-

@ 5d4b6c8d:8a1c1ee3

2025-05-24 15:06:32

@ 5d4b6c8d:8a1c1ee3

2025-05-24 15:06:32I was just updating our potential points, now that we know who won MVP, who made All NBA 1st team, and which teams are still alive for the title, and it turns out that no matter who wins the title @gnilma will win this contest.

Congratulations, @gnilma!

This is just further proof that @gnilma is our NBA Guru.

Let me know where you want your 7k in winnings sent.

https://stacker.news/items/988245

-

@ 6a6be47b:3e74e3e1

2025-05-24 08:21:35

@ 6a6be47b:3e74e3e1

2025-05-24 08:21:35Hi, frens!

🥳 This is my first post over here, yaaay! I’m very excited to start this journey. I have lots of posts on my website https://samhainsam.art/ , but I decided to give you a short introduction to me and my artwork. Shall we?

But first, how’s your weekend going? Already dreading Monday, or just enjoying the moment? I hope it’s the latter, but if not, that’s okay too. Everything passes, and while that might not be the most comforting thought, knowing that it will eventually pass—and, most importantly, that we get to decide how to respond—makes a big difference. Either way, we’re all going to die, so take it as you wish! 😅

Anyway, I wanted to share a little something. If you’ve visited my shop on Ko-fi https://ko-fi.com/samhainsam/shop , you might have wondered why it seems a bit all over the place. Or maybe you haven’t noticed or don’t care—but either way, I thought I’d clarify.

🖼️ I’m a self-taught artist who loves everything related to religion, occultism, paganism, animals, and esotericism—and how all these themes intertwine in our lives. I paint and illustrate inspired by these ideas.

Most of my recent paintings come with a blog post explaining their background. Even before, I always researched the subjects I painted, but lately, I’ve been diving much deeper.

🎨 My “Wheel of the Year” series has completely fascinated me. I’ve been learning so many nuggets of wisdom, and discovering how Christianity borrowed or even erased many symbols and traditions to create new narratives. For example, Imbolc was rebranded as Candlemas, and my blog post about the Spanish Inquisition touches on some of these symbols and their impact on both past and present society.

🐦 I also have some paintings just about birds—I'm a bit of a sucker for them! Shoebills and cassowaries are among my favorites, and I might end up painting them again soon. But you get the picture! If not, why not take a peek at my blog? https://samhainsam.art/blog/

🖋️ You can read something fun and interesting while enjoying my artwork.

Come on over, and let’s have some cool and healthy fun.

Enjoy your weekend, my friends!

Godspeed ⚡

https://stacker.news/items/988069

-

@ 06830f6c:34da40c5

2025-05-24 04:21:03

@ 06830f6c:34da40c5

2025-05-24 04:21:03The evolution of development environments is incredibly rich and complex and reflects a continuous drive towards greater efficiency, consistency, isolation, and collaboration. It's a story of abstracting away complexity and standardizing workflows.

Phase 1: The Bare Metal & Manual Era (Early 1970s - Late 1990s)

-

Direct OS Interaction / Bare Metal Development:

- Description: Developers worked directly on the operating system's command line or a basic text editor. Installation of compilers, interpreters, and libraries was a manual, often arcane process involving downloading archives, compiling from source, and setting environment variables. "Configuration drift" (differences between developer machines) was the norm.

- Tools: Text editors (Vi, Emacs), command-line compilers (GCC), Makefiles.

- Challenges: Extremely high setup time, dependency hell, "works on my machine" syndrome, difficult onboarding for new developers, lack of reproducibility. Version control was primitive (e.g., RCS, SCCS).

-

Integrated Development Environments (IDEs) - Initial Emergence:

- Description: Early IDEs (like Turbo Pascal, Microsoft Visual Basic) began to integrate editors, compilers, debuggers, and sometimes GUI builders into a single application. This was a massive leap in developer convenience.

- Tools: Turbo Pascal, Visual Basic, early Visual Studio versions.

- Advancement: Improved developer productivity, streamlined common tasks. Still relied on local system dependencies.

Phase 2: Towards Dependency Management & Local Reproducibility (Late 1990s - Mid-2000s)

-

Basic Build Tools & Dependency Resolvers (Pre-Package Managers):

- Description: As projects grew, manual dependency tracking became impossible. Tools like Ant (Java) and early versions of

autoconf/makefor C/C++ helped automate the compilation and linking process, managing some dependencies. - Tools: Apache Ant, GNU Autotools.

- Advancement: Automated build processes, rudimentary dependency linking. Still not comprehensive environment management.

- Description: As projects grew, manual dependency tracking became impossible. Tools like Ant (Java) and early versions of

-

Language-Specific Package Managers:

- Description: A significant leap was the emergence of language-specific package managers that could fetch, install, and manage libraries and frameworks declared in a project's manifest file. Examples include Maven (Java), npm (Node.js), pip (Python), RubyGems (Ruby), Composer (PHP).

- Tools: Maven, npm, pip, RubyGems, Composer.

- Advancement: Dramatically simplified dependency resolution, improved intra-project reproducibility.

- Limitation: Managed language-level dependencies, but not system-level dependencies or the underlying OS environment. Conflicts between projects on the same machine (e.g., Project A needs Python 2.7, Project B needs Python 3.9) were common.

Phase 3: Environment Isolation & Portability (Mid-2000s - Early 2010s)

-

Virtual Machines (VMs) for Development:

- Description: To address the "it works on my machine" problem stemming from OS-level and system-level differences, developers started using VMs. Tools like VMware Workstation, VirtualBox, and later Vagrant (which automated VM provisioning) allowed developers to encapsulate an entire OS and its dependencies for a project.

- Tools: VMware, VirtualBox, Vagrant.

- Advancement: Achieved strong isolation and environment reproducibility (a true "single environment" for a project).

- Limitations: Resource-heavy (each VM consumed significant CPU, RAM, disk space), slow to provision and boot, difficult to share large VM images.

-

Early Automation & Provisioning Tools:

- Description: Alongside VMs, configuration management tools started being used to automate environment setup within VMs or on servers. This helped define environments as code, making them more consistent.

- Tools: Chef, Puppet, Ansible.

- Advancement: Automated provisioning, leading to more consistent environments, often used in conjunction with VMs.

Phase 4: The Container Revolution & Orchestration (Early 2010s - Present)

-

Containerization (Docker):

- Description: Docker popularized Linux Containers (LXC), offering a lightweight, portable, and efficient alternative to VMs. Containers package an application and all its dependencies into a self-contained unit that shares the host OS kernel. This drastically reduced resource overhead and startup times compared to VMs.

- Tools: Docker.

- Advancement: Unprecedented consistency from development to production (Dev/Prod Parity), rapid provisioning, highly efficient resource use. Became the de-facto standard for packaging applications.

-

Container Orchestration:

- Description: As microservices and container adoption grew, managing hundreds or thousands of containers became a new challenge. Orchestration platforms automated the deployment, scaling, healing, and networking of containers across clusters of machines.

- Tools: Kubernetes, Docker Swarm, Apache Mesos.

- Advancement: Enabled scalable, resilient, and complex distributed systems development and deployment. The "environment" started encompassing the entire cluster.

Phase 5: Cloud-Native, Serverless & Intelligent Environments (Present - Future)

-

Cloud-Native Development:

- Description: Leveraging cloud services (managed databases, message queues, serverless functions) directly within the development workflow. Developers focus on application logic, offloading infrastructure management to cloud providers. Containers become a key deployment unit in this paradigm.

- Tools: AWS Lambda, Azure Functions, Google Cloud Run, cloud-managed databases.

- Advancement: Reduced operational overhead, increased focus on business logic, highly scalable deployments.

-

Remote Development & Cloud-Based IDEs:

- Description: The full development environment (editor, terminal, debugger, code) can now reside in the cloud, accessed via a thin client or web browser. This means developers can work from any device, anywhere, with powerful cloud resources backing their environment.

- Tools: GitHub Codespaces, Gitpod, AWS Cloud9, VS Code Remote Development.

- Advancement: Instant onboarding, consistent remote environments, access to high-spec machines regardless of local hardware, enhanced security.

-

Declarative & AI-Assisted Environments (The Near Future):

- Description: Development environments will become even more declarative, where developers specify what they need, and AI/automation tools provision and maintain it. AI will proactively identify dependency issues, optimize resource usage, suggest code snippets, and perform automated testing within the environment.

- Tools: Next-gen dev container specifications, AI agents integrated into IDEs and CI/CD pipelines.

- Prediction: Near-zero environment setup time, self-healing environments, proactive problem identification, truly seamless collaboration.

web3 #computing #cloud #devstr

-

-

@ 21335073:a244b1ad

2025-05-21 16:58:36

@ 21335073:a244b1ad

2025-05-21 16:58:36The other day, I had the privilege of sitting down with one of my favorite living artists. Our conversation was so captivating that I felt compelled to share it. I’m leaving his name out for privacy.

Since our last meeting, I’d watched a documentary about his life, one he’d helped create. I told him how much I admired his openness in it. There’s something strange about knowing intimate details of someone’s life when they know so little about yours—it’s almost like I knew him too well for the kind of relationship we have.

He paused, then said quietly, with a shy grin, that watching the documentary made him realize how “odd and eccentric” he is. I laughed and told him he’s probably the sanest person I know. Because he’s lived fully, chasing love, passion, and purpose with hardly any regrets. He’s truly lived.

