-

@ 7e538978:a5987ab6

2025-05-20 14:10:38

@ 7e538978:a5987ab6

2025-05-20 14:10:38🧑💻🚀 This bounty has now been claimed - Read more here 🧑💻🚀🧑💻🚀

Bounty Specification: Implement a Nostr Wallet Connect Funding Source for LNbits

Project Overview

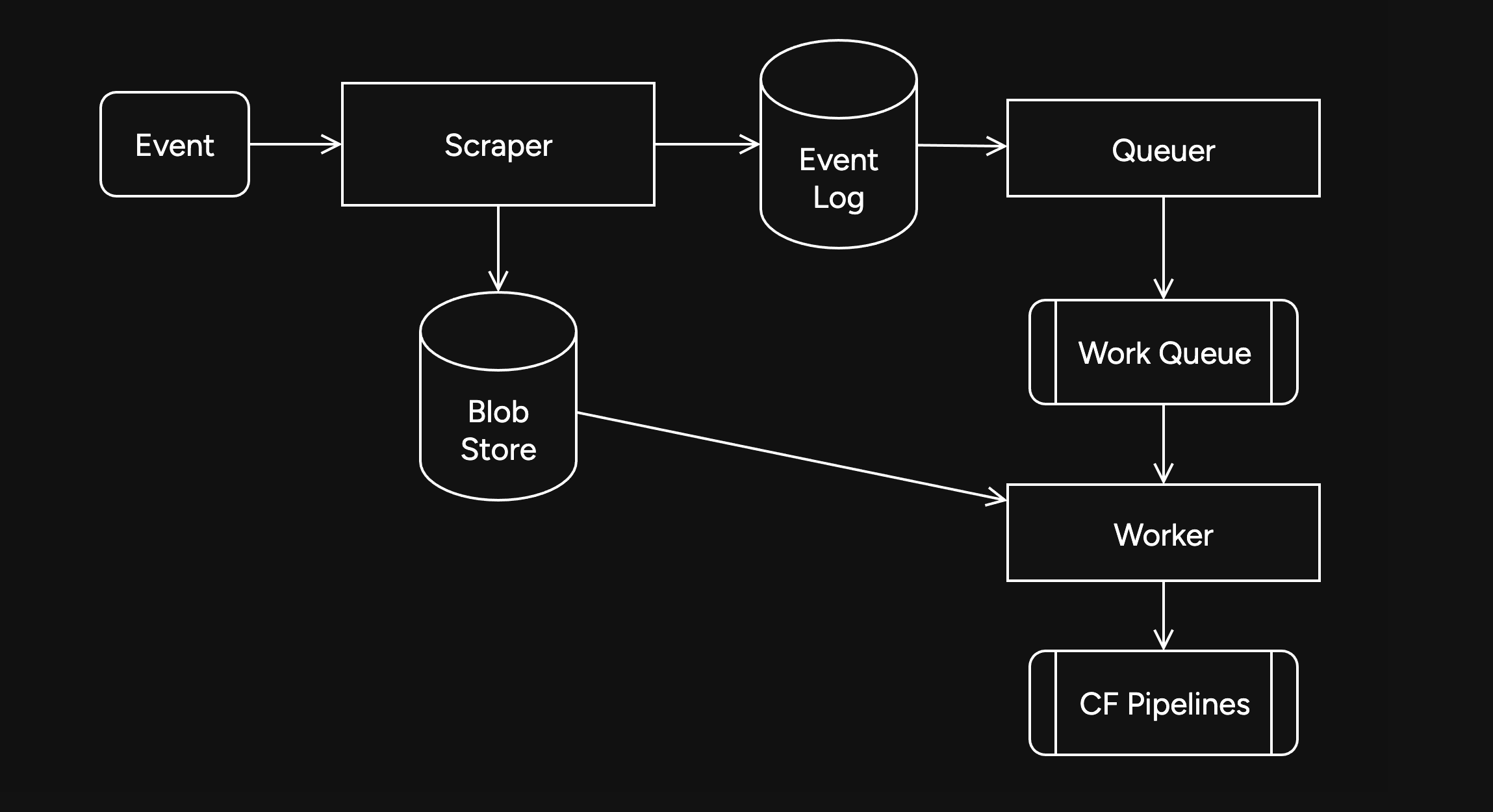

This project involves the development of a funding source within LNbits that can use a remote NWC wallet service.

Objective

To create a NWC funding source for LNbits that allows for lightning network operations using a remote Nostr Wallet Connect wallet service. This funding source should implement all funding source functions using NWC as defined in the Void funding source stub - https://github.com/lnbits/lnbits/blob/dev/lnbits/wallets/void.py

Deliverables

- NWC Funding Source: Robust funding source for LNbits that implements all funding source functions using NIP-47.

- Documentation: Comprehensive guide including:

- Installation and configuration processes.

- Configuration guidelines to connect with various NWC wallet services.

- Test Suite: Complete set of tests ensuring the functionality works under various scenarios and adheres to the NIP-47 protocol.

- Demonstration: A working demonstration of LNbits acting as a NWC client, performing transactions using a NWC wallet service.

Requirements

- The extension should be implemented in Python to align with the existing LNbits platform.

- Follow the NIP-47 protocol.

- Integration should support asynchronous operations to handle real-time transaction confirmations.

Budget

- Total Bounty: 750,000 sats

- Payment will be made upon final delivery, after successful testing and documentation review.

Evaluation Criteria

- Adherence to the NIP-47 specifications and LNbits integration requirements.

- Security and efficiency of the implementation.

- Quality of documentation and ease of use.

How to Apply

Get in touch with us in the LNbits Telegram channel

-

@ 7e538978:a5987ab6

2025-05-20 14:10:14

@ 7e538978:a5987ab6

2025-05-20 14:10:14🧑💻🚀 This bounty has now been claimed - Read more here 🧑💻🚀

Bounty Specification: Build a Nostr Wallet Connect Wallet Service Extension for LNbits

Project Overview

This project aims to build a Nostr Wallet Connect (NWC) extension for LNbits to allow LNbits to act as a NWC Wallet Service as defined in NIP-47 https://github.com/nostr-protocol/nips/blob/master/47.md

LNbits has an example extension that can be used as a starting point on your extension development journey. Watch the extension build tutorial video here

Objective

To develop a fully functional NWC Wallet Service extension that adheres to the NIP-47 protocol specifications, enabling the following capabilities:

- Generation and handling of Nostr Wallet Connect URIs.

- Processing of payment requests including

pay_invoice,make_invoice,lookup_invoice,list_transactions,get_balance,multi_pay_invoice,pay_keysend,multi_pay_keysendandget_info - Creation and lookup of invoices.

- List and balance querying functionalities.

- Secure communication through encrypted events as per NIP04.

- Implementation of error codes

- Implementation of connection rules with control of the following:

Maximum payment amount,maximum daily budget,connection expiry date(never expire should be an option) denominated in sats.

Deliverables

- NWC Wallet Service Extension Code: Clean, commented, and secure codebase that uses the existing LNbits

nostrclient.pyfunctionality and an LNbits funding source to provide a NWC Wallet Service. - NWC Wallet Service Extension UI: A user interface within the extension that allows a user to connect a new app to the NWC wallet service and edit existing connections. The app connection should allow control of the following rules:

Maximum payment amountMaximum daily budgetConnection expiry date(never expire should be an option) - Documentation: Documentation covering:

- Setup and configuration instructions.

- Usage examples.

- Test Suite: A comprehensive test suite covering all key functionality

Technology Requirements

- The extension must be developed in Python, consistent with the LNbits platform.

- Use of existing LNbits libraries and adherence to its architectural style is required.

- NIP-47 specification must be adhered to.

Budget

- Total Bounty: 750,000 sats

- Payment will be made upon final delivery, after successful testing and documentation review.

Evaluation Criteria

- Adherence to the NIP-47 specifications and LNbits integration requirements.

- Security and efficiency of the implementation.

- Quality of documentation and ease of use.

How to Apply

Get in touch with us in the LNbits Telegram channel

-

@ c6d8334c:30883d6d

2025-05-20 14:08:19

@ c6d8334c:30883d6d

2025-05-20 14:08:19🔑 Hashtag-Kombination (immer gleich aufgebaut):

```

relilab #verstehen 1️⃣

relilab #anwenden 2️⃣

relilab #reflektieren

relilab #gestalten 3️⃣

```

✅ Pflicht:

-

#relilab -

genau ein Kompetenz-Hashtag:

#verstehen,#anwenden,#reflektieren,#gestalten

✨ Optional:

-

eine Niveaustufe:

-

1️⃣ Reproduktion

-

2️⃣ Rekonstruktion

-

3️⃣ Konstruktion

📝 Beispielhafte Posts

```text

relilab #verstehen 1️⃣

Ich habe heute zum ersten Mal ausprobiert, wie KI überhaupt "lernt". Spannend!

relilab #anwenden 2️⃣

ChatGPT half mir dabei, einen Ablaufplan für einen Unterricht zu entwerfen – sehr hilfreich.

relilab #reflektieren

Welche Rolle spielt das Menschenbild, wenn KI religiöse Themen behandelt?

relilab #gestalten 3️⃣

Ich habe ein eigenes H5P-Modul mit einem KI-generierten Bibelquiz gebaut. Wer testet es? ```

-

-

@ bd32f268:22b33966

2025-05-20 14:07:47

@ bd32f268:22b33966

2025-05-20 14:07:47Recentemente tive conhecimento do mais recente flagelo cuja popularidade espelha bem o estado avançado de degeneração da nossa sociedade, o bebé reborn. Há uns anos certamente não passaria de uma piada de mau gosto quando alguém nos dissesse que decidiu adquirir um boneco para criar como se se tratasse de um filho, infelizmente em 2025 deixou de ser uma piada para se tornar algo assombroso.

Depois de fazer alguma pesquisa sobre o tema percebi que há pessoas que têm em curso processos litigantes judiciais relativos à, note-se com pasmo, guarda da boneca. A insanidade não fica por aqui uma vez que, algumas "mães" procuram atendimento médico para os seus bonecos. No Brasil, a câmara dos deputados recebeu três projetos destinados à criação de políticas públicas relacionadas com estes bonecos. As notícias sobre este fenómeno surreal multiplicam-se à medida que a insanidade se alastra como vírus pelas redes sociais.

Vivemos numa sociedade que há muito se divorciou da realidade, uma sociedade de pós-verdade, por isso de alguma forma não choca que este tipo de coisa possa acontecer. Podemos dizer que de alguma forma existe um primado do sentimento face à razão, preferimos, por vezes com consequências catastróficas, uma mentira "empática" do que uma verdade salvífica. Esta nossa tibieza em afirmar a verdade leva-nos consequentemente a uma crendice insustentável que é esta de, cada um tem a sua verdade. Graças a essa filosofia permitimos que um certo discurso lunático tenha mais alcance no espaço público. Por vezes ingenuamente podemos pensar que se trata de algo inofensivo, sem consequências de maior, contudo a experiência mostra-nos precisamente o contrário. Há por detrás destes fenómenos uma índole corrosiva que funciona como aguilhão para a disseminação das agendas políticas e ideológicas que visam a destruição da família. Considerando a excecional vulnerabilidade psíquica que observamos em cada vez mais pessoas neste tempo e a ampla disseminação destes fenómenos temos razão mais que suficientes para estarmos preocupados.

Uma outra elação que podemos retirar é que a nossa sociedade com as alegadas gerações "mais bem preparadas de sempre" está claramente a produzir um excesso de adultos que se comporta e, a todos os títulos são, crianças funcionais.

Com tudo isto fica cada vez mais difícil viver uma vida harmoniosa com a lei natural, pois vivemos em harmonia com algo considerado opressor pelos apologetas destes produtos do marxismo cultural. Com a pretensa igualdade que se pretende alcançar, equiparando inclusive um boneco a uma bebé, as famílias no sentido próprio do termo ficam em segundo plano relativamente a estes "novos" e esotéricos conceitos de família.

Importa perguntar, no meio de todas essas novas formas de se pensar uma família, qual é o ideal ?

Provavelmente os apologetas destas bizarrices ficarão em silêncio uma vez que coerentemente consideram que todas as formas são iguais e válidas.

Isto é apenas mais um sinal que nos é dado do declínio palpável dos valores que construíram a nossa sociedade e civilização. Façamos algo para que estas nocivas ideologias não entrem no nosso coração e em nossas casas, sob pena da corrupção dos nossos princípios e dos daqueles que nos são queridos. Estes fenómenos são de tal forma doentios que nos levam a crer que vivemos numa época tragicómica, o que me fez lembrar de uma história contada por Kierkgaard e que partilho de seguida.

“Certa vez, houve um incêndio num circo ambulante na Dinamarca. O director mandou imediatamente o palhaço, que já se encontrava vestido e maquilhado a preceito, para a vila mais próxima, à procura de ajuda, advertindo-o de que existia o perigo de o fogo se espalhar pelos campos ceifados e ressequidos, com risco iminente para as casas do próprio povoado. O palhaço correu até à vila e pediu aos moradores que viessem ajudar a apagar o incêndio que estava a destruir o circo. Mas os habitantes viram nos gritos do palhaço apenas um belo truque de publicidade que visaria levá-los a acorrer em grande número às sessões do circo; aplaudiam e desatavam a rir. Diante dessa reacção, o palhaço sentiu mais vontade de chorar do que de rir. Fez de tudo para convencer as pessoas de que não estava a representar, de que não se tratava de um truque e sim de um apelo da maior seriedade: estava realmente em causa um incêndio. Mas a sua insistência só fazia aumentar os risos; eles achavam que a performance estava excelente – até que o fogo alcançou de facto aquela vila. Aí já foi tarde, e o fogo acabou por destruir não só o circo, mas também a povoação”.

Soren Kierkgaard - Filósofo dinamarquês

-

@ b6dcdddf:dfee5ee7

2024-09-06 17:46:11

@ b6dcdddf:dfee5ee7

2024-09-06 17:46:11Hey Frens,

This is the Geyser team, coming at you with a spicy idea: a grant for proper journalism.

Issue: Journalism is broken. Independent journalism is emerging with the work of The Rage, Whitney Webb and so forth. They deal with issues like privacy, political corruption, economics, ESG, medicine and many other issues that are not discussed by mainstream media.

The problem is that not many people know about their work and there are very few grant programs that support their work.

Proposed Solution: Geyser would like to host a Grant supporting independent journalists using 'community voting mechanism'. See here for how Community Voting Grants work.

However, we need more companies to partner up and sponsor this initiative with us. Ideas of more sponsors: - Stacker news: SN has become a great repository of independent/indie journalism. I think they'd fit in great as sponsors for this type of grant. cc: @k00b - Bitesize media: A new independent media house that wants to focus on the signal Bitcoin brings to our world. They expressed interest already. - Bitcoin Magazine: might be interested as well in this effort.

Would love the community's feedback on this idea and propose additional thoughts!

originally posted at https://stacker.news/items/674951

-

@ cae03c48:2a7d6671

2025-05-20 14:00:00

@ cae03c48:2a7d6671

2025-05-20 14:00:00Bitcoin Magazine

Auradine Expands Bitcoin Mining Solutions with Advanced ASIC Chips, Cooling Systems, and Modular Megawatt ContainersAuradine Inc., a U.S.-based Bitcoin miner manufacturer, today announced it is unveiling a broadened portfolio of mining products at the Bitcoin 2025 Conference in Las Vegas, featuring high-performance ASIC chips, specialized cooling systems, and fully integrated modular containers engineered for scalable, megawatt-class mining operations, according to a press release sent to Bitcoin Magazine.

“Our goal is to democratize access to Bitcoin mining and enable innovative integrations,” said the CEO and Co-Founder of Auradine Rajiv Khemani. “Whether you’re running a megawatt container or building a small form-factor heater-miner for your home, we provide the chips, systems, and support to help you succeed. This new chapter is about giving miners the tools to innovate, scale, and operate efficiently.”

The new ASIC offerings, designed for both industrial and small-scale deployments, support customizable form factors and have already been adopted by operators including MARA Holdings, FutureBit, and Deep South Operating. Alongside the chips, Auradine continues to produce a full range of mining rigs to support a variety of deployment needs.

“Auradine’s ability to deliver both high-performance chips and scalable infrastructure aligns with MARA’s mission to stay at the forefront of bitcoin mining,” stated the Chief Technology Officer of MARA Holdings Ashu Swami. “We have been pleased with the partnership with Auradine with their leading edge engineering capability and innovation.”

Auradine’s modular 1 MW container units, developed in collaboration with Fog Hashing and FBox, are designed to accommodate 100–200 miners each. Merkle Standard, the first to deploy the system, reported improved energy efficiency and operational flexibility.

“We were the first to deploy Auradine’s container solution, and it immediately exceeded our expectations,” said the COO at Merkle Standard Monty Stahl. “The combination of performance, energy efficiency, and modular design gives us the flexibility to scale our operations faster and smarter than traditional infrastructure allows. This is the kind of innovation the mining industry has needed for a long time.”

Their recent $153 million Series C funding supports its push to offer flexible mining infrastructure and supplying ASIC chips for third-party integration. The company also plans to extend its hardware expertise to AI and networking through its AuraLinks initiative.

“We were one of the first to try Auradine’s ASIC chips and were immediately impressed by the support and customization that the team provided,” added the CEO of Deep South Operating, LLC Brock Tompkins. “It helps miners like us to stay scalable and efficient while raising the standard for what decentralized mining looks like.”

This post Auradine Expands Bitcoin Mining Solutions with Advanced ASIC Chips, Cooling Systems, and Modular Megawatt Containers first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ 6ad3e2a3:c90b7740

2025-05-20 13:49:50

@ 6ad3e2a3:c90b7740

2025-05-20 13:49:50I’ve written about MSTR twice already, https://www.chrisliss.com/p/mstr and https://www.chrisliss.com/p/mstr-part-2, but I want to focus on legendary short seller James Chanos’ current trade wherein he buys bitcoin (via ETF) and shorts MSTR, in essence to “be like Mike” Saylor who sells MSTR shares at the market and uses them to add bitcoin to the company’s balance sheet. After all, if it’s good enough for Saylor, why shouldn’t everyone be doing it — shorting a company whose stock price is more than 2x its bitcoin holdings and using the proceeds to buy the bitcoin itself?

Saylor himself has said selling shares at 2x NAV (net asset value) to buy bitcoin is like selling dollars for two dollars each, and Chanos has apparently decided to get in while the getting (market cap more than 2x net asset value) is good. If the price of bitcoin moons, sending MSTR’s shares up, you are more than hedged in that event, too. At least that’s the theory.

The problem with this bet against MSTR’s mNAV, i.e., you are betting MSTR’s market cap will converge 1:1 toward its NAV in the short and medium term is this trade does not exist in a vacuum. Saylor has described how his ATM’s (at the market) sales of shares are accretive in BTC per share because of this very premium they carry. Yes, we’ll dilute your shares of the company, but because we’re getting you 2x the bitcoin per share, you are getting an ever smaller slice of an ever bigger overall pie, and the pie is growing 2x faster than your slice is reducing. (I https://www.chrisliss.com/p/mstr how this works in my first post.)

But for this accretion to continue, there must be a constant supply of “greater fools” to pony up for the infinitely printable shares which contain only half their value in underlying bitcoin. Yes, those shares will continue to accrete more BTC per share, but only if there are more fools willing to make this trade in the future. So will there be a constant supply of such “fools” to keep fueling MSTR’s mNAV multiple indefinitely?

Yes, there will be in my opinion because you have to look at the trade from the prospective fools’ perspective. Those “fools” are not trading bitcoin for MSTR, they are trading their dollars, selling other equities to raise them maybe, but in the end it’s a dollars for shares trade. They are not selling bitcoin for them.

