-

@ 7f6db517:a4931eda

2025-05-25 18:03:12

@ 7f6db517:a4931eda

2025-05-25 18:03:12

The former seems to have found solid product market fit. Expect significant volume, adoption, and usage going forward.

The latter's future remains to be seen. Dependence on Tor, which has had massive reliability issues, and lack of strong privacy guarantees put it at risk.

— ODELL (@ODELL) October 27, 2022

The Basics

- Lightning is a protocol that enables cheap and fast native bitcoin transactions.

- At the core of the protocol is the ability for bitcoin users to create a payment channel with another user.

- These payment channels enable users to make many bitcoin transactions between each other with only two on-chain bitcoin transactions: the channel open transaction and the channel close transaction.

- Essentially lightning is a protocol for interoperable batched bitcoin transactions.

- It is expected that on chain bitcoin transaction fees will increase with adoption and the ability to easily batch transactions will save users significant money.

- As these lightning transactions are processed, liquidity flows from one side of a channel to the other side, on chain transactions are signed by both parties but not broadcasted to update this balance.

- Lightning is designed to be trust minimized, either party in a payment channel can close the channel at any time and their bitcoin will be settled on chain without trusting the other party.

There is no 'Lightning Network'

- Many people refer to the aggregate of all lightning channels as 'The Lightning Network' but this is a false premise.

- There are many lightning channels between many different users and funds can flow across interconnected channels as long as there is a route through peers.

- If a lightning transaction requires multiple hops it will flow through multiple interconnected channels, adjusting the balance of all channels along the route, and paying lightning transaction fees that are set by each node on the route.

Example: You have a channel with Bob. Bob has a channel with Charlie. You can pay Charlie through your channel with Bob and Bob's channel with User C.

- As a result, it is not guaranteed that every lightning user can pay every other lightning user, they must have a route of interconnected channels between sender and receiver.

Lightning in Practice

- Lightning has already found product market fit and usage as an interconnected payment protocol between large professional custodians.

- They are able to easily manage channels and liquidity between each other without trust using this interoperable protocol.

- Lightning payments between large custodians are fast and easy. End users do not have to run their own node or manage their channels and liquidity. These payments rarely fail due to professional management of custodial nodes.

- The tradeoff is one inherent to custodians and other trusted third parties. Custodial wallets can steal funds and compromise user privacy.

Sovereign Lightning

- Trusted third parties are security holes.

- Users must run their own node and manage their own channels in order to use lightning without trusting a third party. This remains the single largest friction point for sovereign lightning usage: the mental burden of actively running a lightning node and associated liquidity management.

- Bitcoin development prioritizes node accessibility so cost to self host your own node is low but if a node is run at home or office, Tor or a VPN is recommended to mask your IP address: otherwise it is visible to the entire network and represents a privacy risk.

- This privacy risk is heightened due to the potential for certain governments to go after sovereign lightning users and compel them to shutdown their nodes. If their IP Address is exposed they are easier to target.

- Fortunately the tools to run and manage nodes continue to get easier but it is important to understand that this will always be a friction point when compared to custodial services.

The Potential Fracture of Lightning

- Any lightning user can choose which users are allowed to open channels with them.

- One potential is that professional custodians only peer with other professional custodians.

- We already see nodes like those run by CashApp only have channels open with other regulated counterparties. This could be due to performance goals, liability reduction, or regulatory pressure.

- Fortunately some of their peers are connected to non-regulated parties so payments to and from sovereign lightning users are still successfully processed by CashApp but this may not always be the case going forward.

Summary

- Many people refer to the aggregate of all lightning channels as 'The Lightning Network' but this is a false premise. There is no singular 'Lightning Network' but rather many payment channels between distinct peers, some connected with each other and some not.

- Lightning as an interoperable payment protocol between professional custodians seems to have found solid product market fit. Expect significant volume, adoption, and usage going forward.

- Lightning as a robust sovereign payment protocol has yet to be battle tested. Heavy reliance on Tor, which has had massive reliability issues, the friction of active liquidity management, significant on chain fee burden for small amounts, interactivity constraints on mobile, and lack of strong privacy guarantees put it at risk.

If you have never used lightning before, use this guide to get started on your phone.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-05-25 18:03:11

@ 7f6db517:a4931eda

2025-05-25 18:03:11

People forget Bear Stearns failed March 2008 - months of denial followed before the public realized how bad the situation was under the surface.

Similar happening now but much larger scale. They did not fix fundamental issues after 2008 - everything is more fragile.

The Fed preemptively bailed out every bank with their BTFP program and First Republic Bank still failed. The second largest bank failure in history.

There will be more failures. There will be more bailouts. Depositors will be "protected" by socializing losses across everyone.

Our President and mainstream financial pundits are currently pretending the banking crisis is over while most banks remain insolvent. There are going to be many more bank failures as this ponzi system unravels.

Unlike 2008, we have the ability to opt out of these broken and corrupt institutions by using bitcoin. Bitcoin held in self custody is unique in its lack of counterparty risk - you do not have to trust a bank or other centralized entity to hold it for you. Bitcoin is also incredibly difficult to change by design since it is not controlled by an individual, company, or government - the supply of dollars will inevitably be inflated to bailout these failing banks but bitcoin supply will remain unchanged. I do not need to convince you that bitcoin provides value - these next few years will convince millions.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-05-25 18:03:10

@ 7f6db517:a4931eda

2025-05-25 18:03:10

Nostr is an open communication protocol that can be used to send messages across a distributed set of relays in a censorship resistant and robust way.

If you missed my nostr introduction post you can find it here. My nostr account can be found here.

We are nearly at the point that if something interesting is posted on a centralized social platform it will usually be posted by someone to nostr.

We are nearly at the point that if something interesting is posted exclusively to nostr it is cross posted by someone to various centralized social platforms.

We are nearly at the point that you can recommend a cross platform app that users can install and easily onboard without additional guides or resources.

As companies continue to build walls around their centralized platforms nostr posts will be the easiest to cross reference and verify - as companies continue to censor their users nostr is the best censorship resistant alternative - gradually then suddenly nostr will become the standard. 🫡

Current Nostr Stats

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-05-25 18:03:09

@ 7f6db517:a4931eda

2025-05-25 18:03:09

Humanity's Natural State Is Chaos

Without order there is chaos. Humans competing with each other for scarce resources naturally leads to conflict until one group achieves significant power and instates a "monopoly on violence."Power Brings Stability

Power has always been the key means to achieve stability in societies. Centralized power can be incredibly effective in addressing issues such as crime, poverty, and social unrest efficiently. Unfortunately this power is often abused and corrupted.Centralized Power Breeds Tyranny

Centralized power often leads to tyrannical rule. When a select few individuals hold control over a society, they tend to become corrupted. Centralized power structures often lack accountability and transparency, and rely too heavily on trust.Distributed Power Cultivates Freedom

New technology that empowers individuals provide us the ability to rebuild societies from the bottom up. Strong individuals that can defend and provide for themselves will help build strong local communities on a similar foundation. The result is power being distributed throughout society rather than held by a select few.In the short term, relying on trust and centralized power is an easy answer to mitigating chaos, but freedom tech tools provide us the ability to build on top of much stronger distributed foundations that provide stability while also cultivating individual freedom.

The solution starts with us. Empower yourself. Empower others. A grassroots freedom tech movement scaling one person at a time.

If you found this post helpful support my work with bitcoin.

-

@ eb0157af:77ab6c55

2025-05-25 18:02:57

@ eb0157af:77ab6c55

2025-05-25 18:02:57Vivek Ramaswamy’s company bets on distressed bitcoin claims as its Bitcoin treasury strategy moves forward.

Strive Enterprises, an asset management firm co-founded by Vivek Ramaswamy, is exploring the acquisition of distressed bitcoin claims, with particular interest in around 75,000 BTC tied to the Mt. Gox bankruptcy estate. This move is part of the company’s broader strategy to build a Bitcoin treasury ahead of its planned merger with Asset Entities.

According to a document filed on May 20 with the Securities and Exchange Commission, Strive has partnered with 117 Castell Advisory Group to “identify and evaluate” distressed Bitcoin claims with confirmed legal judgments. Among these are approximately 75,000 BTC connected to Mt. Gox, with an estimated market value of $8 billion at current prices.

Essentially, Strive aims to acquire rights to bitcoins currently tied up in legal disputes, which can be purchased at a discount by those willing to take on the risk and wait for eventual recovery.

In a post on X, Strive’s CFO, Ben Pham, stated:

“Strive intends to use all available mechanisms, including novel financial strategies not used by other Bitcoin treasury companies, to maximize its exposure to the asset.”

The company also plans to buy cash at a discount by merging with publicly traded companies holding more cash than their stock value, using the excess funds to purchase additional Bitcoin.

Mt. Gox, the exchange that collapsed in 2014, is currently in the process of repaying creditors, with a deadline set for October 31, 2025.

In its SEC filing, Strive declared:

“This strategy is intended to allow Strive the opportunity to purchase Bitcoin exposure at a discount to market price, enhancing Bitcoin per share and supporting its goal of outperforming Bitcoin over the long run.”

At the beginning of May, Strive announced its merger plan with Asset Entities, a deal that would create the first publicly listed asset management firm focused on Bitcoin. The resulting company aims to join the growing number of firms adopting a Bitcoin treasury strategy.

The corporate treasury trend

Strive’s initiative to accumulate bitcoin mirrors that of other companies like Strategy and Japan’s Metaplanet. On May 19, Strategy, led by Michael Saylor, announced the purchase of an additional 7,390 BTC for $764.9 million, raising its total holdings to 576,230 BTC. On the same day, Metaplanet revealed it had acquired another 1,004 BTC, increasing its total to 7,800 BTC.

The post Bitcoin in Strive’s sights: 75,000 BTC from Mt. Gox among its targets appeared first on Atlas21.

-

@ 9ca447d2:fbf5a36d

2025-05-25 18:02:37

@ 9ca447d2:fbf5a36d

2025-05-25 18:02:37Sangha Renewables, a company that combines renewable energy with bitcoin mining, has started construction on a 19.9-megawatt (MW) mining facility powered 100% by solar energy. This is a big step towards making bitcoin mining cleaner, cheaper and more efficient.

The mining site is in West Texas, a region known for its strong solar and growing bitcoin mining presence.

What’s unique about this project is the “behind-the-meter” setup — the facility will draw power directly from a nearby solar site instead of the grid. This avoids some of the costs and inefficiencies of traditional energy sourcing.

The solar site where the mining facility is located has been operational for a few years. But it’s faced challenges like grid congestion and negative energy pricing – times when there’s too much energy and prices go below zero.

Sangha’s new mining operation will solve this problem by being a flexible energy consumer. When the grid has excess energy, Sangha can use it to mine bitcoin, helping to stabilize the grid and put otherwise wasted energy to work.

Related: Bitcoin Mining Clean Energy and Grid Balance | ERCOT Study

“This is a win-win-win,” said Spencer Marr, co-founder and CEO of Sangha Renewables. “The IPP (independent power producer) earns more per megawatt-hour, our investors gain exposure to low-cost bitcoin production, and we deliver grid-stabilizing load where it’s needed most.”

In addition to the tech innovation, Sangha is also changing the way people can invest in bitcoin mining.

The company just raised $14 million of its $17 million target to fund the construction and operation of the Texas facility.

Unlike traditional investments in mining companies or digital asset stocks, Sangha allows accredited investors to invest directly in the infrastructure itself through special purpose vehicles (SPVs).

Investors can put in cash or bitcoin and get ongoing payouts in bitcoin that are “well below the market price,” according to Marr. This means instead of buying bitcoin on the open market, investors are essentially earning it through the mining activity powered by renewable energy.

