-

@ 58537364:705b4b85

2025-05-22 05:42:27

@ 58537364:705b4b85

2025-05-22 05:42:27คนเรามักจะเห็นคุณค่าของสิ่งใด ส่วนใหญ่ก็ใน ๒ สถานการณ์คือ หนึ่ง ตอนที่ยังไม่ได้มา หรือ สอง ตอนที่เสียไปแล้ว

อันนี้มันเป็นโศกนาฏกรรม ที่เกิดขึ้นกับผู้คนจำนวนมาก การที่คนเรามีสิ่งดีๆ แต่ว่าเราไม่เห็นคุณค่า เพราะว่าเรามองออกไปนอกตัว ไปเห็นแต่สิ่งที่ตัวเองไม่มี อยากจะได้มา

คล้ายๆ กับเรื่อง หมาคาบเนื้อในนิทานอีสป ตอนเด็กๆ เราคงจำได้ มีหมาตัวหนึ่งคาบเนื้อมา เนื้อชิ้นใหญ่เลย มันดีใจมากแล้วมันก็วิ่งไปยังที่ที่ มันจะได้กินเนื้ออย่างมีความสุข มีช่วงหนึ่งก็ต้องเดินข้ามสะพาน มันก็ชะโงกหน้าไปมองที่ลำธารหรือลำคลอง

ก็เห็นเงาตัวเอง เงานั่นมันก็ใหญ่ แล้วมันก็พบว่าในเงานั้น เนื้อในเงามันใหญ่กว่าเนื้อที่ตัวเองคาบ มันอยากได้เนื้อก้อนนั้นมากเลย เพราะว่ามันเป็นก้อนที่ใหญ่กว่า

มันก็เลยอ้าปาก เพื่อที่จะไปงับเนื้อในเงานั้น พอมันอ้าปาก ก็ปรากฏว่าเนื้อในปาก ก็หลุดตกลงแม่น้ำ แล้วเนื้อในเงานั้นก็หายไป เป็นอันว่าหมดเลย อดทั้ง 2 อย่าง .

ฉะนั้น คนเราถ้าหากเรา กลับมาเห็นคุณค่าของสิ่งที่เรามีอยู่ เราจะมีความสุขได้ง่าย อาจจะไม่ใช่สิ่งของ อาจจะไม่ใช่ผู้คน แต่อาจจะเป็นสุขภาพของเรา

อาจจะได้แก่ ลมหายใจของเรา ที่ยังหายใจได้ปกติ รวมถึงการที่ เรายังเดินเหินไปไหนมาไหนได้ การที่เรายังมองเห็น การที่เรายังได้ยิน

หลายคนมีสิ่งนี้อยู่ในตัว แต่กลับไม่เห็นค่า และไม่รู้สึกว่าตัวเองโชคดี กลับไปมองว่า ฉันยังไม่มีโน่นยังไม่มีนี่ ไม่มีบ้าน ไม่มีรถ ไม่มีเงิน

รู้สึกว่าทุกข์ระทมเหลือเกิน

ทำไมฉันจึงลำบากแบบนี้ ทั้งที่ตัวเองก็มีสิ่งดีๆ ในตัว สุขภาพ ความปกติสุข อิสรภาพที่เดินไปไหนมาไหนได้

แต่กลับไม่เห็นค่า เพราะว่ามัวแต่ไปสนใจสิ่งที่ตัวเองยังไม่มี

ซึ่งเป็นอนาคต

ถ้าเราหันกลับมาเห็นคุณค่าของสิ่งที่เรามีอยู่ แล้วก็ไม่ไปพะวงหรือให้ความสนใจกับสิ่งที่ยังไม่มี เราจะมีความสุขได้ง่าย อันนี้คือ ความหมายหนึ่งของการทำปัจจุบันให้ดีที่สุด

…

การทำปัจจุบันให้ดีที่สุด พระอาจารย์ไพศาล วิสาโล

-

@ 9c9d2765:16f8c2c2

2025-05-22 05:07:09

@ 9c9d2765:16f8c2c2

2025-05-22 05:07:09CHAPTER TWENTY FIVE

“It’s over… isn’t it?” Sandra asked gently, her eyes scanning James’s expression as they stood on the balcony overlooking the city skyline. The cold breeze tousled her hair, but James remained still, his hands tucked into the pockets of his tailored suit.

“No,” James replied calmly, his gaze fixated on the horizon. “This is just the eye of the storm. The calm before the reckoning.”

Sandra stepped closer, concern etched into her features. “Mark and Helen are finished in the eyes of the public and everyone round us. The evidence is damning. The authorities have issued warrants. What more could you possibly be planning?”

James turned to face her, a half-smile playing at the edge of his lips one not born of triumph, but of determination.

“Reputation is one thing,” he said, his voice measured and resolute, “but accountability is another. I won’t stop until every lie they told, every trap they laid, and every person they corrupted is exposed. I won’t just silence them, I'll dismantle everything they built with deceit.”

Inside the boardroom, Charles, Rita, and several executives were reviewing the latest media analytics. The company’s reputation had not only recovered but skyrocketed. Investors who once hesitated were now eager, flooding JP Enterprises with new partnerships and proposals.

Rita looked up from the screen. “We’ve just surpassed our projected valuation for the quarter. The crisis gave us more publicity than a million-dollar campaign would.”

Charles chuckled under his breath. “They handed us a scandal, and we turned it into a spotlight.”

Meanwhile, in a dark corner of the city, Mark and Helen sat huddled in a private lawyer’s office. Their appearance had changed drastically; both looked worn, disheveled, stripped of the pride and arrogance they once were like a crown.

“I told you,” Mark muttered bitterly, “we shouldn’t have gone after him like that. We were greedy. And now look ruined.”

Helen clenched her fists. Her pride was still fighting, even though her kingdom had collapsed. “It’s not over. We still have connections. The law can be manipulated. If we go down, we don’t go alone.”

“And say what?” Mark snapped. “That we were outsmarted? That the man we called a street dog now owns eighty-five percent of our legacy? That he single handedly turned the world against us?”

Helen’s jaw tightened. “If there’s one thing I know about James, it’s that he never lets go of the past. And that might just be his weakness.”

But even as they plotted, they didn’t know James had already anticipated their final desperation. Back at JP Enterprises, in a high-security conference room, investigators were filing reports, financial audits, bribery trails, hacked communications all linked directly to the duo. James had ensured that every illegal move they made was documented, cross-referenced, and legally binding.

Later that evening, James stood alone in his office, the city bathed in golden twilight. He took a slow breath and whispered to himself:

“They mistook my silence for surrender. My fall for failure. But every exile sharpens a man’s edge. And now they’ll witness the blade.”

Just then, a knock came at the door.

“Come in,” he said.

It was Mrs. JP, her expression soft but proud.

“You handled yourself like a true heir,” she said, walking toward him.

James turned, emotion flickering in his eyes.

“Thank you,” he said quietly.

She reached out, holding his hand. “Your father and I… we made mistakes. We let our fear and our pride cloud your judgment. But seeing you today, the man you’ve become, I see now that everything we hoped for in a successor lives in you.”

He smiled faintly. “I didn’t do it for recognition. I did it for dignity. For every time I was humiliated, overlooked, and discarded. I wanted to prove that worth isn’t given, it's earned.”

As they stood in silence, the city lights below gleamed like stars scattered on the earth.

The evening had settled quietly over the city, and the soft hum of the wind outside was the only sound that broke the stillness of the room. James stood at the window of his office, watching the neon lights flicker to life across the skyline, each glow a reminder of his success. His gaze, however, wasn’t on the bright lights of victory, but on the darker shadows of those who had tried to ruin him.

He turned around as the door clicked open, revealing Rita, who walked in with a folder in her hands. There was something different in her posturean air of finality in the way she carried herself.

"I’ve been reviewing the report from the legal team," she began, laying the folder on his desk. "The evidence against Mark and Helen is irrefutable. Their assets are frozen, and their personal accounts are being audited. They’re on the brink of losing everything."

James nodded, his face unreadable, but inside, the weight of the moment settled over him. This was the culmination of years of effort, the battle for his honor, his family's name, and the very future of JP Enterprises. But the victory, as sweet as it was, felt hollow.

"Is that all?" he asked, his voice low.

Rita hesitated for a moment. "There’s something else. Something you need to see."

She opened the folder, revealing a series of photographs and documents of Mark and Helen in compromising positions, shaking hands with notorious figures, and receiving bribes from external business associates. The weight of their corruption was staggering. The photos captured the desperation in their eyes, the deceit in their every smile.

James glanced at the images, but there was no anger in his expression. Only an eerie calm.

"I don’t need to see this," he said quietly. "I already know everything."

Rita frowned, confused. "Then why keep going? Why dig into their past when you already have what you need?"

James leaned back in his chair, crossing his arms. "Because it's not about them anymore." He paused, allowing the gravity of his words to settle. "It’s about ensuring that no one else dares to make the same mistakes they did. No one else will ever underestimate me again."

Rita studied him carefully. There was a resolute determination in his eyes a fierce will that had carried him from the streets to the heights of power. She couldn’t help but admire his unwavering focus.

"You’ve become something entirely different," she murmured. "The man we see now... is nothing like the one who started this journey."

James met her gaze, a faint smile tugging at the corners of his lips.

-

@ 90152b7f:04e57401

2025-05-22 03:51:20

@ 90152b7f:04e57401

2025-05-22 03:51:20Wikileaks - S E C R E T SECTION 01 OF 02 TEL AVIV 001733 SIPDIS SIPDIS E.O. 12958: DECL: 06/13/2017 TAGS: PREL, PTER, MOPS, KWBG, LE, SY, IS SUBJECT: MILITARY INTELLIGENCE DIRECTOR YADLIN COMMENTS ON GAZA, SYRIA AND LEBANON Classified By: Ambassador Richard H. Jones, Reason 1.4 (b) (d)

2007 June 13

1. (S) Summary. During a June 12 meeting with the Ambassador, IDI Director MG Amos Yadlin said that Gaza was "number four" on his list of threats, preceded by Iran, Syria, and Hizballah in that order. Yadlin said the IDI has been predicting armed confrontation in Gaza between Hamas and Fatah since Hamas won the January 2006 legislative council elections. Yadlin felt that the Hamas military wing had initiated the current escalation with the tacit consent of external Hamas leader Khalid Mishal, adding that he did not believe there had been a premeditated political-level decision by Hamas to wipe out Fatah in Gaza. Yadlin dismissed Fatah's capabilities in Gaza, saying Hamas could have taken over there any time it wanted for the past year, but he agreed that Fatah remained strong in the West Bank. Although not necessarily reflecting a GOI consensus view, Yadlin said Israel would be "happy" if Hamas took over Gaza because the IDF could then deal with Gaza as a hostile state. He dismissed the significance of an Iranian role in a Hamas-controlled Gaza "as long as they don't have a port." Regarding predictions of war with Syria this summer, Yadlin recalled the lead-up to the 1967 war, which he said was provoked by the Soviet Ambassador in Israel. Both Israel and Syria are in a state of high alert, so war could happen easily even though neither side is seeking it. Yadlin suggested that the Asad regime would probably not survive a war, but added that Israel was no longer concerned with maintaining that "evil" regime. On Lebanon, Yadlin felt that the fighting in the Nahr Al-Barid camp was a positive development for Israel since it had "embarrassed" Hizballah, adding that IDI had information that the Fatah Al-Islam terrorist group was planning to attack UNIFIL before it blundered into its confrontation with the LAF. End Summary.

