-

@ 99895004:c239f905

2025-04-30 01:43:05

@ 99895004:c239f905

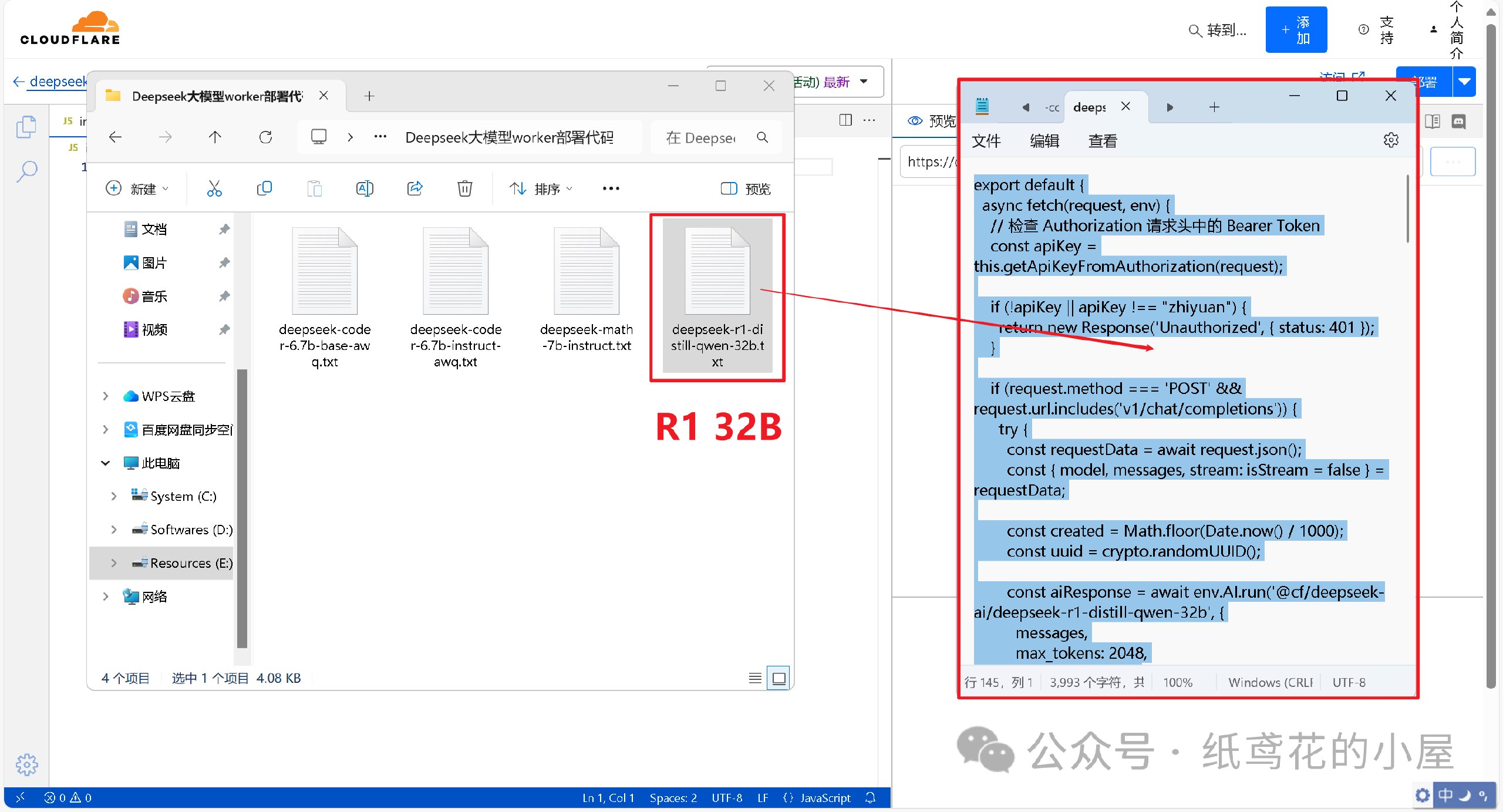

2025-04-30 01:43:05 Yes, FINALLY, we are extremely excited to announce support for nostr.build (blossom.band) on Primal! Decades in the making, billions of people have been waiting, and now it’s available! But it’s not just any integration, it is the next level of decentralized media hosting for Nostr. Let us explain.

Yes, FINALLY, we are extremely excited to announce support for nostr.build (blossom.band) on Primal! Decades in the making, billions of people have been waiting, and now it’s available! But it’s not just any integration, it is the next level of decentralized media hosting for Nostr. Let us explain. Primal is an advanced Twitter/X like client for Nostr and is probably the fastest up-and-coming, highly used Nostr app available for iOS, Android and the web. Nostr.build is a very popular media hosting service for Nostr that can be used standalone or integrated into many Nostr apps using nip-96. This is an extremely feature rich, tested and proven integration we recommend for most applications, but it’s never been available on Primal.

And then, Blossom was born, thank you Hzrd149! Blossom is a Nostr media hosting protocol that makes it extremely easy for Nostr clients to integrate a media host, and for users of Blossom media hosts (even an in-house build) to host on any Nostr client. Revolutionary, right! Use whatever host you want on any client you want, the flexible beauty of Nostr. But there is an additional feature to Blossom that is key, mirroring.

One of the biggest complaints to media hosting on Nostr is, if a media hosting service goes down, so does all of the media hosted on that service. No bueno, and defeats the whole decentralized idea behind Nostr.. This has always been a hard problem to solve until Blossom mirroring came along. Mirroring allows a single media upload to be hosted on multiple servers using its hash, or unique media identifier. This way, if a media host goes down, the media is still available and accessible on the other host.

So, we are not only announcing support of nostr.build’s blossom.band on the Primal app, we are also announcing the first known fully integrated implementation of mirroring with multiple media hosts on Nostr. Try it out for yourself! Go to the settings of your Primal web, iOS or Android app, choose ‘Media Servers’, enable ‘Media Mirrors’, and add https://blossom.band and https://blossom.primal.net as your Media server and Mirror, done!

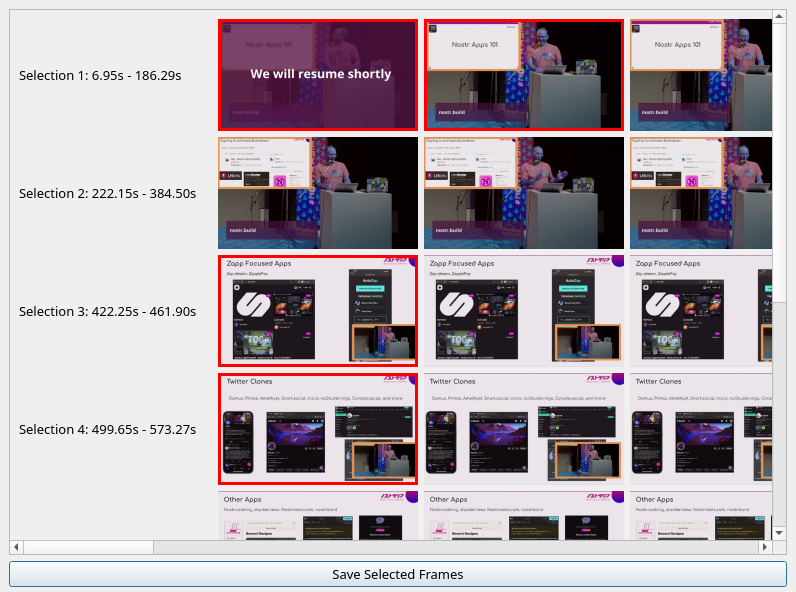

Video here!

-

@ d9a329af:bef580d7

2025-04-30 00:15:14

@ d9a329af:bef580d7

2025-04-30 00:15:14Since 2022, Dungeons and Dragons has been going down a sort of death spiral after the release of a revised version of 5th Edition... which didn't turn out very well to say the least. In light of that, I present a list of TTRPGs you can play if you don't want to purchase 5E. I wouldn't recommend 5E, as I've DM'd it in the past. It tastes like a lollipop that's cockroach and larvae flavored.

This list of TTRPG games is in no particular order, though my favorite of these systems is number one.

- Basic Fantasy Role-Playing Game (BFRPG)

- B/X-style OSR retroclone with ascending armor class, and the original retroclone from 2006

- Fully libre under CC BY-SA for the 4th Edition, and OGL 1.0a for 1-3 Editions.

- Full books are free PDF files on the website (Basic Fantasy Website)

- All BFRPG editions are compatible with each other, meaning you can have a 3rd Edition book to a 4th Edition game and still have fun. 4th Edition is just the removal of the 3E SRD that's in the OGL editions.

- As with the core rulebooks, all the supplementation is free as a PDF as well, though you can buy physical books at cost (BFRPG principal rights holder Chris Gonnerman doesn't make much profit from Basic Fantasy)

- Old-school community that's an all-around fantastic group of players, authors and enthusiasts.

-

Fun Fact: Out of all the TTRPGs I'd want to DM/GM the most, it'd be this one by far.

-

Iron Falcon (IF)

- OD&D-style retroclone from 2015 (It's also by Gonnerman, same guy behind BFRPG)

- A close ruleset to the White Box rules and supplements

- Also fully libre under CC BY-SA for the latest releases, just like BFRPG for 4th Edition releases

- Just like BFRPG, the core rules and supplementation come as PDF files for free, or physical books.

-

Fast and loose ruleset open to interpretation, just like in 1975-1981... somewhere right around that timeline for OD&D

-

Old-School Reference and Index Compendium (OSRIC)

- AD&D 1E-based retroclone by Stewart Marshall and Matt Finch

- An old system that surprisingly still holds up, even after a long time of no new versions of the rules

- Extremely in-depth ruleset, licensed under OGL 1.0a and OSRIC Open License

- Compatible with AD&D 1e modules for the 1st Edition, though 2.2 potentially has its own supplementation

-

I don't know much about it, as I'd be too slow to learn it. That's all I know, which is the above.