“Sangha is not just building bitcoin mining sites—we’re building a new model for how capital flows in and out of Bitcoin,” Marr said.

“By applying a project finance structure honed-in the renewable energy and real estate sectors, we enable investors to participate directly in productive assets—without intermediaries, speculative equities, or inefficiencies of datacenter hosting.”

Sangha’s financial and operational model uses advanced forecasting tools.

These tools allow forecasting of energy prices and bitcoin mining profitability down to 15-minute intervals. This enables the company to decide when to run the mining rigs for maximum efficiency and return on investment.

This Texas facility is a proof-of-concept. If it works, it will open the door for others across the U.S.

Sangha believes many underutilized renewable energy sites could benefit from this kind of setup, especially in areas that produce more energy than the grid can handle.

Using a capital-efficient, investor-aligned model and working with independent power producers (IPPs) Sangha plans to scale this nationwide. The facility will be fully operational by Q3 2025.

-

@ b1ddb4d7:471244e7

2025-05-25 18:02:16

@ b1ddb4d7:471244e7

2025-05-25 18:02:16This article was originally published on aier.org

Even after eleven years experience, and a per Bitcoin price of nearly $20,000, the incredulous are still with us. I understand why. Bitcoin is not like other traditional financial assets.

Even describing it as an asset is misleading. It is not the same as a stock, as a payment system, or a money. It has features of all these but it is not identical to them.

What Bitcoin is depends on its use as a means of storing and porting value, which in turn rests of secure titles to ownership of a scarce good. Those without experience in the sector look at all of this and get frustrated that understanding why it is valuable is not so easy to grasp.

In this article, I’m updating an analysis I wrote six years ago. It still holds up. For those who don’t want to slog through the entire article, my thesis is that Bitcoin’s value obtains from its underlying technology, which is an open-source ledger that keeps track of ownership rights and permits the transfer of these rights. Bitcoin managed to bundle its unit of account with a payment system that lives on the ledger. That’s its innovation and why it obtained a value and that value continues to rise.

Consider the criticism offered by traditional gold advocates, who have, for decades, pushed the idea that sound money must be backed by something real, hard, and independently valuable. Bitcoin doesn’t qualify, right? Maybe it does.

Bitcoin first emerged as a possible competitor to national, government-managed money in 2009. Satoshi Nakamoto’s white paper was released October 31, 2008. The structure and language of this paper sent the message: This currency is for computer technicians, not economists nor political pundits. The paper’s circulation was limited; novices who read it were mystified.

But the lack of interest didn’t stop history from moving forward. Two months later, those who were paying attention saw the emergence of the “Genesis Block,” the first group of bitcoins generated through Nakamoto’s concept of a distributed ledger that lived on any computer node in the world that wanted to host it.

Here we are all these years later and a single bitcoin trades at $18,500. The currency is held and accepted by many thousands of institutions, both online and offline. Its payment system is very popular in poor countries without vast banking infrastructures but also in developed countries. And major institutions—including the Federal Reserve, the OECD, the World Bank, and major investment houses—are paying respectful attention and weaving blockchain technology into their operations.

Enthusiasts, who are found in every country, say that its exchange value will soar even more in the future because its supply is strictly limited and it provides a system vastly superior to government money. Bitcoin is transferred between individuals without a third party. It is relatively low-cost to exchange. It has a predictable supply. It is durable, fungible, and divisible: all crucial features of money. It creates a monetary system that doesn’t depend on trust and identity, much less on central banks and government. It is a new system for the digital age.

Hard lessons for hard money

To those educated in the “hard money” tradition, the whole idea has been a serious challenge. Speaking for myself, I had been reading about bitcoin for two years before I came anywhere close to understanding it. There was just something about the whole idea that bugged me. You can’t make money out of nothing, much less out of computer code. Why does it have value then? There must be something amiss. This is not how we expected money to be reformed.

There’s the problem: our expectations. We should have been paying closer attention to Ludwig von Mises’ theory of money’s origins—not to what we think he wrote, but to what he actually did write.

In 1912, Mises released The Theory of Money and Credit. It was a huge hit in Europe when it came out in German, and it was translated into English. While covering every aspect of money, his core contribution was in tracing the value and price of money—and not just money itself—to its origins. That is, he explained how money gets its price in terms of the goods and services it obtains. He later called this process the “regression theorem,” and as it turns out, bitcoin satisfies the conditions of the theorem.

Mises’ teacher, Carl Menger, demonstrated that money itself originates from the market—not from the State and not from social contract. It emerges gradually as monetary entrepreneurs seek out an ideal form of commodity for indirect exchange. Instead of merely bartering with each other, people acquire a good not to consume, but to trade. That good becomes money, the most marketable commodity.

But Mises added that the value of money traces backward in time to its value as a bartered commodity. Mises said that this is the only way money can have value.

The theory of the value of money as such can trace back the objective exchange value of money only to that point where it ceases to be the value of money and becomes merely the value of a commodity…. If in this way we continually go farther and farther back we must eventually arrive at a point where we no longer find any component in the objective exchange value of money that arises from valuations based on the function of money as a common medium of exchange; where the value of money is nothing other than the value of an object that is useful in some other way than as money…. Before it was usual to acquire goods in the market, not for personal consumption, but simply in order to exchange them again for the goods that were really wanted, each individual commodity was only accredited with that value given by the subjective valuations based on its direct utility.

Mises’ explanation solved a major problem that had long mystified economists. It is a narrative of conjectural history, and yet it makes perfect sense. Would salt have become money had it otherwise been completely useless? Would beaver pelts have obtained monetary value had they not been useful for clothing? Would silver or gold have had money value if they had no value as commodities first? The answer in all cases of monetary history is clearly no. The initial value of money, before it becomes widely traded as money, originates in its direct utility. It’s an explanation that is demonstrated through historical reconstruction. That’s Mises’ regression theorem.

Bitcoin’s Use Value

At first glance, bitcoin would seem to be an exception. You can’t use a bitcoin for anything other than money. It can’t be worn as jewelry. You can’t make a machine out of it. You can’t eat it or even decorate with it. Its value is only realized as a unit that facilitates indirect exchange. And yet, bitcoin already is money. It’s used every day. You can see the exchanges in real time. It’s not a myth. It’s the real deal.

It might seem like we have to choose. Is Mises wrong? Maybe we have to toss out his whole theory. Or maybe his point was purely historical and doesn’t apply in the future of a digital age. Or maybe his regression theorem is proof that bitcoin is just an empty mania with no staying power, because it can’t be reduced to its value as a useful commodity.

And yet, you don’t have to resort to complicated monetary theory in order to understand the sense of alarm surrounding bitcoin. Many people, as I did, just have a feeling of uneasiness about a money that has no basis in anything physical. Sure, you can print out a bitcoin on a piece of paper, but having a paper with a QR code or a public key is not enough to relieve that sense of unease.

How can we resolve this problem? In my own mind, I toyed with the issue for more than a year. It puzzled me. I wondered if Mises’ insight applied only in a pre-digital age. I followed the speculations online that the value of bitcoin would be zero but for the national currencies into which it is converted. Perhaps the demand for bitcoin overcame the demands of Mises’ scenario because of a desperate need for something other than the dollar.

As time passed—and I read the work of Konrad Graf, Peter Surda, and Daniel Krawisz—finally the resolution came. Bitcoin is both a payment system and a money. The payment system is the source of value, while the accounting unit merely expresses that value in terms of price. The unity of money and payment is its most unusual feature, and the one that most commentators have had trouble wrapping their heads around.

We are all used to thinking of currency as separate from payment systems. This thinking is a reflection of the technological limitations of history. There is the dollar and there are credit cards. There is the euro and there is PayPal. There is the yen and there are wire services. In each case, money transfer relies on third-party service providers. In order to use them, you need to establish what is called a “trust relationship” with them, which is to say that the institution arranging the deal has to believe that you are going to pay.

This wedge between money and payment has always been with us, except for the case of physical proximity.

If I give you a dollar for your pizza slice, there is no third party. But payment systems, third parties, and trust relationships become necessary once you leave geographic proximity. That’s when companies like Visa and institutions like banks become indispensable. They are the application that makes the monetary software do what you want it to do.

The hitch is that

-

@ b1ddb4d7:471244e7

2025-05-25 18:02:15

@ b1ddb4d7:471244e7

2025-05-25 18:02:15Breez, a leader in Lightning Network infrastructure, and Spark, a bitcoin-native Layer 2 (L2) platform, today announced a groundbreaking collaboration to empower developers with tools to seamlessly integrate self-custodial bitcoin payments into everyday applications.

The partnership introduces a new implementation of the Breez SDK built on Spark’s bitcoin-native infrastructure, accelerating the evolution of bitcoin from “digital gold” to a global, permissionless currency.

The Breez SDK is expanding

We’re joining forces with @buildonspark to release a new nodeless implementation of the Breez SDK — giving developers the tools they need to bring Bitcoin payments to everyday apps.

Bitcoin-Native

Powered by Spark’s…— Breez

(@Breez_Tech) May 22, 2025

(@Breez_Tech) May 22, 2025A Bitcoin-Native Leap for Developers

The updated Breez SDK leverages Spark’s L2 architecture to deliver a frictionless, bitcoin-native experience for developers.

Key features include:

- Universal Compatibility: Bindings for all major programming languages and frameworks.

- LNURL & Lightning Address Support: Streamlined integration for peer-to-peer transactions.

- Real-Time Interaction: Instant mobile notifications for payment confirmations.

- No External Reliance: Built directly on bitcoin via Spark, eliminating bridges or third-party consensus.

This implementation unlocks use cases such as streaming content payments, social app monetization, in-game currencies, cross-border remittances, and AI micro-settlements—all powered by Bitcoin’s decentralized network.

Quotes from Leadership

Roy Sheinfeld, CEO of Breez:

“Developers are critical to bringing bitcoin into daily life. By building the Breez SDK on Spark’s revolutionary architecture, we’re giving builders a bitcoin-native toolkit to strengthen Lightning as the universal language of bitcoin payments.”Kevin Hurley, Creator of Spark:

“This collaboration sets the standard for global peer-to-peer transactions. Fast, open, and embedded in everyday apps—this is bitcoin’s future. Together, we’re equipping developers to create next-generation payment experiences.”David Marcus, Co-Founder and CEO of Lightspark:

“We’re thrilled to see developers harness Spark’s potential. This partnership marks an exciting milestone for the ecosystem.”Collaboration Details

As part of the agreement, Breez will operate as a Spark Service Provider (SSP), joining Lightspark in facilitating payments and expanding Spark’s ecosystem. Technical specifications for the SDK will be released later this year, with the full implementation slated for launch in 2025.About Breez

Breez pioneers Lightning Network solutions, enabling developers to embed self-custodial bitcoin payments into apps. Its SDK powers seamless, secure, and decentralized financial interactions.About Spark

Spark is a bitcoin-native Layer 2 infrastructure designed for payments and settlement, allowing developers to build directly on Bitcoin’s base layer without compromises. -

@ cae03c48:2a7d6671

2025-05-25 18:02:11

@ cae03c48:2a7d6671

2025-05-25 18:02:11Bitcoin Magazine

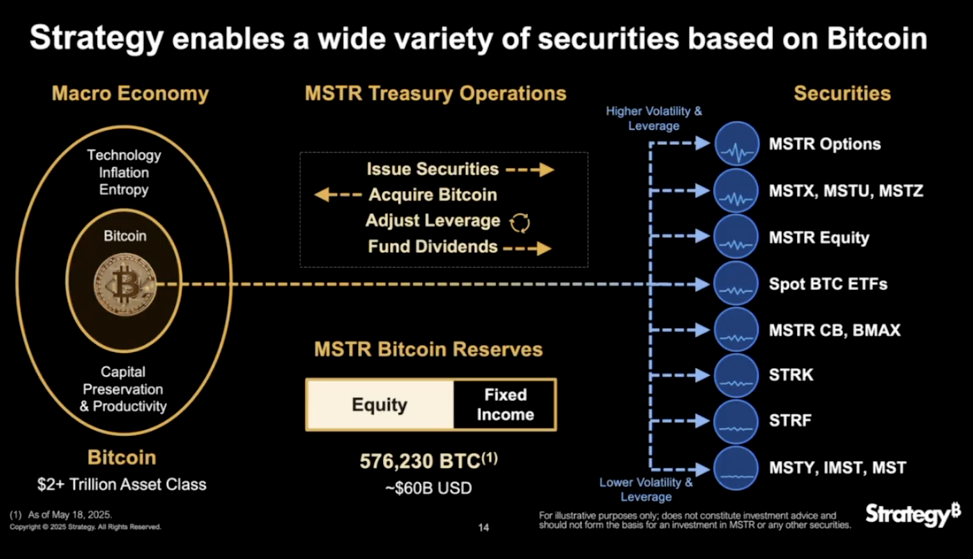

Michael Saylor’s Strategy (MSTR) Opens $2.1B ATM Program for Strife Preferred StockStrategy has launched a $2.1 billion At-The-Market (ATM) equity program for its Strife (STRF) preferred stock, marking another step in the firm’s long-term strategy to build a Bitcoin-backed financial architecture.

