-

@ a95c6243:d345522c

2025-01-31 20:02:25

@ a95c6243:d345522c

2025-01-31 20:02:25Im Augenblick wird mit größter Intensität, großer Umsicht \ das deutsche Volk belogen. \ Olaf Scholz im FAZ-Interview

Online-Wahlen stärken die Demokratie, sind sicher, und 61 Prozent der Wahlberechtigten sprechen sich für deren Einführung in Deutschland aus. Das zumindest behauptet eine aktuelle Umfrage, die auch über die Agentur Reuters Verbreitung in den Medien gefunden hat. Demnach würden außerdem 45 Prozent der Nichtwähler bei der Bundestagswahl ihre Stimme abgeben, wenn sie dies zum Beispiel von Ihrem PC, Tablet oder Smartphone aus machen könnten.

Die telefonische Umfrage unter gut 1000 wahlberechtigten Personen sei repräsentativ, behauptet der Auftraggeber – der Digitalverband Bitkom. Dieser präsentiert sich als eingetragener Verein mit einer beeindruckenden Liste von Mitgliedern, die Software und IT-Dienstleistungen anbieten. Erklärtes Vereinsziel ist es, «Deutschland zu einem führenden Digitalstandort zu machen und die digitale Transformation der deutschen Wirtschaft und Verwaltung voranzutreiben».

Durchgeführt hat die Befragung die Bitkom Servicegesellschaft mbH, also alles in der Familie. Die gleiche Erhebung hatte der Verband übrigens 2021 schon einmal durchgeführt. Damals sprachen sich angeblich sogar 63 Prozent für ein derartiges «Demokratie-Update» aus – die Tendenz ist demgemäß fallend. Dennoch orakelt mancher, der Gang zur Wahlurne gelte bereits als veraltet.

Die spanische Privat-Uni mit Globalisten-Touch, IE University, berichtete Ende letzten Jahres in ihrer Studie «European Tech Insights», 67 Prozent der Europäer befürchteten, dass Hacker Wahlergebnisse verfälschen könnten. Mehr als 30 Prozent der Befragten glaubten, dass künstliche Intelligenz (KI) bereits Wahlentscheidungen beeinflusst habe. Trotzdem würden angeblich 34 Prozent der unter 35-Jährigen einer KI-gesteuerten App vertrauen, um in ihrem Namen für politische Kandidaten zu stimmen.

Wie dauerhaft wird wohl das Ergebnis der kommenden Bundestagswahl sein? Diese Frage stellt sich angesichts der aktuellen Entwicklung der Migrations-Debatte und der (vorübergehend) bröckelnden «Brandmauer» gegen die AfD. Das «Zustrombegrenzungsgesetz» der Union hat das Parlament heute Nachmittag überraschenderweise abgelehnt. Dennoch muss man wohl kein ausgesprochener Pessimist sein, um zu befürchten, dass die Entscheidungen der Bürger von den selbsternannten Verteidigern der Demokratie künftig vielleicht nicht respektiert werden, weil sie nicht gefallen.

Bundesweit wird jetzt zu «Brandmauer-Demos» aufgerufen, die CDU gerät unter Druck und es wird von Übergriffen auf Parteibüros und Drohungen gegen Mitarbeiter berichtet. Sicherheitsbehörden warnen vor Eskalationen, die Polizei sei «für ein mögliches erhöhtes Aufkommen von Straftaten gegenüber Politikern und gegen Parteigebäude sensibilisiert».

Der Vorwand «unzulässiger Einflussnahme» auf Politik und Wahlen wird als Argument schon seit einiger Zeit aufgebaut. Der Manipulation schuldig befunden wird neben Putin und Trump auch Elon Musk, was lustigerweise ausgerechnet Bill Gates gerade noch einmal bekräftigt und als «völlig irre» bezeichnet hat. Man stelle sich die Diskussionen um die Gültigkeit von Wahlergebnissen vor, wenn es Online-Verfahren zur Stimmabgabe gäbe. In der Schweiz wird «E-Voting» seit einigen Jahren getestet, aber wohl bisher mit wenig Erfolg.

Die politische Brandstiftung der letzten Jahre zahlt sich immer mehr aus. Anstatt dringende Probleme der Menschen zu lösen – zu denen auch in Deutschland die weit verbreitete Armut zählt –, hat die Politik konsequent polarisiert und sich auf Ausgrenzung und Verhöhnung großer Teile der Bevölkerung konzentriert. Basierend auf Ideologie und Lügen werden abweichende Stimmen unterdrückt und kriminalisiert, nicht nur und nicht erst in diesem Augenblick. Die nächsten Wochen dürften ausgesprochen spannend werden.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ 57d1a264:69f1fee1

2025-02-05 02:18:03

@ 57d1a264:69f1fee1

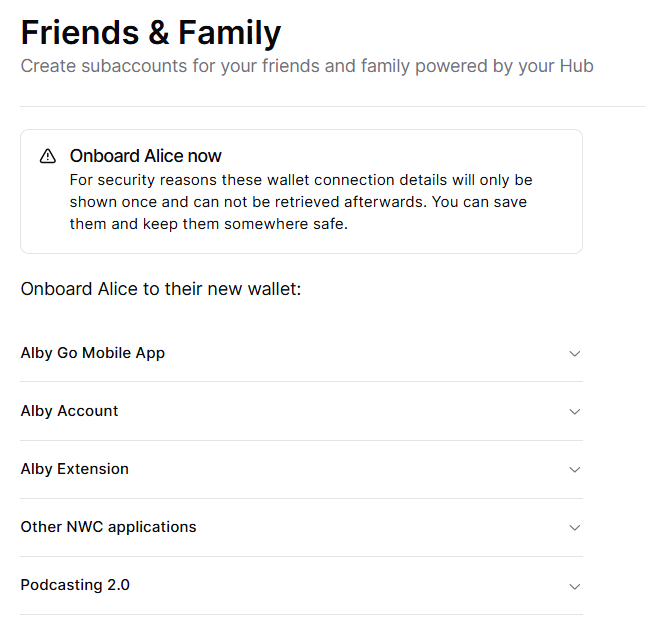

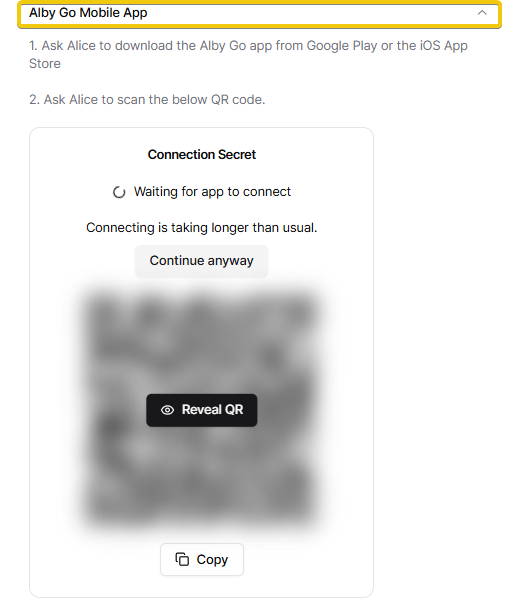

2025-02-05 02:18:03Pre-Foundational learning for these participants has now kicked off in the Bitcoin Design Community, check out the #education channel on the Bitcoin.Design Discord channel.

🪇 10 talented participants from South America will be:

Learning bitcoin UX Design fundamentals using the Bitcoin Design Guide Working hands-on with South American-built products to evaluate their user experiences and support builders with data

Attending BTC++ in Florianópolis

This initiative is sponsored by the Human Rights Foundation in collaboration with the Bitcoin Design Foundation and Area Bitcoin.

🥅 Goals:

- Empower local talent to improve the UX of South American bitcoin products - seeing their passion and drive to bring bitcoin to their countries is really inspiring

- Create meaningful relationships with wallet developers through practical collaboration

- Scale bitcoin adoption by improving the user experience

- Create a public knowledge base: All research conducted in Africa and South America will be made publicly available for builders

originally posted at https://stacker.news/items/876215

-

@ a95c6243:d345522c

2025-01-24 20:59:01

@ a95c6243:d345522c

2025-01-24 20:59:01Menschen tun alles, egal wie absurd, \ um ihrer eigenen Seele nicht zu begegnen. \ Carl Gustav Jung

«Extremer Reichtum ist eine Gefahr für die Demokratie», sagen über die Hälfte der knapp 3000 befragten Millionäre aus G20-Staaten laut einer Umfrage der «Patriotic Millionaires». Ferner stellte dieser Zusammenschluss wohlhabender US-Amerikaner fest, dass 63 Prozent jener Millionäre den Einfluss von Superreichen auf US-Präsident Trump als Bedrohung für die globale Stabilität ansehen.

Diese Besorgnis haben 370 Millionäre und Milliardäre am Dienstag auch den in Davos beim WEF konzentrierten Privilegierten aus aller Welt übermittelt. In einem offenen Brief forderten sie die «gewählten Führer» auf, die Superreichen – also sie selbst – zu besteuern, um «die zersetzenden Auswirkungen des extremen Reichtums auf unsere Demokratien und die Gesellschaft zu bekämpfen». Zum Beispiel kontrolliere eine handvoll extrem reicher Menschen die Medien, beeinflusse die Rechtssysteme in unzulässiger Weise und verwandele Recht in Unrecht.

Schon 2019 beanstandete der bekannte Historiker und Schriftsteller Ruthger Bregman an einer WEF-Podiumsdiskussion die Steuervermeidung der Superreichen. Die elitäre Veranstaltung bezeichnete er als «Feuerwehr-Konferenz, bei der man nicht über Löschwasser sprechen darf.» Daraufhin erhielt Bregman keine Einladungen nach Davos mehr. Auf seine Aussagen machte der Schweizer Aktivist Alec Gagneux aufmerksam, der sich seit Jahrzehnten kritisch mit dem WEF befasst. Ihm wurde kürzlich der Zutritt zu einem dreiteiligen Kurs über das WEF an der Volkshochschule Region Brugg verwehrt.

Nun ist die Erkenntnis, dass mit Geld politischer Einfluss einhergeht, alles andere als neu. Und extremer Reichtum macht die Sache nicht wirklich besser. Trotzdem hat man über Initiativen wie Patriotic Millionaires oder Taxmenow bisher eher selten etwas gehört, obwohl es sie schon lange gibt. Auch scheint es kein Problem, wenn ein Herr Gates fast im Alleingang versucht, globale Gesundheits-, Klima-, Ernährungs- oder Bevölkerungspolitik zu betreiben – im Gegenteil. Im Jahr, als der Milliardär Donald Trump zum zweiten Mal ins Weiße Haus einzieht, ist das Echo in den Gesinnungsmedien dagegen enorm – und uniform, wer hätte das gedacht.

Der neue US-Präsident hat jedoch «Davos geerdet», wie Achgut es nannte. In seiner kurzen Rede beim Weltwirtschaftsforum verteidigte er seine Politik und stellte klar, er habe schlicht eine «Revolution des gesunden Menschenverstands» begonnen. Mit deutlichen Worten sprach er unter anderem von ersten Maßnahmen gegen den «Green New Scam», und von einem «Erlass, der jegliche staatliche Zensur beendet»:

«Unsere Regierung wird die Äußerungen unserer eigenen Bürger nicht mehr als Fehlinformation oder Desinformation bezeichnen, was die Lieblingswörter von Zensoren und derer sind, die den freien Austausch von Ideen und, offen gesagt, den Fortschritt verhindern wollen.»

Wie der «Trumpismus» letztlich einzuordnen ist, muss jeder für sich selbst entscheiden. Skepsis ist definitiv angebracht, denn «einer von uns» sind weder der Präsident noch seine auserwählten Teammitglieder. Ob sie irgendeinen Sumpf trockenlegen oder Staatsverbrechen aufdecken werden oder was aus WHO- und Klimaverträgen wird, bleibt abzuwarten.

Das WHO-Dekret fordert jedenfalls die Übertragung der Gelder auf «glaubwürdige Partner», die die Aktivitäten übernehmen könnten. Zufällig scheint mit «Impfguru» Bill Gates ein weiterer Harris-Unterstützer kürzlich das Lager gewechselt zu haben: Nach einem gemeinsamen Abendessen zeigte er sich «beeindruckt» von Trumps Interesse an der globalen Gesundheit.

Mit dem Projekt «Stargate» sind weitere dunkle Wolken am Erwartungshorizont der Fangemeinde aufgezogen. Trump hat dieses Joint Venture zwischen den Konzernen OpenAI, Oracle, und SoftBank als das «größte KI-Infrastrukturprojekt der Geschichte» angekündigt. Der Stein des Anstoßes: Oracle-CEO Larry Ellison, der auch Fan von KI-gestützter Echtzeit-Überwachung ist, sieht einen weiteren potenziellen Einsatz der künstlichen Intelligenz. Sie könne dazu dienen, Krebserkrankungen zu erkennen und individuelle mRNA-«Impfstoffe» zur Behandlung innerhalb von 48 Stunden zu entwickeln.

Warum bitte sollten sich diese superreichen «Eliten» ins eigene Fleisch schneiden und direkt entgegen ihren eigenen Interessen handeln? Weil sie Menschenfreunde, sogenannte Philanthropen sind? Oder vielleicht, weil sie ein schlechtes Gewissen haben und ihre Schuld kompensieren müssen? Deswegen jedenfalls brauchen «Linke» laut Robert Willacker, einem deutschen Politikberater mit brasilianischen Wurzeln, rechte Parteien – ein ebenso überraschender wie humorvoller Erklärungsansatz.

