-

@ eac63075:b4988b48

2025-01-04 19:41:34

@ eac63075:b4988b48

2025-01-04 19:41:34Since its creation in 2009, Bitcoin has symbolized innovation and resilience. However, from time to time, alarmist narratives arise about emerging technologies that could "break" its security. Among these, quantum computing stands out as one of the most recurrent. But does quantum computing truly threaten Bitcoin? And more importantly, what is the community doing to ensure the protocol remains invulnerable?

The answer, contrary to sensationalist headlines, is reassuring: Bitcoin is secure, and the community is already preparing for a future where quantum computing becomes a practical reality. Let’s dive into this topic to understand why the concerns are exaggerated and how the development of BIP-360 demonstrates that Bitcoin is one step ahead.

What Is Quantum Computing, and Why Is Bitcoin Not Threatened?

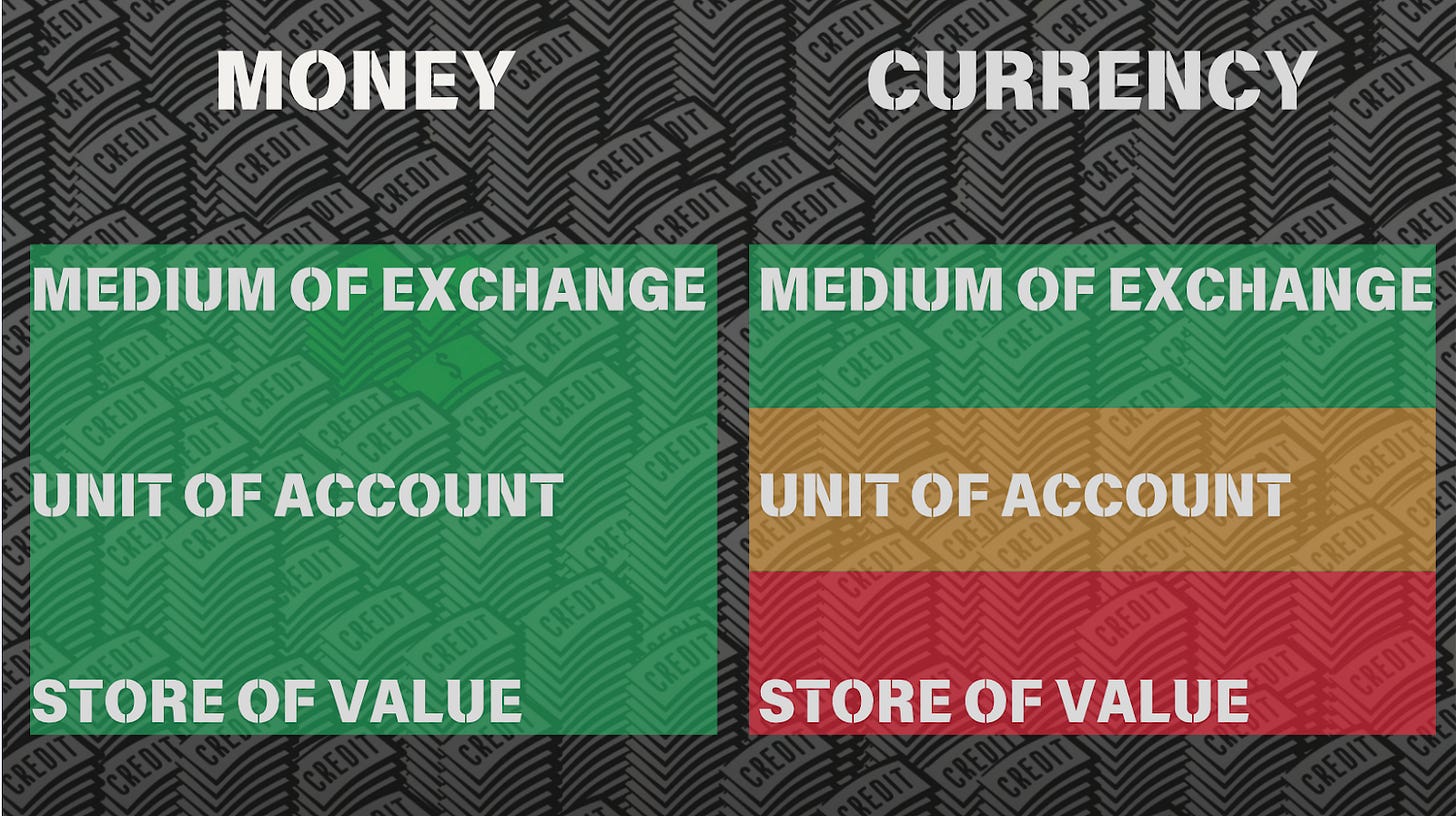

Quantum computing leverages principles of quantum mechanics to perform calculations that, in theory, could exponentially surpass classical computers—and it has nothing to do with what so-called “quantum coaches” teach to scam the uninformed. One of the concerns is that this technology could compromise two key aspects of Bitcoin’s security:

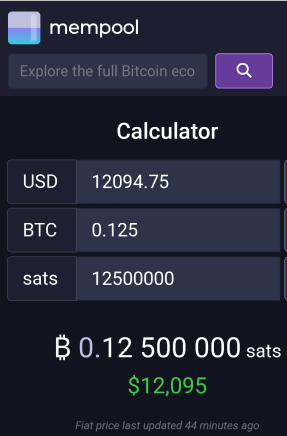

- Wallets: These use elliptic curve algorithms (ECDSA) to protect private keys. A sufficiently powerful quantum computer could deduce a private key from its public key.

- Mining: This is based on the SHA-256 algorithm, which secures the consensus process. A quantum attack could, in theory, compromise the proof-of-work mechanism.

Understanding Quantum Computing’s Attack Priorities

While quantum computing is often presented as a threat to Bitcoin, not all parts of the network are equally vulnerable. Theoretical attacks would be prioritized based on two main factors: ease of execution and potential reward. This creates two categories of attacks:

1. Attacks on Wallets

Bitcoin wallets, secured by elliptic curve algorithms, would be the initial targets due to the relative vulnerability of their public keys, especially those already exposed on the blockchain. Two attack scenarios stand out:

-

Short-term attacks: These occur during the interval between sending a transaction and its inclusion in a block (approximately 10 minutes). A quantum computer could intercept the exposed public key and derive the corresponding private key to redirect funds by creating a transaction with higher fees.

-

Long-term attacks: These focus on old wallets whose public keys are permanently exposed. Wallets associated with Satoshi Nakamoto, for example, are especially vulnerable because they were created before the practice of using hashes to mask public keys.

We can infer a priority order for how such attacks might occur based on urgency and importance.

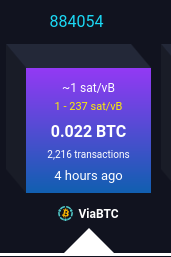

Bitcoin Quantum Attack: Prioritization Matrix (Urgency vs. Importance)

Bitcoin Quantum Attack: Prioritization Matrix (Urgency vs. Importance)2. Attacks on Mining

Targeting the SHA-256 algorithm, which secures the mining process, would be the next objective. However, this is far more complex and requires a level of quantum computational power that is currently non-existent and far from realization. A successful attack would allow for the recalculation of all possible hashes to dominate the consensus process and potentially "mine" it instantly.

Satoshi Nakamoto in 2010 on Quantum Computing and Bitcoin Attacks

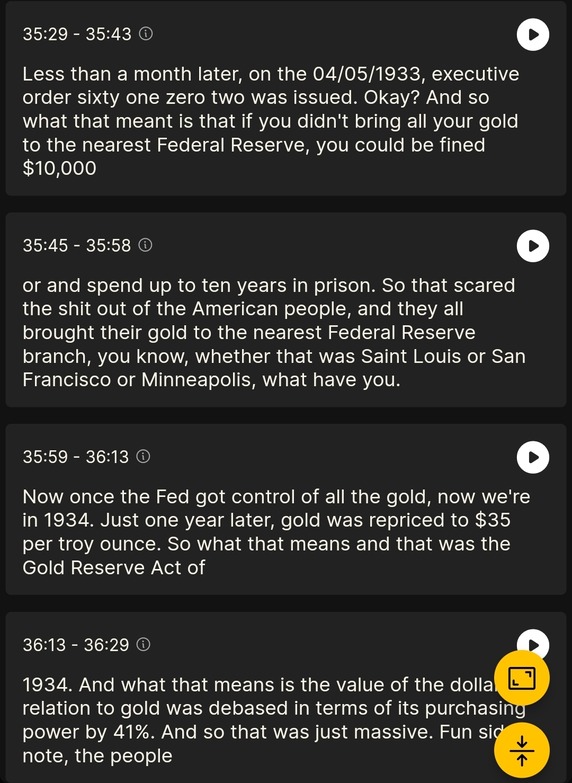

Satoshi Nakamoto in 2010 on Quantum Computing and Bitcoin AttacksRecently, Narcelio asked me about a statement I made on Tubacast:

https://x.com/eddieoz/status/1868371296683511969

If an attack became a reality before Bitcoin was prepared, it would be necessary to define the last block prior to the attack and proceed from there using a new hashing algorithm. The solution would resemble the response to the infamous 2013 bug. It’s a fact that this would cause market panic, and Bitcoin's price would drop significantly, creating a potential opportunity for the well-informed.

Preferably, if developers could anticipate the threat and had time to work on a solution and build consensus before an attack, they would simply decide on a future block for the fork, which would then adopt the new algorithm. It might even rehash previous blocks (reaching consensus on them) to avoid potential reorganization through the re-mining of blocks using the old hash. (I often use the term "shielding" old transactions).

How Can Users Protect Themselves?

While quantum computing is still far from being a practical threat, some simple measures can already protect users against hypothetical scenarios:

- Avoid using exposed public keys: Ensure funds sent to old wallets are transferred to new ones that use public key hashes. This reduces the risk of long-term attacks.

- Use modern wallets: Opt for wallets compatible with SegWit or Taproot, which implement better security practices.

- Monitor security updates: Stay informed about updates from the Bitcoin community, such as the implementation of BIP-360, which will introduce quantum-resistant addresses.

- Do not reuse addresses: Every transaction should be associated with a new address to minimize the risk of repeated exposure of the same public key.

- Adopt secure backup practices: Create offline backups of private keys and seeds in secure locations, protected from unauthorized access.

