-

@ f6488c62:c929299d

2025-05-24 05:10:20

@ f6488c62:c929299d

2025-05-24 05:10:20คุณเคยจินตนาการถึงอนาคตที่ AI มีความฉลาดเทียบเท่ามนุษย์หรือไม่? นี่คือสิ่งที่ Sam Altman ซีอีโอของ OpenAI และทีมพันธมิตรอย่าง SoftBank, Oracle และ MGX กำลังผลักดันผ่าน โครงการ Stargate! โครงการนี้ไม่ใช่แค่เรื่องเทคโนโลยี แต่เป็นก้าวกระโดดครั้งใหญ่ของมนุษยชาติ! Stargate คืออะไร? Stargate เป็นโปรเจกต์สร้าง ศูนย์ข้อมูล AI ขนาดยักษ์ที่ใหญ่ที่สุดในประวัติศาสตร์ ด้วยเงินลงทุนเริ่มต้น 100,000 ล้านดอลลาร์ และอาจสูงถึง 500,000 ล้านดอลลาร์ ภายในปี 2029! เป้าหมายคือการพัฒนา Artificial General Intelligence (AGI) หรือ AI ที่ฉลาดเทียบเท่ามนุษย์ เพื่อให้สหรัฐฯ ครองความเป็นผู้นำด้าน AI และแข่งขันกับคู่แข่งอย่างจีน โครงการนี้เริ่มต้นที่เมือง Abilene รัฐเท็กซัส โดยจะสร้างศูนย์ข้อมูล 10 แห่ง และขยายไปยังญี่ปุ่น สหราชอาณาจักร และสหรัฐอาหรับเอมิเรตส์ ทำไม Stargate ถึงสำคัญ?

นวัตกรรมเปลี่ยนโลก: AI จาก Stargate จะช่วยพัฒนาวัคซีน mRNA รักษามะเร็งได้ใน 48 ชั่วโมง และยกระดับอุตสาหกรรมต่าง ๆ เช่น การแพทย์และความมั่นคงแห่งชาติสร้างงาน: คาดว่าจะสร้างงานกว่า 100,000 ตำแหน่ง ในสหรัฐฯ

พลังงานมหาศาล: ศูนย์ข้อมูลอาจใช้พลังงานถึง 1.2 กิกะวัตต์ เทียบเท่ากับเมืองขนาดใหญ่!

ใครอยู่เบื้องหลัง? Sam Altman ร่วมมือกับ Masayoshi Son จาก SoftBank และได้รับการสนับสนุนจาก Donald Trump ซึ่งผลักดันนโยบายให้ Stargate เป็นจริง การก่อสร้างดำเนินการโดย Oracle และพันธมิตรด้านพลังงานอย่าง Crusoe Energy Systems ความท้าทาย? ถึงจะยิ่งใหญ่ แต่ Stargate ก็เจออุปสรรค ทั้งปัญหาการระดมทุน ความกังวลเรื่องภาษีนำเข้าชิป และการแข่งขันจากคู่แข่งอย่าง DeepSeek ที่ใช้โครงสร้างพื้นฐานน้อยกว่า แถม Elon Musk ยังออกมาวิจารณ์ว่าโครงการนี้อาจ “ไม่สมจริง” แต่ Altman มั่นใจและเชิญ Musk ไปดูไซต์งานที่เท็กซัสเลยทีเดียว! อนาคตของ Stargate ศูนย์ข้อมูลแห่งแรกจะเริ่มใช้งานในปี 2026 และอาจเปลี่ยนโฉมวงการ AI ไปตลอดกาล นี่คือก้าวสำคัญสู่ยุคใหม่ของเทคโนโลยีที่อาจเปลี่ยนวิถีชีวิตของเรา! และไม่ใช่ประตูดวงดาวแบบในหนังนะ! ถึงชื่อ Stargate จะได้แรงบันดาลใจจากภาพยนตร์ sci-fi อันโด่งดัง แต่โครงการนี้ไม่ได้พาเราไปยังดวงดาวอื่น มันคือการเปิดประตูสู่โลกแห่ง AI ที่ทรงพลัง และอาจเปลี่ยนอนาคตของมนุษยชาติไปเลย! และไม่เหมือน universechain ของ star ของผมนะครับ

Stargate #AI #SamAltman #OpenAI #อนาคตของเทคโนโลยี

-

@ c1d77557:bf04ec8b

2025-05-24 05:02:26

@ c1d77557:bf04ec8b

2025-05-24 05:02:26O 567br é uma plataforma de entretenimento online que tem se destacado pela sua inovação, variedade de jogos e foco na experiência do jogador. Com uma interface amigável e recursos de alta qualidade, a plataforma oferece uma jornada divertida e segura para os seus usuários. Neste artigo, vamos explorar os principais aspectos do 567br, incluindo a introdução da plataforma, os jogos que ela oferece e como a experiência do jogador é aprimorada em cada detalhe.

O 567br foi desenvolvido com o objetivo de proporcionar aos jogadores uma experiência imersiva e prazerosa. Sua interface é simples, intuitiva e de fácil navegação, permitindo que os usuários encontrem rapidamente seus jogos favoritos. A plataforma também é otimizada para dispositivos móveis, o que significa que os jogadores podem acessar seus jogos em qualquer lugar e a qualquer momento, seja no computador ou no smartphone.

Além disso, o 567brse preocupa com a segurança de seus usuários, implementando tecnologias de criptografia de ponta para garantir que todos os dados pessoais e financeiros estejam protegidos. A plataforma também oferece suporte ao cliente de alta qualidade, disponível 24/7, para resolver quaisquer dúvidas ou problemas que possam surgir durante a experiência de jogo.

Jogos Empolgantes e Variedade para Todos os Gostos No 567br, a diversidade de jogos é um dos pontos fortes da plataforma. Desde jogos de mesa e cartas até opções de entretenimento mais dinâmicas e inovadoras, há algo para todos os gostos e preferências. Os jogos disponíveis são desenvolvidos por alguns dos melhores fornecedores de conteúdo da indústria, garantindo gráficos de alta qualidade, jogabilidade fluida e mecânicas envolventes.

Os jogadores podem escolher entre diferentes categorias, como:

Jogos de Mesa: Para quem gosta de uma experiência mais estratégica e de tomada de decisões, os jogos de mesa são uma excelente opção. São oferecidas diversas variantes de jogos populares, como pôquer, blackjack, roleta, entre outros.

Jogos de Ação e Aventura: Para os que buscam adrenalina e emoção, a plataforma oferece uma seleção de jogos de ação e aventura com temas envolventes e gráficos impressionantes. Esses jogos garantem uma experiência de jogo emocionante e desafiadora.

Jogos de Arcade: Se você está em busca de algo mais descontraído e divertido, os jogos de arcade são uma excelente escolha. Eles são rápidos, fáceis de entender e proporcionam diversão instantânea.

A plataforma está sempre atualizando seu portfólio de jogos para garantir que os jogadores tenham acesso às últimas novidades e inovações do mundo do entretenimento online.

A Experiência do Jogador: Personalização e Interatividade O 567br não se limita a oferecer apenas uma plataforma de jogos, mas também busca criar uma experiência personalizada e interativa para cada jogador. A plataforma possui funcionalidades que permitem que os usuários ajustem sua experiência de jogo de acordo com suas preferências individuais.

A personalização da interface é um exemplo claro disso. O jogador pode escolher o tema e a disposição dos elementos na tela, criando um ambiente que seja confortável e agradável de usar. Além disso, o 567br oferece recursos interativos, como chats ao vivo, onde os jogadores podem interagir com outros usuários e até mesmo com os dealers, proporcionando uma sensação de comunidade.

Outro aspecto importante é a possibilidade de acompanhar o desempenho e os resultados de jogo. A plataforma oferece relatórios detalhados, permitindo que os jogadores monitorem seu progresso, analisem suas vitórias e perdas, e façam ajustes em sua estratégia de jogo.

Promoções e Benefícios para os Jogadores O 567br também oferece uma série de promoções e benefícios que tornam a experiência de jogo ainda mais atrativa. Novos jogadores podem aproveitar bônus de boas-vindas e outras ofertas especiais, enquanto jogadores regulares podem se beneficiar de programas de fidelidade e promoções exclusivas.

Essas ofertas ajudam a aumentar a diversão e proporcionam mais oportunidades para que os jogadores explorem novos jogos e tenham uma experiência ainda mais rica. Além disso, o sistema de recompensas é transparente e justo, garantindo que todos os jogadores tenham as mesmas oportunidades de aproveitar os benefícios.

Conclusão: Uma Plataforma Completa para Todos os Gostos Com sua interface intuitiva, variedade de jogos e foco na experiência do jogador, o 567br se consolida como uma plataforma de entretenimento online de alta qualidade. Seja para quem busca jogos estratégicos, ação intensa ou diversão casual, o 567br tem algo para todos.

A segurança, o suporte ao cliente e a personalização da experiência de jogo tornam o 567br uma opção atraente para jogadores que buscam mais do que apenas uma plataforma de jogos – buscam uma jornada de entretenimento envolvente e segura. Se você está procurando por uma experiência completa e agradável, o 567br é, sem dúvida, uma excelente escolha.

-

@ eb0157af:77ab6c55

2025-05-24 05:01:18

@ eb0157af:77ab6c55

2025-05-24 05:01:18Vivek Ramaswamy’s company bets on distressed bitcoin claims as its Bitcoin treasury strategy moves forward.

Strive Enterprises, an asset management firm co-founded by Vivek Ramaswamy, is exploring the acquisition of distressed bitcoin claims, with particular interest in around 75,000 BTC tied to the Mt. Gox bankruptcy estate. This move is part of the company’s broader strategy to build a Bitcoin treasury ahead of its planned merger with Asset Entities.

According to a document filed on May 20 with the Securities and Exchange Commission, Strive has partnered with 117 Castell Advisory Group to “identify and evaluate” distressed Bitcoin claims with confirmed legal judgments. Among these are approximately 75,000 BTC connected to Mt. Gox, with an estimated market value of $8 billion at current prices.

Essentially, Strive aims to acquire rights to bitcoins currently tied up in legal disputes, which can be purchased at a discount by those willing to take on the risk and wait for eventual recovery.

In a post on X, Strive’s CFO, Ben Pham, stated:

“Strive intends to use all available mechanisms, including novel financial strategies not used by other Bitcoin treasury companies, to maximize its exposure to the asset.”