Wenn eine Krähe der anderen kein Auge aushackt, dann tut sie das sich selbst noch weniger an. Dass Millionäre ernsthaft ihre eigene Besteuerung fordern oder Machteliten ihren eigenen Einfluss zugunsten anderer einschränken würden, halte ich für sehr unwahrscheinlich. So etwas glaube ich erst, wenn zum Beispiel die Rüstungsindustrie sich um Friedensverhandlungen bemüht, die Pharmalobby sich gegen institutionalisierte Korruption einsetzt, Zentralbanken ihre CBDC-Pläne für Bitcoin opfern oder der ÖRR die Abschaffung der Rundfunkgebühren fordert.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ fd208ee8:0fd927c1

2025-02-02 10:33:19

@ fd208ee8:0fd927c1

2025-02-02 10:33:19GitCitadel Development Operations

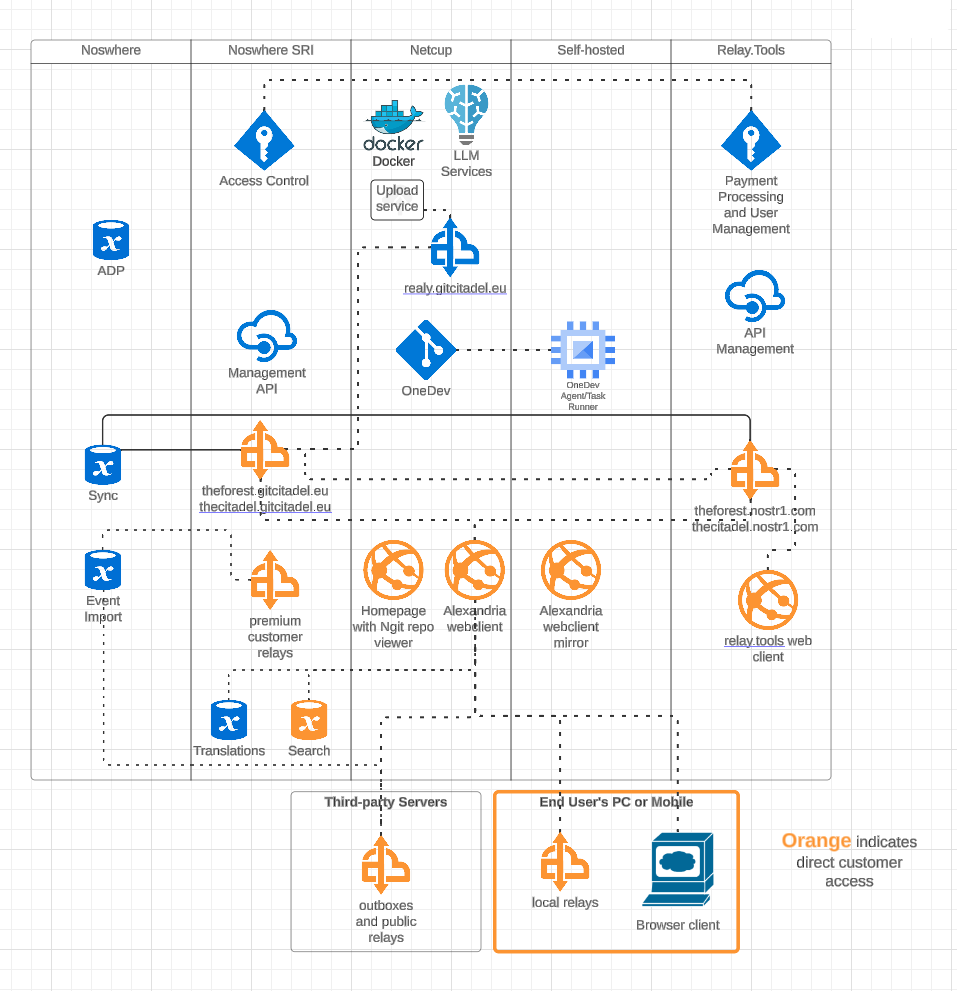

We, at GitCitadel, have been updating, moving, and rearranging our servers, for quite some time. As a rather large, complex, sprawling project, we have the infrastructure setup to match, so we've decided to give you all a quick run-down of what we are doing behind-the-scenes.

Supplier Coordination

Our first task, this week, was figuring out who would host what where. We have four different locations, where our infra is stored and managed, including two locations from our suppliers. We got that straightened out, quickly, and it's all slowly coming together and being connected and networked. Exciting to watch our DevOps landscape evolve and all of the knowledge-transfer that the interactions provide.

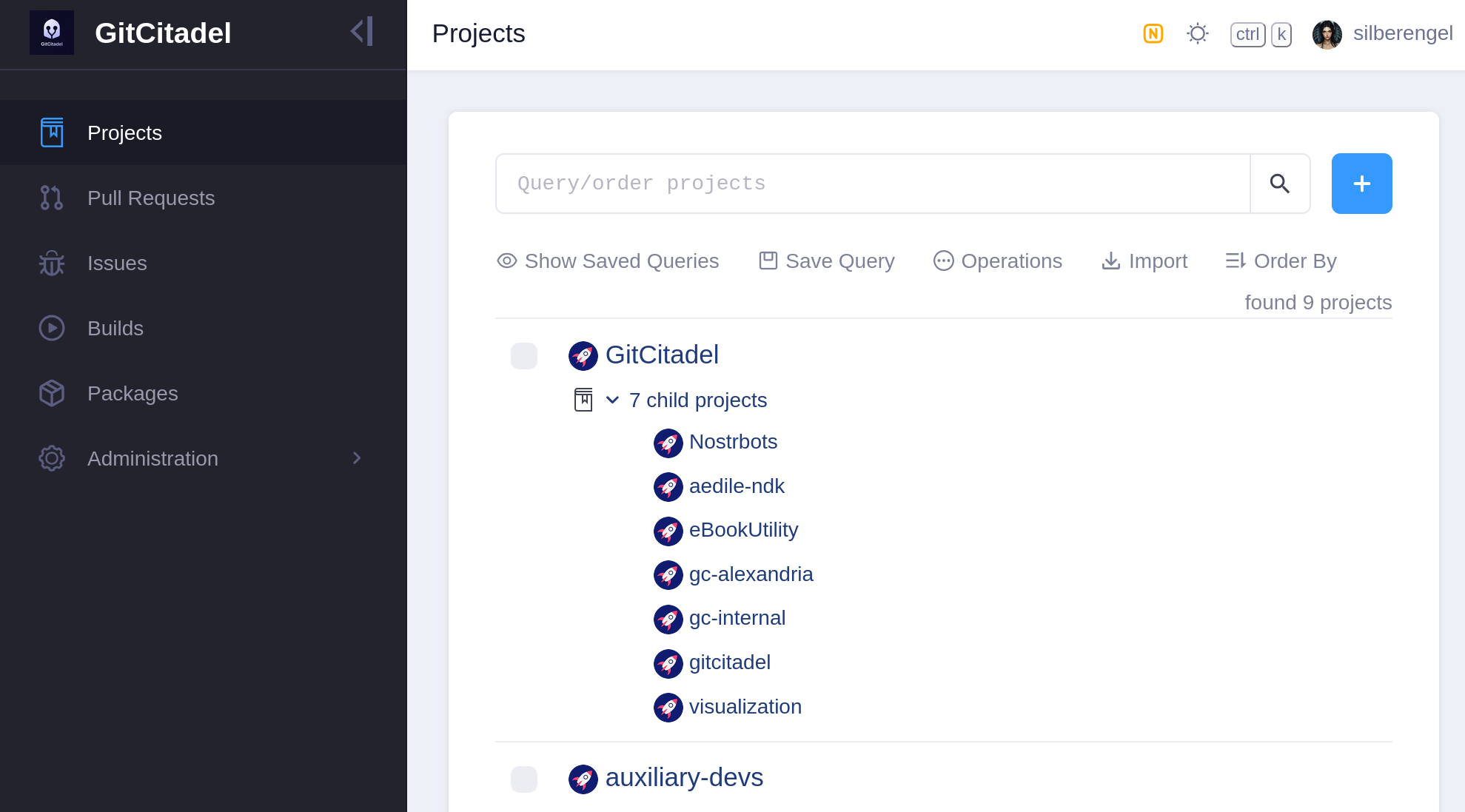

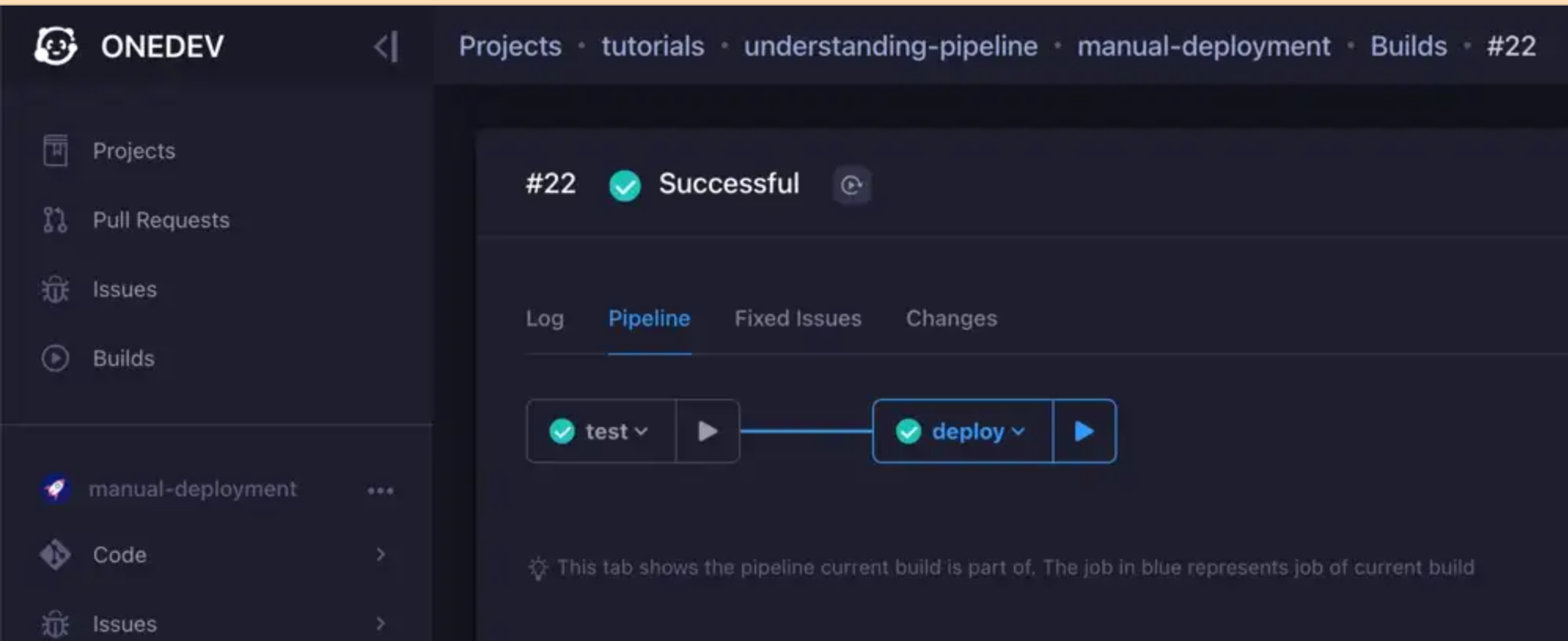

OneDev Implementation

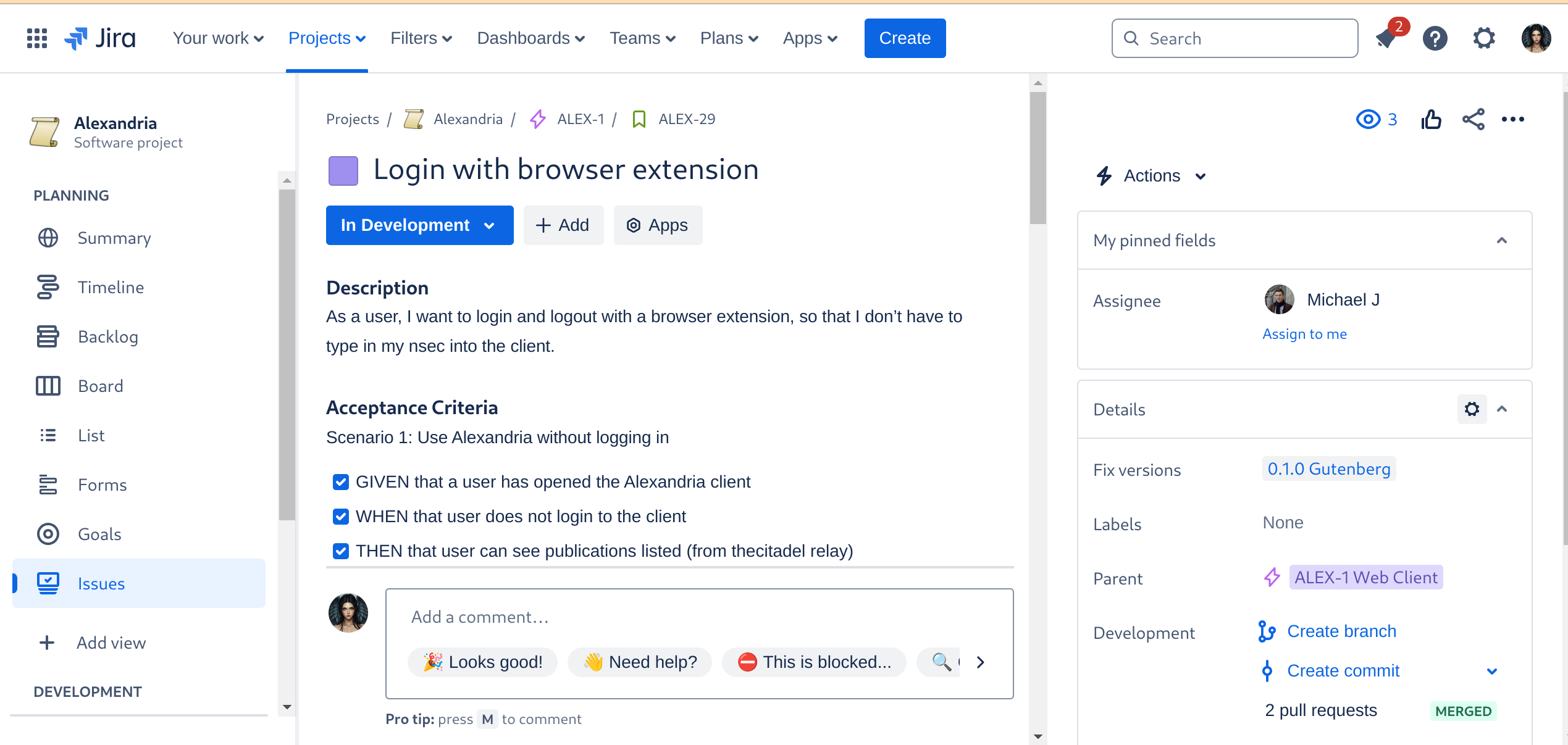

Our biggest internal infra project this week was the migration of all of our issues from Jira, build scripts from Jenkins, and repos from GitHub to a self-hosted OneDev instance. In the future, all of our internal build, test, issue, patch/PR, etc. effort will take place there. We also have a separate repo there for communicating with external developers and suppliers.