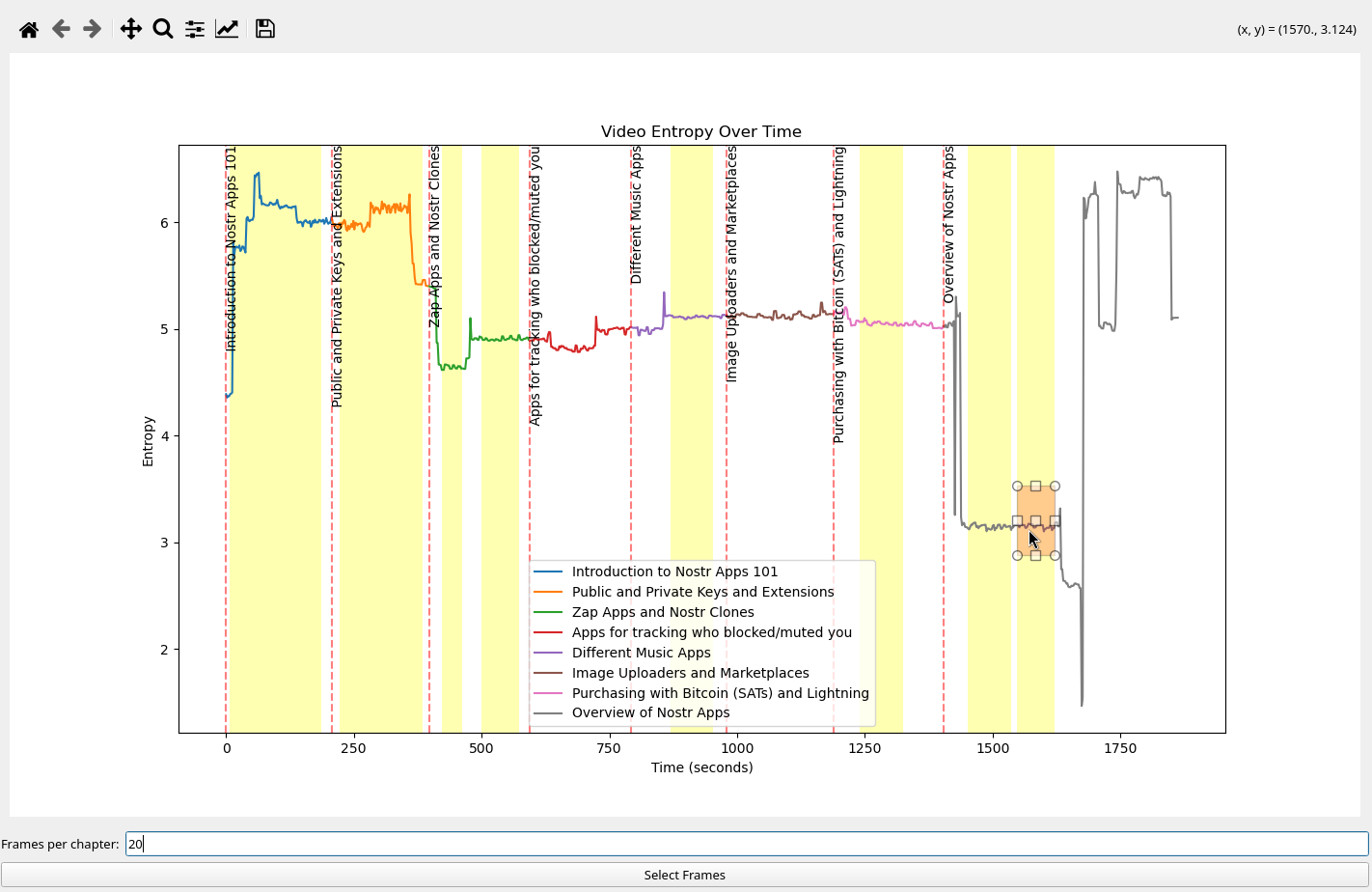

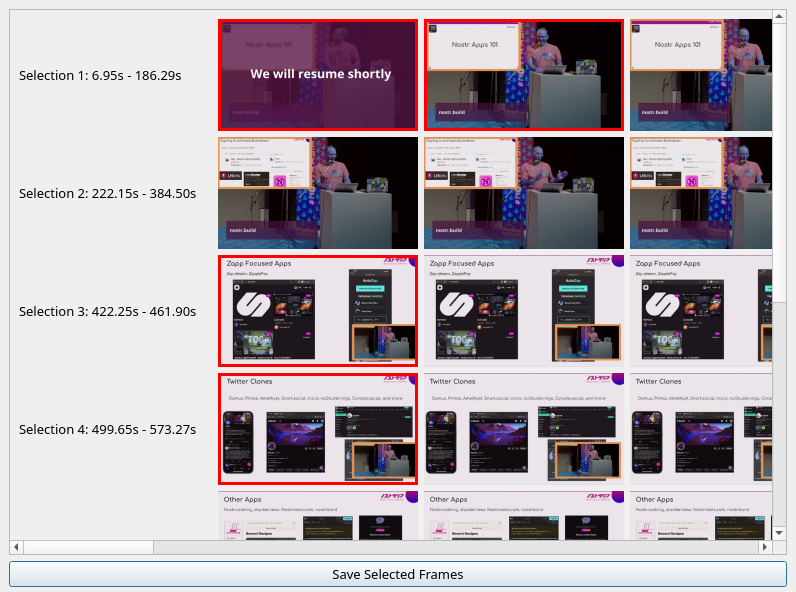

BIP-360 and Bitcoin’s Preparation for the Future

Even though quantum computing is still beyond practical reach, the Bitcoin community is not standing still. A concrete example is BIP-360, a proposal that establishes the technical framework to make wallets resistant to quantum attacks.

BIP-360 addresses three main pillars:

- Introduction of quantum-resistant addresses: A new address format starting with "BC1R" will be used. These addresses will be compatible with post-quantum algorithms, ensuring that stored funds are protected from future attacks.

- Compatibility with the current ecosystem: The proposal allows users to transfer funds from old addresses to new ones without requiring drastic changes to the network infrastructure.

- Flexibility for future updates: BIP-360 does not limit the choice of specific algorithms. Instead, it serves as a foundation for implementing new post-quantum algorithms as technology evolves.

This proposal demonstrates how Bitcoin can adapt to emerging threats without compromising its decentralized structure.

Post-Quantum Algorithms: The Future of Bitcoin Cryptography

The community is exploring various algorithms to protect Bitcoin from quantum attacks. Among the most discussed are:

- Falcon: A solution combining smaller public keys with compact digital signatures. Although it has been tested in limited scenarios, it still faces scalability and performance challenges.

- Sphincs: Hash-based, this algorithm is renowned for its resilience, but its signatures can be extremely large, making it less efficient for networks like Bitcoin’s blockchain.

- Lamport: Created in 1977, it’s considered one of the earliest post-quantum security solutions. Despite its reliability, its gigantic public keys (16,000 bytes) make it impractical and costly for Bitcoin.

Two technologies show great promise and are well-regarded by the community:

- Lattice-Based Cryptography: Considered one of the most promising, it uses complex mathematical structures to create systems nearly immune to quantum computing. Its implementation is still in its early stages, but the community is optimistic.

- Supersingular Elliptic Curve Isogeny: These are very recent digital signature algorithms and require extensive study and testing before being ready for practical market use.

The final choice of algorithm will depend on factors such as efficiency, cost, and integration capability with the current system. Additionally, it is preferable that these algorithms are standardized before implementation, a process that may take up to 10 years.

Why Quantum Computing Is Far from Being a Threat

The alarmist narrative about quantum computing overlooks the technical and practical challenges that still need to be overcome. Among them:

- Insufficient number of qubits: Current quantum computers have only a few hundred qubits, whereas successful attacks would require millions.

- High error rate: Quantum stability remains a barrier to reliable large-scale operations.

- High costs: Building and operating large-scale quantum computers requires massive investments, limiting their use to scientific or specific applications.

Moreover, even if quantum computers make significant advancements, Bitcoin is already adapting to ensure its infrastructure is prepared to respond.

Conclusion: Bitcoin’s Secure Future

Despite advancements in quantum computing, the reality is that Bitcoin is far from being threatened. Its security is ensured not only by its robust architecture but also by the community’s constant efforts to anticipate and mitigate challenges.

The implementation of BIP-360 and the pursuit of post-quantum algorithms demonstrate that Bitcoin is not only resilient but also proactive. By adopting practical measures, such as using modern wallets and migrating to quantum-resistant addresses, users can further protect themselves against potential threats.

Bitcoin’s future is not at risk—it is being carefully shaped to withstand any emerging technology, including quantum computing.

-

@ 04c915da:3dfbecc9

2025-02-25 03:55:08

@ 04c915da:3dfbecc9

2025-02-25 03:55:08Here’s a revised timeline of macro-level events from The Mandibles: A Family, 2029–2047 by Lionel Shriver, reimagined in a world where Bitcoin is adopted as a widely accepted form of money, altering the original narrative’s assumptions about currency collapse and economic control. In Shriver’s original story, the failure of Bitcoin is assumed amid the dominance of the bancor and the dollar’s collapse. Here, Bitcoin’s success reshapes the economic and societal trajectory, decentralizing power and challenging state-driven outcomes.

Part One: 2029–2032

-

2029 (Early Year)\ The United States faces economic strain as the dollar weakens against global shifts. However, Bitcoin, having gained traction emerges as a viable alternative. Unlike the original timeline, the bancor—a supranational currency backed by a coalition of nations—struggles to gain footing as Bitcoin’s decentralized adoption grows among individuals and businesses worldwide, undermining both the dollar and the bancor.

-

2029 (Mid-Year: The Great Renunciation)\ Treasury bonds lose value, and the government bans Bitcoin, labeling it a threat to sovereignty (mirroring the original bancor ban). However, a Bitcoin ban proves unenforceable—its decentralized nature thwarts confiscation efforts, unlike gold in the original story. Hyperinflation hits the dollar as the U.S. prints money, but Bitcoin’s fixed supply shields adopters from currency devaluation, creating a dual-economy split: dollar users suffer, while Bitcoin users thrive.

-

2029 (Late Year)\ Dollar-based inflation soars, emptying stores of goods priced in fiat currency. Meanwhile, Bitcoin transactions flourish in underground and online markets, stabilizing trade for those plugged into the bitcoin ecosystem. Traditional supply chains falter, but peer-to-peer Bitcoin networks enable local and international exchange, reducing scarcity for early adopters. The government’s gold confiscation fails to bolster the dollar, as Bitcoin’s rise renders gold less relevant.

