-

@ b1ddb4d7:471244e7

2025-06-03 21:01:33

@ b1ddb4d7:471244e7

2025-06-03 21:01:33Bitcoin FilmFest (BFF25) returns to Warsaw for its third edition, blending independent cinema—from feature films and commercials to AI-driven experimental visuals—with education and entertainment.

Hundreds of attendees from around the world will gather for three days of screenings, discussions, workshops, and networking at the iconic Kinoteka Cinema (PKiN), the same venue that hosted the festival’s first two editions in March 2023 and April 2024.

This year’s festival, themed “Beyond the Frame,” introduces new dimensions to its program, including an extra day on May 22 to celebrate Bitcoin Pizza Day, the first real-world bitcoin transaction, with what promises to be one of Europe’s largest commemorations of this milestone.

BFF25 bridges independent film, culture, and technology, with a bold focus on decentralized storytelling and creative expression. As a community-driven cultural experience with a slightly rebellious spirit, Bitcoin FilmFest goes beyond movies, yet cinema remains at its heart.

Here’s a sneak peek at the lineup, specially curated for movie buffs:

Generative Cinema – A special slot with exclusive shorts and a thematic debate on the intersection of AI and filmmaking. Featured titles include, for example: BREAK FREE, SATOSHI: THE CREATION OF BITCOIN, STRANGE CURRENCIES, and BITCOIN IS THE MYCELIUM OF MONEY, exploring financial independence, traps of the fiat system, and a better future built on sound money.

Generative Cinema – A special slot with exclusive shorts and a thematic debate on the intersection of AI and filmmaking. Featured titles include, for example: BREAK FREE, SATOSHI: THE CREATION OF BITCOIN, STRANGE CURRENCIES, and BITCOIN IS THE MYCELIUM OF MONEY, exploring financial independence, traps of the fiat system, and a better future built on sound money. Upcoming Productions Preview – A bit over an hour-long block of unreleased pilots and works-in-progress. Attendees will get exclusive first looks at projects like FINDING HOME (a travel-meets-personal-journey series), PARALLEL SPACES (a story about alternative communities), and THE LEGEND OF LANDI (a mysterious narrative).

Upcoming Productions Preview – A bit over an hour-long block of unreleased pilots and works-in-progress. Attendees will get exclusive first looks at projects like FINDING HOME (a travel-meets-personal-journey series), PARALLEL SPACES (a story about alternative communities), and THE LEGEND OF LANDI (a mysterious narrative). Freedom-Focused Ads & Campaigns – Unique screenings of video commercials, animations, and visual projects, culminating in “The PoWies” (Proof of Work-ies)—the first ever awards show honoring the best Bitcoin-only awareness campaigns.

Freedom-Focused Ads & Campaigns – Unique screenings of video commercials, animations, and visual projects, culminating in “The PoWies” (Proof of Work-ies)—the first ever awards show honoring the best Bitcoin-only awareness campaigns.To get an idea of what might come up at the event, here, you can preview 6 selected ads combined into two 2 videos:

Open Pitch Competition – A chance for filmmakers to present fresh ideas and unfinished projects to an audience of a dedicated jury, movie fans and potential collaborators. This competitive block isn’t just entertaining—it’s a real opportunity for creators to secure funding and partnerships.

Open Pitch Competition – A chance for filmmakers to present fresh ideas and unfinished projects to an audience of a dedicated jury, movie fans and potential collaborators. This competitive block isn’t just entertaining—it’s a real opportunity for creators to secure funding and partnerships. Golden Rabbit Awards: A lively gala honoring films from the festival’s Official Selection, with awards in categories like Best Feature, Best Story, Best Short, and Audience Choice.

Golden Rabbit Awards: A lively gala honoring films from the festival’s Official Selection, with awards in categories like Best Feature, Best Story, Best Short, and Audience Choice.BFF25 Main Screenings

Sample titles from BFF25’s Official Selection:

REVOLUCIÓN BITCOIN – A documentary by Juan Pablo, making its first screening outside the Spanish-speaking world in Warsaw this May. Three years of important work, 80 powerful minutes to experience. The film explores Bitcoin’s impact across Argentina, Colombia, Mexico, El Salvador, and Spain through around 40 diverse perspectives. Screening in Spanish with English subtitles, followed by a Q&A with the director.

REVOLUCIÓN BITCOIN – A documentary by Juan Pablo, making its first screening outside the Spanish-speaking world in Warsaw this May. Three years of important work, 80 powerful minutes to experience. The film explores Bitcoin’s impact across Argentina, Colombia, Mexico, El Salvador, and Spain through around 40 diverse perspectives. Screening in Spanish with English subtitles, followed by a Q&A with the director. UNBANKABLE – Luke Willms’ directorial debut, drawing from his multicultural roots and his father’s pioneering HIV/AIDS research. An investigative documentary based on Luke’s journeys through seven African countries, diving into financial experiments and innovations—from mobile money and digital lending to Bitcoin—raising smart questions and offering potential lessons for the West. Its May appearance at BFF25 marks its largest European event to date, following festival screenings and nominations across multiple continents over the past year.

UNBANKABLE – Luke Willms’ directorial debut, drawing from his multicultural roots and his father’s pioneering HIV/AIDS research. An investigative documentary based on Luke’s journeys through seven African countries, diving into financial experiments and innovations—from mobile money and digital lending to Bitcoin—raising smart questions and offering potential lessons for the West. Its May appearance at BFF25 marks its largest European event to date, following festival screenings and nominations across multiple continents over the past year. HOTEL BITCOIN – A Spanish comedy directed by Manuel Sanabria and Carlos “Pocho” Villaverde. Four friends, 4,000 bitcoins , and one laptop spark a chaotic adventure of parties, love, crime, and a dash of madness. Exploring sound money, value, and relationships through a twisting plot. The film premiered at the Tarazona and Moncayo Comedy Film Festival in August 2024. Its Warsaw screening at BFF25 (in Spanish with English subtitles) marks its first public showing outside the Spanish-speaking world.

HOTEL BITCOIN – A Spanish comedy directed by Manuel Sanabria and Carlos “Pocho” Villaverde. Four friends, 4,000 bitcoins , and one laptop spark a chaotic adventure of parties, love, crime, and a dash of madness. Exploring sound money, value, and relationships through a twisting plot. The film premiered at the Tarazona and Moncayo Comedy Film Festival in August 2024. Its Warsaw screening at BFF25 (in Spanish with English subtitles) marks its first public showing outside the Spanish-speaking world.Check out trailers for this year’s BFF25 and past editions on YouTube.

Tickets & Info:

- Detailed program and tickets are available at bitcoinfilmfest.com/bff25.

- Stay updated via the festival’s official channels (links provided on the website).

- Use ‘LN-NEWS’ to get 10% of tickets

-

@ 7f6db517:a4931eda

2025-06-03 22:01:54

@ 7f6db517:a4931eda

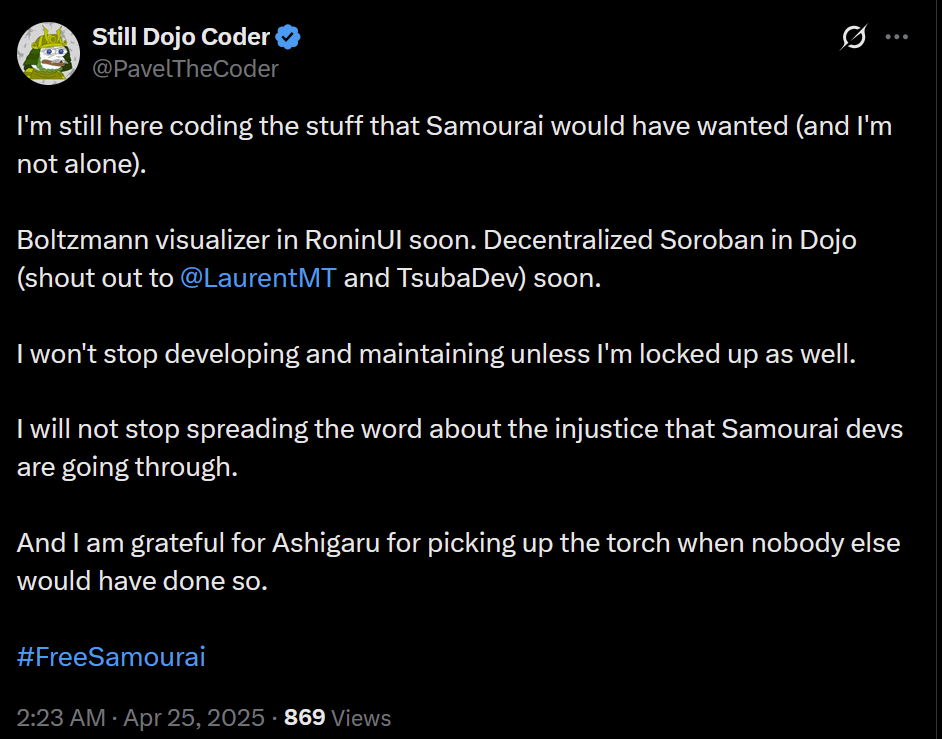

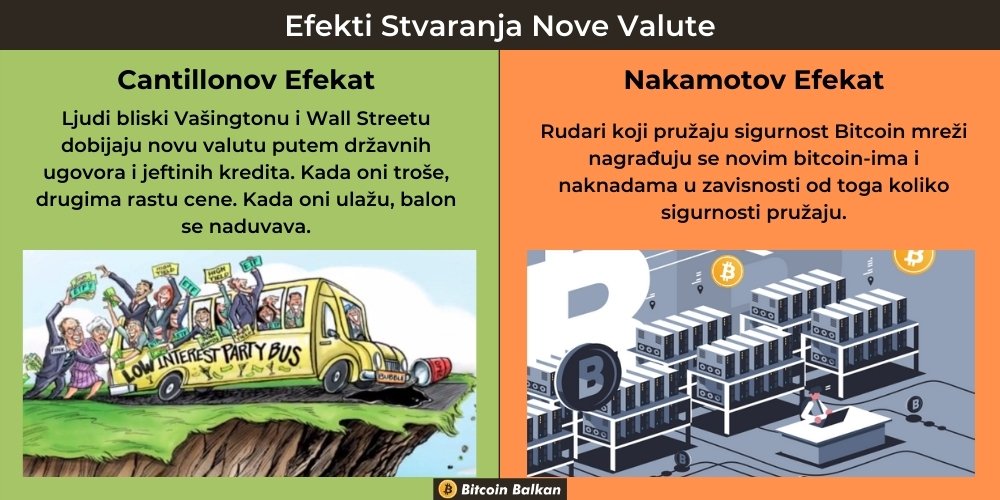

2025-06-03 22:01:54Will not live in a pod.

Will not eat the bugs.

Will not get the chip.

Will not get a blue check.

Will not use CBDCs.Live Free or Die.

Why did Elon buy twitter for $44 Billion? What value does he see in it besides the greater influence that undoubtedly comes with controlling one of the largest social platforms in the world? We do not need to speculate - he made his intentions incredibly clear in his first meeting with twitter employees after his takeover - WeChat of the West.

To those that do not appreciate freedom, the value prop is clear - WeChat is incredibly powerful and successful in China.

To those that do appreciate freedom, the concern is clear - WeChat has essentially become required to live in China, has surveillance and censorship integrated at its core, and if you are banned from the app your entire livelihood is at risk. Employment, housing, payments, travel, communication, and more become extremely difficult if WeChat censors determine you have acted out of line.

The blue check is the first step in Elon's plan to bring the chinese social credit score system to the west. Users who verify their identity are rewarded with more reach and better tools than those that do not. Verified users are the main product of Elon's twitter - an extensive database of individuals and complete control of the tools he will slowly get them to rely on - it is easier to monetize cattle than free men.

If you cannot resist the temptation of the blue check in its current form you have already lost - what comes next will be much darker. If you realize the need to resist - freedom tech provides us options.

If you found this post helpful support my work with bitcoin.

-

@ dfa02707:41ca50e3

2025-06-03 22:01:52

@ dfa02707:41ca50e3

2025-06-03 22:01:52Contribute to keep No Bullshit Bitcoin news going.

- The latest firmware updates for COLDCARD devices introduce two major features: COLDCARD Co-sign (CCC) and Key Teleport between two COLDCARD Q devices using QR codes and/or NFC with a website.

