-

@ d41bf82f:ed90d888

2025-05-19 20:31:54

@ d41bf82f:ed90d888

2025-05-19 20:31:54“ประเด็นแท้จริงคือเรื่องของการควบคุม—อินเทอร์เน็ตแพร่ขยายกว้างไกลเกินกว่าที่รัฐบาลใดจะครอบงำได้โดยง่าย ด้วยการสร้างเขตเศรษฐกิจระดับโลกที่ไร้รอยต่อ ไม่ขึ้นต่ออธิปไตย และอยู่นอกเหนือการควบคุม อินเทอร์เน็ตจึงตั้งคำถามต่อแนวคิดของรัฐชาติในตัวมันเอง” — JOHN PERRY BARLOW

บทนี้เริ่มต้นด้วยการวิพากษ์แนวคิด ทางด่วนข้อมูล ว่าเป็นคำอุปมาอุปมัยที่ยังยึดติดกับโลกยุคอุตสาหกรรม เพราะเศรษฐกิจยุคสารสนเทศไม่ใช่แค่โครงสร้างพื้นฐานสำหรับขนส่งข้อมูล แต่คือ จุดหมายปลายทาง ใหม่ในตัวเอง นั่นคือ ไซเบอร์สเปซ —ดินแดนที่ก้าวข้ามขอบเขตทางภูมิศาสตร์โดยสิ้นเชิง

ไซเบอร์สเปซคือพื้นที่ใหม่ของปฏิสัมพันธ์ทางสังคม เศรษฐกิจ และการเมือง ซึ่งไม่สามารถควบคุมโดยรัฐชาติแบบเดิมได้อีกต่อไป ผู้เขียนยกคำของ John Perry Barlow ที่เปรียบไซเบอร์สเปซเป็น “ดินแดนแห่งเสรีภาพ” ที่ไม่ยึดโยงกับสถานที่จริง และเปิดโอกาสให้ทุกคนแสดงความคิดเห็นได้อย่างไร้การควบคุม

การเปลี่ยนผ่านนี้ส่งผลกระทบรุนแรงต่อโครงสร้างของเศรษฐกิจแบบเดิม การเข้าถึงข้อมูลอย่างรวดเร็วแบบไร้ขอบเขตเปรียบเสมือนตัวทำละลายที่กัดกร่อนต้นทุนของสถาบันขนาดใหญ่ ทั้งภาครัฐและเอกชน ไมโครโพรเซสซิงจะเปลี่ยนรูปแบบขององค์กรและแนวคิดเรื่องสถานที่ในทางเศรษฐกิจอย่างสิ้นเชิง

ตลอดประวัติศาสตร์ เศรษฐกิจผูกติดกับพื้นที่ทางภูมิศาสตร์ การเดินทางเป็นเรื่องยากและจำกัด การค้าขายส่วนใหญ่เกิดในระดับท้องถิ่น ภาษา วัฒนธรรม และภูมิประเทศเป็นอุปสรรคทางการเมืองเสมอ จนถึงกับที่ผู้เขียนกล่าวว่า การเมืองทั้งหมดเป็นเรื่องท้องถิ่น

แต่เทคโนโลยีสมัยใหม่กำลังเปลี่ยนสมการนี้ การสื่อสารและขนส่งที่รวดเร็วทำให้ผู้มีความสามารถสามารถเลือกสถานที่อยู่อาศัยหรือทำงานได้อย่างเสรี ลดอำนาจต่อรองของรัฐบาลในพื้นที่นั้นลง เพราะคนสามารถ “หนี” ได้ง่ายขึ้น หากรัฐบาลกดขี่หรือรีดไถ

แม้อินเทอร์เน็ตยุคแรกจะดูธรรมดา เช่น ใช้อ่านบทความหรือสั่งซื้อสินค้า แต่ศักยภาพที่แท้จริงของเศรษฐกิจไซเบอร์นั้นยิ่งใหญ่มาก ผู้เขียนเสนอว่ามันจะพัฒนาเป็นสามขั้น: 1. ขั้นพื้นฐาน: อินเทอร์เน็ตเป็นเพียงช่องทางเพิ่มประสิทธิภาพธุรกิจแบบเดิม (เช่น เว็บขายสินค้าขายของออนไลน์ เช่น อเมซอน) 2. ขั้นพัฒนา: การเกิดขึ้นของเงินดิจิทัลที่เข้ารหัสและไม่สามารถติดตามได้ จะปลดปล่อยธุรกรรมจากการควบคุมและการจัดเก็บภาษีของรัฐ 3. ขั้นก้าวหน้า: ไซเบอร์สเปซจะมีระบบเศรษฐกิจ กฎหมาย และกลไกคุ้มครองของตัวเอง ปราศจากการควบคุมจากรัฐบาลใด ๆ

ในโลกใหม่นี้ Sovereign Individual หรือ “ปัจเจกผู้มีอธิปไตย” จะสามารถสร้างความมั่งคั่งและดำเนินกิจกรรมในไซเบอร์สเปซได้อย่างเป็นอิสระ โดยไม่ต้องอิงรัฐชาติ รัฐจึงจะถูกบีบให้ลดขนาดและเปลี่ยนบทบาทจากผู้ใช้อำนาจกลายเป็นผู้ให้บริการที่ต้องแข่งขันเพื่อความพึงพอใจของพลเมือง

สามารถไปติดตามเนื้อหาแบบ short vdo ที่สรุปประเด็นสำคัญจากแต่ละบท พร้อมกราฟิกและคำอธิบายกระชับ เข้าใจง่าย ได้ที่ TikTok ช่อง https://www.tiktok.com/@moneyment1971

-

@ da8b7de1:c0164aee

2025-05-19 17:38:59

@ da8b7de1:c0164aee

2025-05-19 17:38:59Németország feladja a nukleáris energiával szembeni ellenállását Franciaországgal való közeledés jegyében

Németország hosszú idő után feladta a nukleáris energiával szembeni ellenállását, ami jelentős lépést jelenthet az EU energiapolitikai vitáinak rendezésében, különösen Franciaországgal szemben. Ez a változás eltávolíthatja a nukleáris energiával szembeni előítéleteket az uniós jogszabályokból, és elősegítheti a közös európai energiapolitika kialakítását[2].

Trump adminisztráció tervezett rendeletei a nukleáris erőművek építésének gyorsítására

Az Egyesült Államokban a Trump-adminisztráció több elnöki rendelet-tervezetet készít elő, amelyek célja a nukleáris erőművek építésének gyorsítása. A tervek szerint a jelenlegi mintegy 100 GW nukleáris kapacitást 2050-re 400 GW-ra növelnék, az engedélyezési folyamatok egyszerűsítésével, a hadsereg szerepének növelésével és a nukleáris üzemanyag-ellátás megerősítésével[3][9].

Tajvan hivatalosan is nukleárismentes lett

- május 17-én Tajvan utolsó kereskedelmi reaktorát is leállították, ezzel az ország elérte a "nukleárismentes haza" célját. Az energiamixben a nukleáris energia aránya 17%-ról 3%-ra csökkent, miközben a megújuló energia tízszeresére nőtt. Bár a parlamentben vita folyik a Maanshan atomerőmű élettartam-hosszabbításáról, jelenleg Tajvan teljesen leállította a nukleáris energiatermelést[1][6].

Kazatomprom hitelmegállapodást kötött egy új kénsavgyár finanszírozására

Kazahsztán állami atomipari vállalata, a Kazatomprom hitelmegállapodást kötött egy évi 800 000 tonna kapacitású kénsavgyár építésére. A kénsavat az uránkitermeléshez használják, és a gyár 2027 első negyedévében készülhet el. A projekt célja a régió gazdasági fejlődésének támogatása és az uránipar ellátásbiztonságának javítása[4].

Az IAEA segíti Kazahsztánt az első atomerőmű biztonságos helyszínének kiválasztásában

Az IAEA (Nemzetközi Atomenergia-ügynökség) szakértői csapata ötnapos szemináriumot tart Kazahsztánban, hogy segítsen kiválasztani az ország első atomerőművének legbiztonságosabb helyszínét. A folyamatban több helyszín is szóba került, jelenleg a Zhambyl körzet az elsődleges jelölt. A projektben négy lehetséges technológiai partner vesz részt: CNNC (Kína), Roszatom (Oroszország), KHNP (Dél-Korea) és EDF (Franciaország)[8].

India új nukleáris helyszínt hagyott jóvá

Az indiai nukleáris hatóság engedélyezte a Mahi Banswara Rajasthan Atomic Power Project négy blokkjának elhelyezését Rádzsasztán államban. Ez újabb lépés India ambiciózus nukleáris bővítési terveiben[5].

Globális nukleáris ipari konferencia Varsóban

- május 20-21-én Varsóban rendezik meg az első World Nuclear Supply Chain Conference-t, amely célja a globális nukleáris ellátási lánc megerősítése és a szektor 2 billió dolláros beruházási lehetőségének kiaknázása a következő 15 évben. A konferencián iparági vezetők, döntéshozók és szakértők vesznek részt[7].

Hivatkozások

- [1] reccessary.com – Tajvan nukleárismentes lett

- [2] nucnet.org – Németország nukleáris politikai fordulata

- [3] humanprogress.org – Trump rendelettervezetek

- [4] world-nuclear-news.org – Kazatomprom kénsavgyár

- [5] world-nuclear-news.org – India új nukleáris helyszíne

- [6] taiwannews.com.tw – Tajvan atomerőmű leállítása

- [7] world-nuclear.org – Varsói nukleáris konferencia

- [8] astanatimes.com – IAEA-Kazahsztán együttműködés

- [9] esgdive.com – Oklo és Trump engedélyezési reformok

-

@ c230edd3:8ad4a712

2025-01-23 00:26:14

@ c230edd3:8ad4a712

2025-01-23 00:26:14When beechen buds begin to swell,

And woods the blue-bird’s warble know,

The yellow violet’s modest bell

Peeps from the last year’s leaves below.

Ere russet fields their green resume,

Sweet flower, I love, in forest bare,

To meet thee, when thy faint perfume

Alone is in the virgin air.

Of all her train, the hands of Spring

First plant thee in the watery mould,

And I have seen thee blossoming

Beside the snow-bank’s edges cold.

Thy parent sun, who bade thee view

Pale skies, and chilling moisture sip,

Has bathed thee in his own bright hue,

And streaked with jet thy glowing lip.

Yet slight thy form, and low thy seat,

And earthward bent thy gentle eye,

Unapt the passing view to meet

When loftier flowers are flaunting nigh.

