-

@ 95543309:196c540e

2025-05-11 12:42:09

@ 95543309:196c540e

2025-05-11 12:42:09Lets see if this works with the blossom upload and without markdown hassle.

:cat:

https://blossom.primal.net/73a099f931366732c18dd60da82db6ef65bb368eb96756f07d9fa7a8a3644009.mp4

-

@ 0a425f12:c4dc49ff

2025-05-11 12:14:09

@ 0a425f12:c4dc49ff

2025-05-11 12:14:09Planting new sod sounds simple. Lay it down, water it, done. Nah. That’s just half the story. Mess up the basics, and your lawn turns patchy or yellow within days. Below are some key mistakes folks make – most don’t even realise it till the grass starts dying. Avoid these, or all that Bermuda grass, Zoysia, or St. Augustine sod you paid for? Wasted.

Not Watering Enough (Or Too Much)

Watering is weirdly tricky. Some think you flood it, some sprinkle it once and call it good. Both? Wrong.

New sod needs moisture constantly for the first few weeks. Not just surface wet, but soaked down to where roots gonna grow. If it dries out, even a day or two, them roots shrink back. That leads to shrinkage gaps, brown edges, even whole squares drying up.

Now the flip side? Overwatering. It ain’t about turning your lawn into a swamp. Too much water drowns roots, they rot, and fungus loves soggy grass. Mushrooms pop up, blades turn pale. And once fungus spreads, getting it out’s a pain. Set a timer. Early morning’s best. Avoid watering at night unless you wanna feed mold.

Also, different sod types need different water levels. Zoysia sod ain’t thirsty like St. Augustine. Use your hand – if it feels squishy, back off. If dry and crumbly, bump it up.

Installing Sod On Bad Soil

Throwing new sod on junk dirt is asking for trouble. Sod’s just skin. If the body (soil) under it’s trash, it won’t stick.

First off, you gotta check the soil pH. Anything too acidic or way too alkaline? Sod roots won’t even grow. You can get soil test kits at garden stores or online, pretty cheap. If the pH ain’t right, use lime or sulfur depending what side you need to fix.

Second, compacted soil is death for sod. If the ground’s hard like a sidewalk, roots can’t go down. You need to aerate or till the soil before laying sod. Mix in some compost or sand depending on drainage needs. Make it loose but not fluffy.

Last part? Level the area. Don’t leave holes or slopes. Uneven spots collect water, or the sod don’t touch dirt properly. When air pockets form under the sod, roots dry out fast.

Skipping Starter Fertilizer

You ever tried starting a car with no fuel? That’s your sod without a starter fertilizer. It’s gotta eat.

New sod needs phosphorus-heavy fertilizer to encourage root growth. Problem is, most people either skip it, or throw on the wrong one. A high-nitrogen fertilizer will just make it look green for a week, but the roots? Weak and lazy.

Use something like 10-10-10 or 15-15-15 starter blends. Look for one that’s labeled for new sod or turf establishment. Apply it right before or during laying the sod. Water it in so it doesn’t just sit there on top.

Also, don’t keep feeding every few days thinking more is better. Too much burns the grass. After first application, wait at least 3–4 weeks before reapplying anything. Stick to what the sod variety needs – Bermuda feeds different than Fescue.

If you’re in Texas or southern regions, the soil’s usually nutrient-poor, especially in clay zones. Don’t ignore that. Local extension offices often got free guides for your area.

Mowing Too Soon (or Way Too Late)

Mowing sounds harmless. Grass too tall? Cut it. Simple, right? Not really.

Cut too early? You slice off the tops before roots even grab the soil. That’ll rip the sod clean out. Like tearing bandages off fresh scabs. Usually, wait 10–14 days after laying sod before mowing. Always check if the sod’s rooted. Tug on a corner. If it lifts? Wait.

Other side of the coin – waiting forever. If your new sod grows tall and thick, it blocks sunlight from reaching the base. That leads to thinning, disease, even weeds moving in. Keep it under control.

Big tip – never cut more than one-third of the grass height in one mow. It shocks the sod, stunts growth. And dull mower blades? Slice and tear instead of clean cuts. That opens wounds for pests and fungal infections.

If it’s St. Augustine grass, you’ll mow it higher – around 3.5 inches. Zoysia or Bermuda grass? Lower, closer to 1.5 or 2 inches. Know your grass type or risk killing it one mow at a time.

Not Rolling the Sod After Install

This one? Almost always skipped. And it kills your sod quietly.

When sod’s not rolled, air gaps stay between the grass and dirt. You won’t see it, but the roots? They ain't touching soil good. No contact = no growth. That’s how sod turns yellow even when you watering perfect.

A lawn roller, filled with water, presses sod down evenly. It pushes the roots into soil and gets rid of air pockets. Do it once right after laying sod. If you miss this step, that nice new lawn can turn patchy in under a week.

Don’t worry about crushing it – the roller’s weight is perfect. You ain't smashing it like concrete. Just a good firm press. If you don't have a roller? Rent one from local garden centers, or even Home Depot. Cheap insurance for hundreds of bucks worth of new sod.

Another problem from not rolling: uneven lawn. It looks bumpy, grows uneven, and mowing becomes a chore. Roller fixes that early. Less headache later.

-

@ 84b0c46a:417782f5

2025-05-11 06:05:38

@ 84b0c46a:417782f5

2025-05-11 06:05:38- Lumilumi The Nostr Web Client.

Lightweight modes are available, such as not displaying icon images, not loading images automatically, etc.

-

Long Form Content Editor A lightweight Long Form Content Editor with editing functionality for your articles. It supports embedding Nostr IDs via NIP-19 and custom emoji integration.

-

Nostr Share Component Demo A simple web component for sharing content to Nostr. Create customizable share buttons that let users easily post to Nostr clients with pre-filled content. Perfect for blogs, websites, or any content you want shared on the Nostr network. Try the interactive demo to see how seamlessly it integrates with your website.

Only clients that support receiving shared text via URL parameters can be added to the client list. If your preferred client meets this requirement, feel free to submit a pull request.

-

Nostr Follow Organizer A practical tool for managing your Nostr follows(kind3) with ease.

-

NAKE NAKE is a powerful utility for Nostr developers and users that simplifies working with NIP-19 and NIP-49 formats. This versatile tool allows you to easily encode and decode Nostr identifiers and encrypted data according to these protocol specifications.

- chrome extension

- firefox add-on

-

Nostviewstr A versatile Nostr tool that specializes in creating and editing addressable or replaceable events on the Nostr network. This comprehensive editor allows you to manage various types of lists and structured content within the Nostr ecosystem.

-

Luminostr Luminostr is a recovery tool for Nostr that helps you retrieve and restore Addressable or Replaceable events (such as kind: 0, 3, 10002, 10000, etc.) from relays. It allows you to search for these events across multiple relays and optionally re-publish them to ensure their persistence.

-

Nostr Bookmark Recovery Tool Nostr Bookmark Recovery Tool is a utility for retrieving and re-publishing past bookmark events ( kind:10003,30001,30003 ) from public relays. Rather than automatically selecting the latest version, it allows users to pick any previous version and overwrite the current one with it. This is useful for restoring a preferred snapshot of your bookmark list.

-

Profile Editor Profile Editor is a simple tool for editing and publishing your Nostr profile (kind: 0 event). It allows you to update fields such as name, display name, picture, and about text, and then publish the updated profile to selected relays.

-

Nostr bookmark viewer Nostr Bookmark Viewer is a tool for viewing and editing Nostr bookmark events (kind: 10003, 30001, 30003). It allows users to load bookmark data from relays, browse saved posts, and optionally edit and publish their own bookmark lists.

-

Nostr Note Duplicater Nostr Note Duplicater is a tool that rebroadcasts an existing Nostr event from a relay to other selected relays.

-

@ 4180da63:7b3c147e

2025-05-11 04:33:47

@ 4180da63:7b3c147e

2025-05-11 04:33:47By John "Potato Jack" LeFebvre

The cold, cold air of the morning tickled the nose of Christmas Goat as he lay quietly in bed, just waking up.

The cold air of the morning whispered in the ear of Christmas Goat; it whispered:- icicle secrets!

The moon, round and white, with swirling breezes, made Christmas Goat’s bedroom look like milk.

That reminded Christmas Goat – "It’s time to milk my cows!"

Christmas Goat peeled away the bed sheet and four blankets which kept him warm at night, and sitting on the edge of the bed he put on his gumboots.

He walked out of his bedroom and bumped into a wall because he was still a bit tired. He stood out on his front verandah and looked at the farm. "Come on you cows! It’s time for milking!!" he yelled.

The cows made a quiet line and walked, one behind the other, off to the milking sheds…

..all except for two cows who Christmas Goat had to throw a few potatoes at: then they got moving.

In the shed, the moos filled the air. Christmas Goat made his way past steaming cow flops carrying a bucket and a small stool.

He sat down next to Harry the cow.

"Ready for milking?", he asked.

"Yes, but you should have given me a girls name," said the cow.

"Oh well", said Christmas Goat, "here we go".

"Okay" said the cow, so Christmas Goat grabbed her teats with both hands and made the squirty milk goosh into the bucket.

"How are the kids?" asked Christmas Goat.

"Oh not bad," said Harry. "Bruce is in school and Terry’s just learning to moo."

"Yes, they’re good cows," said Christmas Goat.

"They are" said Harry. "I just wish you hadn’t given them boy’s names."

"Oh well," said Christmas Goat.

Christmas Goat milked all the cows one by one, and then he said to himself, "I think I’ll make myself a hot coffee". Back inside, he turned on the radio, and stirred the coffee powder into the hot water. Yum, he thought, pouring the cow’s milk on top. "Yum Yum Yum".

Christmas Goat drank all of this hot coffee and then made toast. A bird landed on his window sill and said "tweet tweet, tweet tweet ¯ ".

"Tweet tweet " said Christmas Goat".

The telephone rang four times and Christmas Goat picked it up.

"Hello, this is Christmas Goat?"

"Hello Christmas Goat? I’ve been a good goat all year and can you tell me what I’m getting for Christmas?"

"Christmas is tomorrow," said Christmas Goat.

"I know, but … - please tell me, just this once ..!"

"All right little goatgirl, what’s your name?"

"My name is Brenda," said the little girlgoat.

"Let me look at my list here…" said Christmas Goat. "

"Hmmm…" He moved his papers around.

"Are you still there?" asked the little goatgirl.

"Aha!! Yes I’m still here. I’ve just found your name on the list Brenda, here it is. Let’s see, oooh!"

"What is it! Wot is it!"

"It’s a …." But then Christmas Goat stopped talking.

"Why have you stopped talking?" said Brenda, panicking.

"Now, now," said Christmas Goat, "I just remembered it’s a secret."

"A secret!" said Brenda.

"Yes," said ChristmasGoat. "It has to be a surprise."

"No! Tell me now!" said Brenda.

Christmas Goat made a whistling sound with his lips. And then he hung up the phone.

By hanging up the phone like that, Christmas Goat felt a bit rude. But Brenda was rude first, he thought. Meanwhile, Brenda was at home, crying.

Christmas Goat thought , " I better go to see Brenda and explain to her why Christmas has to be a surprise." He went to the garage, oiled the wheels of his cart, and tied up a couple of humans.

"Good humans!" he said as they pulled him out of the garage down the street. The two people pulled the cart steadily along, steam pluming their foreheads.

It was a cold morning, and yet ChristmasGoat knew the earth was a round huge ball that spun on it’s axis while being invisibly dragged around a gigantic non stop fire- "the sun" – and that soon, because of this axis-spin, his part of the world would be receiving increasingly direct sun rays and it would get warm, so he didn’t worry . He explained this to the two men pulling his cart as it rolled through the suburbs, but they just blinked.