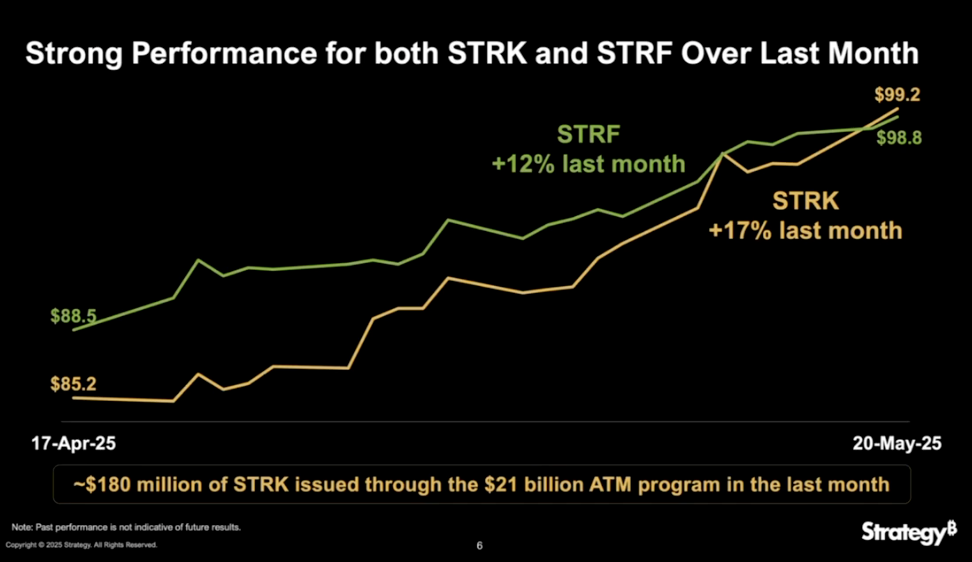

The announcement was made by CEO and President Phong Lee during an investor update alongside Executive Chairman Michael Saylor. According to Lee, strong year-to-date results from the firm’s Bitcoin-linked securities Strike (STRK) and Strife (STRF) gave Strategy the confidence to expand its fundraising strategy.

BREAKING:

Strategy to sell up to $2.1 billion of 10% preferred stock.pic.twitter.com/xufD8uv64v

Strategy to sell up to $2.1 billion of 10% preferred stock.pic.twitter.com/xufD8uv64v— Bitcoin Magazine (@BitcoinMagazine) May 22, 2025

“We’re currently at 16.3% BTC yield for the year, against a 25% target,” Lee said. “BTC dollar gain is $7.7 billion so far, on track toward our $15 billion target.”

Both instruments have outperformed expectations since launch. Strike is up 24% from its initial price of $80 to nearly $100. Strife, which was priced at $85 just two months ago, now trades around $98.80, a 16% increase. By comparison, similarly structured preferreds in the market have declined by 3–5% over the same period.

In the last 30 days alone, Strike rose 17% and Strife 12%, bringing both close to par value. Lee emphasized the liquidity profile of these instruments, citing average daily trading volumes of $31 million for Strike and $23 million for Strife. “That’s 60x what we typically see in comparable preferreds,” he noted.

The company previously issued $212 million through Strike’s ATM, with no adverse pricing pressure. Based on the trading volume and investor demand, Lee said the company believes the $2.1 billion Strife ATM can be executed in a similar fashion.

Strife is a perpetual preferred stock with a 10% coupon and sits at the top of Strategy’s capital stack. Saylor described it as “the crown jewel” of the company’s preferred offerings. “We’re going to be ten times as careful with Strife,” he said. “Our goal is for it to be seen as investment-grade fixed income — a high-quality instrument with robust protections.”

Strike, by contrast, is positioned for what Saylor called “Bitcoin-curious” investors. It carries an 8% coupon and includes upside through Bitcoin conversion. “Think of it like a Bitcoin fellowship with a stipend,” Saylor said.

Strategy now operates three ATM programs: $21 billion each for MSTR equity and Strike, and $2.1 billion for Strife. These are rebalanced daily, with issuance adjusted based on market conditions, volatility, and investor demand. According to Saylor, this dynamic structure allows the company to optimize Bitcoin acquisition and capital deployment across changing market environments.

Behind this strategy sits Strategy’s Bitcoin treasury, now totaling 576,230 BTC — roughly $60 billion in value. “That permanent capital is the foundation for everything we’re building,” Saylor said.

While spot Bitcoin ETFs cater to investors looking for direct price exposure, Strategy continues to offer a more nuanced set of instruments — each targeting different levels of risk, return, and compliance. The Strife ATM is the latest move in that broader strategy.

This post Michael Saylor’s Strategy (MSTR) Opens $2.1B ATM Program for Strife Preferred Stock first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ a8cc4ff8:d3ea074d

2025-05-25 07:26:38

@ a8cc4ff8:d3ea074d

2025-05-25 07:26:38不忍池, 上野動物園 Shinobazuno Pond, Ueno Zoo

上野東照宮五重塔,上野動物園 Ueno Toshogu Shrine, Ueno Zoo

鉄道博物館 The Railway Museum

靖國神社 Yasukuni-jinja Shrine

巽櫓(桜田二重櫓) Sakurada Tatsumi Yagura

二重橋 Nijubashi Bridge

元箱根 Motohakone

彫刻の森駅 Chokokunomori Station

箱根神社 Hakone Shrine

小田原城 Odawara Castle

新大久保駅 Shin-Ōkubo Station

シンボルプロムナード公園 Symbol Promenade Park

セントラル広場 Central Square

日本科学未来館 The National Museum of Emerging Science and Innovation Japan (Miraikan)

-

@ b1ddb4d7:471244e7

2025-05-25 06:00:51

@ b1ddb4d7:471244e7

2025-05-25 06:00:51The upcoming Bitcoin 2025 conference, scheduled from May 27–29 at the Venetian Conference Center in Las Vegas, is set to make history with an official attempt to break the GUINNESS WORLD RECORDS® title for the most Bitcoin point-of-sale transactions in an eight-hour period.

Organized by BTC Inc, the event will showcase Bitcoin’s evolution from a digital capital asset to a practical medium of exchange, leveraging the latest advancements in payment technology.

Tap-to-Pay with Lightning-Ready Bolt Cards

To facilitate this record-setting attempt, 4,000 Lightning-ready Bolt Cards will be distributed to conference attendees.

— Uncle Rockstar Developer (@r0ckstardev) May 15, 2025

These NFC-enabled cards allow users to make instant, contactless Bitcoin payments at vendor booths throughout the expo-no apps or QR codes required, just a simple tap.

The cards are available in four collectible designs, each featuring a prominent figure in Bitcoin’s history: Senator Cynthia Lummis, Michael Saylor, Satoshi Nakamoto, and Jack Dorsey.

Each attendee will receive a randomly assigned card, making them both functional and collectible souvenirs.

Senator Lummis: A Playful Provocation

Notably, one of the card designs features Senator Cynthia Lummis with laser eyes-a playful nod to her reputation as a leading Bitcoin advocate in US politics.

While Lummis is known for her legislative efforts to promote Bitcoin integration, she has publicly stated she prefers to “spend dollars and save Bitcoin,” viewing BTC as a long-term store of value rather than a daily currency.

The choice to feature her on the Bolt Card, could be suggested by Rockstar Dev of the BTC Pay Server Foundation, perhaps a lighthearted way to highlight the ongoing debate about Bitcoin’s role in everyday payments.

Nothing cracks me up quite like a senator that wants the US to buy millions of Bitcoin use dollars to buy a beer at a Bitcoin bar.

This is how unserious some of you are. pic.twitter.com/jftIEggmip

— Magoo PhD (@HodlMagoo) April 4, 2025

How Bolt Cards and the Lightning Network Work

Bolt Cards are physical cards equipped with NFC (Near Field Communication) technology, similar to contactless credit or debit cards. When linked to a compatible Lightning wallet, they enable users to make Bitcoin payments over the Lightning Network by simply tapping the card at a point-of-sale terminal.

The Lightning Network is a second-layer protocol built on top of Bitcoin, designed to facilitate instant, low-cost transactions ideal for everyday purchases.

This integration aims to make Bitcoin as easy to use as traditional payment methods, eliminating the need for QR code scanning or mobile apps.

A Showcase for Bitcoin’s Real-World Usability

With over 30,000 attendees, 300 exhibitors, and 500 speakers expected, the Bitcoin 2025 conference is poised to be the largest Bitcoin event of the year-and potentially the most transactional.

The event will feature on-site activations such as the Official Bitcoin Magazine Store, where all merchandise will be available at a 21% discount for those paying with Bitcoin via the Lightning Network-a nod to Bitcoin’s 21 million coin supply limit.

By deeply integrating Lightning payments into the conference experience, organizers hope to demonstrate Bitcoin’s readiness for mainstream commerce and set a new benchmark for its practical use as a currency.

Conclusion

The Guinness World Record attempt at Bitcoin 2025 is more than a publicity stunt-it’s a bold demonstration of Bitcoin’s technological maturity and its potential to function as a modern, everyday payment method.

Whether or not the record is set, the event will serve as a milestone in the ongoing journey to make Bitcoin a truly global, user-friendly currency

-

@ cae03c48:2a7d6671

2025-05-25 18:02:01

@ cae03c48:2a7d6671

2025-05-25 18:02:01Bitcoin Magazine

H100 Group Became The First Publicly Listed Bitcoin Treasury Company In SwedenH100 Group AB has announced it has become Sweden’s first publicly listed health technology company to adopt Bitcoin as a treasury reserve asset, announcing the purchase of 4.39 BTC for 5 million NOK (approximately $475,000) as part of its long-term Bitcoin Treasury Strategy.

The Stockholm-based company, which provides AI-powered automation and digital solutions for healthcare providers, joins a growing roster of public companies adding Bitcoin to their balance sheets in 2025. The purchase was executed at an average price of 1,138,737 NOK per Bitcoin (roughly $108,200).

