-

@ bf47c19e:c3d2573b

2025-05-11 17:58:59

@ bf47c19e:c3d2573b

2025-05-11 17:58:59Originalni tekst na thebitcoinmanual.com

Lightning Network (eng. lightning - munja, network - mreža) je jedno od primarnih rešenja za skaliranje Bitkoin mreže sa ciljem da je više ljudi može koristiti na različite načine čime bi se zaobišla ograničenja glavnog blokčejna. Lightning mreža deluje kao "drugi sloj" koji je dodat Bitkoin (BTC) blokčejnu koji omogućava transakcije van glavnog lanca (blokčejna) pošto se transakcije između korisnika ne registruju na samoj blokčejn mreži.

Lightning kao "sloj-2 (layer-2)" pojačava skalabilnost blokčejn aplikacija tako što upravlja transakcijama van glavnog blokčejna ("sloj-1" / layer-1), dok istovremeno uživa benefite moćne decentralizovane sigurnosti glavnog blokčejna, tako da korisnici mogu ulaziti i izlaziti iz Lightning mreže koristeći custodial ili non-custodial servise u zavisnosti od sopstvene sposobnosti i znanja da koriste glavni blokčejn.

Kao što i samo ime govori Lightning Network je dizajnirana za brza, instant i jeftina plaćanja u svrhu sredstva razmene i druga programabilna plaćanja kojima nije potrebna instant konačnost (finality) ali ni sigurnost glavnog lanca. Lightning je najbolje uporediti sa vašom omiljenom aplikacijom za plaćanja ili debitnom karticom.

Šta je Lightning mreža?

Lightning mreža vuče svoje poreklo još od tvorca Bitkoina, Satošija Nakamota, ali je formalizovana od strane istraživača Joseph Poon-a i Thaddeus Dryja-a koji su 14. januara 2016. godine objavili beli papir o Lightning Network-u.

Radilo se o predlogu alternativnog rešenja za skaliranje Bitkoina da bi se izbeglo proširenje kapaciteta bloka Bitkoin mreže i smanjio rizik od centralizacije blokčejna. Dalje, skaliranje van glavnog lanca znači zadržavanje integriteta samog blokčejna što omogućuje više eksperimentalnog rada na Bitkoinu bez ograničenja koja su postavljena na glavnom blokčejnu.

Lightning Labs, kompanija za blokčejn inženjering, pomogla je pokretanje beta verzije Lightning mreže u martu 2018. - pored dve druge popularne implementacije od strane kompanija kao što su ACINQ i Blockstream.

- Lightning Labs – LND

- Blockstream – Core Lightning (implementacija nekada poznata kao c-lightning)

- ACINQ – Eclair

Svaka verzija protokola ima svoje poglede i načine kako rešava određene probleme ali ostaje interoperabilna sa ostalim implementacijama u smislu korišćenja novčanika, tako da za krajnjeg korisnika nije bitno kojom verzijom se služi kada upravlja svojim čvororom (node-om).

Lightning Network je protokol koji svako može koristiti i razvijati ga, proširivati i unapređivati i koji kreira posebno i odvojeno okruženje za korišćenje Bitkoina kroz seriju pametnih ugovora (smart contracts) koji zaključavaju BTC na Lightning-u radi izbegavanja dvostruke potrošnje (double-spending). Lightning Network nije blokčejn ali živi i funkcioniše na samom Bitkoinu i koristi glavni lanac kao sloj za konačno, finalno poravnanje.

Lightning mreža ima sopstvene čvorove koji pokreću ovaj dodatni protokol i zaključavaju likvidnost Bitkoina u njemu sa ciljem olakšavanja plaćanja.

Lightning omogućava svakom korisniku da kreira p2p (peer-to-peer) platni kanal (payment channel) između dve strane, kao npr. između mušterije i trgovca. Kada je uspostavljen, ovaj kanal im omogućava da međusobno šalju neograničen broj transakcija koje su istovremeno gotovo instant i veoma jeftine. Ponaša se kao svojevrsna mala "knjiga" (ledger) koja omogućava korisnicima da plaćaju još manje proizvode i usluge poput kafe i to bez uticaja na glavnu Bitkoin mrežu.

Kako radi Lightning Network?

Lightning Network se zasniva na pametnim ugovorima koji su poznati kao hashed time lock contracts koji između dve strane kreiraju platne kanale van glavnog blokčejna (off-chain payment channels). Kada zaključate BTC na glavnom lancu u ovim posebnim pametnim ugovorima, ova sredstva se otključavaju na Lightning mreži.

Ova sredstva zatim možete koristiti da biste napravili platne kanale sa ostalim korisnicima Lightning mreže, aplikacijama i menjačnicama.

Ovo su direktne platne linije koje se dešavaju na vrhu, odnosno izvan glavnog blokčejna. Kada je platni kanal otvoren, možete izvršiti neograničen broj plaćanja sve dok ne potrošite sva sredstva.

Korišćenje Lightning sredstava nije ograničeno pravilima glavnog Bitkoin lanca i ova plaćanja se vrše gotovo trenutno i za samo delić onoga što bi koštalo na glavnom blokčejnu.

Vaš platni kanal ima svoj sopstveni zapisnik (ledger) u koji se beleže transakcije izvan glavnog BTC blokčejna. Svaka strana ima mogućnost da ga zatvori ili obnovi po svom nahođenju i vrati sredstva nazad na glavni Bitkoin lanac objavljivanjem transakcije kojom se zatvara kanal.

Kada dve strane odluče da zatvore platni kanal, sve transakcije koje su se desile unutar njega se objedinjuju i zatim objavljuju na glavni blokčejn "registar".

Zašto biste želeli da koristite Lightning mrežu?

Trenutno slanje satošija

Lightning Network je "sloj-2" izgrađen na vrhu glavnog Bitkoin lanca koji omogućava instant i veoma jeftine transakcije između lightning novčanika. Ova mreža se nalazi u interakciji sa glavnim blokčejnom ali se plaćanja pre svega sprovode off-chain, van glavnog lanca, pošto koristi sopstvenu evidenciju plaćanja na lightning mreži.

Razvijene su različite aplikacije koje su kompatibilne sa Lightning mrežom, koje su veoma lake za korišćenje i ne zahtevaju više od QR koda za primanje i slanje prekograničnih transakcija.

Možete deponovati BTC na vaše lightning novčanike tako što ćete slati satošije sa menjačnica ili ih kupovati direktno unutar ovih aplikacija. Većina ovih novčanika ima ograničenje od nekoliko miliona satošija (iako će se ovaj limit povećavati kako više biznisa i država bude prihvatalo Bitkoin) koje možete poslati po transakciji što ima smisla budući da je za slanje većih iznosa bolje korišćenje glavnog blokčejna.

Pokretanje sopstvenog čvora

Kako se više ljudi bude povezivalo sa lightning mrežom i koristilo njene mogućnosti, sve više ljudi pokreće svoje čvorove radi verifikacije transakcija putem svojih lightning platnih kanala. Kroz ove kanale je moguće bezbedno poslati različite iznose satošija, a takođe je moguće zarađivati i male naknade za svaku transakciju koja prolazi kroz vaš kanal.

Transakcione naknade

Uprkos trenutnim transakcijama, još uvek postoje transakcione naknade povezane sa otvaranjem i zatvaranjem platnih kanala koje se moraju platiti rudarima na glavnom blokčejnu prilikom finalizacije lightning platnih kanala. Takođe postoje i naknade za rutiranje (routing fees) koje idu lightning čvorovima (i njihovim platnim kanalima) koji su uspostavljeni da bi se omogućila plaćanja.

Sa daljim napredovanjem razvoja Bitkoina i novim nadogradnjama, imaćemo sve veći rast i razvoj layer-2 aplikacija kao što je lightning.

Više izvora o Lightning mreži

Ukoliko želite da naučite više o Lightning mreži, najbolje je da pročitate dodatne tekstove na sajtu thebitcoinmanual.com.

-

@ bf47c19e:c3d2573b

2025-05-11 17:50:31

@ bf47c19e:c3d2573b

2025-05-11 17:50:31Originalni tekst na dvadesetjedan.com

Autor: Parker Lewis / Prevod na srpski: Plumsky

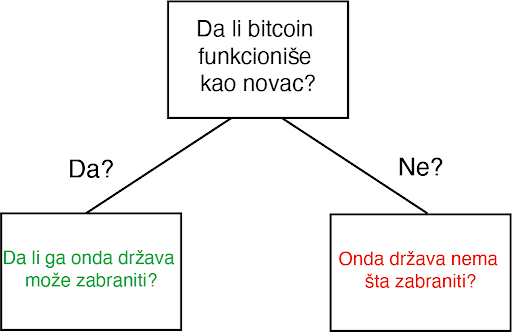

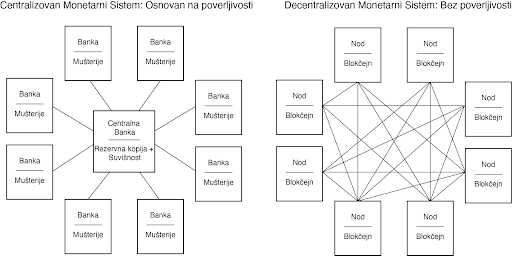

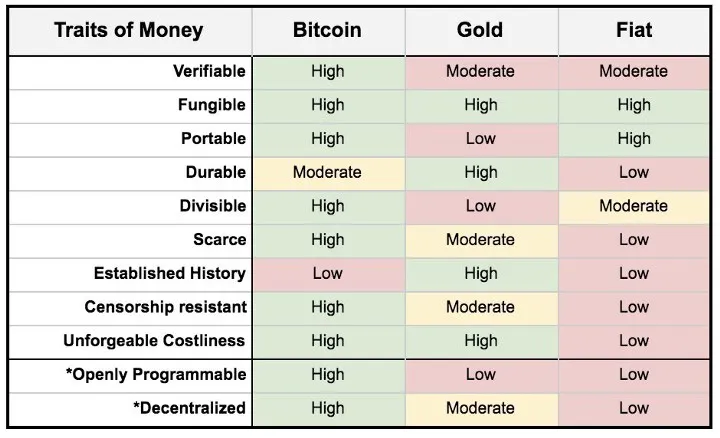

Ideja da država može nekako zabraniti bitcoin je jedna od poslednjih faza tuge, tačno pred prihvatanje realnosti. Posledica ove rečenice je priznanje da bitcoin “funkcioniše”. U stvari, ona predstavlja činjenicu da bitcoin funkcioniše toliko dobro da on preti postojećim državnim monopolima nad novcem i da će zbog toga države da ga unište kroz regulativne prepreke da bi eliminisale tu pretnju. Gledajte na tvrdnju da će države zabraniti bitcoin kao kondicionalnu logiku. Da li bitcoin funkcioniše kao novac? Ako je odgovor „ne“, onda države nemaju šta da zabrane. Ako je odgovor „da“, onda će države da probaju da ga zabrane. Znači, glavna poenta ovog razmišljanja je pretpostavka da bitcoin funkcioiniše kao novac. Onda je sledeće logično pitanje da li intervencija od strane države može uspešno da uništi upravo taj funkcionalan bitcoin.