Today, I turn 44, and I’ll admit I’m a bit eccentric myself. I think I came into the world this way. I’ve made mistakes along the way, but I carry few regrets. Every misstep taught me something. And as I age, I’m not interested in blending in with the world—I’ll probably just lean further into my own brand of “weird.” I want to live life to the brim. The older I get, the more I see that the “normal” folks often seem less grounded than the eccentric artists who dare to live boldly. Life’s too short to just exist, actually live.

I’m not saying to be strange just for the sake of it. But I’ve seen what the crowd celebrates, and I’m not impressed. Forge your own path, even if it feels lonely or unpopular at times.

It’s easy to scroll through the news and feel discouraged. But actually, this is one of the most incredible times to be alive! I wake up every day grateful to be here, now. The future is bursting with possibility—I can feel it.

So, to my fellow weirdos on nostr: stay bold. Keep dreaming, keep pushing, no matter what’s trending. Stay wild enough to believe in a free internet for all. Freedom is radical—hold it tight. Live with the soul of an artist and the grit of a fighter. Thanks for inspiring me and so many others to keep hoping. Thank you all for making the last year of my life so special.

-

@ 5d4b6c8d:8a1c1ee3

2025-05-23 23:37:17

@ 5d4b6c8d:8a1c1ee3

2025-05-23 23:37:17@grayruby loves to blow up the odds of various sports markets at Predyx. Well, the jig is up, because I finally managed to deposit some sats at BetPlay where I can leverage the mismatched odds.

So, I've now locked in guaranteed wins on the 49ers winning the Super Bowl and the Panthers winning the Stanley Cup.

https://stacker.news/items/987847

-

@ eb0157af:77ab6c55

2025-05-24 15:01:34

@ eb0157af:77ab6c55

2025-05-24 15:01:34Vivek Ramaswamy’s company bets on distressed bitcoin claims as its Bitcoin treasury strategy moves forward.

Strive Enterprises, an asset management firm co-founded by Vivek Ramaswamy, is exploring the acquisition of distressed bitcoin claims, with particular interest in around 75,000 BTC tied to the Mt. Gox bankruptcy estate. This move is part of the company’s broader strategy to build a Bitcoin treasury ahead of its planned merger with Asset Entities.

According to a document filed on May 20 with the Securities and Exchange Commission, Strive has partnered with 117 Castell Advisory Group to “identify and evaluate” distressed Bitcoin claims with confirmed legal judgments. Among these are approximately 75,000 BTC connected to Mt. Gox, with an estimated market value of $8 billion at current prices.

Essentially, Strive aims to acquire rights to bitcoins currently tied up in legal disputes, which can be purchased at a discount by those willing to take on the risk and wait for eventual recovery.

In a post on X, Strive’s CFO, Ben Pham, stated:

“Strive intends to use all available mechanisms, including novel financial strategies not used by other Bitcoin treasury companies, to maximize its exposure to the asset.”

The company also plans to buy cash at a discount by merging with publicly traded companies holding more cash than their stock value, using the excess funds to purchase additional Bitcoin.

Mt. Gox, the exchange that collapsed in 2014, is currently in the process of repaying creditors, with a deadline set for October 31, 2025.

In its SEC filing, Strive declared:

“This strategy is intended to allow Strive the opportunity to purchase Bitcoin exposure at a discount to market price, enhancing Bitcoin per share and supporting its goal of outperforming Bitcoin over the long run.”

At the beginning of May, Strive announced its merger plan with Asset Entities, a deal that would create the first publicly listed asset management firm focused on Bitcoin. The resulting company aims to join the growing number of firms adopting a Bitcoin treasury strategy.

The corporate treasury trend

Strive’s initiative to accumulate bitcoin mirrors that of other companies like Strategy and Japan’s Metaplanet. On May 19, Strategy, led by Michael Saylor, announced the purchase of an additional 7,390 BTC for $764.9 million, raising its total holdings to 576,230 BTC. On the same day, Metaplanet revealed it had acquired another 1,004 BTC, increasing its total to 7,800 BTC.

The post Bitcoin in Strive’s sights: 75,000 BTC from Mt. Gox among its targets appeared first on Atlas21.

-

@ 57d1a264:69f1fee1

2025-05-24 06:07:19

@ 57d1a264:69f1fee1

2025-05-24 06:07:19Definition: when every single person in the chain responsible for shipping a product looks at objectively horrendous design decisions and goes: yup, this looks good to me, release this. Designers, developers, product managers, testers, quality assurance... everyone.

I nominate Peugeot as the first example in this category.

Continue reading at https://grumpy.website/1665

https://stacker.news/items/988044

-

@ 5d4b6c8d:8a1c1ee3

2025-05-23 19:32:28

@ 5d4b6c8d:8a1c1ee3

2025-05-23 19:32:28https://primal.net/e/nevent1qvzqqqqqqypzp6dtxy5uz5yu5vzxdtcv7du9qm9574u5kqcqha58efshkkwz6zmdqqszj207pl0eqkgld9vxknxamged64ch2x2zwhszupkut5v46vafuhg9833px

Some of my colleagues were talking about how they're even more scared of RFK Jr. than they are of Trump. I hope he earns it.

https://stacker.news/items/987685

-

@ 57d1a264:69f1fee1

2025-05-24 05:53:43

@ 57d1a264:69f1fee1

2025-05-24 05:53:43This talks highlights tools for product management, UX design, web development, and content creation to embed accessibility.

Organizations need scalability and consistency in their accessibility work, aligning people, policies, and processes to integrate it across roles. This session highlights tools for product management, UX design, web development, and content creation to embed accessibility. We will explore inclusive personas, design artifacts, design systems, and content strategies to support developers and creators, with real-world examples.

https://www.youtube.com/watch?v=-M2cMLDU4u4

https://stacker.news/items/988041

-

@ eb0157af:77ab6c55

2025-05-24 15:01:33

@ eb0157af:77ab6c55

2025-05-24 15:01:33According to the ECB Executive Board member, the launch of the digital euro depends on the timing of the EU regulation.

The European Central Bank (ECB) is making progress in preparing for the digital euro. According to Piero Cipollone, ECB Executive Board member and coordinator of the project, the technical phase “is proceeding quickly and on schedule,” but moving to operational implementation still requires political approval of the regulation at the European level.

Speaking at the ‘Voices on the Future’ event organized by Ansa and Asvis, Cipollone outlined a possible timeline:

“If the regulation is approved at the start of 2026 — in the best-case scenario for the European legislative process — we could see the first transactions with the digital euro by mid-2028.”

Cipollone also highlighted Europe’s current dependence on electronic payment systems managed by non-European companies:

“Today in Europe, whenever we don’t use cash, any transaction online or at the supermarket has to go through credit cards, with their fees. The payment system relies on companies that aren’t based in Europe. You can see why it would make sense to have a system fully under our control.”

For the ECB board member, the digital euro would act as a direct alternative to cash in the digital world, working like “a banknote you can spend anywhere in Europe for any purpose.”

The digital euro project is part of the ECB’s broader strategy to strengthen the independence of Europe’s financial system. According to Cipollone and the Central Bank, Europe’s digital currency would be a key step toward greater autonomy in electronic payments, reducing reliance on infrastructure and services outside the European Union.

The post ECB: digital euro by mid-2028, says Cipollone appeared first on Atlas21.

-

@ 9ca447d2:fbf5a36d

2025-05-22 14:01:52

@ 9ca447d2:fbf5a36d

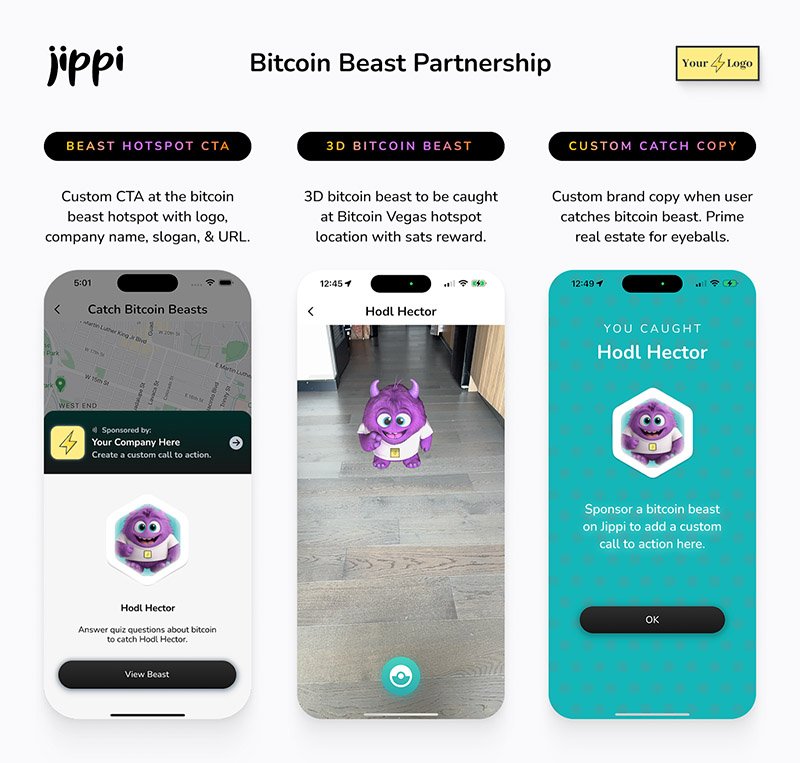

2025-05-22 14:01:52Gen Z (those born between 1997 and 2012) are not rushing to stack sats, and Oliver Porter, Founder & CEO of Jippi, understands the challenge better than most. His strategy revolves around adapting Bitcoin education to fit seamlessly into the digital lives of young adults.

