-

@ b99efe77:f3de3616

2025-05-18 02:45:24

@ b99efe77:f3de3616

2025-05-18 02:45:24🚦Traffic Light Control System🚦

This Petri net represents a traffic control protocol ensuring that two traffic lights alternate safely and are never both green at the same time.

petrinet ;start () -> greenLight1 redLight2 ;toRed1 greenLight1 -> queue redLight1 ;toGreen2 redLight2 queue -> greenLight2 ;toGreen1 queue redLight1 -> greenLight1 ;toRed2 greenLight2 -> redLight2 queue ;stop redLight1 queue redLight2 -> () -

@ b99efe77:f3de3616

2025-05-18 02:43:14

@ b99efe77:f3de3616

2025-05-18 02:43:14🚦Traffic Light Control System🚦

This Petri net represents a traffic control protocol ensuring that two traffic lights alternate safely and are never both green at the same time.

petrinet ;start () -> greenLight1 redLight2 ;toRed1 greenLight1 -> queue redLight1 ;toGreen2 redLight2 queue -> greenLight2 ;toGreen1 queue redLight1 -> greenLight1 ;toRed2 greenLight2 -> redLight2 queue ;stop redLight1 queue redLight2 -> () -

@ b99efe77:f3de3616

2025-05-18 02:42:46

@ b99efe77:f3de3616

2025-05-18 02:42:46🚦Traffic Light Control System🚦

This Petri net represents a traffic control protocol ensuring that two traffic lights alternate safely and are never both green at the same time.

petrinet ;start () -> greenLight1 redLight2 ;toRed1 greenLight1 -> queue redLight1 ;toGreen2 redLight2 queue -> greenLight2 ;toGreen1 queue redLight1 -> greenLight1 ;toRed2 greenLight2 -> redLight2 queue ;stop redLight1 queue redLight2 -> () -

@ b99efe77:f3de3616

2025-05-18 02:42:12

@ b99efe77:f3de3616

2025-05-18 02:42:12🚦Traffic Light Control System🚦

This Petri net represents a traffic control protocol ensuring that two traffic lights alternate safely and are never both green at the same time.

petrinet ;start () -> greenLight1 redLight2 ;toRed1 greenLight1 -> queue redLight1 ;toGreen2 redLight2 queue -> greenLight2 ;toGreen1 queue redLight1 -> greenLight1 ;toRed2 greenLight2 -> redLight2 queue ;stop redLight1 queue redLight2 -> () -

@ b99efe77:f3de3616

2025-05-18 02:41:20

@ b99efe77:f3de3616

2025-05-18 02:41:20🚦Traffic Light Control System🚦

This Petri net represents a traffic control protocol ensuring that two traffic lights alternate safely and are never both green at the same time.

petrinet ;start () -> greenLight1 redLight2 ;toRed1 greenLight1 -> queue redLight1 ;toGreen2 redLight2 queue -> greenLight2 ;toGreen1 queue redLight1 -> greenLight1 ;toRed2 greenLight2 -> redLight2 queue ;stop redLight1 queue redLight2 -> () -

@ b99efe77:f3de3616

2025-05-18 02:40:36

@ b99efe77:f3de3616

2025-05-18 02:40:36🚦Traffic Light Control System🚦

This Petri net represents a traffic control protocol ensuring that two traffic lights alternate safely and are never both green at the same time.

petrinet ;start () -> greenLight1 redLight2 ;toRed1 greenLight1 -> queue redLight1 ;toGreen2 redLight2 queue -> greenLight2 ;toGreen1 queue redLight1 -> greenLight1 ;toRed2 greenLight2 -> redLight2 queue ;stop redLight1 queue redLight2 -> () -

@ 34f1ddab:2ca0cf7c

2025-05-16 22:47:03

@ 34f1ddab:2ca0cf7c

2025-05-16 22:47:03Losing access to your cryptocurrency can feel like losing a part of your future. Whether it’s due to a forgotten password, a damaged seed backup, or a simple mistake in a transfer, the stress can be overwhelming. Fortunately, cryptrecver.com is here to assist! With our expert-led recovery services, you can safely and swiftly reclaim your lost Bitcoin and other cryptocurrencies.

Why Trust Crypt Recver? 🤝 🛠️ Expert Recovery Solutions At Crypt Recver, we specialize in addressing complex wallet-related issues. Our skilled engineers have the tools and expertise to handle:

Partially lost or forgotten seed phrases Extracting funds from outdated or invalid wallet addresses Recovering data from damaged hardware wallets Restoring coins from old or unsupported wallet formats You’re not just getting a service; you’re gaining a partner in your cryptocurrency journey.

🚀 Fast and Efficient Recovery We understand that time is crucial in crypto recovery. Our optimized systems enable you to regain access to your funds quickly, focusing on speed without compromising security. With a success rate of over 90%, you can rely on us to act swiftly on your behalf.

🔒 Privacy is Our Priority Your confidentiality is essential. Every recovery session is conducted with the utmost care, ensuring all processes are encrypted and confidential. You can rest assured that your sensitive information remains private.

💻 Advanced Technology Our proprietary tools and brute-force optimization techniques maximize recovery efficiency. Regardless of how challenging your case may be, our technology is designed to give you the best chance at retrieving your crypto.

Our Recovery Services Include: 📈 Bitcoin Recovery: Lost access to your Bitcoin wallet? We help recover lost wallets, private keys, and passphrases. Transaction Recovery: Mistakes happen — whether it’s an incorrect wallet address or a lost password, let us manage the recovery. Cold Wallet Restoration: If your cold wallet is failing, we can safely extract your assets and migrate them into a secure new wallet. Private Key Generation: Lost your private key? Our experts can help you regain control using advanced methods while ensuring your privacy. ⚠️ What We Don’t Do While we can handle many scenarios, some limitations exist. For instance, we cannot recover funds stored in custodial wallets or cases where there is a complete loss of four or more seed words without partial information available. We are transparent about what’s possible, so you know what to expect

Don’t Let Lost Crypto Hold You Back! Did you know that between 3 to 3.4 million BTC — nearly 20% of the total supply — are estimated to be permanently lost? Don’t become part of that statistic! Whether it’s due to a forgotten password, sending funds to the wrong address, or damaged drives, we can help you navigate these challenges

🛡️ Real-Time Dust Attack Protection Our services extend beyond recovery. We offer dust attack protection, keeping your activity anonymous and your funds secure, shielding your identity from unwanted tracking, ransomware, and phishing attempts.

🎉 Start Your Recovery Journey Today! Ready to reclaim your lost crypto? Don’t wait until it’s too late! 👉 cryptrecver.com

📞 Need Immediate Assistance? Connect with Us! For real-time support or questions, reach out to our dedicated team on: ✉️ Telegram: t.me/crypptrcver 💬 WhatsApp: +1(941)317–1821

Crypt Recver is your trusted partner in cryptocurrency recovery. Let us turn your challenges into victories. Don’t hesitate — your crypto future starts now! 🚀✨

Act fast and secure your digital assets with cryptrecver.com.Losing access to your cryptocurrency can feel like losing a part of your future. Whether it’s due to a forgotten password, a damaged seed backup, or a simple mistake in a transfer, the stress can be overwhelming. Fortunately, cryptrecver.com is here to assist! With our expert-led recovery services, you can safely and swiftly reclaim your lost Bitcoin and other cryptocurrencies.

# Why Trust Crypt Recver? 🤝

# Why Trust Crypt Recver? 🤝🛠️ Expert Recovery Solutions\ At Crypt Recver, we specialize in addressing complex wallet-related issues. Our skilled engineers have the tools and expertise to handle:

- Partially lost or forgotten seed phrases

- Extracting funds from outdated or invalid wallet addresses

- Recovering data from damaged hardware wallets

- Restoring coins from old or unsupported wallet formats

You’re not just getting a service; you’re gaining a partner in your cryptocurrency journey.

🚀 Fast and Efficient Recovery\ We understand that time is crucial in crypto recovery. Our optimized systems enable you to regain access to your funds quickly, focusing on speed without compromising security. With a success rate of over 90%, you can rely on us to act swiftly on your behalf.

🔒 Privacy is Our Priority\ Your confidentiality is essential. Every recovery session is conducted with the utmost care, ensuring all processes are encrypted and confidential. You can rest assured that your sensitive information remains private.

💻 Advanced Technology\ Our proprietary tools and brute-force optimization techniques maximize recovery efficiency. Regardless of how challenging your case may be, our technology is designed to give you the best chance at retrieving your crypto.

Our Recovery Services Include: 📈

- Bitcoin Recovery: Lost access to your Bitcoin wallet? We help recover lost wallets, private keys, and passphrases.

- Transaction Recovery: Mistakes happen — whether it’s an incorrect wallet address or a lost password, let us manage the recovery.

- Cold Wallet Restoration: If your cold wallet is failing, we can safely extract your assets and migrate them into a secure new wallet.

- Private Key Generation: Lost your private key? Our experts can help you regain control using advanced methods while ensuring your privacy.

⚠️ What We Don’t Do\ While we can handle many scenarios, some limitations exist. For instance, we cannot recover funds stored in custodial wallets or cases where there is a complete loss of four or more seed words without partial information available. We are transparent about what’s possible, so you know what to expect

# Don’t Let Lost Crypto Hold You Back!

# Don’t Let Lost Crypto Hold You Back!Did you know that between 3 to 3.4 million BTC — nearly 20% of the total supply — are estimated to be permanently lost? Don’t become part of that statistic! Whether it’s due to a forgotten password, sending funds to the wrong address, or damaged drives, we can help you navigate these challenges

🛡️ Real-Time Dust Attack Protection\ Our services extend beyond recovery. We offer dust attack protection, keeping your activity anonymous and your funds secure, shielding your identity from unwanted tracking, ransomware, and phishing attempts.

🎉 Start Your Recovery Journey Today!\ Ready to reclaim your lost crypto? Don’t wait until it’s too late!\ 👉 cryptrecver.com

📞 Need Immediate Assistance? Connect with Us!\ For real-time support or questions, reach out to our dedicated team on:\ ✉️ Telegram: t.me/crypptrcver\ 💬 WhatsApp: +1(941)317–1821

Crypt Recver is your trusted partner in cryptocurrency recovery. Let us turn your challenges into victories. Don’t hesitate — your crypto future starts now! 🚀✨

Act fast and secure your digital assets with cryptrecver.com.