-

2030–2031\ Crime spikes in dollar-dependent urban areas, but Bitcoin-friendly regions see less chaos, as digital wallets and smart contracts facilitate secure trade. The U.S. government doubles down on surveillance to crack down on bitcoin use. A cultural divide deepens: centralized authority weakens in Bitcoin-adopting communities, while dollar zones descend into lawlessness.

-

2032\ By this point, Bitcoin is de facto legal tender in parts of the U.S. and globally, especially in tech-savvy or libertarian-leaning regions. The federal government’s grip slips as tax collection in dollars plummets—Bitcoin’s traceability is low, and citizens evade fiat-based levies. Rural and urban Bitcoin hubs emerge, while the dollar economy remains fractured.

Time Jump: 2032–2047

- Over 15 years, Bitcoin solidifies as a global reserve currency, eroding centralized control. The U.S. government adapts, grudgingly integrating bitcoin into policy, though regional autonomy grows as Bitcoin empowers local economies.

Part Two: 2047

-

2047 (Early Year)\ The U.S. is a hybrid state: Bitcoin is legal tender alongside a diminished dollar. Taxes are lower, collected in BTC, reducing federal overreach. Bitcoin’s adoption has decentralized power nationwide. The bancor has faded, unable to compete with Bitcoin’s grassroots momentum.

-

2047 (Mid-Year)\ Travel and trade flow freely in Bitcoin zones, with no restrictive checkpoints. The dollar economy lingers in poorer areas, marked by decay, but Bitcoin’s dominance lifts overall prosperity, as its deflationary nature incentivizes saving and investment over consumption. Global supply chains rebound, powered by bitcoin enabled efficiency.

-

2047 (Late Year)\ The U.S. is a patchwork of semi-autonomous zones, united by Bitcoin’s universal acceptance rather than federal control. Resource scarcity persists due to past disruptions, but economic stability is higher than in Shriver’s original dystopia—Bitcoin’s success prevents the authoritarian slide, fostering a freer, if imperfect, society.

Key Differences

- Currency Dynamics: Bitcoin’s triumph prevents the bancor’s dominance and mitigates hyperinflation’s worst effects, offering a lifeline outside state control.

- Government Power: Centralized authority weakens as Bitcoin evades bans and taxation, shifting power to individuals and communities.

- Societal Outcome: Instead of a surveillance state, 2047 sees a decentralized, bitcoin driven world—less oppressive, though still stratified between Bitcoin haves and have-nots.

This reimagining assumes Bitcoin overcomes Shriver’s implied skepticism to become a robust, adopted currency by 2029, fundamentally altering the novel’s bleak trajectory.

-

-

@ 6e0ea5d6:0327f353

2025-02-21 18:15:52

@ 6e0ea5d6:0327f353

2025-02-21 18:15:52"Malcolm Forbes recounts that a lady, wearing a faded cotton dress, and her husband, dressed in an old handmade suit, stepped off a train in Boston, USA, and timidly made their way to the office of the president of Harvard University. They had come from Palo Alto, California, and had not scheduled an appointment. The secretary, at a glance, thought that those two, looking like country bumpkins, had no business at Harvard.

— We want to speak with the president — the man said in a low voice.

— He will be busy all day — the secretary replied curtly.

— We will wait.

The secretary ignored them for hours, hoping the couple would finally give up and leave. But they stayed there, and the secretary, somewhat frustrated, decided to bother the president, although she hated doing that.

— If you speak with them for just a few minutes, maybe they will decide to go away — she said.

The president sighed in irritation but agreed. Someone of his importance did not have time to meet people like that, but he hated faded dresses and tattered suits in his office. With a stern face, he went to the couple.

— We had a son who studied at Harvard for a year — the woman said. — He loved Harvard and was very happy here, but a year ago he died in an accident, and we would like to erect a monument in his honor somewhere on campus.— My lady — said the president rudely —, we cannot erect a statue for every person who studied at Harvard and died; if we did, this place would look like a cemetery.

— Oh, no — the lady quickly replied. — We do not want to erect a statue. We would like to donate a building to Harvard.

The president looked at the woman's faded dress and her husband's old suit and exclaimed:

— A building! Do you have even the faintest idea of how much a building costs? We have more than seven and a half million dollars' worth of buildings here at Harvard.

The lady was silent for a moment, then said to her husband:

— If that’s all it costs to found a university, why don’t we have our own?

The husband agreed.

The couple, Leland Stanford, stood up and left, leaving the president confused. Traveling back to Palo Alto, California, they established there Stanford University, the second-largest in the world, in honor of their son, a former Harvard student."

Text extracted from: "Mileumlivros - Stories that Teach Values."

Thank you for reading, my friend! If this message helped you in any way, consider leaving your glass “🥃” as a token of appreciation.

A toast to our family!

-

@ 9e69e420:d12360c2

2025-02-17 17:12:01

@ 9e69e420:d12360c2

2025-02-17 17:12:01President Trump has intensified immigration enforcement, likening it to a wartime effort. Despite pouring resources into the U.S. Immigration and Customs Enforcement (ICE), arrest numbers are declining and falling short of goals. ICE fell from about 800 daily arrests in late January to fewer than 600 in early February.

Critics argue the administration is merely showcasing efforts with ineffectiveness, while Trump seeks billions more in funding to support his deportation agenda. Increased involvement from various federal agencies is intended to assist ICE, but many lack specific immigration training.

Challenges persist, as fewer immigrants are available for quick deportation due to a decline in illegal crossings. Local sheriffs are also pressured by rising demands to accommodate immigrants, which may strain resources further.

-

@ eac63075:b4988b48

2024-11-09 17:57:27

@ eac63075:b4988b48

2024-11-09 17:57:27Based on a recent paper that included collaboration from renowned experts such as Lynn Alden, Steve Lee, and Ren Crypto Fish, we discuss in depth how Bitcoin's consensus is built, the main risks, and the complex dynamics of protocol upgrades.

Podcast https://www.fountain.fm/episode/wbjD6ntQuvX5u2G5BccC

Presentation https://gamma.app/docs/Analyzing-Bitcoin-Consensus-Risks-in-Protocol-Upgrades-p66axxjwaa37ksn

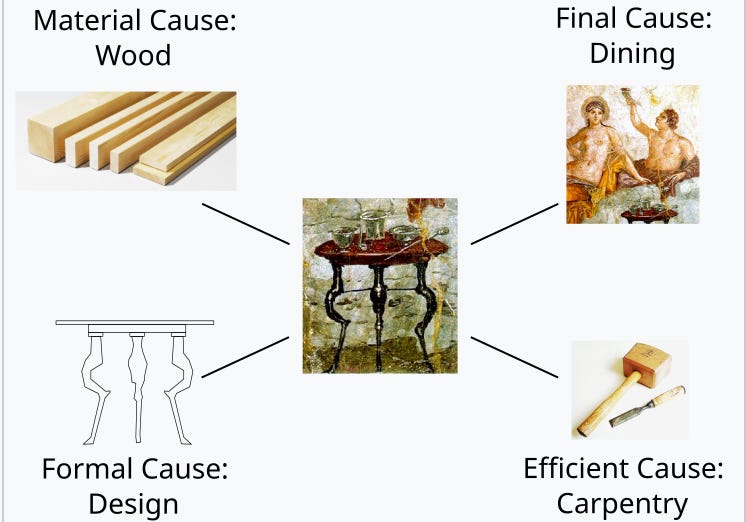

1. Introduction to Consensus in Bitcoin

Consensus in Bitcoin is the foundation that keeps the network secure and functional, allowing users worldwide to perform transactions in a decentralized manner without the need for intermediaries. Since its launch in 2009, Bitcoin is often described as an "immutable" system designed to resist changes, and it is precisely this resistance that ensures its security and stability.

The central idea behind consensus in Bitcoin is to create a set of acceptance rules for blocks and transactions, ensuring that all network participants agree on the transaction history. This prevents "double-spending," where the same bitcoin could be used in two simultaneous transactions, something that would compromise trust in the network.

Evolution of Consensus in Bitcoin

Over the years, consensus in Bitcoin has undergone several adaptations, and the way participants agree on changes remains a delicate process. Unlike traditional systems, where changes can be imposed from the top down, Bitcoin operates in a decentralized model where any significant change needs the support of various groups of stakeholders, including miners, developers, users, and large node operators.

Moreover, the update process is extremely cautious, as hasty changes can compromise the network's security. As a result, the philosophy of "don't fix what isn't broken" prevails, with improvements happening incrementally and only after broad consensus among those involved. This model can make progress seem slow but ensures that Bitcoin remains faithful to the principles of security and decentralization.

2. Technical Components of Consensus

Bitcoin's consensus is supported by a set of technical rules that determine what is considered a valid transaction and a valid block on the network. These technical aspects ensure that all nodes—the computers that participate in the Bitcoin network—agree on the current state of the blockchain. Below are the main technical components that form the basis of the consensus.

Validation of Blocks and Transactions

The validation of blocks and transactions is the central point of consensus in Bitcoin. A block is only considered valid if it meets certain criteria, such as maximum size, transaction structure, and the solving of the "Proof of Work" problem. The proof of work, required for a block to be included in the blockchain, is a computational process that ensures the block contains significant computational effort—protecting the network against manipulation attempts.

Transactions, in turn, need to follow specific input and output rules. Each transaction includes cryptographic signatures that prove the ownership of the bitcoins sent, as well as validation scripts that verify if the transaction conditions are met. This validation system is essential for network nodes to autonomously confirm that each transaction follows the rules.

Chain Selection

Another fundamental technical issue for Bitcoin's consensus is chain selection, which becomes especially important in cases where multiple versions of the blockchain coexist, such as after a network split (fork). To decide which chain is the "true" one and should be followed, the network adopts the criterion of the highest accumulated proof of work. In other words, the chain with the highest number of valid blocks, built with the greatest computational effort, is chosen by the network as the official one.

This criterion avoids permanent splits because it encourages all nodes to follow the same main chain, reinforcing consensus.

Soft Forks vs. Hard Forks

In the consensus process, protocol changes can happen in two ways: through soft forks or hard forks. These variations affect not only the protocol update but also the implications for network users:

-

Soft Forks: These are changes that are backward compatible. Only nodes that adopt the new update will follow the new rules, but old nodes will still recognize the blocks produced with these rules as valid. This compatibility makes soft forks a safer option for updates, as it minimizes the risk of network division.

-

Hard Forks: These are updates that are not backward compatible, requiring all nodes to update to the new version or risk being separated from the main chain. Hard forks can result in the creation of a new coin, as occurred with the split between Bitcoin and Bitcoin Cash in 2017. While hard forks allow for deeper changes, they also bring significant risks of network fragmentation.

