-

@ 2e8970de:63345c7a

2025-05-21 12:06:12

@ 2e8970de:63345c7a

2025-05-21 12:06:12https://x.com/Google/status/1924893837295546851

compare it to Will Smith eating Spaghetti from 2 years ago:

The end of objective truth from video evidence is nearing. In a sense we are retvrning to 1999.

https://stacker.news/items/985441

-

@ 21335073:a244b1ad

2025-05-09 13:56:57

@ 21335073:a244b1ad

2025-05-09 13:56:57Someone asked for my thoughts, so I’ll share them thoughtfully. I’m not here to dictate how to promote Nostr—I’m still learning about it myself. While I’m not new to Nostr, freedom tech is a newer space for me. I’m skilled at advocating for topics I deeply understand, but freedom tech isn’t my expertise, so take my words with a grain of salt. Nothing I say is set in stone.

Those who need Nostr the most are the ones most vulnerable to censorship on other platforms right now. Reaching them requires real-time awareness of global issues and the dynamic relationships between governments and tech providers, which can shift suddenly. Effective Nostr promoters must grasp this and adapt quickly.

The best messengers are people from or closely tied to these at-risk regions—those who truly understand the local political and cultural dynamics. They can connect with those in need when tensions rise. Ideal promoters are rational, trustworthy, passionate about Nostr, but above all, dedicated to amplifying people’s voices when it matters most.

Forget influencers, corporate-backed figures, or traditional online PR—it comes off as inauthentic, corny, desperate and forced. Nostr’s promotion should be grassroots and organic, driven by a few passionate individuals who believe in Nostr and the communities they serve.

The idea that “people won’t join Nostr due to lack of reach” is nonsense. Everyone knows X’s “reach” is mostly with bots. If humans want real conversations, Nostr is the place. X is great for propaganda, but Nostr is for the authentic voices of the people.

Those spreading Nostr must be so passionate they’re willing to onboard others, which is time-consuming but rewarding for the right person. They’ll need to make Nostr and onboarding a core part of who they are. I see no issue with that level of dedication. I’ve been known to get that way myself at times. It’s fun for some folks.

With love, I suggest not adding Bitcoin promotion with Nostr outreach. Zaps already integrate that element naturally. (Still promote within the Bitcoin ecosystem, but this is about reaching vulnerable voices who needed Nostr yesterday.)

To promote Nostr, forget conventional strategies. “Influencers” aren’t the answer. “Influencers” are not the future. A trusted local community member has real influence—reach them. Connect with people seeking Nostr’s benefits but lacking the technical language to express it. This means some in the Nostr community might need to step outside of the Bitcoin bubble, which is uncomfortable but necessary. Thank you in advance to those who are willing to do that.

I don’t know who is paid to promote Nostr, if anyone. This piece isn’t shade. But it’s exhausting to see innocent voices globally silenced on corporate platforms like X while Nostr exists. Last night, I wondered: how many more voices must be censored before the Nostr community gets uncomfortable and thinks creatively to reach the vulnerable?

A warning: the global need for censorship-resistant social media is undeniable. If Nostr doesn’t make itself known, something else will fill that void. Let’s start this conversation.

-

@ ecda4328:1278f072

2025-05-21 11:44:17

@ ecda4328:1278f072

2025-05-21 11:44:17An honest response to objections — and an answer to the most important question: why does any of this matter?

Last updated: May 21, 2025\ \ 📄 Document version:\ EN: https://drive.proton.me/urls/A4A8Y8A0RR#Sj2OBsBYJFr1\ RU: https://drive.proton.me/urls/GS9AS1NB30#ZdKKb5ackB5e

\ Statement: Deflation is not the enemy, but a natural state in an age of technological progress.\ Criticism: in real macroeconomics, long-term deflation is linked to depressions.\ Deflation discourages borrowers and investors, and makes debt heavier.\ Natural ≠ Safe.

1. “Deflation → Depression, Debt → Heavier”

This is true in a debt-based system. Yes, in a fiat economy, debt balloons to the sky, and without inflation it collapses.

But Bitcoin offers not “deflation for its own sake,” but an environment where you don’t need to be in debt to survive. Where savings don’t melt away.\ Jeff Booth said it clearly:

“Technology is inherently deflationary. Fighting deflation with the printing press is fighting progress.”

You don’t have to take on credit to live in this system. Which means — deflation is not an enemy, but an ally.

💡 People often confuse two concepts:

-

That deflation doesn’t work in an economy built on credit and leverage — that’s true.

-

That deflation itself is bad — that’s a myth.

📉 In reality, deflation is the natural state of a free market when technology makes everything cheaper.

Historical example:\ In the U.S., from the Civil War to the early 1900s, the economy experienced gentle deflation — alongside economic growth, employment expansion, and industrial boom.\ Prices fell: for example, a sack of flour cost \~$1.00 in 1865 and \~$0.50 in 1895 — and there was no crisis, because wages held and productivity increased.

Modern example:\ Consumer electronics over the past 20–30 years are a vivid example of technological deflation:\ – What cost $5,000 in 2000 (e.g., a 720p plasma TV) now costs $300 and delivers 10× better quality.\ – Phones, computers, cameras — all became far more powerful and cheaper at the same time.\ That’s how tech-driven deflation works: you get more for less.

📌 Bitcoin doesn’t make the world deflationary. It just doesn’t fight against deflation, unlike the fiat model that fights to preserve its debt pyramid.\ It stops punishing savers and rewards long-term thinkers.

Even economists often confuse organic tech deflation with crisis-driven (debt) deflation.

\ \ Statement: We’ve never lived in a truly free market — central banks and issuance always existed.\ Criticism: ideological statement.\ A truly “free” market is utopian.\ Banks and monetary issuance emerged in response to crises.\ A market without arbiters is not always fair, especially under imperfect competition.

2. “The Free Market Is a Utopia”

Yes, “pure markets” are rare. But what we have today isn’t regulation — it’s centralized power in the hands of central banks and cartels.

Bitcoin offers rules without rulers. 21 million. No one can change the issuance. It’s not ideology — it’s code instead of trust. And it has worked for 15 years.

💬 People often say that banks and centralized issuance emerged as a response to crises — as if the market couldn’t manage on its own.\ But if a system needs to be “rescued” again and again through money printing… maybe the problem isn’t freedom, but the system itself?

📌 Crises don’t disprove the value of free markets. They only reveal how fragile a system becomes when the price of money is set not by the market, but by a boardroom vote.\ Bitcoin doesn’t magically eliminate crises — it removes the root cause: the ability to manipulate money in someone’s interest.

\ \ Statement: Inflation is an invisible tax, especially on the poor and working class.\ Criticism: partly true: inflation can reduce debt burden, boost employment.\ The state indexes social benefits. Under stable inflation, compensators can work. Under deflation, things might be worse (mass layoffs, defaults).

3. “Inflation Can Help”

Theoretically — yes. Textbooks say moderate inflation can reduce debt burdens and stimulate consumption and jobs.\ But in practice — it works as a stealth tax, especially on those without assets. The wealthy escape — into real estate, stocks, funds.\ But the poor and working class lose purchasing power because their money is held in cash — and cash devalues.

💬 As Lyn Alden says:

“When your money can’t hold value, you’re forced to become an investor — even if you just want to save and live.”

The state may index pensions or benefits — but always with a lag, and always less than actual price increases.\ If bread rises 15% and your payment increase is 5%, you got poorer, even if the number on paper went up.

💥 We live in an inflationary system of everything:\ – Inflationary money\ – Inflationary products\ – Inflationary content\ – And now even inflationary minds

🧠 This is more than just rising prices — it’s a degradation of reality perception. You’re always rushing, everything loses meaning.\ But when did the system start working against you?

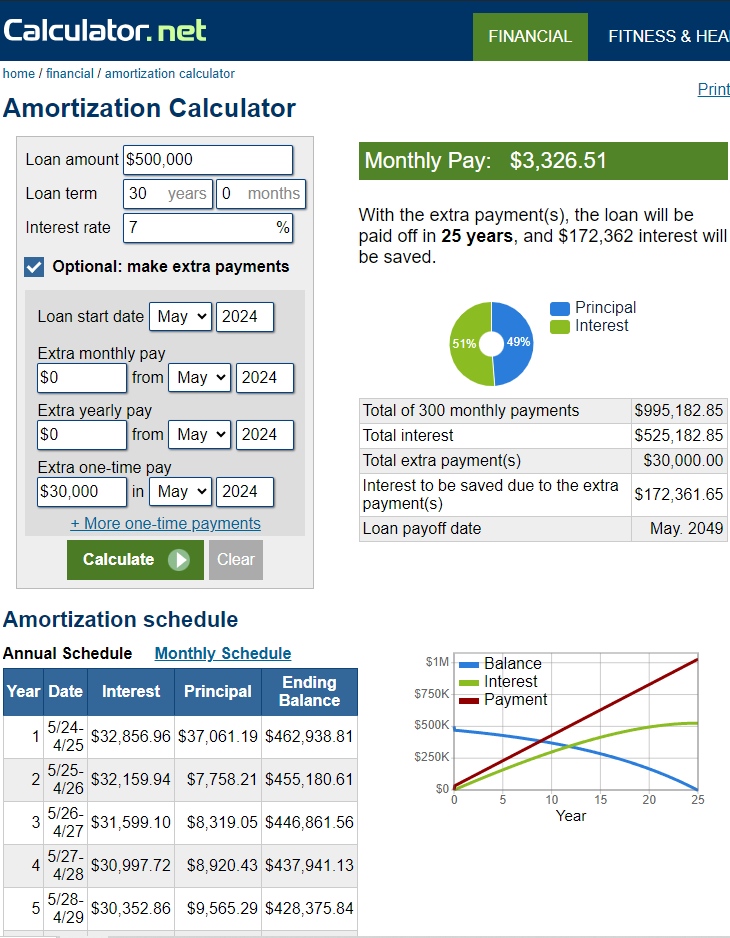

📉 What went wrong after 1971?