Our team's GitHub projects will be demoted to mirrors and a place for external devs to PR to. Public issues and patches will continue to be managed over our self-hosted GitWorkshop instance.

We're especially glad to finally escape the GitHub Gulag, and avoid being bled dry by Jira fees, without having to give up the important features that we've come to know and love. So, yay!

Next Infrasteps

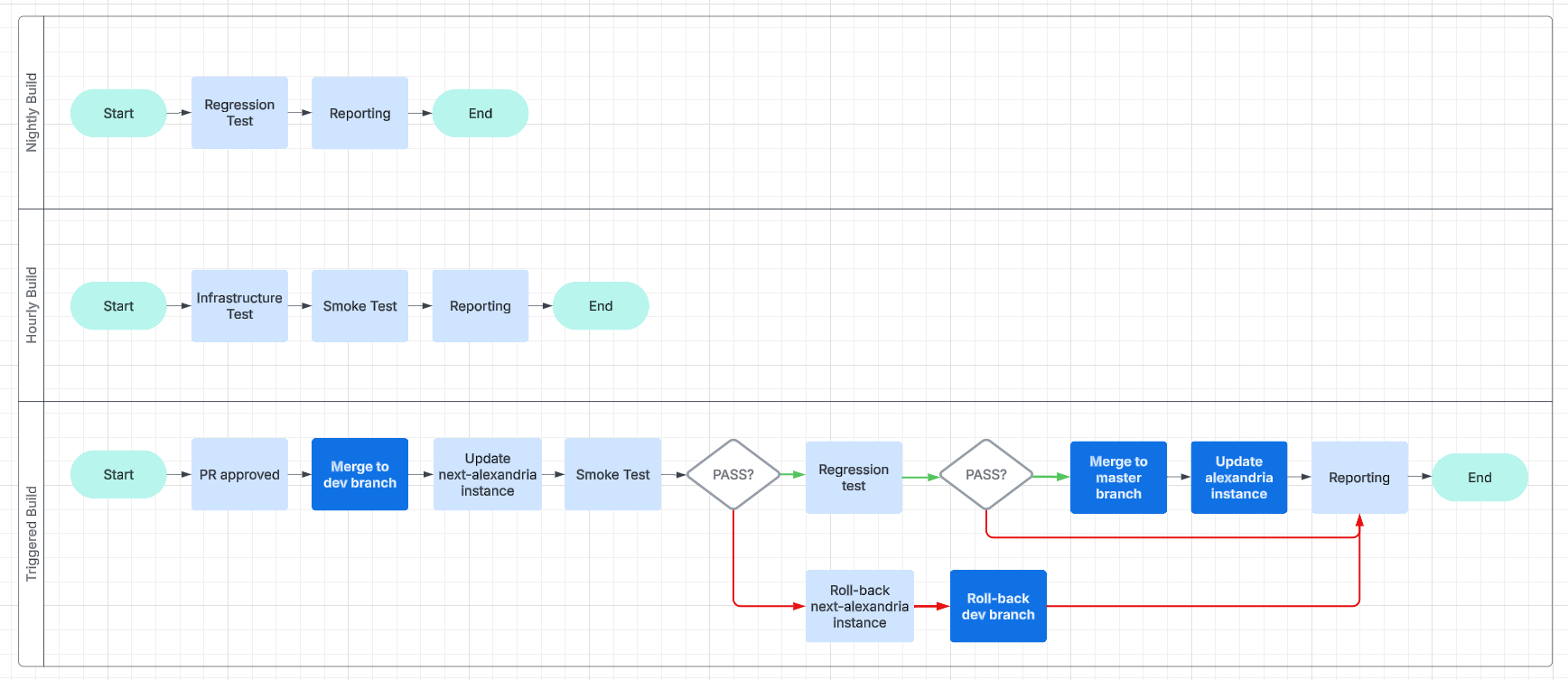

Automated Testing

Now, that we have everything tied up in one, neat, backed-up package, we can finally move on to the nitty-gritty and the dirty work. So, we're rolling up our sleeves and writing the Selenium smoke test for our Alexandria client. We'll be running that in Docker containers containing different "typical Nostr" images, such as Chrome browser with Nostr Connect signing extension, or Firefox browser with Nos2x-fox extension. Once we get the Nsec Bunker and Amber logins going, we'll add test cases and images for them, as well. (Yes, we can do Bunker. I hope you are in awe at our powers).

We are also designing an automated infrastructure test, that will simply rattle through all the various internal and external websites and relays, to make sure that everything is still online and responsive.

After that, a Gherkin-based Behave feature test for Alexandria is planned, so that we can prevent regression of completed functionality, from one release to the next.

The Gherkin scenarios are written and attached to our stories before development begins (we use acceptance tests as requirements), a manual test-execution is then completed, in order to set the story to Done. These completed scenarios will be automated, following each release, with the resulting script linked to from the origin story.

Automated Builds

As the crowning glory of every DevOps tool chain stands the build automation. This is where everything gets tied together, straightened out, configured, tested, measured, and -- if everything passes the quality gates -- released. I don't have to tell you how much time developers spend staring at the build process display, praying that it all goes through and they can celebrate a Green Wave.

We are currently designing the various builds, but the ones we have defined for the Alexandria client will be a continuous delivery pipeline, like so:

This will make it easier for us to work and collaborate asynchronously and without unnecessary delays.

Expanding the Status Page

And, finally, we get to the point of all of this busyness: reporting.

We are going to have beautiful reports, and we are going to post them online, on our status page. We will use bots, to inform Nostriches of the current status of our systems, so go ahead and follow our GitCitadel DevOps npub, to make sure you don't miss out on the IT action.

Building on stone

All in all, we're really happy with the way things are humming along, now, and the steady increase in our productivity, as all the foundational work we've put in starts to pay off. It's getting easier and easier to add new team members, repos, or features/fixes, so we should be able to scale up and out from here. Our GitCitadel is built on a firm foundation.

Happy building!

-

@ c631e267:c2b78d3e

2025-01-18 09:34:51

@ c631e267:c2b78d3e

2025-01-18 09:34:51Die grauenvollste Aussicht ist die der Technokratie – \ einer kontrollierenden Herrschaft, \ die durch verstümmelte und verstümmelnde Geister ausgeübt wird. \ Ernst Jünger

«Davos ist nicht mehr sexy», das Weltwirtschaftsforum (WEF) mache Davos kaputt, diese Aussagen eines Einheimischen las ich kürzlich in der Handelszeitung. Während sich einige vor Ort enorm an der «teuersten Gewerbeausstellung der Welt» bereicherten, würden die negativen Begleiterscheinungen wie Wohnungsnot und Niedergang der lokalen Wirtschaft immer deutlicher.

Nächsten Montag beginnt in dem Schweizer Bergdorf erneut ein Jahrestreffen dieses elitären Clubs der Konzerne, bei dem man mit hochrangigen Politikern aus aller Welt und ausgewählten Vertretern der Systemmedien zusammenhocken wird. Wie bereits in den vergangenen vier Jahren wird die Präsidentin der EU-Kommission, Ursula von der Leyen, in Begleitung von Klaus Schwab ihre Grundsatzansprache halten.

Der deutsche WEF-Gründer hatte bei dieser Gelegenheit immer höchst lobende Worte für seine Landsmännin: 2021 erklärte er sich «stolz, dass Europa wieder unter Ihrer Führung steht» und 2022 fand er es bemerkenswert, was sie erreicht habe angesichts des «erstaunlichen Wandels», den die Welt in den vorangegangenen zwei Jahren erlebt habe; es gebe nun einen «neuen europäischen Geist».

Von der Leyens Handeln während der sogenannten Corona-«Pandemie» lobte Schwab damals bereits ebenso, wie es diese Woche das Karlspreis-Direktorium tat, als man der Beschuldigten im Fall Pfizergate die diesjährige internationale Auszeichnung «für Verdienste um die europäische Einigung» verlieh. Außerdem habe sie die EU nicht nur gegen den «Aggressor Russland», sondern auch gegen die «innere Bedrohung durch Rassisten und Demagogen» sowie gegen den Klimawandel verteidigt.

Jene Herausforderungen durch «Krisen epochalen Ausmaßes» werden indes aus dem Umfeld des WEF nicht nur herbeigeredet – wie man alljährlich zur Zeit des Davoser Treffens im Global Risks Report nachlesen kann, der zusammen mit dem Versicherungskonzern Zurich erstellt wird. Seit die Globalisten 2020/21 in der Praxis gesehen haben, wie gut eine konzertierte und konsequente Angst-Kampagne funktionieren kann, geht es Schlag auf Schlag. Sie setzen alles daran, Schwabs goldenes Zeitfenster des «Great Reset» zu nutzen.

Ziel dieses «großen Umbruchs» ist die totale Kontrolle der Technokraten über die Menschen unter dem Deckmantel einer globalen Gesundheitsfürsorge. Wie aber könnte man so etwas erreichen? Ein Mittel dazu ist die «kreative Zerstörung». Weitere unabdingbare Werkzeug sind die Einbindung, ja Gleichschaltung der Medien und der Justiz.

Ein «Great Mental Reset» sei die Voraussetzung dafür, dass ein Großteil der Menschen Einschränkungen und Manipulationen wie durch die Corona-Maßnahmen praktisch kritik- und widerstandslos hinnehme, sagt der Mediziner und Molekulargenetiker Michael Nehls. Er meint damit eine regelrechte Umprogrammierung des Gehirns, wodurch nach und nach unsere Individualität und unser soziales Bewusstsein eliminiert und durch unreflektierten Konformismus ersetzt werden.

Der aktuelle Zustand unserer Gesellschaften ist auch für den Schweizer Rechtsanwalt Philipp Kruse alarmierend. Durch den Umgang mit der «Pandemie» sieht er die Grundlagen von Recht und Vernunft erschüttert, die Rechtsstaatlichkeit stehe auf dem Prüfstand. Seiner dringenden Mahnung an alle Bürger, die Prinzipien von Recht und Freiheit zu verteidigen, kann ich mich nur anschließen.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ a95c6243:d345522c

2025-01-13 10:09:57

@ a95c6243:d345522c

2025-01-13 10:09:57Ich begann, Social Media aufzubauen, \ um den Menschen eine Stimme zu geben. \ Mark Zuckerberg

Sind euch auch die Tränen gekommen, als ihr Mark Zuckerbergs Wendehals-Deklaration bezüglich der Meinungsfreiheit auf seinen Portalen gehört habt? Rührend, oder? Während er früher die offensichtliche Zensur leugnete und später die Regierung Biden dafür verantwortlich machte, will er nun angeblich «die Zensur auf unseren Plattformen drastisch reduzieren».

«Purer Opportunismus» ob des anstehenden Regierungswechsels wäre als Klassifizierung viel zu kurz gegriffen. Der jetzige Schachzug des Meta-Chefs ist genauso Teil einer kühl kalkulierten Business-Strategie, wie es die 180 Grad umgekehrte Praxis vorher war. Social Media sind ein höchst lukratives Geschäft. Hinzu kommt vielleicht noch ein bisschen verkorkstes Ego, weil derartig viel Einfluss und Geld sicher auch auf die Psyche schlagen. Verständlich.

«Es ist an der Zeit, zu unseren Wurzeln der freien Meinungsäußerung auf Facebook und Instagram zurückzukehren. Ich begann, Social Media aufzubauen, um den Menschen eine Stimme zu geben», sagte Zuckerberg.

Welche Wurzeln? Hat der Mann vergessen, dass er von der Überwachung, dem Ausspionieren und dem Ausverkauf sämtlicher Daten und digitaler Spuren sowie der Manipulation seiner «Kunden» lebt? Das ist knallharter Kommerz, nichts anderes. Um freie Meinungsäußerung geht es bei diesem Geschäft ganz sicher nicht, und das war auch noch nie so. Die Wurzeln von Facebook liegen in einem Projekt des US-Militärs mit dem Namen «LifeLog». Dessen Ziel war es, «ein digitales Protokoll vom Leben eines Menschen zu erstellen».

Der Richtungswechsel kommt allerdings nicht überraschend. Schon Anfang Dezember hatte Meta-Präsident Nick Clegg von «zu hoher Fehlerquote bei der Moderation» von Inhalten gesprochen. Bei der Gelegenheit erwähnte er auch, dass Mark sehr daran interessiert sei, eine aktive Rolle in den Debatten über eine amerikanische Führungsrolle im technologischen Bereich zu spielen.

Während Milliardärskollege und Big Tech-Konkurrent Elon Musk bereits seinen Posten in der kommenden Trump-Regierung in Aussicht hat, möchte Zuckerberg also nicht nur seine Haut retten – Trump hatte ihn einmal einen «Feind des Volkes» genannt und ihm lebenslange Haft angedroht –, sondern am liebsten auch mitspielen. KI-Berater ist wohl die gewünschte Funktion, wie man nach einem Treffen Trump-Zuckerberg hörte. An seine Verhaftung dachte vermutlich auch ein weiterer Multimilliardär mit eigener Social Media-Plattform, Pavel Durov, als er Zuckerberg jetzt kritisierte und gleichzeitig warnte.

Politik und Systemmedien drehen jedenfalls durch – was zu viel ist, ist zu viel. Etwas weniger Zensur und mehr Meinungsfreiheit würden die Freiheit der Bürger schwächen und seien potenziell vernichtend für die Menschenrechte. Zuckerberg setze mit dem neuen Kurs die Demokratie aufs Spiel, das sei eine «Einladung zum nächsten Völkermord», ernsthaft. Die Frage sei, ob sich die EU gegen Musk und Zuckerberg behaupten könne, Brüssel müsse jedenfalls hart durchgreifen.