Za početak, svako ko pokušava da razume kako, zašto, ili da li bitcoin funkcioniše mora da proceni ta pitanja potpuno nezavisno od prouzrekovanja državne regulacije ili intervencije. Iako je nesumnjivo da bitcoin mora da postoji uzgred državnih regulativa, zamislite na momenat da države ne postoje. Sam od sebe, da li bi bitcoin funkcionisao kao novac, kad bi se prepustio slobodnom tržištu? Ovo pitanje se širi u dodatna pitanja i ubrzo se pretvara u bunar bez dna. Šta je novac? Šta su svojstva koja čine jednu vrstu novca bolje od druge? Da li bitcoin poseduje ta svojstva? Da li je bitcoin bolja verzija novca po takvim osobinama? Ako je finalni zaključak da bitcoin ne funkcioniše kao novac, implikacije državne intervencije su nebitne. Ali, ako je bitcoin funkcionalan kao novac, ta pitanja onda postaju bitna u ovoj debati, i svako ko o tome razmišlja bi morao imati taj početnički kontekst da bi mogao proceniti da li je uopšte moguće zabraniti. Po svom dizajnu, bitcoin postoji van države. Ali bitcoin nije samo van kontrole države, on u stvari funkcioniše bez bilo kakve saradnje centralizovanih identiteta. On je globalan i decentralizovan. Svako može pristupiti bitcoinu bez potrebe saglasnosti bilo koga i što se više širi sve je teže cenzurisati celokupnu mrežu. Arhitektura bitcoina je namerno izmišljena da bude otporna na bilo koje pokušaje države da ga zabrane. Ovo ne znači da države širom sveta neće pokušavati da ga regulišu, oporezuju ili čak da potpuno zabrane njegovo korišćenje. Naravno da će biti puno bitki i otpora protiv usvajanja bitcoina među građanima. Federal Reserve i Američki Treasury (i njihovi globalni suparnici) se neće ležeći predati dok bitcoin sve više i više ugrožava njihove monopole prihvatljivog novca. Doduše, pre nego što se odbaci ideja da države mogu potpuno zabraniti bitcoin, mora se prvo razumeti posledice tog stava i njegovog glasnika.

Progresija poricanja i stepeni tuge

Pripovesti skeptičara se neprestano menjaju kroz vreme. Prvi stepen tuge: bitcoin nikad ne može funkcionisati-njegova vrednost je osnovana ni na čemu. On je moderna verzija tulip manije. Sa svakim ciklusom uzbuđenja, vrednost bitcoina skače i onda vrlo brzo se vraća na dole. Često nazvano kao kraj njegove vrednosti, bitcoin svaki put odbija da umre i njegova vrednost pronađe nivo koji je uvek viši od prethodnih ciklusa globalne usvajanja. Tulip pripovetka postaje stara i dosadna i skeptičari pređu na više nijansirane teme, i time menjaju bazu debate. Drugi stepen tuge predstoji: bitcoin je manjkav kao novac. On je previše volatilan da bi bio valuta, ili je suviše spor da bi se koristio kao sistem plaćanja, ili se ne može proširiti dovoljno da zadovolji sve promete plaćanja na svetu, ili troši isuviše struje. Taj niz kritike ide sve dalje i dalje. Ovaj drugi stepen je progresija poricanja i dosta je udaljen od ideje da je bitcoin ništa više od bukvalno bezvrednog ničega.

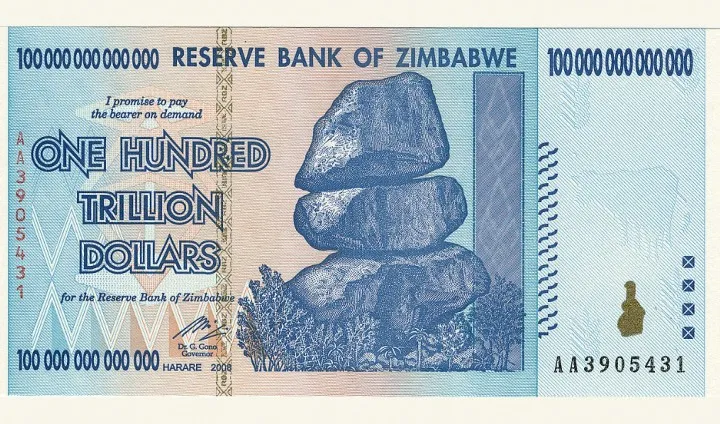

Uprkos tim pretpostavnim manjcima, vrednost bitcoin mreže nastavje da raste vremenom. Svaki put, ona ne umire, nasuprot, ona postaje sve veća i jača. Dok se skeptičari bave ukazivanjem na manjke, bitcoin ne prestaje. Rast u vrednosti je prouzrokovan jednostavnom dinamikom tržišta: postoji više kupca nego prodavca. To je sve i to je razlog rasta u adopciji. Sve više i više ljudi shvata zašto postoji fundamentalna potražnja za bitcoinom i zašto/kako on funkcioniše. To je razlog njegovog dugotrajnog rasta. Dokle god ga sve više ljudi koristi za čuvanje vrednosti, neće pasti cena snabdevanja. Zauvek će postojati samo 21 milion bitcoina. Nebitno je koliko ljudi zahtevaju bitcoin, njegova cela količina je uvek ista i neelastična. Dok skeptičari nastavljaju sa svojom starom pričom, mase ljudi nastavljaju da eliminišu zabludu i zahtevaju bitcoin zbog njegovih prednosti u smislu novčanih svojstva. Između ostalog, ne postoji grupa ljudi koja je više upoznata sa svim argumentima protiv bitcoina od samih bitcoinera.

Očajanje počinje da se stvara i onda se debata još jedanput pomera. Sada nije više činjenica je vrednost bitcoina osnovana ni na čemu niti da ima manjke kao valuta; sada se debata centrira na regulaciji državnih autoriteta. U ovom zadnjem stepenu tuge, bitcoin se predstavlja kao u stvari isuviše uspešnom alatkom i zbog toga države ne smeju dozvoliti da on postoji. Zaista? Znači da je genijalnost čoveka ponovo ostvarila funkcionalan novac u tehnološko superiornoj formi, čije su posledice zaista neshvatljive, i da će države upravo taj izum nekako zabraniti. Primetite da tom izjavom skeptičari praktično priznaju svoj poraz. Ovo su poslednji pokušaji u seriji promašenih argumenata. Skeptičari u isto vreme prihvataju da postoji fundamentalna potražnja za bitcoinom a onda se premeštaju na neosnovan stav da ga države mogu zabraniti.

Ajde da se poigramo i tim pitanjem. Kada bih zapravo razvijene države nastupile na scenu i pokušale da zabrane bitcoin? Trenutno, Federal Reserve i Treasury ne smatraju bitcoin kao ozbiljnu pretnju superiornosti dolara. Po njihovom celokupnom mišljenju, bitcoin je slatka mala igračka i ne može da funkcioniše kao novac. Sadašnja kompletna kupovna moć bitcoina je manja od $200 milijardi. Sa druge strane, zlato ima celokupnu vrednost od $8 triliona (40X veću od bitcoina) i količina odštampanog novca (M2) je otprilike 15 triliona (75X veličine bitcoinove vrednosti). Kada će Federal Reserve i Treasury da počne da smatra bitcoin kao ozbiljnu pretnju? Kad bitcoin poraste na $1, $2 ili $3 triliona? Možete i sami da izaberete nivo, ali implikacija je da će bitcoin biti mnogo vredniji, i posedovaće ga sve više ljudi širom sveta, pre nego što će ga državne vlasti shvatiti kao obiljnog protivnika.

Predsednik Tramp & Treasury Sekretar Mnučin o Bitcoinu (2019):

„Ja neću pričati o bitcoinu za 10 godina, u to možete biti sigurni {…} Ja bi se kladio da čak za 5 ili 6 godina neću više pričati o bitcoinu kao sekretar Trusury-a. Imaću preča posla {…} Mogu vam obećati da ja lično neću biti pun bitcoina.“ – Sekretar Treasury-a Stiv Mnučin

„Ja nisam ljubitelj bitcoina {…}, koji nije novac i čija vrednost je jako volatilna i osnovana na praznom vazduhu.“ – Predsednik Donald J. Tramp

Znači, logika skeptika ide ovako: bitcoin ne funkcioniše, ali ako funkcioniše, onda će ga država zabraniti. Ali, države slobodnog sveta neće pokušati da ga zabrane dokle god se on ne pokaže kao ozbiljna pretnja. U tom trenutku, bitcoin će biti vredniji i sigurno teži da se zabrani, pošto će ga više ljudi posedovati na mnogo širem geografskom prostoru. Ignorišite fundamentalne činjenice i asimetriju koja je urođena u globalnom dešavanju monetizacije zato što u slučaju da ste u pravu, države će taj proces zabraniti. Na kojoj strani tog argumenta bi radije stajao racionalan ekonomski učesnik? Posedovanje finansijske imovine kojoj vrednost toliko raste da preti globalnoj rezervnoj valuti, ili nasuprot – nemati tu imovinu? Sa pretpostavkom da individualci razumeju zašto je mogućnost (a sve više i verovatnoća) ove realnosti, koji stav je logičniji u ovom scenariju? Asimetrija dve strane ovog argumenta sama od sebe zahteva da je prvi stav onaj istinit i da fundamentalno razumevanje potražnje bitcoina samo još više ojačava to mišljenje.

Niko ne moze zabraniti bitcoin

Razmislite šta bitcoin u stvari predstavlja pa onda šta bi predstavljala njegova zabrana. Bitcoin je konverzija subjektivne vrednosti, stvorena i razmenjena u realnošću, u digitalne potpise. Jednostavno rečeno, to je konverzija ljudskog vremena u novac. Kad neko zahteva bitcoin, oni u isto vreme ne zahtevaju neki drugi posed, nek to bio dolar, kuća, auto ili hrana itd. Bitcoin predstavlja novčanu štednju koja sa sobom žrtvuje druge imovine i servise. Zabrana bitcoina bi bio napad na najosnovnije ljudske slobode koje je on upravo stvoren da brani. Zamislite reakciju svih onih koji su prihvatili bitcoin: „Bilo je zabavno, alatka za koju su svi eksperti tvrdili da neće nikad funkcionisati, sada toliko dobro radi i sad ti isti eksperti i autoriteti kažu da mi to nemožemo koristiti. Svi idite kući, predstava je gotova.“verovanje da će svi ljudi koji su učestvovali u bitcoin usvajanju, suverenitetu koji nudi i finansiskoj slobodi, odjednom samo da se predaju osnovnom rušenju njihovih prava je potpuno iracionalna pozicija.

Novac je jedan od najbitnijih instrumenata za slobodu koji je ikad izmišljen. Novac je to što u postojećem društvu ostvaruje mogućnosti siromašnom čoveku – čiji je domet veći nego onaj koji je bio dostižan bogatim ljudima pre ne toliko puno generacija.“ – F. A. Hajek

Države nisu uspele da zabrane konzumiranje alkohola, droga, kupovinu vatrenog oružja, pa ni posedovanje zlata. Država može samo pomalo da uspori pristup ili da deklariše posedovanje ilegalnim, ali ne može da uništi nešto što veliki broj raznovrsnih ljudi smatra vrednim. Kada je SAD zabranila privatno posedovanje zlata 1933., zlato nije palo u vrednosti ili nestalo sa finansijskog tržišta. Ono je u stvari poraslo u vrednosti u poređenju sa dolarom, i samo trideset godina kasnije, zabrana je bila ukinuta. Ne samo da bitcoin nudi veću vrednosno obećanje od bilo kog drugog dobra koje su države pokušale da zabrane (uključujući i zlato); nego po svojim osobinama, njega je mnogo teže zabraniti. Bitcoin je globalan i decentralizovan. On ne poštuje granice i osiguran je mnoštvom nodova i kriptografskim potpisima. Sam postupak zabrane bi zahtevao da se u isto vreme zaustavi „open source“ softver koji emituje i izvršava slanje i potvrđivanje digitalno enkriptovanih ključeva i potpisa. Ta zabrana bi morala biti koordinisana između velikog broja zemalja, sa tim da je nemoguće znati gde se ti nodovi i softver nalazi ili da se zaustavi instaliranje novih nodova u drugim pravnim nadležnostima. Da ne pominjemo i ustavske pitanja, bilo bi tehnički neizvodljivo da se takva zabrana primeni na bilo kakav značajan način.