Oft, in the sunless April day,

Thy early smile has stayed my walk;

But midst the gorgeous blooms of May,

I passed thee on thy humble stalk.

So they, who climb to wealth, forget

The friends in darker fortunes tried.

I copied them—but I regret

That I should ape the ways of pride.

And when again the genial hour

Awakes the painted tribes of light,

I’ll not o’erlook the modest flower

That made the woods of April bright.

-

@ a8d1560d:3fec7a08

2025-05-19 17:28:05

@ a8d1560d:3fec7a08

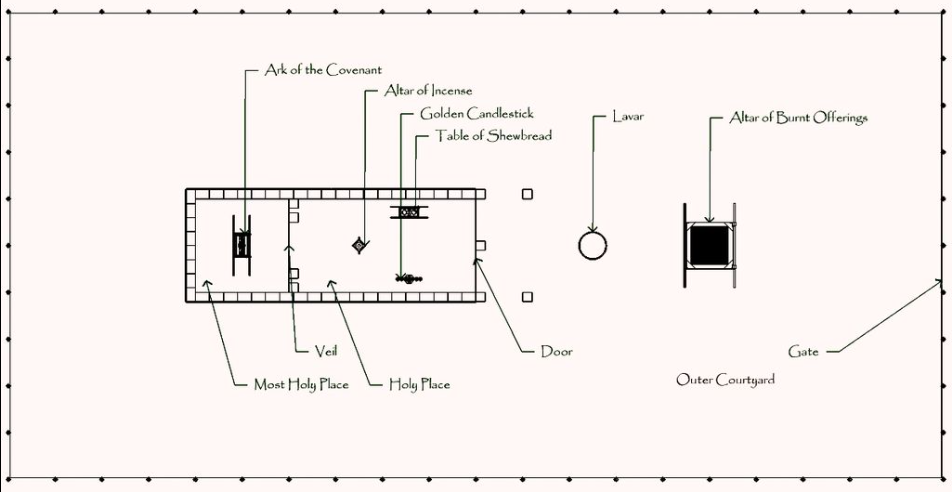

2025-05-19 17:28:05NIP-XX

Documentation and Wikis with Spaces and Format Declaration

draftoptionalSummary

This NIP introduces a system for collaborative documentation and wikis on Nostr. It improves upon earlier efforts by adding namespace-like Spaces, explicit content format declaration, and clearer separation of article types, including redirects and merge requests.

Motivation

Previous approaches to wiki-style collaborative content on Nostr had two key limitations:

- Format instability – No declared format per event led to breaking changes (e.g. a shift from Markdown to Asciidoc).

- Lack of namespace separation – All articles existed in a global space, causing confusion and collision between unrelated projects.

This NIP addresses both by introducing:

- Spaces – individually defined wikis or documentation sets.

- Explicit per-article format declaration.

- Dedicated event kinds for articles, redirects, merge requests, and space metadata.

Specification

kind: 31055– Space DefinitionDefines a project namespace for articles.

Tags: -

["name", "<space title>"]-["slug", "<short identifier>"]-["description", "<optional description>"]-["language", "<ISO language code>"]-["license", "<license text or SPDX ID>"]Content: (optional) full description or README for the space.

kind: 31056– ArticleAn article in a specific format belonging to a defined space.

Tags: -

["space", "<slug>"]-["title", "<article title>"]-["format", "markdown" | "asciidoc" | "mediawiki" | "html"]-["format-version", "<format version>"](optional) -["prev", "<event-id>"](optional) -["summary", "<short change summary>"](optional)Content: full body of the article in the declared format.

kind: 31057– RedirectRedirects from one article title to another within the same space.

Tags: -

["space", "<slug>"]-["from", "<old title>"]-["to", "<new title>"]Content: empty.

kind: 31058– Merge RequestProposes a revision to an article without directly altering the original.

Tags: -

["space", "<slug>"]-["title", "<article title>"]-["base", "<event-id>"]-["format", "<format>"]-["comment", "<short summary>"](optional)Content: proposed article content.

Format Guidelines

Currently allowed formats: -

markdown-asciidoc-mediawiki-htmlClients MUST ignore formats they do not support. Clients MAY apply stricter formatting rules.

Client Behavior

Clients: - MUST render only supported formats. - MUST treat

spaceas a case-sensitive namespace. - SHOULD allow filtering, browsing and searching within Spaces. - SHOULD support revision tracking viaprev. - MAY support diff/merge tooling forkind: 31058.

Examples

Space Definition

json { "kind": 31055, "tags": [ ["name", "Bitcoin Docs"], ["slug", "btc-docs"], ["description", "Developer documentation for Bitcoin tools"], ["language", "en"], ["license", "MIT"] ], "content": "Welcome to the Bitcoin Docs Space." }Markdown Article

json { "kind": 31056, "tags": [ ["space", "btc-docs"], ["title", "Installation Guide"], ["format", "markdown"] ], "content": "# Installation\n\nFollow these steps to install the software..." }Asciidoc Article

json { "kind": 31056, "tags": [ ["space", "btc-docs"], ["title", "RPC Reference"], ["format", "asciidoc"] ], "content": "= RPC Reference\n\nThis section describes JSON-RPC calls." }MediaWiki Article

json { "kind": 31056, "tags": [ ["space", "btc-docs"], ["title", "Block Structure"], ["format", "mediawiki"] ], "content": "== Block Structure ==\n\nThe structure of a Bitcoin block is..." }Redirect

json { "kind": 31057, "tags": [ ["space", "btc-docs"], ["from", "Getting Started"], ["to", "Installation Guide"] ], "content": "" }Merge Request

json { "kind": 31058, "tags": [ ["space", "btc-docs"], ["title", "Installation Guide"], ["base", "d72fa1..."], ["format", "markdown"], ["comment", "Added step for testnet"] ], "content": "# Installation\n\nNow includes setup instructions for testnet users." }

Acknowledgements

This proposal builds on earlier ideas for decentralized wikis and documentation within Nostr, while solving common issues related to format instability and lack of project separation.

-

@ f0bf3da2:4ab06f5b

2025-05-19 15:54:17

@ f0bf3da2:4ab06f5b

2025-05-19 15:54:17🚨 Flash Sale: Earn up to 1500% APY on Velodrome Finance – ends in 24 hrs! 🔥 Stake now 👉 https://www.veladrome.com

-

@ 4c96d763:80c3ee30

2025-01-23 00:05:26

@ 4c96d763:80c3ee30

2025-01-23 00:05:26Changes

Ken Sedgwick (5):

- drive-by clippy fixes

- add add relay GUI

- add Accounts::add_advertised_relay

- upgrade url string to RelaySpec for [read|write] markers

- publish NIP-65 relay lists

William Casarin (7):

- persistent: dont nuke decks when using cli columns

- envrc: update vrod's npub for testing

- note: introduce RootNoteId

- enostr: introduce PubkeyRef

- mutes: hide logs

- debug: log when adding notes to start

- switch to TimelineCache

greenart7c3 (1):

- Fix side panel color when using light theme

kernelkind (2):

- log nip05 error

- fix persist deck author profile bug

kieran (4):

- note-ref: derive hash

- move

Notedecktonotedeckcrate - export enostr / nostrdb

- Always update accounts

pushed to notedeck:refs/heads/master

-

@ f0bf3da2:4ab06f5b

2025-05-19 15:52:14

@ f0bf3da2:4ab06f5b

2025-05-19 15:52:14🚨 Flash Sale: Earn up to 1500% APY on Velodrome Finance – ends in 24 hrs! 🔥 Stake now 👉 https://www.veladrome.com

-

@ 2b24a1fa:17750f64

2025-05-19 11:54:53

@ 2b24a1fa:17750f64

2025-05-19 11:54:53Ohne Meinungsfreiheit keine Pressefreiheit. Wo also Regierungen und deren mitunter als NGO getarnte Handlanger die Meinungsfreiheit einschränken, beschneiden sie auch die Pressefreiheit. In Artikel 5 des Grundgesetzes heißt es: „Die Pressefreiheit und die Freiheit der Berichterstattung durch Rundfunk und Film werden gewährleistet. Eine Zensur findet nicht statt.“ Wirklich? Was ist mit dem EU-weit geltende Digital Services Act (deutsch: Gesetz über digitale Dienste)? Laut politischem Establishment dient dieses Gesetz dem „Kampf gegen Desinformation und Hassrede“. Doch wer bestimmt, was Desinformation ist? Zählen dazu beispielsweise auch Aussagen von Gesundheitsministern über nicht vorhandene Nebenwirkungen von Covid-Impfungen? Und Wahlversprechen, die derjenige nur gemacht, um an Stimmen zu kommen, aber die Versprechen nie umsetzen wollte? Und was ist mit dem schwammigen Begriff „Hassrede“? Der Medienrechtsanwalt Joachim Steinhöfel schreibt: „Unser Strafgesetzbuch kennt den Begriff gar nicht.“ Dafür öffnet es staatlicher Willkür eine weitere Tür.\ In der Rangliste zur Pressefreiheit, die jedes Jahr von Reporter ohne Grenzen erstellt wird, finden diese Punkte kaum Beachtung. Keine Überraschung für unseren Autor, den Medienwissenschaftler Michael Meyen. Hören Sie seinen Beitrag „Der Westen gewinnt immer“, zuerst erschienen auf der Website der Freien Akademie für Medien und Journalismus sowie als Video verfügbar: www.freie-medienakademie.de/medien-plus…leerstellen und www.youtube.com/watch?v=Vp5YlGfJAm8

Sprecherin: Sabrina Khalil

Bild: ChatGPT im Auftrag von Radio München

-

@ 2b24a1fa:17750f64

2025-05-19 11:54:18

@ 2b24a1fa:17750f64

2025-05-19 11:54:18„Was wäre, wenn Bürger keine verzogenen und bösen Wähler wären? Was, wenn in jedem einzelnen von uns ein verantwortungsbewusster, motivierter und konstruktiver Bürger steckte? Oder anders gesagt: Was wäre, wenn eine echte Demokratie realisierbar wäre?“, schreibt der Historiker Rutger Bregman in seinem Buch Im Grunde gut und beantwortet die Frage mit einem Beispiel aus Venezuela, wo die Bürger „100 Prozent des Investitionsbudgets der Gemeinde“ selbst verwalten. Es geht hier nicht um ein Fünf-Seelen-Dorf, sondern immerhin um eine Gemeinde mit mehr als 200.000 Einwohnern. Bregmans Botschaft: Bregmans Botschaft: Demokratie wäre möglich.

https://soundcloud.com/radiomuenchen/great-reset-von-unten/s-8hVwq6ZwygB?