This chart shows that from 1948 to the early 1970s, productivity and wages grew together.\

But after the end of the gold standard in 1971 — the connection broke. Productivity kept rising, but real wages stalled.

This chart shows that from 1948 to the early 1970s, productivity and wages grew together.\

But after the end of the gold standard in 1971 — the connection broke. Productivity kept rising, but real wages stalled.👉 This means: you work more, better, faster — but buy less.

🔗 Source: wtfhappenedin1971.com

When you must spend today because tomorrow it’ll be worth less — that’s rewarding impulse and punishing long-term thinking.

Bitcoin offers a different environment:\ – Savings work\ – Long-term thinking is rewarded\ – The price of the future is calculated, not forced by a printing press

📌 Inflation can be a tool. But in government hands, it became a weapon — a slow, inevitable upward redistribution of wealth.

\ \ Statement: War is not growth, but a reallocation of resources into destruction.

Criticism: war can spur technological leaps (Internet, GPS, nuclear energy — all from military programs). "Military Keynesianism" was a real model.

4. “War Drives R&D”

Yes, wars sometimes give rise to tech spin-offs: Internet, GPS, nuclear power — all originated from military programs.

But that doesn’t make war a source of progress — it makes tech a byproduct of catastrophe.

“War reallocates resources toward destruction — not growth.”

Progress doesn’t happen because of war — it happens despite it.

If scientific breakthroughs require a million dead and burnt cities — maybe you’ve built your economy wrong.

💬 Even Michael Saylor said:

“If you need war to develop technology — you’ve built civilization wrong.”

No innovation justifies diverting human labor, minds, and resources toward destruction.\ War is always the opposite of efficiency — more is wasted than created.

🧠 Bitcoin, on the other hand, is an example of how real R&D happens without violence.\ No taxes. No army. Just math, voluntary participation, and open-source code.

📌 Military Keynesianism is not a model of progress — it’s a symptom of a sick monetary system that needs destruction to reboot.

Bitcoin shows that coordination without violence is possible.\ This is R&D of a new kind: based not on destruction, but digital creation.

Statement: Bitcoin isn’t “Gold 1.0,” but an improved version: divisible, verifiable, unseizable.

Criticism: Bitcoin has no physical value; "unseizability" is a theory;\ Gold is material and autonomous.

5. “Bitcoin Has No Physical Value”

And gold does? Just because it shines?

Physical form is no guarantee of value.\ Real value lies in: scarcity, reliable transfer, verifiability, and non-confiscatability.

Gold is:\ – Hard to divide\ – Hard to verify\ – Expensive to store\ – Easy to seize

💡 Bitcoin is the first store of value in history that is fully free from physical limitations, and yet:\ – Absolutely scarce (21M, forever)\ – Instantly transferable over the Internet\ – Cryptographically verifiable\ – Controlled by no government

🔑 Bitcoin’s value lies in its liberation from the physical.\ It doesn’t need to be “backed” by gold or oil. It’s backed by energy, mathematics, and ongoing verification.

“Price is what you pay, value is what you get.” — Warren Buffett

When you buy bitcoin, you’re not paying for a “token” — you’re gaining access to a network of distributed financial energy.

⚡️ What are you really getting when you own bitcoin?\ – A key to a digital asset that can’t be faked\ – The ability to send “crystallized energy” anywhere on Earth (it takes 10 minutes on the base L1 layer, or instantly via the Lightning Network)\ – A role in a new accounting system that runs 24/7/365\ – Freedom: from banks, borders, inflation, and force

📉 Bitcoin doesn’t require physical value — because it creates value:\ Through trust, scarcity, and energy invested in mining.\ And unlike gold, it was never associated with slavery.

Statement: There’s no “income without risk” in Bitcoin: just hold — you preserve; want more — invest, risk, build.

Criticism: contradicts HODL logic; speculation remains dominant behavior.

6. “Speculation Dominates”

For now — yes. That’s normal for the early phase of a new technology. Awareness doesn’t come instantly.

What matters is not the motive of today’s buyer — but what they’re buying.

📉 A speculator may come and go — but the asset remains.\ And this asset is the only one in history that will never exist again. 21 million. Forever.

📌 Look deeper. Bitcoin has:\ – No CEO\ – No central issuer\ – No inflation\ – No “off switch”\ 💡 It was fairly distributed — through mining, long before ASICs existed. In the early years, bitcoin was spent and exchanged — not hoarded. Only those who truly believed in it are still holding it today.

💡 It’s not a stock. Not a startup. Not someone’s project.\ It’s a new foundation for trust.\ It’s opting out of a system where freedom is a privilege you’re granted under conditions.

🧠 People say: “Bitcoin can be copied.”\ Theoretically — yes.\ Practically — never.

Here’s what you’d need to recreate Bitcoin:\ – No pre-mine\ – A founder who disappears and never sells\ – No foundation or corporation\ – Tens of thousands of nodes worldwide\ – 701 million terahashes of hash power\ – Thousands of devs writing open protocols\ – Hundreds of global conferences\ – Millions of people defending digital sovereignty\ – All that without a single marketing budget

That’s all.

🔁 Everything else is an imitation, not a creation.\ Just like you can’t “reinvent fire” — Bitcoin can only exist once.

Statements:\ **The Russia's '90s weren’t a free market — just anarchic chaos without rights protection.\ **Unlike fiat or even dollars, Bitcoin is the first asset with real defense — from governments, inflation, even thugs.\ *And yes, even if your barber asks about Bitcoin — maybe it's not a bubble, but a sign that inflation has already hit everyone.

Criticism: Bitcoin’s protection isn’t universal — it works only with proper handling and isn’t available to all.\ Some just want to “get rich.”\ None of this matters because:

-

Bitcoin’s volatility (-30% in a week, +50% in a month) makes it unusable for price planning or contracts.

-

It can’t handle mass-scale usage.

-

To become currency, geopolitical will is needed — and without the first two, don’t even talk about the third.\ Also: “Bitcoin is too complicated for the average person.”

7. “It’s Too Complex for the Masses”

It’s complex — if you’re using L1 (Layer 1). But even grandmas use Telegram. In El Salvador, schoolkids buy lunch with Lightning. My barber installed Wallet of Satoshi in minutes right in front of me — and I now pay for my haircut via Lightning.

UX is just a matter of time. And it’s improving. Emerging tools:\ Cashu, Fedimint, Fedi, Wallet of Satoshi, Phoenix, Proton Wallet, Swiss Bitcoin Pay, Bolt Card / CoinCorner (NFC cards for Lightning payments).

This is like the internet in 1995:\ It started with modems — now it’s 4K streaming.

💸 Now try sending a regular bank transfer abroad:\ – you need to type a long IBAN\ – add SWIFT/BIC codes\ – include the recipient’s full physical address (!), compromising their privacy\ – sometimes add extra codes or “purpose of payment”\ – you might get a call from your bank “just to confirm”\ – no way to check the status — the money floats somewhere between correspondent/intermediary banks\ – weekends or holidays? Banks are closed\ – and don’t forget the limits, restrictions, and potential freezes

📌 With Bitcoin, you just scan a QR code and send.\ 10 minutes on-chain = final settlement.\ Via Lightning = instant and nearly free.\ No bureaucracy. No permission. No borders.

8. “Can’t Handle the Load”

A common myth.\ Yes, Bitcoin L1 processes about 7 transactions per second — intentionally. It’s not built to be Visa. It’s a financial protocol, just like TCP/IP is a network protocol. TCP/IP isn’t “fast” or “slow” — the experience depends on the infrastructure built on top: servers, routers, hardware. In the ’90s, it delivered text. Today, it streams Netflix. The protocol didn’t change — the stack did.

Same with Bitcoin: L1 defines rules, security, finality.\ Scaling and speed? That’s the second layer’s job.

To understand scale:

| Network | TPS (Transactions/sec) | | --- | --- | | Visa | up to 24,000 | | Mastercard | \~5,000 | | PayPal | \~193 | | Litecoin | \~56 | | Ethereum | \~20 | | Bitcoin | \~7 |

\ ⚡️ Enter Lightning Network — Bitcoin’s “fast lane.”\ It allows millions of transactions per second, instantly and nearly free.

And it’s not a sidechain.

❗️ Lightning is not a separate network.\ It uses real Bitcoin transactions (2-of-2 multisig). You can close the channel to L1 at any time. It’s not an alternative — it’s a native extension built into Bitcoin.\ Also evolving: Ark, Fedimint, eCash — new ways to scale and add privacy.

