-

@ 04c915da:3dfbecc9

2025-05-20 15:53:48

@ 04c915da:3dfbecc9

2025-05-20 15:53:48This piece is the first in a series that will focus on things I think are a priority if your focus is similar to mine: building a strong family and safeguarding their future.

Choosing the ideal place to raise a family is one of the most significant decisions you will ever make. For simplicity sake I will break down my thought process into key factors: strong property rights, the ability to grow your own food, access to fresh water, the freedom to own and train with guns, and a dependable community.

A Jurisdiction with Strong Property Rights

Strong property rights are essential and allow you to build on a solid foundation that is less likely to break underneath you. Regions with a history of limited government and clear legal protections for landowners are ideal. Personally I think the US is the single best option globally, but within the US there is a wide difference between which state you choose. Choose carefully and thoughtfully, think long term. Obviously if you are not American this is not a realistic option for you, there are other solid options available especially if your family has mobility. I understand many do not have this capability to easily move, consider that your first priority, making movement and jurisdiction choice possible in the first place.

Abundant Access to Fresh Water

Water is life. I cannot overstate the importance of living somewhere with reliable, clean, and abundant freshwater. Some regions face water scarcity or heavy regulations on usage, so prioritizing a place where water is plentiful and your rights to it are protected is critical. Ideally you should have well access so you are not tied to municipal water supplies. In times of crisis or chaos well water cannot be easily shutoff or disrupted. If you live in an area that is drought prone, you are one drought away from societal chaos. Not enough people appreciate this simple fact.

Grow Your Own Food

A location with fertile soil, a favorable climate, and enough space for a small homestead or at the very least a garden is key. In stable times, a small homestead provides good food and important education for your family. In times of chaos your family being able to grow and raise healthy food provides a level of self sufficiency that many others will lack. Look for areas with minimal restrictions, good weather, and a culture that supports local farming.

Guns

The ability to defend your family is fundamental. A location where you can legally and easily own guns is a must. Look for places with a strong gun culture and a political history of protecting those rights. Owning one or two guns is not enough and without proper training they will be a liability rather than a benefit. Get comfortable and proficient. Never stop improving your skills. If the time comes that you must use a gun to defend your family, the skills must be instinct. Practice. Practice. Practice.

A Strong Community You Can Depend On

No one thrives alone. A ride or die community that rallies together in tough times is invaluable. Seek out a place where people know their neighbors, share similar values, and are quick to lend a hand. Lead by example and become a good neighbor, people will naturally respond in kind. Small towns are ideal, if possible, but living outside of a major city can be a solid balance in terms of work opportunities and family security.

Let me know if you found this helpful. My plan is to break down how I think about these five key subjects in future posts.

-

@ 04c915da:3dfbecc9

2025-05-20 15:47:16

@ 04c915da:3dfbecc9

2025-05-20 15:47:16Here’s a revised timeline of macro-level events from The Mandibles: A Family, 2029–2047 by Lionel Shriver, reimagined in a world where Bitcoin is adopted as a widely accepted form of money, altering the original narrative’s assumptions about currency collapse and economic control. In Shriver’s original story, the failure of Bitcoin is assumed amid the dominance of the bancor and the dollar’s collapse. Here, Bitcoin’s success reshapes the economic and societal trajectory, decentralizing power and challenging state-driven outcomes.

Part One: 2029–2032

-

2029 (Early Year)\ The United States faces economic strain as the dollar weakens against global shifts. However, Bitcoin, having gained traction emerges as a viable alternative. Unlike the original timeline, the bancor—a supranational currency backed by a coalition of nations—struggles to gain footing as Bitcoin’s decentralized adoption grows among individuals and businesses worldwide, undermining both the dollar and the bancor.

-

2029 (Mid-Year: The Great Renunciation)\ Treasury bonds lose value, and the government bans Bitcoin, labeling it a threat to sovereignty (mirroring the original bancor ban). However, a Bitcoin ban proves unenforceable—its decentralized nature thwarts confiscation efforts, unlike gold in the original story. Hyperinflation hits the dollar as the U.S. prints money, but Bitcoin’s fixed supply shields adopters from currency devaluation, creating a dual-economy split: dollar users suffer, while Bitcoin users thrive.

-

2029 (Late Year)\ Dollar-based inflation soars, emptying stores of goods priced in fiat currency. Meanwhile, Bitcoin transactions flourish in underground and online markets, stabilizing trade for those plugged into the bitcoin ecosystem. Traditional supply chains falter, but peer-to-peer Bitcoin networks enable local and international exchange, reducing scarcity for early adopters. The government’s gold confiscation fails to bolster the dollar, as Bitcoin’s rise renders gold less relevant.

-

2030–2031\ Crime spikes in dollar-dependent urban areas, but Bitcoin-friendly regions see less chaos, as digital wallets and smart contracts facilitate secure trade. The U.S. government doubles down on surveillance to crack down on bitcoin use. A cultural divide deepens: centralized authority weakens in Bitcoin-adopting communities, while dollar zones descend into lawlessness.

-

2032\ By this point, Bitcoin is de facto legal tender in parts of the U.S. and globally, especially in tech-savvy or libertarian-leaning regions. The federal government’s grip slips as tax collection in dollars plummets—Bitcoin’s traceability is low, and citizens evade fiat-based levies. Rural and urban Bitcoin hubs emerge, while the dollar economy remains fractured.

Time Jump: 2032–2047

- Over 15 years, Bitcoin solidifies as a global reserve currency, eroding centralized control. The U.S. government adapts, grudgingly integrating bitcoin into policy, though regional autonomy grows as Bitcoin empowers local economies.

Part Two: 2047

-

2047 (Early Year)\ The U.S. is a hybrid state: Bitcoin is legal tender alongside a diminished dollar. Taxes are lower, collected in BTC, reducing federal overreach. Bitcoin’s adoption has decentralized power nationwide. The bancor has faded, unable to compete with Bitcoin’s grassroots momentum.

-

2047 (Mid-Year)\ Travel and trade flow freely in Bitcoin zones, with no restrictive checkpoints. The dollar economy lingers in poorer areas, marked by decay, but Bitcoin’s dominance lifts overall prosperity, as its deflationary nature incentivizes saving and investment over consumption. Global supply chains rebound, powered by bitcoin enabled efficiency.

-

2047 (Late Year)\ The U.S. is a patchwork of semi-autonomous zones, united by Bitcoin’s universal acceptance rather than federal control. Resource scarcity persists due to past disruptions, but economic stability is higher than in Shriver’s original dystopia—Bitcoin’s success prevents the authoritarian slide, fostering a freer, if imperfect, society.

Key Differences

- Currency Dynamics: Bitcoin’s triumph prevents the bancor’s dominance and mitigates hyperinflation’s worst effects, offering a lifeline outside state control.

- Government Power: Centralized authority weakens as Bitcoin evades bans and taxation, shifting power to individuals and communities.

- Societal Outcome: Instead of a surveillance state, 2047 sees a decentralized, bitcoin driven world—less oppressive, though still stratified between Bitcoin haves and have-nots.

This reimagining assumes Bitcoin overcomes Shriver’s implied skepticism to become a robust, adopted currency by 2029, fundamentally altering the novel’s bleak trajectory.

-

-

@ cefb08d1:f419beff

2025-05-21 09:02:28

@ cefb08d1:f419beff

2025-05-21 09:02:28https://www.youtube.com/watch?v=OOmr2s-JPXo

The GWM Catch Up Day 3: Men's Quarterfinalists Locked, The Box delivers for pro surfing’s faithful:

https://www.youtube.com/watch?v=Owe-rjECP3M

The Box dishes West Oz power, Main Break decides last Quarters draws I Stone & Wood Post Show Day 3:

https://www.youtube.com/watch?v=qN3oi4kOGAA

Men 16 Round Results:

Source: https://www.worldsurfleague.com/events/2025/ct/326/western-australia-margaret-river-pro/results?roundId=24776

https://stacker.news/items/985339

-

@ 57c631a3:07529a8e

2025-05-20 15:40:04

@ 57c631a3:07529a8e

2025-05-20 15:40:04The Video: The World's Biggest Toddler

https://connect-test.layer3.press/articles/3f9d28a4-0876-4ee8-bdac-d1a56fa9cd02

-

@ f6488c62:c929299d

2025-05-21 08:52:36

@ f6488c62:c929299d

2025-05-21 08:52:36ปี 2568 ตลาดคริปโตยังคงเต็มไปด้วยความร้อนแรงและโอกาส Bitcoin พุ่งแตะ 106,595.5 ดอลลาร์ (ณ วันที่ 21 พ.ค. 2568) ขณะที่เหรียญมีมอย่าง KPEPE ก็กลายเป็นที่จับตามองของเหล่านักลงทุนรายใหญ่ แต่ท่ามกลางกระแสความร้อนแรง คำถามสำคัญยังคงอยู่: ตลาดคริปโตอยู่ช่วงไหนของวัฏจักร? และโอกาสใหญ่กำลังมาหรือใกล้จบลงแล้ว?

หนึ่งในเสียงที่ดังที่สุดในชุมชนคริปโตตอนนี้คือชื่อที่หลายคนอาจยังไม่รู้จักแน่ชัด – James Wynn เขาโพสต์ข้อความเมื่อวันที่ 31 มีนาคม 2568 ว่า

“The best is yet to come.” หรือ “สิ่งที่ดีที่สุดยังมาไม่ถึง” – คำพูดที่จุดประกายความหวังในชุมชนนักเทรดทั่วโลก

แม้เขาจะถูกยกย่องว่าเป็น “วาฬคริปโต” จากการถือครองมูลค่ามหาศาล แต่ในความเป็นจริง เรายังไม่รู้ว่าเขาคือใคร – ชื่อ James Wynn อาจเป็นเพียงนามแฝง หรือ persona บนโลกออนไลน์ก็เป็นได้

ในบทความนี้ เราจะวิเคราะห์มุมมองของเขาอย่างมีวิจารณญาณ พร้อมแนะแนวทางที่นักเทรดควรเตรียมตัวเพื่อคว้าโอกาสในช่วงขาขึ้นนี้

ภาพรวมตลาดคริปโตในปี 2568 ปีนี้ถือเป็นช่วงขาขึ้นที่เกิดจากหลายปัจจัยสำคัญ:

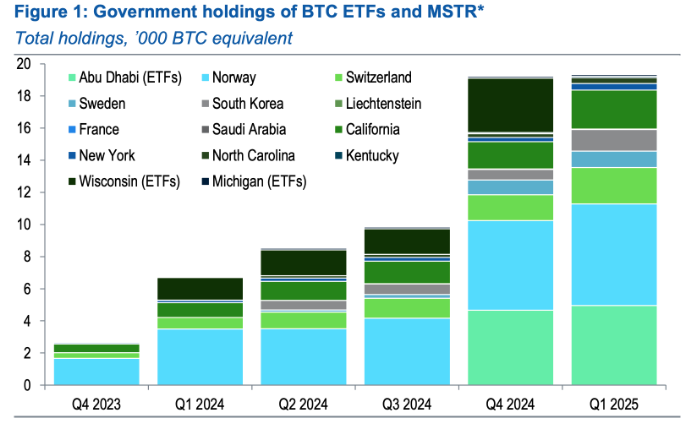

การอนุมัติ Bitcoin Spot ETFs ในสหรัฐฯ

การเข้ารับตำแหน่งของ Donald Trump พร้อมนโยบายที่เป็นมิตรต่อคริปโต เช่น การผลักดันให้ Bitcoin เป็นสินทรัพย์สำรองของชาติ

ปัจจัยเหล่านี้ได้ดึงดูดทั้งนักลงทุนรายย่อยและสถาบันเข้าสู่ตลาด ส่งผลให้ราคาของ BTC และเหรียญมีมอย่าง KPEPE พุ่งสูงขึ้นอย่างรวดเร็ว สะท้อนถึงโมเมนตัมที่ยังคงแข็งแกร่ง

มุมมองจาก ‘James Wynn’: ปลายวัฏจักร? หรือแค่เริ่มต้น? แม้จะไม่มีใครรู้แน่ชัดว่า James Wynn คือใคร แต่เขากลายเป็นบุคคลที่มีอิทธิพลในชุมชนคริปโตจากการเปิดเผยมุมมองที่เฉียบคมและพอร์ตการลงทุนขนาดใหญ่

เขาโพสต์ไว้ว่า

“ถ้าใครคิดว่าเราอยู่ท้ายวัฏจักรแล้ว คุณคิดผิด”

