-

@ 51bbb15e:b77a2290

2025-05-21 00:24:36

@ 51bbb15e:b77a2290

2025-05-21 00:24:36Yeah, I’m sure everything in the file is legit. 👍 Let’s review the guard witness testimony…Oh wait, they weren’t at their posts despite 24/7 survellience instructions after another Epstein “suicide” attempt two weeks earlier. Well, at least the video of the suicide is in the file? Oh wait, a techical glitch. Damn those coincidences!

At this point, the Trump administration has zero credibility with me on anything related to the Epstein case and his clients. I still suspect the administration is using the Epstein files as leverage to keep a lot of RINOs in line, whereas they’d be sabotaging his agenda at every turn otherwise. However, I just don’t believe in ends-justify-the-means thinking. It’s led almost all of DC to toss out every bit of the values they might once have had.

-

@ b83a28b7:35919450

2025-05-16 19:23:58

@ b83a28b7:35919450

2025-05-16 19:23:58This article was originally part of the sermon of Plebchain Radio Episode 110 (May 2, 2025) that nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqyg8wumn8ghj7mn0wd68ytnvv9hxgqpqtvqc82mv8cezhax5r34n4muc2c4pgjz8kaye2smj032nngg52clq7fgefr and I did with nostr:nprofile1qythwumn8ghj7ct5d3shxtnwdaehgu3wd3skuep0qyt8wumn8ghj7ct4w35zumn0wd68yvfwvdhk6tcqyzx4h2fv3n9r6hrnjtcrjw43t0g0cmmrgvjmg525rc8hexkxc0kd2rhtk62 and nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqyg8wumn8ghj7mn0wd68ytnvv9hxgqpq4wxtsrj7g2jugh70pfkzjln43vgn4p7655pgky9j9w9d75u465pqahkzd0 of the nostr:nprofile1qythwumn8ghj7ct5d3shxtnwdaehgu3wd3skuep0qyt8wumn8ghj7etyv4hzumn0wd68ytnvv9hxgtcqyqwfvwrccp4j2xsuuvkwg0y6a20637t6f4cc5zzjkx030dkztt7t5hydajn

Listen to the full episode here:

<https://fountain.fm/episode/Ln9Ej0zCZ5dEwfo8w2Ho>

Bitcoin has always been a narrative revolution disguised as code. White paper, cypherpunk lore, pizza‑day legends - every block is a paragraph in the world’s most relentless epic. But code alone rarely converts the skeptic; it’s the camp‑fire myth that slips past the prefrontal cortex and shakes hands with the limbic system. People don’t adopt protocols first - they fall in love with protagonists.

Early adopters heard the white‑paper hymn, but most folks need characters first: a pizza‑day dreamer; a mother in a small country, crushed by the cost of remittance; a Warsaw street vendor swapping złoty for sats. When their arcs land, the brain releases a neurochemical OP_RETURN which says, “I belong in this plot.” That’s the sly roundabout orange pill: conviction smuggled inside catharsis.

That’s why, from 22–25 May in Warsaw’s Kinoteka, the Bitcoin Film Fest is loading its reels with rebellion. Each documentary, drama, and animated rabbit‑hole is a stealth wallet, zipping conviction straight into the feels of anyone still clasped within the cold claw of fiat. You come for the plot, you leave checking block heights.

Here's the clip of the sermon from the episode:

nostr:nevent1qvzqqqqqqypzpwp69zm7fewjp0vkp306adnzt7249ytxhz7mq3w5yc629u6er9zsqqsy43fwz8es2wnn65rh0udc05tumdnx5xagvzd88ptncspmesdqhygcrvpf2

-

@ 04c915da:3dfbecc9

2025-05-16 17:59:23

@ 04c915da:3dfbecc9

2025-05-16 17:59:23Recently we have seen a wave of high profile X accounts hacked. These attacks have exposed the fragility of the status quo security model used by modern social media platforms like X. Many users have asked if nostr fixes this, so lets dive in. How do these types of attacks translate into the world of nostr apps? For clarity, I will use X’s security model as representative of most big tech social platforms and compare it to nostr.

The Status Quo

On X, you never have full control of your account. Ultimately to use it requires permission from the company. They can suspend your account or limit your distribution. Theoretically they can even post from your account at will. An X account is tied to an email and password. Users can also opt into two factor authentication, which adds an extra layer of protection, a login code generated by an app. In theory, this setup works well, but it places a heavy burden on users. You need to create a strong, unique password and safeguard it. You also need to ensure your email account and phone number remain secure, as attackers can exploit these to reset your credentials and take over your account. Even if you do everything responsibly, there is another weak link in X infrastructure itself. The platform’s infrastructure allows accounts to be reset through its backend. This could happen maliciously by an employee or through an external attacker who compromises X’s backend. When an account is compromised, the legitimate user often gets locked out, unable to post or regain control without contacting X’s support team. That process can be slow, frustrating, and sometimes fruitless if support denies the request or cannot verify your identity. Often times support will require users to provide identification info in order to regain access, which represents a privacy risk. The centralized nature of X means you are ultimately at the mercy of the company’s systems and staff.

Nostr Requires Responsibility

Nostr flips this model radically. Users do not need permission from a company to access their account, they can generate as many accounts as they want, and cannot be easily censored. The key tradeoff here is that users have to take complete responsibility for their security. Instead of relying on a username, password, and corporate servers, nostr uses a private key as the sole credential for your account. Users generate this key and it is their responsibility to keep it safe. As long as you have your key, you can post. If someone else gets it, they can post too. It is that simple. This design has strong implications. Unlike X, there is no backend reset option. If your key is compromised or lost, there is no customer support to call. In a compromise scenario, both you and the attacker can post from the account simultaneously. Neither can lock the other out, since nostr relays simply accept whatever is signed with a valid key.

The benefit? No reliance on proprietary corporate infrastructure.. The negative? Security rests entirely on how well you protect your key.

Future Nostr Security Improvements

For many users, nostr’s standard security model, storing a private key on a phone with an encrypted cloud backup, will likely be sufficient. It is simple and reasonably secure. That said, nostr’s strength lies in its flexibility as an open protocol. Users will be able to choose between a range of security models, balancing convenience and protection based on need.

One promising option is a web of trust model for key rotation. Imagine pre-selecting a group of trusted friends. If your account is compromised, these people could collectively sign an event announcing the compromise to the network and designate a new key as your legitimate one. Apps could handle this process seamlessly in the background, notifying followers of the switch without much user interaction. This could become a popular choice for average users, but it is not without tradeoffs. It requires trust in your chosen web of trust, which might not suit power users or large organizations. It also has the issue that some apps may not recognize the key rotation properly and followers might get confused about which account is “real.”

For those needing higher security, there is the option of multisig using FROST (Flexible Round-Optimized Schnorr Threshold). In this setup, multiple keys must sign off on every action, including posting and updating a profile. A hacker with just one key could not do anything. This is likely overkill for most users due to complexity and inconvenience, but it could be a game changer for large organizations, companies, and governments. Imagine the White House nostr account requiring signatures from multiple people before a post goes live, that would be much more secure than the status quo big tech model.

Another option are hardware signers, similar to bitcoin hardware wallets. Private keys are kept on secure, offline devices, separate from the internet connected phone or computer you use to broadcast events. This drastically reduces the risk of remote hacks, as private keys never touches the internet. It can be used in combination with multisig setups for extra protection. This setup is much less convenient and probably overkill for most but could be ideal for governments, companies, or other high profile accounts.

Nostr’s security model is not perfect but is robust and versatile. Ultimately users are in control and security is their responsibility. Apps will give users multiple options to choose from and users will choose what best fits their need.

