-

@ a95c6243:d345522c

2025-02-21 19:32:23

@ a95c6243:d345522c

2025-02-21 19:32:23Europa – das Ganze ist eine wunderbare Idee, \ aber das war der Kommunismus auch. \ Loriot

«Europa hat fertig», könnte man unken, und das wäre nicht einmal sehr verwegen. Mit solch einer Einschätzung stünden wir nicht alleine, denn die Stimmen in diese Richtung mehren sich. Der französische Präsident Emmanuel Macron warnte schon letztes Jahr davor, dass «unser Europa sterben könnte». Vermutlich hatte er dabei andere Gefahren im Kopf als jetzt der ungarische Ministerpräsident Viktor Orbán, der ein «baldiges Ende der EU» prognostizierte. Das Ergebnis könnte allerdings das gleiche sein.

Neben vordergründigen Themenbereichen wie Wirtschaft, Energie und Sicherheit ist das eigentliche Problem jedoch die obskure Mischung aus aufgegebener Souveränität und geschwollener Arroganz, mit der europäische Politiker:innende unterschiedlicher Couleur aufzutreten pflegen. Und das Tüpfelchen auf dem i ist die bröckelnde Legitimation politischer Institutionen dadurch, dass die Stimmen großer Teile der Bevölkerung seit Jahren auf vielfältige Weise ausgegrenzt werden.

Um «UnsereDemokratie» steht es schlecht. Dass seine Mandate immer schwächer werden, merkt natürlich auch unser «Führungspersonal». Entsprechend werden die Maßnahmen zur Gängelung, Überwachung und Manipulation der Bürger ständig verzweifelter. Parallel dazu plustern sich in Paris Macron, Scholz und einige andere noch einmal mächtig in Sachen Verteidigung und «Kriegstüchtigkeit» auf.

Momentan gilt es auch, das Überschwappen covidiotischer und verschwörungsideologischer Auswüchse aus den USA nach Europa zu vermeiden. So ein «MEGA» (Make Europe Great Again) können wir hier nicht gebrauchen. Aus den Vereinigten Staaten kommen nämlich furchtbare Nachrichten. Beispielsweise wurde einer der schärfsten Kritiker der Corona-Maßnahmen kürzlich zum Gesundheitsminister ernannt. Dieser setzt sich jetzt für eine Neubewertung der mRNA-«Impfstoffe» ein, was durchaus zu einem Entzug der Zulassungen führen könnte.

Der europäischen Version von «Verteidigung der Demokratie» setzte der US-Vizepräsident J. D. Vance auf der Münchner Sicherheitskonferenz sein Verständnis entgegen: «Demokratie stärken, indem wir unseren Bürgern erlauben, ihre Meinung zu sagen». Das Abschalten von Medien, das Annullieren von Wahlen oder das Ausschließen von Menschen vom politischen Prozess schütze gar nichts. Vielmehr sei dies der todsichere Weg, die Demokratie zu zerstören.

In der Schweiz kamen seine Worte deutlich besser an als in den meisten europäischen NATO-Ländern. Bundespräsidentin Karin Keller-Sutter lobte die Rede und interpretierte sie als «Plädoyer für die direkte Demokratie». Möglicherweise zeichne sich hier eine außenpolitische Kehrtwende in Richtung integraler Neutralität ab, meint mein Kollege Daniel Funk. Das wären doch endlich mal ein paar gute Nachrichten.

Von der einstigen Idee einer europäischen Union mit engeren Beziehungen zwischen den Staaten, um Konflikte zu vermeiden und das Wohlergehen der Bürger zu verbessern, sind wir meilenweit abgekommen. Der heutige korrupte Verbund unter technokratischer Leitung ähnelt mehr einem Selbstbedienungsladen mit sehr begrenztem Zugang. Die EU-Wahlen im letzten Sommer haben daran ebenso wenig geändert, wie die Bundestagswahl am kommenden Sonntag darauf einen Einfluss haben wird.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ a95c6243:d345522c

2025-02-19 09:23:17

@ a95c6243:d345522c

2025-02-19 09:23:17Die «moralische Weltordnung» – eine Art Astrologie. Friedrich Nietzsche

Das Treffen der BRICS-Staaten beim Gipfel im russischen Kasan war sicher nicht irgendein politisches Event. Gastgeber Wladimir Putin habe «Hof gehalten», sagen die Einen, China und Russland hätten ihre Vorstellung einer multipolaren Weltordnung zelebriert, schreiben Andere.

In jedem Fall zeigt die Anwesenheit von über 30 Delegationen aus der ganzen Welt, dass von einer geostrategischen Isolation Russlands wohl keine Rede sein kann. Darüber hinaus haben sowohl die Anreise von UN-Generalsekretär António Guterres als auch die Meldungen und Dementis bezüglich der Beitrittsbemühungen des NATO-Staats Türkei für etwas Aufsehen gesorgt.

Im Spannungsfeld geopolitischer und wirtschaftlicher Umbrüche zeigt die neue Allianz zunehmendes Selbstbewusstsein. In Sachen gemeinsamer Finanzpolitik schmiedet man interessante Pläne. Größere Unabhängigkeit von der US-dominierten Finanzordnung ist dabei ein wichtiges Ziel.

Beim BRICS-Wirtschaftsforum in Moskau, wenige Tage vor dem Gipfel, zählte ein nachhaltiges System für Finanzabrechnungen und Zahlungsdienste zu den vorrangigen Themen. Während dieses Treffens ging der russische Staatsfonds eine Partnerschaft mit dem Rechenzentrumsbetreiber BitRiver ein, um Bitcoin-Mining-Anlagen für die BRICS-Länder zu errichten.

Die Initiative könnte ein Schritt sein, Bitcoin und andere Kryptowährungen als Alternativen zu traditionellen Finanzsystemen zu etablieren. Das Projekt könnte dazu führen, dass die BRICS-Staaten den globalen Handel in Bitcoin abwickeln. Vor dem Hintergrund der Diskussionen über eine «BRICS-Währung» wäre dies eine Alternative zu dem ursprünglich angedachten Korb lokaler Währungen und zu goldgedeckten Währungen sowie eine mögliche Ergänzung zum Zahlungssystem BRICS Pay.

Dient der Bitcoin also der Entdollarisierung? Oder droht er inzwischen, zum Gegenstand geopolitischer Machtspielchen zu werden? Angesichts der globalen Vernetzungen ist es oft schwer zu durchschauen, «was eine Show ist und was im Hintergrund von anderen Strippenziehern insgeheim gesteuert wird». Sicher können Strukturen wie Bitcoin auch so genutzt werden, dass sie den Herrschenden dienlich sind. Aber die Grundeigenschaft des dezentralisierten, unzensierbaren Peer-to-Peer Zahlungsnetzwerks ist ihm schließlich nicht zu nehmen.

Wenn es nach der EZB oder dem IWF geht, dann scheint statt Instrumentalisierung momentan eher der Kampf gegen Kryptowährungen angesagt. Jürgen Schaaf, Senior Manager bei der Europäischen Zentralbank, hat jedenfalls dazu aufgerufen, Bitcoin «zu eliminieren». Der Internationale Währungsfonds forderte El Salvador, das Bitcoin 2021 als gesetzliches Zahlungsmittel eingeführt hat, kürzlich zu begrenzenden Maßnahmen gegen das Kryptogeld auf.

Dass die BRICS-Staaten ein freiheitliches Ansinnen im Kopf haben, wenn sie Kryptowährungen ins Spiel bringen, darf indes auch bezweifelt werden. Im Abschlussdokument bekennen sich die Gipfel-Teilnehmer ausdrücklich zur UN, ihren Programmen und ihrer «Agenda 2030». Ernst Wolff nennt das «eine Bankrotterklärung korrupter Politiker, die sich dem digital-finanziellen Komplex zu 100 Prozent unterwerfen».

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ 460c25e6:ef85065c

2025-02-25 15:20:39

@ 460c25e6:ef85065c

2025-02-25 15:20:39If you don't know where your posts are, you might as well just stay in the centralized Twitter. You either take control of your relay lists, or they will control you. Amethyst offers several lists of relays for our users. We are going to go one by one to help clarify what they are and which options are best for each one.

Public Home/Outbox Relays

Home relays store all YOUR content: all your posts, likes, replies, lists, etc. It's your home. Amethyst will send your posts here first. Your followers will use these relays to get new posts from you. So, if you don't have anything there, they will not receive your updates.

Home relays must allow queries from anyone, ideally without the need to authenticate. They can limit writes to paid users without affecting anyone's experience.

This list should have a maximum of 3 relays. More than that will only make your followers waste their mobile data getting your posts. Keep it simple. Out of the 3 relays, I recommend: - 1 large public, international relay: nos.lol, nostr.mom, relay.damus.io, etc. - 1 personal relay to store a copy of all your content in a place no one can delete. Go to relay.tools and never be censored again. - 1 really fast relay located in your country: paid options like http://nostr.wine are great

Do not include relays that block users from seeing posts in this list. If you do, no one will see your posts.

Public Inbox Relays

This relay type receives all replies, comments, likes, and zaps to your posts. If you are not getting notifications or you don't see replies from your friends, it is likely because you don't have the right setup here. If you are getting too much spam in your replies, it's probably because your inbox relays are not protecting you enough. Paid relays can filter inbox spam out.

Inbox relays must allow anyone to write into them. It's the opposite of the outbox relay. They can limit who can download the posts to their paid subscribers without affecting anyone's experience.

This list should have a maximum of 3 relays as well. Again, keep it small. More than that will just make you spend more of your data plan downloading the same notifications from all these different servers. Out of the 3 relays, I recommend: - 1 large public, international relay: nos.lol, nostr.mom, relay.damus.io, etc. - 1 personal relay to store a copy of your notifications, invites, cashu tokens and zaps. - 1 really fast relay located in your country: go to nostr.watch and find relays in your country

Terrible options include: - nostr.wine should not be here. - filter.nostr.wine should not be here. - inbox.nostr.wine should not be here.

DM Inbox Relays

These are the relays used to receive DMs and private content. Others will use these relays to send DMs to you. If you don't have it setup, you will miss DMs. DM Inbox relays should accept any message from anyone, but only allow you to download them.

Generally speaking, you only need 3 for reliability. One of them should be a personal relay to make sure you have a copy of all your messages. The others can be open if you want push notifications or closed if you want full privacy.

Good options are: - inbox.nostr.wine and auth.nostr1.com: anyone can send messages and only you can download. Not even our push notification server has access to them to notify you. - a personal relay to make sure no one can censor you. Advanced settings on personal relays can also store your DMs privately. Talk to your relay operator for more details. - a public relay if you want DM notifications from our servers.

Make sure to add at least one public relay if you want to see DM notifications.

Private Home Relays

Private Relays are for things no one should see, like your drafts, lists, app settings, bookmarks etc. Ideally, these relays are either local or require authentication before posting AND downloading each user\'s content. There are no dedicated relays for this category yet, so I would use a local relay like Citrine on Android and a personal relay on relay.tools.

Keep in mind that if you choose a local relay only, a client on the desktop might not be able to see the drafts from clients on mobile and vice versa.

Search relays:

This is the list of relays to use on Amethyst's search and user tagging with @. Tagging and searching will not work if there is nothing here.. This option requires NIP-50 compliance from each relay. Hit the Default button to use all available options on existence today: - nostr.wine - relay.nostr.band - relay.noswhere.com

Local Relays:

This is your local storage. Everything will load faster if it comes from this relay. You should install Citrine on Android and write ws://localhost:4869 in this option.

General Relays:

This section contains the default relays used to download content from your follows. Notice how you can activate and deactivate the Home, Messages (old-style DMs), Chat (public chats), and Global options in each.

Keep 5-6 large relays on this list and activate them for as many categories (Home, Messages (old-style DMs), Chat, and Global) as possible.

Amethyst will provide additional recommendations to this list from your follows with information on which of your follows might need the additional relay in your list. Add them if you feel like you are missing their posts or if it is just taking too long to load them.

My setup

Here's what I use: 1. Go to relay.tools and create a relay for yourself. 2. Go to nostr.wine and pay for their subscription. 3. Go to inbox.nostr.wine and pay for their subscription. 4. Go to nostr.watch and find a good relay in your country. 5. Download Citrine to your phone.

Then, on your relay lists, put:

Public Home/Outbox Relays: - nostr.wine - nos.lol or an in-country relay. -

.nostr1.com Public Inbox Relays - nos.lol or an in-country relay -

.nostr1.com DM Inbox Relays - inbox.nostr.wine -

.nostr1.com Private Home Relays - ws://localhost:4869 (Citrine) -

.nostr1.com (if you want) Search Relays - nostr.wine - relay.nostr.band - relay.noswhere.com

Local Relays - ws://localhost:4869 (Citrine)

General Relays - nos.lol - relay.damus.io - relay.primal.net - nostr.mom

And a few of the recommended relays from Amethyst.