Auch um die Faktenchecker macht man sich Sorgen. Für die deutsche Nachrichtenagentur dpa und die «Experten» von Correctiv, die (noch) Partner für Fact-Checking-Aktivitäten von Facebook sind, sei das ein «lukratives Geschäftsmodell». Aber möglicherweise werden die Inhalte ohne diese vermeintlichen Korrektoren ja sogar besser. Anders als Meta wollen jedoch Scholz, Faeser und die Tagesschau keine Fehler zugeben und zum Beispiel Correctiv-Falschaussagen einräumen.

Bei derlei dramatischen Befürchtungen wundert es nicht, dass der öffentliche Plausch auf X zwischen Elon Musk und AfD-Chefin Alice Weidel von 150 EU-Beamten überwacht wurde, falls es irgendwelche Rechtsverstöße geben sollte, die man ihnen ankreiden könnte. Auch der Deutsche Bundestag war wachsam. Gefunden haben dürften sie nichts. Das Ganze war eher eine Show, viel Wind wurde gemacht, aber letztlich gab es nichts als heiße Luft.

Das Anbiedern bei Donald Trump ist indes gerade in Mode. Die Weltgesundheitsorganisation (WHO) tut das auch, denn sie fürchtet um Spenden von über einer Milliarde Dollar. Eventuell könnte ja Elon Musk auch hier künftig aushelfen und der Organisation sowie deren größtem privaten Förderer, Bill Gates, etwas unter die Arme greifen. Nachdem Musks KI-Projekt xAI kürzlich von BlackRock & Co. sechs Milliarden eingestrichen hat, geht da vielleicht etwas.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ a95c6243:d345522c

2025-01-03 20:26:47

@ a95c6243:d345522c

2025-01-03 20:26:47Was du bist hängt von drei Faktoren ab: \ Was du geerbt hast, \ was deine Umgebung aus dir machte \ und was du in freier Wahl \ aus deiner Umgebung und deinem Erbe gemacht hast. \ Aldous Huxley

Das brave Mitmachen und Mitlaufen in einem vorgegebenen, recht engen Rahmen ist gewiss nicht neu, hat aber gerade wieder mal Konjunktur. Dies kann man deutlich beobachten, eigentlich egal, in welchem gesellschaftlichen Bereich man sich umschaut. Individualität ist nur soweit angesagt, wie sie in ein bestimmtes Schema von «Diversität» passt, und Freiheit verkommt zur Worthülse – nicht erst durch ein gewisses Buch einer gewissen ehemaligen Regierungschefin.

Erklärungsansätze für solche Entwicklungen sind bekannt, und praktisch alle haben etwas mit Massenpsychologie zu tun. Der Herdentrieb, also der Trieb der Menschen, sich – zum Beispiel aus Unsicherheit oder Bequemlichkeit – lieber der Masse anzuschließen als selbstständig zu denken und zu handeln, ist einer der Erklärungsversuche. Andere drehen sich um Macht, Propaganda, Druck und Angst, also den gezielten Einsatz psychologischer Herrschaftsinstrumente.

Aber wollen die Menschen überhaupt Freiheit? Durch Gespräche im privaten Umfeld bin ich diesbezüglich in der letzten Zeit etwas skeptisch geworden. Um die Jahreswende philosophiert man ja gerne ein wenig über das Erlebte und über die Erwartungen für die Zukunft. Dabei hatte ich hin und wieder den Eindruck, die totalitären Anwandlungen unserer «Repräsentanten» kämen manchen Leuten gerade recht.

«Desinformation» ist so ein brisantes Thema. Davor müsse man die Menschen doch schützen, hörte ich. Jemand müsse doch zum Beispiel diese ganzen merkwürdigen Inhalte in den Social Media filtern – zur Ukraine, zum Klima, zu Gesundheitsthemen oder zur Migration. Viele wüssten ja gar nicht einzuschätzen, was richtig und was falsch ist, sie bräuchten eine Führung.

Freiheit bedingt Eigenverantwortung, ohne Zweifel. Eventuell ist es einigen tatsächlich zu anspruchsvoll, die Verantwortung für das eigene Tun und Lassen zu übernehmen. Oder die persönliche Freiheit wird nicht als ausreichend wertvolles Gut angesehen, um sich dafür anzustrengen. In dem Fall wäre die mangelnde Selbstbestimmung wohl das kleinere Übel. Allerdings fehlt dann gemäß Aldous Huxley ein Teil der Persönlichkeit. Letztlich ist natürlich alles eine Frage der Abwägung.

Sind viele Menschen möglicherweise schon so «eingenordet», dass freiheitliche Ambitionen gar nicht für eine ganze Gruppe, ein Kollektiv, verfolgt werden können? Solche Gedanken kamen mir auch, als ich mir kürzlich diverse Talks beim viertägigen Hacker-Kongress des Chaos Computer Clubs (38C3) anschaute. Ich war nicht nur überrascht, sondern reichlich erschreckt angesichts der in weiten Teilen mainstream-geformten Inhalte, mit denen ein dankbares Publikum beglückt wurde. Wo ich allgemein hellere Köpfe erwartet hatte, fand ich Konformismus und enthusiastisch untermauerte Narrative.

Gibt es vielleicht so etwas wie eine Herdenimmunität gegen Indoktrination? Ich denke, ja, zumindest eine gestärkte Widerstandsfähigkeit. Was wir brauchen, sind etwas gesunder Menschenverstand, offene Informationskanäle und der Mut, sich freier auch zwischen den Herden zu bewegen. Sie tun das bereits, aber sagen Sie es auch dieses Jahr ruhig weiter.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ 961e8955:d7fa53e4

2025-02-01 23:20:53

@ 961e8955:d7fa53e4

2025-02-01 23:20:53"@YakiHonne community partners successfully convened a seminal Nostr101 meetup in Barnawa, Nigeria! Donning bespoke YakiHonne Nigeria Limited Edition T-shirts, the Purple Army infused the town with infectious energy.

Facilitated by @Olaoluwa Ezekiel Michael, this gathering leveraged YakiHonne's decentralized platform to foster unbridled dialogue, idea exchange, and community engagement.

The event's resounding success underscores the burgeoning demand for decentralized solutions in Africa. This milestone marks the inception of a revolutionary movement, empowering voices and fostering collaboration throughout the continent.

Nostr #DecentralizedRevolution #Africa #CommunityFirst #YakiHonne"

-

@ b17fccdf:b7211155

2025-02-01 18:28:39

@ b17fccdf:b7211155

2025-02-01 18:28:39

Check out the MiniBolt guide -> HERE <-

- Core guides

- System

- Bitcoin

- Bitcoin client (Bitcoin Core)

- Electrum server (Fulcrum)

- Desktop signing app (Sparrow Wallet)

- Blockchain explorer (BTC RPC Explorer)

- Lightning

- Lightning client (LND)

- Channel backup

- Web app (ThunderHub)

- Mobile app (Zeus)

- Bonus guides

- System bonus guide

- Dashboard & Appearance

- System Administration

- Install / Update / Uninstall common languages

- Databases

- Security

- Resilience

- Hardware

- Bitcoin bonus guides

- Electrum servers

- Signing apps

- Desktop

- Electrum Wallet Desktop

- Decentralized exchange

- Resilience

- Fun

- Testnet

- Payment processors

- Nostr bonus guides

- Relays

- Nostr relay

🏗️ Roadmap | 🌐 Dynamic Network map | 🔧 Issues | 📥 Pull requests | 🗣️ Discussions

By ⚡2FakTor⚡

Last updated: 22/12/2024

-

@ a95c6243:d345522c

2025-01-01 17:39:51

@ a95c6243:d345522c

2025-01-01 17:39:51Heute möchte ich ein Gedicht mit euch teilen. Es handelt sich um eine Ballade des österreichischen Lyrikers Johann Gabriel Seidl aus dem 19. Jahrhundert. Mir sind diese Worte fest in Erinnerung, da meine Mutter sie perfekt rezitieren konnte, auch als die Kräfte schon langsam schwanden.

Dem originalen Titel «Die Uhr» habe ich für mich immer das Wort «innere» hinzugefügt. Denn der Zeitmesser – hier vermutliche eine Taschenuhr – symbolisiert zwar in dem Kontext das damalige Zeitempfinden und die Umbrüche durch die industrielle Revolution, sozusagen den Zeitgeist und das moderne Leben. Aber der Autor setzt sich philosophisch mit der Zeit auseinander und gibt seinem Werk auch eine klar spirituelle Dimension.

Das Ticken der Uhr und die Momente des Glücks und der Trauer stehen sinnbildlich für das unaufhaltsame Fortschreiten und die Vergänglichkeit des Lebens. Insofern könnte man bei der Uhr auch an eine Sonnenuhr denken. Der Rhythmus der Ereignisse passt uns vielleicht nicht immer in den Kram.

Was den Takt pocht, ist durchaus auch das Herz, unser «inneres Uhrwerk». Wenn dieses Meisterwerk einmal stillsteht, ist es unweigerlich um uns geschehen. Hoffentlich können wir dann dankbar sagen: «Ich habe mein Bestes gegeben.»

Ich trage, wo ich gehe, stets eine Uhr bei mir; \ Wieviel es geschlagen habe, genau seh ich an ihr. \ Es ist ein großer Meister, der künstlich ihr Werk gefügt, \ Wenngleich ihr Gang nicht immer dem törichten Wunsche genügt.

Ich wollte, sie wäre rascher gegangen an manchem Tag; \ Ich wollte, sie hätte manchmal verzögert den raschen Schlag. \ In meinen Leiden und Freuden, in Sturm und in der Ruh, \ Was immer geschah im Leben, sie pochte den Takt dazu.

Sie schlug am Sarge des Vaters, sie schlug an des Freundes Bahr, \ Sie schlug am Morgen der Liebe, sie schlug am Traualtar. \ Sie schlug an der Wiege des Kindes, sie schlägt, will's Gott, noch oft, \ Wenn bessere Tage kommen, wie meine Seele es hofft.

Und ward sie auch einmal träger, und drohte zu stocken ihr Lauf, \ So zog der Meister immer großmütig sie wieder auf. \ Doch stände sie einmal stille, dann wär's um sie geschehn, \ Kein andrer, als der sie fügte, bringt die Zerstörte zum Gehn.

Dann müßt ich zum Meister wandern, der wohnt am Ende wohl weit, \ Wohl draußen, jenseits der Erde, wohl dort in der Ewigkeit! \ Dann gäb ich sie ihm zurücke mit dankbar kindlichem Flehn: \ Sieh, Herr, ich hab nichts verdorben, sie blieb von selber stehn.

Johann Gabriel Seidl (1804-1875)

-

@ a95c6243:d345522c

2024-12-21 09:54:49

@ a95c6243:d345522c

2024-12-21 09:54:49Falls du beim Lesen des Titels dieses Newsletters unwillkürlich an positive Neuigkeiten aus dem globalen polit-medialen Irrenhaus oder gar aus dem wirtschaftlichen Umfeld gedacht hast, darf ich dich beglückwünschen. Diese Assoziation ist sehr löblich, denn sie weist dich als unverbesserlichen Optimisten aus. Leider muss ich dich diesbezüglich aber enttäuschen. Es geht hier um ein anderes Thema, allerdings sehr wohl ein positives, wie ich finde.

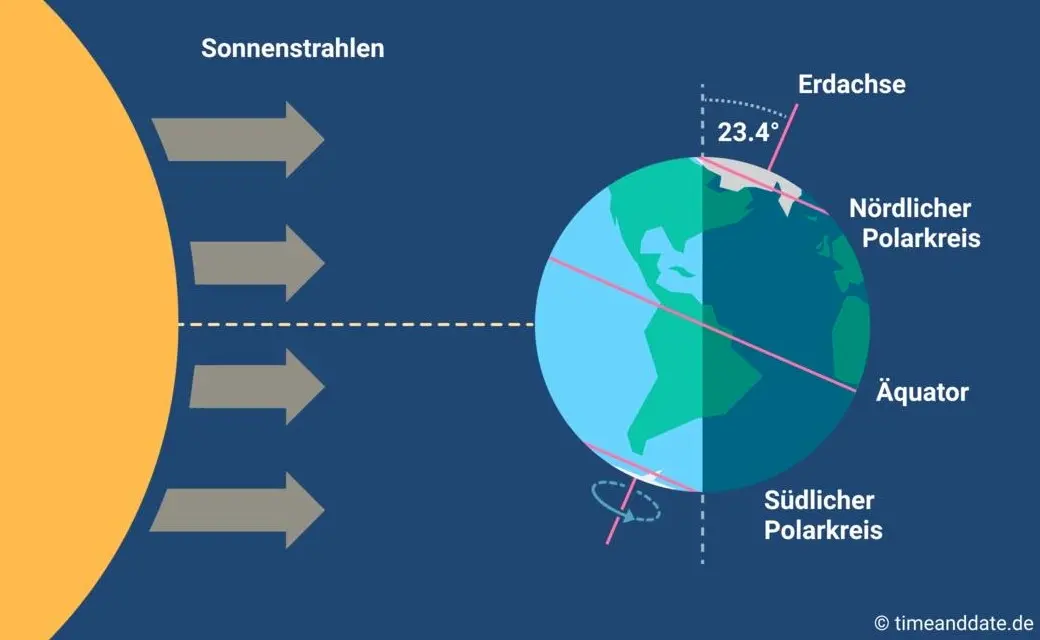

Heute ist ein ganz besonderer Tag: die Wintersonnenwende. Genau gesagt hat heute morgen um 10:20 Uhr Mitteleuropäischer Zeit (MEZ) auf der Nordhalbkugel unseres Planeten der astronomische Winter begonnen. Was daran so außergewöhnlich ist? Der kürzeste Tag des Jahres war gestern, seit heute werden die Tage bereits wieder länger! Wir werden also jetzt jeden Tag ein wenig mehr Licht haben.