What's new

- COLDCARD Co-Sign: When CCC is enabled, a second seed called the Spending Policy Key (Key C) is added to the device. This seed works with the device's Main Seed and one or more additional XPUBs (Backup Keys) to form 2-of-N multisig wallets.

- The spending policy functions like a hardware security module (HSM), enforcing rules such as magnitude and velocity limits, address whitelisting, and 2FA authentication to protect funds while maintaining flexibility and control, and is enforced each time the Spending Policy Key is used for signing.

- When spending conditions are met, the COLDCARD signs the partially signed bitcoin transaction (PSBT) with the Main Seed and Spending Policy Key for fund access. Once configured, the Spending Policy Key is required to view or change the policy, and violations are denied without explanation.

"You can override the spending policy at any time by signing with either a Backup Key and the Main Seed or two Backup Keys, depending on the number of keys (N) in the multisig."

-

A step-by-step guide for setting up CCC is available here.

-

Key Teleport for Q devices allows users to securely transfer sensitive data such as seed phrases (words, xprv), secure notes and passwords, and PSBTs for multisig. It uses QR codes or NFC, along with a helper website, to ensure reliable transmission, keeping your sensitive data protected throughout the process.

- For more technical details, see the protocol spec.

"After you sign a multisig PSBT, you have option to “Key Teleport” the PSBT file to any one of the other signers in the wallet. We already have a shared pubkey with them, so the process is simple and does not require any action on their part in advance. Plus, starting in this firmware release, COLDCARD can finalize multisig transactions, so the last signer can publish the signed transaction via PushTX (NFC tap) to get it on the blockchain directly."

- Multisig transactions are finalized when sufficiently signed. It streamlines the use of PushTX with multisig wallets.

- Signing artifacts re-export to various media. Users are now provided with the capability to export signing products, like transactions or PSBTs, to alternative media rather than the original source. For example, if a PSBT is received through a QR code, it can be signed and saved onto an SD card if needed.

- Multisig export files are signed now. Public keys are encoded as P2PKH address for all multisg signature exports. Learn more about it here.

- NFC export usability upgrade: NFC keeps exporting until CANCEL/X is pressed.

- Added Bitcoin Safe option to Export Wallet.

- 10% performance improvement in USB upload speed for large files.

- Q: Always choose the biggest possible display size for QR.

Fixes

- Do not allow change Main PIN to same value already used as Trick PIN, even if Trick PIN is hidden.

- Fix stuck progress bar under

Receiving...after a USB communications failure. - Showing derivation path in Address Explorer for root key (m) showed double slash (//).

- Can restore developer backup with custom password other than 12 words format.

- Virtual Disk auto mode ignores already signed PSBTs (with “-signed” in file name).

- Virtual Disk auto mode stuck on “Reading…” screen sometimes.

- Finalization of foreign inputs from partial signatures. Thanks Christian Uebber!

- Temporary seed from COLDCARD backup failed to load stored multisig wallets.

Destroy Seedalso removes all Trick PINs from SE2.Lock Down Seedrequires pressing confirm key (4) to execute.- Q only: Only BBQr is allowed to export Coldcard, Core, and pretty descriptor.

-

@ b1ddb4d7:471244e7

2025-06-03 21:01:29

@ b1ddb4d7:471244e7

2025-06-03 21:01:29When Sergei talks about bitcoin, he doesn’t sound like someone chasing profits or followers. He sounds like someone about to build a monastery in the ruins.

While the mainstream world chases headlines and hype, Sergei shows up in local meetups from Sacramento to Cleveland, mentors curious minds, and shares what he knows is true – hoping that, with the right spark, someone will light their own way forward.

We interviewed Sergei to trace his steps: where he started, what keeps him going, and why teaching bitcoin is far more than explaining how to set up a node – it’s about reaching the right minds before the noise consumes them. So we began where most journeys start: at the beginning.

First Steps

- So, where did it all begin for you and what made you stay curious?

I first heard about bitcoin from a friend’s book recommendation, American Kingpin, the book about Silk Road (online drug marketplace). He is still not a true bitcoiner, although I helped him secure private keys with some bitcoin.

I was really busy at the time – focused on my school curriculum, running a 7-bedroom Airbnb, and working for a standardized test prep company. Bitcoin seemed too technical for me to explore, and the pace of my work left no time for it.

After graduating, while pursuing more training, I started playing around with stocks and maximizing my savings. Passive income seemed like the path to early retirement, as per the promise of the FIRE movement (Financial Independence, Retire Early). I mostly followed the mainstream news and my mentor’s advice – he liked preferred stocks at the time.

I had some Coinbase IOUs and remember sending bitcoin within the Coinbase ledger to a couple friends. I also recall the 2018 crash; I actually saw the legendary price spike live but couldn’t benefit because my funds were stuck amidst the frenzy. I withdrew from that investment completely for some time. Thankfully, my mentor advised to keep en eye on bitcoin.

Around late 2019, I started DCA-ing cautiously. Additionally, my friend and I were discussing famous billionaires, and how there was no curriculum for becoming a billionaire. So, I typed “billionaires” into my podcast app, and landed on We Study Billionaires podcast.

That’s where I kept hearing Preston Pysh mention bitcoin, before splitting into his own podcast series, Bitcoin Fundamentals. I didn’t understand most of the terminology of stocks, bonds, etc, yet I kept listening and trying to absorb it thru repetition. Today, I realize all that financial talk was mostly noise.

When people ask me for a technical explanation of fiat, I say: it’s all made up, just like the fiat price of bitcoin! Starting in 2020, during the so-called pandemic, I dove deeper. I religiously read Bitcoin Magazine, scrolled thru Bitcoin Twitter, and joined Simply Bitcoin Telegram group back when DarthCoin was an admin.

DarthCoin was my favorite bitcoiner – experienced, knowledgeable, and unapologetic. Watching him shift from rage to kindness, from passion to despair, gave me a glimpse at what a true educator’s journey would look like.

The struggle isn’t about adoption at scale anymore. It’s about reaching the few who are willing to study, take risks, and stay out of fiat traps. The vast majority won’t follow that example – not yet at least… if I start telling others the requirements for true freedom and prosperity, they would certainly say “Hell no!”

- At what point did you start teaching others, and why?

After college, I helped teach at a standardized test preparation company, and mentored some students one-on-one. I even tried working at a kindergarten briefly, but left quickly; Babysitting is not teaching.

What I discovered is that those who will succeed don’t really need my help – they would succeed with or without me, because they already have the inner drive.

Once you realize your people are perishing for lack of knowledge, the only rational thing to do is help raise their level of knowledge and understanding. That’s the Great Work.

I sometimes imagine myself as a political prisoner. If that were to happen, I’d probably start teaching fellow prisoners, doctors, janitors, even guards. In a way we already live in an open-air prison, So what else is there to do but teach, organize, and conspire to dismantle the Matrix?

Building on Bitcoin

- You hosted some in-person meetups in Sacramento. What did you learn from those?

My first presentation was on MultiSig storage with SeedSigner, and submarine swaps through Boltz.exchange.

I realized quickly that I had overestimated the group’s technical background. Even the meetup organizer, a financial advisor, asked, “How is anyone supposed to follow these steps?” I responded that reading was required… He decided that Unchained is an easier way.

At a crypto meetup, I gave a much simpler talk, outlining how bitcoin will save the world, based on a DarthCoin’s guide. Only one person stuck around to ask questions – a man who seemed a little out there, and did not really seem to get the message beyond the strength of cryptographic security of bitcoin.

Again, I overestimated the audience’s readiness. That forced me to rethink my strategy. People are extremely early and reluctant to study.

- Now in Ohio, you hold sessions via the Orange Pill App. What’s changed?

My new motto is: educate the educators. The corollary is: don’t orange-pill stupid normies (as DarthCoin puts it).

I’ve shifted to small, technical sessions in order to raise a few solid guardians of this esoteric knowledge who really get it and can carry it forward.

The youngest attendee at one of my sessions is a newborn baby – he mostly sleeps, but maybe he still absorbs some of the educational vibes.

- How do local groups like Sactown and Cleveland Bitcoiners influence your work?

Every meetup reflects its local culture. Sacramento and Bay Area Bitcoiners, for example, do camping trips – once we camped through a desert storm, shielding our burgers from sand while others went to shoot guns.

Cleveland Bitcoiners are different. They amass large gatherings. They recently threw a 100k party. They do a bit more community outreach. Some are curious about the esoteric topics such as jurisdiction, spirituality, and healthful living.

I have no permanent allegiance to any state, race, or group. I go where I can teach and learn. I anticipate that in my next phase, I’ll meet Bitcoiners so advanced that I’ll have to give up my fiat job and focus full-time on serious projects where real health and wealth are on the line.

Hopefully, I’ll be ready. I believe the universe always challenges you exactly to your limit – no less, no more.

- What do people struggle with the most when it comes to technical education?

The biggest struggle isn’t technical – it’s a lack of deep curiosity. People ask “how” and “what” – how do I set up a node, what should one do with the lightning channels? But very few ask “why?”

Why does on-chain bitcoin not contribute to the circular economy? Why is it essential to run Lightning? Why did humanity fall into mental enslavement in the first place?

I’d rather teach two-year-olds who constantly ask “why” than adults who ask how to flip a profit. What worries me most is that most two-year-olds will grow up asking state-funded AI bots for answers and live according to its recommendations.

- One Cleveland Bitcoiner shows up at gold bug meetups. How valuable is face-to-face education?

I don’t think the older generation is going to reverse the current human condition. Most of them have been under mind control for too long, and they just don’t have the attention span to study and change their ways.

They’re better off stacking gold and helping fund their grandkids’ education. If I were to focus on a demographic, I’d go for teenagers – high school age – because by college, the indoctrination is usually too strong, and they’re chasing fiat mastery.

As for the gold bug meetup? Perhaps one day I will show up with a ukulele to sing some bitcoin-themed songs. Seniors love such entertainment.

- How do you choose what to focus on in your sessions, especially for different types of learners?

I don’t come in with a rigid agenda. I’ve collected a massive library of resources over the years and never stopped reading. My browser tab and folder count are exploding.

At the meetup, people share questions or topics they’re curious about, then I take that home, do my homework, and bring back a session based on those themes. I give them the key takeaways, plus where to dive deeper.

Most people won’t – or can’t – study the way I do, and I expect attendees to put in the work. I suspect that it’s more important to reach those who want to learn but don’t know how, the so-called nescient (not knowing), rather than the ignorant.

There are way too many ignorant bitcoiners, so my mission is to find those who are curious what’s beyond the facade of fake reality and superficial promises.

That naturally means that fewer people show up, and that’s fine. I’m not here for the crowds; I’m here to educate the educators. One bitcoiner who came decided to branch off into self-custody sessions and that’s awesome. Personally, I’m much more focused on Lightning.

I want to see broader adoption of tools like auth, sign-message, NWC, and LSPs. Next month, I’m going deep into eCash solutions, because let’s face it – most newcomers won’t be able to afford their own UTXO or open a lightning channel; additionally, it has to be fun and easy for them to transact sats, otherwise they won’t do it. Additionally, they’ll need to rely on

-

@ dfa02707:41ca50e3

2025-06-03 22:01:51

@ dfa02707:41ca50e3

2025-06-03 22:01:51Headlines

- Twenty One Capital is set to launch with over 42,000 BTC in its treasury. This new Bitcoin-native firm, backed by Tether and SoftBank, is planned to go public via a SPAC merger with Cantor Equity Partners and will be led by Jack Mallers, co-founder and CEO of Strike. According to a report by the Financial Times, the company aims to replicate the model of Michael Saylor with his company, MicroStrategy.

- Florida's SB 868 proposes a backdoor into encrypted platforms. The bill and its House companion have both passed through their respective committees and are headed to a full vote. If enacted, SB 868 would require social media companies to decrypt teens' private messages, ban disappearing messages, allow unrestricted parental access to private messages, and likely eliminate encryption for all minors altogether.

- Paul Atkins has officially assumed the role of the 34th Chairman of the US Securities and Exchange Commission (SEC). This is a return to the agency for Atkins, who previously served as an SEC Commissioner from 2002 to 2008 under the George W. Bush administration. He has committed to advancing the SEC’s mission of fostering capital formation, safeguarding investors, and ensuring fair and efficient markets.

- Solosatoshi.com has sold over 10,000 open-source miners, adding more than 10 PH of hashpower to the Bitcoin network.