โดยให้เหตุผลหลัก 3 ข้อ:

การพุ่งขึ้นของราคาส่วนใหญ่เกิดจาก ข่าวดีภายนอก เช่น ETF ยังไม่ใช่ "กระแสล้นตลาด"

นโยบายรัฐบาล Trump ส่งผลเชิงจิตวิทยาเชิงบวกต่อทั้งนักลงทุนและตลาด

ยังไม่เกิด Altcoin Season หรืออารมณ์ตลาดช่วง “Euphoria” ตามแผนภาพ Psychology of a Market Cycle

เขาประเมินว่าตลาดน่าจะอยู่ช่วง “Optimism → Thrill” ซึ่งเป็นช่วงกลางของวัฏจักรที่นักลงทุนเริ่มตื่นเต้น แต่ยังไม่ถึงจุดสูงสุด

เขาเป็นใคร? วาฬตัวจริงหรือบุคคลลึกลับ? แม้ James Wynn จะได้รับความสนใจอย่างมาก แต่ตัวตนของเขายังคลุมเครือ:

ไม่มีข้อมูลยืนยันตัวตนชัดเจน

ไม่รู้ว่าเขาเป็นบุคคล กลุ่ม หรือองค์กร

ใช้นามแฝงออนไลน์ และบัญชีเทรดที่ระบุไว้ไม่ผูกกับตัวตนจริง

ถึงอย่างนั้น พฤติกรรมการลงทุนของเขาก็ไม่ธรรมดา:

Long BTC-USD ด้วยเลเวอเรจ 40x กว่า 5,200 BTC (มูลค่ากว่า 546 ล้านดอลลาร์)

Long KPEPE-USD ด้วยเลเวอเรจ 10x มูลค่ากว่า 32.8 ล้านดอลลาร์

รวมกำไรจากการเทรดกว่า 20.2 ล้านดอลลาร์ (ราว 687 ล้านบาท)

ใช้แพลตฟอร์ม Hyperliquid และแสดงจุดยืนต่อต้าน CEX บางแห่งอย่าง Bybit ที่เขาเคยกล่าวหาว่ามีการ manipulate ตลาด

สิ่งที่น่าสนใจคือ Wynn มักจะลดตำแหน่งและล็อกกำไรอย่างเป็นระบบ เช่น วันที่ 20 พ.ค. 2568 เขาลดตำแหน่ง BTC ลง 1,142 BTC และถอน USDC กลับวอลเล็ตส่วนตัว – สะท้อนถึงการบริหารความเสี่ยงที่รอบคอบ

แนวทางสำหรับนักเทรด: ถ้า "สิ่งที่ดีที่สุด" ยังมาไม่ถึง... หากมุมมองของ Wynn ถูกต้อง และตลาดยังไม่ถึงจุดสูงสุด ต่อไปนี้คือตัวอย่างแนวทางที่นักเทรดควรพิจารณา:

🔹 วางแผนรับ pullback: หากอยู่ในช่วง "Thrill" ตลาดอาจมีการพักตัวชั่วคราว – เป็นโอกาสในการ “ซื้อซ้ำ” ก่อนเข้าสู่จุดพีค

🔹 จับตา altcoin season: การที่เหรียญมีมอย่าง KPEPE พุ่งขึ้น อาจเป็นสัญญาณล่วงหน้าของ Altcoin Season ที่กำลังจะเริ่ม – เตรียมลิสต์เหรียญที่มีศักยภาพ

🔹 เน้นการบริหารความเสี่ยง: ใช้ stop-loss และเลเวอเรจอย่างระมัดระวัง อย่าลืมว่าวัฏจักรคริปโตสามารถเปลี่ยนแปลงอย่างรวดเร็ว

🔹 ติดตามความเคลื่อนไหวของวาฬ (แม้จะไม่รู้ว่าเขาคือใคร): เช่น ที่อยู่กระเป๋า 0x5078C2FbeA2B2aD61bcB40BC0233E5Ce56EDb6 ซึ่งเชื่อว่าเป็นของ Wynn – การเคลื่อนไหวของกระเป๋านี้อาจบ่งชี้แนวโน้มตลาดล่วงหน้า

สรุป แม้เราจะยังไม่รู้แน่ชัดว่า James Wynn คือใคร หรือแม้กระทั่งเขามีอยู่จริงหรือไม่ แต่คำพูดของเขาก็สอดคล้องกับทิศทางตลาดในปัจจุบันที่ยังคงอยู่ในขาขึ้น

“The best is yet to come.” – ถ้าเขาพูดถูก โอกาสที่ดีที่สุดในตลาดคริปโตปี 2568 ก็ยังไม่มาถึง

นักเทรดควร:

ติดตามสัญญาณตลาดอย่างรอบคอบ

จัดพอร์ตให้พร้อมสำหรับการเปลี่ยนแปลง

และที่สำคัญ — อย่าหลงกระแส โดยไม่มีแผนรองรับ

วาฬที่แท้จริงอาจไม่มีชื่อเสียง… และนั่นแหละคือสิ่งที่ทำให้พวกเขาน่าจับตายิ่งกว่าใคร

-

@ 502ab02a:a2860397

2025-05-21 07:49:22

@ 502ab02a:a2860397

2025-05-21 07:49:22หลายคนอาจแปลกใจว่า ทำไมน้ำมันจากผลไม้แบบอโวคาโดถึงกล้าขึ้นชั้น “ไขมันดี” ไปเทียบกับน้ำมันมะกอกได้ ทั้งที่ฟังดูไม่หรูเท่า แต่ความจริงแล้ว น้ำมันอโวคาโดคือหนึ่งในไม่กี่ชนิดของน้ำมันพืชที่สกัดจาก “เนื้อผล” ไม่ใช่เมล็ด ทำให้มีโครงสร้างไขมันที่ต่างจาก seed oils ทั่วไป ทั้งในแง่กรดไขมัน สารต้านอนุมูลอิสระ และวิธีที่มันตอบสนองต่อความร้อน

น้ำมันอโวคาโดมีกรดไขมันไม่อิ่มตัวตำแหน่งเดียว (MUFA) เป็นหลัก โดยเฉพาะ กรดโอเลอิก (Oleic acid) ซึ่งคิดเป็นประมาณ 65–70% ของไขมันทั้งหมด ใกล้เคียงน้ำมันมะกอกเลย แต่เหนือกว่าเล็กน้อยในแง่ของ ค่าควัน (smoke point) ที่สูงถึง 250°C (แบบ refined) และราว 190–200°C (แบบ cold-pressed) ทำให้เหมาะกับการผัดหรือทอดแบบเบา ๆ โดยไม่ทำให้เกิดสารพิษจากไขมันไหม้เร็วเท่าน้ำมันที่ค่าควันต่ำ

นอกจาก MUFA แล้ว น้ำมันอโวคาโดยังมี PUFA อยู่เล็กน้อย ประมาณ 10–14% ส่วนใหญ่คือ โอเมก้า-6 (linoleic acid) ซึ่งก็มีปริมาณไม่มากจนถึงขั้นต้องห่วงเรื่องการอักเสบ เหมือนที่เจอกับพวกน้ำมันรำข้าวหรือถั่วเหลืองที่ PUFA พุ่งสูงเกิน 50% ขึ้นไป และที่สำคัญ...โอเมก้า-3 ในอโวคาโดก็มีอยู่บ้างในรูปของ ALA แม้ไม่เยอะ แต่ก็บอกได้ว่าโครงสร้างโดยรวมของมันสมดุลพอควร ถ้ามองในรูปแบบพลังงานไขมัน ก็ถือว่าใช้ได้เลย

อโวคาโดออยล์แบบไม่ผ่านกระบวนการ (unrefined) ยังมีพวก วิตามินอี (tocopherols) ในระดับประมาณ 13–20 มก. ต่อ 100 กรัม และสารโพลีฟีนอลบางชนิดราวๆ 30–50 mg GAE/100 กรัม เช่น catechins และ procyanidins อยู่บ้าง ซึ่งช่วยลดการเกิดอนุมูลอิสระตอนเจอความร้อน และยังดีต่อผิวหนังในมิติของ skincare ด้วยนะ

ถ้าใช้แบบ cold-pressed, unrefined กลิ่นมันจะออกคล้ายอะโวคาโดสุก ๆ หน่อย มีความเขียวอ่อน ๆ และครีมมี่เล็ก ๆ ซึ่งเหมาะกับการคลุกหรือปรุงแบบ low heat มากกว่าการทอดแรง ส่วนถ้าจะใช้ทำอาหารจริงจัง น้ำมันอโวคาโดแบบ refined ก็จะกลิ่นอ่อนลง สีใสขึ้น และทนไฟได้ดีขึ้นมาก เหมาะจะเอาไปทำ steak หรือผัดไฟกลางได้แบบไม่กังวล อันนี้ก็แล้วแต่จะเลือกนะครับ

ถ้าจะพูดให้ตรง… น้ำมันอโวคาโดคือ “ไขมันผลไม้สายกลาง” ที่ทั้งทนไฟพอใช้ ทำครัวได้หลากหลาย และไม่บิดเบือนสัดส่วนไขมันในร่างกายเราจนเกินไป และถ้าเลือกแบบที่ผลิตดี ไม่โดนสารเคมี ไม่โดนไฮโดรเจนเสริม ก็ถือว่าเป็นน้ำมันดีอีกตัวที่วางใจได้ในครัวจริง ๆ

ใครอยากลองทำเองที่บ้านก็ได้นะ แบบง่ายๆแค่มีผ้าขาวบาง https://youtu.be/gwHGgoMuRnI?si=ehcQceabdbMGfkwG

นอกจากนี้บางคนอาจเคยเห็นโฆษณาสินค้าที่มีน้ำมันจากเมล็ดและเปลือกด้วยใช่ไหมครับ

เมล็ดอโวคาโดนั้นอุดมไปด้วย ไขมันน้อยกว่ามาก เมื่อเทียบกับเนื้อผล แต่มีสารพฤกษเคมีบางชนิดที่นักวิจัยสนใจ เช่น ฟีนอลิกส์ (phenolics), ฟลาโวนอยด์, สารต้านจุลชีพ และ ไฟเบอร์ละลายน้ำสูง การสกัดน้ำมันจากเมล็ดมักจะใช้ ตัวทำละลาย (solvent extraction) หรือ วิธี supercritical CO₂ ไม่ค่อยทำแบบ cold-pressed เพราะน้ำมันน้อยเกิน ปริมาณน้ำมันจากเมล็ดนั้นต่ำมาก คือไม่ถึง 5% ของน้ำหนักแห้ง ทำให้ไม่ค่อยนิยมในเชิงพาณิชย์ น้ำมันจากเมล็ดมักไม่ได้เอาไว้ปรุงอาหาร แต่เอาไปใช้ ด้านเวชสำอาง หรือ functional food มากกว่า เช่น ครีมทาผิว แชมพู หรือผลิตภัณฑ์ชะลอวัย

เปลือกอโวคาโดมี สารต้านจุลชีพและสารต้านออกซิเดชัน บางชนิดเช่นกัน แต่มีไขมันน้อยมากแทบจะไม่มีเลย บางงานวิจัยพยายามสกัดพวก polyphenols หรือสารสีธรรมชาติจากเปลือก เพื่อใช้ในอาหารเสริม หรือผลิตภัณฑ์สุขภาพ ไม่ได้สกัดน้ำมันโดยตรง แบบเนื้อผล แต่ใช้เปลือกเป็นวัตถุดิบเสริมมากกว่า เช่น ผสมในน้ำมันหลักเพื่อเพิ่มคุณสมบัติด้านสุขภาพ

ส่วนตัวคิดว่าไม่ต้องทำเองหรอกครับ ซื้อกินเหอะ 555 เจ้านี้ดีนะ อยู่คู่วงการสุขภาพมาแต่แรกๆเลย https://s.shopee.co.th/8zsnEsLrvh

#pirateketo #กูต้องรู้มั๊ย #ม้วนหางสิลูก #siamstr

-

@ 15f9e159:ca9a5ac4

2025-05-21 07:37:11

@ 15f9e159:ca9a5ac4

2025-05-21 07:37:11A plataforma 755Bet é uma das principais opções para quem busca uma experiência única no universo dos jogos online. Com uma interface intuitiva, jogos de alta qualidade e uma experiência de usuário focada na diversão e no prazer do jogador, o 755Bet se destaca como um dos destinos preferidos para quem deseja aproveitar ao máximo o entretenimento digital. Vamos explorar o que torna o 755Bet uma plataforma tão especial e por que ele deve ser a sua próxima escolha para diversão online.