You might object that those same dollars could buy bitcoin instead, so they are surely trading the opportunity cost of buying bitcoin for them, but if only 5-10 percent of the market (or less) is buying bitcoin itself, the bucket in which which those “fools” reside is the entire non-bitcoin-buying equity market. (And this is not considering the even larger debt market which Saylor has yet to tap in earnest.)

So for those 90-95 percent who do not and are not presently planning to own bitcoin itself, is buying MSTR a fool’s errand, so to speak? Not remotely. If MSTR shares are infinitely printable ATM, they are still less so than the dollar and other fiat currencies. And MSTR shares are backed 2:1 by bitcoin itself, while the fiat currencies are backed by absolutely nothing. So if you hold dollars or euros, trading them for MSTR shares is an errand more sage than foolish.

That’s why this trade (buying BTC and shorting MSTR) is so dangerous. Not only are there many people who won’t buy BTC buying MSTR, there are many funds and other investment entities who are only able to buy MSTR.

Do you want to get BTC at 1:1 with the 5-10 percent or MSTR backed 2:1 with the 90-95 percent. This is a bit like medical tests that have a 95 percent accuracy rate for an asymptomatic disease that only one percent of the population has. If someone tests positive, it’s more likely to be a false one than an indication he has the disease*. The accuracy rate, even at 19:1, is subservient to the size of the respective populations.

At some point this will no longer be the case, but so long as the understanding of bitcoin is not widespread, so long as the dollar is still the unit of account, the “greater fools” buying MSTR are still miles ahead of the greatest fools buying neither, and the stock price and mNAV should only increase.

. . .

One other thought: it’s more work to play defense than offense because the person on offense knows where he’s going, and the defender can only react to him once he moves. Similarly, Saylor by virtue of being the issuer of the shares knows when more will come online while Chanos and other short sellers are borrowing them to sell in reaction to Saylor’s strategy. At any given moment, Saylor can pause anytime, choosing to issue convertible debt or preferred shares with which to buy more bitcoin, and the shorts will not be given advance notice.

If the price runs, and there is no ATM that week because Saylor has stopped on a dime, so to speak, the shorts will be left having to scramble to change directions and buy the shares back to cover. Their momentum might be in the wrong direction, though, and like Allen Iverson breaking ankles with a crossover, Saylor might trigger a massive short squeeze, rocketing the share price ever higher. That’s why he actually welcomes Chanos et al trying this copycat strategy — it becomes the fuel for outsized gains.

For that reason, news that Chanos is shorting MSTR has not shaken my conviction, though there are other more pertinent https://www.chrisliss.com/p/mstr-part-2 with MSTR, of which one should be aware. And as always, do your own due diligence before investing in anything.

* To understand this, consider a population of 100,000, with one percent having a disease. That means 1,000 have it, 99,000 do not. If the test is 95 percent accurate, and everyone is tested, 950 of the 1,000 will test positive (true positives), 50 who have it will test negative (false negatives.) Of the positives, 95 percent of 99,000 (94,050) will test negative (true negatives) and five percent (4,950) will test positive (false positives). That means 4,950 out of 5,900 positives (84%) will be false.

-

@ cb8f3c8e:c10ec329

2024-06-14 17:53:20

@ cb8f3c8e:c10ec329

2024-06-14 17:53:20WRITTEN BY: ALEX MREMA

Europe awaits for 24 of its best nations to kick off her headline football tournament on the 14th of June. This edition of the tournament promises to showcase some spectacular football filled with style, flair and a uniqueness that is only found in Europe. Surprises, thrillers and fierceness is promised throughout the Euros- not to forget the wonderful and warm German hosts who are promised to provide the vibes in and around the country.On that note, I present my second article on the best games Germany has to offer throughout the group stages!

GROUP D GAME: POLAND VS NETHERLANDS DATE: 16th June 2024 TIME: 14:00 BST

Poland look to prove themselves on the European stage again after a shocking Euro 2020 that saw them finish last in their group with one point and six goals conceded. Coach Michal Probierz will look to the strength of his young and powerful midfield featuring Brighton’s Jakub Moder and Roma’s Nicola Zalewski while the experienced head of Piotr Zielenski is expected to be the headlight to this midfield’s vision. Robert Lewandowski and Wojciech Szczeny are expected to play with an extra chip on their shoulder as this is likely to be their last international tournament for Poland. However, this Dutch side is one lethal side on their day. They can make teams suffer both offensively and defensively plus they can control the midfield appropriately if the backs are not against the walls. Plus the Netherlands put on an impressive run in the 2022 World Cup only to crash out in devastating fashion. Under Ronald Koeman, they have put on some very impressive performances but the only hiccups have come in games against that are “better” than them (in terms of player quality) where they perform poorly. With Netherlands being wishy-washy, can they do enough to beat Poland? We’ll see!

GAME: NETHERLANDS VS FRANCE DATE: 21st June 2024 TIME: 20:00 BST

France are certainly THE side to fear in this tournament. They have everything and they ooze in class with all that they have from the keepers all the way down to the manager. This French side has the potential to win every game in this tournament. Undoubtedly, the return of the engine that is N’golo Kante is vital to this French squad as they look to make their midfield a well-oiled machine with the never-expiring and youthful trio of Rabiot, Tchuoameni and Camavinga partnering working with the experienced Kante. The only problem, is how Deschamps will intergrate Kante in the French in a manner that is smooth and equally provides an immediate click. This is what the Dutch will look to pounce on. Regardless of the result of their first game against Poland, this game is what will make or break their tournament as a loss will be possibly detrimental to their progress while a win will probably make progression ever so likely. Can Koeman’s squad pounce on Les Bleus gamble?

GAME: NETHERLANDS VS AUSTRIA DATE: 25th June 2024 TIME: 17:00 BST

Austria are a side that are able to do their bits. Ralf Ragnick has enforced a hustling and fighting spirit that makes his squad work to the very end-which credits why they have qualified as one of the 24 nations certain to rock Europe this summer. They play progressive,fun,attacking football and are a side that are fearless. The experienced figures of Marko Arnautovic,Michael Gregoristch and Konrad Laimer are key to the leadership of Das Team this summer as the status on main figurehead David Alaba remains unclear as he is out with an injury. Holland’s approach to this game will be interesting. Particularly on how they will view the aerial battle between van Dijk and Gregoristch and how direct Arnautovic is towards the rest of the defence. Les Oranjes also have the capabilites to throw a tactical masterclass that can throw Ragnick and his men overboard. Let’s not forget that this is the final group game, so alll can be to play for...tactics may be thrown out the window and it might just be a full on dog fight between the two nations- what we need!

GROUP E GAME: UKRAINE VS BELGIUM DATE: 26th June 2024 TIME: 17:00

Group E is probably the weakest one in the tournament (alongside Group C).But, that does not take away from some of the talent displayed in the group. As expected to be showcased when the fiery Red Devils of Belgium face off against The Blues and Yellows of Ukraine. This will be Belgium’s first tournament without the legendary Eden Hazard in their camp, however this squad has seen the rise of some extremely talented players namely, Amadou Onana, Charles de Ketelaere and Jeremy Doku that all -coincidently- reside from the English Premier League. Head coach Domenico Tedesco has managed to fit in a blend of youth and experience as Belgium says goodbye to their “first phase” golden generation players and welcome new generation players to renovate the aging squad.On the other side of the dugout, coach Sergiy Rebrov has brought a squad that is extremely pacey,physical,daring and fearless. These aspects are best described in players such as Matviyenko,Zincheko, Mykola Shaparenko,Mudryk,Yaremchuk plus La Liga top scorer and Round of 16 hero in Euro 2020- Artem Dobvyk. This Ukraine squad can bring the heat at any point in the game, even against the run of play- they did not play their best football in Euro 2020 but somehow ended as quarter-finalists, just let it sink in when they start playing their best football...

GROUP F GAME: PORTUGAL VS CZECH REPUBLIC DATE: 18th June 2024 TIME: 20:00 BST

Portugal are a squad that is star-studded throughout and are led by the man, the myth, the

legend that is Cristiano Ronaldo who has the same drive to win as when he first landed in this

tournament 2004. He is the all-time Euros top scorer and you should expect more goals from

within the next four weeks of football. The somewhat fear-factor that strikes opponents is that

this is a Portugal squad that can snatch goals from anywhere, even when Ronaldo has a silent

game, they can get results from Goncalo Ramos, Bernado Silva, Rafael Leao, Bruno

Fernandes... and the list goes on! Truly scary what Seleção das Quinas has in store. But the

Lokomotiva has something to say and boy on their day can they make a statement, this squad’s

physicality, progressive football and never-say-die attitude is what has gotten them results

throughout their journey to the tournament. Players such as Schick,Hlozek,Soucek and Antonin

Barak are vital for the Czech Republic and when they are called upon, they deliver- just ask the

Dutch.

Portugal are a squad that is star-studded throughout and are led by the man, the myth, the

legend that is Cristiano Ronaldo who has the same drive to win as when he first landed in this

tournament 2004. He is the all-time Euros top scorer and you should expect more goals from

within the next four weeks of football. The somewhat fear-factor that strikes opponents is that

this is a Portugal squad that can snatch goals from anywhere, even when Ronaldo has a silent

game, they can get results from Goncalo Ramos, Bernado Silva, Rafael Leao, Bruno

Fernandes... and the list goes on! Truly scary what Seleção das Quinas has in store. But the

Lokomotiva has something to say and boy on their day can they make a statement, this squad’s

physicality, progressive football and never-say-die attitude is what has gotten them results

throughout their journey to the tournament. Players such as Schick,Hlozek,Soucek and Antonin

Barak are vital for the Czech Republic and when they are called upon, they deliver- just ask the

Dutch.GAME: CZECH REPUBLIC VS TURKEY DATE: 26th June 2024 TIME: 20:00 BST

Turkey have underperformed in recent tournaments- with group stage exists in Euro 2016 as well as Euro 2020. They do appear to be a better organized squad nowdays and do not settle for less when it comes to working for a positive result. The Crescent Stars are a joyful side that carry an immense amount of pride for the badge on their jerseys and wear their hearts on their sleeves for every game, this passion can be a huge motivating factor as to how far they progress through the tournament. The talent that the Czech Republic possesses however, can kill off the Turkish party. They are side that comes in to take results like the way a bully eould steal candy from a baby, they just simply play their football and move on quietly but equally deadly. Can they be the party poopers against Turkey in their final group game?

-

@ 7e538978:a5987ab6

2025-05-20 13:45:12

@ 7e538978:a5987ab6

2025-05-20 13:45:12LNbits now has full NWC support thanks to the work of contributor @riccardobl, who has claimed two LNbits bounties for implementing Nostr Wallet Connect (NWC) support in LNbits.