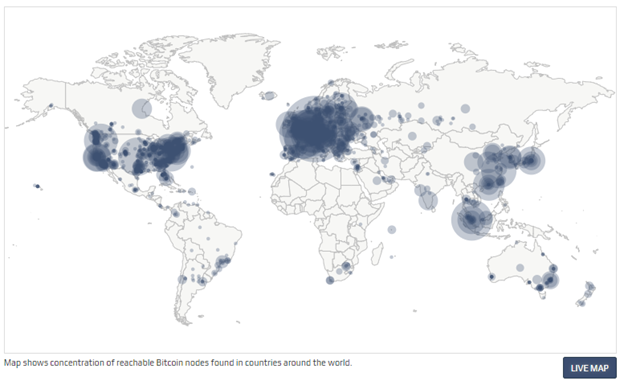

Čak kada bih sve zemlje iz G-20 grupe koordinisale takvu zabranu u isto vreme, to ne bi uništilo bitcoin. U stvari, to bi bilo samoubistvo za fiat novčani sistem. To bi još više prikazalo masama da je bitcoin u stvari novac koji treba shvatiti ozbiljno, i to bi samo od sebe započelo globalnu igru vatanje mačke za rep. Bitcoin nema centralnu tačku za napad; bitcoin rudari, nodovi i digitalni potpisi su rasejani po celom svetu. Svaki aspekt bitcoina je decentralizovan, zato su glavni stubovi njegove arhitekture da učesnici uvek treba kontrolisati svoje potpise i upravljati svojim nodom. Što više digitalnih potpisa i nodova koji postoje, to je više bitcoin decentralizovan, i to je više odbranjiva njegova mreža od strane neprijatelja. Što je više zemalja gde rudari izvršavaju svoj posao, to je manji rizik da jedan nadležni identitet može uticati na njegov bezbednosni sistem. Koordinisan internacionalni napad na bitcoin bi samo koristio da bitcoin još više ojača svoj imuni sistem. Na kraju krajeva, to bi ubrzalo seobu iz tradicionalnog finansijskog sistema (i njegovih valuta) a i inovaciju koja postoji u bitcoin ekosistemu. Sa svakom bivšom pretnjom, bitcoin je maštovito pronalazio način da ih neutrališe pa i koordinisan napad od strane država ne bi bio ništa drugačiji.

Inovacija u ovoj oblasti koja se odlikuje svojom „permissionless“ (bez dozvole centralnih identiteta) osobinom, omogućava odbranu od svakojakih napada. Sve varijante napada koje su bile predvidjene je upravo to što zahteva konstantnu inovaciju bitcoina. To je ona Adam Smitova nevidljiva ruka, ali dopingovana. Pojedinačni učesnici mogu da veruju da su motivisani nekim većim uzrokom, ali u stvari, korisnost kaja je ugrađena u bitcoin stvara kod učesnika dovoljno snažan podsticaj da omogući svoje preživljavanje. Sopstveni interes milione, ako ne milijarde, nekoordinisanih ljudi koji se jedino slažu u svojom međusobnom potrebom za funkcionalnim novcem podstiče inovacije u bitcoinu. Danas, možda to izgleda kao neka kul nova tehnologija ili neki dobar investment u finansijskom portfoliju, ali čak i ako to mnogi ne razumeju, bitcoin je apsolutna nužnost u svetu. To je tako zato što je novac nužnost a historijski priznate valute se fundamentalno raspadaju. Pre dva meseca, tržište američkih državnih obveznica je doživeo kolaps na šta je Federal Reserve reagovao time što je povećao celokupnu količinu dolara u postojanju za $250 milijardi, a još više u bliskoj budućnosti. Tačno ovo je razlog zašto je bitcoin nužnost a ne samo luksuzni dodatak. Kada inovacija omogućava bazično funkcionisanje ekonomije ne postoji ni jedna država na svetu koja može da zaustavi njenu adopciju i rast. Novac je nužnost a bitcoin znatno poboljšava sistem novca koji je ikada postojao pre njega.

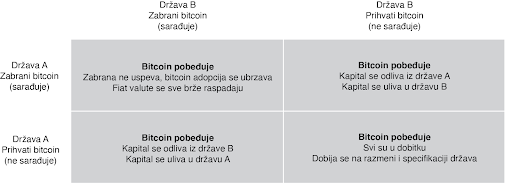

Sa više praktične strane, pokušaj zabranjivanja bitcoina ili njegove velike regulacije od nadležnosti bi direktno bilo u korist susedne nadležnih organa. Podsticaj da se odustane od koordinisanog napada na bitcoin bi bio isuviše veliki da bi takvi dogovori bili uspešni. Kada bi SAD deklarisovale posed bitcoina ilegalnim sutra, da li bi to zaustavilo njegov rast, razvoj i adopciji i da li bi to smanjilo vrednost celokupne mreže? Verovatno. Da li bi to uništilo bitcoin? Ne bi. Bitcoin predstavlja najpokretljivije kapitalno sredstvo na svetu. Zemlje i nadležne strukture koje kreiraju regulativnu strukturu koja najmanje ustručava korišćenje bitcoina će biti dobitnici velike količine uliva kapitala u svoje države.

Zabrana Bitcoinove Zatvoreničke Dileme

U praksi, zatvorenička dilema nije igra jedan na jedan. Ona je multidimenzijska i uključuje mnoštvo nadležnosti, čiji se interesi nadmeću međusobno, i to uskraćuje mogućnosti bilo kakve mogućnosti zabrane. Ljudski kapital, fizički kapital i novčani kapital će sav ići u pravcu država i nadležnosti koje najmanje ustručuju bitcoin. To se možda neće desiti sve odjednom, ali pokušaji zabrane su isto za badava koliko bi bilo odseći sebi nos u inat svom licu. To ne znači da države to neće pokušati. India je već probala da zabrani bitcoin. Kina je uvela puno restrikcija. Drugi će da prate njihove tragove. Ali svaki put kada država preduzme takve korake, to ima nepredvidljive efekte povećanja bitcoin adopcije. Pokušaji zabranjivanja bitcoina su jako efektivne marketing kampanje. Bitcoin postoji kao sistem nevezan za jednu suverenu državu i kao novac je otporan na cenzuru. On je dizajniran da postoji van državne kontrole. Pokušaji da se taj koncept zabrani samo još više daje njemu razlog i logiku za postojanje.

Jedini Pobednički Potez je da se Uključiš u Igru

Zabrana bitcoina je trošenje vremena. Neki će to pokušati; ali svi će biti neuspešni. Sami ti pokušaji će još više ubrzati njegovu adopciju i širenje. Biće to vetar od 100 km/h koji raspaljuje vatru. To će ojačati bitcoin sve više i doprineće njegovoj pouzdanosti. U svakom slučaju, verovanje da će države zabraniti bitcoin u momentu kada on postane dovoljno velika pretnja rezervnim valutam sveta, je iracionalan razlog da se on no poseduje kao instrument štednje novca. To ne samo da podrazumeva da je bitcoin novac, ali u isto vreme i ignoriše glavne razloge zašto je to tako: on je decentralizovan i otporan na cenzure. Zamislite da razumete jednu od nojvećih tajni današnjice i da u isto vreme tu tajnu asimetrije koju bitcoin nudi ne primenjujete u svoju korist zbog straha od države. Pre će biti, neko ko razume zašto bitcoin funkcioniše i da ga država ne može zaustaviti, ili nepuno znanje postoji u razumevanju kako bitcoin uopšte funckioniše. Počnite sa razmatranjem fundamentalnih pitanja, a onda primenite to kao temelj da bi procenili bilo koji potencijalan rizik od strane budućih regulacija ili restrikcija državnih organa. I nikad nemojte da zaboravite na vrednost asimetrije između dve strane ovde prezentiranih argumenata. Jedini pobednički potez je da se uključite u igru.

Stavovi ovde prezentirani su samo moji i ne predstavljaju Unchained Capital ili moje kolege. Zahvaljujem se Fil Gajgeru za razmatranje teksta i primedbe.

-

@ bf47c19e:c3d2573b

2025-05-11 17:48:52

@ bf47c19e:c3d2573b

2025-05-11 17:48:52Originalni tekst na medium.com.

Autor: Aleksandar Svetski / Prevod: ₿itcoin Serbia

Nemojte kupovati Bitkoin!

Ni danas, ni kasnije, nikada!

Posvećeno skepticima, neznalicama, arogantnima i nezainteresovanima.

NE TREBA vam Bitkoin.

Molim vas. Nemojte ga kupovati.

Lično me ne zanima "masovna adopcija".

Draža mi je selektivna adopcija.

Svinja ne zaslužuje bisere.

Na vama je da platite cenu neznanja.

Kao i cenu glupavosti.

Kada dođe vreme, sa zadovoljstvom ću vam platiti hiljadu satošija mesečno za vaše vreme i smejati se usput.

Najbitnija odluka koju ćete ikada doneti

NEMA važnije odluke za vašu finansijsku, ekonomsku i suverenu budućnost koju danas možete doneti nego da kupite Bitkoin.

A ako ne želite da izdvojite malo vremena da ga dalje proučite, JEDINA osoba koju treba da krivite kasnije ste vi sami.

Danas, Bitkoin se nalazi u svojoj ranoj, početnoj fazi. O ovome možete više pročitati ovde (hvala ObiWan Kenobit):

Hiperbitkoinizacija: pobednik uzima sve

Ovo JE prilika ne samo vašeg života, već verovatno i najveći mogući transfer bogatstva u istoriji, a najluđa stvar je što će se najveći deo toga odigrati u narednih nekoliko decenija.

Nalazimo se tek u prvih 12 godina ove promene, a već smo videlo kako je Bitkoin eksplodirao sa $0.008c (kada su za 10.000 BTC kupljene dve pice) na trenutnu cenu od oko $11.500.

Ovo je tek početak. Tek 0.001% svetskog bogatstva je denominirano u Bitkoinu.

Ako sada izdvojite samo trenutak da razumete novac, njegovu ulogu u društvu i kako će ekonomski darvinizam voditi ceo svet prema najrobusnijem, najčvršćem i najsigurnijem obliku očuvanja bogatstva, možete odlučiti da kupite neki deo pre nego što se ostatak sveta priključi.

Čitajući ovo, vi ste poput drevnog pojedinca koji je pronašao zlato, dok svi ostali koriste školjke. Razlika je u tome što živite u digitalnom dobu tokom kojeg će se ovaj novac pojaviti i sazreti za vreme vašeg života. Taj drevni pojedinac bi bio u pravu ali mrtav zato što je zlatu bilo potrebno nekoliko hiljada godina da uradi ono za šta će Bitkoinu biti potrebne decenije.

Zamislite. Se. Nad. Tim.

I naučite dalje o nastanku Bitkoina ovde:

I za ime ljubavi prema sopstvenoj budućnosti, preuzmite ovu kratku elektronsku knjigu i jebeno se edukujte!!

Preuzmite "Investiranje u Bitkoin"

I eto, dajem vam izvore.. jbt.. Svejedno...

Danas, imate izbor da kupite Bitkoin; najoskudniji novac u univerzumu, za siću!! Bukvalno možete kupiti hiljade satošija (najmanju jedinicu Bitkoina gde je 100.000.000 satošija = 1 BTC) za $1!!!

Danas ne postoji veća prilika, kao što sutradan neće postojati veće žaljenje kada više ne budete imali "izbor" da ga kupite.

Kada taj dan bude došao i kada budete to morali da prihvatite, setićete se ovih reči, ali avaj, biće prekasno, a vreme ne možete vratiti.

Više nije 2012

Tada ste imali izgovor. Sada je 2020...

Apsolutno NEMA razloga zašto neko sa malo radoznalosti i relativno funkcionalnim mozgom ne može da prouči šta je Bitkoin, zašto postoji, zašto je važan i zašto bi trebalo da u njega prebaci malo ličnog bogatstva.

Naročito ako ima prijatelja poput mene ili mnoštvo Bitkoinera negde tamo.

Ja više neću smarati ljude sa porukama "zašto treba kupiti Bitkoin".

Više nije 2012. godina.

Danas imamo toliko puno informacija od toliko mnogo dobrih ljudi na svim mogućim medijima, tako da NEMATE IZGOVORA da ga ignorišete ili kažete: "ali niko mi nije rekao".