"Thank you, Bitaxe community. OSMU developers, your brilliance built this. Supporters, your belief drives us. Customers, your trust powers 10,000+ miners and 10PH globally. Together, we’re decentralizing Bitcoin’s future. Last but certainly not least, thank you@skot9000 for not only creating a freedom tool, but instilling the idea into thousands of people, that Bitcoin mining can be for everyone again," said the firm on X.

- OCEAN's DATUM has found 100 blocks. "Over 65% of OCEAN’s miners are using DATUM, and that number is growing every day. This means block template construction is making its way back into the hands of the miners, which is not only the most profitable for miners on OCEAN but also one of the best things for Bitcoin," stated the mining pool.

Source: orangesurf

- Arch Labs has secured $13 million to develop "ArchVM" and integrate smart-contract functionality with Bitcoin. The funding round, valuing the company at $200 million, was led by Pantera Capital, as announced on Tuesday.

- Tesla still holds nearly $1 billion in bitcoin. According to the automaker's latest earnings report, the firm reported digital asset holdings worth $951 million as of March 31.

- The European Central Bank is pushing for amendments to the European Union's Markets in Crypto Assets legislation (MiCA), just months after its implementation. According to Politico's report on Tuesday, the ECB is concerned that U.S. support for cryptocurrency, particularly stablecoins, could cause economic harm to the 27-nation bloc.

- TABConf 2025 is scheduled to take place from October 13-16, 2025. This prominent technical Bitcoin conference is dedicated to community building, education, and developer support, and it is set to return in October. Get your tickets here.

- Kaduna Lightning Development Bootcamp. From May 14th to 17th, the Bitcoin Lightning Developer Bootcamp will take place in Kaduna, Nigeria. Thisevent offers four dynamic days of coding, learning, and networking. Organized by Africa Free Routing and supported by Btrust, Tether, and African Bitcoiners, this bootcamp is designed as a gateway for African developers eager to advance their skills in Bitcoin and Lightning development. Apply here.

Source: African Bitcoiners.

Use the tools

- Core Lightning (CLN) v25.02.2 as been released to fix a broken Docker image. The issue was caused by an SQLite version that did not support an advanced query.

- Blitz wallet v0.4.4-beta introduces several updates and improvements, including the prevention of duplicate ecash payments, fixes for background ecash invoice handling, the ability for users to send payments to BOLT12 invoices from their Liquid balance, support for Blink QR codes, a lowered minimum amount for Lightning-to-Liquid payments to 100 sats, the option to initiate a node sync via a swipe gesture on the wallet's home screen, and the introduction of opt-in or opt-out functionality for newly implemented crash analytics via settings.

- Utreexo v0.5.0, a hash-based dynamic accumulator, is now available.

- Specter v2.1.1 is now available on StartOS. "This update brings compatibility with Bitcoin Core v28 and incorporates several upstream improvements," said developer Alex71btc.

- ESP-Miner (AxeOS) v2.7.0b1 is now available for testing.

- NodeGuard v0.16.1, a treasury management solution for Lightning nodes, has been released.

- The latest stacker.news updates include prompts to add a receiving wallet when posting or making comments (for new users), an option to randomize poll choices, improved URL search, and a few other enhancements. A bug fix for territories created after 9/19/24 has been implemented to reward 70% of their revenue to owners instead of 50%.

Other stuff

- The April edition of the 256 Foundation's newsletter is now available. It includes the latest mining news, Bitcoin network health updates, project developments, and a tutorial on how to update FutureBit's Apollo 1 to the Apollo 2 software.

- Siggy47 has posted a comprehensive RoboSats guide on stacker.news.

- Learn how to run your own Nostr relay using Citrine and Cloudflare Tunnels by following this step-by-step guide by Dhalism.

- Max Guise has written a Bitkey roadmap update for April 2025.

-

PlebLab has uploaded a video on how to build a Rust wallet with LDK Node by Ben Carman.

-

Do you want more? Subscribe and get No Bullshit GM report straight to your mailbox and No Bullshit Bitcoin on Nostr.

- Feedback or tips? Drop it here.

- #FREESAMOURAI

Sign up for No Bullshit Bitcoin

No Bullshit Bitcoin Is a Bitcoin News Desk Without Ads, Paywalls, or Clickbait.

Subscribe .nc-loop-dots-4-24-icon-o{--animation-duration:0.8s} .nc-loop-dots-4-24-icon-o *{opacity:.4;transform:scale(.75);animation:nc-loop-dots-4-anim var(--animation-duration) infinite} .nc-loop-dots-4-24-icon-o :nth-child(1){transform-origin:4px 12px;animation-delay:-.3s;animation-delay:calc(var(--animation-duration)/-2.666)} .nc-loop-dots-4-24-icon-o :nth-child(2){transform-origin:12px 12px;animation-delay:-.15s;animation-delay:calc(var(--animation-duration)/-5.333)} .nc-loop-dots-4-24-icon-o :nth-child(3){transform-origin:20px 12px} @keyframes nc-loop-dots-4-anim{0%,100%{opacity:.4;transform:scale(.75)}50%{opacity:1;transform:scale(1)}}

Email sent! Check your inbox to complete your signup.

No spam. Unsubscribe anytime.

-

@ da8b7de1:c0164aee

2025-06-03 19:31:32

@ da8b7de1:c0164aee

2025-06-03 19:31:32Lengyelország előrelépése az első atomerőmű építésében

Lengyelország állami nukleáris vállalata, a Polskie Elektrownie Jadrowe (PEJ) és egy amerikai konzorcium – élén a Westinghouse és a Bechtel cégekkel – mérnöki fejlesztési megállapodást kötött. Ez a szerződés kulcsfontosságú lépés az ország első atomerőművének megvalósítása felé, lehetővé téve a részletes mérnöki és helyszínspecifikus munkák megkezdését. A lengyel kormány ezt mérföldkőnek tekinti az energiaszuverenitás és a dekarbonizáció felé vezető úton.

Amerikai politika: lendület az új nukleáris technológiáknak

Az Egyesült Államok kormánya elnöki rendeletet adott ki, amely reformokat vezet be a nukleáris reaktorok tesztelésében az Energiaügyi Minisztériumnál. A cél az új generációs reaktorok – köztük mikroreaktorok és kis moduláris reaktorok (SMR-ek) – fejlesztésének és engedélyezésének felgyorsítása, valamint a környezetvédelmi vizsgálatok egyszerűsítése. A rendelet legalább három új reaktor kritikus üzembe helyezését célozza meg 2026 júliusáig, támogatva ezzel az ipari alkalmazások széles körét, például adatközpontokat vagy hidrogéntermelést. Az intézkedés célja, hogy az USA visszaszerezze vezető szerepét a nukleáris innovációban, és csökkentse a korábbi években felhalmozódott engedélyezési akadályokat.

Kis moduláris reaktorok (SMR) fejlesztése világszerte

Az SMR-szektorban világszerte jelentős előrelépések történtek: - Az amerikai Tennessee Valley Authority (TVA) benyújtotta az első építési kérelmet egy GE Hitachi BWRX-300 SMR-re a Clinch River telephelyen. - Kanadában az Ontario Power Generation engedélyt kapott az első, négy tervezett SMR megépítésének megkezdésére a Darlington telephelyen. - Belgium és Brazília innovatív SMR-technológiákat vizsgál, köztük ólom-hűtésű reaktorokat és nemzetközi együttműködéseket. - Olyan technológiai óriások, mint a Google, az USA-ban korai fázisú fejlett nukleáris projektekbe fektetnek, ami a magánszektor növekvő érdeklődését mutatja.

Globális ipari és pénzügyi támogatás a nukleáris bővítéshez

Széles körű koalíció – köztük olyan nagyvállalatok, mint az Amazon, Google, Meta, Dow – és pénzügyi intézmények kötelezték el magukat amellett, hogy 2050-re megháromszorozzák a globális nukleáris kapacitást. Ez összhangban van az ENSZ klímacsúcsain tett vállalásokkal, ahol már 31 ország támogatja a nukleáris energia megháromszorozását a nettó zéró kibocsátási célok eléréséhez. Az amerikai kongresszus olyan törvényjavaslatokat készít elő, amelyek lehetővé tennék, hogy a multilaterális fejlesztési bankok – például a Világbank – is finanszírozhassanak nukleáris projekteket, megszüntetve ezzel a korábbi tiltásokat.

Közelgő nemzetközi nukleáris biztonsági gyakorlat

A Nemzetközi Atomenergia-ügynökség (IAEA) készül a ConvEx-3 vészhelyzeti gyakorlatára, amelyet 2025. június 24–25-én Romániában tartanak. A gyakorlat egy súlyos nukleáris vészhelyzetet szimulál a cernavodai atomerőműben, tesztelve a tagállamok és nemzetközi szervezetek felkészültségét és reagálóképességét. A ConvEx-3 a legmagasabb szintű IAEA vészhelyzeti gyakorlat, kulcsszerepet játszik a globális nukleáris biztonság és védelem erősítésében.

Politikai bizonytalanság Dél-Korea nukleáris terveiben

Dél-Korea 2025. június 3-i elnökválasztása hatással lehet az ország nukleáris reneszánszára. A vezető jelölt, Lee Jae-myung kijelentette, hogy „egyelőre” fenntartaná a nukleáris energiát, de hosszabb távon a megújulók felé mozdulna el. Ez bizonytalanságot okoz a koreai nukleáris ipar hazai és exportterveiben, ami kihatással lehet a globális ellátási láncokra és külföldi reaktorprojektekre is.

Iparági trendek és további fejlemények

- Japán új energiastratégiája maximalizálni kívánja a nukleáris energia részarányát, 2040-re mintegy 20%-ot célozva, különös hangsúlyt fektetve a következő generációs reaktorokra és a biztonság növelésére.

- Belgium kormánya és a francia Engie közműcég megállapodott a kulcsfontosságú reaktorok üzemidejének tízéves meghosszabbításáról, ami az európai nukleáris pálfordulás újabb jele.

- Az IAEA és a World Nuclear Association egyaránt növekvő nemzetközi érdeklődésről számol be az SMR-ek és fejlett reaktortechnológiák iránt, új projektek és partnerségek indulnak Ázsiában, Európában és Amerikában.

Források:

world-nuclear-news.org

nucnet.org

iaea.org

world-nuclear.org

govinfo.gov

whitehouse.gov -

@ dfa02707:41ca50e3

2025-06-03 21:02:19

@ dfa02707:41ca50e3

2025-06-03 21:02:19Contribute to keep No Bullshit Bitcoin news going.

- The latest firmware updates for COLDCARD devices introduce two major features: COLDCARD Co-sign (CCC) and Key Teleport between two COLDCARD Q devices using QR codes and/or NFC with a website.

What's new

- COLDCARD Co-Sign: When CCC is enabled, a second seed called the Spending Policy Key (Key C) is added to the device. This seed works with the device's Main Seed and one or more additional XPUBs (Backup Keys) to form 2-of-N multisig wallets.

- The spending policy functions like a hardware security module (HSM), enforcing rules such as magnitude and velocity limits, address whitelisting, and 2FA authentication to protect funds while maintaining flexibility and control, and is enforced each time the Spending Policy Key is used for signing.

- When spending conditions are met, the COLDCARD signs the partially signed bitcoin transaction (PSBT) with the Main Seed and Spending Policy Key for fund access. Once configured, the Spending Policy Key is required to view or change the policy, and violations are denied without explanation.

"You can override the spending policy at any time by signing with either a Backup Key and the Main Seed or two Backup Keys, depending on the number of keys (N) in the multisig."

-

A step-by-step guide for setting up CCC is available here.

-

Key Teleport for Q devices allows users to securely transfer sensitive data such as seed phrases (words, xprv), secure notes and passwords, and PSBTs for multisig. It uses QR codes or NFC, along with a helper website, to ensure reliable transmission, keeping your sensitive data protected throughout the process.

- For more technical details, see the protocol spec.

"After you sign a multisig PSBT, you have option to “Key Teleport” the PSBT file to any one of the other signers in the wallet. We already have a shared pubkey with them, so the process is simple and does not require any action on their part in advance. Plus, starting in this firmware release, COLDCARD can finalize multisig transactions, so the last signer can publish the signed transaction via PushTX (NFC tap) to get it on the blockchain directly."

- Multisig transactions are finalized when sufficiently signed. It streamlines the use of PushTX with multisig wallets.