📉 So criticizing Bitcoin for “slowness” is like blaming TCP/IP because your old modem won’t stream YouTube.\ The protocol isn’t the problem — it’s the infrastructure.

🛡️ And by the way: Visa crashes more often than Bitcoin.

9. “We Need Geopolitical Will”

Not necessarily. All it takes is the will of the people — and leaders willing to act. El Salvador didn’t wait for G20 approval or IMF blessings. Since 2001, the country had used the US dollar as its official currency, abandoning its own colón. But that didn’t save it from inflation or dependency on foreign monetary policy. In 2021, El Salvador became the first country to recognize Bitcoin as legal tender. Since March 13, 2024, they’ve been purchasing 1 BTC daily, tracked through their public address:

🔗 Address\ 📅 First transaction

This policy became the foundation of their Strategic Bitcoin Reserve (SBR) — a state-led effort to accumulate Bitcoin as a national reserve asset for long-term stability and sovereignty.

Their example inspired others.

In March 2025, U.S. President Donald Trump signed an executive order creating the Strategic Bitcoin Reserve of the USA, to be funded through confiscated Bitcoin and digital assets.\ The idea: accumulate, don’t sell, and strategically expand the reserve — without extra burden on taxpayers.

Additionally, Senator Cynthia Lummis (Wyoming) proposed the BITCOIN Act, targeting the purchase of 1 million BTC over five years (\~5% of the total supply).\ The plan: fund it via revaluation of gold certificates and other budget-neutral strategies.

📚 More: Strategic Bitcoin Reserve — Wikipedia

👉 So no global consensus is required. No IMF greenlight.\ All it takes is conviction — and an understanding that the future of finance lies in decentralized, scarce assets like Bitcoin.

10. “-30% in a week, +50% in a month = not money”

True — Bitcoin is volatile. But that’s normal for new technologies and emerging money. It’s not a bug — it’s a price discovery phase. The world is still learning what this asset is.

📉 Volatility is the price of entry.\ 📈 But the reward is buying the future at a discount.

As Michael Saylor put it:

“A tourist sees Niagara Falls as chaos — roaring, foaming, spraying water.\ An engineer sees immense energy.\ It all depends on your mental model.”

Same with Bitcoin. Speculators see chaos. Investors see structural scarcity. Builders see a new financial foundation.

💡 Now consider gold:

👉 After the gold standard was abandoned in 1971, the price of gold skyrocketed from around \~$300 to over $2,700 (adjusted to 2023 dollars) by 1980. Along the way, it experienced extreme volatility — with crashes of 40–60% even amid the broader uptrend.\ 💡 (\~$300 is the inflation-adjusted equivalent of about $38 in 1971 dollars)\ 📈 Source: Gold Price Chart — Macrotrends\ \ Nobody said, “This can’t be money.” \ Because money is defined not by volatility, but by scarcity, adoption, and trust — which build over time.

📊 The more people save in Bitcoin, the more its volatility fades.

This is a journey — not a fixed state.

We don’t judge the internet by how it worked in 1994.\ So why expect Bitcoin to be the “perfect currency” in 2025?

It grows bottom-up — without regulators’ permission.\ And the longer it survives, the stronger it becomes.

Remember how many times it’s been declared dead.\ And how many times it came back — stronger.

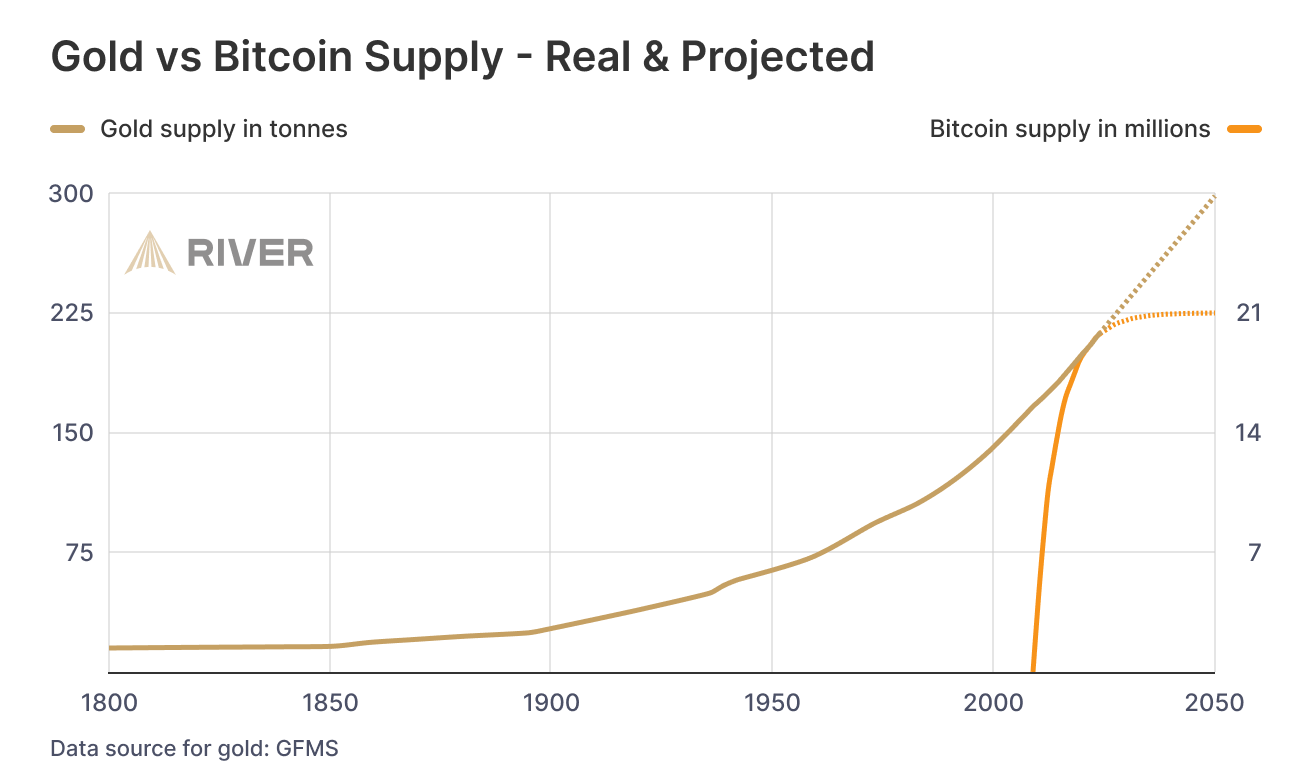

📊 Gold vs. Bitcoin: Supply Comparison

This chart shows the key difference between the two hard assets:

🔹 Gold — supply keeps growing.\ Mining may be limited, but it’s still inflationary.\ Each year, there’s more — with no known cap: new mines, asteroid mining, recycling.

🔸 Bitcoin — capped at 21 million.\ The emission schedule is public, mathematically predictable, and ends completely around 2140.

🧠 Bottom line:\ Gold is good.\ Bitcoin is better — for predictability and scarcity.

💡 As Saifedean Ammous said:

“Gold was the best monetary good… until Bitcoin.”

### While we argue — fiat erodes every day.

### While we argue — fiat erodes every day.No matter your view on Bitcoin, just show me one other asset that is simultaneously:

– immune to devaluation by decree\ – impossible to print more of\ – impossible to confiscate by a centralized order\ – impossible to counterfeit\ – and, most importantly — transferable across borders without asking permission from a bank, a state, or a passport

💸 Try sending $10,000 through PayPal from Iran to Paraguay, or Bangladesh to Saint Lucia.\ Good luck. PayPal doesn't even work there.

Now open a laptop, type 12 words — and you have access to your savings anywhere on Earth.

🌍 Bitcoin doesn't ask for permission.\ It works for everyone, everywhere, all the time.

📌 There has never been anything like this before.

Bitcoin is the first asset in history that combines:

– digital nature\ – predictable scarcity\ – absolute portability\ – and immunity from tyranny

💡 As Michael Saylor said:

“Bitcoin is the first money in human history not created by bankers or politicians — but by engineers.”

You can own it with no bank.\ No intermediary.\ No passport.\ No approval.

That’s why Bitcoin isn’t just “internet money” or “crypto” or “digital gold.”\ It may not be perfect — but it’s incorruptible.\ And it’s not going away.\ It’s already here.\ It is the foundation of a new financial reality.

🔒 This is not speculation. This is a peaceful financial revolution.\ 🪙 This is not a stock. It’s money — like the world has never seen.\ ⛓️ This is not a fad. It’s a freedom protocol.

And when even the barber starts asking about Bitcoin — it’s not a bubble.\ It’s a sign that the system is breaking.\ And people are looking for an exit.

For the first time — they have one.

💼 This is not about investing. It’s about the dignity of work.

Imagine a man who cleans toilets at an airport every day.

Not a “prestigious” job.\ But a crucial one.\ Without him — filth, bacteria, disease.

He shows up on time. He works with his hands.

And his money? It devalues. Every day.

He doesn’t work less — often he works more than those in suits.\ But he can afford less and less — because in this system, honest labor loses value each year.

Now imagine he’s paid in Bitcoin.

Not in some “volatile coin,” but in hard money — with a limited supply.\ Money that can’t be printed, reversed, or devalued by central banks.