These technical components form the base of Bitcoin's security and resilience, allowing the system to remain functional and immutable without losing the necessary flexibility to evolve over time.

3. Stakeholders in Bitcoin's Consensus

Consensus in Bitcoin is not decided centrally. On the contrary, it depends on the interaction between different groups of stakeholders, each with their motivations, interests, and levels of influence. These groups play fundamental roles in how changes are implemented or rejected on the network. Below, we explore the six main stakeholders in Bitcoin's consensus.

1. Economic Nodes

Economic nodes, usually operated by exchanges, custody providers, and large companies that accept Bitcoin, exert significant influence over consensus. Because they handle large volumes of transactions and act as a connection point between the Bitcoin ecosystem and the traditional financial system, these nodes have the power to validate or reject blocks and to define which version of the software to follow in case of a fork.

Their influence is proportional to the volume of transactions they handle, and they can directly affect which chain will be seen as the main one. Their incentive is to maintain the network's stability and security to preserve its functionality and meet regulatory requirements.

2. Investors

Investors, including large institutional funds and individual Bitcoin holders, influence consensus indirectly through their impact on the asset's price. Their buying and selling actions can affect Bitcoin's value, which in turn influences the motivation of miners and other stakeholders to continue investing in the network's security and development.

Some institutional investors have agreements with custodians that may limit their ability to act in network split situations. Thus, the impact of each investor on consensus can vary based on their ownership structure and how quickly they can react to a network change.

3. Media Influencers

Media influencers, including journalists, analysts, and popular personalities on social media, have a powerful role in shaping public opinion about Bitcoin and possible updates. These influencers can help educate the public, promote debates, and bring transparency to the consensus process.

On the other hand, the impact of influencers can be double-edged: while they can clarify complex topics, they can also distort perceptions by amplifying or minimizing change proposals. This makes them a force both of support and resistance to consensus.

4. Miners

Miners are responsible for validating transactions and including blocks in the blockchain. Through computational power (hashrate), they also exert significant influence over consensus decisions. In update processes, miners often signal their support for a proposal, indicating that the new version is safe to use. However, this signaling is not always definitive, and miners can change their position if they deem it necessary.

Their incentive is to maximize returns from block rewards and transaction fees, as well as to maintain the value of investments in their specialized equipment, which are only profitable if the network remains stable.

5. Protocol Developers

Protocol developers, often called "Core Developers," are responsible for writing and maintaining Bitcoin's code. Although they do not have direct power over consensus, they possess an informal veto power since they decide which changes are included in the main client (Bitcoin Core). This group also serves as an important source of technical knowledge, helping guide decisions and inform other stakeholders.

Their incentive lies in the continuous improvement of the network, ensuring security and decentralization. Many developers are funded by grants and sponsorships, but their motivations generally include a strong ideological commitment to Bitcoin's principles.

6. Users and Application Developers

This group includes people who use Bitcoin in their daily transactions and developers who build solutions based on the network, such as wallets, exchanges, and payment platforms. Although their power in consensus is less than that of miners or economic nodes, they play an important role because they are responsible for popularizing Bitcoin's use and expanding the ecosystem.

If application developers decide not to adopt an update, this can affect compatibility and widespread acceptance. Thus, they indirectly influence consensus by deciding which version of the protocol to follow in their applications.

These stakeholders are vital to the consensus process, and each group exerts influence according to their involvement, incentives, and ability to act in situations of change. Understanding the role of each makes it clearer how consensus is formed and why it is so difficult to make significant changes to Bitcoin.

4. Mechanisms for Activating Updates in Bitcoin

For Bitcoin to evolve without compromising security and consensus, different mechanisms for activating updates have been developed over the years. These mechanisms help coordinate changes among network nodes to minimize the risk of fragmentation and ensure that updates are implemented in an orderly manner. Here, we explore some of the main methods used in Bitcoin, their advantages and disadvantages, as well as historical examples of significant updates.

Flag Day

The Flag Day mechanism is one of the simplest forms of activating changes. In it, a specific date or block is determined as the activation moment, and all nodes must be updated by that point. This method does not involve prior signaling; participants simply need to update to the new software version by the established day or block.

-

Advantages: Simplicity and predictability are the main benefits of Flag Day, as everyone knows the exact activation date.

-

Disadvantages: Inflexibility can be a problem because there is no way to adjust the schedule if a significant part of the network has not updated. This can result in network splits if a significant number of nodes are not ready for the update.

An example of Flag Day was the Pay to Script Hash (P2SH) update in 2012, which required all nodes to adopt the change to avoid compatibility issues.

BIP34 and BIP9

BIP34 introduced a more dynamic process, in which miners increase the version number in block headers to signal the update. When a predetermined percentage of the last blocks is mined with this new version, the update is automatically activated. This model later evolved with BIP9, which allowed multiple updates to be signaled simultaneously through "version bits," each corresponding to a specific change.

-

Advantages: Allows the network to activate updates gradually, giving more time for participants to adapt.

-

Disadvantages: These methods rely heavily on miner support, which means that if a sufficient number of miners do not signal the update, it can be delayed or not implemented.

BIP9 was used in the activation of SegWit (BIP141) but faced challenges because some miners did not signal their intent to activate, leading to the development of new mechanisms.

User Activated Soft Forks (UASF) and User Resisted Soft Forks (URSF)

To increase the decision-making power of ordinary users, the concept of User Activated Soft Fork (UASF) was introduced, allowing node operators, not just miners, to determine consensus for a change. In this model, nodes set a date to start rejecting blocks that are not in compliance with the new update, forcing miners to adapt or risk having their blocks rejected by the network.

URSF, in turn, is a model where nodes reject blocks that attempt to adopt a specific update, functioning as resistance against proposed changes.

-

Advantages: UASF returns decision-making power to node operators, ensuring that changes do not depend solely on miners.

-

Disadvantages: Both UASF and URSF can generate network splits, especially in cases of strong opposition among different stakeholders.

An example of UASF was the activation of SegWit in 2017, where users supported activation independently of miner signaling, which ended up forcing its adoption.

BIP8 (LOT=True)

BIP8 is an evolution of BIP9, designed to prevent miners from indefinitely blocking a change desired by the majority of users and developers. BIP8 allows setting a parameter called "lockinontimeout" (LOT) as true, which means that if the update has not been fully signaled by a certain point, it is automatically activated.

-

Advantages: Ensures that changes with broad support among users are not blocked by miners who wish to maintain the status quo.

-

Disadvantages: Can lead to network splits if miners or other important stakeholders do not support the update.

Although BIP8 with LOT=True has not yet been used in Bitcoin, it is a proposal that can be applied in future updates if necessary.

These activation mechanisms have been essential for Bitcoin's development, allowing updates that keep the network secure and functional. Each method brings its own advantages and challenges, but all share the goal of preserving consensus and network cohesion.

5. Risks and Considerations in Consensus Updates

Consensus updates in Bitcoin are complex processes that involve not only technical aspects but also political, economic, and social considerations. Due to the network's decentralized nature, each change brings with it a set of risks that need to be carefully assessed. Below, we explore some of the main challenges and future scenarios, as well as the possible impacts on stakeholders.

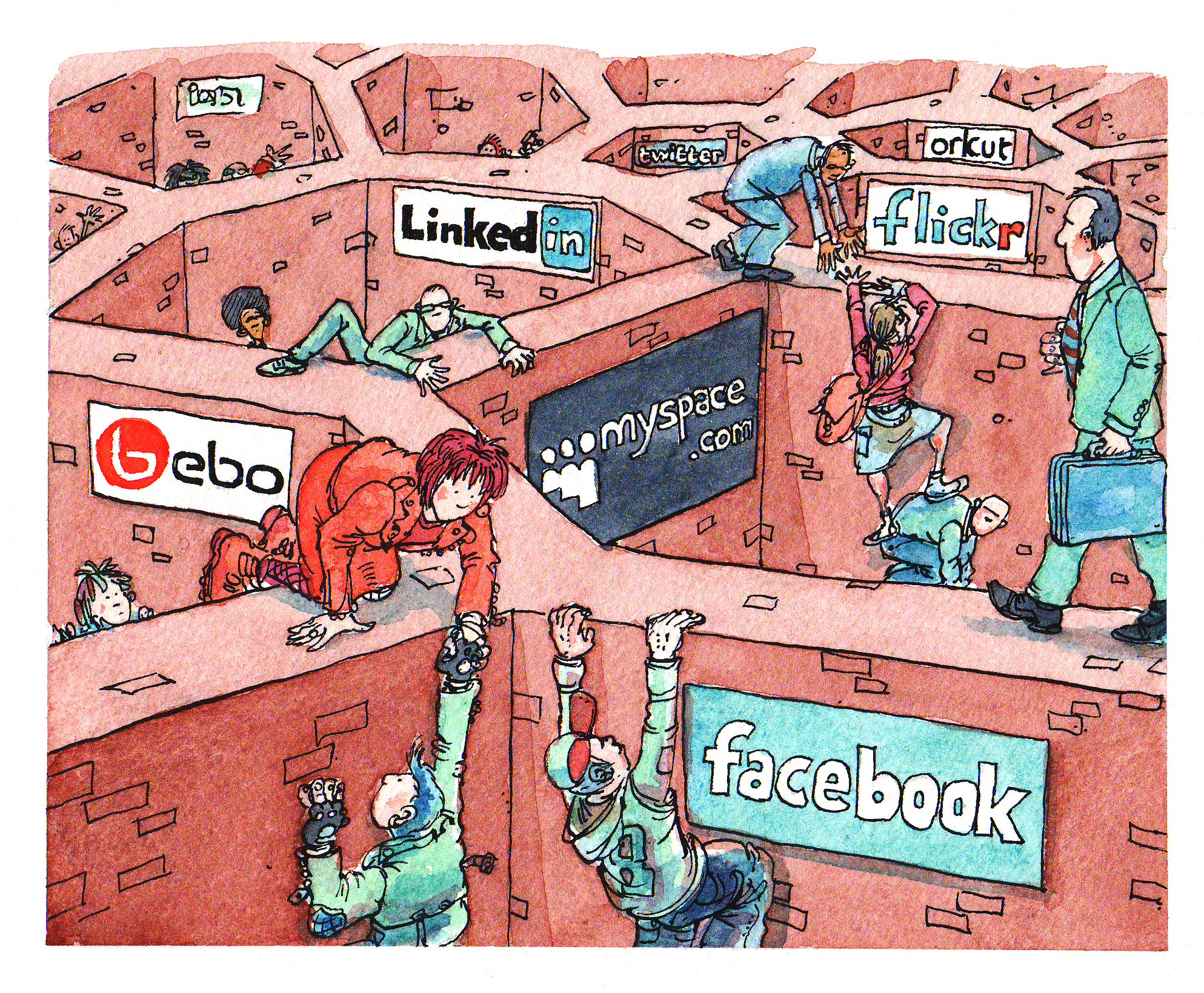

Network Fragility with Alternative Implementations

One of the main risks associated with consensus updates is the possibility of network fragmentation when there are alternative software implementations. If an update is implemented by a significant group of nodes but rejected by others, a network split (fork) can occur. This creates two competing chains, each with a different version of the transaction history, leading to unpredictable consequences for users and investors.