The company also plans to buy cash at a discount by merging with publicly traded companies holding more cash than their stock value, using the excess funds to purchase additional Bitcoin.

Mt. Gox, the exchange that collapsed in 2014, is currently in the process of repaying creditors, with a deadline set for October 31, 2025.

In its SEC filing, Strive declared:

“This strategy is intended to allow Strive the opportunity to purchase Bitcoin exposure at a discount to market price, enhancing Bitcoin per share and supporting its goal of outperforming Bitcoin over the long run.”

At the beginning of May, Strive announced its merger plan with Asset Entities, a deal that would create the first publicly listed asset management firm focused on Bitcoin. The resulting company aims to join the growing number of firms adopting a Bitcoin treasury strategy.

The corporate treasury trend

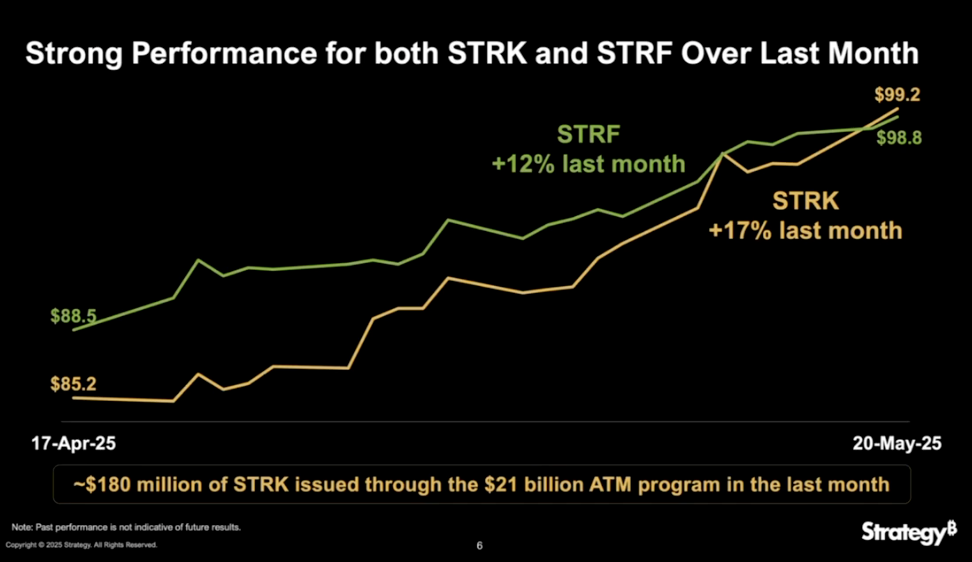

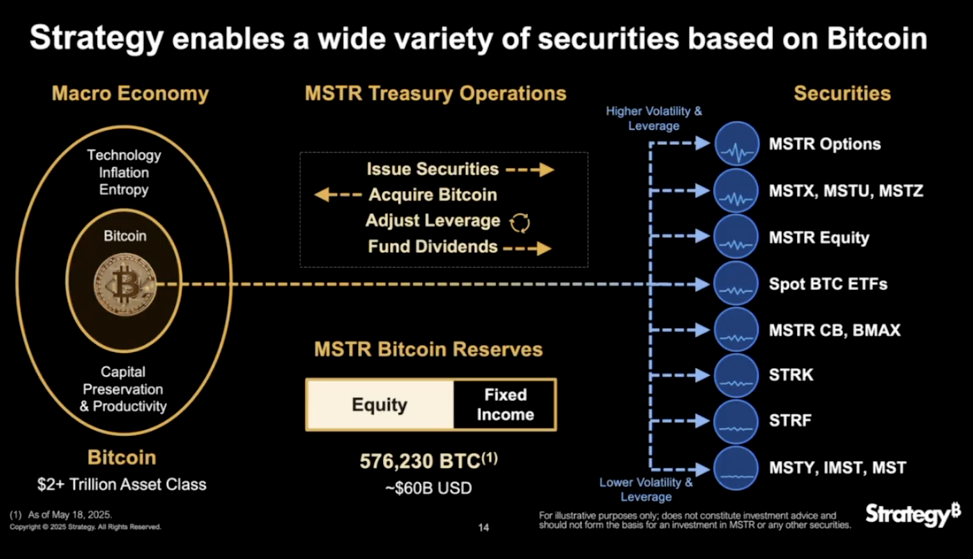

Strive’s initiative to accumulate bitcoin mirrors that of other companies like Strategy and Japan’s Metaplanet. On May 19, Strategy, led by Michael Saylor, announced the purchase of an additional 7,390 BTC for $764.9 million, raising its total holdings to 576,230 BTC. On the same day, Metaplanet revealed it had acquired another 1,004 BTC, increasing its total to 7,800 BTC.

The post Bitcoin in Strive’s sights: 75,000 BTC from Mt. Gox among its targets appeared first on Atlas21.

-

@ c1d77557:bf04ec8b

2025-05-24 05:01:44

@ c1d77557:bf04ec8b

2025-05-24 05:01:44O P11Bet é uma plataforma inovadora que chega para oferecer uma experiência de jogo única, reunindo uma variedade de opções para os entusiastas de diferentes tipos de entretenimento online. Com uma interface moderna e fácil de usar, ela se destaca por proporcionar uma jornada divertida e segura para os jogadores, com um foco especial na qualidade da experiência e no atendimento às necessidades do público.

Uma Plataforma Completa e Acessível Ao acessar o P11Bet, os usuários encontram uma plataforma intuitiva, que facilita a navegação e oferece uma variedade de recursos para tornar o jogo mais agradável. A estrutura do site é otimizada para fornecer uma experiência fluida, seja no desktop ou em dispositivos móveis. Além disso, a plataforma se preocupa em manter um ambiente seguro, garantindo a proteção dos dados dos jogadores e permitindo que se concentrem na diversão.

A plataforma é projetada para todos os tipos de jogadores, desde os iniciantes até os mais experientes. A simplicidade de uso é uma das grandes vantagens, permitindo que qualquer pessoa possa se registrar e começar a jogar sem dificuldades. Além disso, a p11betoferece suporte ao cliente em português, o que facilita a comunicação e garante um atendimento de alta qualidade para os usuários brasileiros.

Diversidade de Jogos para Todos os Gostos O P11Bet se destaca pela vasta gama de opções de jogos que oferece aos seus usuários. A plataforma abriga uma seleção diversificada que vai desde jogos clássicos até as opções mais modernas, atendendo a todos os estilos e preferências. Entre as opções mais procuradas estão jogos de mesa, apostas esportivas, slots, e outras modalidades que garantem horas de entretenimento.

Um dos principais atrativos do P11Bet são os jogos de habilidade e de sorte, que exigem tanto estratégia quanto um pouco de sorte. As opções variam desde os mais simples aos mais complexos, oferecendo algo para todos os gostos. Os jogadores podem se aventurar em diversas modalidades, testando suas habilidades em jogos que vão de roletas e blackjack a versões mais inovadoras e dinâmicas.

Para aqueles que preferem algo mais emocionante e competitivo, as apostas esportivas são uma das maiores atrações. O P11Bet oferece uma ampla variedade de eventos esportivos ao vivo para apostar, com odds atrativas e uma plataforma que permite realizar apostas de forma rápida e eficiente. Seja em esportes populares como futebol, basquete ou até mesmo esportes menos tradicionais, há sempre algo para os apostadores mais exigentes.

A Experiência do Jogador: Diversão e Segurança O P11Bet não apenas se preocupa com a diversidade de jogos, mas também com a experiência do jogador. A plataforma foi desenvolvida para garantir que os jogadores possam desfrutar de seus jogos favoritos com a maior segurança e conforto possível. Além de um design intuitivo, a plataforma oferece diversas opções de pagamento, incluindo métodos populares no Brasil, para facilitar depósitos e retiradas. Isso garante que o processo de transações seja simples, rápido e seguro.

Outro ponto positivo do P11Bet é a experiência imersiva que ele oferece aos jogadores. A plataforma está sempre atualizada com novas funcionalidades, com promoções atraentes e bônus especiais que aumentam ainda mais a diversão. A interação com outros jogadores também é um diferencial, com espaços que permitem competir, conversar e trocar experiências com pessoas de todo o mundo.

Além disso, o suporte ao cliente da P11Bet é um dos mais elogiados pelos usuários. A equipe está sempre disponível para resolver dúvidas e fornecer assistência de maneira eficaz e amigável. Isso garante que os jogadores tenham sempre uma experiência tranquila, sem se preocupar com questões técnicas ou problemas relacionados à plataforma.

Conclusão Em resumo, o P11Bet é uma excelente escolha para quem busca uma plataforma completa e de qualidade para se divertir e desafiar suas habilidades. Com uma grande variedade de jogos, uma interface de fácil navegação e um suporte excepcional, ele garante que cada momento na plataforma seja único e prazeroso. Para quem deseja se aventurar no mundo dos jogos online, o P11Bet é uma opção que combina segurança, inovação e diversão.

-

@ 9ca447d2:fbf5a36d

2025-05-24 05:01:35

@ 9ca447d2:fbf5a36d

2025-05-24 05:01:35KYC database of Coinbase, the largest U.S. digital asset exchange, has been breached and up to 1% of monthly active users, or around 100,000 customers, have had their personal info stolen.

Hackers reportedly bribed overseas customer support agents and contractors to leak internal company info and user data. They then demanded $20 million and threatened to release the stolen data if Coinbase didn’t pay.

Instead of paying the ransom, Coinbase said no and is setting up a $20 million reward fund for anyone who can help catch the hackers.

“They then tried to extort Coinbase for $20 million to cover this up. We said no,” the company said in a blog post. “Instead of paying the $20 million ransom, we’re establishing a $20 million reward fund.”

So what’s been stolen? The breach, which was first disclosed in a filing with the U.S. Securities and Exchange Commission (SEC), did not involve any theft of customer funds, login credentials, private keys or wallets.

But the hackers did get:

- Full names

- Addresses

- Phone numbers

- Email addresses

- Last 4 digits of Social Security numbers

- Bank account numbers and some bank identifiers

- Government ID images (driver’s licenses, passports, etc.)

- Account balances and transaction history

- Internal corporate documents and training materials

Coinbase says Prime accounts were not affected and no passwords or 2FA codes were stolen.

