-

@ eac63075:b4988b48

2024-11-09 17:57:27

@ eac63075:b4988b48

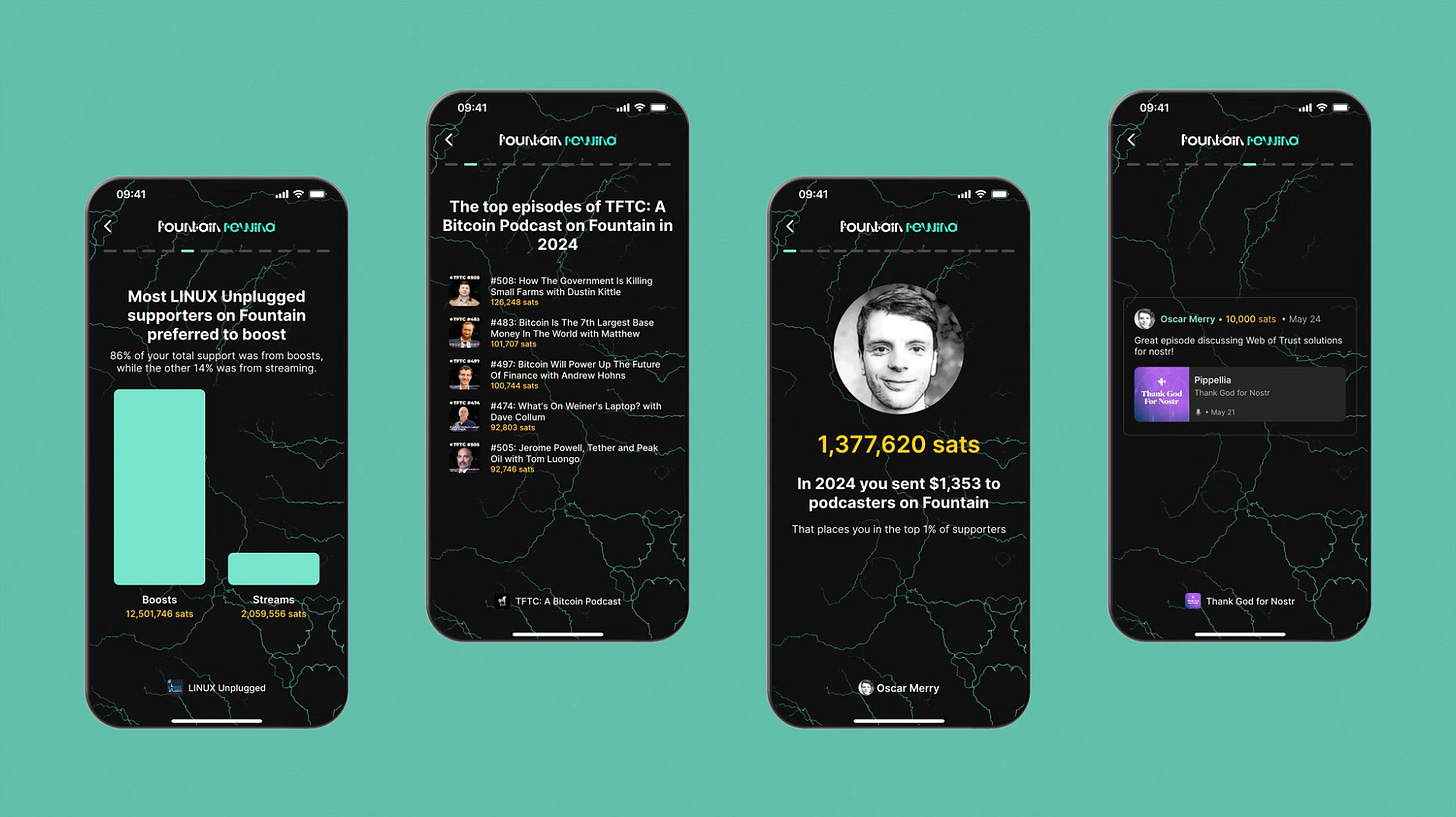

2024-11-09 17:57:27Based on a recent paper that included collaboration from renowned experts such as Lynn Alden, Steve Lee, and Ren Crypto Fish, we discuss in depth how Bitcoin's consensus is built, the main risks, and the complex dynamics of protocol upgrades.

Podcast https://www.fountain.fm/episode/wbjD6ntQuvX5u2G5BccC

Presentation https://gamma.app/docs/Analyzing-Bitcoin-Consensus-Risks-in-Protocol-Upgrades-p66axxjwaa37ksn

1. Introduction to Consensus in Bitcoin

Consensus in Bitcoin is the foundation that keeps the network secure and functional, allowing users worldwide to perform transactions in a decentralized manner without the need for intermediaries. Since its launch in 2009, Bitcoin is often described as an "immutable" system designed to resist changes, and it is precisely this resistance that ensures its security and stability.

The central idea behind consensus in Bitcoin is to create a set of acceptance rules for blocks and transactions, ensuring that all network participants agree on the transaction history. This prevents "double-spending," where the same bitcoin could be used in two simultaneous transactions, something that would compromise trust in the network.

Evolution of Consensus in Bitcoin

Over the years, consensus in Bitcoin has undergone several adaptations, and the way participants agree on changes remains a delicate process. Unlike traditional systems, where changes can be imposed from the top down, Bitcoin operates in a decentralized model where any significant change needs the support of various groups of stakeholders, including miners, developers, users, and large node operators.

Moreover, the update process is extremely cautious, as hasty changes can compromise the network's security. As a result, the philosophy of "don't fix what isn't broken" prevails, with improvements happening incrementally and only after broad consensus among those involved. This model can make progress seem slow but ensures that Bitcoin remains faithful to the principles of security and decentralization.

2. Technical Components of Consensus

Bitcoin's consensus is supported by a set of technical rules that determine what is considered a valid transaction and a valid block on the network. These technical aspects ensure that all nodes—the computers that participate in the Bitcoin network—agree on the current state of the blockchain. Below are the main technical components that form the basis of the consensus.

Validation of Blocks and Transactions

The validation of blocks and transactions is the central point of consensus in Bitcoin. A block is only considered valid if it meets certain criteria, such as maximum size, transaction structure, and the solving of the "Proof of Work" problem. The proof of work, required for a block to be included in the blockchain, is a computational process that ensures the block contains significant computational effort—protecting the network against manipulation attempts.

Transactions, in turn, need to follow specific input and output rules. Each transaction includes cryptographic signatures that prove the ownership of the bitcoins sent, as well as validation scripts that verify if the transaction conditions are met. This validation system is essential for network nodes to autonomously confirm that each transaction follows the rules.

Chain Selection

Another fundamental technical issue for Bitcoin's consensus is chain selection, which becomes especially important in cases where multiple versions of the blockchain coexist, such as after a network split (fork). To decide which chain is the "true" one and should be followed, the network adopts the criterion of the highest accumulated proof of work. In other words, the chain with the highest number of valid blocks, built with the greatest computational effort, is chosen by the network as the official one.

This criterion avoids permanent splits because it encourages all nodes to follow the same main chain, reinforcing consensus.

Soft Forks vs. Hard Forks

In the consensus process, protocol changes can happen in two ways: through soft forks or hard forks. These variations affect not only the protocol update but also the implications for network users:

-

Soft Forks: These are changes that are backward compatible. Only nodes that adopt the new update will follow the new rules, but old nodes will still recognize the blocks produced with these rules as valid. This compatibility makes soft forks a safer option for updates, as it minimizes the risk of network division.

-

Hard Forks: These are updates that are not backward compatible, requiring all nodes to update to the new version or risk being separated from the main chain. Hard forks can result in the creation of a new coin, as occurred with the split between Bitcoin and Bitcoin Cash in 2017. While hard forks allow for deeper changes, they also bring significant risks of network fragmentation.

These technical components form the base of Bitcoin's security and resilience, allowing the system to remain functional and immutable without losing the necessary flexibility to evolve over time.

3. Stakeholders in Bitcoin's Consensus

Consensus in Bitcoin is not decided centrally. On the contrary, it depends on the interaction between different groups of stakeholders, each with their motivations, interests, and levels of influence. These groups play fundamental roles in how changes are implemented or rejected on the network. Below, we explore the six main stakeholders in Bitcoin's consensus.

1. Economic Nodes

Economic nodes, usually operated by exchanges, custody providers, and large companies that accept Bitcoin, exert significant influence over consensus. Because they handle large volumes of transactions and act as a connection point between the Bitcoin ecosystem and the traditional financial system, these nodes have the power to validate or reject blocks and to define which version of the software to follow in case of a fork.

Their influence is proportional to the volume of transactions they handle, and they can directly affect which chain will be seen as the main one. Their incentive is to maintain the network's stability and security to preserve its functionality and meet regulatory requirements.

2. Investors

Investors, including large institutional funds and individual Bitcoin holders, influence consensus indirectly through their impact on the asset's price. Their buying and selling actions can affect Bitcoin's value, which in turn influences the motivation of miners and other stakeholders to continue investing in the network's security and development.

Some institutional investors have agreements with custodians that may limit their ability to act in network split situations. Thus, the impact of each investor on consensus can vary based on their ownership structure and how quickly they can react to a network change.

3. Media Influencers

Media influencers, including journalists, analysts, and popular personalities on social media, have a powerful role in shaping public opinion about Bitcoin and possible updates. These influencers can help educate the public, promote debates, and bring transparency to the consensus process.

On the other hand, the impact of influencers can be double-edged: while they can clarify complex topics, they can also distort perceptions by amplifying or minimizing change proposals. This makes them a force both of support and resistance to consensus.

4. Miners

Miners are responsible for validating transactions and including blocks in the blockchain. Through computational power (hashrate), they also exert significant influence over consensus decisions. In update processes, miners often signal their support for a proposal, indicating that the new version is safe to use. However, this signaling is not always definitive, and miners can change their position if they deem it necessary.

Their incentive is to maximize returns from block rewards and transaction fees, as well as to maintain the value of investments in their specialized equipment, which are only profitable if the network remains stable.

5. Protocol Developers

Protocol developers, often called "Core Developers," are responsible for writing and maintaining Bitcoin's code. Although they do not have direct power over consensus, they possess an informal veto power since they decide which changes are included in the main client (Bitcoin Core). This group also serves as an important source of technical knowledge, helping guide decisions and inform other stakeholders.

Their incentive lies in the continuous improvement of the network, ensuring security and decentralization. Many developers are funded by grants and sponsorships, but their motivations generally include a strong ideological commitment to Bitcoin's principles.

6. Users and Application Developers

This group includes people who use Bitcoin in their daily transactions and developers who build solutions based on the network, such as wallets, exchanges, and payment platforms. Although their power in consensus is less than that of miners or economic nodes, they play an important role because they are responsible for popularizing Bitcoin's use and expanding the ecosystem.