Such fragmentation weakens Bitcoin because, by dividing hashing power (computing) and coin value, it reduces network security and investor confidence. A notable example of this risk was the fork that gave rise to Bitcoin Cash in 2017 when disagreements over block size resulted in a new chain and a new asset.

Chain Splits and Impact on Stakeholders

Chain splits are a significant risk in update processes, especially in hard forks. During a hard fork, the network is split into two separate chains, each with its own set of rules. This results in the creation of a new coin and leaves users with duplicated assets on both chains. While this may seem advantageous, in the long run, these splits weaken the network and create uncertainties for investors.

Each group of stakeholders reacts differently to a chain split:

-

Institutional Investors and ETFs: Face regulatory and compliance challenges because many of these assets are managed under strict regulations. The creation of a new coin requires decisions to be made quickly to avoid potential losses, which may be hampered by regulatory constraints.

-

Miners: May be incentivized to shift their computing power to the chain that offers higher profitability, which can weaken one of the networks.

-

Economic Nodes: Such as major exchanges and custody providers, have to quickly choose which chain to support, influencing the perceived value of each network.

Such divisions can generate uncertainties and loss of value, especially for institutional investors and those who use Bitcoin as a store of value.

Regulatory Impacts and Institutional Investors

With the growing presence of institutional investors in Bitcoin, consensus changes face new compliance challenges. Bitcoin ETFs, for example, are required to follow strict rules about which assets they can include and how chain split events should be handled. The creation of a new asset or migration to a new chain can complicate these processes, creating pressure for large financial players to quickly choose a chain, affecting the stability of consensus.

Moreover, decisions regarding forks can influence the Bitcoin futures and derivatives market, affecting perception and adoption by new investors. Therefore, the need to avoid splits and maintain cohesion is crucial to attract and preserve the confidence of these investors.

Security Considerations in Soft Forks and Hard Forks

While soft forks are generally preferred in Bitcoin for their backward compatibility, they are not without risks. Soft forks can create different classes of nodes on the network (updated and non-updated), which increases operational complexity and can ultimately weaken consensus cohesion. In a network scenario with fragmentation of node classes, Bitcoin's security can be affected, as some nodes may lose part of the visibility over updated transactions or rules.

In hard forks, the security risk is even more evident because all nodes need to adopt the new update to avoid network division. Experience shows that abrupt changes can create temporary vulnerabilities, in which malicious agents try to exploit the transition to attack the network.

Bounty Claim Risks and Attack Scenarios

Another risk in consensus updates are so-called "bounty claims"—accumulated rewards that can be obtained if an attacker manages to split or deceive a part of the network. In a conflict scenario, a group of miners or nodes could be incentivized to support a new update or create an alternative version of the software to benefit from these rewards.

These risks require stakeholders to carefully assess each update and the potential vulnerabilities it may introduce. The possibility of "bounty claims" adds a layer of complexity to consensus because each interest group may see a financial opportunity in a change that, in the long term, may harm network stability.

The risks discussed above show the complexity of consensus in Bitcoin and the importance of approaching it gradually and deliberately. Updates need to consider not only technical aspects but also economic and social implications, in order to preserve Bitcoin's integrity and maintain trust among stakeholders.

6. Recommendations for the Consensus Process in Bitcoin

To ensure that protocol changes in Bitcoin are implemented safely and with broad support, it is essential that all stakeholders adopt a careful and coordinated approach. Here are strategic recommendations for evaluating, supporting, or rejecting consensus updates, considering the risks and challenges discussed earlier, along with best practices for successful implementation.

1. Careful Evaluation of Proposal Maturity

Stakeholders should rigorously assess the maturity level of a proposal before supporting its implementation. Updates that are still experimental or lack a robust technical foundation can expose the network to unnecessary risks. Ideally, change proposals should go through an extensive testing phase, have security audits, and receive review and feedback from various developers and experts.

2. Extensive Testing in Secure and Compatible Networks

Before an update is activated on the mainnet, it is essential to test it on networks like testnet and signet, and whenever possible, on other compatible networks that offer a safe and controlled environment to identify potential issues. Testing on networks like Litecoin was fundamental for the safe launch of innovations like SegWit and the Lightning Network, allowing functionalities to be validated on a lower-impact network before being implemented on Bitcoin.

The Liquid Network, developed by Blockstream, also plays an important role as an experimental network for new proposals, such as OP_CAT. By adopting these testing environments, stakeholders can mitigate risks and ensure that the update is reliable and secure before being adopted by the main network.

3. Importance of Stakeholder Engagement

The success of a consensus update strongly depends on the active participation of all stakeholders. This includes economic nodes, miners, protocol developers, investors, and end users. Lack of participation can lead to inadequate decisions or even future network splits, which would compromise Bitcoin's security and stability.

4. Key Questions for Evaluating Consensus Proposals

To assist in decision-making, each group of stakeholders should consider some key questions before supporting a consensus change:

- Does the proposal offer tangible benefits for Bitcoin's security, scalability, or usability?

- Does it maintain backward compatibility or introduce the risk of network split?

- Are the implementation requirements clear and feasible for each group involved?

- Are there clear and aligned incentives for all stakeholder groups to accept the change?

5. Coordination and Timing in Implementations

Timing is crucial. Updates with short activation windows can force a split because not all nodes and miners can update simultaneously. Changes should be planned with ample deadlines to allow all stakeholders to adjust their systems, avoiding surprises that could lead to fragmentation.

Mechanisms like soft forks are generally preferable to hard forks because they allow a smoother transition. Opting for backward-compatible updates when possible facilitates the process and ensures that nodes and miners can adapt without pressure.

6. Continuous Monitoring and Re-evaluation

After an update, it's essential to monitor the network to identify problems or side effects. This continuous process helps ensure cohesion and trust among all participants, keeping Bitcoin as a secure and robust network.

These recommendations, including the use of secure networks for extensive testing, promote a collaborative and secure environment for Bitcoin's consensus process. By adopting a deliberate and strategic approach, stakeholders can preserve Bitcoin's value as a decentralized and censorship-resistant network.

7. Conclusion

Consensus in Bitcoin is more than a set of rules; it's the foundation that sustains the network as a decentralized, secure, and reliable system. Unlike centralized systems, where decisions can be made quickly, Bitcoin requires a much more deliberate and cooperative approach, where the interests of miners, economic nodes, developers, investors, and users must be considered and harmonized. This governance model may seem slow, but it is fundamental to preserving the resilience and trust that make Bitcoin a global store of value and censorship-resistant.

Consensus updates in Bitcoin must balance the need for innovation with the preservation of the network's core principles. The development process of a proposal needs to be detailed and rigorous, going through several testing stages, such as in testnet, signet, and compatible networks like Litecoin and Liquid Network. These networks offer safe environments for proposals to be analyzed and improved before being launched on the main network.

Each proposed change must be carefully evaluated regarding its maturity, impact, backward compatibility, and support among stakeholders. The recommended key questions and appropriate timing are critical to ensure that an update is adopted without compromising network cohesion. It's also essential that the implementation process is continuously monitored and re-evaluated, allowing adjustments as necessary and minimizing the risk of instability.

By following these guidelines, Bitcoin's stakeholders can ensure that the network continues to evolve safely and robustly, maintaining user trust and further solidifying its role as one of the most resilient and innovative digital assets in the world. Ultimately, consensus in Bitcoin is not just a technical issue but a reflection of its community and the values it represents: security, decentralization, and resilience.

8. Links

Whitepaper: https://github.com/bitcoin-cap/bcap

Youtube (pt-br): https://www.youtube.com/watch?v=rARycAibl9o&list=PL-qnhF0qlSPkfhorqsREuIu4UTbF0h4zb

-

-

@ fd208ee8:0fd927c1

2025-02-15 07:37:01

@ fd208ee8:0fd927c1

2025-02-15 07:37:01E-cash are coupons or tokens for Bitcoin, or Bitcoin debt notes that the mint issues. The e-cash states, essentially, "IoU 2900 sats".

They're redeemable for Bitcoin on Lightning (hard money), and therefore can be used as cash (softer money), so long as the mint has a good reputation. That means that they're less fungible than Lightning because the e-cash from one mint can be more or less valuable than the e-cash from another. If a mint is buggy, offline, or disappears, then the e-cash is unreedemable.

It also means that e-cash is more anonymous than Lightning, and that the sender and receiver's wallets don't need to be online, to transact. Nutzaps now add the possibility of parking transactions one level farther out, on a relay. The same relays that cannot keep npub profiles and follow lists consistent will now do monetary transactions.

What we then have is * a transaction on a relay that triggers * a transaction on a mint that triggers * a transaction on Lightning that triggers * a transaction on Bitcoin.

Which means that every relay that stores the nuts is part of a wildcat banking system. Which is fine, but relay operators should consider whether they wish to carry the associated risks and liabilities. They should also be aware that they should implement the appropriate features in their relay, such as expiration tags (nuts rot after 2 weeks), and to make sure that only expired nuts are deleted.

There will be plenty of specialized relays for this, so don't feel pressured to join in, and research the topic carefully, for yourself.

https://github.com/nostr-protocol/nips/blob/master/60.md https://github.com/nostr-protocol/nips/blob/master/61.md

-

@ d23af4ac:7bf07adb

2025-02-18 17:07:55

@ d23af4ac:7bf07adb

2025-02-18 17:07:55This is a test-note published directly from Obsidian

Heading 1

Some paragraph text [^2]

Heading 2

Second paragraph text. * List item 1 * List item 2

js console.log("Hello world!")Json

json { name: "Alise", age: 45 }[!SCRUNCHABLE NOTE]- This should be collapsed when the page first loads. This should be collapsed when the page first loads. This should be collapsed when the page first loads. This should be collapsed when the page first loads. This should be collapsed when the page first loads. This should be collapsed when the page first loads. This should be collapsed when the page first loads. This should be collapsed when the page first loads. This should be collapsed when the page first loads. This should be collapsed when the page first loads.