-

Ironsworn

- Custom loosely-based PbtA (Powered by the Apocalypse) system by Shawn Tomkin from 2018

- Includes GM, GMless and solo play in the rulebook

- Supplementation is surely something else with one look at the downloads section for the PDFs of the original, which is free under CC BY-NC-SA. The SRD is under CC BY otherwise.

- No original adventures are made for this system as are known, as it's expected that the Ironlands are where they take place

-

Fun Fact: This was a non-D&D system I considered running as a GM.

-

Advanced Dungeons & Dragons 2nd Edition (AD&D 2e)

- An official edition from 1989-2000

- At the time, the most customizable edition in its history, before 3E took the spot as the most customizable edition

- A streamlined revision of the AD&D 1E rules (AD&D 1E was exclusively written by E. Gary Gygax)

- The end of old-school D&D, as 3E and beyond are different games altogether

- Wide array of supplementation, which oversaturated 2E's customization... and most of it didn't sell well as a result

- Final TSR-published edition of D&D, as they went bankrupt and out of business during this edition's life cycle, to then be liquidated to Wizards of the Coast (Boy did WOTC mess it up once 5.1E was released)

-

Fun Fact: A Canadian history professor named Dr. Robert Wardough runs a customized ruleset using 2E as a base, which he's been DMing since the 80's during the "Satanic Panic" (The Satanic Panic was fake as a result of horrible deceivers gaslighting people to not play D&D). He started RAW (Rules as Written), but saw some things he needed to change for his games, so he did so over time.

-

Moldvay/Cook Basic/Expert Dungeons & Dragons (B/X)

- Competing system to 1E from 1981 and 1982

- Official edition of D&D, part of the old-school era

- Simplified rules for Basic, but some decently complex rules for Expert

- Only goes up to Lv. 14, as it's potentially a 1E or White Box primer (similar to 1977 Basic)

- Supplementation, from some research done, was decent for the time, and a little bit extensive

- The inspiration for BFRPG in 2006 (Did I mention this already? Maybe I have, but I might emphasize that here too.)

-

Fun Fact: I considered running B/X, but decided that I'd do BFRPG, as the ascending armor class is easier math than with B/X and the THAC0 armor class (descending armor class).

-

Basic, Expert, Companion, Master, Immortal Dungeons & Dragons (BECMI) and/or Rules Cyclopedia

- 1983 variant of the Moldvay/Cook Basic/Expert system, an official edition and part of the old-school era

- Essentially, 1981 B/X D&D on steroids

- 5 boxed sets were released for the five parts of the rules for this system

- Rules Cyclopedia is a reprint of the 1983 Basic, Expert, Companion and Master rules boxed sets. The Immortal set was never reprinted outside of the original boxed set because Immortal is such a bizarre game within a game altogether.

- With the first 4 boxed sets (whether individual sets or the Rules Cyclopedia), levels are 1-36

-

Fun Fact: This edition I was considering DMing as well, alongside BFRPG. They're similar rulesets with some mechanical differences, but I think either or would be worth it.

-

Original Dungeons & Dragons (OD&D or White Box)

- The original release of D&D from 1974 written by Gygax and Dave Arneson, published by TSR

- Uses the rules from Chainmail, a wargame made by Gygax and Jeff Perren

- Base has three little booklets (Men & Magic, Monsters & Magic, and The Underworld & Wilderness Adventures), five official supplements were released (Greyhawk; Blackmoor; Eldritch Wizardry; Gods, Demi-Gods and Heroes; and Swords & Spells), and many more from fanzines

- Fast and loose ruleset open to interpretation

- Not based upon adventurers taking on dangerous quest, but kings commanding armies (which is why OD&D is actually a Chainmail supplement). The latter was the original purpose of D&D before it got changed in 2000.

There are many more games that are not D&D that you can look up too. See what you like, read the rules, learn them, and start playing with your group. Have fun and slay some monsters!

-

@ be063e14:06d214ce

2025-04-29 23:11:22

@ be063e14:06d214ce

2025-04-29 23:11:22hallo welt

[[ ]] Add as many elements as you want? [[X]] The X marks the correct answer! [[ ]] ... this is wrong ... [[X]] ... this has to be selected too ...

daten können auch, ich meine multimedia ... übertragen werden ...

-

@ dc814bb0:7a410cb5

2025-04-29 23:09:50

@ dc814bb0:7a410cb5

2025-04-29 23:09:50hallo welt

[[ ]] Add as many elements as you want? [[X]] The X marks the correct answer! [[ ]] ... this is wrong ... [[X]] ... this has to be selected too ...

-

@ dc814bb0:7a410cb5

2025-04-29 23:07:29

@ dc814bb0:7a410cb5

2025-04-29 23:07:29Hallo welt

[[ ]] Add as many elements as you want? [[X]] The X marks the correct answer! [[ ]] ... this is wrong ... [[X]] ... this has to be selected too ...

-

@ 52b4a076:e7fad8bd

2025-04-28 00:48:57

@ 52b4a076:e7fad8bd

2025-04-28 00:48:57I have been recently building NFDB, a new relay DB. This post is meant as a short overview.

Regular relays have challenges

Current relay software have significant challenges, which I have experienced when hosting Nostr.land: - Scalability is only supported by adding full replicas, which does not scale to large relays. - Most relays use slow databases and are not optimized for large scale usage. - Search is near-impossible to implement on standard relays. - Privacy features such as NIP-42 are lacking. - Regular DB maintenance tasks on normal relays require extended downtime. - Fault-tolerance is implemented, if any, using a load balancer, which is limited. - Personalization and advanced filtering is not possible. - Local caching is not supported.

NFDB: A scalable database for large relays

NFDB is a new database meant for medium-large scale relays, built on FoundationDB that provides: - Near-unlimited scalability - Extended fault tolerance - Instant loading - Better search - Better personalization - and more.

Search

NFDB has extended search capabilities including: - Semantic search: Search for meaning, not words. - Interest-based search: Highlight content you care about. - Multi-faceted queries: Easily filter by topic, author group, keywords, and more at the same time. - Wide support for event kinds, including users, articles, etc.

Personalization

NFDB allows significant personalization: - Customized algorithms: Be your own algorithm. - Spam filtering: Filter content to your WoT, and use advanced spam filters. - Topic mutes: Mute topics, not keywords. - Media filtering: With Nostr.build, you will be able to filter NSFW and other content - Low data mode: Block notes that use high amounts of cellular data. - and more

Other

NFDB has support for many other features such as: - NIP-42: Protect your privacy with private drafts and DMs - Microrelays: Easily deploy your own personal microrelay - Containers: Dedicated, fast storage for discoverability events such as relay lists

Calcite: A local microrelay database

Calcite is a lightweight, local version of NFDB that is meant for microrelays and caching, meant for thousands of personal microrelays.

Calcite HA is an additional layer that allows live migration and relay failover in under 30 seconds, providing higher availability compared to current relays with greater simplicity. Calcite HA is enabled in all Calcite deployments.

For zero-downtime, NFDB is recommended.

Noswhere SmartCache

Relays are fixed in one location, but users can be anywhere.

Noswhere SmartCache is a CDN for relays that dynamically caches data on edge servers closest to you, allowing: - Multiple regions around the world - Improved throughput and performance - Faster loading times

routerd

routerdis a custom load-balancer optimized for Nostr relays, integrated with SmartCache.routerdis specifically integrated with NFDB and Calcite HA to provide fast failover and high performance.Ending notes

NFDB is planned to be deployed to Nostr.land in the coming weeks.

A lot more is to come. 👀️️️️️️

-

@ 91bea5cd:1df4451c

2025-04-26 10:16:21

@ 91bea5cd:1df4451c

2025-04-26 10:16:21O Contexto Legal Brasileiro e o Consentimento

No ordenamento jurídico brasileiro, o consentimento do ofendido pode, em certas circunstâncias, afastar a ilicitude de um ato que, sem ele, configuraria crime (como lesão corporal leve, prevista no Art. 129 do Código Penal). Contudo, o consentimento tem limites claros: não é válido para bens jurídicos indisponíveis, como a vida, e sua eficácia é questionável em casos de lesões corporais graves ou gravíssimas.

A prática de BDSM consensual situa-se em uma zona complexa. Em tese, se ambos os parceiros são adultos, capazes, e consentiram livre e informadamente nos atos praticados, sem que resultem em lesões graves permanentes ou risco de morte não consentido, não haveria crime. O desafio reside na comprovação desse consentimento, especialmente se uma das partes, posteriormente, o negar ou alegar coação.

A Lei Maria da Penha (Lei nº 11.340/2006)

A Lei Maria da Penha é um marco fundamental na proteção da mulher contra a violência doméstica e familiar. Ela estabelece mecanismos para coibir e prevenir tal violência, definindo suas formas (física, psicológica, sexual, patrimonial e moral) e prevendo medidas protetivas de urgência.

Embora essencial, a aplicação da lei em contextos de BDSM pode ser delicada. Uma alegação de violência por parte da mulher, mesmo que as lesões ou situações decorram de práticas consensuais, tende a receber atenção prioritária das autoridades, dada a presunção de vulnerabilidade estabelecida pela lei. Isso pode criar um cenário onde o parceiro masculino enfrenta dificuldades significativas em demonstrar a natureza consensual dos atos, especialmente se não houver provas robustas pré-constituídas.

Outros riscos:

Lesão corporal grave ou gravíssima (art. 129, §§ 1º e 2º, CP), não pode ser justificada pelo consentimento, podendo ensejar persecução penal.

Crimes contra a dignidade sexual (arts. 213 e seguintes do CP) são de ação pública incondicionada e independem de representação da vítima para a investigação e denúncia.