-

@ 5144fe88:9587d5af

2025-05-23 17:01:37

@ 5144fe88:9587d5af

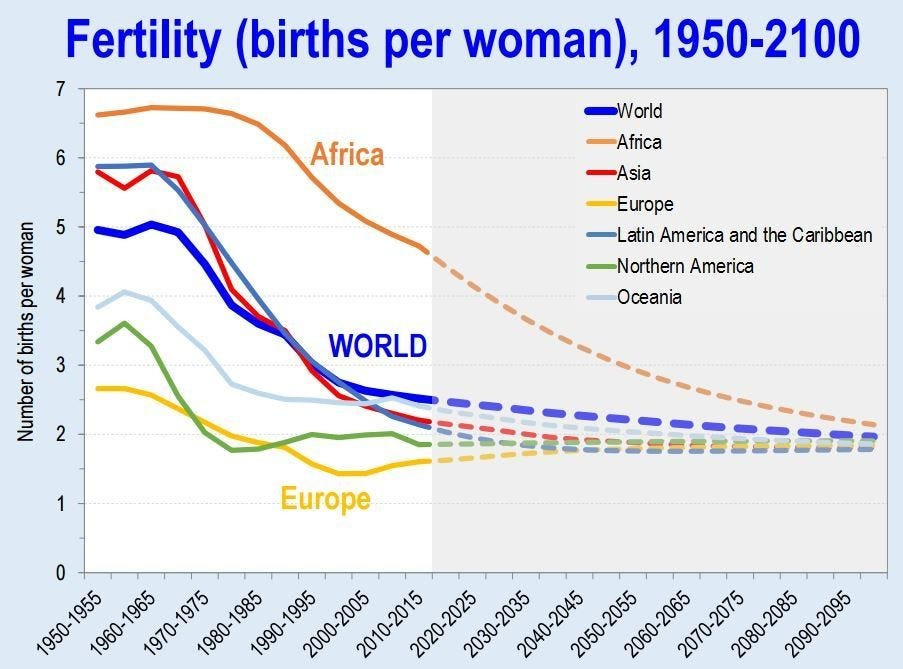

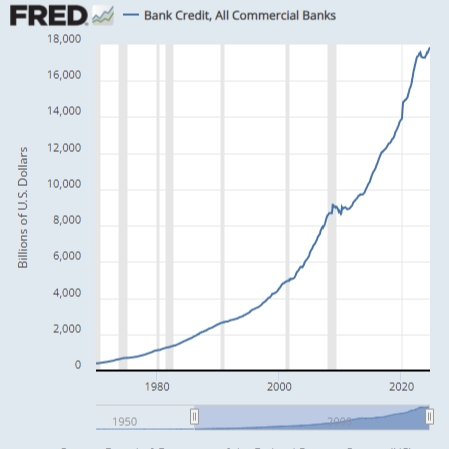

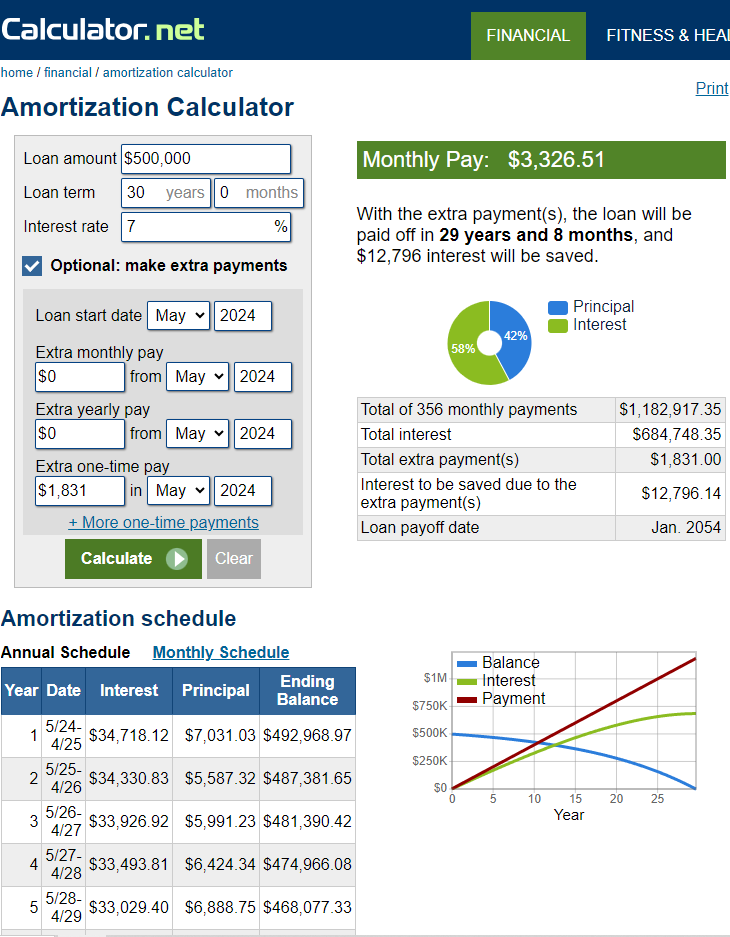

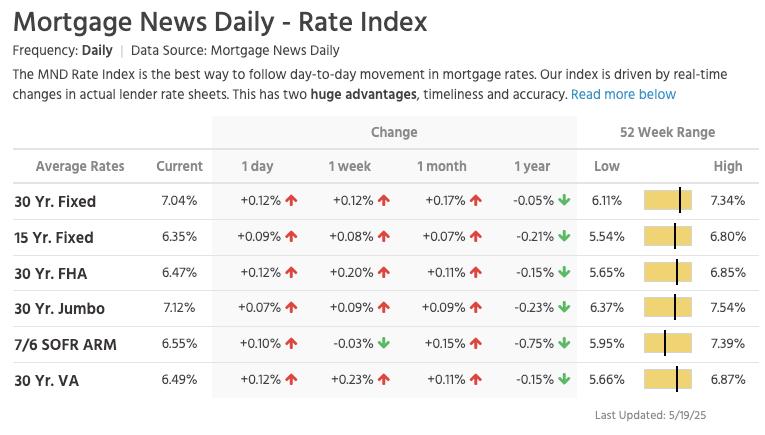

2025-05-23 17:01:37The recent anomalies in the financial market and the frequent occurrence of world trade wars and hot wars have caused the world's political and economic landscape to fluctuate violently. It always feels like the financial crisis is getting closer and closer.

This is a systematic analysis of the possibility of the current global financial crisis by Manus based on Ray Dalio's latest views, US and Japanese economic and financial data, Buffett's investment behavior, and historical financial crises.

Research shows that the current financial system has many preconditions for a crisis, especially debt levels, market valuations, and investor behavior, which show obvious crisis signals. The probability of a financial crisis in the short term (within 6-12 months) is 30%-40%,

in the medium term (within 1-2 years) is 50%-60%,

in the long term (within 2-3 years) is 60%-70%.

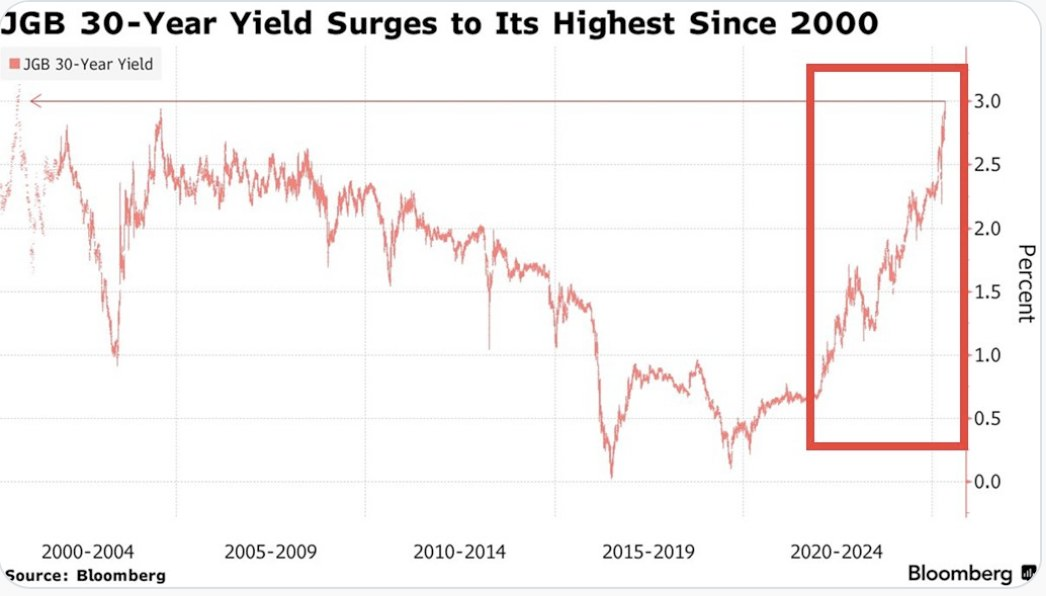

Japan's role as the world's largest holder of overseas assets and the largest creditor of the United States is particularly critical. The sharp appreciation of the yen may be a signal of the return of global safe-haven funds, which will become an important precursor to the outbreak of a financial crisis.

Potential conditions for triggering a financial crisis Conditions that have been met 1. High debt levels: The debt-to-GDP ratio of the United States and Japan has reached a record high. 2. Market overvaluation: The ratio of stock market to GDP hits a record high 3. Abnormal investor behavior: Buffett's cash holdings hit a record high, with net selling for 10 consecutive quarters 4. Monetary policy shift: Japan ends negative interest rates, and the Fed ends the rate hike cycle 5. Market concentration is too high: a few technology stocks dominate market performance

Potential trigger points 1. The Bank of Japan further tightens monetary policy, leading to a sharp appreciation of the yen and the return of overseas funds 2. The US debt crisis worsens, and the proportion of interest expenses continues to rise to unsustainable levels 3. The bursting of the technology bubble leads to a collapse in market confidence 4. The trade war further escalates, disrupting global supply chains and economic growth 5. Japan, as the largest creditor of the United States, reduces its holdings of US debt, causing US debt yields to soar

Analysis of the similarities and differences between the current economic environment and the historical financial crisis Debt level comparison Current debt situation • US government debt to GDP ratio: 124.0% (December 2024) • Japanese government debt to GDP ratio: 216.2% (December 2024), historical high 225.8% (March 2021) • US total debt: 36.21 trillion US dollars (May 2025) • Japanese debt/GDP ratio: more than 250%-263% (Japanese Prime Minister’s statement)

Before the 2008 financial crisis • US government debt to GDP ratio: about 64% (2007) • Japanese government debt to GDP ratio: about 175% (2007)

Before the Internet bubble in 2000 • US government debt to GDP ratio: about 55% (1999) • Japanese government debt to GDP ratio: about 130% (1999)

Key differences • The current US debt-to-GDP ratio is nearly twice that before the 2008 crisis • The current Japanese debt-to-GDP ratio is more than 1.2 times that before the 2008 crisis • Global debt levels are generally higher than historical pre-crisis levels • US interest payments are expected to devour 30% of fiscal revenue (Moody's warning)

Monetary policy and interest rate environment

Current situation • US 10-year Treasury yield: about 4.6% (May 2025) • Bank of Japan policy: end negative interest rates and start a rate hike cycle • Bank of Japan's holdings of government bonds: 52%, plans to reduce purchases to 3 trillion yen per month by January-March 2026 • Fed policy: end the rate hike cycle and prepare to cut interest rates

Before the 2008 financial crisis • US 10-year Treasury yield: about 4.5%-5% (2007) • Fed policy: continuous rate hikes from 2004 to 2006, and rate cuts began in 2007 • Bank of Japan policy: maintain ultra-low interest rates

