-

@ a95c6243:d345522c

2024-12-21 09:54:49

@ a95c6243:d345522c

2024-12-21 09:54:49Falls du beim Lesen des Titels dieses Newsletters unwillkürlich an positive Neuigkeiten aus dem globalen polit-medialen Irrenhaus oder gar aus dem wirtschaftlichen Umfeld gedacht hast, darf ich dich beglückwünschen. Diese Assoziation ist sehr löblich, denn sie weist dich als unverbesserlichen Optimisten aus. Leider muss ich dich diesbezüglich aber enttäuschen. Es geht hier um ein anderes Thema, allerdings sehr wohl ein positives, wie ich finde.

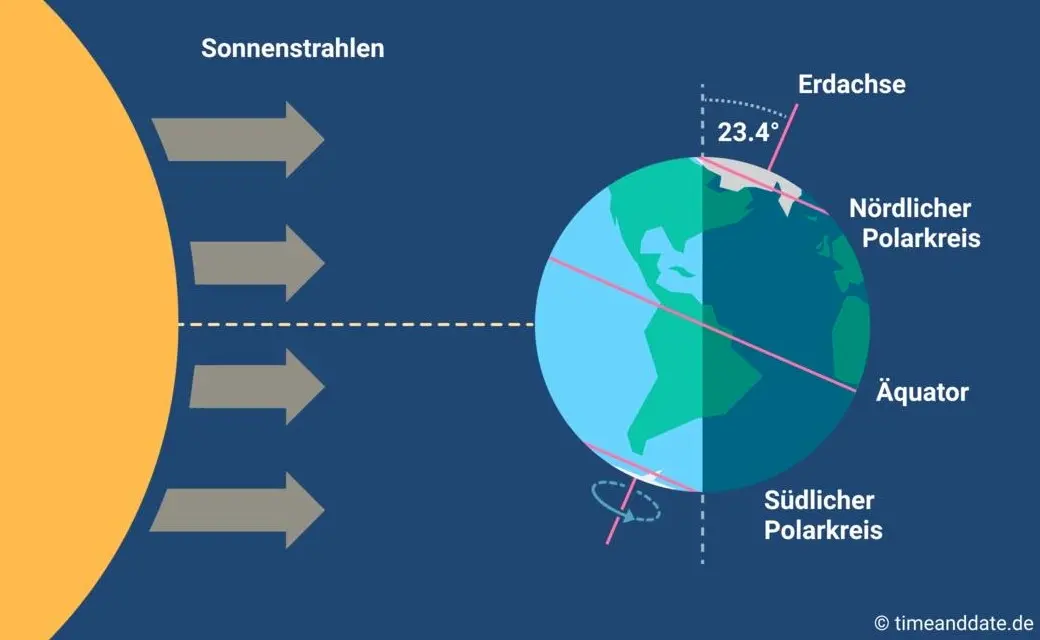

Heute ist ein ganz besonderer Tag: die Wintersonnenwende. Genau gesagt hat heute morgen um 10:20 Uhr Mitteleuropäischer Zeit (MEZ) auf der Nordhalbkugel unseres Planeten der astronomische Winter begonnen. Was daran so außergewöhnlich ist? Der kürzeste Tag des Jahres war gestern, seit heute werden die Tage bereits wieder länger! Wir werden also jetzt jeden Tag ein wenig mehr Licht haben.

Für mich ist dieses Ereignis immer wieder etwas kurios: Es beginnt der Winter, aber die Tage werden länger. Das erscheint mir zunächst wie ein Widerspruch, denn meine spontanen Assoziationen zum Winter sind doch eher Kälte und Dunkelheit, relativ zumindest. Umso erfreulicher ist der emotionale Effekt, wenn dann langsam die Erkenntnis durchsickert: Ab jetzt wird es schon wieder heller!

Natürlich ist es kalt im Winter, mancherorts mehr als anderswo. Vielleicht jedoch nicht mehr lange, wenn man den Klimahysterikern glauben wollte. Mindestens letztes Jahr hat Väterchen Frost allerdings gleich zu Beginn seiner Saison – und passenderweise während des globalen Überhitzungsgipfels in Dubai – nochmal richtig mit der Faust auf den Tisch gehauen. Schnee- und Eischaos sind ja eigentlich in der Agenda bereits nicht mehr vorgesehen. Deswegen war man in Deutschland vermutlich in vorauseilendem Gehorsam schon nicht mehr darauf vorbereitet und wurde glatt lahmgelegt.

Aber ich schweife ab. Die Aussicht auf nach und nach mehr Licht und damit auch Wärme stimmt mich froh. Den Zusammenhang zwischen beidem merkt man in Andalusien sehr deutlich. Hier, wo die Häuser im Winter arg auskühlen, geht man zum Aufwärmen raus auf die Straße oder auf den Balkon. Die Sonne hat auch im Winter eine erfreuliche Kraft. Und da ist jede Minute Gold wert.

Außerdem ist mir vor Jahren so richtig klar geworden, warum mir das südliche Klima so sehr gefällt. Das liegt nämlich nicht nur an der Sonne als solcher, oder der Wärme – das liegt vor allem am Licht. Ohne Licht keine Farben, das ist der ebenso simple wie gewaltige Unterschied zwischen einem deprimierenden matschgraubraunen Winter und einem fröhlichen bunten. Ein großes Stück Lebensqualität.

Mir gefällt aber auch die Symbolik dieses Tages: Licht aus der Dunkelheit, ein Wendepunkt, ein Neuanfang, neue Möglichkeiten, Übergang zu neuer Aktivität. In der winterlichen Stille keimt bereits neue Lebendigkeit. Und zwar in einem Zyklus, das wird immer wieder so geschehen. Ich nehme das gern als ein Stück Motivation, es macht mir Hoffnung und gibt mir Energie.

Übrigens ist parallel am heutigen Tag auf der südlichen Halbkugel Sommeranfang. Genau im entgegengesetzten Rhythmus, sich ergänzend, wie Yin und Yang. Das alles liegt an der Schrägstellung der Erdachse, die ist nämlich um 23,4º zur Umlaufbahn um die Sonne geneigt. Wir erinnern uns, gell?

Insofern bleibt eindeutig festzuhalten, dass “schräg sein” ein willkommener, wichtiger und positiver Wert ist. Mit anderen Worten: auch ungewöhnlich, eigenartig, untypisch, wunderlich, kauzig, … ja sogar irre, spinnert oder gar “quer” ist in Ordnung. Das schließt das Denken mit ein.

In diesem Sinne wünsche ich euch allen urige Weihnachtstage!

Dieser Beitrag ist letztes Jahr in meiner Denkbar erschienen.

-

@ a95c6243:d345522c

2024-12-13 19:30:32

@ a95c6243:d345522c

2024-12-13 19:30:32Das Betriebsklima ist das einzige Klima, \ das du selbst bestimmen kannst. \ Anonym

Eine Strategie zur Anpassung an den Klimawandel hat das deutsche Bundeskabinett diese Woche beschlossen. Da «Wetterextreme wie die immer häufiger auftretenden Hitzewellen und Starkregenereignisse» oft desaströse Auswirkungen auf Mensch und Umwelt hätten, werde eine Anpassung an die Folgen des Klimawandels immer wichtiger. «Klimaanpassungsstrategie» nennt die Regierung das.

Für die «Vorsorge vor Klimafolgen» habe man nun erstmals klare Ziele und messbare Kennzahlen festgelegt. So sei der Erfolg überprüfbar, und das solle zu einer schnelleren Bewältigung der Folgen führen. Dass sich hinter dem Begriff Klimafolgen nicht Folgen des Klimas, sondern wohl «Folgen der globalen Erwärmung» verbergen, erklärt den Interessierten die Wikipedia. Dabei ist das mit der Erwärmung ja bekanntermaßen so eine Sache.

Die Zunahme schwerer Unwetterereignisse habe gezeigt, so das Ministerium, wie wichtig eine frühzeitige und effektive Warnung der Bevölkerung sei. Daher solle es eine deutliche Anhebung der Nutzerzahlen der sogenannten Nina-Warn-App geben.

Die ARD spurt wie gewohnt und setzt die Botschaft zielsicher um. Der Artikel beginnt folgendermaßen:

«Die Flut im Ahrtal war ein Schock für das ganze Land. Um künftig besser gegen Extremwetter gewappnet zu sein, hat die Bundesregierung eine neue Strategie zur Klimaanpassung beschlossen. Die Warn-App Nina spielt eine zentrale Rolle. Der Bund will die Menschen in Deutschland besser vor Extremwetter-Ereignissen warnen und dafür die Reichweite der Warn-App Nina deutlich erhöhen.»

Die Kommunen würden bei ihren «Klimaanpassungsmaßnahmen» vom Zentrum KlimaAnpassung unterstützt, schreibt das Umweltministerium. Mit dessen Aufbau wurden das Deutsche Institut für Urbanistik gGmbH, welches sich stark für Smart City-Projekte engagiert, und die Adelphi Consult GmbH beauftragt.

Adelphi beschreibt sich selbst als «Europas führender Think-and-Do-Tank und eine unabhängige Beratung für Klima, Umwelt und Entwicklung». Sie seien «global vernetzte Strateg*innen und weltverbessernde Berater*innen» und als «Vorreiter der sozial-ökologischen Transformation» sei man mit dem Deutschen Nachhaltigkeitspreis ausgezeichnet worden, welcher sich an den Zielen der Agenda 2030 orientiere.

Über die Warn-App mit dem niedlichen Namen Nina, die möglichst jeder auf seinem Smartphone installieren soll, informiert das Bundesamt für Bevölkerungsschutz und Katastrophenhilfe (BBK). Gewarnt wird nicht nur vor Extrem-Wetterereignissen, sondern zum Beispiel auch vor Waffengewalt und Angriffen, Strom- und anderen Versorgungsausfällen oder Krankheitserregern. Wenn man die Kategorie Gefahreninformation wählt, erhält man eine Dosis von ungefähr zwei Benachrichtigungen pro Woche.

Beim BBK erfahren wir auch einiges über die empfohlenen Systemeinstellungen für Nina. Der Benutzer möge zum Beispiel den Zugriff auf die Standortdaten «immer zulassen», und zwar mit aktivierter Funktion «genauen Standort verwenden». Die Datennutzung solle unbeschränkt sein, auch im Hintergrund. Außerdem sei die uneingeschränkte Akkunutzung zu aktivieren, der Energiesparmodus auszuschalten und das Stoppen der App-Aktivität bei Nichtnutzung zu unterbinden.