Für mich ist dieses Ereignis immer wieder etwas kurios: Es beginnt der Winter, aber die Tage werden länger. Das erscheint mir zunächst wie ein Widerspruch, denn meine spontanen Assoziationen zum Winter sind doch eher Kälte und Dunkelheit, relativ zumindest. Umso erfreulicher ist der emotionale Effekt, wenn dann langsam die Erkenntnis durchsickert: Ab jetzt wird es schon wieder heller!

Natürlich ist es kalt im Winter, mancherorts mehr als anderswo. Vielleicht jedoch nicht mehr lange, wenn man den Klimahysterikern glauben wollte. Mindestens letztes Jahr hat Väterchen Frost allerdings gleich zu Beginn seiner Saison – und passenderweise während des globalen Überhitzungsgipfels in Dubai – nochmal richtig mit der Faust auf den Tisch gehauen. Schnee- und Eischaos sind ja eigentlich in der Agenda bereits nicht mehr vorgesehen. Deswegen war man in Deutschland vermutlich in vorauseilendem Gehorsam schon nicht mehr darauf vorbereitet und wurde glatt lahmgelegt.

Aber ich schweife ab. Die Aussicht auf nach und nach mehr Licht und damit auch Wärme stimmt mich froh. Den Zusammenhang zwischen beidem merkt man in Andalusien sehr deutlich. Hier, wo die Häuser im Winter arg auskühlen, geht man zum Aufwärmen raus auf die Straße oder auf den Balkon. Die Sonne hat auch im Winter eine erfreuliche Kraft. Und da ist jede Minute Gold wert.

Außerdem ist mir vor Jahren so richtig klar geworden, warum mir das südliche Klima so sehr gefällt. Das liegt nämlich nicht nur an der Sonne als solcher, oder der Wärme – das liegt vor allem am Licht. Ohne Licht keine Farben, das ist der ebenso simple wie gewaltige Unterschied zwischen einem deprimierenden matschgraubraunen Winter und einem fröhlichen bunten. Ein großes Stück Lebensqualität.

Mir gefällt aber auch die Symbolik dieses Tages: Licht aus der Dunkelheit, ein Wendepunkt, ein Neuanfang, neue Möglichkeiten, Übergang zu neuer Aktivität. In der winterlichen Stille keimt bereits neue Lebendigkeit. Und zwar in einem Zyklus, das wird immer wieder so geschehen. Ich nehme das gern als ein Stück Motivation, es macht mir Hoffnung und gibt mir Energie.

Übrigens ist parallel am heutigen Tag auf der südlichen Halbkugel Sommeranfang. Genau im entgegengesetzten Rhythmus, sich ergänzend, wie Yin und Yang. Das alles liegt an der Schrägstellung der Erdachse, die ist nämlich um 23,4º zur Umlaufbahn um die Sonne geneigt. Wir erinnern uns, gell?

Insofern bleibt eindeutig festzuhalten, dass “schräg sein” ein willkommener, wichtiger und positiver Wert ist. Mit anderen Worten: auch ungewöhnlich, eigenartig, untypisch, wunderlich, kauzig, … ja sogar irre, spinnert oder gar “quer” ist in Ordnung. Das schließt das Denken mit ein.

In diesem Sinne wünsche ich euch allen urige Weihnachtstage!

Dieser Beitrag ist letztes Jahr in meiner Denkbar erschienen.

-

@ dd1f9d50:06113a21

2025-02-05 01:48:55

@ dd1f9d50:06113a21

2025-02-05 01:48:55(Because Most People Don’t Understand Money)

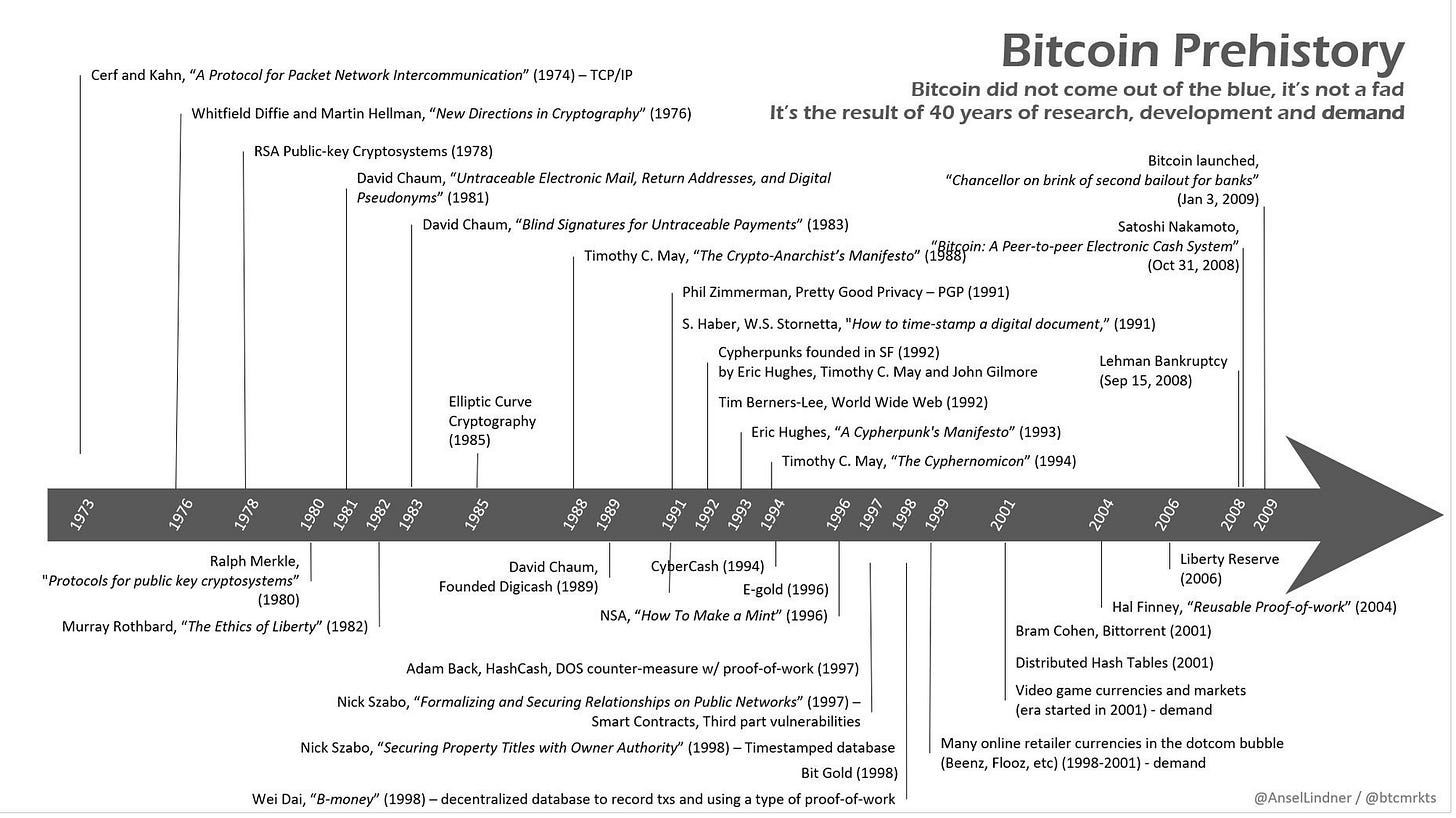

The requisite knowledge needed to know whether $100 or $100,000 per Bitcoin is relatively speaking “a lot,” is what value means. One way to measure value is through a universal yardstick we call “Money.” The question of “What is money?” is perhaps one of the most overlooked and under answered in our day and age. There is even an entire podcast dedicated to that question with the eponymous title, hosted by Robert Breedlove. That podcast often delves into the more philosophical underpinnings whereas I hope to approach this with a more practical answer.

Money is a technology.

Money is the technology with which we interact with one another to reorganize goods and services to the place and time they are best suited. Most money of the past has been tangible (though not a requisite feature), scarce, recognizable (read: verifiable), durable, portable, and divisible. These features one might call the “Attributes of Money.” These attributes are absolutely essential for a money to maintain its status as a money. (Those of you who understand the U.S. Dollar system maybe scratching your heads right now but, believe me, I will address that elephant in due time.) These attributes, you may notice, are not a yes or no but more of a gradient. A money can be MORE portable than another yet, less durable. One more divisible but not scarce whatsoever. The point being they must have, in some capacity, these attributes or they simply aren’t money.

One of These Things is Not Like the Other

| | Bitcoin | Gold | Dollars | |-----------------|:----------------------------------------------------------------------------------------------------------------:|:------------------------------------------------------------------:|:--------------------------------------------------------------------------------------------------------------------------------------------------:| | Scarcity | 21 million coins

is the maximum supply | Unknown- the

supply grows roughly 2% per year | Also unknown to anyone outside of the Federal Reserve, Trillions and counting | | Recognizability | Each coin is verifiable to it's genesis on the timechain | Each molecule of gold has distinct physical verifiable properties | If the Federal reserve says it is a valid note, it is (Unless you are an enemy of the United States) | | Durablility | Each "Bitcoin" is information stored on a globally distributed network | Doesn't Rust and as far as can be measured Au197 is stable forever | Can be destroyed by any means that effect fabric and centralized databases | | Portability | Available wherever data can be store- Anywhere | Can be moved at 9.81 Newtons per Kilogram- Methods may vary | Can be moved physically with fabric notes- Digitally with express permission from a US accredited banking institution | | Divisibility | Currently can be divided into 100 million parts called Sats (can be further subdivided by adding decimal places) | Can be divided to the Atomic level (Though not practical) | Can be divided (without dilution) by adding new denominative bills or coinage

Can be divided (with dilution) by printing new bills or coinage | | | Bitcoin | Gold | Dollars |You may think with all of the great functionality of Bitcoin that the phrase "One of these things is not like the other" refers to BTC. No, I was referring to the Dollar. It is the only one on the list that was a currency that was substituted as some kind of faux money. It asserts itself, or rather the Federal Reserve asserts it, as money, de facto.

Dollars are NOT money.

Dollars are (allegedly) a currency. If money is a specific technology, currency is the financial infrastructure that allows that technology to reach and be used by the most number of people possible. This requires a firm tether between the asset being used as money and the currency used as a claim to that money. For example: If I hand you a chicken, you have a chicken. But, if I hand you a coupon that is redeemable for a chicken, you do not have a chicken. You have a claim to a chicken that is only as good as the party making that claim. Bringing it back to money again, dollars (Prior to 1971) were redeemable for gold at a rate of $35 per ounce. This is that strong tether that pegged dollars to gold and physical reality itself. Without a proof of work, mining, . Until…

WTF Happened in 1971?

The Nixon shock happened. Briefly, The U.S. took in Europe’s gold in the 1940’s to keep it out of Hitler’s hands. The U.S. made an agreement to peg the dollar to Europe’s gold. The U.S. over printed dollars in relation to the gold holdings. Around 1971 France (among others) called the U.S. out for devaluing the dollar and thus European currencies. So, Nixon “Temporarily” suspended the convertibility of dollars to gold. Now, here we all are like Wile E. Coyote having run off of the golden cliff clutching our dollars in our arms and 54 years later we still haven’t looked down to see the truth.

Dollars Aren’t Backed by Anything

This is why no country in the world today has a money standard. Seemingly they all forgot the number one rule of issuing currency, it must be backed by something. Now, you may hear dollar proponents say “The U.S. dollar is backed by the full faith and credit of the United States!” Another way of saying that is, “We said it is worth something, so it is!” This fiat (by decree) mentality creates a plethora of perverse incentives. The ever growing supply disallows users of the Dollar to save without inccuring the penalties of inflation.

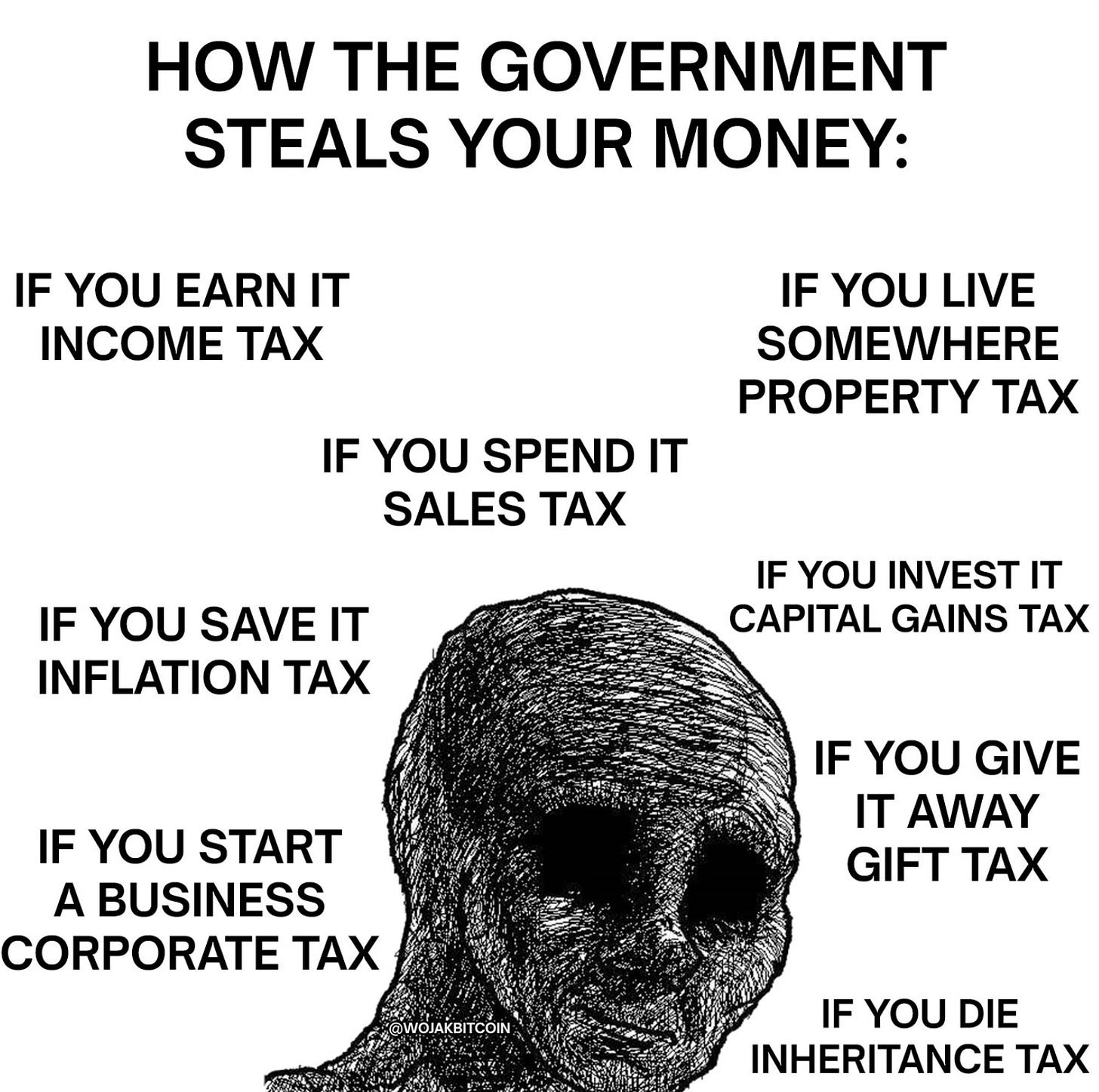

Just a Few Examples of How You're Being Crushed

Because your dollar loses value:

- It pushes people to spend them on assets that seem to appreciate (as the dollar debases) but are truly staying stagnant.