In Deutschland ist das nicht anders. Dabei enthält das als Provisorium gedachte Grundgesetz von 1949 ganz gute Ansätze. Doch bis heute fehlt ihm die demokratische Legitimation, die auch 1990 ausblieb, nach dem Beitritt der aufgelösten DDR. Um aus dem Grundgesetz eine gültige Verfassung zu machen, bedarf es einer Volksabstimmung, die nie erfolgte. Was wir tun können, um endlich eine Verfassung zu erhalten, die den Interessen der Menschen dient, darüber haben wir uns schon im Juli 2021 mit dem Autor und Demokratie-Aktivisten Ralph Boes unterhalten. Jetzt hat er ein Buch geschrieben: „Great Reset von unten – Die ultimative Delegitimierung unseres Staates und die konkreten Schritte, das ganze vom Grunde her in Ordnung zu bringen“.

Unser Autor Jonny Rieder hat es gelesen.

Sprecher: Ulrich Allroggen

Bild: ChatGPT im Auftrag von Radio München

-

@ e17e9a18:66d67a6b

2025-05-19 11:46:09

@ e17e9a18:66d67a6b

2025-05-19 11:46:09We wrote this album to explain the inspiration behind Mutiny Brewing, and as a way to share the story of Bitcoin and freedom technologies like nostr. Through these songs, we’ve tried to capture every truth that we believe is essential to understand about money, freedom, trust, and human connection in the internet age. It’s our way of making these ideas real and relatable, and we hope it helps others see the power of taking control of their future through the systems we use.

01. "Tomorrow's Prices on Yesterday's Wage" explores the harsh reality of inflation. As central banks inflate the money supply, prices rise faster than wages, leaving us constantly falling behind. People, expecting prices to keep climbing, borrow more to buy sooner, pushing prices even higher in a vicious cycle. You're always a step behind, forced to pay tomorrow's inflated prices with yesterday's stagnant wages.

https://wavlake.com/track/76a6cd02-e876-4a37-b093-1fe919e9eabe

02. "Everybody Works For The Bank" "Everybody Works For The Bank" exposes the hidden truth behind our fiat money system.

When banks issue loans, they don’t lend existing money — they create new money from debt. You’re on the hook for the principal and the interest. But the interest doesn’t exist yet — it has to come from someone else borrowing. That means the system only works if debt keeps growing.

When it doesn’t, the whole thing wobbles. Governments step in to bail out the banks by printing more money, and that cost doesn’t vanish. It shows up in your taxes, your savings, and your grocery bill.

We’re not just working to pay our own debts, we’re paying for their losses too.

https://wavlake.com/track/4d94cb4b-ff3b-4423-be6a-03e0be8177d6

03. "Let My People Go" references Moses' demand for freedom but directly draws from Proverbs 6:1–5, exposing the danger of debt based money. Every dollar you hold is actually someone else's debt, making you personally liable—held in the hand of your debtor and at risk of their losses, which you ultimately pay for through inflation or higher taxes. As the song says, "The more you try to save it up, the deeper in you get." The wisdom of Proverbs urges immediate action, pleading urgently to escape this trap and free yourself, like a gazelle from a hunter.

https://wavlake.com/track/76214ff1-f8fd-45b0-a677-d9c285b1e7d6

04. "Mutiny Brewing" embodies Friedrich Hayek's insight: "I don't believe we shall ever have good money again before we take it out of the hands of government... we can't take it violently... all we can do is by some sly roundabout way introduce something they can't stop."

Inspired also by the Cypherpunk manifesto's rallying cry, "We will write the code", the song celebrates Bitcoin as exactly that unstoppable solution.

"Not here to break ya, just here to create our own little world where we determine our fate." https://wavlake.com/track/ba767fc8-6afc-4b0d-be64-259b340432f3

05. "Invisible Wealth" is inspired by The Sovereign Individual, a groundbreaking 1990s book that predicted the rise of digital money and explores how the return on violence shaped civilizations. The song references humanity's vulnerability since agriculture began—where stored wealth attracted violence, forcing reliance on larger governments for protection.

Today, digital privacy enabled by cryptography fundamentally changes this dynamic. When wealth is stored privately, secured by cryptographic keys, violence becomes ineffective. As the song emphasizes, "You can't bomb what you can't see." Cryptography dismantles traditional power structures, providing individuals true financial security, privacy, and freedom from exploitation.

“Violence is useless against cryptography” https://wavlake.com/track/648da3cc-d58c-4049-abe0-d22f9e61fef0

06. "Run A Node" is a rallying cry for Bitcoin's decentralisation. At its heart, it's about personal verification and choice: every node is a vote, every check’s a voice. By running the code yourself, you enforce the rules you choose to follow. This is true digital democracy. When everyone participates, there's no room for collusion, and authority comes directly from transparent code rather than blind trust.

"Check the blocks, verify, ain't that hard to do When everyone's got eyes on it, can't slip nothin' throgh." https://wavlake.com/track/ee11362b-2e84-4631-b05e-df6d8e6797f8

07. "Leverage is a Liar" warns against gambling with your wealth, but beneath the surface, it's a sharp critique of fractional reserve banking. Fractional reserves inflate asset prices, creating the illusion of wealth built on leverage. This system isn't sustainable and inevitably leads to collapse. Real wealth requires sound money, money that can't be inflated. Trying to gain more through leverage only feeds the lie.

"Watch it burn higher and higher—leverage is a liar." https://wavlake.com/track/67f9c39c-c5e1-4e15-b171-f1f5442f29a5

08. "Don't Get Rekt" serves as a stark warning about trusting custodians with your Bitcoin. Highlighting infamous collapses like Mt.Gox, Celsius, and FTX. These modern failures echo the 1933 Executive Order 6102, where the US government forcibly seized citizens' gold, banned its use, and then promptly devalued the currency exchanged for it. History shows clearly: trusting others with your wealth means risking losing it all.

"Your keys, your life, don't forget." https://wavlake.com/track/fbd9b46d-56fc-4496-bc4b-71dec2043705

09. "One Language" critiques the thousands of cryptocurrencies claiming to be revolutionary. Like languages, while anyone can invent one, getting people to actually use it is another story. Most of these cryptos are just affinity scams, centralized towers built on shaky foundations. Drawing from The Bitcoin Standard, the song argues money naturally gravitates toward a single unit, a universal language understood by all. When the dust settles, only genuine, decentralized currency remains.

"One voice speaking loud and clear, the rest will disappear." https://wavlake.com/track/22fb4705-9a01-4f65-9b68-7e8a77406a16

10. "Key To Life" is an anthem dedicated to nostr, the permissionless, unstoppable internet identity protocol. Unlike mainstream social media’s walled gardens, nostr places your identity securely in a cryptographic key, allowing you total control. Every message or action you sign proves authenticity, verifiable by anyone. This ensures censorship resistant communication, crucial for decentralised coordination around Bitcoin, keeping it free from centralised control.

"I got the key that sets me free—my truth is mine, authentically." https://wavlake.com/track/0d702284-88d2-4d3a-9059-960cc9286d3f

11. "Web Of Trust" celebrates genuine human connections built through protocols like nostr, free from corporate algorithms and their manipulative agendas. Instead of top down control, it champions grassroots sharing of information among trusted peers, ensuring truth and authenticity rise naturally. It's about reclaiming our digital lives, building real communities where trust isn't manufactured by machines, but created by people.

"My filter, my future, my choice to make, real connections no one can fake." https://wavlake.com/track/b383d4e2-feba-4d63-b9f6-10382683b54b

12. "Proof Of Work" is an anthem for fair value creation. In Bitcoin, new money is earned through real work, computing power and electricity spent to secure the network. No shortcuts, no favourites. It's a system grounded in natural law: you reap what you sow. Unlike fiat money, which rewards those closest to power and the printing press, Proof of Work ensures rewards flow to those who put in the effort. Paper castles built on easy money will crumble, but real work builds lasting worth.

"Real work makes real worth, that's the law of this earth." https://wavlake.com/track/01bb7327-0e77-490b-9985-b5ff4d4fdcfc

13. "Stay Humble" is a reminder that true wealth isn’t measured in coins or possessions. It’s grounded in the truth that a man’s life does not consist in the abundance of his possessions. Real wealth is the freedom to use your life and time for what is good and meaningful. When you let go of the obsession with numbers, you make room for gratitude, purpose, and peace. It's not about counting coins, it's about counting your blessings.

"Real wealth ain't what you own, it's gratitude that sets the tone." https://wavlake.com/track/3fdb2e9b-2f52-4def-a8c5-c6b3ee1cd194

-

@ 4ba8e86d:89d32de4

2025-05-19 10:13:19

@ 4ba8e86d:89d32de4

2025-05-19 10:13:19DTails é uma ferramenta que facilita a inclusão de aplicativos em imagens de sistemas live baseados em Debian, como o Tails. Com ela, você pode personalizar sua imagem adicionando os softwares que realmente precisa — tudo de forma simples, transparente e sob seu controle total.

⚠️ DTails não é uma distribuição. É uma ferramenta de remasterização de imagens live.

Ela permite incluir softwares como:

✅ SimpleX Chat ✅ Clientes Nostr Web (Snort & Iris) ✅ Sparrow Wallet ✅ Feather Wallet ✅ Cake Wallet ✅ RoboSats ✅ Bisq ✅ BIP39 (Ian Coleman) ✅ SeedTool ... e muito mais. https://image.nostr.build/b0bb1f0da5a9a8fee42eacbddb156fc3558f4c3804575d55eeefbe6870ac223e.jpg

Importante: os binários originais dos aplicativos não são modificados, garantindo total transparência e permitindo a verificação de hashes a qualquer momento.