According to Coinbase, the attackers targeted outsourced support agents in countries like India. They were offering cash bribes in exchange for access to the company’s internal customer support tools.

“What these attackers were doing was finding Coinbase employees and contractors based in India who were associated with our business process outsourcing or support operations, that kind of thing, and bribing them in order to obtain customer data,” said Philip Martin, Coinbase’s Chief Security Officer.

Coinbase said it first saw suspicious activity in January 2025 but didn’t get a direct email from the threat actors until May 11. The email had evidence of stolen data and the ransom demand.

Coinbase quickly launched an investigation, fired all the involved support agents and notified law enforcement. It also started notifying users via email on May 15.

The Coinbase data breach has hit it hard, financially and publicly. The company estimates it will spend $180-$400 million on security upgrades, reimbursements and other remediation.

Coinbase’s stock also took a hit, dropping 6.4% after the news broke, before rebounding.

Analysts say this couldn’t have come at a worse time, as Coinbase is about to be added to the S&P 500 index – a big deal for any publicly traded company.

It’s definitely an unfortunate timing. “This may push the industry to adopt stricter employee vetting and introduce some reputational risks,” said Bo Pei, analyst at U.S. Tiger Securities.

Coinbase will reimburse any customers who were tricked into sending their digital assets to the attackers as part of social engineering scams. They’ve also introduced new security measures:

- Extra ID verification for high-risk withdrawals

- Scam-awareness prompts

- A new U.S.-based support center

- Stronger insider threat monitoring

- Simulation testing for internal systems

Affected customers have already been notified and the exchange is working with U.S. and international law enforcement to track down the attackers.

This is part of a larger trend in the digital assets world. Earlier this year, Bybit, another exchange, was hit with a $1.5 billion theft, dubbed the biggest digital asset heist in history.

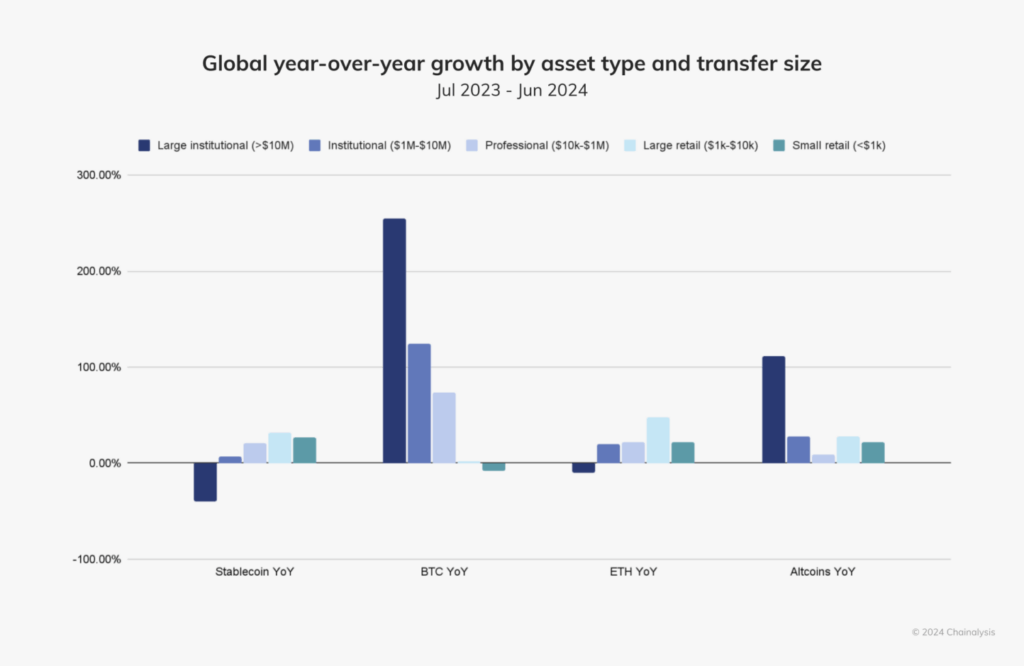

Research from Chainalysis shows over $2.2 billion was stolen from digital asset platforms in 2024 alone.

-

@ eb0157af:77ab6c55

2025-05-24 05:01:17

@ eb0157af:77ab6c55

2025-05-24 05:01:17According to the ECB Executive Board member, the launch of the digital euro depends on the timing of the EU regulation.

The European Central Bank (ECB) is making progress in preparing for the digital euro. According to Piero Cipollone, ECB Executive Board member and coordinator of the project, the technical phase “is proceeding quickly and on schedule,” but moving to operational implementation still requires political approval of the regulation at the European level.

Speaking at the ‘Voices on the Future’ event organized by Ansa and Asvis, Cipollone outlined a possible timeline:

“If the regulation is approved at the start of 2026 — in the best-case scenario for the European legislative process — we could see the first transactions with the digital euro by mid-2028.”

Cipollone also highlighted Europe’s current dependence on electronic payment systems managed by non-European companies:

“Today in Europe, whenever we don’t use cash, any transaction online or at the supermarket has to go through credit cards, with their fees. The payment system relies on companies that aren’t based in Europe. You can see why it would make sense to have a system fully under our control.”

For the ECB board member, the digital euro would act as a direct alternative to cash in the digital world, working like “a banknote you can spend anywhere in Europe for any purpose.”

The digital euro project is part of the ECB’s broader strategy to strengthen the independence of Europe’s financial system. According to Cipollone and the Central Bank, Europe’s digital currency would be a key step toward greater autonomy in electronic payments, reducing reliance on infrastructure and services outside the European Union.

The post ECB: digital euro by mid-2028, says Cipollone appeared first on Atlas21.

-

@ eb0157af:77ab6c55

2025-05-24 05:01:15

@ eb0157af:77ab6c55

2025-05-24 05:01:15A new study reveals: 4 out of 5 Americans would like the US to convert some of its gold into Bitcoin.

A recent survey conducted by the Nakamoto Project revealed that a majority of Americans support converting a portion of the United States’ gold reserves into Bitcoin. The survey, carried out online by Qualtrics between February and March 2025, involved 3,345 participants with demographic characteristics representative of US census standards. Most respondents expressed a desire to convert between 1% and 30% of the gold reserves into BTC.

Troy Cross, co-founder of the Nakamoto Project, stated:

“When given a slider and asked to advise the US government on the right proportion of Bitcoin and gold, subjects were very reluctant to put that slider on 0% Bitcoin and 100% gold. Instead, they settled around 10% Bitcoin.”

One significant finding from the research is the correlation between age and openness to Bitcoin: younger respondents showed a greater inclination toward the cryptocurrency compared to older generations.

A potential US strategy

Bo Hines, a White House advisor, is promoting an initiative for the Treasury Department to acquire Bitcoin by selling off a portion of its gold. Under the proposed plan, the government could acquire up to 1 million BTC over the next five years.

To finance these purchases, the government plans to sell Federal Reserve gold certificates. The proposal aligns with Senator Cynthia Lummis’ 2025 Bitcoin Act, which aims to declare Bitcoin a critical national strategic asset.

Currently, the United States holds 8,133 metric tons of gold, valued at over $830 billion, and about 200,000 BTC, valued at $21 billion.

The post The majority in the US wants to convert part of the gold reserves into Bitcoin appeared first on Atlas21.

-

@ c1d77557:bf04ec8b

2025-05-24 05:01:11

@ c1d77557:bf04ec8b

2025-05-24 05:01:11Se você está em busca de uma experiência de jogo dinâmica e diversificada, o 59h é a plataforma que você precisa conhecer. Com um foco claro na satisfação dos jogadores, ela oferece uma ampla variedade de opções de entretenimento, além de uma interface amigável e segura. Neste artigo, vamos explorar a plataforma 59h, destacando suas principais funcionalidades, jogos emocionantes e a experiência do usuário.

O Que é a Plataforma 59h? O 59h é uma plataforma inovadora que oferece uma vasta gama de jogos e experiências digitais para os entusiastas do entretenimento online. A plataforma se destaca pela sua interface intuitiva, que permite aos jogadores navegar com facilidade entre as diferentes categorias de jogos. Ela é ideal para quem busca uma experiência divertida e acessível, sem complicações.

Desde o momento em que você acessa o 59h, fica evidente o compromisso com a qualidade. A plataforma é projetada para ser acessível em diversos dispositivos, seja no seu computador, tablet ou smartphone. Isso garante que os jogadores possam aproveitar seus jogos favoritos a qualquer momento e em qualquer lugar, com a mesma qualidade e desempenho.

Uma Grande Variedade de Jogos para Todos os Gostos O 59h se destaca por sua impressionante variedade de jogos. Independentemente do tipo de jogo que você prefere, certamente encontrará algo que se adapte ao seu estilo. A plataforma oferece desde jogos de habilidade, até opções mais relaxantes e divertidas para aqueles que buscam algo mais descontraído.

Entre as opções mais populares, destacam-se os jogos de mesa, onde os jogadores podem testar suas habilidades em jogos como pôquer, blackjack e outros. Para quem prefere algo mais voltado para a sorte, o 59h também oferece jogos com elementos de sorte que podem garantir grandes recompensas.

Além disso, a plataforma está sempre atualizando seu portfólio de jogos, trazendo novidades para os jogadores. Isso significa que você nunca ficará entediado, já que sempre haverá algo novo e emocionante para experimentar.

A Experiência do Jogador no 59h Uma das maiores qualidades da plataforma 59h é sua atenção à experiência do usuário. Desde o processo de registro até a escolha de um jogo, tudo foi pensado para garantir uma navegação tranquila e sem estresse.

A plataforma é completamente segura, oferecendo métodos de pagamento rápidos e confiáveis. Isso significa que os jogadores podem depositar e retirar seus fundos com confiança, sem se preocupar com a segurança de suas informações pessoais. Além disso, o suporte ao cliente está sempre disponível para ajudar em caso de dúvidas ou problemas, garantindo que sua experiência seja o mais fluida possível.

Outro ponto que merece destaque é a comunidade de jogadores. A interação com outros jogadores é uma parte importante da plataforma, permitindo que você compartilhe dicas, participe de torneios e crie amizades. A plataforma 59h se esforça para criar um ambiente amigável e inclusivo, onde todos podem se divertir e aprender uns com os outros.

Acessibilidade e Facilidade de Uso O 59h não é apenas sobre a diversidade de jogos; também se trata de tornar o acesso o mais simples possível. A plataforma oferece um design responsivo, que se adapta perfeitamente a qualquer tipo de dispositivo. Isso significa que você pode jogar no computador, smartphone ou tablet com a mesma facilidade.