Key differences • Current US interest rates are similar to those before the 2008 crisis, but debt levels are much higher than then • Japan is in the early stages of ending its loose monetary policy, unlike before historical crises • The size of global central bank balance sheets is far greater than at any time in history

Market valuations and investor behavior Current situation • The ratio of stock market value to the size of the US economy: a record high • Buffett's cash holdings: $347 billion (28% of assets), a record high • Market concentration: US stock growth mainly relies on a few technology giants • Investor sentiment: Technology stocks are enthusiastic, but institutional investors are beginning to be cautious

Before the 2008 financial crisis • Buffett's cash holdings: 25% of assets (2005) • Market concentration: Financial and real estate-related stocks performed strongly • Investor sentiment: The real estate market was overheated and subprime products were widely popular

Before the 2000 Internet bubble • Buffett's cash holdings: increased from 1% to 13% (1998) • Market concentration: Internet stocks were extremely highly valued • Investor sentiment: Tech stocks are in a frenzy

Key differences • Buffett's current cash holdings exceed any pre-crisis level in history • Market valuation indicators have reached a record high, exceeding the levels before the 2000 bubble and the 2008 crisis • The current market concentration is higher than any period in history, and a few technology stocks dominate market performance

Safe-haven fund flows and international relations Current situation • The status of the yen: As a safe-haven currency, the appreciation of the yen may indicate a rise in global risk aversion • Trade relations: The United States has imposed tariffs on Japan, which is expected to reduce Japan's GDP growth by 0.3 percentage points in fiscal 2025 • International debt: Japan is one of the largest creditors of the United States

Before historical crises • Before the 2008 crisis: International capital flows to US real estate and financial products • Before the 2000 bubble: International capital flows to US technology stocks

Key differences • Current trade frictions have intensified and the trend of globalization has weakened • Japan's role as the world's largest holder of overseas assets has become more prominent • International debt dependence is higher than any period in history

-

@ 04c915da:3dfbecc9

2025-05-16 17:51:54

@ 04c915da:3dfbecc9

2025-05-16 17:51:54In much of the world, it is incredibly difficult to access U.S. dollars. Local currencies are often poorly managed and riddled with corruption. Billions of people demand a more reliable alternative. While the dollar has its own issues of corruption and mismanagement, it is widely regarded as superior to the fiat currencies it competes with globally. As a result, Tether has found massive success providing low cost, low friction access to dollars. Tether claims 400 million total users, is on track to add 200 million more this year, processes 8.1 million transactions daily, and facilitates $29 billion in daily transfers. Furthermore, their estimates suggest nearly 40% of users rely on it as a savings tool rather than just a transactional currency.

Tether’s rise has made the company a financial juggernaut. Last year alone, Tether raked in over $13 billion in profit, with a lean team of less than 100 employees. Their business model is elegantly simple: hold U.S. Treasuries and collect the interest. With over $113 billion in Treasuries, Tether has turned a straightforward concept into a profit machine.

Tether’s success has resulted in many competitors eager to claim a piece of the pie. This has triggered a massive venture capital grift cycle in USD tokens, with countless projects vying to dethrone Tether. Due to Tether’s entrenched network effect, these challengers face an uphill battle with little realistic chance of success. Most educated participants in the space likely recognize this reality but seem content to perpetuate the grift, hoping to cash out by dumping their equity positions on unsuspecting buyers before they realize the reality of the situation.

Historically, Tether’s greatest vulnerability has been U.S. government intervention. For over a decade, the company operated offshore with few allies in the U.S. establishment, making it a major target for regulatory action. That dynamic has shifted recently and Tether has seized the opportunity. By actively courting U.S. government support, Tether has fortified their position. This strategic move will likely cement their status as the dominant USD token for years to come.

While undeniably a great tool for the millions of users that rely on it, Tether is not without flaws. As a centralized, trusted third party, it holds the power to freeze or seize funds at its discretion. Corporate mismanagement or deliberate malpractice could also lead to massive losses at scale. In their goal of mitigating regulatory risk, Tether has deepened ties with law enforcement, mirroring some of the concerns of potential central bank digital currencies. In practice, Tether operates as a corporate CBDC alternative, collaborating with authorities to surveil and seize funds. The company proudly touts partnerships with leading surveillance firms and its own data reveals cooperation in over 1,000 law enforcement cases, with more than $2.5 billion in funds frozen.

The global demand for Tether is undeniable and the company’s profitability reflects its unrivaled success. Tether is owned and operated by bitcoiners and will likely continue to push forward strategic goals that help the movement as a whole. Recent efforts to mitigate the threat of U.S. government enforcement will likely solidify their network effect and stifle meaningful adoption of rival USD tokens or CBDCs. Yet, for all their achievements, Tether is simply a worse form of money than bitcoin. Tether requires trust in a centralized entity, while bitcoin can be saved or spent without permission. Furthermore, Tether is tied to the value of the US Dollar which is designed to lose purchasing power over time, while bitcoin, as a truly scarce asset, is designed to increase in purchasing power with adoption. As people awaken to the risks of Tether’s control, and the benefits bitcoin provides, bitcoin adoption will likely surpass it.

-

@ 1c5ff3ca:efe9c0f6

2025-05-23 10:13:57

@ 1c5ff3ca:efe9c0f6

2025-05-23 10:13:57Auto-Deployment on a VPS with GitHub Actions

Introduction

This tutorial describes how you can deploy an application on a VPS using GitHub Actions. This way, changes in your GitHub repository are automatically deployed to your VPS.

Prerequisites

- GitHub Account

- GitHub Repository

- Server + SSH access to the server

Step 1 - SSH Login to Server

Open a terminal and log in via SSH. Then navigate to the

.sshdirectoryssh user@hostname cd ~/.sshStep 2 - Create an SSH Key

Now create a new SSH key that we will use for auto-deployment. In the following dialog, simply press "Enter" repeatedly until the key is created.

ssh-keygen -t ed25519 -C "service-name-deploy-github"Step 3 - Add the Key to the

authorized_keysFilecat id_ed25519.pub >> authorized_keys(If you named the key file differently, change this accordingly)

Step 4 - GitHub Secrets

In order for the GitHub Action to perform the deployment later, some secrets must be stored in the repository. Open the repository on GitHub. Navigate to "Settings" -> "Secrets And Variables" -> "Actions". Add the following variables:

HOST: Hostname or IP address of the serverUSERNAME: Username you use to log in via SSHSSHKEY: The private key (copy the content fromcat ~/.ssh/id_ed25519)PORT: 22

Step 5 - Create the GitHub Action

Now create the GitHub Action for auto-deployment. The following GitHub Action will be used: https://github.com/appleboy/scp-action In your local repository, create the file

.github/workflows/deploy.yml:```yaml name: Deploy on: [push] jobs: build: runs-on: ubuntu-latest steps: - uses: actions/checkout@v1 - name: Copy repository content via scp uses: appleboy/scp-action@master with: host: ${{ secrets.HOST }} username: ${{ secrets.USERNAME }} port: ${{ secrets.PORT }} key: ${{ secrets.SSHKEY }} source: "." target: "/your-target-directory"

- name: Executing a remote command uses: appleboy/ssh-action@master with: host: ${{ secrets.HOST }} username: ${{ secrets.USERNAME }} port: ${{ secrets.PORT }} key: ${{ secrets.SSHKEY }} script: | ls```

This action copies the repository files to your server using

scp. Afterwards, thelscommand is executed. Here you can add appropriate commands that rebuild your service or similar. To rebuild and start a docker service you could use something like this or similar:docker compose -f target-dir/docker-compose.yml up --build -dNow commit this file and in the "Actions" tab of your repository, the newly created action should now be visible and executed. With every future change, the git repository will now be automatically copied to your server.Sources

I read this when trying out, but it did not work and I adapted the

deploy.ymlfile: https://dev.to/knowbee/how-to-setup-continuous-deployment-of-a-website-on-a-vps-using-github-actions-54im -

@ 04c915da:3dfbecc9

2025-05-16 17:12:05

@ 04c915da:3dfbecc9

2025-05-16 17:12:05One of the most common criticisms leveled against nostr is the perceived lack of assurance when it comes to data storage. Critics argue that without a centralized authority guaranteeing that all data is preserved, important information will be lost. They also claim that running a relay will become prohibitively expensive. While there is truth to these concerns, they miss the mark. The genius of nostr lies in its flexibility, resilience, and the way it harnesses human incentives to ensure data availability in practice.

A nostr relay is simply a server that holds cryptographically verifiable signed data and makes it available to others. Relays are simple, flexible, open, and require no permission to run. Critics are right that operating a relay attempting to store all nostr data will be costly. What they miss is that most will not run all encompassing archive relays. Nostr does not rely on massive archive relays. Instead, anyone can run a relay and choose to store whatever subset of data they want. This keeps costs low and operations flexible, making relay operation accessible to all sorts of individuals and entities with varying use cases.

Critics are correct that there is no ironclad guarantee that every piece of data will always be available. Unlike bitcoin where data permanence is baked into the system at a steep cost, nostr does not promise that every random note or meme will be preserved forever. That said, in practice, any data perceived as valuable by someone will likely be stored and distributed by multiple entities. If something matters to someone, they will keep a signed copy.

Nostr is the Streisand Effect in protocol form. The Streisand effect is when an attempt to suppress information backfires, causing it to spread even further. With nostr, anyone can broadcast signed data, anyone can store it, and anyone can distribute it. Try to censor something important? Good luck. The moment it catches attention, it will be stored on relays across the globe, copied, and shared by those who find it worth keeping. Data deemed important will be replicated across servers by individuals acting in their own interest.

Nostr’s distributed nature ensures that the system does not rely on a single point of failure or a corporate overlord. Instead, it leans on the collective will of its users. The result is a network where costs stay manageable, participation is open to all, and valuable verifiable data is stored and distributed forever.