Dass man so dramatische Ereignisse wie damals im Ahrtal auch anders bewerten kann als Regierungen und Systemmedien, hat meine Kollegin Wiltrud Schwetje anhand der Tragödie im spanischen Valencia gezeigt. Das Stichwort «Agenda 2030» taucht dabei in einem Kontext auf, der wenig mit Nachhaltigkeitspreisen zu tun hat.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ a95c6243:d345522c

2024-12-06 18:21:15

@ a95c6243:d345522c

2024-12-06 18:21:15Die Ungerechtigkeit ist uns nur in dem Falle angenehm,\ dass wir Vorteile aus ihr ziehen;\ in jedem andern hegt man den Wunsch,\ dass der Unschuldige in Schutz genommen werde.\ Jean-Jacques Rousseau

Politiker beteuern jederzeit, nur das Beste für die Bevölkerung zu wollen – nicht von ihr. Auch die zahlreichen unsäglichen «Corona-Maßnahmen» waren angeblich zu unserem Schutz notwendig, vor allem wegen der «besonders vulnerablen Personen». Daher mussten alle möglichen Restriktionen zwangsweise und unter Umgehung der Parlamente verordnet werden.

Inzwischen hat sich immer deutlicher herausgestellt, dass viele jener «Schutzmaßnahmen» den gegenteiligen Effekt hatten, sie haben den Menschen und den Gesellschaften enorm geschadet. Nicht nur haben die experimentellen Geninjektionen – wie erwartet – massive Nebenwirkungen, sondern Maskentragen schadet der Psyche und der Entwicklung (nicht nur unserer Kinder) und «Lockdowns und Zensur haben Menschen getötet».

Eine der wichtigsten Waffen unserer «Beschützer» ist die Spaltung der Gesellschaft. Die tiefen Gräben, die Politiker, Lobbyisten und Leitmedien praktisch weltweit ausgehoben haben, funktionieren leider nahezu in Perfektion. Von ihren persönlichen Erfahrungen als Kritikerin der Maßnahmen berichtete kürzlich eine Schweizerin im Interview mit Transition News. Sie sei schwer enttäuscht und verspüre bis heute eine Hemmschwelle und ein seltsames Unwohlsein im Umgang mit «Geimpften».

Menschen, die aufrichtig andere schützen wollten, werden von einer eindeutig politischen Justiz verfolgt, verhaftet und angeklagt. Dazu zählen viele Ärzte, darunter Heinrich Habig, Bianca Witzschel und Walter Weber. Über den aktuell laufenden Prozess gegen Dr. Weber hat Transition News mehrfach berichtet (z.B. hier und hier). Auch der Selbstschutz durch Verweigerung der Zwangs-Covid-«Impfung» bewahrt nicht vor dem Knast, wie Bundeswehrsoldaten wie Alexander Bittner erfahren mussten.

Die eigentlich Kriminellen schützen sich derweil erfolgreich selber, nämlich vor der Verantwortung. Die «Impf»-Kampagne war «das größte Verbrechen gegen die Menschheit». Trotzdem stellt man sich in den USA gerade die Frage, ob der scheidende Präsident Joe Biden nach seinem Sohn Hunter möglicherweise auch Anthony Fauci begnadigen wird – in diesem Fall sogar präventiv. Gibt es überhaupt noch einen Rest Glaubwürdigkeit, den Biden verspielen könnte?

Der Gedanke, den ehemaligen wissenschaftlichen Chefberater des US-Präsidenten und Direktor des National Institute of Allergy and Infectious Diseases (NIAID) vorsorglich mit einem Schutzschild zu versehen, dürfte mit der vergangenen Präsidentschaftswahl zu tun haben. Gleich mehrere Personalentscheidungen des designierten Präsidenten Donald Trump lassen Leute wie Fauci erneut in den Fokus rücken.

Das Buch «The Real Anthony Fauci» des nominierten US-Gesundheitsministers Robert F. Kennedy Jr. erschien 2021 und dreht sich um die Machenschaften der Pharma-Lobby in der öffentlichen Gesundheit. Das Vorwort zur rumänischen Ausgabe des Buches schrieb übrigens Călin Georgescu, der Überraschungssieger der ersten Wahlrunde der aktuellen Präsidentschaftswahlen in Rumänien. Vielleicht erklärt diese Verbindung einen Teil der Panik im Wertewesten.

In Rumänien selber gab es gerade einen Paukenschlag: Das bisherige Ergebnis wurde heute durch das Verfassungsgericht annuliert und die für Sonntag angesetzte Stichwahl kurzfristig abgesagt – wegen angeblicher «aggressiver russischer Einmischung». Thomas Oysmüller merkt dazu an, damit sei jetzt in der EU das Tabu gebrochen, Wahlen zu verbieten, bevor sie etwas ändern können.

Unsere Empörung angesichts der Historie von Maßnahmen, die die Falschen beschützen und für die meisten von Nachteil sind, müsste enorm sein. Die Frage ist, was wir damit machen. Wir sollten nach vorne schauen und unsere Energie clever einsetzen. Abgesehen von der Umgehung von jeglichem «Schutz vor Desinformation und Hassrede» (sprich: Zensur) wird es unsere wichtigste Aufgabe sein, Gräben zu überwinden.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ 3bf0c63f:aefa459d

2024-01-15 11:15:06

@ 3bf0c63f:aefa459d

2024-01-15 11:15:06Pequenos problemas que o Estado cria para a sociedade e que não são sempre lembrados

- **vale-transporte**: transferir o custo com o transporte do funcionário para um terceiro o estimula a morar longe de onde trabalha, já que morar perto é normalmente mais caro e a economia com transporte é inexistente. - **atestado médico**: o direito a faltar o trabalho com atestado médico cria a exigência desse atestado para todas as situações, substituindo o livre acordo entre patrão e empregado e sobrecarregando os médicos e postos de saúde com visitas desnecessárias de assalariados resfriados. - **prisões**: com dinheiro mal-administrado, burocracia e péssima alocação de recursos -- problemas que empresas privadas em competição (ou mesmo sem qualquer competição) saberiam resolver muito melhor -- o Estado fica sem presídios, com os poucos existentes entupidos, muito acima de sua alocação máxima, e com isto, segundo a bizarra corrente de responsabilidades que culpa o juiz que condenou o criminoso por sua morte na cadeia, juízes deixam de condenar à prisão os bandidos, soltando-os na rua. - **justiça**: entrar com processos é grátis e isto faz proliferar a atividade dos advogados que se dedicam a criar problemas judiciais onde não seria necessário e a entupir os tribunais, impedindo-os de fazer o que mais deveriam fazer. - **justiça**: como a justiça só obedece às leis e ignora acordos pessoais, escritos ou não, as pessoas não fazem acordos, recorrem sempre à justiça estatal, e entopem-na de assuntos que seriam muito melhor resolvidos entre vizinhos. - **leis civis**: as leis criadas pelos parlamentares ignoram os costumes da sociedade e são um incentivo a que as pessoas não respeitem nem criem normas sociais -- que seriam maneiras mais rápidas, baratas e satisfatórias de resolver problemas. - **leis de trãnsito**: quanto mais leis de trânsito, mais serviço de fiscalização são delegados aos policiais, que deixam de combater crimes por isto (afinal de contas, eles não querem de fato arriscar suas vidas combatendo o crime, a fiscalização é uma excelente desculpa para se esquivarem a esta responsabilidade). - **financiamento educacional**: é uma espécie de subsídio às faculdades privadas que faz com que se criem cursos e mais cursos que são cada vez menos recheados de algum conhecimento ou técnica útil e cada vez mais inúteis. - **leis de tombamento**: são um incentivo a que o dono de qualquer área ou construção "histórica" destrua todo e qualquer vestígio de história que houver nele antes que as autoridades descubram, o que poderia não acontecer se ele pudesse, por exemplo, usar, mostrar e se beneficiar da história daquele local sem correr o risco de perder, de fato, a sua propriedade. - **zoneamento urbano**: torna as cidades mais espalhadas, criando uma necessidade gigantesca de carros, ônibus e outros meios de transporte para as pessoas se locomoverem das zonas de moradia para as zonas de trabalho. - **zoneamento urbano**: faz com que as pessoas percam horas no trânsito todos os dias, o que é, além de um desperdício, um atentado contra a sua saúde, que estaria muito melhor servida numa caminhada diária entre a casa e o trabalho. - **zoneamento urbano**: torna ruas e as casas menos seguras criando zonas enormes, tanto de residências quanto de indústrias, onde não há movimento de gente alguma. - **escola obrigatória + currículo escolar nacional**: emburrece todas as crianças. - **leis contra trabalho infantil**: tira das crianças a oportunidade de aprender ofícios úteis e levar um dinheiro para ajudar a família. - **licitações**: como não existem os critérios do mercado para decidir qual é o melhor prestador de serviço, criam-se comissões de pessoas que vão decidir coisas. isto incentiva os prestadores de serviço que estão concorrendo na licitação a tentar comprar os membros dessas comissões. isto, fora a corrupção, gera problemas reais: __(i)__ a escolha dos serviços acaba sendo a pior possível, já que a empresa prestadora que vence está claramente mais dedicada a comprar comissões do que a fazer um bom trabalho (este problema afeta tantas áreas, desde a construção de estradas até a qualidade da merenda escolar, que é impossível listar aqui); __(ii)__ o processo corruptor acaba, no longo prazo, eliminando as empresas que prestavam e deixando para competir apenas as corruptas, e a qualidade tende a piorar progressivamente. - **cartéis**: o Estado em geral cria e depois fica refém de vários grupos de interesse. o caso dos taxistas contra o Uber é o que está na moda hoje (e o que mostra como os Estados se comportam da mesma forma no mundo todo). - **multas**: quando algum indivíduo ou empresa comete uma fraude financeira, ou causa algum dano material involuntário, as vítimas do caso são as pessoas que sofreram o dano ou perderam dinheiro, mas o Estado tem sempre leis que prevêem multas para os responsáveis. A justiça estatal é sempre muito rígida e rápida na aplicação dessas multas, mas relapsa e vaga no que diz respeito à indenização das vítimas. O que em geral acontece é que o Estado aplica uma enorme multa ao responsável pelo mal, retirando deste os recursos que dispunha para indenizar as vítimas, e se retira do caso, deixando estas desamparadas. - **desapropriação**: o Estado pode pegar qualquer propriedade de qualquer pessoa mediante uma indenização que é necessariamente inferior ao valor da propriedade para o seu presente dono (caso contrário ele a teria vendido voluntariamente). - **seguro-desemprego**: se há, por exemplo, um prazo mínimo de 1 ano para o sujeito ter direito a receber seguro-desemprego, isto o incentiva a planejar ficar apenas 1 ano em cada emprego (ano este que será sucedido por um período de desemprego remunerado), matando todas as possibilidades de aprendizado ou aquisição de experiência naquela empresa específica ou ascensão hierárquica. - **previdência**: a previdência social tem todos os defeitos de cálculo do mundo, e não importa muito ela ser uma forma horrível de poupar dinheiro, porque ela tem garantias bizarras de longevidade fornecidas pelo Estado, além de ser compulsória. Isso serve para criar no imaginário geral a idéia da __aposentadoria__, uma época mágica em que todos os dias serão finais de semana. A idéia da aposentadoria influencia o sujeito a não se preocupar em ter um emprego que faça sentido, mas sim em ter um trabalho qualquer, que o permita se aposentar. - **regulamentação impossível**: milhares de coisas são proibidas, há regulamentações sobre os aspectos mais mínimos de cada empreendimento ou construção ou espaço. se todas essas regulamentações fossem exigidas não haveria condições de produção e todos morreriam. portanto, elas não são exigidas. porém, o Estado, ou um agente individual imbuído do poder estatal pode, se desejar, exigi-las todas de um cidadão inimigo seu. qualquer pessoa pode viver a vida inteira sem cumprir nem 10% das regulamentações estatais, mas viverá também todo esse tempo com medo de se tornar um alvo de sua exigência, num estado de terror psicológico. - **perversão de critérios**: para muitas coisas sobre as quais a sociedade normalmente chegaria a um valor ou comportamento "razoável" espontaneamente, o Estado dita regras. estas regras muitas vezes não são obrigatórias, são mais "sugestões" ou limites, como o salário mínimo, ou as 44 horas semanais de trabalho. a sociedade, porém, passa a usar esses valores como se fossem o normal. são raras, por exemplo, as ofertas de emprego que fogem à regra das 44h semanais. - **inflação**: subir os preços é difícil e constrangedor para as empresas, pedir aumento de salário é difícil e constrangedor para o funcionário. a inflação força as pessoas a fazer isso, mas o aumento não é automático, como alguns economistas podem pensar (enquanto alguns outros ficam muito satisfeitos de que esse processo seja demorado e difícil). - **inflação**: a inflação destrói a capacidade das pessoas de julgar preços entre concorrentes usando a própria memória. - **inflação**: a inflação destrói os cálculos de lucro/prejuízo das empresas e prejudica enormemente as decisões empresariais que seriam baseadas neles. - **inflação**: a inflação redistribui a riqueza dos mais pobres e mais afastados do sistema financeiro para os mais ricos, os bancos e as megaempresas. - **inflação**: a inflação estimula o endividamento e o consumismo. - **lixo:** ao prover coleta e armazenamento de lixo "grátis para todos" o Estado incentiva a criação de lixo. se tivessem que pagar para que recolhessem o seu lixo, as pessoas (e conseqüentemente as empresas) se empenhariam mais em produzir coisas usando menos plástico, menos embalagens, menos sacolas. - **leis contra crimes financeiros:** ao criar legislação para dificultar acesso ao sistema financeiro por parte de criminosos a dificuldade e os custos para acesso a esse mesmo sistema pelas pessoas de bem cresce absurdamente, levando a um percentual enorme de gente incapaz de usá-lo, para detrimento de todos -- e no final das contas os grandes criminosos ainda conseguem burlar tudo. -