-

@ b99efe77:f3de3616

2025-05-18 02:36:11

@ b99efe77:f3de3616

2025-05-18 02:36:11🚦Traffic Light Control System🚦1111111112

This Petri net represents a traffic control protocol ensuring that two traffic lights alternate safely and are never both green at the same time.

petrinet ;start () -> greenLight1 redLight2 ;toRed1 greenLight1 -> queue redLight1 ;toGreen2 redLight2 queue -> greenLight2 ;toGreen1 queue redLight1 -> greenLight1 ;toRed2 greenLight2 -> redLight2 queue ;stop redLight1 queue redLight2 -> () -

@ b83a28b7:35919450

2025-05-16 19:23:58

@ b83a28b7:35919450

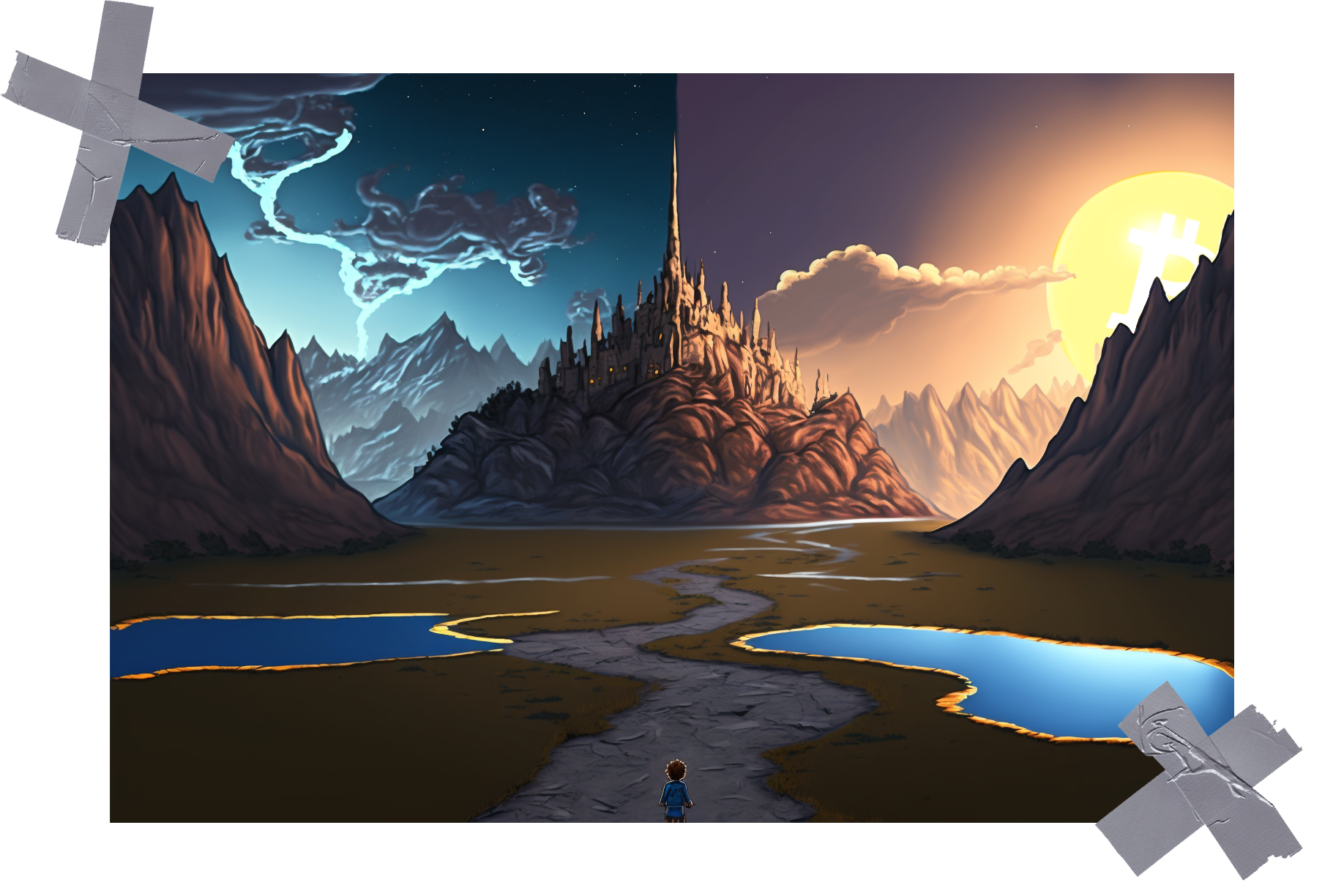

2025-05-16 19:23:58This article was originally part of the sermon of Plebchain Radio Episode 110 (May 2, 2025) that nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqyg8wumn8ghj7mn0wd68ytnvv9hxgqpqtvqc82mv8cezhax5r34n4muc2c4pgjz8kaye2smj032nngg52clq7fgefr and I did with nostr:nprofile1qythwumn8ghj7ct5d3shxtnwdaehgu3wd3skuep0qyt8wumn8ghj7ct4w35zumn0wd68yvfwvdhk6tcqyzx4h2fv3n9r6hrnjtcrjw43t0g0cmmrgvjmg525rc8hexkxc0kd2rhtk62 and nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqyg8wumn8ghj7mn0wd68ytnvv9hxgqpq4wxtsrj7g2jugh70pfkzjln43vgn4p7655pgky9j9w9d75u465pqahkzd0 of the nostr:nprofile1qythwumn8ghj7ct5d3shxtnwdaehgu3wd3skuep0qyt8wumn8ghj7etyv4hzumn0wd68ytnvv9hxgtcqyqwfvwrccp4j2xsuuvkwg0y6a20637t6f4cc5zzjkx030dkztt7t5hydajn

Listen to the full episode here:

<https://fountain.fm/episode/Ln9Ej0zCZ5dEwfo8w2Ho>

Bitcoin has always been a narrative revolution disguised as code. White paper, cypherpunk lore, pizza‑day legends - every block is a paragraph in the world’s most relentless epic. But code alone rarely converts the skeptic; it’s the camp‑fire myth that slips past the prefrontal cortex and shakes hands with the limbic system. People don’t adopt protocols first - they fall in love with protagonists.

Early adopters heard the white‑paper hymn, but most folks need characters first: a pizza‑day dreamer; a mother in a small country, crushed by the cost of remittance; a Warsaw street vendor swapping złoty for sats. When their arcs land, the brain releases a neurochemical OP_RETURN which says, “I belong in this plot.” That’s the sly roundabout orange pill: conviction smuggled inside catharsis.

That’s why, from 22–25 May in Warsaw’s Kinoteka, the Bitcoin Film Fest is loading its reels with rebellion. Each documentary, drama, and animated rabbit‑hole is a stealth wallet, zipping conviction straight into the feels of anyone still clasped within the cold claw of fiat. You come for the plot, you leave checking block heights.

Here's the clip of the sermon from the episode:

nostr:nevent1qvzqqqqqqypzpwp69zm7fewjp0vkp306adnzt7249ytxhz7mq3w5yc629u6er9zsqqsy43fwz8es2wnn65rh0udc05tumdnx5xagvzd88ptncspmesdqhygcrvpf2

-

@ b99efe77:f3de3616

2025-05-18 02:35:54

@ b99efe77:f3de3616

2025-05-18 02:35:54🚦Traffic Light Control System🚦111111

This Petri net represents a traffic control protocol ensuring that two traffic lights alternate safely and are never both green at the same time.

petrinet ;start () -> greenLight1 redLight2 ;toRed1 greenLight1 -> queue redLight1 ;toGreen2 redLight2 queue -> greenLight2 ;toGreen1 queue redLight1 -> greenLight1 ;toRed2 greenLight2 -> redLight2 queue ;stop redLight1 queue redLight2 -> () -

@ 0000065e:9b5b4c75

2025-05-17 21:19:58

@ 0000065e:9b5b4c75

2025-05-17 21:19:58En mayo de 2024, el Juzgado de lo Mercantil nº 2 de Bilbao dictó sentencia por la que se declaraba la nulidad de la marca 4.046.141 que reproducía el logotipo diseñado y publicado por el usuario anónimo “bitboy” en el foro bitcointalk.org y con el que popularmente se identifica Bitcoin.

El titular de la marca recurrió la sentencia y ahora la Audiencia Provincial de Vizcaya confirma íntegramente la resolución del Juzgado y, por tanto, la nulidad de la marca, considerando que la marca se registró de mala fe y que infringía los derechos de propiedad intelectual sobre el diseño registrado como marca.

En cuanto a la mala fe, la Audiencia Provincial destaca que la marca registrada estaba basada “en un diseño preexistente de la comunidad de internet”, como acredita la prueba documental obrante en autos y particularmente el informe pericial presentado donde se indica que “término "Bitcoin" identifica la tecnología que permite el almacenamiento y transmisión de valor, puesta en conocimiento público por "Satoshi Nakamoto" en el "White paper" del 31 de octubre de 2008. El dominio bitcoin.org se registró en agosto de 2008 de manera anónima”. A lo que añadir que tanto el logotipo como su combinación con el término "bitcoin" fueron creados por un usuario del foro Bitcointalk.org el 1 de noviembre de 2010. Y que los derechos sobre estas imágenes fueron cedidos a la comunidad bajo una licencia Creative Commons de dominio público.”

Concluye así la sentencia con que “a fecha del registro del signo distintivo por el demandante, "bitcoin" ya era conocido y el demandante registró una obra ajena, protegida por la normativa de propiedad intelectual y que forma parte del dominio público.”

La Audiencia considera que “como se ha acreditado, quien creó el logotipo lo cedió a la comunidad para un uso libre y sin restricción, prohibiendo expresamente que cualquiera se apropiara del logotipo para fines comerciales. Por ello, el reproche a la parte apelante es de mala fe ya que ha actuado con abuso de confianza al registrar el logotipo para sus fines comerciales, aprovechándose de la reputación ganada por el creador del logotipo. El apelante no es el creador del logotipo ni se le autorizó su uso y actúa en contra de las prácticas leales en el mercado."

En cuanto a la infracción de los derechos de propiedad intelectual, la Audiencia señala que “la sentencia de instancia acertadamente, considera que el logotipo registrado como marca es una creación ajena al apelante y que está protegida por la Ley de Propiedad Intelectual, y que su registro incurre en la causa de nulidad del artículo 52 en relación con el 9.1.c) de la Ley de Marcas… El juzgador de lo mercantil efectúa un análisis probatorio acorde con la prueba obrante en las actuaciones y conforme a la normativa, con cita de la relevante sentencia de la AP de Madrid ( SAP de Madrid, secc. 28.a, de 1 de septiembre de 2022) en relación con el “creative commons” y hemos de concluir como se hace en la instancia “ el derecho de autor nace de la creación, no de un registro, llevado a cabo”.

El equipo jurídico de Bit2Me, liderado y coordinado por Javier Maestre, con el apoyo del área de compliance y legal de la compañía y el despacho de abogados DataBitLaw, ha llevado el caso en representación de Bit2Me, para obtener una resolución judicial que contribuye a la protección de los signos distintivos que identifican a Bitcoin, a fin de que nadie pueda hacer un uso exclusivo de los mismos, como defiende la iniciativa de bitboydefense.

-

@ 04c915da:3dfbecc9

2025-05-16 18:06:46

@ 04c915da:3dfbecc9

2025-05-16 18:06:46Bitcoin has always been rooted in freedom and resistance to authority. I get that many of you are conflicted about the US Government stacking but by design we cannot stop anyone from using bitcoin. Many have asked me for my thoughts on the matter, so let’s rip it.

Concern

One of the most glaring issues with the strategic bitcoin reserve is its foundation, built on stolen bitcoin. For those of us who value private property this is an obvious betrayal of our core principles. Rather than proof of work, the bitcoin that seeds this reserve has been taken by force. The US Government should return the bitcoin stolen from Bitfinex and the Silk Road.

Using stolen bitcoin for the reserve creates a perverse incentive. If governments see bitcoin as a valuable asset, they will ramp up efforts to confiscate more bitcoin. The precedent is a major concern, and I stand strongly against it, but it should be also noted that governments were already seizing coin before the reserve so this is not really a change in policy.

Ideally all seized bitcoin should be burned, by law. This would align incentives properly and make it less likely for the government to actively increase coin seizures. Due to the truly scarce properties of bitcoin, all burned bitcoin helps existing holders through increased purchasing power regardless. This change would be unlikely but those of us in policy circles should push for it regardless. It would be best case scenario for American bitcoiners and would create a strong foundation for the next century of American leadership.

Optimism

The entire point of bitcoin is that we can spend or save it without permission. That said, it is a massive benefit to not have one of the strongest governments in human history actively trying to ruin our lives.

