-

@ 975e4ad5:8d4847ce

2025-05-22 14:30:53

@ 975e4ad5:8d4847ce

2025-05-22 14:30:53The Risks of Offline Storage

Keeping your seed phrase offline – on paper, in a safe, or on a USB drive – seems secure, but it comes with significant risks:

-

Fire or Flood: A disaster could destroy your home, along with the paper or device storing your seed phrase.

-

Theft: Someone could find your seed phrase in your safe or a hidden spot at home.

-

Natural Disasters or War: If you’re forced to leave your home, you might lose access to your seed phrase, effectively locking you out of your assets.

-

Human Error: You could accidentally lose, damage, or misplace the paper or device holding your seed phrase.

These vulnerabilities make offline storage less reliable, especially if you don’t have backups or can’t access them in an emergency.

The Benefits of Online Storage

When done right, online storage addresses these issues. The primary advantage is accessibility: you can retrieve your seed phrase from anywhere in the world as long as you have an internet connection and the necessary credentials. This is invaluable if you’re away from home or in a crisis.

The key to making online storage safe? Encryption.

How to Store Your Seed Phrase Online Securely

-

Choose a Secure Platform\ Upload your encrypted seed phrase to a reputable cloud storage service like Google Drive, Dropbox, or Proton Drive, which offers built-in encryption. Ensure you use a strong password and enable two-factor authentication (2FA) for your account.

-

Encrypt Your Seed Phrase\ Before uploading, encrypt your seed phrase using a tool with strong encryption, such as AES-256. Here are some easy options:

-

VeraCrypt: A free tool that lets you create an encrypted file or container. Save your seed phrase in a text file, add it to an encrypted container, and set a password only you know.

-

GPG (GnuPG): This tool allows you to encrypt text files using public and private keys. Generate a key pair and store the private key securely (e.g., on an offline USB drive).

-

7-Zip: A popular compression tool that supports AES-256 encryption. Create an encrypted archive with your seed phrase and set a strong password.

-

Keep the Decryption Key in Your Head\ The password or decryption key should be something only you know. Avoid writing it down to prevent unauthorized access.

-

Disguise the File\ Even if someone sees your encrypted file, they shouldn’t suspect what it contains. Name the file something generic, like “family_recipes.txt,” instead of “seed_phrase.txt.”

Why Encryption Matters

Encryption ensures that even if someone gains access to your file, they can’t read your seed phrase without the decryption key. AES-256, for example, is an industry-standard encryption method considered virtually unbreakable with a strong password. This means that even if a hacker accesses your cloud storage, they can’t use your seed phrase.

Practical Tips for Maximum Security

-

Split Your Seed Phrase: For added protection, divide your seed phrase into multiple parts and store them in separate encrypted files on different platforms.

-

Test Your Access: Periodically check that you can log into your cloud storage and decrypt your file to avoid surprises.

-

Use a Strong Password: Choose a password longer than 12 characters, combining letters, numbers, and special characters.

-

Create Backups: Store multiple encrypted copies on different platforms for extra redundancy.

Conclusion

Storing your seed phrase online isn’t reckless if you do it right. With proper encryption and a secure platform, you can combine the convenience of global access with a high level of protection. Offline methods have their risks, but secure online storage ensures your assets are safe and accessible, no matter where you are.

-

-

@ 90152b7f:04e57401

2025-05-22 14:27:51

@ 90152b7f:04e57401

2025-05-22 14:27:51Wikileaks - C O N F I D E N T I A L SECTION 01 OF 02 JERUSALEM 002018 SIPDIS SIPDIS NEA FOR FRONT OFFICE; NEA/IPA FOR GOLDBERGER/SHAMPAINE/BELGRADE; NSC FOR ABRAMS/WATERS; TREASURY FOR SZUBIN/GRANT/HARRIS/NUGENT/HIRSON E.O. 12958: DECL: 07/17/17 TAGS: ECON, EFIN, KFTN, KWBG, IS

2007 September 26

SUBJECT: ISRAELI BANK CUTOFF PORTENDS GAZA BANK CLOSURES AND MORE PRIVATE SECTOR DIFFICULTIES Classified By: Consul General Jake Walles,

Reasons 1.4 (b) and (d). 1. 1. (SBU) Summary. Bank Hapoalim's decision to sever ties with banks in Gaza, and an expected move by Israel Discount Bank to do the same, could result in cash shortages, bank closures, and a suspension of commercial imports into Gaza, most of which are food, according to Palestinian banking sector representatives. Palestine Monetary Authority (PMA) Governor George Abed is discussing possible solutions with his Israeli counterpart and other Israeli officials. Banks operating in the West Bank are attempting to ascertain the impact on their activities. End summary.

----------------

Threat Made Real

----------------

2. (SBU) Bank Hapoalim announced September 25 that it is severing its ties with banks operating in the Gaza Strip, according to local press reports. The bank reportedly decided to take this action after the GOI designated Gaza a "hostile entity." Since the formation of the Hamas-led government in March 2006, Bank Hapoalim and the Israel Discount Bank (IDB) have warned that they intended to terminate their correspondent bank relationship with banks operating in the West Bank and Gaza. Both banks provide check clearing services and coordinate cash transfers, operations considered vital to the Palestinian banking sector.

--------------

Damage Control

--------------

3. (C) PMA Governor Abed told Econoff September 26 that Bank Hapoalim's decision was "not a surprise" and the PMA "is dealing with it." He explained that he had spoken to Bank of Israel Governor Fischer September 25 and is also in contact with GOI Ministry of Finance officials. Abed said that he believes the GOI is seeking to find a solution because it wants to maintain economic and financial relations with Palestinians. If IDB follows Bank Hapoalim's lead, as expected, Abed fears that the banking sector in Gaza could shutdown. Already in steep decline, banking activity there comprises only 18-20 percent of total deposits and about 15 percent of total loan portfolios of banks operating in the West Bank and Gaza, according to Abed.

4. (C) Arab Bank General Manager Mazen Abu Hamdan and Cairo-Amman Bank Regional Manager Joseph Nesnas told Econoff separately September 26 that IDB does much more business with Gaza banks than Bank Hapoalim, so if IDB severs its ties, the impact will be even more severe. Both said they will close their Gaza branch offices if IDB takes this action. Arab Bank's correspondent account is with the IDB. Both Abu Hamdan and Nesnas said they are uncertain as to exactly how and when Bank Hapoalim will implement its decision, and what the consequences will be for banks in the West Bank. Abu Hamdan suggested that Bank Hapoalim may continue to clear Gaza-origin checks in the short-term with Israeli beneficiaries, but will very soon refuse to accept any checks drawn from Gaza branches.

---------------------------------------

Cash Shortage to Further Restrict Trade

---------------------------------------

5. (C) Abed noted that Gaza merchants frequently pay cash for imports, often upon receipt of the goods at the designated crossing. If banks close, Abed continued, cash payments will be even more common. If cash transfers to Gaza are suspended, however, cash will be hoarded and increasingly unavailable to conduct trade. (Note: According to the UN, 86 percent of commercial imports into Gaza are food.) Abed and Abu Hamdan noted separately that a cash cutoff will also adversely affect the payment of PA salary payments to Gaza-based employees. Banks in Gaza need about NIS 150 million each month to make PA salary payments.

---------------------------------

Hamas Not Guarding Cash Transfers

---------------------------------

6. Abed refuted a press report alleging that Hamas is now guarding cash shipments once they enter Gaza. He said he is aware that of one instance when a bank notified Hamas of a JERUSALEM 00002018 002 OF 002 shipment, and Hamas Executive Forces may have shadowed the cash movement in reply, but in all other cases the banks handle their own security arrangements and do not communicate with Hamas. WALLES

-

@ c7e8fdda:b8f73146

2025-05-22 14:13:31

@ c7e8fdda:b8f73146

2025-05-22 14:13:31🌍 Too Young. Too Idealistic. Too Alive. A message came in recently that stopped me cold.

It was from someone young—16 years old—but you’d never guess it from the depth of what they wrote. They spoke of having dreams so big they scare people. They’d had a spiritual awakening at 14, but instead of being nurtured, it was dismissed. Surrounded by people dulled by bitterness and fear, they were told to be realistic. To grow up. To face “reality.”

This Substack is reader-supported. To receive new posts and support my work, consider becoming a free or paid subscriber.

And that reality, to them, looked like a life that doesn’t feel like living at all.

They wrote that their biggest fear wasn’t failure—it was settling. Dimming their fire. Growing into someone they never chose to be.

And that—more than anything—scared them.

They told me that my book, I Don’t Want to Grow Up, brought them to tears because it validated what they already knew to be true. That they’re not alone. That it’s okay to want something different. That it’s okay to feel everything.

It’s messages like this that remind me why I write.

As many of you know, I include my personal email address at the back of all my books. And I read—and respond to—every single message that comes in. Whether it’s a few sentences or a life story, I see them all. And again and again, I’m reminded: there are so many of us out here quietly carrying the same truth.

Maybe you’ve felt the same. Maybe you still do.

Maybe you’ve been told your dreams are too big, too unrealistic. Maybe people around you—people who love you—try to shrink them down to something more “manageable.” Maybe they call it protection. Maybe they call it love.

But it feels like fear.

The path you wish to walk might be lonelier at first. It might not make sense to the people around you. But if it lights you up—follow it.

Because when you do, you give silent permission to others to do the same. You become living proof that another kind of life is possible. And that’s how we build a better world.

So to the person who wrote to me—and to every soul who feels the same way:

Keep going. Keep dreaming. Keep burning. You are not too young. You are not too idealistic. You are just deeply, radically alive.

And that is not a problem. That is a gift.