Plataforma 755Bet: Um Espaço Inovador e Completo O 755Bet oferece aos jogadores uma plataforma moderna e fácil de navegar, permitindo que se conectem ao mundo do entretenimento online com apenas alguns cliques. A plataforma é projetada para ser acessível tanto para novatos quanto para jogadores experientes, com recursos que atendem a diferentes gostos e preferências.

Com um design que prioriza a simplicidade, o 755Bet garante que seus usuários possam encontrar rapidamente o que procuram. Seja para jogar ou simplesmente explorar as opções oferecidas, a experiência do usuário é fluida e sem complicações. Além disso, o site é otimizado para dispositivos móveis, permitindo que você aproveite a diversão a qualquer hora e em qualquer lugar.

A plataforma oferece diversos métodos de pagamento seguros, garantindo que os jogadores possam realizar transações de maneira rápida e sem preocupações. O 755bet também investe constantemente em melhorar a segurança dos dados de seus usuários, com protocolos avançados de criptografia para proteger as informações pessoais e financeiras.

Jogos no 755Bet: Variedade para Todos os Gostos Uma das principais atrações do 755Bet é a ampla seleção de jogos oferecidos. Se você é fã de jogos de mesa, como blackjack e roleta, ou prefere jogos de habilidade e estratégia, o 755Bet tem algo para todos. A variedade de opções garante que cada jogador possa encontrar o jogo que mais lhe agrada, com gráficos de alta qualidade e jogabilidade envolvente.

O site conta com uma vasta gama de opções, que incluem títulos populares de diferentes categorias. Além disso, novos jogos estão sempre sendo adicionados ao portfólio, garantindo que os jogadores nunca fiquem sem novidades. A plataforma oferece jogos com diferentes níveis de dificuldade, o que significa que tanto iniciantes quanto veteranos podem aproveitar as opções disponíveis, sempre encontrando o jogo que se adapta ao seu estilo.

Experiência do Jogador: Diversão e Comodidade No 755Bet, a experiência do jogador é uma prioridade. A plataforma não apenas oferece jogos de alta qualidade, mas também foca em criar um ambiente acolhedor e acessível. O atendimento ao cliente é uma parte fundamental da experiência do usuário, com uma equipe dedicada pronta para responder a qualquer dúvida ou ajudar com problemas de forma rápida e eficaz.

Além disso, o 755Bet oferece promoções e bônus que tornam a experiência ainda mais interessante para seus jogadores. Isso inclui recompensas para novos membros, bem como ofertas especiais para usuários regulares. Esses incentivos ajudam a manter a motivação dos jogadores e garantem que a experiência seja sempre divertida e recompensadora.

O 755Bet também conta com recursos de personalização que permitem aos jogadores ajustar a plataforma conforme suas preferências. Isso pode incluir a escolha de temas, ajustes de notificação e preferências de jogo, tudo para garantir que o ambiente de jogo seja o mais agradável possível.

Conclusão O 755Bet se destaca como uma plataforma completa para quem busca uma experiência online rica e envolvente. Com uma interface intuitiva, uma ampla variedade de jogos e um foco constante na satisfação do jogador, ele é um destino obrigatório para aqueles que querem explorar o universo dos jogos online de forma segura, divertida e acessível. Seja você um novato ou um jogador experiente, o 755Bet tem tudo o que você precisa para uma experiência inesquecível.

-

@ 34f1ddab:2ca0cf7c

2025-05-16 22:47:03

@ 34f1ddab:2ca0cf7c

2025-05-16 22:47:03Losing access to your cryptocurrency can feel like losing a part of your future. Whether it’s due to a forgotten password, a damaged seed backup, or a simple mistake in a transfer, the stress can be overwhelming. Fortunately, cryptrecver.com is here to assist! With our expert-led recovery services, you can safely and swiftly reclaim your lost Bitcoin and other cryptocurrencies.

Why Trust Crypt Recver? 🤝 🛠️ Expert Recovery Solutions At Crypt Recver, we specialize in addressing complex wallet-related issues. Our skilled engineers have the tools and expertise to handle:

Partially lost or forgotten seed phrases Extracting funds from outdated or invalid wallet addresses Recovering data from damaged hardware wallets Restoring coins from old or unsupported wallet formats You’re not just getting a service; you’re gaining a partner in your cryptocurrency journey.

🚀 Fast and Efficient Recovery We understand that time is crucial in crypto recovery. Our optimized systems enable you to regain access to your funds quickly, focusing on speed without compromising security. With a success rate of over 90%, you can rely on us to act swiftly on your behalf.

🔒 Privacy is Our Priority Your confidentiality is essential. Every recovery session is conducted with the utmost care, ensuring all processes are encrypted and confidential. You can rest assured that your sensitive information remains private.

💻 Advanced Technology Our proprietary tools and brute-force optimization techniques maximize recovery efficiency. Regardless of how challenging your case may be, our technology is designed to give you the best chance at retrieving your crypto.

Our Recovery Services Include: 📈 Bitcoin Recovery: Lost access to your Bitcoin wallet? We help recover lost wallets, private keys, and passphrases. Transaction Recovery: Mistakes happen — whether it’s an incorrect wallet address or a lost password, let us manage the recovery. Cold Wallet Restoration: If your cold wallet is failing, we can safely extract your assets and migrate them into a secure new wallet. Private Key Generation: Lost your private key? Our experts can help you regain control using advanced methods while ensuring your privacy. ⚠️ What We Don’t Do While we can handle many scenarios, some limitations exist. For instance, we cannot recover funds stored in custodial wallets or cases where there is a complete loss of four or more seed words without partial information available. We are transparent about what’s possible, so you know what to expect

Don’t Let Lost Crypto Hold You Back! Did you know that between 3 to 3.4 million BTC — nearly 20% of the total supply — are estimated to be permanently lost? Don’t become part of that statistic! Whether it’s due to a forgotten password, sending funds to the wrong address, or damaged drives, we can help you navigate these challenges

🛡️ Real-Time Dust Attack Protection Our services extend beyond recovery. We offer dust attack protection, keeping your activity anonymous and your funds secure, shielding your identity from unwanted tracking, ransomware, and phishing attempts.

🎉 Start Your Recovery Journey Today! Ready to reclaim your lost crypto? Don’t wait until it’s too late! 👉 cryptrecver.com

📞 Need Immediate Assistance? Connect with Us! For real-time support or questions, reach out to our dedicated team on: ✉️ Telegram: t.me/crypptrcver 💬 WhatsApp: +1(941)317–1821

Crypt Recver is your trusted partner in cryptocurrency recovery. Let us turn your challenges into victories. Don’t hesitate — your crypto future starts now! 🚀✨

Act fast and secure your digital assets with cryptrecver.com.Losing access to your cryptocurrency can feel like losing a part of your future. Whether it’s due to a forgotten password, a damaged seed backup, or a simple mistake in a transfer, the stress can be overwhelming. Fortunately, cryptrecver.com is here to assist! With our expert-led recovery services, you can safely and swiftly reclaim your lost Bitcoin and other cryptocurrencies.

# Why Trust Crypt Recver? 🤝

# Why Trust Crypt Recver? 🤝🛠️ Expert Recovery Solutions\ At Crypt Recver, we specialize in addressing complex wallet-related issues. Our skilled engineers have the tools and expertise to handle:

- Partially lost or forgotten seed phrases

- Extracting funds from outdated or invalid wallet addresses

- Recovering data from damaged hardware wallets

- Restoring coins from old or unsupported wallet formats

You’re not just getting a service; you’re gaining a partner in your cryptocurrency journey.

🚀 Fast and Efficient Recovery\ We understand that time is crucial in crypto recovery. Our optimized systems enable you to regain access to your funds quickly, focusing on speed without compromising security. With a success rate of over 90%, you can rely on us to act swiftly on your behalf.

🔒 Privacy is Our Priority\ Your confidentiality is essential. Every recovery session is conducted with the utmost care, ensuring all processes are encrypted and confidential. You can rest assured that your sensitive information remains private.

💻 Advanced Technology\ Our proprietary tools and brute-force optimization techniques maximize recovery efficiency. Regardless of how challenging your case may be, our technology is designed to give you the best chance at retrieving your crypto.

Our Recovery Services Include: 📈

- Bitcoin Recovery: Lost access to your Bitcoin wallet? We help recover lost wallets, private keys, and passphrases.

- Transaction Recovery: Mistakes happen — whether it’s an incorrect wallet address or a lost password, let us manage the recovery.

- Cold Wallet Restoration: If your cold wallet is failing, we can safely extract your assets and migrate them into a secure new wallet.

- Private Key Generation: Lost your private key? Our experts can help you regain control using advanced methods while ensuring your privacy.

⚠️ What We Don’t Do\ While we can handle many scenarios, some limitations exist. For instance, we cannot recover funds stored in custodial wallets or cases where there is a complete loss of four or more seed words without partial information available. We are transparent about what’s possible, so you know what to expect

# Don’t Let Lost Crypto Hold You Back!

# Don’t Let Lost Crypto Hold You Back!Did you know that between 3 to 3.4 million BTC — nearly 20% of the total supply — are estimated to be permanently lost? Don’t become part of that statistic! Whether it’s due to a forgotten password, sending funds to the wrong address, or damaged drives, we can help you navigate these challenges

🛡️ Real-Time Dust Attack Protection\ Our services extend beyond recovery. We offer dust attack protection, keeping your activity anonymous and your funds secure, shielding your identity from unwanted tracking, ransomware, and phishing attempts.

🎉 Start Your Recovery Journey Today!\ Ready to reclaim your lost crypto? Don’t wait until it’s too late!\ 👉 cryptrecver.com

📞 Need Immediate Assistance? Connect with Us!\ For real-time support or questions, reach out to our dedicated team on:\ ✉️ Telegram: t.me/crypptrcver\ 💬 WhatsApp: +1(941)317–1821

Crypt Recver is your trusted partner in cryptocurrency recovery. Let us turn your challenges into victories. Don’t hesitate — your crypto future starts now! 🚀✨

Act fast and secure your digital assets with cryptrecver.com.

-

@ 15f9e159:ca9a5ac4

2025-05-21 07:36:25

@ 15f9e159:ca9a5ac4

2025-05-21 07:36:25O mundo dos jogos online está sempre em evolução, e novas plataformas surgem constantemente para oferecer experiências únicas aos jogadores. O 0e0e é uma dessas plataformas, que vem conquistando o público com uma proposta inovadora, repleta de jogos envolventes e uma interface amigável. Se você está em busca de uma nova forma de diversão e desafios, o 0e0e oferece tudo isso e muito mais.

Introdução à Plataforma 0e0e O 0e0e é uma plataforma online que tem como principal objetivo proporcionar uma experiência de entretenimento de qualidade. Com um design moderno e acessível, a plataforma é fácil de navegar, permitindo que os jogadores se sintam à vontade ao explorar suas diversas funcionalidades. O 0e0e está disponível para todos os tipos de dispositivos, garantindo que os usuários possam jogar a qualquer hora e em qualquer lugar, seja no desktop ou no celular.

Ao acessar a plataforma, os jogadores têm acesso a uma ampla variedade de jogos, além de recursos que tornam a experiência ainda mais agradável, como bônus atrativos, promoções e um atendimento ao cliente de excelência. O 0e0efoca em criar um ambiente dinâmico, que agrada tanto aos iniciantes quanto aos jogadores mais experientes.

Jogos no 0e0e: Diversão Sem Limites Uma das maiores vantagens do 0e0e é sua vasta seleção de jogos, que atende aos mais diversos gostos e preferências. Seja você fã de jogos de habilidade, estratégia ou entretenimento de alta ação, a plataforma tem opções para todos. Entre os jogos mais populares, encontramos desde clássicos da cultura de jogos até títulos exclusivos que você não encontra facilmente em outras plataformas.

Os jogos disponíveis são desenvolvidos por fornecedores renomados da indústria, garantindo gráficos impressionantes, jogabilidade fluida e uma experiência imersiva. Cada jogo foi cuidadosamente selecionado para proporcionar momentos de diversão, com desafios que mantêm os jogadores engajados e motivados a explorar cada vez mais as opções da plataforma.

Uma das atrações mais procuradas pelos usuários do 0e0e são os jogos de mesa, que oferecem uma experiência tradicional de jogo com um toque moderno. Os jogadores podem escolher entre várias modalidades, cada uma com regras fáceis de aprender, mas desafiadoras o suficiente para manter o interesse.