“We need to meet them where they are,” Oliver explains. “90% of Gen Z plays games. 70% expect to earn rewards.”

So, what will effectively introduce them to Bitcoin? In Oliver’s mind, the answer is simple: games that don’t feel preachy but still plant the orange pill.

Learn more at Jippi.app

That’s exactly what Jippi is. Based in Austin, Texas, the team has created a mobile augmented reality (AR) game that rewards players in bitcoin and sneakily teaches them why sound money matters.

“It’s Pokémon GO… but for sats,” Oliver puts it succinctly.

Jippi is like Pokemon Go, but for sats

Oliver’s Bitcoin journey, like many in the space, began long before he was ready. A former colleague had tried planting the seed years earlier, handing him a copy of The Bitcoin Standard. But the moment passed.

It wasn’t until the chaos of 2020 when lockdowns hit, printing presses roared, and civil liberties shrank that the message finally landed for him.

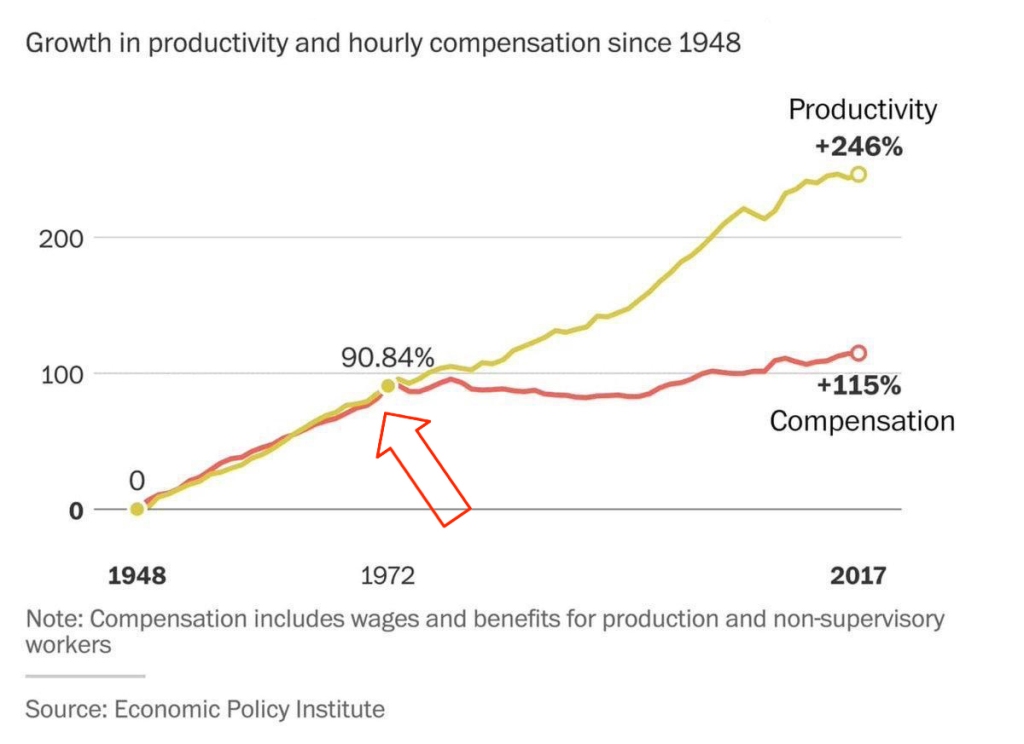

“The government got so good at doing reverse Robin Hood,” Oliver explains. “They steal from the working population and reward the rich.”

By 2020, though, the absurdity of the covid hysteria had caused his eyes to be opened and the orange light seemed the best path back to freedom.

He left the UK for Austin “one of the best places for Bitcoiners,” he says, and dove headfirst into the industry, working at Swan for a year before founding Jippi on PlebLab’s accelerator program.

Jippi’s flagship game lets players roam their cities hunting digital creatures, Bitcoin Beasts, tied to real-world locations. Catching them requires answering Bitcoin trivia, and the reward is sats.

No jargon. No hour-long lectures. Just gameplay with sound money principles woven right in.

The model is working. At a recent hackathon in Austin, Jippi beat out 14 other teams to win first place and $15,000 in prize money.

Oliver of Jippi won Top Builder Season 2 — PlebLab on X

“We’re backdooring Bitcoin education,” Oliver admits. “And while we’re at it, encouraging people to get outside and touch grass.”

Not everyone’s been thrilled. When Jippi team members visited one of the more liberal-leaning places in Texas, UT Austin, to test interest in Bitcoin, they found some seriously committed no-coiners on the campus.

“One young woman told me, ‘I would rather die than talk about Bitcoin,'” Oliver recalls, highlighting the cultural resistance that’s built up among younger demographics.

This resistance is backed by hard data. According to Oliver, some of the Bitcoin podcasters they met with in the space to do market research reported that less than 1% of their listeners are from Gen Z and that number is dropping.

“Unless we find a way to capture their interest in a meaningful way, there’s going to be a big problem around trying to sway Gen Z away from the siren call of s***coins and crypto casinos and towards Bitcoin,” Oliver warns.

Jippi’s next big move is Las Vegas, where they’ll launch the Beast Catch experience at the Venetian during a major Bitcoin event. To mark the occasion, they’re opening up six limited sponsorship spots for Bitcoin companies, each one tied to a custom in-game beast.

Jippi looks to launch a special event at Bitcoin 2025

“It’s real estate inside the game,” Oliver explains. “Brands become allies, not intrusions. You get a logo, company name, and call to action, so we can push people to your site or app.”

Bitcoin Well—an automatic self-custody Bitcoin platform—has claimed Beast #1. Only five exclusive spots remain for Bitcoin companies to “beastify their brand” through Jippi’s immersive AR game.

“I love the Jippi mission. I think gamified learning is how we will onboard the next generation and it’s exciting to see what the Jippi team is doing! I love working with bitcoiners towards our common mission – bullish!” said Adam O’Brien, Bitcoin Well CEO.

Jippi’s sponsorship model is simple: align incentives, respect users, and support builders. Instead of throwing ad money at tech giants, Bitcoin companies can connect with new users naturally while they’re having fun and earning sats in the process.

For Bitcoin companies looking to reach a younger demographic, this represents a unique opportunity to showcase their brand to up to 30,000 potential customers at the Vegas event.

Jippi Bitcoin Beast partnership

While Jippi’s current focus is simple, get the game into more cities, Oliver sees a future where AR glasses and AI help personalize Bitcoin education even further.

“The magic is going to really happen when Apple releases the glasses form factor,” he says, describing how augmented reality could enhance real-world connections rather than isolate users.

In the longer term, Jippi aims to evolve from a free-to-play model toward a pay-to-play version with higher stakes. Users would form “tribes” with friends to compete for substantial bitcoin prizes, creating social connections along with financial education.

Unlike VC-backed startups, Jippi is raising funds pleb style via Timestamp, an open investment platform for Bitcoin companies.

“You don’t have to be an accredited investor,” Oliver explains. “You’re directly supporting the parallel Bitcoin economy by investing in Bitcoin companies for equity.”

Anyone can invest as little as $100. Perks include early access, exclusive game content, and even creating your own beast design with your name/pseudonym and unique game lore. Each investment comes with direct ownership of an early-stage Bitcoin company like Jippi.

For Oliver, this is more than just a business. It’s about future-proofing Bitcoin adoption and ensuring Satoshi’s vision lives on, especially as many people are lured by altcoins, NFTs, and social media dopamine.

“We’re on the right side of history,” he says firmly. “I want my grandkids to know that early on in the Bitcoin revolution, games like Jippi helped make it stick.”

In a world increasingly absorbed by screens and short attention spans, Jippi’s combination of outdoor play, sats rewards, and Bitcoin education might be exactly the bridge Gen Z needs.

Interested in sponsoring a Beast or investing in Jippi? Reach out to Jippi directly by heading to their partnerships page on their website or visit their Timestamp page to invest in Jippi today.

-

@ eb0157af:77ab6c55

2025-05-24 15:01:32

@ eb0157af:77ab6c55

2025-05-24 15:01:32A new study reveals: 4 out of 5 Americans would like the US to convert some of its gold into Bitcoin.

A recent survey conducted by the Nakamoto Project revealed that a majority of Americans support converting a portion of the United States’ gold reserves into Bitcoin. The survey, carried out online by Qualtrics between February and March 2025, involved 3,345 participants with demographic characteristics representative of US census standards. Most respondents expressed a desire to convert between 1% and 30% of the gold reserves into BTC.

Troy Cross, co-founder of the Nakamoto Project, stated:

“When given a slider and asked to advise the US government on the right proportion of Bitcoin and gold, subjects were very reluctant to put that slider on 0% Bitcoin and 100% gold. Instead, they settled around 10% Bitcoin.”

One significant finding from the research is the correlation between age and openness to Bitcoin: younger respondents showed a greater inclination toward the cryptocurrency compared to older generations.

A potential US strategy

Bo Hines, a White House advisor, is promoting an initiative for the Treasury Department to acquire Bitcoin by selling off a portion of its gold. Under the proposed plan, the government could acquire up to 1 million BTC over the next five years.

To finance these purchases, the government plans to sell Federal Reserve gold certificates. The proposal aligns with Senator Cynthia Lummis’ 2025 Bitcoin Act, which aims to declare Bitcoin a critical national strategic asset.