Riscos de Falsas Acusações e Alegação de Coação Futura

Os riscos para os praticantes de BDSM, especialmente para o parceiro que assume o papel dominante ou que inflige dor/restrição (frequentemente, mas não exclusivamente, o homem), podem surgir de diversas frentes:

- Acusações Externas: Vizinhos, familiares ou amigos que desconhecem a natureza consensual do relacionamento podem interpretar sons, marcas ou comportamentos como sinais de abuso e denunciar às autoridades.

- Alegações Futuras da Parceira: Em caso de término conturbado, vingança, arrependimento ou mudança de perspectiva, a parceira pode reinterpretar as práticas passadas como abuso e buscar reparação ou retaliação através de uma denúncia. A alegação pode ser de que o consentimento nunca existiu ou foi viciado.

- Alegação de Coação: Uma das formas mais complexas de refutar é a alegação de que o consentimento foi obtido mediante coação (física, moral, psicológica ou econômica). A parceira pode alegar, por exemplo, que se sentia pressionada, intimidada ou dependente, e que seu "sim" não era genuíno. Provar a ausência de coação a posteriori é extremamente difícil.

- Ingenuidade e Vulnerabilidade Masculina: Muitos homens, confiando na dinâmica consensual e na parceira, podem negligenciar a necessidade de precauções. A crença de que "isso nunca aconteceria comigo" ou a falta de conhecimento sobre as implicações legais e o peso processual de uma acusação no âmbito da Lei Maria da Penha podem deixá-los vulneráveis. A presença de marcas físicas, mesmo que consentidas, pode ser usada como evidência de agressão, invertendo o ônus da prova na prática, ainda que não na teoria jurídica.

Estratégias de Prevenção e Mitigação

Não existe um método infalível para evitar completamente o risco de uma falsa acusação, mas diversas medidas podem ser adotadas para construir um histórico de consentimento e reduzir vulnerabilidades:

- Comunicação Explícita e Contínua: A base de qualquer prática BDSM segura é a comunicação constante. Negociar limites, desejos, palavras de segurança ("safewords") e expectativas antes, durante e depois das cenas é crucial. Manter registros dessas negociações (e-mails, mensagens, diários compartilhados) pode ser útil.

-

Documentação do Consentimento:

-

Contratos de Relacionamento/Cena: Embora a validade jurídica de "contratos BDSM" seja discutível no Brasil (não podem afastar normas de ordem pública), eles servem como forte evidência da intenção das partes, da negociação detalhada de limites e do consentimento informado. Devem ser claros, datados, assinados e, idealmente, reconhecidos em cartório (para prova de data e autenticidade das assinaturas).

-

Registros Audiovisuais: Gravar (com consentimento explícito para a gravação) discussões sobre consentimento e limites antes das cenas pode ser uma prova poderosa. Gravar as próprias cenas é mais complexo devido a questões de privacidade e potencial uso indevido, mas pode ser considerado em casos específicos, sempre com consentimento mútuo documentado para a gravação.

Importante: a gravação deve ser com ciência da outra parte, para não configurar violação da intimidade (art. 5º, X, da Constituição Federal e art. 20 do Código Civil).

-

-

Testemunhas: Em alguns contextos de comunidade BDSM, a presença de terceiros de confiança durante negociações ou mesmo cenas pode servir como testemunho, embora isso possa alterar a dinâmica íntima do casal.

- Estabelecimento Claro de Limites e Palavras de Segurança: Definir e respeitar rigorosamente os limites (o que é permitido, o que é proibido) e as palavras de segurança é fundamental. O desrespeito a uma palavra de segurança encerra o consentimento para aquele ato.

- Avaliação Contínua do Consentimento: O consentimento não é um cheque em branco; ele deve ser entusiástico, contínuo e revogável a qualquer momento. Verificar o bem-estar do parceiro durante a cena ("check-ins") é essencial.

- Discrição e Cuidado com Evidências Físicas: Ser discreto sobre a natureza do relacionamento pode evitar mal-entendidos externos. Após cenas que deixem marcas, é prudente que ambos os parceiros estejam cientes e de acordo, talvez documentando por fotos (com data) e uma nota sobre a consensualidade da prática que as gerou.

- Aconselhamento Jurídico Preventivo: Consultar um advogado especializado em direito de família e criminal, com sensibilidade para dinâmicas de relacionamento alternativas, pode fornecer orientação personalizada sobre as melhores formas de documentar o consentimento e entender os riscos legais específicos.

Observações Importantes

- Nenhuma documentação substitui a necessidade de consentimento real, livre, informado e contínuo.

- A lei brasileira protege a "integridade física" e a "dignidade humana". Práticas que resultem em lesões graves ou que violem a dignidade de forma não consentida (ou com consentimento viciado) serão ilegais, independentemente de qualquer acordo prévio.

- Em caso de acusação, a existência de documentação robusta de consentimento não garante a absolvição, mas fortalece significativamente a defesa, ajudando a demonstrar a natureza consensual da relação e das práticas.

-

A alegação de coação futura é particularmente difícil de prevenir apenas com documentos. Um histórico consistente de comunicação aberta (whatsapp/telegram/e-mails), respeito mútuo e ausência de dependência ou controle excessivo na relação pode ajudar a contextualizar a dinâmica como não coercitiva.

-

Cuidado com Marcas Visíveis e Lesões Graves Práticas que resultam em hematomas severos ou lesões podem ser interpretadas como agressão, mesmo que consentidas. Evitar excessos protege não apenas a integridade física, mas também evita questionamentos legais futuros.

O que vem a ser consentimento viciado

No Direito, consentimento viciado é quando a pessoa concorda com algo, mas a vontade dela não é livre ou plena — ou seja, o consentimento existe formalmente, mas é defeituoso por alguma razão.

O Código Civil brasileiro (art. 138 a 165) define várias formas de vício de consentimento. As principais são:

Erro: A pessoa se engana sobre o que está consentindo. (Ex.: A pessoa acredita que vai participar de um jogo leve, mas na verdade é exposta a práticas pesadas.)

Dolo: A pessoa é enganada propositalmente para aceitar algo. (Ex.: Alguém mente sobre o que vai acontecer durante a prática.)

Coação: A pessoa é forçada ou ameaçada a consentir. (Ex.: "Se você não aceitar, eu termino com você" — pressão emocional forte pode ser vista como coação.)

Estado de perigo ou lesão: A pessoa aceita algo em situação de necessidade extrema ou abuso de sua vulnerabilidade. (Ex.: Alguém em situação emocional muito fragilizada é induzida a aceitar práticas que normalmente recusaria.)

No contexto de BDSM, isso é ainda mais delicado: Mesmo que a pessoa tenha "assinado" um contrato ou dito "sim", se depois ela alegar que seu consentimento foi dado sob medo, engano ou pressão psicológica, o consentimento pode ser considerado viciado — e, portanto, juridicamente inválido.

Isso tem duas implicações sérias:

-

O crime não se descaracteriza: Se houver vício, o consentimento é ignorado e a prática pode ser tratada como crime normal (lesão corporal, estupro, tortura, etc.).

-

A prova do consentimento precisa ser sólida: Mostrando que a pessoa estava informada, lúcida, livre e sem qualquer tipo de coação.

Consentimento viciado é quando a pessoa concorda formalmente, mas de maneira enganada, forçada ou pressionada, tornando o consentimento inútil para efeitos jurídicos.

Conclusão

Casais que praticam BDSM consensual no Brasil navegam em um terreno que exige não apenas confiança mútua e comunicação excepcional, mas também uma consciência aguçada das complexidades legais e dos riscos de interpretações equivocadas ou acusações mal-intencionadas. Embora o BDSM seja uma expressão legítima da sexualidade humana, sua prática no Brasil exige responsabilidade redobrada. Ter provas claras de consentimento, manter a comunicação aberta e agir com prudência são formas eficazes de se proteger de falsas alegações e preservar a liberdade e a segurança de todos os envolvidos. Embora leis controversas como a Maria da Penha sejam "vitais" para a proteção contra a violência real, os praticantes de BDSM, e em particular os homens nesse contexto, devem adotar uma postura proativa e prudente para mitigar os riscos inerentes à potencial má interpretação ou instrumentalização dessas práticas e leis, garantindo que a expressão de sua consensualidade esteja resguardada na medida do possível.

Importante: No Brasil, mesmo com tudo isso, o Ministério Público pode denunciar por crime como lesão corporal grave, estupro ou tortura, independente de consentimento. Então a prudência nas práticas é fundamental.

Aviso Legal: Este artigo tem caráter meramente informativo e não constitui aconselhamento jurídico. As leis e interpretações podem mudar, e cada situação é única. Recomenda-se buscar orientação de um advogado qualificado para discutir casos específicos.

Se curtiu este artigo faça uma contribuição, se tiver algum ponto relevante para o artigo deixe seu comentário.

-

@ 8671a6e5:f88194d1

2025-04-24 07:23:19

@ 8671a6e5:f88194d1

2025-04-24 07:23:19For whoever has, will be given more, and they will have an abundance. Whoever does not have, even what they have will be taken from them.

Matthew 25:29, The Parable of the Talents (New Testament)For whoever has, will be given more,\ and they will have an abundance.\ Whoever does not have, even what\ they have will be taken from them.\ \ Matthew 25:29,\ The Parable of the Talents (New Testament)

How the Pump-my-bags mentality slows Bitcoin adoption

The parable of “thy Bitcoins” (loosely based on Matthew 25:29)

A man, embarking on a journey, entrusted his wealth to his servants. To one he gave five Bitcoin, to another two Bitcoin, and to another one Bitcoin, each according to his ability. Then he departed.

The servant with five Bitcoin buried his master’s wealth, dreaming of its rising price. The servant with two Bitcoin hid his, guarding its value. But the servant with one Bitcoin acted with vision. He spent 0.5 Bitcoin to unite Bitcoiners, teaching them to use the network and building tools to expand its reach. His efforts grew Bitcoin’s power, though his investment left him with only 0.5 Bitcoin.

Years later, the master returned to settle accounts. The servant with five Bitcoin said, “Master, you gave me five Bitcoin. I buried them, and their price has soared. Here is yours.”