If application developers decide not to adopt an update, this can affect compatibility and widespread acceptance. Thus, they indirectly influence consensus by deciding which version of the protocol to follow in their applications.

These stakeholders are vital to the consensus process, and each group exerts influence according to their involvement, incentives, and ability to act in situations of change. Understanding the role of each makes it clearer how consensus is formed and why it is so difficult to make significant changes to Bitcoin.

4. Mechanisms for Activating Updates in Bitcoin

For Bitcoin to evolve without compromising security and consensus, different mechanisms for activating updates have been developed over the years. These mechanisms help coordinate changes among network nodes to minimize the risk of fragmentation and ensure that updates are implemented in an orderly manner. Here, we explore some of the main methods used in Bitcoin, their advantages and disadvantages, as well as historical examples of significant updates.

Flag Day

The Flag Day mechanism is one of the simplest forms of activating changes. In it, a specific date or block is determined as the activation moment, and all nodes must be updated by that point. This method does not involve prior signaling; participants simply need to update to the new software version by the established day or block.

-

Advantages: Simplicity and predictability are the main benefits of Flag Day, as everyone knows the exact activation date.

-

Disadvantages: Inflexibility can be a problem because there is no way to adjust the schedule if a significant part of the network has not updated. This can result in network splits if a significant number of nodes are not ready for the update.

An example of Flag Day was the Pay to Script Hash (P2SH) update in 2012, which required all nodes to adopt the change to avoid compatibility issues.

BIP34 and BIP9

BIP34 introduced a more dynamic process, in which miners increase the version number in block headers to signal the update. When a predetermined percentage of the last blocks is mined with this new version, the update is automatically activated. This model later evolved with BIP9, which allowed multiple updates to be signaled simultaneously through "version bits," each corresponding to a specific change.

-

Advantages: Allows the network to activate updates gradually, giving more time for participants to adapt.

-

Disadvantages: These methods rely heavily on miner support, which means that if a sufficient number of miners do not signal the update, it can be delayed or not implemented.

BIP9 was used in the activation of SegWit (BIP141) but faced challenges because some miners did not signal their intent to activate, leading to the development of new mechanisms.

User Activated Soft Forks (UASF) and User Resisted Soft Forks (URSF)

To increase the decision-making power of ordinary users, the concept of User Activated Soft Fork (UASF) was introduced, allowing node operators, not just miners, to determine consensus for a change. In this model, nodes set a date to start rejecting blocks that are not in compliance with the new update, forcing miners to adapt or risk having their blocks rejected by the network.

URSF, in turn, is a model where nodes reject blocks that attempt to adopt a specific update, functioning as resistance against proposed changes.

-

Advantages: UASF returns decision-making power to node operators, ensuring that changes do not depend solely on miners.

-

Disadvantages: Both UASF and URSF can generate network splits, especially in cases of strong opposition among different stakeholders.

An example of UASF was the activation of SegWit in 2017, where users supported activation independently of miner signaling, which ended up forcing its adoption.

BIP8 (LOT=True)

BIP8 is an evolution of BIP9, designed to prevent miners from indefinitely blocking a change desired by the majority of users and developers. BIP8 allows setting a parameter called "lockinontimeout" (LOT) as true, which means that if the update has not been fully signaled by a certain point, it is automatically activated.

-

Advantages: Ensures that changes with broad support among users are not blocked by miners who wish to maintain the status quo.

-

Disadvantages: Can lead to network splits if miners or other important stakeholders do not support the update.

Although BIP8 with LOT=True has not yet been used in Bitcoin, it is a proposal that can be applied in future updates if necessary.

These activation mechanisms have been essential for Bitcoin's development, allowing updates that keep the network secure and functional. Each method brings its own advantages and challenges, but all share the goal of preserving consensus and network cohesion.

5. Risks and Considerations in Consensus Updates

Consensus updates in Bitcoin are complex processes that involve not only technical aspects but also political, economic, and social considerations. Due to the network's decentralized nature, each change brings with it a set of risks that need to be carefully assessed. Below, we explore some of the main challenges and future scenarios, as well as the possible impacts on stakeholders.

Network Fragility with Alternative Implementations

One of the main risks associated with consensus updates is the possibility of network fragmentation when there are alternative software implementations. If an update is implemented by a significant group of nodes but rejected by others, a network split (fork) can occur. This creates two competing chains, each with a different version of the transaction history, leading to unpredictable consequences for users and investors.

Such fragmentation weakens Bitcoin because, by dividing hashing power (computing) and coin value, it reduces network security and investor confidence. A notable example of this risk was the fork that gave rise to Bitcoin Cash in 2017 when disagreements over block size resulted in a new chain and a new asset.

Chain Splits and Impact on Stakeholders

Chain splits are a significant risk in update processes, especially in hard forks. During a hard fork, the network is split into two separate chains, each with its own set of rules. This results in the creation of a new coin and leaves users with duplicated assets on both chains. While this may seem advantageous, in the long run, these splits weaken the network and create uncertainties for investors.

Each group of stakeholders reacts differently to a chain split:

-

Institutional Investors and ETFs: Face regulatory and compliance challenges because many of these assets are managed under strict regulations. The creation of a new coin requires decisions to be made quickly to avoid potential losses, which may be hampered by regulatory constraints.

-

Miners: May be incentivized to shift their computing power to the chain that offers higher profitability, which can weaken one of the networks.

-

Economic Nodes: Such as major exchanges and custody providers, have to quickly choose which chain to support, influencing the perceived value of each network.

Such divisions can generate uncertainties and loss of value, especially for institutional investors and those who use Bitcoin as a store of value.

Regulatory Impacts and Institutional Investors

With the growing presence of institutional investors in Bitcoin, consensus changes face new compliance challenges. Bitcoin ETFs, for example, are required to follow strict rules about which assets they can include and how chain split events should be handled. The creation of a new asset or migration to a new chain can complicate these processes, creating pressure for large financial players to quickly choose a chain, affecting the stability of consensus.

Moreover, decisions regarding forks can influence the Bitcoin futures and derivatives market, affecting perception and adoption by new investors. Therefore, the need to avoid splits and maintain cohesion is crucial to attract and preserve the confidence of these investors.

Security Considerations in Soft Forks and Hard Forks

While soft forks are generally preferred in Bitcoin for their backward compatibility, they are not without risks. Soft forks can create different classes of nodes on the network (updated and non-updated), which increases operational complexity and can ultimately weaken consensus cohesion. In a network scenario with fragmentation of node classes, Bitcoin's security can be affected, as some nodes may lose part of the visibility over updated transactions or rules.

In hard forks, the security risk is even more evident because all nodes need to adopt the new update to avoid network division. Experience shows that abrupt changes can create temporary vulnerabilities, in which malicious agents try to exploit the transition to attack the network.

Bounty Claim Risks and Attack Scenarios

Another risk in consensus updates are so-called "bounty claims"—accumulated rewards that can be obtained if an attacker manages to split or deceive a part of the network. In a conflict scenario, a group of miners or nodes could be incentivized to support a new update or create an alternative version of the software to benefit from these rewards.

These risks require stakeholders to carefully assess each update and the potential vulnerabilities it may introduce. The possibility of "bounty claims" adds a layer of complexity to consensus because each interest group may see a financial opportunity in a change that, in the long term, may harm network stability.

The risks discussed above show the complexity of consensus in Bitcoin and the importance of approaching it gradually and deliberately. Updates need to consider not only technical aspects but also economic and social implications, in order to preserve Bitcoin's integrity and maintain trust among stakeholders.

6. Recommendations for the Consensus Process in Bitcoin

To ensure that protocol changes in Bitcoin are implemented safely and with broad support, it is essential that all stakeholders adopt a careful and coordinated approach. Here are strategic recommendations for evaluating, supporting, or rejecting consensus updates, considering the risks and challenges discussed earlier, along with best practices for successful implementation.

1. Careful Evaluation of Proposal Maturity

Stakeholders should rigorously assess the maturity level of a proposal before supporting its implementation. Updates that are still experimental or lack a robust technical foundation can expose the network to unnecessary risks. Ideally, change proposals should go through an extensive testing phase, have security audits, and receive review and feedback from various developers and experts.

2. Extensive Testing in Secure and Compatible Networks

Before an update is activated on the mainnet, it is essential to test it on networks like testnet and signet, and whenever possible, on other compatible networks that offer a safe and controlled environment to identify potential issues. Testing on networks like Litecoin was fundamental for the safe launch of innovations like SegWit and the Lightning Network, allowing functionalities to be validated on a lower-impact network before being implemented on Bitcoin.

The Liquid Network, developed by Blockstream, also plays an important role as an experimental network for new proposals, such as OP_CAT. By adopting these testing environments, stakeholders can mitigate risks and ensure that the update is reliable and secure before being adopted by the main network.

3. Importance of Stakeholder Engagement

The success of a consensus update strongly depends on the active participation of all stakeholders. This includes economic nodes, miners, protocol developers, investors, and end users. Lack of participation can lead to inadequate decisions or even future network splits, which would compromise Bitcoin's security and stability.

4. Key Questions for Evaluating Consensus Proposals

To assist in decision-making, each group of stakeholders should consider some key questions before supporting a consensus change:

- Does the proposal offer tangible benefits for Bitcoin's security, scalability, or usability?

- Does it maintain backward compatibility or introduce the risk of network split?

- Are the implementation requirements clear and feasible for each group involved?

- Are there clear and aligned incentives for all stakeholder groups to accept the change?

5. Coordination and Timing in Implementations

Timing is crucial. Updates with short activation windows can force a split because not all nodes and miners can update simultaneously. Changes should be planned with ample deadlines to allow all stakeholders to adjust their systems, avoiding surprises that could lead to fragmentation.

Mechanisms like soft forks are generally preferable to hard forks because they allow a smoother transition. Opting for backward-compatible updates when possible facilitates the process and ensures that nodes and miners can adapt without pressure.

6. Continuous Monitoring and Re-evaluation

After an update, it's essential to monitor the network to identify problems or side effects. This continuous process helps ensure cohesion and trust among all participants, keeping Bitcoin as a secure and robust network.

These recommendations, including the use of secure networks for extensive testing, promote a collaborative and secure environment for Bitcoin's consensus process. By adopting a deliberate and strategic approach, stakeholders can preserve Bitcoin's value as a decentralized and censorship-resistant network.

7. Conclusion

Consensus in Bitcoin is more than a set of rules; it's the foundation that sustains the network as a decentralized, secure, and reliable system. Unlike centralized systems, where decisions can be made quickly, Bitcoin requires a much more deliberate and cooperative approach, where the interests of miners, economic nodes, developers, investors, and users must be considered and harmonized. This governance model may seem slow, but it is fundamental to preserving the resilience and trust that make Bitcoin a global store of value and censorship-resistant.