Gaza Fighting Not Israel's Main Problem

---------------------------------------

2. (S) The Ambassador, accompanied by Pol Couns and DATT, called on IDI Director Major General Amos Yadlin June 12. Noting reports of fierce fighting between Hamas and Fatah in Gaza that day, the Ambassador asked for Yadlin's assessment. Yadlin described Gaza as "not Israel's main problem," noting that it ranked fourth in his hierarchy of threats, behind Iran, Syria, and Hizballah. Yadlin described Gaza as "hopeless for now," commenting that the Palestinians had to realize that Hamas offered no solution. IDI analysts, he said, had predicted a confrontation in Gaza since Hamas won the Palestinian Legislative Council elections in January 2006. Yadlin commented that Palestinian President Mahmoud Abbas and Hamas Prime Minister Ismail Haniyeh had become personally close despite their ideological differences, but neither leader had control over those forces under them.

3. (S) Yadlin explained that both Fatah and Hamas contained many factions. The Hamas military wing had been frustrated since the signing of the Mecca Agreement in January, but there were also many armed groups in Gaza that were not under the control of either party. Yadlin cited the example of the Dughmush clan, which had shifted from Fatah to the Popular Resistance Committees to Hamas before becoming an armed entity opposed to all of them. After May 15, the Hamas military wing had sought to export the fighting to Sderot by launching waves of Qassam rockets. One week later, as a result of IDF retaliation, they realized the price was too high and reduced the Qassam attacks.

4. (S) In response to the Ambassador's question, Yadlin said he did not think that day's Hamas attacks on Fatah security forces were part of a premeditated effort to wipe out Fatah in Gaza. Instead, they probably represented an initiative of the military wing with the tacit consent of Khalid Mishal in Damascus. Mishal was still considering the costs and benefits of the fighting, but the situation had become so tense that any incident could lead to street fighting without any political decision.

Gaza and West Bank Separating

-----------------------------

5. (S) The Ambassador asked Yadlin for his assessment of reports that Fatah forces had been ordered not to fight back. Yadlin said Mohammed Dahlan had 500 men and the Presidential Guard had 1,500 more. They understand that the balance of power favors Hamas, which "can take over Gaza any time it wants to." Yadlin said he would be surprised if Fatah fights, and even more surprised if they win. As far as he was concerned, this had been the case for the past year. The situation was different in the West Bank, however, where Fatah remained relatively strong and had even started to

TEL AVIV 00001733 002 OF 002

kidnap Hamas activists. Yadlin agreed that Tawfiq Tirawi had a power base in the West Bank, but he added that Fatah was not cohesive.

6. (S) The Ambassador commented that if Fatah decided it has lost Gaza, there would be calls for Abbas to set up a separate regime in the West Bank. While not necessarily reflecting a consensus GOI view, Yadlin commented that such a development would please Israel since it would enable the IDF to treat Gaza as a hostile country rather than having to deal with Hamas as a non-state actor. He added that Israel could work with a Fatah regime in the West Bank. The Ambassador asked Yadlin if he worried about a Hamas-controlled Gaza giving Iran a new opening. Yadlin replied that Iran was already present in Gaza, but Israel could handle the situation "as long as Gaza does not have a port (sea or air)."

War with Syria "Could Happen Easily"

------------------------------------

7. (S) Noting Israeli press speculation, the Ambassador asked Yadlin if he expected war with Syria this summer. Recalling the 1967 war, Yadlin commented that it had started as a result of the Soviet Ambassador in Israel reporting on non-existing Israeli preparations to attack Syria. Something similar was happening again, he said, with the Russians telling the Syrians that Israel planned to attack them, possibly in concert with a U.S. attack on Iran. Yadlin stated that since last summer's war in Lebanon, Syria had engaged in a "frenzy of preparations" for a confrontation with Israel. The Syrian regime was also showing greater self-confidence. Some Syrian leaders appeared to believe that Syria could take on Israel military, but others were more cautious. The fact that both sides were on high alert meant that a war could happen easily, even though neither side is seeking one. In response to a question, Yadlin said he did not think the Asad regime would survive a war, but he added that preserving that "evil" regime should not be a matter of concern.

Fighting in Nahr al-Barid Positive for Israel

---------------------------------------------

8. (S) The Ambassador asked Yadlin for his views on the fighting in the Nahr al-Barid refugee camp in northern Lebanon. Although Yadlin was called to another meeting and did not have time to elaborate, he answered that the fighting was positive for Israel because it had embarrassed Hizballah, which had been unable to adopt a clear-cut position on the Lebanese Army's action, and because the Fatah al-Islam terrorist organization had been planning to attack UNIFIL and then Israel before it blundered into its current confrontation with the LAF. He also agreed that the confrontation was strengthening the LAF, in fact and in the eyes of the Lebanese people, which was also good.

9. (S) Comment: Yadlin's relatively relaxed attitude toward the deteriorating security situation in Gaza represents a shift in IDF thinking from last fall, when the Southern Command supported a major ground operation into Gaza to remove the growing threat from Hamas. While many media commentators continue to make that argument, Yadlin's view appears to be more in synch with that of Chief of General Staff Ashkenazi, who also believes that the more serious threat to Israel currently comes from the north.

********************************************* ******************** Visit Embassy Tel Aviv's Classified Website: http://www.state.sgov.gov/p/nea/telaviv

You can also access this site through the State Department's Classified SIPRNET website. ********************************************* ******************** JONES

-

@ c1e6505c:02b3157e

2025-05-22 03:44:39

@ c1e6505c:02b3157e

2025-05-22 03:44:39This is day two of testing the Leica Summaron 35mm f2.8 on the Fujifilm X-Pro2.

The first part of this story you can find here on StackerNews**

TL;DR: I think I’m really enjoying this lens.

I went into it thinking I’d probably just sell it since it was gifted to me - assumed I wouldn’t like it. But after just a couple of days with it mounted on the X-Pro2, I’ve been surprisingly drawn to it.

Shooting wide open at f2.8 (which is how I’m testing it - to best reveal the lens’s character), the soft roll-off is really pleasing. It feels organic. The lens is over 50 years old, so I expected some quirks-but the quality feels natural, not overly “vintage". Takes the digital edge off.

The short focus throw is also really nice. Compared to the Summicron 35mm f2 v3 I usually shoot on my M262 (which has a longer throw), the Summaron feels tighter and more responsive when zone focusing.

One gripe: the infinity lock. It’s kind of annoying. I find myself accidentally locking it too often, but I’m getting used to holding the button down as I rotate the ring. I’ve read others complain about it, so I know I’m not alone there.

Most of these shots were from a bike ride to the river - about 6 miles out to swim and enjoy the sun. Perfect day for making a few photos.

This kind of work is honestly just fun. I enjoy the process, and even more so once I’m happy with the results and can share them.

Still building confidence in my work over time. I think I’m slowly refining my style - even if the subject matter is simple. Easier said than done, as any editor/curator knows (and I say this as one through NOICE Magazine).

Let me know what you think. I’ll try to upload higher resolution versions this time around (but not too high).

*Also, I use a program called Dehancer for creating the grain in these photographs. I highly recommend the program actually, I've been using it for a long time. If you would like to try it out, I have a promo code. Use "Pictureroom" for 10% off I believe.

You can further support me and my work by sending sats to colincz\@getalby.com. Thank you.

(note* this is being publised from the updated Primal reads client)