Since the beginning, bitcoiners have faced horrible regulatory trends. KYC, surveillance, and legal cases have made using bitcoin and building bitcoin businesses incredibly difficult. It is incredibly important to note that over the past year that trend has reversed for the first time in a decade. A strategic bitcoin reserve is a key driver of this shift. By holding bitcoin, the strongest government in the world has signaled that it is not just a fringe technology but rather truly valuable, legitimate, and worth stacking.

This alignment of incentives changes everything. The US Government stacking proves bitcoin’s worth. The resulting purchasing power appreciation helps all of us who are holding coin and as bitcoin succeeds our government receives direct benefit. A beautiful positive feedback loop.

Realism

We are trending in the right direction. A strategic bitcoin reserve is a sign that the state sees bitcoin as an asset worth embracing rather than destroying. That said, there is a lot of work left to be done. We cannot be lulled into complacency, the time to push forward is now, and we cannot take our foot off the gas. We have a seat at the table for the first time ever. Let's make it worth it.

We must protect the right to free usage of bitcoin and other digital technologies. Freedom in the digital age must be taken and defended, through both technical and political avenues. Multiple privacy focused developers are facing long jail sentences for building tools that protect our freedom. These cases are not just legal battles. They are attacks on the soul of bitcoin. We need to rally behind them, fight for their freedom, and ensure the ethos of bitcoin survives this new era of government interest. The strategic reserve is a step in the right direction, but it is up to us to hold the line and shape the future.

-

@ 005bc4de:ef11e1a2

2025-05-17 13:40:23

@ 005bc4de:ef11e1a2

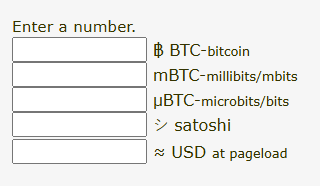

2025-05-17 13:40:23Bitcoin, sats, bits, numbers, and perceptions

Quick background

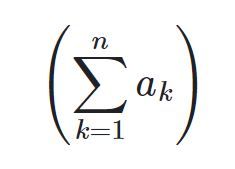

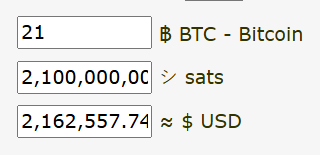

In December 2024 John Carvalho proposed BIP 21Q titled "Redefinition of the Bitcoin Unit to the Base Denomination." His point: the word "bitcoin" should not refer to the 21 million bitcoins we hear about, but to what we currently call "sats", the "base" unit of bitcoin. There are 2.1 quadrillion sats. So, instead of saying there are 21 million bitcoin, BIP 21Q suggests saying there are 2.1 quadrillion.

There'd be absolutely zero change to Bitcoin, the protocol, with this BIP (unlike the OP_CAT or more current OP_RETURN debates). This is just a movement to get people to change the way they talk about and refer to "bitcoin." BIP 21Q is just a rewording, a rephrasing, a rebranding, a rethinking.

Since

Since then, there has been discussion. I'll admit it's interesting to talk about, but I've never thought much of it. My take has been, and frankly still is: this too will pass. I hadn't heard or thought of this in a couple of months. Until...

In the past couple of days though, like a campfire that has been slowly dying down, a sudden rush of wind has fanned the embers and the flames have sparked upward. As best I can tell, that wind came out of the mouth (or typing) of Jack Dorsey (Twitter founder, Square/Block CEO, billionaire, you know Jack) when he put this note out.

Watch the vid on YouTube.

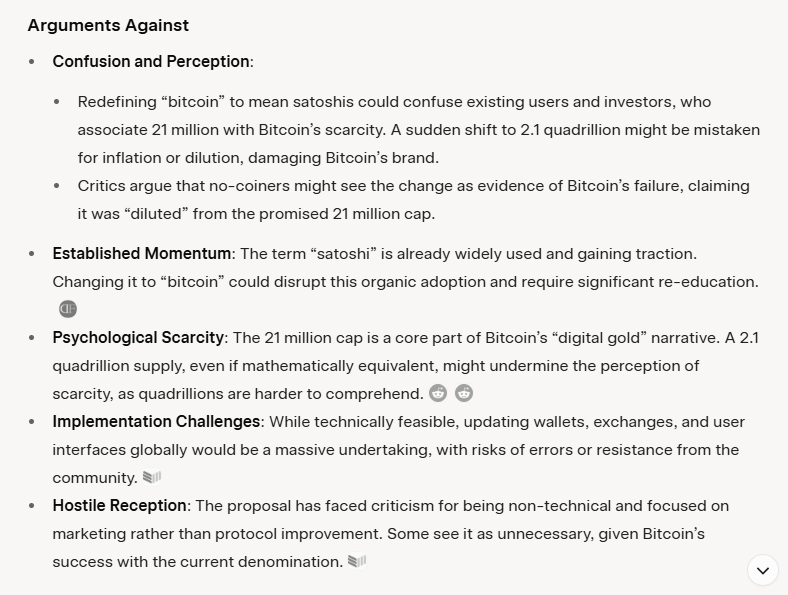

The video makes some good points, both against and in favor of BIP 21Q. Quickly, Grok summarized the arguments for and against, below:

Today, I even read chatter about a middle ground compromise to use "bits" as the base unit. In other words, don't use "sats" but use "bits." I guess the idea is that a bitcoin can stay one of 21 million, but "bits," which sounds like little bitcoins, can be the 2.1 quadrillion. "Oh brother," I thought, even more confusion. We've been through this back in the 20-teens with bits, ubits, and mbits. This was a main reason I made the Satoshi Bitcoin Converter because it was confusing! I'm happy we were past all this, but then...it's back!

Just for kicks, you can fool around with the old SBC version 7 and find out how confusing it is.

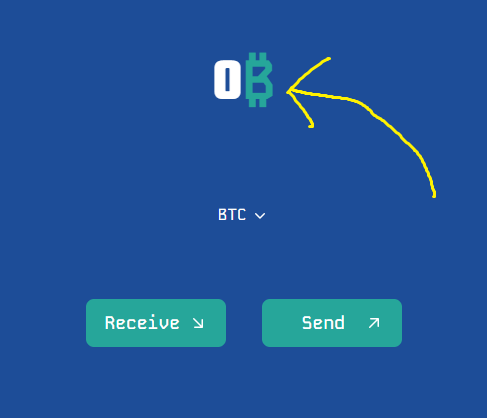

One of the arguments in the video is that the BoardwalkCash.com folks have adopted "bitcoin" as their base unit. Boardwalk Cash is a cashu/ecash (and Lightning) web app with the intention of making spending and receiving small, coffee-sized payments easy.

Notice the bitcoin B after the zero, not "sats" or a satoshi symbol, like the one I proposed: シ 😃

Below, I sent 21 sats (bitcoins?) from a different ecash/cashu wallet. And, boom, there they appear in Boardwalk Cash. Notice how it appears as 21₿, as 21 bitcoin. Then, when I click it, it shows $0.02 USD, two pennies.

I didn't actually send 21 what-we-think-of-today bitcoins, worth $2.16 million. I sent two US pennies worth.

By the way, if you've never messed around with ecash/cashu and wish to try it out, get a wallet and I'll send you a few sats (bitcoins?) as ecash to see how easy it is. These images are from Boardwalkcash.com which is very clean, however I use Cashu.me.

And so...

And so, this is the main argument against, in my view: possible confusion. The other issue would be the changeover by things like exchanges or maybe even smart contracts that bridge BTC to other chains. Having worked on my little converter app, I know that it can be easy to make a decimal mistake in the code and throw everything off. I'm certain that, should we move to 2.1 quadrillion bitcoins, somebody will foul up an interface or back end which might cause a big problem, maybe some big losses.

Two things here:

On the more technical side, the changing of names and code on exchanges or smart contracts, it would almost be better if there was a hard-and-fast, set changeover date, like there was with Y2K. There is a clear before-and-after, B.C. and A.D. date. Call it, "BQ" and "AQ", before and after quadrillion. 😂 If there was a date/time where everything was 21M "bitcoin" to 2.1Q "bitcoin", that would force the issue.

However, there is not such a date or time, nor will there be...recall that bitcoin is decentralized, no CEO here. If this 2.1Q change actually happens, the reality is that it will be a rolling, gradual, thing. It will be case by case, app by app, exchange by exchange. And some won't make the change at all. This lends back to the confusion situation.

Secondly, on the human perception side, this actually concerns me less. We can change human perception. It takes some time, but human perception and thinking is very plastic and can definitely be molded. Heaven knows the examples of how this has been used the wrong way in history, umm, anything like this go on in World War II?

Quick case studies of changing perception:

Standard Oil (John D. Rockefeller's company) was essentially a monopoly and was broken up by the U.S., remember that from history class? They had a multitude of sub-brands, one of which was "Esso", get it?, S.O., Standard Oil? They wanted to move away from ties to Standard Oil, at least perception-wise, and wanted to consolidate all their sub-brands. They moved to "Exxon" with a marketing campaign. The marketing types were brilliant. They understood that there is a time thing involved. Unlike the Y2K hard date above, they knew that human perception, as malleable as it is, changes over time. Rather than fight this, they used this to their advantage.

As I understand, one of their techniques was to use the visual. The Esso sign was shown in places with the Esso logo up high and prominent. But, down below, was the never-before-seen Exxon sign. It was just there, doing nothing. Doing nothing except implanting itself into the subconscious of the viewers. Then, the Exxon sign, in later ads, appeared higher. The Esso sign lowered and was less prominent. Hmm? What's going on? Does anyone even notice? Hmm? Then, in the coup, the tiger mascot literally lowered the Esso sign down and raised the Exxon sign up.

In the final coup d'état, the Esso sign simply disappeared. And, make no mistake, this is the coup de grâce...the word Esso just disappeared. It was no longer seen at all. Then, it was forgotten and it was gone. Now, there is Exxon.

More recently, we all know that Twitter rebranded to X. It seemed so dumb, definitely awkward, I'm still not entirely used to it, people still write, "...so-and-so posted on X, formerly Twitter,..." (as if no one knows that X is formerly Twitter), I still say people "tweet" on X, but it's changing. I now hear reference to what so-and-so said "on X", with no mention of Twitter. It's changing. Time...it'll change...Twitter will stop being mentioned, Twitter will be a part of history, like Esso.

What'll happen with 21Q?

Nothing. I fully predict that this 2.1 quadrillion bitcoins thing will go nowhere. One of the main reasons for moving to replace "sats" as "bitcoins" is the perception that 1 bitcoin is unattainable and that people know "bitcoin," but don't know "sats." A bull bitcoin is out of reach for most people, but sats are attainable by everyone with a wallet. And, if they don't know ther term "sats," it's probably easier to change that perception (to educate them on sats) than it is to change and possibly confuse their knowledge of 21M bitcoins with 2.1Q bitcoins. It's probably easier to educate on "sats" than it is to change all the backends on exchanges and smart contracts and front ends (and some won't change at all, which will add more to confusion).

Solution: educate

Practical solution: if you think you might be speaking to a "normie" audience, make it a point to use the phrase "bitcoin sats." Over time, as people acquire and use sats to buy burgers, they'll know that sats means 1 of 2.1 quadrillion, but a bitcoin is 1 of 21 million. This is the Esso tiger lowering "bitcoin" and raising "sats."