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28Músicas grudentas e conversas

Uma vez que você ouviu uma música grudenta e ela volta, inteira, com toda a melodia e a harmonia, muitos dias depois, contra a sua vontade. Mas uma conversa é impossível de lembrar. Por quê?

-

@ a95c6243:d345522c

2024-11-29 19:45:43

@ a95c6243:d345522c

2024-11-29 19:45:43Konsum ist Therapie.

Wolfgang JoopUmweltbewusstes Verhalten und verantwortungsvoller Konsum zeugen durchaus von einer wünschenswerten Einstellung. Ob man deswegen allerdings einen grünen statt eines schwarzen Freitags braucht, darf getrost bezweifelt werden – zumal es sich um manipulatorische Konzepte handelt. Wie in der politischen Landschaft sind auch hier die Etiketten irgendwas zwischen nichtssagend und trügerisch.

Heute ist also wieder mal «Black Friday», falls Sie es noch nicht mitbekommen haben sollten. Eigentlich haben wir ja eher schon eine ganze «Black Week», der dann oft auch noch ein «Cyber Monday» folgt. Die Werbebranche wird nicht müde, immer neue Anlässe zu erfinden oder zu importieren, um uns zum Konsumieren zu bewegen. Und sie ist damit sehr erfolgreich.

Warum fallen wir auf derartige Werbetricks herein und kaufen im Zweifelsfall Dinge oder Mengen, die wir sicher nicht brauchen? Pure Psychologie, würde ich sagen. Rabattschilder triggern etwas in uns, was den Verstand in Stand-by versetzt. Zusätzlich beeinflussen uns alle möglichen emotionalen Reize und animieren uns zum Schnäppchenkauf.

Gedankenlosigkeit und Maßlosigkeit können besonders bei der Ernährung zu ernsten Problemen führen. Erst kürzlich hat mir ein Bekannter nach einer USA-Reise erzählt, dass es dort offenbar nicht unüblich ist, schon zum ausgiebigen Frühstück in einem Restaurant wenigstens einen Liter Cola zu trinken. Gerne auch mehr, um das Gratis-Nachfüllen des Bechers auszunutzen.

Kritik am schwarzen Freitag und dem unnötigen Konsum kommt oft von Umweltschützern. Neben Ressourcenverschwendung, hohem Energieverbrauch und wachsenden Müllbergen durch eine zunehmende Wegwerfmentalität kommt dabei in der Regel auch die «Klimakrise» auf den Tisch.

Die EU-Kommission lancierte 2015 den Begriff «Green Friday» im Kontext der überarbeiteten Rechtsvorschriften zur Kennzeichnung der Energieeffizienz von Elektrogeräten. Sie nutzte die Gelegenheit kurz vor dem damaligen schwarzen Freitag und vor der UN-Klimakonferenz COP21, bei der das Pariser Abkommen unterzeichnet werden sollte.

Heute wird ein grüner Freitag oft im Zusammenhang mit der Forderung nach «nachhaltigem Konsum» benutzt. Derweil ist die Europäische Union schon weit in ihr Geschäftsmodell des «Green New Deal» verstrickt. In ihrer Propaganda zum Klimawandel verspricht sie tatsächlich «Unterstützung der Menschen und Regionen, die von immer häufigeren Extremwetter-Ereignissen betroffen sind». Was wohl die Menschen in der Region um Valencia dazu sagen?

Ganz im Sinne des Great Reset propagierten die Vereinten Nationen seit Ende 2020 eine «grüne Erholung von Covid-19, um den Klimawandel zu verlangsamen». Der UN-Umweltbericht sah in dem Jahr einen Schwerpunkt auf dem Verbraucherverhalten. Änderungen des Konsumverhaltens des Einzelnen könnten dazu beitragen, den Klimaschutz zu stärken, hieß es dort.

Der Begriff «Schwarzer Freitag» wurde in den USA nicht erstmals für Einkäufe nach Thanksgiving verwendet – wie oft angenommen –, sondern für eine Finanzkrise. Jedoch nicht für den Börsencrash von 1929, sondern bereits für den Zusammenbruch des US-Goldmarktes im September 1869. Seitdem mussten die Menschen weltweit so einige schwarze Tage erleben.

Kürzlich sind die britischen Aufsichtsbehörden weiter von ihrer Zurückhaltung nach dem letzten großen Finanzcrash von 2008 abgerückt. Sie haben Regeln für den Bankensektor gelockert, womit sie «verantwortungsvolle Risikobereitschaft» unterstützen wollen. Man würde sicher zu schwarz sehen, wenn man hier ein grünes Wunder befürchten würde.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ a95c6243:d345522c

2024-11-08 20:02:32

@ a95c6243:d345522c

2024-11-08 20:02:32Und plötzlich weißt du:

Es ist Zeit, etwas Neues zu beginnen

und dem Zauber des Anfangs zu vertrauen.

Meister EckhartSchwarz, rot, gold leuchtet es im Kopf des Newsletters der deutschen Bundesregierung, der mir freitags ins Postfach flattert. Rot, gelb und grün werden daneben sicher noch lange vielzitierte Farben sein, auch wenn diese nie geleuchtet haben. Die Ampel hat sich gerade selber den Stecker gezogen – und hinterlässt einen wirtschaftlichen und gesellschaftlichen Trümmerhaufen.

Mit einem bemerkenswerten Timing hat die deutsche Regierungskoalition am Tag des «Comebacks» von Donald Trump in den USA endlich ihr Scheitern besiegelt. Während der eine seinen Sieg bei den Präsidentschaftswahlen feierte, erwachten die anderen jäh aus ihrer Selbsthypnose rund um Harris-Hype und Trump-Panik – mit teils erschreckenden Auswüchsen. Seit Mittwoch werden die Geschicke Deutschlands nun von einer rot-grünen Minderheitsregierung «geleitet» und man steuert auf Neuwahlen zu.

Das Kindergarten-Gehabe um zwei konkurrierende Wirtschaftsgipfel letzte Woche war bereits bezeichnend. In einem Strategiepapier gestand Finanzminister Lindner außerdem den «Absturz Deutschlands» ein und offenbarte, dass die wirtschaftlichen Probleme teilweise von der Ampel-Politik «vorsätzlich herbeigeführt» worden seien.

Lindner und weitere FDP-Minister wurden also vom Bundeskanzler entlassen. Verkehrs- und Digitalminister Wissing trat flugs aus der FDP aus; deshalb darf er nicht nur im Amt bleiben, sondern hat zusätzlich noch das Justizministerium übernommen. Und mit Jörg Kukies habe Scholz «seinen Lieblingsbock zum Obergärtner», sprich: Finanzminister befördert, meint Norbert Häring.

Es gebe keine Vertrauensbasis für die weitere Zusammenarbeit mit der FDP, hatte der Kanzler erklärt, Lindner habe zu oft sein Vertrauen gebrochen. Am 15. Januar 2025 werde er daher im Bundestag die Vertrauensfrage stellen, was ggf. den Weg für vorgezogene Neuwahlen freimachen würde.

Apropos Vertrauen: Über die Hälfte der Bundesbürger glauben, dass sie ihre Meinung nicht frei sagen können. Das ging erst kürzlich aus dem diesjährigen «Freiheitsindex» hervor, einer Studie, die die Wechselwirkung zwischen Berichterstattung der Medien und subjektivem Freiheitsempfinden der Bürger misst. «Beim Vertrauen in Staat und Medien zerreißt es uns gerade», kommentierte dies der Leiter des Schweizer Unternehmens Media Tenor, das die Untersuchung zusammen mit dem Institut für Demoskopie Allensbach durchführt.

«Die absolute Mehrheit hat absolut die Nase voll», titelte die Bild angesichts des «Ampel-Showdowns». Die Mehrheit wolle Neuwahlen und die Grünen sollten zuerst gehen, lasen wir dort.