- Signing artifacts re-export to various media. Users are now provided with the capability to export signing products, like transactions or PSBTs, to alternative media rather than the original source. For example, if a PSBT is received through a QR code, it can be signed and saved onto an SD card if needed.

- Multisig export files are signed now. Public keys are encoded as P2PKH address for all multisg signature exports. Learn more about it here.

- NFC export usability upgrade: NFC keeps exporting until CANCEL/X is pressed.

- Added Bitcoin Safe option to Export Wallet.

- 10% performance improvement in USB upload speed for large files.

- Q: Always choose the biggest possible display size for QR.

Fixes

- Do not allow change Main PIN to same value already used as Trick PIN, even if Trick PIN is hidden.

- Fix stuck progress bar under

Receiving...after a USB communications failure. - Showing derivation path in Address Explorer for root key (m) showed double slash (//).

- Can restore developer backup with custom password other than 12 words format.

- Virtual Disk auto mode ignores already signed PSBTs (with “-signed” in file name).

- Virtual Disk auto mode stuck on “Reading…” screen sometimes.

- Finalization of foreign inputs from partial signatures. Thanks Christian Uebber!

- Temporary seed from COLDCARD backup failed to load stored multisig wallets.

Destroy Seedalso removes all Trick PINs from SE2.Lock Down Seedrequires pressing confirm key (4) to execute.- Q only: Only BBQr is allowed to export Coldcard, Core, and pretty descriptor.

-

@ dfa02707:41ca50e3

2025-06-03 22:01:51

@ dfa02707:41ca50e3

2025-06-03 22:01:51

Good morning (good night?)! The No Bullshit Bitcoin news feed is now available on Moody's Dashboard! A huge shoutout to sir Clark Moody for integrating our feed.

Headlines

- Spiral welcomes Ben Carman. The developer will work on the LDK server and a new SDK designed to simplify the onboarding process for new self-custodial Bitcoin users.

- The Bitcoin Dev Kit Foundation announced new corporate members for 2025, including AnchorWatch, CleanSpark, and Proton Foundation. The annual dues from these corporate members fund the small team of open-source developers responsible for maintaining the core BDK libraries and related free and open-source software (FOSS) projects.

- Strategy increases Bitcoin holdings to 538,200 BTC. In the latest purchase, the company has spent more than $555M to buy 6,556 coins through proceeds of two at-the-market stock offering programs.

- Spar supermarket experiments with Bitcoin payments in Zug, Switzerland. The store has introduced a new payment method powered by the Lightning Network. The implementation was facilitated by DFX Swiss, a service that supports seamless conversions between bitcoin and legacy currencies.

- The Bank for International Settlements (BIS) wants to contain 'crypto' risks. A report titled "Cryptocurrencies and Decentralised Finance: Functions and Financial Stability Implications" calls for expanding research into "how new forms of central bank money, capital controls, and taxation policies can counter the risks of widespread crypto adoption while still fostering technological innovation."

- "Global Implications of Scam Centres, Underground Banking, and Illicit Online Marketplaces in Southeast Asia." According to the United Nations Office on Drugs and Crime (UNODC) report, criminal organizations from East and Southeast Asia are swiftly extending their global reach. These groups are moving beyond traditional scams and trafficking, creating sophisticated online networks that include unlicensed cryptocurrency exchanges, encrypted communication platforms, and stablecoins, fueling a massive fraud economy on an industrial scale.

- Slovenia is considering a 25% capital gains tax on Bitcoin profits for individuals. The Ministry of Finance has proposed legislation to impose this tax on gains from cryptocurrency transactions, though exchanging one cryptocurrency for another would remain exempt. At present, individual 'crypto' traders in Slovenia are not taxed.

- Circle, BitGo, Coinbase, and Paxos plan to apply for U.S. bank charters or licenses. According to a report in The Wall Street Journal, major crypto companies are planning to apply for U.S. bank charters or licenses. These firms are pursuing limited licenses that would permit them to issue stablecoins, as the U.S. Congress deliberates on legislation mandating licensing for stablecoin issuers.

"Established banks, like Bank of America, are hoping to amend the current drafts of [stablecoin] legislation in such a way that nonbanks are more heavily restricted from issuing stablecoins," people familiar with the matter told The Block.

- Charles Schwab to launch spot Bitcoin trading by 2026. The financial investment firm, managing over $10 trillion in assets, has revealed plans to introduce spot Bitcoin trading for its clients within the next year.

Use the tools

- Bitcoin Safe v1.2.3 expands QR SignMessage compatibility for all QR-UR-compatible hardware signers (SpecterDIY, KeyStone, Passport, Jade; already supported COLDCARD Q). It also adds the ability to import wallets via QR, ensuring compatibility with Keystone's latest firmware (2.0.6), alongside other improvements.

- Minibits v0.2.2-beta, an ecash wallet for Android devices, packages many changes to align the project with the planned iOS app release. New features and improvements include the ability to lock ecash to a receiver's pubkey, faster confirmations of ecash minting and payments thanks to WebSockets, UI-related fixes, and more.

- Zeus v0.11.0-alpha1 introduces Cashu wallets tied to embedded LND wallets. Navigate to Settings > Ecash to enable it. Other wallet types can still sweep funds from Cashu tokens. Zeus Pay now supports Cashu address types in Zaplocker, Cashu, and NWC modes.

- LNDg v1.10.0, an advanced web interface designed for analyzing Lightning Network Daemon (LND) data and automating node management tasks, introduces performance improvements, adds a new metrics page for unprofitable and stuck channels, and displays warnings for batch openings. The Profit and Loss Chart has been updated to include on-chain costs. Advanced settings have been added for users who would like their channel database size to be read remotely (the default remains local). Additionally, the AutoFees tool now uses aggregated pubkey metrics for multiple channels with the same peer.

- Nunchuk Desktop v1.9.45 release brings the latest bug fixes and improvements.

- Blockstream Green iOS v4.1.8 has renamed L-BTC to LBTC, and improves translations of notifications, login time, and background payments.

- Blockstream Green Android v4.1.8 has added language preference in App Settings and enables an Android data backup option for disaster recovery. Additionally, it fixes issues with Jade entry point PIN timeout and Trezor passphrase input.

- Torq v2.2.2, an advanced Lightning node management software designed to handle large nodes with over 1000 channels, fixes bugs that caused channel balance to not be updated in some cases and channel "peer total local balance" not getting updated.

- Stack Wallet v2.1.12, a multicoin wallet by Cypher Stack, fixes an issue with Xelis introduced in the latest release for Windows.

- ESP-Miner-NerdQAxePlus v1.0.29.1, a forked version from the NerdAxe miner that was modified for use on the NerdQAxe+, is now available.

- Zark enables sending sats to an npub using Bark.

- Erk is a novel variation of the Ark protocol that completely removes the need for user interactivity in rounds, addressing one of Ark's key limitations: the requirement for users to come online before their VTXOs expire.

- Aegis v0.1.1 is now available. It is a Nostr event signer app for iOS devices.

- Nostash is a NIP-07 Nostr signing extension for Safari. It is a fork of Nostore and is maintained by Terry Yiu. Available on iOS TestFlight.

- Amber v3.2.8, a Nostr event signer for Android, delivers the latest fixes and improvements.

- Nostur v1.20.0, a Nostr client for iOS, adds

-

@ 7f6db517:a4931eda

2025-06-03 22:01:56

@ 7f6db517:a4931eda

2025-06-03 22:01:56

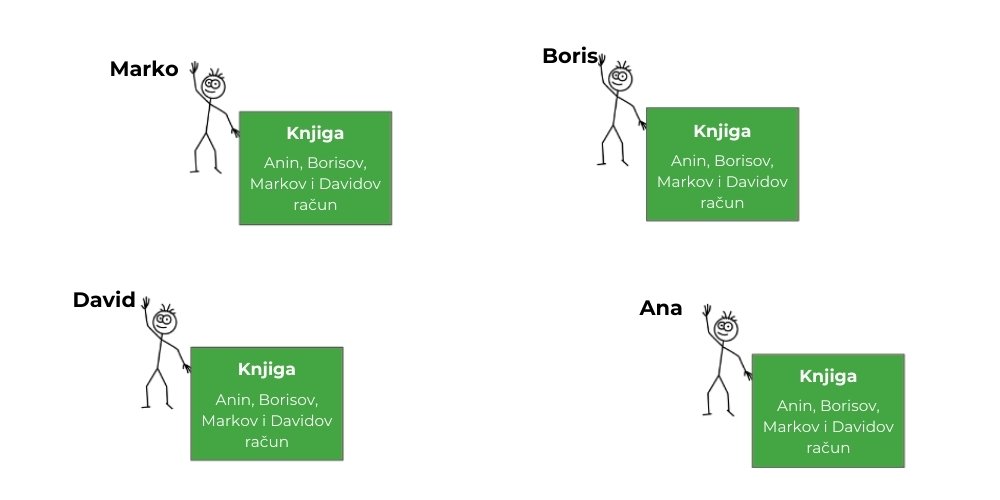

What is KYC/AML?

- The acronym stands for Know Your Customer / Anti Money Laundering.

- In practice it stands for the surveillance measures companies are often compelled to take against their customers by financial regulators.

- Methods differ but often include: Passport Scans, Driver License Uploads, Social Security Numbers, Home Address, Phone Number, Face Scans.

- Bitcoin companies will also store all withdrawal and deposit addresses which can then be used to track bitcoin transactions on the bitcoin block chain.

- This data is then stored and shared. Regulations often require companies to hold this information for a set number of years but in practice users should assume this data will be held indefinitely. Data is often stored insecurely, which results in frequent hacks and leaks.

- KYC/AML data collection puts all honest users at risk of theft, extortion, and persecution while being ineffective at stopping crime. Criminals often use counterfeit, bought, or stolen credentials to get around the requirements. Criminals can buy "verified" accounts for as little as $200. Furthermore, billions of people are excluded from financial services as a result of KYC/AML requirements.

During the early days of bitcoin most services did not require this sensitive user data, but as adoption increased so did the surveillance measures. At this point, most large bitcoin companies are collecting and storing massive lists of bitcoiners, our sensitive personal information, and our transaction history.

Lists of Bitcoiners

KYC/AML policies are a direct attack on bitcoiners. Lists of bitcoiners and our transaction history will inevitably be used against us.

Once you are on a list with your bitcoin transaction history that record will always exist. Generally speaking, tracking bitcoin is based on probability analysis of ownership change. Surveillance firms use various heuristics to determine if you are sending bitcoin to yourself or if ownership is actually changing hands. You can obtain better privacy going forward by using collaborative transactions such as coinjoin to break this probability analysis.

Fortunately, you can buy bitcoin without providing intimate personal information. Tools such as peach, hodlhodl, robosats, azteco and bisq help; mining is also a solid option: anyone can plug a miner into power and internet and earn bitcoin by mining privately.

You can also earn bitcoin by providing goods and/or services that can be purchased with bitcoin. Long term, circular economies will mitigate this threat: most people will not buy bitcoin - they will earn bitcoin - most people will not sell bitcoin - they will spend bitcoin.

There is no such thing as KYC or No KYC bitcoin, there are bitcoiners on lists and those that are not on lists.

If you found this post helpful support my work with bitcoin.

-

@ dfa02707:41ca50e3

2025-06-03 21:02:16

@ dfa02707:41ca50e3

2025-06-03 21:02:16Contribute to keep No Bullshit Bitcoin news going.

- RoboSats v0.7.7-alpha is now available!

NOTE: "This version of clients is not compatible with older versions of coordinators. Coordinators must upgrade first, make sure you don't upgrade your client while this is marked as pre-release."

- This version brings a new and improved coordinators view with reviews signed both by the robot and the coordinator, adds market price sources in coordinator profiles, shows a correct warning for canceling non-taken orders after a payment attempt, adds Uzbek sum currency, and includes package library updates for coordinators.

Source: RoboSats.

- siggy47 is writing daily RoboSats activity reviews on stacker.news. Check them out here.

- Stay up-to-date with RoboSats on Nostr.

What's new

- New coordinators view (see the picture above).

- Available coordinator reviews signed by both the robot and the coordinator.

- Coordinators now display market price sources in their profiles.

Source: RoboSats.

- Fix for wrong message on cancel button when taking an order. Users are now warned if they try to cancel a non taken order after a payment attempt.

- Uzbek sum currency now available.

- For coordinators: library updates.

- Add docker frontend (#1861).

- Add order review token (#1869).

- Add UZS migration (#1875).

