org/ailiteracy/review)

-

@ 8aa70f44:3073d1a6

2025-05-21 13:07:14

@ 8aa70f44:3073d1a6

2025-05-21 13:07:14Earlier this year I launched the asknostr.site project which has been a great journey and learning experience. I had wanted to write down my goals and ideas with the project but didn't get to it yet. Primal launching the article editor was a trigger for me to go for it.

Ever since I joined Nostr i was looking for ways to apply my skillset solve a problem and help with adoption. Around Christmas I figured that a Quora/Stackoverflow alternative is something that needs to exist on Nostr.

Before I knew it I had a pretty decent prototype. And because the network already had so much awesome content, contributors and authors I was never discouraged by the challenge that kills so many good ideas -> "Where do I get the first users?".

Since the initial announcement I have received so much encouragement through zaps, likes, DM's, and maybe most of all seeing the increase in usage of the site and #asknostr content kept me going.

Current State

The current version of the site is stable and most bugs are hashed out. After logging in (remote signer, extension or nsec) you can engage with content through votes, comments and replies. Or simply ask a new question.

All content is stored in the site's own private relay and preprocessed/computed into a single data store (postgres) so the site is fast, accessible and crawl-able.

The site supports browsing hashtags, voting/commenting on answers, asking new questions and every contributor get their own profile (example). At the time of writing the site has 41k questions, almost 200k replies/comments and upwards of 5 million sats purely for #asknostr content.

What to expect/On my list

There are plenty of things and UI bugs that need love and between writing the draft of this post and hitting publish I shipped 3 minor bug fixes. Little by little, bit by bit...

In addition to all those small details here is an overview of the things on my own wish list:

-

Inline Zaps: Ability to zap from the asknostr.site interface. Click the zap button, specify or pick the number of sats zap away.

-

Contributor Rank: A leaderboard to add some gamification. More recognition to those nostriches that spend their time helping other people out

-

Search by Keyword: Search all content by keywords. Experiment with the index to show related questions or answers

-

Better User Profiles: Improve the user profile so it shows all the profile questions and answers. Quick buttons to follow or zap that person. Better insights in the topics (hashtags) the profile contributes to

-

Bookmarks: Ability to bookmark questions and answers. Increase bookmark weight as a signal to rank answers.

-

Smarter Scoring: Tune how answers are scored (winning answer formula). Perhaps give more weight to the question author or use WoT. Not sure yet.

All of this is happening at some point so follow me if you want to stay up to date.

Goals

To manage expectations and keep me focussed I write down the mid and long term goals of the project.

Long term

Call me cheesy but I believe that humanity will flourish through an open web and sound money. My own journey started from with bitcoin but if you asked me today if it's BTC or nostr that is going to have the most impact I wouldn't know what to answer. Chicken or egg?

The goal of the project is to offer an open platform that empowers individuals to ask questions, share expertise and access high-quality information across different topics. The project empowers anyone to monetize their experience creating a sustainable ecosystem that values and rewards knowledge sharing. This will ultimately democratize access to knowledge for all.

Mid term

The project can help a lot with onboarding new users onto the network. Once we start to rank on certain topics we can get a piece of the search traffic pie (StackOverflows 12 million, and Quora 150 million visitors per month) which is a great way to expose people to the power of the network.

First time visitors do not need to know about nostr or zaps to receive value. They can browse around, discover interesting content and perhaps even create a profile without even knowing they are on Nostr now.

Gradually those users will understand the value of the network through better rankings (zaps beats likes), a cross-client experience and a profile that can be used on any nostr site or app.

In order for the site to do that we need to make sure content is browsable by language, (sub)topics and and we double down on 'the human touch' with real contributors and not LLMs.

Short Term Goal

The first goal is to make the site really good and an important resource for existing Nostr users. Enable visitors to search and discover what they are interested in. Integrate within the existing nostr eco system with 'open in' functionality and quick links to interesting projects (followerpacks?)

One of things i want to get right is to improve user retention by making the whole Q\&A experience more sticky. I want to run some experiments (bots, award, summaries) to get more people to use asknostr.site more often and come back.

What about the name?

Finally the big question: What about the asknostr.site name? I don't like the name that much but it's what people know. I think there is a high chance that people will discover Nostr apps like Olas, Primal or Damus without needing to know what NOSTR is or means.

Therefore I think there is a good chance that the project won't be called asknostr.site forever. I guess it all depends on where we all take this.

Onwards!