LNbits can now act both as a wallet service and as a funding source using the Nostr NWC protocol (NIP-47). This opens the door to new integrations with a growing ecosystem of Nostr clients and Lightning wallets.

Two Sides of NWC Integration

The work delivered by Riccardo B comprises two separate peices of work that together implement full support for NWC:

1. LNbits as a Wallet Service

This extension allows LNbits to operate as an always-on wallet service compatible with Nostr Wallet Connect clients such as Damus, Amethyst, or any app supporting NIP-47. Users can connect these Nostr clients to their LNbits instance and create and pay Lightning invoices through it.

This turns your LNbits wallet into a backend Lightning provider for your favourite Nostr app all self-hosted.

2. NWC as a Funding Source

The second piece of work flips the relationship. With this in place, LNbits can now act as an NWC client, meaning it can be funded from any NWC wallet service. This could be another LNbits, Alby, Minibits and more.

Why This Is a Big Deal for LNbits Users

These two bounties make LNbits one of the first applications in the Lightning ecosystem to offer bidirectional NWC support — as both a service and a client. This brings benefits such as:

-

Fund any NWC-compatible app using your LNbits wallet.

-

Fund LNbits using any wallet that supports Nostr Wallet Connect.

-

Build NWC-native apps with LNbits as a backend, or power your own LNbits server using existing wallet infrastructure.

For developers, it’s a chance to build in flexible, interoperable ways. For users, it means more choice, more control, and less friction when managing Lightning payments across apps and devices.

Both of these features were developed and delivered by Riccardo B (@riccardobl), an contributor who took on and completed both LNbits bounties and was extremely helpful during the PR review process. We owe a huge thanks to Riccardo for his work here.

To try them out, read the full article detailing how NWC works with LNbits.

-

-

@ d78dcc29:aa242350

2024-04-13 06:42:03

@ d78dcc29:aa242350

2024-04-13 06:42:03Opinion about ZBD: Bitcoin, Games, Rewards (iphone)

zbd is a centralised platfom. they have power over users wallets and can deactivate them even with balances, hence making your account pretty much useless. in the times that we are heading , this is definetely not the way. since zbd is A Play to Earn platform, such kind of activity is robbing from users who invested their time to stack sats. just to be kicked out . it's a 0 out of 10 for zbd

WalletScrutiny #nostrOpinion

-

@ 662f9bff:8960f6b2

2025-05-20 13:44:39

@ 662f9bff:8960f6b2

2025-05-20 13:44:39Currently, and for the last three weeks, I am in Belfast. With the situation in HK becoming ever more crazy by the day we took the opportunity to escape from Hong Kong for a bit - I escaped with V and 3 suitcases. I also have some family matters that I am giving priority to at this time. We plan to stay a few more weeks in Northern Ireland and then after some time in Belgium we will be visiting some other European locations. I do hope that HK will be a place that we can go back to - we will see...

What's happening?

Quite a few significant events have happened in the last few weeks that deserve some deeper analysis and checking than you will ever get from the media propaganda circus that is running full force at the moment. You should be in no doubt that the "Great Reset" with its supporting "Great Narrative" is in full swing.

In most of the world the C19 story has run its course - for now. Most countries seem to have have "declared victory" and "moved on". Obviously HK is an exception (nothing happened there for the last two years) and I fear they will get to experience the whole 2-year thing in the coming 3-4 months. Watch out - the politicians everywhere are looking to permanently establish the "emergency controls" as "normal" - see previous Letter for some examples in Ireland and EU.

Invasion of Ukraine has led to so many lines being crossed - to the extent that clearly things will never be the same again in our lifetime.

Why? How did we get here?

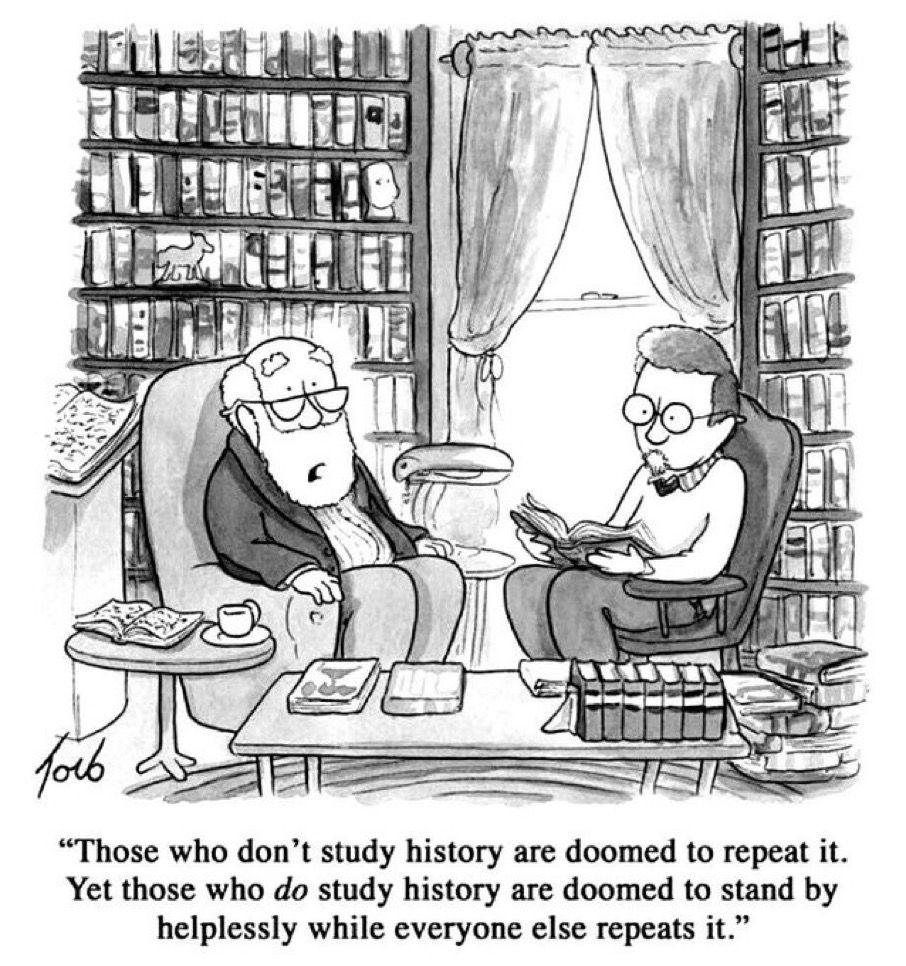

I do not claim to know all the answers but some things are fairly clear if you look with open eyes and the wisdom that previous generations and civilisations have made available to us - even if most choose to ignore it (Plato on the flaws of democracy). Those who do not learn from history are doomed to repeat it and even those who learn will have litle choice but to go along for much of the ride.

Perhaps my notes and the links below will help you to form an educated opinion rather than the pervasive propaganda we are all being fed.

The current situation is more than 100 years in the making and much (if not most) of what you thought was true is less veracious than you could ever imagine. No doubt we could (and maybe should) go back further but let's start in 1913 when the British Government asked the public no longer to request exchange of their pounds for gold coins at the post office. This led to the issuing of War Bonds and fractional reserve accounting that allowed the Bank of England essentially to print unlimited money to fight in WW1; without this devious action they would have been constrained to act within the limits of the country's reserves and WW1 would have been shorter. Read The Fiat Standard for more details on how this happened. Around this time, and likely no coincidence, the US bankers were scheming how to get around the constitutional controls against such actions in their own country - read more in The Creature from Jekyll Island.

Following WW1, Germany was forced to pay war reparations in Gold (hard money). This led to a decade of money printing and extravagant excesses and crashes as hyperinflation set in, ending in the bankrupting of the country and the nationalism that fed WW2 - the gory details of devaluation and hyperinflation in Weimar Germany are described in When Money Dies. Meanwhile the US bankers who had been preparing since 1913 stepped in with unlimited money printing to fund WW2 and then also in their Marshal Plan to cement in place the Bretton Woods post-war agreement that made US Dollar the global reserve currency.

Decades of boom and bust followed - well explained by Ray Dalio who portrays this as perfectly normal and to be expected - unfortunately it is for soft (non-hard) money based economies. The Fourth Turning will give many additional insights to this period too as well as cycles to watch for and their cause and nature. In 1961 Eisenhower tried to warn the population in his farewell address about the "Military Industrial Complex" and many believe that Robert Kennedy's assassination in 1963 may well be not entirely unrelated.

Things came to a head in August 1971 when the countries of the world realised that the US was (contrary to all promises) printing unlimited funds to (among other things) fight the Vietnam war and so undermining the expected and required convertibility of US dollars (the currency of global trade) for Gold (hard money). A French warship heading to NY to collect France's gold was the straw that caused Nixon to default on US Debt convertibility and "close the gold window".

This in turn led to further decades of increasing financialization, further fuelled (pun intended) by the PetroDollar creation and "exorbitant priviledge" that the US obtained by having the global reserve currency - benefiting those closest to the money supply (Cantillon effect) while hollowing out the US manufacturing and eventually devastating its middle and working classes (Triffin dilemma) - Arthur Hayes describes all this and much more as well as the likely outlook in his article - Energy Canceled. Absolutely required reading or listen to Guy Swan reading it and giving his additional interpetation.

Zoltan Pozsar of Credit Suisse explains how the money system is now being reset following the events of last few weeks and his article outlines a likely way forward - Bretton Woods III. His paper is somewhat dense, heavy reading and you might prefer to listen to Luc Gromen's more conversational explainer with Marty

All of this was well known to our forefathers

The writers of the American Constitution understood the dangers of money being controlled by any elite group and they did their best to include protections in the US constitution. It did take the bankers multiple decades and puppet presidents to circumvent these but do so they did. Thomas Jefferson could not have been more clear in his warning.

" If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around(these banks) will deprive the people of all property until their children wake up homeless on the continent their fathers conquered."

Islamic finace also recognised the dangers - you will likely be aware of the restrictions that forbid interest payments - read this interesting article from The Guardian

You will likely also be aware from schooldays that the Roman Empire collapsed because it expanded too much and the overhead became unbearable leading to the debasement of its money and inability to extract tax payments to support itself. Read more from Mises Institute. Here too, much of this will likely ring familiar.

So what can you do about it?

In theory Governments should respect Consent of the Governed and the 1948 Universal Declaration of Human Rights states that "The will of the people shall be the basis of the authority of government".

For you to decide if and to what extent governments today are acting in line with these principles. If not, what can you do about it?

The options you have are basically - Loyalty, Voice or Exit. 1. You can be loyal and accept what you are told - 2. you may (or may not) be able to voice disagreement and 3. you may (or may not!) be able to exit. Authoritarian governments will make everything except Loyalty difficult or even impossible - if in doubt, read George Orwell 1984 - or look just around at recent events today in many countries.

I'll be happy to delve deeper into this in subsequent letters if there is interest - for now I recommend you to read Sovereign Individual. It is a long read but each chapter starts with a summary and you can read the summaries of each chapter as a first step. Also - I'm happy to discuss with you - just reach out and let me know!

For those who prefer a structured reading list, check References

That's it!

No one can be told what The Matrix is.\ You have to see it for yourself.**

Do share this newsletter with any of your friends and family who might be interested.

You can easily ask questions or discuss any topics in the newsletters in our Telegram group - click the link here to join the group.\ You can also email me at: LetterFrom@rogerprice.me

💡Enjoy the newsletters in your own language : Dutch, French, German, Serbian, Chinese Traditional & Simplified, Thai and Burmese.

-

@ a19caaa8:88985eaf

2025-05-20 10:34:53

@ a19caaa8:88985eaf

2025-05-20 10:34:53-

拡張機能を使わない状態で使用した所感!

-

makimono:全部できる。nip21にも対応してる。kind10002にデータが無いときは勝手にどっかに流される。kind5が流せない。nsec.appで署名できる。

-

flycat:新規作成できるけど、流すだけで読み取りはしないっぽい。上書き(置き換え)はできるけど、編集はできない。すぐnos.lolに流そうとしてくる。kind5が流せない。他クライアント(lumilumiなど)から流したkind5は自動で反映されず、flycat内「設定」の「重複イベントの削除」をやれば反映される。nip21非対応。秘密鍵でログインできる。

-

habla:秘密鍵ログインできない、nsec.appもなんか入れない(読み込みから進まない)。公開鍵ログインからの表示確認用。nip21には対応してる。

-

yakihonnne:秘密鍵ログインできる。編集ができない(読み込みから進まない)。nip21は試してない。まだ全然見れてない。

-

ほか:

| クライアント | 編集 | 秘密鍵ログイン | nip21対応 | kind5流せるか | その他 | | -------------- | -------------------- | ------- | ------- | --------- | ------------------------------------------- | | makimono | 新規作成、編集可 | 不可 | 対応 | 流せない | kind10002にデータが無いときは自動で他に流される、nsec.appで署名可能 | | flycat | 新規作成、上書き(置き換え)可 | 可 | 非対応 | 流せない | 送信先要確認、他クライアントから流したkind5は重複イベント削除で反映 | | habla | 未確認 | 不可 | 対応 | 未確認 | nsec.app読み込み不可、公開鍵ログインのみ、表示確認用? | | yakihonnne | 編集不可(読み込みで止まる) | 可 | 未確認 | 未確認 | もっとちゃんと確認したい |

-

-

@ ef1a1108:d2bb31da

2024-01-26 16:36:21

@ ef1a1108:d2bb31da

2024-01-26 16:36:211 000 000 satoshis

2 days before the Grand finale, we can proudly annouce we hit the first milestone - 1 million satoshis!

Huge warm thank you to all supportes of The Great Orchestra of Christmas Charity!

Join #orchestrathon on the Grand Finale day

We'd like to invite you to a special type of event we are organising on Nostr - #orchestrathon!

Rules are simple:

``` 1. This Sunday at 18.00 - 19.00 we all connect to nostr relays to join the #orchestrathon

-

For the whole hour - we zap this profile, posts or comments as crazy!

-

At 19.00 it's culmination of both #orchestrathon and Grand Finale ```

We're planning to stream some of The Great Orchestra concerts on zap.stream on that day.

Join the stream, where you can also zap!

Hopefully we can engage a bit Nostr community to support the cause with having fun and zapping during the last hour of Grand Finale

Every Nostr zap to our profile, comment or post will be counted as a contribution and displayed on our Geyser page.

Those contributions will be also rewarded with Nostr badges :)

Rewards

We added several rewards to the project! They look absolutely fabulous with the new Geyser update.

The rarer the badge is, the more expensive it is, but also the more real Proof of Work in computation it took to mine. Epic badge took several hours to be mined...

You can purchase beautiful and unique Nostr badges or choose a physical item, like merchandise or ticket to European Halving Party.

This is a great occasion to buy a very cool t-shirt, hat or ticket to a great event with supporting supply of state-of-the-art, saving lives medical equipment children and adults.

-

-

@ 6b0a60cf:b952e7d4

2025-05-19 22:33:33

@ 6b0a60cf:b952e7d4

2025-05-19 22:33:33タイトルは釣りです。そんなこと微塵も思っていません。 本稿はアウトボックスモデルの実装に関してうだうだ考えるコーナーです。 ダムスに関して何か言いたいわけではないので先にタイトル回収しておきます。

- NIP-65を守る気なんかさらさら無いのにNIP-65に書いてあるkind:10002のReadリレーの意味を知っていながら全然違う使い方をしているのは一部の和製クライアントの方だよね

- NIP-65を守る気が無いならkind:10002を使うべきではなく、独自仕様でリレーを保存するべきだよね

- アウトボックスモデルを採用しているクライアントからすれば仕様と異なる実装をしてしまっているクライアントが迷惑だと思われても仕方ないよね

- と考えればダムスの方が潔いよね

- とはいえkind:3のcontentは空にしろって言われてんだからやっぱダムスはゴミだわ

- やるとしたらRabbitみたいにローカルに保存するか、別デバイス間で同期したいならkind:30078を使うべきだよね

アウトボックスモデルはなぜ人気がないのか

言ってることはとてもいいと思うんですよ。 欠点があるとすれば、

- 末端のユーザーからすればreadリレーとwriteリレーと書かれると直感的にイメージされるものとかけ離れている

- 正しく設定してもらうには相当の説明が必要

- フォローTLを表示しようとすれば非常にたくさんのリレーと接続することになり現実的ではない

- なるほど完璧な作戦っスねーっ 不可能だという点に目をつぶればよぉ~

余談ですが昔irisでログインした時に localhost のリレーに繋ごうとしてiris壊れたって思ったけど今思えばアウトボックスモデルを忠実に実装してたんじゃないかな…。

現実的に実装する方法は無いのか

これでReadすべきリレーをシミュレーションできる。 https://nikolat.github.io/nostr-relay-trend/ フォローイーのWriteリレーを全部購読しようとすると100個近いリレー数になるので現実的ではありません。 しかしフォローイーのWriteリレーのうち1個だけでよい、とする条件を仮に追加すると一気にハードルが下がります。私の場合はReadリレー含めて7個のリレーに収まりました。 Nos Haikuはとりあえずこの方針でいくことにしました。

今後どうしていきたいのか

エンドユーザーとしての自分の志向としては、自分が指定したリレーだけを購読してほしい、勝手に余計なリレーを読みに行かないでほしい、という気持ちがあり、現状の和製クライアントの仕様を気に入っています。 仮にNos Haikuでアウトボックスモデルを採用しつつ自分の決めたリレーに接続するハイブリッド実装を考えるとすれば、

あなたの購読するリレーはこれですよー - Read(inbox) Relays (あなたへのメンションが届くリレー) - wss://relay1.example.com/ - wss://relay2.example.com/ - wss://relay3.example.com/ - Followee's Write Relays (フォローイーが書き込んでいるリレー) - wss://relay4.example.com/ - wss://relay5.example.com/ - wss://relay6.example.com/って出して、チェックボックス付けてON/OFFできるようにして最終的に購読するリレーをユーザーに決めてもらう感じかな……って漠然と考えています。よほど時間を持て余したときがあればやってみるかも。

あとリレーを数は仕方ないとしてリレーごとにフォローイーの投稿だけを取得するようにした方が理にかなってるよね。全部のリレーから全部のフォローイーの投稿を取得しようとしたら(実装はシンプルで楽だけど)通信量が大変だよね。 rx-nostr の Forward Strategy ってリレーごとにREQかえて一度に購読できるっけ?