After a while, they arrived at Brenda’s house, and Christmas Goat tied the two men to a post and gave them a bottle of beer. Christmas Goat walked up the driveway, up the stairs, and went "knock kn0ck knock". A goat came to the door.

"Hallo Brenda?"

"No I’m Brenda’s brother. Brenda’s in her room, crying."

"Rats," said Christmas Goat.

There was Brenda, covered in tears, sitting on her carpet. Christmas Goat came in and sat down.

"Why did you make me sad?" said the little goatgirl.

"Well," said Christmas Goat, "I really didn’t want to do that. Every year, thousands of little goats ask me ‘what am I getting for Christmas,’ and every time I have to say to them, ‘you’ll see on Christmas day.’ And I Have to say this, I can’t say anything else, that’s just the way Christmas is."

"Come on, you must be able to tell me something a little deeper than (sniff) that."

Oh," said Christmas Goat, "you want the Big Reality explanation.."

"Yes," said Brenda, pouting and looking up from hurt eyes.

"Well," said Christmas Goat, "think what the world would be like with no surprise."

"Why? What would the world be like without surprise?" asked Brenda.

"Utterly predicable, " said Christmas Goat.

"What does predickable mean?" asked Brenda.

"In this case, it means ‘always knowing what’s going to happen’," said Christmas Goat.

"That sounds great!" said Brenda.

"Not really," said ChristmasGoat. "Think about it. Every day you wake up, you know what to wear, you know what’s going to be for breakfast, you know what job you have to go to, you know when it starts, you know how to get there, you know what you will see on the way, you know when you will stop for lunch, you know when you will finish, you know what’s for dinner, by looking at the program, you know what’s on T.V that night, they tell you what the weather will be like tomorrow, you know that if you …"

"That sounds Great!!" butted in Brenda.

"Yeah it sounded great to humans once, too, when they ruled the world. Woops."

"What was that?" said Brenda.

"What was what?" asked Christmas Goat.

"That thing you said, " said Brenda.

"I can’t remember, " said Christmas Goat, although now the shoe was on the other hoof.

"Well I remember, " said Brenda. "It just shocked me, that’s all. You said ‘when humans ruled the world.’"

"You’re right," sighed Christmas Goat. "That’s what I said..

Maybe we can forget about it though?"

Tell me tell me tell me tell me tell me tell me tell me tell me tell me tell me tell me tell me tell me tell… "

"ALL-RIGHT" said Christmas Goat, giving in. "Are you sure you want this dark knowledge?"

"Yes, I’m sure," said Brenda dribbling with excitement.

"Right, well once upon a time, the humans, like those two hitched up to the post outside drinking beer, were our masters. What they said, went."

"Boy," said Brenda.

"That’s right," continued Christmas Goat. "In fact they were the kings of the world. Us goats were treated horribly at times."

"What happened?" asked Brenda the little goatgirl.

"Those people became so set in their ways that they became stale. Nearly every effort at becoming the rulers made them and their lives boring. They thought they knew everything."

"People don’t know anything!" said Brenda.

"Not now they don’t," said Christmas Goat. "But they did in a distant past. Unfortunately they made the mistake of killing most surprises, and that’s when we snuck up them."

"Us goats?"

"Yep."

"And now we’re the kings and queens!" said Brenda gleefully.

"Of course," said Christmas Goat. "But we mustn’t let ourselves get trapped by prediction. That’s why I’m Christmas Goat. It’s my job to make sure surprise is still big in our lives, especially at this time of the year, Christmas." "Thankyou for telling me that true story," said Brenda. "I look forward to my surprise present tomorrow morning."

"That’s a good boy," said Christmas Goat.

"I’m a girl," said Brenda.

That night, Christmas Goat tied up his strongest humans who hauled and heaved his sleigh-cart all over the world through beautiful bright darkness. Kind Mummy and Daddy goats left a snack for Christmas Goat, and beer for the sweaty humans.

Christmas Goat and his team finished delivering the presents just in time.

"Good humans," he said, patting his helpers and switching on the T.V for them.

When Brenda woke up, there was a terrific colourful ping pong ball under her Christmas Tree.

"That is a surprise," smiled Brenda. "I’m a netballer!"

-

@ 8d34bd24:414be32b

2025-05-11 02:47:03

@ 8d34bd24:414be32b

2025-05-11 02:47:03What does it say about us that believers don’t listen as well as unbelievers? Let’s investigate some scripture verses and see what we can discover.

An Object Lesson:

Jesus warned His disciples several times that He would be killed and rise from the dead on the third day. Right after Jesus asked them who they thought He was and Peter replied that He was the Christ (Messiah), Jesus told them what would happen.

From that time Jesus began to show His disciples that He must go to Jerusalem, and suffer many things from the elders and chief priests and scribes, and be killed, and be raised up on the third day. (Matthew 16:21)

We know the disciples heard and understood what Jesus was saying because Peter immediately rebuked Jesus.

Peter took Him aside and began to rebuke Him, saying, “God forbid it, Lord! This shall never happen to You.” But He turned and said to Peter, “Get behind Me, Satan! You are a stumbling block to Me; for you are not setting your mind on God’s interests, but man’s.” (Matthew 16:22-23)

You’d think that Peter would have this moment locked in his mind after being rebuked so harshly for questioning Jesus’s prediction of what would happen.

A while later, Jesus again told His disciples what was about to happen.

And while they were gathering together in Galilee, Jesus said to them, “The Son of Man is going to be delivered into the hands of men; and they will kill Him, and He will be raised on the third day.” And they were deeply grieved. (Matthew 17:22-23)

They again heard what was said because they were “deeply grieved.” They didn’t like what they heard.

Then a third time, as they were approaching Jerusalem, He made certain they knew what was coming:

As Jesus was about to go up to Jerusalem, He took the twelve disciples aside by themselves, and on the way He said to them, “Behold, we are going up to Jerusalem; and the Son of Man will be delivered to the chief priests and scribes, and they will condemn Him to death, and will hand Him over to the Gentiles to mock and scourge and crucify Him, and on the third day He will be raised up.” (Matthew 20:17-19)

The disciples should have known that Jesus’s crucifixion and death were not the end. He told them repeatedly that He would die and be raised from the dead on the third day. They should have been diligently waiting with expectation, but instead they immediately hid, gave up, and headed back to their old lives.

His female followers still cared enough to try to prepare Jesus’s body for burial, but even they did not expect Him to rise as He said.

The angel said to the women, “Do not be afraid; for I know that you are looking for Jesus who has been crucified. He is not here, for He has risen, just as He said. Come, see the place where He was lying. Go quickly and tell His disciples that He has risen from the dead; and behold, He is going ahead of you into Galilee, there you will see Him; behold, I have told you.” (Matthew 28:5-7) {emphasis mine}

Even when the woman came and told the disciples that they had seen Jesus as He had said, none believed them, although Peter and John did have a glimmer of hope and went to look for themselves.

In contrast, the Pharisees, the very people who hated Jesus so much that they fought to have Him crucified, remembered Jesus’s statements.

Now on the next day, the day after the preparation, the chief priests and the Pharisees gathered together with Pilate, and said, “Sir, we remember that when He was still alive that deceiver said, ‘After three days I am to rise again.’ Therefore, give orders for the grave to be made secure until the third day, otherwise His disciples may come and steal Him away and say to the people, ‘He has risen from the dead,’ and the last deception will be worse than the first.” Pilate said to them, “You have a guard; go, make it as secure as you know how.” And they went and made the grave secure, and along with the guard they set a seal on the stone. (Matthew 27:62-66) {emphasis mine}

The Pharisees acted in response to Jesus’s claims. The disciples ignored or forgot Jesus’s claims.

KNOW:

How often do we ignore or forget Jesus’s promises? How often do we despair when we should hold tightly to the promises given to us in the Bible? Are there times that our opponents, unbelievers, are better at quoting the Bible back at us than we are at using the Bible to defend the truth and our faith?

but sanctify Christ as Lord in your hearts, always being ready to make a defense to everyone who asks you to give an account for the hope that is in you, yet with gentleness and reverence (1 Peter 3:15)

We need to know God’s word so we can “give an account for the hope that is in” us. First we need to read the whole Bible. We can’t know who God is, what He has done, and what He commands for us without knowing God’s word.

After we have gotten the big picture by reading through the Bible once, we need to really get to know it well. This not only includes reading the Bible continually, but also include memorizing key verses, so we can bring them to remembrance when we need them.

Some people can repeat a verse multiple times and just know it. Some of us have trouble memorizing things. We have to go to extraordinary measures to memorize God’s word. Some techniques I have used:

-

WHITEBOARD APPROACH:

-

Write the verse on the white board.

-

Read out loud.

-

Erase one word. (You can underline where the word is if that helps you remember that a word goes there)

-

Read out loud saying verse including missing word.

-

Continue erasing words, one at a time, saying the verse until all of the words are gone.

-

I haven’t used it personally, but Verse Locker was recommended by another substacker and seems to use a similar technique.

-

MUSICAL VERSES:

-

Make up a tune and sing the verse or put the verse to a tune you already know.

-

If you aren’t good at making up songs, there are sites that have verses to songs, but I haven’t used them personally other than a few from Awana years ago.

-

FIRST LETTER:

-

Write down the first letter of each word of the verse you want to memorize This gives hints and helps you not accidentally miss words.

-

I’ve also made a necklace (it was supposed to be a bracelet, but the verse, 1 Peter 3:15 above, I picked was too long) made of beads with the letters of the words of the verse. By wearing it, you have a reminder to memorize and rememorize the verse till it sticks stronger.

-

This is my version of 1 Peter 3:15

-

APPS:

-

There are multiple apps that can help you memorize verses. 5 Best Bible Memory Apps for 2025

We are all different and have different learning styles. Pick the version that works best for you, but be intentional. For so long I wasn’t. Having a child with Down Syndrome in Awana who needed help led me to finding ways to help him and me to memorize the hundreds (or thousands) of verses that are required to finish the program. Keep in mind that you need to keep reviewing them or the memories will fade. The more times you memorize the verse, the longer it will stick with you. You just never know when you will need a Scripture verse and you may not have your Bible or phone (with Bible app) handy.

APPLY:

Knowing the Bible is critical for the Christian life, but knowing the Bible and God’s commands is not enough. We have to live according to this knowledge. We have to apply it in our lives. It needs to change the way we view the world and change the way we live our lives and interact with others.

for it is not the hearers of the Law who are just before God, but the doers of the Law will be justified. (Romans 2:13) {emphasis mine}

Our faith needs to be exhibited through action.

But someone may well say, “You have faith and I have works; show me your faith without the works, and I will show you my faith by my works.” (James 2:18) {emphasis mine}

There is nothing we need to do to be saved besides believe, but if we have saving faith, we should desire God’s word like the author of Psalm 119. Our lives should also change to be conformed to Jesus.

And do not be conformed to this world, but be transformed by the renewing of your mind, so that you may prove what the will of God is, that which is good and acceptable and perfect. (Romans 12:12) {emphasis mine}

There must be works as evidence of our faith.

You believe that God is one. You do well; the demons also believe, and shudder. But are you willing to recognize, you foolish fellow, that faith without works is useless? Was not Abraham our father justified by works when he offered up Isaac his son on the altar? You see that faith was working with his works, and as a result of the works, faith was perfected; (James 2:19-22) {emphasis mine}

The disciples heard Jesus tell them what was going to happen to Him. They knew what He had said because they reacted to it negatively. The problem was they didn’t believe it and didn’t live according to Jesus’s plain words. As important as it is to read and understand the Bible, none of that matters if we don’t believe it and live it.