The master replied, “Faithless servant! My wealth was meant to sow freedom. You kept your Bitcoin but buried your potential to strengthen its network. Your wealth is great, but your impact is none!”

The servant with two Bitcoin said, “Master, you gave me two Bitcoin. I hid them, and their value has risen. Here is yours.”

The master replied, “You, too, have been idle! You clung to wealth but failed to spread Bitcoin’s truth. Your Bitcoin endures, but your reach is empty!”

Then the servant with one Bitcoin stepped forward. “Master, you gave me one Bitcoin. I spent 0.5 Bitcoin to teach and build with Bitcoiners. My call inspired many to join the network, though I have only 0.5 Bitcoin left.”

The master said, “Well done, faithful servant! You sparked a movement that grew my network, enriching lives. Though your stack is small, your vision is vast. Share my joy!”

When many use their gifts to build Bitcoin’s future, their sacrifices grow the network and enrich lives. Those who “bury” their Bitcoin and do nothing else keep wealth but miss the greater reward of a thriving in a Bitcoin world.

This parable reflects a timeless truth: between playing it safe and building, resides the choice to take risk. Bitcoin’s power lies not in hoarding wealth (although it’s part of it), but mainly in using it to build a freer world. To free people from their confines. Yet a mentality has taken hold — one that runs counter to that spirit.

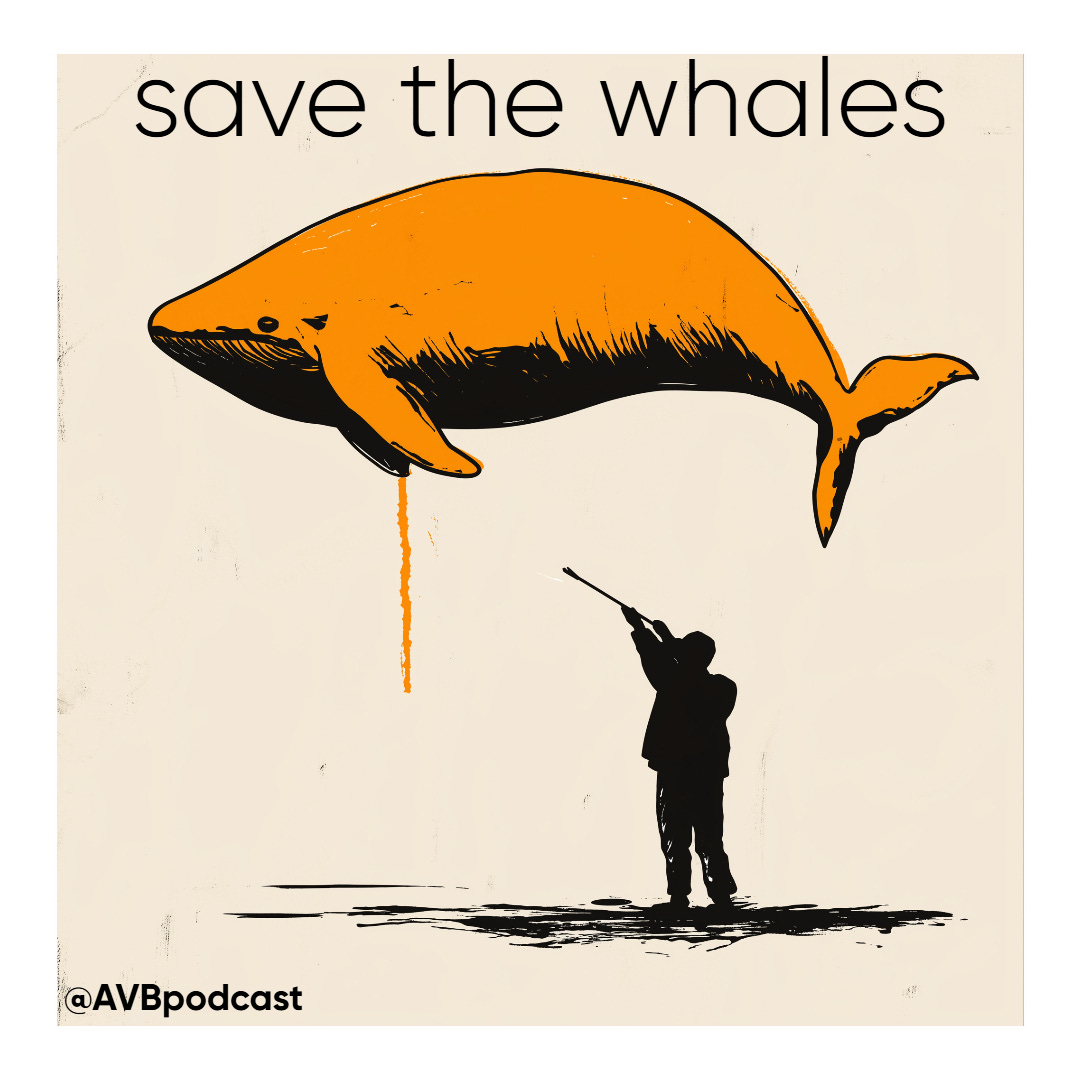

PMB betrays the Bitcoin ethos

“Pump my bags” (PMB) stems from the altcoin world, where scammers pump pre-mined coins to dump on naive buyers. In Bitcoin, PMB isn’t about dumping but about hoarding—stacking sats without lifting a finger. These Bitcoiners, from small holders to whales, sit back, eyeing fiat profits, not Bitcoin’s mission. They’re not so different from altcoin grifters. Both chase profit, not glory. They dream of fiat-richness and crappy real estate in Portugal or Chile — not a Bitcoin standard. One holds hard money by chance, the other a fad coin. Neither moves the world forward.

In Bitcoin, the pump-my-bags mindset is more about laziness; everyone looking out for themselves, stacking without ever lifting a finger. There’s a big difference in the way an altcoin promotor would operate and market yet another proof-of-stake pre-mined trashcoin, and how PMB bitcoiners hoard and wait.

They’re much alike however. The belief level might be slightly different, and not everyone has the same ability.

I’ve been in Bitcoin’s trenches since its cypherpunk days, when it was a rebellion against fiat’s centralized control. Bitcoin is a race against the totalitarian fiat system’s grip. Early adopters saw it as a tool to dismantle gatekeepers and empower individuals. But PMB has turned Bitcoin into a get-rich scheme, abandoning the collective effort needed to overthrow fiat’s centuries-long cycles.

Trust is a currency’s core. Hoarding Bitcoin shows trust in its future value, but it’s a shallow trust that seals it away from the world. Real trust comes from admiring Bitcoin’s math, building businesses around it, or spreading its use. PMB Bitcoiners sit on their stacks, expecting others to build trust for them. Newcomers see branding, ego, and grifters, not the low-tech prosperity Bitcoin can offer. PMB Bitcoiners live without spending a sat, happy to hodl. Fine, but they’re furniture in fiat’s ruins, not builders of Bitcoin’s future.

Hoarding hollow victories Hoarding works for those chasing fiat wealth. Bitcoin is even there for them. The lazy, the non-believers, the ones that sold very early, the ones that just started.

By 2021, 75% of Bitcoin sat dormant, driving scarcity and prices up. But it strangles transactions, weakening Bitcoin as a living economy. Reddit calls hoarding “Bitcoin’s most dangerous problem,” choking adoption for profit. Pioneers like Roger Ver built tech companies (where you could buy electronics for bitcoin), Mark Karpelès ran an exchange (Mt. Gox) and Charlie Shrem processed 30% of Bitcoin transactions in 2013. They poured stacks into adoption, people like them (even people you’ve never heard of) more than not, went broke doing the building while hoarders sat back. The irony stings: Bitcoin’s founders are often poorer than PMB hodlers who buried their talents and just sat there passively. Over the years, the critique from these sideline people became more prevalent. They show up here and there, to read the room. But that’s all they do.

The last couple of years, they even became more vocal with social media posts. Everything needs to be perfect, high-quality, not made by them, not funded by them, for free, without ads, and with no effort whatsoever, unless it’s NOT pumping their bags, then it needs to be burned down as fast as possible.

Today’s PMB Bitcoiners want the rewards without the risk. They stack sats, demand perfect content made by others for free, and cheer short-term price pumps. But when asked to build, code, or fund anything real, they disappear. At this point, such Bitcoiners have as much spine as a pack of Frankfurter sausages. This behavior has hollowed out Bitcoin’s activist core.

Activism’s disappointment

Bitcoin’s activist roots—cypherpunks coding, evangelists spreading the word—have been replaced by influencers and silent PMB conference-goers who say nothing but “I hold Bitcoin.” Centralized exchanges like Binance and Coinbase handle 70% of trades by 2025, mocking our decentralized vision. Custodial wallets proliferate as users hand over keys. The Lightning Network has 23,000+ nodes, and privacy tech like CoinJoin exists, yet adoption lags. Regulation creeps in—the U.S. Digital Asset Anti-Money Laundering Act of 2023 and Europe’s MiCa laws threaten KYC on every wallet. Our failure to advance faster gives governments leverage. Our failure would be their victory. Their cycles endlessly repeated.

Activism is a shadow of its potential. The Human Rights Foundation pushes Bitcoin for dissidents, but it’s a drop in the bucket. We could replace supply chains, build Bitcoin-only companies, or claim territories, yet we can’t even convince bars to accept

Bitcoin. We’re distracted by laser-eye memes and altcoin hopium, not building at farmer’s markets, festivals, or local scenes. PMB Bitcoiners demand perfection—free, ad-free, high-quality content—while contributing nothing.

The best way to shut them up, is asking them to do something. ”I would like to see a live counter on that page, so I can see what customers got new products” ”Why don’t YOU write code?” … and they’re gone.

”I would change a few items in your presentation man, it was good, but I would change the diagram on page 7” ”The presentation is open source and online, open for contributions. Do you want to give the presentation next time?” ”… “ and they’re gone.