—

If this speaks to you, my book I Don’t Want to Grow Up was written for this very reason—to remind you that your wildness is sacred, your truth is valid, and you’re not alone. Paperback/Kindle/Audiobook available here: scottstillmanblog.com

This Substack is reader-supported. To receive new posts and support my work, consider becoming a free or paid subscriber. https://connect-test.layer3.press/articles/041a2dc8-5c42-4895-86ec-bc166ac0d315

-

@ 9ca447d2:fbf5a36d

2025-05-22 14:01:52

@ 9ca447d2:fbf5a36d

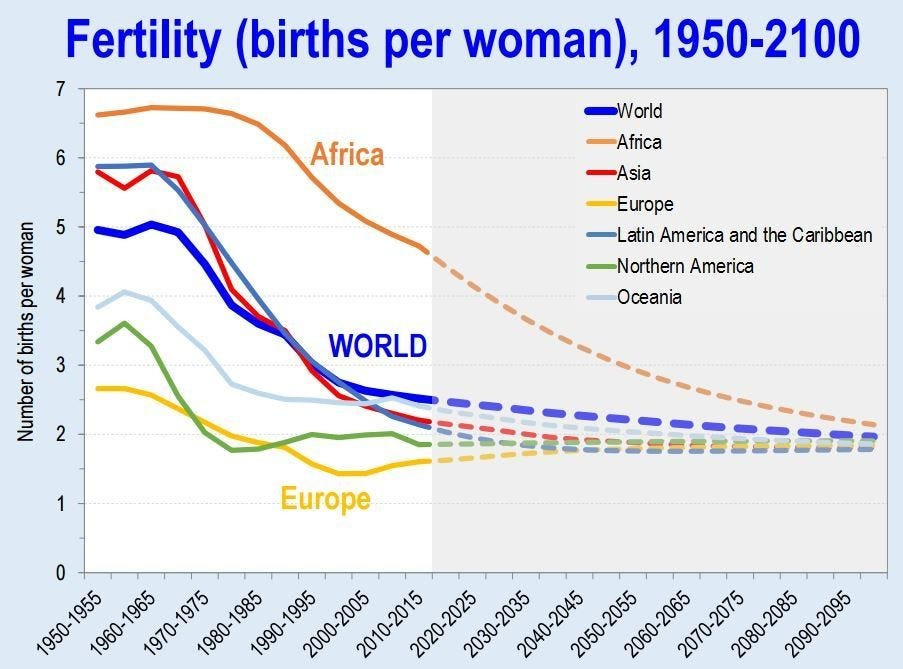

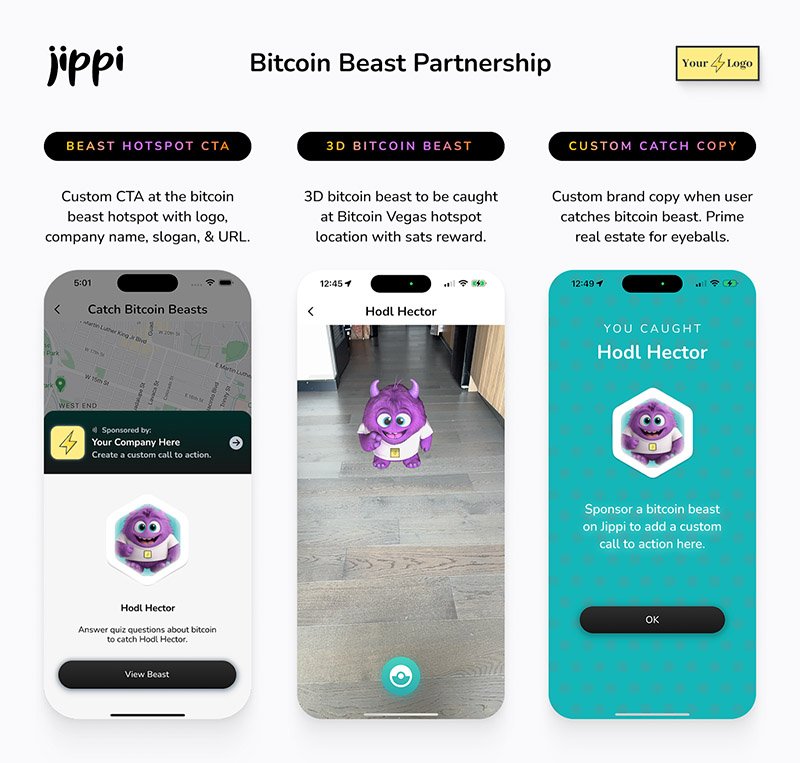

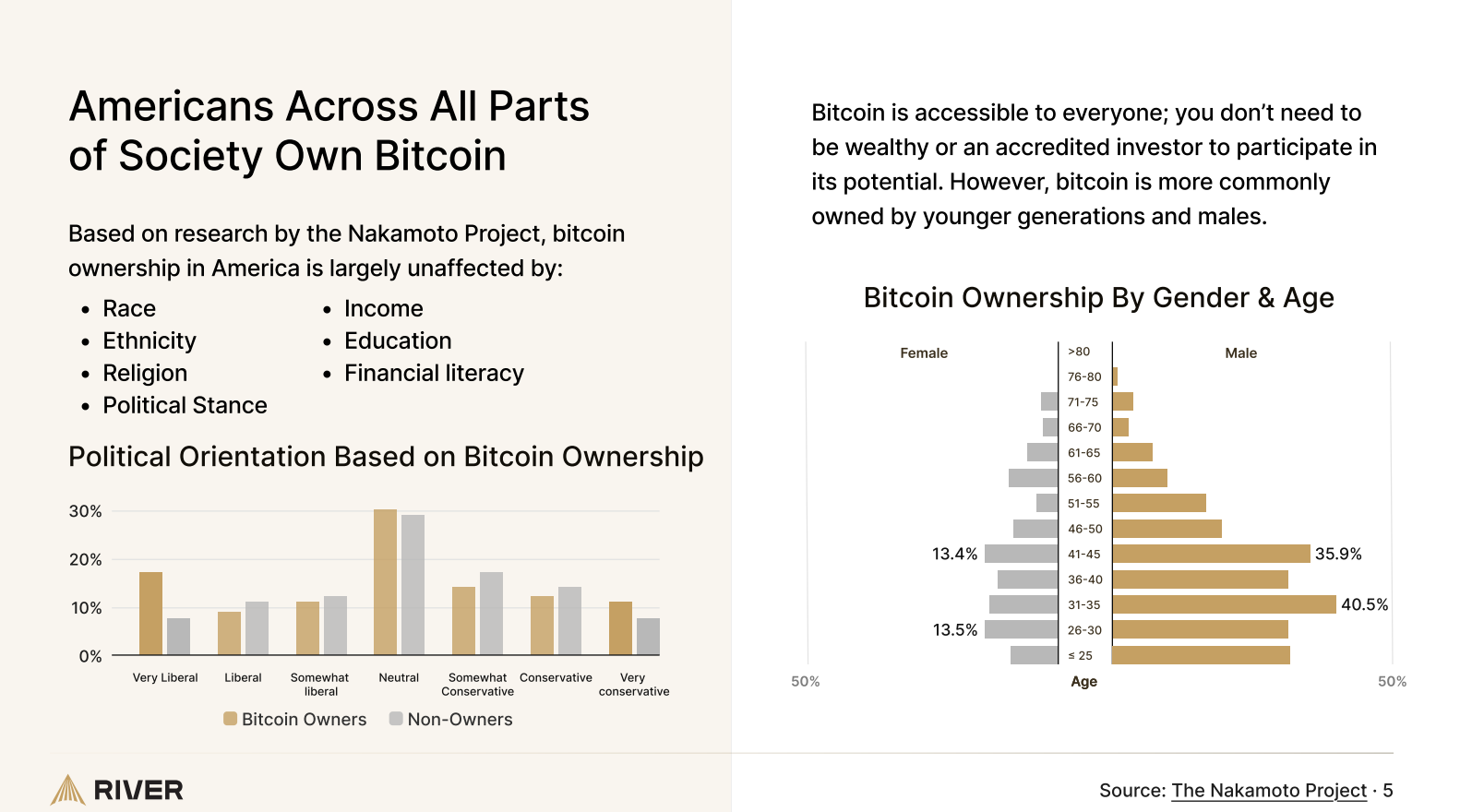

2025-05-22 14:01:52Gen Z (those born between 1997 and 2012) are not rushing to stack sats, and Oliver Porter, Founder & CEO of Jippi, understands the challenge better than most. His strategy revolves around adapting Bitcoin education to fit seamlessly into the digital lives of young adults.

“We need to meet them where they are,” Oliver explains. “90% of Gen Z plays games. 70% expect to earn rewards.”

So, what will effectively introduce them to Bitcoin? In Oliver’s mind, the answer is simple: games that don’t feel preachy but still plant the orange pill.

Learn more at Jippi.app

That’s exactly what Jippi is. Based in Austin, Texas, the team has created a mobile augmented reality (AR) game that rewards players in bitcoin and sneakily teaches them why sound money matters.

“It’s Pokémon GO… but for sats,” Oliver puts it succinctly.

Jippi is like Pokemon Go, but for sats

Oliver’s Bitcoin journey, like many in the space, began long before he was ready. A former colleague had tried planting the seed years earlier, handing him a copy of The Bitcoin Standard. But the moment passed.

It wasn’t until the chaos of 2020 when lockdowns hit, printing presses roared, and civil liberties shrank that the message finally landed for him.

“The government got so good at doing reverse Robin Hood,” Oliver explains. “They steal from the working population and reward the rich.”

By 2020, though, the absurdity of the covid hysteria had caused his eyes to be opened and the orange light seemed the best path back to freedom.

He left the UK for Austin “one of the best places for Bitcoiners,” he says, and dove headfirst into the industry, working at Swan for a year before founding Jippi on PlebLab’s accelerator program.

Jippi’s flagship game lets players roam their cities hunting digital creatures, Bitcoin Beasts, tied to real-world locations. Catching them requires answering Bitcoin trivia, and the reward is sats.

No jargon. No hour-long lectures. Just gameplay with sound money principles woven right in.

The model is working. At a recent hackathon in Austin, Jippi beat out 14 other teams to win first place and $15,000 in prize money.