Ukoliko nemate da izdvojite bar malo vremena od vašeg Netflix rasporeda da biste istražili šta je ova stvar i zašto je bitna za vašu ličnu ekonomsku budućnost, onda zaslužujete to što imate.

Deluje okrutno ali dobrodošao u život, mladi žutokljunče.

Sada... Ako ste izdvojili malo vremena ali ste i dalje nezainteresovani ili dovoljno glupi da ga odbacite, onda zaista zaslužujete to što dolazi i ostatak ovog članka je definitivno za vas.

Ne želim da uopšte kupite Bitkoin!

Ok Aleks, ali šta ćemo sa "masovnom adopcijom"???

Pažljivo me slušajte:

Zabole me kurac da li će masovna adopcija doći za 10, 20, 50 ili 100 godina!

Ja sam skroz za selektivnu adopciju i potpuno za dugačku igru. Tako da sam spreman da čekam.

Kao u SVIM prirodnim, evolutivno funkcionalnim sistemima, oni koji seju i pomažu u izgradnji temelja bi trebalo da budu i nesrazmerno nagrađeni.

Ovo je 100% fer i predivno nejednako (neki od vas koji me znate ste upoznati sa mojim stavom o nejednakosti kao najprezrenijem od svih ljudskih ideala. Radi se o odvratnom idealu koji nagrađuje najgore među nama).

Tako da za skeptike i "neverne Tome" imam jednostavnu poruku:

Nadam se da nećete uopšte kupiti Bitkoin. Ni danas ni bilo kada. Nadam se da će jedini put kada budete stupili u dodir sa Bitkoinom to biti jedini način da za nešto budete isplaćeni; npr. kada budete morali da ga zaradite.

Jedva čekam dan kada će mojih nekoliko hiljada satošija moći da kupi tri, četiri ili pet meseci vašeg vremena.

A u međuvremenu...

Molim vas, držite se vašeg fiat novca. Molim vas, držite se vaših šitkoina.

Ne želim nikoga od vas "blokčejnera", šitkoinera, fiat nokoinera i vas svih ostalih klovnova koji mislite da znate bolje.

Ovaj rolerkoster je specijalan, tako da zašto bih želeo da ga delim sa vama glupanderima? Zašto bih bacao bisere pred svinje?

Ja verujem u principe isključivosti.

Ovo nije "kumbaya" ili "svi smo jedno". Jebite se.

Sa razlogom smo drugačiji.

Napraviću sam svoj krevet i ležati u njemu. Vi napravite svoje.

Kada bude došlo vreme, ja ću vam za vaše vreme plaćati satošijima zato što onda nećete imati izbora.

Tada ja pobeđujem, a vi gubite.

Kako sejete, tako žanjete

Razlika između mene i vas je ta što ja kupujem Bitkoin sada zato što tako želim. Vi ćete morati da radite za Bitkoin sutra zato što tako morate.

To je cena neznanja. To je cena arogancije.

To je cena gluposti koju ćete platiti i, koliko god ovo zvuči okrutno, istina je da zaslužujete svaki delić toga.

Svi ležimo u krevetu koji sami pravimo, a vi svoj krevet pravite sada.

Neće vam samouvereni Bitkoiner reći: "lepo sam vam rekao". Nova ekonomska realnost će vam to reći umesto njega.

"Lepo sam vam rekao" će vas udariti poput tone cigle kada shvatite razliku između vas i onih koji su bili razboriti, koji su marljivo štedeli, koji su uložili vreme i trud da otkriju šta je zapravo Bitkoin dok su ih svi nazivali ludacima.

Neće biti sažaljenja.

Nema više bacanja bisera pred svinje

Oni koji imaju priliku da kupe nešto Bitkoina sada, a odluče da to ne urade zahvaljujući neznanju, aroganciji ili gluposti, zaslužuju da plate sa kamatom.

Zaslužuju da trguju svoje sutrašnje dragoceno vreme i energiju za ono što su mogli da nabave danas i to bukvalno "za kikiriki".

Ovde nema greške: nismo jednaki. Mi smo veoma, veoma različiti ljudi.

Ja sam uložio vreme, trud i energiju sada, ne samo zbog sebe samog, već i da bih posadio seme i pomogao mreži.

Uradio sam svoj deo.

Vi ćete doći kasnije i pomoći mi da žanjem nagrade svog truda. Postojaćete da biste mi pomogli da uživam u plodovima.

To će biti vaša uloga.

Izabrao sam da rizikujem i steknem deo onoga zbog čega su me svi nazivali ludim zato što sam učio, verovao i shvatio danas, sa nadom da se izgradi bolja, poštenija i pravičnija budućnost za sve.

Radeći to, neki od nas će postati džinovi i nesrazmerno bogati. I vi imate tu šansu ali je mnogi od vas neće iskoristiti.

I ja sam skroz ok sa tim. Više neću bacati bisere pred svinje.

Ovaj članak može zvučati neprijatno ali više me zabole kurac. Sada je na vama da sami istražujete.

Ovo se događa bez obzira sviđalo vam se to ili ne. Ja i hiljade drugih Bitkoinera smo pisali eseje i eseje o ovome.

Neka imena sa kvalitetnim materijalom kojih se mogu setiti iz glave su:

- Naravno ja

- Gigi

- Robert Breedlove

- Saifedean Ammous

Ako ste radoznali možete ih pratiti. A ovo je sjajno mesto gde možete preuzeti nekoliko odličnih radova:

I za kraj, ako si Bitkoiner koji ovo čita, nikada nećeš znati da li sam zloban ili samo igram 4D šah.

Iskreno, nije ni bitno.

Ovo se dešava. Bitkoin osvaja svet. Ekonomski darvinizam je činjenica.

Sakupljajte vaše satošije, ponudite maslinovu grančicu, obratite pažnju na njihovu radoznalost ili iskru u njihovom oku kao znak da nastavite. Ukoliko toga nema ili naiđete na odbijanje, ostavite ih da se igraju kao svinje u govnima sa njihovim fiatom, deonicama ili šitkoinima.

Biće nam potrebni čistači za naše citadele.

-

@ bf47c19e:c3d2573b

2025-05-11 17:47:49

@ bf47c19e:c3d2573b

2025-05-11 17:47:49Originalni tekst na dvadesetjedan.com.

Autor: Alex Gladstein / Prevod na hrvatski: TheVeka

Francuska još uvijek koristi monetarni kolonijalizam za iskorištavanje 15 afričkih nacija. Može li Bitcoin biti izlaz?

U jesen 1993. obitelj Fodéa Diopa štedjela je za njegovu budućnost. Briljantan 18-godišnjak koji živi u Senegalu, Fodé je imao pred sobom svijetlu budućnost kao košarkaš i inženjer. Njegov otac, školski učitelj, pomogao mu je pronaći inspiraciju u računalima i povezivanju sa svijetom oko sebe. A njegov atletski talent donio mu je ponude za studiranje u Europi i Sjedinjenim Američkim Državama.

Ali kada se probudio ujutro 12. siječnja 1994., sve se promijenilo. Preko noći je njegova obitelj izgubila pola svoje ušteđevine. Ne zbog krađe, pljačke banke ili bankrota neke tvrtke - već zbog devalvacije valute koju je nametnula strana sila sa sjedištem udaljenim 5000 kilometara od njih.

Prethodne večeri francuski dužnosnici sastali su se sa svojim afričkim kolegama u Dakaru kako bi razgovarali o sudbini "franca de la Communauté financière africaine" (ili franka Financijske zajednice Afrike), široko poznatog kao CFA franak ili skraćeno "seefa". Tijekom čitavog Fodéova života njegov CFA franak bio je vezan za francuski franak u omjeru od 1 naprama 50, ali kad je kasnonoćni sastanak završio, ponoćna objava postavila je novu vrijednost od 1 naprama 100.

Okrutna je ironija bila da je ekonomska sudbina milijuna Senegalaca bila potpuno izvan njihovih vlastitih ruku. Nikakvi prosvjedi nisu mogli svrgnuti njihove ekonomske gospodare. Desetljećima su novi predsjednici dolazili i odlazili, ali temeljni financijski aranžman nikada se nije mijenjao. Za razliku od tipične fiat valute, sustav je bio daleko podmukliji. Bio je to monetarni kolonijalizam.

Mehanika CFA sustava

U svojoj knjizi koja otvara oči, Posljednja afrička kolonijalna valuta: priča o CFA franku (Africa's Last Colonial Currency: The CFA Franc Story), znanstvenici iz područja ekonomije Fanny Pigeaud i Ndongo Samba Sylla govore o tragičnoj i, ponekad šokantnoj, povijesti CFA franka.

Francuska je, kao i druge europske sile, kolonizirala mnoge nacije diljem svijeta u doba svog imperijalnog vrhunca. Veoma često ta kolonizacija bila je brutalna. Nakon okupacije od strane nacističke Njemačke u Drugom svjetskom ratu, Francusko kolonijalno carstvo "Empire colonial français" počeo se raspadati. Francuzi su se borili da zadrže svoje kolonije, nanoseći pritom ogromne ljudske žrtve. Unatoč vođenju skupog niza globalnih ratova, izgubljena je Indokina, zatim Sirija i Libanon, te, na kraju, francuski teritorij u sjevernoj Africi, uključujući cijenjenu naseljeničku koloniju Alžir, bogatu naftom i plinom. No Francuska je bila odlučna ne izgubiti svoje teritorije u zapadnoj i središnjoj Africi. Oni su osiguravali vojnu snagu tijekom dva svjetska rata i nudili obilje prirodnih resursa - uključujući uran, kakao, drvo i boksit - koji su obogatili i održali metropolu (Francusku u njenim postojećim europskim granicama).

Kako se približavala 1960., dekolonizacija se činila neizbježnom. Europa je bila ujedinjena u povlačenju iz Afrike nakon desetljeća pustošenja i pljačke koju su sponzorirale države. Ali francuske su vlasti shvatile da mogu dobiti svoj kolač i pojesti ga, prepuštanjem političke kontrole uz zadržavanje monetarne kontrole.

Ovo naslijeđe i danas postoji u 15 zemalja koje govore francuski i koriste valutu koju kontrolira Pariz: Senegal, Mali, Obala Bjelokosti, Gvineja Bisau, Togo, Benin, Burkina Faso, Niger, Kamerun, Čad, Srednjoafrička Republika, Gabon, Ekvatorijalna Gvineja, Republika Kongo i Komori. U 2022. Francuzi još uvijek vrše monetarnu kontrolu nad više od 2,5 milijuna četvornih kilometara afričkog teritorija, površine 80% veličine Indije.

Francuska je službenu dekolonizaciju započela 1956. s Defferreovim okvirnim zakon "La Loi-cadre Defferre", dijelom zakona koji kolonijama daje više autonomije i stvara demokratske institucije i opće pravo glasa. Godine 1958. francuski ustav je izmijenjen kako bi se uspostavila La Communauté (Zajednica): skupina autonomnih, demokratski upravljanih prekomorskih teritorija. Predsjednik Charles de Gaulle obišao je kolonije diljem zapadne i središnje Afrike kako bi ponudio autonomiju bez neovisnosti kroz La Communauté ili neposrednu potpunu neovisnost. Jasno je dao do znanja da će s prvim biti povlastica i stabilnosti, a s drugim velikih rizika, pa čak i kaosa.

Godine 1960. Francuska je zapravo imala veću populaciju — oko 40 milijuna ljudi — od 30 milijuna stanovnika sadašnjih 15 CFA zemalja. Ali danas 67 milijuna ljudi živi u Francuskoj, a 183 milijuna u CFA zoni. Prema projekcijama UN-a, do 2100. godine Francuska će imati 74 milijuna, a CFA nacije više od 800 milijuna. S obzirom da Francuska još uvijek drži njihovu financijsku sudbinu u svojim rukama, situacija sve više nalikuje ekonomskom apartheidu.