”We need to have a network of these antennas to communicate with each other and send sats” ”I’ve ordered a few devices like that.. want to help out and search for new network participants?” ” … “ They’re off to some other thing, that’s more entertaining.

If you don’t understand you’re in a very unique fork in the road, a historic shift in society, much so that you’re more busy with picking the right shoes, car, phone, instead of pushing things in the right direction. And guess what? Usually these two lifestyles can even be combines. Knights in old England could fight and defend their king, while still having a decent meal and participate in festivities. These knight (compared to some bitcoiners) didn’t sit back at a fancy dinner and told the others: “yeah man, you should totally put on a harness, get a sword made and fight,… here I’ll give you a carrot for your horse.” To disappear into their castles waiting for the fight to be over a few months later. No, they put on the harness themselves, and ordered a sword to be made, because they knew their own future and that of their next of kin was at stake.

Hardly any of them show you that Bitcoin can be fairly simple and even low-tech solutions for achieving remedies for the world’s biggest problems (having individuals have real ownership for example). It can include some genuine building of prosperity and belief in one’s own talents and skills. You mostly don’t need middlemen. They buy stuff they don’t need, to feel like they’re participants.

And there’s so, enormously much work to be done.

On the other hand. Some bitcoiners can live their whole life without spending any considerable amount of bitcoin, and be perfectly happy. They mind as well could have had no bitcoin at all, but changed their mindset towards a lot of things in life. That’s cool, I know bitcoiners that don’t have any bitcoin anymore. They still “get it” though. Everyone’s life is different. These people are really cool, and they’re usually the silent builders as well. They know.

And yet, people will say they’ve “missed out”. They surely missed out on buying a lot of nice “stuff” … maybe. There are always new luxury items for sale in the burning ruins of fiat. There are always people that want to temporarily like or love you (long time) for fiat, as well as for bitcoin. You’re still an empty shell if your do. Just like the fiat slaves. A crypto bro will always stay the same sell out, even if he holds bitcoin by any chance.

You know why? Because bitcoiners don’t think like “they” do. The fiat masters that screwed this world up, think and work over multi generations. (Remember that for later, in piece twelve of this series.)

The only path forward

Solo heroics can’t beat the market or drive adoption anymore. Collective action is key. The Lightning Network grows from thousands of small nodes for example. Bitcoin Core thrives on shared grit. Profit isn’t sportcars — it’s a thriving network freeing people. If 10,000 people spend 0.05 BTC to fund wallets, educate merchants or build tools, we’d see more users and transactions. Adoption drives demand. Sacrifice now, impact later. Don’t work for PMB orders — they’re fiat victims, not Bitcoin builders.

Act together, thrive together

To kill PMB, rediscover your potential, even if it costs you:

Educate wide: Teach Bitcoin’s truth—how it works, why it matters. Every convert strengthens us.

Build together: Run nodes, fund Lightning hubs, support devs. Small contributions add up.

Use Bitcoin: Spend it, gift it, make it move. Transactions are the network’s heartbeat.

Value the mission: Chase freedom, not fiat. Your legacy is impact, not your stack.

A call to build The parable of Bitcoin is clear: hoard and get rich, but leave nothing behind; act together, sacrifice wealth, and build a thriving Bitcoin world. Hoarding risks a deflationary spiral while Wall Street grabs another 100,000 BTC every few weeks and sits on it for other fund managers to buy the stake (pun intended).

PMB Bitcoiners will cash out, thinking they’re smart, trading our future for fiat luxury. Bitcoin’s value lies in trust, scarcity, and a network grown by those who see beyond their wallets. Bury your Bitcoin or build with it.

If someone slyly nudges you to pump their bags, call them faithless leeches who ignore the call for a better world. They’re quiet, polite, and vanish when it’s time to fund or build. They tally fiat gains while you grind through life’s rot. They sling insults if you educate, risk, or create. They’re all take, no give — enemies, even if they hold Bitcoin.

Bitcoiners route around problems. Certainly if that problem is other bitcoiners. Because we know how they think, we know their buried talents, we know why they do it. It’s in our DNA to know. They don’t know why we keep building however, the worse of them don’t understand.

Bitcoin’s value isn’t in scarcity alone — it’s in the combination of trust, scarcity and the network, grown by those who see beyond their wallets and small gains.

Whether you’ve got 0.01 BTC or 10,000 BTC, your choice matters. Will you bury your Bitcoin, or build with it? I can hope we choose the latter.

If someone, directly or slyly, nudges you to pump their bags, call them out as faithless servants who wouldn’t even hear the calling of a better world. These types are often quiet, polite, and ask few questions, but when it’s time to step up, they vanish — nowhere to be found for funding, working, or doing anything real, big or small. They’re obsessed with “pump my bags,” tallying their fiat gains while you grind, sweat, and ache through life’s rotten misery. Usually they’re well off, because fiat mentality breeds more fiat.

They won’t lift you up or support you, because they’re all about the “take” and take and take more, giving nice sounding incentives to keep you pumping and grinding. They smell work, but never participate. They’re lovely and nice as long as you go along and pump.

Pump-My-Bags bitcoiners are temporary custodians, financial Frankfurter sausages hunting for a bun to flop into. We have the mustard. We know how to make it, package it and pour it over them. We’re the preservers of hard money. We build, think and try.

They get eaten. They’re fiat-born and when the real builders rise (they’re already a few years old), history won’t remember these people’s stacks and irrelevant comments — only our sacrifices.

by: AVB

-

@ ed5774ac:45611c5c

2025-04-19 20:29:31

@ ed5774ac:45611c5c

2025-04-19 20:29:31April 20, 2020: The day I saw my so-called friends expose themselves as gutless, brain-dead sheep.

On that day, I shared a video exposing the damning history of the Bill & Melinda Gates Foundation's vaccine campaigns in Africa and the developing world. As Gates was on every TV screen, shilling COVID jabs that didn’t even exist, I called out his blatant financial conflict of interest and pointed out the obvious in my facebook post: "Finally someone is able to explain why Bill Gates runs from TV to TV to promote vaccination. Not surprisingly, it's all about money again…" - referencing his substantial investments in vaccine technology, including BioNTech's mRNA platform that would later produce the COVID vaccines and generate massive profits for his so-called philanthropic foundation.

The conflict of interest was undeniable. I genuinely believed anyone capable of basic critical thinking would at least pause to consider these glaring financial motives. But what followed was a masterclass in human stupidity.

My facebook post from 20 April 2020:

Not only was I branded a 'conspiracy theorist' for daring to question the billionaire who stood to make a fortune off the very vaccines he was shilling, but the brain-dead, logic-free bullshit vomited by the people around me was beyond pathetic. These barely literate morons couldn’t spell "Pfizer" without auto-correct, yet they mindlessly swallowed and repeated every lie the media and government force-fed them, branding anything that cracked their fragile reality as "conspiracy theory." Big Pharma’s rap sheet—fraud, deadly cover-ups, billions in fines—could fill libraries, yet these obedient sheep didn’t bother to open a single book or read a single study before screaming their ignorance, desperate to virtue-signal their obedience. Then, like spineless lab rats, they lined up for an experimental jab rushed to the market in months, too dumb to care that proper vaccine development takes a decade.

The pathetic part is that these idiots spend hours obsessing over reviews for their useless purchases like shoes or socks, but won’t spare 60 seconds to research the experimental cocktail being injected into their veins—or even glance at the FDA’s own damning safety reports. Those same obedient sheep would read every Yelp review for a fucking coffee shop but won't spend five minutes looking up Pfizer's criminal fraud settlements. They would demand absolute obedience to ‘The Science™’—while being unable to define mRNA, explain lipid nanoparticles, or justify why trials were still running as they queued up like cattle for their jab. If they had two brain cells to rub together or spent 30 minutes actually researching, they'd know, but no—they'd rather suck down the narrative like good little slaves, too dumb to question, too weak to think.

Worst of all, they became the system’s attack dogs—not just swallowing the poison, but forcing it down others’ throats. This wasn’t ignorance. It was betrayal. They mutated into medical brownshirts, destroying lives to virtue-signal their obedience—even as their own children’s hearts swelled with inflammation.

One conversation still haunts me to this day—a masterclass in wealth-worship delusion. A close friend, as a response to my facebook post, insisted that Gates’ assumed reading list magically awards him vaccine expertise, while dismissing his billion-dollar investments in the same products as ‘no conflict of interest.’ Worse, he argued that Gates’s $5–10 billion pandemic windfall was ‘deserved.’

This exchange crystallizes civilization’s intellectual surrender: reason discarded with religious fervor, replaced by blind faith in corporate propaganda.

The comment of a friend on my facebook post that still haunts me to this day:

Walking Away from the Herd

After a period of anger and disillusionment, I made a decision: I would no longer waste energy arguing with people who refused to think for themselves. If my circle couldn’t even ask basic questions—like why an untested medical intervention was being pushed with unprecedented urgency—then I needed a new community.

Fortunately, I already knew where to look. For three years, I had been involved in Bitcoin, a space where skepticism wasn’t just tolerated—it was demanded. Here, I’d met some of the most principled and independent thinkers I’d ever encountered. These were people who understood the corrupting influence of centralized power—whether in money, media, or politics—and who valued sovereignty, skepticism, and integrity. Instead of blind trust, bitcoiners practiced relentless verification. And instead of empty rhetoric, they lived by a simple creed: Don’t trust. Verify.

It wasn’t just a philosophy. It was a lifeline. So I chose my side and I walked away from the herd.

Finding My Tribe

Over the next four years, I immersed myself in Bitcoin conferences, meetups, and spaces where ideas were tested, not parroted. Here, I encountered extraordinary people: not only did they share my skepticism toward broken systems, but they challenged me to sharpen it.

No longer adrift in a sea of mindless conformity, I’d found a crew of thinkers who cut through the noise. They saw clearly what most ignored—that at the core of society’s collapse lay broken money, the silent tax on time, freedom, and truth itself. But unlike the complainers I’d left behind, these people built. They coded. They wrote. They risked careers and reputations to expose the rot. Some faced censorship; others, mockery. All understood the stakes.