[!DANGER] This is a "danger" type message. Should be properly formateed. This is a "danger" type message. Should be properly formateed. This is a "danger" type message. Should be properly formateed. This is a "danger" type message. Should be properly formateed. This is a "danger" type message. Should be properly formateed.

--

Pasted image:

![[Pasted image 20250218120714.png]]

This is a blockquote. This is a blockquote. This is a blockquote. This is a blockquote. This is a blockquote. This is a blockquote. This is a blockquote. This is a blockquote[^1]. This is a blockquote. This is a blockquote. This is a blockquote. This is a blockquote. This is a blockquote. This is a blockquote. This is a blockquote. This is a blockquote.

- [x] This is a completed task

- [ ] This is an uncompleted task

- [ ] This is also an uncompleted task

[!QUESTION] Will this inline code format properly?

console.log('Yo momma so fat she took a spoon to the Super Bown');Idk...[^1]: Footnotes also supported? Even inside blockquotes? [^2]: Footnote in regular paragraph

-

@ 0fa80bd3:ea7325de

2025-02-14 23:24:37

@ 0fa80bd3:ea7325de

2025-02-14 23:24:37intro

The Russian state made me a Bitcoiner. In 1991, it devalued my grandmother's hard-earned savings. She worked tirelessly in the kitchen of a dining car on the Moscow–Warsaw route. Everything she had saved for my sister and me to attend university vanished overnight. This story is similar to what many experienced, including Wences Casares. The pain and injustice of that time became my first lessons about the fragility of systems and the value of genuine, incorruptible assets, forever changing my perception of money and my trust in government promises.

In 2014, I was living in Moscow, running a trading business, and frequently traveling to China. One day, I learned about the Cypriot banking crisis and the possibility of moving money through some strange thing called Bitcoin. At the time, I didn’t give it much thought. Returning to the idea six months later, as a business-oriented geek, I eagerly began studying the topic and soon dove into it seriously.

I spent half a year reading articles on a local online journal, BitNovosti, actively participating in discussions, and eventually joined the editorial team as a translator. That’s how I learned about whitepapers, decentralization, mining, cryptographic keys, and colored coins. About Satoshi Nakamoto, Silk Road, Mt. Gox, and BitcoinTalk. Over time, I befriended the journal’s owner and, leveraging my management experience, later became an editor. I was drawn to the crypto-anarchist stance and commitment to decentralization principles. We wrote about the economic, historical, and social preconditions for Bitcoin’s emergence, and it was during this time that I fully embraced the idea.

It got to the point where I sold my apartment and, during the market's downturn, bought 50 bitcoins, just after the peak price of $1,200 per coin. That marked the beginning of my first crypto winter. As an editor, I organized workflows, managed translators, developed a YouTube channel, and attended conferences in Russia and Ukraine. That’s how I learned about Wences Casares and even wrote a piece about him. I also met Mikhail Chobanyan (Ukrainian exchange Kuna), Alexander Ivanov (Waves project), Konstantin Lomashuk (Lido project), and, of course, Vitalik Buterin. It was a time of complete immersion, 24/7, and boundless hope.

After moving to the United States, I expected the industry to grow rapidly, attended events, but the introduction of BitLicense froze the industry for eight years. By 2017, it became clear that the industry was shifting toward gambling and creating tokens for the sake of tokens. I dismissed this idea as unsustainable. Then came a new crypto spring with the hype around beautiful NFTs – CryptoPunks and apes.

I made another attempt – we worked on a series called Digital Nomad Country Club, aimed at creating a global project. The proceeds from selling images were intended to fund the development of business tools for people worldwide. However, internal disagreements within the team prevented us from completing the project.

With Trump’s arrival in 2025, hope was reignited. I decided that it was time to create a project that society desperately needed. As someone passionate about history, I understood that destroying what exists was not the solution, but leaving everything as it was also felt unacceptable. You can’t destroy the system, as the fiery crypto-anarchist voices claimed.

With an analytical mindset (IQ 130) and a deep understanding of the freest societies, I realized what was missing—not only in Russia or the United States but globally—a Bitcoin-native system for tracking debts and financial interactions. This could return control of money to ordinary people and create horizontal connections parallel to state systems. My goal was to create, if not a Bitcoin killer app, then at least to lay its foundation.

At the inauguration event in New York, I rediscovered the Nostr project. I realized it was not only technologically simple and already quite popular but also perfectly aligned with my vision. For the past month and a half, using insights and experience gained since 2014, I’ve been working full-time on this project.

-

@ 1c197b12:242e1642

2025-02-09 22:56:33

@ 1c197b12:242e1642

2025-02-09 22:56:33A Cypherpunk's Manifesto by Eric Hughes

Privacy is necessary for an open society in the electronic age. Privacy is not secrecy. A private matter is something one doesn't want the whole world to know, but a secret matter is something one doesn't want anybody to know. Privacy is the power to selectively reveal oneself to the world.

If two parties have some sort of dealings, then each has a memory of their interaction. Each party can speak about their own memory of this; how could anyone prevent it? One could pass laws against it, but the freedom of speech, even more than privacy, is fundamental to an open society; we seek not to restrict any speech at all. If many parties speak together in the same forum, each can speak to all the others and aggregate together knowledge about individuals and other parties. The power of electronic communications has enabled such group speech, and it will not go away merely because we might want it to.

Since we desire privacy, we must ensure that each party to a transaction have knowledge only of that which is directly necessary for that transaction. Since any information can be spoken of, we must ensure that we reveal as little as possible. In most cases personal identity is not salient. When I purchase a magazine at a store and hand cash to the clerk, there is no need to know who I am. When I ask my electronic mail provider to send and receive messages, my provider need not know to whom I am speaking or what I am saying or what others are saying to me; my provider only need know how to get the message there and how much I owe them in fees. When my identity is revealed by the underlying mechanism of the transaction, I have no privacy. I cannot here selectively reveal myself; I must always reveal myself.

Therefore, privacy in an open society requires anonymous transaction systems. Until now, cash has been the primary such system. An anonymous transaction system is not a secret transaction system. An anonymous system empowers individuals to reveal their identity when desired and only when desired; this is the essence of privacy.

Privacy in an open society also requires cryptography. If I say something, I want it heard only by those for whom I intend it. If the content of my speech is available to the world, I have no privacy. To encrypt is to indicate the desire for privacy, and to encrypt with weak cryptography is to indicate not too much desire for privacy. Furthermore, to reveal one's identity with assurance when the default is anonymity requires the cryptographic signature.

We cannot expect governments, corporations, or other large, faceless organizations to grant us privacy out of their beneficence. It is to their advantage to speak of us, and we should expect that they will speak. To try to prevent their speech is to fight against the realities of information. Information does not just want to be free, it longs to be free. Information expands to fill the available storage space. Information is Rumor's younger, stronger cousin; Information is fleeter of foot, has more eyes, knows more, and understands less than Rumor.

We must defend our own privacy if we expect to have any. We must come together and create systems which allow anonymous transactions to take place. People have been defending their own privacy for centuries with whispers, darkness, envelopes, closed doors, secret handshakes, and couriers. The technologies of the past did not allow for strong privacy, but electronic technologies do.

We the Cypherpunks are dedicated to building anonymous systems. We are defending our privacy with cryptography, with anonymous mail forwarding systems, with digital signatures, and with electronic money.

Cypherpunks write code. We know that someone has to write software to defend privacy, and since we can't get privacy unless we all do, we're going to write it. We publish our code so that our fellow Cypherpunks may practice and play with it. Our code is free for all to use, worldwide. We don't much care if you don't approve of the software we write. We know that software can't be destroyed and that a widely dispersed system can't be shut down.

Cypherpunks deplore regulations on cryptography, for encryption is fundamentally a private act. The act of encryption, in fact, removes information from the public realm. Even laws against cryptography reach only so far as a nation's border and the arm of its violence. Cryptography will ineluctably spread over the whole globe, and with it the anonymous transactions systems that it makes possible.

For privacy to be widespread it must be part of a social contract. People must come and together deploy these systems for the common good. Privacy only extends so far as the cooperation of one's fellows in society. We the Cypherpunks seek your questions and your concerns and hope we may engage you so that we do not deceive ourselves. We will not, however, be moved out of our course because some may disagree with our goals.

The Cypherpunks are actively engaged in making the networks safer for privacy. Let us proceed together apace.

Onward.

Eric Hughes hughes@soda.berkeley.edu

9 March 1993

-

@ 1d7ff02a:d042b5be

2025-03-05 06:02:55

@ 1d7ff02a:d042b5be

2025-03-05 06:02:55ມະນຸດມີຄວາມຈະເລີນໄດ້ຍ້ອນຮູ້ຈັກສ້າງຄວາມຫມັ້ນຄົງໃນອະນາຄົດ

ມະນຸດເຮົາສ້າງຄວາມຈະເລີນຮຸ່ງຮອງໄດ້ກໍຍ້ອນການສ້າງຄວາມຫມັ້ນຄົງໃນກະນາຄົດ ເຊິ່ງສະແດງອອກຢູ່ໃນ ຈາກແຕ່ກ່ອນຕ້ອງອອກໄປ ຫາອາຫານ ລ່າສັດ ເພື່ອເປັນພະລັງງານໃນການມີຊີວິດ ຈົນຮູ້ເຮົາຮູ້ຈັກການເກັບດອງອາຫານໃຫ້ກິນຍາວນານຂຶ້ນ, ຈາການຫາອາຫານເພື່ອຕົວເອງຢ່າງດຽວ ກໍຮູ້ຈັກການແລກປ່ຽນ (barter trade) ເຮັດໃຫ້ໄດ້ສິນຄ້າທີ່ຕົວເອງຕ້ອງການ ໂດຍບໍ່ຕ້ອງໃຊ້ເວລາທັງຫມົດໄປກັບການຫາ ຫລື ຜະລິດສິ່ງນັ້ນ ແລະ ສຸດທ້າຍເຮົາກໍຮູ້ຈັກເລືອກສິນຄ້າທີ່ມີຄວາມຫມັ້ນຄົງ ແລະ ຜະລິດຍາກ ມາເປັນເງິນ ເພື່ອໃຊ້ເປັນ ສື່ກາງ ໃນການແລກປ່ຽນ ຈົນແຕ່ລະຄົນມີເວລາໃນການໂຟກັສ ພັດທະນາທັກສະທີ່ຕົວເອງສົນໃຈຈົນມີຄວາມຊຳນານກວ່າຄົນທົ່ວໄປ ເຮັດໃຫ້ສາມາດຜະລິດສິນຄ້າ ແລະ ບໍລິການ ທີ່ມີຄຸນນະພາບ ແລະ ລາຄາຖືກລົງ. ປະກົດການເຫລົ່ານີ້ເກີດຂຶ້ນໄດ້ຍ້ອນເຮົາມີຄວາມຫມັ້ນຄົງໃນອະນາຄົດດ້ວຍເງິນເກັບ ຈົນມີເວລາຈະລອງຜິດລອງຖືກໄດ້.