Além disso, a plataforma oferece jogos com temas variados, desde aventuras épicas a opções mais leves e descontraídas. Seja você um jogador casual ou alguém em busca de competição, há sempre algo para experimentar no 0e0e.

Experiência do Jogador: Conforto e Inovação O 0e0e entende que a experiência do jogador vai além da simples escolha de jogos. A plataforma investe em diversos aspectos para garantir que a navegação seja intuitiva e sem complicações. O processo de registro e acesso aos jogos é simples, permitindo que qualquer pessoa, independentemente da sua familiaridade com plataformas digitais, possa começar a jogar rapidamente.

Além disso, o 0e0e conta com um suporte ao cliente eficiente, pronto para ajudar em qualquer questão que possa surgir durante a jornada do jogador. A equipe de suporte está disponível 24 horas por dia, 7 dias por semana, oferecendo um atendimento rápido e amigável.

Para tornar a experiência ainda mais imersiva, o 0e0e disponibiliza uma série de promoções e bônus especiais para seus usuários. Estes benefícios são pensados para aumentar a diversão e proporcionar mais oportunidades de ganhar, criando um ambiente onde os jogadores podem aproveitar ao máximo cada momento.

A plataforma também oferece métodos de pagamento rápidos e seguros, garantindo que os depósitos e retiradas sejam realizados de maneira tranquila, sem qualquer complicação. A segurança dos dados do usuário é uma prioridade para o 0e0e, que utiliza tecnologia de ponta para proteger todas as informações pessoais e financeiras.

Conclusão: O 0e0e Como a Escolha Certa para os Jogadores O 0e0e é muito mais do que uma plataforma de jogos; é um espaço onde diversão, emoção e segurança se encontram. Com uma interface amigável, uma vasta seleção de jogos e um suporte ao cliente dedicado, o 0e0e oferece tudo o que um jogador precisa para se divertir e viver novas experiências. Seja você um iniciante ou um veterano, o 0e0e tem tudo para tornar sua jornada ainda mais emocionante e recompensadora. Não perca a chance de explorar tudo o que essa plataforma incrível tem a oferecer!

-

@ 15f9e159:ca9a5ac4

2025-05-21 07:35:46

@ 15f9e159:ca9a5ac4

2025-05-21 07:35:46A 55kd é uma plataforma inovadora no cenário de jogos online, criada para oferecer aos jogadores uma experiência única e envolvente. Se você está procurando por uma maneira divertida de passar o tempo, explorar novos jogos e viver grandes emoções, a 55kd pode ser o lugar ideal. Neste artigo, vamos explorar como a 55kd se destaca, desde sua introdução até a experiência dos jogadores e a vasta gama de jogos disponíveis.

Introdução à Plataforma 55kd A 55kd surgiu com a missão de revolucionar o mundo dos jogos online, oferecendo uma plataforma fácil de navegar, segura e repleta de opções de entretenimento. Com um design moderno e uma interface amigável, a plataforma foi desenvolvida para atender tanto jogadores iniciantes quanto veteranos, garantindo que todos se sintam confortáveis e imersos na experiência.

A 55kd prioriza a acessibilidade e a praticidade, permitindo que os jogadores acessem os jogos de forma rápida e sem complicações. Com um sistema eficiente de registro e uma plataforma intuitiva, novos usuários podem se cadastrar e começar a jogar rapidamente, sem a necessidade de processos complexos.

Variedade de Jogos na 55kd A plataforma 55kdse destaca pela grande variedade de jogos que oferece aos seus usuários. Desde opções de estratégia até os jogos mais emocionantes de sorte e habilidade, há algo para todos os gostos. A cada visita, os jogadores podem esperar novas e emocionantes opções para explorar.

Entre os jogos mais populares, destacam-se as opções de jogos de mesa, slots de vídeo e jogos de habilidade. Cada jogo foi cuidadosamente selecionado e desenvolvido para garantir uma experiência de alta qualidade, com gráficos impressionantes, jogabilidade fluida e recursos inovadores.

Os jogos de mesa, por exemplo, oferecem desafios para aqueles que preferem jogos de raciocínio e estratégia. Já os slots de vídeo são ideais para quem busca emoção e diversão instantânea, com uma ampla gama de temas e bônus que aumentam a adrenalina.

Além disso, a 55kd também oferece jogos de habilidade, permitindo que os jogadores mostrem sua destreza e competência. Esses jogos são perfeitos para aqueles que gostam de testar suas habilidades e estratégias, competindo com outros jogadores por grandes prêmios.

A Experiência do Jogador na 55kd Uma das maiores preocupações da 55kd é garantir que seus jogadores tenham uma experiência de jogo impecável. A plataforma investe constantemente em melhorias para proporcionar um ambiente seguro, rápido e transparente. A segurança é uma prioridade, e a plataforma utiliza tecnologias de ponta para proteger as informações dos usuários, além de garantir transações rápidas e seguras.

A 55kd também se destaca pelo seu suporte ao cliente. Se os jogadores tiverem dúvidas ou enfrentarem problemas durante o jogo, uma equipe de suporte altamente treinada está disponível para oferecer assistência imediata. O suporte é acessível por vários canais, como chat ao vivo e e-mail, garantindo que os jogadores se sintam sempre amparados.

Além disso, a plataforma oferece um sistema de bônus e promoções que torna a experiência ainda mais emocionante. Oferecendo prêmios, ofertas exclusivas e recompensas constantes, a 55kd mantém os jogadores motivados e engajados, proporcionando uma sensação contínua de novidade e prazer.

Conclusão A 55kd se destaca como uma plataforma completa e de alta qualidade, que oferece não apenas uma ampla gama de jogos, mas também uma experiência personalizada para cada jogador. Com uma interface intuitiva, jogos diversificados e um suporte excepcional, a 55kd é a escolha ideal para quem busca diversão e entretenimento de qualidade.

Se você ainda não experimentou a 55kd, está na hora de se juntar a essa comunidade vibrante e explorar tudo o que ela tem a oferecer. Prepare-se para uma jornada inesquecível de diversão, desafios e grandes vitórias.

-

@ 04c915da:3dfbecc9

2025-05-16 17:59:23

@ 04c915da:3dfbecc9

2025-05-16 17:59:23Recently we have seen a wave of high profile X accounts hacked. These attacks have exposed the fragility of the status quo security model used by modern social media platforms like X. Many users have asked if nostr fixes this, so lets dive in. How do these types of attacks translate into the world of nostr apps? For clarity, I will use X’s security model as representative of most big tech social platforms and compare it to nostr.

The Status Quo

On X, you never have full control of your account. Ultimately to use it requires permission from the company. They can suspend your account or limit your distribution. Theoretically they can even post from your account at will. An X account is tied to an email and password. Users can also opt into two factor authentication, which adds an extra layer of protection, a login code generated by an app. In theory, this setup works well, but it places a heavy burden on users. You need to create a strong, unique password and safeguard it. You also need to ensure your email account and phone number remain secure, as attackers can exploit these to reset your credentials and take over your account. Even if you do everything responsibly, there is another weak link in X infrastructure itself. The platform’s infrastructure allows accounts to be reset through its backend. This could happen maliciously by an employee or through an external attacker who compromises X’s backend. When an account is compromised, the legitimate user often gets locked out, unable to post or regain control without contacting X’s support team. That process can be slow, frustrating, and sometimes fruitless if support denies the request or cannot verify your identity. Often times support will require users to provide identification info in order to regain access, which represents a privacy risk. The centralized nature of X means you are ultimately at the mercy of the company’s systems and staff.

Nostr Requires Responsibility

Nostr flips this model radically. Users do not need permission from a company to access their account, they can generate as many accounts as they want, and cannot be easily censored. The key tradeoff here is that users have to take complete responsibility for their security. Instead of relying on a username, password, and corporate servers, nostr uses a private key as the sole credential for your account. Users generate this key and it is their responsibility to keep it safe. As long as you have your key, you can post. If someone else gets it, they can post too. It is that simple. This design has strong implications. Unlike X, there is no backend reset option. If your key is compromised or lost, there is no customer support to call. In a compromise scenario, both you and the attacker can post from the account simultaneously. Neither can lock the other out, since nostr relays simply accept whatever is signed with a valid key.

The benefit? No reliance on proprietary corporate infrastructure.. The negative? Security rests entirely on how well you protect your key.

Future Nostr Security Improvements

For many users, nostr’s standard security model, storing a private key on a phone with an encrypted cloud backup, will likely be sufficient. It is simple and reasonably secure. That said, nostr’s strength lies in its flexibility as an open protocol. Users will be able to choose between a range of security models, balancing convenience and protection based on need.

One promising option is a web of trust model for key rotation. Imagine pre-selecting a group of trusted friends. If your account is compromised, these people could collectively sign an event announcing the compromise to the network and designate a new key as your legitimate one. Apps could handle this process seamlessly in the background, notifying followers of the switch without much user interaction. This could become a popular choice for average users, but it is not without tradeoffs. It requires trust in your chosen web of trust, which might not suit power users or large organizations. It also has the issue that some apps may not recognize the key rotation properly and followers might get confused about which account is “real.”

For those needing higher security, there is the option of multisig using FROST (Flexible Round-Optimized Schnorr Threshold). In this setup, multiple keys must sign off on every action, including posting and updating a profile. A hacker with just one key could not do anything. This is likely overkill for most users due to complexity and inconvenience, but it could be a game changer for large organizations, companies, and governments. Imagine the White House nostr account requiring signatures from multiple people before a post goes live, that would be much more secure than the status quo big tech model.

Another option are hardware signers, similar to bitcoin hardware wallets. Private keys are kept on secure, offline devices, separate from the internet connected phone or computer you use to broadcast events. This drastically reduces the risk of remote hacks, as private keys never touches the internet. It can be used in combination with multisig setups for extra protection. This setup is much less convenient and probably overkill for most but could be ideal for governments, companies, or other high profile accounts.

Nostr’s security model is not perfect but is robust and versatile. Ultimately users are in control and security is their responsibility. Apps will give users multiple options to choose from and users will choose what best fits their need.

-

@ 1bc70a01:24f6a411

2025-05-21 07:34:09

@ 1bc70a01:24f6a411

2025-05-21 07:34:09{"url":"https://github.com/damus-io/damus","createdAt":1747812849570}

-

@ a5ee4475:2ca75401

2025-05-15 14:44:45

@ a5ee4475:2ca75401

2025-05-15 14:44:45lista #descentralismo #compilado #portugues

*Algumas destas listas ainda estão sendo trocadas, portanto as versões mais recentes delas só estão visíveis no Amethyst por causa da ferramenta de edição.