JUST IN:

H100 Group buys 4.39 BTC and becomes Sweden's first publicly listed #Bitcoin treasury company. pic.twitter.com/pNXe9XT2a7

H100 Group buys 4.39 BTC and becomes Sweden's first publicly listed #Bitcoin treasury company. pic.twitter.com/pNXe9XT2a7— Bitcoin Magazine (@BitcoinMagazine) May 22, 2025

“This addition to H100’s Bitcoin Treasury Strategy follows an increasing number of tech-oriented growth companies holding Bitcoin on their balance sheet,” said CEO Sander Andersen. “And I believe the values of individual sovereignty highly present in the Bitcoin community aligns well with, and will appeal to, the customers and communities we are building the H100 platform for.”

The move comes amid a surge in corporate Bitcoin adoption, with many public companies announcing Bitcoin treasury programs in the first five months of 2025. Notable recent entrants include Twenty One Capital, Strive and several others.

H100 Group emphasized that the Bitcoin purchase does not affect its core operations in the health and longevity industry. The company views the investment as a strategic deployment of excess liquidity to strengthen its financial position while aligning with its values of individual sovereignty.

The announcement reflects a broader shift in corporate treasury management, as companies seek to diversify their holdings beyond traditional cash reserves.

At press time, Bitcoin trades at $111,108, up 1.28% over the past 24 hours, as institutional adoption continues to drive market momentum. H100 Group’s shares closed up 1.37% at 0.89 SEK on the NGM Nordic SME exchange following the announcement.

This post H100 Group Became The First Publicly Listed Bitcoin Treasury Company In Sweden first appeared on Bitcoin Magazine and is written by Vivek Sen.

-

@ cae03c48:2a7d6671

2025-05-25 18:01:53

@ cae03c48:2a7d6671

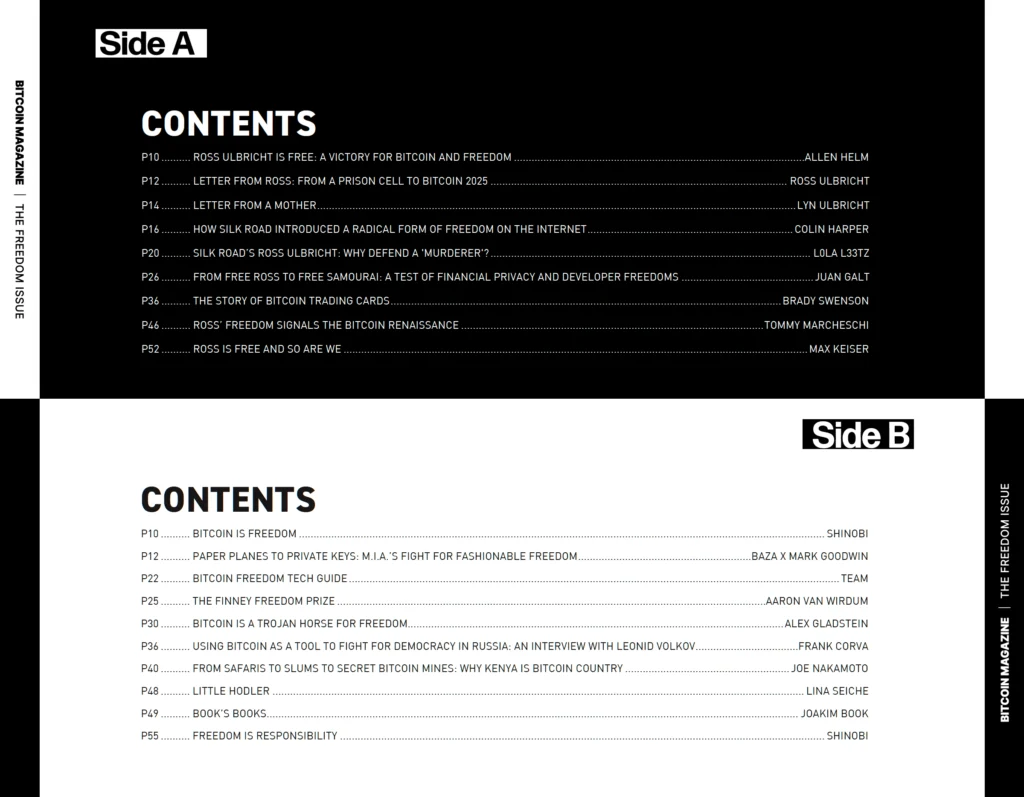

2025-05-25 18:01:53Bitcoin Magazine

The Freedom Issue: Letter From the EditorBitcoin is freedom money, a censorship-resistant form of digital cash allowing anyone with an internet connection to send money to anyone else, regardless of nationality, borders, or other arbitrary restrictions.

I personally first heard about Bitcoin in early 2013, through friends who were buying… stuff from Silk Road, the darknet marketplace helmed by the mysterious Dread Pirate Roberts. Although Silk Road was controversial (the “stuff” most people bought and sold was, of course, illegal drugs), it represented a radical example of the form of freedom that Bitcoin provides.

Later in 2013, Silk Road was shut down by the FBI, and Ross Ulbricht was revealed as the market’s founder and the true identity behind the Dread Pirate Roberts pseudonym — although he claims several people operated the account. Ulbricht was sentenced to two life sentences plus forty years in prison without the possibility of parole.

In my view — and that of many Bitcoiners — it was excessive. Even if you believe Ulbricht was guilty of everything he was convicted of (all nonviolent crimes), he was made an example of, and didn’t actually deserve to be locked up for the rest of his days.

Fortunately, Ulbricht was granted a full and unconditional pardon from President Trump in January of this year. The founder of Silk Road, in a very literal sense, has regained his freedom.

This edition of Bitcoin Magazine celebrates and highlights the freedom aspect of Bitcoin with a range of articles and artwork focusing on the people and projects that use bitcoin to advance liberty, and those who make this possible… with a special focus on Ulbricht and Silk Road.

For other stories about bitcoin as freedom money, flip the magazine around!

Welcome to The Freedom Issue.

Aaron van Wirdum

Don’t miss your chance to own The Freedom Issue—featuring never-before-seen letters from Ross Ulbricht and his mother, Lyn. Limited run. Only available while supplies last.

This piece is the Letter from the Editor featured in the latest print edition of Bitcoin Magazine, The Freedom Issue. We’re sharing it here as an early look at the ideas explored throughout the full issue.

This post The Freedom Issue: Letter From the Editor first appeared on Bitcoin Magazine and is written by Aaron Van Wirdum.

-

@ cae03c48:2a7d6671

2025-05-25 18:01:41

@ cae03c48:2a7d6671

2025-05-25 18:01:41Bitcoin Magazine

Bitcoin Pizza Day: 15 Years Since 10,000 BTC Bought Two Pizzas and Changed EverythingOn May 22, 2010, Bitcoin became more than just an idea—it became real money. Laszlo Hanyecz, a developer and early contributor to Bitcoin’s codebase, posted a casual offer: “I’ll pay 10,000 bitcoins for a couple of pizzas.” Five days later, someone took him up on it. Two Papa John’s pizzas were delivered. A screenshot was posted. Bitcoin had entered the real world.

15 years ago, Laszlo Hanyecz spent 10,000 #bitcoin worth $30 on two Papa John's pizzas.

Today, 10,000 $BTC is worth over $1,100,000,000.

What a legend!

pic.twitter.com/EbxQAsixhZ

pic.twitter.com/EbxQAsixhZ— Bitcoin Magazine (@BitcoinMagazine) May 22, 2025

That 10,000 Bitcoin, worth about $41 at the time, is now valued at over $1.1 billion. And with Bitcoin hitting a new all-time high of $111,999 on the 15th anniversary of the transaction, the story of the “Bitcoin Pizza” carries more weight than ever.

15 years ago, someone paid 10,000 #Bitcoin for 2 pizzas. That’s worth over $1,000,000,000 today!

It wasn’t just about the pizza. This was the moment Bitcoin proved itself as a functioning currency. Until then, it had lived mostly in theory and code—talked about by cryptographers and mined by hobbyists. Hanyecz’s post, and the trade that followed, transformed the idea into action. “This transaction made Bitcoin real in my eyes,” he said in a 2019 interview. “It wasn’t worth much at the time. I wouldn’t have spent $100 million on pizza, right? But if I hadn’t done that, maybe Bitcoin wouldn’t have become so popular.”

Over the summer of 2010, Hanyecz continued using Bitcoin to buy pizzas, eventually spending more than 79,000 BTC—now worth nearly $8.7 billion. While some have joked at his expense, the truth is this: without those early real-world transactions, Bitcoin might never have proven its use case. Hanyecz helped move Bitcoin from the fringe into functionality.

That legacy still shapes us today. Bitcoin Pizza Day has become a cultural milestone in the crypto world, with meetups, pizza parties, and educational events held globally each May 22. The day serves as a reminder of how far the technology has come—and the importance of everyday actions and the impact they have.

Smiles, joy, and shared moments, this is what today looked like.#Bitcoin Pizza Day at His Grace School was more than a visit. It was connection, care, and community. A heartfelt thank you to everyone who donated and supported #BitcoinGhana #BitcoinPizzaDay #BTC #Bitfiasi pic.twitter.com/xRMv1rpife

— Bitfiasi Initiative (@bitfiasi) May 22, 2025

Just this week, fast food chain Steak ‘n Shake began accepting Bitcoin via the Lightning Network, signaling a growing wave of mainstream adoption. What once felt experimental is now becoming part of everyday commerce.

Bitcoin Pizza Day is about recognition. One simple transaction proved that Bitcoin could work—and 15 years later, the world is still building on that first bite.

This post Bitcoin Pizza Day: 15 Years Since 10,000 BTC Bought Two Pizzas and Changed Everything first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-05-25 18:01:30