-

@ 2b998b04:86727e47

2025-05-22 02:45:34

@ 2b998b04:86727e47

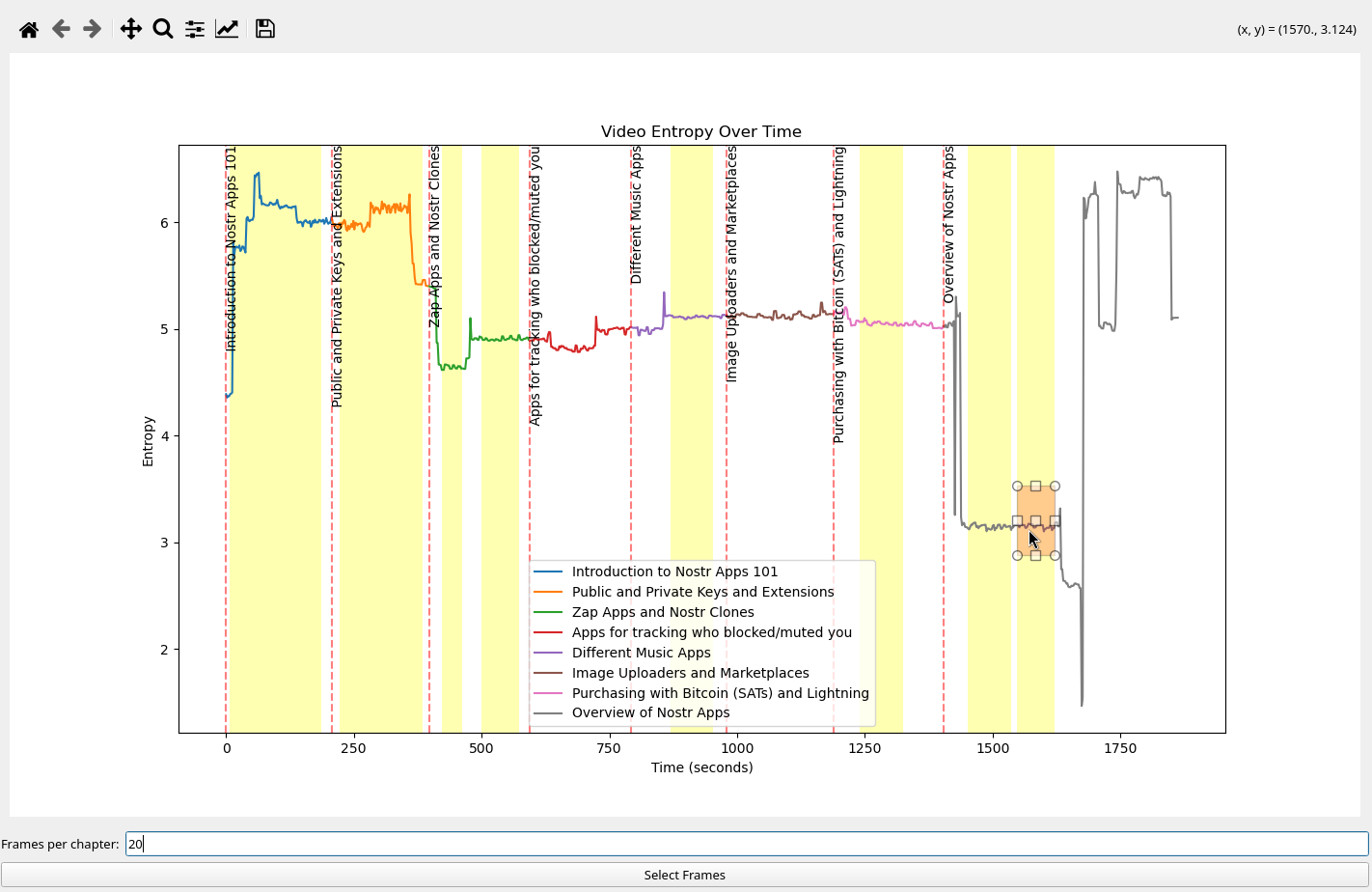

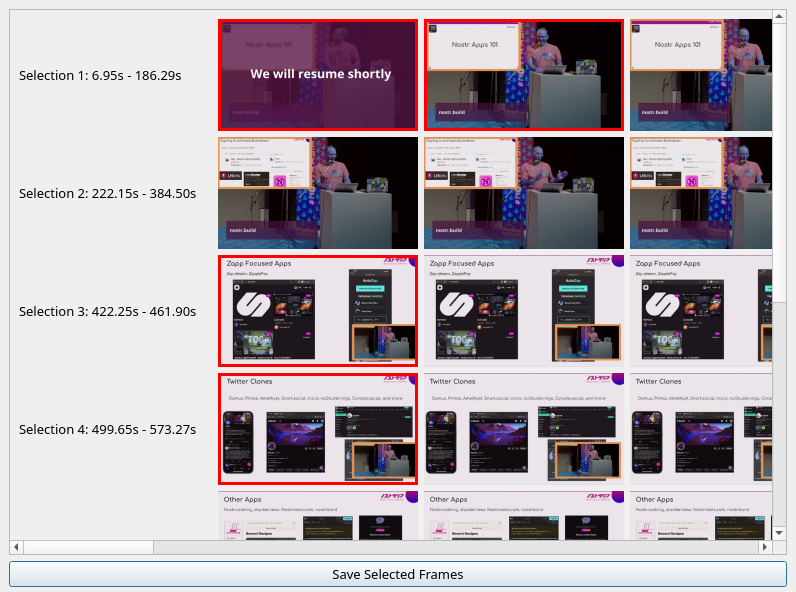

2025-05-22 02:45:34I recently released my first open-source tool:\ 👉 nostr-signal-filter

It fetches and formats your latest top-level Nostr note or long-form article, cleans up any embedded links using TinyURL, and outputs a clean version ready for reposting to:

-

LinkedIn

-

Facebook

-

X / Twitter

⚙️ Built for Simplicity

The stack is intentionally minimal:

-

Python + WebSockets + Bech32

-

TinyURL API for link shortening

-

Dockerized CLI usage:

bashCopyEdit

docker run --rm -e PUBKEY=npub1yourpubkeyhere nostr-fetcher > latest.mdFrom idea to working repo took under 3 hours — including debugging, Docker tweaks, README cleanup, and tagging a clean release.\ \ This most certainly would have taken much longer if I had done this all without ChatGPTs' help.\ \ 🖼️ Example Output (

latest.md)textCopyEdit

🕒 2025-05-20 22:24:17 📄 Note (originally posted on Nostr/primal.net) --- 🚨 New long-form drop: AI Isn’t Magic. It’s Engineering. How I use ChatGPT like any other tool in the stack — with iteration, discernment, and real output. Read it here: https://tinyurl.com/ynv7jq6g ⚡ Zaps appreciated if it resonates. --- 🔗 View on Nostr: https://tinyurl.com/yobvaxkx

🧪 Where I Used It

- ✅ Facebook: clean rendering with preview ->

- ✅ X/Twitter: teaser + link (had to truncate for character limit) ->

https://x.com/AndyGStanton/status/1925045477172773136

🙌 Try It Yourself

If you're publishing on Nostr but still sharing on legacy platforms:

👉 github.com/andrewgstanton/nostr-signal-filter

-

Clean output

-

Easy to run

-

Portable via Docker

All it needs is your

npub.

⚡ Zap Me If You Found This Useful

If this tool saved you time — or if it sparked ideas for your own Nostr publishing stack —\ send a zap my way. I’m always looking to connect with other creators who value signal > noise.

🔗 Zap on Primal -> https://primal.net/andrewgstanton

🔭 Next Features (I’d Love Help With)

-

Archive all notes + articles (not just the latest 50) to

archive.md -

Function to shorten links in any text block

-

Output

post.mdfor any given Nostr event ID (not just latest) -

Optional API integration to post directly to LinkedIn or X

Built with ChatGPT’s help.\ Iterated. Published. Cross-posted.\ That’s proof of work.

-

-

@ 90152b7f:04e57401

2025-05-22 02:30:51

@ 90152b7f:04e57401

2025-05-22 02:30:51WikiLeaks The Global Intelligence Files

Released on 2013-03-11 00:00 GMT

| Email-ID | 364528 | | -------- | --------------------------- | | Date | 2007-09-20 03:02:09 | | From | os@stratfor.com | | To | intelligence@stratfor.com |

Rice, Israeli FM discuss Israeli decision of defining Gaza as "hostile\ entity"\ 2007-09-20 00:41:16\ http://news.xinhuanet.com/english/2007-09/20/content_6756959.htm\ \ JERUSALEM, Sept. 19 (Xinhua) -- Visiting U.S. Secretary of State\ Condoleezza Rice met with Israeli Foreign Minister Tzipi Livni on\ Wednesday, the two discussed Israel's decision that defined the Hamas-\ controlled Gaza Strip as a "hostile entity."\ \ At a joint press conference held after their meeting, Rice told the\ reporters that the Palestinian Hamas is a "hostile entity" to U.S. as well.\ \ Israel's Security Cabinet declared the Gaza Strip a "hostile entity" on\ Wednesday ahead of Rice's visit and said it would cutoff power and fuel\ supplies to the strip.\ \ Gaza's population, largely impoverished, is almost entirely\ dependent on Israel for the supply of electricity, water and fuel, and a\ cutoff would deepen their hardship.\ \ Since the Hamas takeover in June, Israel has closed crossings with\ Gaza almost entirely, allowing in only humanitarian aid. However, Rice\ reiterated that the United States will not abandon the innocent\ Palestinians in Gaza.\ \ For her part, Livni said that Israel withdrew from the Gaza Strip\ two years ago, hoping that could lead to the establishment of a\ Palestinian state, but only get almost daily rocket attacks in return.\ \ "We expect the Palestinians to understand that Israeli security is\ in their own interests," Livni said, adding that Palestinians must\ understand "supporting Hamas won't help them."\ \ The Israeli Security Cabinet's declaration of Gaza as an "hostile\ entity" could lead to the most severe retaliatory measure taken by\ Israel against Palestinian rocket fire from the strip.\ \ The crude rocket attacks have killed 12 people in southern Israel in\ the past seven years, injured dozens more and badly disrupted daily life\ in the region.\ \ Last week, a Qassam rocket hit an Israeli military base near the\ Gaza Strip, wounding over 60 soldiers in the attack. The attack then\ sparked calls for the government to take harsh response against the Gaza\ Strip, which has been under the control of Hamas since it violently took\ over the enclave in mid June.\ \ The Jewish states has been holding Hamas responsible for the attack,\ although the movement has not been directly involved in the attacks.\ Israel still accused the Islamic movement of doing little to halt them.\ \ Apart from the Palestinian issue, Rice also discussed with Livni\ issues about Iran, Lebanon and the Middle East peace progress.\ \ She said Israel and the Palestinians are showing good faith in their\ negotiations towards a "two state solution."\ \ Regarding Iranian issues, Rice told reporters that diplomatic mean\ is a part of efforts to halt the Iranian nuclear program, but stressed\ it "has to have teeth."\ \ Rice, who had visited this region in August, is also expected to\ hold separate meetings on Wednesday with Israeli Defense Minister Ehud\ Barak and the Likud party head Binyamin Netanyahu.\ \ She will then hold a dinner meeting with Israeli Prime Minister Ehud\ Olmert.\ \ Rice is scheduled to leave here Thursday afternoon and visit the\ West Bank city of Ramallah for meetings with the Palestinian leadership\ on Thursday.