-

-

@ 57d1a264:69f1fee1

2025-05-21 05:47:41

@ 57d1a264:69f1fee1

2025-05-21 05:47:41As a product builder over too many years to mention, I’ve lost count of the number of times I’ve seen promising ideas go from zero to hero in a few weeks, only to fizzle out within months.

The problem with most finance apps, however, is that they often become a reflection of the internal politics of the business rather than an experience solely designed around the customer. This means that the focus is on delivering as many features and functionalities as possible to satisfy the needs and desires of competing internal departments, rather than providing a clear value proposition that is focused on what the people out there in the real world want. As a result, these products can very easily bloat to become a mixed bag of confusing, unrelated and ultimately unlovable customer experiences—a feature salad, you might say.

Financial products, which is the field I work in, are no exception. With people’s real hard-earned money on the line, user expectations running high, and a crowded market, it’s tempting to throw as many features at the wall as possible and hope something sticks. But this approach is a recipe for disaster.

Here’s why: https://alistapart.com/article/from-beta-to-bedrock-build-products-that-stick/

https://stacker.news/items/985285

-

@ 2e941ad1:fac7c2d0

2025-05-22 18:59:27

@ 2e941ad1:fac7c2d0

2025-05-22 18:59:27Unlocks: 26

-

@ c9badfea:610f861a

2025-05-20 19:49:20

@ c9badfea:610f861a

2025-05-20 19:49:20- Install Sky Map (it's free and open source)

- Launch the app and tap Accept, then tap OK

- When asked to access the device's location, tap While Using The App

- Tap somewhere on the screen to activate the menu, then tap ⁝ and select Settings

- Disable Send Usage Statistics

- Return to the main screen and enjoy stargazing!

ℹ️ Use the 🔍 icon in the upper toolbar to search for a specific celestial body, or tap the 👁️ icon to activate night mode

-

@ 8096ed6b:4901018b

2025-05-22 18:55:48

@ 8096ed6b:4901018b

2025-05-22 18:55:48🎵 Race Against Time by Ray Volpe

🔗 https://song.link/us/i/1586254555

-

@ 9ca447d2:fbf5a36d

2025-05-22 18:03:13

@ 9ca447d2:fbf5a36d

2025-05-22 18:03:13May 13, 2025 – We are proud to announce that My First Bitcoin has received a $1 million grant from #startsmall. With this financial support from Jack Dorsey’s philanthropic initiative, we will continue to serve grassroots Bitcoin education initiatives worldwide.

This grant accelerates our work in the creation and distribution of free and open-source Bitcoin education materials and infrastructure.

It will not only help us improve existing resources, such as the Bitcoin Diploma, Bitcoin Intro Course, and teacher training workshops, but also to scale our digital platforms like our Online School and Community Hub.

As a non-profit, founded in 2021, we have grown from a local project into a global movement. Besides creating curricula and frameworks, our team has directly taught tens of thousands of in-person students, as we workshop and refine our materials based on real world feedback.

In 2023, we launched the Independent Bitcoin Educators Node Network, providing a space for others to join us on our mission. The network spans 65+ projects from 35+ countries, including circular economies, meetup organizers and other grassroots projects.

All commit to the same six pillars: that their education is independent, impartial, community-led, Bitcoin-only, quality, and focused on empowerment over profit.

While we support that network, it is now self-governing. We always seek to give power-to, rather than have power-over.

John Dennehy, founder and Executive Director of My First Bitcoin, explains:

“The revolution of Bitcoin education is that it teaches students HOW to think, not WHAT to think. Funding from sources with their own incentives is the greatest vulnerability that threatens that. Education will be captured by whoever funds it.

“We will never take any government money and frequently turn down funding from corporations and companies. The subtle influence of funding has ruined fiat education and we need to create alternative models for the revolution of Bitcoin education to realize its full potential.”

Funding for Bitcoin education must be transparent.

This grant is a huge win for all of us. For Bitcoin itself, but even more for Independent Bitcoin Education as a whole. It enables us to serve the global community better than ever before. It shows everyone what can be achieved if you stay close to your values.

“My First Bitcoin is a proof-of-concept for all independent Bitcoin educators that if you stay on the mission, even when it’s challenging, then you will come out the other side even stronger,” added Dennehy.

Arnold Hubach, Director of Communications of My First Bitcoin, continued:

“Open source money deserves open source education. Over the past few years, we’ve seen growing demand for our resources around the world, and we remain committed to serving everyone in the Bitcoin space who needs support.