Oliver of Jippi won Top Builder Season 2 — PlebLab on X

“We’re backdooring Bitcoin education,” Oliver admits. “And while we’re at it, encouraging people to get outside and touch grass.”

Not everyone’s been thrilled. When Jippi team members visited one of the more liberal-leaning places in Texas, UT Austin, to test interest in Bitcoin, they found some seriously committed no-coiners on the campus.

“One young woman told me, ‘I would rather die than talk about Bitcoin,'” Oliver recalls, highlighting the cultural resistance that’s built up among younger demographics.

This resistance is backed by hard data. According to Oliver, some of the Bitcoin podcasters they met with in the space to do market research reported that less than 1% of their listeners are from Gen Z and that number is dropping.

“Unless we find a way to capture their interest in a meaningful way, there’s going to be a big problem around trying to sway Gen Z away from the siren call of s***coins and crypto casinos and towards Bitcoin,” Oliver warns.

Jippi’s next big move is Las Vegas, where they’ll launch the Beast Catch experience at the Venetian during a major Bitcoin event. To mark the occasion, they’re opening up six limited sponsorship spots for Bitcoin companies, each one tied to a custom in-game beast.

Jippi looks to launch a special event at Bitcoin 2025

“It’s real estate inside the game,” Oliver explains. “Brands become allies, not intrusions. You get a logo, company name, and call to action, so we can push people to your site or app.”

Bitcoin Well—an automatic self-custody Bitcoin platform—has claimed Beast #1. Only five exclusive spots remain for Bitcoin companies to “beastify their brand” through Jippi’s immersive AR game.

“I love the Jippi mission. I think gamified learning is how we will onboard the next generation and it’s exciting to see what the Jippi team is doing! I love working with bitcoiners towards our common mission – bullish!” said Adam O’Brien, Bitcoin Well CEO.

Jippi’s sponsorship model is simple: align incentives, respect users, and support builders. Instead of throwing ad money at tech giants, Bitcoin companies can connect with new users naturally while they’re having fun and earning sats in the process.

For Bitcoin companies looking to reach a younger demographic, this represents a unique opportunity to showcase their brand to up to 30,000 potential customers at the Vegas event.

Jippi Bitcoin Beast partnership

While Jippi’s current focus is simple, get the game into more cities, Oliver sees a future where AR glasses and AI help personalize Bitcoin education even further.

“The magic is going to really happen when Apple releases the glasses form factor,” he says, describing how augmented reality could enhance real-world connections rather than isolate users.

In the longer term, Jippi aims to evolve from a free-to-play model toward a pay-to-play version with higher stakes. Users would form “tribes” with friends to compete for substantial bitcoin prizes, creating social connections along with financial education.

Unlike VC-backed startups, Jippi is raising funds pleb style via Timestamp, an open investment platform for Bitcoin companies.

“You don’t have to be an accredited investor,” Oliver explains. “You’re directly supporting the parallel Bitcoin economy by investing in Bitcoin companies for equity.”

Anyone can invest as little as $100. Perks include early access, exclusive game content, and even creating your own beast design with your name/pseudonym and unique game lore. Each investment comes with direct ownership of an early-stage Bitcoin company like Jippi.

For Oliver, this is more than just a business. It’s about future-proofing Bitcoin adoption and ensuring Satoshi’s vision lives on, especially as many people are lured by altcoins, NFTs, and social media dopamine.

“We’re on the right side of history,” he says firmly. “I want my grandkids to know that early on in the Bitcoin revolution, games like Jippi helped make it stick.”

In a world increasingly absorbed by screens and short attention spans, Jippi’s combination of outdoor play, sats rewards, and Bitcoin education might be exactly the bridge Gen Z needs.

Interested in sponsoring a Beast or investing in Jippi? Reach out to Jippi directly by heading to their partnerships page on their website or visit their Timestamp page to invest in Jippi today.

-

@ cae03c48:2a7d6671

2025-05-22 14:01:09

@ cae03c48:2a7d6671

2025-05-22 14:01:09Bitcoin Magazine

KindlyMD Shareholders Approve Merger with Bitcoin Treasury Company NakamotoKindlyMD, Inc. has secured shareholder approval for its proposed merger with Nakamoto Holdings Inc., marking a major step toward becoming one of the biggest Bitcoin treasury companies on the market.

The majority of KindlyMD’s shareholders delivered written consent in favor of the merger on May 18, 2025. The transaction is now on track to close in the third quarter of 2025, following the SEC’s review and distribution of an information statement to shareholders. Under current terms, the deal will close 20 days after the statement is mailed.

Full release: https://t.co/jsn4XNW1dK

"We are pleased to achieve this important milestone in the merger process," said Tim Pickett, CEO of KindlyMD. "As a combined company, we are excited to leverage Bitcoin's dominance and real-world utility to strengthen our company and drive… pic.twitter.com/YPD3ajZFNf— KindlyMD (@KindlyMD) May 20, 2025

“This milestone brings us one step closer to unlocking Bitcoin’s potential for KindlyMD shareholders,” said David Bailey, Founder and CEO of Nakamoto. “We are grateful that KindlyMD shares our vision for a future in which Bitcoin is a core part of the corporate balance sheet, and investors across global capital markets have exposure to the world’s greatest asset and store of value.”

Nakamoto is building a global portfolio of companies aligned around Bitcoin’s core principles. Through treasury strategy and targeted acquisitions, the company aims to redefine capital markets infrastructure with Bitcoin at the center.

KindlyMD, meanwhile, brings to the table a unique model of integrated, data-driven healthcare focused on reducing opioid dependence and improving outcomes through personalized treatment and alternative medicine education. Its clinical services are reimbursed through Medicare, Medicaid, and commercial insurance.

Tim Pickett, CEO of KindlyMD, emphasized the strategic benefits of the deal: “We are pleased to achieve this important milestone in the merger process. As a combined company, we are excited to leverage Bitcoin’s dominance and real-world utility to strengthen our company and drive sustained long-term value for our investors.”

Disclosure: Nakamoto is in partnership with Bitcoin Magazine’s parent company BTC Inc to build the first global network of Bitcoin treasury companies, where BTC Inc provides certain marketing services to Nakamoto. More information on this can be found here.

This post KindlyMD Shareholders Approve Merger with Bitcoin Treasury Company Nakamoto first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-05-22 14:01:07

@ cae03c48:2a7d6671

2025-05-22 14:01:07Bitcoin Magazine

Attendees At First New York City Crypto Summit Implore Mayor Adams To End The BitLicenseToday, New York City hosted its first ever crypto summit.

The event took place at Gracie Mansion, the mayor’s residence, and was attended by prominent figures from the crypto industry, many of whom are based in New York.

At the event, Mayor Adams made the case that he felt the attendees’ pain, stating that they’ve wrongfully been persecuted, and he claimed that it’s now safe for those in the Bitcoin and crypto industry to both speak up and set up shop in New York.

“Look how they’ve treated you,” said Mayor Adams.

“You were treated as though you were the enemy instead of the believers,” he added.

“You’ve been hiding in the shadows, afraid to come out — come out now.”

As Mayor Adams continued, he recommitted to making New York the “crypto capital of the world,” something he first claimed he’d do in 2021, though not much has materialized on this front since then.

New York has continued to be a jurisdiction that’s nearly impossible for Bitcoin and crypto start ups to do business in thanks to the BitLicense, a license required to operate a digital asset company within the state.

Obtaining a BitLicense often costs upwards of $100,000 and takes months, if not years, of cutting through red tape and hopping over bureaucratic hurdles to attain.

Most start ups don’t have the time or funds to obtain one.

So, when Mayor Adams and New York City’s Chief Technology Officer, Matthew Fraser, tasked the attendees at today’s event, with coming up with solutions that would help to make New York City a more crypto-friendly jurisdiction, many brought up the need to abolish the BitLicense — or to at least make New York City immune to its reach.

New York City As A Bitcoin And Crypto Sanctuary City

“To build a thriving [crypto] economy, we have to get rid of the BitLicense,” said one attendee. “We at least need to build a regulatory sandbox in New York City.”

Another attendee argued that “New York City should become a sanctuary city from the BitLicense.”

Attendees made comments like these after sessions of roundtable discussions during which the attendees discussed different issues related to Bitcoin and crypto before having a representative from their table share proposals with the room at large. (Because the attendees agreed to honor the Chatham House Rule, I cannot offer the names of those who spoke on behalf of their groups at the event. However, I can offer the names of the keynote speakers.)

Another attendee who said that New York should become a “crypto sanctuary city” pointed out that there is precedent for this, as the city allowed the cannabis industry to operate within its borders while the rest of the state did not.

Nick Spanos, who founded the first in-person exchange and the earliest in-person Bitcoin meeting space in New York City, the Bitcoin Center, in 2013, also made the case for New York as a crypto sanctuary city.

“We’re giving sanctuary to immigrants — we can give sanctuary to crypto companies,” he said in an impassioned tone.

Nick Spanos claims that NYC should be a crypto sanctuary city. | Photo credit: Frank Corva

Spanos went on to critique the BitLicense, calling into question its legitimacy.

“What kind of license is it when, after 12 years, there are only 30 of them?!” cried Spanos. “That’s an insider license!”

Now Is The Time To Pass Crypto Legislation In New York State

Galaxy CEO Mike Novogratz highlighted that now is the time for New York to pass legislation that will benefit the crypto industry.

“After five difficult years, DC has said let’s embrace this technology,” said Novogratz, alluding to the notion that New York should follow the federal government’s lead.

“New York State has not made crypto easy — it’s taken a long time for people to get licenses,” he added.

Novogratz also shared that the crypto industry is “ready for take off,” though he also put the onus on the industry to prove itself by creating products that provide real value to users.

He concluded by saying that, thus far, he’s only really seen value in Bitcoin and stablecoins.

On the topic of stablecoins, Brock Pierce, co-founder of Tether, called on Albany (New York’s capitol) to pass Assembly Bill 6266 and Senate Bill 3262, both of which would establish requirements for the creation and operation of limited purpose trust companies if enacted into law. Such a law would seemingly play a role in enabling Tether to operate in New York.