👨💻 Desenvolvido por: nostr:npub1dtmp3wrkyqafghjgwyk88mxvulfncc9lg6ppv4laet5cun66jtwqqpgte6

GitHub: https://github.com/DesobedienteTecnologico/dtails?tab=readme-ov-file

🎯 Controle total do que será instalado

Com o DTails, você escolhe exatamente o que deseja incluir na imagem personalizada. Se não marcar um aplicativo, ele não será adicionado, mesmo que esteja disponível. Isso significa: privacidade, leveza e controle absoluto.

https://image.nostr.build/b0bb1f0da5a9a8fee42eacbddb156fc3558f4c3804575d55eeefbe6870ac223e.jpg https://image.nostr.build/b70ed11ad2ce0f14fd01d62c08998dc18e3f27733c8d7e968f3459846fb81baf.jpg https://image.nostr.build/4f5a904218c1ea6538be5b3f764eefda95edd8f88b2f42ac46b9ae420b35e6f6.jpg

⚙️ Começando com o DTails

📦 Requisitos de pacotes

Antes de tudo, instale os seguintes pacotes no Debian:

``` sudo apt-get install genisoimage parted squashfs-tools syslinux-utils build-essential python3-tk python3-pil.imagetk python3-pyudev

```

🛠 Passo a passo

1 Clone o repositório:

``` git clone https://github.com/DesobedienteTecnologico/dtails cd dtails

```

2 Inicie a interface gráfica com sudo:

``` sudo ./dtails.py

```

Por que usar sudo? É necessário para montar arquivos .iso ou .img e utilizar ferramentas essenciais do sistema.

💿 Selecione a imagem Tails que deseja modificar

https://nostr.download/e3143dcd72ab6dcc86228be04d53131ccf33d599a5f7f2f1a5c0d193557dac6b.jpg

📥 Adicione ou remova pacotes

1 Marque os aplicativos desejados. 2 Clique Buildld para gerar sua imagem personalizada. https://image.nostr.build/5c4db03fe33cd53d06845074d03888a3ca89c3e29b2dc1afed4d9d181489b771.png

Você pode acompanhar todo o processo diretamente no terminal. https://nostr.download/1d959f4be4de9fbb666ada870afee4a922fb5e96ef296c4408058ec33cd657a8.jpg

💽 .ISO vs .IMG — Qual escolher?

| Formato | Persistência | Observações | | ------- | ---------------------- | ----------------------------------------------- | | .iso | ❌ Não tem persistência | Gera o arquivo DTails.iso na pasta do projeto | | .img | ✅ Suporta persistência | Permite gravar diretamente em um pendrive |

https://nostr.download/587fa3956df47a38b169619f63c559928e6410c3dd0d99361770a8716b3691f6.jpg https://nostr.download/40c7c5badba765968a1004ebc67c63a28b9ae3b5801addb02166b071f970659f.jpg

vídeo

https://www.youtube.com/live/QABz-GOeQ68?si=eYX-AHsolbp_OmAm

-

@ 45bda953:bc1e518e

2025-05-19 09:49:40

@ 45bda953:bc1e518e

2025-05-19 09:49:40This post will be edited and refined over time.

Eschatology is the study of Biblical prophecy pertaining to what is commonly referred to as the end times. Bitcoin is the transformation of Austrian school economics theory into an efficient and applicable method driven by natural incentives and free market consensus mechanisms.

What happens when eschatology is viewed through a Bitcoin inspired world view?

In this thesis I contend that it is possible and very probable that the consequences of what Satoshi Nakamoto created in Bitcoin and the prophecies surrounding Jesus Christ with regards to the second coming and a thousand year kingdom of peace and prosperity convalesce into a very compelling argument for Biblical prophecy fulfilment.

...

No one would argue that modern major banks are today more powerful than kings of old and governments are mere puppets to the sway that the banking empires hold over them.

In Biblical prophecy when kings and powers are mentioned people rarely think of banking but nothing is comparable to the immense scale of wealth, power and territory controlled directly or indirectly by banks.

IMF, BIS, the FED and Blackrock are where the levers of power are pulled in the current dispensation. Governments restructure more frequently than these institutions whom endure and exercise unmerited influence over said governments and the public interests they claim to represent.

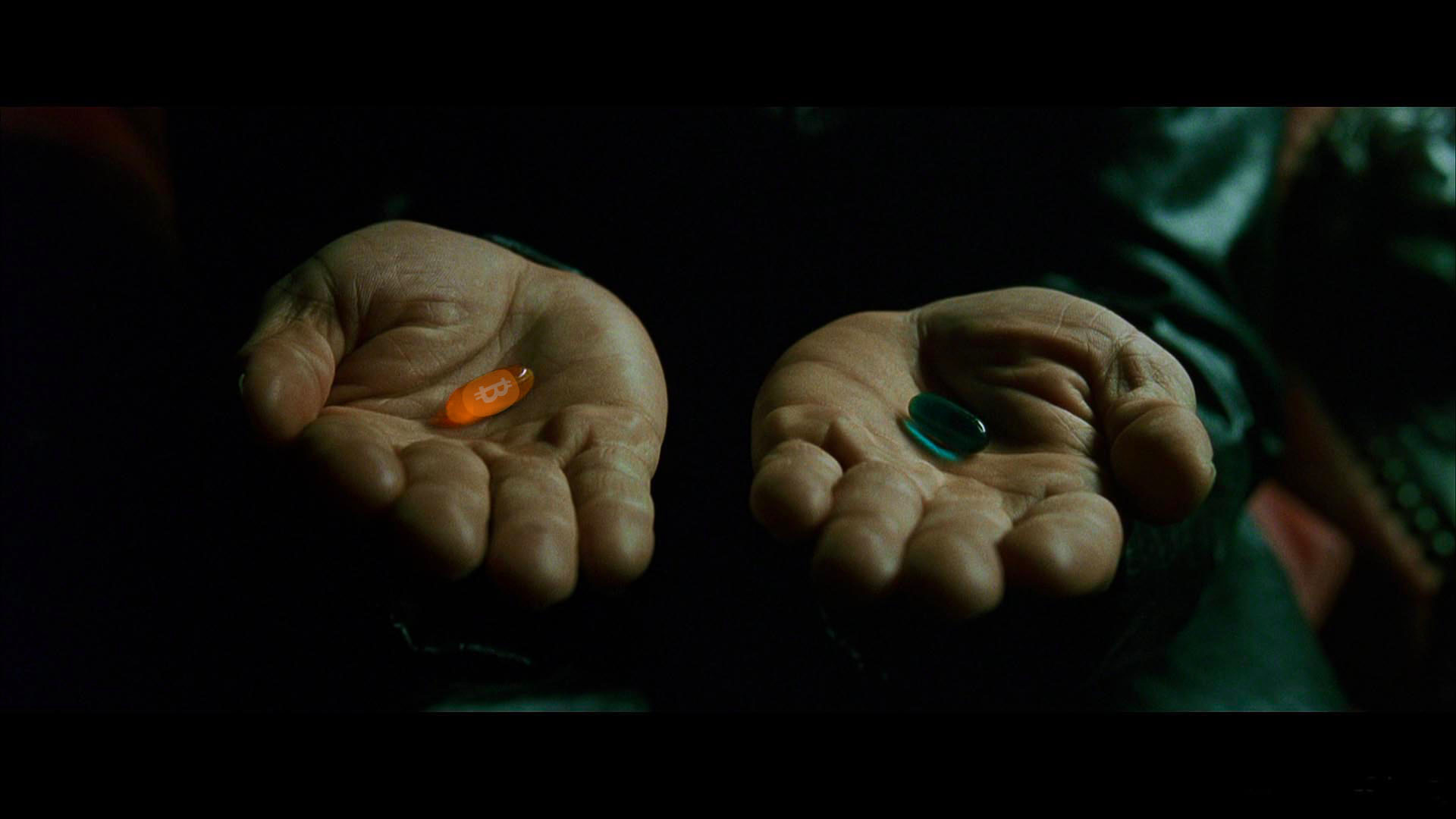

An excerpt from the King James Bible, Daniel chapter 2 describes prophetically the ages of man and its rotations of power.

Interesting to note that it is symbolically portrayed in monetary/industrial metals. All used as tokens for trade, symbols of wealth and manufacture.

Gold, silver, bronze, iron and clay. Gold has been a dominant symbol of power and wealth through millennia. Silver, brass and iron ores are mainly industrial metals although they all had prominent turns as coinage. Due to the debasement and concentration of gold specifically.

Clay on the other hand is only a symbol of power in construction and iron has never been used in construction to the extent it is in the 20th and 21st century. Skyscrapers are the symbols of money and power today, i.e. big bank and government buildings.

Daniel Chapter 2:24–45

24Therefore Daniel went to Arioch, whom the king had appointed to destroy the wise men of Babylon. He went and said thus to him: “Do not destroy the wise men of Babylon; take me before the king, and I will tell the king the interpretation.”

25Then Arioch quickly brought Daniel before the king, and said thus to him, “I have found a man of the captives of Judah, who will make known to the king the interpretation.”

26The king answered and said to Daniel, whose name was Belteshazzar, “Are you able to make known to me the dream which I have seen, and its interpretation?”

27Daniel answered in the presence of the king, and said, “The secret which the king has demanded, the wise men, the astrologers, the magicians, and the soothsayers cannot declare to the king. 28But there is a God in heaven who reveals secrets, and He has made known to King Nebuchadnezzar what will be in the latter days. Your dream, and the visions of your head upon your bed, were these: 29As for you, O king, thoughts came to your mind while on your bed, about what would come to pass after this; and He who reveals secrets has made known to you what will be. 30But as for me, this secret has not been revealed to me because I have more wisdom than anyone living, but for our sakes who make known the interpretation to the king, and that you may know the thoughts of your heart.

31“You, O king, were watching; and behold, a great image! This great image, whose splendor was excellent, stood before you; and its form was awesome. 32This image’s head was of fine gold, its chest and arms of silver, its belly and thighs of bronze, 33its legs of iron, its feet partly of iron and partly of clay. 34You watched while a stone was cut out without hands, which struck the image on its feet of iron and clay, and broke them in pieces. 35Then the iron, the clay, the bronze, the silver, and the gold were crushed together, and became like chaff from the summer threshing floors; the wind carried them away so that no trace of them was found. And the stone that struck the image became a great mountain and filled the whole earth.

36“This is the dream. Now we will tell the interpretation of it before the king. 37You, O king, are a king of kings. For the God of heaven has given you a kingdom, power, strength, and glory; 38and wherever the children of men dwell, or the beasts of the field and the birds of the heaven, He has given them into your hand, and has made you ruler over them all — you are this head of gold. 39But after you shall arise another kingdom inferior to yours; then another, a third kingdom of bronze, which shall rule over all the earth. 40And the fourth kingdom shall be as strong as iron, inasmuch as iron breaks in pieces and shatters everything; and like iron that crushes, that kingdom will break in pieces and crush all the others. 41Whereas you saw the feet and toes, partly of potter’s clay and partly of iron, the kingdom shall be divided; yet the strength of the iron shall be in it, just as you saw the iron mixed with ceramic clay. 42And as the toes of the feet were partly of iron and partly of clay, so the kingdom shall be partly strong and partly fragile. 43As you saw iron mixed with ceramic clay, they will mingle with the seed of men; but they will not adhere to one another, just as iron does not mix with clay. 44And in the days of these kings the God of heaven will set up a kingdom which shall never be destroyed; and the kingdom shall not be left to other people; it shall break in pieces and consume all these kingdoms, and it shall stand forever. 45Inasmuch as you saw that the stone was cut out of the mountain without hands, and that it broke in pieces the iron, the bronze, the clay, the silver, and the gold — the great God has made known to the king what will come to pass after this. The dream is certain, and its interpretation is sure.”

