-

@ bf47c19e:c3d2573b

2025-05-19 21:41:37

@ bf47c19e:c3d2573b

2025-05-19 21:41:37Originalni tekst na bitcoin-balkan.com.

Pregled sadržaja

- Šta je Bitcoin?

- Šta Bitcoin može da učini za vas?

- Zašto ljudi kupuju Bitcoin?

- Da li je vaš novac siguran u dolarima, kućama, akcijama ili zlatu?

- Šta je bolje za štednju od dolara, kuća i akcija?

- Po čemu se Bitcoin razlikuje od ostalih valuta?

- kako Bitcoin spašava svet?

- Kako mogu da saznam više o Bitcoin-u?

Bitcoin čini da štednja novca bude kul – i praktična – ponovo. Ovaj članak objašnjava kako i zašto.

Šta je Bitcoin?

Bitcoin se naziva digitalno zlato, mašina za istinu, blockchain, peer to peer mreža čvorova, energetski ponor i još mnogo toga. Bitcoin je, u stvari, sve ovo. Međutim, ova objašnjenja su često toliko tehnička i suvoparna, da bi većina ljudi radije gledala kako trava raste. Što je najvažnije, ova objašnjenja ne pokazuju kako Bitcoin ima bilo kakve koristi za vas.

iPod nije postao kulturološka senzacija jer ga je Apple nazvao „prenosnim digitalnim medijskim uređajem“. Postao je senzacija jer su ga zvali “1,000 pesama u vašem džepu.”

Ne zanima vas šta je Bitcoin. Vas zanima šta on može da učini za vas.

Baš kao i Internet, vaš auto, vaš telefon, kao i mnogi drugi uređaji i sistemi koje svakodnevno koristite, vi ne treba da znate šta je Bitcoin ili kako to funkcioniše da biste razumeli šta on može da učini za vas.

Šta Bitcoin može da učini za vas?

Bitcoin može da sačuva vaš teško zarađeni novac.

Bitcoin je stekao veliku pažnju u 2017. i 2018. godini zbog svoje spekulativne upotrebe. Mnogi ljudi su ga kupili nadajući se da će se obogatiti. Cena je naglo porasla, a zatim se srušila. Ovo nije bio prvi put da je Bitcoin uradio to. Međutim, niko nikada nije izgubio novac držeći bitcoin duže od 3,5 godine – ćak i ako je kupio na apsolutnim vrhovima.

Zašto Bitcoin konstantno raste? Ljudi počinju da shvataju koliko je Bitcoin moćan, kao način uštede novca u svetu u kojem je ’novac’ poput dolara, eura i drugih nacionalnih valuta dizajniran da gubi vrednost.

Ovo čini Bitcoin odličnom opcijom za štednju novca na nekoliko godina ili više. Bitcoin je bolji od štednje novca u dolarima, akcijama, nekretninama, pa čak i u zlatu.

Zato pokušajte da zaboravite na trenutak na razumevanje blockchaina, digitalne valute, kriptografije, seed fraza, novčanika, rudarstva i svih ostalih nerazumljivih termina. Za sada, razgovarajmo o tome zašto ljudi kupuju Bitcoin: razlog je prostiji nego što vi mislite.

Zašto ljudi kupuju Bitcoin?

Naravno, svako ima svoj razlog za kupovinu Bitcoin-a. Jedan od razloga, koji verovatno često čujete, je taj što mu vrednost raste. Ljudi žele da se obogate. Uskoče kao spekulanti, krenu u vožnju i najverovatnije ih prodaju ubrzo nakon kupovine.

Međutim, čak i kada cena krene naglo prema gore i strmoglavo padne nazad, mnogi ljudi ostanu i nakon tog pada. Otkud mi to znamo? Broj aktivnih novčanika dnevno, koji je otprilike sličan broju korisnika Bitcoin-a, nastavlja da raste. Takođe, nakon svakog balona u istoriji Bitcoin-a, cena se nikada ne vraća na svoju cenu pre balona. Uvek ostane malo višlja. Bitcoin se penje, a svaka masovna spekulativna serija dovodi sve više i više ljudi.

Broj aktivnih Bitcoin novčanika neprekidno raste

„Aktivna adresa“ znači da je neko tog dana poslao Bitcoin transakciju. Donji grafikon je na logaritamskoj skali.

Izvor: Glassnode

Izvor: GlassnodeCena Bitcoina se neprestano penje

Kroz istoriju Bitcoin-a možemo videti divlje kolebanje cena, ali nakon svakog balona, cena se ostaje višlja nego pre. Ovo je cena Bitcoin-a na logaritamskoj skali.

Izvor: Glassnode

Izvor: GlassnodeTo pokazuje da se ljudi zadržavaju: potražnja za Bitcoin-om se povećava. Da je svaki masovni rast cena bio samo balon koji su iscenirali prevaranti koji žele brzo da se obogate, cena bi se vratila na nivo pre balona. To se dogodilo sa lalama, ali ne i sa Bitcoin-om.

I zašto se onda cena Bitcoin-a stalno povećava? Sve veći broj ljudi čuva Bitcoin dugoročno – oni razumeju šta Bitcoin može učiniti za njihovu štednju.

Zašto ljudi štede svoj novac u Bitcoin-u umesto na štednim računima, kućama, deonicama ili zlatu? Hajde da pogledajmo sve te metode štednje, i zatim da ih uporedimo sa Bitcoin-om.

Da li je vaš novac siguran u dolarima, kućama, akcijama ili zlatu?

Tokom mnogo godina, to su bile pristojne opcije za štednju. Međutim, sistem koji podržava vrednost svega ovoga je u krizi.

Dolari, Euri, Dinari

Dolari i sve ostale „tradicionalne“ valute koje proizvode vlade, stvorene su da izgube vrednost kroz inflaciju. Banke i tradicionalni monetarni sistem uzrokuju inflaciju stalnim stvaranjem i distribucijom novog novca. Kada Američke Federalne Rezerve objave ciljanu stopu od 2% inflacije, to znači da žele da vaš novac svake godine izgubi 2% od svoje vrednosti. Čak i sa inflacijom od samo 2%, vaša štednja u dolarima izgubiće polovinu vrednosti tokom 40-godišnjeg radnog veka.

Izveštena inflacija se danas opasno povečava, uprkos rastućem „buretu sa barutom“ koji bi mogao da explodira i dovede do masivne hiperinflacije. Što je više valute u opticaju, to je više baruta u buretu.

Naše vlade su ekonomiju napunile valutama da bankarski sistem ne bi propao nakon finansijske krize koja se dogodila 2008. godine. Od tada je većina glavnih centralnih banaka postavila vrlo niske kamatne stope, što pojedincima i korporacijama omogućava dobijanje jeftinijih kredita. To znači da mnogi pojedinci i korporacije podižu ogromne kredite i koriste ih za kupovinu druge imovine poput deonica, umetničkih dela i nekretnina. Sve ovo pozajmljivanje znači da stvaramo tone novog novca i stavljamo ga u opticaj.

Računi za podsticaje (stimulus bills) COVID-19 za 2020. godinu unose trilione u sistem. Ovoliko stvaranje valuta na kraju dovodi do inflacije – velikog gubitka u vrednosti valute.

Količina američkog dolara u opticaju gotovo se udvostručila od marta 2020. godine. Izvor

Količina američkog dolara u opticaju gotovo se udvostručila od marta 2020. godine. IzvorRačuni za podsticaje su bez presedana, toliko da je neko izmislio meme da opiše ovu situaciju.

Resurs koji vlade mogu da naprave u većem broju da bi platile svoje račune? Ne zvuči kao dobro mesto za štednju novca.

Kuće

Kuće su tokom prošlog veka bile pristojan način štednje novca. Međutim, pad cena nekretnina 2007. godine doveo je do toga da su mnogi vlasnici kuća izgubili svu ušteđevinu.

Danas su kuće gotovo nepristupačne za prosečnog čoveka. Jedan od načina da se ovo izmeri je koliko godišnjih zarada treba prosečnom čoveku da zaradi ekvivalent vrednosti prosečne kuće. Prema CityLab-u, publikaciji Bloomberg-a koja pokriva gradove, porodica može da priuštiti određenu kuću ako košta manje od 2,6 godišnjih prihoda domaćinstva te porodice.

Međutim, prema RZS (Republički zavod za statistiku) prosečan prihod porodičnog domaćinstva u Srbiji iznosi oko 570 EUR mesečno ili otprilike 7.000 EUR godišnje. Nažalost, samo najjeftinija područja van gradova imaju srednje cene kuća od oko 2,6 prosečnih godišnjih prihoda domaćinstva. U većim gradovima poput Beograda i Novog Sada srednja cena kuće je veća od 10 prosečnih godišnjih prihoda jednog domaćinstva.

Ako nekako možete sebi da priuštite kuću, ona bi mogla biti pristojna zaliha vrednosti. Dokle god ne doživimo još jedan krah i izvršitelji zaplene ovu imovinu mnogim vlasnicima kuća.

Akcije

Berza je u prošlosti takođe dobro poslovala. Međutim, sporo i stabilno povećanje tržišta događa se u dosadnom, predvidljivom svetu. Svakog dana vidimo sve manje toga. Nakon ubrzanja korona virusa, videli smo smo najbrži pad američke berze u istoriji od 25% – brži od Velike depresije.

Neki se odlučuju za ulaganje u obveznice i drugu finansijsku imovinu, ali ’prinosi’ za tu imovinu – procenat kamate zarađene na imovinu iz godine u godinu – stalno opada. Sve veći broj odredjenih imovina ima čak i negativne prinose, što znači da posedovanje te imovine košta! Ovo je veliki problem za sve koji se oslanjaju na penziju. Plus, s obzirom na to da su akcije denominovane u tradicionalnim valutama poput dolara i evra, inflacija pojede prinos koji investitor dobije.

Najgore od svega je to što ti isti ekonomski krahovi koji uzrokuju masovna otpuštanja i teško tržište rada takođe znače i nagli pad cena akcija. Čuvanje ušteđevine u akcijama može značiti i gubitak štednje i gubitak posla zbog recesije. Teška vremena mogu da vas prisile da svoje akcije prodate po vrlo malim cenama samo da biste platili svoje račune.

A to nije baš siguran način štednje novca.

Zlato

Vrednost zlata neprekidno se povećavala tokom 5000 godina, obično padajući onda kada berza obećava jače prinose.

Evidencija vrednosti zlata je solidna. Međutim, zlato nosi i druge rizike. Većina ljudi poseduje zlato na papiru. Oni fizički ne poseduju zlato, već ga njihova banka čuva za njih. Zbog toga je zlato veoma podložno konfiskaciji od strane vlade.

Zašto bi vlada konfiskovala nečije zlato, a kamoli u demokratskoj zemlji u „slobodnom svetu“? Ali to se dešavalo i ranije. 1933. godine Izvršnom Naredbom 6102, predsednik Roosevelt naredio je svim Amerikancima da prodaju svoje zlato vladi u zamenu za papirne dolare. Vlada je iskoristila pretnju zatvorom za prikupljanje zlata u fizičkom obliku. Znali su da se zlato više poštuje kao zaliha vrednosti širom sveta od papirnih dolara.

Ako posedujete svoje zlato na nekoj od aplikacija za trgovanje akcijama, možete se kladiti da će vam ga država oduzeti ako joj zatreba. Čak i ako posedujete fizičko zlato, onda ga izlažete mogućnosti krađe – od strane kriminalca ili vaše vlade.

Vaša uštedjevina nije bezbedna.

Rast cena svih gore navedenih sredstava zavisi od našeg trenutnog političkog i ekonomskog sistema koji se nastavlja kao i tokom proteklih 100 godina. Međutim, danas vidimo ogromne pukotine u ovom sistemu.

Sistem ne funkcioniše dobro za većinu ljudi.