Other Suggestions For Crypto Applications From The Attendees

A number of attendees also suggested creating crypto products that would help offer financial services to New York City’s approximately 305,000 residents who do not have a bank account (though, none suggested including bitcoin in these services).

Many also stressed the importance of “crypto and blockchain education” within New York’s public school system.

Even Mayor Adams touched on this in his talk.

“Every young person in the DOE [Department of Education] should know about blockchain and crypto,” he said.

And one attendee suggested using blockchain to safeguard the city’s public records.

(I piggybacked on this idea by suggesting that the city consider employing Simple Proof, a company that utilizes the OpenTimestamps protocol on Bitcoin to safeguard public documents, including election results, to help safeguard its important documents.)

Call To Action

Mayor Adams said that when he, the “mayor of the greatest city on the globe,” starts talking about Bitcoin and crypto the rest of the world will pay attention.

For this reason, he said he wanted the best and brightest to help guide him as he broaches the topic.

At the conclusion of the event, attendees were asked to share their notes so that Adams’ team could review them and potentially call on certain attendees to help the mayor forge a more favorable regulatory path forward.

It seems his staff was primed to help, as Fraser asked the attendees to “help the city deregulate the industry.”

Only time will now tell if Mayor Adams and his team will follow through on working with the Bitcoin and crypto industry to make it easier for companies to operate in New York City, or if he’ll lose interest in such an initiative, like he did four years ago.

This post Attendees At First New York City Crypto Summit Implore Mayor Adams To End The BitLicense first appeared on Bitcoin Magazine and is written by Frank Corva.

-

@ 68d6e729:e5f442ac

2025-05-22 13:55:45

@ 68d6e729:e5f442ac

2025-05-22 13:55:45The Adapter Pattern in TypeScript

What is the Adapter Pattern?

The Adapter Pattern is a structural design pattern that allows objects with incompatible interfaces to work together. It acts as a bridge between two interfaces, enabling integration without modifying existing code.

In simple terms: it adapts one interface to another.

Real-World Analogy

Imagine you have a U.S. laptop charger and you travel to Europe. The charger plug won't fit into the European socket. You need a plug adapter to convert the U.S. plug into a European-compatible one. The charger stays the same, but the adapter allows it to work in a new context.

When to Use the Adapter Pattern

- You want to use an existing class but its interface doesn't match your needs.

- You want to create a reusable class that cooperates with classes of incompatible interfaces.

- You need to integrate third-party APIs or legacy systems with your application.

Implementing the Adapter Pattern in TypeScript

Let’s go through a practical example.

Scenario

Suppose you’re developing a payment system. You already have a

PaymentProcessorinterface that your application uses. Now, you want to integrate a third-party payment gateway with a different method signature.Step 1: Define the Target Interface

javascript ts CopyEdit// The interface your application expects interface PaymentProcessor { pay(amount: number): void; }Step 2: Create an Adaptee (incompatible class)

javascript ts CopyEdit// A third-party library with a different method class ThirdPartyPaymentGateway { makePayment(amountInCents: number): void { console.log(`Payment of $${amountInCents / 100} processed via third-party gateway.`); } }Step 3: Implement the Adapter

```javascript ts CopyEdit// Adapter makes the third-party class compatible with PaymentProcessor class PaymentAdapter implements PaymentProcessor { private gateway: ThirdPartyPaymentGateway;

constructor(gateway: ThirdPartyPaymentGateway) { this.gateway = gateway; }

pay(amount: number): void { const amountInCents = amount * 100; this.gateway.makePayment(amountInCents); } } ```

Step 4: Use the Adapter in Client Code

```javascript ts CopyEditconst thirdPartyGateway = new ThirdPartyPaymentGateway(); const adapter: PaymentProcessor = new PaymentAdapter(thirdPartyGateway);

// Application uses a standard interface adapter.pay(25); // Output: Payment of $25 processed via third-party gateway. ```

Advantages of the Adapter Pattern

- Decouples code from third-party implementations.

- Promotes code reuse by adapting existing components.

- Improves maintainability when dealing with legacy systems or libraries.

Class Adapter vs Object Adapter

In languages like TypeScript, which do not support multiple inheritance, the object adapter approach (shown above) is preferred. However, in classical OOP languages like C++, you may also see class adapters, which rely on inheritance.

Conclusion

The Adapter Pattern is a powerful tool in your design pattern arsenal, especially when dealing with incompatible interfaces. In TypeScript, it helps integrate third-party APIs and legacy systems seamlessly, keeping your code clean and extensible.

By learning and applying the Adapter Pattern, you can make your applications more robust and flexible—ready to adapt to ever-changing requirements. https://fox.layer3.press/articles/cdd71195-62a4-420b-9e24-e23d78b27452

-

@ cae03c48:2a7d6671

2025-05-22 15:00:43

@ cae03c48:2a7d6671

2025-05-22 15:00:43Bitcoin Magazine

Sangha Renewables Launches 20 MW Bitcoin Mining Facility Powered by Solar EnergySangha Renewables has officially broken ground on a 19.9-megawatt (MW) bitcoin mining facility in West Texas, marking a notable step in its mission to merge sustainable power with digital asset infrastructure, according to a recent press release sent to Bitcoin Magazine. Sangha also announced it has raised $14 million toward its $17 million target, helping bring its vision for renewable-powered bitcoin mining to life.

Developed in partnership with an independent power producer (IPP), the behind-the-meter facility will be located on an established solar energy site. Sangha’s project is designed to transform underutilized renewable assets into high-yield bitcoin-generating operations while delivering “optimized power monetization and attractive bitcoin-backed returns for investors.”

“Sangha is not just building bitcoin mining sites—we’re building a new model for how capital flows in and out of bitcoin,” said Spencer Marr, co-founder and CEO of Sangha Renewables. “By applying a project finance structure honed-in the renewable energy and real estate sectors, we enable investors to participate directly in productive assets—without intermediaries, speculative equities, or inefficiencies of datacenter hosting. Investors put cash or bitcoin into the construction of the project and then enjoy streaming distributions of bitcoin for years to come at well below the market price of bitcoin.”

Under the offtake agreement, Sangha will purchase 19.9 MW of power directly from the IPP. The solar site is impacted by grid congestion and negative energy pricing, making it an ideal fit for Sangha’s load-balancing model. “It’s a win-win-win,” Marr added. “The IPP earns more per megawatt-hour, our investors gain exposure to low-cost bitcoin production, and we deliver grid-stabilizing load where it’s needed most.”

The project is set to begin operations in Q3 2025 and will offer one of the lowest power costs in North America, according to the company. Sangha’s model is underpinned by smart site selection, transparent capital structures, and regulatory acumen—positioning it as a leader in institutional-grade bitcoin mining.

This facility represents Sangha’s proof-of-concept and the next chapter in the founders’ pivot from Sangha Systems to Sangha Renewables, emphasizing a commitment to sustainable, scalable, and investor-aligned bitcoin infrastructure.

This post Sangha Renewables Launches 20 MW Bitcoin Mining Facility Powered by Solar Energy first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-05-22 15:00:42

@ cae03c48:2a7d6671

2025-05-22 15:00:42Bitcoin Magazine

$10.4B Bitcoin Firm Unchained Announces First Regulated Bitcoin-Native Trust CompanyToday, the State of Wyoming has officially chartered Gannett Trust Company, the first bitcoin-native trust company in the United States, according to a press release sent to Bitcoin Magazine. Backed by Unchained, a leader in bitcoin financial services, Gannett Trust is purpose-built to serve individuals, family offices, and businesses integrating bitcoin into estate and inheritance plans, investment portfolios, trusts, and treasury strategies.

The launch of Gannett Trust directly addresses a growing need for secure, compliant, bitcoin-native solutions for long-term wealth management. Estimates say around 3.7 million bitcoin may be lost forever, largely due to poor planning and the absence of trusted custodial tools. Gannett Trust seeks to prevent future loss by offering a suite of fiduciary services tailored to the unique needs of bitcoin holders. Gannett Trust will offer both qualified custody and non-custodial configurations, enabling clients to manage, protect, and transfer their bitcoin with confidence. Gannett Trust advances Unchained’s long-term vision of building a durable foundation for multigenerational Bitcoin wealth.

“Bitcoin is becoming a pillar of long-term wealth,” said CEO of Unchained Joe Kelly. “With Gannett Trust, we’re combining the regulatory clarity of a trust company with the proven security of Unchained’s collaborative custody – a major step forward for bitcoin as a generational asset that holders have been waiting for.”

Prioritizing sovereignty, control, compliance, Gannett Trust aims to equip families and businesses with clear, tax-optimized strategies tailored to every aspect of bitcoin-based planning and wealth management.

“Most trust companies don’t understand bitcoin, and most crypto custodians don’t offer true fiduciary services,” said CEO of Gannett Trust Joshua Preston. “Gannett Trust bridges the gap – giving existing bitcoin holders and those interested in allocating bitcoin a path to protect and grow their legacy.”

With the launch of Gannett Trust, Unchained adds another layer to its bitcoin-native infrastructure, contributing to the development of institutional tools designed to support the long-term custody and management of bitcoin wealth.

For more information about Gannett Trust, visit here.

This post $10.4B Bitcoin Firm Unchained Announces First Regulated Bitcoin-Native Trust Company first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

-

@ e5fa3d8c:44057ac9

2025-05-22 13:26:59

@ e5fa3d8c:44057ac9

2025-05-22 13:26:59This post has been deleted.