Consensus updates in Bitcoin must balance the need for innovation with the preservation of the network's core principles. The development process of a proposal needs to be detailed and rigorous, going through several testing stages, such as in testnet, signet, and compatible networks like Litecoin and Liquid Network. These networks offer safe environments for proposals to be analyzed and improved before being launched on the main network.

Each proposed change must be carefully evaluated regarding its maturity, impact, backward compatibility, and support among stakeholders. The recommended key questions and appropriate timing are critical to ensure that an update is adopted without compromising network cohesion. It's also essential that the implementation process is continuously monitored and re-evaluated, allowing adjustments as necessary and minimizing the risk of instability.

By following these guidelines, Bitcoin's stakeholders can ensure that the network continues to evolve safely and robustly, maintaining user trust and further solidifying its role as one of the most resilient and innovative digital assets in the world. Ultimately, consensus in Bitcoin is not just a technical issue but a reflection of its community and the values it represents: security, decentralization, and resilience.

8. Links

Whitepaper: https://github.com/bitcoin-cap/bcap

Youtube (pt-br): https://www.youtube.com/watch?v=rARycAibl9o&list=PL-qnhF0qlSPkfhorqsREuIu4UTbF0h4zb

-

-

@ eac63075:b4988b48

2024-10-26 22:14:19

@ eac63075:b4988b48

2024-10-26 22:14:19The future of physical money is at stake, and the discussion about DREX, the new digital currency planned by the Central Bank of Brazil, is gaining momentum. In a candid and intense conversation, Federal Deputy Julia Zanatta (PL/SC) discussed the challenges and risks of this digital transition, also addressing her Bill No. 3,341/2024, which aims to prevent the extinction of physical currency. This bill emerges as a direct response to legislative initiatives seeking to replace physical money with digital alternatives, limiting citizens' options and potentially compromising individual freedom. Let's delve into the main points of this conversation.

https://www.fountain.fm/episode/i5YGJ9Ors3PkqAIMvNQ0

What is a CBDC?

Before discussing the specifics of DREX, it’s important to understand what a CBDC (Central Bank Digital Currency) is. CBDCs are digital currencies issued by central banks, similar to a digital version of physical money. Unlike cryptocurrencies such as Bitcoin, which operate in a decentralized manner, CBDCs are centralized and regulated by the government. In other words, they are digital currencies created and controlled by the Central Bank, intended to replace physical currency.

A prominent feature of CBDCs is their programmability. This means that the government can theoretically set rules about how, where, and for what this currency can be used. This aspect enables a level of control over citizens' finances that is impossible with physical money. By programming the currency, the government could limit transactions by setting geographical or usage restrictions. In practice, money within a CBDC could be restricted to specific spending or authorized for use in a defined geographical area.

In countries like China, where citizen actions and attitudes are also monitored, a person considered to have a "low score" due to a moral or ideological violation may have their transactions limited to essential purchases, restricting their digital currency use to non-essential activities. This financial control is strengthened because, unlike physical money, digital currency cannot be exchanged anonymously.

Practical Example: The Case of DREX During the Pandemic

To illustrate how DREX could be used, an example was given by Eric Altafim, director of Banco Itaú. He suggested that, if DREX had existed during the COVID-19 pandemic, the government could have restricted the currency’s use to a 5-kilometer radius around a person’s residence, limiting their economic mobility. Another proposed use by the executive related to the Bolsa Família welfare program: the government could set up programming that only allows this benefit to be used exclusively for food purchases. Although these examples are presented as control measures for safety or organization, they demonstrate how much a CBDC could restrict citizens' freedom of choice.

To illustrate the potential for state control through a Central Bank Digital Currency (CBDC), such as DREX, it is helpful to look at the example of China. In China, the implementation of a CBDC coincides with the country’s Social Credit System, a governmental surveillance tool that assesses citizens' and companies' behavior. Together, these technologies allow the Chinese government to monitor, reward, and, above all, punish behavior deemed inappropriate or threatening to the government.

How Does China's Social Credit System Work?

Implemented in 2014, China's Social Credit System assigns every citizen and company a "score" based on various factors, including financial behavior, criminal record, social interactions, and even online activities. This score determines the benefits or penalties each individual receives and can affect everything from public transport access to obtaining loans and enrolling in elite schools for their children. Citizens with low scores may face various sanctions, including travel restrictions, fines, and difficulty in securing loans.

With the adoption of the CBDC — or “digital yuan” — the Chinese government now has a new tool to closely monitor citizens' financial transactions, facilitating the application of Social Credit System penalties. China’s CBDC is a programmable digital currency, which means that the government can restrict how, when, and where the money can be spent. Through this level of control, digital currency becomes a powerful mechanism for influencing citizens' behavior.

Imagine, for instance, a citizen who repeatedly posts critical remarks about the government on social media or participates in protests. If the Social Credit System assigns this citizen a low score, the Chinese government could, through the CBDC, restrict their money usage in certain areas or sectors. For example, they could be prevented from buying tickets to travel to other regions, prohibited from purchasing certain consumer goods, or even restricted to making transactions only at stores near their home.

Another example of how the government can use the CBDC to enforce the Social Credit System is by monitoring purchases of products such as alcohol or luxury items. If a citizen uses the CBDC to spend more than the government deems reasonable on such products, this could negatively impact their social score, resulting in additional penalties such as future purchase restrictions or a lowered rating that impacts their personal and professional lives.

In China, this kind of control has already been demonstrated in several cases. Citizens added to Social Credit System “blacklists” have seen their spending and investment capacity severely limited. The combination of digital currency and social scores thus creates a sophisticated and invasive surveillance system, through which the Chinese government controls important aspects of citizens’ financial lives and individual freedoms.

Deputy Julia Zanatta views these examples with great concern. She argues that if the state has full control over digital money, citizens will be exposed to a level of economic control and surveillance never seen before. In a democracy, this control poses a risk, but in an authoritarian regime, it could be used as a powerful tool of repression.

DREX and Bill No. 3,341/2024

Julia Zanatta became aware of a bill by a Workers' Party (PT) deputy (Bill 4068/2020 by Deputy Reginaldo Lopes - PT/MG) that proposes the extinction of physical money within five years, aiming for a complete transition to DREX, the digital currency developed by the Central Bank of Brazil. Concerned about the impact of this measure, Julia drafted her bill, PL No. 3,341/2024, which prohibits the elimination of physical money, ensuring citizens the right to choose physical currency.

“The more I read about DREX, the less I want its implementation,” says the deputy. DREX is a Central Bank Digital Currency (CBDC), similar to other state digital currencies worldwide, but which, according to Julia, carries extreme control risks. She points out that with DREX, the State could closely monitor each citizen’s transactions, eliminating anonymity and potentially restricting freedom of choice. This control would lie in the hands of the Central Bank, which could, in a crisis or government change, “freeze balances or even delete funds directly from user accounts.”

Risks and Individual Freedom

Julia raises concerns about potential abuses of power that complete digitalization could allow. In a democracy, state control over personal finances raises serious questions, and EddieOz warns of an even more problematic future. “Today we are in a democracy, but tomorrow, with a government transition, we don't know if this kind of power will be used properly or abused,” he states. In other words, DREX gives the State the ability to restrict or condition the use of money, opening the door to unprecedented financial surveillance.

EddieOz cites Nigeria as an example, where a CBDC was implemented, and the government imposed severe restrictions on the use of physical money to encourage the use of digital currency, leading to protests and clashes in the country. In practice, the poorest and unbanked — those without regular access to banking services — were harshly affected, as without physical money, many cannot conduct basic transactions. Julia highlights that in Brazil, this situation would be even more severe, given the large number of unbanked individuals and the extent of rural areas where access to technology is limited.

The Relationship Between DREX and Pix

The digital transition has already begun with Pix, which revolutionized instant transfers and payments in Brazil. However, Julia points out that Pix, though popular, is a citizen’s choice, while DREX tends to eliminate that choice. The deputy expresses concern about new rules suggested for Pix, such as daily transaction limits of a thousand reais, justified as anti-fraud measures but which, in her view, represent additional control and a profit opportunity for banks. “How many more rules will banks create to profit from us?” asks Julia, noting that DREX could further enhance control over personal finances.

International Precedents and Resistance to CBDC

The deputy also cites examples from other countries resisting the idea of a centralized digital currency. In the United States, states like New Hampshire have passed laws to prevent the advance of CBDCs, and leaders such as Donald Trump have opposed creating a national digital currency. Trump, addressing the topic, uses a justification similar to Julia’s: in a digitalized system, “with one click, your money could disappear.” She agrees with the warning, emphasizing the control risk that a CBDC represents, especially for countries with disadvantaged populations.

Besides the United States, Canada, Colombia, and Australia have also suspended studies on digital currencies, citing the need for further discussions on population impacts. However, in Brazil, the debate on DREX is still limited, with few parliamentarians and political leaders openly discussing the topic. According to Julia, only she and one or two deputies are truly trying to bring this discussion to the Chamber, making DREX’s advance even more concerning.

Bill No. 3,341/2024 and Popular Pressure

For Julia, her bill is a first step. Although she acknowledges that ideally, it would prevent DREX's implementation entirely, PL 3341/2024 is a measure to ensure citizens' choice to use physical money, preserving a form of individual freedom. “If the future means control, I prefer to live in the past,” Julia asserts, reinforcing that the fight for freedom is at the heart of her bill.

However, the deputy emphasizes that none of this will be possible without popular mobilization. According to her, popular pressure is crucial for other deputies to take notice and support PL 3341. “I am only one deputy, and we need the public’s support to raise the project’s visibility,” she explains, encouraging the public to press other parliamentarians and ask them to “pay attention to PL 3341 and the project that prohibits the end of physical money.” The deputy believes that with a strong awareness and pressure movement, it is possible to advance the debate and ensure Brazilians’ financial freedom.

What’s at Stake?

Julia Zanatta leaves no doubt: DREX represents a profound shift in how money will be used and controlled in Brazil. More than a simple modernization of the financial system, the Central Bank’s CBDC sets precedents for an unprecedented level of citizen surveillance and control in the country. For the deputy, this transition needs to be debated broadly and transparently, and it’s up to the Brazilian people to defend their rights and demand that the National Congress discuss these changes responsibly.

The deputy also emphasizes that, regardless of political or partisan views, this issue affects all Brazilians. “This agenda is something that will affect everyone. We need to be united to ensure people understand the gravity of what could happen.” Julia believes that by sharing information and generating open debate, it is possible to prevent Brazil from following the path of countries that have already implemented a digital currency in an authoritarian way.

