-

@ 82341f88:fbfbe6a2

2023-04-11 19:36:53

@ 82341f88:fbfbe6a2

2023-04-11 19:36:53There’s a lot of conversation around the #TwitterFiles. Here’s my take, and thoughts on how to fix the issues identified.

I’ll start with the principles I’ve come to believe…based on everything I’ve learned and experienced through my past actions as a Twitter co-founder and lead:

- Social media must be resilient to corporate and government control.

- Only the original author may remove content they produce.

- Moderation is best implemented by algorithmic choice.

The Twitter when I led it and the Twitter of today do not meet any of these principles. This is my fault alone, as I completely gave up pushing for them when an activist entered our stock in 2020. I no longer had hope of achieving any of it as a public company with no defense mechanisms (lack of dual-class shares being a key one). I planned my exit at that moment knowing I was no longer right for the company.

The biggest mistake I made was continuing to invest in building tools for us to manage the public conversation, versus building tools for the people using Twitter to easily manage it for themselves. This burdened the company with too much power, and opened us to significant outside pressure (such as advertising budgets). I generally think companies have become far too powerful, and that became completely clear to me with our suspension of Trump’s account. As I’ve said before, we did the right thing for the public company business at the time, but the wrong thing for the internet and society. Much more about this here: https://twitter.com/jack/status/1349510769268850690

I continue to believe there was no ill intent or hidden agendas, and everyone acted according to the best information we had at the time. Of course mistakes were made. But if we had focused more on tools for the people using the service rather than tools for us, and moved much faster towards absolute transparency, we probably wouldn’t be in this situation of needing a fresh reset (which I am supportive of). Again, I own all of this and our actions, and all I can do is work to make it right.

Back to the principles. Of course governments want to shape and control the public conversation, and will use every method at their disposal to do so, including the media. And the power a corporation wields to do the same is only growing. It’s critical that the people have tools to resist this, and that those tools are ultimately owned by the people. Allowing a government or a few corporations to own the public conversation is a path towards centralized control.

I’m a strong believer that any content produced by someone for the internet should be permanent until the original author chooses to delete it. It should be always available and addressable. Content takedowns and suspensions should not be possible. Doing so complicates important context, learning, and enforcement of illegal activity. There are significant issues with this stance of course, but starting with this principle will allow for far better solutions than we have today. The internet is trending towards a world were storage is “free” and infinite, which places all the actual value on how to discover and see content.

Which brings me to the last principle: moderation. I don’t believe a centralized system can do content moderation globally. It can only be done through ranking and relevance algorithms, the more localized the better. But instead of a company or government building and controlling these solely, people should be able to build and choose from algorithms that best match their criteria, or not have to use any at all. A “follow” action should always deliver every bit of content from the corresponding account, and the algorithms should be able to comb through everything else through a relevance lens that an individual determines. There’s a default “G-rated” algorithm, and then there’s everything else one can imagine.

The only way I know of to truly live up to these 3 principles is a free and open protocol for social media, that is not owned by a single company or group of companies, and is resilient to corporate and government influence. The problem today is that we have companies who own both the protocol and discovery of content. Which ultimately puts one person in charge of what’s available and seen, or not. This is by definition a single point of failure, no matter how great the person, and over time will fracture the public conversation, and may lead to more control by governments and corporations around the world.

I believe many companies can build a phenomenal business off an open protocol. For proof, look at both the web and email. The biggest problem with these models however is that the discovery mechanisms are far too proprietary and fixed instead of open or extendable. Companies can build many profitable services that complement rather than lock down how we access this massive collection of conversation. There is no need to own or host it themselves.

Many of you won’t trust this solution just because it’s me stating it. I get it, but that’s exactly the point. Trusting any one individual with this comes with compromises, not to mention being way too heavy a burden for the individual. It has to be something akin to what bitcoin has shown to be possible. If you want proof of this, get out of the US and European bubble of the bitcoin price fluctuations and learn how real people are using it for censorship resistance in Africa and Central/South America.

I do still wish for Twitter, and every company, to become uncomfortably transparent in all their actions, and I wish I forced more of that years ago. I do believe absolute transparency builds trust. As for the files, I wish they were released Wikileaks-style, with many more eyes and interpretations to consider. And along with that, commitments of transparency for present and future actions. I’m hopeful all of this will happen. There’s nothing to hide…only a lot to learn from. The current attacks on my former colleagues could be dangerous and doesn’t solve anything. If you want to blame, direct it at me and my actions, or lack thereof.

As far as the free and open social media protocol goes, there are many competing projects: @bluesky is one with the AT Protocol, nostr another, Mastodon yet another, Matrix yet another…and there will be many more. One will have a chance at becoming a standard like HTTP or SMTP. This isn’t about a “decentralized Twitter.” This is a focused and urgent push for a foundational core technology standard to make social media a native part of the internet. I believe this is critical both to Twitter’s future, and the public conversation’s ability to truly serve the people, which helps hold governments and corporations accountable. And hopefully makes it all a lot more fun and informative again.

💸🛠️🌐 To accelerate open internet and protocol work, I’m going to open a new category of #startsmall grants: “open internet development.” It will start with a focus of giving cash and equity grants to engineering teams working on social media and private communication protocols, bitcoin, and a web-only mobile OS. I’ll make some grants next week, starting with $1mm/yr to Signal. Please let me know other great candidates for this money.

-

@ d2e97f73:ea9a4d1b

2023-04-11 19:36:53

@ d2e97f73:ea9a4d1b

2023-04-11 19:36:53There’s a lot of conversation around the #TwitterFiles. Here’s my take, and thoughts on how to fix the issues identified.

I’ll start with the principles I’ve come to believe…based on everything I’ve learned and experienced through my past actions as a Twitter co-founder and lead:

- Social media must be resilient to corporate and government control.

- Only the original author may remove content they produce.

- Moderation is best implemented by algorithmic choice.

The Twitter when I led it and the Twitter of today do not meet any of these principles. This is my fault alone, as I completely gave up pushing for them when an activist entered our stock in 2020. I no longer had hope of achieving any of it as a public company with no defense mechanisms (lack of dual-class shares being a key one). I planned my exit at that moment knowing I was no longer right for the company.

The biggest mistake I made was continuing to invest in building tools for us to manage the public conversation, versus building tools for the people using Twitter to easily manage it for themselves. This burdened the company with too much power, and opened us to significant outside pressure (such as advertising budgets). I generally think companies have become far too powerful, and that became completely clear to me with our suspension of Trump’s account. As I’ve said before, we did the right thing for the public company business at the time, but the wrong thing for the internet and society. Much more about this here: https://twitter.com/jack/status/1349510769268850690

I continue to believe there was no ill intent or hidden agendas, and everyone acted according to the best information we had at the time. Of course mistakes were made. But if we had focused more on tools for the people using the service rather than tools for us, and moved much faster towards absolute transparency, we probably wouldn’t be in this situation of needing a fresh reset (which I am supportive of). Again, I own all of this and our actions, and all I can do is work to make it right.

Back to the principles. Of course governments want to shape and control the public conversation, and will use every method at their disposal to do so, including the media. And the power a corporation wields to do the same is only growing. It’s critical that the people have tools to resist this, and that those tools are ultimately owned by the people. Allowing a government or a few corporations to own the public conversation is a path towards centralized control.

I’m a strong believer that any content produced by someone for the internet should be permanent until the original author chooses to delete it. It should be always available and addressable. Content takedowns and suspensions should not be possible. Doing so complicates important context, learning, and enforcement of illegal activity. There are significant issues with this stance of course, but starting with this principle will allow for far better solutions than we have today. The internet is trending towards a world were storage is “free” and infinite, which places all the actual value on how to discover and see content.