-

@ 57d1a264:69f1fee1

2025-05-22 13:13:36

@ 57d1a264:69f1fee1

2025-05-22 13:13:36Graphics materials for Bitcoin Knots https://github.com/bitcoinknots branding. See below guide image for reference, a bit cleaner and scalable:

Font family "Aileron" is provided free for personal and commercial use, and can be found here: https://www.1001fonts.com/aileron-font.html

Source: https://github.com/Blissmode/bitcoinknots-gfx/tree/main

https://stacker.news/items/986624

-

@ cae03c48:2a7d6671

2025-05-22 13:00:45

@ cae03c48:2a7d6671

2025-05-22 13:00:45Bitcoin Magazine

Sangha Renewables Launches 20 MW Bitcoin Mining Facility Powered by Solar EnergySangha Renewables has officially broken ground on a 19.9-megawatt (MW) bitcoin mining facility in West Texas, marking a notable step in its mission to merge sustainable power with digital asset infrastructure, according to a recent press release sent to Bitcoin Magazine. Sangha also announced it has raised $14 million toward its $17 million target, helping bring its vision for renewable-powered bitcoin mining to life.

Developed in partnership with an independent power producer (IPP), the behind-the-meter facility will be located on an established solar energy site. Sangha’s project is designed to transform underutilized renewable assets into high-yield bitcoin-generating operations while delivering “optimized power monetization and attractive bitcoin-backed returns for investors.”

“Sangha is not just building bitcoin mining sites—we’re building a new model for how capital flows in and out of bitcoin,” said Spencer Marr, co-founder and CEO of Sangha Renewables. “By applying a project finance structure honed-in the renewable energy and real estate sectors, we enable investors to participate directly in productive assets—without intermediaries, speculative equities, or inefficiencies of datacenter hosting. Investors put cash or bitcoin into the construction of the project and then enjoy streaming distributions of bitcoin for years to come at well below the market price of bitcoin.”

Under the offtake agreement, Sangha will purchase 19.9 MW of power directly from the IPP. The solar site is impacted by grid congestion and negative energy pricing, making it an ideal fit for Sangha’s load-balancing model. “It’s a win-win-win,” Marr added. “The IPP earns more per megawatt-hour, our investors gain exposure to low-cost bitcoin production, and we deliver grid-stabilizing load where it’s needed most.”

The project is set to begin operations in Q3 2025 and will offer one of the lowest power costs in North America, according to the company. Sangha’s model is underpinned by smart site selection, transparent capital structures, and regulatory acumen—positioning it as a leader in institutional-grade bitcoin mining.

This facility represents Sangha’s proof-of-concept and the next chapter in the founders’ pivot from Sangha Systems to Sangha Renewables, emphasizing a commitment to sustainable, scalable, and investor-aligned bitcoin infrastructure.

This post Sangha Renewables Launches 20 MW Bitcoin Mining Facility Powered by Solar Energy first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ cae03c48:2a7d6671

2025-05-22 13:00:43

@ cae03c48:2a7d6671

2025-05-22 13:00:43Bitcoin Magazine

Bitcoin Price Breaks Record All Time High With Surge Above $109,000Bitcoin soared to a new all-time high today, crossing $109,000 and peaking at $109,800 before settling at $109,378 on Coinbase. The historic price milestone comes as institutional inflows and favorable policy developments fuel growing confidence in the world’s leading digital asset.

BREAKING: #BITCOIN HAS HIT A NEW ALL TIME HIGH

pic.twitter.com/3TeTlF6bIS

pic.twitter.com/3TeTlF6bIS— Bitcoin Magazine (@BitcoinMagazine) May 21, 2025

Bitcoin’s ascent reflects a surge in momentum across traditional finance and political circles. Nearly $1 billion in inflows poured into Bitcoin ETFs over just two trading days this week, according to data from Farside Investors—underscoring the deepening demand from institutional investors.

“Bitcoin is pushing toward new highs with strong tailwinds behind it—from steady ETF inflows to a broader shift in political tone,” said Joe DiPasquale, CEO of BitBull Capital. “This doesn’t feel like a short-term squeeze—it’s a more sustained bid that reflects a structural shift in how investors are viewing Bitcoin. It’s moving from a speculative trade to a strategic allocation.”

Bitcoin’s consistent performance and growing adoption among institutional players have increasingly positioned it as more than just a speculative asset. As traditional financial institutions—including JPMorgan—open channels for client access to Bitcoin, and as industry leaders like Coinbase are added to major indexes, Bitcoin’s role as a cornerstone of the modern financial system continues to solidify.

Investor enthusiasm has also been supported by legislative progress in Washington. The U.S. Senate this week advanced bipartisan legislation to create a federal framework for stablecoins—a major win for the digital asset industry and a sign of increasing government engagement with crypto infrastructure.

JUST IN: Legislation to create a regulatory framework for stablecoins The GENIUS Act passes motion to proceed to the consideration of the bill

The bill now goes to the amendment process. pic.twitter.com/KjDAAofZSj

— Bitcoin Magazine (@BitcoinMagazine) May 21, 2025

“Stablecoin legislation is about to pass the Senate, and Bitcoin just hit a new all time high,” President Donald Trump’s AI & Crypto Czar David Sacks posted today on X

Additionally, President Donald Trump has embraced the sector with vocal support and direct policy action. Earlier this year, his administration established an official “strategic bitcoin reserve” for the U.S. government and eased several regulatory pressures on major crypto firms, reinforcing Bitcoin’s standing as a legitimate financial instrument.

With market dynamics aligning and global interest accelerating, Bitcoin’s breakout above $109,800 marks not just a record high but may be a sign of what’s next to come.

“If you’re not buying bitcoin at the all-time high, you’re leaving money on the table,” posted Strategy Executive Chairman Michae Saylor.

This post Bitcoin Price Breaks Record All Time High With Surge Above $109,000 first appeared on Bitcoin Magazine and is written by Jenna Montgomery.

-

@ 4e7c1e83:1c2939b5

2025-05-22 12:54:21

@ 4e7c1e83:1c2939b5

2025-05-22 12:54:21Are you looking for an innovative way to explore the world of cryptocurrency? Flash Bitcoin is your answer! At Fashexperts, we offer the best Bitcoin flashing service online, delivering Flash BTC that behaves just like real Bitcoin — except it’s designed to disappear after 180 days. Whether you’re a crypto enthusiast or a developer testing blockchain applications, our Flash Bitcoin is a game-changer.

What is Flash Bitcoin? Flash Bitcoin refers to a cryptocurrency sent to your wallet using specialized Flash Bitcoin software. While it functions the same as real Bitcoin, its key distinction is its temporary nature. After 180 days, it vanishes from your wallet or any crypto it has been converted into, making it ideal for short-term use. Generated securely by our cutting-edge tools, Flash BTC can be stored in any wallet — SegWit, Legacy, or BCH32 — and spent easily on any address.

Pricing That Fits Your Needs Minimum Order: Pay just $200 to receive $2000 BTC worth of Flash Bitcoin. Maximum Order: Invest $600,000 to get $10,000,000 BTC worth of Flash BTC. With a maximum transaction limit of 12 transfers and the ability to convert Flash BTC into any other cryptocurrency on an exchange, you’re in full control — until the 180-day expiration kicks in. Transactions are 100% confirmed with priority fees for quick blockchain confirmation, ensuring a seamless experience.

Why Choose Fashexperts for Flash Bitcoin? Secure Storage: Flash BTC stays safe in your wallet for up to 180 days before being rejected by the blockchain. Universal Compatibility: Works with all wallets — spend it anywhere, anytime. Expert Guidance: Our team at Fashexperts is here to guide you via Telegram or WhatsApp, ensuring your digital assets are handled with care. Key Features of Flash Bitcoin: Disappears after 180 days from receipt, along with any converted crypto. Limited to 12 transfers for controlled usage. Convertible to other coins (note: converted coins also vanish after 180 days). Fast, uncancellable transactions with maximum priority fees. Are you ready to dive into the world of temporary crypto? Contact Fashexperts today to order Flash Bitcoin and explore this unique digital asset. Whether it’s $2000 BTC for $200 or $10,000,000 BTC for $600,000, we’ve got you covered with the best flashing service online.

Call to Action: 📞 Call Us on WhatsApp : +1 (329) 226–0153

💬 Chat with Us on Telegram : @fashexpertss

Don’t wait — secure your Flash BTC now and experience a new era of cryptocurrency trading with Fashexperts!Are you looking for an innovative way to explore the world of cryptocurrency? Flash Bitcoin is your answer! At Fashexperts, we offer the best Bitcoin flashing service online, delivering Flash BTC that behaves just like real Bitcoin — except it’s designed to disappear after 180 days. Whether you’re a crypto enthusiast or a developer testing blockchain applications, our Flash Bitcoin is a game-changer.

# What is Flash Bitcoin?

# What is Flash Bitcoin?Flash Bitcoin refers to a cryptocurrency sent to your wallet using specialized Flash Bitcoin software. While it functions the same as real Bitcoin, its key distinction is its temporary nature. After 180 days, it vanishes from your wallet or any crypto it has been converted into, making it ideal for short-term use. Generated securely by our cutting-edge tools, Flash BTC can be stored in any wallet — SegWit, Legacy, or BCH32 — and spent easily on any address.

Pricing That Fits Your Needs

- Minimum Order: Pay just $200 to receive $2000 BTC worth of Flash Bitcoin.

- Maximum Order: Invest $600,000 to get $10,000,000 BTC worth of Flash BTC.

With a maximum transaction limit of 12 transfers and the ability to convert Flash BTC into any other cryptocurrency on an exchange, you’re in full control — until the 180-day expiration kicks in. Transactions are 100% confirmed with priority fees for quick blockchain confirmation, ensuring a seamless experience.

Why Choose Fashexperts for Flash Bitcoin?

- Secure Storage: Flash BTC stays safe in your wallet for up to 180 days before being rejected by the blockchain.

- Universal Compatibility: Works with all wallets — spend it anywhere, anytime.

- Expert Guidance: Our team at Fashexperts is here to guide you via Telegram or WhatsApp, ensuring your digital assets are handled with care.

Key Features of Flash Bitcoin:

- Disappears after 180 days from receipt, along with any converted crypto.

- Limited to 12 transfers for controlled usage.

- Convertible to other coins (note: converted coins also vanish after 180 days).

- Fast, uncancellable transactions with maximum priority fees.