A Call to Action

The future of physical money in Brazil is at risk. For those who share Deputy Julia Zanatta’s concerns, the time to act is now. Mobilize, get informed, and press your representatives. PL 3341/2024 is an opportunity to ensure that Brazilian citizens have a choice in how to use their money, without excessive state interference or surveillance.

In the end, as the deputy puts it, the central issue is freedom. “My fear is that this project will pass, and people won’t even understand what is happening.” Therefore, may every citizen at least have the chance to understand what’s at stake and make their voice heard in defense of a Brazil where individual freedom and privacy are respected values.

-

@ 8fb140b4:f948000c

2023-11-21 21:37:48

@ 8fb140b4:f948000c

2023-11-21 21:37:48Embarking on the journey of operating your own Lightning node on the Bitcoin Layer 2 network is more than just a tech-savvy endeavor; it's a step into a realm of financial autonomy and cutting-edge innovation. By running a node, you become a vital part of a revolutionary movement that's reshaping how we think about money and digital transactions. This role not only offers a unique perspective on blockchain technology but also places you at the heart of a community dedicated to decentralization and network resilience. Beyond the technicalities, it's about embracing a new era of digital finance, where you contribute directly to the network's security, efficiency, and growth, all while gaining personal satisfaction and potentially lucrative rewards.

In essence, running your own Lightning node is a powerful way to engage with the forefront of blockchain technology, assert financial independence, and contribute to a more decentralized and efficient Bitcoin network. It's an adventure that offers both personal and communal benefits, from gaining in-depth tech knowledge to earning a place in the evolving landscape of cryptocurrency.

Running your own Lightning node for the Bitcoin Layer 2 network can be an empowering and beneficial endeavor. Here are 10 reasons why you might consider taking on this task:

-

Direct Contribution to Decentralization: Operating a node is a direct action towards decentralizing the Bitcoin network, crucial for its security and resistance to control or censorship by any single entity.

-

Financial Autonomy: Owning a node gives you complete control over your financial transactions on the network, free from reliance on third-party services, which can be subject to fees, restrictions, or outages.

-

Advanced Network Participation: As a node operator, you're not just a passive participant but an active player in shaping the network, influencing its efficiency and scalability through direct involvement.

-

Potential for Higher Revenue: With strategic management and optimal channel funding, your node can become a preferred route for transactions, potentially increasing the routing fees you can earn.

-

Cutting-Edge Technological Engagement: Running a node puts you at the forefront of blockchain and bitcoin technology, offering insights into future developments and innovations.

-

Strengthened Network Security: Each new node adds to the robustness of the Bitcoin network, making it more resilient against attacks and failures, thus contributing to the overall security of the ecosystem.

-

Personalized Fee Structures: You have the flexibility to set your own fee policies, which can balance earning potential with the service you provide to the network.

-

Empowerment Through Knowledge: The process of setting up and managing a node provides deep learning opportunities, empowering you with knowledge that can be applied in various areas of blockchain and fintech.

-

Boosting Transaction Capacity: By running a node, you help to increase the overall capacity of the Lightning Network, enabling more transactions to be processed quickly and at lower costs.

-

Community Leadership and Reputation: As an active node operator, you gain recognition within the Bitcoin community, which can lead to collaborative opportunities and a position of thought leadership in the space.

These reasons demonstrate the impactful and transformative nature of running a Lightning node, appealing to those who are deeply invested in the principles of bitcoin and wish to actively shape its future. Jump aboard, and embrace the journey toward full independence. 🐶🐾🫡🚀🚀🚀

-

-

@ 8fb140b4:f948000c

2023-11-18 23:28:31

@ 8fb140b4:f948000c

2023-11-18 23:28:31Chef's notes

Serving these two dishes together will create a delightful centerpiece for your Thanksgiving meal, offering a perfect blend of traditional flavors with a homemade touch.

Details

- ⏲️ Prep time: 30 min

- 🍳 Cook time: 1 - 2 hours

- 🍽️ Servings: 4-6

Ingredients

- 1 whole turkey (about 12-14 lbs), thawed and ready to cook

- 1 cup unsalted butter, softened

- 2 tablespoons fresh thyme, chopped

- 2 tablespoons fresh rosemary, chopped

- 2 tablespoons fresh sage, chopped

- Salt and freshly ground black pepper

- 1 onion, quartered

- 1 lemon, halved

- 2-3 cloves of garlic

- Apple and Sage Stuffing

- 1 loaf of crusty bread, cut into cubes

- 2 apples, cored and chopped

- 1 onion, diced

- 2 stalks celery, diced

- 3 cloves garlic, minced

- 1/4 cup fresh sage, chopped

- 1/2 cup unsalted butter

- 2 cups chicken broth

- Salt and pepper, to taste

Directions

- Preheat the Oven: Set your oven to 325°F (165°C).

- Prepare the Herb Butter: Mix the softened butter with the chopped thyme, rosemary, and sage. Season with salt and pepper.

- Prepare the Turkey: Remove any giblets from the turkey and pat it dry. Loosen the skin and spread a generous amount of herb butter under and over the skin.

- Add Aromatics: Inside the turkey cavity, place the quartered onion, lemon halves, and garlic cloves.

- Roast: Place the turkey in a roasting pan. Tent with aluminum foil and roast. A general guideline is about 15 minutes per pound, or until the internal temperature reaches 165°F (74°C) at the thickest part of the thigh.

- Rest and Serve: Let the turkey rest for at least 20 minutes before carving.

- Next: Apple and Sage Stuffing

- Dry the Bread: Spread the bread cubes on a baking sheet and let them dry overnight, or toast them in the oven.

- Cook the Vegetables: In a large skillet, melt the butter and cook the onion, celery, and garlic until soft.

- Combine Ingredients: Add the apples, sage, and bread cubes to the skillet. Stir in the chicken broth until the mixture is moist. Season with salt and pepper.

- Bake: Transfer the stuffing to a baking dish and bake at 350°F (175°C) for about 30-40 minutes, until golden brown on top.

-

@ 8fb140b4:f948000c

2023-11-02 01:13:01

@ 8fb140b4:f948000c

2023-11-02 01:13:01Testing a brand new YakiHonne native client for iOS. Smooth as butter (not penis butter 🤣🍆🧈) with great visual experience and intuitive navigation. Amazing work by the team behind it! * lists * work

Bold text work!

Images could have used nostr.build instead of raw S3 from us-east-1 region.

Very impressive! You can even save the draft and continue later, before posting the long-form note!

🐶🐾🤯🤯🤯🫂💜

-

@ 8fb140b4:f948000c

2023-08-22 12:14:34

@ 8fb140b4:f948000c

2023-08-22 12:14:34As the title states, scratch behind my ear and you get it. 🐶🐾🫡

-

@ 8fb140b4:f948000c

2023-07-30 00:35:01

@ 8fb140b4:f948000c

2023-07-30 00:35:01Test Bounty Note

-

@ 8fb140b4:f948000c

2023-07-22 09:39:48

@ 8fb140b4:f948000c

2023-07-22 09:39:48Intro

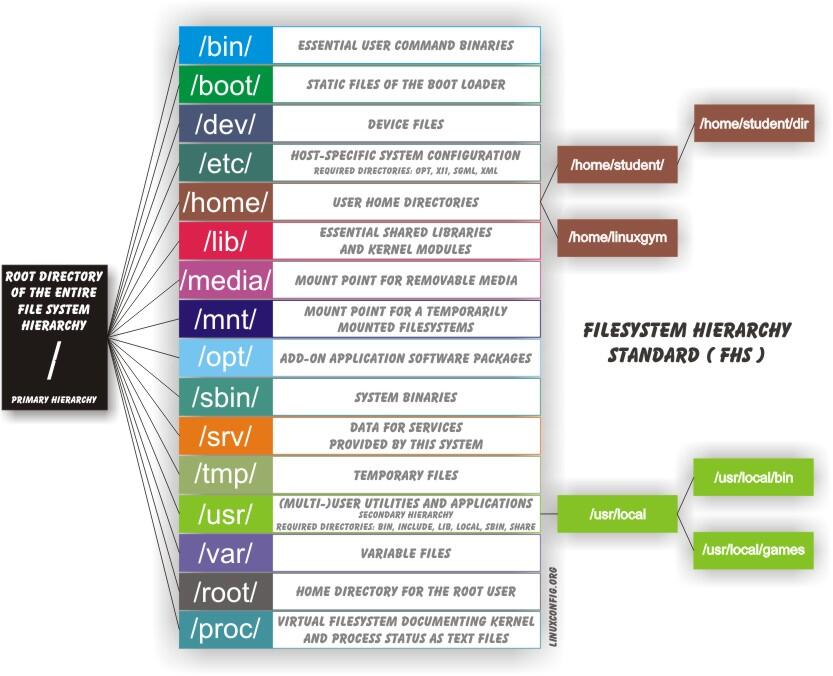

This short tutorial will help you set up your own Nostr Wallet Connect (NWC) on your own LND Node that is not using Umbrel. If you are a user of Umbrel, you should use their version of NWC.

Requirements

You need to have a working installation of LND with established channels and connectivity to the internet. NWC in itself is fairly light and will not consume a lot of resources. You will also want to ensure that you have a working installation of Docker, since we will use a docker image to run NWC.

- Working installation of LND (and all of its required components)

- Docker (with Docker compose)

Installation

For the purpose of this tutorial, we will assume that you have your lnd/bitcoind running under user bitcoin with home directory /home/bitcoin. We will also assume that you already have a running installation of Docker (or docker.io).

Prepare and verify

git version - we will need git to get the latest version of NWC. docker version - should execute successfully and show the currently installed version of Docker. docker compose version - same as before, but the version will be different. ss -tupln | grep 10009- should produce the following output: tcp LISTEN 0 4096 0.0.0.0:10009 0.0.0.0: tcp LISTEN 0 4096 [::]:10009 [::]:**

For things to work correctly, your Docker should be version 20.10.0 or later. If you have an older version, consider installing a new one using instructions here: https://docs.docker.com/engine/install/

Create folders & download NWC

In the home directory of your LND/bitcoind user, create a new folder, e.g., "nwc" mkdir /home/bitcoin/nwc. Change to that directory cd /home/bitcoin/nwc and clone the NWC repository: git clone https://github.com/getAlby/nostr-wallet-connect.git

Creating the Docker image

In this step, we will create a Docker image that you will use to run NWC.

- Change directory to

nostr-wallet-connect:cd nostr-wallet-connect - Run command to build Docker image:

docker build -t nwc:$(date +'%Y%m%d%H%M') -t nwc:latest .(there is a dot at the end) - The last line of the output (after a few minutes) should look like

=> => naming to docker.io/library/nwc:latest nwc:latestis the name of the Docker image with a tag which you should note for use later.