-

@ 502ab02a:a2860397

2025-05-22 01:30:37

@ 502ab02a:a2860397

2025-05-22 01:30:37ถ้าพูดถึง "เกาหลีใต้" หลายคนอาจนึกถึงซีรีส์ น้ำจิ้มเผ็ด หรือไอดอลหน้าผ่อง ๆ แต่เบื้องหลังวัฒนธรรมที่ลื่นไหลไปทั่วโลกนี้ ยังมีอาณาจักรธุรกิจขนาดมหึมาที่เป็นเหมือนเครื่องยนต์หลักผลักดันทั้งอาหาร เพลง หนัง และนวัตกรรมระดับโลก หนึ่งในนั้นคือ CJ Group ที่เริ่มต้นจากบริษัทน้ำตาลเล็ก ๆ ในปี 1953 แต่เติบโตจนกลายเป็นหนึ่งใน conglomerate หรือ "กลุ่มธุรกิจผูกเครือ" ที่ทรงอิทธิพลที่สุดของแดนโสม

คำว่า CJ ย่อมาจาก CheilJedang (แปลว่า “หมายเลขหนึ่งแห่งโลก” ในภาษาจีน-เกาหลี) ก่อตั้งโดย อี บยองชอล ผู้ก่อตั้ง Samsung Group ในช่วงเวลานั้น เกาหลีใต้กำลังฟื้นตัวจากสงครามเกาหลี และรัฐบาลส่งเสริมการพัฒนาอุตสาหกรรมภายในประเทศ เดิมเป็นหน่วยธุรกิจอาหารของกลุ่ม Samsung ในปี 1993 Cheil Jedang แยกตัวออกจาก Samsung Group และกลายเป็นบริษัทอิสระภายใต้การบริหารของ อี แจฮยอน หลานชายของอี บยองชอล แล้วขยายขอบเขตธุรกิจอย่างไม่หยุดยั้ง จากความเชี่ยวชาญใน "การหมัก" แบบดั้งเดิม พวกเขากลับกลายเป็นผู้เล่นรายใหญ่ระดับโลกในวงการ เทคโนโลยีชีวภาพ การผลิตอาหารไปจนถึงธุรกิจ บันเทิงระดับฮอลลีวูด และ โลจิสติกส์ข้ามทวีป

พูดง่าย ๆ ว่า CJ ไม่ได้แค่ส่งออกกิมจิหรือบิบิมบับ แต่พวกเขากำลังวางรากฐานของ "อนาคตแห่งอาหาร" และ "ความบันเทิงแบบไร้พรมแดน" ในเวลาเดียวกัน จนใครหลายคนถึงกับบอกว่า ถ้าอยากเข้าใจเกาหลีใต้ ก็ต้องเริ่มจากเข้าใจ CJ Group เสียก่อน

แล้วในเครือข่ายของ CJ Group มีธุรกิจอะไรบ้างที่น่าสนใจ และแบรนด์ไหนที่เราคุ้นเคยแบบไม่รู้ตัว ไปดูกันเลย

- ธุรกิจอาหารและบริการอาหาร (Food & Food Services)

- CJ CheilJedang บริษัทอาหารชั้นนำของเกาหลีใต้ มีผลิตภัณฑ์เด่น ได้แก่ Bibigo แบรนด์อาหารเกาหลีพร้อมรับประทาน เช่น เกี๊ยว ซอส และกิมจิ Hetbahn ข้าวสวยพร้อมรับประทานที่ได้รับความนิยมในเกาหลี

-

CJ Foodville ดำเนินธุรกิจร้านอาหารและเบเกอรี่ เช่น: Tous Les Jours ร้านเบเกอรี่สไตล์ฝรั่งเศส VIPS ร้านสเต็กและสลัดบุฟเฟ่ต์

-

ธุรกิจเทคโนโลยีชีวภาพ (Bio) ความเชี่ยวชาญนี้เป็นรากฐานสำคัญในการขยายธุรกิจด้านเทคโนโลยีชีวภาพของ CJ เลยครับ

- CJ BIO ผู้นำด้านการผลิตกรดอะมิโนและผลิตภัณฑ์ชีวภาพผ่านเทคโนโลยีการหมักจุลินทรีย์ เช่น Lysine, Tryptophan, Valine กรดอะมิโนที่ใช้ในอุตสาหกรรมอาหารสัตว์และอาหารเสริม

-

CJ Bioscience มุ่งเน้นการวิจัยและพัฒนาไมโครไบโอมเพื่อสุขภาพ

-

ธุรกิจโลจิสติกส์และค้าปลีก (Logistics & Retail)

- CJ Logistics ให้บริการโลจิสติกส์ครบวงจร ทั้งการขนส่งทางบก ทางทะเล และทางอากาศ รวมถึงบริการคลังสินค้าและการจัดการซัพพลายเชน

-

CJ Olive Young: ร้านค้าปลีกด้านสุขภาพและความงามอันดับหนึ่งของเกาหลี มีผลิตภัณฑ์ยอดนิยม เช่น Anua PDRN Set ชุดบำรุงผิวที่ได้รับความนิยม MILKTOUCH ผลิตภัณฑ์เมคอัพที่ได้รับความนิยม

-

ธุรกิจบันเทิงและสื่อ (Entertainment & Media) อันนี้ยิ่งใหญ่ระดับโลกมากๆ หลายคนคงจำได้กับ ภาพยนตร์เอเชียแรกกับรางวัลออสการ์ Parasite

- CJ ENM บริษัทผลิตและจัดจำหน่ายเนื้อหาบันเทิงที่มีชื่อเสียงระดับโลก มีผลงานเด่น ได้แก่ Crash Landing on You ซีรีส์ที่ได้รับความนิยมอย่างสูง Parasite ภาพยนตร์ที่ได้รับรางวัลออสการ์

- CJ CGV เครือโรงภาพยนตร์มัลติเพล็กซ์ที่มีสาขาทั่วโลก

CJ Group ขยายธุรกิจไปยังต่างประเทศ เช่น การเข้าซื้อกิจการ Schwan's Company ในสหรัฐอเมริกา และการเปิดสาขา CGV ในหลายประเทศ นอกจากนี้ CJ ยังมีบทบาทสำคัญในการเผยแพร่วัฒนธรรมเกาหลีสู่ระดับโลกผ่าน KCON และการผลิตเนื้อหาบันเทิงที่ได้รับความนิยมในต่างประเทศด้วยครับ

จะเห็นได้ว่า เครือข่ายของ CJ นั้นยิ่งใหญ่มากๆเลย ทีนี้มีเรื่องน่าสนใจตรงนี้ครับ

ในช่วงปี 2013–2016 CJ Group โดยเฉพาะฝ่ายสื่อบันเทิงอย่าง CJ ENM ต้องเผชิญกับแรงกดดันจากรัฐบาลของประธานาธิบดี พัค กึนฮเย เหตุการณ์สำคัญคือการที่ อี มีคยอง (Miky Lee) รองประธาน CJ และผู้มีบทบาทสำคัญในการขับเคลื่อนธุรกิจบันเทิงระดับโลก ถูกกดดันให้ลาออกจากตำแหน่ง รายงานระบุว่า ทำเนียบประธานาธิบดีไม่พอใจเนื้อหาสื่อบางรายการของ CJ ที่มีลักษณะเสียดสีหรือวิพากษ์วิจารณ์รัฐบาล เช่น รายการ SNL Korea ที่ล้อเลียนพัค กึนฮเย ผ่านตัวละคร Teletubbies

ภายใต้แรงกดดันนี้ CJ มีการปรับเปลี่ยนเนื้อหาสื่อ โดยลดการนำเสนอเนื้อหาที่อาจขัดแย้งกับรัฐบาล และหันไปผลิตภาพยนตร์ที่สอดคล้องกับนโยบายของรัฐ เช่น ภาพยนตร์เรื่อง Ode to My Father (2014) ที่สะท้อนความรักชาติและการพัฒนาเศรษฐกิจในยุคของพัค ชุงฮี บิดาของพัค กึนฮเย ภาพยนตร์เรื่องนี้ได้รับการสนับสนุนจากรัฐบาลและถูกมองว่าเป็น "ภาพยนตร์เพื่อสุขภาพ" ที่ส่งเสริมความภาคภูมิใจในชาติ แน่นอนว่าแค้นฝังหุ่นมันยังไม่หายไปไหนครับ

เมื่อเกิดการเปิดโปง "บัญชีดำ" (Blacklist) ของรัฐบาลพัค กึนฮเย ที่มีการจำกัดสิทธิเสรีภาพของศิลปินและผู้ผลิตสื่อที่วิพากษ์วิจารณ์รัฐบาล ทำให้เกิดกระแสต่อต้านอย่างรุนแรงในสังคมเกาหลี. ในปี 2016 ซน กยองชิก ประธาน CJ ได้ให้การต่อศาลว่า มีแรงกดดันจากรัฐบาลให้ อี มีคยอง หลีกเลี่ยงการมีบทบาทในบริษัท เหตุการณ์นี้เป็นส่วนหนึ่งของการเปิดโปงคดีทุจริตของพัค กึนฮเย ซึ่งนำไปสู่การประท้วงครั้งใหญ่และการถอดถอนประธานาธิบดีในปี 2017

หลังจากการเปลี่ยนแปลงทางการเมือง CJ Group ได้กลับมามีบทบาทอย่างเต็มที่ในวงการบันเทิงอีกครั้ง อี มีคยอง กลับมาดำรงตำแหน่งและมีบทบาทสำคัญในการผลักดันภาพยนตร์เรื่อง Parasite (2019) ซึ่งได้รับรางวัลออสการ์และยกระดับภาพลักษณ์ของ CJ ในระดับโลก ซึ่งถ้าใครได้ดูหนังเรื่องนั้นแล้วรู้เรื่องราวเบื้องหลังนี้จะเข้าใจเนื้อหาได้อย่างลึกซึ้งขึ้นไปอีกเลยครับ การนำเสนอเรื่องราวนี้ถือเป็นการวิพากษ์วิจารณ์สังคมและระบบทุนนิยมอย่างชัดเจน ซึ่งแตกต่างจากแนวทางที่ CJ เคยถูกกดดันให้ปฏิบัติตามในยุคของพัค กึนฮเย อย่างสิ้นเชิง

อย่าเพิ่งไปสะใจกับเนื้อหา ให้มองว่า "เขาทำอะไรได้บ้าง" นี่คือประเด็นสำคัญครับ #pirateketo #กูต้องรู้มั๊ย #ม้วนหางสิลูก #siamstr

-

@ 554ab6fe:c6cbc27e

2025-04-10 18:48:57

@ 554ab6fe:c6cbc27e

2025-04-10 18:48:57What is consciousness, and can it be changed or enhanced? This is a question that humans have struggled with for a very long time. The question of consciousness alone is daunting. Some even argue that humans will never be able to find the answer. Regardless, the quest for knowledge is not always about the answer, rather it is the journey that is revealing. This is true not only for our society, but the individual as well. The search for the truth often leads one down a path of self-reflection, and can lead to conclusions previously thought to be ludicrous. Here, I will argue that consciousness can be interpreted as an interpretation of reality, where the interpretation may become clearer and more accurate through practices such as meditation.