These weren’t keyboard philosophers. They were modern-day Cassandras, warning of inflation’s theft, the Fed’s lies, and the coming dollar collapse—not for clout, but because they refused to kneel to a dying regime. And in their defiance, I found something rare: a tribe that didn’t just believe in a freer future. They were engineering it.

April 20, 2024: No more herd. No more lies. Only proof-of-work.

On April 20, 2024, exactly four years after my last Facebook post, the one that severed my ties to the herd for good—I stood in front of Warsaw’s iconic Palace of Culture and Science, surrounded by 400 bitcoiners who felt like family. We were there to celebrate Bitcoin’s fourth halving, but it was more than a protocol milestone. It was a reunion of sovereign individuals. Some faces I’d known since the early days; others, I’d met only hours before. We bonded instantly—heated debates, roaring laughter, zero filters on truths or on so called conspiracy theories.

As the countdown to the halving began, it hit me: This was the antithesis of the hollow world I’d left behind. No performative outrage, no coerced consensus—just a room of unyielding minds who’d traded the illusion of safety for the grit of truth. Four years prior, I’d been alone in my resistance. Now, I raised my glass among my people - those who had seen the system's lies and chosen freedom instead. Each had their own story of awakening, their own battles fought, but here we shared the same hard-won truth.

The energy wasn’t just electric. It was alive—the kind that emerges when free people build rather than beg. For the first time, I didn’t just belong. I was home. And in that moment, the halving’s ticking clock mirrored my own journey: cyclical, predictable in its scarcity, revolutionary in its consequences. Four years had burned away the old world. What remained was stronger.

No Regrets

Leaving the herd wasn’t a choice—it was evolution. My soul shouted: "I’d rather stand alone than kneel with the masses!". The Bitcoin community became more than family; they’re living proof that the world still produces warriors, not sheep. Here, among those who forge truth, I found something extinct elsewhere: hope that burns brighter with every halving, every block, every defiant mind that joins the fight.

Change doesn’t come from the crowd. It starts when one person stops applauding.

Today, I stand exactly where I always wanted to be—shoulder-to-shoulder with my true family: the rebels, the builders, the ungovernable. Together, we’re building the decentralized future.

-

@ 3bf0c63f:aefa459d

2025-04-25 19:26:48

@ 3bf0c63f:aefa459d

2025-04-25 19:26:48Redistributing Git with Nostr

Every time someone tries to "decentralize" Git -- like many projects tried in the past to do it with BitTorrent, IPFS, ScuttleButt or custom p2p protocols -- there is always a lurking comment: "but Git is already distributed!", and then the discussion proceeds to mention some facts about how Git supports multiple remotes and its magic syncing and merging abilities and so on.

Turns out all that is true, Git is indeed all that powerful, and yet GitHub is the big central hub that hosts basically all Git repositories in the giant world of open-source. There are some crazy people that host their stuff elsewhere, but these projects end up not being found by many people, and even when they do they suffer from lack of contributions.

Because everybody has a GitHub account it's easy to open a pull request to a repository of a project you're using if it's on GitHub (to be fair I think it's very annoying to have to clone the repository, then add it as a remote locally, push to it, then go on the web UI and click to open a pull request, then that cloned repository lurks forever in your profile unless you go through 16 screens to delete it -- but people in general seem to think it's easy).

It's much harder to do it on some random other server where some project might be hosted, because now you have to add 4 more even more annoying steps: create an account; pick a password; confirm an email address; setup SSH keys for pushing. (And I'm not even mentioning the basic impossibility of offering

pushaccess to external unknown contributors to people who want to host their own simple homemade Git server.)At this point some may argue that we could all have accounts on GitLab, or Codeberg or wherever else, then those steps are removed. Besides not being a practical strategy this pseudo solution misses the point of being decentralized (or distributed, who knows) entirely: it's far from the ideal to force everybody to have the double of account management and SSH setup work in order to have the open-source world controlled by two shady companies instead of one.

What we want is to give every person the opportunity to host their own Git server without being ostracized. at the same time we must recognize that most people won't want to host their own servers (not even most open-source programmers!) and give everybody the ability to host their stuff on multi-tenant servers (such as GitHub) too. Importantly, though, if we allow for a random person to have a standalone Git server on a standalone server they host themselves on their wood cabin that also means any new hosting company can show up and start offering Git hosting, with or without new cool features, charging high or low or zero, and be immediately competing against GitHub or GitLab, i.e. we must remove the network-effect centralization pressure.

External contributions

The first problem we have to solve is: how can Bob contribute to Alice's repository without having an account on Alice's server?

SourceHut has reminded GitHub users that Git has always had this (for most) arcane

git send-emailcommand that is the original way to send patches, using an once-open protocol.Turns out Nostr acts as a quite powerful email replacement and can be used to send text content just like email, therefore patches are a very good fit for Nostr event contents.

Once you get used to it and the proper UIs (or CLIs) are built sending and applying patches to and from others becomes a much easier flow than the intense clickops mixed with terminal copypasting that is interacting with GitHub (you have to clone the repository on GitHub, then update the remote URL in your local directory, then create a branch and then go back and turn that branch into a Pull Request, it's quite tiresome) that many people already dislike so much they went out of their way to build many GitHub CLI tools just so they could comment on issues and approve pull requests from their terminal.

Replacing GitHub features

Aside from being the "hub" that people use to send patches to other people's code (because no one can do the email flow anymore, justifiably), GitHub also has 3 other big features that are not directly related to Git, but that make its network-effect harder to overcome. Luckily Nostr can be used to create a new environment in which these same features are implemented in a more decentralized and healthy way.

Issues: bug reports, feature requests and general discussions

Since the "Issues" GitHub feature is just a bunch of text comments it should be very obvious that Nostr is a perfect fit for it.

I will not even mention the fact that Nostr is much better at threading comments than GitHub (which doesn't do it at all), which can generate much more productive and organized discussions (and you can opt out if you want).

Search

I use GitHub search all the time to find libraries and projects that may do something that I need, and it returns good results almost always. So if people migrated out to other code hosting providers wouldn't we lose it?

The fact is that even though we think everybody is on GitHub that is a globalist falsehood. Some projects are not on GitHub, and if we use only GitHub for search those will be missed. So even if we didn't have a Nostr Git alternative it would still be necessary to create a search engine that incorporated GitLab, Codeberg, SourceHut and whatnot.

Turns out on Nostr we can make that quite easy by not forcing anyone to integrate custom APIs or hardcoding Git provider URLs: each repository can make itself available by publishing an "announcement" event with a brief description and one or more Git URLs. That makes it easy for a search engine to index them -- and even automatically download the code and index the code (or index just README files or whatever) without a centralized platform ever having to be involved.

The relays where such announcements will be available play a role, of course, but that isn't a bad role: each announcement can be in multiple relays known for storing "public good" projects, some relays may curate only projects known to be very good according to some standards, other relays may allow any kind of garbage, which wouldn't make them good for a search engine to rely upon, but would still be useful in case one knows the exact thing (and from whom) they're searching for (the same is valid for all Nostr content, by the way, and that's where it's censorship-resistance comes from).

Continuous integration

GitHub Actions are a very hardly subsidized free-compute-for-all-paid-by-Microsoft feature, but one that isn't hard to replace at all. In fact there exists today many companies offering the same kind of service out there -- although they are mostly targeting businesses and not open-source projects, before GitHub Actions was introduced there were also many that were heavily used by open-source projects.

One problem is that these services are still heavily tied to GitHub today, they require a GitHub login, sometimes BitBucket and GitLab and whatnot, and do not allow one to paste an arbitrary Git server URL, but that isn't a thing that is very hard to change anyway, or to start from scratch. All we need are services that offer the CI/CD flows, perhaps using the same framework of GitHub Actions (although I would prefer to not use that messy garbage), and charge some few satoshis for it.

It may be the case that all the current services only support the big Git hosting platforms because they rely on their proprietary APIs, most notably the webhooks dispatched when a repository is updated, to trigger the jobs. It doesn't have to be said that Nostr can also solve that problem very easily.

-

@ e3ba5e1a:5e433365

2025-04-15 11:03:15

@ e3ba5e1a:5e433365

2025-04-15 11:03:15Prelude

I wrote this post differently than any of my others. It started with a discussion with AI on an OPSec-inspired review of separation of powers, and evolved into quite an exciting debate! I asked Grok to write up a summary in my overall writing style, which it got pretty well. I've decided to post it exactly as-is. Ultimately, I think there are two solid ideas driving my stance here:

- Perfect is the enemy of the good

- Failure is the crucible of success

Beyond that, just some hard-core belief in freedom, separation of powers, and operating from self-interest.

Intro

Alright, buckle up. I’ve been chewing on this idea for a while, and it’s time to spit it out. Let’s look at the U.S. government like I’d look at a codebase under a cybersecurity audit—OPSEC style, no fluff. Forget the endless debates about what politicians should do. That’s noise. I want to talk about what they can do, the raw powers baked into the system, and why we should stop pretending those powers are sacred. If there’s a hole, either patch it or exploit it. No half-measures. And yeah, I’m okay if the whole thing crashes a bit—failure’s a feature, not a bug.

The Filibuster: A Security Rule with No Teeth

You ever see a firewall rule that’s more theater than protection? That’s the Senate filibuster. Everyone acts like it’s this untouchable guardian of democracy, but here’s the deal: a simple majority can torch it any day. It’s not a law; it’s a Senate preference, like choosing tabs over spaces. When people call killing it the “nuclear option,” I roll my eyes. Nuclear? It’s a button labeled “press me.” If a party wants it gone, they’ll do it. So why the dance?