Creating docker-compose.yml and necessary data directories

- Let's create a directory that will hold your non-volatile data (DB):

mkdir data - In

docker-compose.ymlfile, there are fields that you want to replace (<> comments) and port “4321” that you want to make sure is open (check withss -tupln | grep 4321which should return nothing). - Create

docker-compose.ymlfile with the following content, and make sure to update fields that have <> comment:

version: "3.8" services: nwc: image: nwc:latest volumes: - ./data:/data - ~/.lnd:/lnd:ro ports: - "4321:8080" extra_hosts: - "localhost:host-gateway" environment: NOSTR_PRIVKEY: <use "openssl rand -hex 32" to generate a fresh key and place it inside ""> LN_BACKEND_TYPE: "LND" LND_ADDRESS: localhost:10009 LND_CERT_FILE: "/lnd/tls.cert" LND_MACAROON_FILE: "/lnd/data/chain/bitcoin/mainnet/admin.macaroon" DATABASE_URI: "/data/nostr-wallet-connect.db" COOKIE_SECRET: <use "openssl rand -hex 32" to generate fresh secret and place it inside ""> PORT: 8080 restart: always stop_grace_period: 1mStarting and testing

Now that you have everything ready, it is time to start the container and test.

- While you are in the

nwcdirectory (important), execute the following command and check the log output,docker compose up - You should see container logs while it is starting, and it should not exit if everything went well.

- At this point, you should be able to go to

http://<ip of the host where nwc is running>:4321and get to the interface of NWC - To stop the test run of NWC, simply press

Ctrl-C, and it will shut the container down. - To start NWC permanently, you should execute

docker compose up -d, “-d” tells Docker to detach from the session. - To check currently running NWC logs, execute

docker compose logsto run it in tail mode add-fto the end. - To stop the container, execute

docker compose down

That's all, just follow the instructions in the web interface to get started.

Updating

As with any software, you should expect fixes and updates that you would need to perform periodically. You could automate this, but it falls outside of the scope of this tutorial. Since we already have all of the necessary configuration in place, the update execution is fairly simple.

- Change directory to the clone of the git repository,

cd /home/bitcoin/nwc/nostr-wallet-connect - Run command to build Docker image:

docker build -t nwc:$(date +'%Y%m%d%H%M') -t nwc:latest .(there is a dot at the end) - Change directory back one level

cd .. - Restart (stop and start) the docker compose config

docker compose down && docker compose up -d - Done! Optionally you may want to check the logs:

docker compose logs

-

@ e97aaffa:2ebd765d

2024-12-31 16:47:12

@ e97aaffa:2ebd765d

2024-12-31 16:47:12Último dia do ano, momento para tirar o pó da bola de cristal, para fazer reflexões, previsões e desejos para o próximo ano e seguintes.

Ano após ano, o Bitcoin evoluiu, foi ultrapassando etapas, tornou-se cada vez mais mainstream. Está cada vez mais difícil fazer previsões sobre o Bitcoin, já faltam poucas barreiras a serem ultrapassadas e as que faltam são altamente complexas ou tem um impacto profundo no sistema financeiro ou na sociedade. Estas alterações profundas tem que ser realizadas lentamente, porque uma alteração rápida poderia resultar em consequências terríveis, poderia provocar um retrocesso.

Código do Bitcoin

No final de 2025, possivelmente vamos ter um fork, as discussões sobre os covenants já estão avançadas, vão acelerar ainda mais. Já existe um consenso relativamente alto, a favor dos covenants, só falta decidir que modelo será escolhido. Penso que até ao final do ano será tudo decidido.

Depois dos covenants, o próximo foco será para a criptografia post-quantum, que será o maior desafio que o Bitcoin enfrenta. Criar uma criptografia segura e que não coloque a descentralização em causa.

Espero muito de Ark, possivelmente a inovação do ano, gostaria de ver o Nostr a furar a bolha bitcoinheira e que o Cashu tivesse mais reconhecimento pelos bitcoiners.

Espero que surjam avanços significativos no BitVM2 e BitVMX.

Não sei o que esperar das layer 2 de Bitcoin, foram a maior desilusão de 2024. Surgiram com muita força, mas pouca coisa saiu do papel, foi uma mão cheia de nada. Uma parte dos projetos caiu na tentação da shitcoinagem, na criação de tokens, que tem um único objetivo, enriquecer os devs e os VCs.

Se querem ser levados a sério, têm que ser sérios.

“À mulher de César não basta ser honesta, deve parecer honesta”

Se querem ter o apoio dos bitcoiners, sigam o ethos do Bitcoin.

Neste ponto a atitude do pessoal da Ark é exemplar, em vez de andar a chorar no Twitter para mudar o código do Bitcoin, eles colocaram as mãos na massa e criaram o protocolo. É claro que agora está meio “coxo”, funciona com uma multisig ou com os covenants na Liquid. Mas eles estão a criar um produto, vão demonstrar ao mercado que o produto é bom e útil. Com a adoção, a comunidade vai perceber que o Ark necessita dos covenants para melhorar a interoperabilidade e a soberania.

É este o pensamento certo, que deveria ser seguido pelos restantes e futuros projetos. É seguir aquele pensamento do J.F. Kennedy:

“Não perguntem o que é que o vosso país pode fazer por vocês, perguntem o que é que vocês podem fazer pelo vosso país”

Ou seja, não fiquem à espera que o bitcoin mude, criem primeiro as inovações/tecnologia, ganhem adoção e depois demonstrem que a alteração do código camada base pode melhorar ainda mais o vosso projeto. A necessidade é que vai levar a atualização do código.

Reservas Estratégicas de Bitcoin

Bancos centrais

Com a eleição de Trump, emergiu a ideia de uma Reserva Estratégia de Bitcoin, tornou este conceito mainstream. Foi um pivot, a partir desse momento, foram enumerados os políticos de todo o mundo a falar sobre o assunto.

A Senadora Cynthia Lummis foi mais além e propôs um programa para adicionar 200 mil bitcoins à reserva ao ano, até 1 milhão de Bitcoin. Só que isto está a criar uma enorme expectativa na comunidade, só que pode resultar numa enorme desilusão. Porque no primeiro ano, o Trump em vez de comprar os 200 mil, pode apenas adicionar na reserva, os 198 mil que o Estado já tem em sua posse. Se isto acontecer, possivelmente vai resultar numa forte queda a curto prazo. Na minha opinião os bancos centrais deveriam seguir o exemplo de El Salvador, fazer um DCA diário.

Mais que comprar bitcoin, para mim, o mais importante é a criação da Reserva, é colocar o Bitcoin ao mesmo nível do ouro, o impacto para o resto do mundo será tremendo, a teoria dos jogos na sua plenitude. Muitos outros bancos centrais vão ter que comprar, para não ficarem atrás, além disso, vai transmitir uma mensagem à generalidade da população, que o Bitcoin é “afinal é algo seguro, com valor”.

Mas não foi Trump que iniciou esta teoria dos jogos, mas sim foi a primeira vítima dela. É o próprio Trump que o admite, que os EUA necessitam da reserva para não ficar atrás da China. Além disso, desde que os EUA utilizaram o dólar como uma arma, com sanção contra a Rússia, surgiram boatos de que a Rússia estaria a utilizar o Bitcoin para transações internacionais. Que foram confirmados recentemente, pelo próprio governo russo. Também há poucos dias, ainda antes deste reconhecimento público, Putin elogiou o Bitcoin, ao reconhecer que “Ninguém pode proibir o bitcoin”, defendendo como uma alternativa ao dólar. A narrativa está a mudar.

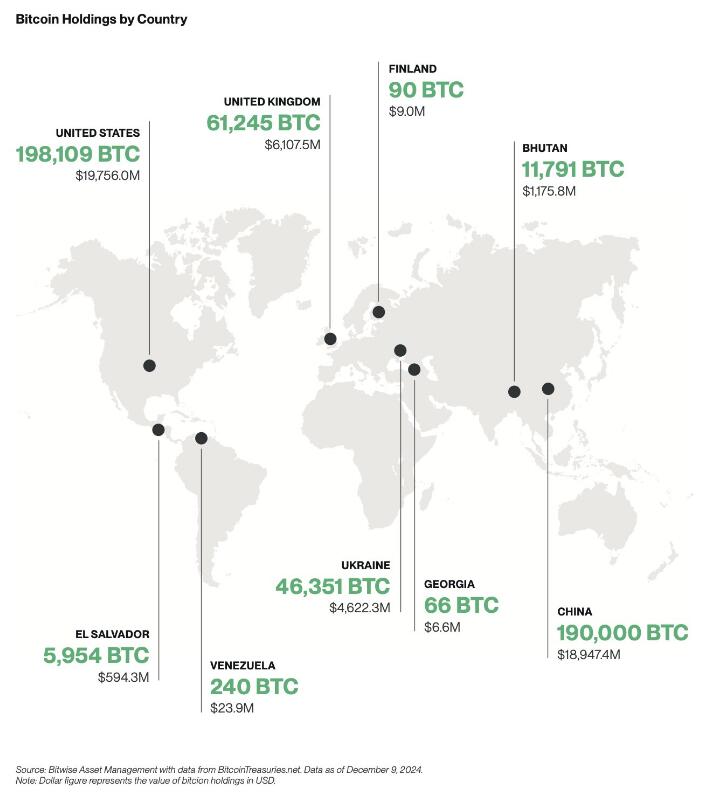

Já existem alguns países com Bitcoin, mas apenas dois o fizeram conscientemente (El Salvador e Butão), os restantes têm devido a apreensões. Hoje são poucos, mas 2025 será o início de uma corrida pelos bancos centrais. Esta corrida era algo previsível, o que eu não esperava é que acontecesse tão rápido.

Empresas

A criação de reservas estratégicas não vai ficar apenas pelos bancos centrais, também vai acelerar fortemente nas empresas em 2025.

Mas as empresas não vão seguir a estratégia do Saylor, vão comprar bitcoin sem alavancagem, utilizando apenas os tesouros das empresas, como uma proteção contra a inflação. Eu não sou grande admirador do Saylor, prefiro muito mais, uma estratégia conservadora, sem qualquer alavancagem. Penso que as empresas vão seguir a sugestão da BlackRock, que aconselha um alocações de 1% a 3%.

Penso que 2025, ainda não será o ano da entrada das 6 magníficas (excepto Tesla), será sobretudo empresas de pequena e média dimensão. As magníficas ainda tem uma cota muito elevada de shareholders com alguma idade, bastante conservadores, que têm dificuldade em compreender o Bitcoin, foi o que aconteceu recentemente com a Microsoft.

Também ainda não será em 2025, talvez 2026, a inclusão nativamente de wallet Bitcoin nos sistema da Apple Pay e da Google Pay. Seria um passo gigante para a adoção a nível mundial.