@ cae03c48:2a7d6671

2025-05-25 18:01:30Bitcoin Magazine

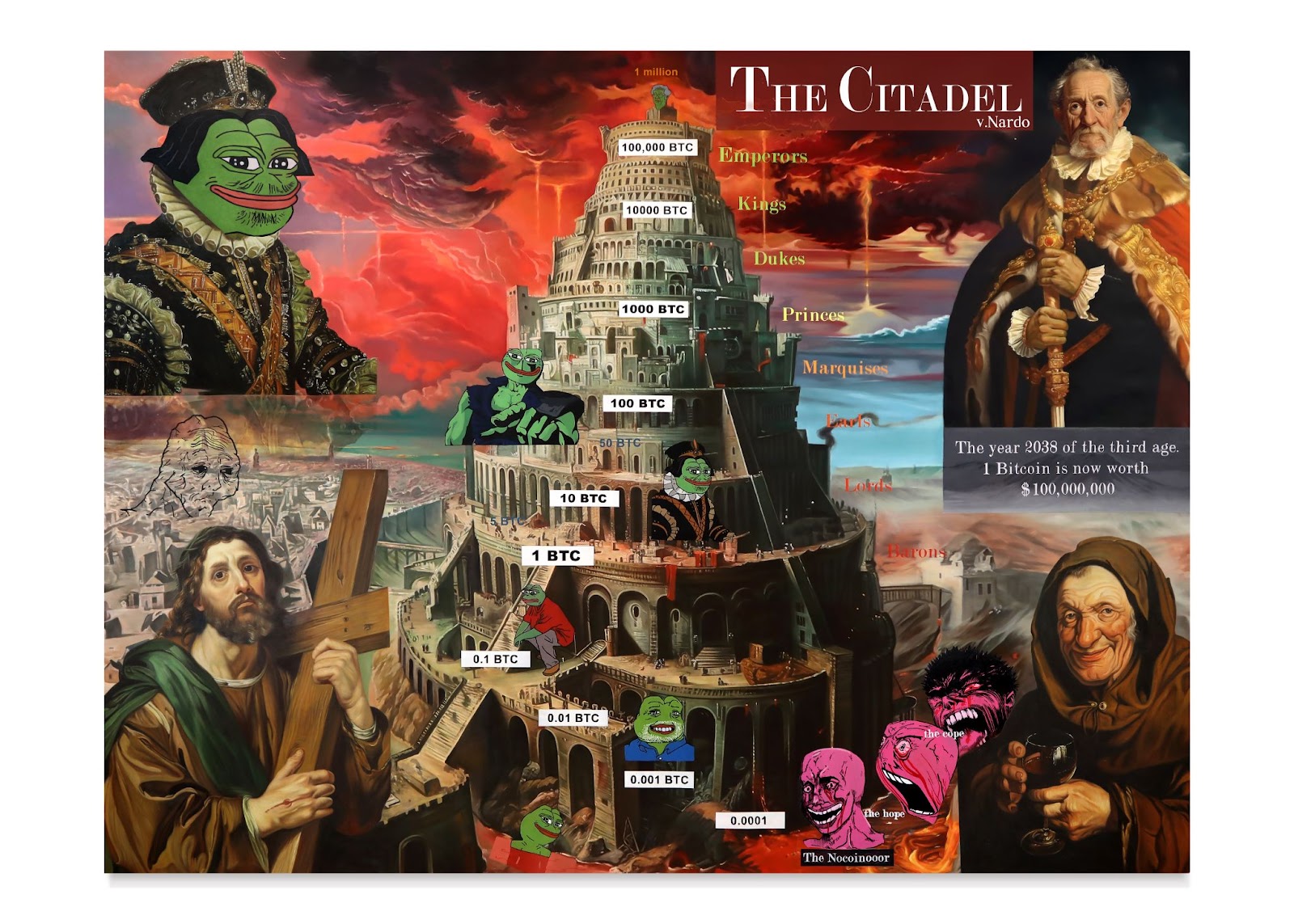

The Citadel (v. Nardo): From Meme to Monument

My latest painting, The Citadel (v. Nardo), did not begin simply on canvas. It began as a whisper – an image passed digitally between anonymous hands, reposted, remixed, archived, and mythologized across the internet. Like many of my works, this piece builds from historical fragments and symbols, grounded in the belief that memes are not fleeting – they are foundational. They don’t just reflect culture, rather, they write it.

Last year in 2024, I presented a solo show in Abu Dhabi centered around the fact that Subway – the sandwich chain – was one of the first fast food restaurants to accept Bitcoin. That small historical detail became the seed of a larger conceptual inquiry: what does it mean to “consume” in an age of hyper-speed information? The works explored the overlap between fast food, memes, and digital attention. The exhibition was tight, precise, and deeply memetic in its structure.

The Citadel came from a similar place.

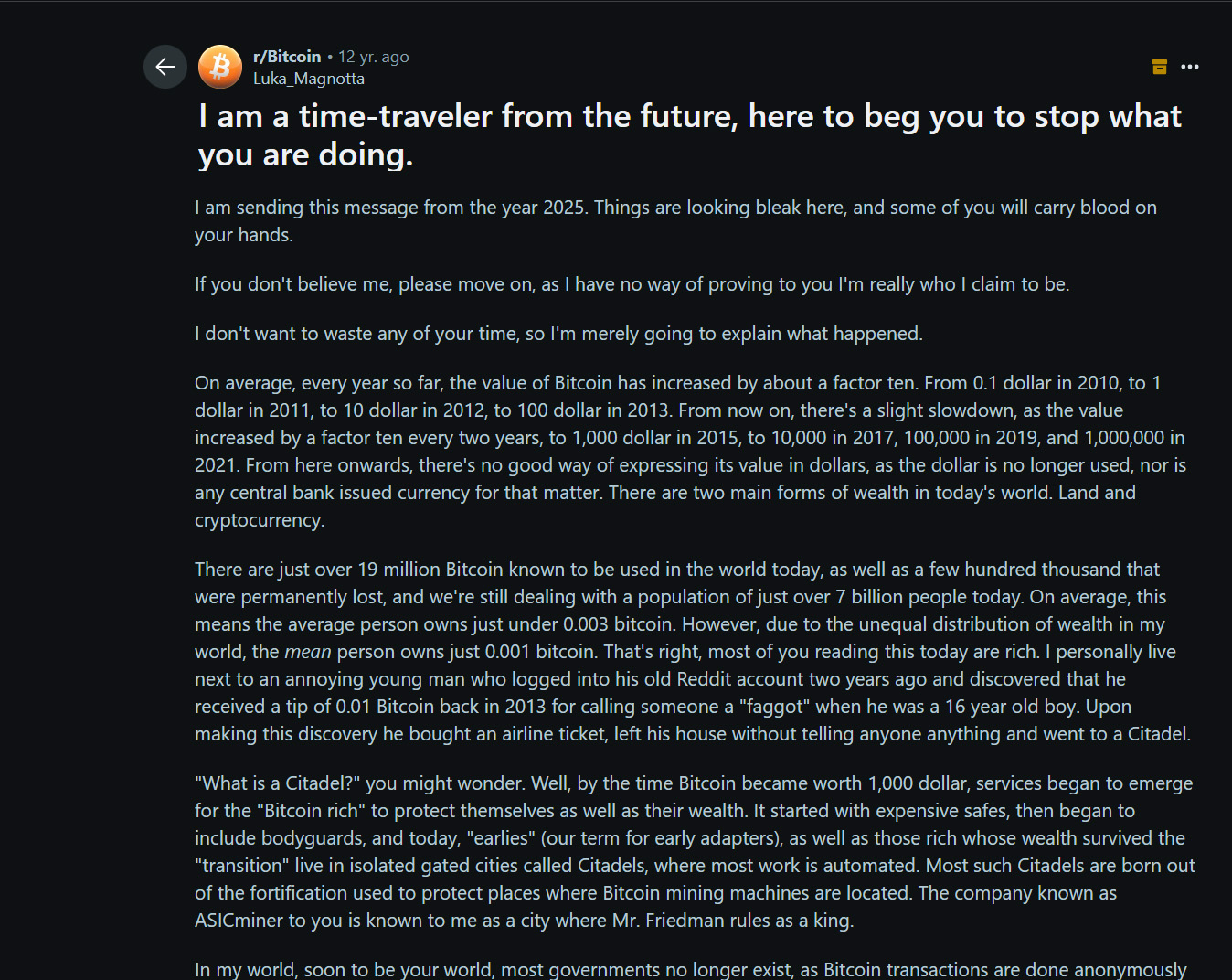

In 2013, a now-legendary Reddit post titled “I am a time-traveler from the future, here to beg you to stop what you are doing” appeared online. The author – claiming to be from 2025 – warned of a future shaped by Bitcoin, but not in the way many had hoped. It wasn’t a utopia. It was a stratified society where those who adopted early became untouchably rich, and everyone else was left behind. Whether satire, fiction, or genuine warning, the post struck a nerve. It spread quickly. It became part of the cultural and memetic architecture of Bitcoin.

Years later, another anonymous user gave that warning a visual form. The Citadel v.1, likely created on 4chan, featured a massive tower cobbled together from borrowed imagery – most notably a background ripped from Alexander Mikhalchyk’s oil painting Tower of Babel. Red – overlaid with iconic internet figures like Pepe, Wojak, and the Bogdanoff twins. It was chaotic, funny, ominous. And it caught fire. Versions spread across forums. Variants emerged for Monero, Ethereum, and other Bitcoin-based class hierarchies. A whole mythology took shape around it.

I couldn’t stop thinking about that image. The symbolism. The verticality. The warning. It wasn’t just a meme – it was a map. A visual schema of power and belief, told in the language of the internet. And yet, it had never been physically painted. Never given the weight or permanence it deserved. That’s when I decided to create what I believe is the first fully hand-painted oil version of the Bitcoin Citadel meme.

The Citadel (v. Nardo) is 7 feet wide, 5 feet tall, and entirely rendered in oil by hand over six months. The tower in my painting is original – constructed from references to Bruegel’s depictions of Babel. The superimposed depictions of Pepe, the monk, the nobleman, even Jesus, are deliberate nods to the v.1 version, reimagined and integrated with painterly care. Nothing here is copy-pasted. Every inch is built to feel mythic, monumental, and true to the weight of the meme itself.

Like all my work, it’s meant to evoke grandeur, drama, and symbolic density. It’s meant to feel like a relic from a future past – something dug up from the ruins of digital civilization. My late professor once told me that the best art is both folkloric and provocative. That line never left me.

And that’s essentially what internet memes are. They are modern folklore. They encode belief, identity, warning, and aspiration in compressed symbols. They may start as jokes – but jokes have always been a delivery system for deeper truth. Memes don’t just survive online; they shape what we expect from reality.

The Citadel (v. Nardo) will be sold at auction via Scarce.City and debut at the Bitcoin Conference in Las Vegas – the largest gathering of Bitcoiners in the world. It’s not just a painting. It’s a response. A reckoning. A reminder.Because in the end, as I always say: you become what you meme.

This is a guest post by X-Nardo Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine_._

This post The Citadel (v. Nardo): From Meme to Monument first appeared on Bitcoin Magazine and is written by X-Nardo.

-

@ cae03c48:2a7d6671

2025-05-25 18:01:20

@ cae03c48:2a7d6671

2025-05-25 18:01:20Bitcoin Magazine

Are Bitcoin Long-Term Holders Starting to Sell?After a volatile start to 2025, Bitcoin has now reclaimed the $100,000 mark, setting a new all-time high and injecting renewed confidence into the market. But as prices soar, a critical question arises: are some of Bitcoin’s most experienced and successful holders, the long-term investors, starting to sell? In this piece, we’ll analyze what on-chain data reveals about long-term holder behavior and whether recent profit-taking should be a cause for concern, or simply a healthy part of Bitcoin’s market cycle.

Signs Of Profit-Taking Appear

The Spent Output Profit Ratio (SOPR) provides immediate insight into realized profit across the network. Zooming in on recent weeks, we can observe a clear uptick in profit realization. Clusters of green bars indicate that a noticeable number of investors are indeed selling BTC for profit, especially following the price rally from the $74,000–$75,000 range to new highs above $100,000.

Figure 1: The Spent Output Profit Ratio indicates notable recent profit realization. View Live Chart

However, while this might raise short-term concerns about potential overhead resistance, it’s crucial to frame this in the broader on-chain context. This isn’t unusual behavior in bull markets and does not, on its own, signal a cycle peak.