Currently, the United States holds 8,133 metric tons of gold, valued at over $830 billion, and about 200,000 BTC, valued at $21 billion.

The post The majority in the US wants to convert part of the gold reserves into Bitcoin appeared first on Atlas21.

-

@ 5144fe88:9587d5af

2025-05-23 17:01:37

@ 5144fe88:9587d5af

2025-05-23 17:01:37The recent anomalies in the financial market and the frequent occurrence of world trade wars and hot wars have caused the world's political and economic landscape to fluctuate violently. It always feels like the financial crisis is getting closer and closer.

This is a systematic analysis of the possibility of the current global financial crisis by Manus based on Ray Dalio's latest views, US and Japanese economic and financial data, Buffett's investment behavior, and historical financial crises.

Research shows that the current financial system has many preconditions for a crisis, especially debt levels, market valuations, and investor behavior, which show obvious crisis signals. The probability of a financial crisis in the short term (within 6-12 months) is 30%-40%,

in the medium term (within 1-2 years) is 50%-60%,

in the long term (within 2-3 years) is 60%-70%.

Japan's role as the world's largest holder of overseas assets and the largest creditor of the United States is particularly critical. The sharp appreciation of the yen may be a signal of the return of global safe-haven funds, which will become an important precursor to the outbreak of a financial crisis.

Potential conditions for triggering a financial crisis Conditions that have been met 1. High debt levels: The debt-to-GDP ratio of the United States and Japan has reached a record high. 2. Market overvaluation: The ratio of stock market to GDP hits a record high 3. Abnormal investor behavior: Buffett's cash holdings hit a record high, with net selling for 10 consecutive quarters 4. Monetary policy shift: Japan ends negative interest rates, and the Fed ends the rate hike cycle 5. Market concentration is too high: a few technology stocks dominate market performance

Potential trigger points 1. The Bank of Japan further tightens monetary policy, leading to a sharp appreciation of the yen and the return of overseas funds 2. The US debt crisis worsens, and the proportion of interest expenses continues to rise to unsustainable levels 3. The bursting of the technology bubble leads to a collapse in market confidence 4. The trade war further escalates, disrupting global supply chains and economic growth 5. Japan, as the largest creditor of the United States, reduces its holdings of US debt, causing US debt yields to soar

Analysis of the similarities and differences between the current economic environment and the historical financial crisis Debt level comparison Current debt situation • US government debt to GDP ratio: 124.0% (December 2024) • Japanese government debt to GDP ratio: 216.2% (December 2024), historical high 225.8% (March 2021) • US total debt: 36.21 trillion US dollars (May 2025) • Japanese debt/GDP ratio: more than 250%-263% (Japanese Prime Minister’s statement)

Before the 2008 financial crisis • US government debt to GDP ratio: about 64% (2007) • Japanese government debt to GDP ratio: about 175% (2007)

Before the Internet bubble in 2000 • US government debt to GDP ratio: about 55% (1999) • Japanese government debt to GDP ratio: about 130% (1999)

Key differences • The current US debt-to-GDP ratio is nearly twice that before the 2008 crisis • The current Japanese debt-to-GDP ratio is more than 1.2 times that before the 2008 crisis • Global debt levels are generally higher than historical pre-crisis levels • US interest payments are expected to devour 30% of fiscal revenue (Moody's warning)

Monetary policy and interest rate environment

Current situation • US 10-year Treasury yield: about 4.6% (May 2025) • Bank of Japan policy: end negative interest rates and start a rate hike cycle • Bank of Japan's holdings of government bonds: 52%, plans to reduce purchases to 3 trillion yen per month by January-March 2026 • Fed policy: end the rate hike cycle and prepare to cut interest rates

Before the 2008 financial crisis • US 10-year Treasury yield: about 4.5%-5% (2007) • Fed policy: continuous rate hikes from 2004 to 2006, and rate cuts began in 2007 • Bank of Japan policy: maintain ultra-low interest rates

Key differences • Current US interest rates are similar to those before the 2008 crisis, but debt levels are much higher than then • Japan is in the early stages of ending its loose monetary policy, unlike before historical crises • The size of global central bank balance sheets is far greater than at any time in history

Market valuations and investor behavior Current situation • The ratio of stock market value to the size of the US economy: a record high • Buffett's cash holdings: $347 billion (28% of assets), a record high • Market concentration: US stock growth mainly relies on a few technology giants • Investor sentiment: Technology stocks are enthusiastic, but institutional investors are beginning to be cautious

Before the 2008 financial crisis • Buffett's cash holdings: 25% of assets (2005) • Market concentration: Financial and real estate-related stocks performed strongly • Investor sentiment: The real estate market was overheated and subprime products were widely popular

Before the 2000 Internet bubble • Buffett's cash holdings: increased from 1% to 13% (1998) • Market concentration: Internet stocks were extremely highly valued • Investor sentiment: Tech stocks are in a frenzy

Key differences • Buffett's current cash holdings exceed any pre-crisis level in history • Market valuation indicators have reached a record high, exceeding the levels before the 2000 bubble and the 2008 crisis • The current market concentration is higher than any period in history, and a few technology stocks dominate market performance

Safe-haven fund flows and international relations Current situation • The status of the yen: As a safe-haven currency, the appreciation of the yen may indicate a rise in global risk aversion • Trade relations: The United States has imposed tariffs on Japan, which is expected to reduce Japan's GDP growth by 0.3 percentage points in fiscal 2025 • International debt: Japan is one of the largest creditors of the United States

Before historical crises • Before the 2008 crisis: International capital flows to US real estate and financial products • Before the 2000 bubble: International capital flows to US technology stocks

Key differences • Current trade frictions have intensified and the trend of globalization has weakened • Japan's role as the world's largest holder of overseas assets has become more prominent • International debt dependence is higher than any period in history

-

@ 57d1a264:69f1fee1

2025-05-22 13:13:36

@ 57d1a264:69f1fee1

2025-05-22 13:13:36Graphics materials for Bitcoin Knots https://github.com/bitcoinknots branding. See below guide image for reference, a bit cleaner and scalable:

Font family "Aileron" is provided free for personal and commercial use, and can be found here: https://www.1001fonts.com/aileron-font.html

Source: https://github.com/Blissmode/bitcoinknots-gfx/tree/main

https://stacker.news/items/986624

-

@ 57d1a264:69f1fee1

2025-05-22 12:36:20

@ 57d1a264:69f1fee1

2025-05-22 12:36:20Graphics materials for Bitcoin Knots https://github.com/bitcoinknots branding. See below guide image for reference, a bit cleaner and scalable:

Font family "Aileron" is provided free for personal and commercial use, and can be found here: https://www.1001fonts.com/aileron-font.html

Source: https://github.com/Blissmode/bitcoinknots-gfx/tree/main

https://stacker.news/items/986587

-

@ 57d1a264:69f1fee1

2025-05-22 06:21:22

@ 57d1a264:69f1fee1

2025-05-22 06:21:22You’ve probably seen it before.

You open an agency’s website or a freelancer’s portfolio. At the very top of the homepage, it says:

We design for startups.

You wait 3 seconds. The last word fades out and a new one fades in:

We design for agencies.

Wait 3 more seconds:

We design for founders.

I call this design pattern The Wheel of Nothing: a rotating list of audience segments meant to impress through inclusion and draw attention through motion… for absolutely no reason.

Revered brand studio Pentagram recently launched a new website. To my surprise, the homepage features the Wheel of Nothing front and center, boldly claiming:

We design Everything for Everyone…before cycling through more specific combinations every few seconds.

Dan Mall, a husband, dad, teacher, creative director, designer, founder, and entrepreneur from Philly. I share as much as I can to create better opportunities for those who wouldn’t have them otherwise. Most recently, I ran design system consultancy SuperFriendly for over a decade.

Read more at Dans' website https://danmall.com/posts/the-wheel-of-nothing/

https://stacker.news/items/986392

-

@ 5d4b6c8d:8a1c1ee3

2025-05-23 13:46:21

@ 5d4b6c8d:8a1c1ee3

2025-05-23 13:46:21You'd think I'd be most excited to talk about that awesome Pacers game, but, no. What I'm most excited about this week is that @grayruby wants to continue Beefing with Cowherd.

Still, I am excited to talk about Tyrese Haliburton becoming a legendary Knicks antagonist. Unfortunately, the Western Conference Finals are not as exciting. Also, why was the MVP announcement so dumb?

The T20k cricket contest is tightening up, as we head towards the finish. Can @Coinsreporter hold on to his vanishing lead?

@Carresan has launched Football Madness. Let's see if we understand whatever the hell this is any better than we did last week.

On this week's Blok'd Shots, we'll ridicule Canada for their disgraceful loss in the World Championships and talk about the very dominant American Florida Panthers, who are favorites to win the Stanley Cup.

Are the Colorado the worst team in MLB history?

The Tush Push has survived another season. Will the NFL eventually ban it or will teams adjust?

Plus, whatever else Stackers want to talk about.

https://stacker.news/items/987399

-

@ eb0157af:77ab6c55

2025-05-24 15:01:32

@ eb0157af:77ab6c55

2025-05-24 15:01:32The exchange reveals the extent of the breach that occurred last December as federal authorities investigate the recent data leak.

Coinbase has disclosed that the personal data of 69,461 users was compromised during the breach in December 2024, according to documentation filed with the Maine Attorney General’s Office.