ETFs

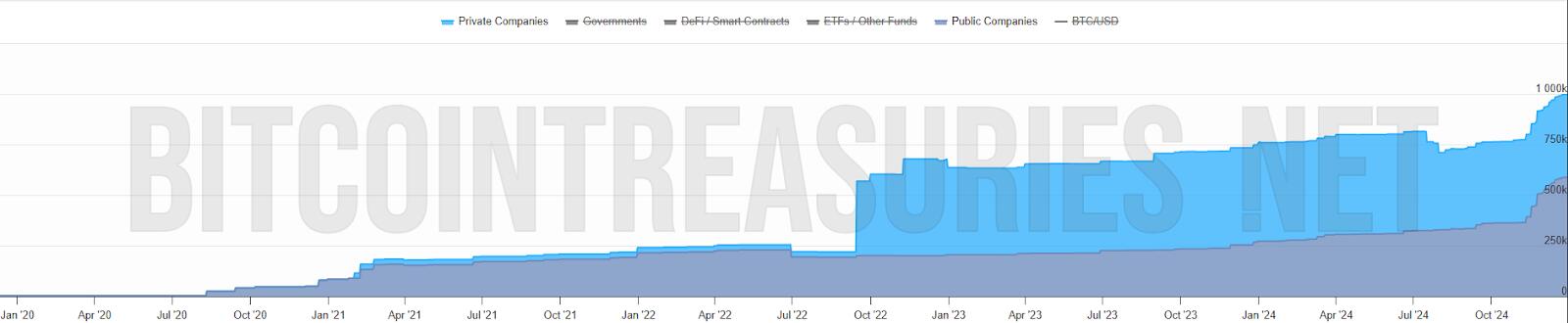

Os ETFs para mim são uma incógnita, tenho demasiadas dúvidas, como será 2025. Este ano os inflows foram superiores a 500 mil bitcoins, o IBIT foi o lançamento de ETF mais bem sucedido da história. O sucesso dos ETFs, deve-se a 2 situações que nunca mais se vão repetir. O mercado esteve 10 anos à espera pela aprovação dos ETFs, a procura estava reprimida, isso foi bem notório nos primeiros meses, os inflows foram brutais.

Também se beneficiou por ser um mercado novo, não existia orderbook de vendas, não existia um mercado interno, praticamente era só inflows. Agora o mercado já estabilizou, a maioria das transações já são entre clientes dos próprios ETFs. Agora só uma pequena percentagem do volume das transações diárias vai resultar em inflows ou outflows.

Estes dois fenómenos nunca mais se vão repetir, eu não acredito que o número de inflows em BTC supere os número de 2024, em dólares vai superar, mas em btc não acredito que vá superar.

Mas em 2025 vão surgir uma infindável quantidade de novos produtos, derivativos, novos ETFs de cestos com outras criptos ou cestos com ativos tradicionais. O bitcoin será adicionado em produtos financeiros já existentes no mercado, as pessoas vão passar a deter bitcoin, sem o saberem.

Com o fim da operação ChokePoint 2.0, vai surgir uma nova onda de adoção e de produtos financeiros. Possivelmente vamos ver bancos tradicionais a disponibilizar produtos ou serviços de custódia aos seus clientes.

Eu adoraria ver o crescimento da adoção do bitcoin como moeda, só que a regulamentação não vai ajudar nesse processo.

Preço

Eu acredito que o topo deste ciclo será alcançado no primeiro semestre, posteriormente haverá uma correção. Mas desta vez, eu acredito que a correção será muito menor que as anteriores, inferior a 50%, esta é a minha expectativa. Espero estar certo.

Stablecoins de dólar

Agora saindo um pouco do universo do Bitcoin, acho importante destacar as stablecoins.

No último ciclo, eu tenho dividido o tempo, entre continuar a estudar o Bitcoin e estudar o sistema financeiro, as suas dinâmicas e o comportamento humano. Isto tem sido o meu foco de reflexão, imaginar a transformação que o mundo vai sofrer devido ao padrão Bitcoin. É uma ilusão acreditar que a transição de um padrão FIAT para um padrão Bitcoin vai ser rápida, vai existir um processo transitório que pode demorar décadas.

Com a re-entrada de Trump na Casa Branca, prometendo uma política altamente protecionista, vai provocar uma forte valorização do dólar, consequentemente as restantes moedas do mundo vão derreter. Provocando uma inflação generalizada, gerando uma corrida às stablecoins de dólar nos países com moedas mais fracas. Trump vai ter uma política altamente expansionista, vai exportar dólares para todo o mundo, para financiar a sua própria dívida. A desigualdade entre os pobres e ricos irá crescer fortemente, aumentando a possibilidade de conflitos e revoltas.

“Casa onde não há pão, todos ralham e ninguém tem razão”

Será mais lenha, para alimentar a fogueira, vai gravar os conflitos geopolíticos já existentes, ficando as sociedade ainda mais polarizadas.

Eu acredito que 2025, vai haver um forte crescimento na adoção das stablecoins de dólares, esse forte crescimento vai agravar o problema sistémico que são as stablecoins. Vai ser o início do fim das stablecoins, pelo menos, como nós conhecemos hoje em dia.

Problema sistémico

O sistema FIAT não nasceu de um dia para outro, foi algo que foi construído organicamente, ou seja, foi evoluindo ao longo dos anos, sempre que havia um problema/crise, eram criadas novas regras ou novas instituições para minimizar os problemas. Nestes quase 100 anos, desde os acordos de Bretton Woods, a evolução foram tantas, tornaram o sistema financeiro altamente complexo, burocrático e nada eficiente.

Na prática é um castelo de cartas construído sobre outro castelo de cartas e que por sua vez, foi construído sobre outro castelo de cartas.

As stablecoins são um problema sistémico, devido às suas reservas em dólares e o sistema financeiro não está preparado para manter isso seguro. Com o crescimento das reservas ao longo dos anos, foi se agravando o problema.

No início a Tether colocava as reservas em bancos comerciais, mas com o crescimento dos dólares sob gestão, criou um problema nos bancos comerciais, devido à reserva fracionária. Essas enormes reservas da Tether estavam a colocar em risco a própria estabilidade dos bancos.

A Tether acabou por mudar de estratégia, optou por outros ativos, preferencialmente por títulos do tesouro/obrigações dos EUA. Só que a Tether continua a crescer e não dá sinais de abrandamento, pelo contrário.

Até o próprio mundo cripto, menosprezava a gravidade do problema da Tether/stablecoins para o resto do sistema financeiro, porque o marketcap do cripto ainda é muito pequeno. É verdade que ainda é pequeno, mas a Tether não o é, está no top 20 dos maiores detentores de títulos do tesouros dos EUA e está ao nível dos maiores bancos centrais do mundo. Devido ao seu tamanho, está a preocupar os responsáveis/autoridades/reguladores dos EUA, pode colocar em causa a estabilidade do sistema financeiro global, que está assente nessas obrigações.

Os títulos do tesouro dos EUA são o colateral mais utilizado no mundo, tanto por bancos centrais, como por empresas, é a charneira da estabilidade do sistema financeiro. Os títulos do tesouro são um assunto muito sensível. Na recente crise no Japão, do carry trade, o Banco Central do Japão tentou minimizar a desvalorização do iene através da venda de títulos dos EUA. Esta operação, obrigou a uma viagem de emergência, da Secretaria do Tesouro dos EUA, Janet Yellen ao Japão, onde disponibilizou liquidez para parar a venda de títulos por parte do Banco Central do Japão. Essa forte venda estava desestabilizando o mercado.

Os principais detentores de títulos do tesouros são institucionais, bancos centrais, bancos comerciais, fundo de investimento e gestoras, tudo administrado por gestores altamente qualificados, racionais e que conhecem a complexidade do mercado de obrigações.

O mundo cripto é seu oposto, é naife com muita irracionalidade e uma forte pitada de loucura, na sua maioria nem faz a mínima ideia como funciona o sistema financeiro. Essa irracionalidade pode levar a uma “corrida bancária”, como aconteceu com o UST da Luna, que em poucas horas colapsou o projeto. Em termos de escala, a Luna ainda era muito pequena, por isso, o problema ficou circunscrito ao mundo cripto e a empresas ligadas diretamente ao cripto.

Só que a Tether é muito diferente, caso exista algum FUD, que obrigue a Tether a desfazer-se de vários biliões ou dezenas de biliões de dólares em títulos num curto espaço de tempo, poderia provocar consequências terríveis em todo o sistema financeiro. A Tether é grande demais, é já um problema sistémico, que vai agravar-se com o crescimento em 2025.

Não tenham dúvidas, se existir algum problema, o Tesouro dos EUA vai impedir a venda dos títulos que a Tether tem em sua posse, para salvar o sistema financeiro. O problema é, o que vai fazer a Tether, se ficar sem acesso às venda das reservas, como fará o redeem dos dólares?

Como o crescimento do Tether é inevitável, o Tesouro e o FED estão com um grande problema em mãos, o que fazer com o Tether?

Mas o problema é que o atual sistema financeiro é como um curto cobertor: Quanto tapas a cabeça, destapas os pés; Ou quando tapas os pés, destapas a cabeça. Ou seja, para resolver o problema da guarda reservas da Tether, vai criar novos problemas, em outros locais do sistema financeiro e assim sucessivamente.

Conta mestre

Uma possível solução seria dar uma conta mestre à Tether, dando o acesso direto a uma conta no FED, semelhante à que todos os bancos comerciais têm. Com isto, a Tether deixaria de necessitar os títulos do tesouro, depositando o dinheiro diretamente no banco central. Só que isto iria criar dois novos problemas, com o Custodia Bank e com o restante sistema bancário.

O Custodia Bank luta há vários anos contra o FED, nos tribunais pelo direito a ter licença bancária para um banco com full-reserves. O FED recusou sempre esse direito, com a justificativa que esse banco, colocaria em risco toda a estabilidade do sistema bancário existente, ou seja, todos os outros bancos poderiam colapsar. Perante a existência em simultâneo de bancos com reserva fracionária e com full-reserves, as pessoas e empresas iriam optar pelo mais seguro. Isso iria provocar uma corrida bancária, levando ao colapso de todos os bancos com reserva fracionária, porque no Custodia Bank, os fundos dos clientes estão 100% garantidos, para qualquer valor. Deixaria de ser necessário limites de fundos de Garantia de Depósitos.

Eu concordo com o FED nesse ponto, que os bancos com full-reserves são uma ameaça a existência dos restantes bancos. O que eu discordo do FED, é a origem do problema, o problema não está nos bancos full-reserves, mas sim nos que têm reserva fracionária.