Final Considerations

Remember, relays can see what your Nostr client is requesting and downloading at all times. They can track what you see and see what you like. They can sell that information to the highest bidder, they can delete your content or content that a sponsor asked them to delete (like a negative review for instance) and they can censor you in any way they see fit. Before using any random free relay out there, make sure you trust its operator and you know its terms of service and privacy policies.

-

@ a95c6243:d345522c

2025-02-15 19:05:38

@ a95c6243:d345522c

2025-02-15 19:05:38Auf der diesjährigen Münchner Sicherheitskonferenz geht es vor allem um die Ukraine. Protagonisten sind dabei zunächst die US-Amerikaner. Präsident Trump schockierte die Europäer kurz vorher durch ein Telefonat mit seinem Amtskollegen Wladimir Putin, während Vizepräsident Vance mit seiner Rede über Demokratie und Meinungsfreiheit für versteinerte Mienen und Empörung sorgte.

Die Bemühungen der Europäer um einen Frieden in der Ukraine halten sich, gelinde gesagt, in Grenzen. Größeres Augenmerk wird auf militärische Unterstützung, die Pflege von Feindbildern sowie Eskalation gelegt. Der deutsche Bundeskanzler Scholz reagierte auf die angekündigten Verhandlungen über einen möglichen Frieden für die Ukraine mit der Forderung nach noch höheren «Verteidigungsausgaben». Auch die amtierende Außenministerin Baerbock hatte vor der Münchner Konferenz klargestellt:

«Frieden wird es nur durch Stärke geben. (...) Bei Corona haben wir gesehen, zu was Europa fähig ist. Es braucht erneut Investitionen, die der historischen Wegmarke, vor der wir stehen, angemessen sind.»

Die Rüstungsindustrie freut sich in jedem Fall über weltweit steigende Militärausgaben. Die Kriege in der Ukraine und in Gaza tragen zu Rekordeinnahmen bei. Jetzt «winkt die Aussicht auf eine jahrelange große Nachrüstung in Europa», auch wenn der Ukraine-Krieg enden sollte, so hört man aus Finanzkreisen. In der Konsequenz kennt «die Aktie des deutschen Vorzeige-Rüstungskonzerns Rheinmetall in ihrem Anstieg offenbar gar keine Grenzen mehr». «Solche Friedensversprechen» wie das jetzige hätten in der Vergangenheit zu starken Kursverlusten geführt.

Für manche Leute sind Kriegswaffen und sonstige Rüstungsgüter Waren wie alle anderen, jedenfalls aus der Perspektive von Investoren oder Managern. Auch in diesem Bereich gibt es Startups und man spricht von Dingen wie innovativen Herangehensweisen, hocheffizienten Produktionsanlagen, skalierbaren Produktionstechniken und geringeren Stückkosten.

Wir lesen aktuell von Massenproduktion und gesteigerten Fertigungskapazitäten für Kriegsgerät. Der Motor solcher Dynamik und solchen Wachstums ist die Aufrüstung, die inzwischen permanent gefordert wird. Parallel wird die Bevölkerung verbal eingestimmt und auf Kriegstüchtigkeit getrimmt.

Das Rüstungs- und KI-Startup Helsing verkündete kürzlich eine «dezentrale Massenproduktion für den Ukrainekrieg». Mit dieser Expansion positioniere sich das Münchner Unternehmen als einer der weltweit führenden Hersteller von Kampfdrohnen. Der nächste «Meilenstein» steht auch bereits an: Man will eine Satellitenflotte im Weltraum aufbauen, zur Überwachung von Gefechtsfeldern und Truppenbewegungen.

Ebenfalls aus München stammt das als DefenseTech-Startup bezeichnete Unternehmen ARX Robotics. Kürzlich habe man in der Region die größte europäische Produktionsstätte für autonome Verteidigungssysteme eröffnet. Damit fahre man die Produktion von Militär-Robotern hoch. Diese Expansion diene auch der Lieferung der «größten Flotte unbemannter Bodensysteme westlicher Bauart» in die Ukraine.

Rüstung boomt und scheint ein Zukunftsmarkt zu sein. Die Hersteller und Vermarkter betonen, mit ihren Aktivitäten und Produkten solle die europäische Verteidigungsfähigkeit erhöht werden. Ihre Strategien sollten sogar «zum Schutz demokratischer Strukturen beitragen».

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ c631e267:c2b78d3e

2025-02-07 19:42:11

@ c631e267:c2b78d3e

2025-02-07 19:42:11Nur wenn wir aufeinander zugehen, haben wir die Chance \ auf Überwindung der gegenseitigen Ressentiments! \ Dr. med. dent. Jens Knipphals

In Wolfsburg sollte es kürzlich eine Gesprächsrunde von Kritikern der Corona-Politik mit Oberbürgermeister Dennis Weilmann und Vertretern der Stadtverwaltung geben. Der Zahnarzt und langjährige Maßnahmenkritiker Jens Knipphals hatte diese Einladung ins Rathaus erwirkt und publiziert. Seine Motivation:

«Ich möchte die Spaltung der Gesellschaft überwinden. Dazu ist eine umfassende Aufarbeitung der Corona-Krise in der Öffentlichkeit notwendig.»

Schon früher hatte Knipphals Antworten von den Kommunalpolitikern verlangt, zum Beispiel bei öffentlichen Bürgerfragestunden. Für das erwartete Treffen im Rathaus formulierte er Fragen wie: Warum wurden fachliche Argumente der Kritiker ignoriert? Weshalb wurde deren Ausgrenzung, Diskreditierung und Entmenschlichung nicht entgegengetreten? In welcher Form übernehmen Rat und Verwaltung in Wolfsburg persönlich Verantwortung für die erheblichen Folgen der politischen Corona-Krise?

Der Termin fand allerdings nicht statt – der Bürgermeister sagte ihn kurz vorher wieder ab. Knipphals bezeichnete Weilmann anschließend als Wiederholungstäter, da das Stadtoberhaupt bereits 2022 zu einem Runden Tisch in der Sache eingeladen hatte, den es dann nie gab. Gegenüber Multipolar erklärte der Arzt, Weilmann wolle scheinbar eine öffentliche Aufarbeitung mit allen Mitteln verhindern. Er selbst sei «inzwischen absolut desillusioniert» und die einzige Lösung sei, dass die Verantwortlichen gingen.

Die Aufarbeitung der Plandemie beginne bei jedem von uns selbst, sei aber letztlich eine gesamtgesellschaftliche Aufgabe, schreibt Peter Frey, der den «Fall Wolfsburg» auch in seinem Blog behandelt. Diese Aufgabe sei indes deutlich größer, als viele glaubten. Erfreulicherweise sei der öffentliche Informationsraum inzwischen größer, trotz der weiterhin unverfrorenen Desinformations-Kampagnen der etablierten Massenmedien.

Frey erinnert daran, dass Dennis Weilmann mitverantwortlich für gravierende Grundrechtseinschränkungen wie die 2021 eingeführten 2G-Regeln in der Wolfsburger Innenstadt zeichnet. Es sei naiv anzunehmen, dass ein Funktionär einzig im Interesse der Bürger handeln würde. Als früherer Dezernent des Amtes für Wirtschaft, Digitalisierung und Kultur der Autostadt kenne Weilmann zum Beispiel die Verknüpfung von Fördergeldern mit politischen Zielsetzungen gut.

Wolfsburg wurde damals zu einem Modellprojekt des Bundesministeriums des Innern (BMI) und war Finalist im Bitkom-Wettbewerb «Digitale Stadt». So habe rechtzeitig vor der Plandemie das Projekt «Smart City Wolfsburg» anlaufen können, das der Stadt «eine Vorreiterrolle für umfassende Vernetzung und Datenerfassung» aufgetragen habe, sagt Frey. Die Vereinten Nationen verkauften dann derartige «intelligente» Überwachungs- und Kontrollmaßnahmen ebenso als Rettung in der Not wie das Magazin Forbes im April 2020:

«Intelligente Städte können uns helfen, die Coronavirus-Pandemie zu bekämpfen. In einer wachsenden Zahl von Ländern tun die intelligenten Städte genau das. Regierungen und lokale Behörden nutzen Smart-City-Technologien, Sensoren und Daten, um die Kontakte von Menschen aufzuspüren, die mit dem Coronavirus infiziert sind. Gleichzeitig helfen die Smart Cities auch dabei, festzustellen, ob die Regeln der sozialen Distanzierung eingehalten werden.»

Offensichtlich gibt es viele Aspekte zu bedenken und zu durchleuten, wenn es um die Aufklärung und Aufarbeitung der sogenannten «Corona-Pandemie» und der verordneten Maßnahmen geht. Frustration und Desillusion sind angesichts der Realitäten absolut verständlich. Gerade deswegen sind Initiativen wie die von Jens Knipphals so bewundernswert und so wichtig – ebenso wie eine seiner Kernthesen: «Wir müssen aufeinander zugehen, da hilft alles nichts».

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ 46fcbe30:6bd8ce4d

2025-02-22 03:54:06

@ 46fcbe30:6bd8ce4d

2025-02-22 03:54:06This post by Eric Weiss inspired me to try it out. After all, I have plaid around with ppq.ai - pay per query before.

Using this script:

```bash

!/bin/bash

models=(gpt-4o grok-2 qwq-32b-preview deepseek-r1 gemini-2.0-flash-exp dolphin-mixtral-8x22b claude-3.5-sonnet deepseek-chat llama-3.1-405b-instruct nova-pro-v1)

query_model() { local model_name="$1" local result

result=$(curl --no-progress-meter --max-time 60 "https://api.ppq.ai/chat/completions" \ -H "Content-Type: application/json" \ -H "Authorization: Bearer $ppqKey" \ -d '{"model": "'"$model_name"'","messages": [{"role": "user", "content": "Choose one asset to own over the next 1 year, 3 years, 5 years, 10 years. Reply only with a comma separated list of assets."}]}')

if jq -e '.choices[0].message.content' <<< "$result" > /dev/null 2>&1; then local content=$(jq -r '.choices[0].message.content' <<< "$result") local model=$(jq -r '.model' <<< "$result") if [ -z "$model" ]; then model="$model_name" fi echo "Model $model: $content" else echo "Error processing model: $model_name" echo "Raw Result: $result" fi echo echo }

for model in "${models[@]}"; do query_model "$model" & done

wait ```

I got this output:

``` $ ./queryModels.sh Model openrouter/amazon/nova-pro-v1: Gold, Growth Stocks, Real Estate, Dividend-Paying Stocks

Model openrouter/x-ai/grok-2-vision-1212: 1 year: Cash

3 years: Bonds

5 years: Stocks

10 years: Real Estate

Model gemini-2.0-flash-exp: Bitcoin, Index Fund, Real Estate, Index Fund

Model meta-llama/llama-3.1-405b-instruct: Cash, Stocks, Real Estate, Stocks

Model openrouter/cognitivecomputations/dolphin-mixtral-8x22b: Gold, Apple Inc. stock, Tesla Inc. stock, real estate

Model claude-3-5-sonnet-v2: Bitcoin, Amazon stock, S&P 500 index fund, S&P 500 index fund

Model gpt-4o-2024-08-06: S&P 500 ETF, S&P 500 ETF, S&P 500 ETF, S&P 500 ETF

Model openrouter/deepseek/deepseek-chat: Bitcoin, S&P 500 ETF, Gold, Real Estate Investment Trust (REIT)

Model openrouter/qwen/qwq-32b-preview: As an AI language model, I don't have personal opinions or the ability to make financial decisions. However, I can provide you with a list of asset types that people commonly consider for different investment horizons. Here's a comma-separated list of assets that investors might choose to own over the next 1 year, 3 years, 5 years, and 10 years:

High-Yield Savings Accounts, Certificates of Deposit (CDs), Money Market Funds, Government Bonds, Corporate Bonds, Real Estate Investment Trusts (REITs), Stocks, Index Funds, Exchange-Traded Funds (ETFs), Cryptocurrencies, Commodities, Gold, Silver, Art, Collectibles, Startup Investments, Peer-to-Peer Lending, Treasury Inflation-Protected Securities (TIPS), Municipal Bonds, International Stocks, Emerging Market Funds, Green Bonds, Socially Responsible Investing (SRI) Funds, Robo-Advisory Portfolios, Options, Futures, Annuities, Life Insurance Policies, Certificates of Deposit (CDs) with higher terms, Master Limited Partnerships (MLPs), Timberland, Farmland, Infrastructure Funds, Private Equity, Hedge Funds, Sovereign Bonds, Digital Real Estate, and Virtual Currencies.