The disclosure comes after Coinbase announced last week that a group of hackers had demanded a $20 million ransom, threatening to publish the stolen data on the dark web. The attackers allegedly bribed overseas customer service agents to extract information from the company’s systems.

Coinbase had previously stated that the breach affected less than 1% of its user base, compromising KYC (Know Your Customer) data such as names, addresses, and email addresses. In a filing with the U.S. Securities and Exchange Commission (SEC), the company clarified that passwords, private keys, and user funds were not affected.

Following the reports, the SEC has reportedly opened an official investigation to verify whether Coinbase may have inflated user metrics ahead of its 2021 IPO. Separately, the Department of Justice is investigating the breach at Coinbase’s request, according to CEO Brian Armstrong.

Meanwhile, Coinbase has faced criticism for its delayed response to the data breach. Michael Arrington, founder of TechCrunch, stated that the stolen data could cause irreparable harm. In a post on X, Arrington wrote:

“The human cost, denominated in misery, is much larger than the $400m or so they think it will actually cost the company to reimburse people. The consequences to companies who do not adequately protect their customer information should include, without limitation, prison time for executives.”

Coinbase estimates the incident could cost between $180 million and $400 million in remediation expenses and customer reimbursements.

Arrington also condemned KYC laws as ineffective and dangerous, calling on both regulators and companies to better protect user data:

“Combining these KYC laws with corporate profit maximization and lax laws on penalties for hacks like these means these issues will continue to happen. Both governments and corporations need to step up to stop this. As I said, the cost can only be measured in human suffering.”

The post Coinbase: 69,461 users affected by December 2024 data breach appeared first on Atlas21.

-

@ 000002de:c05780a7

2025-05-22 20:50:21

@ 000002de:c05780a7

2025-05-22 20:50:21I'm mostly curious about how Tapper can do this with a straight face.

https://stacker.news/items/986926

-

@ cefb08d1:f419beff

2025-05-22 07:16:18

@ cefb08d1:f419beff

2025-05-22 07:16:18https://stacker.news/items/986402

-

@ 8aa70f44:3073d1a6

2025-05-21 13:07:14

@ 8aa70f44:3073d1a6

2025-05-21 13:07:14Earlier this year I launched the asknostr.site project which has been a great journey and learning experience. I had wanted to write down my goals and ideas with the project but didn't get to it yet. Primal launching the article editor was a trigger for me to go for it.

Ever since I joined Nostr i was looking for ways to apply my skillset solve a problem and help with adoption. Around Christmas I figured that a Quora/Stackoverflow alternative is something that needs to exist on Nostr.

Before I knew it I had a pretty decent prototype. And because the network already had so much awesome content, contributors and authors I was never discouraged by the challenge that kills so many good ideas -> "Where do I get the first users?".

Since the initial announcement I have received so much encouragement through zaps, likes, DM's, and maybe most of all seeing the increase in usage of the site and #asknostr content kept me going.

Current State

The current version of the site is stable and most bugs are hashed out. After logging in (remote signer, extension or nsec) you can engage with content through votes, comments and replies. Or simply ask a new question.

All content is stored in the site's own private relay and preprocessed/computed into a single data store (postgres) so the site is fast, accessible and crawl-able.

The site supports browsing hashtags, voting/commenting on answers, asking new questions and every contributor get their own profile (example). At the time of writing the site has 41k questions, almost 200k replies/comments and upwards of 5 million sats purely for #asknostr content.

What to expect/On my list

There are plenty of things and UI bugs that need love and between writing the draft of this post and hitting publish I shipped 3 minor bug fixes. Little by little, bit by bit...

In addition to all those small details here is an overview of the things on my own wish list:

-

Inline Zaps: Ability to zap from the asknostr.site interface. Click the zap button, specify or pick the number of sats zap away.

-

Contributor Rank: A leaderboard to add some gamification. More recognition to those nostriches that spend their time helping other people out

-

Search by Keyword: Search all content by keywords. Experiment with the index to show related questions or answers

-

Better User Profiles: Improve the user profile so it shows all the profile questions and answers. Quick buttons to follow or zap that person. Better insights in the topics (hashtags) the profile contributes to

-

Bookmarks: Ability to bookmark questions and answers. Increase bookmark weight as a signal to rank answers.

-

Smarter Scoring: Tune how answers are scored (winning answer formula). Perhaps give more weight to the question author or use WoT. Not sure yet.

All of this is happening at some point so follow me if you want to stay up to date.

Goals

To manage expectations and keep me focussed I write down the mid and long term goals of the project.

Long term

Call me cheesy but I believe that humanity will flourish through an open web and sound money. My own journey started from with bitcoin but if you asked me today if it's BTC or nostr that is going to have the most impact I wouldn't know what to answer. Chicken or egg?

The goal of the project is to offer an open platform that empowers individuals to ask questions, share expertise and access high-quality information across different topics. The project empowers anyone to monetize their experience creating a sustainable ecosystem that values and rewards knowledge sharing. This will ultimately democratize access to knowledge for all.

Mid term

The project can help a lot with onboarding new users onto the network. Once we start to rank on certain topics we can get a piece of the search traffic pie (StackOverflows 12 million, and Quora 150 million visitors per month) which is a great way to expose people to the power of the network.

First time visitors do not need to know about nostr or zaps to receive value. They can browse around, discover interesting content and perhaps even create a profile without even knowing they are on Nostr now.

Gradually those users will understand the value of the network through better rankings (zaps beats likes), a cross-client experience and a profile that can be used on any nostr site or app.

In order for the site to do that we need to make sure content is browsable by language, (sub)topics and and we double down on 'the human touch' with real contributors and not LLMs.

Short Term Goal

The first goal is to make the site really good and an important resource for existing Nostr users. Enable visitors to search and discover what they are interested in. Integrate within the existing nostr eco system with 'open in' functionality and quick links to interesting projects (followerpacks?)

One of things i want to get right is to improve user retention by making the whole Q\&A experience more sticky. I want to run some experiments (bots, award, summaries) to get more people to use asknostr.site more often and come back.

What about the name?

Finally the big question: What about the asknostr.site name? I don't like the name that much but it's what people know. I think there is a high chance that people will discover Nostr apps like Olas, Primal or Damus without needing to know what NOSTR is or means.

Therefore I think there is a good chance that the project won't be called asknostr.site forever. I guess it all depends on where we all take this.

Onwards!

-

-

@ 000002de:c05780a7

2025-05-21 20:00:21

@ 000002de:c05780a7

2025-05-21 20:00:21I enjoy Jonathan Pageau's perspectives from time to time. He is big on myth and symbolic signs in culture and history. I find this stuff fascinating as well. I watched this video last week, and based on the title, I was thinking... hmm, I wonder if it is a review of Return of the Strong Gods. It wasn't, but it really flows with the thesis of that book. You should read it if you haven't, and before you do, go check out @SimpleStacker's review of it.

Pageau starts the video by talking about the concept of "watching the clown." He uses Ye as the clown. Ye has been a leading indicator in the past when he publicly claimed he was a Christian and began making music and holding church services. Now he's going "off the rails" seemingly with his Hitler songs and art. Clearly, the stigma of Hitler will not last forever. It's hard for us to realize this. At least for someone of my age, but Pageau points out that eventually, the villains of history become less of a stand-in for Satan and more of a purely historical figure. He mentions Alexander the Great as a man who did incredibly evil things, but today we just read about him in school and don't really think about it too much. One day, that will be the way Hitler is viewed. Sure, evil, but the power of using him as the mythical Satan will wane.

The most interesting point I took away from this video, though, was that the post-war consensus was built on a dark secret. Now, it's not a secret to me, but at some point, it was. And this secret is a deep flaw in the current state of the West that keeps affecting us in negative ways. The secret is that in order to defeat Hitler and the Nazis, the West allied itself with the Soviets. Stalin. An incredibly evil man and an ideology that has led to the death and suffering of more humans than the Nazis. This is just a fact, but it's so dark that we don't talk about it.

For many years as I began to study Communism and the Soviet Union I began to question why on earth did the allies align themselves with Stalin. Obviously it was for stratigic reasons. I get it. But the fact that this topic is not really discussed in our culture has had a dark effect. Now, I'm not interested in figuring out if Stalin was more evil than Hitler or if Fascism is worse that Communism. I think this misses the point. The point is that today if soneone has Nazi symbols it is very likely not gonna go well for them but Communist symbols are usually just fine. We see the ideas of Socialism discussed openly without concern. Its popular even. Fascism on the other hand is always (until recently) masked at best.

Today we are seeing more and more people openly talk about this reality, and it is a signal that the WW2 consensus is breaking. As people age out and our collective memory fades, this lie will become more visible because the mythical view of Hitler will fade. This will allow people to be more objective about viewing the decisions of the past. I don't recall the book discussing this directly, but it is an interesting connection for sure.

I recommend watching The World War II Consensus is Breaking Down by Jonathan Pageau.

https://stacker.news/items/985962

-

@ 000002de:c05780a7

2025-05-21 17:42:27

@ 000002de:c05780a7

2025-05-21 17:42:27I've been trying out Arch Linux again and the thing that always surprises me is pacman. The way it works seems so unintuitive to me coming from the apt, yum, and dnf worlds.

I know I will get it and it will become internalized but I just wonder what the designer was thinking when making the flags/commands.

https://stacker.news/items/985808

-

@ 57d1a264:69f1fee1

2025-05-21 05:47:41

@ 57d1a264:69f1fee1

2025-05-21 05:47:41As a product builder over too many years to mention, I’ve lost count of the number of times I’ve seen promising ideas go from zero to hero in a few weeks, only to fizzle out within months.