O FED ao conceder uma conta mestre ao Tether, abre um precedente, o Custodia Bank irá o aproveitar, reclamando pela igualdade de direitos nos tribunais e desta vez, possivelmente ganhará a sua licença.

Ainda há um segundo problema, com os restantes bancos comerciais. A Tether passaria a ter direitos similares aos bancos comerciais, mas os deveres seriam muito diferentes. Isto levaria os bancos comerciais aos tribunais para exigir igualdade de tratamento, é uma concorrência desleal. Isto é o bom dos tribunais dos EUA, são independentes e funcionam, mesmo contra o estado. Os bancos comerciais têm custos exorbitantes devido às políticas de compliance, como o KYC e AML. Como o governo não vai querer aliviar as regras, logo seria a Tether, a ser obrigada a fazer o compliance dos seus clientes.

A obrigação do KYC para ter stablecoins iriam provocar um terramoto no mundo cripto.

Assim, é pouco provável que seja a solução para a Tether.

FED

Só resta uma hipótese, ser o próprio FED a controlar e a gerir diretamente as stablecoins de dólar, nacionalizado ou absorvendo as existentes. Seria uma espécie de CBDC. Isto iria provocar um novo problema, um problema diplomático, porque as stablecoins estão a colocar em causa a soberania monetária dos outros países. Atualmente as stablecoins estão um pouco protegidas porque vivem num limbo jurídico, mas a partir do momento que estas são controladas pelo governo americano, tudo muda. Os países vão exigir às autoridades americanas medidas que limitem o uso nos seus respectivos países.

Não existe uma solução boa, o sistema FIAT é um castelo de cartas, qualquer carta que se mova, vai provocar um desmoronamento noutro local. As autoridades não poderão adiar mais o problema, terão que o resolver de vez, senão, qualquer dia será tarde demais. Se houver algum problema, vão colocar a responsabilidade no cripto e no Bitcoin. Mas a verdade, a culpa é inteiramente dos políticos, da sua incompetência em resolver os problemas a tempo.

Será algo para acompanhar futuramente, mas só para 2026, talvez…

É curioso, há uns anos pensava-se que o Bitcoin seria a maior ameaça ao sistema ao FIAT, mas afinal, a maior ameaça aos sistema FIAT é o próprio FIAT(stablecoins). A ironia do destino.

Isto é como uma corrida, o Bitcoin é aquele atleta que corre ao seu ritmo, umas vezes mais rápido, outras vezes mais lento, mas nunca pára. O FIAT é o atleta que dá tudo desde da partida, corre sempre em velocidade máxima. Só que a vida e o sistema financeiro não é uma prova de 100 metros, mas sim uma maratona.

Europa

2025 será um ano desafiante para todos europeus, sobretudo devido à entrada em vigor da regulamentação (MiCA). Vão começar a sentir na pele a regulamentação, vão agravar-se os problemas com os compliance, problemas para comprovar a origem de fundos e outras burocracias. Vai ser lindo.

O Travel Route passa a ser obrigatório, os europeus serão obrigados a fazer o KYC nas transações. A Travel Route é uma suposta lei para criar mais transparência, mas prática, é uma lei de controle, de monitorização e para limitar as liberdades individuais dos cidadãos.

O MiCA também está a colocar problemas nas stablecoins de Euro, a Tether para já preferiu ficar de fora da europa. O mais ridículo é que as novas regras obrigam os emissores a colocar 30% das reservas em bancos comerciais. Os burocratas europeus não compreendem que isto coloca em risco a estabilidade e a solvência dos próprios bancos, ficam propensos a corridas bancárias.

O MiCA vai obrigar a todas as exchanges a estar registadas em solo europeu, ficando vulnerável ao temperamento dos burocratas. Ainda não vai ser em 2025, mas a UE vai impor políticas de controle de capitais, é inevitável, as exchanges serão obrigadas a usar em exclusividade stablecoins de euro, as restantes stablecoins serão deslistadas.

Todas estas novas regras do MiCA, são extremamente restritas, não é para garantir mais segurança aos cidadãos europeus, mas sim para garantir mais controle sobre a população. A UE está cada vez mais perto da autocracia, do que da democracia. A minha única esperança no horizonte, é que o sucesso das políticas cripto nos EUA, vai obrigar a UE a recuar e a aligeirar as regras, a teoria dos jogos é implacável. Mas esse recuo, nunca acontecerá em 2025, vai ser um longo período conturbado.

Recessão

Os mercados estão todos em máximos históricos, isto não é sustentável por muito tempo, suspeito que no final de 2025 vai acontecer alguma correção nos mercados. A queda só não será maior, porque os bancos centrais vão imprimir dinheiro, muito dinheiro, como se não houvesse amanhã. Vão voltar a resolver os problemas com a injeção de liquidez na economia, é empurrar os problemas com a barriga, em de os resolver. Outra vez o efeito Cantillon.

Será um ano muito desafiante a nível político, onde o papel dos políticos será fundamental. A crise política na França e na Alemanha, coloca a UE órfã, sem um comandante ao leme do navio. 2025 estará condicionado pelas eleições na Alemanha, sobretudo no resultado do AfD, que podem colocar em causa a propriedade UE e o euro.

Possivelmente, só o fim da guerra poderia minimizar a crise, algo que é muito pouco provável acontecer.

Em Portugal, a economia parece que está mais ou menos equilibrada, mas começam a aparecer alguns sinais preocupantes. Os jogos de sorte e azar estão em máximos históricos, batendo o recorde de 2014, época da grande crise, não é um bom sinal, possivelmente já existe algum desespero no ar.

A Alemanha é o motor da Europa, quanto espirra, Portugal constipa-se. Além do problema da Alemanha, a Espanha também está à beira de uma crise, são os países que mais influenciam a economia portuguesa.

Se existir uma recessão mundial, terá um forte impacto no turismo, que é hoje em dia o principal motor de Portugal.

Brasil

Brasil é algo para acompanhar em 2025, sobretudo a nível macro e a nível político. Existe uma possibilidade de uma profunda crise no Brasil, sobretudo na sua moeda. O banco central já anda a queimar as reservas para minimizar a desvalorização do Real.

Sem mudanças profundas nas políticas fiscais, as reservas vão se esgotar. As políticas de controle de capitais são um cenário plausível, será interesse de acompanhar, como o governo irá proceder perante a existência do Bitcoin e stablecoins. No Brasil existe um forte adoção, será um bom case study, certamente irá repetir-se em outros países num futuro próximo.

Os próximos tempos não serão fáceis para os brasileiros, especialmente para os que não têm Bitcoin.

Blockchain

Em 2025, possivelmente vamos ver os primeiros passos da BlackRock para criar a primeira bolsa de valores, exclusivamente em blockchain. Eu acredito que a BlackRock vai criar uma própria blockchain, toda controlada por si, onde estarão os RWAs, para fazer concorrência às tradicionais bolsas de valores. Será algo interessante de acompanhar.

Estas são as minhas previsões, eu escrevi isto muito em cima do joelho, certamente esqueci-me de algumas coisas, se for importante acrescentarei nos comentários. A maioria das previsões só acontecerá após 2025, mas fica aqui a minha opinião.

Isto é apenas a minha opinião, Don’t Trust, Verify!

-

@ 933f9d20:996b56ae

2024-12-31 16:41:41

@ 933f9d20:996b56ae

2024-12-31 16:41:41คำถามจากความอยากตระหนักรู้ในตนเอง

จู่ๆตัวเราก็นึกอยากจะเข้าใจตนเองมากขึ้น บนโลกนี้มีศาสตร์แห่งบุคลิกภาพมากมายที่ให้เราได้ศึกษาและทำแบบทดสอบ แต่จะดีกว่ามั้ยที่เรารู้อย่างคร่าวๆเกี่ยวกับศาสตร์ที่อยู่เบื้องหลังแบบทดสอบเหล่านั้น

Enneargram คืออะไร?

Enneargram ความหมายคือ 'นพลักษณ์' เป็นศาสตร์ที่มีจุดประสงค์ไว้เพื่อการเข้าใจตนเองและเข้าใจคนอื่นหรือเพื่อให้เราอยู่ร่วมกันในสังคมได้อย่างสงบสุข(และหลีกเลี่ยงการแทงใจดำคนอื่นโดยที่ตัวเองไม่ได้ตั้งใจได้!) โดยในแต่ละประเภทจะเรียกกันว่า 'ลักษณ์'

และในบทความนี้ผมจะพูดถึงความรู้เกี่ยวกับ Enneargram ในภาพรวมกันครับ!

นพลักษณ์ (Enneargram)

หากคุณบ้าบอคิดจะข้าม(เผลอๆข้ามไปแล้วมั้ง..)จากหัวข้อนี้ไปดื้อๆคุณก็จะอ่านไม่รู้เรื่องเลยด้วยซ้ำหากคุณไม่รู้ว่านพลักษณ์คืออะไร

'นพลักษณ์' โดยคำว่า 'นพ' ซึ่งแปลว่า 9(เก้า) และคำว่า 'ลักษณ์' ก็คือความหมายว่าเป็น ลักษณะ

ซึ่งก็จะแปลได้เป็น ลักษณะทั้ง 9 นั่นเองครับ!

แล้วก็จะมีการจัดกลุ่มลักษณ์โดยแบ่งเป็น 3 กลุ่มซึ่งก็จะถูกเรียกว่า

ปัญญา 3 ฐาน (The 3 centers) อันได้แก่

ฐานการกระทำหรือฐานกาย แทนเป็น (A) ฐานความรู้สึกหรือฐานใจ แทนเป็น (F) ฐานความคิดหรือฐานหัว แทนเป็น (T)

พอรู้ปัญญา 3 ฐานแล้ว...เรามาดูลักษณะในแต่ละลักษณ์กันเลยดีกว่า!