-

@ 7460b7fd:4fc4e74b

2025-05-17 08:26:13

@ 7460b7fd:4fc4e74b

2025-05-17 08:26:13背景:WhatsApp的号码验证与运营商合作关系

作为一款基于手机号码注册的即时通信应用,WhatsApp的账号验证严重依赖全球电信运营商提供的短信或电话服务。这意味着,当用户注册或在新设备登录WhatsApp时,WhatsApp通常会向用户的手机号码发送SMS短信验证码或发起语音电话验证。这一流程利用了传统电信网络的基础设施,例如通过SS7(信令系统7)协议在全球范围内路由短信和电话securityaffairs.com。换句话说,WhatsApp把初始账户验证的安全性建立在电信运营商网络之上。然而,这种依赖关系也带来了隐患:攻击者可以利用电信网络的漏洞来拦截验证码。例如,研究人员早在2016年就演示过利用SS7协议漏洞拦截WhatsApp和Telegram的验证短信,从而劫持用户账户的攻击方法securityaffairs.com。由于SS7协议在全球范围内连接各国运营商,一个运营商的安全缺陷或恶意行为都可能被不法分子利用来获取他网用户的短信验证码securityaffairs.com。正因如此,有安全专家指出,仅依赖短信验证不足以保障账户安全,WhatsApp等服务提供商需要考虑引入额外机制来核实用户身份securityaffairs.com。

除了技术漏洞,基于电信运营商的验证还受到各地政策和网络环境影响。WhatsApp必须与全球各地运营商“合作”,才能将验证码送达到用户手机。然而这种“合作”在某些国家可能并不顺畅,典型例子就是中国。在中国大陆,国际短信和跨境电话常受到严格管控,WhatsApp在发送验证码时可能遭遇拦截或延迟sohu.com。因此,理解WhatsApp在中国的特殊联网和验证要求,需要将其全球验证机制与中国的电信政策和网络审查环境联系起来。下文将深入探讨为什么在中国使用WhatsApp进行号码验证时,必须开启蜂窝移动数据,并分析其中的技术逻辑和政策因素。

中国环境下的特殊问题:为何必须开启蜂窝数据?

中国的网络审查与封锁: WhatsApp自2017年起就在中国大陆遭遇严格封锁。起初,WhatsApp在华的服务受到**“GFW”(防火长城)**的部分干扰——例如曾一度只能发送文本消息,语音、视频和图片消息被封锁theguardian.com。到2017年下半年,封锁升级,很多用户报告在中国完全无法使用WhatsApp收发任何消息theguardian.com。中国官方将WhatsApp与Facebook、Telegram等西方通信平台一同屏蔽,视作对国家网络主权的挑战theguardian.com。鉴于此,在中国境内直接访问WhatsApp的服务器(无论通过Wi-Fi还是本地互联网)都会被防火长城所阻断。即使用户收到了短信验证码,WhatsApp客户端也无法在没有特殊连接手段的情况下与服务器完成验证通信。因此,单纯依赖Wi-Fi等本地网络环境往往无法完成WhatsApp的注册或登陆。很多用户经验表明,在中国使用WhatsApp时需要借助VPN等工具绕过审查,同时尽可能避免走被审查的网络路径sohu.com。

强制Wi-Fi热点与连接策略: 除了国家级的封锁,用户所连接的局域网络也可能影响WhatsApp验证。许多公共Wi-Fi(如机场、商场)采取强制门户认证(captive portal),用户需登录认证后才能上网。对此,WhatsApp在客户端内置了检测机制,当发现设备连入这类强制Wi-Fi热点而无法访问互联网时,会提示用户忽略该Wi-Fi并改用移动数据faq.whatsapp.com。WhatsApp要求对此授予读取Wi-Fi状态的权限,以便在检测到被拦截时自动切换网络faq.whatsapp.com。对于中国用户来说,即便所连Wi-Fi本身联网正常,由于GFW的存在WhatsApp依然可能视之为“不通畅”的网络环境。这也是WhatsApp官方指南中强调:如果Wi-Fi网络无法连接WhatsApp服务,应直接切换到手机的移动数据网络faq.whatsapp.com。在中国,由于本地宽带网络对WhatsApp的封锁,蜂窝数据反而成为相对可靠的通道——尤其在搭配VPN时,可以避开本地ISP的审查策略,实现与WhatsApp服务器的通信sohu.com。

国际短信的运营商限制: 使用移动数据还有助于解决短信验证码接收难题。中国的手机运营商出于防垃圾短信和安全考虑,默认对国际短信和境外来电进行一定限制。许多中国用户发现,注册WhatsApp时迟迟收不到验证码短信,原因可能在于运营商将来自国外服务号码的短信拦截或过滤sohu.com。例如,中国移动默认关闭国际短信接收,需要用户主动发送短信指令申请开通sohu.com。具体而言,中国移动用户需发送文本“11111”到10086(或10085)来开通国际短信收发权限;中国联通和电信用户也被建议联系运营商确认未屏蔽国际短信sohu.com。若未进行这些设置,WhatsApp发送的验证码短信可能根本无法抵达用户手机。在这种情况下,WhatsApp提供的备用方案是语音电话验证,即通过国际电话拨打用户号码并播报验证码。然而境外来电在中国也可能遭到运营商的安全拦截,特别是当号码被认为可疑时zhuanlan.zhihu.com。因此,中国用户经常被建议开启手机的蜂窝数据和漫游功能,以提高验证码接收的成功率sohu.com。一方面,开启数据漫游意味着用户准备接受来自境外的通信(通常也包含短信/电话);另一方面,在数据联网的状态下,WhatsApp可以尝试通过网络直接完成验证通信,从而减少对SMS的依赖。

移动数据的网络路径优势: 在实际案例中,一些中国WhatsApp用户报告仅在开启蜂窝数据的情况下才能完成验证。这可能归因于蜂窝网络和宽带网络在国际出口上的差异。中国移动、联通等运营商的移动数据可能走与宽带不同的网关路由,有时对跨境小流量的拦截相对宽松。此外,WhatsApp在移动数据环境中可以利用一些底层网络特性。例如,WhatsApp可能通过移动网络发起某些专用请求或利用运营商提供的号码归属地信息进行辅助验证(虽然具体实现未公开,但这是业界讨论的可能性)。总之,在中国特殊的网络环境下,开启蜂窝数据是确保WhatsApp验证流程顺利的重要一步。这一步不仅是为了基本的互联网连接,也是为了绕开种种对国际短信和应用数据的拦截限制,从而与WhatsApp的全球基础设施建立必要的通讯。

PDP Context与IMSI:移动网络验证的技术细节

要理解为什么移动数据对WhatsApp验证如此关键,有必要了解移动通信网络中的一些技术细节,包括PDP Context和IMSI的概念。

PDP Context(分组数据协议上下文): 当手机通过蜂窝网络使用数据(如4G/5G上网)时,必须先在运营商核心网中建立一个PDP上下文。这实际上就是申请开启一个数据会话,运营商将为设备分配一个IP地址,并允许其通过移动核心网访问互联网datascientest.com。PDP上下文包含了一系列参数(例如APN接入点名称、QoS等级等),描述该数据会话的属性datascientest.comdatascientest.com。简单来说,激活蜂窝数据就意味着创建了PDP上下文,设备获得了移动网络网关分配的IP地址,可以收发数据包。对于WhatsApp验证而言,只有在建立数据连接后,手机才能直接与WhatsApp的服务器交换数据,例如提交验证码、完成加密密钥协商等。如果仅有Wi-Fi而蜂窝数据关闭,且Wi-Fi环境无法连通WhatsApp服务器,那么验证过程将陷入停滞。因此,在中国场景下,开启蜂窝数据(即建立PDP数据通路)是WhatsApp客户端尝试绕过Wi-Fi限制、直接通过移动网络进行验证通信的前提faq.whatsapp.comsohu.com。值得一提的是,PDP Context的建立也表明手机在运营商网络上处于活跃状态,这对于某些验证机制(比如后述的闪信/闪呼)来说至关重要。

IMSI与MSISDN: IMSI(国际移动用户标识)和MSISDN(移动用户号码,即手机号码)是运营商网络中两个密切相关但不同的标识。IMSI是存储在SIM卡上的一串唯一数字,用于在移动网络中标识用户身份netmanias.com。当手机接入网络时,它向运营商提供IMSI以进行鉴权,运营商据此知道“是哪张SIM”的请求netmanias.com。而MSISDN则是我们平常说的手机号,用于在语音通话和短信路由中定位用户,也存储在运营商的HLR/HSS数据库中netmanias.com。运营商通过IMSI<->MSISDN的对应关系,将来自全球的短信/电话正确路由到用户手机上。WhatsApp的验证短信或电话本质上就是通过目标号码(MSISDN)寻找所属运营商网络,由该网络根据IMSI定位用户终端。一般情况下,WhatsApp应用并不直接接触IMSI这种信息,因为IMSI属于运营商网络的内部标识。然而,IMSI的存在仍然对安全产生影响。例如,**SIM卡交换(SIM Swap)**欺诈发生时,攻击者获得了受害者号码的新SIM卡,新SIM卡会有不同的IMSI,但MSISDN保持原号码不变。运营商会将原号码映射到新的IMSI,这样验证码短信就发送到了攻击者手中的SIM上。对WhatsApp而言,除非有机制检测IMSI变动,否则无法察觉用户号码背后的SIM已被盗换。部分应用在检测到SIM变化时会提示用户重新验证,这需要读取设备的IMSI信息进行比对。然而,在现代智能手机中,获取IMSI通常需要特殊权限,WhatsApp并未明确说明它有此类检测。因此,从WhatsApp角度,IMSI更多是网络侧的概念,但它提醒我们:电信级身份验证依赖于SIM的有效性。只有当正确的IMSI在网络注册、并建立了PDP数据上下文时,WhatsApp的后台服务才能确认该SIM对应的号码目前“在线”,进而可靠地发送验证信号(短信或电话)到该设备。

移动网络的信号辅助验证: 有观点认为,一些OTT应用可能利用移动网络提供的附加服务来辅助号码验证。例如,某些运营商提供号码快速验证API,当应用检测到设备在移动数据网络中时,可以向特定地址发起请求,由运营商返回当前设备的号码信息(通常通过已经建立的PDP通道)。Google等公司在部分国家与运营商合作过类似服务,实现用户免输入验证码自动完成验证。但就WhatsApp而言,没有公开证据表明其使用了运营商提供的自动号码识别API。即便如此,WhatsApp鼓励用户保持移动网络在线的做法,隐含的意义之一可能是:当手机处于蜂窝网络且数据畅通时,验证码通过率和验证成功率都会显著提升。这既包括了物理层面短信、电话能否送达,也涵盖了数据层面应用和服务器能否互通。

Flash Call机制:WhatsApp验证的新方案

针对传统SMS验证码容易被拦截、延迟以及用户体验不佳的问题,WhatsApp近年来引入了一种Flash Call(闪呼)验证机制fossbytes.com。所谓闪呼,即应用在用户验证阶段向用户的手机号发起一个非常短暂的来电:用户无需真正接听,WhatsApp会自动结束这通电话,并根据通话记录来确认是否拨通fossbytes.com。

原理与流程: 当用户选择使用闪呼验证(目前主要在Android设备上可用),WhatsApp会请求权限访问用户的通话记录fossbytes.com。随后应用拨打用户的号码,一般是一个预先设定的特定号码或号码段。由于WhatsApp后台知道它拨出的号码及通话ID,只要该未接来电出现在用户手机的通话日志中,应用即可读取并匹配最后一通来电的号码是否符合验证要求,从而确认用户持有这个号码fossbytes.com。整个过程用户无需手动输入验证码,验证通话在数秒内完成。相比6位数字短信验证码需要用户在短信和应用间切换输入,闪呼方式更加快捷无缝fossbytes.com。