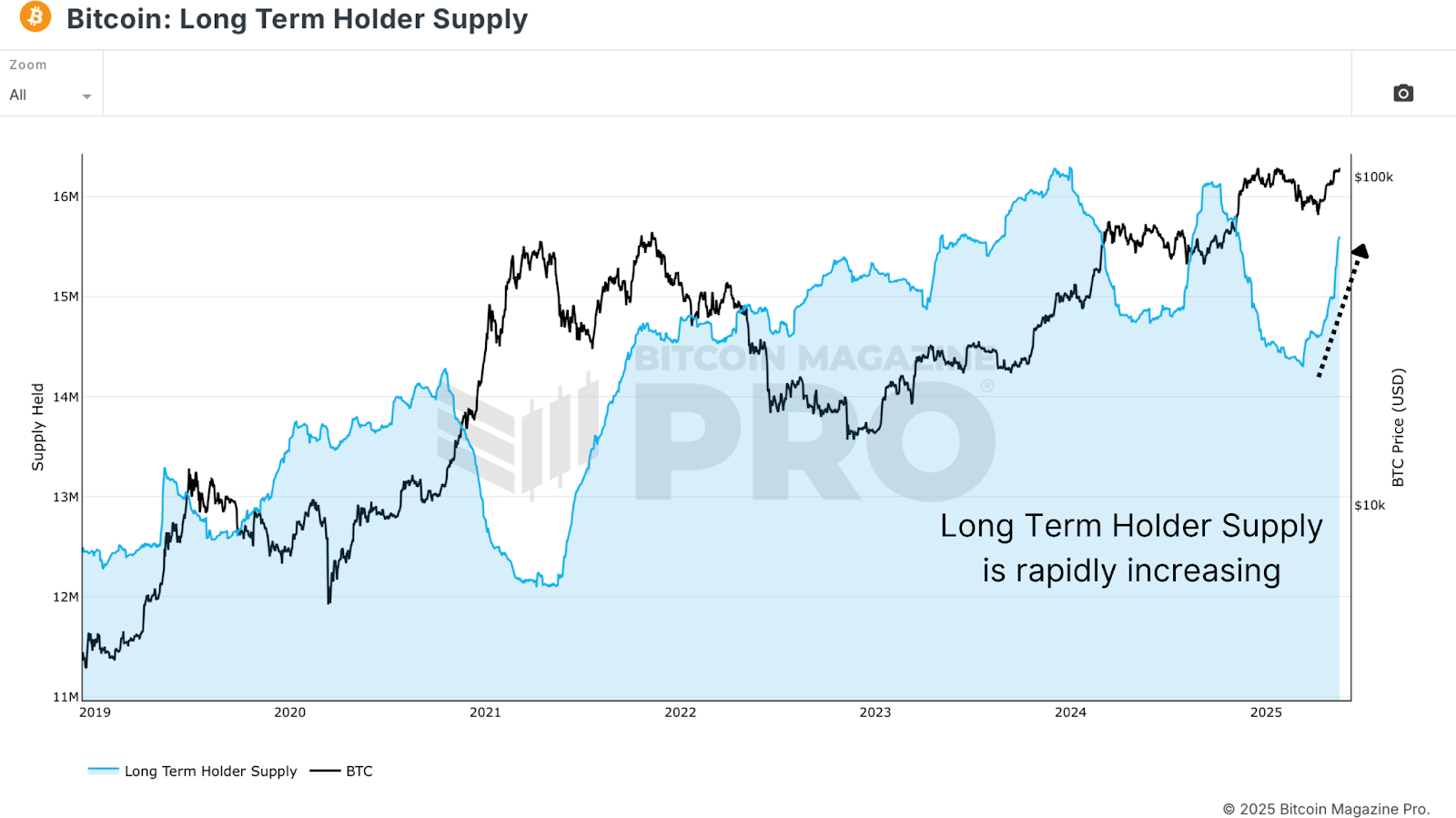

Long-Term Holder Supply Is Still Growing

The Long-Term Holder Supply, the total amount of Bitcoin held by addresses for at least 155 days, continues to climb, even as prices surge. This metric doesn’t necessarily mean fresh accumulation is occurring now, but rather that coins are aging into long-term status without being moved or sold.

Figure 2: Sharp increases in the Bitcoin Long-Term Holder Supply. View Live Chart

In other words, many investors who bought in late 2024 or early 2025 are holding strong, transitioning into long-term holders. This is a healthy dynamic typical of the earlier to mid-stages of bull markets, and not yet indicative of widespread distribution.

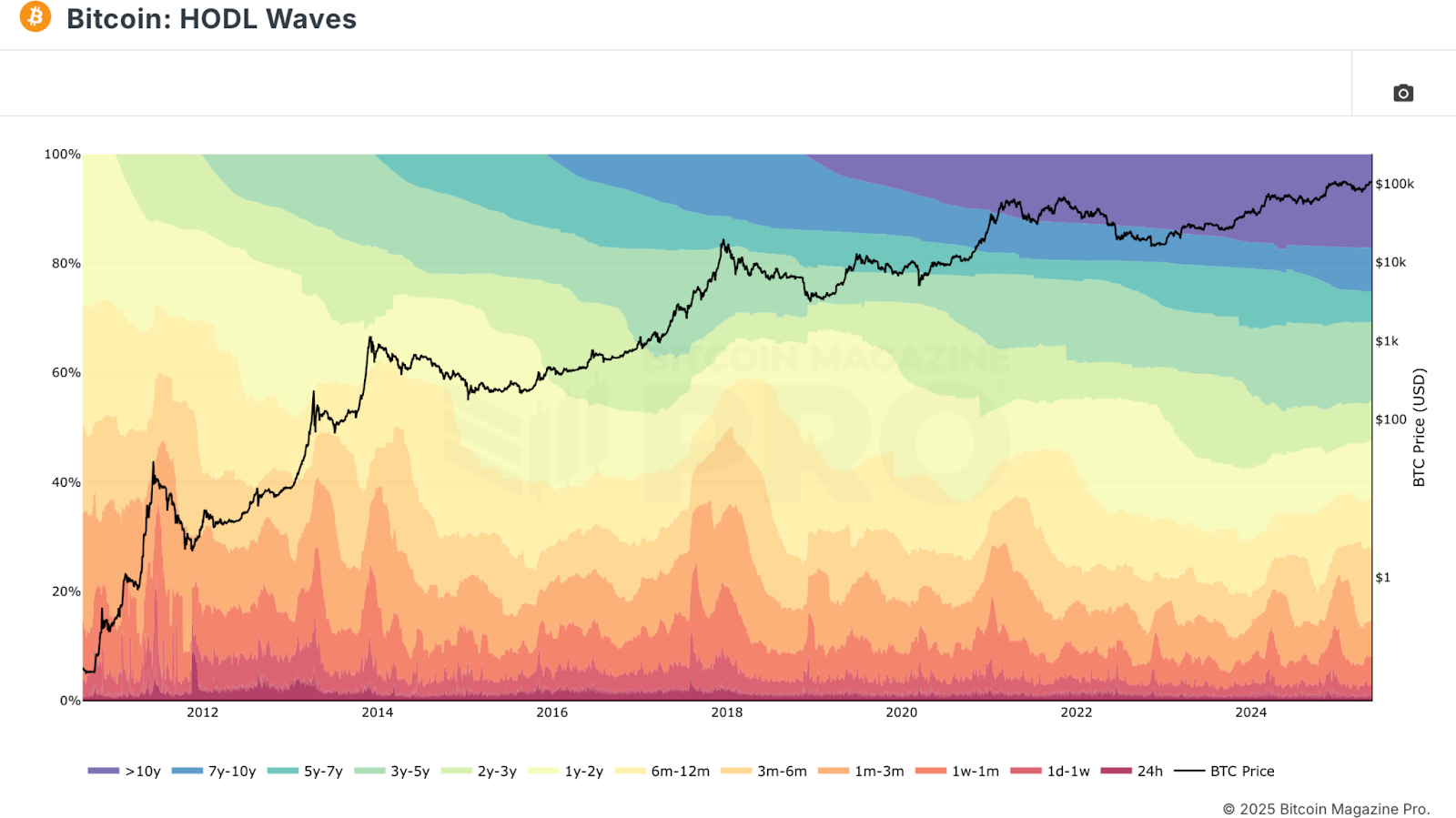

HODL Waves Analysis

To dig deeper, we use HODL Waves data, which breaks down BTC holdings by wallet age bands. When isolating wallets holding BTC for 6 months or more, we find that over 70% of the Bitcoin supply is currently held by mid to long-term participants.

Figure 3: HODL Waves analysis reveals mid- to long-term investors hold the majority of BTC. View Live Chart

Interestingly, while this number remains high, it has started to decrease slightly, indicating that a portion of long-term holders may be selling even as the long-term holder supply increases. The primary driver of the long-term holder supply growth appears to be short-term holders aging into the 155+ day bracket, not fresh accumulation or large-scale buying.

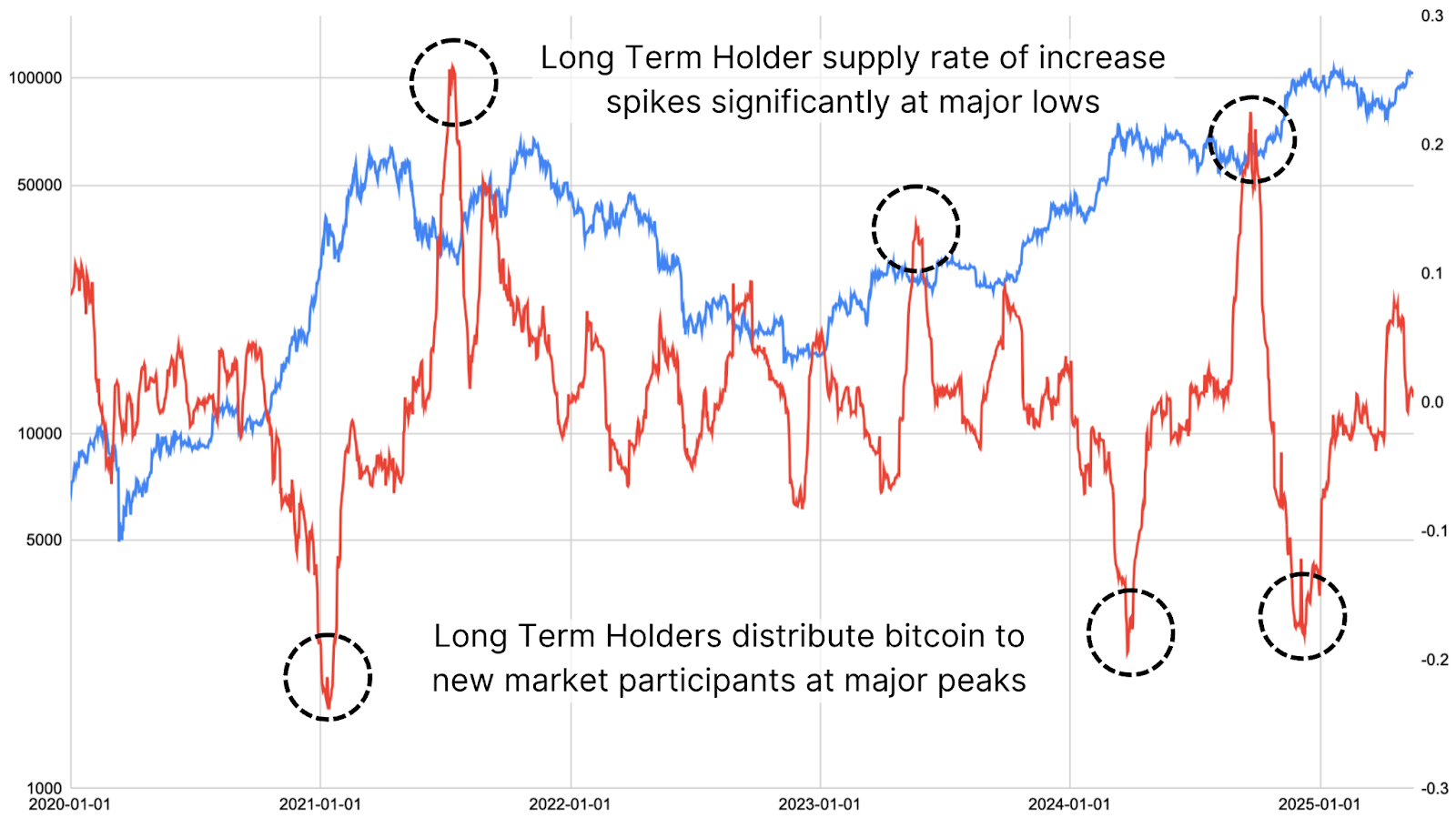

Figure 4: The inverse correlation between long-term holder supply rate and price.