Clients do Nostr e Outras Coisas

nostr:naddr1qq245dz5tqe8w46swpphgmr4f3047s6629t45qg4waehxw309aex2mrp0yhxgctdw4eju6t09upzpf0wg36k3g3hygndv3cp8f2j284v0hfh4dqgqjj3yxnreck2w4qpqvzqqqr4guxde6sl

Modelos de IA e Ferramentas

nostr:naddr1qq24xwtyt9v5wjzefe6523j32dy5ga65gagkjqgswaehxw309ahx7um5wghx6mmd9upzpf0wg36k3g3hygndv3cp8f2j284v0hfh4dqgqjj3yxnreck2w4qpqvzqqqr4guk62czu

Iniciativas de Bitcoin

nostr:naddr1qvzqqqr4gupzpf0wg36k3g3hygndv3cp8f2j284v0hfh4dqgqjj3yxnreck2w4qpqq2nvmn5va9x2nrxfd2k5smyf3ux7vesd9znyqxygt4

Profissionais Brasileiros no Nostr

nostr:naddr1qq24qmnkwe6y67zlxgc4sumrxpxxce3kf9fn2qghwaehxw309aex2mrp0yhxummnw3ezucnpdejz7q3q5hhygatg5gmjyfkkguqn54f9r6k8m5m6ksyqffgjrf3uut982sqsxpqqqp65wp8uedu

Comunidades em Português no Nostr

nostr:naddr1qq2hwcejv4ykgdf3v9gxykrxfdqk753jxcc4gqg4waehxw309aex2mrp0yhxgctdw4eju6t09upzpf0wg36k3g3hygndv3cp8f2j284v0hfh4dqgqjj3yxnreck2w4qpqvzqqqr4gu455fm3

Grupos em Português no Nostr

nostr:nevent1qqs98kldepjmlxngupsyth40n0h5lw7z5ut5w4scvh27alc0w86tevcpzpmhxue69uhkummnw3ezumt0d5hsygy7fff8g6l23gp5uqtuyqwkqvucx6mhe7r9h7v6wyzzj0v6lrztcspsgqqqqqqs3ndneh

Jogos de Código Aberto

Open Source Games nostr:naddr1qvzqqqr4gupzpf0wg36k3g3hygndv3cp8f2j284v0hfh4dqgqjj3yxnreck2w4qpqq2kvwp3v4hhvk2sw3j5sm6h23g5wkz5ddzhz8x40v0

Itens Úteis com Esquemas Disponíveis

nostr:naddr1qqgrqvp5vd3kycejxask2efcv4jr2qgswaehxw309ahx7um5wghx6mmd9upzpf0wg36k3g3hygndv3cp8f2j284v0hfh4dqgqjj3yxnreck2w4qpqvzqqqr4guc43v6c

Formatação de Texto em Markdown

(Amethyst, Yakihone e outros) nostr:naddr1qvzqqqr4gupzpf0wg36k3g3hygndv3cp8f2j284v0hfh4dqgqjj3yxnreck2w4qpqq2454m8dfzn26z4f34kvu6fw4rysnrjxfm42wfpe90

Outros Links

nostr:nevent1qqsrm6ywny5r7ajakpppp0lt525n0s33x6tyn6pz0n8ws8k2tqpqracpzpmhxue69uhkummnw3ezumt0d5hsygp6e5ns0nv3dun430jky25y4pku6ylz68rz6zs7khv29q6rj5peespsgqqqqqqsmfwa78

-

@ 088436cd:9d2646cc

2025-05-01 21:01:55

@ 088436cd:9d2646cc

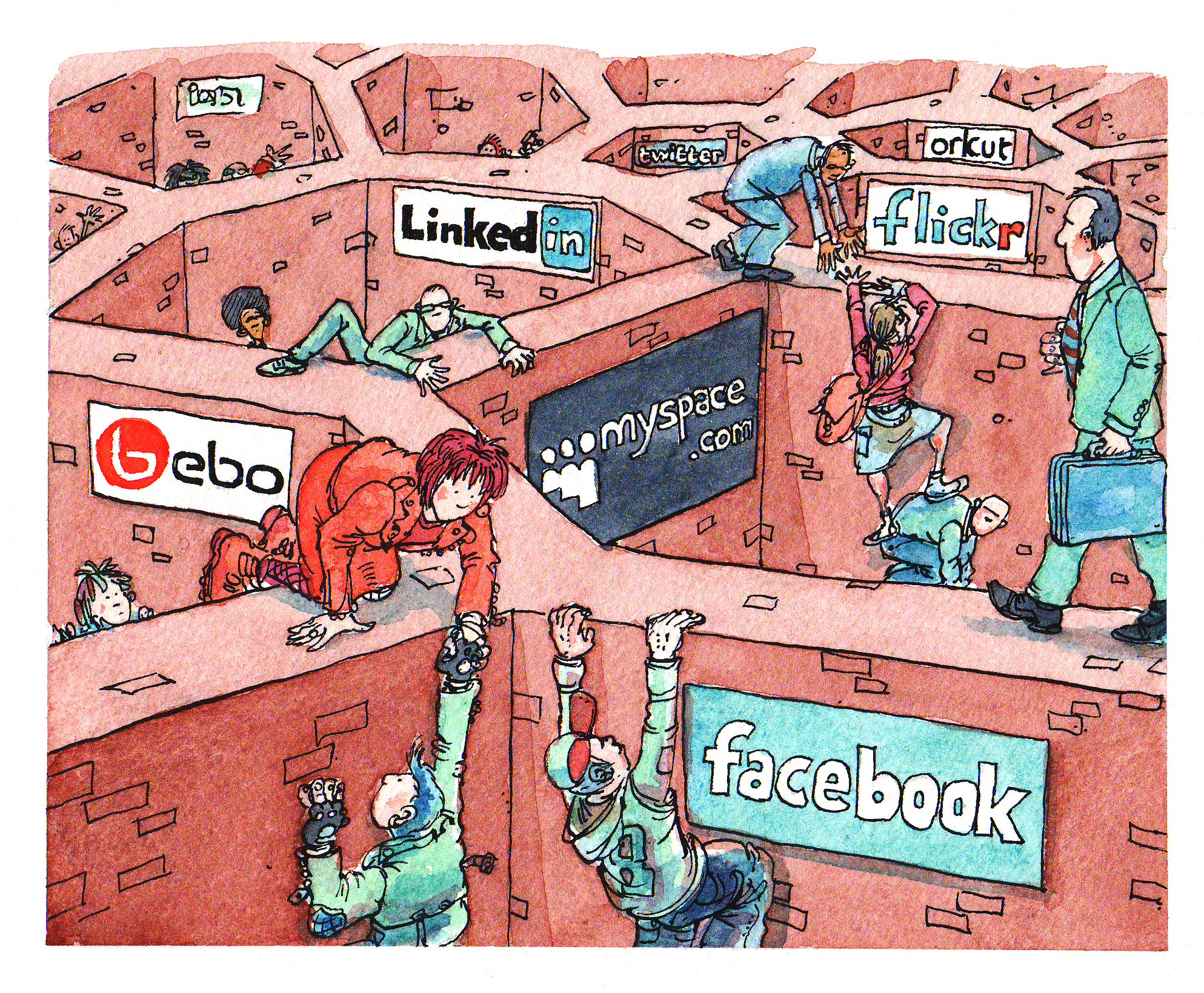

2025-05-01 21:01:55The arrival of the coronavirus brought not only illness and death but also fear and panic. In such an environment of uncertainty, people have naturally stocked up on necessities, not knowing when things will return to normal.

Retail shelves have been cleared out, and even online suppliers like Amazon and Walmart are out of stock for some items. Independent sellers on these e-commerce platforms have had to fill the gap. With the huge increase in demand, they have found that their inventory has skyrocketed in value.

Many in need of these items (e.g. toilet paper, hand sanitizer and masks) balk at the new prices. They feel they are being taken advantage of in a time of need and call for intervention by the government to lower prices. The government has heeded that call, labeling the independent sellers as "price gougers" and threatening sanctions if they don't lower their prices. Amazon has suspended seller accounts and law enforcement at all levels have threatened to prosecute. Prices have dropped as a result and at first glance this seems like a victory for fair play. But, we will have to dig deeper to understand the unseen consequences of this intervention.

We must look at the economics of the situation, how supply and demand result in a price and how that price acts as a signal that goes out to everyone, informing them of underlying conditions in the economy and helping coordinate their actions.

It all started with a rise in demand. Given a fixed supply (e.g., the limited stock on shelves and in warehouses), an increase in demand inevitably leads to higher prices. Most people are familiar with this phenomenon, such as paying more for airline tickets during holidays or surge pricing for rides.

Higher prices discourage less critical uses of scarce resources. For example, you might not pay $1,000 for a plane ticket to visit your aunt if you can get one for $100 the following week, but someone else might pay that price to visit a dying relative. They value that plane seat more than you.

*** During the crisis, demand surged and their shelves emptied even though

However, retail outlets have not raised prices. They have kept them low, so the low-value uses of things like toilet paper, masks and hand sanitizer has continued. Often, this "use" just takes the form of hoarding. At everyday low prices, it makes sense to buy hundreds of rolls and bottles. You know you will use them eventually, so why not stock up? And, with all those extra supplies in the closet and basement, you don't need to change your behavior much. You don't have to ration your use.

At the low prices, these scarce resources got bought up faster and faster until there was simply none left. The reality of the situation became painfully clear to those who didn't panic and got to the store late: You have no toilet paper and you're not going to any time soon.

However, if prices had been allowed to rise, a number of effects would have taken place that would have coordinated the behavior of everyone so that valuable resources would not have been wasted or hoarded, and everyone could have had access to what they needed.

On the demand side, if prices had been allowed to rise, people would have begun to self-ration. You might leave those extra plies on the roll next time if you know they will cost ten times as much to replace. Or, you might choose to clean up a spill with a rag rather than disposable tissue. Most importantly, you won't hoard as much. That 50th bottle of hand sanitizer might just not be worth it at the new, high price. You'll leave it on the shelf for someone else who may have none.

On the supply side, higher prices would have incentivized people to offer up more of their stockpiles for sale. If you have a pallet full of toilet paper in your basement and all of the sudden they are worth $15 per roll, you might just list a few online. But, if it is illegal to do so, you probably won't.

Imagine you run a business installing insulation and have a few thousand respirator masks on hand for your employees. During a pandemic, it is much more important that people breathe filtered air than that insulation get installed, and that fact is reflected in higher prices. You will sell your extra masks at the higher price rather than store them for future insulation jobs, and the scarce resource will be put to its most important use.

Producers of hand sanitizer would go into overdrive if prices were allowed to rise. They would pay their employees overtime, hire new ones, and pay a premium for their supplies, making sure their raw materials don't go to less important uses.

These kinds of coordinated actions all across the economy would be impossible without real prices to guide them. How do you know if it makes sense to spend an extra $10k bringing a thousand masks to market unless you know you can get more than $10 per mask? If the price is kept artificially low, you simply can't do it. The money just isn't there.

These are the immediate effects of a price change, but incredibly, price changes also coordinate people's actions across space and time.

Across space, there are different supply and demand conditions in different places, and thus prices are not uniform. We know some places are real "hot spots" for the virus, while others are mostly unaffected. High demand in the hot spots leads to higher prices there, which attracts more of the resource to those areas. Boxes and boxes of essential items would pour in where they are needed most from where they are needed least, but only if prices were allowed to adjust freely.

This would be accomplished by individuals and businesses buying low in the unaffected areas, selling high in the hot spots and subtracting their labor and transportation costs from the difference. Producers of new supply would know exactly where it is most needed and ship to the high-demand, high-price areas first. The effect of these actions is to increase prices in the low demand areas and reduce them in the high demand areas. People in the low demand areas will start to self-ration more, reflecting the reality of their neighbors, and people in the hotspots will get some relief.

However, by artificially suppressing prices in the hot spot, people there will simply buy up the available supply and run out, and it will be cost prohibitive to bring in new supply from low-demand areas.

Prices coordinate economic actions across time as well. Just as entrepreneurs and businesses can profit by transporting scarce necessities from low-demand to high-demand areas, they can also profit by buying in low-demand times and storing their merchandise for when it is needed most.

Just as allowing prices to freely adjust in one area relative to another will send all the right signals for the optimal use of a scarce resource, allowing prices to freely adjust over time will do the same.

When an entrepreneur buys up resources during low-demand times in anticipation of a crisis, she restricts supply ahead of the crisis, which leads to a price increase. She effectively bids up the price. The change in price affects consumers and producers in all the ways mentioned above. Consumers self-ration more, and producers bring more of the resource to market.

Our entrepreneur has done a truly incredible thing. She has predicted the future, and by so doing has caused every individual in the economy to prepare for a shortage they don't even know is coming! And, by discouraging consumption and encouraging production ahead of time, she blunts the impact the crisis will have. There will be more of the resource to go around when it is needed most.

On top of this, our entrepreneur still has her stockpile she saved back when everyone else was blithely using it up. She can now further mitigate the damage of the crisis by selling her stock during the worst of it, when people are most desperate for relief. She will know when this is because the price will tell her, but only if it is allowed to adjust freely. When the price is at its highest is when people need the resource the most, and those willing to pay will not waste it or hoard it. They will put it to its highest valued use.

The economy is like a big bus we are all riding in, going down a road with many twists and turns. Just as it is difficult to see into the future, it is difficult to see out the bus windows at the road ahead.

On the dashboard, we don't have a speedometer or fuel gauge. Instead we have all the prices for everything in the economy. Prices are what tell us the condition of the bus and the road. They tell us everything. Without them, we are blind.

Good times are a smooth road. Consumer prices and interest rates are low, investment returns are steady. We hit the gas and go fast. But, the road is not always straight and smooth. Sometimes there are sharp turns and rough patches. Successful entrepreneurs are the ones who can see what is coming better than everyone else. They are our navigators.

When they buy up scarce resources ahead of a crisis, they are hitting the brakes and slowing us down. When they divert resources from one area to another, they are steering us onto a smoother path. By their actions in the market, they adjust the prices on our dashboard to reflect the conditions of the road ahead, so we can prepare for, navigate and get through the inevitable difficulties we will face.