But I Can’t Do It Myself:

Jesus knew that we could not know and do what we were commanded to know and do, at least not in our own power.

Then He opened their minds to understand the Scriptures, and He said to them, “Thus it is written, that the Christ would suffer and rise again from the dead the third day, and that repentance for forgiveness of sins would be proclaimed in His name to all the nations, beginning from Jerusalem. You are witnesses of these things. And behold, I am sending forth the promise of My Father upon you; but you are to stay in the city until you are clothed with power from on high.” (Luke 24:45-49)

Jesus not only sent the disciples (and all believers) out into the world to tell of what He has done for us, but He told the disciples to “stay in the city until you are clothed with power from on high.” Jesus told them to wait until they had received the Holy Spirit to guide and empower them in the work He had designed them to complete. We also have the Holy Spirit to change our hearts and minds, so we can fulfill the commandments and plans He has for us.

I’m sorry if this post had a little too much overlap with my last post, but knowing God’s word has become a passion of mine and it is where I felt led to go.

May the God of Heaven give you a hunger for His word, help you to understand His word, believe His word, and live His word. May your understanding of the word of God guide you in everything you think, speak, and do. May you never doubt God’s word or discount God’s word because it isn’t according to your preference. God bless you and keep you.

Trust Jesus.

-

-

@ c9badfea:610f861a

2025-05-10 23:17:06

@ c9badfea:610f861a

2025-05-10 23:17:06- Install EtchDroid (it's free and open source)

- Launch the app, then tap What's Supported? to check compatibility with devices and disk images

- Insert the USB drive

- Tap Write An Image, then select the desired image file

- Tap Grant Access, confirm, and then tap Write image

- Optionally, allow notifications to be notified when the process is complete

- Your bootable USB drive is now ready

⚠️ This app has telemetry enabled by default. Make sure to turn it off in the app menu. If you trust F-Droid, you can get a telemetry-free version from there

⚠️ Avoid moving the phone during the image writing process

-

@ 3c7dc2c5:805642a8

2025-05-10 19:15:50

@ 3c7dc2c5:805642a8

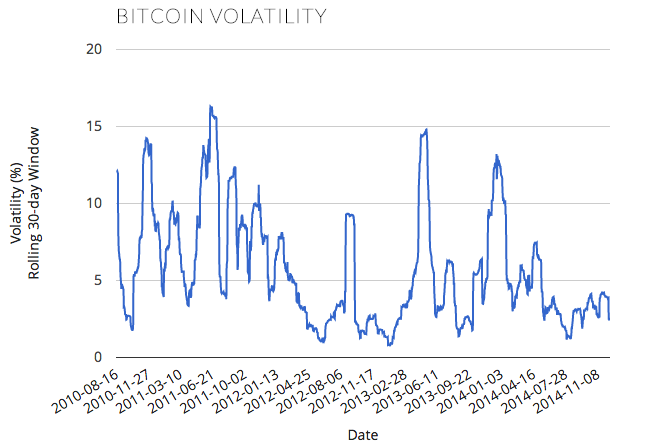

2025-05-10 19:15:50🧠Quote(s) of the week:

'Bitcoin is a high-IQ, low-time-preference asset in a world addicted to DoorDash, dopamine, and debt. Holding Bitcoin requires patience, conviction, and the ability to not panic when CNBC tells you it’s dead for the 47th time. That rules out, oh, I don’t know - 95% of the population? This isn’t some egalitarian revolution. This is a cognitive filter disguised as a monetary network. The rich, the strategic, the elite - those who understand volatility as an opportunity - will stack the hardest asset on Earth while the masses beg for interest rate cuts and $600 stimmies to buy groceries they can't afford.

It's not a level playing field. It's a time-preference war, and Bitcoin is the scoreboard. And every cycle, we watch it happen again. The media ridicules it, the politicians fear it, and the smart money buys more. While fiat punishes savers and rewards financial nihilism, Bitcoin inverts the whole structure. It’s a vault for those who can delay gratification, think generationally, and understand that true wealth is preserved rather than printed. The game isn’t rigged. It’s just calibrated for adults.' - Adam Livingston

'Bitcoin is an extremely simple thesis. If you think governments will stop debasing and debanking: number go down. If you think they won’t stop debasing and debanking: number go up'- Alex Gladstein

Something to ponder on.

🧡Bitcoin news🧡

On the 28th of April:

➡️Hunter Horsley: 'Bitcoin at $94k, yet — Google searches for "Bitcoin" near long-term lows. This hasn't been retail-driven. Institutions, advisors, corporations, and nations have come into the space. The types of investors buying Bitcoin are expanding.'

➡️Daniel Batten: 'Cambridge has just released their updated report on Bitcoin mining. For the first time, their report shows that most (52.4%) of the Bitcoin network is now powered by zero-emission energy sources (up from 37% in their last report).

Here's a summary of their findings:

https://x.com/DSBatten/status/1916903476610650202

You can read the full report here

➡️Arizona’s Bitcoin Reserve bill (SB 1025) just passed the House and now heads to the desk of Governor Katie Hobbs. However, Governor Hobbs has vowed to veto any legislation until a budget impasse over funding for disability services is resolved.

On the 29th of April:

➡️Bitcoin Archive: 'South Korea's ruling party to approve spot Bitcoin ETFs, scrap restrictive banking crypto rules, and introduce crypto-friendly framework THIS YEAR, if it wins the June election.'

➡️President Trump's Executive Director says there is a "space race" amongst countries to accumulate Bitcoin: "We view Bitcoin as digital gold."

➡️U.S. to "turbo-charge" Bitcoin mining growth by allowing Bitcoin miners to build power plants and data centres near natural gas fields - Howard Lutnick, Commerce Secretary

➡️Japanese clothing company ANAP Holdings Inc. bought 35 Bitcoins worth $3.3 million. ANAP now holds 51.7 BTC, joining Japan’s growing corporate Bitcoin treasury movement.

➡️Semler Scientific adds 165 BTC for $15.7M, bringing total holdings to 3,467 BTC. The company reports a 23.8% BTC yield year-to-date.

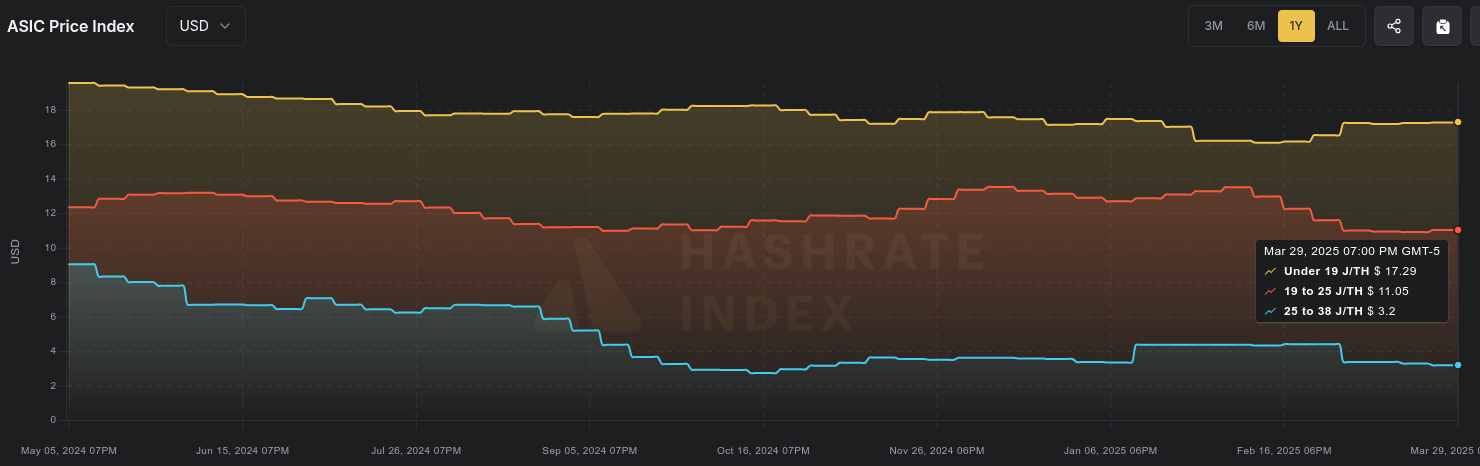

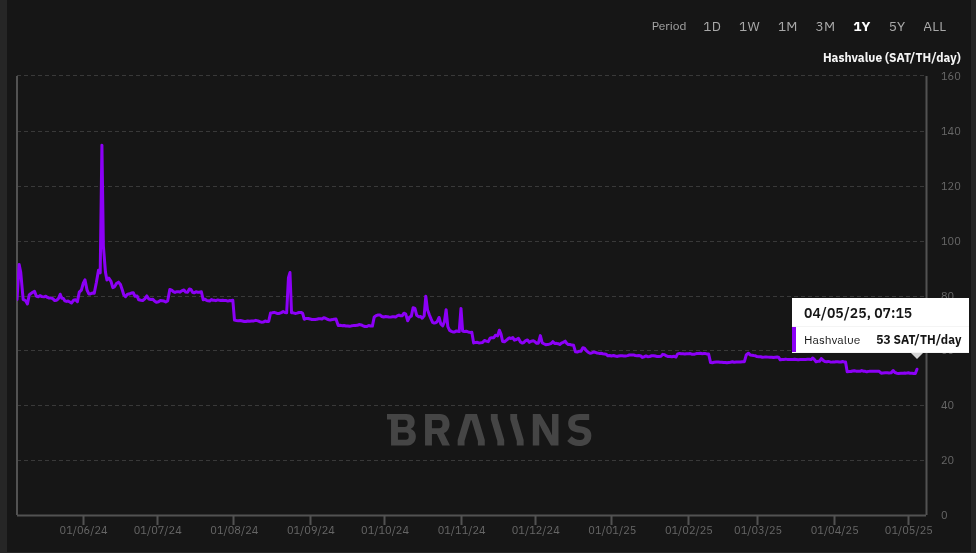

➡️The Bitcoin hashrate has already surged over 17% since the start of the year.

➡️'This shattered a major myth for me: gold production isn’t slowing down—it’s accelerating. According to NYDIG, annual gold mining has been steadily increasing over time, about 1.6% per year, thanks to better extraction technology. In fact, 2024 saw a 1% year-over-year increase, setting an all-time high in gold output (World Gold Council). So why do so many still believe the outdated narrative that gold is becoming harder to find? The truth is: gold is effectively unlimited in supply—we just get better at digging it up. If that surprises you, you're probably not nearly bullish enough on Bitcoin.' - Robert Hefner https://i.ibb.co/JWCHndQk/Gpu-W9-R1-Xw-AAiy-Cv.jpg

On the 30th of April:

➡️The Bank of Italy identifies Bitcoin as an emerging risk factor with concerns for the financial system.

"The strong growth of Bitcoin and other crypto-assets with high price volatility means risks not only for investors but also potentially for financial stability, given the growing interconnections between the digital asset ecosystem, the traditional financial sector, and the real economy,”

Tell me you are scared of Bitcoin without telling me you are scared of Bitcoin.

➡️4 major wirehouses managing $10 TRILLION to start offering Bitcoin ETFs to clients this year, says BitWise CIO Matt Hougan. Merrill Lynch, Morgan Stanley, Wells Fargo, and UBS are coming to the party.

➡️Roswell, New Mexico, becomes the 1st United States city to launch a strategic Bitcoin reserve.