- It pushes people to gamble on securities hoping the perceived value is enough to beat the inflationary curve.

- It pushes people away from saving for their future and the future of their families.

- It creates insane credit incentives so that people borrow way more than they can afford today knowing that dollars will be cheaper in the future. (Effectively a short position)

- It pushes people to spend less and less time making and maintaining their families as it becomes more expensive to keep a similar lifestyle to which it was founded.

These are just a few of the terrible consequences of not knowing that trading a currency with no monetary backing has on a society. Most may blame this soley on the ability to print currency by a central bank but, that is not the only factor. If the fed printed dollars against gold, people would simply take the best rate they could get and remonetize themselves with the gold. But because there is no monetary escape hatch guaranteed by the issuance of dollars, I.E. no one has to take your dollars in exchange for their Bitcoin or gold, you are left at the mercy of the market.

One Day, People Will Stop Accepting Your Dollars

Those lementing the high price of Bitcoin might want to thank their lucky stars that Bitcoin still has a rational number next to the "BTC 1=$?" sign. One day you will have to exchange something of actual value to the spender (no longer a seller). Your product, good or service, will be the only thing that anyone might be willing to part with their Bitcoin over. That is what makes a money, the most salable non-consumable good, whose only funtion is to back a financial structure that facilitates trade.

Bitcoin is Capital

Capital is a broad term that can describe anything that confers value or benefit to its owners, such as a factory and its machinery, or the financial assets of a business or an individual. Bitcoin being the latter creates the financial structures from which you build upon. You use capital to hold, transfer, and grow value. You do not do this with cash. Cash is a depreciating asset when you don't use it to gain goods or services for yourself or your business. This misconception around the equivalance between cash and money (financial capital) is what tricks people into believing Dollars are money. And what's worse is that even some of our greatest heroes have done this.

Slay Your Heroes, Within Reason

Unfortunately due to a mixing of verbiage that have very distinct differences, the title: "Bitcoin: A Peer-to-Peer Electronic Cash System" is technically inaccurate. Bitcoin doesn't fit the definition of cash, which is a liquid asset that can be easily converted into its equivalent value. In short, Satoshi misspoke. In reality, owning Bitcoin UTXOs (with private keys) means you already possess the asset, not just a claim to it. When you spend Bitcoin, the recipient receives the actual asset, not a promise of it. When you receive Bitcoin, you have final settlement on that transaction. Fundamentally Bitcoin is not cash, electronic or otherwise.

Bitcoin is Money.

-

@ 57d1a264:69f1fee1

2025-02-05 01:26:18

@ 57d1a264:69f1fee1

2025-02-05 01:26:18How does the collaborative nature of open design in bitcoin influence innovation and product development in the ecosystem?

originally posted at https://stacker.news/items/876187

-

@ a95c6243:d345522c

2024-12-13 19:30:32

@ a95c6243:d345522c

2024-12-13 19:30:32Das Betriebsklima ist das einzige Klima, \ das du selbst bestimmen kannst. \ Anonym

Eine Strategie zur Anpassung an den Klimawandel hat das deutsche Bundeskabinett diese Woche beschlossen. Da «Wetterextreme wie die immer häufiger auftretenden Hitzewellen und Starkregenereignisse» oft desaströse Auswirkungen auf Mensch und Umwelt hätten, werde eine Anpassung an die Folgen des Klimawandels immer wichtiger. «Klimaanpassungsstrategie» nennt die Regierung das.

Für die «Vorsorge vor Klimafolgen» habe man nun erstmals klare Ziele und messbare Kennzahlen festgelegt. So sei der Erfolg überprüfbar, und das solle zu einer schnelleren Bewältigung der Folgen führen. Dass sich hinter dem Begriff Klimafolgen nicht Folgen des Klimas, sondern wohl «Folgen der globalen Erwärmung» verbergen, erklärt den Interessierten die Wikipedia. Dabei ist das mit der Erwärmung ja bekanntermaßen so eine Sache.

Die Zunahme schwerer Unwetterereignisse habe gezeigt, so das Ministerium, wie wichtig eine frühzeitige und effektive Warnung der Bevölkerung sei. Daher solle es eine deutliche Anhebung der Nutzerzahlen der sogenannten Nina-Warn-App geben.

Die ARD spurt wie gewohnt und setzt die Botschaft zielsicher um. Der Artikel beginnt folgendermaßen:

«Die Flut im Ahrtal war ein Schock für das ganze Land. Um künftig besser gegen Extremwetter gewappnet zu sein, hat die Bundesregierung eine neue Strategie zur Klimaanpassung beschlossen. Die Warn-App Nina spielt eine zentrale Rolle. Der Bund will die Menschen in Deutschland besser vor Extremwetter-Ereignissen warnen und dafür die Reichweite der Warn-App Nina deutlich erhöhen.»

Die Kommunen würden bei ihren «Klimaanpassungsmaßnahmen» vom Zentrum KlimaAnpassung unterstützt, schreibt das Umweltministerium. Mit dessen Aufbau wurden das Deutsche Institut für Urbanistik gGmbH, welches sich stark für Smart City-Projekte engagiert, und die Adelphi Consult GmbH beauftragt.

Adelphi beschreibt sich selbst als «Europas führender Think-and-Do-Tank und eine unabhängige Beratung für Klima, Umwelt und Entwicklung». Sie seien «global vernetzte Strateg*innen und weltverbessernde Berater*innen» und als «Vorreiter der sozial-ökologischen Transformation» sei man mit dem Deutschen Nachhaltigkeitspreis ausgezeichnet worden, welcher sich an den Zielen der Agenda 2030 orientiere.

Über die Warn-App mit dem niedlichen Namen Nina, die möglichst jeder auf seinem Smartphone installieren soll, informiert das Bundesamt für Bevölkerungsschutz und Katastrophenhilfe (BBK). Gewarnt wird nicht nur vor Extrem-Wetterereignissen, sondern zum Beispiel auch vor Waffengewalt und Angriffen, Strom- und anderen Versorgungsausfällen oder Krankheitserregern. Wenn man die Kategorie Gefahreninformation wählt, erhält man eine Dosis von ungefähr zwei Benachrichtigungen pro Woche.

Beim BBK erfahren wir auch einiges über die empfohlenen Systemeinstellungen für Nina. Der Benutzer möge zum Beispiel den Zugriff auf die Standortdaten «immer zulassen», und zwar mit aktivierter Funktion «genauen Standort verwenden». Die Datennutzung solle unbeschränkt sein, auch im Hintergrund. Außerdem sei die uneingeschränkte Akkunutzung zu aktivieren, der Energiesparmodus auszuschalten und das Stoppen der App-Aktivität bei Nichtnutzung zu unterbinden.

Dass man so dramatische Ereignisse wie damals im Ahrtal auch anders bewerten kann als Regierungen und Systemmedien, hat meine Kollegin Wiltrud Schwetje anhand der Tragödie im spanischen Valencia gezeigt. Das Stichwort «Agenda 2030» taucht dabei in einem Kontext auf, der wenig mit Nachhaltigkeitspreisen zu tun hat.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ df478568:2a951e67

2025-02-05 01:02:39

@ df478568:2a951e67

2025-02-05 01:02:39

About 150,000 blocks ago, I bought burgers for my family with sats at NextBurger in Newport, California. The Orange County Bitcoin Meetup found a hamburger stand that wanted to accept Bitcoin. This attracted Bitcoiners from all over Southern California. People brought their families. Some sat stackers sold wares outside as if it were a Farmer's Market. A couple kids sold some hats. One dude sold pins. I bought one off him. It resembled the Opendime I use as a keychain. He wore a 21M/infinity hat. We talked about Knut Svanholm books. He asked me, "What do you do for bitcoin?"

"I write a blog," I said. I must have written three articles about Bitcoin back then. I set up a BTCpayServer with LunaNode. My real idea was to write for sats, but I spent more sats on Lunanode than I made. I needed something to sell.

I had a few shitty ideas but no real business plan. I told Pins about one of these shitty ideas.

"I'm thinking about selling BIP39 raffle tickets, but they're a pain in the ass to cut." See what I mean, bad ideas.

Pins didn't say it was a bad idea though. I assure you, it was, but Pins gave this advice.

”Maybe you can use a 3D Printer."

I never did it, but I was impressed by how willing he was to help me. That's common in bitcoin. Bitcoiners are incentivized to help other Bitcoiners. The more people that accept Bitcoin at their stores, the bigger the demand for Bitcoin. The bigger the demand, the more the

Bitcoin Is For Spending

I participate in the circular economy because I consider using Bitcoin as money to be more advantageous for my savings strategy. When you earn sats, spend sats, and save sats, you break free from the chains of fiat debasement. Dollars are designed to go down in purchasing power to manipulate the public into spending more. That's why most people have more than one TV, but can't afford a $400 emergency. I spend Bitcoin because it forces me to be frugal. Fiat is designed to spend as quickly as possible since it will buy less groceries tomorrow than it will today.

Bitcoin is designed to buy more groceries tomorrow than it will today. When you expect $30 worth of Open AI services will likely be worth $433 in 21 years(if we assume Saylor is correct) you evaluate everything you buy with an orange colored lens. Your shopping habits change. A month of Chat GPT premium mightr be a month's worth of groceries in the future. I no longer buy Nike's because they coat 80k-120k sats, but I expect them to look like shredded cheese in six months. I would rather pay 100k sats for a nice pair of hiking shoes. I expect they will last me a few years.

Knowing this, you might ask, why would you spend Sats on a stupid pin? I've had my open dime pin for almost 4 years now and I expect to have it for years to come. It must have cost me about 100k sats. I don't expect it to be worth that much in the future, but you never know. Sometimes, I watch The Antique Road Show on PBS. Some pins, made by famous artists, are worth thousands of dollars. There is a chance collectibles like this will become more valuable, but I'm skeptical of this. I bought this PIN because it sparks joy, as Marie Kondo says.

This is not investment advice. Your Sats will almost certainly be worth more than your pins in the future, but if you buy a PIN from Salvador Dali, nobody stacks Sats. If you buy a PIN from BTCPins, a hardcore bitccoiner stack sats, which means less sats on the market will be availavle for 8 billion people when you buy a pin. Maybe pins will buy another hat from a bitccoiner, but that just means another bitccoiner stacks Sats. Notice how these Sats never make it back to the exchange because Bitcoiners know their stack will be more valuable in the future than they are today. So when you spend Sats, you only spend Sats on the things you find most valuable.

Pins I Bought Online

Although I consider these Pins art. I don't view art as an investment. I don't expect to ever sell one of these Pins for $110,000 like that banana duct-taped to a canvas before the artist got the munchies. I don't want dollars anyway. That's like a whole coin for a banana. I wouldn't spend 100,000,000 sats for one of these Pins, but BTCPins are not so pretentiously priced.

I recently bought some pins I've been salivating over for months. I need a better way of displaying them, but here are the pins I recently bought.