Kada je CFA franak prvobitno uveden 1945., vrijedio je 1,7 francuskih franaka. Godine 1948. ojačan je na 2 francuska franka. Ali u vrijeme kad je CFA franak bio vezan za euro krajem 1990-ih, vrijedio je 0,01 francuski franak. To je ukupna devalvacija od 99,5%. Svaki put kad je Francuska devalvirala CFA franak, povećala je svoju kupovnu moć u odnosu na svoje bivše kolonije i poskupila im uvoz vitalne robe. Godine 1992. Francuzi su putem nacionalnog referenduma mogli glasovati o prihvaćanju eura ili ne. Državljanima CFA-e bilo je uskraćeno takvo pravo i bili su isključeni iz pregovora koji bi njihov novac vezali za novu valutu.

Točan mehanizam CFA sustava evoluirao je od njegovog nastanka, ali osnovna funkcionalnost i metode iskorištavanja su nepromijenjene. Oni su opisani onim što Pigeaud i Sylla nazivaju "teorijom ovisnosti", gdje se resursi perifernih nacija u razvoju "kontinuirano crpe u korist središnjih bogatih nacija... bogate nacije ne ulažu u siromašne nacije da bi ih učinile bogatijima... [ovo] izrabljivanje evoluiralo je tijekom vremena od brutalnih režima ropstva do sofisticiranijih i manje očitih načina održavanja političkog i ekonomskog ropstva.”

Tri središnje banke danas opslužuju 15 zemalja CFA: Središnja banka zapadnoafričkih država (Banque Centrale des États de l'Afrique de l'Ouest - BCEAO) za zapadnoafričke zemlje, Banka država Srednje Afrike (Banque des États de l'Afrique Centrale - BEAC) za srednjoafričke zemlje i Središnja banka Komora (Banque Centrale des Comores BCC) za Komore. Središnje banke drže devizne rezerve (tj. nacionalnu štednju) za pojedinačne nacije u svojoj regiji, koje u svakom trenutku moraju držati nevjerojatnih 50% u francuskoj riznici. Ova brojka, koliko god visoka, rezultat je povijesnih pregovora. Izvorno su bivše kolonije morale držati 100% svojih rezervi u Francuskoj, a tek su 1970-ih stekle pravo kontrolirati neke i ustupiti "samo" 65% Parizu. CFA države nemaju nikakvu diskreciju u pogledu svojih rezervi pohranjenih u inozemstvu. Zapravo, oni ne znaju kako se taj novac troši. U međuvremenu, Pariz točno zna kako se troši novac svake CFA države, budući da vodi "operativne račune" za svaku zemlju u tri središnje banke.

Kao primjer kako ovo funkcionira, kada tvrtka za proizvodnju kave iz Bjelokosti proda robu u vrijednosti od milijun dolara kineskom kupcu, juani od kupca se mijenjaju u eure na francuskom tržištu valuta. Zatim francuska riznica preuzima eure i kreditira iznos u CFA francima na račun Obale Bjelokosti u BCEAO, koji zatim kreditira račun proizvođača kave u zemlji. Sve prolazi kroz Pariz. Prema Pigeaudu i Sylli, Francuska još uvijek proizvodi sve novčanice i kovanice koje se koriste u CFA regiji — naplaćujući 45 milijuna eura godišnje za uslugu — i još uvijek drži 90% zlatnih rezervi CFA, oko 36,5 tona.

Sustav CFA daje pet glavnih prednosti francuskoj vladi:

- rezerve bonusa koje može koristiti prema vlastitom nahođenju;

- velika tržišta za skup izvoz i jeftin uvoz;

- mogućnost kupnje strateških minerala u domaćoj valuti bez smanjenja rezervi;

- povoljne zajmove kada su CFA zemlje u kreditima i povoljne kamatne stope kada su u dugovima (dugo je vremena francuska stopa - inflacije čak premašivala kamatnu stopu zajma, što znači da je Francuska zapravo prisiljavala CFA nacije da plaćaju naknadu za -skladištenje svojih rezervi u inozemstvu); i, konačno,

- "dvostruki zajam", u kojem će CFA nacija posuditi novac od Francuske, i, u potrazi za raspoređivanjem kapitala, imati malo izbora s obzirom na perverzne makroekonomske okolnosti u kojima treba sklopiti ugovor s francuskim tvrtkama. To znači da se glavnica kredita odmah vraća u Francusku, ali je afrička nacija još uvijek opterećena i glavnicom i kamatama.

To dovodi do svojevrsnog fenomena "recikliranja petrodolara" (slično onome kako bi Saudijska Arabija uzimala dolare zarađene prodajom nafte i ulagala ih u američke trezorske zapise), jer bi CFA izvoznici povijesno prodavali sirovine Francuskoj, a dio prihoda bivao prikupljen od strane regionalne središnje banke i “reinvestiran” natrag u dug metropole kroz francuski ili danas europski državni dug. Pored toga, tu je još i selektivna konvertibilnost CFA franka. Poduzeća danas mogu lako prodati svoje CFA franke za eure (prethodno francuske franke), ali građani koji nose CFA franke izvan zone svoje središnje banke ne mogu ih formalno nigdje zamijeniti. Beskorisne su otprilike kao i razglednice. Ako državljanka Bjelokosti napušta svoju zemlju, mora prvo zamijeniti novčanice za eure, gdje francusko ministarstvo financija i Europska središnja banka (ECB) izdvajaju seigniorage (danak feudalnom gospodaru) putem tečaja.

Monetarna represija u igri je da Francuska prisiljava CFA nacije da drže golemu količinu rezervi u pariškim blagajnama, sprječavajući Afrikance u stvaranju domaćih kredita. Regionalne središnje banke na kraju posuđuju vrlo malo po vrlo visokim stopama, umjesto da posuđuju više po niskim stopama. A CFA nacije na kraju, protiv svojih želja, kupuju francuski ili, danas europski, dug svojim strateškim rezervama.

Ono što možda najviše iznenađuje jest posebna povlastica prava prvenstva pri uvozu i izvozu. Ako ste malijski proizvođač pamuka, svoju robu prvo morate ponuditi Francuskoj prije nego što odete na međunarodna tržišta. Ili ako ste u Beninu i želite izgraditi novi infrastrukturni projekt, morate razmotriti francuske ponude, prije ostalih. To je povijesno značilo da je Francuska mogla doći do robe jeftinije od tržišne iz svojih bivših kolonija i prodavati vlastitu robu i usluge po cijenama višim od tržišnih.

Pigeaud i Sylla ovo nazivaju nastavkom "kolonijalnog pakta", koji je bio usredotočen na četiri temeljna načela:

- kolonijama je bila zabranjena industrijalizacija i morale su se zadovoljiti opskrbom metropole sirovinama koje su ih pretvarale u gotove proizvode koji su se zatim preprodani kolonijama,

- metropola je uživala monopol kolonijalnog izvoza i uvoza,

- monopol prilikom slanja kolonijalnih proizvoda u inozemstvo i konačno,

- metropola je dala trgovačke povlastice proizvodima kolonija.

Rezultat toga je situacija u kojoj “središnje banke imaju velike devizne rezerve plaćene po niskim ili čak negativnim stopama u realnom iznosu, u kojoj komercijalne banke drže višak likvidnosti, gdje je pristup kreditima za kućanstva i poduzeća racionaliziran i u kojoj su države sve više prisiljene, kako bi financirali svoje razvojne projekte, ugovarati devizne kredite po neodrživim kamatama, što dodatno potiče bijeg kapitala.

Danas je CFA sustav "afrikaniziran", što znači da novčanice sada prikazuju afričku kulturu te floru i faunu na njima, a središnje banke nalaze se u Dakaru, Yaoundéu i Moroniju - ali to su samo kozmetičke promjene. Novčanice se još uvijek izrađuju u Parizu, operativne račune još uvijek vode francuske vlasti, a francuski dužnosnici još uvijek sjede u odborima regionalnih središnjih banaka i de facto imaju pravo veta. Nevjerojatna je situacija u kojoj građanin Gabona ima francuskog birokrata koji donosi odluke u njezino ime. Kao da ECB ili Federalne rezerve imaju Japance ili Ruse koji odlučuju umjesto Europljana i Amerikanaca.

Svjetska banka i Međunarodni monetarni fond kroz povijest su radili zajedno s Francuskom na provođenju CFA sustava i rijetko, ako ikad, kritiziraju njegovu izrabljivačku prirodu. Zapravo, kao dio sustava Bretton Woods nakon Drugog svjetskog rata - gdje bi Amerikanci vodili Svjetsku banku, a Europljani MMF - položaj generalnog direktora MMF-a često je držao francuski dužnosnik, do nedavno Christine Lagarde. Tijekom godina MMF je pomagao Francuskoj da vrši pritisak na CFA nacije da slijede željenu politiku. Istaknuti primjer bio je ranih 1990-ih, kada Obala Bjelokosti nije htjela devalvirati svoju valutu, ali Francuzi su se zalagali za takvu promjenu. Prema Pigeaudu i Sylli, “krajem 1991., MMF je odbio nastaviti posuđivati novac Obali Bjelokosti, ponudivši zemlji dvije mogućnosti. Ili će država vratiti dugove ugovorene s Fondom ili će prihvatiti devalvaciju.” Obala Bjelokosti i druge CFA nacije su poklekle i prihvatile devalvaciju tri godine kasnije.

U suprotnosti s vrijednostima sloboda, jednakost, bratstvo (liberté, égalité, fraternité), francuski su dužnosnici podupirali tiraniju u CFA zoni posljednjih šest desetljeća. Na primjer, tri čovjeka - Omar Bongo u Gabonu, Paul Biya u Kamerunu i Gnassingbé Eyadéma u Togu - zajedno su skupili 120 godina na vlasti. Sve bi ih njihovi ljudi izbacili daleko prije da Francuzi nisu osigurali gotovinu, oružje i diplomatsko pokriće. Prema Pigeaudu i Sylli, između 1960. i 1991. “Pariz je izveo gotovo 40 vojnih intervencija u 16 zemalja kako bi obranio svoje interese.” Taj je broj danas sigurno veći.

S vremenom je CFA sustav omogućio francuskoj državi da iskorištava resurse i rad CFA nacija, ne dopuštajući im da povećaju svoju akumulaciju kapitala i razviju vlastita izvozno vođena gospodarstva. Rezultati su bili katastrofalni za razvoj društva općenito.

Danas je BDP Obale Slonovače (korigiran za inflaciju) po glavi stanovnika (u dolarima) oko 1.700 USD, u usporedbi s 2.500 USD u kasnim 1970-ima. U Senegalu je tek 2017. BDP po stanovniku premašio visine dosegnute 1960-ih. Kao što primjećuju Pigeaud i Sylla, “10 država zone franka zabilježilo je svoje najviše razine prosječnog dohotka prije 2000-ih. U posljednjih 40 godina prosječna se kupovna moć gotovo posvuda pogoršala. U Gabonu je najveći prosječni prihod zabilježen 1976. godine, nešto ispod 20.000 dolara. Četrdeset godina kasnije smanjio se za pola. Gvineja Bisau pridružila se CFA sustavu 1997. godine, godine u kojoj je zabilježila vrhunac svog prosječnog prihoda. 19 godina kasnije, ovo je palo za 20%.”

Zapanjujućih 10 od 15 CFA zemalja Ujedinjeni narodi smatraju među "najmanje razvijenim zemljama" u svijetu, uz Haiti, Jemen i Afganistan. Na raznim međunarodnim ljestvicama Niger, Srednjoafrička Republika, Čad i Gvineja Bisau često se ubrajaju u najsiromašnije zemlje svijeta. Francuzi održavaju, zapravo, ekstremnu verziju onoga što je Allen Farrington nazvao "kapitalnim površinskim rudnikom".