💡 Then he could:

– Stop rushing to spend, knowing his labor won’t be worth less tomorrow\ – Save for a dream — without fear of inflation eating it away\ – Feel that his time and effort are respected — because they retain value

Bitcoin gives anyone — engineer or janitor — a way out of the game rigged against them.\ A chance to finally build a future where savings are real.

This is economic justice.\ This is digital dignity.

📉 In fiat, you have to spend — or your money melts.\ 📈 In Bitcoin, you choose when to spend — because it’s up to you.

🧠 In a deflationary economy, both saving and spending are healthy:

You don’t scramble to survive — you choose to create.

🎯 That’s true freedom.

When even someone cleaning floors can live without fear —\ and know that their time doesn’t vanish... it turns into value.

🧱 The Bigger Picture

Bitcoin is not just a technology — it’s rooted in economic philosophy.\ The Austrian School of Economics has long argued that sound money, voluntary exchange, and decentralized decision-making are prerequisites for real prosperity.\ Bitcoin doesn’t reinvent these ideas — it makes them executable.

📉 Inflation doesn’t just erode savings.\ It quietly destroys quality of life.\ You work more — and everything becomes worse:\ – food is cheaper but less nutritious\ – homes are newer but uglier and less durable\ – clothes cost more but fall apart in months\ – streaming is faster, but your attention span collapses\ This isn’t just consumerism — it’s the economics of planned obsolescence.

🧨 Meanwhile, the U.S. debt has exceeded 3x its GDP.\ And nobody wants to buy U.S. bonds anymore — so the U.S. has to buy its own debt.\ Yes: printing money to buy the IOUs you just printed.\ This is the endgame of fiat.

🎭 Bonds are often sold as “safe.”\ But in practice, they are a weapon — especially abroad.\ The U.S. and IMF give loans to developing countries.\ But when those countries can’t repay (due to rigged terms or global economic headwinds), they’re forced to sell land, resources, or strategic assets.\ Both sides lose: the debtor collapses under the weight of debt, while the creditor earns resentment and instability.\ This isn’t cooperation — it’s soft colonialism enabled by inflation.

📌 Bitcoin offers a peaceful exit.\ A financial system where money can’t be created out of thin air.\ Where savings work.\ Where dignity is restored — even for those who clean toilets.

-

-

@ fd208ee8:0fd927c1

2024-12-26 07:02:59

@ fd208ee8:0fd927c1

2024-12-26 07:02:59I just read this, and found it enlightening.

Jung... notes that intelligence can be seen as problem solving at an everyday level..., whereas creativity may represent problem solving for less common issues

Other studies have used metaphor creation as a creativity measure instead of divergent thinking and a spectrum of CHC components instead of just g and have found much higher relationships between creativity and intelligence than past studies

https://www.mdpi.com/2079-3200/3/3/59

I'm unusually intelligent (Who isn't?), but I'm much more creative, than intelligent, and I think that confuses people. The ability to apply intelligence, to solve completely novel problems, on the fly, is something IQ tests don't even claim to measure. They just claim a correlation.

Creativity requires taking wild, mental leaps out into nothingness; simply trusting that your brain will land you safely. And this is why I've been at the forefront of massive innovation, over and over, but never got rich off of it.

I'm a starving autist.

Zaps are the first time I've ever made money directly, for solving novel problems. Companies don't do this because there is a span of time between providing a solution and the solution being implemented, and the person building the implementation (or their boss) receives all the credit for the existence of the solution. At best, you can hope to get pawned off with a small bonus.

Nobody can remember who came up with the solution, originally, and that person might not even be there, anymore, and probably never filed a patent, and may have no idea that their idea has even been built. They just run across it, later, in a tech magazine or museum, and say, "Well, will you look at that! Someone actually went and built it! Isn't that nice!"

Universities at least had the idea of cementing novel solutions in academic papers, but that: 1) only works if you're an academic, and at a university, 2) is an incredibly slow process, not appropriate for a truly innovative field, 3) leads to manifestations of perverse incentives and biased research frameworks, coming from 'publish or perish' policies.

But I think long-form notes and zaps solve for this problem. #Alexandria, especially, is being built to cater to this long-suffering class of chronic underachievers. It leaves a written, public, time-stamped record of Clever Ideas We Have Had.

Because they are clever, the ideas. And we have had them.

-

@ 21335073:a244b1ad

2025-05-01 01:51:10

@ 21335073:a244b1ad

2025-05-01 01:51:10Please respect Virginia Giuffre’s memory by refraining from asking about the circumstances or theories surrounding her passing.

Since Virginia Giuffre’s death, I’ve reflected on what she would want me to say or do. This piece is my attempt to honor her legacy.

When I first spoke with Virginia, I was struck by her unshakable hope. I had grown cynical after years in the anti-human trafficking movement, worn down by a broken system and a government that often seemed complicit. But Virginia’s passion, creativity, and belief that survivors could be heard reignited something in me. She reminded me of my younger, more hopeful self. Instead of warning her about the challenges ahead, I let her dream big, unburdened by my own disillusionment. That conversation changed me for the better, and following her lead led to meaningful progress.

Virginia was one of the bravest people I’ve ever known. As a survivor of Epstein, Maxwell, and their co-conspirators, she risked everything to speak out, taking on some of the world’s most powerful figures.

She loved when I said, “Epstein isn’t the only Epstein.” This wasn’t just about one man—it was a call to hold all abusers accountable and to ensure survivors find hope and healing.

The Epstein case often gets reduced to sensational details about the elite, but that misses the bigger picture. Yes, we should be holding all of the co-conspirators accountable, we must listen to the survivors’ stories. Their experiences reveal how predators exploit vulnerabilities, offering lessons to prevent future victims.

You’re not powerless in this fight. Educate yourself about trafficking and abuse—online and offline—and take steps to protect those around you. Supporting survivors starts with small, meaningful actions. Free online resources can guide you in being a safe, supportive presence.

When high-profile accusations arise, resist snap judgments. Instead of dismissing survivors as “crazy,” pause to consider the trauma they may be navigating. Speaking out or coping with abuse is never easy. You don’t have to believe every claim, but you can refrain from attacking accusers online.

Society also fails at providing aftercare for survivors. The government, often part of the problem, won’t solve this. It’s up to us. Prevention is critical, but when abuse occurs, step up for your loved ones and community. Protect the vulnerable. it’s a challenging but a rewarding journey.

If you’re contributing to Nostr, you’re helping build a censorship resistant platform where survivors can share their stories freely, no matter how powerful their abusers are. Their voices can endure here, offering strength and hope to others. This gives me great hope for the future.

Virginia Giuffre’s courage was a gift to the world. It was an honor to know and serve her. She will be deeply missed. My hope is that her story inspires others to take on the powerful.

-

@ 52b4a076:e7fad8bd

2025-04-28 00:48:57

@ 52b4a076:e7fad8bd

2025-04-28 00:48:57I have been recently building NFDB, a new relay DB. This post is meant as a short overview.

Regular relays have challenges

Current relay software have significant challenges, which I have experienced when hosting Nostr.land: - Scalability is only supported by adding full replicas, which does not scale to large relays. - Most relays use slow databases and are not optimized for large scale usage. - Search is near-impossible to implement on standard relays. - Privacy features such as NIP-42 are lacking. - Regular DB maintenance tasks on normal relays require extended downtime. - Fault-tolerance is implemented, if any, using a load balancer, which is limited. - Personalization and advanced filtering is not possible. - Local caching is not supported.

NFDB: A scalable database for large relays

NFDB is a new database meant for medium-large scale relays, built on FoundationDB that provides: - Near-unlimited scalability - Extended fault tolerance - Instant loading - Better search - Better personalization - and more.

Search

NFDB has extended search capabilities including: - Semantic search: Search for meaning, not words. - Interest-based search: Highlight content you care about. - Multi-faceted queries: Easily filter by topic, author group, keywords, and more at the same time. - Wide support for event kinds, including users, articles, etc.

Personalization

NFDB allows significant personalization: - Customized algorithms: Be your own algorithm. - Spam filtering: Filter content to your WoT, and use advanced spam filters. - Topic mutes: Mute topics, not keywords. - Media filtering: With Nostr.build, you will be able to filter NSFW and other content - Low data mode: Block notes that use high amounts of cellular data. - and more

Other

NFDB has support for many other features such as: - NIP-42: Protect your privacy with private drafts and DMs - Microrelays: Easily deploy your own personal microrelay - Containers: Dedicated, fast storage for discoverability events such as relay lists

Calcite: A local microrelay database

Calcite is a lightweight, local version of NFDB that is meant for microrelays and caching, meant for thousands of personal microrelays.

Calcite HA is an additional layer that allows live migration and relay failover in under 30 seconds, providing higher availability compared to current relays with greater simplicity. Calcite HA is enabled in all Calcite deployments.

For zero-downtime, NFDB is recommended.

Noswhere SmartCache

Relays are fixed in one location, but users can be anywhere.

Noswhere SmartCache is a CDN for relays that dynamically caches data on edge servers closest to you, allowing: - Multiple regions around the world - Improved throughput and performance - Faster loading times

routerd

routerdis a custom load-balancer optimized for Nostr relays, integrated with SmartCache.routerdis specifically integrated with NFDB and Calcite HA to provide fast failover and high performance.Ending notes

NFDB is planned to be deployed to Nostr.land in the coming weeks.