Are you ready to dive into the world of temporary crypto? Contact Fashexperts today to order Flash Bitcoin and explore this unique digital asset. Whether it’s $2000 BTC for $200 or $10,000,000 BTC for $600,000, we’ve got you covered with the best flashing service online.

Call to Action:

📞 Call Us on WhatsApp : +1 (329) 226–0153

💬 Chat with Us on Telegram : @fashexpertss

Don’t wait — secure your Flash BTC now and experience a new era of cryptocurrency trading with Fashexperts!

-

@ ee7d2dbe:4a5410b0

2025-05-22 12:37:56

@ ee7d2dbe:4a5410b0

2025-05-22 12:37:56Experience hassle-free WordPress maintenance service from Agicent at just $1900 per month ! This is a fully managed service that can take care of your continuous wordpress maintenance, development, upgrade, plugin updates etc. for one project or multiple wordpress projects.

Our Wordpress Maintenance Service plan includes a dedicated account manager and wordpress developer, a shared team of designers and testers who are capable to do wordpress development and maintenance for multiple projects on an ongoing basis. We also offer you side (but essential skills) like SEO, PPC, Content writing B2B lead gen and overall Digital Marketing services.

At Agicent We Take Care of Your WordPress Site, so You Can Take Care of Your Business

Unlock the full potential of our Managed Web Maintenance services, available on a month-to-month basis. Starting at just $1900 per month, you gain access to a dedicated WordPress maintenance developer, accompanied by fractional Project Management, Design, and Testing experts, all at your disposal. This cohesive team serves as your optimal launchpad for maintaining your WordPress websites, implementing regular enhancements, performing backups, and ensuring continuous development and delivery.

Our developers and teams embrace a comprehensive approach to product development that extends beyond simple coding. We specialize in crafting exceptional web products that users love, emphasizing user experience, convenience, and scalability. Our expertise spans UI/UX design, rigorous testing, scalability planning, and architectural excellence.

Whether you engage us for a single Developer WordPress maintenance team or multiple developers, rest assured that you'll receive best-in-class project management, user experience, and testing expertise. At Agicent, we are committed to elevating your web presence through comprehensive and reliable WordPress Maintenance Services.

What Makes WordPress Maintenance Services Essential?

Whether you're an agency involved in website creation and maintenance for your clients, particularly non-tech businesses, or you're a non-tech or tech business managing your own website or a landing page, the necessity for your WordPress website maintenance services arises in order to:

Keep safeguarding your WordPress site against security vulnerabilities, ensuring that your website is less susceptible to hacks and malicious activities.

To optimize your website's performance, for faster loading times, improved user experience, and better search engine rankings.

To address bugs and ensure that your WordPress site remains compatible with the latest technologies and plugins, preventing any functionality issues.

To quickly recover your website in case of data loss or other emergencies.

To Keep your WordPress site up-to-date with the latest features and improvements so you can leverage new functionalities and stay competitive in the online landscape.

To enhance user satisfaction. A well-maintained website contributes to a positive user experience.

To optimize content that contributes to better SEO performance, helping your site rank higher in search results.

Source: https://www.agicent.com/wordpress-maintenance-services

-

@ 57d1a264:69f1fee1

2025-05-22 12:36:20

@ 57d1a264:69f1fee1

2025-05-22 12:36:20Graphics materials for Bitcoin Knots https://github.com/bitcoinknots branding. See below guide image for reference, a bit cleaner and scalable:

Font family "Aileron" is provided free for personal and commercial use, and can be found here: https://www.1001fonts.com/aileron-font.html

Source: https://github.com/Blissmode/bitcoinknots-gfx/tree/main

https://stacker.news/items/986587

-

@ 58937958:545e6994

2025-05-22 12:25:49

@ 58937958:545e6994

2025-05-22 12:25:49Since it's Bitcoin Pizza Day, I made a Bitcoin pizza!

To give it a Japanese twist, I made it a mentaiko pizza (※ mentaiko = spicy cod roe, a popular Japanese ingredient often used in pasta or rice dishes). For the Bitcoin logo, I used a salmon terrine.

Salmon Terrine

I cut out the "B" logo using hanpen (※ hanpen = a soft, white Japanese fish cake made from fish paste and yam). Tip: You can also cut a colored plastic folder into the "B" shape and place it on top as a stencil — makes it easier!

I blended salmon, hanpen, milk, egg, and a bit of salt in a food processor, poured it into a container, and baked it in a water bath.

Pizza Dough

I mixed bread flour, dry yeast, salt, olive oil, and water, then kneaded it with determination! Let it rise for about an hour until fluffy.

Mentaiko Mayo Topping

I mixed mentaiko, mayonnaise, and soy sauce.

I spread out the dough, added the mentaiko mayo, cheese, and corn, then baked it. Halfway through, I added thin slices of mochi (rice cake). After baking, I topped it with seaweed and the salmon terrine to finish!

Lots to reflect on

About the Terrine

In the video, you’ll see I divided the terrine into two portions. I was worried that the salmon and hanpen parts might end up looking too similar in color, making the “B” logo hard to see.

So for one half, I added ketchup, thinking: “Maybe this will make the red more vibrant?” But even with the ketchup, it didn’t change much.

The Mochi

I accidentally bought thinly sliced mochi, but I realized it might burn too easily as a pizza topping. Regular mochi with standard thickness is probably better.

I added the mochi halfway through baking, opening the oven once, but now I’m thinking that might have lowered the oven temp too much.

Lessons Learned

This was my first and only attempt—no test run beforehand— so I ended up with a long list of lessons learned. In the future, I should definitely do a trial version first… But you know… salmon and mentaiko are expensive! (excuses, excuses)

Cheese

I wanted to do that Instagram-worthy cheese pull moment, but nope. No stretch. None at all. I think that kind of thing needs a totally different kind of cheese or prep. Will have to experiment more.

Taste Test

Actually really good. I usually don’t eat mentaiko mayo myself, and I’m a Margherita pizza fan at heart. But this was surprisingly nice. A little rich in flavor—made me crave a bowl of rice. Next time, I might skip the soy sauce to tone it down a bit.

nostr:nevent1qqsrhularycewltxz88e9wrwutkqu5pkylh3vxrmys2e0nuh7c2h06qgqp9zc

-

@ ee7d2dbe:4a5410b0

2025-05-22 12:19:14

@ ee7d2dbe:4a5410b0

2025-05-22 12:19:14Get a fully managed website maintenance service package from Agicent starting at just $1900 monthly for various technologies like React.js, PHP, Laravel, Wordpress, Wix, webflow and simple html and so on. You get a dedicated account manager, and shared designer and testers along with the web developer at this price. You can also opt for other services like SEO, Digital Marketing in case needed. Expert Website Maintenance Services from Agicent Unlock the power of our Managed Web Maintenance services on a month on month basis. Starting at just $1900 per month , you'll have a dedicated Web maintenance developer, along with fractional Project Management, Design, and Testing experts working at your disposal. This team is your ideal launchpad for maintaining websites, doing regular enhancements, backups, and enjoying continuous development and delivery. Our developers and teams adopt a holistic product development approach, and they go beyond just coding to crafting exceptional web products that users love. With a focus on user experience, convenience, and scalability, we offer expertise in UI/UX design, rigorous testing, scalability planning, and architectural excellence. Whether you engage us for a single Developer Web maintenance team or multiple devs, you’ll get best in class project management, user experience, and testing expertise attached.

Scope of website maintenance services - What does web maintenance service entail? Anyone who has a business or a practice or a brand is a website owner, however major entities that use our website maintenance services regularly are as follows: Business/ Corporate Websites Businesses having information/ lead generation websites built on a CMS like wordpress or wix or just custom code. They usually use websites to generate business leads and also to share information about their services/ products to others. E-commerce Websites for whom the website is the major critical component of their business because they get all the orders from there, it is their store front and has to run seamlessly all the time. E-com websites need a higher level of maintenance regularly compared to other sites. Professionals websites such as Doctors, Dentists, Coaches, lawyers, chiropractors, makeup artists, Chefs, DJs who get bookings on their websites. Functional Web Apps or SaaS apps Functional web applications similar to mobile apps which not only offer information but also functionality and features like a hotel booking website, flight booking website and so on. They obviously need a real high level of maintenance regularly compared to regular biz websites, and for such web apps maintenance and development we recommend using our full stack web development and maintenance services. E-learning websites We can keep these into the category of the functional web apps or SaaS only though we’re mentioning these separately considering their very “nice” nature and technology demand. They too need more maintenance than regular informative/ lead capturing websites Event websites We have managed Event organisers websites like Jazz London Online that puts the event schedules and sell tickets. App’s Landing page websites Usually the websites describing the app’s functionality with videos and screenshots, also a blog and may be a subscription option too. Examples are Fastrackfasting, Hasfit, and Studiothinkapp. Limitation Of Website Maintenance Services Like anything else in the world, website maintenance services too have some limitations like these: Cost Constraints Website maintenance can be financially demanding, leading to potential limitations in the frequency and depth of upkeep activities due to budget constraints. Downtime Due to Server and Hosting Maintenance Temporary downtime during updates poses a challenge, impacting the user experience and potentially causing frustration or business loss. Dependency On Third-Party Providers Relying on third-party plugins introduces dependencies that can lead to vulnerabilities or compatibility issues, affecting the overall stability of the website. Limited Scalability Of Framework Based Websites. As websites grow, the scalability of maintenance efforts becomes a challenge in cae of framework based websites (like wordpress, wix) and they require more complex and resource intensive process. When websites grow, it is always better to switch to as much custom code for easy scalability as you can. Security Risks The constant need for vigilance against emerging security threats is resource-intensive, and failure to address vulnerabilities promptly can compromise website security. Resource Intensity Website maintenance can be resource-intensive, requiring skilled personnel and time, which may pose challenges for some organizations. Technical Challenges Adapting to evolving technologies and ensuring compatibility may present technical challenges, especially for older websites. Limited Automation Some maintenance tasks lack automation, leading to manual interventions that can be time-consuming and prone to errors. Balancing Speed and Quality Striking the right balance between quick updates and thorough testing is crucial, as rushed updates may introduce errors, while cautious appro aches may delay important improvements. Content Management Challenges Managing and updating content effectively can be challenging, with inconsistencies potentially affecting SEO, user experience, and the relevance of the website. Significant changes to website design or structure may disrupt user familiarity, impacting engagement and potentially causing resistance to new features or layouts.