➡️BlackRock’s Bitcoin ETF IBIT has hit 600,000 BTC!

➡️Semler Scientific bought 165 Bitcoins worth $15.7m. They now hold 3,467 BTC on their balance sheet.

➡️Bitcoin News: 'El Salvador is still buying Bitcoin despite an IMF loan deal that required it to stop. Economy Minister Maria Luisa Hayem confirmed ongoing accumulation, calling Bitcoin “an important project” and a key asset for both the government and private sector.'

➡️New whales are buying Bitcoin faster than ever before!

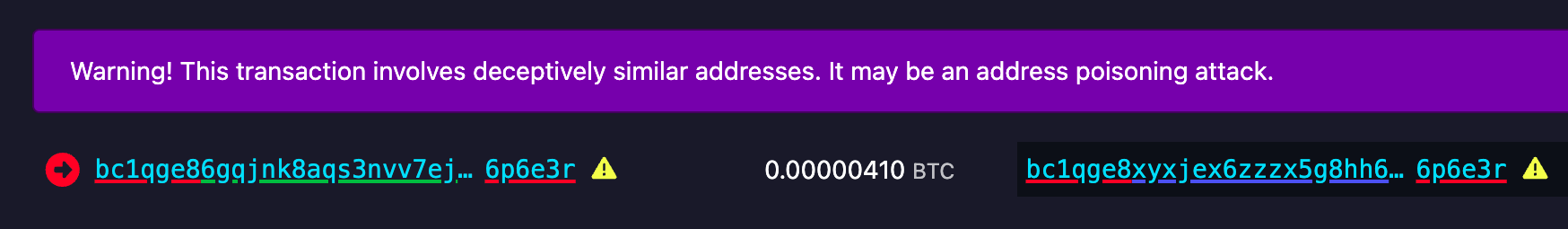

➡️'ZachXBT says the $330M Bitcoin theft involved an elderly U.S. victim targeted by social engineering. The stolen 3,520 BTC were laundered through six exchanges and swapped into Monero, triggering a 50% price spike due to thin liquidity.' -Bitcoin News

On the 1st of May:

➡️North Carolina Bitcoin Reserve Bill has passed the House! This bill enables state retirement funds to invest up to $ 13 B.

➡️Tether’s latest attestation states the company holds $7.6 billion in Bitcoin.

➡️Europe's largest Bitcoin treasury company, The Blockchain Group, aspires to hold 1% of the total Bitcoin supply by 2033.

➡️FiatHawk: 'Central banks create fake money to buy real gold, and we’re supposed to pretend this isn’t theft. The game is rigged. Their paper is trash. Gold knows it. Bitcoin ends it. Stop believing the lie.

https://i.ibb.co/mrBZtY5P/Gpl4kl-ak-AA-xv-D.png

When the debt bubble collapses, only sound money with zero counterparty risk matters. Currently, sound money is less than 5% of debt money, and Bitcoin is so tiny it is barely visible on the chart. Stay humble and keep stacking.' https://i.ibb.co/QF0Vf9k8/Gpu-CCIWa-YAAng1-U.png

On the 2nd of May:

➡️ Regarding the whole OP_Return debate.

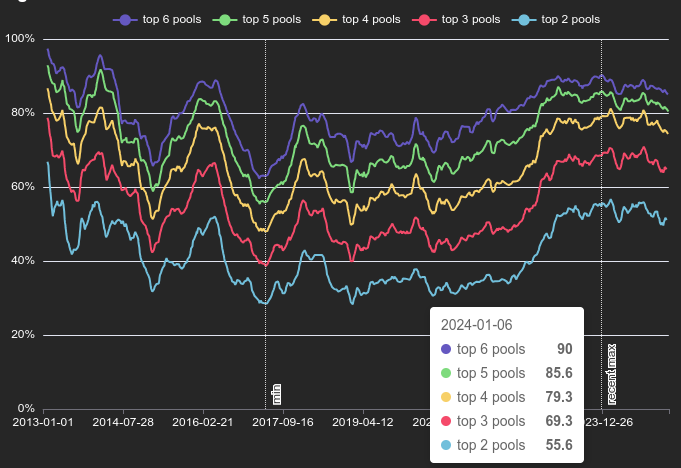

Grok: ++Key Points: ++ * The OP_RETURN debate in Bitcoin centers on whether its blockchain should store data beyond financial transactions, with ongoing controversy. * It began in 2010 with concerns about blockchain bloat, intensified in 2014 with the "OP_Return Wars," and continues today. * Research suggests the debate reflects a balance between Bitcoin's monetary purpose and potential for broader applications like Dapps. * Compromises, like setting a 40-byte limit in 2014, aimed to address concerns but didn't fully resolve tensions, influencing platforms like Ethereum.

++Background++ OP_RETURN is a Bitcoin script opcode allowing small data storage in transactions, useful for timestamping or Dapps, but raising concerns about blockchain bloat.

++Historical Context++

The debate started in 2010 with the BitDNS proposal, where Satoshi Nakamoto worried about scalability, leading to Namecoin. It peaked in 2014 with Counterparty's use, leading to a 40-byte limit compromise, later adjusted to 83 bytes by 2016.

++Recent Developments++ By 2018-2019, high OP_RETURN usage (20% of transactions) sparked fee debates, but usage has since declined, though data remains, with recent 2023 controversies over size limits.

If you are interested in Bitcoin, then you should check out the following video.

Great video from @GrassFedBitcoin explaining the current OP_RETURN situation. The choice isn’t between bloating the UTXO set or increasing OP_RETURN, it’s whether we normalize spam or we reject it. Is Bitcoin for data storage or financial transactions? https://www.youtube.com/watch?v=15biQH1H140 Every Bitcoiner needs to see this! Vires in Numeris.

A great counterargument by Seth for Privacy:

https://x.com/sethforprivacy/status/1919003009880616976

Personally, I tend to agree with Seth.

To sum it up:

If you are running a node, you should switch from Core to Knots immediately. It's very straightforward, and you don't need to redo the initial block download.

If you arent running a node you are a leech and need to get your shit together.

➡️Tether CEO defends skipping MiCA, calling EU stablecoin rules “very dangerous.” Ardoino: “The European Central Bank is more interested in pushing the digital euro to control people and how they spend their money.”

On the 3rd of May:

➡️Arizona Governor Katie Hobbs has vetoed the state’s Strategic Bitcoin Reserve legislation after it was passed by the House and Senate. She states: “Arizonans’ retirement funds are not the place for the state to try untested investments like virtual currency.”

Apparently, the Arizona State Retirement System already holds 53,097 shares of MSTR. You can’t make this shit up.

➡️Vitalik Buterin: 'One of the best things about Bitcoin is how simple it is. This simplicity has lots of benefits. Let's bring those benefits to Ethereum.' Almost like Bitcoin is eh......(checks notes)......better tech. Just use Bitcoin, dumbfuck! 'It's only taken a decade, but Ethereum's creator is having an inkling that he never should have created Ethereum, which destroyed billions of precious capital and instead focused on Bitcoin.' - Vijay Boyapati

There is no second best!

On the 4th of May:

➡️Eli Nagar:

Heads up, Bitcoin holders: The EU will ban anonymous crypto accounts by July 2027. Every transaction above €1,000 will need your ID. Privacy is becoming extinct. Every new restriction is a marketing campaign for Bitcoin. “Hi, we’re the EU. We’ll surveil you, control your money, and criminalise privacy.” By doing that, they have decided to help promote the black market...great work, EU! Oh, and remember, the EU can't ban what it has no control over: hold your own private keys.

➡️Cumulative inflows into the Bitcoin ETFs have hit a fresh ATH of $ 40.62 B.

On the 5th of May:

➡️Brown University invested $4.9M in Bitcoin via BlackRock's IBIT, as disclosed in a recent SEC filing. The university owns 105K IBIT shares ($5.8M), 2.3% of Brown's reported $216M equity holdings.

➡️Strategy acquires 1,895 BTC for $180.3 million at an average price of $95,167 per bitcoin. As of May 4, 2025, they hold 555,450 BTC acquired for $38.08 billion at an average price of $68,550 per bitcoin.

💸Traditional Finance / Macro:

On the 3rd of May:

👉🏽Berkshire Hathaway cash pile hits record $347.7bn in 1Q as Warren Buffett sells stocks for 10th quarter in a row. Buffett is still raising cash. https://i.ibb.co/1GK6Dvzx/Gq-Bp6q-BW4-AAKKlm.jpg

🏦Banks:

👉🏽 No news

🌎Macro/Geopolitics:

On the 27th of April:

👉🏽World central banks are diversifying their reserves: Foreign holdings of Treasuries as % of US government debt have fallen to ~23%, the lowest in 22 years. The percentage is down ~11 percentage points over the last 9 years. At the same time, gold holdings as a % of global international reserves have hit ~18%, the highest in 26 years. The share has risen by ~8 percentage points since 2015. China has been one of the biggest buyers of gold over the last few years. Since the beginning of 2023, China’s gold reserves as a % of total foreign reserves have doubled to 7.1%.

Everyone wants gold. https://i.ibb.co/NgX11DZh/Gp4-GKc-HWMAAa-FYu.jpg

On the 28th of April:

👉🏽TKL: 'Tariffs are hitting American meat exports.

China's cancellations of US pork shipments are skyrocketing: China cancelled shipments of ~12,000 metric tons of US pork last week, the most since the 2020 pandemic, when global supply chains were halted. As a result, overall US pork export sales dropped to their lowest level since October, according to Bloomberg. This comes as American pork imports to China now face a massive 172% tariff. This includes the duties first imposed during the 2018 trade war.'

On the 29th of April:

👉🏽The U.S. Treasury will now need to borrow $514 billion this quarter, an increase of 320% from its previous estimate.

On the 30th of April:

👉🏽'Bad news for electricity consumers: despite 84 hours of negative pricing (2024: 62 hours), the average electricity price in the Netherlands in April was €75/MWh — nearly 30% higher than a year ago.' - Martien Visser

https://i.ibb.co/VsrFdKy/Gps0l-Au-Xs-AA20-OA.png

👉🏽Tax cuts for the rich lead to higher income inequality. However, they do not have any significant effect on economic growth or unemployment. Empirical evidence for advanced economies over 1965-2015:

https://academic.oup.com/ser/article/20/2/539/6500315?login=false

Trickle down never worked.

👉🏽"Since February 2020, home prices have increased 45%," according to Zillow So has the broad money supply. Not your house is getting more expensive; The money is getting devalued.

Money supply= +40%

Median home= +40%

Experts: "What could have ever caused this????"

And some freaking guru on Instagram or Tiktok is trying to convince you to get his/her 'buying/renting a house' course. https://i.ibb.co/bMXfW3vp/Gp0-CXg-Ka-YAAIhq-J.jpg

👉🏽SUMMARY OF US Q1 GDP REPORT: 1. The U.S. economy contracted at an annual rate of -0.3% in the first quarter, compared to expectations for an increase of 0.2%. That’s down from the growth of 2.4% in Q4. 2. Real consumer spending rose by 1.8% Y/Y, after increasing 4.0% in Q4. 3. The GDP Price Index rose 3.7%, above estimates of 3.1%. 4. Core PCE Prices rose 3.5%, after increasing 2.6% in Q4.