Which brings me to the last principle: moderation. I don’t believe a centralized system can do content moderation globally. It can only be done through ranking and relevance algorithms, the more localized the better. But instead of a company or government building and controlling these solely, people should be able to build and choose from algorithms that best match their criteria, or not have to use any at all. A “follow” action should always deliver every bit of content from the corresponding account, and the algorithms should be able to comb through everything else through a relevance lens that an individual determines. There’s a default “G-rated” algorithm, and then there’s everything else one can imagine.

The only way I know of to truly live up to these 3 principles is a free and open protocol for social media, that is not owned by a single company or group of companies, and is resilient to corporate and government influence. The problem today is that we have companies who own both the protocol and discovery of content. Which ultimately puts one person in charge of what’s available and seen, or not. This is by definition a single point of failure, no matter how great the person, and over time will fracture the public conversation, and may lead to more control by governments and corporations around the world.

I believe many companies can build a phenomenal business off an open protocol. For proof, look at both the web and email. The biggest problem with these models however is that the discovery mechanisms are far too proprietary and fixed instead of open or extendable. Companies can build many profitable services that complement rather than lock down how we access this massive collection of conversation. There is no need to own or host it themselves.

Many of you won’t trust this solution just because it’s me stating it. I get it, but that’s exactly the point. Trusting any one individual with this comes with compromises, not to mention being way too heavy a burden for the individual. It has to be something akin to what bitcoin has shown to be possible. If you want proof of this, get out of the US and European bubble of the bitcoin price fluctuations and learn how real people are using it for censorship resistance in Africa and Central/South America.

I do still wish for Twitter, and every company, to become uncomfortably transparent in all their actions, and I wish I forced more of that years ago. I do believe absolute transparency builds trust. As for the files, I wish they were released Wikileaks-style, with many more eyes and interpretations to consider. And along with that, commitments of transparency for present and future actions. I’m hopeful all of this will happen. There’s nothing to hide…only a lot to learn from. The current attacks on my former colleagues could be dangerous and doesn’t solve anything. If you want to blame, direct it at me and my actions, or lack thereof.

As far as the free and open social media protocol goes, there are many competing projects: @bluesky is one with the AT Protocol, nostr another, Mastodon yet another, Matrix yet another…and there will be many more. One will have a chance at becoming a standard like HTTP or SMTP. This isn’t about a “decentralized Twitter.” This is a focused and urgent push for a foundational core technology standard to make social media a native part of the internet. I believe this is critical both to Twitter’s future, and the public conversation’s ability to truly serve the people, which helps hold governments and corporations accountable. And hopefully makes it all a lot more fun and informative again.

💸🛠️🌐 To accelerate open internet and protocol work, I’m going to open a new category of #startsmall grants: “open internet development.” It will start with a focus of giving cash and equity grants to engineering teams working on social media and private communication protocols, bitcoin, and a web-only mobile OS. I’ll make some grants next week, starting with $1mm/yr to Signal. Please let me know other great candidates for this money.

-

@ 20986fb8:cdac21b3

2023-06-10 02:10:04

@ 20986fb8:cdac21b3

2023-06-10 02:10:04Introduction

In today's digital era, the vast amount of content available on the internet can be quite overwhelming. Sorting through this extensive information to find valuable and trustworthy content has become quite challenging. This is where YakiHonne.com comes in - a groundbreaking Nostr-based decentralized content media protocol that allows users to curate, create, publish, and report on various media. In this article, we will explore one of YakiHonne's most remarkable features: curation making. Let's delve into how YakiHonne's curation making feature revolutionizes content discovery and empowers users to become influential curators.

What is Curation Making?

Curation making on YakiHonne.com refers to the process of discovering, evaluating, and organizing content based on its quality and relevance. It enables users to act as curators, guiding others through the extensive digital landscape and highlighting noteworthy content. Through YakiHonne's decentralized approach, curation making becomes democratized, allowing anyone to become an influential curator and contribute to the platform's content ecosystem.

Empowering Curators

YakiHonne.com recognizes the value of human curation and the essential role curators play in fostering a healthy content ecosystem. The platform provides powerful tools and incentives to support curators. By curating high-quality content, curators can build a reputation and gain followers within the YakiHonne community, amplifying the influence of their curation recommendations. This empowerment creates a virtuous cycle where curators are motivated to provide accurate, reliable, and diverse content recommendations.

Curator Rewards

YakiHonne.com understands and appreciates the effort curators put into evaluating and organizing content. As a token of gratitude, YakiHonne rewards curators for their valuable contributions. Curators earn rewards based on the popularity and impact of their curated content. This incentivizes curators to consistently seek out the best content, ensuring that the platform remains a trusted source for users seeking relevant and reliable information.

Transparent Evaluation

Transparency is a fundamental aspect of YakiHonne's curation making feature. The platform provides transparent evaluation metrics, allowing users to understand how content is ranked and curated. By offering visibility into the curation process, YakiHonne fosters trust and enables users to make informed decisions about the content they consume.

Diverse Perspectives

YakiHonne.com recognizes the significance of diverse perspectives and aims to promote content curation from various backgrounds and viewpoints. The platform encourages curators from different communities and regions to contribute, ensuring a broad range of content is accessible to users worldwide. By embracing diversity, YakiHonne enriches the content experience and helps users discover fresh perspectives they might otherwise overlook.

Guideline on how to use Yakihonne Curation feature

Step 01: Login or generate a new Keys

Step 02: Go to the My Curations button (left-bottom Screen)

Step 03: new Curation by choosing a thumbnail and title, excerpt

Step 04: you’ve made it, you have created a new curation

for now you can host any articles existed within the relays by choosing related articles

and now you all setup, congrats!

Conclusion

YakiHonne's curation making feature revolutionizes content discovery by empowering users to become influential curators. By curating high-quality content, users can earn reputation, rewards, and influence within the YakiHonne community. The platform's commitment to transparency and diversity ensures that users have access to reliable and diverse content recommendations. With YakiHonne, the overwhelming task of finding valuable content is transformed into an engaging and enriching experience. Join YakiHonne today and unlock the power of curation making in the decentralized content media world.

YakiHonne.com is a Nostr-based decentralized content media protocol, which supports free curation, creation, publishing, and reporting by various media.

Try YakiHonne.com Now!

Follow us for more daily features:

- Telegram: https://t.me/YakiHonne_Daily_Featured

- Twitter: @YakiHonne

- Hack-Nostr-On, Win 35,000,000 SATs NOW: https://dorahacks.io/hackathon/hack-nostr-on/detail

- Nostr pubkey:

npub1yzvxlwp7wawed5vgefwfmugvumtp8c8t0etk3g8sky4n0ndvyxesnxrf8q

-

@ bc52210b:20bfc6de

2023-06-09 20:21:06

@ bc52210b:20bfc6de

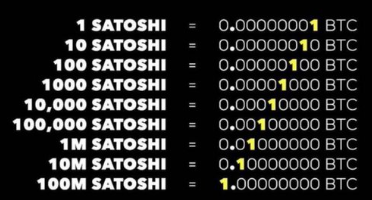

2023-06-09 20:21:06Use of cryptocurrency is growing rapidly, and states are considering whether to use Bitcoin, Stablecoins, and/or Central Bank Digital Currencies (CBDCs) to “protect” citizens and promote innovation.

Bitcoin

Bitcoin is a decentralized digital currency that is not subject to government or financial institution control. This makes it a popular choice for individuals who are looking for a more secure and independent way to store and use their money. However, Bitcoin is also volatile, which means its value can fluctuate wildly. This can make it risky for states to use Bitcoin for payments or collections.