“This funding enables us to plan further into the future and continue being the first-stop provider of free educational tools.”

We’re grateful to #startsmall for believing in our mission and for understanding that Bitcoin education should always be free from external influence. We’re also grateful to the community for helping us arrive at this point where we are ready to receive such a grant.

You lead us to where we are today. You have been our primary funding source. You will continue to lead us forward.

We will always serve the community.

We’re also grateful for our amazing team and their proof of work. The grant will accelerate the work that they are already doing, such as curricula development, teacher training programs, the expansion of the global network, building online platforms, and providing in-person classes.

We will continue to lead by example, we will continue to push the limits, and we will continue to reimagine what’s possible.

We do not seek to please power in this world, we seek to create a proof-of-concept for a better one where the individual is empowered and able to think critically.

If you are an educator in need of tools or infrastructure; please contact us.

If you can help us continue to build out these tools and maintain this growing global movement; please contact us.

If you are aligned with our mission and are a supporter of independent Bitcoin education, please donate.

We work for the public. In public.

-

@ 9223d2fa:b57e3de7

2025-05-22 18:34:59

@ 9223d2fa:b57e3de7

2025-05-22 18:34:599,379 steps

-

@ 9ca447d2:fbf5a36d

2025-05-22 18:03:12

@ 9ca447d2:fbf5a36d

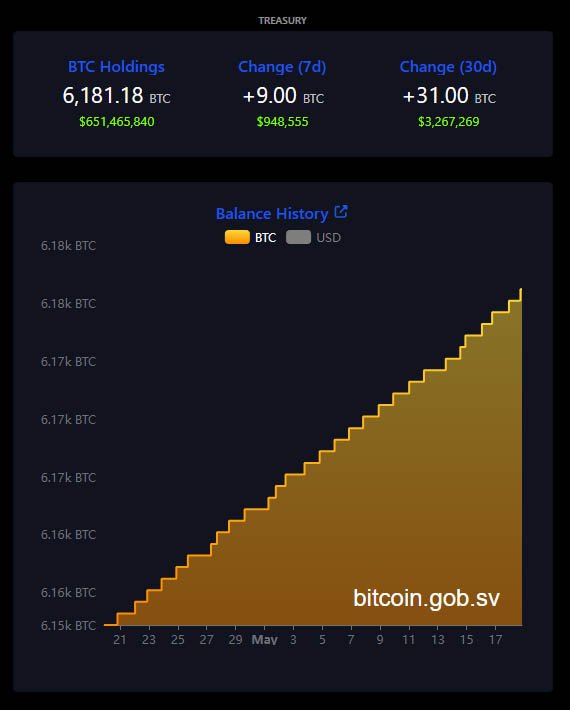

2025-05-22 18:03:12American Bitcoin, a bitcoin mining company backed by President Donald Trump’s sons, is going public in a new merger deal with Gryphon Digital Mining. Investors and political observers are taking notice as it presents a mixture of Bitcoin, Wall Street and the Trump brand.

This reverse merger allows for American Bitcoin Corporation to become a publicly traded company. This will happen through a stock-for-stock merger with Gryphon Digital Mining, a small-cap bitcoin miner already listed on the Nasdaq.

Once the deal is done, the new company will be called American Bitcoin and will trade on the Nasdaq under the ticker symbol ABTC. The merger is expected to close in the 3rd quarter of 2025.