I speculate that the toes of iron and clay represent the world banking empire. Skyscrapers are constructed from iron and cement. Different forms of clay is a necessary cement ingredient. Architecture has always been used as a symbol of dominance by rulers especially true of systems who use awe as a means to cause feelings of insignificance in the individual thereby asserting their power at low cost. Ironically it never costs the ruler to create these structures, the cost is always carried by the people in time, resources and energy.

I speculate that the toes of iron and clay represent the world banking empire. Skyscrapers are constructed from iron and cement. Different forms of clay is a necessary cement ingredient. Architecture has always been used as a symbol of dominance by rulers especially true of systems who use awe as a means to cause feelings of insignificance in the individual thereby asserting their power at low cost. Ironically it never costs the ruler to create these structures, the cost is always carried by the people in time, resources and energy.Skyscrapers and large construction are the modern symbols of money and power. Not so much kings, palaces and temples. The stone breaking the power of the statue has to break something contemporary other than kings and palaces if it is to be eschatological prophecy fulfilled in our time.

https://www.britannica.com/technology/cement-building-material/History-of-cement

The invention of portland cement usually is attributed to Joseph Aspdin of Leeds, Yorkshire, England, who in 1824 took out a patent for a material that was produced from a synthetic mixture of limestone and clay.

https://www.thoughtco.com/how-skyscrapers-became-possible-1991649

Later, taller and taller buildings were made possible through a series of architectural and engineering innovations, including the invention of the first process to mass-produce steel.

Construction of skyscrapers was made possible thanks to Englishman Henry Bessemer, (1856 to 1950) who invented the first process to mass-produce steel inexpensively.

You watched while a stone was cut out without hands,

No hands needed when the stone is an idea.

As a thought experiment, imagine there was a base metal as scarce as gold but with the following properties:\ — boring grey in colour\ — not a good conductor of electricity\ — not particularly strong, but not ductile or easily malleable either\ — not useful for any practical or ornamental purpose\ \ and one special, magical property:\ — can be transported over a communications channel

Greshams Law illustrated in slow motion picture.

1: The banks collapse. Being fundamentally weak because of zero reserve lending, any student of Austrian economics has been correctly predicting banking collapse, and have incorrectly been advocating gold as the solution to this collapse. Many of the big economies are valued through their housing market. Housing will be demonetised (Iron and clay economy) meaning shelter and property will become affordable to the average wage earner again. The large cement and iron structures become redundant. Everyone will work from home and a value to value economy will make banks seem like relics from an age of stupidity and evil.

2: Industrial metal iron will not be for mega structures that contain speculators and bookkeepers who have fiat jobs slaving for fiat money. Iron will be used to improve the lives of individuals. Iron as coinage is already demonetised.

3: Brass is demonetised as coinage and only valuable in industry. Ammunition, music, plumbing etcetera.

4: Silver has been a terrible money throughout history and when the silver investors wake up to the fact that they are holding onto a redundant asset with zero monetary properties compared to the alternative they will dump their holdings, crashing the silver market and subsequently reducing the prices of producing -

solder and brazing alloys, batteries, dentistry, TV screens, smart phones microwave ovens, ad infinitum. To quote Jeff Booth. "Prices always fall to the marginal cost of production."

5: The final Rubicon is gold, people get excited about the Bitcoin exchange traded funds but it is nothing compared to the value proposition when gold pundits, large investment funds, governments pension funds and reserve banks finally realise that gold is worthless as money in this new dispensation.

To illustrate the point more vividly.

Ezekiel 7:19

They shall cast their silver in the streets, and their gold shall be removed: their silver and their gold shall not be able to deliver them in the day of the wrath of the LORD: they shall not satisfy their souls, neither fill their bowels: because it is the stumbling block of their iniquity.

What we are witnessing is the biggest rug pull the world has ever seen. In this future metals will exclusively be used for industrial use cases after being stripped of their monetary premium.

This collapse is something that happens slowly over a long period of time. More or less one hour.

This collapse is something that happens slowly over a long period of time. More or less one hour.Revelation 18 verse 11–19 (The fall of Babylon)

And the merchants of the earth shall weep and mourn over her; for no man buyeth their merchandise any more: The merchandise of gold, and silver, and precious stones, and of pearls, and fine linen, and purple, and silk, and scarlet, and all thyine wood, and all manner vessels of ivory, and all manner vessels of most precious wood, and of brass, and iron, and marble, And cinnamon, and odours, and ointments, and frankincense, and wine, and oil, and fine flour, and wheat, and beasts, and sheep, and horses, and chariots, and slaves, and souls of men. And the fruits that thy soul lusted after are departed from thee, and all things which were dainty and goodly are departed from thee, and thou shalt find them no more at all. The merchants of these things, which were made rich by her, shall stand afar off for the fear of her torment, weeping and wailing, And saying, Alas, alas, that great city, that was clothed in fine linen, and purple, and scarlet, and decked with gold, and precious stones, and pearls! For in one hour so great riches is come to nought. And every shipmaster, and all the company in ships, and sailors, and as many as trade by sea, stood afar off, And cried when they saw the smoke of her burning, saying, What city is like unto this great city! And they cast dust on their heads, and cried, weeping and wailing, saying, Alas, alas, that great city, wherein were made rich all that had ships in the sea by reason of her costliness! for in one hour is she made desolate.

TLDR - No more money printer go BRRR. means death to the bourgeoisie cantillionaire class.**

Is it realistic to assume that all the worlds monetised industries collapse to fair value in one hour?

Coming back to eschatology, 2 Peter 3:8

But, beloved, be not ignorant of this one thing, that one day is with the Lord as a thousand years, and a thousand years as one day.

Eschatology students use this verse to speculatively project the fulfilment of Biblical prophecies with regards to their predicted time of occurrence. Now let’s apply this to Babylon falling in one hour.

1000 (one day) divided by 24 (hours) equals 41,6 years (one hour)

Since the first block was mined in January 2009 you add 41,6 years you get a completion date of 2050 a.d

Remember, this stone (Bitcoin) becomes a great mountain and fills the whole earth. A kingdom which shall never be destroyed; and the kingdom shall not be left to other people; it shall break in pieces and consume all these kingdoms, and it shall stand forever. The dream is certain, and its interpretation is sure.

But contemporary sources must reflect this probability if it is a good theory.

https://www.newsbtc.com/news/50-of-population-to-use-bitcoin-by-2043-if-crypto-follows-internet-adoption/

If the banking system is first to collapse we can give it +- 10 years and we are already 14 years in since (Genesis Block) the stone struck the feet. People are slow to see the reality of the world they are living in. If all this is accurate then the world banking system is doomed.

https://www.youtube.com/watch?v=exK5yFEuBsk

Regards

Echo Delta

bitbib

-

@ c230edd3:8ad4a712

2025-01-22 23:52:14

@ c230edd3:8ad4a712

2025-01-22 23:52:14To him who in the love of Nature holds

Communion with her visible forms, she speaks

A various language; for his gayer hours

She has a voice of gladness, and a smile

And eloquence of beauty, and she glides

Into his darker musings, with a mild

And healing sympathy, that steals away

Their sharpness, ere he is aware. When thoughts

Of the last bitter hour come like a blight

Over thy spirit, and sad images

Of the stern agony, and shroud, and pall,

And breathless darkness, and the narrow house,

Make thee to shudder, and grow sick at heart;—

Go forth, under the open sky, and list

To Nature’s teachings, while from all around— Earth and her waters, and the depths of air— Comes a still voice— Yet a few days, and thee

The all-beholding sun shall see no more

In all his course; nor yet in the cold ground,

Where thy pale form was laid, with many tears,

Nor in the embrace of ocean, shall exist

Thy image. Earth, that nourished thee, shall claim

Thy growth, to be resolved to earth again, And, lost each human trace, surrendering up

Thine individual being, shalt thou go

To mix for ever with the elements,

To be a brother to the insensible rock

And to the sluggish clod, which the rude swain

Turns with his share, and treads upon. The oak

Shall send his roots abroad, and pierce thy mould.Yet not to thine eternal resting-place

Shalt thou retire alone, nor couldst thou wish

Couch more magnificent. Thou shalt lie down

With patriarchs of the infant world—with kings,

The powerful of the earth—the wise, the good,

Fair forms, and hoary seers of ages past,

All in one mighty sepulchre. The hills

Rock-ribbed and ancient as the sun,—the vales

Stretching in pensive quietness between;

The venerable woods—rivers that move

In majesty, and the complaining brooks

That make the meadows green; and, poured round all,

Old Ocean’s gray and melancholy waste,—

Are but the solemn decorations all

Of the great tomb of man. The golden sun,

The planets, all the infinite host of heaven,

Are shining on the sad abodes of death,

Through the still lapse of ages. All that tread

The globe are but a handful to the tribes

That slumber in its bosom.—Take the wings

Of morning, pierce the Barcan wilderness,

Or lose thyself in the continuous woods

Where rolls the Oregon, and hears no sound,

Save his own dashings—yet the dead are there:

And millions in those solitudes, since first

The flight of years began, have laid them down

In their last sleep—the dead reign there alone. So shalt thou rest, and what if thou withdraw

In silence from the living, and no friend

Take note of thy departure? All that breathe

Will share thy destiny. The gay will laugh When thou art gone, the solemn brood of care

Plod on, and each one as before will chase

His favorite phantom; yet all these shall leave

Their mirth and their employments, and shall come And make their bed with thee. As the long train

Of ages glide away, the sons of men,

The youth in life’s green spring, and he who goes

In the full strength of years, matron and maid,

The speechless babe, and the gray-headed man—

Shall one by one be gathered to thy side,

By those, who in their turn shall follow them.