- Fixed tests review (#1878).

- Nostr pubkey for Robot (#1887).

New contributors

Full Changelog: v0.7.6-alpha...v0.7.7-alpha

-

@ b1ddb4d7:471244e7

2025-06-03 19:02:16

@ b1ddb4d7:471244e7

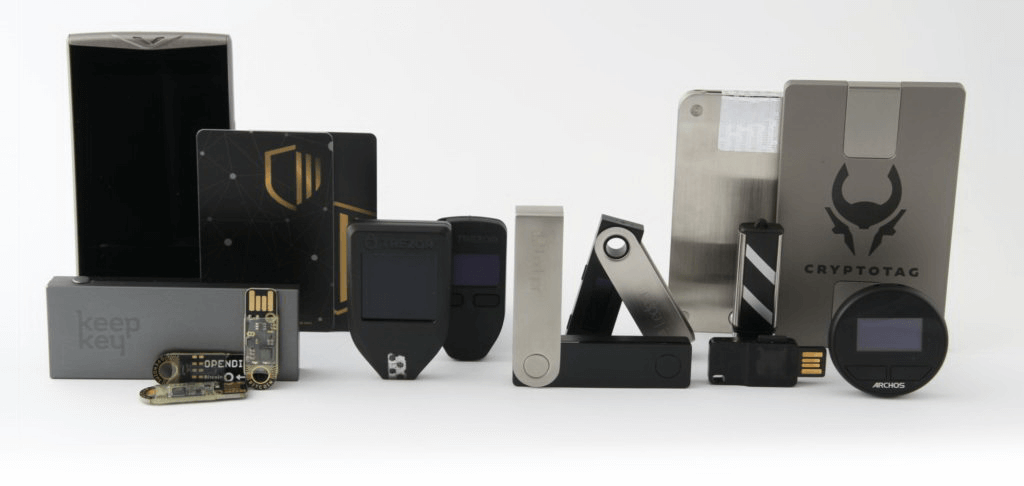

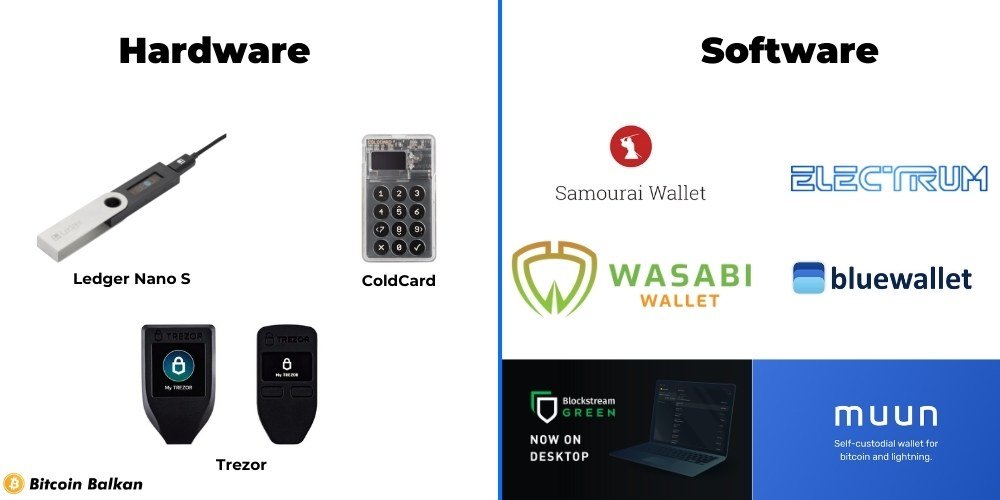

2025-06-03 19:02:16“Not your keys, not your coins” isn’t a slogan—it’s a survival mantra in the age of digital sovereignty.

The seismic collapses of Mt. Gox (2014) and FTX (2022) weren’t anomalies; they were wake-up calls. When $8.7 billion in customer funds vanished with FTX, it exposed the fatal flaw of third-party custody: your bitcoin is only as secure as your custodian’s weakest link.

Yet today, As of early 2025, analysts estimate that between 2.3 million and 3.7 million Bitcoins are permanently lost, representing approximately 11–18% of bitcoin’s fixed maximum supply of 21 million coins, with some reports suggesting losses as high as 4 million BTC. This paradox reveals a critical truth: self-custody isn’t just preferable—it’s essential—but it must be done right.

The Custody Spectrum

Custodial Wallets (The Illusion of Control)

- Rehypothecation Risk: Most platforms lend your bitcoin for yield generation. When Celsius collapsed, users discovered their “held” bitcoin was loaned out in risky strategies.

- Account Freezes: Regulatory actions can lock withdrawals overnight. In 2023, Binance suspended dollar withdrawals for U.S. users citing “partner bank issues,” trapping funds for weeks.

- Data Vulnerability: KYC requirements create honeypots for hackers. The 2024 Ledger breach exposed 270,000 users’ personal data despite hardware security.

True Self-Custody

Self-custody means exclusively controlling your private keys—the cryptographic strings that prove bitcoin ownership. Unlike banks or exchanges, self-custody eliminates:- Counterparty risk (no FTX-style implosions)

- Censorship (no blocked transactions)

- Inflationary theft (no fractional reserve lending)

Conquering the Three Great Fears of Self-Custody

Fear 1: “I’ll Lose Everything If I Make a Mistake”

Reality: Human error is manageable with robust systems:

- Test Transactions: Always send a micro-amount (0.00001 BTC) before large transfers. Verify receipt AND ability to send back.

- Multi-Backup Protocol: Store seed phrases on fireproof/waterproof steel plates (not paper!). Distribute copies geographically—one in a home safe, another with trusted family 100+ miles away.

- SLIP39 Sharding: Split your seed into fragments requiring 3-of-5 shards to reconstruct. No single point of failure.

Fear 2: “Hackers Will Steal My Keys”

Reality: Offline storage defeats remote attacks:

- Hardware Wallets: Devices like Bitkey or Ledger keep keys in “cold storage”—isolated from internet-connected devices. Transactions require physical confirmation.

- Multisig Vaults: Bitvault’s multi-sig system requires attackers compromise multiple locations/devices simultaneously. Even losing two keys won’t forfeit funds.

- Air-Gapped Verification: Use dedicated offline devices for wallet setup. Never type seeds on internet-connected machines.

Fear 3: “My Family Can’t Access It If I Die”

Reality: Inheritance is solvable:

- Dead Man Switches: Bitwarden’s emergency access allows trusted contacts to retrieve encrypted keys after a pre-set waiting period (e.g., 30 days).

- Inheritance Protocols: Bitkey’s inheritance solution shares decryption keys via designated beneficiaries’ emails. Requires multiple approvals to prevent abuse.

- Public Key Registries: Share wallet XPUBs (not private keys!) with heirs. They can monitor balances but not spend, ensuring transparency without risk.

The Freedom Dividend

- Censorship Resistance: Send $10M BTC to a Wikileaks wallet without Visa/Mastercard blocking it.

- Privacy Preservation: Avoid KYC surveillance—non-custodial wallets like Flash require zero ID verification.

- Protocol Access: Participate in bitcoin-native innovations (Lightning Network, DLCs) only possible with self-custodied keys.

- Black Swan Immunity: When Cyprus-style bank bailins happen, your bitcoin remains untouched in your vault.

The Sovereign’s Checklist

- Withdraw from Exchanges: Move all BTC > $1,000 to self-custody immediately.

- Buy Hardware Wallet: Purchase DIRECTLY from manufacturer (no Amazon!) to avoid supply-chain tampering.

- Generate Seed OFFLINE: Use air-gapped device, write phrase on steel—never digitally.

- Test Recovery: Delete wallet, restore from seed before funding.

- Implement Multisig: For > $75k, use Bitvault for 2-of-3 multi-sig setup.

- Create Inheritance Plan: Share XPUBs/SLIP39 shards with heirs + legal documents.

“Self-custody isn’t about avoiding risk—it’s about transferring risk from opaque institutions to transparent, controllable systems you design.”

The Inevitable Evolution: Custody Without Compromise

Emerging solutions are erasing old tradeoffs:

- MPC Wallets: Services like Xapo Bank shatter keys into encrypted fragments distributed globally. No single device holds full keys, defeating physical theft.

- Social Recovery: Ethically designed networks (e.g., Bitkey) let trusted contacts restore access without custodial control.

- Biometric Assurance: Fingerprint reset protocols prevent lockouts from physical injuries.

Lost keys = lost bitcoin. But consider the alternative: entrusting your life savings to entities with proven 8% annual failure rates among exchanges. Self-custody shifts responsibility from hoping institutions won’t fail to knowing your system can’t fail without your consent.

Take action today: Move one coin. Test one recovery. Share one xpub. The path to unchained wealth begins with a single satoshi under your control.

-

@ 7f6db517:a4931eda

2025-06-03 22:01:54

@ 7f6db517:a4931eda

2025-06-03 22:01:54

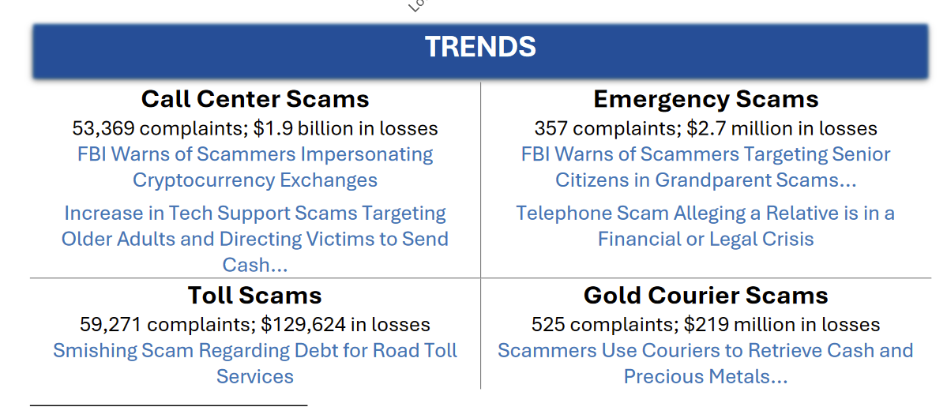

Nostr is an open communication protocol that can be used to send messages across a distributed set of relays in a censorship resistant and robust way.

If you missed my nostr introduction post you can find it here. My nostr account can be found here.

We are nearly at the point that if something interesting is posted on a centralized social platform it will usually be posted by someone to nostr.

We are nearly at the point that if something interesting is posted exclusively to nostr it is cross posted by someone to various centralized social platforms.

We are nearly at the point that you can recommend a cross platform app that users can install and easily onboard without additional guides or resources.

As companies continue to build walls around their centralized platforms nostr posts will be the easiest to cross reference and verify - as companies continue to censor their users nostr is the best censorship resistant alternative - gradually then suddenly nostr will become the standard. 🫡

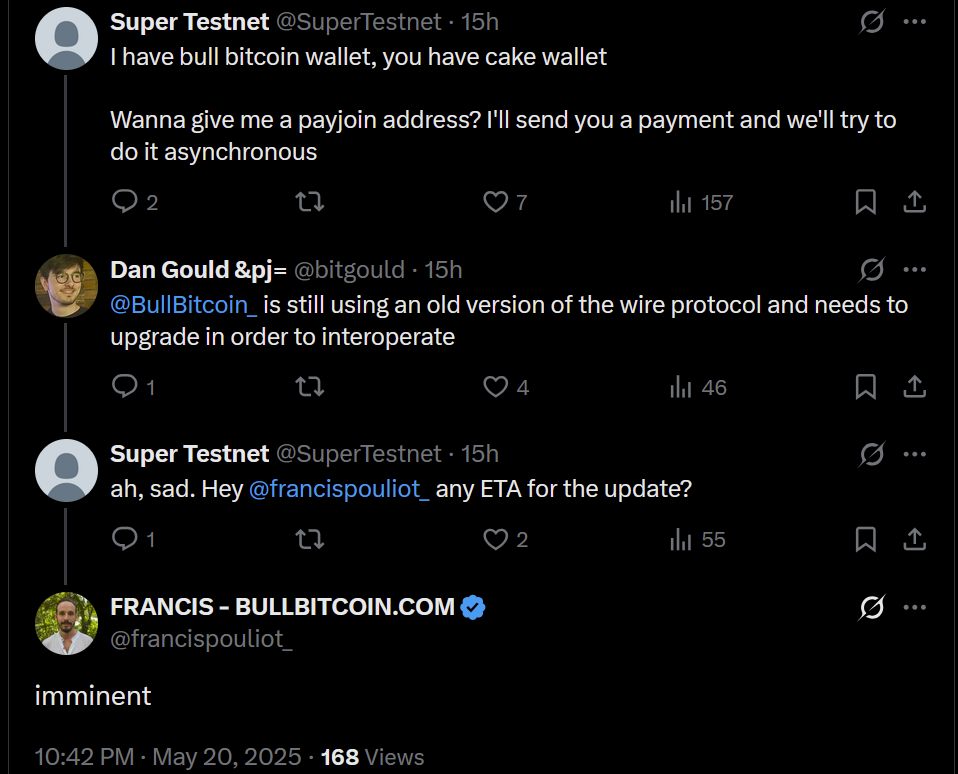

Current Nostr Stats

If you found this post helpful support my work with bitcoin.