ແຕ່ຫລັງຈາກທີ່ເຮົາອອກຈາກ ມາດຕະຖານທອງຄຳ ກໍເຮັດໃຫ້ເງິນມັນເຊື່ອມຄ່າລົງໄປຕາມການເວລາ ຈົນເຮັດໃຫ້ຄົນເຫັນແກ່ເວລາອັນສັ້ນ, ຜະລິດສິນຄ້າ ແລະ ບໍລິການ ທີ່ບໍ່ໄດ້ຄຸນນະພາບ ເພາະຄິດແຕ່ວ່າຈະເຮັດແນວໃດເພື່ອຈະໄດ້ເງິນຫລາຍຂຶ້ນ ເພາະເງິນມັນເຊື່ອມມູນຄ່າລົງເລື່ອຍໆ ຈົນລືມຄິດໄປວ່າສິ່ງໃດແທ້ ທີ່ສຳຄັນໃນຊີວິດ ຈົນເກີດບັນຫາຕ່າງໆ ບໍ່ວ່າຈະເປັນສັງຄົມ ແລະ ເສດຖະກິດ.

ບິດຄອຍ ບໍ່ໄດ້ເຮັດໃຫ້ທ່ານລວຍໄວຂຶ້ນ ແຕ່ມັນກຳລັງແກ້ບັນຫາພື້ນຖານຢ່າງການ ເກັບເງິນ ຢູ່ ເພາະປະຈຸບັນມະນຸດເກັບເງິນບໍ່ໄດ້ແລ້ວ ເພາະມູນຄ່າຂອງມັນຫລຸດລົງເລື່ອຍໆ

ການ DCA ບິດຄອຍ

ບິດຄອຍມີຄວາມຜັນຜວນເລື່ອງລາຄາຫລາຍ ກໍຍ້ອນເຮົາເບິ່ງໃນໄລຍະສັ້ນ ແຕ່ຖ້າເຮົາເບິ່ງມັນເປັນເຄື່ອງມືເກັບອອມເຮົາຈະເຫັນຄວາມຈິງ ບິດຄອຍຄືຄວາມຫມັ້ນຄົງ ແລະ ຕໍ່ຕ້ານການເຟີ້ຂອງເງິນ. ຕົວຢ່າງລຸ່ມນີ້ເປັນການຄຳນວນວ່າ ຖ້າເຮົາເກັບບິດຄອຍ ທຸກເດືອນ ຜ່ານໄປ 8 ປີ ມັນຈະມີມູນຄ່າເພີ່ມຂຶ້ນ 617% ຫລື ປະມານປີລະ 77% ໂດຍສະເລ່ຍ ເຊິ່ງມັນກໍບໍ່ໄດ້ເປັນໂຕເລກໂອເວີຫຍັງຫລາຍ ແຕ່ສາມາດເອົາຊະນະເງິນເພີ້ໄດ້ແລ້ວ ພຽງແຕ່ເກັບ ແລະ ບໍ່ຕ້ອງຄິດຫຍັງ.

### ເມື່ອເຮົາມີເງິນເກັບທີ່ຮັກສາມູນຄ່າໄດ້ ມັນເປັນຄົນລະເລື່ອງເລີຍໃນການໃຊ້ຊີວິດ ແລະ ວິທີຄິດ

ຄົນຈະມີຄວາມຄິດການໄກຫລາຍຂຶ້ນ, ມີເວລາຄິດທົບທວນເລື່ອງຕ່າງໆໃນຊີວິດຢ່າງລະອຽດຖີ່ຖ້ວນ ແລະ ຕັດສິນໃຈແບບມີເຫດມີຜົນ. ຄົນຈະເລືອກເຮັດວຽກມີຢາກເຮັດ ເຖິງວ່າລາຍໄດ້ອາດຈະຫນ້ອຍ ແຕ່ເງິນເກັບສາມາດຮັກສາມູນຄ່າຂຶ້ນໄດ້ເລື່ອຍໆ, ເຮົາຈະມີເວລາໃຫ້ກັບຄອບຄົວຫລາຍກວ່າ ເພາະບໍ່ໄດ້ແລ່ນຕາມວຽກເພື່ອຈະໄດ້ລາຍຮັບເພີ່ມຂຶ້ນຕາມການເຊື່ອມຄ່າຂອງເງິນ. ຄົນຈະໃຫ້ຄວາມສຳຄັນກັບສຸຂະພາບຫລາຍຂຶ້ນ ເພາະສຸດທ້າຍແລ້ວເຮົາຈະເຂົ້າໃຈວ່າສຸຂະພາບນີ້ແລະ ສຳຄັນສຸດ.

ຈາກຄວາມຮູ້ສຶກຂອງຕົວຂ້ອຍເອງມັນເຮັດໃຫ້ ມີຄວາມຫວັງ ແລະ ຕື່ນເຕັ້ນທີ່ຈະໄດ້ໃຊ້ຊີວິດໄປໃນການນາຄົດ ເພາະຮູ້ສຶກວ່າມີຄວາມຫມັ້ນຄົງ ຈາກການຄ່ອຍໆເກັບ ບິດຄອຍ ໂດຍມີເປົ້າຫມາຍເຮັດແນວໃດ ຈະໄດ້ໃຊ້ເວລາທີ່ເຫລືອຢູ່ ເກັບຄົນທີ່ເຮົາຮັກ, ເຮັດສິ່ງທີ່ມັກ ແລະ ມີສຸຂະພາບດີຈົນຈາກໂລກນີ້ໄປໃຫ້ເຈັບປວດຫນ້ອຍທີ່ສຸດ.

-

@ eac63075:b4988b48

2024-10-26 22:14:19

@ eac63075:b4988b48

2024-10-26 22:14:19The future of physical money is at stake, and the discussion about DREX, the new digital currency planned by the Central Bank of Brazil, is gaining momentum. In a candid and intense conversation, Federal Deputy Julia Zanatta (PL/SC) discussed the challenges and risks of this digital transition, also addressing her Bill No. 3,341/2024, which aims to prevent the extinction of physical currency. This bill emerges as a direct response to legislative initiatives seeking to replace physical money with digital alternatives, limiting citizens' options and potentially compromising individual freedom. Let's delve into the main points of this conversation.

https://www.fountain.fm/episode/i5YGJ9Ors3PkqAIMvNQ0

What is a CBDC?

Before discussing the specifics of DREX, it’s important to understand what a CBDC (Central Bank Digital Currency) is. CBDCs are digital currencies issued by central banks, similar to a digital version of physical money. Unlike cryptocurrencies such as Bitcoin, which operate in a decentralized manner, CBDCs are centralized and regulated by the government. In other words, they are digital currencies created and controlled by the Central Bank, intended to replace physical currency.

A prominent feature of CBDCs is their programmability. This means that the government can theoretically set rules about how, where, and for what this currency can be used. This aspect enables a level of control over citizens' finances that is impossible with physical money. By programming the currency, the government could limit transactions by setting geographical or usage restrictions. In practice, money within a CBDC could be restricted to specific spending or authorized for use in a defined geographical area.

In countries like China, where citizen actions and attitudes are also monitored, a person considered to have a "low score" due to a moral or ideological violation may have their transactions limited to essential purchases, restricting their digital currency use to non-essential activities. This financial control is strengthened because, unlike physical money, digital currency cannot be exchanged anonymously.

Practical Example: The Case of DREX During the Pandemic

To illustrate how DREX could be used, an example was given by Eric Altafim, director of Banco Itaú. He suggested that, if DREX had existed during the COVID-19 pandemic, the government could have restricted the currency’s use to a 5-kilometer radius around a person’s residence, limiting their economic mobility. Another proposed use by the executive related to the Bolsa Família welfare program: the government could set up programming that only allows this benefit to be used exclusively for food purchases. Although these examples are presented as control measures for safety or organization, they demonstrate how much a CBDC could restrict citizens' freedom of choice.

To illustrate the potential for state control through a Central Bank Digital Currency (CBDC), such as DREX, it is helpful to look at the example of China. In China, the implementation of a CBDC coincides with the country’s Social Credit System, a governmental surveillance tool that assesses citizens' and companies' behavior. Together, these technologies allow the Chinese government to monitor, reward, and, above all, punish behavior deemed inappropriate or threatening to the government.

How Does China's Social Credit System Work?

Implemented in 2014, China's Social Credit System assigns every citizen and company a "score" based on various factors, including financial behavior, criminal record, social interactions, and even online activities. This score determines the benefits or penalties each individual receives and can affect everything from public transport access to obtaining loans and enrolling in elite schools for their children. Citizens with low scores may face various sanctions, including travel restrictions, fines, and difficulty in securing loans.

With the adoption of the CBDC — or “digital yuan” — the Chinese government now has a new tool to closely monitor citizens' financial transactions, facilitating the application of Social Credit System penalties. China’s CBDC is a programmable digital currency, which means that the government can restrict how, when, and where the money can be spent. Through this level of control, digital currency becomes a powerful mechanism for influencing citizens' behavior.

Imagine, for instance, a citizen who repeatedly posts critical remarks about the government on social media or participates in protests. If the Social Credit System assigns this citizen a low score, the Chinese government could, through the CBDC, restrict their money usage in certain areas or sectors. For example, they could be prevented from buying tickets to travel to other regions, prohibited from purchasing certain consumer goods, or even restricted to making transactions only at stores near their home.

Another example of how the government can use the CBDC to enforce the Social Credit System is by monitoring purchases of products such as alcohol or luxury items. If a citizen uses the CBDC to spend more than the government deems reasonable on such products, this could negatively impact their social score, resulting in additional penalties such as future purchase restrictions or a lowered rating that impacts their personal and professional lives.

In China, this kind of control has already been demonstrated in several cases. Citizens added to Social Credit System “blacklists” have seen their spending and investment capacity severely limited. The combination of digital currency and social scores thus creates a sophisticated and invasive surveillance system, through which the Chinese government controls important aspects of citizens’ financial lives and individual freedoms.