A lot more is to come. 👀️️️️️️

-

@ 662f9bff:8960f6b2

2025-05-21 11:09:22

@ 662f9bff:8960f6b2

2025-05-21 11:09:22Issue 11 already - I will be including numbers going forward to make past letters easier to find and refer to. The past two weeks I have been on vacation - my first real vacation is a couple of years. Monday I am back to work for a bit. I have decided to work from here rather than subject myself to more international travel - we are still refugees from the insanity in Hong Kong. We really have been relaxing and enjoying life on the island. Levada hikes and Jeep tours!

220415 Jeep tour - Cabo Girao, Porto Moniz, Fanal and Ponto do Sol - Madeira

We had plenty of time to relax and enjoy life. Madeira is a fantastic place to visit with lots to see and do and even more weather!. I did think that HK was mountainous - but Madeira is next level! Portuguese is also something else; have not yet made much progress but we did not try much and English will generally suffice. As you see in the video above, Madeira is getting serious about attracting Digital Nomads and as you will see below they have forward-thinking local government - exactly as foreseen in my top book pick - The Sovereign Indvidual.

I did get to read quite a lot of interesting books and material - will be sharing insights below and going forward. Happy to discuss too - that offer is still open.

Among other things I got to appreciate more the Apple ecosystem and the seamless integration between Mac, iPhone and iPad - in combination with working with no/limited WiFi and using tethering from my CalyxOS Pixel. Strong privacy is important and Apple scores reasonably well - though you will want to take some additional precautions, I have been enjoying reading my kindle on all platforms and listening to the audio-books with reading-location syncing (fantastic). I am considering sharing tips and tricks on secure setups as well as aspects that I find particularly useful - do talk to me if you have questions or suggestions.

Bitcoin BTC

Given how important Bitcoin already is and will become I think it is right that I should include a section here with relevant news, insights and provocations to discuss. Note that Bitcoin is different from "Crypto"; do not get them mixed up!

-

Madeira is not just trying to be friendly to digital nomads - photo above and Ponto do Sol. Last week the President of the Government of Madeira, Miguel Albuquerque attended the Miami conference to announce that his government will “work to create a fantastic environment for bitcoin in Madeira.” This is part of the Game Theory of Bitcoin Adoption by Nation States

-

Announcing Taro, Multi-Asset Bitcoin & Lightning** **- this has potential to be something really big. It complements, and may even be better than, Jack Mallers' Strike. Their Blog post is here and the Wiki with the detailed specification is here.

-

Michael Saylor is one of today's pre-eminent thinkers and communicators. Listen and learn from his revcent interview with Lex Friedman.

-

SLP365 Anita Posch - Bitcoin For Fairness in Zimbabwe and Zambia — A great interview by Stephan Livera. Key takeaways: Learn how to use it before you really need it. if it works in Zimbabwe and Namibia it will work anywhere It’s still early and governments will give no help; rather they will be busy putting sticks in the wheels and sand in the gears…

-

For those who look for education on Bitcoin - a starting point can be Anita Posch's The Art of (L)earning Bitcoin with many useful resources linked.

Discovery of the week - Obsidian

For years I have been an avid notetaker. I caught the bug when I did Electronic Engineering at Southampton University and we had to keep a "lab book". Ever since then in my professional work I kept a notebook and took daily notes. Recently this evolved into taking notes on computer. With the arrival of online working and screen-sharing such notes can be very useful and this unleased new value in note-taking.

For personal notes I found great value with Apple Notes - a tool that has improved dramatically in recent years and works perfectly on Mac, iPhone and iPad. However, like many notetakers I often felt that I was "missing a trick". The reality is that searching and retrieval is not as easy as you want it to be and it's hard to reassemble and repurpose your collected information into new output.

In recent years I have considered using several tools but found none of them compelling enough to put in the time to learn and adopt. There is also the fear of "lock in" and endless subscriptions to pay - as anyone who has used Evernote will know!

Big thank you to Rachel for this one. She did get me thinking and encouraged me to give Obsidian another try - I had looked at it last year but it felt overwhelming compared to Apple Notes - I could never have imagined how great it could be!

The absolute best overview of Obsidian and how to use it is FromSergio - his playlist is required watching. Particular highlights:

-

Kindle Highlights - this is a superbly useful feature that normally you can only get with a subscription service - do buy the developer a coffee!

-

No Lock-in - your files are simple markdown and you have full control

-

Works perfectly on Mac and iPhones using iCloud - no annoying sync subscription to pay for

-

It's free for personal use - no payment or annoying subscription

-

Lots of high quality training material readily available and a great community of people to help you

Reading

-

Empires Rise and Fall this extracts and summarises from John Glubb's paper of nearly 100 years ago, The Fate of Empires - I think you call that foresight! I do identify with his frustrations about how history has been taught considering how important it is to learn from past generations.

-

The Sovereign Individual is required reading for everyone - I did dip back into it a few times over the last week or so, making Kindle highlights that magically sync into Obsidian - how great is that! If you read nothing else, read chapter 7.

-

From Paris to Karachi – Regime Change is In the Air - Tom Luongo is a most interesting character and he does speak his mind. Read and consider. You might prefer to listen to him discussing with Marty.

-

Aleks Svetski: The Remnant, The Parasite & The Masses - inspired by the incredible 1930’s essay by Albert J Nock; Isaiah’s Job. Aleks discusses this in his Wake Up podcast - also recommended.

-

In my TBR queue (to be read): Atlas Shrugged by Ayn Rand - I must admit, I am in intrigued by Odolena's review in addition to Aleks' recommendation.

-

I also think that I need to restart on (and finish) Foundation by Isaac Asimov - after watching Odolena's review of it!

-

...and I need to add Meditations by Marcus Aurelius - again inspired by Odolena's review and I have seen others recommend it too!

Watching and Listening

-

Joe Blogs: Who is BUYING Russian Oil Now? Can Europe really change SUPPLIERS & are SANCTIONS Working? - do stop and think - in who's name are the governments implementing all these extreme measures - go back and re-read section "So what can you do about it?" in issue 9

-

Rupert Murdochizing The Internet — The Cyberlaw Podcast — whether you agree with him or not Stewart Baker is just the best podcast provocateur!

-

AntiWarhol, Culture Creation, & The Pop Art Syndicate — One of The Higherside Chats - perhaps this might open your mind and make you question some things. The rabbit hole goes deep.

-

How Britain's Bankers Made Billions From The End Of Empire. At the demise of British Empire, City of London financial interests created a web of offshore secrecy jurisdictions that captured wealth from across the globe and hid it behind obscure financial structures in a web of offshore islands.

-

Secret City - A film about the City of London, the Corporation that runs it.

-

How things get Re-Priced when a Currency Fails — An important explainer from Joe Brown of The Heresy Financial Podcast — keep an eye out for signs!

-

E76: Elon vs. Twitter — the All-In Podcast. I do not agree with all these boyz say but it is interesting to listen to see how the Silicon Valley types think. David Sacks nails it, and Chamath is not far behind! If you were in any doubt as to how corrupt things are this should put you right!

For those who prefer a structured reading list, check References

That's it!

No one can be told what The Matrix is.\ You have to see it for yourself.**

Do share this newsletter with any of your friends and family who might be interested.

You can also email me at: LetterFrom@rogerprice.me

💡Enjoy the newsletters in your own language : Dutch, French, German, Serbian, Chinese Traditional & Simplified, Thai and Burmese.

-

-

@ 04c915da:3dfbecc9

2025-05-20 15:50:22

@ 04c915da:3dfbecc9

2025-05-20 15:50:22There is something quietly rebellious about stacking sats. In a world obsessed with instant gratification, choosing to patiently accumulate Bitcoin, one sat at a time, feels like a middle finger to the hype machine. But to do it right, you have got to stay humble. Stack too hard with your head in the clouds, and you will trip over your own ego before the next halving even hits.

Small Wins

Stacking sats is not glamorous. Discipline. Stacking every day, week, or month, no matter the price, and letting time do the heavy lifting. Humility lives in that consistency. You are not trying to outsmart the market or prove you are the next "crypto" prophet. Just a regular person, betting on a system you believe in, one humble stack at a time. Folks get rekt chasing the highs. They ape into some shitcoin pump, shout about it online, then go silent when they inevitably get rekt. The ones who last? They stack. Just keep showing up. Consistency. Humility in action. Know the game is long, and you are not bigger than it.

Ego is Volatile

Bitcoin’s swings can mess with your head. One day you are up 20%, feeling like a genius and the next down 30%, questioning everything. Ego will have you panic selling at the bottom or over leveraging the top. Staying humble means patience, a true bitcoin zen. Do not try to "beat” Bitcoin. Ride it. Stack what you can afford, live your life, and let compounding work its magic.

Simplicity

There is a beauty in how stacking sats forces you to rethink value. A sat is worth less than a penny today, but every time you grab a few thousand, you plant a seed. It is not about flaunting wealth but rather building it, quietly, without fanfare. That mindset spills over. Cut out the noise: the overpriced coffee, fancy watches, the status games that drain your wallet. Humility is good for your soul and your stack. I have a buddy who has been stacking since 2015. Never talks about it unless you ask. Lives in a decent place, drives an old truck, and just keeps stacking. He is not chasing clout, he is chasing freedom. That is the vibe: less ego, more sats, all grounded in life.