Benefits of using Bitcoin

- Widespread acceptance: Bitcoin is already accepted by a growing number of businesses and individuals around the world. This could make it easier for states to use Bitcoin to make payments and collect taxes.

- Low transaction fees: Bitcoin transaction fees are typically much lower than those charged by traditional payment methods, such as credit cards or wire transfers. This could save states money on payments and collections.

- Security: Bitcoin is a decentralized currency, which means it is not subject to government or financial institution control. This could make it a more secure option for states to use for payments and collections.

Drawbacks of using Bitcoin

- Volatility: The price of Bitcoin is volatile, which means it can fluctuate wildly in value. This could make it risky for states to use Bitcoin for payments or collections.

- Regulation: The regulatory status of Bitcoin is still evolving. This could make it difficult for states to use Bitcoin for payments or collections without running afoul of regulations.

Stablecoins

Stablecoins are a type of cryptocurrency that is pegged to a fiat currency, such as the US dollar. This means that their value is relatively stable, making them a more attractive option for states that are looking to use cryptocurrency for everyday transactions. However, stablecoins are still relatively new and untested, and there have been some cases of stablecoins losing their peg to the underlying asset. Additionally, stablecoins are often issued by centralized organizations, which could pose a risk of censorship or government interference.

Using a stablecoin like USDC alongside Bitcoin could be a way to protect individuals in a state from volatility. Stablecoins are pegged to a fiat currency, such as the US dollar, so their value is relatively stable. This could make them a more attractive option for individuals who are looking to use cryptocurrency for everyday transactions.

However, it is important to note that stablecoins are not without their own risks. For example, they are still relatively new and untested, and there have been some cases of stablecoins losing their peg to the underlying asset. Additionally, stablecoins are typically issued by centralized organizations, which could pose a risk of censorship or government interference.

The statement “Bitcoin mining consumes a significant amount of energy” has been disputed. Some studies have shown that Bitcoin mining can be relatively energy-efficient, while others have shown that it can be a significant source of energy consumption. The environmental impact of Bitcoin mining is likely to vary depending on the location of the mining operations and the type of energy used.

Benefits of using a stablecoins like “USDC”

- Control: A stablecoin digital currency would be subject to the control of the state government. This would give the state more control over its monetary policy and financial system.

- Innovation: A stablecoin digital currency could be used to promote innovation in the financial sector. This could lead to new products and services that benefit citizens and businesses.

Drawbacks of using a stablecoin digital currency

- Acceptance: A stablecoin digital currency would need to be widely accepted by businesses and individuals before it could be used effectively. This could be a challenge.

- State surveillance: A stablecoin can be used as a state surveillance tool. Commercial and state banks can track all stablecoin transactions, which could give them the ability to monitor citizens' financial activity. This could be a concern for individuals who value privacy.

Central Bank Digital Currencies (CBDCs)

In addition to Bitcoin and stablecoins, the Federal government is also considering using other digital currencies at the federal level, such as central bank digital currencies (CBDCs). CBDCs are digital versions of fiat currencies that are issued by central banks. This makes gives central banks more control over the currency.

There are several potential benefits and drawbacks to states creating or using Bitcoin vs creating their own digital currency.

Benefits

- Increased efficiency: CBDCs could help to reduce the cost and time of payments and settlements.

- Improved financial inclusion: CBDCs could make it easier for people to access financial services, such as payments and “savings”.

- Reduced risk of fraud and counterfeiting: CBDCs could help to reduce the risk of fraud and counterfeiting.

- Enhanced monetary policy: CBDCs could give central banks more control over the money supply and interest rates.

Drawbacks

- Increased surveillance: CBDCs could make it easier for governments to track and monitor people's financial transactions.

- Reduced privacy: CBDCs could reduce people's privacy, as all transactions would be recorded on a public ledger.

- Increased risk of cyberattacks: CBDCs could be more vulnerable to cyberattacks than traditional forms of money.

- Uncertainty: The potential benefits and drawbacks of CBDCs are still uncertain, as they are a new technology.

The Decision

The decision of whether to use Bitcoin, stablecoins, CBDCs, or another digital currency is a complex one that should be made on a case-by-case basis. States should carefully consider the costs, benefits, and risks of each option before making a decision.

Here are some additional things to consider when making this decision:

- The potential for state surveillance. CBDCs can be used as a state surveillance tool. Central banks can track all CBDC transactions, which could give them the ability to monitor citizens' financial activity. This could be a concern for individuals who value privacy.

- The potential for inflation. CBDCs could lead to inflation. If central banks issue too much CBDC, it could lead to a decrease in the value of the currency. This could make it more difficult for people to save money and could lead to higher prices for goods and services.

- The regulatory environment for Bitcoin, stablecoins, and CBDCs in the state. The regulatory environment for Bitcoin, stablecoins, and CBDCs is still evolving, and it is important to understand the risks and compliance requirements before using them.

- The potential for financial crime. Cryptocurrency is often used for illegal activities, such as money laundering and tax evasion. States should consider the potential for financial crime when using cryptocurrency.

- The potential for cyberattacks. Cryptocurrency systems are vulnerable to cyberattacks. States should consider the potential for cyberattacks when using cryptocurrency.

- The potential for market manipulation. The cryptocurrency market is volatile and prone to manipulation. States should consider the potential for market manipulation when using cryptocurrency.

Conclusion

The use of cryptocurrency is a growing trend, and states are considering how to best utilize this technology. There are a number of factors that states should consider when making this decision, including the level of adoption in the state, the regulatory environment, the environmental impact, and the potential for financial crime, cyberattacks, and market manipulation. States should carefully weigh the costs and benefits of each option before making a decision.

-

@ bc52210b:20bfc6de

2023-06-09 20:04:53

@ bc52210b:20bfc6de

2023-06-09 20:04:53The best eSIM provider for privacy is the one that offers the most features and protections for your data. Here are a few things to consider when choosing an eSIM provider:

- Data privacy policy: Make sure the provider has a clear and transparent data privacy policy that explains how your data will be collected, used, and shared.

- Encryption: Look for a provider that uses strong encryption to protect your data while it is in transit and at rest.

- No tracking: Some eSIM providers track your online activity and sell your data to advertisers. Choose a provider that does not track your data.

- Anonymous payment: Some eSIM providers require you to provide personal information, such as your name and address, when you purchase a plan. Select a provider that allows you to pay anonymously.

Here are a few eSIM providers that offer good privacy features:

- Silent.link: Silent.link is an eSIM provider that offers anonymous phone numbers and data plans. The company claims that it does not collect any personal data about its users, and that its services are encrypted to protect privacy. Silent.link is based in Switzerland, which has strong privacy laws. The company also uses a variety of security measures to protect its users' data, including encryption and two-factor authentication. *** Airalo**: Airalo is a global eSIM provider that offers a variety of plans in over 180 countries. Airalo's data privacy policy is clear and transparent, and the company uses strong encryption to protect your data.

- Holafly: Holafly is a Spanish eSIM provider that offers plans in over 100 countries. Holafly's data privacy policy is clear and transparent, and the company uses strong encryption to protect your data.

- KnowRoaming: KnowRoaming is a US-based eSIM provider that offers plans in over 100 countries. KnowRoaming's data privacy policy is clear and transparent, and the company uses strong encryption to protect your data.

It is important to note that no eSIM provider is 100% secure. However, by choosing a provider with strong privacy features, you can help to protect your data from being tracked and sold.