-

@ 56f27915:5fee3024

2025-05-23 18:51:08

@ 56f27915:5fee3024

2025-05-23 18:51:08Ralph Boes – Menschenrechtsaktivist, Philosoph, Vorstandsmitglied im Verein Unsere Verfassung e.V.

Ralph Boes zeigt in dem Buch auf, wie wir uns von der Übermacht des Parteienwesens, die zur Entmündigung des Volkes führt, befreien können. Er zeigt, dass schon im Grundgesetz selbst höchst gegenläufige, an seinen freiheitlich-demokratischen Idealen bemessen sogar als verfassungswidrig zu bezeichnende Tendenzen wirken. Und dass diese es sind, die heute in seine Zerstörung führen. Er weist aber auch die Ansatzpunkte auf, durch die der Zerstörung des Grundgesetzes wirkungsvoll begegnet werden kann.

Eintritt frei, Spendentopf

Ralph Boes hat u.a. dafür gesorgt, dass die unmäßigen Sanktionen in Hartz IV 2019 vom Bundesverfassungsgericht für menschenrechts- und verfassungswidrig erklärt wurden. Aktuell setzt er sich für eine Ur-Abstimmung des Volkes über seine Verfassung ein.

-

@ 87e98bb6:8d6616f4

2025-05-23 15:36:32

@ 87e98bb6:8d6616f4

2025-05-23 15:36:32Use this guide if you want to keep your NixOS on the stable branch, but enable unstable application packages. It took me a while to figure out how to do this, so I wanted to share because it ended up being far easier than most of the vague explanations online made it seem.

I put a sample configuration.nix file at the very bottom to help it make more sense for new users. Remember to keep a backup of your config file, just in case!

If there are any errors please let me know. I am currently running NixOS 24.11.

Steps listed in this guide: 1. Add the unstable channel to NixOS as a secondary channel. 2. Edit the configuration.nix to enable unstable applications. 3. Add "unstable." in front of the application names in the config file (example: unstable.program). This enables the install of unstable versions during the build. 4. Rebuild.

Step 1:

- Open the console. (If you want to see which channels you currently have, type: sudo nix-channel --list)

- Add the unstable channel, type: sudo nix-channel --add https://channels.nixos.org/nixpkgs-unstable unstable

- To update the channels (bring in the possible apps), type: sudo nix-channel --update

More info here: https://nixos.wiki/wiki/Nix_channels

Step 2:

Edit your configuration.nix and add the following around your current config:

``` { config, pkgs, lib, ... }:

let unstable = import

{ config = { allowUnfree = true; }; }; in { #insert normal configuration text here } #remember to close the bracket!```

At this point it would be good to save your config and try a rebuild to make sure there are no errors. If you have errors, make sure your brackets are in the right places and/or not missing. This step will make for less troubleshooting later on if something happens to be in the wrong spot!

Step 3:

Add "unstable." to the start of each application you want to use the unstable version. (Example: unstable.brave)

Step 4:

Rebuild your config, type: sudo nixos-rebuild switch

Example configuration.nix file:

```

Config file for NixOS

{ config, pkgs, lib, ... }:

Enable unstable apps from Nix repository.

let unstable = import

{ config = { allowUnfree = true; }; }; in { #Put your normal config entries here in between the tags. Below is what your applications list needs to look like.

environment.systemPackages = with pkgs; [ appimage-run blender unstable.brave #Just add unstable. before the application name to enable the unstable version. chirp discord ];