The perfectionist (ลักษณ์ 1 A) เป็นลักษณ์ที่รักความสมบูรณ์แบบอย่างสุดซึ้ง มีระเบียบวินัยในชีวิตโคตรๆ เป็นคนเนี้ยบของทุกอย่างรอบตัวจะถูกจัดอย่างเป็นระเบียบ หากมีเศษขี้เล็บใครอยู่บนโต๊ะเขาก็จะรู้เลยว่ามันไม่ใช่ของเขา ยึดมั่นในคุณธรรมจริยธรรมอันดี และชอบความแน่นอน

The giver (ลักษณ์ 2 F) เป็นผู้ชอบให้ชอบเสียสละสิ่งที่ตนมี โดยที่ตนเองก็หวังลึกๆว่าจะได้สิ่งตอบแทนกลับมาด้วย มีนิสัยที่ร่าเริงแจ่มใสใจกว้างและเป็นมิตรต่อทุกๆคน

The preformer (ลักษณ์ 3 F) รัก(บ้า)การแข่งขันและชอบการเอาชนะเป็นที่สุด เกลียดการพ่ายแพ้และต้องการเป็นภาพลักษณ์ตามที่ตนเองต้องการ

The romantic (ลักษณ์ 4 F) พื้นฐานคืออารมณ์เศร้าหมองและมีความอิจฉาลึกๆ ไม่อยากเหมือนใครในสิ่งที่ตนเองสนใจและความเป็นศิลปินในตัวสูง

The observer (ลักษณ์ 5 T) คลั่งการหาความรู้(หรือจะฝึกฝนก็ตาม)มาใส่หัวแบบจะเอาให้เทพสุดๆรู้มากสุดๆในเรื่องนั้นๆไปเลย มักแยกอารมณ์ออกจากกระบวนการคิดเชิงเหตุผล ต้องการพื้นที่ส่วนตัวสูงและเป็นลักษณ์ที่เก็บตัวสูง

The guardian (ลักษณ์ 6 T) เป็นลักษณ์ที่มีความกลัวเป็นพื้นฐานของอารมณ์ ชอบวิเคราะห์และวางแผนอนาคตแถมขี้สงสัยด้วย ไม่ชอบความไม่มั่นคงและความไม่ปลอดภัยหวาดระแวงตลอด(โดยเฉพาะอนาคต) ชอบอยู่ใต้การบังคับบัญชามากกว่า

The optimist (ลักษณ์ 7 T) เสพสุขรักการจญภัยและชอบเติมเต็มชีวิตด้วยความแปลกใหม่ตลอดเวลา มีความตะกละเป็นสันดานและไม่ชอบให้ใครมาวาดกรอบให้ตัวเอง

The leader (ลักษณ์ 8 A) มีความโกรธเป็นพื้นฐานของอารมณ์และมีความเป็นผู้นำโดยธรรมชาติ ฝักใฝ่หรือสนใจในอำนาจและการควบคุม สามารถใช้ความโกรธเชื่อมโยงในสิ่งใดก็ได้ตามใจอยาก(และมันโคตรทรงพลังนะจะบอกให้!) ชอบปฏิเสธความอ่อนแอ(ซึ่งเป็นข้อเสีย)และชอบทำสุดใส่สุด(โดยเฉพาะทางกายภาพ เช่น จะกินก๋วยเตี๋ยวเผ็ดๆก็เทพริกซะหมดแก้วบรรจุซะ)

The peacemaker (ลักษณ์ 9 A) นักการทูตตัวจริงเสียงจริง มักเป็นลักษณ์ที่เมื่อเกิดความขัดแย้งระหว่างกลุ่ม ลักษณ์นี้นี่แหละคือตัวปิดความขัดแย้งที่แท้ทรู แต่หากไม่เกิดผลลักษณ์นี้ก็จะหนีออกมาจากความขัดแย้งแทนซะงั้น เป็นลักษณ์ที่รักสงบและเกลียดความขัดแย้งนั่นเอง

Wing (สภาวะปีก)

เป็นสภาวะที่เกิดขึ้นโดยที่ลักษณ์หลักของเราได้รับผลกระทบจากลักษณ์รอบๆ เช่น คนที่มีลักษณ์ 8 ก็จะมีปีกเป็น ลักษณ์ 7 และ ลักษณ์9 ซึ่งจะมีเพียงด้านที่ถนัดที่สุดเท่านั้น หากใช้ลักษณ์ 7 บ่อยที่สุด เราก็จะเขียนได้เป็น

8w7(8 คือลักษณ์หลักของเรา และ 7 ก็คือลักษณ์รองลงมาที่อยู่ข้างๆนั่นเอง โดยมีตัว 'w' เป็นสัญลักษณ์คั่นกลางไว้) และเราจะต้องอ่านว่าลักษณ์8ปีก7ซึ่งเราก็จะได้อิทธิพลลักษณะจากลักษณะข้างด้วยนั่นเองครับ ซึ่งบางสถานการณ์ก็อาจจะไม่มีก็ได้

Subtype (ลักษณ์ย่อย)

เป็นการแบ่งลักษณะการใส่ใจของแต่ละลักษณ์ โดยลักษณ์แต่ละลักษณ์จะต้องมี 3 ลักษณะ ซึ่งจะมีทั้งหมด 27 ลักษณ์ทั้งหมดในนพลักษณ์

Self-preservation (sp) เป็นลักษณ์ย่อยที่ใส่ใจกับความปลอดภัยและความมั่นคงของตนเองก่อน ซึ่งรวมถึงความมั่งคั่งและสิ่งของด้วย

Sexual,one-to-one (sx) เป็นลักษณ์ย่อยที่ให้ความสำคัญกับความสัมพันธ์กับใครคนใดคนหนึ่ง ไม่จำกัดว่าต้องเป็นคน จะเป็นสัตว์เลี้ยงก็ได้ ความสัมพันธ์ในครอบครัวหรือความสัมพันธ์แบบกุ๊กกิ๊กจักจี้หัวใจ(ก็โรแมนติกนั่นแหละ)

Social (so) เป็นลักษณ์ที่อยากมีส่วนร่วมหรือให้ความสำคัญในสังคมหรือในครอบครัว กลุ่มเพื่อน กลุ่มเพื่อนร่วมงาน ต้องการเป็นที่จดจำและต้องการความเคารพจากคนอื่น

Arrow line (สภาวะลูกศร)

เป็นสภาวะที่จะแสดงถึงพฤติกรรมต่างๆในแต่ละสถานการณ์ โดยจะเรียกกันว่าสภาวะมั่นคง ไม่มั่นคง และสภาวะปกติ

สภาวะปกติ ก็คือปกติ ไม่สุขไม่ทุกข์ มั่นคงและไม่มั่นคงในเวลาเดียวกัน

สภาวะมั่นคง เป็นสภาวะที่รู้สึกมั่นคงตามชื่อเลย เป็นความรู้สึกที่เป็นไปตามอยากตามต้องการ

สภาวะไม่มั่นคง ไม่ปกติ ไม่มั่นคง เครียด! หรือก็คือกำลังเจออยู่กับสิ่งที่ตนหลีกเลี่ยงนั่นเอง

โดยหากคนที่เป็นคนลักษณ์ 8 (อีกแล้ว!) ได้อยู่ใน....

-สภาวะไม่มั่นคง คนลักษณ์ 8 ก็จะได้รับอานิสงส์จากลักษณ์ที่ 5 หรือก็คือจะเก็บตัวมากขึ้น โฟกัสหรือสนใจแค่สิ่งๆหนึ่ง กลับไปจัดระเบียบชีวิต ความคิดตนเองหรือข้าวของที่อาจกระจัดกระจายไปทั่วในบ้านของตนเอง

-สภาวะมั่นคง คนลักษณ์ 8 ก็จะได้รับอิทธิพลจากลักษณ์ 2 ซึ่งนั่นก็คือการ Takecare ใจกว้างและรับฟังคนด้วย! ซึ่งดูมีความสุขแฮปปี้ลั้นลาในฉบับของลักษณ์ 8

ส่งท้าย

บทความนี้เป็นบทความแรกในชีวิตของผมเลย ซึ่งตัวผมเองก็เป็นลักษณ์ 8 ปีก 7 (8w7) ผมได้จมปรักกับเรื่องพวกนี้มากพอควร (3 ปีกว่าแล้วล่ะครับ) ซึ่งตัวผมในอดีตก็คงไม่ได้คิดหรอกว่าจะเขียนบทความ แถมยังเขียนใน Nostr อีก!

แต่ก็นะ.... ผมก็ขอขอบคุณที่อ่านมาจนถึงวรรคนี้นะครับ

ขอให้คุณตั้งใจใช้ชีวิตไปกับปีหน้านะครับ!

-From 31/12/2024

-

@ 6bae33c8:607272e8

2024-12-31 14:52:56

@ 6bae33c8:607272e8

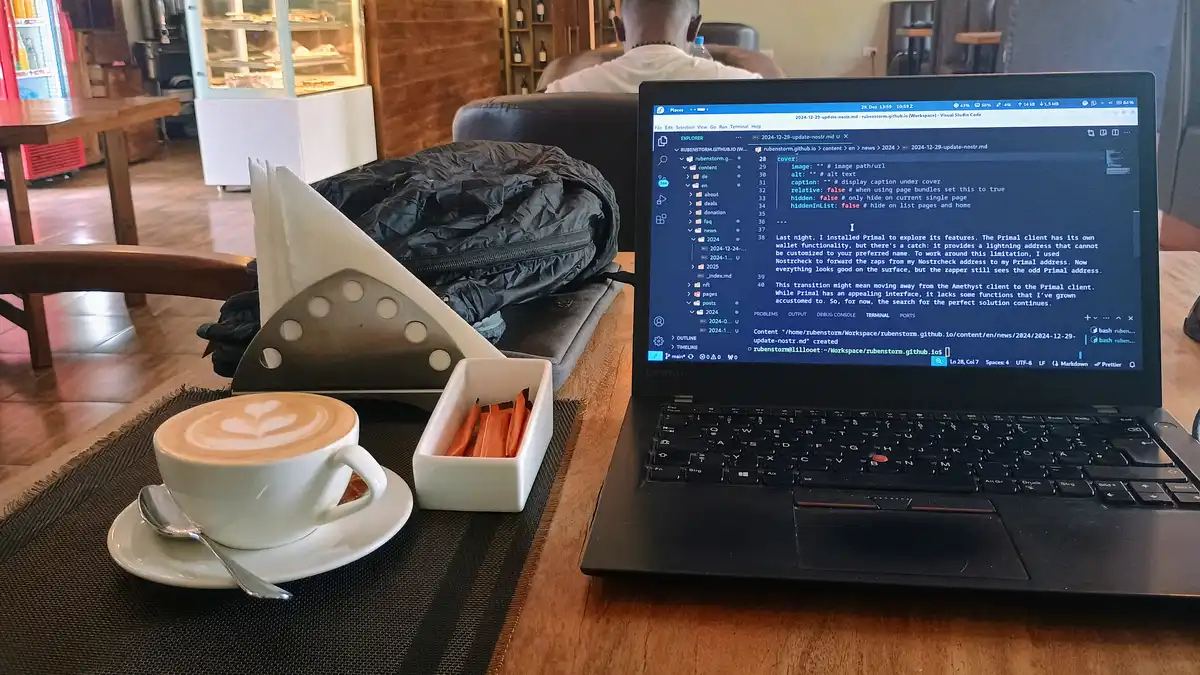

2024-12-31 14:52:56I missed this game because I was on an overnight flight back to Portugal via Munich last night. Just got in, actually, jetlagged af, so I won’t have too much to say about it. Plus, our bags didn’t make the connecting flight, which is annoying.

-