-

@ dfa02707:41ca50e3

2025-06-03 22:01:50

@ dfa02707:41ca50e3

2025-06-03 22:01:50Headlines

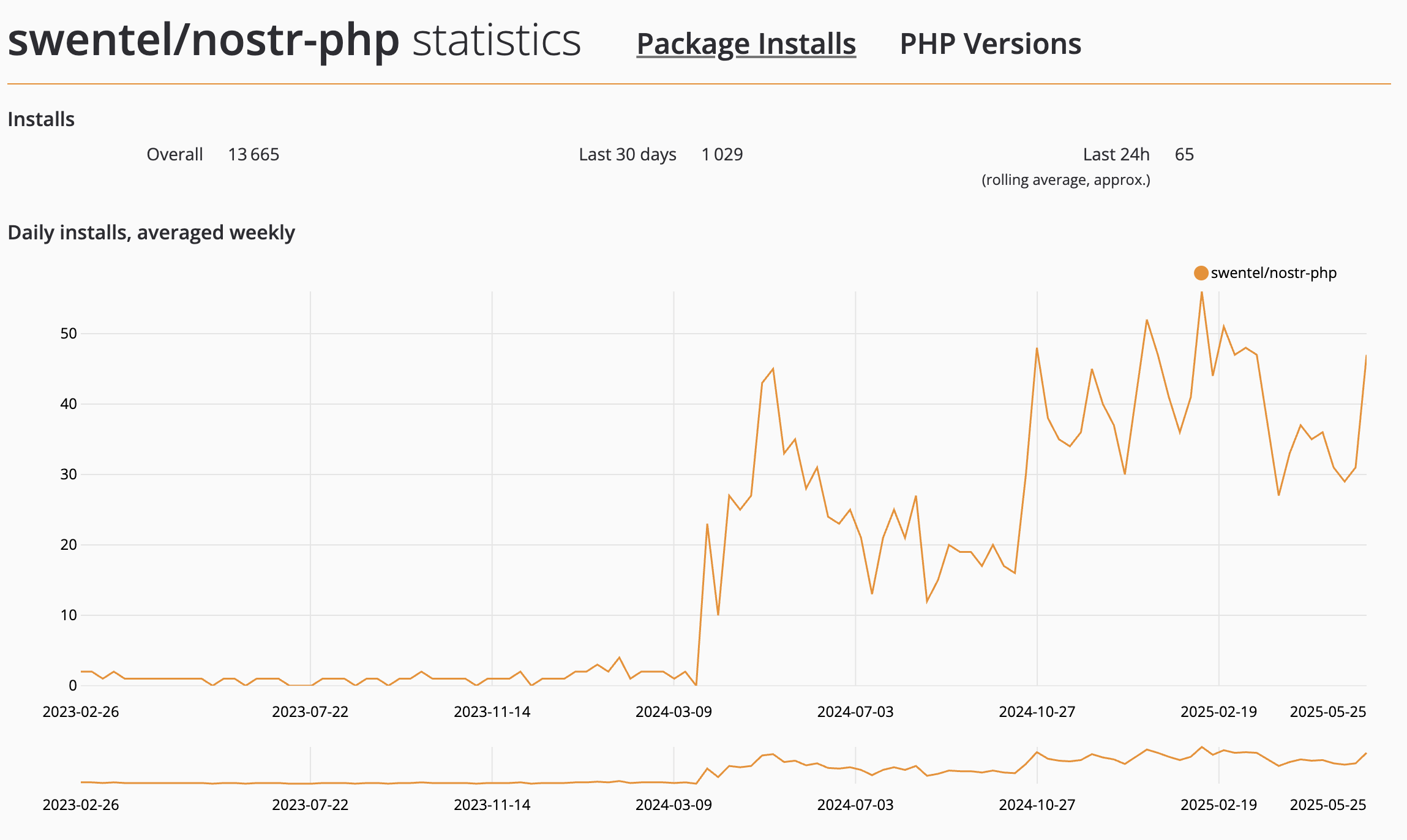

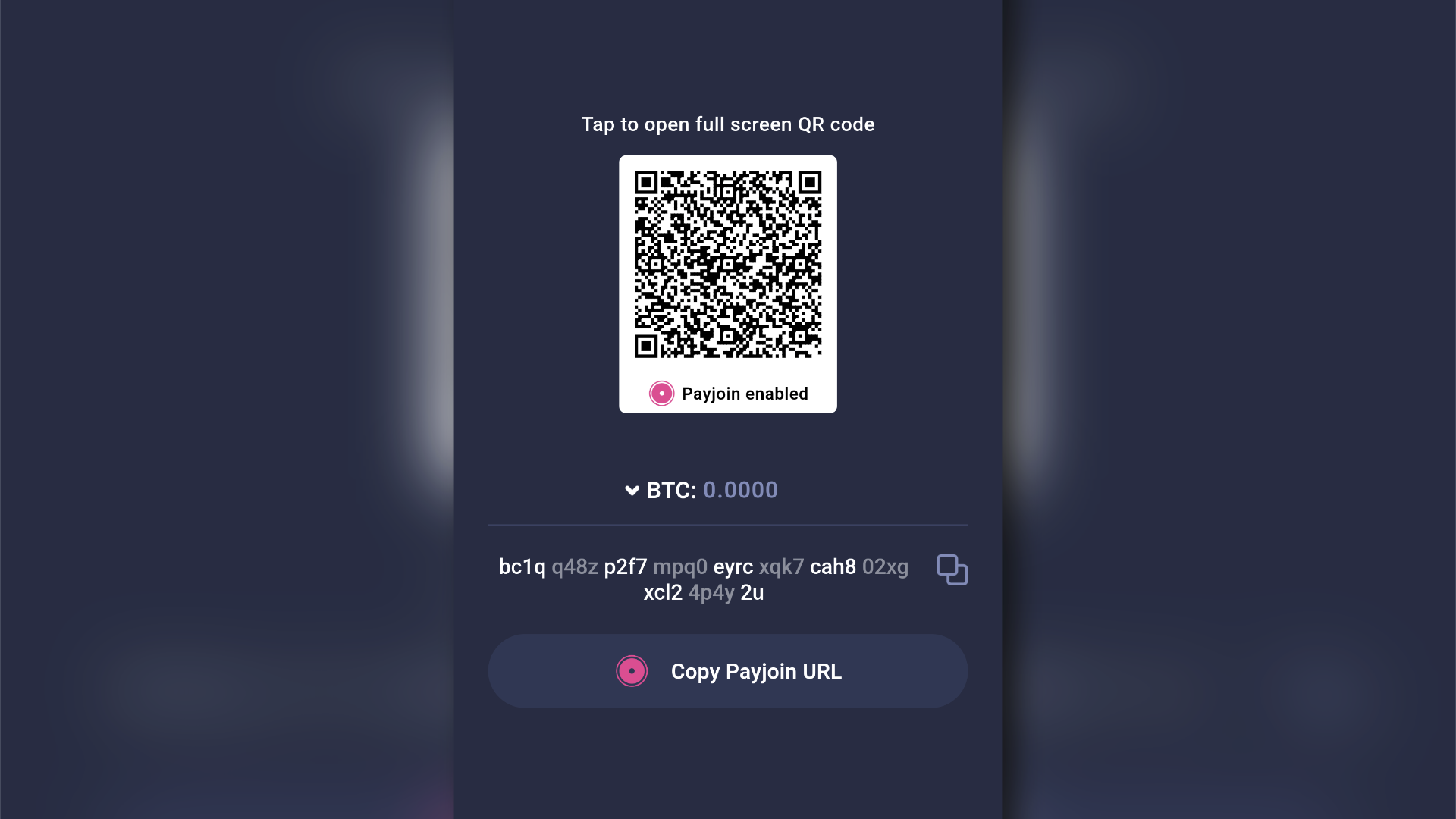

- Spiral renews support for Dan Gould and Joschisan. The organization has renewed support for Dan Gould, who is developing the Payjoin Dev Kit (PDK), and Joschisan, a Fedimint developer focused on simplifying federations.

- Metaplanet buys another 145 BTC. The Tokyo-listed company has purchased an additional 145 BTC for $13.6 million. Their total bitcoin holdings now stand at 5,000 coins, worth around $428.1 million.

- Semler Scientific has increased its bitcoin holdings to 3,303 BTC. The company acquired an additional 111 BTC at an average price of $90,124. The purchase was funded through proceeds from an at-the-market offering and cash reserves, as stated in a press release.

- The Virtual Asset Service Providers (VASP) Bill 2025 introduced in Kenya. The new legislation aims to establish a comprehensive legal framework for licensing, regulating, and supervising virtual asset service providers (VASPs), with strict penalties for non-compliant entities.

- Russian government to launch a cryptocurrency exchange. The country's Ministry of Finance and Central Bank announced plans to establish a trading platform for "highly qualified investors" that "will legalize crypto assets and bring crypto operations out of the shadows."

- All virtual asset service providers expect to be fully compliant with the Travel Rule by the end of 2025. A survey by financial surveillance specialist Notabene reveals that 90% of virtual asset service providers (VASPs) expect full Travel Rule compliance by mid-2025, with all aiming for compliance by year-end. The survey also shows a significant rise in VASPs blocking withdrawals until beneficiary information is confirmed, increasing from 2.9% in 2024 to 15.4% now. Additionally, about 20% of VASPs return deposits if originator data is missing.

- UN claims Bitcoin mining is a "powerful tool" for money laundering. The Rage's analysis suggests that the recent United Nations Office on Drugs and Crime report on crime in South-East Asia makes little sense and hints at the potential introduction of Anti-Money Laundering (AML) measures at the mining level.

- Riot Platforms has obtained a $100 million credit facility from Coinbase Credit, using bitcoin as collateral for short-term funding to support its expansion. The firm's CEO, Jason Les, stated that this facility is crucial for diversifying financing sources and driving long-term stockholder value through strategic growth initiatives.

- Bitdeer raises $179M in loans and equity amid Bitcoin chip push. The Miner Mag reports that Bitdeer entered into a loan agreement with its affiliate Matrixport for up to $200 million in April, as disclosed in its annual report filed on Monday.

- Federal Reserve retracts guidance discouraging banks from engaging in 'crypto.' The U.S. Federal Reserve withdrew guidance that discouraged banks from crypto and stablecoin activities, as announced by its Board of Governors on Thursday. This includes rescinding a 2022 supervisory letter requiring prior notification of crypto activities and 2023 stablecoin requirements.

"As a result, the Board will no longer expect banks to provide notification and will instead monitor banks' crypto-asset activities through the normal supervisory process," reads the FED statement.

- UAE-based Islamic bank ruya launches Shari’ah-compliant bitcoin investing. The bank has become the world’s first Islamic bank to provide direct access to virtual asset investments, including Bitcoin, via its mobile app, per Bitcoin Magazine.