The Big Picture

Stack those sats. Do it quietly, do it consistently, and do not let the green days puff you up or the red days break you down. Humility is the secret sauce, it keeps you grounded while the world spins wild. In a decade, when you look back and smile, it will not be because you shouted the loudest. It will be because you stayed the course, one sat at a time. \ \ Stay Humble and Stack Sats. 🫡

-

@ 91bea5cd:1df4451c

2025-04-26 10:16:21

@ 91bea5cd:1df4451c

2025-04-26 10:16:21O Contexto Legal Brasileiro e o Consentimento

No ordenamento jurídico brasileiro, o consentimento do ofendido pode, em certas circunstâncias, afastar a ilicitude de um ato que, sem ele, configuraria crime (como lesão corporal leve, prevista no Art. 129 do Código Penal). Contudo, o consentimento tem limites claros: não é válido para bens jurídicos indisponíveis, como a vida, e sua eficácia é questionável em casos de lesões corporais graves ou gravíssimas.

A prática de BDSM consensual situa-se em uma zona complexa. Em tese, se ambos os parceiros são adultos, capazes, e consentiram livre e informadamente nos atos praticados, sem que resultem em lesões graves permanentes ou risco de morte não consentido, não haveria crime. O desafio reside na comprovação desse consentimento, especialmente se uma das partes, posteriormente, o negar ou alegar coação.

A Lei Maria da Penha (Lei nº 11.340/2006)

A Lei Maria da Penha é um marco fundamental na proteção da mulher contra a violência doméstica e familiar. Ela estabelece mecanismos para coibir e prevenir tal violência, definindo suas formas (física, psicológica, sexual, patrimonial e moral) e prevendo medidas protetivas de urgência.

Embora essencial, a aplicação da lei em contextos de BDSM pode ser delicada. Uma alegação de violência por parte da mulher, mesmo que as lesões ou situações decorram de práticas consensuais, tende a receber atenção prioritária das autoridades, dada a presunção de vulnerabilidade estabelecida pela lei. Isso pode criar um cenário onde o parceiro masculino enfrenta dificuldades significativas em demonstrar a natureza consensual dos atos, especialmente se não houver provas robustas pré-constituídas.

Outros riscos:

Lesão corporal grave ou gravíssima (art. 129, §§ 1º e 2º, CP), não pode ser justificada pelo consentimento, podendo ensejar persecução penal.

Crimes contra a dignidade sexual (arts. 213 e seguintes do CP) são de ação pública incondicionada e independem de representação da vítima para a investigação e denúncia.

Riscos de Falsas Acusações e Alegação de Coação Futura

Os riscos para os praticantes de BDSM, especialmente para o parceiro que assume o papel dominante ou que inflige dor/restrição (frequentemente, mas não exclusivamente, o homem), podem surgir de diversas frentes:

- Acusações Externas: Vizinhos, familiares ou amigos que desconhecem a natureza consensual do relacionamento podem interpretar sons, marcas ou comportamentos como sinais de abuso e denunciar às autoridades.

- Alegações Futuras da Parceira: Em caso de término conturbado, vingança, arrependimento ou mudança de perspectiva, a parceira pode reinterpretar as práticas passadas como abuso e buscar reparação ou retaliação através de uma denúncia. A alegação pode ser de que o consentimento nunca existiu ou foi viciado.

- Alegação de Coação: Uma das formas mais complexas de refutar é a alegação de que o consentimento foi obtido mediante coação (física, moral, psicológica ou econômica). A parceira pode alegar, por exemplo, que se sentia pressionada, intimidada ou dependente, e que seu "sim" não era genuíno. Provar a ausência de coação a posteriori é extremamente difícil.

- Ingenuidade e Vulnerabilidade Masculina: Muitos homens, confiando na dinâmica consensual e na parceira, podem negligenciar a necessidade de precauções. A crença de que "isso nunca aconteceria comigo" ou a falta de conhecimento sobre as implicações legais e o peso processual de uma acusação no âmbito da Lei Maria da Penha podem deixá-los vulneráveis. A presença de marcas físicas, mesmo que consentidas, pode ser usada como evidência de agressão, invertendo o ônus da prova na prática, ainda que não na teoria jurídica.

Estratégias de Prevenção e Mitigação

Não existe um método infalível para evitar completamente o risco de uma falsa acusação, mas diversas medidas podem ser adotadas para construir um histórico de consentimento e reduzir vulnerabilidades:

- Comunicação Explícita e Contínua: A base de qualquer prática BDSM segura é a comunicação constante. Negociar limites, desejos, palavras de segurança ("safewords") e expectativas antes, durante e depois das cenas é crucial. Manter registros dessas negociações (e-mails, mensagens, diários compartilhados) pode ser útil.

-

Documentação do Consentimento:

-

Contratos de Relacionamento/Cena: Embora a validade jurídica de "contratos BDSM" seja discutível no Brasil (não podem afastar normas de ordem pública), eles servem como forte evidência da intenção das partes, da negociação detalhada de limites e do consentimento informado. Devem ser claros, datados, assinados e, idealmente, reconhecidos em cartório (para prova de data e autenticidade das assinaturas).

-

Registros Audiovisuais: Gravar (com consentimento explícito para a gravação) discussões sobre consentimento e limites antes das cenas pode ser uma prova poderosa. Gravar as próprias cenas é mais complexo devido a questões de privacidade e potencial uso indevido, mas pode ser considerado em casos específicos, sempre com consentimento mútuo documentado para a gravação.

Importante: a gravação deve ser com ciência da outra parte, para não configurar violação da intimidade (art. 5º, X, da Constituição Federal e art. 20 do Código Civil).

-

-

Testemunhas: Em alguns contextos de comunidade BDSM, a presença de terceiros de confiança durante negociações ou mesmo cenas pode servir como testemunho, embora isso possa alterar a dinâmica íntima do casal.

- Estabelecimento Claro de Limites e Palavras de Segurança: Definir e respeitar rigorosamente os limites (o que é permitido, o que é proibido) e as palavras de segurança é fundamental. O desrespeito a uma palavra de segurança encerra o consentimento para aquele ato.

- Avaliação Contínua do Consentimento: O consentimento não é um cheque em branco; ele deve ser entusiástico, contínuo e revogável a qualquer momento. Verificar o bem-estar do parceiro durante a cena ("check-ins") é essencial.

- Discrição e Cuidado com Evidências Físicas: Ser discreto sobre a natureza do relacionamento pode evitar mal-entendidos externos. Após cenas que deixem marcas, é prudente que ambos os parceiros estejam cientes e de acordo, talvez documentando por fotos (com data) e uma nota sobre a consensualidade da prática que as gerou.

- Aconselhamento Jurídico Preventivo: Consultar um advogado especializado em direito de família e criminal, com sensibilidade para dinâmicas de relacionamento alternativas, pode fornecer orientação personalizada sobre as melhores formas de documentar o consentimento e entender os riscos legais específicos.

Observações Importantes

- Nenhuma documentação substitui a necessidade de consentimento real, livre, informado e contínuo.

- A lei brasileira protege a "integridade física" e a "dignidade humana". Práticas que resultem em lesões graves ou que violem a dignidade de forma não consentida (ou com consentimento viciado) serão ilegais, independentemente de qualquer acordo prévio.

- Em caso de acusação, a existência de documentação robusta de consentimento não garante a absolvição, mas fortalece significativamente a defesa, ajudando a demonstrar a natureza consensual da relação e das práticas.

-

A alegação de coação futura é particularmente difícil de prevenir apenas com documentos. Um histórico consistente de comunicação aberta (whatsapp/telegram/e-mails), respeito mútuo e ausência de dependência ou controle excessivo na relação pode ajudar a contextualizar a dinâmica como não coercitiva.

-

Cuidado com Marcas Visíveis e Lesões Graves Práticas que resultam em hematomas severos ou lesões podem ser interpretadas como agressão, mesmo que consentidas. Evitar excessos protege não apenas a integridade física, mas também evita questionamentos legais futuros.

O que vem a ser consentimento viciado

No Direito, consentimento viciado é quando a pessoa concorda com algo, mas a vontade dela não é livre ou plena — ou seja, o consentimento existe formalmente, mas é defeituoso por alguma razão.

O Código Civil brasileiro (art. 138 a 165) define várias formas de vício de consentimento. As principais são:

Erro: A pessoa se engana sobre o que está consentindo. (Ex.: A pessoa acredita que vai participar de um jogo leve, mas na verdade é exposta a práticas pesadas.)

Dolo: A pessoa é enganada propositalmente para aceitar algo. (Ex.: Alguém mente sobre o que vai acontecer durante a prática.)

Coação: A pessoa é forçada ou ameaçada a consentir. (Ex.: "Se você não aceitar, eu termino com você" — pressão emocional forte pode ser vista como coação.)

Estado de perigo ou lesão: A pessoa aceita algo em situação de necessidade extrema ou abuso de sua vulnerabilidade. (Ex.: Alguém em situação emocional muito fragilizada é induzida a aceitar práticas que normalmente recusaria.)

No contexto de BDSM, isso é ainda mais delicado: Mesmo que a pessoa tenha "assinado" um contrato ou dito "sim", se depois ela alegar que seu consentimento foi dado sob medo, engano ou pressão psicológica, o consentimento pode ser considerado viciado — e, portanto, juridicamente inválido.