Senegalski političar Amadou Lamine-Guèye jednom je sažeo CFA sustav kao građani koji imaju "samo dužnosti, a nikakva prava", te da je "zadatak koloniziranih teritorija bio proizvoditi puno, proizvoditi iznad vlastitih potreba i proizvoditi na štetu njihovih neposrednijih interesa, kako bi se metropoli omogućio bolji životni standard i sigurnija opskrba.” Metropola, naravno, odolijeva ovom opisu. Kao što je francuski ministar gospodarstva Michel Sapin rekao u travnju 2017., "Francuska je tu kao prijatelj."

Sada se možete zapitati: Opiru li se afričke zemlje ovom iskorištavanju? Odgovor je da, ali oni plaćaju visoku cijenu. Rani nacionalistički vođe iz doba afričke neovisnosti prepoznali su kritičnu vrijednost ekonomske slobode.

“Neovisnost je samo uvod u novu i uključeniju borbu za pravo na vođenje vlastitih gospodarskih i društvenih poslova [..] neometano uništavajućom i ponižavajućom neokolonijalističkom kontrolom i uplitanjem,” izjavio je 1963. Kwame Nkrumah, koji je vodio pokret koji je Ganu učinio prvom neovisnom nacijom u podsaharskoj Africi. Ali kroz povijest CFA regije, nacionalni čelnici koji su se suprotstavili francuskim vlastima uglavnom su loše prolazili.

Godine 1958. Gvineja je pokušala zatražiti monetarnu neovisnost. U poznatom govoru, vatreni nacionalist Sekou Touré rekao je gostujućem Charlesu de Gaulleu: "Radije bismo imali siromaštvo u slobodi nego bogatstvo u ropstvu," i nedugo zatim napustio sustav CFA. Prema The Washington Postu, “kao reakcija, i kao upozorenje drugim područjima s francuskim govornim područjem, Francuzi su se povukli iz Gvineje tijekom dva mjeseca, odnoseći sa sobom sve što su mogli. Odvrnuli su žarulje, uklonili planove za kanalizacijske cjevovode u Conakryju, glavnom gradu, pa čak i spalili lijekove umjesto da ih ostave Gvinejcima.”

Zatim, kao čin destabilizirajuće odmazde, Francuzi su pokrenuli operaciju Persil, tijekom koje su, prema Pigeaudu i Sylli, francuske obavještajne službe krivotvorile goleme količine novih gvinejskih novčanica i zatim ih "masovno" ubacile u zemlju. "Rezultat", pišu oni, "bio je kolaps gvinejskog gospodarstva." Demokratske nade zemlje srušene su zajedno s njezinim financijama, jer je Touré uspio učvrstiti svoju moć u kaosu i započeti 26 godina brutalne vladavine.

U lipnju 1962. malijski vođa za neovisnost Modibo Keita objavio je da Mali napušta CFA zonu kako bi kovao vlastitu valutu. Keita je detaljno objasnio razloge za taj potez, kao što su ekonomska prevelika ovisnost (80% malijskog uvoza dolazi iz Francuske), koncentracija ovlasti za donošenje odluka u Parizu i usporavanje ekonomske diversifikacije i rasta.

“Istina je da je vjetar dekolonizacije prošao preko starog zdanja, ali nije ga previše poljuljao”, rekao je o statusu quo. Kao odgovor, francuska vlada učinila je malijski franak nekonvertibilnim. Uslijedila je duboka gospodarska kriza, a Keita je svrgnut vojnim udarom 1968. Mali je na kraju odlučio ponovno ući u CFA zonu, ali su Francuzi nametnuli dvije devalvacije malijskog franka kao uvjete za povratak i nisu dopustili ponovni ulazak do 1984. godine.

Godine 1969., kada je predsjednik Nigera Hamani Diori tražio "fleksibilniji" aranžman, gdje bi njegova zemlja imala veću monetarnu neovisnost, Francuzi su to odbili. Prijetili su mu uskraćivanjem plaćanja za uran koji su skupljali iz pustinjskih rudnika koji će Francuskoj dati energetsku neovisnost putem nuklearne energije. Šest godina kasnije, Diorijevu vladu svrgnuo je general Seyni Kountché, tri dana prije planiranog sastanka za ponovno pregovaranje o cijeni nigerskog urana. Diori je želio povisiti cijenu, ali se njegov bivši kolonijalni gospodar nije složio s tim. Francuska vojska bila je stacionirana u blizini tijekom puča, ali, kako Pigeaud i Sylla primjećuju, nisu ni prstom maknuli.

Godine 1985., revolucionarni vojni vođa Thomas Sankara iz Burkine Faso upitan je u intervjuu: “Nije li CFA franak oružje za dominaciju Afrikom? Planira li Burkina Faso nastaviti nositi ovaj teret? Zašto afričkom seljaku u njegovom selu treba konvertibilna valuta?” Sankara je odgovorio: “Je li valuta konvertibilna ili ne to nikada nije bila briga afričkog seljaka. On je protiv svoje volje bačen u ekonomski sustav protiv kojeg je bespomoćan.”

Sankaru je dvije godine kasnije ubio njegov najbolji prijatelj i drugi zapovjednik, Blaise Compaoré. Nikada nije održano suđenje. Umjesto toga, Compaoré je preuzeo vlast i vladao do 2014., lojalan i brutalan sluga CFA sustava.

Borba Faride Nabourema za financijsku slobodu Toga

U prosincu 1962. prvi postkolonijalni vođa Toga Sylvanus Olympio formalno je krenuo u osnivanje središnje banke Togoa i togoanskog franka. Ali ujutro 13. siječnja 1963., nekoliko dana prije nego što je trebao zacementirati ovu tranziciju, ubili su ga togoanski vojnici koji su prošli obuku u Francuskoj. Gnassingbé Eyadéma bio je jedan od vojnika koji su počinili zločin. Kasnije je preuzeo vlast i postao diktator Toga uz punu francusku podršku, vladajući više od pet desetljeća i promičući CFA franak do svoje smrti 2005. Njegov sin vlada do danas. Olympiovo ubojstvo nikada nije riješeno.

Obitelj Faride Nabourema uvijek je bila uključena u borbu za ljudska prava u Togu. Njezin otac bio je aktivni vođa opozicije, a služio je kao politički zatvorenik. Njegov se otac suprotstavljao Francuzima tijekom kolonijalnih vremena. Danas je ona vodeća figura demokratskog pokreta u zemlji.

Farida je imala 15 godina kada je saznala da je povijest diktature Toga bila isprepletena s CFA frankom. Do tog vremena, ranih 2000-ih, počela se zbližavati sa svojim ocem i postavljati mu pitanja o povijesti svoje zemlje. “Zašto je naš prvi predsjednik ubijen samo nekoliko godina nakon što smo stekli neovisnost?” upitala je.

Odgovor: opirao se CFA franku.

Godine 1962. Olympia je započela pokret prema financijskoj neovisnosti od Francuske. Parlament je glasovao za početak takve tranzicije i stvaranje togoanskog franka i držanje njihovih rezervi u vlastitoj središnjoj banci. Farida je bila šokirana kada je saznala da je Olympio ubijen samo dva dana prije nego što je Togo trebao napustiti CFA aranžman. Kako je rekla: “Njegova odluka da traži monetarnu slobodu viđena je kao uvreda hegemoniji u frankofonskoj Africi. Bojali su se da će ih drugi slijediti.”

Danas je, kaže ona, za mnoge togoanske aktiviste CFA glavni razlog za traženje veće slobode. “To je ono što animira mnoge u oporbenom pokretu.”

Razlozi zašto su jasni. Farida je rekla da Francuska drži više od polovice rezervi Toga u svojim bankama, gdje Togoanci nemaju nikakav nadzor nad time kako se te rezerve troše. Često se te rezerve, koje su zaradili Togoanci, koriste za kupnju francuskog duga za financiranje aktivnosti francuskog naroda. Zapravo, taj se novac često posuđuje bivšem kolonijalnom gospodaru uz negativan stvarni prinos. Togoanci plaćaju Parizu da im čuva novac, a pritom financiraju životni standard Francuza.

Godine 1994. devalvacija koja je ukrala ušteđevinu obitelji Fode Diopa u Senegalu teško je pogodila i Togo, uzrokujući ogroman porast državnog duga, smanjenje javnog financiranja lokalne infrastrukture i povećanje siromaštva.

“Zapamtite,” rekla je Farida, “naša vlada je prisiljena dati prednost držanju naših rezervi u francuskoj banci umjesto trošenju kod kuće, tako da kada nas udari šok, moramo se degradirati, kako bismo osigurali da odgovarajuća količina gotovine bude u rukama Parižana .”

To stvara nacionalnu klimu ovisnosti, u kojoj su Togoanci prisiljeni isporučivati sirovu robu i unositi gotovu robu. To je zatvoreni krug iz kojeg nema izlaza.

Farida je rekla da je prije otprilike 10 godina pokret protiv CFA-a počeo dobivati na snazi. Zbog mobilnih telefona i društvenih medija ljudi su se mogli ujediniti i organizirati na decentraliziran način. Nekada su se samo građani Bjelokosti i Togoa borili odvojeno, rekla je, ali sada postoji regionalni napor između aktivista.

Desetljećima postoji ideja o "eko" valuti za sve zemlje Ekonomske zajednice zapadnoafričkih država (ECOWAS), uključujući regionalne gospodarske sile Nigeriju i Ganu. Farida je rekla da su Francuzi pokušali preoteti ovaj plan, videći ga kao način za proširenje vlastitog financijskog carstva. Godine 2013. tadašnji predsjednik François Hollande formirao je komisiju koja je izradila dokument za francusku budućnost u Africi. U njemu su izjavili da je imperativ uključiti anglofone zemlje (afričke zemlje u kojima se priča engleskim jezikom) poput Gane.

Administracija Emmanuela Macrona sada pokušava preimenovati CFA franak u Eco, u kontinuiranom procesu "afrikanizacije" francuskog kolonijalnog financijskog sustava. Nigerija i Gana odustale su od Eko projekta, nakon što su shvatile da će Francuzi i dalje imati kontrolu. Ništa se još formalno nije dogodilo, ali zemlje kojima trenutačno upravlja središnja banka BCEAO na putu su da pređu na ovu eko valutu do 2027. Francuzi će i dalje imati sposobnost donošenja odluka i ne postoje službeni planovi za prilagodbu središnjeg bankarstva srednjoafričkih CFA nacija ili Komora.

"Vrhunac je licemjerja za francuske vođe poput Macrona da odu u Davos i kažu da su gotovi s kolonijalizmom", rekla je Farida, "dok ga zapravo pokušavaju proširiti."

Rekla je da je izvorno CFA franak stvoren na temelju valutnog plana koji su koristili nacistički okupatori Francuske. Tijekom Drugog svjetskog rata, Njemačka je stvorila nacionalnu valutu za francuske kolonije kako bi mogla lako kontrolirati uvoz i izvoz koristeći samo jednu financijsku polugu. Kada je rat završio i Francuzi ponovno stekli slobodu, odlučili su koristiti isti model za svoje kolonije. Dakle, rekla je Farida, temelj CFA franka je zapravo nacistički.

Sustav ima mračnu genijalnost u tome što su Francuzi s vremenom uspjeli tiskati novac za kupnju vitalnih dobara iz svojih bivših kolonija, ali te afričke zemlje moraju raditi kako bi zaradile rezerve.

"To nije fer, to nije neovisnost", rekla je Farida. “To je čista eksploatacija.”

Francuska tvrdi da je sustav dobar jer osigurava stabilnost, nisku inflaciju i konvertibilnost Togoancima. Ali konvertibilnost na kraju olakšava bijeg kapitala - kada je tvrtkama lako pobjeći od CFA-a i danas parkirati svoje profite u eurima - dok zarobljavaju Togoance u režimu seigniorage. Kad god se CFA pretvori - a mora biti pretvoren, jer se ne može koristiti izvan ekonomske zone u kojoj građani međusobno razmijenjuju dobra i usluge - Francuzi i ECB uzimaju svoj dio.