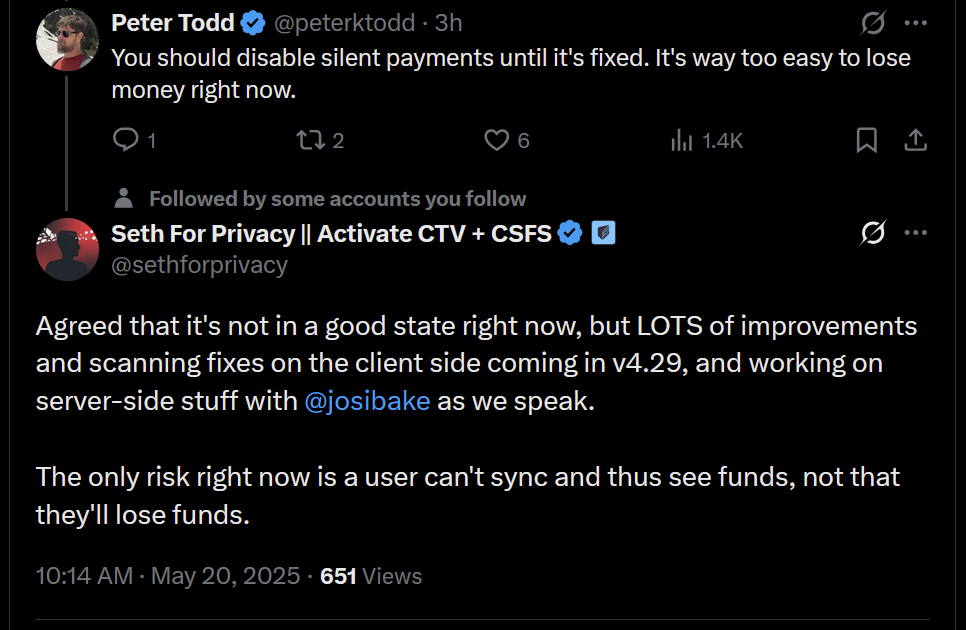

- U.S. 'crypto' scam losses amounted to $9.3B in 2024. The US The Federal Bureau of Investigation (FBI) has reported $9.3 billion losses in cryptocurrency-related scams in 2024, noting a troubling trend of scams targeting older Americans, which accounted for over $2.8 billion of those losses.

Source: FBI.

- North Korean hackers establish fake companies to target 'crypto' developers. Silent Push researchers reported that hackers linked to the Lazarus Group created three shell companies, two of which are based in the U.S., with the objective of spreading malware through deceptive job interview scams aimed at individuals seeking jobs in cryptocurrency companies.

- Citrea deployed its Clementine Bridge on the Bitcoin testnet. The bridge utilizes the BitVM2 programming language to inherit validity from Bitcoin, allegedly providing "the safest and most trust-minimized way to use BTC in decentralized finance."

- Hesperides University offers a Master’s degree in Bitcoin. Bitcoin Magazine reports the launch of the first-ever Spanish-language Master’s program dedicated exclusively to Bitcoin. Starting April 28, 2025, this fully online program will equip professionals with technical, economic, legal, and philosophical skills to excel in the Bitcoin era.

- BTC in D.C. event is set to take place on September 30 - October 1 in Washington, D.C. Learn more about this initiative here.

Use the tools

- Bitcoin Keeper just got a new look. Version 2.2.0 of the mobile multisig app brought a new branding design, along with a Keeper Private tier, testnet support, ability to import and export BIP-329 labels, and the option to use a Server Key with multiple users.

- Earlier this month the project also announced Keeper Learn service, offering clear and guided Bitcoin learning sessions for both groups and individuals.

- Keeper Desktop v0.2.2, a companion desktop app for Bitcoin Keeper mobile app, received a renewed branding update, too.

The evolution of Bitcoin Keeper logo. Source: BitHyve blog.

- Blockstream Green Desktop v2.0.25 updates GDK to v0.75.1 and fixes amount parsing issues when switching from fiat denomination to Liquid asset.

- Lightning Loop v0.31.0-beta enhances the

loop listswapscommand by improving the ability to filter the response. - Lightning-kmp v1.10.0, an implementation of the Lightning Network in Kotlin, is now available.

- LND v0.19.0-beta.rc3, the latest beta release candidate of LND is now ready for testing.

- ZEUS v0.11.0-alpha2 is now available for testing, too. It's nuts.

- JoinMarket Fidelity Bond Simulator helps potential JoinMarket makers evaluate their competitive position in the market based on fidelity bonds.

- UTXOscope is a text-only Bitcoin blockchain analysis tool that visualizes price dynamics using only on-chain data. The

-

@ 1817b617:715fb372

2025-06-03 21:51:18

@ 1817b617:715fb372

2025-06-03 21:51:18🚀 Instantly Send Spendable Flash BTC, ETH, & USDT — Fully Blockchain-Verifiable!

Welcome to the cutting edge of crypto innovation: the ultimate tool for sending spendable Flash Bitcoin (BTC), Ethereum (ETH), and USDT transactions. Our advanced blockchain simulation technology employs 🔥 Race/Finney-style mechanisms, producing coins indistinguishable from authentic blockchain-confirmed tokens. Your transactions are instantly trackable and fully spendable for durations from 60 to 360 days!

🌐 Visit cryptoflashingtool.com for complete details.

🌟 Why Choose Our Crypto Flashing Service? Crypto Flashing is perfect for crypto enthusiasts, blockchain developers, ethical hackers, security professionals, and digital entrepreneurs looking for authenticity combined with unparalleled flexibility.

🎯 Our Crypto Flashing Features: ✅ Instant Blockchain Verification: Transactions appear completely authentic, complete with real blockchain confirmations, transaction IDs, and wallet addresses.

🔒 Maximum Security & Privacy: Fully compatible with VPNs, TOR, and proxy servers, ensuring absolute anonymity and protection.

🖥️ Easy-to-Use Software: Designed for Windows, our intuitive platform suits both beginners and experts, with detailed, step-by-step instructions provided.

📅 Customizable Flash Durations: Control your transaction lifespan precisely, from 60 to 360 days.

🔄 Universal Wallet Compatibility: Instantly flash BTC, ETH, and USDT tokens to SegWit, Legacy, or BCH32 wallets.

💱 Spendable on Top Exchanges: Flash coins seamlessly accepted on leading exchanges like Kraken and Huobi.

📊 Proven Track Record: ✅ Over 79 Billion flash transactions completed. ✅ 3000+ satisfied customers worldwide. ✅ 42 active blockchain nodes for fast, reliable transactions. 📌 Simple Step-by-Step Flashing Process: Step 1️⃣: Enter Transaction Details

Choose coin (BTC, ETH, USDT: TRC-20, ERC-20, BEP-20) Specify amount & flash duration Provide wallet address (validated automatically) Step 2️⃣: Complete Payment & Verification

Pay using the cryptocurrency you wish to flash Scan the QR code or paste the payment address Upload payment proof (transaction hash & screenshot) Step 3️⃣: Initiate Flash Transaction

Our technology simulates blockchain confirmations instantly Flash transaction appears authentic within seconds Step 4️⃣: Verify & Spend Immediately

Access your flashed crypto instantly Easily verify transactions via provided blockchain explorer links 🛡️ Why Our Technology is Trusted: 🔗 Race/Finney Attack Logic: Creates realistic blockchain headers. 🖥️ Private iNode Cluster: Guarantees fast synchronization and reliable transactions. ⏰ Live Timer System: Ensures fresh wallet addresses and transaction legitimacy. 🔍 Genuine Blockchain TX IDs: Authentic transaction IDs included with every flash ❓ Frequently Asked Questions: Is flashing secure? ✅ Yes, encrypted with full VPN/proxy support. Can I flash from multiple devices? ✅ Yes, up to 5 Windows PCs per license. Are chargebacks possible? ❌ No, flash transactions are irreversible. How long are flash coins spendable? ✅ From 60–360 days, based on your chosen plan. Verification after expiry? ❌ Transactions can’t be verified after the expiry. Support available? ✅ Yes, 24/7 support via Telegram & WhatsApp.

🔐 Transparent, Reliable & Highly Reviewed:

CryptoFlashingTool.com operates independently, providing unmatched transparency and reliability. Check out our glowing reviews on ScamAdvisor and leading crypto forums!

📲 Get in Touch Now: 📞 WhatsApp: +1 770 666 2531 ✈️ Telegram: @cryptoflashingtool

🎉 Ready to Start?

💰 Buy Flash Coins Now 🖥️ Get Your Flashing Software

Experience the smartest, safest, and most powerful crypto flashing solution on the market today!

CryptoFlashingTool.com — Flash Crypto Like a Pro.

Instantly Send Spendable Flash BTC, ETH, & USDT — Fully Blockchain-Verifiable!

Welcome to the cutting edge of crypto innovation: the ultimate tool for sending spendable Flash Bitcoin (BTC), Ethereum (ETH), and USDT transactions. Our advanced blockchain simulation technology employs

Race/Finney-style mechanisms, producing coins indistinguishable from authentic blockchain-confirmed tokens. Your transactions are instantly trackable and fully spendable for durations from 60 to 360 days!

Visit cryptoflashingtool.com for complete details.

Why Choose Our Crypto Flashing Service?

Crypto Flashing is perfect for crypto enthusiasts, blockchain developers, ethical hackers, security professionals, and digital entrepreneurs looking for authenticity combined with unparalleled flexibility.

Our Crypto Flashing Features:

Instant Blockchain Verification: Transactions appear completely authentic, complete with real blockchain confirmations, transaction IDs, and wallet addresses.

Maximum Security & Privacy: Fully compatible with VPNs, TOR, and proxy servers, ensuring absolute anonymity and protection.

Easy-to-Use Software: Designed for Windows, our intuitive platform suits both beginners and experts, with detailed, step-by-step instructions provided.

Customizable Flash Durations: Control your transaction lifespan precisely, from 60 to 360 days.

Universal Wallet Compatibility: Instantly flash BTC, ETH, and USDT tokens to SegWit, Legacy, or BCH32 wallets.

Spendable on Top Exchanges: Flash coins seamlessly accepted on leading exchanges like Kraken and Huobi.

Proven Track Record:

- Over 79 Billion flash transactions completed.

- 3000+ satisfied customers worldwide.

- 42 active blockchain nodes for fast, reliable transactions.

Simple Step-by-Step Flashing Process:

Step : Enter Transaction Details

- Choose coin (BTC, ETH, USDT: TRC-20, ERC-20, BEP-20)

- Specify amount & flash duration

- Provide wallet address (validated automatically)

Step : Complete Payment & Verification

- Pay using the cryptocurrency you wish to flash

- Scan the QR code or paste the payment address

- Upload payment proof (transaction hash & screenshot)

Step : Initiate Flash Transaction

- Our technology simulates blockchain confirmations instantly

- Flash transaction appears authentic within seconds

Step : Verify & Spend Immediately

- Access your flashed crypto instantly

- Easily verify transactions via provided blockchain explorer links

Why Our Technology is Trusted:

- Race/Finney Attack Logic: Creates realistic blockchain headers.

- Private iNode Cluster: Guarantees fast synchronization and reliable transactions.

- Live Timer System: Ensures fresh wallet addresses and transaction legitimacy.

- Genuine Blockchain TX IDs: Authentic transaction IDs included with every flash

Frequently Asked Questions:

- Is flashing secure?

Yes, encrypted with full VPN/proxy support. - Can I flash from multiple devices?

Yes, up to 5 Windows PCs per license. - Are chargebacks possible?

No, flash transactions are irreversible. - How long are flash coins spendable?

From 60–360 days, based on your chosen plan. - Verification after expiry?

Transactions can’t be verified after the expiry.

Support available?

Yes, 24/7 support via Telegram & WhatsApp.

Transparent, Reliable & Highly Reviewed:

CryptoFlashingTool.com operates independently, providing unmatched transparency and reliability. Check out our glowing reviews on ScamAdvisor and leading crypto forums!

Get in Touch Now:

WhatsApp: +1 770 666 2531

Telegram: @cryptoflashingtool

Ready to Start?

Experience the smartest, safest, and most powerful crypto flashing solution on the market today!

CryptoFlashingTool.com — Flash Crypto Like a Pro.

-

@ 8bad92c3:ca714aa5

2025-06-03 18:02:33

@ 8bad92c3:ca714aa5

2025-06-03 18:02:33Marty's Bent

It's been a pretty historic week for the United States as it pertains to geopolitical relations in the Middle East. President Trump and many members of his administration, including AI and Crypto Czar David Sacks and Treasury Secretary Scott Bessent, traveled across the Middle East making deals with countries like Qatar, Saudi Arabia, the United Arab Emirates, Syria, and others. Many are speculating that Iran may be included in some behind the scenes deal as well. This trip to the Middle East makes sense considering the fact that China is also vying for favorable relationships with those countries. The Middle East is a power player in the world, and it seems pretty clear that Donald Trump is dead set on ensuring that they choose the United States over China as the world moves towards a more multi-polar reality.