O processo de cadastro é simples e rápido, permitindo que você comece a jogar em questão de minutos. Além disso, a plataforma oferece uma série de recursos adicionais, como promoções e bônus exclusivos, que tornam a experiência ainda mais empolgante.

Conclusão O 59h se posiciona como uma plataforma de entretenimento online completa, oferecendo uma vasta gama de jogos, uma experiência de usuário de alta qualidade e um ambiente seguro e amigável para jogadores de todos os níveis. Se você procura uma plataforma confiável, diversificada e divertida, o 59h é a escolha ideal. Não importa se você é um iniciante ou um jogador experiente, há sempre algo novo para descobrir e aproveitar no 59h.

-

@ dfa02707:41ca50e3

2025-05-24 05:00:55

@ dfa02707:41ca50e3

2025-05-24 05:00:55Contribute to keep No Bullshit Bitcoin news going.

- "Today we're launching the beta version of our multiplatform Nostr browser! Think Google Chrome but for Nostr apps. The beta is our big first step toward this vision," announced Damus.

- This version comes with the Dave Nostr AI assistant, support for zaps and the Nostr Wallet Connect (NWC) wallet interface, full-text note search, GIFs and fullscreen images, multiple media uploads, user tagging, relay list and mute list support, along with a number of other improvements."

"Included in the beta is the Dave, the Nostr AI assistant (its Grok for Nostr). Dave is a new Notedeck browser app that can search and summarize notes from the network. For a full breakdown of everything new, check out our beta launch video."

What's new

- Dave Nostr AI assistant app.

- GIFs.

- Fulltext note search.

- Add full screen images, add zoom, and pan.

- Zaps! NWC/ Wallet UI.

- Introduce last note per pubkey feed (experimental).

- Allow multiple media uploads per selection.

- Major Android improvements (still WIP).

- Added notedeck app sidebar.

- User Tagging.

- Note truncation.

- Local network note broadcast, broadcast notes to other notedeck notes while you're offline.

- Mute list support (reading).

- Relay list support.

- Ctrl-enter to send notes.

- Added relay indexing (relay columns soon).

- Click hashtags to open hashtag timeline.

- Fixed timelines sometimes not updating (stale feeds).

- Fixed UI bounciness when loading profile pictures

- Fixed unselectable post replies.

-

@ b1ddb4d7:471244e7

2025-05-24 05:00:42

@ b1ddb4d7:471244e7

2025-05-24 05:00:42Asia has emerged as a powerhouse for bitcoin adoption, with diverse countries across the region embracing the world’s leading digital currency in unique ways.

From institutional investors in Singapore to grassroots movements in Indonesia, the Asian bitcoin ecosystem presents a fascinating tapestry of innovation, regulation, and community-driven initiatives.

We dive deep into the current state of bitcoin adoption across key Asian markets, providing investors with actionable insights into this dynamic region.

The Numbers: Asia’s Bitcoin Dominance

As of early 2025, over 500 million people worldwide hold some form of digital currency, with bitcoin remaining the most widely adopted digital asset. Asia stands at the forefront of this adoption wave, with the Central & Southern Asia and Oceania (CSAO) region leading the world in digital currency adoption according to Chainalysis’s 2024 Global Crypto Adoption Index.

The statistics paint a compelling picture:

- Seven of the top 20 countries in global crypto adoption are located in the CSAO region.

- India and China together comprise almost half of the world’s digital currency user base.

- Japan’s digital currency market is expected to reach 19.43 million users by the end of 2025, with a penetration rate of 15.93%.

Behind these impressive numbers lies a complex ecosystem shaped by diverse factors including regulatory environments, technological infrastructure, economic necessities, and vibrant community initiatives.

Photo Source: Chainalysis

Country-by-Country Analysis

India: The Grassroots Powerhouse

India ranks first in Chainalysis’s Global Crypto Adoption Index, with bitcoin adoption thriving particularly in tier-2 and tier-3 cities. This grassroots movement is driven primarily by:

- Financial inclusion: Bitcoin offers banking-like services to India’s large unbanked population.

- Remittance solutions: Lower fees for the significant Indian diaspora sending money home.

- Mobile wallet proliferation: India’s high smartphone penetration enables easy access to bitcoin services.

Japan: The Regulatory Pioneer

Japan has long played a significant role in bitcoin’s evolution, from hosting some of the earliest exchanges to pioneering regulatory clarity. In 2025, Japan finds itself at a fascinating crossroads:

- The Japan Financial Services Agency is considering reclassifying digital currency assets as financial products akin to stocks, potentially enhancing user protection.

- Major corporations like Metaplanet Inc. are expanding their bitcoin holdings, with plans to increase holdings by 470% to reach 10,000 BTC in 2025.

- The country boasts a thriving grassroots bitcoin community and a strong developer ecosystem.

Bitcoin adoption in Japan is uniquely balanced between institutional involvement and community enthusiasm, with initiatives like Blockstream’s Tokyo office working to promote layer-2 solutions, self-custody, and developer education.

Vietnam: The P2P Leader

Vietnam consistently ranks among the top countries for bitcoin adoption per capita. The country’s relationship with bitcoin is characterized by:

- Strong peer-to-peer (P2P) platform usage for daily transactions and remittances.

- High mobile wallet adoption driving grassroots usage.

- Bitcoin serving as a hedge against local currency fluctuations.

- Relatively favorable regulatory attitude compared to some neighboring countries.

Singapore: The Institutional Hub

Singapore has established itself as Asia’s premier institutional bitcoin destination through:

- Clear and forward-thinking regulatory frameworks, particularly the Payment Services Act.

- Growing presence of global digital currency firms including Gemini, OKX, and HashKey, which have received regulatory approvals.

- A robust financial infrastructure catering to high-net-worth individuals and institutional investors.

While Singapore’s consumer protection-focused framework restricts promotional activities and public advertising by digital currency service providers, the city-state remains a beacon for institutional bitcoin adoption in Asia.

South Korea: Retail Dominance Transitioning to Institutional

South Korea presents a fascinating case study of a market in transition:

- Retail investors currently dominate digital currency trading volume, while institutional participation significantly lags behind.

- Experts expect institutional involvement to increase, though a significant shift may not occur until around 2027.

- The local finance watchdog recently launched a crypto committee to assess permissions for corporate digital currency investors and ETFs.

- Users must access fiat-to-digital currency services through local exchanges with official banking partnerships, linking digital currency activities to legal identities.

Bitcoin Communities: The Grassroots Movements

What truly sets Asia apart in the global bitcoin landscape is the vibrant tapestry of community-driven initiatives across the region. These grassroots movements are instrumental in driving adoption from the ground up.

Bitcoin House Bali: A Community Hub

In Indonesia, the Bitcoin House Bali project exemplifies grassroots innovation. This initiative has transformed an old mining container into a vibrant hub for bitcoin education and community engagement.

Key features include:

- Free workshops (including “Bitcoin for Beginners” and “Bitcoin for Kids”).

- Developer programs including online classes, BitDevs Workshops, and Hackathons.

- A closed-loop economic system that turns bitcoin into community points.

- Merchant onboarding—from restaurants and drivers to scooter rentals and street vendors.

Bitcoin Seoul 2025: Bringing the Community Together

The upcoming Bitcoin Seoul 2025 conference (June 4-6, 2025) represents Asia’s largest bitcoin-focused gathering, bringing together global leaders, executives, and community members.

The event will feature:

- The Bitcoin Policy Summit: Seoul Edition, providing insights into regulatory trends.

- The Bitcoin Finance Forum, addressing institutional investment and treasury management.

- A Global Bitcoin Community Assembly for bitcoin grassroots and community leaders.

- Live Lightning Network payments demonstrations at the on-site Lightning Market.

This event underscores South Korea’s emerging role in the global Bitcoin ecosystem and highlights the growing institutional interest in the region.

Regulatory Landscapes: A Mixed Picture

The regulatory environment for bitcoin across Asia presents a complex and evolving picture that significantly impacts adoption patterns.

Japan’s Regulatory Evolution

Japan is considering tightening regulations on digital asset transactions by reclassifying them as financial products similar to stocks. If implemented, these changes would:

- Require issuers to disclose more detailed information on their corporate status.

- Potentially enhance user protection.

- Come into effect after June 2025, following policy direction outlines by the administration.

Current regulations in Japan are relatively digital currency-friendly, with bitcoin recognized as a legal form of payment under the Payment Services Act since 2016.

Singapore’s Balanced Approach

Singapore maintains a regulatory framework that emphasizes market stability and consumer protection, including:

- Restrictions on promoting digital services in public areas.

- The Payment Services Act that regulates digital currency exchanges.

- A general approach that supports institutional adoption while carefully managing retail exposure.

This balanced approach has helped establish Singapore as a trusted hub for bitcoin businesses and institutional investors.