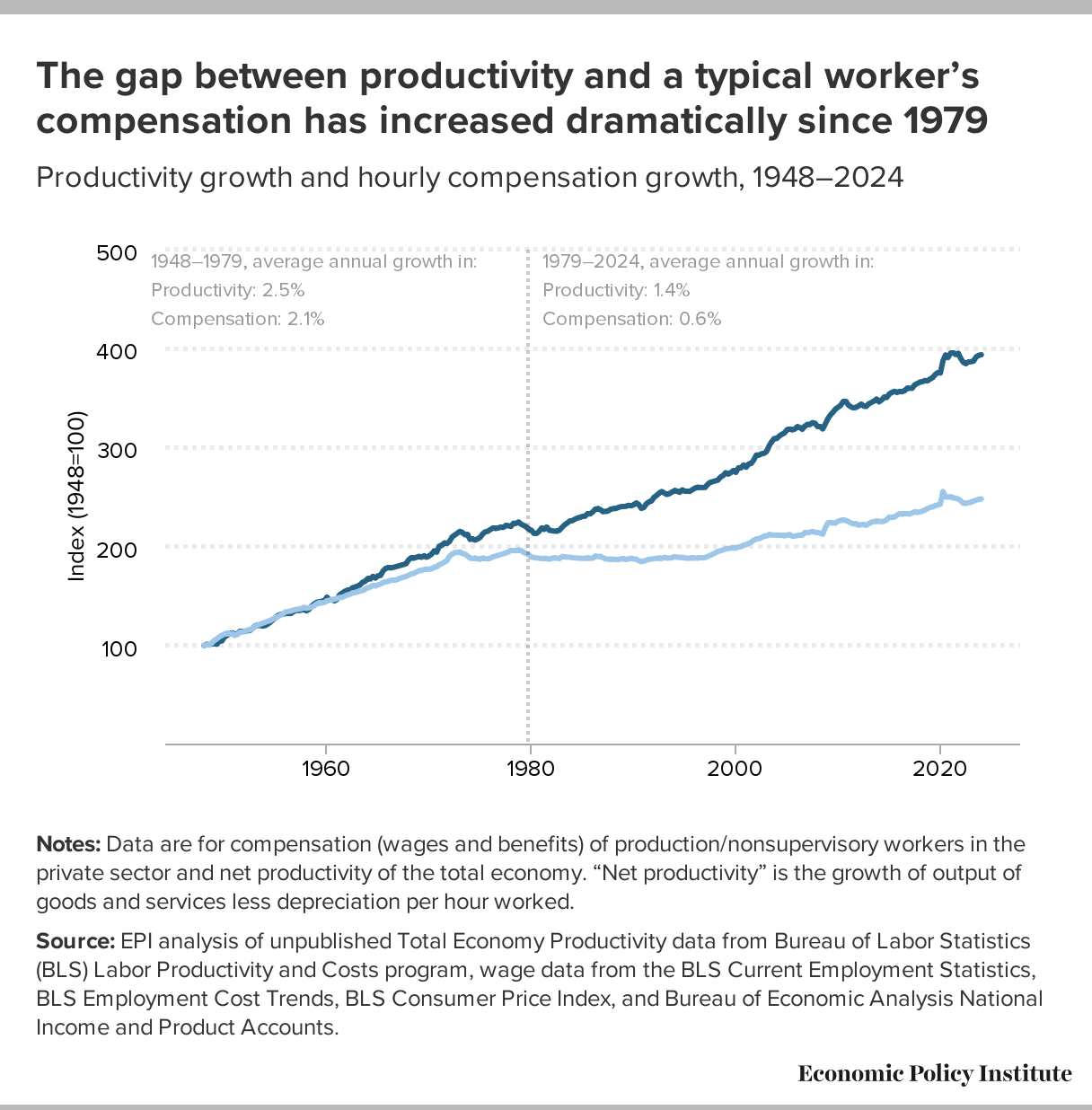

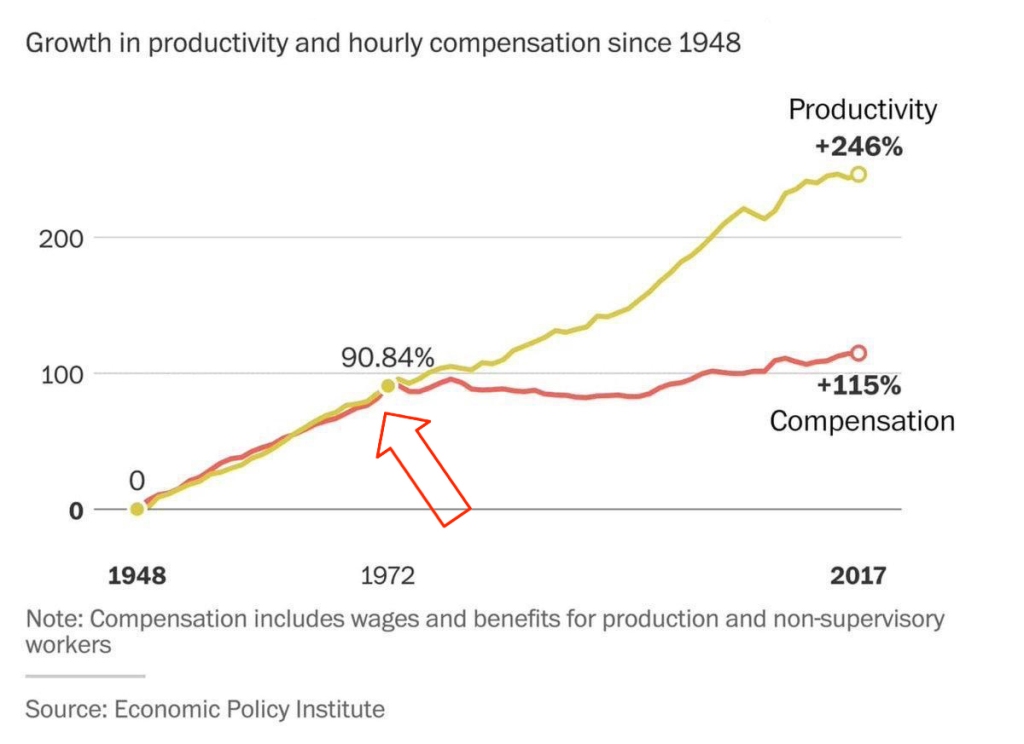

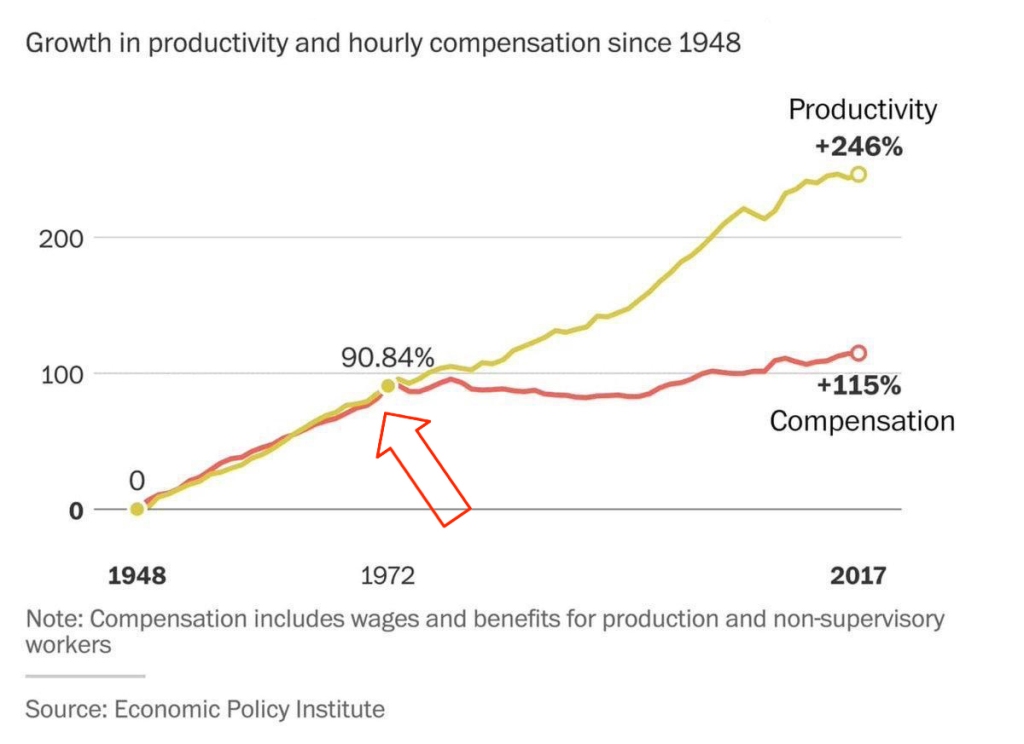

Od 1971. plate većine američkih radnika nisu rasle. S druge strane, bogatstvo koje imaju najbogatiji u društvu nalazi se na nivoima koji nisu viđeni više od 80 godina. U međuvremenu, ljudi sve manje i manje veruju institucijama poput banaka i vlada.

CBPP Nejednakost Bogatstva Tokom Vremena

CBPP Nejednakost Bogatstva Tokom VremenaŠirom sveta možemo videti dokaze o slamanju sistema kroz politički ekstremizam: izbor Trampa i drugih ekstremističkih desničarskih kandidata, Bregzit, pokret Occupy, popularizacija koncepta univerzalnog osnovnog dohotka, povratak pojma „socijalizam“ nazad u modu. Ljudi na svim delovima političkog i društvenog spektra osećaju problematična vremena i posežu za sve radikalnijim rešenjima.

Šta je bolje za štednju od dolara, kuća i akcija?

Pa kako ljudi mogu da štede novac u ovim teškim vremenima? Ili ne koriste tradicionalne valute, ili kupuju sredstva koja će zadržati vrednost u teškim vremenima.

Bitcoin ima najviše potencijala da zadrži vrednost kroz politička i ekonomska previranja od bilo koje druge imovine. Na tom putu će biti rupa na kojima će se rušiti ili pumpati, međutim, njegova svojstva čine ga takvim da će verovatno preživeti previranja kada druga imovina ne bude to mogla.

Šta Bitcoin čini drugačijim?