Da, rekla je Farida, inflacija je niska u Togu u usporedbi s neovisnim državama, ali velik dio njihove zarade ide za borbu protiv inflacije umjesto za podršku razvoju infrastrukture i industrije kod kuće. Istaknula je rast Gane, koja ima neovisnu monetarnu politiku i višu inflaciju tijekom vremena od CFA zemalja, u usporedbi s Togom. Po svim pokazateljima - zdravstvu, rastu srednje klase, nezaposlenosti - Gana je superiornija. Zapravo, kad pogledamo iz većega, rekla je da niti jedna CFA nacija nije među 10 najbogatijih zemalja u Africi. Ali od 10 najsiromašnijih, polovica je u CFA zoni.

Farida kaže da francuski kolonijalizam nadilazi novac. Također utječe na obrazovanje i kulturu. Na primjer, rekla je, Svjetska banka daje 130 milijuna dolara godišnje za potporu frankofonim zemljama (zemlje u kojima se priča francuskim jezikom) za plaćanje udžbenika u javnim školama. Farida kaže da je 90% tih knjiga tiskano u Francuskoj. Novac ide izravno iz Svjetske banke u Pariz, a ne u Togo ili bilo koju drugu afričku naciju. Knjige su alat za ispiranje mozga, rekla je Farida. Usredotočeni su na slavu francuske kulture i potkopavaju postignuća drugih naroda, bilo da su američki, azijski ili afrički.

U srednjoj školi Farida je pitala svog oca: "Koriste li ljudi u Europi neki drugi jezik osim francuskog?" On se smijao. Učili su samo o francuskoj povijesti, francuskim izumiteljima i francuskim filozofima. Odrasla je misleći da su jedini pametni ljudi Francuzi. Nikada nije pročitala nijednu američku ili britansku knjigu prije nego što je prvi put otputovala u inozemstvo.

Općenito, rekla je Farida, Francuska Afrika konzumira 80% knjiga koje Francuzi tiskaju. Predsjednik Macron želi proširiti ovu dominaciju i obećao je potrošiti stotine milijuna eura za jačanje francuskog jezika u Africi, izjavljujući da bi on mogao biti "prvi jezik" kontinenta i nazivajući ga "jezikom slobode". S obzirom na trenutne trendove, do 2050. 85% svih govornika francuskog moglo bi živjeti u Africi. Jezik je jedan od stupova podrške opstanku CFA franka.

Politika je nešto drugo. Važan dio CFA sustava je francuska podrška diktaturi. S iznimkom Senegala, niti jedna zemlja bloka CFA nije imala smislenu demokratizaciju. Svaki pojedini uspješni tiranin u frankofonskoj Africi, rekla je Farida, imao je punu podršku francuske države. Kad god dođe do državnog udara protiv demokracije, Francuzi podržavaju pučiste sve dok su oni prijatelji CFA režima. Ali u trenutku kad netko ima antifrancuske tendencije, vidite sankcije, prijetnje ili čak atentate.

Farida ističe primjer Chad i Malija danas. Obje zemlje su pod prijetnjom terorizma i pobune. U Cahdu je pokojnog vojnog diktatora Idrissa Debyja Francuska podržavala tri desetljeća do njegove smrti u travnju. Prema chadskom ustavu, čelnik parlamenta obično je sljedeći na redu za predsjednika, no umjesto toga vojska je postavila Debyjeva sina, generala u vojsci. Francuska vlada pozdravila je ovu ilegalnu tranziciju, a predsjednik Macron je čak posjetio Chad kako bi proslavio ovu prijevaru. U govoru odavanja počasti nazvao je Debyja "prijateljem" i "hrabrim vojnikom" i rekao "Francuska neće dopustiti da itko dovede u pitanje ili prijeti stabilnosti i integritetu Chada danas ili sutra". Sin će, naravno, promovirati CFA franak.

Mali je, s druge strane, rekla je Farida, imao državni udar mjesec dana nakon Chadovog. Hunta i stanovništvo nisu toliko prijateljski raspoloženi prema Parizu i čini se da u Rusiji traže novog partnera za suzbijanje terorizma. Tako je francuska vlada državni udar nazvala "neprihvatljivim", prijeti da će povući trupe iz Malija kako bi ih "ostavila nasamo s teroristima", kako je rekao Farida, i priprema sankcije. Mali je kažnjen od strane Francuske jer je učinio isto što i Chad. Ima despotizma i korupcije s obje strane. Jedina razlika je u tome što se Mali želio odmaknuti od francuske monetarne kontrole, dok Chad i dalje surađuje.

“Kada ste diktator, dokle god radite za Francusku, oni će i dalje nalaziti izgovore da vam pomognu da ostanete na vlasti”, rekla je Farida. Isto su učinili 2005. u njezinoj zemlji Togo, što je dovelo do toga da je sin preuzeo vlast od svog oca diktatora i do njezinog vlastitog političkog buđenja.

Misija Fode Diopa da donese bitcoin u Senegal

Tek kada je Fodé Diop imao priliku otputovati u SAD, mogao je početi gledati svoju zemlju Senegal izvana.

Isprva je devalvacija CFA franka 1994. dovela njegovu akademsku budućnost u opasnost. Imao je priliku otići studirati i igrati košarku na sveučilištu u Kansasu, ali je njegova obiteljska ušteđevina bila uništena. Sretniji od većine oko njega, njegova je obitelj imala još jednu mogućnost: njegov je otac imao prava na knjige za nastavne materijale koje je on izradio, a on ih je mogao upotrijebiti da posudi ono što je bilo potrebno da Fodé ode u školu.

Jednog dana, nekoliko godina nakon što je završio fakultet, dok je živio u SAD-u i radio na novoj web stranici za video on demand sa svojim bratom, Fodé je slučajno naišao na YouTube video dr. Cheikha Anta Diopa, senegalskog znanstvenika i povjesničara, govoreći o tome kako su novac i jezik bili alati za kontrolu ljudskih umova i sredstava za život.

Fodé je već čuo za dr. Diopa - najveće sveučilište u Senegalu nazvano je po njemu - ali nije slušao njegovu kritiku CFA sustava. To je teško pogodilo Fodéa. Kaže da je to bilo poput trenutka u "Matrixu", jednom od njegovih omiljenih filmova, kada Neo uzima crvenu pilulu od Morpheusa i bježi iz svoje kapsule u uznemirujuće brutalni stvarni svijet. Napokon je ugledao vodu u kojoj je plivao dok je odrastao.

"Ovo je bio prvi put u životu da sam počeo razmišljati svojom glavom", rekao je Fodé. “Prvi put sam shvatio da je valuta moje zemlje mehanizam kontrole.”

Rekao je da je to više od puke kontrole nad valutom. Budući da Francuzi tiskaju i kontroliraju novac preko operativnih računa svake zemlje, oni imaju podatke.

“Oni znaju što kamo ide, imaju informacije o svim zemljama. Oni imaju prednost nad tim zemljama. Oni znaju tko je korumpiran. Oni znaju tko kupuje nekretnine u Francuskoj. Oni znaju što je dostupno. Oni imaju prvo pravo odbijanja povlaštenih uvoznih i izvoznih cijena. Imaju potpunu dominaciju,” rekao je Fodé.

Kasnije će razmišljati o devalvaciji iz 1994. godine. Tada je imao samo 18 godina pa nije shvaćao što se dogodilo, osim činjenice da su obiteljske financije postale znatno teže.

“Stavljaju vam vreću na glavu kako ne biste primijetili svoju stvarnost”, rekao je.

U retrospektivi, o tome se vodila velika javna rasprava. Ljudi su shvatili da kada bi išli pretvarati u francuski franak, dobili bi upola manje za svoj novac, iako su radili istu količinu posla. Francuski razlog, rekao je Fodé, bio je učiniti izvoz jeftinijim kako bi afričke zemlje mogle proizvoditi konkurentnije. Ali Fodé to vidi drugačije: to je Francuskoj omogućilo da udari bičem i kupi jeftiniju robu.

Fodé je imao još dva trenutka "crvene pilule". Sljedeći je došao 2007., kada je radio u Las Vegasu na tehnološkoj sceni. Gledao je video Stevea Jobsa, koji je upravo predstavio prvi iPhone. Fodé je bio zapanjen: mobilni telefon koji je imao izvorni preglednik sa zaslonom osjetljivim na dodir. Ista stvar koja je bila na vašem računalu sada je bila i na vašem telefonu. Odmah je znao da će to promijeniti svijet. Njegova sljedeća misao: Kako da izvorna plaćanja unesemo u iPhone aplikacije, tako da ljudi bez bankovnih računa i kreditnih kartica mogu koristiti mobilni novac?

Posljednja crvena pilula za Fodéa bilo je učenje o Bitcoinu 2010. godine. Živio je u Los Angelesu kada je prvi put pročitao bitcoin white paper (bijeli knjiga) Satoshija Nakamota za "peer-to-peer elektronički novčani sustav". Od trenutka kada ga je pročitao, Fodé je pomislio: Po prvi put imamo oružje kojim se možemo boriti protiv ugnjetavanja i kolonijalizma. Novac naroda, koji ne kontroliraju vlade. "Ovo je", rekao je, "upravo ono što nam treba."

Godinama ranije, Fodé je pročitao "Izvan kontrole" Kevina Kellyja. Jedno od poglavlja bilo je o e-valutama. Znao je da će na kraju sav novac biti digitalan, dio velike globalne elektroničke revolucije. Ali nikada nije preduboko razmišljao o transformativnoj snazi koju digitalni novac može imati, sve do Bitcoina.

“Što je novac? Odakle dolazi? Postavljajući ova pitanja, to je ono što je Bitcoin učinio za mene,” rekao je. "Prije toga, ne postavljate sami sebi ova pitanja."

Možda, mislio je, jednog dana Francuska više neće imati pravo ili mogućnost tiskati i kontrolirati novac senegalskog naroda.

Fodé i njegov cimer u Las Vegasu ostajali bi do kasno mnogo puta tijekom narednih godina, razmišljajući o tome što bi Bitcoin mogao omogućiti za plaćanja, štednju i sve gospodarske aktivnosti. Saznao je što se dogodilo kad ste ukrali svoju kreditnu karticu, kakve je informacije to otkrilo. I što su treće strane radile s tim informacijama.

Mislio je da bi brak pametnog telefona i Bitcoina bio nevjerojatan alat za osnaživanje. Fodé bi se često vraćao u Senegal, a svaki put kad bi išao, sa sobom bi ponio hrpu telefona koje bi poklonio. Promatrao ih je kao veze s vanjskim svijetom za svoje prijatelje kod kuće.

Tijekom sljedećih godina radio je u različitim startupovima, a sve u industriji digitalizacije različitih dijelova naših života. Godine 2017. napustio je Vegas i otišao u San Francisco. Pridružio se kampu za kodiranje i odlučio postati računalni inženjer. U početku se jako uključio u scenu kriptovaluta u cjelini, no na kraju se, kaže, "odljubio" od Ethereuma, otprilike u vrijeme kad je počeo ići na sokratske seminare u San Franciscu s osnivačem Rivera Alexom Leishmanom. Upoznao je mnoge programere koji su radili na razvoju bitcoina i najranije korisnike Lightning mreže.

Godine 2019. pobijedio je na hackathonu u sektoru transporta, izradivši Lightning fakturu koja bi otključala Teslu. To mu je dalo veliki poticaj samopouzdanju da može pomoći promijeniti svijet. Odlučio je otići kući u Senegal kako bi širio znanje o Bitcoin. Na putu mu je izvršna direktorica Lightning Labsa Elizabeth Stark dala stipendiju za putovanje na Lightning konferenciju u Berlinu. Tamo je upoznao Richarda Myersa iz GoTenne i programera Willa Clarka, koji su razmišljali o tome kako se mesh mrežama boriti protiv internetske cenzure. Fodé je pomislio: U Senegalu francuski telekom Orange kontrolira sve telefonske mreže. Možda bi mogli pronaći način da zaobiđu francusku kontrolu nad komunikacijama i mogućnost "isključivanja interneta" putem Bitcoina i Lightninga.