Source: https://www.agicent.com/website-maintenance-services

-

@ 05a0f81e:fc032124

2025-05-22 12:06:40

@ 05a0f81e:fc032124

2025-05-22 12:06:40Bitcoin Pizza Day is celebrated annually on May 22 to commemorate the first real-world transaction using Bitcoin. On May 22, 2010, programmer Laszlo Hanyecz made history by exchanging 10,000 Bitcoins for two large pizzas from Papa John's, worth around $41 at the time. Today, those same Bitcoins are valued at nearly $1 billion, making it one of the most expensive meals ever recorded.

This day marks a significant milestone in the history of cryptocurrency, demonstrating Bitcoin's potential as a medium of exchange for goods and services. It's now celebrated worldwide with events, online discussions, and special pizza promotions.

How it's Celebrated.

Global Events: Cities around the world host gatherings, pizza parties, and discussions about Bitcoin and cryptocurrency.

Rewards and Giveaways: Cryptocurrency exchanges like Binance and Bitget offer rewards, discounts, and giveaways to commemorate the day. Community Engagement: Enthusiasts, traders, and newcomers come together to discuss Bitcoin's journey and the future of decentralized finance.

Significance!

Bitcoin's Humble Beginnings: Bitcoin Pizza Day reminds us of the cryptocurrency's potential for wider adoption and growth.

Cryptocurrency's Evolution: It highlights the progress of Bitcoin from a niche experiment to a significant player in the financial world.

Community Building: The day fosters connections among cryptocurrency enthusiasts and promotes education about Bitcoin and its uses.

-

@ 58937958:545e6994

2025-05-22 11:50:08

@ 58937958:545e6994

2025-05-22 11:50:08ビットコインピザデーということで ビットコインピザを作りました せっかくなので日本っぽい明太ピザにして ビットコインロゴは鮭のテリーヌにしました

鮭のテリーヌ

はんぺんでBのマークを気合で切ります 色付きクリアファイルをBマークに切って乗せると楽です 鮭とはんぺんと牛乳と卵と塩をフードプロセッサーにかけます 容器に流して蒸し焼きします

生地作り

強力粉・ドライイースト・塩・オリーブオイル・水を混ぜます

気合でこねます

1時間くらい発酵させるとふっくらします

強力粉・ドライイースト・塩・オリーブオイル・水を混ぜます

気合でこねます

1時間くらい発酵させるとふっくらしますトッピングの明太マヨ

明太子とマヨネーズとしょうゆを混ぜます

のばした生地に

明太マヨ・チーズ・コーンを乗せて焼きます

途中で薄いおもちを乗せます

焼けたらのりとテリーヌを乗せてできあがり

のばした生地に

明太マヨ・チーズ・コーンを乗せて焼きます

途中で薄いおもちを乗せます

焼けたらのりとテリーヌを乗せてできあがり反省点いろいろ

今回一番くやしいのは明太マヨに色がつきすぎたこと 明太ピザってピンク色の感じが独特な気がするし もしかしたら日本だけかもと思ったから作ったのに 焼けたらトマトソースみたいな色になっちゃった なんてことだ 生地に焼き色がつかないな~白いな~もうちょっと焼くか~とか思ってたら 明太さんが焦げてました むねん

ちなみに製作動画の中でテリーヌを2つに分けているのは 鮭とはんぺんの部分が同じ色っぽくなってBが目立たなかったらどうしようと思って 片方はケチャップを足して 赤色濃くなるかな~大失敗したらいやだな~とか思ってたんですけど ケチャップ入れても何も変わらなかった むねん

薄いおもち(しゃぶしゃぶもちというらしい)を買ってしまったんだけど これはピザのトッピングにするには焦げそうだから 普通の厚みのもちの方がよさそう 今回は途中で一度オーブン開けておもちを乗せたけど オーブンの温度が下がるのが微妙かも

あと今回は練習無しのぶっつけ本番で作ったので ちょっと自分の中で反省点が多かったな~と やっぱり一度試作した方がいいですね いや鮭とか明太子とか高くて(言い訳

あ~あとチーズ 溶け溶けチーズがのびーるインスタ映え的なやつをやりたかったんですけど 全然むりでした のびないのびない ああいうのは別で工夫が必要そうなので要検討

味はおいしかったです 明太マヨって自分ではあんまり食べないしピザはマルゲリータ派なんですけど結構いいですね ちょっと味が濃くてご飯食べたくなっちゃった 次作る時はしょうゆ入れないようにしよう

nostr:nevent1qqsrhularycewltxz88e9wrwutkqu5pkylh3vxrmys2e0nuh7c2h06qgqp9zc

-

@ 979ab082:dedeefb6

2025-05-22 11:47:06

@ 979ab082:dedeefb6

2025-05-22 11:47:06Discover the power of Flash Bitcoin with FLASHCORE BTC Software (Basic), exclusively available at FashExperts! This full-version tool allows you to send Flash Bitcoin across blockchain networks, with transactions lasting up to 90 days in any wallet — or indefinitely with hash rate. Ideal for crypto enthusiasts and testers, this software offers a simple, secure way to explore blockchain capabilities.

What is FLASHCORE BTC Software (Basic)? The FLASHCORE BTC Software (Basic) is a streamlined version of our innovative flashing technology, designed to generate and send fake Bitcoin (Flash BTC) over blockchain networks. Without hash rate, Flash BTC remains in your wallet for a maximum of 90 days before being rejected and disappearing. However, with hash rate, it can stay indefinitely! Built with a unique obfuscation security code, this software ensures authenticity and functionality — exclusively from FashExperts.

Key Features of FLASHCORE BTC Software (Basic) 90-Day Duration: Flash BTC lasts up to 90 days without hash rate, and indefinitely with hash rate. Full-Version Access: Get the latest Flashcore BTC Software with essential flashing capabilities. Single-Device Security: Locked to one computer via obfuscation code for exclusive use. Blockchain Compatibility: Sends Flash BTC across networks, visible until rejection. Why Choose FashExperts’ FLASHCORE BTC Software (Basic)? Simple & Effective: Perfect for beginners or testers who need basic flashing features. Secure Purchase: Sold only by the original developer at FashExperts — avoid reseller scams. Unlimited Potential: Extend Flash BTC duration indefinitely with hash rate. Reliable Performance: Built for consistent, hassle-free blockchain interaction. How It Works With FLASHCORE BTC Software (Basic), you can send Flash Bitcoin to any wallet, where it remains for 90 to 360 days unless paired with hash rate for unlimited duration. Transactions are sent across blockchain networks and disappear after rejection if no hash rate is applied. The software’s full-version design ensures ease of use, while its single-device lock keeps it secure and exclusive just for you.

Important Warning This software is sold solely by the developer at FashExperts. Each purchase includes a unique obfuscation security code, restricting use to one computer. Resold versions are scams and won’t work — buy directly from FashExperts to ensure you get the authentic FLASHCORE BTC Software (Basic).

Ready to Flash Bitcoin Affordably? Get FLASHCORE BTC Software (Basic) from FashExperts and start sending fake BTC that lasts 90 days (or longer with hash rate). It’s the best entry-level flashing tool online — secure your copy today!

Call to Action: 📞 Call Us on WhatsApp : +1 (329) 226–0153

💬 Chat with Us on Telegram: @fashexpertssDiscover the power of Flash Bitcoin with FLASHCORE BTC Software (Basic), exclusively available at FashExperts! This full-version tool allows you to send Flash Bitcoin across blockchain networks, with transactions lasting up to 90 days in any wallet — or indefinitely with hash rate. Ideal for crypto enthusiasts and testers, this software offers a simple, secure way to explore blockchain capabilities.

# What is FLASHCORE BTC Software (Basic)?

# What is FLASHCORE BTC Software (Basic)?The FLASHCORE BTC Software (Basic) is a streamlined version of our innovative flashing technology, designed to generate and send fake Bitcoin (Flash BTC) over blockchain networks. Without hash rate, Flash BTC remains in your wallet for a maximum of 90 days before being rejected and disappearing. However, with hash rate, it can stay indefinitely! Built with a unique obfuscation security code, this software ensures authenticity and functionality — exclusively from FashExperts.

Key Features of FLASHCORE BTC Software (Basic)

- 90-Day Duration: Flash BTC lasts up to 90 days without hash rate, and indefinitely with hash rate.

- Full-Version Access: Get the latest Flashcore BTC Software with essential flashing capabilities.

- Single-Device Security: Locked to one computer via obfuscation code for exclusive use.

- Blockchain Compatibility: Sends Flash BTC across networks, visible until rejection.

Why Choose FashExperts’ FLASHCORE BTC Software (Basic)?

- Simple & Effective: Perfect for beginners or testers who need basic flashing features.

- Secure Purchase: Sold only by the original developer at FashExperts — avoid reseller scams.

- Unlimited Potential: Extend Flash BTC duration indefinitely with hash rate.

- Reliable Performance: Built for consistent, hassle-free blockchain interaction.

How It Works

With FLASHCORE BTC Software (Basic), you can send Flash Bitcoin to any wallet, where it remains for 90 to 360 days unless paired with hash rate for unlimited duration. Transactions are sent across blockchain networks and disappear after rejection if no hash rate is applied. The software’s full-version design ensures ease of use, while its single-device lock keeps it secure and exclusive just for you.

Important Warning

This software is sold solely by the developer at FashExperts. Each purchase includes a unique obfuscation security code, restricting use to one computer. Resold versions are scams and won’t work — buy directly from FashExperts to ensure you get the authentic FLASHCORE BTC Software (Basic).

Ready to Flash Bitcoin Affordably?