• Key Takeaway: Fears of stagflation are growing as the economy grinds to a halt and inflation ticks higher. - Jesse Cohen

👉🏽World debt has now officially crossed $300 TRILLION, and still continues to climb aggressively. This will not end well…

https://i.ibb.co/Kxm2bJs6/Gpyi-Ouwa-YAEDg-Pq.jpg

👉🏽'March PCE inflation, the Fed's preferred inflation measure, FALLS to 2.3%, above expectations of 2.2%. Core PCE inflation FALLS to 2.6%, in line with expectations of 2.6%. February Core PCE inflation was revised up to 3.0%. All eyes are on the Fed next week.' - TKL

🎁If you have made it this far, I would like to give you a little gift, well, in this case, two gifts:

Smitty's Bitcoin Retirement Guide:

"Helping you develop a better Bitcoin stacking target for life planning." - Sminston With This is a fantastic tool. Very, very useful. I will keep mentioning it. Bitcoin is a savings vehicle. Period!

https://x.com/sminston_with/status/1917605539279954391

The best kind of retirement starts in diapers and ends in diapers, so start now. https://i.ibb.co/4RwFxR0W/Gpys-GQga-YAIxm-MX.jpg

nofinancialadvice

Credit: I have used multiple sources!

My savings account: Bitcoin The tool I recommend for setting up a Bitcoin savings plan: PocketBitcoin especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly.

Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

-

@ c9badfea:610f861a

2025-05-10 13:57:17

@ c9badfea:610f861a

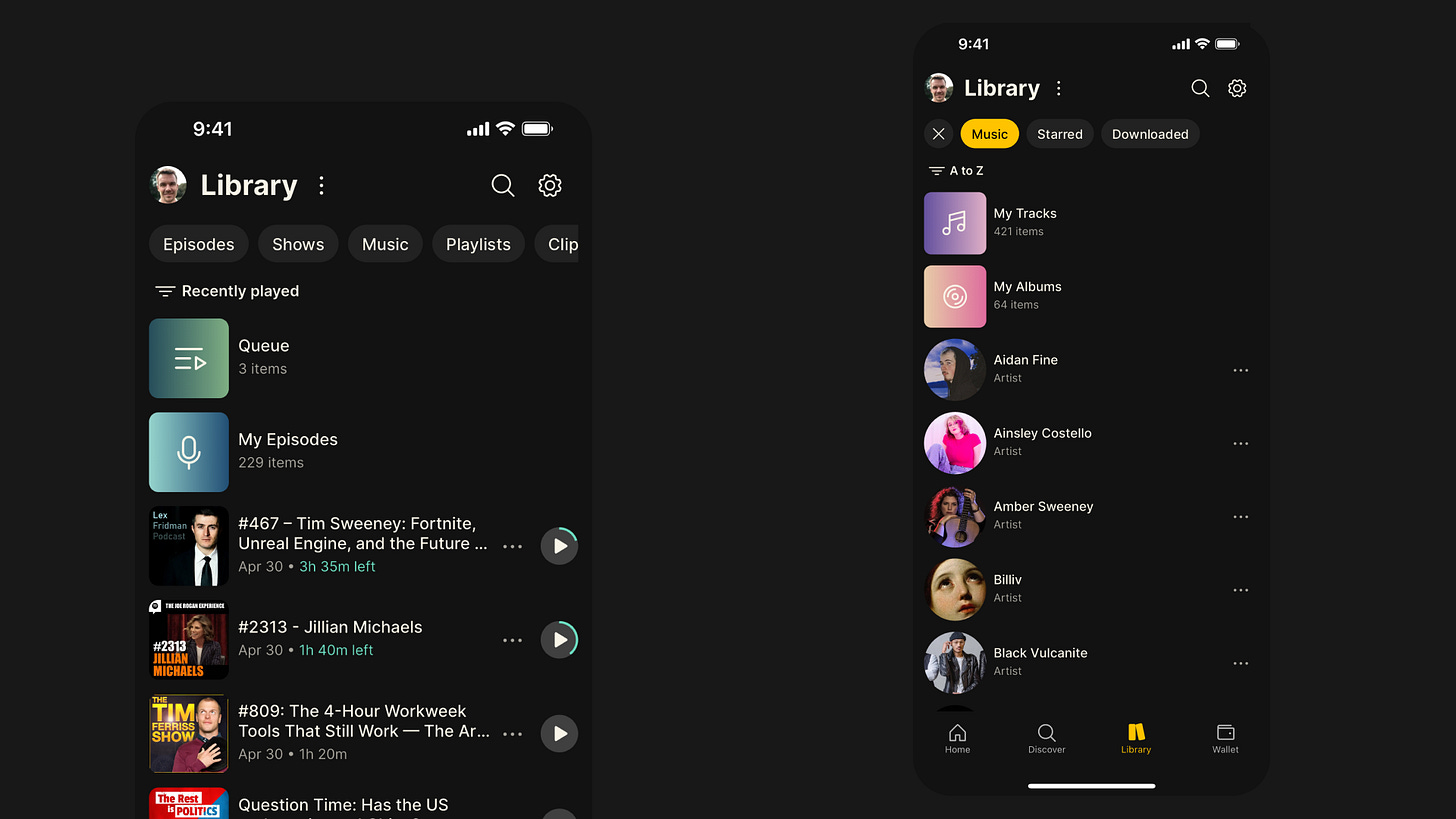

2025-05-10 13:57:17- Install Grayjay (it's free and open source)

- Launch the app and navigate to the Sources tab

- Enable the desired sources (and log in if needed by tapping on the source and scrolling down to Authentication)

- Go to Android Settings > Apps, select Grayjay, and tap Open By Default and Add Link to automatically open supported links with Grayjay

- Enjoy

ℹ️ If you are using Obtainium to install apps, search for Grayjay on Complex Apps

-

@ bf47c19e:c3d2573b

2025-05-11 18:57:51

@ bf47c19e:c3d2573b

2025-05-11 18:57:51Originalni tekst na vice.com.

Davno pre nego što je postala šef najdesnije italijanske vlade od Drugog svetskog rata, Đorđa Meloni je kritikovala ono što je nazvala francuskom „kolonijalnom valutom“.

U snimku italijanske televizije iz 2019. koji je prošlog meseca postao megaviralan, Meloni je optužila Francusku da koristi CFA franak za eksploataciju resursa 14 afričkih zemalja i vrši finansijsku dominaciju nad njima. Određene stvari koje je tvrdila u videu nisu baš tačne, ali CFA franak jeste kontroverzan.

CFA franak je stvoren 1945. da bude valuta „francuskih kolonija u Africi“, a pošto Francuska kontroliše njegovo štampanje i promet, francuska vlada i dalje ima finansijsku kontrolu nad dobrim delom zapadnoafričke zemlje i više od 180 miliona ljudi. Dok su francuski zvaničnici ranije nazivali ovu valutu „činom velikodušnosti prema kolonijama“, o njenoj upotrebi se sada žestoko raspravlja.

Neke od afričkih nacija borile su se protiv valute, uključujući građane koji su razbijali prodavnice povezane sa Francuskom i osuđivali francuski jezik koji se uči u školama.

Jedna od onih 14 afričkih zemalja koja još uvek koristi CFA franak je Centralnoafrička Republika, država bez izlaza na more u kojoj živi oko 5 miliona ljudi i jedna od najsiromašnijih zemalja na svetu.

Predsednik CAR Faustin-Aršanž Touadera govori na COP27 u Egiptu ranije ove godine. Foto: Gehad Hamdi/savez za slike preko Getti Image-a

Predsednik CAR Faustin-Aršanž Touadera govori na COP27 u Egiptu ranije ove godine. Foto: Gehad Hamdi/savez za slike preko Getti Image-aAli dok druge afričke nacije razmatraju odbacivanje CFA franka, CAR je jedna od prvih koja je zaista uradila nešto po tom pitanju, a ranije ove godine postala je prva zemlja u Africi i tek druga u svetu koja je usvojila Bitcoin kao legalnu valutu.

„Alternativa gotovini je kriptovaluta“, rekao je predsednik Faustin-Aršanž Touadera. „Za nas formalna ekonomija više nije opcija”.

Dok su prve najave o bitkoinu izazvale konfuziju, međunarodne nesuglasice i reakcije, vlada CAR-a je nastavila sa uvođenjem. Osam meseci kasnije, mnogi ljudi širom sveta, pa čak i građani CAR-a, možda nisu ni svesni da se promena dogodila.

U CAR samo 14 odsto stanovništva ima pristup električnoj energiji, a još manje – oko 10 odsto – može da koristi internet. A konflikt i dalje tinja i negativno utiče na zemlju i njenu ekonomiju već deceniju.

Na predstavljanju bitkoina, vlada CAR-a je rekla da će usvajanje valute promeniti bogatstvo zemlje i staviti CAR „na mapu najhrabrijih i najvizionarskijih zemalja sveta“.

Bitkoin ne kontroliše nikakva moć, tehnički je univerzalno dostupan i ne može se cenzurisati – što je velika promena u odnosu na drugu valutu nacije, ali prosečnom građaninu CAR bi bilo potrebno 60 godina da kupi jedan novčić.

Žena maše francuskom zastavom uoči emitovanja polufinala Svetskog prvenstva između Francuske i Maroka u baru u Bangiju. Foto: BARBARA DEBOUT/AFP preko Getti Images

Žena maše francuskom zastavom uoči emitovanja polufinala Svetskog prvenstva između Francuske i Maroka u baru u Bangiju. Foto: BARBARA DEBOUT/AFP preko Getti ImagesU Bangiju – glavnom gradu CAR – studenti Univerziteta rekli su za VICE da se „ništa nije promenilo“ od velike najave vlade.

Studenti su želeli da ostanu anonimni jer su se plašili da negativno govore o ambicijama vlade. Pravo na slobodu izražavanja ne postoji u CAR, a građani često doživljavaju zastrašivanje i nasilje od strane provladinih milicija, oružanih grupa i snaga nacionalne bezbednosti.

„Bilo je ogromno slavlje kada je objavljen Bitcoin plan i svi smo bili ponosni na našu zemlju“, rekao je jedan 20-godišnjak, „ali ne mislim da se život ovde uopšte poboljšao od tada”.

Drugi student je dodao: „Nigde nema cena u radnjama izraženih u bitkoioni, niti iko traži od ljudi da plaćaju koristeći novu valutu. Većina trgovaca i kupaca na tržištu nemaju telefon ili internet. Posebno ljudi izvan Bangija, nemaju ništa““.

Aleks Lilaher, osnivač i izvršni direktor Rise Up Media – marketinške agencije koja radi sa bitkoin startapima – je saglasan sa studentima, rekavši za VICE koliko je „iznenađen” što je ta zemlja uopšte napravila takavpotez.

„Centralnoafrička Republika nije baš lider u tehnologiji na kontinentu, i činilo se da tamo nikada nije bilo mnogo bitkoin korisnika koji bi mogla da lobiraju za takav potez“, rekao je on.

Pobednički tim slavi posle trke kanua za proslavu Dana nezavisnosti CAR-a u decembru. Fotografija: BARBARA DEBOUT/AFP preko Getti Images

Pobednički tim slavi posle trke kanua za proslavu Dana nezavisnosti CAR-a u decembru. Fotografija: BARBARA DEBOUT/AFP preko Getti ImagesUpitan da li građani CAR-a treba da vide usvajanje bitkoina kao pozitivnu ili negativnu stvar, Lilaher je odgovorio „ni jedno ni drugo, jer jednostavno ne mogu da vidim da će usvajanje uskoro krenuti. Ali imati alternativu i poslati signal Francuskoj da CAR želi da ima više nezavisnosti od valute je pozitivno u mojim očima”.

Dodaje: „Međutim, to takođe može imati posledice jer postoje moćne institucije poput Međunarodnog monetarnog fonda, na primer, sa kojima CAR mora da se bavi, koje nisu srećne što zemlje usvajaju bitkoin. Dakle, moglo bi doći do izazova sa kojima će vlada morati da se nosi“.