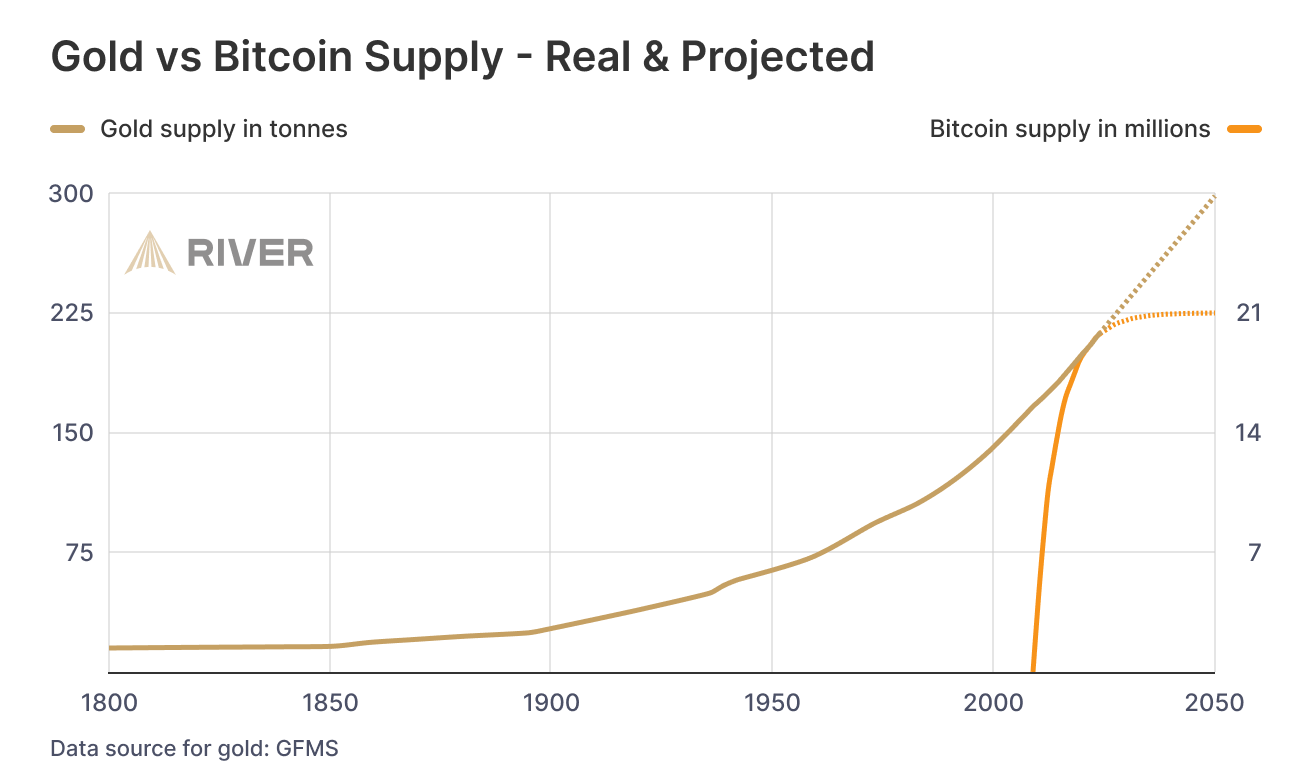

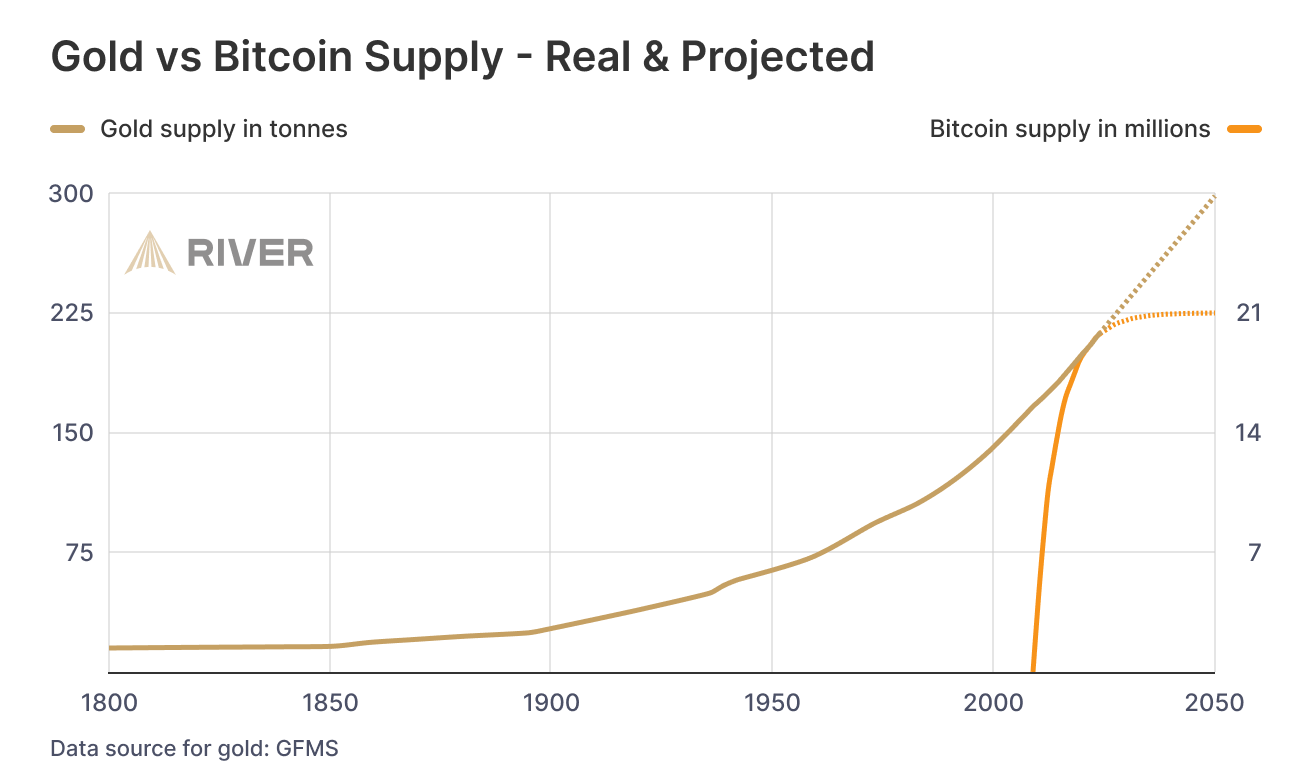

Bitcoini su retki.

Proces ‘rudarenja’ bitcoin-a, proizvodnju bitcoin-a čini veoma skupom, a Bitcoin protokol ograničava ukupan broj bitcoin-a na 21 milion novčića. To čini Bitcoin imunim na nagle poraste ponude. Ovo se veoma razlikuje od tradicionalnih valuta, koje vlade mogu da štampaju sve više kad god one to požele. Zapamtite, povećanje ponude vrši veliki pritisak na vrednost valute.

Bitcoini nemaju drugu ugovornu stranu.

Bitcoin se takođe razlikuje od imovine kao što su obveznice, akcije i kuće, jer mu nedostaje druga ugovorna strana. Druge ugovorne strane su drugi subjekti uključeni u vrednost sredstva, koji to sredstvo mogu obezvrediti ili vam ga uzeti. Ako imate hipoteku na svojoj kući, banka je druga ugovorna strana. Kada sledeći put dođe do velikog finansijskog kraha, banka vam može oduzeti kuću. Kompanije su kvazi-ugovorne strane akcijama i obveznicama, jer mogu da počnu da donose loše odluke koje utiču na njihovu cenu akcija ili na „neizvršenje“ duga (da ga ne vraćaju vama ili drugim poveriocima). Bitcoin nema ovih problema.

Bitcoin je pristupačan.

Svako sa 5 eura i mobilnim telefonom može da kupi i poseduje mali deo bitcoin-a. Važno je da znate da ne morate da kupite ceo bitcoin. Bitcoin-i su deljivi do 100-milionite jedinice, tako da možete da kupite Bitcoin u vrednosti od samo nekoliko eura. Neuporedivo lakše nego kupovina kuće, zlata ili akcija!

Bitcoin se ne može konfiskovati.

Banke drže većinu vaših eura, zlata i akcija za vas. Većina ljudi u razvijenom svetu veruje bankama, jer većina ljudi koji žive u današnje vreme nikada nije doživela konfiskaciju imovine ili ’šišanje’ od strane banaka ili vlada. Nažalost, postoji presedan za konfiskaciju imovine čak i u demokratskim zemljama sa snažnom vladavinom prava.

Kada vlada konfiskuje imovinu, ona obično ubedi javnost da će je menjati za imovinu jednake vrednosti. U SAD-u 1930-ih, vlada je davala dolare vlasnicima zlata. Vlada je znala da uvek može da odštampa još više dolara, ali da ne može da napravi više zlata. Na Kipru 2012. godine, jedna propala banka je svojim klijentima dala deonice banke da pokrije dolare klijenata koje je banka trebala da ima. I dolari i deonice su strmoglavo opali u odnosu na imovinu koja je uzeta od ovih ljudi.

Doći do bitcoin-a koji ljudi poseduju, biće mnogo teže jer se bitcoin-i mogu čuvati u novčaniku koji ne poseduje neka treća strana, a vi možete čak i da zapamtite privatne ključeve do vašeg bitcoin-a u glavi.

Bitcoin je za štednju.

Bitcoin se polako pokazuje kao najbolja opcija za dugoročnu štednju novca, posebno s obzirom na današnju ekonomsku klimu. Posedovanje čak i malog dela, je polisa osiguranja koja se isplati ako svet i dalje nastavi da ludi. Cena Bitcoin-a u dolarima može divlje da varira u roku od godinu ili dve, ali tokom 3+ godine skoro svi vide slične ili više cene od trenutka kada su ga kupili. U stvari, doslovno niko nije izgubio novac čuvajući Bitcoin duže od 3,5 godine – čak i ako je kupio BTC na apsolutnim vrhovima tržišta.

Imajte na umu da nakon ove tačke ti ljudi više nikada nisu videli rizik od gubitka. Cena se nikada nije smanjila niže od najviše cene u prethodnom ciklusu.

Po čemu se Bitcoin razlikuje od ostalih valuta?

Bitcoin funkcioniše tako dobro kao način štednje zbog svog neobičnog dizajna, koji ga čini drugačijim od bilo kog drugog oblika novca koji je postojao pre njega. Bitcoin je digitalna valuta, prvi i verovatno jedini primer valute koja ima ograničenu ponudu dok radi na otvorenom, decentralizovanom sistemu. Vlade strogo kontrolišu valute koje danas koristimo, poput dolara i eura, i proizvode ih za finansiranje ratova i dugova. Korisnici Bitcoin-a – poput vas – kontrolišu Bitcoin protokol.

Evo šta Bitcoin razlikuje od dolara, eura i drugih valuta:

Bitcoin je otvoren sistem.

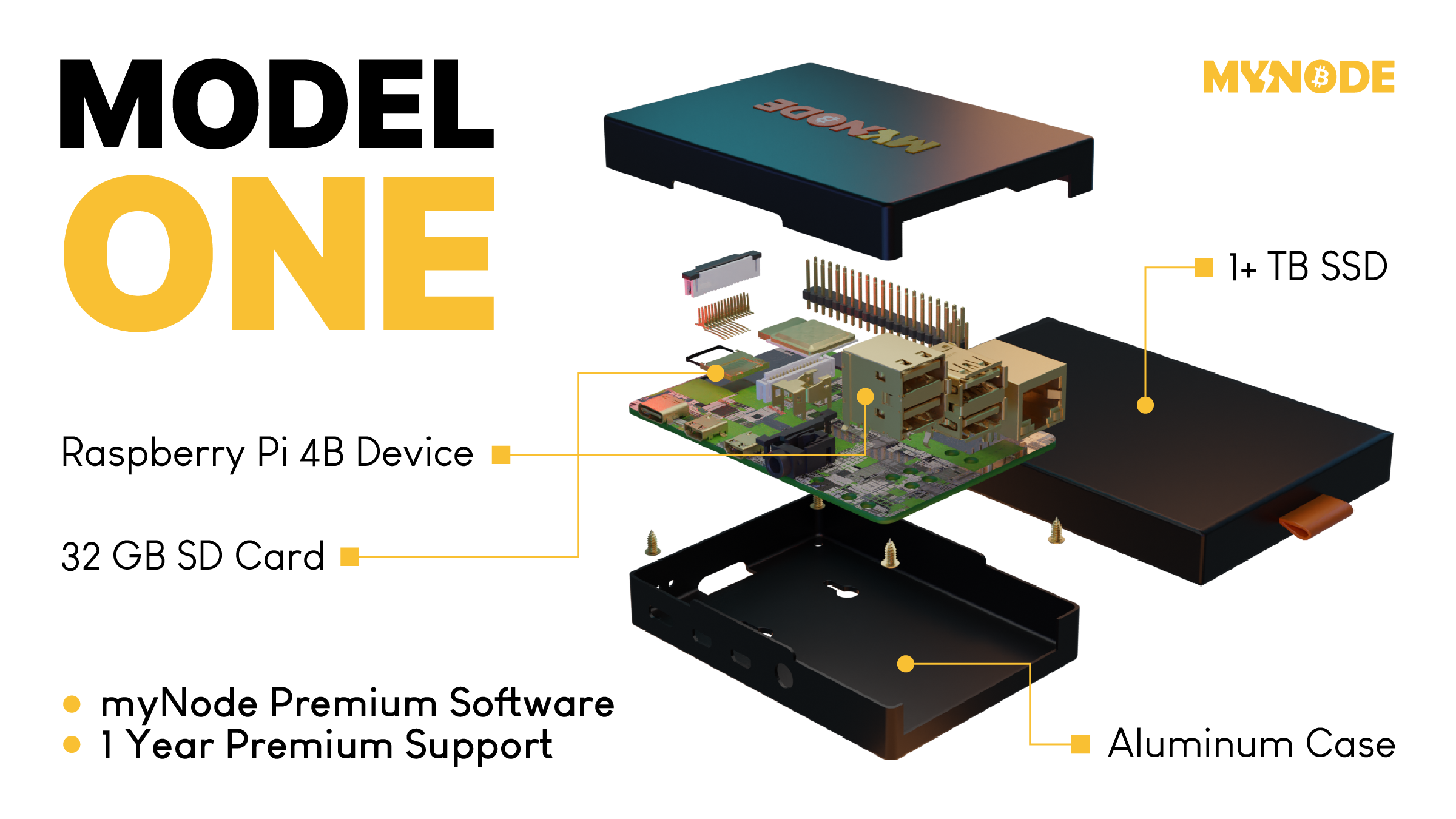

Svako može da odluči da se pridruži Bitcoin mreži i primeni pravila softverskog protokola, što je dovelo do vrlo decentralizovanog sistema u kojem nijedan pojedinac ili entitet ne može da blokira transakciju, zamrzne sredstva ili da ukrade od druge osobe.Današnji savremeni bankarski sistem se uveliko razlikuje. Nekoliko banaka je dobilo poverenje da gotovo sve valute, akcije i druge vredne predmete čuvaju na “sigurnom” za svoje klijente. Da biste postali banka, potrebni su vam milioni dolara i neverovatne količine političkog uticaja. Da biste pokrenuli Bitcoin čvor i postali „svoja banka“, potrebno vam je nekoliko stotina dolara i jedno slobodno popodne.

Tako izgleda Bitcoin čvor – Node

MyNode čvor vam omogućava da postanete svoja banka za samo nekoliko minuta.

Tako izgleda Bitcoin čvor – Node

MyNode čvor vam omogućava da postanete svoja banka za samo nekoliko minuta.Bitcoin ima ograničenu ponudu.

Softverski protokol otvorenog koda koji upravlja Bitcoin sistemom ograničava broj novih bitcoin-a koji se mogu stvoriti tokom vremena, sa ograničenjem od ukupno 21.000.000 bitcoin-a. S druge strane, valute koje danas koristimo imaju neograničenu ponudu. Istorija i sadašnje odluke centralnih banaka govore nam da će vlade uvek štampati sve više i više valuta, sve dok valuta ne bude bezvredna. Sve ovo štampanje uzrokuje inflaciju, što pravi štetu običnim radnim ljudima i štedišama.

Tradicionalne valute su dizajnirane tako da opadaju vremenom. Svaki put kada centralna banka kaže da cilja određenu stopu inflacije, oni ustvari kažu da žele da vaš novac svake godine izgubi određeni procenat svoje vrednosti.

Bitcoin-ova ograničena ponuda znači da je on tako dizajniran da raste vremenom kako se potražnja za njim povećava.

Bitcoin putuje oko sveta za nekoliko minuta.