} # Don't forget to close bracket at the end of the config file!

``` That should be all. Hope it helps.

-

@ ecda4328:1278f072

2025-05-23 18:16:24

@ ecda4328:1278f072

2025-05-23 18:16:24And what does it mean to withdraw back to Bitcoin Layer 1?

Disclaimer: This post was written with help from ChatGPT-4o. If you spot any mistakes or have suggestions — feel free to reply or zap in feedback!

Let’s break it down — using three popular setups:

1. Wallet of Satoshi (WoS)

Custodial — you don’t touch Lightning directly

Sending sats:

- You open WoS, paste a Lightning invoice, hit send.

- WoS handles the payment entirely within their system.

- If recipient uses WoS: internal balance update.

- If external: routed via their node.

- You never open channels, construct routes, or sign anything.

Withdrawing to L1:

- You paste a Bitcoin address.

- WoS sends a regular on-chain transaction from their custodial wallet.

- You pay a fee. It’s like a bank withdrawal.

You don’t interact with Lightning directly. Think of it as a trusted 3rd party Lightning “bank”.

2. Phoenix Wallet

Non-custodial — you own keys, Phoenix handles channels

Sending sats:

- You scan a Lightning invoice and hit send.

- Phoenix uses its backend node (ACINQ) to route the payment.

- If needed, it opens a real 2-of-2 multisig channel on-chain automatically.

- You own your keys (12-word seed), Phoenix abstracts the technical parts.

Withdrawing to L1:

- You enter your Bitcoin address.

- Phoenix closes your Lightning channel (cooperatively, if possible).

- Your sats are sent as a real Bitcoin transaction to your address.

You’re using Lightning “for real,” with real Bitcoin channels — but Phoenix smooths out the UX.

3. Your Own Lightning Node

Self-hosted — you control everything

Sending sats:

- You manage your channels manually (or via automation).

- Your node:

- Reads the invoice

- Builds a route using HTLCs

- Sends the payment using conditional logic (preimages, time locks).

- If routing fails: retry or adjust liquidity.

Withdrawing to L1:

- You select and close a channel.

- A channel closing transaction is broadcast:

- Cooperative = fast and cheap

- Force-close = slower, more expensive, and time-locked

- Funds land in your on-chain wallet.

You have full sovereignty — but also full responsibility (liquidity, fees, backups, monitoring).

Core Tech Behind It: HTLCs, Multisig — and No Sidechain

- Lightning channels = 2-of-2 multisig Bitcoin addresses

- Payments = routed via HTLCs (Hashed Time-Locked Contracts)

- HTLCs are off-chain, but enforceable on-chain if needed

- Important:

- The Lightning Network is not a sidechain.

- It doesn't use its own token, consensus, or separate blockchain.

- Every Lightning channel is secured by real Bitcoin on L1.

Lightning = fast, private, off-chain Bitcoin — secured by Bitcoin itself.

Summary Table

| Wallet | Custody | Channel Handling | L1 Withdrawal | HTLC Visibility | User Effort | |--------------------|--------------|------------------------|---------------------|------------------|--------------| | Wallet of Satoshi | Custodial | None | Internal to external| Hidden | Easiest | | Phoenix Wallet | Non-custodial| Auto-managed real LN | Channel close | Abstracted | Low effort | | Own Node | You | Manual | Manual channel close| Full control | High effort |

Bonus: Withdrawing from LN to On-Chain

- WoS: sends sats from their wallet — like PayPal.

- Phoenix: closes a real channel and sends your UTXO on-chain.

- Own node: closes your multisig contract and broadcasts your pre-signed tx.

Bitcoin + Lightning = Sovereign money + Instant payments.

Choose the setup that fits your needs — and remember, you can always level up later.P.S. What happens in Lightning... usually stays in Lightning.

-

@ 8d34bd24:414be32b

2025-05-21 15:52:46

@ 8d34bd24:414be32b

2025-05-21 15:52:46In our culture today, people like to have “my truth” as opposed to “your truth.” They want to have teachers who tell them what they want to hear and worship in the way they desire. The Bible predicted these times.

For the time will come when people will not put up with sound doctrine. Instead, to suit their own desires, they will gather around them a great number of teachers to say what their itching ears want to hear. (2 Timothy 4:3)

My question is, “do we get to choose what we want to believe about God and how we want to worship Him, or does God tell us what we are to believe and how we are to worship Him?”

The Bible makes it clear that He is who He says He is and He expects obedience and worship according to His commands. We do not get to decide for ourselves.

The woman said to Him, “Sir, I perceive that You are a prophet. Our fathers worshiped in this mountain, and you people say that in Jerusalem is the place where men ought to worship.” Jesus said to her, “Woman, believe Me, an hour is coming when neither in this mountain nor in Jerusalem will you worship the Father. You worship what you do not know; we worship what we know, for salvation is from the Jews. But an hour is coming, and now is, when the true worshipers will worship the Father in spirit and truth; for such people the Father seeks to be His worshipers. God is spirit, and those who worship Him must worship in spirit and truth.” (John 4:19-24) {emphasis mine}

In this passage, Jesus gently corrects the woman for worshipping what she does not know. He also says, “God is spirit, and those who worship Him must worship in spirit and truth.” He states what God is (spirit) and how He must be worshipped “in spirit and truth.” We don’t get to define God however we wish, and we don’t get to worship Him any way we wish. God is who He has revealed Himself to be and we must obey Him and worship Him the way He has commanded.

In this next passage, God makes clear that He is holy and we do not get to worship Him any way we wish. We are to interact with Him in the prescribed manner.

Now Nadab and Abihu, the sons of Aaron, took their respective firepans, and after putting fire in them, placed incense on it and offered strange fire before the Lord, which He had not commanded them. And fire came out from the presence of the Lord and consumed them, and they died before the Lord. Then Moses said to Aaron, “It is what the Lord spoke, saying,

‘By those who come near Me I will be treated as holy,\ And before all the people I will be honored.’ ”

So Aaron, therefore, kept silent. (Leviticus 10:1-3) {emphasis mine}

God had prescribed a particular way to approach Him and only those whom He had chosen (priests of the lineage of Aaron). Nadab and Abihu chose to “do it their way” and paid the price for ignoring God’s command. God set an example with them.

God has been gracious enough to reveal Himself, His character, His power, and His commands to us. If we have truly submitted ourselves to His rule, we should hunger for God’s words so we can know Him better and honor Him in obedience.

But now I come to You; and these things I speak in the world so that they may have My joy made full in themselves. I have given them Your word; and the world has hated them, because they are not of the world, even as I am not of the world. I do not ask You to take them out of the world, but to keep them from the evil one. They are not of the world, even as I am not of the world. Sanctify them in the truth; Your word is truth. (John 17:13-17) {emphasis mine}

In today’s culture, everybody likes to claim their own personal truth, but that isn’t how truth works. The truth is not determined by an individual for themselves. It isn’t even determined by a consensus or majority vote. The truth is the truth even if not one person on earth believes it. God speaks truth and God is truth. Our belief or lack thereof doesn’t change the truth, but our lack of belief in the truth, especially the truth as revealed by God in His word, can negatively affect our relationship with God.

God expects us to study His word so we can obey His commands.

For I did not speak to your fathers, or command them in the day that I brought them out of the land of Egypt, concerning burnt offerings and sacrifices. But this is what I commanded them, saying, ‘Obey My voice, and I will be your God, and you will be My people; and you will walk in all the way which I command you, that it may be well with you.’ Yet they did not obey or incline their ear, but walked in their own counsels and in the stubbornness of their evil heart, and went backward and not forward. Since the day that your fathers came out of the land of Egypt until this day, I have sent you all My servants the prophets, daily rising early and sending them. Yet they did not listen to Me or incline their ear, but stiffened their neck; they did more evil than their fathers. (Jeremiah 7:22-26) {emphasis mine}

Today you rarely see someone bowing down to a golden idol, but that doesn’t mean that we are any better at obeying God’s commands or submitting to His will. We still try to make God in our own image so He is a convenience to us and how we want to live our lives. We still put other things ahead of God — family, work, entertainment, fame, etc. Most of us aren’t any more faithful to God than the Israelites were. Just like the Israelites, we put on the trappings of faith but don’t live according to faith and faithfulness.

And He said to them, “Rightly did Isaiah prophesy of you hypocrites, as it is written:

‘This people honors Me with their lips,\ But their heart is far away from Me.\ **But in vain do they worship Me,\ Teaching as doctrines the precepts of men.’\ Neglecting the commandment of God, you hold to the tradition of men.”

He was also saying to them, “You are experts at setting aside the commandment of God in order to keep your tradition. (Mark 7:6-9) {emphasis mine}

How many “churches” and “Christian” leaders teach people according to the culture instead of according to the Word of God? How many tell people what they want to hear and what makes them feel good instead of what they need to hear — the truth as spoken through the Bible? How many church attenders follow a “Christian” leader more than they follow their Creator, Savior, and God? How many church attenders can recite the words of their leaders better than the Holy Scriptures?

I solemnly charge you in the presence of God and of Christ Jesus, who is to judge the living and the dead, and by His appearing and His kingdom: preach the word; be ready in season and out of season; reprove, rebuke, exhort, with great patience and instruction. For the time will come when they will not endure sound doctrine; but wanting to have their ears tickled, they will accumulate for themselves teachers in accordance to their own desires, and will turn away their ears from the truth and will turn aside to myths. But you, be sober in all things, endure hardship, do the work of an evangelist, fulfill your ministry. (2 Timothy 4:1-5) {emphasis mine}

How can we know if a church leader is rightly preaching God’s word? We can only know if we have read the Bible and studied it. We should be like the Bereans:

Now these were more noble-minded than those in Thessalonica, for they received the word with great eagerness, examining the Scriptures daily to see whether these things were so. (Acts 17:11)

Honestly, I don’t trust any spiritual leader who doesn’t encourage me to search the Scriptures to see whether their words are true. Any leader who puts their own word above the Scriptures is a false teacher. Sadly there are many, maybe more than faithful teachers. Some false teachers are intentionally so, but many have been misled by other false teachers. Their guilt is less, but they don’t do any less harm than those who intentionally mislead.

We need to seek trustworthy teachers who speak according to the Word of God, who quote the Bible to support their opinions, and who seek the good of their followers rather than the submission of their followers.

Do not harden your hearts, as at Meribah,\ As in the day of Massah in the wilderness,