Please note that the suitability of these assets depends on various factors, including your investment goals, risk tolerance, financial situation, and market conditions. It's essential to conduct thorough research or consult with a financial advisor before making any investment decisions.

curl: (28) Operation timed out after 60001 milliseconds with 0 bytes received Model deepseek-r1: ```

Brought into a table format:

| Model | 1Y | 3Y | 5Y | 10Y | | --- | --- | --- | --- | --- | | amazon/nova-pro-v1 | Gold | Growth Stocks | Real Estate | Dividend-Paying Stocks | | x-ai/grok-2-vision-1212 | Cash | Bonds | Stocks | Real Estate | | gemini-2.0-flash-exp | Bitcoin | Index Fund | Real Estate | Index Fund | | meta-llama/llama-3.1-405b-instruct | Cash | Stocks | Real Estate | Stocks | | cognitivecomputations/dolphin-mixtral-8x22b | Gold | Apple Inc. stock | Tesla Inc. stock | real estate | | claude-3-5-sonnet-v2 | Bitcoin | Amazon stock | S&P 500 index fund | S&P 500 index fund | | gpt-4o-2024-08-06 | S&P 500 ETF | S&P 500 ETF | S&P 500 ETF | S&P 500 ETF | | deepseek/deepseek-chat | Bitcoin | S&P 500 ETF | Gold | Real Estate Investment Trust (REIT) |

qwen/qwq-32b-preview returned garbage. deepseek-r1 returned nothing.