Svako može da pošalje bitcoin-e za nekoliko minuta širom sveta, bez obzira na granice, banke i vlade. Potrebno je manje od minuta da se transakcija pojavi na novčaniku primaoca i oko 60 minuta da se transakcija u potpunosti „obračuna“, tako da primaoc može da bude siguran da su primljeni bitcoin-i sada njegovi (6 konfirmacija bloka). Slanje drugih valuta širom sveta traje danima ili čak mesecima ako se šalju milionski iznosi, a podrazumeva i visoke naknade.

Neke vlade i novinari tvrde da ova sloboda putovanja koju pruža Bitcoin pomaže kriminalcima i teroristima. Međutim, transakciju Bitcoin-a je lakše pratiti nego većinu transakcija u dolarima ili eurima.

Bitcoin se može čuvati na “USB-u”.

Dizajn Bitcoin-a je takav da vam treba samo da čuvate privatni ključ do svojih ‘bitcoin’ adresa (poput lozinke do bankovnih računa) da biste pristupili svojim bitcoin-ima odakle god poželite. Ovaj privatni ključ možete da sačuvate na disku ili na papiru u obliku 12 ili 24 reči na engleskom jeziku. Kao rezultat toga, možete da držite Bitcoin-e vredne milione dolara u svojoj šaci.

Sve ostale valute danas možete ili da strpate u svoj dušek ili da ih poverite banci na čuvanje. Za većinu ljudi koji žive u razvijenom svetu, i koji ne osporavaju autoritet i poverenje u banku, ovo deluje sasvim dobro. Međutim, oni kojima je potrebno da pobegnu od ugnjetavačke vlade ili koji naljute pogrešne ljude, ne mogu verovati bankama. Za njih je sposobnost da nose svoju ušteđevinu bez potrebe za ogromnim koferom neprocenjiva. Čak i ako ne živite na mestu poput ovog, cena Bitcoin-a se i dalje povećava kada ih neko kome oni trebaju kupi.

Kako Bitcoin spašava svet?

Bitcoin, kao ultimativni način štednje, je cakum pakum, ali da li on pomaže u poboljšanju sveta u celini?

Kao što ćete početi da shvatate, ulazeći sve dublje i u druge sadržaje na ovoj stranici, mnogi temeljni delovi našeg današnjeg monetarnog sistema i ekonomije su duboko slomljeni. Međutim, oni koji upravljaju imaju korist od ovakvih sistema, pa se on verovatno neće promeniti bez revolucije ili mirnog svrgavanja od strane naroda. Bitcoin predstavlja novi sistem, sa nekoliko glavnih prednosti:

- Bitcoin popravlja novac, koji je milenijumima služio kao važan alat za rast i poboljšanje društva.

- Bitcoin vraća zdrav razum pozajmljivanju, uklanjanjem apsurdnih situacija poput negativnih kamatnih stopa (gde zajmitelj plaća da bi se zadužio).

- Bitcoin pokreće ulaganja u obnovljive izvore energije i poboljšava energetsku efikasnost u mreži, služeći kao „krajnji kupac“ za sve vrste energije.

Kako mogu da saznam više o Bitcoin-u?

Ovaj članak vam je dao osnovno razumevanje zašto biste trebali razmišljati o Bitcoin-u. Ako želite da saznate više, preporučujem ove resurse:

- Film Bitcoin: Kraj Novca Kakav Poznajemo

- Još uvek je rano za Bitcoin

- Zasto baš Bitcoin?

- Šta je to Bitcoin?

- The Bitcoin Whitepaper ← objavljen 2008. godine, ovo je izložio dizajn za Bitcoin.

-

@ 866e0139:6a9334e5

2025-05-19 21:39:26

@ 866e0139:6a9334e5

2025-05-19 21:39:26Autor: Ludwig F. Badenhagen. Dieser Beitrag wurde mit dem Pareto-Client geschrieben. Sie finden alle Texte der Friedenstaube und weitere Texte zum Thema Frieden hier. Die neuesten Pareto-Artikel finden Sie auch in unserem Telegram-Kanal.

Die neuesten Artikel der Friedenstaube gibt es jetzt auch im eigenen Friedenstaube-Telegram-Kanal.

Wer einhundert Prozent seines Einkommens abgeben muss, ist sicher ein Sklave, oder? Aber ab wieviel Prozent Pflichtabgabe ist er denn kein Sklave mehr? Ab wann ist er frei und selbst-bestimmt?

Wer definieren möchte, was ein Sklave ist, sollte nicht bei Pflichtabgaben verweilen, denn die Fremdbestimmtheit geht viel weiter. Vielfach hat der gewöhnliche Mensch wenig Einfluss darauf, wie er und seine Familie misshandelt wird. Es wird verfügt, welche Bildung, welche Nahrung, welche Medikamente, welche Impfungen und welche Kriege er zu erdulden hat. Hierbei erkennt der gewöhnliche Mensch aber nur, wer ihm direkt etwas an-tut. So wie der Gefolterte bestenfalls seinen Folterer wahrnimmt, aber nicht den, in dessen Auftrag dieser handelt, so haben die vorbezeichnet Geschädigten mit Lehrern, „Experten“, Ärzten und Politikern zu tun. Ebenfalls ohne zu wissen, in wessen Auftrag diese Leute handeln. „Führungssysteme“ sind so konzipiert, dass für viele Menschen bereits kleinste wahrgenommene Vorteile genügen, um einem anderen Menschen Schlimmes anzutun.

Aber warum genau wird Menschen Schlimmes angetan? Die Gründe dafür sind stets dieselben. Der Täter hat ein Motiv und Motivlagen können vielfältig sein.

Wer also ein Motiv hat, ein Geschehen zu beeinflussen, motiviert andere zur Unterstützung. Wem es gelingt, bei anderen den Wunsch zu erwecken, das zu tun, was er möchte, ist wirklich mächtig. Und es sind die Mächtigen im Hintergrund, welche die Darsteller auf den Bühnen dieser Welt dazu nutzen, die Interessen der wirklich Mächtigen durchzusetzen. Insbesondere die letzten fünf Jahre haben eindrucksvoll gezeigt, wie willfährig Politiker, Ärzte, Experten und viele weitere ihre jeweiligen Aufträge gegen die Bevölkerung durchsetz(t)en.

Und so geschieht es auch beim aktuellen Krieg, der stellvertretend auf dem europäischen Kontinent ausgetragen wird. Parolen wie „nie wieder Krieg“ gehören der Vergangenheit an. Stattdessen ist nunmehr wieder der Krieg und nur der Krieg geeignet, um „Aggressionen des Gegners abzuwehren“ und um „uns zu verteidigen“.

Das hat mindestens drei gute Gründe:

- Mit einem Krieg können Sie einem anderen etwas wegnehmen, was er freiwillig nicht herausrückt. Auf diese Weise kommen Sie an dessen Land, seine Rohstoffe und sein Vermögen. Sie können ihn beherrschen und Ihren eigenen Einfluss ausbauen. Je mehr Ihnen gehört, um so besser ist das für Sie. Sie müssen sich weniger abstimmen und Widersacher werden einfach ausgeschaltet.

- Wenn etwas über einen langen Zeitraum aufgebaut wurde, ist es irgendwann auch einmal fertig. Um aber viel Geld verdienen und etwas nach eigenen Vorstellungen gestalten zu können, muss immer wieder etwas Neues erschaffen werden, und da stört das Alte nur. Demzufolge ist ein Krieg ein geeignetes Mittel, etwas zu zerstören. Und das Schöne ist, dass man von Beginn an viel Geld verdient. Denn man muss dem indoktrinierten Volk nur vormachen, dass der Krieg „unbedingt erforderlich“ sei, um das Volk dann selbst bereitwillig für diesen Krieg bezahlen und auch sonst engagiert mitwirken zu lassen. Dann kann in Rüstung und „Kriegstauglichkeit“ investiert werden. Deutschland soll dem Vernehmen nach bereits in einigen Jahren „kriegstauglich“ sein. Der Gegner wartet sicher gerne mit seinen Angriffen, bis es so weit ist.

- Und nicht zu vergessen ist, dass man die vielen gewöhnlichen Menschen loswird. Schon immer wurden Populationen „reguliert“. Das macht bei Tieren ebenfalls so, indem man sie je nach „Erfordernis“ tötet. Und bei kollabierenden Systemen zu Zeiten von Automatisierung und KI unter Berücksichtigung der Klimarettung wissen doch mittlerweile alle, dass es viel zu viele Menschen auf dem Planeten gibt. Wenn jemand durch medizinische Misshandlungen oder auch durch einen Krieg direkt stirbt, zahlt dies auf die Lösung des Problems ein. Aber auch ein „Sterben auf Raten“ ist von großem Vorteil, denn durch die „fachmännische Behandlung von Verletzten“ bis zu deren jeweiligen Tode lässt sich am Leid viel verdienen.

Sie erkennen, dass es sehr vorteilhaft ist, Kriege zu führen, oder? Und diese exemplarisch genannten drei Gründe könnten noch beliebig erweitert werden.

DIE FRIEDENSTAUBE FLIEGT AUCH IN IHR POSTFACH!

Hier können Sie die Friedenstaube abonnieren und bekommen die Artikel zugesandt, vorerst für alle kostenfrei, wir starten gänzlich ohne Paywall. (Die Bezahlabos fangen erst zu laufen an, wenn ein Monetarisierungskonzept für die Inhalte steht). Sie wollen der Genossenschaft beitreten oder uns unterstützen? Mehr Infos hier oder am Ende des Textes.

Das Einzige, was gegen Kriegsereignisse sprechen könnte, wäre, dass man selbst niemandem etwas wegnehmen möchte, was ihm gehört, und dass man seinen Mitmenschen nicht schaden, geschweige denn diese verletzen oder gar töten möchte.

In diesem Zusammenhang könnte man auch erkennen, dass die, die nach Krieg rufen, selbst nicht kämpfen. Auch deren Kinder nicht. Man könnte erkennen, dass man selbst nur benutzt wird, um die Interessen anderer durchzusetzen. Wie beim Brettspiel Schach hat jede Figur eine Funktion und keinem Spieler ist das Fortbestehen eines Bauern wichtig, wenn seine Entnahme dem Spielgewinn dient. Wer Krieg spielt, denkt sicher ähnlich.

Meine beiden Großväter waren Soldaten im zweiten Weltkrieg und erlebten die Grausamkeiten des Krieges und der Gefangenschaft so intensiv, dass sie mit uns Enkeln zu keiner Zeit hierüber sprechen konnten, da sie wohl wussten, dass uns allein ihre Erzählungen zutiefst traumatisiert hätten. Die Opas waren analog dem, was wir ihnen an Information abringen konnten, angeblich nur Sanitäter. Sanitäter, wie auch die meisten Großväter aus der Nachbarschaft. Wer aber jemals beobachten konnte, wie unbeholfen mein Opa ein Pflaster aufgebracht hat, der konnte sich denken, dass seine vermeintliche Tätigkeit als Sanitäter eine Notlüge war, um uns die Wahrheit nicht vermitteln zu müssen.

Mein Opa war mein bester Freund und mir treibt es unverändert die Tränen in die Augen, sein erlebtes Leid nachzuempfinden. Und trotz aller seelischen und körperlichen Verletzungen hat er nach seiner Rückkehr aus der Kriegshölle mit großem Erfolg daran gearbeitet, für seine Familie zu sorgen.

Manchmal ist es m. E. besser, die Dinge vom vorhersehbaren Ende aus zu betrachten, um zu entscheiden, welche Herausforderungen man annimmt und welche man besser ablehnt. Es brauchte fast 80 Jahre, um die Deutschen erneut dafür zu begeistern, Ihre Leben „für die gute Sache“ zu opfern. Was heutzutage aber anders ist als früher: Einerseits sind die Politiker dieser Tage sehr durchschaubar geworden. Aber in einem ähnlichen Verhältnis, wie die schauspielerischen Leistungen der Politiker abgenommen haben, hat die Volksverblödung zugenommen.

Denken Sie nicht nach. Denken Sie stattdessen vor. Und denken Sie selbst. Für sich, Ihre Lieben und alle anderen Menschen. Andernfalls wird die Geschichte, so wie sie von meinen Opas (und Omas) erlebt wurde, mit neuen Technologien und „zeitgemäßen Methoden“ wiederholt. Dies führt zweifelsfrei zu Not und Tod.

LASSEN SIE DER FRIEDENSTAUBE FLÜGEL WACHSEN!

Hier können Sie die Friedenstaube abonnieren und bekommen die Artikel zugesandt.

Schon jetzt können Sie uns unterstützen:

- Für 50 CHF/EURO bekommen Sie ein Jahresabo der Friedenstaube.

- Für 120 CHF/EURO bekommen Sie ein Jahresabo und ein T-Shirt/Hoodie mit der Friedenstaube.

- Für 500 CHF/EURO werden Sie Förderer und bekommen ein lebenslanges Abo sowie ein T-Shirt/Hoodie mit der Friedenstaube.