Dass «Insolvenzminister» Robert Habeck heute seine Kandidatur für das Kanzleramt verkündet hat, kann nur als Teil der politmedialen Realitätsverweigerung verstanden werden. Wer allerdings denke, schlimmer als in Zeiten der Ampel könne es nicht mehr werden, sei reichlich optimistisch, schrieb Uwe Froschauer bei Manova. Und er kenne Friedrich Merz schlecht, der sich schon jetzt rhetorisch auf seine Rolle als oberster Feldherr Deutschlands vorbereite.

Was also tun? Der Schweizer Verein «Losdemokratie» will eine Volksinitiative lancieren, um die Bestimmung von Parlamentsmitgliedern per Los einzuführen. Das Losverfahren sorge für mehr Demokratie, denn als Alternative zum Wahlverfahren garantiere es eine breitere Beteiligung und repräsentativere Parlamente. Ob das ein Weg ist, sei dahingestellt.

In jedem Fall wird es notwendig sein, unsere Bemühungen um Freiheit und Selbstbestimmung zu verstärken. Mehr Unabhängigkeit von staatlichen und zentralen Institutionen – also die Suche nach dezentralen Lösungsansätzen – gehört dabei sicher zu den Möglichkeiten. Das gilt sowohl für jede/n Einzelne/n als auch für Entitäten wie die alternativen Medien.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ a95c6243:d345522c

2024-10-26 12:21:50

@ a95c6243:d345522c

2024-10-26 12:21:50Es ist besser, ein Licht zu entzünden, als auf die Dunkelheit zu schimpfen. Konfuzius

Die Bemühungen um Aufarbeitung der sogenannten Corona-Pandemie, um Aufklärung der Hintergründe, Benennung von Verantwortlichkeiten und das Ziehen von Konsequenzen sind durchaus nicht eingeschlafen. Das Interesse daran ist unter den gegebenen Umständen vielleicht nicht sonderlich groß, aber es ist vorhanden.

Der sächsische Landtag hat gestern die Einsetzung eines Untersuchungsausschusses zur Corona-Politik beschlossen. In einer Sondersitzung erhielt ein entsprechender Antrag der AfD-Fraktion die ausreichende Zustimmung, auch von einigen Abgeordneten des BSW.

In den Niederlanden wird Bill Gates vor Gericht erscheinen müssen. Sieben durch die Covid-«Impfstoffe» geschädigte Personen hatten Klage eingereicht. Sie werfen unter anderem Gates, Pfizer-Chef Bourla und dem niederländischen Staat vor, sie hätten gewusst, dass diese Präparate weder sicher noch wirksam sind.

Mit den mRNA-«Impfstoffen» von Pfizer/BioNTech befasst sich auch ein neues Buch. Darin werden die Erkenntnisse von Ärzten und Wissenschaftlern aus der Analyse interner Dokumente über die klinischen Studien der Covid-Injektion präsentiert. Es handelt sich um jene in den USA freigeklagten Papiere, die die Arzneimittelbehörde (Food and Drug Administration, FDA) 75 Jahre unter Verschluss halten wollte.

Ebenfalls Wissenschaftler und Ärzte, aber auch andere Experten organisieren als Verbundnetzwerk Corona-Solution kostenfreie Online-Konferenzen. Ihr Ziel ist es, «wissenschaftlich, demokratisch und friedlich» über Impfstoffe und Behandlungsprotokolle gegen SARS-CoV-2 aufzuklären und die Diskriminierung von Ungeimpften zu stoppen. Gestern fand eine weitere Konferenz statt. Ihr Thema: «Corona und modRNA: Von Toten, Lebenden und Physik lernen».

Aufgrund des Digital Services Acts (DSA) der Europäischen Union sei das Risiko groß, dass ihre Arbeit als «Fake-News» bezeichnet würde, so das Netzwerk. Staatlich unerwünschte wissenschaftliche Aufklärung müsse sich passende Kanäle zur Veröffentlichung suchen. Ihre Live-Streams seien deshalb zum Beispiel nicht auf YouTube zu finden.

Der vielfältige Einsatz für Aufklärung und Aufarbeitung wird sich nicht stummschalten lassen. Nicht einmal der Zensurmeister der EU, Deutschland, wird so etwas erreichen. Die frisch aktivierten «Trusted Flagger» dürften allerdings künftige Siege beim «Denunzianten-Wettbewerb» im Kontext des DSA zusätzlich absichern.

Wo sind die Grenzen der Meinungsfreiheit? Sicher gibt es sie. Aber die ideologische Gleichstellung von illegalen mit unerwünschten Äußerungen verfolgt offensichtlich eher das Ziel, ein derart elementares demokratisches Grundrecht möglichst weitgehend auszuhebeln. Vorwürfe wie «Hassrede», «Delegitimierung des Staates» oder «Volksverhetzung» werden heute inflationär verwendet, um Systemkritik zu unterbinden. Gegen solche Bestrebungen gilt es, sich zu wehren.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ c631e267:c2b78d3e

2024-10-23 20:26:10

@ c631e267:c2b78d3e

2024-10-23 20:26:10Herzlichen Glückwunsch zum dritten Geburtstag, liebe Denk Bar! Wieso zum dritten? Das war doch 2022 und jetzt sind wir im Jahr 2024, oder? Ja, das ist schon richtig, aber bei Geburtstagen erinnere ich mich immer auch an meinen Vater, und der behauptete oft, der erste sei ja schließlich der Tag der Geburt selber und den müsse man natürlich mitzählen. Wo er recht hat, hat er nunmal recht. Konsequenterweise wird also heute dieser Blog an seinem dritten Geburtstag zwei Jahre alt.

Das ist ein Grund zum Feiern, wie ich finde. Einerseits ganz einfach, weil es dafür gar nicht genug Gründe geben kann. «Das Leben sind zwei Tage», lautet ein gängiger Ausdruck hier in Andalusien. In der Tat könnte es so sein, auch wenn wir uns im Alltag oft genug von der Routine vereinnahmen lassen.

Seit dem Start der Denk Bar vor zwei Jahren ist unglaublich viel passiert. Ebenso wie die zweieinhalb Jahre davor, und all jenes war letztlich auch der Auslöser dafür, dass ich begann, öffentlich zu schreiben. Damals notierte ich:

«Seit einigen Jahren erscheint unser öffentliches Umfeld immer fragwürdiger, widersprüchlicher und manchmal schier unglaublich - jede Menge Anlass für eigene Recherchen und Gedanken, ganz einfach mit einer Portion gesundem Menschenverstand.»

Wir erleben den sogenannten «großen Umbruch», einen globalen Coup, den skrupellose Egoisten clever eingefädelt haben und seit ein paar Jahren knallhart – aber nett verpackt – durchziehen, um buchstäblich alles nach ihrem Gusto umzukrempeln. Die Gelegenheit ist ja angeblich günstig und muss genutzt werden.

Nie hätte ich mir träumen lassen, dass ich so etwas jemals miterleben müsste. Die Bosheit, mit der ganz offensichtlich gegen die eigene Bevölkerung gearbeitet wird, war früher für mich unvorstellbar. Mein (Rest-) Vertrauen in alle möglichen Bereiche wie Politik, Wissenschaft, Justiz, Medien oder Kirche ist praktisch komplett zerstört. Einen «inneren Totalschaden» hatte ich mal für unsere Gesellschaften diagnostiziert.

Was mich vielleicht am meisten erschreckt, ist zum einen das Niveau der Gleichschaltung, das weltweit erreicht werden konnte, und zum anderen die praktisch totale Spaltung der Gesellschaft. Haben wir das tatsächlich mit uns machen lassen?? Unfassbar! Aber das Werkzeug «Angst» ist sehr mächtig und funktioniert bis heute.

Zum Glück passieren auch positive Dinge und neue Perspektiven öffnen sich. Für viele Menschen waren und sind die Entwicklungen der letzten Jahre ein Augenöffner. Sie sehen «Querdenken» als das, was es ist: eine Tugend.

Auch die immer ernsteren Zensurbemühungen sind letztlich nur ein Zeichen der Schwäche, wo Argumente fehlen. Sie werden nicht verhindern, dass wir unsere Meinung äußern, unbequeme Fragen stellen und dass die Wahrheit peu à peu ans Licht kommt. Es gibt immer Mittel und Wege, auch für uns.

Danke, dass du diesen Weg mit mir weitergehst!

-

@ a95c6243:d345522c

2024-10-19 08:58:08

@ a95c6243:d345522c

2024-10-19 08:58:08Ein Lämmchen löschte an einem Bache seinen Durst. Fern von ihm, aber näher der Quelle, tat ein Wolf das gleiche. Kaum erblickte er das Lämmchen, so schrie er:

"Warum trübst du mir das Wasser, das ich trinken will?"

"Wie wäre das möglich", erwiderte schüchtern das Lämmchen, "ich stehe hier unten und du so weit oben; das Wasser fließt ja von dir zu mir; glaube mir, es kam mir nie in den Sinn, dir etwas Böses zu tun!"

"Ei, sieh doch! Du machst es gerade, wie dein Vater vor sechs Monaten; ich erinnere mich noch sehr wohl, daß auch du dabei warst, aber glücklich entkamst, als ich ihm für sein Schmähen das Fell abzog!"

"Ach, Herr!" flehte das zitternde Lämmchen, "ich bin ja erst vier Wochen alt und kannte meinen Vater gar nicht, so lange ist er schon tot; wie soll ich denn für ihn büßen."

"Du Unverschämter!" so endigt der Wolf mit erheuchelter Wut, indem er die Zähne fletschte. "Tot oder nicht tot, weiß ich doch, daß euer ganzes Geschlecht mich hasset, und dafür muß ich mich rächen."

Ohne weitere Umstände zu machen, zerriß er das Lämmchen und verschlang es.

Das Gewissen regt sich selbst bei dem größten Bösewichte; er sucht doch nach Vorwand, um dasselbe damit bei Begehung seiner Schlechtigkeiten zu beschwichtigen.

Quelle: https://eden.one/fabeln-aesop-das-lamm-und-der-wolf

-

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28Bluesky is a scam

Bluesky advertises itself as an open network, they say people won't lose followers or their identity, they advertise themselves as a protocol ("atproto") and because of that they are tricking a lot of people into using them. These three claims are false.

protocolness

Bluesky is a company. "atproto" is the protocol. Supposedly they are two different things, right? Bluesky just releases software that implements the protocol, but others can also do that, it's open!

And yet, the protocol has an official webpage with a waitlist and a private beta? Why is the protocol advertised as a company product? Because it is. The "protocol" is just a description of whatever the Bluesky app and servers do, it can and does change anytime the Bluesky developers decide they want to change it, and it will keep changing for as long as Bluesky apps and servers control the biggest part of the network.