South Korea’s Transitional Framework

South Korea’s regulatory landscape is in flux, with several developments impacting the bitcoin ecosystem:

- Corporate access to digital currenc

-

@ b1ddb4d7:471244e7

2025-05-24 05:00:40

@ b1ddb4d7:471244e7

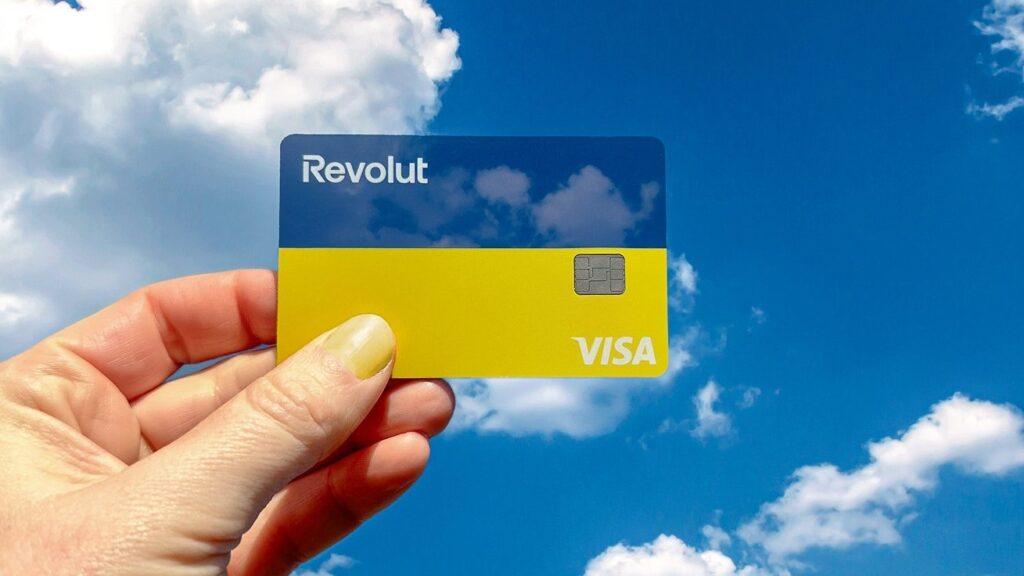

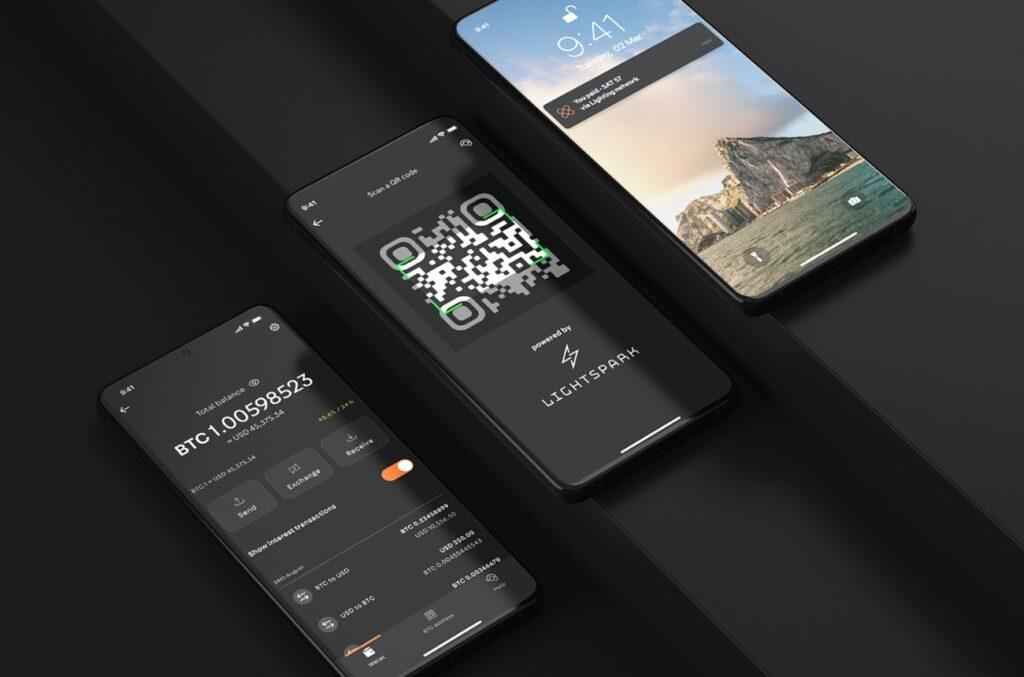

2025-05-24 05:00:40Global fintech leader Revolut has announced a landmark partnership with Lightspark, a pioneer in blockchain infrastructure solutions, to integrate bitcoin’s Lightning Network into its platform.

This collaboration, now live for Revolut users in the UK and select European Economic Area (EEA) countries, marks a transformative leap toward frictionless, real-time transactions—eliminating delays and exorbitant fees traditionally associated with digital asset transfers.

Major update: @RevolutApp is now partnering with @lightspark pic.twitter.com/OUblgrj6Xr

Major update: @RevolutApp is now partnering with @lightspark pic.twitter.com/OUblgrj6Xr— Lightspark (@lightspark) May 7, 2025

Breaking Barriers in Digital Currency Usability

By adopting Lightspark’s cutting-edge technology, Revolut empowers its 40+ million customers to execute bitcoin transactions instantly at a fraction of current costs.

This integration addresses longstanding pain points in digital currency adoption, positioning bitcoin as a practical tool for everyday payments. Users can now seamlessly send, receive, and store bitcoin with the same ease as traditional fiat currencies, backed by Revolut’s secure platform.

The partnership also advances Revolut’s integration into the open Money Grid, a decentralized network enabling universal interoperability between financial platforms.

This move aligns Revolut with forward-thinking fintechs adopting next-gen solutions like Lightning transactions and Universal Money Addresses (UMA), which simplify cross-border payments by replacing complex wallet codes with human-readable addresses (e.g., $john.smith).

Why This Matters

The collaboration challenges conventional payment rails, which often incur delays of days and high fees for cross-border transfers. By contrast, Lightning Network transactions settle in seconds for minimal cost, revolutionizing peer-to-peer payments, remittances, and merchant settlements. For Revolut users, this means:

- Instant transactions: Send bitcoin globally in under three seconds.

- Near-zero fees: Dramatically reduce costs compared to traditional crypto transfers.

- Enhanced utility: Use bitcoin for daily spending, not just as a speculative asset.

The Road Ahead

Revolut plans to expand Lightning Network access to additional markets in 2025, with ambitions to integrate UMA support for seamless fiat and digital currency interactions. Lightspark will continue optimizing its infrastructure to support Revolut’s scaling efforts, further bridging the gap between blockchain innovation and mainstream finance.

About Revolut

Revolut is a global financial app serving over 40 million customers worldwide. Offering services ranging from currency exchange and stock trading to digital assets and insurance, Revolut is committed to building a borderless financial ecosystem.

About Lightspark

Founded by former PayPal and Meta executives, Lightspark develops enterprise-grade solutions for the Lightning Network. Its technology stack empowers institutions to harness bitcoin’s speed and efficiency while maintaining regulatory compliance.

-

@ eb0157af:77ab6c55

2025-05-24 05:01:14

@ eb0157af:77ab6c55

2025-05-24 05:01:14The exchange reveals the extent of the breach that occurred last December as federal authorities investigate the recent data leak.

Coinbase has disclosed that the personal data of 69,461 users was compromised during the breach in December 2024, according to documentation filed with the Maine Attorney General’s Office.

The disclosure comes after Coinbase announced last week that a group of hackers had demanded a $20 million ransom, threatening to publish the stolen data on the dark web. The attackers allegedly bribed overseas customer service agents to extract information from the company’s systems.

Coinbase had previously stated that the breach affected less than 1% of its user base, compromising KYC (Know Your Customer) data such as names, addresses, and email addresses. In a filing with the U.S. Securities and Exchange Commission (SEC), the company clarified that passwords, private keys, and user funds were not affected.

Following the reports, the SEC has reportedly opened an official investigation to verify whether Coinbase may have inflated user metrics ahead of its 2021 IPO. Separately, the Department of Justice is investigating the breach at Coinbase’s request, according to CEO Brian Armstrong.

Meanwhile, Coinbase has faced criticism for its delayed response to the data breach. Michael Arrington, founder of TechCrunch, stated that the stolen data could cause irreparable harm. In a post on X, Arrington wrote:

“The human cost, denominated in misery, is much larger than the $400m or so they think it will actually cost the company to reimburse people. The consequences to companies who do not adequately protect their customer information should include, without limitation, prison time for executives.”

Coinbase estimates the incident could cost between $180 million and $400 million in remediation expenses and customer reimbursements.

Arrington also condemned KYC laws as ineffective and dangerous, calling on both regulators and companies to better protect user data:

“Combining these KYC laws with corporate profit maximization and lax laws on penalties for hacks like these means these issues will continue to happen. Both governments and corporations need to step up to stop this. As I said, the cost can only be measured in human suffering.”

The post Coinbase: 69,461 users affected by December 2024 data breach appeared first on Atlas21.

-

@ b1ddb4d7:471244e7

2025-05-24 05:00:39

@ b1ddb4d7:471244e7

2025-05-24 05:00:39In the heart of East Africa, where M-Pesa reigns supreme and innovation pulses through bustling markets, a quiet revolution is brewing—one that could redefine how millions interact with money.

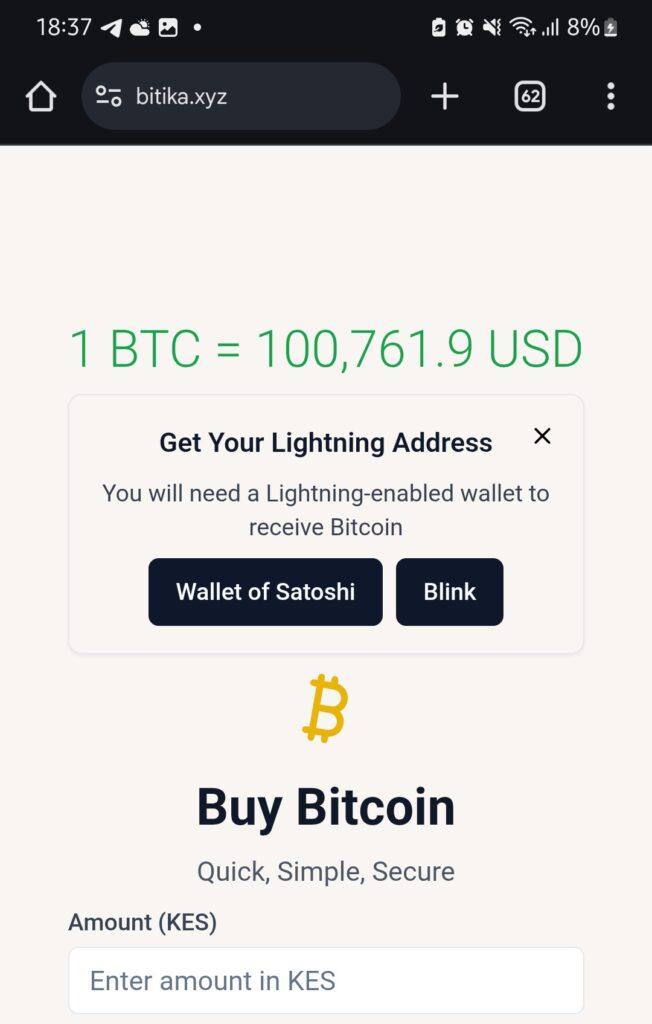

Enter Bitika, the Kenyan startup turning bitcoin’s complexity into a three-step dance, merging the lightning speed of sats with the trusted rhythm of mobile money.