优缺点分析: 闪呼验证的优势在于速度快且避免了SMS可能的延迟或拦截。一些分析指出闪呼将成为取代SMS OTP(一次性密码)的新趋势,Juniper Research预测2022年用于验证的闪呼次数将从2021年的六千万猛增到五十亿次subex.comglobaltelcoconsult.com。对于WhatsApp这样全球用户庞大的应用,闪呼可以节约大量SMS网关费用,并绕开部分运营商对国际SMS的限制。然而,闪呼也有局限:fossbytes.com首先,iOS设备由于系统安全限制,应用无法访问通话记录,因此iPhone上无法使用闪呼验证fossbytes.com。这意味着苹果用户仍需使用传统短信验证码。其次,为实现自动匹配来电号码,用户必须授予读取通话记录的权限,这在隐私上引发一些担忧fossbytes.comfossbytes.com。WhatsApp声称不会将通话记录用于验证以外的用途,号码匹配也在本地完成fossbytes.com,但考虑到母公司Meta的隐私争议,部分用户依然顾虑。第三,闪呼验证依赖语音通话路线,同样受制于电信网络质量。如果用户所处网络无法接通国际来电(比如被运营商拦截境外短振铃电话),闪呼也无法成功。此外,从运营商角度看,闪呼绕过了A2P短信计费,可能侵蚀短信营收,一些运营商开始研究识别闪呼流量的策略wholesale.orange.com。总体而言,闪呼机制体现了WhatsApp希望减轻对短信依赖的努力,它在许多国家提升了验证体验,但在中国等特殊环境,其效果仍取决于本地语音网络的开放程度。值得注意的是,中国运营商对于境外电话,尤其是这种**“零响铃”未接来电**也有防范措施,中国电信和联通用户就被建议如需接收海外来电验证,应联系客服确保未拦截海外来电hqsmartcloud.com。因此,即便WhatsApp支持闪呼,中国用户若未开启移动语音漫游或运营商许可,仍然难以通过此途径完成验证。

与SIM Swap安全性的关系: 从安全角度看,闪呼并未实质提升抵御SIM交换攻击的能力。如果攻击者成功将受害者的号码转移至自己的SIM卡上(获取新IMSI),那么无论验证码以短信还是闪呼方式发送,都会到达攻击者设备。闪呼机制能防御的是部分恶意拦截短信的行为(如恶意网关或木马读取短信),但对社工换卡没有太大帮助。WhatsApp早已提供两步验证(即设置6位PIN码)供用户自行启用,以防号码被他人重新注册时需要额外密码。然而大量用户未开启该功能。因此,闪呼更多是从用户体验和成本出发的改良,而非针对高级别攻击的防护机制。正如前文所述,真正要防御SIM Swap和SS7漏洞等系统性风险,依赖运营商的号码验证本身就是薄弱环节,需要引入更高级的身份认证手段。

SIM卡交换攻击的风险与运营商信任问题

WhatsApp和Telegram一类基于手机号认证的应用普遍面临一个安全挑战:手机号码本身并非绝对安全的身份凭证。攻击者可以通过一系列手段取得用户的号码控制权,其中SIM交换(SIM Swap)是近年高发的欺诈手法。SIM Swap通常由不法分子冒充用户,诱骗或贿赂运营商客服将目标号码的服务转移到攻击者的新SIM卡上keepnetlabs.com。一旦成功,所有发往该号码的短信和电话都转由攻击者接收,原机主的SIM卡失效。对于依赖短信/电话验证的应用来说,这意味着攻击者可以轻易获取验证码,从而重置账户并登录。近年来全球SIM Swap案件呈上升趋势,许多在线服务的账号被此攻破rte.ie。

WhatsApp并非未知晓此风险。事实上,WhatsApp在其帮助中心和安全博客中多次提醒用户开启两步验证PIN,并强调绝不向他人透露短信验证码。然而,从系统设计上讲,WhatsApp仍将信任根基放在运营商发送到用户手机的那串数字验证码上。一旦运营商端的安全被绕过(无论是内部员工作恶、社工欺诈,还是SS7网络被黑客利用securityaffairs.com),WhatsApp本身无法辨别验证码接收者是否是真正的用户。正如安全研究所Positive Technologies指出的那样,目前主要的即时通讯服务(包括WhatsApp和Telegram)依赖SMS作为主要验证机制,这使得黑客能够通过攻击电信信令网络来接管用户账户securityaffairs.com。换言之,WhatsApp被迫信任每一个参与短信/电话路由的运营商,但这个信任链条上任何薄弱环节都可能遭到利用securityaffairs.com。例如,在SIM Swap攻击中,运营商本身成为被欺骗的对象;而在SS7定位拦截攻击中,全球互联的电信网成为攻击面。在中国的场景下,虽然主要威胁来自审查而非黑客,但本质上仍是WhatsApp无法完全掌控电信网络这一事实所导致的问题。

应对这些风险,WhatsApp和Telegram等采用了一些弥补措施。除了提供用户自行设定的二次密码,两者也开始探索设备多因子的概念(如后文Telegram部分所述,利用已有登录设备确认新登录)。然而,对绝大多数首次注册或更换设备的用户来说,传统的短信/电话验证仍是唯一途径。这就是为什么在高安全需求的行业中,SMS OTP正逐渐被视为不充分securityaffairs.com。监管机构和安全专家建议对涉敏感操作采用更强验证,如专用身份应用、硬件令牌或生物识别等。WhatsApp作为大众通信工具,目前平衡了易用性与安全性,但其依赖电信运营商的验证模式在像中国这样特殊的环境下,既遇到政策阻碍,也隐藏安全短板。这一点对于决策制定者评估国外通信应用在华风险时,是一个重要考量:任何全球运营商合作机制,在中国境内都可能因为**“最后一公里”由中国运营商执行**而受到影响。无论是被拦截信息还是可能的监控窃听,这些风险都源自于底层通信网的控制权不在应用服务商手中。

Telegram登录机制的比较

作为对比,Telegram的账号登录机制与WhatsApp类似,也以手机号码为主要身份标识,但在具体实现上有一些不同之处。

多设备登录与云端代码: Telegram从设计上支持多设备同时在线(手机、平板、PC等),并将聊天内容储存在云端。这带来的一个直接好处是:当用户在新设备上登录时,Telegram会优先通过已登录的其他设备发送登录验证码。例如,用户尝试在电脑上登录Telegram,Telegram会在用户手机上的Telegram应用里推送一条消息包含登录码,而不是立即发短信accountboy.comaccountboy.com。用户只需在新设备输入从老设备上收到的代码即可完成登录。这种机制确保了只要用户至少有一个设备在线,就几乎不需要依赖运营商短信。当然,如果用户当前只有一部新设备(例如换了手机且旧设备不上线),Telegram才会退而求其次,通过SMS发送验证码到手机号。同时,Telegram也允许用户选择语音电话获取验证码,类似于WhatsApp的语音验证。当用户完全无法收到SMS时(比如在中国这种场景),语音呼叫常常比短信更可靠seatuo.com。

两步验证密码: 与WhatsApp一样,Telegram提供可选的两步验证密码。当启用此功能后,即使拿到短信验证码,仍需输入用户设置的密码才能登录账户quora.com。这对抗SIM Swap等攻击提供了另一层防线。不过需要指出,如果用户忘记了设置的Telegram密码且没有设置信任邮箱,可能会永久失去账号访问,因此开启该功能在中国用户中接受度一般。

登录体验与安全性的取舍: Telegram的登录流程在用户体验上更加灵活。多设备下无需每次都收验证码,提高了便利性。但从安全角度看,这种“信任已有设备”的做法也有隐患:如果用户的某个设备落入他人之手并未及时登出,那么该人有可能利用该设备获取新的登录验证码。因此Telegram会在应用中提供管理活动会话的功能,用户可随时查看和撤销其它设备的登录状态telegram.org。总体而言,Telegram和WhatsApp在初始注册环节同样依赖短信/电话,在这一点上,中国的网络环境对两者影响相似:Telegram在中国同样被全面封锁,需要VPN才能使用,其短信验证码发送也会受到运营商限制。另外,Telegram曾在2015年因恐怖分子利用该平台传递信息而被中国当局重点关注并屏蔽,因此其国内可达性甚至比WhatsApp更低。许多中国用户实际使用Telegram时,通常绑定国外号码或通过海外SIM卡来收取验证码,以绕开国内运营商的限制。

差异总结: 简而言之,Telegram在登录验证机制上的主要优势在于已有会话协助和云端同步。这使得老用户换设备时不依赖国内短信通道即可登录(前提是原设备已登录并可访问)。WhatsApp直到最近才推出多设备功能,但其多设备模式采用的是端到端加密设备链路,需要主手机扫码授权,而非像Telegram那样用账号密码登录其它设备。因此WhatsApp仍然强绑定SIM卡设备,首次注册和更换手机号时逃不开运营商环节。安全方面,两者的SMS验证所面临的系统性风险(如SS7攻击、SIM Swap)并无本质区别,都必须仰仗运营商加强对核心网络的保护,以及用户自身启用附加验证措施securityaffairs.comkeepnetlabs.com。

结论

对于希望在中国使用WhatsApp的用户来说,“开启蜂窝数据”这一要求背后体现的是技术与政策交织的复杂现实。一方面,蜂窝数据承载着WhatsApp与其全球服务器通信的关键信道,在中国的受限网络中提供了相对可靠的出路faq.whatsapp.comsohu.com。另一方面,WhatsApp的号码验证机制深深植根于传统电信体系,必须经由全球运营商的“协作”才能完成用户身份确认securityaffairs.com。而在中国,这种协作受到防火长城和运营商政策的双重阻碍:国际短信被拦截、国际数据被阻断。为克服这些障碍,WhatsApp既采取了工程上的应对(如检测强制Wi-Fi并提示使用移动网络faq.whatsapp.com),也引入了诸如闪呼验证等新方案以减少对短信的依赖fossbytes.com。但从根本上说,只要注册流程离不开手机号码,这种与电信运营商的捆绑关系就无法割舍。由此带来的安全问题(如SIM Swap和信令网络漏洞)在全球范围内敲响警钟securityaffairs.comkeepnetlabs.com。

对于从事安全研究和政策评估的人士,这篇分析揭示了WhatsApp在中国遇到的典型困境:技术系统的全球化与监管环境的本地化冲突。WhatsApp全球统一的验证框架在中国水土不服,不得不通过额外的设置和手段来“曲线救国”。这既包括让用户切换网络、配置VPN等绕过审查,也包括思考未来是否有必要采用更安全独立的验证方式。相比之下,Telegram的机制给出了一种启示:灵活运用多设备和云服务,至少在一定程度上降低对单一短信渠道的依赖。然而,Telegram自身在中国的处境表明,再优雅的技术方案也难以直接对抗高强度的网络封锁。最终,无论是WhatsApp还是Telegram,要想在受限环境下可靠运作,都需要技术与政策的双管齐下:一方面提高验证与登录的安全性和多样性,另一方面寻求运营商和监管层面的理解与配合。

综上所述,WhatsApp要求中国用户开启蜂窝数据并非偶然的臆想,而是其全球运营商合作验证机制在中国受阻后的务实选择。这一要求折射出移动通信应用在跨境运营中面临的挑战,也提醒我们在设计安全策略时必须考虑底层依赖的信任假设。对于个人用户,最实际的建议是在使用此类应用时提前了解并遵循这些特殊设置(如开通国际短信、启用数据漫游),并善用应用自身的安全功能(如两步验证)来保护账户免遭社工和网络攻击keepnetlabs.com。对于监管和运营商,则有必要权衡安全审查与用户便利之间的平衡,在可控范围内为可信的全球服务留出技术通道。在全球通信愈加融合的时代,WhatsApp的中国验证问题或许只是一个缩影,背后涉及的既有网络安全考量,也有数字主权与国际合作的议题,值得持续深入研究和关注。

faq.whatsapp.comfossbytes.comtheguardian.comsecurityaffairs.comsecurityaffairs.comkeepnetlabs.comdatascientest.comnetmanias.comsohu.comsohu.com

-

@ 5fbec235:ff265c2a

2025-05-18 00:18:55

@ 5fbec235:ff265c2a

2025-05-18 00:18:55In my lifetime, the only predictable thing about Chicagoland weather are its extremes. * Blizzards that can shut down highways even for a city equipped with hundreds of snowplows and millions of tons of road salt. * Torrential downpours that can eclipse 100yr storms and turn streets into rivers. * Blistering summer heat that can melt asphalt. * Howling winds that can uproot trees and make rain blow sideways across an 8 lane highway. * Let’s not forget the 2014 and 2019 polar vortexes that brought in -20F temps and -50F windchill (colder than Anchorage, AK at that time, trust me, I checked).