“When your fathers tested Me,\ They tried Me, though they had seen My work.\ For forty years I loathed that generation,\ And said they are a people who err in their heart,\ And they do not know My ways.\ Therefore I swore in My anger,\ Truly they shall not enter into My rest.” (Psalm 95:8-11) {emphasis mine} *Teach me good discernment and knowledge,\ For I believe in Your commandments*.\ Before I was afflicted I went astray,\ But now I keep Your word.\ You are good and do good;\ Teach me Your statutes.\ The arrogant have forged a lie against me;\ *With all my heart I will observe Your precepts*.\ Their heart is covered with fat,\ But I delight in Your law.\ It is good for me that I was afflicted,\ That I may learn Your statutes.\ The law of Your mouth is better to me\ Than thousands of gold and silver pieces. (Psalm 119:66-72) {emphasis mine}

May our Creator God teach us the truth. May He fill our hearts with the desire to be in His word daily and to seek His will. May He do what is necessary to get our attention and turn our hearts and minds fully to Him, so we can learn His statutes and serve Him faithfully, so one day we are blessed to hear, “Well done! Good and faithful servant.”

Trust Jesus.

FYI, I see lack of knowledge of truth and God’s word as one of the biggest problems in the church today; however, it is possible to know the Bible in depth, but not know God. As important as knowledge of Scriptures is, this knowledge (without faith, submission, obedience, and love) is meaningless. Knowledge doesn’t get us to heaven. Even obedience doesn’t get us to heaven. Only faith and submission to our creator God leads to salvation and heaven. That being said, we can’t faithfully serve our God without knowledge of Him and His commands. Out of gratefulness for who He is and what He has done for us, we should seek to know and please Him.

-

@ 21335073:a244b1ad

2025-05-01 01:51:10

@ 21335073:a244b1ad

2025-05-01 01:51:10Please respect Virginia Giuffre’s memory by refraining from asking about the circumstances or theories surrounding her passing.

Since Virginia Giuffre’s death, I’ve reflected on what she would want me to say or do. This piece is my attempt to honor her legacy.

When I first spoke with Virginia, I was struck by her unshakable hope. I had grown cynical after years in the anti-human trafficking movement, worn down by a broken system and a government that often seemed complicit. But Virginia’s passion, creativity, and belief that survivors could be heard reignited something in me. She reminded me of my younger, more hopeful self. Instead of warning her about the challenges ahead, I let her dream big, unburdened by my own disillusionment. That conversation changed me for the better, and following her lead led to meaningful progress.

Virginia was one of the bravest people I’ve ever known. As a survivor of Epstein, Maxwell, and their co-conspirators, she risked everything to speak out, taking on some of the world’s most powerful figures.

She loved when I said, “Epstein isn’t the only Epstein.” This wasn’t just about one man—it was a call to hold all abusers accountable and to ensure survivors find hope and healing.

The Epstein case often gets reduced to sensational details about the elite, but that misses the bigger picture. Yes, we should be holding all of the co-conspirators accountable, we must listen to the survivors’ stories. Their experiences reveal how predators exploit vulnerabilities, offering lessons to prevent future victims.

You’re not powerless in this fight. Educate yourself about trafficking and abuse—online and offline—and take steps to protect those around you. Supporting survivors starts with small, meaningful actions. Free online resources can guide you in being a safe, supportive presence.

When high-profile accusations arise, resist snap judgments. Instead of dismissing survivors as “crazy,” pause to consider the trauma they may be navigating. Speaking out or coping with abuse is never easy. You don’t have to believe every claim, but you can refrain from attacking accusers online.

Society also fails at providing aftercare for survivors. The government, often part of the problem, won’t solve this. It’s up to us. Prevention is critical, but when abuse occurs, step up for your loved ones and community. Protect the vulnerable. it’s a challenging but a rewarding journey.

If you’re contributing to Nostr, you’re helping build a censorship resistant platform where survivors can share their stories freely, no matter how powerful their abusers are. Their voices can endure here, offering strength and hope to others. This gives me great hope for the future.

Virginia Giuffre’s courage was a gift to the world. It was an honor to know and serve her. She will be deeply missed. My hope is that her story inspires others to take on the powerful.

-

@ e3ba5e1a:5e433365

2025-04-15 11:03:15

@ e3ba5e1a:5e433365

2025-04-15 11:03:15Prelude

I wrote this post differently than any of my others. It started with a discussion with AI on an OPSec-inspired review of separation of powers, and evolved into quite an exciting debate! I asked Grok to write up a summary in my overall writing style, which it got pretty well. I've decided to post it exactly as-is. Ultimately, I think there are two solid ideas driving my stance here:

- Perfect is the enemy of the good

- Failure is the crucible of success

Beyond that, just some hard-core belief in freedom, separation of powers, and operating from self-interest.

Intro

Alright, buckle up. I’ve been chewing on this idea for a while, and it’s time to spit it out. Let’s look at the U.S. government like I’d look at a codebase under a cybersecurity audit—OPSEC style, no fluff. Forget the endless debates about what politicians should do. That’s noise. I want to talk about what they can do, the raw powers baked into the system, and why we should stop pretending those powers are sacred. If there’s a hole, either patch it or exploit it. No half-measures. And yeah, I’m okay if the whole thing crashes a bit—failure’s a feature, not a bug.

The Filibuster: A Security Rule with No Teeth

You ever see a firewall rule that’s more theater than protection? That’s the Senate filibuster. Everyone acts like it’s this untouchable guardian of democracy, but here’s the deal: a simple majority can torch it any day. It’s not a law; it’s a Senate preference, like choosing tabs over spaces. When people call killing it the “nuclear option,” I roll my eyes. Nuclear? It’s a button labeled “press me.” If a party wants it gone, they’ll do it. So why the dance?

I say stop playing games. Get rid of the filibuster. If you’re one of those folks who thinks it’s the only thing saving us from tyranny, fine—push for a constitutional amendment to lock it in. That’s a real patch, not a Post-it note. Until then, it’s just a vulnerability begging to be exploited. Every time a party threatens to nuke it, they’re admitting it’s not essential. So let’s stop pretending and move on.

Supreme Court Packing: Because Nine’s Just a Number

Here’s another fun one: the Supreme Court. Nine justices, right? Sounds official. Except it’s not. The Constitution doesn’t say nine—it’s silent on the number. Congress could pass a law tomorrow to make it 15, 20, or 42 (hitchhiker’s reference, anyone?). Packing the court is always on the table, and both sides know it. It’s like a root exploit just sitting there, waiting for someone to log in.

So why not call the bluff? If you’re in power—say, Trump’s back in the game—say, “I’m packing the court unless we amend the Constitution to fix it at nine.” Force the issue. No more shadowboxing. And honestly? The court’s got way too much power anyway. It’s not supposed to be a super-legislature, but here we are, with justices’ ideologies driving the bus. That’s a bug, not a feature. If the court weren’t such a kingmaker, packing it wouldn’t even matter. Maybe we should be talking about clipping its wings instead of just its size.

The Executive Should Go Full Klingon

Let’s talk presidents. I’m not saying they should wear Klingon armor and start shouting “Qapla’!”—though, let’s be real, that’d be awesome. I’m saying the executive should use every scrap of power the Constitution hands them. Enforce the laws you agree with, sideline the ones you don’t. If Congress doesn’t like it, they’ve got tools: pass new laws, override vetoes, or—here’s the big one—cut the budget. That’s not chaos; that’s the system working as designed.

Right now, the real problem isn’t the president overreaching; it’s the bureaucracy. It’s like a daemon running in the background, eating CPU and ignoring the user. The president’s supposed to be the one steering, but the administrative state’s got its own agenda. Let the executive flex, push the limits, and force Congress to check it. Norms? Pfft. The Constitution’s the spec sheet—stick to it.

Let the System Crash

Here’s where I get a little spicy: I’m totally fine if the government grinds to a halt. Deadlock isn’t a disaster; it’s a feature. If the branches can’t agree, let the president veto, let Congress starve the budget, let enforcement stall. Don’t tell me about “essential services.” Nothing’s so critical it can’t take a breather. Shutdowns force everyone to the table—debate, compromise, or expose who’s dropping the ball. If the public loses trust? Good. They’ll vote out the clowns or live with the circus they elected.

Think of it like a server crash. Sometimes you need a hard reboot to clear the cruft. If voters keep picking the same bad admins, well, the country gets what it deserves. Failure’s the best teacher—way better than limping along on autopilot.

States Are the Real MVPs

If the feds fumble, states step up. Right now, states act like junior devs waiting for the lead engineer to sign off. Why? Federal money. It’s a leash, and it’s tight. Cut that cash, and states will remember they’re autonomous. Some will shine, others will tank—looking at you, California. And I’m okay with that. Let people flee to better-run states. No bailouts, no excuses. States are like competing startups: the good ones thrive, the bad ones pivot or die.

Could it get uneven? Sure. Some states might turn into sci-fi utopias while others look like a post-apocalyptic vidya game. That’s the point—competition sorts it out. Citizens can move, markets adjust, and failure’s a signal to fix your act.

Chaos Isn’t the Enemy

Yeah, this sounds messy. States ignoring federal law, external threats poking at our seams, maybe even a constitutional crisis. I’m not scared. The Supreme Court’s there to referee interstate fights, and Congress sets the rules for state-to-state play. But if it all falls apart? Still cool. States can sort it without a babysitter—it’ll be ugly, but freedom’s worth it. External enemies? They’ll either unify us or break us. If we can’t rally, we don’t deserve the win.

Centralizing power to avoid this is like rewriting your app in a single thread to prevent race conditions—sure, it’s simpler, but you’re begging for a deadlock. Decentralized chaos lets states experiment, lets people escape, lets markets breathe. States competing to cut regulations to attract businesses? That’s a race to the bottom for red tape, but a race to the top for innovation—workers might gripe, but they’ll push back, and the tension’s healthy. Bring it—let the cage match play out. The Constitution’s checks are enough if we stop coddling the system.

Why This Matters

I’m not pitching a utopia. I’m pitching a stress test. The U.S. isn’t a fragile porcelain doll; it’s a rugged piece of hardware built to take some hits. Let it fail a little—filibuster, court, feds, whatever. Patch the holes with amendments if you want, or lean into the grind. Either way, stop fearing the crash. It’s how we debug the republic.

So, what’s your take? Ready to let the system rumble, or got a better way to secure the code? Hit me up—I’m all ears.

-

@ fa984bd7:58018f52

2025-05-21 09:51:34

@ fa984bd7:58018f52

2025-05-21 09:51:34This post has been deleted.

-

@ 0fa80bd3:ea7325de

2025-04-09 21:19:39

@ 0fa80bd3:ea7325de

2025-04-09 21:19:39DAOs promised decentralization. They offered a system where every member could influence a project's direction, where money and power were transparently distributed, and decisions were made through voting. All of it recorded immutably on the blockchain, free from middlemen.

But something didn’t work out. In practice, most DAOs haven’t evolved into living, self-organizing organisms. They became something else: clubs where participation is unevenly distributed. Leaders remained - only now without formal titles. They hold influence through control over communications, task framing, and community dynamics. Centralization still exists, just wrapped in a new package.