Oh, so there is the possibility of other players stepping in and then it becomes an actual interoperable open protocol? Yes, but what is the likelihood of that happening? It is very low. No serious competitor is likely to step in and build serious apps using a protocol that is directly controlled by Bluesky. All we will ever see are small "community" apps made by users and small satellite small businesses -- not unlike the people and companies that write plugins, addons and alternative clients for popular third-party centralized platforms.

And last, even if it happens that someone makes an app so good that it displaces the canonical official Bluesky app, then that company may overtake the protocol itself -- not because they're evil, but because there is no way it cannot be like this.

identity

According to their own documentation, the Bluesky people were looking for an identity system that provided global ids, key rotation and human-readable names.

They must have realized that such properties are not possible in an open and decentralized system, but instead of accepting a tradeoff they decided they wanted all their desired features and threw away the "decentralized" part, quite literally and explicitly (although they make sure to hide that piece in the middle of a bunch of code and text that very few will read).

The "DID Placeholder" method they decided to use for their global identities is nothing more than a normal old boring trusted server controlled by Bluesky that keeps track of who is who and can, at all times, decide to ban a person and deprive them from their identity (they dismissively call a "denial of service attack").

They decided to adopt this method as a placeholder until someone else doesn't invent the impossible alternative that would provide all their desired properties in a decentralized manner -- which is nothing more than a very good excuse: "yes, it's not great now, but it will improve!".

openness

Months after launching their product with an aura of decentralization and openness and getting a bunch of people inside that believed, falsely, they were joining an actually open network, Bluesky has decided to publish a part of their idea of how other people will be able to join their open network.

When I first saw their app and how they were very prominently things like follower counts, like counts and other things that are typical of centralized networks and can't be reliable or exact on truly open networks (like Nostr), I asked myself how were they going to do that once they became and open "federated" network as they were expected to be.

Turns out their decentralization plan is to just allow you, as a writer, to host your own posts on "personal data stores", but not really have any control over the distribution of the posts. All posts go through the Bluesky central server, called BGS, and they decide what to do with it. And you, as a reader, doesn't have any control of what you're reading from either, all you can do is connect to the BGS and ask for posts. If the BGS decides to ban, shadow ban, reorder, miscount, hide, deprioritize, trick or maybe even to serve ads, then you are out of luck.

Oh, but anyone can run their own BGS!, they will say. Even in their own blog post announcing the architecture they assert that "it’s a fairly resource-demanding service" and "there may be a few large full-network providers". But I fail to see why even more than one network provider will exist, if Bluesky is already doing that job, and considering the fact there are very little incentives for anyone to switch providers -- because the app does not seem to be at all made to talk to multiple providers, one would have to stop using the reliable, fast and beefy official BGS and start using some half-baked alternative and risk losing access to things.

When asked about the possibility of switching, one of Bluesky overlords said: "it would look something like this: bluesky has gone evil. there's a new alternative called freesky that people are rushing to. I'm switching to freesky".

The quote is very naïve and sounds like something that could be said about Twitter itself: "if Twitter is evil you can just run your own social network". Both are fallacies because they ignore the network-effect and the fact that people will never fully agree that something is "evil". In fact these two are the fundamental reasons why -- for social networks specifically (and not for other things like commerce) -- we need truly open protocols with no owners and no committees.

-

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28Jofer

Jofer era um jogador diferente. À primeira vista não, parecia igual, um volante combativo, perseguia os atacantes adversários implacavelmente, um bom jogador. Mas não era essa a característica que diferenciava Jofer. Jofer era, digamos, um chutador.

Começou numa semifinal de um torneio de juniores. O time de Jofer precisava do empate e estava sofrendo uma baita pressão do adversário, mas o jogo estava 1 a 1 e parecia que ia ficar assim mesmo, daquele jeito futebolístico que parece, parece mesmo. Só que aos 46 do segundo tempo tomaram um gol espírita, Ruizinho do outro time saiu correndo pela esquerda e, mesmo sendo canhoto, foi cortando para o meio, os zagueiros meio que achando que já tinha acabado mesmo, devia ter só mais aquele lance, o árbitro tinha dado dois minutos, Ruizinho chutou, marcou e o goleiro, que só pulou depois que já tinha visto que não ia ter jeito, ficou xingando.

A bola saiu do meio e tocaram para Jofer, ninguém nem veio marcá-lo, o outro time já estava comemorando, e com razão, o juiz estava de sacanagem em fazer o jogo continuar, já estava tudo acabado mesmo. Mas não, estava certo, mais um minuto de acréscimo, justo. Em um minuto dá pra fazer um gol. Mas como? Jofer pensou nas partidas da NBA em que com alguns centésimos de segundo faltando o armador jogava de qualquer jeito para a cesta e às vezes acertava. De trás do meio de campo, será? Não vou ter nem força pra fazer chegar no gol. Vou virar piada, melhor tocar pro Fumaça ali do lado e a gente perde sem essa humilhação no final. Mas, poxa, e daí? Vou tentar mesmo assim, qualquer coisa eu falo que foi um lançamento e daqui a uns dias todo mundo esquece. Olhou para o próprio pé, virou ele de ladinho, pra fora e depois pra dentro (bom, se eu pegar daqui, direitinho, quem sabe?), jogou a bola pro lado e bateu. A bola subiu escandalosamente, muito alta mesmo, deve ter subido uns 200 metros. Jofer não tinha como ter a menor noção. Depois foi descendo, o goleirão voltando correndo para debaixo da trave e olhando pra bola, foi chegando e pulando já só pra acompanhar, para ver, dependurado no travessão, a bola sair ainda bem alta, ela bateu na rede lateral interna antes de bater no chão, quicar violentamente e estufar a rede no alto do lado direito de quem olhava.

Mas isso tudo foi sonho do Jofer. Sonhou acordado, numa noite em que demorou pra dormir, deitado na sua cama. Ficou pensando se não seria fácil, se ele treinasse bastante, acertar o gol bem de longe, tipo no sonho, e se não dava pra fazer gol assim. No dia seguinte perguntou a Brunildinho, o treinador de goleiros. Era difícil defender essas bolas, ainda mais se elas subissem muito, o goleiro ficava sem perspectiva, o vento alterava a trajetória a cada instante, tinha efeito, ela cairia rápido, mas claro que não valia à pena treinar isso, a chance de acertar o gol era minúscula. Mas Jofer só ia tentar depois que treinasse bastante e comprovasse o que na sua imaginação parecia uma excelente idéia.

Começou a treinar todos os dias. Primeiro escondido, por vergonha dos colegas, chegava um pouco antes e ficava lá, chutando do círculo central. Ao menor sinal de gente se aproximando, parava e ia catar as bolas. Depois, quando começou a acertar, perdeu a vergonha. O pessoal do clube todo achava engraçado quando via Jofer treinando e depois ouvia a explicação da boca de alguém, ninguém levava muito a sério, mas também não achava de todo ridículo. O pessoal ria, mas no fundo torcia praquilo dar certo, mesmo.

Aconteceu que num jogo que não valia muita coisa, empatezinho feio, aos 40 do segundo tempo, a marcação dos adversários já não estava mais pressionando, todo mundo contente com o empate e com vontade de parar de jogar já, o Henrique, meia-esquerdo, humilde, mas ainda assim um pouco intimidante para Jofer (jogava demais), tocou pra ele. Vai lá, tenta sua loucura aí. Assumiu a responsabilidade do nosso volante introspectivo. Seria mais verossímil se Jofer tivesse errado, primeira vez que tentou, restava muito tempo ainda pra ele ter a chance de ser herói, ninguém acerta de primeira, mas ele acertou. Quase como no sonho, Lucas, o goleiro, não esperava, depois que viu o lance, riu-se, adiantou-se para pegar a bola que ele julgava que quicaria na área, mas ela foi mais pra frente, mais e mais, daí Lucas já estava correndo, só que começou a pensar que ela ia pra fora, e ele ia só se dependurar no travessão e fazer seu papel de estar na bola. Acabou que por conta daquele gol eles terminaram em segundo no grupo daquele torneiozinho, ao invés de terceiro, e não fez diferença nenhuma.

-

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28O caso da Grêmio TV

enquanto vinha se conduzindo pela plataforma superior daquela arena que se pensava totalmente preenchida por adeptos da famosa equipe do Grêmio de Porto Alegre, viu-se, como por obra de algum nigromante - dos muitos que existem e estão a todo momento a fazer más obras e a colocar-se no caminhos dos que procuram, se não fazer o bem acima de todas as coisas, a pelo menos não fazer o mal no curso da realização dos seus interesses -, o discretíssimo jornalista a ser xingado e moído em palavras por uma horda de malandrinos a cinco ou seis passos dele surgida que cantavam e moviam seus braços em movimentos que não se pode classificar senão como bárbaros, e assim cantavam:

Grêmio TV pior que o SBT !

-

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28Replacing the web with something saner

This is a simplification, but let's say that basically there are just 3 kinds of websites:

- Websites with content: text, images, videos;

- Websites that run full apps that do a ton of interactive stuff;

- Websites with some interactive content that uses JavaScript, or "mini-apps";

In a saner world we would have 3 different ways of serving and using these. 1 would be "the web" (and it was for a while, although I'm not claiming here that the past is always better and wanting to get back to the glorious old days).

1 would stay as "the web", just static sites, styled with CSS, no JavaScript whatsoever, but designers can still thrive and make they look pretty. Or it could also be something like Gemini. Maybe the two protocols could coexist.

2 would be downloadable native apps, much easier to write and maintain for developers (considering that multi-platform and cross-compilation is easy today and getting easier), faster, more polished experience for users, more powerful, integrates better with the computer.

(Remember that since no one would be striving to make the same app run both on browsers and natively no one would have any need for Electron or other inefficient bloated solutions, just pure native UI, like the Telegram app, have you seen that? It's fast.)

But 2 is mostly for apps that people use every day, something like Google Docs, email (although email is also broken technology), Netflix, Twitter, Trello and so on, and all those hundreds of niche SaaS that people pay monthly fees to use, each tailored to a different industry (although most of functions they all implement are the same everywhere). What do we do with dynamic open websites like StackOverflow, for example, where one needs to not only read, but also search and interact in multiple ways? What about that website that asks you a bunch of questions and then discovers the name of the person you're thinking about? What about that mini-app that calculates the hash of your provided content or shrinks your video, or that one that hosts your image without asking any questions?

All these and tons of others would fall into category 3, that of instantly loaded apps that you don't have to install, and yet they run in a sandbox.

The key for making category 3 worth investing time into is coming up with some solid grounds, simple enough that anyone can implement in multiple different ways, but not giving the app too much choices.