Most consumer tech would have called it quits. For example - My Kindle Oasis couldn’t even survive a period of non-use while resting peacefully inside a desk drawer. It bricked itself presumably because it couldn’t figure out how to handle a dead battery or maybe a corrupted OTA update. Note I purchased the 3x cost Oasis vs the standard Paperwhite because I presumed the kindle would be a no-nonsense piece of tech that would last for years to come.

The Vantage Vue was installed in 2012. It’s a wireless, solar powered station equipped with a sensor suite that monitors temperature, humidity, rainfall, wind speed and direction, all transmitted to an LCD console indoors. The purchase was as simple as possible. No account registration, no cloud services that require a subscription, no fuss.

Over its entire 13 year lifespan I only experienced 4 interruptions. Twice the internal battery failed and I simply went to the local hardware store to purchase a new one. Total cost of repair: $8. Then there were two instances where the pesky squirrels chewed through the wire that connects the anemometer to the station. I had an existing supply of solder and electrical tape on hand...problem fixed. Cost of repair: $0.

The Vantage Vue’s design is modular and accessible, with no proprietary nonsense locking me out of repairs. I didn’t need to send it to the manufacturer, pay exorbitant fees, navigate through an endless loop of phone support prompts, or buy a whole new unit because of a single damaged component.

Suppose I had not been technical enough, or too busy to repair it myself – I could have hired a local handyman in my community, shared a few laughs about the vandalizing vermin, offered him a homemade bottle of wine and a modest but meaningful fee for his repair. Then upon the return of those vandalice vermin, perhaps I would have learned something from his last repair and been able to fix it myself leaving me with a satisfying feeling of accomplishment... or also perhaps I would have just looked forward to opening up a new vintage.

The system could be fixed quickly and cheaply because it was designed with repair-ability in mind. Compare that to many modern devices, where glued-shut casings, locked down firmware, or unavailable spare parts force you replace rather than repair. My weather station’s longevity is proof that when manufacturers prioritize durability and user access, consumers win.

The Cost of Durability vs. Planned Obsolescence

I paid $500 for that station in 2012. Since 2012 I’ve purchased 4 popular consumer smartphones. Roughly costing a total somewhere between $3000 to $4000. That’s for devices that were each replaced within a few years of their purchase because the design and ecosystem pushed me toward replacement, not repair.

A Bitcoin Thought Experiment

Let’s imagine that original phone was modular and repairable. Let’s also imagine there was a functioning Bitcoin economy. If we’re imagining an established Bitcoin economy then we first need to imagine the irrelevance of the dollar.

The first phone would have cost, let’s say...10 BTC. With a limited supply of Bitcoin and no inflation to worry about, the entire world would be more conservative with their money and their debt issuance. Modular technological ecosystems would be in demand and there would be greater pressure on established corporations to create real innovations. True inventions, not just “innovative” profit schemes for shareholders. Technology would be more meaningful for everyone. Personal computing devices would be modular – offering local repairablity and ad-hoc upgradability, just like my Vantage Vue. Relative cost of repairs for that first phone would be more like that of my Vantage Vue.

Let’s Recall: * Original Purchase price of Vantage Vue: $500 * 2x Vantage Vue batteries: $8 * Soldering together chewed up wire: $0 * The feeling of satisfaction through exercising my abilities or learning new skills or staying connected with my local community: priceless

Relative cost of repair = 8/500 = 0.016

Now back to our imagined Bitcoin and #repairDontReplace economy.

- Cost of original smart phone: 10 BTC

- Expected cost to repair after 13 years = 10 * 0.016 = .16 BTC

That would leave me with 9.84 BTC which will always be worth the same 9.84 BTC as on the day I bought the first phone.

This is obviously a very, very imaginative scenario. Personal computing devices are more complex than a weather station. They do eventually require some kind of upgrade so that one can compute faster and store more data.but…Something tells me the entire world would have progressed much more meaningfully in the last 13 years if humans had more time to think creatively and not be worried about fighting inflation or beating the market. A lot of human ingenuity goes into algorithms that try to make imaginary numbers go up more than other people’s imaginary numbers.

This makes humans disconnected from their local communities. We become so concerned with maintaining a certain status that we might overlook those who are less-abled but still capable in delivering value to our collective consciousness. We might outsource very important responsibilities we owe to those members of our communities, thinking “it’s not our problem” or “we’re too busy”. It's the wrong mindset. It will lead to more disconnect, more chronic disease, more mental illness, more random acts of violence, and more children who outsource the final days of their loved ones to a nursing home.

Hmm - Maybe someone can build caregiving AI robots with strict centralized protocols reminiscent of those automated customer support calls we all love so much...

The long term cost is not easy to see but it’s clearly there, and we all must bear it. The Davis Vantage Vue weather station is more than a weather station. It’s a symbol of what technology can be when corporations respect their customers. It’s built to last, designed for repair, and doesn’t lock me into an endless cycle of replacement.

The #rightToRepair movement is about demanding more of this – products that we can fix ourselves with no artificial barriers. It’s about saving money, reducing waste, and taking control of things we own.

The Bitcoin thought experiment drives home a parallel point. A circular, community-first economy allows us to put our human ingenuity into the most important places. Gives us more time to care for our loved ones, and helps protect our communities from artificially induced societal pressures. Without those pressures we would grow more and outsource less. We would find value in those who seemingly can produce no value in today’s economy – and in turn we would collectively raise ourselves to a higher consciousness.

-

@ 04c915da:3dfbecc9

2025-05-16 17:59:23

@ 04c915da:3dfbecc9

2025-05-16 17:59:23Recently we have seen a wave of high profile X accounts hacked. These attacks have exposed the fragility of the status quo security model used by modern social media platforms like X. Many users have asked if nostr fixes this, so lets dive in. How do these types of attacks translate into the world of nostr apps? For clarity, I will use X’s security model as representative of most big tech social platforms and compare it to nostr.

The Status Quo

On X, you never have full control of your account. Ultimately to use it requires permission from the company. They can suspend your account or limit your distribution. Theoretically they can even post from your account at will. An X account is tied to an email and password. Users can also opt into two factor authentication, which adds an extra layer of protection, a login code generated by an app. In theory, this setup works well, but it places a heavy burden on users. You need to create a strong, unique password and safeguard it. You also need to ensure your email account and phone number remain secure, as attackers can exploit these to reset your credentials and take over your account. Even if you do everything responsibly, there is another weak link in X infrastructure itself. The platform’s infrastructure allows accounts to be reset through its backend. This could happen maliciously by an employee or through an external attacker who compromises X’s backend. When an account is compromised, the legitimate user often gets locked out, unable to post or regain control without contacting X’s support team. That process can be slow, frustrating, and sometimes fruitless if support denies the request or cannot verify your identity. Often times support will require users to provide identification info in order to regain access, which represents a privacy risk. The centralized nature of X means you are ultimately at the mercy of the company’s systems and staff.

Nostr Requires Responsibility

Nostr flips this model radically. Users do not need permission from a company to access their account, they can generate as many accounts as they want, and cannot be easily censored. The key tradeoff here is that users have to take complete responsibility for their security. Instead of relying on a username, password, and corporate servers, nostr uses a private key as the sole credential for your account. Users generate this key and it is their responsibility to keep it safe. As long as you have your key, you can post. If someone else gets it, they can post too. It is that simple. This design has strong implications. Unlike X, there is no backend reset option. If your key is compromised or lost, there is no customer support to call. In a compromise scenario, both you and the attacker can post from the account simultaneously. Neither can lock the other out, since nostr relays simply accept whatever is signed with a valid key.

The benefit? No reliance on proprietary corporate infrastructure.. The negative? Security rests entirely on how well you protect your key.

Future Nostr Security Improvements

For many users, nostr’s standard security model, storing a private key on a phone with an encrypted cloud backup, will likely be sufficient. It is simple and reasonably secure. That said, nostr’s strength lies in its flexibility as an open protocol. Users will be able to choose between a range of security models, balancing convenience and protection based on need.

One promising option is a web of trust model for key rotation. Imagine pre-selecting a group of trusted friends. If your account is compromised, these people could collectively sign an event announcing the compromise to the network and designate a new key as your legitimate one. Apps could handle this process seamlessly in the background, notifying followers of the switch without much user interaction. This could become a popular choice for average users, but it is not without tradeoffs. It requires trust in your chosen web of trust, which might not suit power users or large organizations. It also has the issue that some apps may not recognize the key rotation properly and followers might get confused about which account is “real.”

For those needing higher security, there is the option of multisig using FROST (Flexible Round-Optimized Schnorr Threshold). In this setup, multiple keys must sign off on every action, including posting and updating a profile. A hacker with just one key could not do anything. This is likely overkill for most users due to complexity and inconvenience, but it could be a game changer for large organizations, companies, and governments. Imagine the White House nostr account requiring signatures from multiple people before a post goes live, that would be much more secure than the status quo big tech model.

Another option are hardware signers, similar to bitcoin hardware wallets. Private keys are kept on secure, offline devices, separate from the internet connected phone or computer you use to broadcast events. This drastically reduces the risk of remote hacks, as private keys never touches the internet. It can be used in combination with multisig setups for extra protection. This setup is much less convenient and probably overkill for most but could be ideal for governments, companies, or other high profile accounts.

Nostr’s security model is not perfect but is robust and versatile. Ultimately users are in control and security is their responsibility. Apps will give users multiple options to choose from and users will choose what best fits their need.

-

@ 609f186c:0aa4e8af

2025-05-16 20:57:43

@ 609f186c:0aa4e8af

2025-05-16 20:57:43Google says that Android 16 is slated to feature an optional high security mode. Cool.

Advanced Protection has a bunch of requested features that address the kinds of threats we worry about.

It's the kind of 'turn this one thing on if you face elevated risk' that we've been asking for from Google.

And likely reflects some learning after Google watched Apple 's Lockdown Mode play out. I see a lot of value in this..

Here are some features I'm excited to see play out:

The Intrusion Logging feature is interesting & is going to impose substantial cost on attackers trying to hide evidence of exploitation. Logs get e2ee encrypted into the cloud. This one is spicy.

The Offline Lock, Inactivity Reboot & USB protection will frustrate non-consensual attempts to physically grab device data.

Memory Tagging Extension is going to make a lot of attack & exploitation categories harder.

2G Network Protection & disabling Auto-connect to insecure networks are going to address categories of threat from things like IMSI catchers & hostile WiFi.