But there's a second, less obvious problem. Crowds can’t create strategy. In DAOs, people vote for what "feels right to the majority." But strategy isn’t about what feels good - it’s about what’s necessary. Difficult, unpopular, yet forward-looking decisions often fail when put to a vote. A founder’s vision is a risk. But in healthy teams, it’s that risk that drives progress. In DAOs, risk is almost always diluted until it becomes something safe and vague.

Instead of empowering leaders, DAOs often neutralize them. This is why many DAOs resemble consensus machines. Everyone talks, debates, and participates, but very little actually gets done. One person says, “Let’s jump,” and five others respond, “Let’s discuss that first.” This dynamic might work for open forums, but not for action.

Decentralization works when there’s trust and delegation, not just voting. Until DAOs develop effective systems for assigning roles, taking ownership, and acting with flexibility, they will keep losing ground to old-fashioned startups led by charismatic founders with a clear vision.

We’ve seen this in many real-world cases. Take MakerDAO, one of the most mature and technically sophisticated DAOs. Its governance token (MKR) holders vote on everything from interest rates to protocol upgrades. While this has allowed for transparency and community involvement, the process is often slow and bureaucratic. Complex proposals stall. Strategic pivots become hard to implement. And in 2023, a controversial proposal to allocate billions to real-world assets passed only narrowly, after months of infighting - highlighting how vision and execution can get stuck in the mud of distributed governance.

On the other hand, Uniswap DAO, responsible for the largest decentralized exchange, raised governance participation only after launching a delegation system where token holders could choose trusted representatives. Still, much of the activity is limited to a small group of active contributors. The vast majority of token holders remain passive. This raises the question: is it really community-led, or just a formalized power structure with lower transparency?

Then there’s ConstitutionDAO, an experiment that went viral. It raised over $40 million in days to try and buy a copy of the U.S. Constitution. But despite the hype, the DAO failed to win the auction. Afterwards, it struggled with refund logistics, communication breakdowns, and confusion over governance. It was a perfect example of collective enthusiasm without infrastructure or planning - proof that a DAO can raise capital fast but still lack cohesion.

Not all efforts have failed. Projects like Gitcoin DAO have made progress by incentivizing small, individual contributions. Their quadratic funding mechanism rewards projects based on the number of contributors, not just the size of donations, helping to elevate grassroots initiatives. But even here, long-term strategy often falls back on a core group of organizers rather than broad community consensus.

The pattern is clear: when the stakes are low or the tasks are modular, DAOs can coordinate well. But when bold moves are needed—when someone has to take responsibility and act under uncertainty DAOs often freeze. In the name of consensus, they lose momentum.

That’s why the organization of the future can’t rely purely on decentralization. It must encourage individual initiative and the ability to take calculated risks. People need to see their contribution not just as a vote, but as a role with clear actions and expected outcomes. When the situation demands, they should be empowered to act first and present the results to the community afterwards allowing for both autonomy and accountability. That’s not a flaw in the system. It’s how real progress happens.

-

@ 3f770d65:7a745b24

2025-05-20 21:14:28

@ 3f770d65:7a745b24

2025-05-20 21:14:28I’m Derek Ross, and I’m all-in on Nostr.

I started the Grow Nostr Initiative to help more people discover what makes Nostr so powerful: ✅ You own your identity ✅ You choose your social graph and algorithms ✅ You aren't locked into any single app or platform ✅ You can post, stream, chat, and build, all without gatekeepers

What we’re doing with Grow Nostr Initiative: 🌱 Hosting local meetups and mini-conferences to onboard people face-to-face 📚 Creating educational materials and guides to demystify how Nostr works 🧩 Helping businesses and creators understand how they can plug into Nostr (running media servers, relays, and using key management tools)

I believe Nostr is the foundation of a more open internet. It’s still early, but we’re already seeing incredible apps for social, blogging, podcasting, livestreaming, and more. And the best part is that they're all interoperable, censorship-resistant, and built on open standards. Nostr is the world's largest bitcoin economy by transaction volume and I truly believe that the purple pill helps the orange pill go down. Meaning, growing Nostr will also grow Bitcoin adoption.

If you’ve been curious about Nostr or are building something on it, or let’s talk. Whether you're just getting started or you're already deep in the ecosystem, I'm here to answer questions, share what I’ve learned, and hear your ideas. Check out https://nostrapps.com to find your next social decentralized experience.

Ask Me Anything about GNI, Nostr, Bitcoin, the upcoming #NosVegas event at the Bitcoin Conference next week, etc.!

– Derek Ross 🌐 https://grownostr.org npub18ams6ewn5aj2n3wt2qawzglx9mr4nzksxhvrdc4gzrecw7n5tvjqctp424

https://stacker.news/items/984689

-

@ 04c915da:3dfbecc9

2025-05-20 15:53:48

@ 04c915da:3dfbecc9

2025-05-20 15:53:48This piece is the first in a series that will focus on things I think are a priority if your focus is similar to mine: building a strong family and safeguarding their future.

Choosing the ideal place to raise a family is one of the most significant decisions you will ever make. For simplicity sake I will break down my thought process into key factors: strong property rights, the ability to grow your own food, access to fresh water, the freedom to own and train with guns, and a dependable community.

A Jurisdiction with Strong Property Rights

Strong property rights are essential and allow you to build on a solid foundation that is less likely to break underneath you. Regions with a history of limited government and clear legal protections for landowners are ideal. Personally I think the US is the single best option globally, but within the US there is a wide difference between which state you choose. Choose carefully and thoughtfully, think long term. Obviously if you are not American this is not a realistic option for you, there are other solid options available especially if your family has mobility. I understand many do not have this capability to easily move, consider that your first priority, making movement and jurisdiction choice possible in the first place.

Abundant Access to Fresh Water

Water is life. I cannot overstate the importance of living somewhere with reliable, clean, and abundant freshwater. Some regions face water scarcity or heavy regulations on usage, so prioritizing a place where water is plentiful and your rights to it are protected is critical. Ideally you should have well access so you are not tied to municipal water supplies. In times of crisis or chaos well water cannot be easily shutoff or disrupted. If you live in an area that is drought prone, you are one drought away from societal chaos. Not enough people appreciate this simple fact.

Grow Your Own Food

A location with fertile soil, a favorable climate, and enough space for a small homestead or at the very least a garden is key. In stable times, a small homestead provides good food and important education for your family. In times of chaos your family being able to grow and raise healthy food provides a level of self sufficiency that many others will lack. Look for areas with minimal restrictions, good weather, and a culture that supports local farming.

Guns

The ability to defend your family is fundamental. A location where you can legally and easily own guns is a must. Look for places with a strong gun culture and a political history of protecting those rights. Owning one or two guns is not enough and without proper training they will be a liability rather than a benefit. Get comfortable and proficient. Never stop improving your skills. If the time comes that you must use a gun to defend your family, the skills must be instinct. Practice. Practice. Practice.

A Strong Community You Can Depend On

No one thrives alone. A ride or die community that rallies together in tough times is invaluable. Seek out a place where people know their neighbors, share similar values, and are quick to lend a hand. Lead by example and become a good neighbor, people will naturally respond in kind. Small towns are ideal, if possible, but living outside of a major city can be a solid balance in terms of work opportunities and family security.

Let me know if you found this helpful. My plan is to break down how I think about these five key subjects in future posts.

-

@ 63d59db8:be170f6f

2025-05-23 12:53:00

@ 63d59db8:be170f6f

2025-05-23 12:53:00In a world overwhelmed by contradictions—climate change, inequality, political instability, and social disconnection—absurdity becomes an unavoidable lens through which to view the human condition. Inspired by Albert Camus' philosophy, this project explores the tension between life’s inherent meaninglessness and our persistent search for purpose.\ \ The individuals in these images embody a quiet defiance, navigating chaos with a sense of irony and authenticity. Through the act of revolt—against despair, against resignation—they find agency and resilience. These photographs invite reflection, not on solutions, but on our capacity to live meaningfully within absurdity.

Visit Katerina's website here.

Submit your work to the NOICE Visual Expression Awards for a chance to win a few thousand extra sats:

-

@ 04c915da:3dfbecc9

2025-05-20 15:50:48

@ 04c915da:3dfbecc9

2025-05-20 15:50:48For years American bitcoin miners have argued for more efficient and free energy markets. It benefits everyone if our energy infrastructure is as efficient and robust as possible. Unfortunately, broken incentives have led to increased regulation throughout the sector, incentivizing less efficient energy sources such as solar and wind at the detriment of more efficient alternatives.

The result has been less reliable energy infrastructure for all Americans and increased energy costs across the board. This naturally has a direct impact on bitcoin miners: increased energy costs make them less competitive globally.

Bitcoin mining represents a global energy market that does not require permission to participate. Anyone can plug a mining computer into power and internet to get paid the current dynamic market price for their work in bitcoin. Using cellphone or satellite internet, these mines can be located anywhere in the world, sourcing the cheapest power available.

Absent of regulation, bitcoin mining naturally incentivizes the build out of highly efficient and robust energy infrastructure. Unfortunately that world does not exist and burdensome regulations remain the biggest threat for US based mining businesses. Jurisdictional arbitrage gives miners the option of moving to a friendlier country but that naturally comes with its own costs.

Enter AI. With the rapid development and release of AI tools comes the requirement of running massive datacenters for their models. Major tech companies are scrambling to secure machines, rack space, and cheap energy to run full suites of AI enabled tools and services. The most valuable and powerful tech companies in America have stumbled into an accidental alliance with bitcoin miners: THE NEED FOR CHEAP AND RELIABLE ENERGY.

Our government is corrupt. Money talks. These companies will push for energy freedom and it will greatly benefit us all.

-

@ 7e6f9018:a6bbbce5

2025-05-22 18:17:57

@ 7e6f9018:a6bbbce5