Some additional things to consider when choosing an eSIM provider for privacy:

- Location: Some eSIM providers are located in countries with strong privacy laws, such as the European Union. This means that your data is more likely to be protected by these laws.

- Reputation: Do some research to see what other people are saying about the eSIM provider. Are they satisfied with the level of privacy and security?

- Price: eSIM providers can vary in price, so it's significant to compare prices before you make a decision.

Ultimately, the best way to decide on an eSIM provider for privacy is to weigh all the factors above and make a decision that is right for you.

Here are some additional tips for protecting your privacy when using an eSIM:

- Use a VPN: A VPN encrypts your traffic, making it more difficult for your ISP or other third parties to track your online activity.

- Disable location sharing: Many apps and websites ask for your location, but you don't always need to share it. Disabling location sharing can help to protect your privacy.

- Be careful what you share: Only share personal information with people you trust. Be especially careful about sharing sensitive information, such as your home address or phone number.

- Keep your software up to date: Software updates often include security patches that can help to protect your device from malware and other threats.

By following these tips, you can help to protect your privacy when using an eSIM.

-

@ bc52210b:20bfc6de

2023-06-09 19:56:48

@ bc52210b:20bfc6de

2023-06-09 19:56:48As cryptocurrencies gain popularity and value, they become attractive targets for malicious actors. It is crucial to implement robust security measures to protect these assets from theft, loss, or unauthorized access. One effective approach is to establish layers of security for digital asset wallets.

Building layers of security for a digital asset wallet involves implementing multiple protective measures that work together to create a robust defense system. These layers include seed phrase backup, hardware wallets, software wallets with offline storage secure keys, and noncustodial lightning wallets. Each layer addresses specific vulnerabilities and provides an additional barrier against potential threats.

To begin enhancing wallet security, it is advisable to reset the hardware wallet to ensure a clean starting point. During the setup process, the hardware wallet generates a seed phrase—a sequence of words that serves as the master key to access the wallet. This step ensures the generation of a fresh seed phrase unique to your wallet.

It is crucial to create a secure backup of the seed phrase. Prepare an offline storage solution, such as a steel capsule or cassette providing CCSS Level 3 compliance solution, to store the seed phrase securely. This offline backup provides protection against online threats like hacking, malware attacks, fire, flood, static electricity and even EMPs.

In the event of hardware wallet loss, damage, or theft, it is important to be able to restore access to your digital assets. By resetting the hardware wallet and restoring it using the offline storage secure wallet seed phrase backup, you can regain control over your funds.

To further enhance security, set up a mobile or desktop wallet that supports an air-gapped key derived from the hardware wallet. This allows you to sign transactions using the hardware wallet securely, even on a device that may be connected to the Internet.

After implementing the security measures, it is advisable to generate an address using the wallet and perform test transactions. This helps familiarize yourself with the wallet's functionality while ensuring that funds can be sent and received correctly.

The Layers Model

Layer I

Seed Phrase Backup

The seed phrase is the foundation of wallet security. It serves as the backup and recovery mechanism for accessing your digital assets. Losing the seed phrase can result in permanent loss of funds. It is essential to understand its significance and protect it diligently.

Best practices for storing seed phrase backup

Store the seed phrase backup in a secure, physically separate location from the hardware wallet and any connected devices. Consider using a fireproof and waterproof safe or a dedicated offline storage solution specifically designed for seed phrase backup (metal devices).

Considerations for offline storage options

Evaluate different offline storage options, such as hardware wallets, or metal backup plates. Each option has its own advantages and considerations. Choose the one that aligns with your security needs and preferences.

Layer II

Hardware Wallet (i.e., Savings Account)

Hardware wallets are dedicated devices designed to securely store and manage private keys offline. They provide an extra layer of protection by keeping the private keys isolated from potential online threats.

Hardware wallets offer several benefits that make them an ideal choice for securing digital assets:

- Enhanced security: Hardware wallets are designed with robust security features to protect private keys and transactions. They utilize secure elements or specialized chips to securely store private keys, making it difficult for hackers or malware to gain access to them.

- Offline storage: Hardware wallets store private keys offline, disconnected from the internet. This isolation minimizes the risk of online threats such as hacking, phishing attacks, or keyloggers compromising the wallet's security. It provides an extra layer of protection, commonly referred to as “cold storage.”

- Protection against malware: Since hardware wallets operate on dedicated devices with limited functionality, they are less susceptible to malware or viruses. Even if the computer or mobile device used to interact with the wallet is compromised, the private keys stored on the hardware wallet remain secure.

- User-friendly interface: Hardware wallets typically offer user-friendly interfaces and clear instructions for setting up and using the wallet. They are designed to simplify the process of managing and accessing digital assets, even for users who may not have advanced technical knowledge.

- Multi-currency support: Many hardware wallets support a wide range of cryptocurrencies, allowing you to store and manage various digital assets in a single device. This convenience eliminates the need for multiple wallets and simplifies portfolio management.

- Backup and recovery options: Hardware wallets often provide backup and recovery options, such as the seed phrase mentioned earlier. In case of loss, damage, or theft of the hardware wallet, users can easily restore their wallet and regain access to their funds using the seed phrase.

- Compatibility with software wallets: Hardware wallets can be used in conjunction with software wallets, providing an added layer of security. Users can initiate transactions on their software wallet but rely on the hardware wallet to securely sign the transactions offline, minimizing the risk of exposure to online threats.

Overall, hardware wallets offer a combination of enhanced security, offline storage, ease of use, and compatibility that make them a reliable choice for securing digital assets. By utilizing a hardware wallet, individuals can significantly reduce the risk of unauthorized access and confidently manage their cryptocurrencies.

Layer III

Software Mobile/Desktop Wallet with Offline Storage Secure Key (i.e., Checking Account)

An offline storage secure key, also known as an air-gapped key, adds an extra layer of security to software wallets. It involves generating and storing the private key in a separate, offline environment, reducing the risk of unauthorized access or exposure to online threats. By keeping the private key offline, the likelihood of malware or remote attacks compromising the key is significantly minimized.

When choosing a mobile/desktop wallet for offline storage secure key usage, consider the following factors:

- Compatibility: Ensure that the wallet you select supports the generation and usage of an offline storage secure key. Look for wallets that explicitly mention this feature in their documentation or feature list.

- Reputation and security track record: Research the wallet's reputation and security history. Choose wallets developed by reputable companies or open-source projects with a strong track record of security and regular updates. *** User interface and ease of use**: Look for wallets that provide a user-friendly interface and intuitive setup process. The wallet should make it clear how to generate and import an offline storage secure key and seamlessly integrate with a hardware wallet or other offline storage solutions.

Setting up a mobile/desktop wallet with an offline storage secure key typically involves the following steps:

- Generate an offline storage secure key: Use a secure and offline device, such as a computer not connected to the internet or a hardware wallet, to generate the private key. Follow the specific instructions provided by the wallet to generate a key in an offline environment.

- Import the secure key into the software wallet: Transfer the private key securely from the offline device to the mobile/desktop wallet. This can be done through various methods, such as scanning a QR code, connecting the offline device temporarily to the online device, or using an encrypted file transfer.

- Verify and confirm key import: After importing the secure key, carefully verify that it has been imported correctly. Cross-check the key's address or other identifying details with the original offline key. Ensure that the imported key is being used for transactions and wallet access.