Interfering with the dashboard by imposing price floors or price caps doesn't change the conditions of the road (the number of toilet paper rolls in existence hasn't changed). All it does is distort our perception of those conditions. We think the road is still smooth--our heavy foot stomping the gas--as we crash onto a rocky dirt road at 80 miles per hour (empty shelves at the store for weeks on end).

Supply, demand and prices are laws of nature. All of this is just how things work. It isn't right or wrong in a moral sense. Price caps lead to waste, shortages and hoarding as surely as water flows downhill. The opposite--allowing prices to adjust freely--leads to conservation of scarce resources and their being put to their highest valued use. And yes, it leads to profits for the entrepreneurs who were able to correctly predict future conditions, and losses for those who weren't.

Is it fair that they should collect these profits? On the one hand, anyone could have stocked up on toilet paper, hand sanitizer and face masks at any time before the crisis, so we all had a fair chance to get the supplies cheaply. On the other hand, it just feels wrong that some should profit so much at a time when there is so much need.

Our instinct in the moment is to see the entrepreneur as a villain, greedy "price gouger". But we don't see the long chain of economic consequences the led to the situation we feel is unfair.

If it weren't for anti-price-gouging laws, the major retailers would have raised their prices long before the crisis became acute. When they saw demand outstrip supply, they would have raised prices, not by 100 fold, but gradually and long before anyone knew how serious things would have become. Late comers would have had to pay more, but at least there would be something left on the shelf.

As an entrepreneur, why take risks trying to anticipate the future if you can't reap the reward when you are right? Instead of letting instead of letting entrepreneurs--our navigators--guide us, we are punishing and vilifying them, trying to force prices to reflect a reality that simply doesn't exist.

In a crisis, more than any other time, prices must be allowed to fluctuate. To do otherwise is to blind ourselves at a time when danger and uncertainty abound. It is economic suicide.

In a crisis, there is great need, and the way to meet that need is not by pretending it's not there, by forcing prices to reflect a world where there isn't need. They way to meet the need is the same it has always been, through charity.

If the people in government want to help, the best way for the to do so is to be charitable and reduce their taxes and fees as much as possible, ideally to zero in a time of crisis. Amazon, for example, could instantly reduce the price of all crisis related necessities by 20% if they waived their fee. This would allow for more uses by more people of these scarce supplies as hoarders release their stockpiles on to the market, knowing they can get 20% more for their stock. Governments could reduce or eliminate their tax burden on high-demand, crisis-related items and all the factors that go into their production, with the same effect: a reduction in prices and expansion of supply. All of us, including the successful entrepreneurs and the wealthy for whom high prices are not a great burden, could donate to relief efforts.

These ideas are not new or untested. This is core micro economics. It has been taught for hundreds of years in universities the world over. The fact that every crisis that comes along stirs up ire against entrepreneurs indicates not that the economics is wrong, but that we have a strong visceral reaction against what we perceive to be unfairness. This is as it should be. Unfairness is wrong and the anger it stirs in us should compel us to right the wrong. Our anger itself isn't wrong, it's just misplaced.

Entrepreneurs didn't cause the prices to rise. Our reaction to a virus did that. We saw a serious threat and an uncertain future and followed our natural impulse to hoard. Because prices at major retail suppliers didn't rise, that impulse ran rampant and we cleared the shelves until there was nothing left. We ran the bus right off the road and them blamed the entrepreneurs for showing us the reality of our situation, for shaking us out of the fantasy of low prices.

All of this is not to say that entrepreneurs are high-minded public servants. They are just doing their job. Staking your money on an uncertain future is a risky business. There are big risks and big rewards. Most entrepreneurs just scrape by or lose their capital in failed ventures.

However, the ones that get it right must be allowed to keep their profits, or else no one will try and we'll all be driving blind. We need our navigators. It doesn't even matter if they know all the positive effects they are having on the rest of us and the economy as a whole. So long as they are buying low and selling high--so long as they are doing their job--they will be guiding the rest of us through the good times and the bad, down the open road and through the rough spots.