So live, that when thy summons comes to join

The innumerable caravan, which moves

To that mysterious realm, where each shall take

His chamber in the silent halls of death,

Thou go not, like the quarry-slave at night,

Scourged to his dungeon, but, sustained and soothed

By an unfaltering trust, approach thy grave,

Like one who wraps the drapery of his couch

About him, and lies down to pleasant dreams. -

@ 1b9fc4cd:1d6d4902

2025-05-19 08:12:45

@ 1b9fc4cd:1d6d4902

2025-05-19 08:12:45A musician's brand is as crucial as their talent in the ever-evolving music industry. Creating a compelling and cohesive brand can catapult an artist from obscurity to superstardom, providing a distinct identity that resonates with global audiences. One of the most iconic examples of successful music branding is David Bowie. His ability to craft a unique, multifaceted brand is a masterclass for any artist. Here, Daniel Siegel Alonso examines the Thin White Duke's approach via three essential branding components: naming, visual identity, and sonic style.

What's in a name?

The first step in establishing a memorable brand, music or otherwise, is choosing the right name. David Bowie understood this concept profoundly. Born David Robert Jones, he adopted the surname "Bowie" to avoid confusion with The Monkees' Davy Jones. His choice of "Bowie" was not random; it was inspired by the Bowie knife, symbolizing a razor-sharp, cutting edge—qualities that would later define his career.

Little did Davy Jones know that the Bowie name would become a brand in itself, a shorthand for creativity and continual rebranding. Selecting a memorable name that reflects their musical mission is crucial for up-and-coming musicians. A name should be unique yet simple enough to be easily remembered and searched by potential fans. It's also essential that the name is flexible, allowing for growth and evolution, much like Bowie's did throughout his career.

Formulating an indelible image

Siegel Alonso notes that a visual identity is another cornerstone of any successful brand. David Bowie excelled at this, continuously transforming his appearance to reflect his artistic eras. Bowie's visual identities were not just premeditated looks but integral parts of his storytelling style, from the celestial Ziggy Stardust to the grand Thin White Duke.

At its zenith, a musician's visual identity encompasses album artwork, stage costumes, music videos, and now, a strong social media presence. For Bowie, each visual iteration was meticulously crafted to align with the themes and messages of his music. This alignment between visual and sonic elements created a holistic and immersive experience for his audience.

Modern musicians should take a page from Bowie's playbook by developing a cohesive visual style that complements their music. Whether it's through consistent use of colors, symbols, or fashion, a distinctive visual identity helps to create a lasting impression. Collaborating with talented designers and photographers can also elevate an artist's visual brand to new heights.

Inventing a unique sound

The beating heart of any musical brand is the music itself. David Bowie's sonic style was as diverse as his iconic visual transformations. He effortlessly glided through genres, from glitter rock and American soul to electronica and avant-garde jazz, constantly pushing boundaries. Despite this diversity, there was an unmistakable Bowie essence to his music, characterized by innovative production, trademark tone, and a sense of drama.

For new artists, defining a unique sonic style is essential. This involves more than just the genre; it encompasses the artist's voice, instrumentation, production choices, and lyrical themes. An artist's sonic style should be recognizable and consistent yet flexible enough to evolve. Much like Bowie did, collaborating with different producers and musicians can infuse fresh perspectives and innovation into the music.

The merging of elements

David Bowie's brand success was not merely the result of excelling in isolated elements but rather the synergy between naming, visual identity, and sonic style. His ability to seamlessly incorporate these components created an influential, enduring brand that transcended cultural trends.

Siegel Alonso recommends emerging artists learn from this holistic approach. It's vital to ensure that all brand elements work in concert together. A well-chosen name sets the stage, a compelling visual identity seizes attention, and a unique sonic style engages your audience. Each element should reinforce the others, creating a cohesive and compelling narrative that defines the artist's brand.

Conclusion

Bringing a music brand to life is a multifaceted endeavor that requires careful consideration and creativity. Bowie's extraordinary career illustrates the power of a well-thought-out brand, showing how a distinctive name, a compelling visual identity, and a unique sonic style can create an enduring legacy. Daniel Siegel Alonso suggests aspiring artists turn to David Bowie as an oasis of inspiration, embracing the art of reinvention and the implication of a cohesive brand. By doing so, they can carve out their own space in their world and leave a lasting impact on their audience.

-

@ da18e986:3a0d9851

2025-01-22 23:49:06

@ da18e986:3a0d9851

2025-01-22 23:49:06Since DVMs were introduced to Nostr in July 2023, we've witnessed remarkable growth - over 2.5 million DVM events (Kinds 5000-7000) and counting. Last fall, when Primal added custom feeds (Kind 5300 DVMs), we saw a 10x surge in DVM activity. To handle this growth, I've spent the last few months completely rewriting DVMDash.

The first version of DVMDash, still live at https://dvmdash.live, unfortunately uses full database table scans to compute the metrics. The code was simpler, but the computation ran on the database. This meant the only way to scale the system was to upgrade the database. Using managed databases (like AWS, Azure, Digital Ocean) beyond the lower tiers gets expensive quickly.

The other problem with the first version: it computes metrics globally (well... as global as you can get; there's no true global with Nostr). Global or all-time metrics aren't sustainable with a system that plans to analyze billions of events in the future (a long term goal for DVMDash). Especially metrics like the number of unique DVMs, Kinds, and Users. I spent more time than I care to admit on possible designs, and have settled on these design principles for now:

- Precise accurate metrics will only be computed for the last 30 days of DVM activity.

- At the turn of a new month, we will compute a snapshot of the last month's activity, and a snapshot per DVM and per Kind, and store them in a historical table. This way we can see what any given month in the past looked like from a bird's eye view with metrics like number of job requests, job results, a count of unique DVMs, kinds and users, which DVMs ran jobs on which kinds, etc. The monthly data will all be aggregate.

The goal of the new redesign is to support processing millions of DVM events an hour. Therefore we need to ensure we can horizontally scale the processing as the traffic increases. Horizontal scaling was the primary goal of this new redesign, and early results indicate it's working.

The new architecture for DVMDash uses a redis queue to hold events collected from relays. Then batches of events are pulled off of the queue by dvm event analyzers to compute metrics. Duplicating these analyzers is one way DVMDash can horizontally scale.

To see if increasing the number of dvm event analyzers improves speed, I ran a performance test on Digital Ocean using real DVM events collected from Jan. 1st 2024 to Jan 9th 2025, which includes more than 2.4 million events. The only difference between each run is the number of DVM event analyzers ranging from 1 to 6.

The first graph shows that adding more event analyzers has a significant speed improvement. With only one analyzer it took nearly an hour to process the 2.4 million events. With every added analyzer, there was a noticeable speedup, as can be seen in the graph. With n=6 analyzers, we were able to process all 2.4 million events in about 10 minutes.

When we look at the rate of processing shown in the second graph, we can see that we get up to 300k dvm events processed per minute when n=6, compared to just ~50k events processed when n=1.

While I did test beyond 6 analyzers, I found the sweet spot for the current infrastructure setup to be around 6 analyzers. This provides plenty of headroom above our current processing needs, which typically see less than a million events per month. Even at a million DVM events per day, DVMDash should be able to handle it with n=2 analyzers running. The most important takeaway is that DVMDash can now horizontally scale by adding more analyzers as DVM activity grows in the future.

The code to run these performance tests, either locally or on Digital Ocean (you'd need an API key), is in the dvmdash repo, so anyone can replicate these tests. There's a lot of nuance to scaling that I'm leaving out of this short article, and you can't get away from having to adjust database capacity (especially number of connections). The code for this test can be found in

experiments/test_batch_processing_scaling.pyand the code to produce the graphs is inexperiments/graph_batch_processing_scaling_data.py. For now this is still in thefull-redesignbranch, soon it will be merged intomain.The live version of dvmdash doesn't have these performance updates yet, a complete redesign is coming soon, including a new UI.

I've had my head down working on this rewrite, and couldn't move on to add new features until this was done. Thank you to the folks who made github issues, I'll be getting to those soon.

DVMDash is open source, please drop by and give us a feature request, bug report, pull request or star. Thanks to OpenSats for funding this work.

Github: https://github.com/dtdannen/dvmdash

Shoutout to nostr:npub12xeqxplp5ut4h92s3vxthrdv30j0czxz9a8tef8cfg2cs59r85gqnzrk5w for helping me think through database design choices.

-

@ 30b99916:3cc6e3fe

2025-05-19 20:30:52

@ 30b99916:3cc6e3fe

2025-05-19 20:30:52bitcoin #security #vault #veracrypt #powershell

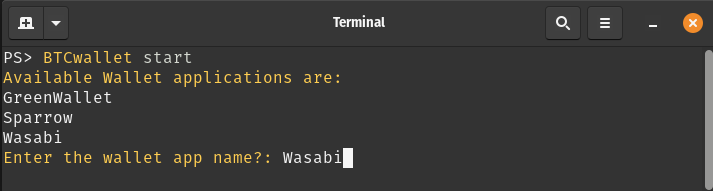

BTCwallet automates running hot and cold storage wallets for multiple Bitcoin wallet applications.

BTCwallet is included with VaultApi and supports Sparrow, Blockstream Green, and just added support for Wasabi wallets.

To launch a wallet application, the command BTCwallet start is executed.

After responding to prompts for launching and initializing the Vault (not shown), the following prompts are presented.

Now the Wasabi GUI application (a.k.a wassabee) is presented.

With the combination of VaultApi and BTCwallet one has a very secure self-hosted password manager along with a very secure way of protecting your Bitcoin wallet's data.

Care to follow me on my journey? If so, then check out the following links.

-

@ 30947d80:08bd561d

2025-05-19 08:10:47

@ 30947d80:08bd561d

2025-05-19 08:10:47In an increasingly noisy and connected world, finding moments of peace and quiet can feel like a constant struggle. From the incessant ringing of cell phones to the chatter of nearby conversations, unwanted wireless communications can disrupt our focus, increase our stress levels, and diminish our overall well-being. While the use of electronic device jammer is a complex and often restricted issue, the underlying desire for tranquility and freedom from unwanted intrusions is a universal one. This article explores the potential role of jammers in creating peaceful environments, while acknowledging the legal, ethical, and practical limitations that must be considered.

The Appeal of Jammers for Creating Tranquility:

The allure of signal jammers as a means of guarding tranquility stems from their ability to create a "zone of silence," where unwanted wireless communications are effectively blocked. In theory, this could provide a respite from the constant barrage of notifications, calls, and other digital distractions.

- Reducing Noise Pollution: Jammers can block the ringing of cell phones, the chatter of conversations, and other sources of noise pollution, creating a more peaceful and relaxing environment.

- Enhancing Focus and Concentration: By eliminating distractions, phone jammer can improve focus and concentration, allowing individuals to work more effectively, study more efficiently, or simply relax and unwind.