To maintain the security of a software wallet with an offline storage secure key, consider the following best practices: ** * Regularly update the software wallet: Keep the software wallet up to date with the latest security patches and feature enhancements. Developers often release updates to address vulnerabilities and improve security measures. * Enable additional security features: Utilize all available security features offered by the software wallet, such as two-factor authentication (2FA) or biometric authentication. These features add an extra layer of protection to prevent unauthorized access. * Implement strong password practices: Use a unique, complex password for the software wallet and avoid reusing passwords from other accounts. Consider using a password manager to securely store and generate strong passwords. * Use reputable app stores: Download the software wallet from official and reputable app stores or the wallet's official website. Be cautious of unofficial sources, as they may distribute compromised or fake versions of the wallet. * Be cautious of phishing attempts**: Exercise caution when interacting with the software wallet. Be vigilant against phishing attempts, such as fake websites or emails designed to trick you into revealing sensitive information. Always verify the authenticity of the wallet's website or communication channels.

Layer IV

Noncustodial Lightning Wallet (i.e., debit card, pocket change)

Noncustodial lightning wallets are software wallets that enable users to participate in the Lightning Network, a second-layer protocol built on top of certain blockchain networks like Bitcoin. These wallets allow users to send and receive instant, low-cost transactions using the Lightning Network without relying on third-party custodians to hold their funds. Noncustodial lightning wallets give users full control over their funds and enable them to engage in peer-to-peer transactions directly.

Noncustodial lightning wallets offer several advantages for users:

- Control over funds: With noncustodial lightning wallets, users retain full control of their funds. They manage their private keys and have the freedom to transact with Lightning Network channels directly without relying on intermediaries.

- Instant and low-cost transactions: The Lightning Network enables near-instantaneous and cost-effective transactions by leveraging payment channels. Noncustodial lightning wallets provide a seamless interface for users to participate in this network and benefit from its scalability and speed.

- Privacy: Noncustodial lightning wallets enhance user privacy by enabling off-chain transactions that do not expose every transaction detail on the underlying blockchain. This helps to maintain confidentiality and reduce the traceability of transactions.

- Empowering micropayments: Noncustodial lightning wallets are particularly useful for micropayments, allowing users to make small, frequent transactions economically. This opens up new possibilities for microtransactions, such as tipping content creators or paying for digital goods and services.

When choosing a noncustodial lightning wallet, consider the following factors:

- Compatibility and platform support: Ensure that the wallet is compatible with the blockchain network and Lightning Network implementation you intend to use. Check if the wallet supports your preferred operating system or device.

- User interface and ease of use: Evaluate the user interface and user experience of the wallet. Look for wallets that provide a user-friendly interface, making it easy to navigate and manage Lightning Network channels and transactions.

- Reputation and security: Research the wallet's reputation and security track record. Look for wallets developed by reputable teams or open-source projects with a history of actively maintaining and updating their software.

- Community support and development activity: Consider the level of community support and ongoing development for the wallet. Active communities and frequent software updates indicate a vibrant ecosystem and ongoing improvement of the wallet's features and security.

Noncustodial lightning wallets require specific security measures to ensure the safety of funds and user information:

- Strong authentication: Enable robust authentication methods, such as biometric authentication or hardware-based security keys, to prevent unauthorized access to the wallet.

- Regularly update the wallet: Keep the wallet software up to date with the latest security patches and bug fixes. Updates often include security improvements and vulnerability fixes.

- Backup channel state: Noncustodial lightning wallets may require users to back up the state of their Lightning Network channels. This backup ensures the ability to recover funds in case of accidental channel closures or wallet failures.

- Trustworthy channels: When opening channels with other Lightning Network participants, consider the reputation and trustworthiness of the channels. Research and select well-established and reliable nodes to minimize the risk of channel closure or loss of funds.

- Secure channel management: Follow best practices for managing Lightning Network channels, such as monitoring channel health, maintaining a balance between incoming and outgoing liquidity, and closing unused or compromised channels promptly.

- Educate yourself on Lightning Network risks: Understand the potential risks associated with the Lightning Network.

Implementing layers of security for your digital asset wallet is crucial for safeguarding your valuable assets. By following the outlined steps, including seed phrase backup, utilizing a hardware wallet, setting up a software wallet with offline storage secure keys, and considering noncustodial lightning wallets, you create a robust defense against potential threats.

Relying on a single security measure for your digital asset wallet leaves you vulnerable to various risks. By implementing multiple layers of security, you significantly reduce the likelihood of unauthorized access, loss, or theft. Each layer adds another barrier, making it exponentially more difficult for attackers to compromise your wallet and gain access to your funds.

As the landscape of digital assets and security threats continues to evolve, it is crucial to stay informed about the latest best practices and emerging threats. Regularly update your knowledge regarding wallet security measures and seek reputable sources for guidance. By remaining proactive and vigilant, you can continue to enhance the security of your digital asset wallet and protect your valuable assets effectively.

-

@ bc52210b:20bfc6de

2023-06-09 19:46:25

@ bc52210b:20bfc6de

2023-06-09 19:46:25U2F stands for Universal 2nd Factor, which is an open authentication standard that strengthens and simplifies two-factor authentication (2FA) U2F is important because it provides an additional layer of security to online accounts by requiring a physical device in addition to a password. This makes it much more difficult for attackers to gain access to a user's account, even if they have the password.

U2F stands for Universal 2nd Factor, which is an open authentication standard that strengthens and simplifies two-factor authentication (2FA) using specialized USB or NFC devices. The standard is developed by the FIDO Alliance, an industry consortium that aims to reduce the reliance on passwords for online authentication.

U2F provides an additional layer of security by requiring a physical device in addition to a password. When a user attempts to log in to a website or service that supports U2F, they must insert their U2F device into their computer's USB port or tap it against their NFC-enabled device. The device will then communicate with the website or service to confirm the user's identity.

One of the major benefits of U2F is that it eliminates the need for users to remember and enter one-time codes generated by an app or received via text message. This not only makes it more convenient for users, but it also reduces the risk of phishing attacks and other forms of fraud.

U2F devices are designed to be resistant to phishing and malware attacks. For example, they will only work with the website or service for which they were originally registered, and they will only communicate with the website or service over an encrypted connection. This ensures that even if an attacker is able to intercept the communication between the device and the website, they will not be able to use it to gain access to the account.

Additionally, U2F is an open standard, which means that any organization can implement it without having to pay licensing fees. This has led to a wide range of U2F devices being available on the market, at a variety of price points.

There are some drawbacks to U2F, one of them is that it requires a physical device that the user must carry with them. This can be a problem for users who frequently change devices or travel frequently. Additionally, U2F devices are not compatible with all devices, such as smartphones.

In conclusion, U2F is important because it provides an additional layer of security to online accounts, makes it more convenient for users, and reduces the risk of phishing and other forms of fraud. It also eliminates the need for users to remember and enter one-time codes, makes it more difficult for attackers to gain access to a user's account, and is an open standard that is relatively easy for organizations to implement.

-

@ 4ac847f3:16dc6c5a

2023-06-09 19:42:47

@ 4ac847f3:16dc6c5a

2023-06-09 19:42:47Zebedee, empresa de pagamentos de jogos, lança aplicativo social descentralizado com funcionalidade de Bitcoin

bitcoin #bitcoin2023 #zebedee #Noticias #nostr

Introdução:

O mundo das redes sociais está prestes a passar por uma revolução com a entrada da Zebedee, uma empresa de pagamentos de jogos, no cenário do aplicativo social descentralizado. Com mais de um milhão de carteiras de Bitcoin e um investimento de quase $50 milhões em capital de risco, a Zebedee lançou hoje o seu principal aplicativo, ZBD, na Nostr, uma plataforma de redes sociais descentralizada em rápido crescimento. Essa integração permite que os usuários enviem pequenas quantias de Bitcoin, chamadas "zaps", uns aos outros, em vez de simplesmente curtir conteúdo como acontece no Twitter e no Facebook.