Telegram or Discord bots are super powerful platforms that can accomodate most kinds of app in them. They can't beat a native app specifically made with one purpose, but they allow anyone to provide instantly usable apps with very low overhead, and since the experience is so simple, intuitive and fast, users tend to like it and sometimes even pay for their services. There could exist a protocol that brings apps like that to the open world of (I won't say "web") domains and the websockets protocol -- with multiple different clients, each making their own decisions on how to display the content sent by the servers that are powering these apps.

Another idea is that of Alan Kay: to design a nice little OS/virtual machine that can load these apps and run them. Kinda like browsers are today, but providing a more well-thought, native-like experience and framework, but still sandboxed. And I add: abstracting away details about design, content disposition and so on.

These 3 kinds of programs could coexist peacefully. 2 are just standalone programs, they can do anything and each will be its own thing. 1 and 3, however, are still similar to browsers of today in the sense that you need clients to interact with servers and show to the user what they are asking. But by simplifying everything and separating the scopes properly these clients would be easy to write, efficient, small, the environment would be open and the internet would be saved.

See also

-

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28IPFS problems: General confusion

Most IPFS open-source projects, libraries and apps (excluding Ethereum stuff) are things that rely heavily on dynamic data and temporary links. The most common projects you'll see when following the IPFS communities are chat rooms and similar things. I've seen dozens of these chat-rooms. There's also a famous IPFS-powered database. How can you do these things with content-addressing is a mistery. Of course they probably rely on IPNS or other external address system.

There's also a bunch of "file-sharing" on IPFS. The kind of thing people use for temporary making a file available for a third-party. There's image sharing on IPFS, pastebins on IPFS and so on. People don't seem to share the preoccupation with broken links here.

-

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28Scala is such a great language

Scala is amazing. The type system has the perfect balance between flexibility and powerfulness.

matchstatements are great. You can write imperative code that looks very nice and expressive (and I haven't tried writing purely functional things yet). Everything is easy to write and cheap and neovim integration works great.But Java is not great. And the fact that Scala is a JVM language doesn't help because over the years people have written stuff that depends on Java libraries -- and these Java libraries are not as safe as the Scala libraries, they contain reflection, slowness, runtime errors, all kinds of horrors.

Scala is also very tightly associated with Akka, the actor framework, and Akka is a giant collection of anti-patterns. Untyped stuff, reflection, dependency on JVM, basically a lot of javisms. I just arrived and I don't know anything about the Scala history or ecosystem or community, but I have the impression that Akka has prevent more adoption of Scala from decent people that aren't Java programmers.

But luckily there is a solution -- or two solutions: ScalaJS is a great thing that exists. It transpiles Scala code into JavaScript and it runs on NodeJS or in a browser!

Scala Native is a much better deal, though, it compiles to LLVM and then to binary code and you can have single binaries that run directly without a JVM -- not that the single JARs are that bad though, they are great and everybody has Java so I'll take that anytime over C libraries or NPM-distributed software, but direct executables even better. Scala Native just needs a little more love and some libraries and it will be the greatest thing in a couple of years.

-

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28Que vença o melhor

Nos esportes e jogos em geral, existe uma constante preocupação em balancear os incentivos e atributos do jogo, as regras do esporte em si e as regras das competições para que o melhor vença, ou, em outras palavras, para que sejam minimizados os outros fatores exceto a habilidade mais pura quanto possível no jogo em questão.

O mundo fora dos jogos, porém, nem sempre pode ter suas regras mudadas por um ente que as controla e está imbuído da vontade e dos meios para escolher as melhores regras possíveis para a obtenção dos resultados acima. Aliás, é muitas vezes essa possibilidade é até impensável. Mesmo quando ela é pensável e levada em conta os fatores que operam no mundo real não são facilmente identificáveis, eles são muitos, e mudam o tempo todo.

Mais do que isso, ao contrário de um jogo em que o objetivo é praticamente o mesmo para todo mundo, os objetivos de cada agente no mundo real são diferentes e incontáveis, e as "competições" que cada um está disputando são diferentes e muitas, cada minúsculo ato de suas vidas compreendendo várias delas simultaneamente.

Da mesma forma, é impossível conceber até mesmo o conceito de "melhor" para que se deseje que ele vença.

Mesmo assim é comum encontrarmos em várias situações gente que parte do princípio de que se Fulano está num certo lugar (por exemplo, um emprego muito bom) e Beltrano não isso se deve ao fato de Fulano ter sido melhor que Beltrano.

Está aí uma crítica à idéia da meritocracia (eu tinha me esquecido que essa palavra existia).

-

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28Token-Curated Registries

So you want to build a TCR?

TCRs (Token Curated Registries) are a construct for maintaining registries on Ethereum. Imagine you have lots of scissor brands and you want a list with only the good scissors. You want to make sure only the good scissors make into that list and not the bad scissors. For that, people will tell you, you can just create a TCR of the best scissors!

It works like this: some people have the token, let's call it Scissor Token. Some other person, let's say it's a scissor manufacturer, wants to put his scissor on the list, this guy must acquire some Scissor Tokens and "stake" it. Holders of the Scissor Tokens are allowed to vote on "yes" or "no". If "no", the manufactures loses his tokens to the holders, if "yes" then its tokens are kept in deposit, but his scissor brand gets accepted into the registry.

Such a simple process, they say, have strong incentives for being the best possible way of curating a registry of scissors: consumers have the incentive to consult the list because of its high quality; manufacturers have the incentive to buy tokens and apply to join the list because the list is so well-curated and consumers always consult it; token holders want the registry to accept good and reject bad scissors because that good decisions will make the list good for consumers and thus their tokens more valuable, bad decisions will do the contrary. It doesn't make sense, to reject everybody just to grab their tokens, because that would create an incentive against people trying to enter the list.

Amazing! How come such a simple system of voting has such enourmous features? Now we can have lists of everything so well-curated, and for that we just need Ethereum tokens!

Now let's imagine a different proposal, of my own creation: SPCR, Single-person curated registries.

Single-person Curated Registries are equal to TCR, except they don't use Ethereum tokens, it's just a list in a text file kept by a single person. People can apply to join, and they will have to give the single person some amount of money, the single person can reject or accept the proposal and so on.

Now let's look at the incentives of SPCR: people will want to consult the registry because it is so well curated; vendors will want to enter the registry because people are consulting it; the single person will want to accept the good and reject the bad applicants because these good decisions are what will make the list valuable.

Amazing! How such a single proposal has such enourmous features! SPCR are going to take over the internet!

What TCR enthusiasts get wrong?

TCR people think they can just list a set of incentives for something to work and assume that something will work. Mix that with Ethereum hype and they think theyve found something unique and revolutionary, while in fact they're just making a poor implementation of "democracy" systems that fail almost everywhere.

The life is not about listing a set of "incentives" and then considering the problems solved. Almost everybody on the Earth has the incentive for being rich: being rich has a lot of advantages over being poor, however not all people get rich! Why are the incentives failing?

Curating lists is a hard problem, it involves a lot of knowledge about the problem that just holding a token won't give you, it involves personal preferences, politics, it involves knowing where is the real limit between "good" and "bad". The Single Person list may have a good result if the single person doing the curation is knowledgeable and honest (yes, you can game the system to accept your uncle's scissors and not their competitor that is much better, for example, without losing the entire list reputation), same thing for TCRs, but it can also fail miserably, and it can appear to be good but be in fact not so good. In all cases, the list entries will reflect the preferences of people choosing and other things that aren't taken into the incentives equation of TCR enthusiasts.

We don't need lists

The most important point to be made, although unrelated to the incentive story, is that we don't need lists. Imagine you're looking for a scissor. You don't want someone to tell if scissor A or B are "good" or "bad", or if A is "better" than B. You want to know if, for your specific situation, or for a class of situations, A will serve well, and do that considering A's price and if A is being sold near you and all that.

Scissors are the worst example ever to make this point, but I hope you get it. If you don't, try imagining the same example with schools, doctors, plumbers, food, whatever.

Recommendation systems are badly needed in our world, and TCRs don't solve these at all.

-

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28

@ 3bf0c63f:aefa459d

2024-01-14 13:55:28Precautionary Principle

The precautionary principle that people, including Nassim Nicholas Taleb, love and treat as some form of wisdom, is actually just a justification for arbitrary acts.

In a given situation for which there's no sufficient knowledge, either A or B can be seen as risky or precautionary measures, there's no way to know except if you have sufficient knowledge.

Someone could reply saying, for example, that the known risk of A is tolerable to the unknown, probably magnitudes bigger, risk of B. Unless you know better or at least have a logical explanation for the risks of B (a thing "scientists" don't have because they notoriously dislike making logical claims), in which case you do know something and is not invoking the precautionary principle anymore, just relying on your logical reasoning – and that can be discussed and questioned by others, undermining your intended usage of the label "precautionary principle" as a magic cover for your actions.

-

@ f9cf4e94:96abc355

2024-12-30 19:02:32

@ f9cf4e94:96abc355

2024-12-30 19:02:32Na era das grandes navegações, piratas ingleses eram autorizados pelo governo para roubar navios.

A única coisa que diferenciava um pirata comum de um corsário é que o último possuía a “Carta do Corso”, que funcionava como um “Alvará para o roubo”, onde o governo Inglês legitimava o roubo de navios por parte dos corsários. É claro, que em troca ele exigia uma parte da espoliação.

Bastante similar com a maneira que a Receita Federal atua, não? Na verdade, o caso é ainda pior, pois o governo fica com toda a riqueza espoliada, e apenas repassa um mísero salário para os corsários modernos, os agentes da receita federal.

Porém eles “justificam” esse roubo ao chamá-lo de imposto, e isso parece acalmar os ânimos de grande parte da população, mas não de nós. Não é por acaso que 'imposto' é o particípio passado do verbo 'impor'. Ou seja, é aquilo que resulta do cumprimento obrigatório -- e não voluntário -- de todos os cidadãos. Se não for 'imposto' ninguém paga. Nem mesmo seus defensores. Isso mostra o quanto as pessoas realmente apreciam os serviços do estado.

Apenas volte um pouco na história: os primeiros pagadores de impostos eram fazendeiros cujos territórios foram invadidos por nômades que pastoreavam seu gado. Esses invasores nômades forçavam os fazendeiros a lhes pagar uma fatia de sua renda em troca de "proteção". O fazendeiro que não concordasse era assassinado.

Os nômades perceberam que era muito mais interessante e confortável apenas cobrar uma taxa de proteção em vez de matar o fazendeiro e assumir suas posses. Cobrando uma taxa, eles obtinham o que necessitavam. Já se matassem os fazendeiros, eles teriam de gerenciar por conta própria toda a produção da fazenda. Daí eles entenderam que, ao não assassinarem todos os fazendeiros que encontrassem pelo caminho, poderiam fazer desta prática um modo de vida.

Assim nasceu o governo.