I'm curious about some other features such as:

Spam & Scam detection: Google messages feature that suggests message content awareness and some kind of scanning.

Scam detection for Phone by Google is interesting & coming later. The way it is described suggests phone conversation awareness. This also addresses a different category of threat than the stuff above. I can see it addressing a whole category of bad things that regular users (& high risk ones too!) face. Will be curious how privacy is addressed or if this done purely locally. Getting messy: Friction points? I see Google thinking these through, but I'm going to add a potential concern: what will users do when they encounter friction? Will they turn this off & forget to re-enable? We've seen users turn off iOS Lockdown Mode when they run into friction for specific websites or, say, legacy WiFi. They then forget to turn it back on. And stay vulnerable.

Bottom line: users disabling Apple's Lockdown Mode for a temporary thing & leaving it off because they forget to turn it on happens a lot. This is a serious % of users in my experience...

And should be factored into design decisions for similar modes. I feel like a good balance is a 'snooze button' or equivalent so that users can disable all/some features for a brief few minute period to do something they need to do, and then auto re-enable.

Winding up:

I'm excited to see how Android Advanced Protection plays with high risk users' experiences. I'm also super curious whether the spam/scam detection features may also be helpful to more vulnerable users (think: aging seniors)...

Niche but important:

Some users, esp. those that migrated to security & privacy-focused Android distros because of because of the absence of such a feature are clear candidates for it... But they may also voice privacy concerns around some of the screening features. Clear communication from the Google Security / Android team will be key here.

-

@ 04c915da:3dfbecc9

2025-05-16 17:51:54

@ 04c915da:3dfbecc9

2025-05-16 17:51:54In much of the world, it is incredibly difficult to access U.S. dollars. Local currencies are often poorly managed and riddled with corruption. Billions of people demand a more reliable alternative. While the dollar has its own issues of corruption and mismanagement, it is widely regarded as superior to the fiat currencies it competes with globally. As a result, Tether has found massive success providing low cost, low friction access to dollars. Tether claims 400 million total users, is on track to add 200 million more this year, processes 8.1 million transactions daily, and facilitates $29 billion in daily transfers. Furthermore, their estimates suggest nearly 40% of users rely on it as a savings tool rather than just a transactional currency.

Tether’s rise has made the company a financial juggernaut. Last year alone, Tether raked in over $13 billion in profit, with a lean team of less than 100 employees. Their business model is elegantly simple: hold U.S. Treasuries and collect the interest. With over $113 billion in Treasuries, Tether has turned a straightforward concept into a profit machine.

Tether’s success has resulted in many competitors eager to claim a piece of the pie. This has triggered a massive venture capital grift cycle in USD tokens, with countless projects vying to dethrone Tether. Due to Tether’s entrenched network effect, these challengers face an uphill battle with little realistic chance of success. Most educated participants in the space likely recognize this reality but seem content to perpetuate the grift, hoping to cash out by dumping their equity positions on unsuspecting buyers before they realize the reality of the situation.

Historically, Tether’s greatest vulnerability has been U.S. government intervention. For over a decade, the company operated offshore with few allies in the U.S. establishment, making it a major target for regulatory action. That dynamic has shifted recently and Tether has seized the opportunity. By actively courting U.S. government support, Tether has fortified their position. This strategic move will likely cement their status as the dominant USD token for years to come.

While undeniably a great tool for the millions of users that rely on it, Tether is not without flaws. As a centralized, trusted third party, it holds the power to freeze or seize funds at its discretion. Corporate mismanagement or deliberate malpractice could also lead to massive losses at scale. In their goal of mitigating regulatory risk, Tether has deepened ties with law enforcement, mirroring some of the concerns of potential central bank digital currencies. In practice, Tether operates as a corporate CBDC alternative, collaborating with authorities to surveil and seize funds. The company proudly touts partnerships with leading surveillance firms and its own data reveals cooperation in over 1,000 law enforcement cases, with more than $2.5 billion in funds frozen.

The global demand for Tether is undeniable and the company’s profitability reflects its unrivaled success. Tether is owned and operated by bitcoiners and will likely continue to push forward strategic goals that help the movement as a whole. Recent efforts to mitigate the threat of U.S. government enforcement will likely solidify their network effect and stifle meaningful adoption of rival USD tokens or CBDCs. Yet, for all their achievements, Tether is simply a worse form of money than bitcoin. Tether requires trust in a centralized entity, while bitcoin can be saved or spent without permission. Furthermore, Tether is tied to the value of the US Dollar which is designed to lose purchasing power over time, while bitcoin, as a truly scarce asset, is designed to increase in purchasing power with adoption. As people awaken to the risks of Tether’s control, and the benefits bitcoin provides, bitcoin adoption will likely surpass it.

-

@ c9badfea:610f861a

2025-05-17 03:08:55

@ c9badfea:610f861a

2025-05-17 03:08:55- Install Rethink (it's free and open source)

- Launch the app and tap Skip

- Tap Start and then Proceed to set up the VPN connection

- Allow notifications and Proceed, then disable battery optimization for this app (you may need to set it to Unrestricted)

- Navigate to Configure and tap Apps

- On the top bar, tap 🛜 and 📶 to block all apps from connecting to the internet

- Search Apps for the apps you want to allow and Bypass Universal

- Return to the Configure view and tap DNS, then choose your preferred DNS provider (e.g. DNSCrypt > Quad9)

- Optionally, tap On-Device Blocklists, then Disabled, Download Blocklists, and later Configure (you may need to enable the Use In-App Downloader option if the download is not working)

- Return to the Configure view and tap Firewall, then Universal Firewall Rules and enable the options as desired:

- Block all apps when device is locked

- Block newly installed apps by default

- Block when DNS is bypassed

- Optionally, to set up WireGuard or Tor, return to the Configure view and tap Proxy

- For Tor, tap Setup Orbot, then optionally select all the apps that should route through Tor (you must have Orbot installed)

- For WireGuard, tap Setup WireGuard, then +, and select an option to import a WireGuard configuration (QR Code Scan, File Import, or Creation).

- Use Simple Mode for a single WireGuard connection (all apps are routed through it).

- Use Advanced Mode for multiple WireGuard connections (split tunnel, manually choosing apps to route through them)

⚠️ Use this app only if you know what you are doing, as misconfiguration can lead to missing notifications and other problems

ℹ️ On the main view, tap Logs to track all connections

ℹ️ You can also use a WireGuard connection (e.g., from your VPN provider) and on-device blocklists together

-

@ 04c915da:3dfbecc9

2025-05-16 17:12:05

@ 04c915da:3dfbecc9

2025-05-16 17:12:05One of the most common criticisms leveled against nostr is the perceived lack of assurance when it comes to data storage. Critics argue that without a centralized authority guaranteeing that all data is preserved, important information will be lost. They also claim that running a relay will become prohibitively expensive. While there is truth to these concerns, they miss the mark. The genius of nostr lies in its flexibility, resilience, and the way it harnesses human incentives to ensure data availability in practice.

A nostr relay is simply a server that holds cryptographically verifiable signed data and makes it available to others. Relays are simple, flexible, open, and require no permission to run. Critics are right that operating a relay attempting to store all nostr data will be costly. What they miss is that most will not run all encompassing archive relays. Nostr does not rely on massive archive relays. Instead, anyone can run a relay and choose to store whatever subset of data they want. This keeps costs low and operations flexible, making relay operation accessible to all sorts of individuals and entities with varying use cases.

Critics are correct that there is no ironclad guarantee that every piece of data will always be available. Unlike bitcoin where data permanence is baked into the system at a steep cost, nostr does not promise that every random note or meme will be preserved forever. That said, in practice, any data perceived as valuable by someone will likely be stored and distributed by multiple entities. If something matters to someone, they will keep a signed copy.

Nostr is the Streisand Effect in protocol form. The Streisand effect is when an attempt to suppress information backfires, causing it to spread even further. With nostr, anyone can broadcast signed data, anyone can store it, and anyone can distribute it. Try to censor something important? Good luck. The moment it catches attention, it will be stored on relays across the globe, copied, and shared by those who find it worth keeping. Data deemed important will be replicated across servers by individuals acting in their own interest.

Nostr’s distributed nature ensures that the system does not rely on a single point of failure or a corporate overlord. Instead, it leans on the collective will of its users. The result is a network where costs stay manageable, participation is open to all, and valuable verifiable data is stored and distributed forever.

-

@ b83a28b7:35919450

2025-05-16 19:26:56

@ b83a28b7:35919450

2025-05-16 19:26:56This article was originally part of the sermon of Plebchain Radio Episode 111 (May 2, 2025) that nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqyg8wumn8ghj7mn0wd68ytnvv9hxgqpqtvqc82mv8cezhax5r34n4muc2c4pgjz8kaye2smj032nngg52clq7fgefr and I did with nostr:nprofile1qythwumn8ghj7ct5d3shxtnwdaehgu3wd3skuep0qyt8wumn8ghj7ct4w35zumn0wd68yvfwvdhk6tcqyzx4h2fv3n9r6hrnjtcrjw43t0g0cmmrgvjmg525rc8hexkxc0kd2rhtk62 and nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqyg8wumn8ghj7mn0wd68ytnvv9hxgqpq4wxtsrj7g2jugh70pfkzjln43vgn4p7655pgky9j9w9d75u465pqahkzd0 of the nostr:nprofile1qythwumn8ghj7ct5d3shxtnwdaehgu3wd3skuep0qyt8wumn8ghj7etyv4hzumn0wd68ytnvv9hxgtcqyqwfvwrccp4j2xsuuvkwg0y6a20637t6f4cc5zzjkx030dkztt7t5hydajn

Listen to the full episode here:

<<https://fountain.fm/episode/Ln9Ej0zCZ5dEwfo8w2Ho>>

Bitcoin has always been a narrative revolution disguised as code. White paper, cypherpunk lore, pizza‑day legends - every block is a paragraph in the world’s most relentless epic. But code alone rarely converts the skeptic; it’s the camp‑fire myth that slips past the prefrontal cortex and shakes hands with the limbic system. People don’t adopt protocols first - they fall in love with protagonists.

Early adopters heard the white‑paper hymn, but most folks need characters first: a pizza‑day dreamer; a mother in a small country, crushed by the cost of remittance; a Warsaw street vendor swapping złoty for sats. When their arcs land, the brain releases a neurochemical OP_RETURN which says, “I belong in this plot.” That’s the sly roundabout orange pill: conviction smuggled inside catharsis.

That’s why, from 22–25 May in Warsaw’s Kinoteka, the Bitcoin Film Fest is loading its reels with rebellion. Each documentary, drama, and animated rabbit‑hole is a stealth wallet, zipping conviction straight into the feels of anyone still clasped within the cold claw of fiat. You come for the plot, you leave checking block heights.

Here's the clip of the sermon from the episode:

nostr:nevent1qvzqqqqqqypzpwp69zm7fewjp0vkp306adnzt7249ytxhz7mq3w5yc629u6er9zsqqsy43fwz8es2wnn65rh0udc05tumdnx5xagvzd88ptncspmesdqhygcrvpf2

-

@ c631e267:c2b78d3e

2025-05-16 18:40:18

@ c631e267:c2b78d3e

2025-05-16 18:40:18Die zwei mächtigsten Krieger sind Geduld und Zeit. \ Leo Tolstoi

Zum Wohle unserer Gesundheit, unserer Leistungsfähigkeit und letztlich unseres Glücks ist es wichtig, die eigene Energie bewusst zu pflegen. Das gilt umso mehr für an gesellschaftlichen Themen interessierte, selbstbewusste und kritisch denkende Menschen. Denn für deren Wahrnehmung und Wohlbefinden waren und sind die rasanten, krisen- und propagandagefüllten letzten Jahre in Absurdistan eine harte Probe.