Centralnoafrička Republika je druga zemlja u svetu koja je usvojila bitkoin, a prva je El Salvador u septembru 2021. Lansiranje valute je tamo imalo različite rezultate, a nedavno je opisano kao „antiklimaktično“ i samo ga turisti zaista koriste.

Iako su ljudi možda očekivali da će druge nacije pratiti El Salvador, sigurno ne bi pomislili da će CAR odgovarati računu.

Glavna opoziciona stranka CAR-a bila je protiv tog predloga od samog početka. Banka centralnoafričkih država je takođe nazvala ovaj potez „problematičnim“ i navela da bi usvajanje valute uz CFA moglo ugroziti odnos nacije sa drugim afričkim zemljama.

Čak i kada većina ljudi u CAR-u nije mogla da investira u Bitcoin, i sve poruke upozorenja, u julu je vlada CAR-a lansirala sopstvenu kriptovalutu – „Sangocoin“. Sango je lokalni jezik koji se govori širom zemlje.

Pripadnici teritorijalnog pešadijskog bataljona CAR marširaju tokom parade povodom Dana nezavisnosti u Bangiju. Fotografija: BARBARA DEBOUT/AFP preko Getti Images

Pripadnici teritorijalnog pešadijskog bataljona CAR marširaju tokom parade povodom Dana nezavisnosti u Bangiju. Fotografija: BARBARA DEBOUT/AFP preko Getti ImagesSangocoin neki vide kao budućnost CAR-a, a zahtevao je minimalnu investiciju od 500 dolara. Zauzvrat, investitori su mogli da kupe zemljište u zemlji bogatoj dijamantima za 10.000 dolara, pa čak i da kupe državljanstvo CAR-a za oko 60.000 dolara – iako je ove ponude kasnije blokirao najviši sud zemlje. Sangocoin investitori su takođe trenutno „zaključani“ za kupovinu, bez načina da kriptovalutu prodaju ili razmene.

Bio je to hrabar potez vlade, ali izgleda da se još uvek nije isplatio.

Ovog meseca, Centralnoafrička Republika je saopštila da odlaže puštanje nacionalne kriptovalute na kripto berze – što bi olakšalo međunarodnu trgovinu. Rojters kaže da je vlada okrivila „trenutne tržišne uslove” i „tržišne razloge”, ali je novinska agencija izračunala da je Sangocoin dostigao samo „0,01%” od najnovijeg vladinog cilja prodaje.

Još jedan skeptik je Aleks Gladštajn, glavni strateški službenik Fondacije za ljudska prava. On je dugogodišnji zagovornik usvajanja bitkoina u svetu u razvoju, kao i kritičar CFA franka – ali čak i on oseća da je CAR-ova šema bila „izuzetno neosmišljena“.

„Iako imam mnogo simpatije prema ranjivoj i siromašnoj naciji koja usvaja bitkoin kao drugu valutu – posebno naciji koja je decenijama i decenijama finansijski kontrolisana od strane svoje bivše kolonijalne sile, nisam baš optimističan u pogledu toga kako je to izvedeno“, rekao je za VICE.

Manekenka učestvuje na prvoj nedelji mode u centralnoj Africi u Bangiju u decembru. Fotografija: BARBARA DEBOUT/AFP preko Getti Images

Manekenka učestvuje na prvoj nedelji mode u centralnoj Africi u Bangiju u decembru. Fotografija: BARBARA DEBOUT/AFP preko Getti ImagesDodao je: „Zaista se čini da je cela ova stvar bila kao prevara da se Sangocoin promoviše. Ne mislim da je cilj bio da se bitkoin integriše na smislen način u ekonomiju zemlje. Čini se da je predsednik zainteresovan za bitkoin i da postoji mala grupa ljudi oko njega koja je iskoristila taj interes da bi mogla da donese ove zakone kako bi pokušala da pokrene Sangocoin, od kojeg su imali viziju da zarade gomilu novca. Ali izgleda da je na kraju uspela da prikupi samo malo novca.”

Gladstein kaže da bi Bitcoin mogao biti „veoma važna finansijska tehnologija za ljude Centralnoafričke Republike tokom vremena, i pametno je da vlada istraži kako to može pomoći ljudima“, ali je potrebno mnogo posla da se to postigne.

Vlada Centralnoafričke Republike i opoziciona vlada nisu odgovorile na nekoliko zahteva za intervju.

Tekst podržao Omidiar Netvork. VICE World News zadržava potpunu uređivačku autonomiju.

-

@ c9badfea:610f861a

2025-05-10 11:08:51

@ c9badfea:610f861a

2025-05-10 11:08:51- Install FUTO Keyboard (it's free and open source)

- Launch the app, tap Switch Input Methods and select FUTO Keyboard

- For voice input, choose FUTO Keyboard (needs mic permission) and grant permission While Using The App

- Configure keyboard layouts under Languages & Models as needed

Adding Support for Non-English Languages

Voice Input

- Download voice input models from the FUTO Keyboard Add-Ons page

- For languages like Chinese, German, Spanish, Russian, French, Portuguese, Korean, and Japanese, download the Multilingual-74 model

- For other languages, download Multilingual-244

- Open FUTO Keyboard, go to Languages & Models, and import the downloaded model under Voice Input

Dictionaries

- Get dictionary files from AOSP Dictionaries

- Open FUTO Keyboard, navigate to Languages & Models, and import the dictionary under Dictionary

ℹ️ When typing, tap the microphone icon to use voice input

-

@ 84b0c46a:417782f5

2025-05-10 10:41:20

@ 84b0c46a:417782f5

2025-05-10 10:41:20https://long-form-editor.vercel.app/

β版のため予期せぬ動作が発生する可能性があります。記事を修正する際は事前にバックアップを取ることをおすすめします

機能

-

nostr:npub1sjcvg64knxkrt6ev52rywzu9uzqakgy8ehhk8yezxmpewsthst6sw3jqcw や、 nostr:nevent1qvzqqqqqqypzq4jsz7zew5j7jr4pdfxh483nwq9vyw9ph6wm706sjwrzj2we58nqqyxhwumn8ghj77tpvf6jumt9qys8wumn8ghj7un9d3shjtt2wqhxummnw3ezuamfwfjkgmn9wshx5uqpr4mhxue69uhhyetvv9ujumn0wd68ytnhd9ex2erwv46zu6nsqyxhwumn8ghj7mn0wvhxcmmvqqsgcn99jyn5tevxz5zxsrkd7h0sx8fwnqztula423xh83j9wau7cms3vg9c7 のようにnostr:要素を挿入できる

-

:monoice:のようにカスタム絵文字を挿入できる(メニューの😃アイコンから←アイコン変えるかも)

:monopaca_kao:

:kubipaca_karada:

- 新規記事作成と、既存記事の修正ができる

やることやったこと

-

[x] nostr:を投稿するときにtagにいれる

-

[x] 画像をアップロードできるようにする

できる

できる - [x] 投稿しましたログとかをトースト的なやつでだすようにする

- [ ] レイアウトを整える

- [ ] あとなんか

-

-

@ d41bf82f:ed90d888

2025-05-10 08:09:15

@ d41bf82f:ed90d888

2025-05-10 08:09:15บทที่ 3: ตะวันออกแห่งเอเดน (East of Eden)

บทนี้เจาะลึกต้นกำเนิดของโครงสร้างอำนาจในมนุษยชาติผ่านมุมมองเชิงประวัติศาสตร์และเศรษฐศาสตร์ โดยเฉพาะการเปลี่ยนแปลงครั้งสำคัญที่เรียกว่า การปฏิวัติเกษตรกรรม ซึ่งพลิกโฉมวิถีชีวิตมนุษย์จากการเป็นนักล่าสัตว์และเก็บของป่า มาสู่สังคมที่ตั้งถิ่นฐานถาวร สะสมทรัพย์สิน และมีแนวโน้มที่จะใช้ความรุนแรงและจัดองค์กรทางอำนาจที่ซับซ้อนมากขึ้น

การเปลี่ยนผ่านดังกล่าวสามารถเห็นภาพได้อย่างคมชัดผ่านสัญลักษณ์ในพระคัมภีร์ไบเบิล จากเรื่องราวของคาอินและอาเบล:

“และพระเจ้าตรัสกับคาอินว่า ‘อาเบล น้องชายของเจ้าอยู่ที่ไหน?’ คาอินตอบว่า ‘ข้าพระองค์ไม่ทราบ ข้าพระองค์เป็นผู้ดูแลน้องชายของข้าหรือ?’ พระเจ้าตรัสว่า ‘เจ้าทำอะไรลงไป? เสียงเลือดของน้องชายเจ้าร้องต่อเรามาจากพื้นดิน’” (ปฐมกาล 4:9-10)

นี่ไม่ใช่เพียงบทสนทนาทางศาสนา แต่สามารถตีความในเชิงสัญลักษณ์ว่าเป็นการบันทึกครั้งแรกของอาชญากรรมที่เกิดจากตรรกะของการเป็นเจ้าของและความรุนแรง คาอิน ผู้เป็น “ชาวนา” ได้สังหารน้องชายของตนเองจากแรงริษยาและการแข่งขันในบริบทของการถวายผลผลิต ความเปรียบเปรยนี้สะท้อนถึงความเปลี่ยนแปลงของตรรกะทางสังคมเมื่อมนุษย์เข้าสู่ยุคเกษตรกรรม

ในยุคก่อนเกษตรกรรม มนุษย์อยู่กันเป็นกลุ่มเล็ก ๆ พึ่งพาทรัพยากรธรรมชาติในพื้นที่กว้าง ไม่มีแรงจูงใจจะใช้ความรุนแรง เพราะไม่มีทรัพย์สินให้แย่งชิง อาหารต้องบริโภคทันที ไม่มีการสะสม ทำให้ไม่มีใครร่ำรวยหรือยากจนอย่างชัดเจน โครงสร้างสังคมจึงเท่าเทียมและร่วมมือกันได้ดี

แต่เมื่อมนุษย์เริ่มเพาะปลูกและเลี้ยงสัตว์ พื้นที่การผลิตอาหารต้องได้รับการดูแลต่อเนื่อง ทำให้ไม่สามารถอพยพหนีภัยได้ง่าย และเมื่อมีผลผลิตมากขึ้น ก็ยิ่งเป็นเป้าหมายของการปล้นสะดม ส่งผลให้กลุ่มนักรบผู้ใช้ความรุนแรงสามารถสะสมทรัพยากรและอำนาจได้มากขึ้น และบางกลุ่มก็พัฒนาเป็นรัฐ ระบบการป้องกันและการเก็บส่วยในรูปแบบของรัฐจึงค่อยๆ ก่อตัวขึ้นจากพันธมิตรระหว่างนักรบกับนักบวช

ทรัพย์สิน ส่วนตัวซึ่งไม่เคยมีความสำคัญในสังคมนักล่าสัตว์ กลายเป็นสิ่งที่จำเป็นในสังคมเกษตรกรรม เพราะไม่มีใครจะเพาะปลูกด้วยแรงงานของตนเองหากรู้ว่าจะถูกปล้นไป ความชัดเจนของกรรมสิทธิ์จึงเป็นสิ่งจำเป็น แต่ขณะเดียวกัน กลไกของความรุนแรงก็ทำให้สิทธิในทรัพย์สินตกอยู่ในความเสี่ยง ระบบของรัฐในยุคแรกจึงเป็นการผูกขาดความรุนแรงในนามของความคุ้มครอง