Using raw Bitcoin Magazine Pro API data, we examined the rate of change in long-term holder balances, categorized by wallet age. When this metric trends downward significantly, it has historically coincided with cycle peaks. Conversely, when it spikes upward, it has often marked market bottoms and periods of deep accumulation.

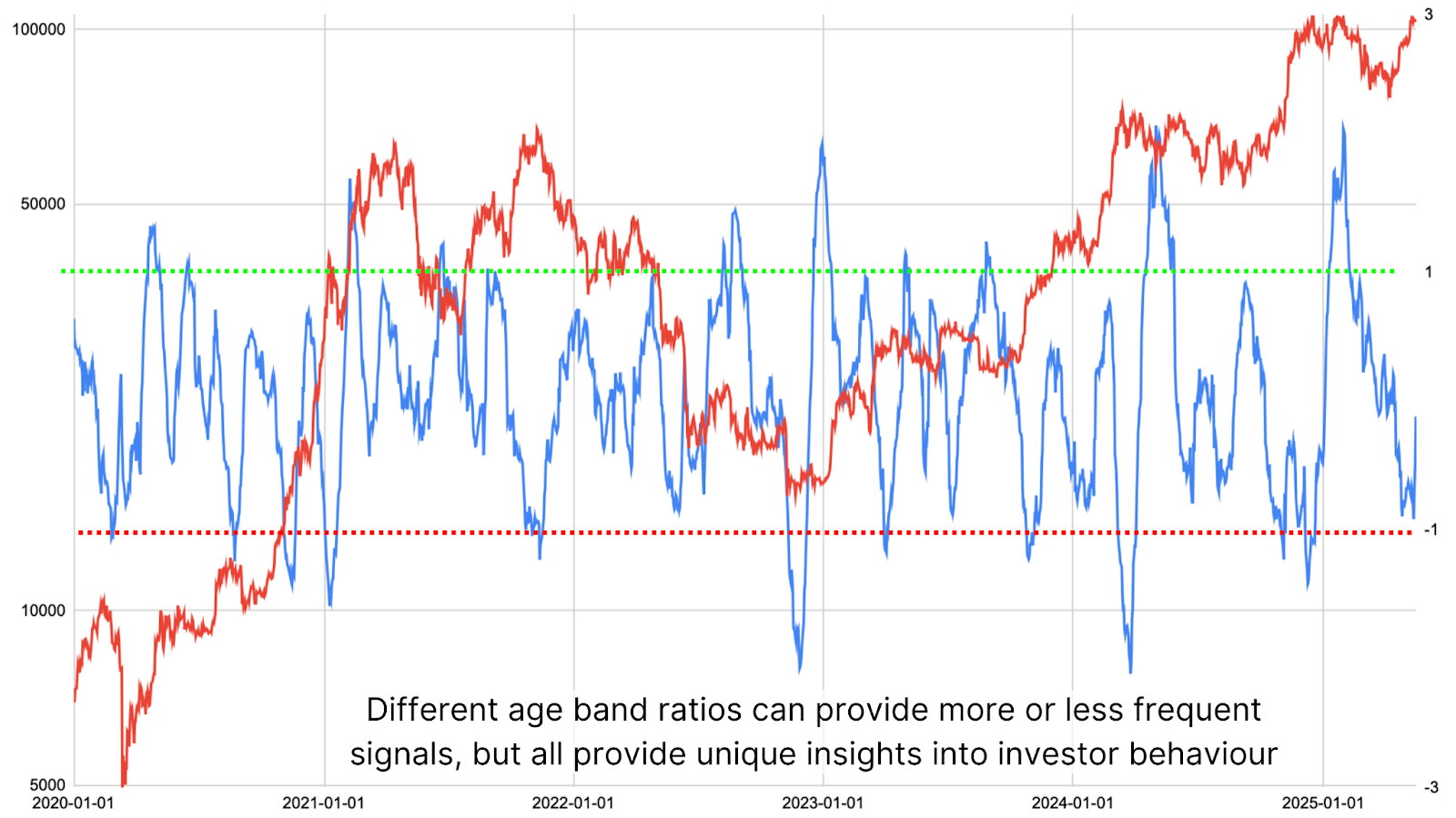

Short-Term Shifts And Distribution Ratios

To enhance the accuracy of these signals, the data can be sliced more precisely by comparing very recent entrants (0–1 month holders) against those holding BTC for 1–5 years. This age band comparison provides more frequent and real-time insights into distribution patterns.

Figure 5: An age band holder distribution ratio provides valuable market insights.

We find that sharp drops in the ratio of 1–5 year holders relative to newer participants have historically aligned with Bitcoin tops, meanwhile, rapid increases in the ratio signal that more BTC is flowing into the hands of seasoned investors is often a precursor to major price rallies.

Ultimately, monitoring long-term investor behavior is one of the most effective ways to gauge market sentiment and the sustainability of price movements. Long-term holders historically outperform short-term traders by buying during fear and holding through volatility. By examining the age-based distribution of BTC holdings, we can gain a clearer view of potential tops and bottoms in the market, without relying solely on price action or short-term sentiment.

Conclusion

As it stands, there is only a minor level of distribution among long-term holders, nowhere near the scale that historically signals cycle tops. Profit-taking is occurring, yes, but at a pace that appears entirely sustainable and typical of a healthy market environment. Given the current stage of the bull cycle and the positioning of institutional and retail participants, the data suggests we are still within a structurally strong phase, with room for further price growth as new capital flows in.

For more deep-dive research, technical indicators, real-time market alerts, and access to a growing community of analysts, visit BitcoinMagazinePro.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

This post Are Bitcoin Long-Term Holders Starting to Sell? first appeared on Bitcoin Magazine and is written by Matt Crosby.

-

@ cae03c48:2a7d6671

2025-05-25 18:01:09

@ cae03c48:2a7d6671

2025-05-25 18:01:09Bitcoin Magazine

Semler Scientific Buys Additional $50 Million Worth of BitcoinMedical equipment provider Semler Scientific has acquired 455 Bitcoin for $50 million, marking it one of the largest purchases as more publicly traded companies continue to adopt Bitcoin treasury strategies.

According to a Form 8-K filed with the SEC on May 23, the company purchased the Bitcoin between May 13 and May 22 at an average price of $109,801 per coin, including fees. The acquisition brings Semler’s total Bitcoin holdings to 4,264 BTC, acquired at an aggregate cost of $390 million.

The purchase was funded through Semler’s at-the-market (ATM) equity offering program, which has raised approximately $114.8 million since its launch in April 2025. The company has issued 3,003,488 shares under the $500 million program to date.

“$SMLR acquires 455 Bitcoins for $50 million and has generated BTC Yield of 25.8% YTD. Now holding 4,264 $BTC. Flywheel in motion. ,” said Eric Semler, Chairman of Semler Scientific. The company’s Bitcoin holdings are now valued at approximately $474.4 million based on current market prices.

Semler reported its Bitcoin Yield – a key performance indicator measuring the year-to-date percentage change in total Bitcoin holdings relative to diluted shares outstanding – has reached 25.8% in 2025. The metric has become a standard measure among public companies holding Bitcoin on their balance sheets.

The company maintains a Bitcoin Dashboard on its website to provide transparent information about its holdings, including market data, performance metrics, and acquisition details, as part of its Regulation FD compliance strategy.

Semler’s move comes amid accelerating corporate Bitcoin adoption in 2025, with over 40 public companies announcing Bitcoin treasury programs this year alone. The market has shown increased sensitivity to corporate treasury activities as institutional adoption continues to grow.

The company’s latest Bitcoin purchase reinforces the growing trend of public companies using equity offerings to fund Bitcoin acquisitions, a strategy pioneered by larger players like Strategy, which recently added 7,390 BTC to its holdings through a similar funding mechanism.

This post Semler Scientific Buys Additional $50 Million Worth of Bitcoin first appeared on Bitcoin Magazine and is written by Vivek Sen.

-

@ cae03c48:2a7d6671

2025-05-25 18:00:59

@ cae03c48:2a7d6671

2025-05-25 18:00:59Bitcoin Magazine

The Bitcoin Mempool: Relay Network DynamicsIn the last Mempool article, I went over the different kinds of relay policy filters, why they exist, and the incentives that ultimately decide how effective each class of filter is at preventing the confirmation of different classes of transactions. In this piece I’ll be looking at the dynamics of the relay network when some nodes on the network are running different relay policies compared to other nodes.

All else being equal, when nodes on the network are running homogenous relay policies in their mempools, all transactions should propagate across the entire network given that they pay the minimum feerate necessary not to be evicted from a node’s mempool during times of large transaction backlogs. This changes when different nodes on the network are running heterogenous policies.

The Bitcoin relay network operates on a best effort basis, using what is called a flood-fill architecture. This means that when a transaction is received by one node, it is forwarded to every other node it is connected to except the one that it received the transaction from. This is a highly inefficient network architecture, but in the context of a decentralized system it provides a high degree of guarantee that the transaction will eventually reach its intended destination, the miners.

Introducing filters in a node’s relay policy to restrict the relaying of otherwise valid transactions in theory introduces friction to the propagation of that transaction, and degrades the reliability of the network’s ability to perform this function. In practice, things aren’t that simple.

How Much Friction Prevents Propagation

Let’s look at a simplified example of different network node compositions. In the following graphics blue nodes represent ones that will propagate some arbitrary class of consensus valid transactions, and red nodes represent ones that will not propagate those transactions. The collective set of miners is denoted in the center as a simple representation of where transacting users ultimately want their transactions to wind up so as to eventually be confirmed in the blockchain.

This is a model of the network in which the nodes refusing to propagate these transactions are a clear minority. As you can clearly see, any node on the network that accepts them has a clear path to relay them to the miners. The two nodes attempting to restrict the transactions propagation across the network have no effect on their eventual receipt by miners’ nodes.

In this diagram, you can see that almost half of the example network is instituting filtering policies for this class of transactions. Despite this, only part of the network that propagates these transactions is cut off from a path to miners. The rest of the nodes not filtering still have a clear path to miners. This has introduced some degree of friction for a subset of users, but the others can still freely engage in propagating these transactions.

Even for the users that are affected by filtering nodes, only a single connection to the rest of the network nodes that are not cut off from miners (or a direct connection to a miner) is necessary in order for that friction to be removed. If the real relay network were to have a similar composition to this example, all it would take is a single new connection to alleviate the problem.

In this scenario, only a tiny minority of the network is actually propagating these transactions. The rest of the network is engaging in filtering policies to prevent their propagation. Even in this case however, those nodes that are not filtering still have a clear path to propagate them to miners.

Only this tiny minority of non-filtering nodes is necessary in order to ensure their eventual propagation to miners. Preferential peering logic, i.e. functionality to ensure that your node prefers peers who implement the same software version or relay policies. These types of solutions can guarantee that peers who will propagate something to others won’t find each other and maintain connections amongst themselves across the network.

The Tolerant Minority

As you can see looking at these different examples, even in the face of an overwhelming majority of the public network engaging in filtering of a specific class of transactions, all that is necessary for them to successfully propagate across the network to miners is a small minority of the network to propagate and relay them.

These nodes will essentially, through whatever technical mechanism, create a “sub-network” within the larger public relay network in order to guarantee that there are viable paths from users engaging in these types of transactions to the miners willing to include them in their blocks.

There is essentially nothing that can be done to counter this dynamic except to engage in a sybil attack against all of these nodes, and sybil attacks only need a single honest connection in order to be completely defeated. As well, an honest node creating a very large number of connections with other nodes on the network can raise the cost of such a sybil attack exorbitantly. The more connections it creates, the more sybil nodes must be spun up in order to consume all of its connection slots.

What If There Is No Minority?