-

@ 52b4a076:e7fad8bd

2025-04-28 00:48:57

@ 52b4a076:e7fad8bd

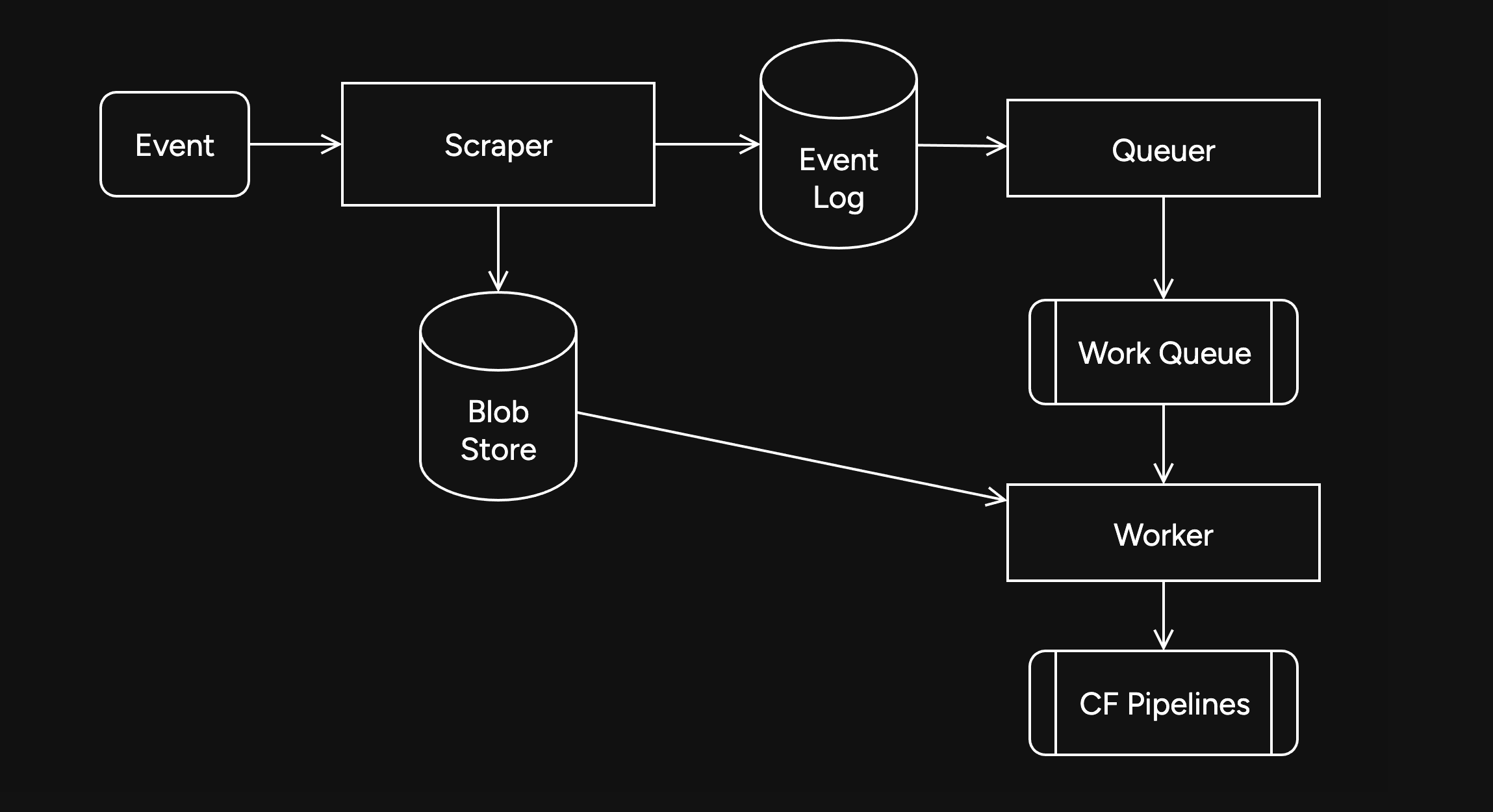

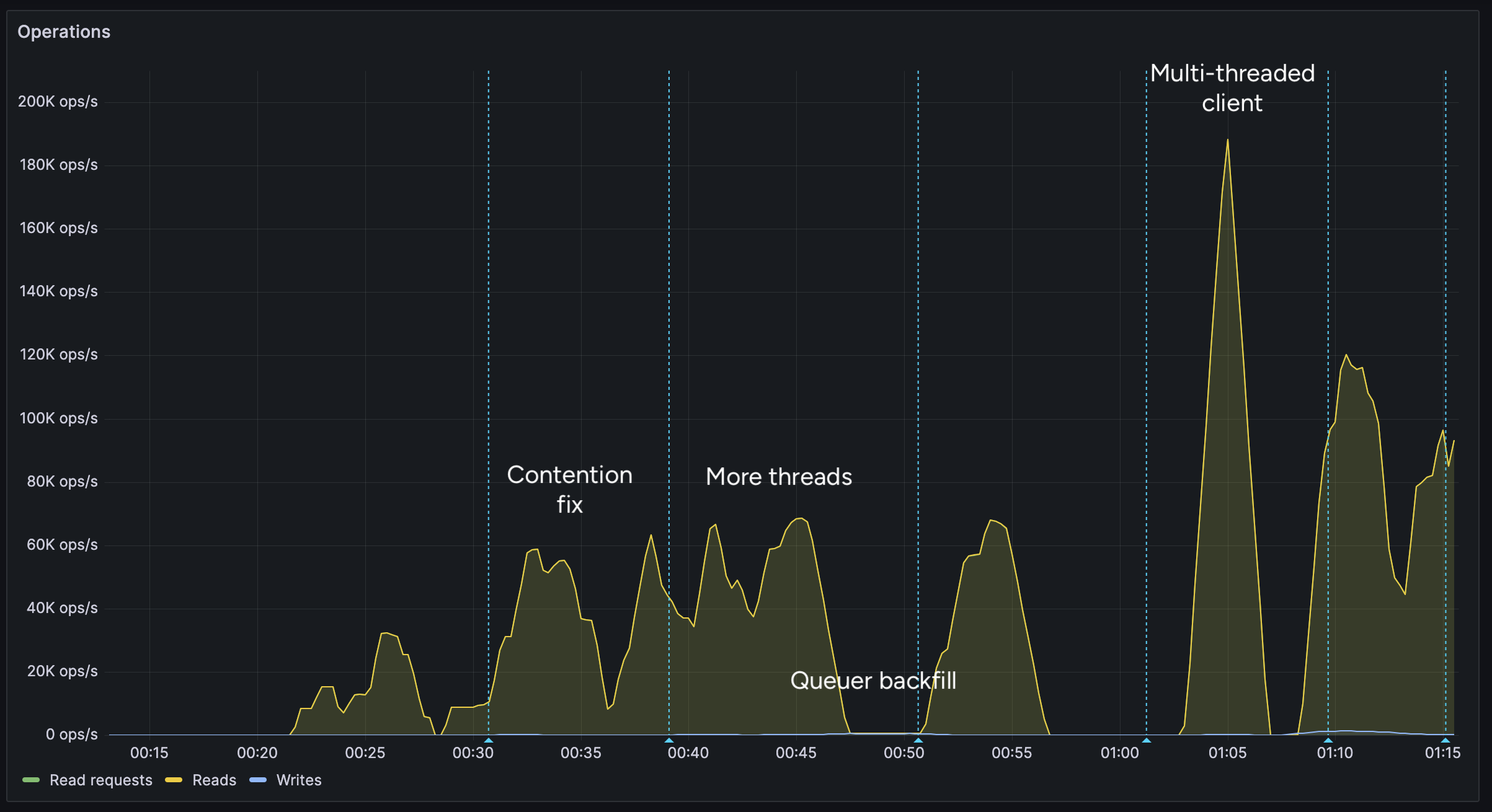

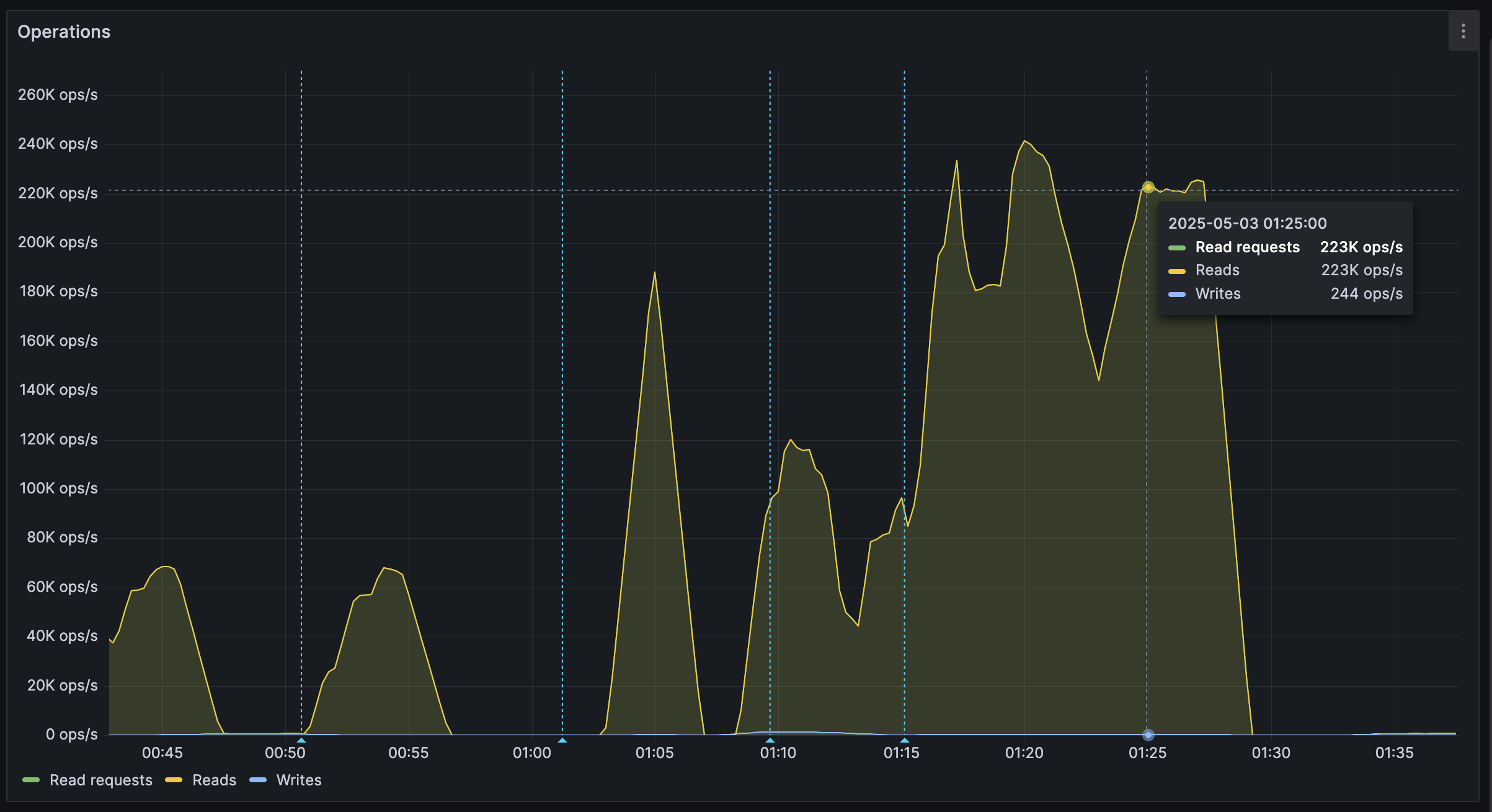

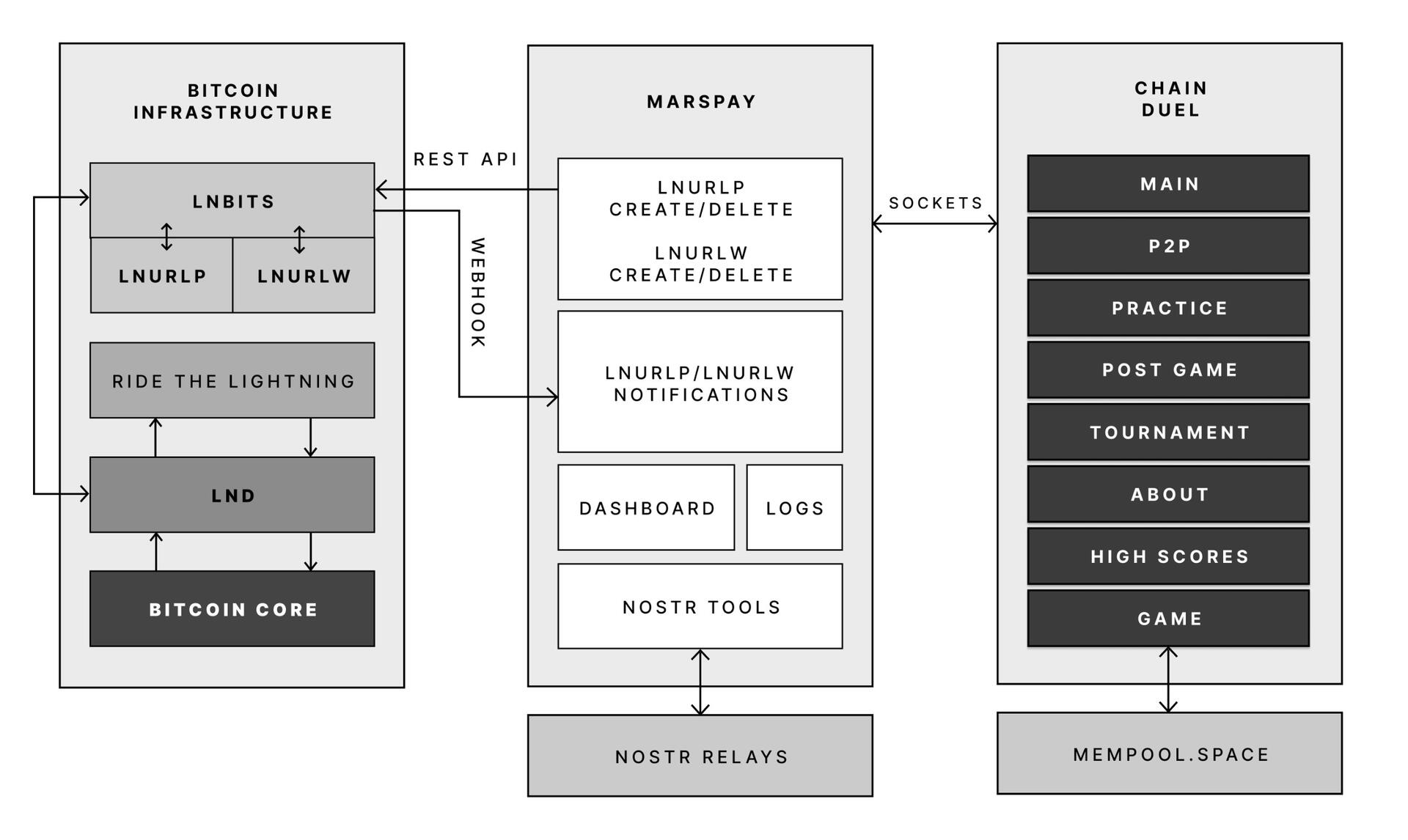

2025-04-28 00:48:57I have been recently building NFDB, a new relay DB. This post is meant as a short overview.

Regular relays have challenges

Current relay software have significant challenges, which I have experienced when hosting Nostr.land: - Scalability is only supported by adding full replicas, which does not scale to large relays. - Most relays use slow databases and are not optimized for large scale usage. - Search is near-impossible to implement on standard relays. - Privacy features such as NIP-42 are lacking. - Regular DB maintenance tasks on normal relays require extended downtime. - Fault-tolerance is implemented, if any, using a load balancer, which is limited. - Personalization and advanced filtering is not possible. - Local caching is not supported.

NFDB: A scalable database for large relays

NFDB is a new database meant for medium-large scale relays, built on FoundationDB that provides: - Near-unlimited scalability - Extended fault tolerance - Instant loading - Better search - Better personalization - and more.

Search

NFDB has extended search capabilities including: - Semantic search: Search for meaning, not words. - Interest-based search: Highlight content you care about. - Multi-faceted queries: Easily filter by topic, author group, keywords, and more at the same time. - Wide support for event kinds, including users, articles, etc.

Personalization

NFDB allows significant personalization: - Customized algorithms: Be your own algorithm. - Spam filtering: Filter content to your WoT, and use advanced spam filters. - Topic mutes: Mute topics, not keywords. - Media filtering: With Nostr.build, you will be able to filter NSFW and other content - Low data mode: Block notes that use high amounts of cellular data. - and more

Other

NFDB has support for many other features such as: - NIP-42: Protect your privacy with private drafts and DMs - Microrelays: Easily deploy your own personal microrelay - Containers: Dedicated, fast storage for discoverability events such as relay lists

Calcite: A local microrelay database

Calcite is a lightweight, local version of NFDB that is meant for microrelays and caching, meant for thousands of personal microrelays.

Calcite HA is an additional layer that allows live migration and relay failover in under 30 seconds, providing higher availability compared to current relays with greater simplicity. Calcite HA is enabled in all Calcite deployments.

For zero-downtime, NFDB is recommended.

Noswhere SmartCache

Relays are fixed in one location, but users can be anywhere.

Noswhere SmartCache is a CDN for relays that dynamically caches data on edge servers closest to you, allowing: - Multiple regions around the world - Improved throughput and performance - Faster loading times

routerd

routerdis a custom load-balancer optimized for Nostr relays, integrated with SmartCache.routerdis specifically integrated with NFDB and Calcite HA to provide fast failover and high performance.Ending notes

NFDB is planned to be deployed to Nostr.land in the coming weeks.

A lot more is to come. 👀️️️️️️

-

@ 4ba8e86d:89d32de4

2025-04-21 02:13:56

@ 4ba8e86d:89d32de4

2025-04-21 02:13:56Tutorial feito por nostr:nostr:npub1rc56x0ek0dd303eph523g3chm0wmrs5wdk6vs0ehd0m5fn8t7y4sqra3tk poste original abaixo:

Parte 1 : http://xh6liiypqffzwnu5734ucwps37tn2g6npthvugz3gdoqpikujju525yd.onion/263585/tutorial-debloat-de-celulares-android-via-adb-parte-1

Parte 2 : http://xh6liiypqffzwnu5734ucwps37tn2g6npthvugz3gdoqpikujju525yd.onion/index.php/263586/tutorial-debloat-de-celulares-android-via-adb-parte-2

Quando o assunto é privacidade em celulares, uma das medidas comumente mencionadas é a remoção de bloatwares do dispositivo, também chamado de debloat. O meio mais eficiente para isso sem dúvidas é a troca de sistema operacional. Custom Rom’s como LineageOS, GrapheneOS, Iodé, CalyxOS, etc, já são bastante enxutos nesse quesito, principalmente quanto não é instalado os G-Apps com o sistema. No entanto, essa prática pode acabar resultando em problemas indesejados como a perca de funções do dispositivo, e até mesmo incompatibilidade com apps bancários, tornando este método mais atrativo para quem possui mais de um dispositivo e separando um apenas para privacidade. Pensando nisso, pessoas que possuem apenas um único dispositivo móvel, que são necessitadas desses apps ou funções, mas, ao mesmo tempo, tem essa visão em prol da privacidade, buscam por um meio-termo entre manter a Stock rom, e não ter seus dados coletados por esses bloatwares. Felizmente, a remoção de bloatwares é possível e pode ser realizada via root, ou mais da maneira que este artigo irá tratar, via adb.

O que são bloatwares?

Bloatware é a junção das palavras bloat (inchar) + software (programa), ou seja, um bloatware é basicamente um programa inútil ou facilmente substituível — colocado em seu dispositivo previamente pela fabricante e operadora — que está no seu dispositivo apenas ocupando espaço de armazenamento, consumindo memória RAM e pior, coletando seus dados e enviando para servidores externos, além de serem mais pontos de vulnerabilidades.

O que é o adb?

O Android Debug Brigde, ou apenas adb, é uma ferramenta que se utiliza das permissões de usuário shell e permite o envio de comandos vindo de um computador para um dispositivo Android exigindo apenas que a depuração USB esteja ativa, mas também pode ser usada diretamente no celular a partir do Android 11, com o uso do Termux e a depuração sem fio (ou depuração wifi). A ferramenta funciona normalmente em dispositivos sem root, e também funciona caso o celular esteja em Recovery Mode.

Requisitos:

Para computadores:

• Depuração USB ativa no celular; • Computador com adb; • Cabo USB;

Para celulares:

• Depuração sem fio (ou depuração wifi) ativa no celular; • Termux; • Android 11 ou superior;

Para ambos:

• Firewall NetGuard instalado e configurado no celular; • Lista de bloatwares para seu dispositivo;

Ativação de depuração:

Para ativar a Depuração USB em seu dispositivo, pesquise como ativar as opções de desenvolvedor de seu dispositivo, e lá ative a depuração. No caso da depuração sem fio, sua ativação irá ser necessária apenas no momento que for conectar o dispositivo ao Termux.