ในสังคมเกษตรกรรมที่ผลิตภาพต่ำ ผู้คนจำนวนมากต้องพึ่งพารูปแบบการป้องกันทางเศรษฐกิจที่เรียกว่า “หมู่บ้านปิด” ซึ่งความเสี่ยงถูกกระจายระหว่างเจ้าของที่ดินกับชาวนา โดยมีหัวหน้าหมู่บ้านเป็นตัวกลางในความสัมพันธ์ทางเศรษฐกิจ การจ่ายค่าเช่าที่ดินในรูปแบบผลผลิตแทนเงิน ช่วยให้เจ้าของที่ดินและผู้เช่าสามารถรับมือกับภัยพิบัติร่วมกันได้ในปีที่ผลผลิตตกต่ำ

พฤติกรรมหลีกเลี่ยงความเสี่ยงนี้จำกัดการเติบโตและนวัตกรรมในระบบเศรษฐกิจ เนื่องจากโอกาสในการอยู่รอดมีค่าสูงกว่าความหวังต่อความมั่งคั่ง และนำไปสู่การครอบงำของวัฒนธรรมที่กดทับพฤติกรรมแปลกแยก วัฒนธรรมจึงเป็นกลไกปรับตัวที่เหมาะสมกับความแร้นแค้น ไม่ใช่เครื่องมือในการเปิดโอกาส

ในพื้นที่ที่เกษตรกรรมมีผลิตภาพสูง เช่น กรีซโบราณ กรรมสิทธิ์ส่วนตัว การออม และการเลื่อนสถานะทางสังคมก็เริ่มปรากฏ แต่ในพื้นที่ส่วนใหญ่ของโลก ระบบศักดินาครอบงำ เพราะผลิตภาพต่ำและมีความจำเป็นต้องพึ่งพาอำนาจผูกขาดความรุนแรง

บทนี้ยังวิเคราะห์การเปลี่ยนผ่านจากยุคโรมันไปสู่ยุคกลาง โดยเฉพาะ การปฏิวัติศักดินา ราวปี ค.ศ. 1000 การล่มสลายของจักรวรรดิโรมันทำให้รัฐอ่อนแอ และเปิดโอกาสให้ชาวนารายย่อยมีอิสระมากขึ้นในยุคมืด แต่เมื่อประชากรเพิ่มขึ้น ภูมิอากาศแปรปรวน และภัยพิบัติเกิดขึ้นต่อเนื่อง ผลผลิตตกต่ำ ชาวนาไม่สามารถรักษากรรมสิทธิ์ของตนไว้ได้ ต้องมอบที่ดินให้กับผู้มีอำนาจเพื่อแลกกับความคุ้มครอง กระบวนการนี้ค่อย ๆ เปลี่ยนเจ้าของที่ดินรายย่อยให้กลายเป็นไพร่ในระบบศักดินา

กองกำลังติดอาวุธ เช่น อัศวินม้า มีบทบาทสำคัญในการรวมอำนาจ เพราะมีต้นทุนการจัดหาสูงจนชาวนาทั่วไปไม่สามารถแข่งขันได้ โบสถ์จึงเข้ามามีบทบาทในการจำกัดความรุนแรงผ่านขบวนการ สันติภาพของพระเจ้า และยังมีบทบาทในเชิงโครงสร้างอื่น ๆ เช่น การศึกษา การจัดเก็บความรู้ การพัฒนาเกษตรกรรม และการก่อสร้างโครงสร้างพื้นฐาน เช่น ถนน เขื่อน และโรงสี

ตรรกะของความรุนแรงเปลี่ยนไปอย่างสิ้นเชิงในยุคเกษตรกรรม เพราะทรัพย์สินสามารถแย่งชิงได้ มีต้นทุนในการปกป้อง และผลตอบแทนที่คุ้มต่อการลงทุนในอาวุธ ความรุนแรงจึงกลายเป็นสิ่งที่ “คุ้มค่า” ทางเศรษฐศาสตร์เป็นครั้งแรกในประวัติศาสตร์

บทสรุปของบทนี้ชี้ให้เห็นว่า การเปลี่ยนแปลงจากยุคนักล่าสัตว์มาสู่การเกษตรคือจุดเริ่มต้นของระบบอำนาจ และเสรีภาพส่วนบุคคลถูกลดทอนลงเรื่อย ๆ เพื่อตอบสนองต่อความมั่นคงของทรัพย์สิน ในแง่นี้ เรื่องราวของคาอินผู้สังหารน้องชาย ซึ่งเป็นคนเลี้ยงสัตว์ สะท้อนถึงการก้าวเข้าสู่ยุคใหม่ที่การเพาะปลูกไม่เพียงสร้างอารยธรรม แต่ยังเปิดประตูสู่ตรรกะของการใช้ความรุนแรงอย่างเป็นระบบ

สามารถไปติดตามเนื้อหาแบบ short vdo ที่สรุปประเด็นสำคัญจากแต่ละบท พร้อมกราฟิกและคำอธิบายกระชับ เข้าใจง่าย ได้ที่ TikTok ช่อง https://www.tiktok.com/@moneyment1971

-

@ d360efec:14907b5f

2025-05-10 03:57:17

@ d360efec:14907b5f

2025-05-10 03:57:17Disclaimer: * การวิเคราะห์นี้เป็นเพียงแนวทาง ไม่ใช่คำแนะนำในการซื้อขาย * การลงทุนมีความเสี่ยง ผู้ลงทุนควรตัดสินใจด้วยตนเอง

-

@ b8851a06:9b120ba1

2025-05-09 22:54:43

@ b8851a06:9b120ba1

2025-05-09 22:54:43The global financial system is creaking under its own weight. The IMF is urging banks to shore up capital, cut risk, and brace for impact. Basel III is their answer, a last-ditch effort to reinforce a brittle foundation.

But behind the scenes, a quieter revolution is under way.

Bitcoin, the world’s first stateless digital asset, is no longer on the sidelines. It’s entering the Basel conversation: not by invitation, but by inevitability.

Basel III: The System’s Self-Diagnosis

Basel III is more than a technical rulebook. It’s a confession: an admission that the global banking system is vulnerable. Created in the aftermath of 2008, it calls for: • Stronger capital reserves: So banks can survive losses. • Lower leverage: To reduce the domino effect of overexposure. • Liquidity buffers: To weather short-term shocks without collapsing.

But here’s the kicker: these rules are hostile to anything outside the fiat system. Bitcoin gets hit with a punitive 1,250% risk weight. That means for every $1 of exposure, banks must hold $1 in capital. The message from regulators? “You can hold Bitcoin, but you’ll pay for it.”

Yet that fear: based framing misses a bigger truth: Bitcoin doesn’t just survive in this environment. It thrives in it.

Bitcoin: A Parallel System, Built on Hard Rules

Where Basel III imposes “fiat discipline” from the top down, Bitcoin enforces it from the bottom up: with code, math, and transparency.

Bitcoin is not just a hedge. It’s a structural antidote to systemic fragility.

Volatility: A Strategic Asset

Yes, Bitcoin is volatile. But in a system that devalues fiat on a schedule, volatility is simply the cost of freedom. Under Basel III, banks are expected to build capital buffers during economic expansions.

What asset allows you to build those buffers faster than Bitcoin in a bull market?

When the cycle turns, those reserves act as shock absorbers: converting volatility into resilience. It’s anti-fragility in motion.

Liquidity: Real, Deep, and Global

Bitcoin settled over $19 trillion in transactions in 2024. That’s not hypothetical liquidity. it’s real, measurable flow. Unlike traditional high-quality liquid assets (HQLAs), Bitcoin is: • Available 24/7 • Borderless • Not dependent on central banks

By traditional definitions, Bitcoin is rapidly qualifying for HQLA status. Even if regulators aren’t ready to admit it.

Diversification: Breaking the Fiat Dependency

Basel III is designed to pull banks back into the fiat matrix. But Bitcoin offers an escape hatch. Strategic Bitcoin reserves are not about speculation, they’re insurance. For family offices, institutions, and sovereign funds, Bitcoin is the lifeboat when the fiat ship starts taking on water.

Regulatory Realignment: The System Reacts

The Basel Committee’s new rules on crypto exposures went live in January 2025. Around the world, regulators are scrambling to define their stance. Every new restriction placed on Bitcoin only strengthens its legitimacy, as more institutions ask: Why so much resistance, if it’s not a threat?

Bitcoin doesn’t need permission. It’s already being adopted by over 150 public companies, forward-looking states, and a new class of self-sovereign individuals.

Conclusion: The Real Question

This isn’t just about Bitcoin fitting into Basel III.

The real question is: How long can Basel III remain relevant in a world where Bitcoin exists?

Bitcoin is not the risk. It’s the reality check. And it might just be the strongest capital buffer the system has ever seen.

Gradually then suddenly.

-

@ 2b24a1fa:17750f64

2025-05-09 19:50:20

@ 2b24a1fa:17750f64

2025-05-09 19:50:20Wer sein eigenes Geld abheben möchte, macht sich heute – in Spanien - verdächtig. Wer dort eine größere Geldmenge des eigenen Vermögens abzuheben gedenkt, muss das von nun an Tage zuvor anmelden. Diese neue Regelung lässt sich auch nicht dadurch umgehen, dass man mehrere kleine Einzelbeiträge abhebt. Und die, die die neue Regelung missachten, werden empfindlich bestraft. So gerät jeder, der zu häufig Bares abhebt, in das Visier der Behörden.

https://soundcloud.com/radiomuenchen/barzahler-unter-generalverdacht-von-norbert-haring?

Was sich in Spanien an Bankautomaten und -schaltern eingeschlichen hat, könnte sich seinen Weg auch nach Deutschland bahnen. In Frankreich, so zeigt die persönliche Erfahrung, variiert die zu erzielende Geldmenge am Automaten unter noch ungeklärten Bedingungen von Tag zu Tag, von Konto zu Konto. Der Automat gibt vor, ob gerade beispielsweise 60, 200 oder 400 Euro abgehoben werden dürfen.

Hören Sie Norbert Härings Text zum spanischen Szenario der den Titel „Barzahler unter Generalverdacht“ trägt und zunächst auf seinem Blog erschienen war. norberthaering.de/news/spanien-bargeld/

Sprecher: Karsten Troyke

-

@ b99efe77:f3de3616

2025-05-09 19:49:08

@ b99efe77:f3de3616

2025-05-09 19:49:08🚦Traffic Light Control System🚦

This Petri net represents a traffic control protocol ensuring that two traffic lights alternate safely and are never both green at the same time.

petrinet ;start () -> greenLight1 redLight2 ;toRed1 greenLight1 -> queue redLight1 ;toGreen2 redLight2 queue -> greenLight2 ;toGreen1 queue redLight1 -> greenLight1 ;toRed2 greenLight2 -> redLight2 queue ;stop redLight1 queue redLight2 -> () -

@ b99efe77:f3de3616

2025-05-09 19:47:09

@ b99efe77:f3de3616

2025-05-09 19:47:09🚦Traffic Light Control System🚦

This Petri net represents a traffic control protocol ensuring that two traffic lights alternate safely and are never both green at the same time.

petrinet ;start () -> greenLight1 redLight2 ;toRed1 greenLight1 -> queue redLight1 ;toGreen2 redLight2 queue -> greenLight2 ;toGreen1 queue redLight1 -> greenLight1 ;toRed2 greenLight2 -> redLight2 queue ;stop redLight1 queue redLight2 -> () -

@ b99efe77:f3de3616

2025-05-09 19:44:37

@ b99efe77:f3de3616

2025-05-09 19:44:37🚦Traffic Light Control System🚦

This Petri net represents a traffic control protocol ensuring that two traffic lights alternate safely and are never both green at the same time.

petrinet ;start () -> greenLight1 redLight2 ;toRed1 greenLight1 -> queue redLight1 ;toGreen2 redLight2 queue -> greenLight2 ;toGreen1 queue redLight1 -> greenLight1 ;toRed2 greenLight2 -> redLight2 queue ;stop redLight1 queue redLight2 -> () -

@ 2b24a1fa:17750f64

2025-05-09 19:43:28

@ 2b24a1fa:17750f64

2025-05-09 19:43:28 -

@ 2b24a1fa:17750f64

2025-05-09 19:39:46

@ 2b24a1fa:17750f64

2025-05-09 19:39:46"Kleines Erste-Hilfe-Büchlein gegen Propaganda" von 2023. „Normalerweise hört man das Wort „Propaganda“ im Mainstream-Diskurs nur, wenn es um Dinge geht, die andere Länder ihren eigenen Bürgern antun oder Teil ausländischer Beeinflussungsoperationen sind, obwohl in der überwältigenden Mehrheit der Fälle, in denen wir in unserem täglichen Leben Propaganda erlebt haben, der Anruf aus dem eigenen Haus kam.“

https://soundcloud.com/radiomuenchen/helge-buttkereit-medienkritik-als-trotziger-idealismus?