The problem with most finance apps, however, is that they often become a reflection of the internal politics of the business rather than an experience solely designed around the customer. This means that the focus is on delivering as many features and functionalities as possible to satisfy the needs and desires of competing internal departments, rather than providing a clear value proposition that is focused on what the people out there in the real world want. As a result, these products can very easily bloat to become a mixed bag of confusing, unrelated and ultimately unlovable customer experiences—a feature salad, you might say.

Financial products, which is the field I work in, are no exception. With people’s real hard-earned money on the line, user expectations running high, and a crowded market, it’s tempting to throw as many features at the wall as possible and hope something sticks. But this approach is a recipe for disaster.

Here’s why: https://alistapart.com/article/from-beta-to-bedrock-build-products-that-stick/

https://stacker.news/items/985285

-

@ 000002de:c05780a7

2025-05-21 17:27:46

@ 000002de:c05780a7

2025-05-21 17:27:46I completely missed this until yesterday. I was listening to our local news talk station and it came up. They had some people that were pretty knowledgeable about prostate cancer on. They talked about other presidents being tested while in office for it. They came to conclusion that it is possible that Biden wasn't having his PSA checked. This is pretty normal for a old dude his age. But it is not normal for a President his age.

My thought is much simpler.

We know his doctors, the media, and his admin were lying about his health when he was in office. Hello! Anyone paying attention and not invested in his regime knew he was declining mentally in front of our very eyes. They covered for him over and over again. Only those that don't pay attention or discounted his critics completely was surprised by his debate performance.

To be clear though, Biden is far from the first president to do this. Wilson, FDR, Kennedy, and Reagan all had issues and they were kept from the public. If we learned these things in school we might actually have a public that thinks critically once and a while.

So, with that in mind do you really think the regime would not withhold medical info about this cancer? Come on. Don't be naive. He clearly was not in charge 100% of the time while in office and the regime wanted to maintain power. Sharing that he had prostate cancer would not be on the menu.

Politics is like a drug that numbs the brain. Because people don't like one party or person they retard their thinking. Its the same thing as happens in sports. Fans of one team see the same play completely differently from the other team's fans. Politics and the investment into parties kills most people's objectivity.

I don't trust liars. It honestly blows my mind how trusting people can be of professional liars. Both parties are full of liars. Trump is a liar and those opposing him are liars. We are drowning in lies. You can vote for a lessor of two evils but never forget what they are.

https://stacker.news/items/985791

-

@ eb0157af:77ab6c55

2025-05-24 15:01:31

@ eb0157af:77ab6c55

2025-05-24 15:01:31Bitcoin adoption will come through businesses: neither governments nor banks will lead the revolution.

In recent years, it’s undeniable that Bitcoin has ceased to be just a radical idea born from the minds of cypherpunks. It is now recognized across the board as a global asset, discussed in the upper echelons of finance, accepted even on Wall Street, purchased by banking groups and included as a “strategic reserve” by some nations.

However, the general perception that hovers today regarding Bitcoin’s diffusion is still that of minimal adoption, almost insignificant. Bitcoin exists, certainly, but in fact it is not being used. It is rarely possible to pay in satoshis in commercial establishments. Demand is still extremely low.

Furthermore, the debate on Bitcoin is still practically absent: excluding some local events, some niche media outlets or some timid discussion, today Bitcoin is in fact excluded from general interest. The level of understanding and knowledge of the phenomenon is certainly still very low.

Yet, Bitcoin represents an unprecedented technological improvement, capable of solving many problems inherent in the fiat system in which we live. What could facilitate its diffusion?

Bitcoin becomes familiar when businesses adopt it

When talking about Bitcoin adoption, many look to States. They imagine governments that legislate or accumulate Bitcoin as a “strategic reserve,” or banks perceived as forward-thinking that would lead technological change, opening up to innovation. But the reality is different: bureaucracy, political constraints, and fear of losing control inherently prevent States and central banks from being pioneers.

What really drives Bitcoin adoption are not States, but businesses. It is the forward-looking entrepreneurs, innovative startups and – eventually – even large multinational companies that decide to integrate Bitcoin into their operating systems that drive adoption. Indeed, the business world has always played a key role in the adoption of new technologies. This was the case, for example, with the internet, e-commerce, mobile telephony, and the cloud. It will also be the case with Bitcoin.

Unlike a State, when a company adopts Bitcoin, it does so for concrete reasons: efficiency, savings, protection, access to new markets, independence from traditional banking circuits, or bureaucratic streamlining. It is a rational choice, not an ideological one, dictated by the intent to improve one’s competitiveness against the competition to survive in the market.

What is currently missing to facilitate adoption is, in all likelihood, a significant number of businesses that have decided to integrate Bitcoin into their company systems.

Bitcoin becomes “normal” when it is integrated into the operational flow of businesses. Holding and framing bitcoin on the balance sheet, paying an invoice, paying salaries to employees in satoshis, making value transfers globally thanks to the blockchain, allowing customers to pay via Lightning Network… when all this becomes possible with the same simplicity with which we use the euro or the dollar, Bitcoin stops being alternative and becomes the standard.

Businesses are not just users. They are adoption multipliers. When a company chooses Bitcoin, it is automatically proposing it to customers, employees, suppliers, and institutional stakeholders. Each business adoption equals tens, hundreds, or thousands of new eyes on Bitcoin.

People, after all, trust what they see every day: if your trusted restaurant accepts bitcoin, or if your favorite e-commerce platform uses it to receive international payments, or if your colleague receives it as a salary, then Bitcoin no longer appears to be a mysterious object. It finally begins to be perceived as a real, useful, and functioning tool.

The integration of a technology in companies helps make it understandable, accessible, and legitimate in the eyes of the public. This is how distrust is overcome: by making Bitcoin visible in daily life.

Bitcoin and businesses today

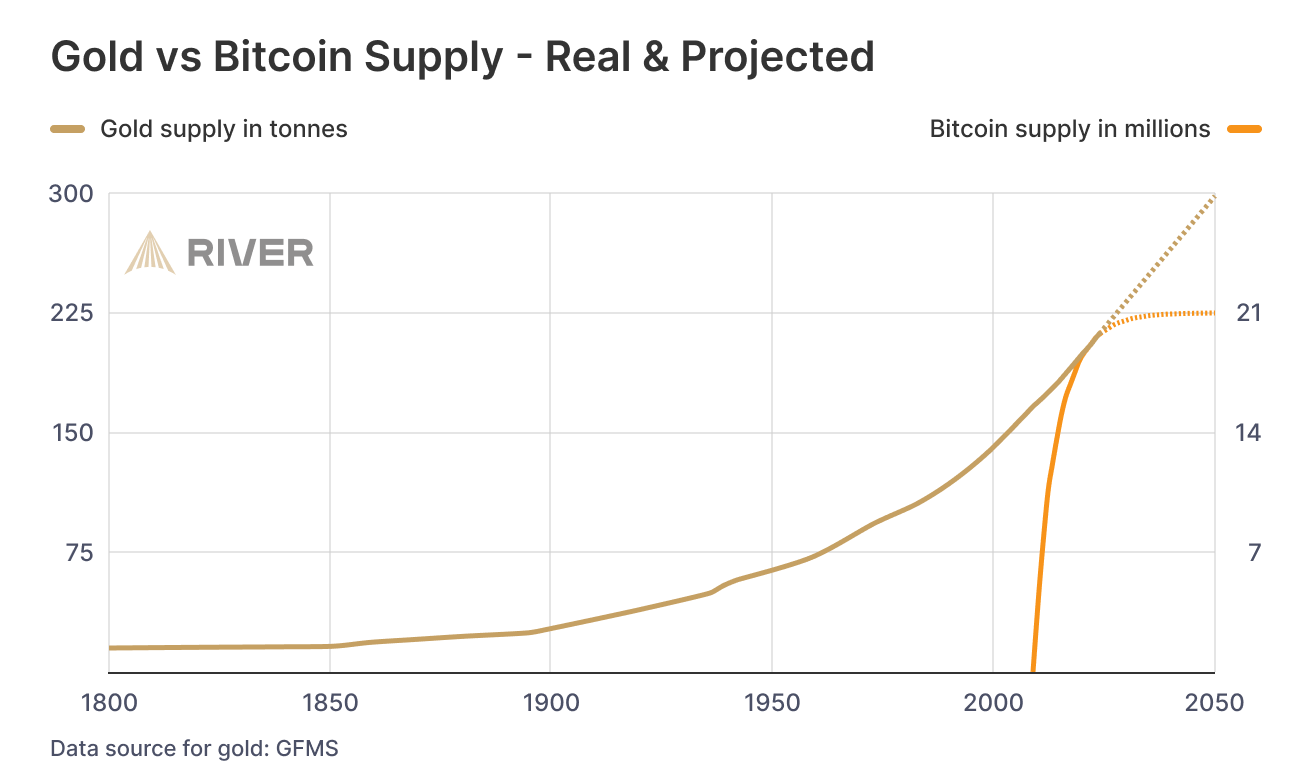

A River Financial report estimates that as of May 2025, only 5% of bitcoin is currently owned by private businesses. A still very small number.

According to research by River, in May 2025 businesses hold just over a million btc (about 5% of available monetary units). More than two-thirds of bitcoin (68.2%) are in the hands of private individuals.