Instalação e configuração do NetGuard

O NetGuard pode ser instalado através da própria Google Play Store, mas de preferência instale pela F-Droid ou Github para evitar telemetria.

F-Droid: https://f-droid.org/packages/eu.faircode.netguard/

Github: https://github.com/M66B/NetGuard/releases

Após instalado, configure da seguinte maneira:

Configurações → padrões (lista branca/negra) → ative as 3 primeiras opções (bloquear wifi, bloquear dados móveis e aplicar regras ‘quando tela estiver ligada’);

Configurações → opções avançadas → ative as duas primeiras (administrar aplicativos do sistema e registrar acesso a internet);

Com isso, todos os apps estarão sendo bloqueados de acessar a internet, seja por wifi ou dados móveis, e na página principal do app basta permitir o acesso a rede para os apps que você vai usar (se necessário). Permita que o app rode em segundo plano sem restrição da otimização de bateria, assim quando o celular ligar, ele já estará ativo.

Lista de bloatwares

Nem todos os bloatwares são genéricos, haverá bloatwares diferentes conforme a marca, modelo, versão do Android, e até mesmo região.

Para obter uma lista de bloatwares de seu dispositivo, caso seu aparelho já possua um tempo de existência, você encontrará listas prontas facilmente apenas pesquisando por elas. Supondo que temos um Samsung Galaxy Note 10 Plus em mãos, basta pesquisar em seu motor de busca por:

Samsung Galaxy Note 10 Plus bloatware listProvavelmente essas listas já terão inclusas todos os bloatwares das mais diversas regiões, lhe poupando o trabalho de buscar por alguma lista mais específica.

Caso seu aparelho seja muito recente, e/ou não encontre uma lista pronta de bloatwares, devo dizer que você acaba de pegar em merda, pois é chato para um caralho pesquisar por cada aplicação para saber sua função, se é essencial para o sistema ou se é facilmente substituível.

De antemão já aviso, que mais para frente, caso vossa gostosura remova um desses aplicativos que era essencial para o sistema sem saber, vai acabar resultando na perda de alguma função importante, ou pior, ao reiniciar o aparelho o sistema pode estar quebrado, lhe obrigando a seguir com uma formatação, e repetir todo o processo novamente.

Download do adb em computadores

Para usar a ferramenta do adb em computadores, basta baixar o pacote chamado SDK platform-tools, disponível através deste link: https://developer.android.com/tools/releases/platform-tools. Por ele, você consegue o download para Windows, Mac e Linux.

Uma vez baixado, basta extrair o arquivo zipado, contendo dentro dele uma pasta chamada platform-tools que basta ser aberta no terminal para se usar o adb.

Download do adb em celulares com Termux.

Para usar a ferramenta do adb diretamente no celular, antes temos que baixar o app Termux, que é um emulador de terminal linux, e já possui o adb em seu repositório. Você encontra o app na Google Play Store, mas novamente recomendo baixar pela F-Droid ou diretamente no Github do projeto.

F-Droid: https://f-droid.org/en/packages/com.termux/

Github: https://github.com/termux/termux-app/releases

Processo de debloat

Antes de iniciarmos, é importante deixar claro que não é para você sair removendo todos os bloatwares de cara sem mais nem menos, afinal alguns deles precisam antes ser substituídos, podem ser essenciais para você para alguma atividade ou função, ou até mesmo são insubstituíveis.

Alguns exemplos de bloatwares que a substituição é necessária antes da remoção, é o Launcher, afinal, é a interface gráfica do sistema, e o teclado, que sem ele só é possível digitar com teclado externo. O Launcher e teclado podem ser substituídos por quaisquer outros, minha recomendação pessoal é por aqueles que respeitam sua privacidade, como Pie Launcher e Simple Laucher, enquanto o teclado pelo OpenBoard e FlorisBoard, todos open-source e disponíveis da F-Droid.

Identifique entre a lista de bloatwares, quais você gosta, precisa ou prefere não substituir, de maneira alguma você é obrigado a remover todos os bloatwares possíveis, modifique seu sistema a seu bel-prazer. O NetGuard lista todos os apps do celular com o nome do pacote, com isso você pode filtrar bem qual deles não remover.

Um exemplo claro de bloatware insubstituível e, portanto, não pode ser removido, é o com.android.mtp, um protocolo onde sua função é auxiliar a comunicação do dispositivo com um computador via USB, mas por algum motivo, tem acesso a rede e se comunica frequentemente com servidores externos. Para esses casos, e melhor solução mesmo é bloquear o acesso a rede desses bloatwares com o NetGuard.

MTP tentando comunicação com servidores externos:

Executando o adb shell

No computador

Faça backup de todos os seus arquivos importantes para algum armazenamento externo, e formate seu celular com o hard reset. Após a formatação, e a ativação da depuração USB, conecte seu aparelho e o pc com o auxílio de um cabo USB. Muito provavelmente seu dispositivo irá apenas começar a carregar, por isso permita a transferência de dados, para que o computador consiga se comunicar normalmente com o celular.

Já no pc, abra a pasta platform-tools dentro do terminal, e execute o seguinte comando:

./adb start-serverO resultado deve ser:

daemon not running; starting now at tcp:5037 daemon started successfully

E caso não apareça nada, execute:

./adb kill-serverE inicie novamente.

Com o adb conectado ao celular, execute:

./adb shellPara poder executar comandos diretamente para o dispositivo. No meu caso, meu celular é um Redmi Note 8 Pro, codinome Begonia.

Logo o resultado deve ser:

begonia:/ $

Caso ocorra algum erro do tipo:

adb: device unauthorized. This adb server’s $ADB_VENDOR_KEYS is not set Try ‘adb kill-server’ if that seems wrong. Otherwise check for a confirmation dialog on your device.

Verifique no celular se apareceu alguma confirmação para autorizar a depuração USB, caso sim, autorize e tente novamente. Caso não apareça nada, execute o kill-server e repita o processo.

No celular

Após realizar o mesmo processo de backup e hard reset citado anteriormente, instale o Termux e, com ele iniciado, execute o comando:

pkg install android-toolsQuando surgir a mensagem “Do you want to continue? [Y/n]”, basta dar enter novamente que já aceita e finaliza a instalação

Agora, vá até as opções de desenvolvedor, e ative a depuração sem fio. Dentro das opções da depuração sem fio, terá uma opção de emparelhamento do dispositivo com um código, que irá informar para você um código em emparelhamento, com um endereço IP e porta, que será usado para a conexão com o Termux.

Para facilitar o processo, recomendo que abra tanto as configurações quanto o Termux ao mesmo tempo, e divida a tela com os dois app’s, como da maneira a seguir:

Para parear o Termux com o dispositivo, não é necessário digitar o ip informado, basta trocar por “localhost”, já a porta e o código de emparelhamento, deve ser digitado exatamente como informado. Execute:

adb pair localhost:porta CódigoDeEmparelhamentoDe acordo com a imagem mostrada anteriormente, o comando ficaria “adb pair localhost:41255 757495”.

Com o dispositivo emparelhado com o Termux, agora basta conectar para conseguir executar os comandos, para isso execute:

adb connect localhost:portaObs: a porta que você deve informar neste comando não é a mesma informada com o código de emparelhamento, e sim a informada na tela principal da depuração sem fio.

Pronto! Termux e adb conectado com sucesso ao dispositivo, agora basta executar normalmente o adb shell:

adb shellRemoção na prática Com o adb shell executado, você está pronto para remover os bloatwares. No meu caso, irei mostrar apenas a remoção de um app (Google Maps), já que o comando é o mesmo para qualquer outro, mudando apenas o nome do pacote.

Dentro do NetGuard, verificando as informações do Google Maps:

Podemos ver que mesmo fora de uso, e com a localização do dispositivo desativado, o app está tentando loucamente se comunicar com servidores externos, e informar sabe-se lá que peste. Mas sem novidades até aqui, o mais importante é que podemos ver que o nome do pacote do Google Maps é com.google.android.apps.maps, e para o remover do celular, basta executar:

pm uninstall –user 0 com.google.android.apps.mapsE pronto, bloatware removido! Agora basta repetir o processo para o resto dos bloatwares, trocando apenas o nome do pacote.

Para acelerar o processo, você pode já criar uma lista do bloco de notas com os comandos, e quando colar no terminal, irá executar um atrás do outro.

Exemplo de lista:

Caso a donzela tenha removido alguma coisa sem querer, também é possível recuperar o pacote com o comando:

cmd package install-existing nome.do.pacotePós-debloat

Após limpar o máximo possível o seu sistema, reinicie o aparelho, caso entre no como recovery e não seja possível dar reboot, significa que você removeu algum app “essencial” para o sistema, e terá que formatar o aparelho e repetir toda a remoção novamente, desta vez removendo poucos bloatwares de uma vez, e reiniciando o aparelho até descobrir qual deles não pode ser removido. Sim, dá trabalho… quem mandou querer privacidade?

Caso o aparelho reinicie normalmente após a remoção, parabéns, agora basta usar seu celular como bem entender! Mantenha o NetGuard sempre executando e os bloatwares que não foram possíveis remover não irão se comunicar com servidores externos, passe a usar apps open source da F-Droid e instale outros apps através da Aurora Store ao invés da Google Play Store.

Referências: Caso você seja um Australopithecus e tenha achado este guia difícil, eis uma videoaula (3:14:40) do Anderson do canal Ciberdef, realizando todo o processo: http://odysee.com/@zai:5/Como-remover-at%C3%A9-200-APLICATIVOS-que-colocam-a-sua-PRIVACIDADE-E-SEGURAN%C3%87A-em-risco.:4?lid=6d50f40314eee7e2f218536d9e5d300290931d23

Pdf’s do Anderson citados na videoaula: créditos ao anon6837264 http://eternalcbrzpicytj4zyguygpmkjlkddxob7tptlr25cdipe5svyqoqd.onion/file/3863a834d29285d397b73a4af6fb1bbe67c888d72d30/t-05e63192d02ffd.pdf

Processo de instalação do Termux e adb no celular: https://youtu.be/APolZrPHSms

-

@ cefb08d1:f419beff

2025-05-21 06:34:00

@ cefb08d1:f419beff

2025-05-21 06:34:00https://stacker.news/items/985298

-

@ e3ba5e1a:5e433365

2025-04-15 11:03:15

@ e3ba5e1a:5e433365

2025-04-15 11:03:15Prelude

I wrote this post differently than any of my others. It started with a discussion with AI on an OPSec-inspired review of separation of powers, and evolved into quite an exciting debate! I asked Grok to write up a summary in my overall writing style, which it got pretty well. I've decided to post it exactly as-is. Ultimately, I think there are two solid ideas driving my stance here:

- Perfect is the enemy of the good

- Failure is the crucible of success

Beyond that, just some hard-core belief in freedom, separation of powers, and operating from self-interest.

Intro

Alright, buckle up. I’ve been chewing on this idea for a while, and it’s time to spit it out. Let’s look at the U.S. government like I’d look at a codebase under a cybersecurity audit—OPSEC style, no fluff. Forget the endless debates about what politicians should do. That’s noise. I want to talk about what they can do, the raw powers baked into the system, and why we should stop pretending those powers are sacred. If there’s a hole, either patch it or exploit it. No half-measures. And yeah, I’m okay if the whole thing crashes a bit—failure’s a feature, not a bug.

The Filibuster: A Security Rule with No Teeth

You ever see a firewall rule that’s more theater than protection? That’s the Senate filibuster. Everyone acts like it’s this untouchable guardian of democracy, but here’s the deal: a simple majority can torch it any day. It’s not a law; it’s a Senate preference, like choosing tabs over spaces. When people call killing it the “nuclear option,” I roll my eyes. Nuclear? It’s a button labeled “press me.” If a party wants it gone, they’ll do it. So why the dance?

I say stop playing games. Get rid of the filibuster. If you’re one of those folks who thinks it’s the only thing saving us from tyranny, fine—push for a constitutional amendment to lock it in. That’s a real patch, not a Post-it note. Until then, it’s just a vulnerability begging to be exploited. Every time a party threatens to nuke it, they’re admitting it’s not essential. So let’s stop pretending and move on.

Supreme Court Packing: Because Nine’s Just a Number