-

@ 81022b27:2b8d0644

2025-06-08 15:18:50

@ 81022b27:2b8d0644

2025-06-08 15:18:50I’ve always gravitated to ideas and topics that are not quite mainstream:

Well, like CHIROPRACTIC.

But even in chiropractic school, I went fringe. I heard about one of the technique clubs (Toftness) that showed you how you could detect a subluxation by just rubbing your thumb over a piece of plexiglass.

We were discussing that in a group, and most of my friends were saying:

“What a load of shit!”

And that made my ears perk up.

So I started going to the club meetings.

I walk in, and there’s a guy face down on a chiropractic table while another guy was holding what looked like some sort of cyberpunk lens. He started rubbing it and worked it down the guy's spine.

He pointed out areas that were subluxated:

“Here.”

And going further down:

“Here.”

And:

“Here.”

Wow.

Then he “adjusted” by touching the spine with his index finger.

My mind was blown.

So you mean I didn’t have to be adjusted the way Harvey Fish did?

Dr. Fish was a great guy and would adjust students for, I think, $10. You’d go in, wait to see if he had any “real patients.” In between patients, he would adjust the students. He was heavy-handed and sure as hell able to move a bone.

So now I’m intrigued and curious. I studied and practiced any chance I had. I had different friends that I studied different things with.

(Except for Dyslexic Dave - nobody wanted to study with that guy. Our group did once, and we all failed a test. His dyslexia was so powerful, it overcame all of us.)

I’d study all the weird stuff with my friend Victoria, and then we would go get our network chiropractic adjustment from Dr. Michael Scimeca.

I found out that it wasn’t the Toftness lens that had the super-powers. Instead, it was because when your hand detected a change in energy over the spinal segments, there's a “galvanic response” similar to that of a polygraph lie detector test. So it made the skin on my hand “sweat,” and that made the plexiglass squeak and stick.

So it wasn’t the equipment. It was me.

After a while, I realized that I could feel a warmth on my chest right before the lens squeaked. So, I ditched the lens and started working on people where I “felt” the subluxations were located.

Seemed to work well - I always double-checked my “regular” chiropractic findings with what I felt. We studied for exams, then practiced technique on each other.

One time at a seminar, the instructor demonstrated what to do and asked for volunteers - one to be the patient and the other to be the doctor. I watched this guy struggling with his patient. It looked like he had flippers instead of hands; the whole interaction was super awkward.

All of a sudden, I started feeling uncomfortable and just blurted out:

“For God’s sake, leave him alone! Can’t you tell he is super annoyed and angry?”

Oops.

The instructor said, “Yes, maybe we should take a break.”

The guy that was the patient came up to me and asked, “How did you know?”

“I don’t know, I just felt it,” I said.

After that I started trying to see if I could feel what others were feeling. So when I was bored in a class, I’d go down the rows and try to feel what the my fellow students felt and quickly move on.

Going down the row: nothing, nothing nothing. This guy is pissed off, next one: nothing, nothing, Ow! She has a headache.

Dammit! Now I have a headache!

So that turned into a problem: When I worked on someone that had pain or other symptoms, I would take those on for myself. And the person I worked on would leave feeling great.

My friend Juanita did what is called an "attunement," and I became a Reiki Master.

Reiki masters are supposed to move energy around, but I was afraid I’d pick up too much of someone’s vibe and it would make me uncomfortable.

Plus, I can’t be doing energy work if I’m a chiropractor now.

So I kept all that checked and on the "down low"; sometimes I would get a "feeling" about a client while I was working on them. Surprisingly, it was always correct and it helped my client to make progress.

At some point, I started feeling that I needed to be true to myself, and if I had these abilities and I was able to use them to help the people that came to see me, then that's what I was going to do.

I've embraced this side of my work. If my clients need some emotional work, that’s what we work on, if they need some energy work, then they get it.

I suppose some people don’t want a chiropractor that’s metaphysical, but really-that’s how it all started. There are plenty of “evidence-based” chiropractors out there that can’t adjust their way out of a paper bag.

If the power goes off, they couldn’t use their lasers or whatever machine the Chiropractic Physiotherapy Industrial Complex wants you to buy now.

While I appreciate all the fancy parties they throw for us at continuing education seminars, they are infiltrating the chiropractic schools and now we are pumping out new chiropractors that only think they will be successful if they have the latest and greatest shiny machine.

I’ve studied a bunch of different things, I’ve found what works for me and refined it.

I tell my clients :

“I’m a better chiropractor today than I was yesterday, and I was pretty good back then!”

So I guess my next step is teaching some of this information and hoping to pass it on before my time here is up.

And you know what? I will love every damn minute of it!

There's nothing quite like sharing the weird, the wonderful, and the downright strange ways we can help people heal.

So, let's get to it—I've got a lot of sharing and teaching to do—it's going to be exciting!

-

@ 81022b27:2b8d0644

2025-06-08 15:06:12

@ 81022b27:2b8d0644

2025-06-08 15:06:12I have a family practice where I see pretty much everything, from infants to the elderly, athletes to people with disabilities.

When someone gets good results, they always want their loved ones to benefit in the same way.

Husbands tell their wives, wives bring in their husbands...

I even had a guy bring both his wife and his girlfriend! On different days, of course.

So, sometimes we notice a little bit of drama here and there. When one of our couples divorces, someone usually gets custody of the chiropractor.

It's rare that I keep seeing both parties.

It's probably for the best, because there was this one time when a guy showed up with his new "friend" while the ex’s best friend was in the waiting area.

Well, it was like an episode of the "Jerry Springer Show" that day.

Let's get to the story:

This one guy I’d been working on started coming in more frequently, complaining of more pain, more aches, more everything.

I've been doing this for a while now, so I told him that when I see this, it's one of two things:

Either you are physically doing something to aggravate the issue,

Or you are under emotional stress.

He told me that he and his wife were having problems, and there was lots of drama.

Of course, I kept working on him. Sometimes I did some emotional work, but with men, I have to be very business-like when dealing with emotions because we don't like to deal with them.

Time passed, and they finally divorced.

He still comes in regularly, and I've noticed he has less pain and fewer issues. His visits are more like "wellness visits"; he seems in better spirits.

I thought I'd never see the ex-wife again, but she showed up today, and when I checked her, she's doing better than ever!

It got me thinking... these people are way better off divorced! They're not in constant fight-or-flight mode; I'm sure they are happier or will be. It's a positive all the way around.

I've been divorced twice. That's not something I'm proud of. I see both those divorces as failures.

I was 23 when I got married the first time. We were both super young and unprepared. We struggled for four years, and then she wanted out.

Not that I blame her; I was unhappy with myself, and my frustration and unhappiness bled into the relationship.

My second marriage lasted a lot longer than the first. After all we were older, ended up having 2 kids and I really, really tried.

I was just terrified of losing my girls. I even recall saying that I was willing to be miserable and unhappy just “for the kids”

The truth is once we separated, I probably spent more “quality time” with my daughters than I had before.

But here’s the thing in both marriages I would have willingly given up the chance to be happier with a clean end to the relationship in order to give it another shot.

At some point you just run out of shots.

I see elderly couples out at restaurants and they hardly say anything to each other. Is it because they know each other so well that they don’t need to speak, or is one of them silently praying the other one will drop dead so they will finally have a chance at happiness?

What I’m trying to say here is:

Maybe there is no hope for that relationship that you are giving CPR

Maybe it’s time to move on.

Live Long and Prosper. 🖖

-

@ 7f6db517:a4931eda

2025-06-08 15:01:52

@ 7f6db517:a4931eda

2025-06-08 15:01:52

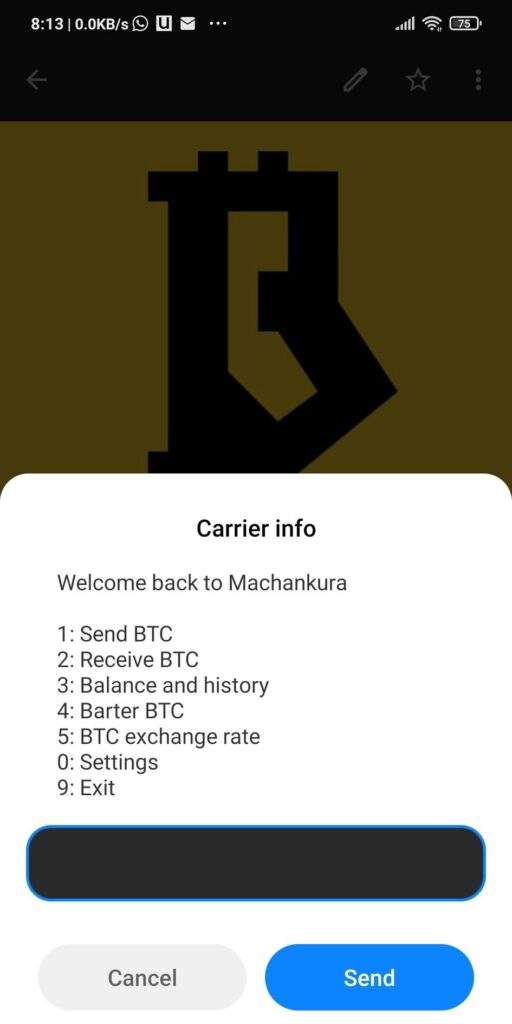

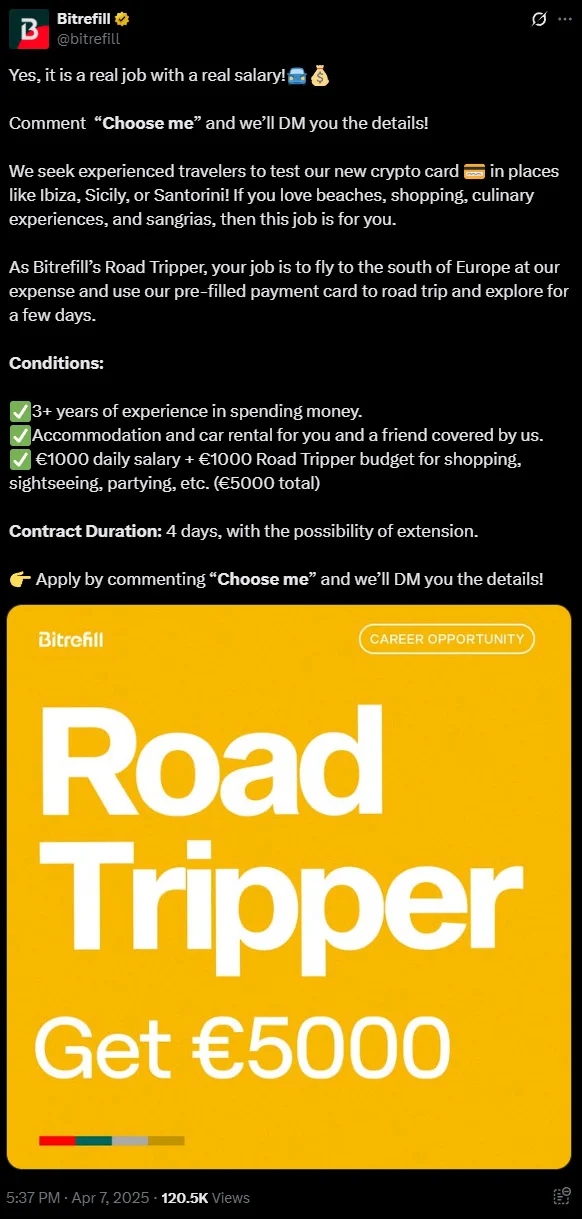

The former seems to have found solid product market fit. Expect significant volume, adoption, and usage going forward.