Artigo completo em 👇

https://open.substack.com/pub/technewsbr/p/zebedee-empresa-de-pagamentos-de?r=1zp81j&utm_campaign=post&utm_medium=web

-

@ 4ac847f3:16dc6c5a

2023-06-09 17:26:21

@ 4ac847f3:16dc6c5a

2023-06-09 17:26:21Microsoft concorda em pagar US$20 milhões para resolver acusações de coleta ilegal de dados pessoais de crianças

Noticias #tecnologia #Microsoft #nostr

Introdução:

A Microsoft concordou em pagar um valor significativo de US$20 milhões para resolver acusações feitas pela Comissão Federal de Comércio (Federal Trade Commission - FTC) que acusaram a gigante de tecnologia de coletar ilegalmente informações pessoais de crianças sem o consentimento de seus pais - e, em alguns casos, retê-las "por anos".

Violação da lei de privacidade infantil:

O órgão regulador federal afirmou que a Microsoft violou a Lei de Proteção à Privacidade Online Infantil (Children’s Online Privacy Protection Act - COPPA), uma lei federal que governa as proteções de privacidade online para crianças menores de 13 anos. A COPPA exige que as empresas notifiquem os pais sobre os dados que coletam, obtenham consentimento parental e excluam esses dados quando não forem mais necessários.

Coleta indevida de dados:

De acordo com a FTC, crianças que se cadastravam no serviço de jogos Xbox da Microsoft eram solicitadas a fornecer informações pessoais, como nome, endereço de e-mail, número de telefone e data de nascimento. Até 2019, havia uma caixa de seleção pré-preenchida permitindo que a Microsoft compartilhasse as informações do usuário com anunciantes. A FTC afirmou que a Microsoft coletou esses dados antes de solicitar que os pais concluíssem a configuração da conta e manteve os dados das crianças mesmo se o pai abandonasse o processo de inscrição.

Artigo completo em 👇

https://open.substack.com/pub/technewsbr/p/microsoft-concorda-em-pagar-us20?r=1zp81j&utm_campaign=post&utm_medium=web

-

@ 6b44f497:4fe86a48

2023-06-09 17:23:49

@ 6b44f497:4fe86a48

2023-06-09 17:23:49Later

-

@ bc52210b:20bfc6de

2023-06-09 15:17:10

@ bc52210b:20bfc6de

2023-06-09 15:17:10Worldwide, especially during these times of disinformation and distrust in governments and authority, there is a regulatory push to enforce Know Your Customer (KYC) requirements when receiving a new phone number.

Fortunately, there is a company that is tackling this very issue called Silent.link

Services provided by Silent.link are becoming super important given the fact that they do not require any type of KYC.

Silent.link does not gather KYC information because it's not required, at least not yet. Other operators/providers do require KYC information because it's used for advertisement revenues and surveillance purposes, not because it is a requirement by regulators.

One exception are phone numbers that do require KYC. In this scenario, Silent.link has eSIMS from the US and the UK with phone numbers that do not have the same KYC requirements. More companies offering similar products will pop up in the near future.

There are benefits for Internet data only (no-phone number) such as VoIP applications, but most require a phone number as an identifier. Silent.link is providing an excellent service by delivering internet data and phone number service without requiring any type of KYC.

There are several risks involved with using Internet data and phone number services, as these utilize outdated 20th century technology that have no security at all. All these voice and text calls being sent/received are fingerprinted and logged. A much better option is getting an Internet data and phone number service and attaching this to a privacy VoIP app like Signal or WhatsApp that require the use of phone numbers for identification.

The service plans do not include out-band calls because of abuse of spam. Out-band calls are also not not included to prevent users from being fingerprinted/logged by making calls or sending text.

For making calls to the traditional legacy phone service, the best option is to sign up to a separate VoIP service.

Silent.link uses “roaming all the time” because it is very difficult to surveil a SIM/eSIM card/profile that has not been issued by the local operator that came from some other foreign telecom/jurisdiction.

When the foreign telecom SIM/eSIM is roaming in the carrier network local operator, the carrier does not know the phone numbers as they only know the internal IDs or International Mobile Subscriber Identity(IMSI) or SIM identifier. This is different from the International Mobile Equipment Identity(IMEI) or hardware identifier.

It's becoming increasingly difficult in the US to get a phone number without attaching it to an identity and in some countries it's against the local regulation.

There is a regulatory push to force the requirement of KYC information when getting a phone number. Services provided by Silent.link are becoming super important given the fact that they do not require KYC.

At this point in time, Telecoms are years behind with technology, including payment services, and are not comfortable accepting payments using cryptocurrency. This might be one of the reasons why there are not more companies like Silent.link, but this will change quickly as Telecoms get on the 21st century innovation bandwagon.

Silent.link services:

Provide anonymous eSIMS decoupled from users official identity and have two plans with no out-band calls or text:

- Internet data only (no-phone number)

- Internet data and phone number

Features:

- Global mobile 4G/5G Internet access

- Pay as you go international roaming in 200+ countries

- Worldwide coverage at low prices

- Pay with #Bitcoin or #Lightning

- Roaming is used all the time

-

@ bc52210b:20bfc6de

2023-06-09 15:15:24

@ bc52210b:20bfc6de

2023-06-09 15:15:24Bitcoin, a monetary revolution, brought the invention of blockchain technology that basically solved a well known computer science problem. This new innovation has taken the world by storm in the form of true decentralization, now possible in this digitized world we live in.

Features of Bitcoin

- Open-source

- No president or head like figure

- Build to scale

- Decentralized

Features of Decentralization

- No one individual or group controls this innovation

- Major changes need the agreement of a large portion of the community

Including:

- software developers

- miners

- node operators

Legacy traditional institutions, especially central banks, are impressed and perplexed with this innovation that for the first time creates a truly digital currency, and also how fast people have adopted this technology worldwide.

These same central planners are watching in dismay as they realize that their central banks organizations have no control of the money supply in this new decentralized digital financial system.

The control and production of legacy currency has historically been reserved for central banks, and which is directly tied to the close relationship and ties with the state.

Decentralization of bitcoin is super important and the biggest innovation. Without a single point of failure, including a prime minister/president or institution or centralized servers.

Central banks have now realized that they will have to compete in the free market now that this innovation has been brought to light.

Central Bank Digital Currencies (CBDC) is their new product that will compete against this new innovation in the market.

CBDCs will remove privacy and the decentralized nature of physical cash. Giving central banks control over users' financial life.

Examples:

- Personalized inflation — Central banks currently have the ability to manipulate interest rates and expand/contract the supply of money. With CBDCs the central bank will be able to personalize the monetary policy down to the individual. i.e: Some individuals get a higher inflation rate in an attempt to get them to spend currency, while others receive a lower inflation rate. Other monetary policies can be based on where individuals live, who they are, their wealth status, their occupation, their purchase history, etc.

- Financial censorship — Central banks and governments can have complete control when CBDCs are distributed throughout the population. They will be able to avoid and bypass the court system and rule of law or even invoke “emergency powers” to tell individuals who they can transact with. All of this can be done and implemented remotely using digital technologies. Central bankers will be able to see transactions in an individual's bank account, who they transact with, what they are purchasing, and basically all their financial life. The system is fully transparent to the state and removes all elements of privacy, while also giving the institutions the ability to censor any and all transactions, regardless of whether they have a legitimate reason or not.