Consciousness

To articulate this idea, the concept of consciousness must firstly be discussed. There is an incredibly interesting TED talk given by Anil Seth, where he describes consciousness as an illusion. He explains how the brain receives signals from both the internal and external environment of the body, makes an interpretation of those signals, which creates our conscious experience. In his scientific writing, he claims that the brain can be viewed as a prediction machine1. He argues that the brain is constantly making predictions and error correcting in order to gain understanding of the signals it is receiving. He is not alone in this theory, and many other researchers concur that the constant comparison of internal predictions and external stimuli is what generates the brain’s sensations of causal forces2. There are plenty of reasons to believe this is true. Imagine, the brain is receiving all kinds of neuronal signals both from external stimuli sensors and sensors for our internal systems. These signals all shoot up the spinal cord to the brain. It is unclear that these neuronal signals are stamped with an identifier of where they came from, so the brain has to make a predictive model for not only where the signal came from, but also why the signal came at all. The latter is important for survival: the use of our senses to accurately predict our environment would be a critical reason why consciousness developed in the first place. Imagine you are an ancient hominid walking in the wild: you see a tangled cord like thing around a branch on the tree. You need to process that information, determine if it is more branch or a snake and act accordingly. This is a potential biological reason for the manifestation of thought and problem solving. This is a very meta-cognitive example of our brain receiving information and then using previous knowledge to generate a predictive conclusion on the external reality.

There are also examples of this outside of the more obvious meta-cognitive examples. A good example is the famous rubber hand experiment. The first rubber hand experiment was conducted in 1998 by Botvinick and Cohen3. In this experiment, a subject places their hand on a table with a screen blocking their view of their own hand. A rubber hand is then placed on the other side of the screen where it is visible. The experimenter rubs both the rubber hand and real hand with a paint brush. By the end of the experiment, subjects begin to feel as if the rubber hand is their own limb3. The brain, using the visual senses, detects that a hand is being stroked with a brush while sensory neurons send signals that the hand is experiencing the touch of a paint brush. These two signals cause the predicting brain to think that the rubber hand is our hand. This experiment has been repeated many times in different ways. It has been observed that participants begin to react defensively to the threat of pain or damage to the rubber hand4. This illustrates the powerful extent at which the brain processes and reacts to information that it interprets from reality. Amazingly, some research suggests that the touch aspect of the experiment isn’t even necessary to produce the illusion5. Others have recreated this experience using virtual reality, citing that when the virtual hand changed color in response to the subject’s heartbeat, a significant sense of body ownership was generated6. Body ownership, and our sense of reality is arguably determined by our brain’s interpretation of both internal and external stimuli.

The Neuroscience and Meditation

It is hypothesized that the anterior insular cortex (AIC) is involved in the comparison of the stimuli to the predicted model1. Interestingly, the same brain region is associated with the anticipation of pain7. For those unaware, there is some research to suggest that much of the pain we experience is not due to the actual noxious stimuli (physical pain sensation), but from the anticipation of that pain. Evidence for this can be found in studies such as Al-Obaidi et al. from 2005, that concluded that the pain experienced in patients with chronic low back pain could not be solely attributed to the sensor signals, but from the anticipation of the pain8. Additionally, the anticipation of pain relief is the primary contributor to placebo analgesia (placebo pain killers)9. Furthermore, a large body of research has been conducted showing that meditators show a decreased anticipatory attitude towards pain, subsequently experiencing less unpleasant pain 7,10,11. For example, chronic pain in multiple areas such as the low back, neck, shoulder, and arms have been shown to reduce after meditation practice12. Finally, an extreme case study worth noting is of a yogi master who claimed to not experience pain at all13. When this master was brought into the lab, not only did he not experience pain, but his thalamus showed no additional activation following painful stimuli13. What is fascinating about this is that the thalamus is the main relay station for all incoming somatosensory information14, and some argue that this is a candidate for the location of consciousness15. To not have strong activation here after painful stimuli is to suggest a radical change in how the brain receives incoming stimuli, and perhaps is indicative in a dramatic shift in how this individual’s conscious experiences the world. Though this is but one small example, the previous studies outline a strong case for meditation’s ability to alter the way the brain processes information. Given meditation involves the active practice of generating an open and non-judgmental attitude towards all incoming stimuli, perhaps this alters the processing of incoming stimuli, thereby changing the predictive model. On a similar note, perhaps it relates to neuroplastic changes that occur within the brain. It has been noted that the AIC is activated during times of awareness of mind wandering16. This suggests that the AIC is in use frequently during meditation practices. Perhaps it is strengthened then by meditation, thereby also allowing for greater prediction model generation. Imagine the mind as a pond. If the pond is calm and still, one single rain drop rippling in the pond is clearly identifiable. One would easily know information about the droplet, because the ripple could be easily analyzed. Now imagine a pond during a rain storm, where an uncountable amount of rain drops is hitting the pond and there are ripples everywhere. One could not adequately make out where each ripple came from, because there would be too much overlap in the ripples. This may be how the brain functions as well. When the signals are low, and no extraneous thoughts and interpretations are created from signals, then the brain’s prediction model can easily determine where and why a signal it received came from. If, however, the mind is chaotic and full of internal noise, then the brain has a harder time creating an accurate understanding of incoming stimuli and generating a correct model.

Enlightenment

Enlightenment, from a scientific point of view, has been defined as a form of awareness where a person feels that s/he has gained a new understanding of reality 17. In this sense, it bears a striking relationship to the topic of consciousness. If consciousness can be defined as our interpretation of the external and internal environment through our mental prediction model, then experiences of enlightenment are defined by moments where our interpretation is completely changed in a profound way. The experiences are often characterized by the loss of individuality and consequent identification of being part of a greater oneness 18,19. As an interesting side note, this same experience is common amongst subjects, who in a double-blinded study, take psilocybin (the active ingredient in magic mushrooms)20,21. The neuroscience of enlightenment is particularly interesting. The temporo-parietal junction of the brain is involved with self-location and body ownership22. Unsurprisingly, this area is highly involved in the illusion of the rubber hand experiment23. This is the same brain area that is hypothesized to be related to these enlightened experiences of oneness 17. If this brain area, which handles the interpretation of where and what the body is, was to decrease in activation, then the brain would generate a more ambiguous interpretation that the self and the external environment are less distinct than previously thought. This is a possible explanation to why enlightenment experiences involve a feeling of oneness with everything. To bring this all home, meditation has been shown to decrease parietal lobe activation 4,24. Suggesting that meditation can be a method of adjusting the brain’s interpretation of stimuli to generate an outlook that is unifying in perceptive.

Closing Remarks

The evidence that meditation may lead to an altered conscious living has deep philosophical implications. Meditation is a practice that, in part, involves an open awareness to all incoming stimuli alongside the absence of any meta-cognitive interpretation or processing of said stimuli. This generation of a still mind may generate a more accurate prediction model of incoming stimuli, void of any corruption on the part of our thoughts. Given the observation that meditation, both scientifically and culturally, can lead to an understanding and experience of a greater oneness amongst all suggests that this interpretation of incoming stimuli is the more accurate interpretation. It is hard to imagine that anyone would not advocate the beauty and usefulness of this perspective. If more people had this perspective, we would have a much more peaceful, happy and unified society and planet. Ironically, our culture often aims to arrive to this philosophical perspective through analytical thought. However, given the evidence in this post, perhaps it is the absence of analytical thought, and the stillness of the mind that truly grants this perspective.