To promote Bitcoin adoption, it is necessary today to support businesses in integrating this standard, leveraging all its enormous opportunities. Among others, this technology allows for fast, economical, and global payments. It eliminates intermediaries, increases transparency and security in value transfers. It removes bureaucratic frictions and allows opening up to a new global market.

Every sector can benefit from Bitcoin: e-commerce, tourism, industry, restaurants, professional services, or any other business. Bitcoin revolutionizes the concept of money, and money is a transversal working tool.

We are still at the beginning, but several signals are encouraging. According to a study by Bitwise and reported by Atlas21, in the first quarter of 2025, a growing number of US companies (+16.11% compared to the previous one) are including Bitcoin in their balance sheets, not just as a financial bet, but as a long-term strategy to protect their assets and access a decentralized monetary system to transfer value worldwide without resorting to financial intermediaries.

Who is driving the change?

Echoing the words of Roy Sheinfeld, CEO of Breez, the true potential of Bitcoin will be unleashed first and foremost from the work of developers, the true architects in designing and refining tools that are increasingly simple and intuitive to use for anyone, regardless of level of expertise. It is the developers – Roy rightly argued – who will enable us to “conquer the world.”

But probably that’s not enough: the next step is to make Bitcoin a globally accepted technological standard, changing its perception towards the general public. And this is where businesses come into play.

Guided by the market, technological innovation, and the desire to meet user demands, entrepreneurs today represent the fulcrum to accelerate the monetary transition from the current fiat system towards the Bitcoin standard. It is entrepreneurs who transform innovations from opportunities for a few to a reality shared by many.

The adoption of Bitcoin will therefore not arise from a sudden event, nor from the exclusive fruit of enthusiasts’ enthusiasm or from arbitrary political choices decreed by States or regulators.

The future of Bitcoin is built in the places where value is created every day: in companies, in their systems, and in their strategic decisions.

“If we conquer developers, we conquer the world. If we conquer businesses, we conquer adoption.”

The post The key to Bitcoin adoption is businesses appeared first on Atlas21.

-

@ eb0157af:77ab6c55

2025-05-24 15:01:30

@ eb0157af:77ab6c55

2025-05-24 15:01:30Governor Abbott will have to decide whether to sign the bill establishing a bitcoin reserve for the state.

Texas could become the third U.S. state to set up a strategic bitcoin reserve, following the approval of Senate Bill 21 by the state House, with 101 votes in favor and 42 against.

Lee Bratcher, founder and president of the Texas Blockchain Council, expressed confidence that Governor Greg Abbott will sign the legislative measure. In an interview with The Block, Bratcher said:

“I’ve talked to the governor about this personally, and I think he wants to see Texas lead in this way.”

The bill is expected to reach the governor’s desk within a week or two, according to Bratcher’s projections. If signed, Texas would follow in the footsteps of New Hampshire and Arizona in creating a state-held bitcoin reserve.

Despite Texas ranking as the world’s eighth-largest economy — ahead of many nations — the initial approach to the reserve will be cautious. Bratcher estimates the starting investment will be in the “tens of millions of dollars,” an amount he describes as “modest” for an economy the size of Texas. The responsibility for operational decisions would fall to the state comptroller, who acts as an executive accountant in charge of managing and investing public funds.

“My sense is that it will be in the tens of millions of dollars, which, while it sounds significant, is a very modest amount, for a state the size of Texas.” explained the president of the Texas Blockchain Council.

The road to approval

According to Bratcher, the idea of creating a state bitcoin reserve dates back to 2022 and represents the culmination of years of work by the Texas Blockchain Council. The organization has worked closely with lawmakers who shared the vision of seeing the state accumulate the world’s leading cryptocurrency. Additionally, Texas has long been home to numerous bitcoin mining companies.

The post Texas one step away from a bitcoin reserve: only the governor’s signature is missing appeared first on Atlas21.

-

@ eb0157af:77ab6c55

2025-05-24 15:01:29

@ eb0157af:77ab6c55

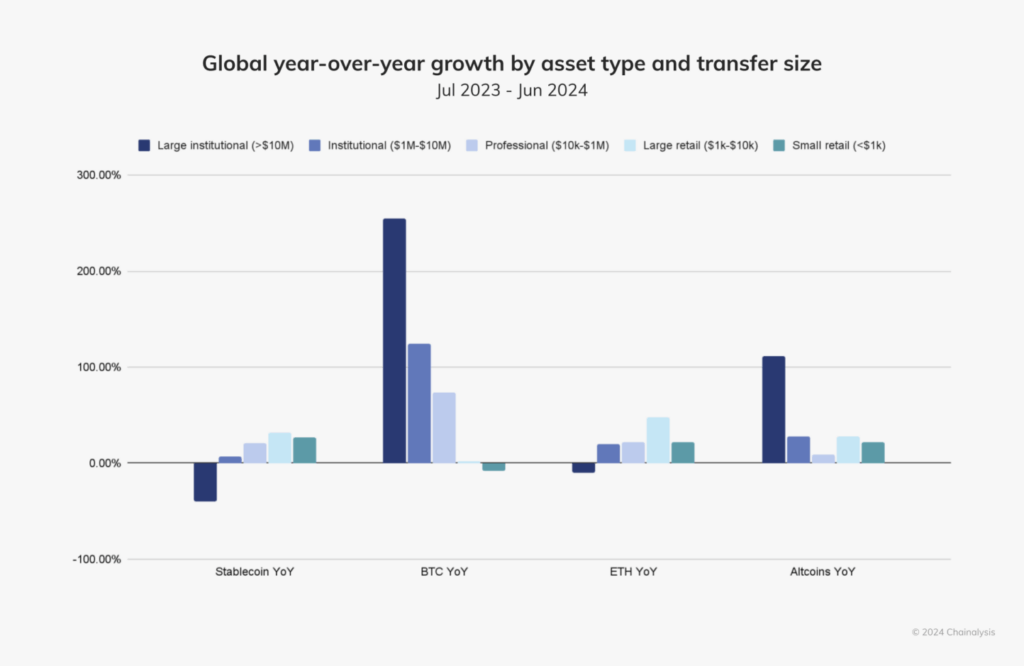

2025-05-24 15:01:29Bitcoin surpasses gold in the United States: 50 million holders and a dominant role in the global market.

According to a new report by River, for the first time in history, the number of Americans owning bitcoin has surpassed that of gold holders. The analysis reveals that approximately 50 million U.S. citizens currently own the cryptocurrency, while gold owners number 37 million. In fact, 14.3% of Americans own bitcoin, the highest percentage of holders worldwide.

Source: River

The report highlights that 40% of all Bitcoin-focused companies are based in the United States, consolidating America’s dominant position in the sector. Additionally, 40.5% of Bitcoin holders are men aged 31 to 35, followed by 35.9% of men aged 41 to 45. In contrast, only 13.4% of holders are women.

Source: River

Notably, U.S. companies hold 94.8% of all bitcoins owned by publicly traded companies worldwide. According to the report, recent regulatory changes in the U.S. have made the asset more accessible through financial products such as spot ETFs.

The document also shows that American investors increasingly view the cryptocurrency as protection against fiscal instability and inflation, appreciating its limited supply and decentralized governance model.

For River, Bitcoin offers significant practical advantages over gold in the modern digital era. Its ease of custody, cross-border transfer, and liquidity make the cryptocurrency an attractive option for both individual and institutional investors, the report suggests.

The post USA: 50 million Americans own bitcoin appeared first on Atlas21.

-

@ 8d34bd24:414be32b

2025-05-21 15:52:46

@ 8d34bd24:414be32b

2025-05-21 15:52:46In our culture today, people like to have “my truth” as opposed to “your truth.” They want to have teachers who tell them what they want to hear and worship in the way they desire. The Bible predicted these times.

For the time will come when people will not put up with sound doctrine. Instead, to suit their own desires, they will gather around them a great number of teachers to say what their itching ears want to hear. (2 Timothy 4:3)

My question is, “do we get to choose what we want to believe about God and how we want to worship Him, or does God tell us what we are to believe and how we are to worship Him?”

The Bible makes it clear that He is who He says He is and He expects obedience and worship according to His commands. We do not get to decide for ourselves.

The woman said to Him, “Sir, I perceive that You are a prophet. Our fathers worshiped in this mountain, and you people say that in Jerusalem is the place where men ought to worship.” Jesus said to her, “Woman, believe Me, an hour is coming when neither in this mountain nor in Jerusalem will you worship the Father. You worship what you do not know; we worship what we know, for salvation is from the Jews. But an hour is coming, and now is, when the true worshipers will worship the Father in spirit and truth; for such people the Father seeks to be His worshipers. God is spirit, and those who worship Him must worship in spirit and truth.” (John 4:19-24) {emphasis mine}

In this passage, Jesus gently corrects the woman for worshipping what she does not know. He also says, “God is spirit, and those who worship Him must worship in spirit and truth.” He states what God is (spirit) and how He must be worshipped “in spirit and truth.” We don’t get to define God however we wish, and we don’t get to worship Him any way we wish. God is who He has revealed Himself to be and we must obey Him and worship Him the way He has commanded.

In this next passage, God makes clear that He is holy and we do not get to worship Him any way we wish. We are to interact with Him in the prescribed manner.