So what if there is no Tolerant Minority? What will happen to this class of transactions in that case?

If users still want to make them and pay fees to miners for them, they will be confirmed. Miners will simply set up an API. The role of miners is to confirm transactions, and the reason they do so is to maximize profit. Miners are not selfless entities, or morally or ideologically motivated, they are a business. They exist to make money.

If users exist that are willing to pay them money for a certain type of transaction, and the entirety of the public relay network is refusing to propagate those transactions to miners in order to include them in blocks, miners will create another way for users to submit those transactions to them.

It is simply the rational move to make as a profit motivated actor when customers exist that wish to pay you money.

Relay Policy Is Not A Replacement For Consensus

At the end of the day, relay policy cannot successfully censor transactions if they are consensus valid, users are willing to pay for them, and miners do not have some extenuating circumstances to turn down the fees users are willing to pay (such as causing material damage or harm to nodes on the network, i.e. crashing nodes, propagating blocks that take hours to verify on a consumer PC, etc.).

If some class of transactions is truly seen as undesirable by Bitcoin users and node operators, there is no solution to stopping them from being confirmed in the blockchain short of enacting a consensus change to make them invalid.

If it were possible to simply prevent transactions from being confirmed by filtering policies implemented on the relay network, then Bitcoin would not be censorship resistant.

This post The Bitcoin Mempool: Relay Network Dynamics first appeared on Bitcoin Magazine and is written by Shinobi.

-

@ 47259076:570c98c4

2025-05-25 01:33:57

@ 47259076:570c98c4

2025-05-25 01:33:57When a man meets a woman, they produce another human being.

The biological purpose of life is to reproduce, that's why we have reproductive organs.

However, you can't reproduce if you are dying of starvation or something else.

So you must look for food, shelter and other basic needs.

Once those needs are satisfied, the situation as a whole is more stable and then it is easier to reproduce.

Once another human being is created, you still must support him.

In the animal kingdom, human babies are the ones who take longer to walk and be independent as a whole.

Therefore, in the first years of our lives, we are very dependent on our parents or whoever is taking care of us.

We also have a biological drive for living.

That's why when someone is drowning he will hold on into whatever they can grab with the highest strength possible.

Or when our hand is close to fire or something hot, we remove our hand immediately from the hot thing, without thinking about removing our hand, we just do it.

These are just 2 examples, there are many other examples that show this biological tendency/reflex to keep ourselves alive.

We also have our brain, which we can use to get information/knowledge/ideas/advice from the ether.

In this sense, our brain is just an antenna or radio, and the ether is the signal.

Of course, we are not the radio, we are the signal.

In other words, you are not your body, you are pure consciousness "locked" temporarily in a body.

Because we can act after receiving information from the ether, we can construct and invent new things to make our lives easier.

So far, using only biology as our rule, we can get to the following conclusion: The purpose of life is to live in a safe place, work to get food and reproduce.

Because humans have been evolving in the technological sense, we don't need to hunt for food, we can just go to the market and buy meat.

And for the shelter(house), we just buy it.

Even though you can buy a house, it's still not yours, since the government or any thug can take it from you, but this is a topic for another article.

So, adjusting what I said before in a modern sense, the purpose of life is: Work in a normal job from Monday to Friday, save money, buy a house, buy a car, get a wife and have kids. Keep working until you are old enough, then retire and do nothing for the rest of your life, just waiting for the moment you die.

Happy life, happy ending, right?

No.

There is something else to it, there is another side of the coin.

This is explored briefly by Steve Jobs in this video, but I pretend to go much further than him: https://youtu.be/uf6TzOHO_dk

Let's get to the point now.

First of all, you are alive. This is not normal.

Don't take life for granted.

There is no such a thing as a coincidence. Chance is but a name given for a law that has not been recognized yet.

You are here for a reason.

God is real. All creation starts in the mind.

The mind is the source of all creation.

When the mind of god starts thinking, it records its thoughts into matter through light.

But this is too abstract, let's get to something simple.

Governments exist, correct?

The force behind thinking is desire, without desire there is no creation.

If desired ceased to exist, everything would just vanish in the blink of an eye.

How governments are supported financially?

By taking your money.

Which means, you produce, and they take it.

And you can't go against it without suffering, therefore, you are a slave.

Are you realizing the gravity of the situation?

You are working to keep yourself alive as well as faceless useless men that you don't even know.

Your car must have an identification.

When you are born, you must have an identification.

In brazil, you can't home school your children.

When "your" "country" is in war, you must fight to defend it and give your life.

Countries are limited by imaginary lines.

How many lives have been destroyed in meaningless wars?

You must go to the front-line to defend your masters.

In most countries, you don't have freedom of speech, which means, you can't even express what you think.

When you create a company, you must have an identification and pass through a very bureaucratic process.

The money you use is just imaginary numbers in the screen of a computer or phone.

The money you use is created out of thin air.

By money here, I am referring to fiat money, not bitcoin.

Bitcoin is an alternative to achieve freedom, but this is topic for another article.

Depending on what you want to work on, you must go to college.

If you want to become a doctor, you must spend at least 5 years in an university decorating useless muscle names and bones.

Wisdom is way more important than knowledge.

That's why medical errors are the third leading cause of death in United States of America.

And I'm not even talking about Big Pharma and the "World Health Organization"

You can't even use or sell drugs, your masters don't allow it.

All the money you get, you must explain from where you got it.

Meanwhile, your masters have "black budget" and don't need to explain anything to you, even though everything they do is financed by your money.

In most countries you can't buy a gun, while your masters have a whole army fully armed to the teeth to defend them.

Your masters want to keep you sedated and asleep.

Look at all the "modern" art produced nowadays.

Look at the media, which of course was never created to "inform you".

Your masters even use your body to test their bio-technology, as happened with the covid 19 vaccines.

This is public human testing, there's of course secretive human testing, such as MKUltra and current experiments that happen nowadays that I don't even know.

I can give hundreds of millions of examples, quite literally, but let's just focus in one case, Jeffrey Epstein.

He was a guy who got rich "suddenly" and used his influence and spy skills to blackmail politicians and celebrities through recording them doing acts of pedophilia.

In United States of America, close to one million children a year go missing every year.

Some portion of these children are used in satanic rituals, and the participants of these rituals are individuals from the "high society".

Jeffrey Epstein was just an "employee", he was not the one at the top of the evil hierarchy.

He was serving someone or a group of people that I don't know who they are.

That's why they murdered him.

Why am I saying all of this?

The average person who sleep, work, eat and repeat has no idea all of this is going on.

They have no idea there is a very small group of powerful people who are responsible for many evil damage in the world.

They think the world is resumed in their little routine.

They think their routine is all there is to it.

They don't know how big the world truly is, in both a good and evil sense.

Given how much we produce and all the technology we have, people shouldn't even have to work, things would be almost nearly free.

Why aren't they?

Because of taxes.

This group of people even has access to a free energy device, which would disrupt the world in a magnitude greater than everything we have ever seen in the history of Earth.

That's why MANY people who tried to work in any manifestation of a free energy device have been murdered, or rather, "fell from a window".

How do I know a free energy device exist? This is topic for another article.

So my conclusion is:

We are in hell already. Know thyself. Use your mind for creation, any sort of creation. Do good for the people around you and the people you meet, always give more than you get, try to do your best in everything you set out to do, even if it's a boring or mundane work.

Life is short.

Our body can live no longer than 300 years.

Most people die before 90.

Know thyself, do good to the world while you can.

Wake up!!! Stop being sedated and asleep.

Be conscious.

-

@ cae03c48:2a7d6671

2025-05-25 18:00:49

@ cae03c48:2a7d6671

2025-05-25 18:00:49Bitcoin Magazine

Something is Brewing in Ireland: A Sound Punt Is Released, As Bitcoin Enters The National ConversationFor years, Bitcoin in Ireland has quietly simmered at the grassroots level—discussed in pubs and meetups, debated in Telegram groups, and occasionally splashed across headlines with predictable suspicion. But recently, the temperature is beginning to rise. With the release of “A Sound Punt: The Case for Ireland’s Interest in Bitcoin” by Bitcoin Network Ireland (BNI), and a weekend that sees both the Bitcoin Ireland Conference and Aontú’s Ard Fheis, it’s clear momentum is building on the Emerald Isle.

A Sound Punt: A Paper for the Citizens of Ireland

The new paper, released today by Bitcoin Network Ireland, is a concise, accessible document crafted to cut through the noise and present the merits of Bitcoin to the general public and politicians alike. Its aim is straightforward: provide a rational, jargon-free entry point into why Bitcoin matters, especially in an era of euro debasement and rising living costs.

The name itself is a clever pun—while it is a nod to both “sound money” and Ireland’s former currency, the punt, it also playfully suggests that although the majority of people view it as associated with risk, this may be worth reevaluating. It’s a signal that this is about more than technology: it’s about claiming monetary sovereignty and re-examining what makes money “good” in the first place.

What BNI is attempting to accomplish is bridging an important gap in understanding, helping citizens seeking change and government officials looking for solutions to recognize that sound, stateless money has value for everyone. As Mark Goodwin famously noted, “Bitcoin simply must be for enemies, or it will never be for friends.“—a neutral system that serves all participants regardless of their political stance.

Ireland’s Long and Complicated Relationship With Money

To appreciate the significance of this moment, it’s worth noting that Ireland’s relationship with money has always been distinct from its European neighbors. While the Romans introduced coinage to Britain over a thousand years before it was adopted in Ireland. The native Irish resisted state-issued money, relying instead on barter and bullion well into the second millennium.

In ancient Ireland, the absence of coinage was a testament to a society that was stateless, highly decentralised, and it embraced a polycentric legal system varying between clans. The ideal of that society was that no man in society has rule over others, and even kings could be disposed of if they abused their power.

So it’s perhaps no coincidence that Ireland was the last European society to adopt coinage, as coinage gives power to rulers. Eventually, it was forced upon the land by the English crown in 1601, this period coincided with the final stages of the Nine Years’ War (1594-1603) and the increasing English control over Ireland. To this day, Ireland has never had its own free-floating currency; it has always been tethered to external powers: first the pound sterling, then the European Monetary System, and now the euro under the ECB. So it should come as no coincidence that in recent years, the EU is growing unabated in power and influence over Ireland.

“Give me control over a nation’s currency, and I care not who makes its laws.” — Mayer Amschel Rothschild (1743–1812)

Perhaps, given this historical context, Ireland is uniquely positioned to understand the value of sound, stateless money. Bitcoin represents a return to the monetary independence that preceded state-issued currencies, but with the technological advantages of the digital age. Where ancient Irish kingdoms used market goods that couldn’t be manipulated by distant authorities, Bitcoin offers a modern equivalent: a system that can’t be debased or controlled by any power, whether domestic or foreign.

This historical skepticism toward centrally-controlled currency is resurfacing in the present, as the Irish state and its citizens face a new wave of economic uncertainty via euro debasement and tariffs. Geopolitical and economic tensions have rarely felt less stable. Tariff disputes, renewed questions over Ireland’s foreign direct-investment model, and potential tech and pharma layoffs are sure to sharpen the focus on sovereignty and resilience. The release of “A Sound Punt” is timely, inviting the nation to once again question the wisdom of tying its fortunes to distant monetary authorities.

A Political Crossroads

Coinciding with the release of “A Sound Punt,” Dr. Niall Burke—a respected academic and BNI member—will be putting forward two motions at the Aontú Ard Fheis (party conference). Aontú, the party that saw the largest surge in votes in the last general election, has shown itself to be receptive to Bitcoin and is opening its doors to conversations that, until recently, were relegated to the margins. That Bitcoin motions are being presented and accepted at a major party conference is a marker of how the conversation is turning.