At the helm is a founder whose “aha” moment came not in a boardroom, but at his kitchen table, watching his father grapple with the gap between understanding bitcoin and actually using it.

Bitika was born from that friction—a bridge between M-Pesa’s ubiquity and bitcoin’s borderless promise, wrapped in a name as playful as the Swahili slang that inspired it.

But this isn’t just a story about simplifying transactions. It’s about liquidity battles, regulatory tightropes, and a vision to turn Bitika into the invisible rails powering Africa’s Bitcoin future.

Building on Bitcoin

- Tell us a bit about yourself and how you got into bitcoin/fintech, and what keeps you passionate about this space?

I first came across bitcoin in 2020, but like many at that time, I didn’t fully grasp what it really was. It sounded too complicated, probably with the heavy terminologies. Over time, I kept digging deeper and became more curious.

I started digging into finance and how money works and realised this was what I needed to understand bitcoin’s objectives. I realized that bitcoin wasn’t just a new type of money—it was a breakthrough in how we think about freedom, ownership, and global finance.

What keeps me passionate is how bitcoin can empower people—especially in Africa—to take control of their wealth, without relying on unstable systems or middlemen.

- What pivotal moment or experience inspired you to create Bitika? Was there a specific gap in Kenya’s financial ecosystem that sparked the idea?

Yes, this idea was actually born right in my own home. I’ve always been an advocate for bitcoin, sharing it with friends, family, and even strangers. My dad and I had countless conversations about it. Eventually, he understood the concept. But when he asked, “How do I even buy bitcoin?” or “Can you just buy it for me?” and after taking him through binance—that hit me.

If someone I’d educated still found the buying process difficult, how many others were feeling the same way? That was the lightbulb moment. I saw a clear gap: the process of buying bitcoin was too technical for the average Kenyan. That’s the problem Bitika set out to solve.

- How did you identify the synergy between bitcoin and M-Pesa as a solution for accessibility?

M-Pesa is at the center of daily life in Kenya. Everyone uses it—from buying groceries to paying rent. Instead of forcing people to learn new tools, I decided to meet them where they already are. That synergy between M-Pesa and bitcoin felt natural. It’s about bridging what people already trust with something powerful and new.

- Share the story behind the name “Bitika” – does it hold a cultural or symbolic meaning?

Funny enough, Bitika isn’t a deeply planned name. It came while I was thinking about bitcoin and the type of transformation it brings to individuals. In Swahili, we often add “-ka” to words for flair—like “bambika” from “bamba.”

So, I just coined Bitika as a playful and catchy way to reflect something bitcoin-related, but also uniquely local. I stuck with it because thinking of an ideal brand name is the toughest challenge for me.

- Walk us through the user journey – how does buying bitcoin via M-Pesa in “3 simple steps” work under the hood?

It’s beautifully simple.

1. The user enters the amount they want to spend in KES—starting from as little as 50 KES (about $0.30).

2. They input their Lightning wallet address.

3. They enter their M-Pesa number, which triggers an STK push (payment prompt) on their phone. Once confirmed—pap!—they receive bitcoin almost instantly.

Under the hood, we fetch the live BTC price, validate wallet addresses, check available liquidity, process the mobile payment, and send sats via the Lightning Network—all streamlined into a smooth experience for the user.

- Who’s Bitika’s primary audience? Are you focusing on unbanked populations, tech enthusiasts, or both?

Both. Bitika is designed for everyday people—especially the unbanked and underbanked who are excluded from traditional finance. But we also attract bitcoiners who just want a faster, easier way to buy sats. What unites them is the desire for a seamless and low-barrier bitcoin experience.

Community and Overcoming Challenges

- What challenges has Bitika faced navigating Kenya’s bitcoin regulations, and how do you build trust with regulators?

Regulation is still evolving here. Parliament has drafted bills, but none have been passed into law yet. We’re currently in a revision phase where policymakers are trying to strike a balance between encouraging innovation and protecting the public.

We focus on transparency and open dialogue—we believe that building trust with regulators starts with showing how bitcoin can serve the public good.

- What was the toughest obstacle in building Bitika, and how did you overcome it?

Liquidity. Since we don’t have deep capital reserves, we often run into situations where we have to pause operations often to manually restock our bitcoin supply. It’s frustrating—for us and for users. We’re working on automating this process and securing funding to maintain consistent liquidity so users can access bitcoin at any time, without disruption.

This remains our most critical issue—and the primary reason we’re seeking support.

- Are you eyeing new African markets? What’s next for Bitika’s product?

Absolutely. The long-term vision is to expand Bitika into other African countries facing similar financial challenges. But first, we want to turn Bitika into a developer-first tool—infrastructure that others can build on. Imagine local apps, savings products, or financial tools built using Bitika’s simple bitcoin rails. That’s where we’re heading.

- What would you tell other African entrepreneurs aiming to disrupt traditional finance?

Disrupting finance sounds exciting—but the reality is messy. People fear what they don’t understand. That’s why simplicity is everything. Build tools that hide the complexity, and focus on making the user’s life easier. Most importantly, stay rooted in local context—solve problems people actually face.

What’s Next?

- What’s your message to Kenyans hesitant to try bitcoin, and to enthusiasts watching Bitika?

To my fellow Kenyans: bitcoin isn’t just an investment—it’s a sovereign tool. It’s money you truly own. Start small, learn, and ask questions.

To the bitcoin community: Bitika is proof that bitcoin is working in Africa. Let’s keep pushing. Let’s build tools that matter.

- How can the bitcoin community, both locally and globally, support Bitika’s mission?

We’re currently fundraising on Geyser. Support—whether it’s financial, technical, or simply sharing our story—goes a long way. Every sat you contribute helps us stay live, grow our liquidity, and continue building a tool that brings bitcoin closer to the everyday person in Africa.

Support here: https://geyser.fund/project/bitika

-

@ b1ddb4d7:471244e7

2025-05-24 05:00:37

@ b1ddb4d7:471244e7

2025-05-24 05:00:37Custodial Lightning wallets allow users to transact without managing private keys or channel liquidity. The provider handles technical complexities, but this convenience comes with critical trade-offs:

- You don’t control your keys: The custodian holds your bitcoin.

- Centralized points of failure: Servers can be hacked or shut down.

- Surveillance risks: Providers track transaction metadata.

Key Risks of Custodial Lightning Wallets

*1. Hacks and Exit Scams*

Custodians centralize large amounts of bitcoin, attracting hackers:

- Nearly $2.2 billion worth of funds were stolen from hacks in 2024.

- Lightning custodians suffered breaches, losing user funds.

Unlike non-custodial wallets, victims have no recourse since they don’t hold keys.

*2. Censorship and Account Freezes*

Custodians comply with regulators, risking fund seizures:

- Strike (a custodial Lightning app) froze accounts of users in sanctioned regions.

- A U.K. court in 2020 ordered Bitfinex to freeze bitcoin worth $860,000 after the exchange and blockchain sleuthing firm Chainalysis traced the funds to a ransomware payment.

*3. Privacy Erosion*

Custodians log user activity, exposing sensitive data:

- Transaction amounts, receiver addresses, and IPs are recorded.

*4. Service Downtime*

Centralized infrastructure risks outages.

*5. Inflation of Lightning Network Centralization*

Custodians dominate liquidity, weakening network resilience:

- At the moment, 10% of the nodes on Lightning control 80% of the liquidity.

- This centralization contradicts bitcoin’s decentralized ethos.

How to Switch to Self-Custodial Lightning Wallets

Migrating from custodial services is straightforward:

*1. Choose a Non-Custodial Wallet*

Opt for wallets that let you control keys and channels:

- Flash: The self-custodial tool that lets you own your keys, control your coins, and transact instantly.

- Breez Wallet : Non-custodial, POS integrations.

- Core Lightning : Advanced, for self-hosted node operators.

*2. Transfer Funds Securely*

- Withdraw funds from your custodial wallet to a bitcoin on-chain address.

- Send bitcoin to your non-custodial Lightning wallet.

*3. Set Up Channel Backups*

Use tools like Static Channel Backups (SCB) to recover channels if needed.

*4. Best Practices*

- Enable Tor: Mask your IP (e.g., Breez’s built-in Tor support).

- Verify Receiving Addresses: Avoid phishing scams.

- Regularly Rebalance Channels: Use tools like Lightning Pool for liquidity.

Why Self-Custodial Lightning Matters

- Self-custody: Control your keys and funds.

- Censorship resistance: No third party can block transactions.

- Network health: Decentralized liquidity strengthens Lightning.

Self-custodial wallets now rival custodial ease.

Custodial Lightning wallets sacrifice security for convenience, putting users at risk of hacks, surveillance, and frozen funds. As bitcoin adoption grows, so does the urgency to embrace self-custodial solutions.

Take action today:

- Withdraw custodial funds to a hardware wallet.

- Migrate to a self-custodial Lightning wallet.

- Educate others on the risks of custodial control.

The Lightning Network’s potential hinges on decentralization—don’t let custodians become its Achilles’ heel.

-

@ eb0157af:77ab6c55

2025-05-24 05:01:13

@ eb0157af:77ab6c55

2025-05-24 05:01:13Bitcoin adoption will come through businesses: neither governments nor banks will lead the revolution.

In recent years, it’s undeniable that Bitcoin has ceased to be just a radical idea born from the minds of cypherpunks. It is now recognized across the board as a global asset, discussed in the upper echelons of finance, accepted even on Wall Street, purchased by banking groups and included as a “strategic reserve” by some nations.

However, the general perception that hovers today regarding Bitcoin’s diffusion is still that of minimal adoption, almost insignificant. Bitcoin exists, certainly, but in fact it is not being used. It is rarely possible to pay in satoshis in commercial establishments. Demand is still extremely low.

Furthermore, the debate on Bitcoin is still practically absent: excluding some local events, some niche media outlets or some timid discussion, today Bitcoin is in fact excluded from general interest. The level of understanding and knowledge of the phenomenon is certainly still very low.

Yet, Bitcoin represents an unprecedented technological improvement, capable of solving many problems inherent in the fiat system in which we live. What could facilitate its diffusion?

Bitcoin becomes familiar when businesses adopt it

When talking about Bitcoin adoption, many look to States. They imagine governments that legislate or accumulate Bitcoin as a “strategic reserve,” or banks perceived as forward-thinking that would lead technological change, opening up to innovation. But the reality is different: bureaucracy, political constraints, and fear of losing control inherently prevent States and central banks from being pioneers.