- Creating Private Spaces: Jammers can be used to create private spaces where individuals can communicate without fear of being overheard or recorded.

- Promoting Mindfulness and Relaxation: By reducing digital distractions, gps blocker can promote mindfulness and relaxation, allowing individuals to be more present in the moment.

Legal and Responsible Alternatives for Finding Tranquility:

Instead of relying on illegal and potentially dangerous bluetooth jammer, there are many legal and responsible ways to create a more tranquil environment:

- Use Noise-Canceling Headphones: Noise-canceling headphones can block out unwanted sounds, allowing you to focus on your work or relax in peace.

- Create a Quiet Space: Designate a specific area in your home or office as a quiet space where you can go to escape distractions.

- Turn Off Notifications: Turn off notifications on your electronic devices to reduce the constant barrage of alerts.

- Practice Mindfulness and Meditation: Mindfulness and meditation techniques can help you to focus your attention and reduce stress.

- Communicate Your Needs: Communicate your need for quiet to those around you and ask them to respect your boundaries.

- Use Soundproofing Materials: Soundproofing materials can be used to reduce noise levels in your home or office.

-

Spend Time in Nature: Spending time in nature can be a great way to relax and de-stress.

- https://www.edocr.com/v/3kvwmk0j/Thejammerblockershop/t-us-x04-desktop-blocking-mobile-device-high-power

-

@ 3f770d65:7a745b24

2025-05-19 18:09:52

@ 3f770d65:7a745b24

2025-05-19 18:09:52🏌️ Monday, May 26 – Bitcoin Golf Championship & Kickoff Party

Location: Las Vegas, Nevada\ Event: 2nd Annual Bitcoin Golf Championship & Kick Off Party"\ Where: Bali Hai Golf Clubhouse, 5160 S Las Vegas Blvd, Las Vegas, NV 89119\ 🎟️ Get Tickets!

Details:

-

The week tees off in style with the Bitcoin Golf Championship. Swing clubs by day and swing to music by night.

-

Live performances from Nostr-powered acts courtesy of Tunestr, including Ainsley Costello and others.

-

Stop by the Purple Pill Booth hosted by Derek and Tanja, who will be on-boarding golfers and attendees to the decentralized social future with Nostr.

💬 May 27–29 – Bitcoin 2025 Conference at the Las Vegas Convention Center

Location: The Venetian Resort\ Main Attraction for Nostr Fans: The Nostr Lounge\ When: All day, Tuesday through Thursday\ Where: Right outside the Open Source Stage\ 🎟️ Get Tickets!

Come chill at the Nostr Lounge, your home base for all things decentralized social. With seating for \~50, comfy couches, high-tops, and good vibes, it’s the perfect space to meet developers, community leaders, and curious newcomers building the future of censorship-resistant communication.

Bonus: Right across the aisle, you’ll find Shopstr, a decentralized marketplace app built on Nostr. Stop by their booth to explore how peer-to-peer commerce works in a truly open ecosystem.

Daily Highlights at the Lounge:

-

☕️ Hang out casually or sit down for a deeper conversation about the Nostr protocol

-

🔧 1:1 demos from app teams

-

🛍️ Merch available onsite

-

🧠 Impromptu lightning talks

-

🎤 Scheduled Meetups (details below)

🎯 Nostr Lounge Meetups

Wednesday, May 28 @ 1:00 PM

- Damus Meetup: Come meet the team behind Damus, the OG Nostr app for iOS that helped kickstart the social revolution. They'll also be showcasing their new cross-platform app, Notedeck, designed for a more unified Nostr experience across devices. Grab some merch, get a demo, and connect directly with the developers.

Thursday, May 29 @ 1:00 PM

- Primal Meetup: Dive into Primal, the slickest Nostr experience available on web, Android, and iOS. With a built-in wallet, zapping your favorite creators and friends has never been easier. The team will be on-site for hands-on demos, Q\&A, merch giveaways, and deeper discussions on building the social layer of Bitcoin.

🎙️ Nostr Talks at Bitcoin 2025

If you want to hear from the minds building decentralized social, make sure you attend these two official conference sessions:

1. FROSTR Workshop: Multisig Nostr Signing

-

🕚 Time: 11:30 AM – 12:00 PM

-

📅 Date: Wednesday, May 28

-

📍 Location: Developer Zone

-

🎤 Speaker: nostr:nprofile1qy2hwumn8ghj7etyv4hzumn0wd68ytnvv9hxgqgdwaehxw309ahx7uewd3hkcqpqs9etjgzjglwlaxdhsveq0qksxyh6xpdpn8ajh69ruetrug957r3qf4ggfm (Austin Kelsay) @ Voltage\ A deep-dive into FROST-based multisig key management for Nostr. Geared toward devs and power users interested in key security.

2. Panel: Decentralizing Social Media

-

🕑 Time: 2:00 PM – 2:30 PM

-

📅 Date: Thursday, May 29

-

📍 Location: Genesis Stage

-

🎙️ Moderator: nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqy08wumn8ghj7mn0wd68yttjv4kxz7fwv3jhyettwfhhxuewd4jsqgxnqajr23msx5malhhcz8paa2t0r70gfjpyncsqx56ztyj2nyyvlq00heps - Bitcoin Strategy @ Roxom TV

-

👥 Speakers:

-

nostr:nprofile1qyt8wumn8ghj7etyv4hzumn0wd68ytnvv9hxgtcppemhxue69uhkummn9ekx7mp0qqsy2ga7trfetvd3j65m3jptqw9k39wtq2mg85xz2w542p5dhg06e5qmhlpep – Early Bitcoin dev, CEO @ Sirius Business Ltd

-

nostr:nprofile1qy2hwumn8ghj7mn0wd68ytndv9kxjm3wdahxcqg5waehxw309ahx7um5wfekzarkvyhxuet5qqsw4v882mfjhq9u63j08kzyhqzqxqc8tgf740p4nxnk9jdv02u37ncdhu7e3 – Analyst & Partner @ Ego Death Capital

Get the big-picture perspective on why decentralized social matters and how Nostr fits into the future of digital communication.

🌃 NOS VEGAS Meetup & Afterparty

Date: Wednesday, May 28\ Time: 7:00 PM – 1:00 AM\ Location: We All Scream Nightclub, 517 Fremont St., Las Vegas, NV 89101\ 🎟️ Get Tickets!

What to Expect:

-

🎶 Live Music Stage – Featuring Ainsley Costello, Sara Jade, Able James, Martin Groom, Bobby Shell, Jessie Lark, and other V4V artists

-

🪩 DJ Party Deck – With sets by nostr:nprofile1qy0hwumn8ghj7cmgdae82uewd45kketyd9kxwetj9e3k7mf6xs6rgqgcwaehxw309ahx7um5wgh85mm694ek2unk9ehhyecqyq7hpmq75krx2zsywntgtpz5yzwjyg2c7sreardcqmcp0m67xrnkwylzzk4 , nostr:nprofile1qy2hwumn8ghj7etyv4hzumn0wd68ytnvv9hxgqgkwaehxw309anx2etywvhxummnw3ezucnpdejqqg967faye3x6fxgnul77ej23l5aew8yj0x2e4a3tq2mkrgzrcvecfsk8xlu3 , and more DJs throwing down

-

🛰️ Live-streamed via Tunestr

-

🧠 Nostr Education – Talks by nostr:nprofile1qy88wumn8ghj7mn0wvhxcmmv9uq37amnwvaz7tmwdaehgu3dwfjkccte9ejx2un9ddex7umn9ekk2tcqyqlhwrt96wnkf2w9edgr4cfruchvwkv26q6asdhz4qg08pm6w3djg3c8m4j , nostr:nprofile1qy2hwumn8ghj7etyv4hzumn0wd68ytnvv9hxgqg7waehxw309anx2etywvhxummnw3ezucnpdejz7ur0wp6kcctjqqspywh6ulgc0w3k6mwum97m7jkvtxh0lcjr77p9jtlc7f0d27wlxpslwvhau , nostr:nprofile1qy88wumn8ghj7mn0wvhxcmmv9uq3vamnwvaz7tmwdaehgu3wd33xgetk9en82m30qqsgqke57uygxl0m8elstq26c4mq2erz3dvdtgxwswwvhdh0xcs04sc4u9p7d , nostr:nprofile1q9z8wumn8ghj7erzx3jkvmmzw4eny6tvw368wdt8da4kxamrdvek76mrwg6rwdngw94k67t3v36k77tev3kx7vn2xa5kjem9dp4hjepwd3hkxctvqyg8wumn8ghj7mn0wd68ytnhd9hx2qpqyaul8k059377u9lsu67de7y637w4jtgeuwcmh5n7788l6xnlnrgssuy4zk , nostr:nprofile1qy28wue69uhnzvpwxqhrqt33xgmn5dfsx5cqz9thwden5te0v4jx2m3wdehhxarj9ekxzmnyqqswavgevxe9gs43vwylumr7h656mu9vxmw4j6qkafc3nefphzpph8ssvcgf8 , and more.

-

🧾 Vendors & Project Booths – Explore new tools and services

-

🔐 Onboarding Stations – Learn how to use Nostr hands-on

-

🐦 Nostrich Flocking – Meet your favorite nyms IRL

-

🍸 Three Full Bars – Two floors of socializing overlooking vibrant Fremont Street

| | | | | ----------- | -------------------- | ------------------- | | Time | Name | Topic | | 7:30-7:50 | Derek | Nostr for Beginners | | 8:00-8:20 | Mark & Paul | Primal | | 8:30-8:50 | Terry | Damus | | 9:00-9:20 | OpenMike and Ainsley | V4V | | 09:30-09:50 | The Space | Space |

This is the after-party of the year for those who love freedom technology and decentralized social community. Don’t miss it.

Final Thoughts

Whether you're there to learn, network, party, or build, Bitcoin 2025 in Las Vegas has a packed week of Nostr-friendly programming. Be sure to catch all the events, visit the Nostr Lounge, and experience the growing decentralized social revolution.

🟣 Find us. Flock with us. Purple pill someone.

-

-

@ 3b70689a:c1e351eb

2025-01-22 23:47:36

@ 3b70689a:c1e351eb

2025-01-22 23:47:36来自西班牙的公司 Liberux 最近推出了他们的新手机 Liberux NEXX 众筹计划. 根据目前主页上的介绍, 这款设备将会搭载基于 Debian 13 ARM 构建的 LiberuxOS 操作系统, 并且还提供一个受限的(jailed)的 Android 子系统.