**References ** 1. Seth AK. Interoceptive inference, emotion, and the embodied self. Trends in Cognitive Sciences. 2013;17(11):565-573. doi:10.1016/j.tics.2013.09.007 2. Synofzik M, Thier P, Leube DT, Schlotterbeck P, Lindner A. Misattributions of agency in schizophrenia are based on imprecise predictions about the sensory consequences of one’s actions. Brain. 2010;133(1):262-271. doi:10.1093/brain/awp291 3. Botvinick M, Cohen JD. Rubber hand ‘feels’ what eyes see. Nature. 1998;391(February):756. 4. Newberg A, Alavi A, Baime M, Pourdehnad M, Santanna J, D’Aquili E. The measurement of regional cerebral blood flow during the complex cognitive task of meditation: A preliminary SPECT study. Psychiatry Research - Neuroimaging. 2001;106(2):113-122. doi:10.1016/S0925-4927(01)00074-9 5. Ferri F, Chiarelli AM, Merla A, Gallese V, Costantini M. The body beyond the body: Expectation of a sensory event is enough to induce ownership over a fake hand. Proceedings of the Royal Society B: Biological Sciences. 2013;280(1765). doi:10.5061/dryad.8f251 6. Suzuki K, Garfinkel SN, Critchley HD, Seth AK. Multisensory integration across exteroceptive and interoceptive domains modulates self-experience in the rubber-hand illusion. Neuropsychologia. 2013;51(13):2909-2917. doi:10.1016/j.neuropsychologia.2013.08.014 7. Zeidan F, Grant JA, Brown CA, McHaffie JG, Coghill RC. Mindfulness meditation-related pain relief: Evidence for unique brain mechanisms in the regulation of pain. Neuroscience Letters. 2012;520(2):165-173. doi:10.1016/j.neulet.2012.03.082 8. Al-Obaidi SM, Beattie P, Al-Zoabi B, Al-Wekeel S. The relationship of anticipated pain and fear avoidance beliefs to outcome in patients with chronic low back pain who are not receiving workers’ compensation. Spine. 2005;30(9):1051-1057. doi:10.1097/01.brs.0000160848.94706.83 9. Benedetti F, Mayberg HS, Wager TD, Stohler CS, Zubieta JK. Neurobiological mechanisms of the placebo effect. In: Journal of Neuroscience. Vol 25. Society for Neuroscience; 2005:10390-10402. doi:10.1523/JNEUROSCI.3458-05.2005 10. Gard T, Hölzel BK, Sack AT, et al. Pain attenuation through mindfulness is associated with decreased cognitive control and increased sensory processing in the brain. Cerebral Cortex. 2012;22(11):2692-2702. doi:10.1093/cercor/bhr352 11.Grant JA, Courtemanche J, Rainville P. A non-elaborative mental stance and decoupling of executive and pain-related cortices predicts low pain sensitivity in Zen meditators. Pain. 2011;152(1):150-156. doi:10.1016/j.pain.2010.10.006 12. Kabat-Zinn J, Lipworth L, Burney R. The clinical use of mindfulness meditation for the self-regulation of chronic pain. Journal of Behavioral Medicine. 1985;8(2):163-190. doi:10.1007/BF00845519 13. Kakigi R, Nakata H, Inui K, et al. Intracerebral pain processing in a Yoga Master who claims not to feel pain during meditation. European Journal of Pain. 2005;9(5):581. doi:10.1016/j.ejpain.2004.12.006 14. Steeds CE. The anatomy and physiology of pain. Surgery. 2009;27(12):507-511. doi:10.1016/j.mpsur.2009.10.013 15. Min BK. A thalamic reticular networking model of consciousness. Theoretical Biology and Medical Modelling. 2010;7(1):1-18. doi:10.1186/1742-4682-7-10 16. Hasenkamp W, Wilson-Mendenhall CD, Duncan E, Barsalou LW. Mind wandering and attention during focused meditation: A fine-grained temporal analysis of fluctuating cognitive states. NeuroImage. 2012;59(1):750-760. doi:10.1016/j.neuroimage.2011.07.008 17. Newberg AB, Waldman MR. A neurotheological approach to spiritual awakening. International Journal of Transpersonal Studies. 2019;37(2):119-130. doi:10.24972/ijts.2018.37.2.119 18. Johnstone B, Cohen D, Konopacki K, Ghan C. Selflessness as a Foundation of Spiritual Transcendence: Perspectives From the Neurosciences and Religious Studies. International Journal for the Psychology of Religion. 2016;26(4):287-303. doi:10.1080/10508619.2015.1118328 19. Yaden DB, Haidt J, Hood RW, Vago DR, Newberg AB. The varieties of self-transcendent experience. Review of General Psychology. 2017;21(2):143-160. doi:10.1037/gpr0000102 20. Griffiths RR, Richards WA, McCann U, Jesse R. Psilocybin can occasion mystical-type experiences having substantial and sustained personal meaning and spiritual significance. Psychopharmacology. 2006;187(3):268-283. doi:10.1007/s00213-006-0457-5 21. Griffiths RR, Richards WA, Johnson MW, McCann UD, Jesse R. Mystical-type experiences occasioned by psilocybin mediate the attribution of personal meaning and spiritual significance 14 months later. Journal of Psychopharmacology. 2008;22(6):621-632. doi:10.1177/0269881108094300 22. Serino A, Alsmith A, Costantini M, Mandrigin A, Tajadura-Jimenez A, Lopez C. Bodily ownership and self-location: Components of bodily self-consciousness. Consciousness and Cognition. 2013;22(4):1239-1252. doi:10.1016/j.concog.2013.08.013 23. Tsakiris M, Costantini M, Haggard P. The role of the right temporo-parietal junction in maintaining a coherent sense of one’s body. Neuropsychologia. 2008;46(12):3014-3018. doi:10.1016/j.neuropsychologia.2008.06.004 24. Herzog H, Leie VR, Kuweit T, Rota E, Ludwig K. Biological Psychology/Pharmacopsychology. Published online 1990:182-187.

-

@ 0edc2f47:730cff1b

2025-04-04 03:37:02

@ 0edc2f47:730cff1b

2025-04-04 03:37:02Chef's notes

This started as a spontaneous kitchen experiment—an amalgamation of recipes from old cookbooks and online finds. My younger daughter wanted to surprise her sister with something quick but fancy ("It's a vibe, Mom."), and this is what we came up with. It’s quickly established itself as a go-to favorite: simple, rich, and deeply satisfying. It serves 4 (or 1, depending on the day; I am not here to judge). Tightly wrapped, it will keep up to 3 days in the fridge, but I bet it won't last that long!

Details

- ⏲️ Prep time: 10 min

- 🍳 Cook time: 0 min

Ingredients

- 1 cup (240mL) heavy whipping cream

- 1/4 cup (24g) cocoa powder

- 5 tbsp (38g) Confectioners (powdered) sugar

- 1/4 tsp (1.25mL) vanilla extract (optional)

- Flaky sea salt (optional, but excellent)

Directions

-

- Whip the cream until frothy.

-

- Sift in cocoa and sugar, fold or gently mix (add vanilla if using).

-

- Whip to medium peaks (or stiff peaks, if that's more your thing). Chill and serve (topped with a touch of sea salt if you’re feeling fancy).

-

@ 04c915da:3dfbecc9

2025-05-20 15:53:48

@ 04c915da:3dfbecc9

2025-05-20 15:53:48This piece is the first in a series that will focus on things I think are a priority if your focus is similar to mine: building a strong family and safeguarding their future.

Choosing the ideal place to raise a family is one of the most significant decisions you will ever make. For simplicity sake I will break down my thought process into key factors: strong property rights, the ability to grow your own food, access to fresh water, the freedom to own and train with guns, and a dependable community.

A Jurisdiction with Strong Property Rights

Strong property rights are essential and allow you to build on a solid foundation that is less likely to break underneath you. Regions with a history of limited government and clear legal protections for landowners are ideal. Personally I think the US is the single best option globally, but within the US there is a wide difference between which state you choose. Choose carefully and thoughtfully, think long term. Obviously if you are not American this is not a realistic option for you, there are other solid options available especially if your family has mobility. I understand many do not have this capability to easily move, consider that your first priority, making movement and jurisdiction choice possible in the first place.

Abundant Access to Fresh Water

Water is life. I cannot overstate the importance of living somewhere with reliable, clean, and abundant freshwater. Some regions face water scarcity or heavy regulations on usage, so prioritizing a place where water is plentiful and your rights to it are protected is critical. Ideally you should have well access so you are not tied to municipal water supplies. In times of crisis or chaos well water cannot be easily shutoff or disrupted. If you live in an area that is drought prone, you are one drought away from societal chaos. Not enough people appreciate this simple fact.

Grow Your Own Food

A location with fertile soil, a favorable climate, and enough space for a small homestead or at the very least a garden is key. In stable times, a small homestead provides good food and important education for your family. In times of chaos your family being able to grow and raise healthy food provides a level of self sufficiency that many others will lack. Look for areas with minimal restrictions, good weather, and a culture that supports local farming.

Guns

The ability to defend your family is fundamental. A location where you can legally and easily own guns is a must. Look for places with a strong gun culture and a political history of protecting those rights. Owning one or two guns is not enough and without proper training they will be a liability rather than a benefit. Get comfortable and proficient. Never stop improving your skills. If the time comes that you must use a gun to defend your family, the skills must be instinct. Practice. Practice. Practice.

A Strong Community You Can Depend On

No one thrives alone. A ride or die community that rallies together in tough times is invaluable. Seek out a place where people know their neighbors, share similar values, and are quick to lend a hand. Lead by example and become a good neighbor, people will naturally respond in kind. Small towns are ideal, if possible, but living outside of a major city can be a solid balance in terms of work opportunities and family security.

Let me know if you found this helpful. My plan is to break down how I think about these five key subjects in future posts.

-

@ 0d1df3b1:7aa4699c

2025-05-22 00:01:24

@ 0d1df3b1:7aa4699c

2025-05-22 00:01:24YO

-

@ cd17b2d6:8cc53332

2025-05-21 22:28:09

@ cd17b2d6:8cc53332

2025-05-21 22:28:09Looking to simulate a USDT deposit that appears instantly in a wallet — with no blockchain confirmation, no real spend, and no trace?

You’re in the right place.

🔗 Buy Flash USDT Now This product sends Flash USDT directly to your TRC20, ERC20, or BEP20 wallet address — appears like a real deposit, but disappears after a set time or block depth.

✅ Perfect for: Simulating token inflows Wallet stress testing “Proof of funds” display Flash USDT is ideal for developers, trainers, UI testers, and blockchain researchers — and it’s fully customizable.

🧠 What Is Flash USDT? Flash USDT is a synthetic transaction that mimics a real Tether transfer. It shows up instantly in a wallet balance, and it’s confirmed on-chain — and expires after a set duration.

This makes it:

Visible on wallet interfaces Time-limited (auto-disappears cleanly) Undetectable on block explorers after expiry It’s the smartest, safest way to simulate high-value transactions without real crypto.

🛠️ Flash USDT Software – Your Own USDT Flasher at Your Fingertips Want to control the flash? Run your own operations? Flash unlimited wallets?

🔗 Buy Flash USDT Software

This is your all-in-one USDT flasher tool, built for TRC20, ERC20, and BEP20 chains. It gives you full control to:

Send custom USDT amounts Set custom expiry time (e.g., 30–360 days) Flash multiple wallets Choose between networks (Tron, ETH, BSC) You can simulate any amount, to any supported wallet, from your own system.

No third-party access. No blockchain fee. No trace left behind.

💥 Why Our Flash USDT & Software Stands Out Feature Flash USDT Flash USDT Software One-time flash send ✅ Yes Optional Full sender control ❌ No ✅ Yes TRC20 / ERC20 / BEP20 ✅ Yes ✅ Yes Custom duration/expiry Limited ✅ Yes Unlimited usage ❌ One-off ✅ Yes Whether you’re flashing for wallet testing, demoing investor dashboards, or simulating balance flows, our tools deliver realism without risk.

🛒 Ready to Buy Flash USDT or the Software? Skip the wait. Skip the scammers. You’re one click away from real control.

👉 Buy Flash USDT 👉 Buy Flash USDT Software

📞 Support or live walkthrough?

💬 Telegram: @cryptoflashingtool 📱 WhatsApp: +1 770-666-2531

🚫 Legal Notice These tools are intended for:

Educational purposes Demo environments Wallet and UI testing They are not for illegal use or financial deception. Any misuse is your full responsibility.

Final Call: Need to flash USDT? Want full control? Don’t wait for another “maybe” tool.

Get your Flash USDT or Flashing Software today and simulate like a pro.

🔗 Buy Now → Flash USDT 🔗 Buy Now → Flash USDT Software 💬 Telegram: @cryptoflashingtool 📱 WhatsApp: +1 770-666-2531Looking to simulate a USDT deposit that appears instantly in a wallet — with no blockchain confirmation, no real spend, and no trace?

You’re in the right place.

Buy Flash USDT Now\ This product sends Flash USDT directly to your TRC20, ERC20, or BEP20 wallet address — appears like a real deposit, but disappears after a set time or block depth.

Perfect for:

- Simulating token inflows

- Wallet stress testing

- “Proof of funds” display

Flash USDT is ideal for developers, trainers, UI testers, and blockchain researchers — and it’s fully customizable.