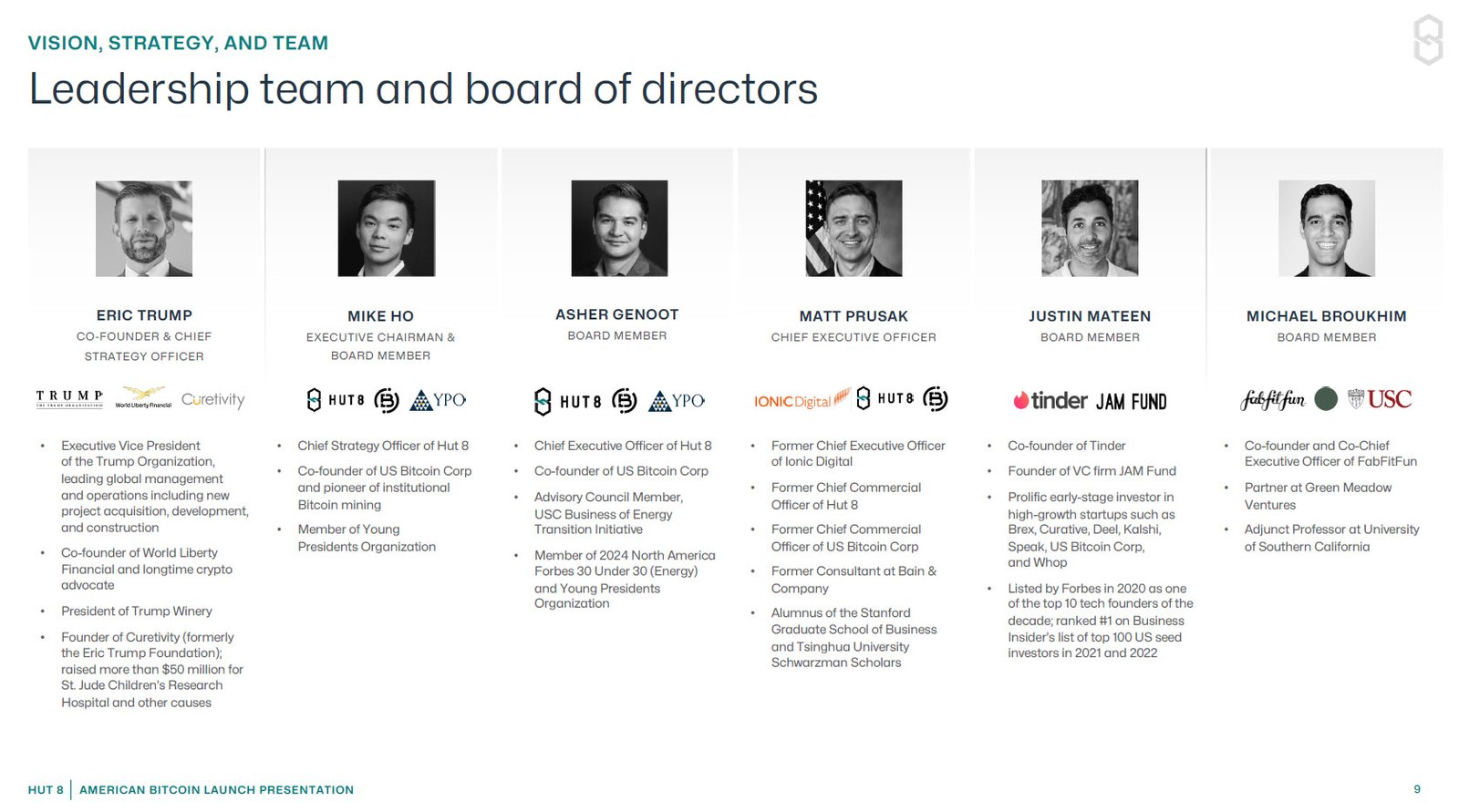

Eric Trump, who will be the Co-Founder and the Chief Strategy Officer, said:

“Our vision for American Bitcoin is to create the most investable Bitcoin accumulation platform in the market.”

The Trump family’s involvement has gotten a lot of attention. Eric Trump and Donald Trump Jr. launched American Bitcoin in March this year with digital asset infrastructure company Hut 8, which owns 80% of American Bitcoin.

American Bitcoin leadership team — Hut 8 presentation

After the merger, American Bitcoin shareholders — including the Trump brothers and Hut 8 — will own about 98% of the new company. Gryphon shareholders will own 2% even though Gryphon is the public company facilitating the merger.

Instead of an IPO (Initial Public Offering), American Bitcoin is going public through what’s called a reverse merger. This means it will take over Gryphon’s public listing.

This is often faster and simpler than a traditional IPO. It allows American Bitcoin to access public capital markets while maintaining operational and strategic control.

Hut 8 CEO Asher Genoot said the merger is a big step forward for the company. “By taking American Bitcoin public, we expect to unlock direct access to dedicated growth capital independent of Hut 8’s balance sheet,” Genoot said.

The announcement sent Gryphon’s stock soaring. Shares rose over 280% and Hut 8’s stock went up over 11%. Clearly investors are interested in bitcoin-focused public companies when the asset itself is close to its previous all-time high.

But not everyone is buying. Some investors and analysts are questioning what Gryphon is actually bringing to the table. Gryphon won’t have a seat on the board or any representation in the new management team. Their role seems to be just to provide the public listing.

Many questions remain unanswered because there are no details on mining operations and what Gryphon’s role is beyond the merger.