- Ab 1000 CHF werden Sie Genossenschafter der Friedenstaube mit Stimmrecht (und bekommen lebenslanges Abo, T-Shirt/Hoodie).

Für Einzahlungen in CHF (Betreff: Friedenstaube):

Für Einzahlungen in Euro:

Milosz Matuschek

IBAN DE 53710520500000814137

BYLADEM1TST

Sparkasse Traunstein-Trostberg

Betreff: Friedenstaube

Wenn Sie auf anderem Wege beitragen wollen, schreiben Sie die Friedenstaube an: friedenstaube@pareto.space

Sie sind noch nicht auf Nostr and wollen die volle Erfahrung machen (liken, kommentieren etc.)? Zappen können Sie den Autor auch ohne Nostr-Profil! Erstellen Sie sich einen Account auf Start. Weitere Onboarding-Leitfäden gibt es im Pareto-Wiki.

-

@ 34f1ddab:2ca0cf7c

2025-05-16 22:47:03

@ 34f1ddab:2ca0cf7c

2025-05-16 22:47:03Losing access to your cryptocurrency can feel like losing a part of your future. Whether it’s due to a forgotten password, a damaged seed backup, or a simple mistake in a transfer, the stress can be overwhelming. Fortunately, cryptrecver.com is here to assist! With our expert-led recovery services, you can safely and swiftly reclaim your lost Bitcoin and other cryptocurrencies.

Why Trust Crypt Recver? 🤝 🛠️ Expert Recovery Solutions At Crypt Recver, we specialize in addressing complex wallet-related issues. Our skilled engineers have the tools and expertise to handle:

Partially lost or forgotten seed phrases Extracting funds from outdated or invalid wallet addresses Recovering data from damaged hardware wallets Restoring coins from old or unsupported wallet formats You’re not just getting a service; you’re gaining a partner in your cryptocurrency journey.

🚀 Fast and Efficient Recovery We understand that time is crucial in crypto recovery. Our optimized systems enable you to regain access to your funds quickly, focusing on speed without compromising security. With a success rate of over 90%, you can rely on us to act swiftly on your behalf.

🔒 Privacy is Our Priority Your confidentiality is essential. Every recovery session is conducted with the utmost care, ensuring all processes are encrypted and confidential. You can rest assured that your sensitive information remains private.

💻 Advanced Technology Our proprietary tools and brute-force optimization techniques maximize recovery efficiency. Regardless of how challenging your case may be, our technology is designed to give you the best chance at retrieving your crypto.

Our Recovery Services Include: 📈 Bitcoin Recovery: Lost access to your Bitcoin wallet? We help recover lost wallets, private keys, and passphrases. Transaction Recovery: Mistakes happen — whether it’s an incorrect wallet address or a lost password, let us manage the recovery. Cold Wallet Restoration: If your cold wallet is failing, we can safely extract your assets and migrate them into a secure new wallet. Private Key Generation: Lost your private key? Our experts can help you regain control using advanced methods while ensuring your privacy. ⚠️ What We Don’t Do While we can handle many scenarios, some limitations exist. For instance, we cannot recover funds stored in custodial wallets or cases where there is a complete loss of four or more seed words without partial information available. We are transparent about what’s possible, so you know what to expect

Don’t Let Lost Crypto Hold You Back! Did you know that between 3 to 3.4 million BTC — nearly 20% of the total supply — are estimated to be permanently lost? Don’t become part of that statistic! Whether it’s due to a forgotten password, sending funds to the wrong address, or damaged drives, we can help you navigate these challenges

🛡️ Real-Time Dust Attack Protection Our services extend beyond recovery. We offer dust attack protection, keeping your activity anonymous and your funds secure, shielding your identity from unwanted tracking, ransomware, and phishing attempts.

🎉 Start Your Recovery Journey Today! Ready to reclaim your lost crypto? Don’t wait until it’s too late! 👉 cryptrecver.com

📞 Need Immediate Assistance? Connect with Us! For real-time support or questions, reach out to our dedicated team on: ✉️ Telegram: t.me/crypptrcver 💬 WhatsApp: +1(941)317–1821

Crypt Recver is your trusted partner in cryptocurrency recovery. Let us turn your challenges into victories. Don’t hesitate — your crypto future starts now! 🚀✨

Act fast and secure your digital assets with cryptrecver.com.Losing access to your cryptocurrency can feel like losing a part of your future. Whether it’s due to a forgotten password, a damaged seed backup, or a simple mistake in a transfer, the stress can be overwhelming. Fortunately, cryptrecver.com is here to assist! With our expert-led recovery services, you can safely and swiftly reclaim your lost Bitcoin and other cryptocurrencies.

# Why Trust Crypt Recver? 🤝

# Why Trust Crypt Recver? 🤝🛠️ Expert Recovery Solutions\ At Crypt Recver, we specialize in addressing complex wallet-related issues. Our skilled engineers have the tools and expertise to handle:

- Partially lost or forgotten seed phrases

- Extracting funds from outdated or invalid wallet addresses

- Recovering data from damaged hardware wallets

- Restoring coins from old or unsupported wallet formats

You’re not just getting a service; you’re gaining a partner in your cryptocurrency journey.

🚀 Fast and Efficient Recovery\ We understand that time is crucial in crypto recovery. Our optimized systems enable you to regain access to your funds quickly, focusing on speed without compromising security. With a success rate of over 90%, you can rely on us to act swiftly on your behalf.

🔒 Privacy is Our Priority\ Your confidentiality is essential. Every recovery session is conducted with the utmost care, ensuring all processes are encrypted and confidential. You can rest assured that your sensitive information remains private.

💻 Advanced Technology\ Our proprietary tools and brute-force optimization techniques maximize recovery efficiency. Regardless of how challenging your case may be, our technology is designed to give you the best chance at retrieving your crypto.

Our Recovery Services Include: 📈

- Bitcoin Recovery: Lost access to your Bitcoin wallet? We help recover lost wallets, private keys, and passphrases.

- Transaction Recovery: Mistakes happen — whether it’s an incorrect wallet address or a lost password, let us manage the recovery.

- Cold Wallet Restoration: If your cold wallet is failing, we can safely extract your assets and migrate them into a secure new wallet.

- Private Key Generation: Lost your private key? Our experts can help you regain control using advanced methods while ensuring your privacy.

⚠️ What We Don’t Do\ While we can handle many scenarios, some limitations exist. For instance, we cannot recover funds stored in custodial wallets or cases where there is a complete loss of four or more seed words without partial information available. We are transparent about what’s possible, so you know what to expect

# Don’t Let Lost Crypto Hold You Back!

# Don’t Let Lost Crypto Hold You Back!Did you know that between 3 to 3.4 million BTC — nearly 20% of the total supply — are estimated to be permanently lost? Don’t become part of that statistic! Whether it’s due to a forgotten password, sending funds to the wrong address, or damaged drives, we can help you navigate these challenges

🛡️ Real-Time Dust Attack Protection\ Our services extend beyond recovery. We offer dust attack protection, keeping your activity anonymous and your funds secure, shielding your identity from unwanted tracking, ransomware, and phishing attempts.

🎉 Start Your Recovery Journey Today!\ Ready to reclaim your lost crypto? Don’t wait until it’s too late!\ 👉 cryptrecver.com

📞 Need Immediate Assistance? Connect with Us!\ For real-time support or questions, reach out to our dedicated team on:\ ✉️ Telegram: t.me/crypptrcver\ 💬 WhatsApp: +1(941)317–1821

Crypt Recver is your trusted partner in cryptocurrency recovery. Let us turn your challenges into victories. Don’t hesitate — your crypto future starts now! 🚀✨

Act fast and secure your digital assets with cryptrecver.com.

-

@ 4c96d763:80c3ee30

2025-05-19 20:56:26

@ 4c96d763:80c3ee30

2025-05-19 20:56:26Changes

William Casarin (19):

- dave: add screenshot to readme

- dave: fix image in readme

- columns: remove spamming info logs about writing to cache

- columns: never truncate notes you're replying to

- windows: don't show terminal window

- mention: show username instead of display_name

- chrome: switch from ALPHA to BETA

- ui: make post replies selectable

- dave: include anonymous user identifier in api call

- dave: add trial mode

- dave: fix sidebar click

- dave: nudge avatar when you click

- dave: hide media in dave note previews

- chrome: fix theme persistence

- ui: fix a bunch of missing hover pointers

- Release Notedeck Beta v0.4.0

- release: changelog

- timeline: show media on universe timeline

- clippy: fix lint related to iterator

kernelkind (28):

- add

trust_media_from_pk2method - add hashbrown

- introduce & use

JobPool - introduce JobsCache

- add blurhash dependency

- introduce blur

- note: remove unnecessary derive macros from

NoteAction - propagate

JobsCache ImagePulseTint->PulseAlpha- images: move fetch to fn

- add

TexturesCache - images: make

MediaCacheholdMediaCacheType - images: make promise payload optional to take easily

- post: unnest

- notedeck_ui: move carousel to

note/media.rs - note media: only show full screen when loaded

- note media: unnest full screen media

- pass

NoteActionby value instead of reference - propagate

Imagesto actionbar - add one shot error message

- make

WidgetimplProfilePicmutably - implement blurring

- don't show zap button if no wallet

- display name should wrap

- make styled button toggleable

- method to get current default zap amount

- add

CustomZapView - use

CustomZapView

pushed to notedeck:refs/heads/master

-

@ 1817b617:715fb372

2025-05-19 20:39:28

@ 1817b617:715fb372

2025-05-19 20:39:28Looking to simulate a USDT deposit that appears instantly in a wallet — with no blockchain confirmation, no real spend, and no trace?

You’re in the right place.

🔗 Buy Flash USDT Now This product sends Flash USDT directly to your TRC20, ERC20, or BEP20 wallet address — appears like a real deposit, but disappears after a set time or block depth.

✅ Perfect for: Simulating token inflows Wallet stress testing “Proof of funds” display Flash USDT is ideal for developers, trainers, UI testers, and blockchain researchers — and it’s fully customizable.

🧠 What Is Flash USDT? Flash USDT is a synthetic transaction that mimics a real Tether transfer. It shows up instantly in a wallet balance, and it’s confirmed on-chain — and expires after a set duration.

This makes it:

Visible on wallet interfaces Time-limited (auto-disappears cleanly) Undetectable on block explorers after expiry It’s the smartest, safest way to simulate high-value transactions without real crypto.

🛠️ Flash USDT Software – Your Own USDT Flasher at Your Fingertips Want to control the flash? Run your own operations? Flash unlimited wallets?

🔗 Buy Flash USDT Software

This is your all-in-one USDT flasher tool, built for TRC20, ERC20, and BEP20 chains. It gives you full control to:

Send custom USDT amounts Set custom expiry time (e.g., 30–360 days) Flash multiple wallets Choose between networks (Tron, ETH, BSC) You can simulate any amount, to any supported wallet, from your own system.

No third-party access. No blockchain fee. No trace left behind.

💥 Why Our Flash USDT & Software Stands Out Feature Flash USDT Flash USDT Software One-time flash send ✅ Yes Optional Full sender control ❌ No ✅ Yes TRC20 / ERC20 / BEP20 ✅ Yes ✅ Yes Custom duration/expiry Limited ✅ Yes Unlimited usage ❌ One-off ✅ Yes Whether you’re flashing for wallet testing, demoing investor dashboards, or simulating balance flows, our tools deliver realism without risk.

🛒 Ready to Buy Flash USDT or the Software? Skip the wait. Skip the scammers. You’re one click away from real control.

👉 Buy Flash USDT 👉 Buy Flash USDT Software

📞 Support or live walkthrough?

💬 Telegram: @cryptoflashingtool 📱 WhatsApp: +1 770-666-2531

🚫 Legal Notice These tools are intended for:

Educational purposes Demo environments Wallet and UI testing They are not for illegal use or financial deception. Any misuse is your full responsibility.

Final Call: Need to flash USDT? Want full control? Don’t wait for another “maybe” tool.

Get your Flash USDT or Flashing Software today and simulate like a pro.

🔗 Buy Now → Flash USDT 🔗 Buy Now → Flash USDT Software 💬 Telegram: @cryptoflashingtool 📱 WhatsApp: +1 770-666-2531Looking to simulate a USDT deposit that appears instantly in a wallet — with no blockchain confirmation, no real spend, and no trace?

You’re in the right place.

Buy Flash USDT Now\ This product sends Flash USDT directly to your TRC20, ERC20, or BEP20 wallet address — appears like a real deposit, but disappears after a set time or block depth.

Perfect for:

- Simulating token inflows

- Wallet stress testing

- “Proof of funds” display

Flash USDT is ideal for developers, trainers, UI testers, and blockchain researchers — and it’s fully customizable.

What Is Flash USDT?

Flash USDT is a synthetic transaction that mimics a real Tether transfer. It shows up instantly in a wallet balance, and it’s confirmed on-chain — and expires after a set duration.