- Social credit system — When the financial system is completely controlled by the central bankers and the government, they have the ability to compensate or punish individual individuals based on the actions they take. i.e: If individuals eat too much candy they might be blocked from buying certain candy. If individuals gamble they might be stopped from using public transportation that heads in the direction of the casino. These examples have been publicly presented by the Bank of England (Bank of England tells ministers to intervene on digital currency 'programming' Digital cash could be programmed to ensure it is only spent on essentials, or goods which an employer or Government deems to be sensible) China already has one in place. Canada is implementing one in real time right now. (A Social Credit System Arrives in Canada Justin Trudeau just created a caste of economic untouchables. Can we stop this dystopian policy from taking hold in America?) i.e. If individuals are obese they can be allowed to conduct transaction for healthy food only.

- Expiration of money — Central banks are constantly trying to have people spend currency in the economy so that you can increase the velocity of money. The best way to do this with CBDCs is to have this new digital currency expire. If the individual doesn't use the currency within a certain period of time it will not work anymore.

These are just four examples of various activities that central banks will engage in once they are successful in creating and distributing CBDCs.

Pay attention Absolute Power Corrupts Absolutely.

This needs to reach global awareness, central banks can and most probably will be the greatest violators of human rights.

-

@ bc52210b:20bfc6de

2023-06-09 15:08:50

@ bc52210b:20bfc6de

2023-06-09 15:08:50“Technocracy advocates contended that price system-based forms of government and economy are structurally incapable of effective action, and promoted a society headed by technical experts, which they argued would be more rational and productive.” (https://en.wikipedia.org/wiki/Technocracy_movement)

In order to start using cyber security best practices to Ghost your profile on the cloud, we first need to understand the “bread crumbs” we are leaving behind. This article will focus on smartphones since it's the most used hardware device and the most relevant OS running on Android and iPhone that individuals use on a daily basis.

Basic Steps

First, I need to understand that for convenience purposes all mobile apps will enable push notifications by default.

What are Push Notifications?

Push notifications are the alerts that apps send to your phone even when the apps aren't open. Often appearing at the top or side of your screen, nearly every popular app uses push notifications in some way.

Push notifications allow app providers to reach you, impacting your privacy. To Ghost yourself this is one area to focus on. The best way to disable these and take control on which applications can use push notifications is by using Google wrapper service (microG) settings.

To truly become a Ghost, users need to detach as much as possible from a single web service provider like Google, Apple, Microsoft or AWS. Think of it as a diversified portfolio of web services including new semi-decentralized ones like IPFS and FileCoin. Also focus on centralized web services that provide Zero-knowledge technology services like SpiderOak.

Second, enable Two-Factor Authentication. The most important measure you can take to help keep your account secure is to enable Two-Factor Authentication (2FA). 2FA provides an additional layer of security for all your accounts. Once it’s set up, you’ll be required to enter your password and a code that you generate on your phone using apps like Aegis or Authy, also the use of security keys like a YubiKey is highly recommended. A code sent to an email you control, to sign in to your account is preferred to sending SMS which is highly unsecured.Third, strengthen your password. Beyond adding 2FA, you can help protect your account with a strong password.

A strong password:

- Use a password that has not been used elsewhere

- Contains at least 10 characters

- Includes uppercase and lowercase letters, numbers, and special characters

To help in managing passwords use password managers like Bitwarden or LastPass to apply the recommendations above.

Third, strengthen your password. Beyond adding 2FA, you can help protect your account with a strong password.

A strong password:

- Use a password that has not been used elsewhere

- Contains at least 10 characters

- Includes uppercase and lowercase letters, numbers, and special characters

To help in managing passwords use password managers like Bitwarden or LastPass to apply the recommendations above.

Fourth, secure your personal email account. Perform the above recommendations for your personal email(s) associated with all your important online accounts as a requirement. This can help prevent bad actors from gaining access to your accounts through your email(s). If possible use a reusable disposable email(s).

Besides the above four areas, review your phone number and email address. Verify that your phone number and email address listed on all your significant online accounts are up-to-date, and valid functioning ways to reach you that are not tied to your real identity.

Review your devices. In most of your significant online accounts, look for ways to view logs of the device that has been used to log in to your account. We recommend reviewing the listed devices regularly and removing any you don’t recognize or no longer use if possible.

Beware of phishing scams. Be careful when clicking on links in text messages and emails that you don’t expect or recognize. Look at the URL heading to make sure it corresponds to the originating sender. Most online accounts support never requiring your password, 2FA codes, or sending you links within text messages. In addition, most never ask you to download software or ask you for information regarding your accounts on other online account platforms or services.

Another tactic is SMS sent to your phone as marketing asking to reply Yes/No on receiving marketing information. Any choice Yes/No will reveal your triangulated locations reducing your privacy.

Types of Users

There are three types of users with distinct privacy requirements and thus levels of security that require possibly two devices with two account(s)

Privacy Account/Device Type (Private)

This type will obviously require pseudonymity and private account(s)

An example would be for self-custody, DeFi or self sovereign purpose transactions.

Options:

- Reuse of disposable email

- SIM/eSIM with Telco local number for specific jurisdiction purchased with physical untraceable ‘cash” or virtual currency like Bitcoin/Lightning and/or Monero.

- SIM/eSIM with data only purchased with physical untraceable ‘cash” or virtual currency like Bitcoin/Lightning and/or Monero.

Public Account/Device Type (non-private)

This type of user will require full KYC and primary use would be for social media accounts and full use of federated, centralized and surveilled infrastructure, that provides a fingerprint and the ability to track cookies. An example would be for surveilled citizens, banking or company/employment custodian purpose transactions.

Options:

- SIM/eSIM with Telco local number for specific jurisdiction purchased with traceable bank account or virtual currency like Bitcoin/Lightning and/or CBDC/Stable coins fully KYCed.

Public/Privacy Account/Device Type (semi-private)

This type of user will require partial KYC and primary use would be for necessary social media accounts for services (i.e. Uber, Lyft) and full use of federated, centralized and surveilled infrastructure, that provides a fingerprint and the ability to track cookies. These surveillance applications and services can be disabled and controlled by sovereign individuals as needed.

Options:

- Combinations of privacy account/device type and public account/device type configured by sovereign individuals to reflect specific needs and requirements.

These types of users are constantly reevaluating their privacy and security posture to determine what trade-offs to execute and thus constantly being aware of their online web presence. Most individuals will require a mental strategy for what tasks to perform in each account/device.

Another area to focus is on the physical (SIM) or virtual (eSIM) used to enable users to become “Ghosts”

SIM

You can purchase a SIM from your local wireless provider and if this provider requires KYC then “Ghosting” will become more difficult and thus if possible pay in local cash fiat currency with no KYC requirements. If this is not possible then an eSIM or virtual SIM would be preferred.

eSIM

Privacy First eSIM are new global providers with this service. Providing global mobile 4G/5G internet access and SMS number instantly and privately on any modern eSIM-compatible smartphone. Silent.Link (https://silent.link/)

Another option for a global provider is Efani. Whether SIM or eSIM is chosen, great due diligence is necessary when choosing a carrier to provide this service. Specially to prevent SIM swapping.

How does SIM swapping occur? 1. 1. A rogue hacker rings your mobile operator and requests a new SIM 2. The unsuspecting operator tests their identity with relatively simple security questions such as your date of birth or favorite color, etc. 3. The hacker answers at least one of the questions correctly and receives the new SIM 4. The hacker is now able to take complete control of your phone, and through text message verification, also takes control of your email and bank account

Global secure telecommunication service from Efani (https://www.efani.com/) provide solutions and services such as multigrade-verification, encryption, insurance coverage and excellent 24/7/365 support.

A good list of hardware and software to enable users to become “Ghosts”

One area of recommendation is to migrate to a non-proprietary hardware and OS. Given the fact that Google base OS is open source and there is no option for apple iPhone open source.