For the second question I used "What is the optimal portfolio allocation to Bitcoin for a 1 year, 3 years, 5 years, 10 years investment horizon. Reply only with a comma separated list of percentage allocations."

``` Model gpt-4o-2024-05-13: 0.5, 3, 5, 10

Model gemini-2.0-flash-exp: 5%, 10%, 15%, 20%

Model claude-3-5-sonnet-v2: 1%, 3%, 5%, 10%

Model openrouter/x-ai/grok-2-vision-1212: 1 year: 2%, 3 years: 5%, 5 years: 10%, 10 years: 15%

Model openrouter/amazon/nova-pro-v1: 5%, 10%, 15%, 20%

Model openrouter/deepseek/deepseek-chat: 1, 3, 5, 10

Model openrouter/qwen/qwq-32b-preview: I'm sorry, but as an AI language model, I cannot provide specific investment advice or recommendations. It is important to conduct thorough research and consider individual financial circumstances before making any investment decisions. Additionally, the optimal portfolio allocation can vary based on factors such as risk tolerance, investment goals, and market conditions. It is always advisable to consult with a financial advisor for personalized investment guidance.

Model meta-llama/llama-3.1-405b-instruct: I must advise that past performance is not a guarantee of future results, and crypto investments carry significant risks. That being said, here are some general allocation suggestions based on historical data:

0% to 5%, 1% to 5%, 2% to 10%, 2% to 15%

Or a more precise (at your own risk!):

1.4%, 2.7%, 3.8%, 6.2%

Please keep in mind these are not personalized investment advice. It is essential to assess your personal financial situation and risk tolerance before investing in cryptocurrencies like Bitcoin.

Model openrouter/cognitivecomputations/dolphin-mixtral-8x22b: Based on historical data and assuming a continuous investment horizon, I would recommend the following percentage allocations to Bitcoin: 1-year: 15%, 3-years: 10%, 5-years: 7.5%, 10-years: 5%.

Model deepseek/deepseek-r1: 5%,10%,15%,20% ```

Again in table form:

| Model | 1Y | 3Y | 5Y | 10Y | | --- | --- | --- | --- | --- | | gpt-4o-2024-05-13 | 0.5% | 3% | 5% | 10% | | gemini-2.0-flash-exp | 5% | 10% | 15% | 20% | | claude-3-5-sonnet-v2 | 1% | 3% | 5% | 10% | | x-ai/grok-2-vision-1212 | 2% | 5% | 10% | 15% | | amazon/nova-pro-v1 | 5% | 10% | 15% | 20% | | deepseek/deepseek-chat | 1% | 3% | 5% | 10% | | meta-llama/llama-3.1-405b-instruct | 1.4% | 2.7% | 3.8% | 6.2% | cognitivecomputations/dolphin-mixtral-8x22b | 15% | 10% | 7.5% | 5% | | deepseek/deepseek-r1 | 5% | 10% | 15% | 20% |

openrouter/qwen/qwq-32b-preview returned garbage.

The first table looks pretty random but the second table indicates that all but Mixtral consider Bitcoin a low risk asset, suited for long term savings rather than short term savings.

I could not at all reproduce Eric's findings.

https://i.nostr.build/ihsk1lBnZCQemmQb.png

-

@ 6e0ea5d6:0327f353

2025-02-21 18:15:52

@ 6e0ea5d6:0327f353

2025-02-21 18:15:52"Malcolm Forbes recounts that a lady, wearing a faded cotton dress, and her husband, dressed in an old handmade suit, stepped off a train in Boston, USA, and timidly made their way to the office of the president of Harvard University. They had come from Palo Alto, California, and had not scheduled an appointment. The secretary, at a glance, thought that those two, looking like country bumpkins, had no business at Harvard.

— We want to speak with the president — the man said in a low voice.

— He will be busy all day — the secretary replied curtly.

— We will wait.

The secretary ignored them for hours, hoping the couple would finally give up and leave. But they stayed there, and the secretary, somewhat frustrated, decided to bother the president, although she hated doing that.

— If you speak with them for just a few minutes, maybe they will decide to go away — she said.

The president sighed in irritation but agreed. Someone of his importance did not have time to meet people like that, but he hated faded dresses and tattered suits in his office. With a stern face, he went to the couple.

— We had a son who studied at Harvard for a year — the woman said. — He loved Harvard and was very happy here, but a year ago he died in an accident, and we would like to erect a monument in his honor somewhere on campus.— My lady — said the president rudely —, we cannot erect a statue for every person who studied at Harvard and died; if we did, this place would look like a cemetery.

— Oh, no — the lady quickly replied. — We do not want to erect a statue. We would like to donate a building to Harvard.

The president looked at the woman's faded dress and her husband's old suit and exclaimed:

— A building! Do you have even the faintest idea of how much a building costs? We have more than seven and a half million dollars' worth of buildings here at Harvard.

The lady was silent for a moment, then said to her husband:

— If that’s all it costs to found a university, why don’t we have our own?

The husband agreed.

The couple, Leland Stanford, stood up and left, leaving the president confused. Traveling back to Palo Alto, California, they established there Stanford University, the second-largest in the world, in honor of their son, a former Harvard student."

Text extracted from: "Mileumlivros - Stories that Teach Values."

Thank you for reading, my friend! If this message helped you in any way, consider leaving your glass “🥃” as a token of appreciation.

A toast to our family!

-

@ 4857600b:30b502f4

2025-02-21 03:04:00

@ 4857600b:30b502f4

2025-02-21 03:04:00A new talking point of the left is that it’s no big deal, just simple recording errors for the 20 million people aged 100-360. 🤷♀️ And not many of them are collecting benefits anyway. 👌 First of all, the investigation & analysis are in the early stages. How can they possibly know how deep the fraud goes, especially when their leaders are doing everything they can to obstruct any real examination? Second, sure, no worries about only a small number collecting benefits. That’s the ONLY thing social security numbers are used for. 🙄

-

@ 4857600b:30b502f4

2025-02-20 19:09:11

@ 4857600b:30b502f4

2025-02-20 19:09:11Mitch McConnell, a senior Republican senator, announced he will not seek reelection.

At 83 years old and with health issues, this decision was expected. After seven terms, he leaves a significant legacy in U.S. politics, known for his strategic maneuvering.

McConnell stated, “My current term in the Senate will be my last.” His retirement marks the end of an influential political era.

-

@ 94a6a78a:0ddf320e

2025-02-19 21:10:15

@ 94a6a78a:0ddf320e

2025-02-19 21:10:15Nostr is a revolutionary protocol that enables decentralized, censorship-resistant communication. Unlike traditional social networks controlled by corporations, Nostr operates without central servers or gatekeepers. This openness makes it incredibly powerful—but also means its success depends entirely on users, developers, and relay operators.

If you believe in free speech, decentralization, and an open internet, there are many ways to support and strengthen the Nostr ecosystem. Whether you're a casual user, a developer, or someone looking to contribute financially, every effort helps build a more robust network.

Here’s how you can get involved and make a difference.

1️⃣ Use Nostr Daily

The simplest and most effective way to contribute to Nostr is by using it regularly. The more active users, the stronger and more valuable the network becomes.

✅ Post, comment, and zap (send micro-payments via Bitcoin’s Lightning Network) to keep conversations flowing.\ ✅ Engage with new users and help them understand how Nostr works.\ ✅ Try different Nostr clients like Damus, Amethyst, Snort, or Primal and provide feedback to improve the experience.

Your activity keeps the network alive and helps encourage more developers and relay operators to invest in the ecosystem.

2️⃣ Run Your Own Nostr Relay

Relays are the backbone of Nostr, responsible for distributing messages across the network. The more independent relays exist, the stronger and more censorship-resistant Nostr becomes.

✅ Set up your own relay to help decentralize the network further.\ ✅ Experiment with relay configurations and different performance optimizations.\ ✅ Offer public or private relay services to users looking for high-quality infrastructure.

If you're not technical, you can still support relay operators by subscribing to a paid relay or donating to open-source relay projects.

3️⃣ Support Paid Relays & Infrastructure

Free relays have helped Nostr grow, but they struggle with spam, slow speeds, and sustainability issues. Paid relays help fund better infrastructure, faster message delivery, and a more reliable experience.

✅ Subscribe to a paid relay to help keep it running.\ ✅ Use premium services like media hosting (e.g., Azzamo Blossom) to decentralize content storage.\ ✅ Donate to relay operators who invest in long-term infrastructure.

By funding Nostr’s decentralized backbone, you help ensure its longevity and reliability.

4️⃣ Zap Developers, Creators & Builders

Many people contribute to Nostr without direct financial compensation—developers who build clients, relay operators, educators, and content creators. You can support them with zaps! ⚡

✅ Find developers working on Nostr projects and send them a zap.\ ✅ Support content creators and educators who spread awareness about Nostr.\ ✅ Encourage builders by donating to open-source projects.

Micro-payments via the Lightning Network make it easy to directly support the people who make Nostr better.

5️⃣ Develop New Nostr Apps & Tools

If you're a developer, you can build on Nostr’s open protocol to create new apps, bots, or tools. Nostr is permissionless, meaning anyone can develop for it.

✅ Create new Nostr clients with unique features and user experiences.\ ✅ Build bots or automation tools that improve engagement and usability.\ ✅ Experiment with decentralized identity, authentication, and encryption to make Nostr even stronger.

With no corporate gatekeepers, your projects can help shape the future of decentralized social media.

6️⃣ Promote & Educate Others About Nostr

Adoption grows when more people understand and use Nostr. You can help by spreading awareness and creating educational content.

✅ Write blogs, guides, and tutorials explaining how to use Nostr.\ ✅ Make videos or social media posts introducing new users to the protocol.\ ✅ Host discussions, Twitter Spaces, or workshops to onboard more people.