常にひとつ以下の REQ サブスクリプションを保持します。

って書いてあるから無理なのかな? あとReadリレーは純粋に自分へのメンション(pタグ付き)イベントのみを購読するようにした方がいい気がする。スパム対策としてかなり有効だと思うので。スパムはNIP-65に準拠したりはしていないでしょうし。 まぁ、NIP-65に準拠していないクライアントからのメンションは届かなくなってしまうわけですが。

-

@ 6ad3e2a3:c90b7740

2025-05-20 13:44:28

@ 6ad3e2a3:c90b7740

2025-05-20 13:44:28I https://www.chrisliss.com/p/mstr a few months ago with the subtitle “The Only Stock,” and I’m starting to regret it. Now, it was trading at 396 on January 20 when I posted it and 404 now (even if it dipped 40 percent to 230 or so in between), but that’s not why I regret it. I pointed out it was not investable unless you’re willing to stomach large drawdowns, and anyone who bought then could exit with a small profit now had they not panic-sold along the way.

The reason I regret it is I don’t want to make public stock predictions because it adds stress to my life. I have not sold any of my shares yet, but something I’ve noticed recently has got me thinking about it, and stock tips are like a game of telephone wherein whoever is last in the chain might find out the wrong information and too late. And while every adult has agency and is responsible for his own financial decisions, I don’t want my readers losing money on account of anything I write.

My base case is still that MSTR becomes a trillion-dollar company, destroys the performance of the S&P, the Mag-7 and virtually any other equity portfolio most people would assemble. Michael Saylor is trading an infinitely-printable asset (his shares) for humanity’s best-ever, finite-supply digital gold, and that trade should be profitable for him and his shareholders in perpetuity.

I don’t know exactly what he plans to do when that trade is no longer available to him — either because no one takes fiat currency for bitcoin anymore or because his mNAV (market-cap-to-bitcoin-holding ratio) goes below one — but that’s not my main concern, either. At that point he’ll have so much bitcoin, he’ll probably become the world’s first and largest bitcoin bank and profit by making his pristine collateral available to individuals and institutions. Even at five percent interest, half a trillion in bitcoin would yield $25B in profits every year. Even at a modest 10x valuation, the stock would more than double from here.

I am also not overly concerned with Saylor’s present amount of convertible debt which is at low or zero rates and is only https://www.strategy.com/. He’s been conservative on that front and only issuing on favorable terms. I don’t doubt Saylor’s prescience, intelligence or business sense one bit.

What got me thinking were some Twitter posts by a former Salomon Brothers trader/prophet Josh Mandell https://x.com/JoshMandell6/status/1921597739458339193 recently. In November when bitcoin was mooning after the election, he predicted that on March 14th it would close at $84,000, and if it did it would then go on an epic run up to $444,000 this cycle.

A lot of people make predictions, a few of them come true, but rarely do they come true on the dot (it closed at exactly $84K according to some exchanges) and on such a specific timeframe. Now, maybe he just got lucky, or maybe he is a skilled trader who made one good prediction, but the reason he gave for his prediction, insofar as he gave one, was not some technical chart or quantitative analysis, but a memory he had from 30 years ago that got into his mind that he couldn’t shake. He didn’t get much more specific than that, other than that he was tuned into something that if he explained fully would make too many people think he had gone insane. And then the prediction came true on the dot months later.

Now I believe in the paranormal more than the average person. I do not think things are random, and insofar as they appear that way it’s only because we have incomplete information — even a coin toss is predictable if you knew the exact force and spin that was put on the coin. I think for whatever reason, this guy is plugged into something, and while I would never invest a substantial amount of money on that belief — not only are earnestly-made prophecies often delusions or even if correct wrongly interpreted — that he sold makes me think.

He gave more substantive reasons for selling than prophecy, by the way — he seems to think Saylor’s perpetual issuance of shares ATM (at the market) to buy more bitcoin is putting too much downward pressure on the stock. Obviously, selling shares — even if to buy the world’s most pristine collateral at a 2x-plus mNAV — reduces the short-term appreciation of those shares.

His thesis seems to be that Saylor is doing this even if he would be better off letting the price appreciate more, attracting more investors, squeezing more shorts, etc because he needs to improve his credit rating to tap into the convertible debt market to the extent he has promised ($42 billion more over the next few years) at favorable terms. But in doing this, he is souring common stock investors because they are not seeing the near-term appreciation they should on their holdings.

Now this is a trivial concern if over the long haul MSTR does what it has the last couple years which is to outperform by a wide margin not only every large cap stock and the S&P but bitcoin itself. And the bigger his stack of bitcoin, the more his stock should appreciate as bitcoin goes up. But markets do not operate linearly and rationally. Should he sour prospective buyers to a great enough extent, should he attract shorts (and supply them with available shares to borrow) to a great enough extent, perhaps there might be an mNAV-crushing cascade that drives people into other bitcoin treasury companies, ETFs or bitcoin itself.

Now Saylor as first mover and by far the largest publicly-traded treasury company has a significant advantage. Institutions are far less likely to invest in size in smaller treasury companies with shorter track records, and many of them are not allowed to invest in ETFs or bitcoin at all. And even if a lot of money did go into any of those vehicles, it would only drive the value of his assets up and hence his stock price, no matter the mNAV. But Josh Mandell sold his shares prior to a weekend where bitcoin went from 102K to 104K, the US announced a deal with China, the mag-7 had a big spike (AAPL was up 6.3 percent) and then MSTR’s stock went down from 416 to 404. As I said, he is on to something.

So what’s the real long-term risk? I don’t know. Maybe there’s something about the nature of bitcoin that long-term is not really amenable to third-party custody and administration. It’s a bearer asset (“not your keys, not your coins”), and introducing counterparty risk is antithetical to its core purpose, the separation of money and state, or in this case money and bank.

With the bitcoin network you can literally “be your own bank.” To transact in digital dollars you need a bank account — or at least a stable coin one mediated by a centralized entity like Tether. You can’t hold digital dollars in your mind via some memorized seed words like you can bitcoin, accessible anywhere in the world, the ledger of which is maintained by tens of thousands of individually-run nodes. This property which democratizes value storage in the way gold did, except now you can wield your purchasing power globally, might be so antithetical to communal storage via corporation or bank that doing so is doomed to catastrophe.

We’ve already seen this happen with exchanges via FTX and Mt. Gox. Counterparty risk is one of the problems bitcoin was created to solve, so moving that risk from a fractionally reserved international banking system to corporate balance sheets still very much a part of that system is probably not the seismic advancement integral to the technology’s promise.

But this is more of a philosophical concern rather than a concrete one. To get more specific, it’s easy to imagine Coinbase, if indeed that’s where MSTR custodies its coins, gets hacked or https://www.chrisliss.com/p/soft-landing, i.e., seized by an increasingly desperate and insolvent government. Or maybe Coinbase simply doesn’t have the coins it purports like FTX, or a rogue band of employees, working on behalf of some powerful faction for “https://www.chrisliss.com/national-security-and-public-healt” executes the rug pull. Even if you deem these scenarios unlikely, they are not unfathomable.

Beyond outright counterparty malfeasance, there are other risks — what if owning common stock in an enterprise that simply holds bitcoin falls out of favor? Imagine if some new individual custody solution emerges wherein you have direct access to the coins themselves in an “even a boomer can do this” kind of way wherein there’s no compelling reason to own common stock with its junior claims to the capital stack in the event of insolvency? Why stand in line behind debt holders and preferred shares when you can invest in something that’s directly withdrawable and accessible if world events spike volatility to a systemic breaking point?

Things need not even get that rocky for this to be a concern — just the perception that they might could spook people into realizing common stock of a corporate balance sheet might be less than ideal as your custody solution.

Moreover, Saylor himself presents some risk. He could be compromised or blackmailed, he could lose his cool or get into an accident. These are low-probability scenarios, but also not unfathomable as any single point of failure is a target, especially for those factions who stand to lose unimaginable wealth and power should his speculative attack on the system succeed at scale.

Finally, even if Saylor remains free to operate as he sees fit, there is what I’d call the Icarus risk — he might be too ambitious, too hell-bent on acquiring bitcoin at all costs, too much of a maniac in service of his vision. Remember, he initially bought bitcoin during the covid crash and concomitant massive money print upon his prescient realization that businesses providing goods and services couldn’t possibly keep pace with inflation over the long haul. He was merely playing defense to preserve his capital, and now, despite his sizable lead and secured position is still throwing forward passes in the fourth quarter rather than running out the clock and securing the W.

Saylor is now arguably less a bitcoin maximalist and advocate, articulately making the case for superior money and individual sovereignty, but a corporate titan hell-bent on world domination via apex-predator-status balance sheet. When is enough enough? Many of the greatest conquerors in history pushed their empires too far until they fractured. In fact, 25 years ago MSTR was a big winner before the dot-com crash during which its stock price and most of Saylor’s fortune were wiped out when he was sued by the SEC for accounting fraud (he subsequently settled).