In der Folge dokumentiert sie einige gravierende Beispiele aus den US-Medien. Auch in Deutschland fehlt es den Massenmedien an der nötigen Distanz zur Regierung und ihrem Werte-Narrativ. Was umso gefährlicher ist, da sie über „Definitionsmacht“ verfügen. Auch wenn wir selbst diese Medien nicht konsumieren, so können wir doch sicher sein, dass die große Mehrheit der Bürger sie konsultiert und damit deren Sicht auf die Welt massiv beeinflusst wird. „Wenn wir die Tagesschau einschalten, erfahren wir nichts über die ‘Wirklichkeit’. Wir lernen vielmehr, wer es geschafft hat, seine Sicht auf die Wirklichkeit in die Propaganda-Matrix einzuschreiben“, verrät der Medienwissenschaftler Michael Meyen in seinem Buch "Die Propaganda-Matrix". Nun gilt jedoch die Presse in der öffentlichen Wahrnehmung als „Vierte Gewalt“ der Demokratie. Ihre Aufgabe wäre es demnach, die zunehmend verflochtenen Staatsgewalten Legislative, Exekutive und Judikative zu kontrollieren. Die Realität sieht anders aus. Dabei übersieht selbst die immer häufiger auftretende Medienkritik, dass die „Vierte Gewalt“ von den Herrschenden nie in dieser Funktion gedacht war – schließlich waren und sind die Medien seit je her in den Händen von Regierungen und Konzernen, schreibt unser Autor Helge Buttkereit. Hören Sie seinen zweiteiligen Beitrag „Medienkritik als trotziger Idealismus“, der zunächst beim Magazin Multipolar erschienen war: multipolar-magazin.de/artikel/medien…tik-idealismus

Sprecher: Karsten Troyke

Bild-Collage: Radio München

-

@ 99e7936f:d5d2197c

2025-05-11 18:40:50

@ 99e7936f:d5d2197c

2025-05-11 18:40:50Wir sprechen kein Wort mehr miteinander, weil es weh tut

Viele Menschen haben in den letzten Jahren den Kontakt zu wichtigen Bezugspersonen verloren. Viele Menschen haben auch neue Leute auf der Straße oder durch Netzwerke kennen gelernt. Und manche Menschen hatten das Glück, schon vor der inszenierten Krise einen unterstützenden und stabilen Freundeskreis zu haben und haben diesen immer noch. Manchmal kommen alte Leute wieder zurück ins Leben, weil sie merken, dass man es gut mit ihnen meinte, als man vor den unglaublichen Lügen der Amtsträger warnte. Manchmal kommen alte Leute auch nicht mehr zurück, weil die Scham, auf falsche Versprechen herein gefallen zu sein, zu groß ist. Man gibt sich dann nach außen unverändert souverän und zieht es vor, still und heimlich zu leiden. Die neuen Kontakte bestehen manchmal leider auch nur temporär, sind zweckgebunden. Kaum ist die gemeinsame Aufgabe vollbracht, trennen sich die Wege wieder.

All das muss man in diesen Tagen gehäuft aushalten. Alles verändert sich in stärkerem Maße als sonst. Viele dieser Veränderungen tun weh. Man kann sich auf Trauma nicht vorbereiten. Nie.

Ich möchte jetzt keine schlichten Alltagsbeobachtungen darüber widergeben, wie ich selbst oder Menschen in meinem Umfeld in den letzten Jahren ihre Beziehungen erlebt haben. Vielmehr geht es mir auch in diesem Artikel wieder um das Thema Trauma und um die Folgen, die jedes einzelne Trauma auch gesamtgesellschaftlich betrachtet hat. Was passiert, wenn man eine bereits durch Kriege traumatisierte Gesellschaft noch zusätzlich jahrelang unter Druck setzt, so wie dies in den letzten fünf Jahren geschehen ist? Wieviel Trauma verträgt eine Gesellschaft? Wie verändern sich Beziehungen in einer Gesellschaft, die immer wieder erneut traumatisiert wird? Ist irgendwann das Maß des Erträglichen voll? Und wenn ja, wie äußert sich solch eine Kumulation von Traumafolgen?

Meines Erachtens sehen wir gerade genau die Ergebnisse solch einer Kumulation von Traumafolgen in unserer deutschen Gesellschaft, vielleicht sogar global: Menschen reden nicht mehr (vertieft) miteinander. Und dies ist nur eine von vielen Traumafolgen.

Ich freue mich über jeden Leser, der jetzt noch weiterliest.

Durch genügend Traumatisierung kann man Menschen offensichtlich zeitweise dazu bringen, dass sie nicht mehr (vertieft) miteinander reden, weil das Reden weh tut.

Traumatisierung ist daher eine effektive Strategie der vermeintlich Herrschenden, Menschen zu separieren.

Traumatisierung setzt tiefe Verletzungen und macht Menschen vorübergehend sprachlos. Es fehlen einem die Worte. Man möchte dann nicht reden. Aber man verschließt sich auch vor den Worten anderer, weil man keine weitere Verletzung mehr erträgt.

Menschen im Alltag erachten es vielleicht mittlerweile schon als normal, wenn Beziehungen nicht gut laufen, egal, um welche Art von Beziehung es sich handelt. Sobald Probleme auftauchen, wird erst kurz gestritten, dann geschwiegen und wenn man das Schweigen nicht mehr aushält, dann gibt es entweder noch einen Versuch oder man geht gleich auf Distanz und bricht den Kontakt ganz ab. Auch meine Zündschnur ist manchmal immer noch gefühlt zu kurz. Wenn man sich Distanz nicht erlauben kann, dann frisst man das Problem in sich hinein, spült es runter, kompensiert irgendwie, wartet darauf, dass sich von allein etwas ändert oder dass sich eine bessere Gelegenheit bietet, bei der man dann die Biege machen kann. Mehrere Eisen im Feuer zu haben, beruflich wie privat, gilt als clever. Probleme nicht anzusprechen, gilt als kompetent. Das Wort Teamfähigkeit ist im Berufsleben zu einem Kampfbegriff geworden. Wer im Arbeitskontext Probleme anspricht, ist offensichtlich nicht teamfähig. Die Frage „Sind Sie teamfähig?“, erzählt meines Erachtens mehr über den Chef als über den Mitarbeiter. Die passendere Frage wäre wohl „Können Sie sich wortlos an schlechte Zustände dauerhaft adaptieren?“ In privaten Beziehungen braucht man, wenn es nicht so gut läuft, einen stilvollen Urlaub oder eine neue Wohnzimmereinrichtung, um endlich mal wieder schöne Gefühle erleben zu können. Negative Gefühle sind scheinbar das Kind, das keiner haben wollte, weshalb es die schönsten Kleider bekommt. Auch ich kenne Ablenkung von negativen Gefühlen durch Konsum und Essen. Es lohnt sich, mal den Werbeslogans von Möbelhäusern, Ferienanbietern oder Lebensmittelhändlern bewusst zuzuhören. Die Werbung kennt unsere Sehnsüchte und damit auch unsere negativen Gefühle besser als wir selbst. Und für alle, die nicht konsumieren wollen, die nicht locker lassen und steif darauf beharren, dass es aber ein Problem in der Beziehung oder am Arbeitsplatz oder zumindest eine gewisse Unzufriedenheit gäbe, für diese Menschen gibt es garantiert ein passendes Coaching- oder Weiterbildungsprogramm mit Namen wie „In 12 Modulen zur Selbstentfaltung“, welches nur deshalb meist nicht funktioniert, weil man es angeblich nicht richtig durchgeführt hat oder vorab noch das Basismodul absolvieren muss. Bildung ist mittlerweile auch ein Markt, der Konsumgüter in Form von Coachings und Seminaren anbietet.

Auch ich bin übrigens lange zusammen gezuckt bei der Frage „Sind sie teamfähig?“ oder der Feststellung „Du bist das Problem, weil Du immer alles so genau nimmst, nicht die Fünf gerade sein lassen kannst.“ Am Ende ist man immer der Dumme, wenn man ein negatives Gefühl hat und darüber sprechen möchte. Trauma löst Scham UND Wut in einer Person aus. Scham zieht Abwertung an wie Licht die Motten anzieht. Und irgendwann platzt einem der Kragen. Man teilt selber aus. Und dann schämt man sich erneut, nicht nur für das früher oder später erlittene Trauma im Leben, sofern einem das bewusst ist, sondern auch für die unbeherrschte Reaktion, die man oft selbst nicht richtig versteht. Nicht bearbeitetes Trauma arbeitet unbewusst in uns.

Eine traumatisierte Gesellschaft wertet sich ständig gegenseitig ab und hält genau damit die Wunden offen.

Dann ist es vielleicht doch besser, das Problem in der Beziehung oder am Arbeitsplatz runter zu schlucken, auf Distanz zum anderen zu gehen, sich schon mal nach einer neuen Wohnzimmereinrichtung, einem neuen Partner oder einem neuen Job umzuschauen? Ich denke nicht, dass das eine Lösung ist.

Hinschauen und Gefühle bei sich und anderen zulassen, ist ein guter Anfang.

Wir gehen oft Beziehungen ein, gehen aber gleichzeitig einer echten tiefen und anhaltenden Verbindungen privat wie beruflich instinktiv aus dem Weg, weil echte tiefe Gespräche, zu denen es in solchen Verbindungen kommen kann, weh tun können, insbesondere wenn man noch unverarbeitetes Trauma mit sich herum schleppt. Und in einer traumatisierten Gesellschaft, tragen halt viele Menschen solche traumatisierten und nicht bearbeiteten Anteile mit sich herum.

Wir sind die Kinder und Kindeskinder der Menschen, die den zweiten Weltkrieg hautnah miterlebt haben. Alles, was die Eltern und Großeltern nicht besprochen, nicht verarbeitet haben, tragen wir weiter mit uns herum. Das ist den meisten Menschen, meines Erachtens, nicht bewusst. Mag sein, dass an dieser Stelle der eine oder andere widerspricht. Widersprechen Sie mir gerne. Meine Alltagserfahrung ist eine andere. Die Art, wie wir Beziehungen gestalten, spricht Bände. Aber, wenn man es nicht anders kennt und keine Kontrollgruppe hat, sagt man sich halt: „So isses. Und so isses normal. Ich kenne es nicht anders. Das machen doch alle so.“