2025-05-22 18:17:57Governments and the press often publish data on the population’s knowledge of Catalan. However, this data only represents one stage in the linguistic process and does not accurately reflect the state of the language, since a language only has a future if it is used. Knowledge is a necessary step toward using a language, but it is not the final stage — that stage is actual use.

So what is the state of Catalan usage? If we look at data on regular use, we see that the Catalan language has remained stagnant over the past hundred years, with nearly the same number of regular speakers. In 1930, there were around 2.5 million speakers, and in 2018, there were 2.7 million.

Regular use of Catalan in Catalonia, in millions of speakers. The dotted segments are an estimate of the trend, based on the statements of Joan Coromines and adjusted according to Catalonia’s population growth.

Regular use of Catalan in Catalonia, in millions of speakers. The dotted segments are an estimate of the trend, based on the statements of Joan Coromines and adjusted according to Catalonia’s population growth.These figures wouldn’t necessarily be negative if the language’s integrity were strong, that is, if its existence weren’t threatened by other languages. But the population of Catalonia has grown from 2.7 million in 1930 to 7.5 million in 2018. This means that today, regular Catalan speakers make up only 36% of Catalonia’s population, whereas in 1930, they represented 90%.

Regular use of Catalan in Catalonia, as a percentage of speakers. The dotted segments are an estimate of the trend, based on the statements of Joan Coromines and adjusted according to Catalonia’s population growth.

Regular use of Catalan in Catalonia, as a percentage of speakers. The dotted segments are an estimate of the trend, based on the statements of Joan Coromines and adjusted according to Catalonia’s population growth.The language that has gained the most ground is mainly Spanish, which went from 200,000 speakers in 1930 to 3.8 million in 2018. Moreover, speakers of other foreign languages (500,000 speakers) have also grown more than Catalan speakers over the past hundred years.

Notes, Sources, and Methodology

The data from 2003 onward is taken from Idescat (source). Before 2003, there are no official statistics, but we can make interpretations based on historical evidence. The data prior to 2003 is calculated based on two key pieces of evidence:

-

1st Interpretation: In 1930, 90% of the population of Catalonia spoke Catalan regularly. Source and evidence: The Romance linguist Joan Coromines i Vigneaux, a renowned 20th-century linguist, stated in his 1950 work "El que s'ha de saber de la llengua catalana" that "In this territory [Greater Catalonia], almost the entire population speaks Catalan as their usual language" (1, 2).\ While "almost the entire population" is not a precise number, we can interpret it quantitatively as somewhere between 80% and 100%. For the sake of a moderate estimate, we assume 90% of the population were regular Catalan speakers, with the remaining 10% being immigrants and officials of the Spanish state.

-

2nd Interpretation: Regarding population growth between 1930 and 1998, on average, 60% is due to immigration (mostly adopting or already using Spanish language), while 40% is natural growth (likely to acquire Catalan language from childhood). Source and evidence: Between 1999 and 2019, when more detailed data is available, immigration accounted for 68% of population growth. From 1930 to 1998, there was a comparable wave of migration, especially between 1953 and 1973, largely of Spanish-speaking origin (3, 4, 5, 6). To maintain a moderate estimate, we assume 60% of population growth during that period was due to immigration, with the ratio varying depending on whether the period experienced more or less total growth.

-

-

@ 04c915da:3dfbecc9

2025-05-20 15:50:22

@ 04c915da:3dfbecc9

2025-05-20 15:50:22There is something quietly rebellious about stacking sats. In a world obsessed with instant gratification, choosing to patiently accumulate Bitcoin, one sat at a time, feels like a middle finger to the hype machine. But to do it right, you have got to stay humble. Stack too hard with your head in the clouds, and you will trip over your own ego before the next halving even hits.

Small Wins

Stacking sats is not glamorous. Discipline. Stacking every day, week, or month, no matter the price, and letting time do the heavy lifting. Humility lives in that consistency. You are not trying to outsmart the market or prove you are the next "crypto" prophet. Just a regular person, betting on a system you believe in, one humble stack at a time. Folks get rekt chasing the highs. They ape into some shitcoin pump, shout about it online, then go silent when they inevitably get rekt. The ones who last? They stack. Just keep showing up. Consistency. Humility in action. Know the game is long, and you are not bigger than it.

Ego is Volatile

Bitcoin’s swings can mess with your head. One day you are up 20%, feeling like a genius and the next down 30%, questioning everything. Ego will have you panic selling at the bottom or over leveraging the top. Staying humble means patience, a true bitcoin zen. Do not try to "beat” Bitcoin. Ride it. Stack what you can afford, live your life, and let compounding work its magic.

Simplicity

There is a beauty in how stacking sats forces you to rethink value. A sat is worth less than a penny today, but every time you grab a few thousand, you plant a seed. It is not about flaunting wealth but rather building it, quietly, without fanfare. That mindset spills over. Cut out the noise: the overpriced coffee, fancy watches, the status games that drain your wallet. Humility is good for your soul and your stack. I have a buddy who has been stacking since 2015. Never talks about it unless you ask. Lives in a decent place, drives an old truck, and just keeps stacking. He is not chasing clout, he is chasing freedom. That is the vibe: less ego, more sats, all grounded in life.

The Big Picture

Stack those sats. Do it quietly, do it consistently, and do not let the green days puff you up or the red days break you down. Humility is the secret sauce, it keeps you grounded while the world spins wild. In a decade, when you look back and smile, it will not be because you shouted the loudest. It will be because you stayed the course, one sat at a time. \ \ Stay Humble and Stack Sats. 🫡

-

@ 7e6f9018:a6bbbce5

2025-05-22 16:33:07

@ 7e6f9018:a6bbbce5

2025-05-22 16:33:07Per les xarxes socials es parla amb efusivitat de que Bitcoin arribarà a valer milions de dòlars. El mateix Hal Finney allà pel 2009, va estimar el potencial, en un cas extrem, de 10 milions $:

\> As an amusing thought experiment, imagine that Bitcoin is successful and becomes the dominant payment system in use throughout the world. Then the total value of the currency should be equal to the total value of all the wealth in the world. Current estimates of total worldwide household wealth that I have found range from $100 trillion to $300 trillion. Withn 20 million coins, that gives each coin a value of about $10 million. <https://satoshi.nakamotoinstitute.org/emails/bitcoin-list/threads/4/>

No estic d'acord amb els càlculs del bo d'en Hal, ja que no consider que la valoració d'una moneda funcioni així. En qualsevol cas, el 2009 la capitalització de la riquesa mundial era de 300 bilions $, avui és de 660 bilions $, és a dir ha anat pujant un 5,3% de manera anual,

$$(660/300)^{1/15} = 1.053$$La primera apreciació amb aquest augment anual del 5% és que si algú llegeix aquest article i té diners que no necessita aturats al banc (estalvis), ara és bon moment per començar a moure'ls, encara sigui amb moviments defensius (títols de deute governamental o la propietat del primer habitatge). La desagregació per actius dels 660 bilions és:

-

Immobiliari residencial = 260 bilions $

-

Títols de deute = 125 bilions $

-

Accions = 110 bilions

-

Diners fiat = 78 bilions $

-

Terres agrícoles = 35 bilions $

-

Immobiliari comercial = 32 bilions $

-

Or = 18 bilions $

-

Bitcoin = 2 bilions $

La riquesa mundial és major que 660 bilions, però aquests 8 actius crec que són els principals, ja que s'aprecien a dia d'avui. El PIB global anual és de 84 bilions $, que no són bromes, però aquest actius creats (cotxes, ordinadors, roba, aliments...), perden valor una vegada produïts, aproximant-se a 0 passades unes dècades.

Partint d'aquest nombres com a vàlids, la meva posició base respecte de Bitcoin, ja des de fa un parell d'anys, és que te capacitat per posar-se al nivell de capitalització de l'or, perquè conceptualment s'emulen bé, i perquè tot i que Bitcoin no té un valor tangible industrial com pot tenir l'or, sí que te un valor intangible tecnològic, que és pales en tot l'ecosistema que s'ha creat al seu voltant:

-

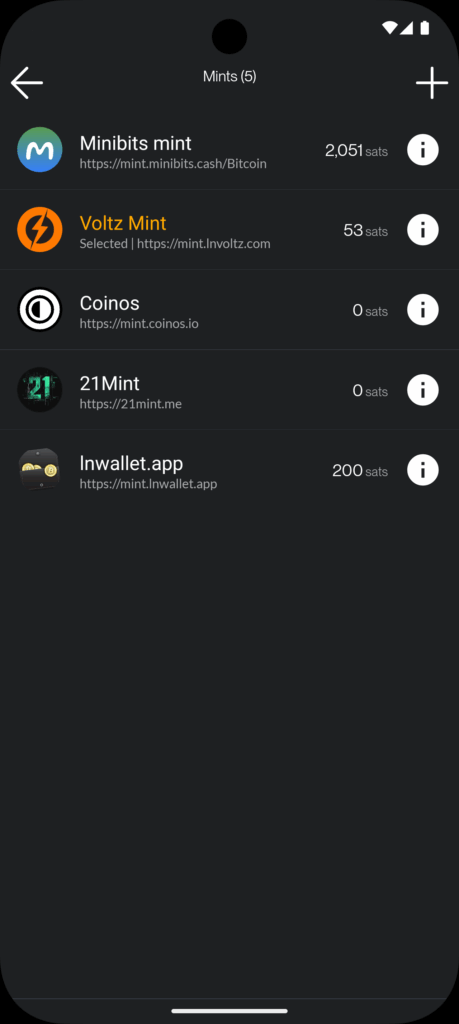

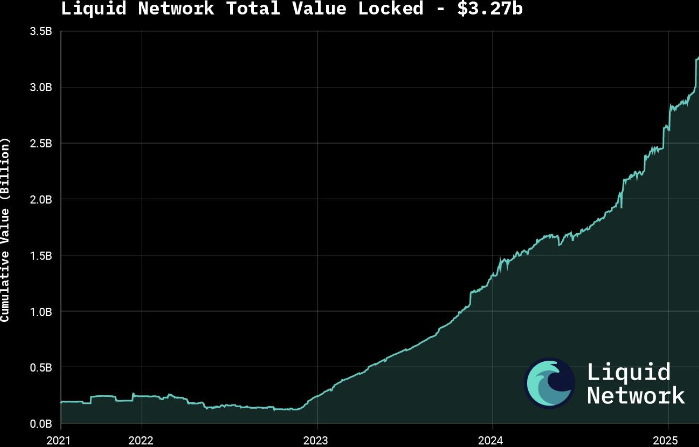

Creació de tecnologies de pagament instantani: la Lightning Network, Cashu i la Liquid Network.

-

Producció d'aplicacions amb l'íntegrament de pagaments instantanis. Especialment destacar el protocol de Nostr (Primal, Amethyst, Damus, Yakihonne, 0xChat...)

-

Industria energètica: permet estabilitzar xarxes elèctriques i emprar energia malbaratada (flaring gas), amb la generació de demanda de hardware i software dedicat.

-

Educació financera i defensa de drets humans. És una eina de defensa contra governs i estats repressius. La Human Rights Foundation fa una feina bastant destacada d'educació.

Ara posem el potencial en nombres:

-

Si iguala l'empresa amb major capitalització, que és Apple, arribaria a uns 160 mil dòlars per bitcoin.

-

Si iguala el nivell de l'or, arribaria a uns 800 mil dòlars per bitcoin.

-

Si iguala el nivell del diner fiat líquid, arribaria a un 3.7 milions de dòlars per bitcoin.

Crec que igualar la capitalització d'Apple és probable en els pròxims 5 - 10 anys. També igualar el nivell de l'or en els pròxims 20 anys em sembla una fita possible. Ara bé, qualsevol fita per sota d'aquesta capitalització ha d'implicar tota una serie de successos al món que no sóc capaç d'imaginar. Que no vol dir que no pugui passar.

-

-

@ 04c915da:3dfbecc9

2025-05-20 15:47:16

@ 04c915da:3dfbecc9

2025-05-20 15:47:16Here’s a revised timeline of macro-level events from The Mandibles: A Family, 2029–2047 by Lionel Shriver, reimagined in a world where Bitcoin is adopted as a widely accepted form of money, altering the original narrative’s assumptions about currency collapse and economic control. In Shriver’s original story, the failure of Bitcoin is assumed amid the dominance of the bancor and the dollar’s collapse. Here, Bitcoin’s success reshapes the economic and societal trajectory, decentralizing power and challenging state-driven outcomes.

Part One: 2029–2032

-

2029 (Early Year)\ The United States faces economic strain as the dollar weakens against global shifts. However, Bitcoin, having gained traction emerges as a viable alternative. Unlike the original timeline, the bancor—a supranational currency backed by a coalition of nations—struggles to gain footing as Bitcoin’s decentralized adoption grows among individuals and businesses worldwide, undermining both the dollar and the bancor.

-

2029 (Mid-Year: The Great Renunciation)\ Treasury bonds lose value, and the government bans Bitcoin, labeling it a threat to sovereignty (mirroring the original bancor ban). However, a Bitcoin ban proves unenforceable—its decentralized nature thwarts confiscation efforts, unlike gold in the original story. Hyperinflation hits the dollar as the U.S. prints money, but Bitcoin’s fixed supply shields adopters from currency devaluation, creating a dual-economy split: dollar users suffer, while Bitcoin users thrive.

-

2029 (Late Year)\ Dollar-based inflation soars, emptying stores of goods priced in fiat currency. Meanwhile, Bitcoin transactions flourish in underground and online markets, stabilizing trade for those plugged into the bitcoin ecosystem. Traditional supply chains falter, but peer-to-peer Bitcoin networks enable local and international exchange, reducing scarcity for early adopters. The government’s gold confiscation fails to bolster the dollar, as Bitcoin’s rise renders gold less relevant.

-