Isso tem duas implicações sérias:

-

O crime não se descaracteriza: Se houver vício, o consentimento é ignorado e a prática pode ser tratada como crime normal (lesão corporal, estupro, tortura, etc.).

-

A prova do consentimento precisa ser sólida: Mostrando que a pessoa estava informada, lúcida, livre e sem qualquer tipo de coação.

Consentimento viciado é quando a pessoa concorda formalmente, mas de maneira enganada, forçada ou pressionada, tornando o consentimento inútil para efeitos jurídicos.

Conclusão

Casais que praticam BDSM consensual no Brasil navegam em um terreno que exige não apenas confiança mútua e comunicação excepcional, mas também uma consciência aguçada das complexidades legais e dos riscos de interpretações equivocadas ou acusações mal-intencionadas. Embora o BDSM seja uma expressão legítima da sexualidade humana, sua prática no Brasil exige responsabilidade redobrada. Ter provas claras de consentimento, manter a comunicação aberta e agir com prudência são formas eficazes de se proteger de falsas alegações e preservar a liberdade e a segurança de todos os envolvidos. Embora leis controversas como a Maria da Penha sejam "vitais" para a proteção contra a violência real, os praticantes de BDSM, e em particular os homens nesse contexto, devem adotar uma postura proativa e prudente para mitigar os riscos inerentes à potencial má interpretação ou instrumentalização dessas práticas e leis, garantindo que a expressão de sua consensualidade esteja resguardada na medida do possível.

Importante: No Brasil, mesmo com tudo isso, o Ministério Público pode denunciar por crime como lesão corporal grave, estupro ou tortura, independente de consentimento. Então a prudência nas práticas é fundamental.

Aviso Legal: Este artigo tem caráter meramente informativo e não constitui aconselhamento jurídico. As leis e interpretações podem mudar, e cada situação é única. Recomenda-se buscar orientação de um advogado qualificado para discutir casos específicos.

Se curtiu este artigo faça uma contribuição, se tiver algum ponto relevante para o artigo deixe seu comentário.

-

@ 04c915da:3dfbecc9

2025-05-16 17:12:05

@ 04c915da:3dfbecc9

2025-05-16 17:12:05One of the most common criticisms leveled against nostr is the perceived lack of assurance when it comes to data storage. Critics argue that without a centralized authority guaranteeing that all data is preserved, important information will be lost. They also claim that running a relay will become prohibitively expensive. While there is truth to these concerns, they miss the mark. The genius of nostr lies in its flexibility, resilience, and the way it harnesses human incentives to ensure data availability in practice.

A nostr relay is simply a server that holds cryptographically verifiable signed data and makes it available to others. Relays are simple, flexible, open, and require no permission to run. Critics are right that operating a relay attempting to store all nostr data will be costly. What they miss is that most will not run all encompassing archive relays. Nostr does not rely on massive archive relays. Instead, anyone can run a relay and choose to store whatever subset of data they want. This keeps costs low and operations flexible, making relay operation accessible to all sorts of individuals and entities with varying use cases.

Critics are correct that there is no ironclad guarantee that every piece of data will always be available. Unlike bitcoin where data permanence is baked into the system at a steep cost, nostr does not promise that every random note or meme will be preserved forever. That said, in practice, any data perceived as valuable by someone will likely be stored and distributed by multiple entities. If something matters to someone, they will keep a signed copy.

Nostr is the Streisand Effect in protocol form. The Streisand effect is when an attempt to suppress information backfires, causing it to spread even further. With nostr, anyone can broadcast signed data, anyone can store it, and anyone can distribute it. Try to censor something important? Good luck. The moment it catches attention, it will be stored on relays across the globe, copied, and shared by those who find it worth keeping. Data deemed important will be replicated across servers by individuals acting in their own interest.

Nostr’s distributed nature ensures that the system does not rely on a single point of failure or a corporate overlord. Instead, it leans on the collective will of its users. The result is a network where costs stay manageable, participation is open to all, and valuable verifiable data is stored and distributed forever.

-

@ 51bbb15e:b77a2290

2025-05-21 00:24:36

@ 51bbb15e:b77a2290

2025-05-21 00:24:36Yeah, I’m sure everything in the file is legit. 👍 Let’s review the guard witness testimony…Oh wait, they weren’t at their posts despite 24/7 survellience instructions after another Epstein “suicide” attempt two weeks earlier. Well, at least the video of the suicide is in the file? Oh wait, a techical glitch. Damn those coincidences!

At this point, the Trump administration has zero credibility with me on anything related to the Epstein case and his clients. I still suspect the administration is using the Epstein files as leverage to keep a lot of RINOs in line, whereas they’d be sabotaging his agenda at every turn otherwise. However, I just don’t believe in ends-justify-the-means thinking. It’s led almost all of DC to toss out every bit of the values they might once have had.

-

@ 70c48e4b:00ce3ccb

2025-05-21 10:52:12

@ 70c48e4b:00ce3ccb

2025-05-21 10:52:12Dear readers,

“The direct use of force is such a poor solution to any problem, it is generally employed only by small children and large nations.” — David Friedman

What If we could enforce promises without force?

David Friedman, in his book The Machinery of Freedom, tosses out a pretty wild idea: that people can build systems of cooperation and justice without needing a government at all. These systems rely on voluntary agreements, social reputation, and mutual incentives. In such a world, contracts hold value because honoring a promise brings greater rewards than breaking it.

From Friedman to Bitcoin

https://i.ytimg.com/vi/e8zsFTV94bw/maxresdefault.jpg

This vision shaped the thinking behind Angor, a funding tool built on Bitcoin. Friedman’s ideas showed that systems of cooperation could work without central authority, and Bitcoin now provides the foundation to build them. It records transactions in a public and tamper-proof way. With features like Taproot, people can set clear rules for funding and accountability. Angor uses these tools to help founders and backers create agreements that are transparent and easy to verify.

The result is a new kind of marketplace where follow-through is visible, and reputation becomes a real asset. Instead of relying on enforcement from above, trust is earned through action and built into the system itself.

What happens after the project succeeds?

One important question kept returning throughout our work: what happens after a project succeeds? The founder raises the funds, delivers the product, and begins earning revenue. What mechanism ensures that revenue is shared as promised? How can investors protect their interests in an environment that relies on voluntary structure rather than external authority?

To explore possible answers, we looked at how libertarian thinkers approach contracts in stateless systems.

How libertarian thinkers approach contracts without the state?

Friedman, along with other libertarian thinkers like Murray Rothbard and Bruce Benson, describes voluntarily created legal systems where people make binding agreements and use private mechanisms to enforce them. These mechanisms include:

• Reputational risk • Collateralized performance • Community arbitration • Decentralized insuranceSuch tools can replace state-backed enforcement when trust is earned and incentives are aligned.

If founders are anonymous:

When a founder chooses to remain pseudonymous, legal enforcement is not available. In this case, the agreement between the founder and investor can rely on cryptographic mechanisms such as performance bonds, revenue proofs, and public reputation systems.

- Performance Bonds

• Founders deposit additional Bitcoin into a separate, time-locked contract. As they meet revenue-sharing milestones, they are allowed to unlock specific portions of this bond.

• If a revenue allocation is missed or a deadline passes without fulfillment, the contract redirects the bond to investors through a Taproot clause i.e. a feature in Bitcoin that lets you set up ‘if-this-then-that’ rules directly into a transaction, but privately. This creates a clear and automatic consequence, reinforcing accountability through financial incentives.

- Revenue Proofs and Oracles

• Most founders, especially those running small businesses like cafes, games, or services, do not earn revenue in Bitcoin. Their income flows through fiat systems, which means automatic on-chain revenue streaming is not an option. The only way to maintain transparency is to prove income after the fact. This starts with exporting a sales report from a platform such as Stripe, Revolut, or a point-of-sale system. The founder hashes the file and posts that hash to the Bitcoin blockchain as a timestamped public reference.

• An oracle plays the role of a neutral verifier. This could be a trusted accountant or an observer chosen by the investor community. Their job is simple: compare the actual report with the hash recorded on-chain. If the data matches, the oracle signs a message that triggers the revenue-share payout using a Discreet Log Contract (DLC).

A DLC is similar to a smart contract, but built for Bitcoin. It allows two parties to agree on a specific outcome, such as how much revenue was made, and only releases funds when that outcome is confirmed by the oracle.

This process does not depend on central enforcement. Instead, it works through mutual agreement and the oracle’s reputation, or any collateral they may have provided in advance.

- Reputation as collateral

• Every revenue-share payout is recorded on the Bitcoin blockchain, making it publicly visible and verifiable. Community-run indexers can scan the chain and track whether a founder consistently delivers payments on time. This performance history is then summarized into what is known as a “contract streak,” which refers to the number of consecutive payouts completed without delay.

• These streaks are published as signed events through protocols like Nostr, allowing anyone to verify a founder’s track record. A strong, uninterrupted streak builds credibility and can improve the chances of raising funds for future projects. In contrast, a broken streak signals risk, which discourages new investment and reduces access to support from the Angor community.

If founders are public:

When a founder uses a real identity, the parties can combine legal agreements with on-chain contracts. These hybrid arrangements allow for tools like enforceable smart contracts, voluntary arbitration, and potentially community-backed insurance.