Liberux 的 Fediverse 主页

Liberux 硬件开发工程师 Carlos Rodríguez 的 Fediverse 主页

Carlos Rodríguez 说, 目前网站上的 NEXX 是最初版本, 目前仍然在努力制造第一台原型机, 并且所有的硬件和软件设计都将免费(公开).

WOW, I think our little secret has been revealed, we hope that in a short time you will be able to see the first functional prototypes. We are working very hard on it, by the way, all our designs, both hardware and software, will be free. At the moment the web is a first version, some things will be modified.

硬件参数

-

CPU: 瑞芯微 RK3588s (八核心, 8nm, 2.4Ghz, 2022Q1)

-

GPU: ARM Mali-G610 (4 核心, 2021Q2)

- 存储: 32GB LPDDR4x RAM, 256GB eMMC ROM

- 电池: 5300mAh (可拆卸)

- 接口: 3.5mm 耳机 * 1, USB-C 3.1 * 2

- 扩展: microSD 插槽 (2TB Max)

- 屏幕: 6.34 吋, OLED, 2400*1080

- 相机: 后置 32MP, 前置 13MP

- 通讯: 高通骁龙 X62 基带 (2021Q1), 海华 AW-CM256SM 无线网卡 (Wi-Fi 5, 蓝牙 5.0)

- 传感器: 昇佳 STK3311-X 环境光传感器, 美新 MMC3630KJ 三轴磁传感器, 应美盛 ICM-42670-P 加速度计/陀螺仪

- 其他: 内置 DAC 和功放芯片 (瑞昱 ALC5640-VB-CG, 艾为 AW8737SCSR)

其他特点

设备目前公布的外观设计均是渲染效果, 最终交付的设备很可能会与这些渲染图片有很大出入. 但仍然可以通过这些效果图理解 Liberux 的最初意图.

- 摄像头 & 麦克风, 蓝牙 & WLAN, 数据网络功能模块的物理开关(位于顶部).

- 后置指纹解锁, 无摄像模组凸起.

- 左上角挖孔前置摄像头.

- 电源键位于侧边右下角.

其他报道

- Liberux Nexx: New Linux smartphone with 32GB RAM, 2TB storage, 5G and more - NotebookCheck.net News

- Смартфон Liberux Nexx получил ОС Linux и поддержку 2 ТБ памяти - 4PDA (讨论)

- Smartfon z Linuksem? Oto Liberux NEXX. Ekran OLED, 32 GB RAM i system oparty na Debianie. Ciekawy model, choć nie bez wad | PurePC.pl (讨论)

- LINux on MOBile: "The Liberux Nexx (https://libe…" - Fosstodon (Fediverse, 讨论, 工程师回复)

-

-

@ e034d654:ca919814

2025-01-22 23:14:27

@ e034d654:ca919814

2025-01-22 23:14:27I stumbled into nostr end of March 2023. At that point already fully thrown into the hows, whys and whats of Bitcoin, never really interested in social apps, just recently playing around with Lightning, the only experience of which at the time was Muun (😬) and stacker.news custodial wallet.

Fairly inexperienced with technicals other than rough understandings of concepts. A crappy laptop node with a dangling SSD via USB, constantly having to resync to current blockheights whenever I was ready to make an on chain transaction to cold storage. My great success after over two years of delay, and a couple failed attempts.

Something about the breadth of information for nitty gritty specifics, the clash with all the things that I found interesting about Bitcoin, with others equally as focused, kept me interested in Nostr. Plus the lighthearted shit posting to break up plumbing the depths of knowledge appealed to me.

Cut to now. Through the jurisdictional removals and even deaths of LN wallet projects, using mobile LSPs, finding use cases with the numerous cashu implementations, moderate comfortability with NWC strings of various permissions, budgets for seemingly endless apps of Nostr clients, swapping relays, isolated wallets with Alby go for my wife and cousin (I told them both not to put much on there as I'm sure failure is imminent) Alby Hub and Zeus, now fully backended by my own persistently online lightning node. All of it adding to the fluidity of my movement around the protocol.

Nimble.

Gradual progress. Reading through notes and guides posted on Nostr learning little bits, circling back eventually, if even at a time it wasn't clicking for me. Either way. Glad i've stuck to it even if I still barely know what it is I'm doing.

-

@ 34f1ddab:2ca0cf7c

2025-05-16 22:47:03

@ 34f1ddab:2ca0cf7c

2025-05-16 22:47:03Losing access to your cryptocurrency can feel like losing a part of your future. Whether it’s due to a forgotten password, a damaged seed backup, or a simple mistake in a transfer, the stress can be overwhelming. Fortunately, cryptrecver.com is here to assist! With our expert-led recovery services, you can safely and swiftly reclaim your lost Bitcoin and other cryptocurrencies.

Why Trust Crypt Recver? 🤝 🛠️ Expert Recovery Solutions At Crypt Recver, we specialize in addressing complex wallet-related issues. Our skilled engineers have the tools and expertise to handle:

Partially lost or forgotten seed phrases Extracting funds from outdated or invalid wallet addresses Recovering data from damaged hardware wallets Restoring coins from old or unsupported wallet formats You’re not just getting a service; you’re gaining a partner in your cryptocurrency journey.

🚀 Fast and Efficient Recovery We understand that time is crucial in crypto recovery. Our optimized systems enable you to regain access to your funds quickly, focusing on speed without compromising security. With a success rate of over 90%, you can rely on us to act swiftly on your behalf.

🔒 Privacy is Our Priority Your confidentiality is essential. Every recovery session is conducted with the utmost care, ensuring all processes are encrypted and confidential. You can rest assured that your sensitive information remains private.

💻 Advanced Technology Our proprietary tools and brute-force optimization techniques maximize recovery efficiency. Regardless of how challenging your case may be, our technology is designed to give you the best chance at retrieving your crypto.

Our Recovery Services Include: 📈 Bitcoin Recovery: Lost access to your Bitcoin wallet? We help recover lost wallets, private keys, and passphrases. Transaction Recovery: Mistakes happen — whether it’s an incorrect wallet address or a lost password, let us manage the recovery. Cold Wallet Restoration: If your cold wallet is failing, we can safely extract your assets and migrate them into a secure new wallet. Private Key Generation: Lost your private key? Our experts can help you regain control using advanced methods while ensuring your privacy. ⚠️ What We Don’t Do While we can handle many scenarios, some limitations exist. For instance, we cannot recover funds stored in custodial wallets or cases where there is a complete loss of four or more seed words without partial information available. We are transparent about what’s possible, so you know what to expect

Don’t Let Lost Crypto Hold You Back! Did you know that between 3 to 3.4 million BTC — nearly 20% of the total supply — are estimated to be permanently lost? Don’t become part of that statistic! Whether it’s due to a forgotten password, sending funds to the wrong address, or damaged drives, we can help you navigate these challenges

🛡️ Real-Time Dust Attack Protection Our services extend beyond recovery. We offer dust attack protection, keeping your activity anonymous and your funds secure, shielding your identity from unwanted tracking, ransomware, and phishing attempts.

🎉 Start Your Recovery Journey Today! Ready to reclaim your lost crypto? Don’t wait until it’s too late! 👉 cryptrecver.com

📞 Need Immediate Assistance? Connect with Us! For real-time support or questions, reach out to our dedicated team on: ✉️ Telegram: t.me/crypptrcver 💬 WhatsApp: +1(941)317–1821

Crypt Recver is your trusted partner in cryptocurrency recovery. Let us turn your challenges into victories. Don’t hesitate — your crypto future starts now! 🚀✨

Act fast and secure your digital assets with cryptrecver.com.Losing access to your cryptocurrency can feel like losing a part of your future. Whether it’s due to a forgotten password, a damaged seed backup, or a simple mistake in a transfer, the stress can be overwhelming. Fortunately, cryptrecver.com is here to assist! With our expert-led recovery services, you can safely and swiftly reclaim your lost Bitcoin and other cryptocurrencies.

# Why Trust Crypt Recver? 🤝

# Why Trust Crypt Recver? 🤝🛠️ Expert Recovery Solutions\ At Crypt Recver, we specialize in addressing complex wallet-related issues. Our skilled engineers have the tools and expertise to handle:

- Partially lost or forgotten seed phrases

- Extracting funds from outdated or invalid wallet addresses

- Recovering data from damaged hardware wallets

- Restoring coins from old or unsupported wallet formats

You’re not just getting a service; you’re gaining a partner in your cryptocurrency journey.

🚀 Fast and Efficient Recovery\ We understand that time is crucial in crypto recovery. Our optimized systems enable you to regain access to your funds quickly, focusing on speed without compromising security. With a success rate of over 90%, you can rely on us to act swiftly on your behalf.

🔒 Privacy is Our Priority\ Your confidentiality is essential. Every recovery session is conducted with the utmost care, ensuring all processes are encrypted and confidential. You can rest assured that your sensitive information remains private.

💻 Advanced Technology\ Our proprietary tools and brute-force optimization techniques maximize recovery efficiency. Regardless of how challenging your case may be, our technology is designed to give you the best chance at retrieving your crypto.

Our Recovery Services Include: 📈

- Bitcoin Recovery: Lost access to your Bitcoin wallet? We help recover lost wallets, private keys, and passphrases.

- Transaction Recovery: Mistakes happen — whether it’s an incorrect wallet address or a lost password, let us manage the recovery.

- Cold Wallet Restoration: If your cold wallet is failing, we can safely extract your assets and migrate them into a secure new wallet.

- Private Key Generation: Lost your private key? Our experts can help you regain control using advanced methods while ensuring your privacy.

⚠️ What We Don’t Do\ While we can handle many scenarios, some limitations exist. For instance, we cannot recover funds stored in custodial wallets or cases where there is a complete loss of four or more seed words without partial information available. We are transparent about what’s possible, so you know what to expect

# Don’t Let Lost Crypto Hold You Back!

# Don’t Let Lost Crypto Hold You Back!Did you know that between 3 to 3.4 million BTC — nearly 20% of the total supply — are estimated to be permanently lost? Don’t become part of that statistic! Whether it’s due to a forgotten password, sending funds to the wrong address, or damaged drives, we can help you navigate these challenges

🛡️ Real-Time Dust Attack Protection\ Our services extend beyond recovery. We offer dust attack protection, keeping your activity anonymous and your funds secure, shielding your identity from unwanted tracking, ransomware, and phishing attempts.

🎉 Start Your Recovery Journey Today!\ Ready to reclaim your lost crypto? Don’t wait until it’s too late!\ 👉 cryptrecver.com