This makes it:

- Visible on wallet interfaces

- Time-limited (auto-disappears cleanly)

- Undetectable on block explorers after expiry

It’s the smartest, safest way to simulate high-value transactions without real crypto.

Flash USDT Software – Your Own USDT Flasher at Your Fingertips

Want to control the flash?\ Run your own operations?\ Flash unlimited wallets?

This is your all-in-one USDT flasher tool, built for TRC20, ERC20, and BEP20 chains. It gives you full control to:

- Send custom USDT amounts

- Set custom expiry time (e.g., 30–360 days)

- Flash multiple wallets

- Choose between networks (Tron, ETH, BSC)

You can simulate any amount, to any supported wallet, from your own system.

No third-party access.\ No blockchain fee.\ No trace left behind.

Why Our Flash USDT & Software Stands Out

Feature

Flash USDT

Flash USDT Software

One-time flash send

Yes

Optional

Full sender control

No

Yes

TRC20 / ERC20 / BEP20

Yes

Yes

Custom duration/expiry

Limited

Yes

Unlimited usage

One-off

Yes

Whether you’re flashing for wallet testing, demoing investor dashboards, or simulating balance flows, our tools deliver realism without risk.

Ready to Buy Flash USDT or the Software?

Skip the wait. Skip the scammers.\ You’re one click away from real control.

Support or live walkthrough?

Telegram: @cryptoflashingtool

WhatsApp: +1 770-666-2531

Legal Notice

These tools are intended for:

- Educational purposes

- Demo environments

- Wallet and UI testing

They are not for illegal use or financial deception. Any misuse is your full responsibility.

Final Call:

Need to flash USDT? Want full control?\ Don’t wait for another “maybe” tool.

Get your Flash USDT or Flashing Software today and simulate like a pro.

Telegram: @cryptoflashingtool

WhatsApp: +1 770-666-2531

-

@ b83a28b7:35919450

2025-05-16 19:23:58

@ b83a28b7:35919450

2025-05-16 19:23:58This article was originally part of the sermon of Plebchain Radio Episode 110 (May 2, 2025) that nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqyg8wumn8ghj7mn0wd68ytnvv9hxgqpqtvqc82mv8cezhax5r34n4muc2c4pgjz8kaye2smj032nngg52clq7fgefr and I did with nostr:nprofile1qythwumn8ghj7ct5d3shxtnwdaehgu3wd3skuep0qyt8wumn8ghj7ct4w35zumn0wd68yvfwvdhk6tcqyzx4h2fv3n9r6hrnjtcrjw43t0g0cmmrgvjmg525rc8hexkxc0kd2rhtk62 and nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqyg8wumn8ghj7mn0wd68ytnvv9hxgqpq4wxtsrj7g2jugh70pfkzjln43vgn4p7655pgky9j9w9d75u465pqahkzd0 of the nostr:nprofile1qythwumn8ghj7ct5d3shxtnwdaehgu3wd3skuep0qyt8wumn8ghj7etyv4hzumn0wd68ytnvv9hxgtcqyqwfvwrccp4j2xsuuvkwg0y6a20637t6f4cc5zzjkx030dkztt7t5hydajn

Listen to the full episode here:

<https://fountain.fm/episode/Ln9Ej0zCZ5dEwfo8w2Ho>

Bitcoin has always been a narrative revolution disguised as code. White paper, cypherpunk lore, pizza‑day legends - every block is a paragraph in the world’s most relentless epic. But code alone rarely converts the skeptic; it’s the camp‑fire myth that slips past the prefrontal cortex and shakes hands with the limbic system. People don’t adopt protocols first - they fall in love with protagonists.

Early adopters heard the white‑paper hymn, but most folks need characters first: a pizza‑day dreamer; a mother in a small country, crushed by the cost of remittance; a Warsaw street vendor swapping złoty for sats. When their arcs land, the brain releases a neurochemical OP_RETURN which says, “I belong in this plot.” That’s the sly roundabout orange pill: conviction smuggled inside catharsis.

That’s why, from 22–25 May in Warsaw’s Kinoteka, the Bitcoin Film Fest is loading its reels with rebellion. Each documentary, drama, and animated rabbit‑hole is a stealth wallet, zipping conviction straight into the feels of anyone still clasped within the cold claw of fiat. You come for the plot, you leave checking block heights.

Here's the clip of the sermon from the episode:

nostr:nevent1qvzqqqqqqypzpwp69zm7fewjp0vkp306adnzt7249ytxhz7mq3w5yc629u6er9zsqqsy43fwz8es2wnn65rh0udc05tumdnx5xagvzd88ptncspmesdqhygcrvpf2

-

@ d41bf82f:ed90d888

2025-05-19 20:31:54

@ d41bf82f:ed90d888

2025-05-19 20:31:54“ประเด็นแท้จริงคือเรื่องของการควบคุม—อินเทอร์เน็ตแพร่ขยายกว้างไกลเกินกว่าที่รัฐบาลใดจะครอบงำได้โดยง่าย ด้วยการสร้างเขตเศรษฐกิจระดับโลกที่ไร้รอยต่อ ไม่ขึ้นต่ออธิปไตย และอยู่นอกเหนือการควบคุม อินเทอร์เน็ตจึงตั้งคำถามต่อแนวคิดของรัฐชาติในตัวมันเอง” — JOHN PERRY BARLOW

บทนี้เริ่มต้นด้วยการวิพากษ์แนวคิด ทางด่วนข้อมูล ว่าเป็นคำอุปมาอุปมัยที่ยังยึดติดกับโลกยุคอุตสาหกรรม เพราะเศรษฐกิจยุคสารสนเทศไม่ใช่แค่โครงสร้างพื้นฐานสำหรับขนส่งข้อมูล แต่คือ จุดหมายปลายทาง ใหม่ในตัวเอง นั่นคือ ไซเบอร์สเปซ —ดินแดนที่ก้าวข้ามขอบเขตทางภูมิศาสตร์โดยสิ้นเชิง

ไซเบอร์สเปซคือพื้นที่ใหม่ของปฏิสัมพันธ์ทางสังคม เศรษฐกิจ และการเมือง ซึ่งไม่สามารถควบคุมโดยรัฐชาติแบบเดิมได้อีกต่อไป ผู้เขียนยกคำของ John Perry Barlow ที่เปรียบไซเบอร์สเปซเป็น “ดินแดนแห่งเสรีภาพ” ที่ไม่ยึดโยงกับสถานที่จริง และเปิดโอกาสให้ทุกคนแสดงความคิดเห็นได้อย่างไร้การควบคุม

การเปลี่ยนผ่านนี้ส่งผลกระทบรุนแรงต่อโครงสร้างของเศรษฐกิจแบบเดิม การเข้าถึงข้อมูลอย่างรวดเร็วแบบไร้ขอบเขตเปรียบเสมือนตัวทำละลายที่กัดกร่อนต้นทุนของสถาบันขนาดใหญ่ ทั้งภาครัฐและเอกชน ไมโครโพรเซสซิงจะเปลี่ยนรูปแบบขององค์กรและแนวคิดเรื่องสถานที่ในทางเศรษฐกิจอย่างสิ้นเชิง

ตลอดประวัติศาสตร์ เศรษฐกิจผูกติดกับพื้นที่ทางภูมิศาสตร์ การเดินทางเป็นเรื่องยากและจำกัด การค้าขายส่วนใหญ่เกิดในระดับท้องถิ่น ภาษา วัฒนธรรม และภูมิประเทศเป็นอุปสรรคทางการเมืองเสมอ จนถึงกับที่ผู้เขียนกล่าวว่า การเมืองทั้งหมดเป็นเรื่องท้องถิ่น

แต่เทคโนโลยีสมัยใหม่กำลังเปลี่ยนสมการนี้ การสื่อสารและขนส่งที่รวดเร็วทำให้ผู้มีความสามารถสามารถเลือกสถานที่อยู่อาศัยหรือทำงานได้อย่างเสรี ลดอำนาจต่อรองของรัฐบาลในพื้นที่นั้นลง เพราะคนสามารถ “หนี” ได้ง่ายขึ้น หากรัฐบาลกดขี่หรือรีดไถ

แม้อินเทอร์เน็ตยุคแรกจะดูธรรมดา เช่น ใช้อ่านบทความหรือสั่งซื้อสินค้า แต่ศักยภาพที่แท้จริงของเศรษฐกิจไซเบอร์นั้นยิ่งใหญ่มาก ผู้เขียนเสนอว่ามันจะพัฒนาเป็นสามขั้น: 1. ขั้นพื้นฐาน: อินเทอร์เน็ตเป็นเพียงช่องทางเพิ่มประสิทธิภาพธุรกิจแบบเดิม (เช่น เว็บขายสินค้าขายของออนไลน์ เช่น อเมซอน) 2. ขั้นพัฒนา: การเกิดขึ้นของเงินดิจิทัลที่เข้ารหัสและไม่สามารถติดตามได้ จะปลดปล่อยธุรกรรมจากการควบคุมและการจัดเก็บภาษีของรัฐ 3. ขั้นก้าวหน้า: ไซเบอร์สเปซจะมีระบบเศรษฐกิจ กฎหมาย และกลไกคุ้มครองของตัวเอง ปราศจากการควบคุมจากรัฐบาลใด ๆ

ในโลกใหม่นี้ Sovereign Individual หรือ “ปัจเจกผู้มีอธิปไตย” จะสามารถสร้างความมั่งคั่งและดำเนินกิจกรรมในไซเบอร์สเปซได้อย่างเป็นอิสระ โดยไม่ต้องอิงรัฐชาติ รัฐจึงจะถูกบีบให้ลดขนาดและเปลี่ยนบทบาทจากผู้ใช้อำนาจกลายเป็นผู้ให้บริการที่ต้องแข่งขันเพื่อความพึงพอใจของพลเมือง

สามารถไปติดตามเนื้อหาแบบ short vdo ที่สรุปประเด็นสำคัญจากแต่ละบท พร้อมกราฟิกและคำอธิบายกระชับ เข้าใจง่าย ได้ที่ TikTok ช่อง https://www.tiktok.com/@moneyment1971

-

@ 9be6a199:6e133301

2025-05-19 20:27:20

@ 9be6a199:6e133301

2025-05-19 20:27:20ssdsdsdsdsdsdsd

-

@ 9be6a199:6e133301

2025-05-19 20:15:18

@ 9be6a199:6e133301

2025-05-19 20:15:18 -

@ 04c915da:3dfbecc9

2025-05-16 18:06:46

@ 04c915da:3dfbecc9

2025-05-16 18:06:46Bitcoin has always been rooted in freedom and resistance to authority. I get that many of you are conflicted about the US Government stacking but by design we cannot stop anyone from using bitcoin. Many have asked me for my thoughts on the matter, so let’s rip it.

Concern

One of the most glaring issues with the strategic bitcoin reserve is its foundation, built on stolen bitcoin. For those of us who value private property this is an obvious betrayal of our core principles. Rather than proof of work, the bitcoin that seeds this reserve has been taken by force. The US Government should return the bitcoin stolen from Bitfinex and the Silk Road.

Using stolen bitcoin for the reserve creates a perverse incentive. If governments see bitcoin as a valuable asset, they will ramp up efforts to confiscate more bitcoin. The precedent is a major concern, and I stand strongly against it, but it should be also noted that governments were already seizing coin before the reserve so this is not really a change in policy.

Ideally all seized bitcoin should be burned, by law. This would align incentives properly and make it less likely for the government to actively increase coin seizures. Due to the truly scarce properties of bitcoin, all burned bitcoin helps existing holders through increased purchasing power regardless. This change would be unlikely but those of us in policy circles should push for it regardless. It would be best case scenario for American bitcoiners and would create a strong foundation for the next century of American leadership.

Optimism

The entire point of bitcoin is that we can spend or save it without permission. That said, it is a massive benefit to not have one of the strongest governments in human history actively trying to ruin our lives.

Since the beginning, bitcoiners have faced horrible regulatory trends. KYC, surveillance, and legal cases have made using bitcoin and building bitcoin businesses incredibly difficult. It is incredibly important to note that over the past year that trend has reversed for the first time in a decade. A strategic bitcoin reserve is a key driver of this shift. By holding bitcoin, the strongest government in the world has signaled that it is not just a fringe technology but rather truly valuable, legitimate, and worth stacking.

This alignment of incentives changes everything. The US Government stacking proves bitcoin’s worth. The resulting purchasing power appreciation helps all of us who are holding coin and as bitcoin succeeds our government receives direct benefit. A beautiful positive feedback loop.

Realism

We are trending in the right direction. A strategic bitcoin reserve is a sign that the state sees bitcoin as an asset worth embracing rather than destroying. That said, there is a lot of work left to be done. We cannot be lulled into complacency, the time to push forward is now, and we cannot take our foot off the gas. We have a seat at the table for the first time ever. Let's make it worth it.