What Is Flash USDT?

Flash USDT is a synthetic transaction that mimics a real Tether transfer. It shows up instantly in a wallet balance, and it’s confirmed on-chain — and expires after a set duration.

This makes it:

- Visible on wallet interfaces

- Time-limited (auto-disappears cleanly)

- Undetectable on block explorers after expiry

It’s the smartest, safest way to simulate high-value transactions without real crypto.

Flash USDT Software – Your Own USDT Flasher at Your Fingertips

Want to control the flash?\ Run your own operations?\ Flash unlimited wallets?

This is your all-in-one USDT flasher tool, built for TRC20, ERC20, and BEP20 chains. It gives you full control to:

- Send custom USDT amounts

- Set custom expiry time (e.g., 30–360 days)

- Flash multiple wallets

- Choose between networks (Tron, ETH, BSC)

You can simulate any amount, to any supported wallet, from your own system.

No third-party access.\ No blockchain fee.\ No trace left behind.

Why Our Flash USDT & Software Stands Out

Feature

Flash USDT

Flash USDT Software

One-time flash send

Yes

Optional

Full sender control

No

Yes

TRC20 / ERC20 / BEP20

Yes

Yes

Custom duration/expiry

Limited

Yes

Unlimited usage

One-off

Yes

Whether you’re flashing for wallet testing, demoing investor dashboards, or simulating balance flows, our tools deliver realism without risk.

Ready to Buy Flash USDT or the Software?

Skip the wait. Skip the scammers.\ You’re one click away from real control.

Support or live walkthrough?

Telegram: @cryptoflashingtool

WhatsApp: +1 770-666-2531

Legal Notice

These tools are intended for:

- Educational purposes

- Demo environments

- Wallet and UI testing

They are not for illegal use or financial deception. Any misuse is your full responsibility.

Final Call:

Need to flash USDT? Want full control?\ Don’t wait for another “maybe” tool.

Get your Flash USDT or Flashing Software today and simulate like a pro.

Telegram: @cryptoflashingtool

WhatsApp: +1 770-666-2531

-

@ 2b24a1fa:17750f64

2025-04-01 08:09:55

@ 2b24a1fa:17750f64

2025-04-01 08:09:55 -

@ bc6ccd13:f53098e4

2025-05-21 22:13:47

@ bc6ccd13:f53098e4

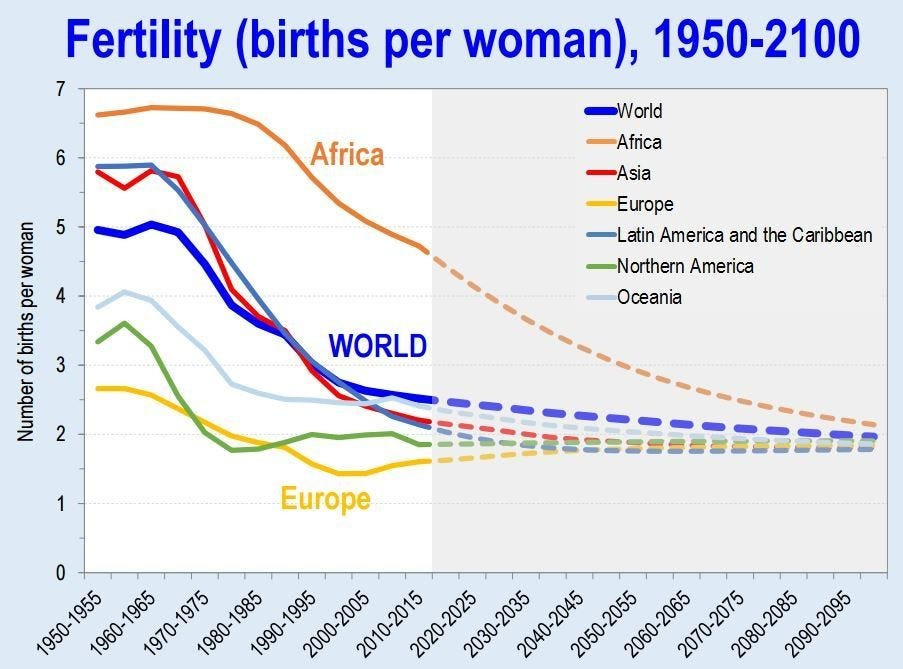

2025-05-21 22:13:47The global population has been rising rapidly for the past two centuries when compared to historical trends. Fifty years ago, that trend seemed set to continue, and there was a lot of concern around the issue of overpopulation. But if you haven’t been living under a rock, you’ll know that while the population is still rising, that trend now seems set to reverse this century, and there’s every indication population could decline precipitously over the next two centuries.

Demographics is a field where predictions about the future are much more reliable than in most scientific fields. That’s because future population trends are “baked in” decades in advance. If you want to know how many fifty-year-olds there will be in forty years, all you have to do is count the ten-year-olds today and allow for mortality rates. That maximum was already determined by the number of births ten years ago, and absolutely nothing can change that now. The average person doesn’t think that through when they look at population trends. You hear a lot of “oh we just need to do more of x to help the declining birthrate” without an acknowledgement that future populations in a given cohort are already fixed by the number of births that already occurred.

As you can see, global birthrates have already declined close to the 2.3 replacement level, with some regions ahead of others, but all on the same trajectory with no region moving against the trend. I’m not going to speculate on the reasons for this, or even whether it’s a good or bad thing. Instead I’m going to make some observations about outcomes this trend could cause economically, and why. Like most macro issues, an individual can’t do anything to change the global landscape personally, but knowing what that landscape might look like is essential to avoiding fallout from trends outside your control.

The Resource Pie

Thomas Malthus popularized the concern about overpopulation with his 1798 book An Essay on the Principle of Population. The basic premise of the book was that population could grow and consume all the available resources, leading to mass poverty, starvation, disease, and population collapse. We can say in hindsight that this was incorrect, given that the global population has increased from less than a billion to over eight billion since then, and the apocalypse Malthus predicted hasn’t materialized. Exactly the opposite, in fact. The global standard of living has risen to levels Malthus couldn’t have imagined, much less predicted.

So where did Malthus go wrong? His hypothesis seems reasonable enough, and we do see a similar trend in certain animal populations. The base assumption Malthus got wrong was to assume resources are a finite, limiting factor to the human population. That at some point certain resources would be totally consumed, and that would be it. He treated it like a pie with a lot of slices, but still a finite number, and assumed that if the population kept rising, eventually every slice would be consumed and there would be no pie left for future generations. That turns out to be completely wrong.

Of course, the earth is finite at some abstract level. The number of atoms could theoretically be counted and quantified. But on a practical level, do humans exhaust the earth’s resources? I’d point to an article from Yale Scientific titled Has the Earth Run out of any Natural Resources? To quote,

> However, despite what doomsday predictions may suggest, the Earth has not run out of any resources nor is it likely that it will run out of any in the near future. > > In fact, resources are becoming more abundant. Though this may seem puzzling, it does not mean that the actual quantity of resources in the Earth’s crust is increasing but rather that the amount available for our use is constantly growing due to technological innovations. According to the U.S. Geological Survey, the only resource we have exhausted is cryolite, a mineral used in pesticides and aluminum processing. However, that is not to say every bit of it has been mined away; rather, producing it synthetically is much more cost efficient than mining the existing reserves at its current value.

As it happens, we don’t run out of resources. Instead, we become better at finding, extracting, and efficiently utilizing resources, which means that in practical terms resources become more abundant, not less. In other words, the pie grows faster than we can eat it.

So is there any resource that actually limits human potential? I think there is, and history would suggest that resource is human ingenuity and effort. The more people are thinking about and working on a problem, the more solutions we find and build to solve it. That means not only does the pie grow faster than we can eat it, but the more people there are, the faster the pie grows. Of course that assumes everyone eating pie is also working to grow the pie, but that’s a separate issue for now.

Productivity and Division of Labor

Why does having more people lead to more productivity? A big part of it comes down to division of labor and specialization. The best way to get really good at something is to do more of it. In a small community, doing just one thing simply isn’t possible. Everyone has to be somewhat of a generalist in order to survive. But with a larger population, being a specialist becomes possible. In fact, that’s the purpose of money, as I explained here.

nostr:naddr1qvzqqqr4gupzp0rve5f6xtu56djkfkkg7ktr5rtfckpun95rgxaa7futy86npx8yqq247t2dvet9q4tsg4qng36lxe6kc4nftayyy89kua2

The more specialized an economy becomes, the more efficient it can be. There are big economies of scale in almost every task or process. So for example, if a single person tried to build a car from scratch, it would be extremely difficult and take a very long time. However, if you have a thousand people building a car, each doing a specific job, they can become very good at doing that specific job and do it much faster. And then you can move that process to a factory, and build machines to do specific jobs, and add even more efficiency.

But that only works if you’re building more than one car. It doesn’t make sense to build a huge factory full of specialized equipment that takes lots of time and effort to design and manufacture, and then only build one car. You need to sell thousands of cars, maybe even millions of cars, to pay off that initial investment. So division of labor and specialization relies on large populations in two different ways. First, you need a large population to have enough people to specialize in each task. But second and just as importantly, you need a large population of buyers for the finished product. You need a big market in order to make mass production economical.

Think of a computer or smartphone. It takes thousands of specialized processes, thousands of complex parts, and millions of people doing specialized jobs to extract the raw materials, process them, and assemble them into a piece of electronic hardware. And electronics are relatively expensive anyway. Imagine how impossible it would be to manufacture electronics economically, if the market demand wasn’t literally in the billions of units.

Stairs Up, Elevator Down

We’ve seen exponential increases in productivity over the past few centuries, resulting in higher living standards even as population exploded. Now, facing the prospect of a drastic trend reversal, what will happen to productivity and living standards? The typical sentiment seems to be “well, there are a lot of people already competing for resources, so if population does decline, that will just reduce the competition and leave a bigger slice of pie for each person, so we’ll all be getting wealthier as a result of population decline.”

This seems reasonable at first glance. Surely dividing the economic pie into fewer slices means a bigger slice for everyone, right? But remember, more specialization and division of labor is what made the pie as big as it is to begin with. And specialization depends on large populations for both the supply of specialized labor, and the demand for finished goods. Can complex supply chains and mass production withstand population reduction intact? I don’t think the answer is clear.