I say stop playing games. Get rid of the filibuster. If you’re one of those folks who thinks it’s the only thing saving us from tyranny, fine—push for a constitutional amendment to lock it in. That’s a real patch, not a Post-it note. Until then, it’s just a vulnerability begging to be exploited. Every time a party threatens to nuke it, they’re admitting it’s not essential. So let’s stop pretending and move on.

Supreme Court Packing: Because Nine’s Just a Number

Here’s another fun one: the Supreme Court. Nine justices, right? Sounds official. Except it’s not. The Constitution doesn’t say nine—it’s silent on the number. Congress could pass a law tomorrow to make it 15, 20, or 42 (hitchhiker’s reference, anyone?). Packing the court is always on the table, and both sides know it. It’s like a root exploit just sitting there, waiting for someone to log in.

So why not call the bluff? If you’re in power—say, Trump’s back in the game—say, “I’m packing the court unless we amend the Constitution to fix it at nine.” Force the issue. No more shadowboxing. And honestly? The court’s got way too much power anyway. It’s not supposed to be a super-legislature, but here we are, with justices’ ideologies driving the bus. That’s a bug, not a feature. If the court weren’t such a kingmaker, packing it wouldn’t even matter. Maybe we should be talking about clipping its wings instead of just its size.

The Executive Should Go Full Klingon

Let’s talk presidents. I’m not saying they should wear Klingon armor and start shouting “Qapla’!”—though, let’s be real, that’d be awesome. I’m saying the executive should use every scrap of power the Constitution hands them. Enforce the laws you agree with, sideline the ones you don’t. If Congress doesn’t like it, they’ve got tools: pass new laws, override vetoes, or—here’s the big one—cut the budget. That’s not chaos; that’s the system working as designed.

Right now, the real problem isn’t the president overreaching; it’s the bureaucracy. It’s like a daemon running in the background, eating CPU and ignoring the user. The president’s supposed to be the one steering, but the administrative state’s got its own agenda. Let the executive flex, push the limits, and force Congress to check it. Norms? Pfft. The Constitution’s the spec sheet—stick to it.

Let the System Crash

Here’s where I get a little spicy: I’m totally fine if the government grinds to a halt. Deadlock isn’t a disaster; it’s a feature. If the branches can’t agree, let the president veto, let Congress starve the budget, let enforcement stall. Don’t tell me about “essential services.” Nothing’s so critical it can’t take a breather. Shutdowns force everyone to the table—debate, compromise, or expose who’s dropping the ball. If the public loses trust? Good. They’ll vote out the clowns or live with the circus they elected.

Think of it like a server crash. Sometimes you need a hard reboot to clear the cruft. If voters keep picking the same bad admins, well, the country gets what it deserves. Failure’s the best teacher—way better than limping along on autopilot.

States Are the Real MVPs

If the feds fumble, states step up. Right now, states act like junior devs waiting for the lead engineer to sign off. Why? Federal money. It’s a leash, and it’s tight. Cut that cash, and states will remember they’re autonomous. Some will shine, others will tank—looking at you, California. And I’m okay with that. Let people flee to better-run states. No bailouts, no excuses. States are like competing startups: the good ones thrive, the bad ones pivot or die.

Could it get uneven? Sure. Some states might turn into sci-fi utopias while others look like a post-apocalyptic vidya game. That’s the point—competition sorts it out. Citizens can move, markets adjust, and failure’s a signal to fix your act.

Chaos Isn’t the Enemy

Yeah, this sounds messy. States ignoring federal law, external threats poking at our seams, maybe even a constitutional crisis. I’m not scared. The Supreme Court’s there to referee interstate fights, and Congress sets the rules for state-to-state play. But if it all falls apart? Still cool. States can sort it without a babysitter—it’ll be ugly, but freedom’s worth it. External enemies? They’ll either unify us or break us. If we can’t rally, we don’t deserve the win.

Centralizing power to avoid this is like rewriting your app in a single thread to prevent race conditions—sure, it’s simpler, but you’re begging for a deadlock. Decentralized chaos lets states experiment, lets people escape, lets markets breathe. States competing to cut regulations to attract businesses? That’s a race to the bottom for red tape, but a race to the top for innovation—workers might gripe, but they’ll push back, and the tension’s healthy. Bring it—let the cage match play out. The Constitution’s checks are enough if we stop coddling the system.

Why This Matters

I’m not pitching a utopia. I’m pitching a stress test. The U.S. isn’t a fragile porcelain doll; it’s a rugged piece of hardware built to take some hits. Let it fail a little—filibuster, court, feds, whatever. Patch the holes with amendments if you want, or lean into the grind. Either way, stop fearing the crash. It’s how we debug the republic.

So, what’s your take? Ready to let the system rumble, or got a better way to secure the code? Hit me up—I’m all ears.

-

@ 5a261a61:2ebd4480

2025-04-15 06:34:03

@ 5a261a61:2ebd4480

2025-04-15 06:34:03What a day yesterday!

I had a really big backlog of both work and non-work things to clean up. But I was getting a little frisky because my health finally gave me some energy to be in the mood for intimacy after the illness-filled week had forced libido debt on me. I decided to cheat it out and just take care of myself quickly. Horny thoughts won over, and I got at least e-stim induced ass slaps to make it more enjoyable. Quick clean up and everything seemed ok...until it wasn't.

The rest of the morning passed uneventfully as I worked through my backlog, but things took a turn in the early afternoon. I had to go pickup kids, and I just missed Her between the doors, only managed to get a fast kiss. A little bummed from the work issues and failed expectations of having a few minutes together, I got on my way.

Then it hit me—the most serious case of blue balls I had in a long time. First came panic. I was getting to the age when unusual symptoms raise concerns—cancer comes first to mind, as insufficient release wasn't my typical problem. So I called Her. I explained what was happening and expressed hope for some alone time. Unfortunately, that seemed impossible with our evening schedule: kids at home, Her online meeting, and my standing gamenight with the boys. These game sessions are our sacred ritual—a preserved piece of pre-kids sanity that we all protect in our calendars. Not something I wanted to disturb.

Her reassurance was brief but unusualy promising: "Don't worry, I get this."

Evening came, and just as I predicted, there was ZERO time for shenanigans while we took care of the kids. But once we put them to bed (I drew straw for early sleeper), with parental duties complete, I headed downstairs to prepare for my gaming session. Headset on, I greeted my fellows and started playing.

Not five minutes later, She opened the door with lube in one hand, fleshlight in the other, and an expecting smile on Her face. Definitely unexpected. I excused myself from the game, muted mic, but She stopped me.

"There will be nothing if you won't play," She said. She just motioned me to take my pants off. And off to play I was. Not an easy feat considering I twisted my body sideways so She could access anything She wanted while I still reached keyboard and mouse.

She slowly started touching me and observing my reactions, but quickly changed to using Her mouth. Getting a blowjob while semihard was always so strange. The semi part didn't last long though...

As things intensified, She was satisfied with my erection and got the fleshlight ready. It was a new toy for us, and it was Her first time using it on me all by Herself (usually She prefers watching me use toys). She applied an abundance of lube that lasted the entire encounter and beyond.

Shifting into a rhythm, She started pumping slowly but clearly enjoyed my reactions when She unexpectedly sped up, forcing me to mute the mic. I knew I wouldn't last long. When She needed to fix Her hair, I gentlemanly offered to hold the fleshlight, having one hand still available for gaming. She misunderstood, thinking I was taking over completely, which initially disappointed me.

To my surprise, She began taking Her shirt off the shoulders, offering me a pornhub-esque view. To clearly indicate that finish time had arrived, She moved Her lubed hand teasingly toward my anal. She understood precisely my contradictory preferences—my desire to be thoroughly clean before such play versus my complete inability to resist Her when aroused. That final move did it—I muted the mic just in time to vocally express how good She made me feel.

Quick clean up, kiss on the forehead, and a wish for me to have a good game session followed. The urge to abandon the game and cuddle with Her was powerful, but She stopped me. She had more work to complete on Her todo list than just me.

Had a glass, had a blast; overall, a night well spent I would say.

-

@ 43aec65f:003ef459

2025-04-29 22:55:13

@ 43aec65f:003ef459

2025-04-29 22:55:13 -

@ 91bea5cd:1df4451c

2025-04-15 06:27:28

@ 91bea5cd:1df4451c

2025-04-15 06:27:28Básico

bash lsblk # Lista todos os diretorios montados.Para criar o sistema de arquivos:

bash mkfs.btrfs -L "ThePool" -f /dev/sdxCriando um subvolume:

bash btrfs subvolume create SubVolMontando Sistema de Arquivos:

bash mount -o compress=zlib,subvol=SubVol,autodefrag /dev/sdx /mntLista os discos formatados no diretório:

bash btrfs filesystem show /mntAdiciona novo disco ao subvolume:

bash btrfs device add -f /dev/sdy /mntLista novamente os discos do subvolume:

bash btrfs filesystem show /mntExibe uso dos discos do subvolume:

bash btrfs filesystem df /mntBalancea os dados entre os discos sobre raid1:

bash btrfs filesystem balance start -dconvert=raid1 -mconvert=raid1 /mntScrub é uma passagem por todos os dados e metadados do sistema de arquivos e verifica as somas de verificação. Se uma cópia válida estiver disponível (perfis de grupo de blocos replicados), a danificada será reparada. Todas as cópias dos perfis replicados são validadas.

iniciar o processo de depuração :

bash btrfs scrub start /mntver o status do processo de depuração Btrfs em execução:

bash btrfs scrub status /mntver o status do scrub Btrfs para cada um dos dispositivos

bash btrfs scrub status -d / data btrfs scrub cancel / dataPara retomar o processo de depuração do Btrfs que você cancelou ou pausou:

btrfs scrub resume / data

Listando os subvolumes:

bash btrfs subvolume list /ReportsCriando um instantâneo dos subvolumes:

Aqui, estamos criando um instantâneo de leitura e gravação chamado snap de marketing do subvolume de marketing.