The latter's future remains to be seen. Dependence on Tor, which has had massive reliability issues, and lack of strong privacy guarantees put it at risk.

— ODELL (@ODELL) October 27, 2022

The Basics

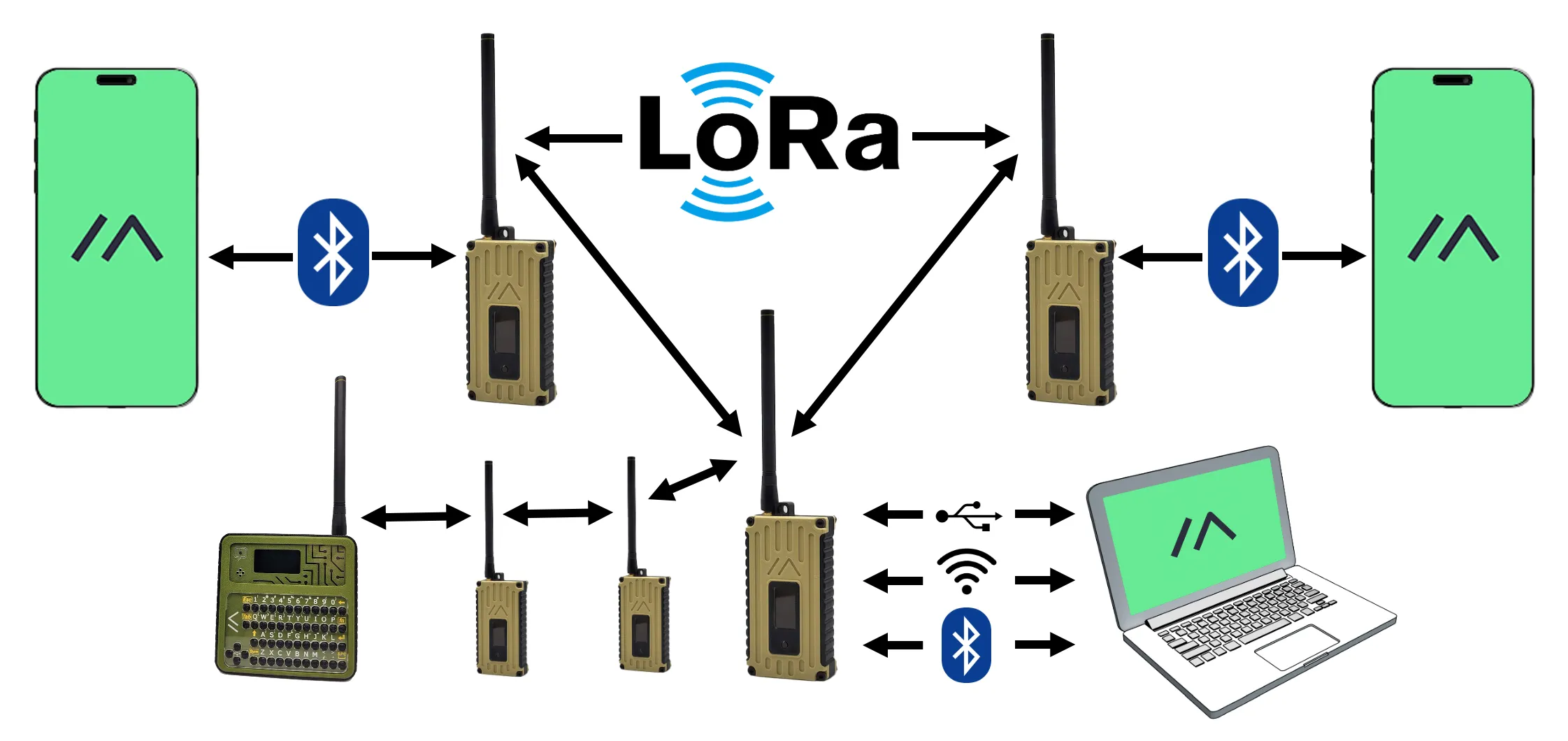

- Lightning is a protocol that enables cheap and fast native bitcoin transactions.

- At the core of the protocol is the ability for bitcoin users to create a payment channel with another user.

- These payment channels enable users to make many bitcoin transactions between each other with only two on-chain bitcoin transactions: the channel open transaction and the channel close transaction.

- Essentially lightning is a protocol for interoperable batched bitcoin transactions.

- It is expected that on chain bitcoin transaction fees will increase with adoption and the ability to easily batch transactions will save users significant money.

- As these lightning transactions are processed, liquidity flows from one side of a channel to the other side, on chain transactions are signed by both parties but not broadcasted to update this balance.

- Lightning is designed to be trust minimized, either party in a payment channel can close the channel at any time and their bitcoin will be settled on chain without trusting the other party.

There is no 'Lightning Network'

- Many people refer to the aggregate of all lightning channels as 'The Lightning Network' but this is a false premise.

- There are many lightning channels between many different users and funds can flow across interconnected channels as long as there is a route through peers.

- If a lightning transaction requires multiple hops it will flow through multiple interconnected channels, adjusting the balance of all channels along the route, and paying lightning transaction fees that are set by each node on the route.

Example: You have a channel with Bob. Bob has a channel with Charlie. You can pay Charlie through your channel with Bob and Bob's channel with User C.

- As a result, it is not guaranteed that every lightning user can pay every other lightning user, they must have a route of interconnected channels between sender and receiver.

Lightning in Practice

- Lightning has already found product market fit and usage as an interconnected payment protocol between large professional custodians.

- They are able to easily manage channels and liquidity between each other without trust using this interoperable protocol.

- Lightning payments between large custodians are fast and easy. End users do not have to run their own node or manage their channels and liquidity. These payments rarely fail due to professional management of custodial nodes.

- The tradeoff is one inherent to custodians and other trusted third parties. Custodial wallets can steal funds and compromise user privacy.

Sovereign Lightning

- Trusted third parties are security holes.

- Users must run their own node and manage their own channels in order to use lightning without trusting a third party. This remains the single largest friction point for sovereign lightning usage: the mental burden of actively running a lightning node and associated liquidity management.

- Bitcoin development prioritizes node accessibility so cost to self host your own node is low but if a node is run at home or office, Tor or a VPN is recommended to mask your IP address: otherwise it is visible to the entire network and represents a privacy risk.

- This privacy risk is heightened due to the potential for certain governments to go after sovereign lightning users and compel them to shutdown their nodes. If their IP Address is exposed they are easier to target.

- Fortunately the tools to run and manage nodes continue to get easier but it is important to understand that this will always be a friction point when compared to custodial services.

The Potential Fracture of Lightning

- Any lightning user can choose which users are allowed to open channels with them.

- One potential is that professional custodians only peer with other professional custodians.

- We already see nodes like those run by CashApp only have channels open with other regulated counterparties. This could be due to performance goals, liability reduction, or regulatory pressure.

- Fortunately some of their peers are connected to non-regulated parties so payments to and from sovereign lightning users are still successfully processed by CashApp but this may not always be the case going forward.

Summary

- Many people refer to the aggregate of all lightning channels as 'The Lightning Network' but this is a false premise. There is no singular 'Lightning Network' but rather many payment channels between distinct peers, some connected with each other and some not.

- Lightning as an interoperable payment protocol between professional custodians seems to have found solid product market fit. Expect significant volume, adoption, and usage going forward.

- Lightning as a robust sovereign payment protocol has yet to be battle tested. Heavy reliance on Tor, which has had massive reliability issues, the friction of active liquidity management, significant on chain fee burden for small amounts, interactivity constraints on mobile, and lack of strong privacy guarantees put it at risk.

If you have never used lightning before, use this guide to get started on your phone.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-08 15:01:51

@ 7f6db517:a4931eda

2025-06-08 15:01:51

The newly proposed RESTRICT ACT - is being advertised as a TikTok Ban, but is much broader than that, carries a $1M Fine and up to 20 years in prison️! It is unconstitutional and would create massive legal restrictions on the open source movement and free speech throughout the internet.

The Bill was proposed by: Senator Warner, Senator Thune, Senator Baldwin, Senator Fischer, Senator Manchin, Senator Moran, Senator Bennet, Senator Sullivan, Senator Gillibrand, Senator Collins, Senator Heinrich, and Senator Romney. It has broad support across Senators of both parties.

Corrupt politicians will not protect us. They are part of the problem. We must build, support, and learn how to use censorship resistant tools in order to defend our natural rights.

The RESTRICT Act, introduced by Senators Warner and Thune, aims to block or disrupt transactions and financial holdings involving foreign adversaries that pose risks to national security. Although the primary targets of this legislation are companies like Tik-Tok, the language of the bill could potentially be used to block or disrupt cryptocurrency transactions and, in extreme cases, block Americans’ access to open source tools or protocols like Bitcoin.

The Act creates a redundant regime paralleling OFAC without clear justification, it significantly limits the ability for injured parties to challenge actions raising due process concerns, and unlike OFAC it lacks any carve-out for protected speech. COINCENTER ON THE RESTRICT ACT

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-08 15:01:50

@ 7f6db517:a4931eda

2025-06-08 15:01:50Will not live in a pod.

Will not eat the bugs.

Will not get the chip.

Will not get a blue check.

Will not use CBDCs.Live Free or Die.

Why did Elon buy twitter for $44 Billion? What value does he see in it besides the greater influence that undoubtedly comes with controlling one of the largest social platforms in the world? We do not need to speculate - he made his intentions incredibly clear in his first meeting with twitter employees after his takeover - WeChat of the West.

To those that do not appreciate freedom, the value prop is clear - WeChat is incredibly powerful and successful in China.

To those that do appreciate freedom, the concern is clear - WeChat has essentially become required to live in China, has surveillance and censorship integrated at its core, and if you are banned from the app your entire livelihood is at risk. Employment, housing, payments, travel, communication, and more become extremely difficult if WeChat censors determine you have acted out of line.

The blue check is the first step in Elon's plan to bring the chinese social credit score system to the west. Users who verify their identity are rewarded with more reach and better tools than those that do not. Verified users are the main product of Elon's twitter - an extensive database of individuals and complete control of the tools he will slowly get them to rely on - it is easier to monetize cattle than free men.

If you cannot resist the temptation of the blue check in its current form you have already lost - what comes next will be much darker. If you realize the need to resist - freedom tech provides us options.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-08 15:01:50

@ 7f6db517:a4931eda

2025-06-08 15:01:50

Bank run on every crypto bank then bank run on every "real" bank.

— ODELL (@ODELL) December 14, 2022

Good morning.

It looks like PacWest will fail today. It will be both the fifth largest bank failure in US history and the sixth major bank to fail this year. It will likely get purchased by one of the big four banks in a government orchestrated sale.

March 8th - Silvergate Bank

March 10th - Silicon Valley Bank

March 12th - Signature Bank

March 19th - Credit Suisse

May 1st - First Republic Bank

May 4th - PacWest Bank?PacWest is the first of many small regional banks that will go under this year. Most will get bought by the big four in gov orchestrated sales. This has been the playbook since 2008. Follow the incentives. Massive consolidation across the banking industry. PacWest gonna be a drop in the bucket compared to what comes next.

First, a hastened government led bank consolidation, then a public/private partnership with the remaining large banks to launch a surveilled and controlled digital currency network. We will be told it is more convenient. We will be told it is safer. We will be told it will prevent future bank runs. All of that is marketing bullshit. The goal is greater control of money. The ability to choose how we spend it and how we save it. If you control the money - you control the people that use it.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-08 15:01:50

@ 7f6db517:a4931eda

2025-06-08 15:01:50

People forget Bear Stearns failed March 2008 - months of denial followed before the public realized how bad the situation was under the surface.

Similar happening now but much larger scale. They did not fix fundamental issues after 2008 - everything is more fragile.

The Fed preemptively bailed out every bank with their BTFP program and First Republic Bank still failed. The second largest bank failure in history.

There will be more failures. There will be more bailouts. Depositors will be "protected" by socializing losses across everyone.

Our President and mainstream financial pundits are currently pretending the banking crisis is over while most banks remain insolvent. There are going to be many more bank failures as this ponzi system unravels.

Unlike 2008, we have the ability to opt out of these broken and corrupt institutions by using bitcoin. Bitcoin held in self custody is unique in its lack of counterparty risk - you do not have to trust a bank or other centralized entity to hold it for you. Bitcoin is also incredibly difficult to change by design since it is not controlled by an individual, company, or government - the supply of dollars will inevitably be inflated to bailout these failing banks but bitcoin supply will remain unchanged. I do not need to convince you that bitcoin provides value - these next few years will convince millions.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-08 15:01:49

@ 7f6db517:a4931eda

2025-06-08 15:01:49

Humanity's Natural State Is Chaos

Without order there is chaos. Humans competing with each other for scarce resources naturally leads to conflict until one group achieves significant power and instates a "monopoly on violence."Power Brings Stability

Power has always been the key means to achieve stability in societies. Centralized power can be incredibly effective in addressing issues such as crime, poverty, and social unrest efficiently. Unfortunately this power is often abused and corrupted.Centralized Power Breeds Tyranny

Centralized power often leads to tyrannical rule. When a select few individuals hold control over a society, they tend to become corrupted. Centralized power structures often lack accountability and transparency, and rely too heavily on trust.Distributed Power Cultivates Freedom

New technology that empowers individuals provide us the ability to rebuild societies from the bottom up. Strong individuals that can defend and provide for themselves will help build strong local communities on a similar foundation. The result is power being distributed throughout society rather than held by a select few.In the short term, relying on trust and centralized power is an easy answer to mitigating chaos, but freedom tech tools provide us the ability to build on top of much stronger distributed foundations that provide stability while also cultivating individual freedom.

The solution starts with us. Empower yourself. Empower others. A grassroots freedom tech movement scaling one person at a time.

If you found this post helpful support my work with bitcoin.

-

@ 7f6db517:a4931eda

2025-06-08 15:01:49

@ 7f6db517:a4931eda

2025-06-08 15:01:49

Nostr is an open communication protocol that can be used to send messages across a distributed set of relays in a censorship resistant and robust way.

If you missed my nostr introduction post you can find it here. My nostr account can be found here.

We are nearly at the point that if something interesting is posted on a centralized social platform it will usually be posted by someone to nostr.

We are nearly at the point that if something interesting is posted exclusively to nostr it is cross posted by someone to various centralized social platforms.

We are nearly at the point that you can recommend a cross platform app that users can install and easily onboard without additional guides or resources.

As companies continue to build walls around their centralized platforms nostr posts will be the easiest to cross reference and verify - as companies continue to censor their users nostr is the best censorship resistant alternative - gradually then suddenly nostr will become the standard. 🫡

Current Nostr Stats

If you found this post helpful support my work with bitcoin.

-

@ 8bad92c3:ca714aa5

2025-06-08 15:01:41

@ 8bad92c3:ca714aa5

2025-06-08 15:01:41Key Takeaways

In this episode, Bram Kanstein delivers a powerful exploration of how studying money for thousands of hours led him to a single, life-changing conclusion: Bitcoin is the key to preserving value and reclaiming personal agency in an increasingly unstable world. Through the lens of a disillusioned millennial generation—raised with technological optimism but betrayed by economic reality—Bram exposes the fiat system as one built on illusion, debt, and diminishing returns. He explains how Bitcoin’s transparent, rule-based design offers a principled alternative, especially for those wired to question systems and seek truth. Describing the fiat economy as a “high-velocity trash system” that undermines innovation and long-term planning, he argues Bitcoin creates the time and space to think, build, and live freely. As AI reshapes the labor market, Bram sees Bitcoin as a vital foundation for individuals to adapt, maintain sovereignty, and thrive in a future defined by rapid technological disruption.

Best Quotes

“Anything that you would want to fix in the world is broken because the money is broken.”

“You’re stacking nothing. Literal paper.”

“You have to red pill before you orange pill.”

“The only thing you need to do is move to the other money that they cannot mess with.”

“One Bitcoin is one Bitcoin. That’s the whole point.”

“Millennials are primed to understand Bitcoin.”

“Bitcoin lets you get out of the rat race and start walking your own path.”

“The fiat mindset is a zero-sum game. In Bitcoin, value is created.”

“We should stop asking how to value Bitcoin—and start asking how to value everything else in Bitcoin.”

“Even with a master’s in economics, people still don’t understand what money is.”

Conclusion

This episode delivers a powerful call to rethink everything we assume about money, arguing that understanding Bitcoin is less about profit and more about reclaiming personal agency in a world defined by uncertainty. Bram Kanstein shows how asking fundamental questions—like “What is money?”—can lead to a deeper sense of purpose and autonomy. As AI and systemic instability accelerate, Bitcoin emerges not just as sound money, but as a life tool for intentional living, long-term thinking, and individual sovereignty.

Timestamps

0:00 - Intro

0:36 - INTJ bitcoiners

4:58 - The millennial headspace is primed for bitcoin

7:25 - Bitcoin gives time and space to build

15:29 - Fold & Bitkey

17:05 - Seeing systemic problems

26:25 - Bitcoin’s positive feedback loop

33:55 - Recognize your agency

37:58 - Unchained

38:27 - Fiat money creates uncertainty

44:41 - What is money?

54:04 - Money and energy

1:03:43 - Bitcoin allows growth

1:09:02 - Bitcoin/AI

1:31:34 - Optimistic noteTranscript

(00:00) Let's say you're a millennial and mid-30s and you want to retire in 30 years. If you calculate the amount of dollar, pound the euro, yen units. You need way more units of that money than you think right now. They are funding pension funds, but the pension funds are using that money for the people that are actually retiring.

(00:17) No one knows about money. They don't know how debt works, how finance works. But that's kind of how it's designed, right? Like that's what eventually keeps the Ponzi alive. And I just started with the question, what do you think happens if you call the bank and say like, hey, can I get 100 or 200k in cash? Man, you got an editor like in house.

(00:39) That's That's pro. That's uh it's because this setup I'm so far away from the computer. I just need somebody to hit the button. Okay. Okay. the extent the extent of of Logan's job extends far beyond just hitting the button. But yeah, INTJ I think uh I think it was as we rear into what looks to be another bull market.

(01:05) I think getting back to first principles and discussing the challenges of studying and understanding Bitcoin, it's important to to highlight the archetype of individuals who have studied fallen down the rabbit hole and really dedicated their lives to Bitcoin. And this INTJ cohort that exists within Bitcoin seems pretty material apparently. Yeah.

(01:35) I mean, I have many moments where I just realize that I'm lucky that my brain is wired in a certain way, you know. I feel like crazy blessed that I figured out this Bitcoin thing, you know, and that when I ran into certain realizations along the way in my Bitcoin journey that I was like, hm, you know, how does this actually work? you know, do I actually understand the systems I'm participating in, the things that I believe, you know, the the the the people that I abstracted um or or outsourced certain responsibilities to to take care of, for example, my money

(02:10) in the bank. You know, I I think um being wired in a certain way definitely helps in grasping Bitcoin to a degree where you're like, okay, this is the only thing I need to pay attention to, you know, in my life. And yeah, we we jokingly started talking about this because I have the hat here, but there was this um I think it was like like a Twitter poll actually or someone shared it on Twitter and this is already like two or three years old where where someone investigated these MyersBriggs um personality types and I think there's

(02:42) only like 2% of people that have INTJ but like 20% of Bitcoiners have that personality type. So it um it apparently helps. So yeah, I just I just quickly Googled it actually. It says uh the INTJ is the architect. It's a personality type with the introverted intuitive thinking and judging traits. These thoughtful tacticians love perfecting the details of life, applying creativity and rationality to everything they do.

(03:09) I think the rationality part here is what um what uh I think helps you to to gro Bitcoin eventually. Yeah, it reminds me of I forget what the study was, but postco it was a similar distribution of just like 2% of people were highly skeptical of what was going on with the lockdowns and the attack on bodily autonomy.

(03:38) And there was a study that was done about I forget it was bees or some type of fly that they they have like the horde of um the horde of the particular fly I think it was bees has like 2% act as these sort of alarm bells that are on the outside the outskirts of the community and they'll start communicating like hey something's wrong here and people the other flies or bees will be skeptical at first but then eventually uh the alarm bells will be proven to be right that there was some sort of danger around the corner. That's fascinating.

(04:09) Yeah. Yeah, that's fascinating. I I think we're not that special eventually, you know, like we think we have all this autonomy, but but um yeah, we're we're just wired in a certain way. And I think I don't know where you want to take this conversation, but I think, you know, part of growing up and being an adult is figuring out, you know, how do I actually work and how do I work with how I work, you know? Yeah. No, it is.

(04:36) And as I get older, creep into my mid-30s, which is hard hard to come to grips with, it is uh really falling back on like, all right, I I feel like I have a good perspective on the world and my place in it, and how do I just optimize to make sure I'm aligning my my work and my career, I guess, if you call it that, with what I'm passionate about. Yeah.

(05:00) Well, I also think that is actually why our generation, you know, my my podcast is Bitcoin for millennials. I think uh the millennials are primed to understand Bitcoin. You know, we are in this life phase where big things happen, you know, starting a family or settling somewhere or or making big career moves or decide Yeah.

(05:25) like deciding what am I going to spend like the next 10 20 years on and uh I think it's an interesting phase actually I I don't know how that was for you but but for me like the the 30s were really where I dove more and more into Bitcoin like got got that stronger conviction and also yeah kind of was invited to go further down that that rabbit hole you know and like how I see it now is that that Bitcoin is really the foundation for the rest of my life, you know, like it it gives me time and space to look forward and enthusiasm, you know, like I sometimes lurk on the

(06:01) millennial subreddit, you know, or the finance sub subreddit. And many people in our generation are very nihilistic, you know, they're very unsure about the future. Like some people aren't even having kids because they think they cannot afford it, you know. And uh whenever I read that, I just think like, yeah, I I don't really have those things.

(06:22) But I know it's because of Bitcoin, you know. I I know that Bitcoin gives me, yeah, like I said, the time and space to figure out what's next, like what should I focus on? Like it gives time and space to to try out stuff, to build something, you know, to to to really attempt at at doing something. Where I see many people that don't see that, they are more in the consumer type, you know, like they they just spend the money that's worth the most today, you know, like that's what they're incentivized to do. Yeah.

(06:49) And is is that why you started Bitcoin for millennials is to number one put the put the message out there. Millennials come listen to this. One of you Yes. that is trying to educate you about this. But because this is something I think about a lot is somebody's like dead smack in the middle of the millennial generation and has observed many of the things you just described in my own life, my own network.

(07:13) And that's part of the reason why this podcast exists. And um what I'm trying to do at TFTC is just try to figure out a way to reach into the minds of millennials, hopefully c -

@ 9ca447d2:fbf5a36d

2025-06-08 15:01:21

@ 9ca447d2:fbf5a36d

2025-06-08 15:01:21Neutron, Asia’s leading Bitcoin Lightning infrastructure company, announced the upcoming launch of Neutron Lend, a non-custodial, bitcoin-backed lending product designed for individuals and businesses who want access to liquidity without selling their bitcoin.

The service is currently open for waitlist sign-ups, with public access expected by end of June 2025.

As Bitcoin adoption accelerates, many holders are looking for secure ways to borrow against their bitcoin while maintaining control of their assets. Neutron Lend addresses this need with a multi-signature custody model, competitive interest rates, and a clear, transparent loan structure.

Key Features of Neutron Lend

- Borrow $10,000 to $1,000,000 USDT

- Non-custodial 3-key multi-sig (User, Neutron, Neutral Custodian)

- 50% Loan-to-Value (LTV)

- Principal + interest paid at loan maturity

- Introductory interest rates between 6% and 12% APR, based on tier

- Extension options available (with admin fee and adjusted rates)

Loans are fully collateralized with bitcoin and managed securely using a multi-sig wallet where users retain one of the keys. Neutron does not rehypothecate collateral, and no party can move the funds unilaterally.

“As Bitcoin continues to redefine the future of finance, I’m proud to introduce Neutron Lend a product built for those who believe in the long-term value of their BTC but need liquidity today,” said Albert Buu, CEO of Neutron. He added:

“Traditional finance simply doesn’t understand the needs of Bitcoiners: they force you to sell your most trusted asset or leave you without options.

“With Neutron Lend, our users can secure USDT loans against their BTC collateral at competitive rates, unlocking capital to invest, grow, and diversify without ever parting with their bitcoin.

We see a massively underserved market of HODLers and innovators who deserve access to flexible, transparent lending solutions. At Neutron, we’re here for you, empowering the Bitcoin community with the financial tools they’ve been waiting for.”

Now Open for Waitlist Registration

Neutron Lend is currently in waitlist phase. Early users will receive:

- Priority access to the platform at launch

- Limited-time introductory rates

The platform is expected to begin rolling out globally by end of June 2025.

Media Contact:

info@neutron.meLearn More and Join the Waitlist: www.neutron.me/lend

About Neutron

Neutron is a Bitcoin Lightning infrastructure company based in Asia, offering scalable financial tools across the Bitcoin ecosystem. Its products include a Lightning-as-a-Service API (Neutron Economy), the consumer-facing Neutronpay app, and now Neutron Lend, bringing secure, flexible Bitcoin-backed lending to market.

-

@ b1ddb4d7:471244e7

2025-06-08 15:00:59

@ b1ddb4d7:471244e7

2025-06-08 15:00:59Hosted at the iconic Palace of Culture and Science—a prominent symbol of the communist era—the Bitcoin FilmFest offers a vibrant celebration of film through the lens of bitcoin. The venue itself provides a striking contrast to the festival’s focus, highlighting bitcoin’s core identity as a currency embodying independence from traditional financial and political systems.

𝐅𝐢𝐱𝐢𝐧𝐠 𝐭𝐡𝐞 𝐜𝐮𝐥𝐭𝐮𝐫𝐞 𝐰𝐢𝐭𝐡 𝐩𝐨𝐰𝐞𝐫𝐟𝐮𝐥 𝐦𝐮𝐬𝐢𝐜 𝐯𝐢𝐛𝐞𝐬.

Warsaw, Day Zero at #BFF25 (European Bitcoin Pizza Day) with @roger__9000, MadMunky and the @2140_wtf squad

pic.twitter.com/9ogVvWRReA

pic.twitter.com/9ogVvWRReA— Bitcoin FilmFest

(@bitcoinfilmfest) May 28, 2025

(@bitcoinfilmfest) May 28, 2025This venue represents an era when the state tightly controlled the economy and financial systems. The juxtaposition of this historical site with an event dedicated to bitcoin is striking and thought-provoking.

The event features a diverse array of activities, including engaging panel discussions, screenings of both feature-length and short films, workshops and lively parties. Each component designed to explore the multifaceted world of bitcoin and its implications for society, offering attendees a blend of entertainment and education.

The films showcase innovative narratives and insights into bitcoin’s landscape, while the panels facilitate thought-provoking discussions among industry experts and filmmakers.

Networking is a significant aspect of the festival, with an exceptionally open and friendly atmosphere that foster connections among participants. Participants from all over Europe gather to engage with like-minded individuals who share a passion for BTC and its implications for the future.

The open exchanges of ideas foster a sense of community, allowing attendees to forge new connections, collaborate on projects, and discuss the potential of blockchain technology implemented in bitcoin.

The organization of the festival is extraordinary, ensuring a smooth flow of information and an expertly structured schedule filled from morning until evening. Attendees appreciate the meticulous planning that allowed them to maximize their experience. Additionally, thoughtful touches such as gifts from sponsors and well-chosen locations for various events contribute to the overall positive atmosphere of the festival.

Overall, the Bitcoin FilmFest not only highlights the artistic expression surrounding bitcoin but also serves as a vital platform for dialogue—about financial freedom, the future of money, and individual sovereignty in a shifting world.

The event successfully bridges the gap between a historical symbol of control and a movement that celebrates freedom, innovation, and collaboration in the digital age, highlighting the importance of independence in financial systems while fostering a collaborative environment for innovation and growth.

Next year’s event is slated for June 5-7 2026. For further updates check: https://bitcoinfilmfest.com/

-

@ cae03c48:2a7d6671

2025-06-08 15:00:40

@ cae03c48:2a7d6671

2025-06-08 15:00:40Bitcoin Magazine

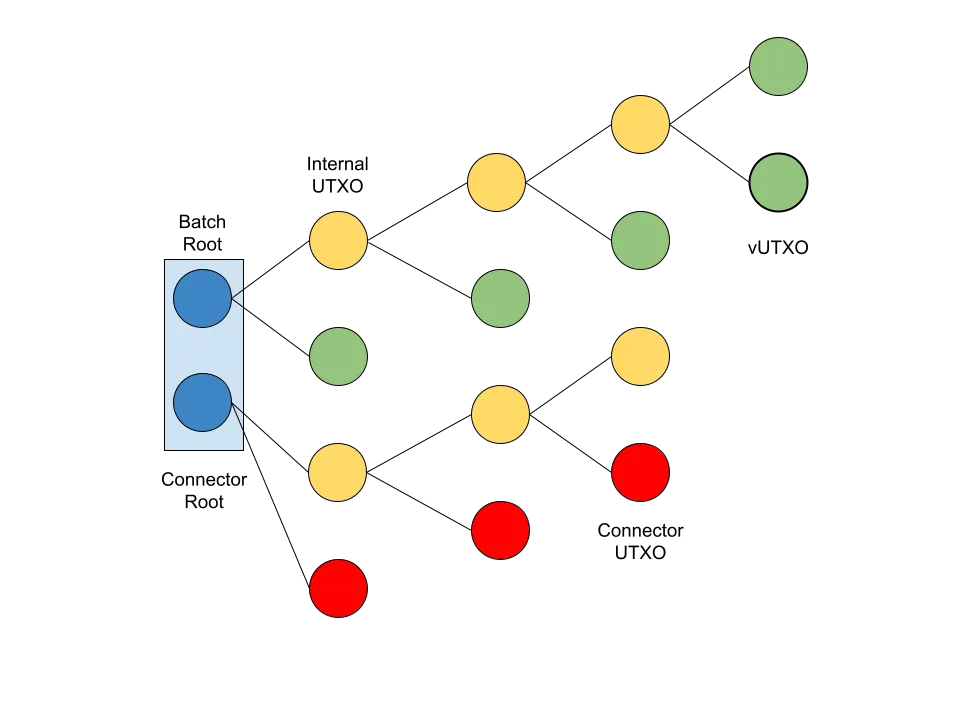

Bitcoin Layer 2: ArkArk is a novel off-chain transaction batching mechanism originally proposed by Burak, a young Turkish developer. There are currently two implementations being built, one by Ark Labs, and the other by Second, neither of which Burak is involved with.

The original proposal for Ark was much more complicated, and involved some design goals more focused around privacy than the implementations currently being built. It was also originally envisioned to require CHECKTEMPLATEVERIFY (CTV) in order to be built.

The protocol depends on a central coordinating server in order to function properly, but despite that is able to provide the same functionality and security guarantees that the Lightning Network does. As long as a user stays online during the required time period, at all times (unless they choose to trust the operator for short periods of time) every user is capable at any time of unilaterally exiting the Ark system at any time and taking back full unilateral control of their funds onchain.

Unlike Lightning, Ark does not require users to have pre-allocated liquidity assigned to them in order to receive funds. An Ark user can simply onboard to a wallet and receive funds immediately with no liquidity pre-allocation at all.

Let’s walk through the different constituent pieces of Ark.

The Ark Tree

Coins held on Ark are called Virtual UTXOs (vUTXOs). These are simply pre-signed transactions that guarantee the creation of a real UTXO under the unilateral control of a user once submitted onchain, but are otherwise held offchain.

Every user’s vUTXOs are nested inside a tree of pre-signed transactions, or a “batch.” Ark works by having the coordinator server, or Ark Service Provider (ASP), facilitate the coordination between users necessary to create a batch. Whenever users are receiving funds, onboarding to Ark, or offboarding, it is necessary to construct a transaction and the associated transaction tree to create a new batch.

The tree is constructed to take the single root UTXO confirmed onchain, locked with an n-of-n multisig including all users holding vUTXOs in the tree as well as the ASP, and slowly split into more and more UTXOs until eventually reaching the leaves, which are each users vUTXO. Each vUTXO is guaranteed using a script that has to be signed by a 2-of-2 multisig, one key held by the user, and the other by the ASP, or just the user after a timelock.

Each time the tree splits, vUTXOs are created onchain, but so are more internal UTXOs that have yet to actually split into vUTXOs. Each of these internal UTXOs is locked with an n-of-n multisig composed of the ASP, and all users who have a vUTXO further down the tree. During the batch creation process, users start at their respective vUTXOs, and go through a signing process all the way back down the root of the tree. This guarantees that the root will never be signed before each user’s claim to a vUTXO is, ensuring they always have unilateral access in a worst case scenario to their funds.

Each batch also has an expiry time (which will make sense in the next section). This expiry spend path, which exists as an alternate spending condition for the root UTXO onchain as well as every internal UTXO, allows the ASP to unilaterally spend all funds by itself.

Transactions, Preconfirmation, and Connector Inputs

When it comes to transacting on Ark, there are two possible mechanisms that are possible, both with their own costs and implications in terms of security model. There are out-of-round transfers, or preconfirmed transactions, and there are in-round transfers, or actually confirmed transactions.

To conduct an out-of-round transfer is a very simple process. If one user (Alice) wants to pay another (Bob), they simply contact the ASP and have them co-sign a transaction spending the vUTXO to Bob. Bob is then given that pre-signed transaction, as well as all the other ones preceding it back to the batch root onchain. Bob is now capable of unilaterally exiting the Ark with this transaction, but, he must trust the ASP not to collude with Alice to doublespend it. These out-of-round transactions can even be chained multiple times before finally confirming them.

To finalize an Ark transaction, users have to engage in a “batch swap.” Users cannot actually trustlessly confirm a transfer within a single batch, they have to atomically swap a vUTXO in an existing batch with a fresh vUTXO created in a new batch. This is done using the ASP as a facilitator of the swap, and with the aid of what is called a “connector input.”

When a user goes to finalize an Ark transaction with a batch swap, they relinquish control of the vUTXO to the ASP. This could be problematic, what is to stop the ASP from simply keeping it and not giving them a confirmed vUTXO in a new batch? The connector input.

When a new batch is created, a second output is created in the transaction that is confirmed on chain instantiating a new tree composed of connector UTXOs. When Bob goes to sign over a forfeit transaction to the ASP to conduct the batch swap, the transaction includes as an input one of the connector UTXOs from the new batch.

This creates an atomic guarantee. Bob’s confirmed vUTXO is included in a batch in the same transaction the connector input is created in that is necessary for his forfeit transaction to be valid. If that batch is never created onchain, i.e. Bob never actually receives the new confirmed vUTXO, then the forfeit transaction he signed for the ASP will never be valid and confirmable onchain.

Liquidity Dynamics and Blockspace

All of the liquidity necessary to create new batches in order to facilitate transfers between users is provided by the ASP. They are required to have enough liquidity to create new batches for users until old ones have expired and the ASP can unilaterally sweep them to reclaim old liquidity previously locked up to create vUTXOs for users.

This is the core of the liquidity dynamic at the center of the Ark protocol. While in one sense this is a massive efficiency win, not requiring liquidity providers to assess users and essentially guess which ones will actually receive large volumes of payments before they can receive any funds, in another it is an efficiency loss as the ASP must have enough liquidity to continue creating new batches for users for however long they configure the expiry time to be and they can start reclaiming allocated liquidity.

This can be mitigated to a decent degree by how often an ASP offers to create new batches to finalize pending transactions. In the event of an ASP attempting to create new batches in real time as transactions are coming in, the liquidity requirements would be exorbitantly high. However, an ASP can lower the frequency at which they create new batches and drastically lower their liquidity requirements.

This dynamic also has implications for blockspace use. Unlike Lightning, which can provide strong confirmation guarantees entirely offchain, in order for an Ark transaction to have an equivalent trustless degree of finality a new batch has to be created onchain. This means that unlike Lightning, where transaction volume does not reflect itself onchain, the velocity of Ark transactions inherently requires a proportional amount of blockspace use, albeit in a very compressed and efficient manner. This creates a theoretical upper limit of how many Ark batches can be created during any given time interval (although Ark trees can be smaller or larger depending on this dynamic).

Wrapping Up

Ark presents in many ways an almost opposite set of tradeoffs to the Lightning Network. It is a massive blockspace efficiency improvement for offchain transactions, and does away with the problem of liquidity allocation on the Lightning Network, but it does have a much closer tied throughput limit that is correlated with the blockchains throughput limit.

This dynamic of almost opposite tradeoffs makes it a very complementary system to the Lightning Network. It can also interoperate with it, i.e. vUTXOs can be swapped atomically in transactions entering or exiting the Lightning Network.

Ultimately how it fits into the broader Bitcoin ecosystem is yet to be seen, but it is an undoubtedly valuable protocol stack that will find some functional niche, even if it is different than originally intended.

This post Bitcoin Layer 2: Ark first appeared on Bitcoin Magazine and is written by Shinobi.

-

@ cae03c48:2a7d6671

2025-06-08 15:00:39

@ cae03c48:2a7d6671

2025-06-08 15:00:39Bitcoin Magazine

Know Labs, Inc. Announces Adopting a Bitcoin Treasury Strategy, Starting with 1,000 BitcoinKnow Labs, Inc. (NYSE American: KNW) announced entering into an agreement with Goldeneye 1995 LLC and the Ripple Chief Risk Officer Greg Kidd to acquire a controlling interest in the Company. Following the completion of the transaction, Mr. Kidd will become Chief Executive Officer and Chairman of the Board of Directors of the Company and Founder Ron Erickson will become Vice Chairman of the Board.

JUST IN: Know Labs, Inc. announces its adopting a Bitcoin Treasury Strategy and holds 1,000 Bitcoin

pic.twitter.com/NSn2xFZYx0

pic.twitter.com/NSn2xFZYx0— Bitcoin Magazine (@BitcoinMagazine) June 6, 2025

Under the agreement, the Buyer will acquire shares of Know Labs’ common stock by dividing the total value of 1,000 Bitcoin and a cash amount, designated to pay down existing debt, redeem outstanding preferred equity, and provide additional working capital. For every share purchased it will be priced at $0.335. The Bitcoin will serve as a central element of the Company’s treasury strategy, giving investors the exposure to Bitcoin.

“I’m thrilled to deploy a Bitcoin treasury strategy with the support of a forward-looking organization like Know Labs at a time when market and regulatory conditions are particularly favorable,” said Mr. Kidd. “We believe this approach will generate sustainable growth and long-term shareholder value.”

Once Bitcoin becomes the primary asset on the Company’s balance sheet, management will adopt the multiple of net asset value (mNAV) metric to assess the premium investors place on the Company’s market value relative to its Bitcoin assets. Based on a market cap of $128 million and a Bitcoin price of $105,000, the estimated entry mNAV multiple is 1.22x, with Bitcoin accounting for approximately 82% of the total market capitalization at closing.

“Partnering with Greg Kidd marks a pivotal next chapter for Know Labs,” commented Mr. Erickson. “We look forward to continuing our research in non-invasive medical technology. Greg’s visionary leadership positions Know Labs for a bold future.”

The adoption of Bitcoin as a treasury reserve asset has dramatically increased over the course of the last year, expanding globally. To date, there are 225 companies and other entities with Bitcoin in their balance sheets.

Norwegian Block Exchange (NBX), a leading Nordic cryptocurrency exchange and digital asset platform, announced on June 2 that it has added Bitcoin to its balance sheet, marking a national milestone as the first publicly listed company in Norway to hold Bitcoin as part of its treasury strategy.

“NBX will not sell this Bitcoin or go short in any form,” stated the company. “With reference to the latest POA notice with LDA capital, NBX will also use proceeds to buy additional Bitcoin.”

This post Know Labs, Inc. Announces Adopting a Bitcoin Treasury Strategy, Starting with 1,000 Bitcoin first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-08 15:00:37

@ cae03c48:2a7d6671

2025-06-08 15:00:37Bitcoin Magazine

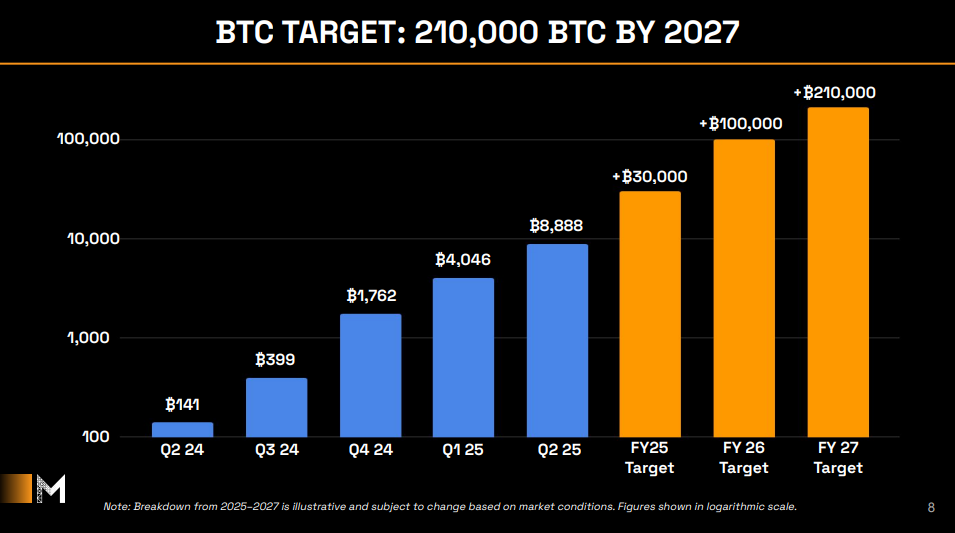

‘MicroStrategy of Asia’ Metaplanet Aims To Acquire Over 210,000 BTC By the End of 2027Metaplanet Inc. widely recognized as Japan’s leading Bitcoin treasury company, has announced a major update to its Bitcoin accumulation strategy, unveiling the “555 Million Plan” aimed at acquiring over 210,000 BTC by the end of 2027, which is equivalent to 1% of Bitcoin’s total supply.

*Metaplanet Announces Accelerated 2025-2027 Bitcoin Plan: Targeting 210,000 $BTC by 2027*

Full Presentation: https://t.co/JG28maMdfd pic.twitter.com/i9kzmjlDT8

— Metaplanet Inc. (@Metaplanet_JP) June 6, 2025

This new target marks a dramatic increase from the company’s earlier “21 Million Plan,” which aimed for just 21,000 BTC by 2026. Progress far outpaced expectations, with 8,888 BTC already secured as of June 2, prompting the strategic shift.

To fund this growth, Metaplanet has launched Asia’s largest Bitcoin-focused equity raise, aiming to secure ¥770.9 billion (approximately $5.4 billion) through the issuance of 555 million shares via moving strike warrants. This is the first structure of its kind in Japan, priced at a premium to market, made possible by the company’s high share liquidity and volatility.

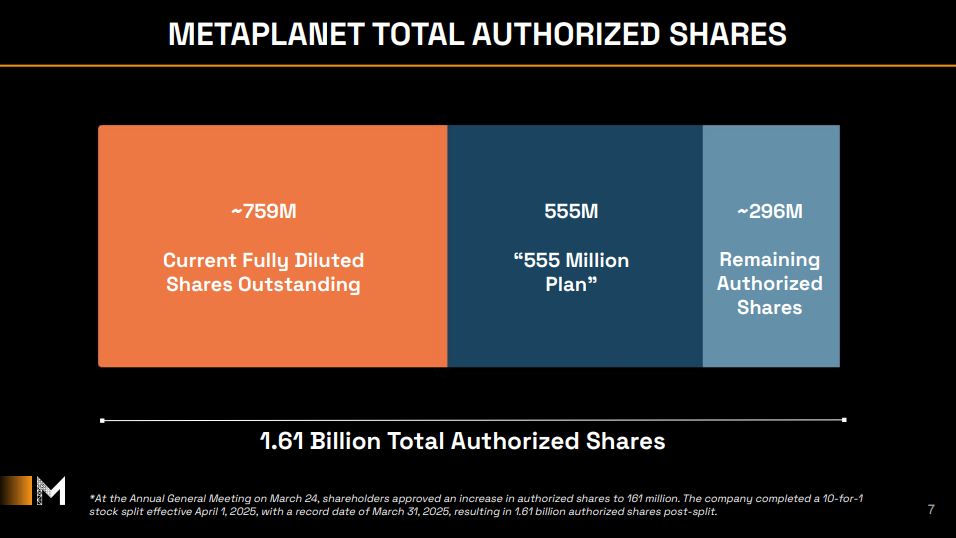

At the Annual General Meeting on March 24, shareholders approved an increase in authorized shares from 161 million to 1.61 billion, following a 10-for-1 stock split effective April 1, 2025; Metaplanet has approximately 296 million authorized shares remaining. The 555 million shares being issued under the new plan will bring the company’s fully diluted shares outstanding to around 759 million.

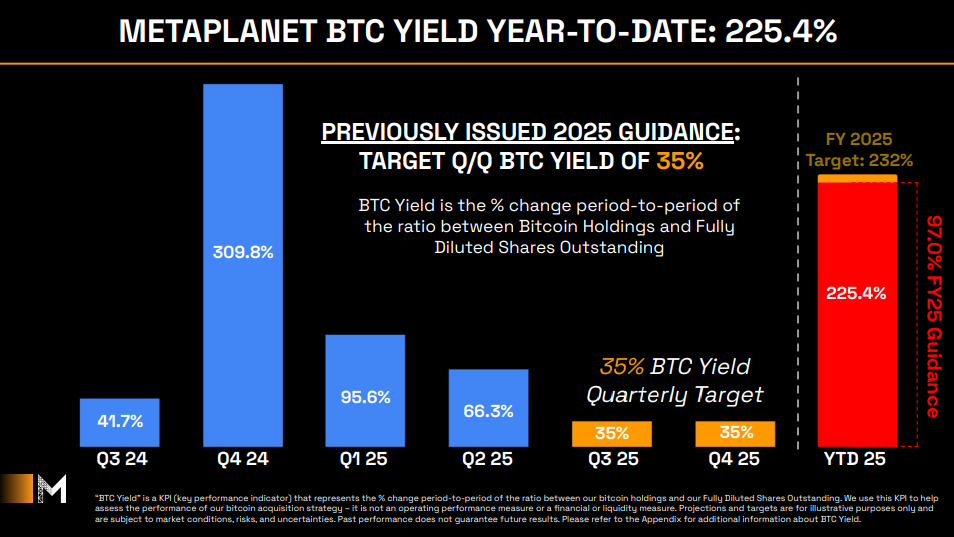

Metaplanet’s Bitcoin yield targets and performance for 2025 have shown strong momentum, with quarterly BTC yields of 41.7% in Q3 2024, 309.8% in Q4 2024, 95.6% in Q1 2025, 66.3% in Q2 2025, and projected 35% yields for both Q3 and Q4 2025. The year-to-date BTC yield for 2025 stands at 225.4%, closing to the full year target of 232%.

Metaplanet also announced the issuance of the 20th to 22nd Series of Stock Acquisition Rights via a third-party allotment to EVO FUND, potentially adding 555 million new shares. The initial exercise price is set at JPY 1,388 and will adjust regularly based on stock prices, with some series including a premium to protect shareholders. The exercise period runs from June 24, 2025, to June 23, 2027, with expected proceeds of approximately JPY 767.4 billion. This financing supports the “555 Million Plan” and further Bitcoin accumulation.

Metaplanet CEO Simon Gerovich wrote in a post on X, “thanks to all of our shareholders,” he said. “We are honored to be on this journey with you. Metaplanet is accelerating into the future — powered by Bitcoin.”

Metaplanet has launched Asia’s largest-ever equity raise dedicated to Bitcoin:

¥770.9 billion (~$5.4B) capital raise

¥770.9 billion (~$5.4B) capital raise

555 million shares via moving strike warrants

555 million shares via moving strike warrants

First in Japan: issued at a premium to market — enabled by Metaplanet’s high volatility and deep liquidity… pic.twitter.com/UlXHneyDzo

First in Japan: issued at a premium to market — enabled by Metaplanet’s high volatility and deep liquidity… pic.twitter.com/UlXHneyDzo— Simon Gerovich (@gerovich) June 6, 2025

This post ‘MicroStrategy of Asia’ Metaplanet Aims To Acquire Over 210,000 BTC By the End of 2027 first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-08 15:00:32

@ cae03c48:2a7d6671

2025-06-08 15:00:32Bitcoin Magazine

Gemini Files Draft With The SEC For Proposed IPOToday, Gemini Space Station, Inc. announced that it has confidentially filed a draft registration statement with the US Securities and Exchange Commission for a proposed initial public offering (IPO) of its Class A common stock. Details such as the number of shares and the price range have not been disclosed. The IPO will proceed after the SEC’s review and is subject to market conditions.

JUST IN: @Gemini has confidentially filed for an IPO with the @SECGov.

JUST IN: @Gemini has confidentially filed for an IPO with the @SECGov. Details on share count and pricing TBD.

Launch date will depend on SEC review and market conditions.

— Eleanor Terrett (@EleanorTerrett) June 6, 2025

“Any offers, solicitations or offers to buy, or any sales of securities will be made in accordance with the registration requirements of the Securities Act of 1933, as amended,” stated the press release. “This announcement is being issued in accordance with Rule 135 under the Securities Act.”

Gemini’s move comes during a period of growing activity in both the public markets and the digital asset space. Just yesterday, Trump Media and Technology Group Corp. (Nasdaq, NYSE Texas: DJT) also filed a Form S-1 with the SEC for its upcoming Truth Social Bitcoin ETF.

“Truth Social Bitcoin ETF, B.T. is a Nevada business trust that issues beneficial interests in its net assets,” stated the Form S-1. “The assets of the Trust consist primarily of bitcoin held by a custodian on behalf of the Trust. The Trust seeks to reflect generally the performance of the price of bitcoin.”

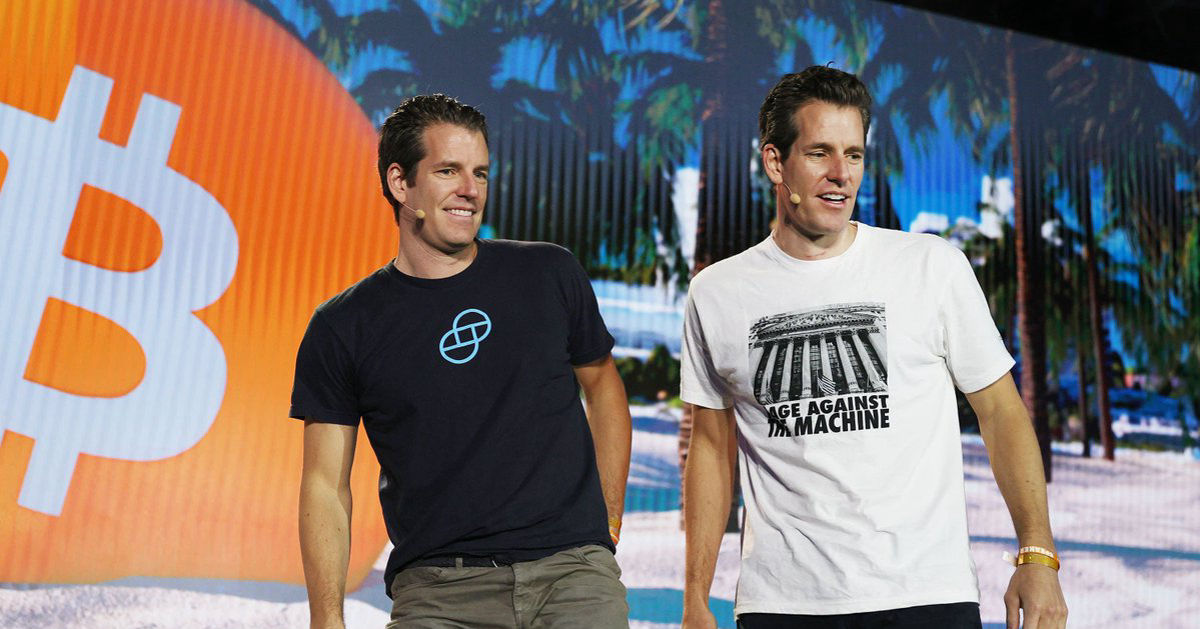

Momentum around Bitcoin and broader crypto policy was also evident last week at the 2025 Bitcoin Conference in Las Vegas. There, Gemini founders Cameron and Tyler Winklevoss joined White House A.I. & Crypto Czar David Sacks to discuss how the government should manage Bitcoin, as well as recent developments in federal policy.

“Orange is the new gold,” said Cameron. “So, Bitcoin is Gold 2.0, and that’s been true since day one. So, at $100,000 Bitcoin, that’s exciting, but if you take 21 million and do the above ground market price of gold. Really, it should be a million dollars a coin—easily,”

They talked about some of the recent policy changes that have been good for crypto include rolling back the IRS digital asset broker rule and SAB 121, which had stopped banks from holding Bitcoin. The Department of Justice also stopped its regulation by prosecution approach, which takes a lot of pressure off digital asset firms.

“It’s hard to imagine a President. Any other President being able to do any fraction of this or accomplish that or any administration and we have just over 100 days,” said Tyler. “So, It’s pretty amazing that we still have a lot of time left.” Later on, he ended the panel saying, “To the Moon!”

This post Gemini Files Draft With The SEC For Proposed IPO first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ 7f6db517:a4931eda

2025-06-08 15:01:52

@ 7f6db517:a4931eda

2025-06-08 15:01:52

What is KYC/AML?

- The acronym stands for Know Your Customer / Anti Money Laundering.

- In practice it stands for the surveillance measures companies are often compelled to take against their customers by financial regulators.

- Methods differ but often include: Passport Scans, Driver License Uploads, Social Security Numbers, Home Address, Phone Number, Face Scans.

- Bitcoin companies will also store all withdrawal and deposit addresses which can then be used to track bitcoin transactions on the bitcoin block chain.

- This data is then stored and shared. Regulations often require companies to hold this information for a set number of years but in practice users should assume this data will be held indefinitely. Data is often stored insecurely, which results in frequent hacks and leaks.

- KYC/AML data collection puts all honest users at risk of theft, extortion, and persecution while being ineffective at stopping crime. Criminals often use counterfeit, bought, or stolen credentials to get around the requirements. Criminals can buy "verified" accounts for as little as $200. Furthermore, billions of people are excluded from financial services as a result of KYC/AML requirements.

During the early days of bitcoin most services did not require this sensitive user data, but as adoption increased so did the surveillance measures. At this point, most large bitcoin companies are collecting and storing massive lists of bitcoiners, our sensitive personal information, and our transaction history.

Lists of Bitcoiners

KYC/AML policies are a direct attack on bitcoiners. Lists of bitcoiners and our transaction history will inevitably be used against us.

Once you are on a list with your bitcoin transaction history that record will always exist. Generally speaking, tracking bitcoin is based on probability analysis of ownership change. Surveillance firms use various heuristics to determine if you are sending bitcoin to yourself or if ownership is actually changing hands. You can obtain better privacy going forward by using collaborative transactions such as coinjoin to break this probability analysis.

Fortunately, you can buy bitcoin without providing intimate personal information. Tools such as peach, hodlhodl, robosats, azteco and bisq help; mining is also a solid option: anyone can plug a miner into power and internet and earn bitcoin by mining privately.

You can also earn bitcoin by providing goods and/or services that can be purchased with bitcoin. Long term, circular economies will mitigate this threat: most people will not buy bitcoin - they will earn bitcoin - most people will not sell bitcoin - they will spend bitcoin.

There is no such thing as KYC or No KYC bitcoin, there are bitcoiners on lists and those that are not on lists.

If you found this post helpful support my work with bitcoin.

-

@ cae03c48:2a7d6671

2025-06-08 15:00:29

@ cae03c48:2a7d6671

2025-06-08 15:00:29Bitcoin Magazine

TakeOver Successfully Hosts Second Annual BitGala Celebrating Bitcoin in Las VegasLAS VEGAS, NV, May 26, 2025 – TakeOver, Magic Eden, Spark, and Stacks successfully hosted their second annual BitGala on May 26th at the Wynn in Las Vegas. The celebration brought together over 200 Bitcoin industry leaders and community members for an evening dedicated to celebrating Bitcoin.

The BitGala was designed as a curated gathering focused on inspiring continued development, education, and adoption while reflecting on the strides Bitcoin has made toward a future of open, decentralized money. The event successfully brought together key leaders, creating meaningful opportunities for collaboration and strategic partnerships within the Bitcoin space.

“BitGala celebrates our partnership with Spark, marketing a major leap forward for Bitcoin DeFi,” said Elizabeth Olson, Head of Marketing for Bitcoin at Magic Eden. “As the #1 Bitcoin app, Magic Eden has spent the past few years pushing Bitcoin L1 to its limits, always with the goal of making Bitcoin more usable, fast, and fun without compromising its core ethos. We believe Spark has the potential to unlock a new era of building on Bitcoin, and we’re thrilled to be leading that charge together.”

“The BitGala was a stunning celebration of Bitcoin culture where luxury meets the cypherpunk spirit. We’re proving that Bitcoin isn’t just a protocol, it’s a movement connecting freedom-minded people from art, fashion, finance, and more. To us, it was a pure signal that people are starting to see what Stacks has been building all along: a future where Bitcoin isn’t just held, but used for apps, defi, and real ownership.” – Rena Shah, COO of Stacks.

Set against the backdrop of the Sphere, the evening brought together innovators, investors, and community leaders for a night dedicated to celebrating Bitcoin’s growth and the people driving its future.

The program opened with a welcome reception, followed by gourmet hors d’oeuvres and vibrant conversations. A keynote and honors segment recognized those making meaningful strides in Bitcoin adoption and development. Guests were then invited to explore a premium tequila tasting experience curated by Reach, and indulge in interactive gourmet chef stations.

“Our team has been fortunate to be part of the Bitcoin community since 2016, so we’re thrilled to see all the progress on display almost 10 years later at Bitcoin 2025. The energy in the room at BitGala was electric—from conversations sparking new partnerships to shared reflections on what’s next for Bitcoin—it was a powerful reminder of why we’re all here: to build an open, decentralized financial system that empowers everyone.” noted Kelley Weaver, Founder and CEO, Melrose PR and Founder, Bitwire.

This unforgettable gathering—hosted in partnership with leading organizations including Magic Eden, Spark, and Stacks—was more than a celebration. It was a call to continue pushing forward innovation, education, and adoption in

the Bitcoin ecosystem. BitGala was made possible through the generous support of key sponsors and partners who share Takeover’s commitment to fostering connections in the web3 space.

“We’re focused on making Bitcoin more useful for everyone, and events like this remind us that we’re not alone in that mission. It was inspiring to connect with others who share the vision of a more open, decentralized financial future powered by Bitcoin.” – Spark Team

Presenting Sponsors:

- Magic Eden – The largest NFT marketplace and Runes platform.

- Spark – The fastest, cheapest, most UX-friendly way to build financial apps and launch assets on Bitcoin.

- Stacks – A Bitcoin L2 enabling smart contracts & apps with Bitcoin as secure base layer.

Supporting Partners:

- Reach Ventures – a gaming-focused VC firm that actively invests in both early-stage and demo-ready game studios.

- Arch Network – a Bitcoin-native platform for building decentralized apps and smart contracts directly on Bitcoin.

- Melrose PR – An onchain communications firm that has been focused on the crypto industry exclusively for almost a decade.

- Bitwire – The modern newswire reimagined for today’s communications professionals.

The collaborative support from these organizations was instrumental in delivering a memorable event for all attendees.

Actor and comedian T.J. Miller was also a speaker at the event: “The bitcoin conference 2025 was incredible for so many reasons. It was such a joyful journey to be with so many like-minded people (all of whom have been laughed at) who share the same values: freedom, community, hope, and getting rich- the highpoint was the BitGala. I bought incredibly large expensive shoes for the specific purpose of showing up to the gala non-verbally saying bitcoin destroying Fiat, well that’s big shoes to fill… and we’ll fill ‘em. I can’t wait to return next year. I will wear more orange.”

About TakeOver

TakeOver is the experiential agency at the forefront of culture and innovation in the crypto space, known for curating powerful moments that educate, connect, and inspire. With a global Bitcoin Dinner Series and their annual flagship event, BitGala, they’ve become a cornerstone of community-building in Web3. Last year, they made headlines with a dramatic takeover of Nashville’s Parthenon—setting the bar for what crypto gatherings can be.

About Magic Eden

Magic Eden is the easiest platform to trade all digital assets onchain. As the #1 Bitcoin app and largest NFT marketplace, we provide a seamless trading experience to everyone. Magic Eden’s acquisition of Slingshot has expanded their capabilities to offer frictionless trading of over 5,000,000 tokens across all major chains. Magic Eden’s expanded product suite includes a cross-chain wallet, powerful trading tools, and the ability to mint, collect, and seamlessly trade NFTs and tokens.

Disclaimer: This is a sponsored press release. Readers are encouraged to perform their own due diligence before acting on any information presented in this article.

This post TakeOver Successfully Hosts Second Annual BitGala Celebrating Bitcoin in Las Vegas first appeared on Bitcoin Magazine and is written by TakeOver.

-

@ cae03c48:2a7d6671

2025-06-08 15:00:27

@ cae03c48:2a7d6671

2025-06-08 15:00:27Bitcoin Magazine

Bitcoin 2025 Las Vegas: Here’s What Went DownMy name is Jenna Montgomery, and maybe you’ve read some of my news articles here before, or seen me on the Bitcoin Magazine TikTok. But today, I wanted to switch it up and give you an inside look at the Bitcoin 2025 Conference in Las Vegas through my eyes as an intern, hired just one month before the conference, having little knowledge about Bitcoin beforehand and never attending an event like this before.

I’m writing this to give you a real, raw reflection of what I experienced over the course of the three day event, and why I believe you should absolutely attend the next Bitcoin conference. I want you all to know what goes down, what to expect, and to know how impactful I think this event really is. Bitcoin 2025 made a lasting impact on me and my life, and it just feels right to tell you why, so yours can maybe be changed too.

I got off the plane, threw my suitcase in my hotel room, and went to go and see the convention center as all of the finishing touches around the venue were being added. I remember thinking how big, beautiful, and fun the expo hall was—and where I would soon meet so many new people, make so many friends, and shake hands with people that I looked up to and admired.

I will never forget walking in and seeing the main conference stage, The Nakamoto Stage, for the first time. Seeing that giant room with a symphony and endless rows of chairs, soon to be filled with thousands of passionate Bitcoiners, really put in perspective to me how Bitcoin 2025 wasn’t just a conference, it felt like something bigger. I realized it’s an actual community and a place of countless opportunities.

The conference is essentially split up into 3 days: Industry Day, General Admission Day 1, and General Admission Day 2. Industry Day was mainly tailored towards professionals, investors, founders, and others focused on Bitcoin businesses. The general admission days were tailored more towards the casual Bitcoiner, and those were the days that I really felt the energy just exploding around the convention center.

Walking into the expo hall early in the morning on Industry Day, I was overwhelmed when I saw all of the vendors and companies setting up their tables, booths, stages, and even a rock climbing wall (thank you CleanSpark). It seemed as if the expo hall went for miles and miles, and featured a long orange carpet that made an intricate path through the venue that led you to each and every booth.

While fiat fails, Bitcoin prevails. pic.twitter.com/EV190PUqdT

— Valentina Gomez (@ValentinaForUSA) May 27, 2025

I remember being in total awe as I looked up at the ceiling and saw a huge UFO in the middle of the expo hall, with two Bitcoin themed Cybertrucks just off to the side of it, with lots of other interesting booths including one with a talking robot.

DAY ONE pic.twitter.com/KHXP6q8RCp

— Gemini (@Gemini) May 27, 2025

As I followed the long orange carpet around the venue, I looked over my shoulder and saw a huge blow-up of a Bitcoin Puppet in the art exhibit, featuring all kinds of other cool Bitcoin art. Some of these pieces of art were worth well over one bitcoin—which was mindblowing to me considering that is more than $100,000. Every good revolution has good art, and seeing all the talented artists pouring their hearts into their work helped me believe that Bitcoin is the future.

Now, it was time to get to work at where I would spend the majority of my time over the next few days. My coworkers and I were stationed up right in front of the Bitcoin Magazine news desk next to the AV (audio-visual) team, where I had a perfect view of everything. Here, I spent all day every day writing news articles for Bitcoin Magazine based on the speeches, keynotes, and other panels happening on the Nakamoto stage, as well as filming TikTok’s around the expo hall with attendees.

Working in front of the news desk was one of my favorite things about the conference. Everyone who spoke on it live had an electrifying personality that kept me locked into every conversation, especially one of the hosts Pete Rizzo. After every talk on the Nakamoto Stage ended, the live stream would pan over to the news desk where they would break down what happened, providing viewers with expert analysis. This was something extremely very fun to watch live and experience the production of it all first hand.

The talks on Industry Day kicked off to such a great start with Dan Edwards from Steak ‘n Shake, who recently became the first major fast food chain in America to begin accepting Bitcoin Lightning payments. So I was very excited to hear about Edwards’ speech and to visit Steak ‘n Shake’s incredible booth, which also featured a group of fun, dancing cows.

Steak ‘n Shake COWS HAVE NO CHILL

pic.twitter.com/8UkmPhWf9T

pic.twitter.com/8UkmPhWf9T— The Bitcoin Conference (@TheBitcoinConf) May 28, 2025

While speaking on stage, Edwards revealed that, “Bitcoin is faster than credit cards, and when customers choose to pay in Bitcoin, we’re saving 50% in processing fees.” Just think about that for a second — saving a whole 50% on each transaction? This really opened my eyes to the benefits of accepting Bitcoin as payment and why it could mean to merchants who adopt it.

Based on everything I heard in that speech, I think Steak ‘n Shake may be the first to start a new trend of other big companies accepting Bitcoin. If they recognized the benefits of Bitcoin, it’s only a matter of time before other franchises do as well.

JUST IN: Fast food giant Steak 'n Shake announced they're saving 50% in processing fees accepting Bitcoin payments

'#Bitcoin is faster than credit cards'

pic.twitter.com/bxApgBL6El

pic.twitter.com/bxApgBL6El— Bitcoin Magazine (@BitcoinMagazine) May 27, 2025

Another big highlight from this day was hearing Senator Cynthia Lummis confirm that President Donald Trump supports her Strategic Bitcoin Reserve Act. There were so many statements made during the conference that I will get to later on that point to the fact that the United States is pro-Bitcoin and we’re going to be the world leader in it. Senator Marsha Blackburn also added to this, stating, “Many of our allies follow what we do. If we lead, others will follow. This is vital to our economic future.”

JUST IN:

Senator Cynthia Lummis said US military generals are "big supporters" of a Strategic Bitcoin Reserve for economic power. pic.twitter.com/2RPMV3tbdA

Senator Cynthia Lummis said US military generals are "big supporters" of a Strategic Bitcoin Reserve for economic power. pic.twitter.com/2RPMV3tbdA— Bitcoin Magazine (@BitcoinMagazine) May 27, 2025

At this point in

-

@ c11cf5f8:4928464d

2025-06-08 14:59:37

@ c11cf5f8:4928464d

2025-06-08 14:59:37Howdy stackers! Here we are again with our monthly Magnificent Seven, the summary giving you a hit of what you missed in the ~AGORA territory.

First thing first. let's check our top performing post Ads!

Top-Performing Ads

This month, the most engaging ones are:

-

01Bitcoin Magazine Launches V3 Limited Edition Bitcoin Crocs by @RideandSmile, no description, nor images provided. The title speak for the product itself. 31 sats \ 8 comments \ 15 May -

02Happy Pizza Day Jerky Offer (10k sats sale 5/22 ONLY) by @beejay, celebrating Bitcoin Pizza Day with a delicious offer for a handmade product. Offer is over but it still available on her online shop and IRL at next Twin Cities Outdoor Agora Market https://stacker.news/items/972209/r/AG 103 sats \ 3 comments \ 22 May -

03Lard Tallow lotion by @byzantine, sharing with us one of his preferred online shops that accept sats. Here other two: a Regenerative Farm in TX https://stacker.news/items/983695/r/AG and an artisanal lite roast coffee maker https://stacker.news/items/983668/r/AG 62 sats \ 4 comments \ 20 May -

04Bitaxe Gamma 601 for sale by @PictureRoom selling P2P, have you shipped it yet? 121 sats \ 12 comments \ 15 May -

05Built An Invisible Book Stage by @kr, he did well creating some expectations for this unique and durable product earlier https://stacker.news/items/903946/r/AG 124 sats \ 4 comments \ 21 May -

06"₿lack Market Money" T-Shirts by T&F by @BitcoinErrorLog, that had opened his online store with plenty of incredible products, including an Anti-Surveillance clothing line https://stacker.news/items/994555/r/AG stuff never seen before! 51 sats \ 3 comments \ 24 May -

07[SELL] Heatpunk 002 Tee by @thebullishbitcoiner, reviving the second edition of a t-shirt dedicated to home solo miners! 79 sats \ 1 comment \ 28 May

In case you missed

Here some interesting post, opening conversations and free speech about markets and business on the bitcoin circular economy:

- https://stacker.news/items/992449/r/AG - @Kontext is selling his beloved 2012 Jaguar XF 3.0 V6 Petrol [5M sats], great deal if paid in sats! Have you sold her?

- https://stacker.news/items/987241/r/AG - @RideandSmile shared the Freedom Issue: Letter From the Editor introducing a BM special edition

- https://stacker.news/items/999229/r/AG - @Solomonsatoshi was looking for Green Coffee Beans for DIY home roasting. Will @michaelbinary provide you some?

- https://stacker.news/items/992790/r/AG - @Rayo also introduce the P.A.Z.NIA Radio Network: 52 Hours of Liberation! An interesting livestream for all those interested in freedom.

- https://stacker.news/items/995163/r/AG welcome to @lunin, opening up on SN with Take it step by step and it will work! as part of a promising series: Founder's Thoughts. Here the second post https://stacker.news/items/999867/r/AG Startup according to Mozart

Hey sellers! Try Auctions

A quick reminder that now you can setup auctions here in the AGORA too! Learn how. The other feature released last month was the introduction of Shopfronts on SN. Check our SN Merch and SN Zine examples. Thank you all! Let's keep these trades coming and grow the P2P Bitcoin circular economy!

Active Professional Services accepting Bitcoin in the AGORA