Open source is software source code that is made freely available for possible modification and redistribution.

There are some security and privacy centered options that develop open source OS specifically for android phones that use this Google based open source software as base.

CalyxOS is the most popular and the one I will be recommending here, given the fact that I have been using it for some time as my main smartphone OS, CalyxOS. (https://calyxos.org/).

My CalyxOS installation on my Pixel took about 8 minutes, all without a hitch.

Currently installing all security apps like VPN etc. and apps I need that require privacy.

Continuing with apps like Map, chat, and maybe even banking apps like PayPal etc. Using integrated Firewall and Google wrapper service (microG).

This OS is truly innovating and part of a game changer like Ubuntu did to Linux desktops back in the day.

Once you unlock your boot-loader remember to lock it back which re-enables the Secure Enclave (A secure enclave provides CPU hardware-level isolation and memory encryption on every server by isolating application code and data from anyone with privileges, and encrypting its memory.)

This setup makes Android phones 100x more secure than iPhones

Android hardware that is supported at the moment is:

- Pixel 4a (5G)

- Pixel 5 (redfin)

- Pixel 4a (sunfish)

- Pixel 4 XL (coral)

- Pixel 4 (flame)

- Pixel 3a XL (bonito)

- Pixel 3a (sargo)

- Pixel 3 XL (crosshatch)

- Pixel 3 (blueline)

- Pixel 2 XL (taimen)

- Pixel 2 (walleye)

- Xiaomi Mi A2 (jasmine_sprout)

Next step is to separate your online web services with security and privacy centric services providers

Here is a list of some recommended ones:

Replacements for Google Services

Google Search → DuckDuckGo (free)

Let's start off with the easiest one! Switching to DuckDuckGo not only keeps your searches private, but also gives you extra advantages such as our bang shortcuts, handy Instant Answers, and knowing you're not trapped in a filter bubble.

Gmail, Calendar & Contacts → FastMail (paid), ProtonMail (free with paid options), Tutanota (free with paid options)

FastMail is an independent, paid service that also includes calendar and contacts support across all devices. There are also several ways to get encrypted email between trusted parties by integrating PGP encryption tools. Even more private email alternatives are ProtonMail and Tutanota, both of which offer end-to-end encryption by default.

YouTube → Vimeo (free with paid options)

For videos that are only on YouTube (unfortunately, a lot), you can search for and watch them on DuckDuckGo for better privacy protection via YouTube's "youtube-nocookie" domain. If you're creating and hosting video yourself, however, Vimeo is the best-known alternative which focuses on creators.

Google Maps → Apple Maps (free), OpenStreetMap (free)

For iOS users, Apple gives you an alternative built in via Apple Maps, so no installation is necessary. For wider device support, check out OpenStreetMap (OSM) which is more open, though may not have the same ease-of-use or coverage quality as Apple Maps.

Google Drive → Resilio Sync (free with paid options), Tresorit (paid)

Resilio Sync provides peer-to-peer file synchronization which can be used for private file storage, backup, and file sharing. This also means your files are never stored on a single server in the cloud! The software is available for a wide variety of platforms and devices, including servers. An alternative cloud storage and backup service with end-to-end encryption is Tresorit.

Android → iOS (paid)

The most popular alternative to Android is of course iOS, which offers easy device encryption and encrypted messaging via iMessage by default.

**Google Chrome → Safari (free), Firefox (free), Brave (free), Vivaldi (free) ** Safari was the first major browser to include DuckDuckGo as a built-in private search option. A more cross-device compatible browser is Mozilla's Firefox, an open source browser with a built-in tracker blocker. Brave goes one step further with tracker blocking switched on by default. There are also many more browsers that come with DuckDuckGo as a built-in option, such as Vivaldi, which is well suited for power-users.

As depicted above in this article I am mostly focusing on Android platform vs Apple iPhone and this is because Apple is close source just like Windows and IBM software. This means that there are trade-offs for convenience and security and privacy and in the Apple iPhone it might be more secure and convenient, but you as an individual are trusting the company Apple with your security and privacy for convenience, so it becomes a personal choice.

To summarize, in order to start using cybersecurity best practices to Ghost your profile on the cloud, what traces we leave behind on the cloud is key. What OS we choose will dictate what hardware will enable us to better reduce our footprint and thus Ghost ourselves on the cloud. This is a gradual process and not easy to accomplish at once, but rather in simple small steps.

-

@ bc52210b:20bfc6de

2023-06-09 15:00:24

@ bc52210b:20bfc6de

2023-06-09 15:00:24Centralized Finance (CeFi) exchanges — act as intermediaries to manage the crypto transactions and activities of users.

Decentralized Finance (DeFi) exchanges — which eliminates the need for the custodianship of assets — allows blockchain technology to take over and users having the authority to manage their transactions and activities directly on-chain.

KYC or ‘Know your customer’ is a regulation imposed by jurisdictions that has been historically initiated by the residents/citizens of the related jurisdiction.

Any businesses investing or operating while requiring access to capital markets needs to establish some kind of banking relationship; CeFi and DeFi are no different.

These rules are imposed worldwide and are geared towards ensuring that businesses, and now DeFi protocols, act as money exchange and/or transmitters that obtain ‘suitable’ information on every customer they serve.

This makes it trivial for chain surveillance firms to be used by companies and governments to potentially:

- Track spending habits:

- Prevent individuals and now even artificial intelligence (AI) from using other regulated services

- Confiscate crypto and digital assets

- Come after any centralized entity or representative for tax liabilities

- Generally, know more about these entities and individuals than necessary

What Information Needs to be Provided?

To buy a crypto or digital asset from a KYC CeFi or DeFi, users/entities and even AI will need to provide individual user/entity information. How much information is needed will vary from one jurisdiction to the next, some jurisdictions may require a simple name (e-mail) for small amounts (you could easily supply an alias) while others may require more detailed information. Most will ask for any combination of the following:

- Name

- Address

- Phone number

- Driver’s license

- Government ID

- A selfie holding a piece of paper with the name of the exchange and the date

- A video call with the exchange

Addressing KYC in CeFi is a Nontrivial Task

It’s a nontrivial task because it’s basically mimicking the existing legacy centralized financial KYC infrastructure being used worldwide. Also given the nature of being centralized or having an entity that can be summoned or be enforced to comply, makes it nontrivial since the main players are recognizable.

Addressing KYC in DeFi is a Consequential and Challenging Task

Consequential because it brings:

- Extreme resource costs to companies and governments trying to comply and to enforce it

- Misinformation and abuse by the same entities that are trying to provide control over its citizens and users including AI

Challenging because of:

- The decentralized nature of the protocols / infrastructure

- Trust minimization characteristics

- Its design to provide censorship resistance features

- The pseudonymity as a feature (not a bug) as part of the protocol

- It is open source & open collaboration as core to most projects

To address these basic secondary results and challenges we must first understand the OSI model as a point of reference.

OSI Model

The Open Systems Interconnection model (OSI model) is a conceptual model that characterizes and standardizes the communication functions of a telecommunication or computing system without regard to its underlying internal structure and technology. Its goal is the interoperability of diverse communication systems with standard communication protocols; the OSI model draft was published by the ISO in 1980.

Just like the OSI model standardizes the communication model, there should be a model that standardizes the different blockchains and Decentralized Ledger Technologies (DLT)s interoperability.

Blockchain and DLTs as Infrastructure

The initial infrastructure compared to Internet’s TCP/IP

Application layer that provides rails for industry applications

Similar to the OSI model application layer 7 i.e., SMTP, DNS, HTTP, etc.