Now Nadab and Abihu, the sons of Aaron, took their respective firepans, and after putting fire in them, placed incense on it and offered strange fire before the Lord, which He had not commanded them. And fire came out from the presence of the Lord and consumed them, and they died before the Lord. Then Moses said to Aaron, “It is what the Lord spoke, saying,

‘By those who come near Me I will be treated as holy,\ And before all the people I will be honored.’ ”

So Aaron, therefore, kept silent. (Leviticus 10:1-3) {emphasis mine}

God had prescribed a particular way to approach Him and only those whom He had chosen (priests of the lineage of Aaron). Nadab and Abihu chose to “do it their way” and paid the price for ignoring God’s command. God set an example with them.

God has been gracious enough to reveal Himself, His character, His power, and His commands to us. If we have truly submitted ourselves to His rule, we should hunger for God’s words so we can know Him better and honor Him in obedience.

But now I come to You; and these things I speak in the world so that they may have My joy made full in themselves. I have given them Your word; and the world has hated them, because they are not of the world, even as I am not of the world. I do not ask You to take them out of the world, but to keep them from the evil one. They are not of the world, even as I am not of the world. Sanctify them in the truth; Your word is truth. (John 17:13-17) {emphasis mine}

In today’s culture, everybody likes to claim their own personal truth, but that isn’t how truth works. The truth is not determined by an individual for themselves. It isn’t even determined by a consensus or majority vote. The truth is the truth even if not one person on earth believes it. God speaks truth and God is truth. Our belief or lack thereof doesn’t change the truth, but our lack of belief in the truth, especially the truth as revealed by God in His word, can negatively affect our relationship with God.

God expects us to study His word so we can obey His commands.

For I did not speak to your fathers, or command them in the day that I brought them out of the land of Egypt, concerning burnt offerings and sacrifices. But this is what I commanded them, saying, ‘Obey My voice, and I will be your God, and you will be My people; and you will walk in all the way which I command you, that it may be well with you.’ Yet they did not obey or incline their ear, but walked in their own counsels and in the stubbornness of their evil heart, and went backward and not forward. Since the day that your fathers came out of the land of Egypt until this day, I have sent you all My servants the prophets, daily rising early and sending them. Yet they did not listen to Me or incline their ear, but stiffened their neck; they did more evil than their fathers. (Jeremiah 7:22-26) {emphasis mine}

Today you rarely see someone bowing down to a golden idol, but that doesn’t mean that we are any better at obeying God’s commands or submitting to His will. We still try to make God in our own image so He is a convenience to us and how we want to live our lives. We still put other things ahead of God — family, work, entertainment, fame, etc. Most of us aren’t any more faithful to God than the Israelites were. Just like the Israelites, we put on the trappings of faith but don’t live according to faith and faithfulness.

And He said to them, “Rightly did Isaiah prophesy of you hypocrites, as it is written:

‘This people honors Me with their lips,\ But their heart is far away from Me.\ **But in vain do they worship Me,\ Teaching as doctrines the precepts of men.’\ Neglecting the commandment of God, you hold to the tradition of men.”

He was also saying to them, “You are experts at setting aside the commandment of God in order to keep your tradition. (Mark 7:6-9) {emphasis mine}

How many “churches” and “Christian” leaders teach people according to the culture instead of according to the Word of God? How many tell people what they want to hear and what makes them feel good instead of what they need to hear — the truth as spoken through the Bible? How many church attenders follow a “Christian” leader more than they follow their Creator, Savior, and God? How many church attenders can recite the words of their leaders better than the Holy Scriptures?

I solemnly charge you in the presence of God and of Christ Jesus, who is to judge the living and the dead, and by His appearing and His kingdom: preach the word; be ready in season and out of season; reprove, rebuke, exhort, with great patience and instruction. For the time will come when they will not endure sound doctrine; but wanting to have their ears tickled, they will accumulate for themselves teachers in accordance to their own desires, and will turn away their ears from the truth and will turn aside to myths. But you, be sober in all things, endure hardship, do the work of an evangelist, fulfill your ministry. (2 Timothy 4:1-5) {emphasis mine}

How can we know if a church leader is rightly preaching God’s word? We can only know if we have read the Bible and studied it. We should be like the Bereans:

Now these were more noble-minded than those in Thessalonica, for they received the word with great eagerness, examining the Scriptures daily to see whether these things were so. (Acts 17:11)

Honestly, I don’t trust any spiritual leader who doesn’t encourage me to search the Scriptures to see whether their words are true. Any leader who puts their own word above the Scriptures is a false teacher. Sadly there are many, maybe more than faithful teachers. Some false teachers are intentionally so, but many have been misled by other false teachers. Their guilt is less, but they don’t do any less harm than those who intentionally mislead.

We need to seek trustworthy teachers who speak according to the Word of God, who quote the Bible to support their opinions, and who seek the good of their followers rather than the submission of their followers.

Do not harden your hearts, as at Meribah,\ As in the day of Massah in the wilderness,

“When your fathers tested Me,\ They tried Me, though they had seen My work.\ For forty years I loathed that generation,\ And said they are a people who err in their heart,\ And they do not know My ways.\ Therefore I swore in My anger,\ Truly they shall not enter into My rest.” (Psalm 95:8-11) {emphasis mine} *Teach me good discernment and knowledge,\ For I believe in Your commandments*.\ Before I was afflicted I went astray,\ But now I keep Your word.\ You are good and do good;\ Teach me Your statutes.\ The arrogant have forged a lie against me;\ *With all my heart I will observe Your precepts*.\ Their heart is covered with fat,\ But I delight in Your law.\ It is good for me that I was afflicted,\ That I may learn Your statutes.\ The law of Your mouth is better to me\ Than thousands of gold and silver pieces. (Psalm 119:66-72) {emphasis mine}

May our Creator God teach us the truth. May He fill our hearts with the desire to be in His word daily and to seek His will. May He do what is necessary to get our attention and turn our hearts and minds fully to Him, so we can learn His statutes and serve Him faithfully, so one day we are blessed to hear, “Well done! Good and faithful servant.”

Trust Jesus.

FYI, I see lack of knowledge of truth and God’s word as one of the biggest problems in the church today; however, it is possible to know the Bible in depth, but not know God. As important as knowledge of Scriptures is, this knowledge (without faith, submission, obedience, and love) is meaningless. Knowledge doesn’t get us to heaven. Even obedience doesn’t get us to heaven. Only faith and submission to our creator God leads to salvation and heaven. That being said, we can’t faithfully serve our God without knowledge of Him and His commands. Out of gratefulness for who He is and what He has done for us, we should seek to know and please Him.

-

@ eb0157af:77ab6c55

2025-05-24 15:01:28

@ eb0157af:77ab6c55

2025-05-24 15:01:28Michigan lawmakers are unveiling a comprehensive strategy to regulate Bitcoin and cryptocurrencies.

On May 21, Republican Representative Bill Schuette introduced House Bill 4510, a proposal to amend the Michigan Public Employee Retirement System Investment Act. The legislation would allow the state treasurer, currently Rachael Eubanks, to diversify the state’s investments by including cryptocurrencies with an average market capitalization of over $250 million in the past calendar year.

Under current criteria, Bitcoin (BTC) and Ether (ETH) are the only cryptocurrencies that meet these selection standards. The proposal specifies that any investment in digital assets must be made through exchange-traded products (spot ETFs) issued by registered investment companies.

Anti-CBDC legislation

Republican Representative Bryan Posthumus is leading the bipartisan initiative behind the second bill, HB 4511, which establishes protections for cryptocurrency holders. The proposal prohibits Michigan from implementing crypto bans or imposing licensing requirements on digital asset holders.

Another key aspect of the legislation is a ban on state officials from supporting or promoting a potential federal central bank digital currency (CBDC). The definition includes the issuance of memorandums or official statements endorsing CBDC proposals related to testing, adoption, or implementation.

Mining and redevelopment of abandoned sites

The third bill, HB 4512, is a proposal led by Democratic Representative Mike McFall for a bipartisan group. This initiative would establish a Bitcoin mining program allowing operators to use abandoned oil and natural gas sites.

The program calls for the appointment of a supervisor tasked with assessing the site’s remaining productive potential, identifying the last operator, and determining the length of abandonment. Prospective participants would need to submit detailed legal documentation of their organizational structure, demonstrate operational expertise in mining, and provide profitability breakeven estimates for their ventures.

The fourth and final bill, HB 4513, also introduced by the bipartisan group led by McFall, focuses on the fiscal aspect of the HB 4512 initiative. The proposal would amend Michigan’s income tax laws to include proceeds generated from the proposed Bitcoin mining program.

The post Michigan: four bills on pension funds, CBDCs, and mining appeared first on Atlas21.

-

@ eb0157af:77ab6c55

2025-05-24 15:01:27

@ eb0157af:77ab6c55

2025-05-24 15:01:27A fake Uber driver steals $73,000 in XRP and $50,000 in Bitcoin after drugging an American tourist.

A U.S. citizen vacationing in the United Kingdom fell victim to a scam that cost him $123,000 in cryptocurrencies stored on his smartphone. The man was drugged by an individual posing as an Uber driver.

According to My London, Jacob Irwin-Cline had spent the evening at a London nightclub, consuming several alcoholic drinks before requesting an Uber ride home. The victim admitted he hadn’t carefully verified the booking details on his device, mistakenly getting into a private taxi driven by someone who, at first glance, resembled the expected Uber driver but was using a completely different vehicle.

Once inside the car, the American tourist reported that the driver offered him a cigarette, allegedly laced with scopolamine — a rare and powerful sedative. Irwin-Cline described how the smoke made him extremely docile and fatigued, causing him to lose consciousness for around half an hour.