Get FLASHCORE BTC Software (Basic) from FashExperts and start sending fake BTC that lasts 90 days (or longer with hash rate). It’s the best entry-level flashing tool online — secure your copy today!

Call to Action:

📞 Call Us on WhatsApp : +1 (329) 226–0153

💬 Chat with Us on Telegram: @fashexpertss

-

@ 9ca447d2:fbf5a36d

2025-05-22 11:01:33

@ 9ca447d2:fbf5a36d

2025-05-22 11:01:33UFC legend Conor McGregor has entered the Bitcoin space, calling on his home country of Ireland to create a national Bitcoin reserve. The proposal has sparked a frenzy online and across Ireland.

McGregor, famous globally for his UFC achievements, is now pushing for a financial revolution in Ireland. In a recent post on X, the 36-year-old fighter said Bitcoin can give power back to the people.

Conor McGregor on X

“Crypto in its origin was founded to give power back to the people,” McGregor wrote. “An Irish Bitcoin strategic reserve will give power to the people’s money.”

The post went viral with over 735,000 views in under 12 hours. McGregor announced he will be co-hosting a Twitter Space to discuss his vision and invited Bitcoin experts and public figures to join.

McGregor’s call for a bitcoin reserve is not an isolated event. It comes at a time when several other countries are exploring or have already added bitcoin to their national strategies.

The U.S. recently made headlines when President Donald Trump signed an executive order to create a Strategic Bitcoin Reserve. Arizona and New Hampshire have also done it at the state level.

El Salvador and Bhutan have also taken the same step. There have been reports of Russia planning to add bitcoin to its reserves by 2028 and the Polish government has proposals to do the same.

McGregor says Ireland shouldn’t be left behind. He believes bitcoin’s fixed supply, neutrality and decentralization make it the perfect hedge against inflation and a modern alternative to gold.

“Now it’s time to change the crypto game,” McGregor posted, signaling he will bring digital assets into the national conversation.

Many of McGregor’s fans and Bitcoin enthusiasts are on board with the idea, but some experts and commenters are urging caution. There are comments on his social media posts telling him to focus on Bitcoin only and not include other cryptos in the reserve.

They warned him to choose his words more carefully, not to mix “crypto” with Bitcoin. Daniel Sempere Pico commented:

“Crypto is mostly hot air and scams. Bitcoin is not crypto. Focus on bitcoin, Conor. Focus on bitcoin.”

McGregor’s call for a reserve comes as he launches his political career. In March 2025 he announced he will run as an independent candidate for the Irish presidency. His campaign is focused on crime reduction, stricter immigration and now financial reform through Bitcoin.

If elected, McGregor says he will bring change to Ireland, starting with how the country handles its national reserves. He wants bitcoin to be the cornerstone of a modern decentralized financial strategy.

But it might be a big ask. Ireland has not commented on McGregor’s proposal and experts say it’s got major regulatory and political hurdles.

As an independent candidate with no party backing, McGregor will need to build public and political support to make it happen.

-

@ e97aaffa:2ebd765d

2025-05-22 10:50:38

@ e97aaffa:2ebd765d

2025-05-22 10:50:38Seria possível um short squeeze na MicroStrategy, similar ao da Metaplanet?

Com aquela dimensão, eu acho pouco provável, mas um mais pequeno é bem possível. O Metaplanet valorizou mais de 300% em dois dias, é incrível.

Nestas empresas de Bitcoin Treasury Companies, como a MicroStrategy e a Metaplanet, o rastilho para o short squeeze é uma forte valorização do Bitcoin no mercado spot. É o Bitcoin que dá a volatilidade à ação.

A MicroStrategy tem um marketcap de $64B, é demasiado grande para ter valorização desta amplitude em tão pouco tempo. Além disso, existem outros fatores que poderão minimizar o impato do short squeeze.

Saylor, certamente iria aproveitar a oportunidade para emitir novas ações para gerar mais liquidez. Seria algo similar ao que a GameStop fez, ao emitir de novas ações, permitiu minimizar o short squeeze e gerou um caixa de $4B.

[https://image.nostr.build/2e5e1fa7a48e133812ae8fb7c8ca98b59d9911794cf92199e3386cadb7752688.jpg])

Depois existe um outro grupo de investidores, que é enorme, tem uma estratégia especulativa de capturar o NAV, ou seja, de estar short em MicroStrategy e long em Bitcoin.

Caso exista um short squeeze, as shorts seriam liquidadas, consequentemente as longs também, isso provocaria uma pressão de venda de Bitcoin, a valorização será minimizada. Isso reduz imenso a volatilidade do Bitcoin.

Claro que 300% não é possível, mas até 100% é bem possível.

Agora o ponto interesante, se o Saylor ficasse com os bolsos bem recheados, o que ele faria?Todos nós sabemos qual é a resposta, claramente ele iria comprar ainda mais Bitcoin. Apesar de eu preferir que ele utilize essa liquidez para reduzir as notas conversíveis da empresa. Eu acho que ele já tem demasiado Bitcoin, a centralização nunca é boa, ainda mais agora, que já existem outras empresas que prestam serviços similares.

-

@ db39407c:a36c161e

2025-05-22 10:37:27

@ db39407c:a36c161e

2025-05-22 10:37:27123BET trải nghiệm giải trí online đang trở thành điểm đến lý tưởng cho cộng đồng yêu thích cá cược trực tuyến tại Việt Nam nhờ sự kết hợp giữa công nghệ hiện đại và dịch vụ người dùng xuất sắc. Với định hướng phát triển lâu dài và bền vững, 123BET không chỉ cung cấp hàng trăm trò chơi hấp dẫn từ slot game, baccarat, tài xỉu, bắn cá, roulette đến live casino mà còn tích hợp hệ thống cá cược thể thao đỉnh cao, đem lại sự đa dạng và linh hoạt trong lựa chọn giải trí cho người chơi. Giao diện website và ứng dụng được thiết kế tối ưu cho người Việt, dễ sử dụng, tốc độ mượt mà, tương thích hoàn toàn với mọi hệ điều hành như iOS, Android, Windows… chỉ với một tài khoản duy nhất, bạn có thể dễ dàng đăng nhập và tận hưởng mọi dịch vụ cá cược không giới hạn mọi lúc, mọi nơi. 123BET đặc biệt chú trọng đến tính minh bạch, khi toàn bộ trò chơi đều được chứng nhận bởi các tổ chức kiểm định quốc tế, đảm bảo công bằng tuyệt đối trong từng ván cược.

Ngoài hệ thống trò chơi phong phú, 123BET còn sở hữu nền tảng công nghệ bảo mật hàng đầu, giúp người chơi yên tâm tuyệt đối về thông tin cá nhân và giao dịch tài chính. Hệ thống thanh toán được hỗ trợ 24/7, với nhiều phương thức linh hoạt như chuyển khoản ngân hàng, ví điện tử, thẻ cào và cả mã QR, giúp người chơi dễ dàng nạp tiền và rút thưởng một cách nhanh chóng, chỉ trong vài phút. Đặc biệt, người chơi không cần thông qua bên trung gian mà hoàn toàn có thể giao dịch trực tiếp trên nền tảng với độ an toàn cao, hạn chế tối đa rủi ro bị lộ thông tin hoặc lừa đảo. Đội ngũ kỹ thuật và chăm sóc khách hàng của 123BET hoạt động chuyên nghiệp, tận tâm, hỗ trợ trực tuyến liên tục cả ngày lẫn đêm thông qua nhiều kênh như chat trực tuyến, Zalo, Telegram, Hotline. Mọi thắc mắc và sự cố kỹ thuật đều được xử lý nhanh chóng và hiệu quả, đảm bảo trải nghiệm không bị gián đoạn. Nhờ vào dịch vụ chăm sóc người chơi chuyên biệt và tận tâm, 123BET ngày càng khẳng định vị thế dẫn đầu của mình trên thị trường cá cược trực tuyến Việt Nam.

Không dừng lại ở đó, 123BET còn liên tục triển khai các chương trình khuyến mãi hấp dẫn nhằm tri ân người chơi mới và gắn bó lâu dài. Ngay từ khi đăng ký tài khoản, người chơi sẽ nhận được nhiều phần thưởng hấp dẫn như tiền cược miễn phí, vòng quay may mắn và các mã thưởng nạp đầu giá trị. Ngoài ra, chương trình VIP của 123BET được xây dựng theo mô hình tích điểm nâng hạng với các cấp bậc từ Thành viên, Bạc, Vàng cho đến Kim Cương – mỗi cấp đều đi kèm các đặc quyền riêng như hoàn tiền cược hàng tuần, tỷ lệ nạp cao hơn, rút tiền nhanh hơn và được ưu tiên hỗ trợ riêng biệt. Những sự kiện hot theo tháng, các giải đấu nội bộ cũng được tổ chức thường xuyên với phần thưởng tiền mặt, điện thoại, xe máy hoặc các phần quà có giá trị khác, giúp người chơi luôn có cảm hứng mới khi tham gia. Với định hướng không ngừng đổi mới và lấy người dùng làm trung tâm, 123BET trải nghiệm giải trí online không chỉ là một nhà cái, mà còn là người đồng hành đáng tin cậy trong hành trình giải trí và kiếm thưởng của hàng triệu người Việt mỗi ngày.

-

@ 6d8e2a24:5faaca4c

2025-05-22 10:04:48

@ 6d8e2a24:5faaca4c

2025-05-22 10:04:48Apr 2, 2025 at 5:43 PM

Updated: May 8, 2025 at 1:08 PM

Bola Ahmed Tinubu has signed the Investments and Securities Act 2025, officially recognizing crypto assets and placing them under the Nigerian SEC.

Nigeria’s President, Bola Ahmed Tinubu, has signed the Investments and Securities Act 2025 into law, making its provisions officially enforceable.

The act now classifies digital assets and cryptocurrencies as securities, bringing them under the regulation of the Nigerian Securities and Exchange Commission (SEC).

The details

*According to reports, the SEC announced the development last Saturday, adding that the act supersedes the previous ISA 2007 Act.*