Não assassinar pessoas foi o primeiro serviço que o governo forneceu. Como temos sorte em ter à nossa disposição esta instituição!

Assim, não deixa de ser curioso que algumas pessoas digam que os impostos são pagos basicamente para impedir que aconteça exatamente aquilo que originou a existência do governo. O governo nasceu da extorsão. Os fazendeiros tinham de pagar um "arrego" para seu governo. Caso contrário, eram assassinados. Quem era a real ameaça? O governo. A máfia faz a mesma coisa.

Mas existe uma forma de se proteger desses corsários modernos. Atualmente, existe uma propriedade privada que NINGUÉM pode tirar de você, ela é sua até mesmo depois da morte. É claro que estamos falando do Bitcoin. Fazendo as configurações certas, é impossível saber que você tem bitcoin. Nem mesmo o governo americano consegue saber.

brasil #bitcoinbrasil #nostrbrasil #grownostr #bitcoin

-

@ 5d4b6c8d:8a1c1ee3

2024-12-30 18:59:05

@ 5d4b6c8d:8a1c1ee3

2024-12-30 18:59:05Remarkably, I have yet to post about how awesome Brock Bowers has been this year.

I was very down on the Bowers pick in the draft. The Raiders took a premier TE in the previous draft and had serious needs at other positions. I'm happy to take a major L on that reaction. - Bowers is already the best TE in the league and one of the best receivers. - No rookie tight end has ever had more receiving yards and we still have another game to play. - No rookie at any position has ever caught more passes than Bowers and we still have another game to play. - No Raider has ever caught more passes than Bowers and we still have another game to play. Six Hall of Fame wide receivers and one Hall of Fame tight end have played for the Raiders, plus Davante Adams and Darren Waller (the previous franchise record holder).

Since he plays for the Raiders, Bowers did this in anything but a stable situation. He's already had three QB's and two OC's this season.

On the season, Bowers has 108 receptions for 1144 yards and 4 touch downs.

This guy is goddamn incredible and they need to give him a franchise QB with a real OC.

originally posted at https://stacker.news/items/830318

-

@ 5d4b6c8d:8a1c1ee3

2024-12-30 16:59:34

@ 5d4b6c8d:8a1c1ee3

2024-12-30 16:59:34With another win, the Silver and Black slide further down the draft board. Are the hopes of landing a top QB dashed?

Mock Draft

8th Pick: QB Shedeur Sanders! 39th Pick: OT Cameron Williams 69th Pick (nice): CB Maxwell Hairston 70th Pick: DE L.T. Overton 106th Pick: RB Nick Singleton 146th Pick: DT Howard Cross III 183rd Pick: WR Jaylin Noel 212th Pick: OG Luke Kandra 216th Pick: S Dante Trader Jr 223rd Pick: WR Jaylin Lane

Jalen Milroe was still available at 39, so even if Sanders is unrealistic at 8th, we might be able to get our QB in the 2nd round. DE isn't really a major need, but a 2nd round graded edge rusher falling into the third is a nice pick up.

No one jumped out as the obvious choice for the final pick, so I took a 2nd WR named Jaylin. If nothing else, that's sort of fun.

I'd be very happy if they could pull off this draft.

originally posted at https://stacker.news/items/830074

-

@ 6538925e:571e55c3

2024-12-30 15:51:30

@ 6538925e:571e55c3

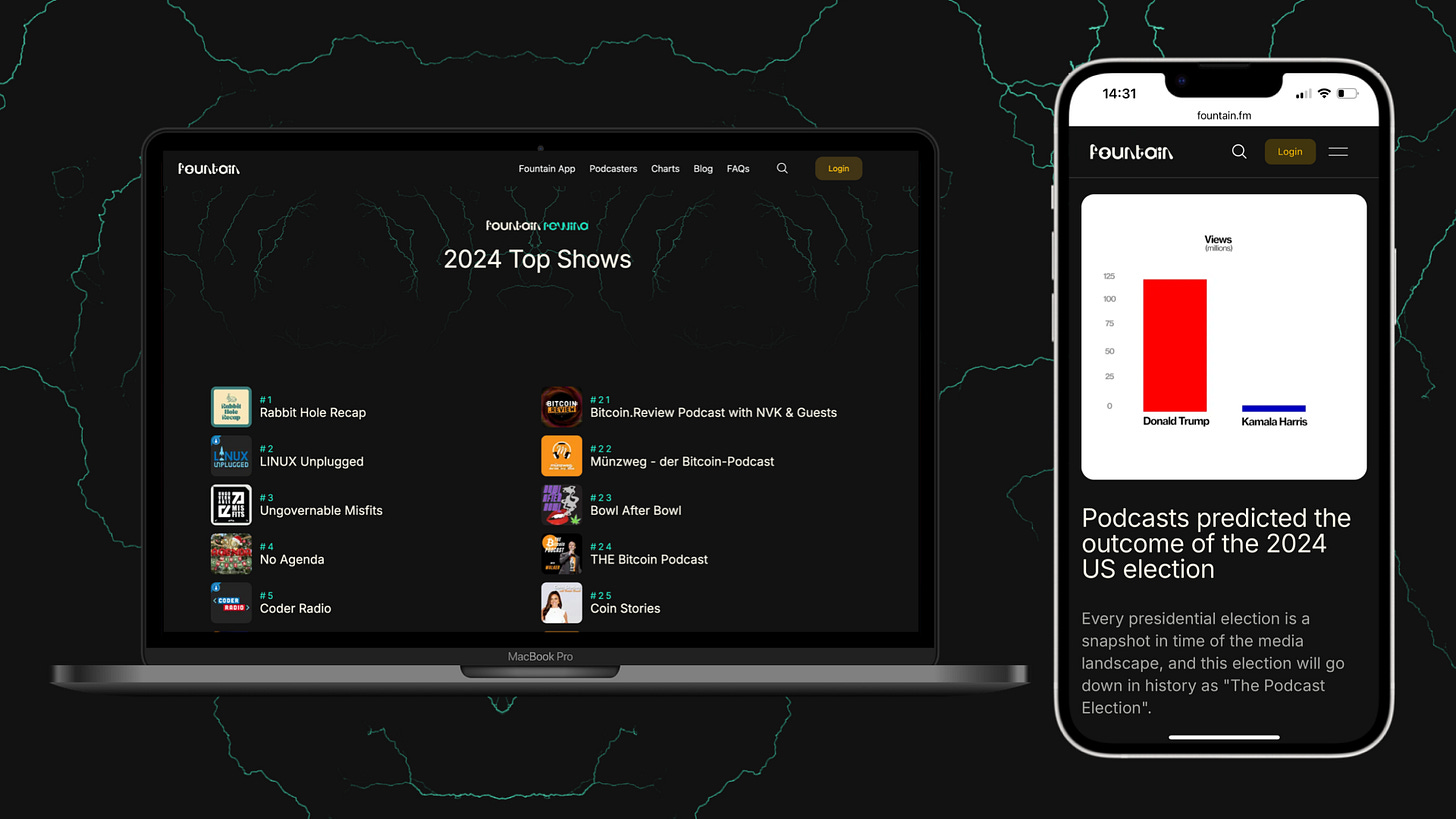

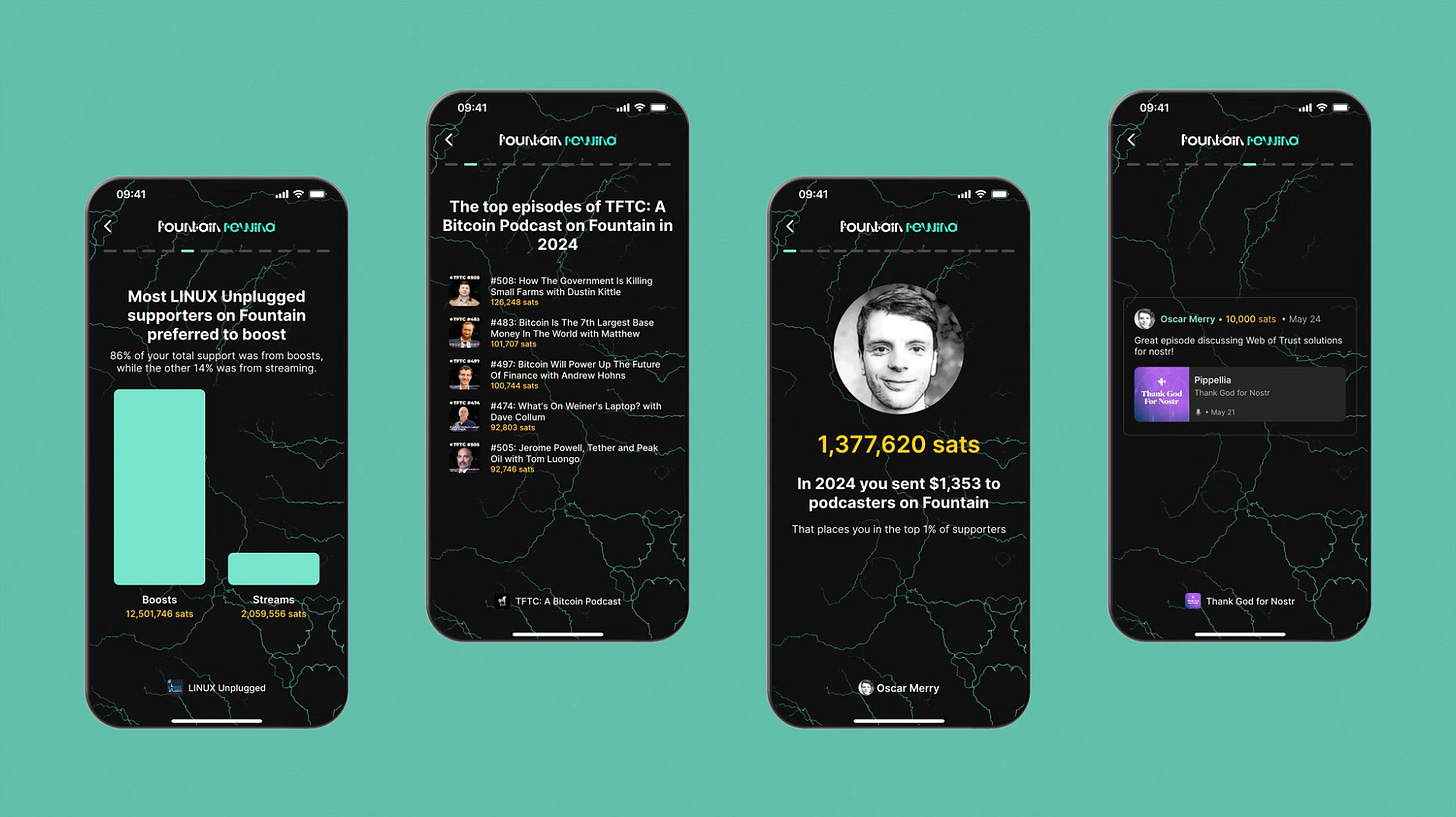

2024-12-30 15:51:30In 2024, listeners sent a total of $127,900 to creators on Fountain

The 2 BTC sent is equivalent to $127,900 based on a daily price conversion but it would be worth nearly 50% more today.