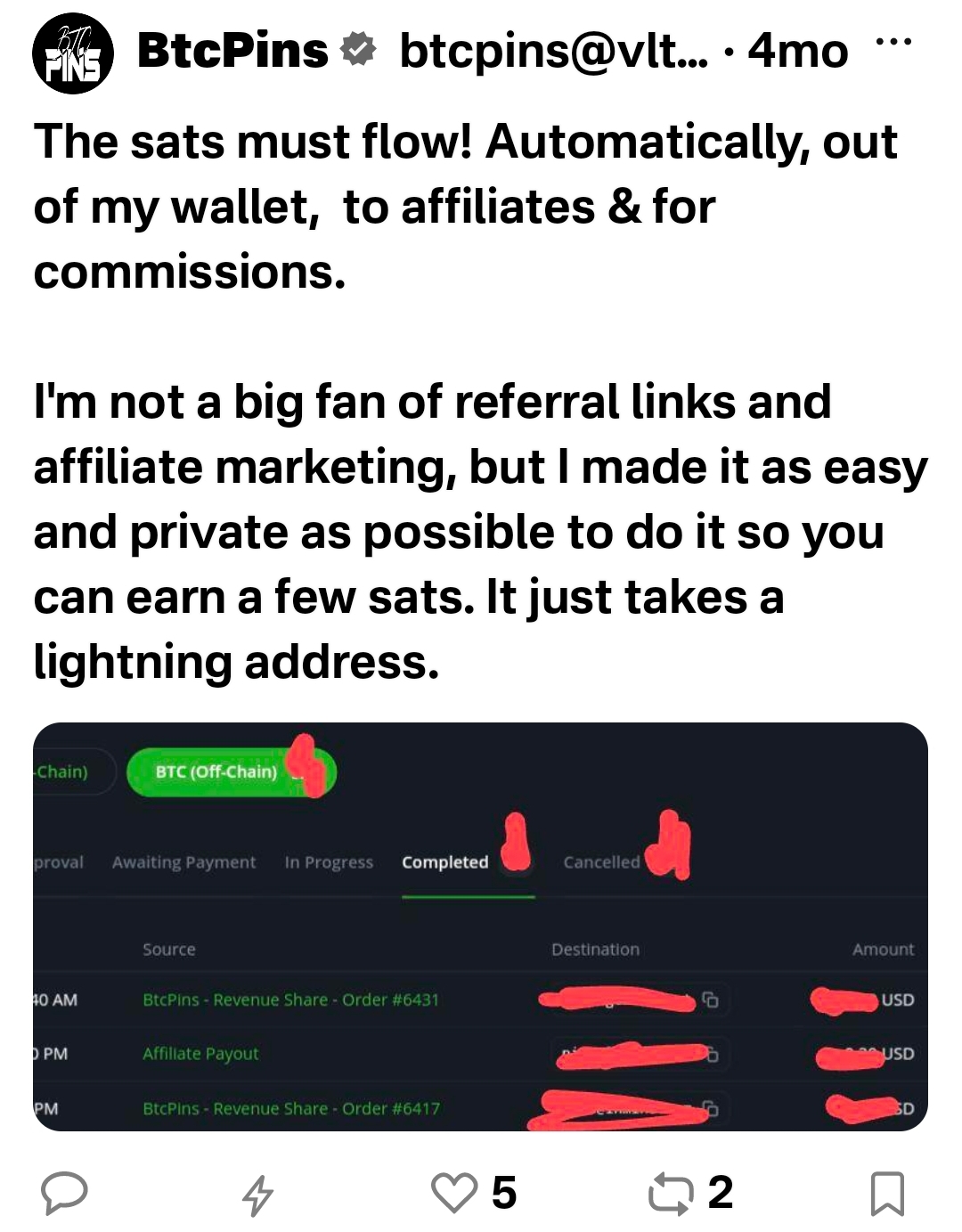

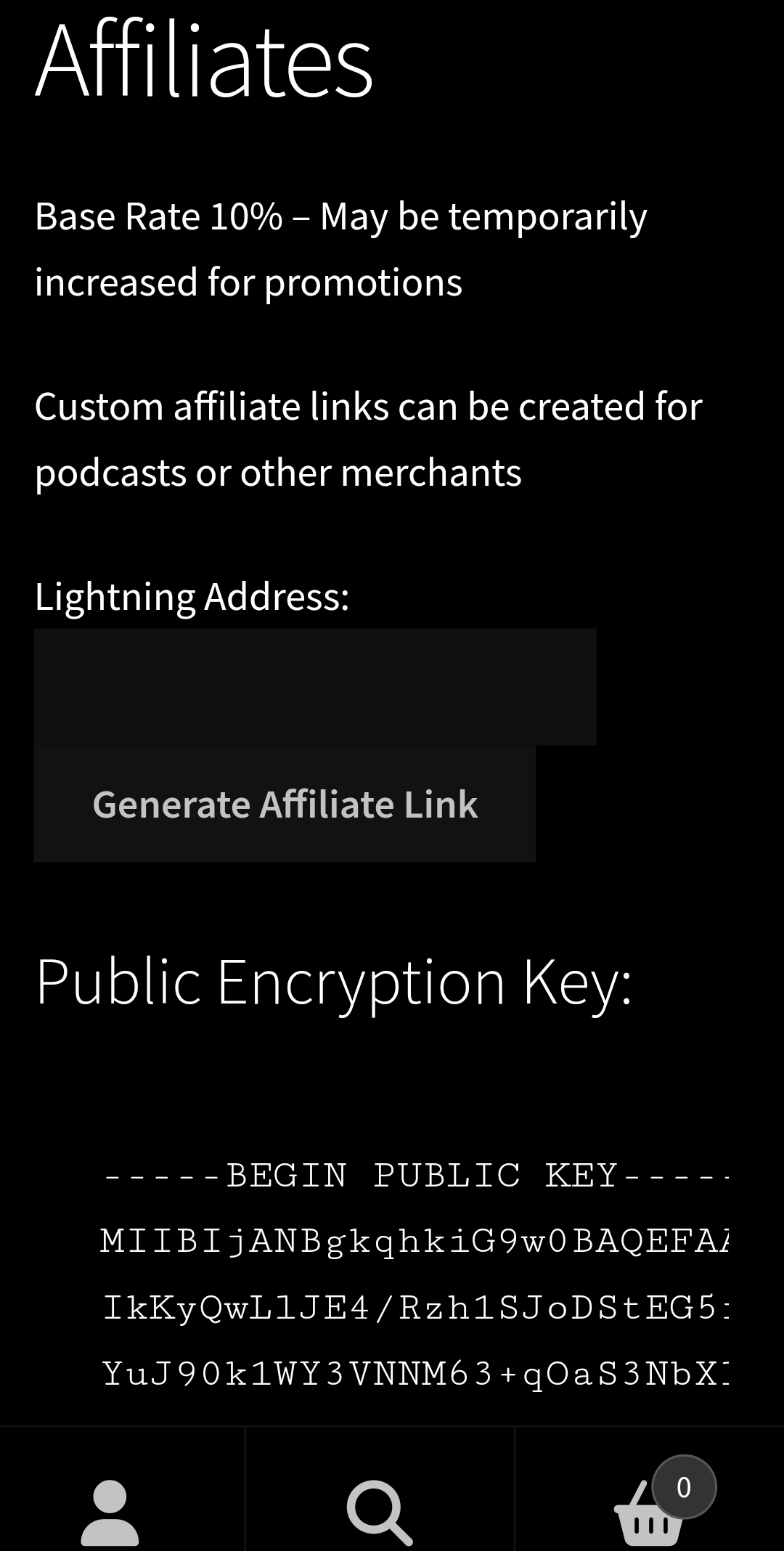

An Awesome Affiliate Link

BTCPins has a unique affiliate link. Provide your lightning address and it will generate an affiliate link for you. These things have been around since the 90s, but what makes this particular link notable is how commissions are paid: In sats on the Bitcoin lightning network.

How BTCPins Affiliates Work

- Navigate to https://btcpins.com/affiliates/

- Enter your lightning address.

- Generate your link

- Share with the world.

So buy a pin or two from BTCPins today using my affiliate link:

Encrypted Link: https://btcpins.com/?aff=ex1GhhNeeU9-PQ1-ZVEkarU9bSnsNyq98Jy_lEUBLmsrWsCqa69PYohMWcCOGK9tK1rAqmuvT2KITFnAjhivbfOajnP3D8A8O09Hi-OY4K8

npub1marc26z8nh3xkj5rcx7ufkatvx6ueqhp5vfw9v5teq26z254renshtf3g0

-

@ 16d11430:61640947

2025-02-05 00:52:05

@ 16d11430:61640947

2025-02-05 00:52:05Introduction: Colonization as a Multi-Generational Trauma

Colonization was not only a political and economic endeavor but also a deeply psychological one. Through forced labor, cultural erasure, and systematic oppression, colonizers imposed a set of economic and social behaviors that favored their interests. Though most colonies gained independence in the mid-20th century, the trauma of colonization remains embedded in their financial and governance structures.

Modern research in epigenetics suggests that trauma can alter gene expression and be passed down through generations (Yehuda & Lehrner, 2018). In a socio-economic context, the colonial mindset—marked by dependency, economic passivity, and a lack of financial sovereignty—persists within many post-colonial nations. One of the most insidious methods by which this trauma is maintained is through fiat currency and debt-based financial systems, which perpetuate economic dependency on former colonizers.

- The Psychological Impact of Colonial Trauma and Economic Passivity

Historical trauma theory suggests that populations subjected to prolonged oppression develop collective learned helplessness—a psychological state in which they stop attempting to resist their conditions because they have been conditioned to believe resistance is futile (Sotero, 2006).

This manifests in post-colonial societies in several ways:

-

Economic Dependency: A tendency to rely on foreign aid, multinational corporations, and foreign direct investment (FDI) rather than fostering self-sustaining industries.

-

Risk Aversion in Economic Policy: Research suggests that traumatic experiences affect the brain’s ability to take financial risks (Shields et al., 2016), leading to post-colonial states preferring IMF/World Bank solutions rather than exploring independent monetary policies.

-

Political Elite Compliance: Many former colonies' elites were educated in Western institutions, perpetuating colonial economic structures that maintain wealth extraction.

- Fiat Currency as a Tool of Economic Control

Fiat currency—money that has no intrinsic value but is backed by government decree—has been one of the most effective tools for maintaining economic dominance over former colonies.

A. The CFA Franc: A Colonial Currency in 2024

One of the most blatant examples of fiat currency maintaining colonial control is the CFA franc, used by 14 African countries, but ultimately controlled by France.

These countries must keep 50% of their foreign reserves in the French Treasury.

France dictates the monetary policies of these countries, limiting their financial autonomy.

Import dependency: Because the CFA franc is overvalued, it makes local goods more expensive while making European imports cheaper, reinforcing dependency on former colonizers.

B. The Role of the IMF and World Bank in Debt Colonialism

Post-colonial nations, lacking industrial infrastructures due to resource extraction under colonial rule, often turn to IMF and World Bank loans for development. However, these loans come with conditions that ensure neo-colonial economic control:

Structural Adjustment Programs (SAPs): Force nations to privatize industries, cut social spending, and open markets to foreign corporations—benefiting Western investors.

Perpetual Debt: Since loans are taken in foreign fiat currencies (USD, Euro), debt is rarely reduced, creating a cycle of endless repayment that prevents real economic independence.

- How Colonial Trauma Conditions Profitable Behaviors for Former Colonizers

Even outside of direct financial mechanisms, the trauma of colonization has conditioned post-colonial societies to adopt behaviors that benefit the former colonizers.

A. Elites as Gatekeepers of Colonial Structures

In many post-colonial nations, political and economic elites maintain colonial financial policies because they personally benefit from them. Studies (Acemoglu & Robinson, 2012) show that economic elites in post-colonial states are more likely to align with global financial institutions rather than advocate for economic self-determination.

B. Consumer Culture as a Neo-Colonial Tool

Western consumerism remains deeply ingrained in many post-colonial societies. This is a legacy of cultural imperialism, where local industries were suppressed in favor of Western goods.

The majority of African, South Asian, and Latin American countries continue to import Western luxury goods, technology, and services instead of developing their own.

As a result, much of the wealth generated in these countries flows back to Western corporations, mirroring the colonial economic extraction model.

Conclusion: Fiat Currency as the Modern Brand of Colonization

The economic and psychological trauma of colonization ensures that former colonies remain profitable markets and debt-ridden nations under the control of their colonizers. Fiat currency, international debt structures, and cultural hegemony serve as the modern pillars of economic colonialism, reinforcing behaviors that favor Western economic dominance.

Key Takeaways:

-

Historical trauma conditions former colonies into economic dependency.

-

Fiat currency (such as the CFA franc) remains a tool of colonial control.

-

The IMF and World Bank perpetuate financial dependency through debt cycles.

-

Consumer culture ensures wealth extraction from former colonies to Western economies.

Unless these structures are dismantled, economic sovereignty for formerly colonized nations remains an illusion. Breaking free from the financial colonial matrix requires monetary independence, de-dollarization strategies, and local industrialization, rather than continued reliance on Western financial systems.

References:

Yehuda, R., & Lehrner, A. (2018). Intergenerational transmission of trauma effects: Putative role of epigenetic mechanisms. World Psychiatry, 17(3), 243-257.

Sotero, M. M. (2006). A conceptual model of historical trauma: Implications for public health practice and research. Journal of Health Disparities Research and Practice, 1(1), 93-108.

Shields, G. S., Sazma, M. A., & Yonelinas, A. P. (2016). The effects of acute stress on economic decision-making. Psychoneuroendocrinology, 67, 226-234.

Acemoglu, D., & Robinson, J. (2012). Why Nations Fail: The Origins of Power, Prosperity, and Poverty. Crown Business.

Sylla, N. S. (2019). The CFA Franc: The Shackles of Monetary Dependence. Pluto Press.

Hudson, M. (2021). Super Imperialism: The Economic Strategy of American Empire. Pluto Press.

-

@ a95c6243:d345522c

2024-12-06 18:21:15

@ a95c6243:d345522c

2024-12-06 18:21:15Die Ungerechtigkeit ist uns nur in dem Falle angenehm,\ dass wir Vorteile aus ihr ziehen;\ in jedem andern hegt man den Wunsch,\ dass der Unschuldige in Schutz genommen werde.\ Jean-Jacques Rousseau

Politiker beteuern jederzeit, nur das Beste für die Bevölkerung zu wollen – nicht von ihr. Auch die zahlreichen unsäglichen «Corona-Maßnahmen» waren angeblich zu unserem Schutz notwendig, vor allem wegen der «besonders vulnerablen Personen». Daher mussten alle möglichen Restriktionen zwangsweise und unter Umgehung der Parlamente verordnet werden.

Inzwischen hat sich immer deutlicher herausgestellt, dass viele jener «Schutzmaßnahmen» den gegenteiligen Effekt hatten, sie haben den Menschen und den Gesellschaften enorm geschadet. Nicht nur haben die experimentellen Geninjektionen – wie erwartet – massive Nebenwirkungen, sondern Maskentragen schadet der Psyche und der Entwicklung (nicht nur unserer Kinder) und «Lockdowns und Zensur haben Menschen getötet».

Eine der wichtigsten Waffen unserer «Beschützer» ist die Spaltung der Gesellschaft. Die tiefen Gräben, die Politiker, Lobbyisten und Leitmedien praktisch weltweit ausgehoben haben, funktionieren leider nahezu in Perfektion. Von ihren persönlichen Erfahrungen als Kritikerin der Maßnahmen berichtete kürzlich eine Schweizerin im Interview mit Transition News. Sie sei schwer enttäuscht und verspüre bis heute eine Hemmschwelle und ein seltsames Unwohlsein im Umgang mit «Geimpften».