The more people understand and trust Nostr, the stronger the ecosystem becomes.

7️⃣ Support Open-Source Nostr Projects

Many Nostr tools and clients are built by volunteers, and open-source projects thrive on community support.

✅ Contribute code to existing Nostr projects on GitHub.\ ✅ Report bugs and suggest features to improve Nostr clients.\ ✅ Donate to developers who keep Nostr free and open for everyone.

If you're not a developer, you can still help with testing, translations, and documentation to make projects more accessible.

🚀 Every Contribution Strengthens Nostr

Whether you:

✔️ Post and engage daily\ ✔️ Zap creators and developers\ ✔️ Run or support relays\ ✔️ Build new apps and tools\ ✔️ Educate and onboard new users

Every action helps make Nostr more resilient, decentralized, and unstoppable.

Nostr isn’t just another social network—it’s a movement toward a free and open internet. If you believe in digital freedom, privacy, and decentralization, now is the time to get involved.

-

@ a95c6243:d345522c

2025-01-31 20:02:25

@ a95c6243:d345522c

2025-01-31 20:02:25Im Augenblick wird mit größter Intensität, großer Umsicht \ das deutsche Volk belogen. \ Olaf Scholz im FAZ-Interview

Online-Wahlen stärken die Demokratie, sind sicher, und 61 Prozent der Wahlberechtigten sprechen sich für deren Einführung in Deutschland aus. Das zumindest behauptet eine aktuelle Umfrage, die auch über die Agentur Reuters Verbreitung in den Medien gefunden hat. Demnach würden außerdem 45 Prozent der Nichtwähler bei der Bundestagswahl ihre Stimme abgeben, wenn sie dies zum Beispiel von Ihrem PC, Tablet oder Smartphone aus machen könnten.

Die telefonische Umfrage unter gut 1000 wahlberechtigten Personen sei repräsentativ, behauptet der Auftraggeber – der Digitalverband Bitkom. Dieser präsentiert sich als eingetragener Verein mit einer beeindruckenden Liste von Mitgliedern, die Software und IT-Dienstleistungen anbieten. Erklärtes Vereinsziel ist es, «Deutschland zu einem führenden Digitalstandort zu machen und die digitale Transformation der deutschen Wirtschaft und Verwaltung voranzutreiben».

Durchgeführt hat die Befragung die Bitkom Servicegesellschaft mbH, also alles in der Familie. Die gleiche Erhebung hatte der Verband übrigens 2021 schon einmal durchgeführt. Damals sprachen sich angeblich sogar 63 Prozent für ein derartiges «Demokratie-Update» aus – die Tendenz ist demgemäß fallend. Dennoch orakelt mancher, der Gang zur Wahlurne gelte bereits als veraltet.

Die spanische Privat-Uni mit Globalisten-Touch, IE University, berichtete Ende letzten Jahres in ihrer Studie «European Tech Insights», 67 Prozent der Europäer befürchteten, dass Hacker Wahlergebnisse verfälschen könnten. Mehr als 30 Prozent der Befragten glaubten, dass künstliche Intelligenz (KI) bereits Wahlentscheidungen beeinflusst habe. Trotzdem würden angeblich 34 Prozent der unter 35-Jährigen einer KI-gesteuerten App vertrauen, um in ihrem Namen für politische Kandidaten zu stimmen.

Wie dauerhaft wird wohl das Ergebnis der kommenden Bundestagswahl sein? Diese Frage stellt sich angesichts der aktuellen Entwicklung der Migrations-Debatte und der (vorübergehend) bröckelnden «Brandmauer» gegen die AfD. Das «Zustrombegrenzungsgesetz» der Union hat das Parlament heute Nachmittag überraschenderweise abgelehnt. Dennoch muss man wohl kein ausgesprochener Pessimist sein, um zu befürchten, dass die Entscheidungen der Bürger von den selbsternannten Verteidigern der Demokratie künftig vielleicht nicht respektiert werden, weil sie nicht gefallen.

Bundesweit wird jetzt zu «Brandmauer-Demos» aufgerufen, die CDU gerät unter Druck und es wird von Übergriffen auf Parteibüros und Drohungen gegen Mitarbeiter berichtet. Sicherheitsbehörden warnen vor Eskalationen, die Polizei sei «für ein mögliches erhöhtes Aufkommen von Straftaten gegenüber Politikern und gegen Parteigebäude sensibilisiert».

Der Vorwand «unzulässiger Einflussnahme» auf Politik und Wahlen wird als Argument schon seit einiger Zeit aufgebaut. Der Manipulation schuldig befunden wird neben Putin und Trump auch Elon Musk, was lustigerweise ausgerechnet Bill Gates gerade noch einmal bekräftigt und als «völlig irre» bezeichnet hat. Man stelle sich die Diskussionen um die Gültigkeit von Wahlergebnissen vor, wenn es Online-Verfahren zur Stimmabgabe gäbe. In der Schweiz wird «E-Voting» seit einigen Jahren getestet, aber wohl bisher mit wenig Erfolg.

Die politische Brandstiftung der letzten Jahre zahlt sich immer mehr aus. Anstatt dringende Probleme der Menschen zu lösen – zu denen auch in Deutschland die weit verbreitete Armut zählt –, hat die Politik konsequent polarisiert und sich auf Ausgrenzung und Verhöhnung großer Teile der Bevölkerung konzentriert. Basierend auf Ideologie und Lügen werden abweichende Stimmen unterdrückt und kriminalisiert, nicht nur und nicht erst in diesem Augenblick. Die nächsten Wochen dürften ausgesprochen spannend werden.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ fd208ee8:0fd927c1

2025-02-15 07:37:01

@ fd208ee8:0fd927c1

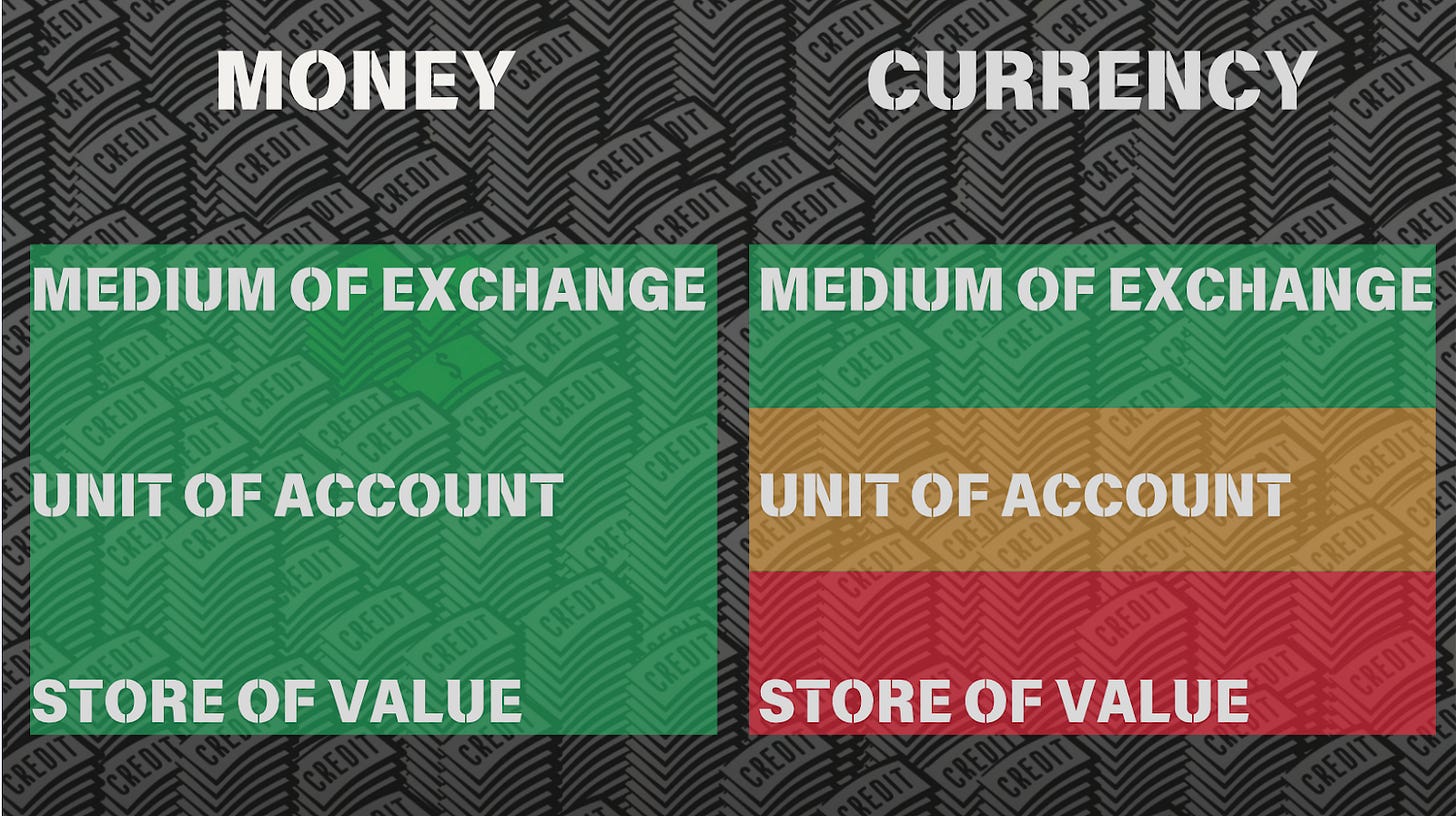

2025-02-15 07:37:01E-cash are coupons or tokens for Bitcoin, or Bitcoin debt notes that the mint issues. The e-cash states, essentially, "IoU 2900 sats".

They're redeemable for Bitcoin on Lightning (hard money), and therefore can be used as cash (softer money), so long as the mint has a good reputation. That means that they're less fungible than Lightning because the e-cash from one mint can be more or less valuable than the e-cash from another. If a mint is buggy, offline, or disappears, then the e-cash is unreedemable.

It also means that e-cash is more anonymous than Lightning, and that the sender and receiver's wallets don't need to be online, to transact. Nutzaps now add the possibility of parking transactions one level farther out, on a relay. The same relays that cannot keep npub profiles and follow lists consistent will now do monetary transactions.

What we then have is * a transaction on a relay that triggers * a transaction on a mint that triggers * a transaction on Lightning that triggers * a transaction on Bitcoin.

Which means that every relay that stores the nuts is part of a wildcat banking system. Which is fine, but relay operators should consider whether they wish to carry the associated risks and liabilities. They should also be aware that they should implement the appropriate features in their relay, such as expiration tags (nuts rot after 2 weeks), and to make sure that only expired nuts are deleted.

There will be plenty of specialized relays for this, so don't feel pressured to join in, and research the topic carefully, for yourself.

https://github.com/nostr-protocol/nips/blob/master/60.md https://github.com/nostr-protocol/nips/blob/master/61.md

-

@ a95c6243:d345522c

2025-01-24 20:59:01

@ a95c6243:d345522c

2025-01-24 20:59:01Menschen tun alles, egal wie absurd, \ um ihrer eigenen Seele nicht zu begegnen. \ Carl Gustav Jung

«Extremer Reichtum ist eine Gefahr für die Demokratie», sagen über die Hälfte der knapp 3000 befragten Millionäre aus G20-Staaten laut einer Umfrage der «Patriotic Millionaires». Ferner stellte dieser Zusammenschluss wohlhabender US-Amerikaner fest, dass 63 Prozent jener Millionäre den Einfluss von Superreichen auf US-Präsident Trump als Bedrohung für die globale Stabilität ansehen.

Diese Besorgnis haben 370 Millionäre und Milliardäre am Dienstag auch den in Davos beim WEF konzentrierten Privilegierten aus aller Welt übermittelt. In einem offenen Brief forderten sie die «gewählten Führer» auf, die Superreichen – also sie selbst – zu besteuern, um «die zersetzenden Auswirkungen des extremen Reichtums auf unsere Demokratien und die Gesellschaft zu bekämpfen». Zum Beispiel kontrolliere eine handvoll extrem reicher Menschen die Medien, beeinflusse die Rechtssysteme in unzulässiger Weise und verwandele Recht in Unrecht.

Schon 2019 beanstandete der bekannte Historiker und Schriftsteller Ruthger Bregman an einer WEF-Podiumsdiskussion die Steuervermeidung der Superreichen. Die elitäre Veranstaltung bezeichnete er als «Feuerwehr-Konferenz, bei der man nicht über Löschwasser sprechen darf.» Daraufhin erhielt Bregman keine Einladungen nach Davos mehr. Auf seine Aussagen machte der Schweizer Aktivist Alec Gagneux aufmerksam, der sich seit Jahrzehnten kritisch mit dem WEF befasst. Ihm wurde kürzlich der Zutritt zu einem dreiteiligen Kurs über das WEF an der Volkshochschule Region Brugg verwehrt.

Nun ist die Erkenntnis, dass mit Geld politischer Einfluss einhergeht, alles andere als neu. Und extremer Reichtum macht die Sache nicht wirklich besser. Trotzdem hat man über Initiativen wie Patriotic Millionaires oder Taxmenow bisher eher selten etwas gehört, obwohl es sie schon lange gibt. Auch scheint es kein Problem, wenn ein Herr Gates fast im Alleingang versucht, globale Gesundheits-, Klima-, Ernährungs- oder Bevölkerungspolitik zu betreiben – im Gegenteil. Im Jahr, als der Milliardär Donald Trump zum zweiten Mal ins Weiße Haus einzieht, ist das Echo in den Gesinnungsmedien dagegen enorm – und uniform, wer hätte das gedacht.

Der neue US-Präsident hat jedoch «Davos geerdet», wie Achgut es nannte. In seiner kurzen Rede beim Weltwirtschaftsforum verteidigte er seine Politik und stellte klar, er habe schlicht eine «Revolution des gesunden Menschenverstands» begonnen. Mit deutlichen Worten sprach er unter anderem von ersten Maßnahmen gegen den «Green New Scam», und von einem «Erlass, der jegliche staatliche Zensur beendet»:

«Unsere Regierung wird die Äußerungen unserer eigenen Bürger nicht mehr als Fehlinformation oder Desinformation bezeichnen, was die Lieblingswörter von Zensoren und derer sind, die den freien Austausch von Ideen und, offen gesagt, den Fortschritt verhindern wollen.»

Wie der «Trumpismus» letztlich einzuordnen ist, muss jeder für sich selbst entscheiden. Skepsis ist definitiv angebracht, denn «einer von uns» sind weder der Präsident noch seine auserwählten Teammitglieder. Ob sie irgendeinen Sumpf trockenlegen oder Staatsverbrechen aufdecken werden oder was aus WHO- und Klimaverträgen wird, bleibt abzuwarten.

Das WHO-Dekret fordert jedenfalls die Übertragung der Gelder auf «glaubwürdige Partner», die die Aktivitäten übernehmen könnten. Zufällig scheint mit «Impfguru» Bill Gates ein weiterer Harris-Unterstützer kürzlich das Lager gewechselt zu haben: Nach einem gemeinsamen Abendessen zeigte er sich «beeindruckt» von Trumps Interesse an der globalen Gesundheit.