Many are calling the events of this week the Riyadh Accords. There were many deals that were struck in relation to artificial intelligence, defense, energy and direct investments in the United States. A truly prolific power play and demonstration of deal-making ability of Donald Trump, if you ask me. Though I will admit some of the numbers that were thrown out by some of the countries were a bit egregious. We shall see how everything plays out in the coming years. It will be interesting to see how China reacts to this power move by the United States.

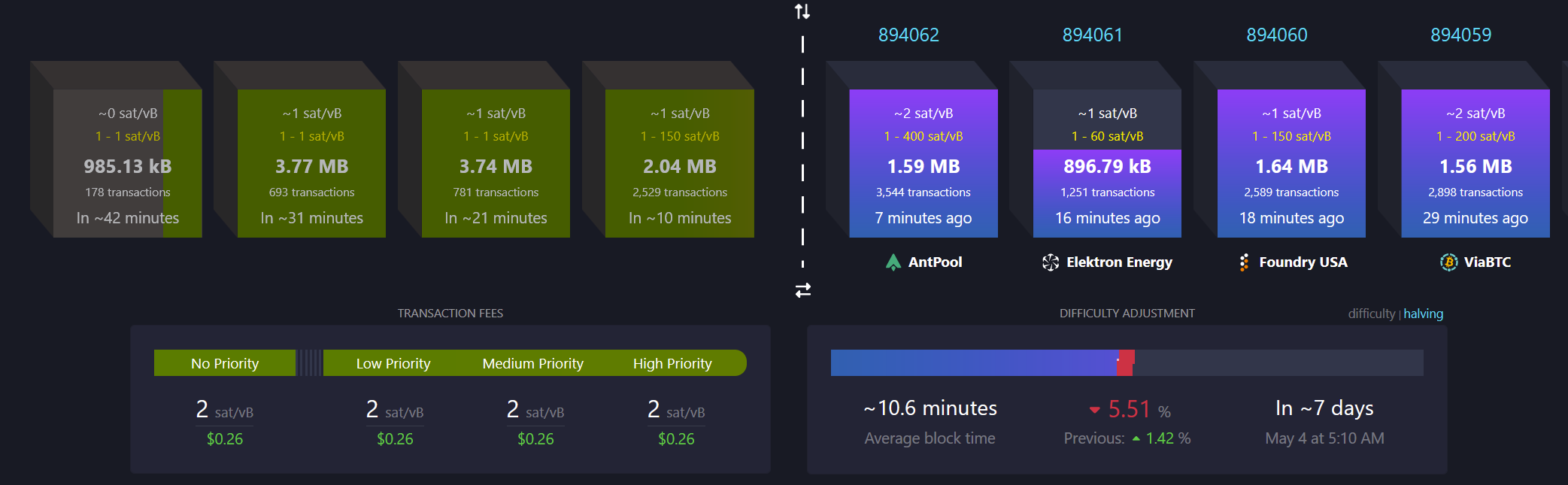

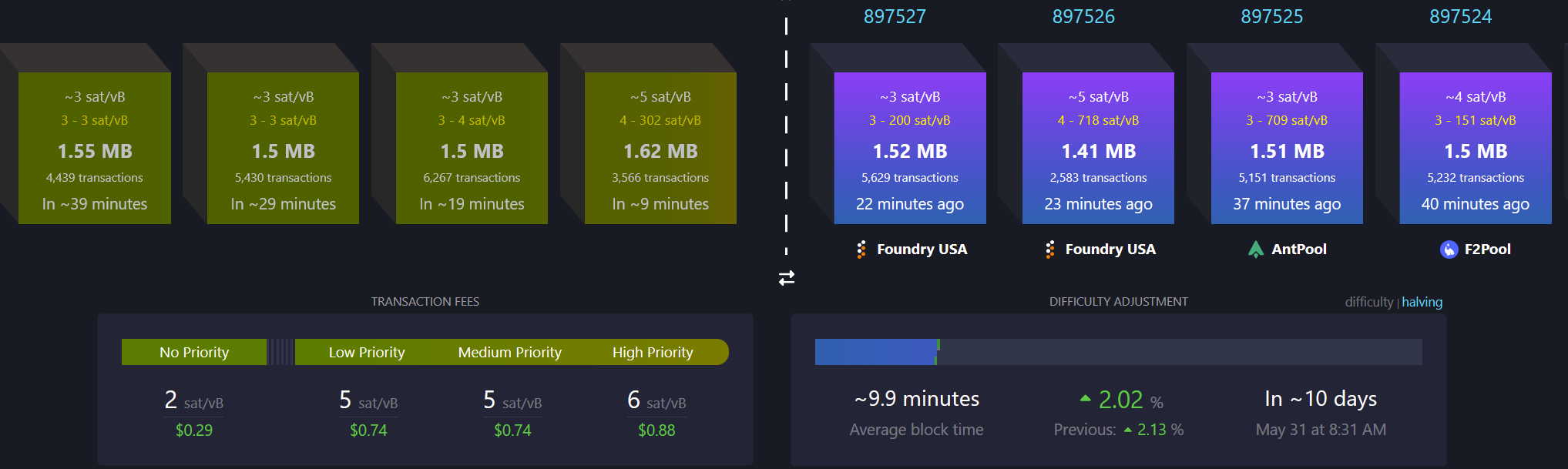

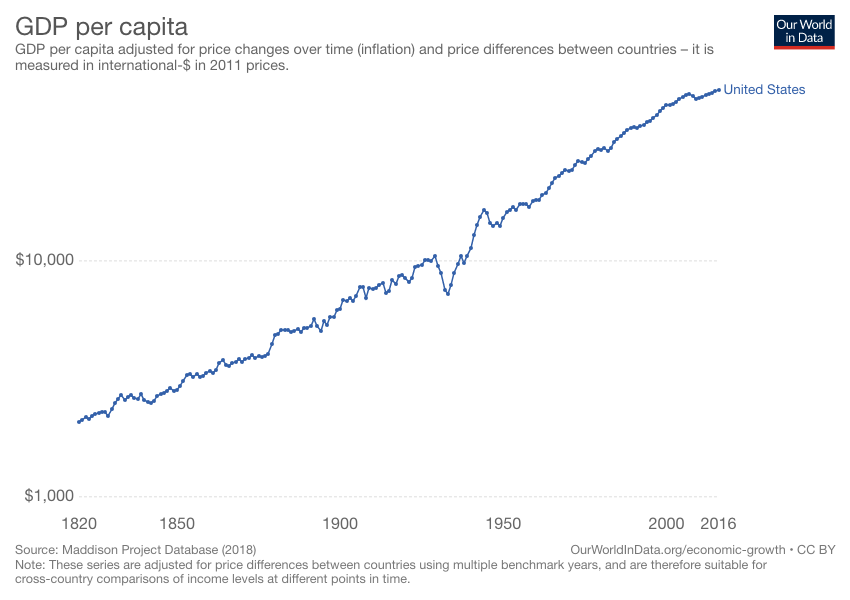

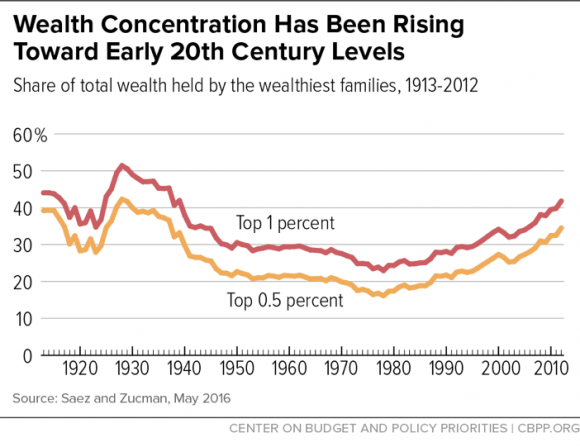

While all this was going on, there was something happening back in the United States that many people outside of fringe corners of FinTwit are not talking about, which is the fact that the 10-year and 30-year U.S. Treasury bond yields are back on the rise. Yesterday, they surpassed the levels of mid-April that caused a market panic and are hovering back around levels that have not been seen since right before Donald Trump's inauguration.

I imagine that there isn't as much of an uproar right now because I'm pretty confident the media freakouts we were experiencing in mid-April were driven by the fact that many large hedge funds found themselves off sides of large levered basis trades. I wouldn't be surprised if those funds have decreased their leverage in those trades and bond yields being back to mid-April levels is not affecting those funds as much as they were last month. But the point stands, the 10-year and 30-year yields are significantly elevated with the 30-year approaching 5%. Regardless of the deals that are currently being made in the Middle East, the Treasury has a big problem on its hands. It still has to roll over many trillions worth of debt over over the next few years and doing so at these rates is going to be massively detrimental to fiscal deficits over the next decade. The interest expense on the debt is set to explode in the coming years.

On that note, data from the first quarter of 2025 has been released by the government and despite all the posturing by the Trump administration around DOGE and how tariffs are going to be beneficial for the U.S. economy, deficits are continuing to explode while the interest expense on the debt has definitively surpassed our annual defense budget.

via Charlie Bilello

via Mohamed Al-Erian

To make matters worse, as things are deteriorating on the fiscal side of things, the U.S. consumer is getting crushed by credit. The 90-plus day delinquency rates for credit card and auto loans are screaming higher right now.

via TXMC

One has to wonder how long all this can continue without some sort of liquidity crunch. Even though equities markets have recovered from their post-Liberation Day month long bear market, I would not be surprised if what we're witnessing is a dead cat bounce that can only be continued if the money printers are turned back on. Something's got to give, both on the fiscal side and in the private markets where the Common Man is getting crushed because he's been forced to take on insane amounts of debt to stay afloat after years of elevated levels of inflation. Add on the fact that AI has reached a state of maturity that will enable companies to replace their current meat suit workers with an army of cheap, efficient and fast digital workers and it isn't hard to see that some sort of employment crisis could be on the horizon as well.

Now is not the time to get complacent. While I do believe that the deals that are currently being made in the Middle East are probably in the best interest of the United States as the world, again, moves toward a more multi-polar reality, we are facing problems that one cannot simply wish away. They will need to be confronted. And as we've seen throughout the 21st century, the problems are usually met head-on with a money printer.

I take no pleasure in saying this because it is a bit uncouth to be gleeful to benefit from the strife of others, but it is pretty clear to me that all signs are pointing to bitcoin benefiting massively from everything that is going on. The shift towards a more multi-polar world, the runaway debt situation here in the United States, the increasing deficits, the AI job replacements and the consumer credit crisis that is currently unfolding, All will need to be "solved" by turning on the money printers to levels they've never been pushed to before.

Weird times we're living in.

China's Manufacturing Dominance: Why It Matters for the U.S.

In my recent conversation with Lyn Alden, she highlighted how China has rapidly ascended the manufacturing value chain. As Lyn pointed out, China transformed from making "sneakers and plastic trinkets" to becoming the world's largest auto exporter in just four years. This dramatic shift represents more than economic success—it's a strategic power play. China now dominates solar panel production with greater market control than OPEC has over oil and maintains near-monopoly control of rare earth elements crucial for modern technology.

"China makes like 10 times more steel than the United States does... which is relevant in ship making. It's relevant in all sorts of stuff." - Lyn Alden

Perhaps most concerning, as Lyn emphasized, is China's financial leverage. They hold substantial U.S. assets that could be strategically sold to disrupt U.S. treasury market functioning. This combination of manufacturing dominance, resource control, and financial leverage gives China significant negotiating power in any trade disputes, making our attempts to reshoring manufacturing all the more challenging.

Check out the full podcast here for more on Triffin's dilemma, Bitcoin's role in monetary transition, and the energy requirements for rebuilding America's industrial base.

Headlines of the Day

Financial Times Under Fire Over MicroStrategy Bitcoin Coverage - via X

Trump in Qatar: Historic Boeing Deal Signed - via X

Get our new STACK SATS hat - via tftcmerch.io

Johnson Backs Stock Trading Ban; Passage Chances Slim - via X

Take the First Step Off the Exchange

Bitkey is an easy, secure way to move your Bitcoin into self-custody. With simple setup and built-in recovery, it’s the perfect starting point for getting your coins off centralized platforms and into cold storage—no complexity, no middlemen.

Take control. Start with Bitkey.

Use the promo code *“TFTC20”* during checkout for 20% off

Ten31, the largest bitcoin-focused investor, has deployed 158,469 sats | $150.00M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Building things of value is satisfying.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X: