-

@ b83a28b7:35919450

2025-06-09 21:14:19

@ b83a28b7:35919450

2025-06-09 21:14:19I posted on nostr last week that I had finally had enough of the fiat job and decided to take action:

nostr:nevent1qvzqqqqqqypzpwp69zm7fewjp0vkp306adnzt7249ytxhz7mq3w5yc629u6er9zsqythwumn8ghj7un9d3shjtnswf5k6ctv9ehx2ap0qyghwumn8ghj7mn0wd68ytnhd9hx2tcqyr604hwzr8vvluvp8y0s42gu4x0e725cetugnh7g293g9cggtpujww6vn8n

I'm going to document my journey from being in a well-established and well-paying fiat job into the unknown world of independent work in freedom tech in a series of articles. Will I end up finding something truly inspiring and fulfilling, while being able to support my family? We'll find out over the course of the next few weeks.

They say a watched pot never boils, but I’ve discovered a corollary: a watched lay-off never lands. It has now been ten full rotations of this curious planet since I politely asked my SVP to lay me off. The axe remains lodged somewhere in upper-management limbo, perhaps awaiting the proper ceremonial robe or a Procrustean bed that meets quarterly OKR standards.

While the paperwork drifts in the stratosphere, I’ve begun a quiet, delicious rebellion. My calendar, once a Tetris board stacked with 10–12 neon bricks of back-to-back calls, now resembles minimalist art: a single meeting block lounging at 11 a.m., sipping espresso and judging the empty white space around it. When unreasonable requests for road-maps, slide-decks, or seventeen-page AI vision statements arrive, I respond with the calm of a mountain lake: That timeline seems ambitious... shall we refine the scope? The sound you hear is the collective gasp of colleagues who thought the only acceptable answer was Yes, by yesterday.

With those reclaimed hours I’ve slipped into my mad-scientist lab (occasionally also known as sofa in the guest bedroom, or Orange Room) to experiment on MKStack. Imagine a Lego set for nostr clients, only the bricks are pure code and half the instructions are written in the margin of a philosophy book. I’m vibecoding away, torching roughly thirty thousand sats in compute every day as GPUs hum like distant Tibetan bowls. An accountant might call it reckless; I call it tuition for the University of Possibility.

The experiments are already bearing odd fruit. NosFabrica, the health-data-on-nostr project I started with nostr:nprofile1qy2hwumn8ghj7etyv4hzumn0wd68ytnvv9hxgqgdwaehxw309ahx7uewd3hkcqpqt8pwzkkhhs94e9acgw9jwca9csyl7a4tnpdttu05039um5j7d6xskflc8d and nostr:nprofile1qy88wumn8ghj7mn0wvhxcmmv9uq3qamnwvaz7tmwdaehgu3wd4hk6tcqyprqcf0xst760qet2tglytfay2e3wmvh9asdehpjztkceyh0s5r9cpvx58v is finally getting the attention it deserves. I've built out a simple prototype for a provider directory, that only lists providers with a "credential" issued by me. I'm polishing the app now, but hope to release it for testing in the next couple of weeks.

Most gratifying of all, I’ve traded status meetings for sideline cheers. My 14-yo son is sprinting toward his final exams and soccer playoffs simultaneously - Hegel might call it thesis and antithesis, I call it Tuesday. Instead of doom-scrolling Microsoft Teams during his matches, I’m barking out instructions to him to stay onside, while curbing my desire to manhandle the incompetent refs for not calling a penalty when he's clearly being roughhoused in the box by 190-lb defenders with neck beards and chest hair.

Here’s an unexpected twist: without the daily psychic smog of corporate urgency, the sky inside my skull has cleared. Ideas that once flickered like fireflies now glow with stadium lighting. I have sketched three chapters of the sequel to 24 (called July 18), and outlined a new creative project called A Muse Stochastic (coming soon). I don’t know which, if any, of these seedlings will grow, but the soil finally feels fertile again.

Do I worry about the math? Of course. The household budget once kept afloat by a predictable salary will soon meet the iceberg of reality. Yet the anxiety is strangely weightless, as though the fear itself got furloughed. Maybe it’s naïveté, maybe faith; either way, the net I cannot see is starting to feel palpable beneath my feet.

Ten days in, the lessons are already crystallizing:

-

Silence is space. Remove a dozen meetings and the mind blooms faster than AWS bills.

-

Pushback is a spiritual practice. Each gentle “no” to nonsense is a “yes” to sanity.

-

Compute credits are cheaper than regrets. I’ll trade a double espresso's worth of GPU time for a shot at building the future any day.

-

Presence compounds. One extra hour on the training pitch yields more familial ROI than a dozen performance reviews.

-

Uncertainty is a mirror. Stare into it long enough and you start seeing yourself, not your résumé.

Where does this road lead? I genuinely have no clue. The map dissolves about three steps ahead, like one of those old adventure games where the terrain renders just before you walk off a cliff. But every time I inch forward, the ground materializes. The net appears.

Next week, perhaps I’ll report that the corporate guillotine finally fell, or that I’ve secured my first contract, or that my son aced biology while scoring the winning goal. Whatever unfolds, I’ll keep threading these reflections into the loom of “The Net Appears.” After all, an abyss is just an invitation to practice flight.

Until then, may your own invisible nets breeze into view exactly when you need them, and may they be woven from stronger stuff than corporate lanyards.

-

-

@ 8bad92c3:ca714aa5

2025-06-09 21:01:56

@ 8bad92c3:ca714aa5

2025-06-09 21:01:56Key Takeaways

In this episode of TFTC, Jessy Gilger, Managing Partner at Sound Advisory and architect of Ganet Trust, unpacks the complexities of retiring on Bitcoin, emphasizing that the “right” amount depends on spending habits, age, and minimizing withdrawal pressure. He introduces Ganet Trust as a Bitcoin-native fiduciary solution that leverages multisig custody to meet institutional compliance standards without sacrificing decentralization. Jessy also critiques high-yield derivative products like MSTY, warning of systemic risks and advocating for safer alternatives like SMAs. The conversation broadens into the emotional pitfalls of financial decision-making, the importance of aligning wealth with values, and the evolving macro landscape where Bitcoin’s intersection with traditional finance and tax policy will shape how individuals and institutions protect and grow their holdings across generations.

Best Quotes

"The most comfort comes from putting as little pressure as possible against that stack."

"Multisig is the upgrade from a honeypot to a distributed key setup."

"If a whale pees in the pool, everyone is affected."

"Everyone feels late to Bitcoin because they know someone who got in earlier."

"Stacking Saturdays is my new stack sats."

"Bitcoin doesn’t know about trust, it knows private keys."

"The money is there to serve your values—not the other way around."

"Some financial products will help, some will hurt, and some will fail. Our job is to help clients navigate them safely."

Conclusion

This episode offers a powerful blend of practical insight and philosophical reflection on long-term Bitcoin strategy, emphasizing the need for sound custody, inheritance planning, and emotional discipline in a volatile, financialized world. Jessy Gilger introduces Ganet Trust as a vital solution for secure, compliant Bitcoin ownership, while his “stacking Saturdays” mantra reframes wealth as a pursuit of time, freedom, and meaningful priorities. As Bitcoin moves further into the mainstream, the conversation urges listeners to stay grounded, think generationally, and build resilient systems for both assets and life.

Timestamps

00:00 - Intro

0:33 - Bitcoin Retirement Planning at New All-Time Highs

5:22 - How Gannett Trust Works

10:05 - High Net Worth Bitcoin Storage and Estate Planning Solutions

16:48 - MSTY Derivatives: Understanding MicroStrategy Product Risks

19:53 - Bitkey

20:56 - How MSTY Works and the Whale in the Pool Problem

30:16 - Unchained

30:37 - Bitcoin Financialization and Corporate Treasury Strategy

39:35 - Avoiding Ego-Driven Bitcoin Mistakes and Building Bridges

47:33 - Stack Saturdays

53:15 - Tax Policy Changes and Wild Times Ahead

57:18 - Where to Find Gannett Trust and ClosingTranscript

(00:00) We have people retiring with hundreds of Bitcoin. Do you need to be on a yacht every week or are you staying humble and keeping those stats? 10 of the 12 ETFs are at Coinbase means all the keys are at Coinbase and with the news of the last week like, hey, there could be cracks. Micro Strategy is built on Bitcoin.

(00:18) It's got all of the risks of Bitcoin, right? But then it's got its own set of risks. Let's call them Sailor and Profitability. Then you have derivatives which are on top of Micro Strategy and they retain the risks of everything underneath. meeting on a on a day when we hit new all-time highs. Bitcoin approached $110,000.

(00:43) Got Jesse back on the show to talk about many things, not just the price ripping. A lot of good things happening on the unch unchained side of things. Watching Ganet Trust. We'll get into it. Yeah, lot lots of stuff happening. I think um the price likes Ganet. I I think that's the uh the mover. What uh I mean that's been a big discussion in in the space right now is uh are we heading to new all-time highs? How should Bitcoiners be preparing? How much Bitcoin do people need to retire? How how are you thinking about all this as we approach what seems

(01:22) to be another bull cycle? Yeah, that's a common question, right? How much Bitcoin do I need to retire? I get it a lot and there's so many other questions I want to ask like, well, how much money are you spending, right? Do you do you need to be on a yacht every week or are you staying humble and keeping those stats? And so, the amount of Bitcoin can vary because the spending pressure you're putting against your Bitcoin stack is the the biggest factor, right? And age is probably the second.

(01:54) a 30-year-old retiring on Bitcoin is different than a 75year-old retiring on Bitcoin just because of the horizon. So, stacks vary. We've got people retiring with um less than seven figures of Bitcoin because they have other assets and then we have people retiring with hundreds of Bitcoin um and putting very little pressure against that portfolio.

(02:16) So, can go in a lot of different ways. Um but it is a question of the day as you're poking new all-time highs. Everyone's like, "Well, how high is it going to get?" And then huge question is do we have cycles again right if countries are buying what what would a downside look like and that's the big question in the retirees mind is how do I protect and not ride that downside all the way down if we do have another 70 80% drawback. Yeah. No.

(02:42) And I think particularly for younger people having in their mind like the perspective of 21 million Bitcoin, 8 billion people, what's the stat? 60 million millionaires in the world. Mhm. How much how many stats do I need to get to to feel comfortable that I have a sufficient slice of the Bitcoin pie? That feel comfortable concept is just so different, right? because Bitcoin is moving and shaking and all-time highs or down 30% and that's still within a bull market.

(03:15) Is that comfortable, right? Can you actually hang it up and like, all right, not going into work and I'm just going to continue to ride these adoption cycles. I don't know if it ever gets comfortable. The most comfort comes from putting as little pressure as possible against that stack, right? that you're not pushing these withdrawal rates of like 5 10 20% of my Bitcoin stack.

(03:38) I'm needing to live on every because then you're requiring Bitcoin to do something for you in the short term which is just not great at, right? What what's Bitcoin price going to be in a year? Far less reliable than what's Bitcoin price going to be in 30 years. Yeah. Yeah. Yeah. Well, I I think one of the holdups too is the ability for people to get into Bitcoin and know where to put it and not only have certainty of what it will be valued at in 30 years, but will they have access to it? That's one thing that you guys

(04:10) have been very much focused. I know sound advisory is separate from Unchained technically but within the Unchained umbrella but Unchained focused on helping secure individuals and businesses and trust uh Bitcoin and I think today's announcement of Ganet Trust is a massive step in a direction towards more certainty for long-term holdings for particular entities.

(04:36) Yes, the unchained umbrella or or family of companies is growing and the intention will be for sound advisory to tuck under or be merged into folded into Ganet Trust Company as it gets stood up. But it is the most robust uh compliance offering that um is out there in the fiduciary space. And so that in my opinion was the one thing missing as people want to live on a Bitcoin standard.

(05:04) Sometimes they're in an entity or an organization or have a structure that requires a fiduciary standard. And these two coming together is solved by Ganet Trust Company. So it's going to be the most robust way to hold Bitcoin and have like true inheritance that can be um administered through generations. So how how does this work mechanically via Ganet? Mechanically.

(05:28) So as the first Bitcoin native trust company, other other trust companies do exist, right? but they don't build upon Bitcoin in the way that Unchained has. So Ganet in its um in its Unchained roots and using Unchained technology is going to be able to use multi-IG to achieve um trust company goals.

(05:50) And what that likely will mean is Ganet holding a key, Unchained holding a key, third party holding a key. Those three keys together ensure that the Bitcoin is not being held at any one spot, right? We could get into the Coinbase honeypot. We actually talked about this on our last episode like, "Hey, what do you think is the uh the risk out there that the industry might disagree with?" Said, "I'm launching a new segment.

(06:15) I'm going to ask you a prediction of what what's out there that the uh the industry doesn't see eye to eye with you at." And I was at conferences and they're saying, "Hey, Coinbase is the best. That's where we put all the cut." That means all the keys are at Coinbase and with the news of the last week like, hey, there could be cracks, right? If you've got exposure to Coinbase now, you could be questioning. I was on the list.

(06:37) I got the email. You were affected. That's not great. It doesn't feel good knowing that information that information could have been a lot worse. That headline could have been private keys being mismanaged. When you overlay what Ganet is going to offer to the custody space, it means that not all of the keys are going to be at any one entity.

(07:00) And so that gives the Bitcoiner who understands multisig the confidence that okay, I'm upgrading from a honeypot to a distributed key setup. But it has to be done in a fiduciary and compliant way to satisfy the the institutional and big money of the world, right? family offices, uh, Bitcoin treasury companies, they're going to need a structure that the CIO, the -

@ 9ca447d2:fbf5a36d

2025-06-09 21:01:36

@ 9ca447d2:fbf5a36d

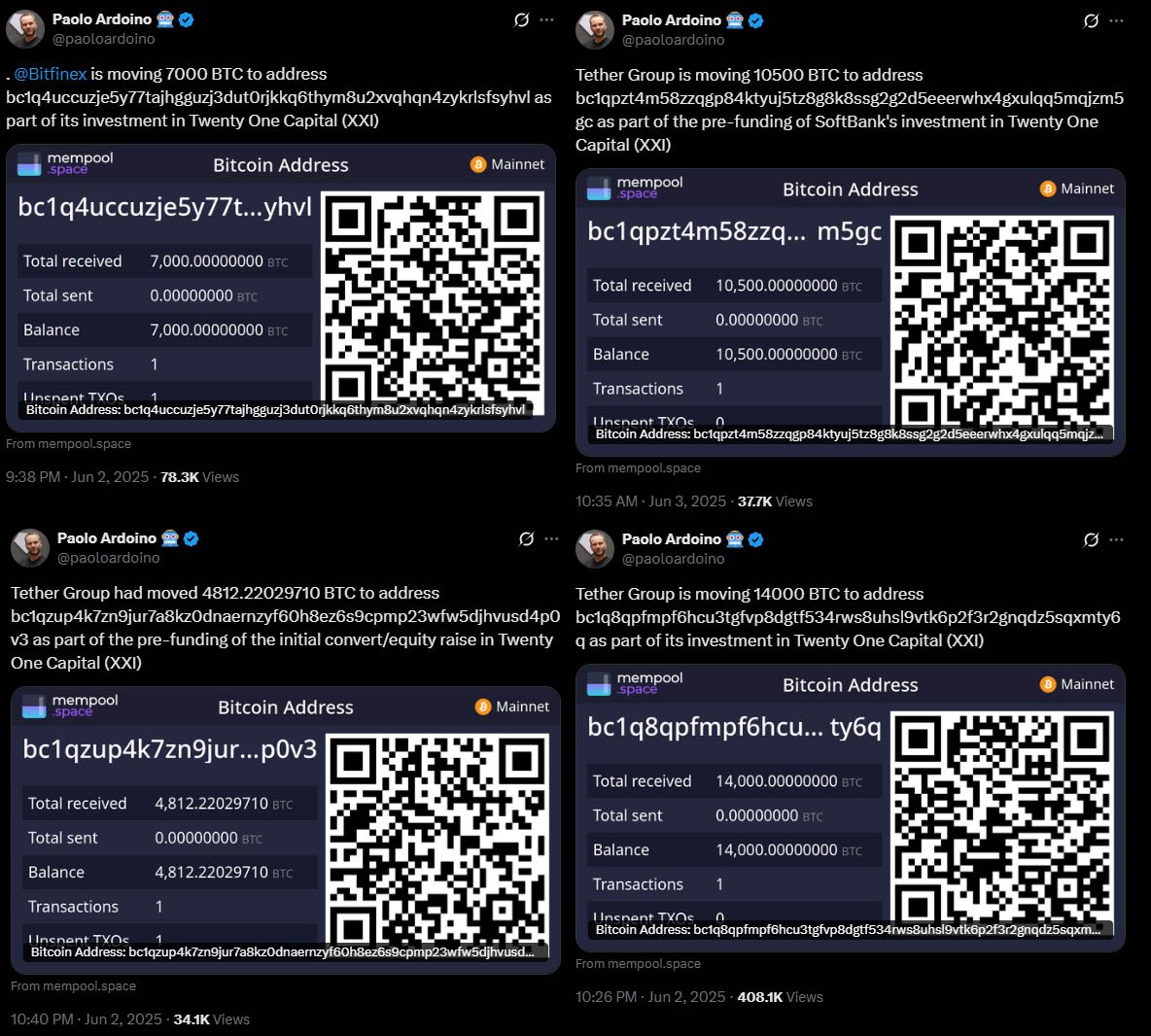

2025-06-09 21:01:36In a massive vote of confidence for a new bitcoin-focused company, Tether and Bitfinex have moved over 37,000 BTC—worth $3.9 billion—to digital treasury firm Twenty One Capital. This is one of the largest Bitcoin transactions in recent history.

The announcement came from Paolo Ardoino, CEO of Tether and CTO of Bitfinex, through multiple posts on X. According to Ardoino, the transfers were part of a pre-funding round for the launch of Twenty One Capital, a new company that will lead the bitcoin treasury space.

Ardoino announced several transfers on X — Sources 1, 2, 3, 4, and 5

“Tether Group is moving 10,500 BTC to address bc1qpzt4m58zzqgp84ktyuj5tz8g8k8ssg2g2d5eeerwhx4gxulqq5mqjzm5gc as part of the pre-funding of SoftBank’s investment in Twenty One Capital (XXI)” Ardoino said.

Twenty One Capital is a new bitcoin treasury firm led by Jack Mallers, CEO of Strike and founder of Zap. The company is backed by Tether, Bitfinex, SoftBank and Cantor Fitzgerald.

The company will go public via a SPAC merger with Cantor Equity Partners (CEP) and will trade under the ticker XXI on Nasdaq. After the merger was announced CEP’s stock price skyrocketed from $11 to $59.75.

Cantor Equity Partners’ stock price jumped on news of the merger — TradingView

Mallers says the company’s mission is bold and clear: accumulate bitcoin and provide full transparency through public wallet disclosures, also known as providing “proof-of-reserves“.

Total bitcoin moved to Twenty One Capital so far include:

- 10,500 BTC from Tether on behalf of SoftBank (worth about $1.1 billion)

- 19,729.69 BTC from Tether (worth around $2 billion)

- 7,000 BTC from Bitfinex (valued at roughly $740 million)

The amounts sum up to 37,229.69 BTC, worth around $3.9 billion at current prices. These were verified on public blockchain explorers.

The Twenty One Capital wallets now show large balances. They have already confirmed they have 31,500 BTC. That makes them the 3rd largest corporate bitcoin holder behind Strategy and Marathon Digital Holdings.

Once these new transfers are confirmed, the company will take over Marathon to become the second-largest corporate holder of the scarce digital asset globally.

Related: Twenty One Capital Becomes 3rd-Largest Corporate Holder of Bitcoin

Unlike companies that add bitcoin to their balance sheet, Twenty One Capital exists solely to accumulate and manage bitcoin. It follows a model similar to Strategy but is more transparent.

Mallers introduced new financial metrics like Bitcoin Per Share (BPS) and Bitcoin Return Rate (BRR) to value the company in bitcoin terms, not fiat.

He thinks economic value in the future will not be measured in dollars but in satoshis—the smallest unit of bitcoin. The company is not just about guarding against fiat collapse, but about completely opting out of the system.

A key part of the firm’s strategy is proof of reserves. Unlike some other big bitcoin holders, Twenty One Capital has already published its public wallet addresses so anyone can verify its holdings in real time.

Ardoino called this approach “Bitcoin Treasury Transparency (BTT)” and said it’s a response to recent industry scandals that showed the dangers of financial opacity in digital assets.

Mallers added openness is the only way to build long-term trust in a bitcoin-native financial system.

Twenty One Capital wants to reshape financial infrastructure, build native bitcoin lending models and promote global Bitcoin adoption.

-

@ b1ddb4d7:471244e7

2025-06-09 21:01:15

@ b1ddb4d7:471244e7

2025-06-09 21:01:15The latest AI chips, 8K displays, and neural processing units make your device feel like a pocket supercomputer. So surely, with all this advancement, you can finally mine bitcoin on your phone profitably, right?

The 2025 Hardware Reality: Can You Mine Bitcoin on Your Phone

Despite remarkable advances in smartphone technology, the fundamental physics of bitcoin mining haven’t changed. In 2025, flagship devices with their cutting-edge 2nm processors can achieve approximately 25-40 megahashes per second when you mine bitcoin on your phone—a notable improvement from previous generations, but still laughably inadequate.

Meanwhile, 2025’s top-tier ASIC miners have evolved dramatically. The latest Bitmain Antminer S23 series and Canaan AvalonMiner A15 Pro deliver 200-300 terahashes per second while consuming 4,000-5,500 watts. That’s a performance gap of roughly 1:8,000,000 between when you mine bitcoin on your phone and professional mining equipment.

To put this in perspective that hits home: if you mine bitcoin on your phone and it earned you one penny, professional miners would earn $80,000 in the same time period with the same effort. It’s not just an efficiency problem—it’s a complete category mismatch.

According to Pocket Option’s 2025 analysis, when you mine bitcoin on your phone in 2025, you generate approximately $0.003-0.006 in daily revenue while consuming $0.45-0.85 in electricity through constant charging cycles. Factor in the accelerated device wear (estimated at $0.75-1.20 daily depreciation), and you’re looking at losses of $1.20-2.00 per day just for the privilege of running mining software.

Mining Economic Factor

Precise Value (April 2025)

Direct Impact on Profitability

Smartphone sustained hash rate

20-35 MH/s

0.00000024% contribution to global hashrate

Daily power consumption

3.2-4.8 kWh (4-6 full charges)

$0.38-0.57 at average US electricity rates

Expected daily BTC earnings

0.0000000086 BTC ($0.0035 at $41,200 BTC)

Revenue covers only 0.9% of electricity costs

CPU/GPU wear cost

$0.68-0.92 daily accelerated depreciation

Reduces smartphone lifespan by 60-70%

Annual profit projection

-$386 to -$412 per year

Guaranteed negative return on investment

Source: PocketOption

Bitcoin’s 2025 Network: Harder Than Ever

Bitcoin’s network difficulty in 2025 has reached unprecedented levels. After the April 2024 halving event that reduced block rewards from 6.25 to 3.125 BTC, mining became significantly more competitive. The global hash rate now exceeds 800 exahashes per second—that’s 800 followed by 18 zeros worth of computational power securing the network.

Here’s what this means in practical terms: Bitcoin’s mining difficulty adjusts every 2,016 blocks (roughly every two weeks) to maintain the 10-minute block time. As more efficient miners join the network, difficulty increases proportionally. In 2025, mining difficulty has increased compared to 2024, making small-scale mining even less viable.

The math is unforgiving:

- Global Bitcoin hash rate: 828.96 EH/s

- Your smartphone’s contribution: ~0.000000003%

- Probability of solo mining a block: Virtually zero

- Expected time to mine one Bitcoin: Several million years

Even joining mining pools doesn’t solve the economic problem. Pool fees typically range from 1-3%, and your minuscule contribution would earn proportionally tiny rewards—far below the electricity and device depreciation costs.

The 2025 Scam Evolution: More Sophisticated, More Dangerous

Fraudsters now leverage AI-generated content, fake influencer endorsements, and impressive-looking apps that simulate realistic mining activity to entice you to mine bitcoin on your phone.

New 2025 scam tactics include:

AI-Powered Fake Testimonials: Deepfake videos of supposed successful mobile miners showing fabricated earnings statements and encouraging downloads of malicious apps.

Gamified Mining Interfaces: Apps that look and feel like legitimate games but secretly harvest personal data while simulating mining progress that can never be withdrawn.

Social Media Manipulation: Coordinated campaigns across TikTok, Instagram, and YouTube featuring fake “financial influencers” promoting mobile mining apps to younger audiences.

Subscription Trap Mining: Apps offering “free trials” that automatically charge $19.99-49.99 monthly for “premium mining speeds” while delivering no actual mining capability.

Recent cybersecurity research shows that over 180 fake mining apps were discovered across major app stores in 2025, with some accumulating more than 500,000 downloads before being removed.

Red flags that scream “scam” in 2025:

- Apps claiming “revolutionary mobile mining breakthrough”

- Promises of earning “$10-50 daily” from phone mining

- Requirements to recruit friends or watch ads to unlock withdrawals

- Apps that don’t require connecting to actual mining pools

- Testimonials that seem too polished or use stock photo models

- Apps requesting permissions unrelated to mining (contacts, camera, microphone)

The 2025 Professional Mining Landscape

To understand why, consider what professional bitcoin mining looks like in 2025. Industrial mining operations now resemble high-tech data centers with:

Cutting-edge hardware:

- Bitmain Antminer S23 Pro: 280 TH/s at 4,800W

- MicroBT WhatsMiner M56S++: 250 TH/s at 4,500W

- Canaan AvalonMiner A1566: 185 TH/s at 3,420W

Infrastructure requirements:

- Megawatt-scale power contracts with industrial electricity rates

- Liquid cooling systems maintaining 24/7 optimal temperatures

- Redundant internet connections ensuring zero downtime

- Professional facility management with 24/7 monitoring

For a small operation, you might need at least $10,000 to $20,000 to buy a few ASIC miners, set up cooling systems, and cover electricity costs. These operations employ teams of engineers, maintain relationships with power companies, and operate with margins measured in single-digit percentages.

2025’s Legitimate Mobile Bitcoin Strategies

While it remains impossible to mine bitcoin on your phone profitably, 2025 offers exciting legitimate ways to engage with bitcoin through your smartphone:

Lightning Network Participation: Apps like Phoenix, Breez, and Zeus allow you to run Lightning nodes on mobile devices, earning small routing fees while supporting bitcoin’s payment layer.

Bitcoin DCA Automation: Services enable automated dollar-cost averaging with amounts as small as $1 daily. Historical data shows $10 weekly bitcoin purchases consistently outperform any mobile mining attempt by 1,500-2,000%.

Educational Mining Simulators: Legitimate apps like “Bitcoin Mining Simulator” teach mining concepts without false earning promises. These educational tools help users understand hash rates, difficulty adjustments, and mining economics.

Stacking Sats Rewards: Apps offering bitcoin rewards for shopping, learning, or completing tasks.

Lightning Gaming: Bitcoin-native mobile games where players can earn sats through skilled gameplay, with some players earning $10 monthly.onfirm that even the most optimized mobile mining setups in 2025 lose money consistently and predictably.

The Bottom Line

When you mine bitcoin on your phone fundamental economics remain unchanged: it’s impossible to profit. The laws of physics, network competition, and energy efficiency create insurmountable barriers that no app can overcome.

However, 2025 offers unprecedented opportunities to engage with bitcoin meaningfully through your smartphone. Focus on education, legitimate earning opportunities, and strategic investment rather than chasing the impossible dream of phone-based mining.

The bitcoin community’s greatest strength lies in its commitment to truth over hype. When someone promises profits to mine bitcoin on your phone in 2025, they’re either uninformed or deliberately misleading you. Trust the mathematics, learn from the community, and build your bitcoin knowledge and holdings through proven methods.

The real opportunity in 2025 isn’t to mine bitcoin on your phone—it’s understanding bitcoin deeply enough to participate confidently in the most important monetary revolution of our lifetime. Your smartphone is the perfect tool for that education; it’s just not a mining rig.

-

@ cae03c48:2a7d6671

2025-06-09 21:00:53

@ cae03c48:2a7d6671

2025-06-09 21:00:53Bitcoin Magazine

BitMine Immersion Technologies Buys 100 Bitcoin in First Treasury AcquisitionBitMine Immersion Technologies, Inc., a Bitcoin focused technology company, has taken its first step into treasury accumulation with the open market purchase of 100 Bitcoin. The acquisition marks the launch of BitMine’s formal Bitcoin Treasury business.

JUST IN:

Publicly traded BitMine Immersion Technologies bought 100 #Bitcoin for the first time. pic.twitter.com/4PPaFQGMbr

Publicly traded BitMine Immersion Technologies bought 100 #Bitcoin for the first time. pic.twitter.com/4PPaFQGMbr— Bitcoin Magazine (@BitcoinMagazine) June 9, 2025

The 100 BTC were purchased using funds raised through BitMine’s recent public stock offering, which closed on June 6, 2025. The offering raised $18 million through the sale of 2,250,000 shares at $8.00 per share.

“We are excited to make our first open market purchase of Bitcoin, and expect to make more Bitcoin purchases moving forward,” said Jonathan Bates, Chairman and CEO of BitMine.

BitMine’s Treasury strategy reflects a growing trend among public companies to diversify their balance sheets with Bitcoin as a store of value. The company joins a cohort of firms leveraging proceeds from capital markets to accumulate BTC as a long term asset, echoing broader institutional adoption.

Based in regions with low-cost energy—including Pecos and Silverton, Texas, and Trinidad—BitMine’s operations span traditional Bitcoin mining, synthetic Bitcoin mining through hashrate financial products, and advisory services for companies seeking Bitcoin-denominated revenues.

The company’s focus is not only on direct mining but also on offering consulting and infrastructure solutions to other public firms entering the Bitcoin space. Its strategic pivot toward treasury holdings represents a natural extension of its belief in Bitcoin as a core financial asset.

BitMine emphasized in its announcement that the move is just the beginning. The company “expects to make more Bitcoin purchases moving forward,” pointing to a sustained long-term accumulation plan.

With this initial acquisition, BitMine has placed itself among a growing group of companies actively converting capital into Bitcoin—showcasing not only conviction in the asset but a business model structured around it.

This post BitMine Immersion Technologies Buys 100 Bitcoin in First Treasury Acquisition first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-06-09 21:00:50

@ cae03c48:2a7d6671

2025-06-09 21:00:50Bitcoin Magazine

Investment Holding Company Belgravia Hartford Capital Makes First Bitcoin Purchase as Part of Treasury StrategyBelgravia Hartford Capital Inc. (CSE:BLGV) announced that it has made its first Bitcoin acquisition as part of the company’s Bitcoin treasury strategy as well as other corporate developments.

JUST IN: Publicly traded investment holding company Belgravia Hartford announces its first Bitcoin purchase for its reserves

pic.twitter.com/TUfPCvGuBk

pic.twitter.com/TUfPCvGuBk— Bitcoin Magazine (@BitcoinMagazine) June 9, 2025

The company confirmed the purchase of 4.86 BTC for USD $500,000 at an average price of $102,848 per BTC. The move follows a previously announced $5 million credit facility with Round13 Digital Asset Fund L.P., from which Belgravia has drawn its first full tranche.

“We are very pleased to have entered the market at this time,” stated CEO of Belgravia Mehdi Azodi. “Belgravia and Round 13 DAF will continue to monitor the Facility and our holdings of BTC as we move into the anticipated active Summer for Belgravia, cryptocurrencies and BTC in particular.”

Belgravia also reported a CAD $44.1 million non-capital tax loss after filing its 2023 return. This loss can be carried forward for up to 20 years. The company is now working with advisors to explore ways to monetize the tax asset to support its Bitcoin treasury strategy and overall balance sheet.

“Belgravia’s accounting, legal and business advisors are exploring a number of options and opportunities in order to monetize this CAD $44 million Non-Capital Loss for the benefit of shareholders and further strengthen our balance sheet to match our stated BTC treasury strategy,” Azodi stated.

The adoption of Bitcoin as a treasury reserve asset has dramatically increased over the course of the last year, expanding globally. To date, there are 226 companies and other entities with Bitcoin in their balance sheets.

Last week, Know Labs, Inc. (NYSE American: KNW) also announced the adoption of a Bitcoin treasury strategy, starting with 1,000 Bitcoin as part of a deal with Goldeneye 1995 LLC and Ripple Chief Risk Officer Greg Kidd, who is the CEO and Chairman of the Board of Directors of Know Labs. The Bitcoin will represent about 82% of Know Labs’ $128 million market cap at a BTC price of $105,000.

“I’m thrilled to deploy a Bitcoin treasury strategy with the support of a forward-looking organization like Know Labs at a time when market and regulatory conditions are particularly favorable,” said Mr. Kidd. “We believe this approach will generate sustainable growth and long-term shareholder value.”

JUST IN: Know Labs, Inc. announces its adopting a Bitcoin Treasury Strategy and holds 1,000 Bitcoin

pic.twitter.com/NSn2xFZYx0

pic.twitter.com/NSn2xFZYx0— Bitcoin Magazine (@BitcoinMagazine) June 6, 2025

This post Investment Holding Company Belgravia Hartford Capital Makes First Bitcoin Purchase as Part of Treasury Strategy first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ cae03c48:2a7d6671

2025-06-09 21:00:48

@ cae03c48:2a7d6671

2025-06-09 21:00:48Bitcoin Magazine

Japan’s ANAP Holdings Launches Full Bitcoin Business Strategy with Goal of Over 1,000 BTC by August 2025ANAP Holdings, Inc. (3189: Tokyo Standard Market) has officially announced the launch of its “Bitcoin Business” in a formal corporate filing, detailing an entry into Bitcoin focused operations across treasury, finance, fashion, and mining.

JUST IN: fashion brand

JUST IN: fashion brand  ANAP, previously purchased 102.9 BTC, goes into FULL #bitcoin Treasury Strategy mode and aims for 1,000+ BTC by August 2025.

ANAP, previously purchased 102.9 BTC, goes into FULL #bitcoin Treasury Strategy mode and aims for 1,000+ BTC by August 2025. They have raised capital to increase their treasury, including an in-kind investment of 584.9135 BTC, which would bring their… pic.twitter.com/k6L8snzmtY

— NLNico (@btcNLNico) June 9, 2025

In a statement signed by President and CEO Yuta Sawaki, the company confirmed that its consolidated subsidiary ANAP Lightning Channel will lead the initiative, with plans to hold more than 1,000 BTC by August 2025. “We aim to strengthen our balance sheet by acquiring Bitcoin in stages as a strategic reserve asset,” the company said.

The company’s pivot toward Bitcoin is rooted in a belief that the asset, like gold, represents a global store of value amid rising inflation and macroeconomic instability. “Bitcoin is a decentralized digital currency… called ‘digital gold’ for its scarcity and durability, and is gaining attention as a store of value,” the document states.

A significant portion of the strategy includes a planned in-kind capital contribution of 584.9135 BTC from Capital T Coin Co., Ltd., scheduled for July 2025. This builds on ANAP’s prior acquisition of 102.9 BTC, bringing its total to 687.8136 BTC, pending shareholder approval on July 18. The group aims to reach 1,000 BTC through further purchases.

Beyond treasury accumulation, the group’s Bitcoin Business will also encompass:

-

A Bitcoin trading desk targeting both institutional and retail participants.

-

A Bitcoin x Fashion/Lifestyle division, which will develop Bitcoin-themed apparel and premium consumer goods.

-

A Bitcoin mining-related business offering software, consulting, and operational support.

As part of its capital strategy, ANAP is executing a ¥7.625 billion Debt-to-Equity Swap (DES) in July 2025, with contributions from stakeholders including Net Prize GK, Q.L.Land, and Tiger Japan Investment.

“Through the in-kind contribution from Capital T Coin, we will strategically hold Bitcoin within the group,” the company wrote. “We aim to maintain a low-cost position with an average acquisition fee of approximately 0.3% including market and spread costs.”

With global institutional interest rising, ANAP’s pivot may position it as a pioneer among Asian consumer brands adopting Bitcoin as a reserve asset and innovation platform.

This post Japan’s ANAP Holdings Launches Full Bitcoin Business Strategy with Goal of Over 1,000 BTC by August 2025 first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

-

@ cae03c48:2a7d6671

2025-06-09 21:00:44

@ cae03c48:2a7d6671

2025-06-09 21:00:44Bitcoin Magazine

New York City Won’t Be Issuing BitBonds Anytime SoonSince 2021, Mayor Eric Adams has been talking about how he’s going to make New York City the center of the crypto industry, though this hasn’t materialized. (Some Bitcoin and crypto companies are based here, but this has little to do with Adams’ efforts — or lack thereof.)

So, when I heard the mayor propose issuing BitBonds in New York City at Bitcoin 2025, I was far from convinced that this would actually happen.

And then when I read a statement from NYC Comptroller Brad Lander on the topic, it became even more clear to me that Adams was merely posturing when it came to BitBonds.

“New York City will not be issuing any bitcoin-backed bonds on my watch,” said Lander in the statement.

“Mayor Eric Adams may be willing to bet our future on crypto in exchange for a trip to Vegas, but my job is to ensure our City’s financial stability. Cryptocurrencies are not sufficiently stable to finance our City’s infrastructure, affordable housing, or schools,” he added.

“Proposing that New York City should open its capital planning to crypto could expose our City to new risks and erode bond buyers’ trust in our City.”

In the statement, Lander went on to discuss how BitBonds would work at the federal level (90% of the funds go to government expenditures, while 10% goes to buying bitcoin for a Strategic Bitcoin Reserve), before noting a key difference between federal bonds and the bonds that New York City issues.

“While the federal government issues bonds to fund traditional expenditures, New York City primarily issues bonds to fund capital assets and in only very narrow circumstances can the City finance other purposes,” wrote Lander.

Lander then went on to lay out a number of other reasons why New York City will not be issuing BitBonds anytime soon, including that ”New York City would have to be able to take transactions in Bitcoin in order to issue bonds backed by Bitcoin” because “New York City has neither any mechanism to pay for its Capital Assets in any other currency besides the US Dollar nor any means to convert Bitcoin to US Dollars.”

(If I read that correctly, Lander says that New York City doesn’t know how to set up a Bitcoin wallet or trade bitcoin for U.S. dollars. Just about on par for an elected official in New York.)

Now, pardon my cynicism here, but I’m a New Yorker — a resident of one of the most restrictive jurisdictions in the world when it comes to Bitcoin and crypto, thanks to the BitLicense — and there are two things you can bet on at this point in time in New York.

- Mayor Eric Adams will talk a good game about Bitcoin and crypto while not taking any action behind the scenes.

- Bureaucrats and elected officials alike in New York will continue to throw cold water on anything that challenges Wall Street’s power, while still claiming that New York is the “financial capital of the world.” (Laughable.)

So, Mayor Adams can make all the proposals he wants from stages in Las Vegas to NYC-sponsored crypto summits, but until I see his administration actually do something substantial for New York City residents as it pertains to Bitcoin and crypto, I’ll just assume that New York will continue to stagnate financially.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

This post New York City Won’t Be Issuing BitBonds Anytime Soon first appeared on Bitcoin Magazine and is written by Frank Corva.

-

@ c5d54dd3:e4a3dfc6

2025-06-09 20:54:07

@ c5d54dd3:e4a3dfc6

2025-06-09 20:54:07I've been working on a few Python scripts to help automate and improve some Lightning node management tasks and wanted to share them with the community. I've bundled them into a GitHub repository called

Lightning-Python-Tools

You can find it here: https://github.com/TrezorHannes/Lightning-Python-Tools

Here's a quick rundown of a few scripts inside:

fee_adjuster.py: This script pulls data from your LNDg database and public fee market data from Amboss. It allows you to build your own custom heuristics for managing your outbound and inbound channel fees automatically.pocketmoney.py: Leveraging your LNBits instance, this tool can trigger regular, scheduled payments. It's perfect for things like sending pocket money to your children's wallets.peerswap-lndg_push.py: For those using Peerswap, this script makes your Peerswap-enabled channels visible in your LNDg dashboard and conveniently enters your past swap history as a note.boltz_swap-out.py: This is a command-line interface (CLI) tool for performing submarine swaps with Boltz. It intelligently suggests swaps based on your most outbound-heavy channels, again by feeding data from LNDg.Disclaimer & Call for Contributions This is an open-source project. Please use it at your own risk. I welcome everyone to fork the repository, create pull requests to make the scripts more robust and versatile, or open issues with suggestions.

I'm also very keen to get your feedback. What other tools could be built to make a node runner's life easier? Let me know your thoughts!

https://stacker.news/items/1002005

-

@ cae03c48:2a7d6671

2025-06-09 21:00:38

@ cae03c48:2a7d6671

2025-06-09 21:00:38Bitcoin Magazine

BlackRock’s iShares Bitcoin Trust Shatters ETF Growth Record, Surpassing $70 Billion in Just 341 DaysBlackRock’s iShares Bitcoin Trust (IBIT) has officially made history. The Bitcoin ETF surged past $70 billion in assets under management (AUM), reaching the milestone in just 341 trading days. This achievement makes IBIT the fastest ETF to ever hit that threshold.

JUST IN: BlackRock's spot Bitcoin ETF becomes the fastest ETF in history to surpass $70 billion AUM

pic.twitter.com/kZkXhjEvq0

pic.twitter.com/kZkXhjEvq0— Bitcoin Magazine (@BitcoinMagazine) June 9, 2025

To put that into perspective, the previous record-holder—SPDR Gold Shares (GLD)—took 1,691 days to reach the same milestone. “5x faster than the old record held by GLD of 1,691 days,” Bloomberg ETF analyst Eric Balchunas wrote in a post on X. Other ETFs like VOO (1,701 days), IEFA (1,773 days), and IEMG (2,063 days) also lag far behind IBIT’s rapid growth.

The explosive rise in IBIT’s AUM coincides with Bitcoin’s continued rally. At the time of reporting, Bitcoin (BTC) is trading above $108,000, up more than 2.06%, and sitting just under 4% below its all-time high of nearly $112,000 set last month.

BlackRock’s accumulation strategy has placed it at the forefront of institutional Bitcoin investment. According to blockchain analytics firm Arkham Intelligence, the firm now holds over 663,000 bitcoin—more than Michael Saylor’s MicroStrategy, which famously owns 582,000 BTC.

The price surge and ETF milestone reflect a broader institutional embrace of Bitcoin as a legitimate and increasingly preferred asset class. The record breaking pace of IBIT’s growth underscores the demand from investors looking for regulated exposure to Bitcoin through traditional financial products.

The chart clearly visualizes the disparity in ETF adoption timelines, with IBIT’s steep, vertical ascent dramatically outpacing its peers in the race to $70 billion. It’s a testament to the accelerating pace at which capital is flowing into Bitcoin markets.

As Bitcoin continues to hold just below its peak, and institutional products like IBIT grow at unprecedented speeds, all eyes are on what comes next—not just for Bitcoin, but for the legacy financial industry now being reshaped by it.

This post BlackRock’s iShares Bitcoin Trust Shatters ETF Growth Record, Surpassing $70 Billion in Just 341 Days first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-06-09 21:00:32

@ cae03c48:2a7d6671

2025-06-09 21:00:32Bitcoin Magazine

KULR Technology Group Announces $300 Million ATM Offering To Invest in Their Bitcoin TreasuryKULR Technology Group, Inc. (NYSE American: KULR) announced it has entered into a Controlled Equity Offering Sales Agreement with Cantor Fitzgerald & Co. and Craig-Hallum Capital Group LLC, enabling the company to sell up to $300 million of its common stock in an at-the-market (ATM) offering to support its Bitcoin treasury reserve.

JUST IN: Public company KULR is raising up to $300 million to buy more #Bitcoin

pic.twitter.com/Jg0yaAFkI7

pic.twitter.com/Jg0yaAFkI7— Bitcoin Magazine (@BitcoinMagazine) June 9, 2025

Under the agreement, Cantor Fitzgerald will act as the sole sales agent, using commercially reasonable efforts to sell shares at market prices. The offering will be made under an existing shelf registration and may occur from time to time based on market conditions and company discretion.

As of June 6, 2025, KULR’s common stock was trading at $1.18 per share. The total number of shares issued under the agreement will not exceed the company’s authorized but unissued shares, after accounting for shares already reserved or committed.

“Our common stock is listed and traded on the NYSE American LLC under the symbol ‘KULR,’” stated the filing.

KULR will pay the sales agents a commission of up to 3.0% of the gross sales proceeds. The agents are considered underwriters under the Securities Act of 1933, and KULR has agreed to indemnify them against certain liabilities.

“Our business and an investment in our common stock involve significant risks,” stated the filing. “These risks are described under the caption “Risk Factors” beginning on page S-6 of this prospectus supplement, and the risk factors incorporated by reference into this prospectus supplement and the accompanying base prospectus.”

KULR started adopting bitcoin as their primary treasury reserve asset in December 2024. Their strategy focuses on acquiring and holding bitcoin by using cash flows that exceed working capital requirements, issuing equity debt securities or raising more capital to purchase more Bitcoin.

“We view our bitcoin holdings as long term holdings and expect to continue to accumulate bitcoin,” mentioned the filing on page S-2. “We have not set any specific target for the amount of bitcoin we seek to hold, and we will continue to monitor market conditions in determining whether to engage in additional bitcoin purchases. This overall strategy also contemplates that we may periodically sell bitcoin for general corporate purposes or in connection with strategies that generate tax benefits in accordance with applicable law, enter into additional capital raising transactions, including those that could be collateralized by our bitcoin holdings, and consider pursuing strategies to create income streams or otherwise generate funds using our bitcoin holdings.”

This post KULR Technology Group Announces $300 Million ATM Offering To Invest in Their Bitcoin Treasury first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ b17fccdf:b7211155

2025-06-09 19:17:52

@ b17fccdf:b7211155

2025-06-09 19:17:52

Check out the MiniBolt guide -> HERE <-

- Core guides

- System

- Bitcoin

- Bitcoin client (Bitcoin Core)

- Electrum server (Fulcrum)

- Blockchain explorer (BTC RPC Explorer)

- Desktop signing app (Sparrow Wallet)

- Lightning

- Lightning client (LND)

- Channel backup

- Web app (ThunderHub)

- Mobile app (Zeus)

- Bonus guides

- System bonus guide

- Dashboard & Appearance

- System Administration

- Install / Update / Uninstall common languages

- Databases

- Hardware

- Bitcoin bonus guides

- Electrum servers

- Signing apps

- Desktop

- Electrum Wallet Desktop

- Decentralized exchange

- Resilience

- Fun

- Payment processors

- Testnet

- Nostr bonus guides

- Relays

- Nostr relay in Rust

- Security bonus guides

- Authentication and Access Control

- SSH Keys

- Networking bonus guides

- VPN & Tunneling

- Resilience

🏗️ Roadmap | 🌐 Dynamic Network map | 🔧 Issues | 📥 Pull requests | 🗣️ Discussions

By ⚡2FakTor⚡

Last updated: 09/06/2025

-

@ 4b3b215f:b091b1f9

2025-06-09 20:21:56

@ 4b3b215f:b091b1f9

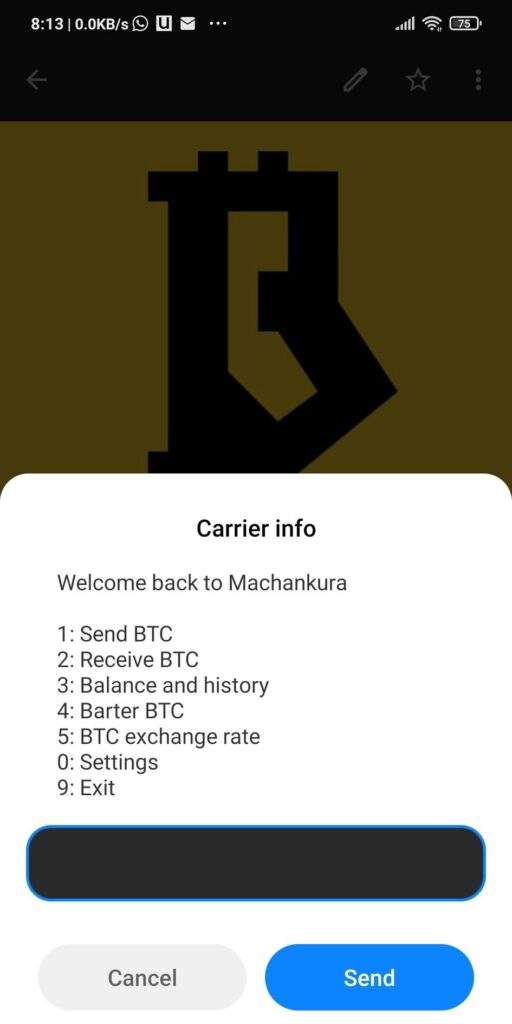

2025-06-09 20:21:56Actualizado: Agosto 10, 2024

⚠️ Advertencia: Esta guía tiene el objetivo de proporcionar información educativa sobre cómo empezar a aceptar Bitcoin en tu negocio. No se ofrece ni se vende ningún servicio relacionado con Bitcoin. Es esencial que sepas que NO DEBES confiar en terceros que te ofrezcan productos o servicios relacionados con Bitcoin, ya que el uso y la gestión de Bitcoin deben ser autónomos y soberanos.

Recuerda: ¡Bitcoin es tu camino hacia la libertad financiera! No confíes en terceros que te ofrezcan productos o servicios para aceptar o utilizar Bitcoin. Bitcoin es dinero, y no necesitas a nadie más para comenzar a usarlo.

¡No aceptes ni pagues por servicios de Bitcoin, tú puedes hacerlo por ti mismo!

¡No confíes, verifica! ₿

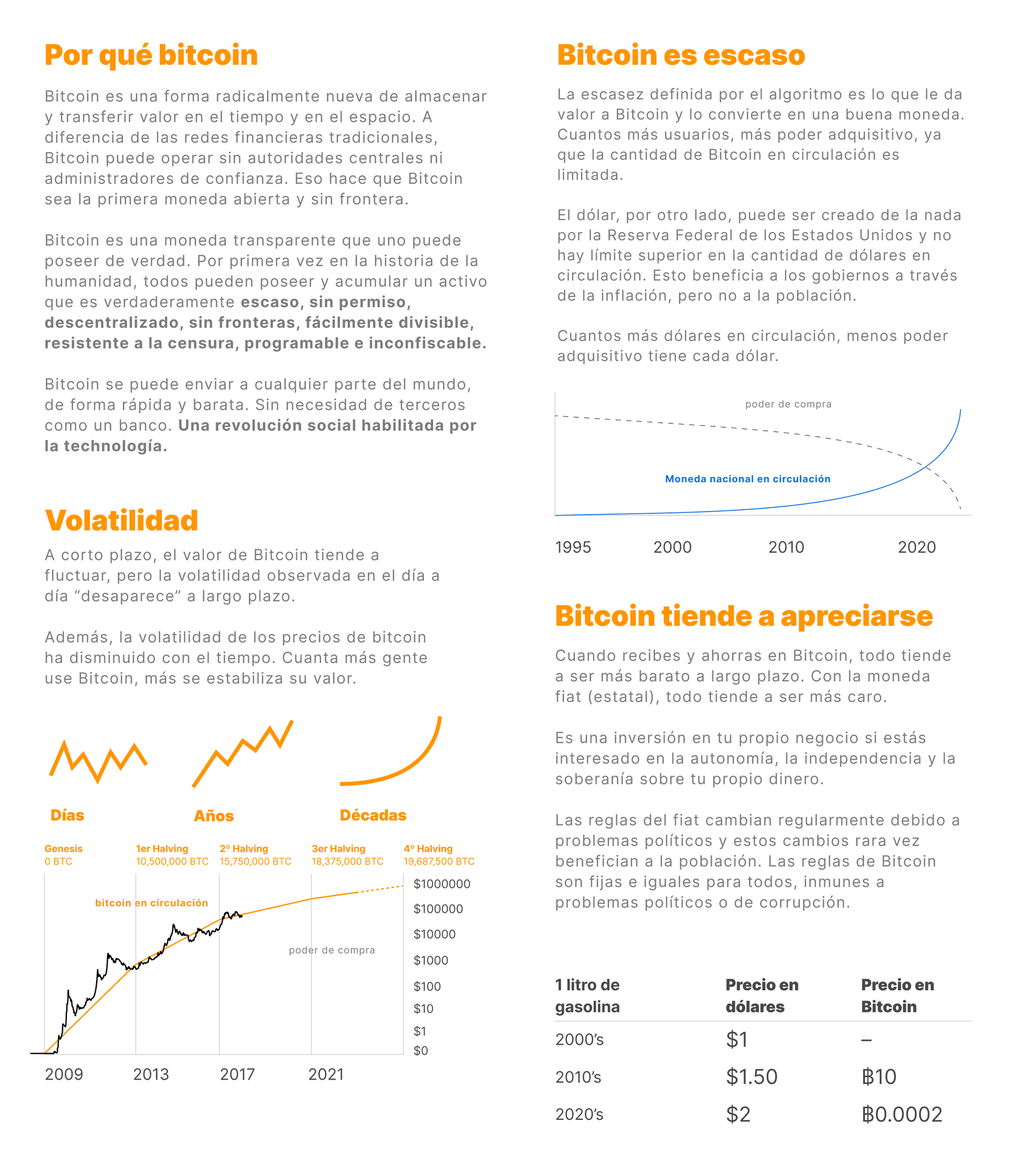

¿Qué es Bitcoin?

Bitcoin es una forma de efectivo electrónico entre pares, una moneda digital que puede transferirse entre personas o computadoras sin necesidad de intermediarios confiables como los bancos. A diferencia de los pagos tradicionales que requieren servicios intermedios como tarjetas de crédito o plataformas de pago digital, Bitcoin permite transacciones directas entre usuarios, preservando así la privacidad y la independencia financiera. Es una alternativa descentralizada al dinero digital controlado centralmente, ofreciendo seguridad y autonomía a sus usuarios.

Además, Bitcoin ofrece una solución a la dependencia de sistemas de pago digitales centralizados, los cuales pueden ser utilizados para el control y la vigilancia gubernamental. Al utilizar una red de computadoras interconectadas, Bitcoin garantiza la verificación independiente de las transacciones y la aplicación de reglas consensuadas, lo que permite un sistema de pagos más transparente y resistente a la censura.

¿Qué es Lightning? ⚡️

La red lightning (Lightning Network) es una red global de pagos de Bitcoin que ofrece transacciones instantáneas, privadas y de bajo o nulo costo. Propuesta en 2015, permite transacciones de Bitcoin más rápidas, económicas y privadas fuera de la cadena de bloques de Bitcoin. Es lo que se conoce como una tecnologîa de capa 2 (L2), con Bitcoin siendo la capa 1 (L1).

A diferencia de las redes bancarias tradicionales, lightning network ofrece liquidación instantánea, sin contracargos y utiliza Bitcoin como su activo subyacente. Aborda un desafío clave para Bitcoin al permitir la escalabilidad para un gran número de usuarios que realizan numerosos pagos.

Esta innovadora red de pagos es sin fronteras, abierta, económica e instantánea, ofreciendo pagos instantáneos, económicos e interoperables en todo el mundo. Los pagos enrutados a través de Lightning se mueven a la velocidad de la luz y son definitivos al llegar, eliminando los retrasos y riesgos asociados con los métodos de pago tradicionales.

*Una poderosa analogía para explicar cómo funciona el Lightning Network.

¿Qué hay de todos estos hacks y quiebras de intercambios?

La base de datos de la cadena de bloques de Bitcoin nunca ha sido hackeada. En sus 15 años de existencia, Bitcoin ha demostrado ser el sistema digital más seguro del mundo y el sistema monetario más confiable jamás inventado. Nunca se ha emitido moneda falsa en la red.

La seguridad de Bitcoin radica en su naturaleza descentralizada. Opera a través de una red de computadoras, llamadas nodos, que se comunican para construir y actualizar la base de datos. Cada nodo almacena una copia de la cadena de bloques, lo que hace virtualmente imposible que los hackers comprometan toda la red. Además, Bitcoin permite a los usuarios mantener sus fondos de forma segura en billeteras personales, reduciendo el riesgo asociado con los exchanges (Intercambios) de terceros. Si dejas tus bitcoins en un intercambio o con cualquier tercero, estás asumiendo un riesgo enorme que, para pequeñas cantidades, puede ser razonable a cambio de conveniencia. Pero piénsalo muy bien.

Si bien Bitcoin opera principalmente a través de internet, incluso en casos de interrupciones de internet, la cadena de bloques permanece intacta. Los nodos continúan almacenando los bloques, asegurando la seguridad y la integridad del sistema. Mientras haya por lo menos un nodo conectado, Bitcoin seguira operando sin interrupciones, es decir, para que Bitcoin deje de funcionar, tendria que caerse el internet en todo el mundo al mismo tiempo, lo cual es poco probable. En caso de una divergencia de red, los nodos pueden reconciliarse y acordar cuál es la cadena de bloques objetivamente más válida a seguir, manteniendo la robustez y seguridad de Bitcoin.

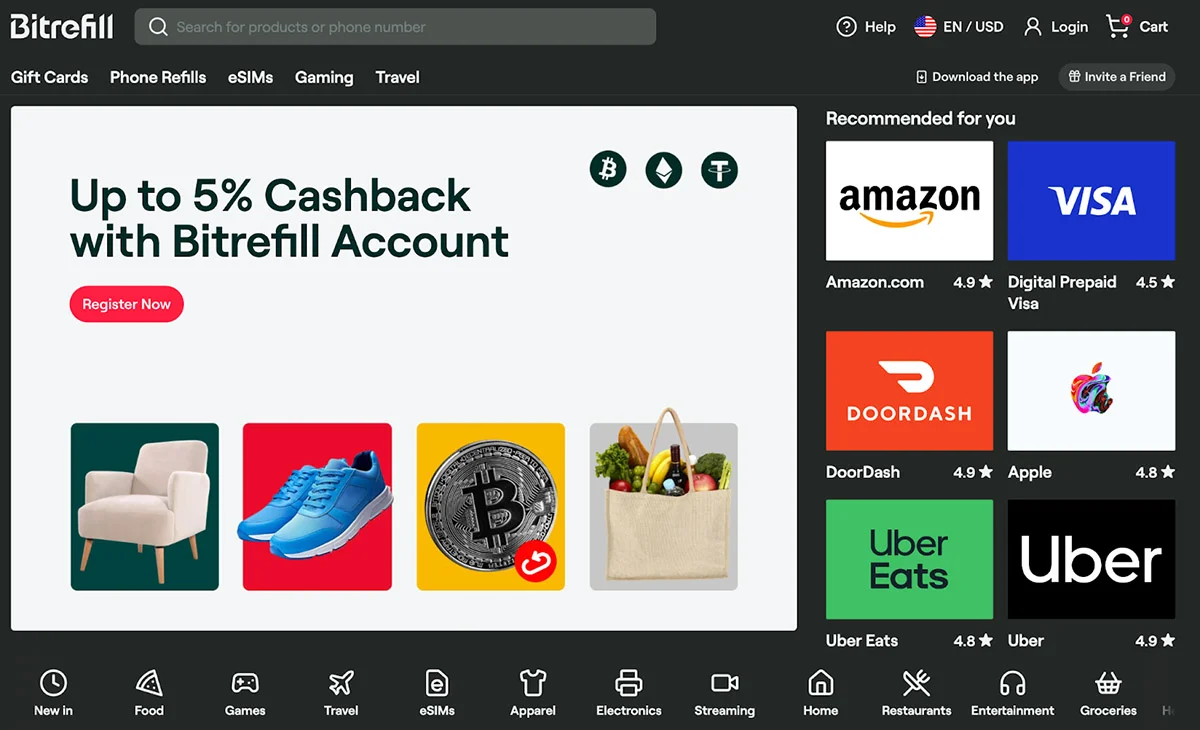

¿Por qué Debería Mi Negocio Aceptar Bitcoin?

En primer lugar, para atraer Bitcoiners. Los Bitcoiners son leales y están altamente motivados a buscar negocios que acepten Bitcoin. Con Bitcoin, puedes recibir pagos las 24 horas del día, los 7 días de la semana, los 365 días del año, sin la necesidad de esperar por días hábiles. Además, no hay contracargos y las tarifas de transacción son muy bajas o casi nulas gracias a la red Lightning.

Bitcoin es Bueno para los Negocios

Bitcoin te permite recibir pagos directamente de tus clientes, al igual que el efectivo. La red Bitcoin opera sin intermediarios como bancos y compañías de tarjetas de crédito, evitando las tarifas elevadas asociadas. Los pagos con Bitcoin se liquidan instantáneamente gracias a la red Lightning, eliminando la espera en comparación con los métodos tradicionales. Además, al ocurrir directamente entre tú y tus clientes, es imposible que alguien te quite el dinero mediante un contracargo. Además, el Bitcoin falsificado no puede ser enviado en la red Bitcoin, lo que asegura la integridad de las transacciones y protege a tu negocio de fraudes financieros.

Al aceptar Bitcoin, atraes más clientes, ya que millones de personas poseen Bitcoin y desean gastarlo en lugares que lo acepten.

Aceptar Bitcoin es completamente gratuito y te brinda la oportunidad de aparecer en mapas de comerciantes de Bitcoin, lo que facilita que los usuarios encuentren tu negocio con facilidad.

Pero, Bitcoin no está regulado. ¿Cómo puedo declarar impuestos si acepto Bitcoin en mi negocio?

Muy bien, antes de comenzar, déjame decirte que el no estar regulado es una cualidad, no un defecto. Bitcoin no lo controla nadie, pero es de todos y está disponible para cualquiera que desee usarlo sin necesidad de pedir permiso. Bitcoin no necesita permiso!

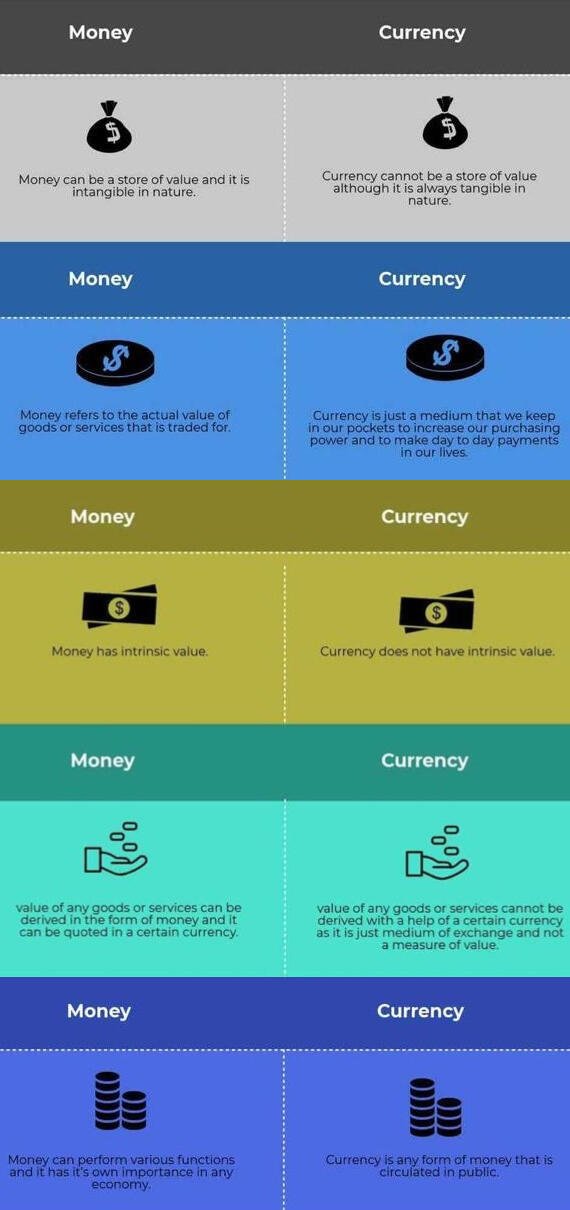

Estamos hablando de una forma superior de dinero y la mejor tecnología de ahorro jamás inventada por los humanos. Aceptar Bitcoin es como recibir efectivo: simplemente registras la venta y te llevas el dinero en efectivo a casa. ¿Acaso cuando recibes efectivo, le tomas fotografías a los billetes para enviárselas al gobierno? Eso pensé.

Bitcoin representa la separación entre el estado y el dinero; no es necesario que el estado sepa cuántos Bitcoin tienes. Si un amigo fuera a tu negocio de hamburguesas y te pagara con canicas, ¿le avisarías al gobierno que tu amigo te ha pagado con canicas? Probablemente no. Registra la venta como efectivo en tus libros contables y guarda tu Bitcoin. Es TU dinero, y tienes derecho a mantenerlo privado.

Se recomienda que cuando poseas un saldo importante de Bitcoin, lo retires a una billetera fría. Imagina que recibes efectivo todo el día en tu negocio; al final del día, ¿dejarías todo ese dinero en la caja? Probablemente no sería una buena idea. Muchos negocios retiran su efectivo al final del día o de la semana y lo depositan en un banco o en una caja fuerte en algún lugar seguro. Haz lo mismo con tu Bitcoin: una vez que tengas un saldo mayor del que llevarías cómodamente en el bolsillo, retíralo a una billetera fría.

Bitcoin ES dinero. No es una divisa, ni una inversión, ni acciones, y mucho menos "sujeto a impuestos". Los impuestos son un robo, punto. No importa lo que tu gobierno te diga: Bitcoin es simplemente dinero.

Si no sabes la diferencia entre el dinero y una divisa (Money and Currency), te invito a revisar la siguiente imagen.

Para todos los "amantes de los impuestos" que vienen a decir "Pero el gobierno regulará Bitcoin" o "El gobierno le impondrá impuestos a mi Bitcoin", solo les digo: ¡Pon tu mierda en orden! El dinero no está sujeto a impuestos, punto.

Si realmente deseas utilizarlo para fines comerciales y por tu propia tranquilidad mental, en tus libros contables, decláralo como "ingreso en efectivo". Así de simple: no es asunto del gobierno saber qué tipo de "efectivo" posees. No es asunto suyo lo que haces con tu dinero.

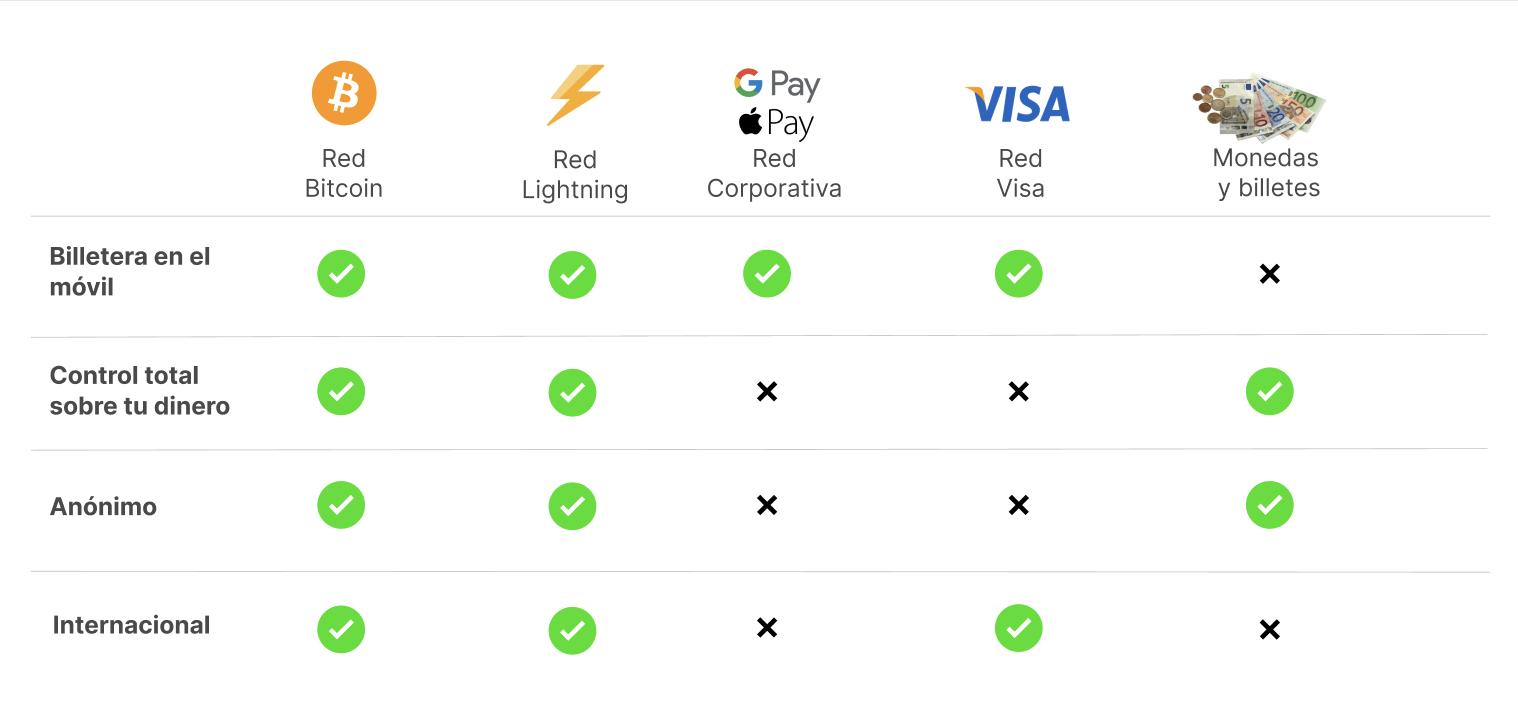

¿Cuál es la diferencia entre billeteras custodiales y no custodiales?

Cuando se trata de billeteras de Bitcoin, hay dos tipos principales: custodiales y no custodiales.

Las billeteras custodiales son como tener tu dinero en un banco. Confías en el proveedor de la billetera para mantener seguro tu Bitcoin y manejar todo por ti. Es conveniente y rápido, especialmente para cantidades pequeñas, pero recuerda, no tienes control total sobre tu Bitcoin. Estás confiando en el proveedor de la billetera para gestionarlo por ti.

Por otro lado, las billeteras no custodiales te dan control total. Tienes tus propias claves y puedes hacer una copia de seguridad de tu billetera. Esto significa que tú eres quien controla tu Bitcoin y puedes moverlo como quieras. Es como guardar efectivo en tu propia caja fuerte en casa. Recuerda, en una billetera no custodial, tú eres el único responsable de tus Bitcoins. Si pierdes u olvidas tus claves (llaves), nadie podrá ayudarte.

Si bien las billeteras custodiales están bien para empezar y para cantidades pequeñas, te recomendamos continuar con tu educación sobre Bitcoin y, eventualmente, pasar a una solución no custodial. Esto te da más control, soberanía, y seguridad sobre tu Bitcoin a largo plazo. Así que, comienza con una billetera custodial como Blink o Wallet Of Satoshi para familiarizarte con Bitcoin, pero apunta a cambiar a una billetera no custodial una vez que te sientas cómodo y listo.

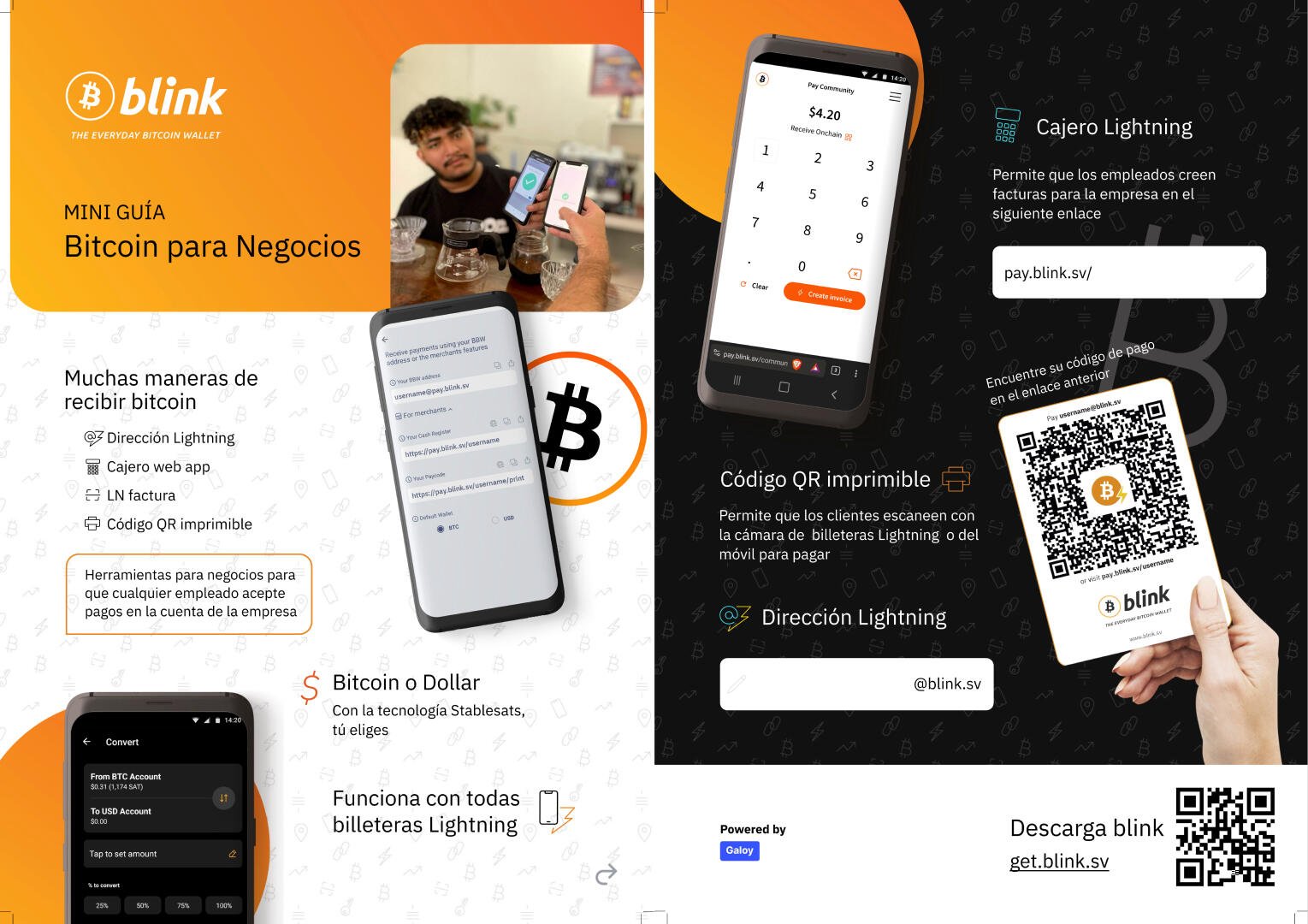

Cómo Aceptar Pagos en Bitcoin

Todo lo que necesitas para aceptar pagos en Bitcoin es una billetera como Blink. Por otro lado, con una billetera híbrida como Wallib, puedes convertir automáticamente los pagos de Bitcoin que recibes a COP.

También puedes optar por ahorrar y mantener una parte de los pagos en Bitcoin, lo que ofrece muchos beneficios a largo plazo.

Ahorra en Bitcoin.

1) Descarga la aplicación:

Bitcoin es una red abierta y hay muchas aplicaciones (wallets) que te permites enviar, recibir, y guardar Bitcoin. Para comenzar, te recomendamos la aplicación Blink Wallet.

Al final de esta guía hay una lista de wallets (billeteras) recomendadas. Pero recuerda, no creas todo lo que lees y haz tu propia investigación.

2) Crea una cuenta:

Una vez que descargues la app, deberas ingresar tu numero de teléfono para registrarte, ya que Blink es una billetera custodial. Pero descuida, no debes dar datos personales adicionales para crear una cuenta.

Una vez ingreses tu teléfono, recibirás un mensaje de texto con un código que deberas ingresar para terminar con el proceso de verificación.

Cuando este configurada, veras la pantalla principal donde está tu balance, tus transacciones, etc. Explora la aplicación y familiarizarte con todas sus opciones.

3) Recibir y enviar Bitcoin:

Ya estas listo para recibir Bitcoin de cualquier persona y desde cualquier lugar, sin importar que aplicacion de lightning usen. Al instante y casi gratis. Esta es la maravilla de la red lightning de Bitcoin!

Aceptar Bitcoin en Persona y en Línea

Aceptar pagos en Bitcoin, ya sea en persona o en línea, es sencillo utilizando tu billetera. Puedes integrar Bitcoin como opción de pago en tu tienda en línea o utilizar la función de "recibir" en tu billetera para recibir pagos en persona. Además, puedes compartir la dirección de pago a través de plataformas como WhatsApp, Instagram, etc.

Cómo Atraer Más Clientes Aceptando Bitcoin

Millones de usuarios de Bitcoin desean gastar sus bitcoins en negocios que los acepten. Al aceptar Bitcoin, puedes aparecer en mapas de comerciantes de Bitcoin como BTC Map de forma gratuita y aumentar tu exposición a nuevos clientes potenciales.

Costo de Aceptar Bitcoin

Aceptar Bitcoin en tu negocio es 100% gratuito. No hay contratos ni tarifas ocultas. No confíes en terceros que te ofrezcan productos o servicios para aceptar o utilizar Bitcoin. Bitcoin es dinero, y no necesitas a nadie más para comenzar a usarlo.

Acepta Bitcoin Ahora! ⚡️

A continuación, algunas billeteras, apps y herramientas que recomendamos.

Billeteras Custodiales

Blink - Billetera móvil de Bitcoin y Lightning

Wallet Of Satoshi - Billetera móvil de Bitcoin y Lightning

Sati - Billetera de Bitcoin y Lightning en WhatsApp

CoinOS - Billetera web (BTC/LN/Liquid)

Alby - Extensión de explorador y web

Billeteras No Custodiales

Phoenix - Billetera móvil de Lightning

Blue Wallet - Billetera móvil y de escritorio de Bitcoin y Lightning.

Green Wallet - Billetera móvil y de escritorio de Bitcoin y Lightning (beta) para principiantes.

Sparrow - Billetera de escritorio solo de Bitcoin (L1 - onchain)

Electrum - Billetera móvil y de escritorio de Bitcoin y Lightning.

Zeus LN - Nodo móvil y billetera de bitcoin y lightning para usuarios avanzados.

Blixt Wallet - Nodo móvil y billetera de Bitcoin y Lightning para usuarios avanzados.

Lecturas Recomendadas

- "La Tesis Alcista de Bitcoin” por Vijay Boyapati [Lectura]

- "Bitcoin: ¿qué, cómo y para qué?” de Franco Amati [Lectura]

- “El Patrón Bitcoin” por Saifedean Ammous [Lectura]

Más Recursos

-

@ bf47c19e:c3d2573b

2025-06-09 20:18:40

@ bf47c19e:c3d2573b

2025-06-09 20:18:40Originalna diskusija na reddit.com iz juna 2025

"Sindrom poremećenosti zbog Bitkoina proističe iz niza zabrinutosti, od pitanja legitimnosti novca, straha da je reč o Ponzijevoj šemi, da je to trojanski konj strane države, da je pomama stvorena za špekulante, do zabrinutosti zbog uticaja rudarenja na životnu sredinu.

Simptomi sindroma poremećenosti zbog Bitkoina (BDS) uključuju odbacivanje svih pozitivnih aspekata povezanih s Bitkoinom uz neodoljivu potrebu da se on prikaže u negativnom svetlu. Sindrom izgleda kao rezultat postepene akumulacije ogorčenja i osećaja da su zakasnili s kupovinom Bitkoina.

Umesto da imaju poniznosti da priznaju da su pogrešili u vezi s Bitkoinom, oni sada posvećuju svoje vreme beznadežnim pokušajima napada na njega i zagovaranju njegovog neuspeha kako bi dokazali da su bili u pravu.

Nije važno ako se više pojedinaca pridruži Bitkoin mreži, ako se pridruže velike kompanije, male zemlje, niti ako globalna plaćanja učini efikasnijim i ako ga korisnici koriste po sopstvenoj volji; oboleli od BDS-a odbijaju da veruju da pojedinci mogu delovati samostalno, već to mora biti neki kult ili potreba za kockanjem.

Ne postoji nijedan argument koji bi mogao promeniti njihovo mišljenje". - The Bitcoin Manual

Diskusija tokom koje se autor posta usled svog neznanja, pogrešne informisanosti ili čak straha, nepovratno upleo "kao pile u kučine".

Mada moram priznati da su određeni delovi njegovog izlaganja, naročito tačke 7) i 8), najbolje reklame za Bitkoin koje bi svakog racionalnog ekonomskog aktera navele na dugoročnu akumulaciju ovog novog oblika novca. Koji razlozi mogu navesti racionalnog učesnika na tržištu koji sledi svoj interes da ignoriše Bitkoin kao novi oblik novca dok se nalazi u fazi svoje monetizacije?

U svojim odgovorima sam pokušao da mu otvoreno ukažem na apsurdnost i nelogičnost njegovih tvrdnji ali sam nailazio na prilično mršave odgovore koji su se više svodili na puko ponavljanje uobičajenih dezinformacija iz klasičnih medija nego autentično i nezavisno mišljenje ovog korisnika Reddita.

Na kraju sam prestao da odgovaram zato što je postalo besmisleno. Ovekovečićemo ga ovde na Nostru i prepustiti vremenu da bude sudija. Za desetak godina će ova debata završiti u sekciji "Retrovizor" pa će analiza sa decenijske distance biti izrazito zanimljiva.

Originalni post

-

Zagovornici bitkoina ga lažno predstavljaju kao rješenje za skoro sve probleme i nešto što će stvoriti nekakvu utopiju. Pritom vrše vrlo agresivnu i toksičnu propagandu. Troše svoj već prilično jak finansijski položaj na lobiranje i uticaj na vladu. Tako su uspjeli da Ameriku okrenu da postane žestoko pro-kripto.

-

Petljanje vlada u kripto svijet omogućava im da tempiraju pumpanje i dumpanje bitkoina (ali i drugih kriptovaluta), prethodno obavijstivši one koje žele da obavijeste, što bi vladi dalo još jedan mehanizam da finansijski nagradi one koji rade za nju razne stvari, ili prosto svoju insajdersku vrhušku, koja bi se time mogla bogati na račun svih ostalih.

-

Vlade su sve bliže tome da počnu koristiti novac poreskih obveznika za ulaganje u bitkoin.

-

Bitkoin se predstavlja kao rješenje problema inflacije, a to je samo djelimično tačno. Ako držiš bitkoin duže od 4 godine, bićeš u plusu - tako je bilo barem zasad. Međutim, na kraći rok oscilacije cijene bitkoina su ogromne. Pad od 80% u roku od godinu dana je normalna stvar. A to kad bi se prevelo na standardni ekonomski jezik u kome se priča o inflaciji značilo bi godišnju inflaciju od 400%. Znači bitkoin rutinski ima stopu inflacije od 400%, a vole da prozivaju fiat valute i za mnogo manju inflaciju tipa već od 5% do 10%, to im je kao mnogo.

-

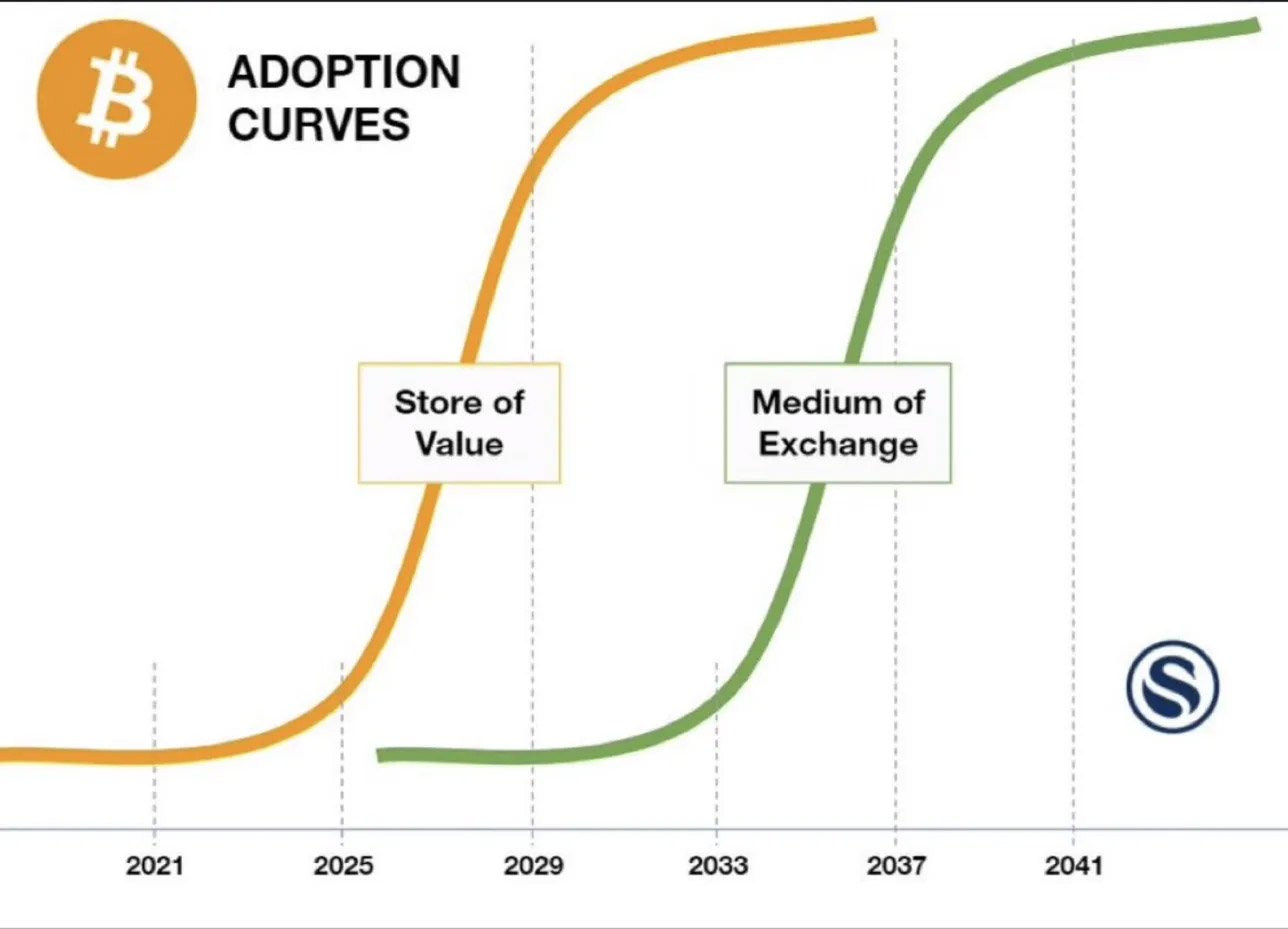

Centralne banke generalno i Fed konkretno, sa svim svojim manama, i uz sve negativne epizode, kad je bila hiperinflacija, istorijski su ipak odigrale i još uvijek igraju pozitivnu ulogu: obezbjeđuju kakvu takvu stabilnost cijena i podstiču veću zaposlenost. To je taj dual mandat feda. Bez centralnih banaka i njihovih intervencija, ekonomske krize bi bile češće i oštrije, a kada se dese, ne bi bilo lakog izlaza iz istih. Trajale bi duže. Bitkoin se protiv centralnih banaka bori. (Ili se bar borio, a sad sve češće odustaje od svojih ideala i sarađuje sa tradicionalnim finansijskim sektorom - što meni ukazuje na to da ti ideali možda nikad nisu ni bili iskreni, već da se narativ prilagođava situaciji, a da je jedino bitno da se u svakom trenutku ima neki narativ koji bi opravdao "number goes up")

-

Jedan od glavnih motora moderne ekonomije je sistem frakcionalnih rezervi koji omogućava bankama da lako daju kredite po relativno povoljnim kamatnim stopama. To ponekad može zaista i dovesti do krize, kad se banke previše opuste, a računaju na Fed ili neku drugu centralnu banku da ih čupa ako upadnu u dubiozu. Tako je bilo 2008. Ali ne treba zbog jedne loše epizode odustati od cijelog tog sistema. Prisustvo jeftinih i lako dostupnih kredita sa niskim kamatnim stopama je jako bitna i povoljna za ekonomiju. Zamislite kad toga ne bi bilo, kad bi ljudi morali za svaku krupnu kupovinu da prvo uštede, pa da onda kupuju u kešu. Niko ne bi mogao kupiti stan prije 50. ili 60. godine. A šta će ti stan sa 50 ili 60 godina?! Porodica se zasniva mnogo ranije. Isto tako, mnoge firme ne bi mogle dobiti kredite za započinjanje ili proširenje poslovanja, što bi usporilo inovaciju i rast produktivnosti. Bitkoin standard koga zagovirnici zagovaraju, podrazumijevao bi mnogo skuplje i teže dostupne kredite, jer tu ne bi bilo mogućnosti za lako uvećavanje novčane mase. Samim tim to bi bilo vrlo nepovoljno za ekonomski rast.

-

Bitkoin bi izazvao i deflaciju cijena (izraženih u bitkoinu, pod pretpostavkom da on postane glavna valuta), koja je takođe vrlo nepovoljna za ekonomski rast. Evo primjera kakve je probleme deflacija svojevremeno izazvala u Japanu: Under deflation, the value of cash increases as time passes. In such a situation, Japanese companies began to cut wages, research and development, and other investments, opting to hold onto cash instead. This tendency, coinciding with the acceleration of the aging population, gradually diminished the competitiveness of the economy and the potential growth rate of the country. The Bank of Japan (BoJ) and the Japanese government has focused on halting the deflation and eventually achieving the 2% inflation target since the early 2000s. However, as deflation persisted, the traditional monetary policy of setting low interest rates to stimulate investment and consumption, which typically causes inflation, became ineffective. This ineffectiveness arose because a nominal rate of 0% effectively meant a positive real rate due to the increasing value of cash. This phenomenon is known as the zero lower bound.

-

Istovremeno, bitkoin (ali samo pod uslovom da bude na putu da postane glavna svjetska valuta) bi izazvao terminalnu inflaciju cijena u svim drugim valutama - tj. njihovu demonetizaciju. Kako bi se bitkoin sve više monetizovao, tako bi se ostale valute, ali i ostali asseti demonetizovali. To bi značilo ogroman transfer bogatstva od onih koji nemaju bitkoin ili kupe kasno, kao onima koji imaju, naročito onima koji imaju mnogo i koji su kupili rano po ekstremno niskoj cijeni. Znači bukvalno, rani vlasnici bitkoina bi se bogatili na račun svih ostalih. I to im je zapravo i cilj. To je jedini razlog zašto toliko promovišu bitkoin - svi ostali narativi, te borba protiv inflacije, te digitalno zlato, te ovo, te ono, su zapravo samo priče i racionalizacije, a poenta je da se nagovaraju svi da nastave kupovati bitkoin, kako bi oni koji su kupili ranije, još više uvećali svoje bogatstvo. Tu činjenicu da bi bitkoin doveo do osiromašivanja svih koji nisu vlasnici bitkoina, prepoznala je Evropska centralna banka u jednom svom članku. Citiraću samo relevantan dio: While most economists argue that the Bitcoin boom is a speculative bubble that will eventually burst, we analyse in this paper the impact of a Bitcoin-positive scenario in which its price continues to rise in the foreseeable future. What sounds intuitively promising or at least not harmful is problematic: Since Bitcoin does not increase the productive potential of the economy, the consequences of the assumed continued increase in value are essentially redistributive, i.e. the wealth effects on consumption of early Bitcoin holders can only come at the expense of consumption of the rest of society. If the price of Bitcoin rises for good, the existence of Bitcoin impoverishes both non-holders and latecomers. While previous discussions on the redistributive effects of Bitcoin assumed that badly timed trading was a necessary condition for losses, this paper shows that neither poor timing of trades nor holding Bitcoin at all are necessary for impoverishment under a Bitcoin-positive scenario.

-

To bi naravno uvećalo nejednakost u svijetu koja je ionako već sad ogromna, i prenijelo bi nejadnakost kakva vlada u samom bitkoin ekosistemu na cijeli svijet. A nejednakost koja vlada u bitkoin ekosistemu je toliko ekstremna da je to teško uopšte i zamisliti. Navešću samo par podataka (iz ovog izvora: bitinfocharts.com/top-100-richest-bitcoin-addresses.html ) 0,03% najbogatijih bitkoin adresa (ili brojem: 18.651 adresa), drže 60,93% cjelokupne količine bitkoina. Sad zamislite da bitkoin postane dominantan oblik bogatstva u svijetu. Znači manje od 20.000 ljudi bi držalo preko 60% kompletnog svjetskog finansijskog bogatstva. Drugi podatak: 23.835.989 najbogatijih bitkoin adresa drži 99,97% cjelokupne količine bitkoina. Ili prostim jezikom, 24 miliona adresa, drže praktično SAV BITKOIN. Nećemo se zamajavati sa onih preostalih 0,03% bitkoina. To se može slobodno zanemariti. Znači sve što ima bitkoina u svijetu je u rukama 24 miliona ljudi. (A od toga preko 60% u rukama manje od 20.000 ljudi). Gdje smi mi ostali u svemu tome? Nema nas!!! Šta je sa 8.2 milijarde ljudi u svijetu? Ništa! Ko ih j... 24 miliona je samo 0,29% svjetske populacije. Tako da ako bi bitkoin zavladao - 20.000 ljudi bi držalo većinu svjetskog finansijskog bogatstva, 24 miliona bi imalo neke kao mrvice, a svi ostali, ne bi praktično imali NIŠTA. Nula. Nada. Sad naravno, promoteri bitkoina će reći kako meni račun nije dobar, jer su neki od najvećih vlasnika bitkoina kripto berze i ETF fondovi, i firme kao Strategy, koje su u vlasništvu velikog broja ljudi, pa je zapravo, po njima distribucija mnogo bolja nego što se to čini. Donekle su u pravu. Ali samo donekle. Ti isti zagovornici će preskočiti činjenicu da postoje i procesi koji čine da je distribucija zapravo još gora nego što se čini. Šta ako mnogi krupni vlasnici (whale-ovi) drže svoj bitkoin, ne na jednoj, nego na više adresa? A to je vrlo česta strategija, jer se plaše, ako slučajno izgube pristup jednoj adresi, ili im neko hakuje wallet ili se nešto desi... izgubiće samo dio bogastva, jer su rasporedili svoj bitkoin na možda desetak i više različitih adresa. Tako da, mogao bi se napraviti i case, da je taj mali broj najbogatihih bitkoina adresa zapravo u rukama još manjeg broja ljudi. Obe tendencije su donekle tačne. Procjenjuje se da institucije, vlade, fondovi, firme i na kraju sam Satoshi Nakamoto, drže ukupno 43% ukupne količine bitkoina. I za tih 43% (osim Satošijevog dijela), bi se možda moglo pretpostaviti da imaju malo bolju distribuciju, jer jedna adresa pokriva veći broj ljudi. Preostalih 57% drže pojedinci. U tom dijelu što drže pojedinci, vjerovatno gotovo cjelokupnu količinu drže krupni vlasnici - whaleovi, a svi ostali neku mizeriju. Bilo kako bilo, raspodjela bogatstva u bitkoinu je ekstremno nejednaka, i ako bi bitkoin postao jedan od dominantnih svjetskih oblika bogatstva, ta nejednakost iz tog ekosistema bi se prelila na cijeli svijet, što bi bilo poprilično distopijski.

-

Ovih 9 tačaka su moje glavne kritike bitkoina, ali bi se na njih mogle dodati i još neke kao što su problem potrošnje struje (koji je ipak donekle riješen halving mehanizmom, i zato bitkoin neće nikad trošiti mnogo više struje nego sad), problem elektronskog otpada, širenje raznih scamova, ransom napadi, i generalno širenje vrlo problematičnog, materijalističkog pogleda na svijet u kome je bitkoin ultimativni statusni simbol (barem u toj zajednici koja za sebe kaže da je orange pilled), a grozničavo štekanje satošija (stacking sats) i držanje istih (hodling), postaje smisao života.

-