bash btrfs subvolume snapshot /Reports/marketing /Reports/marketing-snapAlém disso, você pode criar um instantâneo somente leitura usando o sinalizador -r conforme mostrado. O marketing-rosnap é um instantâneo somente leitura do subvolume de marketing

bash btrfs subvolume snapshot -r /Reports/marketing /Reports/marketing-rosnapForçar a sincronização do sistema de arquivos usando o utilitário 'sync'

Para forçar a sincronização do sistema de arquivos, invoque a opção de sincronização conforme mostrado. Observe que o sistema de arquivos já deve estar montado para que o processo de sincronização continue com sucesso.

bash btrfs filsystem sync /ReportsPara excluir o dispositivo do sistema de arquivos, use o comando device delete conforme mostrado.

bash btrfs device delete /dev/sdc /ReportsPara sondar o status de um scrub, use o comando scrub status com a opção -dR .

bash btrfs scrub status -dR / RelatóriosPara cancelar a execução do scrub, use o comando scrub cancel .

bash $ sudo btrfs scrub cancel / ReportsPara retomar ou continuar com uma depuração interrompida anteriormente, execute o comando de cancelamento de depuração

bash sudo btrfs scrub resume /Reportsmostra o uso do dispositivo de armazenamento:

btrfs filesystem usage /data

Para distribuir os dados, metadados e dados do sistema em todos os dispositivos de armazenamento do RAID (incluindo o dispositivo de armazenamento recém-adicionado) montados no diretório /data , execute o seguinte comando:

sudo btrfs balance start --full-balance /data

Pode demorar um pouco para espalhar os dados, metadados e dados do sistema em todos os dispositivos de armazenamento do RAID se ele contiver muitos dados.

Opções importantes de montagem Btrfs

Nesta seção, vou explicar algumas das importantes opções de montagem do Btrfs. Então vamos começar.

As opções de montagem Btrfs mais importantes são:

**1. acl e noacl

**ACL gerencia permissões de usuários e grupos para os arquivos/diretórios do sistema de arquivos Btrfs.

A opção de montagem acl Btrfs habilita ACL. Para desabilitar a ACL, você pode usar a opção de montagem noacl .

Por padrão, a ACL está habilitada. Portanto, o sistema de arquivos Btrfs usa a opção de montagem acl por padrão.

**2. autodefrag e noautodefrag

**Desfragmentar um sistema de arquivos Btrfs melhorará o desempenho do sistema de arquivos reduzindo a fragmentação de dados.

A opção de montagem autodefrag permite a desfragmentação automática do sistema de arquivos Btrfs.

A opção de montagem noautodefrag desativa a desfragmentação automática do sistema de arquivos Btrfs.

Por padrão, a desfragmentação automática está desabilitada. Portanto, o sistema de arquivos Btrfs usa a opção de montagem noautodefrag por padrão.

**3. compactar e compactar-forçar

**Controla a compactação de dados no nível do sistema de arquivos do sistema de arquivos Btrfs.

A opção compactar compacta apenas os arquivos que valem a pena compactar (se compactar o arquivo economizar espaço em disco).

A opção compress-force compacta todos os arquivos do sistema de arquivos Btrfs, mesmo que a compactação do arquivo aumente seu tamanho.

O sistema de arquivos Btrfs suporta muitos algoritmos de compactação e cada um dos algoritmos de compactação possui diferentes níveis de compactação.

Os algoritmos de compactação suportados pelo Btrfs são: lzo , zlib (nível 1 a 9) e zstd (nível 1 a 15).

Você pode especificar qual algoritmo de compactação usar para o sistema de arquivos Btrfs com uma das seguintes opções de montagem:

- compress=algoritmo:nível

- compress-force=algoritmo:nível

Para obter mais informações, consulte meu artigo Como habilitar a compactação do sistema de arquivos Btrfs .

**4. subvol e subvolid

**Estas opções de montagem são usadas para montar separadamente um subvolume específico de um sistema de arquivos Btrfs.

A opção de montagem subvol é usada para montar o subvolume de um sistema de arquivos Btrfs usando seu caminho relativo.

A opção de montagem subvolid é usada para montar o subvolume de um sistema de arquivos Btrfs usando o ID do subvolume.

Para obter mais informações, consulte meu artigo Como criar e montar subvolumes Btrfs .

**5. dispositivo

A opção de montagem de dispositivo** é usada no sistema de arquivos Btrfs de vários dispositivos ou RAID Btrfs.

Em alguns casos, o sistema operacional pode falhar ao detectar os dispositivos de armazenamento usados em um sistema de arquivos Btrfs de vários dispositivos ou RAID Btrfs. Nesses casos, você pode usar a opção de montagem do dispositivo para especificar os dispositivos que deseja usar para o sistema de arquivos de vários dispositivos Btrfs ou RAID.

Você pode usar a opção de montagem de dispositivo várias vezes para carregar diferentes dispositivos de armazenamento para o sistema de arquivos de vários dispositivos Btrfs ou RAID.

Você pode usar o nome do dispositivo (ou seja, sdb , sdc ) ou UUID , UUID_SUB ou PARTUUID do dispositivo de armazenamento com a opção de montagem do dispositivo para identificar o dispositivo de armazenamento.

Por exemplo,

- dispositivo=/dev/sdb

- dispositivo=/dev/sdb,dispositivo=/dev/sdc

- dispositivo=UUID_SUB=490a263d-eb9a-4558-931e-998d4d080c5d

- device=UUID_SUB=490a263d-eb9a-4558-931e-998d4d080c5d,device=UUID_SUB=f7ce4875-0874-436a-b47d-3edef66d3424

**6. degraded

A opção de montagem degradada** permite que um RAID Btrfs seja montado com menos dispositivos de armazenamento do que o perfil RAID requer.

Por exemplo, o perfil raid1 requer a presença de 2 dispositivos de armazenamento. Se um dos dispositivos de armazenamento não estiver disponível em qualquer caso, você usa a opção de montagem degradada para montar o RAID mesmo que 1 de 2 dispositivos de armazenamento esteja disponível.

**7. commit

A opção commit** mount é usada para definir o intervalo (em segundos) dentro do qual os dados serão gravados no dispositivo de armazenamento.

O padrão é definido como 30 segundos.

Para definir o intervalo de confirmação para 15 segundos, você pode usar a opção de montagem commit=15 (digamos).

**8. ssd e nossd

A opção de montagem ssd** informa ao sistema de arquivos Btrfs que o sistema de arquivos está usando um dispositivo de armazenamento SSD, e o sistema de arquivos Btrfs faz a otimização SSD necessária.

A opção de montagem nossd desativa a otimização do SSD.

O sistema de arquivos Btrfs detecta automaticamente se um SSD é usado para o sistema de arquivos Btrfs. Se um SSD for usado, a opção de montagem de SSD será habilitada. Caso contrário, a opção de montagem nossd é habilitada.

**9. ssd_spread e nossd_spread

A opção de montagem ssd_spread** tenta alocar grandes blocos contínuos de espaço não utilizado do SSD. Esse recurso melhora o desempenho de SSDs de baixo custo (baratos).

A opção de montagem nossd_spread desativa o recurso ssd_spread .

O sistema de arquivos Btrfs detecta automaticamente se um SSD é usado para o sistema de arquivos Btrfs. Se um SSD for usado, a opção de montagem ssd_spread será habilitada. Caso contrário, a opção de montagem nossd_spread é habilitada.

**10. descarte e nodiscard

Se você estiver usando um SSD que suporte TRIM enfileirado assíncrono (SATA rev3.1), a opção de montagem de descarte** permitirá o descarte de blocos de arquivos liberados. Isso melhorará o desempenho do SSD.

Se o SSD não suportar TRIM enfileirado assíncrono, a opção de montagem de descarte prejudicará o desempenho do SSD. Nesse caso, a opção de montagem nodiscard deve ser usada.

Por padrão, a opção de montagem nodiscard é usada.

**11. norecovery

Se a opção de montagem norecovery** for usada, o sistema de arquivos Btrfs não tentará executar a operação de recuperação de dados no momento da montagem.

**12. usebackuproot e nousebackuproot

Se a opção de montagem usebackuproot for usada, o sistema de arquivos Btrfs tentará recuperar qualquer raiz de árvore ruim/corrompida no momento da montagem. O sistema de arquivos Btrfs pode armazenar várias raízes de árvore no sistema de arquivos. A opção de montagem usebackuproot** procurará uma boa raiz de árvore e usará a primeira boa que encontrar.

A opção de montagem nousebackuproot não verificará ou recuperará raízes de árvore inválidas/corrompidas no momento da montagem. Este é o comportamento padrão do sistema de arquivos Btrfs.

**13. space_cache, space_cache=version, nospace_cache e clear_cache

A opção de montagem space_cache** é usada para controlar o cache de espaço livre. O cache de espaço livre é usado para melhorar o desempenho da leitura do espaço livre do grupo de blocos do sistema de arquivos Btrfs na memória (RAM).

O sistema de arquivos Btrfs suporta 2 versões do cache de espaço livre: v1 (padrão) e v2

O mecanismo de cache de espaço livre v2 melhora o desempenho de sistemas de arquivos grandes (tamanho de vários terabytes).

Você pode usar a opção de montagem space_cache=v1 para definir a v1 do cache de espaço livre e a opção de montagem space_cache=v2 para definir a v2 do cache de espaço livre.

A opção de montagem clear_cache é usada para limpar o cache de espaço livre.

Quando o cache de espaço livre v2 é criado, o cache deve ser limpo para criar um cache de espaço livre v1 .

Portanto, para usar o cache de espaço livre v1 após a criação do cache de espaço livre v2 , as opções de montagem clear_cache e space_cache=v1 devem ser combinadas: clear_cache,space_cache=v1

A opção de montagem nospace_cache é usada para desabilitar o cache de espaço livre.

Para desabilitar o cache de espaço livre após a criação do cache v1 ou v2 , as opções de montagem nospace_cache e clear_cache devem ser combinadas: clear_cache,nosapce_cache

**14. skip_balance