Sve telekomunikacijske kanale u Senegalu kontrolira Francuska i mogu ih zatvoriti u slučaju prosvjeda protiv čelnika zemlje, kojeg podržavaju sve dok se drži CFA sustava. Ali, moguće je pronaći krajnje točke, rekao je Fodé, preko drugih pružatelja usluga. To mogu biti druge nacionalne telefonske mreže ili čak satelitske veze. Fodé je stvorio uređaj koji može hvatati ove druge signale. Mobilni telefoni mogli bi se spojiti s tim uređajem, omogućujući korisnicima da budu online čak i kada su Francuzi isključili internet. Kako bi potaknuo ljude koji upravljaju takvim uređajima, plaćao bi im u bitcoinu. Za usmjeravanje podataka i održavanje ovih uređaja u Senegalu plaća se putem Lightninga. To je ono na čemu Fodé danas radi.

"Vrlo je riskantno", rekao je Fodé. “Možete se suočiti sa zatvorom ili novčanom kaznom. Ali uz novčane poticaje, ljudi su voljni.”

Sljedeći put kada Orange isključi internet kako bi zaštitio svog saveznika u vladi, ljudi će možda imati novi način komuniciranja koji režim ne može zaustaviti.

Lightning je, rekao je Fodé, sve.

“Potrebna su nam trenutna i jeftina plaćanja. Ne možemo vršiti on-chain Bitcoin plaćanja. Naknade su jednostavno preskupe. Moramo koristiti Lightning. Nema druge opcije”, rekao je. "I radi."

To posebno zvuči istinito u području doznaka, koje su, prema Svjetskoj banci, glavni izvor BDP-a za mnoge CFA zemlje. Na primjer: 14,5% BDP-a temelji se na inozemnim doznakama. Za Senegal je 10,7%; Gvineja Bisau, 9,8%; Togo, 8,4%; i Mali, 6%. Prosječni trošak slanja doznake od 200 USD u sub-saharsku Afriku je 8%, a prosječni trošak slanja 500 USD 9%. Devizne doznake putem servisa poput Strike-a koje se temelje na bitcoinu mogu smanjiti naknade ispod 1%. Usvajanjem bitcoin modela i koriptenjem ovakvih usluga može se uštedjeti od 0,5% do 1% BDP-a CFA zemalja.Ako to pogledamo izdaleka, svake godine pošiljatelji doznaka širom svijeta šalju kući otprilike 700 milijardi dolara. Moglo bi se uštedjeti između 30 i 40 milijardi dolara, što je otprilike isti iznos koji SAD troši svake godine na inozemnu pomoć.

Fodé razumije zašto bi ljudi na Zapadu mogli biti skeptični prema Bitcoinu. “Ako imate aplikaciju Venmo i Cash, možda ne vidite zašto je to važno. Imate sve pogodnosti modernog monetarnog sustava. Ali kad odete u Senegal, više od 70% naših ljudi nikada nije kročilo u banku. Mama nikada nije imala kreditnu ili debitnu karticu”, rekao je.

Pita se: Kako će uopće sudjelovati u globalnom financijskom sustavu?

Rekao je da će brak pametnih telefona i Bitcoina osloboditi ljude i promijeniti društvo. Fodé je spomenuo "Mobilni val", knjigu koju je izvršni direktor MicroStrategyja Michael Saylor napisao o revoluciji pomoću uređaja koji stanu u jednu ruku. Kad je Fodé prvi put dotaknuo iPhone, znao je da je to ono što je čekao. Svemir se urotio, pomislio je. U samo nekoliko kratkih godina, vidio je iPhone, Veliku financijsku krizu, Satotshijevo izdanje Bitcoina i vlastitu tranziciju da postane američki građanin.

Rekao je da, budući da je pola života proveo u Africi, a pola u SAD-u, vidi put naprijed.

“Kada odem kući, vidim kako su ljudi sputani. Ali na isti način na koji smo preskočili fiksne telefone i prešli ravno na mobitele, preskočit ćemo banke i prijeći ravno na Bitcoin.”

Još jedan učinak koji vidi u Senegalu je da kada su ljudi izloženi Bitcoinu, počnu štedjeti.

“Danas, kod kuće, razmišljam o tome kako pomoći ljudima da uštede novac”, rekao je. “Ovdje nitko ništa ne štedi. Samo troše svaki CFA franak koji mogu dobiti.”

Fodé je "zauvijek zahvalan" za bitcoin koji mu je Leishman dao, jer ga je na kraju dao u malim dijelovima ljudima u Senegalu - onima koji su dolazili na događaje ili postavljali dobra pitanja. Ljudi su vidjeli kako njegova vrijednost raste s vremenom.

S velikim je uzbuđenjem promatrao što se događa u El Salvadoru. Kada je ranije ovog mjeseca stajao u konferencijskoj dvorani u Miamiju i slušao osnivača Strikea Jacka Mallersa kako najavljuje da je jedna država dodala bitcoin kao zakonsko sredstvo plaćanja, Fodé je rekao da je zaplakao. Mislio je da se ovo nikada neće dogoditi.

“Ono što je počelo kao pohrana vrijednosti, sada se razvija u sredstvo razmjene”, rekao je.

El Salvador ima neke sličnosti sa zemljama CFA zone. To je siromašnija nacija, vezana za stranu valutu, ovisna o uvozu, sa slabijom izvoznom bazom. Njegovu monetarnu politiku kontrolira vanjska sila. 70% zemlje nema bankarstvo, a 22% nacionalnog BDP-a oslanja se na inozemne doznake.

"Ako bi to mogla biti dobra opcija za njih," mislio je Fodé, "možda bi mogla biti i za nas."

Ali zna da postoje velike prepreke.

Jedan je francuski jezik. Nema puno francuskih informacija na GitHubu ili u dokumentacijskim materijalima za Lightning ili o Bitcoin coreu. Trenutno Fodé radi na prevođenju dijela ovoga na francuski kako bi se lokalna zajednica programera mogla više uključiti.

Može li se zajednica Bitcoin Beach (Bitcoin plaža) na kraju pojaviti u Senegalu? Da, rekao je Fodé. Zato se vratio i zato vodi sastanke, prikuplja donacije putem Lightninga i gradi verziju Radija Slobodna Europa koju pokreću građani i koja se temelji na Bitcoinu.

"Mogli bi me zatvoriti", rekao je. "Ali kroz sastanke se trudim da ne budem niti jedina točka neuspjeha (single point of failure)."

On misli da će biti teško usvojiti Bitcoin u Senegalu zbog francuskog utjecaja.

"Neće proći bez borbe", rekao je.

Kao što je rekao Ndongo Samba Sylla, “Danas se Francuska suočava s relativnim ekonomskim padom u regiji koju je dugo smatrala svojim privatnim rezervatom. Čak i suočena s usponom drugih sila poput Kine, Francuska nema namjeru odustati od vlasti - borit će se do posljednjeg."

Ali možda bi to, umjesto nasilne revolucije, mogla biti postupna mirna revolucija tijekom vremena koja izbacuje kolonijalizam.

"Ne iznenadno isključivanje, već paralelni sustav, gdje se ljudi mogu sami odlučiti tijekom vremena", rekao je Fodé. “Bez prisile.”

Što se tiče ljudi koji misle da samo trebamo tražiti od vlade da zaštiti naša prava?

"Oni ne znaju da demokracije poput Francuske imaju lošu stranu", rekao je Fodé. “Neće nam dati slobodu. Umjesto toga, trebali bismo slijediti korake cypherpunka i zgrabiti našu slobodu koristeći otvoreni kod.”

Na pitanje o šansama Bitcoina da zamijeni središnje bankarstvo, Fodé je rekao da ta ideja “Amerikancima može zvučati ludo, ali za Senegalce ili Togoance, središnje banke su parazit našeg društva. Moramo uzvratiti.”

Fodé smatra da Bitcoin "mijenja život".

“Nikada prije nismo imali sustav u kojem bi se novac mogao kovati na decentraliziran način. Ali ovo je ono što imamo danas. To je rješenje za one kojima je najpotrebnije. Po prvi put imamo moćno oruđe za suzbijanje ugnjetavanja”, rekao je. “Možda nije savršeno, ali moramo koristiti alate koje danas imamo da se borimo za ljude. Ne čekati da nam netko dođe pomoći.”

Odvajanje novca od države

Godine 1980. kamerunski ekonomist Joseph Tchundjang Pouemi napisao je Novac, ropstvo i sloboda: Afrička monetarna represija (Monnaie, servitude et liberté: La répression monétaire de l’Afrique) Teza: novčana ovisnost je temelj svih drugih oblika ovisnosti. Završne riječi knjige posebno snažno zvuče danas: “Sudbina Afrike bit će iskovana novcem ili se uopće neće iskovati.”

Novac i valuta zakopani su ispod površine u globalnom pokretu za ljudska prava. Oni se gotovo nikada ne spominju na konferencijama o ljudskim pravima i rijetko se o njima raspravlja među aktivistima. Ali pitajte zagovornika demokracije iz autoritarnog režima o novcu, i ispričat će vam nevjerojatne i tragične priče. Demonetizacija u Eritreji i Sjevernoj Koreji, hiperinflacija u Zimbabveu i Venezueli, državni nadzor u Kini i Hong Kongu, zamrznuta plaćanja u Bjelorusiji i Nigeriji i ekonomski zaštitni zidovi u Iranu i Palestini. A sada: monetarni kolonijalizam u Togu i Senegalu. Bez financijske slobode pokreti i nevladine organizacije ne mogu se održati. Ako su njihovi bankovni računi zatvoreni, novčanice demonetizirane ili sredstva obezvrijeđena, njihova moć je ograničena i tiranija maršira.

Monetarna represija i dalje se skriva i o njoj se ne govori u pristojnim krugovima. Današnja stvarnost za 182 milijuna ljudi koji žive u CFA zemljama je da iako su možda politički neovisni po imenu, njihova su gospodarstva i novac još uvijek pod kolonijalnom vlašću, a strane sile još uvijek zlorabe i produljuju taj odnos kako bi iscijedile i iskorištavale što više vrijednosti iz njihova društva i geografije što je više moguće.

Posljednjih godina građani CFA zone sve više ustaju. Slogan Francusko odobrenje "France Dégage!" postao je poklič okupljanja. No čini se da najglasniji kritičari sustava, među njima Pigeaud i Sylla, ne nude održivu alternativu. Oni odbacuju status quo i ropstvo MMF-a, samo kako bi predložili ili regionalnu valutu, koju kontroliraju lokalni čelnici, ili sustav u kojem svaka CFA nacija stvara i upravlja vlastitom valutom. Ali samo zato što su Senegal ili Togo dobili monetarnu neovisnost od Francuske, ne jamči da će imati dobre rezultate ili da čelnici zemlje neće zlorabiti valutu.

Još uvijek postoji prijetnja domaće diktatorske loše vladavine ili novog zarobljavanja od strane ruskih ili kineskih stranih sila. Jasno je da ljudima treba novac koji zapravo lomi kotač, novac koji mogu kontrolirati i kojim vlade bilo koje vrste ne mogu manipulirati. Baš kao što je došlo do povijesnog odvajanja crkve i države koje je utrlo put prosperitetnijem i slobodnijem ljudskom društvu, u tijeku je odvajanje novca od države.

Bi li građani CFA nacija, s vremenom, s povećanjem pristupa internetu, mogli popularizirati Bitcoin do te mjere da bi vlade bile prisiljene de facto ga usvojiti, kao što se dogodilo u zemljama Latinske Amerike poput Ekvadora s "dolarización popular" (popularna dolarizacija)? Povijest ostaje za pisati, ali jedno je sigurno: Svjetska banka i MMF oduprijet će se svim trendovima u tom smjeru. Već su zamahnuli protiv El Salvadora.

Nedavno je glumac Hill Harper citiran u The New York Timesu u vezi s njegovim aktivizmom oko Bitcoina u afroameričkoj zajednici. Rekao je, vrlo jednostavno, "Oni ne mogu kolonizirati Bitcoin."