Mit dem Projekt «Stargate» sind weitere dunkle Wolken am Erwartungshorizont der Fangemeinde aufgezogen. Trump hat dieses Joint Venture zwischen den Konzernen OpenAI, Oracle, und SoftBank als das «größte KI-Infrastrukturprojekt der Geschichte» angekündigt. Der Stein des Anstoßes: Oracle-CEO Larry Ellison, der auch Fan von KI-gestützter Echtzeit-Überwachung ist, sieht einen weiteren potenziellen Einsatz der künstlichen Intelligenz. Sie könne dazu dienen, Krebserkrankungen zu erkennen und individuelle mRNA-«Impfstoffe» zur Behandlung innerhalb von 48 Stunden zu entwickeln.

Warum bitte sollten sich diese superreichen «Eliten» ins eigene Fleisch schneiden und direkt entgegen ihren eigenen Interessen handeln? Weil sie Menschenfreunde, sogenannte Philanthropen sind? Oder vielleicht, weil sie ein schlechtes Gewissen haben und ihre Schuld kompensieren müssen? Deswegen jedenfalls brauchen «Linke» laut Robert Willacker, einem deutschen Politikberater mit brasilianischen Wurzeln, rechte Parteien – ein ebenso überraschender wie humorvoller Erklärungsansatz.

Wenn eine Krähe der anderen kein Auge aushackt, dann tut sie das sich selbst noch weniger an. Dass Millionäre ernsthaft ihre eigene Besteuerung fordern oder Machteliten ihren eigenen Einfluss zugunsten anderer einschränken würden, halte ich für sehr unwahrscheinlich. So etwas glaube ich erst, wenn zum Beispiel die Rüstungsindustrie sich um Friedensverhandlungen bemüht, die Pharmalobby sich gegen institutionalisierte Korruption einsetzt, Zentralbanken ihre CBDC-Pläne für Bitcoin opfern oder der ÖRR die Abschaffung der Rundfunkgebühren fordert.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ c631e267:c2b78d3e

2025-01-18 09:34:51

@ c631e267:c2b78d3e

2025-01-18 09:34:51Die grauenvollste Aussicht ist die der Technokratie – \ einer kontrollierenden Herrschaft, \ die durch verstümmelte und verstümmelnde Geister ausgeübt wird. \ Ernst Jünger

«Davos ist nicht mehr sexy», das Weltwirtschaftsforum (WEF) mache Davos kaputt, diese Aussagen eines Einheimischen las ich kürzlich in der Handelszeitung. Während sich einige vor Ort enorm an der «teuersten Gewerbeausstellung der Welt» bereicherten, würden die negativen Begleiterscheinungen wie Wohnungsnot und Niedergang der lokalen Wirtschaft immer deutlicher.

Nächsten Montag beginnt in dem Schweizer Bergdorf erneut ein Jahrestreffen dieses elitären Clubs der Konzerne, bei dem man mit hochrangigen Politikern aus aller Welt und ausgewählten Vertretern der Systemmedien zusammenhocken wird. Wie bereits in den vergangenen vier Jahren wird die Präsidentin der EU-Kommission, Ursula von der Leyen, in Begleitung von Klaus Schwab ihre Grundsatzansprache halten.

Der deutsche WEF-Gründer hatte bei dieser Gelegenheit immer höchst lobende Worte für seine Landsmännin: 2021 erklärte er sich «stolz, dass Europa wieder unter Ihrer Führung steht» und 2022 fand er es bemerkenswert, was sie erreicht habe angesichts des «erstaunlichen Wandels», den die Welt in den vorangegangenen zwei Jahren erlebt habe; es gebe nun einen «neuen europäischen Geist».

Von der Leyens Handeln während der sogenannten Corona-«Pandemie» lobte Schwab damals bereits ebenso, wie es diese Woche das Karlspreis-Direktorium tat, als man der Beschuldigten im Fall Pfizergate die diesjährige internationale Auszeichnung «für Verdienste um die europäische Einigung» verlieh. Außerdem habe sie die EU nicht nur gegen den «Aggressor Russland», sondern auch gegen die «innere Bedrohung durch Rassisten und Demagogen» sowie gegen den Klimawandel verteidigt.

Jene Herausforderungen durch «Krisen epochalen Ausmaßes» werden indes aus dem Umfeld des WEF nicht nur herbeigeredet – wie man alljährlich zur Zeit des Davoser Treffens im Global Risks Report nachlesen kann, der zusammen mit dem Versicherungskonzern Zurich erstellt wird. Seit die Globalisten 2020/21 in der Praxis gesehen haben, wie gut eine konzertierte und konsequente Angst-Kampagne funktionieren kann, geht es Schlag auf Schlag. Sie setzen alles daran, Schwabs goldenes Zeitfenster des «Great Reset» zu nutzen.

Ziel dieses «großen Umbruchs» ist die totale Kontrolle der Technokraten über die Menschen unter dem Deckmantel einer globalen Gesundheitsfürsorge. Wie aber könnte man so etwas erreichen? Ein Mittel dazu ist die «kreative Zerstörung». Weitere unabdingbare Werkzeug sind die Einbindung, ja Gleichschaltung der Medien und der Justiz.

Ein «Great Mental Reset» sei die Voraussetzung dafür, dass ein Großteil der Menschen Einschränkungen und Manipulationen wie durch die Corona-Maßnahmen praktisch kritik- und widerstandslos hinnehme, sagt der Mediziner und Molekulargenetiker Michael Nehls. Er meint damit eine regelrechte Umprogrammierung des Gehirns, wodurch nach und nach unsere Individualität und unser soziales Bewusstsein eliminiert und durch unreflektierten Konformismus ersetzt werden.

Der aktuelle Zustand unserer Gesellschaften ist auch für den Schweizer Rechtsanwalt Philipp Kruse alarmierend. Durch den Umgang mit der «Pandemie» sieht er die Grundlagen von Recht und Vernunft erschüttert, die Rechtsstaatlichkeit stehe auf dem Prüfstand. Seiner dringenden Mahnung an alle Bürger, die Prinzipien von Recht und Freiheit zu verteidigen, kann ich mich nur anschließen.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ a95c6243:d345522c

2025-01-13 10:09:57

@ a95c6243:d345522c

2025-01-13 10:09:57Ich begann, Social Media aufzubauen, \ um den Menschen eine Stimme zu geben. \ Mark Zuckerberg

Sind euch auch die Tränen gekommen, als ihr Mark Zuckerbergs Wendehals-Deklaration bezüglich der Meinungsfreiheit auf seinen Portalen gehört habt? Rührend, oder? Während er früher die offensichtliche Zensur leugnete und später die Regierung Biden dafür verantwortlich machte, will er nun angeblich «die Zensur auf unseren Plattformen drastisch reduzieren».

«Purer Opportunismus» ob des anstehenden Regierungswechsels wäre als Klassifizierung viel zu kurz gegriffen. Der jetzige Schachzug des Meta-Chefs ist genauso Teil einer kühl kalkulierten Business-Strategie, wie es die 180 Grad umgekehrte Praxis vorher war. Social Media sind ein höchst lukratives Geschäft. Hinzu kommt vielleicht noch ein bisschen verkorkstes Ego, weil derartig viel Einfluss und Geld sicher auch auf die Psyche schlagen. Verständlich.

«Es ist an der Zeit, zu unseren Wurzeln der freien Meinungsäußerung auf Facebook und Instagram zurückzukehren. Ich begann, Social Media aufzubauen, um den Menschen eine Stimme zu geben», sagte Zuckerberg.

Welche Wurzeln? Hat der Mann vergessen, dass er von der Überwachung, dem Ausspionieren und dem Ausverkauf sämtlicher Daten und digitaler Spuren sowie der Manipulation seiner «Kunden» lebt? Das ist knallharter Kommerz, nichts anderes. Um freie Meinungsäußerung geht es bei diesem Geschäft ganz sicher nicht, und das war auch noch nie so. Die Wurzeln von Facebook liegen in einem Projekt des US-Militärs mit dem Namen «LifeLog». Dessen Ziel war es, «ein digitales Protokoll vom Leben eines Menschen zu erstellen».

Der Richtungswechsel kommt allerdings nicht überraschend. Schon Anfang Dezember hatte Meta-Präsident Nick Clegg von «zu hoher Fehlerquote bei der Moderation» von Inhalten gesprochen. Bei der Gelegenheit erwähnte er auch, dass Mark sehr daran interessiert sei, eine aktive Rolle in den Debatten über eine amerikanische Führungsrolle im technologischen Bereich zu spielen.

Während Milliardärskollege und Big Tech-Konkurrent Elon Musk bereits seinen Posten in der kommenden Trump-Regierung in Aussicht hat, möchte Zuckerberg also nicht nur seine Haut retten – Trump hatte ihn einmal einen «Feind des Volkes» genannt und ihm lebenslange Haft angedroht –, sondern am liebsten auch mitspielen. KI-Berater ist wohl die gewünschte Funktion, wie man nach einem Treffen Trump-Zuckerberg hörte. An seine Verhaftung dachte vermutlich auch ein weiterer Multimilliardär mit eigener Social Media-Plattform, Pavel Durov, als er Zuckerberg jetzt kritisierte und gleichzeitig warnte.

Politik und Systemmedien drehen jedenfalls durch – was zu viel ist, ist zu viel. Etwas weniger Zensur und mehr Meinungsfreiheit würden die Freiheit der Bürger schwächen und seien potenziell vernichtend für die Menschenrechte. Zuckerberg setze mit dem neuen Kurs die Demokratie aufs Spiel, das sei eine «Einladung zum nächsten Völkermord», ernsthaft. Die Frage sei, ob sich die EU gegen Musk und Zuckerberg behaupten könne, Brüssel müsse jedenfalls hart durchgreifen.

Auch um die Faktenchecker macht man sich Sorgen. Für die deutsche Nachrichtenagentur dpa und die «Experten» von Correctiv, die (noch) Partner für Fact-Checking-Aktivitäten von Facebook sind, sei das ein «lukratives Geschäftsmodell». Aber möglicherweise werden die Inhalte ohne diese vermeintlichen Korrektoren ja sogar besser. Anders als Meta wollen jedoch Scholz, Faeser und die Tagesschau keine Fehler zugeben und zum Beispiel Correctiv-Falschaussagen einräumen.

Bei derlei dramatischen Befürchtungen wundert es nicht, dass der öffentliche Plausch auf X zwischen Elon Musk und AfD-Chefin Alice Weidel von 150 EU-Beamten überwacht wurde, falls es irgendwelche Rechtsverstöße geben sollte, die man ihnen ankreiden könnte. Auch der Deutsche Bundestag war wachsam. Gefunden haben dürften sie nichts. Das Ganze war eher eine Show, viel Wind wurde gemacht, aber letztlich gab es nichts als heiße Luft.

Das Anbiedern bei Donald Trump ist indes gerade in Mode. Die Weltgesundheitsorganisation (WHO) tut das auch, denn sie fürchtet um Spenden von über einer Milliarde Dollar. Eventuell könnte ja Elon Musk auch hier künftig aushelfen und der Organisation sowie deren größtem privaten Förderer, Bill Gates, etwas unter die Arme greifen. Nachdem Musks KI-Projekt xAI kürzlich von BlackRock & Co. sechs Milliarden eingestrichen hat, geht da vielleicht etwas.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ a95c6243:d345522c

2025-01-03 20:26:47

@ a95c6243:d345522c

2025-01-03 20:26:47Was du bist hängt von drei Faktoren ab: \ Was du geerbt hast, \ was deine Umgebung aus dir machte \ und was du in freier Wahl \ aus deiner Umgebung und deinem Erbe gemacht hast. \ Aldous Huxley

Das brave Mitmachen und Mitlaufen in einem vorgegebenen, recht engen Rahmen ist gewiss nicht neu, hat aber gerade wieder mal Konjunktur. Dies kann man deutlich beobachten, eigentlich egal, in welchem gesellschaftlichen Bereich man sich umschaut. Individualität ist nur soweit angesagt, wie sie in ein bestimmtes Schema von «Diversität» passt, und Freiheit verkommt zur Worthülse – nicht erst durch ein gewisses Buch einer gewissen ehemaligen Regierungschefin.