What really drives Bitcoin adoption are not States, but businesses. It is the forward-looking entrepreneurs, innovative startups and – eventually – even large multinational companies that decide to integrate Bitcoin into their operating systems that drive adoption. Indeed, the business world has always played a key role in the adoption of new technologies. This was the case, for example, with the internet, e-commerce, mobile telephony, and the cloud. It will also be the case with Bitcoin.

Unlike a State, when a company adopts Bitcoin, it does so for concrete reasons: efficiency, savings, protection, access to new markets, independence from traditional banking circuits, or bureaucratic streamlining. It is a rational choice, not an ideological one, dictated by the intent to improve one’s competitiveness against the competition to survive in the market.

What is currently missing to facilitate adoption is, in all likelihood, a significant number of businesses that have decided to integrate Bitcoin into their company systems.

Bitcoin becomes “normal” when it is integrated into the operational flow of businesses. Holding and framing bitcoin on the balance sheet, paying an invoice, paying salaries to employees in satoshis, making value transfers globally thanks to the blockchain, allowing customers to pay via Lightning Network… when all this becomes possible with the same simplicity with which we use the euro or the dollar, Bitcoin stops being alternative and becomes the standard.

Businesses are not just users. They are adoption multipliers. When a company chooses Bitcoin, it is automatically proposing it to customers, employees, suppliers, and institutional stakeholders. Each business adoption equals tens, hundreds, or thousands of new eyes on Bitcoin.

People, after all, trust what they see every day: if your trusted restaurant accepts bitcoin, or if your favorite e-commerce platform uses it to receive international payments, or if your colleague receives it as a salary, then Bitcoin no longer appears to be a mysterious object. It finally begins to be perceived as a real, useful, and functioning tool.

The integration of a technology in companies helps make it understandable, accessible, and legitimate in the eyes of the public. This is how distrust is overcome: by making Bitcoin visible in daily life.

Bitcoin and businesses today

A River Financial report estimates that as of May 2025, only 5% of bitcoin is currently owned by private businesses. A still very small number.

According to research by River, in May 2025 businesses hold just over a million btc (about 5% of available monetary units). More than two-thirds of bitcoin (68.2%) are in the hands of private individuals.

To promote Bitcoin adoption, it is necessary today to support businesses in integrating this standard, leveraging all its enormous opportunities. Among others, this technology allows for fast, economical, and global payments. It eliminates intermediaries, increases transparency and security in value transfers. It removes bureaucratic frictions and allows opening up to a new global market.

Every sector can benefit from Bitcoin: e-commerce, tourism, industry, restaurants, professional services, or any other business. Bitcoin revolutionizes the concept of money, and money is a transversal working tool.

We are still at the beginning, but several signals are encouraging. According to a study by Bitwise and reported by Atlas21, in the first quarter of 2025, a growing number of US companies (+16.11% compared to the previous one) are including Bitcoin in their balance sheets, not just as a financial bet, but as a long-term strategy to protect their assets and access a decentralized monetary system to transfer value worldwide without resorting to financial intermediaries.

Who is driving the change?

Echoing the words of Roy Sheinfeld, CEO of Breez, the true potential of Bitcoin will be unleashed first and foremost from the work of developers, the true architects in designing and refining tools that are increasingly simple and intuitive to use for anyone, regardless of level of expertise. It is the developers – Roy rightly argued – who will enable us to “conquer the world.”

But probably that’s not enough: the next step is to make Bitcoin a globally accepted technological standard, changing its perception towards the general public. And this is where businesses come into play.

Guided by the market, technological innovation, and the desire to meet user demands, entrepreneurs today represent the fulcrum to accelerate the monetary transition from the current fiat system towards the Bitcoin standard. It is entrepreneurs who transform innovations from opportunities for a few to a reality shared by many.

The adoption of Bitcoin will therefore not arise from a sudden event, nor from the exclusive fruit of enthusiasts’ enthusiasm or from arbitrary political choices decreed by States or regulators.

The future of Bitcoin is built in the places where value is created every day: in companies, in their systems, and in their strategic decisions.

“If we conquer developers, we conquer the world. If we conquer businesses, we conquer adoption.”

The post The key to Bitcoin adoption is businesses appeared first on Atlas21.

-

@ eb0157af:77ab6c55

2025-05-24 05:01:12

@ eb0157af:77ab6c55

2025-05-24 05:01:12Governor Abbott will have to decide whether to sign the bill establishing a bitcoin reserve for the state.

Texas could become the third U.S. state to set up a strategic bitcoin reserve, following the approval of Senate Bill 21 by the state House, with 101 votes in favor and 42 against.

Lee Bratcher, founder and president of the Texas Blockchain Council, expressed confidence that Governor Greg Abbott will sign the legislative measure. In an interview with The Block, Bratcher said:

“I’ve talked to the governor about this personally, and I think he wants to see Texas lead in this way.”

The bill is expected to reach the governor’s desk within a week or two, according to Bratcher’s projections. If signed, Texas would follow in the footsteps of New Hampshire and Arizona in creating a state-held bitcoin reserve.

Despite Texas ranking as the world’s eighth-largest economy — ahead of many nations — the initial approach to the reserve will be cautious. Bratcher estimates the starting investment will be in the “tens of millions of dollars,” an amount he describes as “modest” for an economy the size of Texas. The responsibility for operational decisions would fall to the state comptroller, who acts as an executive accountant in charge of managing and investing public funds.

“My sense is that it will be in the tens of millions of dollars, which, while it sounds significant, is a very modest amount, for a state the size of Texas.” explained the president of the Texas Blockchain Council.

The road to approval

According to Bratcher, the idea of creating a state bitcoin reserve dates back to 2022 and represents the culmination of years of work by the Texas Blockchain Council. The organization has worked closely with lawmakers who shared the vision of seeing the state accumulate the world’s leading cryptocurrency. Additionally, Texas has long been home to numerous bitcoin mining companies.

The post Texas one step away from a bitcoin reserve: only the governor’s signature is missing appeared first on Atlas21.

-

@ b1ddb4d7:471244e7

2025-05-24 05:00:36

@ b1ddb4d7:471244e7

2025-05-24 05:00:36The upcoming Bitcoin 2025 conference, scheduled from May 27–29 at the Venetian Conference Center in Las Vegas, is set to make history with an official attempt to break the GUINNESS WORLD RECORDS® title for the most Bitcoin point-of-sale transactions in an eight-hour period.

Organized by BTC Inc, the event will showcase Bitcoin’s evolution from a digital capital asset to a practical medium of exchange, leveraging the latest advancements in payment technology.

Tap-to-Pay with Lightning-Ready Bolt Cards

To facilitate this record-setting attempt, 4,000 Lightning-ready Bolt Cards will be distributed to conference attendees.

— Uncle Rockstar Developer (@r0ckstardev) May 15, 2025

These NFC-enabled cards allow users to make instant, contactless Bitcoin payments at vendor booths throughout the expo-no apps or QR codes required, just a simple tap.

The cards are available in four collectible designs, each featuring a prominent figure in Bitcoin’s history: Senator Cynthia Lummis, Michael Saylor, Satoshi Nakamoto, and Jack Dorsey.

Each attendee will receive a randomly assigned card, making them both functional and collectible souvenirs.

Senator Lummis: A Playful Provocation

Notably, one of the card designs features Senator Cynthia Lummis with laser eyes-a playful nod to her reputation as a leading Bitcoin advocate in US politics.

While Lummis is known for her legislative efforts to promote Bitcoin integration, she has publicly stated she prefers to “spend dollars and save Bitcoin,” viewing BTC as a long-term store of value rather than a daily currency.

The choice to feature her on the Bolt Card, could be suggested by Rockstar Dev of the BTC Pay Server Foundation, perhaps a lighthearted way to highlight the ongoing debate about Bitcoin’s role in everyday payments.

Nothing cracks me up quite like a senator that wants the US to buy millions of Bitcoin use dollars to buy a beer at a Bitcoin bar.

This is how unserious some of you are. pic.twitter.com/jftIEggmip

— Magoo PhD (@HodlMagoo) April 4, 2025

How Bolt Cards and the Lightning Network Work

Bolt Cards are physical cards equipped with NFC (Near Field Communication) technology, similar to contactless credit or debit cards. When linked to a compatible Lightning wallet, they enable users to make Bitcoin payments over the Lightning Network by simply tapping the card at a point-of-sale terminal.

The Lightning Network is a second-layer protocol built on top of Bitcoin, designed to facilitate instant, low-cost transactions ideal for everyday purchases.

This integration aims to make Bitcoin as easy to use as traditional payment methods, eliminating the need for QR code scanning or mobile apps.

A Showcase for Bitcoin’s Real-World Usability

With over 30,000 attendees, 300 exhibitors, and 500 speakers expected, the Bitcoin 2025 conference is poised to be the largest Bitcoin event of the year-and potentially the most transactional.

The event will feature on-site activations such as the Official Bitcoin Magazine Store, where all merchandise will be available at a 21% discount for those paying with Bitcoin via the Lightning Network-a nod to Bitcoin’s 21 million coin supply limit.

By deeply integrating Lightning payments into the conference experience, organizers hope to demonstrate Bitcoin’s readiness for mainstream commerce and set a new benchmark for its practical use as a currency.

Conclusion

The Guinness World Record attempt at Bitcoin 2025 is more than a publicity stunt-it’s a bold demonstration of Bitcoin’s technological maturity and its potential to function as a modern, everyday payment method.

Whether or not the record is set, the event will serve as a milestone in the ongoing journey to make Bitcoin a truly global, user-friendly currency

-

@ b1ddb4d7:471244e7

2025-05-24 05:00:35

@ b1ddb4d7:471244e7

2025-05-24 05:00:35Flash, an all-in-one Bitcoin payment platform, has announced the launch of Flash 2.0, the most intuitive and powerful Bitcoin payment solution to date.

With a completely redesigned interface, expanded e-commerce integrations, and a frictionless onboarding process, Flash 2.0 makes accepting Bitcoin easier than ever for businesses worldwide.

We did the unthinkable!

We did the unthinkable! Website monetization used to be super complicated.

"Buy me a coffee" — But only if we both have a bank account.

WHAT IF WE DON'T?

Thanks to @paywflash and bitcoin, it's just 5 CLICKS – and no banks!