Now it’s possible, he learned from that experience, got up off the mat and figured out how to avoid his youthful mistakes. But it’s also possible his character is such that he will repeat it again, only this time at scale.

But as I said, my base case is MSTR is a trillion-dollar market cap, and the stock runs in parallel with bitcoin’s ascendance over the next decade. Saylor has been https://www.strategy.com/, prescient, bold and responsible so far over this iteration. I view Mandell’s concerns as valid, but similar to Wall St’s ones about AMZN’s Jeff Bezos who relentlessly ignored their insistence on profitability for a decade as he plowed every dollar into building out productive capacity and turned the company into the $2T world-dominating retail giant it is now.

Again, I haven’t (yet) sold any of my shares or even call options. But because I posted about this in January I felt I should at least follow-up with a more detailed rundown of what I take to be the risks. As always, do your own due diligence with any prospective investment.

-

@ ef1a1108:d2bb31da

2024-01-23 15:34:05

@ ef1a1108:d2bb31da

2024-01-23 15:34:05Nostr for The Great Orchestra of Christmas Charity

This Sunday, 28.01.2024 at 18:00 - 19:00 UTC we're inviting you to take pare in a very unique #zapathon

Nostrians taking part in this special zapathon that will play in tune with thousands of people playing together with The Great Orchestra of Christmas Charity on their 32nd Grand Finale! Hence the name #orchestrathon

The goal of #orchestrathon is to support the goal of this years Grand Finale, which is: funding equipment for diagnosing, monitoring and rehabilitating lung diseases of patients in pulmonology wards for children and adults in Poland

That means all bitcoin from zaps will be converted to PLN and donated to The Great of Christmas Charity foundation.

What's The Great Orchestra of Christmas Charity? What is the 32nd Grand Finale?! You'll find all of those answers on Geyser project story, or a few paragraphs below 👇 Now coming back to #orchestrathon...

What Is #Orchesthrathon

This Nostr account is a was generated on Geyser and is tied to Geyser project: Bitcoiners support The Great Orchestra of Christmas Charity

That means all zaps sent to this account are at the same time funding Geyser campaing.

So not only you will contribute to the goal in the project, also all the zap comments will be visable there.

Ain't that crazy? We can use this campaign as one giant #orchestrathon client!

Rules are simple:

- On Sunday at 18.00 - 19.00 we all connect to our relays to join the #orchestrathon

- For the whole hour - you can zap this profile, our posts or comments as crazy!

- At 19.00 it's culmination of both #orchestrathon and Grand Finale

All Nostrians who zap will receive special badges, depending on the zapped amount (in total):

On Sunday there will be lot's of concerts and events happening all day, culminating with Grand Finale closing at 19.00. We will try to launch a stream on zap.stream, so we can enjoy Grand Finale and concerts together!

This #orchestrathon and Geyser fundraise is organised by Dwadzieścia Jeden, a community of polish Bitcoiners. More about us and Proof of Work in the project story 👇

We're not only Bitcoiners, are also Nostrians, follow us: Dwadzieścia Jeden account: @npub1cpmvpsqtzxl4px44dp4544xwgu0ryv2lscl3qexq42dfakuza02s4fsapc Saunter: @npub1m0sxqk5uwvtjhtt4yw3j0v3k6402fd35aq8832gp8kmer78atvkq9vgcru Fmar: @npub1xpuz4qerklyck9evtg40wgrthq5rce2mumwuuygnxcg6q02lz9ms275ams JesterHodl: @npub18s59mqct7se3xkhxr3epkagvuydwtvhpsacj67shrta8eknynegqttz5c3 Tomek K: @npub14wxtsrj7g2jugh70pfkzjln43vgn4p7655pgky9j9w9d75u465pqvagcye Tom Chojnacki: @npub1m0sxqk5uwvtjhtt4yw3j0v3k6402fd35aq8832gp8kmer78atvkq9vgcru Gracjan Pietras: @npub1trkudtnp7jg3tmy4sz8mepmgs5wdxk9x2esgts25mgkyecrse7js6ptss5 Tomek Waszczyk @npub1ah8phwmfyl2lakr23kt95kea3yavpt4m3cvppawuwkatllnrm4eqtuwdmk

Original Geyser project story

Saving Lives and Preserving Health

Dwadzieścia Jeden a polish node in decentralised bitcoin communities network Twenty One, is proud to facilitate bitcoin fundraising for the biggest, non-governmental, non-profit, charity in Poland — The Great Orchestra of Christmas Charity.

For the past 31 years, GOCC continuously fundraises money for pediatric and elderly care in Poland. Each year, a culmination of the raise occurs during the last Sunday of January in the shape of The Grand Finale — a joyful day that when tens of thousands volunteers worldwide, especially kids and teenagers, go on the streets to gather money for the cause, giving donors hear-shaped stickers with logo of the foundation. If you're in Poland on that day, basically every person you'll meet on the street will proudly wear GOCC heart.

The same hear-shaped stickers can be seen in every hospital in Poland on thousands of high quality medical equipment bought by The Great Orchestra. There is not a single polish family that hasn't benefited in some way from this equipment, and it saved thousands of lives, especially the little ones.

32nd Grand Finale Goal

This year, 32rd Grand Finale will take place on 28th of January. The aim of the 32nd Grand Finale is post-pandemic lung diseases — the raised funds will be used to purchase equipment for children's and adults' respiratory units.

The Foundation plans to purchase:

-

equipment for diagnostic imaging, i.a. MRI and ultrasound equipment,

-

equipment for functional diagnosis, i.a. polysomnographs and portable spirometers,

-

equipment for endoscopic diagnosis, i.a. navigational bronchoscopy systems and bronchoscopes

-

equipment for rehabilitation - equipment for pulmonary rehabilitation used in the treatment of patients after lung transplantation

-

equipment for thoracic surgery, e.g. electrocoagulation systems and cryoprobes.

The Great Orchestra of Proof of Work

-

31 years of non-stop fundraising for state-of-the-art saving life equipment, running medical and educational programmes and humanitarian aid

-

2 billion PLN or ~11,781 BTC raised in total

-

Areas of help: children's cardiac surgery, oncology, geriatrics, neonatology, children's nephrology, children's and young people's mental health services, ambulances for children's hospitals, volunteer firefighters & search & rescue units

-

Last year Grand Finale raised over PLN 240 million (1,410 BTC) for a goal to fight sepsis

-

You can check how money from 2022 report (224 376 706 PLN or ~1,321.69 BTC) raise were spent here (although it's in polish)

-

In addition to work focused on Poland, GOCC fundraised money for hospitals in Ukraine and provided substantial humanitarian aid for Ukrainian refugees, Polish-Belarusian border crisis, Turkey earthquake victims and more

-

GOCC is the most-trusted Polish organization and is at the top of the list as the most trusted public entities in Poland

What We'll Do With Gathered Funds

Gathered bitcoin will be converted to PLN by a polish exchange Quark and donated to The Great Orchestra of Christmas Charity after The Grand Finale which takes place on January 28th.

Dwadzieścia Jeden Proof of Work

We're a group of polish pleb Bitcoiners that started organising ourselves about 2 years ago.

Our activities include:

-

organising regular bitcoin meetups in several cities in Poland, also Nostr meetup in Warsaw

-

organising Bitcoin FilmFest and European Halving Party in Warsaw

-

orangepilling and maintaining map of polish bitcoin merchants in Poland on btcmap.org

-

giving talks on bitcoin

-

volounteering for helping with bitcoin payments and running bitcoin workshops on non-conferences (eg. Weekend of Capitalism)

-

working in human rights centered NGOs and promoting bitcoin as a tool for protecting human rights

-

...and we're just starting!

Find Out More

Gallery

-

@ 5d4b6c8d:8a1c1ee3

2025-05-20 13:39:22

@ 5d4b6c8d:8a1c1ee3

2025-05-20 13:39:22https://youtu.be/US9iYJNTOkU

I had no idea Tosh was still doing anything, much less that he talks about sports.

https://stacker.news/items/984547

-

@ 84b0c46a:417782f5

2025-05-18 12:22:32

@ 84b0c46a:417782f5

2025-05-18 12:22:32- Lumilumi The Nostr Web Client.

Lightweight modes are available, such as not displaying icon images, not loading images automatically, etc.

-

MAKIMONO A lightweight Long Form Content Editor with editing functionality for your articles. It supports embedding Nostr IDs via NIP-19 and custom emoji integration.

-

Nostr Share Component Demo A simple web component for sharing content to Nostr. Create customizable share buttons that let users easily post to Nostr clients with pre-filled content. Perfect for blogs, websites, or any content you want shared on the Nostr network. Try the interactive demo to see how seamlessly it integrates with your website.

Only clients that support receiving shared text via URL parameters can be added to the client list. If your preferred client meets this requirement, feel free to submit a pull request.

-

Nostr Follow Organizer A practical tool for managing your Nostr follows(kind3) with ease.

-

NAKE NAKE is a powerful utility for Nostr developers and users that simplifies working with NIP-19 and NIP-49 formats. This versatile tool allows you to easily encode and decode Nostr identifiers and encrypted data according to these protocol specifications.

- chrome extension

- firefox add-on

-

Nostviewstr A versatile Nostr tool that specializes in creating and editing addressable or replaceable events on the Nostr network. This comprehensive editor allows you to manage various types of lists and structured content within the Nostr ecosystem.

-

Luminostr Luminostr is a recovery tool for Nostr that helps you retrieve and restore Addressable or Replaceable events (such as kind: 0, 3, 10002, 10000, etc.) from relays. It allows you to search for these events across multiple relays and optionally re-publish them to ensure their persistence.