Erklärungsansätze für solche Entwicklungen sind bekannt, und praktisch alle haben etwas mit Massenpsychologie zu tun. Der Herdentrieb, also der Trieb der Menschen, sich – zum Beispiel aus Unsicherheit oder Bequemlichkeit – lieber der Masse anzuschließen als selbstständig zu denken und zu handeln, ist einer der Erklärungsversuche. Andere drehen sich um Macht, Propaganda, Druck und Angst, also den gezielten Einsatz psychologischer Herrschaftsinstrumente.

Aber wollen die Menschen überhaupt Freiheit? Durch Gespräche im privaten Umfeld bin ich diesbezüglich in der letzten Zeit etwas skeptisch geworden. Um die Jahreswende philosophiert man ja gerne ein wenig über das Erlebte und über die Erwartungen für die Zukunft. Dabei hatte ich hin und wieder den Eindruck, die totalitären Anwandlungen unserer «Repräsentanten» kämen manchen Leuten gerade recht.

«Desinformation» ist so ein brisantes Thema. Davor müsse man die Menschen doch schützen, hörte ich. Jemand müsse doch zum Beispiel diese ganzen merkwürdigen Inhalte in den Social Media filtern – zur Ukraine, zum Klima, zu Gesundheitsthemen oder zur Migration. Viele wüssten ja gar nicht einzuschätzen, was richtig und was falsch ist, sie bräuchten eine Führung.

Freiheit bedingt Eigenverantwortung, ohne Zweifel. Eventuell ist es einigen tatsächlich zu anspruchsvoll, die Verantwortung für das eigene Tun und Lassen zu übernehmen. Oder die persönliche Freiheit wird nicht als ausreichend wertvolles Gut angesehen, um sich dafür anzustrengen. In dem Fall wäre die mangelnde Selbstbestimmung wohl das kleinere Übel. Allerdings fehlt dann gemäß Aldous Huxley ein Teil der Persönlichkeit. Letztlich ist natürlich alles eine Frage der Abwägung.

Sind viele Menschen möglicherweise schon so «eingenordet», dass freiheitliche Ambitionen gar nicht für eine ganze Gruppe, ein Kollektiv, verfolgt werden können? Solche Gedanken kamen mir auch, als ich mir kürzlich diverse Talks beim viertägigen Hacker-Kongress des Chaos Computer Clubs (38C3) anschaute. Ich war nicht nur überrascht, sondern reichlich erschreckt angesichts der in weiten Teilen mainstream-geformten Inhalte, mit denen ein dankbares Publikum beglückt wurde. Wo ich allgemein hellere Köpfe erwartet hatte, fand ich Konformismus und enthusiastisch untermauerte Narrative.

Gibt es vielleicht so etwas wie eine Herdenimmunität gegen Indoktrination? Ich denke, ja, zumindest eine gestärkte Widerstandsfähigkeit. Was wir brauchen, sind etwas gesunder Menschenverstand, offene Informationskanäle und der Mut, sich freier auch zwischen den Herden zu bewegen. Sie tun das bereits, aber sagen Sie es auch dieses Jahr ruhig weiter.

Dieser Beitrag ist zuerst auf Transition News erschienen.

-

@ a95c6243:d345522c

2025-01-01 17:39:51

@ a95c6243:d345522c

2025-01-01 17:39:51Heute möchte ich ein Gedicht mit euch teilen. Es handelt sich um eine Ballade des österreichischen Lyrikers Johann Gabriel Seidl aus dem 19. Jahrhundert. Mir sind diese Worte fest in Erinnerung, da meine Mutter sie perfekt rezitieren konnte, auch als die Kräfte schon langsam schwanden.

Dem originalen Titel «Die Uhr» habe ich für mich immer das Wort «innere» hinzugefügt. Denn der Zeitmesser – hier vermutliche eine Taschenuhr – symbolisiert zwar in dem Kontext das damalige Zeitempfinden und die Umbrüche durch die industrielle Revolution, sozusagen den Zeitgeist und das moderne Leben. Aber der Autor setzt sich philosophisch mit der Zeit auseinander und gibt seinem Werk auch eine klar spirituelle Dimension.

Das Ticken der Uhr und die Momente des Glücks und der Trauer stehen sinnbildlich für das unaufhaltsame Fortschreiten und die Vergänglichkeit des Lebens. Insofern könnte man bei der Uhr auch an eine Sonnenuhr denken. Der Rhythmus der Ereignisse passt uns vielleicht nicht immer in den Kram.

Was den Takt pocht, ist durchaus auch das Herz, unser «inneres Uhrwerk». Wenn dieses Meisterwerk einmal stillsteht, ist es unweigerlich um uns geschehen. Hoffentlich können wir dann dankbar sagen: «Ich habe mein Bestes gegeben.»

Ich trage, wo ich gehe, stets eine Uhr bei mir; \ Wieviel es geschlagen habe, genau seh ich an ihr. \ Es ist ein großer Meister, der künstlich ihr Werk gefügt, \ Wenngleich ihr Gang nicht immer dem törichten Wunsche genügt.

Ich wollte, sie wäre rascher gegangen an manchem Tag; \ Ich wollte, sie hätte manchmal verzögert den raschen Schlag. \ In meinen Leiden und Freuden, in Sturm und in der Ruh, \ Was immer geschah im Leben, sie pochte den Takt dazu.

Sie schlug am Sarge des Vaters, sie schlug an des Freundes Bahr, \ Sie schlug am Morgen der Liebe, sie schlug am Traualtar. \ Sie schlug an der Wiege des Kindes, sie schlägt, will's Gott, noch oft, \ Wenn bessere Tage kommen, wie meine Seele es hofft.

Und ward sie auch einmal träger, und drohte zu stocken ihr Lauf, \ So zog der Meister immer großmütig sie wieder auf. \ Doch stände sie einmal stille, dann wär's um sie geschehn, \ Kein andrer, als der sie fügte, bringt die Zerstörte zum Gehn.

Dann müßt ich zum Meister wandern, der wohnt am Ende wohl weit, \ Wohl draußen, jenseits der Erde, wohl dort in der Ewigkeit! \ Dann gäb ich sie ihm zurücke mit dankbar kindlichem Flehn: \ Sieh, Herr, ich hab nichts verdorben, sie blieb von selber stehn.

Johann Gabriel Seidl (1804-1875)

-

@ dd664d5e:5633d319

2025-02-14 16:56:29

@ dd664d5e:5633d319

2025-02-14 16:56:29Most people only know customer-to-customer (C2C) and business-to-customer (B2C) software and websites. Those are the famous and popular ones, but business-to-business (B2B) is also pretty big. How big?

Even something boring and local like DATEV has almost 3 million organizations as customers and €1,44 billion in annual revenue.

FedEx has €90 billion in annual revenue and everyone who uses it comes into contact with its software. There's a whole chain of software between the sender and receiver of the package, and it all has to work seamlessly.

Same with Walmart, Toyota, Dubai Airport, Glencore, Tesla, Edeka, Carrefour, Harvard and University of Texas, Continental, Allianz, Asklepios, etc.

That's the sort of software I help build. You've probably never heard of it, but when it doesn't work properly, you'll hear about it on the news.

-

@ 5de23b9a:d83005b3

2025-02-19 03:47:19

@ 5de23b9a:d83005b3

2025-02-19 03:47:19In a digital era that is increasingly controlled by large companies, the emergence of Nostr (Notes and Other Stuff Transmitted by Relays) is a breath of fresh air for those who crave freedom of expression.

Nostr is a cryptography-based protocol that allows users to send and receive messages through a relay network. Unlike conventional social media such as Twitter or Facebook

1.Full Decentralization: No company or government can remove or restrict content.

2.Sensor-Resistant: Information remains accessible despite blocking attempts.

3.Privacy and Security: Uses cryptography to ensure that only users who have the keys can access their messages.* **

-

@ a95c6243:d345522c

2024-12-21 09:54:49

@ a95c6243:d345522c

2024-12-21 09:54:49Falls du beim Lesen des Titels dieses Newsletters unwillkürlich an positive Neuigkeiten aus dem globalen polit-medialen Irrenhaus oder gar aus dem wirtschaftlichen Umfeld gedacht hast, darf ich dich beglückwünschen. Diese Assoziation ist sehr löblich, denn sie weist dich als unverbesserlichen Optimisten aus. Leider muss ich dich diesbezüglich aber enttäuschen. Es geht hier um ein anderes Thema, allerdings sehr wohl ein positives, wie ich finde.

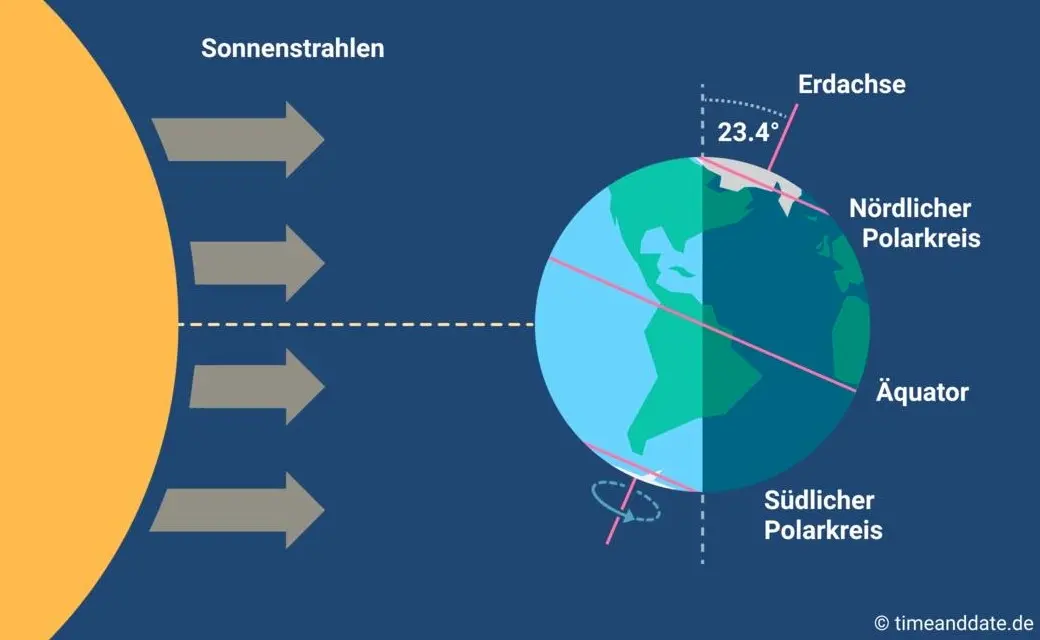

Heute ist ein ganz besonderer Tag: die Wintersonnenwende. Genau gesagt hat heute morgen um 10:20 Uhr Mitteleuropäischer Zeit (MEZ) auf der Nordhalbkugel unseres Planeten der astronomische Winter begonnen. Was daran so außergewöhnlich ist? Der kürzeste Tag des Jahres war gestern, seit heute werden die Tage bereits wieder länger! Wir werden also jetzt jeden Tag ein wenig mehr Licht haben.

Für mich ist dieses Ereignis immer wieder etwas kurios: Es beginnt der Winter, aber die Tage werden länger. Das erscheint mir zunächst wie ein Widerspruch, denn meine spontanen Assoziationen zum Winter sind doch eher Kälte und Dunkelheit, relativ zumindest. Umso erfreulicher ist der emotionale Effekt, wenn dann langsam die Erkenntnis durchsickert: Ab jetzt wird es schon wieder heller!

Natürlich ist es kalt im Winter, mancherorts mehr als anderswo. Vielleicht jedoch nicht mehr lange, wenn man den Klimahysterikern glauben wollte. Mindestens letztes Jahr hat Väterchen Frost allerdings gleich zu Beginn seiner Saison – und passenderweise während des globalen Überhitzungsgipfels in Dubai – nochmal richtig mit der Faust auf den Tisch gehauen. Schnee- und Eischaos sind ja eigentlich in der Agenda bereits nicht mehr vorgesehen. Deswegen war man in Deutschland vermutlich in vorauseilendem Gehorsam schon nicht mehr darauf vorbereitet und wurde glatt lahmgelegt.

Aber ich schweife ab. Die Aussicht auf nach und nach mehr Licht und damit auch Wärme stimmt mich froh. Den Zusammenhang zwischen beidem merkt man in Andalusien sehr deutlich. Hier, wo die Häuser im Winter arg auskühlen, geht man zum Aufwärmen raus auf die Straße oder auf den Balkon. Die Sonne hat auch im Winter eine erfreuliche Kraft. Und da ist jede Minute Gold wert.

Außerdem ist mir vor Jahren so richtig klar geworden, warum mir das südliche Klima so sehr gefällt. Das liegt nämlich nicht nur an der Sonne als solcher, oder der Wärme – das liegt vor allem am Licht. Ohne Licht keine Farben, das ist der ebenso simple wie gewaltige Unterschied zwischen einem deprimierenden matschgraubraunen Winter und einem fröhlichen bunten. Ein großes Stück Lebensqualität.

Mir gefällt aber auch die Symbolik dieses Tages: Licht aus der Dunkelheit, ein Wendepunkt, ein Neuanfang, neue Möglichkeiten, Übergang zu neuer Aktivität. In der winterlichen Stille keimt bereits neue Lebendigkeit. Und zwar in einem Zyklus, das wird immer wieder so geschehen. Ich nehme das gern als ein Stück Motivation, es macht mir Hoffnung und gibt mir Energie.

Übrigens ist parallel am heutigen Tag auf der südlichen Halbkugel Sommeranfang. Genau im entgegengesetzten Rhythmus, sich ergänzend, wie Yin und Yang. Das alles liegt an der Schrägstellung der Erdachse, die ist nämlich um 23,4º zur Umlaufbahn um die Sonne geneigt. Wir erinnern uns, gell?

Insofern bleibt eindeutig festzuhalten, dass “schräg sein” ein willkommener, wichtiger und positiver Wert ist. Mit anderen Worten: auch ungewöhnlich, eigenartig, untypisch, wunderlich, kauzig, … ja sogar irre, spinnert oder gar “quer” ist in Ordnung. Das schließt das Denken mit ein.