- Legally binding smart contracts

• This type of agreement formally identifies the founder’s legal entity and clearly links it to specific Taproot addresses used in the project. It outlines the rules for revenue sharing, describes what constitutes a breach, and specifies how disputes should be resolved. Because it is a formal legal document, it can be enforced in any relevant jurisdiction where the founder has a presence or assets.

- Private arbitration

• During the contract setup, both parties can agree to a neutral arbitrator who will step in if a dispute arises. If a revenue payout is delayed or missed, the arbitrator reviews all relevant data, including on-chain records, oracle confirmations, and supporting documentation. Based on this evidence, the arbitrator issues a decision that determines whether funds should be released, held, or redirected. This method provides a clear resolution process without involving courts, while still maintaining a fair and structured outcome.

- Equity sharing and traditional securities

• When founders are publicly identified and operating under a registered entity, they can also offer equity in the company as part of the funding arrangement. This can take the form of direct share issuance, convertible notes, or tokenized equity, depending on jurisdictional frameworks and investor preferences.

While Angor does not facilitate equity transfers directly, the on-chain agreement can reference these arrangements clearly. Investors may receive shares documented in a cap table, with accompanying legal agreements that govern dividend rights, voting power, or exit terms.

This method provides a more conventional form of investor alignment and is often well-understood by experienced backers. It can also be combined with on-chain revenue-sharing mechanisms to create hybrid models that balance transparency with long-term equity value.

Final Thought: Alignment Over Authority

The ideas in The Machinery of Freedom show how people can build cooperative systems without relying on centralized authority. Angor puts those ideas into action by applying them to decentralized crowdfunding. Each campaign becomes a contract. Each payout becomes a public signal of integrity. Reputation is built over time, through visible and verifiable performance.

This approach shifts enforcement from force to alignment. It rewards honesty and transparency while making misuse costly. By designing systems where trust is earned through action and recorded on-chain, we move toward a more resilient model of funding. This model is grounded in consent, shaped by shared incentives, and supported by the open logic of Bitcoin.

Bitcoin itself works this way. Miners follow the rules not because they are told to, but because breaking them wastes energy, time, and opportunity. The cost of cheating is built into the system. Angor adopts the same principle: integrity is not enforced from above, it is embedded in the architecture.

If you are building on Angor or exploring similar ideas, reach out. The tools are evolving, and the community is growing.

https://docs.angor.io/images/tools/hub.png

Have you tried Angor yet?

Thank you & Ciao. Guest writer: Paco nostr:npub1v67clmf4jrezn8hsz28434nc0y5fu65e5esws04djnl2kasxl5tskjmjjk

-

@ e3ba5e1a:5e433365

2025-04-15 11:03:15

@ e3ba5e1a:5e433365

2025-04-15 11:03:15Prelude

I wrote this post differently than any of my others. It started with a discussion with AI on an OPSec-inspired review of separation of powers, and evolved into quite an exciting debate! I asked Grok to write up a summary in my overall writing style, which it got pretty well. I've decided to post it exactly as-is. Ultimately, I think there are two solid ideas driving my stance here:

- Perfect is the enemy of the good

- Failure is the crucible of success

Beyond that, just some hard-core belief in freedom, separation of powers, and operating from self-interest.

Intro

Alright, buckle up. I’ve been chewing on this idea for a while, and it’s time to spit it out. Let’s look at the U.S. government like I’d look at a codebase under a cybersecurity audit—OPSEC style, no fluff. Forget the endless debates about what politicians should do. That’s noise. I want to talk about what they can do, the raw powers baked into the system, and why we should stop pretending those powers are sacred. If there’s a hole, either patch it or exploit it. No half-measures. And yeah, I’m okay if the whole thing crashes a bit—failure’s a feature, not a bug.

The Filibuster: A Security Rule with No Teeth

You ever see a firewall rule that’s more theater than protection? That’s the Senate filibuster. Everyone acts like it’s this untouchable guardian of democracy, but here’s the deal: a simple majority can torch it any day. It’s not a law; it’s a Senate preference, like choosing tabs over spaces. When people call killing it the “nuclear option,” I roll my eyes. Nuclear? It’s a button labeled “press me.” If a party wants it gone, they’ll do it. So why the dance?

I say stop playing games. Get rid of the filibuster. If you’re one of those folks who thinks it’s the only thing saving us from tyranny, fine—push for a constitutional amendment to lock it in. That’s a real patch, not a Post-it note. Until then, it’s just a vulnerability begging to be exploited. Every time a party threatens to nuke it, they’re admitting it’s not essential. So let’s stop pretending and move on.

Supreme Court Packing: Because Nine’s Just a Number

Here’s another fun one: the Supreme Court. Nine justices, right? Sounds official. Except it’s not. The Constitution doesn’t say nine—it’s silent on the number. Congress could pass a law tomorrow to make it 15, 20, or 42 (hitchhiker’s reference, anyone?). Packing the court is always on the table, and both sides know it. It’s like a root exploit just sitting there, waiting for someone to log in.

So why not call the bluff? If you’re in power—say, Trump’s back in the game—say, “I’m packing the court unless we amend the Constitution to fix it at nine.” Force the issue. No more shadowboxing. And honestly? The court’s got way too much power anyway. It’s not supposed to be a super-legislature, but here we are, with justices’ ideologies driving the bus. That’s a bug, not a feature. If the court weren’t such a kingmaker, packing it wouldn’t even matter. Maybe we should be talking about clipping its wings instead of just its size.

The Executive Should Go Full Klingon

Let’s talk presidents. I’m not saying they should wear Klingon armor and start shouting “Qapla’!”—though, let’s be real, that’d be awesome. I’m saying the executive should use every scrap of power the Constitution hands them. Enforce the laws you agree with, sideline the ones you don’t. If Congress doesn’t like it, they’ve got tools: pass new laws, override vetoes, or—here’s the big one—cut the budget. That’s not chaos; that’s the system working as designed.

Right now, the real problem isn’t the president overreaching; it’s the bureaucracy. It’s like a daemon running in the background, eating CPU and ignoring the user. The president’s supposed to be the one steering, but the administrative state’s got its own agenda. Let the executive flex, push the limits, and force Congress to check it. Norms? Pfft. The Constitution’s the spec sheet—stick to it.

Let the System Crash

Here’s where I get a little spicy: I’m totally fine if the government grinds to a halt. Deadlock isn’t a disaster; it’s a feature. If the branches can’t agree, let the president veto, let Congress starve the budget, let enforcement stall. Don’t tell me about “essential services.” Nothing’s so critical it can’t take a breather. Shutdowns force everyone to the table—debate, compromise, or expose who’s dropping the ball. If the public loses trust? Good. They’ll vote out the clowns or live with the circus they elected.

Think of it like a server crash. Sometimes you need a hard reboot to clear the cruft. If voters keep picking the same bad admins, well, the country gets what it deserves. Failure’s the best teacher—way better than limping along on autopilot.

States Are the Real MVPs

If the feds fumble, states step up. Right now, states act like junior devs waiting for the lead engineer to sign off. Why? Federal money. It’s a leash, and it’s tight. Cut that cash, and states will remember they’re autonomous. Some will shine, others will tank—looking at you, California. And I’m okay with that. Let people flee to better-run states. No bailouts, no excuses. States are like competing startups: the good ones thrive, the bad ones pivot or die.

Could it get uneven? Sure. Some states might turn into sci-fi utopias while others look like a post-apocalyptic vidya game. That’s the point—competition sorts it out. Citizens can move, markets adjust, and failure’s a signal to fix your act.

Chaos Isn’t the Enemy

Yeah, this sounds messy. States ignoring federal law, external threats poking at our seams, maybe even a constitutional crisis. I’m not scared. The Supreme Court’s there to referee interstate fights, and Congress sets the rules for state-to-state play. But if it all falls apart? Still cool. States can sort it without a babysitter—it’ll be ugly, but freedom’s worth it. External enemies? They’ll either unify us or break us. If we can’t rally, we don’t deserve the win.

Centralizing power to avoid this is like rewriting your app in a single thread to prevent race conditions—sure, it’s simpler, but you’re begging for a deadlock. Decentralized chaos lets states experiment, lets people escape, lets markets breathe. States competing to cut regulations to attract businesses? That’s a race to the bottom for red tape, but a race to the top for innovation—workers might gripe, but they’ll push back, and the tension’s healthy. Bring it—let the cage match play out. The Constitution’s checks are enough if we stop coddling the system.

Why This Matters

I’m not pitching a utopia. I’m pitching a stress test. The U.S. isn’t a fragile porcelain doll; it’s a rugged piece of hardware built to take some hits. Let it fail a little—filibuster, court, feds, whatever. Patch the holes with amendments if you want, or lean into the grind. Either way, stop fearing the crash. It’s how we debug the republic.

So, what’s your take? Ready to let the system rumble, or got a better way to secure the code? Hit me up—I’m all ears.

-

@ c9badfea:610f861a

2025-05-20 19:49:20

@ c9badfea:610f861a

2025-05-20 19:49:20- Install Sky Map (it's free and open source)

- Launch the app and tap Accept, then tap OK

- When asked to access the device's location, tap While Using The App

- Tap somewhere on the screen to activate the menu, then tap ⁝ and select Settings

- Disable Send Usage Statistics