You sent over 40,000 boosts to your favourite shows and artists, with an average boost value of 3,380 sats (around $3.20 at today's price).

To add to that, over 63 million sats were streamed over the course of the year, representing 32% of total value sent.

Here are some of the shows and artists who picked up the top awards in 2024. To read the full article, head to our website.

Most Supported Show: Rabbit Hole Recap

Rabbir Hole Recap is a bitcoin news show hosted by Marty Bent and Matt Odell. Over the last three years, RHR has become one of the moved shows among Fountain listeners (affectionately known as ‘freaks’). In 2022 they were #3, in 2023 they were #2, and in 2024 they finally claimed the #1 spot. Congratulations, Marty and ODELL. Your dedication and humility is an inspiration to bitcoiners around the world.

Show with Most Supporters: Mr Obnoxious

Peter McCormack announced earlier this year that What Bitcoin Did, the preeminent podcast he has hosted for as long as we can remember, would come to an end to make way for a new show, Mr Obnoxious. In December, the Real Bedford FC owner announced that Danny Knowles would be the new custodian - much to the relief of the 800 listeners who supported the show this year. Thanks for everything, Pete!

Most Supported Episode: LINUX Unplugged | 545: 3,062 Days Later

LINUX Unplugged is just one of many popular shows about open-source, security and privacy from Jupiter Broadcasting. Editor-in-chief Chris Fisher finishes the year with three shows in Fountain's top 40. How? He and his co-hosts have made boosting a core part the listener experience, with his audience often sending "zip code boosts" (which can get pretty expensive if you live in Alaska).

Most Supported Artist: Ainsley Costello

At just 20 years old, Ainsley has been working toward a career in music for over half her life. Her music is the modern pop soundtrack of the next generation. Ainsley first made "waves" on the internet in August 2023 as the first artist to receive 1 million sats with her hit song “Cherry On Top.” Since then, she has inspired countless artists to follow her path, becoming the face of this exciting new movement.

Artist with Most Supporters: Man Like Kweks

Don Kweka is a producer and rapper from Tanzania. When he's not at his desk working his 9 to 5, he's making beats in his bedroom - and he has been prolific in 2024. Earlier this year he told Forbes he had earned a total of $25.68 from United Masters, the distribution company he uses for traditional DSPs (for which he pays a $60 annual fee). Since first publishing his music on Wavlake, he’s earned 2.3 million sats (over $2,000).

Most Supported Track: Abi Muir | Stockholm

Born in Scotland and now residing in Australia, Abi’s distinctive, goosebump-inducing vocals and heartfelt lyrics define her creative songwriting. Her unique style sees her delivering memorable, catchy pop songs of singer-songwriter prose with a contemporary pop sound. In Stockholm she explores a darker, harder edge to her music that crosses into alt-rock, topped with Muir's piercing, sultry vocals.

### Read Fountain Rewind 2024 in full on our website

### Read Fountain Rewind 2024 in full on our websiteTo see the full list of award winners, the top 40 shows and artists, plus the top stories from this year, hit the link below.

### Share your Rewind for a chance to win Fountain AirPods, limited edition merch and 100,000 sats

### Share your Rewind for a chance to win Fountain AirPods, limited edition merch and 100,000 satsOpen the app to see your Fountain Rewind (make sure you're using the latest version). Post a screenshot of any screen in your Fountain Rewind on X or Nostr and tag @fountain_app in your post. We will be announcing three lucky winners on Dec 31 - good luck!

-

@ 6bae33c8:607272e8

2024-12-30 14:29:06

@ 6bae33c8:607272e8

2024-12-30 14:29:06I was supposed to be back in Lisbon right about now, but am still in Florida. The itinerary changed on me, though it was always this way, and I just didn’t know it. Turns out Heather *thought* she had booked the flight for December 29th to arrive on the 30th, but really had booked the 30th to arrive on the 31st. She discovered this on the night of the 28th. It meant we had to cancel a 6:30 am New Year’s Day ski trip to France which was, to be honest, a relief to all of us.

I love skiing, but it entailed a two hour flight to Geneva, an hour drive to our friend’s house, then 40 minutes each way the next few days from there to the slopes, renting all the gear, etc. all while being jetlagged af and not having slept more than a few hours for two days after an eight day international trip to states. And cancelling only cost us half the price of the Lisbon to Geneva tickets, about $450 total, while saving us a couple thousand in meals, four-wheel drive rental car, lift tickets, etc. Plus we get Oscar back early from the dog camp now.

As a result, instead of traveling, I was able to catch some of the games yesterday, mostly the two late ones. My season is done, so this was more just observing how badly I botched my Steak League lineup at the last second and feeling enraged about that.

Anyway, the French alps would have been cool, but Florida isn’t that bad.

-

I have Anthony Richardson at QB in the Steak League because you get a point every 10 yards rushing and six points per rushing TD, but only four per passing TD and one point every 25 passing yards. But Richardson was hurt, it was a 14-team league, and the best I could do on waivers was his backup Joe Flacco against the Giants. So I had Flacco in the lineup, but right before we were about to leave for brunch, I saw that Davante Adams was active against the Bills, impulsively picked up Aaron Rodgers and subbed him in for Flacco. That cost me 17 points and could very well result in my buying rather than eating Steak.

-

Malik Nabers wears No. 1 and looks like a clone of Ja’Marr Chase in a Giants uniform. He’ll be a first round pick next year, no matter who the Giants QB is. And who knows, maybe Drew Lock is next year’s Sam Darnold.

-

The Giants win kicked them out of the top draft slot, and I’m good with that. I don’t want them to be forced to take a QB — better to sign someone unless the rookie is a can’t-miss generational prospect if that even exists anymore.

-

I thought I was being clever taking the Cowboys +9.5 with Jalen Hurts iffy, but I was not.

-

Saquon Barkley broke 2,000 yards but will probably sit against the Giants next week rather than go for Eric Dickerson’s all-time record of 2,105. It would be easy for him to do, but given he got to 2K in 16 games, and the Eagles are locked into the No. 2 seed, better to rest him. Breaking the 16-game record in a 17-game season means less than it would. The NFL single-season record books are one big asterisk field now.

-

When I started Rodgers I was afraid the game might go the way it did, and that Tyrod Taylor was able to engineer two TDs in garbage time was insult to injury. The Jets have packed it in, and I should have factored that into my decision.

-

I caught some of the Bengals-Broncos Saturday, but was at a restaurant when the Bengals went for the game-winning FG in overtime, assumed they made it, only to find out later they covered on a third-TD catch by Tee Higgins. This after they should have won on a FG in regulation but for some bizarre clock mismanagement. Tough beat if you had the Broncos +3.5.

-

Joe Burrow has 4,641 yards and 42 TDs vs eight picks with one game to go. The Bengals are still alive for the playoffs, but they’d need to beat the Steelers, the resting Chiefs to beat the Broncos and the packed-it-in Jets to beat the Dolphins, so they’re almost drawing dead. It’s too bad because Bengals-Bills in the Wild Card round would be a lot more exciting than Broncos-Bills.

-

Chase Brown sprained his ankle on the dumbest play of all time. Why run the ball toward the end zone and slide to avoid scoring at the one? Just kneel down at the six!

-

Ja’Marr Chase killed me this week with a meager 9-102-0 line.

-

Why wasn’t Marvin Mims getting more looks all year?

-

I went 2-3 in Circa, but boy was I right about Chargers -4. Perfect spot for a solid team to destroy a weak one that had played over its head the prior week.

-

Ladd McConkey is a bit fragile, but he’ll go around the 2/3 turn in next year’s drafts.

-

I didn’t catch much of Rams-Cardinals mercifully. Kyler Murray is so inconsistent.

-

Puka Nacua should be a top-10 fantasy pick next year too. The only receivers I’d take ahead of him are Chase, Nabers, Justin Jefferson, CeeDee Lamb and Amon-Ra St. Brown.

-

Brock Bowers broke Mike Ditka’s rookie receiving record. Depending upon the QB situation there, he might go at the 1-2 turn.

-

You have to love games where where the top RBs are Ameer Abdullah and Clyde Edwards-Helaire. I honestly didn’t realize CEH was even on the Saints until I looked at the box score.

-

The Panthers play everyone tight except apparently the Bucs. I’m glad they won, and the Falcons lost, as the Bucs are a much more entertaining playoff team.

-

Bucky Irving will go no later than the fourth round next year.

-

Mike Evans got 97 yards, putting him just 85 shy of 1,000. The Bucs need the game next week against the Saints, too. Only a injury can prevent him from getting there for an 11th straight year.

-

What if Mac Jones is next year’s Sam Darnold? Trevor Lawrence might be the next Baker Mayfield too.

-

Brian Thomas will go no later than early second-round next year, maybe even late first. I was one pick away in the 14-team RotoWire Dynasty league from getting Nabers and Thomas with my first two picks. Had to settle for Xavier Worthy and Bucky Irving/Jonnu Smith at the 3/4 turn.

-

The Dolphins without Tua are bad, but DTR is the worst QB in NFL history.

-

Jerry Jeudy is going in the third round again next year, and no one can stop this from happening.

-

Darnold threw one bad pick, but otherwise balled out again. He has 35 TDs and 12 picks with 8.2 YPA. If the Vikings upset the Lions in Detroit next week, and he has another big game — which is likely as the Lions defense isn’t good — Darnold will have MVP-type numbers on the 15-2 No. 1 seed. He won’t win because it’s Josh Allen’s “turn” but he would deserve it as much as anyone.

-

I didn’t watch the Sunday night game, but I’m glad the Falcons lost. They have no business being near the playoffs.

-

-

@ a38a5cd0:92b1b8f0

2024-12-30 13:31:02

@ a38a5cd0:92b1b8f0

2024-12-30 13:31:02I was born and raised in Europe—Switzerland, to be exact—and we’ve always had a special relationship with Europe or the EU. Although Switzerland is in the middle of Europe, it has always been isolated—not politically speaking, but through clever negotiations and an attractive financial marketplace.

But it’s still part of Europe, and whenever we drove to Germany, Austria (where I now live), or Italy, we always felt at home. Everyone was welcoming and accepted that Switzerland is the ‘special kid’ on the continent.

This is one of Europe’s superpowers. It lives off its different cultures. Other than America, I’m sorry to compare it, but it feels like many Americans have never left their own country; we can drive somewhere for three hours and pass two or even three countries.