In diesem Sinne wünsche ich euch allen urige Weihnachtstage!

Dieser Beitrag ist letztes Jahr in meiner Denkbar erschienen.

-

@ dd664d5e:5633d319

2025-02-12 07:05:51

@ dd664d5e:5633d319

2025-02-12 07:05:51I think this note from Chip (nostr:npub1qdjn8j4gwgmkj3k5un775nq6q3q7mguv5tvajstmkdsqdja2havq03fqm7) is one of those things that people with business management experience take a lot more seriously than most developers and influencers do.

I am painfully aware of the cost of systems administration, financial transaction management and recordkeeping, recruiting and personnel management, legal and compliance, requirements management, technical support, renting and managing physical spaces and infrastructure, negotiating with suppliers, customer service, etc. etc.

There's this idea, on Nostr, that sort of trickled in along with Bitcoin Twitter, that we would all just be isolated subsistance farmers and one-man-show podcasters with a gigantic server rack in the basement. But some of us are running real companies -- on and off Nostr, for-profit and non-profit -- and it often requires a lot of human labor.

The things we build aren't meant to be used by one person and his girlfriend and his dog. Yes, he can also run all these things, himself, but he no longer has to. Our existence gives him the choice: run these things or pay us to run them and spend your time doing something else, that you do better than we do.

These things are meant to be used by hundreds... thousands... eventually millions of people. The workflows, processes, infrastructure, and personnel need to be able to scale up-and-down, scale in-and-out, work smoothly with 5 people or 50 people. These are the sort of Nostr systems that wouldn't collapse when encountering a sudden influx or mass-escape. But these systems are much more complex and they take time to build and staff to run them. (And, no, AI can't replace them all. AI means that they now also have to integrate a bunch of AI into the system and maintain that, too.)

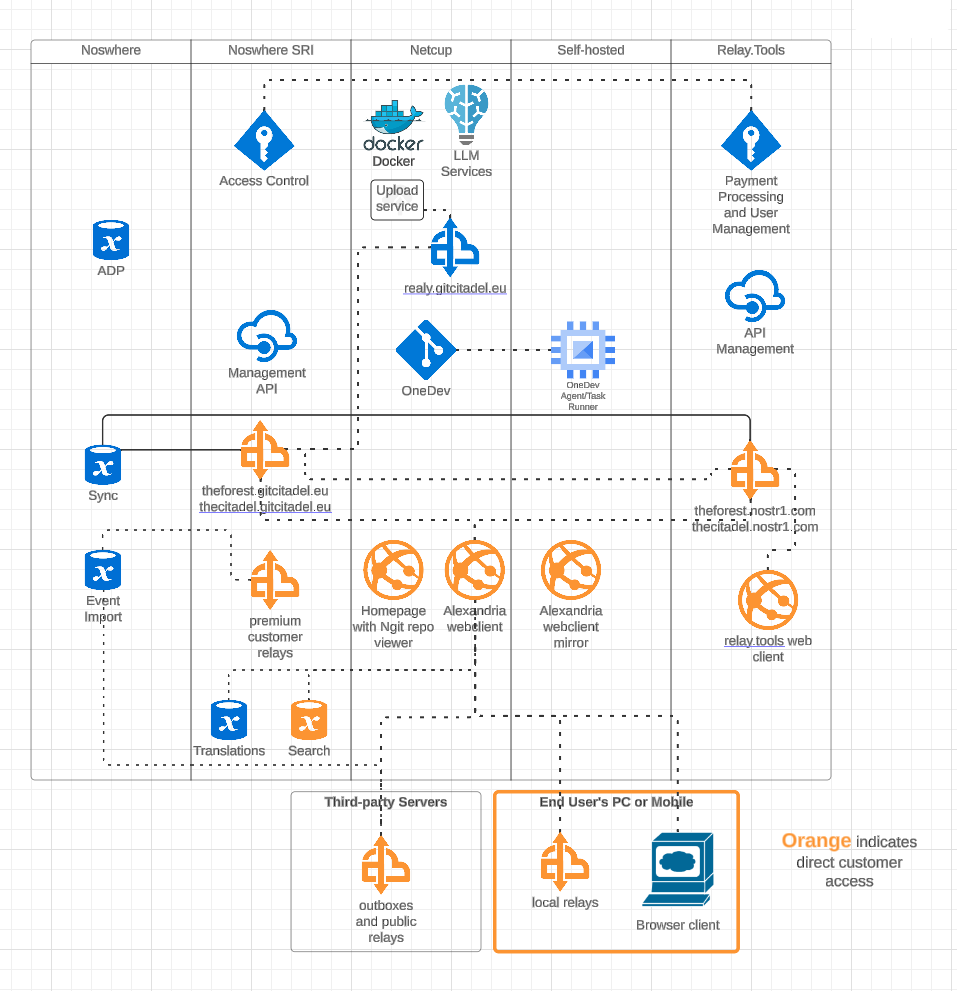

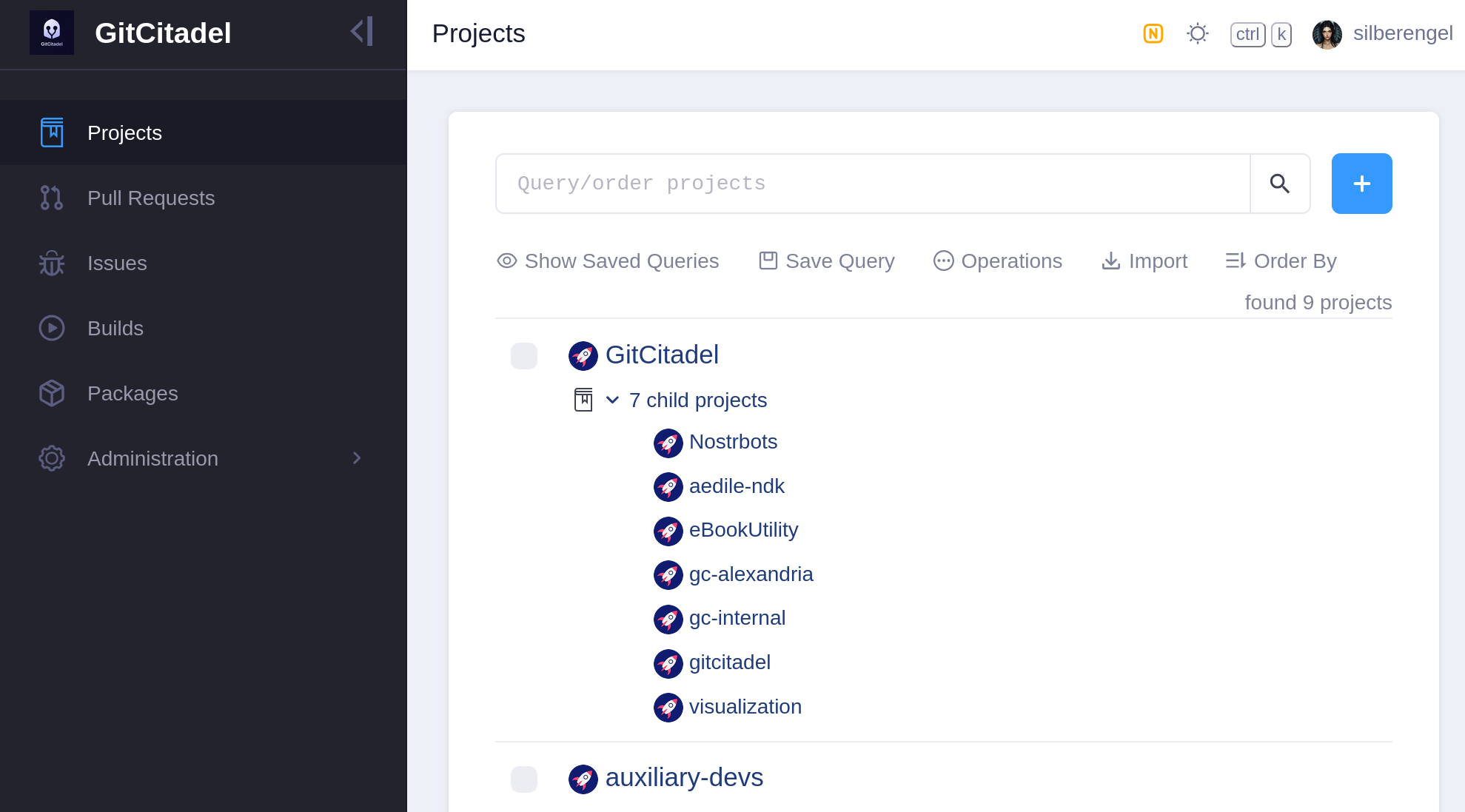

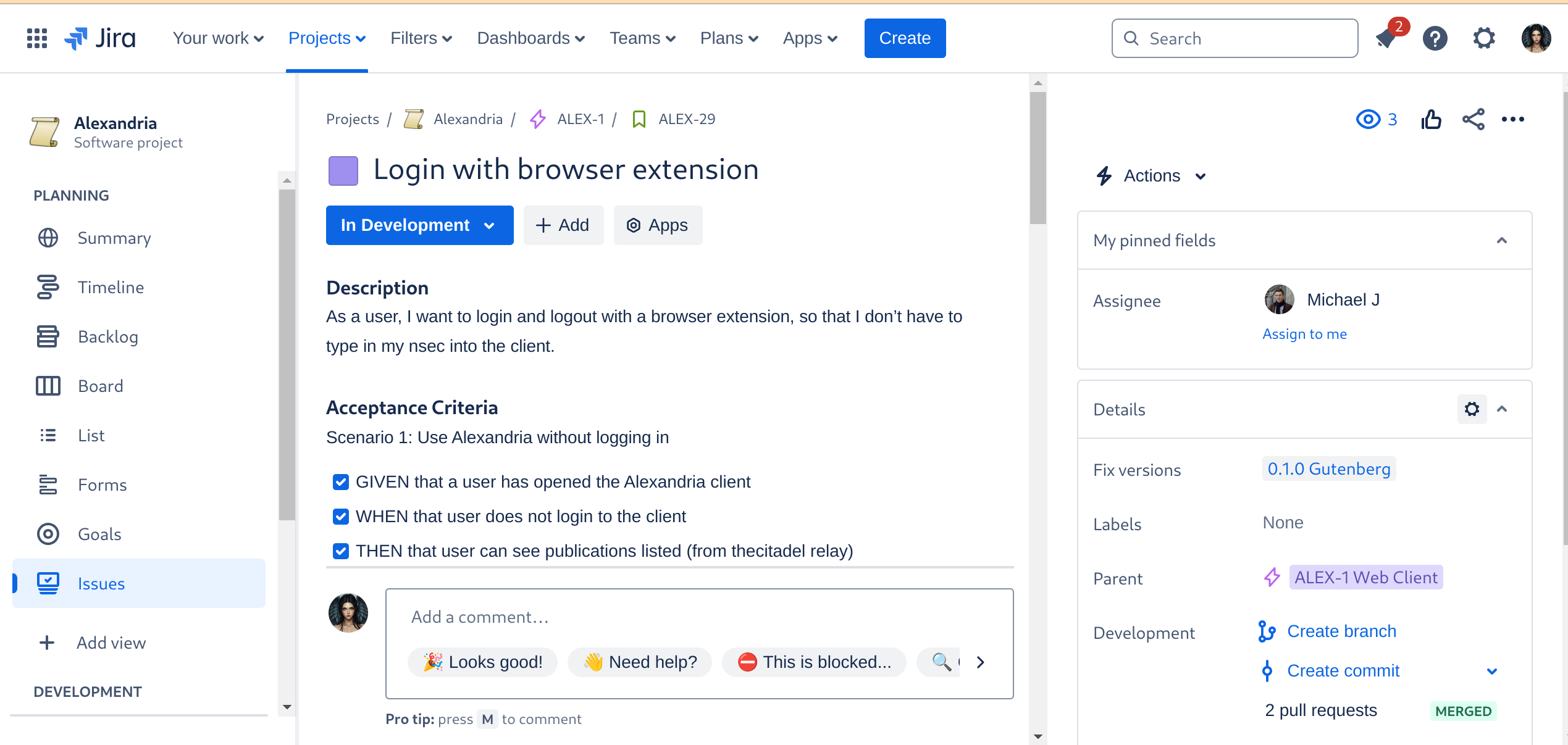

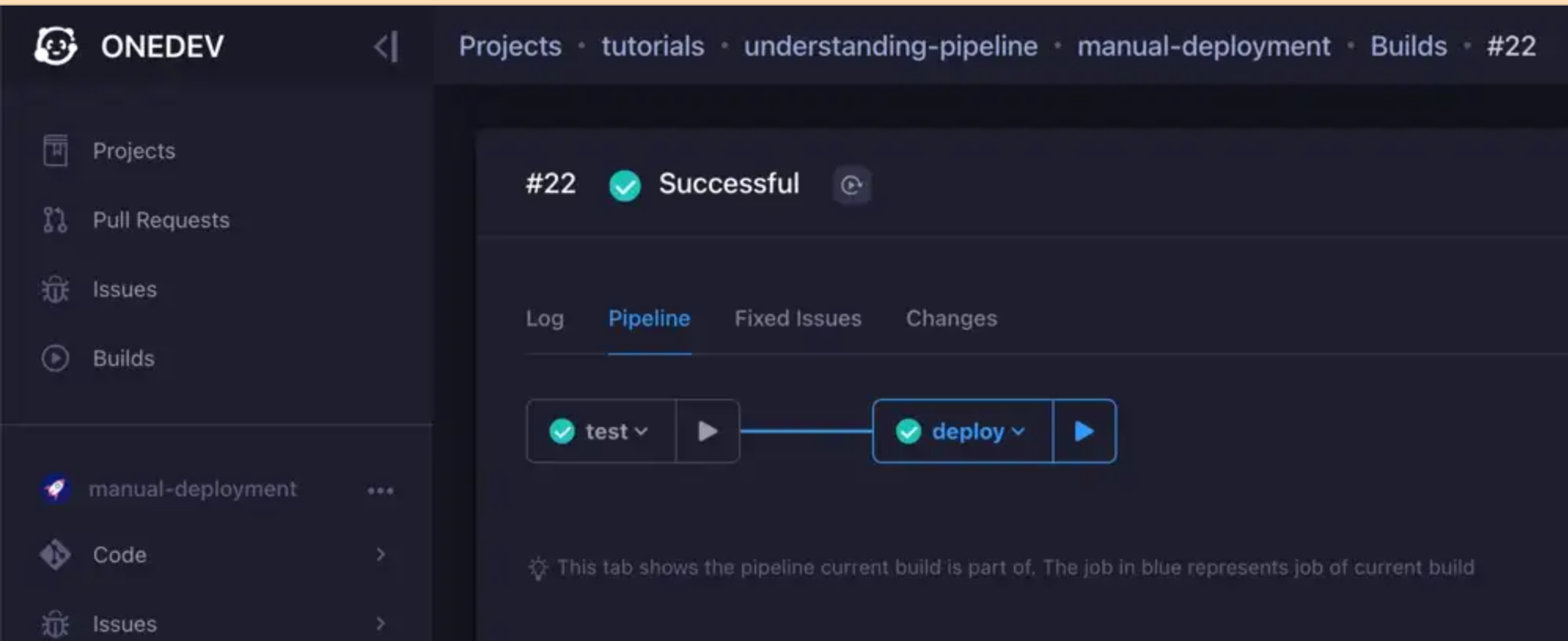

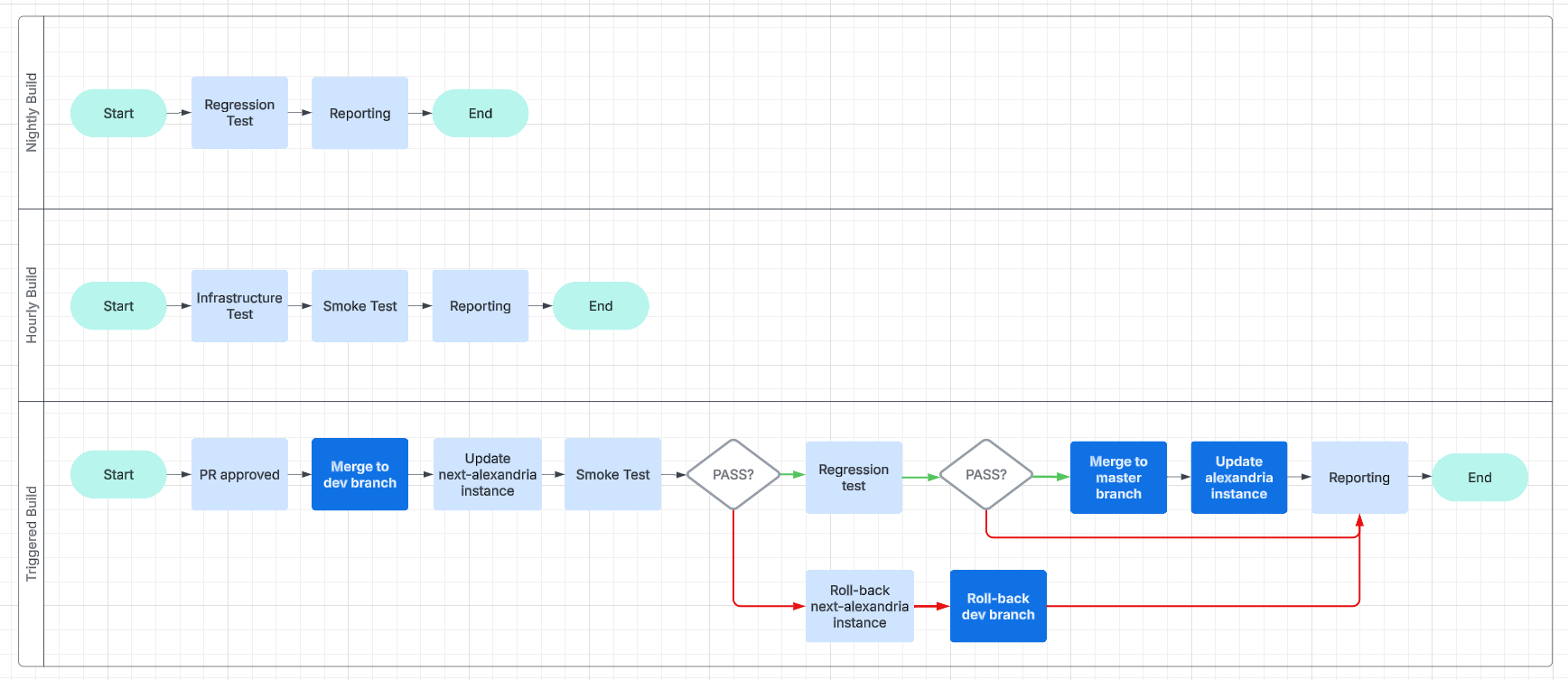

GitCitadel (nostr:npub1s3ht77dq4zqnya8vjun5jp3p44pr794ru36d0ltxu65chljw8xjqd975wz) is very automation-forward, but we still have to front the incredibly high cost of designing and building the automation, train people to interact with it (there are now over 20 people integrated into the workflow!), adjust it based upon their feedback, and we have to support the automation, once it's running.

This sort of streamlined machine is what people pay companies for, not code. That is why there's little business cost to open source.

Open-source is great, but...

nostr:nevent1qqsgqh2dedhagyd9k8yfk2lagswjl7y627k9fpnq4l436ccmlys0s3qprdmhxue69uhhg6r9vehhyetnwshxummnw3erztnrdakj7q3qqdjn8j4gwgmkj3k5un775nq6q3q7mguv5tvajstmkdsqdja2havqxpqqqqqqzdhnyjm

-

@ e31e84c4:77bbabc0

2025-02-25 15:03:34

@ e31e84c4:77bbabc0

2025-02-25 15:03:34The Fine Line: Bitcoin Companies Navigating Regulation and Freedom was written by Bri. If you enjoyed this article then support her writing, by donating to her lightning wallet: bri_1@walletofsatoshi.com

We all know the value proposition of Bitcoin: Bitcoin cannot be controlled by the state. Bitcoin is permissionless, it doesn't need a KYC and we can send money to anyone in the world, without middlemen, without censorship, without limits.

However, when companies use Bitcoin, and more so when they offer Bitcoin services, their activities are indeed controlled by the state. In order to fulfil the regulatory requirements, companies usually have to employ entire compliance teams.

Bitcoin-only exchanges are probably not better off than crypto service providers, even if one can sometimes hopefully recognise an increasing pro-Bitcoin attitude in the world. The Bitcoin scene recently looked expectantly to Nashville when Trump appeared at the Bitcoin 2024 conference as part of his election campaign. He doesn't really seem to be able to distinguish between Bitcoin and crypto though – in his keynote speech he promised to make the U.S. the ‘crypto capital of the planet’.

Nevertheless, the news that the United States plans to accumulate Bitcoin as a strategic reserve currency made headlines around the world and many Bitcoin supporters are delighted. Bitcoin's negative image could be somewhat corrected and it would certainly also be beneficial for Bitcoin adoption, so the hope goes. And indeed, the price of Bitcoin climbed to new record highs during the US election campaign, reaching its ATH of USD 109,000 when Trump took office on 20 January 2025.

The US announcement of a bitcoin strategic reserve can certainly be described as a historic moment. At the moment, it doesn't seem to be entirely clear whether Bitcoin or crypto, but a number of US states are working on advancing Bitcoin reserves. Whether it is a good thing when nation states start hoarding Bitcoin is another question. After all, from the very beginning and to this day, Bitcoin has been about taking power over money away from the state and giving it to the people.

Back to the Bitcoin companies. Let's assume that someone understands Bitcoin and has even discovered that there are Bitcoin-only exchanges. These companies recognise Bitcoin as sound money, support the Bitcoin community and want to integrate the Bitcoin ethos into their business model in the best possible way. Ouch – that already sounds like a compromise.

The Dilemma – Bitcoin at Heart, Regulation at the Back of the Neck

Bitcoin companies are caught between maximum independence and regulatory requirements. Companies such as Strike, Relai and River aim to make it as easy as possible for their customers to access Bitcoin while at the same time enabling them to maximise their independence from third parties. An important aspect of this is self-custody. Customers have full control over their Bitcoin and can avoid counterparty risks such as exchange failures or government seizures.

In contrast, most providers on the market, such as the major players Coinbase or Binance, rely on classic, centralised structures with full custody - and a large range of digital assets. They are basically fiat companies that offer crypto products.

And then, at the other end of the spectrum, there are projects such as Samourai, Wasabi Wallet or Tornado Cash, which are radically opposed to any form of control. They are developing powerful tools for more financial privacy – in line with Bitcoin's original idea as a decentralised cash system. But this commitment comes at a price: the founders of Samourai Wallet were arrested and the developers of Tornado Cash were prosecuted.

These Bitcoin rebels are putting the limits of state regulation to the test. And they raise the fundamental question: Is privacy an inalienable right or should it be subordinated to the public security interest?

The Middle Ground Builders

Bitcoin-only companies that choose the middle ground play an important role in the bitcoin ecosystem. This is because they appeal to the masses by keeping onboarding simple and often offering a range of interesting services. At the same time, they want to give their customers the greatest possible independence.

But are their business models sustainable? Or do these companies run the risk of being worn down by the balancing act between Bitcoin ethos and state control? How can these pioneers survive in a constantly changing regulatory environment?

It's a balancing act between regulation and Bitcoin values, and it's often a fight for the fundamental rights of not just Bitcoiners but people in general. For example, these companies need to have KYC processes in place to be compliant with the law and allow customers the greatest possible flexibility in their Bitcoin activities.

Some popular Bitcoin-companies and their strategies:

-

Strike: Custodial, fast lightning transactions, DCA, bill payments

-

Relai: Simple onramp, self-custody, private and business services

-

River: Multisig and cold storage, proof of reserves, inheritance

-

Unchained: Multisig vaults, DCA, inheritance, loans, retirement, advisory

-

Bull Bitcoin: Non-custodial exchange, DCA, bill payments, OTC desk

Typical features of these accounts usually include a KYC check, which allows users to be granted higher buy and sell limits. Many Bitcoin companies offer self-custody wallets and often some also multi-sig solutions that increase security for users. Partnerships with banks or payment service providers facilitate buying and selling and enable services such as the creation of savings plans.

Bitcoin companies face several challenges. Regulatory pressure remains a key concern, as authorities may tighten KYC obligations or introduce new restrictions. Trust is another issue since die-hard Bitcoiners often see these companies as not being consistent enough with Bitcoin's core principles.

Regulatory Framework and Political Influences

USA: Trump's Bitcoin course and the ‘Crypto Czar’

There are currently contradictory signals in the USA: on the one hand, Donald Trump has hinted at using Bitcoin as a strategic reserve (Strategic Bitcoin Reserve, SBR), while on the other hand, regulation is being tightened further. The newly created position of ‘White House AI and Crypto Czar’, presumably conceived in collaboration with Elon Musk, is intended to implement clear rules for blockchain, AI and the crypto market. This is also likely to affect companies that are committed to the Bitcoin ethos.

-

Positive signals: Bitcoin is increasingly recognised as a legitimate asset class.

-

Regulatory pressure: Stricter regulations could threaten the existence of smaller companies.

-

Possible future: If the US promotes Bitcoin as a strategic asset, this could fundamentally change the regulatory landscape.

Europe and Global Developments

-

MiCA (Markets in Crypto-Assets Regulation): New EU regulation for crypto companies, requiring strict KYC and AML rules, among other things.

-

Restrictive countries: China and India continue to rely on tough regulation or bans.

-

Friendly jurisdictions: Countries such as El Salvador or Switzerland offer attractive conditions for Bitcoin companies.

Self-custody of Bitcoin