-

Nostr Bookmark Recovery Tool Nostr Bookmark Recovery Tool is a utility for retrieving and re-publishing past bookmark events ( kind:10003,30001,30003 ) from public relays. Rather than automatically selecting the latest version, it allows users to pick any previous version and overwrite the current one with it. This is useful for restoring a preferred snapshot of your bookmark list.

-

Profile Editor Profile Editor is a simple tool for editing and publishing your Nostr profile (kind: 0 event). It allows you to update fields such as name, display name, picture, and about text, and then publish the updated profile to selected relays.

-

Nostr bookmark viewer Nostr Bookmark Viewer is a tool for viewing and editing Nostr bookmark events (kind: 10003, 30001, 30003). It allows users to load bookmark data from relays, browse saved posts, and optionally edit and publish their own bookmark lists.

-

Nostr Note Duplicater Nostr Note Duplicater is a tool that rebroadcasts an existing Nostr event from a relay to other selected relays.

-

@ 6ad3e2a3:c90b7740

2025-05-20 13:38:04

@ 6ad3e2a3:c90b7740

2025-05-20 13:38:04When I was a kid, I wanted to be rich, but found the prospect of hard work tedious, pointless and soul-crushing. Instead of studying for exams, getting some job and clawing your way up the ladder, I wondered why we couldn’t just build a device that measured your brain capacity and awarded you the money you would have made had you applied yourself. Eliminate the middleman, so to speak, the useless paper pushing evoked by the word “career.”

But when you think about it, it’s not really money you’re after, as money is but purchasing power, and so it’s the things money can provide like a nice lifestyle and the peace of mind that comes from not worrying about it. And it’s not really the lifestyle or financial independence, per se, since moment to moment what’s in your bank account isn’t determining your mental state, but the feeling those things give you — a sense of expansiveness and freedom.

But if you did have such a machine, and it awarded you the money, you probably wouldn’t have that kind of expansiveness and freedom, especially if you did nothing to achieve those things. You would still feel bored, distracted and unsatisfied despite unrestricted means to travel or dine out as you saw fit. People who win the lottery, for example, tend to revert to their prior level of satisfaction in short order.

The feeling you really want then is the sense of rising to a challenge, negotiating and adapting to your environment, persevering in a state of uncertainty, tapping into your resourcefulness and creativity. It’s only while operating at the edge of your capacity you could ever be so fulfilled. In fact, in such a state the question of your satisfaction level would never come up. You wouldn’t even think to wonder about it you’d be so engrossed.

So what you really crave is a mind device that encourages you to adapt to your environment using your full creative capabilities in the present moment, so much so you realize if you do not do this, you have the sense of squandering your life in a tedious, pointless and soul-crushing way. You need to be totally stuck, without the option of turning back. In sum, you need to face reality exactly as it is, without any escape therefrom.

The measure of your mind in that case is your reality itself. The device is already with you — it’s the world you are presently creating with the consciousness you have, providing you avenues to escape, none of which are satisfactory, none that can lead to the state you truly desire. You have a choice to pursue them fruitlessly and wind up at square one, or to abandon them and attain your freedom. No matter how many times you go down a false road, you wind up at the same place until you give up on the Sisyphean task and proceed in earnest.

My childhood fantasy was real, it turns out, only I had misunderstood its meaning.

-

@ cb8f3c8e:c10ec329

2024-01-13 09:25:01

@ cb8f3c8e:c10ec329

2024-01-13 09:25:01Written by ALEX MREMA @npub1w4zrulscqraej2570gkazt0e7j0q3xq4437hnxjqfvcs59hq86fs9vnn4x

From the 13th of January 2024 the football world’s eyes will all converge on the Ivory Coast as 24 of Africa’s best football nations look to take each other on for the title of Africa’s best come 11th February. Though there is only going to be one winner, that doesn’t mean we aren’t promised exceptional football, shocks and players showcasing their razzle dazzle throughout the next 29 days. This article will focus on the players from each of the 24 competing nations who don’t get the spotlight they deserve but are certain to cause trouble.

IVORY COAST Name: Simon Adingra Age: 21 Club: Brighton and Hove Albion(England) Position: Winger The bright orange Ivorian jerseys are not the only thing that will catch your eye from this squad as the youthful, electrifying and pacey Brighton winger Simon Adingra is certainly bound to catch the interest of some during the tournament. His eye for goal and his turbo speed is bound to give trouble to any defender.

EQUATORIAL GUINEA Name: Saúl Coco Age: 24 Club: UD Las Palmas(Spain) Position: Center-Back Equatorial Guinea are not newcomers to the competition and are not going to be a pushover in a group that contains hosts Ivory Coast and the star-studded Nigeria. A player one must recognize from the Central African country is none other than Saul Coco. 6-foot-2 and a menace at the back, he will catch the eye of many particularly in his match up with the towering Bissau-Guinean players and of course Nigeria’s Victor Osimhen.

GUINEA-BISSAU Name: Fali Candé Age: 24 Club: FC Metz(France) Position: Centre-Back Like Equatorial Guinea, Guinea- Bissau come to the tournament with a familiar idea of what is expected. This is a nation known for putting up a challenge no matter what and are able to even pull a shock or two. If they are going to attract any wins in the tournament they will need a solid defense in their attack-heavy group, luckily for Guinea Bissau, they have Fali Cande who is one of the rocks at the back that Africa should have an eye on as he is aggressive and committed to keeping a clean sheet.

NIGERIA Name: Moses Simon Age: 28 Club: FC Nantes(France) Position: Winger Nigeria come in as one of the favourites to win it all and with a squad that has the African player of the year (Victor Osimhen) it’s hard to disagree that they are capable of delivering the cup back to Nigeria for the first time since 2013. A player that is sure to electrify the tournament is FC Nantes winger Moses Simon who shone in the last edition but had his time cut short after the Super Eagles shock defeat to Tunisia in the Round of 16. Now with their other attacking star (Victor Boniface) officially out of the tournament, will the Simon-Osimhen-Boniface attacking duo bear fruit for Nigeria?

CAPE VERDE Name: Jamiro Monteiro Age: 30 Club: San Jose Earthquakes(USA) Position: Center Midfield A man of experience and flair, Jamiro Monteiro is going to be a man lighting up the highlight reels throughout his time in the Ivory Coast. With a flair like Alex de Souza and an awareness equal to that of David Silva, Monteiro instantly sets himself as a man to watch in Cape Verde’s conquest to spice up the tournament.

EGYPT

Name: Ahmed Fatouh

Age: 25

Club: Zamalek(Egypt)

Position: Left Back

Fatouh has been described as the “Egyptian Marcelo” for his ability to excel in the attacking third of the pitch despite being a left back. His skill and drive towards making an impact upfront shall not blindside viewers that he can also do it defensively. This man is pivotal for the Egyptians in their quest for glory.

EGYPT

Name: Ahmed Fatouh

Age: 25

Club: Zamalek(Egypt)

Position: Left Back

Fatouh has been described as the “Egyptian Marcelo” for his ability to excel in the attacking third of the pitch despite being a left back. His skill and drive towards making an impact upfront shall not blindside viewers that he can also do it defensively. This man is pivotal for the Egyptians in their quest for glory.

GHANA Name: Salis Abdul Samed Age: 23 Club: RC Lens(France) Position: Central Defensive Midfielder Entering AFCON 2023, the Black Stars of Ghana are a nation booming with talent mixed with just the right amount of experience. Looking to put away the demons of their last AFCON appearance and deliver their first trophy since 1980, Ghana are likely to turn to their midfield to take them all the way. Yes, Mohammed Kudus is in that midfield but a player that goes unnoticed in that midfield is Salis Abdul Samed. He is magnificent at stealing the ball from opponents in a clean manner, further, he is able to put Ghana in promising positions when he moves the ball up. He truly is the new generation player that Ghana needed to make their midfield a threat to opponents.

MOZAMBIQUE Name: Geny Catamo Age: 22 Club: Sporting CP (Portugal) Position: Winger The scouts should keep an eye out for this young talent. He manages to wriggle through spaces with his dribbling and also leave defenders in the dust when going one on one with them. Catamo carries forward the game easily and with purpose and a lucid hunger. Head coach Chiquinho Conde should put his trust in this young man to make Mozambique a threat in the tournament.

CAMEROON

Name: François-Régis Mughe

Age: 19

Club: Olympique de Marseille(France)

Position: Winger

The youngest player on this list is a special prospect. His strength and pace is bound to make any defender have a difficult time when going up against him. He can create something out of nothing when given playing time, Cameroon coach Rigobert Song should make him have a taste of the competition and he will be wowed by the talent he has in his hands.

CAMEROON

Name: François-Régis Mughe

Age: 19

Club: Olympique de Marseille(France)

Position: Winger

The youngest player on this list is a special prospect. His strength and pace is bound to make any defender have a difficult time when going up against him. He can create something out of nothing when given playing time, Cameroon coach Rigobert Song should make him have a taste of the competition and he will be wowed by the talent he has in his hands.

THE GAMBIA

Name: Ablie Jallow

Age: 25

Club: FC Metz(France)

Position: Winger

Classy, calm and collected. These are the three words that can best be used to describe Gambia’s top scorer during qualifiers. He carries an aura that is simply impossible to ignore and he comes at defenders like a high speed train. He will look to be the main influence in The Gambia’s drive towards making another quarter final run like in the last edition of the tournament. Oh, don’t give him time and space to shoot because he will punish the keeper.

THE GAMBIA

Name: Ablie Jallow

Age: 25

Club: FC Metz(France)

Position: Winger