Start accepting donations on your website… pic.twitter.com/uwZUrvmEZ1

Start accepting donations on your website… pic.twitter.com/uwZUrvmEZ1— Flash • The Bitcoin Payment Gateway (@paywflash) May 13, 2025

Accept Bitcoin in Three Minutes

Setting up Bitcoin payments has long been a challenge for merchants, requiring technical expertise, third-party processors, and lengthy verification procedures. Flash 2.0 eliminates these barriers, allowing any business to start accepting Bitcoin in just three minutes, with no technical set-up and full control over their funds.

The Bitcoin Payment Revolution

The world is witnessing a seismic shift in finance. Governments are backing Bitcoin funds, major companies are adding Bitcoin to their balance sheets, and political figures are embracing it as the future of money. Just as Stripe revolutionized internet payments, Flash is now doing the same for Bitcoin. Businesses that adapt today will gain a competitive edge in a rapidly evolving financial landscape.

With Bitcoin adoption accelerating, consumers are looking for places to spend it. Flash 2.0 ensures businesses of all sizes can seamlessly accept Bitcoin and position themselves at the forefront of this financial revolution.

All-in-One Monetization Platform

More than just a payment gateway, Flash 2.0 is a complete Bitcoin monetization suite, providing multiple ways for businesses to integrate Bitcoin into their operations. Merchants can accept payments online and in-store, content creators can monetize with donations and paywalls, and freelancers can send instant invoices via payment links.

For example, a jewelry designer selling products on WooCommerce can now integrate Flash for online payments, use Flash’s Point-of-Sale system at trade shows, enable Bitcoin donations for her digital artwork, and lock premium content behind Flash Paywalls. The possibilities are endless.

E-Commerce for Everyone

With built-in integrations for Shopify, WooCommerce, and soon Wix and OpenCart, Flash 2.0 enables Bitcoin payments on 95% of e-commerce stores worldwide. Businesses can now add Bitcoin as a payment option in just a few clicks—without needing developers or external payment processors.

And for those looking to start selling, Flash’s built-in e-commerce features allow users to create online stores, showcase products, and manage payments seamlessly.

No Middlemen, No Chargebacks, No Limits

Unlike traditional payment platforms, Flash does not hold or process funds. Businesses receive Bitcoin directly, instantly, and securely. There are no chargebacks, giving merchants full control over refunds and eliminating fraud. Flash also remains KYC-free, ensuring a seamless experience for businesses and customers alike.

A Completely Redesigned Experience

“The world is waking up to Bitcoin. Just like the internet revolutionized commerce, Bitcoin is reshaping finance. Businesses need solutions that are simple, efficient, and truly decentralized. Flash 2.0 is more than just a payment processor—it’s a gateway to the future of digital transactions, putting financial power back into the hands of businesses.”

— Pierre Corbin, CEO at Flash.

Flash 2.0 introduces a brand-new user interface, making it easier than ever to navigate, set up payments, and manage transactions. With an intuitive dashboard, streamlined checkout, and enhanced mobile compatibility, the platform is built for both new and experienced Bitcoin users.

About Flash

Flash is an all-in-one Bitcoin payment platform that empowers businesses, creators, and freelancers to accept, manage, and grow with Bitcoin. With a mission to make Bitcoin payments accessible to everyone, Flash eliminates complexity and gives users full control over their funds.

To learn more or get started, visit www.paywithflash.com.

Press Contact:

Julien Bouvier

Head of Marketing

+3360941039 -

@ 348e7eb2:3b0b9790

2025-05-24 05:00:33

@ 348e7eb2:3b0b9790

2025-05-24 05:00:33Nostr-Konto erstellen - funktioniert mit Hex

Was der Button macht

Der folgende Code fügt einen Button hinzu, der per Klick einen Nostr-Anmeldedialog öffnet. Alle Schritte sind im Code selbst ausführlich kommentiert.

```html

```

Erläuterungen:

- Dynamisches Nachladen: Das Script

modal.jswird nur bei Klick nachgeladen, um Fehlermeldungen beim Initial-Load zu vermeiden. -

Parameter im Überblick:

-

baseUrl: Quelle für API und Assets. an: App-Name für den Modal-Header.aa: Farbakzent (Foerbico-Farbe als Hex).al: Sprache des Interfaces.am: Licht- oder Dunkelmodus.afb/asb: Bunker-Modi für erhöhten Datenschutz.aan/aac: Steuerung der Rückgabe privater Schlüssel.arr/awr: Primal Relay als Lese- und Schreib-Relay.-

Callbacks:

-

onComplete: Schließt das Modal, zeigt eine Bestätigung und bietet die Weiterleitung zu Primal an. onCancel: Schließt das Modal und protokolliert den Abbruch.

Damit ist der gesamte Code sichtbar, kommentiert und erklärt.

- Dynamisches Nachladen: Das Script

-

@ eb0157af:77ab6c55

2025-05-24 05:01:11

@ eb0157af:77ab6c55

2025-05-24 05:01:11Bitcoin surpasses gold in the United States: 50 million holders and a dominant role in the global market.

According to a new report by River, for the first time in history, the number of Americans owning bitcoin has surpassed that of gold holders. The analysis reveals that approximately 50 million U.S. citizens currently own the cryptocurrency, while gold owners number 37 million. In fact, 14.3% of Americans own bitcoin, the highest percentage of holders worldwide.

Source: River

The report highlights that 40% of all Bitcoin-focused companies are based in the United States, consolidating America’s dominant position in the sector. Additionally, 40.5% of Bitcoin holders are men aged 31 to 35, followed by 35.9% of men aged 41 to 45. In contrast, only 13.4% of holders are women.

Source: River

Notably, U.S. companies hold 94.8% of all bitcoins owned by publicly traded companies worldwide. According to the report, recent regulatory changes in the U.S. have made the asset more accessible through financial products such as spot ETFs.

The document also shows that American investors increasingly view the cryptocurrency as protection against fiscal instability and inflation, appreciating its limited supply and decentralized governance model.

For River, Bitcoin offers significant practical advantages over gold in the modern digital era. Its ease of custody, cross-border transfer, and liquidity make the cryptocurrency an attractive option for both individual and institutional investors, the report suggests.

The post USA: 50 million Americans own bitcoin appeared first on Atlas21.

-

@ eb0157af:77ab6c55

2025-05-24 05:01:10

@ eb0157af:77ab6c55

2025-05-24 05:01:10Michigan lawmakers are unveiling a comprehensive strategy to regulate Bitcoin and cryptocurrencies.

On May 21, Republican Representative Bill Schuette introduced House Bill 4510, a proposal to amend the Michigan Public Employee Retirement System Investment Act. The legislation would allow the state treasurer, currently Rachael Eubanks, to diversify the state’s investments by including cryptocurrencies with an average market capitalization of over $250 million in the past calendar year.

Under current criteria, Bitcoin (BTC) and Ether (ETH) are the only cryptocurrencies that meet these selection standards. The proposal specifies that any investment in digital assets must be made through exchange-traded products (spot ETFs) issued by registered investment companies.

Anti-CBDC legislation

Republican Representative Bryan Posthumus is leading the bipartisan initiative behind the second bill, HB 4511, which establishes protections for cryptocurrency holders. The proposal prohibits Michigan from implementing crypto bans or imposing licensing requirements on digital asset holders.

Another key aspect of the legislation is a ban on state officials from supporting or promoting a potential federal central bank digital currency (CBDC). The definition includes the issuance of memorandums or official statements endorsing CBDC proposals related to testing, adoption, or implementation.

Mining and redevelopment of abandoned sites

The third bill, HB 4512, is a proposal led by Democratic Representative Mike McFall for a bipartisan group. This initiative would establish a Bitcoin mining program allowing operators to use abandoned oil and natural gas sites.

The program calls for the appointment of a supervisor tasked with assessing the site’s remaining productive potential, identifying the last operator, and determining the length of abandonment. Prospective participants would need to submit detailed legal documentation of their organizational structure, demonstrate operational expertise in mining, and provide profitability breakeven estimates for their ventures.

The fourth and final bill, HB 4513, also introduced by the bipartisan group led by McFall, focuses on the fiscal aspect of the HB 4512 initiative. The proposal would amend Michigan’s income tax laws to include proceeds generated from the proposed Bitcoin mining program.

The post Michigan: four bills on pension funds, CBDCs, and mining appeared first on Atlas21.

-

@ b1ddb4d7:471244e7

2025-05-24 05:00:33

@ b1ddb4d7:471244e7

2025-05-24 05:00:33Bitcoin FilmFest (BFF25) returns to Warsaw for its third edition, blending independent cinema—from feature films and commercials to AI-driven experimental visuals—with education and entertainment.

Hundreds of attendees from around the world will gather for three days of screenings, discussions, workshops, and networking at the iconic Kinoteka Cinema (PKiN), the same venue that hosted the festival’s first two editions in March 2023 and April 2024.

This year’s festival, themed “Beyond the Frame,” introduces new dimensions to its program, including an extra day on May 22 to celebrate Bitcoin Pizza Day, the first real-world bitcoin transaction, with what promises to be one of Europe’s largest commemorations of this milestone.

BFF25 bridges independent film, culture, and technology, with a bold focus on decentralized storytelling and creative expression. As a community-driven cultural experience with a slightly rebellious spirit, Bitcoin FilmFest goes beyond movies, yet cinema remains at its heart.

Here’s a sneak peek at the lineup, specially curated for movie buffs:

Generative Cinema – A special slot with exclusive shorts and a thematic debate on the intersection of AI and filmmaking. Featured titles include, for example: BREAK FREE, SATOSHI: THE CREATION OF BITCOIN, STRANGE CURRENCIES, and BITCOIN IS THE MYCELIUM OF MONEY, exploring financial independence, traps of the fiat system, and a better future built on sound money.

Generative Cinema – A special slot with exclusive shorts and a thematic debate on the intersection of AI and filmmaking. Featured titles include, for example: BREAK FREE, SATOSHI: THE CREATION OF BITCOIN, STRANGE CURRENCIES, and BITCOIN IS THE MYCELIUM OF MONEY, exploring financial independence, traps of the fiat system, and a better future built on sound money. Upcoming Productions Preview – A bit over an hour-long block of unreleased pilots and works-in-progress. Attendees will get exclusive first looks at projects like FINDING HOME (a travel-meets-personal-journey series), PARALLEL SPACES (a story about alternative communities), and THE LEGEND OF LANDI (a mysterious narrative).