We must protect the right to free usage of bitcoin and other digital technologies. Freedom in the digital age must be taken and defended, through both technical and political avenues. Multiple privacy focused developers are facing long jail sentences for building tools that protect our freedom. These cases are not just legal battles. They are attacks on the soul of bitcoin. We need to rally behind them, fight for their freedom, and ensure the ethos of bitcoin survives this new era of government interest. The strategic reserve is a step in the right direction, but it is up to us to hold the line and shape the future.

-

@ 91117f2b:111207d6

2025-05-19 18:50:48

@ 91117f2b:111207d6

2025-05-19 18:50:48

Crypto currency is now a buzzword in the financial world. Many people are wondering what it is all about. In my article I will break down the basis of crypto currency and at the same time explore it's basis and risks.

MANY ASKS "WHAT IS CRYPTO CURRENCY

Crypto currency is a virtual or digital currency that uses cryptography for security. Which means it is not controlled by government or financial institutions. The transaction are recorded on a public ledger also called a blockchain which ensures the transparency and security of crypto currency.

MANY ASKS HOW DOES IT WORK

Crypto currency has different stages such as the mining, transaction and the wallet stage. THE MINING STAGE: Crypto currency is created through a process which is described as mining, and where your hardwares or computer solve complex mathematical problem to validate your transaction and create new coins.

TRANSACTION STAGE: crypto currency can be be traded for other currencies, they can also be used to buy goods and services online.

WALLET: crypto currency is stored digitally which can be accessed through your hardwares or even your softwares.

THEY ARE BENEFITS AND RISKS FOR CRYPTO CURRENCY

HERE ARE SOME BENEFITS 1. Decentralization :decentralization gives users more control over their money, because crypto currency operates independently of government and banks.

- ACCESSIBILITY: crypto currency can be accessed by anyone through the use of internet making it to be a solution for finances.

- SECURITY: the transactions of crypto currencies are secure and also transparent through the aid of blockchain technology.

HERE ARE SOME RISKS

-

SECURITY RISKS: during exchange in crypto currency wallets can be vulnerable to hacking and cyber theft.

-

VOLATILITY: crypto currency can fluctuate or tends to fluctuate rapidly making it a risky investment.

-

REGULATORY UNCERTAINTY: the rules and regulations of crypto currency is still evolving, which can create uncertainty and risks for investors.

SOME POPULAR CRYPTO CURRENCIES

- BITCOIN: it is the most reknown crypto currency and is often a gold standard for digital currencies.

-

ETHERIUM: it is a popular platform for building decentralized applications. Etherium has its own crypto currency called Ether.

-

ALTCOINS: they are other crypto currenciss like montero, lite coin and so on, which offers alternatives.

IN CONCLUSION

Crypto currency is complex and it is rapidly evolving, both with benefit and risks. It is essential to stay updated and informed to understand the changes both opportunities and challenges. I assure you whatever you do for a living crypto currency is worth your time and explorations.

-

@ 04c915da:3dfbecc9

2025-05-16 17:59:23

@ 04c915da:3dfbecc9

2025-05-16 17:59:23Recently we have seen a wave of high profile X accounts hacked. These attacks have exposed the fragility of the status quo security model used by modern social media platforms like X. Many users have asked if nostr fixes this, so lets dive in. How do these types of attacks translate into the world of nostr apps? For clarity, I will use X’s security model as representative of most big tech social platforms and compare it to nostr.

The Status Quo

On X, you never have full control of your account. Ultimately to use it requires permission from the company. They can suspend your account or limit your distribution. Theoretically they can even post from your account at will. An X account is tied to an email and password. Users can also opt into two factor authentication, which adds an extra layer of protection, a login code generated by an app. In theory, this setup works well, but it places a heavy burden on users. You need to create a strong, unique password and safeguard it. You also need to ensure your email account and phone number remain secure, as attackers can exploit these to reset your credentials and take over your account. Even if you do everything responsibly, there is another weak link in X infrastructure itself. The platform’s infrastructure allows accounts to be reset through its backend. This could happen maliciously by an employee or through an external attacker who compromises X’s backend. When an account is compromised, the legitimate user often gets locked out, unable to post or regain control without contacting X’s support team. That process can be slow, frustrating, and sometimes fruitless if support denies the request or cannot verify your identity. Often times support will require users to provide identification info in order to regain access, which represents a privacy risk. The centralized nature of X means you are ultimately at the mercy of the company’s systems and staff.

Nostr Requires Responsibility

Nostr flips this model radically. Users do not need permission from a company to access their account, they can generate as many accounts as they want, and cannot be easily censored. The key tradeoff here is that users have to take complete responsibility for their security. Instead of relying on a username, password, and corporate servers, nostr uses a private key as the sole credential for your account. Users generate this key and it is their responsibility to keep it safe. As long as you have your key, you can post. If someone else gets it, they can post too. It is that simple. This design has strong implications. Unlike X, there is no backend reset option. If your key is compromised or lost, there is no customer support to call. In a compromise scenario, both you and the attacker can post from the account simultaneously. Neither can lock the other out, since nostr relays simply accept whatever is signed with a valid key.

The benefit? No reliance on proprietary corporate infrastructure.. The negative? Security rests entirely on how well you protect your key.

Future Nostr Security Improvements

For many users, nostr’s standard security model, storing a private key on a phone with an encrypted cloud backup, will likely be sufficient. It is simple and reasonably secure. That said, nostr’s strength lies in its flexibility as an open protocol. Users will be able to choose between a range of security models, balancing convenience and protection based on need.

One promising option is a web of trust model for key rotation. Imagine pre-selecting a group of trusted friends. If your account is compromised, these people could collectively sign an event announcing the compromise to the network and designate a new key as your legitimate one. Apps could handle this process seamlessly in the background, notifying followers of the switch without much user interaction. This could become a popular choice for average users, but it is not without tradeoffs. It requires trust in your chosen web of trust, which might not suit power users or large organizations. It also has the issue that some apps may not recognize the key rotation properly and followers might get confused about which account is “real.”

For those needing higher security, there is the option of multisig using FROST (Flexible Round-Optimized Schnorr Threshold). In this setup, multiple keys must sign off on every action, including posting and updating a profile. A hacker with just one key could not do anything. This is likely overkill for most users due to complexity and inconvenience, but it could be a game changer for large organizations, companies, and governments. Imagine the White House nostr account requiring signatures from multiple people before a post goes live, that would be much more secure than the status quo big tech model.

Another option are hardware signers, similar to bitcoin hardware wallets. Private keys are kept on secure, offline devices, separate from the internet connected phone or computer you use to broadcast events. This drastically reduces the risk of remote hacks, as private keys never touches the internet. It can be used in combination with multisig setups for extra protection. This setup is much less convenient and probably overkill for most but could be ideal for governments, companies, or other high profile accounts.

Nostr’s security model is not perfect but is robust and versatile. Ultimately users are in control and security is their responsibility. Apps will give users multiple options to choose from and users will choose what best fits their need.

-

@ cae03c48:2a7d6671

2025-05-19 18:29:07

@ cae03c48:2a7d6671

2025-05-19 18:29:07Bitcoin Magazine

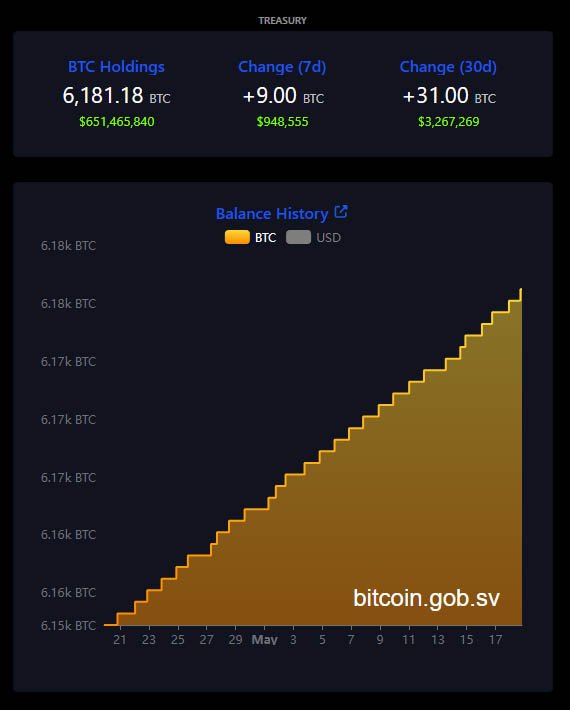

Bitcoin Records Highest Weekly Close Above $106KBitcoin has officially recorded its highest-ever weekly candle close, finishing the week at $106,516. The milestone was achieved on Sunday evening, marking a notable moment in Bitcoin’s ongoing price history and underscoring growing institutional and retail interest.

JUST IN: $107,000 #Bitcoin

pic.twitter.com/Xt1JLm0Ke6

pic.twitter.com/Xt1JLm0Ke6— Bitcoin Magazine (@BitcoinMagazine) May 19, 2025

This weekly close sets a new benchmark for BTC’s price performance and positions the asset in a historically rare range. As of Monday, Bitcoin is trading at $102,924, reflecting typical price movement following a new high as markets adjust to key levels.

Historical data helps illustrate the significance of this moment. According to an analysis shared by on-chain researcher Dan, Bitcoin has closed above $106,439 only once—this week—accounting for just 0.02% of its entire trading history. Closures above $100,000 have occurred in only 40 days total. Even levels like $75,000 and $50,000 remain relatively uncommon in Bitcoin’s lifespan, appearing on just 181 and 586 days, respectively.

— Dan (@robustus) May 19, 2025

This data highlights how current prices place Bitcoin in a historically narrow range of time — a reflection of the long-term upward trend of the asset over the past decade. For market participants, this type of price action often serves as an indicator of continued momentum and interest in Bitcoin’s role as a digital store of value.

The broader Bitcoin ecosystem continues to show strength, with on-chain metrics reflecting growing user engagement and long-term holder confidence. Notably, activity on the Bitcoin network remains elevated, with transaction volumes and address growth signaling continued adoption. Analysts are closely watching inflows into Bitcoin-focused ETFs and the behavior of long-term holders, both of which are key indicators of sustained interest and belief in Bitcoin’s long-term value.

bitcoin just had its all-time high weekly candle close at $106,500 pic.twitter.com/FuqqptHEmA

— Alex Thorn (@intangiblecoins) May 19, 2025

Some traders are watching the $100,000 level closely as a key psychological and technical zone. Bitcoin’s ability to maintain this level following a record weekly close could be important in setting the tone for the weeks ahead.

While near-term price movements are always part of market dynamics, the latest close represents a milestone in Bitcoin’s history. It reaffirms the asset’s resilience and ongoing relevance in the global financial landscape.

This post Bitcoin Records Highest Weekly Close Above $106K first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ 04c915da:3dfbecc9

2025-05-16 17:51:54

@ 04c915da:3dfbecc9

2025-05-16 17:51:54In much of the world, it is incredibly difficult to access U.S. dollars. Local currencies are often poorly managed and riddled with corruption. Billions of people demand a more reliable alternative. While the dollar has its own issues of corruption and mismanagement, it is widely regarded as superior to the fiat currencies it competes with globally. As a result, Tether has found massive success providing low cost, low friction access to dollars. Tether claims 400 million total users, is on track to add 200 million more this year, processes 8.1 million transactions daily, and facilitates $29 billion in daily transfers. Furthermore, their estimates suggest nearly 40% of users rely on it as a savings tool rather than just a transactional currency.

Tether’s rise has made the company a financial juggernaut. Last year alone, Tether raked in over $13 billion in profit, with a lean team of less than 100 employees. Their business model is elegantly simple: hold U.S. Treasuries and collect the interest. With over $113 billion in Treasuries, Tether has turned a straightforward concept into a profit machine.

Tether’s success has resulted in many competitors eager to claim a piece of the pie. This has triggered a massive venture capital grift cycle in USD tokens, with countless projects vying to dethrone Tether. Due to Tether’s entrenched network effect, these challengers face an uphill battle with little realistic chance of success. Most educated participants in the space likely recognize this reality but seem content to perpetuate the grift, hoping to cash out by dumping their equity positions on unsuspecting buyers before they realize the reality of the situation.

Historically, Tether’s greatest vulnerability has been U.S. government intervention. For over a decade, the company operated offshore with few allies in the U.S. establishment, making it a major target for regulatory action. That dynamic has shifted recently and Tether has seized the opportunity. By actively courting U.S. government support, Tether has fortified their position. This strategic move will likely cement their status as the dominant USD token for years to come.

While undeniably a great tool for the millions of users that rely on it, Tether is not without flaws. As a centralized, trusted third party, it holds the power to freeze or seize funds at its discretion. Corporate mismanagement or deliberate malpractice could also lead to massive losses at scale. In their goal of mitigating regulatory risk, Tether has deepened ties with law enforcement, mirroring some of the concerns of potential central bank digital currencies. In practice, Tether operates as a corporate CBDC alternative, collaborating with authorities to surveil and seize funds. The company proudly touts partnerships with leading surveillance firms and its own data reveals cooperation in over 1,000 law enforcement cases, with more than $2.5 billion in funds frozen.