Deputy Julia Zanatta views these examples with great concern. She argues that if the state has full control over digital money, citizens will be exposed to a level of economic control and surveillance never seen before. In a democracy, this control poses a risk, but in an authoritarian regime, it could be used as a powerful tool of repression.

DREX and Bill No. 3,341/2024

Julia Zanatta became aware of a bill by a Workers' Party (PT) deputy (Bill 4068/2020 by Deputy Reginaldo Lopes - PT/MG) that proposes the extinction of physical money within five years, aiming for a complete transition to DREX, the digital currency developed by the Central Bank of Brazil. Concerned about the impact of this measure, Julia drafted her bill, PL No. 3,341/2024, which prohibits the elimination of physical money, ensuring citizens the right to choose physical currency.

“The more I read about DREX, the less I want its implementation,” says the deputy. DREX is a Central Bank Digital Currency (CBDC), similar to other state digital currencies worldwide, but which, according to Julia, carries extreme control risks. She points out that with DREX, the State could closely monitor each citizen’s transactions, eliminating anonymity and potentially restricting freedom of choice. This control would lie in the hands of the Central Bank, which could, in a crisis or government change, “freeze balances or even delete funds directly from user accounts.”

Risks and Individual Freedom

Julia raises concerns about potential abuses of power that complete digitalization could allow. In a democracy, state control over personal finances raises serious questions, and EddieOz warns of an even more problematic future. “Today we are in a democracy, but tomorrow, with a government transition, we don't know if this kind of power will be used properly or abused,” he states. In other words, DREX gives the State the ability to restrict or condition the use of money, opening the door to unprecedented financial surveillance.

EddieOz cites Nigeria as an example, where a CBDC was implemented, and the government imposed severe restrictions on the use of physical money to encourage the use of digital currency, leading to protests and clashes in the country. In practice, the poorest and unbanked — those without regular access to banking services — were harshly affected, as without physical money, many cannot conduct basic transactions. Julia highlights that in Brazil, this situation would be even more severe, given the large number of unbanked individuals and the extent of rural areas where access to technology is limited.

The Relationship Between DREX and Pix

The digital transition has already begun with Pix, which revolutionized instant transfers and payments in Brazil. However, Julia points out that Pix, though popular, is a citizen’s choice, while DREX tends to eliminate that choice. The deputy expresses concern about new rules suggested for Pix, such as daily transaction limits of a thousand reais, justified as anti-fraud measures but which, in her view, represent additional control and a profit opportunity for banks. “How many more rules will banks create to profit from us?” asks Julia, noting that DREX could further enhance control over personal finances.

International Precedents and Resistance to CBDC

The deputy also cites examples from other countries resisting the idea of a centralized digital currency. In the United States, states like New Hampshire have passed laws to prevent the advance of CBDCs, and leaders such as Donald Trump have opposed creating a national digital currency. Trump, addressing the topic, uses a justification similar to Julia’s: in a digitalized system, “with one click, your money could disappear.” She agrees with the warning, emphasizing the control risk that a CBDC represents, especially for countries with disadvantaged populations.

Besides the United States, Canada, Colombia, and Australia have also suspended studies on digital currencies, citing the need for further discussions on population impacts. However, in Brazil, the debate on DREX is still limited, with few parliamentarians and political leaders openly discussing the topic. According to Julia, only she and one or two deputies are truly trying to bring this discussion to the Chamber, making DREX’s advance even more concerning.

Bill No. 3,341/2024 and Popular Pressure

For Julia, her bill is a first step. Although she acknowledges that ideally, it would prevent DREX's implementation entirely, PL 3341/2024 is a measure to ensure citizens' choice to use physical money, preserving a form of individual freedom. “If the future means control, I prefer to live in the past,” Julia asserts, reinforcing that the fight for freedom is at the heart of her bill.

However, the deputy emphasizes that none of this will be possible without popular mobilization. According to her, popular pressure is crucial for other deputies to take notice and support PL 3341. “I am only one deputy, and we need the public’s support to raise the project’s visibility,” she explains, encouraging the public to press other parliamentarians and ask them to “pay attention to PL 3341 and the project that prohibits the end of physical money.” The deputy believes that with a strong awareness and pressure movement, it is possible to advance the debate and ensure Brazilians’ financial freedom.

What’s at Stake?

Julia Zanatta leaves no doubt: DREX represents a profound shift in how money will be used and controlled in Brazil. More than a simple modernization of the financial system, the Central Bank’s CBDC sets precedents for an unprecedented level of citizen surveillance and control in the country. For the deputy, this transition needs to be debated broadly and transparently, and it’s up to the Brazilian people to defend their rights and demand that the National Congress discuss these changes responsibly.

The deputy also emphasizes that, regardless of political or partisan views, this issue affects all Brazilians. “This agenda is something that will affect everyone. We need to be united to ensure people understand the gravity of what could happen.” Julia believes that by sharing information and generating open debate, it is possible to prevent Brazil from following the path of countries that have already implemented a digital currency in an authoritarian way.

A Call to Action

The future of physical money in Brazil is at risk. For those who share Deputy Julia Zanatta’s concerns, the time to act is now. Mobilize, get informed, and press your representatives. PL 3341/2024 is an opportunity to ensure that Brazilian citizens have a choice in how to use their money, without excessive state interference or surveillance.

In the end, as the deputy puts it, the central issue is freedom. “My fear is that this project will pass, and people won’t even understand what is happening.” Therefore, may every citizen at least have the chance to understand what’s at stake and make their voice heard in defense of a Brazil where individual freedom and privacy are respected values.

-

@ 5f3e7e41:81cb07cf

2025-03-05 11:37:27

@ 5f3e7e41:81cb07cf

2025-03-05 11:37:27The question of life’s meaning has long been a central concern in philosophy, debated by existentialists, nihilists, absurdists, and theologians alike. Is there an inherent purpose to human existence, or must we construct our own meaning? This essay explores the philosophical dimensions of the question by examining various perspectives, including existentialism, nihilism, and teleological interpretations. Existentialist Perspective Existentialists argue that meaning is not intrinsic but must be created. Jean-Paul Sartre, for instance, asserts that existence precedes essence—humans exist first and define their own purpose afterward. Unlike an artifact designed for a specific function, human beings are thrown into existence without predetermined meaning. Sartre’s concept of radical freedom suggests that we are entirely responsible for imbuing our lives with purpose through our choices and actions. Albert Camus, while existential in his approach, leans toward absurdism. He argues that human beings seek meaning in a universe that offers none. This fundamental conflict, the absurd, leads to either nihilism or rebellion. Camus advocates for an embrace of the absurd—accepting life’s lack of inherent purpose and living in defiance of this reality, deriving meaning from the act of living itself. Nihilistic Perspective Nihilism, most famously articulated by Friedrich Nietzsche, asserts that life has no objective meaning, purpose, or value. The "death of God" in Nietzsche’s work signifies the collapse of religious and metaphysical sources of meaning, leaving humanity in an existential void. Without a higher order dictating meaning, one might fall into existential despair. However, Nietzsche’s solution is the creation of personal values through the concept of the Übermensch, an individual who forges their own path and meaning without reliance on external validation. Teleological and Theistic Views In contrast, religious and teleological perspectives propose an intrinsic meaning to life, often rooted in divine purpose. Theistic traditions argue that meaning is bestowed upon humanity by a higher power. For example, in Christianity, the purpose of life is to fulfill God’s will, achieve salvation, and cultivate virtue. Similarly, in Aristotelian philosophy, eudaimonia, or human flourishing, is seen as the ultimate telos (end goal) of human existence, achieved through rational activity and moral virtue. Synthesis: A Constructivist Approach Given the divergence in perspectives, one might adopt a constructivist stance that synthesizes elements from each. If no inherent meaning exists, as existentialists and nihilists suggest, and if religious interpretations require faith, then meaning may best be understood as a subjective construction. Humans, as rational and reflective beings, can choose to ascribe significance to their existence based on personal values, relationships, creative endeavors, or contributions to humanity. Conclusion The meaning of life remains an open question, shaped by individual perspectives and cultural influences. Whether meaning is self-created, divinely ordained, or ultimately absent, the inquiry itself underscores a fundamental aspect of human nature: the relentless pursuit of significance. Perhaps the search for meaning is what gives life its greatest meaning.

-

@ e3ba5e1a:5e433365

2025-02-13 06:16:49

@ e3ba5e1a:5e433365

2025-02-13 06:16:49My favorite line in any Marvel movie ever is in “Captain America.” After Captain America launches seemingly a hopeless assault on Red Skull’s base and is captured, we get this line:

“Arrogance may not be a uniquely American trait, but I must say, you do it better than anyone.”

Yesterday, I came across a comment on the song Devil Went Down to Georgia that had a very similar feel to it:

America has seemingly always been arrogant, in a uniquely American way. Manifest Destiny, for instance. The rest of the world is aware of this arrogance, and mocks Americans for it. A central point in modern US politics is the deriding of racist, nationalist, supremacist Americans.

That’s not what I see. I see American Arrogance as not only a beautiful statement about what it means to be American. I see it as an ode to the greatness of humanity in its purest form.

For most countries, saying “our nation is the greatest” is, in fact, twinged with some level of racism. I still don’t have a problem with it. Every group of people should be allowed to feel pride in their accomplishments. The destruction of the human spirit since the end of World War 2, where greatness has become a sin and weakness a virtue, has crushed the ability of people worldwide to strive for excellence.

But I digress. The fears of racism and nationalism at least have a grain of truth when applied to other nations on the planet. But not to America.

That’s because the definition of America, and the prototype of an American, has nothing to do with race. The definition of Americanism is freedom. The founding of America is based purely on liberty. On the God-given rights of every person to live life the way they see fit.

American Arrogance is not a statement of racial superiority. It’s barely a statement of national superiority (though it absolutely is). To me, when an American comments on the greatness of America, it’s a statement about freedom. Freedom will always unlock the greatness inherent in any group of people. Americans are definitionally better than everyone else, because Americans are freer than everyone else. (Or, at least, that’s how it should be.)

In Devil Went Down to Georgia, Johnny is approached by the devil himself. He is challenged to a ridiculously lopsided bet: a golden fiddle versus his immortal soul. He acknowledges the sin in accepting such a proposal. And yet he says, “God, I know you told me not to do this. But I can’t stand the affront to my honor. I am the greatest. The devil has nothing on me. So God, I’m gonna sin, but I’m also gonna win.”

Libertas magnitudo est

-

@ 8fb140b4:f948000c

2023-11-21 21:37:48

@ 8fb140b4:f948000c