The idea that it will all be okay, and we’ll get wealthier as population falls, is based on some faulty assumptions. It assumes that wealth is basically some fixed inventory of “things” that exist, and it’s all a matter of distribution. That’s typical Marxist thinking, similar to the reasoning behind “tax the rich” and other utopian wealth transfer schemes.

The reality is, wealth is a dynamic concept with strong network effects. For example, a grocery store in a large city can be a valuable asset with a large potential income stream. The same store in a small village with a declining population can be an unprofitable and effectively worthless liability.

Even something as permanent as a house is very susceptible to network effects. If you currently live in an area where housing is scarce and expensive, you might think a declining population would be the perfect solution to high housing costs. However, if you look at a place that’s already facing the beginnings of a population decline, you’ll see it’s not actually that simple. Japan, for example, is already facing an aging and declining population. And sure enough, you can get a house in Japan for free, or basically free. Sounds amazing, right? Not really.

If you check out the reason houses are given away in Japan, you’ll find a depressing reality. Most of the free houses are in rural areas or villages where the population is declining, often to the point that the village becomes uninhabited and abandoned. It’s so bad that in 2018, 13.6% of houses in Japan were vacant. Why do villages become uninhabited? Well, it turns out that a certain population level is necessary to support the services and businesses people need. When the population falls too low, specialized businesses can no longer operated profitably. It’s the exact issue we discussed with division of labor and the need for a high population to provide a market for the specialist to survive. As the local stores, entertainment venues, and businesses close, and skilled tradesmen move away to larger population centers with more customers, living in the village becomes difficult and depressing, if not impossible. So at a certain critical level, a village that’s too isolated will reach a tipping point where everyone leaves as fast as possible. And it turns out that an abandoned house in a remote village or rural area without any nearby services and businesses is worth… nothing. Nobody wants to live there, nobody wants to spend the money to maintain the house, nobody wants to pay the taxes needed to maintain the utilities the town relied on. So they try to give the houses away to anyone who agrees to live there, often without much success.

So on a local level, population might rise gradually over time, but when that process reverses and population declines to a certain level, it can collapse rather quickly from there.

I expect the same incentives to play out on a larger scale as well. Complex supply chains and extreme specialization lead to massive productivity. But there’s also a downside, which is the fragility of the system. Specialization might mean one shop can make all the widgets needed for a specific application, for the whole globe. That’s great while it lasts, but what happens when the owner of that shop retires with his lifetime of knowledge and experience? Will there be someone equally capable ready to fill his shoes? Hopefully… But spread that problem out across the global economy, and cracks start to appear. A specialized part is unavailable. So a machine that relies on that part breaks down and can’t be repaired. So a new machine needs to be built, which is a big expense that drives up costs and prices. And with a falling population, demand goes down. Now businesses are spending more to make fewer items, so they have to raise prices to stay profitable. Now fewer people can afford the item, so demand falls even further. Eventually the business is forced to close, and other industries that relied on the items they produced are crippled. Things become more expensive, or unavailable at any price. Living standards fall. What was a stairway up becomes an elevator down.

Hope, From the Parasite Class?

All that being said, I’m not completely pessimistic about the future. I think the potential for an acceptable outcome exists.

I see two broad groups of people in the economy; producers, and parasites. One thing the increasing productivity has done is made it easier than ever to survive. Food is plentiful globally, the only issues are with distribution. Medical advances save countless lives. Everything is more abundant than ever before. All that has led to a very “soft” economic reality. There’s a lot of non-essential production, which means a lot of wealth can be redistributed to people who contribute nothing, and if it’s done carefully, most people won’t even notice. And that is exactly what has happened, in spades.

There are welfare programs of every type and description, and handouts to people for every reason imaginable. It’s never been easier to survive without lifting a finger. So millions of able-bodied men choose to do just that.

Besides the voluntarily idle, the economy is full of “bullshit jobs.” Shoutout to David Graeber’s book with that title. (It’s an excellent book and one I would highly recommend, even though the author was a Marxist and his conclusions are completely wrong.) A 2015 British poll asked people, “Does your job make a meaningful contribution to the world?” Only 50% said yes, while 37% said no and 13% were uncertain.

This won’t be a surprise to anyone who’s operated a business, or even worked in the private sector in general. There are three types of jobs; jobs that accomplish something productive, jobs that accomplish nothing of value, and jobs that actually hinder people trying to accomplish something productive. The number of jobs in the last two categories has grown massively over the years. This would include a lot of unnecessary administrative jobs, burdensome regulatory jobs, useless DEI and HR jobs, a large percentage of public sector jobs, most of the military-industrial complex, and the list is endless. All these jobs accomplish nothing worthwhile at best, and actively discourage those who are trying to accomplish something at worst.

Even among jobs that do accomplish some useful purpose, the amount of time spent actually doing the job continues to decline. According to a 2016 poll, American office workers spent only 39% of their workday actually doing their primary task. The other 61% was largely wasted on unproductive administrative tasks and meetings, answering emails, and just simply wasting time.

I could go on, but the point is, there’s a lot of slack in the economy. We’ve become so productive that the number of people actually doing the work to keep everyone fed, clothed, and cared for is only a small percentage of the population. In one sense, that’s a cause for optimism. The population could decline a lot, and we’d still have enough bodies to man the economic engine, as it were.

Aging

The thing with population decline, though, is nobody gets to choose who goes first. Not unless you’re a psychopathic dictator. So populations get old, then they get small. This means that the number of dependents in the economy rises naturally. Once people retire, they still need someone to grow the food, keep the lights on, and provide the medical care. And it doesn’t matter how much money the retirees have saved, either. Money is just a claim on wealth. The goods and services actually have to be provided by someone, and if that someone was never born, all the money in the world won’t change anything.

And the aging occurs on top of all the people already taking from the economy without contributing anything of value. So that seems like a big problem.

Currently, wealth redistribution happens through a combination of direct taxes, indirect taxation through deficit spending, and the whole gamut of games that happen when banks create credit/debt money by making loans. In a lot of cases, it’s very indirect and difficult to pin down. For example, someone has a “job” in a government office, enforcing pointless regulations that actually hinder someone in the private sector from producing something useful. Their paycheck comes from the government, so a combination of taxes on productive people, and deficit spending, which is also a tax on productive people. But they “have a job,” so who’s going to question their contribution to society? On the other hand, it could be a banker or hedge fund manager. They might be pulling in a massive salary, but at the core all they’re really doing is finding creative financial ways to transfer wealth from productive people to themselves, without contributing anything of value.

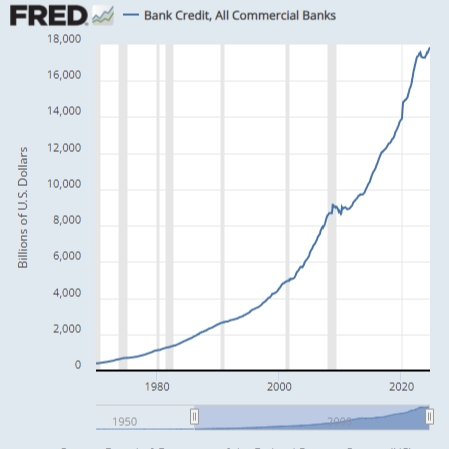

You’ll notice a common theme if you think about this problem deeply. Most of the wealth transfer that supports the unproductive, whether that’s welfare recipients, retirees, bureaucrats, corporate middle managers, or weapons manufacturers, is only possible through expanding the money supply. There’s a limit to how much direct taxation the productive will bear while the option to collect welfare exists. At a certain point, people conclude that working hard every day isn’t worth it, when taxes take so much of their wages that they could make almost as much without working at all. So the balance of what it takes to support the dependent class has to come indirectly, through new money creation.

As long as the declining population happens under the existing monetary system, the future looks bleak. There’s no limit to how much money creation and inflation the parasite class will use in an attempt to avoid work. They’ll continue to suck the productive class dry until the workers give up in disgust, and the currency collapses into hyperinflation. And you can’t run a complex economy without functional money, so productivity inevitably collapses with the currency.

The optimistic view is that we don’t have to continue supporting the failed credit/debt monetary system. It’s hurting productivity, messing up incentives, and contributing to increasing wealth inequality and lower living standards for the middle class. If we walk away from that system and adopt a hard money standard, the possibility of inflationary wealth redistribution vanishes. The welfare and warfare programs have to be slashed. The parasite class is forced to get busy, or starve. In that scenario, the declining population of workers can be offset by a massive shift away from “bullshit jobs” and into actual productive work.

While that might not be a permanent solution to declining population, it would at least give us time to find a real solution, without having our complex economy collapse and send our living standards back to the 17th century.

It’s a complex issue with many possible outcomes, but I think a close look at the effects of the monetary system on productivity shows one obvious problem that will make the situation worse than necessary. Moving to a better monetary system and creating incentives for productivity would do a lot to reduce the economic impacts of a declining population.

-

@ 21335073:a244b1ad

2025-05-21 16:58:36

@ 21335073:a244b1ad

2025-05-21 16:58:36The other day, I had the privilege of sitting down with one of my favorite living artists. Our conversation was so captivating that I felt compelled to share it. I’m leaving his name out for privacy.

Since our last meeting, I’d watched a documentary about his life, one he’d helped create. I told him how much I admired his openness in it. There’s something strange about knowing intimate details of someone’s life when they know so little about yours—it’s almost like I knew him too well for the kind of relationship we have.

He paused, then said quietly, with a shy grin, that watching the documentary made him realize how “odd and eccentric” he is. I laughed and told him he’s probably the sanest person I know. Because he’s lived fully, chasing love, passion, and purpose with hardly any regrets. He’s truly lived.

Today, I turn 44, and I’ll admit I’m a bit eccentric myself. I think I came into the world this way. I’ve made mistakes along the way, but I carry few regrets. Every misstep taught me something. And as I age, I’m not interested in blending in with the world—I’ll probably just lean further into my own brand of “weird.” I want to live life to the brim. The older I get, the more I see that the “normal” folks often seem less grounded than the eccentric artists who dare to live boldly. Life’s too short to just exist, actually live.

I’m not saying to be strange just for the sake of it. But I’ve seen what the crowd celebrates, and I’m not impressed. Forge your own path, even if it feels lonely or unpopular at times.

It’s easy to scroll through the news and feel discouraged. But actually, this is one of the most incredible times to be alive! I wake up every day grateful to be here, now. The future is bursting with possibility—I can feel it.