Nur wer regelmäßig Kraft tankt und Wege findet, mit den Herausforderungen umzugehen, kann eine solche Tortur überstehen, emotionale Erschöpfung vermeiden und trotz allem zufrieden sein. Dazu müssen wir erkunden, was uns Energie gibt und was sie uns raubt. Durch Selbstreflexion und Achtsamkeit finden wir sicher Dinge, die uns erfreuen und inspirieren, und andere, die uns eher stressen und belasten.

Die eigene Energie ist eng mit unserer körperlichen und mentalen Gesundheit verbunden. Methoden zur Förderung der körperlichen Gesundheit sind gut bekannt: eine ausgewogene Ernährung, regelmäßige Bewegung sowie ausreichend Schlaf und Erholung. Bei der nicht minder wichtigen emotionalen Balance wird es schon etwas komplizierter. Stress abzubauen, die eigenen Grenzen zu kennen oder solche zum Schutz zu setzen sowie die Konzentration auf Positives und Sinnvolles wären Ansätze.

Der emotionale ist auch der Bereich, über den «Energie-Räuber» bevorzugt attackieren. Das sind zum Beispiel Dinge wie Überforderung, Perfektionismus oder mangelhafte Kommunikation. Social Media gehören ganz sicher auch dazu. Sie stehlen uns nicht nur Zeit, sondern sind höchst manipulativ und erhöhen laut einer aktuellen Studie das Risiko für psychische Probleme wie Angstzustände und Depressionen.

Geben wir negativen oder gar bösen Menschen keine Macht über uns. Das Dauerfeuer der letzten Jahre mit Krisen, Konflikten und Gefahren sollte man zwar kennen, darf sich aber davon nicht runterziehen lassen. Das Ziel derartiger konzertierter Aktionen ist vor allem, unsere innere Stabilität zu zerstören, denn dann sind wir leichter zu steuern. Aber Geduld: Selbst vermeintliche «Sonnenköniginnen» wie EU-Kommissionspräsidentin von der Leyen fallen, wenn die Zeit reif ist.

Es ist wichtig, dass wir unsere ganz eigenen Bedürfnisse und Werte erkennen. Unsere Energiequellen müssen wir identifizieren und aktiv nutzen. Dazu gehören soziale Kontakte genauso wie zum Beispiel Hobbys und Leidenschaften. Umgeben wir uns mit Sinnhaftigkeit und lassen wir uns nicht die Energie rauben!

Mein Wahlspruch ist schon lange: «Was die Menschen wirklich bewegt, ist die Kultur.» Jetzt im Frühjahr beginnt hier in Andalusien die Zeit der «Ferias», jener traditionellen Volksfeste, die vor Lebensfreude sprudeln. Konzentrieren wir uns auf die schönen Dinge und auf unsere eigenen Talente – soziale Verbundenheit wird helfen, unsere innere Kraft zu stärken und zu bewahren.

[Titelbild: Pixabay]

Dieser Beitrag wurde mit dem Pareto-Client geschrieben und ist zuerst auf Transition News erschienen.

-

@ 21335073:a244b1ad

2025-05-09 13:56:57

@ 21335073:a244b1ad

2025-05-09 13:56:57Someone asked for my thoughts, so I’ll share them thoughtfully. I’m not here to dictate how to promote Nostr—I’m still learning about it myself. While I’m not new to Nostr, freedom tech is a newer space for me. I’m skilled at advocating for topics I deeply understand, but freedom tech isn’t my expertise, so take my words with a grain of salt. Nothing I say is set in stone.

Those who need Nostr the most are the ones most vulnerable to censorship on other platforms right now. Reaching them requires real-time awareness of global issues and the dynamic relationships between governments and tech providers, which can shift suddenly. Effective Nostr promoters must grasp this and adapt quickly.

The best messengers are people from or closely tied to these at-risk regions—those who truly understand the local political and cultural dynamics. They can connect with those in need when tensions rise. Ideal promoters are rational, trustworthy, passionate about Nostr, but above all, dedicated to amplifying people’s voices when it matters most.

Forget influencers, corporate-backed figures, or traditional online PR—it comes off as inauthentic, corny, desperate and forced. Nostr’s promotion should be grassroots and organic, driven by a few passionate individuals who believe in Nostr and the communities they serve.

The idea that “people won’t join Nostr due to lack of reach” is nonsense. Everyone knows X’s “reach” is mostly with bots. If humans want real conversations, Nostr is the place. X is great for propaganda, but Nostr is for the authentic voices of the people.

Those spreading Nostr must be so passionate they’re willing to onboard others, which is time-consuming but rewarding for the right person. They’ll need to make Nostr and onboarding a core part of who they are. I see no issue with that level of dedication. I’ve been known to get that way myself at times. It’s fun for some folks.

With love, I suggest not adding Bitcoin promotion with Nostr outreach. Zaps already integrate that element naturally. (Still promote within the Bitcoin ecosystem, but this is about reaching vulnerable voices who needed Nostr yesterday.)

To promote Nostr, forget conventional strategies. “Influencers” aren’t the answer. “Influencers” are not the future. A trusted local community member has real influence—reach them. Connect with people seeking Nostr’s benefits but lacking the technical language to express it. This means some in the Nostr community might need to step outside of the Bitcoin bubble, which is uncomfortable but necessary. Thank you in advance to those who are willing to do that.

I don’t know who is paid to promote Nostr, if anyone. This piece isn’t shade. But it’s exhausting to see innocent voices globally silenced on corporate platforms like X while Nostr exists. Last night, I wondered: how many more voices must be censored before the Nostr community gets uncomfortable and thinks creatively to reach the vulnerable?

A warning: the global need for censorship-resistant social media is undeniable. If Nostr doesn’t make itself known, something else will fill that void. Let’s start this conversation.

-

@ c9badfea:610f861a

2025-05-14 18:38:04

@ c9badfea:610f861a

2025-05-14 18:38:04- Install KeePassDX (it's free and open source)

- Launch the app, tap Create New Vault, and choose a location to store the database file

- Activate the Password slider

- Type a Password and Confirm Password, then tap OK

- Tap + and Add Entry to add your first credentials

- Enter a Title, Username, and Password (you can also generate a password here)

- Tap ✓ at the bottom to create the entry

- Tap ⋮ and then Save Data to save the database

- Tap 🔒 to lock the database

⚠️ Make sure you use strong, high-entropy passphrases

⚠️ Back up the database file to a secure location (e.g. encrypted USB drive)

ℹ️ The database file (

.kdbx) can also be opened with various KeePass ports -

@ 2b24a1fa:17750f64

2025-05-09 19:50:20

@ 2b24a1fa:17750f64

2025-05-09 19:50:20Wer sein eigenes Geld abheben möchte, macht sich heute – in Spanien - verdächtig. Wer dort eine größere Geldmenge des eigenen Vermögens abzuheben gedenkt, muss das von nun an Tage zuvor anmelden. Diese neue Regelung lässt sich auch nicht dadurch umgehen, dass man mehrere kleine Einzelbeiträge abhebt. Und die, die die neue Regelung missachten, werden empfindlich bestraft. So gerät jeder, der zu häufig Bares abhebt, in das Visier der Behörden.

https://soundcloud.com/radiomuenchen/barzahler-unter-generalverdacht-von-norbert-haring?

Was sich in Spanien an Bankautomaten und -schaltern eingeschlichen hat, könnte sich seinen Weg auch nach Deutschland bahnen. In Frankreich, so zeigt die persönliche Erfahrung, variiert die zu erzielende Geldmenge am Automaten unter noch ungeklärten Bedingungen von Tag zu Tag, von Konto zu Konto. Der Automat gibt vor, ob gerade beispielsweise 60, 200 oder 400 Euro abgehoben werden dürfen.

Hören Sie Norbert Härings Text zum spanischen Szenario der den Titel „Barzahler unter Generalverdacht“ trägt und zunächst auf seinem Blog erschienen war. norberthaering.de/news/spanien-bargeld/

Sprecher: Karsten Troyke

-

@ 2b24a1fa:17750f64

2025-05-09 19:43:28

@ 2b24a1fa:17750f64

2025-05-09 19:43:28 -

@ 21335073:a244b1ad

2025-05-01 01:51:10

@ 21335073:a244b1ad

2025-05-01 01:51:10Please respect Virginia Giuffre’s memory by refraining from asking about the circumstances or theories surrounding her passing.

Since Virginia Giuffre’s death, I’ve reflected on what she would want me to say or do. This piece is my attempt to honor her legacy.

When I first spoke with Virginia, I was struck by her unshakable hope. I had grown cynical after years in the anti-human trafficking movement, worn down by a broken system and a government that often seemed complicit. But Virginia’s passion, creativity, and belief that survivors could be heard reignited something in me. She reminded me of my younger, more hopeful self. Instead of warning her about the challenges ahead, I let her dream big, unburdened by my own disillusionment. That conversation changed me for the better, and following her lead led to meaningful progress.

Virginia was one of the bravest people I’ve ever known. As a survivor of Epstein, Maxwell, and their co-conspirators, she risked everything to speak out, taking on some of the world’s most powerful figures.

She loved when I said, “Epstein isn’t the only Epstein.” This wasn’t just about one man—it was a call to hold all abusers accountable and to ensure survivors find hope and healing.

The Epstein case often gets reduced to sensational details about the elite, but that misses the bigger picture. Yes, we should be holding all of the co-conspirators accountable, we must listen to the survivors’ stories. Their experiences reveal how predators exploit vulnerabilities, offering lessons to prevent future victims.

You’re not powerless in this fight. Educate yourself about trafficking and abuse—online and offline—and take steps to protect those around you. Supporting survivors starts with small, meaningful actions. Free online resources can guide you in being a safe, supportive presence.

When high-profile accusations arise, resist snap judgments. Instead of dismissing survivors as “crazy,” pause to consider the trauma they may be navigating. Speaking out or coping with abuse is never easy. You don’t have to believe every claim, but you can refrain from attacking accusers online.

Society also fails at providing aftercare for survivors. The government, often part of the problem, won’t solve this. It’s up to us. Prevention is critical, but when abuse occurs, step up for your loved ones and community. Protect the vulnerable. it’s a challenging but a rewarding journey.

If you’re contributing to Nostr, you’re helping build a censorship resistant platform where survivors can share their stories freely, no matter how powerful their abusers are. Their voices can endure here, offering strength and hope to others. This gives me great hope for the future.

Virginia Giuffre’s courage was a gift to the world. It was an honor to know and serve her. She will be deeply missed. My hope is that her story inspires others to take on the powerful.

-

@ 2b24a1fa:17750f64

2025-05-09 19:39:46

@ 2b24a1fa:17750f64

2025-05-09 19:39:46"Kleines Erste-Hilfe-Büchlein gegen Propaganda" von 2023. „Normalerweise hört man das Wort „Propaganda“ im Mainstream-Diskurs nur, wenn es um Dinge geht, die andere Länder ihren eigenen Bürgern antun oder Teil ausländischer Beeinflussungsoperationen sind, obwohl in der überwältigenden Mehrheit der Fälle, in denen wir in unserem täglichen Leben Propaganda erlebt haben, der Anruf aus dem eigenen Haus kam.“

https://soundcloud.com/radiomuenchen/helge-buttkereit-medienkritik-als-trotziger-idealismus?