The global demand for Tether is undeniable and the company’s profitability reflects its unrivaled success. Tether is owned and operated by bitcoiners and will likely continue to push forward strategic goals that help the movement as a whole. Recent efforts to mitigate the threat of U.S. government enforcement will likely solidify their network effect and stifle meaningful adoption of rival USD tokens or CBDCs. Yet, for all their achievements, Tether is simply a worse form of money than bitcoin. Tether requires trust in a centralized entity, while bitcoin can be saved or spent without permission. Furthermore, Tether is tied to the value of the US Dollar which is designed to lose purchasing power over time, while bitcoin, as a truly scarce asset, is designed to increase in purchasing power with adoption. As people awaken to the risks of Tether’s control, and the benefits bitcoin provides, bitcoin adoption will likely surpass it.

-

@ 82a7a1ff:2c1e9cdf

2025-05-19 18:18:31

@ 82a7a1ff:2c1e9cdf

2025-05-19 18:18:31Whatever

-

@ 3f770d65:7a745b24

2025-05-19 18:09:52

@ 3f770d65:7a745b24

2025-05-19 18:09:52🏌️ Monday, May 26 – Bitcoin Golf Championship & Kickoff Party

Location: Las Vegas, Nevada\ Event: 2nd Annual Bitcoin Golf Championship & Kick Off Party"\ Where: Bali Hai Golf Clubhouse, 5160 S Las Vegas Blvd, Las Vegas, NV 89119\ 🎟️ Get Tickets!

Details:

-

The week tees off in style with the Bitcoin Golf Championship. Swing clubs by day and swing to music by night.

-

Live performances from Nostr-powered acts courtesy of Tunestr, including Ainsley Costello and others.

-

Stop by the Purple Pill Booth hosted by Derek and Tanja, who will be on-boarding golfers and attendees to the decentralized social future with Nostr.

💬 May 27–29 – Bitcoin 2025 Conference at the Las Vegas Convention Center

Location: The Venetian Resort\ Main Attraction for Nostr Fans: The Nostr Lounge\ When: All day, Tuesday through Thursday\ Where: Right outside the Open Source Stage\ 🎟️ Get Tickets!

Come chill at the Nostr Lounge, your home base for all things decentralized social. With seating for \~50, comfy couches, high-tops, and good vibes, it’s the perfect space to meet developers, community leaders, and curious newcomers building the future of censorship-resistant communication.

Bonus: Right across the aisle, you’ll find Shopstr, a decentralized marketplace app built on Nostr. Stop by their booth to explore how peer-to-peer commerce works in a truly open ecosystem.

Daily Highlights at the Lounge:

-

☕️ Hang out casually or sit down for a deeper conversation about the Nostr protocol

-

🔧 1:1 demos from app teams

-

🛍️ Merch available onsite

-

🧠 Impromptu lightning talks

-

🎤 Scheduled Meetups (details below)

🎯 Nostr Lounge Meetups

Wednesday, May 28 @ 1:00 PM

- Damus Meetup: Come meet the team behind Damus, the OG Nostr app for iOS that helped kickstart the social revolution. They'll also be showcasing their new cross-platform app, Notedeck, designed for a more unified Nostr experience across devices. Grab some merch, get a demo, and connect directly with the developers.

Thursday, May 29 @ 1:00 PM

- Primal Meetup: Dive into Primal, the slickest Nostr experience available on web, Android, and iOS. With a built-in wallet, zapping your favorite creators and friends has never been easier. The team will be on-site for hands-on demos, Q\&A, merch giveaways, and deeper discussions on building the social layer of Bitcoin.

🎙️ Nostr Talks at Bitcoin 2025

If you want to hear from the minds building decentralized social, make sure you attend these two official conference sessions:

1. FROSTR Workshop: Multisig Nostr Signing

-

🕚 Time: 11:30 AM – 12:00 PM

-

📅 Date: Wednesday, May 28

-

📍 Location: Developer Zone

-

🎤 Speaker: nostr:nprofile1qy2hwumn8ghj7etyv4hzumn0wd68ytnvv9hxgqgdwaehxw309ahx7uewd3hkcqpqs9etjgzjglwlaxdhsveq0qksxyh6xpdpn8ajh69ruetrug957r3qf4ggfm (Austin Kelsay) @ Voltage\ A deep-dive into FROST-based multisig key management for Nostr. Geared toward devs and power users interested in key security.

2. Panel: Decentralizing Social Media

-

🕑 Time: 2:00 PM – 2:30 PM

-

📅 Date: Thursday, May 29

-

📍 Location: Genesis Stage

-

🎙️ Moderator: nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqy08wumn8ghj7mn0wd68yttjv4kxz7fwv3jhyettwfhhxuewd4jsqgxnqajr23msx5malhhcz8paa2t0r70gfjpyncsqx56ztyj2nyyvlq00heps - Bitcoin Strategy @ Roxom TV

-

👥 Speakers:

-

nostr:nprofile1qyt8wumn8ghj7etyv4hzumn0wd68ytnvv9hxgtcppemhxue69uhkummn9ekx7mp0qqsy2ga7trfetvd3j65m3jptqw9k39wtq2mg85xz2w542p5dhg06e5qmhlpep – Early Bitcoin dev, CEO @ Sirius Business Ltd

-

nostr:nprofile1qy2hwumn8ghj7mn0wd68ytndv9kxjm3wdahxcqg5waehxw309ahx7um5wfekzarkvyhxuet5qqsw4v882mfjhq9u63j08kzyhqzqxqc8tgf740p4nxnk9jdv02u37ncdhu7e3 – Analyst & Partner @ Ego Death Capital

Get the big-picture perspective on why decentralized social matters and how Nostr fits into the future of digital communication.

🌃 NOS VEGAS Meetup & Afterparty

Date: Wednesday, May 28\ Time: 7:00 PM – 1:00 AM\ Location: We All Scream Nightclub, 517 Fremont St., Las Vegas, NV 89101\ 🎟️ Get Tickets!

What to Expect:

-

🎶 Live Music Stage – Featuring Ainsley Costello, Sara Jade, Able James, Martin Groom, Bobby Shell, Jessie Lark, and other V4V artists

-

🪩 DJ Party Deck – With sets by nostr:nprofile1qy0hwumn8ghj7cmgdae82uewd45kketyd9kxwetj9e3k7mf6xs6rgqgcwaehxw309ahx7um5wgh85mm694ek2unk9ehhyecqyq7hpmq75krx2zsywntgtpz5yzwjyg2c7sreardcqmcp0m67xrnkwylzzk4 , nostr:nprofile1qy2hwumn8ghj7etyv4hzumn0wd68ytnvv9hxgqgkwaehxw309anx2etywvhxummnw3ezucnpdejqqg967faye3x6fxgnul77ej23l5aew8yj0x2e4a3tq2mkrgzrcvecfsk8xlu3 , and more DJs throwing down

-

🛰️ Live-streamed via Tunestr

-

🧠 Nostr Education – Talks by nostr:nprofile1qy88wumn8ghj7mn0wvhxcmmv9uq37amnwvaz7tmwdaehgu3dwfjkccte9ejx2un9ddex7umn9ekk2tcqyqlhwrt96wnkf2w9edgr4cfruchvwkv26q6asdhz4qg08pm6w3djg3c8m4j , nostr:nprofile1qy2hwumn8ghj7etyv4hzumn0wd68ytnvv9hxgqg7waehxw309anx2etywvhxummnw3ezucnpdejz7ur0wp6kcctjqqspywh6ulgc0w3k6mwum97m7jkvtxh0lcjr77p9jtlc7f0d27wlxpslwvhau , nostr:nprofile1qy88wumn8ghj7mn0wvhxcmmv9uq3vamnwvaz7tmwdaehgu3wd33xgetk9en82m30qqsgqke57uygxl0m8elstq26c4mq2erz3dvdtgxwswwvhdh0xcs04sc4u9p7d , nostr:nprofile1q9z8wumn8ghj7erzx3jkvmmzw4eny6tvw368wdt8da4kxamrdvek76mrwg6rwdngw94k67t3v36k77tev3kx7vn2xa5kjem9dp4hjepwd3hkxctvqyg8wumn8ghj7mn0wd68ytnhd9hx2qpqyaul8k059377u9lsu67de7y637w4jtgeuwcmh5n7788l6xnlnrgssuy4zk , nostr:nprofile1qy28wue69uhnzvpwxqhrqt33xgmn5dfsx5cqz9thwden5te0v4jx2m3wdehhxarj9ekxzmnyqqswavgevxe9gs43vwylumr7h656mu9vxmw4j6qkafc3nefphzpph8ssvcgf8 , and more.

-

🧾 Vendors & Project Booths – Explore new tools and services

-

🔐 Onboarding Stations – Learn how to use Nostr hands-on

-

🐦 Nostrich Flocking – Meet your favorite nyms IRL

-

🍸 Three Full Bars – Two floors of socializing overlooking vibrant Fremont Street

| | | | | ----------- | -------------------- | ------------------- | | Time | Name | Topic | | 7:30-7:50 | Derek | Nostr for Beginners | | 8:00-8:20 | Mark & Paul | Primal | | 8:30-8:50 | Terry | Damus | | 9:00-9:20 | OpenMike and Ainsley | V4V | | 09:30-09:50 | The Space | Space |

This is the after-party of the year for those who love freedom technology and decentralized social community. Don’t miss it.

Final Thoughts

Whether you're there to learn, network, party, or build, Bitcoin 2025 in Las Vegas has a packed week of Nostr-friendly programming. Be sure to catch all the events, visit the Nostr Lounge, and experience the growing decentralized social revolution.

🟣 Find us. Flock with us. Purple pill someone.

-

-

@ 04c915da:3dfbecc9

2025-05-16 17:12:05

@ 04c915da:3dfbecc9

2025-05-16 17:12:05One of the most common criticisms leveled against nostr is the perceived lack of assurance when it comes to data storage. Critics argue that without a centralized authority guaranteeing that all data is preserved, important information will be lost. They also claim that running a relay will become prohibitively expensive. While there is truth to these concerns, they miss the mark. The genius of nostr lies in its flexibility, resilience, and the way it harnesses human incentives to ensure data availability in practice.

A nostr relay is simply a server that holds cryptographically verifiable signed data and makes it available to others. Relays are simple, flexible, open, and require no permission to run. Critics are right that operating a relay attempting to store all nostr data will be costly. What they miss is that most will not run all encompassing archive relays. Nostr does not rely on massive archive relays. Instead, anyone can run a relay and choose to store whatever subset of data they want. This keeps costs low and operations flexible, making relay operation accessible to all sorts of individuals and entities with varying use cases.

Critics are correct that there is no ironclad guarantee that every piece of data will always be available. Unlike bitcoin where data permanence is baked into the system at a steep cost, nostr does not promise that every random note or meme will be preserved forever. That said, in practice, any data perceived as valuable by someone will likely be stored and distributed by multiple entities. If something matters to someone, they will keep a signed copy.

Nostr is the Streisand Effect in protocol form. The Streisand effect is when an attempt to suppress information backfires, causing it to spread even further. With nostr, anyone can broadcast signed data, anyone can store it, and anyone can distribute it. Try to censor something important? Good luck. The moment it catches attention, it will be stored on relays across the globe, copied, and shared by those who find it worth keeping. Data deemed important will be replicated across servers by individuals acting in their own interest.

Nostr’s distributed nature ensures that the system does not rely on a single point of failure or a corporate overlord. Instead, it leans on the collective will of its users. The result is a network where costs stay manageable, participation is open to all, and valuable verifiable data is stored and distributed forever.

-

@ cae03c48:2a7d6671

2025-05-19 17:48:53

@ cae03c48:2a7d6671

2025-05-19 17:48:53Bitcoin Magazine

JPMorgan To Allow Clients To Buy Bitcoin, Jamie Dimon SaysToday, Chairman and CEO of JPMorgan Chase Jamie Dimon reiterated his personal disapproval of Bitcoin during the bank’s annual Investor Day event. Despite the bank’s decision to provide clients with access to Bitcoin investments, Dimon emphasized his personal disapproval of Bitcoin.

“I am not a fan” of Bitcoin, stated Dimon.

JPMorgan is going to allow clients to buy Bitcoin, but the bank won’t custody it, according to Bloomberg. Dimon made clear that while JPMorgan will provide clients access to Bitcoin investments, the bank will not hold or manage the digital asset directly.

JUST IN: JPMorgan CEO Jamie Dimon said they will allow clients to buy #Bitcoin

pic.twitter.com/wO0djlYGUM

pic.twitter.com/wO0djlYGUM— Bitcoin Magazine (@BitcoinMagazine) May 19, 2025

In a January 2025 interview with CBS News, Dimon expressed continued skepticism toward Bitcoin. “Bitcoin itself has no intrinsic value. It’s used heavily by sex traffickers, money launderers, ransomware,” said Dimon.