Menschen, die aufrichtig andere schützen wollten, werden von einer eindeutig politischen Justiz verfolgt, verhaftet und angeklagt. Dazu zählen viele Ärzte, darunter Heinrich Habig, Bianca Witzschel und Walter Weber. Über den aktuell laufenden Prozess gegen Dr. Weber hat Transition News mehrfach berichtet (z.B. hier und hier). Auch der Selbstschutz durch Verweigerung der Zwangs-Covid-«Impfung» bewahrt nicht vor dem Knast, wie Bundeswehrsoldaten wie Alexander Bittner erfahren mussten.

Die eigentlich Kriminellen schützen sich derweil erfolgreich selber, nämlich vor der Verantwortung. Die «Impf»-Kampagne war «das größte Verbrechen gegen die Menschheit». Trotzdem stellt man sich in den USA gerade die Frage, ob der scheidende Präsident Joe Biden nach seinem Sohn Hunter möglicherweise auch Anthony Fauci begnadigen wird – in diesem Fall sogar präventiv. Gibt es überhaupt noch einen Rest Glaubwürdigkeit, den Biden verspielen könnte?

Der Gedanke, den ehemaligen wissenschaftlichen Chefberater des US-Präsidenten und Direktor des National Institute of Allergy and Infectious Diseases (NIAID) vorsorglich mit einem Schutzschild zu versehen, dürfte mit der vergangenen Präsidentschaftswahl zu tun haben. Gleich mehrere Personalentscheidungen des designierten Präsidenten Donald Trump lassen Leute wie Fauci erneut in den Fokus rücken.

Das Buch «The Real Anthony Fauci» des nominierten US-Gesundheitsministers Robert F. Kennedy Jr. erschien 2021 und dreht sich um die Machenschaften der Pharma-Lobby in der öffentlichen Gesundheit. Das Vorwort zur rumänischen Ausgabe des Buches schrieb übrigens Călin Georgescu, der Überraschungssieger der ersten Wahlrunde der aktuellen Präsidentschaftswahlen in Rumänien. Vielleicht erklärt diese Verbindung einen Teil der Panik im Wertewesten.

In Rumänien selber gab es gerade einen Paukenschlag: Das bisherige Ergebnis wurde heute durch das Verfassungsgericht annuliert und die für Sonntag angesetzte Stichwahl kurzfristig abgesagt – wegen angeblicher «aggressiver russischer Einmischung». Thomas Oysmüller merkt dazu an, damit sei jetzt in der EU das Tabu gebrochen, Wahlen zu verbieten, bevor sie etwas ändern können.

Unsere Empörung angesichts der Historie von Maßnahmen, die die Falschen beschützen und für die meisten von Nachteil sind, müsste enorm sein. Die Frage ist, was wir damit machen. Wir sollten nach vorne schauen und unsere Energie clever einsetzen. Abgesehen von der Umgehung von jeglichem «Schutz vor Desinformation und Hassrede» (sprich: Zensur) wird es unsere wichtigste Aufgabe sein, Gräben zu überwinden.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ 97c70a44:ad98e322

2025-01-30 17:15:37

@ 97c70a44:ad98e322

2025-01-30 17:15:37There was a slight dust up recently over a website someone runs removing a listing for an app someone built based on entirely arbitrary criteria. I'm not to going to attempt to speak for either wounded party, but I would like to share my own personal definition for what constitutes a "nostr app" in an effort to help clarify what might be an otherwise confusing and opaque purity test.

In this post, I will be committing the "no true Scotsman" fallacy, in which I start with the most liberal definition I can come up with, and gradually refine it until all that is left is the purest, gleamingest, most imaginary and unattainable nostr app imaginable. As I write this, I wonder if anything built yet will actually qualify. In any case, here we go.

It uses nostr

The lowest bar for what a "nostr app" might be is an app ("application" - i.e. software, not necessarily a native app of any kind) that has some nostr-specific code in it, but which doesn't take any advantage of what makes nostr distinctive as a protocol.

Examples might include a scraper of some kind which fulfills its charter by fetching data from relays (regardless of whether it validates or retains signatures). Another might be a regular web 2.0 app which provides an option to "log in with nostr" by requesting and storing the user's public key.

In either case, the fact that nostr is involved is entirely neutral. A scraper can scrape html, pdfs, jsonl, whatever data source - nostr relays are just another target. Likewise, a user's key in this scenario is treated merely as an opaque identifier, with no appreciation for the super powers it brings along.

In most cases, this kind of app only exists as a marketing ploy, or less cynically, because it wants to get in on the hype of being a "nostr app", without the developer quite understanding what that means, or having the budget to execute properly on the claim.

It leverages nostr

Some of you might be wondering, "isn't 'leverage' a synonym for 'use'?" And you would be right, but for one connotative difference. It's possible to "use" something improperly, but by definition leverage gives you a mechanical advantage that you wouldn't otherwise have. This is the second category of "nostr app".

This kind of app gets some benefit out of the nostr protocol and network, but in an entirely selfish fashion. The intention of this kind of app is not to augment the nostr network, but to augment its own UX by borrowing some nifty thing from the protocol without really contributing anything back.

Some examples might include:

- Using nostr signers to encrypt or sign data, and then store that data on a proprietary server.

- Using nostr relays as a kind of low-code backend, but using proprietary event payloads.

- Using nostr event kinds to represent data (why), but not leveraging the trustlessness that buys you.

An application in this category might even communicate to its users via nostr DMs - but this doesn't make it a "nostr app" any more than a website that emails you hot deals on herbal supplements is an "email app". These apps are purely parasitic on the nostr ecosystem.

In the long-term, that's not necessarily a bad thing. Email's ubiquity is self-reinforcing. But in the short term, this kind of "nostr app" can actually do damage to nostr's reputation by over-promising and under-delivering.

It complements nostr

Next up, we have apps that get some benefit out of nostr as above, but give back by providing a unique value proposition to nostr users as nostr users. This is a bit of a fine distinction, but for me this category is for apps which focus on solving problems that nostr isn't good at solving, leaving the nostr integration in a secondary or supporting role.

One example of this kind of app was Mutiny (RIP), which not only allowed users to sign in with nostr, but also pulled those users' social graphs so that users could send money to people they knew and trusted. Mutiny was doing a great job of leveraging nostr, as well as providing value to users with nostr identities - but it was still primarily a bitcoin wallet, not a "nostr app" in the purest sense.

Other examples are things like Nostr Nests and Zap.stream, whose core value proposition is streaming video or audio content. Both make great use of nostr identities, data formats, and relays, but they're primarily streaming apps. A good litmus test for things like this is: if you got rid of nostr, would it be the same product (even if inferior in certain ways)?

A similar category is infrastructure providers that benefit nostr by their existence (and may in fact be targeted explicitly at nostr users), but do things in a centralized, old-web way; for example: media hosts, DNS registrars, hosting providers, and CDNs.

To be clear here, I'm not casting aspersions (I don't even know what those are, or where to buy them). All the apps mentioned above use nostr to great effect, and are a real benefit to nostr users. But they are not True Scotsmen.

It embodies nostr

Ok, here we go. This is the crème de la crème, the top du top, the meilleur du meilleur, the bee's knees. The purest, holiest, most chaste category of nostr app out there. The apps which are, indeed, nostr indigitate.

This category of nostr app (see, no quotes this time) can be defined by the converse of the previous category. If nostr was removed from this type of application, would it be impossible to create the same product?

To tease this apart a bit, apps that leverage the technical aspects of nostr are dependent on nostr the protocol, while apps that benefit nostr exclusively via network effect are integrated into nostr the network. An app that does both things is working in symbiosis with nostr as a whole.

An app that embraces both nostr's protocol and its network becomes an organic extension of every other nostr app out there, multiplying both its competitive moat and its contribution to the ecosystem:

- In contrast to apps that only borrow from nostr on the technical level but continue to operate in their own silos, an application integrated into the nostr network comes pre-packaged with existing users, and is able to provide more value to those users because of other nostr products. On nostr, it's a good thing to advertise your competitors.

- In contrast to apps that only market themselves to nostr users without building out a deep integration on the protocol level, a deeply integrated app becomes an asset to every other nostr app by becoming an organic extension of them through interoperability. This results in increased traffic to the app as other developers and users refer people to it instead of solving their problem on their own. This is the "micro-apps" utopia we've all been waiting for.

Credible exit doesn't matter if there aren't alternative services. Interoperability is pointless if other applications don't offer something your app doesn't. Marketing to nostr users doesn't matter if you don't augment their agency as nostr users.

If I had to choose a single NIP that represents the mindset behind this kind of app, it would be NIP 89 A.K.A. "Recommended Application Handlers", which states:

Nostr's discoverability and transparent event interaction is one of its most interesting/novel mechanics. This NIP provides a simple way for clients to discover applications that handle events of a specific kind to ensure smooth cross-client and cross-kind interactions.

These handlers are the glue that holds nostr apps together. A single event, signed by the developer of an application (or by the application's own account) tells anyone who wants to know 1. what event kinds the app supports, 2. how to link to the app (if it's a client), and (if the pubkey also publishes a kind 10002), 3. which relays the app prefers.

As a sidenote, NIP 89 is currently focused more on clients, leaving DVMs, relays, signers, etc somewhat out in the cold. Updating 89 to include tailored listings for each kind of supporting app would be a huge improvement to the protocol. This, plus a good front end for navigating these listings (sorry nostrapp.link, close but no cigar) would obviate the evil centralized websites that curate apps based on arbitrary criteria.

Examples of this kind of app obviously include many kind 1 clients, as well as clients that attempt to bring the benefits of the nostr protocol and network to new use cases - whether long form content, video, image posts, music, emojis, recipes, project management, or any other "content type".

To drill down into one example, let's think for a moment about forms. What's so great about a forms app that is built on nostr? Well,

- There is a spec for forms and responses, which means that...

- Multiple clients can implement the same data format, allowing for credible exit and user choice, even of...

- Other products not focused on forms, which can still view, respond to, or embed forms, and which can send their users via NIP 89 to a client that does...

- Cryptographically sign forms and responses, which means they are self-authenticating and can be sent to...

- Multiple relays, which reduces the amount of trust necessary to be confident results haven't been deliberately "lost".

Show me a forms product that does all of those things, and isn't built on nostr. You can't, because it doesn't exist. Meanwhile, there are plenty of image hosts with APIs, streaming services, and bitcoin wallets which have basically the same levels of censorship resistance, interoperability, and network effect as if they weren't built on nostr.

It supports nostr

Notice I haven't said anything about whether relays, signers, blossom servers, software libraries, DVMs, and the accumulated addenda of the nostr ecosystem are nostr apps. Well, they are (usually).

This is the category of nostr app that gets none of the credit for doing all of the work. There's no question that they qualify as beautiful nostrcorns, because their value propositions are entirely meaningless outside of the context of nostr. Who needs a signer if you don't have a cryptographic identity you need to protect? DVMs are literally impossible to use without relays. How are you going to find the blossom server that will serve a given hash if you don't know which servers the publishing user has selected to store their content?

In addition to being entirely contextualized by nostr architecture, this type of nostr app is valuable because it does things "the nostr way". By that I mean that they don't simply try to replicate existing internet functionality into a nostr context; instead, they create entirely new ways of putting the basic building blocks of the internet back together.

A great example of this is how Nostr Connect, Nostr Wallet Connect, and DVMs all use relays as brokers, which allows service providers to avoid having to accept incoming network connections. This opens up really interesting possibilities all on its own.

So while I might hesitate to call many of these things "apps", they are certainly "nostr".

Appendix: it smells like a NINO

So, let's say you've created an app, but when you show it to people they politely smile, nod, and call it a NINO (Nostr In Name Only). What's a hacker to do? Well, here's your handy-dandy guide on how to wash that NINO stench off and Become a Nostr.

You app might be a NINO if:

- There's no NIP for your data format (or you're abusing NIP 78, 32, etc by inventing a sub-protocol inside an existing event kind)

- There's a NIP, but no one knows about it because it's in a text file on your hard drive (or buried in your project's repository)

- Your NIP imposes an incompatible/centralized/legacy web paradigm onto nostr

- Your NIP relies on trusted third (or first) parties

- There's only one implementation of your NIP (yours)

- Your core value proposition doesn't depend on relays, events, or nostr identities

- One or more relay urls are hard-coded into the source code

- Your app depends on a specific relay implementation to work (ahem, relay29)

- You don't validate event signatures

- You don't publish events to relays you don't control

- You don't read events from relays you don't control

- You use legacy web services to solve problems, rather than nostr-native solutions

- You use nostr-native solutions, but you've hardcoded their pubkeys or URLs into your app

- You don't use NIP 89 to discover clients and services

- You haven't published a NIP 89 listing for your app

- You don't leverage your users' web of trust for filtering out spam

- You don't respect your users' mute lists

- You try to "own" your users' data

Now let me just re-iterate - it's ok to be a NINO. We need NINOs, because nostr can't (and shouldn't) tackle every problem. You just need to decide whether your app, as a NINO, is actually contributing to the nostr ecosystem, or whether you're just using buzzwords to whitewash a legacy web software product.

If you're in the former camp, great! If you're in the latter, what are you waiting for? Only you can fix your NINO problem. And there are lots of ways to do this, depending on your own unique situation:

- Drop nostr support if it's not doing anyone any good. If you want to build a normal company and make some money, that's perfectly fine.

- Build out your nostr integration - start taking advantage of webs of trust, self-authenticating data, event handlers, etc.

- Work around the problem. Think you need a special relay feature for your app to work? Guess again. Consider encryption, AUTH, DVMs, or better data formats.

- Think your idea is a good one? Talk to other devs or open a PR to the nips repo. No one can adopt your NIP if they don't know about it.

- Keep going. It can sometimes be hard to distinguish a research project from a NINO. New ideas have to be built out before they can be fully appreciated.

- Listen to advice. Nostr developers are friendly and happy to help. If you're not sure why you're getting traction, ask!

I sincerely hope this article is useful for all of you out there in NINO land. Maybe this made you feel better about not passing the totally optional nostr app purity test. Or maybe it gave you some actionable next steps towards making a great NINON (Nostr In Not Only Name) app. In either case, GM and PV.

-

@ a95c6243:d345522c

2024-11-29 19:45:43